Q4 2018 February 7, 2019 Supplemental Information

Non-GAAP Disclaimer The financial results disclosed in this presentation include certain measures calculated and presented in accordance with GAAP. In addition to the GAAP results included in this presentation, Knowles has presented supplemental, non-GAAP gross profit, earnings before interest and income taxes, adjusted earnings before interest and income taxes and non- GAAP diluted earnings per share to facilitate evaluation of Knowles’ operating performance. These non-GAAP financial measures exclude certain amounts that are included in the most directly comparable GAAP measure. In addition, these non-GAAP financial measures do not have standard meanings and may vary from similarly titled non-GAAP financial measures used by other companies. Knowles believes that non-GAAP measures are useful as supplements to its GAAP results of operations to evaluate certain aspects of its operations and performance, and its management team primarily focuses on non-GAAP items in evaluating Knowles’ performance for business planning purposes. Knowles believes that these measures assist it with comparing its performance between various reporting periods on a consistent basis, as these measures remove from operating results the impact of items that, in Knowles’ opinion, do not reflect its core operating performance. Knowles believes that its presentation of these non-GAAP financial measures is useful because it provides investors and securities analysts with the same information that Knowles uses internally for purposes of assessing its core operating performance. For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures, see the reconciliation tables included in the fourth quarter 2018 earnings release. 2

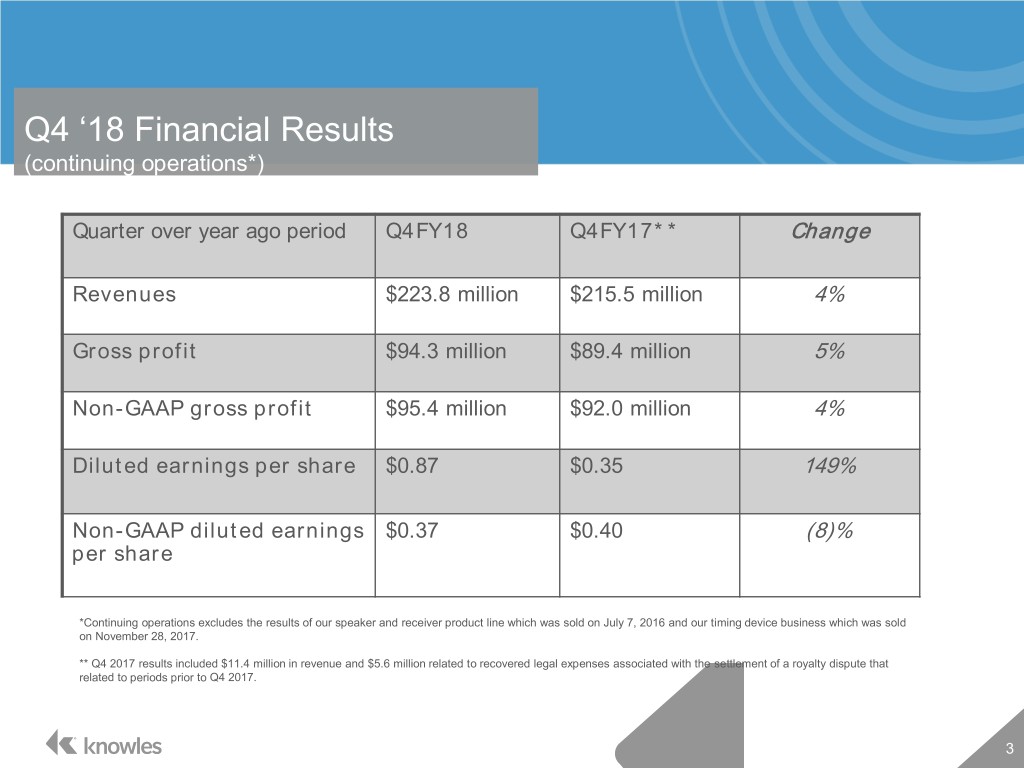

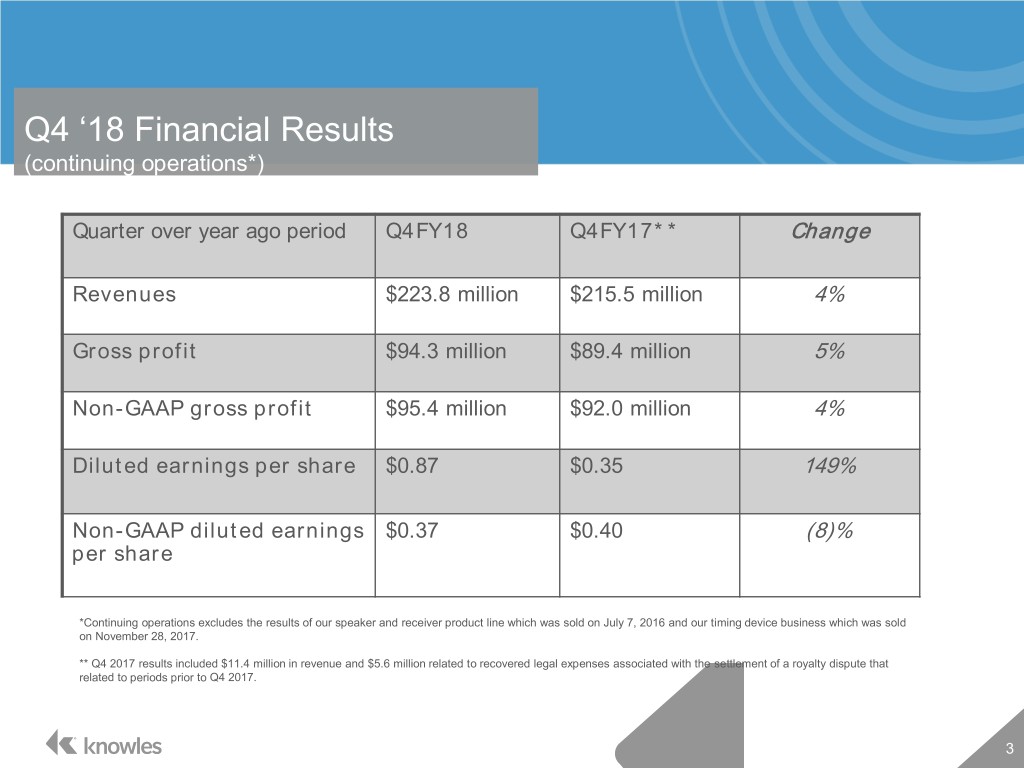

Q4 ‘18 Financial Results (continuing operations*) Quarter over year ago period Q4FY18 Q4FY17** Change Revenues $223.8 million $215.5 million 4% Gross profit $94.3 million $89.4 million 5% Non-GAAP gross profit $95.4 million $92.0 million 4% Diluted earnings per share $0.87 $0.35 149% Non-GAAP diluted earnings $0.37 $0.40 (8)% per share *Continuing operations excludes the results of our speaker and receiver product line which was sold on July 7, 2016 and our timing device business which was sold on November 28, 2017. ** Q4 2017 results included $11.4 million in revenue and $5.6 million related to recovered legal expenses associated with the settlement of a royalty dispute that related to periods prior to Q4 2017. 3

Q1 ‘19 Projections (non-GAAP, cont. ops.)* Q1FY19E Revenues $165 million - $185 million Gross margin 37 percent – 39 percent EPS (diluted) $0.09 - $0.13 *Projections as of 2/7/19; Q1 2019 GAAP results for continuing operations are expected to include approximately $0.07 per share in stock-based compensation, $0.01 per share in amortization of intangibles and debt discount, and $0.01 per share related to production transfer costs. Expected Q1 2019 GAAP results exclude potential discrete income tax and restructuring items. 4

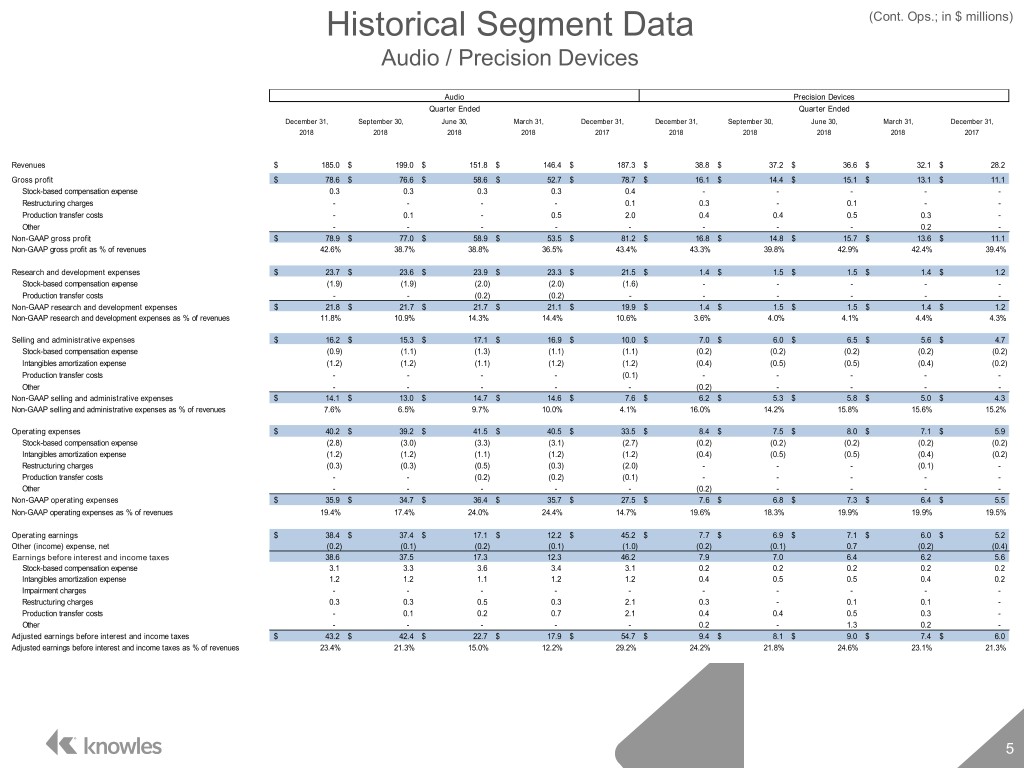

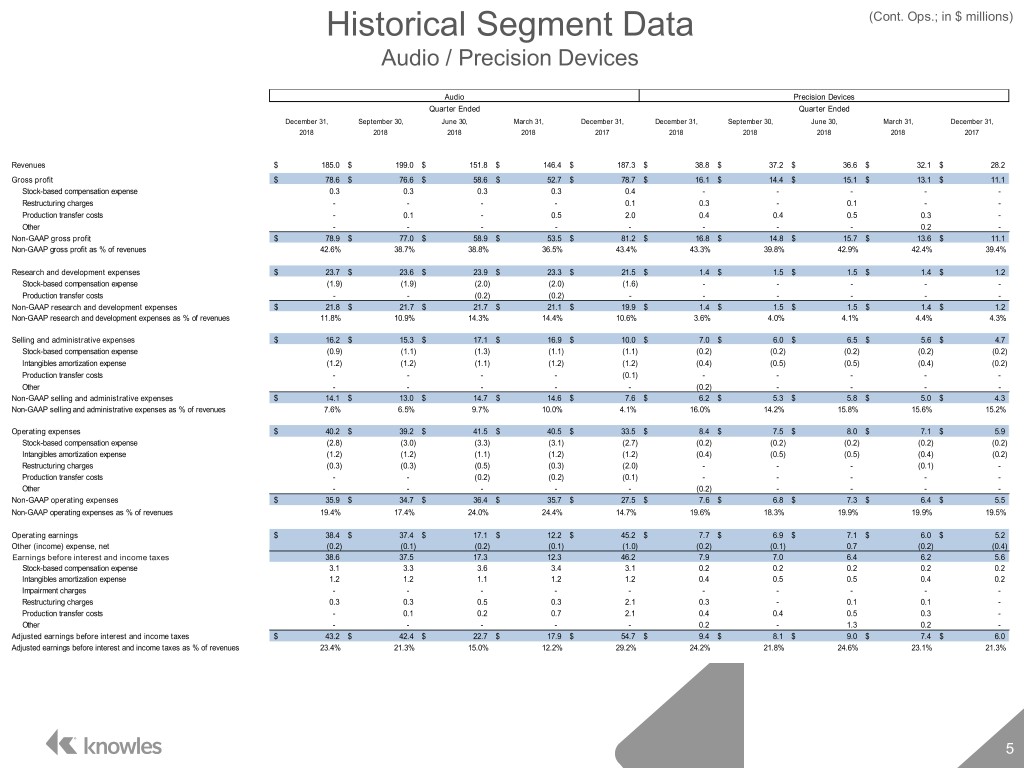

Historical Segment Data (Cont. Ops.; in $ millions) Audio / Precision Devices Audio Precision Devices Quarter Ended Quarter Ended December 31, September 30, June 30, March 31, December 31, December 31, September 30, June 30, March 31, December 31, 2018 2018 2018 2018 2017 2018 2018 2018 2018 2017 Revenues $ 185.0 $ 199.0 $ 151.8 $ 146.4 $ 187.3 $ 38.8 $ 37.2 $ 36.6 $ 32.1 $ 28.2 Gross profit $ 78.6 $ 76.6 $ 58.6 $ 52.7 $ 78.7 $ 16.1 $ 14.4 $ 15.1 $ 13.1 $ 11.1 Stock-based compensation expense 0.3 0.3 0.3 0.3 0.4 - - - - - Restructuring charges - - - - 0.1 0.3 - 0.1 - - Production transfer costs - 0.1 - 0.5 2.0 0.4 0.4 0.5 0.3 - Other - - - - - - - - 0.2 - Non-GAAP gross profit $ 78.9 $ 77.0 $ 58.9 $ 53.5 $ 81.2 $ 16.8 $ 14.8 $ 15.7 $ 13.6 $ 11.1 Non-GAAP gross profit as % of revenues 42.6% 38.7% 38.8% 36.5% 43.4% 43.3% 39.8% 42.9% 42.4% 39.4% Research and development expenses $ 23.7 $ 23.6 $ 23.9 $ 23.3 $ 21.5 $ 1.4 $ 1.5 $ 1.5 $ 1.4 $ 1.2 Stock-based compensation expense (1.9) (1.9) (2.0) (2.0) (1.6) - - - - - Production transfer costs - - (0.2) (0.2) - - - - - - Non-GAAP research and development expenses $ 21.8 $ 21.7 $ 21.7 $ 21.1 $ 19.9 $ 1.4 $ 1.5 $ 1.5 $ 1.4 $ 1.2 Non-GAAP research and development expenses as % of revenues 11.8% 10.9% 14.3% 14.4% 10.6% 3.6% 4.0% 4.1% 4.4% 4.3% Selling and administrative expenses $ 16.2 $ 15.3 $ 17.1 $ 16.9 $ 10.0 $ 7.0 $ 6.0 $ 6.5 $ 5.6 $ 4.7 Stock-based compensation expense (0.9) (1.1) (1.3) (1.1) (1.1) (0.2) (0.2) (0.2) (0.2) (0.2) Intangibles amortization expense (1.2) (1.2) (1.1) (1.2) (1.2) (0.4) (0.5) (0.5) (0.4) (0.2) Production transfer costs - - - - (0.1) - - - - - Other - - - - - (0.2) - - - - Non-GAAP selling and administrative expenses $ 14.1 $ 13.0 $ 14.7 $ 14.6 $ 7.6 $ 6.2 $ 5.3 $ 5.8 $ 5.0 $ 4.3 Non-GAAP selling and administrative expenses as % of revenues 7.6% 6.5% 9.7% 10.0% 4.1% 16.0% 14.2% 15.8% 15.6% 15.2% Operating expenses $ 40.2 $ 39.2 $ 41.5 $ 40.5 $ 33.5 $ 8.4 $ 7.5 $ 8.0 $ 7.1 $ 5.9 Stock-based compensation expense (2.8) (3.0) (3.3) (3.1) (2.7) (0.2) (0.2) (0.2) (0.2) (0.2) Intangibles amortization expense (1.2) (1.2) (1.1) (1.2) (1.2) (0.4) (0.5) (0.5) (0.4) (0.2) Restructuring charges (0.3) (0.3) (0.5) (0.3) (2.0) - - - (0.1) - Production transfer costs - - (0.2) (0.2) (0.1) - - - - - Other - - - - - (0.2) - - - - Non-GAAP operating expenses $ 35.9 $ 34.7 $ 36.4 $ 35.7 $ 27.5 $ 7.6 $ 6.8 $ 7.3 $ 6.4 $ 5.5 Non-GAAP operating expenses as % of revenues 19.4% 17.4% 24.0% 24.4% 14.7% 19.6% 18.3% 19.9% 19.9% 19.5% Operating earnings $ 38.4 $ 37.4 $ 17.1 $ 12.2 $ 45.2 $ 7.7 $ 6.9 $ 7.1 $ 6.0 $ 5.2 Other (income) expense, net (0.2) (0.1) (0.2) (0.1) (1.0) (0.2) (0.1) 0.7 (0.2) (0.4) Earnings from before before interest interest and and income income taxes taxes 38.6 37.5 17.3 12.3 46.2 7.9 7.0 6.4 6.2 5.6 Stock-based compensation expense 3.1 3.3 3.6 3.4 3.1 0.2 0.2 0.2 0.2 0.2 Intangibles amortization expense 1.2 1.2 1.1 1.2 1.2 0.4 0.5 0.5 0.4 0.2 Impairment charges - - - - - - - - - - Restructuring charges 0.3 0.3 0.5 0.3 2.1 0.3 - 0.1 0.1 - Production transfer costs - 0.1 0.2 0.7 2.1 0.4 0.4 0.5 0.3 - Other - - - - - 0.2 - 1.3 0.2 - Adjusted earnings before interest and income taxes $ 43.2 $ 42.4 $ 22.7 $ 17.9 $ 54.7 $ 9.4 $ 8.1 $ 9.0 $ 7.4 $ 6.0 Adjusted earnings before interest and income taxes as % of revenues 23.4% 21.3% 15.0% 12.2% 29.2% 24.2% 21.8% 24.6% 23.1% 21.3% 5 5

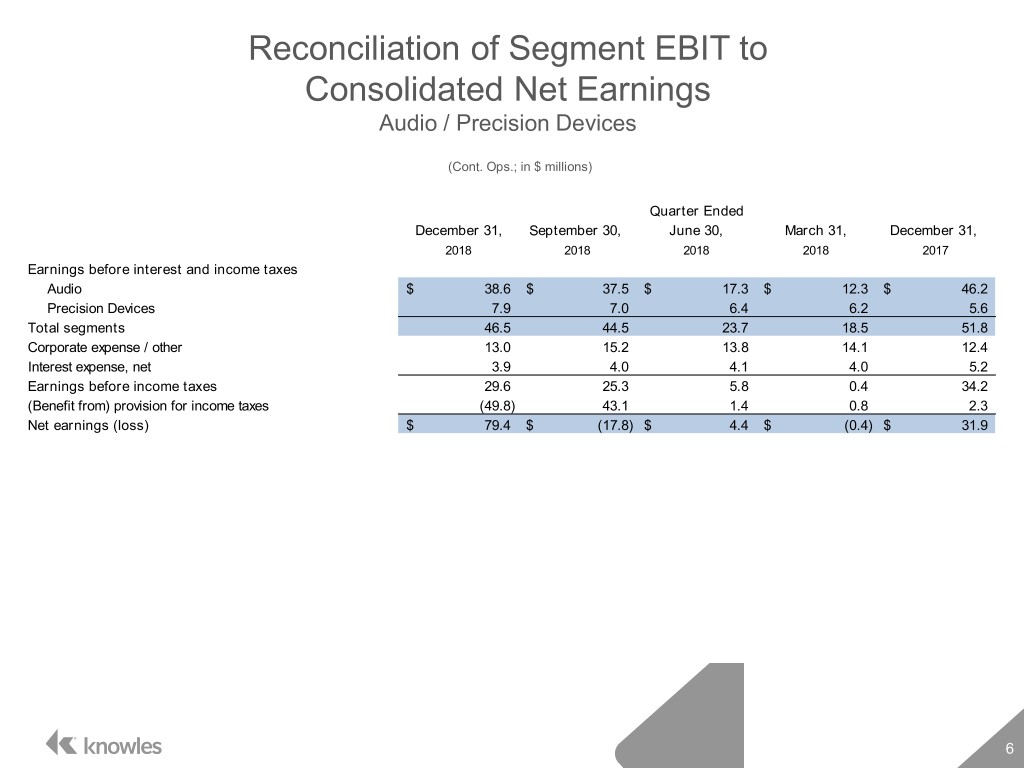

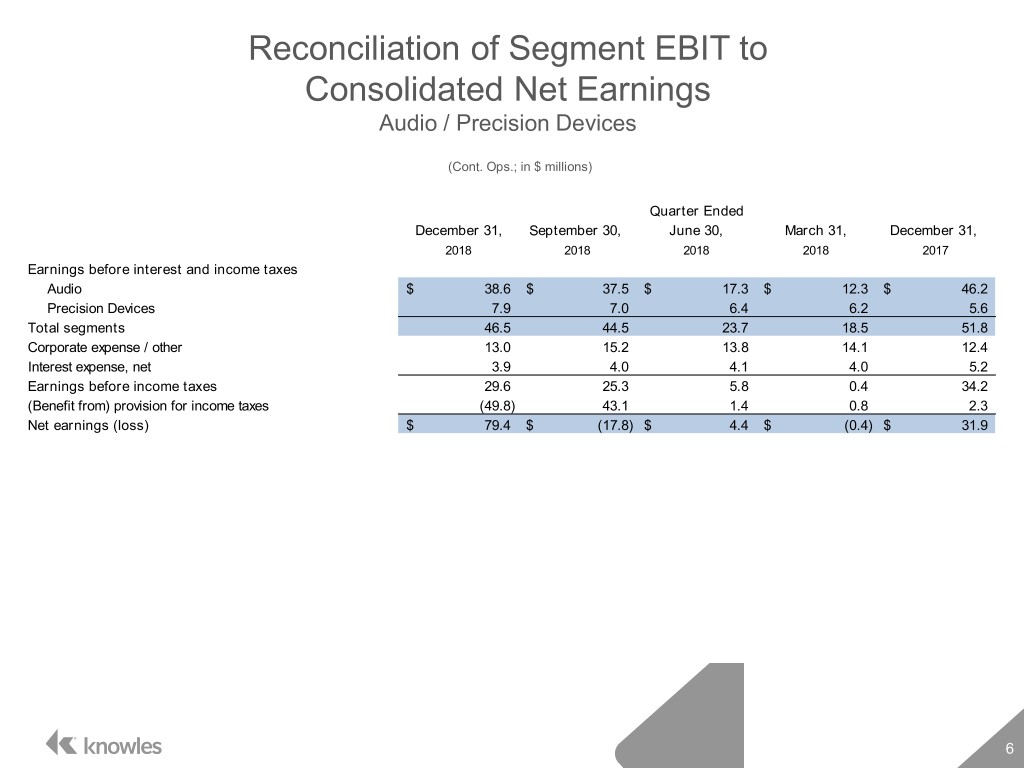

Reconciliation of Segment EBIT to Consolidated Net Earnings Audio / Precision Devices (Cont. Ops.; in $ millions) Quarter Ended December 31, September 30, June 30, March 31, December 31, 2018 2018 2018 2018 2017 Earnings before interest and income taxes Audio $ 38.6 $ 37.5 $ 17.3 $ 12.3 $ 46.2 Precision Devices 7.9 7.0 6.4 6.2 5.6 Total segments 46.5 44.5 23.7 18.5 51.8 Corporate expense / other 13.0 15.2 13.8 14.1 12.4 Interest expense, net 3.9 4.0 4.1 4.0 5.2 Earnings before income taxes 29.6 25.3 5.8 0.4 34.2 (Benefit from) provision for income taxes (49.8) 43.1 1.4 0.8 2.3 Net earnings (loss) $ 79.4 $ (17.8) $ 4.4 $ (0.4) $ 31.9 6 6