Filed Pursuant To Rule 433

Registration No. 333-275079

February 8, 2024

GBTC RIA Channel CE Webinar

Video:

Grayscale Bitcoin Trust (BTC) (the “Trust”) has filed a registration statement

(including a prospectus) with the SEC for the offering to which this

communication relates. Before you invest, you should read the prospectus in

that registration statement and other documents the Trust has filed with the

SEC for more complete information about the Trust and this offering. You may

get these documents for free by visiting EDGAR on the SEC Web site at

www.sec.gov. Alternatively, the Trust or any authorized participant will arrange

to send you the prospectus (when available) if you

request it by calling (833) 903 - 2211 or by contacting Foreside Fund Services,

LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101.

Foreside Fund Services, LLC is the Marketing Agent for the Trust.

An investment in the Trust involves a high degree of risk, including partial or total loss of

invested funds. The Trust holds Bitcoins; however, an investment in the Trust is not a

direct investment in Bitcoin. As a non-diversified and single industry fund, the value of

the shares may fluctuate more than shares

invested in a broader range of industries. Extreme volatility, regulatory changes, and

exposure to digital asset exchanges may impact the value of Bitcoin, and consequently

the value of the Trust.

Transcript:

Sarah [00:00:02] Hi, everyone. Thank you for joining us for today's lecture heading to 2020 for seeking Risk Reduction and Alternative Income Potential, sponsored by Grayscale. Today's webcast will provide one CFP, one IWI, and one CFAC credit. If you have questions on credit, please give us a call to the number on the console. We welcome the encourage your questions. You can type your questions in the Q&A box, and we'll do our best to get to as many of your questions as possible. Materials have been made available for download from the document folder at the bottom of your screen. We appreciate your feedback. Please take a moment to take our brief survey that's also located at the bottom of your console. We will cover quite a bit of information during today's webcast. If at any point in time you're interested in scheduling a one on one meeting with Grayscale, please click the blue confirm button in the request box on your screen. Lastly, move into any part of today's webcast or simply would like to watch it again. A replay will be made available and all registrants will receive that information by email. So with that in. Please introduce our speaker today from Grayscale, Ray Sharif-Askary is Managing Director of Investor Solutions. And David LaValle is Senior managing Director and Global head of ETF. All right, so our agenda on today's webcast we're going to start out with Bitcoin and the blockchain. Then how should advisors be thinking about incorporating Bitcoin ETF into client portfolio. Spot Bitcoin ETF, GBTC. And finally what question should advisors be prepared for from clients. With that I'm going to turn over to Ray to get us started. Welcome, Ray. The floor is yours.

Ray [00:01:28] Great. Thank you. I am excited to be here. I'm Ray Sharif Askari. I've been with Grayscale for almost six years now. I'm responsible for product research and investor relations, and before Grayscale, I worked in traditional finance at an investment bank, for ten years. So I myself was on a journey to learn and understand Bitcoin many years ago. And I'm really excited to, you know, help you all on that journey now. So let's take, to kick it off. I want to just take a very big step back. We we're obviously going to talk about Bitcoin. It's something many of you are probably be asked about. but what even what even is Bitcoin. Let's just start from the very top. So Bitcoin is simply a peer to peer form of money that doesn't take physical form and that no single entity can perform. Sorry, that can control you can compare it to the dollar, to the yen, to any other

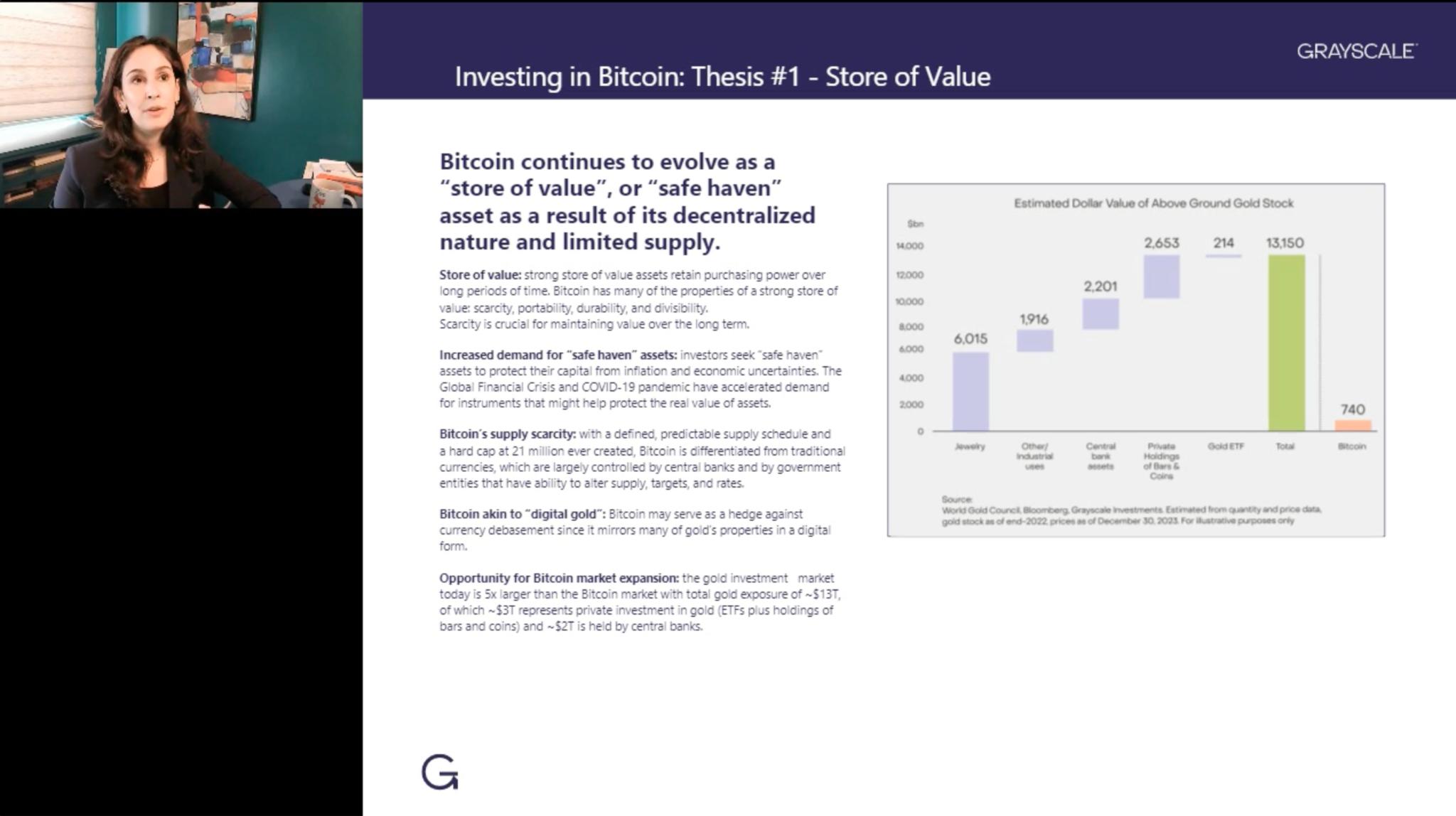

kind of sovereign currency, except that there's no centralized authority that controls it. And we call it a digital currency, because you literally can send money over the internet to anyone at any time of day. And you can kind of compare it to in centralized finance, like a PayPal or Venmo, again, except that it's totally decentralized and totally peer to peer, and there isn't a corporate or a government or a bank intermediary. From a timeline perspective, Bitcoin is really new when we think about the broader framework of different asset classes, right? Stocks, bonds, even leveraged loans, which can be more esoteric, have been around since the 80s, but Bitcoin didn't exist until 2009. It is something that was born out of the financial crisis because people felt distrust towards the financial system, even what happened, and they wanted a form of money that could not be controlled by governments or by central authorities. So again, one more big step back. I think it's important to have the context and the conversation around money. What what is money, right. Since time immemorial, societies have been using different things to exchange value, or differently as money. And at some point it was livestock, grains, coocah shells, and I think over time, the one that has been used for a really long time and is it's kind of ubiquitous as a store of value, has been gold. So you hear people, comparing Bitcoin and gold a lot. And so gold has been used as money. It's been used as a store of value. And, you know, in this slide, we've kind of laid out characteristics that gold has and Bitcoin has. So why gold. Why has gold been useful for folks is money. Why do they have they turned it into coins. it's portable right? You can easily move it around. We know it to be scarce. The supply increases about 2% a year. In theory, there's only a set amount of gold in the ground that can be mined. It's durable. It is a metal that doesn't corrode. It's invisible. You can break it up into tiny pieces if you want to melt it. And it's fungible. Every, you know piece of gold is effectively the same. And so if you think about bitcoin what we've laid out here. Bitcoin is a form of money because it shares these characteristics. And actually has sort of improved upon a lot of these characteristics that gold has. And is more efficient as money. Digital money for these reasons. So Bitcoin is portable. It's more portable than gold. It can move over the internet really quickly. It's not really something we can do with gold. it's durable. It's a network that is secured by computers all over the world. There is, as we said, no centralized form of failure, which is important. It's also

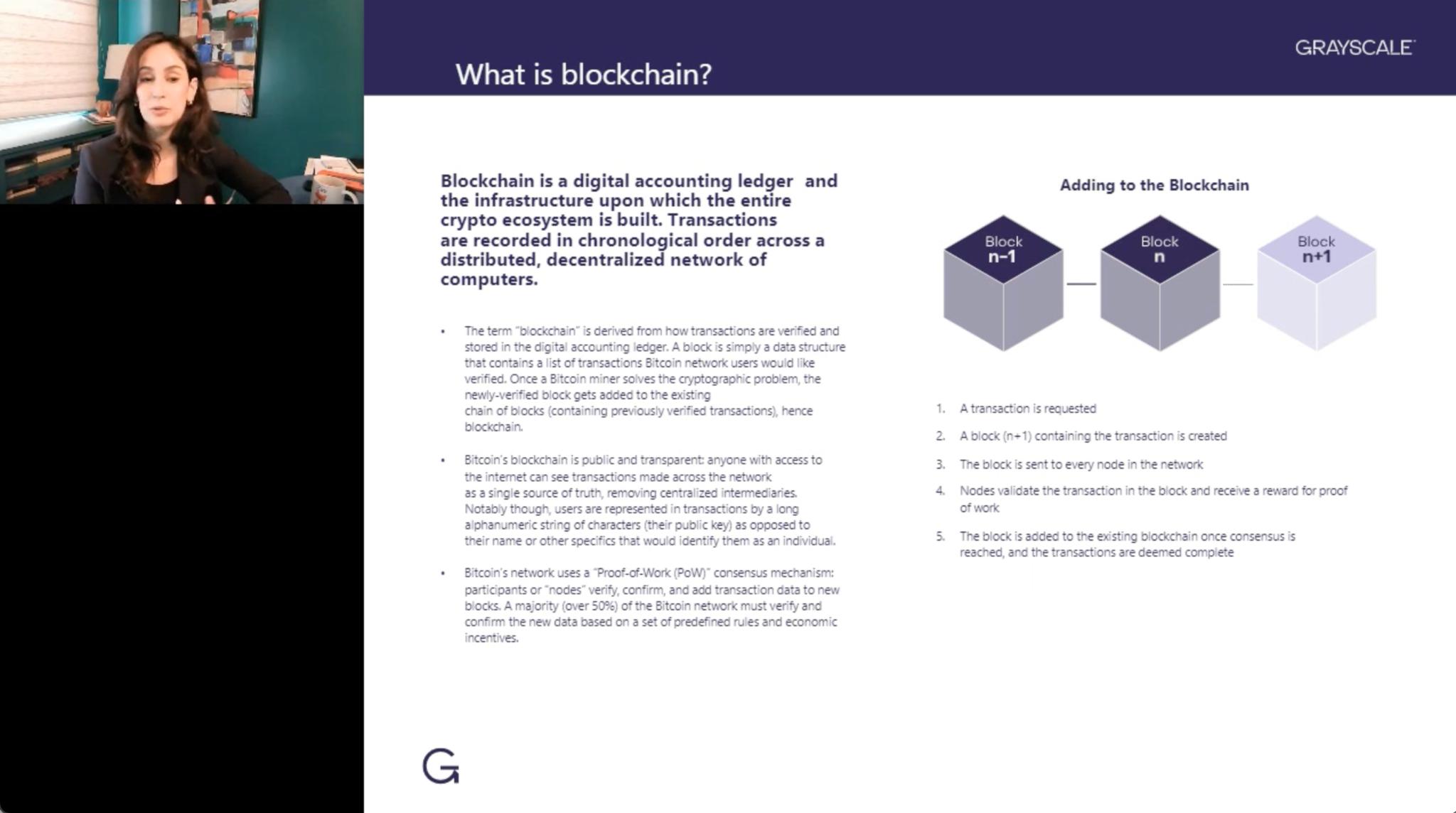

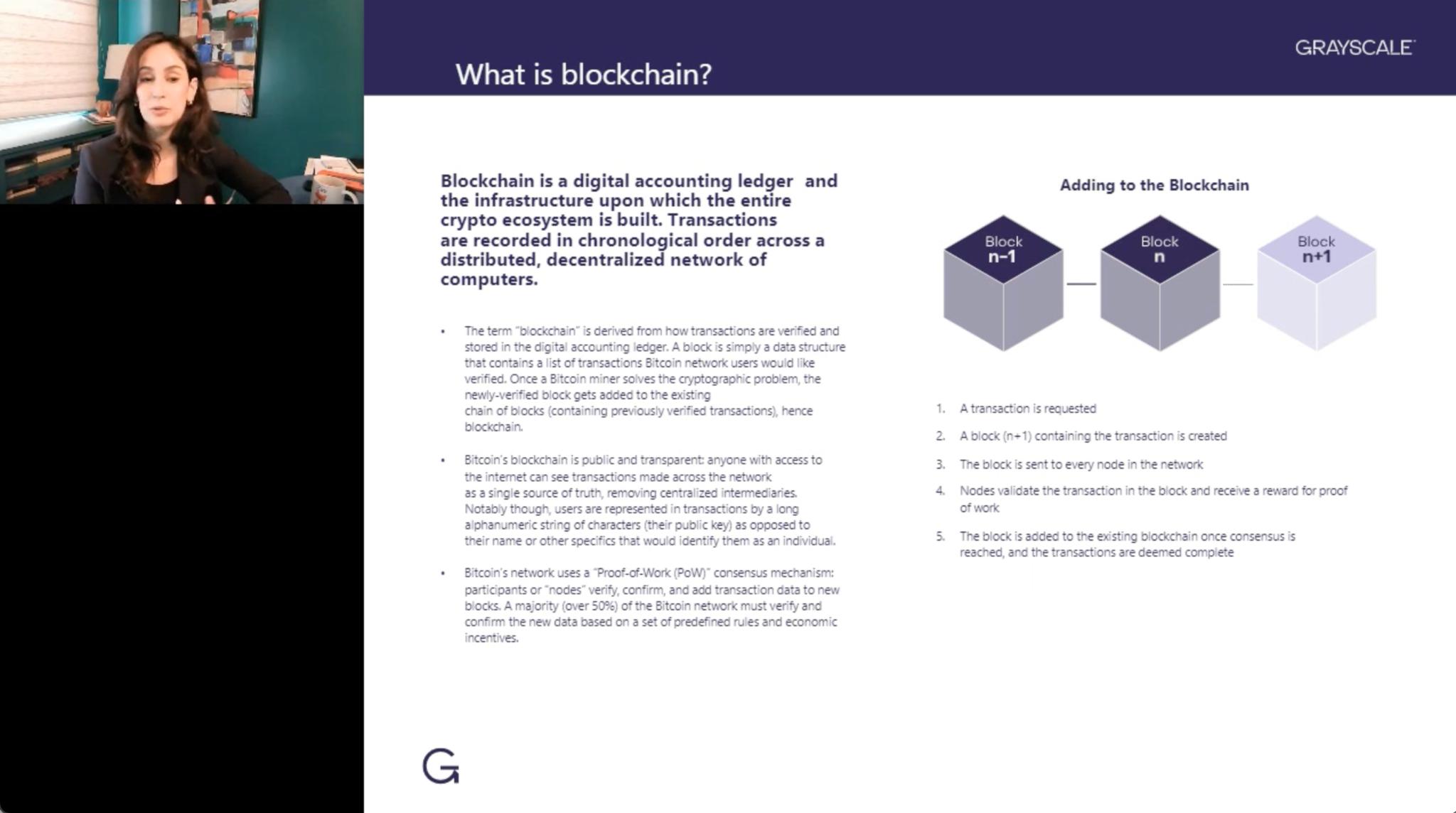

verifiable. And that's something that's really interesting. And a big asset associated with the Bitcoin network is that it's decentralized. And anyone with internet access can actually see all the Bitcoin transactions. Bitcoin is scarce. There can never be more than 21 million bitcoin in existence. And it's divisible. It can actually be divided into very small small increments. And it's fungible. Each Bitcoin at each increment of bitcoin is interchangeable with all the others. So you know, gold is great. Gold has served a purpose. I have a ton of gold on my person in jewelry and in point in time. But and it's beautiful. And we live in a digital world now. We need a digital means to store and send value. So that's how, you know, you can think about the characteristics we've laid out on this slide. Peer to peer money. Bitcoin is a form of digital gold. Can we change the slide, please? All right. So you have also heard about blockchains right. Crypto Bitcoin blockchains. I think for some people it's an intimidating concept because it's a new word. But really a blockchain is just numbers on a database. Except that it's a database that isn't overseen by anybody and that it's distributed all over the world. So you have thousands of individual nodes all over the world that are keeping track of this database. And this database records transactions by just keeping a record of all these computers. And so there's these group of parties known as miners who verify the transactions, which result in these transactions being grouped together into blocks and added to what we call this ledger or this database called the blockchain. And I that's, that's where the name comes from, because it's just literally a chain of blocks of data that are connected. I think the technical nuances are less important than understanding that it's unique because there is no central person. Rather, there are so many different points. It's completely decentralized, and everybody is really maintaining the integrity of that database. And I think for me, as I've been in the space over the last, you know, ten years, there's some points that have come up in some narratives that I think, are important to discuss. So you might meet people that have a viewpoint or people might draw, you know, like, well, I believe in the blockchain, not Bitcoin or I believe in the technological potential of blockchains, but not crypto. That's the first one that I want to discuss. And then the second one is just kind of private or enterprise blockchains. So let's talk about blockchains in their native tokens, Bitcoin or other blockchains to talk to have what makes a blockchain special? Is that it is decentralized. It is not, overseen or

controlled by a central authority. And you have actors that are incentive to verify those transactions and to maintain the integrity of the blockchain by economic incentives. So miners verify transactions as a reward for doing that. They have an economic incentive to get tokens in the Bitcoin blockchain. Those tokens are Bitcoin. And because of this, having a native currency like bitcoin is fundamental. It's a critical part to having a functioning decentralized blockchain. So when you think about investment opportunities you think about Bitcoin blockchain. The two are inextricably linked. You can't have. A decentralized public blockchain without a native token like Bitcoin. Now let's talk about private blockchains, because that's another narrative we hear and you might hear coming up from investors, right? They might say like, well, you know, I like blockchains. And I think like private blockchains and enterprise enterprise blockchains are really interesting. And I think they can be incredible tools for businesses. And that's not really what we're talking about here. Private blockchains, enterprise blockchains are just kind of proprietary databases. The real magic, the real value, the innovation around decentralized blockchains is the decentralization that is enabled by economic incentives, like the native token, which is Bitcoin. So I think we can talk about the investment thesis a little bit, if we don't mind, flipping the slide for me there. We talk about Bitcoin today predominantly, as a tool for investment. And I want to kind of dive into that a little bit later. But there's three main pillars with, that kind of show. The way I think about this. First, Bitcoin has the opportunity to be used as a store of value. It's often we know we call it digital gold because of the characteristics that it shares with gold like its scarcity and its durability. which we discussed earlier. And because of that, the way investors, many investors, and perhaps investors you all speak to who might use gold as a hedge against inflation and currency devaluation, that's a way that investors, can use bitcoin as well. Bitcoin, we've also said, is a peer to peer means of payment. It enables direct peer to peer transactions over the internet. And it's a decentralized alternative, traditional payments. So users can really transfer value directly, quickly, cheaply, efficiently without intermediaries. And then there's the technology, right. Bitcoin blockchains. Their technological innovations, and the blockchain underpinning Bitcoin has a lot of different applications. So these are the three key pillars. And you know, to double click on that a little bit. What we're seeing

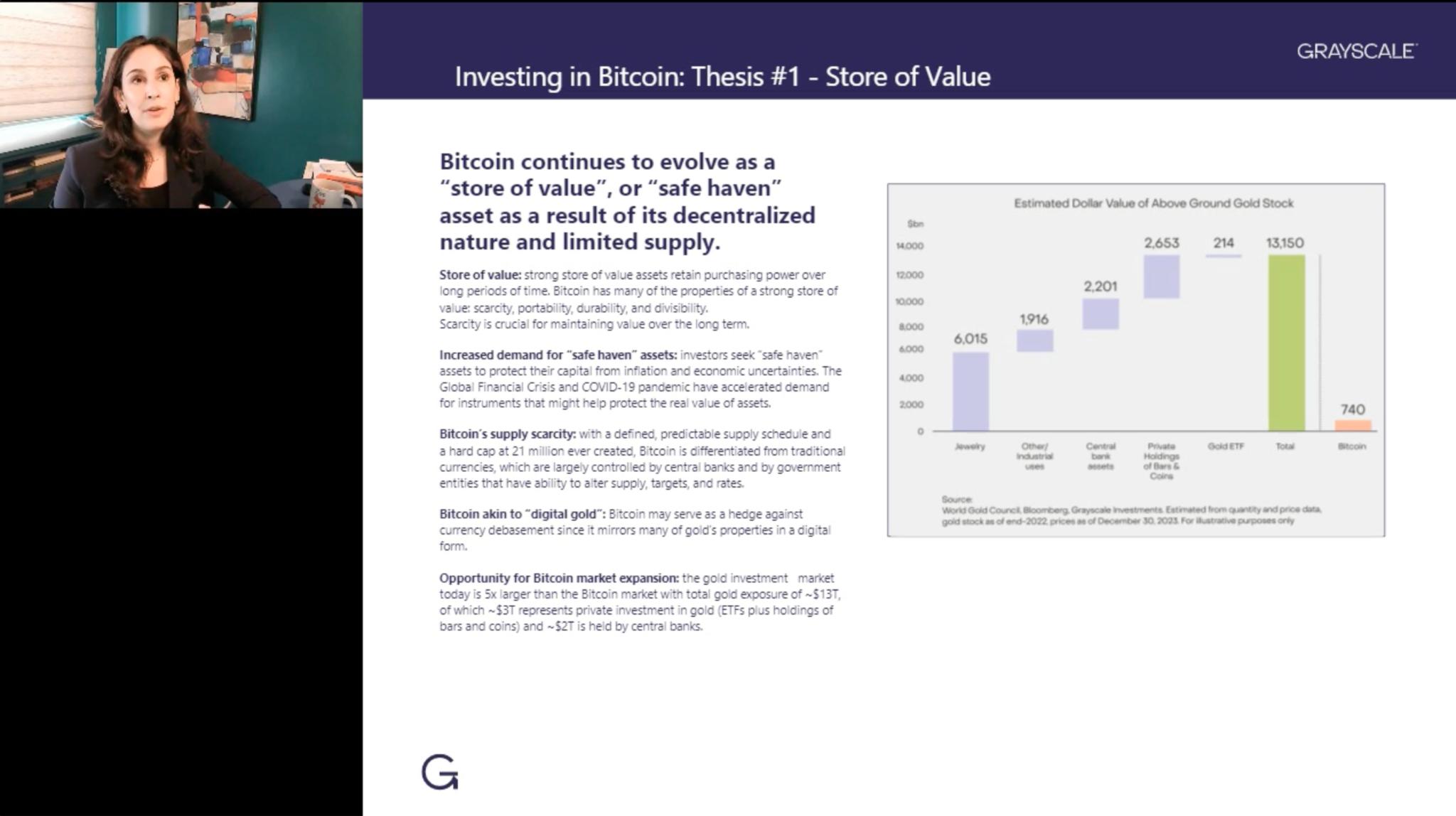

today, there's a broader, you know, we can think about how Bitcoin is being used in the short the intermediate and the long term. So today. We're not really transacting a lot with Bitcoin, at least in the developed world. Right. I'm not going to Starbucks and paying with Bitcoin. I don't need to. It's it's an investment tool. It is being used for, you know, as a store of value. You talk about institutions using it, but I think the intermediate in the intermediate term in the future have the potential to look really different. And that's why when I got into the space, that's something that I got really excited about. Because Bitcoin is unique in that, you know, you have two and a half to 3 billion people all over the world who aren't fortunate, you know, necessarily don't have access to traditional, the incumbent banking system they can't send money with through Venmo. They might not be able to, you know, have access to credit cards and bitcoin because all it requires is literally a phone. And the connection to the internet is going to allow a lot of folks in developing countries that have, been historically unbanked to leapfrog the existing financial system and literally be able to send money anywhere in the world to anyone, basically for free. So over the longer term, I think Bitcoin is going to have an opportunity to fulfill its role as a tool for democratization and financial inclusion. And. Even today, you're starting to hear about countries using bitcoin where they do have a lot of currency deflation or, sorry, currency inflation and a lot of pressure. So this is just something that I think is really important because there is a way to think about Bitcoin today as an investment tool. And you know, I think investor adoption is going to continue to grow and it's going to be even more meaningful when Bitcoin continues to evolve and to fill its role. As a tool for democratization and really, you know, become the asset class that we're really excited about it becoming. So let's move on to the next slide. So Bitcoin you know we've talked about bitcoin as being scarce and sharing characteristics with gold. And I think we really saw that play out in 2020. You know we saw the price of Bitcoin increase. We saw empirically at Grayscale. We talked to a lot of investors over the years. And that was really an inflection point where, you know analysts, big institutions, financial advisors, individual investors. It was the point at which, you know, it became a career risk not to have done the work, not to have gotten educated on Bitcoin because we entered, you know, because of the policy response to the pandemic. We entered an era of unprecedented, you know, printing of money which resulted in inflation and the

store value narrative, became really important. And that was interesting because we started to see Bitcoin really fulfill that use case. And people were actually starting to buy Bitcoin in an inflationary environment, because, again, it does share those characteristics with gold as a store of value. And I think there's a lot more opportunity here. Because if you think about the gold market, it's five times larger. The gold market is about 13 trillion. Let's say 3 trillion of that is in ETFs and bars and coins. And 2 trillion is held by central banks. There's significant upside for Bitcoin to take some of that market share from gold as a store of value asset. And I think that that has the opportunity, to be a really meaningful tailwind over the intermediate term for Bitcoin. So the next use case if we want to switch to the next slide, is a means of payment. So we've talked about this. Bitcoin is money right. We use money in the developed world. We haven't. You don't need to use bitcoin as money within an investment tool. we're not really using bitcoin to buy a coffee. sometimes even for us. If you do have Venmo or credit cards, it's faster, to use that instead of bitcoin. But we're seeing we're seeing development right through the like for instance, something called the Lightning Network that is being built or is being continued to be developed. We, are seeing scaling solutions. We're seeing other digital assets that have forked from Bitcoin that are maximizing for for scaling and for blocksize. And that's kind of technical nuance that we don't need to get to. But I think there's a world where a lot of the, a world where it's going to be more viable to use bitcoin really as a means of exchange because of all the development that's getting done. So let's hop over to the third use case. So for me, I think again, as an asset class, as an investor, as someone who's been an investor in Bitcoin long, you know, before I've worked in the space. The third really interesting thing about Bitcoin, and for me, it's part of the investment thesis, is that you have something, you have a really unique digital asset, you have a unique asset class. It's a new asset. It's. A store of value, which we've discussed. It's diversifying, which we will get to in this presentation. And you also have technology upside. You are getting exposure to a brand new technology. And that is really unique. And I think this technology over the year, you are going to see become more and more ubiquitous. And we because we're so excited about the space and the potential longer term for diversification within it, have actually, you know, because as you all know, there are thousands and thousands

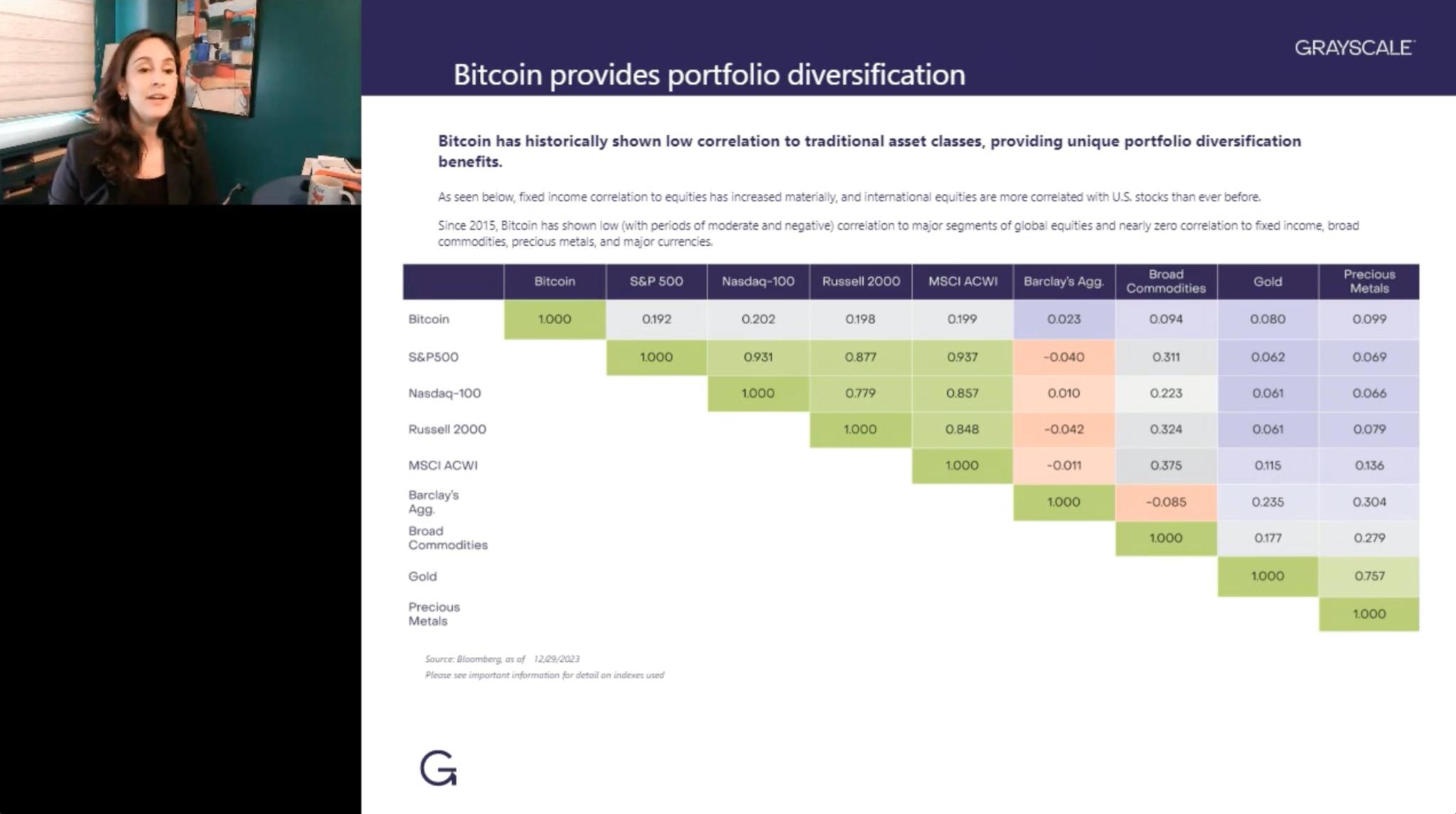

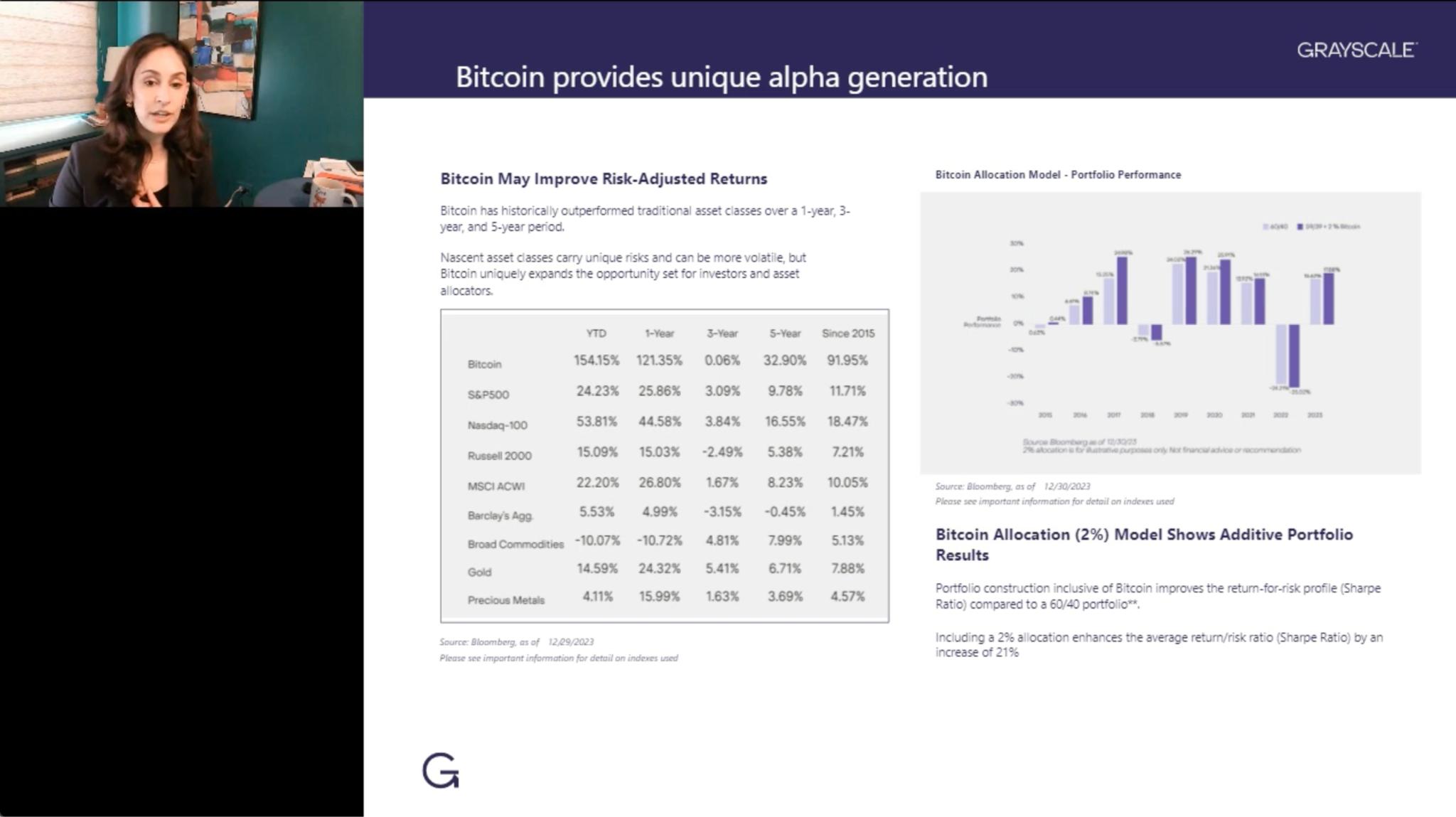

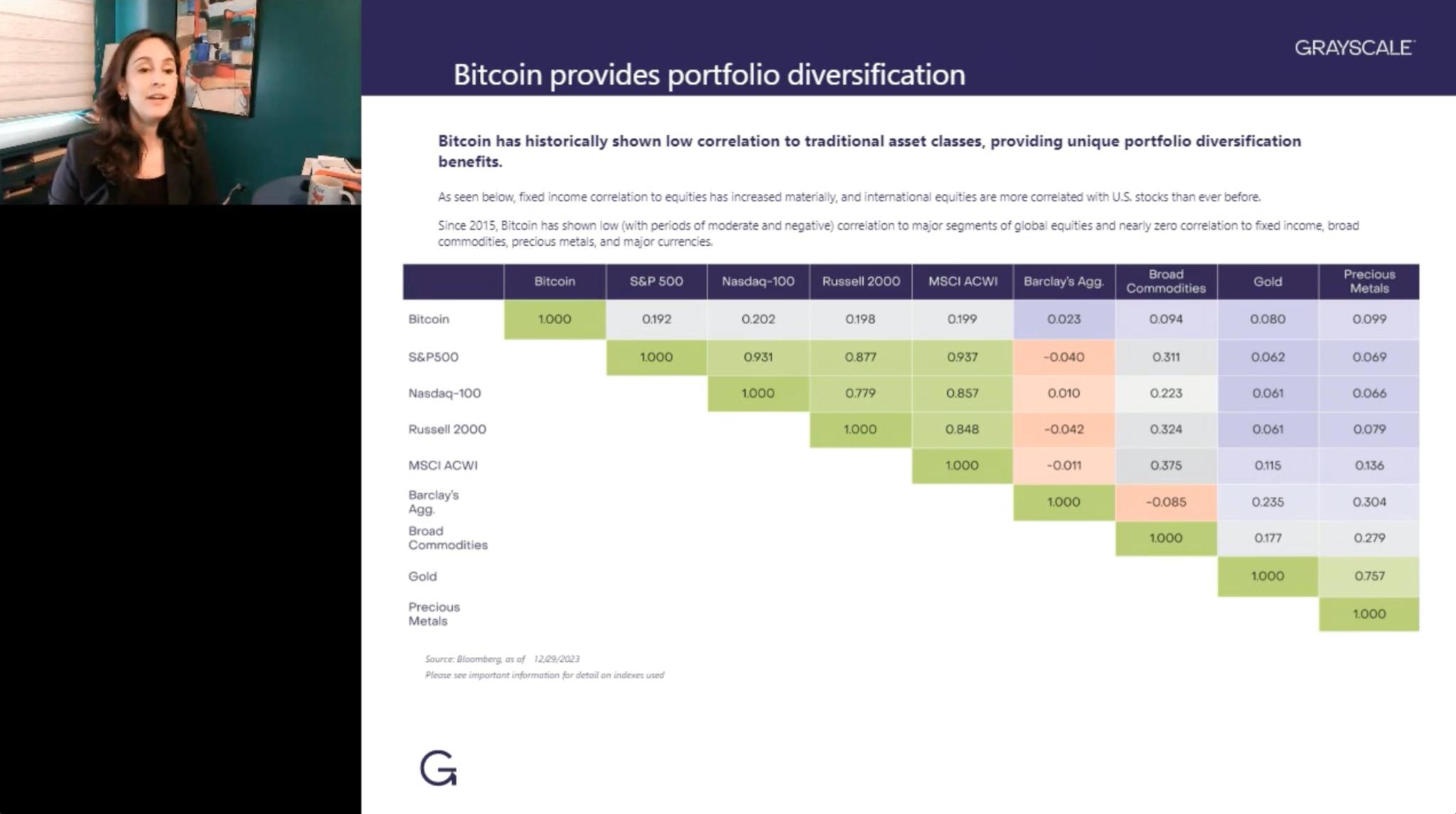

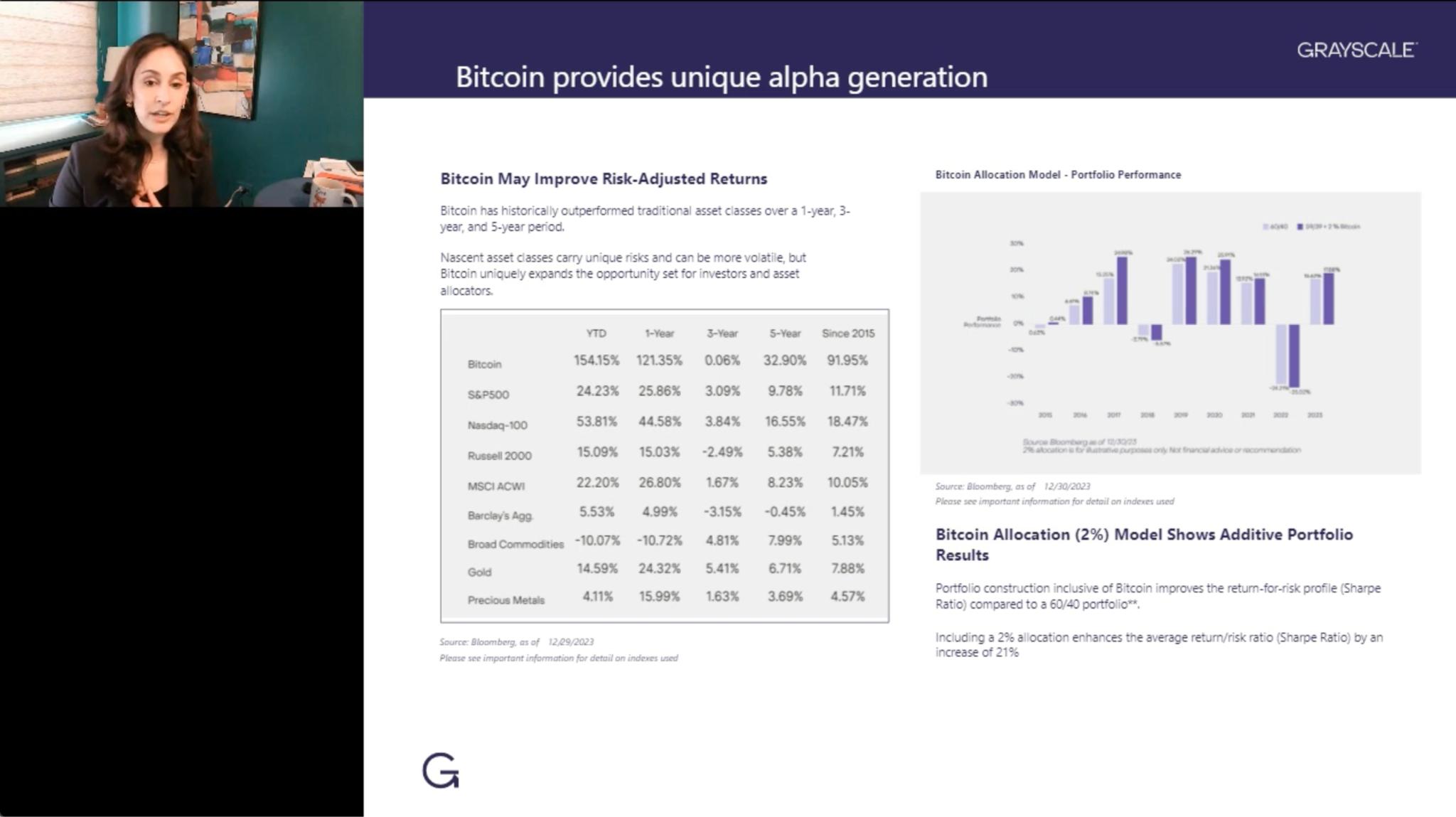

of tokens. We've actually created a taxonomy, and we have grouped these different types of tokens into categories that we call crypto sectors. And you know, we're happy to share more information on that. I think it's not the basis for this presentation about Bitcoin. But again this is there's meaningful technological upside associated with Bitcoin. So, you know, I think we've talked a little bit about Bitcoin in a vacuum. What is it. What is a blockchain. How did the two play together. Why do you need cryptocurrency to even think about investing in blockchain. Now let's take a big, you know, kind of another step back and back into like our shoes. As investors I think about Bitcoin as you know something that we would put in a portfolio. So I think we for me Bitcoin and for us at Grayscale we see it as a high risk, potentially high return asset. That has a low correlation to public equities and traditional assets, generally speaking. And in a risk adjusted portfolio that's where Bitcoin gets really interesting. So when you look at something that you know, we talk about a Sharpe ratio that's incrementally how much does each unit of each unit of reward or upside that you add to a portfolio commensurately change the amount of risk that you're adding. When we run the analysis, we see that, the amount of upside potential that Bitcoin can provide in portfolios empirically is actually, when right sized in a portfolio greater than the rate unit of risk. So what you know, when we think about portfolios, we have a lot of conversations with clients. We see folks looking at their portfolio. And because of these characteristics that Bitcoin has often replaced. And, you know, because of the technology exposure, you might use Bitcoin to replace your some, some part of your exposure to tech stocks or small cap investments because it is a growth asset or even in international equities. Because again, this is an emerging asset class. So this is a powerful tool that investors can use to increase risk adjusted returns and diversification. We can go to the next slide. So we also when we look at bitcoin, and we look at the risk adjusted returns over the years, you know, we think probably, you know, you probably are interested in do you think it's a good investment because while you're listening to this webinar in the first place, I think it's also important to contextualize that and show data. So we're showing returns over the years from different asset classes. I want to preface all of this with saying that this is a nascent asset class. It's risky, it's volatile, and there are tremendous opportunities are out around the right size allocation. And you can

look and compare this to Nasdaq in particular. For instance, tech stocks have done really well over the last ten years. Generally the best performing asset class. And still you see Bitcoin comparing favorably. And so again this is something this is a point in time. Bitcoin is an asset. It has fundamentals just like anything else. It's a kind of money system. It's a type of digital asset or alternative to gold. And these fundamentals change. So again why we feel like making an appropriately sized addition to a portfolio over time is a good idea. It's important for investors to do the work and to look at, you know, make to look at the fundamentals and not really think about this as a short term investment where they're timing the market. It's not going to go up by the same amount every year, every week, every month. We see this as a portfolio diversifying alpha generating asset over the intermediate and long term.

David LaValle [00:21:48] So, you know, Ray, when I look at this chart on the left hand side, I can't help but notice that this is almost a, you know, true chronology of the evolution of the ETF market. And, of course, you know, just recently we've had the advent of, you know, Bitcoin spot Bitcoin ETFs coming to market, which is like a super, super exciting aspect of, you know, the ETF market. You know, I've been in ETFs for the vast majority of my career and started, you know, on the floors of the American Stock Exchange in New York Stock Exchange trading a broad range of products, but really have lived with the evolution of the ETF market. And in 1993, 30 years ago, we had, you know, our first ETF come to market in the US based upon the S&P 500. And over time, we have really kind of evolved, in bringing kind of more and more asset classes. I would say kind of online into the ETF wrapper. And most recently it's been Bitcoin. But as we look at this chart on the left hand side, you know, you go from you know having you know broad based equity exposures into kind of more specialized exposures like the Nasdaq you know 100. And you move into fixed income. Then subsectors of fixed income and commodities and currencies and then more sophisticated index based strategies. And then we've obviously gone into kind of active strategies as well. But I, you know, couldn't help but notice as we were kind of transitioning into the ETF portion of this conversation, that that was actually, you know, you know, a bit of a view into the evolution of the ETF market. And, you know, the truth

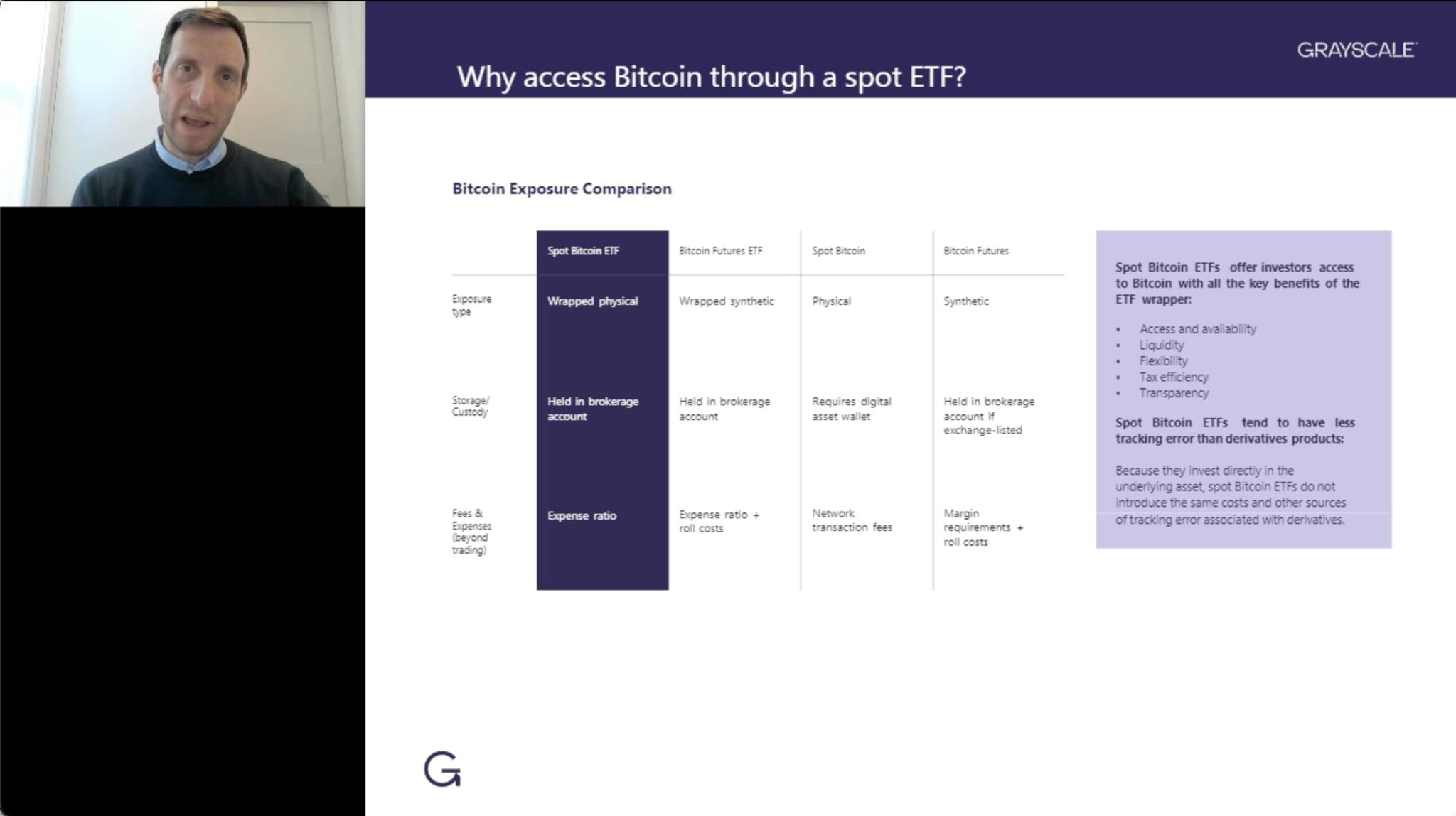

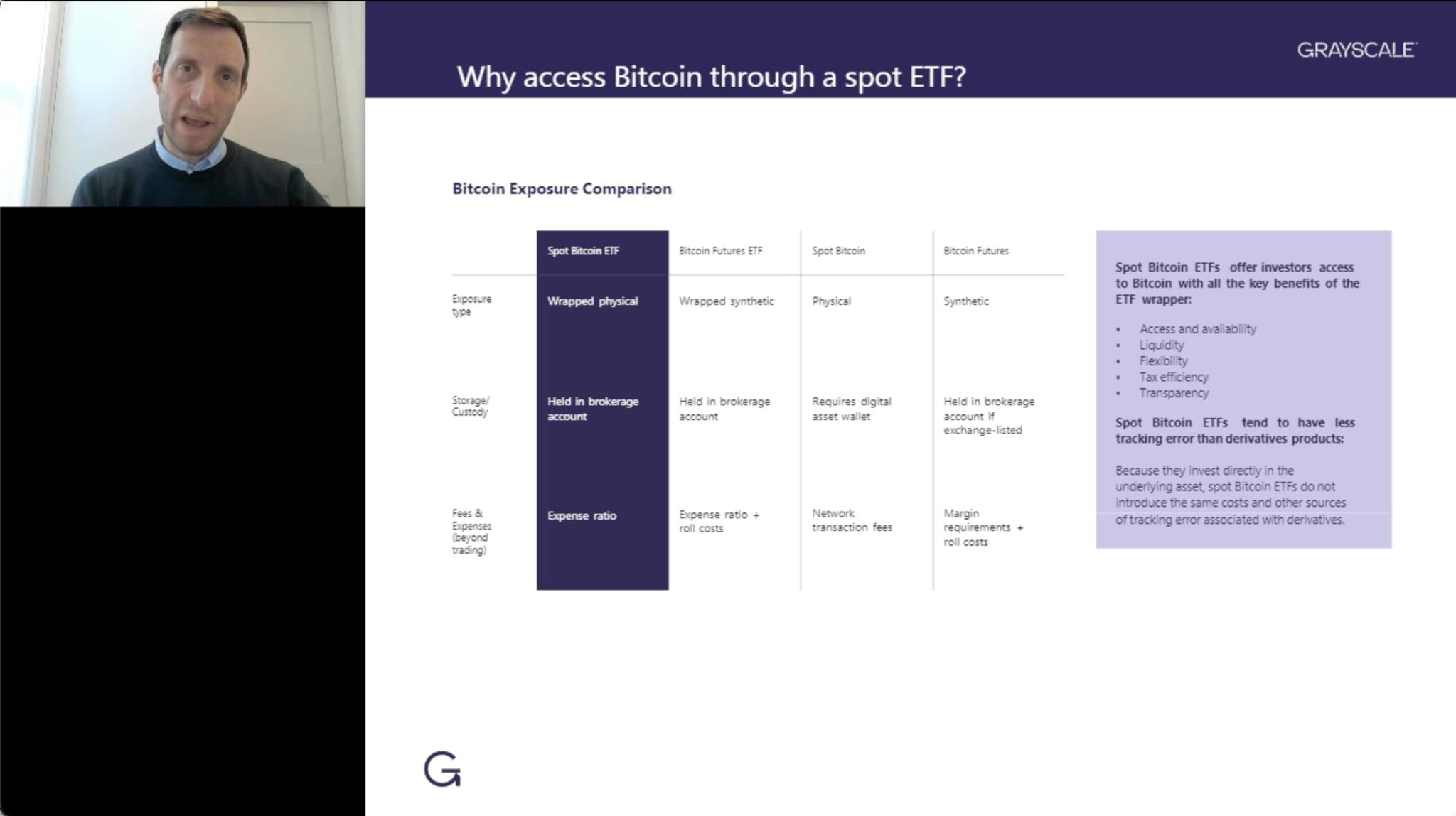

is it has been a long time coming. And I can definitely say in my career the Bitcoin you know, ETF has been something that has been part of my career for, you know, the past ten years. The first time I was brought into the conversation around, you know, is there going to be a Bitcoin ETF was in 2013. And the question is why is it kind of taken this long. And and the truth is, is with every step of evolution in the ETF market, it's been a very similar conversation, which is an engagement with, you know, the SEC and engaging with regulatory agencies to ensure that, you know, the underlying asset was something that was, you know, permissible for a broader range of investors to be able to invest in and, you know, to ensure that, you know, the ETF wrapper was also, you know, going to function as it was designed and, you know, it was the same story with, you know, the S&P 500 coming on board and the same story with fixed income and the same story with, you know, commodities, broad based commodities like gold and silver. And then, you know, some of the more recent subsectors in fixed income. And that really has been the conversation in and around, you know, spot Bitcoin ETFs going to market, as well. So, I thought I would just kind of make a few comments on that before moving to the next slide. So you know, why access, bitcoin through, an ETF. And, you know, there's a number of different ways that that you can access Bitcoin in the ETF. And of course, you know we feel that spot Bitcoin exposure is, you know, the most efficient way. but you have to remember that in every instance where, you know, a commodity can be reliably stored. Spot, you know, ETF exposure has been what has, you know, been really overwhelmingly preferred by, investors. And so in instances with, you know, hard commodities like gold and silver, where there are, you know, spot opportunities to invest in an ETF, the numbers simply just don't lie. In fact, I don't think there, you know, is even another futures based, you know, gold ETF left in market about 15 months ago. The last futures based gold ETF. And you know it's really about you know understanding the the certainty of exposure and the simplicity of structure, which has led investors to really prefer having spot exposure. You know in their ETF. What do I mean by spot exposure? I mean the ETF is actually holding the spot commodity in a vault. So there's, you know, gold in the vault or silver in the vault or, you know, bitcoin in the vault. Now you know this is early days. So we are still you know watching the development of the market. and this is not to say that, you know we're anti you know

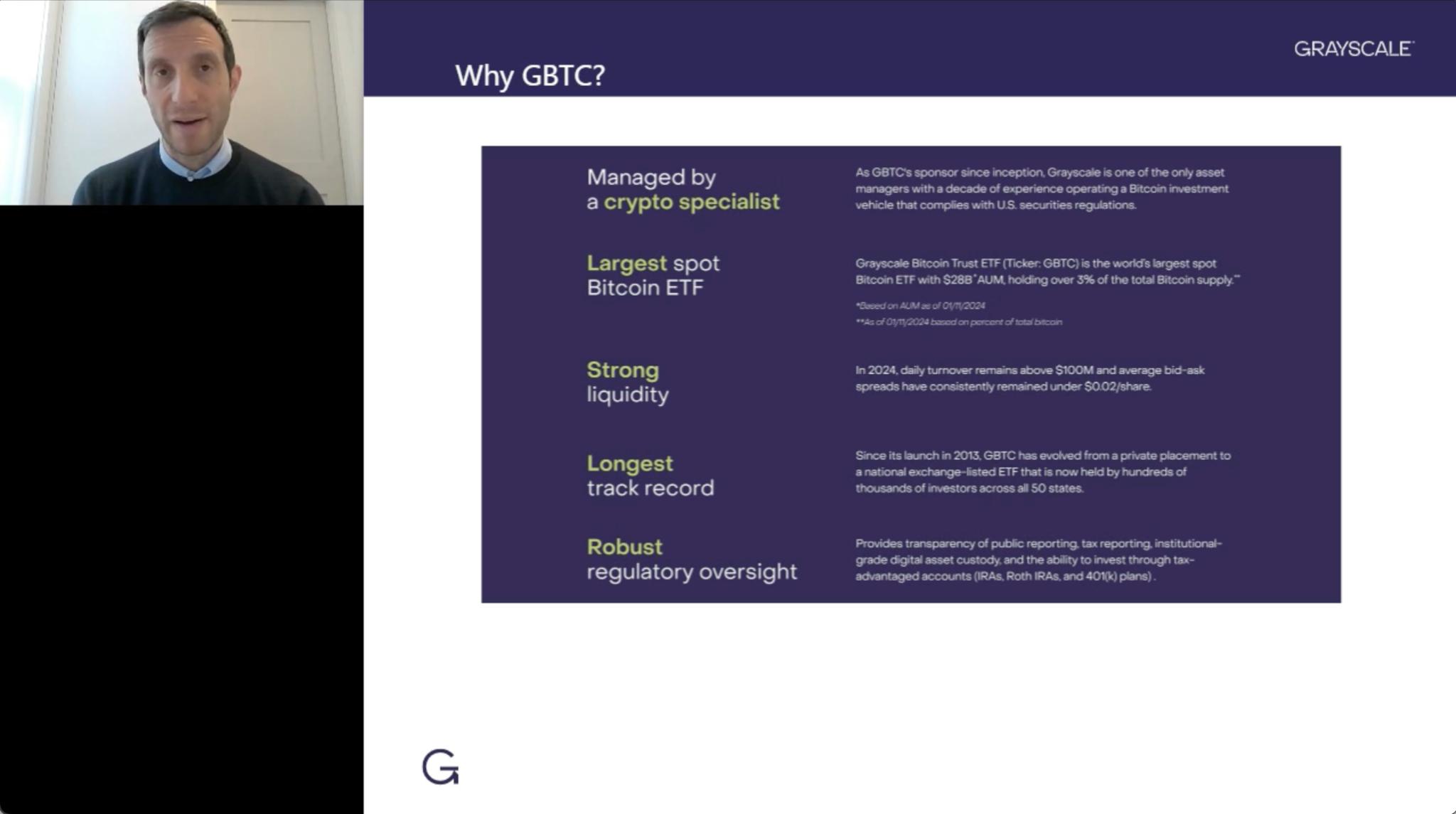

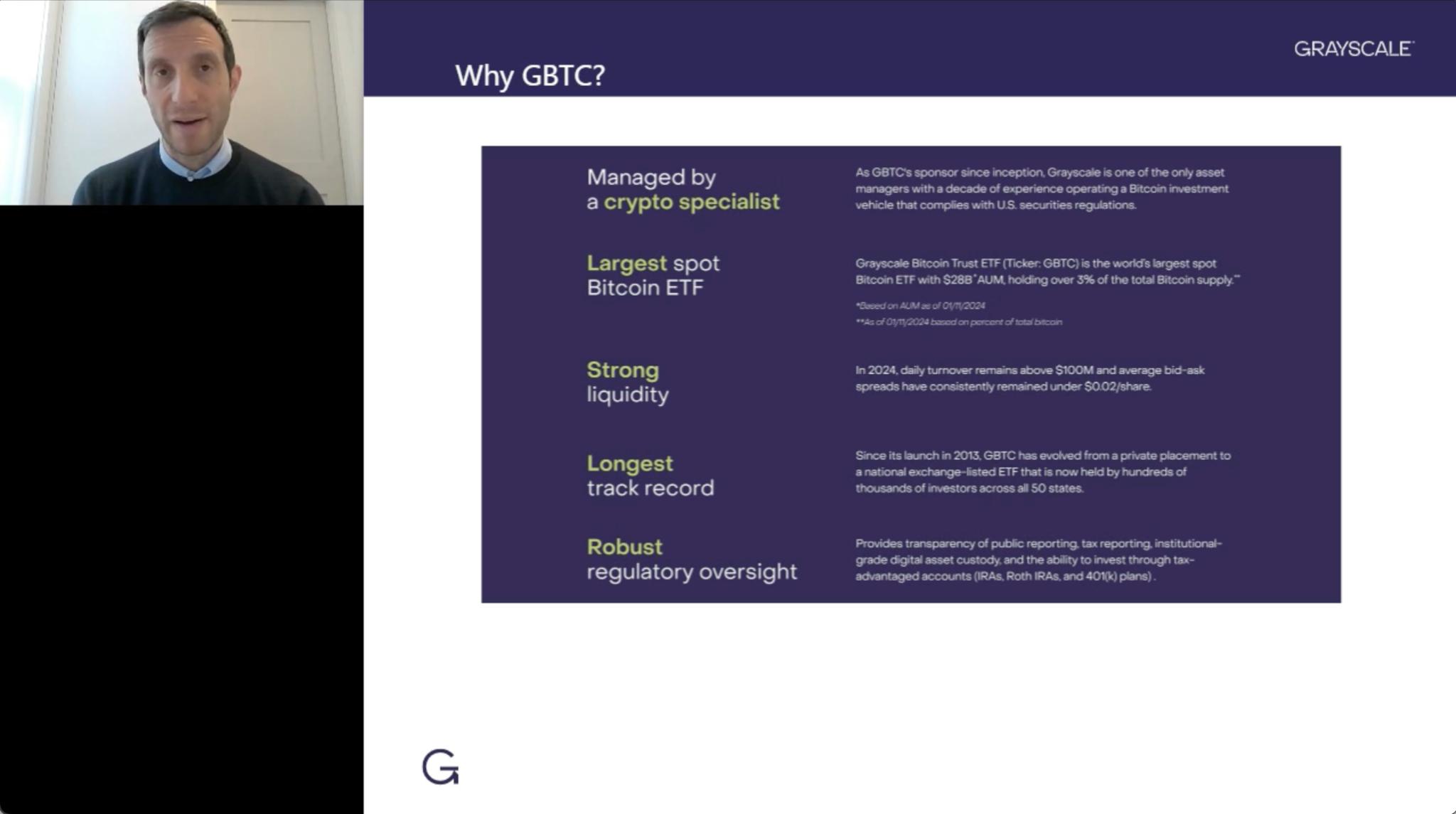

futures based ETFs. There are many commodities that can't be reliably stored. The soft commodities like, you know, wheat or or oil for that matter. And so you know oil exposure in in an ETF is really kind of delivered in the form of, you know, futures exposure. But you know, that comes with some additional level of complexity. And a little bit of additional kind of operational, you know, complexity. And, and that really turns into, you know, uncertainty of returns. And the reason why there's uncertainty of returns is because the, you know, ETF is holding futures and those futures have an expiration. And so the portfolio manager needs to ensure that on a constant basis they're able to, you know, move from one set of futures that might be expiring to the next set of futures, that has kind of a longer duration or a longer term to it. And that process of rolling those futures has cost. Those costs are born by the investors in the ETF. And what that ultimately ends up resulting in is a disparity between the performance of the underlying asset, let's just say gold, or the performance of, you know, the actual futures. And so, look, we are big, big believers in, you know, ensuring that investors have choice. And so we are certainly not anti, you know, futures based exchange traded products. And we're certainly not against bitcoin futures exchange traded products. In fact you know Bitcoin futures. were really the way that you know the the road was paved to be able to get spot Bitcoin ETPs in market. So we're super appreciative of that. And we recognize that, you know, certain investors, you know, may have a preference to utilize Bitcoin futures as an exposure. But we recognize that, you know, in the case of a buy and hold investor who's looking to add an allocation to bitcoin, into their portfolio, you know, history has really been a predictor of what we believe the future will hold, which is to say that, you know, spot, commodity ETPs are going to be the way, of the future. Now, it's early days. We haven't seen, a ton of data points yet. However, what we have initially seen is a tremendous amount of trading volume and inflows into, you know, spot Bitcoin exchange traded products as an entire class. And we've seen some outflows, from, the futures based exchange traded products, Bitcoin exchange traded products. But again, it's early days. But I think in the future we're going to see that, you know from an asset base. And from a volume perspective the spot Bitcoin exchange traded products are really going to going to dominate. So we can move to the next slide. So the question is, you know, why GBTC? You know, I always like to say that not every ETF is created

equal. And not every ETF issuer is not every ETF issuer is created equal. And you know this is really a new asset class. This is something that is specialized. It's going to rely it's going to, you know, require a tremendous amount of expertise. And as we've talked about that, ETFs have, you know, long democratized, asset classes. And, you know, we think about S&P 500 exposure in a market cap weight, as a very plain vanilla exposure for our investors. But the truth of the matter is 30 years ago, that was a really kind of, you know, institutional class of investment. And, you know, bringing that first ETF to market really allowed for all investors to have a very fair and equitable access to S&P 500 exposure. Something that was really only available to a subset of the market at that point in time and in a context of choosing your, you know, spot Bitcoin ETF, we need to make sure that you're kind of partnering the right way and ensuring that you are investing in the right product that is sponsored by the right issuer, and it's going to be a period of education. And I think Ray did a tremendous job of walking through some different use cases for exactly. You know, you may consider making an allocation into Bitcoin. But I always think about it as a financial advisor or as just an investor. You know, your own this democratization and this ETF coming to market. It's kind of changed the paradigm of how you need to be prepared as financial advisor to have a conversation with your client. And some of the questions that we have gotten from financial advisors have really been, you know, in and around where it fits into a client's portfolio, how to think about making an investment. And I know that really spoke about that. You know, a little bit earlier in this presentation, in this webinar. However, the truth is, is now that we have an ETF, I think the availability for financial advisor advisors to utilize this as kind of a building block in their for their clients portfolios is really going to be a new paradigm. Historically, financial advisors really haven't been in a position to offer Bitcoin exposure to their clients because many of the wealth management platforms, did not permit Bitcoin to be, an available asset. And with the ETF coming on board, ETFs are more well understood by, you know, the wealth management platforms. There's, you know, well-established due diligence platforms. And there's going to be an opportunity for financial advisors to utilize Bitcoin ETFs as a building block for their client portfolios, just like they have been able to use ETFs for S&P exposure, for gold exposure, for other commodity exposures and for fixed income

exposures. And so when we're talking to financial advisors and we're having that conversation of where it fits into a portfolio, I know it's a very quick answer to say well it's an alt. But you know, you have to double click on that. And I think that some of the components of, you know, the use cases that, you know, Ray had mentioned earlier in the webinar are really applicable. And when I really double click a little bit further on, you know, this concept of it being a new technology or an emerging technology, I think it's been very helpful for financial advisors to hear a story about this being a disruptive technology, just like other disruptive technologies that we've experienced, in our lifetime thus far. And when you think about the late 90s or the internet coming online, and trying to kind of understand, well, this is certainly going to be something that's going to change the way we think about, you know, communication, but not really having an understanding that, you know, the internet was really going to change the way we did everything. And so I distinctly remember, you know, being on the floor of the American Stock Exchange, you know, being a trader in a small cap equity pit and thinking about, you know, Jeff Bezos, talking about his aspirations to have, you know, an online marketplace where we would, you know, buy books or perhaps other goods and, you know, kind of shrugging my shoulders and not understanding that, well, this is where we are with digital assets. This is where we are with crypto. And Bitcoin is the first application of this digital, you know, transformation in this kind of, you know, new technology and disruptive technology. And as we're thinking about having more and more conversations with financial advisors and with end clients, it's really an opportunity to say this is a high growth opportunity. It certainly has volatility characteristics. It certainly has risk characteristics. And you certainly have to do your due diligence and make sure that the suitability of your client is appropriate. But taking an allocation, a Bitcoin and spot bitcoin using a spot Bitcoin ETF to kind of slot into a small cap equity exposure or small cap tech exposure or growth tech exposure, makes a lot of sense and is something that really has been resonating within clients. Oftentimes this process of educating is a partnership with your, you know, ETF issuer. And so back to my point about not all ETFs being created equally and not all ETF issuers being created equally. GBTC has a number of incredibly strong differentiating characteristics. And Grayscale also has a number of strong differentiating characteristics. First of all, GBTC has a ten

year track record. Not only does it have a ten year track record, you know it has over 25 billion in assets. And so upon conversion, an Up listing to become an ETF. You know, GBTC had, you know, a tremendous liquidity profile, you know, very strong average daily volumes. It had very, you know, tight virus spreads and boasted incredibly strong liquidity even before beginning trading as an exchange traded fund. Now, as we've uplifted to become an ETF trading on the New York Stock Exchanges, aka platform, we have continued to see tremendous liquidity characteristics that, you know, the broadest range of investors are able to rely upon, to date. GBTC has traded over 12 billion, notional, trading volume in the first ten days of trading, which is really incredible. And on average has been trading more than all of the other ETF, spot Bitcoin ETFs combined. So there's 11 spot Bitcoin ETFs that are currently in market. And GBTC is garnering more than half of that trading volume of the entire category. It's really a tremendous, tremendous stat to show the liquidity profile of GBTC. The quoted spreads are incredibly tight, less than five basis points. And the pool of investors, is incredibly strong and over a million investors upon up listing. So those characteristics around liquidity, and a strong asset base are really some of the greatest differentiating characteristics that GBTC can boast. And we're really proud to boast about as it pertains to Grayscale, as the asset manager and as a sponsor of the exchange traded product. There's also a number of differentiating characteristics, which is that we are a crypto expert. We have a tremendous amount of expertise. We are 100% dedicated to being an asset manager in the crypto marketplace. And so, you know, we're going to be here to educate our investors, and we're going to be here to partner with advisors to ensure that they have all the possible information they can have to face off with their clients, and to ensure that their clients are as informed as they can possibly be when it comes to making an allocation into the digital asset marketplace. And in terms of their ability to, you know, help their clients understand and be educated, on Bitcoin. And so again, you know, we want to ensure that. Advisors have the ability to have a full look at their clients portfolios. Historically, Bitcoin has been something that I have had to live outside of the wealth management platforms, and therefore it impaired the ability for financial advisors to have a full view on their clients portfolio. With the advent of a Bitcoin Spot Bitcoin ETF coming online and with, you know, the soon to be hopefully approvals of you know, start

bitcoin ETF being allowed and wealth management platforms. It's going to, you know fulfill that promise that ETFs have long fulfilled. For every other asset class that has been brought to market in the form of an ETF, which is to democratize that exposure, make that exposure available to everybody in a very equitable, very transparent, very tax efficient wrapper, the ETF, and allow financial advisors and clients alike to utilize the ETF as a building block in their portfolio. And so we're really excited to kind of bring the, you know, technology revolution that is, you know, Bitcoin, you know, together with another financial revolution, the ETF. And so with that, Sarah, I will turn it back over to you. So we can get into some of the, participants Q&A.

Sarah [00:37:57] Okay. Great. Thanks so much, David. So before we move into Q&A, just have a couple of reminder materials can be found in the document folder at bottom of your screen. We appreciate your feedback. Please take a moment to fill out our brief survey that's located at the bottom of the console. Our speakers will be taking advisor questions. Please get your questions in the box. In the Media player window, we'll get to as many of your questions as possible. Leave your questions not answered. On today's webcast, a member of the Grayscale team will reach out to you directly if you would like to have a conversation to further discuss the ideas that were covered during today's event, please click the blue confirm button in the request box on your screen. All right, we've gotten a number of questions coming in. So the first one looks like it would be a good one for you. Dave. An advisor asks what does a Bitcoin ETF need for the entire crypto industry as a whole? Why does Bitcoin need a spot ETF when there are already futures? ETF?

David LaValle [00:38:51] So it's a question we've gotten, several times, and I, I there's kind of two prongs to answer. On one hand, it's totally unprecedented. And on the other hand, this is just history repeating itself. This is an enormous for the crypto marketplace because, it's really validation for the asset class as a whole. I think you see some of the largest, you know, financial firms, both on the banks side, and on the asset management side, kind of showing up to support the ETF coming online. And it's, you know, a tremendous vote, of confidence for the asset class holistically. You know, some

of the largest asset managers in the world are launching products, and some of the largest banks are kind of supporting the market from an operations perspective. And it's a real sign of mainstream demand, for this asset class. Now, it's it's unprecedented in the sense that, you know, we've never really seen such, you know, euphoric response to a new ETF coming to market where we have 11, you know, products that began trading on the same day. And it was certainly kind of the most hotly anticipated, and closely followed, you know, innovation in the ETF market that we have ever seen. But then again, at the same time, it's, you know, history repeating itself in the sense that, you know, this is just another asset that is kind of being brought online in the form of an ETF and fulfilling on the promise to kind of democratize investing for investors. And so, you know, I have to say, it's it's certainly huge for, the crypto marketplace as a whole. It's also huge for the ETF marketplace because it's something that has been long sought after, and it's really kind of delivering to the promise that the investors, you know, have been asking for, which is to bring, you know, spot Bitcoin exposure into the market, in an ETF wrapper. You know, why does there need to be spot Bitcoin ETF and also have a futures you know ETF. Again it's back to choice. futures ETFs work as designed. But they are you know again more operationally complex. and you know don't do the best job of kind of giving certain returns. And so spot bitcoin ETF will you know behave much like, you know spot gold in spot silver ETFs that behave which is to, you know, deliver a very very highly correlated return for the underlying asset. And we think that's going to be a tremendous benefit to investors.

Sarah [00:41:22] All right. Great. Thank you. Okay. So this next question is for Ray. How does Bitcoin transaction compared to traditional bank transactions. Are blockchain the same as bitcoin.

Ray [00:41:35] Great question. And you know I love it. I love those types of questions because I was on my soapbox earlier about Bitcoin versus blockchain. So to tackle that part. The blockchain is the decentralized ledger. The Bitcoin is you can think about it is the economic incentive mechanism that allows that whole thing to exist. So they're not the same thing and they work hand in hand. So we think about now the next part of the

question. Fake transactions and Bitcoin transactions definitely similar in that it's a transfer of value. And they are different in many ways. And there's two to highlight. the first is just that when you move Bitcoin it's very fast. It's done in a matter of a few minutes. Is anybody who sent a bank transfer? If I went to send the wire to Dave today, maybe it gets, you know, done. Probably at the end of the day, it can take hours. Can't do it if it's not, you know, kind of Monday through Friday between nine and whatever the wire window is for your bank. So that's something you can really do on the weekends. So that's the thing. And the reason is that they have to check to see the transactions clearing centralized. And with Bitcoin again, I can at any point in time any like wake up at 4:00 am on a Sunday night and send value to anyone, anywhere in the world in a few minutes. And I think that's where a lot of the value is, is that the decentralization, the removal of the intermediary allows that, allows that to happen.

Sarah [00:43:18] All right. Great. Thank you for that. Okay. Next question for Dave. My response a Bitcoin ETF approved now. What are some characteristics to consider when evaluating spot Bitcoin ETF.

David LaValle [00:43:32] So the short answer to that question is, you know, we we finally received regulatory approval. And we also as an industry where we're really ready at this point in time. The the longer answer is, you know, there was, almost a decade of back and forth between the SEC and between, you know. Spot Bitcoin ETF issuers like Grayscale to to really try and achieve that regulatory approval. And I think at first glance, you know, there's some, some frustration, that I think the, the broadest part of the market kind of experience over the past decade. But I think if we kind of pause and kind of count to ten and think about how this has happened in the past, it's really, again, kind of history repeating itself. And, and when SPY came to market in 1993, I don't think many people really realized that was, you know, six years of back and forth with the SEC to ensure that, you know, the marketplace was ready and that the ETF kind of wrapper was going to work. And so, you know, look, we have to respect, the SEC mandate of investor protection. And we do respect that mandate. And recognize that, you know, innovation does take some time. And, you know, at this point in time

where we're really pleased to say that we're we're here, and that we have, you know, respected that process. We didn't always disagree, you know, we didn't always agree, along the way. And, and there were some, you know, protracted disagreements along the way. But the truth is that the regulatory framework is in place. You know, the ETF wrapper is a battle tested wrapper that has worked for the past 30 years for a broad its range of assets. It will continue to work, in the future. You know, for Bitcoin and hopefully for other digital assets going forward as well. This is a real win for investors. And we're you know, we're thrilled to have gotten to this point.

Sarah [00:45:28] All right. Great. Thank you. All right, so, this question, I think would be for Ray, an investor asks, would you consider crypto to be an early stage technology? Do you think Bitcoin is an investable asset for long term portfolio?

Ray [00:45:45] I do, I do. And I think about, for me, one of the things that I think is really interesting about being able to invest in cryptocurrencies in Bitcoin is that it's not it's not that different than if you think about investing in a so early stage technology. And when you think about the types of investments that are available, you think about venture capital investments, for instance. They're not really available to everybody. They're early stage and they can have potentially a lot of upside, but certain, you know, the everyday investor doesn't have access to that. Investing in Bitcoin is really kind of an egalitarian way that democratizes investment in early stage technologies. So so for me, I think that it's it's absolutely that and it's actually a way to take early stage technology investment and open it up to literally everybody.

Sarah [00:46:46] All right. Thank you. Okay, so, next question is for Dave. Where are the bitcoins? In the ETFs. Who's holding them?

David LaValle [00:46:55] Yes. Okay. I just realized I didn't answer the second part of your other question, and it's some of the considerations that investors would have when choosing, you know, their Bitcoin ETF. So I'll answer that one first, and then I'll get to, the question of where, you know, where the bitcoins are held. Well, maybe I'll start with that one because it's the simplest answer. It's a pretty simple answer is the sense that the bitcoins are held at our digital asset custodian, which, that we have, you know, made publicly on record, which is Coinbase. And, you know, having, you know, worked in the ETF industry. And having answered the question, you know, for literally, about a decade, the same question was asked about GLD as well, you know, where's the gold then? You know, it's pretty simple. The gold's in the vault. And so the the answer remains the same. The the bitcoin, is in the vault. And in that vault is held that at Coinbase. And so, you know, the entirety of our product, was envisioned to, you know, be built and be based upon the infrastructure, and the regulatory framework that GLD, was built upon. So it's, essentially the same answer, a very simple answer. But when you're talking about kind of, you know, some of the different characteristics to evaluate, you know, one spot Bitcoin ETP from another. I think there's a number of differentiating characteristics. You should pay attention to. Number one, who is the issuer? Are they a crypto specialist, and can you rely upon them for you? You know, to help educate yourself and it's lines is the first one. The second is the liquidity characteristics, of the product, which I talked about before. Average daily volume, quoted spread size at the inside market or, you know, very good indicators. The asset base of the product, does a product have a very strong asset base? And some of those are, you know, really differentiating characteristics that we think that, you know, clients should be paying very close attention to, you know, it's also something that clients should pay attention to. But that really is just, you know, a top line number that doesn't really encompass the total cost of a client's, ownership of exchange traded product. And so your total cost of ownership is going to be your management fee, plus the cost to buy and sell the product, which is really theoretically the bid ask spread. And so ensuring that you have a high quality understanding, of the cost, total cost of ownership in your product, is really going to be something that, you know, is really important to consider before making an allocation. And the last piece that I would say is, you know, is the product

really tracking, you know, the its own net asset value. You know, many products are trading at a premium right now to its net asset value. And that's, you know, also going to, you know, come in the form of additional cost. And so making sure that you understand that when you're making an allocation to a spot Bitcoin ETF, understanding if it's trading at a premium, is it trading right next to its, you know, net asset value. Is it trading a little bit of a discount. Those can be really expensive decisions. And so just taking a look at the top line, management fee, you know, really isn't doing a full set of due diligence. And for the plus bid ask spread, plus where the products are trading relative to its net asset value.

Sarah [00:50:16] Okay. Great. Thank you for that. All right. So I think we have one last question. And it would be great if I could get both of you maybe to weigh in on this one. So the question is what are your thoughts on the first few weeks of stock Bitcoin ETF trading?

David LaValle [00:50:31] So maybe I'll start. I think we have, you know, seen, something that has been really exciting for the marketplace. You know, you have to you have to really applaud the entire, ecosystem for, you know, something that we have never seen before. We have 11 products coming to market. The volumes are, you know, exuberant, but it was really a tremendous amount of hard work by a number of members of the ecosystem. That's the market makers, trading firms, authorized participants. You know, the listing exchanges, all the sponsors that have put the hard work into it. A tremendous amount of work from, you know, 33 act, attorneys. But, you know, the mechanics have, have work. And again, the ETF has kind of behaved as designed. And it is, you know, affording the opportunity for the broadest range of investors to, you know, kind of exchange risk or to buy and sell, you know, Bitcoin in the form of ETF shares with a high degree of confidence, with a high degree of liquidity, with a high degree of transparency. And some of the volumes that we have seen, the first, you know, ten days of trading, have been unlike any volumes that we have ever seen before, in an ETF launch. And that's really just to, you know, accentuate the demand profile. You know, for investors to be able to, you know, seek exposure for

bitcoin in, an ETF wrapper. And so I think, you know, what we have seen is pretty much what we had expected. And it's, been really exciting to see that the ETF marketplace as a whole, has been able to kind of like meet that demand and that the ETF has continue to, you know, behave as designed.

Ray [00:52:14] I would echo that. I mean, David David's the expert here. But it's been, you know, having worked at this firm and really worked towards this moment since 2018. It's it's a historic moment and it's super encouraging and exciting to see the results of all the work and how well everything is, has come together. And the volume, is really a testament to the demand, from consumers for a product like this.

Sarah [00:52:42] Right. Wonderful. Yeah. Thank you so much to both of our speakers today for such informative discussion. As a reminder, materials have been made available for download. Can you found the document folder at the bottom of your screen? We appreciate your feedback. Please take a moment to fill out our survey, also located at the bottom of the console. And you bet your question was not answered with discussed a member of the Grayscale team. I'll reach out to you directly if you'd like to have a conversation to further discuss the ideas that were covered during today's event, please click the blue confirm button in the Media Request box on your screen. Thank you so much for joining us and enjoy the rest of your day.

Grayscale Bitcoin Trust (BTC) (the “Trust”) has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Trust has filed with the SEC for more complete information about the Trust and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Trust or any authorized participant will arrange to send you the prospectus (when available) if you request it by calling (833) 903 - 2211 or by contacting Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101.