Knowles Corporation 2019 Analyst & Investor Day September 17, 2019 Exhibit 99.1

Forward Looking Statements This presentation contains forward-looking statements within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” “project,” “estimate,” “budget,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “seek,” “should,” “will,” “would,” “objective,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” and similar expressions, among others, generally identify forward-looking statements, which speak only as of the date the statements were made. The statements in this presentation are based on currently available information and the current expectations, forecasts, and assumptions of Knowles’ management concerning risks and uncertainties that could cause actual outcomes or results to differ materially from those outcomes or results that are projected, anticipated, or implied in these statements. These risks and uncertainties include, but are not limited to: unforeseen changes in MEMS microphone demand from our largest customers, in particular, two North American, a Korean, and Chinese OEM customers; the success and rate of multi-microphone and smart microphone adoption and proliferation of our “intelligent audio” solutions, including our audio edge processors, to high volume platforms; our ongoing ability to execute our strategy to diversify our end markets and customers; our ability to stem or overcome price erosion in our segments; fluctuations in our stock's market price; fluctuations in operating results and cash flows; our ability to prevent or identify quality issues in our products or to promptly remedy any such issues that are identified; the timing of OEM product launches; risks associated with increasing our inventories in advance of anticipated orders by customers; global economic instability including the recent economic slowdown in China; the impact of changes to laws and regulations that affect the Company’s ability to offer products or services to customers in different regions; risks associated with shareholder activism, including proxy contests; our ability to achieve continued reductions in our operating expenses; our ability to obtain, enforce, defend or monetize our intellectual property rights; increases in the costs of critical raw materials and components; availability of raw materials and components; managing new product ramps and introductions for our customers; our dependence on a limited number of large customers; our ability to maintain and expand our existing relationships with leading OEMs in order to maintain and increase our revenue; increasing competition and new entrants in the market for our products; our ability to develop new or enhanced products or technologies in a timely manner that achieve market acceptance; our reliance on third parties to manufacture, assemble, and test our products and sub-components; escalating international trade tensions, new or increased tariffs and trade wars among countries; financial risks, including risks relating to currency fluctuations, credit risks and fluctuations in the market value of the Company; and changes in tax laws, changes in tax rates and exposure to additional tax liabilities; and other risks, relevant factors, and uncertainties identified in our Annual Report on Form 10-K for the fiscal year ended December 31, 2018, subsequent Reports on Forms 10-Q and 8-K and our other filings we make with the U.S. Securities and Exchange Commission. Knowles disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Non-GAAP Financial Measures Unless otherwise indicated, all financial results included in this presentation are on a non-GAAP, continuing operations basis, including gross profit, earnings before interest and income taxes, adjusted earnings before interest and income taxes, diluted earnings per share, operating expenses, as well as other metrics that exclude certain amounts that are included in the most directly comparable GAAP measure to facilitate evaluation of Knowles’ operating performance. Non-GAAP results are not presented in accordance with GAAP. Non-GAAP information should be considered a supplement to, and not a substitute for, financial statements prepared in accordance with GAAP. In addition, the non-GAAP financial measures included in this presentation do not have standard meanings and may vary from similarly titled non-GAAP financial measures used by other companies. Knowles believes that non-GAAP measures are useful as supplements to its GAAP results of operations to evaluate certain aspects of its operations and financial performance, and its management team primarily focuses on non-GAAP items in evaluating Knowles’ performance for business planning purposes. Knowles also believes that these measures assist it with comparing its performance between various reporting periods on a consistent basis, as these measures remove from operating results the impact of items that, in Knowles’ opinion, do not reflect its core operating performance including, for example, stock-based compensation, certain intangibles amortization expense, fixed asset impairment charges, restructuring, production transfer costs, and other charges which management considers to be outside our core operating results. Knowles believes that its presentation of these non-GAAP financial measures is useful because it provides investors and securities analysts with the same information that Knowles uses internally for purposes of assessing its core operating performance. For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures, see the reconciliation tables included in the Appendix to this presentation. When we provide our expectation for non-GAAP diluted EPS, adjusted earnings before interest and income taxes, and non-GAAP gross profit margin, operating expenses, on a forward-looking basis, a reconciliation of the differences between the non-GAAP expectations and the corresponding GAAP measures generally is not available without unreasonable effort due to potentially high variability, complexity and low visibility as to the items that would be excluded from the GAAP measure in the relevant future period, such as unusual gains and losses, the impact and timing of potential acquisitions and divestitures, and other structural changes or their probable significance. The variability of the excluded items may have a significant, and potentially unpredictable, impact on our future GAAP results. Safe Harbor

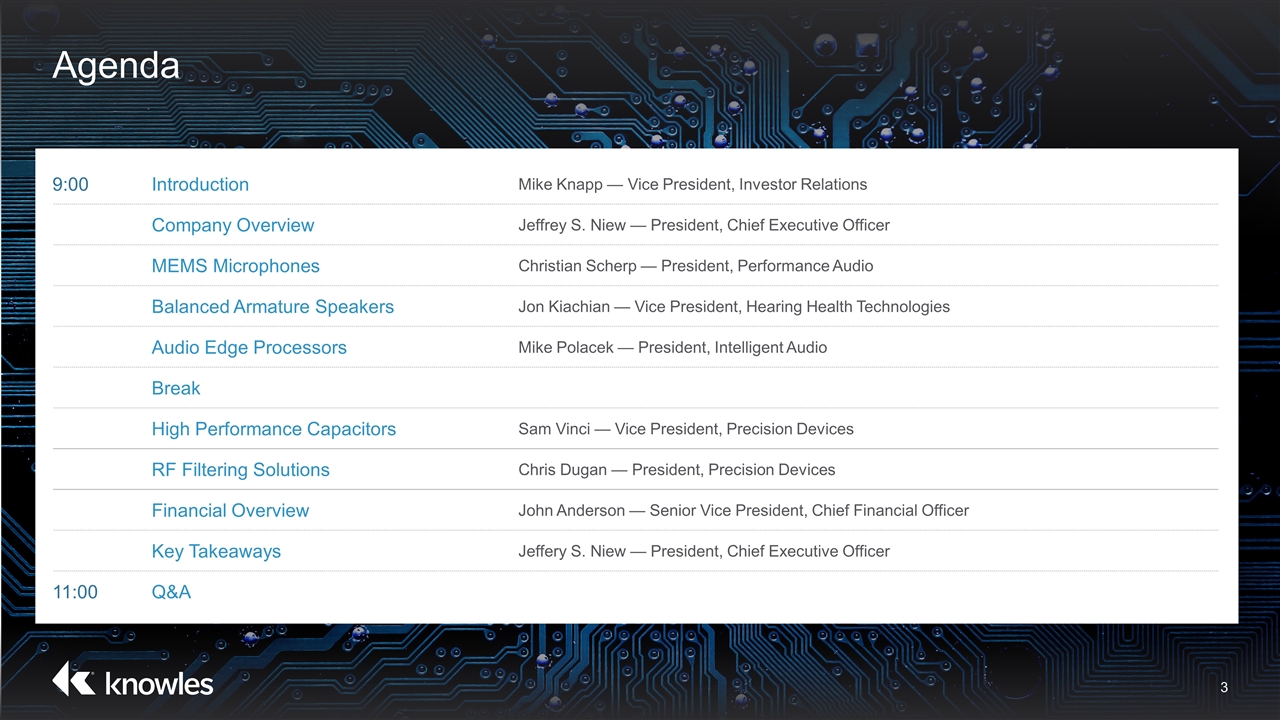

Agenda 9:00 Introduction Mike Knapp — Vice President, Investor Relations Company Overview Jeffrey S. Niew — President, Chief Executive Officer MEMS Microphones Christian Scherp — President, Performance Audio Balanced Armature Speakers Jon Kiachian — Vice President, Hearing Health Technologies Audio Edge Processors Mike Polacek — President, Intelligent Audio Break High Performance Capacitors Sam Vinci — Vice President, Precision Devices RF Filtering Solutions Chris Dugan — President, Precision Devices Financial Overview John Anderson — Senior Vice President, Chief Financial Officer Key Takeaways Jeffery S. Niew — President, Chief Executive Officer 11:00 Q&A

Company Overview & Key Takeaways

Differentiated Solutions for Growing Markets Large, attractive, and growing end markets Innovative product portfolio sustains differentiation Driving accelerated revenues and margin expansion

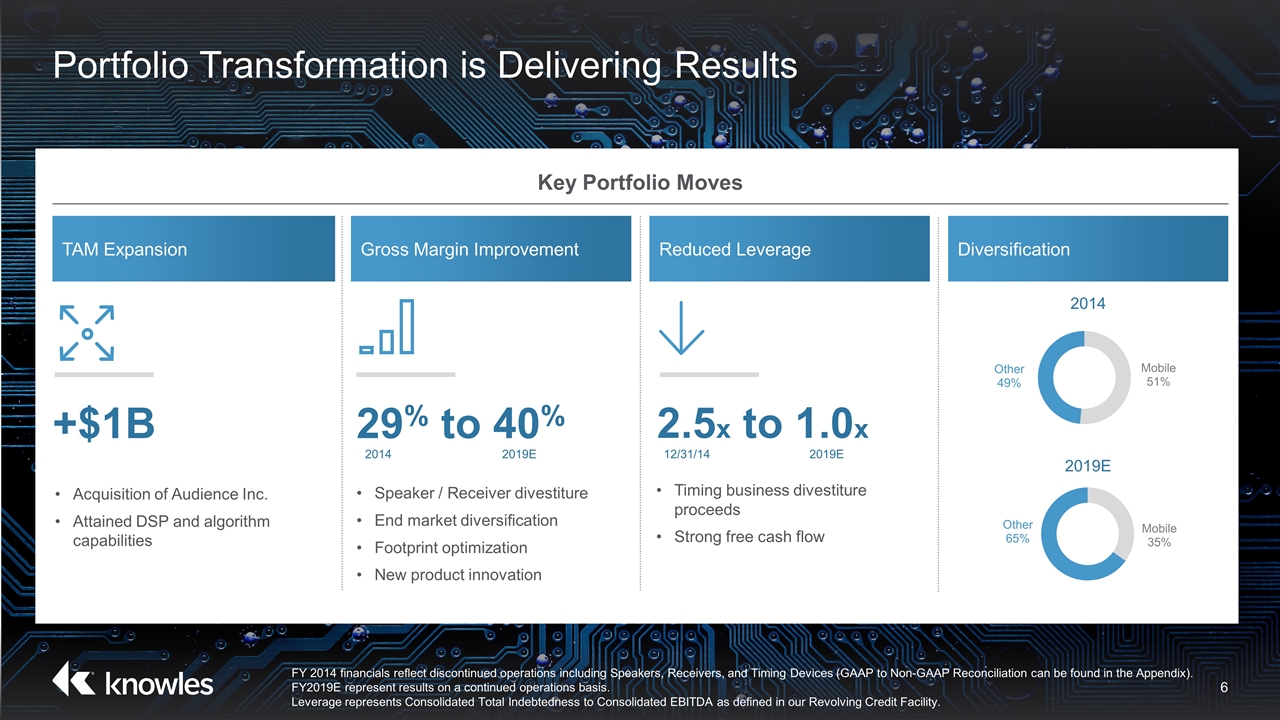

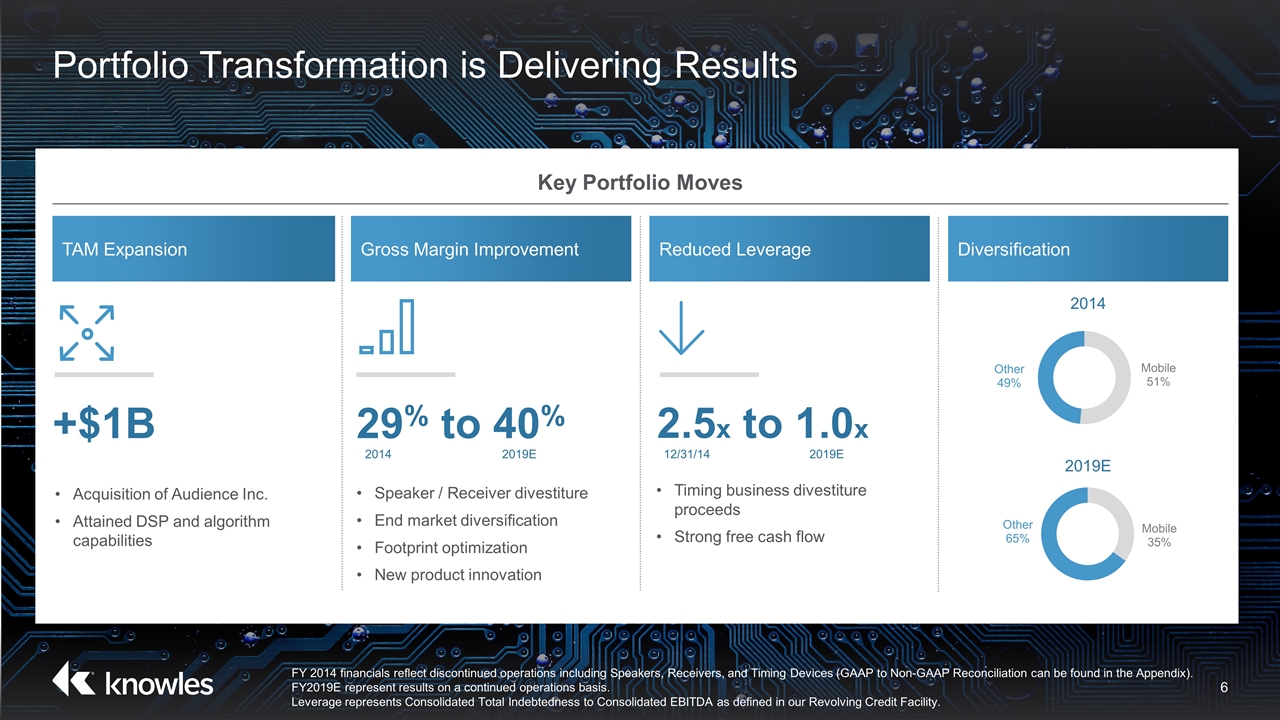

Portfolio Transformation is Delivering Results Key Portfolio Moves Acquisition of Audience Inc. Attained DSP and algorithm capabilities TAM Expansion Speaker / Receiver divestiture End market diversification Footprint optimization New product innovation Gross Margin Improvement Timing business divestiture proceeds Strong free cash flow Reduced Leverage Diversification +$1B 29% to 40% 2.5x to 1.0x 2014 2019E FY 2014 financials reflect discontinued operations including Speakers, Receivers, and Timing Devices (GAAP to Non-GAAP Reconciliation can be found in the Appendix). FY2019E represent results on a continued operations basis. Leverage represents Consolidated Total Indebtedness to Consolidated EBITDA as defined in our Revolving Credit Facility. 12/31/14 2019E 2014 2019E

Leading Provider of High-Performance Audio, Audio Processing and Precision Device Solutions Headquartered: Itasca, IL Listed: KN Countries: 11 KN is a market leader in: Balanced Armature Speakers Edge Processors RF Filtering Solutions MEMS Microphones High Performance Capacitors

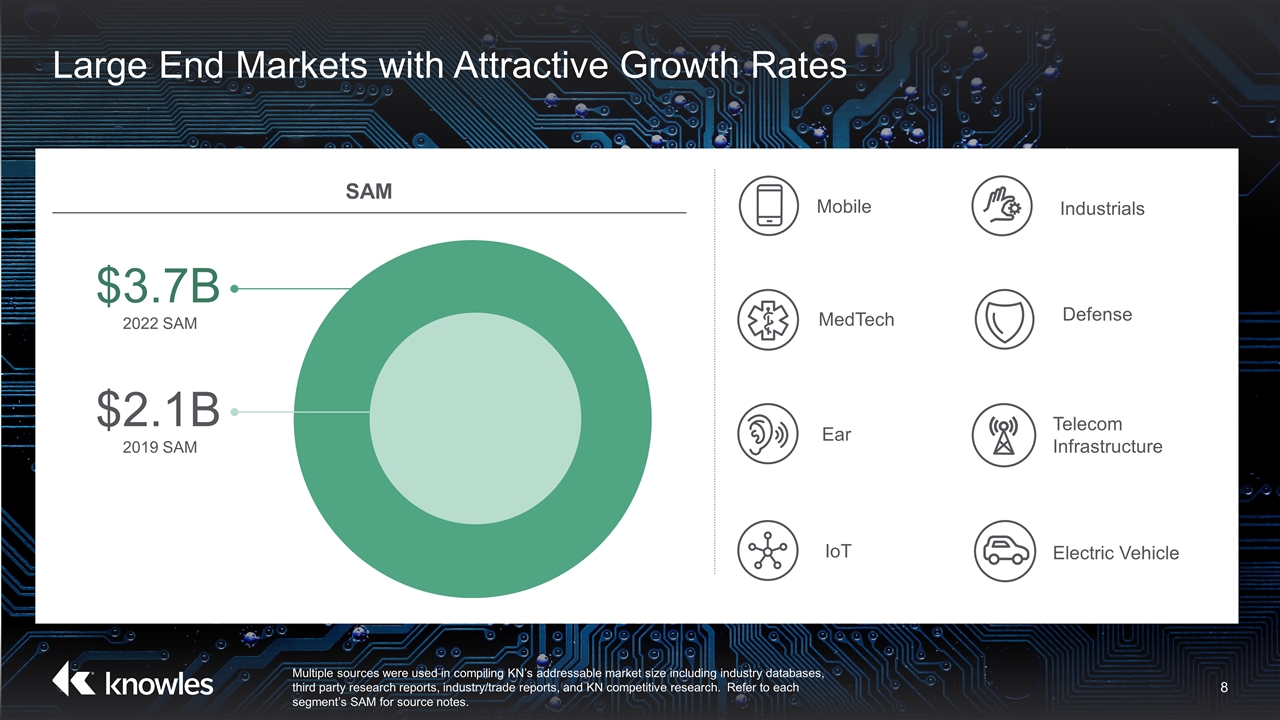

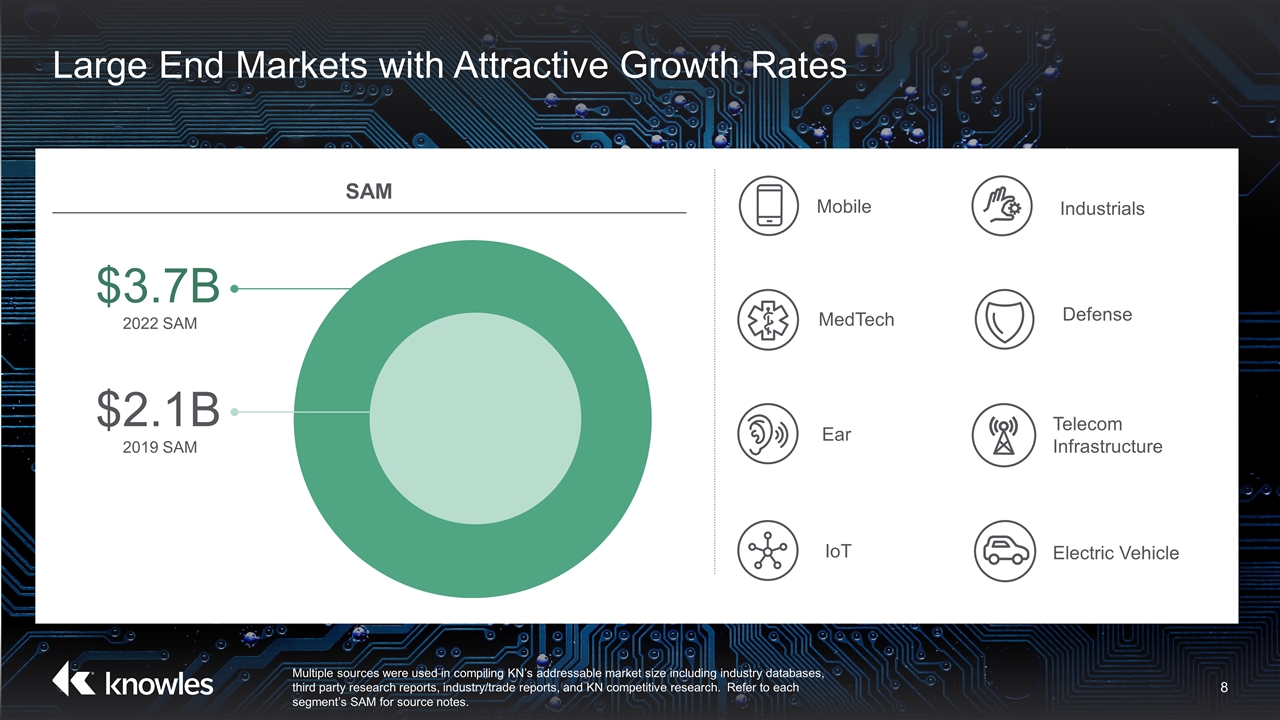

Large End Markets with Attractive Growth Rates Multiple sources were used in compiling KN’s addressable market size including industry databases, third party research reports, industry/trade reports, and KN competitive research. Refer to each segment’s SAM for source notes. SAM $3.7B 2022 SAM $2.1B 2019 SAM Ear Telecom Infrastructure Industrials Mobile MedTech Defense IoT Electric Vehicle

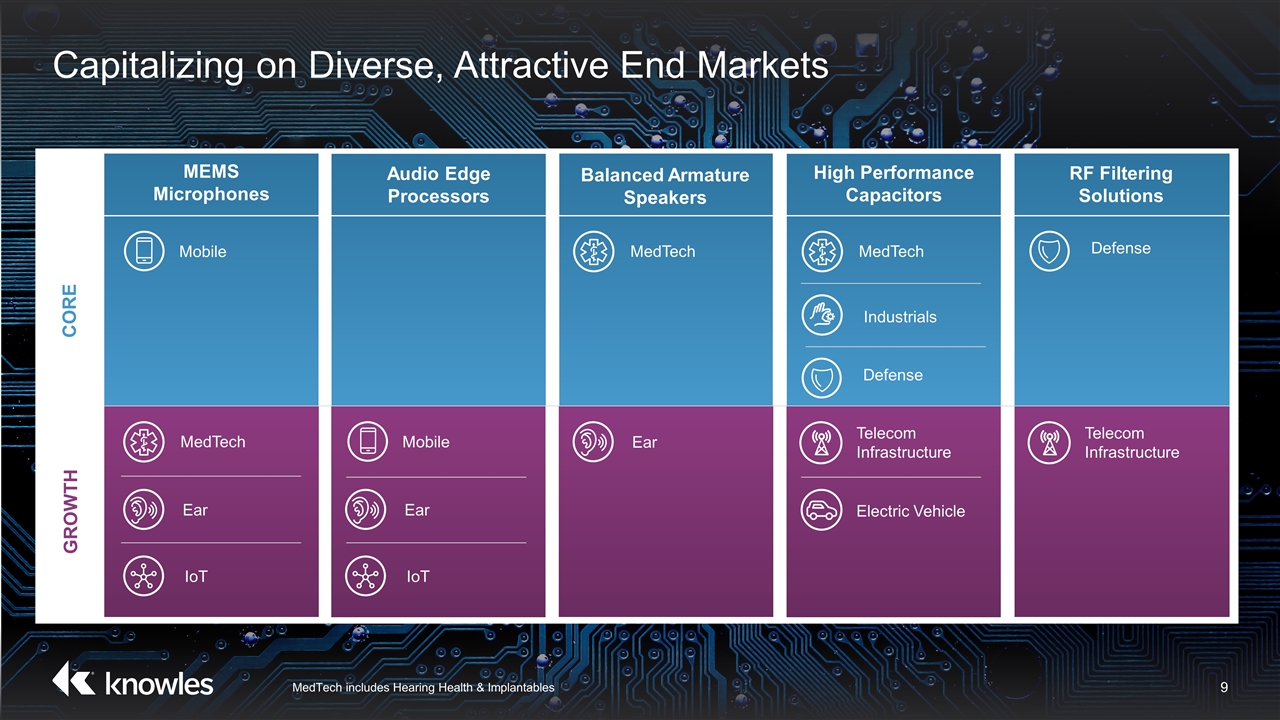

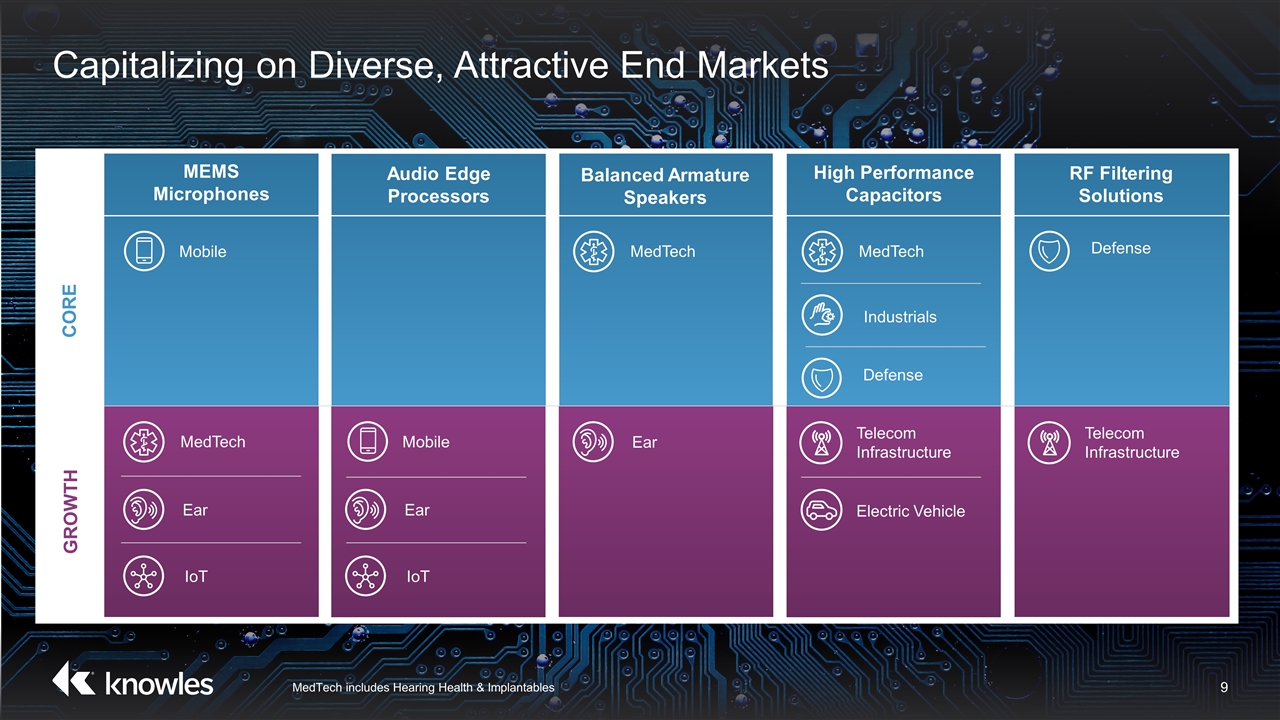

Capitalizing on Diverse, Attractive End Markets MedTech includes Hearing Health & Implantables MedTech IoT Mobile Ear MedTech MEMS Microphones Audio Edge Processors RF Filtering Solutions Balanced Armature Speakers High Performance Capacitors Telecom Infrastructure Ear IoT Ear Mobile CORE GROWTH MedTech Industrials Defense Electric Vehicle Telecom Infrastructure Defense

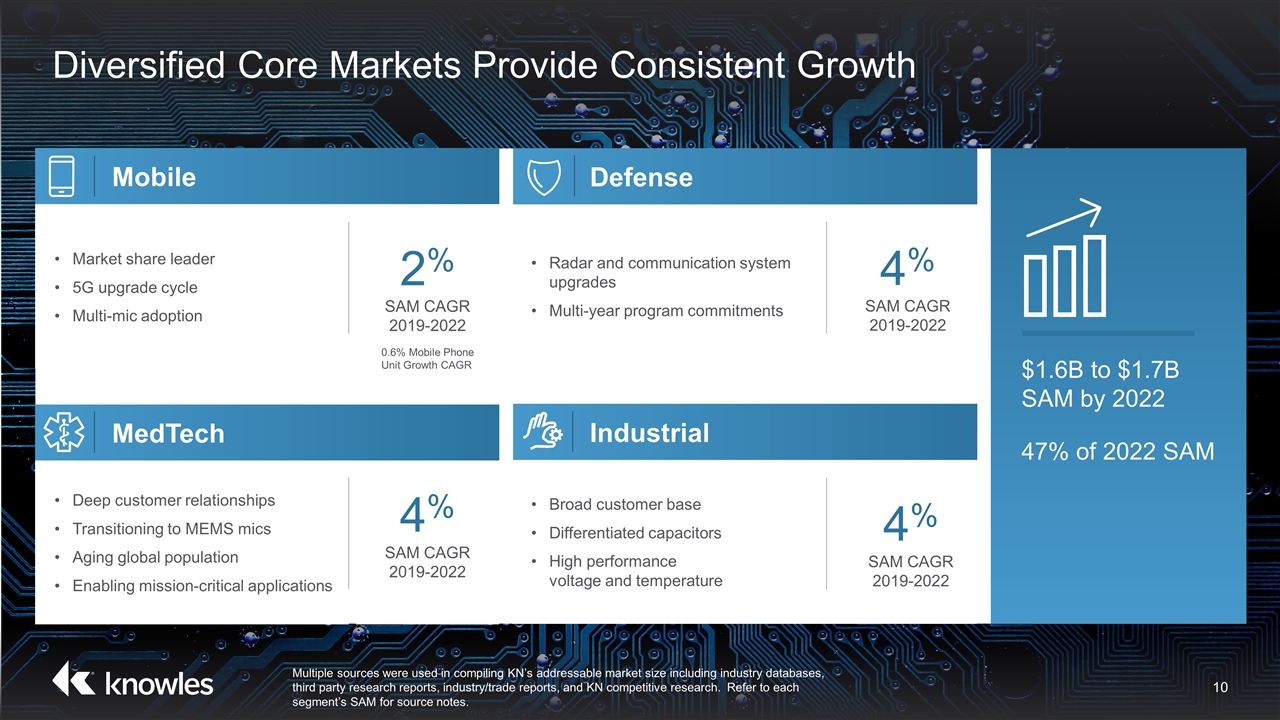

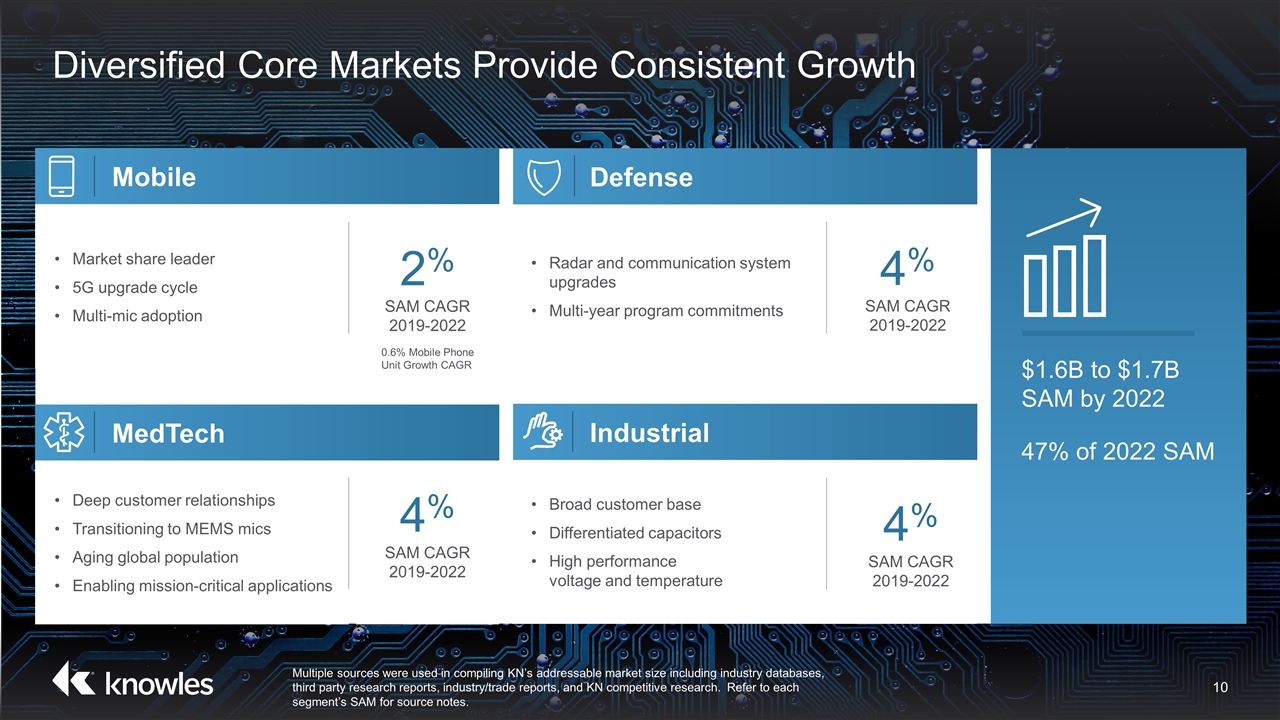

$1.6B to $1.7B SAM by 2022 47% of 2022 SAM Diversified Core Markets Provide Consistent Growth MedTech Deep customer relationships Transitioning to MEMS mics Aging global population Enabling mission-critical applications 4% SAM CAGR 2019-2022 Mobile Market share leader 5G upgrade cycle Multi-mic adoption 2% SAM CAGR 2019-2022 Defense Radar and communication system upgrades Multi-year program commitments 4% SAM CAGR 2019-2022 Industrial Broad customer base Differentiated capacitors High performance voltage and temperature 4% SAM CAGR 2019-2022 Multiple sources were used in compiling KN’s addressable market size including industry databases, third party research reports, industry/trade reports, and KN competitive research. Refer to each segment’s SAM for source notes. 0.6% Mobile Phone Unit Growth CAGR

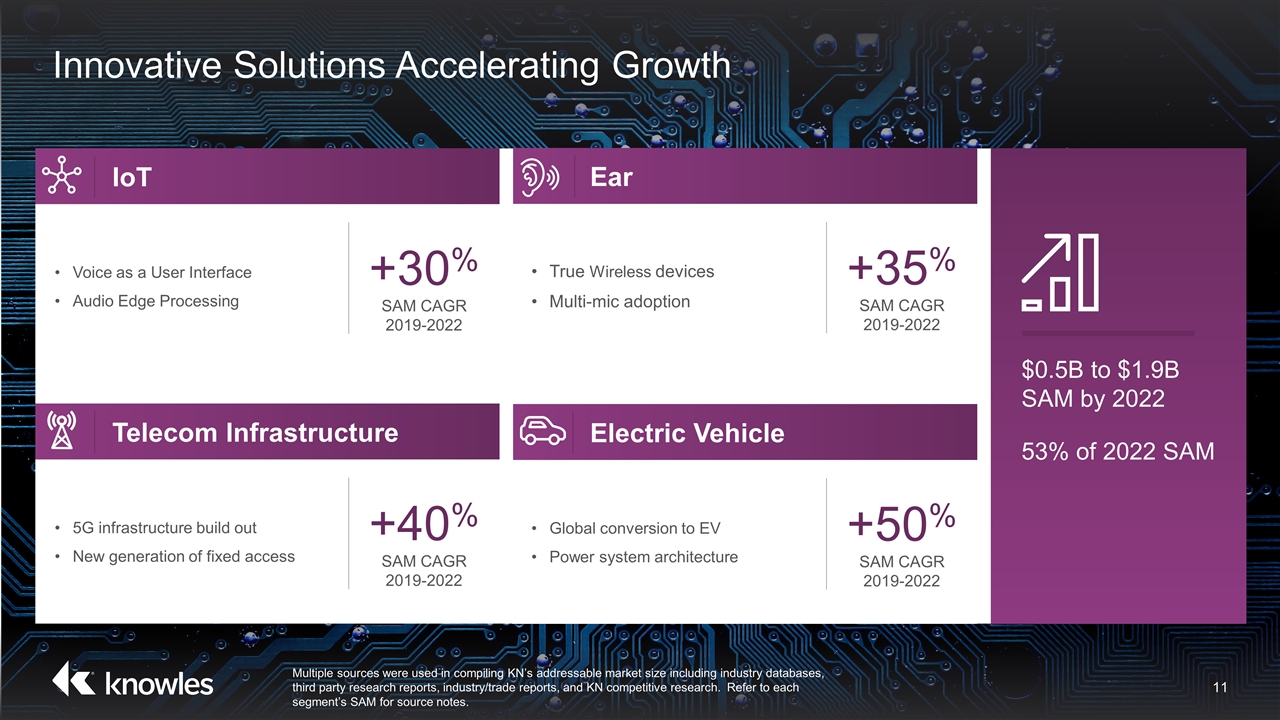

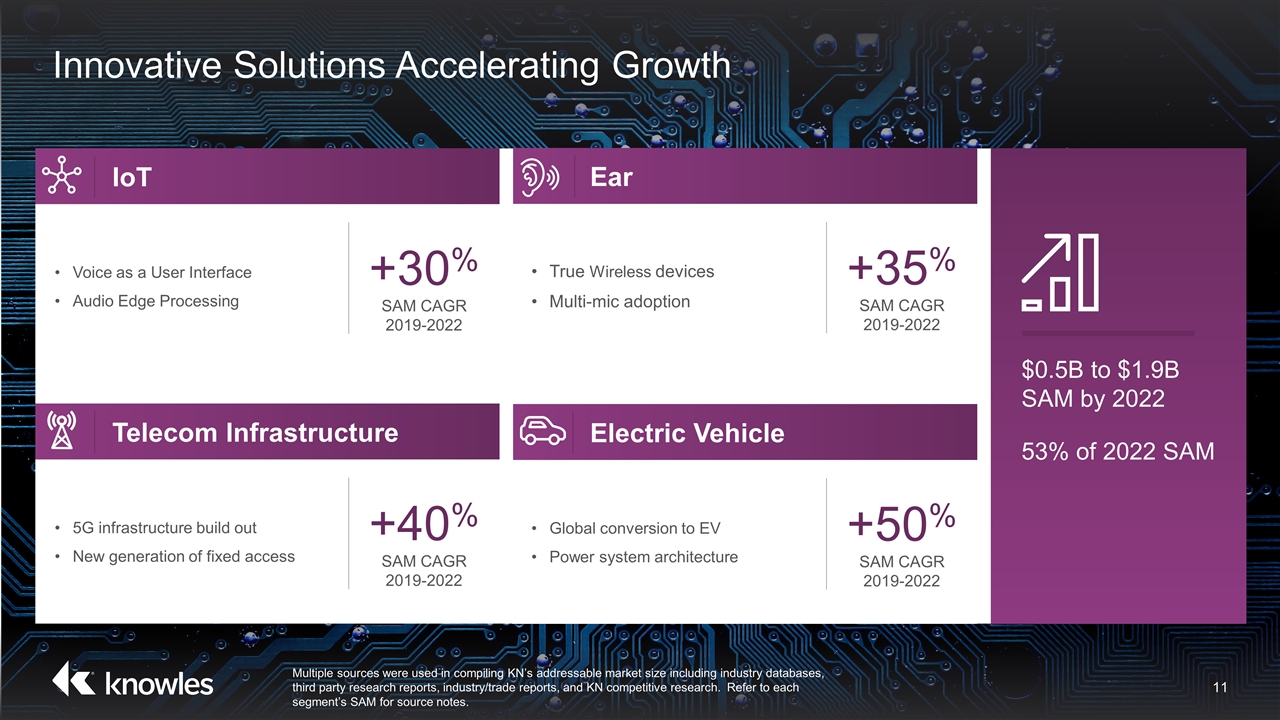

IoT Voice as a User Interface Audio Edge Processing +30% SAM CAGR 2019-2022 Telecom Infrastructure 5G infrastructure build out New generation of fixed access +40% SAM CAGR 2019-2022 Ear True Wireless devices Multi-mic adoption +35% SAM CAGR 2019-2022 Electric Vehicle Global conversion to EV Power system architecture +50% SAM CAGR 2019-2022 Innovative Solutions Accelerating Growth $0.5B to $1.9B SAM by 2022 53% of 2022 SAM Multiple sources were used in compiling KN’s addressable market size including industry databases, third party research reports, industry/trade reports, and KN competitive research. Refer to each segment’s SAM for source notes.

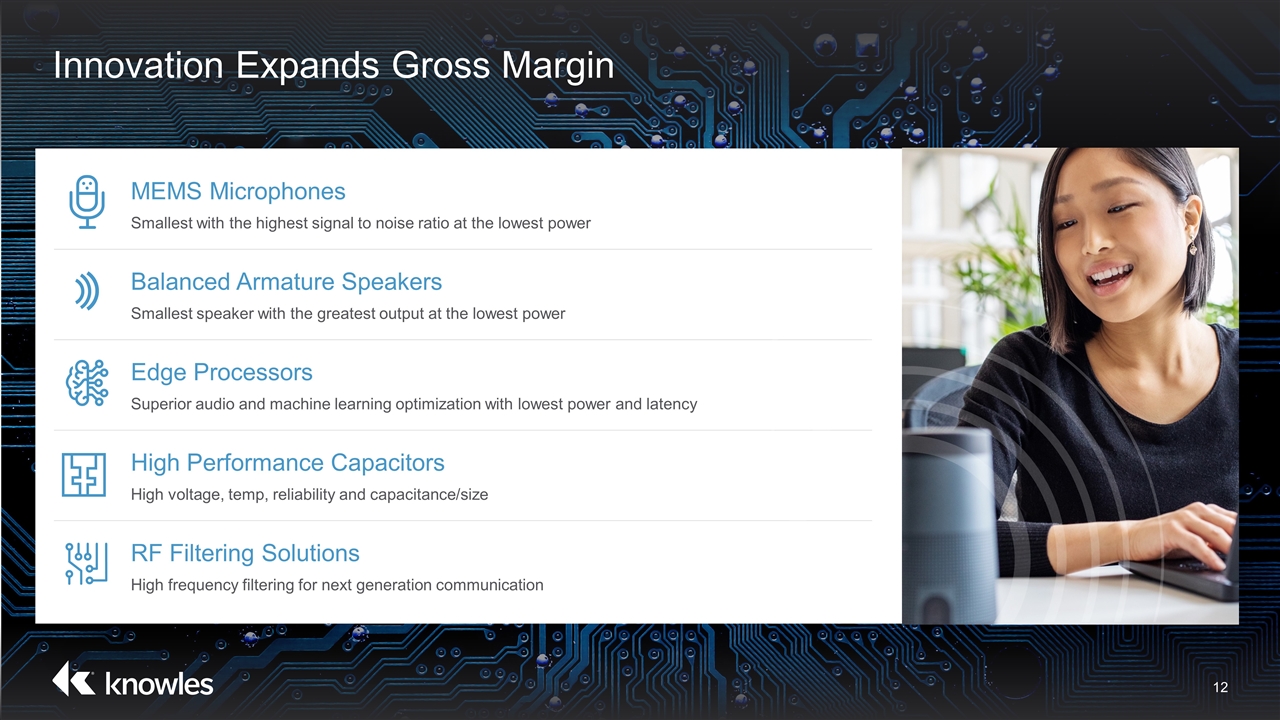

MEMS Microphones Smallest with the highest signal to noise ratio at the lowest power Balanced Armature Speakers Smallest speaker with the greatest output at the lowest power Edge Processors Superior audio and machine learning optimization with lowest power and latency High Performance Capacitors High voltage, temp, reliability and capacitance/size RF Filtering Solutions High frequency filtering for next generation communication Innovation Expands Gross Margin

Our Team Jeffrey S. Niew President & CEO Company Overview Key Takeaways John Anderson Senior Vice President & CFO Financial Overview Chris Dugan President, Precision Devices RF Filtering Solutions Mike Polacek President, Intelligent Audio Audio Edge Processors Christian Scherp President, Performance Audio MEMS Microphones Jon Kiachian Vice President, Hearing Health Technologies Balanced Armature Speakers Sam Vinci Vice President, Precision Devices High Performance Capacitors

MEMS Microphones Voice as the User Interface

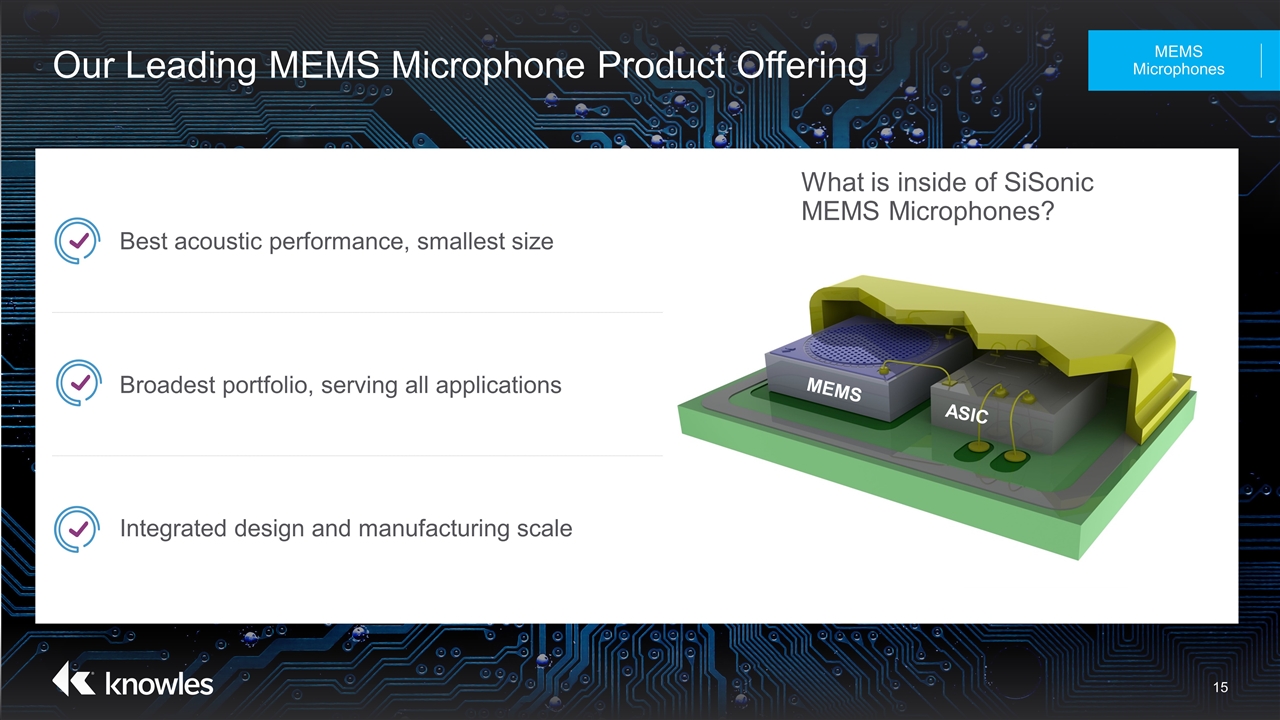

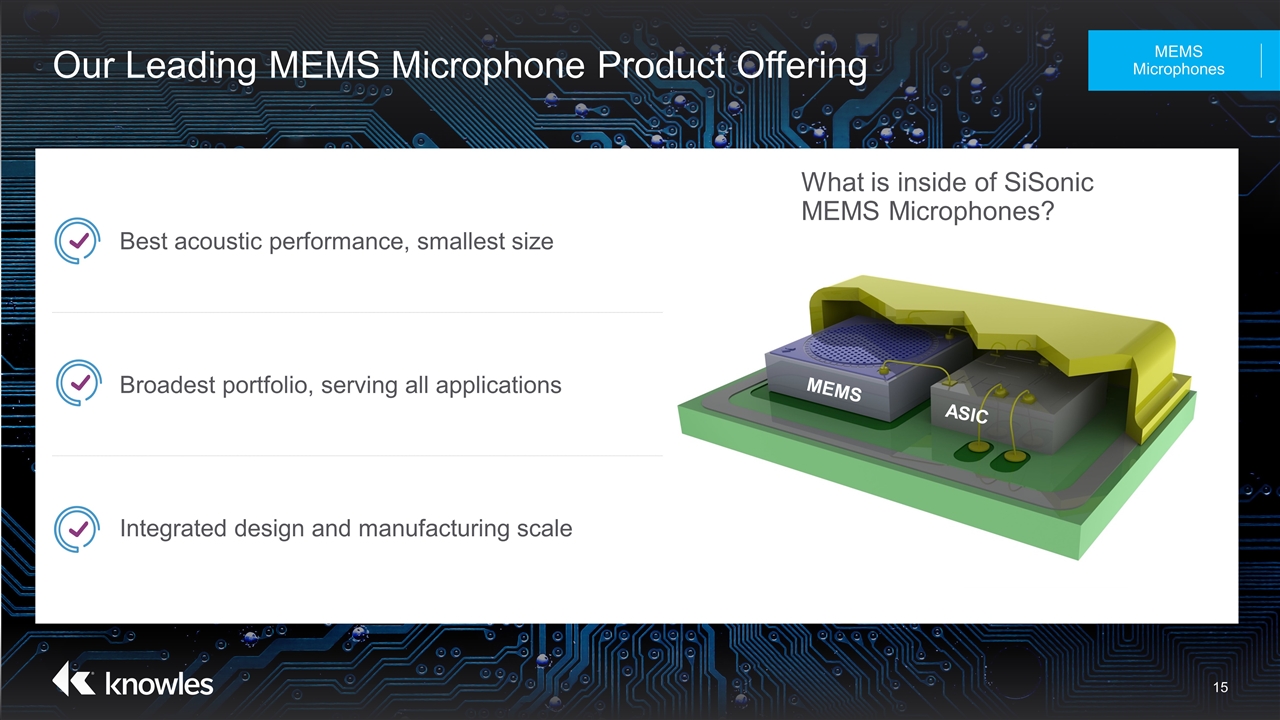

Our Leading MEMS Microphone Product Offering MEMS Microphones Best acoustic performance, smallest size Broadest portfolio, serving all applications Integrated design and manufacturing scale What is inside of SiSonic MEMS Microphones? ASIC MEMS

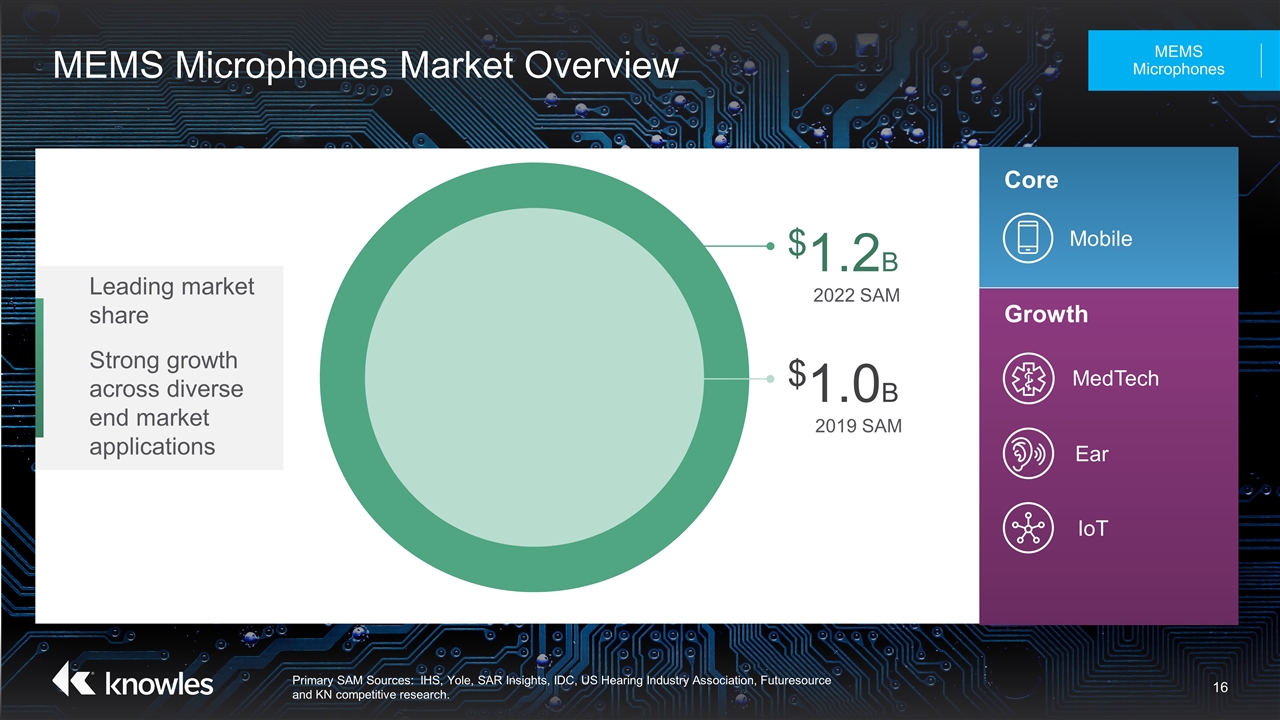

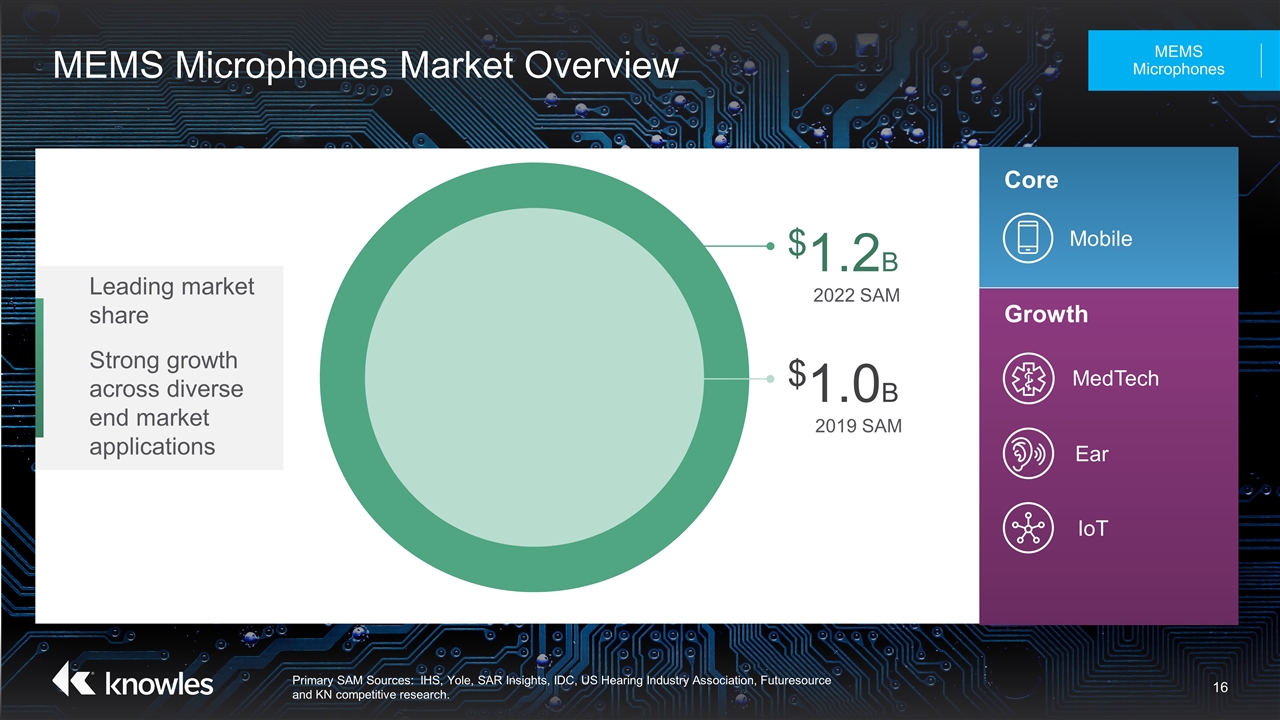

MEMS Microphones Market Overview Primary SAM Sources: IHS, Yole, SAR Insights, IDC, US Hearing Industry Association, Futuresource and KN competitive research. MEMS Microphones $1.2B 2022 SAM Leading market share Strong growth across diverse end market applications Growth Core Mobile MedTech IoT Ear $1.0B 2019 SAM

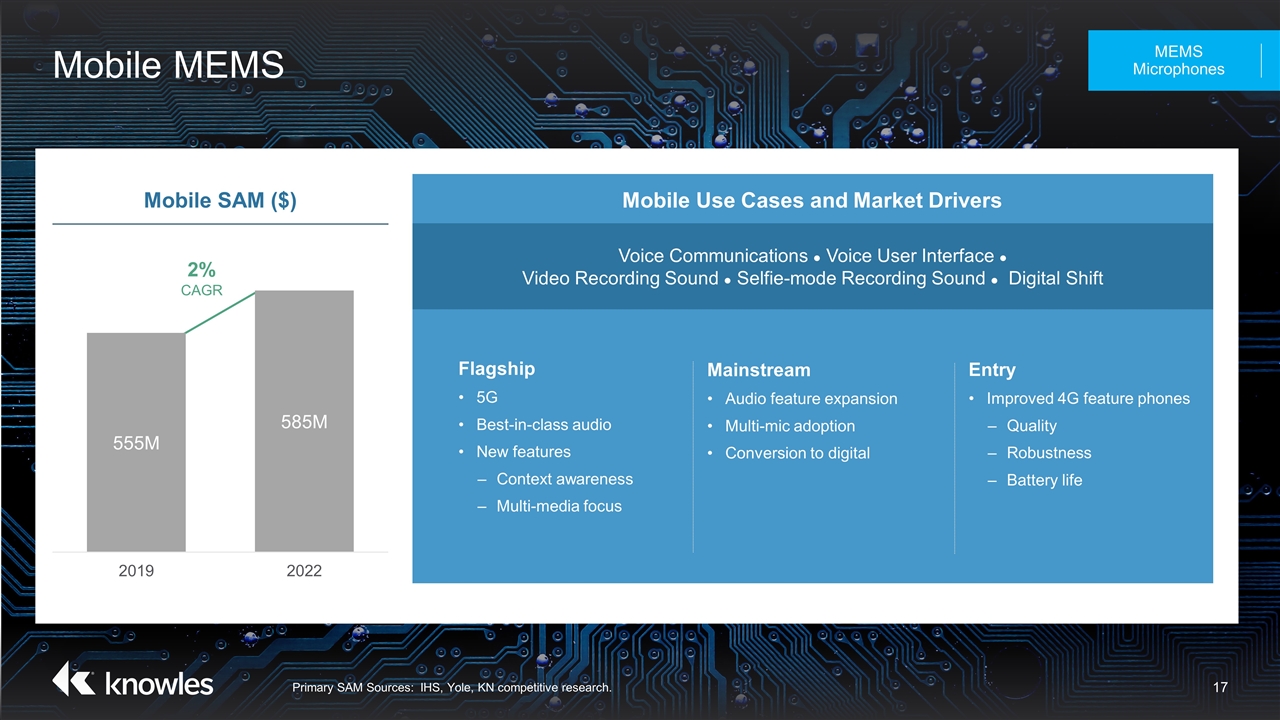

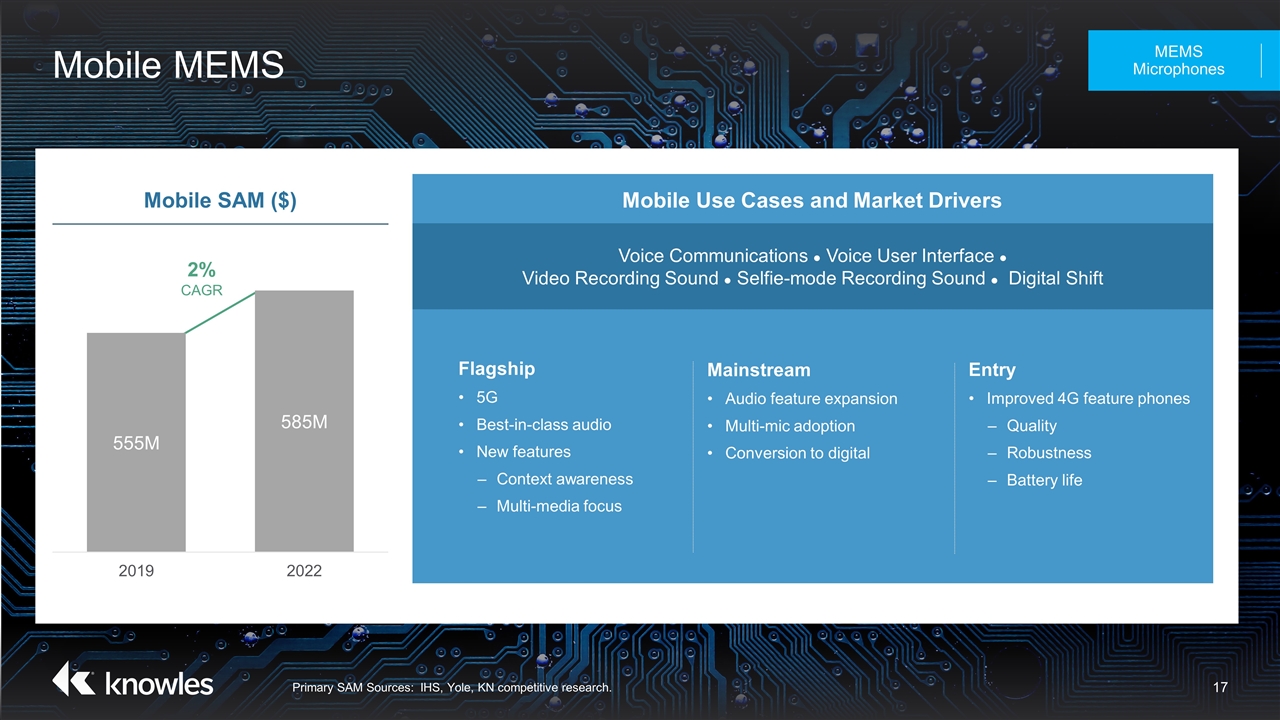

Mobile MEMS Primary SAM Sources: IHS, Yole, KN competitive research. MEMS Microphones Mobile SAM ($) Voice Communications ● Voice User Interface ● Video Recording Sound ● Selfie-mode Recording Sound ● Digital Shift Flagship 5G Best-in-class audio New features Context awareness Multi-media focus Mainstream Audio feature expansion Multi-mic adoption Conversion to digital Entry Improved 4G feature phones Quality Robustness Battery life 2% CAGR Mobile Use Cases and Market Drivers

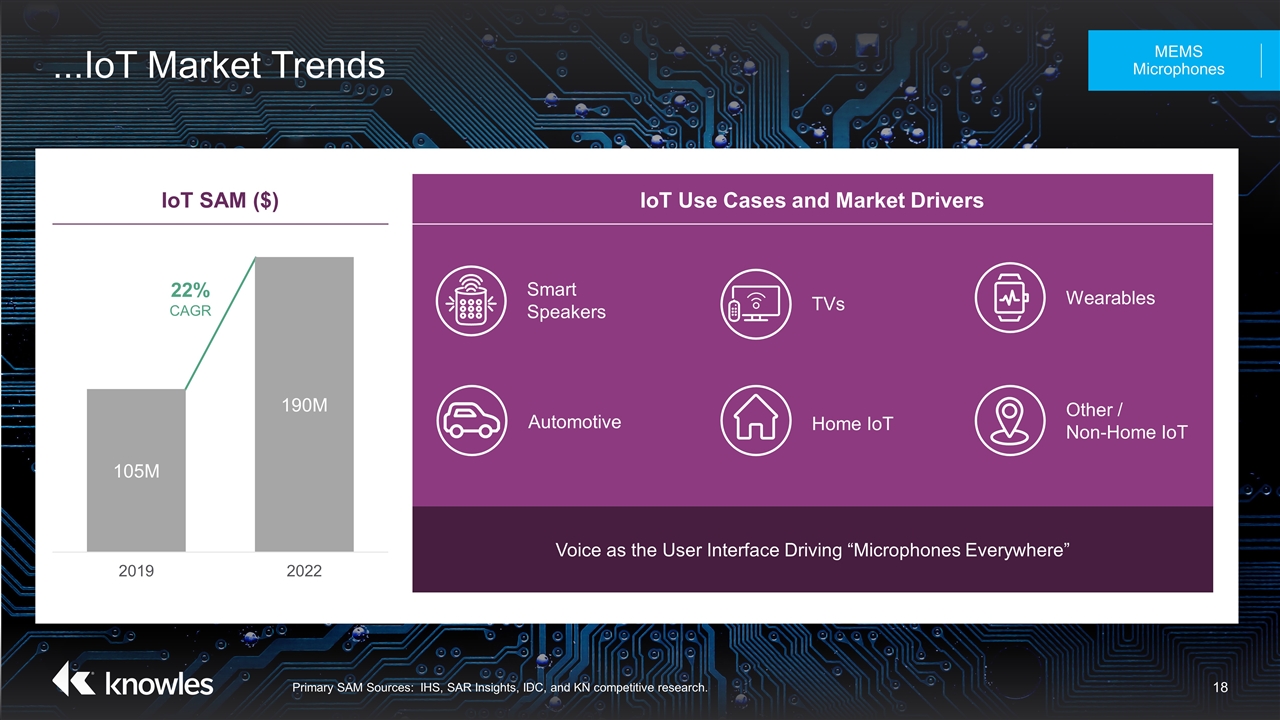

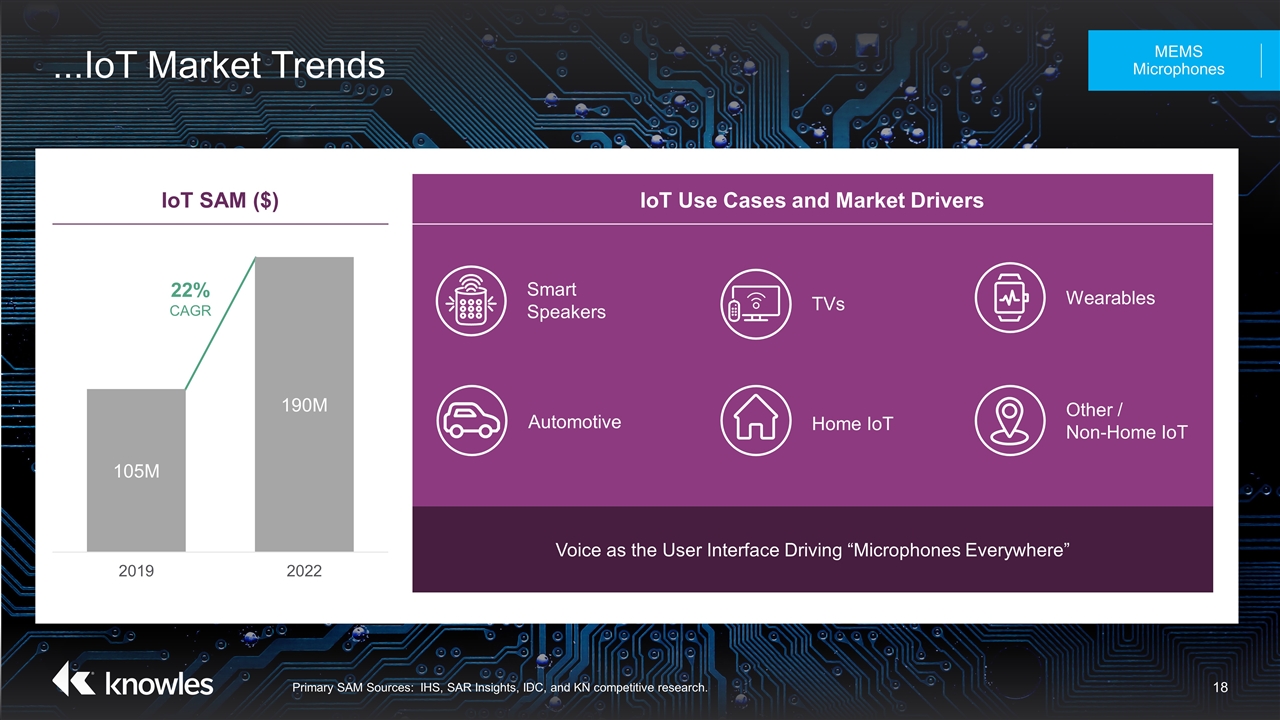

IoT SAM ($) IoT Use Cases and Market Drivers Voice as the User Interface Driving “Microphones Everywhere” ...IoT Market Trends Primary SAM Sources: IHS, SAR Insights, IDC, and KN competitive research. MEMS Microphones TVs Home IoT Other / Non-Home IoT Wearables Automotive Smart Speakers 22% CAGR

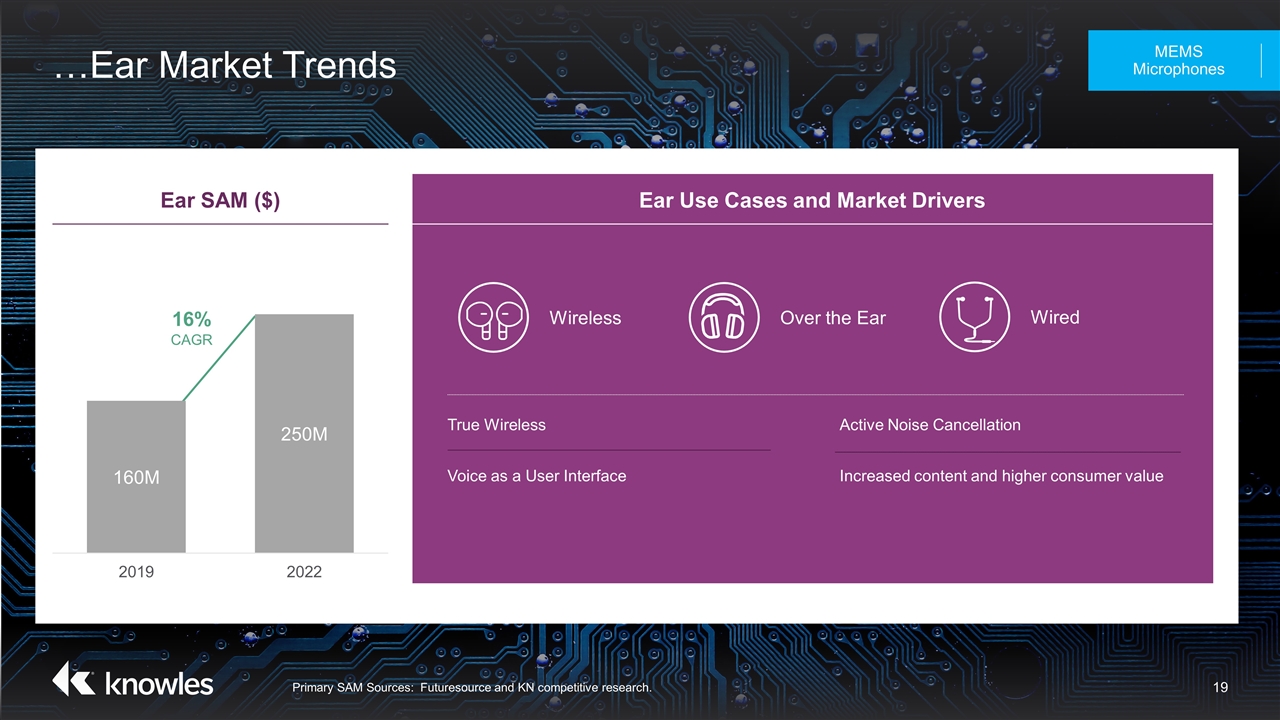

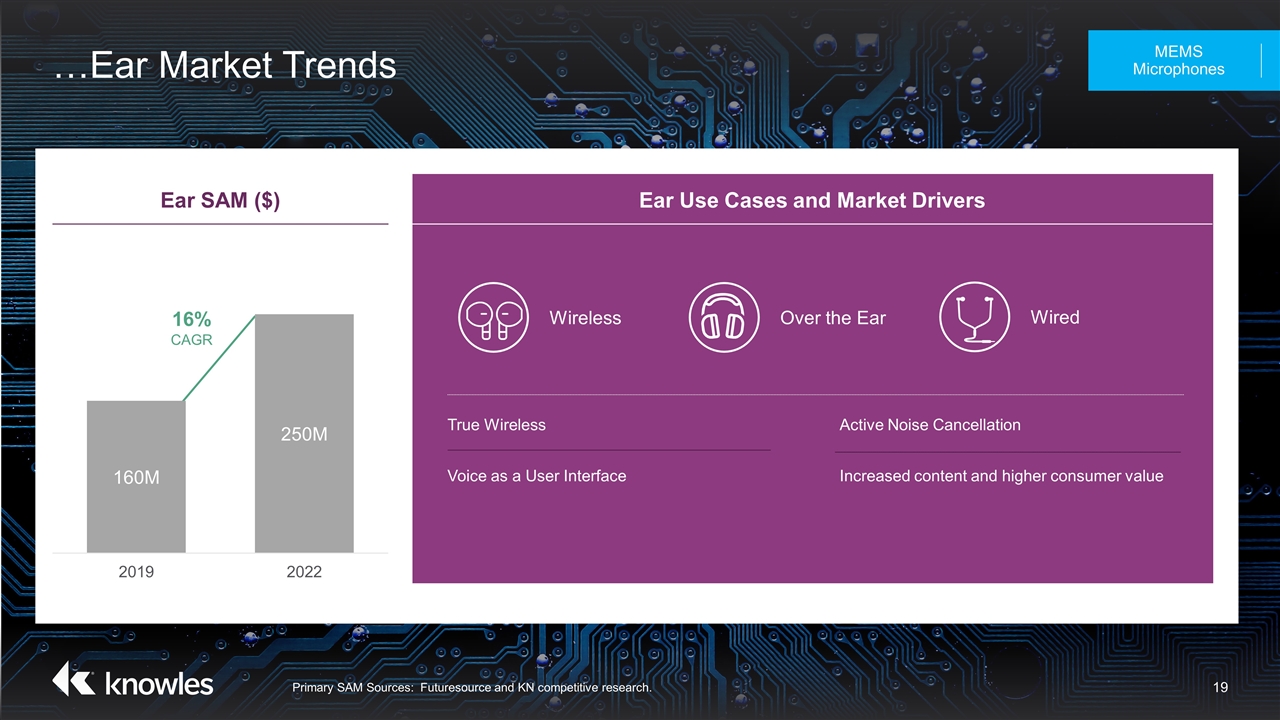

…Ear Market Trends MEMS Microphones Primary SAM Sources: Futuresource and KN competitive research. Ear SAM ($) Ear Use Cases and Market Drivers 16% CAGR True Wireless Voice as a User Interface Active Noise Cancellation Increased content and higher consumer value Wireless Over the Ear Wired

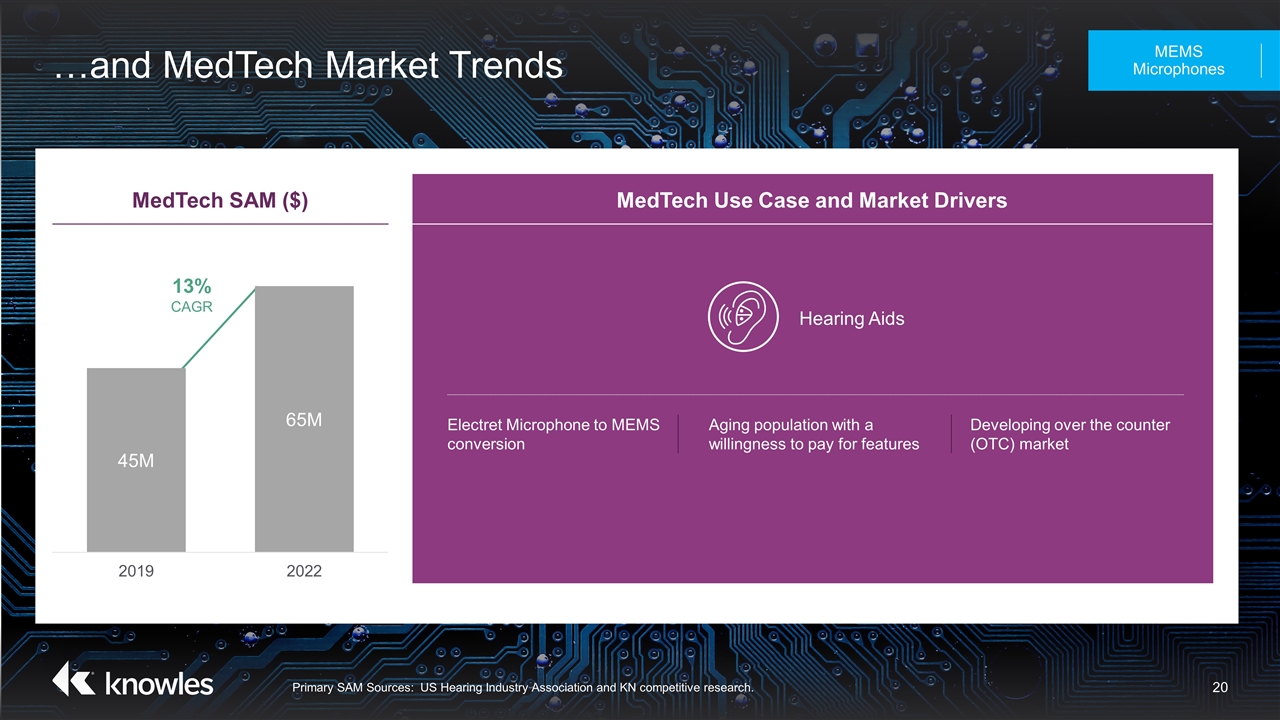

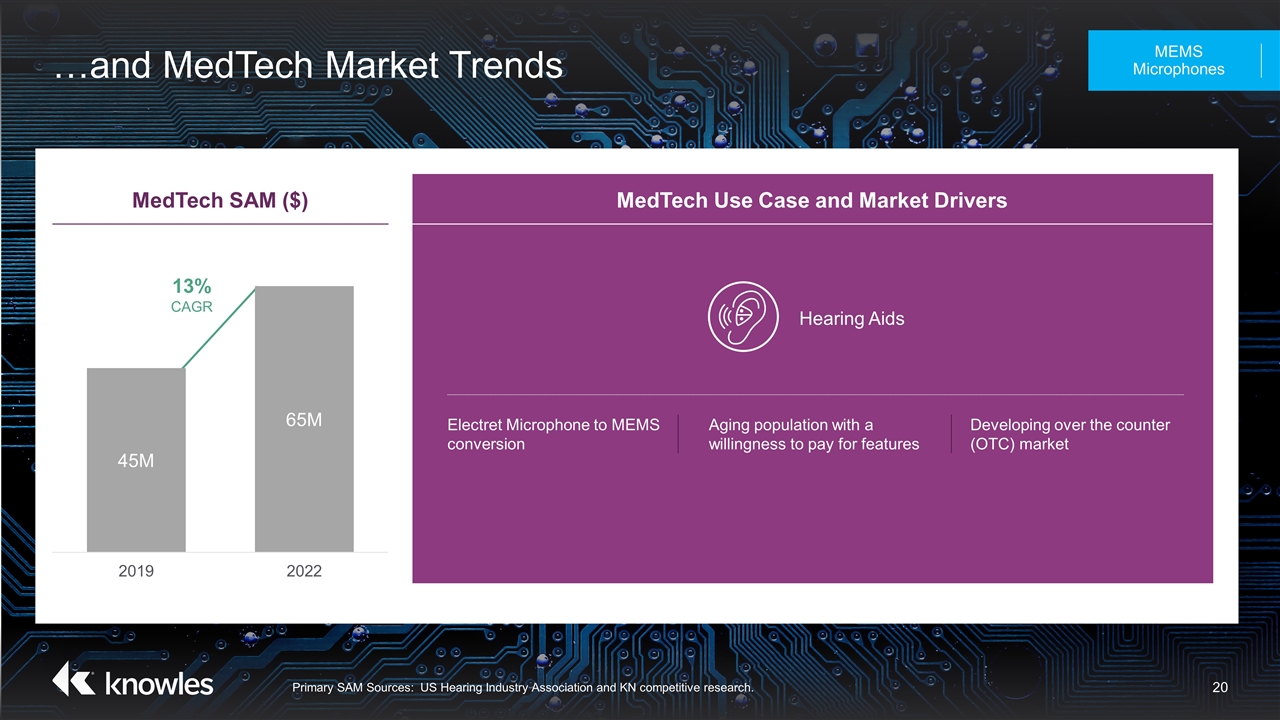

…and MedTech Market Trends MEMS Microphones Primary SAM Sources: US Hearing Industry Association and KN competitive research. MedTech SAM ($) MedTech Use Case and Market Drivers 13% CAGR Electret Microphone to MEMS conversion Aging population with a willingness to pay for features Developing over the counter (OTC) market Hearing Aids

Why We Win in MEMS Core Market MEMS Microphones Well-positioned with market leaders Top supplier across all Mobile tiers Global manufacturing scale and support Investing to meet market trends Growth Above the Market Rate Margin Expansion

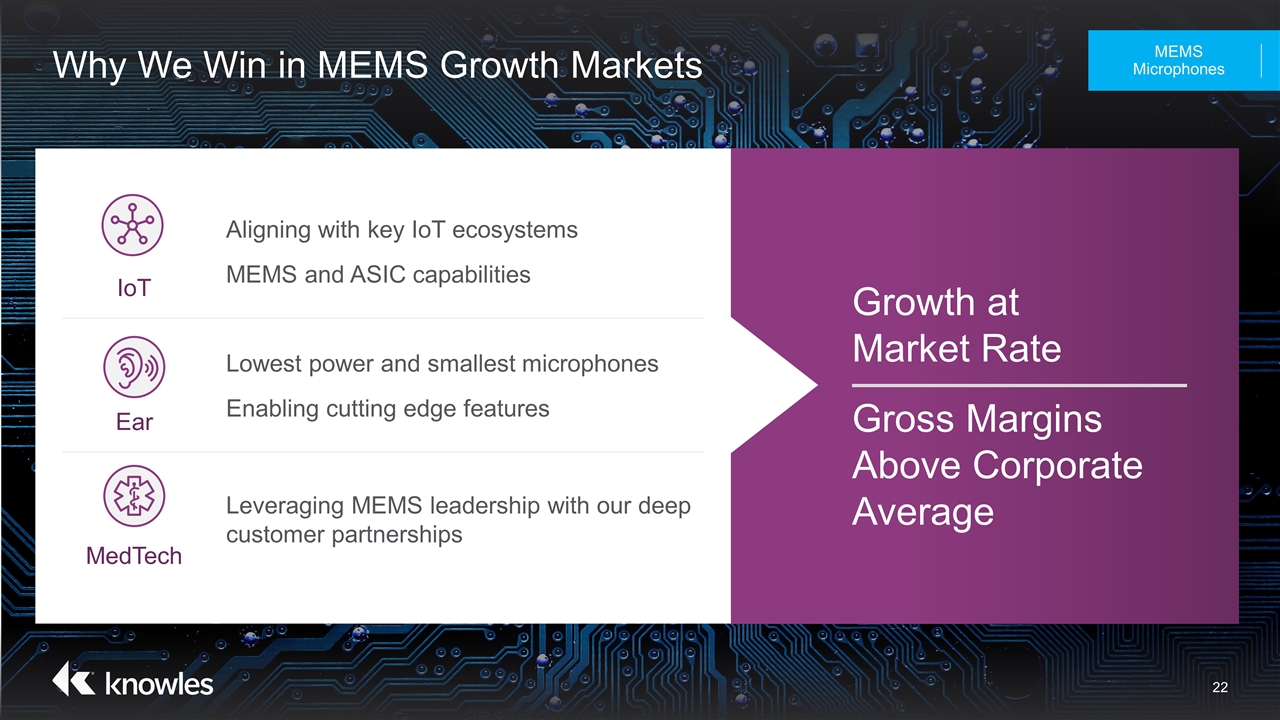

Why We Win in MEMS Growth Markets MEMS Microphones Growth at Market Rate Gross Margins Above Corporate Average IoT Aligning with key IoT ecosystems MEMS and ASIC capabilities Ear Lowest power and smallest microphones Enabling cutting edge features MedTech Leveraging MEMS leadership with our deep customer partnerships

MEMS Microphones Key Takeaways MEMS Microphones Voice as a User Interface Market leading share and scale with diversity of end market applications Profitable growth through technological differentiation

Balanced Armature Speakers Enabling Superior Portable Audio

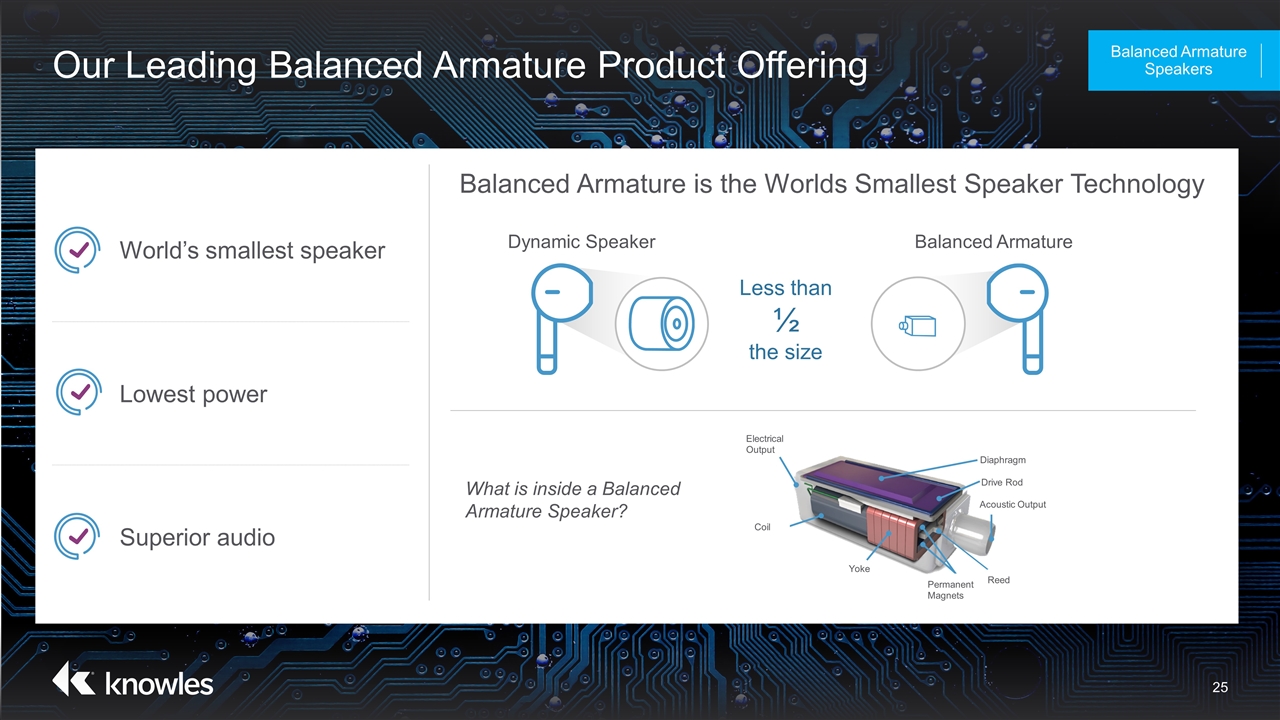

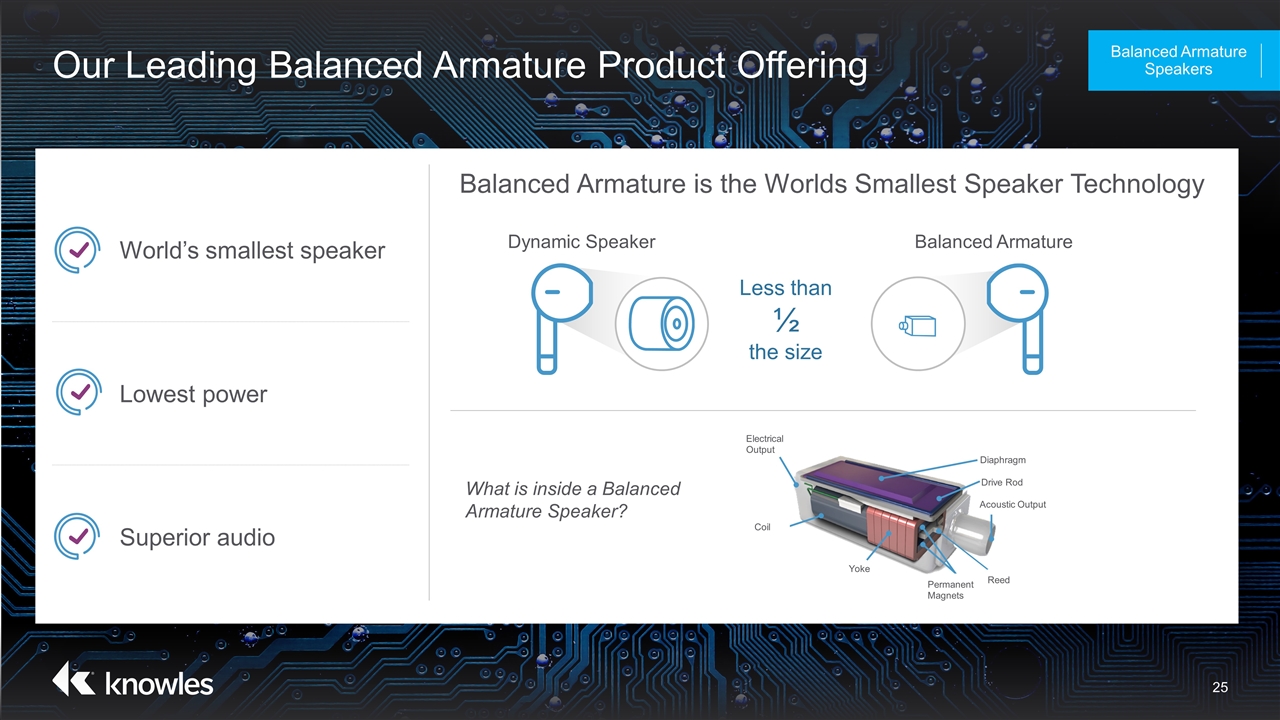

Our Leading Balanced Armature Product Offering Balanced Armature Speakers World’s smallest speaker Lowest power Superior audio Balanced Armature is the Worlds Smallest Speaker Technology Coil Electrical Output Yoke Permanent Magnets Reed Acoustic Output Diaphragm Drive Rod Balanced Armature Dynamic Speaker What is inside a Balanced Armature Speaker? Less than ½ the size

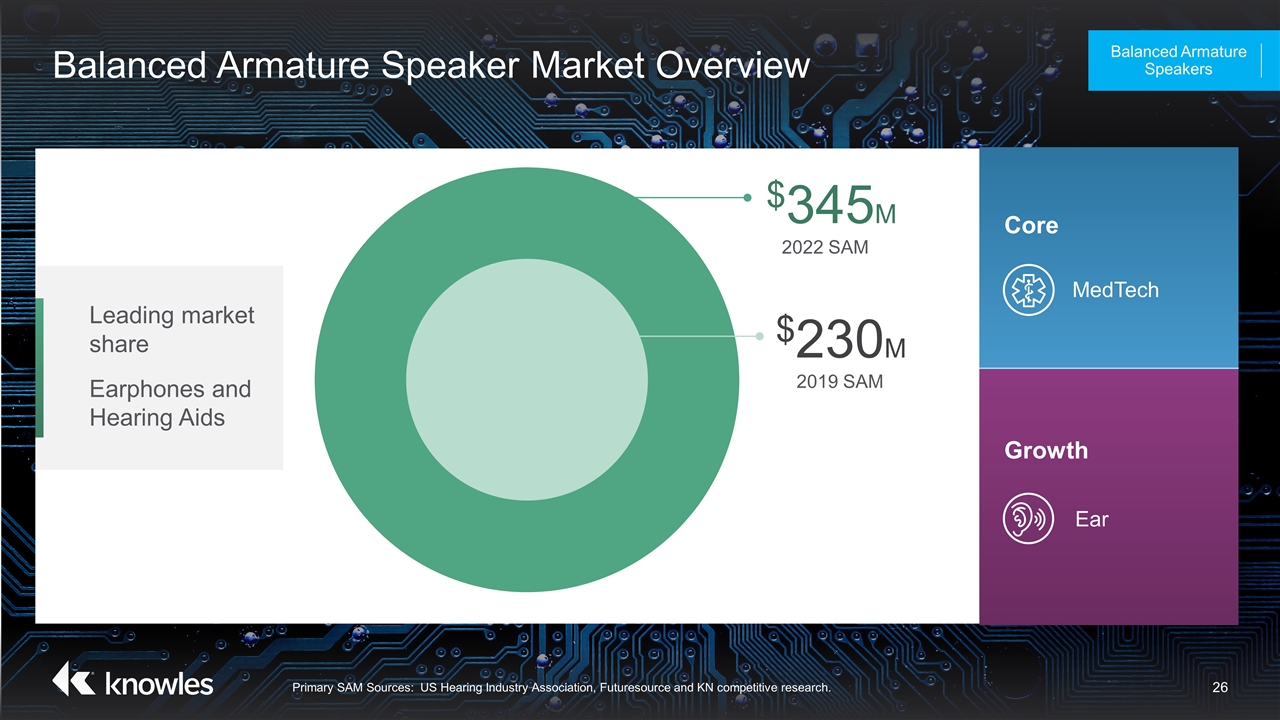

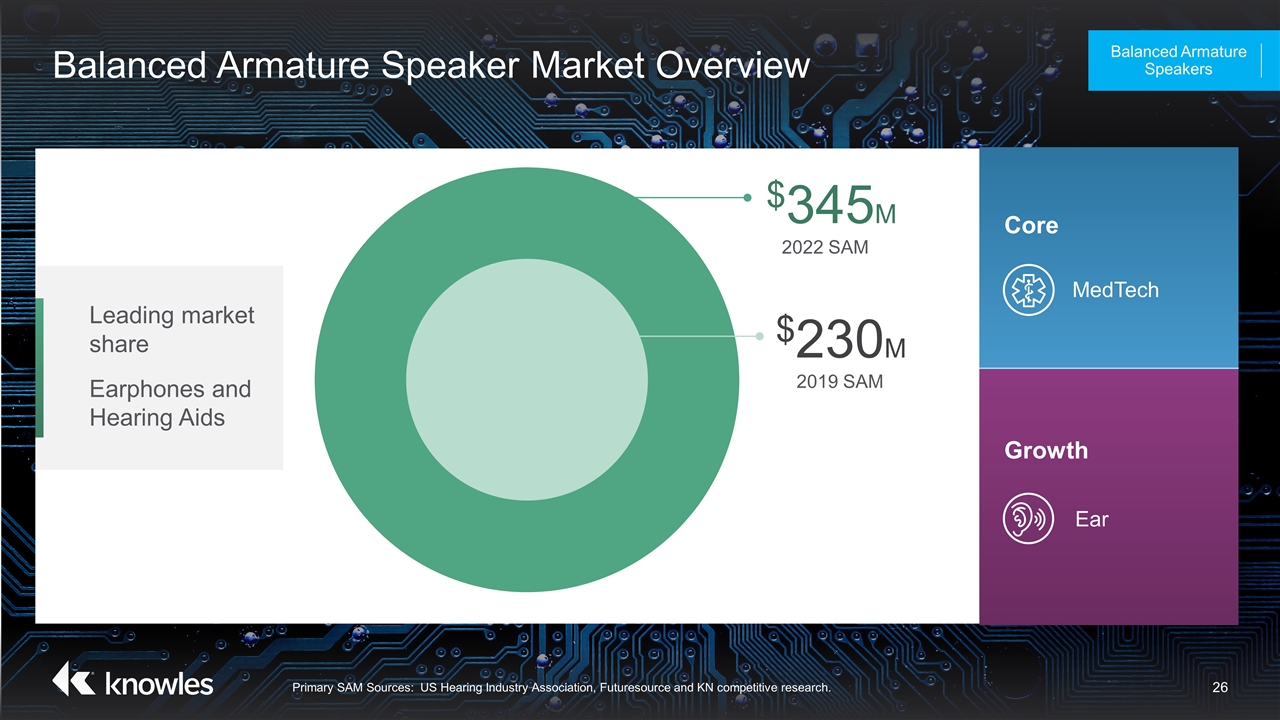

Balanced Armature Speaker Market Overview Balanced Armature Speakers Primary SAM Sources: US Hearing Industry Association, Futuresource and KN competitive research. $345M 2022 SAM Growth Ear Core MedTech $230M 2019 SAM Leading market share Earphones and Hearing Aids

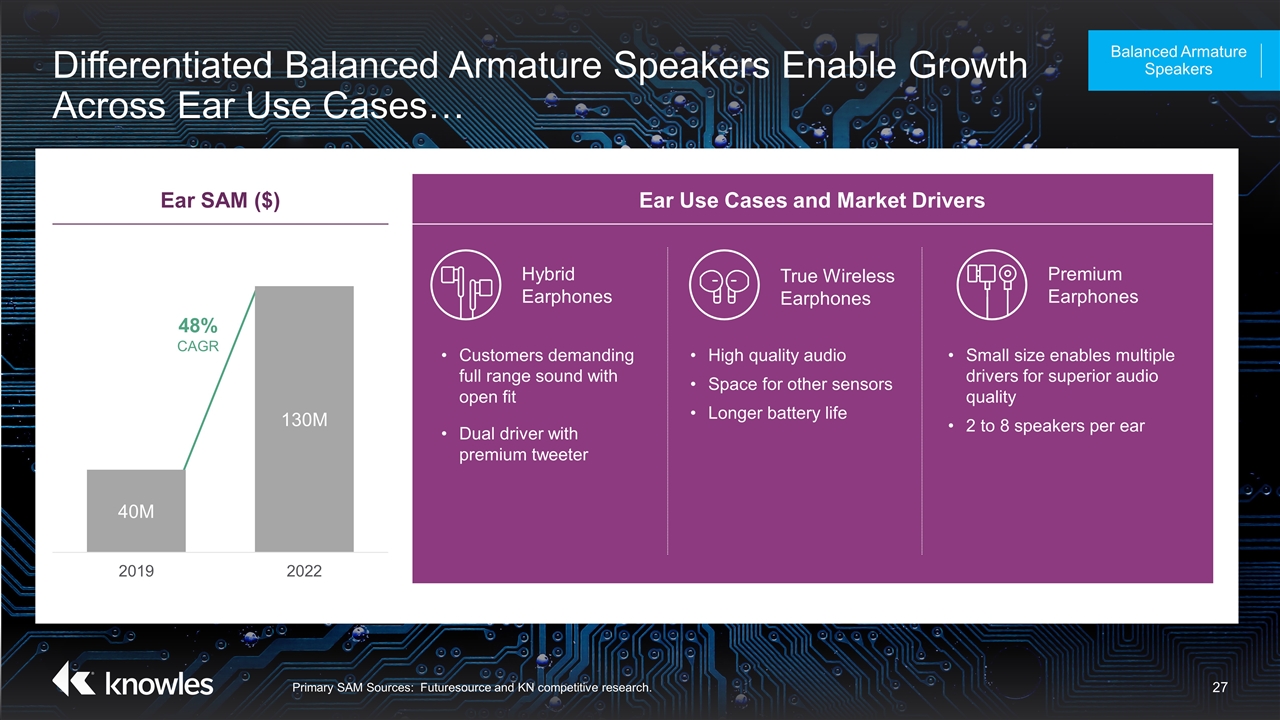

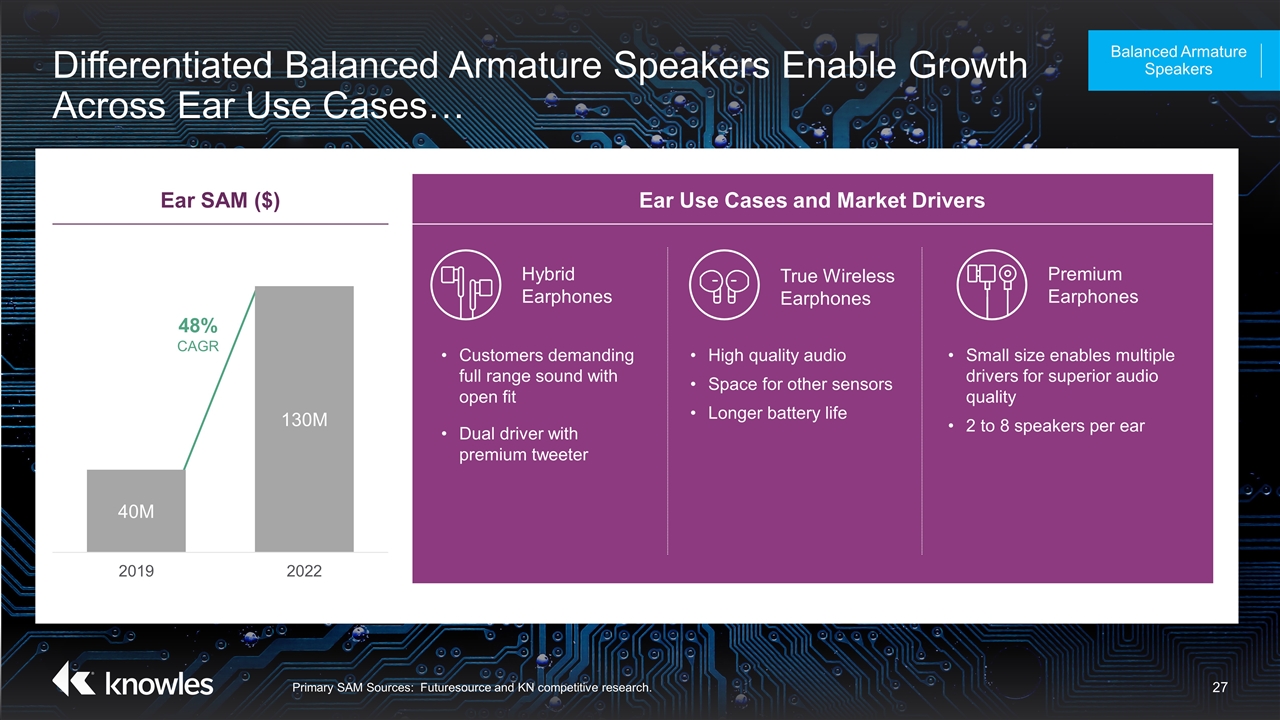

Differentiated Balanced Armature Speakers Enable Growth Across Ear Use Cases… Balanced Armature Speakers Ear SAM ($) Ear Use Cases and Market Drivers Primary SAM Sources: Futuresource and KN competitive research. 48% CAGR Customers demanding full range sound with open fit Dual driver with premium tweeter Hybrid Earphones Premium Earphones True Wireless Earphones Small size enables multiple drivers for superior audio quality 2 to 8 speakers per ear High quality audio Space for other sensors Longer battery life

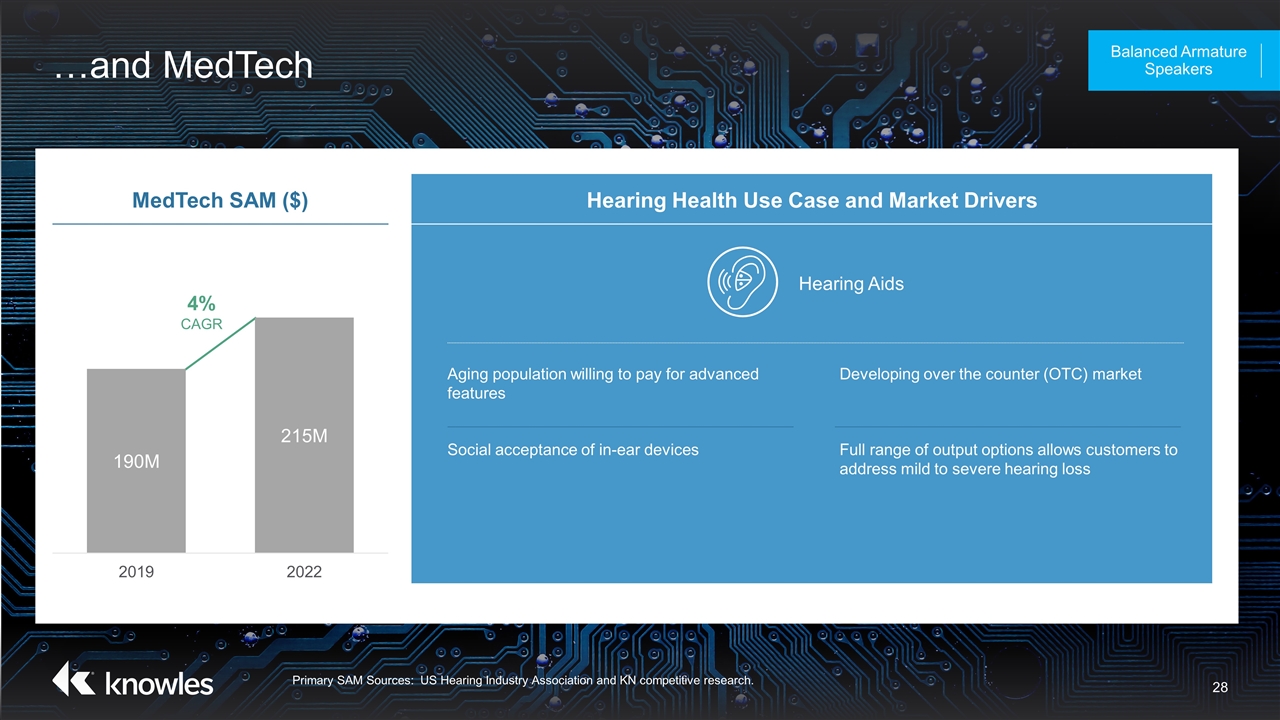

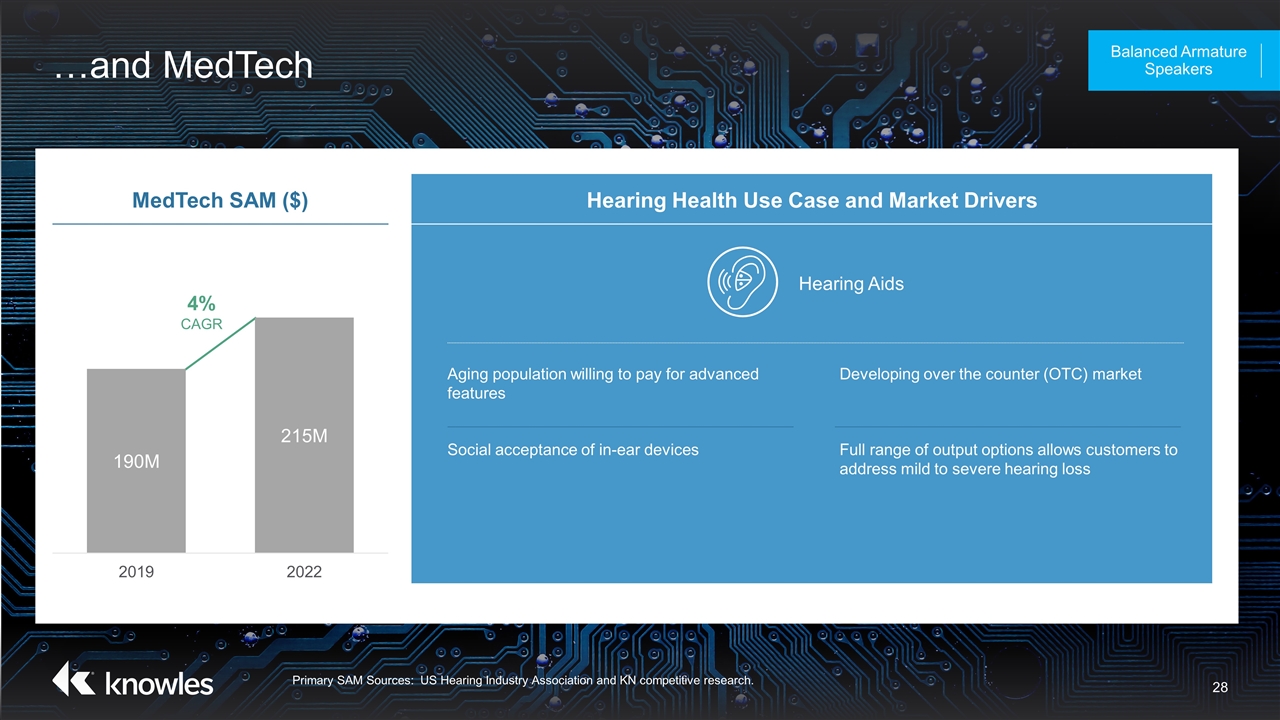

…and MedTech Balanced Armature Speakers Primary SAM Sources: US Hearing Industry Association and KN competitive research. Hearing Health Use Case and Market Drivers MedTech SAM ($) 4% CAGR Aging population willing to pay for advanced features Developing over the counter (OTC) market Hearing Aids Social acceptance of in-ear devices Full range of output options allows customers to address mild to severe hearing loss

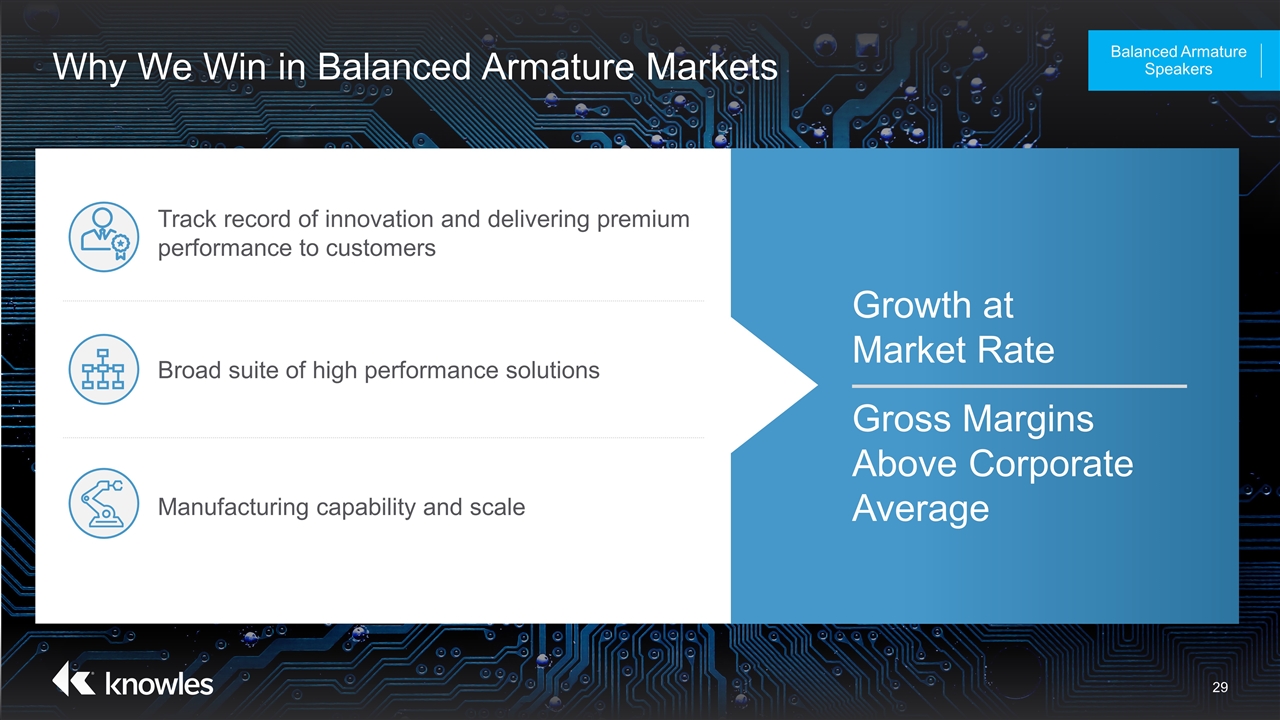

Why We Win in Balanced Armature Markets Balanced Armature Speakers Track record of innovation and delivering premium performance to customers Broad suite of high performance solutions Manufacturing capability and scale Growth at Market Rate Gross Margins Above Corporate Average

Balanced Armature Key Takeaways Balanced Armature Speakers Leadership position in multiple markets Small size, low power, superior audio enable new use cases Innovative design and manufacturing process

Audio Edge Processors Enabling Use Cases Beyond a Continuous Cloud Connection

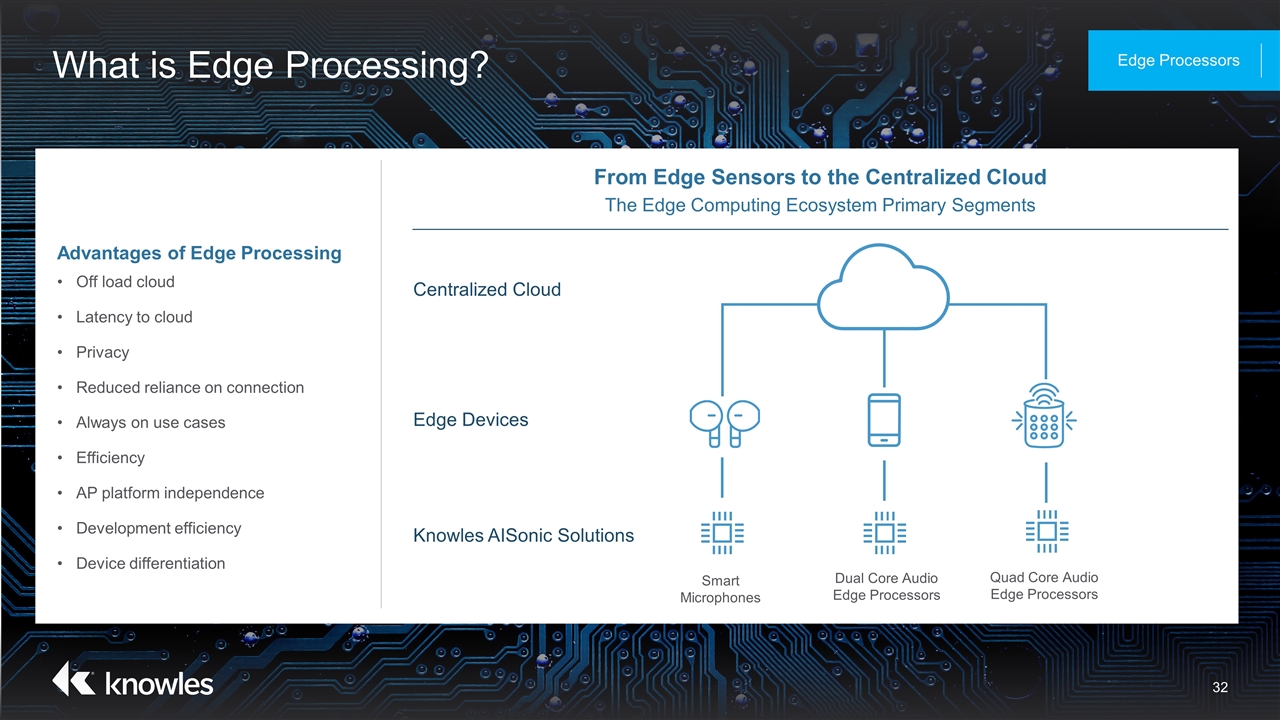

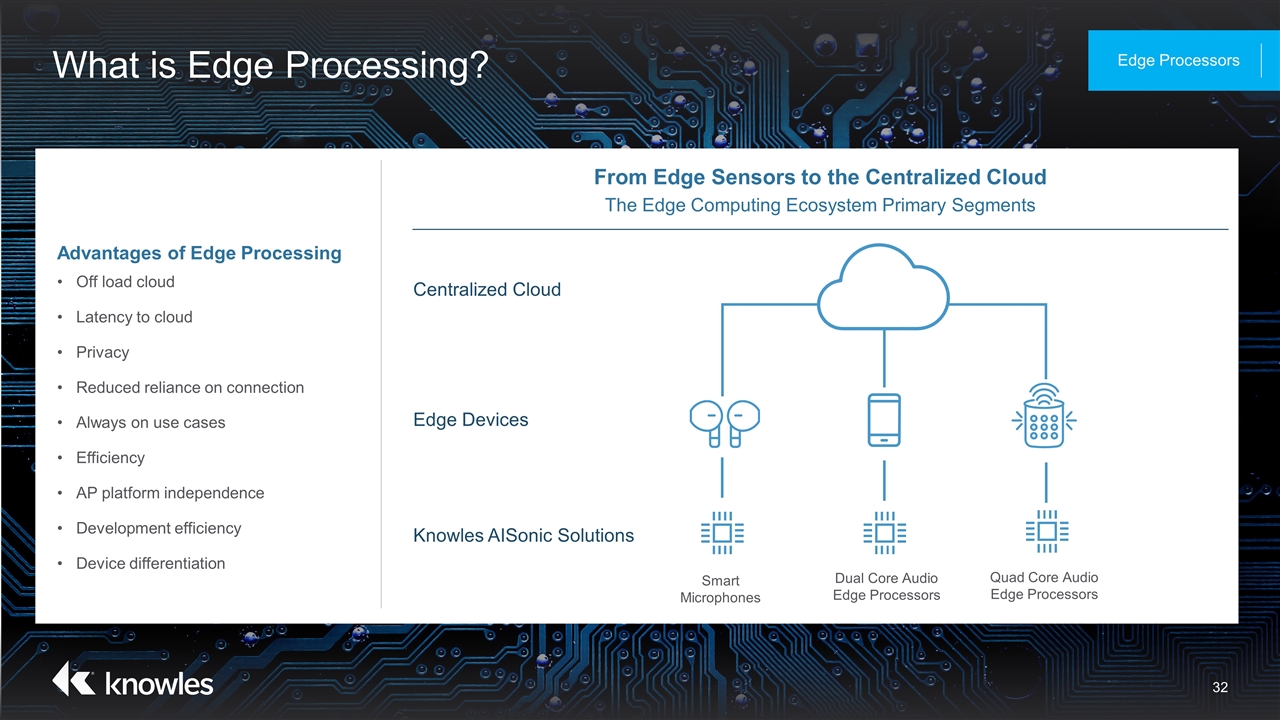

What is Edge Processing? Edge Processors Advantages of Edge Processing Off load cloud Latency to cloud Privacy Reduced reliance on connection Always on use cases Efficiency AP platform independence Development efficiency Device differentiation From Edge Sensors to the Centralized Cloud The Edge Computing Ecosystem Primary Segments Centralized Cloud Edge Devices Knowles AISonic Solutions Quad Core Audio Edge Processors Dual Core Audio Edge Processors Smart Microphones

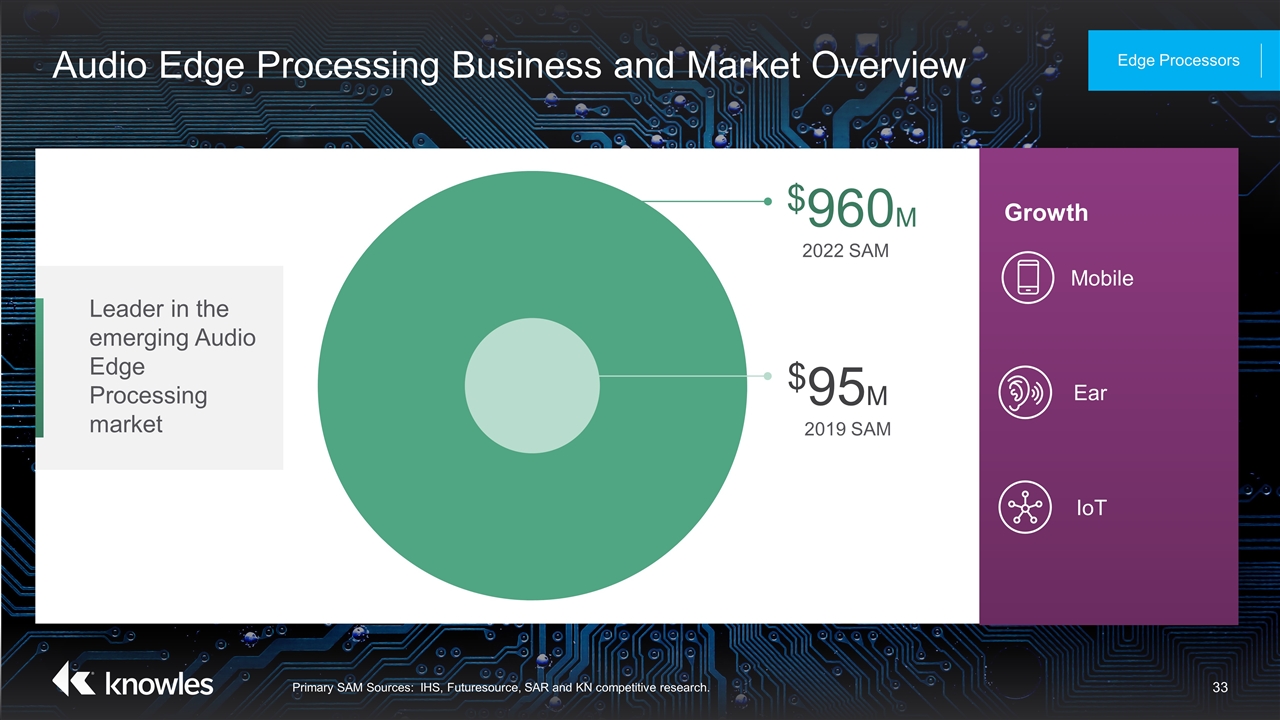

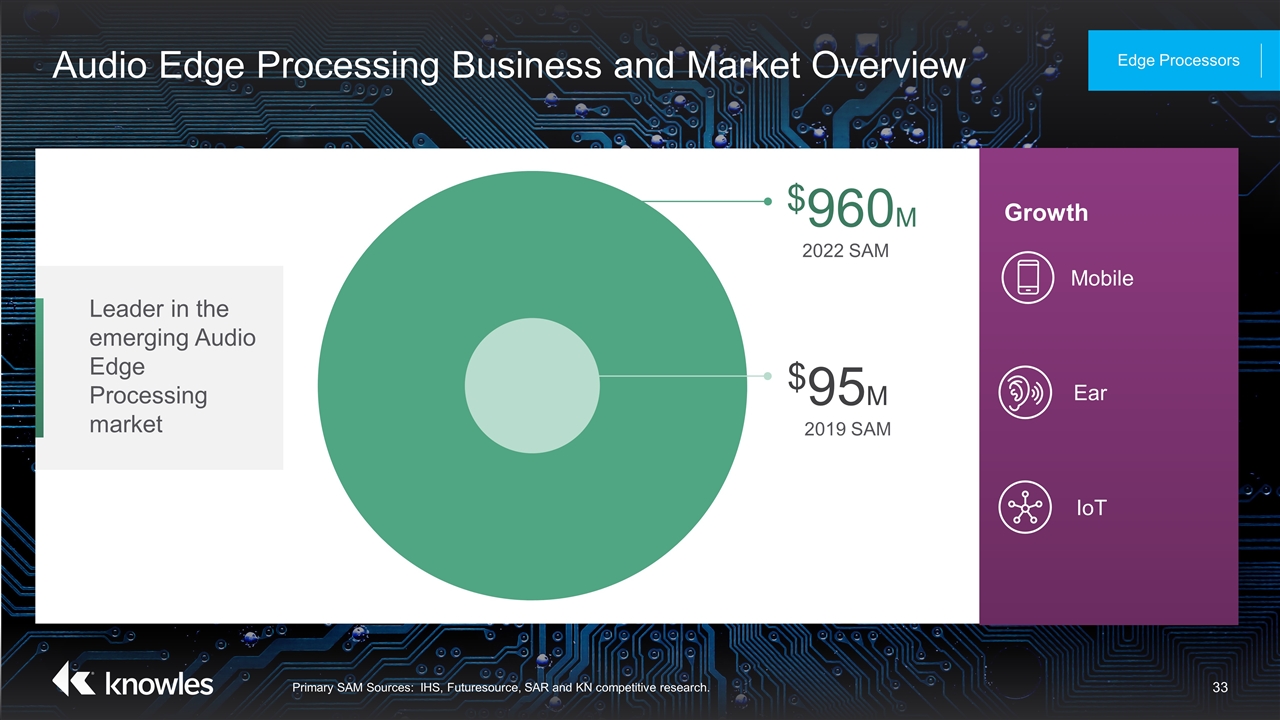

Audio Edge Processing Business and Market Overview Primary SAM Sources: IHS, Futuresource, SAR and KN competitive research. Edge Processors $960M 2022 SAM Growth IoT Ear Mobile $95M 2019 SAM Leader in the emerging Audio Edge Processing market

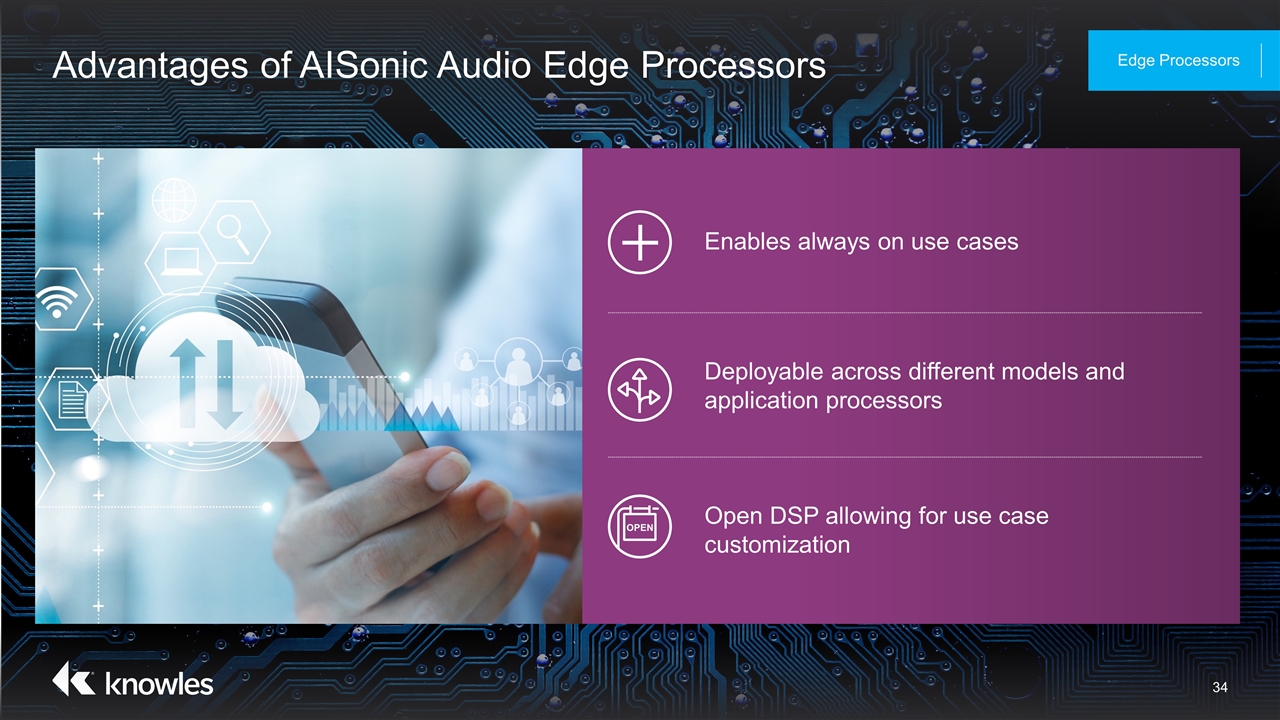

Advantages of AISonic Audio Edge Processors Edge Processors Enables always on use cases Deployable across different models and application processors Open DSP allowing for use case customization OPEN

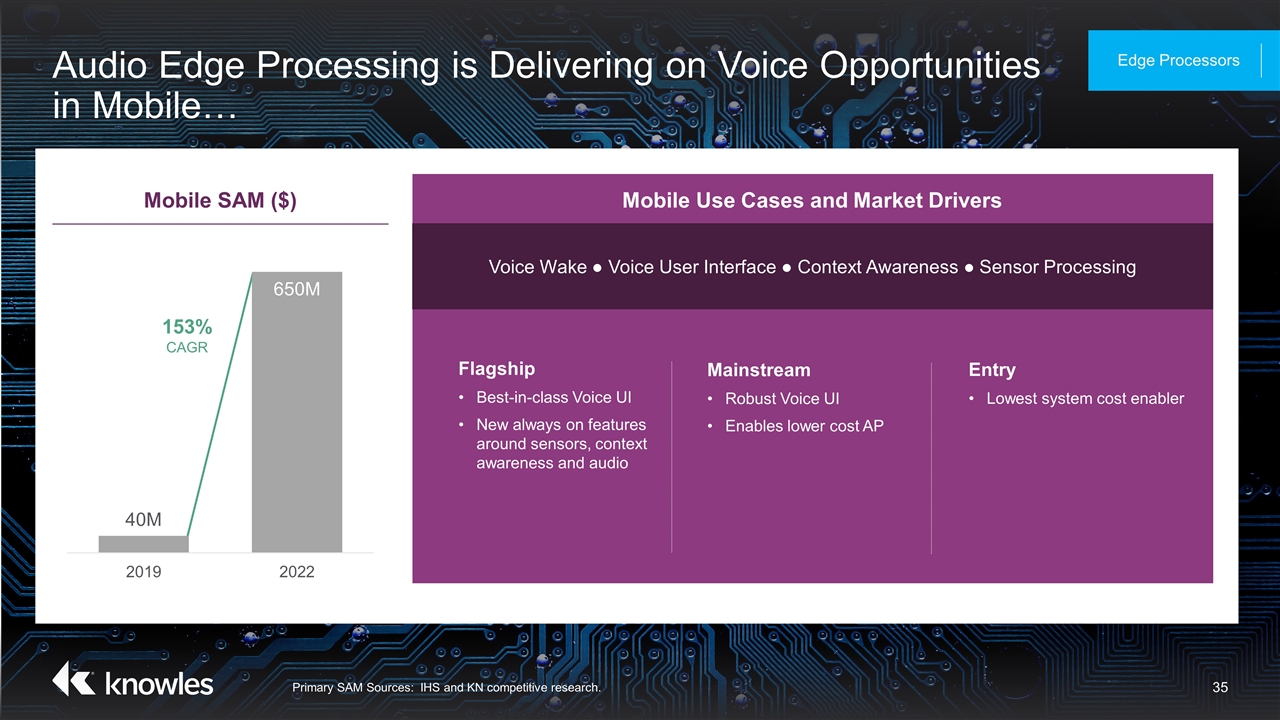

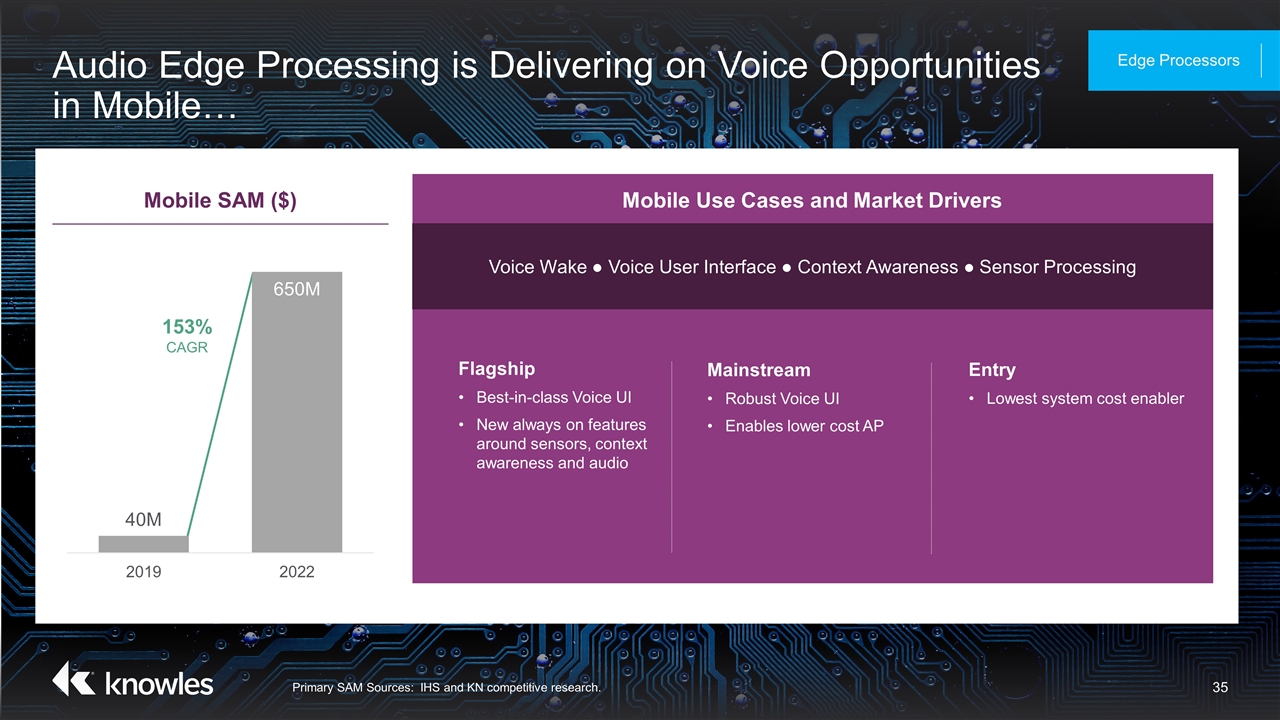

Audio Edge Processing is Delivering on Voice Opportunities in Mobile… Edge Processors Primary SAM Sources: IHS and KN competitive research. Mobile SAM ($) Voice Wake ● Voice User Interface ● Context Awareness ● Sensor Processing Flagship Best-in-class Voice UI New always on features around sensors, context awareness and audio Mainstream Robust Voice UI Enables lower cost AP Entry Lowest system cost enabler Mobile Use Cases and Market Drivers 153% CAGR

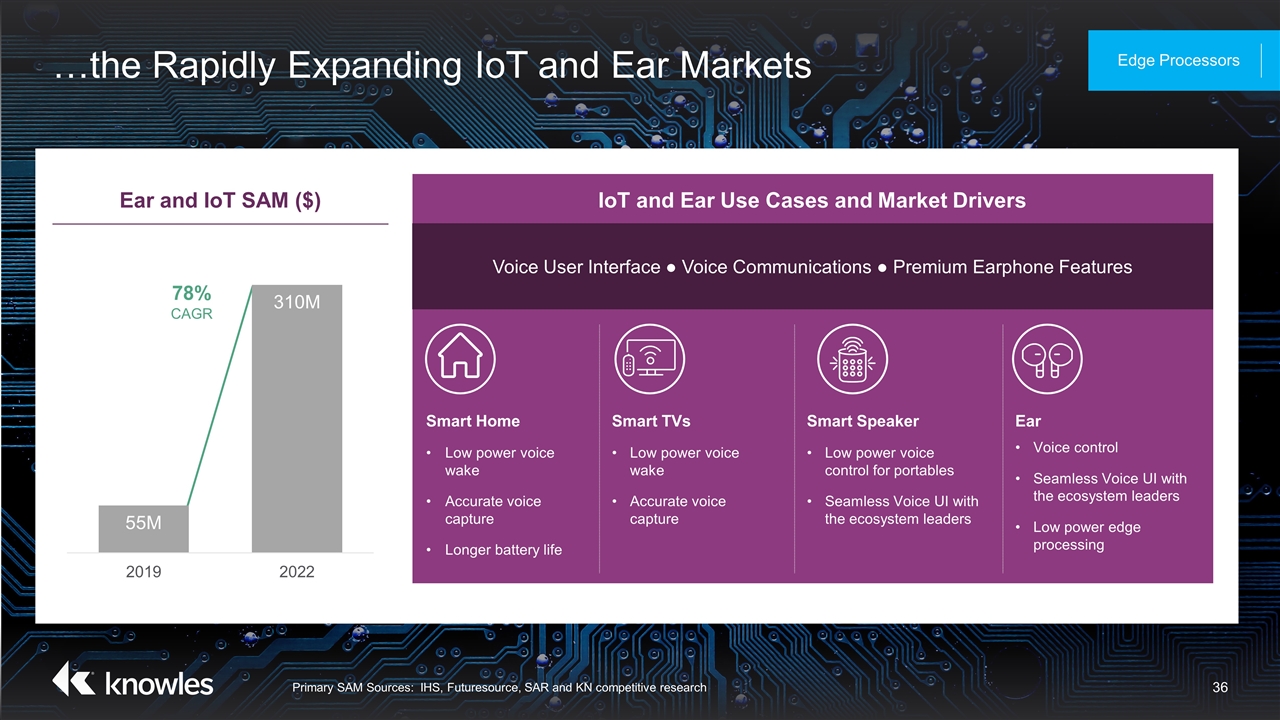

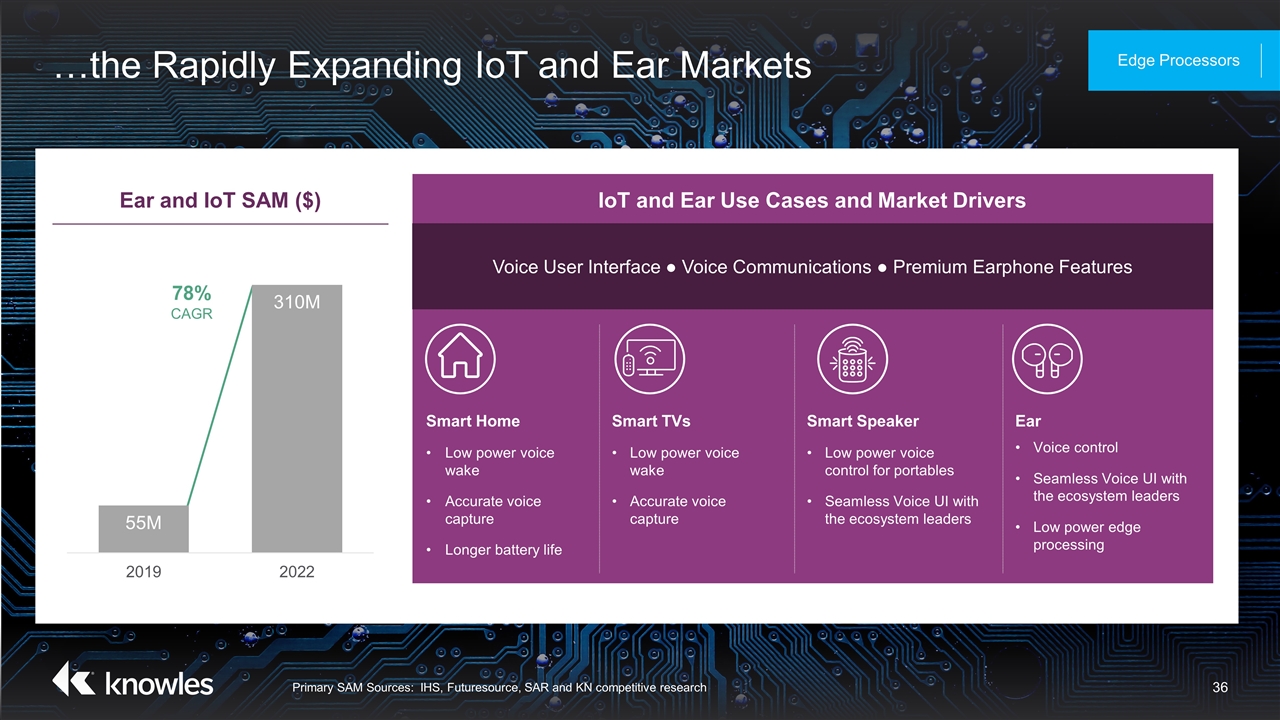

…the Rapidly Expanding IoT and Ear Markets Edge Processors Primary SAM Sources: IHS, Futuresource, SAR and KN competitive research Ear and IoT SAM ($) 78% CAGR Voice User Interface ● Voice Communications ● Premium Earphone Features IoT and Ear Use Cases and Market Drivers Smart TVs Low power voice wake Accurate voice capture Smart Speaker Low power voice control for portables Seamless Voice UI with the ecosystem leaders Smart Home Low power voice wake Accurate voice capture Longer battery life Ear Voice control Seamless Voice UI with the ecosystem leaders Low power edge processing

Why We Win in Audio Edge Processing Growth Markets Edge Processors Growth at Market Rate Gross Margins Above Corporate Average Optimal, low power edge processing Open platform for customer and third-party innovation Early stage alignment with leading players creates opportunity both within and across the ecosystem OPEN

Audio Edge Processing Key Takeaways Edge Processors Explosion of voice/audio/sensor data Unique low power, high performance platform Open platform enables full participation across ecosystems

High Performance Capacitors Creating Solutions for the Most Demanding Applications

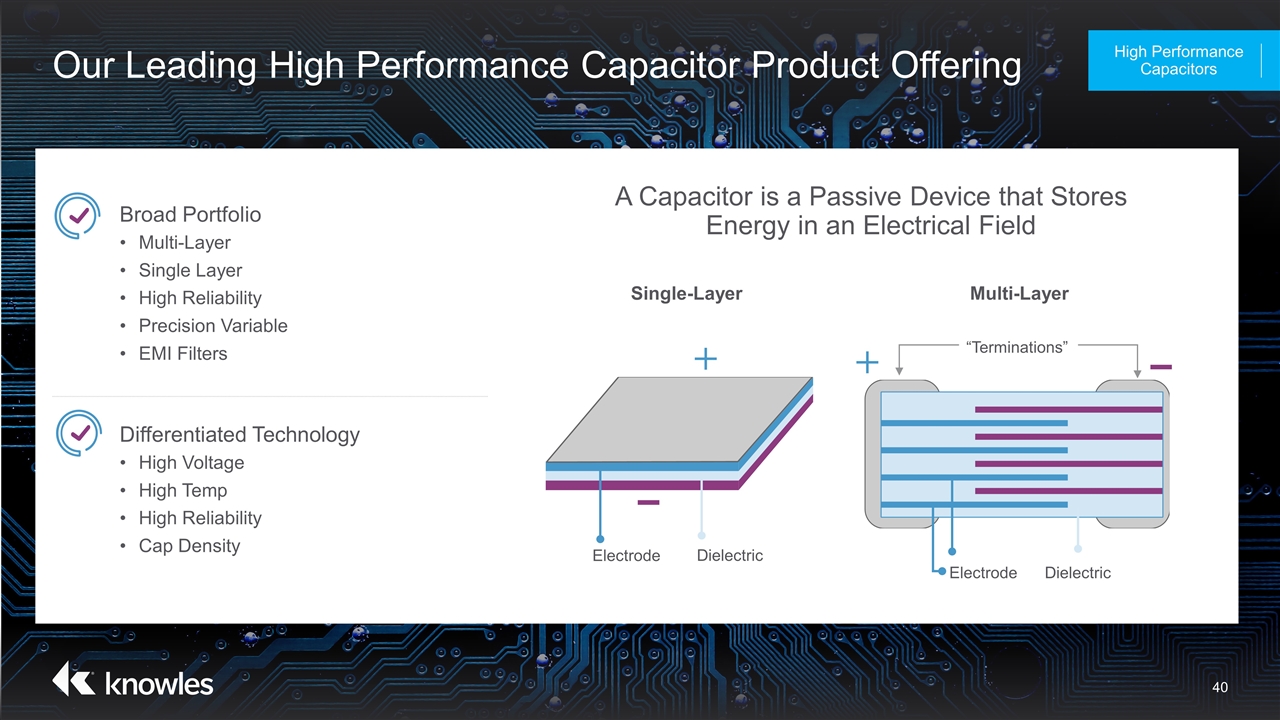

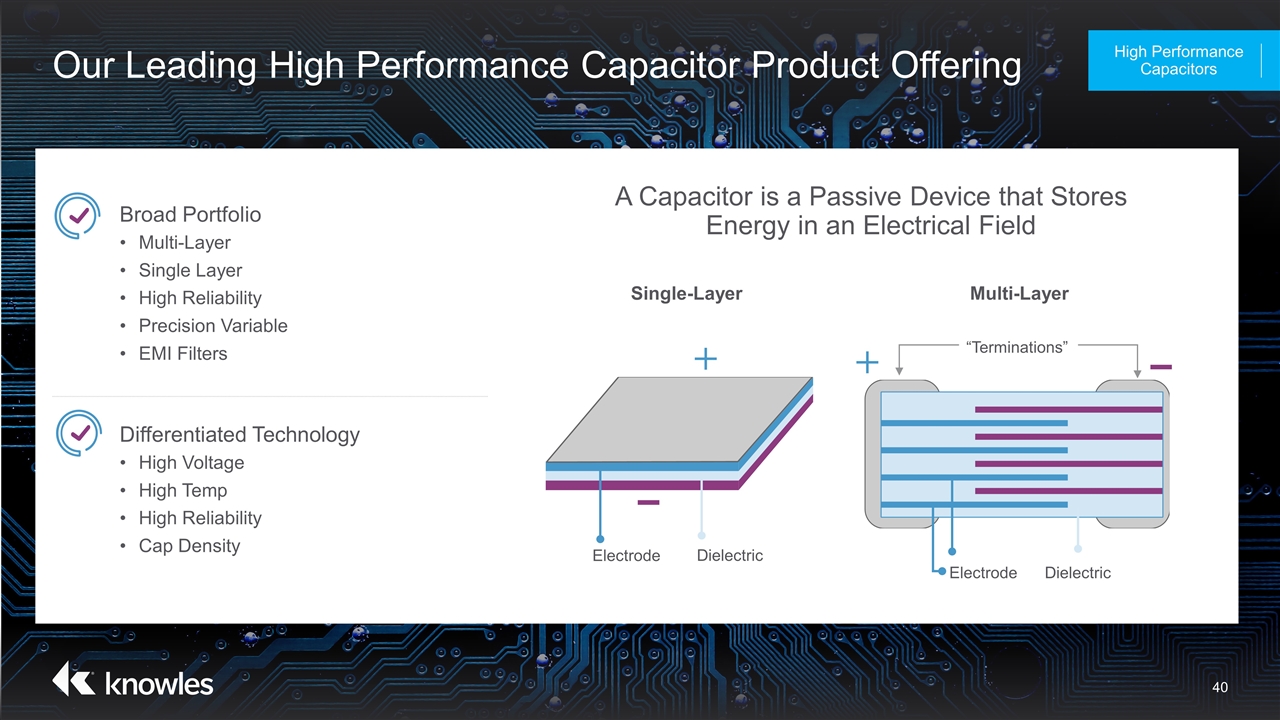

Our Leading High Performance Capacitor Product Offering High Performance Capacitors Broad Portfolio Multi-Layer Single Layer High Reliability Precision Variable EMI Filters Differentiated Technology High Voltage High Temp High Reliability Cap Density A Capacitor is a Passive Device that Stores Energy in an Electrical Field Dielectric Electrode “Terminations” Dielectric Electrode Single-Layer Multi-Layer

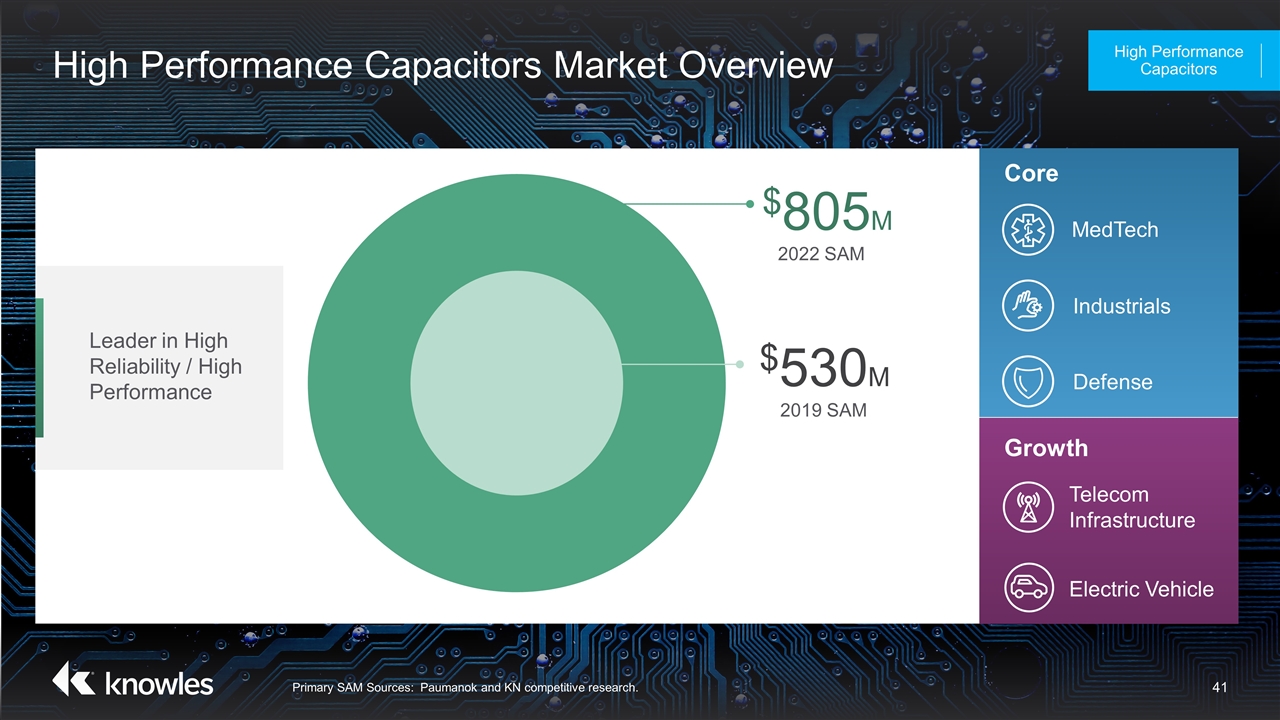

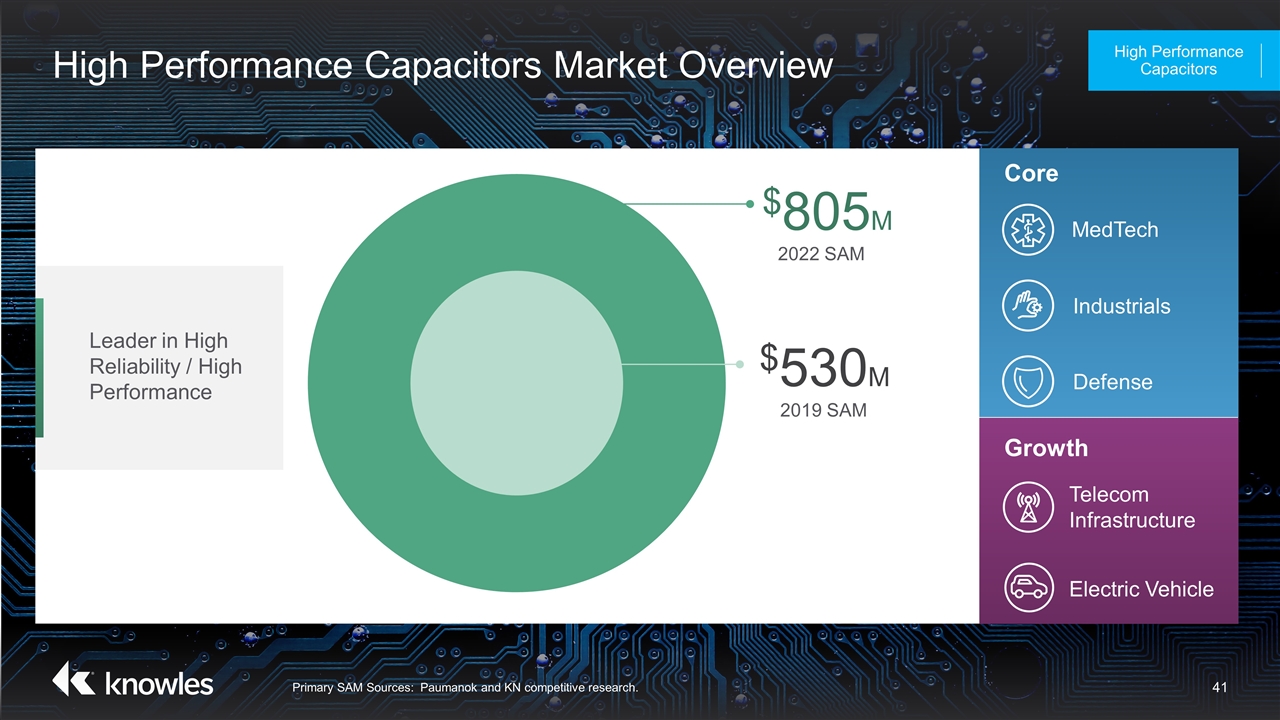

High Performance Capacitors Market Overview High Performance Capacitors Primary SAM Sources: Paumanok and KN competitive research. Growth Core MedTech $805M 2022 SAM $530M 2019 SAM Electric Vehicle Telecom Infrastructure Industrials Defense Leader in High Reliability / High Performance

Broad Portfolio of Solutions Driving Steady Demand in Core… High Performance Capacitors Primary SAM Sources: Paumanok and KN competitive research. Capacitor Core SAM ($) Delivering high performance in unique form factors to address broad range of applications Core Market Use Cases and Market Drivers 4% CAGR MedTech MRIs and implantable medical devices Industrials Advanced power supply and motor control systems Defense Electronics and power systems upgrades across multiple programs

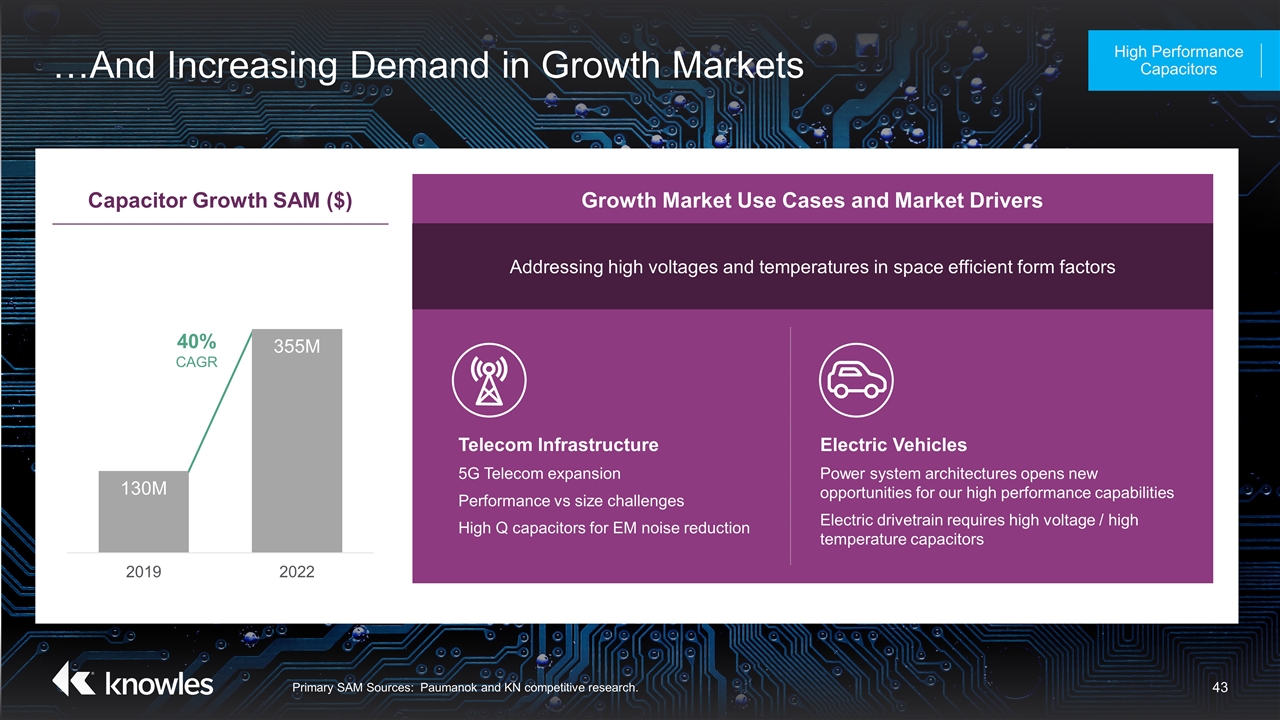

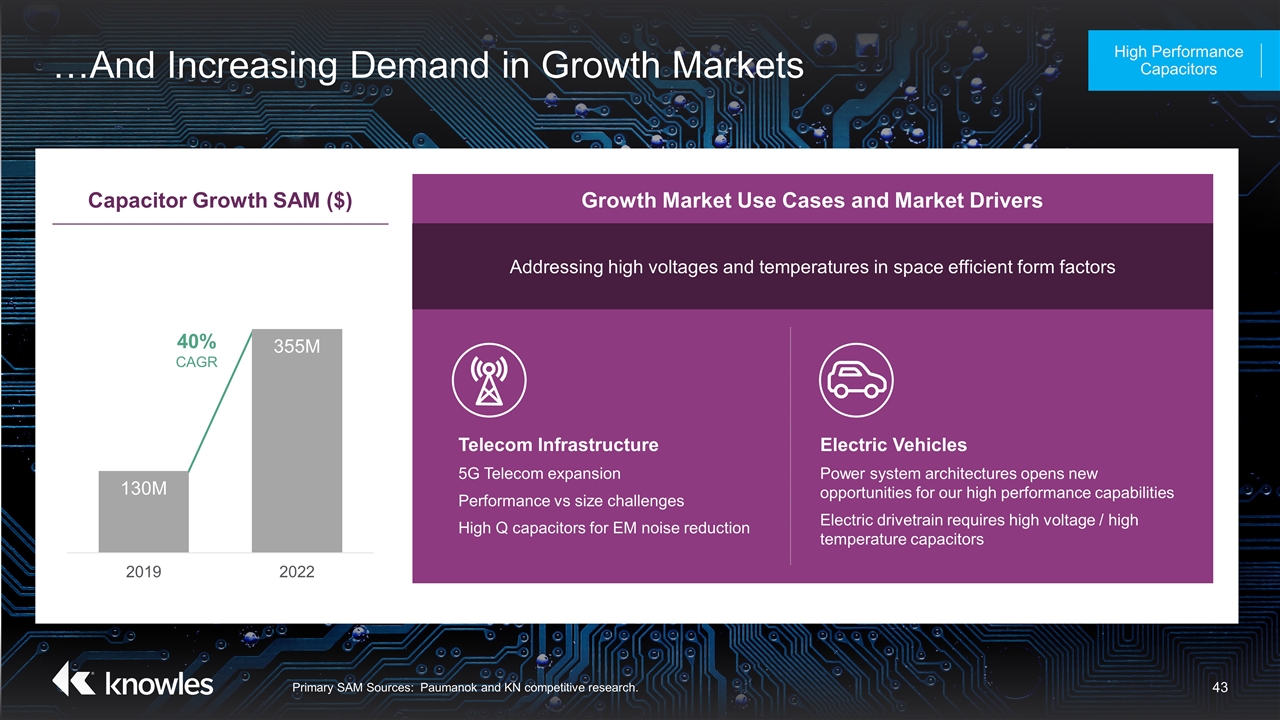

…And Increasing Demand in Growth Markets High Performance Capacitors Primary SAM Sources: Paumanok and KN competitive research. Capacitor Growth SAM ($) Addressing high voltages and temperatures in space efficient form factors Growth Market Use Cases and Market Drivers Telecom Infrastructure 5G Telecom expansion Performance vs size challenges High Q capacitors for EM noise reduction Electric Vehicles Power system architectures opens new opportunities for our high performance capabilities Electric drivetrain requires high voltage / high temperature capacitors 40% CAGR

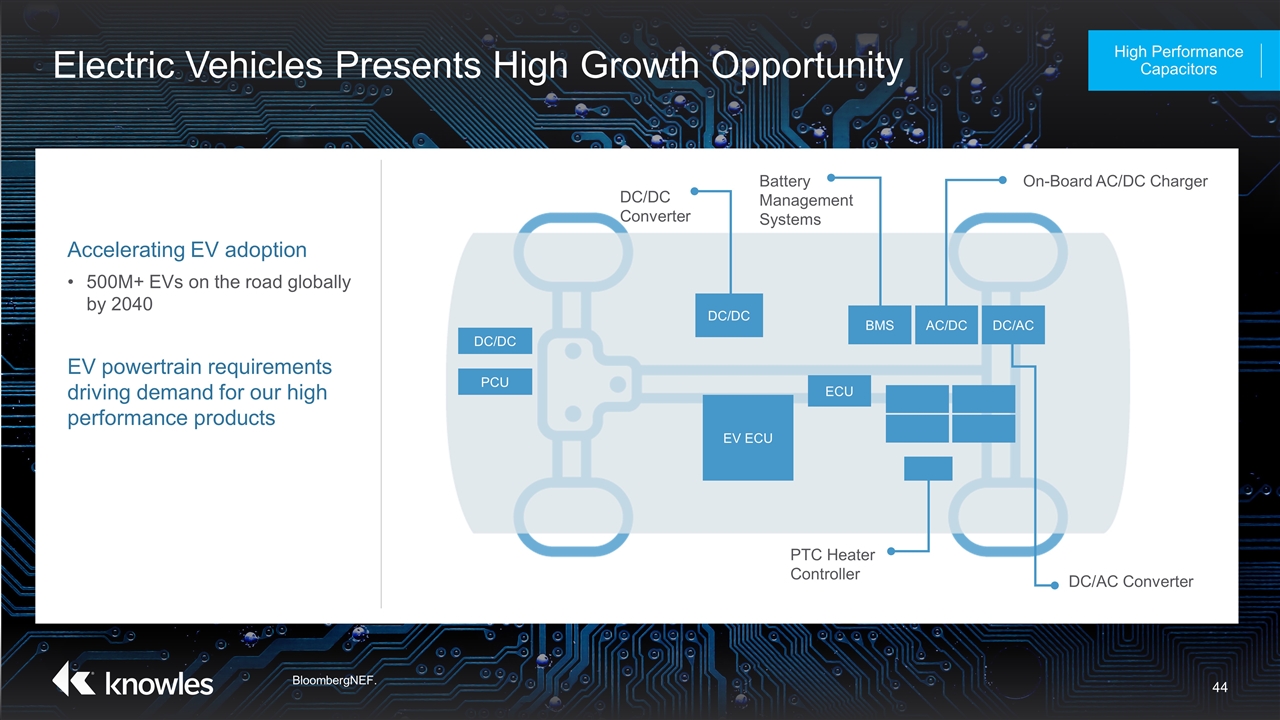

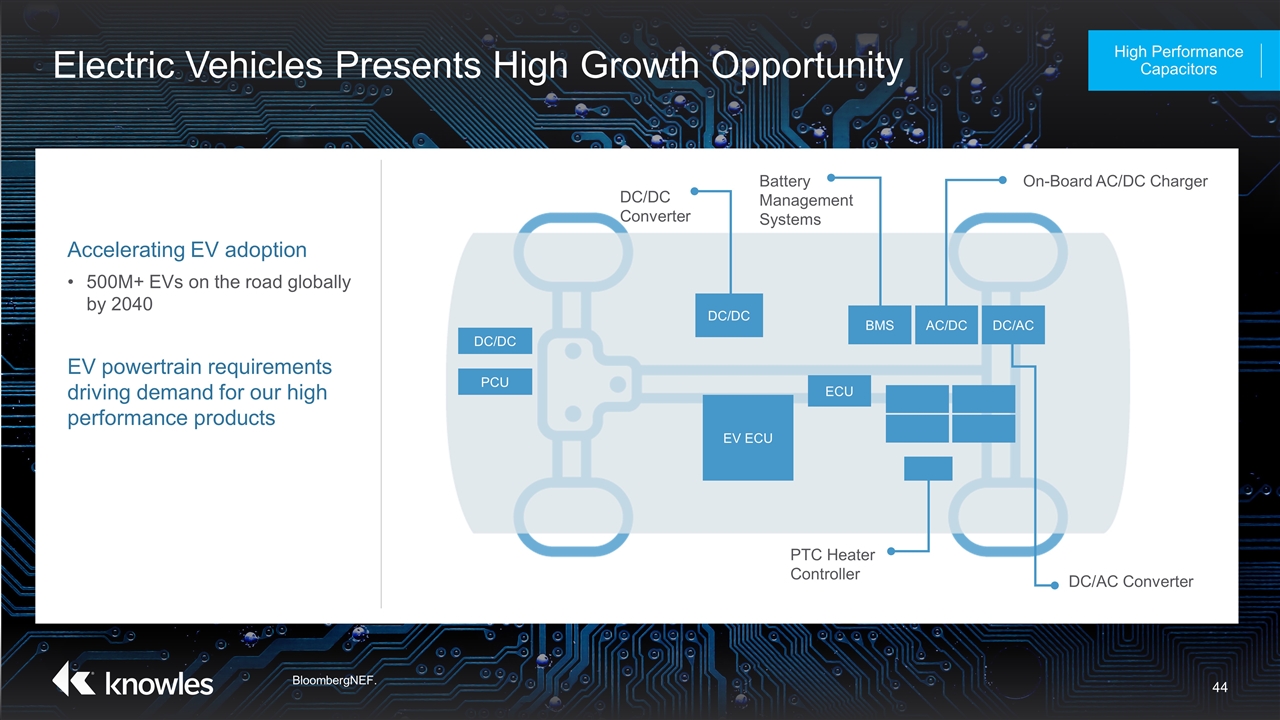

Electric Vehicles Presents High Growth Opportunity High Performance Capacitors Accelerating EV adoption 500M+ EVs on the road globally by 2040 EV powertrain requirements driving demand for our high performance products DC/DC PCU DC/DC EV ECU ECU BMS AC/DC DC/AC On-Board AC/DC Charger Battery Management Systems DC/DC Converter DC/AC Converter PTC Heater Controller BloombergNEF.

Why We Win in High Performance Capacitors High Performance Capacitors Ability to solve complex challenges Resources aligned to key markets Application customization through close collaboration with customers Unique ceramic formulations Demonstrated reliability commands premium pricing Growth at Market Rate Gross Margins In Line With Corporate Average

High Performance Capacitors Key Takeaways High Performance Capacitors Well-established technology leader in specialty markets Positioned to win by leveraging established high-performance capabilities Electric Vehicle growth and 5G tailwinds

RF Filtering Solutions Designing Filters for the Future of Connectivity

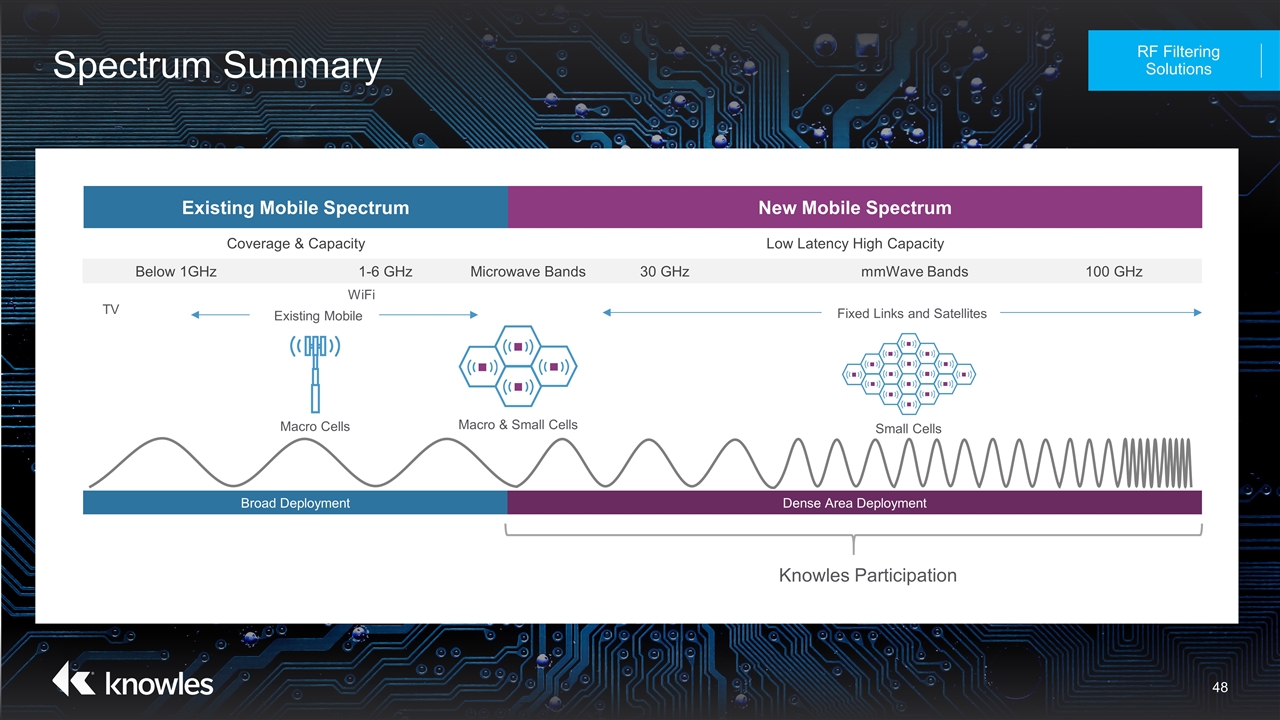

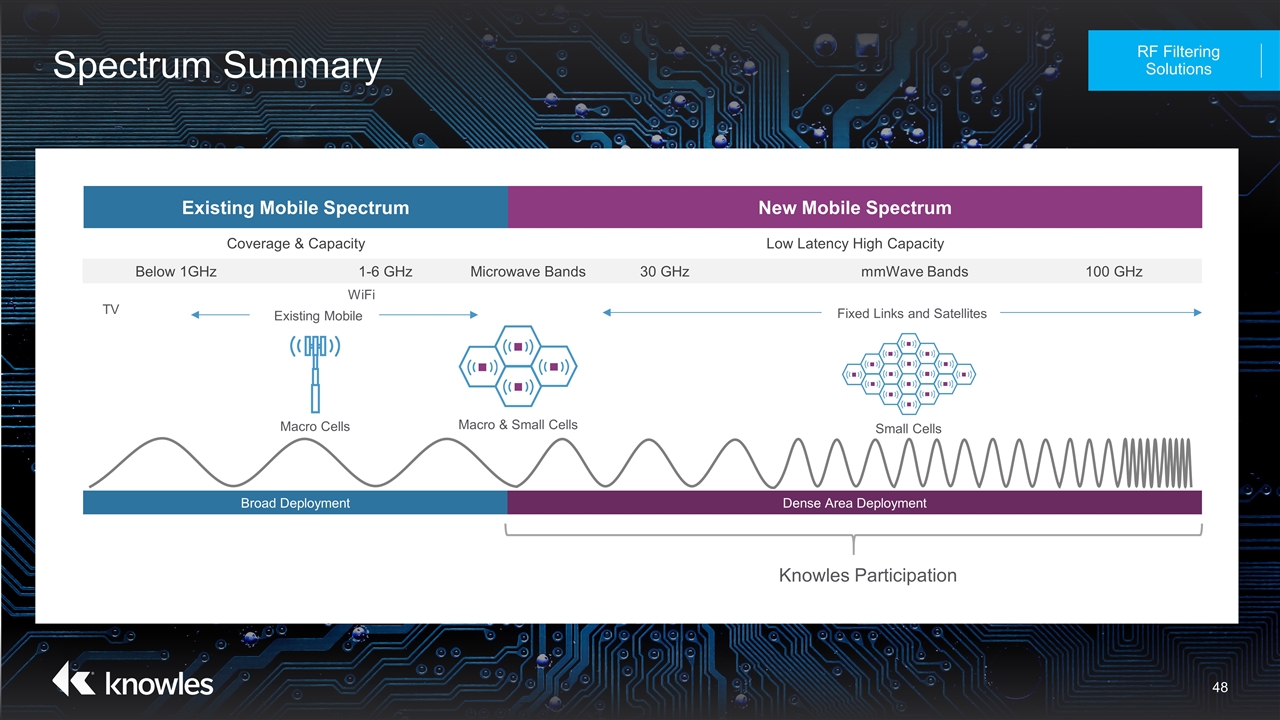

Spectrum Summary RF Filtering Solutions Broad Deployment Dense Area Deployment Knowles Participation Existing Mobile Spectrum New Mobile Spectrum Coverage & Capacity Low Latency High Capacity Below 1GHz 1-6 GHz 30 GHz mmWave Bands 100 GHz Macro Cells Existing Mobile TV WiFi Macro & Small Cells Fixed Links and Satellites Small Cells Microwave Bands

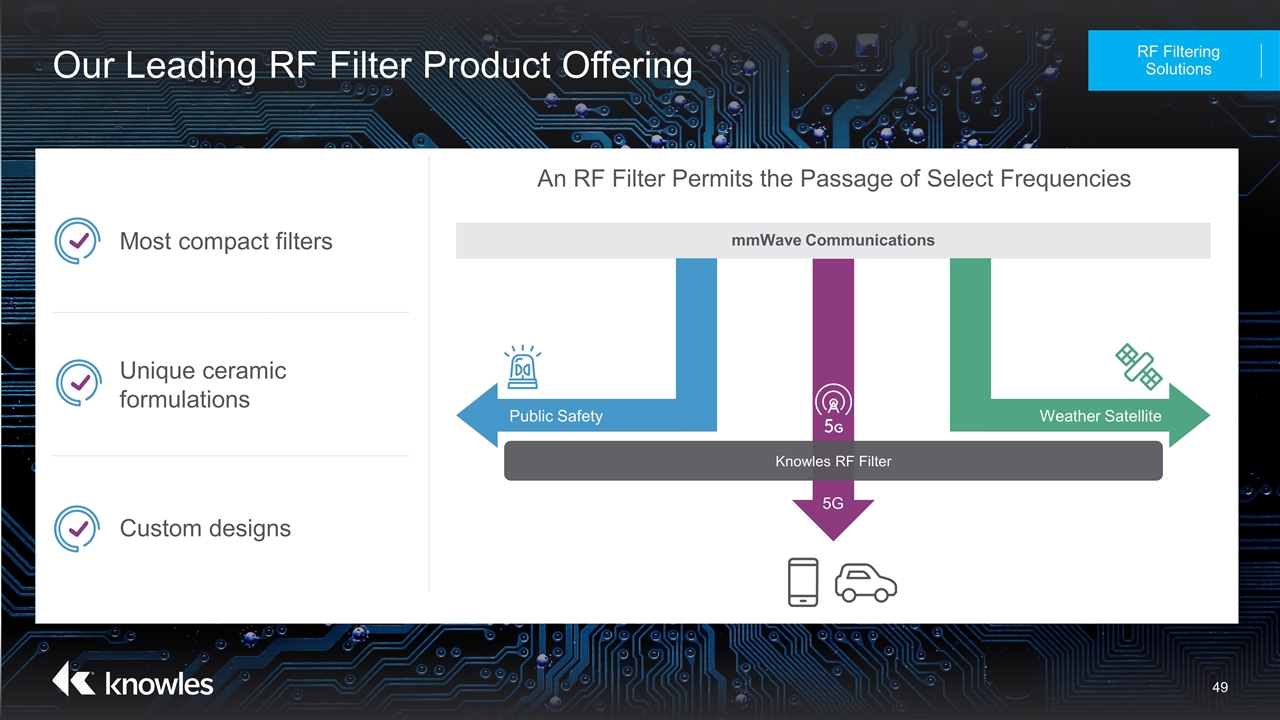

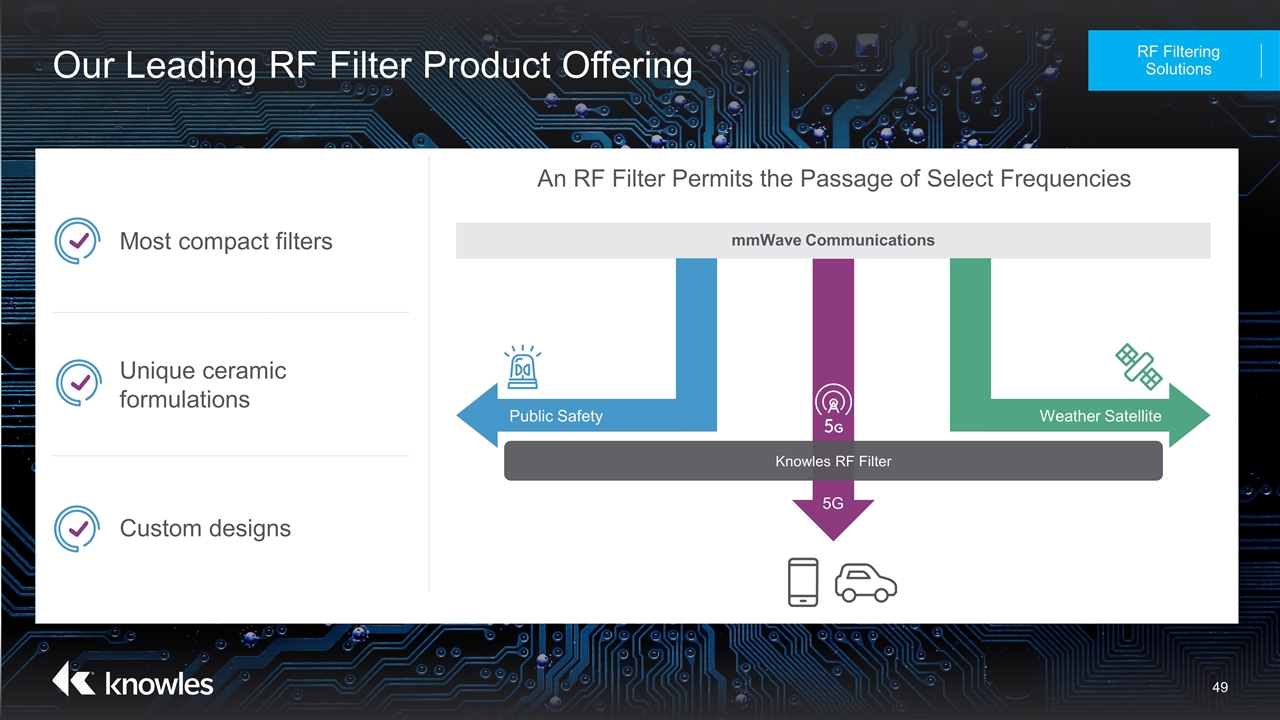

Our Leading RF Filter Product Offering RF Filtering Solutions Most compact filters Unique ceramic formulations Custom designs An RF Filter Permits the Passage of Select Frequencies mmWave Communications 5G Public Safety Weather Satellite Knowles RF Filter

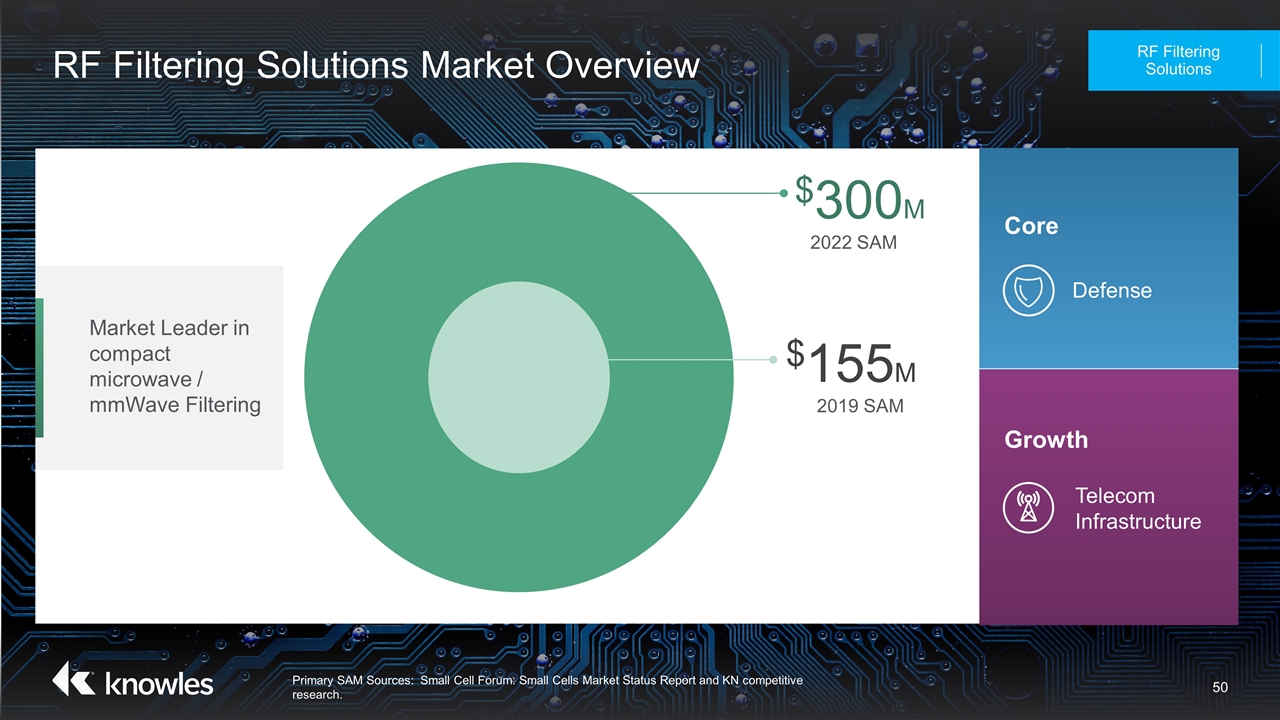

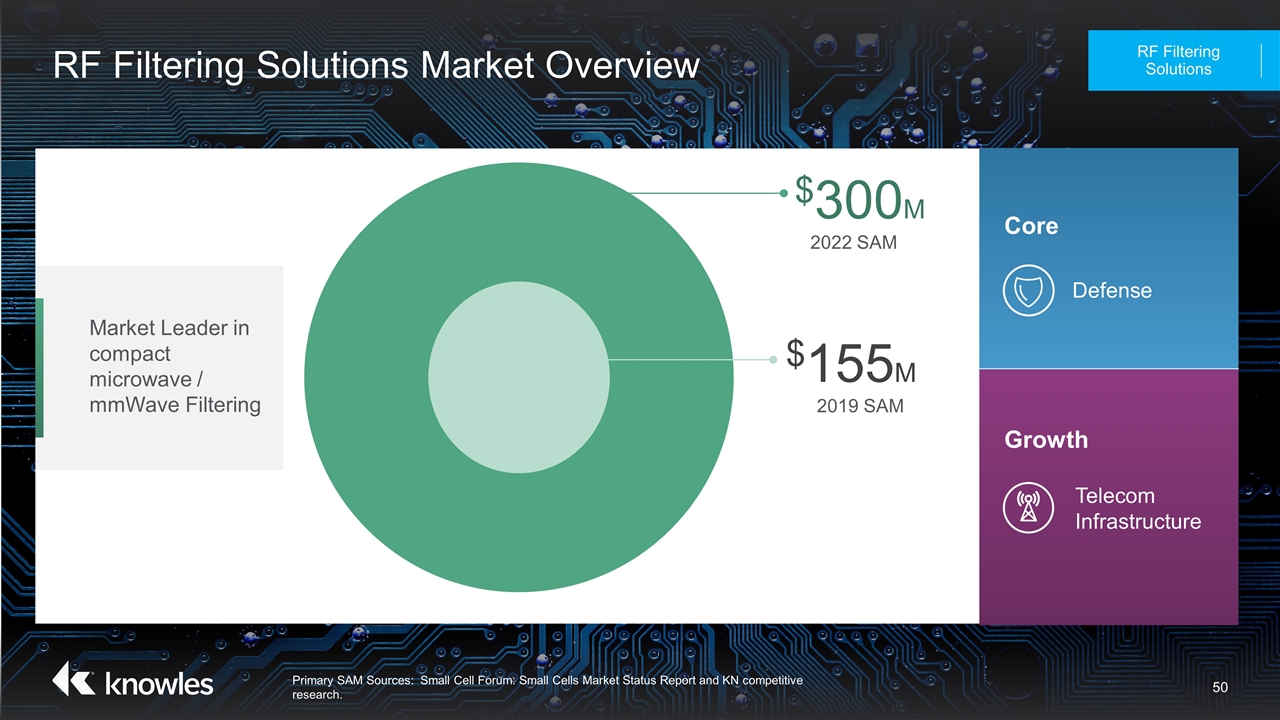

RF Filtering Solutions Market Overview Primary SAM Sources: Small Cell Forum: Small Cells Market Status Report and KN competitive research. RF Filtering Solutions $300M 2022 SAM Growth Telecom Infrastructure Core Defense $155M 2019 SAM Market Leader in compact microwave / mmWave Filtering

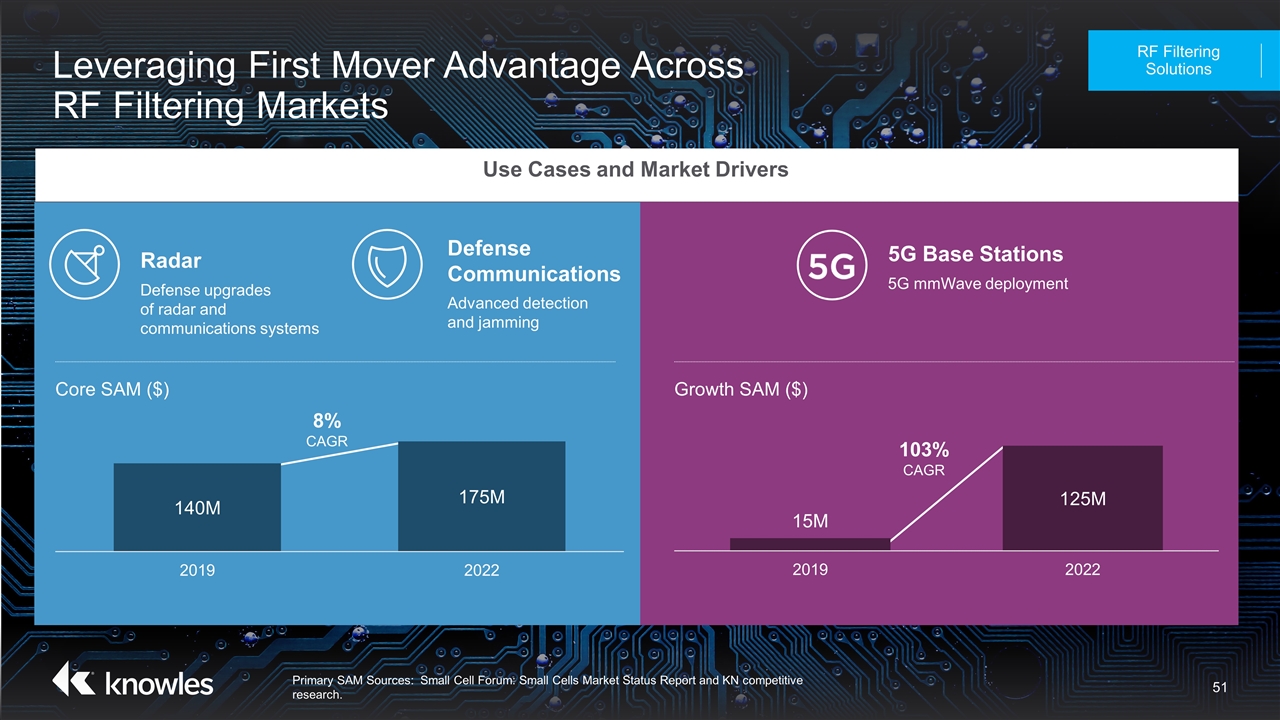

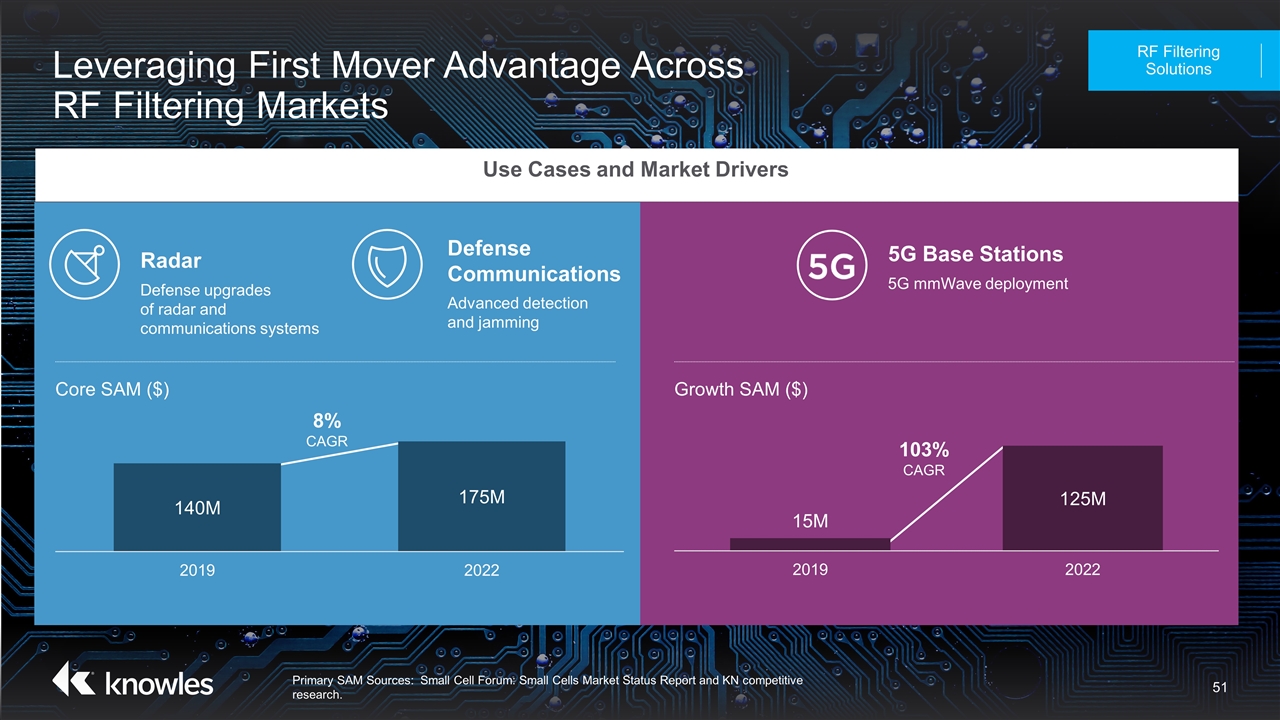

Leveraging First Mover Advantage Across RF Filtering Markets RF Filtering Solutions Primary SAM Sources: Small Cell Forum: Small Cells Market Status Report and KN competitive research. Use Cases and Market Drivers Radar Defense upgrades of radar and communications systems Defense Communications Advanced detection and jamming Core SAM ($) Growth SAM ($) 5G Base Stations 5G mmWave deployment 103% CAGR 8% CAGR

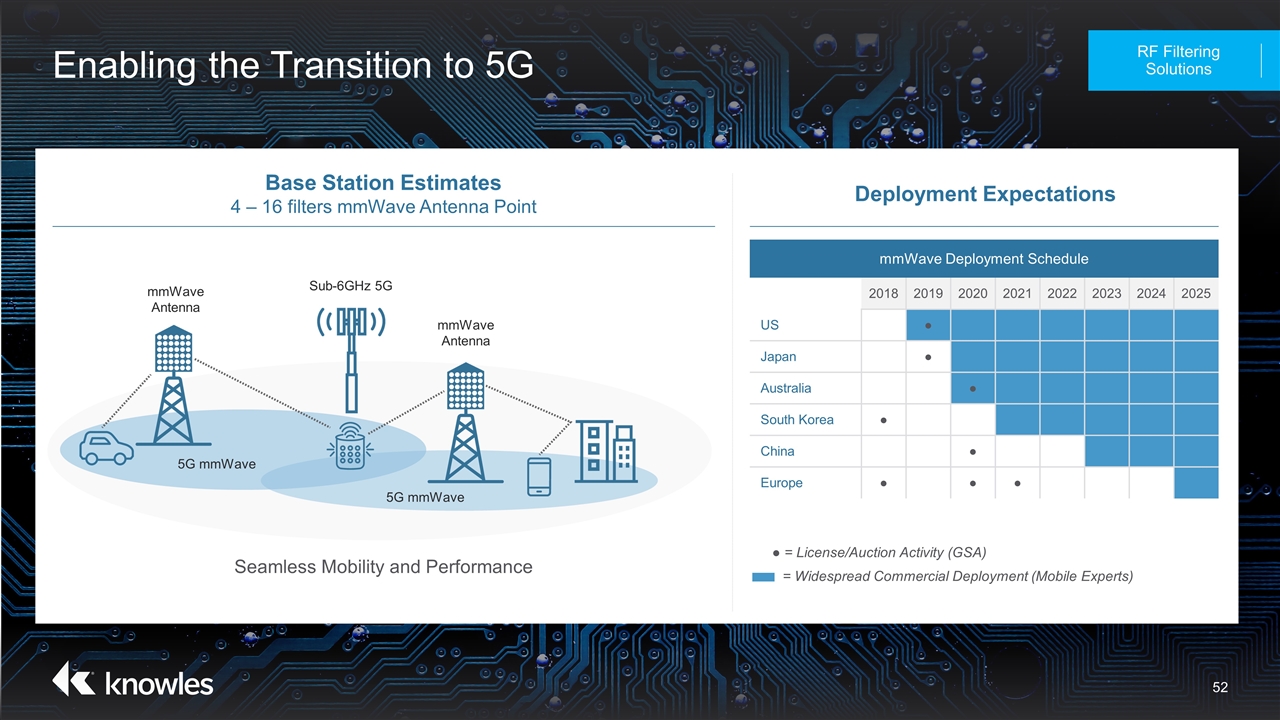

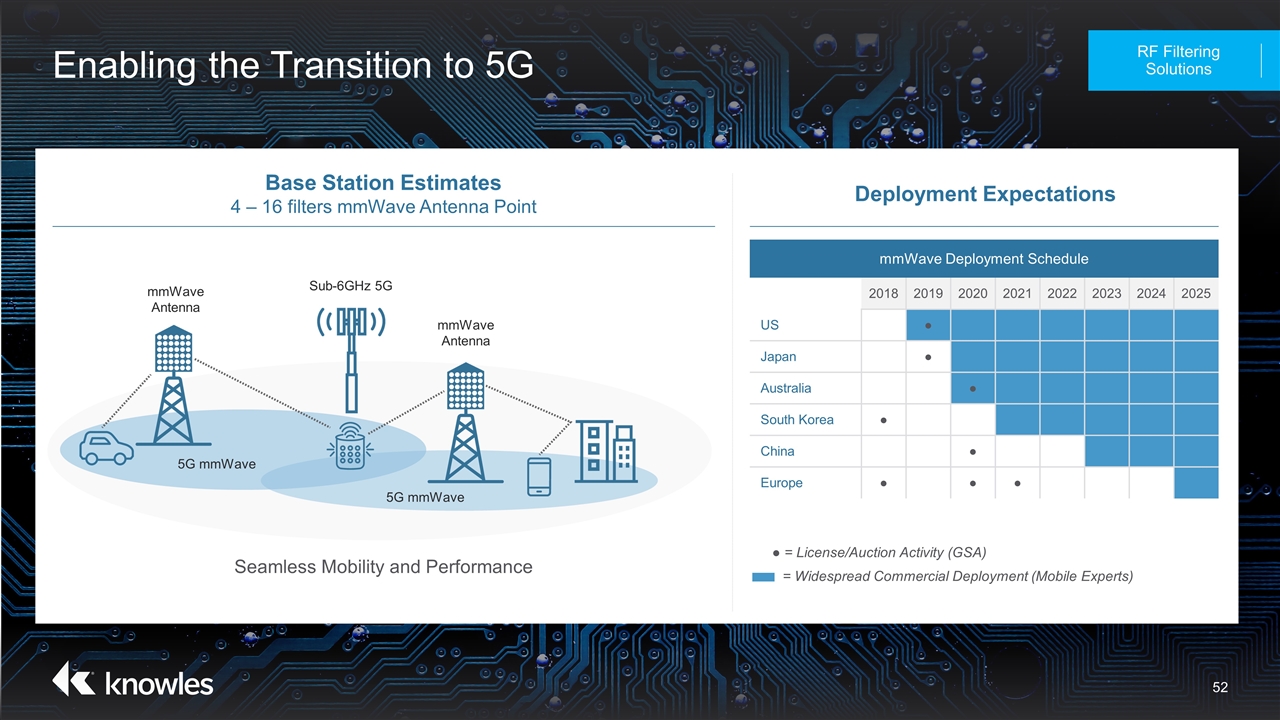

Enabling the Transition to 5G RF Filtering Solutions = Widespread Commercial Deployment (Mobile Experts) ● = License/Auction Activity (GSA) mmWave Deployment Schedule 2018 2019 2020 2021 2022 2023 2024 2025 US ● Japan ● Australia ● South Korea ● China ● Europe ● ● ● Base Station Estimates 4 – 16 filters mmWave Antenna Point Deployment Expectations 5G mmWave Seamless Mobility and Performance 5G mmWave mmWave Antenna mmWave Antenna Sub-6GHz 5G

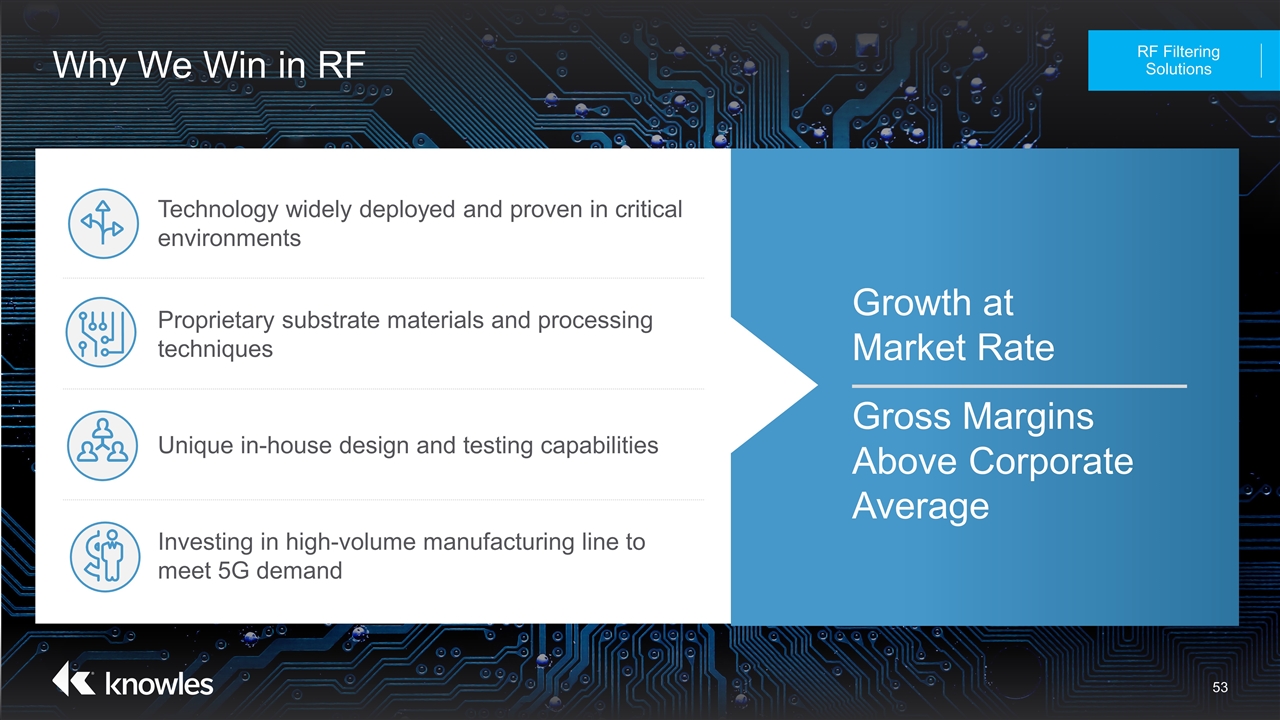

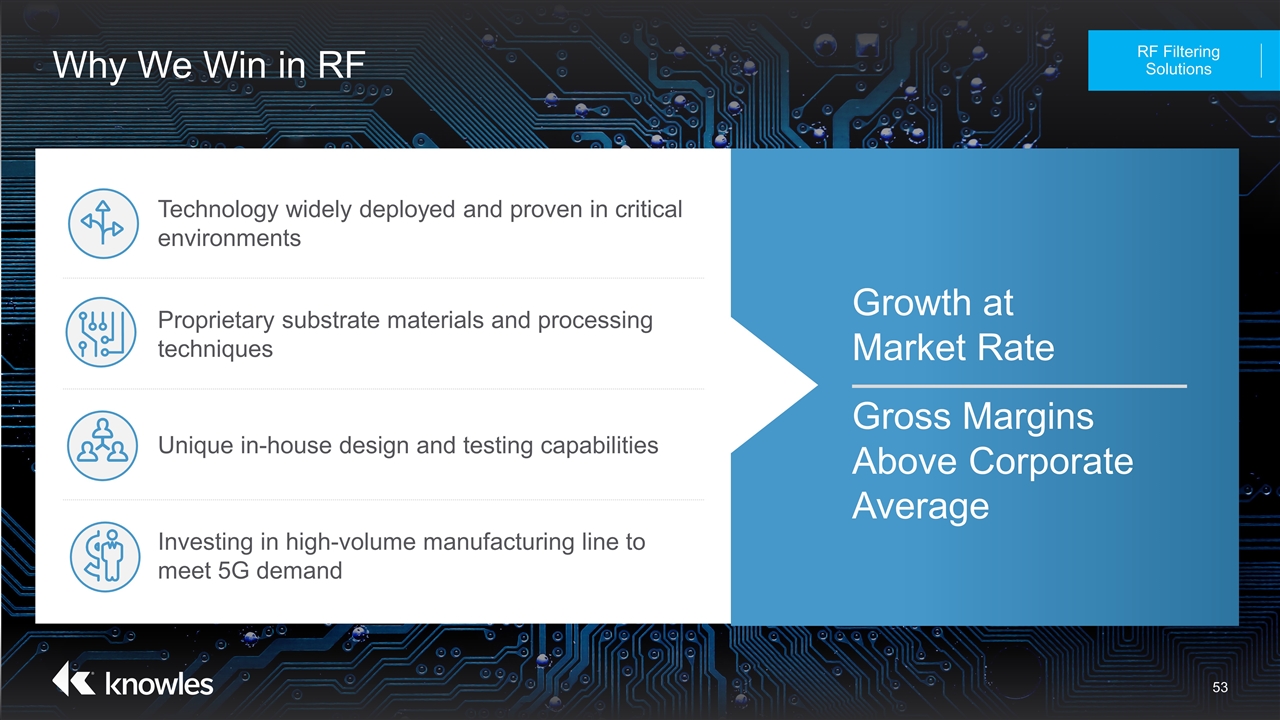

Why We Win in RF RF Filtering Solutions Technology widely deployed and proven in critical environments Proprietary substrate materials and processing techniques Unique in-house design and testing capabilities Investing in high-volume manufacturing line to meet 5G demand Growth at Market Rate Gross Margins Above Corporate Average

RF Filtering Solutions Key Takeaways RF Filtering Solutions Leveraging historical defense technology leadership Only technology that can achieve filtering and size requirements Leader in 5G mmWave filtering

Financial Overview

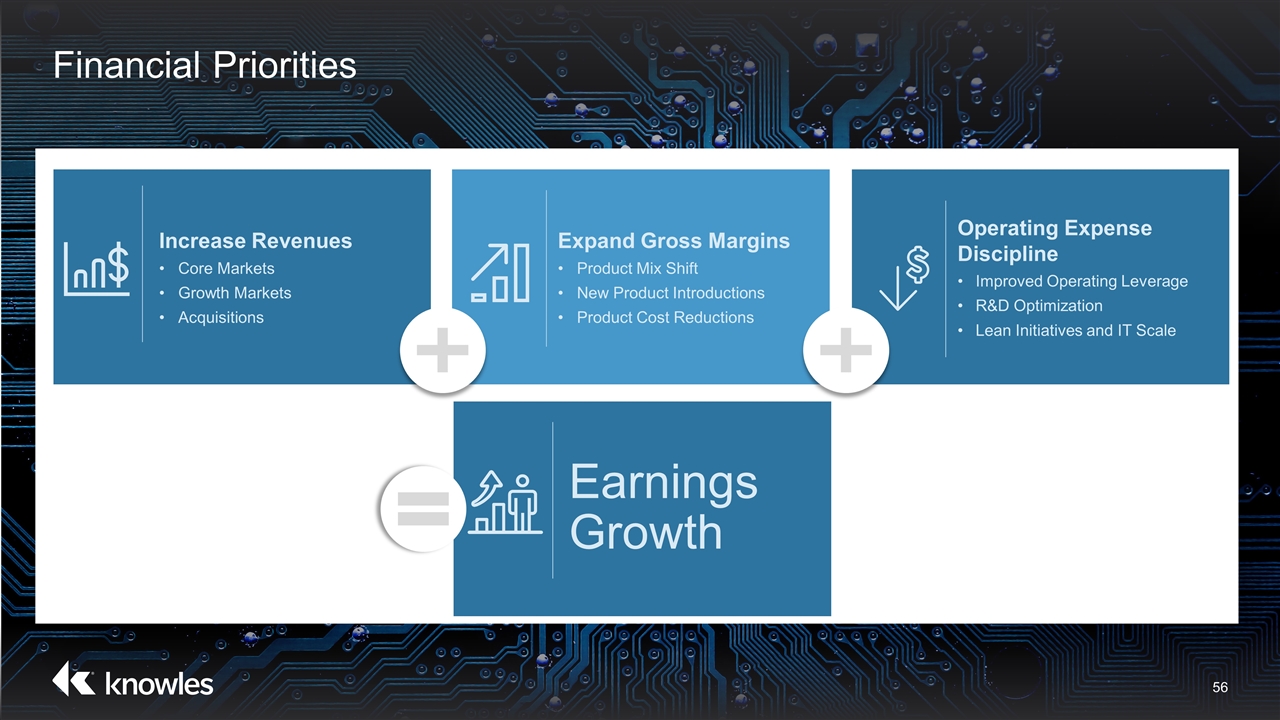

Financial Priorities Operating Expense Discipline Improved Operating Leverage R&D Optimization Lean Initiatives and IT Scale Expand Gross Margins Product Mix Shift New Product Introductions Product Cost Reductions Increase Revenues Core Markets Growth Markets Acquisitions Earnings Growth

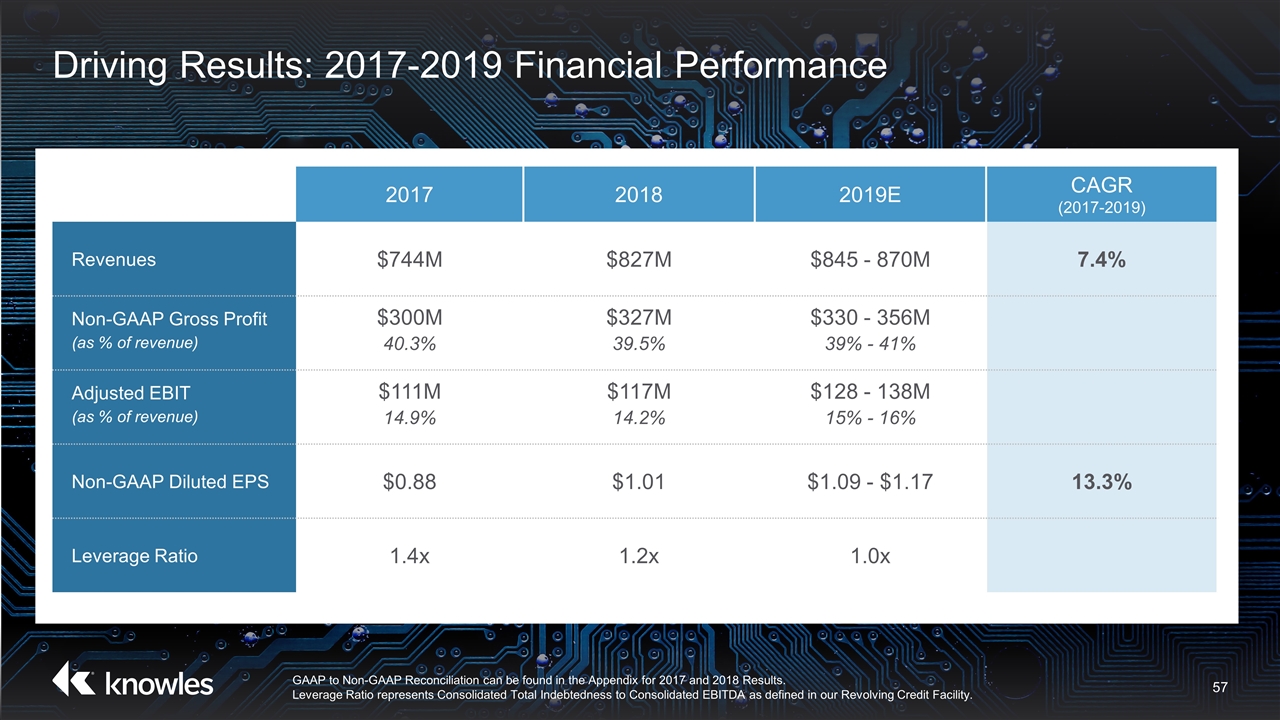

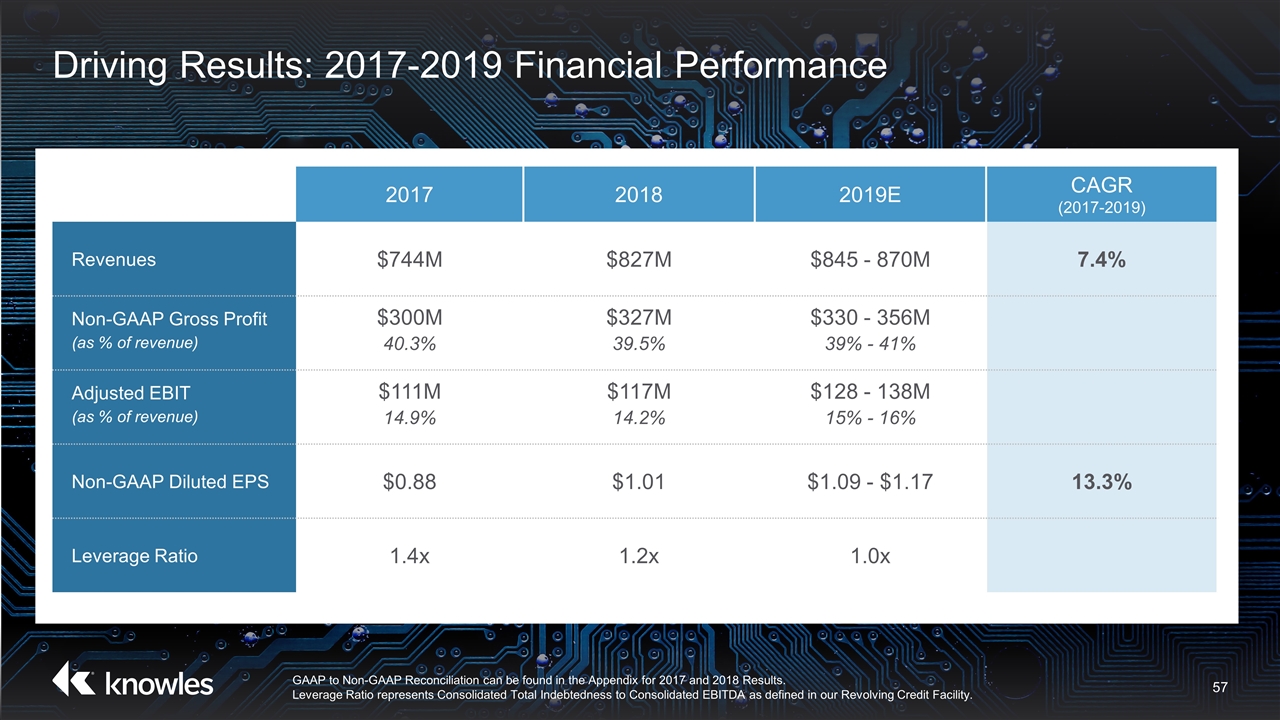

Driving Results: 2017-2019 Financial Performance 2017 2018 2019E CAGR (2017-2019) Revenues $744M $827M $845 - 870M 7.4% Non-GAAP Gross Profit (as % of revenue) $300M 40.3% $327M 39.5% $330 - 356M 39% - 41% Adjusted EBIT (as % of revenue) $111M 14.9% $117M 14.2% $128 - 138M 15% - 16% Non-GAAP Diluted EPS $0.88 $1.01 $1.09 - $1.17 13.3% Leverage Ratio 1.4x 1.2x 1.0x GAAP to Non-GAAP Reconciliation can be found in the Appendix for 2017 and 2018 Results. Leverage Ratio represents Consolidated Total Indebtedness to Consolidated EBITDA as defined in our Revolving Credit Facility.

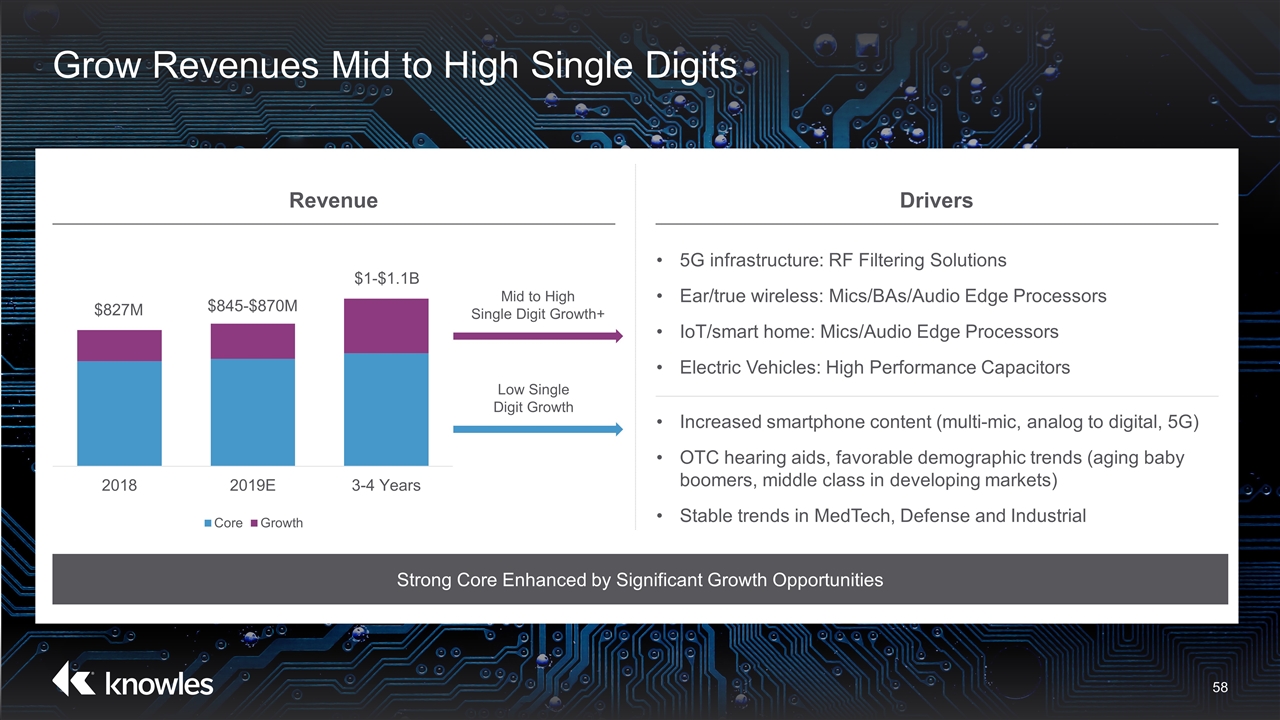

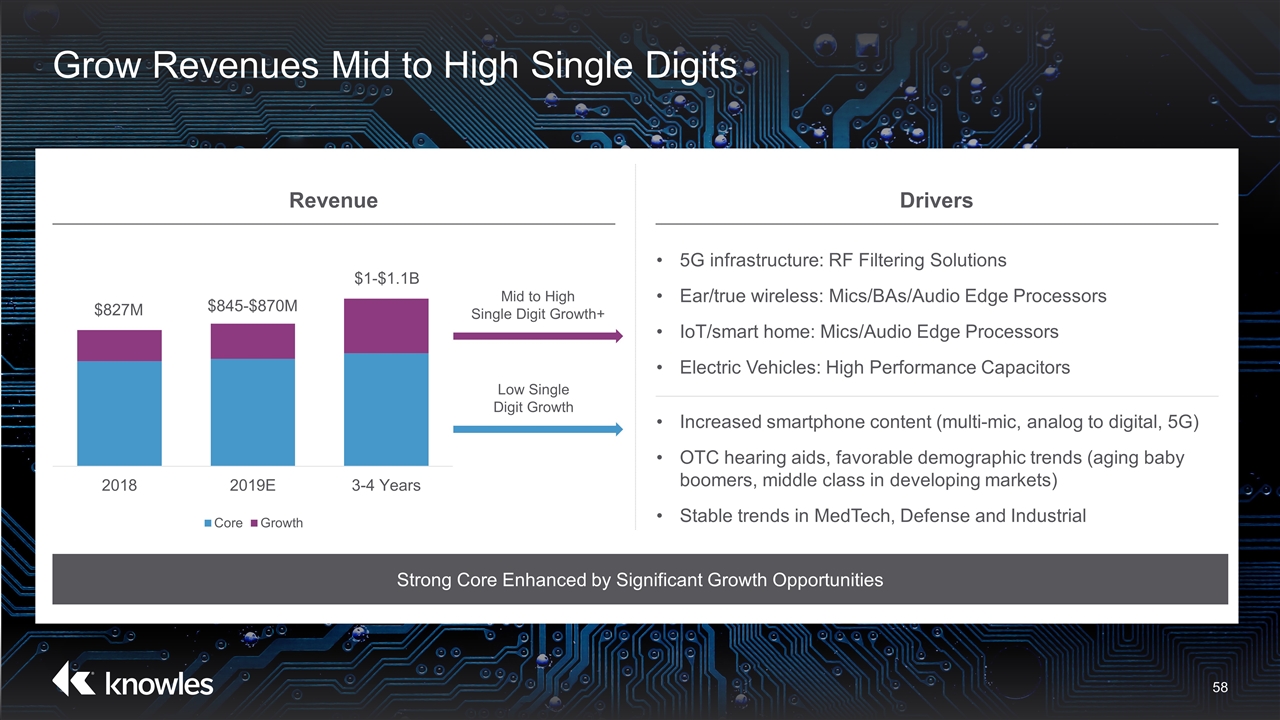

Grow Revenues Mid to High Single Digits Revenue Drivers 5G infrastructure: RF Filtering Solutions Ear/true wireless: Mics/BAs/Audio Edge Processors IoT/smart home: Mics/Audio Edge Processors Electric Vehicles: High Performance Capacitors Increased smartphone content (multi-mic, analog to digital, 5G) OTC hearing aids, favorable demographic trends (aging baby boomers, middle class in developing markets) Stable trends in MedTech, Defense and Industrial Strong Core Enhanced by Significant Growth Opportunities $845-$870M Mid to High Single Digit Growth+ Low Single Digit Growth

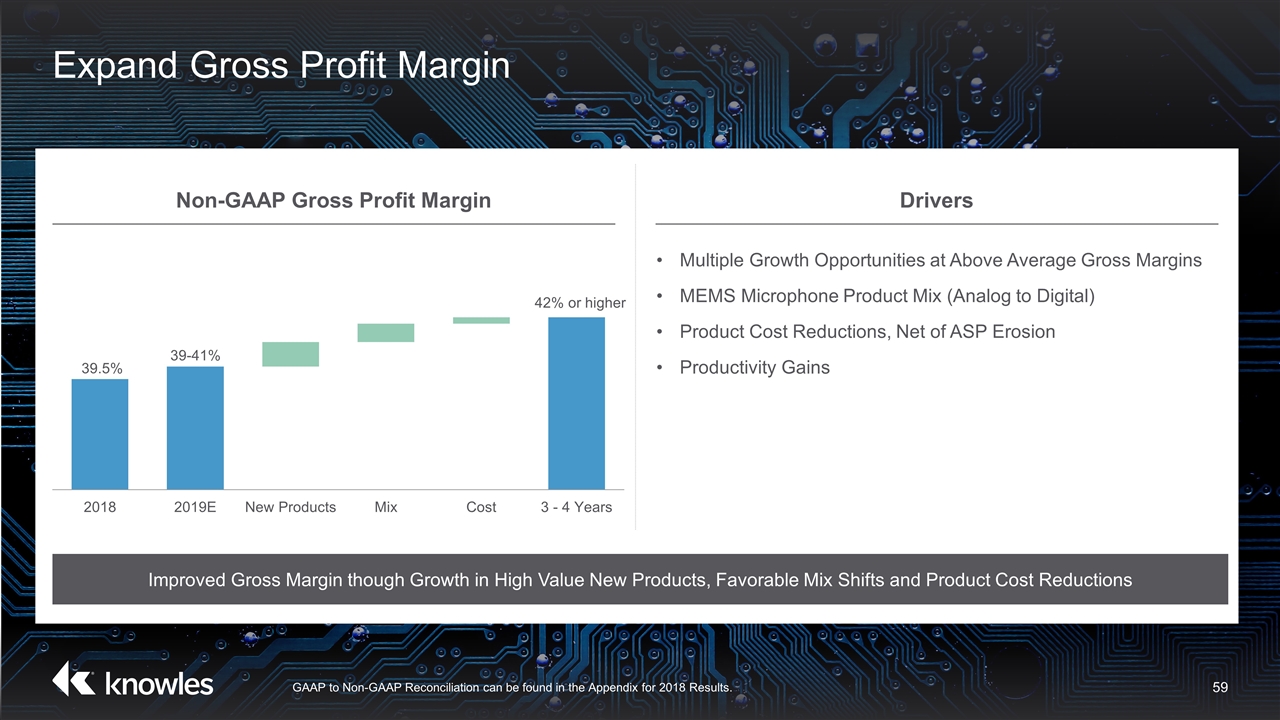

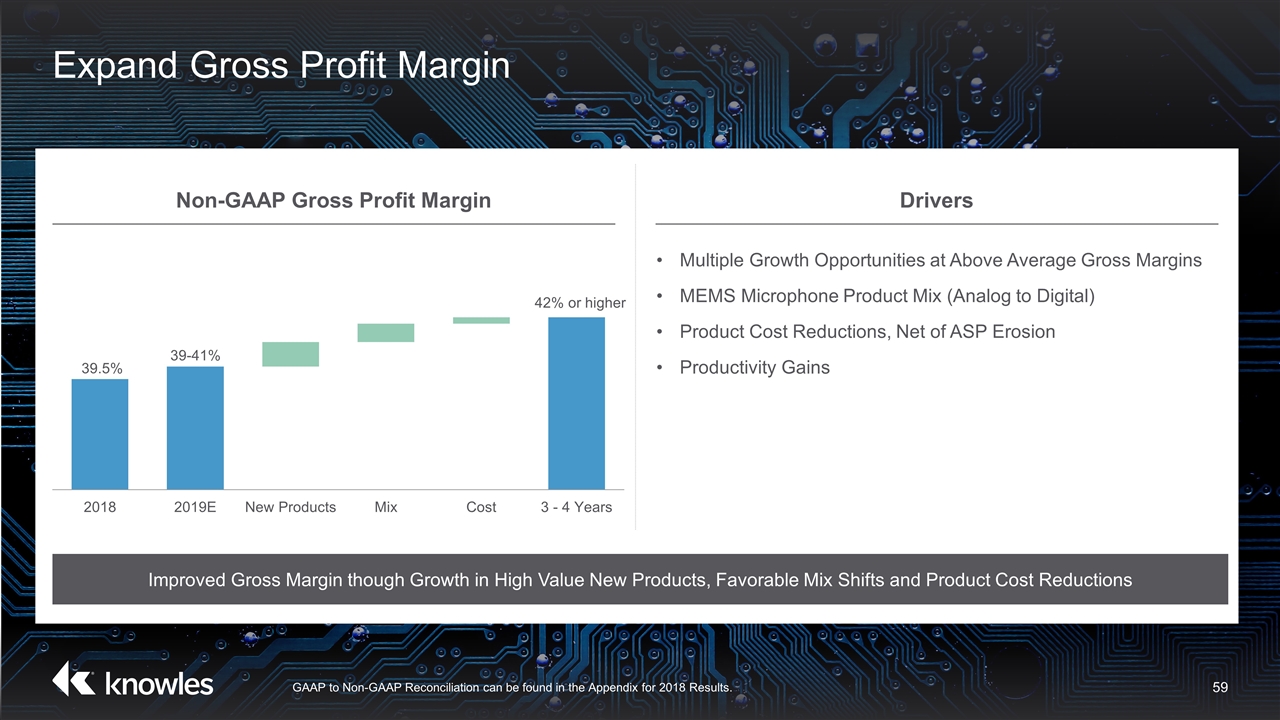

Expand Gross Profit Margin Non-GAAP Gross Profit Margin Drivers Multiple Growth Opportunities at Above Average Gross Margins MEMS Microphone Product Mix (Analog to Digital) Product Cost Reductions, Net of ASP Erosion Productivity Gains Improved Gross Margin though Growth in High Value New Products, Favorable Mix Shifts and Product Cost Reductions GAAP to Non-GAAP Reconciliation can be found in the Appendix for 2018 Results. 42% or higher

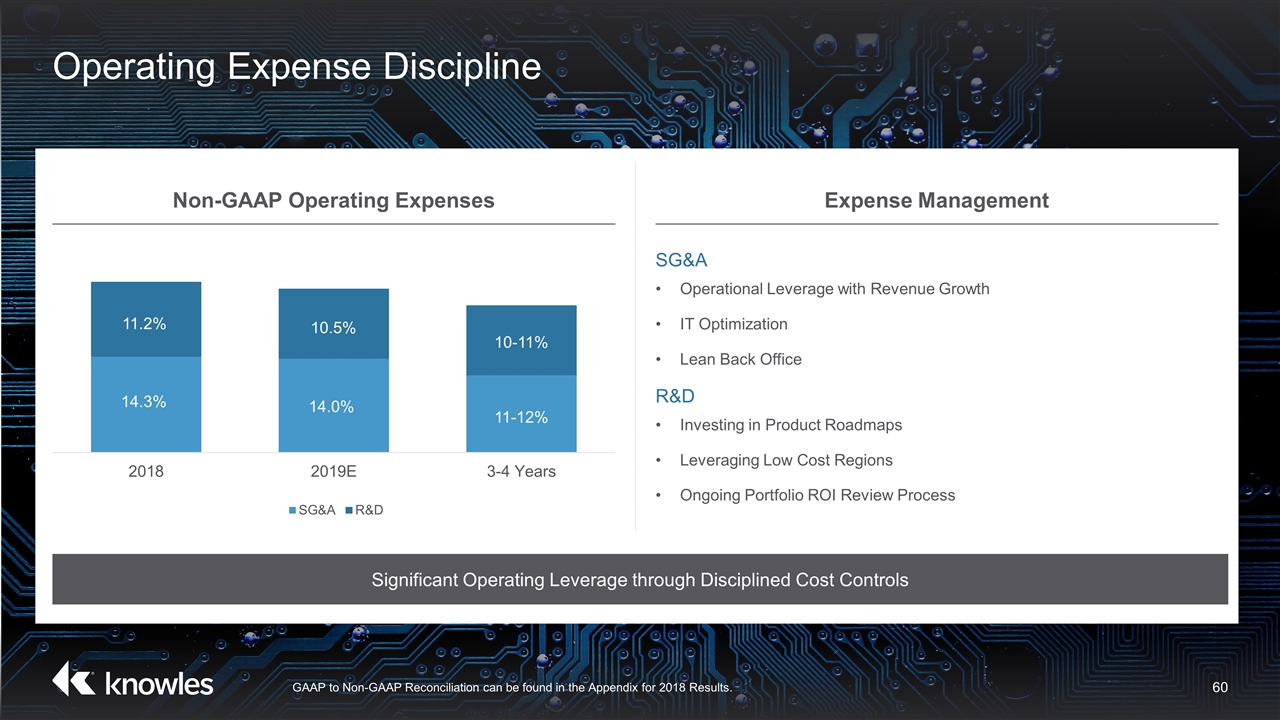

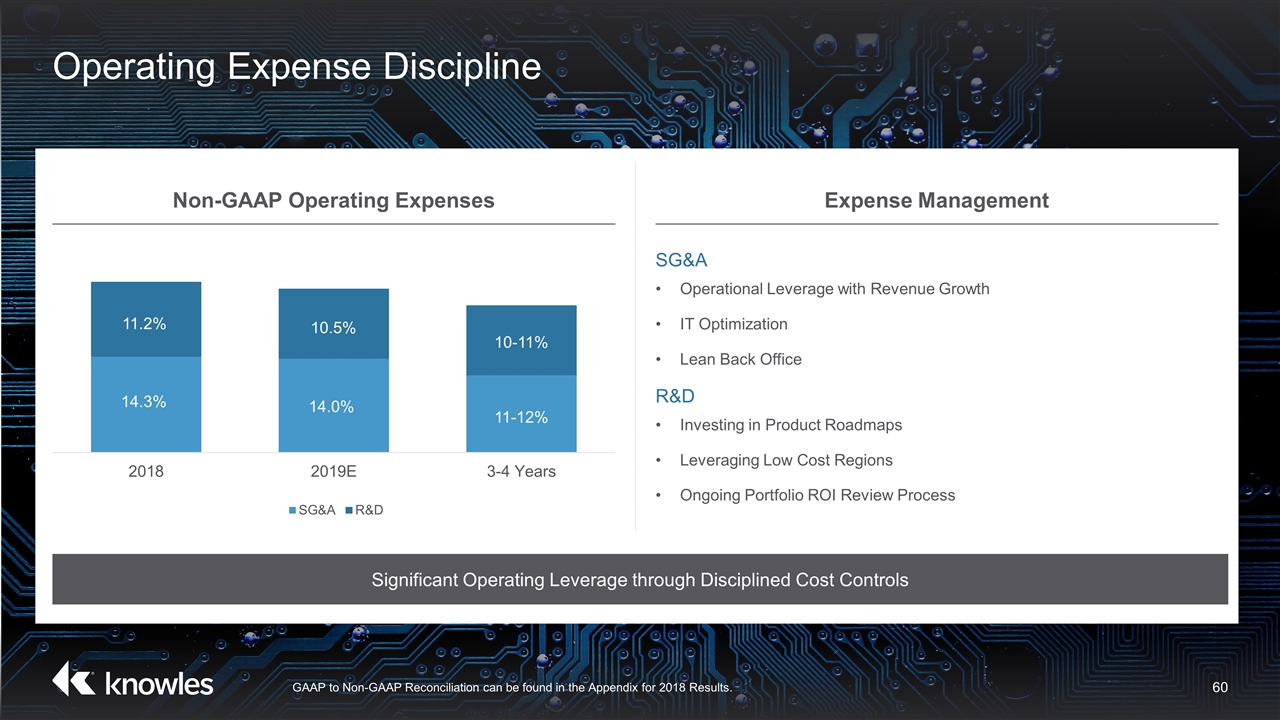

Operating Expense Discipline Non-GAAP Operating Expenses Expense Management SG&A Operational Leverage with Revenue Growth IT Optimization Lean Back Office R&D Investing in Product Roadmaps Leveraging Low Cost Regions Ongoing Portfolio ROI Review Process Significant Operating Leverage through Disciplined Cost Controls 11.2% 10.5% 10-11% 14.3% 14.0% 11-12% GAAP to Non-GAAP Reconciliation can be found in the Appendix for 2018 Results.

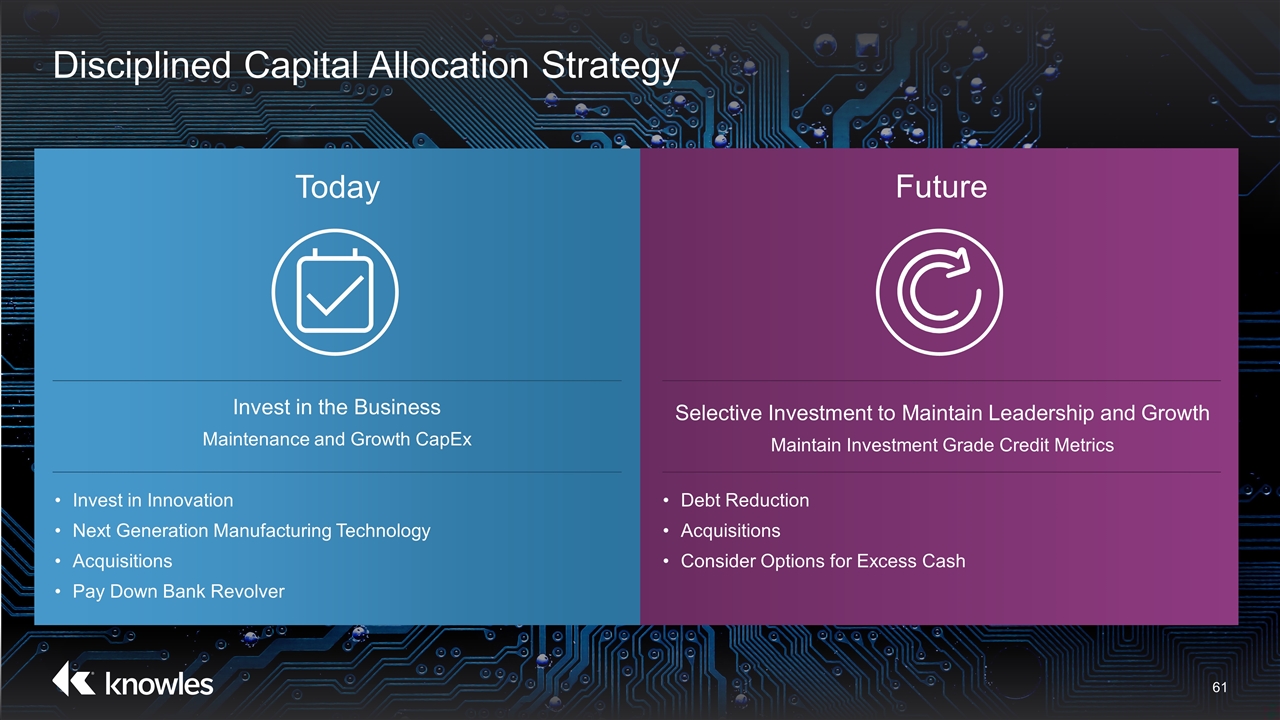

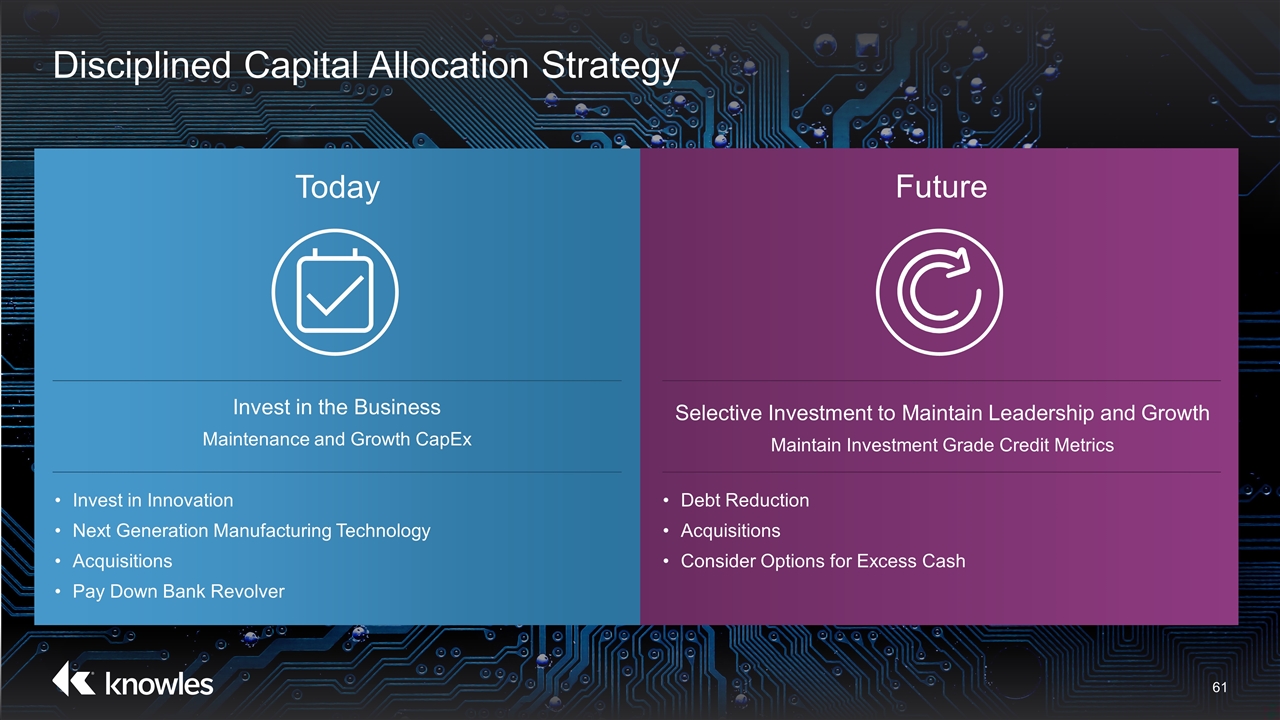

Disciplined Capital Allocation Strategy Invest in the Business Maintenance and Growth CapEx Invest in Innovation Next Generation Manufacturing Technology Acquisitions Pay Down Bank Revolver Today Selective Investment to Maintain Leadership and Growth Maintain Investment Grade Credit Metrics Debt Reduction Acquisitions Consider Options for Excess Cash Future

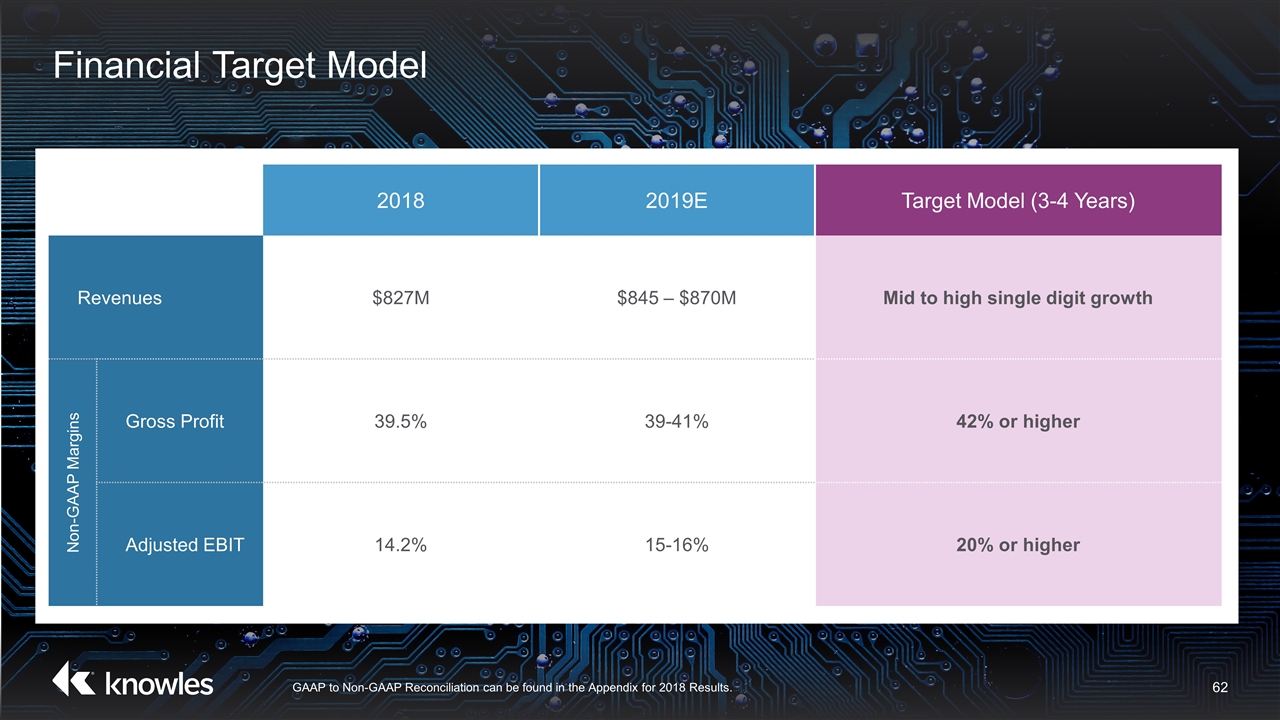

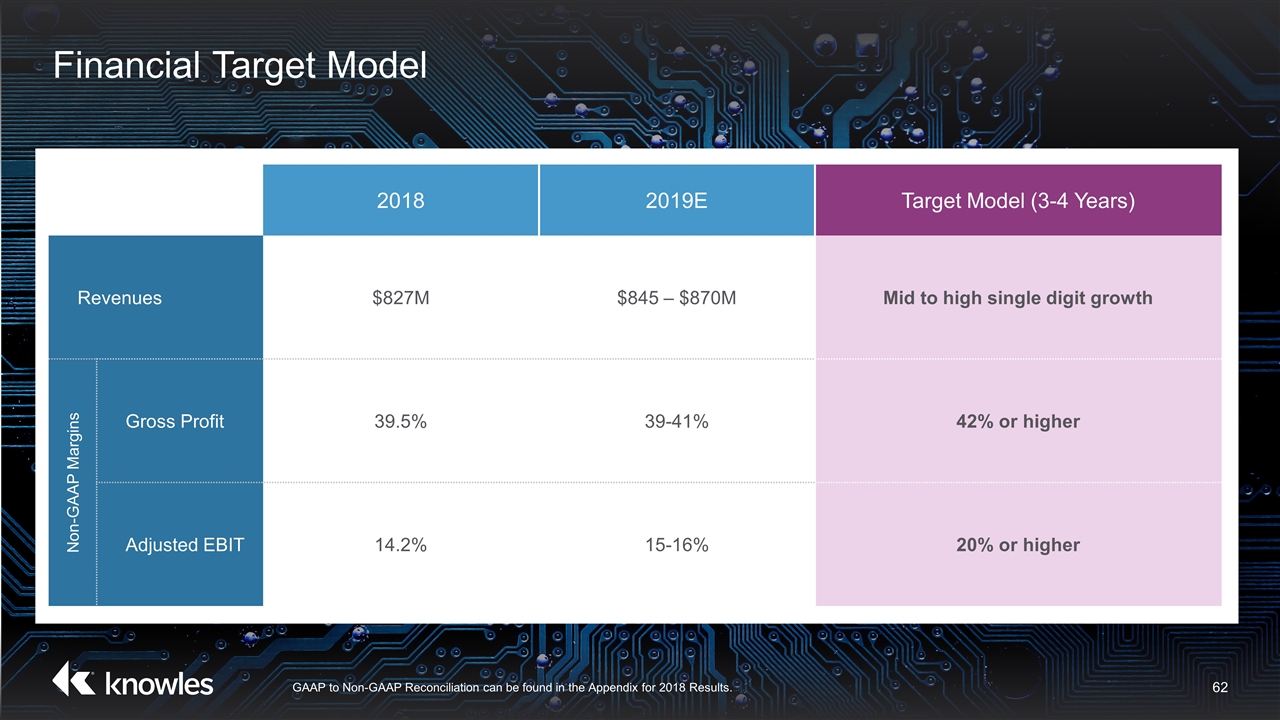

Financial Target Model 2018 2019E Target Model (3-4 Years) Revenues $827M $845 – $870M Mid to high single digit growth Non-GAAP Margins Gross Profit 39.5% 39-41% 42% or higher Adjusted EBIT 14.2% 15-16% 20% or higher GAAP to Non-GAAP Reconciliation can be found in the Appendix for 2018 Results.

Key Takeaways

Powering Sustainable Growth Large, attractive, and growing end markets Innovative product portfolio sustains differentiation Driving accelerated revenues and margin expansion Strong financial foundation and disciplined capital allocation On path to exceed $1B in revenue and achieve 50% increase in operating income

Appendix

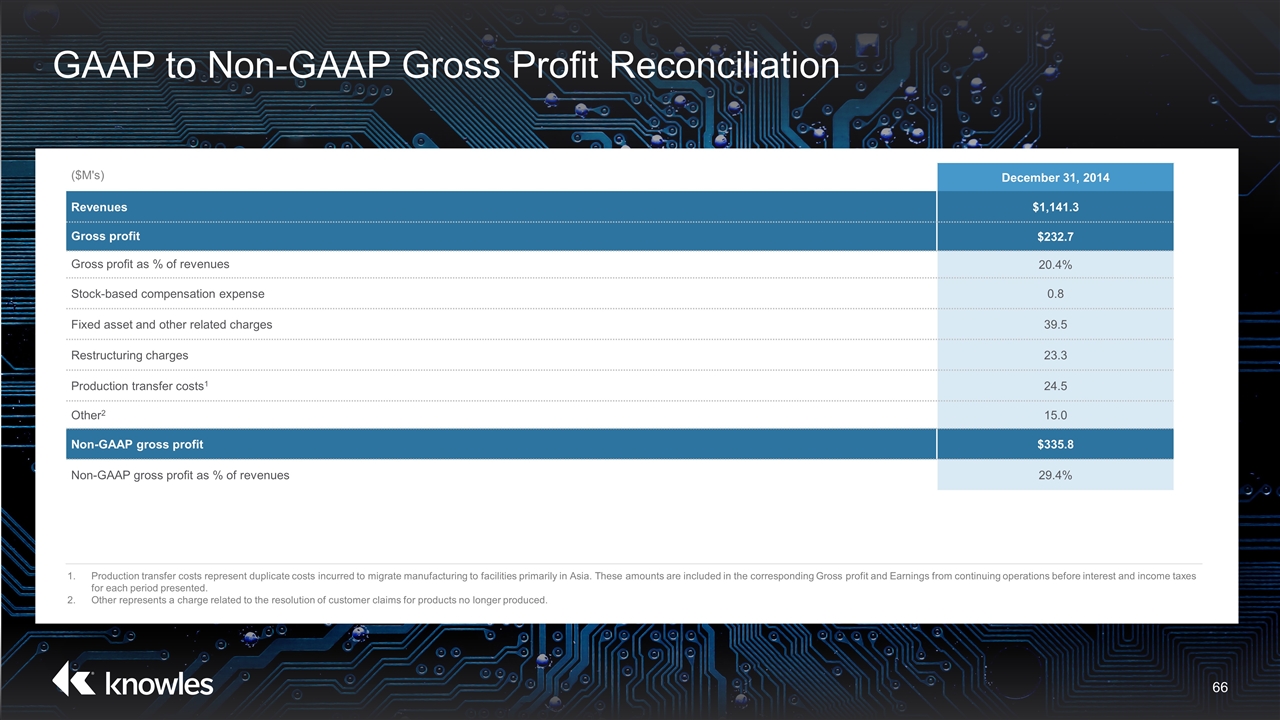

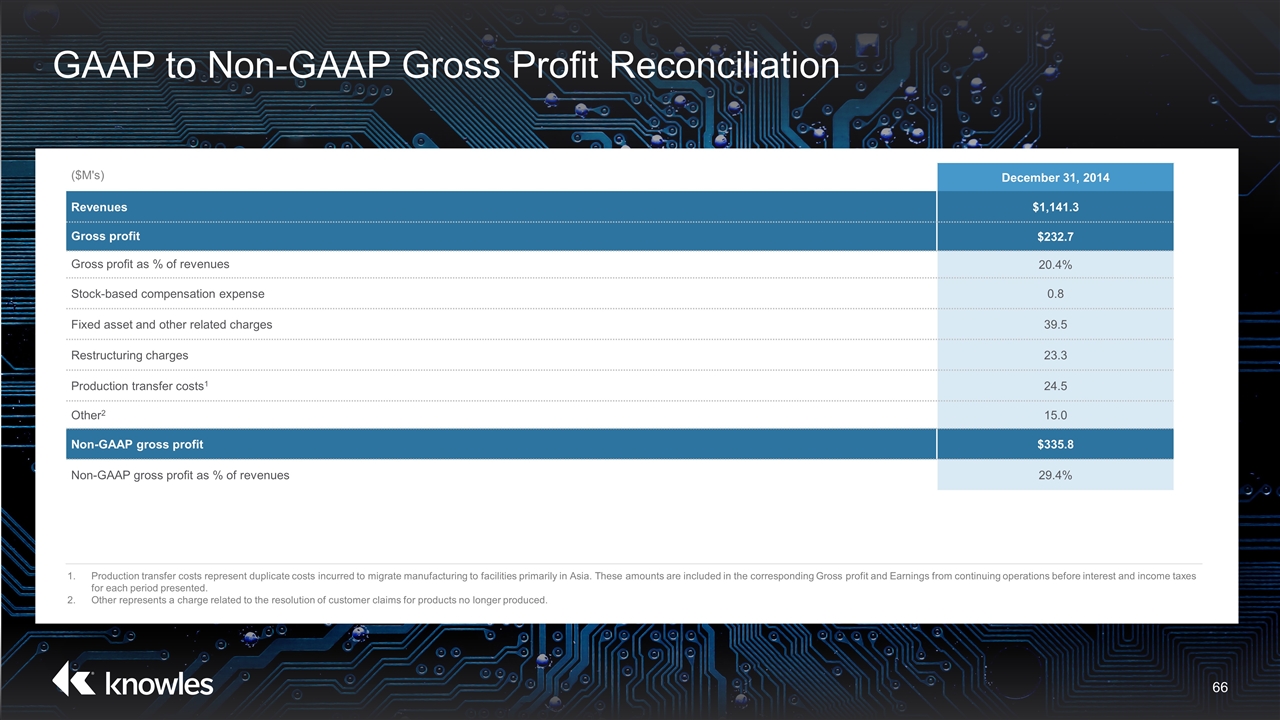

GAAP to Non-GAAP Gross Profit Reconciliation ($M's) December 31, 2014 Revenues $1,141.3 Gross profit $232.7 Gross profit as % of revenues 20.4% Stock-based compensation expense 0.8 Fixed asset and other related charges 39.5 Restructuring charges 23.3 Production transfer costs1 24.5 Other2 15.0 Non-GAAP gross profit $335.8 Non-GAAP gross profit as % of revenues 29.4% Production transfer costs represent duplicate costs incurred to migrate manufacturing to facilities primarily in Asia. These amounts are included in the corresponding Gross profit and Earnings from continuing operations before interest and income taxes for each period presented. Other represents a charge related to the resolution of customer claims for products no longer produced.

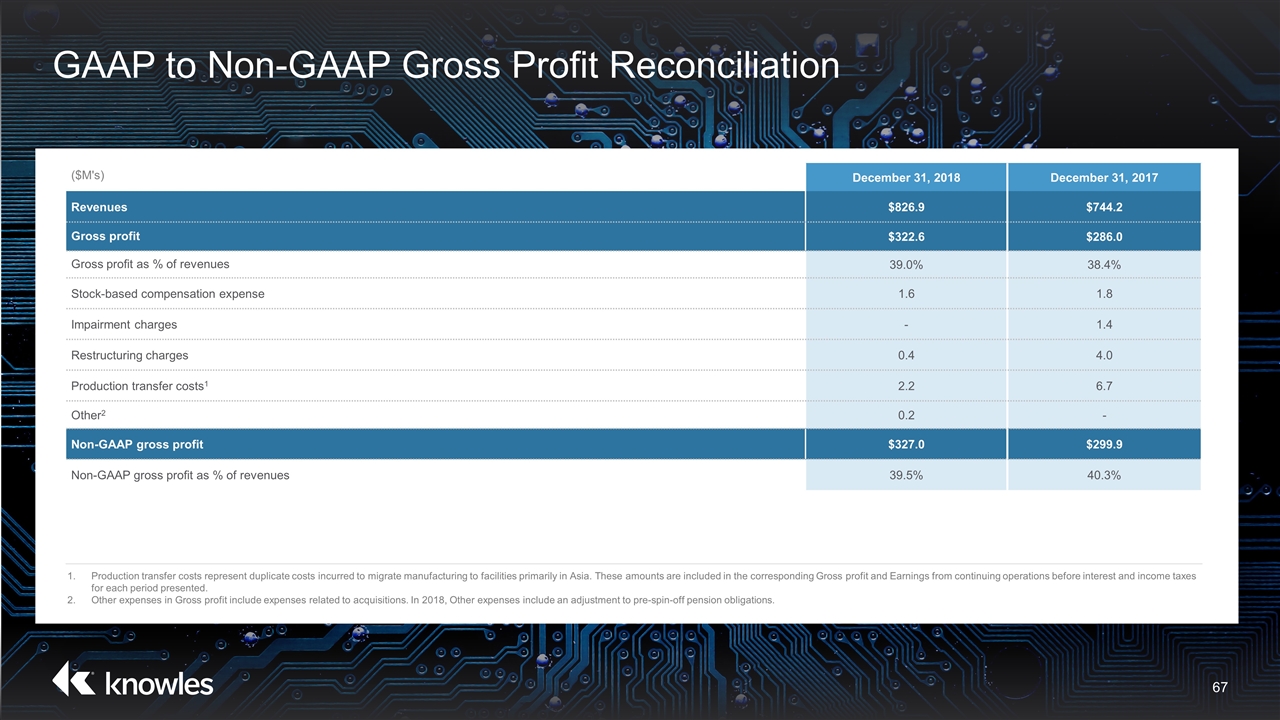

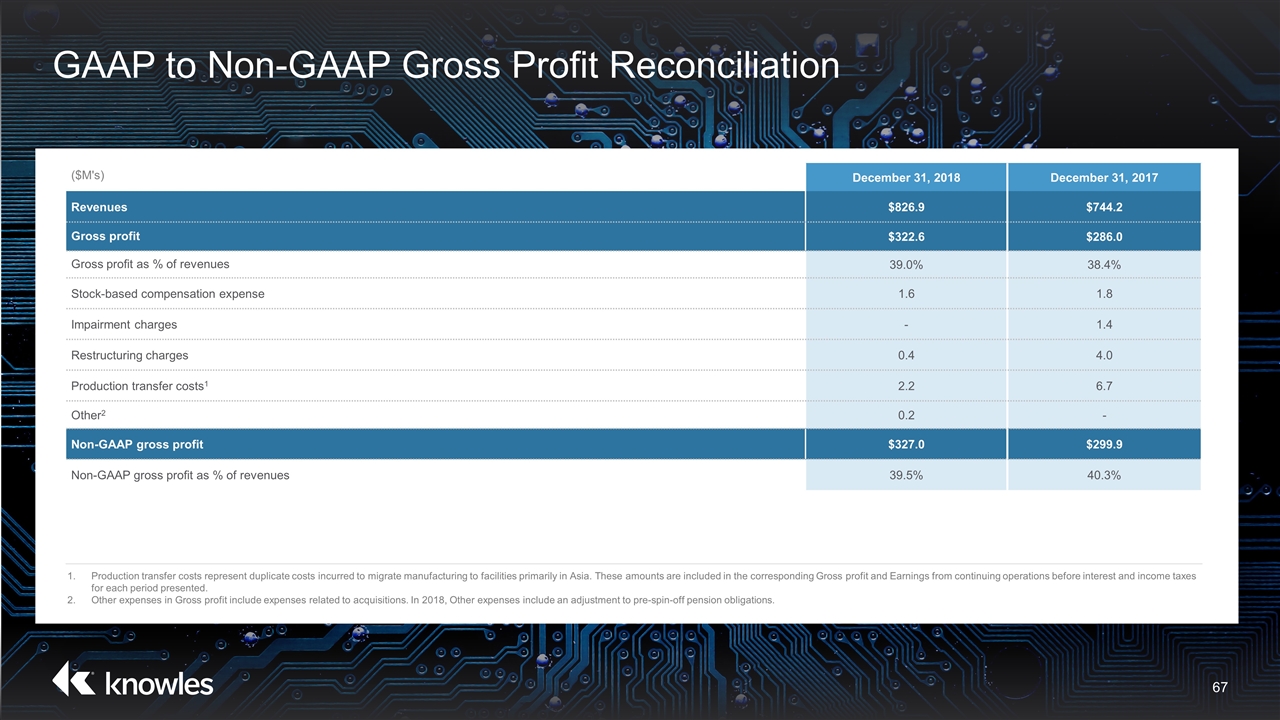

GAAP to Non-GAAP Gross Profit Reconciliation ($M's) December 31, 2018 December 31, 2017 Revenues $826.9 $744.2 Gross profit $322.6 $286.0 Gross profit as % of revenues 39.0% 38.4% Stock-based compensation expense 1.6 1.8 Impairment charges - 1.4 Restructuring charges 0.4 4.0 Production transfer costs1 2.2 6.7 Other2 0.2 - Non-GAAP gross profit $327.0 $299.9 Non-GAAP gross profit as % of revenues 39.5% 40.3% Production transfer costs represent duplicate costs incurred to migrate manufacturing to facilities primarily in Asia. These amounts are included in the corresponding Gross profit and Earnings from continuing operations before interest and income taxes for each period presented. Other expenses in Gross profit include expenses related to acquisitions. In 2018, Other expenses include an adjustment to pre-spin-off pension obligations.

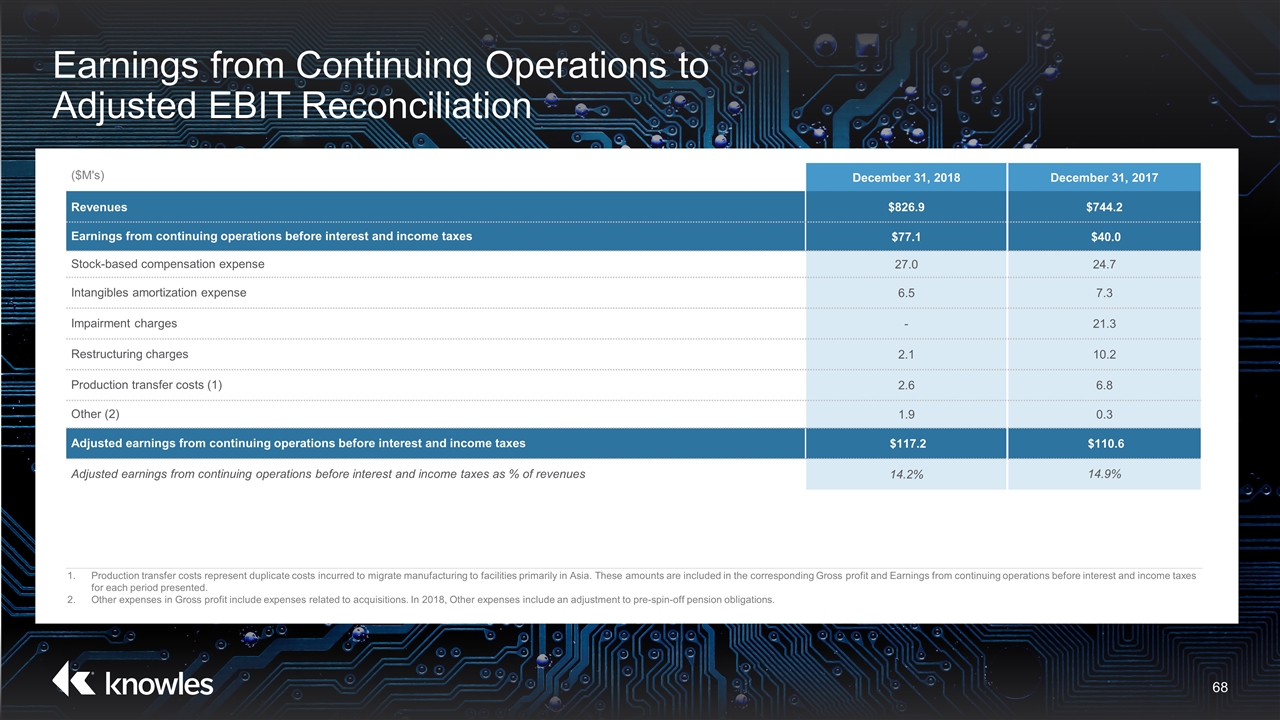

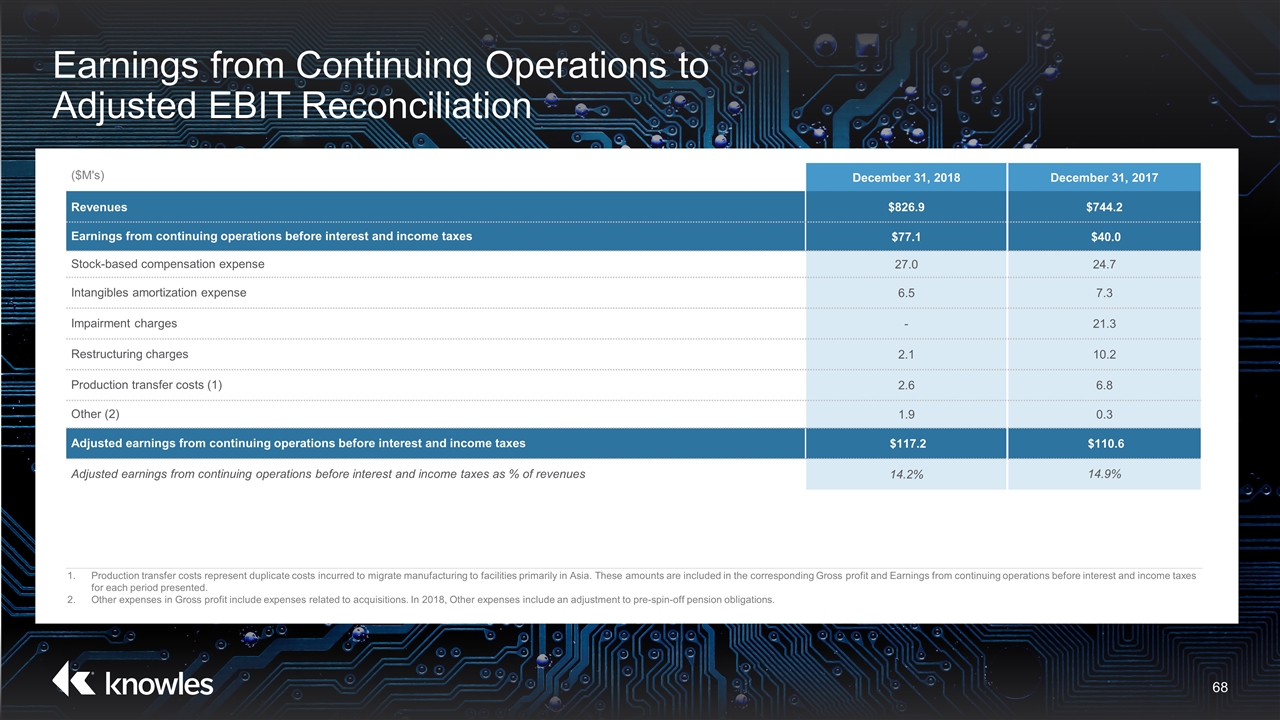

Earnings from Continuing Operations to Adjusted EBIT Reconciliation ($M's) December 31, 2018 December 31, 2017 Revenues $826.9 $744.2 Earnings from continuing operations before interest and income taxes $77.1 $40.0 Stock-based compensation expense 27.0 24.7 Intangibles amortization expense 6.5 7.3 Impairment charges - 21.3 Restructuring charges 2.1 10.2 Production transfer costs (1) 2.6 6.8 Other (2) 1.9 0.3 Adjusted earnings from continuing operations before interest and income taxes $117.2 $110.6 Adjusted earnings from continuing operations before interest and income taxes as % of revenues 14.2% 14.9% Production transfer costs represent duplicate costs incurred to migrate manufacturing to facilities primarily in Asia. These amounts are included in the corresponding Gross profit and Earnings from continuing operations before interest and income taxes for each period presented. Other expenses in Gross profit include expenses related to acquisitions. In 2018, Other expenses include an adjustment to pre-spin-off pension obligations.

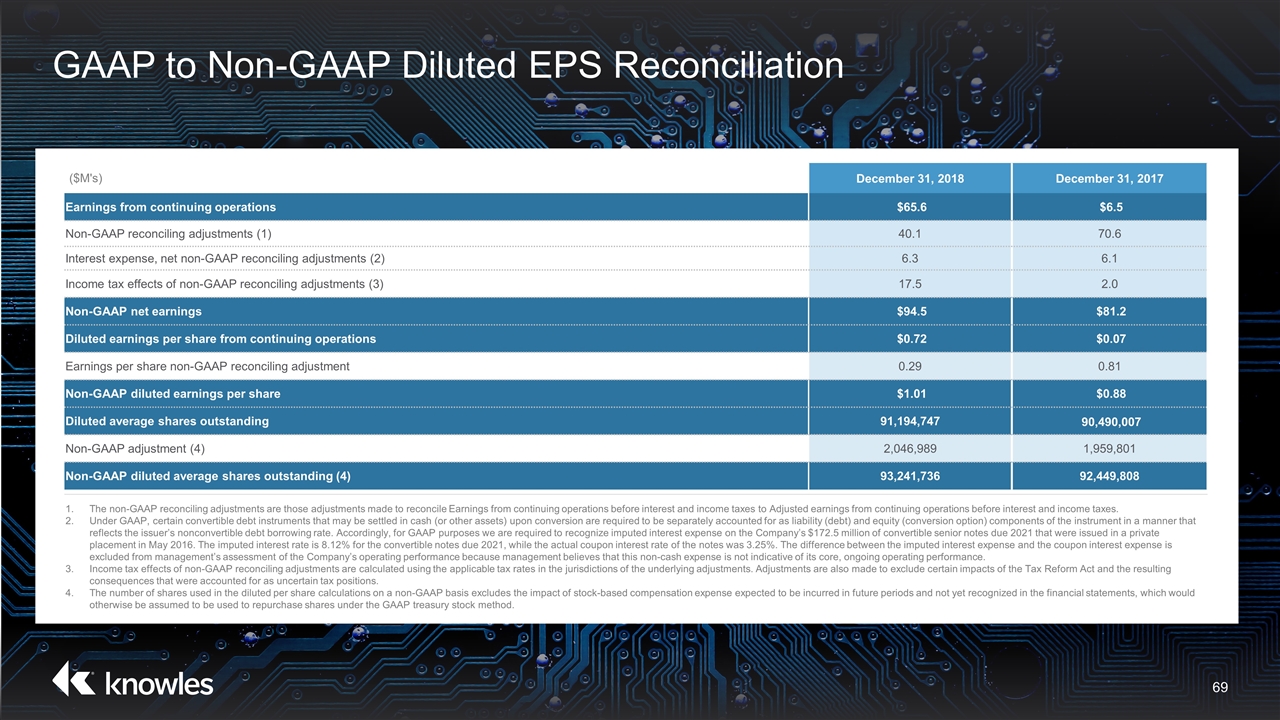

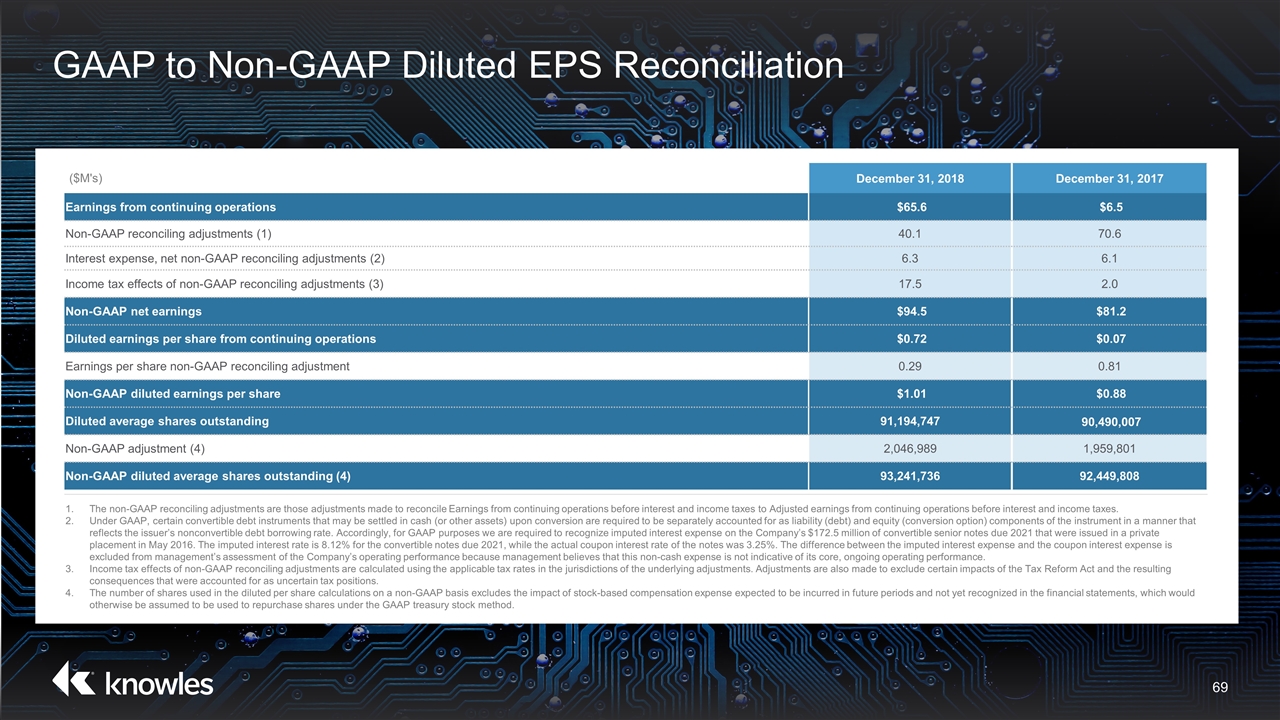

GAAP to Non-GAAP Diluted EPS Reconciliation ($M's) December 31, 2018 December 31, 2017 Earnings from continuing operations $65.6 $6.5 Non-GAAP reconciling adjustments (1) 40.1 70.6 Interest expense, net non-GAAP reconciling adjustments (2) 6.3 6.1 Income tax effects of non-GAAP reconciling adjustments (3) 17.5 2.0 Non-GAAP net earnings $94.5 $81.2 Diluted earnings per share from continuing operations $0.72 $0.07 Earnings per share non-GAAP reconciling adjustment 0.29 0.81 Non-GAAP diluted earnings per share $1.01 $0.88 Diluted average shares outstanding 91,194,747 90,490,007 Non-GAAP adjustment (4) 2,046,989 1,959,801 Non-GAAP diluted average shares outstanding (4) 93,241,736 92,449,808 The non-GAAP reconciling adjustments are those adjustments made to reconcile Earnings from continuing operations before interest and income taxes to Adjusted earnings from continuing operations before interest and income taxes. Under GAAP, certain convertible debt instruments that may be settled in cash (or other assets) upon conversion are required to be separately accounted for as liability (debt) and equity (conversion option) components of the instrument in a manner that reflects the issuer’s nonconvertible debt borrowing rate. Accordingly, for GAAP purposes we are required to recognize imputed interest expense on the Company’s $172.5 million of convertible senior notes due 2021 that were issued in a private placement in May 2016. The imputed interest rate is 8.12% for the convertible notes due 2021, while the actual coupon interest rate of the notes was 3.25%. The difference between the imputed interest expense and the coupon interest expense is excluded from management’s assessment of the Company’s operating performance because management believes that this non-cash expense is not indicative of its core, ongoing operating performance. Income tax effects of non-GAAP reconciling adjustments are calculated using the applicable tax rates in the jurisdictions of the underlying adjustments. Adjustments are also made to exclude certain impacts of the Tax Reform Act and the resulting consequences that were accounted for as uncertain tax positions. The number of shares used in the diluted per share calculations on a non-GAAP basis excludes the impact of stock-based compensation expense expected to be incurred in future periods and not yet recognized in the financial statements, which would otherwise be assumed to be used to repurchase shares under the GAAP treasury stock method.

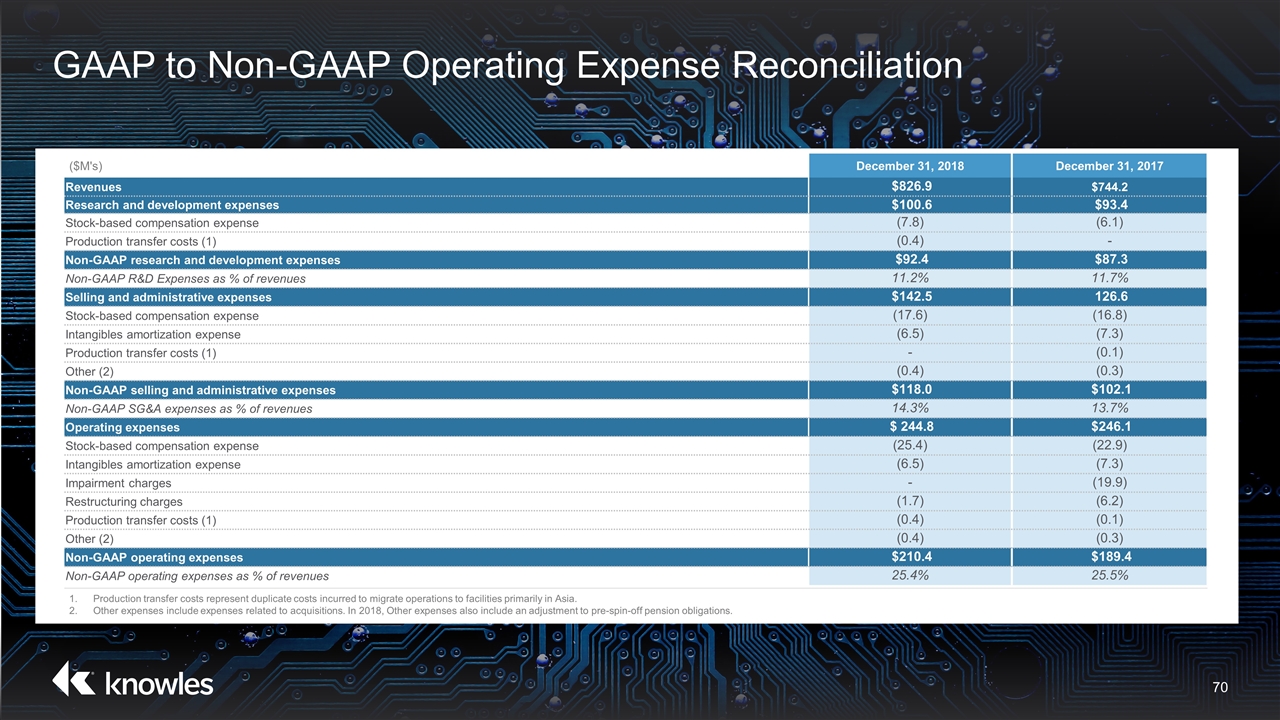

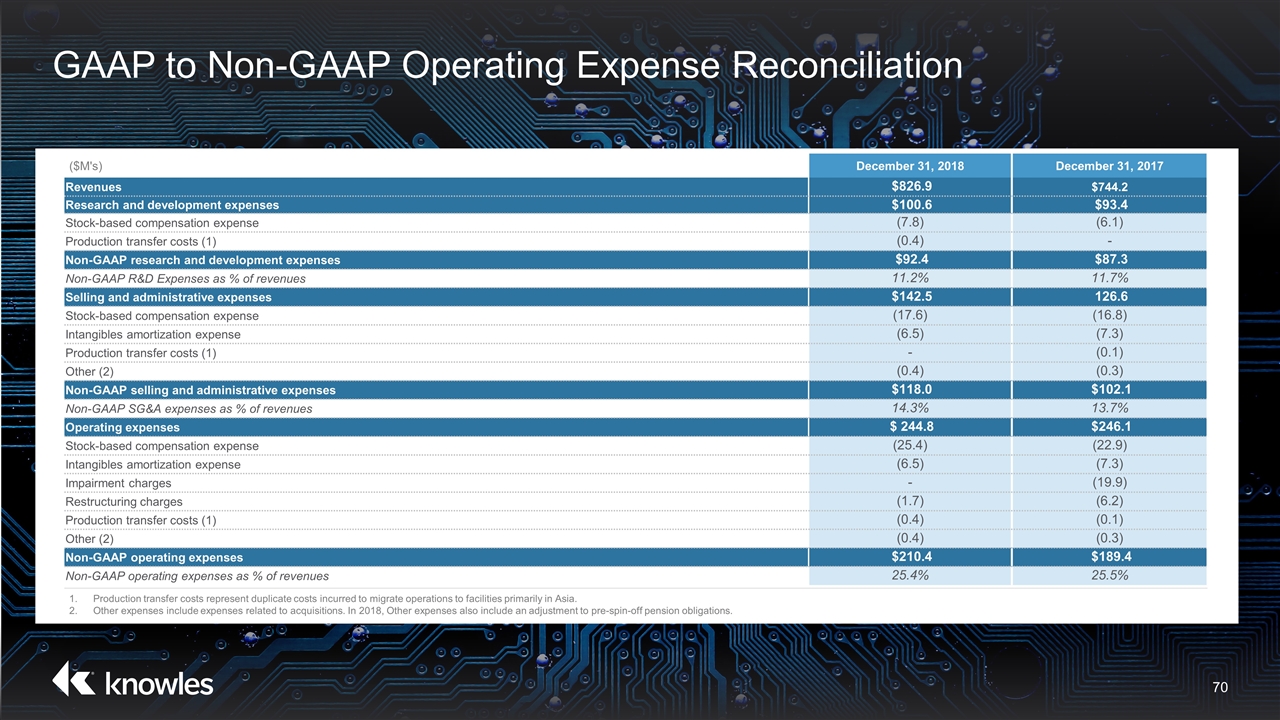

GAAP to Non-GAAP Operating Expense Reconciliation ($M's) December 31, 2018 December 31, 2017 Revenues $826.9 $744.2 Research and development expenses $100.6 $93.4 Stock-based compensation expense (7.8) (6.1) Production transfer costs (1) (0.4) - Non-GAAP research and development expenses $92.4 $87.3 Non-GAAP R&D Expenses as % of revenues 11.2% 11.7% Selling and administrative expenses $142.5 126.6 Stock-based compensation expense (17.6) (16.8) Intangibles amortization expense (6.5) (7.3) Production transfer costs (1) - (0.1) Other (2) (0.4) (0.3) Non-GAAP selling and administrative expenses $118.0 $102.1 Non-GAAP SG&A expenses as % of revenues 14.3% 13.7% Operating expenses $ 244.8 $246.1 Stock-based compensation expense (25.4) (22.9) Intangibles amortization expense (6.5) (7.3) Impairment charges - (19.9) Restructuring charges (1.7) (6.2) Production transfer costs (1) (0.4) (0.1) Other (2) (0.4) (0.3) Non-GAAP operating expenses $210.4 $189.4 Non-GAAP operating expenses as % of revenues 25.4% 25.5% Production transfer costs represent duplicate costs incurred to migrate operations to facilities primarily in Asia. Other expenses include expenses related to acquisitions. In 2018, Other expenses also include an adjustment to pre-spin-off pension obligations.