|

Exhibit 99.1

|

Exhibit 99.1

Corporate Presentation

Ladenburg Thalmann 2015 Healthcare Conference September 29, 2015

Forward-Looking Statements

This presentation contains forward-looking statements. All statements other than statements of historical fact contained in this presentation, including statements regarding our commercialization, our research and other development programs, our ability to undertake certain activities and accomplish certain goals, projected timelines for our research and development activities (including any clinical trials), our ability to secure and further possible regulatory approvals, the enforceability of our intellectual property rights, our capital requirements, the prospects for third-party reimbursement for our products, the expected pricing of our products, our expectations regarding the relative benefits of our product candidates versus competitive therapies, our expectations regarding the possibility of licensing or collaborating with third parties regarding our product candidates or research, our business strategy, our expectations regarding potential markets or market sizes, and our expectations regarding the therapeutic and commercial potential of our product candidates, research, technologies and intellectual property, are forward-looking statements. In some cases, you can identify these statements by forward-looking words, such as the words “believe,” “may,” “estimate,” “continue,” “anticipate,” “design,” “intend,” “expect,” “potential” and similar expressions, as well as the negative version of these words and similar expressions. The forward-looking statements in this presentation do not constitute guarantees of future performance. Statements in this presentation that are not strictly historical statements are subject to a number of known and unknown risks and uncertainties that could cause actual results to differ materially and adversely from those anticipated or implied in the forward-looking statements, including, without limitation, those described under the heading “Risk Factors” in our Form 10-K filed with the SEC on March 26 , 2015, and new risks emerge from time to time. These forward-looking statements are based upon our current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties which include, without limitation, risks associated with the process of discovering, developing and commercializing products that are safe and effective for use as human therapeutics and risks inherent in the effort to build a business around such products. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot in any way guarantee that the future results, level of activity, performance or events and circumstances reflected in forward-looking statements will be achieved or occur. Any forward-looking statement made by us in this presentation speaks only as of the date this presentation is actually delivered by us in person. We assume no obligation or undertaking to update or revise any forward-looking statements contained herein to reflect any changes in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based, except as required by law.

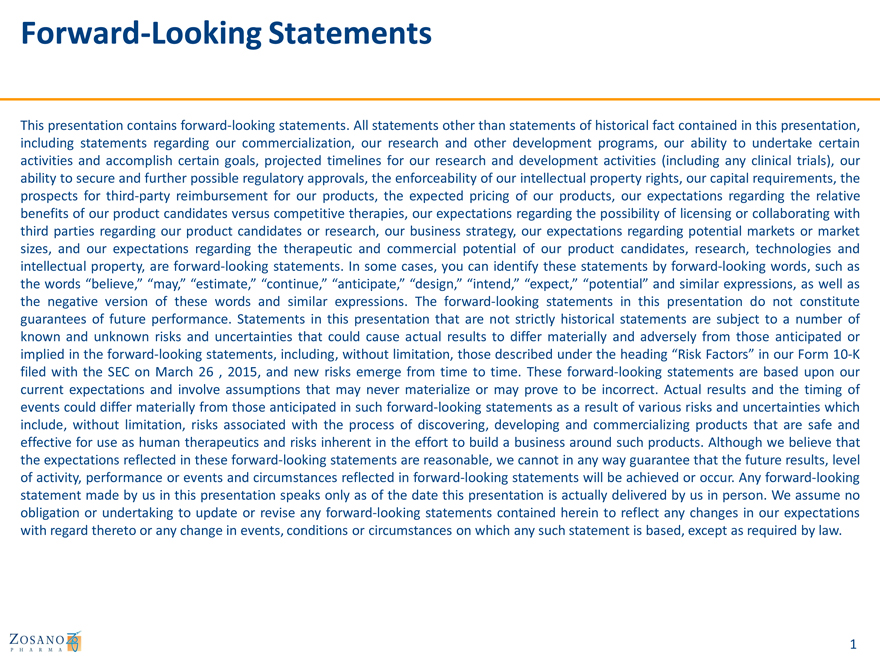

Zosano Pharma Drug Delivery System

Convenient and Easy-to-Use

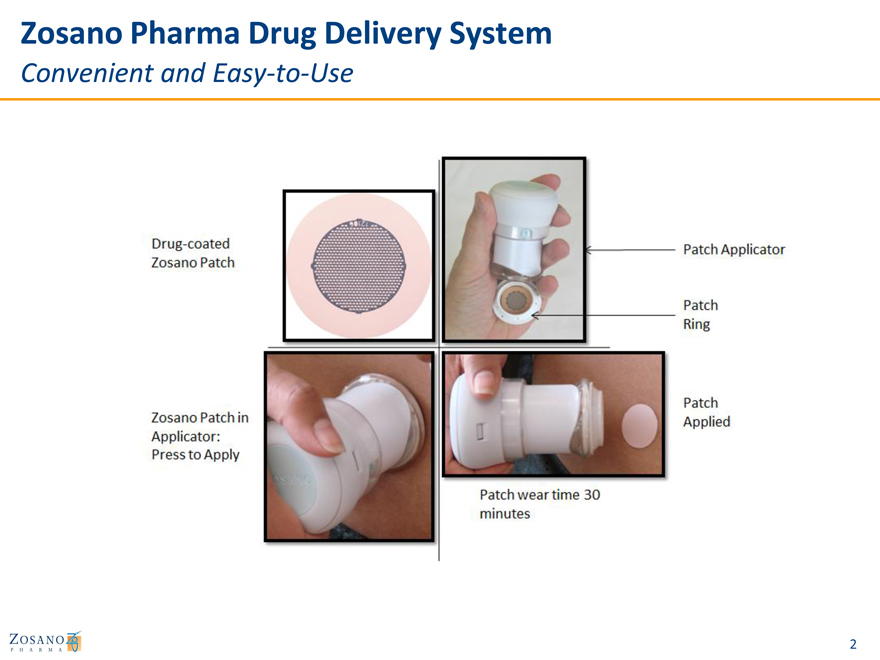

Zosano Pharma Drug Delivery System

Rapid Onset and High Bioavailability

Zosano approach provides rapid onset

Hydrophilic drug formulation coated on tips of microneedles

Microneedles are 200-350 microns long – close proximity to capillary bed Formulation quickly dissolved by interstitial fluid for short Tmax

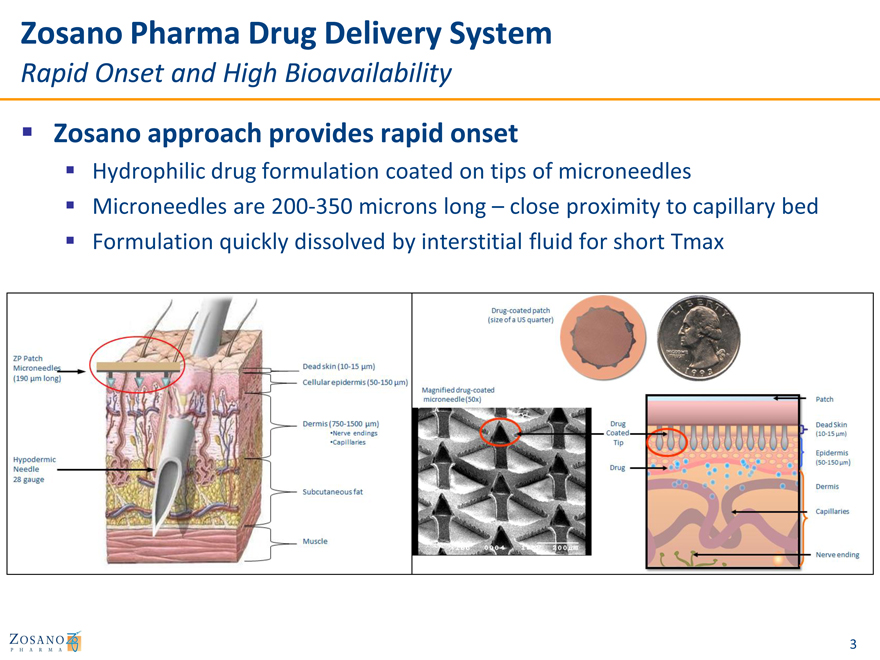

Zosano Pharma Drug Delivery System

Formulations Stable at Room Temperature

Higher product stability, longer shelf life vs. injectables requiring refrigeration

Dry, hydrophilic formulation of ZP-PTH more stable than Forteo liquid injectables

Packaging purged with nitrogen – no moisture or oxygen ensures product stability

Demonstrated 36 month shelf life at room temperature for ZP-PTH

Phase 2 Zosano PTH 40 mcg vs. Forteo

100

ZP-PTH

Stable

Forteo (2-8 oC)

(%)

rity 90

u

P

H

PT

Forteo RT

0 5 10 15 20 25 30 35 40

Storage Time (months)

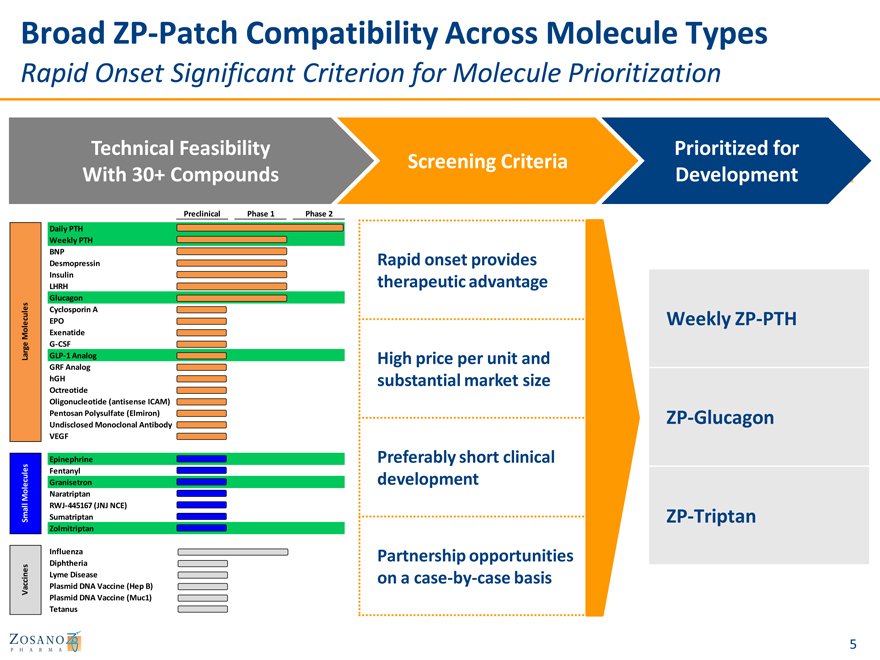

Broad ZP-Patch Compatibility Across Molecule Types

Rapid Onset Significant Criterion for Molecule Prioritization

Technical Feasibility Prioritized for

Screening Criteria

With 30+ Compounds Development

Preclinical Phase 1 Phase 2

Daily PTH

Weekly PTH

BNP

Desmopressin

Insulin

LHRH

Glucagon

es Cyclosporin A

l

u

e c EPO

ol Exenatide

M

ge G-CSF

Lar GLP-1 Analog

GRF Analog

hGH

Octreotide

Oligonucleotide (antisense ICAM)

Pentosan Polysulfate (Elmiron)

Undisclosed Monoclonal Antibody

VEGF

Epinephrine

Fentanyl

ecules Granisetron

Mol Naratriptan

RWJ-445167 (JNJ NCE)

Small Sumatriptan

Zolmitriptan

Influenza

Diphtheria

Lyme Disease

Vaccines Plasmid DNA Vaccine (Hep B)

Plasmid DNA Vaccine (Muc1)

Tetanus

Rapid onset provides

therapeutic advantage

Weekly ZP-PTH

High price per unit and

substantial market size

ZP-Glucagon

Preferably short clinical

development

ZP-Triptan

Partnership opportunities

on a case-by-case basis

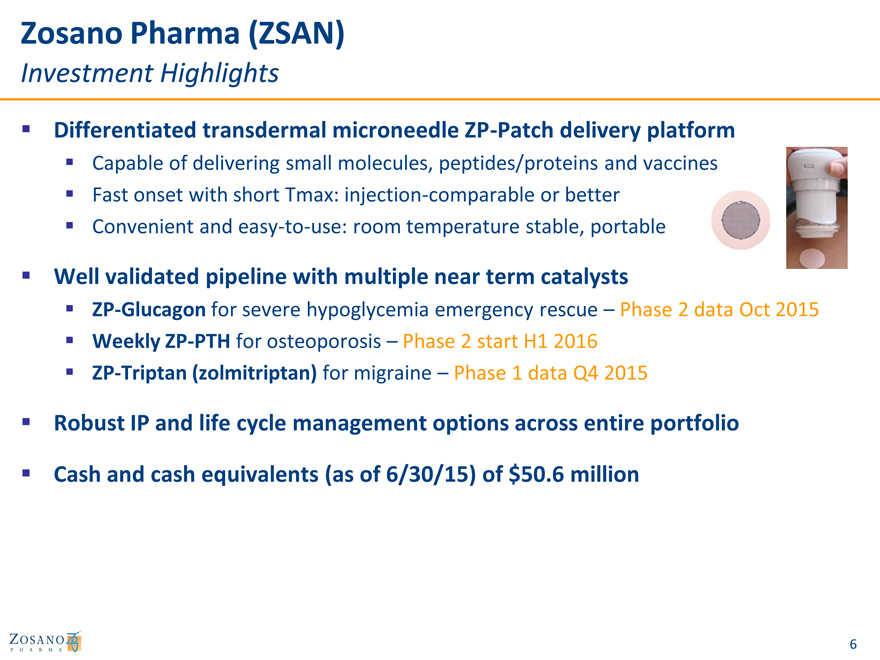

Zosano Pharma (ZSAN)

Investment Highlights

Differentiated transdermal microneedle ZP-Patch delivery platform

Capable of delivering small molecules, peptides/proteins and vaccines

Fast onset with short Tmax: injection-comparable or better

Convenient and easy-to-use: room temperature stable, portable

Well validated pipeline with multiple near term catalysts

ZP-Glucagon for severe hypoglycemia emergency rescue – Phase 2 data Oct 2015

Weekly ZP-PTH for osteoporosis – Phase 2 start H1 2016

ZP-Triptan (zolmitriptan) for migraine – Phase 1 data Q4 2015

Robust IP and life cycle management options across entire portfolio

Cash and cash equivalents (as of 6/30/15) of $50.6 million

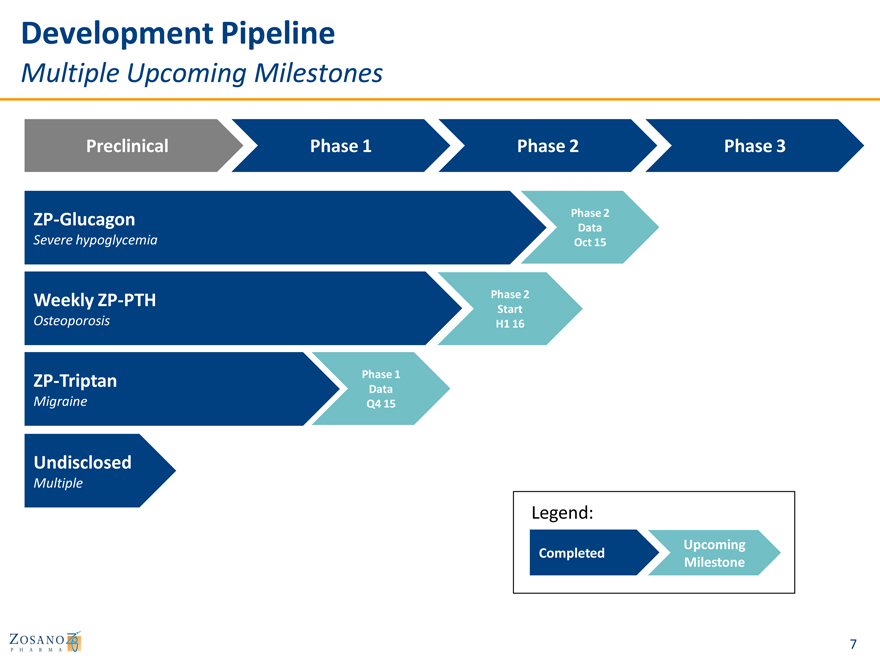

Development Pipeline

Multiple Upcoming Milestones

Preclinical Phase 1 Phase 2 Phase 3

ZP-Glucagon Phase 2

Data

Severe hypoglycemia Oct 15

Weekly ZP-PTH Phase 2

Start

Osteoporosis H1 16

ZP-Triptan Phase 1

Data

Migraine Q4 15

Undisclosed

Multiple

Legend:

Upcoming

Completed

Milestone

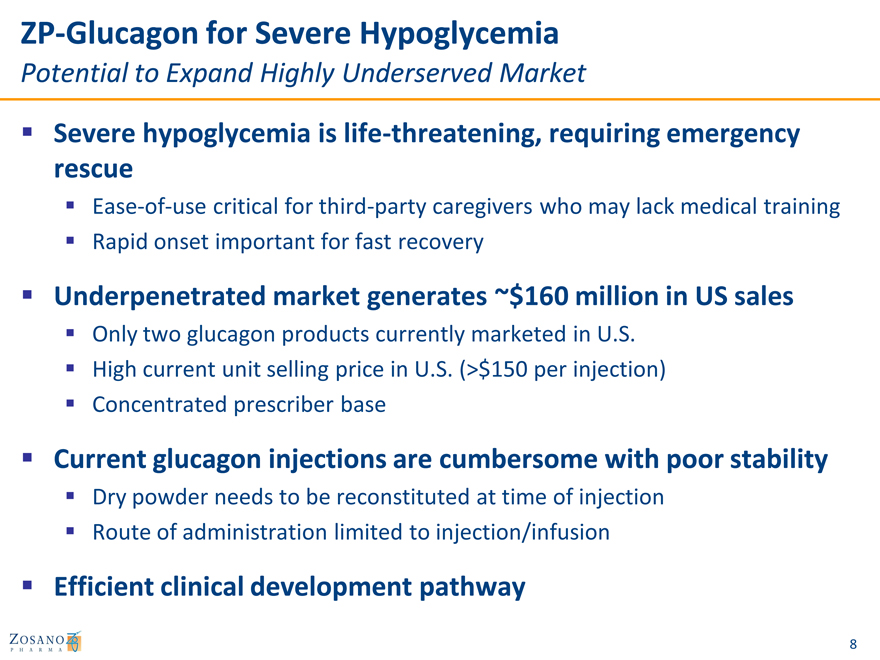

ZP-Glucagon for Severe Hypoglycemia

Potential to Expand Highly Underserved Market

Severe hypoglycemia is life-threatening, requiring emergency rescue

Ease-of-use critical for third-party caregivers who may lack medical training Rapid onset important for fast recovery

Underpenetrated market generates ~$160 million in US sales

Only two glucagon products currently marketed in U.S. High current unit selling price in U.S. (>$150 per injection) Concentrated prescriber base

Current glucagon injections are cumbersome with poor stability

Dry powder needs to be reconstituted at time of injection Route of administration limited to injection/infusion

Efficient clinical development pathway

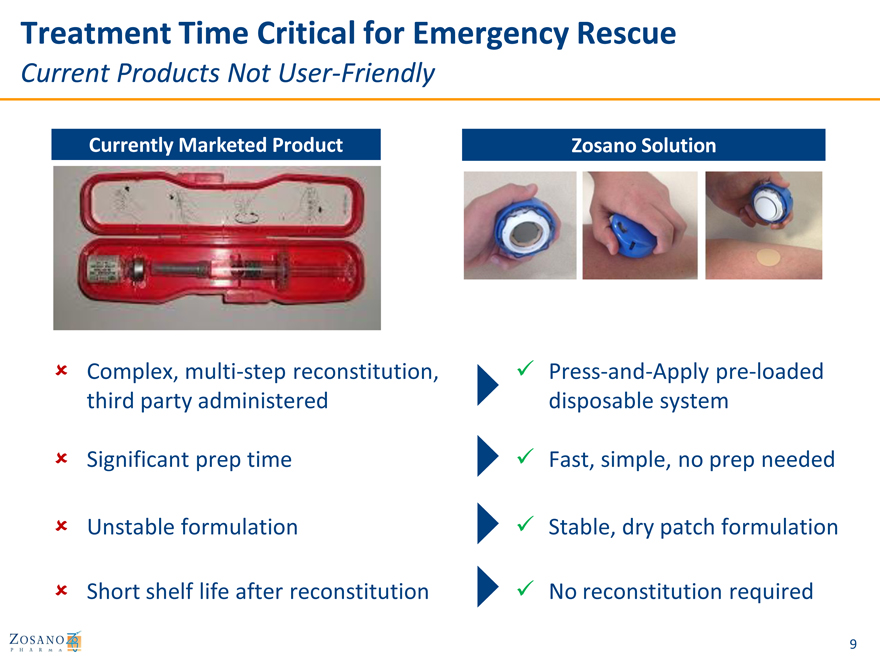

Treatment Time Critical for Emergency Rescue

Current Products Not User-Friendly

Complex, multi-step reconstitution, third party administered

Significant prep time

Unstable formulation

Short shelf life after reconstitution

Zosano Solution

Press-and-Apply pre-loaded disposable system

Fast, simple, no prep needed Stable, dry patch formulation No reconstitution required

9

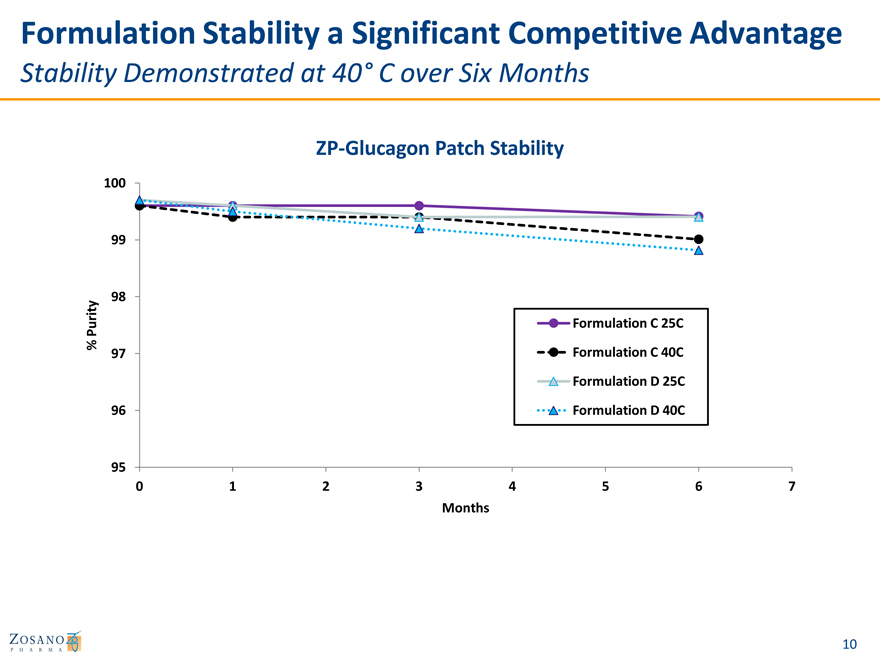

Formulation Stability a Significant Competitive Advantage

Stability Demonstrated at 40° C over Six Months

ZP-Glucagon Patch Stability

100

Purity Formulation C 25C

% 97 Formulation C 40C

Formulation D 25C

0 1 2 3 4 5 6 7

Months

10

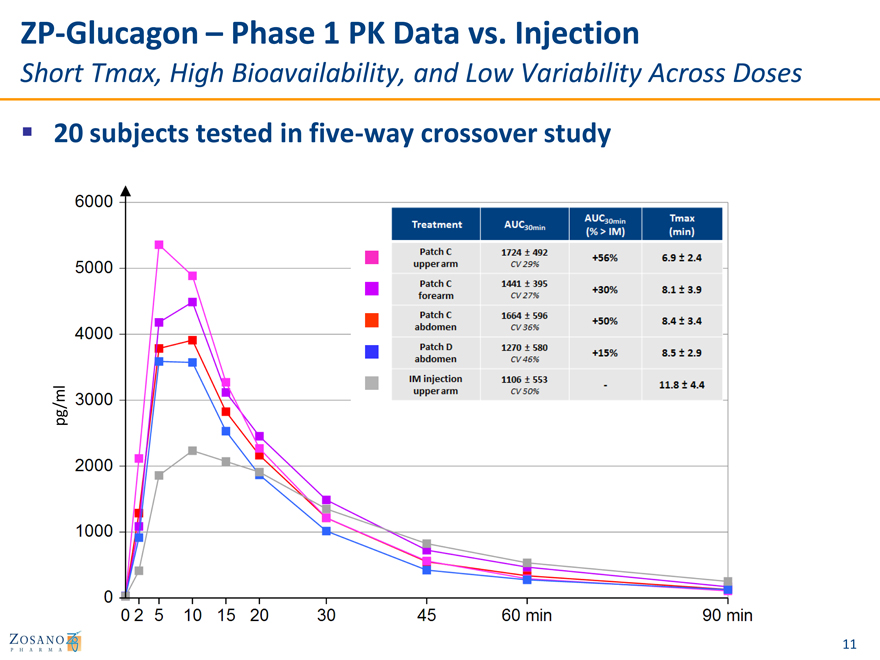

ZP-Glucagon – Phase 1 PK Data vs. Injection

Short Tmax, High Bioavailability, and Low Variability Across Doses

20 subjects tested in five-way crossover study

pg/ml

11

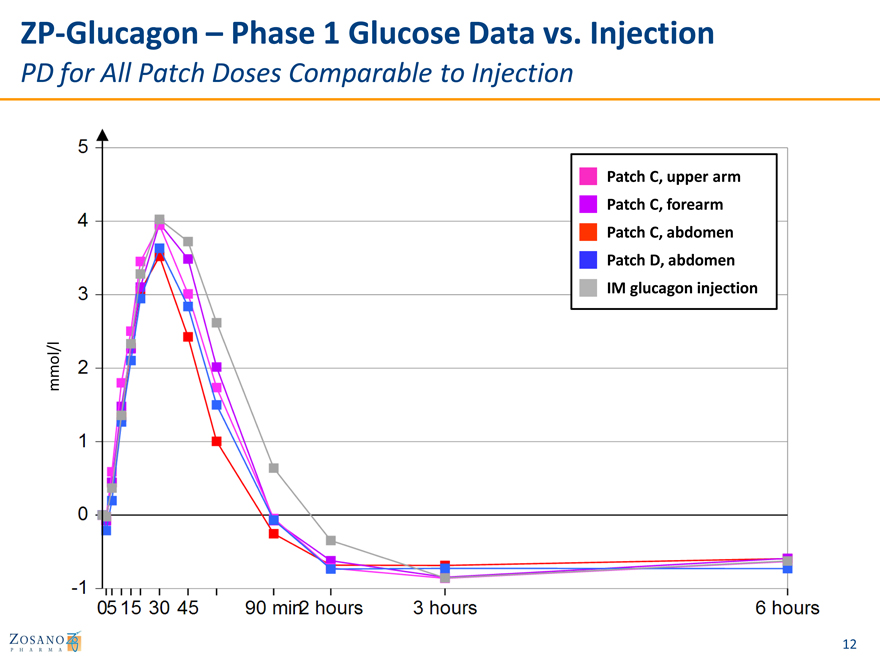

ZP-Glucagon – Phase 1 Glucose Data vs. Injection

PD for All Patch Doses Comparable to Injection

Patch C, upper arm

Patch C, forearm

Patch C, abdomen

Patch D, abdomen

IM glucagon injection

mmol/l

12

ZP-Glucagon for Severe Hypoglycemia

Next Steps

Launch Gen 1 product using reusable applicator

Phase 1 completed Q1 2014; received FDA feedback regarding development plan H2 2014 Phase 2 trial to compare patch vs. injection in diabetic patients with induction of hypoglycemia (16 patient crossover) commenced in Q1 2015 Phase 2 data expected October 2015 Phase 3 trial to compare patch vs. injection in diabetic patients with induction of hypoglycemia (~100 patients) after the completion of the Phase 2 trial

Develop Gen 2 product using single-use applicator and integrated patch

13

Weekly ZP-PTH for Osteoporosis

Differentiated Product Profile for Large, Growing Market

Forteo (PTH 1-34) is only anabolic in U.S. market with $1.3 billion in revenue

20 µg daily subcutaneous injection requiring refrigeration and carrying a black box warning with a two-year lifetime limitation on treatment

Zosano patch technology tested extensively with PTH molecule (1-34)

Completed Daily ZP-PTH Phase 2

Completed Weekly ZP-PTH Phase 1 in early 2014

Demonstrated 36 month room-temperature stability with ZP-PTH

Efficacy of weekly dose proven in two fracture-reduction studies by Asahi Kasei; product in Japanese market since 2011

79% fracture reduction with marketed 56.5 µg weekly injectable (n=~600)

66% fracture reduction with ~28 µg weekly injectable (n=~300) based on a post-hoc analysis of the study data 65% fracture reduction demonstrated in pivotal study for daily injectable Forteo®

Zosano completed a successful Phase 1 study with weekly patch dose in early 2014

Low weekly ZP-PTH dose has potential for longer treatment duration and removal of black box

14

Daily ZP-PTH Patch Program

Phase 2 Trial Design

6 month multi-national trial

165 post-menopausal women with low bone density Daily dose, patient self-administered ZP-PTH patch at 3 doses (20 µg, 30 µg and 40 µg) ZP-Placebo patch as control Forteo® injection product (20 µg) as active comparator Primary endpoint – Increase in spine bone density Secondary endpoint – Increase in hip bone density

Ref: Cosman, F., et al. J. Clin. Endocrin Metab, 95,151,2010

15

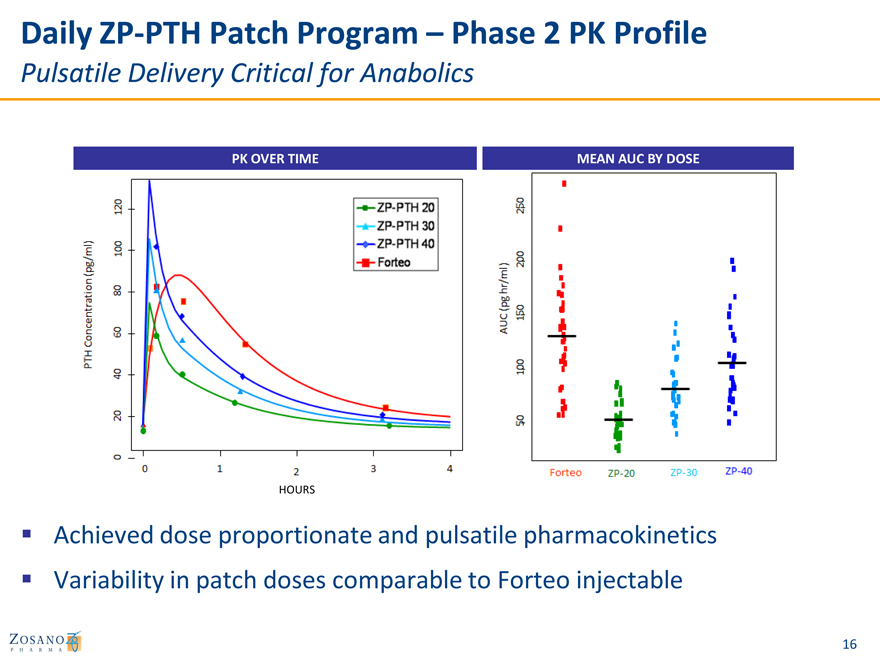

Daily ZP-PTH Patch Program – Phase 2 PK Profile

Pulsatile Delivery Critical for Anabolics

PK OVER TIME MEAN AUC BY DOSE

Achieved dose proportionate and pulsatile pharmacokinetics Variability in patch doses comparable to Forteo injectable

16

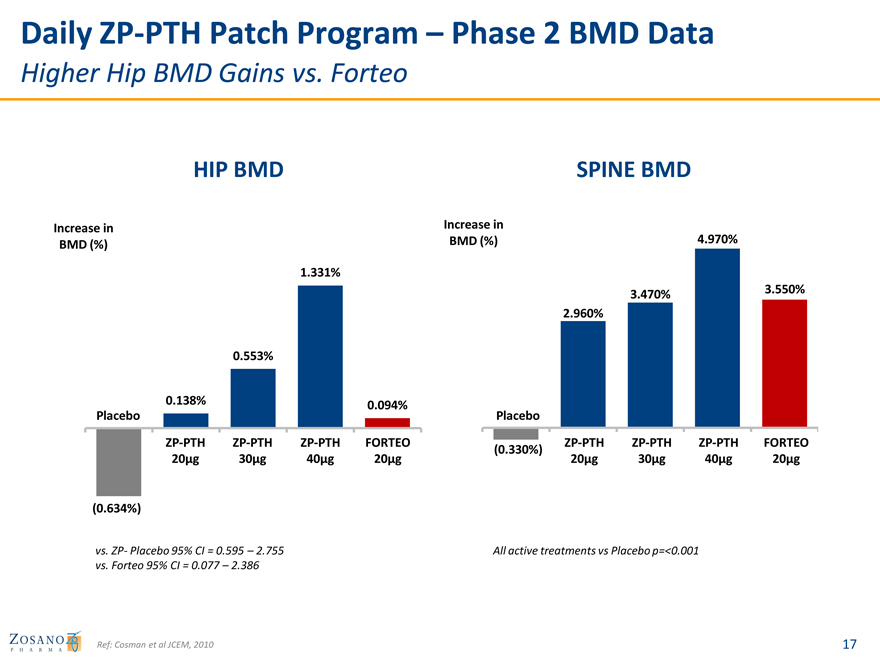

Daily ZP-PTH Patch Program – Phase 2 BMD Data

Higher Hip BMD Gains vs. Forteo

HIP BMD

Increase in

BMD (%)

1.331%

0.553%

Placebo

ZP-PTH ZP-PTH ZP-PTH FORTEO

20µg 30µg 40µg 20µg

(0.634%)

vs. ZP- Placebo 95% CI = 0.595 – 2.755

vs. Forteo 95% CI = 0.077 – 2.386

SPINE BMD

Increase in

BMD (%) 4.970%

2.960%

Placebo

(0.330%) | | ZP-PTH ZP-PTH ZP-PTH FORTEO |

20µg 30µg 40µg 20µg

All active treatments vs Placebo p=<0.001

Ref: Cosman et al JCEM, 2010

17

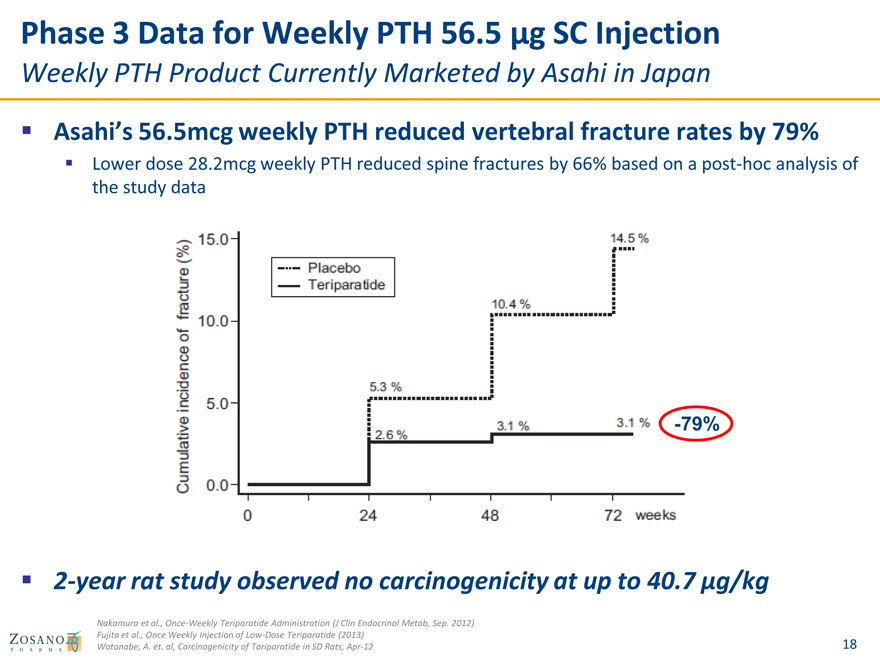

Phase 3 Data for Weekly PTH 56.5 µg SC Injection

Weekly PTH Product Currently Marketed by Asahi in Japan

Asahi’s 56.5mcg weekly PTH reduced vertebral fracture rates by 79%

Lower dose 28.2mcg weekly PTH reduced spine fractures by 66% based on a post-hoc analysis of the study data

-79%

2-year rat study observed no carcinogenicity at up to 40.7 µg/kg

Nakamura et al., Once-Weekly Teriparatide Administration (J Clin Endocrinol Metab, Sep. 2012)

Fujita et al., Once Weekly Injection of Low-Dose Teriparatide (2013)

Watanabe, A. et. al, Carcinogenicity of Tariparatide in SD Rats, Apr-12

18

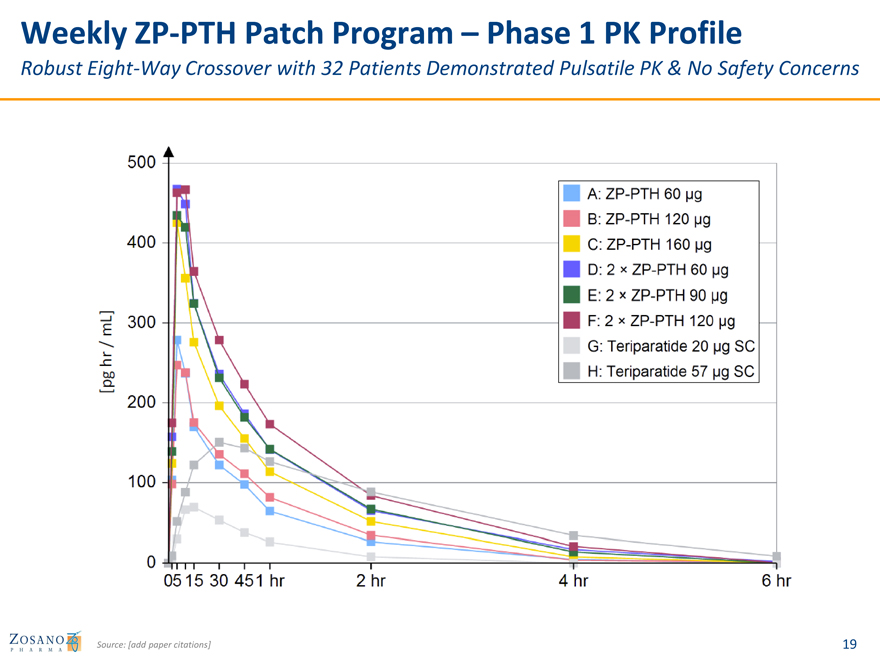

Weekly ZP-PTH Patch Program – Phase 1 PK Profile

Robust Eight-Way Crossover with 32 Patients Demonstrated Pulsatile PK & No Safety Concerns

Source: [add paper citations]

19

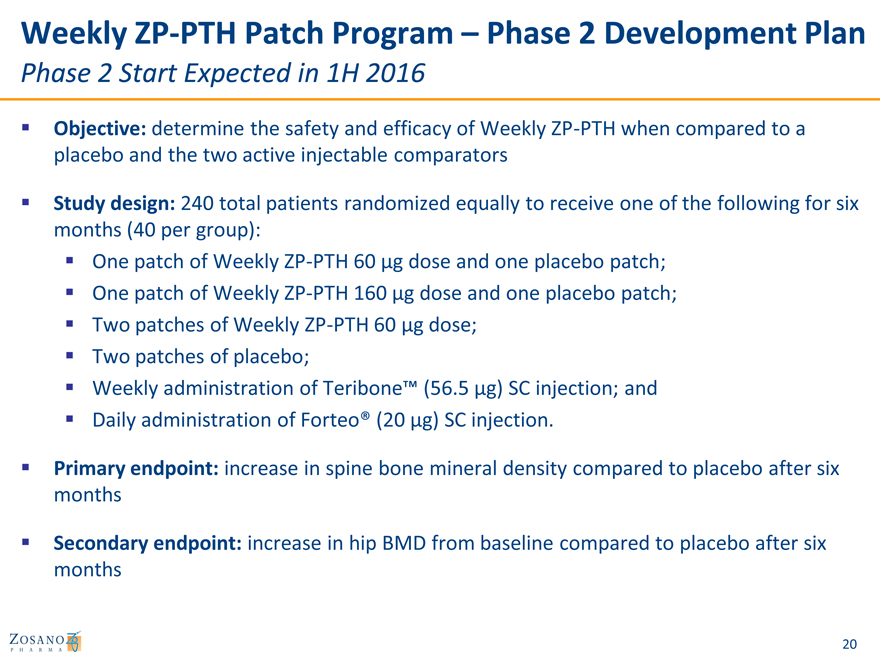

Weekly ZP-PTH Patch Program – Phase 2 Development Plan

Phase 2 Start Expected in 1H 2016

Objective: determine the safety and efficacy of Weekly ZP-PTH when compared to a placebo and the two active injectable comparators

Study design: 240 total patients randomized equally to receive one of the following for six months (40 per group):

One patch of Weekly ZP-PTH 60 µg dose and one placebo patch;

One patch of Weekly ZP-PTH 160 µg dose and one placebo patch;

Two patches of Weekly ZP-PTH 60 µg dose; Two patches of placebo; administration Teribone™ (56.5 µg) SC injection; and

Weekly of Daily administration of Forteo® (20 µg) SC injection.

Primary endpoint: increase in spine bone mineral density compared to placebo after six months

Secondary endpoint: increase in hip BMD from baseline compared to placebo after six months

20

ZP-Triptan for Migraine

Highly Suited for Acute Condition Requiring Immediate Relief

Potential best-in-class rapid onset: Tmax = 9 minutes

Comparable or better onset of action than existing triptans/injectables

Self-administration provides significant advantage vs. injectables Large, growing market with attractive unit pricing for injectables

US $1.9 billion total migraine market ($1.1 billion for triptans)

Multiple products in a large and growing market but no clear, effective solution

Phase 1 PK and safety study data expected Q4 2015

Completed enrollment in Sep 2015

21

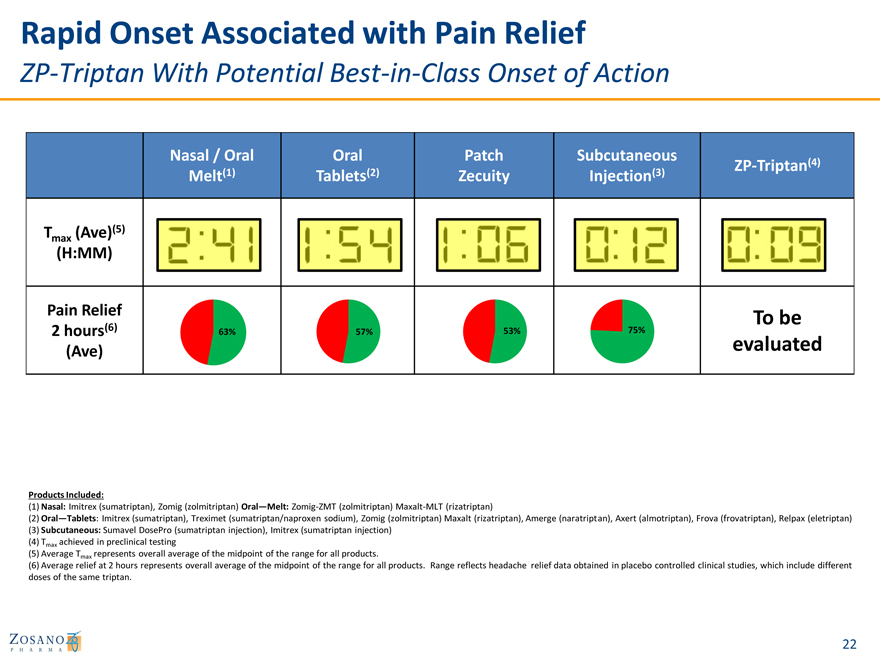

Rapid Onset Associated with Pain Relief

ZP-Triptan With Potential Best-in-Class Onset of Action

Nasal / Oral Oral Patch Subcutaneous

Melt(1) Tablets(2) Zecuity Injection(3) ZP-Triptan(4)

Tmax (Ave)(5)

(H:MM)

Pain Relief To be

2 | | hours(6) 63% 57% 53% 75% |

(Ave) evaluated

Products Included:

(1) | | Nasal: Imitrex (sumatriptan), Zomig (zolmitriptan) Oral—Melt: Zomig-ZMT (zolmitriptan) Maxalt-MLT (rizatriptan) |

(2) Oral—Tablets: Imitrex (sumatriptan), Treximet (sumatriptan/naproxen sodium), Zomig (zolmitriptan) Maxalt (rizatriptan), Amerge (naratriptan), Axert (almotriptan), Frova (frovatriptan), Relpax (eletriptan)

(3) | | Subcutaneous: Sumavel DosePro (sumatriptan injection), Imitrex (sumatriptan injection) |

(4) | | Tmax achieved in preclinical testing |

(5) | | Average Tmax represents overall average of the midpoint of the range for all products. |

(6) Average relief at 2 hours represents overall average of the midpoint of the range for all products. Range reflects headache relief data obtained in placebo controlled clinical studies, which include different doses of the same triptan.

22

ZP-Triptan for Migraine

Next Steps

Developing product using current applicator and patch

Phase 1 data expected Q4 2015

Enrollment completed Sep 2015

Single dose crossover / ascending combination study

Multiple patch doses with zolmitriptan compared to one subcutaneous injection of sumatriptan and one oral administration of zolmitriptan in healthy volunteers

Phase 2 trial with 200 patients planned in 2016

Expected to compare three ZP-Triptan doses vs. placebo

Primary endpoint: reduction in headache severity in 2 hours or less Subcutaneous sumatriptan injection as reference arm

23

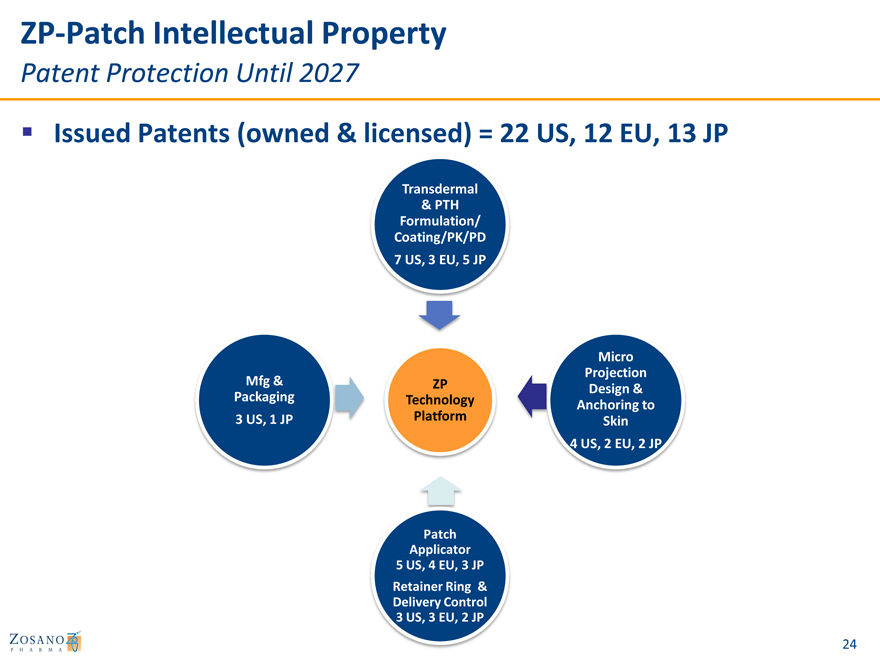

ZP-Patch Intellectual Property

Patent Protection Until 2027

Issued Patents (owned & licensed) = 22 US, 12 EU, 13 JP

Transdermal & PTH Formulation/ Coating/PK/PD

Mfg & Packaging

Micro Projection Design & Anchoring to Skin

Patch Applicator 5 US, 4 EU, 3 JP

Retainer Ring & Delivery Control 3 US, 3 EU, 2 JP

24

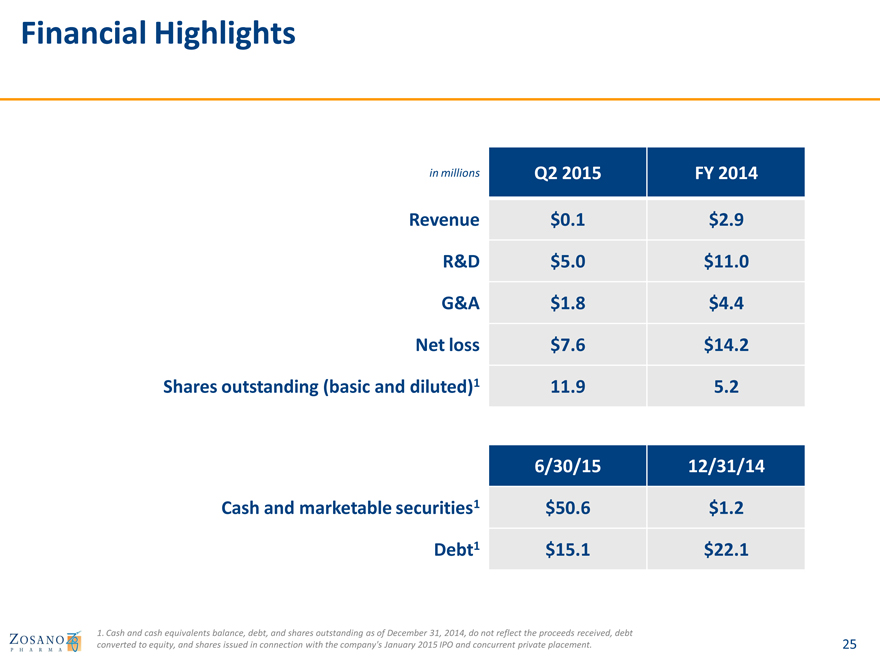

Financial Highlights

in millions Q2 2015 FY 2014

Revenue $0.1 $2.9

R&D $5.0 $11.0

G&A $1.8 $4.4

Net loss $7.6 $14.2

Shares outstanding (basic and diluted)1 11.9 5.2

6/30/15 12/31/14

Cash and marketable securities1 $50.6 $1.2

Debt1 $15.1 $22.1

1. Cash and cash equivalents balance, debt, and shares outstanding as of December 31, 2014, do not reflect the proceeds received, debt converted to equity, and shares issued in connection with the company’s January 2015 IPO and concurrent private placement.

25

Zosano Pharma (ZSAN)

Investment Highlights

Differentiated transdermal microneedle ZP-Patch delivery platform

Capable of delivering small molecules, peptides/proteins and vaccines

Fast onset with short Tmax: injection-comparable or better

Convenient and easy-to-use: room temperature stable, portable

Well validated pipeline with multiple near term catalysts

ZP-Glucagon for severe hypoglycemia emergency rescue – Phase 2 data Oct 2015

Weekly ZP-PTH for osteoporosis – Phase 2 start H1 2016

ZP-Triptan (zolmitriptan) for migraine – Phase 1 data Q4 2015

Robust IP and life cycle management options across entire portfolio

Cash and cash equivalents (as of 6/30/15) of $50.6 million

26

Corporate Presentation

Ladenburg Thalmann 2015 Healthcare Conference September 29, 2015