Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

GBTC Vettafi Webinar

Video

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Disclosures

Grayscale Bitcoin Trust (BTC) (the “Trust”) has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Trust has filed with the SEC for more complete information about the Trust and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Trust or any authorized participant will arrange to send you the prospectus (when available) if you request it by calling (833) 903 - 2211 or by contacting Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101.

Foreside Fund Services, LLC is the Marketing Agent for the Trust.

An investment in the Trust involves risks, including possible loss of principal. The Trust holds Bitcoins; however, an investment in the Trust is not a direct investment in Bitcoin. As a non-diversified and single industry fund, the value of the shares may fluctuate more than shares invested in a broader range of industries. Extreme volatility, regulatory changes, and exposure to digital asset exchanges may impact the value of Bitcoin, and consequently the value of the Trust.

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Transcript

Todd Rosenbluth All right, here we go. Hi, everyone. Todd Rosenbluth, Head of research at Vettafi, and thanks for joining us for our latest webcast. We're going to explore Bitcoin in 2024. You've got questions. We're going to have some answers. And we're going to talk about spot Bitcoin ETFs. Now this webcast is sponsored by Grayscale Investments. And yes we're going to discuss a lot about Bitcoin. We're going to talk about investor sentiment. Since we've had approval of a spot Bitcoin ETF we'll talk about how to incorporate Bitcoin ETFs into portfolios. And we'll talk about the challenges and opportunities that come with some of these innovative products. Now a few housekeeping items to go over before I introduce my fellow presenters, and we dive into your questions as well. Please submit those questions. Use that Q&A box in the bottom right corner of the screen. We'll get to as many questions as we possibly can. Now these slides as well as recording of presentation should be made available on demand shortly. But go to that folder, which is where you'll find a copy of the presentation, as well as a lot of great material that the Grayscale team put together. There's an ETF overview and a fact sheet. There's a video about why GBTC the Grayscale ETF. There's an overview of the firm. And there's a 101 about Bitcoin in general. Now we mentioned questions. We're actually going to ask you a couple of questions that will pop up on the screen. And we'd love your participation in these polls. Also go check out that clipboard widget. There's a survey where we'll have additional questions, and we'll also get some of your feedback on the event and how you thought it went. And if you're looking for CE credit, you're in the right place. Just go to that certificate widget on the bottom of the screen, and everything that you need to do will be accomplished. Now I'm really excited that we've got the Grayscale team joining us for this event, because they have the largest, ETF that's available for Bitcoin. It just became an ETF, and I want to be able to dive in deeper about how that came about and most importantly why we're talking Bitcoin. So we've got Dave LaValle, who's a senior managing director and global head of ETFs at Grayscale Investments. And we have Zach Pandl, who's a managing director of research at Grayscale Investments. They both come with a lot of experience to help us understand what's going on in the marketplace, understand why ETFs, and perhaps understand why Grayscale should be your partner of choice for Bitcoin ETFs. Now, before I bring Zach on, just love to get a sense from the audience. Are you considering incorporating Bitcoin into client portfolios in the next six months? A simple yes or no would be great and while we wait for people to answer that, Zach, I'll just say good afternoon to you from New York. How are you doing?

Zach Pandl Thanks Todd. I'm doing great. It's awesome to be with you and everyone else here today.

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Todd Rosenbluth Same here. Well, great to have you in the broader Grayscale team as part of this. Again for the audience. Just let us know. Are you considering incorporating Bitcoin into client portfolios in the next six months? A simple yes or no will suffice. And let's see what the answer is. So yes, I'm excited to see that we've got two thirds of the audience just about that, that the answer is yes. For those of you that the answer is no. It's okay. It's great for you to learn now and understand how it can fit into the portfolio overall. Right, Zach?

Zach Pandl Absolutely.

Todd Rosenbluth So let's dive in. Let's just talk about what we're going to accomplish on this webcast and and why specifically Grayscale could be the partner of choice. Zach, Let me let you get things started.

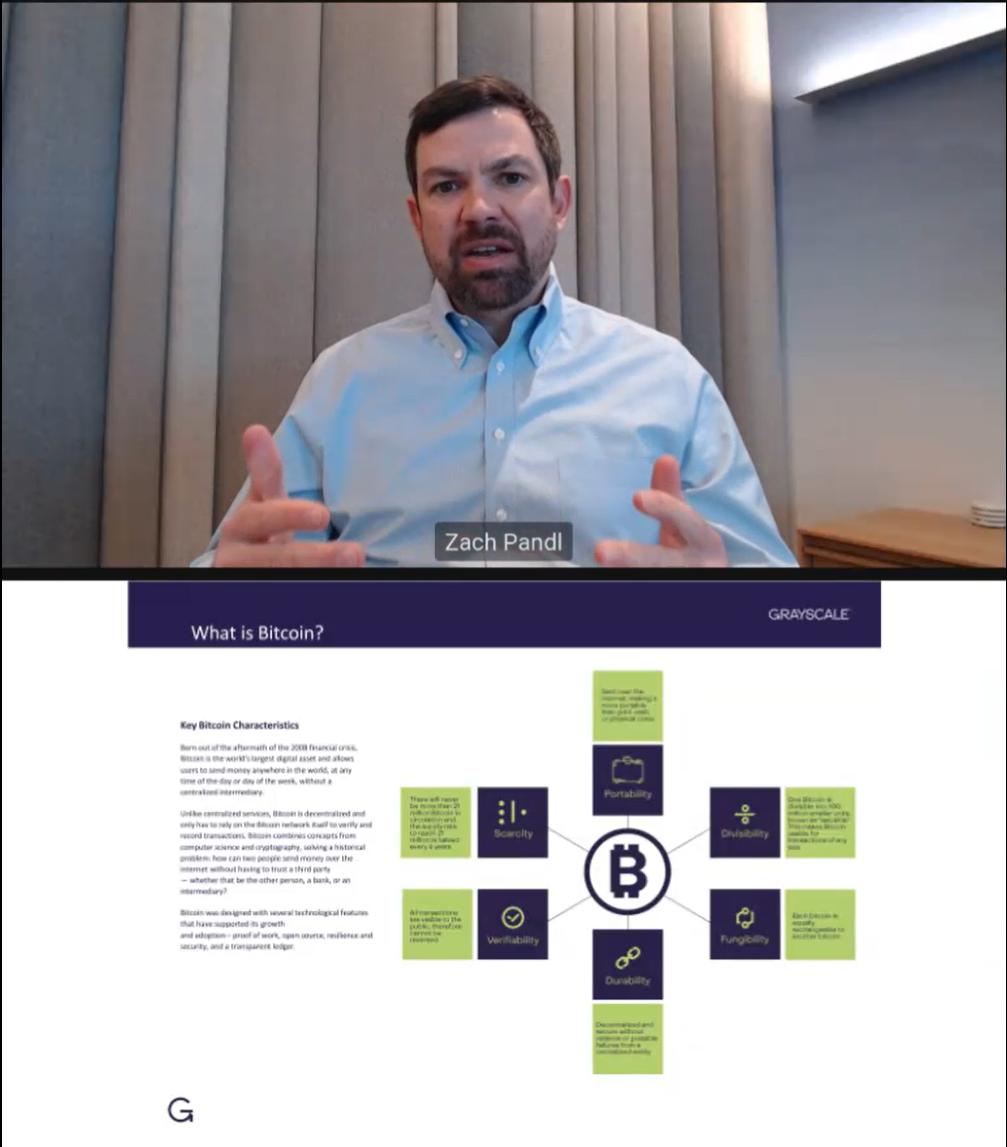

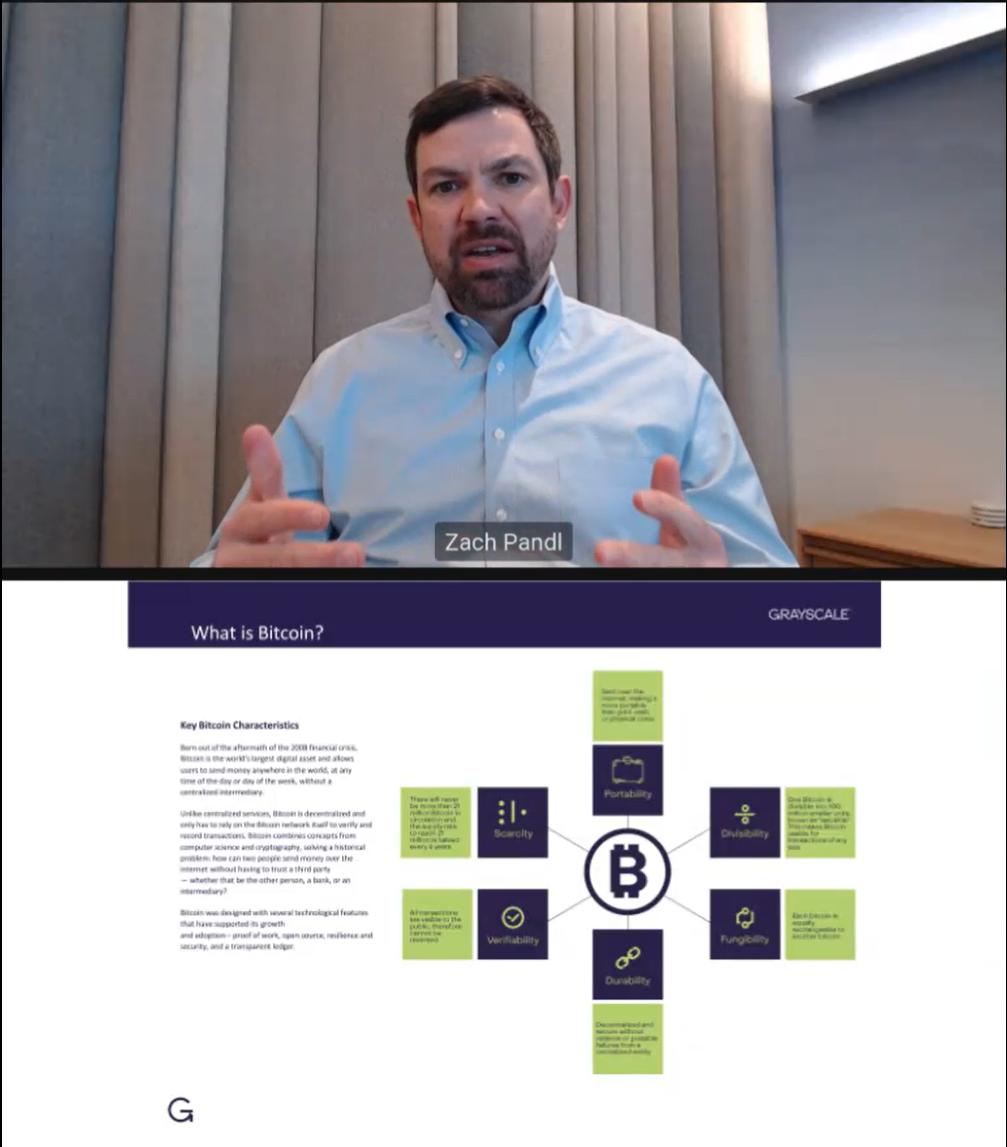

Zach Pandl Thanks, Todd. Great to be on with you. If you could please, kick us off with, with the next slide, and I'll. I'll dive right in. Bitcoin must be the most talked about and least understood asset in the financial system. And I hope through this discussion, all of you will come away with a better understanding of what Bitcoin is, what we do at Grayscale and, you know, be in a place where your, your clients and you are able to confidently invest in the asset class. So what what is Bitcoin? Bitcoin is a money system that is not controlled, not created by a government or a central bank. Most of the money that we are familiar with, whether it's the US dollar or the Japanese yen, are created by national governments, and we use these monies, you know, to pay for, for goods and services in the economy. Bitcoin is a type of money that is not created by a government. Now we have something like that already, in the financial system. Gold serves that value and has served that value for, for some time. As as everyone on this call is probably aware, gold has a very long history, as a money, medium, in our, in our world, in our economies, and while it was sometimes shaped into coins, gold does not derive its value from, from governments. And today, gold is basically a legacy money system that is only used by, central banks, the world's central banks, hold gold in a vault in the basement of the New York Fed in downtown Manhattan. And they count those assets toward, their, their national assets and think of them as a kind of a store of value. Many private investors, hold gold for the same sort of reasons, they think that is a sort of an asset for worst case scenarios when maybe traditional assets like stocks and bonds, are expected to not perform very well. But I think we should sort of take a step back and say, you know why gold? You know, why gold and not the 90 other metals, in th, periodic table, for example. Well, gold has specific physical properties that make it useful as a money instrument. Okay, for one thing, gold is scarce, the supply of gold increases about only 2% per year, so it's fairly limited, in terms of the growth of new supply, gold is also quite dense, but it's also shapable and it doesn't rust or corrode. Essentially, if you have a gold coin or gold bar and you put it away somewhere and return to it after a long period of time, it will be exactly as you left it. And, you can't actually say that for many other types of metals. So gold has these physical properties that make it attractive as a money medium. Now, there's nothing wrong with gold. And I think that there will always be investors that hold gold bars, gold coins, gold ETFs for this purpose as a kind of store of value asset. Something that we'll talk about in a little

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

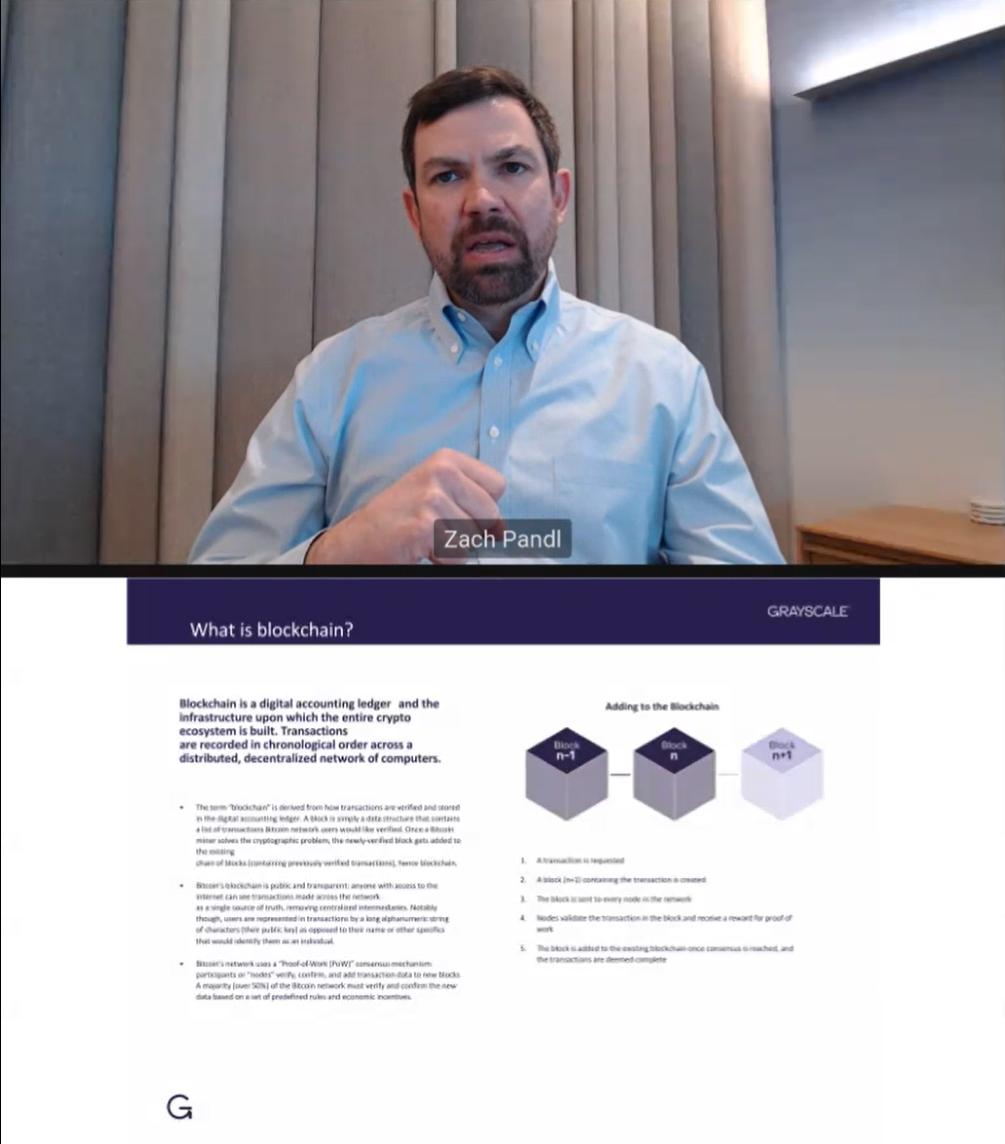

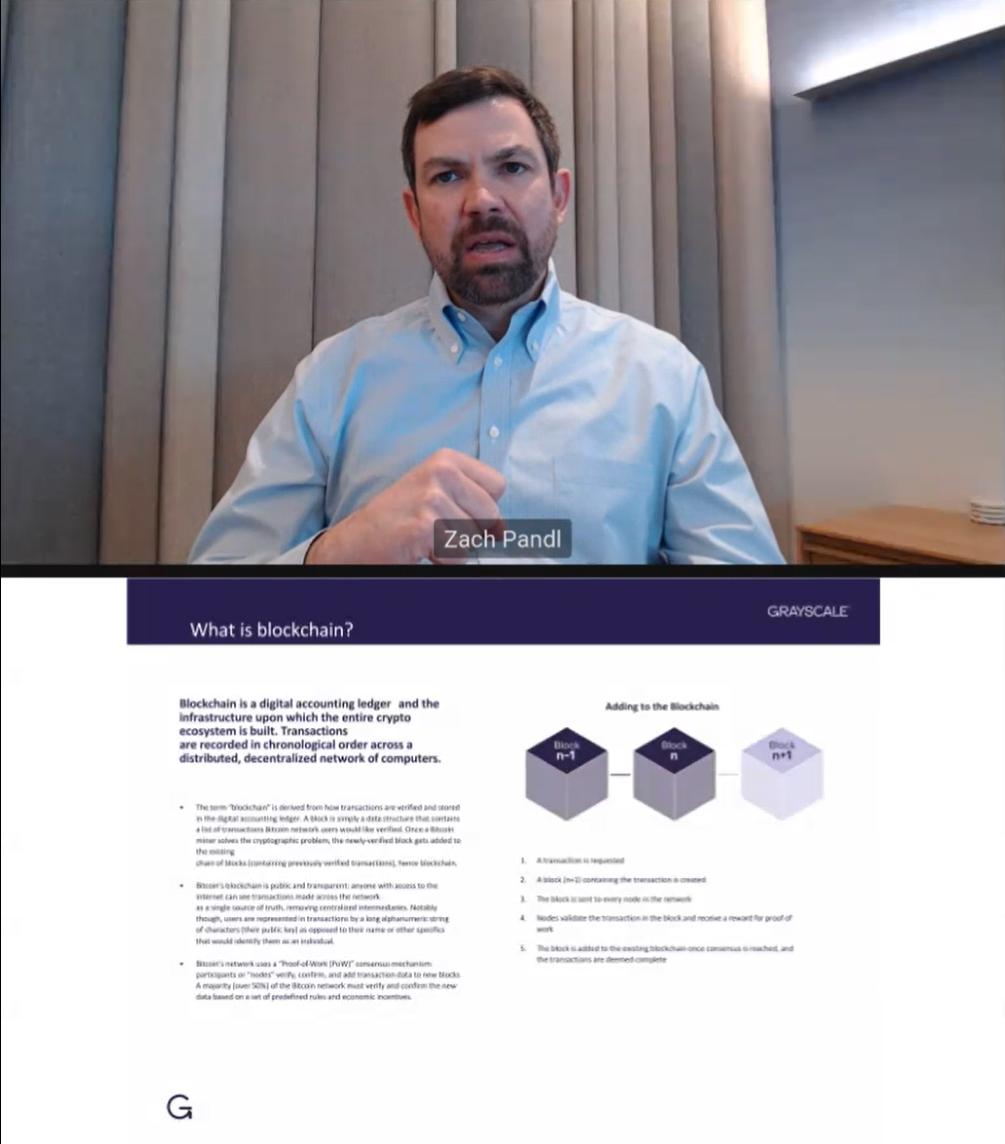

bit more detail later. But the truth is that we live in a digital world now. For better or worse, many people, and especially young people, spend an incredible amount of time during their day online and sometimes, you know, literally staring into their, into their phones. And many, many aspects of our life are moving from physical to digital. We think that same phenomenon is happening here in the case of asset markets. There has always been a kind of demand for a type of money that is not issued by by governments, not created by central banks. In the past, really, over the last generation, gold has served that purpose so well. But today, and looking into the future, we believe strongly that Bitcoin is now that asset, that Bitcoin will serve as a primary store of value. Money system not issued by a government. Now gold has, as I was saying, physical attributes that make it attractive as a money medium. It's dense and malleable. For example. Bitcoin has digital features that make it attractive as a money medium. Bitcoin is also scarce. There are only 21 million Bitcoin in existence and there will never be any more than that. Bitcoin is also verifiable. Divisible. Fungible. Essentially, it has all the good qualities that we would expect in a money medium. So when you're thinking about, Bitcoin, I would encourage you to start with this sort of concept, that we investors seek out a type of money not issued by governments. Gold has served that purpose well, but we're going through a sort of digitization of our lives, and that's happening in many aspects. And it's happening in in investing. Bitcoin, we think, will be that store of value, non-government money medium, for the future. If we could please flip to the next slide, Todd. Now. Hopefully that gives you some of the intuition of what, what Bitcoin is. Um, but it's natural to ask okay, well, but what what is it? That that makes intuitive sense, but where where does this come from? What what is what is bitcoin at a more technical or fundamental level? So to understand that we need to talk about, something called a blockchain. Now. Most of your money these days is digital. We carry a little bit of cash around but by and large, our financial system, our our money system is already digital. And that means it's, you know, it's not a physical item. It's just something in a database, somewhere, your bank, maintains a record of your assets and your liabilities and a similar record for all the other, customers. You can open up you, your app or go online and look at your balance, at your bank. But it is that bank, that company that is responsible for maintaining that record, for making sure that your assets and your liabilities, those of other customers are correctly, recorded. Bitcoin is, on something called a blockchain. And a blockchain is just another type of database. It's a place that we store digital information. The critical difference, though, compared to our system today, is that with a public blockchain, there is no central authority overseeing that database. No person, no company or bank and no a government. And that's really the technological breakthrough that Bitcoin gave to the world, you know, there isn't that sort of building with a server in it somewhere that's telling us where all the bitcoin is stored. All the relevant information is distributed across a network of computers, really thousands of individual nodes all around the world. And there is no one entity in charge of that. And this structure, this idea of a public blockchain is how we can have a digital money system that is not controlled by a central authority. How we can have a digital alternative to physical gold. Now, how does something like that work? You may have heard crypto market jargon like proof-of-work or proof-of-stake. Some of those things are listed on this slide. But really how it works is through the power of economic incentives. Economic incentives built into the Bitcoin algorithm, written into the software,

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

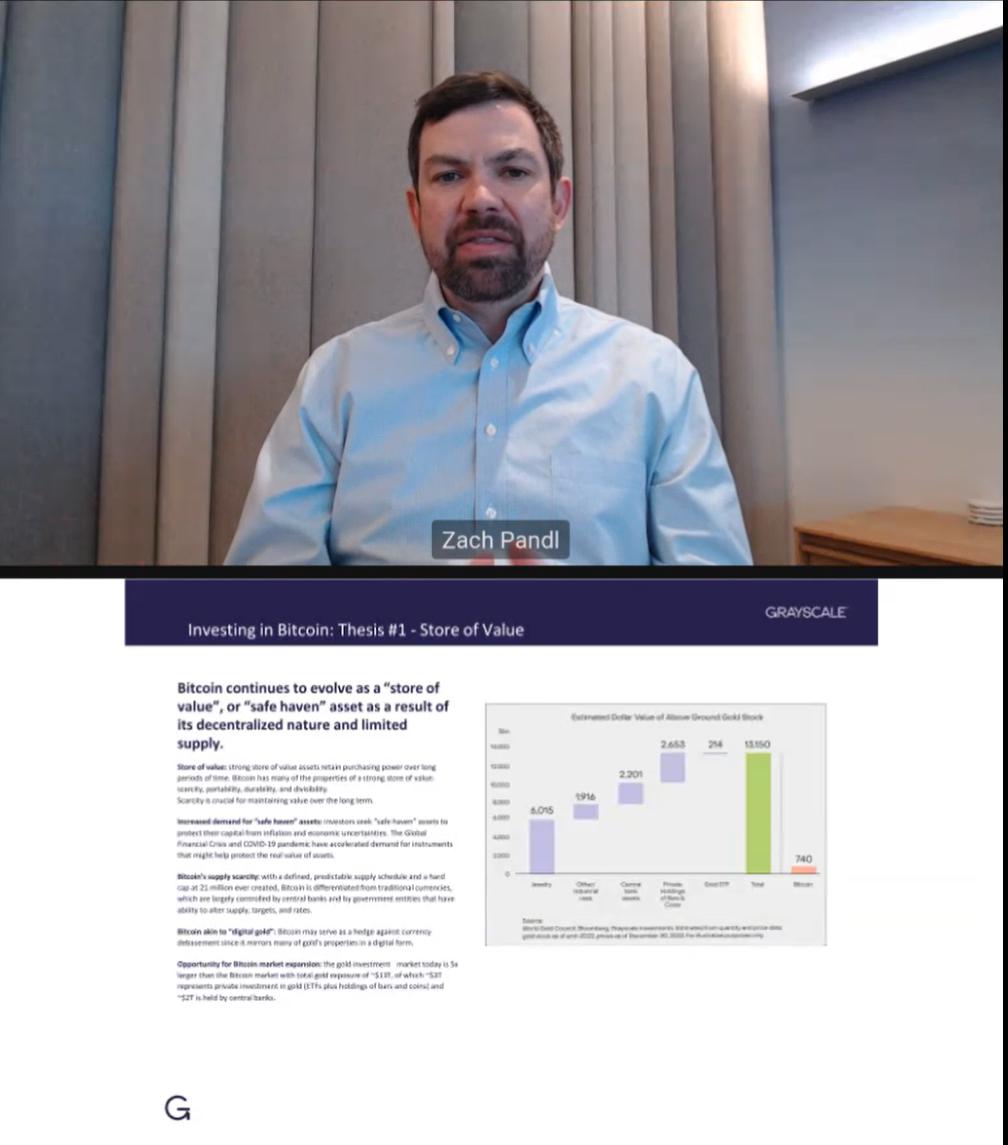

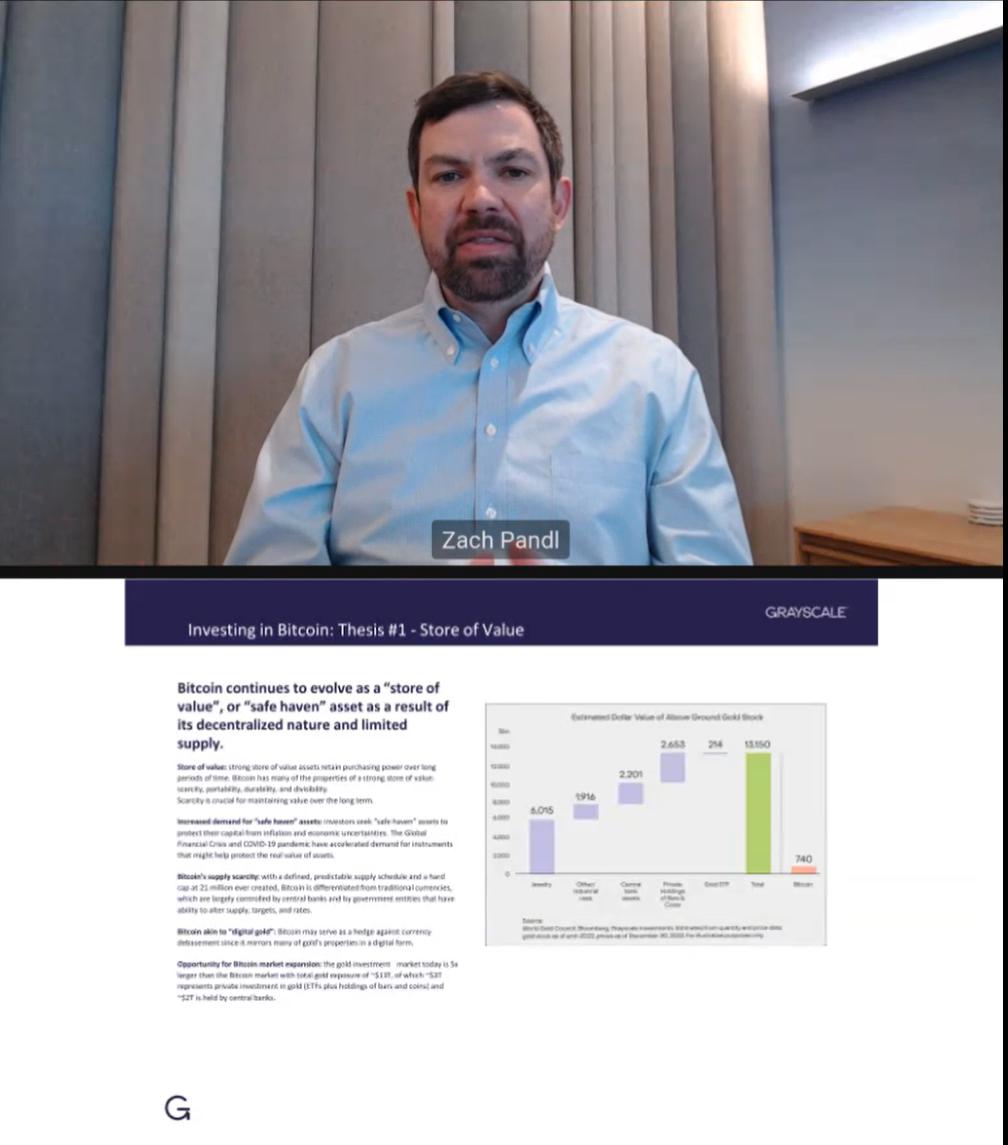

encourage a decentralized set of actors all around the world to maintain this database, to maintain this network and ensure that your balances and other people's balances are correctly recorded. So that is what a blockchain is. It is just a just a database. So your bank maintains a database of your assets and liabilities. The blockchain is just another type of database. The difference is that it doesn't have a central authority. And it's distributed over a network of computers rather than stored in one place. Now it is called a blockchain, for the simple reason that this is how the data are added to this database. It's not exactly like an Excel spreadsheet. Instead, the data are added in blocks in a sequential matter, so one block after another, hence a block chain. That's where the name comes from. But I would encourage you to think of it really as a distributed network, a distributed database over a network of computers with no one party in charge. If we can please turn to th, the next slide. Now, I think this is an incredible, idea, an idea that we can have digital information that is safe and secure, stored in the same way that, a traditional, database will be a storing digital information with no central authority, but as interesting as that idea might be, for asset, in this space to have value, they need to have some kind of function in the real world, of course, it can't just be an interesting piece of technology. So there are these sort of use cases for Bitcoin that underpin the investment thesis, and there are basically three, the first is bitcoin as a store of value. The second is Bitcoin as a medium of exchange or means of payment. And the third is Bitcoin as a kind of technological innovation or a cornerstone of a whole new asset class related to public blockchain technology. And I'm going to take each of these concepts in turn. Okay. Please turn to the next slide. Now, the first and most established use case for Bitcoin is as a store of value. And this is where I started the conversation really as a digital alternative to physical gold. Gold is a store of value or a safe haven asset. What does that what does that mean? A store of value asset or a safe haven asset is expected to maintain its value versus inflation over long periods of time. And gold has been successful at doing that for 500 or so years that we have recorded data. Safe haven assets are also supposed to pay out at specific times, really to perform well when macroeconomic conditions may be harmful for other assets. So, for example, in a period of high inflation, we may expect these types of assets to perform well while other assets, stocks and bonds, to perform poorly. That's what we mean by a store of value or a safe haven holding its value versus inflation over time, and paying out when other assets are not performing so well. Bitcoin is again the same concept, but just a digital alternative to this physical thing that we've had for a long time. But even though Bitcoin has been amazingly successful as an investment instrument so far, and we'll talk a little bit about that later, total Bitcoin market capitalization is still relatively modest compared to the size of the gold market. Now gold as you can see on this slide, has different uses some of which of course is jewelry. But the investment gold market, the amount of gold held around the world for investment purposes in bars and coins or in ETF type structures is about $5 trillion. Bitcoin market capitalization today, depending on how you measure it, is something like 1 trillion to $750 billion or so. So Bitcoin is, let's say, 15 to 20% of the size of the investment gold market. And our thesis would be as the world is, is rapidly digitizing. And as adoption of these technologies continues, that Bitcoin will say capture market share in the store of value assets. It will become larger and larger relative to the gold market, although both will continue to exist side by side. So the first and most established use case of Bitcoin, again, it's just a

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

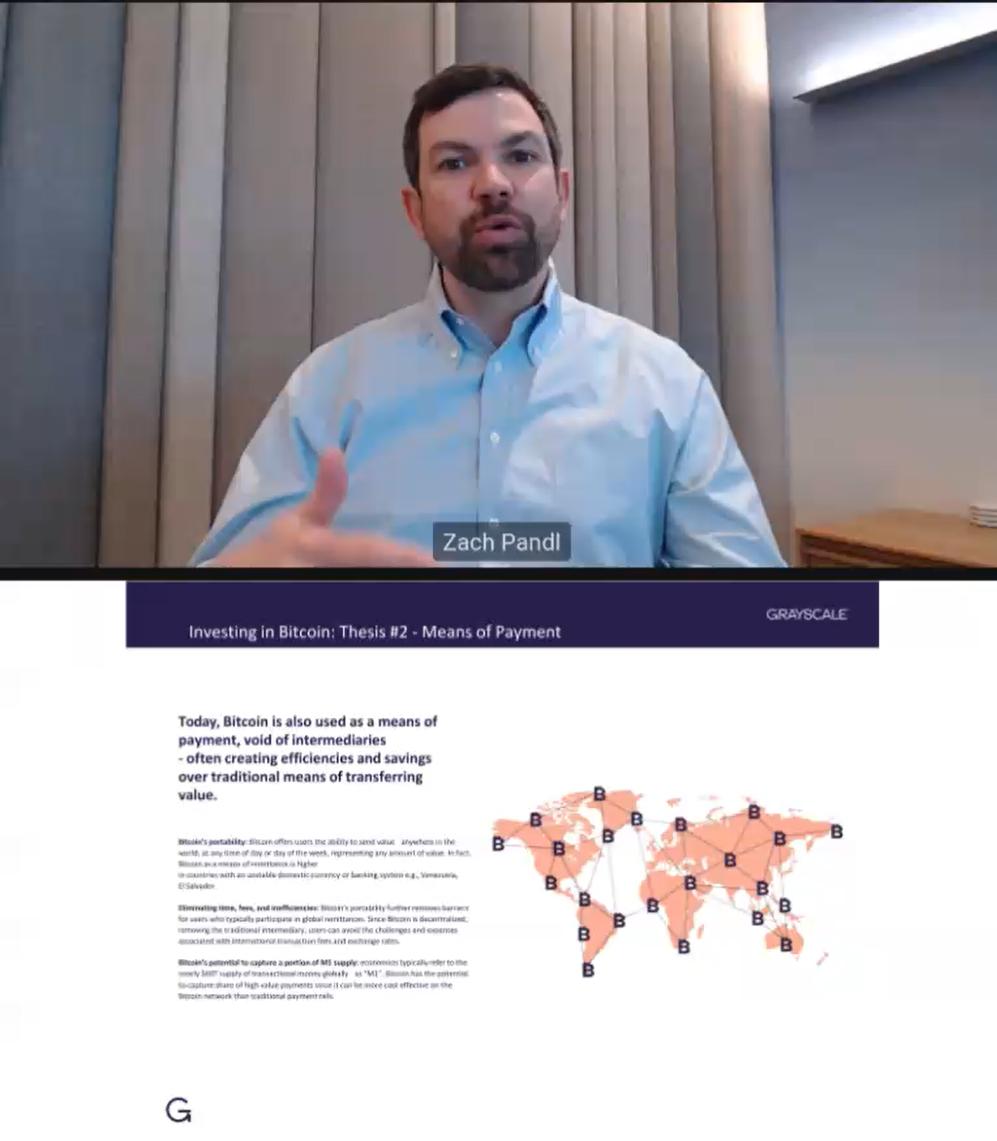

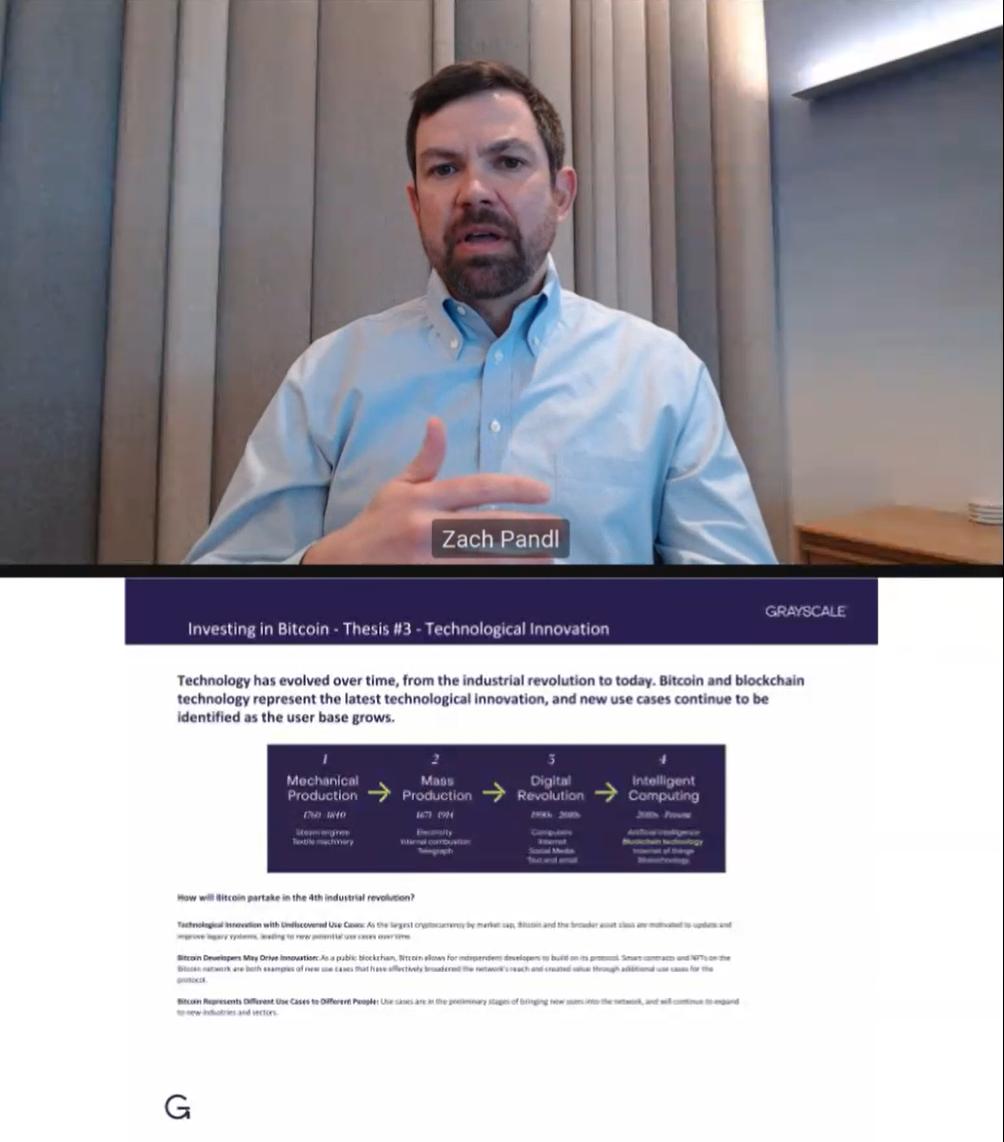

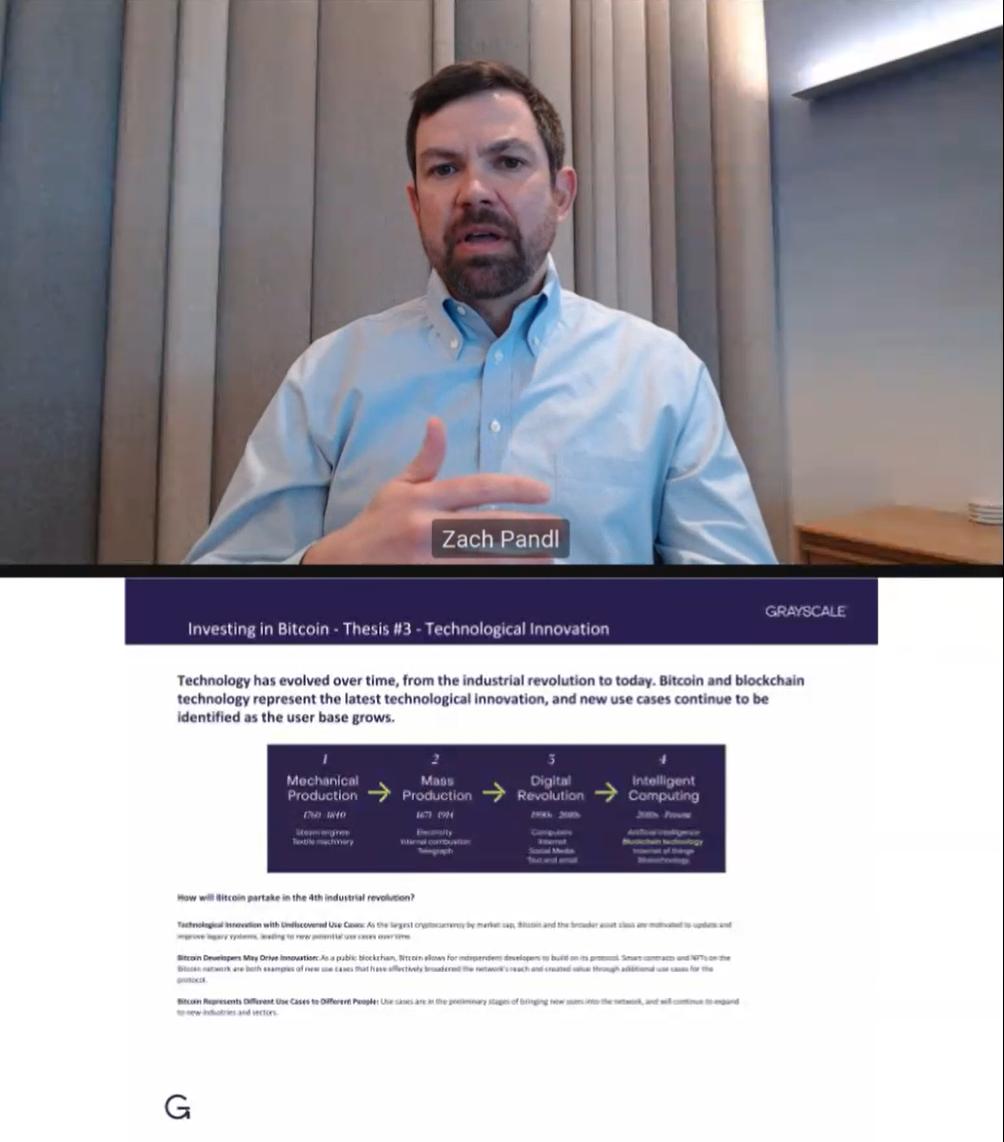

digital alternative to physical gold. And that investment use case in and of itself I think is enough for Bitcoin to be relatively attractive to be incorporated into investor portfolios. We can turn to the to the next slide, please. Now that is not the only potential use case of Bitcoin. So that is sort of the core use case today. But we can think of a kind of expansion of use cases over time that may add to the investment thesis. The next potential use case is as a means of payment or medium of exchange is how we would talk about this in economics a textbook, the concept here is, you know, just exactly what it sounds like. You know, we that sort of function that money use is used for on a day to day basis to buy, goods and service, now the bitcoin has been slower to take off, in this regard, even the crypto enthusiasts at Grayscale are not buying cups of coffee or things at the mall with their with their Bitcoin. The reason for this is a kind of technological challenge related to how fees work, transaction fees, in the Bitcoin network. So those sort of fees and the the technology behind that has held back the growth of Bitcoin as a medium of exchange, exchange. We think, though, that there is a possible technological solution to that challenge. And there are a lot of sophisticated developers that are working on this problem. For those of you that have spent some time looking at Bitcoin, you may have heard of something called the Lightning Network. I'm not going to talk about that here today, but the point is that it's a sort of technological challenge, and there are technological minds trying to overcome that challenge. And I do believe that it is possible that Bitcoin in the future will be used in some cases as a means of payment. Now, um, that is very important because the global market for money, for payment money is extremely large, we talked about gold's investment a use case. That market is about $5 trillion. The market for money, for payment money around the world is about 6 trillion dollars. So even if Bitcoin were to capture a relatively small piece of that market, it could add substantially to, bitcoin's, potential value and therefore add to the investment use case. I do want to stress here that, we are not going to see Bitcoin displace the dollar in everyday transactions in the US economy. Money works, you know, reasonably good. We certainly think that it has some room for improvement, but money works reasonably good in the U.S. economy. And there are other things related to blockchain technology that will help displace what we,how we use money in the U.S. economy today. But we'll still probably be using the dollar for most of our payments. But Bitcoin's use as a medium of exchange, we think, can take place in pockets of the global economy where the money system doesn't work so great to begin with, or where people are using the US dollar already instead of their national currency. There's a concept in economics called dollarization, you know, when your domestic money, if you're in a place that has hyperinflation and your money doesn't work so great, sometimes people will use the dollar instead. That's called dollarization. We think in the future there could be something similar, like Bitcoin-ization or crypto-ization: the use of these types of instruments instead of the national currency when you have too much inflation. So this sort of means of payment, medium of exchange, is the second major potential use case that we think could evolve over time. If we could flip to the, to the next slide. Now, the final kind of layer to this story of Bitcoin's potential use cases is as a kind of technological innovation. We think Bitcoin, again, is compelling enough as a store of value. You know, I own the asset. I'm enthusiastic about the asset primarily for, for that reason. But as I started out discussing, you know, Bitcoin is not just its own thing. It's really, a new piece of technology delivered to the world in this new technology

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

called public, blockchain. And so investing in Bitcoin in some sense can be thought of as investing in this, new technological innovation through the most established, and highest market cap asset. We think this technology will eventually be ubiquitous, throughout the economy. So by, by buying a Bitcoin, you're able to sort of capture that, that trend. I'm not going to talk about all the other things that are happening in crypto besides this. This is a Bitcoin focused discussion. But I will take a moment just to plug, one other Grayscale initiative, something that we call crypto sectors. Um, this is a educational campaign and a set of tools that we, developed, alongside, index provider FTSE Russell. that will really give you the full landscape of things that are happening in crypto that go well beyond Bitcoin and frankly, well beyond money. If you're interested in much more depth around these things, check out the crypto sectors content on the Grayscale, website. If we could please turn to the, to the next slide.

Todd Rosenbluth Yeah. So the next slide is actually going to be a poll, Zach, that we're going to bring up for the audience. But I'd love to just stay here for a second on on technological innovation. How far into the future do you think we need to look for that to become more of a reality? That's not a 2024 initiative. That's three, five years down the road, perhaps?

Zach Pandl Well, that's a great that's a great question. You know how how long until this technology is ubiquitous? So the, the big prize is displacing the structure of the financial system as it exists today. In the future, your digital money is not going to be some item, recorded, on a spreadsheet at a bank. In the future, your digital money is probably going to be, a stablecoin on a public blockchain. You know, of course, displacing the global financial system is not something that is done overnight. So this could be, you know, a decades long process, as Bitcoin and related technologies, gain more and more progress. I would say, though, we don't have to wait that long to start seeing some progress. There are many, again, applications of this technology besides, money, things like video games, for example. Again, I'm not going to get into all that, today, but you will see these things have a kind of creeping presence throughout your everyday life. And I do want to say one, one other, one more thing on, on this, um, you know, from, I have my background is as a macro investor, I spent my career on, on Wall Street, most recently at Goldman Sachs and looking at, um, you know, broader financial markets, currencies, commodities, stocks and stocks and bonds. Um, in a sense, Bitcoin has already worked in that sense. Bitcoin is already a huge, macro, asset. It is already an a very important asset in the, in the global financial system, something that major investors,put in their portfolios. And so it can be thought of essentially as the first, you know, killer app. So, you know, you asked about timeline. What are we waiting for? I would actually look backwards when it comes to Bitcoin. It it has already worked. It's it's already established itself as a digital alternative to gold that is extremely widely held, all the way around the world. and there are bigger prizes in the future, like, displacing elements of the global financial system that will take time to, to achieve.

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Todd Rosenbluth Well, thanks for that, Zach. while you were. You were talking. I brought a pull up for the audience. Would allow for folks to weigh in. Does the approval of a spot Bitcoin ETF increase your intention to allocate Bitcoin into client portfolios? A simple yes or no. if you have not responded, would be great. Again, does this spot Bitcoin ETF increase your intention to allocate, bitcoin to client portfolios? I'm not at all surprised by this. Based on what we've seen out of the gate from tied to the Grayscale product, as well as some peers, that close to 80% of the audience is more likely because of the accessibility that's there. So, Zach, I'm confident this doesn't surprise you. You know, it's been a journey for Grayscale, to become part of the ETF community with GBTC. So what I'd love for you to just do is talk more about the diversification benefits of having Bitcoin within a client portfolio.

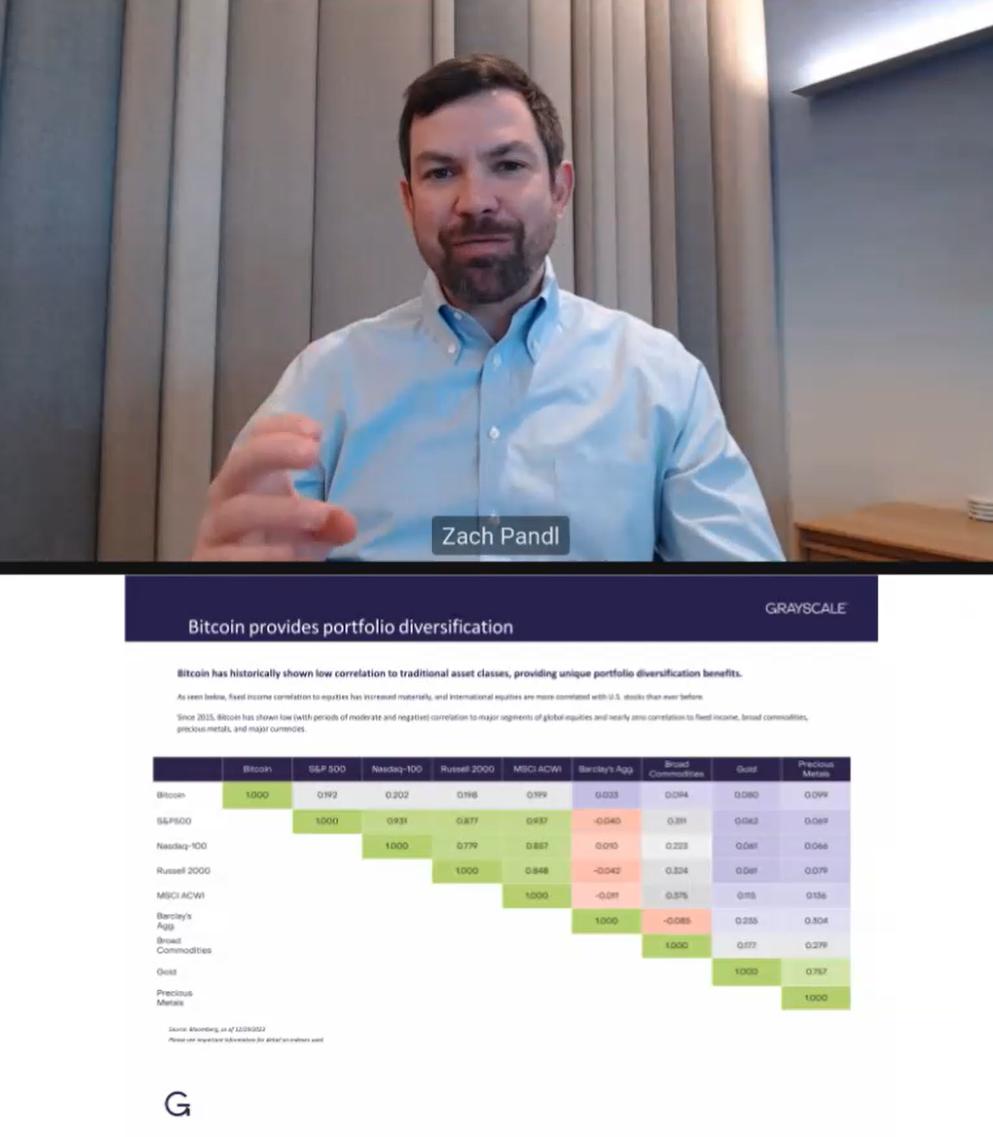

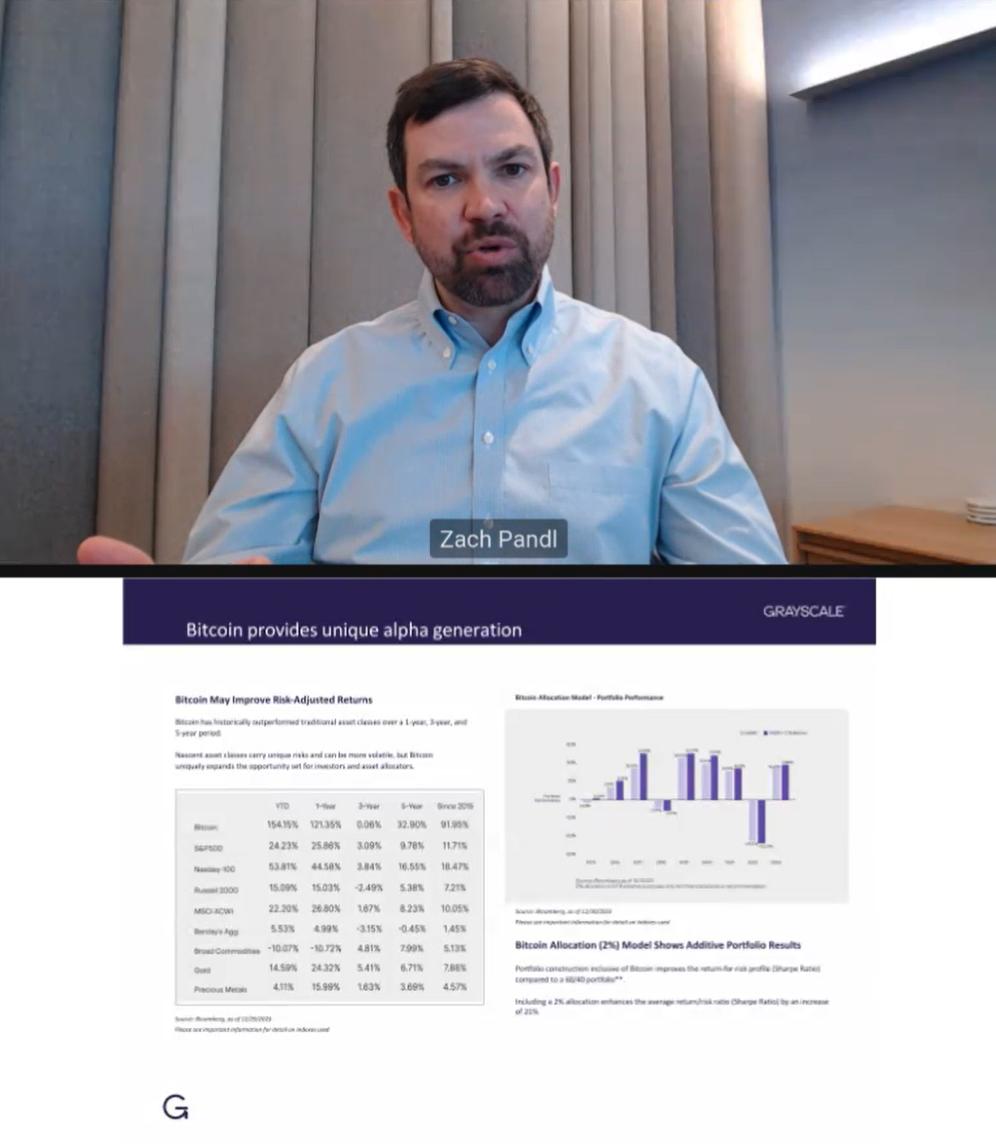

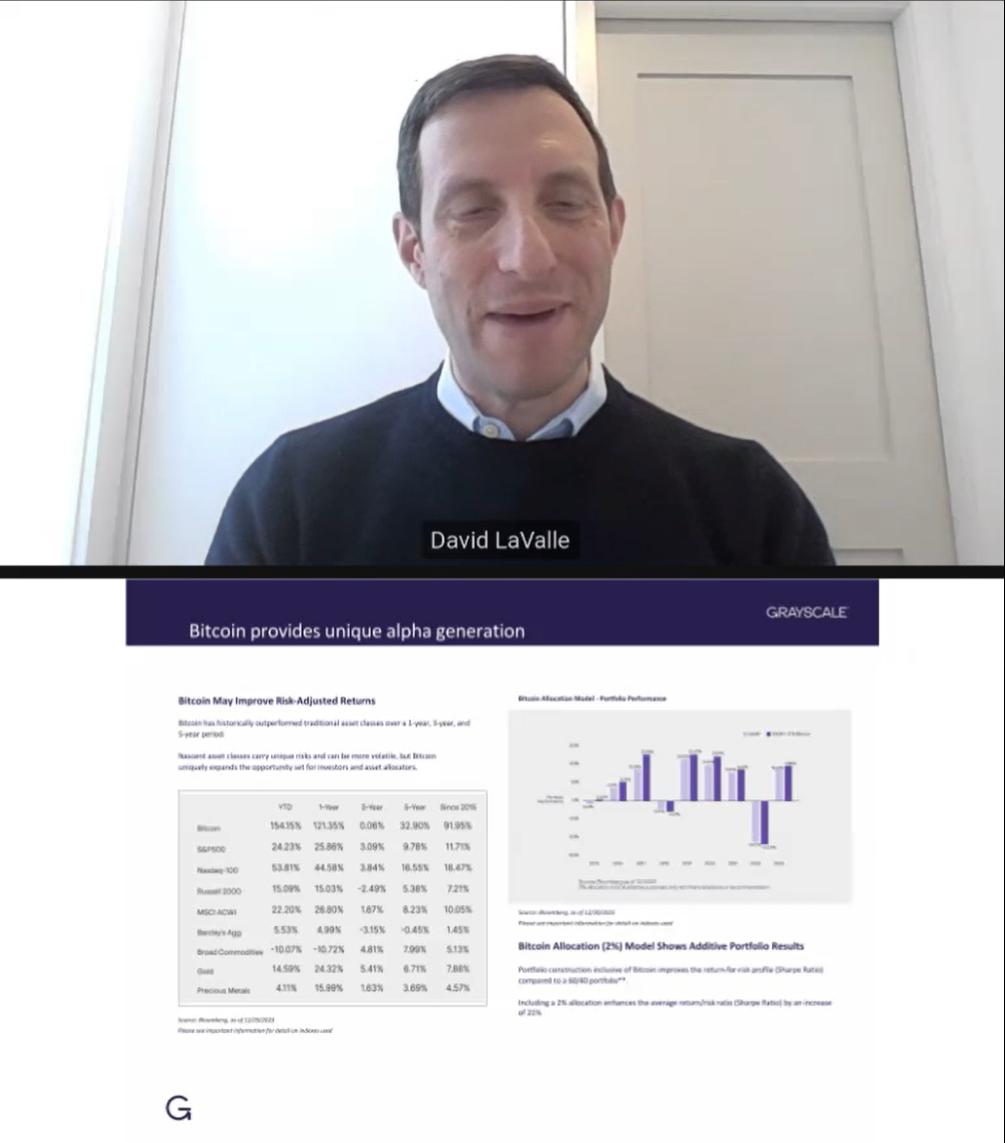

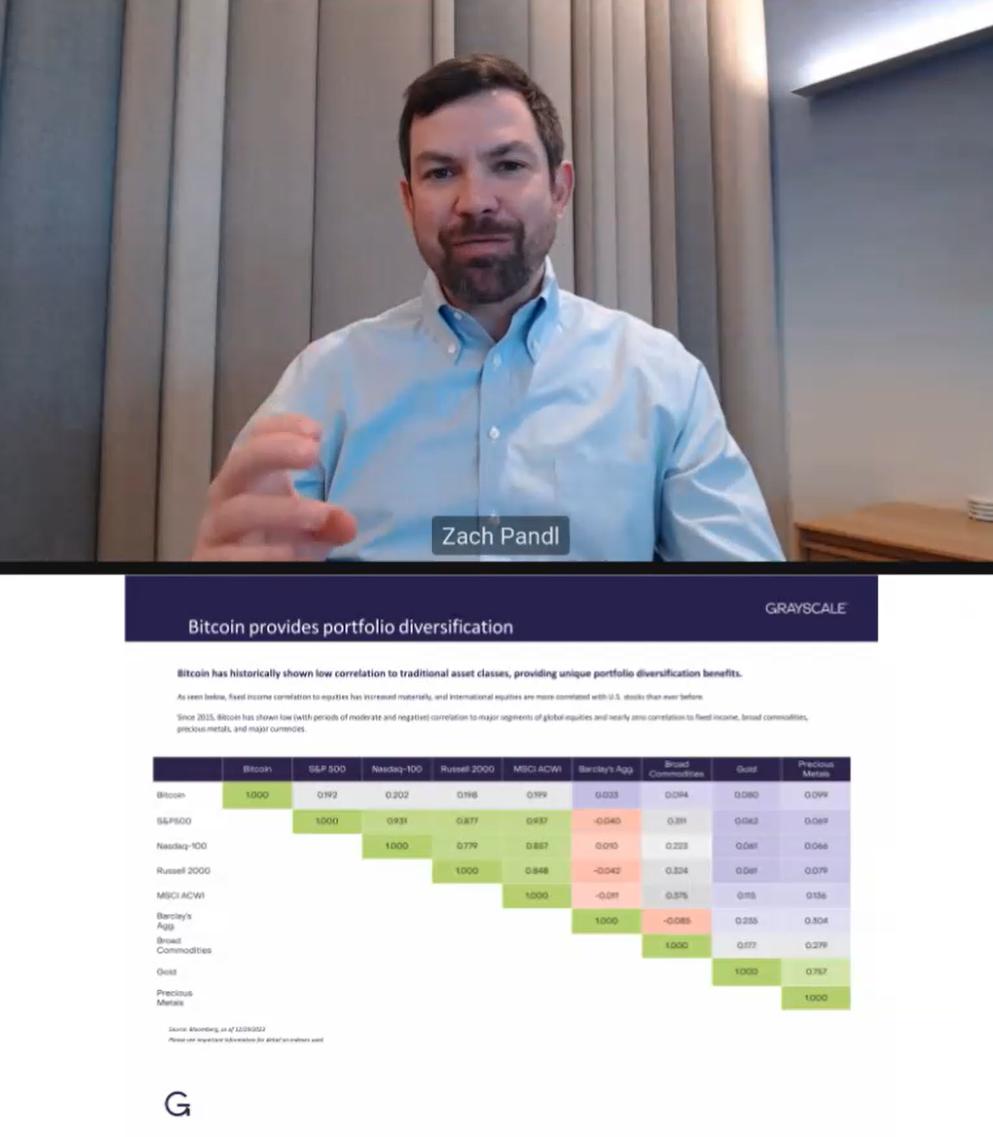

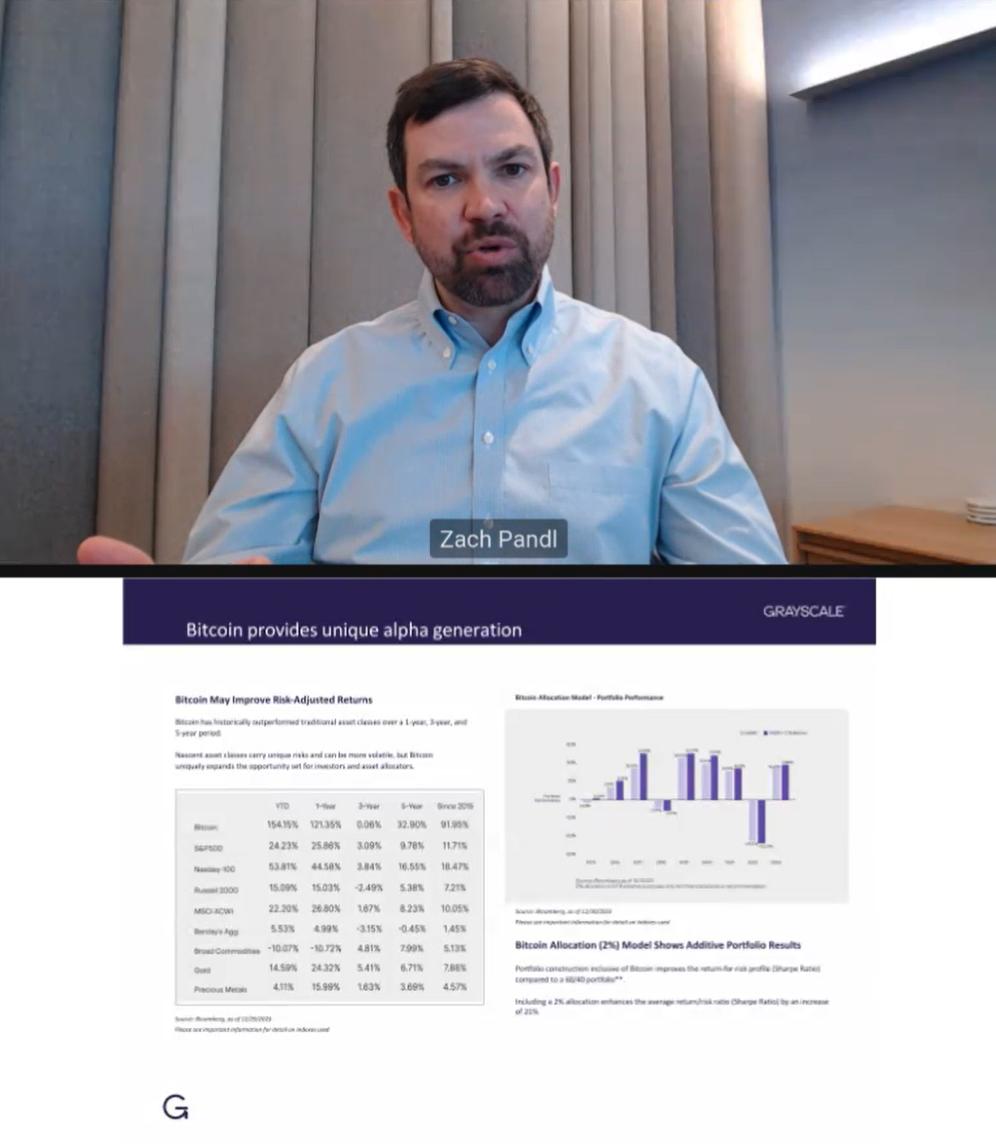

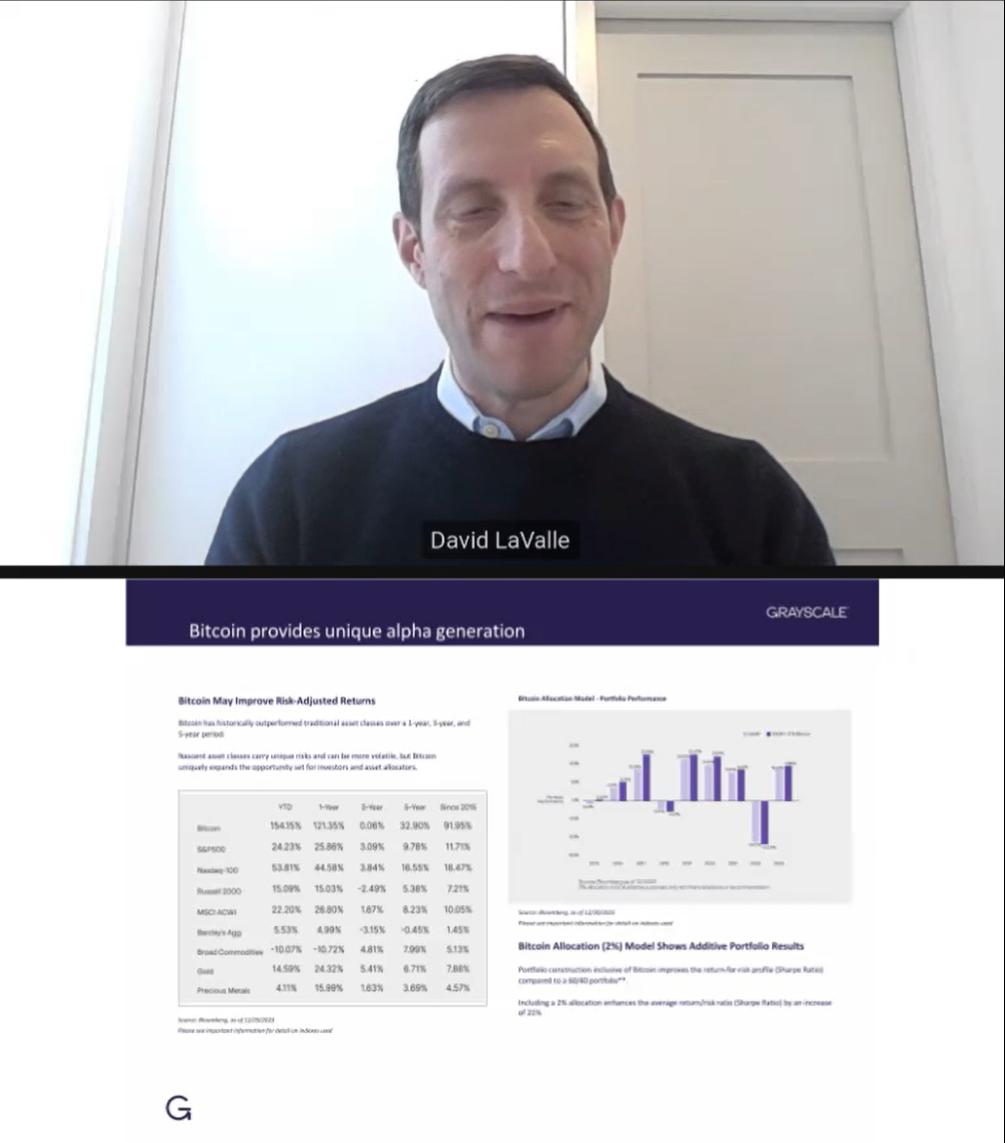

Zach Pandl Yeah, absolutely. And I love talking about this, this topic. So, if you were to bring Bitcoin into your portfolio, what should you expect? How do you start thinking about this thing as an asset in the context of, portfolio construction? So I just try to keep it as simple as possible. Bitcoin is a high risk but high return potential asset with a relatively low correlation to stocks. Okay. When we're building a portfolio, sometimes we think of the, stocks as the as the return and risky, part of our portfolio and bonds as the maybe the income, part of the portfolio. Bitcoin should be put in that that other category as a higher risk, higher return potential, asset. But it has a low correlation to stocks. You know, I'm sure everyone on this call knows sort of what that means in the context of building an optimal portfolio. Um, but it means that by bringing Bitcoin intimately, you can add both to total return. Of course. It's a it's a fast horse. It's it's been growing at a, at a fast rate. Um, but because it has a low correlation, it can also improve risk adjusted returns. We're always looking for these types of things when we're, when we're building portfolios, things that have high returns and low correlation. And, you know, there's a lot of technology to understand when thinking about Bitcoin. But when we think about portfolio construction, I would really stress, those elements. So when you're looking at your own portfolios, when you're looking at client portfolios, I would think about, you know, investments that you might have in things like tech stocks or small caps or international equities. These are the parts of the portfolio that maybe you can take. Maybe the weight of those things can come down, and maybe some of that capital could be, shifted towards, Bitcoin. Thought if we could put one more slide up on this on this topic. Um, so I just wanted to show you some, data on on returns. Um, I think, frankly, you'd have to be living under a rock, to not know that Bitcoin produced high investment returns, over a variety of look back periods. But you can see the, the actual data, on the left hand side of this, this slide, um, I just like to highlight, um, the Nasdaq as well. U.S. tech stocks have been sort of the only game in town for a decade. in traditional, financial markets. Um, you can see that, you know, Bitcoin has outperformed even even the Nasdaq. So, you know, it has produced exceptionally strong returns, even, compared to the best returning, segment of traditional financial markets. I do want to say, before passing over to a Dave, just sort of one important point. You know, bitcoin, is an asset with fundamentals just like anything, anything else. Um, and it's not going to go up every, every day, every week or sometimes even even every year. It's had exceptionally strong, returns. But it's important to think about the fundamental drivers of, of these things. Um, in the same way that we would in any other, investment.

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

and some of these relate to, you know, the dollar, the actions of the Federal Reserve, the health of the economy. So before making an investment in Bitcoin, please, you know, have a think about, those, fundamental drivers, um, and, and, you know, and do the appropriate research. With that, I'm happy to pass it over to Dave.

David LaValle Hey, thanks a lot, Zach. It's, always fantastic to hear you talk about how bitcoin, something that's, you know, relatively new, you know, in the theme of, kind of broader and historical markets with such a, you know, thoughtful, um, you know, kind of macro view on, on how you see it and bringing some of the experience you've had in the past 20 years, kind of looking at markets overall. So, you know, it's a great it's a great example of what Grayscale brings to, you know, this new asset class. But I can't help but um, actually, we could go back one slide. Um, I wanted to, you know, actually talk about when I look at this table on the left, it's it's almost, um, you know, entertaining to me that we see that that's, you know, basically a chronological list of some of the ETF evolution that we've seen in the markets. And, you know, ETFs have long been taking an exposure, um, that has been available to some. And then really democratizing investing. I mean, Todd, you know, and Tom um, and the entire benefit is spend a lot of time talking about how ETFs have democratized investing. And I think, you know, the Bitcoin ETF is kind of the the most recent example of that. But if you think about, you know, in 1993, we're 30 years into, you know, the history of ETFs and people think of S&P 500 market cap weighted exposure as something that's pretty plain vanilla. But you know, when we think about it in 1993, think about, you know, the access to that type of strategy, which was really a an institutional quality strategy. And and bringing this ETF to market was something that was availing an institutional quality of exposure to, to the masses in a, in a really unique way, albeit in a, you know, new type of investment wrapper, the exchange traded fund. And I think, you know, it's been 30 years, but people also tend to forget, um, or don't even know that it was the crash in 1987 that brought about the whole concept of creating the exchange traded fund. And so it was, you know, roughly six years of, you know, back and forth with, with regulators and, and, you know, it's a real, you know, high quality financial architects and, you know, the American Stock Exchange and a lot of high quality, you know, 40 act counsel to really come up with this, you know, evolution in the market. But as I look at this chart, you know, S&P 500 exposure Nasdaq 100, Russell2, ACWI, you know, Barclays agg. You know, commodities, currencies, um, you know, currency hedge products and and a lot of evolution in the broader indexing marketplace allowed for, you know, a real strong set of evolution in the ETF wrapper. And it was really until very recently, there was no generic list of kind of listing standards that the exchanges that allowed for ETFs to come to market very quickly. And so with each new innovation, the issuers bringing products to market, um, would have to work in concert with, you know, their listing exchange to engage with the SEC and to get the permission to, you know, not only issue the product, but also list and trade the product. And, you know, for a long time it was of you at the asset and the permissibility of kind of that asset to be put into the ETF wrapper. And then also a very strong review of kind of the ETF wrapper as a whole. And would the ETF behave as designed given that a different, you know, asset would be put inside of it. And there's, you know, you know, too much of my time over the past 15 years trying to innovate in the ETF market was focused on ensuring that the intrinsic value of

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

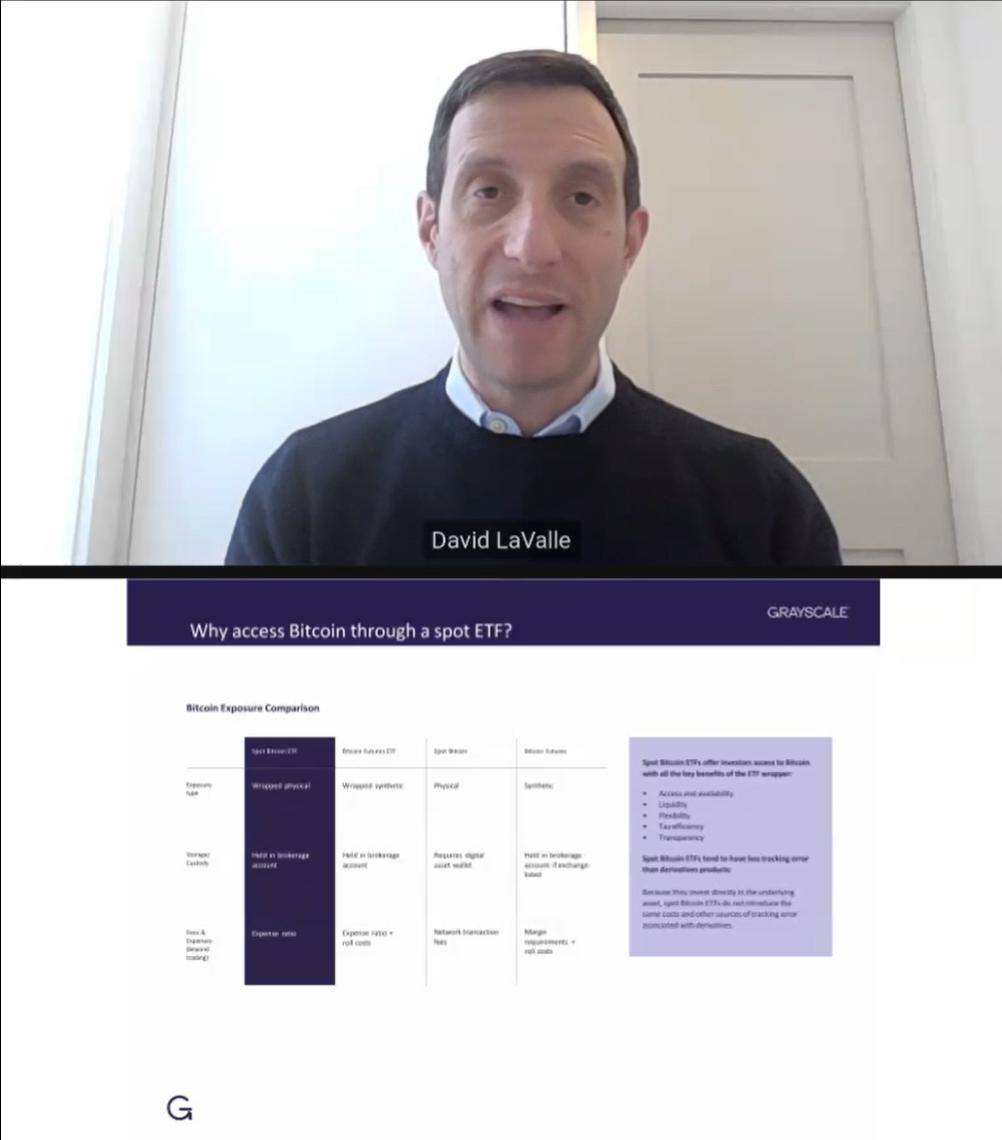

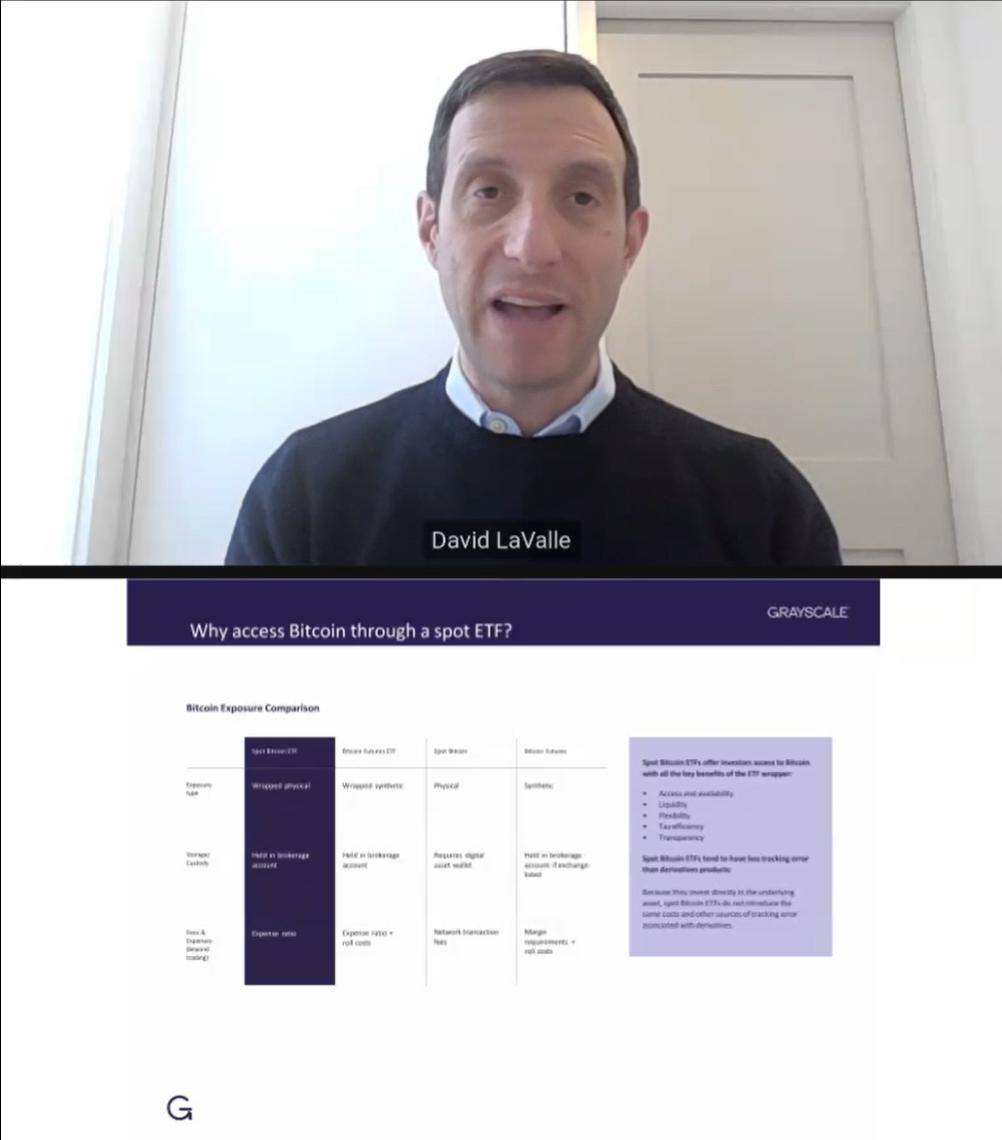

the underlying asset. So whatever the exposure was, um, you know, was going to actually track the price of the ETF as it was trading on exchange. And the biggest difference in this, the biggest difference in this innovation in the ETF market is that, you know, the bulk of the focus was really on the Bitcoin underlying market. And less focused on is the ETF actually going to work? We're 30 years into the ETF market and as a real proud, um, you know, evangelist of ETFs who, I'm really happy to have, you know, gotten to the point where, you know, an ETF is actually a point of credibility for the asset in many ways. And that's something that I think is a result of, you know, everybody, investors, self-directed investors, certainly, you know, financial advisors utilizing ETFs as building block for their clients' portfolios with a tremendous amount of confidence. And so I couldn't help but notice when we were looking at this chart that, it really was actually, you know, somewhat of a chronology of some of the evolution that, you know, those of us in the ETF market have really seen over the past 30 years. So, moving to the to the next slide, Todd, please, um, you know, the books I think go back one. Thank you. so the question is, you know, there's a number of different ways that you could gain your, your spot Bitcoin exposure. Um, and I think this is something that we have seen in other, you know, assets and I think rightly so. Zach was pointing out some of the similarities between the bitcoin market and the gold market. And I think similarly, um, we see, um, you know, some ways to to kind of make an analogy between the gold ETF market and the Bitcoin ETF market and more broadly, the commodity ETF market, um, in general. And so history has told us in instances when a commodity can be reliably stored, that the market has really overwhelmingly, preferred a spot commodity exposure inside of an ETF wrapper. And conversely, when you know, a commodity is is unable to be reliably stored, some of the soft commodities like, you know, or, oil or wheat, I think that the marketplace has largely, you know, settled for, um, an exposure that is really backed by the futures of that, you know, particular commodity. We actually think the same is going be true with Bitcoin ETFs. And until you know, this past Thursday, there really was only one, exposure type for Bitcoin. And that was in an ETF wrapper. And that was, you know, ETFs that were holding Bitcoin futures. Um, you know, this is not to say that we are anti bitcoin futures. That's not the case at all. in fact we've long been on record, very supportive of the commission's approval of bitcoin futures, ETFs. But it is to say that now that we have Bitcoin spot ETFs, um, you know, some of the characteristics that have long allowed, you know, investors and advisors, um, and advisors clients to to rely on spot commodity exposure was because of its, you know, simplicity of structure and really certainty of exposure. And so when you start comparing the different ways that you can gain Bitcoin exposure, we certainly think that spot, Bitcoin ETFs are going to be, um, a shining star and are going to offer that simplicity and that certainty, and really going to put advisors in a position to utilize, a Bitcoin, spot Bitcoin ETFs as building blocks for their clients' portfolios and to determine, you know, what allocation they should utilize. And then, you know, to to make that allocation utilizing um, you know, spot, spot Bitcoin. If you take a look at this table obviously it shows some of the considerations, um, with the, you know, exposure type and some of the considerations around storage or custody and then also the fees. Um, you know, this is a new asset class. And, and there's a tremendous amount of education that is needed to ensure that, you know, clients, and financial advisors are able to truly understand exactly what those, you know, considerations are

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

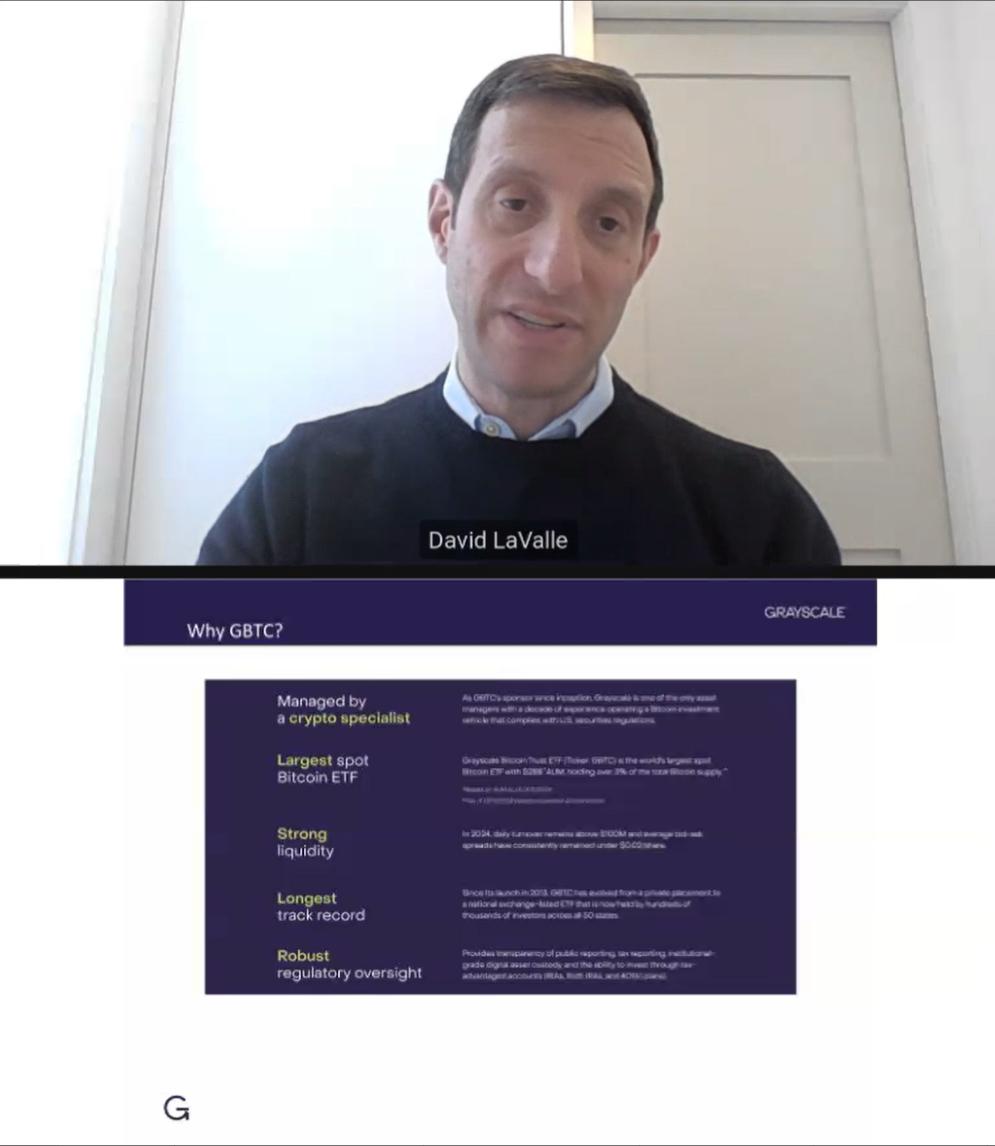

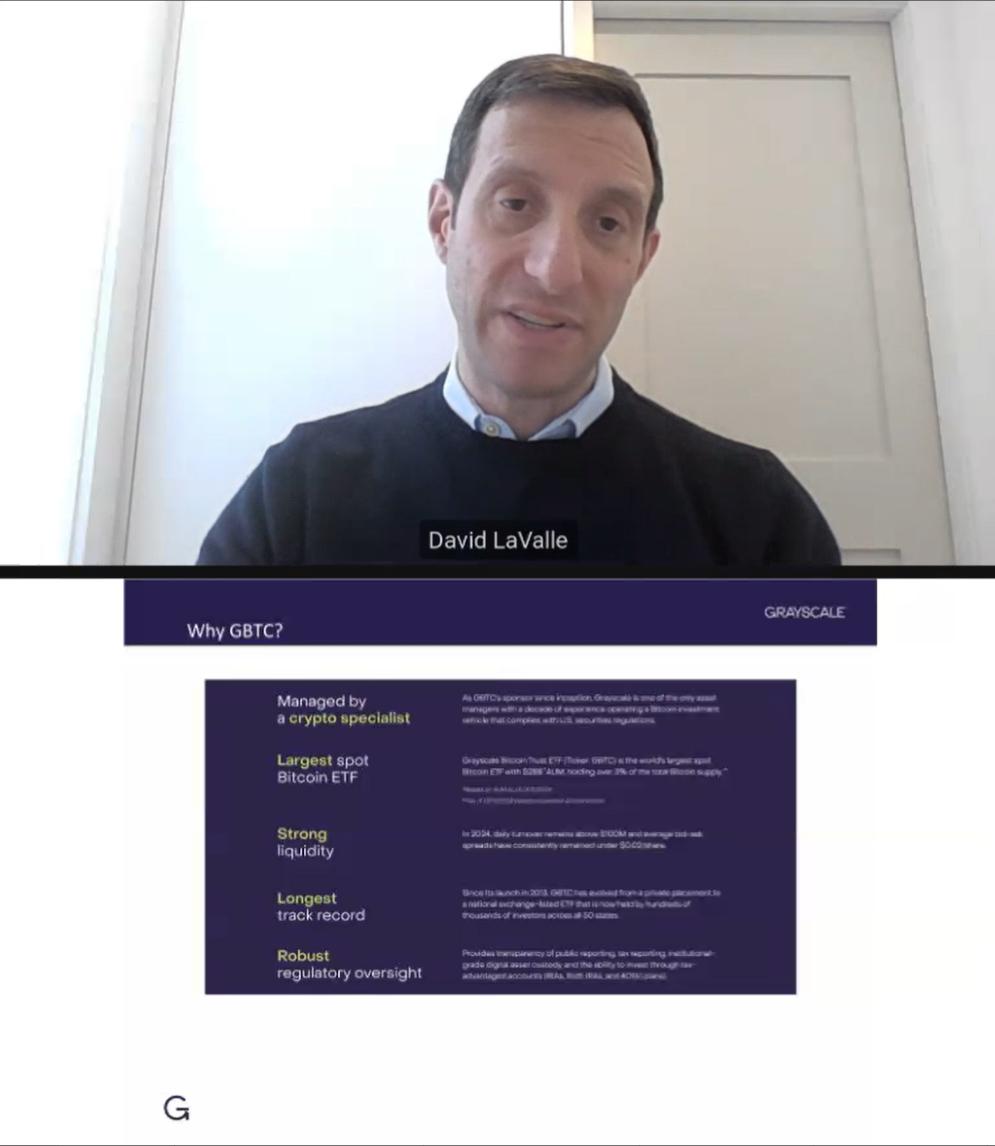

and what those components are. Um, but, you know, most importantly, we speak with a high degree of confidence and feel, really strongly that, you know, with the advent of Bitcoin ETFs, investors of all shapes and sizes are really going to, you know, enjoy some of the, you know, core, benefits of ETFs, which is, you know, access and availability and some liquidity characteristics that are particularly prominent with GBTC. Um, and the tax efficiency and of course, the transparency. Um, you know, it's very unique as as we had been going back and forth with the commission, and trying to get GBTC uplisted as an ETF. Um, you know, we we were in a unique, um, you know, circumstance where we were really proactively trying to, you know, pull, Bitcoin further into the regulatory perimeter. Typically when you have a difference of opinion with, um, a regulator, it's usually that you're you're pushing against the regulation. But you know, we were actually very interested in, you know, pulling Bitcoin and pulling, Bitcoin ETFs kind of further into the regulatory perimeter. Um, and allowing for, you know, the up listing to a national stock exchange, and allowing for all those benefits of transparency and regulatory oversight that come along with, the requirement of, of being an ETF. Um, listen, we are big believers in investor choice. Um, and we continue to feel strongly that, you know, this spot Bitcoin ETF, um, is a great allocation tool. and again building block for clients portfolios. But we also recognize, much like gold that investors should have choice. And you know, just like some investors would prefer to have some gold, you know, perhaps in, in a, in a vault or in a safe in their home. Um, you know, or with their, their custody bank. Um, but also may want to have some of the flexibility associated with a spot gold ETF. We feel the same way. Some investors are going to have that sophistication, are going to want to hold, um, you know, Bitcoin directly. Um, you know, if you have that sophistication. And you undertstand it and you have that comfort, we certainly encourage that. But we also think it's also, you know, beneficial to have the option for us for Bitcoin, um, in the form of an ETF wrapper. Additionally, when you're taking a look at, you know, futures exposure, there's complexity operationally there's additional, complexity in terms of, you know, the need for the fund to actually roll the futures, right. Futures have, um, a term to them and an expiry to them. And so to ensure that the ETF manager is maintaining the highest level of exposure to the underlying asset. There's a process of rolling, those futures to, to maintain the highest level of exposure. Um, and that rule has uncertainty, um, in terms of the cost of that role. Um, it also has uncertainty. You know, operationally, um, and that can lead to an underperformance, of the asset relative to, excuse me, an underperformance of the ETF relative to, you know, the assets, exposure. We believe that spot Bitcoin ETPs will do an incredible job of tracking the underlying asset. Um, and I mean, at this point in time, there there is no longer even a gold futures, you know, ETF in market, I think about 14, 15 months ago was when the last, of the gold futures based ETFs. Um, you know, we're we're we're actually in the market. So maybe we go to the next slide. You know why GBTC is the is the question. Um, I have long, stated that, you know, not all ETFs are created equally and not all ETF issuers are created equally. Um, I think it's really important. And I think Zach did an incredible job of articulating this is a new asset class. Um, it's specialized. It's a specialized asset class. And it requires tremendous amount of expertise. And I think we're embarking on an, you know, a really important period of education. investors are going to need to be educated. Financial advisors are going to need to be educated. Um, you know, your clients are going to need to be educated. And

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

in a number of conversations that I had with financial advisors, notwithstanding the reality that, um, there was very limited access to the asset class through their platforms. I think many financial advisors were intimidated by the asset class and further put in a compromised position or frustrated position where their client knew more about the asset class than than they may have known. And the two most prominent questions that you know, I receive from financial advisors are, you know, why would I use Bitcoin to to go to Starbucks and, and buy a coffee? And I think, you know, Zach did a good job of saying that's not that's not really something that's a relevant question in the US market when we have a reliable, you know, fiat currency. but the question and the second question is, you know, where does it fit in a client's portfolio? And and until now, many clients have been going to the direct, digital asset marketplaces to kind of get that and gain that exposure. And the frustration that we hear from financial advisors is that really impairs the transparency, um, of the ability for the financial advisor to understand the entirety of the picture of their client. And so we now have this opportunity to, you know, utilize the Bitcoin ETF, um, as a building block in, in, in the clients portfolios and kind of, you know, pull those assets back into the perimeter of, you know, the advisors, um, you know, mandate, um, and the, the advisors purview. And so it's going to be really important that you're partnering with, a crypto specialist. Um, we are that, um, you know, our entire team is committed to digital assets. Our entire team is focused on bitcoin and other digital assets. Um, and that's going to put, you know, you and your clients in the best position to, to be educated and to really be at the bleeding edge of exactly where digital assets and digital asset investing is going. Um, some of the attributes that, you know, we both, and we're very proud of is our ten year track record. Um, you know, we've been doing this a long time. Um, we feel in, in great company with some of the other kind of largest, you know, asset managers in the world who have chosen to, you know, step into the Bitcoin ETF. Um, um, you know, arena. But this is something that we've been doing for a very long time. we launched our product in, in 2013. Um, this product had, you know, long been trading on the, OTC markets and quoted on the OTC markets before being up listed last week, the New York Stock Exchange. Um, we have the largest spot bitcoin ETF in market at over 25 billion in assets. Um, we have incredibly strong liquidity and liquidity matters in ETFs. Um, you know, proud to boast that, you know, over the first two days of trading, we had over, you know, $4 billion that were traded notionally. Um, and those two days, you know, GBTC was a top ten, you know, traded ETF. So of all the 3000 plus ETFs in market, GBTC, ranked in the top ten, which is an incredible stat in and of itself for an ETF geek like myself. was really, really a proud moment. Um, and the spread quality that we've had in GBTC over the first few days of trading has been really impressive as well. Um, you know, in the 5 to 6 basis point range and in many times even tighter than that. Um, having a long track record, partnering with, um, you know, an ETF issuer that has expertise in crypto expertise in Bitcoin is going to be a real differentiator. And I think when you and your clients need to be educated, and you and your clients need, to have access to information and to ensure that you're at the cutting edge of what's happening in the digital asset ecosystem or what's happening in the Bitcoin market. Um, we're certainly going to be there and we're going to be leading the charge. Um, I think the first, you know, 25 plus minutes of this webinar, if nothing else, was to prove that we certainly have a tremendous amount, of expertise in bitcoin and digital assets. and we're

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

employing, a very strong team that can, can, can be to your advantage and be to your client's advantage. from an education front, um, in terms of regulatory oversight. Look, um, ETFs are highly regulated vehicles. but we have long been, um, you know, an SEC reporting company, even before we were an ETF in market, um, filing 10-Qs and 10-Ks and 8-K's you know, on the periodic basis necessary either quarterly or when required by the regulation. And so we're certainly, you know, advocates of transparency and advocates of regulation. And again, pulling Bitcoin further into the regulatory perimeter, utilizing a well-established battle tested ETF wrapper, to offer our clients is something that, um, we've been championing for a long time. And we're, we're really proud of that. So, um, I'll pause there for now. Todd, maybe, we could take some of the the questions that have been coming in from, um, our viewers.

Todd Rosenbluth Yeah. thanks, Dave. And thanks to Zach for for setting the framework for why I just want to stay on this slide for a second. Dave, you thank you for being a part of VettaFi crypto symposium that we did last week. and you and your colleagues in the industry did an excellent job. There's a replay of that available on our ETF trends website for folks who want to see the full two hour session. But I highlighted because one of the questions we asked the audience, Dave, it was not during your session. So you don't know all of the facts behind this, but we asked what characteristics were most important when choosing a spot Bitcoin ETF. and we gave a number of choices that were, available. And the most popular one was, the expertise of the partner, the expertise of the firm that they would be partnering with to invest for their client. And then that second one was liquidity. So this slide here obviously shows why, Grayscale should be among the mix, if not the leading firm for those people who prioritize those two factors. So love for you, just if you had a moment, just to respond to while we put up a final poll question.

David LaValle Yeah. Look, the expertise is really critical. I'm an ETF guy. I joined this firm. and I'm a markets guy. Um, exchange guy. I'm a market structure guy. and I've long been innovating in the ETF market, but I had this opportunity two and a half years ago to kind of dive into the deep end of crypto. Um, and it's complex, but it's not impossible to understand. And, you know, when I've been surrounded by, you know, the very people that we are planning to partner with, the advisor community to educate. Um, if they if they got me to a place where I understand it and believe it. Um, I have a high degree of confidence that they'll be able to do the same for financial advisors and for, you know, the clients of financial advisors. Um, you know, I think the the points around, um, expertise are really critical. And, and the thing that I often say is go back to 1998. And we were embarking on another technology revolution with the internet, and it was complex. But I think, um, the words that that Zach uses is that you're going to see this creeping into your life and all different facets. The first application of this, you know, transformative technology is a currency in the form of Bitcoin. Um, and that's not very usable in the US market given the strength of our fiat currency. But I think that notion of creeping into other aspects of your market, or other aspects of your life, is something that's absolutely going to happen with blockchain technology and more broadly with digital assets, and it's going to be something that you're going to want to have a

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

partnership with a strong, asset manager and a strong. Um, you know, some of the strong in crypto education to help bring you and your clients along for that journey.

Todd Rosenbluth Well, thanks for that, Dave. So just, again, in the interest of time, we popped up a poll question. We're not going to show the results of this. but do you plan on adding to or initiating a position in GBTC? That's the Grayscale Bitcoin Trust ETF in the next six months? A simple yes or no would be great. we got a lot of questions that came in. Dave. Let me start with you, and then Zach, I'll bring you in on the next one. but maybe you could just help frame. What does this mean? You talked about why an ETF and why it's good for advisors. Why is having a Bitcoin ETF a good thing for the crypto industry? What does it do for the overall industry now that there's people like, well, myself and my colleagues at ETF trends talking about it and advisors being able to invest in it?

David LaValle Yeah. I mean, look, it's it's great that you guys are talking about it. This is this is huge for crypto. It's also huge for the ETF industry. Um, you know in terms of huge for crypto. It's validation. It's a story of validation. Um, you know, the largest asset manager in the world and largest banks in the world are mobilizing, um, and are really putting themselves in position to launch products or support the market, from operations perspective, um, and it's a sign of real mainstream demand. And it's the sign that this is really, you know, being validated as a full fledged asset class from from the ETF industry perspective. Um, it's, well, unprecedented on the one hand. And it's also, you know, history repeating itself on the other hand. So very quickly, it's unprecedented, as we've never seen, um, you know, 11 firms mobilized to bring a product to market at the same time that's showing what the market opportunity looks like and, and what the demand looks like from their clients. But it's also the history repeating itself. And I talked about this on that first slide. It's the next wave of innovation. It's the next evolution of the ETF market. It's the next same old story of an asset class or an exposure that has been available to a subset of the market being brought ubiquitously, being brought equitably, in the ETF wrapper. That has been a real a real benefit, um, and a real, tool, not only for ETF investors, um, and financial advisors, but also for the broader market from an exposure perspective.

Todd Rosenbluth Great, great Zach. So I want to tap into the expertise that you have. And at Grayscale has. We're getting some questions of people that are confused about the terminology. So could you help? How does a Bitcoin transaction compare to a traditional bank transaction?

Zach Pandl Well, it, a couple of different ways. So the first is where that transaction, takes place. so, if I'm making a payment to you, Todd, through the traditional, banking system, you have an account that is basically, let's call it on on a spreadsheet a your bank. I have an account, on a spreadsheet at at my bank. That's that's our money. Our money is represented, by the items in the cells and the spreadsheets managed by the world's, commercial bank. So I'm taking making a payment to you. It is being routed from, you know, my bank accounts essentially to your bank account. So that's sort of taking place on the, the database or the spreadsheet or the the ledger, to use a term

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

that is common in, in crypto, you know, the ledger of these, commercial banks, a Bitcoin payment, takes place, again on a, on a ledger, a database, a spreadsheet that exists outside, of of the banking system. You have an account or an address? I have an account or an address. I send this to you on a peer to peer basis, through this, network. And there are no, central, centralized intermediaries, standing in between us. So the first thing that I think recognizes, like how this transaction, where it exists, and it doesn't exist on, the traditional, banking systems, accounts or ledgers that exist on, a blockchain, um, this, decentralized, network distributed over, thousands of nodes, all over, all over the world. So it's a completely different, structure. That is a revolutionary concept. And frankly, I think difficult for people to get their heads around. But I think, you know, that that is essentially how how it works. Um, there are also sort of fees, involved in, in both cases, and we can kind of compare those is probably too much depth for this call. Um, but the other thing I would just stress is the, the time, that it takes to, to make a payment. So a payment, a bitcoin, a transaction from from me to you, or, or a payment or transaction on any other blockchain is nearly instantaneous. It can take a couple of minutes, in the case of a Bitcoin or a couple of seconds in, in the case of other, blockchains. but it is, it is essentially immediate and final. that is way different, of course, than how the financial system, works today. our finance system today, like, sometimes takes, um, you know, two days, of course, to settle a payment. there are no business, happening, after, work hours or on weekends or on Martin Luther King Day. The Bitcoin blockchain, is always open, always functioning. Since it was launched, 15 years ago, these sort of payments have been made at any hour of the day by people all over, all over the world, and have worked, exactly as, as expected. So, um, it's I would say those are the kind of two key differences, you know, structure outside of the existing, payment system. Um, and on its really own, structure, and instant, near instant, payments that are, that are immediately, settled it and final that don't take, multiple days, the financial system that we have today evolved, to the arrival of computers in, in the 1970s. Um, but it looks and feels in many ways, the same way, that it did, in the days of paper check clearing, at the end of the 19th century, it's time to move beyond, that, that structure. it's time to have, um, financial system that is as, as modern, as many other things, in the rest of our life. And the Bitcoin is, is one kind of key element, to, to that. And so the final settlement, and payments taking place outside of the banking system are really the two key differences.

Todd Rosenbluth Okay. My eyes are opened on that one because I'm still waiting for, you know, the check to clear. is something that just isn't happening as fast, as it was. Something that also didn't happen as fast as it would was the approval of Spot Bitcoin ETFs. So Dave would love to get your take on this. Obviously, Grayscale helped to lead the charge to convince the government and convince the SEC, to allow these products to be available. So first of all, thank you for that because I now have ten new products, to be covering and that's job security, but it's also great investment opportunities for everybody else. So could you just maybe expand on that and then maybe some obviously, you mentioned you're not alone. in this space. What what are some of the characteristics advisors should think about and why GBTC should be at the top of that list?

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

David LaValle Yeah. So I guess the short answer is, um, obviously we are we are waiting for regulatory approval. The first time that this was put in front of me, was 2013. I was at Nasdaq, um, leading the ETF franchise and trying to build an ETF listings business. And I got a phone call, um, you know, from a great, um, you know, 40 act attorney that said, hey, I've got this new idea. Can we talk about it? So we're, you know, ten plus years later, um, when we got here, but but also, it's not just regulatory approval. It's also industry readiness, which is really critical to make sure that this, you know, these products are going to behave appropriately. And I think, you know, look, we're three days in. It was a absolute, you know, Herculean lift, by the industry to be able to be prepare, to trade these products, um, you know, and and that goes to, you know, market making firms and trading firms and authorized participants and, you know, liquidity providers and the exchanges and, you know, um, you know, custodians and, you know, and certainly the administrators that are supporting this ETF. So it was really an incredible feat of operational readiness. Um, and the ETF industry really answered there. Um, look, this was, you know, roughly ten years of back and forth with a couple of, you know, spurts along the way, innovation can take time. We obviously respect the regulatory process. And we we respect the SEC mandate for, investor protection. Um, but we're incredibly pleased that we actually got to this point. Um, and it's a win for our investor, you know, look, I appreciate the accolade that you that you've offered. certainly it was our uplisting filing, you know, that we put in at the end of 2021 that was denied and in the middle of 2022 that we we challenged that decision in the DC circuit court. Um, and, you know, the DC circuit, you know, unanimously, you know, ruled in our favor and against the SEC, saying that the SEC is denial of our listing, um, was impermissible under the Administrative Procedures Act. So, look, those are all real facts. And we have, you know, can long champion the fact that we, you know, innovated, we can long champion the fact that we were a leader. Um, and there are now, you know, ten plus products in market that are vying for market share. What makes us different, you know, I'll reiterate it, we're 25 plus billion in assets. We have a ten year track record. Um, you know, we are a crypto specialist. That's going to be critically important, to you and your clients. Um, liquidity is is, you know, unmatched in our product. right now, the average daily trading volume and the quoted spreads are, are incredibly impressive, not just within the asset class, but incredibly impressive when you look across the landscape of, you know, 3000 plus ETFs. Um, we're pleased to boast that. But we are a crypto specialist. We're focused on this. This is everything that we do. We will not lose focus on it. And we're incredibly excited about the opportunity to, you know, partner with VettaFi and to partner with advisors, you know, with that, with that goal of educating, and really taking you on this journey of the next, you know, financial revolution.

Todd Rosenbluth Well, thanks for that, David. We at Vettafi are honored to be part of the education efforts that you and the team at Grayscale are offering. I want to thank you and Zach, for sharing your expertise. It really shines through, and the overall Grayscale team for supporting this educational effort with us. If you haven't filled out the survey, or downloaded the resources, take the time to do so in the bottom of the screen, and we'll see everybody, next time. Have a great rest of the day.

David LaValle Thanks Todd

Filed Pursuant To Rule 433

Registration No. 333-275079

January 17, 2024

Grayscale Bitcoin Trust (BTC) (the “Trust”) has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Trust has filed with the SEC for more complete information about the Trust and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Trust or any authorized participant will arrange to send you the prospectus (when available) if you request it by calling (833) 903 - 2211 or by contacting Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101.