UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: 811-22895 |

Capitol Series Trust

(Exact name of registrant as specified in charter)

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Zachary P. Richmond

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

| Registrant’s telephone number, including area code: | 513-587-3400 |

| Date of fiscal year end: | September 30 |

| Date of reporting period: | March 31, 2023 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| Fuller & Thaler Behavioral Small-Cap Equity Fund |

| |

| Fuller & Thaler Behavioral Small-Cap Growth Fund |

| |

| Fuller & Thaler Behavioral Mid-Cap Value Fund |

| |

| Fuller & Thaler Behavioral Unconstrained Equity Fund |

| |

| Fuller & Thaler Behavioral Small-Mid Core Equity Fund |

| |

| Fuller & Thaler Behavioral Micro-Cap Equity Fund |

| |

| |

| Semi-Annual Report |

| |

| March 31, 2023 |

| |

| |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| 411 Borel Avenue, Suite 300 |

| San Mateo, CA 94402 |

| (888) 912-4562 |

| www.fullerthalerfunds.com |

Investment Results (Unaudited)

Average Annual Total Returns* as of March 31, 2023

| | | | | | Since | |

| | | | | | Inception | |

| | Six Months | One Year | Five Year | Ten Year | (12/19/18) | |

| Fuller & Thaler Behavioral Small-Cap Equity Fund | | | | |

| R6 Shares | 16.12% | 4.30% | 9.81% | 11.95% | — | |

| Institutional Shares | 16.06% | 4.18% | 9.70% | 11.82% | — | |

| Investor Shares | 15.88% | 3.91% | 9.39% | 11.58% | — | |

| A Shares | | | | | | |

| Without Load | 15.89% | 3.89% | — | — | 14.51% | |

| With Load | 9.23% | (2.08)% | — | — | 12.93% | |

| C Shares | | | | | | |

| Without Load | 15.53% | 3.24% | — | — | 13.81% | |

| With Load | 14.53% | 3.24% | — | — | 13.81% | |

| Russell 2000® Index(a) | 9.14% | (11.61)% | 4.71% | 8.04% | 8.43% | |

| | | | Institutional | Investor | | |

| | | R6 Shares | Shares | Shares | A Shares | C Shares |

| Expense Ratio(b) | | 0.65% | 0.77% | 1.06% | 1.05% | 1.65% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fuller & Thaler Behavioral Small-Cap Equity Fund (the “Small-Cap Equity Fund”) distributions or the redemption of Small-Cap Equity Fund shares. Current performance of the Small-Cap Equity Fund may be lower or higher than the performance quoted. The Small-Cap Equity Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 912-4562.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Small-Cap Equity Fund’s returns reflect any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower. Prior to October 26, 2015, the performance reflected represents that of a series of Allianz Funds Multi-Strategy Trust for which Fuller & Thaler Asset Management, Inc. (the “Adviser”) served as the sole sub-adviser (“the Predecessor Fund”) (see Note 1). Total returns for periods less than 1 year are not annualized. |

| (a) | The Russell 2000® Index (“Russell 2000”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Small-Cap Equity Fund’s portfolio. The Russell 2000 measures the performance of the small-cap segment of the U.S. equity universe and is a subset of the Russell 3000® Index. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (b) | The expense ratios are from the Small-Cap Equity Fund’s most recent prospectus dated January 30, 2023. The Adviser has contractually agreed to waive its management fee and/or reimburse Small-Cap Equity Fund expenses so that total annual operating expenses do not exceed 1.30%, |

Investment Results (Unaudited) (continued)

1.80%, 1.25%, 0.92% and 0.80% for A Shares, C Shares, Investor Shares, Institutional Shares and R6 Shares, respectively, of the average daily net assets for each class through January 31, 2024. The expense limitation does not apply to (i) interest (other than custodial overdraft fees and expenses associated with the Small-Cap Fund’s participation in an alternative liquidity program), (ii) taxes, (iii) brokerage fees and commissions, (iv) other extraordinary expenses not incurred in the ordinary course of the Small-Cap Equity Fund’s business, (v) dividend expense on short sales and (vi) indirect expenses such as acquired fund fees and expenses incurred by the Small-Cap Equity Fund in any fiscal year. During any fiscal year that the Investment Advisory Agreement between the Adviser and Capitol Series Trust (the “Trust”) is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement occurred and provided further that such recoupment can be achieved within the Expense Limitation Agreement currently in effect and the Expense Limitation Agreement in place when the waiver/reimbursement occurred. The Expense Limitation Agreement may not be terminated by the Adviser prior to its expiration date, but the Board of Trustees of the Trust (the “Board”) may terminate such agreement at any time. The Expense Limitation Agreement shall terminate automatically upon the termination of the Advisory Agreement. Additional information pertaining to the Small-Cap Equity Fund’s expense ratios as of March 31, 2023 can be found in the financial highlights.

The Small-Cap Equity Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The Small-Cap Equity Fund’s prospectus contains this and other important information about the Small-Cap Equity Fund and may be obtained by calling (888) 912-4562. Please read it carefully before investing.

The Small-Cap Equity Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

Investment Results (Unaudited) (continued)

Average Annual Total Returns* as of March 31, 2023

| | | | | Since | Since |

| | | | | Inception | Inception |

| | Six Months | One Year | Five Year | (12/21/17) | (12/19/18) |

| Fuller & Thaler Behavioral Small-Cap Growth Fund | | | | |

| R6 Shares | 17.58% | (5.21)% | 12.57% | 12.34% | — |

| Institutional Shares | 17.56% | (5.33)% | 12.48% | 12.24% | — |

| Investor Shares | 17.39% | (5.55)% | 12.19% | 11.95% | — |

| A Shares | | | | | |

| Without Load | 17.39% | (5.59)% | — | — | 15.43% |

| With Load | 10.63% | (11.02)% | — | — | 13.84% |

| C Shares | | | | | |

| Without Load | 17.05% | (6.07)% | — | — | 14.86% |

| With Load | 16.05% | (6.07)% | — | — | 14.86% |

| Russell 2000® Growth Index(a) | 10.46% | (10.60)% | 4.26% | 4.39% | 8.11% |

| | | | | | |

| | Expense Ratios(b) |

| | | Institutional | Investor | | |

| | R6 Shares | Shares | Shares | A Shares | C Shares |

| Gross | 1.09% | 1.18% | 1.51% | 1.44% | 2.09% |

| With Applicable Waivers | 0.86% | 0.96% | 1.25% | 1.30% | 1.80% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fuller & Thaler Behavioral Small-Cap Growth Fund (the “Small-Cap Growth Fund”) distributions or the redemption of Small-Cap Growth Fund shares. Current performance of the Small-Cap Growth Fund may be lower or higher than the performance quoted. The Small-Cap Growth Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 912-4562.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Small-Cap Growth Fund’s returns reflect any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower. Total returns for periods less than 1 year are not annualized. |

| (a) | The Russell 2000® Growth Index (“Russell 2000 Growth”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Small-Cap Growth Fund’s portfolio. Russell 2000 Growth measures the performance of those Russell 2000 companies with higher price/book ratios and higher forecasted growth values. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (b) | The expense ratios are from the Small-Cap Growth Fund’s most recent prospectus dated January |

Investment Results (Unaudited) (continued)

30, 2023. The Adviser has contractually agreed to waive its management fee and/or reimburse Small-Cap Growth Fund expenses so that total annual operating expenses do not exceed 1.30%, 1.80%, 1.25%, 0.96%, and 0.86% for A Shares, C Shares, Investor Shares, Institutional Shares and R6 Shares, respectively, of the average daily net assets for each class through January 31, 2024. The expense limitation does not apply to (i) interest (other than custodial overdraft fees and expenses associated with the Small-Cap Growth Fund’s participation in an alternative liquidity program), (ii) taxes, (iii) brokerage fees and commissions, (iv) other extraordinary expenses not incurred in the ordinary course of the Small-Cap Growth Fund’s business, (v) dividend expense on short sales and (vi) indirect expenses such as acquired fund fees and expenses incurred by the Small-Cap Growth Fund in any fiscal year. During any fiscal year that the Investment Advisory Agreement between the Adviser and the Trust is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement occurred and provided further that such recoupment can be achieved within the Expense Limitation Agreement currently in effect and the Expense Limitation Agreement in place when the waiver/reimbursement occurred. The Expense Limitation Agreement may not be terminated by the Adviser prior to its expiration date, but the Board may terminate such agreement at any time. The Expense Limitation Agreement shall terminate automatically upon the termination of the Advisory Agreement. Additional information pertaining to the Small-Cap Growth Fund’s expense ratios as of March 31, 2023 can be found in the financial highlights.

The Small-Cap Growth Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Small-Cap Growth Fund and may be obtained by calling (888) 912-4562. Please read it carefully before investing.

The Small-Cap Growth Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

Investment Results (Unaudited) (continued)

Average Annual Total Returns* as of March 31, 2023

| | | | | Since | Since |

| | | | | Inception | Inception |

| | Six Months | One Year | Five Year | (12/21/17) | (3/10/22) |

| Fuller & Thaler Behavioral Mid-Cap Value Fund | | | | |

| R6 Shares | 6.44% | (9.55)% | 8.71% | 7.61% | — |

| Institutional Shares | 6.37% | (9.66)% | 8.59% | 7.50% | — |

| Investor Shares | 6.26% | (9.85)% | 8.32% | 7.22% | — |

| A Shares | | | | | |

| Without Load | 6.26% | (9.88)% | — | — | (5.82)% |

| With Load | 0.13% | (15.05)% | — | — | (10.95)% |

| C Shares | | | | | |

| Without Load | 5.94% | (10.39)% | — | — | (6.36)% |

| With Load | 4.94% | (10.39)% | — | — | (6.36)% |

| Russell Midcap® Value Index(a) | 11.91% | (9.22)% | 6.54% | 5.74% | (4.66)% |

| | | | | | |

| | | Expense Ratios(b) | |

| | | Institutional | Investor | | |

| | R6 Shares | Shares | Shares | A Shares | C Shares |

| Gross | 0.83% | 0.98% | 1.26% | 1.17% | 1.84% |

| With Applicable Waivers | 0.75% | 0.85% | 1.15% | 1.17% | 1.70% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fuller & Thaler Behavioral Mid-Cap Value Fund (the “Mid-Cap Value Fund”) distributions or the redemption of Mid-Cap Value Fund shares. Current performance of the Mid-Cap Value Fund may be lower or higher than the performance quoted. The Mid-Cap Value Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 912-4562.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Mid-Cap Value Fund’s returns reflect any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower. Total returns for periods less than 1 year are not annualized. |

| (a) | The Russell Midcap® Value Index (“Russell Midcap Value”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Mid-Cap Value Fund’s portfolio. The Russell Midcap Value measures the performance of those Russell Midcap companies with lower price/book ratios and lower forecasted growth values. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (b) | The expense ratios are from the Mid-Cap Value Fund’s most recent prospectus dated January 30, |

Investment Results (Unaudited) (continued)

2023. The Adviser has contractually agreed to waive its management fee and/or reimburse Mid-Cap Value Fund expenses so that total annual operating expenses do not exceed 1.20%, 1.70%, 1.15%, 0.85%, and 0.75% for A Shares, C Shares, Investor Shares, Institutional Shares and R6 Shares, respectively, of the average daily net assets for each class through January 31, 2024. The expense limitation does not apply to (i) interest (other than custodial overdraft fees and expenses associated with the Mid-Cap Value Fund’s participation in an alternative liquidity program), (ii) taxes, (iii) brokerage fees and commissions, (iv) other extraordinary expenses not incurred in the ordinary course of the Mid-Cap Value Fund’s business, (v) dividend expense on short sales and (vi) indirect expenses such as acquired fund fees and expenses incurred by the Mid-Cap Value Fund in any fiscal year. During any fiscal year that the Investment Advisory Agreement between the Adviser and the Trust is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement occurred and provided further that such recoupment can be achieved within the Expense Limitation Agreement currently in effect and the Expense Limitation Agreement in place when the waiver/ reimbursement occurred. This Expense Limitation Agreement may not be terminated by the Adviser prior to its expiration date, but the Board may terminate such agreement at any time. The Expense Limitation Agreement shall terminate automatically upon the termination of the Advisory Agreement. Additional information pertaining to the Mid-Cap Value Fund’s expense ratios as of March 31, 2023 can be found in the financial highlights.

The Mid-Cap Value Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Mid-Cap Value Fund and may be obtained by calling (888) 912-4562. Please read it carefully before investing.

The Mid-Cap Value Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

Investment Results (Unaudited) (continued)

Average Annual Total Returns* as of March 31, 2023

| | | | Since | Since |

| | | | Inception | Inception |

| | Six Months | One Year | (12/26/18) | (5/27/21) |

| Fuller & Thaler Behavioral Unconstrained Equity Fund | | | |

| R6 Shares | 17.94% | (3.28)% | 14.23% | — |

| Institutional Shares | 17.92% | (3.36)% | 14.12% | — |

| A Shares | | | | |

| Without Load | 17.81% | (3.65)% | — | (4.66)% |

| With Load | 11.04% | (9.19)% | — | (7.67)% |

| C Shares | | | | |

| Without Load | 17.69% | (4.09)% | — | (5.14)% |

| With Load | 16.69% | (4.09)% | — | (5.14)% |

| Russell 3000® Index(a) | 14.88% | (8.58)% | 14.06% | (1.67)% |

| | | | | |

| | | Expense Ratios(b) | |

| | | Institutional | | |

| | R6 Shares | Shares | A Shares | C Shares |

| Gross | 1.19% | 1.34% | 1.59% | 2.21% |

| With Applicable Waivers | 0.87% | 0.97% | 1.30% | 1.80% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fuller & Thaler Behavioral Unconstrained Equity Fund (the “Unconstrained Equity Fund”) distributions or the redemption of Unconstrained Equity Fund shares. Current performance of the Unconstrained Equity Fund may be lower or higher than the performance quoted. The Unconstrained Equity Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 912-4562.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Unconstrained Equity Fund’s returns reflect any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower. Total returns for periods less than 1 year are not annualized. |

| (a) | The Russell 3000® Index (“Russell 3000”) measures the performance of the broad U.S. equity market. The Russell 3000 represents the 3000 largest U.S. publicly traded companies as measured by market capitalization. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (b) | The expense ratios are from the Unconstrained Equity Fund’s most recent prospectus dated January 30, 2023. The Adviser has contractually agreed to waive its management fee and/or reimburse Unconstrained Equity Fund expenses so that total annual operating expenses do not exceed 1.30%, 1.80%, 0.97% and 0.87% for A Shares, C Shares, Institutional Shares and R6 Shares, |

Investment Results (Unaudited) (continued)

respectively, of the average daily net assets for each class through January 31, 2024. The expense limitation does not apply to (i) interest (other than custodial overdraft fees and expenses associated with the Unconstrained Equity Fund’s participation in an alternative liquidity program), (ii) taxes, (iii) brokerage fees and commissions, (iv) other extraordinary expenses not incurred in the ordinary course of the Unconstrained Equity Fund’s business, (v) dividend expense on short sales and (vi) indirect expenses such as acquired fund fees and expenses incurred by the Unconstrained Equity Fund in any fiscal year. During any fiscal year that the Investment Advisory Agreement between the Adviser and the Trust is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement occurred and provided further that such recoupment can be achieved within the Expense Limitation Agreement currently in effect and the Expense Limitation Agreement in place when the waiver/reimbursement occurred. This Expense Limitation Agreement may not be terminated by the Adviser prior to its expiration date, but the Board may terminate such agreement at any time. The Expense Limitation Agreement shall terminate automatically upon the termination of the Advisory Agreement. Additional information pertaining to the Unconstrained Equity Fund’s expense ratios as of March 31, 2023 can be found in the financial highlights.

The Unconstrained Equity Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Unconstrained Equity Fund and may be obtained by calling (888) 912-4562. Please read it carefully before investing.

The Unconstrained Equity Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/ SIPC.

Investment Results (Unaudited) (continued)

Average Annual Total Returns* as of March 31, 2023

| | | | Since | Since |

| | | | Inception | Inception |

| | Six Months | One Year | (12/26/18) | (3/10/22) |

| Fuller & Thaler Behavioral Small-Mid Core Equity Fund | | | |

| Institutional Shares | 19.37% | (2.79)% | 13.51% | — |

| A Shares | | | | |

| Without Load | 19.19% | (3.09)% | — | (2.92)% |

| With Load | 12.32% | (8.67)% | — | (8.21)% |

| Russell 2500® Index(a) | 11.07% | (10.39)% | 10.90% | (6.36)% |

| | | | | |

| | | | Expense Ratios(b) |

| | | | Institutional | |

| | | | Shares | A Shares |

| Gross | | | 2.59% | 2.75% |

| With Applicable Waivers | | | 0.93% | 1.26% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fuller & Thaler Behavioral Small-Mid Core Equity Fund (the “Small-Mid Core Equity Fund”) distributions or the redemption of Small-Mid Core Equity Fund shares. Current performance of the Small-Mid Core Equity Fund may be lower or higher than the performance quoted. The Small-Mid Core Equity Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 912-4562.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Small-Mid Core Equity Fund’s returns reflect any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower. Total returns for periods less than 1 year are not annualized. |

| (a) | The Russell 2500® Index (“Russell 2500”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Small-Mid Core Equity Fund’s portfolio. The Russell 2500 measures the performance of those Russell 2500 companies with lower price/book ratios and lower forecasted growth values. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (b) | The expense ratios are from the Small-Mid Core Equity Fund’s most recent prospectus dated January 30, 2023. The Adviser has contractually agreed to waive its management fee and/ or reimburse Small-Mid Core Equity Fund expenses so that total annual operating expenses do not exceed 1.26% and 0.93% of the Small-Mid Core Equity Fund’s A Shares and Institutional Shares average daily net assets through January 31, 2024. The expense limitation does not apply to (i) interest (other than custodial overdraft fees and expenses associated with the Small-Mid Core Equity Fund’s participation in an alternative liquidity program), (ii) taxes, (iii) brokerage fees and commissions, (iv) other extraordinary expenses not incurred in the ordinary course of the Small-Mid |

Investment Results (Unaudited) (continued)

Core Equity Fund’s business, (v) dividend expense on short sales and (vi) indirect expenses such as acquired fund fees and expenses incurred by the Small-Mid Core Equity Fund in any fiscal year. During any fiscal year that the Investment Advisory Agreement between the Adviser and the Trust is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement occurred and provided further that such recoupment can be achieved within the Expense Limitation Agreement currently in effect and the Expense Limitation Agreement in place when the waiver/reimbursement occurred. This Expense Limitation Agreement may not be terminated by the Adviser prior to its expiration date, but the Board may terminate such agreement at any time. The Expense Limitation Agreement shall terminate automatically upon the termination of the Advisory Agreement. Additional information pertaining to the Small-Mid Core Equity Fund’s expense ratios as of March 31, 2023 can be found in the financial highlights.

The Small-Mid Core Equity Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Small-Mid Core Equity Fund and may be obtained by calling (888) 912-4562. Please read it carefully before investing.

The Small-Mid Core Equity Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/ SIPC.

Investment Results (Unaudited) (continued)

Average Annual Total Returns* as of March 31, 2023

| | | | Since |

| | | | Inception |

| | Six Months | One Year | (12/28/18) |

| Fuller & Thaler Behavioral Micro-Cap Equity Fund | | | |

| Institutional Shares | 7.15% | (27.19)% | 6.85% |

| Russell Microcap® Index(a) | 1.78% | (17.92)% | 7.33% |

| | | | |

| | Expense Ratios(b) |

| | Institutional |

| | Shares |

| Gross | 2.25% |

| With Applicable Waivers | 1.43% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fuller & Thaler Behavioral Micro-Cap Equity Fund (the “Micro-Cap Equity Fund”) distributions or the redemption of Micro-Cap Equity Fund shares. Current performance of the Micro-Cap Equity Fund may be lower or higher than the performance quoted. The Micro-Cap Equity Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 912-4562.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Micro-Cap Equity Fund’s returns reflect any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower. Total returns for periods less than 1 year are not annualized. |

| (a) | The Russell Microcap® Index (“Russell Microcap”) measures the performance of the microcap segment of the U.S. equity market. Russell Microcap stocks make up less than 3% of the U.S. equity market (by market cap) and consist of the smallest 1,000 securities in the small cap Russell 2000® Index, plus the next smallest eligible securities by market cap. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (b) | The expense ratios are from the Micro-Cap Equity Fund’s most recent prospectus dated January 30, 2023. The Adviser has contractually agreed to waive its management fee and/or reimburse Micro-Cap Equity Fund expenses so that total annual operating expenses do not exceed 1.40% of the Micro-Cap Equity Fund’s Institutional Shares average daily net assets through January 31, 2024. The expense limitation does not apply to (i) interest (other than custodial overdraft fees and expenses associated with the Micro-Cap Equity Fund’s participation in an alternative liquidity program), (ii) taxes, (iii) brokerage fees and commissions, (iv) other extraordinary expenses not incurred in the ordinary course of the Micro-Cap Equity Fund’s business, (v) dividend expense on short sales and (vi) indirect expenses such as acquired fund fees and expenses incurred by the Micro-Cap Equity Fund in any fiscal year. During any fiscal year that the Investment Advisory Agreement between the Adviser and the Trust is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser |

Investment Results (Unaudited) (continued)

is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement occurred and provided further that such recoupment can be achieved within the Expense Limitation Agreement currently in effect and the Expense Limitation Agreement in place when the waiver/reimbursement occurred. This Expense Limitation Agreement may not be terminated by the Adviser prior to its expiration date, but the Board may terminate such agreement at any time. The Expense Limitation Agreement shall terminate automatically upon the termination of the Advisory Agreement. Additional information pertaining to the Micro-Cap Equity Fund’s expense ratios as of March 31, 2023 can be found in the financial highlights.

The Micro-Cap Equity Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Micro-Cap Equity Fund and may be obtained by calling (888) 912-4562. Please read it carefully before investing.

The Micro-Cap Equity Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

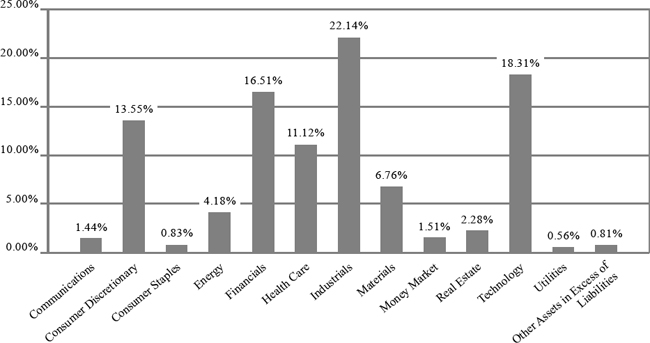

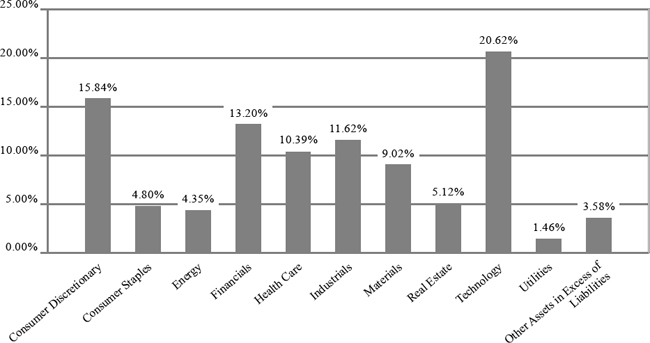

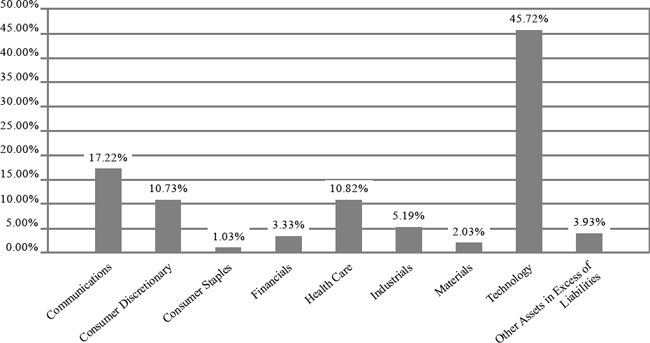

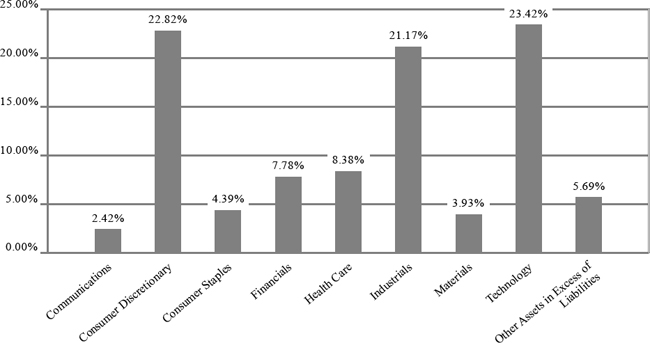

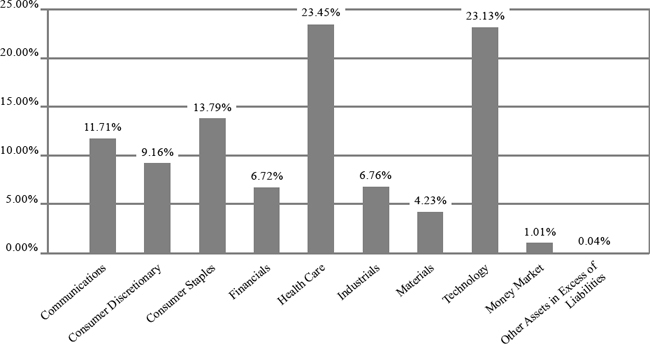

Portfolio Illustration (Unaudited)

Fuller & Thaler Behavioral Small-Cap Equity Fund Sector Holdings as of March 31, 2023.*

Fuller & Thaler Behavioral Small-Cap Growth Fund Sector Holdings as of March 31, 2023.*

| * | As a percentage of net assets. |

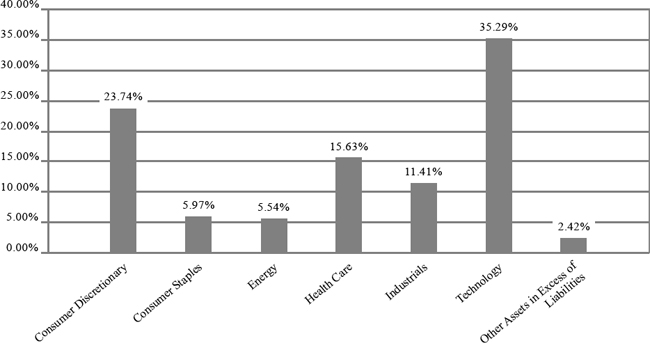

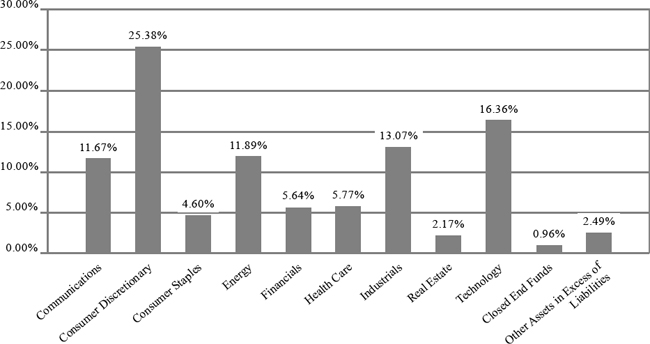

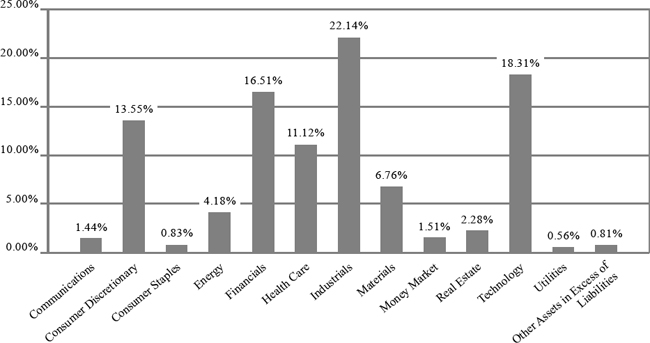

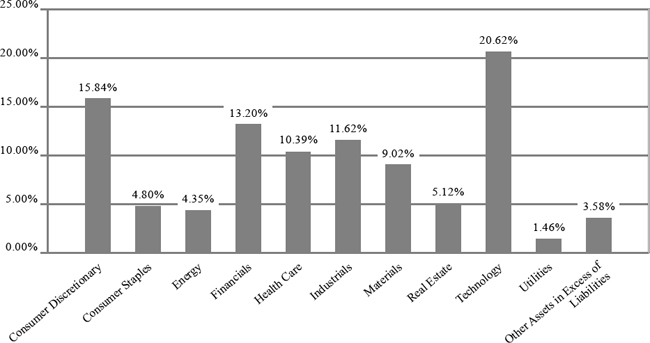

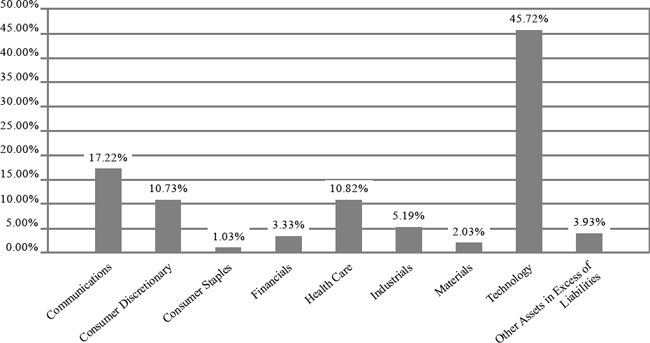

Portfolio Illustration (Unaudited)

Fuller & Thaler Behavioral Mid-Cap Value Fund Sector Holdings as of March 31, 2023.*

Fuller & Thaler Behavioral Unconstrained Equity Fund Sector Holdings as of March 31, 2023.*

| * | As a percentage of net assets. |

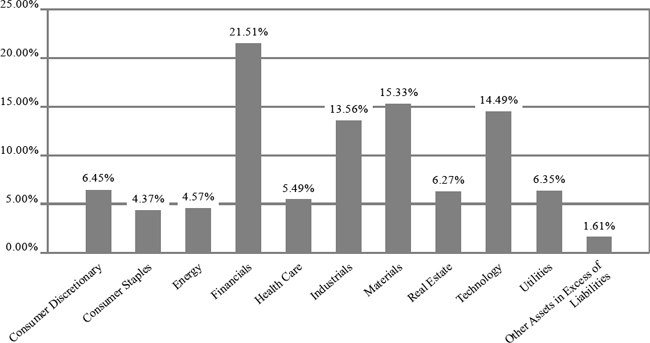

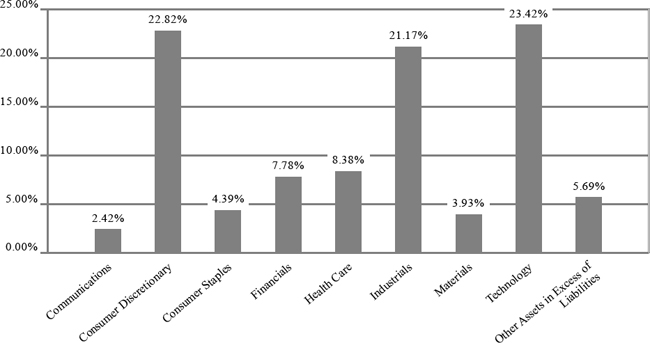

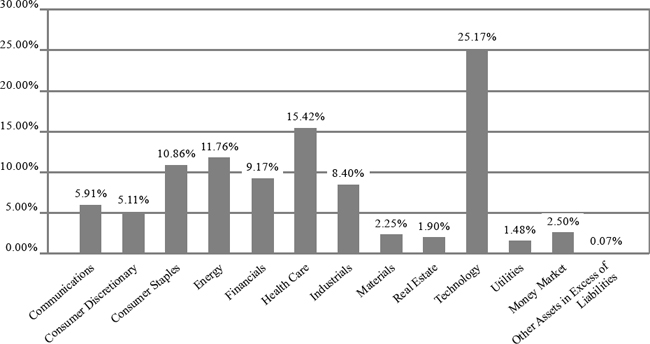

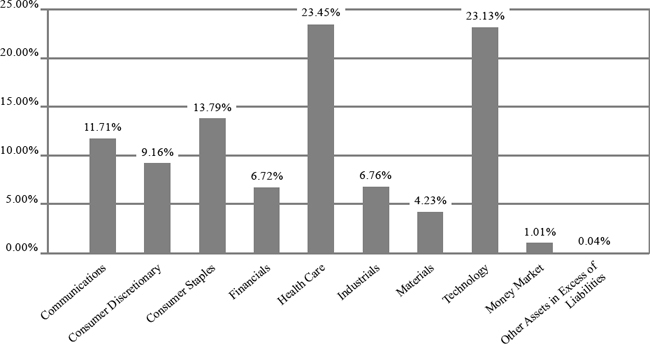

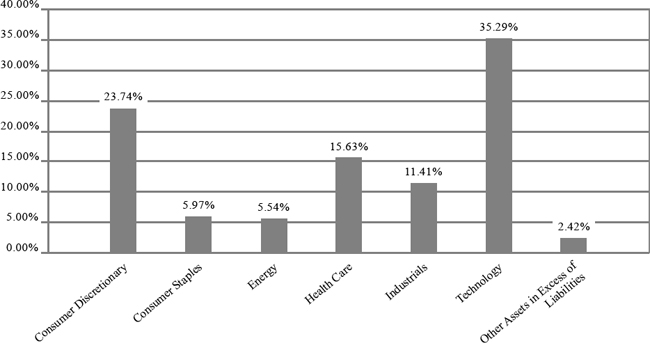

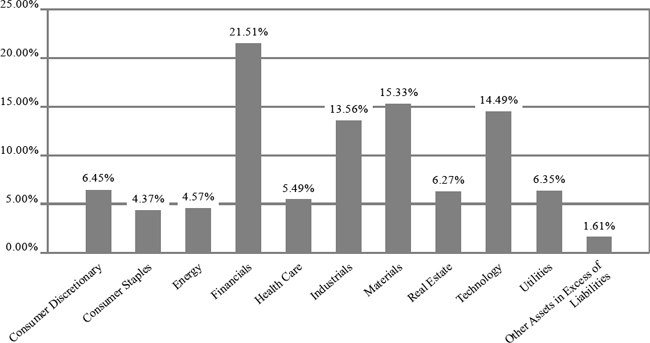

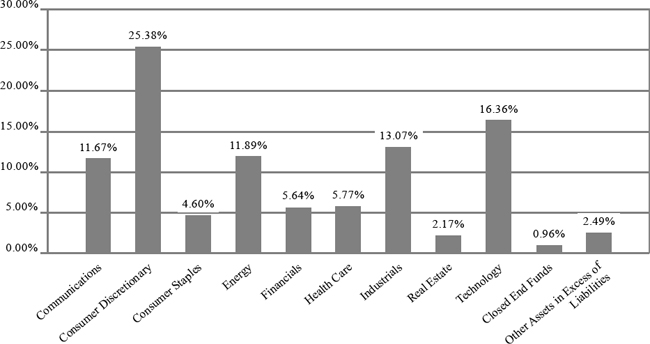

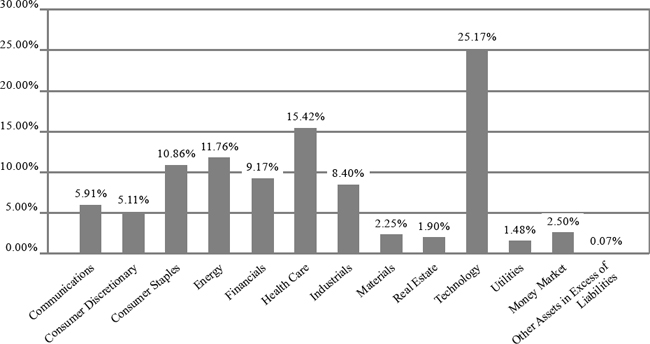

Portfolio Illustration (Unaudited)

Fuller & Thaler Behavioral Small-Mid Core Equity Fund Sector Holdings as of March 31, 2023.*

Fuller & Thaler Behavioral Micro-Cap Equity Fund Sector Holdings as of March 31, 2023.*

| * | As a percentage of net assets. |

Availability of Portfolio Schedules (Unaudited)

The Funds file their complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Funds’ Form N-PORT reports are available on the SEC’s website at http://www. sec.gov and on the Funds’ website at www.fullerthalerfunds.com.

| Fuller & Thaler Behavioral Small-Cap Equity Fund |

| Schedule of Investments |

| March 31, 2023 - (Unaudited) |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 97.68% | | | | | | | | |

| Apparel & Textile Products — 5.63% | | | | | | | | |

| Carter’s, Inc. | | | 500,719 | | | $ | 36,011,710 | |

| Deckers Outdoor Corp.(a) | | | 341,618 | | | | 153,574,373 | |

| Kontoor Brands, Inc. | | | 1,244,665 | | | | 60,229,339 | |

| Oxford Industries, Inc. | | | 288,061 | | | | 30,416,361 | |

| Ralph Lauren Corp. | | | 673,329 | | | | 78,557,295 | |

| | | | | | | | 358,789,078 | |

| Asset Management — 2.18% | | | | | | | | |

| Federated Hermes, Inc., | | | | | | | | |

| Class B | | | 1,159,056 | | | | 46,524,508 | |

| Stifel Financial Corp. | | | 1,562,799 | | | | 92,345,793 | |

| | | | | | | | 138,870,301 | |

| Banking — 11.31% | | | | | | | | |

| Atlantic Union Bancshares Corp. | | | 999,912 | | | | 35,046,916 | |

| Axos Financial, Inc.(a) | | | 1,399,148 | | | | 51,656,544 | |

| Bank OZK | | | 4,644,715 | | | | 158,849,252 | |

| Berkshire Hills Bancorp, Inc. | | | 795,456 | | | | 19,934,127 | |

| Cadence Bank | | | 3,645,953 | | | | 75,689,984 | |

| F.N.B. Corp. | | | 4,201,787 | | | | 48,740,729 | |

| First Commonwealth Financial Corp. | | | 1,699,559 | | | | 21,125,518 | |

| First Financial Bancorp | | | 1,347,063 | | | | 29,325,562 | |

| First Financial Bankshares, Inc. | | | 1,063,631 | | | | 33,929,829 | |

| First Financial Corp. | | | 112,829 | | | | 4,228,831 | |

| Fulton Financial Corp. | | | 1,972,947 | | | | 27,266,128 | |

| Hancock Whitney Corp. | | | 1,676,975 | | | | 61,041,890 | |

| Lakeland Bancorp, Inc. | | | 173,754 | | | | 2,717,513 | |

| Lakeland Financial Corp. | | | 411,577 | | | | 25,781,183 | |

| Provident Financial Services, Inc. | | | 504,422 | | | | 9,674,814 | |

| TowneBank | | | 197,960 | | | | 5,275,634 | |

| Washington Federal, Inc. | | | 1,470,972 | | | | 44,305,677 | |

| Wintrust Financial Corp. | | | 903,928 | | | | 65,941,548 | |

| | | | | | | | 720,531,679 | |

| Biotech & Pharma — 2.81% | | | | | | | | |

| Amphastar Pharmaceuticals, Inc.(a) | | | 768,619 | | | | 28,823,213 | |

| Exelixis, Inc.(a) | | | 2,049,690 | | | | 39,784,483 | |

| | | Shares | | | Fair Value | |

| | | | | | | |

| Biotech & Pharma — (continued) | | | | | | | | |

| United Therapeutics Corp.(a) | | | 492,973 | | | $ | 110,406,232 | |

| | | | | | | | 179,013,928 | |

| Chemicals — 2.43% | | | | | | | | |

| Avient Corp. | | | 371,729 | | | | 15,300,366 | |

| Huntsman Corp. | | | 4,736,086 | | | | 129,579,312 | |

| Stepan Co. | | | 97,138 | | | | 10,008,128 | |

| | | | | | | | 154,887,806 | |

| Commercial Support Services — 6.28% | | | | | | | | |

| AMN Healthcare Services, Inc.(a) | | | 1,639,296 | | | | 135,995,995 | |

| Clean Harbors, Inc.(a) | | | 191,051 | | | | 27,236,231 | |

| CRA International, Inc. | | | 70,331 | | | | 7,583,088 | |

| FTI Consulting, Inc.(a) | | | 215,707 | | | | 42,569,776 | |

| H&R Block, Inc. | | | 2,015,476 | | | | 71,045,529 | |

| Kforce, Inc. | | | 482,148 | | | | 30,491,040 | |

| ManpowerGroup, Inc. | | | 255,000 | | | | 21,045,150 | |

| TriNet Group, Inc.(a) | | | 796,829 | | | | 64,232,386 | |

| | | | | | | | 400,199,195 | |

| Consumer Services — 1.30% | | | | | | | | |

| Adtalem Global Education, Inc.(a) | | | 898,903 | | | | 34,715,634 | |

| Perdoceo Education Corp.(a) | | | 565,802 | | | | 7,598,721 | |

| Rent-A-Center, Inc. | | | 482,996 | | | | 11,838,232 | |

| Stride, Inc.(a) | | | 726,557 | | | | 28,517,362 | |

| | | | | | | | 82,669,949 | |

| Containers & Packaging — 2.29% | | | | | | | | |

| Graphic Packaging Holding Co. | | | 2,950,673 | | | | 75,212,655 | |

| Sonoco Products Co. | | | 1,158,531 | | | | 70,670,391 | |

| | | | | | | | 145,883,046 | |

| Electric Utilities — 0.56% | | | | | | | | |

| Otter Tail Corp. | | | 389,764 | | | | 28,168,244 | |

| Portland General Electric Co. | | | 152,877 | | | | 7,474,157 | |

| | | | | | | | 35,642,401 | |

| Electrical Equipment — 4.75% | | | | | | | | |

| Acuity Brands, Inc. | | | 501,550 | | | | 91,648,232 | |

| Atkore, Inc.(a) | | | 931,395 | | | | 130,842,369 | |

| Belden, Inc. | | | 922,187 | | | | 80,018,166 | |

| | | | | | | | 302,508,767 | |

| Engineering & Construction — 4.38% | | | | | | | | |

| Comfort Systems USA, Inc. | | | 393,764 | | | | 57,473,793 | |

| EMCOR Group, Inc. | | | 717,899 | | | | 116,723,199 | |

See accompanying notes which are an integral part of these financial statements.

| Fuller & Thaler Behavioral Small-Cap Equity Fund |

| Schedule of Investments (continued) |

| March 31, 2023 - (Unaudited) |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — (continued) | | | | | | | | |

| Engineering & Construction — (continued) | | | | | | | | |

| Installed Building Products, Inc. | | | 447,527 | | | $ | 51,031,504 | |

| Primoris Services Corp. | | | 306,858 | | | | 7,567,118 | |

| TopBuild Corp.(a) | | | 223,451 | | | | 46,509,091 | |

| | | | | | | | 279,304,705 | |

| Food — 0.77% | | | | | | | | |

| Simply Good Foods Co. (The)(a) | | | 1,241,841 | | | | 49,388,016 | |

| | | | | | | | | |

| Forestry, Paper & Wood Products — 0.63% | | | | | | | | |

| Louisiana-Pacific Corp. | | | 739,613 | | | | 40,094,421 | |

| | | | | | | | | |

| Health Care Facilities & Services — 3.01% | | | | | | | | |

| Chemed Corp. | | | 70,275 | | | | 37,790,381 | |

| Medpace Holdings, Inc.(a) | | | 819,775 | | | | 154,158,689 | |

| | | | | | | | 191,949,070 | |

| Home Construction — 1.51% | | | | | | | | |

| Masonite International Corp.(a) | | | 325,515 | | | | 29,546,997 | |

| Meritage Homes Corp. | | | 573,701 | | | | 66,985,328 | |

| | | | | | | | 96,532,325 | |

| Household Products — 0.06% | | | | | | | | |

| Helen of Troy Ltd.(a) | | | 39,517 | | | | 3,760,833 | |

| | | | | | | | | |

| Industrial Intermediate Products — 1.26% | | | | | | | | |

| Mueller Industries, Inc. | | | 1,094,554 | | | | 80,427,828 | |

| | | | | | | | | |

| Industrial Support Services — 0.91% | | | | | | | | |

| Applied Industrial | | | | | | | | |

| Technologies, Inc. | | | 407,175 | | | | 57,871,783 | |

| | | | | | | | | |

| Institutional Financial Services — 1.35% | | | | | | | | |

| Evercore, Inc., Class A | | | 681,442 | | | | 78,624,778 | |

| Jefferies Financial Group, Inc. | | | 236,169 | | | | 7,496,004 | |

| | | | | | | | 86,120,782 | |

| Insurance — 1.52% | | | | | | | | |

| Hanover Insurance Group, Inc. | | | 675,957 | | | | 86,860,475 | |

| Primerica, Inc. | | | 59,622 | | | | 10,269,293 | |

| | | | | | | | 97,129,768 | |

| Machinery — 0.99% | | | | | | | | |

| Crane Holding Co. | | | 453,846 | | | | 51,511,521 | |

| Donaldson Co., Inc. | | | 175,059 | | | | 11,438,355 | |

| | | | | | | | 62,949,876 | |

| Medical Equipment & Devices — 5.30% | | | | | | | | |

| Bruker Corp. | | | 2,121,002 | | | | 167,219,797 | |

| | | Shares | | | Fair Value | |

| | | | | | | |

| Medical Equipment & Devices — (continued) | | | | | | | | |

| Globus Medical, Inc., Class A(a) | | | 94,138 | | | $ | 5,331,976 | |

| Integer Holdings Corp.(a) | | | 82,083 | | | | 6,361,433 | |

| Integra LifeSciences Holdings Corp.(a) | | | 1,419,546 | | | | 81,496,136 | |

| Merit Medical Systems, Inc.(a) | | | 1,044,127 | | | | 77,213,192 | |

| | | | | | | | 337,622,534 | |

| Oil & Gas Producers — 4.18% | | | | | | | | |

| Chord Energy Corp. | | | 983,446 | | | | 132,371,832 | |

| HF Sinclair Corp. | | | 469,774 | | | | 22,727,666 | |

| Murphy USA, Inc. | | | 432,220 | | | | 111,534,371 | |

| | | | | | | | 266,633,869 | |

| Publishing & Broadcasting — 1.44% | | | | | | | | |

| Nexstar Media Group, Inc., Class A | | | 531,681 | | | | 91,800,041 | |

| | | | | | | | | |

| Real Estate — 2.03% | | | | | | | | |

| Apple Hospitality REIT, Inc. | | | 6,106,152 | | | | 94,767,479 | |

| City Office, Inc. | | | 1,435,374 | | | | 9,904,081 | |

| Piedmont Office Realty Trust, Inc., Class A | | | 3,413,153 | | | | 24,916,017 | |

| | | | | | | | 129,587,577 | |

| Real Estate Services — 0.25% | | | | | | | | |

| Newmark Group, Inc., Class A | | | 2,220,688 | | | | 15,722,471 | |

| | | | | | | | | |

| Retail - Discretionary — 4.82% | | | | | | | | |

| Academy Sports & Outdoors, Inc. | | | 2,212,952 | | | | 144,395,118 | |

| AutoNation, Inc.(a) | | | 625,200 | | | | 84,001,872 | |

| Builders FirstSource, Inc.(a) | | | 362,445 | | | | 32,177,867 | |

| Signet Jewelers Ltd. | | | 596,663 | | | | 46,408,448 | |

| | | | | | | | 306,983,305 | |

| Semiconductors — 4.26% | | | | | | | | |

| Amkor Technology, Inc. | | | 1,083,508 | | | | 28,192,878 | |

| Cirrus Logic, Inc.(a) | | | 1,346,758 | | | | 147,308,390 | |

| Diodes, Inc.(a) | | | 842,898 | | | | 78,187,218 | |

| MaxLinear, Inc.(a) | | | 511,417 | | | | 18,006,993 | |

| | | | | | | | 271,695,479 | |

| Software — 3.03% | | | | | | | | |

| Concentrix Corp. | | | 187,098 | | | | 22,741,762 | |

| Donnelley Financial Solutions, Inc.(a) | | | 324,108 | | | | 13,243,053 | |

| Progress Software Corp. | | | 1,117,747 | | | | 64,214,565 | |

| Teradata Corp.(a) | | | 835,849 | | | | 33,667,998 | |

See accompanying notes which are an integral part of these financial statements.

| Fuller & Thaler Behavioral Small-Cap Equity Fund |

| Schedule of Investments (continued) |

| March 31, 2023 - (Unaudited) |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — (continued) | | | | | | | | |

| Software — (continued) | | | | | | | | |

| Ziff Davis, Inc. (a) | | | 759,138 | | | $ | 59,250,721 | |

| | | | | | | | 193,118,099 | |

| Specialty Finance — 0.15% | | | | | | | | |

| Stewart Information | | | | | | | | |

| Services Corp. | | | 232,201 | | | | 9,369,310 | |

| | | | | | | | | |

| Steel — 1.41% | | | | | | | | |

| Commercial Metals Co. | | | 1,839,655 | | | | 89,959,130 | |

| | | | | | | | | |

| Technology Hardware — 5.97% | | | | | | | | |

| Avnet, Inc. | | | 699,172 | | | | 31,602,574 | |

| Jabil, Inc. | | | 2,664,299 | | | | 234,884,600 | |

| Lumentum Holdings, Inc.(a) | | | 134,852 | | | | 7,283,357 | |

| Sanmina Corp.(a) | | | 1,747,195 | | | | 106,561,423 | |

| | | | | | | | 380,331,954 | |

| Technology Services — 5.05% | | | | | | | | |

| CSG Systems | | | | | | | | |

| International, Inc. | | | 947,636 | | | | 50,888,053 | |

| EVERTEC, Inc. | | | 1,216,638 | | | | 41,061,533 | |

| ExlService Holdings, Inc.(a) | | | 572,851 | | | | 92,704,477 | |

| Insight Enterprises, Inc.(a) | | | 342,689 | | | | 48,990,819 | |

| Science Applications International Corp. | | | 732,460 | | | | 78,710,152 | |

| TTEC Holdings, Inc. | | | 249,879 | | | | 9,302,995 | |

| | | | | | | | 321,658,029 | |

| Transportation & Logistics — 3.57% | | | | | | | | |

| Hub Group, Inc., Class A(a) | | | 1,020,180 | | | | 85,633,909 | |

| Landstar System, Inc. | | | 791,745 | | | | 141,928,209 | |

| | | | | | | | 227,562,118 | |

| Wholesale - Discretionary — 0.29% | | | | | | | | |

| Veritiv Corp. | | | 135,630 | | | | 18,329,038 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | | |

| (Cost $5,082,228,651) | | | | | | | 6,224,898,511 | |

| | | | | | | | | |

| MONEY MARKET FUNDS - 1.51% | | | | | | | | |

| Fidelity Investments | | | | | | | | |

| Money Market | | | | | | | | |

| Government | | | | | | | | |

| Portfolio, Institutional | | | | | | | | |

| Class, 4.76%(b) | | | 96,427,505 | | | | 96,427,505 | |

| | | | | | | | | |

| Total Money Market Funds | | | | | | | | |

| (Cost $96,427,505) | | | | | | | 96,427,505 | |

| | | Shares | | | Fair Value | |

| MONEY MARKET FUNDS - 1.51% - continued | | | | | | | | |

| Total Investments — 99.19% | | | | | | | | |

| (Cost $5,178,656,156) | | | | | | $ | 6,321,326,016 | |

| Other Assets in Excess of Liabilities — 0.81% | | | | | | | 51,597,233 | |

| NET ASSETS — 100.00% | | | | | | $ | 6,372,923,249 | |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of March 31, 2023. |

See accompanying notes which are an integral part of these financial statements.

| Fuller & Thaler Behavioral Small-Cap Growth Fund |

| Schedule of Investments |

| March 31, 2023 - (Unaudited) |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 97.58% | | | | | | | | |

| Apparel & Textile Products — 1.45% | | | | | | | | |

| PVH Corp. | | | 27,630 | | | $ | 2,463,491 | |

| | | | | | | | | |

| Biotech & Pharma — 3.13% | | | | | | | | |

| Alkermes PLC(a) | | | 79,125 | | | | 2,230,534 | |

| WillScot Mobile Mini Holdings Corp., Class A(a) | | | 65,840 | | | | 3,086,579 | |

| | | | | | | | 5,317,113 | |

| Electrical Equipment — 8.72% | | | | | | | | |

| AAON, Inc. | | | 27,200 | | | | 2,629,968 | |

| Acuity Brands, Inc. | | | 21,920 | | | | 4,005,442 | |

| Atkore, Inc.(a) | | | 41,595 | | | | 5,843,266 | |

| Vertiv Holdings Co., Class A | | | 163,830 | | | | 2,344,407 | |

| | | | | | | | 14,823,083 | |

| Engineering & Construction — 1.35% | | | | | | | | |

| Dycom Industries, Inc.(a) | | | 24,565 | | | | 2,300,512 | |

| | | | | | | | | |

| Food — 1.66% | | | | | | | | |

| BellRing Brands, Inc.(a) | | | 83,200 | | | | 2,828,800 | |

| | | | | | | | | |

| Health Care Facilities & Services — 3.04% | | | | | | | | |

| Medpace Holdings, Inc.(a) | | | 15,050 | | | | 2,830,152 | |

| Progyny, Inc.(a) | | | 72,931 | | | | 2,342,544 | |

| | | | | | | | 5,172,696 | |

| Home Construction — 4.24% | | | | | | | | |

| Griffon Corp. | | | 108,675 | | | | 3,478,687 | |

| Skyline Champion Corp.(a) | | | 49,662 | | | | 3,736,072 | |

| | | | | | | | 7,214,759 | |

| Household Products — 4.31% | | | | | | | | |

| e.l.f. Beauty, Inc.(a) | | | 89,010 | | | | 7,329,974 | |

| | | | | | | | | |

| Leisure Facilities & Services — 10.15% | | | | | | | | |

| Everi Holdings, Inc.(a) | | | 186,350 | | | | 3,195,903 | |

| Jack in the Box, Inc. | | | 28,685 | | | | 2,512,519 | |

| Playa Hotels & Resorts N.V.(a) | | | 279,700 | | | | 2,685,120 | |

| Six Flags Entertainment Corp.(a) | | | 97,100 | | | | 2,593,541 | |

| Wingstop, Inc. | | | 20,360 | | | | 3,737,688 | |

| | | Shares | | | Fair Value | |

| | | | | | | |

| Leisure Facilities & Services — (continued) | | | | | | | | |

| Xponential Fitness, Inc., Class A(a) | | | 83,775 | | | $ | 2,545,922 | |

| | | | | | | | 17,270,693 | |

| Leisure Products — 3.60% | | | | | | | | |

| Axon Enterprise, Inc.(a) | | | 17,315 | | | | 3,893,278 | |

| Callaway Golf Co.(a) | | | 103,355 | | | | 2,234,535 | |

| | | | | | | | 6,127,813 | |

| Medical Equipment & Devices — 9.46% | | | | | | | | |

| Lantheus Holdings, Inc.(a) | | | 56,926 | | | | 4,699,811 | |

| Merit Medical Systems, Inc.(a) | | | 54,900 | | | | 4,059,855 | |

| Neogen Corp.(a) | | | 199,350 | | | | 3,691,962 | |

| ShockWave Medical, Inc.(a) | | | 16,795 | | | | 3,641,660 | |

| | | | | | | | 16,093,288 | |

| Oil & Gas Producers — 1.54% | | | | | | | | |

| Par Pacific Holdings, Inc.(a) | | | 89,579 | | | | 2,615,707 | |

| | | | | | | | | |

| Oil & Gas Services & Equipment — 2.60% | | | | | | | | |

| Weatherford International PLC(a) | | | 74,510 | | | | 4,422,168 | |

| | | | | | | | | |

| Renewable Energy — 1.40% | | | | | | | | |

| Array Technologies, Inc.(a) | | | 109,220 | | | | 2,389,734 | |

| | | | | | | | | |

| Retail - Discretionary — 4.30% | | | | | | | | |

| Freshpet, Inc.(a) | | | 72,220 | | | | 4,780,242 | |

| Sonic Automotive, Inc., Class A | | | 46,500 | | | | 2,526,810 | |

| | | | | | | | 7,307,052 | |

| Semiconductors — 6.88% | | | | | | | | |

| Axcelis Technologies, Inc.(a) | | | 43,310 | | | | 5,771,058 | |

| Cirrus Logic, Inc.(a) | | | 28,935 | | | | 3,164,910 | |

| Synaptics, Inc.(a) | | | 24,880 | | | | 2,765,412 | |

| | | | | | | | 11,701,380 | |

| Software — 16.77% | | | | | | | | |

| Alteryx, Inc., Class A(a) | | | 37,600 | | | | 2,212,384 | |

| Calix, Inc.(a) | | | 42,085 | | | | 2,255,335 | |

| Evolent Health, Inc., Class A(a) | | | 132,340 | | | | 4,294,432 | |

See accompanying notes which are an integral part of these financial statements.

| Fuller & Thaler Behavioral Small-Cap Growth Fund |

| Schedule of Investments (continued) |

| March 31, 2023 - (Unaudited) |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — (continued) | | | | | | | | |

| Software — (continued) | | | | | | | | |

| Fastly, Inc., Class A(a) | | | 207,425 | | | $ | 3,683,868 | |

| New Relic, Inc.(a) | | | 31,520 | | | | 2,373,141 | |

| Nutanix, Inc., Class A(a) | | | 138,120 | | | | 3,589,739 | |

| Smartsheet, Inc., Class A(a) | | | 52,600 | | | | 2,514,280 | |

| Tenable Holdings, Inc.(a) | | | 57,174 | | | | 2,716,337 | |

| Teradata Corp.(a) | | | 60,700 | | | | 2,444,996 | |

| Zeta Global Holdings Corp., Class A(a) | | | 225,411 | | | | 2,441,201 | |

| | | | | | | | 28,525,713 | |

| Technology Hardware — 6.92% | | | | | | | | |

| Extreme Networks, | | | | | | | | |

| Inc.(a) | | | 155,240 | | | | 2,968,189 | |

| Sanmina Corp.(a) | | | 67,685 | | | | 4,128,108 | |

| Super Micro Computer, Inc.(a) | | | 43,875 | | | | 4,674,880 | |

| | | | | | | | 11,771,177 | |

| Technology Services — 4.72% | | | | | | | | |

| Payoneer Global, Inc.(a) | | | 360,050 | | | | 2,261,114 | |

| Remitly Global, Inc.(a) | | | 176,850 | | | | 2,997,608 | |

| Shift4 Payments, Inc., Class A(a) | | | 36,650 | | | | 2,778,070 | |

| | | | | | | | 8,036,792 | |

| Transportation & Logistics — 1.34% | | | | | | | | |

| Scorpio Tankers, Inc. | | | 40,500 | | | | 2,280,555 | |

| Total Common Stocks/ Investments — 97.58% | | | | | | | | |

| (Cost $142,400,332) | | | | | | | 165,992,500 | |

| Other Assets in Excess of Liabilities — 2.42% | | | | | | | 4,119,247 | |

| NET ASSETS — 100.00% | | | | | | $ | 170,111,747 | |

| (a) | Non-income producing security. |

See accompanying notes which are an integral part of these financial statements.

| Fuller & Thaler Behavioral Mid-Cap Value Fund |

| Schedule of Investments |

| March 31, 2023 - (Unaudited) |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 98.39% | | | | | | | | |

| Aerospace & Defense — 1.62% | | | | | | | | |

| Howmet Aerospace, Inc. | | | 159,580 | | | $ | 6,761,405 | |

| | | | | | | | | |

| Banking — 14.61% | | | | | | | | |

| Citizens Financial Group, Inc. | | | 132,900 | | | | 4,036,173 | |

| East West Bancorp, Inc. | | | 127,875 | | | | 7,097,063 | |

| First Citizens BancShares, Inc., Class A | | | 11,622 | | | | 11,309,368 | |

| First Horizon National Corp. | | | 170,610 | | | | 3,033,446 | |

| First Republic Bank | | | 63,600 | | | | 889,764 | |

| Huntington Bancshares, Inc. | | | 661,784 | | | | 7,411,981 | |

| KeyCorp | | | 665,650 | | | | 8,333,938 | |

| M&T Bank Corp. | | | 61,310 | | | | 7,330,837 | |

| Wells Fargo & Co. | | | 309,935 | | | | 11,585,370 | |

| | | | | | | | 61,027,940 | |

| Chemicals — 5.88% | | | | | | | | |

| Celanese Corp. | | | 103,470 | | | | 11,266,848 | |

| Olin Corp. | | | 178,290 | | | | 9,895,095 | |

| Sherwin-Williams Co. (The) | | | 15,014 | | | | 3,374,697 | |

| | | | | | | | 24,536,640 | |

| Commercial Support Services — 4.89% | | | | | | | | |

| Aramark | | | 266,275 | | | | 9,532,644 | |

| Brink’s Co. (The) | | | 99,660 | | | | 6,657,288 | |

| Republic Services, Inc. | | | 31,395 | | | | 4,245,232 | |

| | | | | | | | 20,435,164 | |

| Containers & Packaging — 9.39% | | | | | | | | |

| Berry Plastics Group, | | | | | | | | |

| Inc. | | | 179,610 | | | | 10,579,029 | |

| Crown Holdings, Inc. | | | 108,080 | | | | 8,939,297 | |

| Graphic Packaging Holding Co. | | | 537,660 | | | | 13,704,954 | |

| WestRock Co. | | | 196,335 | | | | 5,982,327 | |

| | | | | | | | 39,205,607 | |

| Electric Utilities — 4.45% | | | | | | | | |

| Alliant Energy Corp. | | | 49,685 | | | | 2,653,179 | |

| CenterPoint Energy, Inc. | | | 284,945 | | | | 8,394,479 | |

| CMS Energy Corp. | | | 34,425 | | | | 2,113,007 | |

| | | Shares | | | Fair Value | |

| | | | | | | |

| Electric Utilities — (continued) | | | | | | | | |

| Edison International | | | 36,850 | | | $ | 2,601,242 | |

| Pinnacle West Capital Corp. | | | 35,315 | | | | 2,798,360 | |

| | | | | | | | 18,560,267 | |

| Electrical Equipment — 2.20% | | | | | | | | |

| AMETEK, Inc. | | | 22,940 | | | | 3,333,870 | |

| Johnson Controls International PLC | | | 54,835 | | | | 3,302,164 | |

| Roper Technologies, Inc. | | | 5,740 | | | | 2,529,561 | |

| | | | | | | | 9,165,595 | |

| Food — 1.60% | | | | | | | | |

| Ingredion, Inc. | | | 60,780 | | | | 6,183,149 | |

| J.M. Smucker Co. (The) | | | 3,270 | | | | 514,600 | |

| | | | | | | | 6,697,749 | |

| Gas & Water Utilities — 1.90% | | | | | | | | |

| Atmos Energy Corp. | | | 70,650 | | | | 7,938,234 | |

| | | | | | | | | |

| Health Care Facilities & Services — 3.27% | | | | | | | | |

| Centene Corp.(a) | | | 35,875 | | | | 2,267,659 | |

| Henry Schein, Inc.(a) | | | 41,080 | | | | 3,349,663 | |

| Laboratory Corp. of America Holdings | | | 34,870 | | | | 7,999,875 | |

| | | | | | �� | | 13,617,197 | |

| Home & Office Products — 0.65% | | | | | | | | |

| Newell Brands, Inc. | | | 219,111 | | | | 2,725,741 | |

| | | | | | | | | |

| Home Construction — 0.96% | | | | | | | | |

| Mohawk Industries, Inc.(a) | | | 40,105 | | | | 4,019,323 | |

| | | | | | | | | |

| Industrial Support Services — 2.48% | | | | | | | | |

| AMERCO | | | 199,250 | | | | 10,331,112 | |

| | | | | | | | | |

| Insurance — 4.29% | | | | | | | | |

| Everest Re Group Ltd. | | | 15,710 | | | | 5,624,494 | |

| Globe Life, Inc. | | | 28,175 | | | | 3,099,814 | |

| Markel Corp.(a) | | | 7,195 | | | | 9,190,965 | |

| | | | | | | | 17,915,273 | |

| Leisure Facilities & Services — 0.53% | | | | | | | | |

| Live Nation Entertainment, Inc.(a) | | | 31,595 | | | | 2,211,650 | |

See accompanying notes which are an integral part of these financial statements.

| Fuller & Thaler Behavioral Mid-Cap Value Fund |

| Schedule of Investments (continued) |

| March 31, 2023 - (Unaudited) |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — (continued) | | | | | | | | |

| Machinery — 2.37% | | | | | | | | |

| Donaldson Co., Inc. | | | 116,970 | | | $ | 7,642,820 | |

| Snap-on, Inc. | | | 9,145 | | | | 2,257,809 | |

| | | | | | | | 9,900,629 | |

| Medical Equipment & Devices — 2.22% | | | | | | | | |

| DENTSPLY SIRONA, Inc. | | | 236,250 | | | | 9,279,900 | |

| | | | | | | | | |

| Metals & Mining — 0.06% | | | | | | | | |

| Arconic Corp.(a) | | | 9,357 | | | | 245,434 | |

| | | | | | | | | |

| Oil & Gas Producers — 4.57% | | | | | | | | |

| Cheniere Energy, Inc. | | | 50,305 | | | | 7,928,068 | |

| Devon Energy Corp. | | | 142,475 | | | | 7,210,660 | |

| Pioneer Natural Resources Co. | | | 19,310 | | | | 3,943,874 | |

| | | | | | | | 19,082,602 | |

| Real Estate — 6.27% | | | | | | | | |

| American Tower Corp. | | | 41,685 | | | | 8,517,913 | |

| Brixmor Property Group, Inc. | | | 313,625 | | | | 6,749,210 | |

| Public Storage | | | 12,855 | | | | 3,884,010 | |

| Simon Property Group, Inc. | | | 30,580 | | | | 3,424,043 | |

| WP Carey, Inc. | | | 46,205 | | | | 3,578,577 | |

| | | | | | | | 26,153,753 | |

| Retail - Consumer Staples — 2.77% | | | | | | | | |

| Dollar General Corp. | | | 26,845 | | | | 5,649,799 | |

| Dollar Tree, Inc.(a) | | | 40,955 | | | | 5,879,090 | |

| | | | | | | | 11,528,889 | |

| Retail - Discretionary — 4.31% | | | | | | | | |

| Advance Auto Parts, Inc. | | | 46,335 | | | | 5,634,799 | |

| CarMax, Inc.(a) | | | 118,090 | | | | 7,590,825 | |

| O’Reilly Automotive, Inc.(a) | | | 5,601 | | | | 4,755,137 | |

| | | | | | | | 17,980,761 | |

| Specialty Finance — 2.61% | | | | | | | | |

| Synchrony Financial | | | 374,115 | | | | 10,879,264 | |

| | | | | | | | | |

| Technology Hardware — 1.06% | | | | | | | | |

| CommScope Holding Co., Inc.(a) | | | 250,715 | | | | 1,597,055 | |

| | | Shares | | | Fair Value | |

| | | | | | | |

| Technology Hardware — (continued) | | | | | | | | |

| NCR Corp.(a) | | | 120,440 | | | $ | 2,841,179 | |

| | | | | | | | 4,438,234 | |

| Technology Services — 13.43% | | | | | | | | |

| Amdocs Ltd. | | | 39,930 | | | | 3,834,478 | |

| Dun & Bradstreet Holdings, Inc. | | | 709,925 | | | | 8,334,520 | |

| Fidelity National Information Services, Inc. | | | 323,825 | | | | 17,593,412 | |

| Global Payments, Inc. | | | 123,150 | | | | 12,960,306 | |

| TransUnion | | | 141,600 | | | | 8,799,024 | |

| Verisk Analytics, Inc. | | | 23,495 | | | | 4,507,751 | |

| | | | | | | | 56,029,491 | |

| Total Common Stocks/ Investments — 98.39% | | | | | | | | |

| (Cost $438,216,158) | | | | | | | 410,667,854 | |

| Other Assets in Excess of Liabilities — 1.61% | | | | | | | 6,729,478 | |

| NET ASSETS — 100.00% | | | | | | $ | 417,397,332 | |

| (a) | Non-income producing security. |

See accompanying notes which are an integral part of these financial statements.

| Fuller & Thaler Behavioral Unconstrained Equity Fund |

| Schedule of Investments |

| March 31, 2023 - (Unaudited) |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 94.31% | | | | | | | | |

| Automotive — 3.40% | | | | | | | | |

| Gentex Corp. | | | 46,560 | | | $ | 1,305,077 | |

| | | | | | | | | |

| Biotech & Pharma — 4.48% | | | | | | | | |

| Amgen, Inc. | | | 1,905 | | | | 460,534 | |

| Exelixis, Inc.(a) | | | 64,715 | | | | 1,256,118 | |

| | | | | | | | 1,716,652 | |

| Chemicals — 3.93% | | | | | | | | |

| Ecolab, Inc. | | | 9,101 | | | | 1,506,489 | |

| | | | | | | | | |

| Commercial Support Services — 5.90% | | | | | | | | |

| Cintas Corp. | | | 4,898 | | | | 2,266,206 | |

| | | | | | | | | |

| E-Commerce Discretionary — 5.95% | | | | | | | | |

| eBay, Inc. | | | 51,390 | | | | 2,280,174 | |

| | | | | | | | | |

| Electrical Equipment — 5.59% | | | | | | | | |

| Acuity Brands, Inc. | | | 6,335 | | | | 1,157,595 | |

| Generac Holdings, Inc.(a) | | | 9,105 | | | | 983,431 | |

| | | | | | | | 2,141,026 | |

| Leisure Facilities & Services — 4.39% | | | | | | | | |

| Starbucks Corp. | | | 16,170 | | | | 1,683,782 | |

| | | | | | | | | |

| Machinery — 5.46% | | | | | | | | |

| Parker-Hannifin Corp. | | | 6,223 | | | | 2,091,613 | |

| | | | | | | | | |

| Medical Equipment & Devices — 3.90% | | | | | | | | |

| Waters Corp.(a) | | | 4,827 | | | | 1,494,584 | |

| | | | | | | | | |

| Publishing & Broadcasting — 2.42% | | | | | | | | |

| Liberty Media Corp.- Liberty Sirius XM, Class C(a) | | | 33,131 | | | | 927,337 | |

| | | | | | | | | |

| Retail - Consumer Staples — 4.39% | | | | | | | | |

| Dollar General Corp. | | | 7,995 | | | | 1,682,628 | |

| | | | | | | | | |

| Retail - Discretionary — 9.08% | | | | | | | | |

| O’Reilly Automotive, Inc.(a) | | | 1,867 | | | | 1,585,046 | |

| Ross Stores, Inc. | | | 17,840 | | | | 1,893,359 | |

| | | | | | | | 3,478,405 | |

| Semiconductors — 14.18% | | | | | | | | |

| Lam Research Corp. | | | 4,515 | | | | 2,393,490 | |

| NVIDIA Corp. | | | 8,030 | | | | 2,230,493 | |

| Teradyne, Inc. | | | 7,582 | | | | 815,141 | |

| | | | | | | | 5,439,124 | |

| | | Shares | | | Fair Value | |

| | | | | | | |

| Software — 4.17% | | | | | | | | |

| Fortinet, Inc.(a) | | | 24,030 | | | $ | 1,597,034 | |

| | | | | | | | | |

| Specialty Finance — 7.78% | | | | | | | | |

| Capital One Financial Corp. | | | 15,695 | | | | 1,509,231 | |

| Synchrony Financial | | | 50,640 | | | | 1,472,611 | |

| | | | | | | | 2,981,842 | |

| Technology Hardware — 5.07% | | | | | | | | |

| Zebra Technologies Corp., Class A(a) | | | 6,110 | | | | 1,942,980 | |

| | | | | | | | | |

| Transportation & Logistics — 1.82% | | | | | | | | |

| Union Pacific Corp. | | | 3,472 | | | | 698,775 | |

| | | | | | | | | |

| Transportation Equipment — 2.40% | | | | | | | | |

| Allison Transmission Holdings, Inc. | | | 20,305 | | | | 918,598 | |

| Total Common Stocks/ Investments — 94.31% | | | | | | | | |

| (Cost $36,378,951) | | | | | | | 36,152,326 | |

| Other Assets in Excess of Liabilities — 5.69% | | | | | | | 2,182,196 | |

| NET ASSETS — 100.00% | | | | | | $ | 38,334,522 | |

| (a) | Non-income producing security. |

See accompanying notes which are an integral part of these financial statements.

| Fuller & Thaler Behavioral Small-Mid Core Equity Fund |

| Schedule of Investments |

| March 31, 2023 - (Unaudited) |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 96.42% | | | | | | | | |

| Asset Management — 1.55% | | | | | | | | |

| Hamilton Lane, Inc., Class A | | | 7,990 | | | $ | 591,100 | |

| | | | | | | | | |

| Automotive — 2.33% | | | | | | | | |

| Gentex Corp. | | | 31,815 | | | | 891,774 | |

| | | | | | | | | |

| Banking — 5.54% | | | | | | | | |

| First Citizens BancShares, Inc., Class A | | | 690 | | | | 671,440 | |

| First Commonwealth Financial Corp. | | | 21,040 | | | | 261,527 | |

| First Financial Bankshares, Inc. | | | 8,270 | | | | 263,813 | |

| Live Oak Bancshares, Inc. | | | 22,717 | | | | 553,613 | |

| Western Alliance Bancorp | | | 10,322 | | | | 366,844 | |

| | | | | | | | 2,117,237 | |

| Biotech & Pharma — 2.07% | | | | | | | | |

| Exelixis, Inc.(a) | | | 40,765 | | | | 791,249 | |

| | | | | | | | | |

| Chemicals — 4.55% | | | | | | | | |

| Huntsman Corp. | | | 29,665 | | | | 811,634 | |

| Orion Engineered Carbons SA | | | 35,505 | | | | 926,326 | |

| | | | | | | | 1,737,960 | |

| Commercial Support Services — 0.99% | | | | | | | | |

| Cintas Corp. | | | 820 | | | | 379,398 | |

| | | | | | | | | |

| Construction Materials — 1.62% | | | | | | | | |

| Owens Corning | | | 6,460 | | | | 618,868 | |

| | | | | | | | | |

| E-Commerce Discretionary — 2.14% | | | | | | | | |

| eBay, Inc. | | | 18,400 | | | | 816,408 | |

| | | | | | | | | |

| Electrical Equipment — 5.22% | | | | | | | | |

| Acuity Brands, Inc. | | | 4,940 | | | | 902,686 | |

| Advanced Energy Industries, Inc. | | | 7,495 | | | | 734,510 | |

| Generac Holdings, Inc.(a) | | | 3,302 | | | | 356,649 | |

| | | | | | | | 1,993,845 | |

| Food — 4.80% | | | | | | | | |

| John B. Sanfilippo & Son, Inc. | | | 2,090 | | | | 202,563 | |

| | | Shares | | | Fair Value | |

| | | | | | | |

| Food — (continued) | | | | | | | | |

| Lancaster Colony Corp. | | | 8,040 | | | $ | 1,631,155 | |

| | | | | | | | 1,833,718 | |

| Gas & Water Utilities — 1.46% | | | | | | | | |

| UGI Corp. | | | 16,030 | | | | 557,203 | |

| | | | | | | | | |

| Health Care Facilities & Services — 3.32% | | | | | | | | |

| Medpace Holdings, Inc.(a) | | | 3,340 | | | | 628,087 | |

| Quest Diagnostics, Inc. | | | 4,520 | | | | 639,490 | |

| | | | | | | | 1,267,577 | |

| Home & Office Products — 2.46% | | | | | | | | |

| Tempur Sealy International, Inc. | | | 23,805 | | | | 940,059 | |

| | | | | | | | | |

| Home Construction — 4.94% | | | | | | | | |

| Masco Corp. | | | 16,425 | | | | 816,651 | |

| PulteGroup, Inc. | | | 18,425 | | | | 1,073,810 | |

| | | | | | | | 1,890,461 | |

| Insurance — 4.45% | | | | | | | | |

| Brown & Brown, Inc. | | | 13,273 | | | | 762,136 | |

| Old Republic International Corp. | | | 37,545 | | | | 937,498 | |

| | | | | | | | 1,699,634 | |

| Machinery — 0.51% | | | | | | | | |

| Parker-Hannifin Corp. | | | 580 | | | | 194,944 | |

| | | | | | | | | |

| Medical Equipment & Devices — 5.00% | | | | | | | | |

| Align Technology, Inc.(a) | | | 1,980 | | | | 661,597 | |

| DENTSPLY SIRONA, Inc. | | | 14,430 | | | | 566,810 | |

| Waters Corp.(a) | | | 2,205 | | | | 682,734 | |

| | | | | | | | 1,911,141 | |

| Oil & Gas Producers — 4.35% | | | | | | | | |

| Coterra Energy, Inc. | | | 40,285 | | | | 988,594 | |

| Devon Energy Corp. | | | 13,294 | | | | 672,809 | |

| | | | | | | | 1,661,403 | |

| Real Estate — 5.12% | | | | | | | | |

| American Assets Trust, Inc. | | | 15,770 | | | | 293,164 | |

| Apple Hospitality REIT, Inc. | | | 38,020 | | | | 590,070 | |

See accompanying notes which are an integral part of these financial statements.

| Fuller & Thaler Behavioral Small-Mid Core Equity Fund |

| Schedule of Investments (continued) |

| March 31, 2023 - (Unaudited) |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — (continued) | | | | | | | | |

| Real Estate — (continued) | | | | | | | | |

| Gaming and Leisure Properties, Inc. | | | 20,584 | | | $ | 1,071,604 | |

| | | | | | | | 1,954,838 | |

| Retail - Discretionary — 2.18% | | | | | | | | |

| Advance Auto Parts, Inc. | | | 5,360 | | | | 651,829 | |

| Ross Stores, Inc. | | | 1,690 | | | | 179,360 | |

| | | | | | | | 831,189 | |

| Semiconductors — 9.36% | | | | | | | | |

| Cirrus Logic, Inc.(a) | | | 6,675 | | | | 730,112 | |

| IPG Photonics Corp.(a) | | | 6,640 | | | | 818,777 | |

| Lattice Semiconductor Corp.(a) | | | 5,845 | | | | 558,198 | |

| Power Integrations, Inc. | | | 7,870 | | | | 666,117 | |

| Teradyne, Inc. | | | 7,515 | | | | 807,937 | |

| | | | | | | | 3,581,141 | |

| Software — 4.49% | | | | | | | | |

| Akamai Technologies, Inc.(a) | | | 2,630 | | | | 205,929 | |

| Concentrix Corp. | | | 6,075 | | | | 738,416 | |

| SS&C Technologies Holdings, Inc. | | | 13,740 | | | | 775,898 | |

| | | | | | | | 1,720,243 | |

| Specialty Finance — 1.66% | | | | | | | | |

| Synchrony Financial | | | 21,840 | | | | 635,107 | |

| | | | | | | | | |

| Steel — 2.85% | | | | | | | | |

| Steel Dynamics, Inc. | | | 9,630 | | | | 1,088,768 | |

| | | | | | | | | |

| Technology Hardware — 2.33% | | | | | | | | |

| Zebra Technologies Corp., Class A(a) | | | 2,795 | | | | 888,810 | |

| | | | | | | | | |

| Technology Services — 4.44% | | | | | | | | |

| Leidos Holdings, Inc. | | | 7,740 | | | | 712,544 | |

| Science Applications International Corp. | | | 9,140 | | | | 982,185 | |

| | | | | | | | 1,694,729 | |

| Transportation & Logistics — 2.10% | | | | | | | | |

| Expeditors International of Washington, Inc. | | | 7,300 | | | | 803,876 | |

| | | Shares | | | Fair Value | |

| | | | | | | |

| Transportation Equipment — 2.80% | | | | | | | | |

| Allison Transmission | | | | | | | | |

| Holdings, Inc. | | | 23,610 | | | $ | 1,068,116 | |

| | | | | | | | | |

| Wholesale - Discretionary — 1.79% | | | | | | | | |

| Pool Corp. | | | 2,000 | | | | 684,880 | |

| Total Common Stocks/ Investments — 96.42% | | | | | | | | |

| (Cost $36,608,022) | | | | | | | 36,845,676 | |

| Other Assets in Excess of Liabilities — 3.58% | | | | | | | 1,366,780 | |

| NET ASSETS — 100.00% | | | | | | $ | 38,212,456 | |

| (a) | Non-income producing security. |

See accompanying notes which are an integral part of these financial statements.

| Fuller & Thaler Behavioral Micro-Cap Equity Fund |

| Schedule of Investments |

| March 31, 2023 - (Unaudited) |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 96.55% | | | | | | | | |

| Advertising & Marketing — 1.87% | | | | | | | | |

| Magnite, Inc.(a) | | | 17,385 | | | $ | 160,985 | |

| Quotient Technology, Inc.(a) | | | 50,785 | | | | 166,575 | |

| | | | | | | | 327,560 | |

| Aerospace & Defense — 1.45% | | | | | | | | |

| Byrna Technologies, Inc.(a) | | | 33,450 | | | | 253,886 | |

| | | | | | | | | |

| Asset Management — 3.58% | | | | | | | | |

| B. Riley Financial, Inc. | | | 11,171 | | | | 317,144 | |

| Vitesse Energy, Inc. | | | 16,250 | | | | 309,238 | |

| | | | | | | | 626,382 | |

| Beverages — 1.08% | | | | | | | | |

| Farmer Bros. Co.(a) | | | 49,130 | | | | 189,642 | |

| | | | | | | | | |

| Biotech & Pharma — 1.09% | | | | | | | | |

| PetIQ, Inc., Class A(a) | | | 16,600 | | | | 189,904 | |

| | | | | | | | | |

| Commercial Support Services — 1.39% | | | | | | | | |

| Acacia Research Corp.(a) | | | 63,035 | | | | 243,315 | |

| | | | | | | | | |

| Consumer Services — 1.23% | | | | | | | | |

| 2U, Inc.(a) | | | 31,300 | | | | 214,405 | |

| | | | | | | | | |

| E-Commerce Discretionary — 3.03% | | | | | | | | |

| BARK, Inc.(a) | | | 207,975 | | | | 301,564 | |

| Solo Brands, Inc., Class A(a) | | | 31,850 | | | | 228,683 | |

| | | | | | | | 530,247 | |

| Entertainment Content — 1.46% | | | | | | | | |

| PLAYSTUDIOS, Inc., Class A(a) | | | 69,046 | | | | 254,780 | |

| | | | | | | | | |

| Food — 1.86% | | | | | | | | |

| Limoneira Co.(a) | | | 19,475 | | | | 324,453 | |

| | | | | | | | | |

| Health Care Facilities & Services — 1.57% | | | | | | | | |

| Enzo Biochem, Inc.(a) | | | 112,650 | | | | 273,740 | |

| | | | | | | | | |

| Institutional Financial Services — 1.24% | | | | | | | | |

| Greenhill & Co., Inc.(a) | | | 24,450 | | | | 216,872 | |

| | | | | | | | | |

| Internet Media & Services — 3.87% | | | | | | | | |

| LiveOne, Inc.(a) | | | 122,455 | | | | 139,599 | |

| Nerdy, Inc., Class A(a) | | | 78,075 | | | | 326,353 | |

| TrueCar, Inc.(a) | | | 91,897 | | | | 211,363 | |

| | | | | | | | 677,315 | |

| Leisure Facilities & Services — 7.20% | | | | | | | | |

| Century Casinos, Inc.(a) | | | 32,150 | | | | 235,660 | |

| Chuy’s Holdings, Inc.(a) | | | 7,700 | | | | 276,045 | |

| Full House Resorts, Inc.(a) | | | 42,920 | | | | 310,312 | |

| | | Shares | | | Fair Value | |

| | | | | | | |

| Leisure Facilities & Services — (continued) | | | | | | | | |

| Red Robin Gourmet Burgers, Inc.(a) | | | 30,535 | | | $ | 437,261 | |

| | | | | | | | 1,259,278 | |

| Leisure Products — 3.03% | | | | | | | | |

| American Outdoor Brands, Inc.(a) | | | 26,897 | | | | 264,666 | |

| MasterCraft Boat Holdings, Inc.(a) | | | 8,700 | | | | 264,741 | |

| | | | | | | | 529,407 | |

| Machinery — 5.14% | | | | | | | | |

| Manitowoc Co., Inc. (The)(a) | | | 14,792 | | | | 252,795 | |

| NN, Inc.(a) | | | 99,825 | | | | 106,813 | |

| Ranpak Holdings Corp., Class A(a) | | | 51,315 | | | | 267,864 | |

| Titan International, Inc.(a) | | | 25,855 | | | | 270,960 | |

| | | | | | | | 898,432 | |

| Medical Equipment & Devices — 3.11% | | | | | | | | |

| Quanterix Corp.(a) | | | 19,335 | | | | 217,905 | |

| ViewRay, Inc.(a) | | | 94,885 | | | | 328,302 | |

| | | | | | | | 546,207 | |

| Oil & Gas Producers — 4.99% | | | | | | | | |

| Matador Resources Co. | | | 12,135 | | | | 578,232 | |

| SandRidge Energy, Inc.(a) | | | 20,310 | | | | 292,667 | |

| | | | | | | | 870,899 | |

| Oil & Gas Services & Equipment — 4.94% | | | | | | | | |

| Helix Energy Solutions Group, Inc.(a) | | | 73,263 | | | | 567,056 | |

| Newpark Resources, Inc.(a) | | | 77,300 | | | | 297,605 | |

| | | | | | | | 864,661 | |

| Publishing & Broadcasting — 1.32% | | | | | | | | |

| Townsquare Media, Inc., Class A(a) | | | 28,815 | | | | 230,520 | |

| | | | | | | | | |

| Real Estate Services — 0.86% | | | | | | | | |

| Douglas Elliman, Inc.(a) | | | 48,561 | | | | 151,025 | |

| | | | | | | | | |

| REIT — 1.31% | | | | | | | | |

| Farmland Partners, Inc. | | | 21,425 | | | | 229,247 | |

| | | | | | | | | |

| Renewable Energy — 1.96% | | | | | | | | |

| Eneti, Inc.(a) | | | 36,740 | | | | 343,519 | |

| | | | | | | | | |

| Retail - Discretionary — 5.68% | | | | | | | | |

| Build-A-Bear Workshop, Inc.(a) | | | 9,880 | | | | 229,611 | |

See accompanying notes which are an integral part of these financial statements.

| Fuller & Thaler Behavioral Micro-Cap Equity Fund |

| Schedule of Investments (continued) |

| March 31, 2023 - (Unaudited) |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — (continued) | | | | | | | | |

| Retail - Discretionary — (continued) | | | | | | | | |

| Lazydays Holdings, Inc.(a) | | | 12,693 | | | $ | 148,127 | |

| Sportsman’s Warehouse Holdings, Inc.(a) | | | 29,950 | | | | 253,976 | |

| Vera Bradley, Inc.(a) | | | 60,330 | | | | 361,377 | |

| | | | | | | | 993,091 | |

| Semiconductors — 1.74% | | | | | | | | |

| ACM Research, Inc., Class A(a) | | | 25,950 | | | | 303,615 | |

| | | | | | | | | |

| Software — 6.06% | | | | | | | | |

| Brightcove, Inc.(a) | | | 36,750 | | | | 163,538 | |

| Cantaloupe, Inc.(a) | | | 56,037 | | | | 319,411 | |

| Donnelley Financial Solutions, Inc.(a) | | | 8,588 | | | | 350,905 | |

| Tabula Rasa HealthCare, Inc.(a) | | | 40,360 | | | | 225,612 | |

| | | | | | | | 1,059,466 | |

| Specialty Finance — 0.82% | | | | | | | | |

| Applied Blockchain, Inc.(a) | | | 64,125 | | | | 143,640 | |

| | | | | | | | | |

| Technology Hardware — 8.56% | | | | | | | | |

| CalAmp Corp.(a) | | | 56,935 | | | | 204,397 | |

| Comtech Telecommunications Corp. | | | 25,060 | | | | 312,749 | |

| PlayAGS, Inc.(a) | | | 42,330 | | | | 302,660 | |