Filed Pursuant To Rule 433

Registration No. 333-275079

February 12, 2024

GBTC Grayscale Bitcoin Trust ETF Bitcoin Investing Begins here Grayscale. The world’s largest Bitcoin ETF* * as of January 11, 2024.

GBTC Grayscale Bitcoin Trust ETF Bitcoin Investing Begins here Grayscale. The world’s largest Bitcoin ETF* * as of January 11, 2024.

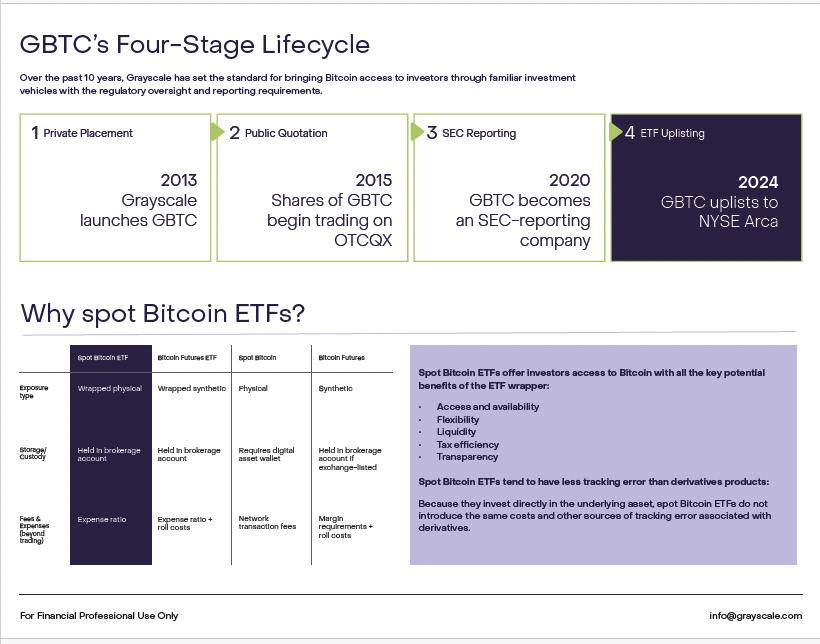

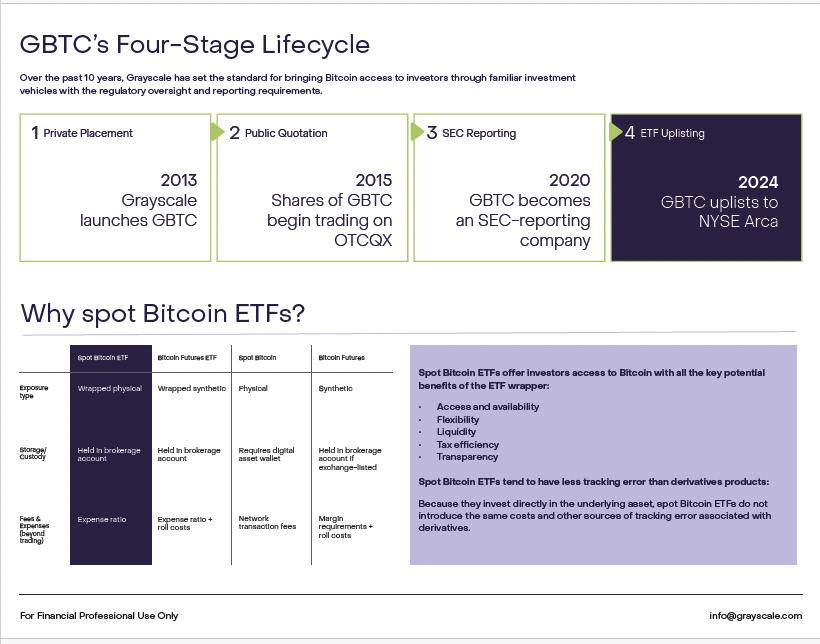

GBTC’s Four-Stage Lifecycle Over the past 10 years, Grayscale has set the standard for bringing Bitcoin access to investors through familiar investment vehicles with the regulatory oversight and reporting requirements. 1 Private Placement 2 Public Quotation 3 SEC Reporting 4 ETF Uplisting 2013 Grayscale Launches GBTC 2015 Shares of GBTC Begin Trading on OTCQX 2020 GBTC becomes an SEC-reporting company 2024 GBTC uplists to NYSE Arca

Why spot Bitcoin ETFs?

For Financial Professional Use Only info@grayscale.com Exposure type Wrapped physical Wrapped synthetic Physical Synthetic Held in brokerage account

Held in brokerage account Requires digital asset wallet Held in brokerage account if exchange-listed Expense ratio Expense ratio + roll costs Network transaction fees Margin requirements + roll costs Spot Bitcoin ETF Bitcoin Futures ETF Spot Bitcoin Bitcoin Futures Storage/ Custody Fees & Expenses (beyond trading) Spot Bitcoin ETFs offer investors access to Bitcoin with all the key potential benefits of the ETF wrapper:

Access and availability Flexibility Liquidity Tax efficiency Transparency Spot Bitcoin ETFs tend to have less tracking error than derivatives products: Because they invest directly in the underlying asset, spot Bitcoin ETFs do not introduce the same costs and other sources of tracking error associated with derivatives.

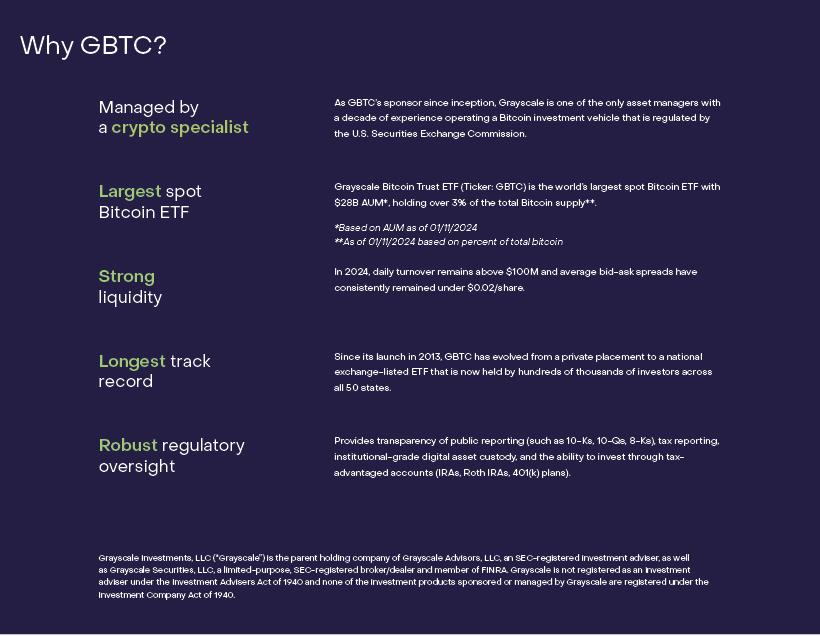

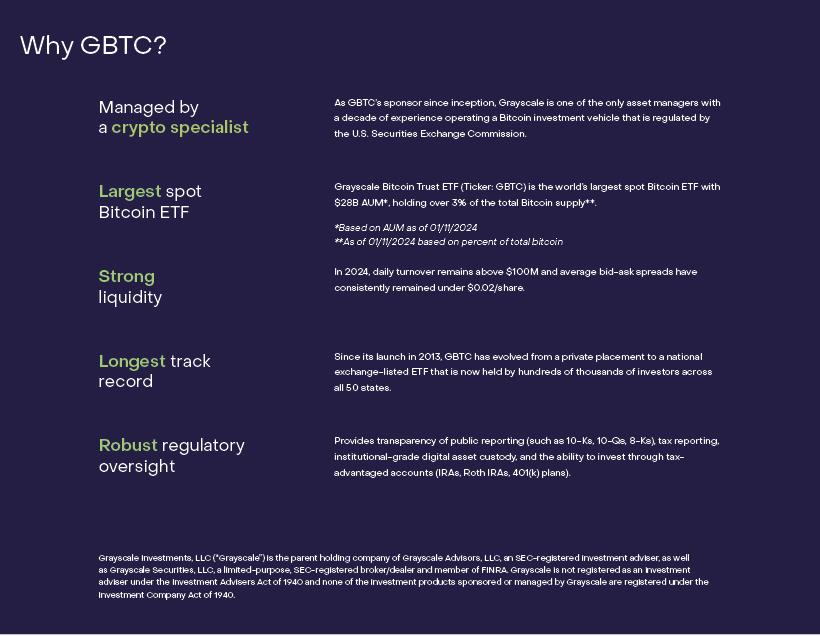

"Why GBTC?

Managed by As GBTC’s sponsor since inception, Grayscale is one of the only asset managers with a decade of experience operating a Bitcoin investment vehicle that is regulated by

a crypto specialist the U.S. Securities Exchange Commission.

Largest spot Grayscale Bitcoin Trust ETF (Ticker: GBTC) is the world’s largest spot Bitcoin ETF with

$28B AUM*, holding over 3% of the total Bitcoin supply**.

Bitcoin ETF

*Based on AUM as of 01/11/2024

**As of 01/11/2024 based on percent of total bitcoin

Strong In 2024, daily turnover remains above $100M and average bid-ask spreads have consistently remained under $0.02/share.

liquidity

Longest track Since its launch in 2013, GBTC has evolved from a private placement to a national exchange-listed ETF that is now held by hundreds of thousands of investors across

record all 50 states.

Robust regulatory Provides transparency of public reporting (such as 10-Ks, 10-Qs, 8-Ks), tax reporting,

institutional-grade digital asset custody, and the ability to invest through tax-

oversight advantaged accounts (IRAs, Roth IRAs, 401(k) plans).

Grayscale Investments, LLC (“Grayscale”) is the parent holding company of Grayscale Advisors, LLC, an SEC-registered investment adviser, as well as Grayscale Securities, LLC, a limited-purpose, SEC-registered broker/dealer and member of FINRA. Grayscale is not registered as an investment

adviser under the Investment Advisers Act of 1940 and none of the investment products sponsored or managed by Grayscale are registered under the Investment Company Act of 1940."

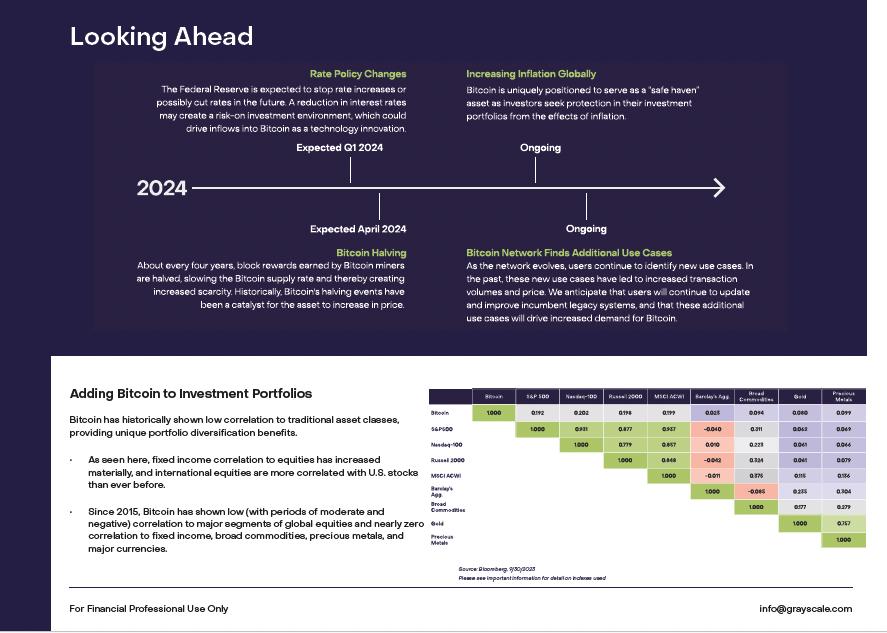

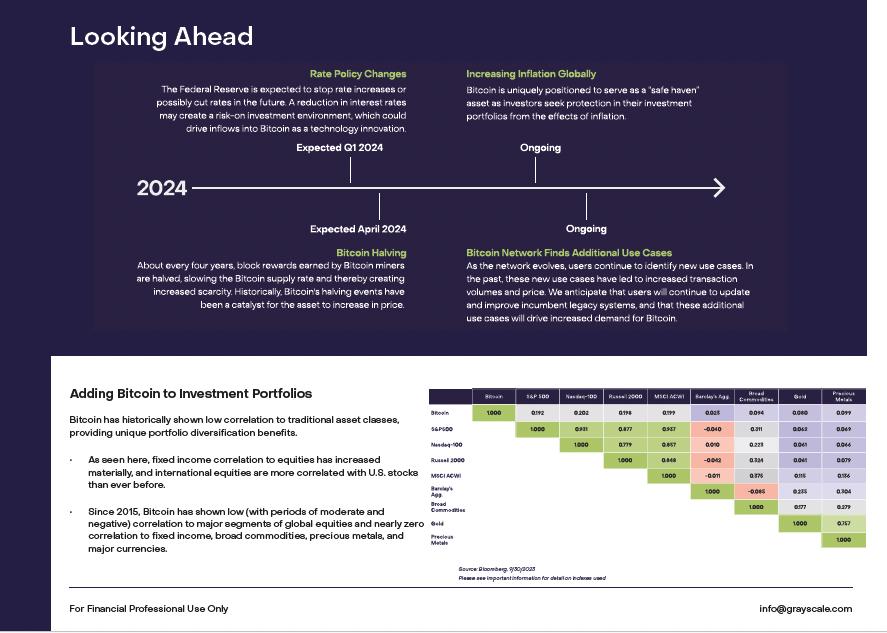

"Looking Ahead"

"Adding Bitcoin to Investment Portfolios

Bitcoin has historically shown low correlation to traditional asset classes, providing unique portfolio diversification benefits.

• As seen here, fixed income correlation to equities has increased materially, and international equities are more correlated with U.S. stocks than ever before.

• Since 2015, Bitcoin has shown low (with periods of moderate and negative) correlation to major segments of global equities and nearly zero correlation to fixed income, broad commodities, precious metals, and major currencies.

Source: Bloomberg, 9/30/2023

Please see important information for detail on indexes used

For Financial Professional Use Only info@grayscale.com"

Important Disclosures

The Grayscale Bitcoin Trust (BTC) (the “Trust”) has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Trust has filed with the SEC for more complete information about the Trust and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Trust or any authorized participant will arrange to send you the prospectus (when available) if you request it by calling (833) 903-2211 or by contacting Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101.

Foreside Fund Services, LLC is the Marketing Agent for the Trust.

An investment in the Trust involves risks, including possible loss of principal. The Trust holds Bitcoins; however, an investment in the Trust is not a direct investment in Bitcoin. As a non-diversified and single industry fund, the value of the shares may fluctuate more than shares invested in a broader range of industries. Extreme volatility, regulatory changes, and exposure to digital asset exchanges may impact the value of Bitcoin, and consequently the value of the Trust. Investments in digital assets are speculative investments that involve high degrees of risk, including a partial or total loss of invested funds. Investments in digital assets are not suitable for an investor that cannot afford loss of the entire investment.

The Trust relies on third party service providers to perform certain functions essential to the affairs of the Trust and the replacement of such service providers could pose a challenge to the safekeeping of the digital asset and to the operations of the Trust.

Risk Disclosures

Extreme volatility of trading prices that many digital assets, including Bitcoin, have experienced in recent periods and may continue to experience, could have a material adverse effect on the value of Grayscale Bitcoin Trust (“GBTC” or the “Trust”) and the shares could lose all or substantially all of their value.

Digital assets represent a new and rapidly evolving industry. The value of GBTC depends on the acceptance of the digital assets, the capabilities and development of blockchain technologies and the fundamental investment characteristics of the digital asset.

Digital asset networks are developed by a diverse set of contributors and the perception that certain high-profile contributors will no longer contribute to the network could have an adverse effect on the market price of the related digital asset.

Digital assets may have concentrated ownership and large sales or distributions by holders of such digital assets could have an adverse effect on the market price of such digital assets.

The value of GBTC relates directly to the value of the underlying digital asset, the value of which may be highly volatile and subject to fluctuations due to a number of factors.

A substantial direct investment in digital assets may require expensive and sometimes complicated arrangements in connection with the acquisition, security and safekeeping of the digital asset and may involve the payment of substantial acquisition fees from third party facilitators through cash payments of U.S. dollars. Because the value of GBTC is correlated with the value of Bitcoin, it is important to understand the investment attributes of, and the market for, the underlying digital asset. Please consult with your financial professional.

Prior to 1/11/2024, shares of Trust were offered only in private placement transactions exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), and were quoted on the OTCQX® Best Market. The Trust did not have an ongoing share creation and redemption program. Effective as of the open of business on 1/11/2024, the shares of the Trust were listed on to NYSE Arca as an exchange-traded product, the Trust established an ongoing share creation and redemption program and the shares are being offered on a registered basis pursuant to a Registration Statement on Form S-3.

The Trust’s investment objective both before and after 1/11/2024 has remained constant, namely to reflect the value of Bitcoin held by the Trust, less the Trust’s expenses and other liabilities. However prior to 1/11/2024, the Trust did not meet its investment objective and the Trust’s shares traded at both premiums and discounts to such value, which at times were substantial, in part due to the lack of an ongoing redemption program. Furthermore, the Trust’s performance prior to 1/11/2024 is based on market-determined prices on the OTCQX, while the Trust’s performance following such date is based on market-determined prices on NYSE Arca. As a result, the Trust’s historical data prior to 1/11/2024 is not directly comparable to, and should not be used to make conclusions in conjunction with, the Trust’s performance following that date. The performance of the Trust before and after 1/11/2024 may differ significantly.

Spot Bitcoin: Direct Bitcoin exposure

Physical: Direct investment in an asset, as opposed to accessing exposure to the asset through a derivative vehicle

Synthetic: Indirect investment in an asset through a derivative vehicle

Roll Costs: Transactions fees involved in trading out of expiring futures contracts and reinvesting into new ones

Network Transaction Fees: Charges incurred when taking an action with a digital asset (for example, buying or selling) on the blockchain

Margin Requirements: A portion of open notional value which an investor must pay in cash

The CoinDesk Bitcoin Price Index (XBX) leverages real-time prices from multiple constituent exchanges to provide a representative spot price of Bitcoin in US dollars and is calculated once per second. Each constituent exchange is weighted proportionally to its trailing 24-hour liquidity with adjustments for price variance and inactivity.

The S&P 500 Index is a market-capitalization-weighted index that measures the performance of 500 of the largest publicly traded companies in the United States.

The Nasdaq 100 Index is a stock index of the 100 largest companies by modified market capitalization trading on Nasdaq exchanges.

The Russell 2000 Index is composed of the smallest 2000 companies in the Russell 3000 Index, representing approximately 8% of the Russell 3000 total market capitalization.

The MSCI ACWI captures large and mid cap representation across 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries. With 2,946 constituents, the index covers approximately 85% of the global investable equity opportunity set.

The LBMA Gold and Silver Price benchmarks are the global benchmark prices for unallocated gold and silver delivered in London, and are administered by ICE Benchmark Administration Limited.

BCOMPR Index, Formerly known as Dow Jones-UBS Precious Metals Subindex (DJUBSPR), the index is a commodity group subindex of the Bloomberg CI. It is composed of futures contracts on gold and silver. It reflects the return of underlying commodity futures price movements only and is quoted in USD.

© 2024 Grayscale Investments, LLC. All trademarks, service marks and/or trade names (e.g., BITCOIN INVESTING BEGINS HERE, DROP GOLD, G, GRAYSCALE, GRAYSCALE CRYPTO

SECTORS, and GRAYSCALE INVESTMENTS) are owned and/or registered by Grayscale Investments, LLC.

Grayscale Bitcoin Trust (BTC) (the “Trust”) has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Trust has filed with the SEC for more complete information about the Trust and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Trust or any authorized participant will arrange to send you the prospectus (when available) if you request it by calling (833) 903 - 2211 or by contacting Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101.