2021 FINANCIAL GUIDANCE January 19, 2021 Exhibit 99.3

FORWARD LOOKING STATEMENTS | 2 Forward-Looking Statements Statements contained in this presentation that include company expectations or predictions should be considered forward-looking statements that are covered by the safe harbor provisions of the Securities Act of 1933 and the Securities and Exchange Act of 1934. It is important to note that the actual results could differ materially from those projected in such forward-looking statements. For additional information that could cause actual results to differ materially from such forward-looking statements, refer to ONE Gas’ Securities and Exchange Commission filings. Coronavirus Disease 2019 (COVID-19) – Factors that could cause our actual results to differ materially from those contemplated in any forward-looking statement include, among others, the length and severity of a pandemic or other health crisis, such as the outbreak of COVID-19, including the impact to our operations, customers, contractors, vendors and employees, and the measures that international, federal, state and local governments, agencies, law enforcement and/or health authorities implement to address it, which may (as with COVID-19) precipitate or exacerbate one or more other risks, and significantly disrupt or prevent us from operating our business in the ordinary course for an extended period. All future cash dividends discussed in this presentation are subject to the approval of the ONE Gas board of directors. All references in this presentation to guidance are based on news releases issued on or before Jan.19, 2021, and are not being updated or affirmed by this presentation.

FINANCIAL GUIDANCE | 3 Five-Year Financial Outlook Expected average annual growth rates: (2020 base year) • 7 – 8% Rate base • 6 – 8% Net income • 5 – 7% Earnings per diluted share • 6 – 8% Dividend • ~3% Operations & maintenance expenses $3 billion in total capital investments • ~65 – 70% for system integrity & replacement projects For the five years ending Dec. 31, 2025

FINANCIAL GUIDANCE | 4 $3.08 $3.25 $3.51 $3.68** $3.80** $163 $172 $187 $196** $204** 2017 2018 2019 2020G 2021G DILUTED EPS & NET INCOME Diluted EPS Net Income ** Represents midpoint of guidance range as of Jan. 19, 2021* For definition of average rate base, see Appendix 2021 Guidance Summary • Net income range of $198 ‒ $210 million • EPS range of $3.68 ‒ $3.92 per diluted share • Estimated average rate base* of $4.23 billion • Assumes diluted shares outstanding of 53.7 million Initiated Jan. 19, 2021 (Millions)

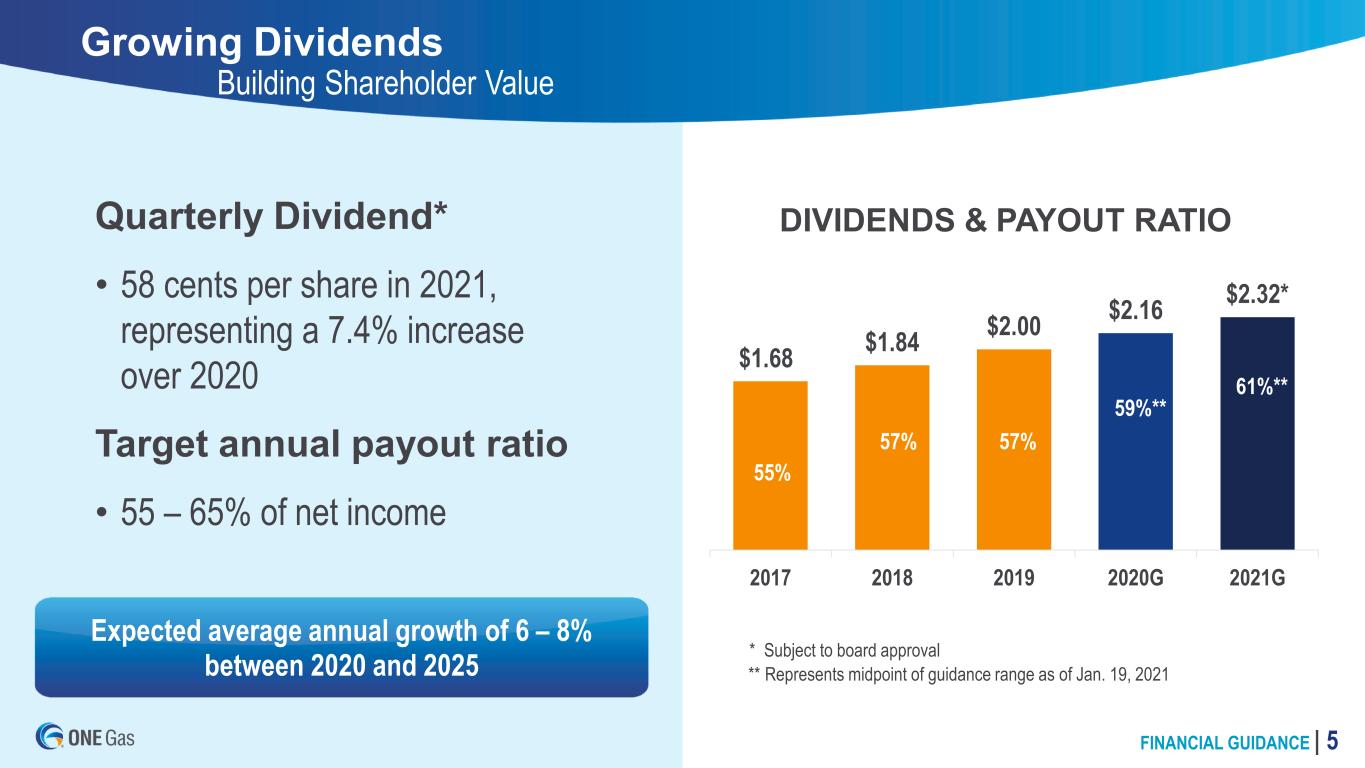

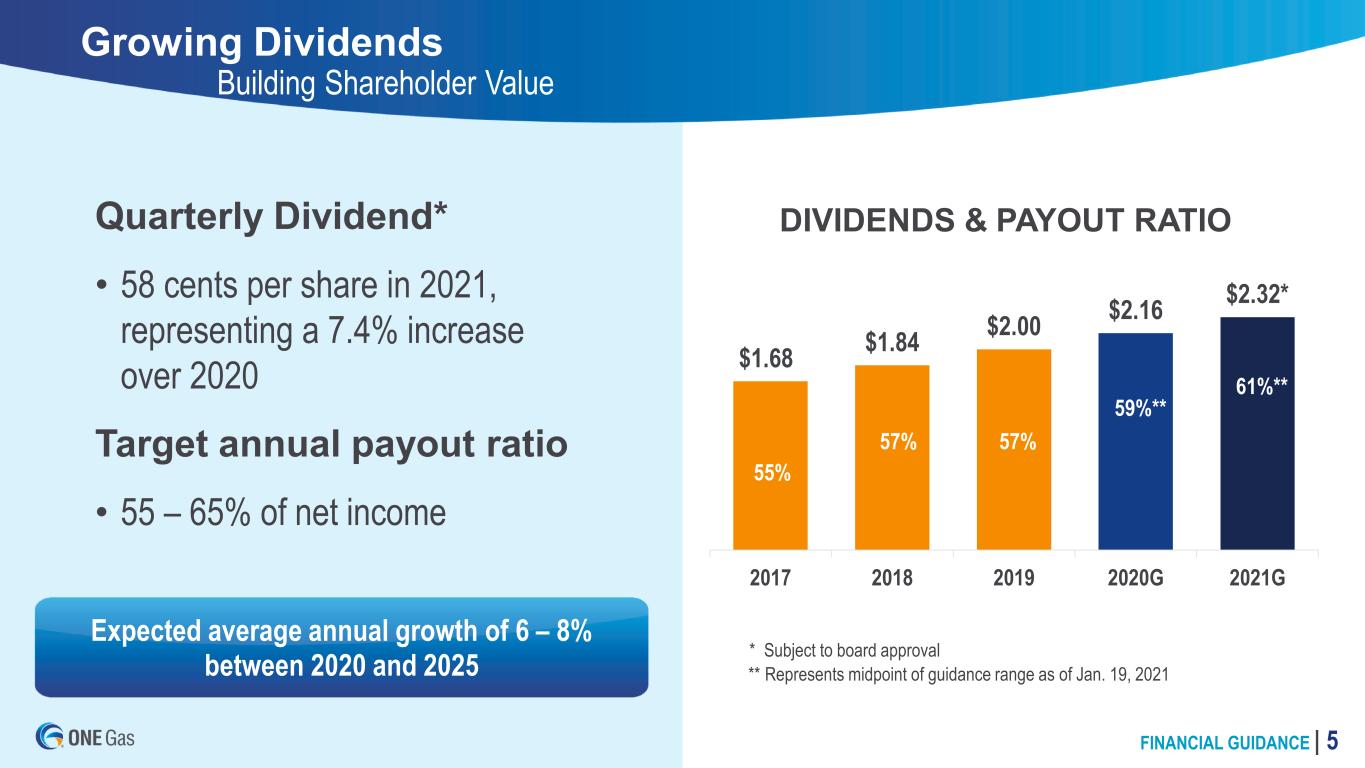

FINANCIAL GUIDANCE | 5 Growing Dividends Quarterly Dividend* • 58 cents per share in 2021, representing a 7.4% increase over 2020 Target annual payout ratio • 55 – 65% of net income Building Shareholder Value $1.68 $1.84 $2.00 $2.16 $2.32* 2017 2018 2019 2020G 2021G DIVIDENDS & PAYOUT RATIO 55% 57% 57% 59%** * Subject to board approval Expected average annual growth of 6 – 8% between 2020 and 2025 61%** ** Represents midpoint of guidance range as of Jan. 19, 2021

FINANCIAL GUIDANCE | 6 Financing Requirements Sources and Uses * Before changes in working capital. See non-GAAP information in Appendix. ** Based on midpoint of 2021 capital guidance range. Financing requirements $174 2021 Sources 2021 Uses (M IL LI ON S) Dividends $125 Capital expenditures and asset removal costs $540**Cash flow from operations* $455 $665 $665Dividends and capital expenditures primarily funded by cash flow from operations ~$1 billion net financing needs through 2025 • ~30% expected to be equity – ATM program established February 2020 Financing requirements $210

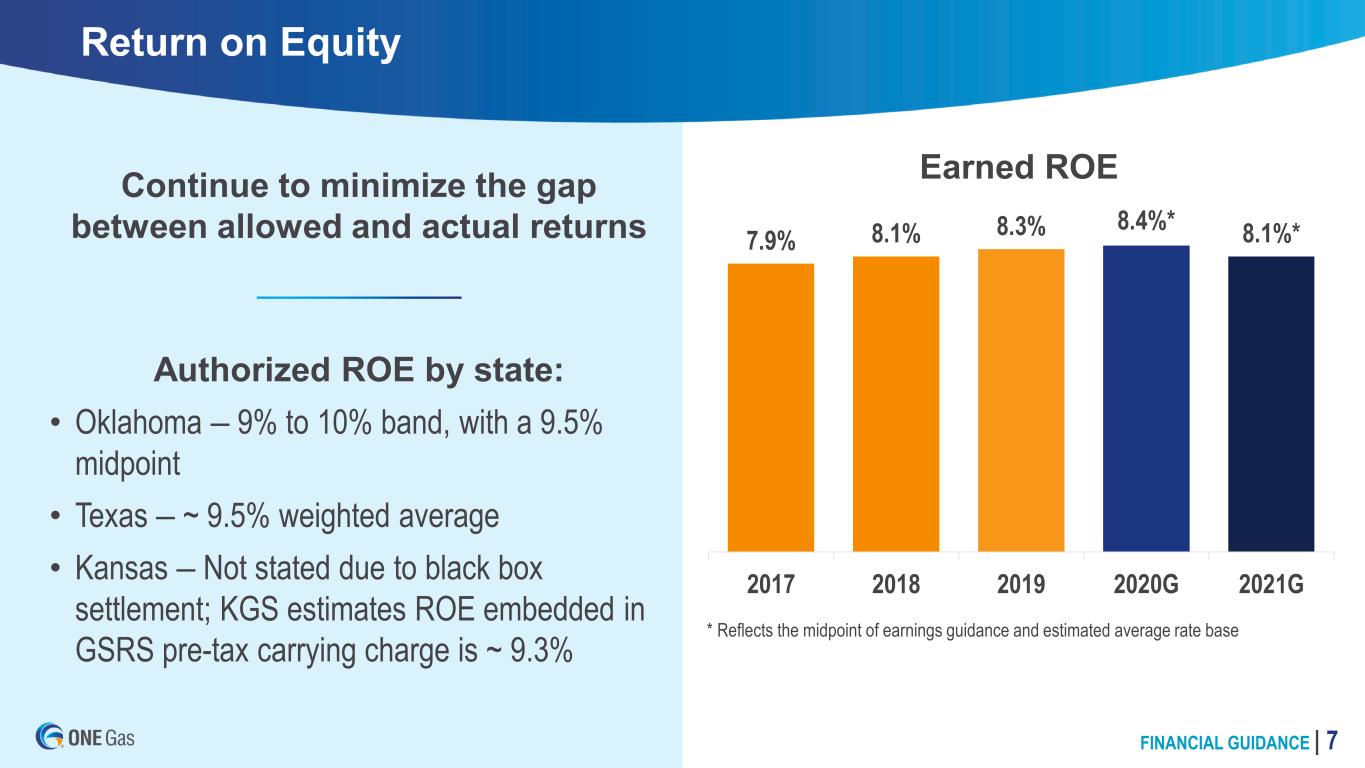

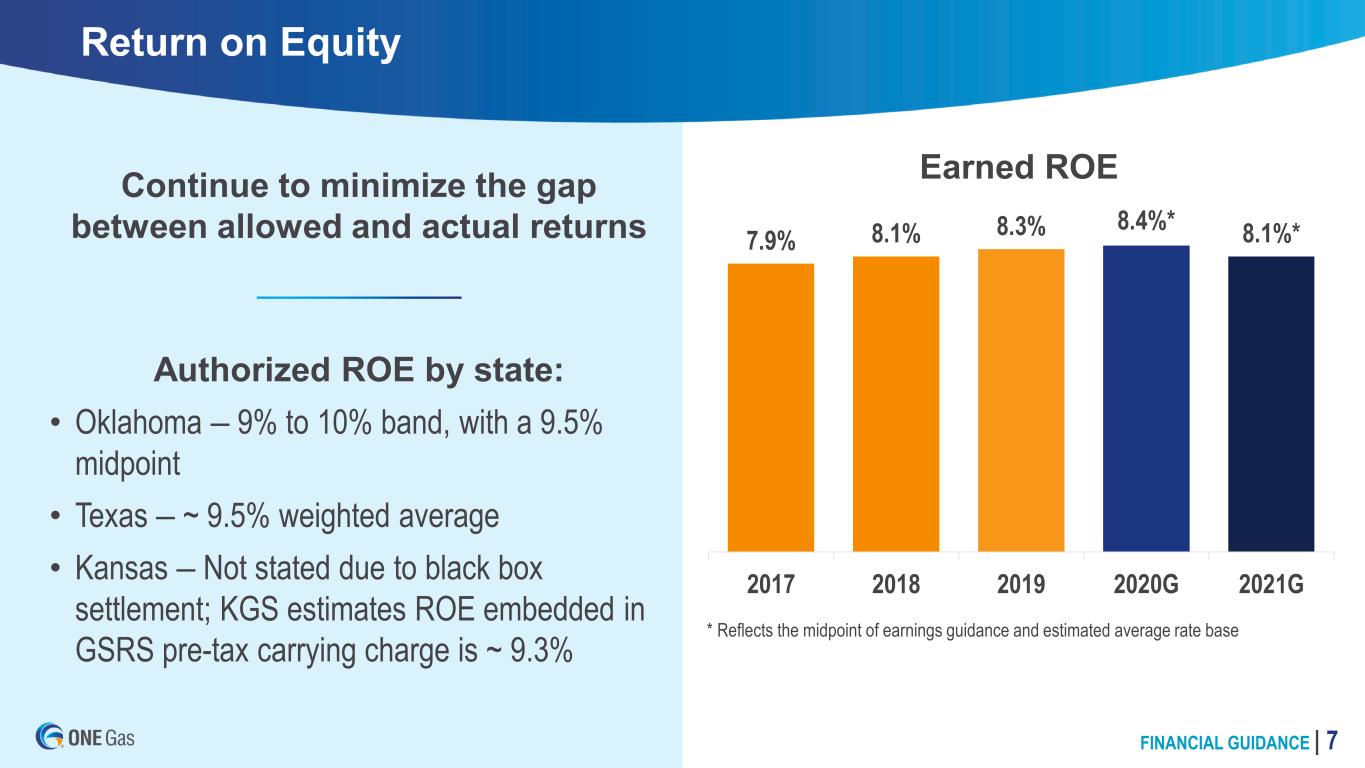

FINANCIAL GUIDANCE | 7 Return on Equity 7.9% 8.1% 8.3% 8.4%* 8.1%* 2017 2018 2019 2020G 2021G * Reflects the midpoint of earnings guidance and estimated average rate base Continue to minimize the gap between allowed and actual returns Authorized ROE by state: • Oklahoma ‒ 9% to 10% band, with a 9.5% midpoint • Texas ‒ ~ 9.5% weighted average • Kansas ‒ Not stated due to black box settlement; KGS estimates ROE embedded in GSRS pre-tax carrying charge is ~ 9.3% Earned ROE

CAPITAL INVESTMENTS & RATE BASE

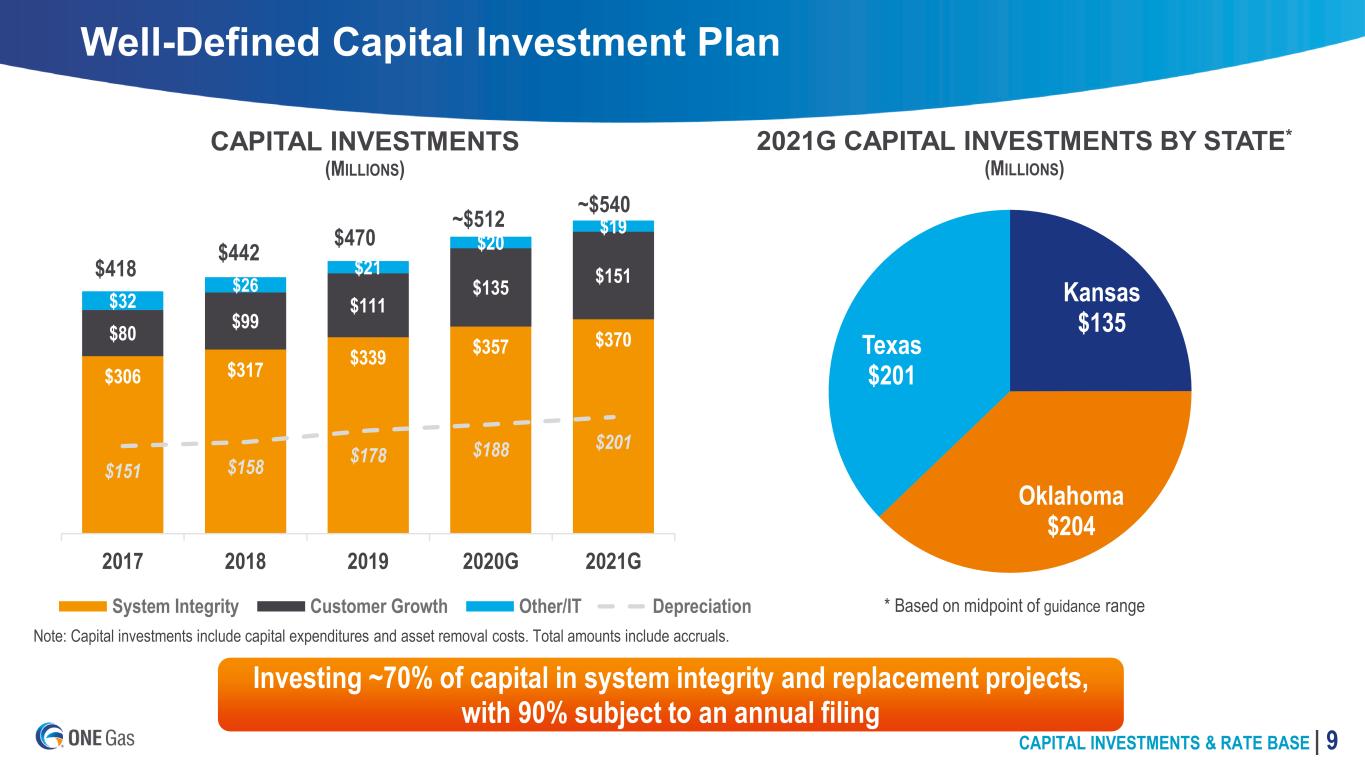

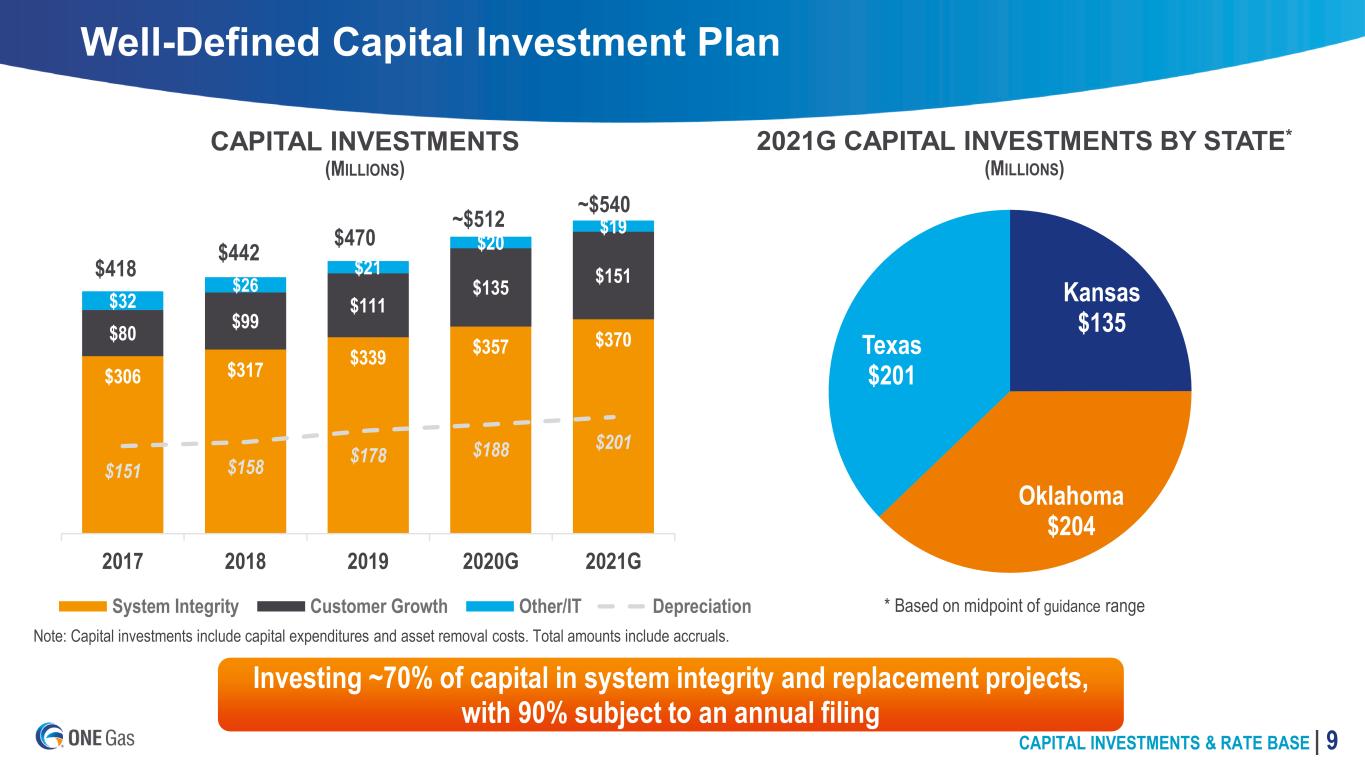

CAPITAL INVESTMENTS & RATE BASE | 9 $306 $317 $339 $357 $370$80 $99 $111 $135 $151 $32 $26 $21 $20 $19 $151 $158 $178 $188 $201 2017 2018 2019 2020G 2021G CAPITAL INVESTMENTS (MILLIONS) System Integrity Customer Growth Other/IT Depreciation $418 $442 $470 ~$512 ~$540 Well-Defined Capital Investment Plan Note: Capital investments include capital expenditures and asset removal costs. Total amounts include accruals. Investing ~70% of capital in system integrity and replacement projects, with 90% subject to an annual filing Kansas $135 Oklahoma $204 Texas $201 2021G CAPITAL INVESTMENTS BY STATE* (MILLIONS) * Based on midpoint of guidance range

CAPITAL INVESTMENTS & RATE BASE | 10 Capital Expenditures with Asset Removal Costs $123 $126 $123 $125 $135 * $50 $52 $64 $67 $72 2017 2018 2019 2020G 2021G KANSAS 2021: 1.9X DEPRECIATION $173 $180 $191 $198 $204 * $67 $69 $74 $78 $81 2017 2018 2019 2020G 2021G OKLAHOMA Depreciation 2021: 2.5X DEPRECIATION $122 $136 $156 $189 $201 * $34 $37 $40 $43 $48 2017 2018 2019 2020G 2021G TEXAS 2021: 4.2X DEPRECIATION (M IL LI ON S) * Based on midpoint of guidance range Note: Capital expenditures include accruals

CAPITAL INVESTMENTS & RATE BASE | 11 $1.16 billion $1.75 billion $1.32 billion 2021 ESTIMATED AVERAGE RATE BASE* TOTAL: $4.23 BILLION Kansas Oklahoma Texas Rate Base Growth $3.18 $3.36 $3.62 $3.91 $4.23 2017 2018 2019 2020G 2021G AVERAGE RATE BASE* (BILLIONS) * For definition of average rate base, see Appendix Expected average annual growth 7 – 8% between 2020 and 2025

APPENDIX

APPENDIX | 13 Authorized Rate Base $1,202 $1,257 $1,407 3 $1,475 $1,616 2016 2017 2018 2019 2020 OKLAHOMA2 1 KGS’ most recent rate case, approved in February 2019, was settled without a determination of rate base and reflects Kansas Gas Service’s estimate of rate base contained within the settlement; these amounts are not necessarily indicative of current or future rate base. 2 Reflects authorized rate base as of Dec. 31, 2020. These amounts are not necessarily indicative of current or future rate bases. 3 Reflects the 2018 PBRC filing, approved in January 2019. (M IL LI ON S) $925 $947 $1,033 $1,068 $1,133 2016 2017 2018 2019 2020 KANSAS1 $745 $822 $895 $986 $1,047 2016 2017 2018 2019 2020 TEXAS2

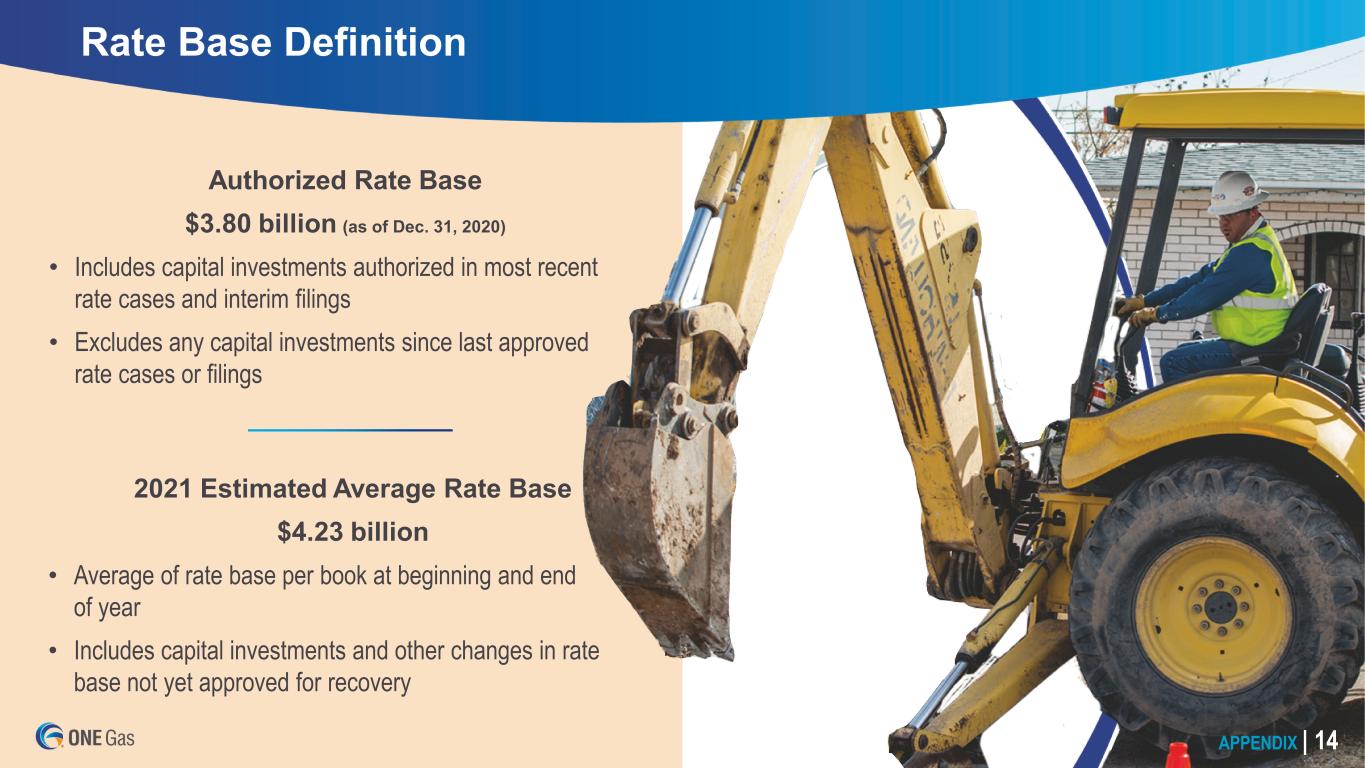

APPENDIX | 14 Rate Base Definition Authorized Rate Base $3.80 billion (as of Dec. 31, 2020) • Includes capital investments authorized in most recent rate cases and interim filings • Excludes any capital investments since last approved rate cases or filings 2021 Estimated Average Rate Base $4.23 billion • Average of rate base per book at beginning and end of year • Includes capital investments and other changes in rate base not yet approved for recovery

APPENDIX | 15 Non-GAAP Information ONE Gas has disclosed in this presentation cash flow from operations before changes in working capital, which is a non-GAAP financial measure. Cash flow from operations before changes in working capital is used as a measure of the company's financial performance. Cash flow from operations before changes in working capital is defined as net income adjusted for depreciation and amortization, deferred income taxes, and certain other noncash items. This non-GAAP financial measure is useful to investors as an indicator of financial performance of the company to generate cash flows sufficient to support our capital investment programs and pay dividends to our investors. ONE Gas cash flow from operations before changes in working capital should not be considered in isolation or as a substitute for net income or any other measure of financial performance presented in accordance with GAAP. This non-GAAP financial measure excludes some, but not all, items that affect net income. Additionally, this calculation may not be comparable with similarly titled measures of other companies. A reconciliation of cash flow from operations before changes in working capital to the most directly comparable GAAP measure is included in this presentation.

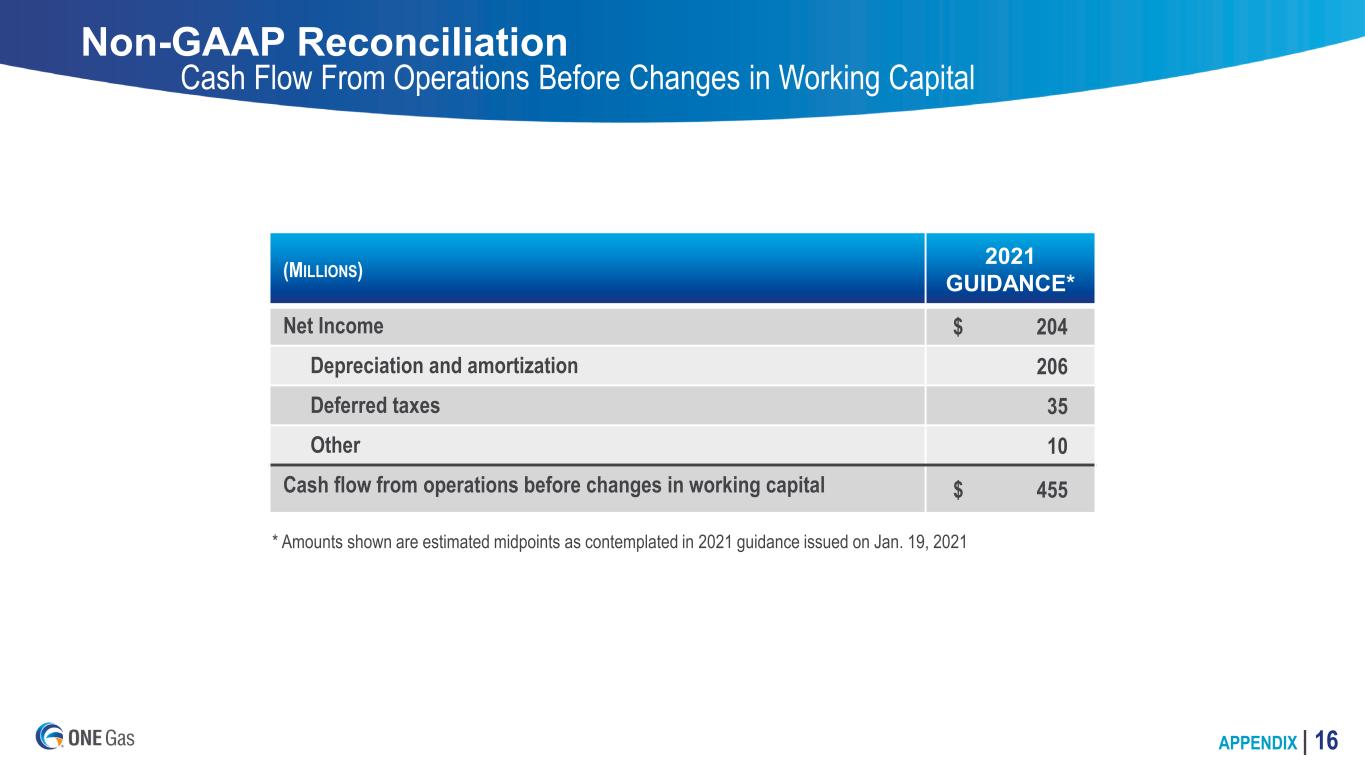

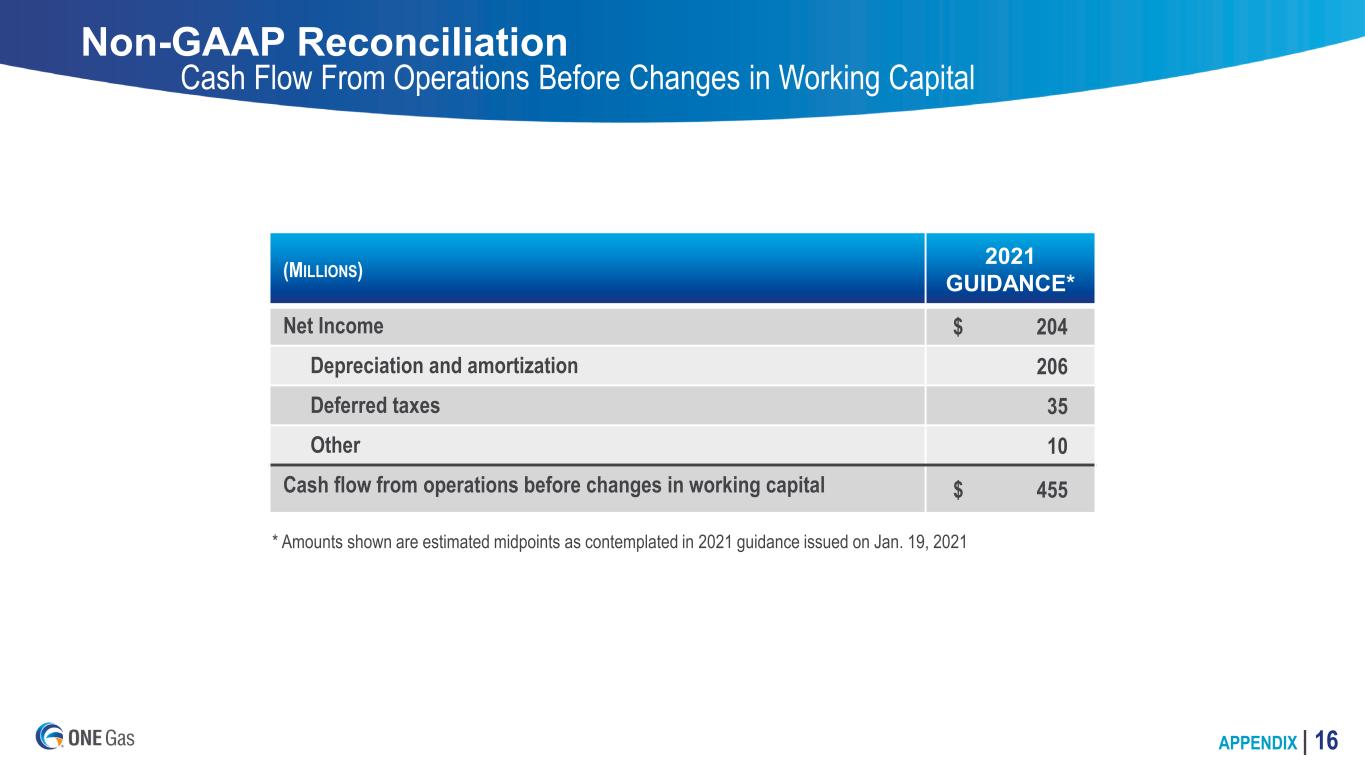

APPENDIX | 16 (MILLIONS) 2021 GUIDANCE* Net Income $ 204 Depreciation and amortization 206 Deferred taxes 35 Other 10 Cash flow from operations before changes in working capital $ 455 * Amounts shown are estimated midpoints as contemplated in 2021 guidance issued on Jan. 19, 2021 Non-GAAP Reconciliation Cash Flow From Operations Before Changes in Working Capital