Investor Presentation November 30, 2021

2 Safe Harbor Forward Looking Statements This presentation contains forward-looking statements within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995, such as statements about our future plans, objectives, expectations, financial performance, and continued business operations. The words “believe,” “expect,” “anticipate,” “project,” “estimate,” “budget,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “seek,” “should,” “will,” “would,” “objective,” ”path,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” and similar expressions, among others, generally identify forward-looking statements, which speak only as of the date the statements were made. The statements in this presentation are based on currently available information and the current expectations, forecasts, and assumptions of Knowles’ management concerning risks and uncertainties that could cause actual outcomes or results to differ materially from those outcomes or results that are projected, anticipated, or implied in these statements, including risks relating to the COVID-19 pandemic and governmental responses to it, including but not limited to, the impact on our supply chain, power disruptions, customer demand, and costs associated with our operations. Other risks and uncertainties include, but are not limited to: unforeseen changes in MEMS microphone demand from our largest customers, in particular, two North American, a Korean, and Chinese OEM customers; our ongoing ability to execute our strategy to diversify our end markets and customers; our ability to stem or overcome price erosion in our segments; fluctuations in our stock's market price; fluctuations in operating results and cash flows; our ability to prevent or identify quality issues in our products or to promptly remedy any such issues that are identified; the timing of OEM product launches; risks associated with increasing our inventories in advance of anticipated orders by customers; global economic instability; the impact of changes to laws and regulations that affect the Company’s ability to offer products or services to customers in different regions; risks associated with shareholder activism, including proxy contests; our ability to achieve continued reductions in our operating expenses; the ability to qualify our products and facilities with customers; our ability to obtain, enforce, defend or monetize our intellectual property rights; difficulties or delays in and/or the Company’s inability to realize expected cost synergies from its acquisitions; increases in the costs of critical raw materials and components; availability of raw materials and components; managing new product ramps and introductions for our customers; our dependence on a limited number of large customers; our ability to maintain and expand our existing relationships with leading OEMs in order to maintain and increase our revenue; increasing competition and new entrants in the market for our products; our ability to develop new or enhanced products or technologies in a timely manner that achieve market acceptance; our reliance on third parties to manufacture, assemble, and test our products and sub-components; escalating international trade tensions, new or increased tariffs and trade wars among countries; financial risks, including risks relating to currency fluctuations, credit risks and fluctuations in the market value of the Company; market risk associated with fluctuations in commodity prices, particularly for various precious metals used in our manufacturing operation, and changes in tax laws, changes in tax rates and exposure to additional tax liabilities; and other risks, relevant factors, and uncertainties identified in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, as updated in our Quarterly Report on Form 10-Q for the quarter ended June 30,2021, subsequent Reports on Forms 10-Q and 8-K and our other filings we make with the U.S. Securities and Exchange Commission. These forward-looking statements speak only as of the date of this presentation, and Knowles disclaims any intention or obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Non-GAAP Disclaimer The financial results disclosed in this presentation include certain measures calculated and presented in accordance with GAAP. In addition to the GAAP results included in this presentation, Knowles has presented supplemental, non-GAAP gross profit, earnings before interest and income taxes, adjusted earnings before interest and income taxes, adjusted earnings before interest and income taxes margin, non-GAAP gross profit margin, non-GAAP diluted earnings per share, free cash flow, free cash flow margin, and non-GAAP operating expense margin to facilitate evaluation of Knowles’ operating performance. These non-GAAP financial measures exclude certain amounts that are included in the most directly comparable GAAP measure. In addition, these non-GAAP financial measures do not have standard meanings and may vary from similarly titled non-GAAP financial measures used by other companies. Knowles uses non-GAAP measures as supplements to its GAAP results of operations in evaluating certain aspects of its business, and its executive management team focuses on non-GAAP items as key measures of Knowles’ performance for business planning purposes. These measures assist Knowles in comparing its performance between various reporting periods on a consistent basis, as these measures remove from operating results the impact of items that, in Knowles’ opinion, do not reflect its core operating performance. Knowles believes that its presentation of these non-GAAP financial measures is useful because it provides investors and securities analysts with the same information that Knowles uses internally for purposes of assessing its core operating performance. For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures, see the reconciliation tables in the Appendix.

Our Company 3

A global technology leader and manufacturer. Knowles develops advanced micro-acoustic microphones, speakers, audio solutions, high performance capacitors and RF filters for the world’s leading technology providers. * For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation 2021 Estimates are calculated using the mid-point of Q4 guidance as of November 30, 2021 and the nine months ended September 30, 2021 Who We Are 13 Countries 1000+ Engineering & Technology Employees 7000+ Total Employees $866M 2021E Revenue $171M 2021E Adjusted EBIT * $118M 2021E Free Cash Flow * Founded: 1946 HQ: Itasca, IL NYSE: KN 2021E REVENUE BY SEGMENT Precision Devices 23% 77% Audio 900+ Granted and Pending Patents 4

LOWER MARGIN PRODUCTS AND MARKETS HIGHEST VALUE PRODUCTS & MARKETS $ Over the past five years, we have optimized our product and market portfolio to deliver higher growth, earnings and cash flow. We have built a highly sustainable business with unique capabilities in solving customers’ most complex technical challenges. Our product innovation and manufacturing expertise are unparalleled in the industry. 5 Repositioned to drive improved financial performance. Investment Thesis Investment in High-Growth Markets • Leader in technology and market share across diversified set of end markets • Focusing on market segments with most favorable tailwinds Innovation in Design • Shifting R&D towards higher value areas • Innovating across complex customer needs to maximize differentiation Discipline in Capital Deployment • Returns-focused approach to R&D and CapEx investment • Strengthening balance sheet through debt paydown • Driving value through accretive M&A and share buybacks

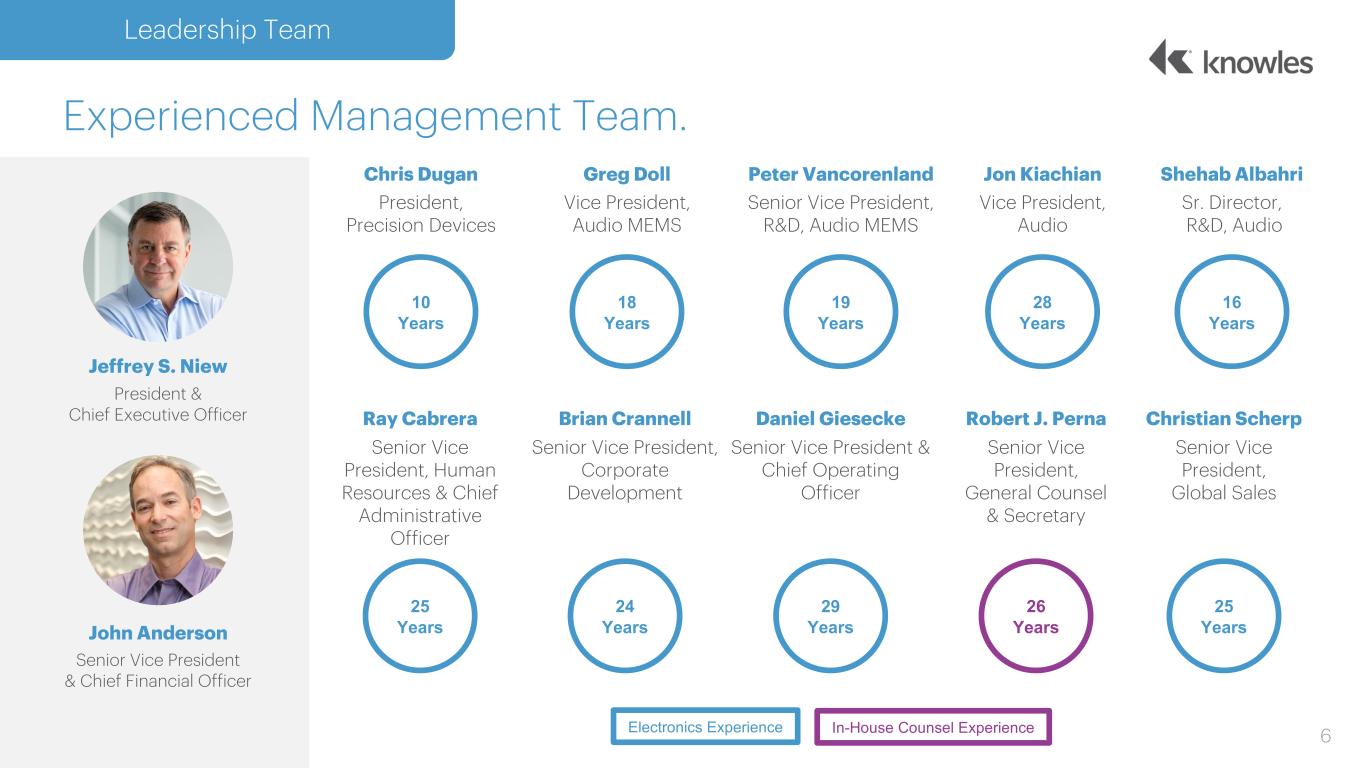

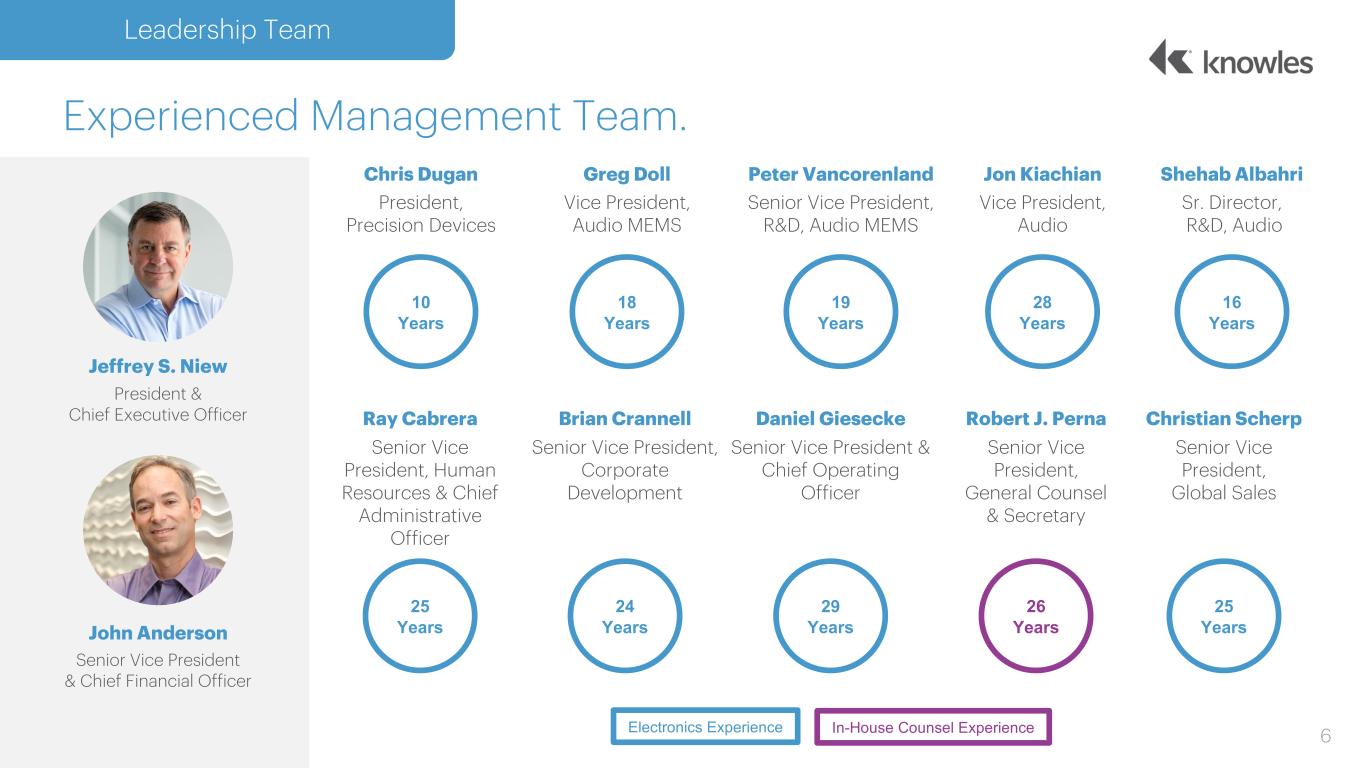

6 Experienced Management Team. Leadership Team Jeffrey S. Niew President & Chief Executive Officer John Anderson Senior Vice President & Chief Financial Officer Chris Dugan President, Precision Devices Daniel Giesecke Senior Vice President & Chief Operating Officer Ray Cabrera Senior Vice President, Human Resources & Chief Administrative Officer Brian Crannell Senior Vice President, Corporate Development Christian Scherp Senior Vice President, Global Sales Robert J. Perna Senior Vice President, General Counsel & Secretary Jon Kiachian Vice President, Audio Greg Doll Vice President, Audio MEMS Shehab Albahri Sr. Director, R&D, Audio Peter Vancorenland Senior Vice President, R&D, Audio MEMS Electronics Experience 10 Years 24 Years 25 Years 18 Years 19 Years 28 Years 16 Years 29 Years 25 Years 26 Years In-House Counsel Experience

7 Shift in strategy to expand margins. Business Transformation Achievements Since 2016, we have executed multiple initiatives to improve performance and shareholder value: • Divested smartphone focused, lower margin speaker and receiver business • Divested highly cyclical, lower margin timing device business • Closed four accretive transactions expanding our capabilities for the defense and medical markets • Acquired MEMS Microphone ASIC capabilities • Realigned R&D and CapEx spend to higher value markets • Drove SG&A and overhead expense efficiencies Revenue above 40% Gross Profit Margin * 2021 Revenue through the nine months ended September 30, 2021. Above 40% Gross Profit Margin Below 40% Gross Profit Margin 2017 2021*

Non-GAAP DILUTED EPS* ($) 2017 2021E Since implementing our strategy to more deeply invest in market segments that yield the most attractive margins and free cash flow, our financial performance has continued to improve year over year. * For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation 2017 results include $13.6 million in revenue and $5.6 million related to recovered legal expenses associated with the settlement of a royalty dispute. Management estimates that $13.0 million of the settlement proceeds relate to years prior to 2017 2021 Estimates are calculated using the mid-point of Q4 guidance as of November 30, 2021 and the nine months ended September 30, 2021 8 We have significantly improved our financial performance from 2017 to 2021. Financial Improvement 5.5 13.7 2017 2021E 14.9 19.7 2017 2021E 744.2 866.3 2017 2021E REVENUE ($M) Non-GAAP GROSS PROFIT MARGIN* (%) ADJUSTED EBIT MARGIN* (%) FREE CASH FLOW MARGIN* (%) +4.8% 40.3 41.1 2017 2021E +0.8%3.9% CAGR +8.2% 0.88 1.50 14.3% CAGR

* Reconciliations of these forward-looking Non-GAAP financial measures to the most directly comparable GAAP financial measures are not provided because the information needed to complete a reconciliation is unavailable without unreasonable effort Strategy provides a path to greater returns. Growth Potential remove the “mid- term target” time reference, just focus it on $2.50. Provides path to $2.50+ Non-GAAP diluted earnings per share* Organic growth Improving gross margins Focused investments Accretive M&A and share buybacks 9

Our Markets 10

While every one of our markets is experiencing favorable tailwinds, we are investing in those with the strongest growth and macro trends. 11 Focusing on markets with the most attractive growth potential. Market Focus MedTech Smartphone Industrial Compute Ear IoT Defense Electric Vehicle Telecom Growth Core

12 Shift in mix of markets drives higher gross margins. 2017 results include $13.6 million in revenue and $5.6 million related to recovered legal expenses associated with the settlement of a royalty dispute. Management estimates that $13.0 million of the settlement proceeds relate to years prior to 2017 2021 Estimates are calculated using the mid-point of Q4 guidance as of November 30, 2021 and the nine months ended September 30, 2021 Market Shift We have expanded the markets we serve beyond the the smartphone industry. Today, our business is more diversified across the markets that yield higher gross margins. 2017 REVENUE Electric Vehicle 2% Defense 9% Industrial/Telecom 9% Ear/IoT/Compute 31% MedTech 27% Smartphone 22% 2021E REVENUE Electric Vehicle 1% Defense 5% Industrial/Telecom 7% Ear/IoT/Compute 26% MedTech 26% Smartphone 35%

Our Products 13

Long-held reputation in delivering high performance products. 14 Product Innovation With decade upon decade of manufacturing expertise, our technology has consistently outperformed competitive products. We are uniquely capable of creating innovative solutions to complex technical needs, enabling performance for our customers. Innovate Deliver Design Innovate a concept for differentiated, customer-driven features & functionality Design a high quality, high performance, cost-effective product Differentiate ourselves through unique manufacturing techniques & processes Enable our customers to consistently offer new products & applications Manufacture

We have redirected our innovation and manufacturing capabilities to focus on higher growth and financial return opportunities. We seek to amplify the success of our fastest growing segment, Precision Devices. Focus on value and specialization. Product Investments Reduced Investments: • Commoditized products with low gross margins and ROIC • Audio DSP opportunities where the rate of market adoption did not justify our level of investment Increased Investments: • Specialized products for unique and emerging applications which value our differentiated technology • Focused organic investments which provide reliable earnings and cash flow • Solutions that cater to attractive Defense, EV, and MedTech markets 15

16 Two platforms with industry-leading performance in every market. 1. Source for SAM: GlobalData Plc, Paumanok Group, Mobile Experts LLC, and KN customer intelligence 2. Source for SAM: Futuresource Consulting Ltd, SAR Insight & Consulting, Omdia, European Hearing Instrument Manufacturers Association, ABI Research and KN customer intelligence Product Portfolio RF Filtering Solutions High frequency filtering for next generation communication. COMPUTE EAR IoT MEDTECH SMARTPHONE A U D IO MEMS Microphones Optimized signal to noise and power performance in compact, environmentally robust, cost- effective form factors. PR EC IS IO N D EV IC ES RF & MICROWAVE CAPACITORS $1.0B SAM $1.7B SAM High Performance Capacitors High voltage, temp, reliability and capacitance/size. Balanced Armature Speakers High output in a compact power efficient package. Audio Solutions Advanced assemblies and signal processing solutions. 1 2

INDUSTRIAL 5–7%CAGR Source for CAGR and SAM: GlobalData Plc, Paumanok Group, and KN customer intelligence 17 PR EC IS IO N D EV IC ES Specializing in high voltage, high temp, high reliability capacitors for mission critical applications. CAPACITORS RF & MICROWAVE SAM $550M ADVANTAGES Broad offering and highest performance for the most challenging applications The ability to solve customer-specific design challenges Our unique high voltage, high temperature, high reliability ceramic capabilities Multiple proprietary manufacturing processes provide advantages in speed, flexibility and customization PRODUCT LIST Multi-Layer Ceramic Capacitors Single Layer Ceramic Capacitors Trimmer Capacitors IMPLANTABLE ELECTRIC VEHICLE DEFENSE IMAGING SYSTEM 2021–2024

CAGR Source for CAGR and SAM: Mobile Experts LLC, Global Data Plc, and KN customer intelligence 18 PR EC IS IO N D EV IC ES Delivering high performance ceramic filtering across a broad range of applications and frequencies. CAPACITORS RF & MICROWAVE SAM $475M ADVANTAGES Materials and RF expertise in ceramic filtering for 30 MHz to 60GHz Capabilities to serve expanded use of radio spectrum in defense and 5G telecom Higher stability (K) in smallest footprint enables customers to expand capabilities in size constrained applications Custom design, rapid prototyping and RF testing to ensure optimal performance PRODUCT LIST Microwave and mmWave Filters Couplers Power Dividers Gain Equalizers Bias Networks and Resonators DEFENSE COMMUNICATION AEROSPACE DEFENSE RADAR 5G TELECOM 6–10% 2021–2024

CAGR Source for CAGR and SAM: Futuresource Consulting Ltd, SAR Insight & Consulting, Omdia, and KN customer intelligence 19 A U D IO Enabling an unrivaled listening experience through groundbreaking innovation in ear-worn devices. SAM $475M ADVANTAGES Recognized as the leader in providing microphones and balanced armature speakers for high- performance all-day wear Size, power, robustness and audio performance enabling new use cases and form factors Unmatched Ear audio application expertise Investments in automation enable the adoption of balanced armature for volume consumer applications PRODUCT LIST Microphones Speakers Audio Solutions COMPUTEEAR IoT MEDTECH SMARTPHONE TRUE WIRELESS STEREO (TWS) IN EAR MONITOR 10–20% 2021–2024

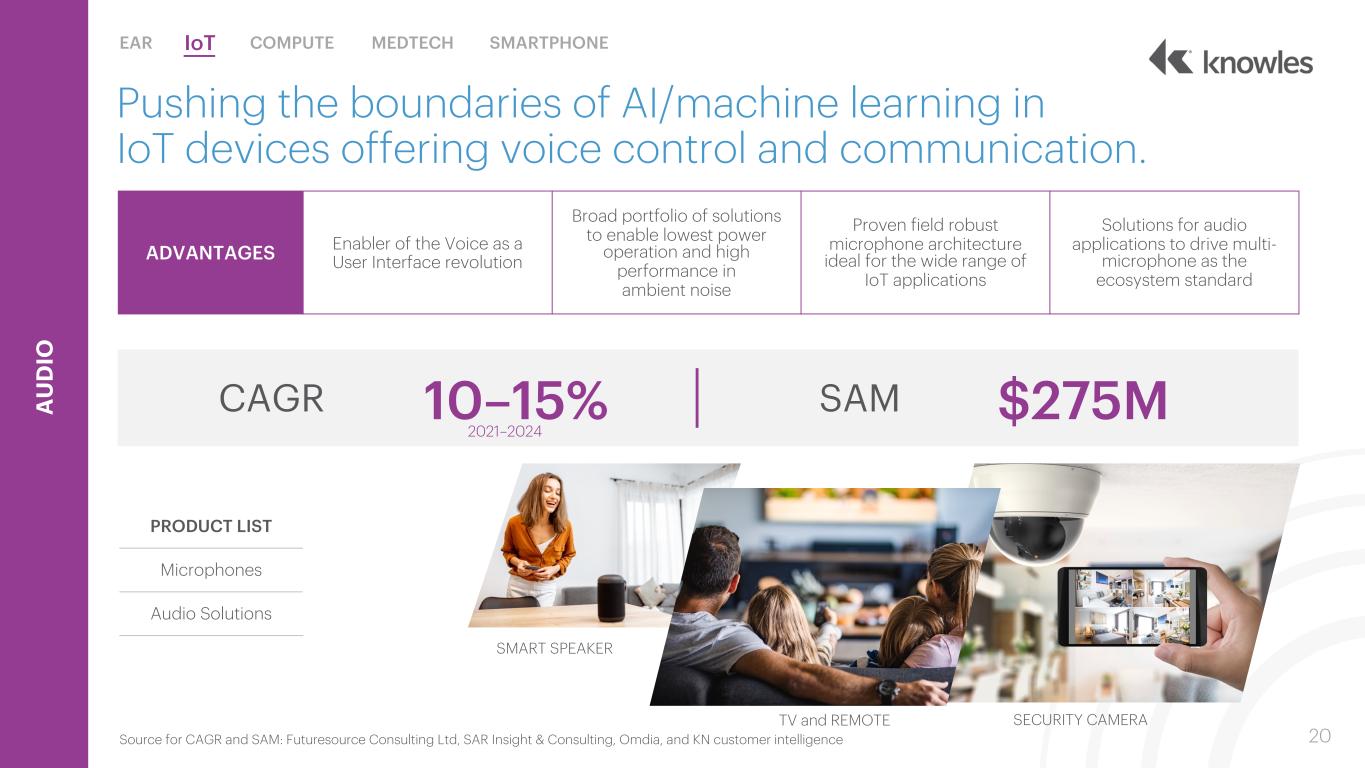

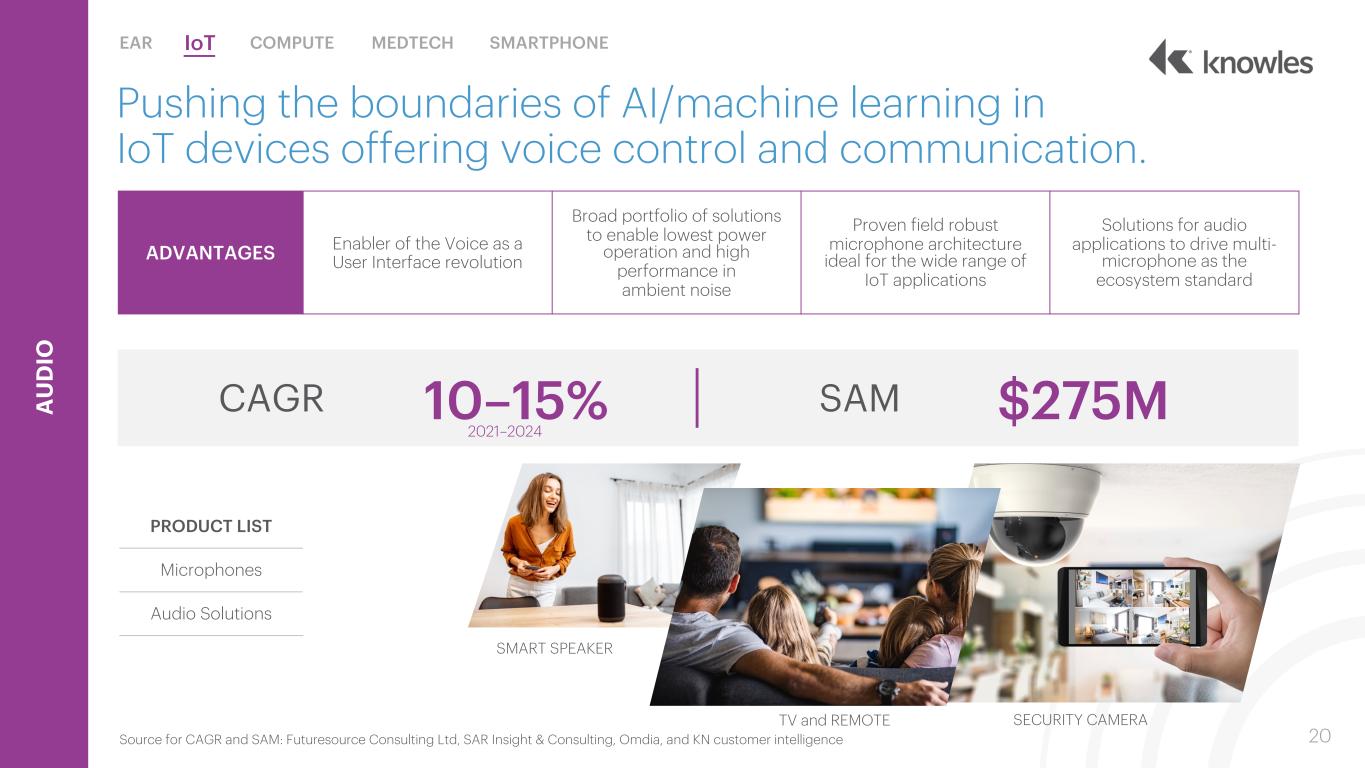

SMART SPEAKER CAGR 20 A U D IO Pushing the boundaries of AI/machine learning in IoT devices offering voice control and communication. SAM $275M ADVANTAGES Enabler of the Voice as a User Interface revolution Broad portfolio of solutions to enable lowest power operation and high performance in ambient noise Proven field robust microphone architecture ideal for the wide range of IoT applications Solutions for audio applications to drive multi- microphone as the ecosystem standard PRODUCT LIST Microphones Audio Solutions COMPUTEEAR IoT MEDTECH SMARTPHONE SECURITY CAMERATV and REMOTE 10–15% 2021–2024 Source for CAGR and SAM: Futuresource Consulting Ltd, SAR Insight & Consulting, Omdia, and KN customer intelligence

CAGR Source for CAGR and SAM: Omdia 21 A U D IO Enabling high quality communication from anywhere. SAM $165M PRODUCT LIST Microphones COMPUTEEAR IoT MEDTECH SMARTPHONE ADVANTAGES Pioneering leader with a proven track record of quality Differentiated with compute application expertise, system simulation and test capabilities Performance to enable next generation compute form factors and audio ecosystem trends Enabling high performance communication for the work from anywhere world TABLET DESKTOP LAPTOP 2–5% 2021–2024

CAGR Source for CAGR and SAM: European Hearing Instrument Manufacturers Association and KN customer intelligence 22 A U D IO Delivering the highest performing solutions to address hearing loss. SAM $300M PRODUCT LIST Microphones Speakers Advanced Assemblies COMPUTEEAR IoT MEDTECH SMARTPHONE ADVANTAGES An undisputed legacy in microphone and balanced armature speaker innovation for the hearing health market Leveraging audio and application expertise to address new use cases and enhanced environmental performance Leading the market in manufacturing scale, quality, process design and supply reliability Unique expertise for addressing needs in both hearing augmentation and audio quality HEARING AID 3–6% 2021–2024

CAGR Source for CAGR and SAM: ABI Research and KN customer intelligence 23 A U D IO Driving innovation to enable audio features for leading, high volume smartphone providers. SAM $475M PRODUCT LIST Microphones COMPUTEEAR IoT MEDTECH SMARTPHONE ADVANTAGES Industry leader with field proven technology for demanding smartphone applications Broad, unique portfolio to support price and performance levels across the entire market Fully integrated from design to final shipment with dual site manufacturing flexibility and scale Expertise in addressing application RF immunity, environmental robustness, and product quality SMARTPHONE 1–4% 2021–2024

Social Responsibility • Diversity and inclusion strategy centered on three pillars • Closing the gender gap through multiple programs, e.g. University of Illinois at Chicago Women in Engineering Program • Training programs in place to educate employees about workplace safety and their health and well-being outside of the workplace Striving to be an ethically, socially and environmentally responsible steward to the communities in which we live and work. A steadfast commitment. ESG Efforts * The use by Knowles of any MSCI ESG Research LLC or its affiliates (“MSCI”) data, and the use of MSCI logos, trademarks, service marks or index names herein, do not constitute a sponsorship, endorsement, recommendation, or promotion of Knowles by MSCI. MSCI services and data are the property of MSCI or its information providers, and are provided ‘as-is’ and without warranty. MSCI names and logos are trademarks or service marks of MSCI. 24 Environmental Sustainability • Issued inaugural 2021 Corporate Sustainability Report • Continually investigating and evaluating new ways to reduce the materials we use, waste we produce and energy we consume • Working towards a sustainable supply chain • Engineering our products to enable lower power consumption • As of 2021, Knowles received an MSCI ESG Rating of A Governance Highlights • Declassified Board as of 2021 • Separate non-executive Chairman and CEO roles • Board member average tenure is 5 years • Committees comprised of independent directors • Regular Board, Committee and Director evaluations Educate, Train & Build Awareness Recruit, Grow & Promote Give Back & Get Involved BOARD DIVERSITY Women 25% 2 of 8 directors are women Ethnically Diverse 25% 1 African American director, 1 Asian American director Born Outside U.S. 50% 4 of 8 directors MSCI* ESG RATING A CCC B BB BBB A AA AAA

Our Financials 25

25.4 21.9 20 17 20 21 E ADJUSTED EBIT MARGIN* (%) REVENUE ($M) 744.2 866.3 20 17 20 21 E Non-GAAP OPERATING EXPENSE MARGIN* (%) 40.3 41.1 20 17 20 21 E Non-GAAP GROSS PROFIT MARGIN* (%) Non-GAAP DILUTED EPS* ($) 20 17 20 21 E 0.88 1.50 * For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation 2017 results include $13.6 million in revenue and $5.6 million related to recovered legal expenses associated with the settlement of a royalty dispute. Management estimates that $13.0 million of the settlement proceeds relate to years prior to 2017 2021 Estimates are calculated using the mid-point of Q4 guidance as of November 30, 2021 and the nine months ended September 30, 2021 26 Track record of improved financial performance. Financial Performance 14.9 19.7 20 17 20 21 E 3.9% CAGR +0.8% +4.8% 14.3% CAGR -3.5%

41.3 18.4 82.7 96.2 118.4 20 17 20 18 20 19 20 20 20 21 E FREE CASH FLOW* ($M) 27 Proven ability to deliver strong free cash flow. Cash Generation * For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation 2017 results include $13.6 million in revenue and $5.6 million related to recovered legal expenses associated with the settlement of a royalty dispute. Management estimates that $13.0 million of the settlement proceeds relate to years prior to 2017 2021 Estimates are calculated using the mid-point of Q4 guidance as of November 30, 2021 and the nine months ended September 30, 2021 Gross Margin Expansion • Focused on markets that value our technology and manufacturing differentiation • Implemented a more disciplined approach to pricing • Divested lower gross margin businesses • Completed acquisitions that were accretive to gross margin Expense Control • Reduced R&D spend where pace of market adoption was below our expectations • Committed to continuous improvement in processes to drive efficiencies • Leveraged ERP system and low-cost shared service center CapEx Discipline • Optimized investments across areas with attractive returns FREE CASH FLOW MARGIN* (%) 5.5 2.2 9.7 12.6 13.7 20 17 20 18 20 19 20 20 20 21 E

28 Strong cash flow generation and debt reduction enables shift in future capital allocation priorities. 2021 Estimates are calculated using the mid-point of Q4 guidance as of November 30, 2021 and the nine months ended September 30, 2021 Capital Deployment Organic Growth • Shift R&D spend to markets with optimal growth trends and products with better profit potential • Redirect Capital Expenditures to markets and products with attractive returns Accretive M&A • Expand technology solutions in focus growth markets Shareholder Returns • Continue to return capital through share repurchase 2 2021E CAPITAL ALLOCATION CURRENT % FUTURE % R&D 23% CapEx 13% Acquisitions & Investments 23% Share Buyback 8% Debt Reduction 33%

Our Outlook 29

30 Drivers of our mid-term financial targets. * Reconciliations of these forward-looking Non-GAAP financial measures to the most directly comparable GAAP financial measures are not provided because the information needed to complete a reconciliation is unavailable without unreasonable effort Financial Outlook Revenue Growth • Growth in the mid to high single digit CAGR% Non-GAAP Gross Profit Margin* • Improve to 43% or more on mix and new product introductions Non-GAAP Operating Expense* • Efficiently leverage resources to support growth and reduce expenses to approximately 20% of revenues

31 Mid-term financial targets. Financial Outlook Adjusted EBIT Margin* 22–24% Free Cash Flow Margin* 15–17% * Reconciliations of these forward-looking Non-GAAP financial measures to the most directly comparable GAAP financial measures are not provided because the information needed to complete a reconciliation is unavailable without unreasonable effort

Focusing on market segments with the most favorable tailwinds including Ear, IoT, MedTech, EV and DefenseDiversification in high-growth markets Successful debt reduction enables increased share buyback Cash generation Unparalleled product performance Innovating across complex customer needs to maximize differentiation Focusing CapEx on our attractive products and markets Expanding M&A to deliver accretive returnsDiscipline in capital deployment Strong earnings potential Path to $2.50+ Non-GAAP Diluted EPS* with top quartile financial metrics among diversified electronic component peers 32 We have built a highly sustainable business with unique capabilities in solving customers’ most complex technical challenges. Key Takeaways Deploying R&D to markets and products with better profit potentialAccretive new product introductions * Reconciliations of these forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures are not provided because the information needed to complete a reconciliation is unavailable without unreasonable effort

Question & Answer (888) 330-3292 (United States) or (646) 960-0857 (International) The conference ID is 7928348 Dial *1 to ask a question 33

Appendix 34

July 28, 2021 Q4 2021 Projections § July 28, 2021 35 GAAP ADJUSTMENTS NON-GAAP Revenue $230–235M — $230–235M Gross Profit Margin 40.5–41.0% 0.3% 40.0–42.0% Diluted EPS $0.32–0.34 $0.11 $0.43–0.45 Projections as of November 30, 2021; Q4 2021 GAAP results are expected to include approximately $0.07 per share in stock-based compensation and $0.04 per share in amortization of intangibles and debt discount. Q4 2021 GAAP guidance does not consider the impact of a potential positive adjustment to the valuation allowance for our U.S. subsidiary. The potential benefit would not impact non-GAAP results.

Years Ended December 31 2021E 1 2017 Gross profit $353.3 $286.3 Gross profit margin 40.8% 38.5% Stock-based compensation expense 1.7 1.8 Impairment charges - 1.4 Restructuring charges - 4.0 Production transfer costs 2 - 6.7 Other 3 1.0 - Non-GAAP gross profit $356.0 $300.2 Non-GAAP gross profit margin 41.1% 40.3% Operating expenses $241.0 $245.8 Stock-based compensation expense (30.7) (22.9) Intangibles amortization expense (14.9) (7.3) Impairment charges (4.0) (19.9) Restructuring charges (0.3) (6.2) Production transfer costs 2 - (0.1) Other 3 (1.7) (0.3) Non-GAAP operating expenses $189.4 $189.1 Non-GAAP operating expenses margin 21.9% 25.4% Earnings from continuing operations $88.4 $6.5 Interest expense, net 13.9 20.6 Provision for income taxes 14.2 12.9 Earnings from continuing operations before interest and income taxes 116.5 40.0 Earnings from continuing operations before interest and income taxes margin 13.5% 5.4% Stock-based compensation expense 32.4 24.7 Intangibles amortization expense 14.9 7.3 Impairment charges 4.0 21.3 Restructuring charges 0.3 10.2 Production transfer costs 2 - 6.8 Other 3 2.7 0.3 Adjusted earnings from continuing operations before interest and income taxes $170.8 $110.6 Adjusted earnings from continuing operations before interest and income taxes margin 19.7% 14.9% Earnings from continuing operations $88.4 $6.5 Non-GAAP reconciling adjustments 4 54.3 70.6 Interest expense, net non-GAAP reconciling adjustments 5 6.6 6.1 Income tax effects of non-GAAP reconciling adjustments 6 6.0 2.0 Non-GAAP net earnings $143.3 $81.2 Diluted earnings per share from continuing operations $0.93 $0.07 Earnings per share non-GAAP reconciling adjustment 0.57 0.81 Non-GAAP diluted earnings per share $1.50 $0.88 Diluted average shares outstanding 94.8 90.5 Non-GAAP adjustment 7 0.8 1.9 Non-GAAP diluted average shares outstanding 7 95.6 92.4 RECONCILIATION OF GAAP FINANCIAL MEASURES TO NON-GAAP FINANCIAL MEASURES ($M, except per share amounts) (unaudited) 5 36 (1) Projections as of November 30, 2021. Calculated as results for the nine months ended September 30, 2021 plus the midpoint of Q4 2021 projections. (2) Production transfer costs represent duplicate costs incurred to migrate manufacturing to facilities primarily in Asia. These amounts are included in the corresponding Gross profit and Earnings from continuing operations before interest and income taxes for each period presented. (3) In 2021, Other expenses represent the ongoing net lease cost (income) related to facilities not used in operations and expenses related to the acquisition of Integrated Microwave Corporation by the Precision Devices segment. In 2017, Other primarily represents expenses related to the acquisition of certain assets of a capacitors manufacturer. (4) The non-GAAP reconciling adjustments are those adjustments made to reconcile Earnings from continuing operations before interest and income taxes to Adjusted earnings from continuing operations before interest and income taxes. (5) Under GAAP, certain convertible debt instruments that may be settled in cash (or other assets) upon conversion are required to be separately accounted for as liability (debt) and equity (conversion option) components of the instrument in a manner that reflects the issuer’s nonconvertible debt borrowing rate. Accordingly, for GAAP purposes we were required to recognize imputed interest expense on the Company’s $172.5 million of convertible senior notes due November 1, 2021 that were issued in a private placement in May 2016. The imputed interest rate for the convertible notes was 8.12%, while the actual coupon interest rate of the notes was 3.25%. The difference between the imputed interest expense and the coupon interest expense is excluded from management’s assessment of the Company’s operating performance because management believes that this non-cash expense is not indicative of its core, ongoing operating performance. (6) Income tax effects of non-GAAP reconciling adjustments are calculated using the applicable tax rates in the jurisdictions of the underlying adjustments. (7) The number of shares used in the diluted per share calculations on a non-GAAP basis excludes the impact of stock-based compensation expense expected to be incurred in future periods and not yet recognized in the financial statements, which would otherwise be assumed to be used to repurchase shares under the GAAP treasury stock method. In addition, the Company entered into convertible note hedge transactions to offset any potential dilution from the convertible notes. Although the anti-dilutive impact of the convertible note hedges is not reflected under GAAP, the Company includes the anti-dilutive impact of the convertible note hedges in non-GAAP diluted average shares outstanding, if applicable.

5 37 FREE CASH FLOW ($M) Years Ended Dec. 31, 2021E1 2020 2019 2018 2017 Cash provided by operating activities $166.6 $128.1 $123.9 $98.5 $92.9 Less: Capital expenditures (48.2) (31.9) (41.2) (80.1) (51.6) Free cash flow $118.4 $96.2 $82.7 $18.4 $41.3 Free cash flow margin 13.7% 12.6% 9.7% 2.2% 5.5% (1) Projections as of November 30, 2021. Calculated as results for the nine months ended September 30, 2021 plus the midpoint of Q4 2021 projections.