UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22891

Little Harbor MultiStrategy Composite Fund

(Exact name of registrant as specified in charter)

30 Doaks Lane

Marblehead, Massachusetts 01945

(Address of principal executive offices) (Zip code)

Randall Carrigan, Esq.

Managing Principal, Chief Legal and Compliance Officer

Little Harbor Advisors, LLC

30 Doaks Lane

Marblehead, Massachusetts 01945

(Name and address of agent for service)

Registrant's telephone number, including area code: (781) 639-3000

Copy To:

John Hunt, Esq.

Sullivan & Worcester, LLP

One Post Office Square

Boston, Massachusetts 02109

Date of fiscal year end: March 31

Date of reporting period: March 31, 2016

ITEM 1. REPORTS TO STOCKHOLDERS.

The Report to Shareholders is attached herewith.

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Financial Statements

For the Year Ended March 31, 2016

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Table of Contents

For the Year Ended March 31, 2016

| Report of Independent Registered Public Accounting Firm | 1 |

| Schedule of Investments | 2-3 |

| Statement of Assets and Liabilities | 4 |

| Statement of Operations | 5 |

| Statements of Changes in Net Assets | 6 |

| Statement of Cash Flows | 7 |

| Financial Highlights | 8 |

| Notes to Financial Statements | 9-19 |

| Fund Management (unaudited) | 20-21 |

| Other Information (unaudited) | 22 |

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders

Little Harbor MultiStrategy Composite Fund

We have audited the accompanying statement of assets and liabilities, including the schedule of investments of Little Harbor MultiStrategy Composite Fund (the Fund) as of March 31, 2016, and the related statement of operations for the year then ended and the statements of changes in net assets, cash flows, and financial highlights for the year ended March 31, 2016 and for the period from February 2, 2015 (commencement of operations) to March 31, 2015. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free from material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of March 31, 2016, by correspondence with the custodian and investee funds’ investment advisor or administrator. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Little Harbor MultiStrategy Composite Fund as of March 31, 2016, and the results of its operations and its cash flows for the year then ended, the changes in net assets and financial highlights for the year ended March 31, 2016 and for the period from February 2, 2015 (commencement of operations) to March 31, 2015 in conformity with U.S. generally accepted accounting principles.

/s/ RSM US LLP

Boston, Massachusetts

June 7, 2016

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Schedule of Investments - March 31, 2016

| Investments in Investee Funds (93.1%) | | Cost | | | Fair Value | | | % of Net Assets | Redemptions Permitted | Redemption Notification Period |

| Hedged Equity Strategies (47.1%) (See Note 2) | | | | | | | | | | |

Buckingham RAF Partners L.P. a,b | | $ | 762,836 | | | $ | 751,695 | | | 12.7% | Quarterly c | 30 days |

Corsair Capital Partners 100, L.P. a,b | | | 709,973 | | | | 659,733 | | | 11.2% | Quarterly c | 45 days |

Hadron Fund, L.P. a,b | | | 685,025 | | | | 703,986 | | | 11.9% | Monthly c | 30 days |

Zadig Fund a,b | | | 632,004 | | | | 667,157 | | | 11.3% | Monthly c | 30 days |

| Total Hedged Equity Strategies | | | | | | $ | 2,782,571 | | | | | |

| | | | | | | | | | | | | |

| Global Macro Strategies (35.1%) (See Note 2) | | | | | | | | | | | | |

Argonaut Macro Partnership, L.P. a,b | | $ | 758,386 | | | $ | 670,948 | | | 11.3% | Quarterly c | 30 days |

Eclipse Global Partners, L.P. a,b | | | 835,686 | | | | 750,716 | | | 12.7% | Monthly c | 30 days |

Revolution Capital Management Alpha Fund, L.P. a,b | | | 596,800 | | | | 657,269 | | | 11.1% | Monthly c | 30 days |

| Total Global Macro Strategies | | | | | | $ | 2,078,933 | | | | | |

| | | | | | | | | | | | | |

| Opportunistic Value in Credit and Equity Securities Strategies (10.9%) (See Note 2) | | | | | | | | | | | | |

New Generation Limited Partnership a,b | | $ | 810,000 | | | $ | 646,910 | | | 10.9% | Quarterly c | 30 days |

| Total Opportunistic Value in Credit and Equity Securities Strategies | | | | | | | | | | | | |

| Total Investments in Investee Funds (cost $5,790,710) | | | | | | $ | 5,508,414 | | | | | |

| | | | | | | | | | | |

| Short-Term Investment (4.7%) | | Shares | | | Fair Value | | | | | |

Fidelity Institutional Money Market Portfolio, Class I, 0.35% d | | | 280,546 | | | $ | 280,546 | | | | | |

| Total Short-Term Investment (cost $280,546) | | | | | | $ | 280,546 | | | | | |

| | | | | | | | | | | | | |

| Total Investments (cost $6,071,256) (97.9%) | | | | | | $ | 5,788,960 | | | | | |

| | | | | | | | | | | | | |

| Other assets in excess of liabilities (2.1%) | | | | | | | 127,141 | | | | | |

| Net Assets - 100.0% | | | | | | $ | 5,916,101 | | | | | |

| Futures Contracts | Expiration Date | Number of contracts | Notional Amount | | | Unrealized Appreciation (Deprecation) | | | | |

| Short Contracts | | | | | | | | | | |

| E-MINI S&P 500 | Jun-2016 | 2 | 205,150 | | | $ | 370 | | | 0%e | |

| b | Investee Funds are issued in private placement transactions and as such are restricted as to resale and redemption frequency, as further discussed in footnotes. |

| c | The Fund has a right to withdraw at least once per quarter at least 25% of its investment in the Investee Fund. The Investee Fund may permit larger and more frequent redemptions. |

| d | Variable rate security; represents the published 7-day yield as of March 31, 2016. |

| e | Rounds to less than 0.05% of Net Assets. |

There are also no unfunded commitments to the Investee Funds.

See Notes to Financial Statements

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Schedule of Investments - March 31, 2016 (continued)

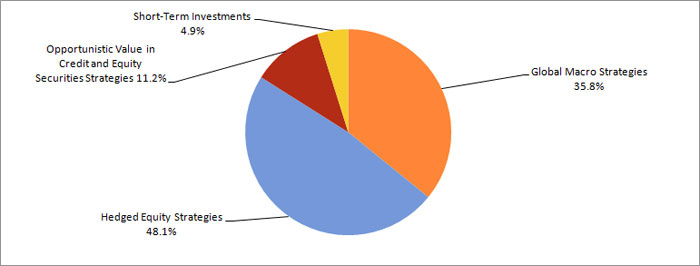

INVESTMENT TYPE AS A PERCENTAGE OF TOTAL INVESTMENTS AS FOLLOWS (unaudited):

See Notes to Financial Statements

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Statement of Assets and Liabilities - March 31, 2016

| Assets | | | |

| Investments in Investee Funds, at fair value (cost $5,790,710) | | $ | 5,508,414 | |

| Short-term investments, at fair value (cost $280,546) | | | 280,546 | |

| Cash held with broker | | | 88,961 | |

| Unrealized depreciation on open futures contracts | | | 370 | |

| Prepaid assets | | | 42,599 | |

| Sales of investee funds receivable | | | 127,000 | |

| Due from Investment Manager | | | 59,747 | |

| Interest receivable | | | 172 | |

| Total Assets | | | 6,107,809 | |

| | | | | |

| Liabilities | | | | |

| Investment Manager fees payable | | | 4,826 | |

| Legal fees payable | | | 123,140 | |

| Professional fees payable | | | 46,250 | |

| Accounting and administration fees payable | | | 7,983 | |

| Transfer agent fees payable | | | 4,400 | |

| Shareholder servicing fees payable | | | 1,308 | |

| Custodian fees payable | | | 2,600 | |

| Other payable | | | 1,201 | |

| Total Liabilities | | | 191,708 | |

| | | | | |

| Components of Net Assets | | | | |

| Paid-in capital | | | 6,550,982 | |

| Accumulated net investment loss | | | (360,574 | ) |

| Accumulated net realized gain on investments and futures | | | (2,006 | ) |

| Net unrealized depreciation on investments and futures | | | (272,301 | ) |

| Total Net Assets | | $ | 5,916,101 | |

| | | | | |

| Net asset value per share of beneficial interest (Total net assets divided by 13,783 shares of beneficial interest outstanding) | | $ | 429.23 | |

| Number of authorized shares of beneficial interest* | | | 698,926 | * |

| Number of outstanding shares of beneficial interest | | | 13,783 | |

| * | Based on $300,000,000 total value of shares of beneficial interest currently registered, divided by the Fund's current Net Asset Value per share. |

See Notes to Financial Statements

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Statement of Operations - For the Year Ended March 31, 2016

| Investment income | | | |

| Interest | | $ | 965 | |

| Total investment income | | | 965 | |

| Expenses | | | | |

| Investment management fees (see Note 3) | | | 136,478 | |

| Legal fees (see Note 2.e) | | | 402,731 | |

| Accounting and administration fees (see Note 4) | | | 94,500 | |

| Professional fees | | | 52,775 | |

| Insurance expense | | | 37,649 | |

| Transfer agent fees | | | 27,072 | |

| Registration fees | | | 22,900 | |

| Shareholder servicing fees (see Note 3) | | | 17,060 | |

| Custodian fees | | | 16,538 | |

| Trustees' fees (see Note 3) | | | 15,000 | |

| Other expenses | | | 20,607 | |

| Total expenses, before reimbursement from Investment Manager | | | 843,310 | |

| | | | | |

| Expense reimbursement (see Note 3) | | | (63,793 | ) |

| Expense waiver (see Note 3) | | | (15,000 | ) |

| Net expenses | | | 764,517 | |

| Net investment loss | | | (763,552 | ) |

| | | | | |

| Net realized gains and unrealized appreciation/depreciation on investments and futures | | | | |

| Net realized gain on investments | | | 14,710 | |

| Net realized gain on futures | | | 1,622 | |

| Net change in unrealized appreciation on futures | | | 370 | |

| Net change in unrealized depreciation on investments | | | (391,741 | ) |

| Net realized gains and unrealized appreciation/depreciation of investments and futures | | | (375,039 | ) |

| | | | |

| Net decrease in Net Assets resulting from operations | | $ | (1,138,591 | ) |

See Notes to Financial Statements

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Statements of Changes in Net Assets

| | | For the Year ended March 31, 2016 | | | For the Period February 2, 2015 through March 31, 2015 | |

| Operations | | | | | | |

| Net investment loss | | $ | (763,552 | ) | | $ | (77,712 | ) |

| Net realized gains on investments | | | 14,710 | | | | - | |

| Net realized gains on futures | | | 1,622 | | | | 26,852 | |

| Net change in unrealized appreciation of futures | | | 370 | | | | - | |

| Net change in unrealized depreciation of investments | | | (391,741 | ) | | | 109,445 | |

| Net Increase (decrease) in Net Assets resulting from operations | | $ | (1,138,591 | ) | | $ | 58,585 | |

| | | | | | | | | |

| Distributions to Shareholders from realized gains | | $ | (19,860 | ) | | $ | - | |

| Decrease in Net Assets from distributions to shareholders | | $ | (19,860 | ) | | $ | - | |

| | | | | | | | | |

| Capital Share Transactions | | | | | | | | |

| Capital contributions | | $ | 2,060,000 | | | $ | 5,280,000 | |

| Reinvested distributions | | $ | 13,076 | | | $ | - | |

| Capital redemptions | | | (587,109 | ) | | | - | |

| Increase in Net Assets from capital share transactions | | $ | 1,485,967 | | | $ | 5,280,000 | |

| | | | | | | | | |

| Total Increase | | $ | 327,516 | | | $ | 5,338,585 | |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of year/period | | | 5,588,585 | | | | 250,000 | |

| End of year/period | | $ | 5,916,101 | | | $ | 5,588,585 | |

| | | | | | | | | |

| Accumulated net Investment Income | | $ | (360,574 | ) | | $ | - | |

| | | | | | | | | |

| Share of Beneficial Interest (Shares) Activity | | | | | | | | |

| Shares beginning of year/period | | | 10,970 | | | | 500 | * |

| Share contributions | | | 4,088 | | | | 10,470 | |

| Share reinvestments | | | 28 | | | | - | |

| Share redemptions | | | (1,303 | ) | | | - | |

| Shares end of year/period | | | 13,783 | | | | 10,970 | |

| Net increase in outstanding shares from share activity | | | 2,813 | | | | 10,470 | |

| * | Net of capital contributions and prior period capital contribution of $250,000 and 500 shares from before the Fund commenced operations. |

See Notes to Financial Statements

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Statement of Cash Flows - For the Year Ended March 31, 2016

| Cash flows from operating activities: | | | |

| Net decrease in Net Assets resulting from operations | | $ | (1,138,591 | ) |

| Adjustments to reconcile net decrease in Net Assets resulting from operations to net cash used in operating activities: | | | | |

| Net realized gain from investments | | | (14,710 | ) |

| Net purchases of investments in Investee Funds | | | (1,376,000 | ) |

| Net purchases of short-term investments | | | (70,639 | ) |

| Net change in unrealized depreciation on investments | | | 391,371 | |

| Decrease in advance investment fund contributions | | | 1,150,000 | |

| Decrease in shareholder subscriptions received in advance | | | (1,060,000 | ) |

| Increase in sales receivable | | | (127,000 | ) |

| Increase in interest receivable | | | (164 | ) |

| Decrease in prepaid assets | | | 5,647 | |

| Increase in due from Investment Manager | | | (43,175 | ) |

| Increase in legal fees payable | | | 111,140 | |

| Increase in professional fees payable | | | 20,065 | |

| Decrease in accounting and administartion fees payable | | | (7,033 | ) |

| Decrease in incentive fee payable | | | (12,581 | ) |

| Decrease in transfer agent fees payable | | | (1,406 | ) |

| Decrease in shareholder servicing fees payable | | | (325 | ) |

| Increase in custodian fees payable | | | 2,263 | |

| Decrease in other payable | | | (7,860 | ) |

| Net cash used in operating activities | | | (2,178,998 | ) |

| | | | | |

| Cash flows from financing activities: | | | | |

| Capital contributions | | | 2,060,000 | |

| Capital redemptions | | | (587,109 | ) |

| Distributions from realized gains paid to shareholders, net of reinvestments | | | (6,784 | ) |

| Net cash provided by financing activities | | | 1,466,107 | |

| | | | | |

| Net change in cash | | | (712,891 | ) |

| | | | | |

| Cash at beginning of year* | | | 801,852 | |

| Cash at end of year* | | $ | 88,961 | |

| * | This represents cash held at a broker. For credit-specific risks, which includes amounts held at the broker, see Note 7. |

See Notes to Financial Statements.

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Financial Highlights

| Class I | | For the Year Ended March 31, 2016 | | | For the Period February 2, 2015 through March 31, 2015 | |

| NET ASSET VALUE PER SHARE, BEGINNING OF YEAR/PERIOD | | $ | 509.44 | | | $ | 500.00 | (1) |

| | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | |

Net investment loss (2) | | | (54.13 | ) | | | (9.40 | ) |

| Net realized and unrealized losses on investments and futures | | | (24.72 | ) | | | 18.84 | |

| | | | | | | | | |

| Net Decrease in Net Assets from Operations | | | (78.85 | ) | | | 9.44 | |

| | | | | | | | | |

| Less Distributions from Capital Gains | | | (1.36 | ) | | | - | |

| | | | | | | | | |

| NET ASSET VALUE PER SHARE, END OF YEAR/PERIOD | | $ | 429.23 | | | $ | 509.44 | |

| | | | | | | | | |

| TOTAL RETURN BEFORE INCENTIVE FEE | | | (15.98 | )%(3) | | | 2.12 | %(4) |

| TOTAL RETURN AFTER INCENTIVE FEE | | | (15.98 | )%(3) | | | 1.89 | %(4) |

| | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | |

| Net Assets, end of year/period in thousands (000's) | | | 5,916 | | | | 5,589 | |

| Net investment loss to average net assets, excluding incentive fee | | | (11.45 | )% | | | (6.29 | )%(5) |

| Ratio of gross expenses to average net assets, excluding incentive fee | | | 12.64 | % | | | 8.69 | %(6) |

| Ratio of expense reimbursement to average net assets | | | (0.96 | )% | | | (1.83 | )%(7) |

| Ratio of expense waivers to average net assets | | | (0.22 | )% | | | (0.57 | )%(8) |

| Ratio of net expenses to average net assets, excluding incentive fee | | | 11.46 | % | | | 6.29 | %(5) |

| Ratio of incentive fee to average net assets | | | 0.00 | % | | | 0.30 | %(4) |

| Ratio of net expenses, including incentive fee | | | 11.46 | % | | | 6.59 | %(9) |

| Portfolio Turnover | | | 25.36 | % | | | 0.00 | %(4) |

(1) | The net asset value for the beginning period February 2, 2015 (commencement of operations) through March 31, 2015 represents the initial contribution per share of $500.00. |

(2) | Calculated using average monthly shares outstanding during the period. |

(3) | Total return before and total return after incentive is the same due to no incentive fee expense in the current year. |

(5) | Annualized except for certain professional fees of $36,000, as they approximate the annual fee and an $8,000 expense waiver, as this was a one-time voluntary waiver. |

(6) | Annualized except for certain professional fees of $36,000, as they approximate the annual fee. |

(8) | Voluntary waiver of $10,500. $8,000 is not annualized, as this was a one-time voluntary waiver, but $2,500 was annualized to approximate the annual fee that will be waived. |

(9) | Annualized except for certain professional fees of $36,000, as they approximate the annual fee, an $8,000 expense waiver, as this was a one-time voluntary waiver, and incentive fees. |

The financial ratios do not reflect the Fund's share of income and expenses of the underlying Investee Funds.

See Notes to Financial Statements.

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Notes to Financial Statements – March 31, 2016

1. ORGANIZATION

Little Harbor MultiStrategy Composite Fund (the “Fund”) was organized as a Delaware statutory trust on September 13, 2013 and commenced operations on February 2, 2015. The Fund is registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”), as a non-diversified, closed-end management investment company and meets the requirements of an interval fund pursuant to Rule 23c-3 under the Investment Company Act. The Fund is authorized to issue two classes of Shares, Class I Shares (formally, the sole non-denominated class of shares offered by the Fund) and Class Y Shares. During the period covered by these financial statements, only Class I Shares were offered. The Fund is managed by Little Harbor Advisors, LLC (the “Investment Manager”), an investment adviser registered with the Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940, as amended. The Fund’s investment objective is to realize long-term, risk-adjusted returns that are attractive as compared to those of traditional public equity and fixed-income markets. The Fund intends to pursue its investment objective by investing primarily in U.S. and non-U.S. equities of companies with any market capitalization, fixed income securities of any quality, currencies, derivative instruments, futures contracts, options on futures contracts, and commodities through the allocation of the Fund’s assets among separate accounts (each, a “Portfolio Account”).

Each Portfolio Account is managed by a separate portfolio adviser (each, a “Portfolio Adviser”) selected by the Investment Manager, subject to the approval of the Trustees of the Fund (the “Trustees”) and shareholders of the Fund (each, a “Shareholder”). Each Portfolio Adviser is expected to employ a proprietary investment strategy in managing those Fund assets allocated to it. The Portfolio Advisers’ investment strategies are intended to be complementary to allow the Fund to pursue its objective in a variety of market conditions. Subject to the direction of the Investment Manager, a Portfolio Adviser will invest some or all of those Fund assets allocated to it in a collective investment fund, such as a hedge fund, over which the Portfolio Adviser or one of its affiliates has investment discretion (each an “Investee Fund”).

By investing in an Investee Fund indirectly through the Fund, a Shareholder will bear the expenses (but not any management or incentive fees as stated in the agreement between the Fund and the Investee Fund or the Portfolio Adviser) of the Investee Fund in addition to the expenses of the Fund.

2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company, and as such, these financial statements have applied the guidance set forth in Accounting Standards Codification (ASC) 946, Financial Services—Investment Companies (“ASC 946”). The following is a summary of significant accounting and reporting policies used in preparing the financial statements.

a. Basis of Accounting

The Fund’s accounting and reporting policies conform to accounting principles generally accepted within the United States of America (“U.S. GAAP”).

b. Cash

Cash, if any, includes short-term interest bearing deposit accounts. At times, such deposits may be in excess of federally insured limits. The Fund has not experienced any losses in such accounts and does not believe it is exposed to any significant credit risk on such accounts.

c. Valuation of Investments

The Trustees are responsible for the valuation of the Fund’s assets and liabilities. They have delegated such responsibilities to the Investment Manager. The Trustees have approved procedures pursuant to which the Fund will value its investments in accordance with U.S. GAAP, which requires that the Fund’s investment securities be recorded at fair value. Under the valuation procedures adopted by the Trustees, assets of the Fund held directly and for which market quotations are readily available will be valued at their current market value. Assets for which no market quotations are readily available will be valued at fair value. In general, fair value represents a good faith approximation of the current value of an asset and will be used when there is no public market or possibly no market at all for the asset. The fair values of one or more assets may not be the prices at which those assets are ultimately sold. In these circumstances, the Trustees will reevaluate their fair value methodology to determine what, if any, adjustments should be made to the methodology.

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Notes to Financial Statements – March 31, 2016 (continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

c. Valuation of Investments (continued)

No market quotations are available for shares of Investee Funds. As a practical expedient for determining the fair value of the Fund’s investment in an Investee Fund, the Fund generally uses the net asset value (the “NAV”) per share of the Investee Fund, or its equivalent, provided that the NAV of the Investee Fund is calculated in a manner consistent with the measurement principles applied to investment companies in accordance with ASC 946. An Investee Fund’s NAV is periodically, typically monthly, determined and reported by the Investee Fund’s Portfolio Advisor or a related person. The Investment Manager has an internal process to independently evaluate the process used by the Investee Fund to calculate the Investee Fund’s NAV in accordance with ASC 946. On days when the Investee Fund’s NAV is not determined and reported by the Portfolio Adviser or a related person, the Fund uses a fair value based on the Investee Fund’s last reported NAV, as well as the Investee Fund’s daily gross return performance information provided by the Portfolio Adviser.

The Fund values investments in securities and securities sold short that are freely tradable and are listed on a national securities exchange or reported on the NASDAQ national market at their last sales price. Securities (other than shares of Investee Funds) which are not listed and listed securities in which there were no transactions on the date of valuation, are valued at their last reported “bid” price if held long, and last reported “asked” price if sold short. Futures contracts negotiated on futures exchanges are valued based on their notional value. Money market instruments and other temporary cash equivalent investments whose maturity is less than 60 days usually are valued at amortized cost, which approximates fair value, by amortizing any discount or premium in a straight line from the present to the maturity date. The Fund may from time to time utilize a valuation method other than amortized costs when appropriate, for example, when credit worthiness of the issuer is impaired.

In May 2015, the Financial Accounting Standards Board issued Accounting Standards Update (ASU No. 2015-07, Disclosures for Investments in Certain Entities that Calculate Net Asset Value per Share (or Its Equivalent)), which amends disclosure requirements of Accounting Standards Codification Topic 820, Fair Value Measurement, for reporting entities that measure the fair value of an investment using the net asset value per share (or its equivalent) as a practical expedient. The amendments remove the requirement to categorize within the fair value hierarchy all investments for which fair value is measured using the net asset value per share practical expedient, and also remove the requirements to make certain disclosures for all investments that are eligible to be measured at fair value using the net asset value per share practical expedient. The ASU is effective for the Fund’s fiscal years beginning after December 15, 2015 and interim periods within those fiscal years, with early application permitted. The Fund has chosen to early adopt ASU 2015-07 as of April 1, 2015.

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Notes to Financial Statements – March 31, 2016 (continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

c. Valuation of Investments (continued)

Various inputs are used in determining the value of the Fund’s investments. The inputs are summarized in the three broad levels listed below:

| · | Level 1 – quoted prices (unadjusted) in active markets for identical assets and liabilities |

| · | Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| · | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

For the period ended March 31, 2016, there were no transfers into or out of Level 1, Level 2 or Level 3. It is the Fund’s policy to recognize transfers into and out of all levels at the end of the reporting period.

The following is a summary categorization of the Fund’s investments based on the level of inputs utilized in determining the value of such investments as of March 31, 2016:

| Investment Category | | Level 1 | | | Level 2 | | | Level 3 | | | Investments Valued at NAV | | | Total Investments | |

| Investee Funds | | | | | | | | | | | | | | | |

| Hedged Equity Strategies (a) | | $ | - | | | $ | - | | | $ | - | | | $ | 2,782,571 | | | $ | 2,782,571 | |

| Global Macro Strategies (b) | | | - | | | | - | | | | - | | | | 2,078,933 | | | | 2,078,933 | |

| Opportunistic Value in Credit and Equity Securities Strategies (c) | | | - | | | | - | | | | - | | | | 646,910 | | | | 646,910 | |

| Short-Term Investment | | | 280,546 | | | | - | | | | - | | | | - | | | | 280,546 | |

| Total Investments | | $ | 280,546 | | | $ | - | | | $ | - | | | $ | 5,508,414 | | | $ | 5,788,960 | |

| | | | | | | | | | | | | | | | | | | | | |

| Other Financial Instruments* | | | | | | | | | | | | | | | | | | | | |

| Futures Contracts | | $ | 370 | | | $ | - | | | $ | - | | | $ | - | | | | 370 | |

| Total Other Financial Instruments | | $ | 370 | | | $ | - | | | $ | - | | | $ | - | | | $ | 370 | |

| * | Other Financial Instruments are derivative instruments not reflected in total investments. Amounts shown represent unrealized appreciation/(depreciation) on open contracts as of March 31, 2016. |

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Notes to Financial Statements – March 31, 2016 (continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

c. Valuation of Investments (continued)

In accordance with Subtopic 820-10, shares of Investee Funds have not been classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the statement of assets and liabilities.

(a) A Hedged Equity Strategy maintains at least 50% exposure to, and may in some cases be entirely invested in, equity and equity derivatives - both long and short. A wide variety of investment processes can be employed to arrive at an investment decision, including both quantitative and fundamental techniques. A Hedged Equity Strategy can be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding period, concentrations of market capitalizations and valuation ranges of typical portfolios. A Hedged Equity Strategy can also employ an investment process primarily focused on equity related instruments of companies which are currently engaged in a corporate transaction, security issuance/repurchase, asset sales, division spin-off or other situations identified via fundamental research that are likely to result in a corporate transactions or other realization of shareholder value through the occurrence of some identifiable catalyst.

(b) A Global Macro Strategy is a strategy in which the investment process is predicated on movements in underlying economic variables and the impact these have on equity, fixed income, hard currency and commodity markets. In most cases, a strategy is principally but not exclusively invested in managed futures and index securities. Each Portfolio Adviser employs a variety of techniques, both discretionary and systematic analysis, combinations of top down and bottom up theses, quantitative and fundamental approaches and long and short term holding periods in which the overriding investment thesis is predicated on the impact movements in underlying macroeconomic variables may have on security prices.

(c) An Opportunistic Value in Credit and Equity Securities Strategy uses a distressed-bonds and equities strategy with both long and short positions, primarily using a bottom-up, fundamental approach, including financial modeling, extensive capital structure analysis and market monitoring techniques, to help identify profit opportunities in securities of companies that are restructuring or that are otherwise turning around.

During the year ended March 31, 2016, the Fund had an average of 3 futures contracts outstanding on a monthly basis. The average number of contracts is based on the average monthly outstanding contracts held during the year ended March 31, 2016. The Fund had a net change of $370 in unrealized appreciation and $1,622 in net realized gains on futures contracts for the year ended March 31, 2016, both of which are recorded on the Statement of Operations.

d. Investment Transactions, Investment Income and Realized and Unrealized Gains and Losses

The Fund initially records distributions of cash from each Investee Fund based on the information from distribution notices when distributions are received. Thus, the Fund would recognize within the Statement of Operations its share of realized gains or (losses) and the Fund’s share of net investment income or (loss) based upon information received regarding distribution, from each Investee Fund. Unrealized appreciation/ (depreciation) on investments, within the Statement of Operations, includes the Fund’s share of unrealized gains and losses, realized undistributed gains, and undistributed net investment income or (loss) from each Investee Fund for the relevant period. Realized gains and losses from all investments are calculated based on average cost methodology. Purchases of investments in Investee Funds are recorded as of the first day of legal ownership of each Investee Fund. Sales of Investee Funds are recorded as of the last day of legal ownership or participation in each Investee Fund. For all other investments, the Fund records investments on a trade date basis. Interest income is recorded on an accrual basis.

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Notes to Financial Statements – March 31, 2016 (continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

e. Fund Expenses

The Fund will pay all of its expenses, or reimburse the Investment Manager or its affiliates to the extent they have previously paid such expenses on behalf of the Fund. The expenses of the Fund include, but are not limited to, fees for custody of Fund securities holdings, transfer agency and shareholder servicing, fund administration, legal and independent auditing.

Included in “Legal Fees” are $65,740 of legal fees and related expenses incurred in relation to a joint regulatory examination of the Fund and the Investment Manager and represent an allocation of the total costs deemed by the Investment Manager to relate to the Fund’s activities. Also included in “Legal Fees” are $125,253 of legal fees and related expenses incurred in, among other things, obtaining certain exemptive relief from the Securities and Exchange Commission, the amendment of the Fund’s prospectus and offering costs related to the creation and offering of a new share class for the Fund. As discussed in Note 9, the Trustees of the Fund have adopted a plan to liquidate the Fund and the proposed share class will not become effective.

f. Income Tax Information & Distributions to Shareholders

The Fund has elected to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, that are applicable to regulated investment companies (“RICs”) and to distribute substantially all of its net investment income and any net realized gains to its shareholders (“Shareholders”). Therefore, no provision is made for federal income or excise taxes. Due to the timing of dividend distributions and the differences in accounting for income and realized gains and losses for financial statement and federal income tax purposes, the fiscal year in which amounts are distributed may differ from the year in which the income and realized gains and losses are recorded by the Fund.

Accounting for Uncertainty in Income Taxes (the “Income Tax Statement”) requires an evaluation of tax positions taken (or expected to be taken) in the course of preparing Fund’s tax returns to determine whether these positions meet a “more-likely-than-not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained by a taxing authority upon examination. A tax position that meets the “more-likely-than-not” recognition threshold is measured to determine the amount of benefit to recognize in the financial statements. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations.

The Income Tax Statement requires management of the Fund to analyze tax positions expected to be taken in the Fund’s tax returns, as defined by Internal Revenue Service (the “IRS”) statute of limitations for all major jurisdictions, including federal tax authorities and certain state tax authorities. During the year ended March 31, 2016, the Fund did not have a liability for any unrecognized tax benefits.

The Fund has no examination in progress and is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Notes to Financial Statements – March 31, 2016 (continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

f. Income Tax Information & Distributions to Shareholders (continued)

The character of distributions made during the year from net investment income or net realized gain may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense and gain/(loss) items for financial statement and tax purposes. Where appropriate, reclassifications between net asset accounts are made for such differences that are permanent in nature.

Additionally, U.S. GAAP requires certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. Permanent differences between book and tax basis are attributable to certain non-deductible expenses for tax purposes, including certain offering, organizational, and registration expenses. These reclassifications have no effect on net assets or net asset value per share. For the tax year ended December 31, 2015, the following amounts were reclassified:

| Paid-in capital | | $ | (398,014 | ) |

| Accumulated net investment loss | | | 402,978 | |

| Accumulated net realized gains (losses) on investments and futures | | | (4,964 | ) |

At March 31, 2016, the federal tax cost of investment securities and unrealized appreciation (depreciation) as of the year end were as follows:

| Gross unrealized appreciation | | $ | 116,559 | |

| Gross unrealized depreciation | | | (225,443 | ) |

| Net unrealized depreciation | | $ | (108,884 | ) |

| Tax cost | | $ | 5,897,844 | |

The Fund had realized capital losses from transactions between November 1, 2015 and December 31, 2015 of $160,007. The Fund has elected to treat post-October capital losses as arising in the next tax year.

The difference between cost amounts for financial statement and federal income tax purposes is due primarily to timing differences in recognizing certain gains and losses in security transactions.

For the tax year ended December 31, 2015, the components of accumulated earnings on a tax basis were as follows:

| Undistributed ordinary income | | $ | - | |

| Undistributed long-term capital gains | | | - | |

| Tax accumulated earnings | | | - | |

| Accumulated capital and other losses | | | (160,007 | ) |

| Unrealized depreciation | | | (296,554 | ) |

| Other differences | | | - | |

| Total accumulated earnings | | $ | (456,561 | ) |

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Notes to Financial Statements – March 31, 2016 (continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

f. Income Tax Information & Distributions to Shareholders (continued)

The tax character of the distribution for the tax year ended December 31, 2015 was as follows:

| Distributions paid from: | | | |

| Ordinary Income | | $ | - | |

| Net long term capital gains | | | 19,860 | |

| Total taxable distributions | | | 19,860 | |

| Total distributions paid | | $ | 19,860 | |

For the tax year ended December 31, 2015, the Fund designated $19,860, as long term capital gain dividends for the purpose of the dividends paid deduction.

g. Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires the Fund’s management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

3. INVESTMENT MANAGEMENT AND RELATED PARTY TRANSACTIONS

The Fund has entered into an investment management agreement with the Investment Manager. Pursuant to that agreement, the Investment Manager is entitled to a management fee (the “Management Fee”), calculated and paid monthly, in arrears, at an annual rate of 2.00% percent of the Fund’s net assets. The Management Fee is paid directly to the Investment Manager by the Fund. For the year ended March 31, 2016, the total Management Fee was $136,478.

In addition to the Management Fee, the Investment Manager is paid an incentive fee (the “Incentive Fee”) pursuant to the Investment Management Agreement. The Incentive Fee is calculated based on the performance of the Fund as a whole. The Incentive Fee is calculated and paid quarterly in arrears. The amount of the Incentive Fee for any quarter equals 20 percent of the Fund’s “Pre-Incentive Fee Net Profits” (as defined below) for that quarter. The Fund’s “Pre-Incentive Fee Net Profits (or Losses)” for a specific quarter means an amount equal to (a) the sum of the interest income, dividend income and any other income accrued by the Fund during the quarter and all realized and unrealized gains during such quarter, minus (b) the Fund’s accrued operating expenses for the quarter (including the Management Fee), other than the Incentive Fee due for that quarter, and all realized and unrealized losses during such quarter. No Incentive Fee will be payable, however, for any quarter unless all Pre-Incentive Fee Net Loss from prior quarters has been recovered in full by the Fund, occasionally referred to as a “high water mark” calculation. The Pre-Incentive Fee Net Losses, if any, to be recovered before payment of any Incentive Fees will be reduced proportionately in the event of withdrawals by Shareholders. There is no guarantee that the Fund will have any Pre-Incentive Fee Net Profits in any fiscal quarter. There was no Incentive Fee due or paid to the Investment Manager for the year ended March 31, 2016.

All Management and Incentive Fees are paid directly to the Investment Manager by the Fund. All amounts owed to the Portfolio Advisers for serving as sub-advisers to the Fund are owed by the Investment Manager. The Portfolio Advisers are each paid a portion of the Management and Incentive Fees received by the Investment Manager based on the percentage of Fund assets allocated to the Portfolio Account managed by the Portfolio Adviser. No Portfolio Adviser receives a management fee or an incentive fee or performance allocation from a collective investment fund managed by the Portfolio Adviser or any of its affiliates (including an Investee Fund) that relates to an investment in that collective investment fund by the Fund.

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Notes to Financial Statements – March 31, 2016 (continued)

3. INVESTMENT MANAGEMENT AND RELATED PARTY TRANSACTIONS (continued)

The Investment Manager has contractually agreed, through March 31, 2017, to waive some or all of the fees that it receives from the Fund and/or reimburse the Fund for some or all of the expenses incurred by the Fund if the fund administration and Fund accounting servicing fees exceed an annual rate of 0.45 percent of the Fund’s net assets. For the year ended March 31, 2016, the Investment Manager waived fees in the aggregate amount of $63,793, the entire amount of which is subject to recoupment by the Investment Manager through February 2, 2018. In addition, the Investment Manager also agreed to pay on behalf of the fund, organizational and offering costs, incurred up to the time that the Fund’s registration statement was declared effective, which is subject to recoupment by the Investment Manager through February 2, 2018. The Fund has agreed to repay the Investment Manager, provided that: (a) reimbursement for Fund administration expenses and organizational and offering costs (each as defined below) will be made only if payable not more than three years from the date the Fund commences investment operations; and (b) reimbursement will only be made to the extent that Fund administration expenses are less than the annual rate of 0.45 percent of the Fund’s net assets. The Fund’s organizational costs will be expensed at the time they are deemed to be a Fund liability or obligation (either when they are paid or can be determined to be probable and estimable) and offering costs will be deferred and amortized over the ensuing 12 months at the time they are deemed to be a Fund liability or obligation. The total amount of waived management fees and organizational and offering costs subject to the recoupment is $879,574. For the year ended, March 31, 2016, the Trustees agreed to waive all of their fees associated with serving as trustee of the Fund, the aggregated amount of which is $15,000. Those waived fees are not subject to recoupment by the Trustees.

Pursuant to a shareholder servicing agreement, the Fund pays the Investment Manager or one of its affiliates (in such capacity, the “Servicing Agent”) an ongoing shareholder servicing fee at an annualized rate of 0.25 percent of the average net assets of the Fund for personal services provided to Shareholders and/or the maintenance of Shareholder accounts including, among others, responding to Shareholder inquires and providing information on their investments in the Fund (the “Shareholder Servicing Fee”). The Shareholder Servicing Fee will be paid to the Servicing Agent out of the Fund’s assets and will decrease the net profits or increase the net losses of the Fund. The Servicing Agent may waive (to all investors on a pro rata basis) or pay to third parties all or a portion of any such fees in its sole discretion. The Servicing Agent may delegate some or all of its servicing responsibilities to one or more service providers. For the year ended March 31, 2016, the amount of the Shareholder Servicing Fee paid to the Servicing Agent was $17,060.

Foreside Fund Services, LLC acts as distributor (the “Distributor”) to the Fund. The Distributor does not control, is not controlled by, or is not under common control with, the Investment Manager or any Portfolio Adviser.

Amounts due from the Investment Manager at March 31, 2016 on the Statement of Assets and Liabilities represent amounts due the Fund from the Investment Manager for Fund expenses that the Investment Manager had agreed to reimburse the Fund.

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Notes to Financial Statements – March 31, 2016 (continued)

4. ADMINISTRATION AND CUSTODY AGREEMENT

UMB Fund Services, Inc., serves as administrator (the “Administrator”) to the Fund and provides certain accounting, administrative, record keeping and investor related services. The Fund pays a monthly fee to the Administrator based upon average net assets, subject to certain minimums. At March 31, 2016, the total administration fees paid to the Administrator were $94,500.

UMB Bank, N.A. (the “Custodian”), an affiliate of the Administrator, serves as the primary custodian of the assets of the Fund, and may maintain custody of such assets with U.S. and non-U.S. sub-custodians, securities depositories and clearing agencies.

R.J. O’Brien & Associates, LLC (“RJO”) serves as a futures commission merchant for the Fund. From time to time, the Fund may place and maintain with RJO cash, securities, and similar investments in amounts necessary to effect the Fund’s transactions in exchange-traded futures contracts.

5. INVESTMENT TRANSACTIONS

For the year ended March 31, 2016, total purchases and sales, other than short-term securities, amounted to $2,862,000 and $1,486,000, respectively.

6. INDEMNIFICATION

In the normal course of business, the Fund enters into agreements that provide general indemnifications. Under the Fund’s Declaration of Trust, the Fund generally is required to indemnify each person who at any time serves as a Trustee or officer of the Fund against certain losses he or she may incur. The Fund’s maximum exposure under its Declaration of Trust and these agreements is dependent on future claims that may be made against the Fund, and therefore cannot be established; however, the Fund expects the risk of loss from such claims to be remote.

7. RISK FACTORS

In the normal course of business, the Investee Funds may enter into certain financial instrument transactions which may result in off-balance sheet market risk and credit risk. The Fund invests in these instruments for trading and hedging purposes. The Fund is indirectly subject to certain risks arising from investments made by the Investee Funds. The Fund may be exposed to these risks whether it enters into those types of transactions directly or whether it invests in an Investee Fund that enters into those types transactions. To the extent that the Fund invests in an Investee Fund, the Fund is exposed to those risks to which the Investee Fund is exposed.

Market Risk: The values of Fund investments are affected by general economic and market conditions, such as changes in interest rates, the availability of credit to investors, issuers and others, credit defaults rates, inflation rates, economic uncertainty, changes in laws, including laws relating to taxation of the Fund’s investments, trade barriers, currency exchange controls, and national and international political circumstances, including wars, terrorist acts or security operations.

Credit Risk: Credit risk arises from the potential inability of counterparties to perform their obligations under the terms of a contract. The Fund is indirectly exposed to credit risk related to the amount of accounting loss that the Investee Funds would incur if a counterparty failed to perform its obligations under contractual terms and if the Investee Funds fail to perform under their respective agreements.

Asset Segregation/Offsetting Transactions: As a closed-end investment company registered with the SEC, the Fund is subject to the federal securities laws, including the 1940 Act, related rules, and various SEC and SEC staff positions. In accordance with these positions, with respect to certain kinds of derivatives, the Fund must “set aside” (referred to sometimes as “asset segregation”) liquid assets, or engage in other SEC- or staff-approved measures, while the derivatives contracts are open. For example, with respect to forwards and futures contracts that are not contractually required to “cash-settle,” the Fund must cover its open positions by setting aside liquid assets equal to the contracts’ full, notional value. With respect to forwards and futures that are contractually required to “cash-settle,” however, the Fund is permitted to set aside liquid assets in an amount equal to the Fund’s daily marked-to-market (net) obligations, if any (i.e., the Fund’s daily net liability, if any), rather than the notional value. By setting aside assets equal to only its net obligations under cash-settled forward and futures contracts, the Fund will have the ability to employ leverage to a greater extent than if the Fund were required to segregate assets equal to the full notional value of such contracts. The Fund reserves the right to modify its asset segregation policies in the future to comply with any changes in the positions articulated from time to time by the SEC and its staff.

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Notes to Financial Statements – March 31, 2016 (continued)

7. RISK FACTORS (continued)

Futures Contract Risk: Futures contracts in which the Fund may invest typically have volatile prices, generate significant leverage in the Fund, and are subject to position and trading limits.

8. FUND TERMS

a. Issuance of Shares

The Fund is authorized to issue up to $300,000,000 in Shares of beneficial interest (“Shares”). The Fund will issue Shares as of the first business day of the month or at such other times as determined by the Trustees upon receipt of an initial or additional application for Shares. The Shares are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under the Fund’s Prospectus.

b. Repurchase of Shares

As an “interval fund” complying with Rule 23c-3 under the Investment Company Act, the Fund will make periodic offers to repurchase a portion of its outstanding shares at NAV per share. On periodic 3-month intervals, the Fund will make repurchase offers in conformity with Rule 23c-3. In accordance with Rule 23c-3, the Trustees will determine the percentage of Shares that are be subject to any repurchase offer, which will range from 5 percent to 25 percent of the Fund’s outstanding Shares at the time of the repurchase offer. The Fund does not expect to impose any direct charges on repurchases of Shares in the Fund. In April 2015, the Fund made a repurchase offer and set a repurchase payment date that were approximately four months since the immediately preceding repurchase offer and repurchase date.

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Notes to Financial Statements – March 31, 2016 (continued)

9. SUBSEQUENT EVENTS

On May 16, 2016, at a Special Meeting of the Trustees of Little Harbor MultiStrategy Composite Fund (the “Fund”), the Trustees voted unanimously to liquidate and dissolve the Fund in accordance with the Delaware Statutory Trust Act and the Fund’s Agreement and Declaration of Trust dated September 20, 2013 (the “Declaration of Trust”). In accordance with the Declaration of Trust, the Fund may be dissolved without shareholder consent upon the approval of not less than 75 percent of the Trustees.

As of May 16, 2016, the Fund no longer will offer and sell shares of beneficial interests in the Fund (“Shares”) to the public, and shall not engage in any business activities, except for the purposes of winding up its business and affairs. In addition, the Shareholders’ respective interests in the Fund’s assets shall not be transferable or available for repurchase, including pursuant to any repurchase offer previously authorized by the Trustees or otherwise required by the Fund’s fundamental policy relating to repurchase offers adopted pursuant to Rule 23c-3 under the Investment Company Act of 1940, as amended.

The Fund will convert all its portfolio securities and other assets for cash, cash equivalents and other liquid assets and reserve a portion of the proceeds to pay, or make reasonable provision to pay, all the outstanding debts, claims and obligations of the Fund, together with the expenses related to carrying out the Plan of Liquidation. Thereafter, the Fund will make certain regulatory and tax filings, and then file a certificate with the Delaware Secretary of State to terminate the Fund.

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Fund Management (unaudited) – March 31, 2016

The identity of the members of the Board and brief biographical information as of March 31, 2015 is set forth below. The business address of each Trustee and officer is; C/O Little Harbor Advisors LLC, 30 Doaks Lane, Marblehead, Massachusetts 01945. The Fund’s Statement of Additional Information includes additional information about the membership of the Board. The Statement of Additional Information is available, without charge, upon request by calling 1-844-454-2672.

INDEPENDENT TRUSTEES

| NAME (YEAR OF BIRTH) | POSITION(S) HELD WITH THE FUND | LENGTH OF TIME SERVED | PRINCIPAL OCCUPATION(S) DURING PAST 5 YEARS | NUMBER OF PORTFOLIOS IN FUND COMPLEX OVERSEEN BY TRUSTEE OR OFFICER | Other Trusteeships Held by Trustee |

Brian M. Barefoot Year of Birth: 1943 | Trustee | Since Inception | Consultant (2009 - present). | 1 | Director, Cyonsure, Inc. |

David L. Losito, Jr. Year of Birth: 1958 | Trustee | Since Inception | Managing Director, Cappello Global, LLC (2014 - Present); Managing Director, Cappello Capital Corp. (2011 - 2014); Managing Director, Jeffries & Company (1992 - 2010). | 1 | N/A |

Joseph M. Lyons. Year of Birth: 1960

| Trustee | Since Inception | Co-Founder Boston Boot Company, LLC (2013 - present); Private Investor (2012): Managing Director, RBC Asset Management (2009 - 2011). | 1 | N/A |

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Fund Management (unaudited) – March 31, 2016

| NAME (YEAR OF BIRTH) | POSITION(S) HELD WITH THE FUND | LENGTH OF TIME SERVED | PRINCIPAL OCCUPATION(S) DURING PAST 5 YEARS | NUMBER OF PORTFOLIOS IN FUND COMPLEX OVERSEEN BY TRUSTEE OR OFFICER |

John J. Hassett* Year of Birth: 1952 | President (principal executive officer) | Since Inception | Independent adviser fulfilling role of President of the Investment Manager (2012 – present); Managing Principal of Tuckerbrook Alternative Investments, LP and independent consultant (2008 – 2012). | 1 |

M.C. Moses Grader Year of Birth:1961 | Vice President | Since 2014 | Independent adviser fulfilling role of Chief Operating Officer of the Investment Manager (2012 – present); Initial sole trustee of the Fund (2013 – 2014); Chief Operating Officer of Tuckerbrook Alternative Investments, LP and independent consultant (2008 – 2012). | 1 |

David P. Hausler Year of Birth:1969** | Treasurer; Principal Financial and Accounting Officer | Since Inception | Independent adviser fulfilling role of Chief Financial Officer (2013 – present); Director of Finance at SCS Financial (2012 – 2013); Chief Financial Officer & Chief Compliance Officer, Tuckerbrook Alternative Investments, LP (2008 – 2012). | 1 |

Randall J. Carrigan Year of Birth: 1962 | Chief Compliance Officer, Secretary | Since Inception | Independent adviser fulfilling role of Chief Legal Officer and Chief Compliance Officer of the Investment Manager (2012 – present); Attorney, private practice (2008 – 2012). | 1 |

INTERESTED TRUSTEES & OFFICERS

| * | “Interested Person” of the Fund, as defined by the Investment Company Act. Mr. Hassett is an interested person because of his affiliation with the Investment Manager and its affiliates. |

| ** | David P. Hausler is no longer serving as Treasurer; Principal Financial and Accounting Officer of the Fund, effective April 22, 2016. |

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Other Information (unaudited) – March 31, 2016

Proxy Voting

The Fund has delegated proxy voting responsibilities to the Investment Manager, and the Investment Manager has further delegated certain voting responsibilities to the Portfolio Advisers, in each case subject to the Trustees’ general oversight. A description of the policies and procedures used to vote proxies related to the Fund’s portfolio securities, and information regarding how the Fund voted proxies relating to their portfolio securities for the twelve months ended June 30, no later than August 31, will be available (i) without charge, upon request, by calling toll free, 1-844-454-2672 and (ii) on the SEC’s website at http://www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Fund will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available, without charge and upon request by calling toll free 1-844-454-2672, on the SEC’s website at http://www.sec.gov or may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Additional Information

The Fund’s registration statement includes additional information about the Trustees. The registration statement is available, without charge, upon request by calling 1-844-454-2672.

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

Other Information (unaudited) – March 31, 2016 (continued)

BACK COVER

Little Harbor MultiStrategy Composite Fund

(a Delaware Statutory Trust)

30 Doaks Lane

Marblehead, Massachusetts 01945

Custodian

UMB Bank, N.A.

928 Grand Blvd.

Kansas City, Missouri 64106

R.J. O’Brien & Associates, LLC

222 South Riverside Plaza #900

Chicago, IL 60606

Fund Administrator, Transfer Agent and Fund Accountant

UMB Fund Services, Inc.

235 W. Galena Street

Milwaukee, Wisconsin 53212

Distributor

Foreside Fund Services, LLC

Three Canal Plaza, Suite 100

Portland, Maine 04101

Independent Auditor

RSM US LLP

80 City Square

Boston, Massachusetts 02129

Fund Counsel

Sullivan & Worcester, LLP

One Post Office Square

Boston, Massachusetts 02109

This report, including the financial information herein, is transmitted to the shareholders of Little Harbor MultiStrategy Composite Fund for their information. It is not a prospectus or representation intended for use in the purchase of shares of the Fund or any securities or other financial instrument mentioned in this report.

You can request a copy of the Fund’s prospectus and statement of additional information without charge by calling the Fund’s transfer agent at 1-844-454-2672.

ITEM 2. CODE OF ETHICS.

(a) Little Harbor MultiStrategy Composite Fund (the “registrant” or the “Fund”), as of the end of the period covered by this report, has adopted a code of ethics (the “code of ethics”) that applies to the registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party.

(c) There have been no amendments, during the period covered by this report, to a provision of the registrant’s code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions.

(d) The registrant has not granted any waivers, during the period covered by this report, including an implicit waiver, from any provision of the code of ethics to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions that relates to one or more of the items set forth in paragraph (b) of Item 2 of Form N-CSR.

(f) A copy of the registrant’s code of ethics is filed pursuant to Item 12(a)(1).

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

The registrant’s board of trustees has determined that the registrant has at least one audit committee financial expert serving on its audit committee. The audit committee financial expert is Joseph Lyons, who is "independent," as defined by Item 3 of Form N-CSR.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

The following table details the aggregate fees billed for the fiscal year ended March 31, 2016 and for the Period February 2, 2015 through March 31, 2015 for audit fees, audit-related fees, tax fees and other fees by RSM US LLP. “Audit services” refers to performing an audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refers to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refers to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning.

| | FYE 3/31/2016 | Period Ended 3/31/2015 |

| Audit Fees | $30,500 | $24,960 |

| Audit-Related Fees | $0 | $0 |

| Tax Fees | $13,750 | $1,310 |

| All Other Fees | $0 | $0 |

The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

The percentage of each type of fees billed by RSM US LLP that were approved by the audit committee pursuant to paragraph (c) (7)(i)(c) of Rule 2-01 of Regulation S-X was as follows:

| | FYE 3/31/2016 | Period Ended 3/31/2015 |

| Audit Fees | 100% | 100% |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 100% | 100% |

| All Other Fees | 0% | 0% |

All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

The following table indicates the non-audit fees billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.) for the last fiscal year.

The aggregate amount of fees billed by RSM US LLP applicable to non-audit fees were as follows:

| | FYE 3/31/2016 | Period Ended 3/31/2015 |

| Registrant | $0 | $0 |

| Registrant’s Investment Adviser | $3,000 | $0 |

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

ITEM 6. INVESTMENTS.

Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included as part of the report to shareholders filed under Item 1 of this Form.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

The registrant has delegated proxy voting responsibilities to Little Harbor Advisors, LLC, the registrant’s investment manager (the “Investment Manager”), subject to the general oversight of the registrant’s trustees. The Investment Manager has further delegated proxy voting responsibilities to each sub-adviser to the registrant (each, a “Portfolio Adviser”), but only with respect to those securities of the Fund managed by the Portfolio Adviser. The proxy voting policies and procedures of the Investment Manager and each Portfolio Adviser are attached hereto as Appendices A.1 through A.10.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

(a)(1) Identification of Portfolio Manager(s) and Description of Role of Portfolio Manager(s)

Subject to the general supervision of the Trustees and in accordance with the investment objective, policies, and restrictions of the Fund, the Investment Manager is responsible for the management and operation of the Fund, the selection of the Portfolio Advisers, and the allocation of Fund assets among separate accounts (each, a “Portfolio Account”).

The Investment Manager, Little Harbor Advisors, LLC, is registered as an investment adviser under the Advisers Act and has principal offices at 30 Doaks Lane, Marblehead, Massachusetts 01945. The Investment Manager provides investment advisory services for public and private funds and registered investment companies. The Investment Manager devotes such time to the ongoing operations of the Fund as it deems appropriate in order to implement and monitor the Fund’s investment program.

Certain employees of the Investment Manager act as the Investment Committee (the “Investment Committee”). The Investment Committee makes recommendations to the Investment Manager on the allocation and rebalancing of Fund assets. In order to perform their responsibilities, each of the Investment Manager and the Investment Committee regularly monitors and analyzes the holdings, investment activities, and performance of the Portfolio Accounts and of the Fund.

The Investment Committee currently is composed of M. C. Moses Grader, John Hassett and Jeffrey Landle. Biographical information with respect to each member of the Investment Committee is included in the table below.

The Investment Manager pursues the Fund’s investment objective by allocating a portion of the Fund assets among multiple Portfolio Advisers whose investment strategies, collectively, are intended to be complementary to allow the Fund to achieve its objective under a variety of market conditions.

The following table provides biographical information about the Portfolio Managers, who are primarily responsible for the day-to-day portfolio management of the Fund as of the date hereof:

| Name of Portfolio Manager | Business Experience During the Past 5 Years |

| John Hassett | Independent adviser fulfilling role of President of the Investment Manager (2012 to present); Managing Principal of Tuckerbrook Alternative Investments, LP and independent consultant (2008-2012). |

| M. C. Moses Grader | Independent adviser fulfilling role of Chief Operating Officer of the Investment Manager (2012 to present); Initial sole trustee of the Fund (2013 to 2014); Chief Operating Officer of Tuckerbrook Alternative Investments, LP and independent consultant (2008-2012). |

| Jeffrey Landle | Managing Principal and Chief Investment Officer of the Investment Manager (2012 to present); founding principal and member of Executive Committee of HARDT Group (2004-present). |

David E. Gerstenhaber (Argonaut Management, L.P.) | President of Argonaut, serves as portfolio manager with respect to Argonaut’s Portfolio Account. Mr. Gerstenhaber is also the sole owner of Argonaut. Mr. Gerstenhaber has, among other things, served as a portfolio manager of Argonaut since 1993. |

Laurence C. Leeds (Buckingham Capital Management, Inc.) | Mr. Leeds, the Chairman of Buckingham Capital Management, Inc (“BCM”), joined BCM in 1988 and was previously Chairman and Chief Executive Officer of Manhattan Industries, an apparel manufacturer and retailer from 1974 to 1998. |

Daniel R. Schwarzwalder (Buckingham Capital Management, Inc.) | Mr. Schwarzwalder, a Senior Managing Director of BCM, joined BCM in 1999 with over 25 years of retail experience as a senior member of management for several corporations, including Federated Department Stores. |

Jay Petschek (Corsair Capital Management, L.P.) | Mr. Petschek serves as a Managing Member of Corsair Capital Management, L.L.C., and since 2014 has served as a Managing Member of the General Partner of Corsair Capital Management, L.P., the successor of Corsair Capital Management, L.L.C. |

Steve Major (Corsair Capital Management, L.P.) | Mr. Major serves as a Managing Member of Corsair Capital Management, L.L.C., and since 2014 has served as a Managing Member of the General Partner of Corsair Capital Management, L.P., the successor of Corsair Capital Management, L.L.C. |

Francis S. Olszweski (Eclipse Capital Management, Inc.) | Francis S. Olszweski currently serves as Managing Director and Chief Investment Officer of Eclipse. Mr. Olszweski joined Eclipse in 2001, has served as Managing Director since 2012, and as Chief Investment Officer since 2015. From 2007 through 2014, Mr. Olszweski served as Chief Portfolio Manager. As CIO, Mr. Olszweski serves as the portfolio manager to the Portfolio Account assigned to Eclipse. |

Marco D’Attanasio (Hadron Capital, LLP) | Mr. D’Attanasio serves as a co-portfolio manager for the Portfolio Account assigned to Hadron. Mr. Attanasio is a co-founder of Hadron and has held one or more positions at Hadron since 2004. |

Massimiliano Ciuchini, PhD (Hadron Capital, LLP) | Mr. Ciuchini serves as a co-portfolio manager for the Portfolio Account assigned to Hadron. Mr. Ciuchini is a co-founder of Hadron and has held one or more positions at Hadron since 2004. |

Giuseppe Di Cecio (Hadron Capital, LLP) | Mr. Cecio serves as a co-portfolio manager for the Portfolio Account assigned to Hadron. Mr. Cecio is a co-founder of Hadron and has held one or more positions at Hadron since 2004. |

Bradford Paskewitz (Paskewitz Asset Management, LLC) | Mr. Paskewitz is the portfolio manager to the Portfolio Account assigned to Paskewitz. Paskewitz was founded in 2002 by Bradford Paskewitz, and since then Mr. Paskewitz has served as its Chief Executive Officer and sole owner. |

George Putnam III (New Generation Advisors, LLC) | Mr. Putnam, III has served as President and Chief Executive Officer of New Generation Advisors, LLC since 1988. Mr. Putnam, III has also served as Chairman of New Generation Research, Inc (a publishing company) since 1986. |

Rob Olson (Revolution Capital Management LLC) | Mr. Olson serves as the portfolio manager to the Portfolio Account assigned to Revolution. Mr. Olson has been a principal of Revolution since 2006 and his primary duties include operations and research and development. |

Michael Mundt (Revolution Capital Management LLC) | Mr. Mundt serves as the portfolio manager to the Portfolio Account assigned to Revolution. Mr. Mundt has been a principal of Revolution since 2007 and focuses primarily on research and development, business development and marketing. |

Laurent Saglio (Zadig Gestion (Luxembourg) S.A.) | Laurent Saglio is a founder and current director of Zadig. He also serves as the portfolio manager for the Portfolio Account assigned to Zadig. Prior to founding Zadig, Mr. Saglio was a founder and managing director of Voltaire Asset Management Limited, a firm authorized and regulated by the Financial Services Authority. |

(a)(2) Other Accounts Managed by Portfolio Managers and Conflicts of Interest

The following table provides information about portfolios and accounts, other than the Fund, for which the portfolio managers are primarily responsible for the day-to-day portfolio management as well as the dollar range of equity securities beneficially owned by each portfolio manager as of March 31, 2016:

| Name of Portfolio Manager | Type of Accounts | Total Number of Accounts Managed | Total Assets Managed

(in thousands) | Number of Accounts Managed for Which Advisory Fee is Based on Performance | Total Assets for Which Advisory Fee is Based on Performance

(in thousands) | Dollar Range of Fund Shares Beneficially Owned |

John J. Hassett

(Little Harbor Advisors, LLC) | Registered Investment Companies | 0 | $0 | 0 | $0 | $0 |

| Other Pooled Investment Vehicles | 0 | $0 | 0 | $0 | $0 |

| Other Accounts | 0 | $0 | 0 | $0 | $0 |

M.C. Moses Grader (Little Harbor Advisors, LLC) | Registered Investment Companies | 0 | $0 | 0 | $0 | $0 |

| Other Pooled Investment Vehicles | 0 | $0 | 0 | $0 | $0 |

| Other Accounts | 0 | $0 | 0 | $0 | $0 |

Jeffrey C. Landle (Little Harbor Advisors, LLC) | Registered Investment Companies | 0 | $0 | 0 | $0 | $0 |

| Other Pooled Investment Vehicles | 0 | $0 | 0 | $0 | $0 |

| Other Accounts | 0 | $0 | 0 | $0 | $0 |

David E. Gerstenhaber (Argonaut Management, L.P.) | Registered Investment Companies | 0 | $0 | | $0 | $0 |

| Other Pooled Investment Vehicles | 4 | $107,000 | 4 | $107,000 | $0 |

| Other Accounts | 0 | $0 | 0 | $0 | $0 |

Laurence C. Leeds, Jr. (Buckingham Capital Management, Inc.) | Registered Investment Company | 0 | $0 | 0 | $0 | $0 |

| Other Pooled Investment Company | 3 | $430,000 | 3 | $430,000 | $63,700 |

| Other | 0 | $0 | 0 | $0 | $0 |

Daniel R. Schwarzwalder (Buckingham Capital Management, Inc.) | Registered Investment Company | 0 | $0 | 0 | $0 | $0 |

| Other Pooled Investment Company | 3 | $430,000 | 3 | $430,000 | $11,200 |

| Other | 0 | $0 | 0 | $0 | $0 |

Jay R. Petschek (Corsair Capital Management, L.P.) | Registered Investment Company | 1 | $14,649 | 1 | $14,649 | $0 |

| Other Pooled Investment Company | 6 | $874,515 | 6 | $874,515 | $0 |

| Other | 2 | $173,944 | 1 | $59,326 | $0 |

Steven Major (Corsair Capital Management, L.P.) | Registered Investment Company | 1 | $14,649 | 1 | $14,649 | $0 |

| Other Pooled Investment Company | 6 | $874,515 | 6 | $874,515 | $0 |

| Other | 2 | $173,944 | 1 | $59,326 | $0 |

Francis S. Olszweski (Eclipse Capital Management, Inc.) | Registered Investment Company | 1 | $188,800 | 0 | $0 | $0 |

| Other Pooled Investment Company | 4 | $144,800 | 3 | $142,400 | $0 |

| Other | 5 | $33,700 | 2 | $18,200 | $0 |

Marco D’Attanasio (Hadron Capital, LLP) | Registered Investment Company | 0 | $0 | 0 | $0 | $0 |

| Other Pooled Investment Company | 19 | $37,919 | 19 | $37,919 | $0 |

| Other | 32 | $131,501 | 32 | $131,501 | $0 |

Giuseppe Di Cecio (Hadron Capital, LLP) | Registered Investment Company | 0 | $0 | 0 | $0 | $0 |

| Other Pooled Investment Company | 19 | $24,762 | 19 | $24,762 | $0 |

| Other | 32 | $99,347 | 32 | $99,347 | $0 |