UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

INVESTMENT MANAGERS SERIES TRUST II

(Exact name of registrant as specified in charter)

235 W. Galena Street

Milwaukee, WI 53212

(Address of principal executive offices) (Zip code)

Diane J. Drake

Mutual Fund Administration, LLC

2220 E. Route 66, Suite 226

Glendora, CA 91740

(Name and address of agent for service)

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders.

(a) The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Act”), is as follows:

AXS

Adaptive Plus Fund

AXSPX

ANNUAL SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the AXS Adaptive Plus Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.axsinvestments.com/axspx/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Ticker) | | | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

AXS Adaptive Plus Fund

(AXSPX) | | | $220 | 1.99% |

Management's Discussion of Fund Performance

HOW DID THE FUND PERFORM?

Class I shares of the Fund (AXSPX) returned 21.42% for the fiscal year.

As an indexed-based strategy, the Fund is designed to replicate the performance of the Profit Score Regime Adaptive Long/Short Equity Index (“PSRAE”). The Index reflects the returns of a highly liquid, systematic trading program that invests long the S&P 500 or Nasdaq 100 futures, short the S&P 500 futures or takes a defensive position in cash. The trading program is based on signals generated by ProfitScore’s proprietary research. These signals change depending on the current volatility regime.

The Fund invests in options and swaps designed to produce returns similar to the PSRAE index. The Fund does not invest more than 25% of its net assets with any one option counterparty or swap contract counterparty. To generate additional income, Fund’s assets not invested in options or swaps or used as collateral for such investments may be allocated to money market funds and/or U.S. Government securities, such as bills, notes and bonds issued by the U.S. Treasury, and/or other investment grade fixed income securities or fixed income ETFs.

Fund performance was in line with the ProfitScore Regime Adaptive Long/Short Equity Index gross performance of 19.52%. The Fund’s prospectus benchmark S&P 500 Total Return Index returned 36.35%.

WHAT AFFECTED FUND PERFORMANCE?

Fund performance is driven by: 1) the ProfitScore trading program, 2) the Fund’s efforts to track PSRAE index performance with its swap partner, and 3) the Fund’s investment of idle cash in short term treasuries and money market funds.

The ProfitScore trading program is proprietary. The signals it generated performed well against the S&P 500 in some months (December 2023, April 2024 and June 2024), and underperformed the S&P 500 in other months (November 2023, February 2024, July 2024 and August 2024).

Operationally, the Fund monitored the swap exposure on a daily basis throughout the year and modified exposure as necessary to ensure proper replication of the PSRAE index.

Finally, the Fund benefited from high treasury and money market yields throughout the year.

OUTLOOK

As unique index-based strategy, the AXS Adaptive Plus Fund is designed to give investors exposure to an institutional-level long/short equity futures strategy. Direct investment in such strategies have historically required large capital commitments and long lock-up periods in private hedge fund structures. Replication strategies using an open-end mutual fund structure address these hurdles by allowing lower investment minimums and offering daily liquidity.

Institutions have utilized long/short equity strategies as long-term strategic investments and we suggest the outlook for this strategy should undertake a similar approach.

We thank you for your continued support and confidence in our implementation of this strategy.

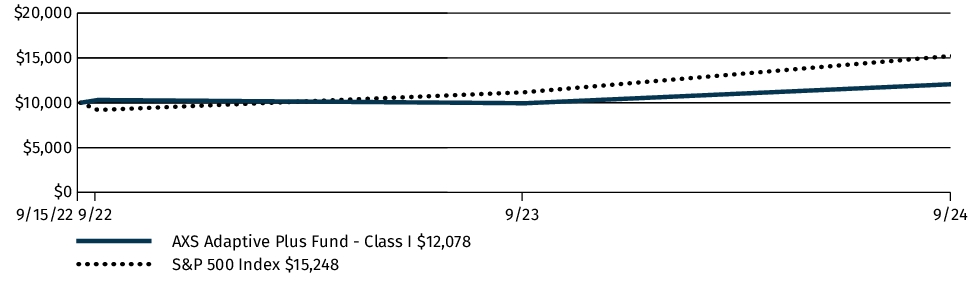

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | Since

Inception1 |

| AXS Adaptive Plus Fund (AXSPX) | 21.42% | 9.69% |

| S&P 500 Index | 36.35% | 22.96% |

| 1 | Class I shares commenced operations on September 15, 2022. |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $58,742,410 |

| Total number of portfolio holdings | 5 |

| Total advisory fees paid (net) | $719,459 |

| Portfolio turnover rate as of the end of the reporting period | 0% |

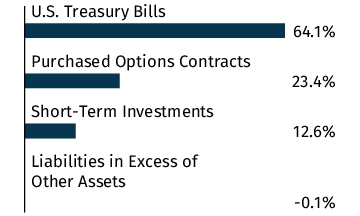

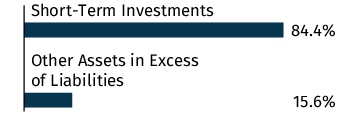

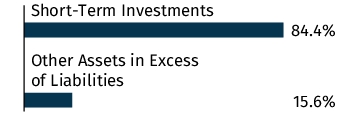

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings exclude short-term holdings, if any.

| United States Treasury Bill, 12/5/2024 | 23.6% |

| United States Treasury Bill, 2/6/2025 | 23.5% |

| Nomura Galaxy Option -ProfitScore Regime-Adaptive Equity Index, 12/15/2024 | 23.4% |

| United States Treasury Bill, 10/3/2024 | 17.0% |

Material Fund Changes

The Fund did not have any material changes that occurred since the beginning of the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.axsinvestments.com/axspx/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (833) 297-2587 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

AXS

Tactical Income Fund

Class A/TINAX

ANNUAL SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the AXS Tactical Income Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.axsinvestments.com/tinix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Ticker) | | | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

AXS Tactical Income Fund

(Class A/TINAX) | | | $209 | 2.01% |

Management's Discussion of Fund Performance

HOW DID THE FUND PERFORM?

The Fund is available in class A and I shares. For the fiscal year ended September 30, 2024, performance for the class A share was 7.51% (1.33% with load).

Fund performance trailed the Bloomberg Aggregate Bond Index performance of 11.57%. However, the Fund achieved its return at reduced volatility (3.1% standard deviation) and max drawdown (1.2%) compared to the Bloomberg Aggregate Bond Index (7.1% standard deviation, 3.1% max drawdown).

WHAT AFFECTED FUND PERFORMANCE?

The Fund is a tactical income fund that takes a systematic trading approach in the portfolio. Our goal is to actively participate in up-trending, income-oriented sectors while avoiding down-trending sectors. We exercise discretion in adjusting the allocation of investments to the various fixed income ETFs, with a focus on optimizing yield and performance with a reduction in overall volatility and drawdown.

The Fund ended the fiscal year diversified across ten bond sectors with a half of the holdings allocated to the high yield corporate bonds, investment grade corporate bonds and bank loans combined. The largest contributors to performance for the fiscal year include SPDR Barclays Convertible Securities ETF, iShares 20+ Year Treasury ETF and SPDR Barclays High Yield Corporate Bond. The largest detractors to performance included the ProShares Short 20+ Year Treasury ETF, Alerian MLP ETF and SPDR Blackstone/GSO Senior Loan ETF.

OUTLOOK

Long time AXS Tactical Income portfolio managers Jordan Kahn and Eric Hua left the AXS team in June of 2024 and we wish them continued success. We manage the Fund with the same goals as Jordan and Eric. The Fund is designed as a core investment for investors seeking income generation, while also focusing on capital preservation. The fund employs a tactical strategy which is geared towards seizing promising income-generating opportunities and minimizing potential losses during market downturns. Our primary goal is to enable our investors to benefit from financial market gains while managing risk on the downside.

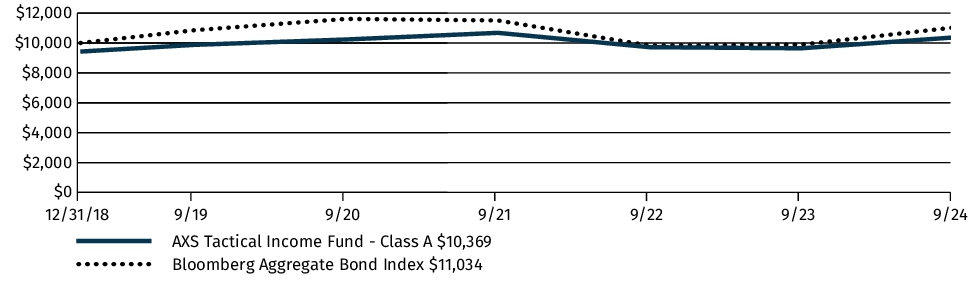

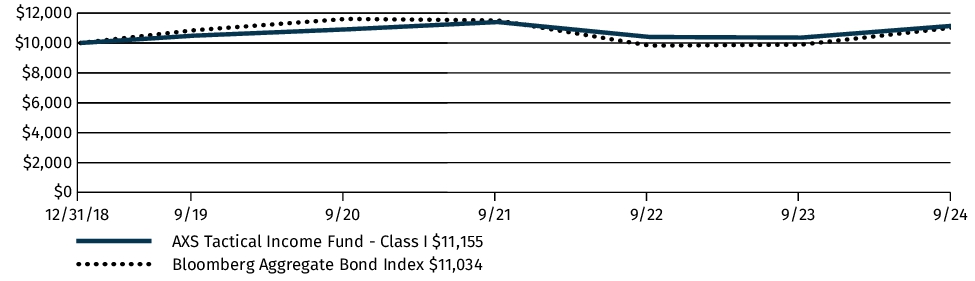

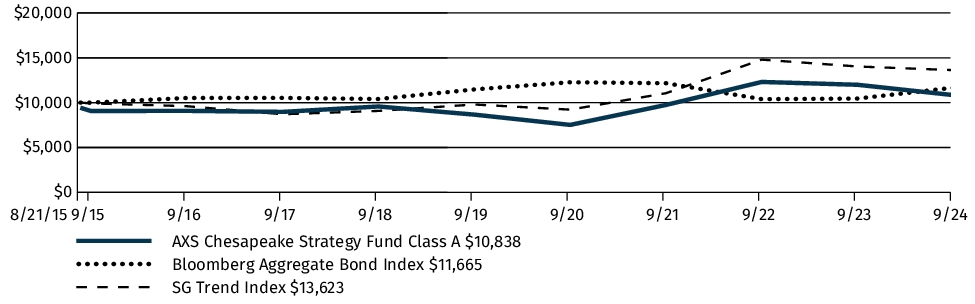

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | Since

Inception1 |

| AXS Tactical Income Fund (Class A/TINAX) | 1.33% | -0.20% | 0.63% |

| AXS Tactical Income Fund (Class A/TINAX)- excluding sales load | 7.51% | 0.99% | 1.67% |

| Bloomberg Aggregate Bond Index | 11.57% | 0.33% | 1.73% |

| 1 | Class A shares commenced operations on December 31, 2018 |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $33,914,675 |

| Total number of portfolio holdings | 20 |

| Total advisory fees paid (net) | $330,618 |

| Portfolio turnover rate as of the end of the reporting period | 406% |

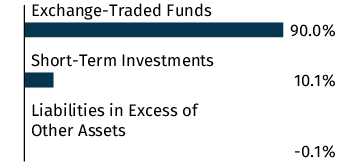

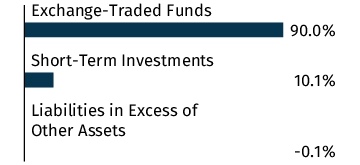

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings exclude short-term holdings, if any.

| Vanguard Long-Term Corporate Bond ETF | 4.9% |

| SPDR Bloomberg Convertible Securities ETF | 4.9% |

| Vanguard Long-Term Treasury ETF | 4.8% |

| Vanguard Emerging Markets Government Bond ETF | 4.8% |

| Vanguard Intermediate-Term Corporate Bond ETF | 4.8% |

| iShares Fallen Angels USD Bond ETF | 4.8% |

| SPDR Bloomberg High Yield Bond ETF | 4.8% |

| Vanguard Mortgage-Backed Securities ETF | 4.8% |

| Vanguard Intermediate-Term Treasury ETF | 4.7% |

| iShares 0-5 Year High Yield Corporate Bond ETF | 4.7% |

Material Fund Changes

The Fund did not have any material changes that occurred since the beginning of the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.axsinvestments.com/tinix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (833) 297-2587 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

AXS

Tactical Income Fund

Class I/TINIX

ANNUAL SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the AXS Tactical Income Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.axsinvestments.com/tinix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Ticker) | | | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

AXS Tactical Income Fund

(Class I/TINIX) | | | $183 | 1.76% |

Management's Discussion of Fund Performance

HOW DID THE FUND PERFORM?

The Fund is available in class A and I shares. For the fiscal year ended September 30, 2024, performance for the class I share returned 7.68%.

Fund performance trailed the Bloomberg Aggregate Bond Index performance of 11.57%. However, the Fund achieved its return at reduced volatility (3.1% standard deviation) and max drawdown (1.2%) compared to the Bloomberg Aggregate Bond Index (7.1% standard deviation, 3.1% max drawdown).

WHAT AFFECTED FUND PERFORMANCE?

The Fund is a tactical income fund that takes a systematic trading approach in the portfolio. Our goal is to actively participate in up-trending, income-oriented sectors while avoiding down-trending sectors. We exercise discretion in adjusting the allocation of investments to the various fixed income ETFs, with a focus on optimizing yield and performance with a reduction in overall volatility and drawdown.

The Fund ended the fiscal year diversified across ten bond sectors with a half of the holdings allocated to the high yield corporate bonds, investment grade corporate bonds and bank loans combined. The largest contributors to performance for the fiscal year include SPDR Barclays Convertible Securities ETF, iShares 20+ Year Treasury ETF and SPDR Barclays High Yield Corporate Bond. The largest detractors to performance included the ProShares Short 20+ Year Treasury ETF, Alerian MLP ETF and SPDR Blackstone/GSO Senior Loan ETF.

OUTLOOK

Long time AXS Tactical Income portfolio managers Jordan Kahn and Eric Hua left the AXS team in June of 2024 and we wish them continued success. We manage the Fund with the same goals as Jordan and Eric. The Fund is designed as a core investment for investors seeking income generation, while also focusing on capital preservation. The fund employs a tactical strategy which is geared towards seizing promising income-generating opportunities and minimizing potential losses during market downturns. Our primary goal is to enable our investors to benefit from financial market gains while managing risk on the downside.

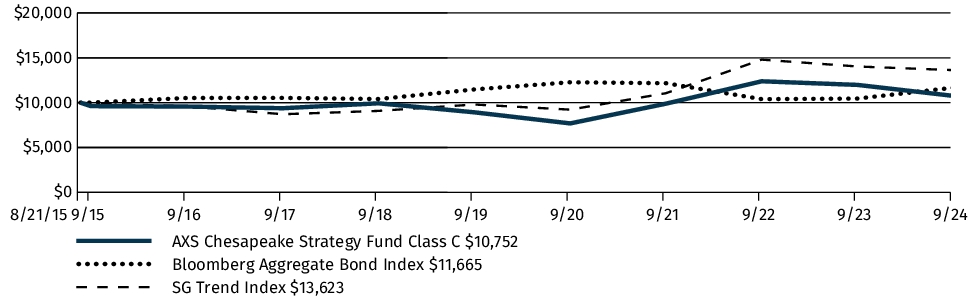

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | Since

Inception1 |

| AXS Tactical Income Fund (Class I/TINIX) | 7.68% | 1.24% | 1.92% |

| Bloomberg Aggregate Bond Index | 11.57% | 0.33% | 1.73% |

| 1 | Class I shares commenced operations on December 31, 2018 |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $33,914,675 |

| Total number of portfolio holdings | 20 |

| Total advisory fees paid (net) | $330,618 |

| Portfolio turnover rate as of the end of the reporting period | 406% |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings exclude short-term holdings, if any.

| Vanguard Long-Term Corporate Bond ETF | 4.9% |

| SPDR Bloomberg Convertible Securities ETF | 4.9% |

| Vanguard Long-Term Treasury ETF | 4.8% |

| Vanguard Emerging Markets Government Bond ETF | 4.8% |

| Vanguard Intermediate-Term Corporate Bond ETF | 4.8% |

| iShares Fallen Angels USD Bond ETF | 4.8% |

| SPDR Bloomberg High Yield Bond ETF | 4.8% |

| Vanguard Mortgage-Backed Securities ETF | 4.8% |

| Vanguard Intermediate-Term Treasury ETF | 4.7% |

| iShares 0-5 Year High Yield Corporate Bond ETF | 4.7% |

Material Fund Changes

The Fund did not have any material changes that occurred since the beginning of the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.axsinvestments.com/tinix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (833) 297-2587 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

AXS

Merger Fund

Class I/GAKIX

ANNUAL SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the AXS Merger Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.axsinvestments.com/gakix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Ticker) | | | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

AXS Merger Fund

(Class I/GAKIX) | | | $213 | 2.09% |

Management's Discussion of Fund Performance

SUMMARY OF RESULTS

For the 12-month period ending 09/30/24, the AXS Merger Fund’s Class I returned 4.10%. The Fund invested exclusively in securities that were involved in mergers and acquisitions. This was a difficult period for the Fund with a decrease in overall deal activity and heightened regulatory scrutiny.

TOP PERFORMANCE CONTRIBUTORS

Positive performance was driven by the completion of the $70 billion transaction between Broadcom and VMware, after almost a year and a half wait for China’s approval. As tensions mounted between the countries over U.S. curbs on semiconductor exports, increased volatility allowed the Fund to maximize its position at a very favorable spread. Broadcom’s CEO attended a White House roundtable with the president of China, apparently having discussed the deal during the visit, smoothing the way for its approval and closure only a couple of weeks later.

Also contributing positively to performance was the closing of the Seagen transaction with Pfizer. The spread remained wide as investors were unsure how the current U.S. administration would react to a $40 billion deal in the pharmaceutical industry. We believed the deal had minimal traditional antitrust concerns and built a sizeable position, believing that the deal would not face a lawsuit. After Pfizer agreed to donate the rights of royalties from the sales of one of its drugs, the FTC approved the transaction in mid-December, and the deal closed a couple of days later.

The third top contributor to performance was the closing of the $68 billion deal between Pioneer Natural Resources and Exxon Mobil. The companies received FTC approval in May after an unusual agreement whereby the former CEO and current board member of the target Pioneer would not be allowed to sit on the combined companies board.

TOP PERFORMANCE DETRACTORS

The top detractor for the fund was the widening of the spread in Chevron’s $53 billion takeover of Hess. In March, Exxon Mobil (which has a joint venture (JV) with Hess on valuable assets in Guyana) accused Chevron of trying to sidestep its right of first refusal to buy the JV assets. The case will head to arbitration in 2025. We expect a positive arbitration approval/settlement in the middle of next year.

Also contributing negatively was when the FTC sued to block the $8.5 billion merger between Capri Holdings and Tapestry claiming the deal would stifle competition in the “accessible luxury” handbag market. The FTC posited that these brands constantly monitor each other to determine pricing. The response from the companies stated that even if this narrow market definition exists, it faces competitive pressures from both lower and higher-end priced products. A NY judge granted a preliminary injunction in September and the companies are appealing the decision.

The third detractor from performance was the widening in the spread in Nippon Steel’s $13.4 billion deal with United States Steel. The deal got embroiled in politics as both presidential candidates threatened to block the deal on national security grounds. In addition, the U. S. Steelworkers union does not back the transaction. Shareholders and employees back it as Nippon has made several large investment commitments to sure up plants and employment. The decision on whether to approve has been postponed until after the election when cooler heads will hopefully prevail.

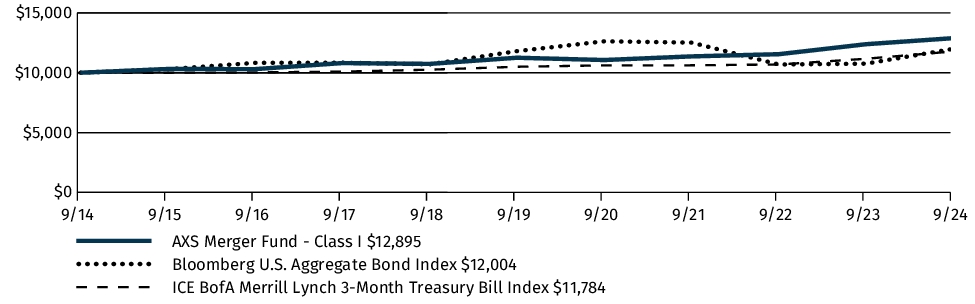

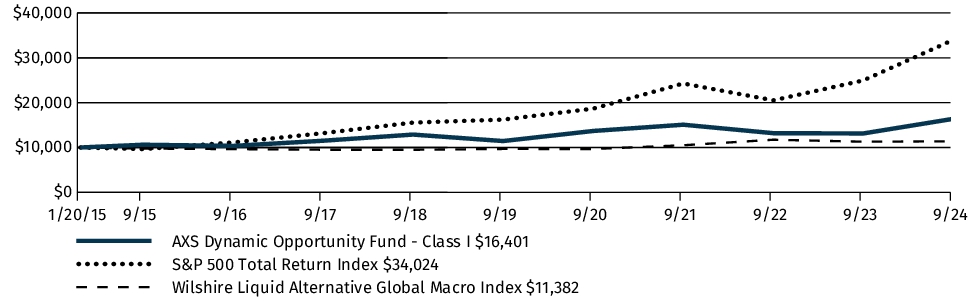

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | 10 Years |

| AXS Merger Fund (Class I/GAKIX) | 4.10% | 2.76% | 2.58% |

| ICE BofAML 3-Month U.S. Treasury Bill | 5.49% | 2.33% | 1.66% |

| Bloomberg Aggregate Bond Index | 11.57% | 0.33% | 1.84% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $16,136,616 |

| Total number of portfolio holdings | 56 |

| Total advisory fees paid (net) | $149,081 |

| Portfolio turnover rate as of the end of the reporting period | 280% |

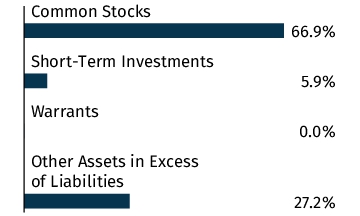

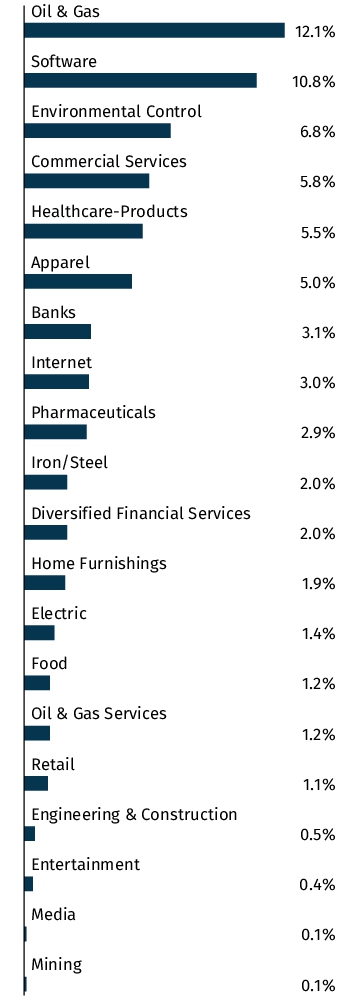

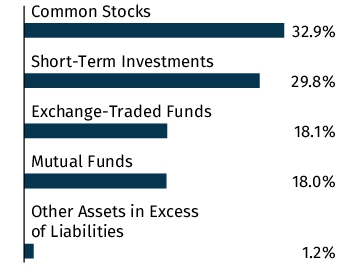

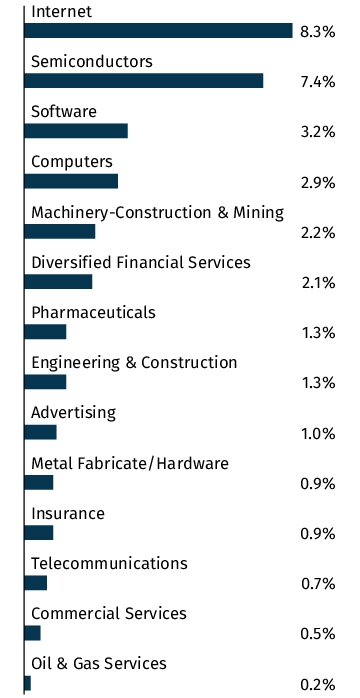

Graphical Representation of Holdings

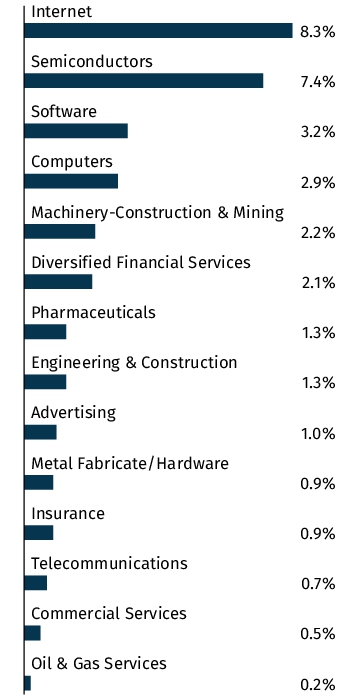

The tables below show the investment makeup of the Fund, representing percentage of the total net asset of the Fund. The Top Ten Holdings and Industry Allocation exclude short-term holdings, if any. The Industry Allocation chart represents Common Stocks of the Fund.

| Hess Corp. | 10.7% |

| Stericycle, Inc. | 6.8% |

| Capri Holdings Ltd. | 5.0% |

| ANSYS, Inc. | 3.2% |

| Axonics, Inc. | 3.1% |

| Envestnet, Inc. | 2.4% |

| Surmodics, Inc. | 2.4% |

| PetIQ, Inc. | 2.4% |

| R1 RCM, Inc. | 2.1% |

| HashiCorp, Inc. - Class A | 2.1% |

Material Fund Changes

On November 15, 2024, the Funds’ Board of Trustees of the Trust approved a Plan of Liquidation for the Merger Fund. The Plan of Liquidation authorizes the termination, liquidation and dissolution of the Merger Fund, and the Merger Fund will be liquidated on or about December 27, 2024. In anticipation of the liquidation of the Merger Fund, Kellner Management, L.P., the Merger Fund’s Sub-advisor, may manage the Merger Fund in a manner intended to facilitate its orderly liquidation, such as by raising cash or making investments in other highly liquid assets. As a result, all or a portion of the Merger Fund may not be invested in a manner consistent with its stated investment strategies, which may prevent the Merger Fund from achieving its investment objective.

There were no other events or transactions that occurred during this period that materially impacted the amounts or disclosures in the Funds’ financial statements.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.axsinvestments.com/gakix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (833) 297-2587 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

AXS

Merger Fund

Investor Class/GAKAX

ANNUAL SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the AXS Merger Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.axsinvestments.com/gakix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Ticker) | | | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

AXS Merger Fund

(Investor Class/GAKAX) | | | $238 | 2.34% |

Management's Discussion of Fund Performance

SUMMARY OF RESULTS

For the 12-month period ending 09/30/24, the AXS Merger Fund’s Investor Class returned 3.77%. The Fund invested exclusively in securities that were involved in mergers and acquisitions. This was a difficult period for the Fund with a decrease in overall deal activity and heightened regulatory scrutiny.

TOP PERFORMANCE CONTRIBUTORS

Positive performance was driven by the completion of the $70 billion transaction between Broadcom and VMware, after almost a year and a half wait for China’s approval. As tensions mounted between the countries over U.S. curbs on semiconductor exports, increased volatility allowed the Fund to maximize its position at a very favorable spread. Broadcom’s CEO attended a White House roundtable with the president of China, apparently having discussed the deal during the visit, smoothing the way for its approval and closure only a couple of weeks later.

Also contributing positively to performance was the closing of the Seagen transaction with Pfizer. The spread remained wide as investors were unsure how the current U.S. administration would react to a $40 billion deal in the pharmaceutical industry. We believed the deal had minimal traditional antitrust concerns and built a sizeable position, believing that the deal would not face a lawsuit. After Pfizer agreed to donate the rights of royalties from the sales of one of its drugs, the FTC approved the transaction in mid-December, and the deal closed a couple of days later.

The third top contributor to performance was the closing of the $68 billion deal between Pioneer Natural Resources and Exxon Mobil. The companies received FTC approval in May after an unusual agreement whereby the former CEO and current board member of the target Pioneer would not be allowed to sit on the combined companies board.

TOP PERFORMANCE DETRACTORS

The top detractor for the fund was the widening of the spread in Chevron’s $53 billion takeover of Hess. In March, Exxon Mobil (which has a joint venture (JV) with Hess on valuable assets in Guyana) accused Chevron of trying to sidestep its right of first refusal to buy the JV assets. The case will head to arbitration in 2025. We expect a positive arbitration approval/settlement in the middle of next year.

Also contributing negatively was when the FTC sued to block the $8.5 billion merger between Capri Holdings and Tapestry claiming the deal would stifle competition in the “accessible luxury” handbag market. The FTC posited that these brands constantly monitor each other to determine pricing. The response from the companies stated that even if this narrow market definition exists, it faces competitive pressures from both lower and higher-end priced products. A NY judge granted a preliminary injunction in September and the companies are appealing the decision.

The third detractor from performance was the widening in the spread in Nippon Steel’s $13.4 billion deal with United States Steel. The deal got embroiled in politics as both presidential candidates threatened to block the deal on national security grounds. In addition, the U. S. Steelworkers union does not back the transaction. Shareholders and employees back it as Nippon has made several large investment commitments to sure up plants and employment. The decision on whether to approve has been postponed until after the election when cooler heads will hopefully prevail.

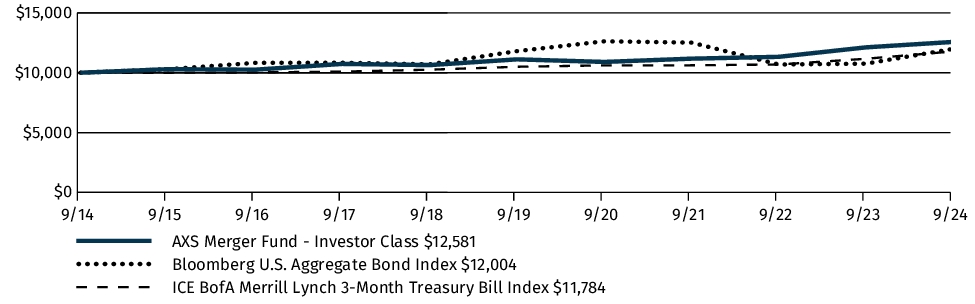

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | 10 Years |

| AXS Merger Fund (Investor Class/GAKAX) | 3.77% | 2.50% | 2.32% |

| ICE BofAML 3-Month U.S. Treasury Bill | 5.49% | 2.33% | 1.66% |

| Bloomberg Aggregate Bond Index | 11.57% | 0.33% | 1.84% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $16,136,616 |

| Total number of portfolio holdings | 56 |

| Total advisory fees paid (net) | $149,081 |

| Portfolio turnover rate as of the end of the reporting period | 280% |

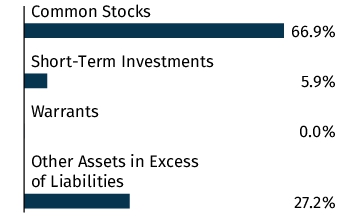

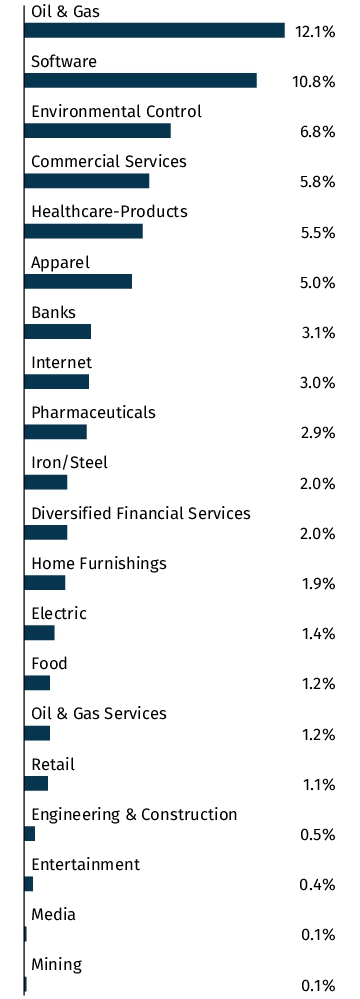

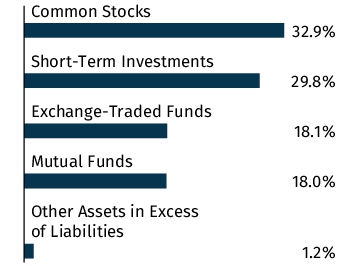

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net asset of the Fund. The Top Ten Holdings and Industry Allocation exclude short-term holdings, if any. The Industry Allocation chart represents Common Stocks of the Fund.

| Hess Corp. | 10.7% |

| Stericycle, Inc. | 6.8% |

| Capri Holdings Ltd. | 5.0% |

| ANSYS, Inc. | 3.2% |

| Axonics, Inc. | 3.1% |

| Envestnet, Inc. | 2.4% |

| Surmodics, Inc. | 2.4% |

| PetIQ, Inc. | 2.4% |

| R1 RCM, Inc. | 2.1% |

| HashiCorp, Inc. - Class A | 2.1% |

Material Fund Changes

On November 15, 2024, the Funds’ Board of Trustees of the Trust approved a Plan of Liquidation for the Merger Fund. The Plan of Liquidation authorizes the termination, liquidation and dissolution of the Merger Fund, and the Merger Fund will be liquidated on or about December 27, 2024. In anticipation of the liquidation of the Merger Fund, Kellner Management, L.P., the Merger Fund’s Sub-advisor, may manage the Merger Fund in a manner intended to facilitate its orderly liquidation, such as by raising cash or making investments in other highly liquid assets. As a result, all or a portion of the Merger Fund may not be invested in a manner consistent with its stated investment strategies, which may prevent the Merger Fund from achieving its investment objective.

There were no other events or transactions that occurred during this period that materially impacted the amounts or disclosures in the Funds’ financial statements.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.axsinvestments.com/gakix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (833) 297-2587 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

AXS

Market Neutral Fund

Class I/COGIX

ANNUAL SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the AXS Market Neutral Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.axsinvestments.com/cogix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Ticker) | | | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

AXS Market Neutral Fund

(Class I/COGIX) | | | $339 | 3.21% |

Management's Discussion of Fund Performance

HOW DID THE FUND PERFORM?

The Fund is available in class I, and Investor shares. For the fiscal year ended September 30, 2024, performance for the I share was 11.02%. Fund performance was in line with the prospectus benchmark Bloomberg Aggregate Bond Index gross performance of 11.57%. For comparison, the broad-based S&P 500 Index returned 36.35%

WHAT AFFECTED FUND PERFORMANCE?

Fund performance can be attributed to the following:

For the period, the Fund took long positions in approximately 75 S&P 500 stocks identified for their intrinsic value by the Cognios ROTA-ROME methodology. ROTA stands for return on total assets and ROME stands for return on market equity. These stocks were rebalanced quarterly.

In addition, the Fund took short positions in approximately 125 S&P 500 stocks identified as overvalued by ROTA-ROME. These long and short exposures were beta adjusted to market neutral on a quarterly basis. Beta measures the expected move of a stock relative to the overall market. A stock with a beta of 0.7 would be expected to gain or lose 70% of the overall market’s gain or loss. The stocks contained in the Fund’s long and short holdings typically have vastly different betas, and thus the Fund equalizes the beta exposure to the market between the long and short books. Usually this means more dollars are allocated to the long holdings to balance the higher beta of the short holdings.

The Fund weighted its allocations toward the consumer, industrial, technology, financial and communications sectors. Top contributors for the period included Leidos Holdings, Resmed, AT&T, Kellanova and Verizon while Humana, Lamb Weston, Hormel Foods, CVS, and Incyte were among the largest detractors.

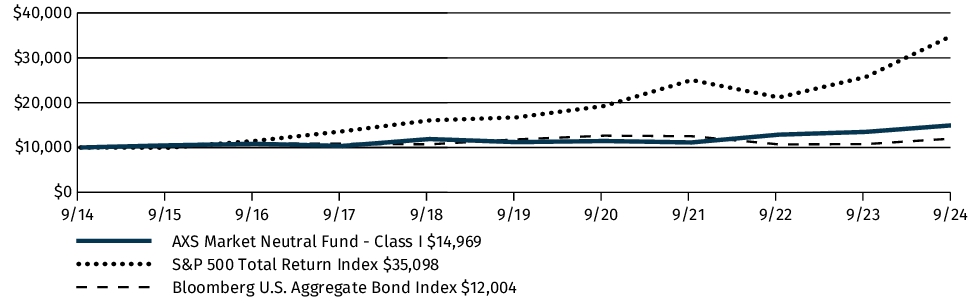

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | 10 Years |

| AXS Market Neutral Fund (Class I/COGIX) | 11.02% | 5.99% | 4.12% |

| S&P 500 Total Return Index | 36.35% | 15.98% | 13.38% |

| Bloomberg U.S. Aggregate Bond Index | 11.57% | 0.33% | 1.84% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $15,393,967 |

| Total number of portfolio holdings | 229 |

| Total advisory fees paid (net) | $69,028 |

| Portfolio turnover rate as of the end of the reporting period | 30% |

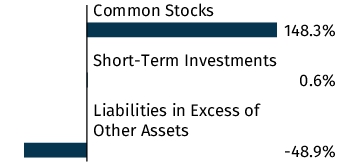

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net asset of the Fund. The Top Ten Holdings exclude short-term holdings, if any.

| C.H. Robinson Worldwide, Inc. | 2.6% |

| Kellanova | 2.6% |

| Public Service Enterprise Group, Inc. | 2.5% |

| Philip Morris International, Inc. | 2.4% |

| Lockheed Martin Corp. | 2.4% |

| Public Storage - REIT | 2.3% |

| AT&T, Inc. | 2.3% |

| NiSource, Inc. | 2.3% |

| ResMed, Inc. | 2.3% |

| Entergy Corp. | 2.3% |

Material Fund Changes

Effective October 16, 2024, Quantitative Value Technologies, LLC d/b/a Cognios Capital (“Cognios Capital”) no longer serves as the AXS Market Neutral Fund’s Sub-advisor, and AXS Investments LLC (“AXS”), and the Fund’s investment advisor, will assume the day-to-day management of the Fund’s portfolio. For principal investment strategies changes, the Fund will invest in pairs of equity securities, such as leveraged and inverse exchange-traded funds (“ETFs”) as well as equities of U.S. companies, in equalized long and short exposures for which AXS Investments LLC, the Fund’s investment advisor (the “Advisor”), believes that the long position of the pairing will outperform the short position over a longer-term basis (at least one- year). Leveraged ETFs are designed to produce returns that are a multiple of the index or security to which they are linked. Inverse ETFs are constructed by using various derivatives for the purpose of profiting from a decline in the value of underlying index or underlying security. The Fund may invest in the securities of issuers of any size.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.axsinvestments.com/cogix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (833) 297-2587 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

AXS

Market Neutral Fund

Investor Class/COGMX

ANNUAL SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the AXS Market Neutral Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.axsinvestments.com/cogix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Ticker) | | | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

AXS Market Neutral Fund

(Investor Class/COGMX) | | | $364 | 3.46% |

Management's Discussion of Fund Performance

HOW DID THE FUND PERFORM?

The Fund is available in class I, and Investor shares. For the fiscal year ended September 30, 2024, performance for the Investor class returned 10.63%. Fund performance was in line with the prospectus benchmark Bloomberg Aggregate Bond Index gross performance of 11.57%. For comparison, the broad-based S&P 500 Index returned 36.35%

WHAT AFFECTED FUND PERFORMANCE?

Fund performance can be attributed to the following:

For the period, the Fund took long positions in approximately 75 S&P 500 stocks identified for their intrinsic value by the Cognios ROTA-ROME methodology. ROTA stands for return on total assets and ROME stands for return on market equity. These stocks were rebalanced quarterly.

In addition, the Fund took short positions in approximately 125 S&P 500 stocks identified as overvalued by ROTA-ROME. These long and short exposures were beta adjusted to market neutral on a quarterly basis. Beta measures the expected move of a stock relative to the overall market. A stock with a beta of 0.7 would be expected to gain or lose 70% of the overall market’s gain or loss. The stocks contained in the Fund’s long and short holdings typically have vastly different betas, and thus the Fund equalizes the beta exposure to the market between the long and short books. Usually this means more dollars are allocated to the long holdings to balance the higher beta of the short holdings.

The Fund weighted its allocations toward the consumer, industrial, technology, financial and communications sectors. Top contributors for the period included Leidos Holdings, Resmed, AT&T, Kellanova and Verizon while Humana, Lamb Weston, Hormel Foods, CVS, and Incyte were among the largest detractors.

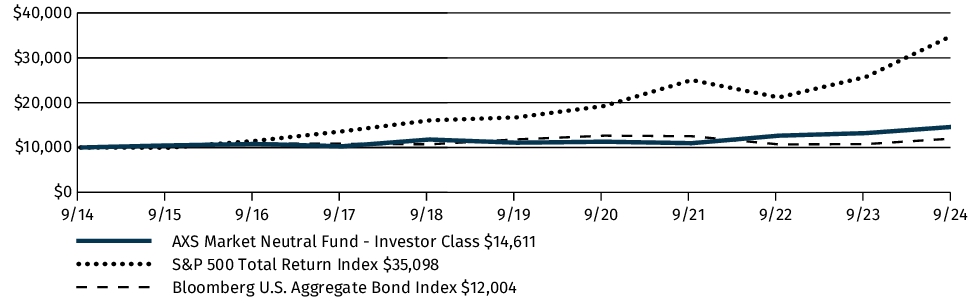

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | 10 Years |

| AXS Market Neutral Fund (Investor Class/COGMX) | 10.63% | 5.71% | 3.86% |

| S&P 500 Total Return Index | 36.35% | 15.98% | 13.38% |

| Bloomberg U.S. Aggregate Bond Index | 11.57% | 0.33% | 1.84% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $15,393,967 |

| Total number of portfolio holdings | 229 |

| Total advisory fees paid (net) | $69,028 |

| Portfolio turnover rate as of the end of the reporting period | 30% |

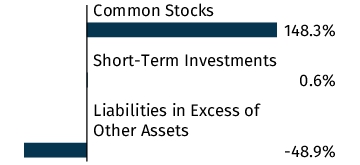

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings exclude short-term holdings, if any.

| C.H. Robinson Worldwide, Inc. | 2.6% |

| Kellanova | 2.6% |

| Public Service Enterprise Group, Inc. | 2.5% |

| Philip Morris International, Inc. | 2.4% |

| Lockheed Martin Corp. | 2.4% |

| Public Storage - REIT | 2.3% |

| AT&T, Inc. | 2.3% |

| NiSource, Inc. | 2.3% |

| ResMed, Inc. | 2.3% |

| Entergy Corp. | 2.3% |

Material Fund Changes

Effective October 16, 2024, Quantitative Value Technologies, LLC d/b/a Cognios Capital (“Cognios Capital”) no longer serves as the AXS Market Neutral Fund’s Sub-advisor, and AXS Investments LLC (“AXS”), and the Fund’s investment advisor, will assume the day-to-day management of the Fund’s portfolio. For principal investment strategies changes, the Fund will invest in pairs of equity securities, such as leveraged and inverse exchange-traded funds (“ETFs”) as well as equities of U.S. companies, in equalized long and short exposures for which AXS Investments LLC, the Fund’s investment advisor (the “Advisor”), believes that the long position of the pairing will outperform the short position over a longer-term basis (at least one- year). Leveraged ETFs are designed to produce returns that are a multiple of the index or security to which they are linked. Inverse ETFs are constructed by using various derivatives for the purpose of profiting from a decline in the value of underlying index or underlying security. The Fund may invest in the securities of issuers of any size.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.axsinvestments.com/cogix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (833) 297-2587 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

AXS

Income Opportunities Fund

Class A/OIOAX

ANNUAL SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the AXS Income Opportunities Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.axsinvestments.com/oioix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Ticker) | | | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

AXS Income Opportunities Fund

(Class A/OIOAX) | | | $314 | 2.77% |

Management's Discussion of Fund Performance

How did the Fund perform last year?

For the year ended September 30, 2024, the AXS Income Opportunities Fund Class A (OIOAX) shares registered a total return of 27.06% (with load 19.73%), comparing favorably to the Bloomberg U.S. Aggregate Bond Index which returned 11.57% during the period. The Fund’s three year annualized total return was 4.37% compared to -1.39% for the Index.

What affected the Fund’s performance?

Fund performance can be attributed to the following:

Preferred stocks, which totaled 95% of net assets at year-end, performed well during the year. They benefited especially from the Federal Reserve’s long awaited decision to begin easing the Fed Funds rate, starting with fifty basis points (0.50%) at its September meeting, creating a very real tailwind for these fixed income securities.

REIT common stock portfolio exposure, which totaled 16% of net assets at year-end, contributed significantly to performance. Particularly notable were the retail and office sectors, which continued to rebound as especially high-end shoppers and return to office mandates drove solid operating performance.

Hotel preferred stocks and healthcare common stock holdings lagged by comparison but were still generally positive performers during the period.

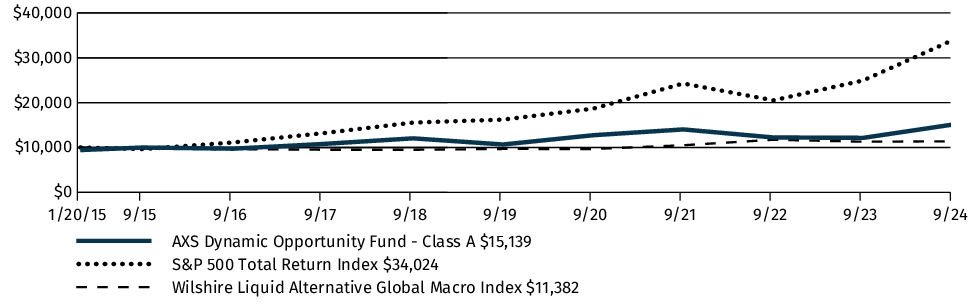

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | 10 Years |

| AXS Income Opportunities Fund (Class A/OIOAX) | 19.73% | 0.92% | 2.36% |

| AXS Income Opportunities Fund (Class A/OIOAX)- excluding sales load | 27.06% | 1.96% | 2.88% |

| Bloomberg U.S. Aggregate Bond Index | 11.57% | 0.33% | 1.84% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $58,410,415 |

| Total number of portfolio holdings | 57 |

| Total advisory fees paid (net) | $435,112 |

| Portfolio turnover rate as of the end of the reporting period | 63% |

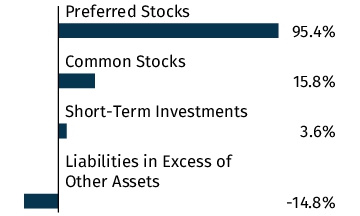

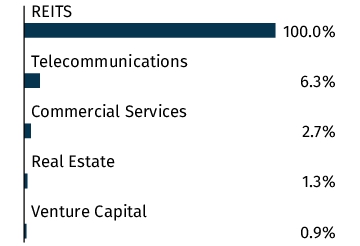

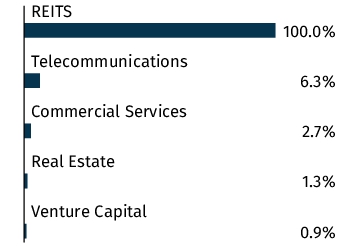

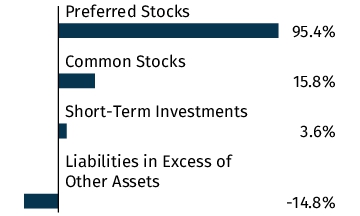

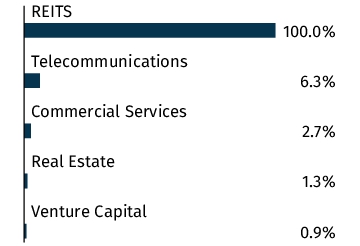

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net asset of the Fund. The Top Ten Holdings and Industry Allocation exclude short-term holdings, if any. The Industry Allocation chart represents Common Stocks or Preferred Stocks of the Fund.

| RLJ Lodging Trust, Series A | 5.3% |

| AGNC Investment Corp., Series C | 5.1% |

| Armada Hoffler Properties, Inc., Series A | 4.2% |

| Macerich Co. - REIT | 3.4% |

| EPR Properties, Series G | 3.2% |

| KKR Real Estate Finance Trust, Inc., Series A | 3.1% |

| Summit Hotel Properties, Inc., Series F | 3.1% |

| American Homes 4 Rent, Series G | 2.9% |

| Annaly Capital Management, Inc., Series F | 2.8% |

| DiamondRock Hospitality Co., Series A | 2.8% |

Material Fund Changes

The Fund did not have any material changes that occurred since the beginning of the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.axsinvestments.com/oioix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (833) 297-2587 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

AXS

Income Opportunities Fund

Class D/OIODX

ANNUAL SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the AXS Income Opportunities Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.axsinvestments.com/oioix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Ticker) | | | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

AXS Income Opportunities Fund

(Class D/OIODX) | | | $398 | 3.52% |

Management's Discussion of Fund Performance

How did the Fund perform last year?

For the year ended September 30, 2024, the AXS Income Opportunities Fund Class D (OIODX) shares registered a total return of 26.13%, comparing favorably to the Bloomberg U.S. Aggregate Bond Index which returned 11.57% during the period. The Fund’s three year annualized total return was 3.60% compared to -1.39% for the Index.

What affected the Fund’s performance?

Fund performance can be attributed to the following:

Preferred stocks, which totaled 95% of net assets at year-end, performed well during the year. They benefited especially from the Federal Reserve’s long awaited decision to begin easing the Fed Funds rate, starting with fifty basis points (0.50%) at its September meeting, creating a very real tailwind for these fixed income securities.

REIT common stock portfolio exposure, which totaled 16% of net assets at year-end, contributed significantly to performance. Particularly notable were the retail and office sectors, which continued to rebound as especially high-end shoppers and return to office mandates drove solid operating performance.

Hotel preferred stocks and healthcare common stock holdings lagged by comparison but were still generally positive performers during the period.

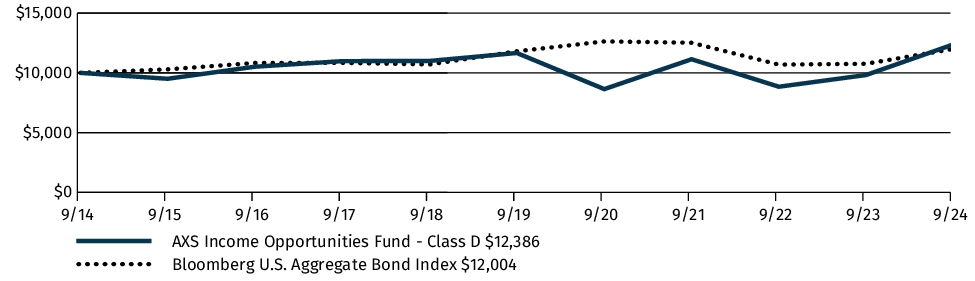

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | 10 Years |

| AXS Income Opportunities Fund (Class D/OIODX) | 26.13% | 1.21% | 2.16% |

| Bloomberg U.S. Aggregate Bond Index | 11.57% | 0.33% | 1.84% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $58,410,415 |

| Total number of portfolio holdings | 57 |

| Total advisory fees paid (net) | $435,112 |

| Portfolio turnover rate as of the end of the reporting period | 63% |

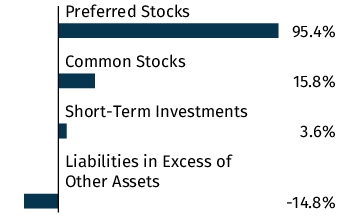

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net asset of the Fund. The Top Ten Holdings and Industry Allocation exclude short-term holdings, if any. The Industry Allocation chart represents Common Stocks or Preferred Stocks of the Fund.

| RLJ Lodging Trust, Series A | 5.3% |

| AGNC Investment Corp., Series C | 5.1% |

| Armada Hoffler Properties, Inc., Series A | 4.2% |

| Macerich Co. - REIT | 3.4% |

| EPR Properties, Series G | 3.2% |

| KKR Real Estate Finance Trust, Inc., Series A | 3.1% |

| Summit Hotel Properties, Inc., Series F | 3.1% |

| American Homes 4 Rent, Series G | 2.9% |

| Annaly Capital Management, Inc., Series F | 2.8% |

| DiamondRock Hospitality Co., Series A | 2.8% |

Material Fund Changes

The Fund did not have any material changes that occurred since the beginning of the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.axsinvestments.com/oioix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (833) 297-2587 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

AXS

Income Opportunities Fund

Class I/OIOIX

ANNUAL SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the AXS Income Opportunities Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.axsinvestments.com/oioix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Ticker) | | | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

AXS Income Opportunities Fund

(Class I/OIOIX) | | | $286 | 2.52% |

Management's Discussion of Fund Performance

How did the Fund perform last year?

For the year ended September 30, 2024, the AXS Income Opportunities Fund Class I (OIOIX) shares registered a total return of 27.35%, comparing favorably to the Bloomberg U.S. Aggregate Bond Index which returned 11.57% during the period. The Fund’s three year annualized total return was 4.64% compared to -1.39% for the Index.

What affected the Fund’s performance?

Fund performance can be attributed to the following:

Preferred stocks, which totaled 95% of net assets at year-end, performed well during the year. They benefited especially from the Federal Reserve’s long awaited decision to begin easing the Fed Funds rate, starting with fifty basis points (0.50%) at its September meeting, creating a very real tailwind for these fixed income securities.

REIT common stock portfolio exposure, which totaled 16% of net assets at year-end, contributed significantly to performance. Particularly notable were the retail and office sectors, which continued to rebound as especially high-end shoppers and return to office mandates drove solid operating performance.

Hotel preferred stocks and healthcare common stock holdings lagged by comparison but were still generally positive performers during the period.

The Fund’s Class I share distribution rate amounted to 6.82% at the end of the year. [1] The subsidized and unsubsidized SEC 30-day yields as of September 30th were 6.46 % and 6.71%, respectively.

[1] Distribution Rate is the most recent Class I share dividend amount annualized ($1.1682) divided by the NAV as of 9/30/24 ($17.14), which equates to 6.82%.

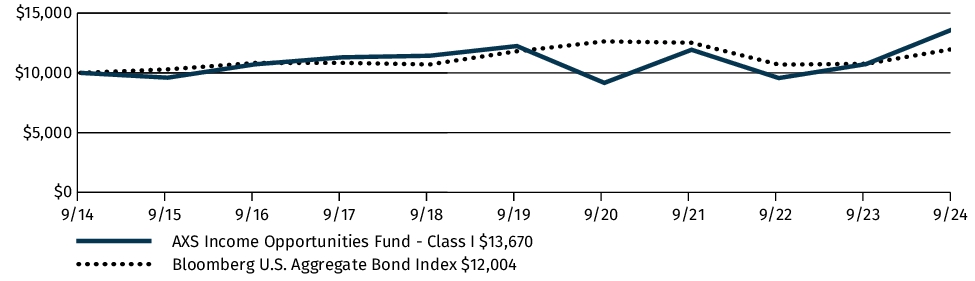

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | 10 Years |

| AXS Income Opportunities Fund (Class I/OIOIX) | 27.35% | 2.23% | 3.18% |

| Bloomberg U.S. Aggregate Bond Index | 11.57% | 0.33% | 1.84% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $58,410,415 |

| Total number of portfolio holdings | 57 |

| Total advisory fees paid (net) | $435,112 |

| Portfolio turnover rate as of the end of the reporting period | 63% |

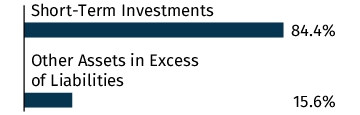

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net asset of the Fund. The Top Ten Holdings and Industry Allocation exclude short-term holdings, if any. The Industry Allocation chart represents Common Stocks or Preferred Stocks of the Fund.

| RLJ Lodging Trust, Series A | 5.3% |

| AGNC Investment Corp., Series C | 5.1% |

| Armada Hoffler Properties, Inc., Series A | 4.2% |

| Macerich Co. - REIT | 3.4% |

| EPR Properties, Series G | 3.2% |

| KKR Real Estate Finance Trust, Inc., Series A | 3.1% |

| Summit Hotel Properties, Inc., Series F | 3.1% |

| American Homes 4 Rent, Series G | 2.9% |

| Annaly Capital Management, Inc., Series F | 2.8% |

| DiamondRock Hospitality Co., Series A | 2.8% |

Material Fund Changes

The Fund did not have any material changes that occurred since the beginning of the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.axsinvestments.com/oioix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (833) 297-2587 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

AXS

FTSE Venture Capital

Return Tracker Fund

Class A/LDVAX

ANNUAL SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the AXS FTSE Venture Capital Return Tracker Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.axsinvestments.com/ldvix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Ticker) | | | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

AXS FTSE Venture Capital Return Tracker Fund

(Class A/LDVAX) | | | $216 | 1.76% |

Management's Discussion of Fund Performance

HOW DID THE FUND PERFORM?

The Fund is available in class A, I, and C shares. For the fiscal year ended September 30, 2024, performance for the class A share was 45.97% (37.60% with load).

As an indexed-based strategy, the Fund is designed to track the performance of the FTSE Venture Capital Index which seeks to replicate the aggregate risk and performance profile of the Venture Capital space.

Fund performance was in line with the FTSE Venture Capital Index[1] gross performance of 48.82%. The Fund’s prospectus benchmark NASDAQ Composite Total Return Index returned 38.64%

WHAT AFFECTED FUND PERFORMANCE?

The Fund replicates the exposures of its underlying index using U.S. listed equities and total return swaps to create economic leverage and to implement a relative-value overlay. U.S. listed equities provide exposures to the economic sectors represented by the universe of venture capital backed private companies.

The index is constructed using the FTSE Business Classification to classify and measure the direct economic exposures of the universe of venture capital backed companies. The index selects U.S. listed large cap equities among the respective sectors and weights the membership according to their market value subject to a 4.5% (ex-cash) weight constraint. Each sector is diversified in the number of securities within each sector and through use of the weight constraint. In this manner, the intent is to reduce idiosyncratic risks and to isolate the systemic risks of each sector. The Fund implements the index membership in both the security and relative target weights.

The index, and therefore the Fund, was weighted between 70-75% during the year in favor of the information technology, communication services and financial sectors. Another 18-20% was allocated to Health Care and Industrials. All of these sectors performed strongly during the year with Health Care trailing the others.

Top contributors for the period included Meta Platforms, Netflix, NVIDIA, Oracle and IBM while Adobe, Visa, Mastercard, Accenture and Snowflake were among the largest detractors.

[1] The FTSE Venture Capital Index utilizes a prosperity model designed by DSC Quantitative Group, LLC (“DSC”). The index: 1) identifies a set of publicly listed assets weighted in an attempt replicate the returns of the Venture Capital universe, 2) utilizes economic factors and market indicators to calculate optimal asset weights and 3) modifies the portfolio over time to reflect changes in the venture capital universe.

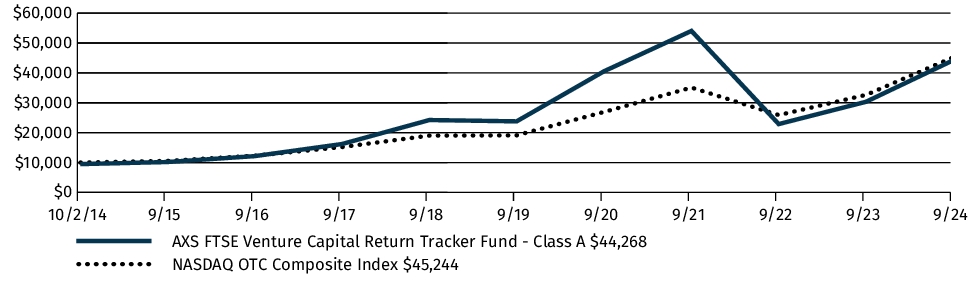

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | Since

Inception1 |

| AXS FTSE Venture Capital Return Tracker Fund (Class A/LDVAX) | 37.60% | 11.90% | 16.05% |

| AXS FTSE Venture Capital Return Tracker Fund (Class A/LDVAX)- excluding sales load | 45.97% | 13.23% | 16.67% |

| NASDAQ OTC Composite Index | 38.64% | 18.81% | 16.30% |

| 1 | Class A shares commenced operations on October 2, 2014. |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $96,889,887 |

| Total number of portfolio holdings | 145 |

| Total advisory fees paid (net) | $1,223,278 |

| Portfolio turnover rate as of the end of the reporting period | 29% |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings exclude short-term holdings, if any.

| Meta Platforms, Inc. - Class A | 4.6% |

| Microsoft Corp. | 4.4% |

| Mastercard, Inc. - Class A | 4.3% |

| Alphabet, Inc. - Class A | 4.3% |

| Netflix, Inc. | 4.3% |

| Visa, Inc. - Class A | 4.2% |

| Oracle Corp. | 3.9% |

| Salesforce, Inc. | 3.8% |

| Accenture PLC - Class A | 3.4% |

| Adobe, Inc. | 3.2% |

Material Fund Changes

On January 31, 2024, the Fund changed its name from AXS Thomson Reuters Venture Capital Return Tracker Fund to AXS FTSE Venture Capital Return Tracker Fund.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.axsinvestments.com/ldvix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (833) 297-2587 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

AXS

FTSE Venture Capital

Return Tracker Fund

Class C/LDVCX

ANNUAL SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about the AXS FTSE Venture Capital Return Tracker Fund (“Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.axsinvestments.com/ldvix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Ticker) | | | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

AXS FTSE Venture Capital Return Tracker Fund

(Class C/LDVCX) | | | $306 | 2.50% |

Management's Discussion of Fund Performance

HOW DID THE FUND PERFORM?

The Fund is available in class A, I, and C shares. For the fiscal year ended September 30, 2024, performance for the class C share returned 44.92%.

As an indexed-based strategy, the Fund is designed to track the performance of the FTSE Venture Capital Index which seeks to replicate the aggregate risk and performance profile of the Venture Capital space.

Fund performance was in line with the FTSE Venture Capital Index[1] gross performance of 48.82%. The Fund’s prospectus benchmark NASDAQ Composite Total Return Index returned 38.64%

WHAT AFFECTED FUND PERFORMANCE?

The Fund replicates the exposures of its underlying index using U.S. listed equities and total return swaps to create economic leverage and to implement a relative-value overlay. U.S. listed equities provide exposures to the economic sectors represented by the universe of venture capital backed private companies.

The index is constructed using the FTSE Business Classification to classify and measure the direct economic exposures of the universe of venture capital backed companies. The index selects U.S. listed large cap equities among the respective sectors and weights the membership according to their market value subject to a 4.5% (ex-cash) weight constraint. Each sector is diversified in the number of securities within each sector and through use of the weight constraint. In this manner, the intent is to reduce idiosyncratic risks and to isolate the systemic risks of each sector. The Fund implements the index membership in both the security and relative target weights.

The index, and therefore the Fund, was weighted between 70-75% during the year in favor of the information technology, communication services and financial sectors. Another 18-20% was allocated to Health Care and Industrials. All of these sectors performed strongly during the year with Health Care trailing the others.

Top contributors for the period included Meta Platforms, Netflix, NVIDIA, Oracle and IBM while Adobe, Visa, Mastercard, Accenture and Snowflake were among the largest detractors.

[1] The FTSE Venture Capital Index utilizes a prosperity model designed by DSC Quantitative Group, LLC (“DSC”). The index: 1) identifies a set of publicly listed assets weighted in an attempt replicate the returns of the Venture Capital universe, 2) utilizes economic factors and market indicators to calculate optimal asset weights and 3) modifies the portfolio over time to reflect changes in the venture capital universe.

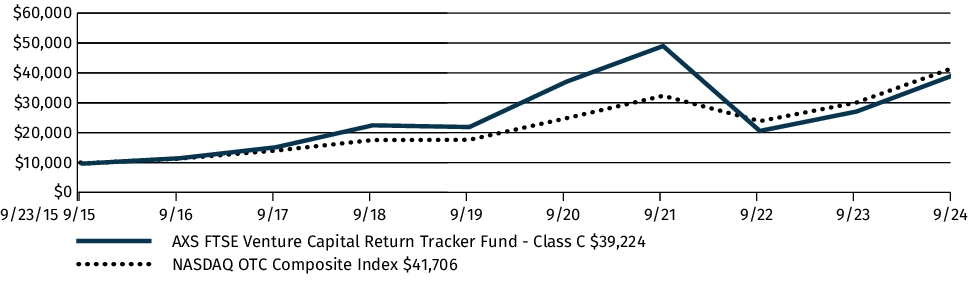

Fund Performance

The following graph and chart compare the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Fund or for the life of the Fund, if shorter. It assumes a $10,000 initial investment at the beginning of the first fiscal year in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURN | 1 Year | 5 Years | Since

Inception1 |

| AXS FTSE Venture Capital Return Tracker Fund (Class C/LDVCX) | 43.92% | 12.39% | 16.36% |

| AXS FTSE Venture Capital Return Tracker Fund (Class C/LDVCX)- excluding sales load | 44.92% | 12.39% | 16.36% |

| NASDAQ OTC Composite Index | 38.64% | 18.81% | 17.16% |

| 1 | Class C shares commenced operation on September 23, 2015. |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $96,889,887 |

| Total number of portfolio holdings | 145 |

| Total advisory fees paid (net) | $1,223,278 |

| Portfolio turnover rate as of the end of the reporting period | 29% |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings exclude short-term holdings, if any.

| Meta Platforms, Inc. - Class A | 4.6% |

| Microsoft Corp. | 4.4% |

| Mastercard, Inc. - Class A | 4.3% |

| Alphabet, Inc. - Class A | 4.3% |

| Netflix, Inc. | 4.3% |

| Visa, Inc. - Class A | 4.2% |

| Oracle Corp. | 3.9% |

| Salesforce, Inc. | 3.8% |

| Accenture PLC - Class A | 3.4% |

| Adobe, Inc. | 3.2% |

Material Fund Changes

On January 31, 2024, the Fund changed its name from AXS Thomson Reuters Venture Capital Return Tracker Fund to AXS FTSE Venture Capital Return Tracker Fund.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.axsinvestments.com/ldvix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

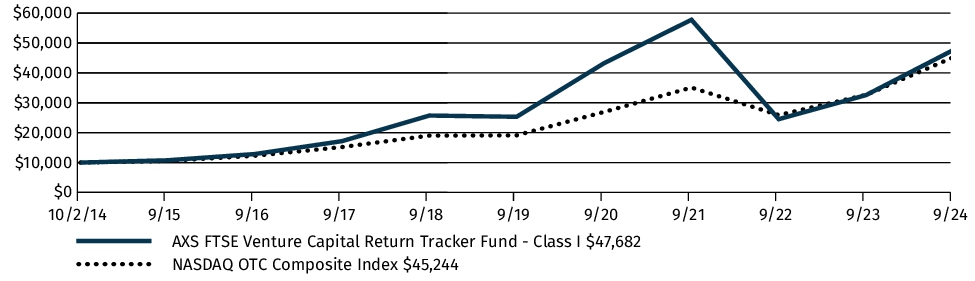

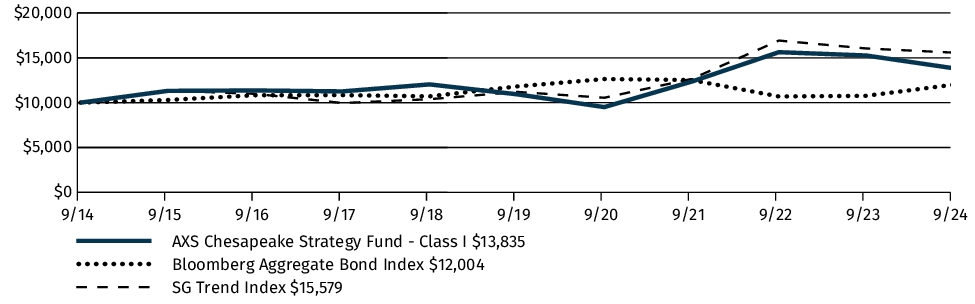

Householding