UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22894

INVESTMENT MANAGERS SERIES TRUST II

(Exact name of registrant as specified in charter)

235 W. Galena Street

Milwaukee, WI 53212

(Address of principal executive offices) (Zip code)

Diane J. Drake

Mutual Fund Administration, LLC

2220 E. Route 66, Suite 226

Glendora, CA 91740

(Name and address of agent for service)

(414) 299-2295

Registrant's telephone number, including area code

Date of fiscal year end: November 30

Date of reporting period: November 30, 2020

Item 1. Report to Stockholders.

| (a) | The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows: |

ACR Multi-Strategy Quality Return (MQR) Fund

Class A Shares

(Ticker Symbol: MQRAX)

Class I Shares

(Ticker Symbol: MQRIX)

ACR International Quality Return (IQR) Fund

Class A Shares

(Ticker Symbol: IQRAX)

Class I Shares

(Ticker Symbol: IQRIX)

ANNUAL REPORT

November 30, 2020

ACR Funds

Each a series of Investment Managers Series Trust II

Table of Contents

| Shareholder Letters | 1 |

| Fund Performance | 27 |

| Schedule of Investments | 31 |

| Statements of Assets and Liabilities | 37 |

| Statements of Operations | 38 |

| Statements of Changes in Net Assets | 39 |

| Financial Highlights | 41 |

| Notes to Financial Statements | 45 |

| Report of Independent Registered Public Accounting Firm | 56 |

| Supplemental Information | 58 |

| Expense Examples | 67 |

This report and the financial statements contained herein are provided for the general information of the shareholders of the ACR Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

www.acr-investfunds.com

November 30, 2020

Dear Shareholders:

The ACR Alpine Capital Research investment team is pleased to present its sixth annual investment letter for the ACR Multi-Strategy Quality Return (MQR) Fund (“MQR” or “MQR Fund,” or “the Fund”).

Our aim with this annual report is to provide a summary and discussion of the MQR Fund’s performance and positioning, plus its audited financial statements. ACR’s fund website, www.acr-investfunds.com, also provides information about the Fund and connects you to ACR’s firm website, which includes quarterly firm commentaries that explain our investment philosophy, view of market conditions, and investment strategies.

ACR understands that the trust and confidence of MQR Fund shareholders is contingent upon integrity between ACR’s words and actions and, ultimately, the MQR Fund’s investment results. The ACR investment team strives to earn and keep that trust and confidence, and we look forward to partnering with shareholders for many years of prosperity and intelligent decision-making.

8000 Maryland Avenue, Suite 700 | St. Louis, MO 63105

t 314.932.7600 | f 314.932.1111 | 877.849.7733 | acr-invest.com

Management’s Discussion of Fund Performance

| Total Fund Market Return | Fiscal Year Ended 11/30/2020 | Inception To Date Return1 |

| MQRAX with Maximum Sales Load2 | 7.24% | 3.10% |

| MQRAX at NAV | 13.76% | 4.14% |

| MQRIX at NAV | 13.91% | 4.32% |

| MSCI ACWI (Gross) Index | 15.58% | 9.57% |

| HFRI Equity Hedge (Total) Index | 14.72% | 5.83% |

| 1 | Reflects 71 months of performance, annualized, as fund was launched 12/31/2014. |

| 2 | Reflects a deduction for the fund’s maximum front-end sales charge of 5.75%. |

Per the current prospectus, gross and net expense ratios for the Class I Shares were 1.70% and 1.31% respectively and for the Class A Shares were 1.91% and 1.52% respectively.

The Fund’s Advisor has contractually agreed to waive its fees and/or pay for operating expenses to ensure that total annual fund operating expenses do not exceed 1.40% and 1.25% of the average daily net assets of Class A and Class I shares of the Fund, respectively. This agreement is in effect until March 31, 2021, and it may be terminated before that date only by the Trust’s Board of Trustees. The Fund’s advisor is permitted to seek reimbursement from the Fund, subject to certain limitations, of fees waived or payments made to the Fund for a period of three years from the date of the waiver or payment.

The performance data quoted here represents past performance, which is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares when redeemed may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (855) 955-9552.

The MQR Fund Class I generated a 13.91% return in Fiscal 2020 versus a return of 15.58% for the MSCI ACWI (Gross) Index.

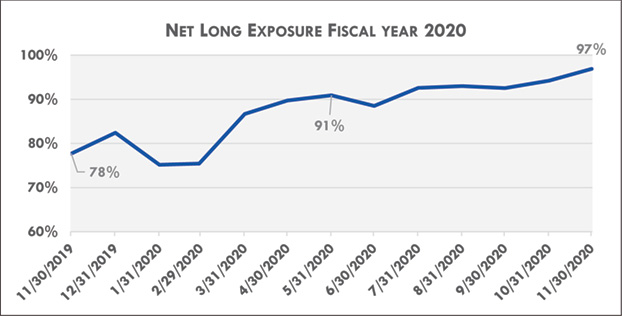

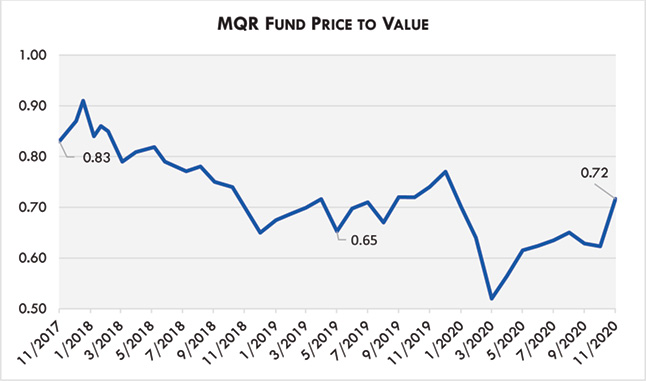

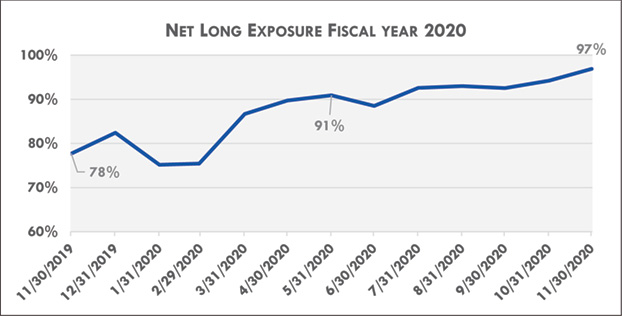

Although MQR modestly underperformed its benchmark, the Fund had a good year as it generated returns above its investee companies’ cost of capital. As market volatility grew, the investment team deployed substantial capital in fiscal year 2020 as the Fund’s net long exposure increased to approximately 97% from 78% at the prior year end. Finally, the price-to-value ratio of the Fund declined to 0.72x from 0.74x at the end of the prior year, suggesting that the Fund’s net asset value is well supported and that there is the potential for strong returns in the periods ahead.

This following will provide an overview of the Fund’s Fiscal 2020 performance, discuss the market conditions that have caused the Fund to underperform since inception, and discuss why the investment team’s research indicates that the Fund is well positioned going forward.

MQR Objectives

The investment objectives of the MQR Fund are to preserve capital during periods of economic decline and provide above-average absolute and relative returns in the long run. “Long run” is defined as an investment performance period that includes a full economic cycle of expansion and contraction in output and equity market prices.

“Above-average absolute returns” means higher than a “fair” equity-like return (i.e., stock market returns over a full market cycle) commensurate with the risk of investing in equities in the long run. The term “absolute return” in no way implies there will be positive returns in any period other than in the “long run” as defined above. Market value fluctuations are expected to produce significant negative returns in certain short-term periods. Annual market returns are expected to be both positive and negative.

“Above-average relative returns” means returns higher than returns of an equity-market benchmark in the long run. The equity market benchmark is the MSCI ACWI Index because it is a broad proxy for the world equity market.

ACR achieves each of these objectives by seeking securities that (a) have reliable cash flows and (b) are priced at a discount to a conservative estimate of the present value of these cash flows. The investment team refrains from putting capital to work in a security unless the investment, at fundamental value, is expected to generate at least a 5-7% annualized return over inflation. We believe the discipline to purchase the security at a discount to our estimate of fundamental value should allow us to earn an excess return over this minimum hurdle. More importantly, the discount to fundamental value helps protect capital against permanent impairment, thereby increasing the likelihood that the Fund meets its return hurdles.

Overview of Fiscal 2020 Performance

The MQR Fund Class I generated a 13.91% return in Fiscal 2020 versus a return of 15.58% for the MSCI ACWI (Gross) Index.

Though modestly underperforming its benchmark, the Fund had a good year, generating returns above its investee companies’ cost of capital.

The investment team believes these market returns were solid in view of the fact that growth stocks continued to outperform value stocks throughout the year. In fact, the Russell 1000 Growth Index was up an astonishing 36.4%, while the Russell 1000 value index was up just 1.7% in the period!1

Our fundamental investment approach relies upon our team investing in industries in which our research can drive an understanding of future margin structures for businesses, the opportunity for those companies to redeploy capital in their businesses at attractive returns, and ultimately an understanding of the terminal economics of each business we analyze. In general, our investments hew closer to the types of companies found in value indices versus those of growth indices. This is because companies in growth industries tend to have embedded pricing expectations that force one to speculate on the long-term structure of each of the items above rather than establish a high-quality understanding of those items. Given this value bent, we were pleased to see that the Fund performed within earshot of its benchmark’s return while also giving Fund shareholders an opportunity to own very inexpensive securities.

| 1 | The Russell 1000® Growth Index measures the performance of the large cap growth segment of the US equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000® Value Index measures the performance of the large cap value segment of the US equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values. |

In each of our commentaries since Fund’s inception, we have written about the high-priced market environment that has caused us to remain cautious in deploying Fund capital. Indeed, in last year’s letter, we discussed how the Fund closed the year with just 77% net long exposure. In FY2020, market volatility around COVID-19 lockdowns in March caused intra-market discrepancies to widen and allowed ACR’s investment team to take off the majority of its hedges against small-cap stock indices and increase exposures to certain holdings, such that we ended the year with a 97% net long position.

The chart below illustrates that as markets reached their peak in February 2020, our net exposure drifted down modestly from the fiscal year, and then as markets declined in March and April, we materially added to our net exposures—ultimately becoming nearly fully invested by year end as equity prices in the portfolio appreciated.

As of November 30, 2020

Source: ACR

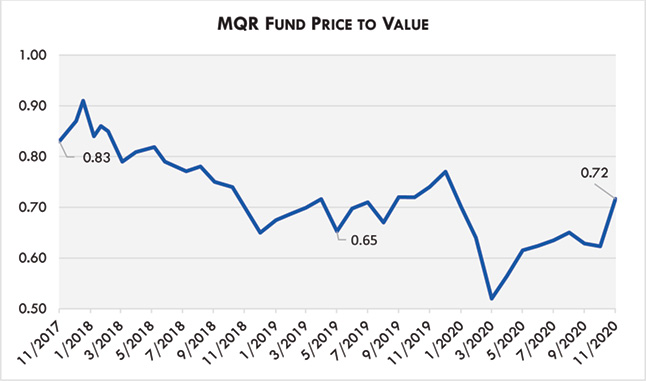

In addition to increasing the Fund’s net exposures, the Price to Value (P/V) ratio of the Fund declined modestly in the period to 0.72x from 0.74x in the prior year. Note that the P/V statistic measures the discount at which our portfolio trades to intrinsic value, and its reciprocal, 1/0.72x, or 39%, is the amount by which these holdings would appreciate if the Fund’s holdings were all to immediately reach intrinsic value. The chart below shows the Fund’s P/V since we began recording it in November 2017. One can see the significant volatility caused by COVID-19 dislocations this year and then the Fund’s material recovery.

As of November 30, 2020

Source: ACR

Detractors and Contributors Fiscal 2020

The three largest detractors for the Fund in FY2020 were Embraer, Fairfax Financial and Howard Hughes.

Embraer, a Brazilian company and the world’s third largest manufacturer of commercial aircraft, was impacted by two events. COVID-19 caused aircraft orders to falter, and then, unexpectedly, Boeing cancelled a planned joint venture with Embraer. The combination of these two items weakened Embraer’s balance sheet and future prospects. We re-evaluated our investment thesis based on these items and concluded that Embraer’s business quality was impaired, and we sold at a material loss.

Fairfax Financial declined in the period with other insurers given the company’s insured exposure to COVID-19 claims as well as material mark-to-market losses in its investment book, which is made up of a number of deep-value equity investments. The Fund continues to hold its shares in Fairfax as the investment team believes the company is well positioned to administrate COVID-19 claims, and that the fair value of its investment holdings is well in excess of their current market prices. A “hard market,” which is a period of higher insurance pricing, also appears to have started, and we believe this bodes well for Fairfax’s future profitability.

Howard Hughes, a real estate operating company and developer, declined because of two factors. First, in December 2019 and January 2020, the company was reviewing strategic options that included the potential for selling the entire company outright. In January, the company announced that it had opted not to move forward with a sale, and the market sold the shares off some 25% on disappointment that no deal occurred. In February and March, Howard Hughes declined materially as COVID-19 impacted lease revenue at the company’s operating assets while also forcing the company to push out its plans to develop more of its real estate assets. The investment team believes that the market overreacted to the situation at Howard Hughes and that the company’s shares trade at a material discount to their intrinsic value.

The three largest contributors to the Fund in FY2020 were Naked Wines, Ashtead and General Motors.

The largest positive contributor to performance was the Fund’s investment in Naked Wines. Although Naked Wines is a U.K.-based company it is considered the largest winery in the U.S. selling wine online only, direct to consumer. The business was already well positioned with a superior product at a better value for money than retail wine merchants and was growing approximately 15% per year. The COVID-19 induced lockdowns in all its markets (i.e., U.S., U.K., Australia), however, further improved the company’s market opportunity. Individuals hesitant to order wine online were convinced to try the product during this lockdown period. This led to Naked Wines’ revenue increasing by 80% year over year for the six-month period ending September 2020. While it is uncertain how many of the newly acquired customers will remain loyal post the COVID-19 environment, the step change in the company’s revenue generation, name recognition and product awareness has materially improved its operating efficiency and prospects. We have increased our estimate of value for the business and remain shareholders.

The second largest contributor to Fund performance was the Fund’s investment in Ashtead Group plc. Ashtead is a U.K.-based general equipment rental business most well-known for its U.S.-based equipment rental subsidiary, Sunbelt Rentals. As the U.S.’s second largest equipment rental company, just behind United Rentals, we had admired Sunbelt Rentals, its strategy and its management team for many years. The items that kept us from investing in the business before were its high share price and our view on the sustainability of its market share gains. The opportunity to finally invest in the business came during the COVID-19 pandemic as Ashtead’s share price dropped approximately 40% from the end of 2019 to mid-March 2020. In addition to the more attractive share price, our market share gain concerns were alleviated as we estimated that the company’s competitive positioning would improve during the COVID-19 pandemic. The COVID-19 pandemic required equipment tool rental businesses to shift to digital order intake, have contactless equipment pick-up, maintain a well serviced and available equipment inventory, and abide by all the newly introduced health and safety protocols. Local and even regional competitors appeared less able to satisfy these new customer demands and hence our confidence in Ashtead’s continued market share gains from its current 10% position increased. The stock market, eventually, appeared to see a similar improvement in Ashtead’s long-term business prospects, as its share price appreciated materially from the date of the Fund’s initial investment through the end of fiscal 2020. The Fund remains a shareholder of the company at fiscal year-end 2020.

General Motors, the third largest contributor to Fund performance, outperformed in the period as the company surprised Wall Street with very low losses in its calendar second quarter due to COVID-19 production stoppages. Additionally, throughout the third and fourth quarter new auto sales recovered dramatically, and stimulus from the CARES Act kept non-performing auto loans to low levels while also helping to drive unprecedented used vehicle pricing and demand. GM continues to trade at a substantial discount to the sum of its parts and it ended the fiscal year as the Fund’s largest holding.

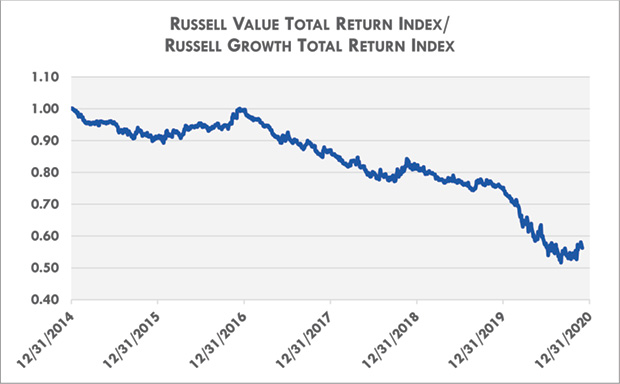

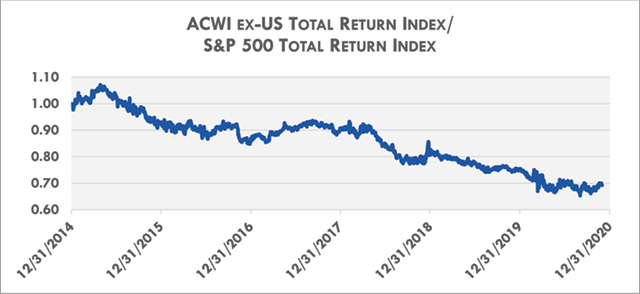

Market Conditions that Have Caused Underperformance Since Inception

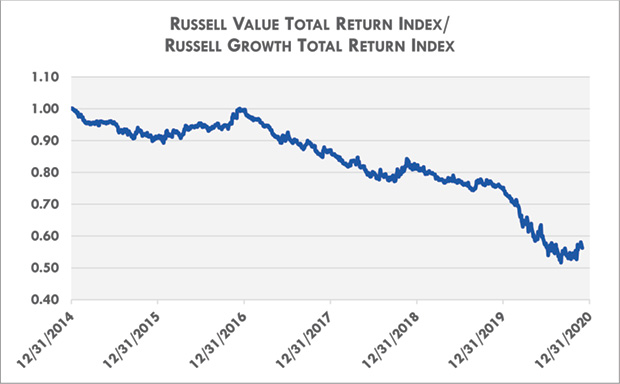

Two phenomena have impacted the MQR Fund since inception. First, as discussed briefly above, ACR’s analysis generally has a “value” tilt to it, and value stocks have been exceptionally out of favor. Second, the Fund has a global investment mandate and has overweighted ex-US since inception due to lower valuations found in international markets.

ACR’s investment team has come to call the past several years the “Value Depression,” as generally those companies with established business models and lower price/earnings (P/E) ratios have underperformed, while those in nascent businesses have seen their share prices rise exponentially. One example of this is in the U.S., where the Russell 1000 Growth Index is up 171% since the inception of the Fund, while the Russell 1000 Value Index is up just 50%.

As of November 30, 2020

Source: Bloomberg

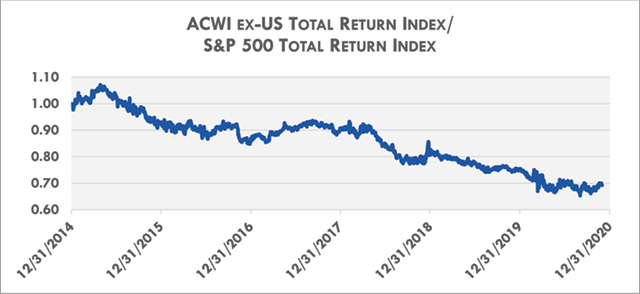

Secondarily, ACR has been overweight ex-U.S. holdings since the MQR Fund’s inception. This overweight has been driven in part by low P/E ratios internationally relative to that of the U.S. Due to the technology sector’s low weighting outside of the U.S., international benchmarks have underperformed the U.S. during this Value Depression. Specifically, the S&P 500 is up 98% since inception of the Fund versus a 37% return for the MSCI ACWI Ex-US. MQR has generally held 30-40% of its holdings in U.S. stocks, while the U.S. weighting in the MSCI is over 50%.

As of November 30, 2020

Source: Bloomberg

As we discuss in the section below, ACR does not expect these trends to persist forever, and our research shows that our companies are well positioned relative to those in the ACWI.

Current Positioning of the MQR Fund

The MQR Fund is concentrated in a select number of opportunities with characteristics that the ACR investment team believes are substantially different than that of the market. In order to outperform, a manager must develop a portfolio of ideas that is differentiated from the market and be willing to underperform (as we have recently) for periods of time as the underlying characteristics of the manager’s holdings are recognized. ACR is excited about the makeup of its portfolio today relative to that of the market.

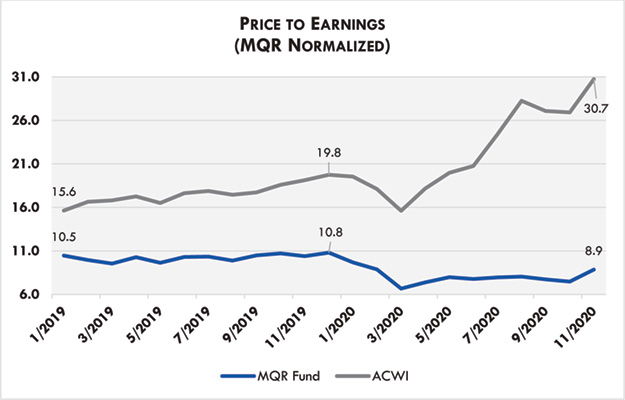

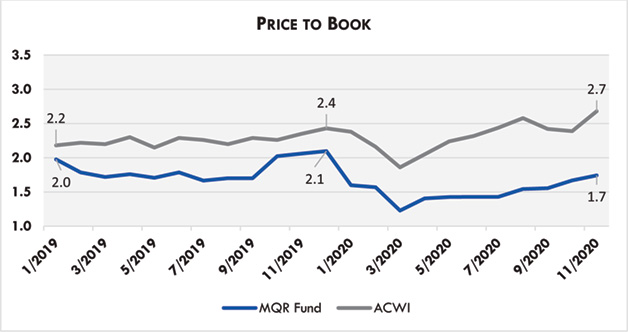

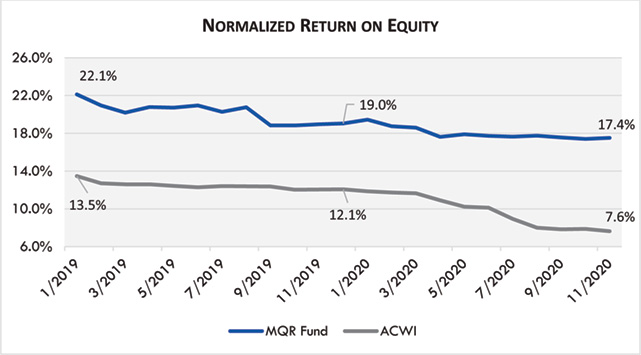

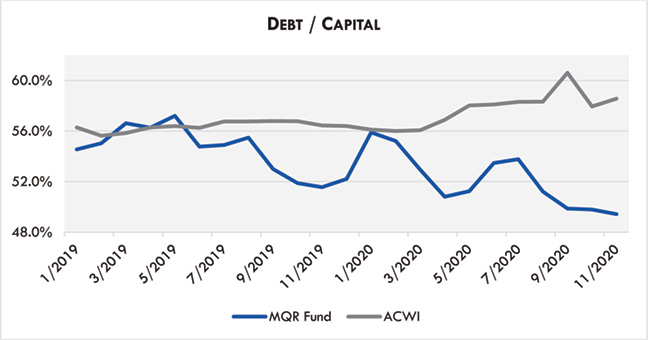

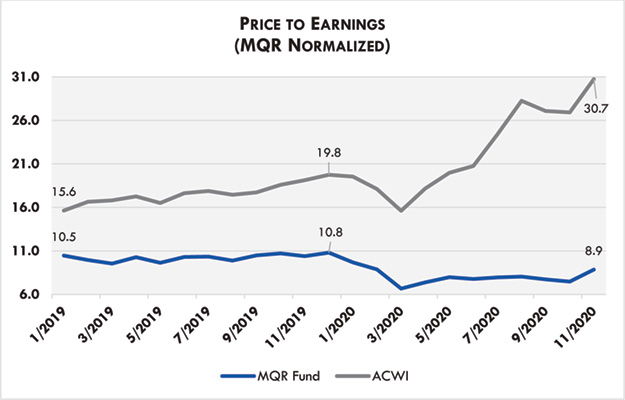

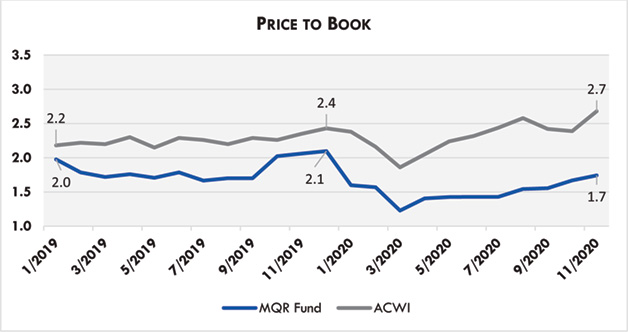

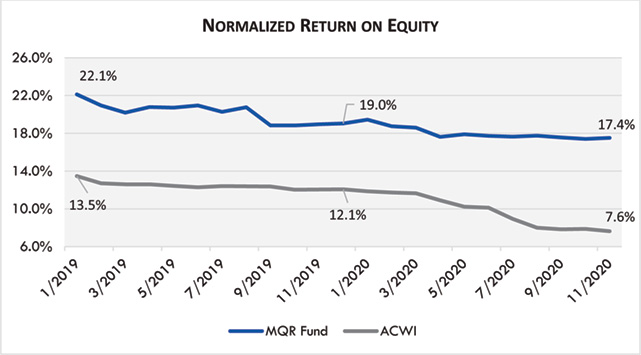

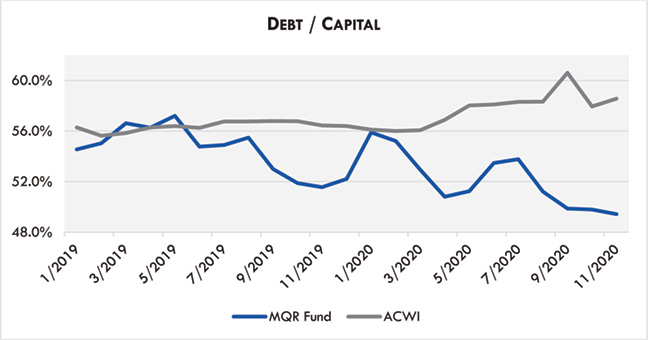

Today, as is shown graphically in the charts below, MQR is structured with a portfolio that has a weighted average P/E that is well below that of the ACWI with returns on equity that are well above and price to book (P/B) values that are well below those of the index.2 Plus, with debt to capital that is below that of the average company in the index, we believe that our Fund as a whole has greater financial flexibility than that of the index.3

2 Price to Book compares the market capitalization of a company to its common shareholders’ equity.

3 Debt to Capital compares the debt of a company to the total of its debt plus its shareholders’ equity.

As of November 30, 2020

Source: Bloomberg

As of November 30, 2020

Source: Bloomberg

As of November 30, 2020

Source: Bloomberg

As of November 30, 2020

Source: Bloomberg

Though we don’t know when the market will appreciate the characteristics of our portfolio companies, we believe that the substantial discrepancy between each of the figures above bodes very well for future relative and absolute returns in MQR Fund.

Conclusion

MQR’s performance in the just completed fiscal year was good from an intrinsic value and market price growth perspective. However, the Fund’s longer-term performance has been constrained by the Value Depression and an overweight to international holdings. Given the low P/E, low P/B, high ROE and low debt to capital statistics of the MQR Fund in both absolute terms and relative to that of its benchmark, the ACR investment team is confident that the MQR fund is well positioned to generate attractive returns in future periods.

Thank you for your continued trust,

The ACR Investment Team

Appendix: ACR’s Investment Principles

Investment Principles

Intrinsic value and risk is our focus when evaluating investments

Intrinsic (or fundamental) value is the cash generated by an enterprise or asset over its useful life. Intrinsic value is earned in the future as dividends, interest, and principal are paid or as retained earnings are successfully reinvested.

Risk is the likelihood and potential magnitude of a permanent decline in the earning power or asset value of an enterprise, or the payment of a market price at purchase which is higher than intrinsic value. Our objective is to mitigate risk through integrity with our investment principles and investment process excellence.

When buying, we never confuse intrinsic value with market price. Market price is what we pay. Intrinsic value is what we get. Market price may be found quoted daily from news services or ascertained from past transaction records. Intrinsic value is determined by enterprise cash flows.

Market price, it follows, is not a barometer we would use to evaluate corporate performance. Our evaluation of corporate performance is based on items such as income, assets, and return on capital. We view the price of a security simply as a record of what others – well informed or not – were willing to pay for it at various times in the past.

Intrinsic value is such a critical concept because it is the only reference point for what an investment is actually worth, and therefore, whether or not the market price is fair, high, or low. Two facts support this view. First, the theoretical point that an investment is worth the present value of its future cash flows is self-evident and undisputed. Second, new era theories that have driven market prices to speculative levels in the short run have always succumbed to intrinsic value in the long run.

We insist on quality with a margin of safety

The quality of a security is defined by the reliability of the cash flows or assets which comprise its intrinsic value. The quality of an investment is defined by the price paid for the intrinsic value received.

A quantifiable margin of safety is the hallmark of a quality investment. For higher rated fixed income investments, an issuer’s available resources must be significantly greater than the interest and principal due the investor. For lower rated fixed income investments selling below their principal value, the assets backing an issue must be significantly greater than its price. For equity investments, the intrinsic value of a company must be significantly greater than its price. For other types of investments and as a general rule, the probability of achieving a return commensurate with the risk taken must be very high.

We only invest in what we understand

True understanding is built upon high probability statements about security values. It requires a dogged determination to get to the bottom of things and an equally dogged honesty about whether or not we did.

Understanding is also relative. Achieving better-than-average returns requires understanding security values better-than-average. The problem is most investment managers believe they are better-than-average.

Competence and honesty are the keys to assuring that we are not fooling ourselves. Competence means that we are capable of estimating security values and returns for both our portfolios and the markets in which we participate. Honesty means that we are candid about our relative return advantage or lack thereof, and only commit capital when we have an advantage.

Diversification and concentration are balanced with knowledge

Proper diversification is paramount to quality at the portfolio level. Proper diversification is achieved when the overall portfolio return is protected from unexpected adverse results in individual holdings, industries, countries, or other risk factors.

Proper concentration can be risk reducing as well as value enhancing. Concentration refers to making greater commitments to more attractive investments. The greater the difference between intrinsic value and market price, the more robust our knowledge of an investment’s value, and the lower the risk of the investment, the more capital we are willing to concentrate in that investment.

Successfully executed, concentration has three benefits: (a) returns are enhanced by selecting investments with the highest probability of success, (b) risk is reduced by avoiding mediocre and poor commitments, and (c) knowledge is improved by concentrating the analytical effort.

A concentrated portfolio with fewer holdings is desirable when value-to-price, understanding, and quality are high. A low-cost, more widely diversified approach to a market is appropriate when there are no clear advantages in understanding, and therefore, in our ability to evaluate quality or estimate value-to-price.

Communication is essential for intelligent investor decision-making

One of the greatest risks investors face is selling low in a panic. Education and communication can greatly reduce this risk. We explain to investors the difference between intrinsic and market value and openly share the rationale behind our investment decision-making. We believe this significantly reduces the risk of investors selling at market bottoms or buying at market tops.

Communication is also important for evaluating an investment manager’s abilities. Luck, risk, and a bull market can make an incompetent manager look brilliant. Conversely, every brilliant manager will under-perform at some time, and usually this is the best time to invest with them. Investors must look beyond performance to evaluate manager competence. To aid current and prospective investors in this endeavor, we regularly discuss the strategy and holdings behind our performance, and candidly address both our successes and mistakes.

The views in this letter were as of November 30th 2020 and may not necessarily reflect the same views on the date this letter is first published or any time thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

November 30, 2020

Dear Shareholders:

The ACR Alpine Capital Research investment team is pleased to present our fourth annual investment report for the ACR International Quality Return (IQR) Fund (“IQR” or “IQR Fund” or “the Fund”) covering the period November 30, 2019 through November 30, 2020.

Communication is one of ACR’s core principles, and we firmly believe that clear communication is essential for intelligent shareholder decision-making. Without clear communication and an understanding of the Fund’s investment process, shareholders risk making suboptimal financial decisions. ACR seeks a shareholder base who remains committed to a long-term investment holding horizon and makes investment decisions based on logic and relevant facts rather than impulse or fear. A more stable shareholder base with a longer holding horizon allows the ACR investment team to appropriately execute the IQR Fund investment process.

Our aim with this annual report is to provide you the information you need to understand the performance and positioning of the IQR Fund. This report includes a summary and discussion of the Fund’s performance and its audited financial statements. In addition, our website, www.acr-investfunds.com, provides a wealth of information about the Fund and ACR. We would also encourage you to read ACR’s investment principles (attached as an appendix to this letter) as these underpin the IQR investment process.

We understand that your trust and confidence in ACR, and the IQR Fund, is contingent upon the integrity between ACR’s words and actions, and ultimately the IQR Fund’s investment results. The ACR investment team will strive to earn and keep that trust and confidence, and we look forward to partnering with shareholders for many years of prosperity and intelligent decision- making.

Sincerely,

Willem Schilpzand, CFA ®

Portfolio Manager

8000 Maryland Avenue, Suite 700 | St. Louis, MO 63105

t 314.932.7600 | f 314.932.1111 | 877.849.7733 | acr-invest.com

Management’s Discussion of Fund’s Performance

The net performance of the Fund’s I Class shares for fiscal year 2020, from November 30, 2019 to November 30, 2020, was 20.23% vs. 9.52% for the Fund’s benchmark, the MSCI All Country World Index Ex-U.S. This letter will give an overview of the Fund’s 2020 performance, highlight the Fund’s advantages that allowed for this satisfactory performance, provide a macro-overview of the global environment, present data on the overall valuation levels of the financial markets we participate in and provide clarity into the Fund’s positioning entering fiscal year 2021. We will start the shareholder letter by providing the Fund’s investment objective and will end it with our conclusions.

IQR Fund Investment Objective

“The IQR Fund’s investment objective is to protect capital from permanent impairment while providing a return above the Fund’s cost of capital and the Fund’s benchmark over a full market cycle.”

Please reference the appendix for a discussion on the Fund’s investment objective.

| I. | Fiscal Year 2020 in Review |

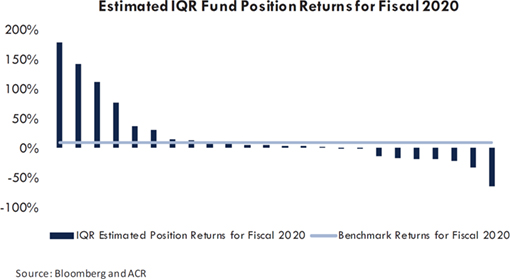

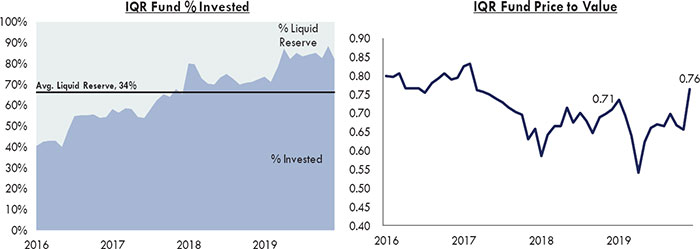

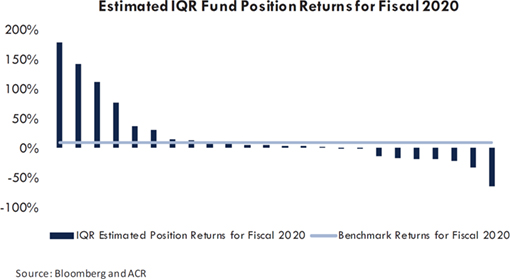

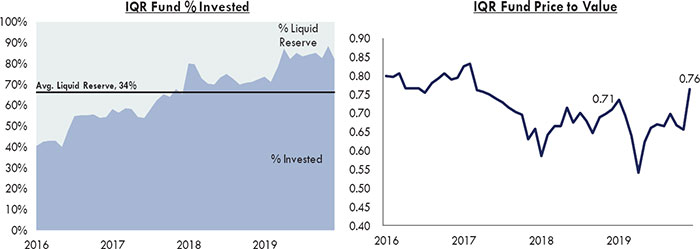

The net performance of the Fund’s I Class shares for fiscal year 2020 was 20.23% vs. 9.52% for the Fund’s benchmark. While we did not predict the Covid-19 pandemic, we were prepared for increased volatility and opportunity. In the 2019 annual letter we discussed the Fund’s defensive positioning in an environment with potentially inflated asset prices and heightened uncertainty. In the 2018 annual letter we mentioned that the Fund’s investment performance was not reflective of underlying fundamentals and that we believed the underperformance of that year would be transitory. Both statements proved prescient. The Fund’s defensive position (i.e., the approximate 28% cash balance) coming into March 2020 allowed the Fund to be opportunistic during the March 2020 market sell-off. Further, the investments the Fund already owned outperformed during the April to November 2020 market rebound and hereby unwound a portion of the “transitory” underperformance referenced in the 2018 letter. The chart below highlights the estimated position returns for fiscal 2020. Below we will describe in more detail the main contributors and detractors that comprised the fiscal 2020 performance.

The largest detractor for the Fund was our investment in the Brazilian company Embraer. Embraer is the world’s third largest aircraft manufacturer, and this business was negatively impacted by the intersection of two events. Firstly, Covid-19 brought air traffic to a stop and secondly, Boeing, the U.S. based aircraft manufacturer and defense business, backed out of an agreed to joint venture with the company. The combination of these events weakened Embraer’s balance sheet and reduced its prospects. We re-evaluated our investment thesis based on the new facts and concluded the business was now of insufficient quality and we sold at a material loss. The second largest detractor was Liberty Latin America. Liberty Latin America is a telecommunication company with exposure to various countries in Latin America and the Caribbean. Although the company’s services (e.g., cable internet, mobile phone, landline phone, pay tv) became more important during the Covid-19 pandemic, payment holidays on the company’s services and a large Chilean Peso devaluation versus the U.S. dollar lowered earnings. We believe the company’s negative share price performance is an overreaction to a temporary issue. The Fund remains a shareholder in the company and we anticipate attractive forward going returns on the investment.

The largest positive contributor to performance was the Fund’s investment in Naked Wines. Naked Wines is a U.K. based company but is considered the largest winery in the U.S. that only sells wine online, direct to consumer. The business was already well positioned with a superior product at a better value for money than retail wine merchants and was growing approximately 15% per year. The Covid-19 induced lockdowns in all its markets (e.g., U.S., U.K., Australia), however, further improved the company’s market opportunity. Individuals hesitant to order wine online were convinced to try the product during this lockdown period. This led to Naked Wine’s revenue increasing by 80% year over year for the six-month period ending September 2020. While it is uncertain how many of the newly acquired customers will remain loyal customers post the Covid-19 environment, the step change in the company’s revenue generation, name recognition and product awareness has materially improved the company’s operating efficiency and prospects. We have increased our estimate of value for the business and remain shareholders. The second largest contributor was G4S Plc, a manned security provider based in the U.K. The Fund was a prior investor in the company, and we opportunistically reinvested in the business after its share price fell 50%+ during the Covid-19 market selloff. The sharper decline relative to the market appeared related to the company’s higher than desired debt balance. What the market appeared to miss was that G4S is a noncyclical business that would most likely hold up reasonably well during a Covid-19 lockdown environment. This view was validated as the company reported that its revenue was reduced by less than 3% year over year for the six-month period ending June 2020. Our view of the company’s undervalued share price and quality underlying business was further supported when the company received competing buyout offers from two of its rivals. G4S’ share price appreciated materially, and the Fund sold its investment at a sizeable gain.

Fiscal 2020 was a satisfactory year for the Fund, but we believe a much longer time horizon is needed to validate whether an investment manager has added value to investors. We believe that the Fund’s four-year historical track record is insufficient to come to a valid conclusion on this, but since this is all we have, we provide the below information.

The above table highlights the large performance differences between the Fund Class I Shares and the benchmark in any given year. The IQR Fund is unique in its strategy (more on this in the next section titled “IQR Fund’s Advantages”) and therefore divergences from the benchmark are to be expected. 2017 was the inception year of the Fund and we consider this year the start-up phase. The Fund held an abnormally high 51% average cash balance as the Fund got off the ground, and therefore we exclude it from the below performance analysis. Starting at fiscal 2018 we consider the Fund’s performance illustrative.

The Fund’s Class I Shares trailing three-year performance is ahead of its benchmark, but still not up to our objective of the total return annualizing 6% real + inflation. We believe the IQR Fund is invested in a group of quality companies that have solid growth opportunities, generate attractive returns on equity and are available in the public markets at attractive prices (more on this in the “IQR Fund’s Positioning” part of the letter). We continue to have confidence that the prospective returns for the Fund will be satisfactory and we remain confident in obtaining the Fund’s investment objective.

Fiscal 2020 was a good illustration of the Fund’s advantages.

Most investment funds are fully invested. This implies that nearly all funds play the “relative” versus the “absolute” game. The goal for these funds is to do better than the benchmark. The IQR Fund’s objective is to do better than the benchmark and provide a satisfactory return over a full market cycle. We, at ACR, analyze and value businesses as a passion and for a living. We find it reasonable to believe that at times opportunities in the public markets are plentiful, hence you can invest nearly indiscriminately, and at times opportunities are scarce, hence you should be selective and hold cash in the absence of good investment opportunities. The benefit of this process implementation was highlighted in 2020. The Fund came into the March 2020 market selloff with approximately 28% of the Fund’s assets in cash and we were able to bring this cash balance down to high single digits during the depth of the March 2020 selloff. The approximate 20% of capital deployed during this period generated significant returns as the market rebounded from April through fiscal year end 2020.

| (b) | Balancing Concentration with Diversification |

Most investment funds own significantly more than 20 investments. This makes these investment vehicles more a closet index fund and less an active manager. Further, we wonder about the special insights that are possible over so many holdings. The IQR Fund strives to invest in a select group of approximately 20 companies that we know well. This level of knowledge proved vital this year as the Covid-19 pandemic created a recession and business environment without a historical parallel. No longer could an investment manager refer to the last recession and extrapolate those outcomes for each business to this Covid-19 environment. If you did not intimately know your investments and did not understand their end markets and competitive positions, you probably made incorrect investment decisions or were late making potentially correct ones. The IQR Fund was quickly able to sell (Embraer), add to (most of the portfolio) and newly acquire (G4S, Ashtead and Thales) investments. We believe that without our intimate knowledge of our investments and of several companies we have been following for a long time we would not have had the conviction to deploy 20% of the Fund’s capital during this uncertain Covid-19 period.

| (c) | Ability to Invest Across Market Capitalization Ranges |

It is a tremendous advantage for the Fund to be able to invest in any company regardless of market cap size. The Fund’s investment in a sub $500 million market cap company was the biggest contributor to returns in fiscal 2020. Two new investments during the Covid-19 induced market selloff were in the $10 billion market cap range and the other new investment in fiscal 2020 was in the sub $2 billion range. At fiscal year-end 2020, the Fund’s three largest market cap companies (average market cap of approximately $39 billion) had an average price-to-value (P/V) of 0.66 versus 0.76 for the entire portfolio. Hence, the largest contributor to performance in 2020 was a small cap, two out of the three new purchases in fiscal 2020 were from the mid cap space and the three largest companies in the portfolio are cheaper than the overall portfolio and are expected to drive the Fund’s future performance.

| (d) | Focus on Long Term Fundamentals |

In the short run, market prices can move up and down for any number of reasons. In the long run, however, equity total returns appear to approximate the dividends paid out and the growth in earnings per share (i.e., fundamentals). The oddity about markets is that nearly everyone can agree that fundamentals like dividends and earnings per share growth matter, but market participants appear to disagree on when these fundamentals should be reflected in prices. This dynamic can create market prices that diverge wildly from underlying fundamentals and has created a market that appears increasingly myopic, focused on speculating in stocks based on potential short-term outcomes. The IQR Fund does not play these short-term speculation games. Instead, we focus on investing shareholder (and our own) capital in businesses that should generate satisfactory long-term returns. The benefit of this process implementation was also highlighted in 2020. We deployed capital in businesses that were negatively impacted by the Covid-19 pandemic and whose short-term corporate performance would be uncertain. Exactly the type of companies the myopic market appeared interested in selling at nearly any price. We were, and are, confident in making these investment decisions because we know the companies well and have validated their investment quality under various scenarios. The timing of when the market prices of our investments will approximately reflect the value we ascribe to them is always uncertain, but the Fund’s strong absolute and relative performance since April 2020 validates our approach. As we will discuss in the IQR Fund’s Positioning section, we continue to have confidence in satisfactory forward going absolute and relative returns as well.

| III. | Global Macro and Market Overview |

The current global macro environment is one of extremes. The IMF’s October 2020 World Economic Outlook projected global GDP growth at -4.4% for 2020, the lowest growth since the Second World War. Governments reacted quickly to the Covid-19 pandemic by providing large fiscal stimulus in the form of grants to businesses, tax payment holidays, low-cost loans, wage payments, spending on growth projects (e.g., infrastructure, green initiatives) and direct cash payments to individuals. These measures were needed to keep global GDP growth from becoming more negative, but the cost of these measures has been higher debt balances. Global debt balances are now at a historical high.

The fiscal stimulus was, and perhaps remains, necessary but the levels of debt leave less room to maneuver for future potential crises. Will current debt balances be manageable if interest rates rise? Will markets decide at some point that debt balances are too high? Can government programs last long enough to create a soft landing for the economy or could an increase in business bankruptcies and payment delinquencies lead to a more traditional recession post the Covid-19 induced recession? Could inflation return and create havoc in global bond markets? Could increased inequality cause further social unrest? We do not know. We believe, however, that with interest rates near zero globally and with high global debt balances the scope for monetary and fiscal policy intervention is diminished versus what it was before. We will repeat what we stated in our 2019 annual letter, we, at ACR, are not doomsayers and are firm believers in the continued increase in future living standards globally. We, however, do not stick our head in the sand when thinking about the macro backdrop. We acknowledge that risks remain high.

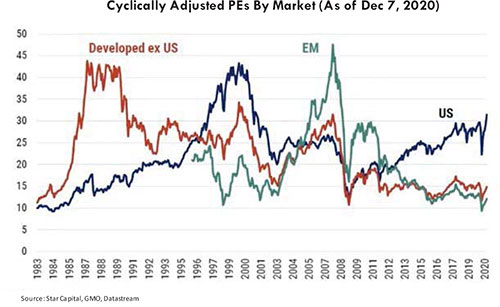

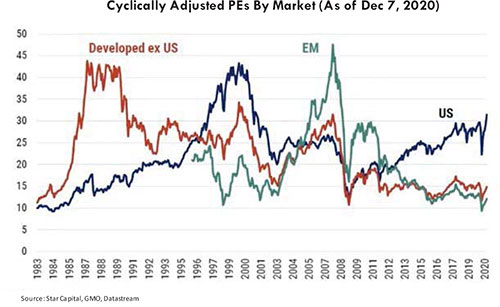

With a backdrop of high uncertainty, we view the global opportunity set as fully valued to overvalued. The U.S. market appears overvalued versus its own valuation history as we have found no reason to believe that U.S. growth is set to be greater than it was in the past. The developed markets ex the U.S., to us, appear approximately fully valued as there are indications that the lower growth environment of the past decade will continue. Lower levels of productivity and lower growth in the working age population (in many countries this is negative) warrant a cyclically adjusted price to earnings (PE) ratio near the bottom of the historical range.

The global markets excluding the U.S. appear reasonably valued but perhaps less attractive considering the state of the global macro environment. Thankfully, the IQR Fund has many advantages (discussed in a prior section) and we believe the Fund is positioned to perform well from an absolute and relative perspective in the future.

| IV. | IQR Fund’s Positioning |

The IQR Fund is well suited for the current environment with investments in a select group of quality companies available at attractive prices. The Fund managed to decrease its cash balance from approximately 28% at the start of fiscal year 2020 to end the year with a cash balance of approximately 18%. More importantly, the Fund generated a 20.23% return in fiscal 2020 and only saw its portfolio P/V increase from approximately 0.71 at fiscal year-end 2019 to 0.76 at the 2020 fiscal year end. In other words, the Fund generated a strong return in fiscal 2020 but still managed to become more invested and retain an overall portfolio with a sizeable discount to our estimate of fair value. A satisfactory discount to our estimate of value underpins our confidence in generating a satisfactory forward going return.

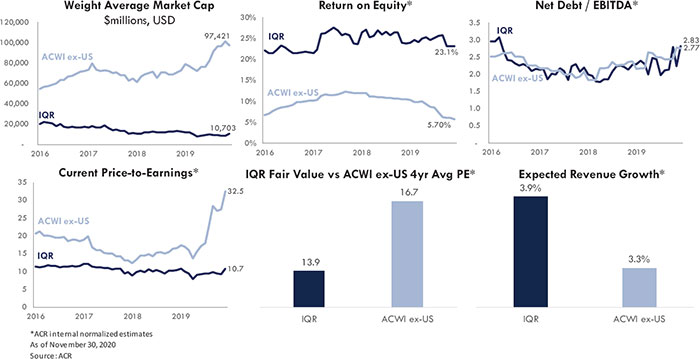

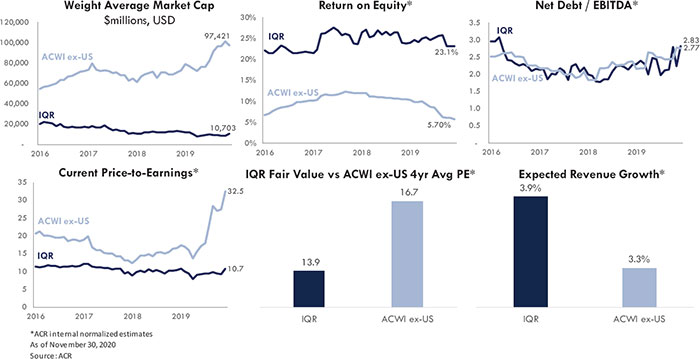

The Fund accomplished the solid fiscal 2020 return while retaining an attractive forward going portfolio by being opportunistic during the March 2020 market selloff and being highly selective in the normal course of business. The IQR Fund held 20 investments with the below weighted average statistics. Our all-cap mandate allows the Fund to be invested in several smaller cap companies where market prices appear more favorable. The Fund has similar debt leverage (net debt / EBITDA) and slightly higher normalized growth expectation than the benchmark but with a better return on equity (ROE) and at a much lower valuation. The quality of our companies gives us confidence in their resilience during a potentially volatile macro environment and the attractive fundamental statistics give us confidence in an attractive forward going absolute and relative investment return.

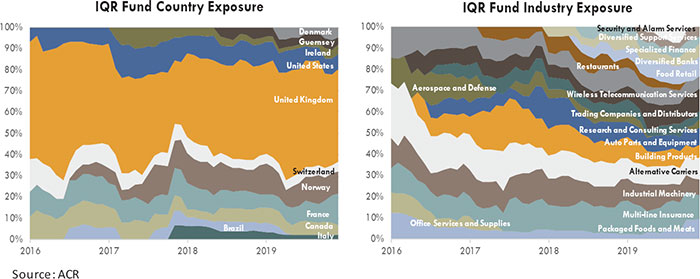

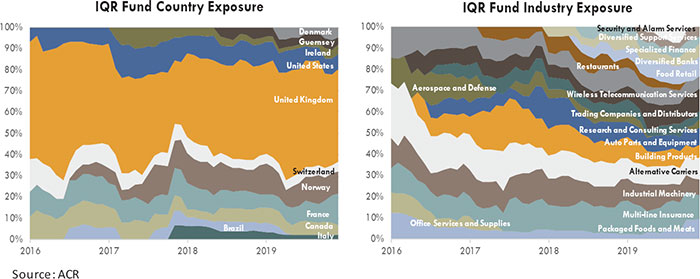

The Fund continues to balance concentration with diversification to accomplish the favorable portfolio statistics. The Fund has more concentration in one of the cheaper global markets (i.e., the U.K.) but remains significantly diversified across industries.

Fiscal 2020 highlighted the advantages of the Fund’s process and implementation. The Fund’s ability to hold cash, balancing concentration with diversification, investing across market capitalization ranges and focusing on long term fundamentals of businesses all contributed to the satisfactory absolute and relative fiscal 2020 performance. The current macro environment remains uncertain and market valuation levels approximate fair value, but we continue to believe the IQR advantages will bear fruit in the future as well. The Fund holds investments in a select group of companies with attractive absolute statistics and ones favorable to the Fund’s benchmark. In addition, the Fund holds approximately 18% in cash to take advantage of future opportunities as they arise. The Fund’s investment team looks towards the future with confidence in attaining the Fund’s investment objective.

Thank you for your continued trust,

The ACR Investment Team

Willem Schilpzand, CFA ®

Portfolio Manager

Appendix: Notes on the IQR Fund Investment Objectives

IQR Fund Investment Objective

“The IQR Fund’s investment objective is to protect capital from permanent impairment while providing a return above the Fund’s cost of capital and the Fund’s benchmark over a full market cycle.”

It is important to note that “providing a return above the Fund’s cost of capital and the Fund’s benchmark” are performance objectives the Fund expects to meet. We consider the “cost of capital” of the Fund to be approximately 6% real + inflation (the opportunity cost for our Fund shareholders). The Fund’s benchmark is the MSCI All Country World Index Ex-U.S. The timeframe of “over a full market cycle” remains purposefully undefined as market prices can vary widely from fundamental value over the short to medium term. The IQR Fund has no control over when prices start to converge towards underlying fundamental value (as determined by actual cash flows of companies), but history and corporate financial theory give us significant confidence that prices will eventually converge with value. This is the Fund’s advantage. We make the trade-off for short to medium term uncertainty for the opportunity to outperform over the longer term (i.e., “a full market cycle”). “Protect capital from permanent impairment” is a philosophical objective that signals to Fund shareholders that the IQR Fund is resolutely focused on risk and will not allocate capital (i.e., will build a cash balance) in the absence of satisfactory risk/reward investment opportunities. This is a similar methodology to what private equity firms deploy, but IQR executes this strategy in the public markets. “Risk” does not mean volatility as the IQR Fund portfolio is expected to move around similarly to markets, but “risk” means taking equity risk and not getting an equity like return over a sufficiently long investment period.

Appendix: ACR’s Investment Principles

Investment Principles

Intrinsic value and risk is our focus when evaluating investments

Intrinsic (or fundamental) value is the cash generated by an enterprise or asset over its useful life. Intrinsic value is earned in the future as dividends, interest, and principal are paid or as retained earnings are successfully reinvested.

Risk is the likelihood and potential magnitude of a permanent decline in the earning power or asset value of an enterprise, or the payment of a market price at purchase which is higher than intrinsic value. Our objective is to mitigate risk through integrity with our investment principles and investment process excellence.

When buying, we never confuse intrinsic value with market price. Market price is what we pay. Intrinsic value is what we get. Market price may be found quoted daily from news services or ascertained from past transaction records. Intrinsic value is determined by enterprise cash flows.

Market price, it follows, is not a barometer we would use to evaluate corporate performance. Our evaluation of corporate performance is based on items such as income, assets, and return on capital. We view the price of a security simply as a record of what others – well informed or not – were willing to pay for it at various times in the past.

Intrinsic value is such a critical concept because it is the only reference point for what an investment is actually worth, and therefore, whether or not the market price is fair, high, or low. Two facts support this view. First, the theoretical point that an investment is worth the present value of its future cash flows is self-evident and undisputed. Second, new era theories that have driven market prices to speculative levels in the short run have always succumbed to intrinsic value in the long run.

We insist on quality with a margin of safety

The quality of a security is defined by the reliability of the cash flows or assets which comprise its intrinsic value. The quality of an investment is defined by the price paid for the intrinsic value received.

A quantifiable margin of safety is the hallmark of a quality investment. For higher rated fixed income investments, an issuer’s available resources must be significantly greater than the interest and principal due the investor. For lower rated fixed income investments selling below their principal value, the assets backing an issue must be significantly greater than its price. For equity investments, the intrinsic value of a company must be significantly greater than its price. For other types of investments and as a general rule, the probability of achieving a return commensurate with the risk taken must be very high.

We only invest in what we understand

True understanding is built upon high probability statements about security values. It requires a dogged determination to get to the bottom of things and an equally dogged honesty about whether or not we did.

Understanding is also relative. Achieving better-than-average returns requires understanding security values better-than-average. The problem is most investment managers believe they are better-than-average.

Competence and honesty are the keys to assuring that we are not fooling ourselves. Competence means that we are capable of estimating security values and returns for both our portfolios and the markets in which we participate. Honesty means that we are candid about our relative return advantage or lack thereof, and only commit capital when we have an advantage.

Diversification and concentration are balanced with knowledge

Proper diversification is paramount to quality at the portfolio level. Proper diversification is achieved when the overall portfolio return is protected from unexpected adverse results in individual holdings, industries, countries, or other risk factors.

Proper concentration can be risk reducing as well as value enhancing. Concentration refers to making greater commitments to more attractive investments. The greater the difference between intrinsic value and market price, the more robust our knowledge of an investment’s value, and the lower the risk of the investment, the more capital we are willing to concentrate in that investment.

Successfully executed, concentration has three benefits: (a) returns are enhanced by selecting investments with the highest probability of success, (b) risk is reduced by avoiding mediocre and poor commitments, and (c) knowledge is improved by concentrating the analytical effort.

A concentrated portfolio with fewer holdings is desirable when value-to-price, understanding, and quality are high. A low-cost, more widely diversified approach to a market is appropriate when there are no clear advantages in understanding, and therefore, in our ability to evaluate quality or estimate value-to-price.

Communication is essential for intelligent investor decision-making

One of the greatest risks investors face is selling low in a panic. Education and communication can greatly reduce this risk. We explain to investors the difference between intrinsic and market value and openly share the rationale behind our investment decision-making. We believe this significantly reduces the risk of investors selling at market bottoms or buying at market tops.

Communication is also important for evaluating an investment manager’s abilities. Luck, risk, and a bull market can make an incompetent manager look brilliant. Conversely, every brilliant manager will under-perform at some time, and usually this is the best time to invest with them. Investors must look beyond performance to evaluate manager competence. To aid current and prospective investors in this endeavor, we regularly discuss the strategy and holdings behind our performance, and candidly address both our successes and mistakes.

The views in this letter were as of November 30th, 2020 and may not necessarily reflect the same views on the date this letter is first published or any time thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice.

ACR Multi-Strategy Quality Return (MQR) Fund

FUND PERFORMANCE at November 30, 2020 (Unaudited)

This graph compares a hypothetical $10,000 investment in the Fund’s Class I shares, made at its inception, with a similar investment in the HFRI Equity Hedge (Total) Index and the MSCI ACWI Index. The performance graph above is shown for the Fund Class I shares, Class A shares performance may vary. Results include the reinvestment of all dividends and capital gains.

HFRI Equity Hedge Index consists of Investment Managers who maintain positions both long and short in primarily equity and equity derivative securities.

MSCI ACWI Index captures large and mid cap representation across 23 Developed Markets (DM) and 23 Emerging Markets (EM) countries. With 2,469 constituents, the index covers approximately 85% of the global investable equity opportunity set.

These indices do not reflect expenses, fees or sales charge, which would lower performance. The indices are unmanaged and they are not available for investment.

| Average Annual Total Returns as of November 30, 2020 | 1 Year | 5 Years | Since Inception | Inception Date |

| Before deducting maximum sales charge | | | | |

| Class A1 | 13.76% | 5.25% | 4.14% | 12/31/14 |

| Class I | 13.91% | 5.45% | 4.32% | 12/31/14 |

| After deducting maximum sales charge | | | | |

| Class A1 | 7.24% | 4.01% | 3.10% | 12/31/14 |

| HFRI Equity Hedge (Total) Index | 14.72% | 6.90% | 5.83% | 12/31/14 |

| MSCI ACWI Index | 15.58% | 11.44% | 9.57% | 12/31/14 |

| ¹ | Maximum sales charge for Class A shares is 5.75%. |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (855) 955-9552.

ACR Multi-Strategy Quality Return (MQR) Fund

FUND PERFORMANCE at November 30, 2020 (Unaudited) - Continued

Gross and net expense ratios for Class A shares were 1.91% and 1.52%, respectively, and for Class I shares were 1.70% and 1.31%, respectively, which were the amounts stated in the current prospectus dated April 1, 2020. For the Fund’s current one-year expense ratios, please refer to the Financial Highlights. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 1.40% and 1.25% of the average daily net assets of Class A and Class I shares of the Fund, respectively. This agreement is in effect until March 31, 2021, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would be lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Shares redeemed within 90 days of purchase will be charged 2.00% redemption fee.

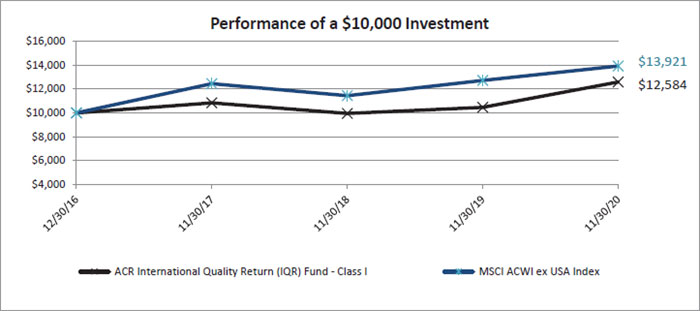

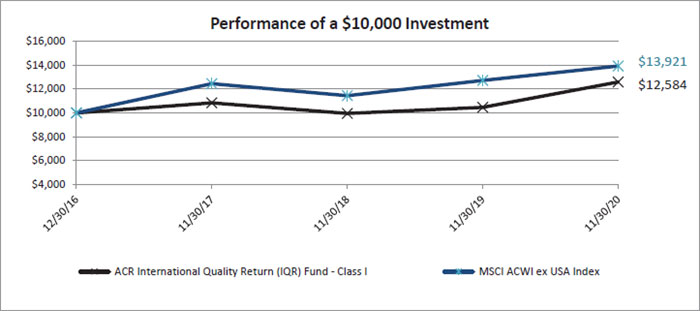

ACR International Quality Return (IQR) Fund

FUND PERFORMANCE at November 30, 2020 (Unaudited)

This graph compares a hypothetical $10,000 investment in the Fund’s Class I shares, made at its inception, with a similar investment in the MSCI ACWI ex USA Index. The performance graph above is shown for the Fund Class I shares, Class A shares performance may vary. Results include the reinvestment of all dividends and capital gains.

The MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 Developed Markets (DM) countries (excluding the US) and 24 Emerging Markets (EM) countries. With 1,866 constituents, the index covers approximately 85% of the global equity opportunity set outside the US.

This index does not reflect expenses, fees or sales charge, which would lower performance. The index is unmanaged and it is not available for investment.

Average Annual Total Returns as of November 30, 2020 | 1 Year | 3 Years | Since

Inception | Inception Date |

Before deducting maximum sales charge Class A1 | 19.99% | 4.94% | 5.87% | 12/30/16 |

| Class I | 20.23% | 5.10% | 6.04% | 12/30/16 |

After deducting maximum sales charge Class A1 | 13.09% | 2.89% | 4.28% | 12/30/16 |

| MSCI ACWI ex USA Index | 9.52% | 3.82% | 8.81% | 12/30/16 |

| ¹ | Maximum sales charge for Class A shares is 5.75%. |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (855) 955-9552.

ACR International Quality Return (IQR) Fund

FUND PERFORMANCE at November 30, 2020 (Unaudited) - Continued

Gross and net expense ratios for Class A shares were 2.41% and 1.37%, respectively, and for Class I shares were 2.26% and 1.22%, respectively, which were the amounts stated in the current prospectus dated April 1, 2020. For the Fund’s current one-year expense ratios, please refer to the Financial Highlights. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 1.40% and 1.25% of the average daily net assets of Class A and Class I shares of the Fund, respectively. This agreement is in effect until March 31, 2021, and it may be terminated before that date only by the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would be lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Shares redeemed within 90 days of purchase will be charged 2.00% redemption fee.

ACR Multi-Strategy Quality Return (MQR) Fund

SCHEDULE OF INVESTMENTS

As of November 30, 2020

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS — 97.9% | | | | |

| | | | | COMMUNICATIONS — 16.4% | | | | |

| | 112,000 | | | CenturyLink, Inc.1 | | $ | 1,170,400 | |

| | 80,000 | | | Liberty Global PLC - Class C*1,2 | | | 1,731,200 | |

| | 61,000 | | | Liberty Latin America Ltd. - Class C*2 | | | 689,910 | |

| | 110,000 | | | Vodafone Group PLC - ADR1 | | | 1,823,800 | |

| | | | | | | | 5,415,310 | |

| | | | | | | | | |

| | | | | CONSUMER DISCRETIONARY — 20.9% | | | | |

| | 61,000 | | | Cie Plastic Omnium S.A. | | | 2,101,135 | |

| | 52,000 | | | General Motors Co.1 | | | 2,279,680 | |

| | 67,000 | | | Howden Joinery Group PLC* | | | 560,751 | |

| | 22,500 | | | Lennar Corp. | | | 1,365,750 | |

| | 9,750 | | | Magna International, Inc.2 | | | 598,845 | |

| | | | | | | | 6,906,161 | |

| | | | | | | | | |

| | | | | CONSUMER STAPLES — 5.8% | | | | |

| | 260,000 | | | Greencore Group PLC | | | 404,125 | |

| | 198,000 | | | Naked Wines PLC | | | 1,525,716 | |

| | | | | | | | 1,929,841 | |

| | | | | | | | | |

| | | | | ENERGY — 7.2% | | | | |

| | 13,454 | | | Chevron Corp. | | | 1,172,920 | |

| | 246,676 | | | Comstock Resources, Inc.* | | | 1,201,312 | |

| | | | | | | | 2,374,232 | |

| | | | | | | | | |

| | | | | FINANCIALS — 33.0% | | | | |

| | 15,000 | | | Affiliated Managers Group, Inc. | | | 1,306,800 | |

| | 220,000 | | | Barclays PLC - ADR*1 | | | 1,566,400 | |

| | 100,753 | | | Burford Capital Ltd. | | | 1,004,709 | |

| | 26,980 | | | Citigroup, Inc.1 | | | 1,485,788 | |

| | 2,900 | | | Fairfax Financial Holdings Ltd.1,2 | | | 994,294 | |

| | 73,000 | | | Jefferies Financial Group, Inc.1 | | | 1,659,290 | |

| | 30,000 | | | Kingstone Cos., Inc. | | | 198,900 | |

| | 40,000 | | | Power Corp. of Canada | | | 900,593 | |

| | 328,847 | | | Protector Forsikring A.S.A.* | | | 1,806,598 | |

| | | | | | | | 10,923,372 | |

| | | | | | | | | |

| | | | | INDUSTRIALS — 5.5% | | | | |

| | 17,000 | | | Ashtead Group PLC | | | 717,547 | |

| | 40,000 | | | ISS A/S* | | | 729,357 | |

| | 7,000 | | | SPX FLOW, Inc.*1 | | | 375,060 | |

| | | | | | | | 1,821,964 | |

| | | | | | | | | |

| | | | | MATERIALS — 5.3% | | | | |

| | 510,000 | | | Eurocell PLC* | | | 1,489,001 | |

ACR Multi-Strategy Quality Return (MQR) Fund

SCHEDULE OF INVESTMENTS - Continued

As of November 30, 2020

Number

of Shares | | | | | Value | |

| | | | COMMON STOCKS (Continued) | | | |

| | | | MATERIALS (Continued) | | | |

| | 48,000 | | | Resolute Forest Products, Inc.*1 | | $ | 263,040 | |

| | | | | | | | 1,752,041 | |

| | | | | | | | | |

| | | | | REAL ESTATE — 3.8% | | | | |

| | 17,000 | | | Howard Hughes Corp.* | | | 1,236,410 | |

| | | | | TOTAL COMMON STOCKS | | | | |

| | | | | (Cost $32,295,073) | | | 32,359,331 | |

| | | | | PREFERRED STOCKS — 1.3% | | | | |

| | | | | ENERGY — 1.3% | | | | |

| | 3,357 | | | Elk Petroleum, Inc. Series A3,4,5 | | | 136,560 | |

| | 3,073 | | | Elk Petroleum, Inc. Series B3,4,5 | | | 292,629 | |

| | | | | | | | 429,189 | |

| | | | | | | | | |

| | | | | TOTAL PREFERRED STOCKS | | | | |

| | | | | (Cost $3,357,427) | | | 429,189 | |

| | | | | SHORT-TERM INVESTMENTS — 0.3% | | | | |

| | 106,203 | | | Federated Treasury Obligations Fund - Institutional Class, 0.01%6 | | | 106,203 | |

| | | | | TOTAL SHORT-TERM INVESTMENTS | | | | |

| | | | | (Cost $106,203) | | | 106,203 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS — 99.5% | | | | |

| | | | | (Cost $35,758,703) | | | 32,894,723 | |

| | | | | Other Assets in Excess of Liabilities — 0.5% | | | 175,934 | |

| | | | | TOTAL NET ASSETS — 100.0% | | $ | 33,070,657 | |

| | | | | SECURITIES SOLD SHORT — (1.4)% | | | | |

| | | | | EXCHANGE-TRADED FUNDS — (1.4)% | | | | |

| | (2,500 | ) | | iShares Russell 2000 ETF | | | (452,550 | ) |

| | | | | TOTAL EXCHANGE-TRADED FUNDS | | | | |

| | | | | (Proceeds $382,871) | | | (452,550 | ) |

| | | | | TOTAL SECURITIES SOLD SHORT | | | | |

| | | | | (Proceeds $382,871) | | $ | (452,550 | ) |

| ADR – American Depository Receipt |

| ETF – Exchange-Traded Fund |

| PLC – Public Limited Company |

| * | Non-income producing security. |

| 1 | All or a portion of this security is segregated as collateral for securities sold short. The market value of the securities pledged as collateral was $9,940,471, which represents 30.06% of total net assets of the Fund. |

| 2 | Foreign security denominated in U.S. Dollars. |

| 3 | Level 3 securities fair valued under procedures established by the Board of Trustees, represent 1.3% of Net Assets. The aggregate value of these securities is $429,189. |

| 4 | Security in a privately owned company. |

| 6 | The rate is the annualized seven-day yield at period end. |

See accompanying Notes to Financial Statements.

ACR Multi-Strategy Quality Return (MQR) Fund

SUMMARY OF INVESTMENTS

As of November 30, 2020

| Security Type/Industry | Percent of Total

Net Assets |

| Common Stocks | |

| Financials | 33.0% |

| Consumer Discretionary | 20.9% |

| Communications | 16.4% |

| Energy | 7.2% |

| Consumer Staples | 5.8% |

| Industrials | 5.5% |

| Materials | 5.3% |

| Real Estate | 3.8% |

| Total Common Stocks | 97.9% |

| Preferred Stocks | 1.3% |

| Short-Term Investments | 0.3% |

| Total Investments | 99.5% |

| Other Assets in Excess of Liabilities | 0.5% |

| Total Net Assets | 100.0% |

See accompanying Notes to Financial Statements.

ACR International Quality Return (IQR) Fund

SCHEDULE OF INVESTMENTS

As of November 30, 2020

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS — 82.2% | | | | |

| | | | | CANADA — 3.8% | | | | |

| | 3,353 | | | Fairfax Financial Holdings Ltd. | | $ | 1,149,939 | |

| | | | | | | | | |

| | | | | DENMARK — 3.8% | | | | |

| | 62,886 | | | ISS A/S* | | | 1,146,658 | |

| | | | | | | | | |

| | | | | FRANCE — 12.0% | | | | |

| | 43,142 | | | Cie Plastic Omnium S.A. | | | 1,486,019 | |

| | 18,659 | | | Danone S.A. | | | 1,203,273 | |

| | 10,567 | | | Thales S.A. | | | 968,483 | |

| | | | | | | | 3,657,775 | |

| | | | | | | | | |

| | | | | IRELAND — 3.8% | | | | |

| | 734,724 | | | Greencore Group PLC | | | 1,142,001 | |

| | | | | | | | | |

| | | | | ITALY — 1.9% | | | | |

| | 44,885 | | | Brembo S.p.A.* | | | 581,149 | |

| | | | | | | | | |

| | | | | NORWAY — 8.8% | | | | |

| | 72,887 | | | Multiconsult A.S.A.*1 | | | 1,042,666 | |

| | 295,370 | | | Protector Forsikring A.S.A.* | | | 1,622,684 | |

| | | | | | | | 2,665,350 | |

| | | | | SWITZERLAND — 3.5% | | | | |

| | 10,778 | | | Sulzer A.G. | | | 1,079,217 | |

| | | | | | | | | |

| | | | | UNITED KINGDOM — 41.7% | | | | |

| | 28,661 | | | Ashtead Group PLC | | | 1,209,742 | |

| | 213,426 | | | Barclays PLC - ADR* | | | 1,519,593 | |

| | 82,715 | | | Burford Capital Ltd. | | | 824,834 | |

| | 504,684 | | | Eurocell PLC* | | | 1,473,481 | |

| | 167,511 | | | Howden Joinery Group PLC* | | | 1,401,970 | |

| | 73,021 | | | Liberty Global PLC - Class C*2 | | | 1,580,174 | |

| | 83,848 | | | Liberty Latin America Ltd. - Class C*2 | | | 948,321 | |

| | 300,177 | | | Naked Wines PLC | | | 2,313,056 | |

| | 83,230 | | | Vodafone Group PLC - ADR | | | 1,379,953 | |

| | | | | | | | 12,651,124 | |

| | | | | | | | | |

| | | | | UNITED STATES — 2.9% | | | | |

| | 16,301 | | | SPX FLOW, Inc.* | | | 873,408 | |

| | | | | TOTAL COMMON STOCKS | | | | |

| | | | | (Cost $20,645,943) | | | 24,946,621 | |

ACR International Quality Return (IQR) Fund

SCHEDULE OF INVESTMENTS - Continued

As of November 30, 2020

Number

of Shares | | | | | Value | |

| | | | | SHORT-TERM INVESTMENTS — 17.8% | | | | |

| | 5,392,000 | | | Federated Treasury Obligations Fund - Institutional Class, 0.01%3 | | $ | 5,392,000 | |

| | | | | TOTAL SHORT-TERM INVESTMENTS | | | | |

| | | | | (Cost $5,392,000) | | | 5,392,000 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS — 100.0% | | | | |

| | | | | (Cost $26,037,943) | | | 30,338,621 | |

| | | | | Liabilities in Excess of Other Assets — (0.0)% | | | (3,428 | ) |

| | | | | TOTAL NET ASSETS — 100.0% | | $ | 30,335,193 | |

| ADR – American Depository Receipt |

| PLC – Public Limited Company |

| * | Non-income producing security. |

| 1 | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities are restricted and may be resold in transactions exempt from registration normally to qualified institutional buyers. The total value of these securities is $1,042,666 which represents 3.4% of Net Assets. |

| 2 | Foreign security denominated in U.S. Dollars. |

| 3 | The rate is the annualized seven-day yield at period end. |

See accompanying Notes to Financial Statements.

ACR International Quality Return (IQR) Fund

SUMMARY OF INVESTMENTS

As of November 30, 2020

| Security Type/Industry | Percent of Total

Net Assets |

| Common Stocks | |

| Industrials | 20.8% |

| Financials | 16.9% |

| Consumer Staples | 15.3% |

| Communications | 12.9% |

| Consumer Discretionary | 11.4% |

| Materials | 4.9% |

| Total Common Stocks | 82.2% |

| Short-Term Investments | 17.8% |

| Total Investments | 100.0% |

| Liabilities in Excess of Other Assets | (0.0)% |

| Total Net Assets | 100.0% |

See accompanying Notes to Financial Statements.

STATEMENTS OF ASSETS AND LIABILITIES

As of November 30, 2020

| | | ACR Multi-Strategy Quality Return (MQR) Fund | | | ACR International Quality Return (IQR) Fund | |

| Assets: | | | | | | |

| Investments, at value (cost $35,758,703 and $26,037,943, respectively) | | $ | 32,894,723 | | | $ | 30,338,621 | |

| Cash | | | - | | | | 23,719 | |

| Cash deposited with broker for securities sold short | | | 530,862 | | | | - | |

| Receivables: | | | | | | | | |

| Investment securities sold | | | 151,968 | | | | - | |

| Fund shares sold | | | 20 | | | | - | |

| Dividends and interest | | | 49,871 | | | | 21,037 | |

| Prepaid expenses | | | 18,838 | | | | 18,786 | |

| Total assets | | | 33,646,282 | | | | 30,402,163 | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Securities sold short, at value (proceeds $382,871 and $0, respectively) | | | 452,550 | | | | - | |

| Payables: | | | | | | | | |

| Fund shares redeemed | | | 31,050 | | | | 5,525 | |

| Advisory fees | | | 5,110 | | | | 2,750 | |

| Shareholder servicing fees (Note 8) | | | 3,112 | | | | 2,838 | |

| Distribution fees - Class A (Note 7) | | | 855 | | | | 9 | |

| Fund administration and accounting fees | | | 15,200 | | | | 12,370 | |

| Transfer agent fees and expenses | | | 9,595 | | | | 5,536 | |

| Custody fees | | | 4,247 | | | | 1,420 | |

| Trustees' deferred compensation (Note 3) | | | 16,729 | | | | 15,882 | |

| Auditing fees | | | 15,022 | | | | 15,001 | |

| Legal fees | | | 6,538 | | | | 2,981 | |

| Chief Compliance Officer fees | | | 2,384 | | | | 1,128 | |

| Trustees' fees and expenses | | | 1,432 | | | | 277 | |

| Interest expense | | | 899 | | | | - | |

| Due to broker | | | - | | | | 22 | |

| Accrued other expenses | | | 10,902 | | | | 1,231 | |

| Total Liabilities | | | 575,625 | | | | 66,970 | |

| | | | | | | | | |

| Net Assets | | $ | 33,070,657 | | | $ | 30,335,193 | |

| | | | | | | | | |

| Components of Net Assets: | | | | | | | | |

| Paid-in capital (par value of $0.01 per share with an unlimited number of shares authorized) | | $ | 36,099,812 | | | $ | 26,400,444 | |

| Total distributable earnings (accumulated deficit) | | | (3,029,155 | ) | | | 3,934,749 | |

| Net Assets | | $ | 33,070,657 | | | $ | 30,335,193 | |

| | | | | | | | | |

| Maximum Offering Price per Share: | | | | | | | | |

| Class A Shares: | | | | | | | | |

| Net assets applicable to shares outstanding | | $ | 4,355,888 | | | $ | 6,251 | |

| Shares of beneficial interest issued and outstanding | | | 385,284 | | | | 515 | |

| Redemption price per share | | | 11.31 | | | | 12.13 | |

| Maximum sales charge (5.75% of offering price)* | | | 0.69 | | | | 0.74 | |

| Maximum offering price to public | | $ | 12.00 | | | $ | 12.87 | |

| Class I Shares: | | | | | | | | |

| Net assets applicable to shares outstanding | | $ | 28,714,769 | | | $ | 30,328,942 | |

| Shares of beneficial interest issued and outstanding | | | 2,522,555 | | | | 2,498,866 | |

| Redemption price per share | | $ | 11.38 | | | $ | 12.14 | |

| * | On sales of $25,000 or more, the sales charge will be reduced and no initial sales charge is applied to purchases of $1 million or more. |

See accompanying Notes to Financial Statements.

STATEMENTS OF OPERATIONS

For the Year Ended November 30, 2020

| | | ACR Multi-Strategy Quality Return (MQR) Fund | | | ACR International Quality Return (IQR) Fund | |

| Investment income: | | | | | | |

| Dividends (net of foreign withholdings taxes of $31,128 and $18,490, respectively) | | $ | 699,701 | | | $ | 197,953 | |

| Interest | | | 28,697 | | | | 27,670 | |

| Total investment income | | | 728,398 | | | | 225,623 | |

| | | | | | | | | |

| Expenses: | | | | | | | | |

| Advisory fees | | | 410,906 | | | | 225,232 | |

| Shareholder servicing fees - Class I (Note 8) | | | 25,799 | | | | 20,232 | |

| Shareholder servicing fees - Class A (Note 8) | | | 943 | | | | - | |

| Distribution fees - Class A (Note 7) | | | 11,783 | | | | 12 | |

| Fund administration and accounting fees | | | 101,254 | | | | 83,838 | |

| Trustees' fees and expenses | | | 16,512 | | | | 15,135 | |

| Legal fees | | | 76,743 | | | | 15,768 | |

| Transfer agent fees and expenses | | | 47,115 | | | | 39,112 | |

| Dividends on securities sold short | | | 44,101 | | | | - | |

| Registration fees | | | 28,186 | | | | 32,202 | |

| Custody fees | | | 16,674 | | | | 25,602 | |

| Auditing fees | | | 15,001 | | | | 15,001 | |

| Shareholder reporting fees | | | 14,230 | | | | 4,845 | |

| Interest expense | | | 13,296 | | | | - | |

| Chief Compliance Officer fees | | | 11,264 | | | | 8,989 | |

| Miscellaneous | | | 7,053 | | | | 7,194 | |

| Insurance fees | | | 3,660 | | | | 3,192 | |

| Total expenses | | | 844,520 | | | | 496,354 | |

| Advisory fees waived | | | (289,883 | ) | | | (222,043 | ) |

| Fees paid indirectly (Note 3) | | | (6,717 | ) | | | (6,309 | ) |

| Net expenses | | | 547,920 | | | | 268,002 | |

| Net investment income (loss) | | | 180,478 | | | | (42,379 | ) |

| | | | | | | | | |

| Realized and Unrealized Gain (Loss): | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments | | | (449,848 | ) | | | 52,477 | |

| Securities sold short | | | 333,071 | | | | - | |

| Written options contracts | | | 42,994 | | | | - | |

| Foreign currency transactions | | | (1,926 | ) | | | (9,223 | ) |

| Net realized gain (loss) | | | (75,709 | ) | | | 43,254 | |

| Net change in unrealized appreciation/depreciation on: | | | | | | | | |

| Investments | | | 197,726 | | | | 4,875,694 | |

| Securities sold short | | | 367,858 | | | | - | |

| Foreign currency translations | | | (32 | ) | | | 1,621 | |

| Net change in unrealized appreciation/depreciation | | | 565,552 | | | | 4,877,315 | |

| Net increase from reimbursement by affiliates (Note 3) | | | - | | | | 4,202 | |

| Net realized and unrealized gain | | | 489,843 | | | | 4,924,771 | |

| | | | | | | | | |

| Net Increase in Net Assets from Operations | | $ | 670,321 | | | $ | 4,882,392 | |

See accompanying Notes to Financial Statements.

ACR Multi-Strategy Quality Return (MQR) Fund

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the

Year Ended

November 30, 2020 | | | For the

Year Ended