1

Safe Harbor Forward Looking Statements This presentation contains forward-looking statements within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995, such as statements about our future plans, objectives, expectations, financial performance, and continued business operations. The words "believe," "expect," "anticipate," "project," "estimate," "budget," "continue," "could," "intend," "may," "plan," "potential," "predict," "seek," "should," "will," "would," "objective," "forecast," "goal," "guidance," "outlook," "effort," "target," and similar expressions, among others, generally identify forward-looking statements, which speak only as of the date the statements were made. The statements in this presentation are based on currently available information and the current expectations, forecasts, and assumptions of Knowles’ management concerning risks and uncertainties that could cause actual outcomes or results to differ materially from those outcomes or results that are projected, anticipated, or implied in these statements. Other risks and uncertainties include, but are not limited to: the occurrence of any event, change, or other circumstance giving rise to our inability to achieve some or all of the strategic and financial benefits that we expect to achieve in connection with our CMM divestiture; fluctuations in our stock's market price; fluctuations in operating results and cash flows; our ability to prevent or identify quality issues in our products or to promptly remedy any such issues that are identified; the timing of OEM product launches; risks associated with increasing our inventories in advance of anticipated orders by customers; global economic instability, including due to inflation, rising interest rates, negative impacts caused by pandemics and public health crises, or the impacts of geopolitical uncertainties; the impact of changes to laws and regulations that affect the Company’s ability to offer products or services to customers in different regions; our ability to achieve reductions in our operating expenses; the ability to qualify our products and facilities with customers; our ability to obtain, enforce, defend or monetize our intellectual property rights; disruption caused by a cybersecurity incident, including a cyber-attack, cyber breach, theft, or other unauthorized access; increases in the costs of critical raw materials and components; availability of raw materials and components; managing new product ramps and introductions for our customers; our dependence on a limited number of large customers; our ability to maintain and expand our existing relationships with leading OEMs in order to maintain and increase our revenue; increasing competition and new entrants in the market for our products; our ability to develop new or enhanced products or technologies in a timely manner that achieve market acceptance; our reliance on third parties to manufacture, assemble, and test our products and sub-components; escalating international trade tensions, new or increased tariffs and trade wars among countries; financial risks, including risks relating to currency fluctuations, credit risks and fluctuations in the market value of the Company; a sustained decline in our stock price and market capitalization may result in the impairment of certain intangible or long-lived assets; market risk associated with fluctuations in commodity prices, particularly for various precious metals used in our manufacturing operation, changes in tax laws, changes in tax rates and exposure to additional tax liabilities; and other risks, relevant factors, and uncertainties identified in our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, subsequent Reports on Forms 10-Q and 8-K and our other filings we make with the U.S. Securities and Exchange Commission. Knowles disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Non-GAAP Disclaimer The financial results disclosed in this presentation include certain measures calculated and presented in accordance with GAAP. In addition to the GAAP results included in this presentation, Knowles has presented supplemental, non-GAAP gross profit, adjusted earnings before interest and income taxes, adjusted earnings before interest and income taxes margin, adjusted earnings before interest, taxes, depreciation, and amortization; adjusted earnings before interest, taxes, depreciation, and amortization margin; non-GAAP gross profit margin, non-GAAP diluted earnings per share, non-GAAP operating expense; free cash flow; and free cash flow margin to facilitate evaluation of Knowles’ operating performance. These non-GAAP financial measures exclude certain amounts that are included in the most directly comparable GAAP measure. In addition, these non-GAAP financial measures do not have standard meanings and may vary from similarly titled non-GAAP financial measures used by other companies. Knowles uses non-GAAP measures as supplements to its GAAP results of operations in evaluating certain aspects of its business, and its executive management team focuses on non-GAAP items as key measures of Knowles’ performance for business planning purposes. These measures assist Knowles in comparing its performance between various reporting periods on a consistent basis, as these measures remove from operating results the impact of items that, in Knowles’ opinion, do not reflect its core operating performance. Knowles believes that its presentation of these non-GAAP financial measures is useful because it provides investors and securities analysts with the same information that Knowles uses internally for purposes of assessing its core operating performance. For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures, see the reconciliation tables in the Appendix. 2

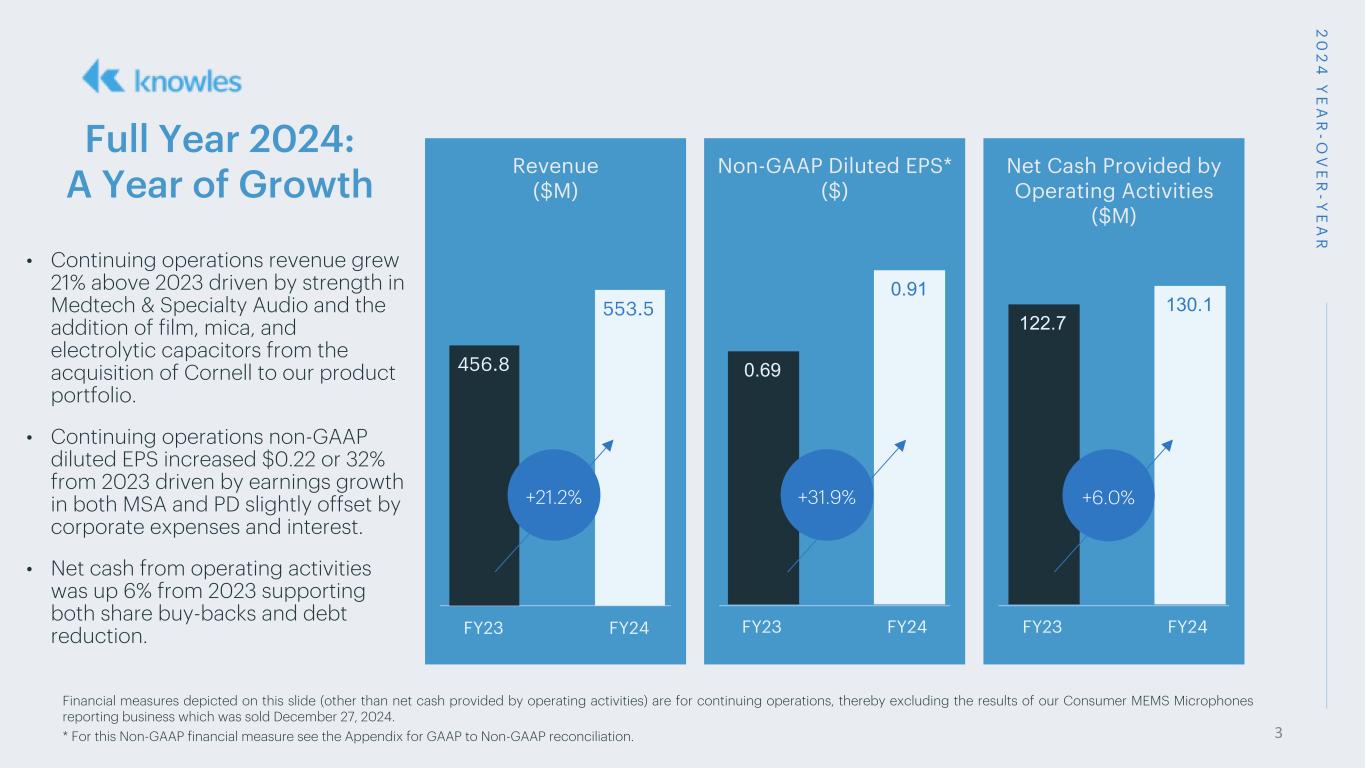

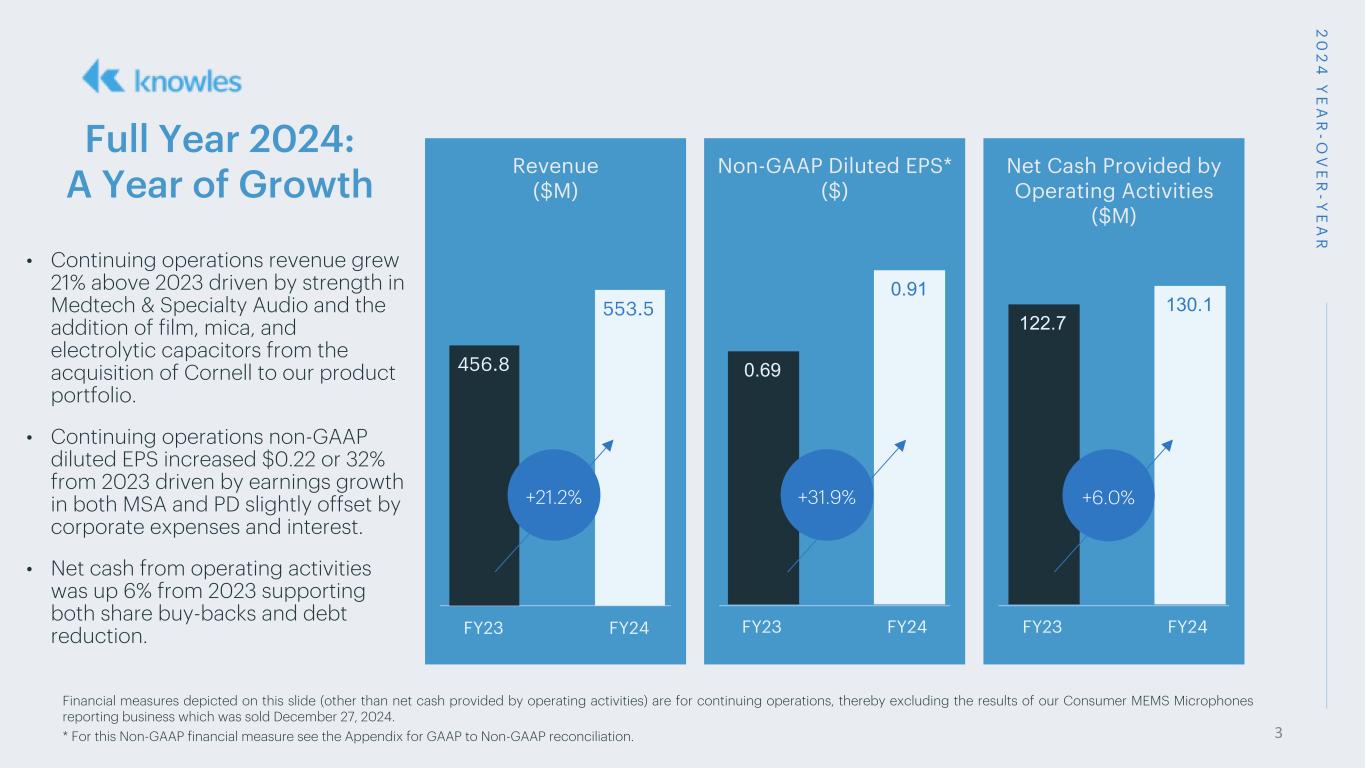

Financial measures depicted on this slide (other than net cash provided by operating activities) are for continuing operations, thereby excluding the results of our Consumer MEMS Microphones reporting business which was sold December 27, 2024. * For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation. 2 0 2 4 Y E A R -O V E R -Y E A R Full Year 2024: A Year of Growth • Continuing operations revenue grew 21% above 2023 driven by strength in Medtech & Specialty Audio and the addition of film, mica, and electrolytic capacitors from the acquisition of Cornell to our product portfolio. • Continuing operations non-GAAP diluted EPS increased $0.22 or 32% from 2023 driven by earnings growth in both MSA and PD slightly offset by corporate expenses and interest. • Net cash from operating activities was up 6% from 2023 supporting both share buy-backs and debt reduction. Revenue ($M) 456.8 553.5 FY23 FY24 +21.2% Non-GAAP Diluted EPS* ($) 0.69 0.91 FY23 FY24 +31.9% Net Cash Provided by Operating Activities ($M) 122.7 130.1 FY23 FY24 +6.0% 3

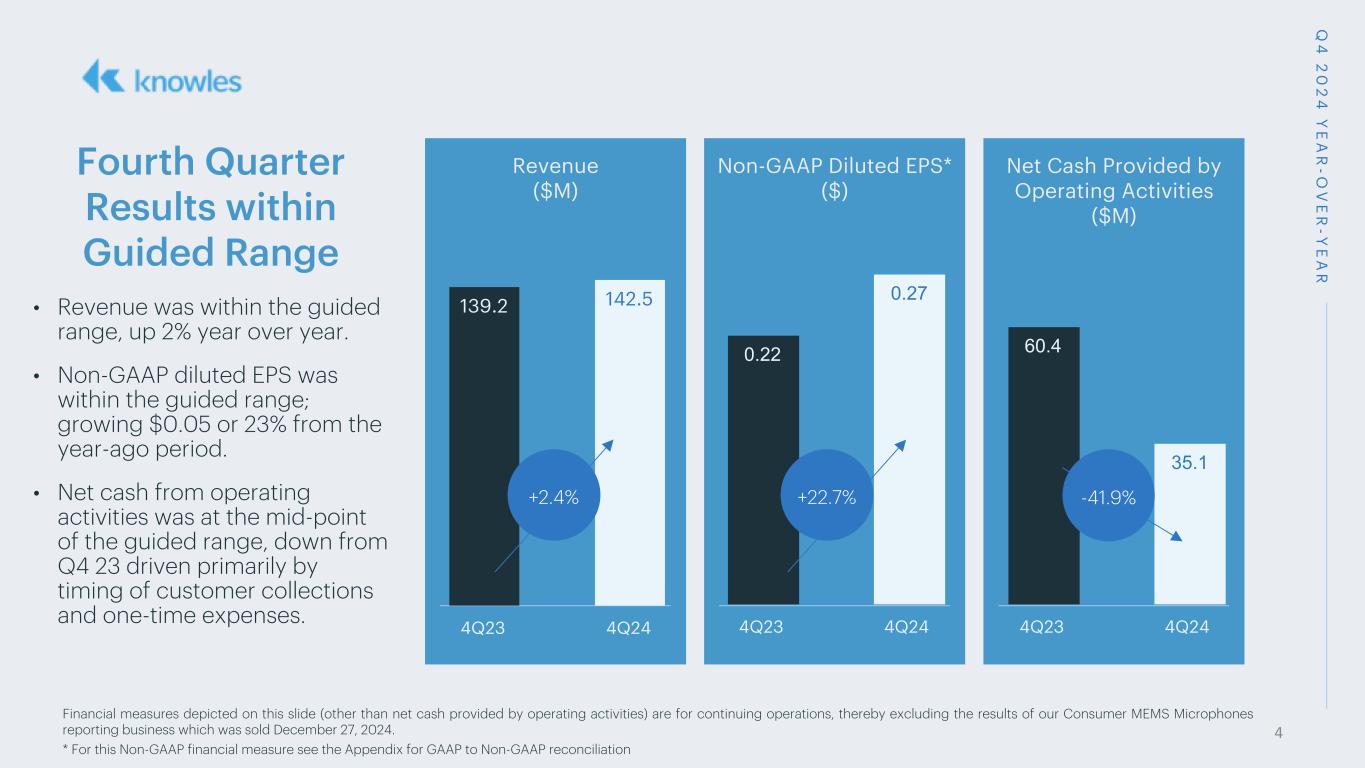

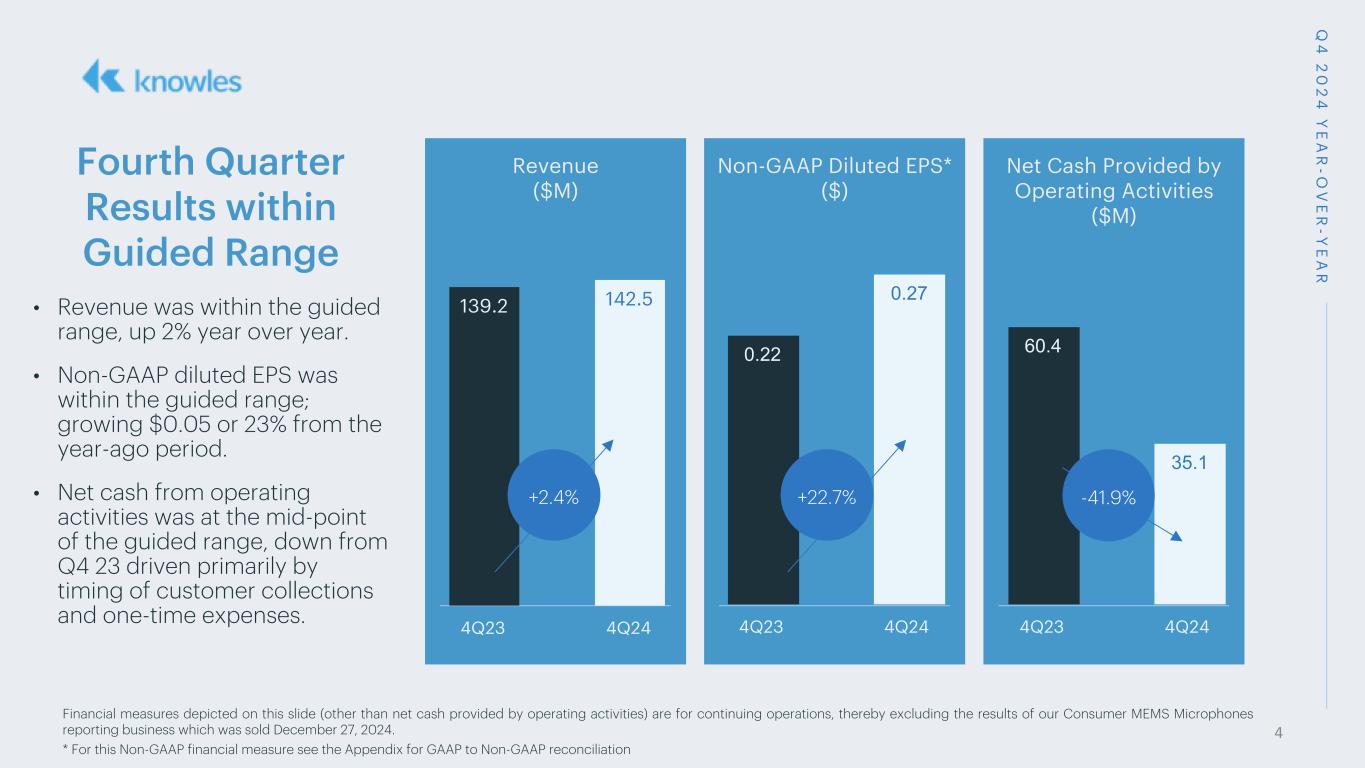

Financial measures depicted on this slide (other than net cash provided by operating activities) are for continuing operations, thereby excluding the results of our Consumer MEMS Microphones reporting business which was sold December 27, 2024. * For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation Q 4 2 0 2 4 Y E A R -O V E R -Y E A R Fourth Quarter Results within Guided Range • Revenue was within the guided range, up 2% year over year. • Non-GAAP diluted EPS was within the guided range; growing $0.05 or 23% from the year-ago period. • Net cash from operating activities was at the mid-point of the guided range, down from Q4 23 driven primarily by timing of customer collections and one-time expenses. Net Cash Provided by Operating Activities ($M) Revenue ($M) Non-GAAP Diluted EPS* ($) 139.2 142.5 4Q23 4Q24 0.22 0.27 4Q23 4Q24 +22.7% 60.4 35.1 4Q23 4Q24 -41.9%+2.4% 4

* For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation. 2 0 2 4 S E G M E N T P E R F O R M A N C EFull Year MedTech & Specialty Audio Continued partnership with our customers to create innovative solutions which enhance the performance of their products drove full year revenue growth. • Revenue grew 8% year over year with strong demand for our hearing health products. Our ability to leverage fixed overhead drove profitable growth. • Adjusted EBITDA margins improved 200 bps driven by operating leverage with adjusted EBIT* increasing 14% from 2023 levels. Revenue ($M) Adjusted EBITDA Margin* (%) 235.4 253.5 FY23 FY24 41.6 43.6 FY23 FY24 +7.7% +200 bps 5

* For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation. Q 4 2 0 2 4 S E G M E N T P E R F O R M A N C E Q4 MedTech & Specialty Audio Revenue ($M) Adjusted EBITDA Margin* (%) 69.5 69.7 4Q23 4Q24 45.8 42.5 4Q23 4Q24 +0.3% -330 bps • Revenue was flat year over year based on shifts in product mix. • Adjusted EBITDA margins were down 330 bps year over year driven by higher incentive compensation costs and lower average pricing on mature products. 6

* For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation. Full Year Precision Devices 2 0 2 4 S E G M E N T P E R F O R M A N C E Adjusted EBITDA Margin* (%) Revenue ($M) 221.4 300.0 FY23 FY24 j t I r i ( ) +35.5% 22.0 20.2 FY23 FY24 -180 bps Demand for high-performance capacitors is strong with a noticeable acceleration of orders from Q3 on. • Revenue grew 36% from 2023 with the expansion of our high-performance capacitor product portfolio to include film, mica, and electrolytic capacitors from the acquisition of Cornell. • Adjusted EBITDA margins declined 180 bps from 2023 largely driven by the acquisition of Cornell in Q4 2023. A strong pipeline of new opportunities positions us well for growth in 2025 as production improves within the Specialty Film line. 7

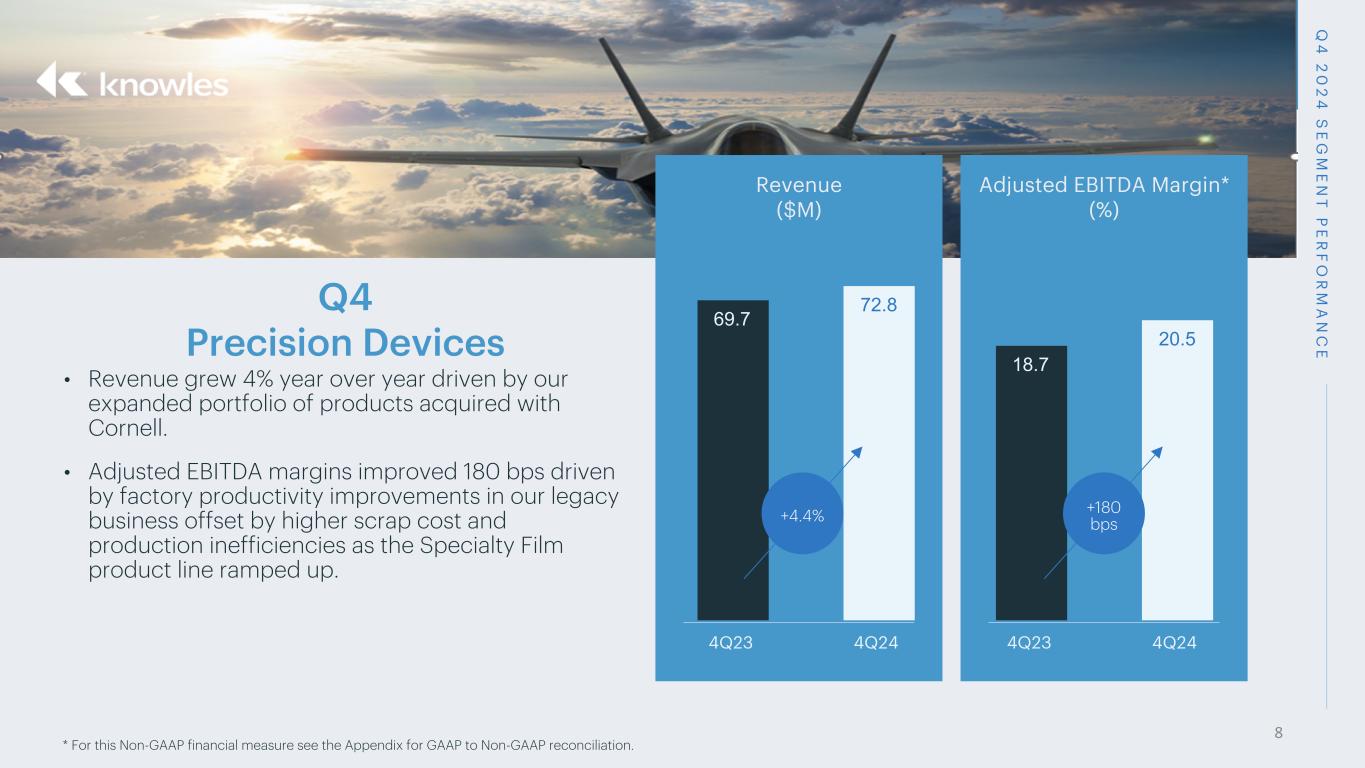

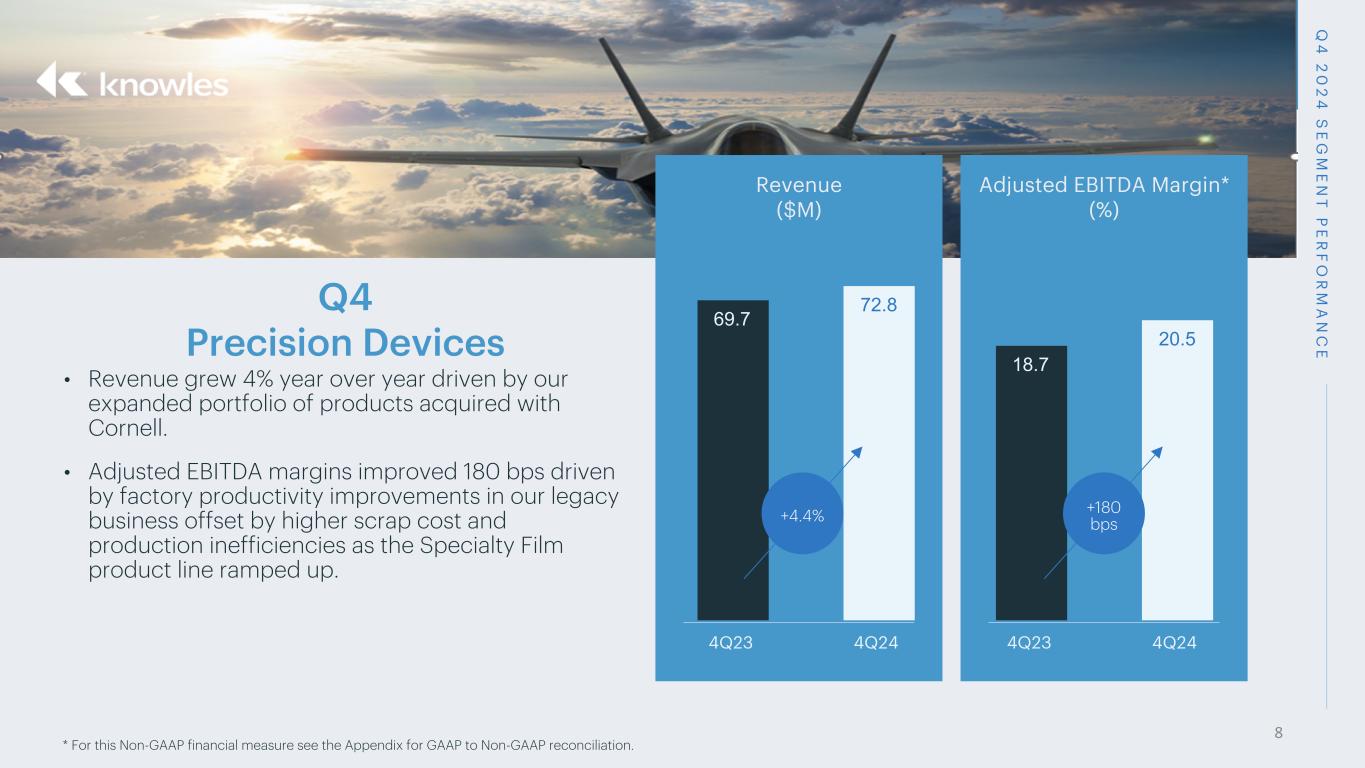

* For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation. Q4 Precision Devices Q 4 2 0 2 4 S E G M E N T P E R F O R M A N C E Revenue ($M) 69.7 72.8 4Q23 4Q24 Adjusted EBITDA Margin* (%) +4.4% 18.7 20.5 4Q23 4Q24 +180 bps • Revenue grew 4% year over year driven by our expanded portfolio of products acquired with Cornell. • Adjusted EBITDA margins improved 180 bps driven by factory productivity improvements in our legacy business offset by higher scrap cost and production inefficiencies as the Specialty Film product line ramped up. 8

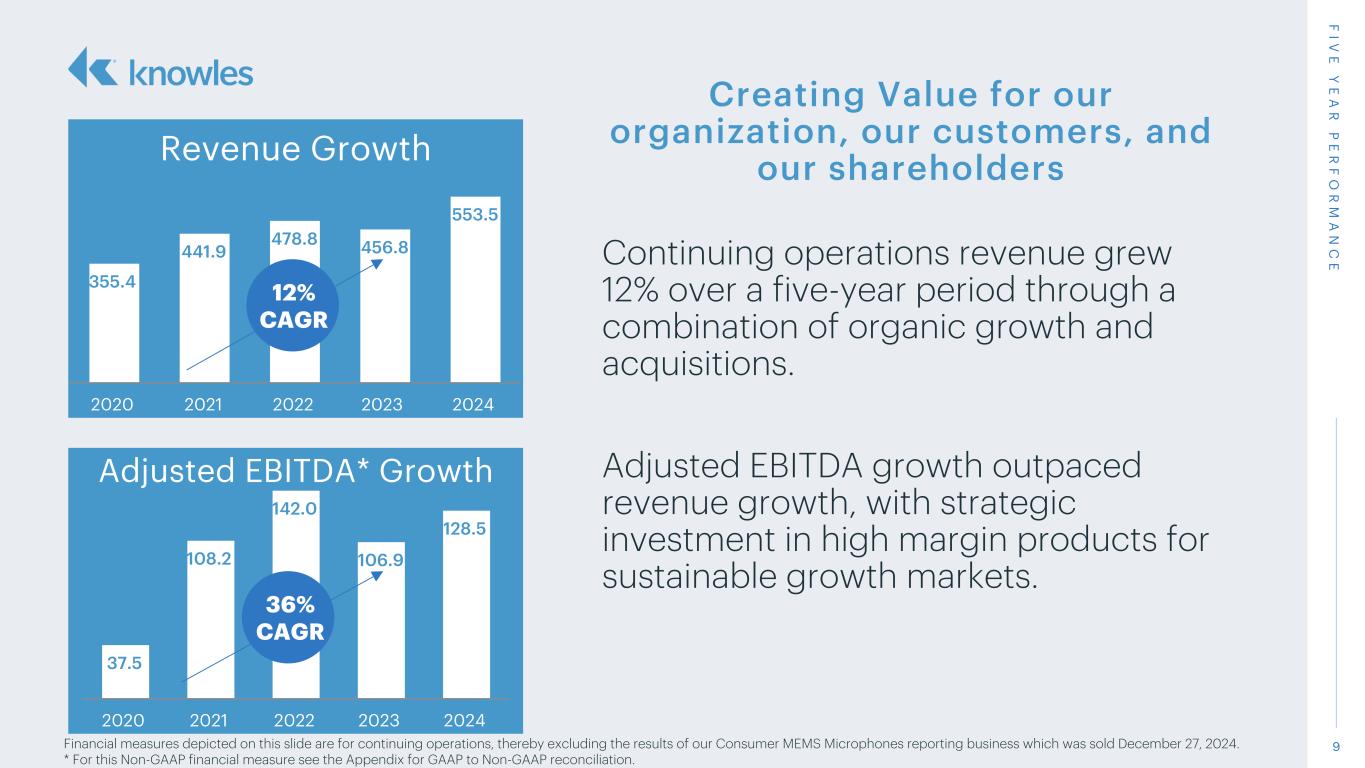

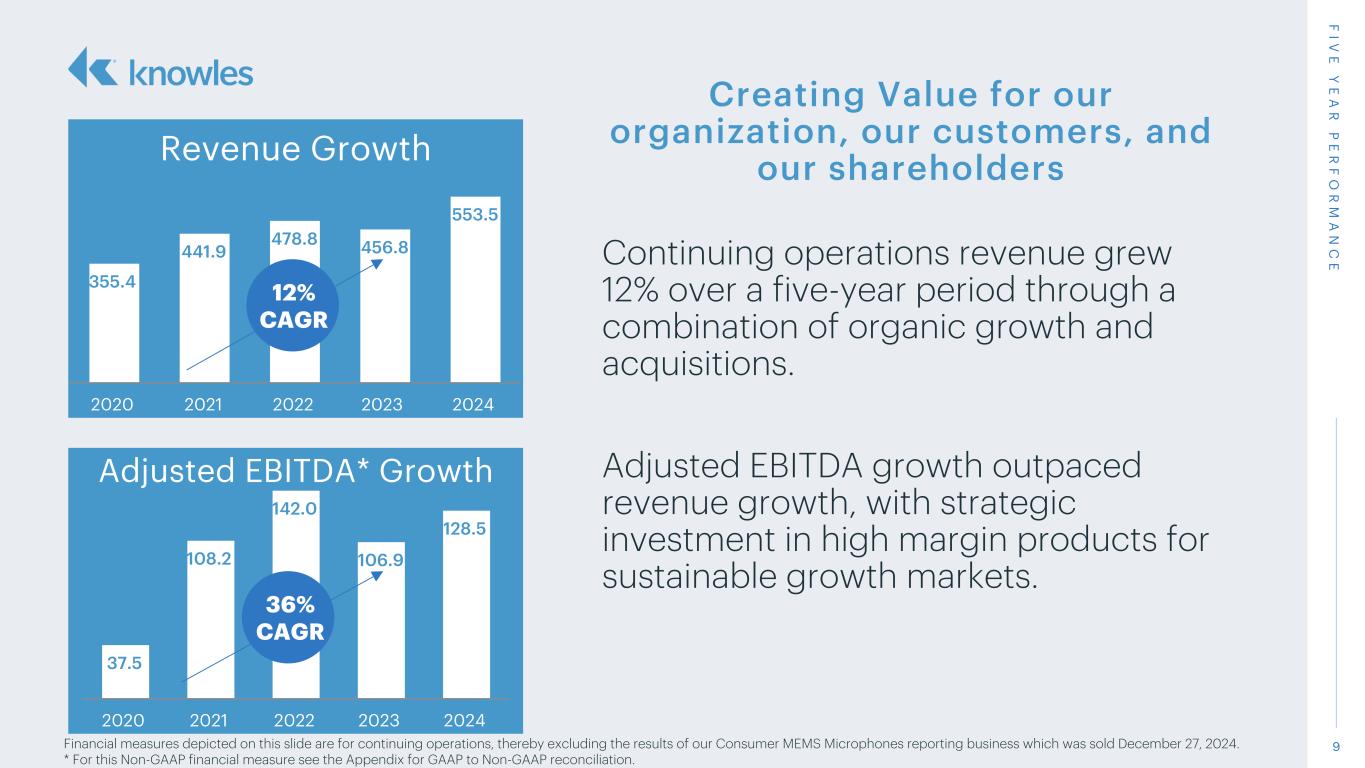

9Financial measures depicted on this slide are for continuing operations, thereby excluding the results of our Consumer MEMS Microphones reporting business which was sold December 27, 2024. * For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation. Adjusted EBITDA* Growth Revenue Growth F IV E Y E A R P E R F O R M A N C E Creating Value for our organization, our customers, and our shareholders Continuing operations revenue grew 12% over a five-year period through a combination of organic growth and acquisitions. Adjusted EBITDA growth outpaced revenue growth, with strategic investment in high margin products for sustainable growth markets. 37.5 108.2 142.0 106.9 128.5 2020 2021 2022 2023 2024 36% CAGR 355.4 441.9 478.8 456.8 553.5 2020 2021 2022 2023 2024 12% CAGR

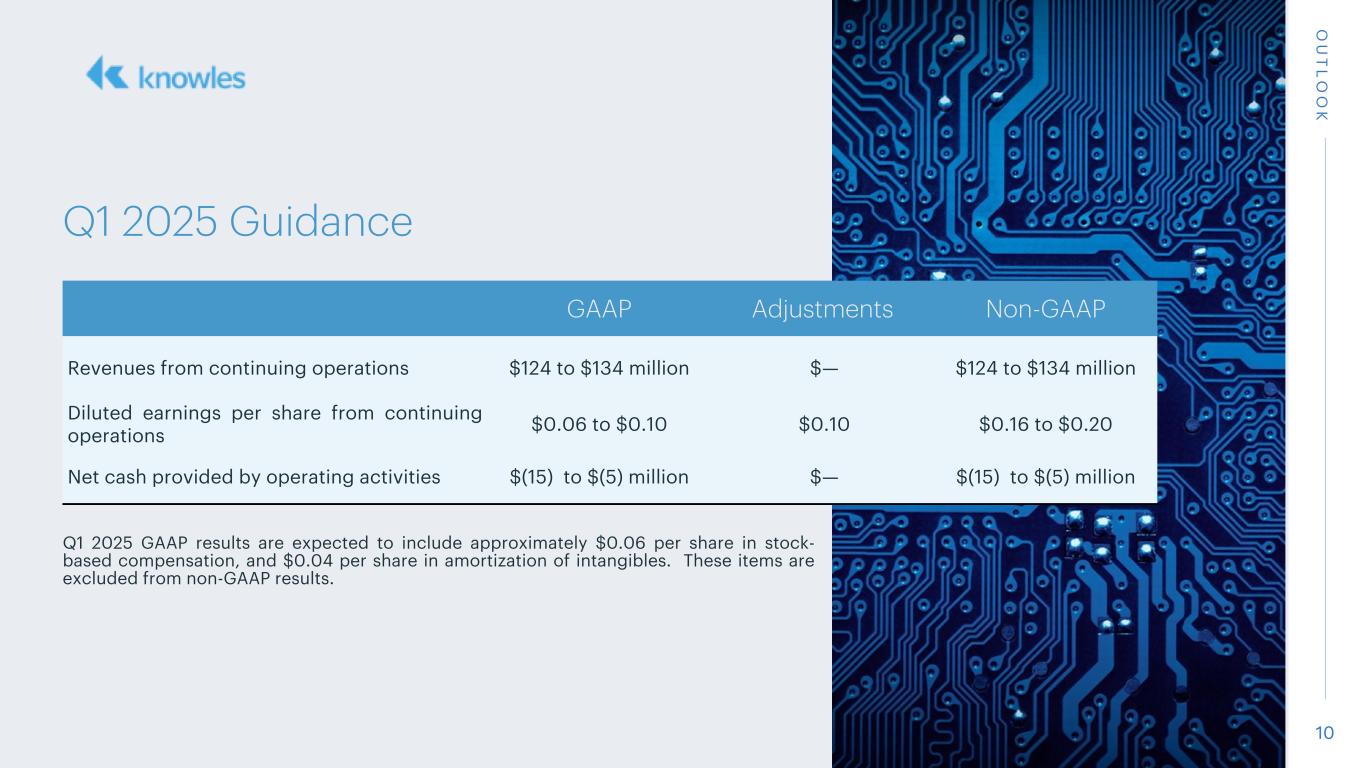

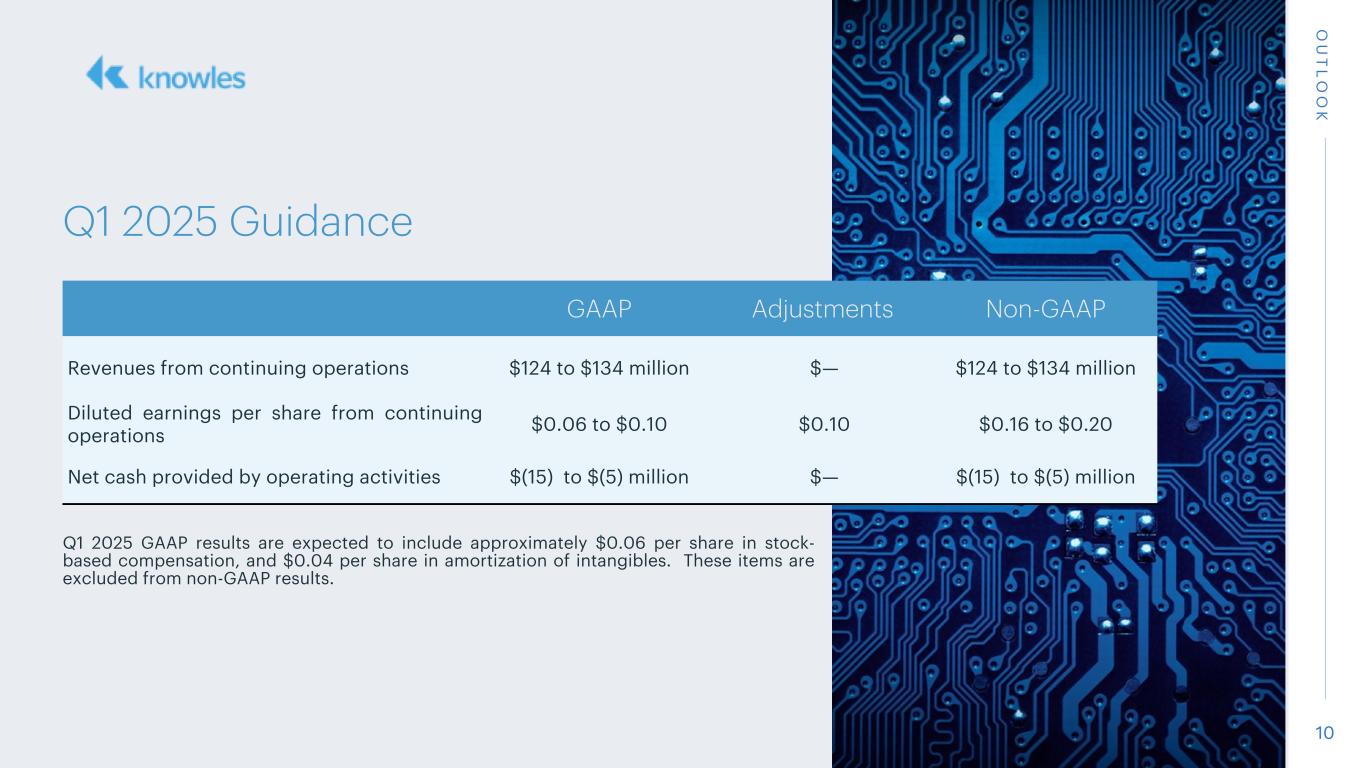

Q1 2025 GAAP results are expected to include approximately $0.06 per share in stock- based compensation, and $0.04 per share in amortization of intangibles. These items are excluded from non-GAAP results. 10 O U T L O O K Q1 2025 Guidance GAAP Adjustments Non-GAAP Revenues from continuing operations $124 to $134 million $— $124 to $134 million Diluted earnings per share from continuing operations $0.06 to $0.10 $0.10 $0.16 to $0.20 Net cash provided by operating activities $(15) to $(5) million $— $(15) to $(5) million

Appendix 11

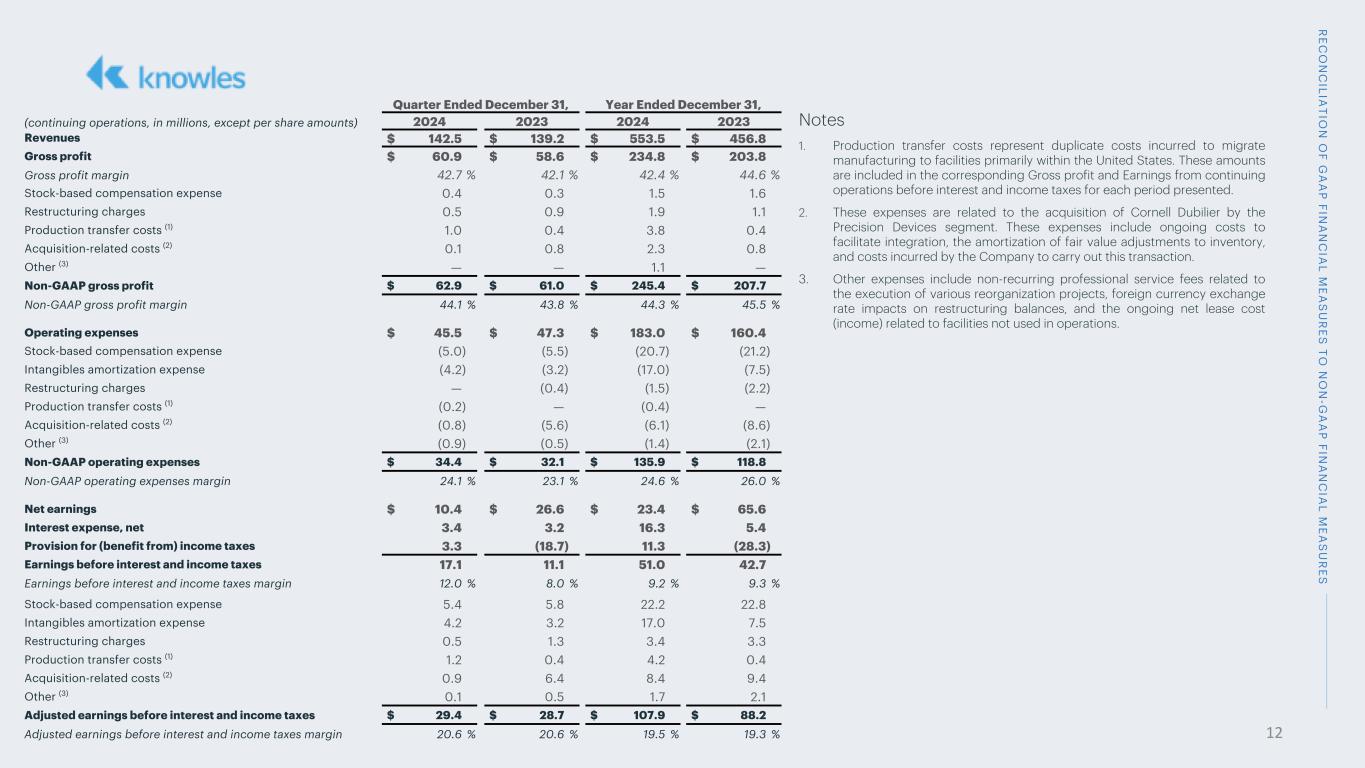

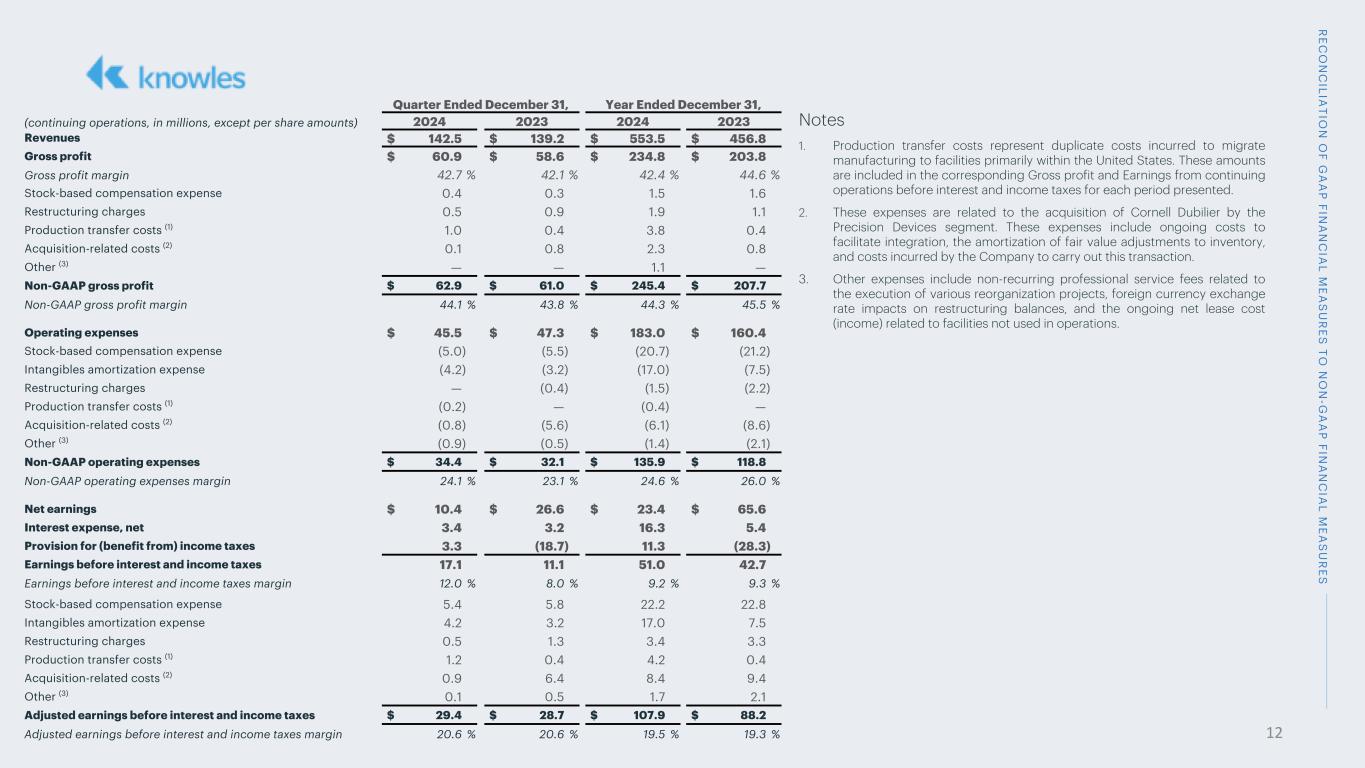

Notes 1. Production transfer costs represent duplicate costs incurred to migrate manufacturing to facilities primarily within the United States. These amounts are included in the corresponding Gross profit and Earnings from continuing operations before interest and income taxes for each period presented. 2. These expenses are related to the acquisition of Cornell Dubilier by the Precision Devices segment. These expenses include ongoing costs to facilitate integration, the amortization of fair value adjustments to inventory, and costs incurred by the Company to carry out this transaction. 3. Other expenses include non-recurring professional service fees related to the execution of various reorganization projects, foreign currency exchange rate impacts on restructuring balances, and the ongoing net lease cost (income) related to facilities not used in operations. R EC O N C ILIA TIO N O F G A A P FIN A N C IA L M EA S U R ES TO N O N -G A A P FIN A N C IA L M EA S U R ES Quarter Ended December 31, Year Ended December 31, (continuing operations, in millions, except per share amounts) 2024 2023 2024 2023 Revenues $ 142.5 $ 139.2 $ 553.5 $ 456.8 Gross profit $ 60.9 $ 58.6 $ 234.8 $ 203.8 Gross profit margin 42.7 % 42.1 % 42.4 % 44.6 % Stock-based compensation expense 0.4 0.3 1.5 1.6 Restructuring charges 0.5 0.9 1.9 1.1 Production transfer costs (1) 1.0 0.4 3.8 0.4 Acquisition-related costs (2) 0.1 0.8 2.3 0.8 Other (3) — — 1.1 — Non-GAAP gross profit $ 62.9 $ 61.0 $ 245.4 $ 207.7 Non-GAAP gross profit margin 44.1 % 43.8 % 44.3 % 45.5 % Operating expenses $ 45.5 $ 47.3 $ 183.0 $ 160.4 Stock-based compensation expense (5.0) (5.5) (20.7) (21.2) Intangibles amortization expense (4.2) (3.2) (17.0) (7.5) Restructuring charges — (0.4) (1.5) (2.2) Production transfer costs (1) (0.2) — (0.4) — Acquisition-related costs (2) (0.8) (5.6) (6.1) (8.6) Other (3) (0.9) (0.5) (1.4) (2.1) Non-GAAP operating expenses $ 34.4 $ 32.1 $ 135.9 $ 118.8 Non-GAAP operating expenses margin 24.1 % 23.1 % 24.6 % 26.0 % Net earnings $ 10.4 $ 26.6 $ 23.4 $ 65.6 Interest expense, net 3.4 3.2 16.3 5.4 Provision for (benefit from) income taxes 3.3 (18.7) 11.3 (28.3) Earnings before interest and income taxes 17.1 11.1 51.0 42.7 Earnings before interest and income taxes margin 12.0 % 8.0 % 9.2 % 9.3 % Stock-based compensation expense 5.4 5.8 22.2 22.8 Intangibles amortization expense 4.2 3.2 17.0 7.5 Restructuring charges 0.5 1.3 3.4 3.3 Production transfer costs (1) 1.2 0.4 4.2 0.4 Acquisition-related costs (2) 0.9 6.4 8.4 9.4 Other (3) 0.1 0.5 1.7 2.1 Adjusted earnings before interest and income taxes $ 29.4 $ 28.7 $ 107.9 $ 88.2 Adjusted earnings before interest and income taxes margin 20.6 % 20.6 % 19.5 % 19.3 % 12

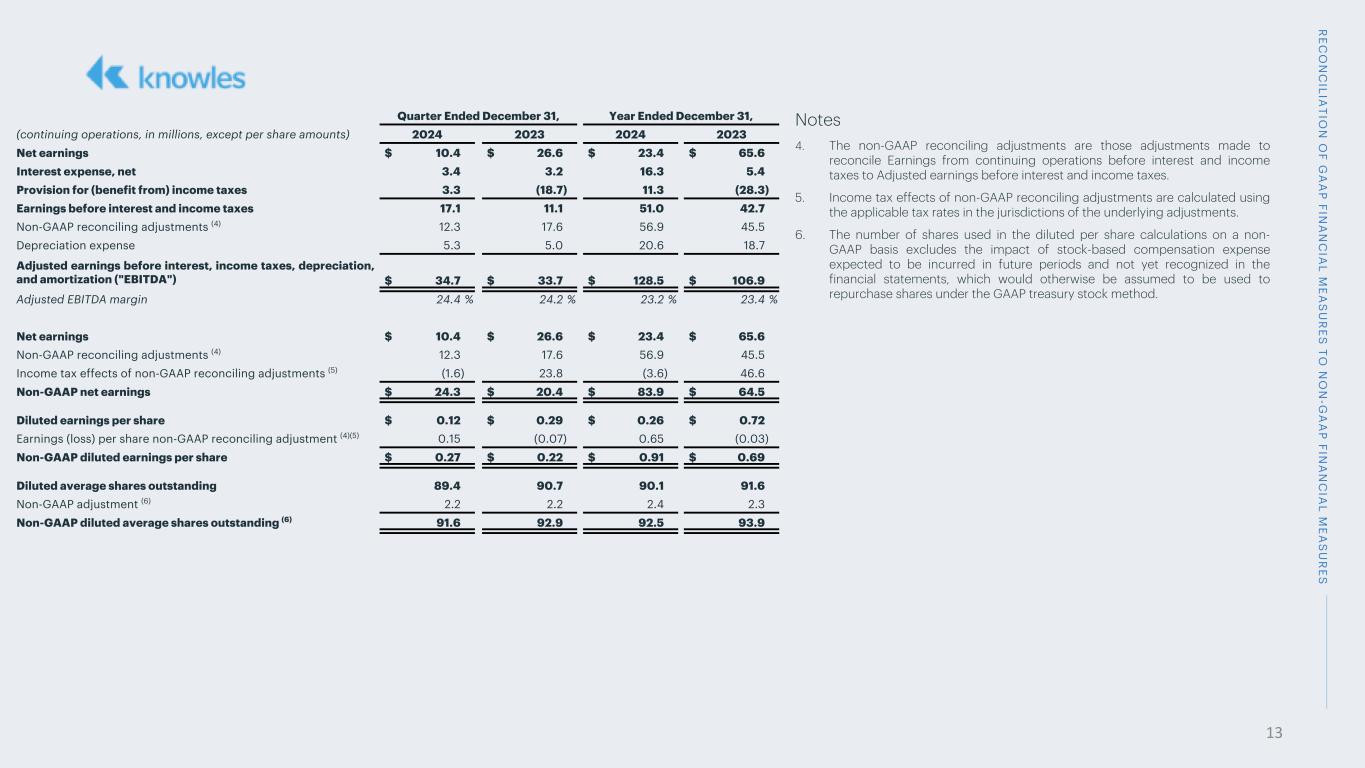

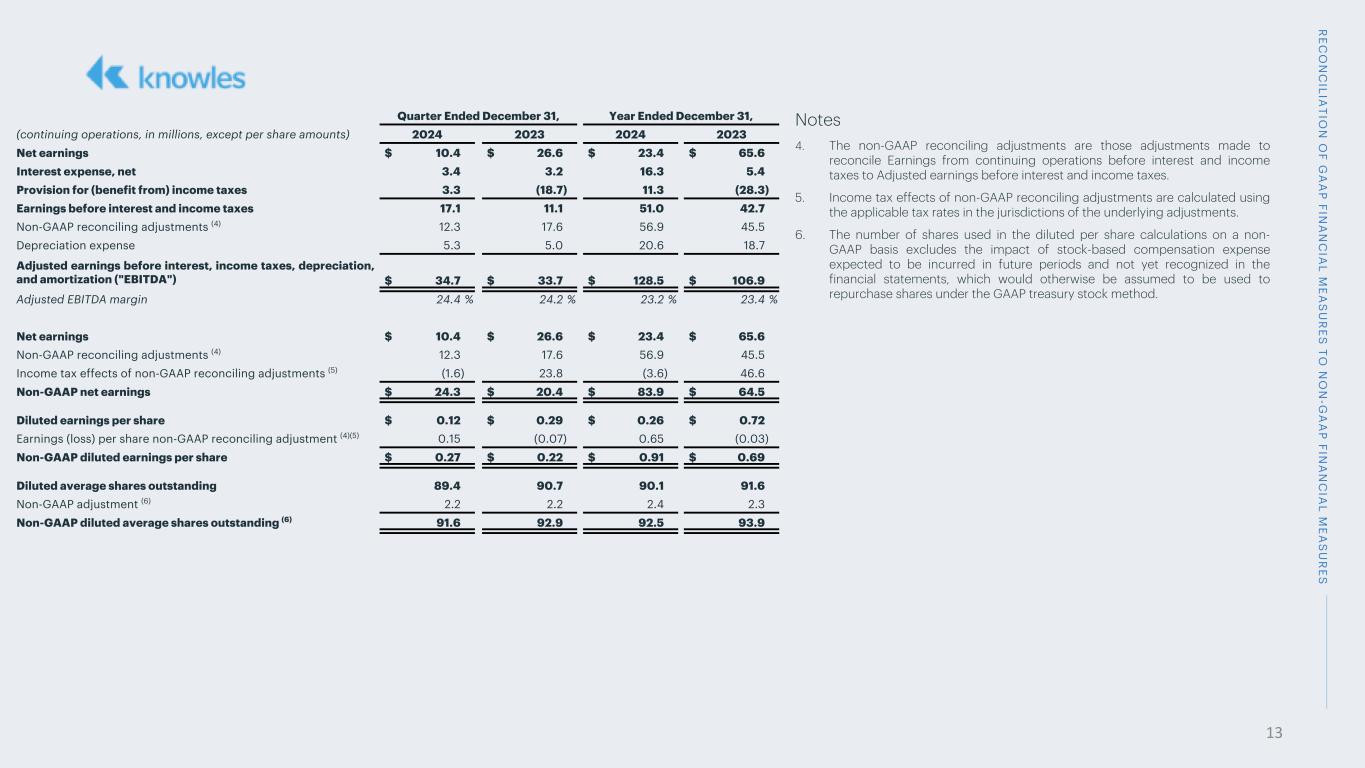

R EC O N C ILIA TIO N O F G A A P FIN A N C IA L M EA S U R ES TO N O N -G A A P FIN A N C IA L M EA S U R ES Notes 4. The non-GAAP reconciling adjustments are those adjustments made to reconcile Earnings from continuing operations before interest and income taxes to Adjusted earnings before interest and income taxes. 5. Income tax effects of non-GAAP reconciling adjustments are calculated using the applicable tax rates in the jurisdictions of the underlying adjustments. 6. The number of shares used in the diluted per share calculations on a non- GAAP basis excludes the impact of stock-based compensation expense expected to be incurred in future periods and not yet recognized in the financial statements, which would otherwise be assumed to be used to repurchase shares under the GAAP treasury stock method. Quarter Ended December 31, Year Ended December 31, (continuing operations, in millions, except per share amounts) 2024 2023 2024 2023 Net earnings $ 10.4 $ 26.6 $ 23.4 $ 65.6 Interest expense, net 3.4 3.2 16.3 5.4 Provision for (benefit from) income taxes 3.3 (18.7) 11.3 (28.3) Earnings before interest and income taxes 17.1 11.1 51.0 42.7 Non-GAAP reconciling adjustments (4) 12.3 17.6 56.9 45.5 Depreciation expense 5.3 5.0 20.6 18.7 Adjusted earnings before interest, income taxes, depreciation, and amortization ("EBITDA") $ 34.7 $ 33.7 $ 128.5 $ 106.9 Adjusted EBITDA margin 24.4 % 24.2 % 23.2 % 23.4 % Net earnings $ 10.4 $ 26.6 $ 23.4 $ 65.6 Non-GAAP reconciling adjustments (4) 12.3 17.6 56.9 45.5 Income tax effects of non-GAAP reconciling adjustments (5) (1.6) 23.8 (3.6) 46.6 Non-GAAP net earnings $ 24.3 $ 20.4 $ 83.9 $ 64.5 Diluted earnings per share $ 0.12 $ 0.29 $ 0.26 $ 0.72 Earnings (loss) per share non-GAAP reconciling adjustment (4)(5) 0.15 (0.07) 0.65 (0.03) Non-GAAP diluted earnings per share $ 0.27 $ 0.22 $ 0.91 $ 0.69 Diluted average shares outstanding 89.4 90.7 90.1 91.6 Non-GAAP adjustment (6) 2.2 2.2 2.4 2.3 Non-GAAP diluted average shares outstanding (6) 91.6 92.9 92.5 93.9 13

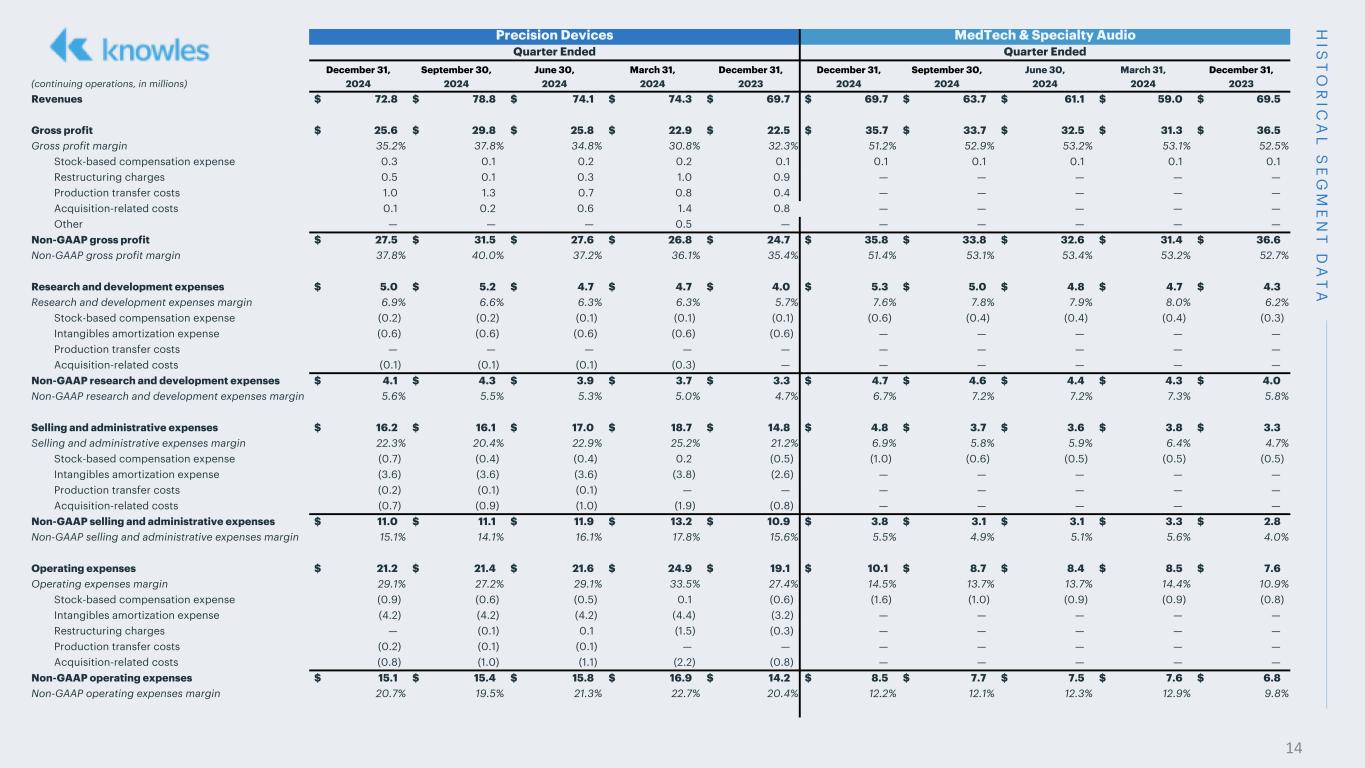

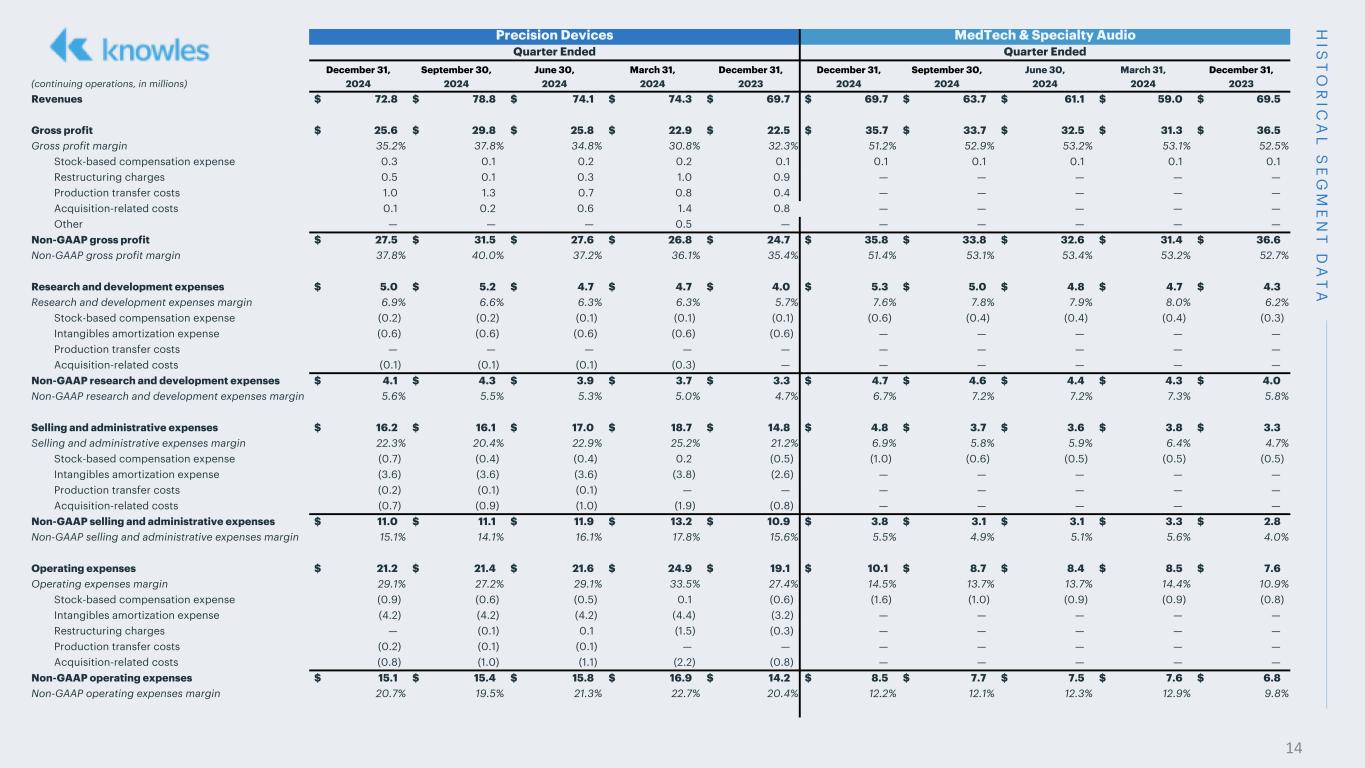

H IS T O R IC A L S E G M E N T D A T A Precision Devices MedTech & Specialty Audio Quarter Ended Quarter Ended December 31, September 30, June 30, March 31, December 31, December 31, September 30, June 30, March 31, December 31, (continuing operations, in millions) 2024 2024 2024 2024 2023 2024 2024 2024 2024 2023 Revenues $ 72.8 $ 78.8 $ 74.1 $ 74.3 $ 69.7 $ 69.7 $ 63.7 $ 61.1 $ 59.0 $ 69.5 Gross profit $ 25.6 $ 29.8 $ 25.8 $ 22.9 $ 22.5 $ 35.7 $ 33.7 $ 32.5 $ 31.3 $ 36.5 Gross profit margin 35.2 % 37.8 % 34.8 % 30.8 % 32.3 % 51.2 % 52.9 % 53.2 % 53.1 % 52.5 % Stock-based compensation expense 0.3 0.1 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.1 Restructuring charges 0.5 0.1 0.3 1.0 0.9 — — — — — Production transfer costs 1.0 1.3 0.7 0.8 0.4 — — — — — Acquisition-related costs 0.1 0.2 0.6 1.4 0.8 — — — — — Other — — — 0.5 — — — — — — Non-GAAP gross profit $ 27.5 $ 31.5 $ 27.6 $ 26.8 $ 24.7 $ 35.8 $ 33.8 $ 32.6 $ 31.4 $ 36.6 Non-GAAP gross profit margin 37.8 % 40.0 % 37.2 % 36.1 % 35.4 % 51.4 % 53.1 % 53.4 % 53.2 % 52.7 % Research and development expenses $ 5.0 $ 5.2 $ 4.7 $ 4.7 $ 4.0 $ 5.3 $ 5.0 $ 4.8 $ 4.7 $ 4.3 Research and development expenses margin 6.9 % 6.6 % 6.3 % 6.3 % 5.7 % 7.6 % 7.8 % 7.9 % 8.0 % 6.2 % Stock-based compensation expense (0.2) (0.2) (0.1) (0.1) (0.1) (0.6) (0.4) (0.4) (0.4) (0.3) Intangibles amortization expense (0.6) (0.6) (0.6) (0.6) (0.6) — — — — — Production transfer costs — — — — — — — — — — Acquisition-related costs (0.1) (0.1) (0.1) (0.3) — — — — — — Non-GAAP research and development expenses $ 4.1 $ 4.3 $ 3.9 $ 3.7 $ 3.3 $ 4.7 $ 4.6 $ 4.4 $ 4.3 $ 4.0 Non-GAAP research and development expenses margin 5.6 % 5.5 % 5.3 % 5.0 % 4.7 % 6.7 % 7.2 % 7.2 % 7.3 % 5.8 % Selling and administrative expenses $ 16.2 $ 16.1 $ 17.0 $ 18.7 $ 14.8 $ 4.8 $ 3.7 $ 3.6 $ 3.8 $ 3.3 Selling and administrative expenses margin 22.3 % 20.4 % 22.9 % 25.2 % 21.2 % 6.9 % 5.8 % 5.9 % 6.4 % 4.7 % Stock-based compensation expense (0.7) (0.4) (0.4) 0.2 (0.5) (1.0) (0.6) (0.5) (0.5) (0.5) Intangibles amortization expense (3.6) (3.6) (3.6) (3.8) (2.6) — — — — — Production transfer costs (0.2) (0.1) (0.1) — — — — — — — Acquisition-related costs (0.7) (0.9) (1.0) (1.9) (0.8) — — — — — Non-GAAP selling and administrative expenses $ 11.0 $ 11.1 $ 11.9 $ 13.2 $ 10.9 $ 3.8 $ 3.1 $ 3.1 $ 3.3 $ 2.8 Non-GAAP selling and administrative expenses margin 15.1 % 14.1 % 16.1 % 17.8 % 15.6 % 5.5 % 4.9 % 5.1 % 5.6 % 4.0 % Operating expenses $ 21.2 $ 21.4 $ 21.6 $ 24.9 $ 19.1 $ 10.1 $ 8.7 $ 8.4 $ 8.5 $ 7.6 Operating expenses margin 29.1 % 27.2 % 29.1 % 33.5 % 27.4 % 14.5 % 13.7 % 13.7 % 14.4 % 10.9 % Stock-based compensation expense (0.9) (0.6) (0.5) 0.1 (0.6) (1.6) (1.0) (0.9) (0.9) (0.8) Intangibles amortization expense (4.2) (4.2) (4.2) (4.4) (3.2) — — — — — Restructuring charges — (0.1) 0.1 (1.5) (0.3) — — — — — Production transfer costs (0.2) (0.1) (0.1) — — — — — — — Acquisition-related costs (0.8) (1.0) (1.1) (2.2) (0.8) — — — — — Non-GAAP operating expenses $ 15.1 $ 15.4 $ 15.8 $ 16.9 $ 14.2 $ 8.5 $ 7.7 $ 7.5 $ 7.6 $ 6.8 Non-GAAP operating expenses margin 20.7 % 19.5 % 21.3 % 22.7 % 20.4 % 12.2 % 12.1 % 12.3 % 12.9 % 9.8 % 14

H IS T O R IC A L S E G M E N T D A T A Precision Devices MedTech & Specialty Audio Quarter Ended Quarter Ended December 31, September 30, June 30, March 31, December 31, December 31, September 30, June 30, March 31, December 31, (continuing operations, in millions) 2024 2024 2024 2024 2023 2024 2024 2024 2024 2023 Revenues $ 72.8 $ 78.8 $ 74.1 $ 74.3 $ 69.7 $ 69.7 $ 63.7 $ 61.1 $ 59.0 $ 69.5 Operating earnings (loss) $ 4.4 $ 8.4 $ 4.2 $ (2.0) $ 3.4 $ 25.6 $ 25.0 $ 24.1 $ 22.8 $ 28.9 Other expense, net 0.1 — — 0.1 — — — — — — Earnings (loss) before interest and income taxes $ 4.3 $ 8.4 $ 4.2 $ (2.1) $ 3.4 $ 25.6 $ 25.0 $ 24.1 $ 22.8 $ 28.9 Earnings (loss) before interest and income taxes margin 5.9 % 10.7 % 5.7 % -2.8 % 4.9 % 36.7 % 39.2 % 39.4 % 38.6 % 41.6 % Stock-based compensation expense 1.2 0.7 0.7 0.1 0.7 1.7 1.1 1.0 1.0 0.9 Intangibles amortization expense 4.2 4.2 4.2 4.4 3.2 — — — — — Restructuring charges 0.5 0.2 0.2 2.5 1.2 — — — — — Production transfer costs 1.2 1.4 0.8 0.8 0.4 — — — — — Acquisition-related costs 0.9 1.2 1.7 3.6 1.6 — — — — — Other — — — 0.5 — — — — — — Adjusted earnings before interest and income taxes $ 12.3 $ 16.1 $ 11.8 $ 9.8 $ 10.5 $ 27.3 $ 26.1 $ 25.1 $ 23.8 $ 29.8 Adjusted earnings before interest and income taxes margin 16.9 % 20.4 % 15.9 % 13.2 % 15.1 % 39.2 % 41.0 % 41.1 % 40.3 % 42.9 % Operating earnings (loss) $ 4.4 $ 8.4 $ 4.2 $ (2.0) $ 3.4 $ 25.6 $ 25.0 $ 24.1 $ 22.8 $ 28.9 Other expense, net 0.1 — — 0.1 — — — — — — Earnings (loss) before interest and income taxes $ 4.3 $ 8.4 $ 4.2 $ (2.1) $ 3.4 $ 25.6 $ 25.0 $ 24.1 $ 22.8 $ 28.9 Non-GAAP reconciling adjustments 8.0 7.7 7.6 11.9 7.1 1.7 1.1 1.0 1.0 0.9 Depreciation expense 2.6 2.6 2.6 2.7 2.5 2.3 2.0 2.0 2.0 2.0 Adjusted earnings before interest, income taxes, depreciation, and amortization ("EBITDA") $ 14.9 $ 18.7 $ 14.4 $ 12.5 $ 13.0 $ 29.6 $ 28.1 $ 27.1 $ 25.8 $ 31.8 Adjusted EBITDA margin 20.5 % 23.7 % 19.4 % 16.8 % 18.7 % 42.5 % 44.1 % 44.4 % 43.7 % 45.8 % 15

H IS T O R IC A L S E G M E N T D A T A Precision Devices MedTech & Specialty Audio Year Ended Year Ended December 31, December 31, December 31, December 31, (continuing operations, in millions) 2024 2023 2024 2023 Revenues $ 300.0 $ 221.4 $ 253.5 $ 235.4 Gross profit $ 104.1 $ 86.2 $ 133.2 $ 119.7 Gross profit margin 34.7 % 38.9 % 52.5 % 50.8 % Stock-based compensation expense 0.8 0.7 0.4 0.4 Restructuring charges 1.9 1.1 — — Production transfer costs 3.8 0.4 — — Acquisition-related costs 2.3 0.8 — — Other 0.5 — — — Non-GAAP gross profit $ 113.4 $ 89.2 $ 133.6 $ 120.1 Non-GAAP gross profit margin 37.8 % 40.3 % 52.7 % 51.0 % Research and development expenses $ 19.6 $ 13.8 $ 19.8 $ 18.3 Research and development expenses margin 6.5 % 6.2 % 7.8 % 7.8 % Stock-based compensation expense (0.6) (0.6) (1.8) (1.3) Intangibles amortization expense (2.4) (0.9) — — Acquisition-related costs (0.6) — — — Other — — — — Non-GAAP research and development expenses $ 16.0 $ 12.3 $ 18.0 $ 17.0 Non-GAAP research and development expenses margin 5.3 % 5.6 % 7.1 % 7.2 % Selling and administrative expenses $ 68.0 $ 45.7 $ 15.9 $ 15.1 Selling and administrative expenses margin 22.7 % 20.6 % 6.3 % 6.4 % Stock-based compensation expense (1.3) (2.2) (2.6) (1.8) Intangibles amortization expense (14.6) (6.6) — — Production transfer costs (0.4) — — — Acquisition-related costs (4.5) (0.8) — — Non-GAAP selling and administrative expenses $ 47.2 $ 36.1 $ 13.3 $ 13.3 Non-GAAP selling and administrative expenses margin 15.7 % 16.3 % 5.2 % 5.6 % Operating expenses $ 89.1 $ 60.9 $ 35.7 $ 33.4 Operating expenses margin 29.7 % 27.5 % 14.1 % 14.2 % Stock-based compensation expense (1.9) (2.8) (4.4) (3.1) Intangibles amortization expense (17.0) (7.5) — — Restructuring charges (1.5) (1.4) — — Production transfer costs (0.4) — — — Acquisition-related costs (5.1) (0.8) — — Non-GAAP operating expenses $ 63.2 $ 48.4 $ 31.3 $ 30.3 Non-GAAP operating expenses margin 21.1 % 21.9 % 12.3 % 12.9 % 16

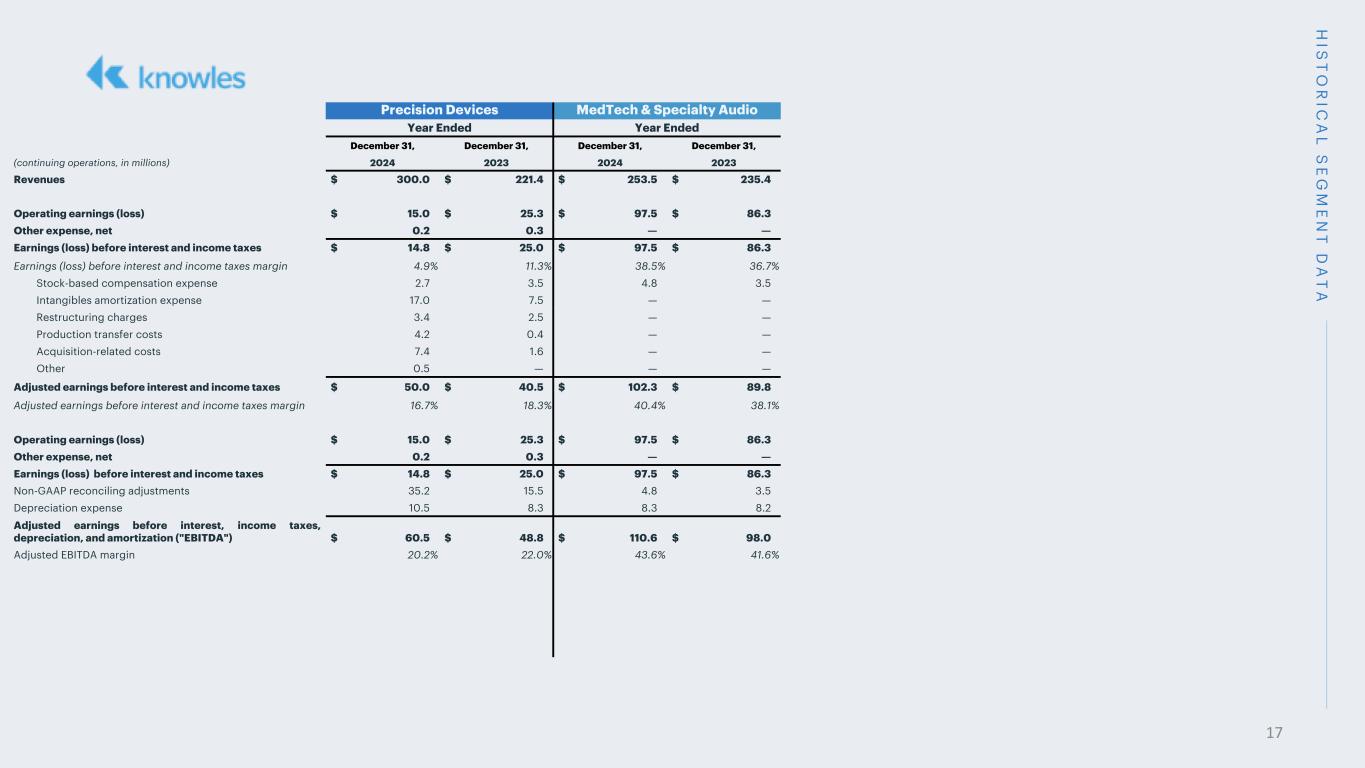

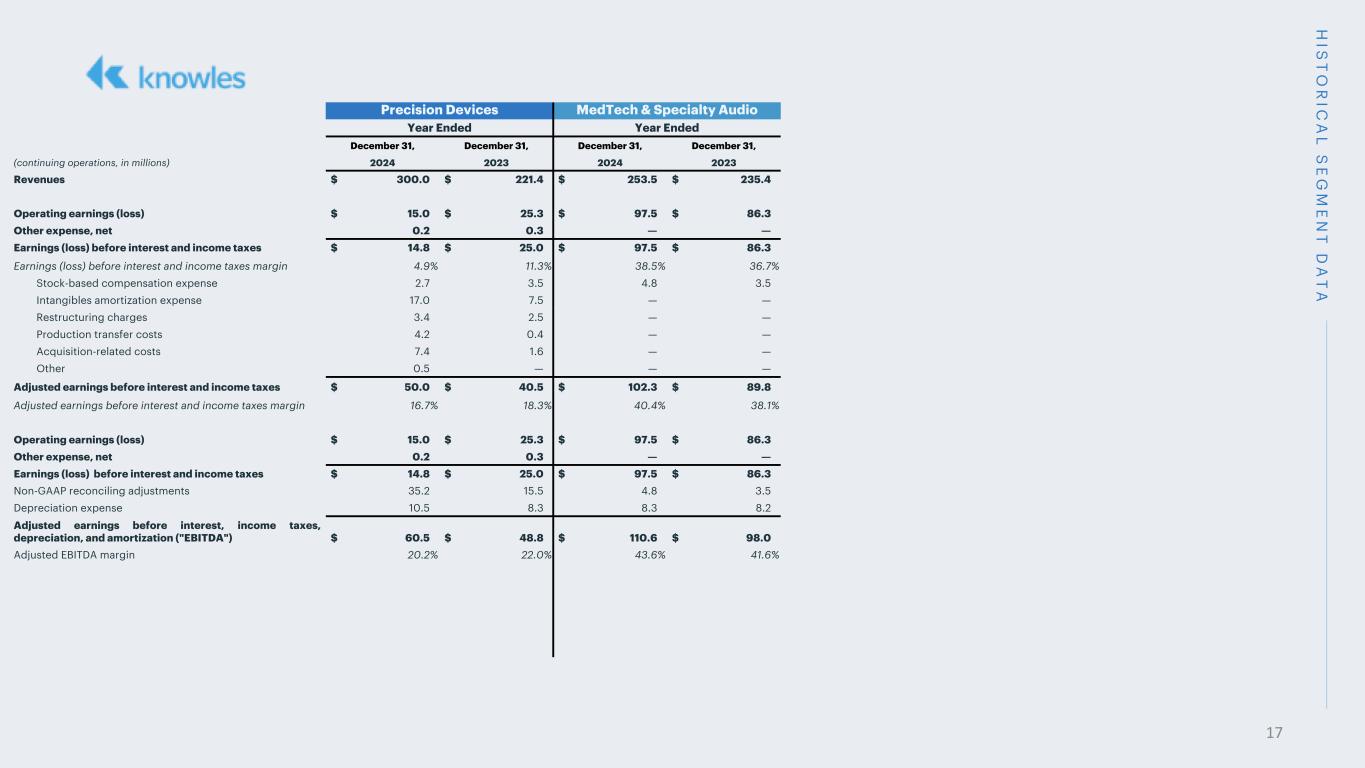

H IS T O R IC A L S E G M E N T D A T A Precision Devices MedTech & Specialty Audio Year Ended Year Ended December 31, December 31, December 31, December 31, (continuing operations, in millions) 2024 2023 2024 2023 Revenues $ 300.0 $ 221.4 $ 253.5 $ 235.4 Operating earnings (loss) $ 15.0 $ 25.3 $ 97.5 $ 86.3 Other expense, net 0.2 0.3 — — Earnings (loss) before interest and income taxes $ 14.8 $ 25.0 $ 97.5 $ 86.3 Earnings (loss) before interest and income taxes margin 4.9 % 11.3 % 38.5 % 36.7 % Stock-based compensation expense 2.7 3.5 4.8 3.5 Intangibles amortization expense 17.0 7.5 — — Restructuring charges 3.4 2.5 — — Production transfer costs 4.2 0.4 — — Acquisition-related costs 7.4 1.6 — — Other 0.5 — — — Adjusted earnings before interest and income taxes $ 50.0 $ 40.5 $ 102.3 $ 89.8 Adjusted earnings before interest and income taxes margin 16.7 % 18.3 % 40.4 % 38.1 % Operating earnings (loss) $ 15.0 $ 25.3 $ 97.5 $ 86.3 Other expense, net 0.2 0.3 — — Earnings (loss) before interest and income taxes $ 14.8 $ 25.0 $ 97.5 $ 86.3 Non-GAAP reconciling adjustments 35.2 15.5 4.8 3.5 Depreciation expense 10.5 8.3 8.3 8.2 Adjusted earnings before interest, income taxes, depreciation, and amortization ("EBITDA") $ 60.5 $ 48.8 $ 110.6 $ 98.0 Adjusted EBITDA margin 20.2 % 22.0 % 43.6 % 41.6 % 17

R EC O N C ILIA TIO N O F S EG M EN T EB IT TO C O N S O LID A TED N ET EA R N IN G S Quarter Ended December 31, September 30, June 30, March 31, December 31, (Continuing operations, in millions) 2024 2024 2024 2024 2023 Earnings (loss) before interest and income taxes Precision Devices $ 4.3 $ 8.4 $ 4.2 $ (2.1) $ 3.4 MedTech & Specialty Audio 25.6 25.0 24.1 22.8 28.9 Total segments 29.9 33.4 28.3 20.7 32.3 Corporate expense / other 12.8 17.3 15.9 15.3 21.2 Interest expense, net 3.4 3.9 4.6 4.4 3.2 Earnings before income taxes 13.7 12.2 7.8 1.0 7.9 Provision for (benefit from) income taxes 3.3 3.0 3.0 2.0 (18.7) Net earnings (loss) $ 10.4 $ 9.2 $ 4.8 $ (1.0) $ 26.6 18

Quarter Ended December 31, September 30, June 30, March 31, Trailing 12-months(Continuing operations, in millions) 2024 2024 2024 2024 Net earnings (loss) $ 10.4 $ 9.2 $ 4.8 $ (1.0) $ 23.4 Interest expense, net 3.4 3.9 4.6 4.4 16.3 Provision for income taxes 3.3 3.0 3.0 2.0 11.3 Earnings before interest and income taxes 17.1 16.1 12.4 5.4 51.0 Stock-based compensation expense 5.4 5.8 5.9 5.1 22.2 Intangibles amortization expense 4.2 4.2 4.2 4.4 17.0 Restructuring charges 0.5 0.2 0.2 2.5 3.4 Production transfer costs 1.2 1.4 0.8 0.8 4.2 Acquisition-related costs 0.9 1.3 2.0 4.2 8.4 Other 0.1 1.0 (0.3) 0.9 1.7 Non-GAAP reconciling adjustments 12.3 13.9 12.8 17.9 56.9 Depreciation expense 5.3 5.0 5.1 5.2 20.6 Adjusted earnings before interest, income taxes, depreciation, and amortization ("Adjusted EBITDA") $ 34.7 $ 35.0 $ 30.3 $ 28.5 $ 128.5 19 R E C O N C IL IA T IO N O F N E T E A R N IN G S T O A D JU S T E D E B IT D A

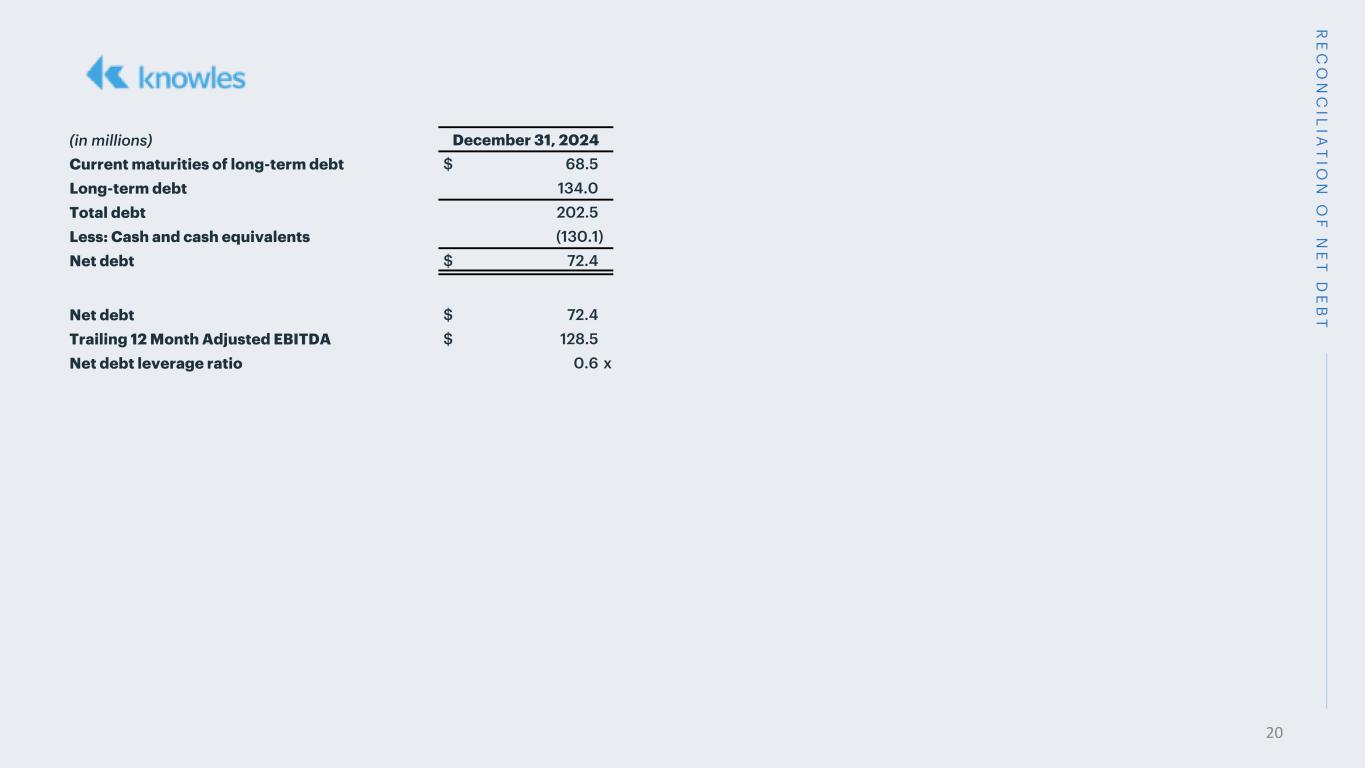

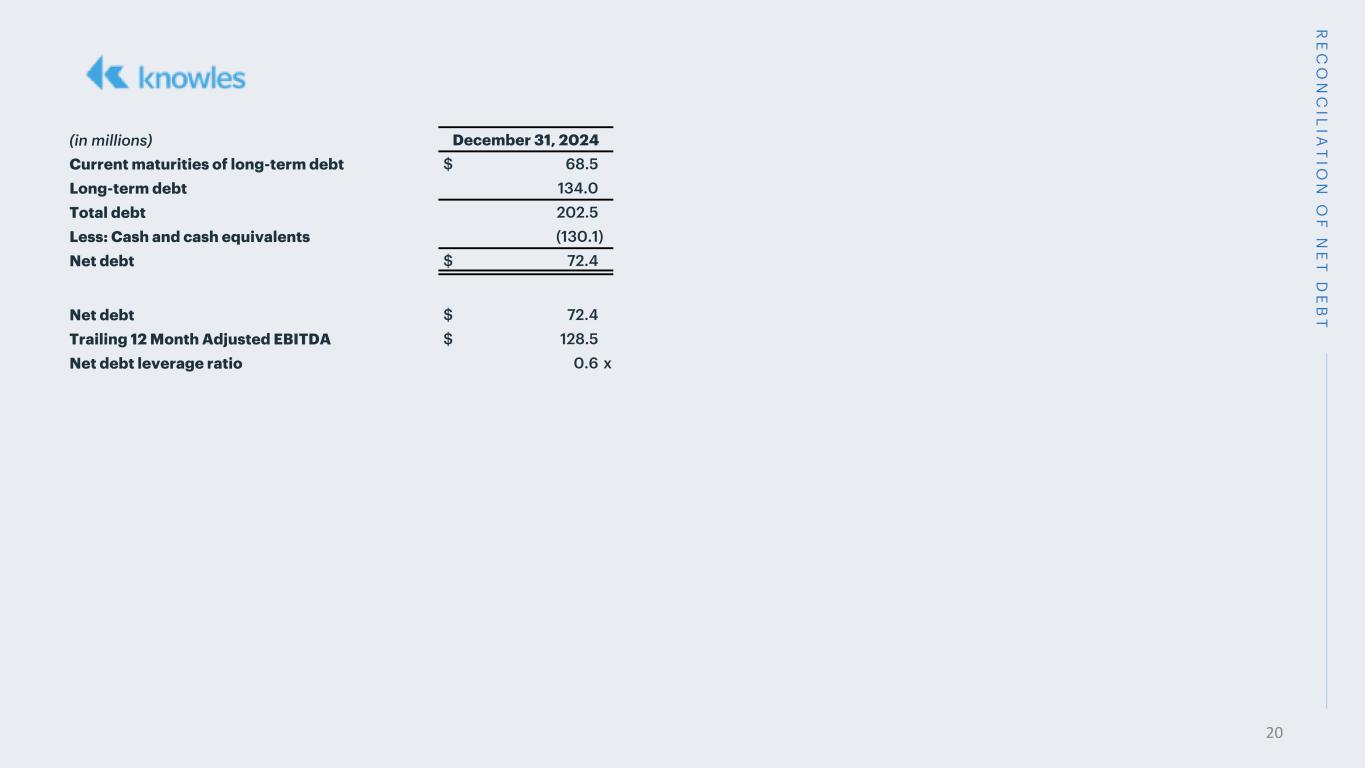

R E C O N C IL IA T IO N O F N E T D E B T (in millions) December 31, 2024 Current maturities of long-term debt $ 68.5 Long-term debt 134.0 Total debt 202.5 Less: Cash and cash equivalents (130.1) Net debt $ 72.4 Net debt $ 72.4 Trailing 12 Month Adjusted EBITDA $ 128.5 Net debt leverage ratio 0.6 x 20

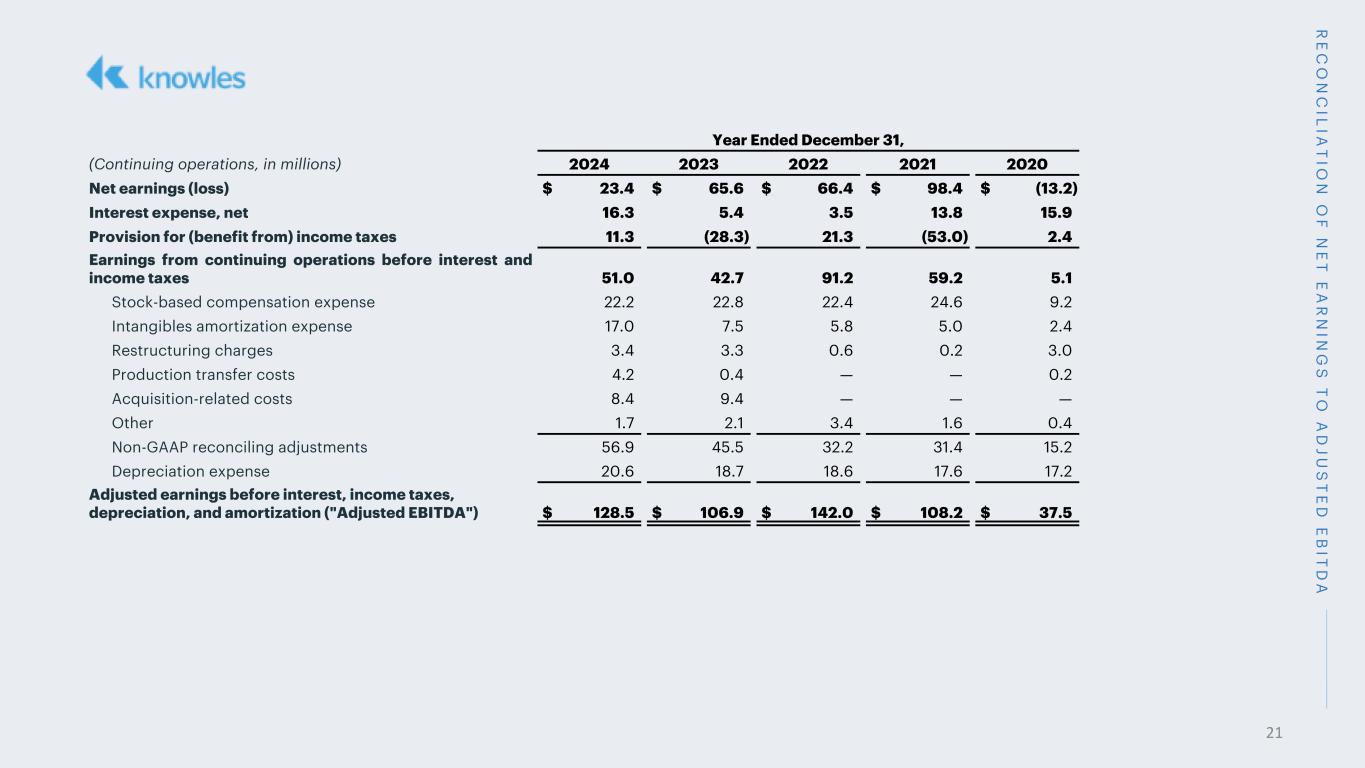

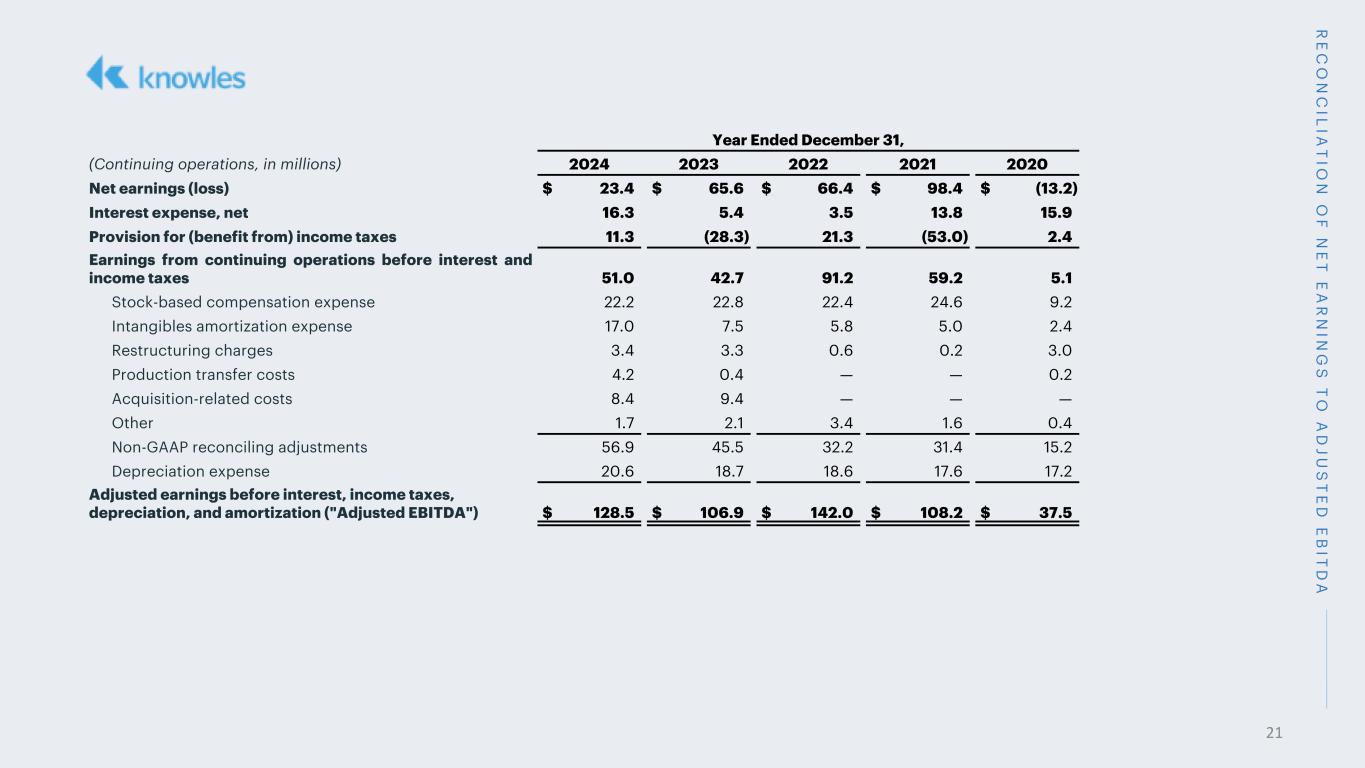

R E C O N C IL IA T IO N O F N E T E A R N IN G S T O A D JU S T E D E B IT D A 21 Year Ended December 31, (Continuing operations, in millions) 2024 2023 2022 2021 2020 Net earnings (loss) $ 23.4 $ 65.6 $ 66.4 $ 98.4 $ (13.2) Interest expense, net 16.3 5.4 3.5 13.8 15.9 Provision for (benefit from) income taxes 11.3 (28.3) 21.3 (53.0) 2.4 Earnings from continuing operations before interest and income taxes 51.0 42.7 91.2 59.2 5.1 Stock-based compensation expense 22.2 22.8 22.4 24.6 9.2 Intangibles amortization expense 17.0 7.5 5.8 5.0 2.4 Restructuring charges 3.4 3.3 0.6 0.2 3.0 Production transfer costs 4.2 0.4 — — 0.2 Acquisition-related costs 8.4 9.4 — — — Other 1.7 2.1 3.4 1.6 0.4 Non-GAAP reconciling adjustments 56.9 45.5 32.2 31.4 15.2 Depreciation expense 20.6 18.7 18.6 17.6 17.2 Adjusted earnings before interest, income taxes, depreciation, and amortization ("Adjusted EBITDA") $ 128.5 $ 106.9 $ 142.0 $ 108.2 $ 37.5

22