Filed Pursuant To Rule 433

Registration No. 333-275079

February 1, 2024

GBTC Wealth Management CE Webinar

Video:

Transcript:

David Bodamer:

Hello and welcome to today's wealthmanagement.com webinar. What to Know About Spot Bitcoin ETFs. This webinar is sponsored by Grayscale. I'm David Bodamer. I'm with the wealth management.com editorial team and I'll be your host today. In a moment, I'm going to be turning things over to our speakers, but first I'm going to explain how you can use the webinar tool and get the most out of this event. To improve your viewing and listening experience, you can move your webcast windows around by dragging on the title bar or resize them by clicking on their lower right corner. At the bottom of your screen, you'll find multiple application widgets. Clicking on these icons will allow you to open and close widgets on your screen, but will not remove you from the event. Located in the resources list widget, you'll find several additional resources that are available for download.

Also note that this webinar has been accepted for one CE credit hour towards the AEP designation program. The live broadcast of this event has been approved for one CFP Board CE credit hour and Investments in Wealth Institute has accepted this program for one hour of CE credit towards the CIMA, CPWA, CIMC and RMA certifications. Instructions for getting those credits are available in the resource list widget. I'll also take questions about today's topic and answer as many as possible following the presentation. Feel free to submit questions to the queue at any time. Just type them into the Q and A window on the left-hand side of your screen and hit the submit button. Also note that this session is being recorded and will be available for on-demand viewing following the event today. Simply use the same URL that you're using right now to access the replay.

With the housekeeping out of the way, just a couple of quick introductions. We have with us today, John Hoffman, head of distribution and partnerships at Grayscale. And joining John, we have Zach Pandl, head of research at Grayscale. You can find out more information about both our speakers by clicking on the speaker bio widget at the bottom of your screen. Also, just to go through a quick agenda of what to expect today. You could see on your screen right now the main bullet points, Bitcoin and the blockchain. How should advisors be thinking about incorporating Bitcoin ETFs into client portfolios Spot Bitcoin, ETFs and GPTC, and what questions should advisors be prepared for when talking with clients? So with that, I'm going to hand the floor over to Zach.

Zach Pandl:

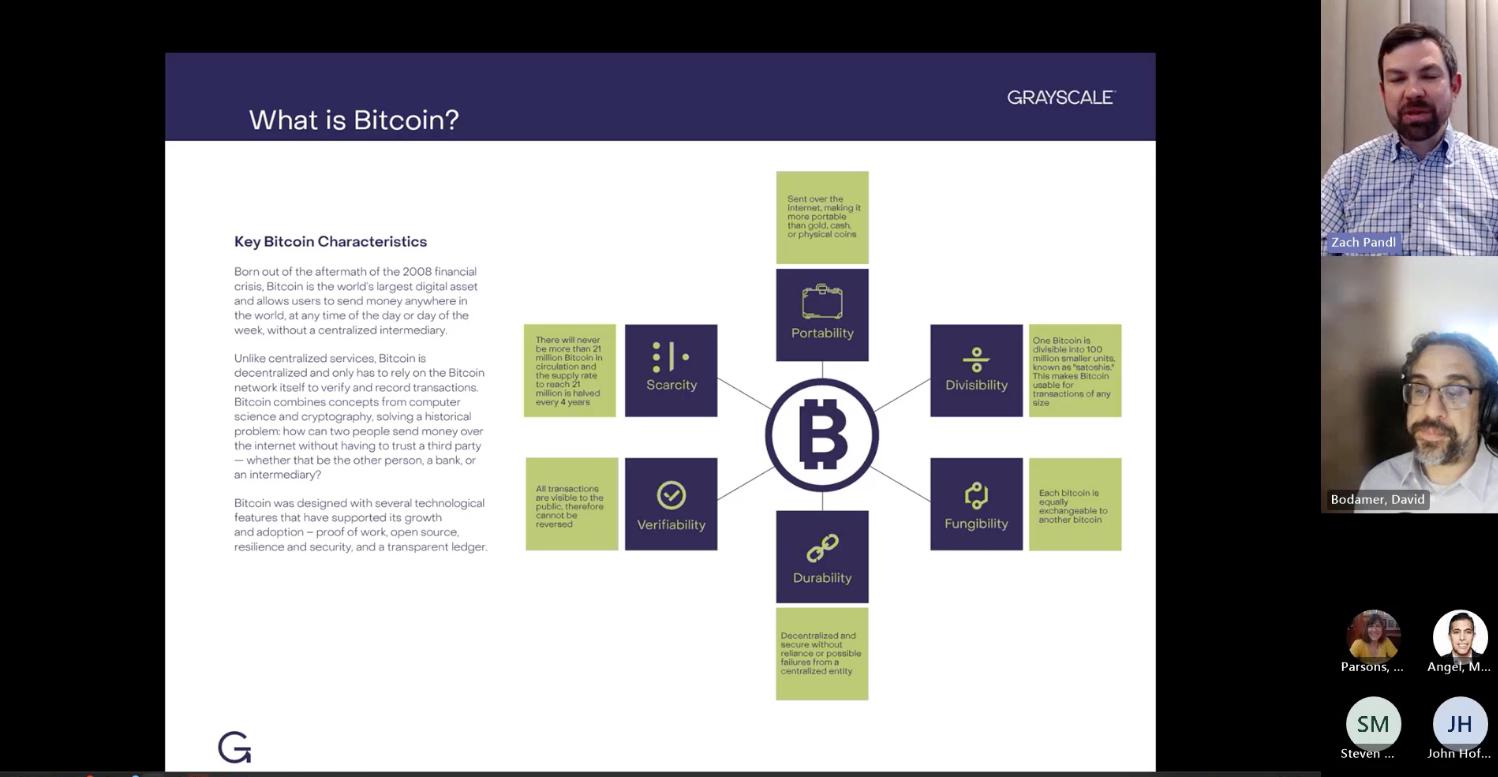

Thank you David, and thanks everybody for joining us today. It's great to be on with you. Bitcoin must be the most talked about and least understood asset in the world. So what we're trying to do here today is provide some of the basic tools you need to understand this new asset and the broader crypto asset class so that you and your clients can confidently invest in crypto. So a great place to start is just to answer what is Bitcoin? Bitcoin is a kind of money system that is not issued by a government or a central bank. Most of the money that we use US dollars or if we travel Euros or Japanese yen are money systems that are issued by a government, by a nation state, by a central bank. Bitcoin is a money system that is not issued by a government or a central bank.

Now we have something like that already in the financial system. Gold, monetary gold serves that purpose is a kind of money system not issued by a government. As most people on this call will be aware, gold has a very long history as a money medium, and it sometimes was shaped into coins by governments, but it didn't derive its value from governments. It was independent of the choices of a nation state or a central bank. Today, gold is a kind of legacy money system that is only really used by central banks. The world's central banks actually store gold in the basement of the Federal Reserve Bank of New York in downtown Manhattan. You can go there and see those assets anytime and they count them towards their national assets and think of them as a kind of a store of value. Many private individuals also hold gold for the same purpose as a kind of asset that's supposed to work in worst case scenarios when traditional assets like stocks and bonds are not expected to perform well for whatever reason.

Now, how did we end up with that? Why gold and not the 90 or so other metals that are in the periodic table? Well, it turns out that gold has some specific physical properties that make it quite useful as a money media. It's not by accident. Gold has things that make it useful for exactly this purpose. For one thing, gold is relatively scarce. Supply of gold in the world increases very slowly only about 2% per year, so it's very difficult to have inflation in the supply. Gold is also quite dense, but it's also malleable or shapeable and it doesn't rust or corrode. So for example, if you have a gold coin or a gold bar and you put it away somewhere and you come back to that gold coin or gold bar many years later, it's going to be in exactly the same state as you left it.

Not every metal has that attribute, but gold does, and that's one of the things that make it a very good money instrument. Now, there's nothing wrong with gold, and we think that gold will always have a place in the financial system. There will always be people that want to hold gold as a investment vehicle. That being said, we I think can acknowledge that many things about our world are changing and becoming less physical and more digital. In many ways, our world is moving into a more digital age, and as part of that, we think we are seeing changes in the financial system as well. So while gold served a purpose as a non-government money medium in the past. We think that today's investors, modern investors and new generation investors are adopting Bitcoin for that same purpose as a non-government money medium or store value asset.

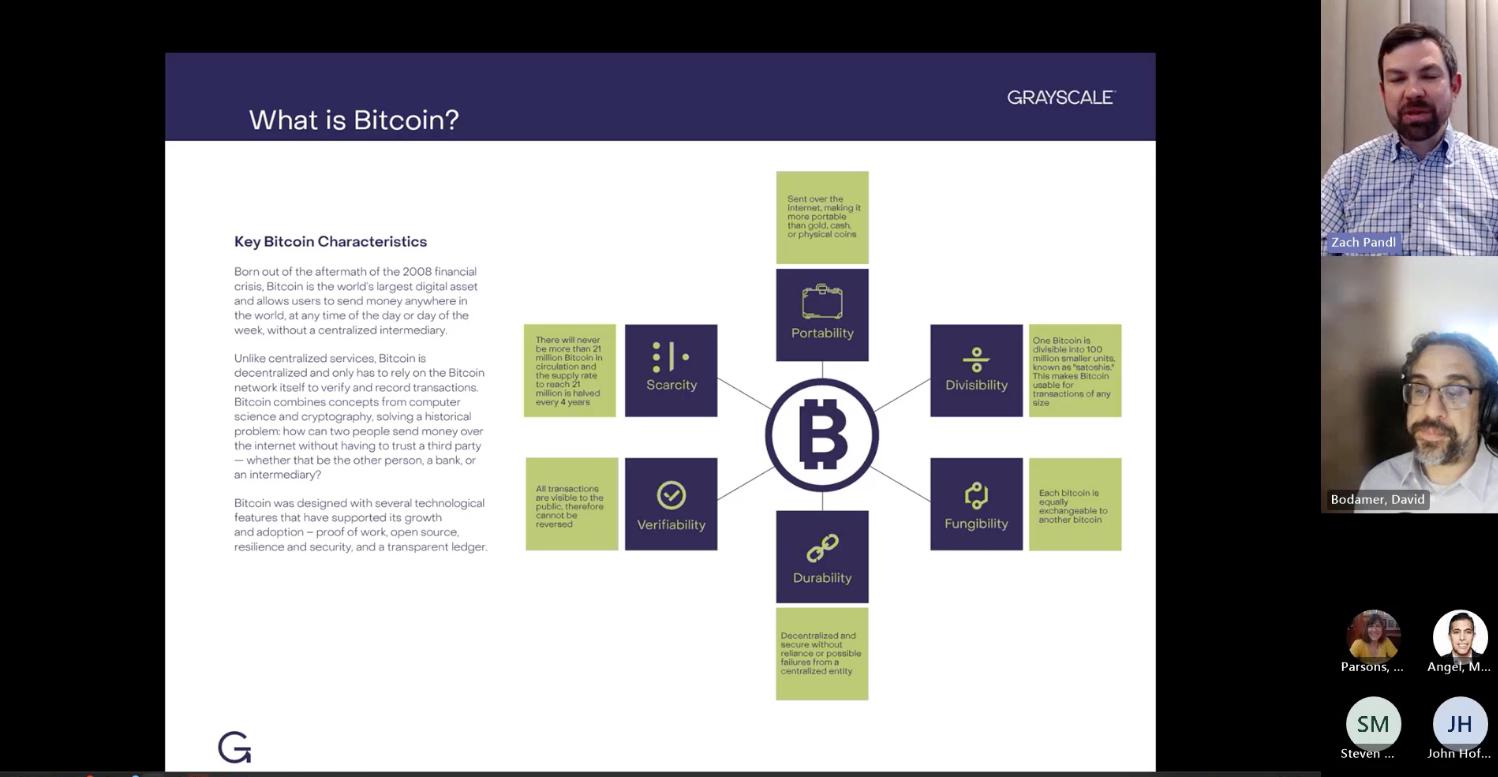

Now, if gold has certain physical properties that make it useful as a money medium, Bitcoin has certain digital attributes that make it useful as a money medium. For one thing, Bitcoin is also scarce. There are only 21 million Bitcoin that will ever be in existence, and so you can't have sort of inflation with supply as you can with government issued money. Bitcoin is also verifiable divisible and secure. It's also fungible, so it has all these qualities that make a good money instrument. It just happens to be digital. So I would encourage listeners to think about Bitcoin first in that way. Gold is a kind of physical instrument that has properties that make it useful as a form of money. Bitcoin is a kind of digital object that has attributes that make it useful as a form of money. We could please flip ahead to the next slide.

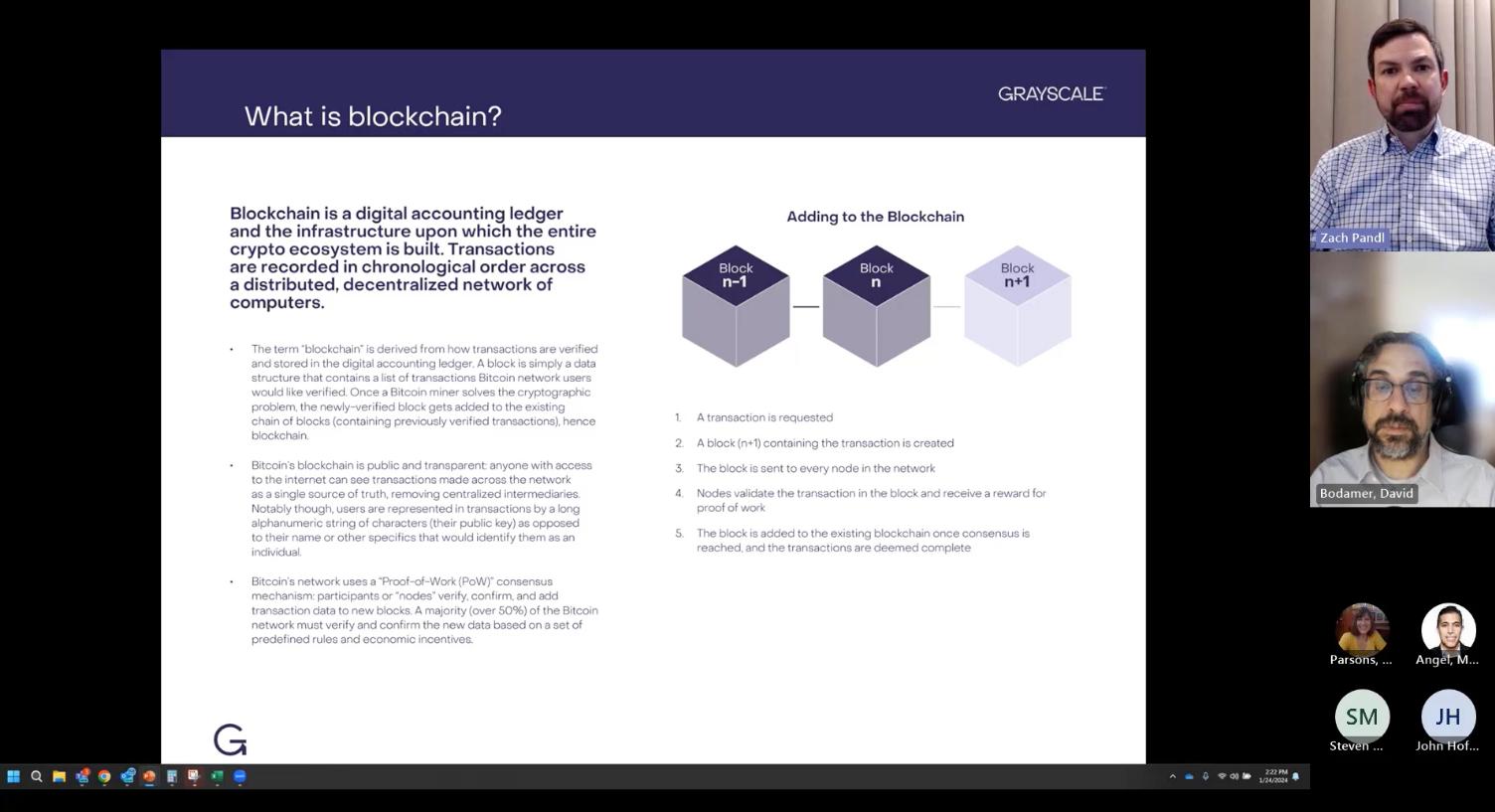

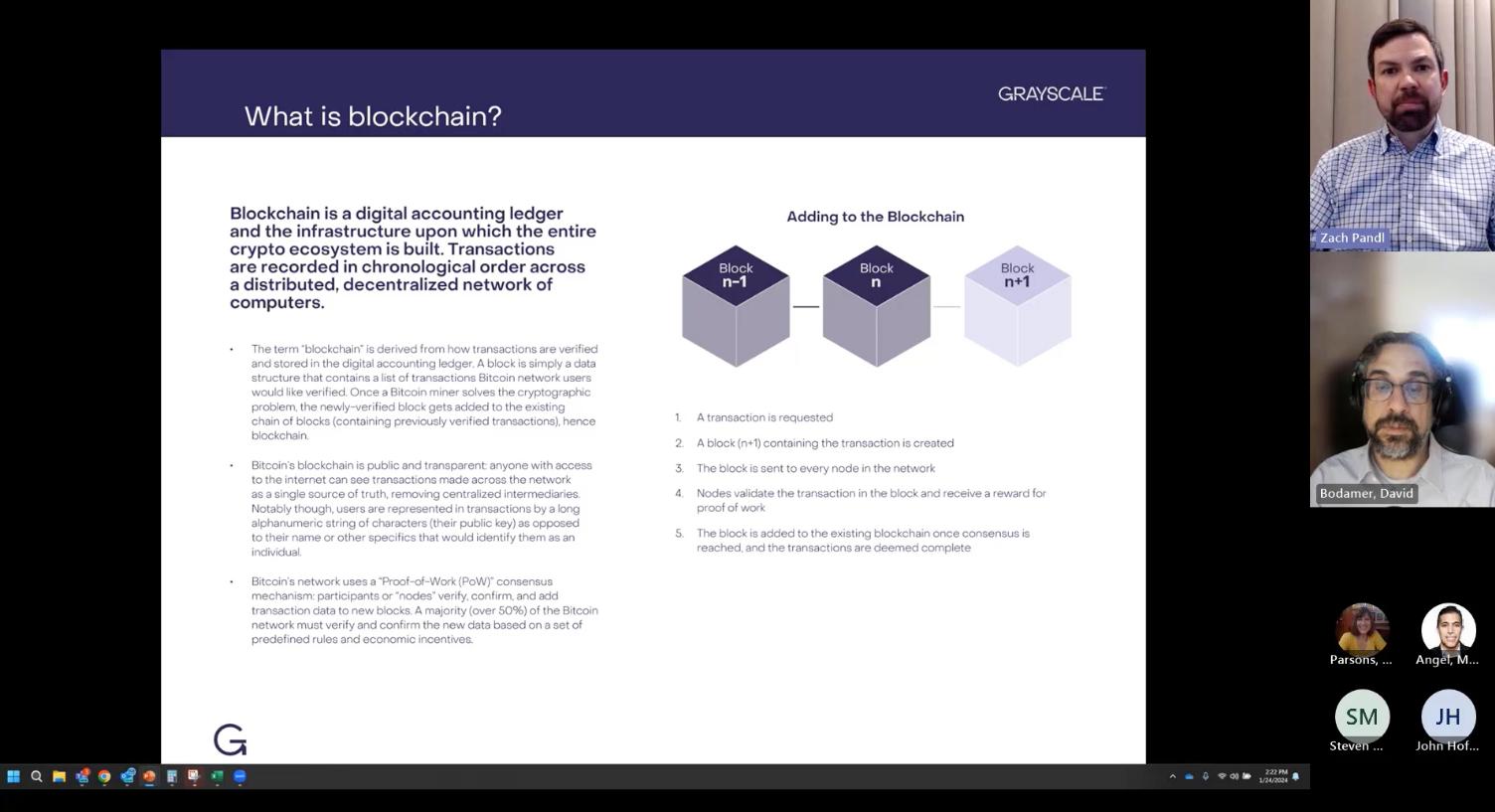

Now, where does Bitcoin come from? Of course, it's easy maybe to get that basic intuition, but to understand what it really is, we need to understand another concept called the public blockchain. Now, most of the money that you use today isn't physical at all. We carry a small amount of physical cash around, but most of our money is digital and that means it's just information stored in a database somewhere. So your bank manages a spreadsheet, if you will, or a database of all your assets and all your liabilities and those of all its other customers. You can go online and look at those things, but it's really your bank that's responsible to make sure that all the right information is stored in all the right places.

A blockchain is just another kind of database. It's a place where we store digital information. The critical difference however, is that there's no one central authority overseeing this database. So in the case of your bank, your bank is responsible to maintaining the integrity of that information, that your digital money is correctly counter and stored in the right places. With Bitcoin, there is no central authority overseeing this database. There's no government, no company or no person. This is really the kind of core technological breakthrough that Bitcoin brought to us. It's sort of a money system and we can record all that same information that we have with our current money system, but the relevant data isn't owned by anybody or controlled by anybody. It's distributed across a network of computers. Really thousands of individual nodes all over the world are maintaining that database and no one entity is in charge.

It's through this technological breakthrough that we're allowed to have a digital money system not issued by a government or not issued by a central authority. A digital alternative to gold required an innovation like this, an innovation like a public blockchain. So how does something like that work, right? It doesn't happen by accident. You may have heard terminology, sort of crypto jargon called proof of work or proof of stake. But what I would emphasize is that how this works is through economic incentives. Economic incentives written in to the Bitcoin algorithm encourage this decentralized set of actors all over the world to maintain the integrity of this database. So we give it labels in Bitcoin's case, proof of work. In other blockchains case, sometimes proof of stake. There are different versions of this, but they're all versions of economic incentives that enforce a decentralized set of actors to maintain this database.

So that's really what a blockchain is, a database or a server distributed across computers all over the world maintaining the integrity of the information supporting the Bitcoin network. Now it's called a blockchain because the way that the data are added to this database is not exactly like a spreadsheet. The data are kind of clustered into blocks and then added sequentially, one after the another hands say a blockchain.

If we could please flip to the next slide. Now, something like this is a technological marvel. I find this incredibly interesting and it's one of the reasons why I spend my time doing research on this industry. But for this to be interesting for you, interesting from a financial standpoint, Bitcoin cannot just be a kind of technological breakthrough. It has to have an application in the real world. It has to have some real world use case that gives it economic value. So we're going to talk about that here and I think you can put those things really in three buckets. The first is as a store of value or an alternative to gold, and we'll talk about that first, and that's where we started this conversation.

The second is as a means of payment or what an economic textbook would call a medium of exchange. The third is as a kind of technological innovation, Bitcoin is a foundational piece of a whole new asset class, a whole new set of technology around this idea of public blockchains. So we'll talk through these in turn, hopefully give some clarity to what brings economic value to Bitcoin.

The first use case and really the most established is Bitcoin's role as a store of value or a safe haven asset. What does that mean when I use these terms, store of value or safe haven? Generally what investors mean or economists mean when they use those terms is that a store of value assets should maintain its value versus inflation over the long haul. Gold has been incredibly successful at that. Gold has maintained its real value as value versus inflation for at least 500 years when we have data which we can measure these things.

A safe haven asset I also think is supposed to pay out at times when other assets do not. So since they perform well, for example, in periods of rising inflation, when other assets like your fixed income assets, your bonds may perform poorly. So I think investors hold gold or hold Bitcoin for those purposes to maintain its value versus inflation over time and to diversify to perform when other assets are not performing.

Now relative to the size of the gold market, Bitcoin is still quite small. Some gold is used for jewelry of course, but the investment gold market, as you can see on this chart is about $5 trillion. That's the amount of gold that is held for strictly for investment purposes in bars and coins and ETFs. For example, the Bitcoin market today is a little bit less than $1 trillion. It depends on how exactly you measure it, but I think we can say that it's about 15 to 20% of the size of the gold market. So the first reason to value Bitcoin as an asset is just that it is a substitute to gold and is taking market share. So Bitcoin had a 0% market share in this sort of store of value market at one point, and it's gaining market share over time to something like 15 to 20% today.We at Grayscale think that that number is going to rise over time and that Bitcoin will gain more market share and therefore gain more value relative to the size of the gold market.

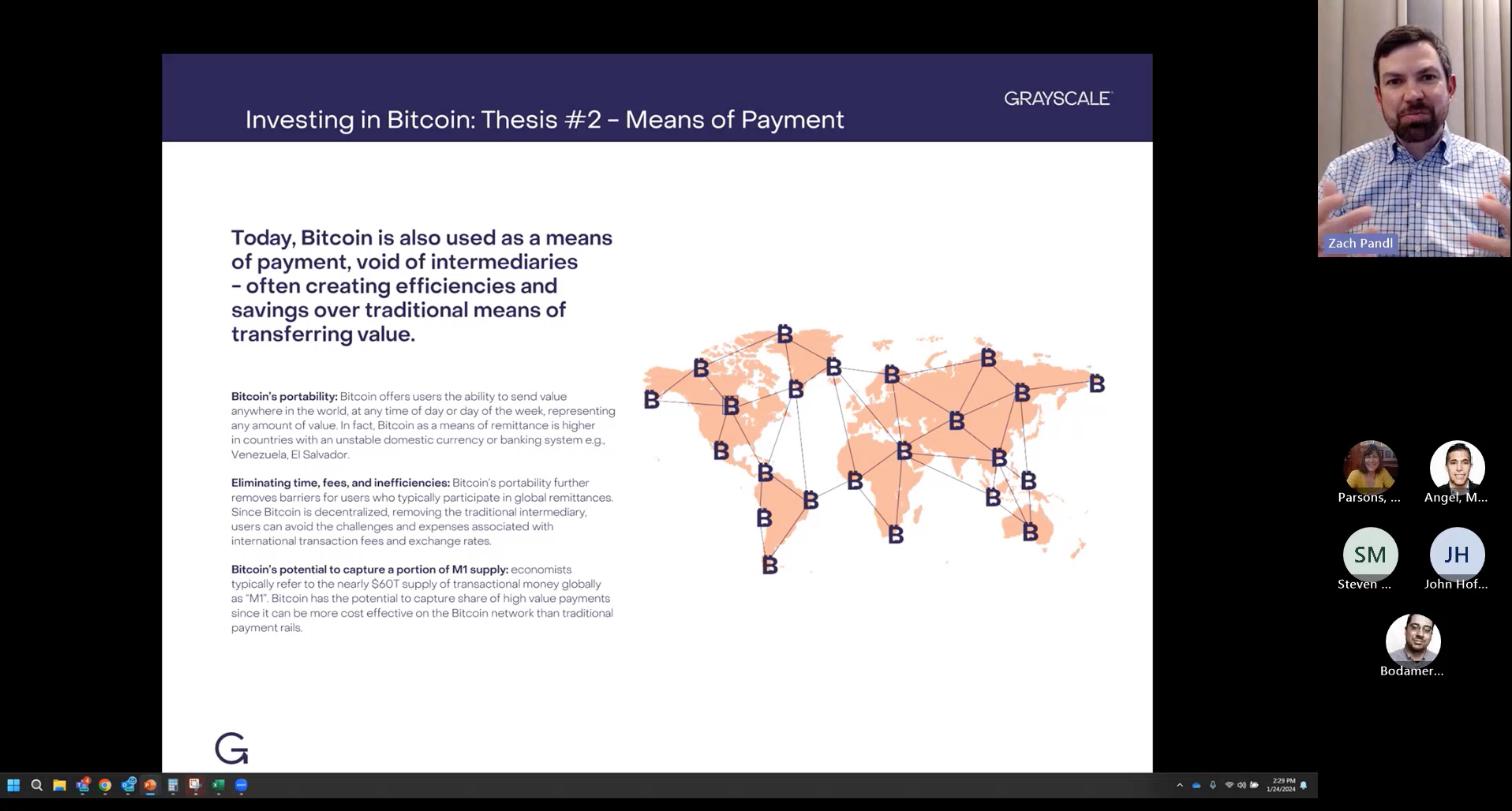

The next potential use case of Bitcoin is as a means of payment, or again, as an economic textbook put it, a medium of exchange. This is just the standard of function of money that you use every day to purchase goods and services. Now, Bitcoin has been slower to take off in that regard. It was originally envisioned as a peer-to-peer electronic cash system. You may be familiar with that jargon from the Bitcoin white paper, but it's been slower to take off in this regard. Even the Bitcoin enthusiasts at Grayscale are not using Bitcoin to buy cups of coffee or to purchase things at the mall. Now, the reason for this has to do with a technological challenge that relates to how transaction fees work on the Bitcoin network. So when we make a digital payment today with our credit card, there are lots of transaction fees involved.

Some of those go to the credit card company, some go to the issuing bank. You may be familiar with things called interchange fees for example. We have these types of fees on the Bitcoin network. So there's a kind of technological challenge with fees that prevents it from being used as a widely used as a medium of change or means of payment. Now, we think that there is a technological solution to that technological challenge, and there's lots of smart people working on this problem. It's not solved yet, but we think that there is a prospect for this problem to be solved. So in the future, my belief would be that Bitcoin is used in some cases as a means of payment, and this can add significantly to its value. The reason is that the market for transaction money, the money that we use to pay for things, goods and services in our everyday lives is enormous.

So if the gold market, the investment gold market is $5 trillion, the market for payment money is something like $60 trillion. Even if Bitcoin were used in a relatively small scale as payment money, if it were to take any part of that market at all, it would have a meaningful effect on Bitcoin's total addressable market and therefore it's market capitalization. Now, I will say one caveat about this, we don't think that Bitcoin is going to displace the US dollar or anything like that in the US economy. We're still going to be paying with dollars for goods and services. I do think that public blockchain technology will move deeply into our financial system and the way that we make dollar payments will be completely different in the future and it will use blockchains, but it's probably still going to be dollars or dollar stable coins, not Bitcoin. I think Bitcoin will have more traction in other places around the world where the existing money system is much weaker.

So around the world today in emerging markets for example, we have this concept called dollarization. That's when the domestic money system is not well managed. There's hyperinflation or there's lots of rules and restrictions on how you can use money, and the general public decides to use dollars instead. Even though their national government issues a money system, people prefer to hold dollars. That's called dollarization. We think in the future it's possible that we see a phenomenon that you could call cryptoizatoin or bitcoinization. So that same phenomenon where the domestic money system doesn't work very well and people choose to hold Bitcoin instead of their domestic money. So I think that's really where the application is most likely to take place in less developed economies with weaker money systems.

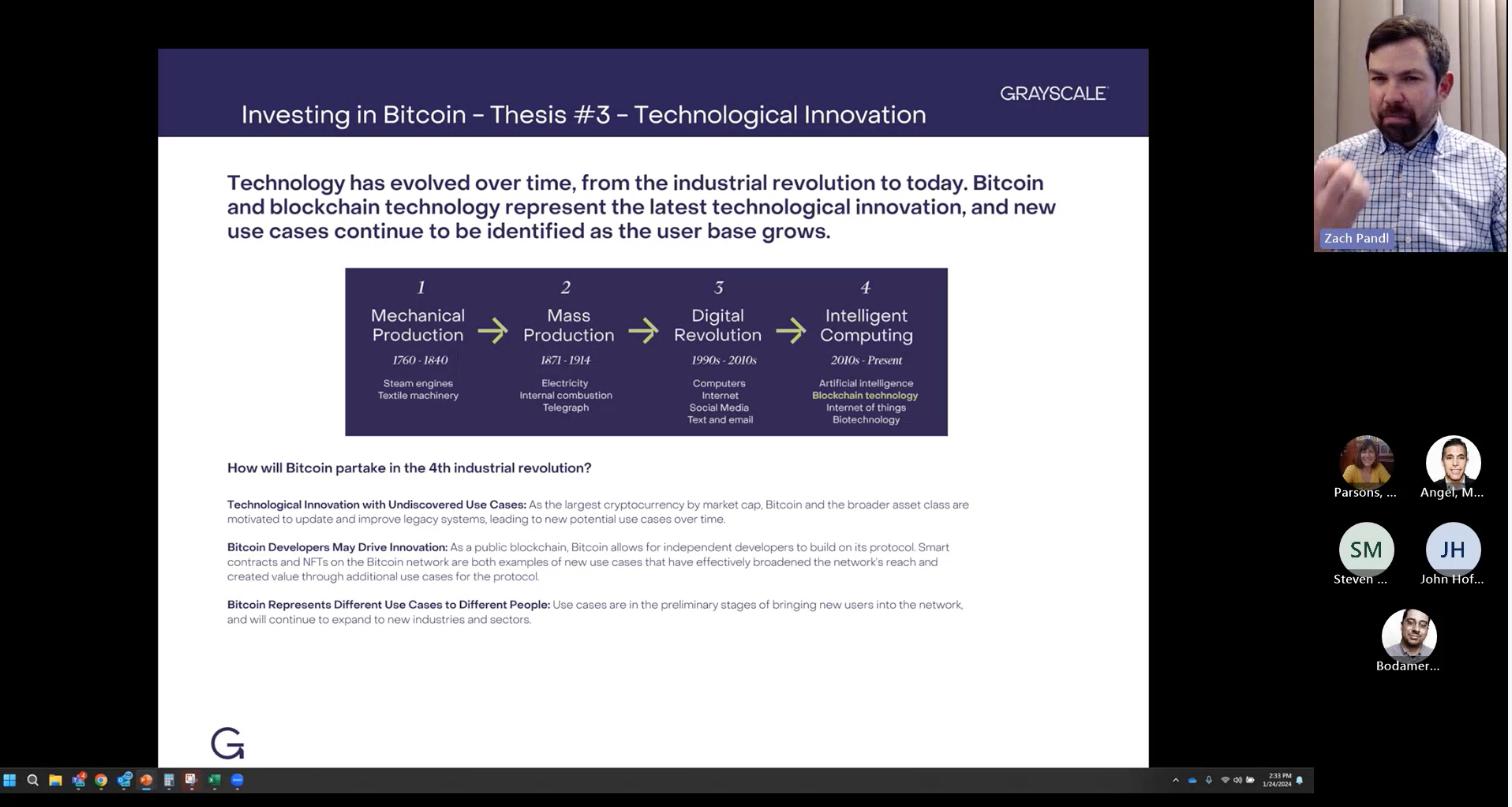

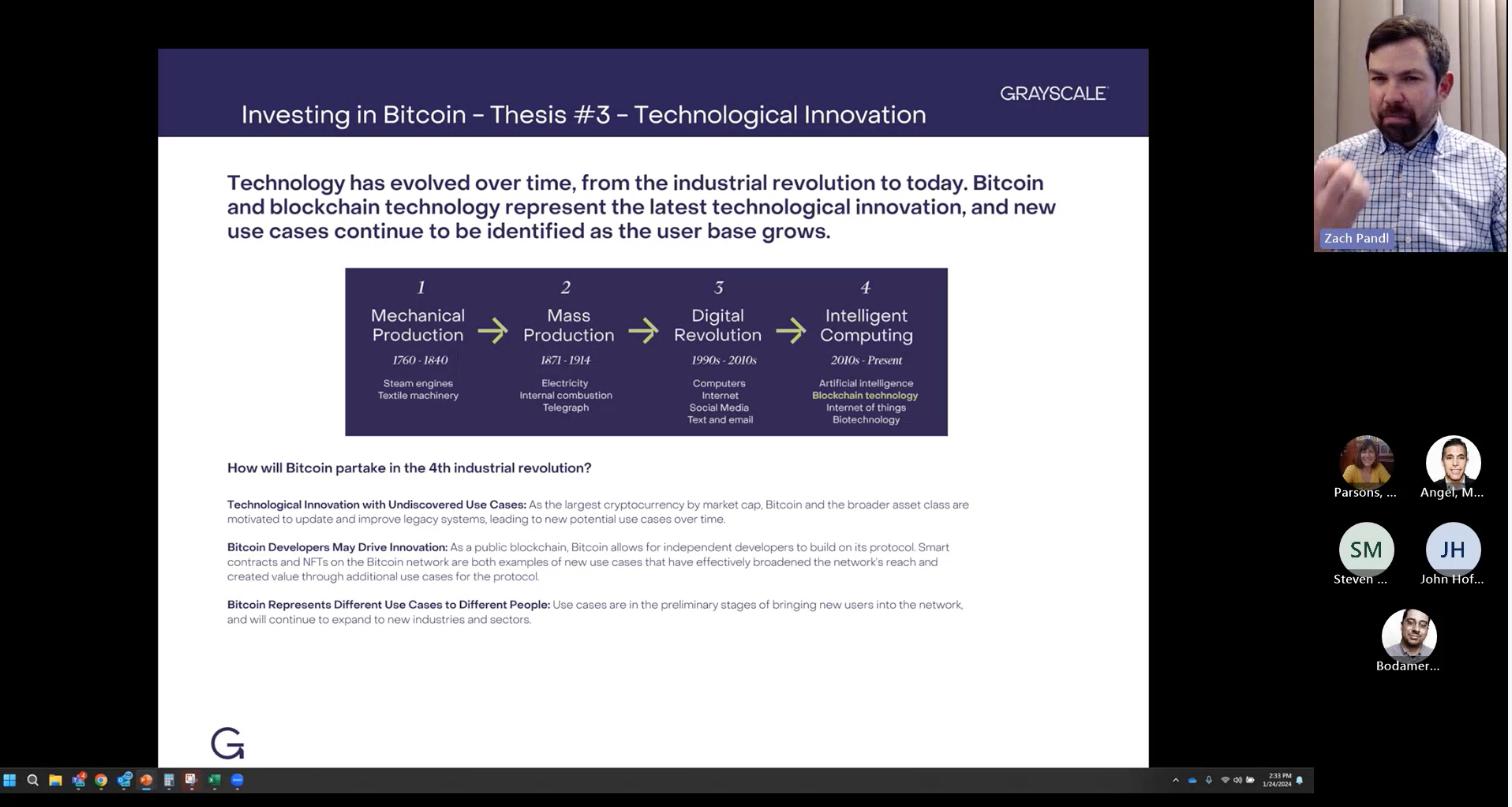

Now, Bitcoin is also a kind of technological innovation. Now, I think Bitcoin as a store of value, whereas a kind of money instrument really is enough to make it a fantastic investment. I don't know that we need to think of things beyond that necessarily for Bitcoin to deserve a place in many investors' portfolios, but I think it can be thought of as more than that. I talked about earlier this idea of the blockchain, the public blockchain technology. Bitcoin is really in one way just the first killer app of a technology that we think will eventually be ubiquitous and in fact lots of different parts of the economy.

So when you're investing in Bitcoin, you're of course getting access to this idea as a new store of value, as a gold alternative that's taking market share, maybe with some attributes that help diversify away from other assets. But you're also sort of making a bet on this broader exposure to public blockchain technology. If we're right and that technology does become ubiquitous in the future, Bitcoin is likely to benefit. So it's a way to invest in that industry and that sector and that asset class, if you will, through the most established largest market cap and most liquid instrument.

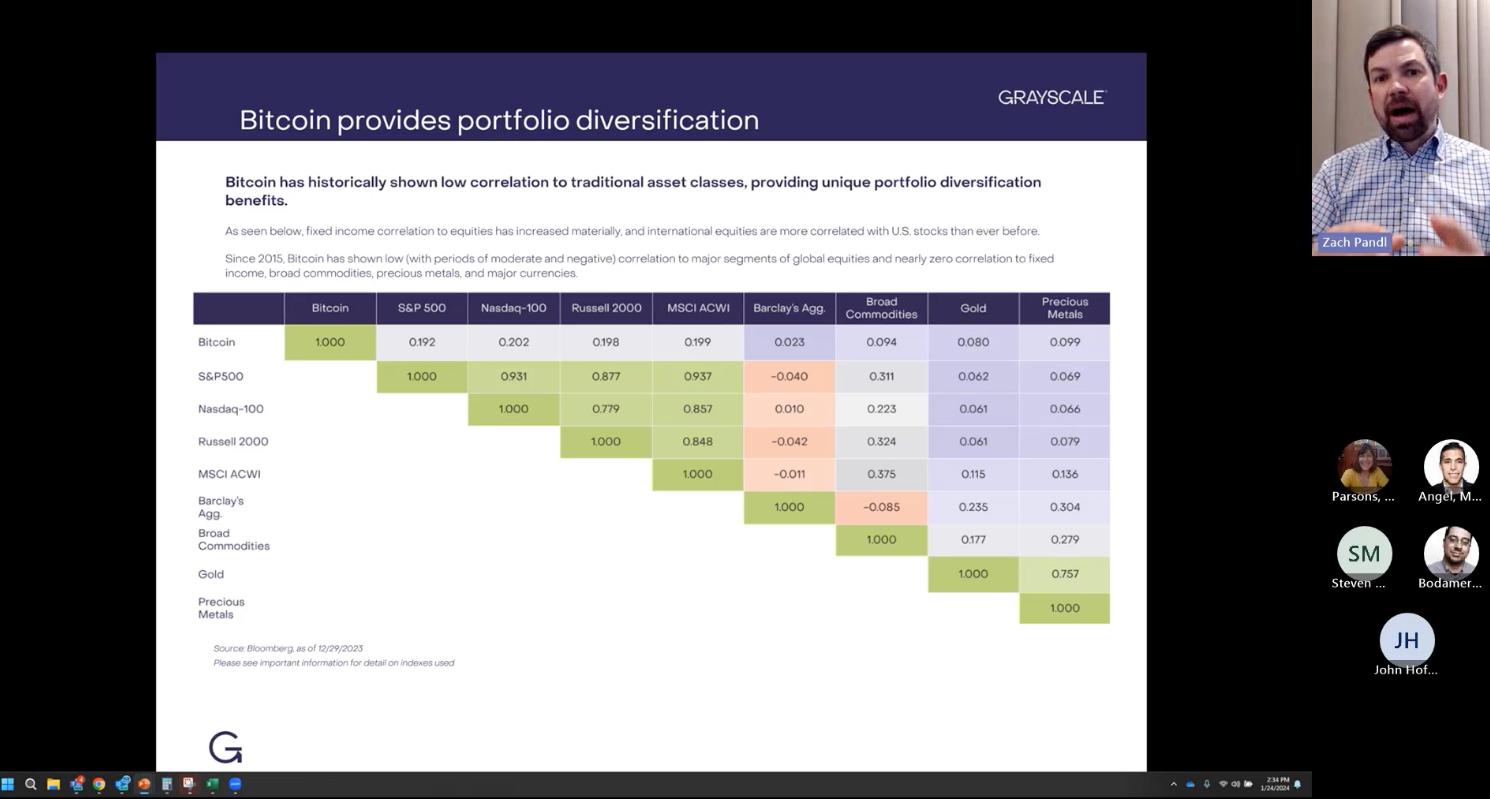

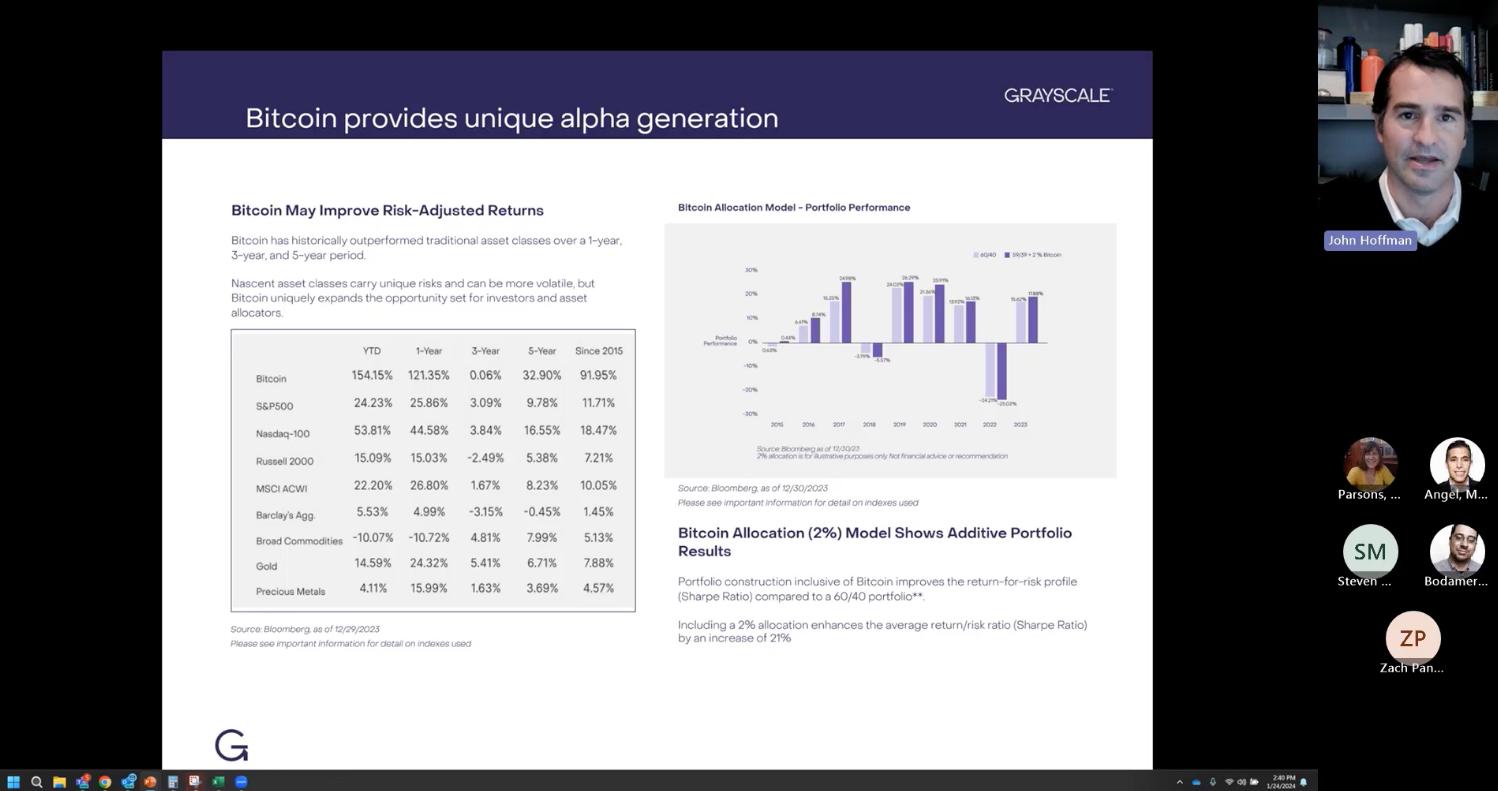

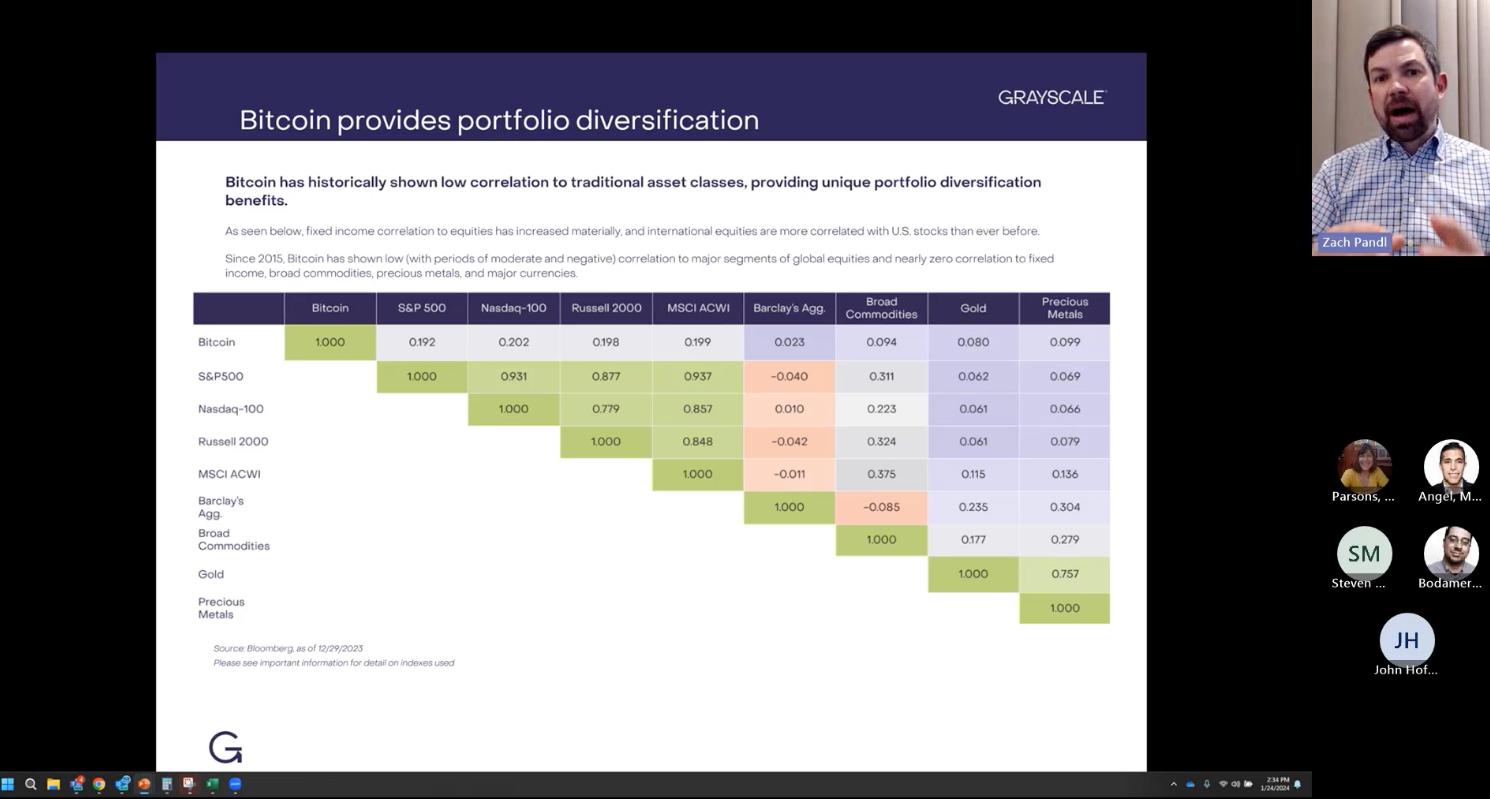

Now, when you put Bitcoin in a portfolio, what should you expect really? So what I would stress, and I think it's easier to understand this frankly for financial professionals than it is sometimes to understand the concept of blockchain and some of the computer science ideas behind that, but think of it as investment I think is relatively straightforward. Bitcoin is a high risk, high potential return asset with a low correlation to stocks. Now, investors typically or often think of their portfolio in kind of two buckets where stocks are sort of the capital appreciation, higher risk part of your portfolio and bonds are the lower risk income producing part of the portfolio, to oversimplify things. Bitcoin definitely should be in that higher risk bucket, but the critical thing is that it has a low correlation to stocks, typically the kind of higher risk capital appreciation part of our portfolio.

That means that Bitcoin can both add to total returns of a portfolio. It's a pretty fast horse. It produces high returns over time, but it can also contribute to portfolio diversification because of that low correlation. You can see some of those correlations here are displayed on this graphic. So I really stress both of those two points as why investors should consider thinking about Bitcoin in a portfolio. It has high returns, but low correlation. So it's good for both things, good for improving portfolio returns, good for improving portfolio diversification. Investors should probably think about if you're going to put Bitcoin in your portfolio, think about replacing some aspects of those equity allocations. For example, maybe things like small caps or international stocks, tech stocks, things that are intended to be there for return or diversification or a little bit of both. Bitcoin can potentially fit in your portfolio in that way.

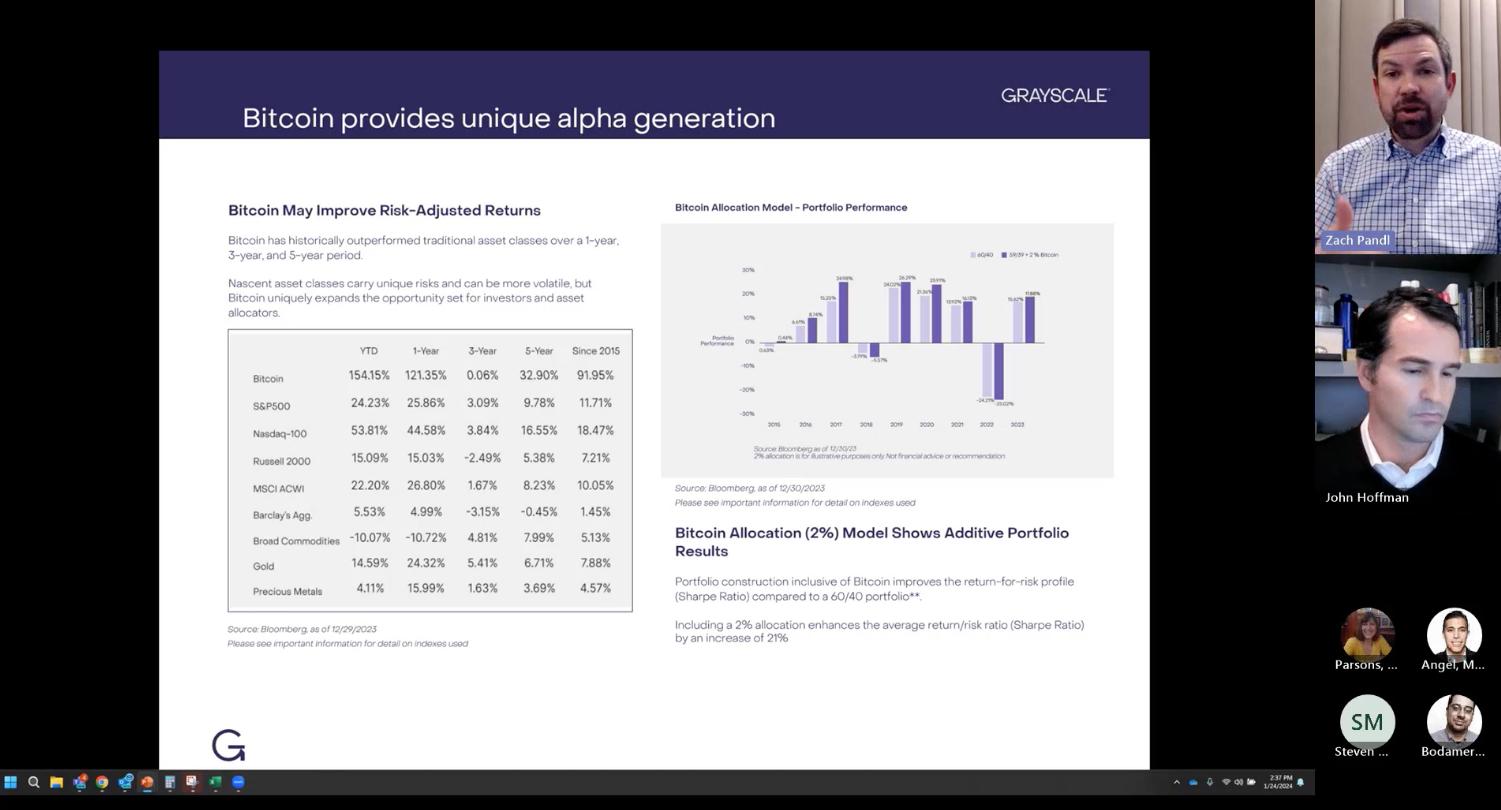

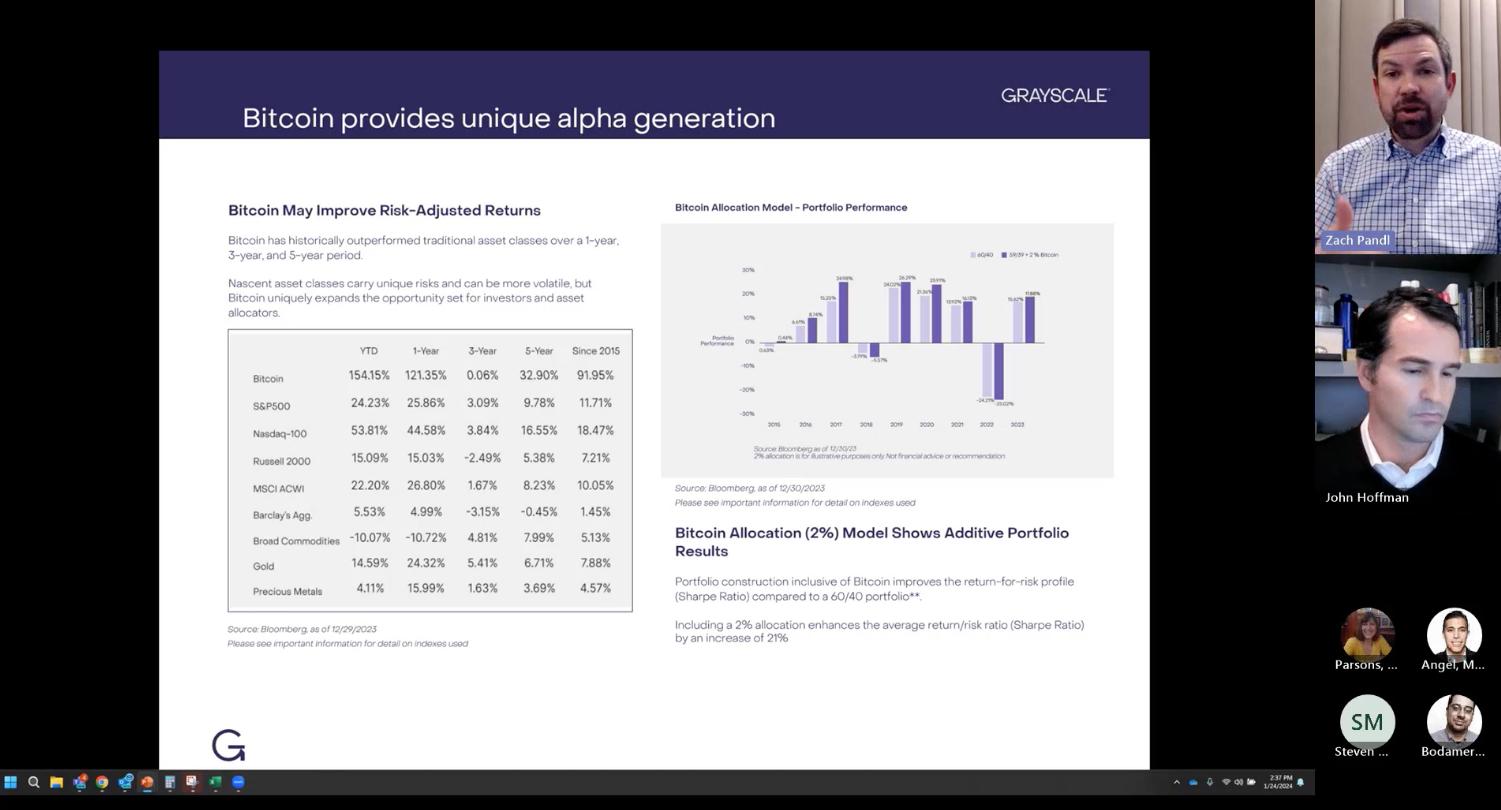

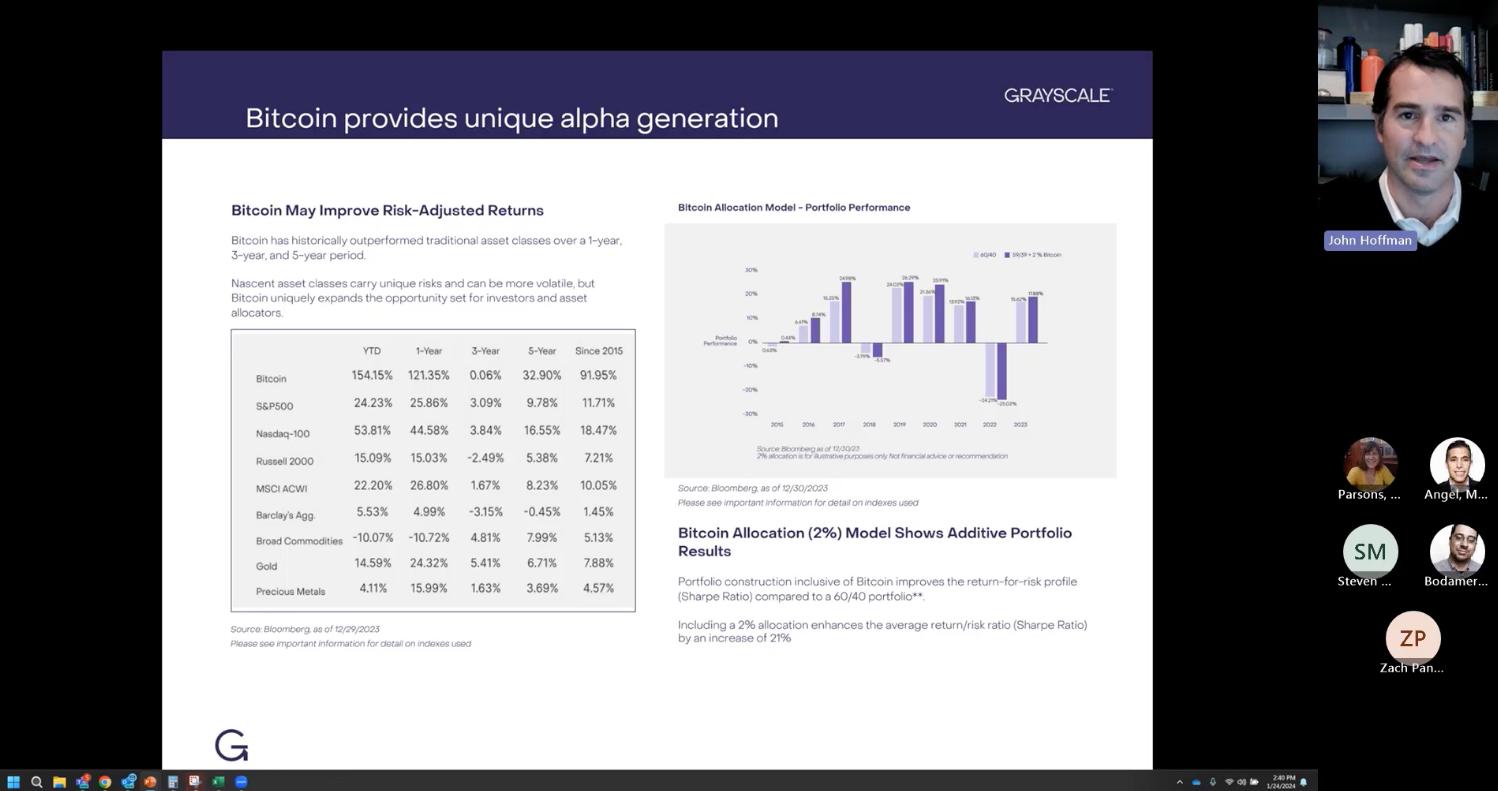

Now, just to back up this point's about high returns. You can see some of the historical returns in the table in the left-hand side of this graphic. Frankly, you probably had to be living under a rock for the last several years to not know that Bitcoin has produced a fantastic investment returns. So those numbers are fairly clear. What I would call out in this graphic is maybe the comparison with the NASDAQ index. There haven't been a lot of things that have worked so great over the last 10 years as investments, international stocks, US bonds, international bonds, emerging market stocks haven't had great performance.

Really the tech stocks or the NASDAQ index has been the dominant performer. Bitcoin has performed well, even compared to the best performing TRADFY index, which I think we consider the NASDAQ. Now, I do want to say one other thing, which is that of course Bitcoin is an asset with fundamentals just like anything else. So while it has produced high returns over time, it does have draw downs and should be considered a high risk. So investors should think about those fundamentals, about risk management, about thinking about the right size that Bitcoin should be in your portfolio before making investment decisions. So I'm quite enthusiastic about the asset class, but this should always be considered in a portfolio context and investors should consider their own goals and investment needs before making an allocation.

John Hoffman:

So Zach, I'm going to pick up on your comments here and let's stay on this slide actually for a moment. So Zach covered the background on Bitcoin and blockchain, and he covered the investment thesis and he talked most recently about the correlation properties relative to other asset classes and again, the potential benefits of adding Bitcoin to a portfolio. It's a pretty compelling setup here that Zach provided. I'm going to shift gears a little bit and talk about implementation, how to add Bitcoin to portfolios and also about selection, how to select the right product as there's a number of different ways to add Bitcoin to portfolios, and each one of them have different and unique. So we're going to talk about that a little bit over the next couple of slides. But before we go there, I want to spend a minute still on this page.

If you look at the left side of this page, the table that Zach talked about with the historic returns, I want to build on that a little bit, but I want to shine a slightly different light on this table and go beyond just the historic performance of each of the asset classes. I want to talk about a different technology that's related to each of these exposures, and that's exchange traded funds or ETFs. I think at this point we're all familiar with ETFs and ETFs have really transformed the way that capital is allocated, the way that portfolios are built. ETFs are a modern technology for delivering investment returns, and it's a benefit rich vehicle. We know the benefits today, they're generally low cost, transparent, generally tax efficient. They provide for inner day liquidity. So these are the benefits that have propelled ETFs to over $8 trillion in assets here in the United States and over $10 trillion globally.

Each of the asset classes on this page, when you look at the different indices there over the past 30 years, have been ETFI. So they've come online via the ETF. So it's simple, easy, convenient to access the associated risk pattern or return pattern with that particular index. Again, it started with the S and P 500 in 1993. You see the NASDAQ 100 commodities fixed income and the ETF technology as a means for delivering investment returns. It's a technology that has made it simple, has made it easy, convenient, really for investors to allocate capital and build better portfolios. It's really been a transformative technology when you think about the capability in terms of how portfolios are being built today. ETFs have also forced the electronification of all asset classes. So for example, ETFs have driven the electronification of fixed income markets, bringing those markets from OTC to on exchange to instantly investible.

Again, if you look at fixed income ETFs, they're now over $1.5 trillion here in the US. So now we have for the first time ever spot Bitcoin ETFs, so the ability to add this return pattern to portfolios with the click of a mouse in the infrastructure that you're currently operating in. That's obviously a very, very significant advancement and something that we're talking about here today. If we go a step further, at its core, ETFs are a technology. It's really about the simple design that again, makes it easy to invest and the investor has really been the beneficiary of this technology. Fees have come down, transparency has gone up. We're starting to see that in Bitcoin ETFs. It's incredibly efficient now to buy and sell Bitcoin through the ETF wrapper. Spreads have compressed significantly, and it's become incredibly efficient to add Bitcoin to a portfolio in this example. Equity ETFs, just as an analog here for a moment, equity ETFs now make up over 3% of the overall equity market.

So meaning the ETFs hold about 3% or a little more than 3% of the overall outstanding equity markets. That number's a little bit smaller in fixed income because fixed income ETFs came to market a little bit later. But again, on the back of Zach's comments about the investment thesis for Bitcoin, I want you also to think about the potential price implications again, of making it easy to invest through this ETF structure to this asset class here with Bitcoin with a fixed supply and true scarcity. So really something that we're very excited about here at Grayscale. If we could advance to the next slide. At Grayscale, we've been focused on this asset class for over a decade and focused on making it easier for investors to access this asset class in a real safe and insecure way. Again, on January 11th of this year, it was a historic day for the market.

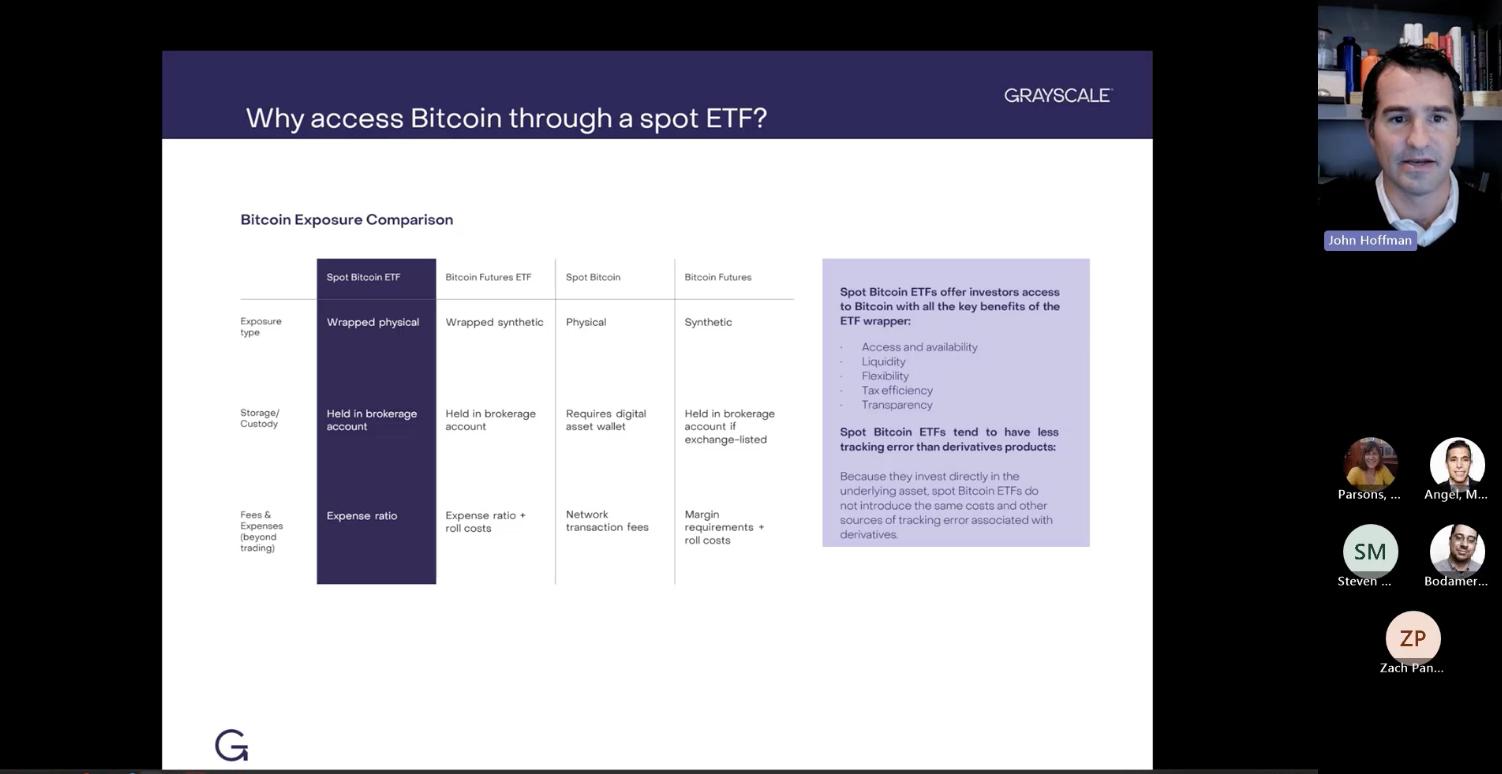

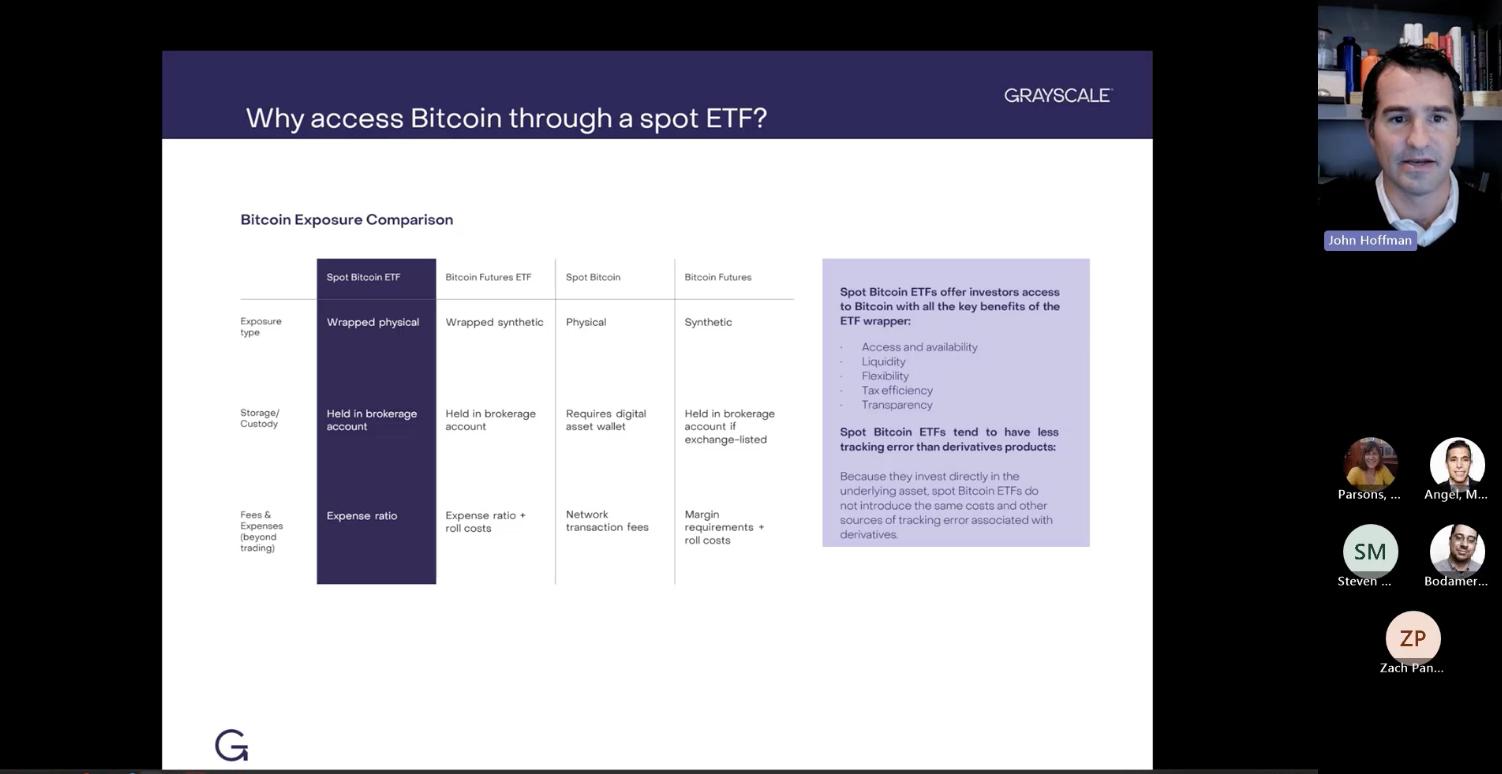

It was particularly historic for us at Grayscale as we up listed our flagship fund, which is ticker GBTC, the Grayscale Bitcoin Trust to an ETF that is now listed in trading on NICE EARCA. So now for the first time ever, investors can access spot Bitcoin exposure through the ETF wrapper in a vehicle like GBTC and Bitcoin is Bitcoin. It's a commodity that's fungible. Each Bitcoin is the same digital commodity. However, as I mentioned on the front end here, there's various ways that you could access this digital asset. So for example, there's futures on Bitcoin, and as we talked about, there's spot exposure. So much like you're used to in the gold markets or corn or oil, there's futures now on Bitcoin that are cash settled that enable investors, speculators, hedgers to get exposure to Bitcoin. The first futures on Bitcoin launched in 2017, again in 2021 and ETF launched that holds Bitcoin futures.

Again, futures are simply contracts that allow the investor to buy or sell the asset at a future date at a fixed price. So they do not track the spot price perfectly. They're a synthetic exposure. So the actual performance of that future may differ from the spot performance. Again, when we talk about the trade-offs of the different ways to access Bitcoin, obviously there's a trade-off there relative to spot, again, mainly due to the effects of contango and backwardation and the roll costs associated with futures. So with a Bitcoin futures fund as an example, again, the futures contracts near expiry. A new contract has to be bought to maintain the exposure. Again, there can be friction associated with rolling those futures. That gets to again, the topic of why the futures price will differ or may differ from the spot price.

The other means of exposure is to physically hold the asset. Again, it's easy to understand if we're talking about gold where you literally hold gold bars, or in the instance of a gold ETF, the fund holds the gold bars in vault and the ETF shares trade on exchange. They simply represent a pro rata exposure to the actual bars that are owned by the fund. So it sounds strange, but you can physically hold Bitcoin. So you can have a spot Bitcoin exposure where the holder actually possesses the Bitcoin keys in their own wallet. Again, the advantage here is that you own the coin or you own the token. So there's not this roll cost like you would have in futures, and your position would be really equal to the exposure or to the number of coins that you own. So as I mentioned earlier on January 11th of this year, spot Bitcoin ETFs came to market here in the United States.

So this is a structure where again, the ETF, the exchange traded fund trades on exchange, and you can invest just as you would like another ETF. The fund actually holds Bitcoin. So again, not futures. This fund actually holds Bitcoin and the coin is held at a custodian. So for Grayscale, our Bitcoin is held at Coinbase as the custodian. So the ETF shares for GBTC represent the exposure to the Bitcoin that is held in the trust, which is safeguarded at Coinbase. So this advancement makes it really very easy and efficient to now add Bitcoin to a portfolio.

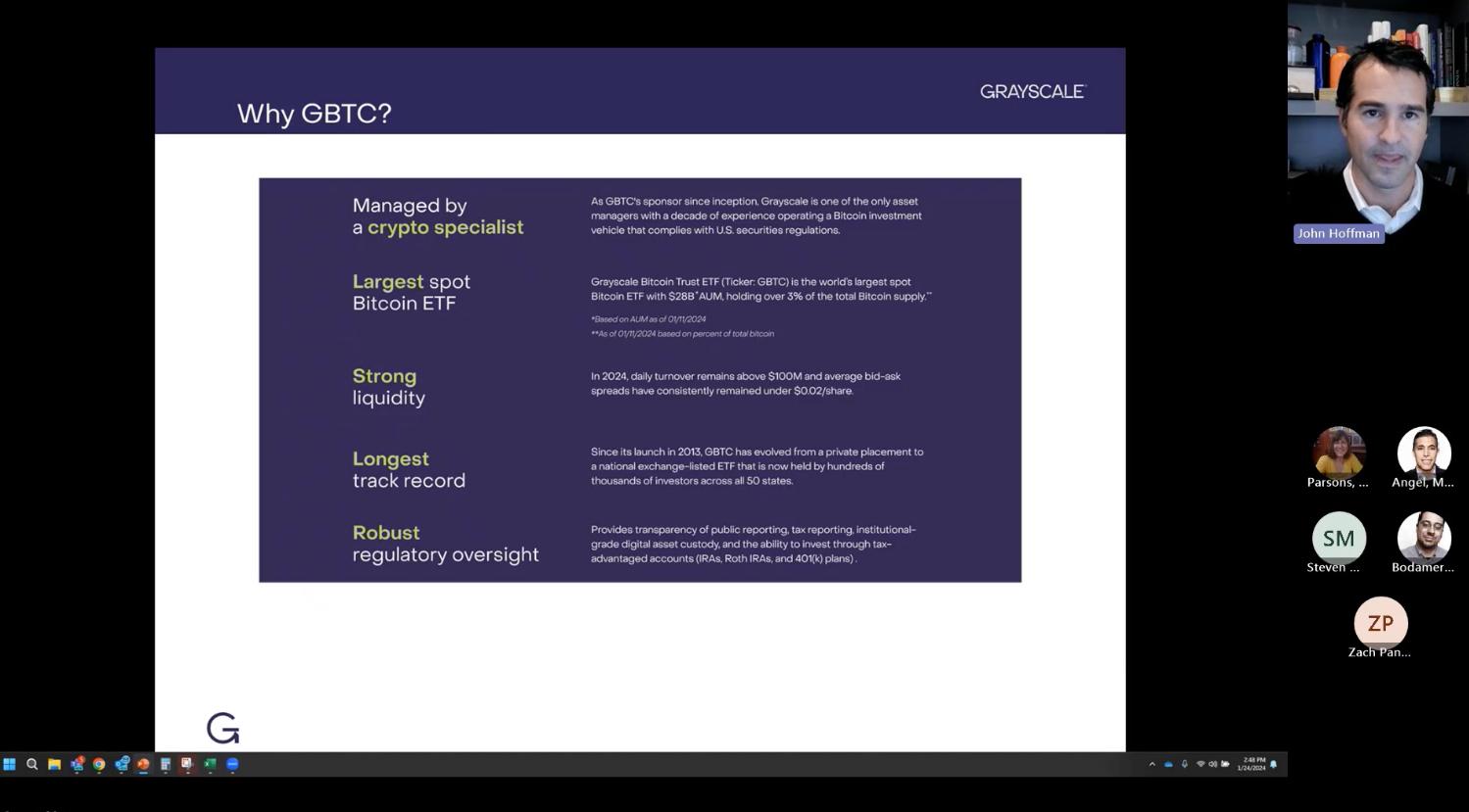

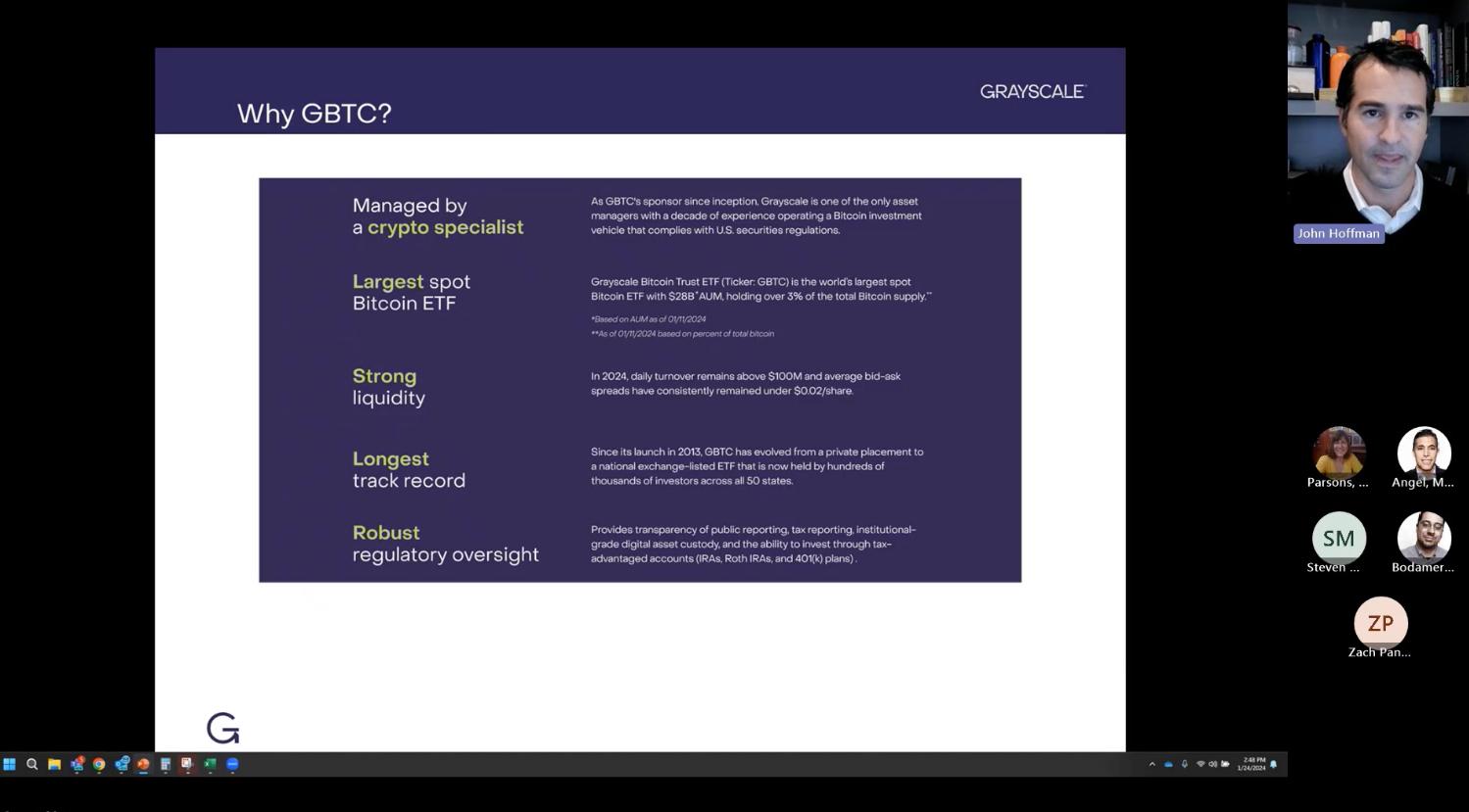

If we advance one more slide, why GBTC? So now that we've discussed the different ways that you could implement Bitcoin in a portfolio, the different exposures and wrappers and ways to gain that exposure across futures and spot or physically holding Bitcoin or holding futures outright, it's important to also understand the differences in the various spot Bitcoin ETFs because there's choice there as well.

So at Grayscale, we're solely focused on crypto. A hundred percent of our focus is on crypto day in and day out. Everybody on the team is purely focused on this asset class, and we have a deep operating history here in crypto. Specifically within Bitcoin, we've been operating GBTC for over 10 years continuously. So deep expertise and experience in the category GBTC, again, the Grayscale, Bitcoin ETF is the largest Bitcoin fund in the world. It has the deepest liquidity, the largest shareholder base. Again, that means that it's very efficient to get in and out of a position because of this deep liquidity tight spreads in the secondary market and high AUM.

Again, it's the largest fund with the largest shareholder base as well. I would leave you with, we have this long track record in the category. The team here at Grayscale is again purely focused on crypto. So as you navigate this segment and you ramp up your educational efforts, we'd ask that you reach out to Grayscale as a partner to help you and your clients navigate this new asset class. So I'm going to cap my comments there and I'm going to turn it back to our moderator, David, for Q and A.

David Bodamer:

Great. I want to thank you John and Zach for that very in depth and interesting discussion of what you guys are doing and just the market in general. So that was fantastic. So we do have a few questions here and we're going to try to get to as many as possible before we wrap this up. So first question here is I think for John, what does a Bitcoin ETF mean for the entire crypto industry as a whole? And why does Bitcoin need a spot ETF when there are already futures ETFs?

John Hoffman:

Yeah, so for the industry, this is a massive step forward. The US is the largest capital market in the world, and opening this market to Bitcoin ETFs is transformative. Again, for some of the comments I had earlier, it makes it easier, simpler, more convenient, more flexible, and again, is within the infrastructure where our capital markets operate. So again, very transformative for the crypto industry more broadly. Maybe I draw a parallel or an analogy here to the app store. The app store on our phones that we all use, many of us have smartphones at this point. You access the app store to download various applications. So think about if you built an app and it was not available in the app store, so it wasn't on the Apple or the Android app store. Think what your reach would be with that. It'd be pretty narrow because it'd be difficult to get your app.

You wouldn't be connected to the natural user base. You probably wouldn't have a lot of downloads of that app. The parallel I'm drawing here is if you think about the reach you would have if your app then moved to the Apple store and the Android store, the reach that you would have there, I think that's similar to what's happening with the Bitcoin ETFs specifically. It's making it easier to allocate to Bitcoin in the native system that everybody is already operating in and running on. So again, very, very significant event here for the crypto industry more broadly. As far as the futures part of the question that I think was in there as well, I think we hit that a little bit in the conversation earlier, between each of these technologies and each of these ways of accessing the asset class. Again, the spot product provides a different exposure than the futures exposures as we talked about.

David Bodamer:

A question here for Zach. How does a Bitcoin transaction compare to traditional bank transactions? Are blockchains the same as Bitcoin?

Zach Pandl:

Yeah, great question. So the first difference is that with a bank transaction, it's really not a peer-to-peer transaction. So if John and I wanted to change money on a peer-to-peer basis, we would need to use cash. That's the only way to make a peer-to-peer person-to-person transaction, meaning no intermediary is involved that works with cash, but with digital money, which is where most of our money is, there has to be the involvement of intermediaries because we don't hold our digital money directly. Our digital money is a record on the balance sheet of a commercial bank. So if I want to send John a digital payment, it has to be done by my bank and then recorded by his bank on the other end. So if we're on different banks, there's at least two banks involved. If we're making an overseas transaction, there'll be at least one more intermediary involved.

You're making a credit card payment, there will be at least one additional intermediary involved. So digital payments require intermediaries. The core thing about Bitcoin is that there is no intermediaries. It is more like a cash system where we can make a transaction on a peer-to-peer basis. John has a kind of identity on the blockchain. I have a kind of identity on the blockchain. We call these addresses. I can just send money to John and no one can stand in between that. So that's really the kind of core difference from a structural standpoint. The other closely related point that I would stress is instant finality. So depending on which blockchain we're talking about, whether it's Bitcoin or Ethereum or the many others now, this will be a matter of minutes or seconds, how long it takes to make a payment. But once a payment is done, it is final.

Unlike the traditional financial system, there isn't this sort of waiting multiple days for the check to clear. We don't have to wait for the bank to be open. We can transact in the evening, on weekends, during public holidays, and all those payments are instant and final. So I really think that those are really the two key differences that they take place on a peer-to-peer basis, and they're more or less instantly final. I really think that that is a huge improvement on the financial system that we have today. So while the banking system adopted and adapted to the arrival of computers in the 1970s, the system otherwise that we have today doesn't really look all that different from the world of paper check clearing that we left in the 19th century. So we can move beyond that system today we believe at Grayscale and Bitcoin is one key part of that, really showing us how public blockchains can give us a different structure for the financial system that will be much more efficient and I think really more realistic for our modern lives.

David Bodamer:

Great. So next question we have here, which I think John touched on during the presentation, but if you could just draw this out a little more. Why were spot Bitcoin ETFs approved now and what are some characteristics to consider when evaluating the different spot Bitcoin ETFs that are on the market?

John Hoffman:

So the first spot Bitcoin ETF application was filed in the US in 2013, so it's been 11 years to get to this point of a spot Bitcoin ETF. Grayscale really blazed that path and pioneered that path in many ways. All the previous denials were based on concerns from the commission about the underlying markets, where Bitcoin is traded and the surveillance of that, and really as the financialization of Bitcoin has evolved. So we talked about the futures market and the futures on Bitcoin evolving. So as the market has evolved and the surveillance of the underlying markets has evolved, the modernization of this asset class to many ways has really enabled the launch now of a spot ETF. As it relates to the second part of your question, which was what to consider when you're evaluating spot Bitcoin ETFs, there's a number of factors. The size of the fund, the spreads and liquidity are important.

As I touched upon, the manager of that fund is important. Their expertise and history. Operating in that segment is very important. Again, at Grayscale, that's a space that we have been purely focused on. So we've seen what's happened over the last decade in this space and have operating history there that is I think, differentiated. The other piece to think about is the total cost of ownership, which is not just the management fee of the ETF. It's again, the spreads in the secondary market. How efficient is it to get in and out? Is there a premium or a discount in the secondary market associated with that ETF? Is there stock loan or lending revenue applicable or tied to or connected to it to really create that total cost of ownership?

In a lot of situations, we believe that GBTC, the Grayscale Bitcoin ETF provides tremendous value for money in a number of the characteristics that I just mentioned today. So something we're certainly talking to a lot of clients about today, and again, back to the approval portion of this, something that we put a lot of energy and resource into over the last decade to open up these markets to make it easier, more convenient, more flexible, more transparent, and more cost-effective to access this asset class.

David Bodamer:

Great. Another one for Zach. Would you consider crypto to be an early stage technology and do you think Bitcoin is an investible asset for long-term portfolios?

Zach Pandl: Absolutely. I think the answer to both of those things is yes, and yes. There are different ways to conceptualize Bitcoin and crypto. One is as a kind of store a value asset and competitor to gold. And maybe investors should think about, say, replacing gold or some allocation to gold in their portfolio to Bitcoin. But it is also a technological innovation and can maybe fit in that part of the portfolio. Look, we'll have to see how the industry evolves over time, but I'm totally convinced that we have a new asset class here that has unique foundations, unique fundamentals, and it is different than everything else that we have.

I think it will be a component to a diversified portfolio for the long haul. Now, investors are still going to have stocks and bonds and traditional assets, but when building a diversified portfolio, adding a core allocation to crypto to me makes a lot of sense. Now it's important to stress, it's a volatile and risky asset. So a little goes a long way. I think we're talking on the order of 5% in that kind of a ballpark for the typical investor, but adding about that much to this sort of asset class for the long haul I absolutely think can help both improve total returns and risk adjuster returns to the typical investor's portfolio.

David Bodamer:

Great. Another question here for John. Could you talk about where are the bitcoins in the ETF? Who's actually holding them?

John Hoffman:

Sure. So I'll talk about it from Grayscale's perspective and obviously for the fund GBTC that we've been talking about today. So again, specifically at Grayscale and for GBTC, that Grayscale Spot Bitcoin, ETF, the Bitcoin is actually held and safeguarded at Coinbase. So that's the custodian that is holding the spot Bitcoin on behalf of the fund itself. So I think one of the elements here that's very interesting that Zach talked about the transparency within the blockchain. So what's interesting here is you can actually see within the Bitcoin network coin moving on chain as the fiat moves. Again, something that is another characteristic of the blockchain, again, that transparency level. But again, our Bitcoin at Grayscale is held by Coinbase as the custodian.

David Bodamer:

Either Zach or John, if you had any final thoughts that you wanted to leave the audience with before we take this home?

Zach Pandl:

David, I'm seeing one more question coming through on the Bitcoin having, so why don't I just address that one quick before we wrap. So this is a kind of quirk of how Bitcoin works, but it's something that's in focus here today and could affect prices. So maybe just touching on briefly. So the amount of Bitcoin in circulation increases each day. Every block in this blockchain releases a little bit of Bitcoin. So that's how the supply is introduced into the market. Every four years, again, written in the algorithm in the same way that the total amount of Bitcoin and all the other features are written in code. Written into the code, every four years, the amount of Bitcoin issued to the market falls by half. So we'll still have new Bitcoin added, but it'll be at half of the rate, and that's going to happen in April, 2024.

So we'll see supply decline. So just like any other marketplace, the price of the asset is determined by the intersection of demand and supply. So the having is one reason why investors are enthusiastic about Bitcoin this year. That among other things. But we know that demand we think will be relatively firm because of new ETFs and potentially because of macroeconomic conditions, Federal Reserve rate cuts, maybe the presidential election. We'll have to see how that all unfolds. But on the supply side, we know for sure that the rate of new supply will be cut in half in April of this year.

So if demand growth continues and supply is cut in half, potentially that's relatively bullish for prices. Now just emphasize, as I said before, Bitcoin has other fundamentals besides things like having investors should consider all of those things, the state of the macroeconomy or the actions of the Federal Reserve. But I do think that the Bitcoin having should be considered something that is an incremental positive for Bitcoin's price for 2024 specifically.

David Bodamer:

Great. Well, with that, I'd like to thank John Hoffman and Zach Pandl for both of your presentations and for taking some of those questions. I would also like to thank Grayscale for making today's program possible for our audience. Thank you for tuning in and, once you leave the event, a short survey is going to pop into your browser window. We would appreciate it if you could share some feedback as it does help us provide you with the best content going forward. So with that, thank you so much for sharing your day with us and, on behalf of wealthmanagement.com, have a great rest of the day.

Grayscale Bitcoin Trust (BTC) (the “Trust”) has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Trust has filed with the SEC for more complete information about the Trust and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Trust or any authorized participant will arrange to send you the prospectus (when available) if you request it by calling (833) 903 - 2211 or by contacting Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101.