UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22923

Infinity Core Alternative Fund

(Exact name of registrant as specified in charter)

c/o UMB Fund Services, Inc.

235 West Galena Street

Milwaukee, WI 53212

(Address of principal executive offices) (Zip code)

Terrance P. Gallagher

235 West Galena Street

Milwaukee, WI 53212

(Name and address of agent for service)

registrant's telephone number, including area code: (414) 299-2270

Date of fiscal year end: March 31

Date of reporting period: September 30, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The Report to Shareholders is attached herewith.

INFINITY CORE ALTERNATIVE FUND

(a Maryland Statutory Trust)

Semi-Annual Report

For the Six Months Ended September 30, 2021

(Unaudited)

INFINITY CORE ALTERNATIVE FUND

(a Maryland Statutory Trust)

For the Six Months Ended September 30, 2021

(Unaudited)

Table of Contents

This report has been prepared for shareholders and may be distributed to others only if preceded or accompanied by a prospectus for the Fund. Please read it carefully before investing.

INFINITY CORE ALTERNATIVE FUND

(a Maryland Statutory Trust)

Schedule of Investments

September 30, 2021 (Unaudited)

| | | Redemptions | | Redemption | | Investment | | | | | | | | Original

Acquisition |

| Investment Funds (103.98%) | | Permitted | | Notice Period | | Strategy | | Cost | | | Fair Value | | | Date |

| Anchorage Capital Partners, L.P., Series K a,b | | Annually d | | 90 Days | | Event driven credit | | $ | 4,688,225 | | | $ | 6,147,031 | | | 3/1/2015 |

| Atlas Enhanced Fund, L.P. a,b | | Monthly | | 45 Days | | Multi-strategy | | | 6,071,679 | | | | 8,978,242 | | | 5/1/2014 |

| D.E. Shaw Composite International Fund, Collective Liquidity Class a,b | | Quarterly | | 75 Days | | Multi-strategy | | | 6,526,702 | | | | 11,947,364 | | | 10/1/2013 |

| Elliott Associates, L.P., Class B a,b | | Semi-annually c,d | | 60 Days | | Multi-strategy | | | 10,234,979 | | | | 15,704,329 | | | 10/1/2013 |

| Eton Park Fund, L.P., Class E a,b | | Quarterly c | | 65 Days | | Multi-strategy | | | 5,551 | | | | 6,353 | | | 10/1/2013 |

| King Street Capital, L.P. a,b | | Quarterly c | | 65 Days | | Global long/short credit and event-driven | | | 5,095,048 | | | | 6,922,199 | | | 10/1/2013 |

| Millennium USA LP, Class EE a,b | | Quarterly c | | 90 Days | | Multi-strategy | | | 7,730,043 | | | | 15,354,812 | | | 10/1/2013 |

| Perry Partners, L.P., Class C a,b | | Quarterly d | | 90 Days | | Opportunistic and event-driven | | | 6,702 | | | | 8,764 | | | 1/1/2014 |

| Point72 Capital, L.P., Class A-n a,b | | Quarterly c | | 45 Days | | Multi-strategy | | | 12,975,763 | | | | 17,348,894 | | | 1/1/2019 |

| Schonfeld Strategic Partners Offshore Fund Ltd., Class B a,b | | Quarterly d | | 45 Days | | Multi-strategy | | | 3,750,000 | | | | 4,847,315 | | | 5/1/2020 |

| Voloridge Fund, LP a,b | | Monthly | | 30 Days | | Quantitative Equities and Futures | | | 5,400,000 | | | | 5,280,860 | | | 12/1/2020 |

| Total Investment Funds (cost $62,484,692) (103.98%) | | | | | | | | | | | | | 92,546,163 | | | |

| | | | | | | | | | | | | | | | | |

| Total Investments (cost $62,484,692) (103.98%) | | | | | | | | | | | | $ | 92,546,163 | | | |

| Liabilities less other assets (-3.98%) | | | | | | | | | | | | | (3,538,625 | ) | | |

| Shareholders' Equity - 100.00% | | | | | | | | | | | | $ | 89,007,538 | | | |

| a | Non-income producing. |

| | |

| b | Investment Funds are issued in private placement transactions and as such are restricted as to resale. |

| | |

| c | The Investment Fund can institute a gate provision on redemptions at the investor level of 25% of the fair value of the investment in the Investment Fund. |

| | |

| d | The Investment Fund can institute a gate provision on redemptions at the fund level of 10 - 20% of the fair value of the investment in the Investment Fund. |

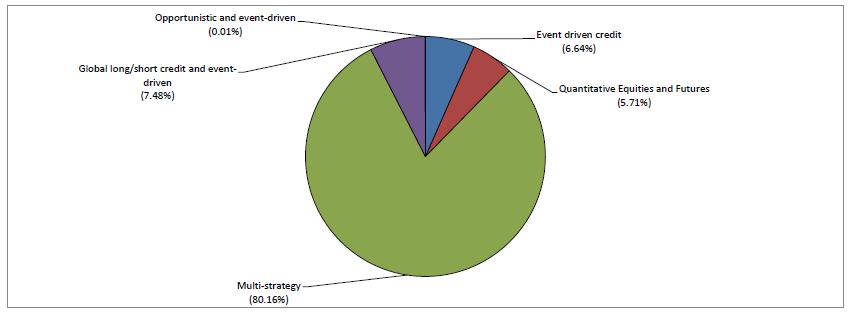

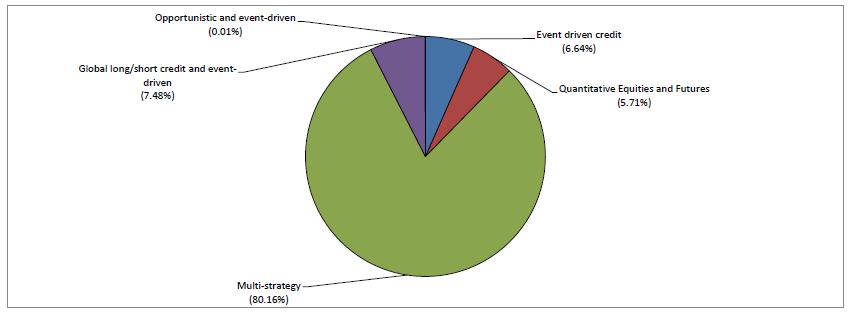

INVESTMENT STRATEGIES OF INVESTMENT FUND HOLDINGS AS A PERCENTAGE OF TOTAL INVESTMENT FUNDS

Investment strategies as a percentage of total investment funds are as follows:

The accompanying notes are an integral part of these Financial Statements.

INFINITY CORE ALTERNATIVE FUND

(a Maryland Statutory Trust)

Statement of Assets, Liabilities and Shareholders' Equity

September 30, 2021 (Unaudited)

| Assets | | | |

| Investments, at fair value (cost $62,484,692) | | $ | 92,546,163 | |

| Cash | | | 49,663 | |

| Investments in Investment Funds paid in advance | | | 2,500,000 | |

| Other assets | | | 29,019 | |

| Total Assets | | | 95,124,845 | |

| | | | | |

| Liabilities | | | | |

| Payable for shares repurchased | | | 1,689,863 | |

| Sale of Fund shares to shareholders received in advance | | | 105,000 | |

| Due to Investment Manager | | | 70,838 | |

| Line of credit payable | | | 4,190,000 | |

| Professional fees payable | | | 47,352 | |

| Accounting and administration fees payable | | | 9,865 | |

| Insurance fees payable | | | 2,956 | |

| Custody fees payable | | | 851 | |

| Interest expense payable | | | 582 | |

| Total Liabilities | | | 6,117,307 | |

| | | | | |

| Shareholders' Equity | | | 89,007,538 | |

| | | | | |

| Shareholders' Equity consists of: | | | | |

| Shareholders' Equity paid-in capital | | $ | 79,263,368 | |

| Total distributable earnings | | | 9,744,170 | |

| | | | | |

| Total Shareholders' Equity | | $ | 89,007,538 | |

| | | | | |

| Number of Shares Outstanding | | | 771,891 | |

| | | | | |

| Shareholders' Equity per Share | | $ | 115.31 | |

The accompanying notes are an integral part of these Financial Statements.

INFINITY CORE ALTERNATIVE FUND

(a Maryland Statutory Trust)

Statement of Operations

For the Six Months Ended September 30, 2021 (Unaudited)

| Income | | | |

| Interest | | $ | 18 | |

| | | | | |

| | | | | |

| Expenses | | | | |

| Investment management fee | | | 544,249 | |

| Professional fees | | | 120,294 | |

| Accounting and administration fees | | | 58,752 | |

| Interest expense | | | 30,572 | |

| Line of credit fees | | | 21,047 | |

| Trustees' fees | | | 20,595 | |

| Registration fees | | | 11,085 | |

| Chief Compliance Officer fees | | | 10,004 | |

| Insurance fees | | | 4,144 | |

| Custody fees | | | 4,363 | |

| Other expenses | | | 34,129 | |

| Total Operating Expenses | | | 859,234 | |

| | | | | |

| Expense Waivers | | | (159,711 | ) |

| | | | | |

| Net Expenses | | | 699,523 | |

| | | | | |

| Net Investment Loss | | | (699,505 | ) |

| | | | | |

| Realized and Unrealized Gain on Investments | | | | |

| Net realized loss from investments | | | (1,785 | ) |

| Net change in unrealized appreciation/depreciation on investments | | | 5,976,251 | |

| | | | | |

| Net Realized and Unrealized Gain on Investments | | | 5,974,466 | |

| | | | | |

| Net Increase in Shareholders' Equity from Operations | | $ | 5,274,961 | |

The accompanying notes are an integral part of these Financial Statements.

INFINITY CORE ALTERNATIVE FUND

(a Maryland Statutory Trust)

Statements of Changes in Shareholders' Equity

| | | For the | | | | |

| | | Six Months Ended | | | | |

| | | September 30, 2021 | | | Year Ended | |

| | | (Unaudited) | | | March 31, 2021 | |

| Operations | | | | | | | | |

| Net investment loss | | $ | (699,505 | ) | | $ | (1,279,499 | ) |

| Net realized gain (loss) on investments | | | (1,785 | ) | | | 2,107,404 | |

| Net change in unrealized appreciation/depreciation on investments | | | 5,976,251 | | | | 12,351,340 | |

| Net change in shareholders' equity from operations | | | 5,274,961 | | | | 13,179,245 | |

| | | | | | | | | |

| Distributions to Shareholders | | | | | | | | |

| Distributions | | | - | | | | (7,614,195 | ) |

| Net change in shareholders' equity from distributions to shareholders | | | - | | | | (7,614,195 | ) |

| | | | | | | | | |

| Capital Share Transactions | | | | | | | | |

| Sale of shares | | | 3,750,500 | | | | 4,330,800 | |

| Reinvested distributions | | | - | | | | 6,934,929 | |

| Shares repurchased | | | (2,432,607 | ) | | | (5,430,829 | ) |

| Net change in shareholders' equity from capital transactions | | | 1,317,893 | | | | 5,834,900 | |

| | | | | | | | | |

| Total Increase (Decrease) | | | 6,592,854 | | | | 11,399,950 | |

| | | | | | | | | |

| Shareholders' Equity | | | | | | | | |

| Beginning of period | | | 82,414,684 | | | | 71,014,734 | |

| End of period | | $ | 89,007,538 | | | $ | 82,414,684 | |

The accompanying notes are an integral part of these Financial Statements.

INFINITY CORE ALTERNATIVE FUND

(a Maryland Statutory Trust)

Statement of Cash Flows

For the Six Months Ended September 30, 2021 (Unaudited)

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | |

| Net Increase in Shareholders' Equity from Operations | | $ | 5,274,961 | |

| Adjustments to reconcile Net Increase in Shareholders' Equity from | | | | |

| Operations to net cash used in operating activities: | | | | |

| Net realized loss from investments | | | 1,785 | |

| Net change in unrealized appreciation/depreciation on investments | | | (5,976,251 | ) |

| Purchases of Investment Funds | | | (2,500,000 | ) |

| Proceeds from Investment Funds sold | | | 51,689 | |

| Changes in operating assets and liabilities: | | | | |

| Increase in other assets | | | (21,755 | ) |

| Increase in due to Investment Manager | | | 11,415 | |

| Decrease in professional fees payable | | | (9,953 | ) |

| Increase in accounting and administration fees payable | | | 234 | |

| Decrease in custody fees payable | | | (675 | ) |

| Increase in insurance fees payable | | | 305 | |

| Decrease in commitment fees payable | | | (7,443 | ) |

| Decrease in interest expense payable | | | (12,565 | ) |

| Decrease in other fees payable | | | (6,341 | ) |

| Net Cash Used in Operating Activities | | | (3,194,594 | ) |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | |

| Proceeds from sale of shares, including sale of shares received in advance | | | 3,780,500 | |

| Payments for shares repurchased | | | (1,130,718 | ) |

| Draw on line of credit | | | 3,415,000 | |

| Repayments on line of credit | | | (2,880,000 | ) |

| Net Cash Provided by Financing Activities | | | 3,184,782 | |

| | | | | |

| Net change in cash | | | (9,812 | ) |

| | | | | |

| Cash at beginning of period | | | 59,475 | |

| | | | | |

| Cash at end of period | | $ | 49,663 | |

| | | | | |

| Supplemental disclosure of interest expense paid | | $ | 43,137 | |

The accompanying notes are an integral part of these Financial Statements.

INFINITY CORE ALTERNATIVE FUND

(a Maryland Statutory Trust)

Financial Highlights

| | | For the | | | | | | | | | | | | | | | | |

| | | Six Months Ended | | | | | | | | | | | | | | | | |

| Per share operating performance. | | September 30, 2021 | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| For a capital share outstanding throughout each period. | | (Unaudited) | | | March 31, 2021 | | | March 31, 2020 | | | March 31, 2019 | | | March 31, 2018 | | | March 31, 2017 | |

| Shareholders' Equity, Beginning of Period | | $ | 108.52 | | | $ | 100.84 | | | $ | 105.22 | | | $ | 107.18 | | | $ | 104.65 | | | $ | 100.17 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss (1) | | | (0.91 | ) | | | (1.80 | ) | | | (1.74 | ) | | | (1.74 | ) | | | (1.71 | ) | | | (1.61 | ) |

| Net realized and unrealized gain/(loss) on investments | | | 7.70 | | | | 20.53 | | | | 3.99 | | | | 2.57 | | | | 4.78 | | | | 7.20 | |

| Total from investment operations: | | | 6.79 | | | | 18.73 | | | | 2.25 | | | | 0.83 | | | | 3.07 | | | | 5.59 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions to shareholders | | | | | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | - | | | | (8.19 | ) | | | (4.11 | ) | | | - | | | | - | | | | (0.29 | ) |

| From net realized gains | | | - | | | | (2.86 | ) | | | (2.52 | ) | | | (2.79 | ) | | | (0.54 | ) | | | (0.82 | ) |

| Net change in shareholders' equity due to distributions to shareholders | | | - | | | | (11.05 | ) | | | (6.63 | ) | | | (2.79 | ) | | | (0.54 | ) | | | (1.11 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholders' Equity, End of Period | | $ | 115.31 | | | $ | 108.52 | | | $ | 100.84 | | | $ | 105.22 | | | $ | 107.18 | | | $ | 104.65 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return (2) | | | 6.26 | %(7) | | | 18.83 | % | | | 2.01 | % | | | 0.82 | % | | | 2.94 | % | | | 4.82 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholders' Equity, end of period (in thousands) | | $ | 89,008 | | | $ | 82,415 | | | $ | 71,015 | | | $ | 79,212 | | | $ | 88,376 | | | $ | 122,128 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss to average shareholders' equity | | | (1.62 | )%(8) | | | (1.68 | )% | | | (1.64 | )% | | | (1.63 | )% | | | (1.63 | )% | | | (1.57 | )% |

| Ratio of gross expenses to average shareholders' equity (3) | | | 1.99 | %(8) | | | 1.98 | % | | | 1.91 | % | | | 1.85 | % | | | 1.77 | % | | | 1.84 | % |

| Ratio of expense waiver to average shareholders' equity | | | (0.37 | )%(8) | | | (0.30 | )% | | | (0.27 | )% | | | (0.22 | )% | | | (0.14 | )% | | | (0.27 | )% |

| Ratio of net expenses to average shareholders' equity | | | 1.62 | %(4)(8) | | | 1.68 | %(4) | | | 1.64 | %(4) | | | 1.63 | %(4) | | | 1.63 | %(4) | | | 1.57 | %(4) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio Turnover | | | 0.00 | %(7) | | | 16.78 | % | | | 3.30 | % | | | 15.98 | % | | | 18.17 | % | | | 4.19 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Senior Securities | | | | | | | | | | | | | | | | | | | | | | | | |

| Total borrowings (000's omitted) | | $ | 4,190 | | | $ | 3,655 | | | $ | 2,510 | | | $ | - | | | $ | 6,300 | | | $ | - | (6) |

| Asset coverage per $1,000 unit of senior indebtedness (5) | | $ | 22,243 | | | $ | 23,548 | | | $ | 29,293 | | | $ | - | | | $ | 15,028 | | | $ | - | (6) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Based on average shares outstanding for the period. |

| (2) | Total Return based on shareholders' equity is the combination of changes in shareholders' equity and reinvested dividend income in shareholders' equity, if any. Total Return does not reflect the impact of any applicable sales charges. |

| (3) | Represents the ratio of expenses to average shareholders' equity absent fee waivers and/or expense reimbursement by the Advisers. |

| (4) | The Fund's operating expenses include fees and interest expense associated with the Line of Credit, which are excluded from the Expense Limitation calculation. If the interest expense associated with the Line of Credit was excluded from operating expenses, the net expense ratio would be 1.50%. |

| (5) | Calculated by subtracting the Fund's total liabilities (not including borrowings) from the Fund's total assets and dividing this by the total number of senior indebtedness units, where one unit equals $1,000 of senior indebtedness. |

| (6) | Unaudited |

| (7) | Not annualized. |

| (8) | Annualized. |

The accompanying notes are an integral part of these Financial Statements.

INFINITY CORE ALTERNATIVE FUND

(a Maryland Statutory Trust)

Notes to Financial Statements – September 30, 2021 (unaudited)

1. ORGANIZATION

Infinity Core Alternative Fund (the “Fund”) is a Maryland statutory trust that operates under an Agreement and Declaration of Trust dated August 15, 2013 and commenced operations on October 1, 2013. Effective December 20, 2013, the Fund registered with the Securities and Exchange Commission (the “SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company. Effective April 18, 2014, the Fund also registered under the Securities and Exchange Act of 1933, as amended. First Trust Capital Management L.P. (formerly known as Vivaldi Asset Management, LLC) serves as the investment adviser (the “Investment Manager”) of the Fund. Infinity Capital Advisors, LLC serves as sub-adviser to the Fund (the “Sub-Adviser” and, together with the Investment Manager, the “Advisers”). Each of the Advisers is an investment adviser registered with the SEC under the Investment Advisers Act of 1940, as amended.

The investment objective of the Fund is to seek long-term capital growth. The Fund invests primarily in general or limited partnerships, funds, corporations, trusts or other investment vehicles (collectively, “Investment Funds”) based primarily in the United States that invest or trade in a wide range of securities, and, to a lesser extent, other property and currency interests. The Fund may also make investments outside of Investment Funds to hedge exposures deemed too risky or to invest in strategies not employed by the Fund’s Investment Funds. Such investments could also be used to hedge a position in an Investment Fund that is locked up or difficult to sell. Direct investments could include U.S. and foreign equity securities, debt securities, exchange-traded funds and derivatives related to such instruments, including futures and options thereon.

The Board of Trustees of the Fund (the “Board”) has overall responsibility for the management and supervision of the business operations of the Fund.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of the significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from these estimates. The Fund is an investment company and follows the accounting and reporting guidance in Financial Accounting Standards Board Accounting Standards Codification Topic 946.

a. Valuation of Investments

The Board has established a Valuation Committee to oversee the valuation of the Fund’s investments on behalf of the Fund. The Board has approved valuation procedures for the Fund (the “Valuation Procedures”). The Valuation Procedures provide that the Fund will value its investments in direct investments and Investment Funds at fair value.

The valuations of investments in Investment Funds are supported by information received from the Investment Funds, such as monthly net asset values, investor reports, and audited financial statements, when available.

In accordance with the Valuation Procedures, fair value as of each month-end or other applicable accounting periods, as applicable, ordinarily will be the value determined as of such date by each Investment Fund in accordance with the Investment Fund’s valuation policies and reported at the time of the Fund’s valuation. As a general matter, the fair value of the Fund’s interest in an Investment Fund will represent the amount that the Fund could reasonably expect to receive from the Investment Fund if the Fund’s interest was redeemed at the time of valuation, based on information reasonably available at the time the valuation is made and that the Fund believes to be reliable. Generally, the fair value of an Investment Fund is its net asset value. In the event that the Investment Fund does not report a month-end net asset value to the Fund on a timely basis, the Fund will determine the fair value of such Investment Fund based on the most recent final or estimated value reported by the Investment Fund, as well as any other relevant information available at the time the Fund values its portfolio. Using the nomenclature of the hedge fund industry, any values reported as “estimated” or “final” are expected to reasonably reflect fair market values of securities when available or fair value as of the Fund’s valuation date. A substantial amount of time may elapse between the occurrence of an event necessitating the pricing of the Fund’s assets and the receipt of valuation information from the underlying manager of an Investment Fund.

INFINITY CORE ALTERNATIVE FUND

(a Maryland Statutory Trust)

Notes to Financial Statements – September 30, 2021 (unaudited) (continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

a. Valuation of Investments (continued)

If it is probable that the Fund will sell an investment at an amount different from the net asset valuation or in other situations where the month-end valuation of the Investment Fund is not available, or when the Fund believes alternative valuation techniques are more appropriate, the Advisers and the Valuation Committee may consider other factors, including subscription and redemption rights, expected discounted cash flows, transactions in the secondary market, bids received from potential buyers, and overall market conditions in determining fair value.

The Fund classifies its assets and liabilities into three levels based on the lowest level of input that is significant to the fair value measurement. Estimated values may differ from the values that would have been used if a ready market existed or if the investments were liquidated at the valuation date.

The three-tier hierarchy distinguishes between (1) inputs that reflect the assumptions market participants would use in pricing an asset or liability developed based on market data obtained from sources independent of the reporting entity (observable inputs) and (2) inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing an asset or liability developed based on the best information available in the circumstances (unobservable inputs) and to establish classification of fair value measurements for disclosure purposes. Various inputs are used in determining the value of the Fund’s investments. The inputs are summarized in the three broad levels listed below:

| | · | Level 1 - quoted prices (unadjusted) in active markets for identical assets and liabilities |

| | · | Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, ability to redeem in the near term (generally within the next calendar quarter for Investment Funds), etc.) |

| | · | Level 3 - significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) or investments that cannot be fully redeemed at the net asset value in the “near term” (these are investments that generally have one or more of the following characteristics: gated redemptions, suspended redemptions, or have lock-up periods greater than 90 days). |

Investments in affiliated and private investment funds valued at the net asset value as practical expedient are not required under U.S. GAAP to be classified in the fair value hierarchy. Investment Funds with a fair value of $92,546,163 are excluded from the fair value hierarchy as of September 30, 2021.

As of September 30, 2021, the Fund does not hold any investments that are required to be included in the fair value hierarchy.

The Advisers generally categorize the investment strategies of the Investment Funds into investment strategy categories. The investment objective of multi-strategy hedge funds is to deliver consistently positive returns regardless of the directional movement in equity, interest rates or currency markets by engaging in a variety of investment strategies. The investment objective of global long/short credit investing involves investing in instruments around the world related to any level of an issuer’s capital structure. On the long side, this strategy focuses on companies, assets and instruments that are perceived to be trading below their inherent value. On the short side, the strategy involves securities of companies that are believed to have their credit quality deteriorate due to operating or financial challenges, become subject to a leveraging event or have a negative event in the future. Opportunistic investing involves deploying capital where it is needed most, predominantly in complex, deep value situations that are misunderstood by the markets. Event-driven investing involves the purchase or sale of securities of companies which are undergoing substantial changes. The investment objective of quantitative futures and equities investing seek to exploit trading opportunities in equity and global futures markets while seeking to achieve near zero correlation to markets over the long-term using quantitative analysis and/or systematic-based trading systems.

The Investment Funds compensate their respective Investment Fund managers through management fees currently ranging from 0.0% to 3.0% of average net asset value of the Fund’s investment annually and incentive allocations typically ranging between 10.0% and 30.0% of profits, subject to loss carryforward provisions, as defined in the respective Investment Funds’ agreements.

As of September 30, 2021, the Fund has no outstanding investment commitments.

INFINITY CORE ALTERNATIVE FUND

(a Maryland Statutory Trust)

Notes to Financial Statements – September 30, 2021 (unaudited) (continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

b. Investment

Interest income is recorded on an accrual basis. Investment transactions are accounted for on a trade date basis. The Fund determines the gain or loss realized from the investment transactions by comparing the original cost of the security lot sold with the net sale proceeds.

c. Fund Expenses

The Fund will pay all of its expenses, or reimburse the Advisers or their affiliates to the extent they have previously paid such expenses on behalf of the Fund. The expenses of the Fund include, but are not limited to, any fees and expenses in connection with the offering and issuance of shares of beneficial interest (“Shares”) of the Fund; all fees and expenses directly related to portfolio transactions and positions for the Fund’s account such as direct and indirect expenses associated with the Fund’s investments, and enforcing the Fund’s rights in respect of such investments; all fees and expenses reasonably incurred in connection with the operation of the Fund, such as investment management fee, legal fees, auditing fees, accounting, administration, and tax preparation fees, custodial fees, fees for data and software providers, costs of insurance, registration expenses, trustees’ fees, and expenses of meetings of the Board.

d. Income Tax Information & Distributions to Shareholders

The Fund's policy is to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, that are applicable to regulated investment companies and to distribute substantially all of its net investment income and any net realized gains to its shareholders (“Shareholders”). Therefore, no provision is made for federal income or excise taxes. Due to the timing of dividend distributions and the differences in accounting for income and realized gains and losses for financial statement and federal income tax purposes, the fiscal year in which amounts are distributed may differ from the year in which the income and realized gains and losses are recorded by the Fund.

Accounting for Uncertainty in Income Taxes (the “Income Tax Statement”) requires an evaluation of tax positions taken (or expected to be taken) in the course of preparing the Fund’s tax returns to determine whether these positions meet a “more-likely-than-not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained by a taxing authority upon examination. A tax position that meets the “more-likely-than-not” recognition threshold is measured to determine the amount of benefit to recognize in the financial statements. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations.

The Income Tax Statement requires management of the Fund to analyze tax positions expected to be taken in the Fund’s tax returns, as defined by Internal Revenue Service (the “IRS”) statute of limitations for all major jurisdictions, including federal tax authorities and certain state tax authorities. During the six months ended September 30, 2021, the Fund did not have a liability for any unrecognized tax benefits. At September 30, 2021, the tax years ended October 31, 2018, October 31, 2019, and October 31, 2020 remain open to examination by the IRS. The Fund has no examination in progress and is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

The amount and timing of distributions are determined in accordance with federal income tax regulations. For financial reporting purposes, dividends and distributions to Shareholders are recorded on the ex-date.

The character of distributions made during the year from net investment income or net realized gain may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense and gain/(loss) items for financial statement and tax purposes. Where appropriate, reclassifications between net asset accounts are made for such differences that are permanent in nature.

INFINITY CORE ALTERNATIVE FUND

(a Maryland Statutory Trust)

Notes to Financial Statements – September 30, 2021 (unaudited) (continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

d. Income Tax Information & Distributions to Shareholders (continued)

Additionally, U.S. GAAP requires certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. Permanent differences between book and tax basis are attributable to partnerships and passive foreign investment companies adjustments. These reclassifications have no effect on Shareholders’ Equity or Shareholders’ Equity per Share. For the tax year ended October 31, 2020 the following amounts were reclassified:

| Shareholder’s Equity paid-in capital | | $ | 488,340 | |

| Total distributable earnings | | | (488,340 | ) |

At March 31, 2021, the federal tax cost of investment securities and unrealized appreciation (depreciation) as of the year-end were as follows:

| Gross unrealized appreciation | | $ | 8,300,725 | |

| Gross unrealized depreciation | | | (336,752 | ) |

| Net unrealized appreciation | | $ | 7,963,973 | |

| Cost of investments | | $ | 78,658,975 | |

The difference between cost amounts for financial statement and federal income tax purposes is due primarily to timing differences in recognizing certain gains and losses in security transactions.

As of October 31, 2020, the components of accumulated earnings on a tax basis were as follows:

| Undistributed ordinary income | | $ | - | |

| Undistributed long-term capital gains | | - | |

| Tax accumulated earnings | | | - | |

| Accumulated capital and other losses | | | - | |

| Unrealized appreciation | | | 3,714,729 | |

| Other differences | | | - | |

| Distributable net earnings | | $ | 3,714,729 | |

The tax character of distributions paid during the tax years ended October 31, 2020 and 2019 was as follows:

| Distributions paid from: | | 2020 | | | 2019 | |

| Ordinary income | | $ | 4,522,579 | | | $ | 460,326 | |

| Net long-term capital gains | | | 86,011 | | | | 1,670,819 | |

| Total taxable distributions | | | 4,608,590 | | | | 2,131,145 | |

| Non-taxable distributions | | | 174,806 | | | | - | |

| Total distributions paid | | $ | 4,783,396 | | | $ | 2,131,145 | |

e. Cash

Cash, if any, includes amounts held in interest bearing money market accounts. Such deposits, at times, may exceed federally insured limits. The Fund has not experienced any losses in such accounts and does not believe it is exposed to any significant credit risk on such accounts.

INFINITY CORE ALTERNATIVE FUND

(a Maryland Statutory Trust)

Notes to Financial Statements – September 30, 2021 (unaudited) (continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

f. Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires the Fund’s management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of increases and decreases in Shareholders’ Equity from operations during the reporting period. Actual results could differ from those estimates.

3. INVESTMENT MANAGEMENT AND OTHER AGREEMENTS

The Fund pays the Investment Manager a management fee (“Investment Management Fee”) at an annual rate of 1.25%, payable monthly in arrears, based upon the Fund’s Shareholders’ Equity as of month-end. The Investment Management Fee is paid to the Investment Manager before giving effect to any repurchase of Shares in the Fund effective as of that date, and will decrease the net profits or increase the net losses of the Fund that are credited to its Shareholders. The Investment Manager pays the Sub-Adviser 50% of the Investment Management Fee it receives from the Fund.

The Investment Manager and the Sub-Adviser have entered into an expense limitation and reimbursement agreement (the “Expense Limitation and Reimbursement Agreement”) with the Fund, whereby the Investment Manager and the Sub-Adviser have jointly agreed to waive fees that they would otherwise have been paid, and/or to assume expenses of the Fund (a “Waiver”), if required to ensure the Total Annual Expenses (excluding taxes, interest, brokerage commissions, other transaction-related expenses, extraordinary expenses, commitment or non-use fees related to the Fund’s line of credit, and any acquired fund fees and expenses) do not exceed 1.50% of the net assets of the Fund on an annualized basis (the “Expense Limit”).

For a period not to exceed three years from the date on which a Waiver is made, the Investment Manager and/or Sub-Adviser may recoup amounts waived or assumed, provided they are able to effect such recoupment without causing the Fund’s expense ratio (after recoupment) to exceed the lesser of (i) the expense limit in effect at the time of the waiver, and (ii) the expense limit in effect at the time of recoupment. The Expense Limitation and Reimbursement Agreement is in effect until November 1, 2022 and will automatically renew for consecutive one-year terms thereafter. Each of the Fund, the Investment Manager or the Sub-Adviser may terminate the Expense Limitation and Reimbursement Agreement upon thirty days’ written notice to the other parties. For the six months ended September 30, 2021, the Advisers waived fees and reimbursed expenses of $159,711. Also, for the six months ended September 30, 2021, the Investment Manager is owed by the Fund an Investment Management Fee of $70,838 as disclosed in the Due to Investment Manager balance on the Statement of Assets, Liabilities and Shareholders’ Equity. At September 30, 2021, $186,237 is subject to recoupment through March 31, 2022, $208,486 is subject to recoupment through March 31, 2023, $227,940 is subject to recoupment through March 31, 2024, and $159,711 is subject to recoupment through March 31, 2025.

UMB Fund Services, Inc (“UMBFS”) acts as the Fund’s platform manager pursuant to a Platform Manager Agreement with the Fund. UMBFS does not receive a fee pursuant to the Platform Manager Agreement.

Foreside Fund Services, LLC acted as distributor to the Fund for the six months ended September 30, 2021; UMBFS serves as the Fund’s fund accountant, transfer agent and administrator; UMB Bank, n.a., an affiliate of UMBFS, serves as the Fund’s custodian.

A trustee and certain officers of the Fund are employees of UMBFS. The Fund does not compensate trustees or officers affiliated with the Fund’s administrator. For the year ended March 31, 2021, the Fund’s allocated fees incurred for directors are reported on the Statement of Operations.

Vigilant Compliance Services, LLC provides Chief Compliance Officer (“CCO”) services to the Fund. The Fund’s allocated fees incurred for CCO services for the six months ended September 30, 2021 were $10,004.

4. RELATED PARTY TRANSACTIONS

At September 30, 2021, Shareholders who are affiliated with the Investment Manager or the Sub-Adviser owned approximately $2,743,236 (or 3.08% of Shareholders’ Equity) of the Fund.

INFINITY CORE ALTERNATIVE FUND

(a Maryland Statutory Trust)

Notes to Financial Statements – September 30, 2021 (unaudited) (continued)

5. ADMINISTRATION AND CUSTODY AGREEMENT

UMB Fund Services, Inc. serves as administrator (the “Administrator”) to the Fund and provides certain accounting, administrative, record keeping and investor related services. The Fund pays a monthly fee to the Administrator based upon average Shareholders’ Equity, subject to certain minimums. UMB Bank, n.a. (the “Custodian”), an affiliate of the Administrator, serves as the primary custodian of the assets of the Fund, and may maintain custody of such assets with U.S. and non-U.S. sub-custodians, securities depositories and clearing agencies.

6. INVESTMENT TRANSACTIONS

For the six months ended September 30, 2021, the purchase and sale of investments, excluding short-term investments and U.S. Government securities were $438 and $51,689, respectively.

7. CAPITAL SHARE TRANSACTIONS

Shares are generally offered for purchase as of the first day of each calendar month at the Fund’s then-current Shareholders’ Equity per Share (determined as of the close of the preceding month), except that Shares may be offered more or less frequently as determined by the Board in its sole discretion. Transactions in Shares were as follows:

| Shares outstanding, March 31, 2020 | | | 704,212.681 | |

| Shares issued | | | 40,369.708 | |

| Shares reinvested | | | 65,399.195 | |

| Shares redeemed | | | (50,551,281 | ) |

| Shares outstanding, March 31, 2021 | | | 759,430.303 | |

| Shares issued | | | 33,775.367 | |

| Shares redeemed | | | (21,315.151 | ) |

| Shares outstanding, September 30, 2021 | | | 771,890.519 | |

8. REPURCHASE OF SHARES

At the discretion of the Board and provided that it is in the best interests of the Fund and Shareholders to do so, the Fund intends to provide a limited degree of liquidity to the Shareholders by conducting repurchase offers generally quarterly with a Valuation Date (as defined below) on or about March 31, June 30, September 30 and December 31 of each year. In each repurchase offer, the Fund may offer to repurchase its Shares at their net asset value as determined as of approximately March 31, June 30, September 30 and December 31, of each year, as applicable. Each repurchase offer ordinarily will be limited to the repurchase of approximately 25% of the Shares outstanding, but if the value of Shares tendered for repurchase exceeds the value the Fund intended to repurchase, the Fund may determine to repurchase less than the full number of Shares tendered. In such event, Shareholders will have their Shares repurchased on a pro rata basis, and tendering Shareholders will not have all of their tendered Shares repurchased by the Fund. Shareholders tendering Shares for repurchase will be asked to give written notice of their intent to do so by the date specified in the notice describing the terms of the applicable repurchase offer, which date will be approximately 95 days prior to the date of repurchase by the Fund.

9. CREDIT FACILITY

The Fund maintains a credit facility (the “Facility”) with a maximum borrowing amount of $8,000,000, which is secured by certain interests in Investment Funds. A fee of 80 basis points per annum is payable monthly in arrears on the unused portion of the Facility, while the interest rate charged on borrowings is the 3-month London Interbank Offer Rate plus a spread of 195 basis points (2.09% at September 30, 2021). Collateral for the Facility is held by the Custodian. The line of credit is secured by a portfolio of hedge funds. Interest and fees incurred for the six months ended September 30, 2021 are disclosed in the accompanying Statement of Operations. At September 30, 2021, the Fund had $4,190,000 payable on the Facility and a $582 interest payable balance on the borrowings.

INFINITY CORE ALTERNATIVE FUND

(a Maryland Statutory Trust)

Notes to Financial Statements – September 30, 2021 (unaudited) (continued)

9. CREDIT FACILITY (continued)

For the six months ended September 30, 2021, the average interest rate, the average daily loan balance and the maximum balance outstanding for the 183 days the Fund had outstanding borrowings under the Facility was 2.106%, $2,816,667 and $4,190,000, respectively. The Fund is subject to certain loan covenants, the most restrictive covenant being the maintenance of a loan to value ratio. The Fund was in compliance with these covenants for the six months ended September 30, 2021.

10. INDEMNIFICATION

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund’s maximum exposure under these agreements is dependent on future claims that may be made against the Fund, and therefore cannot be established; however, the Fund expects the risk of loss from such claims to be remote.

11. RISK FACTORS

The Fund is subject to substantial risks — including market risks, strategy risks and Investment Fund manager risks. Investment Funds generally will not be registered as investment companies under the Investment Company Act and, therefore, the Fund will not be entitled to the various protections afforded by the Investment Company Act with respect to its investments in Investment Funds. While the Advisers will attempt to moderate any risks of securities activities of the Investment Fund managers, there can be no assurance that the Fund’s investment activities will be successful or that the Shareholders will not suffer losses. The Advisers will not have any control over the Investment Fund managers, thus there can be no assurances that an Investment Fund manager will manage its Investment Funds in a manner consistent with the Fund’s investment objective.

In early 2020, an outbreak of a novel strain of coronavirus (COVID-19) emerged globally. This coronavirus has resulted in closing international borders, enhanced health screenings, healthcare service preparation and delivery, quarantines, cancellations, disruptions to supply chains and customer activity, as well as general public concern and uncertainty. The impact of this outbreak has negatively affected the worldwide economy, as well as the economies of individual countries, the financial health of individual companies and the market in general in significant and unforeseen ways. Although vaccines for COVID-19 are becoming more widely available, the future impact of COVID-19 is currently unknown, and it may exacerbate other risks that apply to the Fund, including political, social and economic risks. Any such impact could adversely affect the Fund’s performance, the performance of the securities in which the Fund invests and may lead to losses on your investment in the Fund. The ultimate impact of COVID-19 on the financial performance of the Fund’s investments is not reasonably estimable at this time.

12. Results of a Special Meeting of Shareholders (Unaudited)

At a special meeting of shareholders of the Fund held on September 28, 2021, the following matter was submitted to the vote of the shareholders, with the results of voting set forth below:

Proposal 1. That Gary E. Shugrue be, and hereby is, elected to the Board of Trustees of the Infinity Core Alternative Fund:

| Director Nominee | | Votes For | | | Votes Withheld | |

| Gary E. Shugrue | | | 122,157 | | | | 155,788 | |

The other Trustees of the Fund are David G. Lee, Robert Seyferth and Terrance P. Gallagher.

13. SUBSEQUENT EVENTS

Management has evaluated the impact of all subsequent events on the Fund through the date the financial statements were issued and has the following event for disclosure: Effective October 1, 2021 there were capital contributions to the Fund in the amount of $694,000.

INFINITY CORE ALTERNATIVE FUND

(a Maryland Statutory Trust)

Notes to Financial Statements – September 30, 2021 (unaudited) (continued)

Effective November 1, 2021, Vivaldi Holdings, LLC (“Vivaldi Holdings”), the controlling member of Vivaldi Asset Management, LLC, partnered with First Trust Capital Partners, LLC in a joint venture to create a new entity called First Trust Capital Solutions L.P., resulting in a change in control of Vivaldi Asset Management, LLC (the “Transaction”). As a result of the Transaction, there were no changes in the management or day-to-day advisory services provided to the Fund. As part of the Transaction, Vivaldi Asset Management, LLC changed its name to First Trust Capital Management L.P. and Vivaldi Holdings changed its name to VFT Holdings LP. First Trust Capital Management L.P. is a Delaware limited partnership and a registered investment adviser controlled by First Trust Capital Solutions L.P. First Trust Capital Solutions L.P. is a Delaware limited partnership owned 50% by First Trust Capital Partners, LLC and 50% by VFT Holdings LP and its affiliates. On November 1, 2021, the Fund entered into a new Distribution Agreement with First Trust Portfolios L.P., who replaced Foreside Fund Services, LLC as the Fund's distributor. First Trust Portfolios L.P. is an affiliate of First Trust Capital Management L.P.

At a second special meeting of shareholders held on September 28, 2021 and adjourned to October 22, 2021, in connection with the above-referenced November 1, 2021 Transaction, the following matters were submitted to the vote of the shareholders, with the results of voting set forth below:

Proposal 1. The proposed Investment Management Agreement between the Fund and Vivaldi Asset Management, LLC, be, and the same hereby is, approved:

| For the Proposal | Against the Proposal | Abstain |

| |

| 431,943 | 0 | 1,683 |

Proposal 2. The proposed Investment Sub-Advisory Agreement by and among the Fund, Vivaldi Asset Management, LLC and Infinity Capital Advisors, LLC, be, and the same hereby is, approved:

| For the Proposal | Against the Proposal | Abstain |

| |

| 433,626 | 0 | 0 |

INFINITY CORE ALTERNATIVE FUND

(a Maryland Statutory Trust)

Other Information – September 30, 2021 (unaudited)

Proxy Voting

The Fund is required to file Form N-PX, with its complete proxy voting record for the twelve months ended June 30, no later than August 31. The Fund’s Form N-PX filing and a description of the Fund’s proxy voting policies and procedures are available: (i) without charge, upon request, by calling the Fund at (877) 779-1999 or (ii) by visiting the SEC’s website at https://www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Form N-PORT is available on the SEC’s website at https://www.sec.gov.

Approval of Investment Management and Sub-Advisory Agreements

At a meeting of the Board held on June 2-3, 2021, by a unanimous vote, the Board, including a majority of Trustees who are not “interested persons” within the meaning of Section 2(a)(19) of the 1940 Act (the “Independent Trustees”), approved the Investment Management Agreement between the Investment Manager and the Fund and the Sub-Advisory Agreement among the Investment Manager, the Sub-Adviser and the Fund (collectively, the “Agreements”).

In advance of the June 2-3, 2021 meeting, the Independent Trustees requested and received materials from the Investment Manager and Sub-Adviser to assist them in considering the approval of the Agreements. The Independent Trustees reviewed reports from third parties and management about the below factors. The Board did not consider any single factor as controlling in determining whether or not to approve each of the Agreements. Nor are the items described herein all-encompassing of the matters considered by the Board. Pursuant to relief granted by the U.S. Securities and Exchange Commission (“the SEC”) in light of the COVID-19 pandemic (the “Order”) and a determination by the Board that reliance on the Order was appropriate due to circumstances related to the current or potential effects of COVID-19, the June 2-3, 2021 meeting was held by videoconference.

The Board engaged in a detailed discussion of the materials with management of the Advisers. The Independent Trustees then met separately with independent counsel to the Independent Trustees for a full review of the materials. Following this session, the full Board reconvened and after further discussion determined that the information presented provided a sufficient basis upon which to approve the Agreements.

Nature, Extent and Quality of Services

The Board reviewed and considered the nature and extent of the investment advisory services provided by the Investment Manager to the Fund under the Investment Management Agreement and by the Sub-Adviser under the Sub-Advisory Agreement, including the selection of Fund investments. The Board also reviewed and considered the nature and extent of the non-advisory, administrative services provided by the Investment Manager and Sub-Adviser to the Fund, including, among other things, providing office facilities, equipment, and personnel. The Board reviewed and considered the qualifications of the portfolio managers, and other key personnel of the Investment Manager and/or Sub-Adviser who provide the investment advisory and administrative services to the Fund. The Board determined that the Investment Manager’s and Sub-Adviser's portfolio managers and key personnel are well- qualified by education and/or training and experience to perform the services for the Fund in an efficient and professional manner. The Board also took into account the Investment Manager’s and Sub-Adviser’s compliance policies and procedures, including the procedures used to determine the value of the Fund's investments. The Board concluded that the overall quality of the advisory, sub-advisory and administrative services provided to the Fund was satisfactory.

Performance

The Board considered the investment performance of the Investment Manager and Sub-Adviser with respect to the Fund. The Board considered the performance of the Fund, noting that the Fund had outperformed the HFRX Global Hedge Fund Index for the quarter ended March 31, 2021 and the one, three and five-year periods ended March 31, 2021.

INFINITY CORE ALTERNATIVE FUND

(a Maryland Statutory Trust)

Other Information – September 30, 2021 (unaudited) (continued)

Fees and Expenses Relative to Comparable Funds Managed by Other Investment Managers

The Board reviewed the advisory fee rate and total expense ratio of the Fund, noting that the Investment Manager pays the Sub-Adviser from its fee. The Board compared the advisory fee and total expense ratio for the Fund with various comparative data, including reports on the expenses of other comparable funds and other funds managed by the Investment Manager and Sub-Adviser. The Board noted that the advisory fees were comparable to the fees payable by other funds managed by the Investment Manager. In addition, the Board noted that the Investment Manager and Sub-Adviser have contractually agreed to limit total annual operating expenses until assets support the expenses of the Fund. The Board concluded that the advisory fees paid by the Fund, the sub-advisory fees and total expense ratio were reasonable and satisfactory in light of the services provided.

Breakpoints and Economies of Scale

The Board reviewed the structure of the Fund's investment management under the Investment Management Agreement and Sub-Advisory Agreement. The Board considered the Fund's advisory and sub-advisory fees and concluded that the fees were reasonable and satisfactory in light of the services provided. The Board also determined that, given the Fund’s current size, economies of scale were not present at this time.

Profitability of Investment Manager and Sub-Adviser

The Board considered and reviewed information concerning the costs incurred and profits realized by the Investment Manager and Sub-Adviser from their respective relationships with the Fund. The Board also reviewed the Investment Manager’s and Sub-Adviser’s financial condition. The Board noted that the financial condition of each appeared stable. The Board determined that the advisory fees, sub-advisory fees and the compensation to the Investment Manager and Sub-Adviser were reasonable and the financial condition of each was adequate.

Ancillary Benefits and Other Factors

The Board also discussed other benefits to be received by the Investment Manager and Sub-Adviser from their management of the Fund including, without limitation, the ability to market their advisory services for similar products in the future. The Board noted that neither the Investment Manager nor the Sub-Adviser has affiliations with the Funds’ transfer agent, fund accountant, custodian, or distributor and, therefore, they do not derive any benefits from the relationships these parties may have with the Fund. The Board concluded that the advisory fees and sub-advisory fees were reasonable in light of the fall-out benefits.

General Conclusion

Based on its consideration of all factors that it deemed material, and assisted by the advice of its counsel, the Board concluded it would be in the best interest of the Fund and its shareholders to approve the continuance of the Investment Management Agreement and Sub-Advisory Agreement.

Approval of the Investment Management and Sub-Advisory Agreements

At a meeting of the Board held on July 27, 2021 (“Meeting”), by a unanimous vote, the Board, including a majority of Trustees who are not “interested persons” within the meaning of Section 2(a)(19) of the 1940 Act (the “Independent Trustees”), approved a new investment management agreement between the Investment Manager and the Fund (“New Investment Management Agreement”) and a new investment sub-advisory agreement among the Investment Manager, the Fund, and the Sub-Adviser (the “New Sub-Advisory Agreement” and, together with the New Investment Management Agreement, the “New Advisory Agreements”).

During the Meeting, the Board discussed the proposed Transaction (as described above) and noted that the Transaction would result in an assignment and termination of the existing advisory agreements. The Board also approved an interim investment management (“Interim Investment Management Agreement”) and an interim investment sub-advisory agreement with the Sub-Adviser (“Interim Sub-Advisory Agreement) to go into effect in the event shareholders did not approve the New Advisory Agreements before the Transaction was completed. The interim agreements would have allowed the Investment Manager and the Sub-Adviser (collectively, the “Advisers”) to continue providing services to the Fund while the Fund continues to seek shareholder approval of the New Advisory Agreements. Hereinafter, the term “New Advisory Agreements” also include the interim agreements.

INFINITY CORE ALTERNATIVE FUND

(a Maryland Statutory Trust)

Other Information – September 30, 2021 (unaudited) (continued)

In light of the foregoing, the Independent Trustees requested and received materials from the Investment Manager and the Sub-Adviser, respectively, to assist them in considering the approval of the New Advisory Agreements. The Independent Trustees reviewed reports from third parties and management about the below factors. The Board did not consider any single factor as controlling in determining whether to approve the New Advisory Agreements. Nor are the items described herein all-encompassing of the matters considered by the Board.

Pursuant to relief granted by the SEC in light of the COVID-19 pandemic (the “Order”) and a determination by the Board that reliance on the Order was appropriate due to circumstances related to the current or potential effects of COVID-19, the Meeting was held by videoconference. At this Meeting and throughout the consideration process, the Board, including a majority of the Independent Trustees, was advised by counsel.

The Board engaged in a detailed discussion of the materials with management of the Advisers. The Independent Trustees then met separately with independent counsel to the Independent Trustees for a full review of the materials. Following this session, the full Board reconvened and after further discussion determined that the information presented provided a sufficient basis upon which to approve the New Advisory Agreements.

New Investment Management Agreement and Interim Investment Management Agreement

Nature, Extent, and Quality of Services

The Board reviewed and considered that the nature and extent of the investment advisory services to be provided by the Investment Manager to the Fund under the Interim Investment Management Agreement and the New Investment Management Agreement, including the selection of Fund investments. The Board noted that the services would be the same as the services provided under the investment advisory agreement between the Fund and the Investment Manager dated August 16, 2013 (“Original Investment Management Agreement”). The Board also considered that the Transaction was not expected to affect the nature, extent and quality of the services to be provided by the Investment Manager under the terms of the Interim Investment Management Agreement and the New Investment Management Agreement. The Board reviewed and considered the nature and extent of the non-advisory, administrative services provided by the Investment Manager to the Fund, including, among other things, providing office facilities, equipment, and personnel. The Board also reviewed and considered the qualifications of the portfolio managers and key personnel of the Investment Manager who provide investment advisory and administrative services to the Fund. The Board determined that the Investment Manager’s portfolio managers and key personnel are well-qualified by education and/or training and experience to perform the services for the Fund in an efficient and professional manner. The Board also took into account the Investment Manager’s compliance policies and procedures, including the procedures used to determine the value of the Fund's investments. The Board concluded that the overall quality of the advisory and administrative services provided to the Fund by the Investment Manager was satisfactory.

Performance

The Board considered the investment performance of Investment Manager with respect to the Fund. The Board considered the performance of the Fund, noting that the Fund had outperformed the HFRX Index for the quarter ended March 31, 2021 and the one-year, three-year and five-year periods ended March 31, 2021. The Board concluded that the performance of the Fund was satisfactory. The Board agreed that the Transaction was not expected to cause any changes that were or could be expected to materially affect the performance of the Fund.

Fees and Expenses Relative to Comparable Funds Managed by Other Investment Managers

The Board considered the advisory fee rate and total expense ratio of the Fund under the Original Investment Management Agreement, noting that the Investment Manager pays the Sub-Adviser from its fee, as compared to the advisory fee rate and total expense rate assuming the approval of the New Investment Management Agreement. The Board considered that the advisory fee rate that the Fund pays the Investment Manager would not change under the Interim Investment Management Agreement or the New Investment Management Agreement (although the fees will be held in escrow during the term of the Interim Investment Management Agreement, if applicable). In addition, the Board noted that the Investment Manager and the Sub-Adviser would continue to contractually limit total annual operating expenses for at least one year after the effective date of the Transaction. The Board concluded that the management fees paid by the Fund under the Interim Investment Management Agreement and the New Investment Management Agreement and the total expense ratio were reasonable and satisfactory in light of the services provided.

INFINITY CORE ALTERNATIVE FUND

(a Maryland Statutory Trust)

Other Information – September 30, 2021 (unaudited) (continued)

Breakpoints and Economies of Scale

The Board reviewed the structure of the Fund’s investment management under the Interim Investment Management Agreement and the New Investment Management Agreement. The Board considered the Fund’s management fees and concluded that the fees were reasonable and satisfactory in light of the services provided. The Board also determined that, given the Fund’s current size, economies of scale were not present at this time.

Profitability of Investment Managers and Affiliates

The Board considered and reviewed information concerning the costs incurred and profits realized by the Investment Manager from its relationships with the Fund. The Board also reviewed the Investment Manager’s financial condition. The Board noted that the financial condition of the Investment Manager appeared stable. The Board determined that the compensation to the Investment Manager was reasonable and the financial condition was adequate.

After receiving adequate information, the Board was satisfied that the Transaction would not result in any adverse consequences for the Fund. The Board noted representations from the Investment Manager that the Transaction was not expected to result in any changes to the services it provides to the Fund, or the personnel providing those services.

General Conclusion

Based on its consideration of all factors that it deemed material, and assisted by the advice of its counsel, the Board concluded it would be in the best interest of the Fund and its shareholders to approve the New Investment Management Agreement.

New Sub-Advisory Agreement and Interim Sub-Advisory Agreement

Nature, Extent and Quality of Services

The Board reviewed and considered the nature and extent of the investment sub-advisory services to be provided by the Sub-Adviser to the Fund under the Interim Sub-Advisory Agreement and the New Sub-Advisory Agreement, including the selection of Fund investments. The Board also reviewed and considered the nature and extent of the non-advisory, administrative services to be provided by the Sub-Adviser, including among other things, providing office facilities, equipment; and personnel. The Board also reviewed and considered the qualifications of the portfolio managers, and other key personnel of the Sub-Adviser who would provide the investment advisory services to the Fund. The Board determined that the Sub-Adviser’s portfolio managers and key personnel are well qualified by education and/or training and experience to perform the services in an efficient and professional manner. The Board also took into account the Sub-Adviser 's procedures used to determine the value of the Fund's investments. Based on their review, the Trustees concluded that the nature, extent and quality of services expected to be provided to the Fund under the Interim Sub-Advisory Agreement and the New Sub-Advisory Agreement are satisfactory.

Performance

The Board considered the investment performance of the Sub-Adviser with respect to the Fund. The Board considered the performance of the Fund, noting that the Fund had outperformed the HFRX Index for the quarter ended March 31, 2021 and the one-year, three-year and five-year periods ended March 31, 2021. The Board concluded that the performance of the Fund was satisfactory.

Fees and Expenses

The Board considered the sub-advisory fee rate under the investment sub-advisory agreement among the Fund, the Investment Manager and the Sub-Adviser dated August 16, 2013 (the “Original Investment Sub-Advisory Agreement”), noting that the Investment Manager pays the Sub-Adviser from its fee, as compared to the sub-advisory fee rate assuming the approval of the New Sub-Advisory Agreement, noting the Investment Manager pays the Sub-Adviser from its fees. The Board considered that the sub-advisory fee rate that the Investment Manager pays to the Sub-Adviser would not change under the Interim Sub-Advisory Agreement and the New Sub-Advisory Agreement (although the fees would be held in escrow during the term of the Interim Sub-Advisory Agreement, if applicable). In addition, the Board noted that the Sub-Adviser would continue to contractually limit total annual operating expenses. The Board concluded that the sub-advisory fees were reasonable and satisfactory in light of the services provided.

INFINITY CORE ALTERNATIVE FUND

(a Maryland Statutory Trust)

Other Information – September 30, 2021 (unaudited) (continued)

Economies of Scale

The Board reviewed the structure of the Fund’s investment management under the Interim Sub-Advisory Agreement and the New Sub-Advisory Agreement. The Board considered the Fund’s sub-advisory fees and concluded that the fees were reasonable and satisfactory in light of the services provided. The Board also determined that, given the Fund’s current size, economies of scale were not present at this time.

Profitability, Ancillary Benefits and Other Factors

The Board reviewed the Sub-Adviser’s financial condition. The Board noted that the financial condition of the Sub-Adviser appeared stable. The Board determined that the compensation to the Sub-Adviser was reasonable and the financial condition was adequate.

Other Benefits to the Sub-Adviser

The Trustees received and reviewed information regarding any “fall-out” or ancillary benefits that might be received by the Sub-Adviser or its affiliates as a result of their relationship with the Fund. Based on their review, the Trustees concluded that the fall-out benefits that might be received by the Sub-Adviser and its affiliates as a result of the relationship with the Fund are reasonable.

Conclusion

Based on its consideration of all factors that it deemed material, and assisted by the advice of its counsel, the Board concluded it would be in the best interest of the Fund and its shareholders to approve the New Sub-Advisory Agreement.

ITEM 2. CODE OF ETHICS.

Not applicable to semi-annual reports.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable to semi-annual reports.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable to semi-annual reports.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

ITEM 6. SCHEDULE OF INVESTMENTS.

Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included as part of the report to shareholders filed under Item 1 of this form.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable to semi-annual reports.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable to semi-annual reports.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

Not applicable.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

There have been no material changes to the procedures by which the shareholders may recommend nominees to the registrant's board of trustees, where those changes were implemented after the registrant last provided disclosure in response to the requirements of Item 407(c)(2)(iv) of Regulation S-K (17CFR 229.407), or this Item.

ITEM 11. CONTROLS AND PROCEDURES.

(a) The registrant's principal executive and principal financial officers, or persons performing similar functions, have concluded that the registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the "1940 Act") (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d-15(b)).

(b) There were no changes in the registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act (17 CFR 270.30a-3(d)) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting.

ITEM 12. DISCLOSURE OF THE SECURITIES LENDING ACTIVITIES FOR CLOSED-END MANAGEMENT COMPANIES.

Not applicable.

ITEM 13. EXHIBITS.

(a)(1) Not applicable to semi-annual reports.

(a)(2) Certifications pursuant to Rule 30a-2(a) under the 1940 Act and Section 302 of the Sarbanes-Oxley Act of 2002 are attached hereto.

(a)(3) Not applicable.

(a)(4) Not applicable.

(b) Certifications pursuant to Rule 30a-2(a) under the 1940 Act and Section 906 of the Sarbanes-Oxley Act of 2002 are attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (registrant) | Infinity Core Alternative Fund | |

| | | |

| By (Signature and Title)* | /s/ Michael Peck | |

| | Michael Peck, President | |

| | (Principal Executive Officer) | |

| | | |

| Date | December 9, 2021 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title)* | /s/ Michael Peck | |

| | Michael Peck, President | |

| | (Principal Executive Officer) | |

| | | |

| Date | December 9, 2021 | |

| | | |

| By (Signature and Title)* | /s/ Randal Golden | |

| | Randal Golden, Treasurer | |

| | (Principal Financial Officer) | |

| | | |

| Date | December 9, 2021 | |

* Print the name and title of each signing officer under his or her signature.