UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: 811-22895 |

Capitol Series Trust

(Exact name of registrant as specified in charter)

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Zachary P. Richmond

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

| Registrant’s telephone number, including area code: | 513-587-3400 |

| Date of fiscal year end: | January 31 |

| Date of reporting period: | July 31, 2024 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) |

Fairlead Tactical Sector ETF

(TACK) NYSE Arca, Inc.

Semi-Annual Shareholder Report - July 31, 2024

Fund Overview

This semi-annual shareholder report contains important information about Fairlead Tactical Sector ETF for the period of February 1, 2024 to July 31, 2024. You can find additional information about the Fund at https://funddocs.filepoint.com/fairlead/. You can also request this information by contacting us at (877) 865-9549.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Fund | $29 | 0.59% |

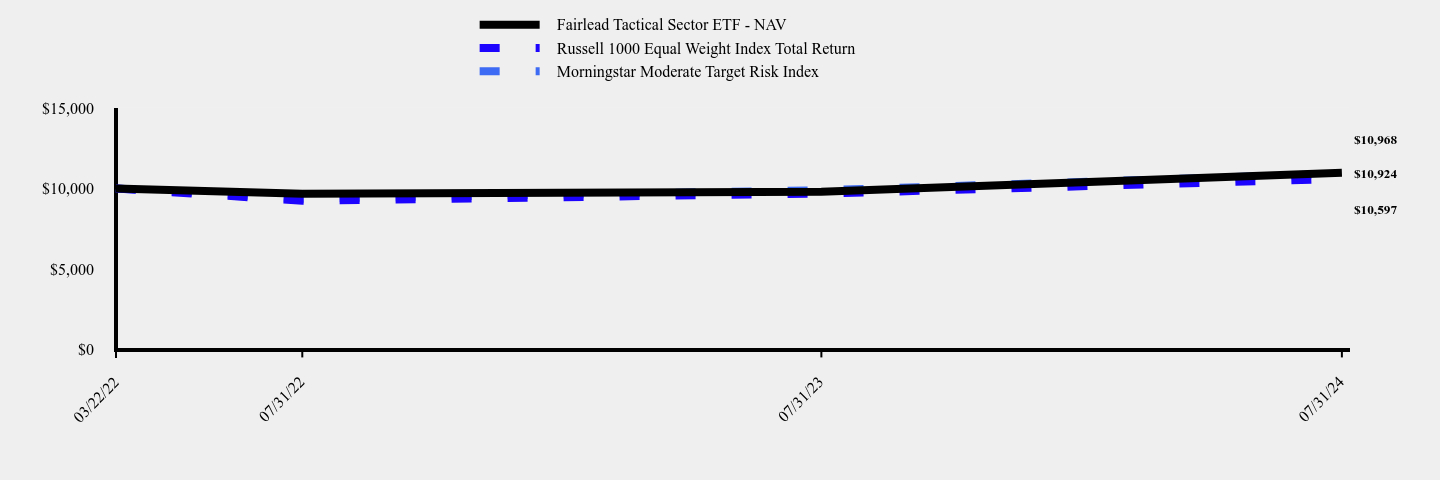

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Fairlead Tactical Sector ETF - NAV | Russell 1000 Equal Weight Index Total Return | Morningstar Moderate Target Risk Index | |

|---|---|---|---|

| 03/22/22 | $10,000 | $10,000 | $10,000 |

| 07/31/22 | $9,675 | $9,235 | $9,363 |

| 07/31/23 | $9,794 | $9,679 | $9,885 |

| 07/31/24 | $10,968 | $10,597 | $10,924 |

Fund Statistics

- Net Assets$211,639,632

- Number of Portfolio Holdings8

- Advisory Fee $621,375

- Portfolio Turnover34%

Average Annual Total Returns

| 1 Year | Since Inception (March 22, 2022) | |

|---|---|---|

| Fairlead Tactical Sector ETF - NAV | 11.99% | 4.00% |

| Fairlead Tactical Sector ETF - Market Price | 12.13% | 4.00% |

| Russell 1000 Equal Weight Index Total Return | 9.49% | 2.49% |

| Morningstar Moderate Target Risk Index | 10.51% | 3.82% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

The Morningstar Moderate Target Risk Index is representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual may invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

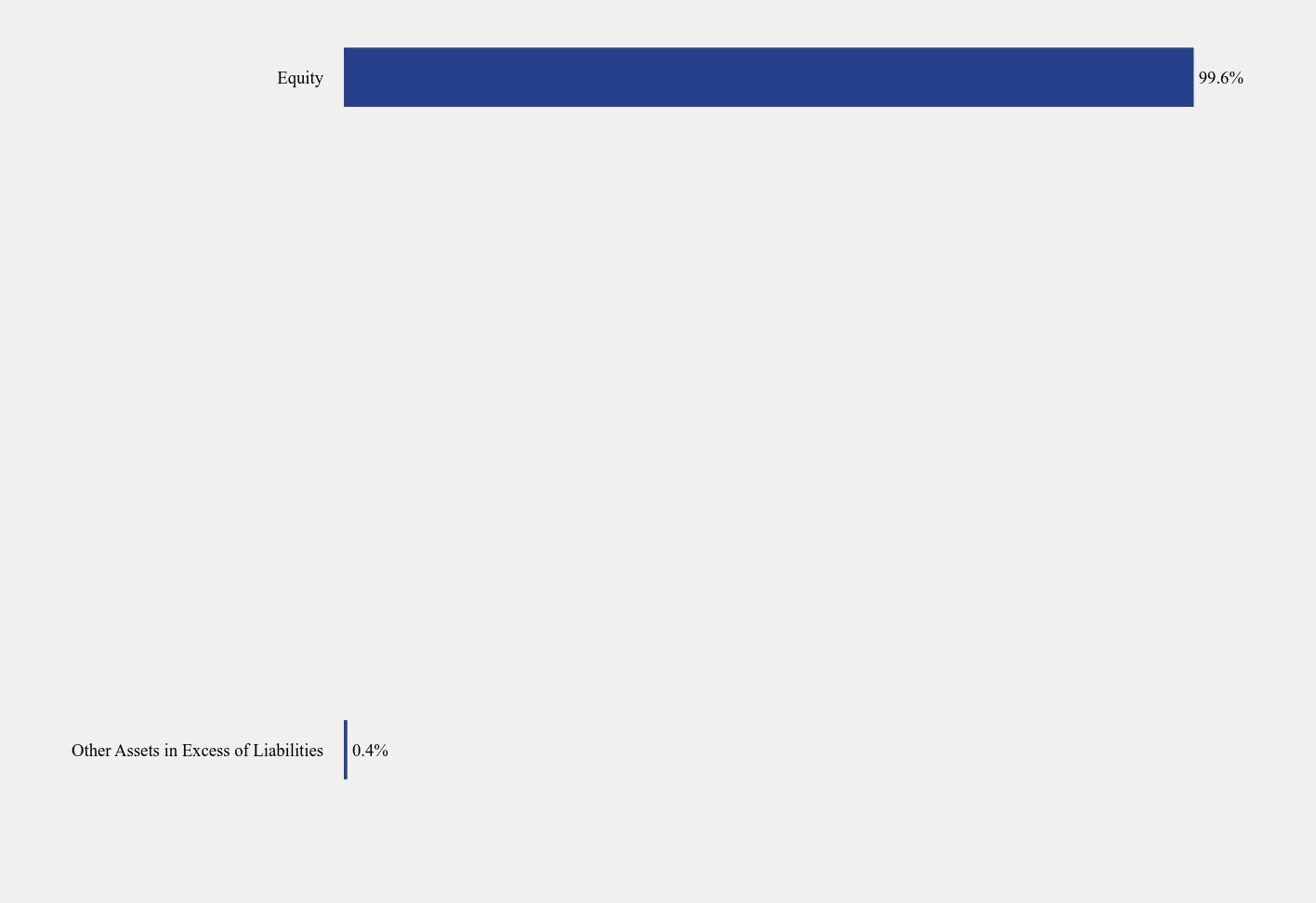

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|---|

| Other Assets in Excess of Liabilities | 0.4% |

| Equity | 99.6% |

Material Fund Changes

No material changes occurred during the period ended July 31, 2024.

Fairlead Tactical Sector ETF (TACK)

Semi-Annual Shareholder Report - July 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://funddocs.filepoint.com/fairlead/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

TSR-SAR 073124-TACK

Reynders, McVeigh Core Equity Fund

Institutional Shares (ESGEX)

Semi-Annual Shareholder Report - July 31, 2024

Fund Overview

This semi-annual shareholder report contains important information about Reynders, McVeigh Core Equity Fund for the period of February 1, 2024 to July 31, 2024. You can find additional information about the Fund at https://funddocs.filepoint.com/reyndersmcveigh/. You can also request this information by contacting us at (800) 950-6868.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Institutional | $47 | 0.95% |

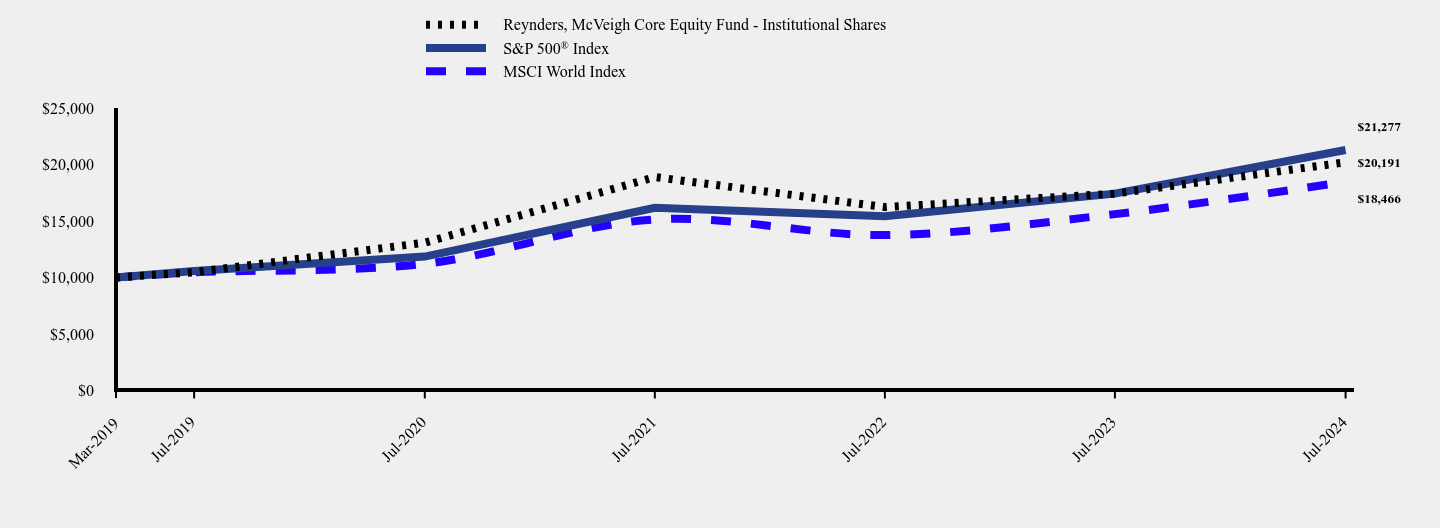

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Reynders, McVeigh Core Equity Fund - Institutional Shares | S&P 500® Index | MSCI World Index | |

|---|---|---|---|

| Mar-2019 | $10,000 | $10,000 | $10,000 |

| Jul-2019 | $10,460 | $10,580 | $10,452 |

| Jul-2020 | $13,076 | $11,845 | $11,207 |

| Jul-2021 | $18,885 | $16,163 | $15,138 |

| Jul-2022 | $16,228 | $15,413 | $13,751 |

| Jul-2023 | $17,416 | $17,419 | $15,605 |

| Jul-2024 | $20,191 | $21,277 | $18,466 |

Fund Statistics

- Net Assets$85,726,512

- Number of Portfolio Holdings50

- Advisory Fee (net of waivers)$224,719

- Portfolio Turnover10%

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (March 29, 2019) | |

|---|---|---|---|

| Reynders, McVeigh Core Equity Fund - Institutional Shares | 15.93% | 14.06% | 14.06% |

S&P 500® Index | 22.15% | 15.00% | 15.19% |

| MSCI World Index | 18.34% | 12.06% | 12.17% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

What did the Fund invest in?

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|---|

| Other Assets in Excess of Liabilities | 1.1% |

| Financials | 0.9% |

| Energy | 2.0% |

| Communications | 4.3% |

| Consumer Staples | 5.5% |

| Materials | 6.2% |

| Consumer Discretionary | 6.8% |

| Health Care | 19.7% |

| Industrials | 22.9% |

| Technology | 30.6% |

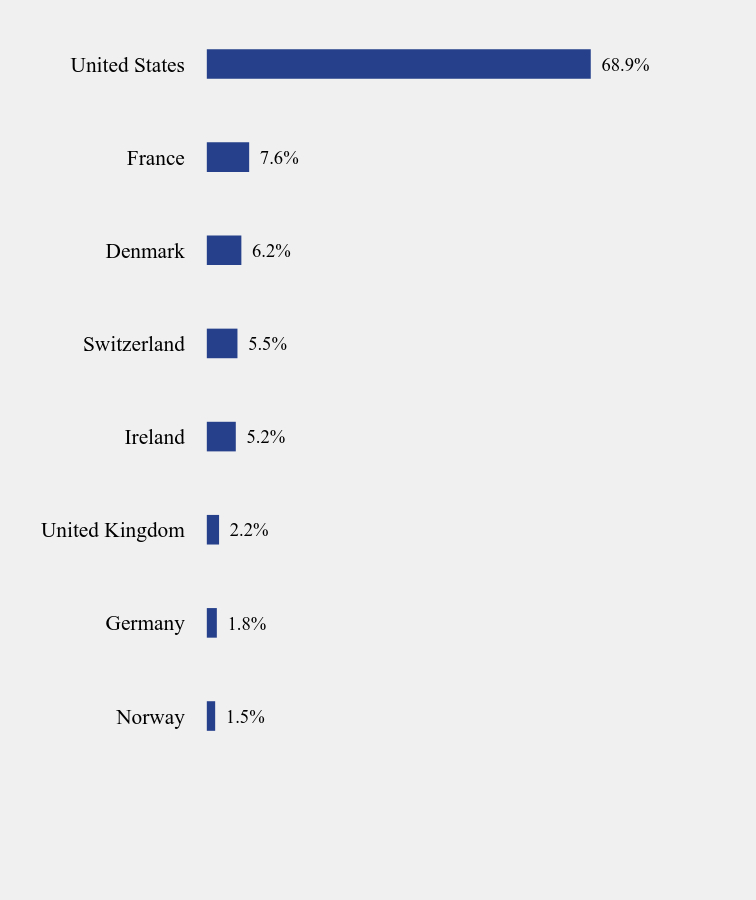

Country Weighting (% of net assets)

| Value | Value |

|---|---|

| Norway | 1.5% |

| Germany | 1.8% |

| United Kingdom | 2.2% |

| Ireland | 5.2% |

| Switzerland | 5.5% |

| Denmark | 6.2% |

| France | 7.6% |

| United States | 68.9% |

Material Fund Changes

No material changes occurred during the period ended July 31, 2024.

Reynders, McVeigh Core Equity Fund - Institutional (ESGEX)

Semi-Annual Shareholder Report - July 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://funddocs.filepoint.com/reyndersmcveigh/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

TSR-SAR 073124-ESGEX

The Nightview Fund

(NITE) NYSE Arca, Inc.

Semi-Annual Shareholder Report - July 31, 2024

Fund Overview

This semi-annual shareholder report contains information about The Nightview Fund (the "Fund") for the period of June 21, 2024 to July 31, 2024. You can find additional information about the fund at https://www.nightviewfund.com/. You can also rest this information by contacting us at 866-666-7156.

What were the Fund’s costs for the period since inception?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| The Nightview Fund | $13 | 1.25% |

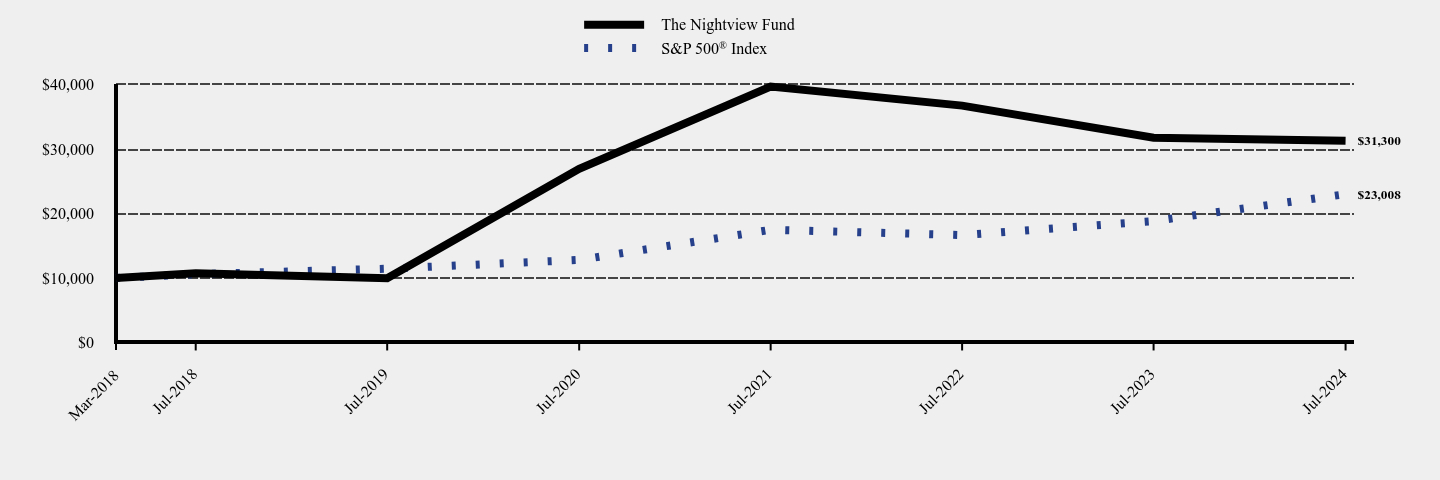

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| The Nightview Fund | S&P 500® Index | |

|---|---|---|

| Mar-2018 | $10,000 | $10,000 |

| Jul-2018 | $10,724 | $10,595 |

| Jul-2019 | $9,959 | $11,441 |

| Jul-2020 | $26,950 | $12,809 |

| Jul-2021 | $39,709 | $17,478 |

| Jul-2022 | $36,746 | $16,667 |

| Jul-2023 | $31,770 | $18,836 |

| Jul-2024 | $31,300 | $23,008 |

Fund Statistics

- Net Assets$19,678,236

- Number of Portfolio Holdings18

- Advisory Fee $24,631

- Portfolio Turnover29%

Average Annual Total Returns

| 6 Months | 1 Year | 5 years | Since Inception (03/01/2018) | |

|---|---|---|---|---|

| The Nightview Fund - NAV | 7.20% | -1.48% | 25.74% | 19.46% |

| The Nightview Fund - Market Price | -% | -% | -% | 0.52% |

S&P 500® Index | 14.77% | 22.15% | 15.00% | 13.87% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

The performance results shown above in the line chart and the average annual total returns table are for periods prior to June 21, 2024 and represent the performance of The Nightview Capital Fund, LP - Series B (formerly known as The Worm Capital Fund, LP - Series B) (the "Predecessor Fund") which converted into NITE and is attributable to NITE moving forward. The Fund's performance has not been restated to reflect any differences in expenses paid by the Predecessor Fund and those paid by the Fund.

The Market Price performance started on June 21, 2024.

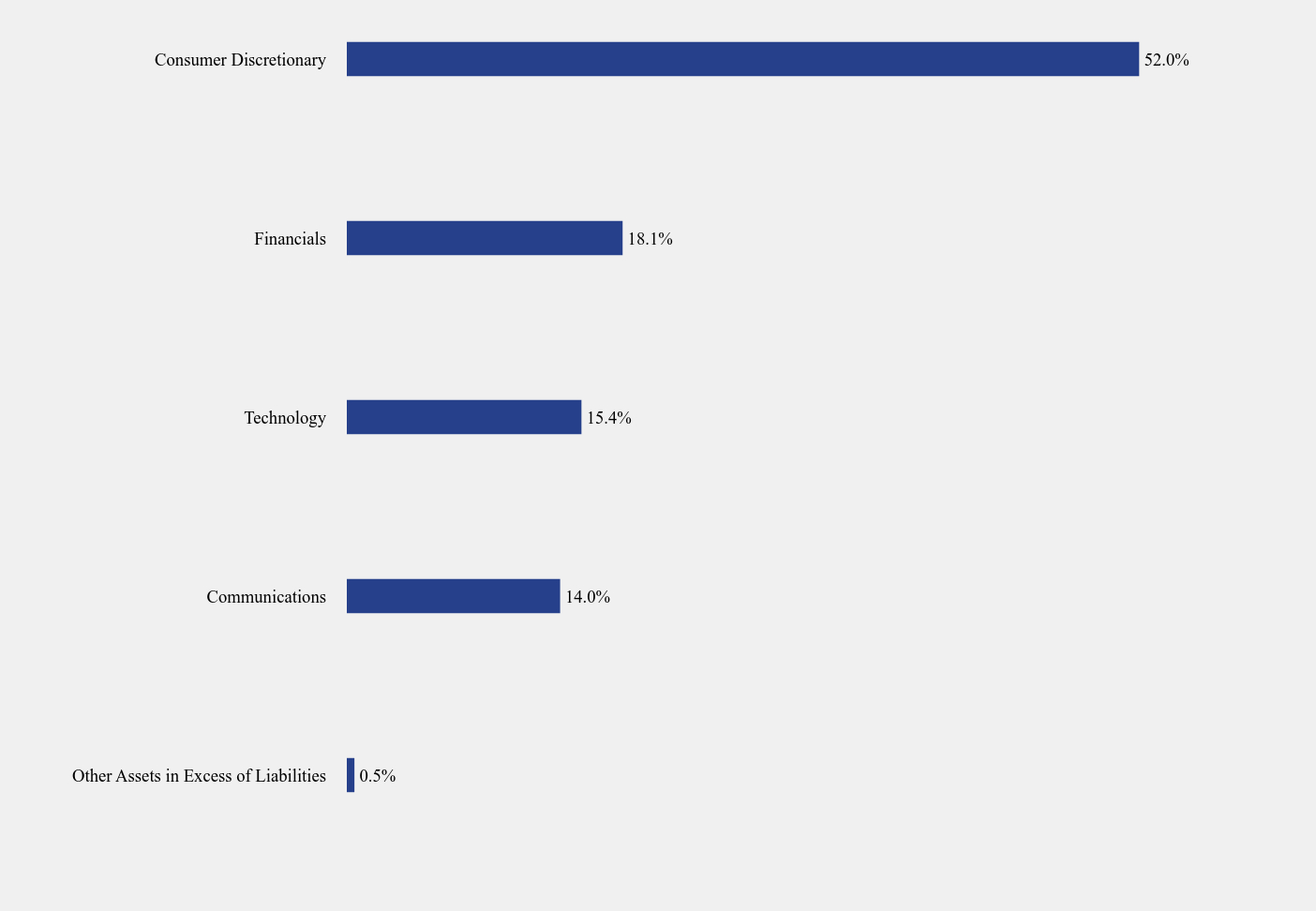

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|---|

| Other Assets in Excess of Liabilities | 0.5% |

| Communications | 14.0% |

| Technology | 15.4% |

| Financials | 18.1% |

| Consumer Discretionary | 52.0% |

Material Fund Changes

No material changes occurred during the period ended July 31, 2024.

The Nightview Fund

Semi-Annual Shareholder Report - July 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://www.nightviewfund.com/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

TSR-SAR 073124-NITE

| (b) | NOT APPLICABLE. |

Item 2. Code of Ethics.

NOT APPLICABLE – disclosed with annual report

Item 3. Audit Committee Financial Expert.

NOT APPLICABLE – disclosed with annual report

|

Item 4. Principal Accountant Fees and Services.

NOT APPLICABLE – disclosed with annual report

Item 5. Audit Committee of Listed Registrants.

NOT APPLICABLE – disclosed with annual report

Item 6. Investments.

The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a)

|

| Fairlead Tactical Sector ETF (TACK) |

| NYSE Arca, Inc. |

| Financial Statements |

| July 31, 2024 |

| Fund Adviser: |

| Cary Street Partners Asset Management LLC |

| 901 East Byrd Street, Suite 1001 |

| Richmond, VA 23219 |

| (877) 865-9549 |

| Fairlead Tactical Sector ETF |

| Schedule of Investments |

| July 31, 2024 (Unaudited) |

| Shares | Fair Value | |||||||

| EXCHANGE-TRADED FUNDS — 99.62% | ||||||||

| Communication Services Select Sector SPDR® Fund | 299,279 | $ | 25,675,145 | |||||

| Consumer Staples Select Sector SPDR® Fund | 334,718 | 26,057,796 | ||||||

| Financial Select Sector SPDR® Fund | 619,601 | 27,101,348 | ||||||

| Health Care Select Sector SPDR® Fund | 175,431 | 26,249,741 | ||||||

| Industrial Select Sector SPDR® Fund | 210,311 | 26,890,364 | ||||||

| Materials Select Sector SPDR® Fund | 293,489 | 27,042,076 | ||||||

| Technology Select Sector SPDR® Fund | 112,352 | 24,582,618 | ||||||

| Utilities Select Sector SPDR® Fund | 374,121 | 27,232,268 | ||||||

| Total Exchange-Traded Funds (Cost $189,160,553) | 210,831,356 | |||||||

| Total Investments — 99.62% (Cost $189,160,553) | 210,831,356 | |||||||

| Other Assets in Excess of Liabilities — 0.38% | 808,276 | |||||||

| NET ASSETS — 100.00% | $ | 211,639,632 | ||||||

ETF - Exchange-Traded Fund

SPDR - Standard & Poor’s Depositary Receipt

See accompanying notes which are an integral part of these financial statements.

1

| Fairlead Tactical Sector ETF |

| Statement of Assets and Liabilities |

| July 31, 2024 (Unaudited) |

| Assets | ||||

| Investments in securities, at fair value (cost $189,160,553) | $ | 210,831,356 | ||

| Cash | 910,414 | |||

| Dividends receivable | 3,875 | |||

| Total Assets | 211,745,645 | |||

| Liabilities | ||||

| Payable to Adviser | 106,013 | |||

| Total Liabilities | 106,013 | |||

| Net Assets | $ | 211,639,632 | ||

| Net Assets consist of: | ||||

| Paid-in capital | 198,161,240 | |||

| Accumulated earnings | 13,478,392 | |||

| Net Assets | $ | 211,639,632 | ||

| Shares outstanding (unlimited number of shares authorized, no par value) | 7,920,000 | |||

| Net asset value per share | $ | 26.72 |

See accompanying notes which are an integral part of these financial statements.

2

| Fairlead Tactical Sector ETF |

| Statement of Operations |

| For the Six Months Ended July 31, 2024 (Unaudited) |

| Investment Income | ||||

| Dividend income | $ | 1,985,761 | ||

| Interest income | 37,068 | |||

| Total investment income | 2,022,829 | |||

| Expenses | ||||

| Adviser | 621,375 | |||

| Net operating expenses | 621,375 | |||

| Net investment income | 1,401,454 | |||

| Net Realized and Change in Unrealized Gain (Loss) on Investments | ||||

| Net realized gain (loss) on: | ||||

| Investment securities | 4,287,206 | |||

| Change in unrealized appreciation on: | ||||

| Investment securities | 10,111,727 | |||

| Net realized and change in unrealized gain (loss) on investment securities | 14,398,933 | |||

| Net increase in net assets resulting from operations | $ | 15,800,387 |

See accompanying notes which are an integral part of these financial statements.

3

| Fairlead Tactical Sector ETF |

| Statements of Changes in Net Assets |

| For the Six | For the | |||||||

| Months | Year Ended | |||||||

| Ended July | January 31, | |||||||

| 31, 2024 | 2024 | |||||||

| (Unaudited) | ||||||||

| Increase (Decrease) in Net Assets due to: | ||||||||

| Operations | ||||||||

| Net investment income | $ | 1,401,454 | $ | 3,186,899 | ||||

| Net realized gain (loss) on investment securities | 4,287,206 | (3,692,041 | ) | |||||

| Change in unrealized appreciation on investment securities | 10,111,727 | 5,920,707 | ||||||

| Net increase in net assets resulting from operations | 15,800,387 | 5,415,565 | ||||||

| Distributions to Shareholders from: | ||||||||

| Earnings | (747,530 | ) | (3,017,537 | ) | ||||

| Total distributions | (747,530 | ) | (3,017,537 | ) | ||||

| Capital Transactions | ||||||||

| Proceeds from shares sold | 95,547,917 | 124,160,708 | ||||||

| Amount paid for shares redeemed | (107,329,158 | ) | (132,066,180 | ) | ||||

| Net decrease in net assets resulting from capital transactions | (11,781,241 | ) | (7,905,472 | ) | ||||

| Total Increase (Decrease) in Net Assets | 3,271,616 | (5,507,444 | ) | |||||

| Net Assets | ||||||||

| Beginning of period | $ | 208,368,016 | $ | 213,875,460 | ||||

| End of period | $ | 211,639,632 | $ | 208,368,016 | ||||

| Share Transactions | ||||||||

| Shares sold | 3,700,000 | 5,180,000 | ||||||

| Shares redeemed | (4,160,000 | ) | (5,590,000 | ) | ||||

| Net decrease in shares outstanding | (460,000 | ) | (410,000 | ) | ||||

See accompanying notes which are an integral part of these financial statements.

4

| Fairlead Tactical Sector ETF |

| Financial Highlights |

| (For a share outstanding during the period) |

| For the | ||||||||||||

| For the Six | For the | Period | ||||||||||

| Months | Year Ended | Ended | ||||||||||

| Ended July | January 31, | January 31, | ||||||||||

| 31, 2024 | 2024 | 2023(a) | ||||||||||

| (Unaudited) | ||||||||||||

| Selected Per Share Data: | ||||||||||||

| Net asset value, beginning of period | $ | 24.86 | $ | 24.33 | $ | 25.00 | ||||||

| Investment operations: | ||||||||||||

| Net investment income | 0.17 | 0.34 | 0.21 | |||||||||

| Net realized and unrealized gain (loss) on investments | 1.78 | 0.51 | (0.67 | ) | ||||||||

| Total from investment operations | 1.95 | 0.85 | (0.46 | ) | ||||||||

| Less distributions to shareholders from: | ||||||||||||

| Net investment income | (0.09 | ) | (0.32 | ) | (0.21 | ) | ||||||

| Total distributions | (0.09 | ) | (0.32 | ) | (0.21 | ) | ||||||

| Net asset value, end of period | $ | 26.72 | $ | 24.86 | $ | 24.33 | ||||||

| Market price, end of period | $ | 26.72 | $ | 24.86 | $ | 24.48 | ||||||

| Total Return(b) | 7.85 | % (c) | 3.56 | % | (1.80 | %) (c) | ||||||

| Ratios and Supplemental Data: | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 211,640 | $ | 208,368 | $ | 213,875 | ||||||

| Ratio of net expenses to average net assets | 0.59 | % (d) | 0.59 | % | 0.59 | % (d) | ||||||

| Ratio of net investment income to average net assets | 1.33 | % (d) | 1.43 | % | 1.22 | % (d) | ||||||

| Portfolio turnover rate(e) | 34 | % (c) | 81 | % | 68 | % (c) | ||||||

| (a) | For the period March 22, 2022 (commencement of operations) to January 31, 2023. |

| (b) | Total return is calculated assuming a purchase of shares at net asset value on the first day and a sale at net asset value on the last day of the period. Distributions are assumed, for the purpose of this calculation, to be reinvested at the ex-dividend date net asset value per share on their respective payment dates. |

| (c) | Not annualized. |

| (d) | Annualized. |

| (e) | Portfolio turnover rate excludes securities received or delivered from in-kind processing of creations or redemptions. |

See accompanying notes which are an integral part of these financial statements.

5

Fairlead Tactical Sector ETF

Notes to the Financial Statements

July 31, 2024 (Unaudited)

NOTE 1. ORGANIZATION

Fairlead Tactical Sector ETF (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a diversified series of Capitol Series Trust (the “Trust”) on December 9, 2021. The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated September 18, 2013, as amended and restated November 18, 2021 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees of the Trust (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series. The Fund is one of a series of funds currently authorized by the Board. The Fund’s investment adviser is Cary Street Partners Asset Management LLC (the “Adviser”). The Fund’s subadviser is Fairlead Strategies, LLC (the “Subadviser” or “Fairlead”). The Subadviser is primarily responsible for the day-to-day portfolio management of the Fund. The investment objective of the Fund is capital appreciation with limited drawdowns.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Regulatory Update – Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds (“ETFs”) – The Securities and Exchange Commission adopted rule and form amendments that have resulted in changes to the design and delivery of shareholder reports of mutual funds and ETFs, requiring them to transmit concise and visually engaging streamlined annual and semiannual reports to shareholders that highlight key information by July 24, 2024. Other information, including financial statements, will no longer appear in a streamlined shareholder report but must be available online, delivered free of charge upon request, and filed on a semiannual basis on Form N-CSR.

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment

6

Fairlead Tactical Sector ETF

Notes to the Financial Statements (continued)

July 31, 2024 (Unaudited)

company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

The Fund recognizes tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the interim tax period since inception, as applicable) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next twelve months. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period, the Fund did not incur any interest or penalties.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Board). The Adviser has agreed to pay all regular and recurring expenses of the Fund under terms of the management agreement.

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The specific identification method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date.

Dividends and Distributions – The Fund intends to distribute substantially all of its net investment income, if any, at least quarterly. The Fund intends to distribute its net realized long-term and short-term capital gains, if any, annually. Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Fund.

7

Fairlead Tactical Sector ETF

Notes to the Financial Statements (continued)

July 31, 2024 (Unaudited)

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

The Fund values its portfolio securities at fair value as of the close of regular trading on the New York Stock Exchange (the “NYSE”) (normally 4:00 p.m. Eastern Time) on each business day the NYSE is open for business. Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

8

Fairlead Tactical Sector ETF

Notes to the Financial Statements (continued)

July 31, 2024 (Unaudited)

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange-traded security is generally valued at the mean between the most recent quoted bid and ask prices. Securities traded in the Nasdaq over-the-counter market are generally valued at the Nasdaq Official Closing Price. When using market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily available or are considered unreliable due to market or other events, securities are valued in good faith by the Adviser as “Valuation Designee” under the oversight of the Board. The Adviser has adopted written policies and procedures for valuing securities and other assets in circumstances where market quotes are not readily available. In the event that market quotes are not readily available, and the security or asset cannot be valued pursuant to one of the valuation methods, the value of the security or asset will be determined in good faith by the Adviser pursuant to its policies and procedures. On a quarterly basis, the Adviser’s fair valuation determinations will be reviewed by the Board. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

In accordance with the Trust’s Portfolio Valuation Procedures, the Adviser, as Valuation Designee, is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single standard exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued pursuant to the Trust’s Fair Value Guidelines would be the amount which the Fund might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair value pricing is permitted if, in accordance with the Trust’s Portfolio Valuation Procedures, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or other data calls into question the reliability of market quotations.

9

Fairlead Tactical Sector ETF

Notes to the Financial Statements (continued)

July 31, 2024 (Unaudited)

The following is a summary of the inputs used to value the Fund’s investments as of July 31, 2024:

| Valuation Inputs | ||||||||||||||||

| Assets | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Exchange-Traded Funds | $ | 210,831,356 | $ | — | $ | — | $ | 210,831,356 | ||||||||

| Total | $ | 210,831,356 | $ | — | $ | — | $ | 210,831,356 | ||||||||

The Fund did not hold any investments during or at the end of the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

The Adviser, under the terms of the management agreement with the Trust with respect to the Fund (the “Agreement”), manages the Fund’s investments. As compensation for its management services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 0.59% of the Fund’s average daily net assets. Pursuant to its Agreement, the Adviser pays all other expenses of the Fund (other than acquired fund fees and expenses, taxes and governmental fees, brokerage fees, commissions and other transaction expenses, certain foreign custodial fees and expenses, costs of borrowing money, including interest expenses and extraordinary expenses (such as litigation and indemnification expenses)). For the six months ended July 31, 2024, the Adviser earned a fee of $621,375 from the Fund. At July 31, 2024, the Fund owed the Adviser $106,013.

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration and fund accounting services to the Fund. The Adviser pays Ultimus fees in accordance with the agreements for such services.

Northern Lights Compliance Services, LLC (“NLCS”), an affiliate of Ultimus, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives fees from the Adviser, which are approved annually by the Board.

The Board supervises the business activities of the Trust. Each Trustee serves as a Trustee for the lifetime of the Trust or until the earlier of his or her required retirement as a Trustee at age 78 (which may be extended for up to two years in an emeritus non-voting capacity at the pleasure and request of the Board), or until he/she dies, resigns, or is removed, whichever is sooner. “Independent Trustees”, meaning those Trustees who are not “interested persons” of the Trust, as defined in the 1940 Act, as amended, have each received an annual retainer of $2,000 per Fund and $500 per Fund for each quarterly Board meeting. The Adviser pays the Independent Trustees their annual retainer

10

Fairlead Tactical Sector ETF

Notes to the Financial Statements (continued)

July 31, 2024 (Unaudited)

and quarterly Board meeting fees and also reimburses Trustees for out-of-pocket expense incurred in conjunction with attendance at Board meetings.

The officers of the Trust are employees of Ultimus. Northern Lights Distributors, LLC (the “Distributor”) acts as the principal distributor of the Fund’s shares. The Distributor is an affiliate of Ultimus. The Distributor is compensated by the Adviser (not the Fund) for acting as principal underwriter.

NOTE 5. INVESTMENT TRANSACTIONS

For the six months ended July 31, 2024, purchases and sales of investment securities, other than short-term investments, were $163,488,900 and $70,225,748, respectively.

For the six months ended July 31, 2024, purchases and sales for in-kind transactions were $2,584,085 and $170,402,234, respectively.

For the six months ended July 31, 2024, the Fund had in-kind net realized gains of $6,198,782.

There were no purchases or sales of long-term U.S. government obligations during the six months ended July 31, 2024.

NOTE 6. CAPITAL SHARE TRANSACTIONS

Shares are not individually redeemable and may be redeemed by the Fund at NAV only in large blocks known as “Creation Units”. Shares are created and redeemed by the Fund only in Creation Unit size aggregations of 10,000 shares. Only Authorized Participants or transactions done through an Authorized Participant are permitted to purchase or redeem Creation Units from the Fund. An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a Depository Trust Company participant and, in each case, must have executed a Participant Agreement with the Distributor. Such transactions are generally permitted on an in-kind basis, with a balancing cash component to equate the transaction to the NAV per share of the Fund on the transaction date. Cash may be substituted equivalent to the value of certain securities generally when they are not available in sufficient quantity for delivery, not eligible for trading by the Authorized Participant or as a result of other market circumstances. In addition, the Fund may impose transaction fees on purchases and redemptions of Fund shares to cover the custodial and other costs incurred by the Fund in effecting trades. A fixed fee payable to the Custodian may be imposed on each creation and redemption transaction regardless of the number of Creation Units involved in the transaction (“Fixed Fee”). Purchases and redemptions of Creation Units for cash or involving cash-in-lieu are required to pay an additional variable

11

Fairlead Tactical Sector ETF

Notes to the Financial Statements (continued)

July 31, 2024 (Unaudited)

charge to compensate the Fund and its ongoing shareholders for brokerage and market impact expenses relating to Creation Unit transactions (“Variable Charge”, and together with the Fixed Fee, the “Transaction Fees”). Transactions in capital shares for the Fund are disclosed in the Statement of Changes in Net Assets. For the six months ended July 31, 2024, the Fund received $5,200 and $0 in Fixed Fees and Variable Charges, respectively. The Transaction Fees for the Fund are listed in the table below:

| Variable | |

| Fixed Fee | Charge |

| $200 | 2.00%* |

| * | The maximum Transaction Fee may be up to 2.00% of the amount invested. |

NOTE 7. FEDERAL TAX INFORMATION

At July 31, 2024, the net unrealized appreciation (depreciation) and tax cost of investments for tax purposes were as follows:

| Gross unrealized appreciation | $ | 21,619,022 | ||

| Gross unrealized depreciation | (30,039 | ) | ||

| Net unrealized appreciation on investments | $ | 21,588,983 | ||

| Tax cost of investments | $ | 189,242,373 |

The tax character of distributions paid for the fiscal year ended January 31, 2024, the Fund’s most recent fiscal year end, was as follows:

| Distributions paid from: | ||||

| Ordinary income(a) | $ | 3,017,537 | ||

| Total distributions paid | $ | 3,017,537 |

| (a) | Short-term capital gain distributions are treated as ordinary income for tax purposes. |

At January 31, 2024, the Fund’s most recent fiscal year end, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Accumulated capital and other losses | $ | (13,051,721 | ) | |

| Unrealized appreciation on investments | 11,477,256 | |||

| Total accumulated deficit | $ | (1,574,465 | ) |

As of January 31, 2024, the Fund had long-term capital loss carryforwards of $9,653,135 and short-term capital loss carryforwards of $3,298,281, respectively. These capital loss

12

Fairlead Tactical Sector ETF

Notes to the Financial Statements (continued)

July 31, 2024 (Unaudited)

carryforwards, which do not expire, may be utilized in future years to offset net realized capital gains, if any, prior to distributing such gains to shareholders.

Certain capital losses and specified gains realized after October 31, and net investment losses realized after December 31 of the Fund’s fiscal year may be deferred and treated as occurring on the first business day of the Fund’s following taxable year. For the tax period ended January 31, 2024, the Fund deferred qualified late year ordinary losses in the amount of $100,305.

NOTE 8. COMMITMENTS AND CONTINGENCIES

In October 2020, the Securities and exchange Commission (the “SEC”) adopted new regulations governing the use of derivatives by registered investment companies (“Rule 18f-4”). Rule 18f-4 imposes limits on the amount of derivatives a fund can enter into, eliminates the asset segregation framework currently used by funds to comply with section 18 of the 1940 Act, treats derivatives as senior securities and requires funds whose use of derivatives is more than a limited specified exposure amount to establish and maintain a comprehensive derivatives risk management program and appoint a derivatives risk manager.

NOTE 9. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date at which these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

13

Investment Advisory Agreement Approval (Unaudited)

At a quarterly meeting of the Board of Trustees of Capitol Series Trust (the “Trust”) on December 7 and 8, 2023, the Trust’s Board of Trustees (the “Board”), including all of the Trustees who are not “interested persons” of the Trust (the “Independent Trustees”) as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”), considered and approved the continuation for an additional one-year period the following advisory agreements with respect to the Fairlead Tactical Sector ETF (the “Fund”), a series of the Trust:

| ● | An Investment Advisory Agreement between the Trust and Cary Street Partners Asset Management LLC (“Cary Street”) (the “Investment Advisory Agreement”); and |

| ● | An Investment Sub-Advisory Agreement between Cary Street and Fairlead Strategies, LLC (“Fairlead”) (the “Sub-Advisory Agreement”). |

Prior to the meeting, the Trustees received and considered information from Cary Street, Fairlead and the Trust’s administrator designed to provide the Trustees with the information necessary to evaluate the terms of the Investment Advisory Agreement and Sub-Advisory Agreement. Such information included, but was not limited to: Cary Street’s response to counsel’s due diligence letter requesting information relevant to the approval of the Investment Advisory Agreement, Fairlead’s response to counsel’s due diligence letter requesting information relevant to the approval of the Sub-Advisory Agreement, the operating expenses of the Fund, the unitary fee contained in the Investment Advisory Agreement pursuant to which the operating expenses of the Fund would be limited to those fees paid by the Fund to Cary Street (subject to specific exclusions disclosed in the Fund’s prospectus), the profitability of the Fund to Cary Street and Fairlead, respectively, the overall financial condition of Cary Street and Fairlead, and peer group expense and performance data provided by Broadridge for comparative purposes (collectively, the “Support Materials”). At various times, the Trustees reviewed the Support Materials with Cary Street, Fairlead, Trust management, and with counsel to the Independent Trustees. The completeness of the Support Materials provided by each of Cary Street and Fairlead, which included both responses and materials provided in response to initial and supplemental due diligence requests, was noted. Representatives from Cary Street and Fairlead met with the Trustees and provided further information, including but not limited to, the services each provides to the Fund and the management fee paid for those services, asset growth in the Fund, the business and marketing strategy for the Fund, the ownership and financial condition of each firm, resources available to service the Fund, including compliance resources, other investment strategies managed by Cary Street and Fairlead, oversight of Fairlead by Cary Street, and each firm’s profitability. This information formed the primary, but not exclusive, basis for the Board’s determinations.

Before voting to approve the continuation of the Investment Advisory Agreement and Sub-Advisory Agreement for an additional one-year period, the Trustees reviewed the terms and the Investment Advisory Agreement and Sub-Advisory Agreement and the Support Materials with Trust management and with counsel to the Independent Trustees. The Trustees also received a memorandum from counsel discussing the legal standards for their consideration of the approval of the continuation of the Investment Advisory Agreement and Sub-Advisory Agreement, which memorandum described the various factors that the U.S. Securities and Exchange Commission (“SEC”) and U.S. Courts over the years have suggested would be appropriate for trustee consideration in the advisory agreement approval process, including the factors outlined in the case of Gartenberg v. Merrill Lynch Asset

14

Investment Advisory Agreement Approval (Unaudited) (continued)

Management Inc., 694 F.2d 923, 928 (2d Cir. 1982); cert. denied sub. nom. and Andre v. Merrill Lynch Ready Assets Trust, Inc., 461 U.S. 906 (1983).

In determining whether to approve the continuation of the Investment Advisory Agreement and the Sub-Advisory Agreement for an additional one-year period, the Trustees considered all factors they believed to be relevant with respect to the Fund, including the following: (1) the nature, extent, and quality of the services provided by Cary Street and Fairlead; (2) the cost of the services provided and the profits realized by Cary Street and Fairlead from services rendered to the Trust with respect to the Fund; (3) comparative fee and expense data for the Fund and other investment companies with similar investment objectives; (4) the extent to which economies of scale may be realized as the Fund grows and whether the advisory fee for the Fund reflects these economies of scale for the Fund’s benefit; and (5) other financial benefits to Cary Street and Fairlead resulting from services rendered to the Fund. In their deliberations, the Trustees did not identify any particular information that was all-important or controlling.

Together with the Support Materials, and after having received and reviewed investment performance, compliance, operating, and distribution reports of the Fund on a quarterly basis since the Fund’s inception, and noting additional discussions with representatives of Cary Street and Fairlead that had occurred at various times, the Trustees determined that they had all of the information they deemed reasonably necessary to make an informed decision concerning the approval of the continuation of the Investment Advisory Agreement and the Sub-Advisory Agreement. The Trustees discussed the facts and factors relevant to the approval of the Investment Advisory Agreement and Sub-Advisory Agreement, which incorporated and reflected their knowledge of the services that Cary Street and Fairlead each provide to the Fund. The Trustees reviewed and discussed the Fund’s performance versus its benchmark index, the performance of comparable funds in the Morningstar Tactical Allocation fund category, and a group of peer funds selected by Broadridge from the Morningstar category “Tactical Allocation.” The Trustees noted the factors used by Broadridge to compile the custom group of peer funds: exchange traded funds, tactical allocation category, actively managed funds, and fund of funds. The Trustees also discussed the Fund’s authorized participant relationships, noting that arbitrage opportunities will make the Fund more attractive to authorized participants. The material factors and conclusions that formed the basis of the Trustees’ determination to approve the continuation of the Investment Advisory Agreement and Sub-Advisory Agreement for an additional one-year period are summarized below.

Nature, Extent and Quality of Services Provided. With respect to the Investment Advisory Agreement and the Sub-Advisory Agreement, the Trustees considered the scope of services that Cary Street and Fairlead each provide to the Fund, which include, but are not limited to the following: (1) providing overall supervisory responsibility for the general management and investment of the Fund’s securities portfolio, including providing pre-trade portfolio compliance; (2) investing or overseeing the investment of the Fund’s assets consistent with its investment objective and investment policies; (3) directly managing the Fund’s assets and determining or overseeing the portfolio securities to be purchased, sold or otherwise disposed of and the timing of such transactions for a period of time; (4) voting or overseeing the voting of all proxies with respect to the Fund’s portfolio securities; (5) maintaining or overseeing the maintenance of the required books and records for transactions effected by Fairlead on behalf of the Fund; (6) selecting or overseeing the selection of broker-dealers to execute orders on behalf of the Fund; (7) providing marketing support; and (8)

15

Investment Advisory Agreement Approval (Unaudited) (continued)

responding to questions from investors. The Trustees considered each of Cary Street and Fairlead’s capitalization separately and its assets under management, as well as the commitment on the part of Cary Street and Fairlead to enhance the Fund’s capitalization over time. The Trustees considered Cary Street and Fairlead’s compliance resources, including a Chief Compliance Officer. The Trustees also considered the technical investment methodology and Fairlead’s portfolio management team, as well as their investment industry experience and expertise in technical analysis. The Trustees also noted the capabilities and expertise of personnel responsible for implementing the Fund’s portfolio construction methodology and Cary Street and Fairlead’s oversight and risk management process, including the due diligence process employed by Fairlead in allocating the Fund’s assets among its stated investment options. The Trustees also considered information regarding Cary Street and Fairlead’s disaster recovery and contingency plans and data protection safeguards, among other things.

The Trustees also noted the Fund’s performance compared to its prospectus benchmark, the Morningstar Moderate Target Risk Total Return Index, and the S&P 500 Total Return Index. The Trustees considered that the Fund underperformed its benchmark index for the one-year and since inception periods ended September 30, 2023. The Trustees also considered the Fund’s performance compared to the Morningstar Tactical Allocation category and those of other funds in the peer group category analysis provided by Broadridge. The Trustees noted that the custom peer group category analysis of Broadridge was based upon the Morningstar Tactical Allocation category with adjustments to include actively managed fund-of-funds of the category. The appropriateness of Broadridge’s peer group analysis was discussed and the Trustees noted that the peer group was relatively small and comprised of funds with varying investments and investment methodologies. The Trustees noted that the Fund underperformed the Morningstar Tactical Allocation category median and Broadridge custom peer group median for the one-year period, but outperformed the Morningstar Tactical Allocation category median and Broadridge custom peer group median for the since inception period ended September 30, 2023. The Trustees noted that the Fund had exhibited substantially less volatility relative to the benchmark indices during a period of substantial volatility in securities markets. The Trustees noted that the Fund was not yet rated by Morningstar because of its short performance record. Lastly, the Trustees took note of Fairlead’s representation that the Fund is well-situated competitively compared to other tactical allocation funds primarily because Fairlead’s focus on technical analysis and Cary Street’s commitment to marketing the Fund. The Trustees concluded that they were satisfied with the nature, extent, and quality of services that Cary Street and Fairlead each provide to the Fund under the Investment Advisory Agreement and Sub-Advisory Agreement, respectively.

Cost of Advisory Services and Profitability. With respect to the Investment Advisory Agreement, the Trustees considered the annual management fee that the Fund pays to Cary Street, as well as the firm’s profitability analysis for services rendered to the Fund. In this regard, the Trustees noted the Fund’s unitary fee structure and that Cary Street agreed to be responsible for any operating expenses that exceed the unitary fee, subject to stated exclusion. With respect to the Sub-Advisory Agreement, the Trustees considered that portion of the unitary management fee paid by Cary Street to Fairlead and the expenses of the Fund allocated to Fairlead. The Trustees further noted that Cary Street was not projected to earn profits from the Fund at current asset levels. The Trustees also considered Cary Street’s pro forma financial projections at higher asset levels which reflected that the Fund would break even and become profitable at higher asset levels. The Trustees also noted the Fund’s favorable

16

Investment Advisory Agreement Approval (Unaudited) (continued)

performance and competitive unitary fee and total operating expense ratio. Finally, the Trustees reviewed each of Cary Street’s and Fairlead’s financial conditions and fiscal health as it relates to each firm’s financial ability to provide the contractually required services to the Fund and concluded that such resources were adequate.

Comparative Fee and Expense Data. The Trustees also reviewed and discussed with Cary Street and Fairlead the unitary management fee and expenses of the Fund as compared to the Morningstar Tactical Allocation category and the custom peer group category analysis provided by Broadridge. The Trustees noted that the Fund’s unitary management fee was lower than the average and median of both the Morningstar Tactical Allocation category and the custom peer group. In addition, the Trustees considered that the gross total expense ratio of the Fund was the lowest among the eleven-fund custom peer group and lower than the average and median of the Morningstar Tactical Allocation category. While recognizing that it is difficult to compare management fees because the scope of advisory services provided may vary from one investment adviser to another, the Trustees concluded that Cary Street’s management fee continues to be reasonable.

Economies of Scale. The Trustees considered whether the Fund would benefit from any economies of scale with respect to the services provided by Cary Street and Fairlead, noting that the unitary management fee does not contain breakpoints. In light of all of the factors considered, including the size of the Fund, the Trustees concluded that no material economies of scale exist at this time.

Other Benefits. The Trustees noted that Cary Street and Fairlead confirmed that they do not and will not utilize soft dollar arrangements with respect to portfolio transactions in the Fund and do not anticipate the use of affiliated brokers to execute the Fund’s portfolio transactions. The Trustees concluded that neither Cary Street nor Fairlead would receive any other material financial benefits from services rendered to the Fund.

Other Considerations. The Trustees also considered potential conflicts of interest of Cary Street and Fairlead. Based on the assurances from representatives of Cary Street and Fairlead, the Trustees concluded that no material conflicts of interest currently exist that could adversely impact the Fund. They also noted that Cary Street and Fairlead have compliance policies and procedures in place to address any conflict-of-interest situations that may arise.

Conclusions. Based upon discussions with Cary Street and Fairlead and the Support Materials provided, the Board concluded that: (1) the overall arrangements between the Trust and Cary Street as set forth in the Investment Advisory Agreement are fair and reasonable in light of the services that Cary Street performs, the investment advisory fees that the Fund pays, and such other matters as the Trustees considered relevant in the exercise of their reasonable business judgment; and (2) the overall arrangements between Cary Street and Fairlead as set forth in the Sub-Advisory Agreement are fair and reasonable in light of the services that Fairlead performs, the sub-advisory fees that Cary Street pays, and such other matters as the Trustees considered relevant in the exercise of their reasonable judgement.

17

Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30, are available (1) without charge upon request by calling the Fund at (877) 865-9549 and (2) in Fund documents filed with the SEC on the SEC’s website at www.sec.gov.

| TRUSTEES | INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

| Walter B. Grimm, Chairman | Ernst & Young LLP |

| Lori Kaiser | 221 East 4th Street, Suite 2900 |

| Janet Smith Meeks | Cincinnati, OH 45202 |

| Mary Madick | |

| OFFICERS | LEGAL COUNSEL |

| Matthew J. Miller, Chief Executive Officer and President | Practus, LLP |

| Zachary P. Richmond, Chief Financial Officer and Treasurer | 11300 Tomahawk Creek Parkway, Suite 310 |

| Martin R. Dean, Chief Compliance Officer | Leawood, KS 66211 |

| Tiffany R. Franklin, Secretary | |

| INVESTMENT ADVISER | CUSTODIAN AND TRANSFER AGENT |

| Cary Street Partners Asset Management LLC | Brown Brothers Harriman & Co. |

| 901 East Byrd Street, Suite 1001 | 50 Post Office Square |

| Richmond, VA 23219 | Boston, MA 02110 |

| DISTRIBUTOR | ADMINISTRATOR AND FUND ACCOUNTANT |

| Northern Lights Distributors, LLC | Ultimus Fund Solutions, LLC |

| 4221 North 203rd Street, Suite 100 | 225 Pictoria Drive, Suite 450 |

| Elkhorn, NE 68022 | Cincinnati, OH 45246 |

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Northern Lights Distributors, LLC, Member FINRA/SIPC

|

| The Nightview Fund (NITE) |

| NYSE Arca, Inc. |

| Financial Statements |

| July 31, 2024 |

| Fund Adviser: |

| Nightview Capital, LLC 809 South Lamar Boulevard #326 Austin, TX 78704 (866) 666-7156 |

| The Nightview Fund |

| Schedule of Investments |

| July 31, 2024 (Unaudited) |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 99.51% | ||||||||

| Communications — 14.03% | ||||||||

| Airbnb, Inc., Class A(a) | 8,857 | $ | 1,236,082 | |||||

| Alphabet, Inc., Class A | 4,204 | 721,154 | ||||||

| Meta Platforms, Inc., Class A | 891 | 423,074 | ||||||

| Netflix, Inc. (a) | 605 | 380,152 | ||||||

| 2,760,462 | ||||||||

| Consumer Discretionary — 51.98% | ||||||||

| Amazon.com, Inc.(a) | 13,235 | 2,474,680 | ||||||

| DraftKings, Inc., Class A(a) | 24,663 | 911,299 | ||||||

| Hyatt Hotels Corp., Class A | 8,364 | 1,232,269 | ||||||

| Las Vegas Sands Corp. | 22,720 | 901,302 | ||||||

| MGM Resorts International(a) | 20,789 | 893,303 | ||||||

| Tesla, Inc.(a) | 12,574 | 2,918,048 | ||||||

| Wynn Resorts Ltd. | 10,837 | 897,520 | ||||||

| 10,228,421 | ||||||||

| Financials — 18.14% | ||||||||

| BlackRock, Inc. | 1,022 | 895,783 | ||||||

| Charles Schwab Corp. (The) | 13,344 | 869,895 | ||||||

| Goldman Sachs Group, Inc. (The) | 1,775 | 903,528 | ||||||

| Morgan Stanley | 8,727 | 900,714 | ||||||

| 3,569,920 | ||||||||

| Technology — 15.36% | ||||||||

| Apple, Inc. | 4,105 | 911,638 | ||||||

| Qualcomm, Inc. | 6,598 | 1,193,908 | ||||||

| Taiwan Semiconductor Manufacturing Co., Ltd. - ADR | 5,531 | 917,040 | ||||||

| 3,022,586 | ||||||||

| Total Common Stocks/Investments — 99.51% (Cost $14,784,360) | 19,581,389 | |||||||

| Other Assets in Excess of Liabilities — 0.49% | 96,847 | |||||||

| NET ASSETS — 100.00% | $ | 19,678,236 | ||||||

| (a) | Non-income producing security. |

ADR - American Depositary Receipt

See accompanying notes which are an integral part of these financial statements.

1

| The Nightview Fund |

| Statement of Assets and Liabilities |

| July 31, 2024 (Unaudited) |

| Assets | ||||

| Investments in securities, at fair value (cost $14,784,360) | $ | 19,581,389 | ||

| Cash | 109,571 | |||

| Receivable for investments sold | 40,696 | |||

| Dividends receivable | 8,251 | |||

| Total Assets | 19,739,907 | |||

| Liabilities | ||||

| Payable for investments purchased | 40,836 | |||

| Payable to Adviser | 20,835 | |||

| Total Liabilities | 61,671 | |||

| Net Assets | $ | 19,678,236 | ||

| Net Assets consist of: | ||||

| Paid-in capital | 19,632,910 | |||

| Accumulated earnings | 45,326 | |||

| Net Assets | $ | 19,678,236 | ||

| Shares outstanding (unlimited number of shares authorized, no par value) | 783,768 | |||

| Net asset value per share | $ | 25.11 |

See accompanying notes which are an integral part of these financial statements.

2

| The Nightview Fund |

| Statement of Operations |

| For the Period Ended July 31, 2024(a) (Unaudited) |

| Investment Income | ||||

| Dividend income | $ | 8,073 | ||

| Interest income | 178 | |||

| Total investment income | 8,251 | |||

| Expenses | ||||

| Adviser | 24,631 | |||

| Net operating expenses | 24,631 | |||

| Net investment loss | (16,380 | ) | ||

| Net Realized and Change in Unrealized Gain (Loss) on Investments | ||||

| Net realized gain (loss) on: | ||||

| Investment securities | 1,399,713 | |||

| Change in unrealized depreciation on: | ||||

| Investment securities | (1,338,007 | ) | ||

| Net realized and change in unrealized gain (loss) on investment securities | 61,706 | |||

| Net increase in net assets resulting from operations | $ | 45,326 |

| (a) | For the period June 21, 2024 (commencement of operations) to July 31, 2024. |

See accompanying notes which are an integral part of these financial statements.

3

| The Nightview Fund |

| Statement of Changes in Net Assets |

| For the | ||||

| Period Ended | ||||

| July 31, | ||||

| 2024(a) | ||||

| (Unaudited) | ||||

| Increase (Decrease) in Net Assets due to: | ||||

| Operations | ||||

| Net investment loss | $ | (16,380 | ) | |

| Net realized gain on investment securities | 1,399,713 | |||

| Change in unrealized depreciation on investment securities | (1,338,007 | ) | ||

| Net increase in net assets resulting from operations | 45,326 | |||

| Capital Transactions | ||||

| Proceeds from shares sold | 6,835,613 | |||

| Amount paid for shares redeemed | (4,046,903 | ) | ||

| Issued in connection with reorganization | 16,844,200 | |||

| Net increase in net assets resulting from capital transactions | 19,632,910 | |||

| Total Increase in Net Assets | 19,678,236 | |||

| Net Assets | ||||

| Beginning of period | $ | — | ||

| End of period | $ | 19,678,236 | ||

| Share Transactions | ||||

| Shares sold | 270,000 | |||

| Shares redeemed | (160,000 | ) | ||

| Issued in connection with reorganization | 673,768 | |||

| Net increase in shares outstanding | 783,768 | |||

| (a) | For the period June 21, 2024 (commencement of operations) to July 31, 2024. |

See accompanying notes which are an integral part of these financial statements.

4

| The Nightview Fund |

| Financial Highlights |

| (For a share outstanding during the period) |

| For the | ||||

| Period | ||||

| Ended July | ||||

| 31, 2024(a) | ||||

| (Unaudited) | ||||

| Selected Per Share Data: | ||||

| Net asset value, beginning of period | $ | 25.00 | ||

| Investment operations: | ||||

| Net investment income | (0.02 | ) | ||

| Net realized and unrealized gain on investments | 0.13 | |||

| Total from investment operations | 0.11 | |||

| Net asset value, end of period | $ | 25.11 | ||

| Market price, end of period | $ | 25.13 | ||

| Total Return(b) | 0.44 | % (c) | ||

| Ratios and Supplemental Data: | ||||

| Net assets, end of period (000 omitted) | $ | 19,678 | ||

| Ratio of net expenses to average net assets | 1.25 | % (d) | ||

| Ratio of net investment loss to average net assets | (0.81 | )% (d) | ||

| Portfolio turnover rate(e) | 29 | % (c) | ||

| (a) | For the period June 21, 2024 (commencement of operations) to July 31, 2024. |

| (b) | Total return is calculated assuming a purchase of shares at net asset value on the first day and a sale at net asset value on the last day of the period. Distributions are assumed, for the purpose of this calculation, to be reinvested at the ex-dividend date net asset value per share on their respective payment dates. |

| (c) | Not annualized. |

| (d) | Annualized. |

| (e) | Portfolio turnover rate excludes securities received or delivered from in-kind processing of creations or redemptions. |

See accompanying notes which are an integral part of these financial statements.

5

The Nightview Fund

Notes to the Financial Statements

July 31, 2024 (Unaudited)

NOTE 1. ORGANIZATION

The Nightview Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified series of Capitol Series Trust (the “Trust”). The Fund commenced operations on June 21, 2024. The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated September 18, 2013, as amended November 18, 2021 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees of the Trust (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series. The Fund is one of a series of funds currently authorized by the Board. The Fund’s investment adviser is Nightview Capital, LLC (the “Adviser”). The Fund’s trading sub-adviser is Exchange Traded Concepts, LLC (the “Trading Sub-Adviser” or “ETC”). The Trading Sub-Adviser is responsible for maintaining certain transaction and compliance related records of the Fund. The investment objective of the Fund is long-term capital appreciation with a goal of outperforming the S&P 500 Total Return Index over a rolling five-year period.

The Fund is the successor to a limited partnership, the Nightview Capital Fund, LP – Series B (formerly known as The Worm Capital Fund, LP – Series B) (the “Predecessor Fund”), which was organized on March 1, 2018. The Fund has substantially the same investment objectives and strategies as did the Predecessor Fund. Effective as of the close of business on June 21, 2024, all the assets, subject to the liabilities of the Predecessor Fund, were transferred to the Fund in exchange for 673,768 shares at a net asset value per share (“NAV”) of $25.00 of the Fund to the limited partners of the Predecessor Fund. The net assets contributed resulting from these tax-free transactions on the close of business June 21, 2024, after the reorganization, was $16,844,200, including net unrealized appreciation of $6,135,037 and net investment cost of $10,606,173. For financial reporting purposes, assets received and shares issued were recorded at fair value; however, the cost basis of the investments received was carried forward to align ongoing reporting of the Fund’s realized and unrealized gains and losses with amounts distributable to shareholders for tax purposes.

The Fund is non-diversified, which means it may invest a greater percentage of its assets in a limited number of issuers as compared to other mutual funds that are more broadly diversified. As a result, the Fund’s share price may be more volatile than the share price of some other mutual funds, and the poor performance of an individual holding in the Fund’s portfolio may have a significant negative impact on the Fund’s performance.

6

The Nightview Fund

Notes to the Financial Statements (continued)

July 31, 2024 (Unaudited)

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Regulatory Update – Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds (“ETFs”) – The Securities and Exchange Commission adopted rule and form amendments that have resulted in changes to the design and delivery of shareholder reports of mutual funds and ETFs, requiring them to transmit concise and visually engaging streamlined annual and semiannual reports to shareholders that highlight key information. Other information, including financial statements, will no longer appear in a streamlined shareholder report but must be available online, delivered free of charge upon request, and filed on a semiannual basis on Form N-CSR.

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

The Fund recognizes tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the interim tax period since inception, as applicable) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next twelve months. The Fund recognizes interest and penalties, if any,

7

The Nightview Fund

Notes to the Financial Statements (continued)

July 31, 2024 (Unaudited)

related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period, the Fund did not incur any interest or penalties.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Board). The Adviser has agreed to pay all regular and recurring expenses of the Fund under terms of the management agreement.

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The specific identification method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date.

Dividends and Distributions – The Fund intends to distribute substantially all of its net investment income and net capital gains annually. Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Fund.

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

The Fund values its portfolio securities at fair value as of the close of regular trading on the New York Stock Exchange (the “NYSE”) (normally 4:00 p.m. Eastern Time) on each business day the NYSE is open for business. Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable.

8

The Nightview Fund

Notes to the Financial Statements (continued)

July 31, 2024 (Unaudited)

Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange-traded security is generally valued at the mean between the most recent quoted bid and ask prices. Securities traded in the Nasdaq over-the-counter market are generally valued at the Nasdaq Official Closing Price. When using market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily available or are considered unreliable due to market or other events, securities are valued in good faith by the Adviser as “Valuation Designee” under the oversight of the Board. The Adviser has adopted written policies and procedures for valuing securities and other assets in circumstances where market quotes are not readily available. In the event that market quotes are not readily available, and the security or asset cannot be valued pursuant to one of the valuation methods, the value of the security or asset will be determined in good faith by the Adviser pursuant to its policies and procedures. On a quarterly basis, the Adviser’s fair valuation determinations will be

9

The Nightview Fund

Notes to the Financial Statements (continued)

July 31, 2024 (Unaudited)

reviewed by the Board. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.