We are registering 30,000,000 shares of our common stock for offer and sale at $0.001 per share.

There is currently no active trading market for our common stock, and such a market may not develop or be sustained. We currently plan to have our common stock listing on the OTC Bulletin Board, subject to the effectiveness of this Registration Statement. In addition, a market maker will be required to file a Form 211 with the Financial Industry Regulatory Authority (FINRA) before the market maker will be able to make a market in the shares of our common stock. At the date hereof, we are not aware that any market maker has any such intention.

We may not sell the shares registered herein until the registration statement filed with the Securities and Exchange Commission is effective. Further, we will not offer the shares through a broker-dealer or anyone affiliated with a broker-dealer. Upon effectiveness, all of the shares being registered herein may become tradable. The stock may be traded or listed only to the extent that there is interest by broker-dealers in acting as a market maker in our stock. Despite our best efforts, it may not be able to convince any broker/dealers to act as market-makers and make quotations on the OTC Bulletin Board. We may consider pursuing a listing on the OTCBB after this registration becomes effective and we have completed our offering.

The price per share will remain at $0.001. Even if we obtain a listing on any exchange or are quoted on the Over-The-Counter (OTC) Bulletin Board, the offering price of $0.001 will not change for the duration of the offering.

We will receive all of the proceeds from such sales of securities and are bearing all expenses in connection with the registration of our shares.

This is a self-underwritten (“best-efforts”) Offering. This Prospectus is part of a prospectus that permits our sole officer and director to sell the shares being offered by the Company directly to the public, with no commission or other remuneration payable to them for any shares they may sell. There are no plans or arrangements to enter into any contracts or agreements to sell the shares with a broker or dealer. Ilyssa Suarez, our sole officer and director, will sell the shares and intend to offer them to friends, family members and business acquaintances. In offering the securities on our behalf, our officer and director will rely on the safe harbor from broker dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934.

The officer and director will not register as broker-dealers pursuant to Section 15 of the Securities Exchange Act of 1934, in reliance upon Rule 3a4-1, which sets forth those conditions under which a person associated with an issuer may participate in the offering of the issuer’s securities and not be deemed to be a broker-dealer.

a. Our officer and director are not subject to a statutory disqualification, as that term is defined in Section 3(a)(39) of the Act, at the time of their participation; and,

b. Our officer and director will not be compensated in connection with their participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities; and

c. Our officer and director are not, nor will be at the time of their participation in the offering, an associated person of a broker-dealer; and

d. Our officer and director meet the conditions of paragraph (a)(4)(ii) of Rule 3a4-1 of the Exchange Act, in that they (A) primarily perform, or is intended primarily to perform at the end of the offering, substantial duties for or on behalf of our Company, other than in connection with transactions in securities; and (B) is not a broker or dealer, or been an associated person of a broker or dealer, within the preceding twelve months; and (C) has not participated in selling and offering securities for any Issuer more than once every twelve months other than in reliance on Paragraphs (a)(4)(i) or (a)(4)(iii).

Our officer, director, control persons and affiliates of same do not intend to purchase any shares in this offering.

Terms of the Offering

The Shares offered by the Company will be sold at the fixed price of $0.001 per share until the completion of this Offering. There is a $500 minimum subscription required per investor, and subscriptions, once received, are irrevocable.

This Offering commenced on the date the registration statement was declared effective (which also serves as the date of this prospectus) and continues for a period of 270 days, unless we extend the Offering period for an additional 90 days, or unless the offering is completed or otherwise terminated by us (the “Expiration Date”).

This Offering has no minimum and, as such, we will be able to spend any of the proceeds received by us.

Offering Proceeds

We will be selling all of the 30,000,000 shares of common stock we are offering as a self-underwritten Offering. There is no minimum amount we are required to raise in this offering and any funds received will be immediately available to us.

Procedures and Requirements for Subscription

If you decide to subscribe for any Shares in this Offering, you will be required to execute a Subscription Agreement and tender it, together with a check or certified funds to us. Subscriptions, once received by the Company, are irrevocable. All checks for subscriptions should be made payable to “Sunchip Technology, Inc.”.

Right to Reject Subscriptions

We have the right to accept or reject subscriptions in whole or in part, for any reason or for no reason. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions. Subscriptions for securities will be accepted or rejected within 48 hours after we receive them.

PRINCIPAL STOCKHOLDERS

The following table sets forth, as of the date of this prospectus, the total number of shares owned beneficially by our sole officer and director, and key employees, individually and as a group, and the present owners of 5% or more of our total outstanding shares. The stockholder listed below has direct ownership of her shares and possesses sole voting and dispositive power with respect to the shares.

| | | | | | |

| | | | Number of | | Percentage |

Title of Class | | Name | | Shares Owned | | of Shares(1) |

Shares of Common Stock | | Ilyssa Suarez (2) | | 90,000,000 | | 100% |

| | 2501 East Aragon Blvd, Unit 1 | | | | |

| | Sunrise, FL 33313 | | | | |

(1) Based on 90,000,000 shares outstanding as of August 31, 2013.

(2) The person named above may be deemed to be a “parent” and “promoter” of our company, within the meaning of such terms under the Securities Act of 1933, Ilyssa Suarez is the only “parent” and “promoter” of the company.

For the period ended August 31, 2013, a total of 90,000,000 shares of common stock were issued to our sole officer and director, all of which are restricted securities, as defined in Rule 144 of the Rules and Regulations of the SEC promulgated under the Securities Act. Under Rule 144, the shares can be publicly sold, subject to volume restrictions and restrictions on the manner of sale, commencing one year after their acquisition. Under Rule 144, a shareholder can sell up to 1% of total outstanding shares every three months in brokers’ transactions. Note that the resale of shares sold in a 144(i), clarifies that holders of securities of shell companies may not use Rule 144 for resales until 12 months after the company has reported Form 10 information reflecting the company’s status as no longer being a shell Company Shares purchased in this offering, which will be immediately resalable, and sales of all of our other shares after applicable restrictions expire, could have a depressive effect on the market price, if any, of our common stock and the shares we are offering.

Our sole officer and director will continue to own the majority of our common stock after the offering, regardless of the number of shares sold. Since she will continue control our company after the offering, investors in this offering will be unable to change the course of our operations. Thus, the shares we are offering lack the value normally attributable to voting rights. This could result in a reduction in value of the shares you own because of their ineffective voting power. None of our common stock is subject to outstanding options, warrants, or securities convertible into common stock.

- 20 -

The company is hereby registering 30,000,000 of its common shares, in addition to the 90,000,000 shares currently issued and outstanding. The price per share is $0.001 (please see “Plan of Distribution” above).

The 90,000,000 shares currently issued and outstanding were acquired by our sole officer and director for the period ended August 31, 2013. We issued a total of 90,000,000 common shares for consideration of $9,000, which was accounted for as a purchase of common stock. The Company received $9,000 cash.

DESCRIPTION OF SECURITIES

Common Stock

The authorized common stock is five hundred million (700,000,000) shares with a par value of $0.0001. Shares of our common stock:

| | |

| · | have equal ratable rights to dividends from funds legally available if and when declared by our Board of Directors; |

| | |

| · | are entitled to share ratably in all of our assets available for distribution to holders of common stock upon liquidation, dissolution or winding up of our affairs; |

| | |

| · | do not have preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights; and |

| | |

| · | are entitled to one non-cumulative vote per share on all matters on which stockholders may vote. |

We refer you to our Bylaws, our Articles of Incorporation, and the applicable statutes of the State of Florida for a more complete description of the rights and liabilities of holders of our securities.

Non-Cumulative Voting

Holders of shares of our common stock do not have cumulative voting rights, which means that the holders of more than 50% of the outstanding shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in that event, the holders of the remaining shares will not be able to elect any of our directors. After this offering is completed, present stockholders will own approximately 76% of our outstanding shares.

Cash Dividends

As of the date of this Prospectus, we have not declared or paid any cash dividends to stockholders. The declaration of any future cash dividend will be at the discretion of our Board of Directors and will depend upon our earnings, if any, our capital requirements and financial position, our general economic conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

INTEREST OF NAMED EXPERTS AND COUNSEL

No expert or counsel named in this Prospectus as having prepared or certified any part thereof or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of our common stock was employed on a contingency basis or had or is to receive, in connection with the offering, a substantial interest, directly or indirectly, in us. Additionally, no such expert or counsel was connected with us as a promoter, managing or principal underwriter, voting trustee, director, officer or employee.

Wilson Campilongo, LLP, 12881 Low Hills Rd, Nevada City, CA 95959, has passed upon certain legal matters in connection with the validity of the issuance of the shares of common stock.

Messineo & Co., CPAs, LLC, Certified Public Accountant, at 2451 North McMullen Booth Road, Suite 308, Clearwater, FL 33759, 727-444-0931 has audited our Financial Statements for the period August 1, 2013 (date of inception) through August 31, 2013 and to the extent set forth in its report, which are included herein in reliance upon the authority of said firm as experts in accounting and auditing. There were no disagreements related to accounting principles or practices, financial statement disclosure, internal controls or auditing scope or procedure from date of appointment as our independent registered accountant through the period of audit inception August 1, 2013 through August 31, 2013.

- 21 -

BUSINESS DESCRIPTION

We were incorporated in the State of Florida on August 1, 2013, as a for-profit company with a fiscal year end of August 31.

We have not accomplished any of our intended efforts to date. We have not generated any revenues to date and our activities have been limited to the completion of our business and financial plan. We will not have the necessary capital to develop our Business Plan until we are able to secure additional financing. There can be no assurance that such financing will be available on suitable terms. Please see “Risk Factors” elsewhere in this Prospectus for full discussion on this potential business risk.

We have no plans to change our business activities or to combine with another business and are not aware of any events or circumstances that might cause us to change our plans. We have no revenues, have incurred losses since inception, have no operations, have been issued a going concern opinion from our auditors and rely upon the sale of our securities to fund operations.

We have not established a schedule for the completion of specific tasks or milestones contained in our business plan. With the clear exception of the costs associated with this offering ($5,000) virtually all aspects of our business plan are scalable in terms of size, quality, and effectiveness, and the timing of their execution must be concurrent or near concurrent and progressive over a eighteen month period. We anticipate that we will require $900,000 in order to generate significant revenues within an 18 month period, subsequent to this $30,000 offering.

Sunchip Technology, Inc. has not started the product development. The Company does not have any products, customers and has not generated any revenues. The Company must develop the product and attract customers before it can start generating revenues.

Sunchip Technology, Inc. (“SC”) is a application software service company that intends to provide proximity location information to businesses about their consumers on their premise by using WiFi technology. The application-based software consists of programs for detecting consumer access to WiFi hotspots as well as the analytics to provide detailed reports on consumers location, entry time, exit time, duration, etc. The benefit of the application software is that businesses can use the analytics to assist in customer service to drive additional revenues, address any customer questions, and make sure the store is adequately staffed by department to address consumer needs and questions. The benefit to the consumer is that they can use the WiFi hotspots for free for item information and reviews, price comparisons, and other general store inquiries.

Market Overview

To date, indoor location solutions have come with limited accuracy or high cost. Wireless networking solutions can calculate location using data from WiFi access points (APs), but technology limitations, multipath, and physical obstructions such as shelving decrease accuracy to a point where it does not meet most business requirements. Other indoor location solutions such as RFID, Bluetooth, or Zigbee are only financially viable in niche application scenarios because they require the purchase and installation of expensive infrastructure.

WiFi has grown exponentially over the last ten years, moving from a technology that was once thought of as primarily a productivity enhancement for vertical industries to one now pervasive throughout society. The wide-spread acceptance of Wi-Fi networks has fueled this dramatic adoption, from deployments in offices, retail stores, and distribution centers. Maturing rapidly and reaching critical mass, this widespread adoption has driven down the cost of wireless infrastructure dramatically and has resulted in the availability of higher quality equipment at lower cost.

The rapid increase in the adoption rate of Wi-Fi coupled with the availability of high quality infrastructure at reasonable cost are key factors behind the flurry of activity regarding Wi-Fi location-based services.

It is not difficult to understand why this is so. With integrated location tracking, corporate wireless LANs become much more valuable as a corporate business asset. This is especially true in today’s fast-paced and highly competitive marketplace, where an otherwise well-positioned enterprise may falter against its peers not because of a lack of necessary assets, but rather due to its inability to quickly locate and re-deploy those assets to address today’s rapidly changing business climate. Corporate network administrators, security personnel, users, asset owners and others have expressed great interest in location-based services to allow them to better address key issues in their environments, such as the following:

- 22 -

| |

· | The need to quickly and efficiently locate valuable assets and key personnel. |

| |

· | Improving productivity via effective asset and personnel allocation. |

| |

· | Improving customer satisfaction by rapid location of critical service-impacting assets. |

Product Overview

Background

More and more companies are faced with increasing challenges to compete with online retailers on price, quality, and customer experience. Companies are searching for ways to increase sales, lower expenses while maintaining quality customer service. Businesses need to understand where their customers are, what departments they are in, how long they are there, and where the employee resources are located to service the customers’ needs and inquiries. Corporate networks with WiFi and mobile devices help solve these business questions and needs. WiFi networks can provide consumers Internet access to improve their shopping experience while also providing the business detailed analytics about the consumer’s location and dwell times in the store. This helps business managers allocate resources to assist customers with the shopping experience, improve customer service, and ultimately drive more revenues.

Sunchip Solution (SC-Locate & SC-Analytics)

SC-Locate delivers real-time location information with department-level accuracy for people carrying any mobile device. After being deployed in retail stores, SC-Locate technology provides micro-location data to:

| |

· | Give store leadershipvisibility into shopping patterns at each store |

| |

· | Help managers use sales associates more efficiently bytracking the location of employees equipped with mobile devices |

| |

· | Powerlocation-based mobile shopping applications |

SC-Locate: the first micro-location technology that is accurate, real-time, and affordable. The SC-Locate solution can track location within zones from three to ten meter using data from infrastructure that retailers already have in place. There are no sensors or beacons to install. There is no software that must be deployed to thousands of wireless access points. Just install the software in the store and the solution is up and running quickly, and are ready to go.

Sunchip Technology’s key goal is to attract, engage and grow the customer base. Also, Sunchip allows the business to gain unprecedented insight into customers’ in-store and online browsing behavior. For the first time, accurately answer:

| |

· | How many first time customers did a local TV spot, coupon or event generate to drive them in store? |

| |

· | What percentage of these first time customers returned over time? |

| |

· | How many times does a customer return? |

| |

· | What is the lifetime value of these first time customers? |

SC-Analytics provides web based analytics to key management, executives, and store managers. The analytics will provide the following:

| |

· | A complete picture of customer shopping patterns across all departments. SC-Analytics will link in-store activities with guest WiFi analytics, in real-time. |

| |

· | Role-based views, giving retailers full control over access to and ownership of data. SC-Locate proves a standard API to incorporate multichannel shopping data into enterprise business intelligence. |

- 23 -

Solution Benefits

| |

· | Flexible technologies to suit all needs: the SC-Locate intends to provide multiple capabilities from real-time location to presence detection, dwell times, room and sub-room location detection. The Company’s solutions bring together CDMA, GSM, UTMS, and LTE wireless technologies with a single Wi-Fi platform. |

| |

· | Standard Wi-Fi infrastructure:SC-Locate utilizes standard wireless networks for its communications protocol, keeping the infrastructure cost low and enabling enterprises to gain more benefit from their existing WiFi. |

| |

· | Visibility of any valuable asset: Tracks the location and status of all mobile devices that can be used to track customers and employees. |

| |

· | Business-class application platform for real-time analytics:SC intends to create real-time visibility at the enterprise, store, department level of customer tracking, alerting and reporting, as well as an integration platform for delivering location-based services. SC-Locate turns location information from any source into everyday business value. |

SALES & DISTRIBUTION

Sunchip Technology plans to market the products and solutions both direct via our own sales force and indirectly via partners. The Company intends to hire key sales personnel to sell directly to major accounts like Costco, Wal-Mart, Walgreens. For other accounts in the retail space, the Company will build strategic and OEM partnerships to market, sell, and manage those accounts.

MARKET OPPORTUNITY

According to the US Bureau of Economic Analysis (BEA), consumer spending in Q2 2013 was $10,690 billion. The consumer spending has increased 827 billion over the last 30 months or 3.23% annually.

Today, more and more consumers are using mobile devices for purchasing goods and services. According to eMarketer, consumers using mobile devices will spend over $41 billion this year (2013) and will increase to over $100 billion by 2017.

- 24 -

eMarketer believes mobile devices contribute to overall commerce sales growth in two ways, both as a driver of total sales, as more consumers make purchases on their smartphones and tablets, and, increasingly, as a shopping research tool, driving consumers into stores or back to desktops where they complete transactions. Source: www.emarketer.com/Article/Mobile-Devices-Boost-US-Holiday-Ecommerce-Sales-Growth/1010189#D87eZlhtsoHoh4z2.99

In addition to sales, retailers are also looking to use mobile technology to assist with supporting sales and customer service. Consumers are always looking for assistance with product information, directions, recommendations and other customer services. In the grocery business, having sales and customer service people available to address customer inquiries is very important. eMarketer projected in April that US ecommerce retail sales of food and beverage products, of which groceries are a part, would grow from $5.8 billion in this year (2013) to $11 billion in 2017 (source: www.emarketer.com/Article/Grocery-Retailers-Embrace-Multichannel-Tech-tools/1010164#oEh8XET09EdJilqX.99). The workforce management is over 37% of the core use of mobile technology in the grocery stores.

- 25 -

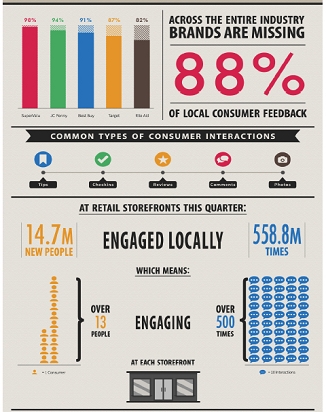

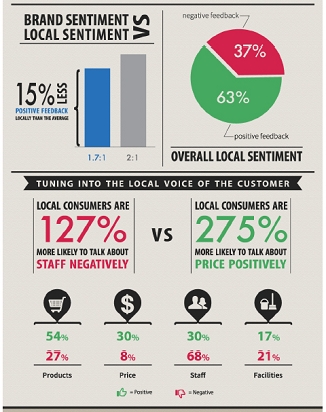

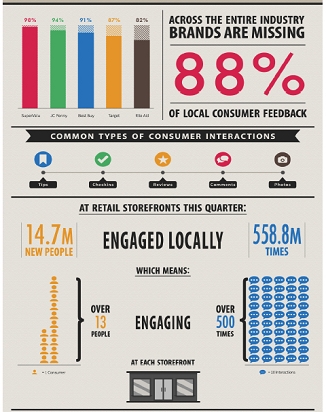

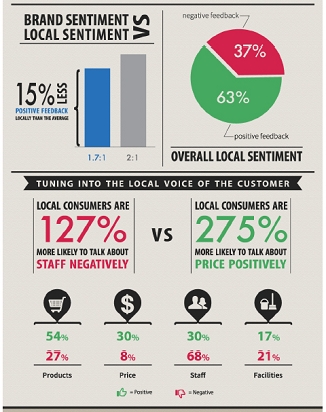

Retailer are always looking for customer feedback to improve the customer experience, retain customer loyalty, and generally understand what they are doing right and wrong. Although customer feedback is essential, it’s rarely obtained. According to The LBMA research, 88% of retailers do NOT get any local customer feedback. In addition, according to the same research, 127% of the consumers are likely to comment “negatively” on the retailer’s workforce. This present a major problem for retailers which they are seeking solutions to help fix.

Source: http://www.thelbma.com/research/54/study-14-7-million-people-engaged-locally-with-retail-brands-in-q4/

Retailers need to engage the consumer when they are in the store. They need to build brand loyalty, make the shopping experience easy and efficient. They must recognize that consumers will use their mobile devices to find the best value and price. Those retail stores that welcome mobile technology will benefit greatly.

According to Deloitte, LLP, mobile-influenced retail store sales such as product research, price comparison or mobile app use will account for 5.1% of retail store sales over the holidays. Ms. Paul from Deloitte says that “Retailers that welcome the smartphone shopper in their stores with mobile apps and Wi-Fi access—rather than fear the showrooming effect—can be better positioned to accelerate their in-store sales this holiday season.” (Showrooming refers to consumers checking out products inside stores before buying online from other retailers (source: http://www.internetretailer.com/2012/09/26/web-and-other-non-store-holiday-sales-will-increase-15-17).

Competition

The market for inside location is a competitive market. There are large organizations like Cisco that provide these solutions that consist of hardware, software and services. Cisco solutions are more targeted for asset tracking and inventory management and they like to target large warehouse customers. There are also smaller competitors like Digby, Loc-Aid, and IndoorLBS. These companies target smaller retail stores and are the primary competition. They use either the mobile device’s resource to access the GPS for location which requires a consumer application and their consent. Others like LocAid use the carrier’s cellular network with is expense and time consuming. In addition, there are more specialized companies that market and sell location-based services and asset tracking solutions that are specific to an industry, geography, or unique business need. Sunchip does not anticipate competition from these players since their solutions are very specific, however, these competitors can always expand their offerings and could become competitive to the Company at a later time.

- 26 -

The Company believes that a software only solution that can easily integrate with the retailer’s existing infrastructure to provide the location information of customers while offering them WiFi access for their mobile device is our core value proposition. In addition, the software will include analytics to report on the customers entrance, exit, movement in store, dwell times, first time/repeat customers,etc. The company believes that when you couple the software only solution along with deep analytics functionality and offer that at a competitive price, the Company has the right product offering to build a profitable business.

Although the Company believes that it will offer a compelling value proposition to differentiate itself from competitors, the Company will face competitive challenges because the Company has not developed the product, does not have any revenues, and lacks the necessary capital to fund operations. The Company must overcome these challenges to be successful in the marketplace.

Employees and Employment Agreements

As of August 31, 2013, we have no employees other than Ms. Suarez, our sole officer and director. Ms. Suarez has the flexibility to work on our business up to 25 to 30 hours per week. She is prepared to devote more time to our operations as may be required and we do not have any employment agreements with her.

We do not presently have pension, health, annuity, insurance, stock options, profit sharing, or similar benefit plans; however, we may adopt plans in the future. There are presently no personal benefits available to our sole director and officer.

During the initial implementation of our business plan, we intend to hire independent consultants to assist in the development and execution of our business operations.

Government Regulations

We are unaware of and do not anticipate having to expend significant resources to comply with any local/ state and governmental regulations of the market. We are subject to the laws and regulations of those jurisdictions in which we plan to offer our services’ which are generally applicable to business operations, such as business licensing requirements, income taxes and payroll taxes. In general, the development and operation of our business is not subject to special regulatory and/or supervisory requirements.

Intellectual Property

We do not currently hold rights to any intellectual property and have not filed for copyright or trademark protection for our name or intended website.

Research and Development

Since our inception to the date of this Prospectus, we have not spent any money on research and development activities.

Reports to Security Holders

We intend to furnish annual reports to stockholders, which will include audited financial statements reported on by our Certified Public Accountants. In addition, we will issue unaudited quarterly or other interim reports to stockholders, as we deem appropriate or required by applicable securities regulations.

Any member of the public may read and copy any materials filed by us with the Securities and Exchange Commission at the Securities and Exchange Commission’s Public Reference Room at 100 F Street, N.E. Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the Securities and Exchange Commission at 1-800-732-0330. The Securities and Exchange Commission maintains an internet website (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Securities and Exchange Commission.

DESCRIPTION OF PROPERTY

As our office space needs are limited at the current time, we are currently operating out of our sole director and officer’s office located at 2501 East Aragon Blvd, Unit 1, Sunrise, FL 33313. This space usage is donated free of charge by our sole director and officer.

- 27 -

LEGAL PROCEEDINGS

We know of no materials, active or pending legal proceedings against us, nor are we involved as a plaintiff in any material proceedings or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any beneficial shareholder are an adverse party or has a material interest adverse to us.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market Information

Our common stock is not traded on any exchange. We intend to apply to have our common stock quoted on the OTC Bulletin Board once this Prospectus has been declared effective by the SEC; however, there is no guarantee that we will obtain a listing.

There is currently no trading market for our common stock and there is no assurance that a regular trading market will ever develop. OTC Bulletin Board securities are not listed and traded on the floor of an organized national or regional stock exchange. Instead, OTC Bulletin Board securities transactions are conducted through a telephone and computer network connecting dealers. OTC Bulletin Board issuers are traditionally smaller companies that do not meet the financial and other listing requirements of a regional or national stock exchange.

To have our common stock listed on any of the public trading markets, including the OTC Bulletin Board, we will require a market maker to sponsor our securities. We have not yet engaged any market maker to sponsor our securities, and there is no guarantee that our securities will meet the requirements for quotation or that our securities will be accepted for listing on the OTC Bulletin Board. This could prevent us from developing a trading market for our common stock.

Holders

As of the date of this Prospectus there were 1 holders of record of our common stock.

Dividends

To date, we have not paid dividends on shares of our common stock and we do not expect to declare or pay dividends on shares of our common stock in the foreseeable future. The payment of any dividends will depend upon our future earnings, if any, our financial condition, and other factors deemed relevant by our Board of Directors.

Equity Compensation Plans

As of the date of this Prospectus we did not have any equity compensation plans.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

This section of the prospectus includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: “believe”, “expect”, “estimate”, “anticipate”, “intend”, “project” and similar expressions, or words that, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this prospectus. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions.

Our financial statements are stated in United States Dollars (USD or US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. All references to “common shares” refer to the common shares in our capital stock.

Overview

We are a development-stage company, incorporated in the State of Florida on August 1, 2013, as a for-profit company, and an established fiscal year of August 31. We have not yet generated or realized any revenues from business operations. Our auditor has issued a going concerned opinion. This means there is substantial doubt that we can continue as an on-going business for the next eighteen (18) months unless we obtain additional capital to pay our bills. Accordingly, we must raise cash from other sources other than loans we undertake.

- 28 -

From inception (August 1, 2013) through August 31, 2013, our business operations have primarily been focused on developing our business plan. We have spent a total of approximately $3,100 on general expenses, legal, accounting and SEC filing costs. We have not generated any revenue from business operations. All cash held by us is the result of the sale of common stock to our sole director and officer and 11 accredited, non-affiliated investors.

The proceeds from this offering will satisfy our cash requirements for up to 12 months. If we are unable to raise additional monies, we only have enough capital to cover the costs of this offering and to begin implementing the business plan. The expenses of this offering include the preparation of this prospectus, the filing of this registration statement and transfer agent fees and developing the business plan. As of August 31, 2013 we had $5,900 cash on hand.

Plan of Operations

We anticipate that the $30,000 we intend to raise in this offering will be sufficient to enable us to develop the retail consumer location based service prototype and sustain our basic operations. Efforts will be proportional to funds raised to achieve these results. Raising less than the $30,000 will decrease funds for the product development. The first money raised, of course, will be set aside and used for meeting our reporting requirements to the Securities Exchange Commission and the State of Florida.

Our business plan and allocation of proceeds will vary to accommodate the amount of proceeds raised by the sale of securities hereunder and through other financing efforts. The Use of Proceeds table shows an increase in funds allocated to each category of expenses under our business plan somewhat in proportion to the percentage of shares sold (whether 33%, 50%, 75% or 100%). Initially, we intend to develop the prototype retail shopping application. We intend to interview technical consultants in the development of the prototype, but would not engage these technical consultants unless and until sufficient funds were raised. Initially, Ms. Suarez will provide her office computer and equipment at no cost. However, we estimate that we will require as much as $900,000 ($900,000 in addition to the maximum of $30,000 that we are seeking to raise through this offering) in order to establish operations of a sufficient size and quality to ensure the competitiveness of our business and to generate significant revenues to support an office outside Ms. Suarez’s residential office. Nevertheless, if our potential to raise capital appears exhausted, our management may decide to modify our business plan on a reduced scale and quality. A decision by management to implement our business plan on a reduced scale and quality may occur at any juncture during the early stages of our business development, whether we have raised 35%, 50%, 75% or 100% of the proceeds that we will be seeking to raise through this offering.

If we sell all the shares in this offering, we believe we have adequate funds to satisfy our basic working capital requirements for the next twelve months. However, beyond this period, we will need to raise additional capital to continue our operations. During the 18 months following the completion of this offering, we intend to implement our business and marketing plan. We believe we must raise an additional $900,000 (in addition to this $30,000 capital raise) to pay for expenses associated with our development over the next 18 months. $900,000 (in addition to this $30,000 capital raise) will be used to finance anticipated activities.

As of August 31, 2013, we had cash on hand of $5,900.

During the next eighteen months we intend to develop a retail oriented consumer location based service offering to promote and sell to retailers in the US. Retailers are loosing sales to online sites because of poor service and higher prices. The market is looking for new solutions to assist the retailer with helping them make the consumer experience in the store more rewarding, find more products to buy, easier to get questions addressed, and improve the overall shopping experience. These goals help the retailer build and/or expand customer loyalty and brand awareness.

The following description of our business is intended to provide an understanding of our company and the direction of our strategy.

Sunchip Technology, Inc. was founded to provide retailers important information about consumers in their stores so that the retailer can better service and support the customer’s shopping experience. The better the customer experience, the more items the shopper will buy and in return generate more revenue for the retailer. In addition, it builds brand loyalty. Sunchip’s solutions provide the retailer real-time information on the whereabouts of their consumers in the store. The Company intends to provide the retailer extensive analytics to allow them to make critical business decisions on workforce management and customer service.

The Company plans to develop and release the product offering functionality in stages for potential customers. The first stage is the consumer location aware software. The second stage is to add the analytics so that retail management can use the location data to make important decisions. The first and second stage are expected to be completed in twelve (12) and eighteen (18) months respectively after product development starts which is contingent on the subsequent financing of $900,000. If and when the offerings are launched, the Company plans re-evaluate the market and determine future product/service offerings.

- 29 -

During product development, the Company plans to create a product prototype to show and attract customers and is expected to be completed within six (6) to nine (9) months after this capital of $30,000 is secured. Although the Company plans to use the prototype to attract customers, the Company does not expect to start generating revenues until twelve (12) months after the successful completion of this offering and launch of the service offering. The timeline for the prototype is subject to change and is based on securing the necessary financing and retaining qualified resources for the product development.

Opportunity / Benefits

US retail sales continue to grow year over year and are currently in the month of August 2013 are $380.69 Billion (source: http://ycharts.com/indicators/retail_sales). Retailers with storefronts are constantly competing with online retailers like Amazon.com and other online only companies. The storefront retailers realize that they need to compete on value and service. Therefore, they must adopt new solutions to better service the customer while maintaining competitive prices. Consumers love their mobile devices and the combination of providing consumers free WiFi while shopping helps the retailer because they can use the WiFi technology to monitor the consumer’s presence in the store. This allows the retailer to make better decisions to assist the consumer during the shopping experience. Sunchip Technology intends to provide location based services to help the retailer monitor the consumers presence and better serve the consumer during the store visit. The retailers improved customer service will not only satisfy the consumer demands and requests, but it will make the shopping experience much more enjoyable and build more customer loyalty.

Since inception, we have incurred a net loss of approximately $3,100.

We believe that it will cost approximately $900,000 (subsequent to the $30,000 capital raise) to execute the business plan. There can be no assurance that we will be able to secure financing or if offered that it will be on terms acceptable to us. In the event we are unable to secure adequate financing we will not be able to develop the business.

We intend to pursue capital through public or private financing in order to finance our businesses activities. We cannot guarantee that additional funding will be available on favorable terms, if at all. If adequate funds are not available, then our ability to continue our operations may be significantly hindered.

We have not yet begun the development of any of our product development and even if we do secure adequate financing, there can be no assurance that our products will be accepted by the marketplace and that we will be able to generate revenues. Our management does not plan to hire any employees at this time. Our sole officer and director will be responsible for the business plan development.

Results of Operations

There is no historical financial information about us upon which to base an evaluation of our performance. We have incurred expenses of $3,100 on our operations as of August 31, 2013 and our only other activity consisted of the sale of 90,000,000 shares of our common stock to our sole director and officer for aggregate proceeds of $9,000.

We have not generated any revenues from our operations. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including the financial risks associated with the limited capital resources currently available to us for the implementation of our business strategies. (See “Risk Factors”). To become profitable and competitive, we must develop the business plan and execute the plan. Our management will attempt to secure financing through various means including borrowing and investment from institutions and private individuals.

Since inception, the majority of our time has been spent refining its business plan and preparing for a primary financial offering.

Our results of operations are summarized below:

| | | | |

| | August 1, 2013

(Inception) To | |

| | August 31, 2013 | |

Revenue | | | — | |

Cost of Revenue | | | — | |

Expenses | | $ | 3,100 | |

Net Loss - | | $ | 3,100 | |

Net Loss per Share - Basic and Diluted | | | (0.00 | ) |

Weighted Average Number Shares Outstanding - Basic and Diluted | | | 90,000,000 | |

- 30 -

Liquidity and Capital Resources

As of the date of this prospectus, we had yet to generate any revenues from our business operations. For the period ended August 31, 2013, we issued 90,000,000 shares of common stock to our sole officer and director for cash proceeds of $9,000.

Our current cash on hand is $5,900, which will be used to meet our current obligations. However, our current cash is not sufficient to meet the new obligations associated with being a company that is fully reporting with the SEC. Based on our disclosure above under “Use of Proceeds,” we anticipate that any level of capital raised above 50% will allow us minimal operations for a eighteen month period while meeting our state and SEC required compliance obligations. Nonetheless, even the sale of 100% of the securities in this offering will not provide sufficient capital to fully implement the business plan, but it will provide for vetting of the business plan to support pursuing investment capital.

We anticipate needing $900,000 (subsequent to this $30,000 capital raise) in order to effectively execute our business plan over the next eighteen months. Currently available cash is not sufficient to allow us to commence full execution of our business plan. Our business expansion will require significant capital resources that may be funded through the issuance of common stock or of notes payable or other debt arrangements that may affect our debt structure. Despite our current financial status we believe that we may be able to issue notes payable or debt instruments in order to start executing our business plan. However, there can be no assurance that we will be able to raise money in this fashion and have not entered into any agreements that would obligate a third party to provide us with capital.

Through August 31, 2013, we spent $3,100 on general and administrative operating expenses. We raised the cash amounts of $9,000 to be used in these activities from the sale of common stock to our sole officer and director. We currently have no accrued liabilities and working capital of $5,900.

To date, the Company has managed to keep our monthly cash flow requirement low for two reasons. First, our sole officer does not draw a salary at this time. Second, the Company has been able to keep our operating expenses to a minimum by operating in space owned by our sole officer.

As of the date of this registration statement, the current funds available to the Company will not be sufficient to continue maintaining a reporting status. Management believes if the Company cannot maintain its reporting status with the SEC it will have to cease all efforts directed towards the Company. As such, any investment previously made would be lost in its entirety.

The Company currently has no external sources of liquidity such as arrangements with credit institutions or off-balance sheet arrangements that will have or are reasonably likely to have a current or future effect on our financial condition or immediate access to capital.

The Sole director and officer has made no written commitments with respect to providing a source of liquidity in the form of cash advances, loans and/or financial guarantees.

If the Company is unable to raise the funds partially through this offering the Company will seek alternative financing through means such as borrowings from institutions or private individuals. There can be no assurance that the Company will be able to keep costs from being more than these estimated amounts or that the Company will be able to raise such funds. Even if we sell all shares offered through this registration statement, we expect that the Company will seek additional financing in the future. However, the Company may not be able to obtain additional capital or generate sufficient revenues to fund our operations. If we are unsuccessful at raising sufficient funds, for whatever reason, to fund our operations, the Company may be forced to seek a buyer for our business or another entity with which we could create a joint venture. If all of these alternatives fail, we expect that the Company will be required to seek protection from creditors under applicable bankruptcy laws.

Our independent auditor has expressed doubt about our ability to continue as a going concern and believes that our ability is dependent on our ability to implement our business plan, raise capital and generate revenues. See Note 2 of our financial statements.

Recent Federal legislation, including the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity of the corporate management and the securities markets. Some of these measures have been adopted in response to legal requirements. Others have been adopted by companies in response to the requirements of national securities exchanges, such as the NYSE or The NASDAQ Stock Market, on which their securities are listed. Among the corporate governance measures that are required under the rules of national securities exchanges are those that address board of directors’ independence, audit committee oversight, and the adoption of a code of ethics. Our Board of Directors is comprised of one individual who is also our executive officer. Our executive officer makes decisions on all significant corporate matters such as the approval of terms of the compensation of our executive officer and the oversight of the accounting functions.

- 31 -

Although the Company has adopted a Code of Ethics and Business Conduct the Company has not yet adopted any of these other corporate governance measures and, since our securities are not yet listed on a national securities exchange, the Company is not required to do so. The Company has not adopted corporate governance measures such as an audit or other independent committees of our board of directors as we presently do not have any independent directors. If we expand our board membership in future periods to include additional independent directors, the Company may seek to establish an audit and other committees of our board of directors. It is possible that if our Board of Directors included independent directors and if we were to adopt some or all of these corporate governance measures, stockholders would benefit from somewhat greater assurances that internal corporate decisions were being made by disinterested directors and that policies had been implemented to define responsible conduct. For example, in the absence of audit, nominating and compensation committees comprised of at least a majority of independent directors, decisions concerning matters such as compensation packages to our senior officer and recommendations for director nominees may be made by a majority of directors who have an interest in the outcome of the matters being decided. Prospective investors should bear in mind our current lack of corporate governance measures in formulating their investment decisions.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our stockholders.

Inflation

The effect of inflation on our revenues and operating results has not been significant.

Significant Accounting Policies

Our financial statements are affected by the accounting policies used and the estimates and assumptions made by management during their preparation. A complete listing of these policies is included in Note 3 of the notes to our financial statements for the year ended August 31, 2013. We have identified below the accounting policies that are of particular importance in the presentation of our financial position, results of operations and cash flows, and which require the application of significant judgment by management.

The Company has elected to use the extended transition period for complying with new or revised financial accounting standards available under Section 102(b)(2)(B) of the Act. Among other things, this means that the Company’s independent registered public accounting firm will not be required to provide an attestation report on the effectiveness of the Company’s internal control over financial reporting so long as it qualifies as an emerging growth company, which may increase the risk that weaknesses or deficiencies in the internal control over financial reporting go undetected. Likewise, so long as it qualifies as an emerging growth company, the Company may elect not to provide certain information, including certain financial information and certain information regarding compensation of executive officers, that would otherwise have been required to provide in filings with the SEC, which may make it more difficult for investors and securities analysts to evaluate the Company. As a result, investor confidence in the Company and the market price of its common stock may be adversely affected.

Use of Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Research and Development Expenses: Expenditures for research and development will be expensed as incurred.

Earnings (Loss) Per Share: Basic loss per share is computed by dividing net loss attributable to common stockholders by the weighted average common shares outstanding for the period. Diluted loss per share is computed giving effect to all potentially dilutive common shares. Potentially dilutive common shares may consist of incremental shares issuable upon the exercise of stock options and warrants and the conversion of notes payable to common stock. In periods in which a net loss has been incurred, all potentially dilutive common shares are considered antidilutive and thus are excluded from the calculation. At August 31, 2013 the Company did not have any potentially dilutive common shares.

- 32 -

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING

AND FINANCIAL DISCLOSURE

Messineo & Co., CPAs, LLC has audited our Financial Statements for the period from August 1, 2013 (date of inception) through August 31, 2013 and to the extent set forth in its report, which are included herein in reliance upon the authority of said firm as experts in accounting and auditing. There were no disagreements related to accounting principles or practices, financial statement disclosure, internal controls or auditing scope or procedure during the two fiscal years and interim period.

CODE OF BUSINESS CONDUCT AND ETHICS

On September 16, 2013 we adopted a Code of Ethics and Business Conduct which is applicable to our employees and which also includes a Code of Ethics for our CEO and principal financial officer and persons performing similar functions. A code of ethics is a written standard designed to deter wrongdoing and to promote

| | |

| · | honest and ethical conduct, |

| | |

| · | full, fair, accurate, timely and understandable disclosure in regulatory filings and public statements, |

| | |

| · | compliance with applicable laws, rules and regulations, |

| | |

| · | the prompt reporting violation of the code, and |

| | |

| · | accountability for adherence to the code. |

A copy of our Code of Business Conduct and Ethics has been filed with the Securities and Exchange Commission as an exhibit to this S-1 filing. Any person desiring a copy of the Code of Business Conduct and Ethics, can obtain one by going to Edgar and looking at the attachments to this S-1 filing.

MANAGEMENT

Officer and Director

Our sole officer and director will serve until her successor is elected and qualified. Our officers are elected by the board of directors to a term of one (1) year and serve until their successor is duly elected and qualified, or until they are removed from office. The board of directors has no nominating, auditing or compensation committees.

The name, address, age and position of our president, secretary/treasurer, and director and vice president is set forth below:

| | | | |

NAME AND ADDRESS | | AGE | | POSITION(S) |

Ilyssa Suarez 2501 East Aragon Blvd, Unit 1 Sunrise, FL 33313 | | | | President, Secretary/ Treasurer, Principal Executive Officer, Principal Financial Officer and sole member of the Board of Directors |

The person named above has held her offices/positions since the inception of our company and is expected to hold her offices/positions until the next annual meeting of our stockholders.

Business Experience

ILYSSA SUAREZ, SOLE OFFICER AND DIRECTOR

Ms. Suarez is our CEO and President and has served as our sole officer and director since August 1, 2013. Ms. Suarez started her career as a Test Equipment Design Engineer with Motorola Mobility in 2009 and served until 2012. In August of 2012, Ms. Suarez left Motorola Mobility. In January, 2013 she joined CrossMatch Technologies.

Ms. Suarez earned a Bachelor of Science in Mechanical Engineering from the University of Florida in 2009, and also working on an MBA, Concentration in Operations Management from Florida Atlantic University and is expected to complete her MBA in December 2014.

- 33 -

Currently Ms. Suarez devotes approximately 25-30 hours per week for the Company. The balance of her time is spent at her current employer CrossMatch Technologies.

CONFLICTS OF INTEREST

As of August 31, 2013, we have no employees. Ms. Suarez, our CEO, President, Sole officer and director, currently devotes 25 to 30 hours per week to our business as required from time to time without compensation. We have not entered into any formal agreement with Ms. Suarez regarding the provision of her services to the Company.

Ms. Suarez is not obligated to commit her full time and attention to our business and accordingly, she may encounter a conflict of interest in allocating her time between our operations and those of other businesses. Presently, Ms. Suarez earns her livelihood as a Operational Engineer at CrossMatch Technologies.

Although Ms. Suarez is presently able to devote 25 to 30 hours per week to our business while maintaining her own livelihood, this may change. Also, if we require Ms. Suarez to devote more than 25 to 30 hours per week to our business on a regular basis for an extended period, it is uncertain that she will be able to satisfy our requirements unless we have sufficient resources to compensate her for any lost income from her livelihood.

In general, officers and directors of a corporation are required to present business opportunities to the corporation if:

| | |

| · | the corporation could financially undertake the opportunity; |

| | |

| · | the opportunity is within the corporation’s line of business; and |

| | |

| · | it would be unfair to the corporation and its stockholders not to bring the opportunity to the attention of the corporation. |

COMMITTEES OF THE BOARD OF DIRECTORS

Our sole director has not established any committees, including an Audit Committee, a Compensation Committee or a Nominating Committee, or any committee performing a similar function. The functions of those committees are being undertaken by our sole director. Because we do not have any independent directors, our sole director believes that the establishment of committees of the Board would not provide any benefits to our company and could be considered more form than substance.

We do not have a policy regarding the consideration of any director candidates that may be recommended by our stockholders, including the minimum qualifications for director candidates, nor has our sole director established a process for identifying and evaluating director nominees. We have not adopted a policy regarding the handling of any potential recommendation of director candidates by our stockholders, including the procedures to be followed. Our sole director has not considered or adopted any of these policies as we have never received a recommendation from any stockholder for any candidate to serve on our Board of Directors.

Given our relative size and lack of directors and officers insurance coverage, we do not anticipate that any of our stockholders will make such a recommendation in the near future. While there have been no nominations of additional directors proposed, in the event such a proposal is made, all current members of our Board will participate in the consideration of director nominees.

Our sole director is not an “audit committee financial expert” within the meaning of Item 401(e) of Regulation S-K. In general, an “audit committee financial expert” is an individual member of the audit committee or Board of Directors who:

| | |

| · | understands generally accepted accounting principles and financial statements, |

| | |

| · | is able to assess the general application of such principles in connection with accounting for estimates, accruals and reserves, |

| | |

| · | has experience preparing, auditing, analyzing or evaluating financial statements comparable to the breadth and complexity to our financial statements, |

| | |

| · | understands internal controls over financial reporting, and |

| | |

| · | understands audit committee functions. |

- 34 -

Our Board of Directors is comprised of solely of Ms. Suarez who was integral to our business and who is involved in our day to day operations. While we would prefer to have an audit committee financial expert on our board of directors, Ms. Suarez does not have a professional yet. Currently, Ms. Suarez is pursuing her MBA at the Florida Atlantic University and expects to complete her degree next year. As with most small, early stage companies until such time our company further develops its business, achieves a stronger revenue base and has sufficient working capital to purchase directors and officers insurance, the Company does not have any immediate prospects to attract independent directors. When the Company is able to expand our Board of Directors to include one or more independent directors, the Company intends to establish an Audit Committee of our Board of Directors. It is our intention that one or more of these independent directors will also qualify as an audit committee financial expert. Our securities are not quoted on an exchange that has requirements that a majority of our Board members be independent and the Company is not currently otherwise subject to any law, rule or regulation requiring that all or any portion of our Board of Directors include “independent” directors, nor are we required to establish or maintain an Audit Committee or other committee of our Board of Directors.

Wedo not have any independent directors and the Companyhas not voluntarily implemented various corporate governance measures, in the absence of which, stockholders may have more limited protections against interested director transactions, conflicts of interest and similar matters.

INDEMNIFICATION OF DIRECTORS AND OFFICERS

Title XXXVI, Chapter 607, of the Florida Statutes (the “Florida Business Corporation Act”) permits, but does not require, corporations to indemnify a director, officer or control person of the corporation for any liability asserted against her and liability and expenses incurred by her in her capacity as a director, officer, employee or agent, or arising out of her status as such, if she or she acted in good faith and in a manner she or she reasonably believed to be in, or not opposed to, the best interests of the corporation, and, unless the Articles of Incorporation provide otherwise, whether or not the corporation has provided for indemnification in its Articles of Incorporation. Our Articles of Incorporation have no separate provision for indemnification of directors, officers, or control persons.

Regarding indemnification for liabilities arising under the Securities Act of 1933, which may be permitted to directors or officers under Florida law, we are informed that, in the opinion of the Securities and Exchange Commission, indemnification is against public policy, as expressed in the Act and is, therefore, unenforceable.

EXECUTIVE COMPENSATION

We have made no provisions for paying cash or non-cash compensation to our sole officer and director. No salaries are being paid at the present time, no salaries or other compensation were paid in cash, or otherwise, for services performed prior to August 1, 2013 our date of inception, and no compensation will be paid unless and until our operations generate sufficient cash flows.

The table below summarizes all compensation awarded to, earned by, or paid to our named executive officer for all services rendered in all capacities to us for the period from inception August 1, 2013 through August 31, 2013.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | |

Name | | | | | | | | | | | | Non-Equity | | Nonqualified | | | | |

and | | | | | | | | Stock | | Option | | Incentive Plan | | Deferred | | All Other | | |

principal | | | | Salary | | Bonus | | Awards | | Awards | | Compensation | | Compensation | | Compensation | | Total |

position | | Year | | ($) | | ($) | | ($) | | ($) | | ($) | | Earnings ($) | | ($) | | ($) |

Ilyssa Suarez

CEO | | 2013 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 |

We have not paid any salaries to our sole director and officer as of the date of this Prospectus. We do not anticipate beginning to pay salaries until we have adequate funds to do so. There are no other stock option plans, retirement, pension, or profit sharing plans for the benefit of our officer and director other than as described herein.

- 35 -

Outstanding Equity Awards at Fiscal Year-End

The table below summarizes all unexercised options, stock that has not vested, and equity incentive plan awards for each named executive officer as of August 31, 2013.

| | | | | | | | | | | |

| Option Awards | | Stock Awards |

Name | Number of Securities Underlying Unexercised Option (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Equity

Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option Exercise Price ($) | Option Expiration

Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) | Equity

Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity

Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested (#) |

Ilyssa Suarez | — | — | — | — | — | — | — | — | — |

There were no grants of stock options since inception to the date of this Prospectus.

We do not have any long-term incentive plans that provide compensation intended to serve as incentive for performance.

Our sole director has not adopted a stock option plan. We have no plans to adopt a stock option plan, but may choose to do so in the future. If such a plan is adopted, this may be administered by the board or a committee appointed by the board (the “Committee”). The committee would have the power to modify, extend or renew outstanding options and to authorize the grant of new options in substitution therefore, provided that any such action may not impair any rights under any option previously granted. We may develop an incentive based stock option plan for our officer and director and may reserve up to 10% of our outstanding shares of common stock for that purpose.

Options Grants during the Last Fiscal Year / Stock Option Plans

We do not currently have a stock option plan in favor of any director, officer, consultant or employee of our company. No individual grants of stock options, whether or not in tandem with stock appreciation rights known as SARs or freestanding SARs have been made to our Sole director and officer since our inception; accordingly, no stock options have been granted or exercised by our sole director and officer since we were founded.

Aggregated Options Exercises in Last Fiscal Year

No individual grants of stock options, whether or not in tandem with stock appreciation rights known as SARs or freestanding SARs have been made to our sole director and officer since our inception; accordingly, no stock options have been granted or exercised by our sole director and officer since we were founded.

Long-Term Incentive Plans and Awards

We do not have any long-term incentive plans that provide compensation intended to serve as incentive for performance. No individual grants or agreements regarding future payouts under non-stock price-based plans have been made to our sole director and officer or any employee or consultant since our inception; accordingly, no future payouts under non-stock price-based plans or agreements have been granted or entered into or exercised by our Sole director and officer or employees or consultants since we were founded.

Compensation of Directors

Our sole director is not compensated by us for acting as such. She is reimbursed for reasonable out-of-pocket expenses incurred. There are no arrangements pursuant to which our Sole director is or will be compensated in the future for any services provided as a director.

We do not have any agreements for compensating our directors for their services in their capacity as directors, although such directors are expected in the future to receive stock options to purchase shares of our common stock as awarded by our board of directors.

- 36 -

Employment Contracts, Termination of Employment, Change-In-Control Arrangements

There are no employment contracts or other contracts or arrangements with our officer or director other than those disclosed in this report. There are no compensation plans or arrangements, including payments to be made by us, with respect to Ms. Suarez that would result from her resignation, retirement or any other termination. There are no arrangements for directors, officers or employees that would result from a change-in-control.

Indebtedness of Directors, Senior Officers, Executive Officers and Other Management

Neither our sole director and officer nor any associate or affiliate of our company during the last two fiscal years is or has been indebted to our company by way of guarantee, support agreement, letter of credit or other similar agreement or understanding currently outstanding.

Director Compensation

The table below summarizes all compensation awarded to, earned by, or paid to our sole director for all services rendered in all capacities to us for the period from inception August 1, 2013 through August 31, 2013.

Director Compensation

| | | | | | | |

Name | Fees

Earned

or Paid

in Cash

($) | Stock

Awards

($) | Option

Awards

($) | Non-Equity

Incentive Plan

Compensation

($) | Change in

Pension Value

and

Non-Qualified

Deferred

Compensation

Earnings

($) | All Other

Compensation

($) | Total

($) |

Ilyssa Suarez | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

At this time, we have not entered into any employment agreements with our sole officer and director. If there is sufficient cash flow available from our future operations, we may enter into employment agreements with our sole officer and director or future key staff members.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth, as of the date of this prospectus, the total number of shares owned beneficially by our Sole officer and director, and key employees, individually and as a group, and the present owners of 5% or more of our total outstanding shares. The table also reflects what her ownership will be assuming completion of the sale of all shares in this offering. The stockholder listed below has direct ownership of her shares and possesses sole voting and dispositive power with respect to the shares.

| | | | | | | |

Title of Class | | Name and Address of Beneficial Owner | | Amount and Nature of

Beneficial Ownership | | Percent of

Class | |

Common Stock | | Ilyssa Suarez | | 90,000,000 | | 100 | % |

| | 2501 East Aragon Blvd, Unit 1 | | | | | |

| | Sunrise, FL 33313 | | | | | |

| | | | | | | |

| | All Officers and Directors as a Group (1 person) | | 90,000,000 | | 100 | % |

- 37 -

The following table sets forth the beneficial ownership table after the anticipated 100% completion of the offering.

After completion of the offering

| | | | | | | |

Title of Class | | Name and Address of Shareholders | | Amount and Nature of

Shareholders Ownership | | Percent of

Class | |

Common Stock | | Ilyssa Suarez | | 90,000,000 | | 75 | % |

| | 2501 East Aragon Blvd, Unit 1 | | | | | |

| | Sunrise, FL 33313 | | | | | |

| | | | | | | |

| | All other Shareholders | | 30,000,000 | | 25 | % |

Change in Control

We are not aware of any arrangement that might result in a change in control of our company in the future.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

On August 1, 2013 we issued 90,000,000 shares of our common stock to our sole director and officer at $0.0001 per share for aggregate proceeds of $9,000.

There have been no other transactions since our inception August 1, 2013, or any currently proposed transactions in which we are, or plan to be, a participant and in which any related person had or will have a direct or indirect material interest.

Director Independence

We intend to quote our securities on the OTC Bulletin Board which does not have any director independence requirements. Once we engage further directors and officers, we plan to develop a definition of independence and scrutinize our Board of Directors with regard to this definition.

Legal Proceedings

We know of no material, active or pending legal proceedings against us, nor are we involved as a plaintiff in any material proceedings or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered beneficial shareholder is an adverse party or has a material interest adverse to us.

We intend to furnish annual reports to stockholders, which will include audited financial statements reported on by our Certified Public Accountants. In addition, we will issue unaudited quarterly or other interim reports to stockholders, as we deem appropriate or required by applicable securities regulations.

REPORTS TO SECURITY HOLDERS

As a result of this offering, we will become subject to the information and reporting requirements of the Exchange Act and, in accordance with this law, will file periodic reports, proxy statements and other information with the SEC. These periodic reports, proxy statements and other information will be available for inspection and copying at the SEC’s Public Reference Room at 100 F Street, NE, Washington DC 20549. If we fail to meet the Exchange Act’s reporting requirements we will lose our status as a reporting Issuer with the SEC. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You can receive copies of these documents upon payment of a duplicating fee by writing to the SEC. The public may also read any materials filed by us with the SEC through the SEC’s website at www.sec.gov. In addition to documents related to the registration statement of which this prospectus forms a part, you may access our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act with the SEC free of charge at www.sec.gov.

- 38 -

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the Securities and Exchange Commission, 100 F Street NE, Washington, D.C. 20549, under the Securities Act of 1933 a registration statement on Form S-1 of which this prospectus is a part, with respect to the shares offered hereby. We have not included in this prospectus all the information contained in the registration statement, and you should refer to the registration statement and our exhibits for further information.

In the Registration Statement, certain items of which are contained in exhibits and schedules as permitted by the rules and regulations of the Securities and Exchange Commission. You can obtain a copy of the Registration Statement from the Securities and Exchange Commission by mail from the Public Reference Room of the Securities and Exchange Commission at 100 F Street, NE, Washington, D.C. 20549, at prescribed rates. In addition, the Securities and Exchange Commission maintains a Web site at http://www.sec.gov containing reports, proxy and information statements and other information regarding registrants that file electronically with the Securities and Exchange Commission. The Securities and Exchange Commission’s telephone number is 1-800-SEC-0330 (1-800-732-0330). These SEC filings are also available to the public from commercial document retrieval services.