Exhibit 10.32

DATED 30 MAY 2013

| (1) | STYRON EUROPE GMBH |

(as Swiss Seller, Investment Manager, Styron Noteholder and Chargor)

| (2) | STYRON DEUTSCHLAND ANLAGENGESELLSCHAFT MBH |

(as German Seller and German Servicer)

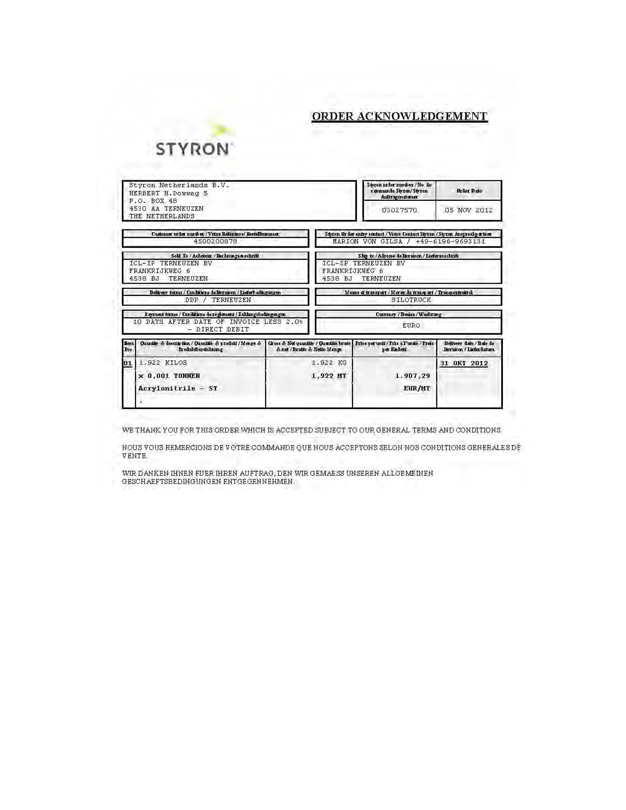

| (3) | STYRON NETHERLANDS B.V. |

(as Dutch Seller and Dutch Servicer)

| (4) | STYRON LLC |

(as U.S. Seller and U.S. Servicer)

| (5) | TRINSEO U.S. RECEIVABLES COMPANY SPV LLC |

(as U.S. Intermediate Transferor)

| (6) | STYRON RECEIVABLES FUNDING LIMITED |

(as Master Purchaser and Chargee)

| (7) | STYRON FINANCE LUXEMBOURG S.À R.L., LUXEMBOURG, ZWEIGNIEDERLASSUNG HORGEN |

(as Styfco)

| (8) | REGENCY ASSETS LIMITED |

(as Regency Noteholder)

| (9) | HSBC BANK PLC |

(as Cash Manager and Master Purchaser Account Bank)

| (10) | STYRON HOLDING S.À R.L. |

(as Parent)

| (11) | TMF ADMINISTRATION SERVICES LIMITED |

(as Corporate Administrator and Registrar)

| (12) | THE LAW DEBENTURE TRUST CORPORATION P.L.C. |

(as Styron Security Trustee)

| reedsmith.com |

CONTENTS

CLAUSE

| 1 | DEFINITIONS AND INTERPRETATION | 3 | ||||

| 2. | CONSENT TO THE STYRON SECURITY TRUSTEE | 7 | ||||

| 3. | AMENDMENTS AND ACCESSION | 8 | ||||

| 4. | TRANSFER OF THE STYRON NOTES | 10 | ||||

| 5. | CONTINUITY AND FURTHER ASSURANCE | 10 | ||||

| 6. | COSTS, EXPENSES AND INDEMNIFICATION | 11 | ||||

| 7. | GOVERNING LAW AND JURISDICTION | 11 |

CONTENTS PAGE 1

CONTENTS

CLAUSE

| 1 | DEFINITIONS AND INTERPRETATION | 3 | ||||

| 2. | CONSENT TO THE STYRON SECURITY TRUSTEE | 7 | ||||

| 3. | AMENDMENTS AND ACCESSION | 8 | ||||

| 4. | TRANSFER OF THE STYRON NOTES | 10 | ||||

| 5. | CONTINUITY AND FURTHER ASSURANCE | 10 | ||||

| 6. | COSTS, EXPENSES AND INDEMNIFICATION | 11 | ||||

| 7. | GOVERNING LAW AND JURISDICTION | 11 |

CONTENTS PAGE 1

SCHEDULES

SCHEDULE 1 | ||||

AMENDED AND RESTATED CASH MANAGEMENT AGREEMENT | 12 | |||

SCHEDULE 2 | ||||

AMENDED AND RESTATED MASTER DEFINITIONS AND FRAMEWORK DEED | 13 | |||

SCHEDULE 3 | ||||

AMENDED AND RESTATED STYRON GUARANTEE AGREEMENT | 14 | |||

SCHEDULE 4 | ||||

AMENDED AND RESTATED STYRON SECURITY DEED | 15 | |||

SCHEDULE 5 | ||||

AMENDED AND RESTATED VARIABLE LOAN NOTE ISSUANCE DEED | 16 | |||

SCHEDULE 6 | ||||

AMENDED AND RESTATED SWISS SERVICING AGREEMENT | 17 | |||

SCHEDULE 7 | ||||

AMENDMENT CONDITIONS PRECEDENT | 18 | |||

EXECUTION PAGE |

CONTENTS PAGE 1

THIS DEED is made on 30 MAY 2013

BETWEEN:

| (1) | STYRON EUROPE GMBH, a limited liability company incorporated in Switzerland, having its registered office at Zugerstrasse 231, CH-8810 Horgen. Switzerland, being an indirect wholly-owned subsidiary of the Parent (the “Swiss Seller”, the “Investment Manager”, the “Styron Noteholder” and the “Chargor”); |

| (2) | STYRON DEUTSCHLAND ANLAGENGESELLSCHAFT MBH, incorporated in Germany as a limited liability company (Gesellschaft mit beschränkter Haftung), registered at the “local court (Amtsgericht) of Tostedt under HRB 202609 and having its business address at Bützflether Sand, 21683 Stade, Germany (the “German Seller” and the “German Servicer”); |

| (3) | STYRON NETHERLANDS B.V., a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) incorporated in The Netherlands, having its corporate seat (statutaire zetel) in Temeuzen, The Netherlands and its registered office at Herbert H. Dowweg 5, 4542 NM Hoek, The Netherlands 20162359 (the “Dutch Seller” and the “Dutch Servicer”); |

| (4) | STYRON LLC, a limited liability company formed under the laws of the State of Delaware, having its primary office at 1000 Chesterbrook Boulevard, Suite 300, Berwyn, Pennsylvania 19312, (the “U.S. Seller” and the “U.S. Servicer”); |

| (5) | TRINSEO U.S. RECEIVABLES COMPANY SPV LLC, a limited liability company organized under the laws of the State of Delaware, having its primary office at c/o Styron LLC at 1000 Chesterbrook Boulevard, Suite 300, Berwyn, Pennsylvania 19312, in its capacity as the U.S. Intermediate Transferor (the “U.S. Intermediate Transferor” and, together with the Swiss Seller, the German Seller, the Dutch Seller and the U.S. Seller, the “Sellers”); |

| (6) | STYRON RECEIVABLES FUNDING LIMITED a company incorporated in Ireland, whose registered office is at 53 Merrion Square, Dublin 2, Ireland (the “Master Purchaser”, the “Pledgee”, and the “Chargee”); |

| (7) | STYRON FINANCE LUXEMBOURG S.À R.L., LUXEMBOURG, ZWEIGNIEDERLASSUNG HORGEN, a Swiss branch, with offices located at Zugerstrasse 231, CH-8810, Horgen, Switzerland, of Styron Finance Luxembourg S.à r.l., a Luxembourg private limited liability company (société à responsabilité limitée) with registered office at 9A, rue Gabriel Lippmann, L-5365 Munsbach, Grand Duchy of Luxembourg, registered with the Luxembourg Register of Commerce and Companies under number B 151.012 and having a share capital of USD 25,001 (“Styfco”); |

| (8) | REGENCY ASSETS LIMITED a company incorporated in Ireland, whose registered office is at 5 Harbourmaster Place, I.F.S.C., Dublin 1, Ireland (the “Regency Noteholder”); |

| (9) | HSBC BANK PLC, a company incorporated in England and Wales (Company Number: 14259) having its registered office at 8 Canada Square, London E14 5HQ (the “Cash Manager” and the “Master Purchaser Account Bank”); |

page 2

| (10) | STYRON HOLDING S.À R.L., a Luxembourg private limited liability company (société à responsabilité limitée) with registered office at 9A, rue Gabriel Lippmann, L-5365 Munsbach, Grand Duchy of Luxembourg, registered with the Luxembourg Register of Commerce and Companies under number B 153.582 and having a share capital of US$ 162,815,834.12 (the “Parent” and the “Guarantor”); |

| (11) | TMF ADMINISTRATION SERVICES LIMITED, a company incorporated in Ireland, whose registered office is at 53 Merrion Square, Dublin 2, Ireland (the “Corporate Administrator” and the “Registrar”); and |

| (12) | THE LAW DEBENTURE TRUST CORPORATION P.L.C., a company incorporated with limited liability in England and Wales, having its registered office at Fifth Floor, 100 Wood Street, London EC2V 7EX in its capacity as security trustee under the Styron Security Deed (the “Styron Security Trustee”), |

(together the“Parties”).

IT IS AGREED as follows:

| 1 | DEFINITIONS AND INTERPRETATION |

| 1.1 | Definitions |

In this Deed:

Accession means the accession to the Transaction Documents of: (i) the Dutch Seller and Dutch Servicer by execution of this Deed, the Amended Master Definitions and Framework Deed, the Dutch Receivables Purchase Agreement, the Dutch Servicing Agreement, the Belgian Collection Account Pledge Agreement and the Dutch Collection Account Security Document, (ii) the U.S. Seller and U.S. Servicer by execution of this Deed, the Amended Master Definitions and Framework Deed, the U.S. Receivables Purchase Agreement, the U.S. Servicing Agreement, the U.S. Intermediate Transfer Agreement and the U.S. Account Control Agreements, (iii) the U.S Intermediate Transferor by execution of this Deed, the Amended Master Definitions and Framework Deed, the U.S. Receivables Purchase Agreement, the U.S. Intermediate Transfer Agreement and the U.S. Account Control Agreements and (iv) Styfco, in its capacities immediately following the execution of this Deed as Investment Manager or Styron Noteholder, as applicable, by execution of this Deed, the Amended Master Definitions and Framework Deed, the Amended Cash Management Agreement, the Amended Styron Security Deed, the Amended Variable Loan Note Issuance Deed, the U.S. Receivables Purchase Agreement, the U.S. Intermediate Transfer Agreement, the Dutch Receivables Purchase Agreement, the German Receivables Purchase Agreement and the Swiss Receivables Purchase Agreement.

page 3

Amended Cash Management Agreement has the meaning given to it in Clause 3.1 (Amendment of the Original Cash Management Agreement).

Amended Master Definitions and Framework Deed has the meaning given to it in Clause 3.2 (Amendment of the Original Master Definitions and Framework Deed).

Amended Styron Security Deed has the meaning given to it in Clause 3.4 (Amendment of the Original Styron Security Deed).

Amended Variable Loan Note Issuance Deed has the meaning given to it in Clause 3.5 (Amendment of the Original Variable Loan Note Issuance Deed).

Amendment Conditions Precedent means the conditions precedent set out in Schedule 7 hereto.

Amendments means the English Law Amendments and the Foreign Law Amendments.

Belgian Collection Account Pledge Agreement means the Belgian Collection Account Pledge Agreement dated on or about the date of the Deed by which the Dutch Seller has created security over the Belgian law governed Collection Accounts and any other account control agreements entered into among the Dutch Seller, the Master Purchaser, the Styron Security Trustee and the relevant Collection Account Bank.

Dutch ClosingDate means the date hereof.

Dutch Collection Account Security Document means the Dutch Collection Account Security Agreement dated on or about the date of this Deed by which the Dutch Seller has created security over the Dutch law governed Collection Accounts and any other account control agreements entered into among the Dutch Seller, the Master Purchaser, the Styron Security Trustee and the relevant Collection Account Bank.

Dutch Funding Date means the date falling two Business Days after the day the first Offer is delivered under the Dutch Receivables Purchase Agreement or such other date as may be agreed by the Dutch Seller and the Instructing Party.

Dutch Receivables Purchase Agreement means the agreement so named, dated on or about the date of this Deed, between the Dutch Seller, Styfco, in its capacity as the Investment Manager, the Styron Security Trustee and the Master Purchaser.

Dutch Servicing Agreement means the agreement so named, dated on or about the date of this Deed, between the Dutch Servicer, the Master Purchaser and the Styron Security Trustee.

page 4

Dutch Transaction Documents means the Dutch Receivables Purchase Agreement, the Dutch Servicing Agreement, this Deed, the Dutch Collection Account Security Agreement and the Belgian Collection Account Pledge Agreement.

English Law Amendments means the amendments effected by this Deed.

Foreign Law Amendments means the amendments to be affected on or around the date hereof to the German Receivables Purchase Agreement, the German Servicing Agreement, the German Security Assignment and Trust Agreement and the Original Master Receivables Purchase Agreement.

German Receivables Purchase Agreement means the agreement so named, dated 24 May 2011, as amended and restated on or around the date hereof, between the German Seller, the Swiss Seller, Styfco, in its capacity as Investment Manager, the Styron Security Trustee and the Master Purchaser.

German Security Assignment and Trust Agreement means the agreement so named dated on or about the German Closing Date, as amended and restated on around the date hereof, between the Master Purchaser, the Styron Security Trustee, the Regency Noteholder and the Styron Noteholder.

German Servicing Agreement means the agreement so named, dated 24 May 2011, as amended and restated on or around the date hereof between the German Servicer, the Master Purchaser and the Styron Security Trustee,

Novation means the transfer effected pursuant to Clause 4 (Novation by Styron Noteholder).

Original Cash Management Agreement means the Cash Management Agreement dated 12 August 2010 and amended and restated on 24 May 2011 between the Master Purchaser, the Cash Manager, the Regency Noteholder, Styron Europe GmbH, in its capacity as the Styron Noteholder, and the Styron Security Trustee,

Original Investment Management and Servicing Agreement means the Investment Management and Servicing Agreement dated 12 August 2010 among the Master Purchaser, Styron Europe GmbH, in its capacity as the Investment Manager, and the Styron Security Trustee.

Original Master Definitions and Framework Deed means the Master Definitions and Framework Deed dated 12 August 2010 and amended on 17 August 2010, 24 May 2011 and 4 July 2012, between Styron Europe GmbH, in its capacities as the Swiss Seller, the Investment Manager, the Styron Noteholder and the Chargor, the German Seller, the German Servicer, the Master Purchaser, the Chargee, the Regency Noteholder, the Cash Manager, the Master Purchaser Account Bank, the Parent, the Guarantor, the Corporate Administrator, the Registrar and the Styron Security Trustee.

page 5

Original Master Receivables Purchase Agreement means the Master Receivables Purchase Agreement dated 12 August 2010 and amended on 24 May 2011 between the Swiss Seller, the Master Purchaser, and the Styron Security Trustee (which, following amendment herein, shall be referred to as the Swiss Receivables Purchase Agreement).

Original Styron Guarantee Agreement means the Styron Guarantee Agreement dated 12 August 2010 and amended and restated on 24 May 2011 between the Guarantor, the Master Purchaser, the Beneficiaries and the Styron Security Trustee.

Original Styron Security Deed means the Styron Security Deed dated 12 August 2010 and amended and restated on 24 May 2011 between the Master Purchaser, the Styron Security Trustee, the Regency Noteholder and Styron Europe GmbH, in its capacity as the Styron Noteholder.

Original Variable Loan Note Issuance Deed means the Variable Loan Note Issuance Deed dated 12 August 2010 and amended and restated on 24 May 2011 between, the Master Purchaser, the Regency Noteholder, Styron Europe GmbH, in its capacity as the Styron Noteholder, the Styron Security Trustee, the Cash Manager, and the Registrar,

U.S. Account Control Agreement means each deposit account control agreement dated on or about the U.S. Closing Date by which the U.S. Seller has created security over the U.S. Collection Accounts and any other account control agreements entered into among the U.S. Seller, the U.S. Intermediate Transferor, the Master Purchaser, the Styron Security Trustee and the relevant Collection Account Bank.

U.S. Intermediate Transfer Agreement means the intermediate receivables purchase agreement to be dated on or about the date hereof, among the U.S. Intermediate Transferor, Styfco, in its capacity as the Investment Manager, and the Master Purchaser, as may be amended, supplemented, extended or restated, or otherwise modified from time to time.

U.S. Receivables Purchase Agreement means the receivables purchase agreement to be dated on or about the date hereof among the U.S. Seller, Styfco, in its capacity as the Investment Manager, and the U.S. Intermediate Transferor, as may be amended, supplemented, extended or restated, or otherwise modified from time to time.

U.S. Servicing Agreement means the servicing agreement to be dated on or about the date hereof, among the U.S. Servicer, the U.S. Seller, the U.S. Intermediate Transferor and the Master Purchaser, relating to the Purchased Receivables purchased by the U.S. Intermediate Transferor pursuant to the U.S. Receivables Purchase Agreement and by the Master Purchaser pursuant to the U.S. Intermediate Transfer Agreement.

page 6

U.S. Transaction Documents means the U.S. Account Control Agreements, U.S. Intermediate Transfer Agreement, U.S. Receivables Purchase Agreement and U.S. Servicing Agreement.

| 1.2 | Incorporation of defined terms |

Unless otherwise defined herein, a term defined in any other Transaction Document has the same meaning in this Deed.

The principles of construction set out in the Original Master Definitions and Framework Deed shall have effect as if set out in this Deed,

| 1.3 | Framework Provisions |

The Framework Provisions shall be expressly and specifically incorporated into this Agreement, as though they were set out in full in this Agreement. In the event of any conflict between the provisions of this Agreement and the Framework Provisions, the provisions of this Agreement shall prevail other than Clause 22 of the Original Master Definitions and Framework Deed or the Amended Master Definitions and Framework Deed as it relates to the Styron Security Trustee.

| 1.4 | Clauses |

In this Deed any reference to a “Clause” or a “Schedule” is, unless the context otherwise requires, a reference to a Clause or a Schedule to this Deed.

| 1.5 | Designation |

In accordance with the Original Master Definitions and Framework Deed, the Instructing Party and the Master Purchaser nominate this Deed a Transaction Document.

| 2. | CONSENT TO THE STYRON SECURITY TRUSTEE |

Each of the Parties (other than the Styron Security Trustee):

| 2.1 | confirms that it has formed its own view in relation to the Amendments, the Accession and the Novation without any reliance on the Styron Security Trustee; |

| 2.2 | confirms it consents to the Amendments, the Accession and the Novation; |

| 2.3 | authorises and directs the Styron Security Trustee to consent to such Amendments, Accession and Novation, and to execute the U.S. Security Agreement and this Deed together with each of the documents required to effect such Amendments, Accession and Novation; |

page 7

| 2.4 | agrees that the Styron Security Trustee shall not be responsible for any losses or Liabilities that may arise under this Deed, the Notes, or any Transaction Document as a result of implementing Clause 2.3 (and the Noteholders irrevocably waive any claims against the Styron Security Trustee in respect of such losses or Liabilities) and shall have no liability for the exercise or non-exercise of any trusts, powers, authorities or discretions vested in the Styron Security Trustee in connection with this Deed, the Amendments, the Accession and the Novation or any Transaction Document or any operation of law; |

| 2.5 | acknowledges that this Deed constitutes (a) notice by the Master Purchaser of the Security in accordance with Clause 7.1 (Master Purchaser’s Notice) of the Styron Security Deed and (b) acknowledgment by each Transaction Party of its receipt of the Master Purchaser’s notice of Security in accordance with Clause 7.2 (Acknowledgment of Notices) of the Styron Security Deed; and |

| 2.6 | for the avoidance of doubt, acknowledges that whenever the Styron Security Trustee acts under any of the Transaction Documents it does so in accordance with the Styron Security Deed solely in accordance with the requests and instructions of the Instructing Party and that the Styron Security Trustee shall take no actions unless indemnified, pre-funded or secured to its satisfaction, having received instructions. All Parties acknowledge that the Styron Security Trustee has no liability to monitor provisions under any of the Transaction Documents and that the Styron Security Trustee may assume that a right or obligation has not arisen until notified otherwise. The Styron Security Trustee shall not be responsible for any loss or liability incurred by any person as a result of any delay in it exercising such discretion or power, taking such action, making such decision, or giving such discretion where the Styron Security Trustee is seeking but has not yet received such directions from the Instructing Party or such delay is caused by the Instructing Party not giving directions to the Styron Security Trustee or where, in the opinion of the Styron Security Trustee, such directions when given are insufficiently clear. |

| 2.7 | The Instructing Party confirms and acknowledges that the opinions to be delivered as to U.S. law by Kirkland & Ellis LLP will not cover or address the legality or enforceability of or any other matter in relation to the U.S. Security Agreement. |

| 3. | AMENDMENTS AND ACCESSION |

The English Law Amendments and the Accession shall take place subject to the satisfaction or waiver by the Cash Manager of each of the Amendment Conditions Precedent (acting reasonably).

page 8

| 3.1 | Amendment of the Original Cash Management Agreement |

With effect from the date of this Deed the Cash Management Agreement shall be amended and restated so as to be in the form set out in Schedule 1 (Amended Cash Management Agreement) (the “Amended Cash Management Agreement”) and Styfco, in its capacity as Styron Noteholder, shall become party thereto with the benefit of the rights and subject to the obligations set out therein.

| 3.2 | Amendment of the Original Master Definitions and Framework Deed |

With effect from the date of this Deed the Original Master Definitions and Framework Deed shall be amended and restated so as to be in the form set out in Schedule 2 (Amended and Restated Master Definitions and Framework Deed) (the “Amended Master Definitions and Framework Deed”) and the Dutch Seller, Dutch Servicer, Styfco, in its capacity as Investment Manager and Styron Noteholder, U.S. Seller, U.S. Servicer and U.S. Intermediate Purchaser shall all become parties thereto with the benefit of the rights and subject to the obligations set out therein.

| 3.3 | Amendment of the Original Styron Guarantee Agreement |

With effect from the date of this Deed the Original Styron Guarantee Agreement shall be amended and restated so as to be in the form set out in Schedule 3 (Amended and Restated Styron Guarantee Agreement).

| 3.4 | Amendment of the Original Styron Security Deed |

With effect from the date of this Deed the Original Styron Security Deed shall be amended and restated, so as to be in the form set out in Schedule 4 (Amended and Restated Styron Security Deed) (the “Amended Styron Security Deed”) and Styfco, in its capacity as Styron Noteholder, shall become a party thereto with the benefit of the rights and subject to the obligations therein.

| 3.5 | Amendment of the Original Variable Loan Note Issuance Deed |

With effect from the date of this Deed the Original Variable Loan Note Issuance Deed shall be amended and restated so as to be in the form set out in Schedule 5 (Amended and Restated Variable Loan Note Issuance Deed) (the “Amended Variable Loan Note Issuance Deed”) and Styfco, in its capacity as Styron Noteholder, shall become a party thereto with the benefit of the rights and subject to the obligations therein.

page 9

| 3.6 | Amendment of the Original Investment Management and Servicing Agreement |

With effect from the date of this Deed the Original Investment Management and Servicing Agreement shall be amended and restated so as to be in the form set out in Schedule 6 (Amended and Restated Swiss Servicing Agreement).

| 4. | TRANSFER OF THE STYRON NOTES |

| 4.1 | Subject to the satisfaction or waiver by the Cash Manager of each of the Amendment Conditions Precedent (acting reasonably), with effect from and including the date hereof and in consideration of the mutual representations, warranties and covenants contained in this agreement and the Transaction Documents and other good and valuable consideration the receipt and sufficiency of which are hereby acknowledged by each of the relevant Transaction Parties and notwithstanding the terms of any other Transaction Document, the Styron Notes are hereby transferred by the Swiss Seller to Styfco. Any rights and obligations of the Styron Noteholder which accrued prior to the transfer in accordance with the above shall be rights and obligations of Styfco in its capacity as the Styron Noteholder from the time of such transfer. The Registrar shall register Styfco as holder of the Styron Notes in accordance with Clause 8 of the Variable Loan Note Issuance Deed. |

| 5. | CONTINUITY AND FURTHER ASSURANCE |

| 5.1 | Continuing obligations |

The provisions of the Original Master Definitions and Framework Deed and the other Transaction Documents shall, save as amended by this Deed, continue in full force and effect.

| 5.2 | Further assurance |

Each of the Parties shall, at the request of the Sellers or the Master Purchaser, and at the expense of the Sellers, do all such acts and things necessary or desirable to give effect to the amendments effected or to be effected pursuant to this Deed.

| 5.3 | Additional Covenant |

Styfco shall procure that the variation of corporate purpose resolved in the resolution of Styron Finance Luxembourg S.a r.l. dated 23 May 2013 varying the purpose of its Swiss branch (and the amendments and changes resolved therein) and provided to the Cash Manager has been duly filed and registered and all other steps required in all applicable jurisdictions completed such that such variation of corporate purpose is effective against all persons in Luxembourg and Switzerland. If all such steps have not been completed (and in particular the applicable registration in the Commercial Register of the Canton of Zurich) by 14 June 2013, that shall constitute a Termination Event.

page 10

| 6. | COSTS, EXPENSES AND INDEMNIFICATION |

The Master Purchaser shall, from time to time on demand of the Styron Security Trustee, reimburse the Styron Security Trustee for all properly incurred, costs and expenses (including legal fees) incurred by it in connection with the negotiation, preparation and execution or purported execution of this Deed.

The Master Purchaser hereby agrees to indemnify the Styron Security Trustee against all actions, proceedings, claims, demands, liabilities, losses, damages, costs, expenses and charges (including legal expenses and together with value added tax or any similar tax charged or chargeable in respect thereof) which the Styron Security Trustee or any person appointed by it (or their respective officers or employees) may incur directly or indirectly from the exercise of the powers vested in the Styron Security Trustee by or pursuant to the Styron Security Deed or as a result of any actions taken pursuant to this Deed.

| 7. | GOVERNING LAW AND JURISDICTION |

| 7.1 | This Deed and any non-contractual obligations arising out of or in connection with it are governed by English law. |

| 7.2 | For the avoidance of doubt, Clause 4 (Jurisdiction) of the Master Definitions and Framework Deed shall apply to this Agreement. |

This Deed has been entered into on the date stated at the beginning of this Deed.

page 11

SCHEDULE 1

AMENDED AND RESTATED CASH MANAGEMENT AGREEMENT

page 12

SCHEDULE 2

AMENDED AND RESTATED MASTER DEFINITIONS AND FRAMEWORK DEED

page 13

SCHEDULE 3

AMENDED AND RESTATED STYRON GUARANTEE AGREEMENT

page 14

SCHEDULE 4

AMENDED AND RESTATED STYRON SECURITY DEED

page 15

SCHEDULE 5

AMENDED AND RESTATED VARIABLE LOAN NOTE ISSUANCE DEED

page 16

SCHEDULE 6

AMENDED AND RESTATED SWISS SERVICING AGREEMENT

page 17

SCHEDULE 7

AMENDMENT CONDITIONS PRECEDENT

The Dutch Seller

| (1) | Copies of the latest versions of the constitutional documents of the Dutch Seller certified by the Dutch Seller to be a true and up to date copy of the original. |

| (2) | Copies of the resolutions, in form and substance satisfactory to the Instructing Party, authorising the execution, delivery and performance of the Dutch Receivables Purchase Agreement, the Dutch Servicing Agreement, this Deed, Dutch Collection Account Security Agreement and the Belgian Collection Account Pledge Agreement (the “Dutch Transaction Documents”), certified by an officer of the Dutch Seller as not having been amended, modified, revoked or rescinded on the date of execution of this Agreement. |

| (3) | Delivery of a closing certificate dated the Dutch Funding Date from the Dutch Seller including a certificate as to the incumbency and signature of the officers or other employees authorised to sign the Dutch Transaction Documents on behalf of the Dutch Seller and any certificate or other document to be delivered pursuant thereto, certified by the company secretary or a manager of the Dutch Seller together with evidence of the incumbency of such company secretary or director. |

| (4) | An electronic excerpt of the commercial register in respect of the Dutch Seller dated no earlier than 10 calendar days prior to the Dutch Closing Date. |

| (5) | Solvency Certificates in respect of the Dutch Seller in the form set out in Schedule 2 to the Dutch Receivables Purchase Agreement, one dated the Dutch Closing Date and one dated the Dutch Funding Date. |

| (6) | Compliance Certificates in respect of the Dutch Seller in the form set out in Schedule 3 to the Dutch Receivables Purchase Agreement, one dated the Dutch Closing Date and one dated the Dutch Funding Date. |

| (7) | Delivery of Dutch Master Purchaser Receivables Power of Attorney pursuant to Clause 5.1(b) of the Dutch Receivables Purchase Agreement. |

Parent

| (8) | Copies of the resolutions, in form and substance satisfactory to the Instructing Party, of the board of managers of the Parent authorising the execution, delivery and performance of this Deed, certified by a manager of the Parent as of the Dutch Closing Date and the Dutch Funding Date which certificate shall state that the resolutions thereby certified have not been amended, modified, revoked or rescinded. |

| (9) | A certificate as to the incumbency and signature of the managers or other attorneys authorised to sign this Deed on behalf of the Parent and any certificate or other document to be delivered pursuant thereto, certified by any manager of the Parent together with evidence of the incumbency of such manager. |

page 18

| (10) | Up to date Commercial Register excerpts in respect of the Parent dated no earlier than 10 calendar days prior to the Dutch Funding Date. |

| (11) | Solvency Certificates in respect of the Parent in the form agreed by the Instructing Party, one dated the Dutch Closing Date and one dated the Dutch Funding Date. |

Swiss Seller

| (12) | Copies of the resolutions, in form and substance satisfactory to the Instructing Party, of the board of managers of the Swiss Seller authorising the execution, delivery and performance of this Deed, certified by a manager of the Swiss Seller as of the Dutch Closing Date and the Dutch Funding Date which certificate shall state that the resolutions thereby certified have not been amended, modified, revoked or rescinded. |

| (13) | A certificate as to the incumbency and signature of the managers or other attorneys authorised to sign this Deed on behalf of the Swiss Seller and any certificate or other document to be delivered pursuant thereto, certified by any manager of the Swiss Seller together with evidence of the incumbency of such manager. |

| (14) | A copy of an up to date Commercial Register excerpt in respect of the Swiss Seller dated no earlier than 10 calendar days prior to the Dutch Funding Date. |

| (15) | Solvency Certificates in respect of the Swiss Seller in the form set out in Schedule 2 to the Swiss Receivables Purchase Agreement, one dated the Dutch Closing Date and one dated the Dutch Funding Date. |

| (16) | Compliance Certificates in respect of the Swiss Seller in the form set out in Schedule 3 to the Swiss Receivables Purchase Agreement, one dated the Dutch Closing Date and one dated the Dutch Funding Date. |

German Seller

| (17) | Copies of the resolutions, in form and substance satisfactory to the Instructing Party, of the shareholders of the German Seller authorising the execution, delivery and performance of this Deed, certified by a managing director of the German Seller as of the Dutch Closing Date and the Dutch Funding Date which certificate shall state that the resolutions thereby certified have not been amended, modified, revoked or rescinded. |

| (18) | Up to date commercial register excerpts (Handelsregistrerauszug) in respect of the German Seller dated no earlier than 10 calendar days prior to the Dutch Funding Date. |

| (19) | Copy of the shareholders’ list (Gesellschafterliste) certified by the German Seller to be a true and up to date copy of the original. |

page 19

| (20) | Solvency Certificates in respect of the German Seller in the form set out in Schedule 2 to the German Receivables Purchase Agreement, one dated the Dutch Closing Date and one dated the Dutch Funding Date. |

| (21) | Compliance Certificates in respect of the German Seller in the form set out in Schedule 3 to the German Receivables Purchase Agreement, one dated the Dutch Closing Date and one dated the Dutch Funding Date. |

U.S. Seller

| (22) | Satisfaction of the conditions precedent set out as Schedule 6 to the U.S. Receivables Purchase Agreement. |

U.S. Intermediate Transferor

| (23) | Satisfaction of the conditions precedent set out as Schedule 7 to the U.S. Intermediate Transfer Agreement. |

Styfco

| (24) | Copies of the resolutions, in form and substance satisfactory to the Instructing Party, of the board of managers of the Styfco authorising the execution, delivery and performance, in Styfco’s capacity as the Investment Manager or the Styron Noteholder, of this Deed, the Master Definitions and Framework Deed, the Cash Management Agreement, the Styron Security Deed, the Variable Loan Note Issuance Deed, the Dutch Receivables Purchase Agreement, the Swiss Receivables Purchase Agreement, the German Receivables Purchase Agreement, the U.S. Receivables Purchase Agreement and the U.S. Intermediate Transfer Agreement certified by a manager of the Styfco as of the Dutch Closing Date and the Dutch Funding Date which certificate shall state that the resolutions thereby certified have not been amended, modified, revoked or rescinded. |

| (25) | A certificate as to the incumbency and signature of the managers or other attorneys authorised to sign this Deed, the Master Definitions and Framework Deed, the Cash Management Agreement, the Styron Security Deed, the Variable Loan Note Issuance Deed, the Dutch Receivables Purchase Agreement, the Swiss Receivables Purchase Agreement, the German Receivables Purchase Agreement, the U.S. Receivables Purchase Agreement and the U.S. Intermediate Transfer Agreement on behalf of the Styfco and any certificate or other document to be delivered pursuant thereto, certified by any manager of the Styfco together with evidence of the incumbency of such manager. |

| (26) | A copy of an up to date Commercial Register excerpt in respect of the Styfco dated no earlier than 10 calendar days prior to the Dutch Funding Date. |

| (27) | Evidence in form and substance satisfactory to the Cash Manager that the variation of corporate purpose resolved in the resolution of Styron Finance Luxembourg S.a r.l. dated 23 May 2013 varying the purpose of its Swiss branch and provided to the Cash Manager and the amendments and changes resolved therein has been duly filed with the Commercial Register of the Canton of Zurich, Switzerland. |

page 20

Master Purchaser

| (28) | Copies of the resolutions, in form and substance satisfactory to the Instructing Party, of the boards of directors of the Master Purchaser authorising the execution, delivery and performance of the Relevant Transaction Documents, certified by an officer of the Master Purchaser as of the Dutch Closing Date and the Dutch Funding Date which certificate shall state that the resolutions thereby certified have not been amended, modified, revoked or rescinded. |

| (29) | A certified copy of the power of attorney granted by the Master Purchaser to the attorneys of the Master Purchaser authorised to sign the Relevant Transaction Documents on behalf of the Master Purchaser. |

| (30) | Evidence of the registration of the Irish security. |

Regency Noteholder

| (31) | Copies of the resolutions, in form and substance satisfactory to the Instructing Party, of the boards of directors of the Regency Noteholder authorising the execution, delivery and performance of this Deed, certified by an officer of the Regency Noteholder as of the Dutch Closing Date and the Dutch Funding Date which certificate shall state that the resolutions thereby certified have not been amended, modified, revoked or rescinded. |

| (32) | A certified copy of the power of attorney granted by the Regency Noteholder to the attorneys of the Regency Noteholder authorised to sign this Deed on behalf of the Regency Noteholder. |

Legal Opinions

| (33) | Loyens & Loeff Dutch transaction legal opinion as to true sale, validity of account security created by the Dutch Collection Account Security Document and certain tax issues addressed to HSBC Bank plc, the Master Purchaser, the Regency Noteholder and the Styron Security Trustee dated the Dutch Funding Date. |

| (34) | Loyens & Loeff Belgian legal opinion as to validity of account security created by the Belgian Collection Account Pledge Agreement addressed to HSBC Bank plc, the Master Purchaser, the Regency Noteholder and the Styron Security Trustee dated the Dutch Funding Date. |

| (35) | A Dutch legal opinion from Dutch counsel to the Dutch Seller addressed to HSBC Bank plc, the Master Purchaser, the Regency Noteholder and the Styron Security Trustee on the capacity and authority of the Dutch Seller dated the Dutch Funding Date. |

| (36) | A Swiss legal opinion from Swiss counsel to the Swiss Seller, the Swiss Servicer and Styfco addressed to HSBC Bank plc, the Master Purchaser, the Regency Noteholder and the Styron Security Trustee on the capacity and authority of the Swiss Seller and the Swiss Servicer and covering due execution by representatives of Styfco, in its capacities as the Investment Manager and the Styron Noteholder, dated the Dutch Funding Date. |

page 21

| (37) | A German legal opinion from German counsel to the German Seller and the German Servicer addressed to HSBC Bank plc, the Master Purchaser, the Regency Noteholder and the Styron Security Trustee on the capacity and authority of the German Seller and the German Servicer dated the Dutch Funding Date. |

| (38) | A Luxembourg legal opinion from Luxembourg counsel to the Guarantor and Styfco, in its capacities as the Investment Manager and the Styron Noteholder, addressed to HSBC Bank plc, the Master Purchaser, the Regency Noteholder and the Styron Security Trustee on the capacity and authority of the Guarantor and Styfco dated the Dutch Funding Date. |

| (39) | An Irish legal opinion from Irish counsel addressed to HSBC Bank plc, the Master Purchaser, the Regency Noteholder and the Styron Security Trustee on the capacity and authority of the Master Purchaser dated the Dutch Funding Date. |

| (40) | Reed Smith English transaction legal opinion addressed to HSBC Bank plc, the Master Purchaser, the Regency Noteholder and the Styron Security Trustee dated the Dutch Funding Date in respect of the English law governed Transaction Documents executed on the Dutch Closing Date. |

General

| (41) | Evidence that the fees, costs and expenses then due from the Sellers have been paid or will be paid by the Dutch Funding Date. |

| (42) | Due execution and delivery of the Dutch Transaction Documents (each in a form satisfactory to the Instructing Party) by the respective parties thereto, and all documentation to be delivered therewith (in a form satisfactory to the Instructing Party). |

| (43) | Rating Agencies confirmations. |

| (44) | The delivery of the Dutch Servicer’s Daily Report one Business Day prior to the Dutch Funding Date. |

| (45) | The Master Purchaser Warranties are true on the Dutch Closing Date and on the Dutch Funding Date. |

| (46) | Delivery of an Offer pursuant to the Dutch Receivables Purchase Agreement at least one Business Day prior to the proposed Dutch Funding Date. |

| (47) | Receipt by the Master Purchaser of acknowledgements from the Collection Account Banks in respect of Account Control Agreements relating to Collection Accounts held at branches of the Collection Account bank in The Netherlands and Belgium unless waived by the Master Purchaser in its sole discretion. |

| (48) | Waivers by the Obligors with respect to prohibitions on assignment and confidentiality in the Contracts. |

page 22

EXECUTION PAGE

IN WITNESS of which this Deed has been executed and delivered as a deed by the parties to it on the date above mentioned.

The Swiss Seller, the Investment Manager, the Styron Noteholder and the Chargor

| SIGNED and | ) | |||

| DELIVERED as aDEED bySTYRON | ) | |||

| EUROPE GMBH, a limited liability company | ) | |||

| incorporated in Switzerland acting by, | ) | |||

| ) | /s/ ISABEL HACKER | |||

| being a person who, in accordance with the | ) | ISABEL HACKER | ||

| laws of that territory, is acting under the | ) | |||

| authority of the company | ) |

[Signature Page to Deed of Amendment, Restatement and Accession]

| The German Seller and the German Servicer | ||||

| SIGNED and | ) | |||

| DELIVERED as aDEED bySTYRON | ) | |||

| DEUTSCHLAND | ) | |||

| ANLAGENGESELLSCHAFT MBH | ) | |||

| A company incorporated in Germany, acting | ) | |||

by  | ) | |||

| ) | ||||

| being a person who, in accordance with the | ) | |||

| laws of that territory, is acting under the | ) | |||

| authority of the company | ) | |||

| ||||

[Signature Page to Deed of Amendment, Restatement and Accession]

| The Dutch Seller and the Dutch Servicer | ||||||

| SIGNED and | ) | /s/ F.J.C.M Kempenaars | ||||

| DELIVERED as aDEED bySTYRON | ) | |||||

| NETHERLANDS B.V. | ) | |||||

| A company incorporated in The Netherlands, | ) | |||||

| acting by | ) | |||||

| ) | ||||||

| being a person who, in accordance with the | ) | F.J.C.M Kempenaars | ||||

| laws of that territory, is acting under the | ) | Director | ||||

| authority of the company | ) | Styron Netherlands B.V | ||||

/s/ R.T.C. van Beelen | ||||||

R.T.C. van Beelen Director Styron Netherlands B.V | ||||||

WITNESS:

[Signature Page to Deed of Amendment, Restatement and Accession]

| The U.S. Seller and the U.S. Servicer | ||||||

| SIGNED and | ) | |||||

| DELIVERED as aDEED by | ) | |||||

| STYRON LLC | ) | |||||

| a Delaware limited liability company, acting | ) | |||||

| by | Ralph A. Than | ) | /s/ Ralph A. Than | |||

| Vice President and Treasurer | ) | |||||

| ) | ||||||

| being a person who, in accordance with the | ) | |||||

| laws of that territory, is acting under the | ) | |||||

| authority of the company | ) | |||||

[Signature Page to Deed of Amendment, Restatement and Accession]

| The U.S. Intermediate Transferor | ||||||

| SIGNED and | ) | |||||

| DELIVERED as aDEED by | ) | |||||

| TRINSEO U.S. RECEIVABLES | ) | |||||

| COMPANY SPV LLC | ) | |||||

| a Delaware limited liability company, acting | ) | |||||

| by | Ralph A. Than | ) | /s/ Ralph A. Than | |||

| Vice President and Treasurer | ) | |||||

| ) | ||||||

| being a person who, in accordance with the | ) | |||||

| laws of that territory, is acting under the | ) | |||||

| authority of the company | ) | |||||

[Signature Page to Deed of Amendment, Restatement and Accession]

| The Master Purchaser and the Chargee | ||||

| SIGNED and | ) | /s/ Jacqueline O’Rourke | ||

DELIVERED as aDEED for and on behalf of STYRON RECEIVABLES FUNDING LIMITED acting by its duly authorised Attorney in the presence of: | ) ) )

) | |||

Jacqueline O’Rourke | ||||

Attorney | ||||

| ||||

| ||||

| (Witness’ signature) | ||||

| 53 Merrion Square | ||||

Dublin 2 | ||||

| (Witness’ address) | ||||

Legal Account Manager | ||||

| (Witness’ occupation) | ||||

[Signature Page to Deed of Amendment, Restatement and Accession]

Styfco

SIGNED andDELIVERED as aDEED by for and on behalf ofSTYRON FINANCE LUXEMBOURG S.À R.L., LUXEMBOURG, ZWEIGNIEDERLASSUNG HORGEN, a Swiss branch of Styron Finance Luxembourg S.À R.L. Luxembourg | ) ) ) ) ) ) ) | /s/ Johanna Frisch | ||

| acting by its duly authorised representative: | ) | Johanna Frisch |

[Signature Page to Deed of Amendment, Restatement and Accession]

| The Regency Noteholder | ||||||

SIGNED andDELIVERED as aDEED for and on behalf ofREGENCY ASSETS LIMITED acting by its duly authorised Attorney: | ) ) ) ) | /s/ Rhys Owens Rhys Owens | ||||

in the presence of: |

) | |||||

Authorised Signatory | ||||||

| ||||||

(Witness’ signature)

5 Harbourmaster Place, IFSC, Dublin 1, | ||||||

| (Witness’ address) | ||||||

Bank Official | ||||||

| (Witness’ occupation) | ||||||

[Signature Page to Deed of Amendment, Restatement and Accession]

| The Cash Manager and the Master Purchaser Account Bank | ||||||

SIGNED andDELIVERED as aDEED by for and on behalf ofHSBC BANK PLC acting by its duly authorised Attorney: | ) ) ) ) | /s/ Victoria Lindsell Victoria Lindsell Managing Director | ||||

[Signature Page to Deed of Amendment, Restatement and Accession]

| The Parent and Guarantor | ||||||

SIGNED andDELIVERED as aDEED by for and on behalf ofSTYRON HOLDING S.À R.L. acting by its duly authorised representative: | ) ) ) ) |  | ||||

[Signature Page to Deed of Amendment, Restatement and Accession]

| The Corporate Administrator and Registrar |  | |||

| PRESENT when theCOMMON SEAL wasAFFIXED HERETO by: | ) ) ) | /s/ Jacqueline O’Rourke Jacqueline O’Rourke | ||

| Director: | ) ) | Director | ||

| Director | ) | /s/ Imran Khan Imran Khan Director | ||

For and on behalf ofTMF ADMINISTRATION SERVICES LIMITED | ) ) ) | |||

[Signature Page to Deed of Amendment, Restatement and Accession]

| The Styron Security Trustee | ||||

| SIGNED as aDEED by | ) |

Representing law Debenture Corporate Services Ltd | ||

Director: | ) ) | |||

| ) | ||||

| Secretary: | ) | |||

| ) | ||||

| For and on behalf ofTHE LAW DEBENTURE TRUST CORPORATION P.L.C. | ) ) | |||

[Signature Page to Deed of Amendment, Restatement and Accession]

DATED 12 AUGUST 2010 AS AMENDED AND RESTATED ON 24 MAY 2011 AND 30 MAY 2013

| (1) | STYRON RECEIVABLES FUNDING LIMITED |

(as Master Purchaser)

| (2) | HSBC BANK PLC |

(as Cash Manager)

| (3) | REGENCY ASSETS LIMITED |

(as Regency Noteholder)

| (4) | STYRON FINANCE LUXEMBOURG S.ÀR.L., LUXEMBOURG, ZWEIGNIEDERLASSUNG HORGEN |

(as Styron Noteholder)

| (5) | THE LAW DEBENTURE TRUST CORPORATION P.L.C. |

(as Styron Security Trustee)

CASH MANAGEMENT AGREEMENT

EXECUTION COPY

REFERENCE

735545.00033

| reedsmith.com |

C O N T E N T S

C L A U S E

| Page | ||||||

| 1. | INTERPRETATION | 2 | ||||

| 2. | APPOINTMENT OF CASH MANAGER | 4 | ||||

| 3. | CONDITIONS OF APPOINTMENT | 4 | ||||

| 4. | STANDARD OF CARE | 4 | ||||

| 5. | APPOINTMENT OF SUB-CONTRACTORS | 5 | ||||

| 6. | REPRESENTATIONS AND WARRANTIES | 6 | ||||

| 7. | COVENANTS | 6 | ||||

| 8. | GRANT OF POWERS OF ATTORNEY | 6 | ||||

| 9. | FORCE MAJEURE | 7 | ||||

| 10. | NO PRIMARY LIABILITY OF CASH MANAGER OR STYRON SECURITY TRUSTEE | 8 | ||||

| 11. | INDEMNITIES | 8 | ||||

| 12. | CASH MANAGER FEES | 10 | ||||

| 13. | COSTS AND EXPENSES | 10 | ||||

| 14. | CASH MANAGER EVENTS | 11 | ||||

| 15. | EFFECT OF RECEIPT OF CASH MANAGER EVENT NOTICE | 12 | ||||

| 16. | TERMINATION ON DELIVERY OF CASH MANAGER TERMINATION NOTICE | 12 | ||||

| 17. | TERMINATION OF APPOINTMENT BY NOTICE | 13 | ||||

| 18. | TERMINATION ON FINAL DISCHARGE DATE | 13 | ||||

| 19. | OBLIGATIONS OF CASH MANAGER AFTER TERMINATION | 13 | ||||

| 20. | IDENTIFICATION OF SUCCESSOR CASH MANAGER | 14 | ||||

| 21. | APPOINTMENT OF SUCCESSOR CASH MANAGER | 15 | ||||

| 22. | DELIVERY OF RECORDS ON TERMINATION | 15 | ||||

| 23. | PROVISIONS REGARDING PREMISES DURING TRANSFER PERIOD | 16 | ||||

| 24. | TERMS OF APPOINTMENT | 16 | ||||

| 25. | GOVERNING LAW | 16 | ||||

SCHEDULE 1 SERVICES TO BE PROVIDED BY THE CASH MANAGER | 17 | |||||

PART 1 ADMINISTRATION OF MASTER PURCHASER ACCOUNTS | 18 | |||||

PART 2 COLLECTIONS | 19 | |||||

PART 3 ESTABLISHMENT AND OPERATION OF MASTER PURCHASER ACCOUNTS | 20 | |||||

PART 4 OPERATION OF LEDGERS | 23 | |||||

PART 5 PAYMENTS PRIORITIES | 25 | |||||

PART 6 PURCHASE OF INITIAL AND ADDITIONAL RECEIVABLES | 30 | |||||

PART 7 RECORDS | 31 | |||||

PART 8 PROVISION OF INFORMATION | 32 | |||||

PART 9 TAX MANAGEMENT | 34 | |||||

PART 10 SERVICES IN RESPECT OF THE TRANSACTION DOCUMENTS | 35 | |||

PART 11 SERVICES IN RESPECT OF THE NOTES | 36 | |||

PART 12 VAT MANAGEMENT | 37 | |||

PART 13 EFFECT OF CASH MANAGER TERMINATION | 38 | |||

PART 14 PREPARATION OF STATUTORY ACCOUNTS | 39 | |||

PART 15 LICENCES, CONSENTS, COMPLIANCE AND AUDIT | 40 | |||

SCHEDULE 2 CASH MANAGER REPRESENTATIONS AND WARRANTIES | 42 | |||

PART 1 CORPORATE REPRESENTATIONS AND WARRANTIES | 42 | |||

PART 2 TRANSACTION DOCUMENT REPRESENTATIONS AND WARRANTIES OF THE CASH MANAGER | 43 | |||

SCHEDULE 3 CASH MANAGER COVENANTS | 45 | |||

PART 1 CORPORATE COVENANTS OF THE CASH MANAGER | 45 | |||

PART 2 TRANSACTION DOCUMENT COVENANTS OF THE CASH MANAGER | 46 | |||

SCHEDULE 4 AUTHORISED SIGNATORIES OF THE CASH MANAGER | 48 |

- ii -

THIS AGREEMENT is made on 12 August 2010 as amended and restated on 24 May 2011 and 30 May 2013

BETWEEN:

| (1) | STYRON RECEIVABLES FUNDING LIMITED, a company incorporated with limited liability in Ireland, registered in Ireland with the Companies Registration Office with number 486138, having its registered office at 53 Merrion Square, Dublin 2, Ireland (the “Master Purchaser”); |

| (2) | HSBC BANK PLC, a company incorporated in England and Wales (Company Number: 14259) having its registered office at 8 Canada Square, London E14 5HQ (the “Cash Manager”); |

| (3) | REGENCY ASSETS LIMITED, a company incorporated in Ireland, having its registered office at 5 Harbourmaster Place, I.F.S.C., Dublin 1, Ireland (the “Regency Noteholder”); |

| (4) | STYRON FINANCE LUXEMBOURG S.À R.L., LUXEMBOURG, ZWEIGNIEDERLASSUNG HORGEN, a Swiss branch, with offices located at Zugerstrasse 231, CH-8810, Horgen, Switzerland, of Styron Finance Luxembourg S.à r.l., a Luxembourg private limited liability company (société à responsabilité limitée) with registered office at 9A, rue Gabriel Lippmann, L-5365 Munsbach, Grand Duchy of Luxembourg, registered with the Luxembourg Register of Commerce and Companies under number B 151.012 and having a share capital of USD 25,001 (the “Styron Noteholder”); and |

| (5) | THE LAW DEBENTURE TRUST CORPORATION P.L.C., a company incorporated with limited liability in England and Wales, having its registered office at Fifth Floor, 100 Wood Street, London EC2V 7EX in its capacity as security trustee under the Styron Security Deed (the “Styron Security Trustee”). |

INTRODUCTION:

| (A) | The Sellers carry on the business of originating Receivables from time to time from sales of chemical products to Obligors. |

| (B) | The Sellers have agreed to sell and the U.S. Intermediate Transferor or the Master Purchaser has agreed to purchase Receivables in accordance with the terms of the Master Receivables Purchase Agreements. |

| (C) | The Master Purchaser proposes to fund the purchase of the Receivables through the issuance of the Regency Notes and the Styron Notes and through payments from Collections. |

| (D) | The Cash Manager has agreed to act as Cash Manager of the Master Purchaser and the Styron Security Trustee in relation to the assets and obligations of the Master Purchaser in accordance with the terms of this Agreement. |

- 1 -

THE PARTIES AGREE AS FOLLOWS:

SECTION A

INTERPRETATION

| 1. | INTERPRETATION |

| 1.1 | Master Definitions and Framework Deed |

| 1.1.1 | Capitalised terms in this Agreement shall, except where the context otherwise requires and save where otherwise defined in this Agreement, have the meanings given to them in Clause 2.1 of the Master Definitions and Framework Deed (including any schedules to such deed referred to or incorporated by reference to such terms in Clause 2.1) executed by, among others, each of the parties to this Agreement (the “Framework Deed”) on 12 August 2010 (as amended or amended and restated on 17 August 2010, 24 May 2011, 4 July 2012 and on or around the Dutch Closing Date (as defined therein) and as it may be further amended, varied or supplemented from time to time with the consent of the parties to it) and this Agreement shall be construed in accordance with the principles of construction set out in the Framework Deed. |

| 1.1.2 | In addition, the provisions set out in clauses 3 to 8 and 10 to 25 of the Framework Deed (the “Special Framework Provisions”) shall be expressly and specifically incorporated into this Agreement, as though they were set out in full in this Agreement. In the event of any conflict between the provisions of this Agreement and the Special Framework Provisions, the provisions of this Agreement shall prevail other than Clause 22 of the Framework Deed as it relates to the Styron Security Trustee. |

| 1.2 | Cash Management Agreement |

This Agreement is the Cash Management Agreement referred to in the Framework Deed.

| 1.3 | Meaning of to ensure |

In this Agreement, where there is a reference to the giving of notices, performing of calculations, provision of documents, making of determinations and other similar administrative activities, in each case, to be carried out “to ensure” the compliance with or performance of certain terms in certain agreements, any such reference means the giving of all such notices, the making of all such calculations, the provision of all such documents, the making of all such determinations and all such other administrative activities as are required by the terms of such agreements to make such compliance or performance possible.

| 1.4 | Meaning of to arrange |

Where this Agreement states that the Cash Manager is “to arrange” for a payment to be made, or other obligations to be performed, to or by the Master Purchaser, the Styron Security Trustee or any other person, the Cash Manager (unless expressly provided otherwise) shall be obliged to use all reasonable endeavours to make all the administrative arrangements required on the part of the Master Purchaser, the Styron Security Trustee or any other person and/or of itself to facilitate such payment or performance and to the extent that it has done so shall have discharged its obligation “to arrange” for the relevant payment to be made or other obligation to be performed and shall not be liable as primary debtor, indemnitor, guarantor or otherwise as surety, in respect of such payment or other obligations and, in particular:

| 1.4.1 | the Cash Manager shall incur no liability if the payer or performer (as appropriate) refuses or is unable (for whatever reason) to make such payment or to perform such obligations (as the case may be); and/or |

- 2 -

| 1.4.2 | the Cash Manager shall not be obliged to pay out any money belonging to the Cash Manager in respect of such payment or other obligations, except where and to the extent that: |

| (a) | the refusal or inability of the payer or performer (as the case may be); and/or |

| (b) | the inability of the other person to pay or perform (as the case may be), |

is caused directly by a Breach of Duty in relation to this Agreement by the Cash Manager (whether or not acting in its capacity as Cash Manager) or the Cash Manager’s servants or agents.

| 1.5 | Cash Manager not regarded as payer |

In this Agreement the Cash Manager shall not be regarded as the “payer” merely by reason of its making administrative arrangements for the transmission or payment of funds.

- 3 -

SECTION B

APPOINTMENT OF CASH MANAGER

| 2. | APPOINTMENT OF CASH MANAGER |

| 2.1 | Appointment |

The Master Purchaser and the Styron Security Trustee concur in the appointment of the Cash Manager to act as agent of the Master Purchaser and, following the service of an Enforcement Notice, the Styron Security Trustee, and each appoints the Cash Manager in accordance with this Agreement to be the Cash Manager and its lawful non-exclusive agent, in its name and on its behalf, to provide the Cash Management Services in accordance with the terms of this Agreement and the other applicable Transaction Documents and the Cash Manager accepts such appointment.

| 2.2 | Cash Manager agency limited |

The Cash Manager shall have no authority by virtue of this Agreement to act for or represent the Master Purchaser or the Styron Security Trustee as agent or otherwise save in respect of those functions and duties which it is authorised to perform and discharge by this Agreement and for the period during which this Agreement so authorises it to perform and discharge those functions and duties.

| 2.3 | Cash Manager authority incidental to exercise of rights |

In connection with the rights, powers and discretions conferred under the foregoing provisions of this Clause 2 (but subject to any express limitations imposed by any other provisions of this Agreement or of any other Transaction Documents), the Cash Manager shall have the full power, authority and right to do or cause to be done any and all things which it reasonably considers necessary, convenient or incidental to the exercise of such rights, powers and discretions in relation to the performance of the relevant Cash Management Services.

| 2.4 | Cash Manager’s directions regarding financial policies not binding |

The Master Purchaser (and the Master Purchaser’s directors) shall not be required or obliged at any time to comply with any directions which the Cash Manager may give with respect to the operating and financial policies of the Master Purchaser, control of which is, and shall at all times remain, vested in the Master Purchaser and its directors and the Cash Manager agrees that it will at all times act consistently with this provision.

| 3. | CONDITIONS OF APPOINTMENT |

The appointment of the Cash Manager pursuant to Clause 2 (Appointment of Cash Manager) shall be effective from the Closing Date until termination of such appointment in accordance with Section F (Termination of Cash Manager’s Appointment).

| 4. | STANDARD OF CARE |

The Cash Manager shall, at all times during the term of this Agreement, perform its obligations in the manner of a prudent cash manager but the Cash Manager shall not be required to do or cause to be done anything which it is prevented from doing by any Regulatory Direction or any Requirement of Law.

- 4 -

| 5. | APPOINTMENT OF SUB-CONTRACTORS |

| 5.1 | The Cash Manager may appoint any person (provided, that prior to the occurrence of a Termination Event, such person is a member of the Styron group) as its Sub-contractor to carry out all or part of the Cash Management Services. |

- 5 -

SECTION C

REPRESENTATIONS, WARRANTIES AND COVENANTS

| 6. | REPRESENTATIONS AND WARRANTIES |

| 6.1 | Cash Manager Warranties |

The Cash Manager represents and warrants to the Master Purchaser and the Styron Security Trustee, as at the date of this Agreement on the terms of the Cash Manager Warranties.

| 6.2 | Deemed Cash Manager Warranties |

The Cash Manager is deemed to represent and warrant to the Master Purchaser and the Styron Security Trustee as at each Settlement Date on the terms of the Cash Manager Warranties contained in Schedule 2 hereto as if references in the Cash Manager Warranties to the “Closing Date” in Schedule 2 hereto (Cash Manager Representations and Warranties) were a reference to such Settlement Date.

| 6.3 | Effectiveness of Cash Manager Warranties |

The Cash Manager Warranties shall remain in force until the Cash Manager’s appointment is terminated in accordance with this Agreement but without prejudice to any right or remedy of the Master Purchaser or the Styron Security Trustee arising from any breach of the Cash Manager Warranties prior to the date of termination of this Agreement.

| 7. | COVENANTS |

| 7.1 | Cash Manager Covenants |

The Cash Manager covenants as at the date of this Agreement to the Master Purchaser and the Styron Security Trustee, on the terms of the Cash Manager Covenants.

| 7.2 | Effectiveness of Cash Manager Covenants |

The Cash Manager Covenants shall remain in force until the Cash Manager’s appointment is terminated in accordance with this Agreement but without prejudice to any right or remedy of the Master Purchaser or the Styron Security Trustee arising from the breach of the Cash Manager Covenants prior to the date of termination of this Agreement.

| 8. | GRANT OF POWERS OF ATTORNEY |

| 8.1 | Grant by Master Purchaser |

The Master Purchaser shall on request by the Cash Manager immediately give to the Cash Manager any powers of attorney or other written authorisations or mandates and instruments as are reasonably necessary to enable the Cash Manager to perform its obligations under this Agreement (provided that any such power of attorney or other matter shall be subject to any express limitations that are imposed on the rights and powers of the Cash Manager (whether specifically in its capacity as such or generally as one of the Transaction Parties) by any other provisions of this Agreement or of any other Transaction Document).

- 6 -

| 9. | FORCE MAJEURE |

| 9.1 | Cash Manager not liable for obligations |

Notwithstanding any other provisions of this Agreement, if it is not practicable for the Cash Manager to carry out its obligations under this Agreement as a result of:

| 9.1.1 | failure by the Master Purchaser Account Bank to comply with any of its obligations under the Account Bank Agreement; or |

| 9.1.2 | the occurrence of a Force Majeure Event, |

the Cash Manager shall not be liable for any failure to carry out such obligations for so long as such circumstances subsist. This Clause 9 shall not apply if any such event arises as a direct result of a Breach of Duty by the Cash Manager.

| 9.2 | Cash Manager to minimise loss |

Notwithstanding that in the circumstances specified in Clause 9.1 (Cash Manager not liable for obligations) it is relieved from liability for failure to perform its obligations under this Agreement, the Cash Manager shall take such reasonably practicable steps as are available to it (if any) to meet such obligations while such circumstances subsist and shall take such reasonable steps as are available to it to procure that such event ceases to occur and/or that any loss resulting from any such event is minimised.

| 9.3 | Cash Manager notice of failure to carry out obligations |

If the Cash Manager is prevented from carrying out any of its obligations under this Agreement as a result of any event referred to in Clause 9.1 (Cash Manager not liable for obligations), the Cash Manager shall give notice to the Master Purchaser and the Styron Security Trustee as soon as reasonably practicable after being so prevented detailing the particulars of such event.

- 7 -

SECTION D

LIABILITIES AND INDEMNITIES

| 10. | NO PRIMARY LIABILITY OF CASH MANAGER OR STYRON SECURITY TRUSTEE |

| 10.1 | Obligations solely obligations of Master Purchaser |

The Obligations are solely obligations of the Master Purchaser and nothing in this Agreement shall cause the Cash Manager or the Styron Security Trustee to be liable as primary debtor or guarantor, or otherwise as surety, for the indebtedness of the Master Purchaser evidenced by the Obligations.

| 10.2 | Cash Manager not liable for obligations of Obligors |

The Cash Manager shall have no liability for the obligations of any Obligor in respect of any Receivables and nothing in this Agreement shall constitute a guarantee, or similar obligation, by the Cash Manager in respect of any such obligation.

| 11. | INDEMNITIES |

| 11.1 | Cash Manager Indemnity |

The Cash Manager shall indemnify and at all times hold indemnified the Master Purchaser and (only to the extent that the Cash Manager is instructed by the Styron Security Trustee) the Styron Security Trustee against all Liabilities whatsoever suffered or incurred by either the Master Purchaser or the Styron Security Trustee arising as a result of any Breach of Duty by the Cash Manager.

| 11.2 | Cash Manager not Liable |

Notwithstanding the provisions of Clause 11.1 (Cash Manager Indemnity), the Cash Manager and its directors, officers, employees or agents shall not be liable in respect of any Liabilities suffered or incurred by the Master Purchaser, the Styron Security Trustee, any Seller or any Servicer as a result of the following sub-clauses provided that, should one of the following sub-clauses apply to any of the Master Purchaser, the Styron Security Trustee, any Seller or any Servicer, the indemnity pursuant to Clause 11.1 shall remain unaffected as regards those other parties to whom the following sub-clauses do not apply:

| 11.2.1 | any failure or delay on the part of the Master Purchaser or a Servicer or the Styron Security Trustee or a Seller in supplying any information or the supplying of incorrect, incomplete or inaccurate information; |

| 11.2.2 | any Breach of Duty by the Master Purchaser or a Servicer or a Seller or the gross negligence, wilful default or fraud of the Styron Security Trustee (as the case may be); |

| 11.2.3 | any action taken by the Cash Manager at the request of the Master Purchaser, a Servicer, the Styron Security Trustee or a Seller (as the case may be); or |

| 11.2.4 | any Tax (or any interest or penalties with respect thereto or arising from a failure to pay Tax) required to be paid by the Master Purchaser or the Styron Security Trustee or the Seller or a Servicer (as the case may be). |

- 8 -

| 11.3 | Cash Manager indemnification from own resources |

Any indemnification payable by the Cash Manager under this Clause 11 shall not be paid from any Charged Property.

| 11.4 | Master Purchaser indemnity |

The Master Purchaser shall indemnify the Cash Manager and its directors, officers and employees against all Liabilities whatsoever incurred by the Transaction Manager and/or such directors, officers and employees in the performance of the Cash Manager’s duties hereunder except any such Liability caused solely as a result of a Breach of Duty by the Cash Manager.

- 9 -

SECTION E

FEES, COSTS AND EXPENSES

| 12. | CASH MANAGER FEES |

| 12.1 | Cash Manager fee payable |

Subject to and in accordance with the provisions of the Payments Priorities and this Agreement, as consideration for the provision to it of the relevant Cash Management Services by the Cash Manager, the Master Purchaser shall pay the following fee to the Cash Manager (inclusive of VAT (if any)):

| 12.1.1 | an annual fee of £1,000 payable in arrears on the Monthly Payment Date falling in August each year. |

| 12.2 | Cash Manager recourse only to Master Purchaser for fee |

The Cash Manager hereby acknowledges that it shall not have recourse against any party to this Agreement other than the Master Purchaser for the fees described in Clause 12.1 (Cash Manager fee payable) and further agrees (for the avoidance of doubt) that its recourse against the Master Purchaser and its right to take any action in respect of the payment of such fees shall be limited in the manner set out in clauses 16 (No Liability) and 24 (Restriction on Enforcement of Security, Non-Petition and Limited Recourse in favour of the Master Purchaser) of the Framework Deed.

| 13. | COSTS AND EXPENSES |

| 13.1 | Master Purchaser to reimburse Cash Manager for Liabilities |

Subject to and in accordance with the provisions of the Payments Priorities and this Agreement, the Master Purchaser will reimburse the Cash Manager on each Monthly Payment Date for all Liabilities incurred by the Cash Manager (for the avoidance of doubt, including those Liabilities specified in Clause 9.2) in such capacity or on behalf of the Master Purchaser and/or the Styron Security Trustee pursuant to this Agreement in respect of the Determination Period immediately preceding such Monthly Payment Date.

| 13.2 | Unreimbursed costs and expenses to bear interest |

Subject to and in accordance with the Payments Priorities, any amount not reimbursed in accordance with Clause 13.1 (Master Purchaser to reimburse Cash Manager for Liabilities) shall bear interest at the rate per annum which is one per cent. above the Cash Manager’s reasonable cost of funds. Such interest shall accrue from day to day from the date on which the Cash Manager has made payment of any such amount to the date on which the relevant reimbursement obligation is discharged.

- 10 -

SECTION F

TERMINATION OF CASH MANAGER’S APPOINTMENT

| 14. | CASH MANAGER EVENTS |

If any of the following Cash Manager Events shall occur, namely:

| 14.1.1 | Non-payment: default is made by the Cash Manager in ensuring the payment on the due date of any payment required to be made under this Agreement and such default continues unremedied for a period of three Business Days after the earlier of (i) the Cash Manager becoming aware of the default and (ii) receipt by the Cash Manager of written notice from the Master Purchaser or the Styron Security Trustee requiring the default to be remedied; or |

| 14.1.2 | Breach of other obligations: without prejudice to Clause 14.1.1 (Non-payment) above: |

| (a) | default is made by the Cash Manager in the performance or observance of any of the Cash Manager Covenants or any of its other covenants and obligations under this Agreement; or |

| (b) | any of the Cash Manager Warranties proves to be untrue, incomplete or inaccurate; or |

| (c) | any certification or statement made by the Cash Manager in any certificate or other document delivered pursuant to this Agreement proves to be untrue, incomplete or inaccurate, |

and in each case the Master Purchaser or, following the service of an Enforcement Notice, the Styron Security Trustee certifies that such default or such warranty, certification or statement proving to be untrue, incomplete or inaccurate could reasonably be expected to have a Material Adverse Effect in respect of the Receivables and (if such default is capable of remedy) such default continues unremedied for a period of five Business Days after the earlier of (i) the Cash Manager becoming aware of such default and (ii) receipt by the Cash Manager of written notice from the Master Purchaser or the Styron Security Trustee requiring the same to be remedied; or

| 14.1.3 | Unlawfulness: it is or will become unlawful for the Cash Manager to perform or comply with any of its obligations under this Agreement; or |

| 14.1.4 | Force Majeure: if the Cash Manager is prevented or severely hindered for a period of 20 days or more from complying with its obligations under this Agreement as a result of a Force Majeure Event and such Force Majeure Event continues for 10 Business Days after written notice of such Force Majeure Event has been given by the Master Purchaser or the Styron Security Trustee; or |

| 14.1.5 | Insolvency Event: any Insolvency Event occurs in relation to the Cash Manager, |

then the Master Purchaser may, with the written consent of the Styron Security Trustee, or the Styron Security Trustee may itself following the service of an Enforcement Notice, deliver a Cash Manager Event Notice to the Cash Manager (with a copy to the Master Purchaser or the Styron Security Trustee (as applicable)) immediately or at any time after the occurrence of such a Cash Manager Event.

- 11 -

| 15. | EFFECT OF RECEIPT OF CASH MANAGER EVENT NOTICE |

After receipt by the Cash Manager of a Cash Manager Event Notice but prior to the delivery of a Cash Manager Termination Notice, the Cash Manager shall:

| 15.1.1 | hold to the order of the Master Purchaser or, following the service of an Enforcement Notice, the Styron Security Trustee (or such other person as such party shall direct) the Cash Manager Records and the Transaction Documents; |

| 15.1.2 | hold to the order of the Master Purchaser or, following the service of an Enforcement Notice, the Styron Security Trustee any monies then held by it on behalf of the Master Purchaser together with any other assets of the Master Purchaser then held by it; |

| 15.1.3 | other than as the Master Purchaser or, following the service of an Enforcement Notice, the Styron Security Trustee may direct pursuant to Clause 15.1.5, continue to perform all of the Cash Management Services (unless prevented by any Requirement of Law or any Regulatory Direction) until the time and date specified in a Cash Manager Termination Notice or until the date mutually agreed between the Cash Manager, the Master Purchaser and the Styron Security Trustee; |

| 15.1.4 | take such further action in accordance with the terms of this Agreement as the Master Purchaser or, following the service of an Enforcement Notice, the Styron Security Trustee may reasonably direct in relation to the Cash Manager’s obligations under this Agreement as may be necessary to enable the Calculation Agency Services to be performed by a Successor Cash Manager; and |

| 15.1.5 | stop taking any such action under the terms of this Agreement as the Master Purchaser or, following the service of an Enforcement Notice, the Styron Security Trustee may reasonably direct. |

| 16. | TERMINATION ON DELIVERY OF CASH MANAGER TERMINATION NOTICE |

At any time after the delivery of a Cash Manager Event Notice pursuant to Clause 14 (Cash Manager Events) but prior to the date which is 90 days after the date of such Cash Manager Event Notice, the Master Purchaser may with the written consent of the Styron Security Trustee or the Styron Security Trustee may itself deliver a Cash Manager Termination Notice to the Cash Manager (with a copy to the Master Purchaser or the Styron Security Trustee (as applicable)) the effect of which shall be to terminate the Cash Manager’s appointment under this Agreement from the Cash Manager Termination Date referred to in such notice.

- 12 -

| 17. | TERMINATION OF APPOINTMENT BY NOTICE |

| 17.1 | Termination by notice |

This Agreement shall be terminated if:

| 17.1.1 | the Cash Manager has given not less than three months prior written notice of its intention to terminate this Agreement to the Master Purchaser and the Styron Security Trustee; or |

| 17.1.2 | the Master Purchaser (with the consent of the Styron Security Trustee) has given not less than three months prior written notice of its intention to terminate this Agreement to the Cash Manager; or |

| 17.1.3 | the Styron Security Trustee has given not less than three months prior written notice of its intention to terminate this Agreement to the Cash Manager (with a copy to the Master Purchaser and the Master Purchaser Account Bank), |

and this Agreement shall so terminate with effect from the Cash Manager Termination Date referred to in such notice, provided that a Successor Cash Manager has been appointed in accordance with the provisions of Clause 21 (Appointment of Successor Cash Manager).

| 17.2 | Agreement to terminate on appointment of Successor Cash Manager |

If a Successor Cash Manager has not been appointed by the Cash Manager Termination Date referred to in the relevant notice delivered pursuant to Clause 17.1 (Termination by Notice), this Agreement will terminate on the date of the later appointment of a Successor Cash Manager.

| 18. | TERMINATION ON FINAL DISCHARGE DATE |

Unless previously terminated in accordance with Clause 16 (Termination on Delivery of Cash Manager Termination Notice) or Clause 17 (Termination of Appointment by Notice), the appointment of the Cash Manager under this Agreement shall terminate (but without affecting any accrued rights and liabilities under this Agreement) on the Final Discharge Date.

| 19. | OBLIGATIONS OF CASH MANAGER AFTER TERMINATION |

| 19.1 | Obligations of Retiring Cash Manager from Cash Manager Termination Date |

From the Cash Manager Termination Date:

| 19.1.1 | all authority and power of the Retiring Cash Manager under this Agreement shall be terminated and shall be of no further effect; |

| 19.1.2 | the Retiring Cash Manager shall no longer hold itself out in any way as the agent of any party to this Agreement pursuant to this Agreement; |

| 19.1.3 | the rights and obligations of the Retiring Cash Manager and any obligations of the Master Purchaser, the Noteholders and the Styron Security Trustee to the Retiring Cash Manager shall cease but the relevant termination shall be without prejudice to: |

| (a) | any liabilities or obligations of the Retiring Cash Manager to the Master Purchaser or the Styron Security Trustee or any Successor Cash Manager incurred or arising up to the Cash Manager Termination Date; |

- 13 -

| (b) | any liabilities or obligations of the Master Purchaser or the Styron Security Trustee to the Retiring Cash Manager incurred or arising up to the Cash Manager Termination Date; and |

| (c) | the Retiring Cash Manager’s obligation to deliver documents and materials in accordance with Clause 22 (Delivery of Records on Termination). |

| 19.2 | Fees and other amounts owed to Retiring Cash Manager |

The Retiring Cash Manager shall be entitled to receive all fees and other monies accrued owing to it under this Agreement (whether or not due and payable) pro-rated up to the Cash Manager Termination Date but, notwithstanding any other provisions of this Agreement shall not be entitled to any compensation as the Cash Manager after the Cash Manager Termination Date.

| 19.3 | Payments to Retiring Cash Manager on agreed dates |