November 30, 2022 2023 FINANCIAL GUIDANCE

FORWARD LOOKING STATEMENTS | 2FORWARD LOOKIN ST TE ENTS | 2 Forward-Looking Statements Statements contained in this presentation that include or refer to Company expectations, our business outlook, our future plans or predictions relating to any matters should be considered forward-looking statements that are covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the Securities Act of 1933 and the Securities and Exchange Act of 1934, each as amended. All statements, other than statements of historical facts, included in this presentation are forward-looking statements. Words such as “anticipates,” “expects,” “projects,” “intends,” “goals,” “plans,” “potential,” “might,” “believes,” “target,” “objective,” “strategy,” “opportunity,” “pursue,” “budgets,” “outlook,” “trends,” “focus,” “on schedule,” “on track,” “poised,” “slated,” “seeks,” “estimates,” “forecasts,” “guidance,” “scheduled,” “continues,” “may,” “will,” “would,” “should,” “could,” “likely,” and variations of such words and similar expressions are intended to identify such forward-looking statements. One should not place undue reliance on forward-looking statements. In addition, statements that refer to or are based on estimates, forecasts, projections, uncertain events or assumptions, including statements relating to market opportunities, future products or processes and the expected availability and benefits of such products or processes, and anticipated trends in our businesses or the markets relevant to them, including those developments relating to regulation and litigation trends and developments, also identify forward-looking statements. Such statements are based on management's expectations as of the date of this investor presentation, unless an earlier date is indicated, and involve many risks and uncertainties, known and unknown, that could cause actual results, performance or achievements to differ materially from those expressed or implied in these forward-looking statements. It is important to note that the actual results could differ materially from those projected in such forward-looking statements. Important risks and uncertainties that could cause actual results to differ materially from the company's expectations include, but are not limited to, our ability to recover, manage and maintain costs; the concentration of our operations in Kansas, Oklahoma and Texas; regulatory or legislative changes in the jurisdictions in which we operate; the length and severity of unpredictable events, including, but not limited to, the COVID-19 pandemic, threatened terrorism, war or cyber-attacks or breaches, or extreme weather events, including those related to climate change; the competitive implications of alternative sources of energy and efforts to conserve energy; our competitive position, including, but not limited to our ability to secure competitive sourcing and pricing and our ability to compete with respect to expansion and infrastructure; the economic climate and our comparable economic position; our access to capital and the restrictions that result from our current capital arrangements; the effectiveness of our risk mitigation and compliance efforts; the uncertainties of any estimates or assumptions we use in our projections; our strategic and transactional efforts and future plans; and costs and uncertainties relating to our workforce, and other risks and uncertainties, including those that are set forth in ONE Gas’ earnings release dated Nov 1, 2022, which is included as an exhibit to ONE Gas’ Form 8-K furnished to the SEC on such date. For additional information regarding these and other factors that could cause actual results to differ materially from such forward-looking statements, refer to ONE Gas’ Securities and Exchange Commission filings., including the Company's most recent reports on Forms 10-K and 10-Q. Copies of the Company’s Form 10-K, 10-Q and 8-K reports may be obtained by visiting our “Investors” website under “Financials & Filings” at https://www.onegas.com/investors/financials-and-filings/quarterly-results/default.aspx or the SEC’s website at www.sec.gov. Other unpredictable or unknown factors not discussed in this presentation could also have material adverse effects on the Company, its operations or the outcomes described in the forward- looking statements in this presentation or in the Company’s filings with the Securities and Exchange Commission. All future cash dividends discussed in this presentation are subject to the approval of the ONE Gas board of directors. All references in this presentation to guidance are based on news releases or disclosures issued on or before Nov. 30, 2022 and are not being updated or affirmed by this presentation. ONE Gas does not undertake, and expressly disclaims any duty, to update any statement made in this presentation, whether as a result of new information, new developments or otherwise, except to the extent that disclosure may be required by law.

FINANCIAL OUTLOOK

FINANCIAL OUTLOOK| 4 Five-Year Financial Guidance: 2023 – 2027 The Company’s outlook remains anchored by ongoing investments in system integrity and pipeline replacement, and supported by strong customer growth and regional economic development. However, fundamental shifts in baseline economic conditions during the last year will take time to be fully reflected in our rates: – Higher interest rates, employee-related and contractor costs, and natural gas prices are expected to impact the front- end of our five-year forecast, with out-year growth rates consistent with those we articulated in last year’s guidance communication. – Rapid shifts in financial conditions accentuate the lag intrinsic to our 100% regulated business model. We will be strategic about the sequence and timing of our regulatory activities to ensure new operating realities are prudently reflected in our rates. Safety, reliability and affordability remain central to our long-term strategy. Overview

FINANCIAL OUTLOOK| 5 Macro Environment – Nov. 2021 vs. Nov. 2022 A Fundamental Shift in Baseline Economic Conditions Type Metric Nov 1, 2021 Nov 1, 2022 Year-over-Year Change 10-Yr Avg. Change vs. 10-Yr Avg. In te re st R at es 90-Day LIBOR 0.14% 4.46% 31.9x 0.99% 4.5x 2-Year US Treasury 0.50% 4.54% 9.1x 1.11% 4.1x 10-Year US Treasury 1.56% 4.04% 2.6x 2.11% 1.9x 30-Year US Treasury 1.96% 4.09% 2.1x 2.74% 1.5x C o n su m er US Unemployment 4.70% 3.50% (25.5%) 4.95% (29.3%) Consumer Price Index 5.40% 8.20% 1.5x 2.35% 3.5x Producer Price Index 8.80% 8.50% 1.0x 2.48% 3.4x C o m m o d it ie s TTM Avg NYMEX Natural Gas ($/MMBtu) $3.14 $6.40 103.8% $4.02 59.2% TTM Avg WTI Crude Oil ($/Bbl) $62.93 $93.36 48.4% $65.87 41.7% TTM US Avg Regular Gasoline ($/gal) $3.02 $4.73 56.6% $3.20 47.8% TTM US Avg Diesel Fuel ($/gal) $3.02 $4.74 57.0% $3.20 48.1% E q u it y M ar ke ts NASDAQ 15,596 10,959 (29.7%) S&P 500 4,614 3,890 (15.7%) US Utility Sector ETF (UTY) 882 864 (2.0%) US Energy Select ETF (XLE) 58 91 55.5%

FINANCIAL OUTLOOK| 6 Favorable Regional Growth Dynamics Growing Demand for Natural Gas Key drivers • Residential and commercial development, particularly in Austin and Oklahoma City metro areas, driving system expansion • Projecting five-year compound annual customer growth of 1.0% across our service territories – Texas – 1.6% – Oklahoma – 1.2% – Kansas – 0.3% I-35 Corridor • I-35 Corridor fastest growing population in the U.S • ONE Gas positioned in KS, OK and TX with 5 of the main metro areas in the corridor • Largest warehouse labor force in the country - expected to grow 20% over next decade due to location along primary NAFTA transport route • El Paso is also growing significantly but not considered in the I-35 Corridor Source: Bureau of Labor & Statistics EMSI/QCEW Data

FINANCIAL OUTLOOK| 7 Constructing a Foundation for Growth and Long-term Affordability Operating investments support business expansion • Increasing operating capacities and capabilities • Addressing labor pressures through competitive market wage adjustments • Inflationary pressures impact 3rd party contracts Customer growth positively impacts affordability • New meter sets reached a trailing twelve-month record in November • Backlog of future meter sets has never been larger Building Operational Capacity

FINANCIAL OUTLOOK| 8 Five-Year Financial Highlights Capital Investments & Rate Base • Capital investments of approximately $3.6 billion – $2.5 billion investment in system integrity and replacement projects – Growth capital of approximately $1.0 billion • Average annual rate base growth of 7 – 9% 2023 through 2027 Average Annual Growth Rates • Net income growth of 7 – 9% – In addition to capital investment, key drivers include: • Regulatory outcomes • Annual sales customer CAGR of 1.0%, led by Texas with 1.6% • Operating cost increases averaging ~5% annually • Earnings per diluted share growth of 4 – 6% • Dividend growth of 4 – 6%, subject to board approval

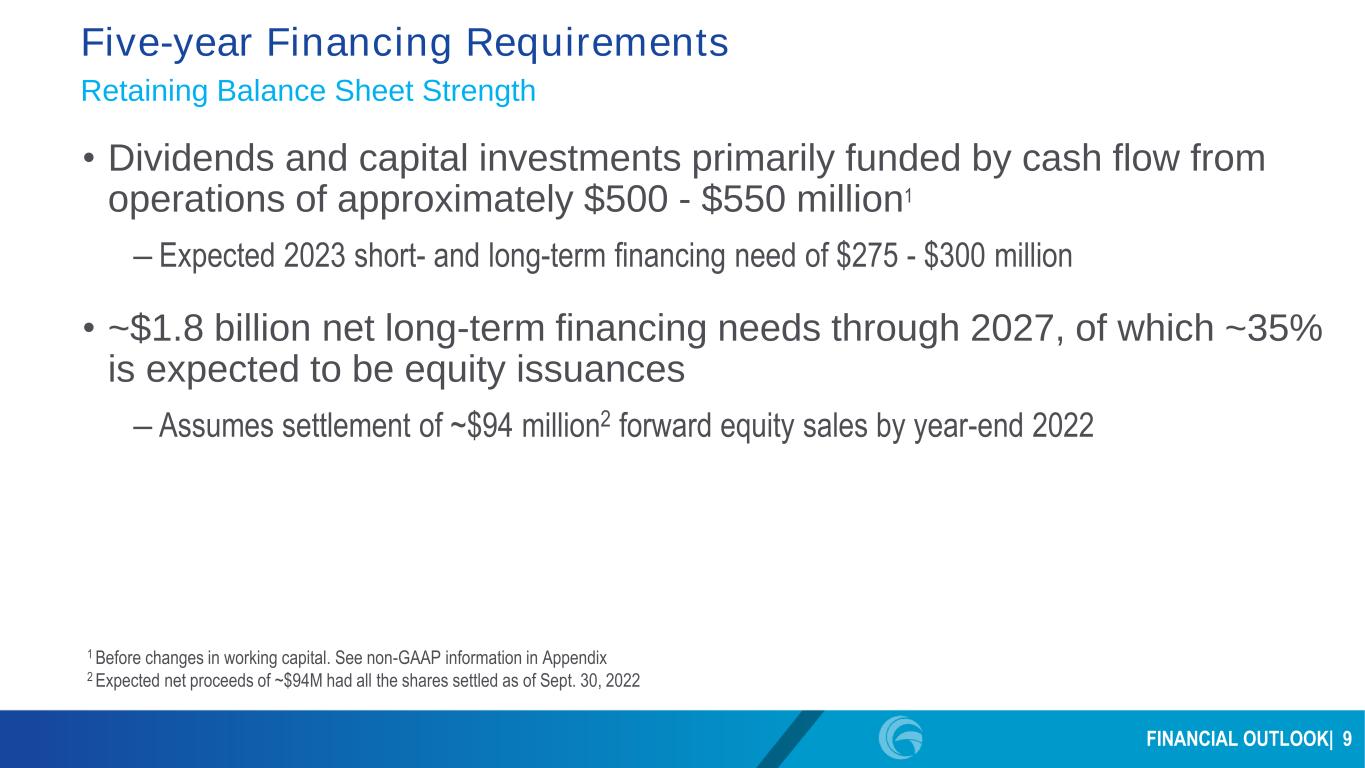

FINANCIAL OUTLOOK| 9 Five-year Financing Requirements • Dividends and capital investments primarily funded by cash flow from operations of approximately $500 - $550 million1 – Expected 2023 short- and long-term financing need of $275 - $300 million • ~$1.8 billion net long-term financing needs through 2027, of which ~35% is expected to be equity issuances – Assumes settlement of ~$94 million2 forward equity sales by year-end 2022 Retaining Balance Sheet Strength 1 Before changes in working capital. See non-GAAP information in Appendix 2 Expected net proceeds of ~$94M had all the shares settled as of Sept. 30, 2022

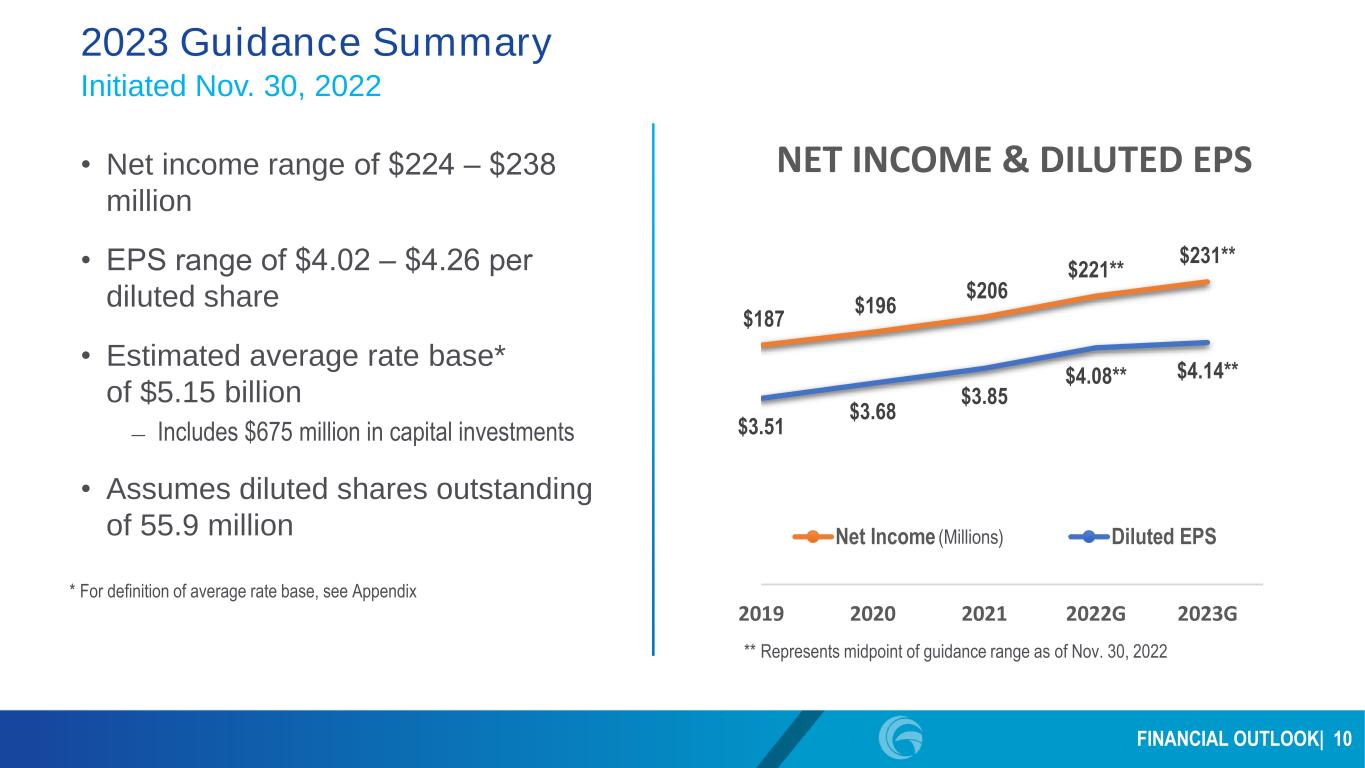

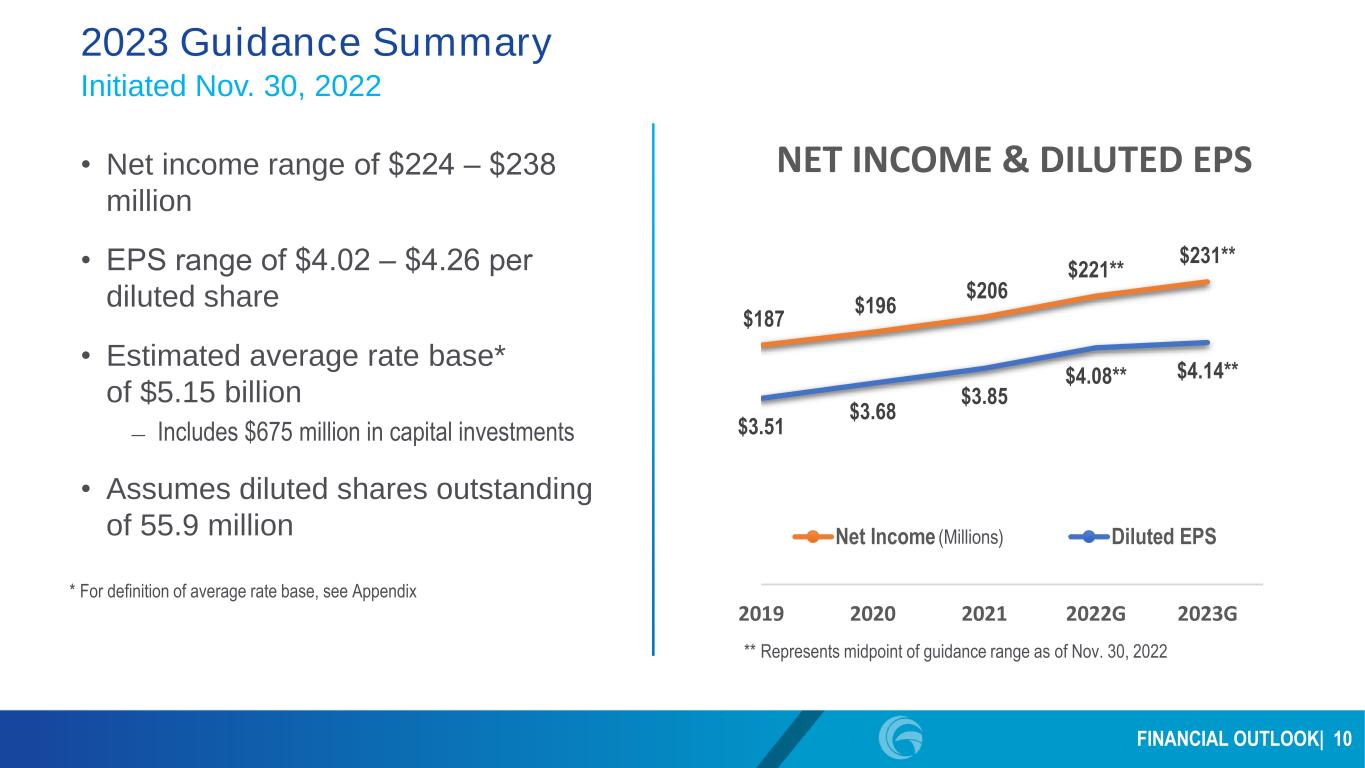

FINANCIAL OUTLOOK| 10 ** Represents midpoint of guidance range as of Nov. 30, 2022 * For definition of average rate base, see Appendix 2023 Guidance Summary • Net income range of $224 ‒ $238 million • EPS range of $4.02 ‒ $4.26 per diluted share • Estimated average rate base* of $5.15 billion – Includes $675 million in capital investments • Assumes diluted shares outstanding of 55.9 million Initiated Nov. 30, 2022 $187 $196 $206 $221** $231** $3.51 $3.68 $3.85 $4.08** $4.14** 2019 2020 2021 2022G 2023G NET INCOME & DILUTED EPS Net Income Diluted EPS(Millions)

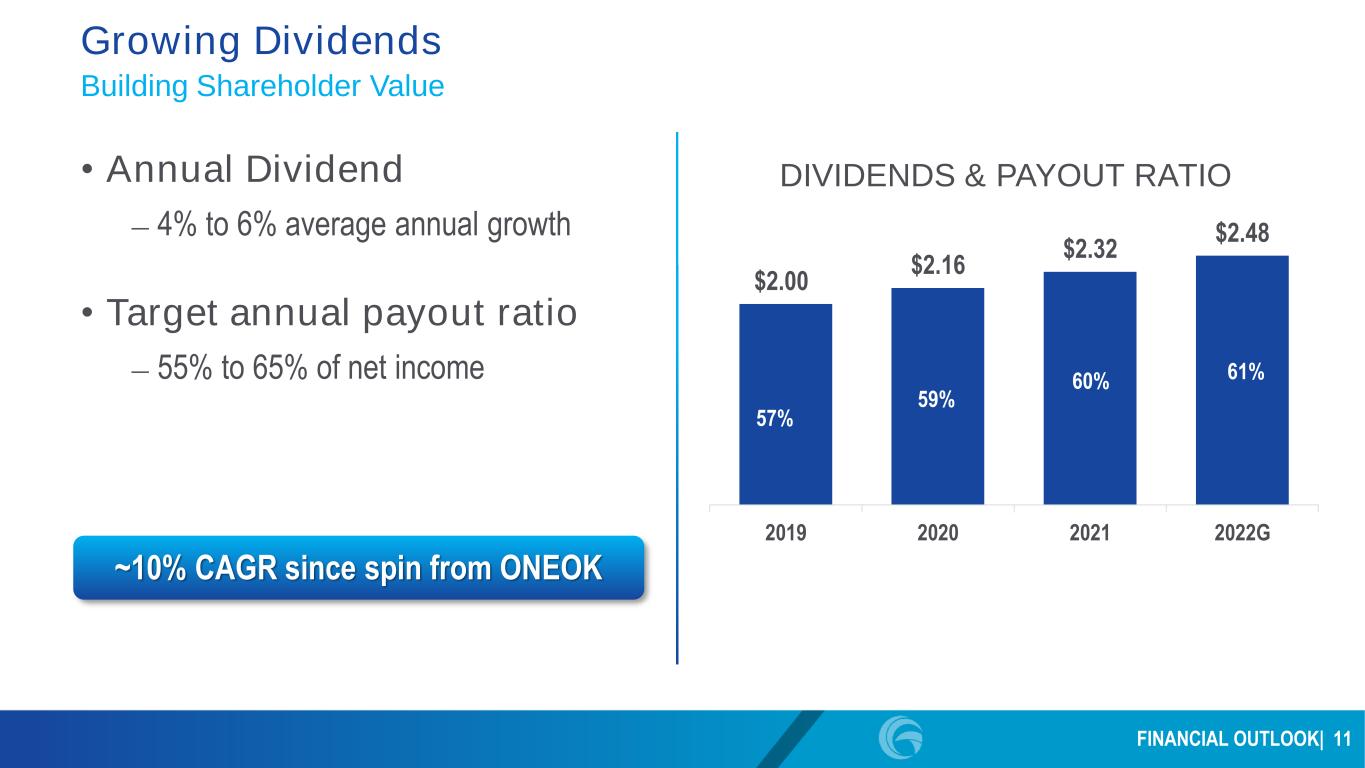

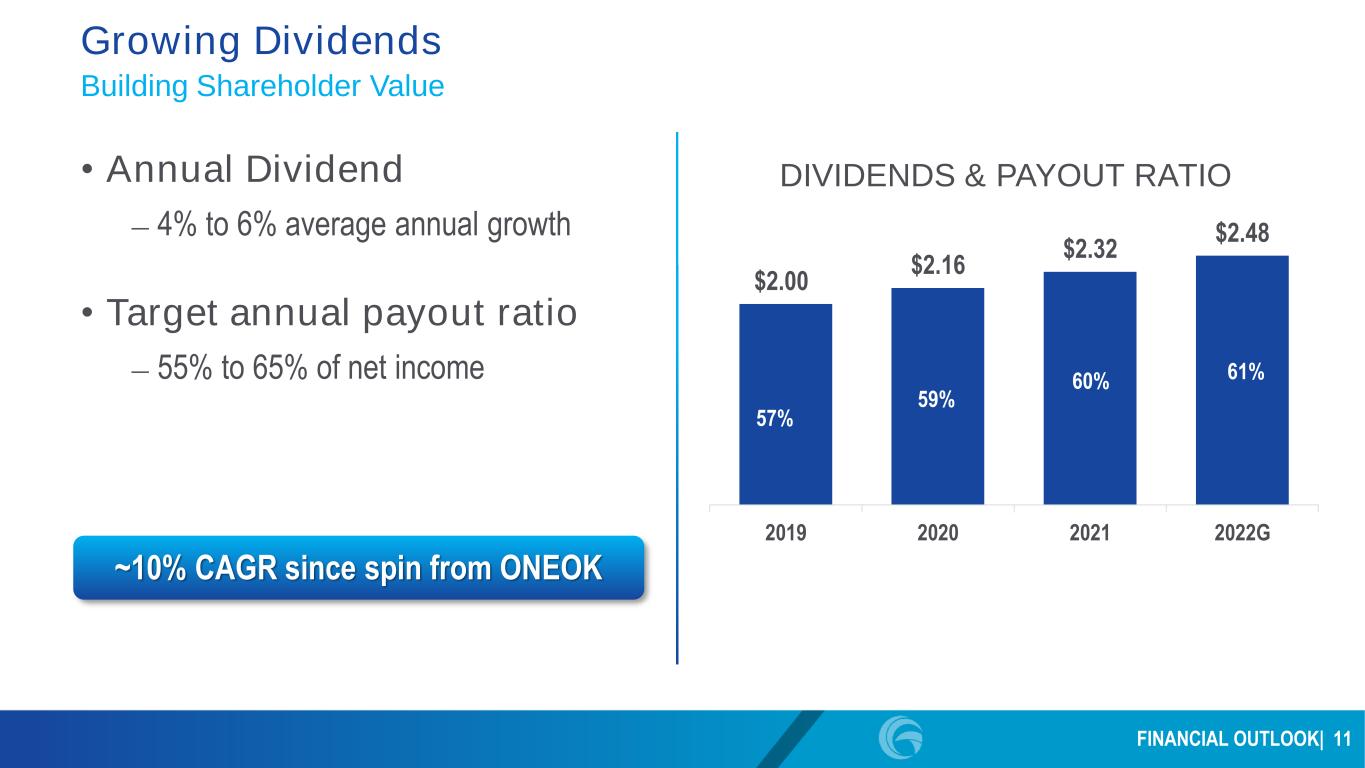

FINANCIAL OUTLOOK| 11 Growing Dividends • Annual Dividend – 4% to 6% average annual growth • Target annual payout ratio – 55% to 65% of net income Building Shareholder Value $2.00 $2.16 $2.32 $2.48 2019 2020 2021 2022G DIVIDENDS & PAYOUT RATIO 57% 59% 60% 61% ~10% CAGR since spin from ONEOK

CAPITAL INVESTMENTS & RATE BASE

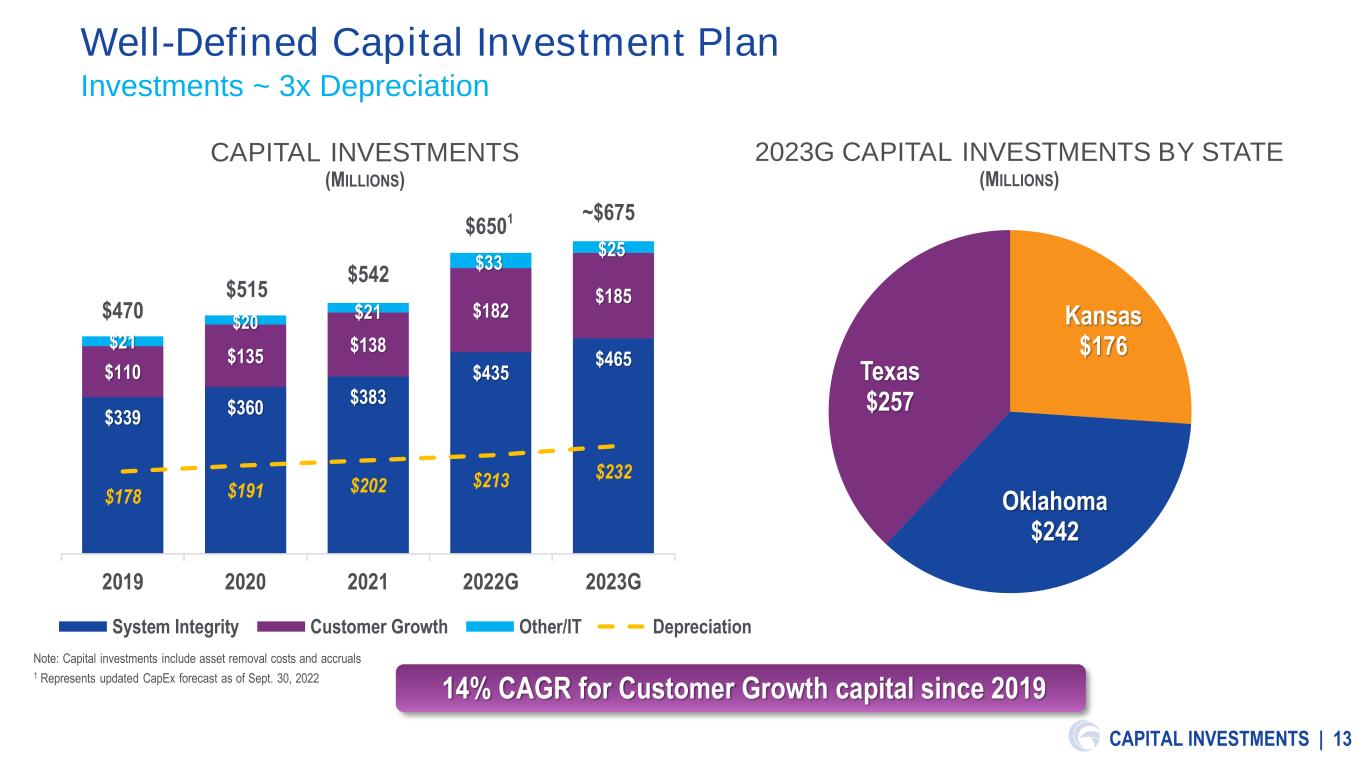

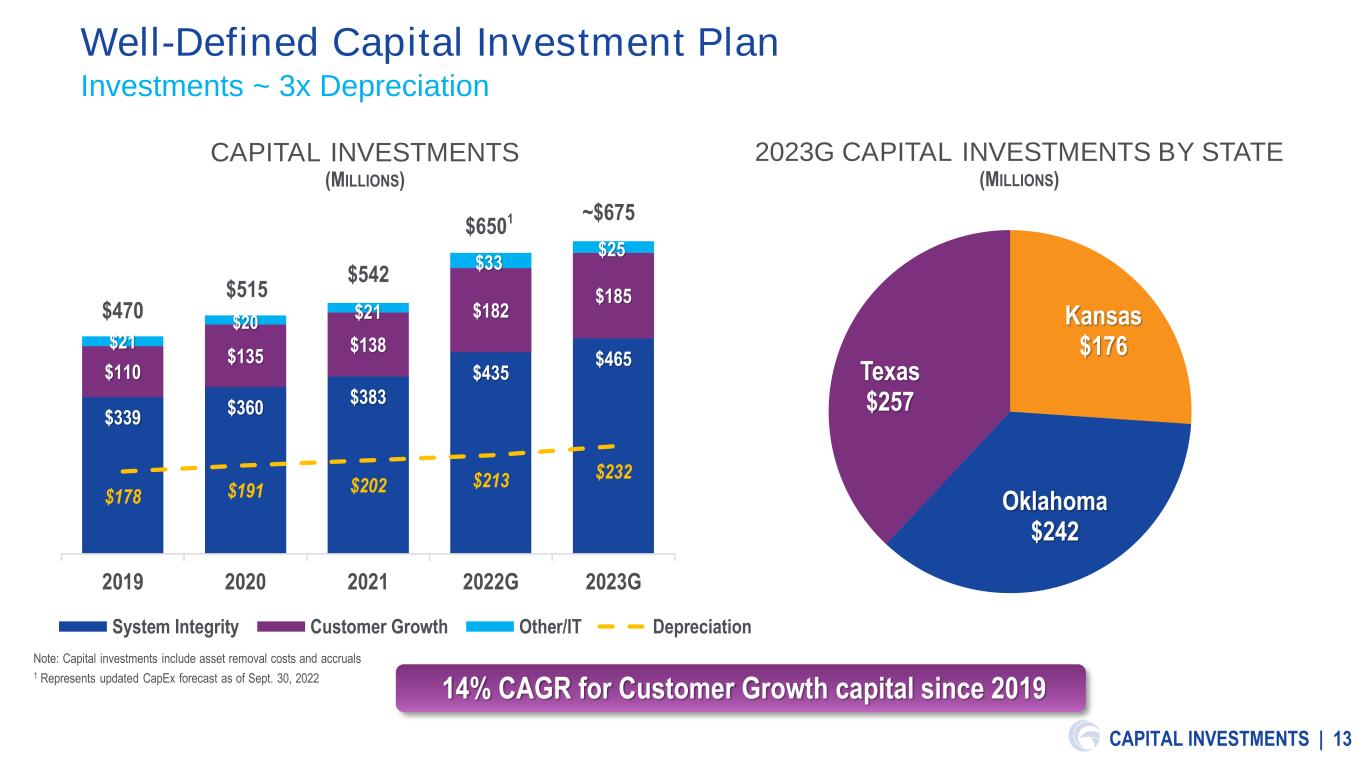

CAPITAL INVESTMENTS | 13 $339 $360 $383 $435 $465 $110 $135 $138 $182 $185 $21 $20 $21 $33 $25 $178 $191 $202 $213 $232 2019 2020 2021 2022G 2023G CAPITAL INVESTMENTS (MILLIONS) System Integrity Customer Growth Other/IT Depreciation $470 $515 $542 $6501 ~$675 Well-Defined Capital Investment Plan Investments ~ 3x Depreciation Kansas $176 Oklahoma $242 Texas $257 2023G CAPITAL INVESTMENTS BY STATE (MILLIONS) Note: Capital investments include asset removal costs and accruals 1 Represents updated CapEx forecast as of Sept. 30, 2022 14% CAGR for Customer Growth capital since 2019

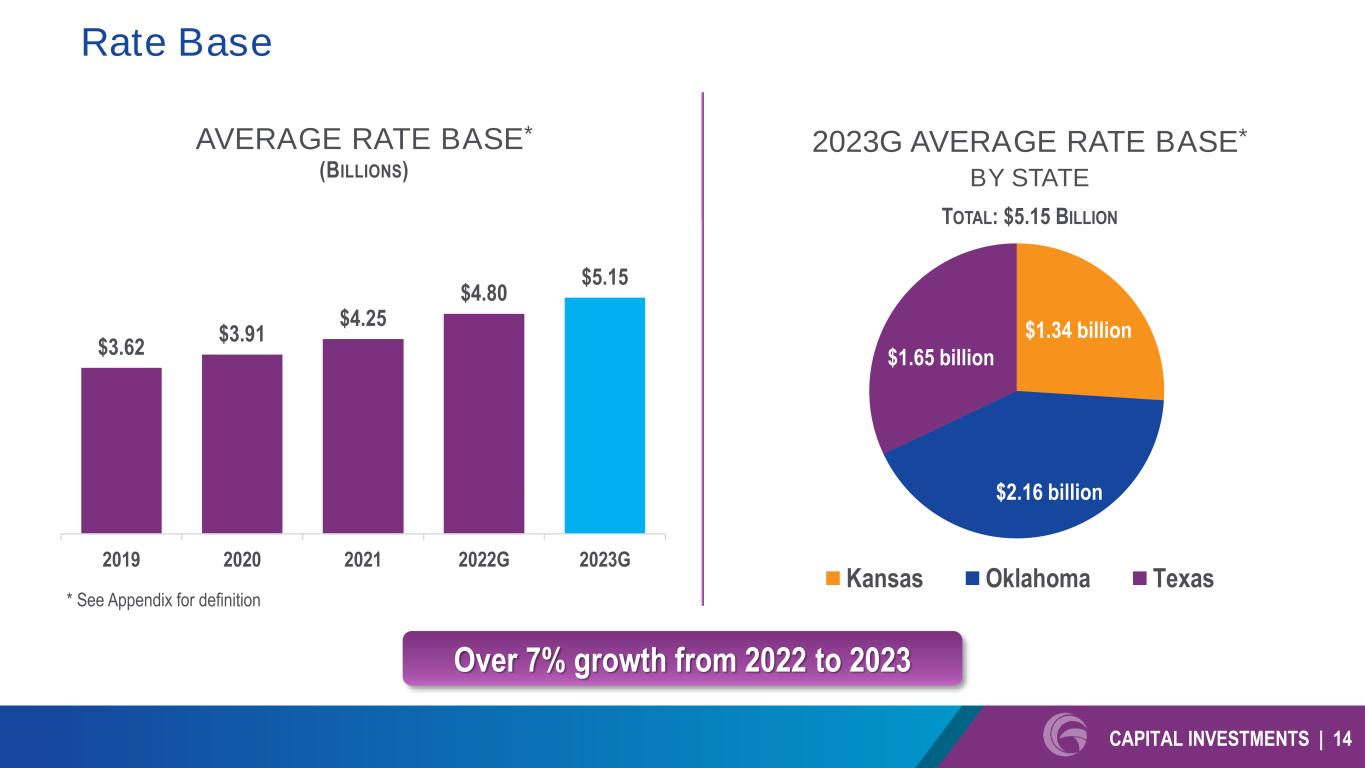

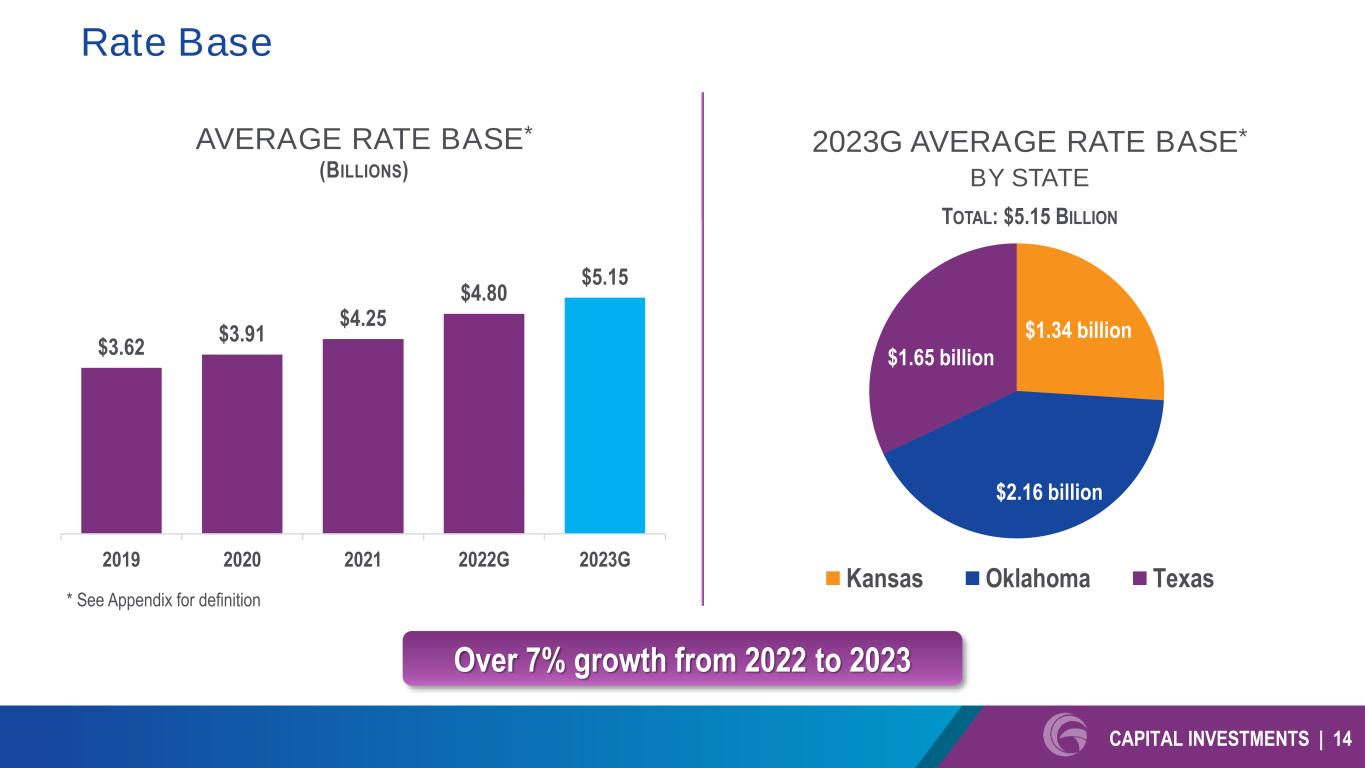

CAPITAL INVESTMENTS | 14 $1.34 billion $2.16 billion $1.65 billion 2023G AVERAGE RATE BASE* BY STATE TOTAL: $5.15 BILLION Kansas Oklahoma Texas Rate Base $3.62 $3.91 $4.25 $4.80 $5.15 2019 2020 2021 2022G 2023G AVERAGE RATE BASE* (BILLIONS) * See Appendix for definition Over 7% growth from 2022 to 2023

APPENDIX

APPENDIX | 16 Average Annual Residential Customer Bill • Natural gas costs represent a majority of customer bills in 2022, while non-commodity costs remain tightly controlled • Customers began to see impact of federal tax reform in 2018 and elimination of Kansas state income taxes in 2020 *Assumes ~$8.75/Mcf average cost of delivered gas for 2023, including transportation, storage, and hedging costs, and excluding securitization charges. Securitization charges expected to avg ~$6/mo. $29 $29 $30 $32 $33 $33 $33 $34 $38 $40 $32 $22 $17 $19 $22 $21 $17 $23 $43 $43 $60 $50 $46 $51 $55 $54 $50 $58 $81 $83 * 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 AVERAGE MONTHLY RESIDENTIAL CUSTOMER BILL Margin, Taxes and Other Cost of Gas Margin, Taxes & Other ~3.5% CAGR since 2014

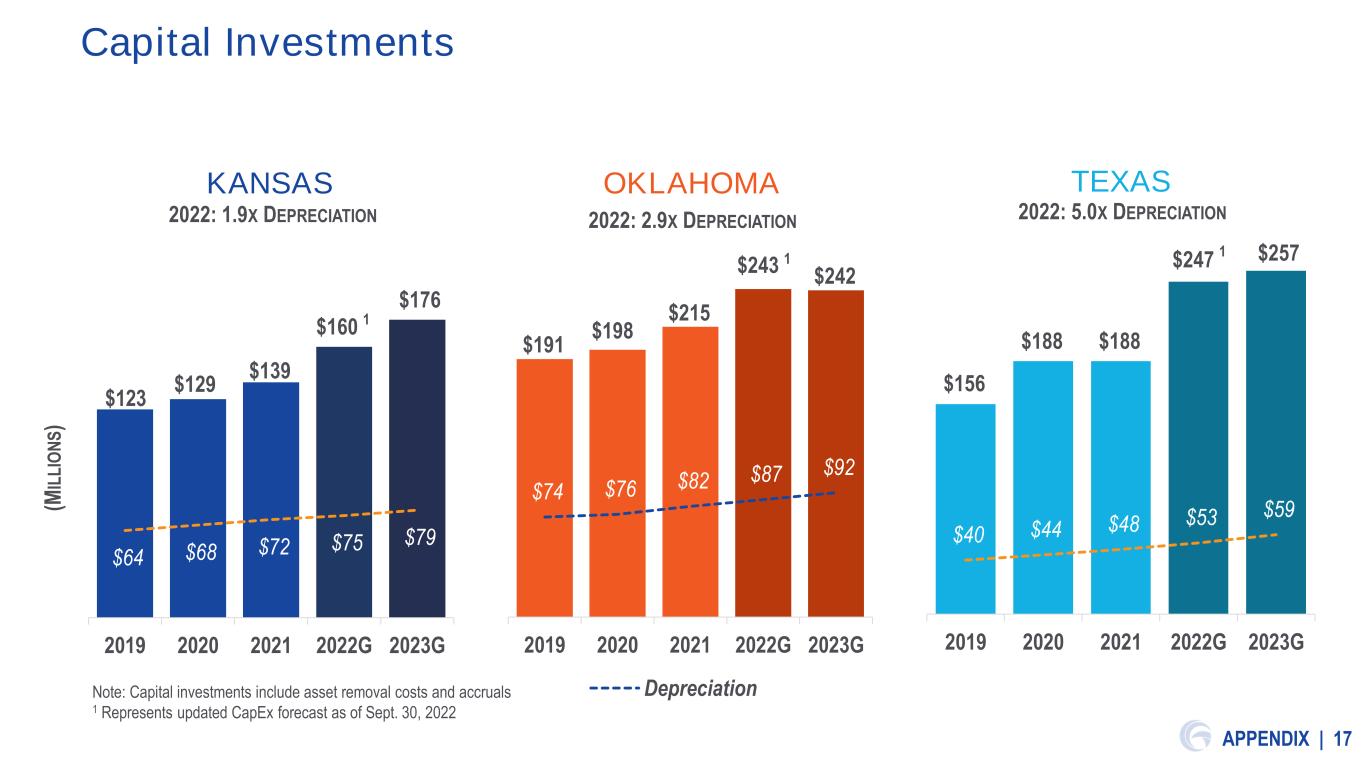

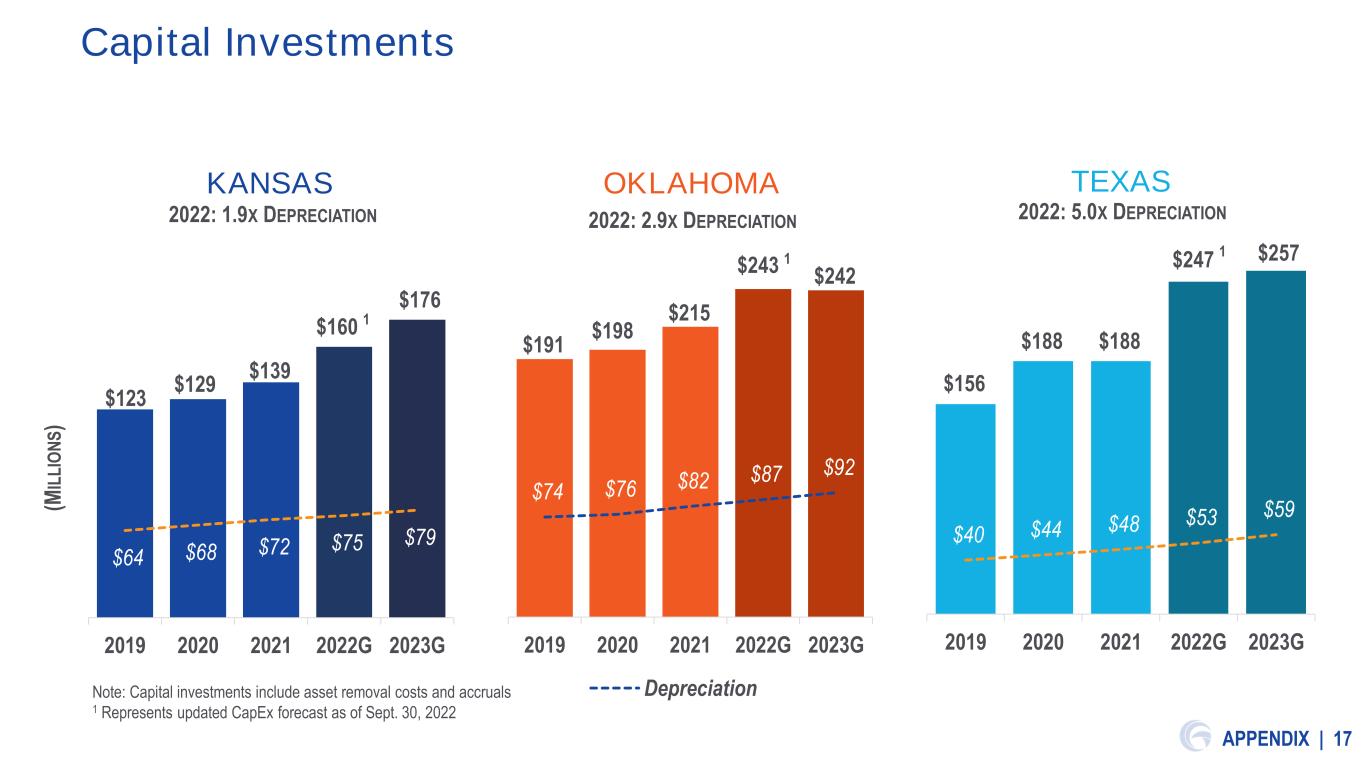

APPENDIX | 17 Capital Investments $123 $129 $139 $160 1 $176 $64 $68 $72 $75 $79 2019 2020 2021 2022G 2023G KANSAS 2022: 1.9X DEPRECIATION $191 $198 $215 $243 1 $242 $74 $76 $82 $87 $92 2019 2020 2021 2022G 2023G OKLAHOMA Depreciation 2022: 2.9X DEPRECIATION $156 $188 $188 $247 1 $257 $40 $44 $48 $53 $59 2019 2020 2021 2022G 2023G TEXAS 2022: 5.0X DEPRECIATION (M IL L IO N S ) Note: Capital investments include asset removal costs and accruals 1 Represents updated CapEx forecast as of Sept. 30, 2022

APPENDIX | 18 Authorized Rate Base $1,407 $1,475 $1,616 $1,726 $1,854 2018 2019 2020 2021 2022 OKLAHOMA2 1 Kansas Gas Service’s most recent rate case, approved in February 2019, was settled without a determination of rate base and reflects Kansas Gas Service’s estimate of rate base contained within the settlement; these amounts are not necessarily indicative of current or future rate base. 2 Reflects authorized rate base as of Nov. 30, 2022. These amounts are not necessarily indicative of current or future rate bases. (M IL L IO N S ) $1,033 $1,068 $1,133 $1,197 $1,261 2018 2019 2020 2021 2022 KANSAS1,2 $895 $986 $1,047 $1,239 $1,360 2018 2019 2020 2021 2022 TEXAS2

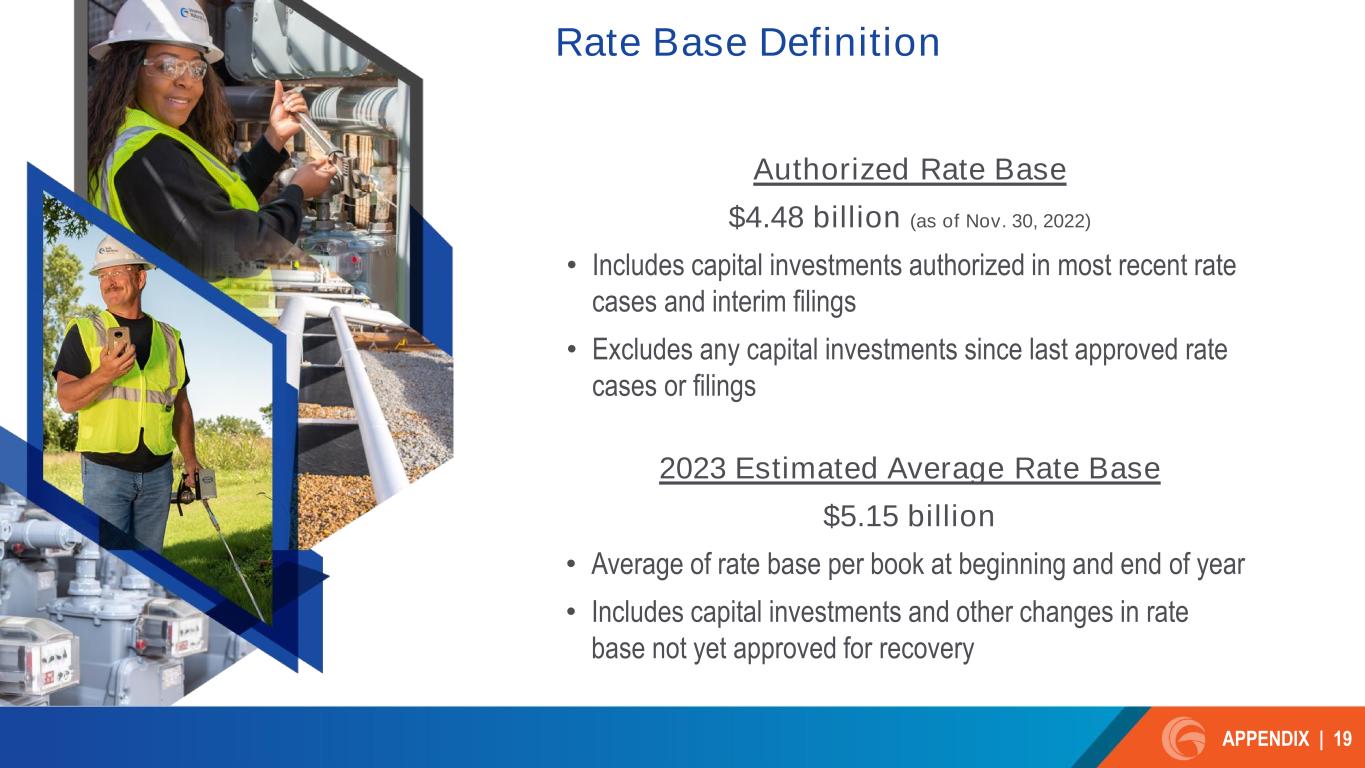

APPENDIX | 19 Rate Base Definition Authorized Rate Base $4.48 billion (as of Nov. 30, 2022) • Includes capital investments authorized in most recent rate cases and interim filings • Excludes any capital investments since last approved rate cases or filings 2023 Estimated Average Rate Base $5.15 billion • Average of rate base per book at beginning and end of year • Includes capital investments and other changes in rate base not yet approved for recovery

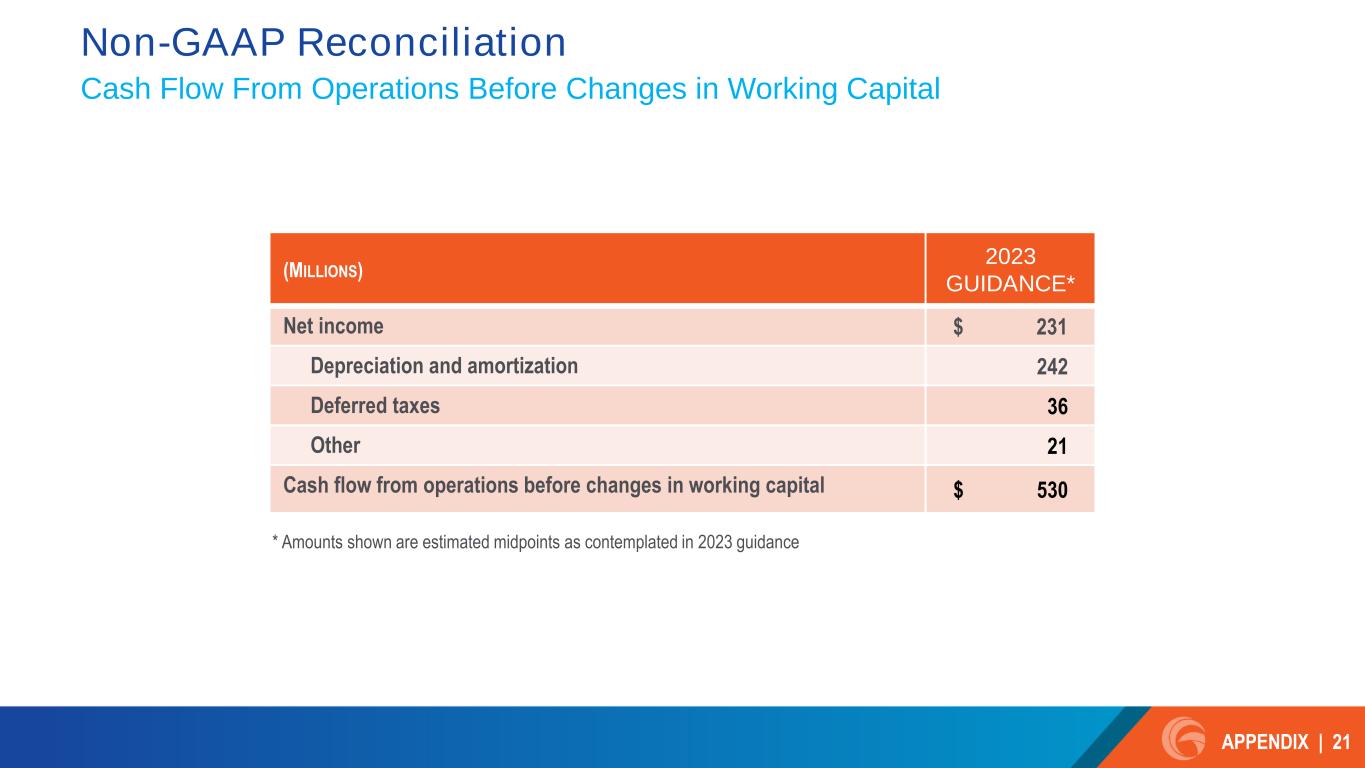

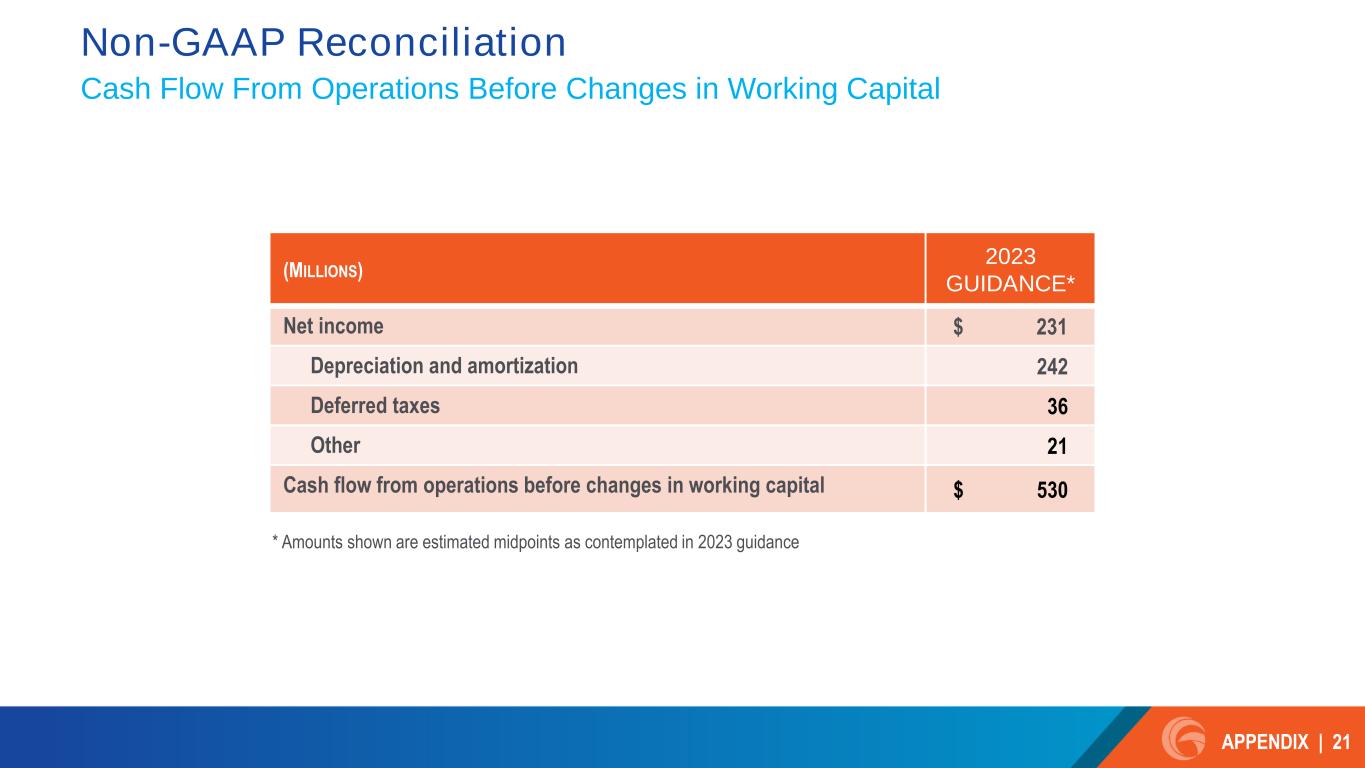

APPENDIX | 20 Non-GAAP Information ONE Gas has disclosed in this presentation cash flow from operations before changes in working capital, which is a non-GAAP financial measure. Cash flow from operations before changes in working capital is used as a measure of the company's financial performance. Cash flow from operations before changes in working capital is defined as net income adjusted for depreciation and amortization, deferred income taxes, and certain other noncash items. This non-GAAP financial measure is useful to investors as an indicator of financial performance of the company to generate cash flows sufficient to support our capital expenditure programs and pay dividends to our investors. ONE Gas cash flow from operations before changes in working capital should not be considered in isolation or as a substitute for net income or any other measure of financial performance presented in accordance with GAAP. This non-GAAP financial measure excludes some, but not all, items that affect net income. Additionally, this calculation may not be comparable with similarly titled measures of other companies. A reconciliation of cash flow from operations before changes in working capital to the most directly comparable GAAP measure are included in this presentation.

APPENDIX | 21 (MILLIONS) 2023 GUIDANCE* Net income $ 231 Depreciation and amortization 242 Deferred taxes 36 Other 21 Cash flow from operations before changes in working capital $ 530 Non-GAAP Reconciliation Cash Flow From Operations Before Changes in Working Capital * Amounts shown are estimated midpoints as contemplated in 2023 guidance