3rd Quarter 2023 Earnings Release Supplemental Information November 2, 2023

2 Safe Harbor Forward Looking Statements This presentation contains forward-looking statements within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995, such as statements about our future plans, objectives, expectations, financial performance, and continued business operations. The words “believe,” “expect,” “anticipate,” “project,” “estimate,” “budget,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “seek,” “should,” “will,” “would,” “objective,” ”path,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” and similar expressions, among others, generally identify forward- looking statements, which speak only as of the date the statements were made. The statements in this presentation, including those statements related to our expectations regarding the acquisition of Cornell Dubilier, are based on currently available information and the current expectations, forecasts, and assumptions of Knowles’ management concerning risks and uncertainties that could cause actual outcomes or results to differ materially from those outcomes or results that are projected, anticipated, or implied in these statements. Other risks and uncertainties include, but are not limited to: unforeseen changes in MEMS microphone demand from our largest customers, particularly our top five customers, who represent a significant portion of revenues for our Consumer MEMS Microphone segment; our ongoing ability to execute our strategy to diversify our end markets and customers; our ability to stem or overcome price erosion in our segments; fluctuations in our stock's market price; fluctuations in operating results and cash flows; our ability to prevent or identify quality issues in our products or to promptly remedy any such issues that are identified; the timing of OEM product launches; risks associated with increasing our inventories in advance of anticipated orders by customers; global economic instability, including due to inflation, rising interest rates, negative impacts caused by pandemics and public health crises, or the impacts of geopolitical uncertainties; the impact of changes to laws and regulations that affect the Company’s ability to offer products or services to customers in different regions; our ability to achieve reductions in our operating expenses; the ability to qualify our products and facilities with customers; our ability to obtain, enforce, defend or monetize our intellectual property rights; disruption caused by a cybersecurity incident, including a cyber attack, cyber breach, theft, or other unauthorized access; difficulties or delays in and/or the Company’s inability to realize expected synergies from its acquisitions; increases in the costs of critical raw materials and components; availability of raw materials and components; managing new product ramps and introductions for our customers; our dependence on a limited number of large customers; our ability to maintain and expand our existing relationships with leading OEMs in order to maintain and increase our revenue; increasing competition and new entrants in the market for our products; our ability to develop new or enhanced products or technologies in a timely manner that achieve market acceptance; our reliance on third parties to manufacture, assemble, and test our products and sub-components; escalating international trade tensions, new or increased tariffs and trade wars among countries; financial risks, including risks relating to currency fluctuations, credit risks and fluctuations in the market value of the Company; a sustained decline in our stock price and market capitalization may result in the impairment of certain intangible or long-lived assets; market risk associated with fluctuations in commodity prices, particularly for various precious metals used in our manufacturing operation, and changes in tax laws, changes in tax rates and exposure to additional tax liabilities; and other risks, relevant factors, and uncertainties identified in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, subsequent Reports on Forms 10-Q and 8-K and our other filings we make with the U.S. Securities and Exchange Commission. These forward-looking statements speak only as of the date of this presentation, and Knowles disclaims any intention or obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Non-GAAP Disclaimer The financial results disclosed in this presentation include certain measures calculated and presented in accordance with GAAP. In addition to the GAAP results included in this presentation, Knowles has presented supplemental, non-GAAP gross profit, adjusted earnings before interest and income taxes, adjusted earnings before interest and income taxes margin, adjusted earnings before interest, taxes, depreciation, and amortization; adjusted earnings before interest, taxes, depreciation, and amortization margin; non-GAAP gross profit margin, non-GAAP diluted earnings per share, non-GAAP operating expense; free cash flow; and free cash flow margin to facilitate evaluation of Knowles’ operating performance. These non-GAAP financial measures exclude certain amounts that are included in the most directly comparable GAAP measure. In addition, these non-GAAP financial measures do not have standard meanings and may vary from similarly titled non-GAAP financial measures used by other companies. Knowles uses non-GAAP measures as supplements to its GAAP results of operations in evaluating certain aspects of its business, and its executive management team focuses on non-GAAP items as key measures of Knowles’ performance for business planning purposes. These measures assist Knowles in comparing its performance between various reporting periods on a consistent basis, as these measures remove from operating results the impact of items that, in Knowles’ opinion, do not reflect its core operating performance. Knowles believes that its presentation of these non-GAAP financial measures is useful because it provides investors and securities analysts with the same information that Knowles uses internally for purposes of assessing its core operating performance. For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures, see the reconciliation tables in the Appendix.

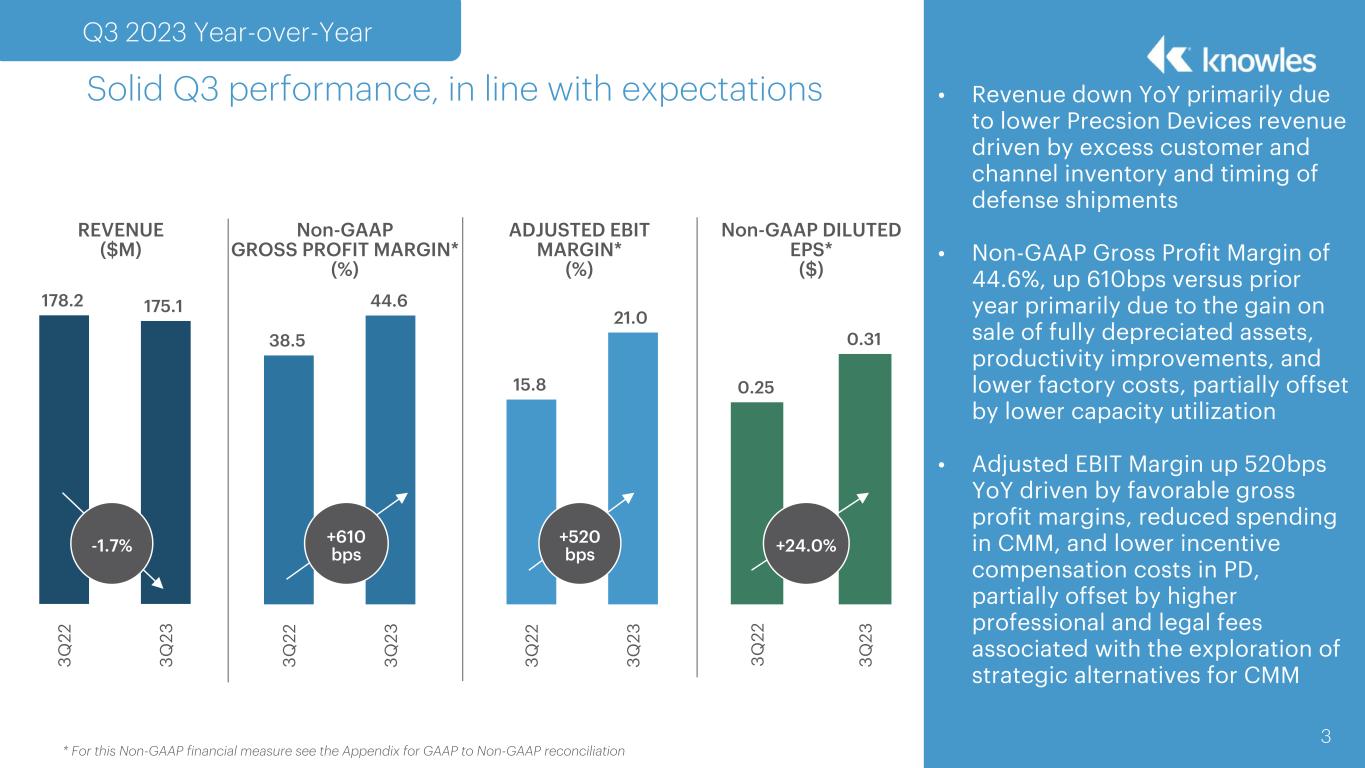

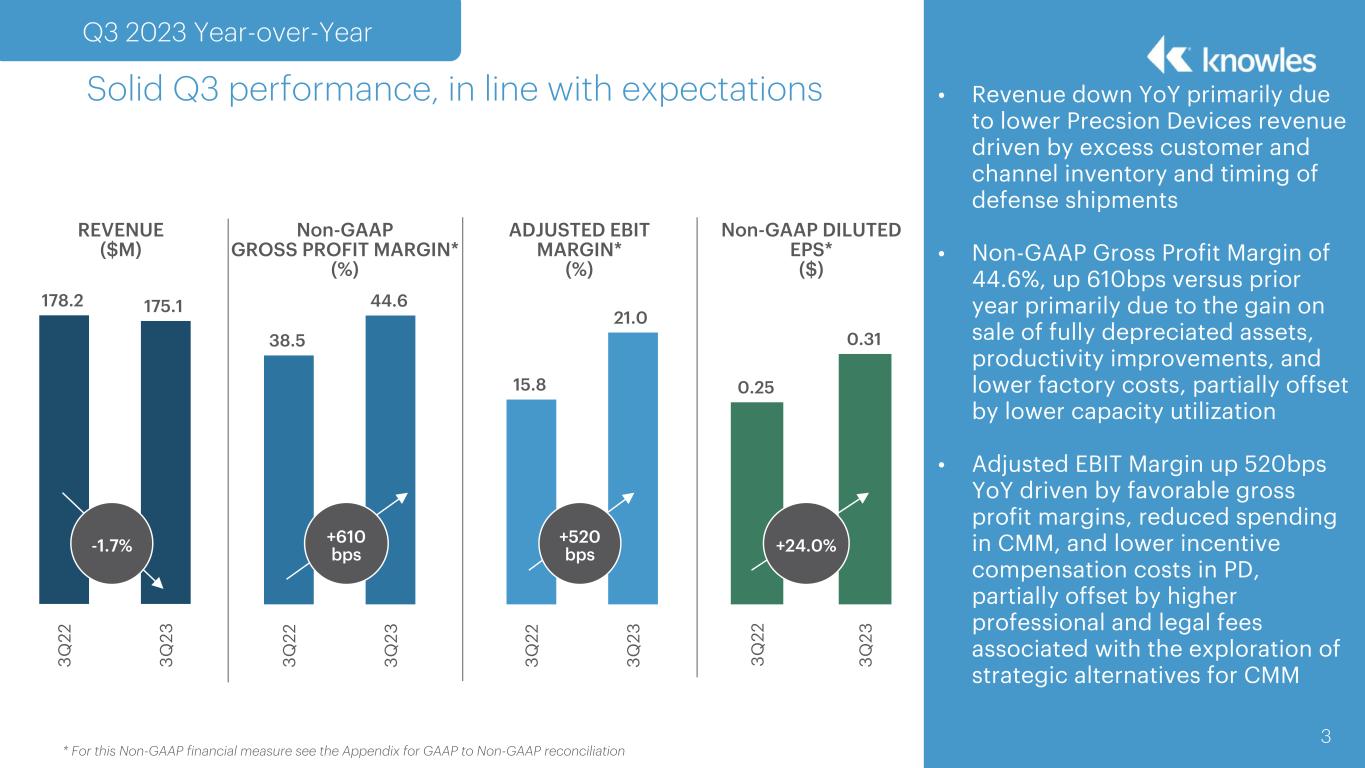

• Revenue down YoY primarily due to lower Precsion Devices revenue driven by excess customer and channel inventory and timing of defense shipments • Non-GAAP Gross Profit Margin of 44.6%, up 610bps versus prior year primarily due to the gain on sale of fully depreciated assets, productivity improvements, and lower factory costs, partially offset by lower capacity utilization • Adjusted EBIT Margin up 520bps YoY driven by favorable gross profit margins, reduced spending in CMM, and lower incentive compensation costs in PD, partially offset by higher professional and legal fees associated with the exploration of strategic alternatives for CMM * For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation 3 Solid Q3 performance, in line with expectations Q3 2023 Year-over-Year 178.2 175.1 3Q 22 3Q 23 38.5 44.6 3Q 22 3Q 23 REVENUE ($M) Non-GAAP GROSS PROFIT MARGIN* (%) 15.8 21.0 3Q 22 3Q 23 ADJUSTED EBIT MARGIN* (%) +520 bps Non-GAAP DILUTED EPS* ($) 0.25 0.31 3Q 22 3Q 23 +24.0%-1.7% +610 bps

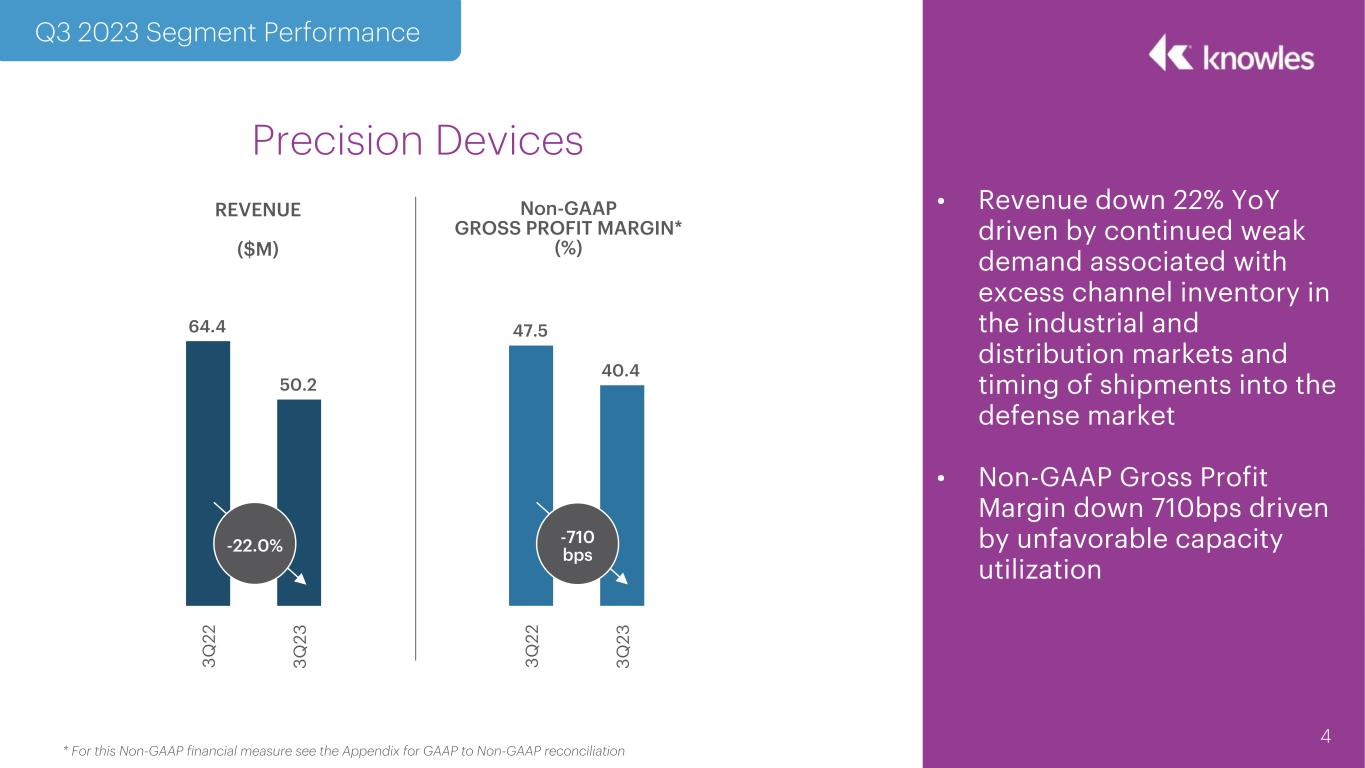

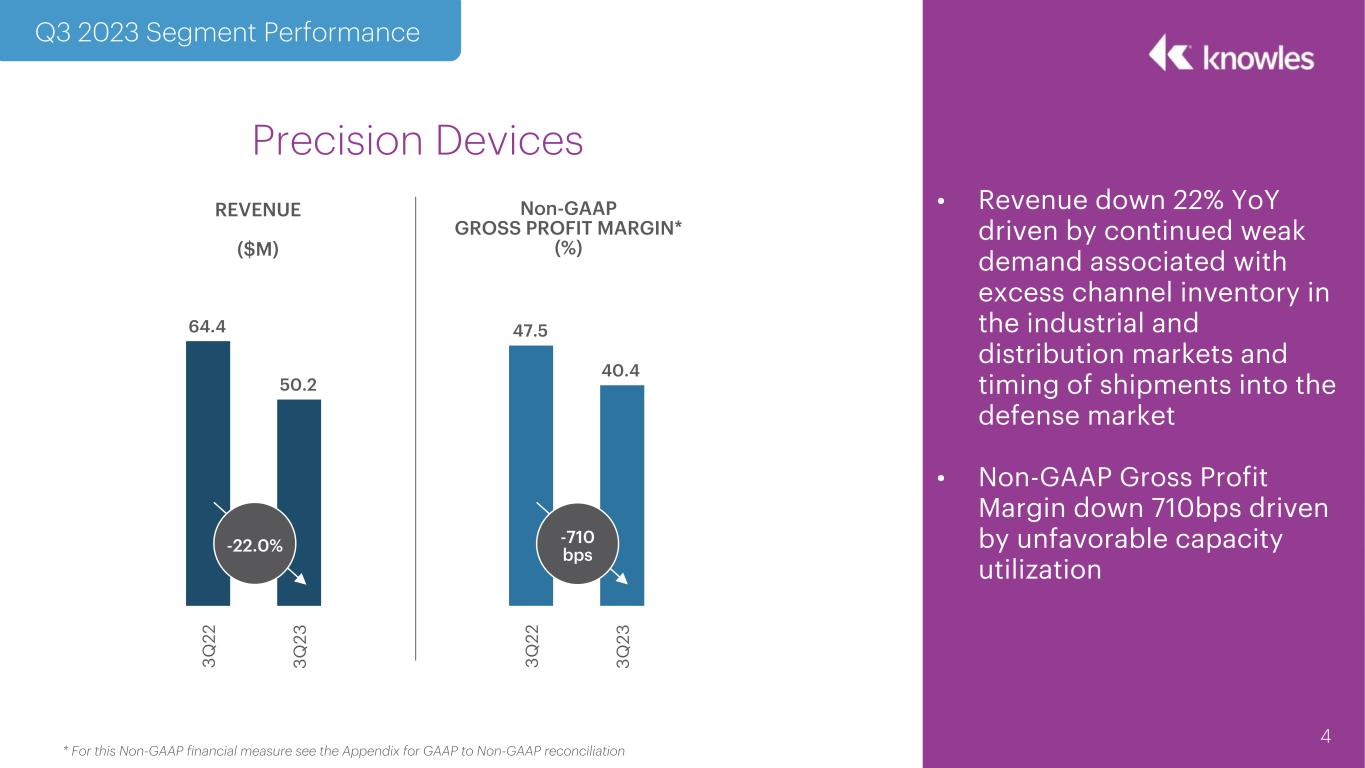

• Revenue down 22% YoY driven by continued weak demand associated with excess channel inventory in the industrial and distribution markets and timing of shipments into the defense market • Non-GAAP Gross Profit Margin down 710bps driven by unfavorable capacity utilization 4 Q3 2023 Segment Performance Precision Devices * For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation REVENUE ($M) Non-GAAP GROSS PROFIT MARGIN* (%) 64.4 50.2 3Q 22 3Q 23 -22.0% 47.5 40.4 3Q 22 3Q 23 -710 bps

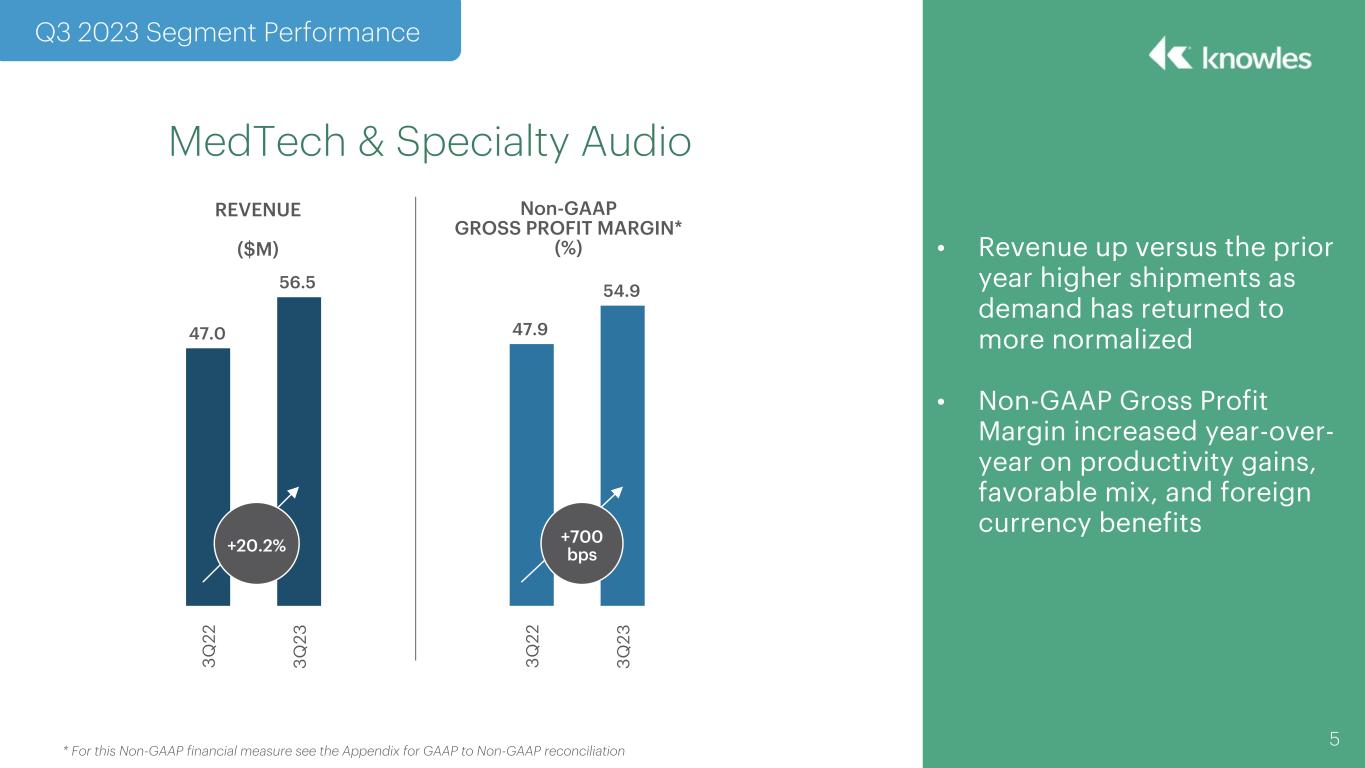

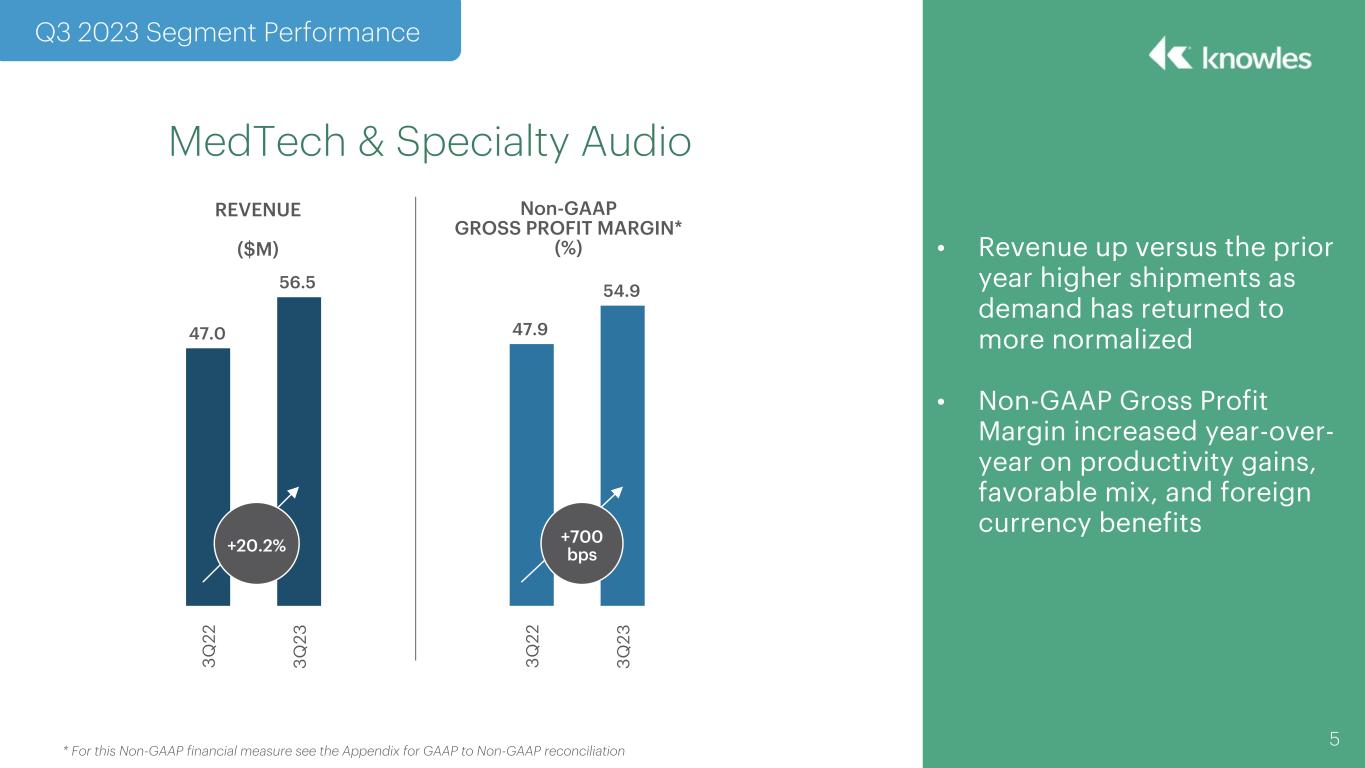

• Revenue up versus the prior year higher shipments as demand has returned to more normalized • Non-GAAP Gross Profit Margin increased year-over- year on productivity gains, favorable mix, and foreign currency benefits Q3 2023 Segment Performance MedTech & Specialty Audio * For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation 5 47.0 56.5 3Q 22 3Q 23 REVENUE ($M) +20.2% Non-GAAP GROSS PROFIT MARGIN* (%) 47.9 54.9 3Q 22 3Q 23 +700 bps

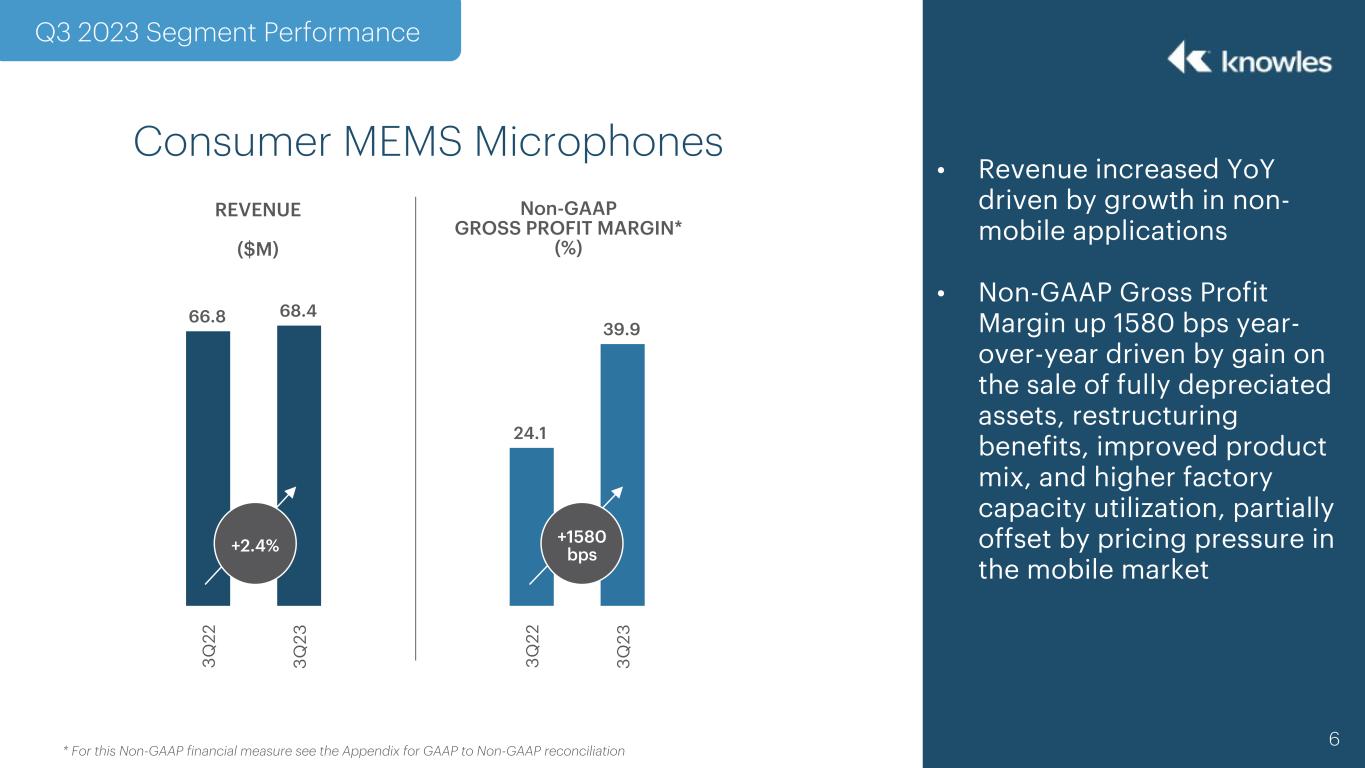

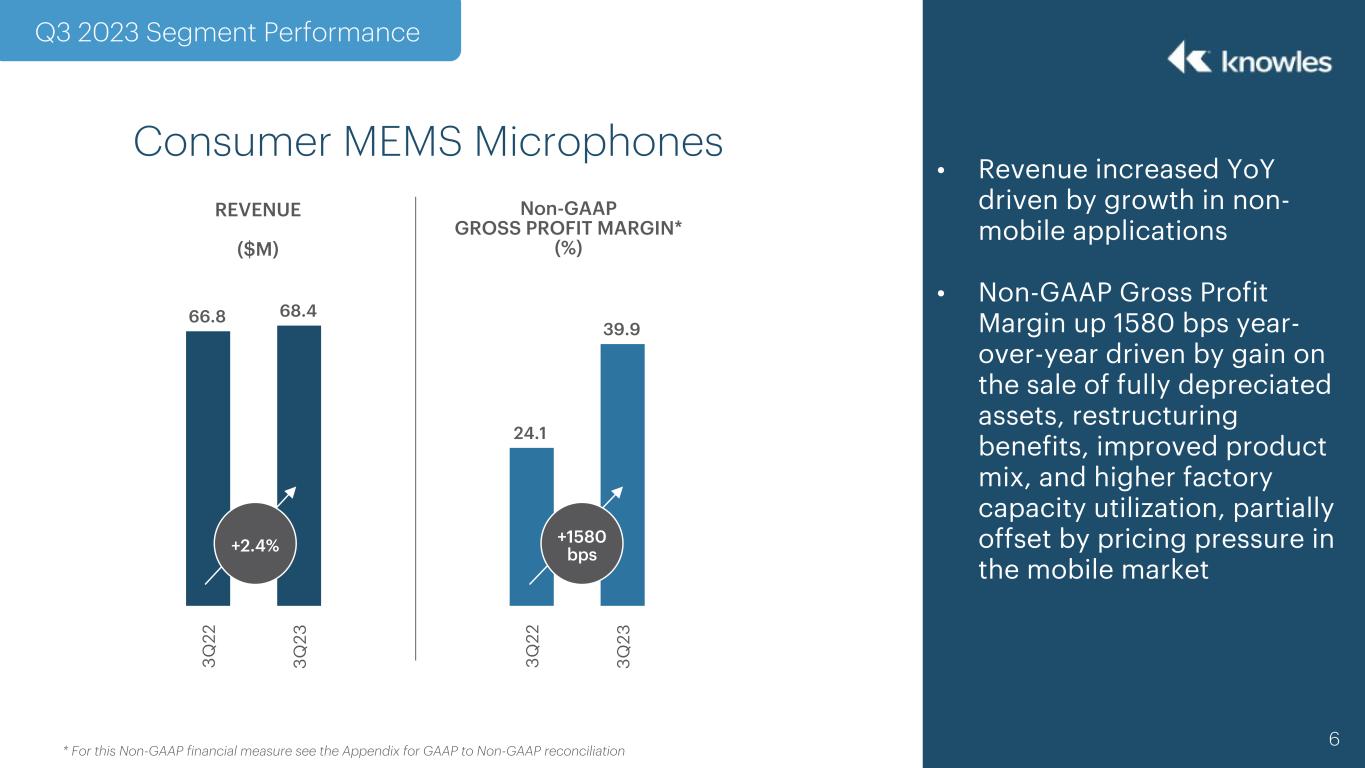

• Revenue increased YoY driven by growth in non- mobile applications • Non-GAAP Gross Profit Margin up 1580 bps year- over-year driven by gain on the sale of fully depreciated assets, restructuring benefits, improved product mix, and higher factory capacity utilization, partially offset by pricing pressure in the mobile market Q3 2023 Segment Performance Consumer MEMS Microphones * For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation 6 66.8 68.4 3Q 22 3Q 23 REVENUE ($M) +2.4% Non-GAAP GROSS PROFIT MARGIN* (%) 24.1 39.9 3Q 22 3Q 23 +1580 bps

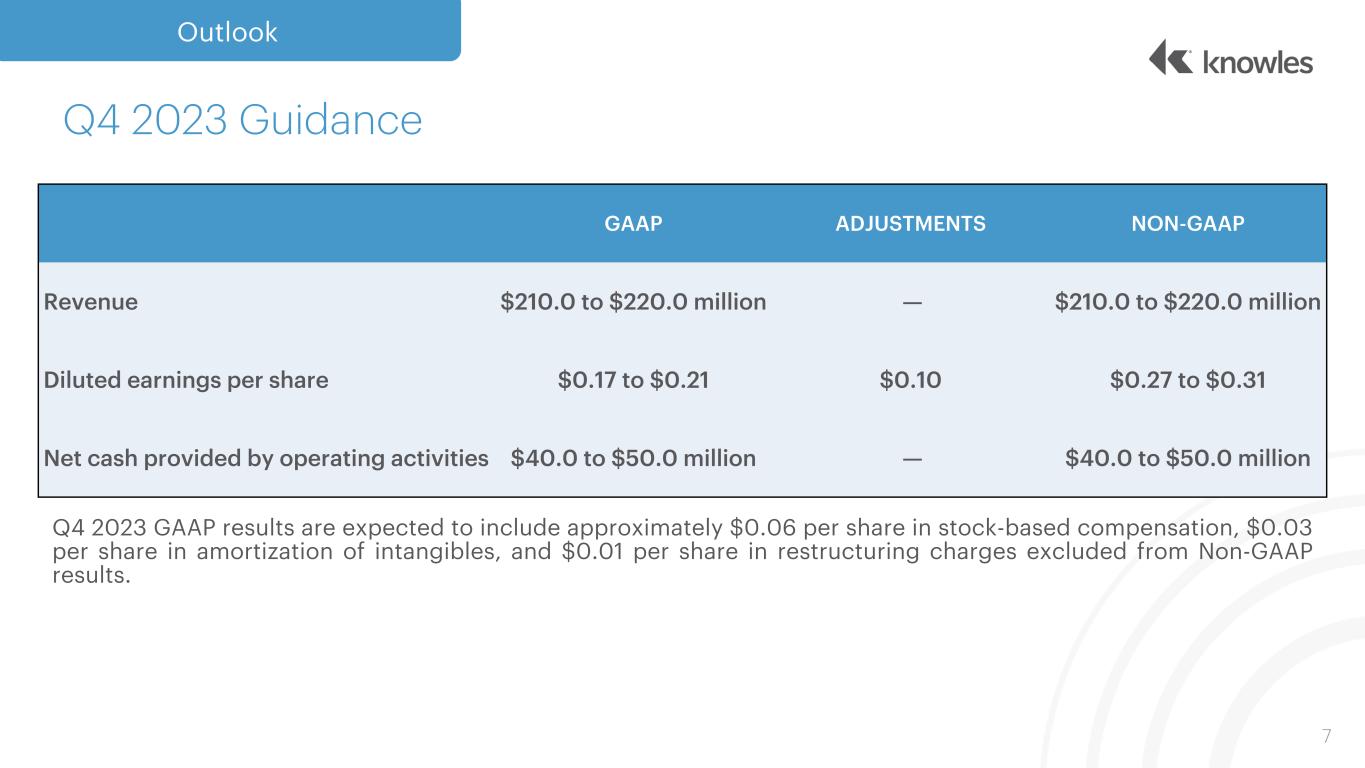

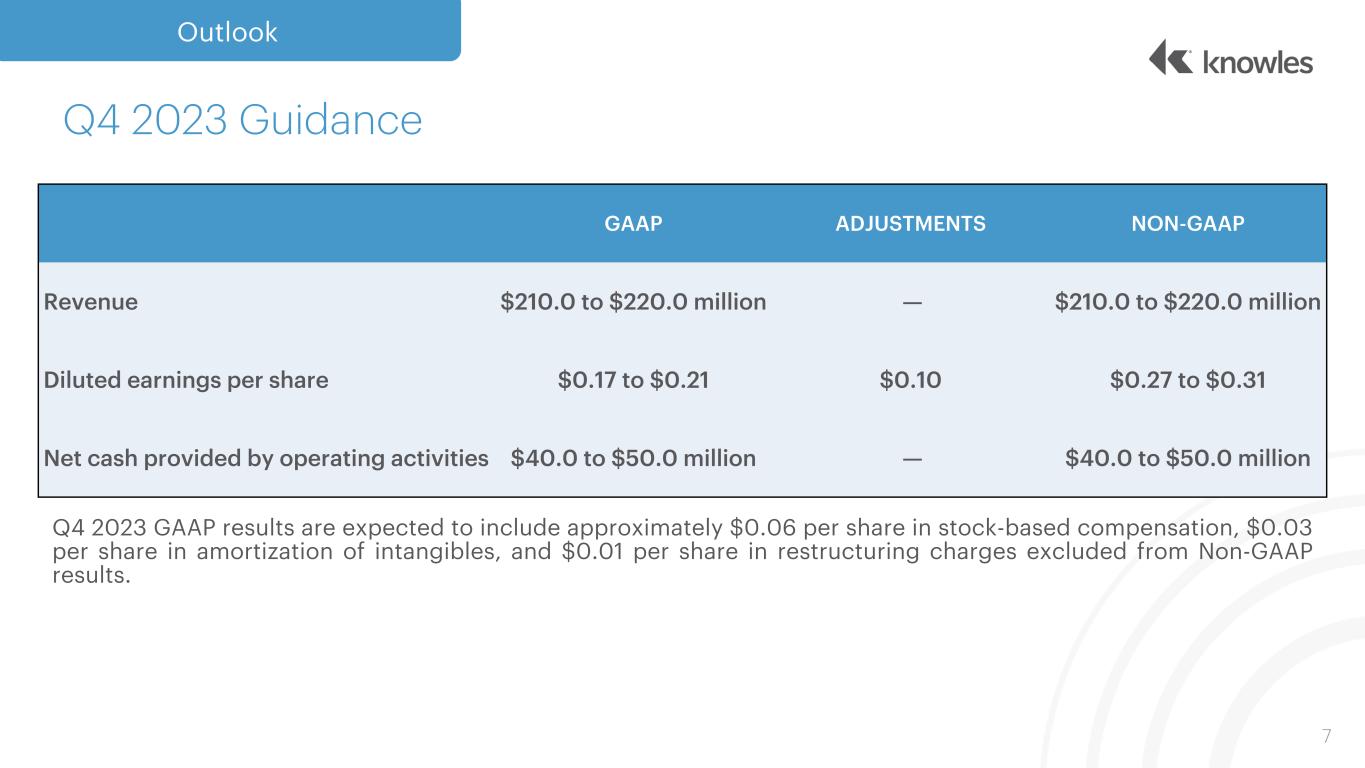

July 28, 2021 Outlook Q4 2023 Guidance 7 GAAP ADJUSTMENTS NON-GAAP Revenue $210.0 to $220.0 million — $210.0 to $220.0 million Diluted earnings per share $0.17 to $0.21 $0.10 $0.27 to $0.31 Net cash provided by operating activities $40.0 to $50.0 million — $40.0 to $50.0 million Q4 2023 GAAP results are expected to include approximately $0.06 per share in stock-based compensation, $0.03 per share in amortization of intangibles, and $0.01 per share in restructuring charges excluded from Non-GAAP results.

8 Appendix

July 28, 2021 Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures 9 Quarter Ended September 30, (in millions, except per share amounts) 2023 2022 Revenues $ 175.1 $ 178.2 Gross profit $ 77.5 $ 40.0 Gross profit margin 44.3 % 22.4 % Stock-based compensation expense 0.5 0.5 Restructuring charges 0.1 28.1 Non-GAAP gross profit $ 78.1 $ 68.6 Non-GAAP gross profit margin 44.6 % 38.5 % Operating expenses $ 55.9 $ 54.6 Stock-based compensation expense (6.4) (6.3) Intangibles amortization expense (3.0) (3.1) Restructuring charges (1.5) (2.7) Acquisition-related costs (2) (3.0) — Other (1) (0.2) — Non-GAAP operating expenses $ 41.8 $ 42.5 Non-GAAP operating expenses margin 23.9 % 23.8 % Net earnings $ 16.6 $ 2.7 Interest expense, net 0.6 1.1 Provision for (benefit from) income taxes 4.9 (16.3) Earnings (loss) before interest and income taxes 22.1 (12.5) Earnings (loss) before interest and income taxes margin 12.6 % (7.0) % Stock-based compensation expense 6.9 6.8 Intangibles amortization expense 3.0 3.1 Restructuring charges 1.6 30.8 Acquisition-related costs (2) 3.0 — Other (1) 0.2 — Adjusted earnings before interest and income taxes $ 36.8 $ 28.2 Adjusted earnings before interest and income taxes margin 21.0 % 15.8 % Notes: (1) In 2023, Other expenses include non-recurring professional service fees related to an evaluation of a reorganization. In addition, Other expenses include the ongoing net lease cost (income) related to facilities not used in operations. In 2022, Other expenses represent an adjustment to pre-spin-off pension obligations of $3.4 million, which was recorded during the second quarter of 2022 in Other expense (income), net line on the Consolidated Statements of Earnings, and the ongoing net lease cost related to facilities not used in operations. (2) These expenses are related to the acquisition of Cornell Dubilier by the Precision Devices segment.

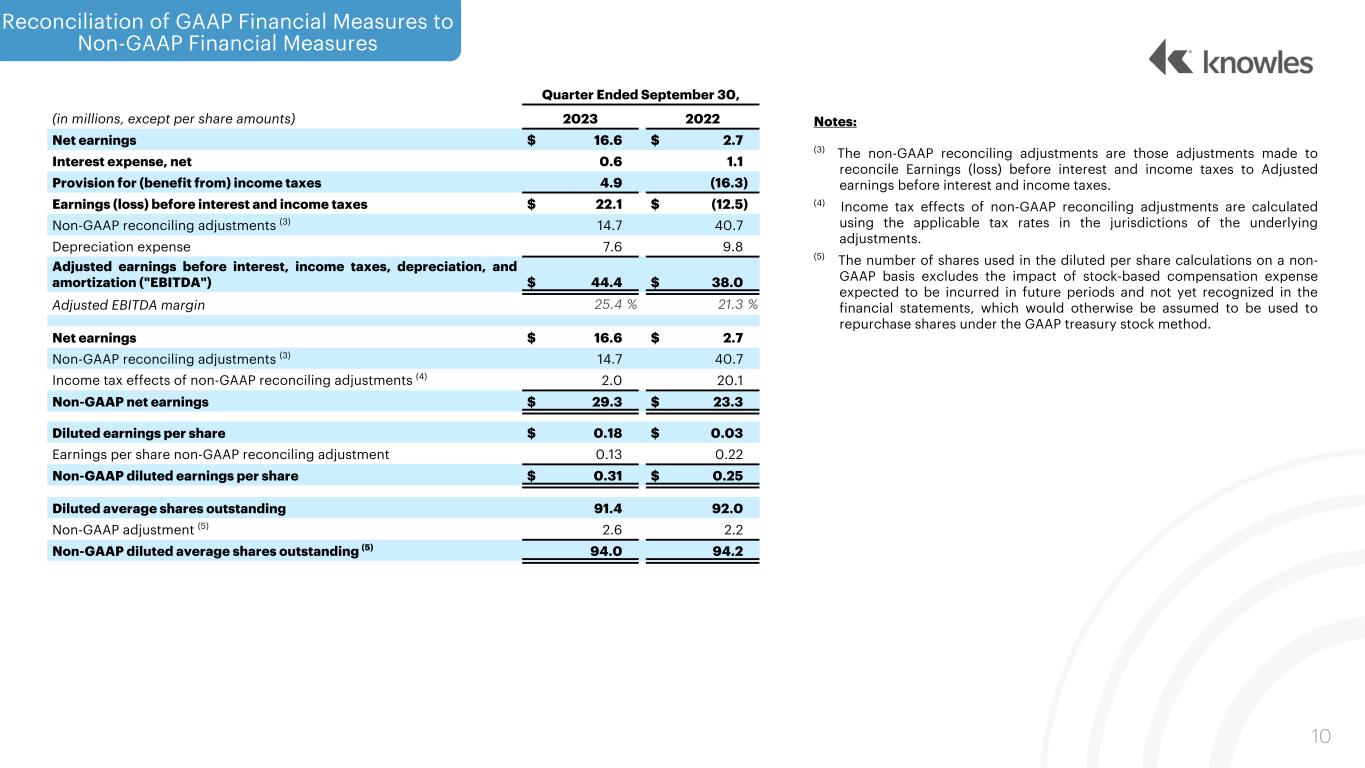

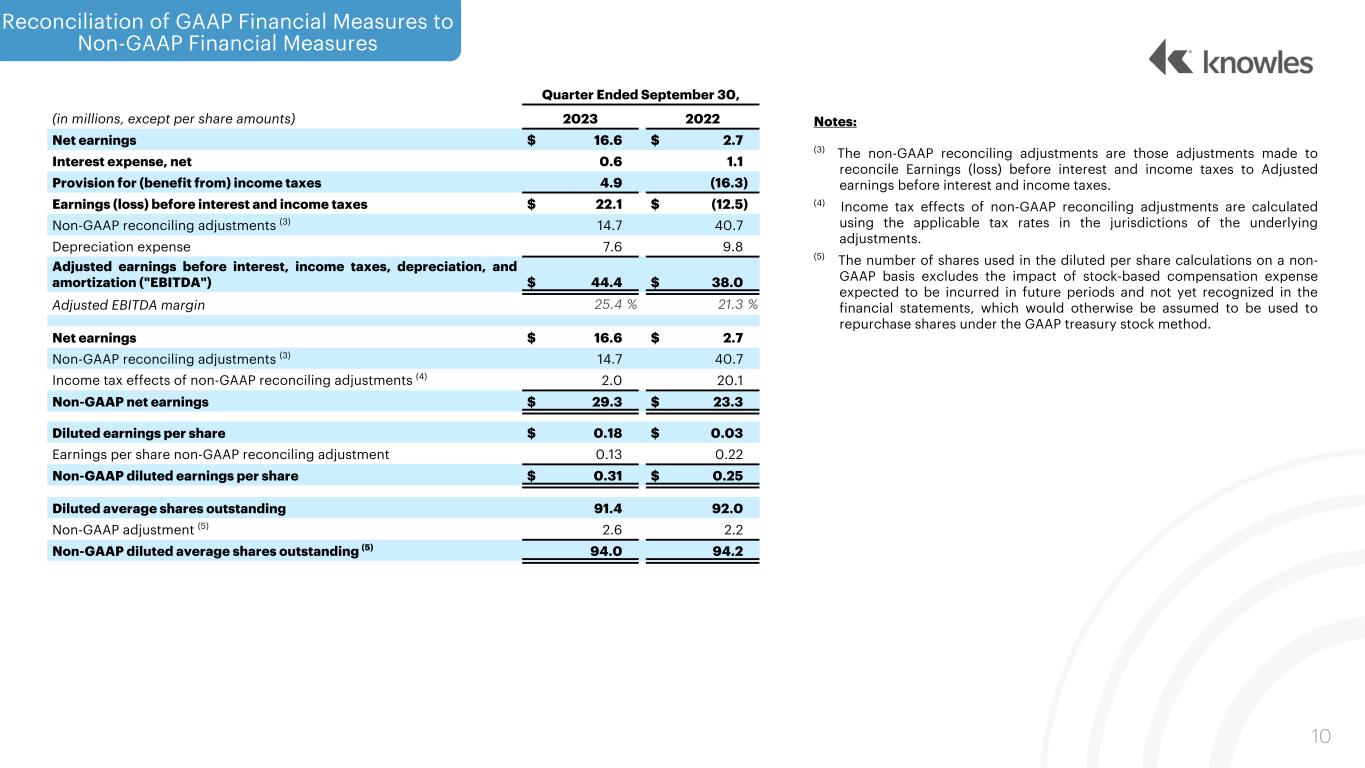

Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures 10 Quarter Ended September 30, (in millions, except per share amounts) 2023 2022 Net earnings $ 16.6 $ 2.7 Interest expense, net 0.6 1.1 Provision for (benefit from) income taxes 4.9 (16.3) Earnings (loss) before interest and income taxes $ 22.1 $ (12.5) Non-GAAP reconciling adjustments (3) 14.7 40.7 Depreciation expense 7.6 9.8 Adjusted earnings before interest, income taxes, depreciation, and amortization ("EBITDA") $ 44.4 $ 38.0 Adjusted EBITDA margin 25.4 % 21.3 % Net earnings $ 16.6 $ 2.7 Non-GAAP reconciling adjustments (3) 14.7 40.7 Income tax effects of non-GAAP reconciling adjustments (4) 2.0 20.1 Non-GAAP net earnings $ 29.3 $ 23.3 Diluted earnings per share $ 0.18 $ 0.03 Earnings per share non-GAAP reconciling adjustment 0.13 0.22 Non-GAAP diluted earnings per share $ 0.31 $ 0.25 Diluted average shares outstanding 91.4 92.0 Non-GAAP adjustment (5) 2.6 2.2 Non-GAAP diluted average shares outstanding (5) 94.0 94.2 Notes: (3) The non-GAAP reconciling adjustments are those adjustments made to reconcile Earnings (loss) before interest and income taxes to Adjusted earnings before interest and income taxes. (4) Income tax effects of non-GAAP reconciling adjustments are calculated using the applicable tax rates in the jurisdictions of the underlying adjustments. (5) The number of shares used in the diluted per share calculations on a non- GAAP basis excludes the impact of stock-based compensation expense expected to be incurred in future periods and not yet recognized in the financial statements, which would otherwise be assumed to be used to repurchase shares under the GAAP treasury stock method.

Historical Segment Data 11 Precision Devices MedTech & Specialty Audio Consumer MEMS Microphones Quarter Ended Quarter Ended Quarter Ended September 30, June 30, March 31, December 31, September 30, September 30, June 30, March 31, December 31, September 30, September 30, June 30, March 31, December 31, September 30, (in millions) 2023 2023 2023 2022 2022 2023 2023 2023 2022 2022 2023 2023 2023 2022 2022 Revenues $ 50.2 $ 47.8 $ 53.7 $ 63.3 $ 64.4 $ 56.5 $ 60.6 $ 45.5 $ 61.8 $ 47.0 $ 68.4 $ 64.6 $ 45.1 $ 72.0 $ 66.8 Gross profit $ 20.0 $ 18.6 $ 25.1 $ 30.7 $ 30.5 $ 30.9 $ 32.3 $ 19.7 $ 31.8 $ 22.4 $ 27.2 $ 23.3 $ 9.6 $ 13.1 $ (12.1) Gross profit margin 39.8 % 38.9 % 46.7 % 48.5 % 47.4 % 54.7 % 53.3 % 43.3 % 51.5 % 47.7 % 39.8 % 36.1 % 21.3 % 18.2 % -18.1 % Stock-based compensation expense 0.1 0.4 0.1 — 0.1 0.1 0.1 0.1 0.1 0.1 0.2 0.1 0.1 0.1 0.1 Restructuring charges 0.2 — — — — — — — — — (0.1) (1.7) 0.1 4.1 28.1 Non-GAAP gross profit $ 20.3 $ 19.0 $ 25.2 $ 30.7 $ 30.6 $ 31.0 $ 32.4 $ 19.8 $ 31.9 $ 22.5 $ 27.3 $ 21.7 $ 9.8 $ 17.3 $ 16.1 Non-GAAP gross profit margin 40.4 % 39.7 % 46.9 % 48.5 % 47.5 % 54.9 % 53.5 % 43.5 % 51.6 % 47.9 % 39.9 % 33.6 % 21.7 % 24.0 % 24.1 % Research and development expenses $ 3.1 $ 3.3 $ 3.4 $ 3.1 $ 3.2 $ 4.8 $ 4.7 $ 4.4 $ 4.2 $ 4.0 $ 11.7 $ 11.7 $ 12.1 $ 10.7 $ 12.1 Research and development expenses margin 6.2 % 6.9 % 6.3 % 4.9 % 5.0 % 8.5 % 7.8 % 9.7 % 6.8 % 8.5 % 17.1 % 18.1 % 26.8 % 14.9 % 18.1 % Stock-based compensation expense (0.2) (0.1) (0.2) (0.1) — (0.3) (0.3) (0.4) (0.4) (0.3) (0.6) (1.4) (1.1) (0.9) (0.9) Intangibles amortization expense (0.1) (0.1) (0.1) (0.1) (0.1) — — — — — (1.5) (1.5) (1.5) (1.5) (1.5) Other — — — — — — — — — — (0.1) (0.1) — (0.2) — Non-GAAP research and development expenses $ 2.8 $ 3.1 $ 3.1 $ 2.9 $ 3.1 $ 4.5 $ 4.4 $ 4.0 $ 3.8 $ 3.7 $ 9.5 $ 8.7 $ 9.5 $ 8.1 $ 9.7 Non-GAAP research and development expenses margin 5.6 % 6.5 % 5.8 % 4.6 % 4.8 % 8.0 % 7.3 % 8.8 % 6.1 % 7.9 % 13.9 % 13.5 % 21.1 % 11.3 % 14.5 % Selling and administrative expenses $ 9.6 $ 10.4 $ 10.9 $ 11.2 $ 11.3 $ 3.9 $ 4.0 $ 3.9 $ 3.2 $ 3.1 $ 4.4 $ 4.7 $ 5.0 $ 4.9 $ 5.5 Selling and administrative expenses margin 19.1 % 21.8 % 20.3 % 17.7 % 17.5 % 6.9 % 6.6 % 8.6 % 5.2 % 6.6 % 6.4 % 7.3 % 11.1 % 6.8 % 8.2 % Stock-based compensation expense (0.5) (0.6) (0.6) (0.5) (0.5) (0.5) (0.4) (0.4) (0.3) (0.3) (0.4) (0.4) (0.5) (0.4) (0.3) Intangibles amortization expense (1.4) (1.3) (1.3) (1.3) (1.4) — — — — — — — — (0.1) (0.1) Acquisition-related costs — — — — — — — — — — — — — — — Other — — — — — — — — — — 0.7 0.3 0.4 0.7 — Non-GAAP selling and administrative expenses $ 7.7 $ 8.5 $ 9.0 $ 9.4 $ 9.4 $ 3.4 $ 3.6 $ 3.5 $ 2.9 $ 2.8 $ 4.7 $ 4.6 $ 4.9 $ 5.1 $ 5.1 Non-GAAP selling and administrative expenses margin 15.3 % 17.8 % 16.8 % 14.8 % 14.6 % 6.0 % 5.9 % 7.7 % 4.7 % 6.0 % 6.9 % 7.1 % 10.9 % 7.1 % 7.6 % Operating expenses $ 13.8 $ 13.7 $ 14.3 $ 14.3 $ 14.5 $ 8.7 $ 8.7 $ 8.3 $ 7.4 $ 7.1 $ 16.1 $ 17.0 $ 17.8 $ 246.5 $ 20.2 Operating expenses margin 27.5 % 28.7 % 26.6 % 22.6 % 22.5 % 15.4 % 14.4 % 18.2 % 12.0 % 15.1 % 23.5 % 26.3 % 39.5 % 342.4 % 30.2 % Stock-based compensation expense (0.7) (0.7) (0.8) (0.6) (0.5) (0.8) (0.7) (0.8) (0.7) (0.6) (1.0) (1.8) (1.6) (1.3) (1.2) Intangibles amortization expense (1.5) (1.4) (1.4) (1.4) (1.5) — — — — — (1.5) (1.5) (1.5) (1.6) (1.6) Impairment charges — — — — — — — — — — — — — (231.1) — Restructuring charges (1.1) — — — — — — — — — — (0.6) (0.7) 0.2 (2.6) Acquisition-related costs — — — — — — — — — — — — — — — Other — — — — — — — — — — 0.6 0.2 0.4 0.5 — Non-GAAP operating expenses $ 10.5 $ 11.6 $ 12.1 $ 12.3 $ 12.5 $ 7.9 $ 8.0 $ 7.5 $ 6.7 $ 6.5 $ 14.2 $ 13.3 $ 14.4 $ 13.2 $ 14.8 Non-GAAP operating expenses margin 20.9 % 24.3 % 22.5 % 19.4 % 19.4 % 14.0 % 13.2 % 16.5 % 10.8 % 13.8 % 20.8 % 20.6 % 31.9 % 18.3 % 22.2 %

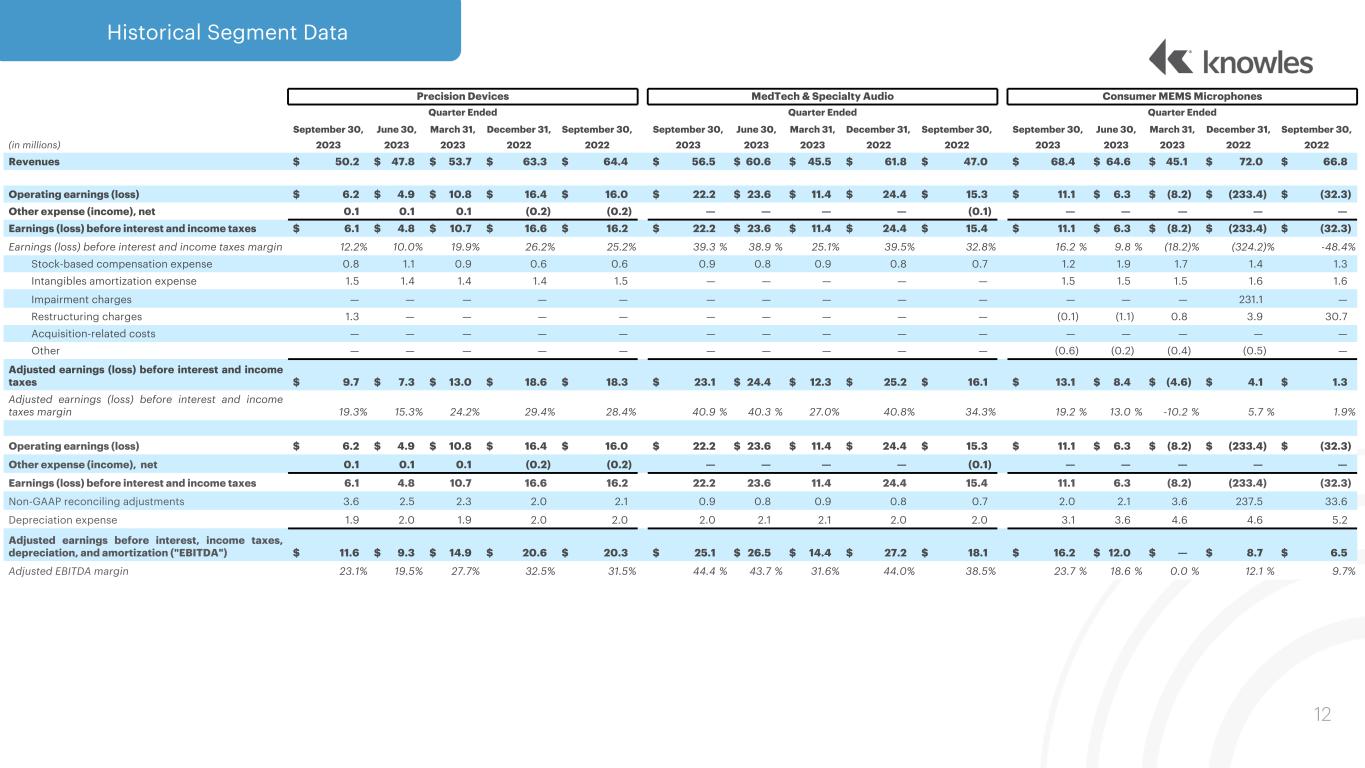

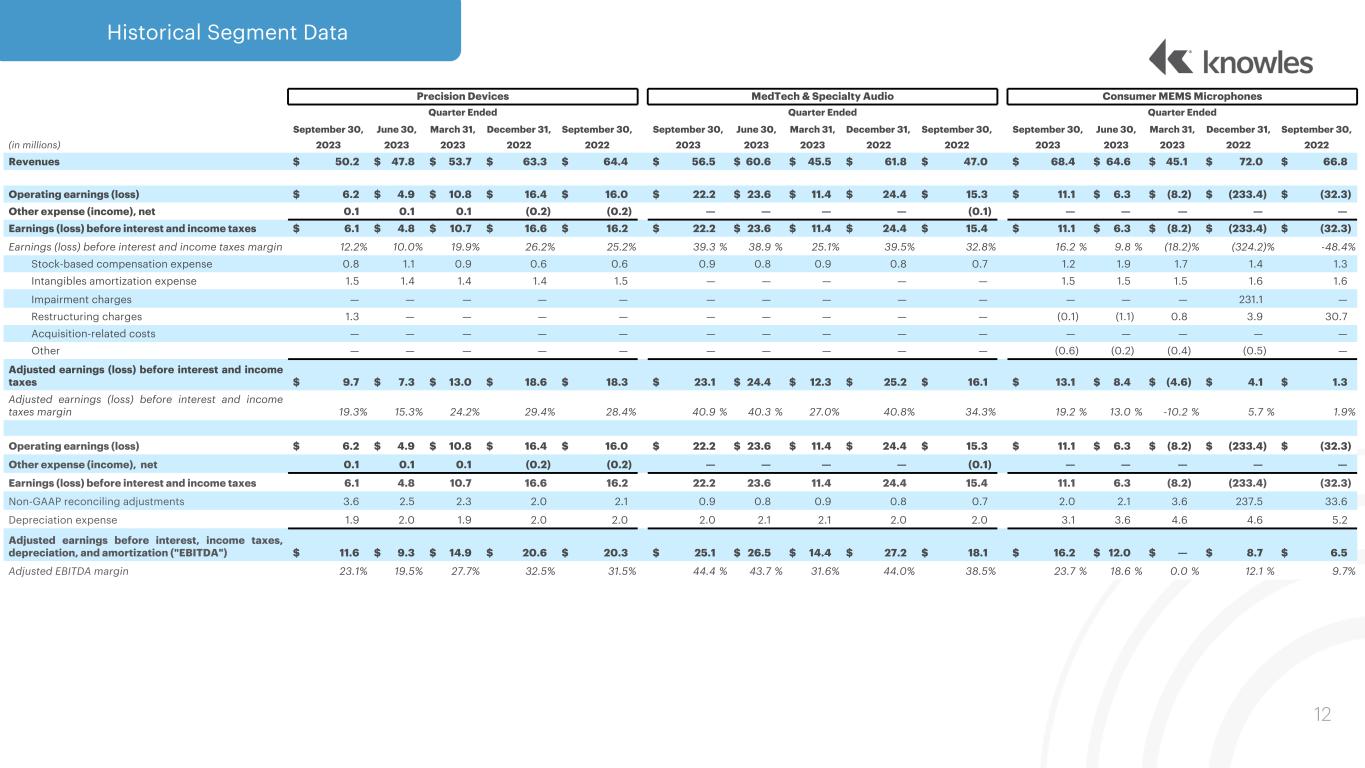

Historical Segment Data 12 Precision Devices MedTech & Specialty Audio Consumer MEMS Microphones Quarter Ended Quarter Ended Quarter Ended September 30, June 30, March 31, December 31, September 30, September 30, June 30, March 31, December 31, September 30, September 30, June 30, March 31, December 31, September 30, (in millions) 2023 2023 2023 2022 2022 2023 2023 2023 2022 2022 2023 2023 2023 2022 2022 Revenues $ 50.2 $ 47.8 $ 53.7 $ 63.3 $ 64.4 $ 56.5 $ 60.6 $ 45.5 $ 61.8 $ 47.0 $ 68.4 $ 64.6 $ 45.1 $ 72.0 $ 66.8 Operating earnings (loss) $ 6.2 $ 4.9 $ 10.8 $ 16.4 $ 16.0 $ 22.2 $ 23.6 $ 11.4 $ 24.4 $ 15.3 $ 11.1 $ 6.3 $ (8.2) $ (233.4) $ (32.3) Other expense (income), net 0.1 0.1 0.1 (0.2) (0.2) — — — — (0.1) — — — — — Earnings (loss) before interest and income taxes $ 6.1 $ 4.8 $ 10.7 $ 16.6 $ 16.2 $ 22.2 $ 23.6 $ 11.4 $ 24.4 $ 15.4 $ 11.1 $ 6.3 $ (8.2) $ (233.4) $ (32.3) Earnings (loss) before interest and income taxes margin 12.2 % 10.0 % 19.9 % 26.2 % 25.2 % 39.3 % 38.9 % 25.1 % 39.5 % 32.8 % 16.2 % 9.8 % (18.2) % (324.2) % -48.4 % Stock-based compensation expense 0.8 1.1 0.9 0.6 0.6 0.9 0.8 0.9 0.8 0.7 1.2 1.9 1.7 1.4 1.3 Intangibles amortization expense 1.5 1.4 1.4 1.4 1.5 — — — — — 1.5 1.5 1.5 1.6 1.6 Impairment charges — — — — — — — — — — — — — 231.1 — Restructuring charges 1.3 — — — — — — — — — (0.1) (1.1) 0.8 3.9 30.7 Acquisition-related costs — — — — — — — — — — — — — — — Other — — — — — — — — — — (0.6) (0.2) (0.4) (0.5) — Adjusted earnings (loss) before interest and income taxes $ 9.7 $ 7.3 $ 13.0 $ 18.6 $ 18.3 $ 23.1 $ 24.4 $ 12.3 $ 25.2 $ 16.1 $ 13.1 $ 8.4 $ (4.6) $ 4.1 $ 1.3 Adjusted earnings (loss) before interest and income taxes margin 19.3 % 15.3 % 24.2 % 29.4 % 28.4 % 40.9 % 40.3 % 27.0 % 40.8 % 34.3 % 19.2 % 13.0 % -10.2 % 5.7 % 1.9 % Operating earnings (loss) $ 6.2 $ 4.9 $ 10.8 $ 16.4 $ 16.0 $ 22.2 $ 23.6 $ 11.4 $ 24.4 $ 15.3 $ 11.1 $ 6.3 $ (8.2) $ (233.4) $ (32.3) Other expense (income), net 0.1 0.1 0.1 (0.2) (0.2) — — — — (0.1) — — — — — Earnings (loss) before interest and income taxes 6.1 4.8 10.7 16.6 16.2 22.2 23.6 11.4 24.4 15.4 11.1 6.3 (8.2) (233.4) (32.3) Non-GAAP reconciling adjustments 3.6 2.5 2.3 2.0 2.1 0.9 0.8 0.9 0.8 0.7 2.0 2.1 3.6 237.5 33.6 Depreciation expense 1.9 2.0 1.9 2.0 2.0 2.0 2.1 2.1 2.0 2.0 3.1 3.6 4.6 4.6 5.2 Adjusted earnings before interest, income taxes, depreciation, and amortization ("EBITDA") $ 11.6 $ 9.3 $ 14.9 $ 20.6 $ 20.3 $ 25.1 $ 26.5 $ 14.4 $ 27.2 $ 18.1 $ 16.2 $ 12.0 $ — $ 8.7 $ 6.5 Adjusted EBITDA margin 23.1 % 19.5 % 27.7 % 32.5 % 31.5 % 44.4 % 43.7 % 31.6 % 44.0 % 38.5 % 23.7 % 18.6 % 0.0 % 12.1 % 9.7 %

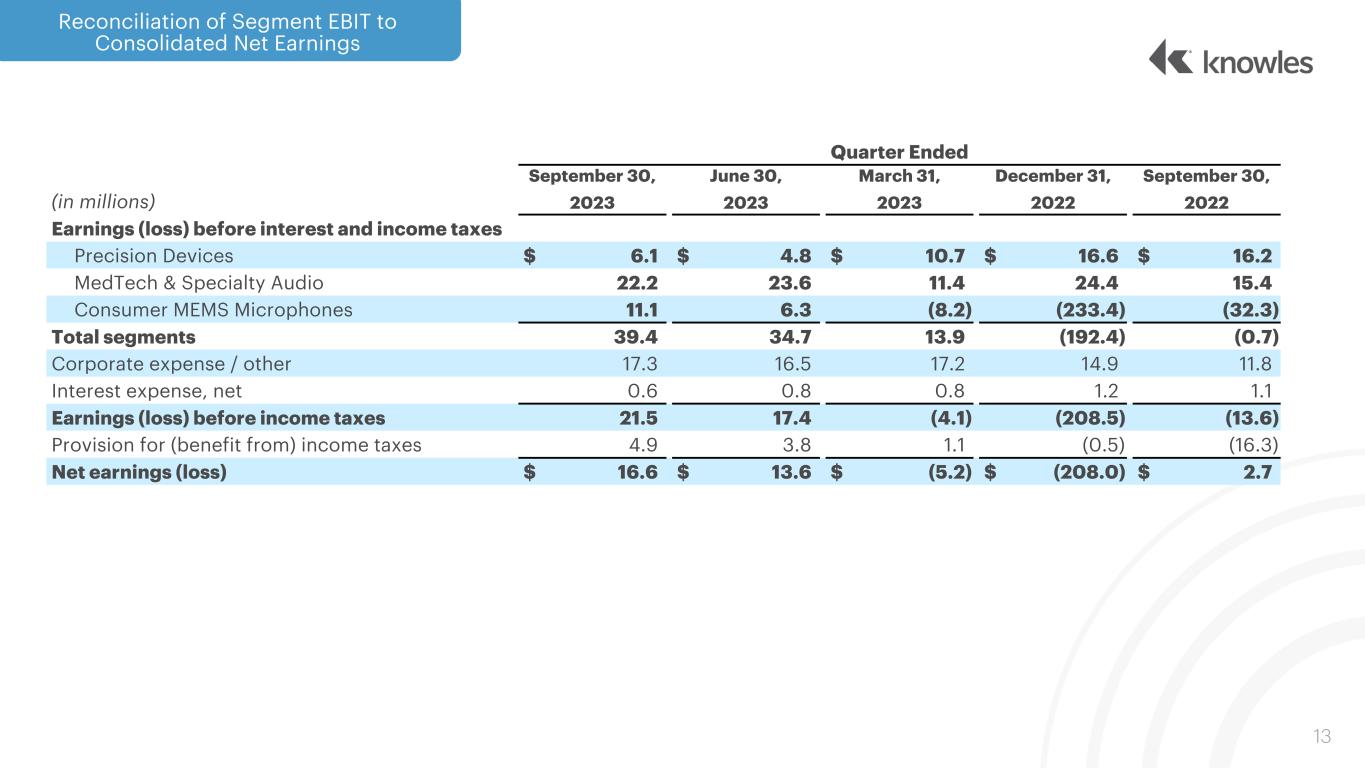

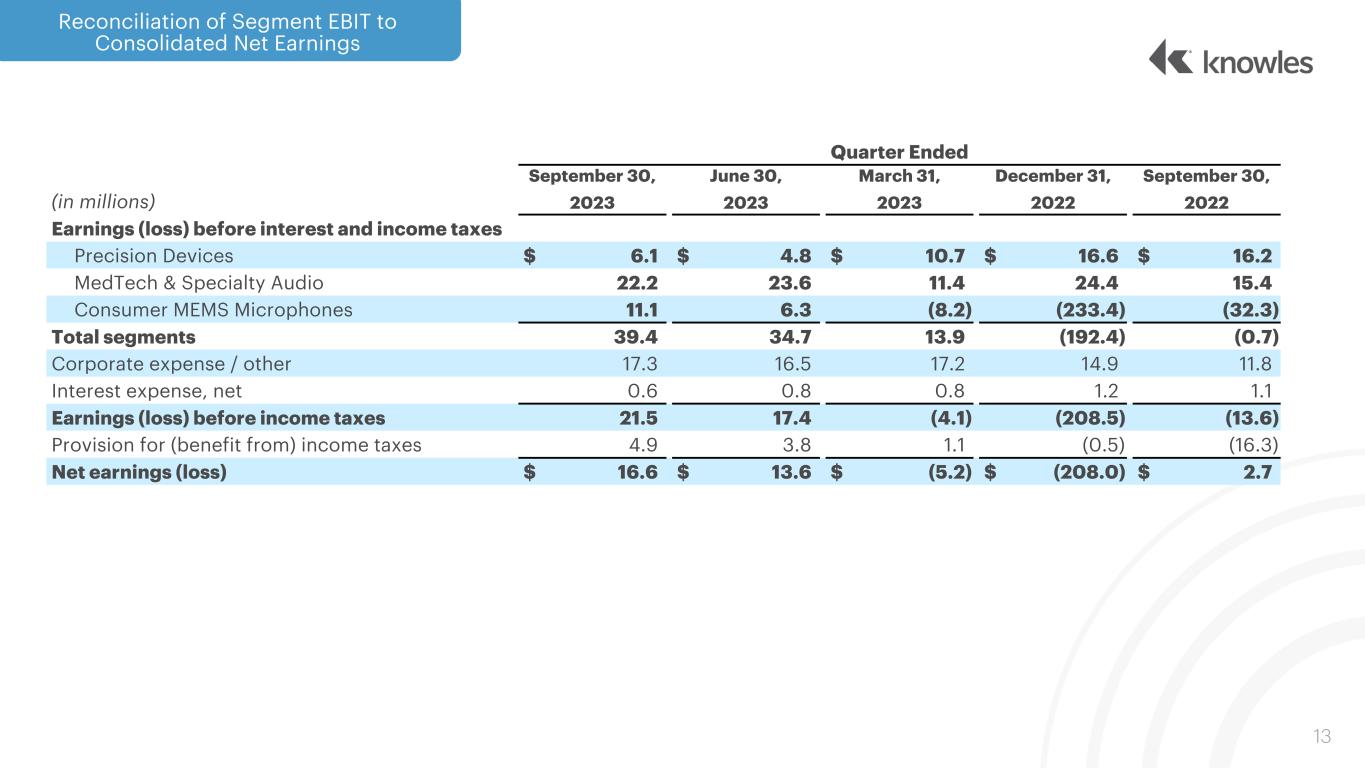

Reconciliation of Segment EBIT to Consolidated Net Earnings 13 Quarter Ended September 30, June 30, March 31, December 31, September 30, (in millions) 2023 2023 2023 2022 2022 Earnings (loss) before interest and income taxes Precision Devices $ 6.1 $ 4.8 $ 10.7 $ 16.6 $ 16.2 MedTech & Specialty Audio 22.2 23.6 11.4 24.4 15.4 Consumer MEMS Microphones 11.1 6.3 (8.2) (233.4) (32.3) Total segments 39.4 34.7 13.9 (192.4) (0.7) Corporate expense / other 17.3 16.5 17.2 14.9 11.8 Interest expense, net 0.6 0.8 0.8 1.2 1.1 Earnings (loss) before income taxes 21.5 17.4 (4.1) (208.5) (13.6) Provision for (benefit from) income taxes 4.9 3.8 1.1 (0.5) (16.3) Net earnings (loss) $ 16.6 $ 13.6 $ (5.2) $ (208.0) $ 2.7

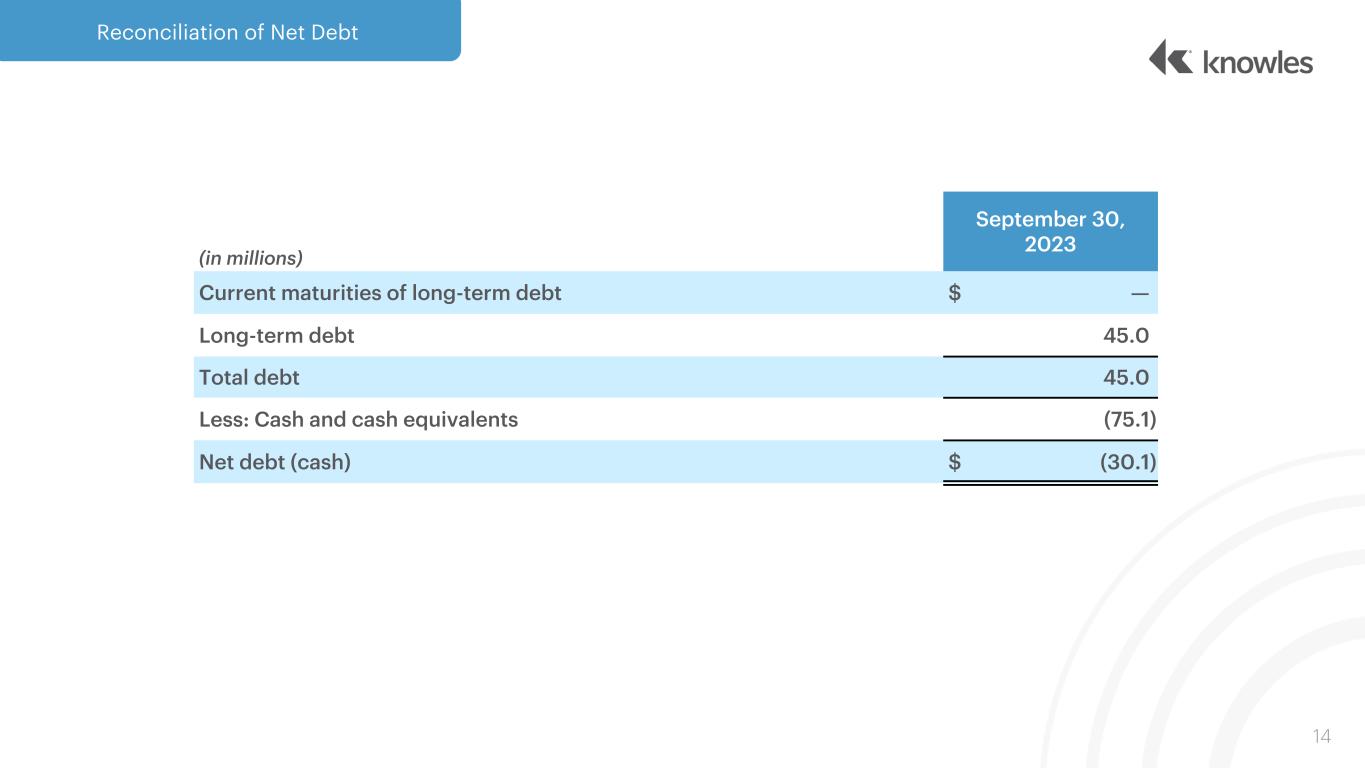

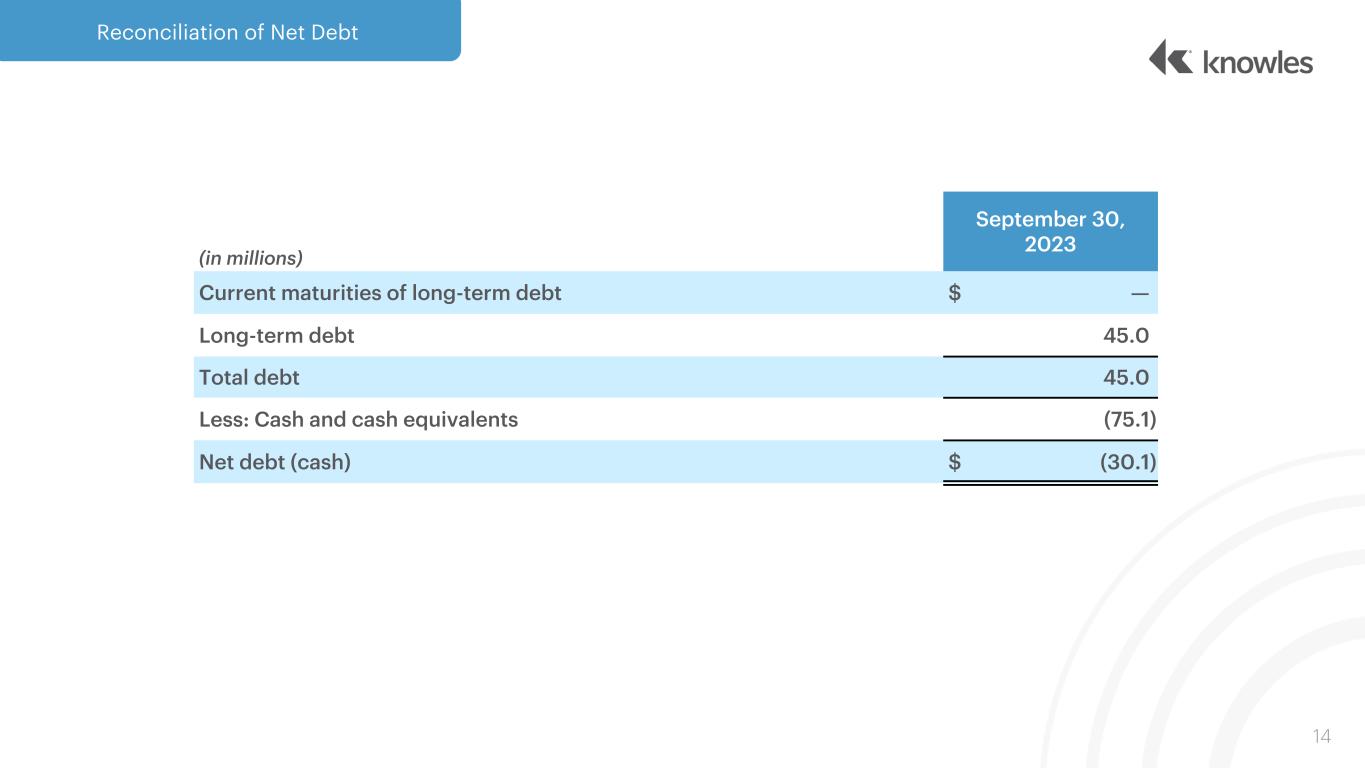

Reconciliation of Net Debt 14 (in millions) September 30, 2023 Current maturities of long-term debt $ — Long-term debt 45.0 Total debt 45.0 Less: Cash and cash equivalents (75.1) Net debt (cash) $ (30.1)