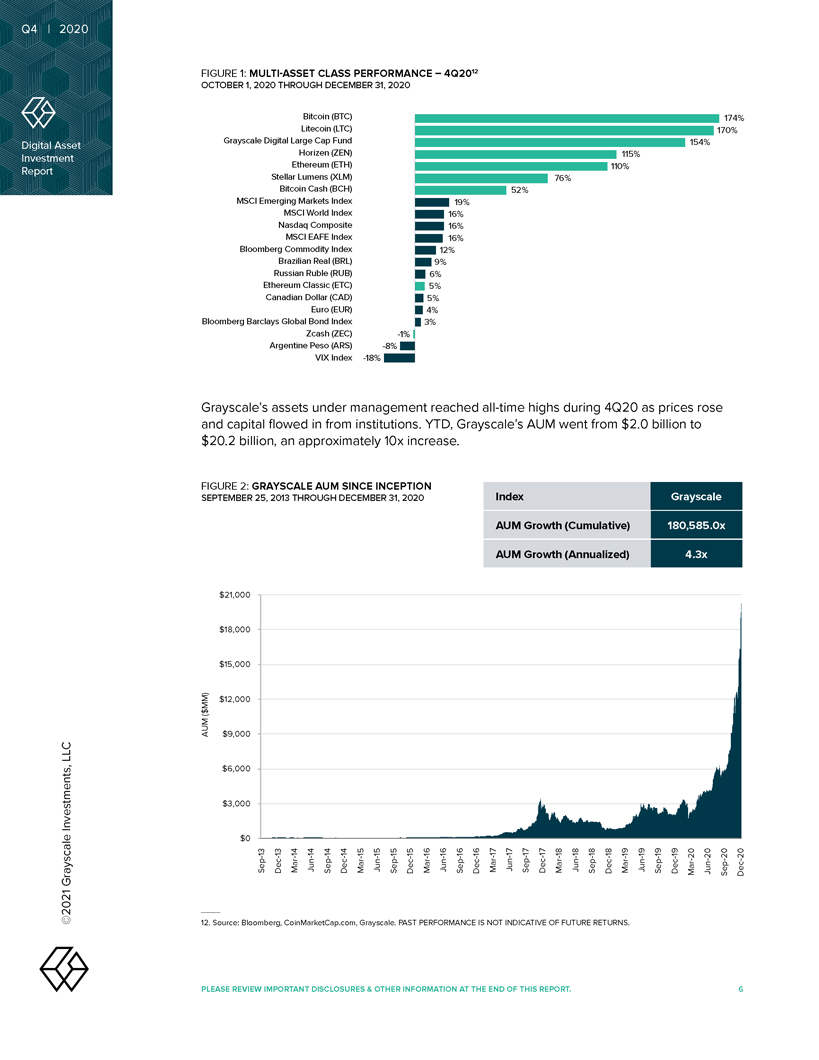

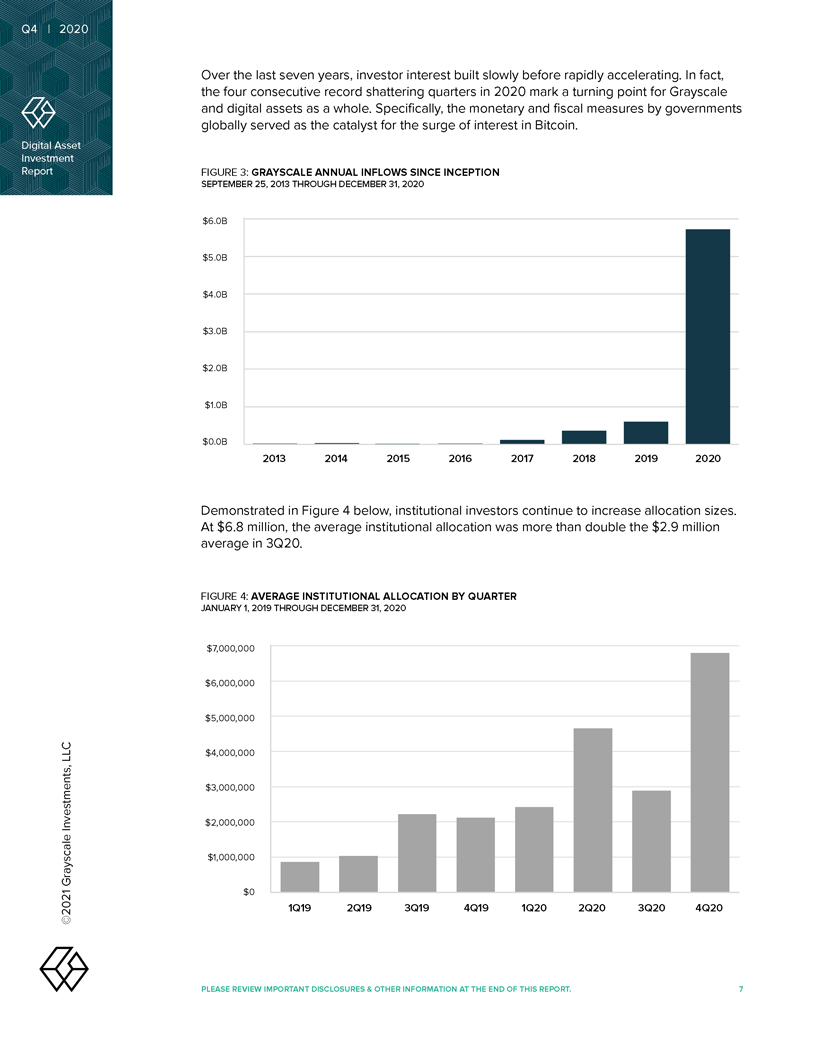

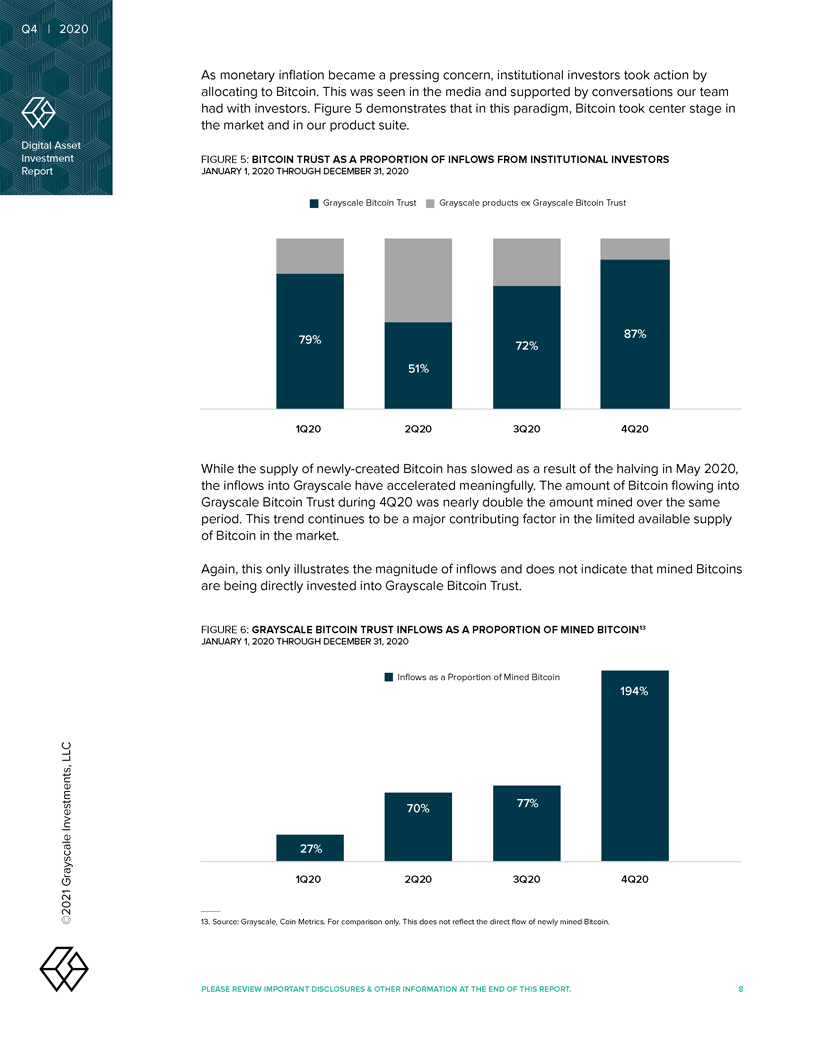

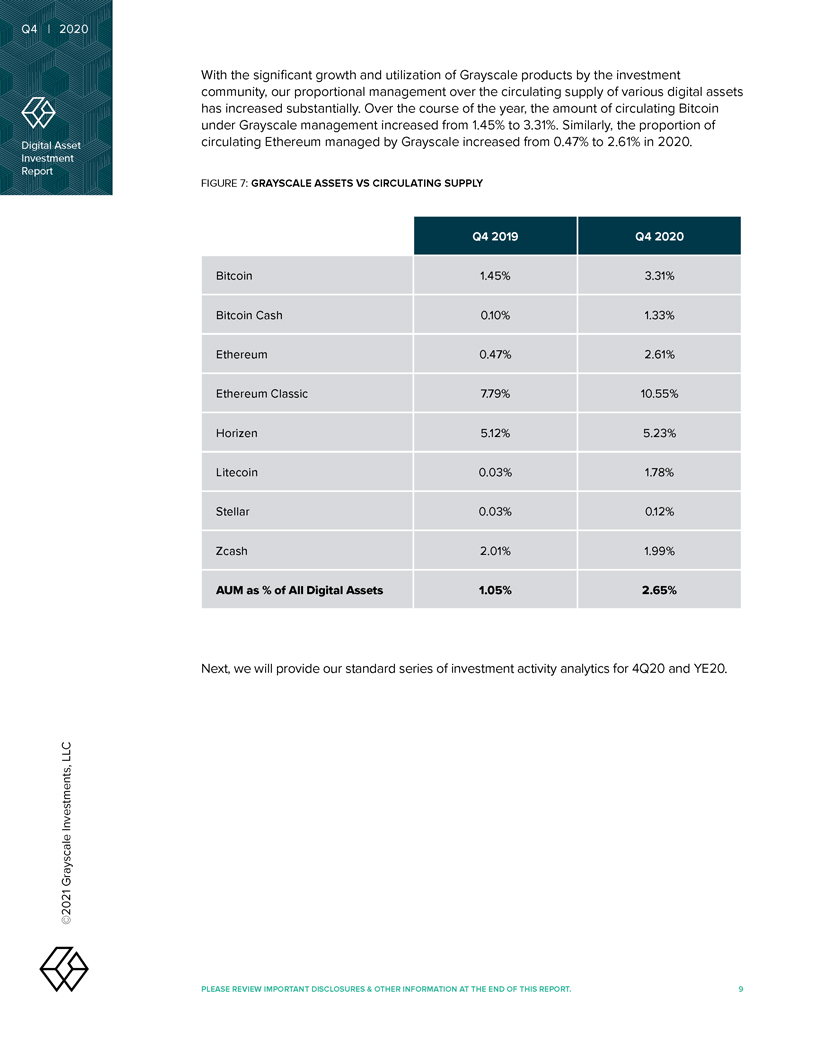

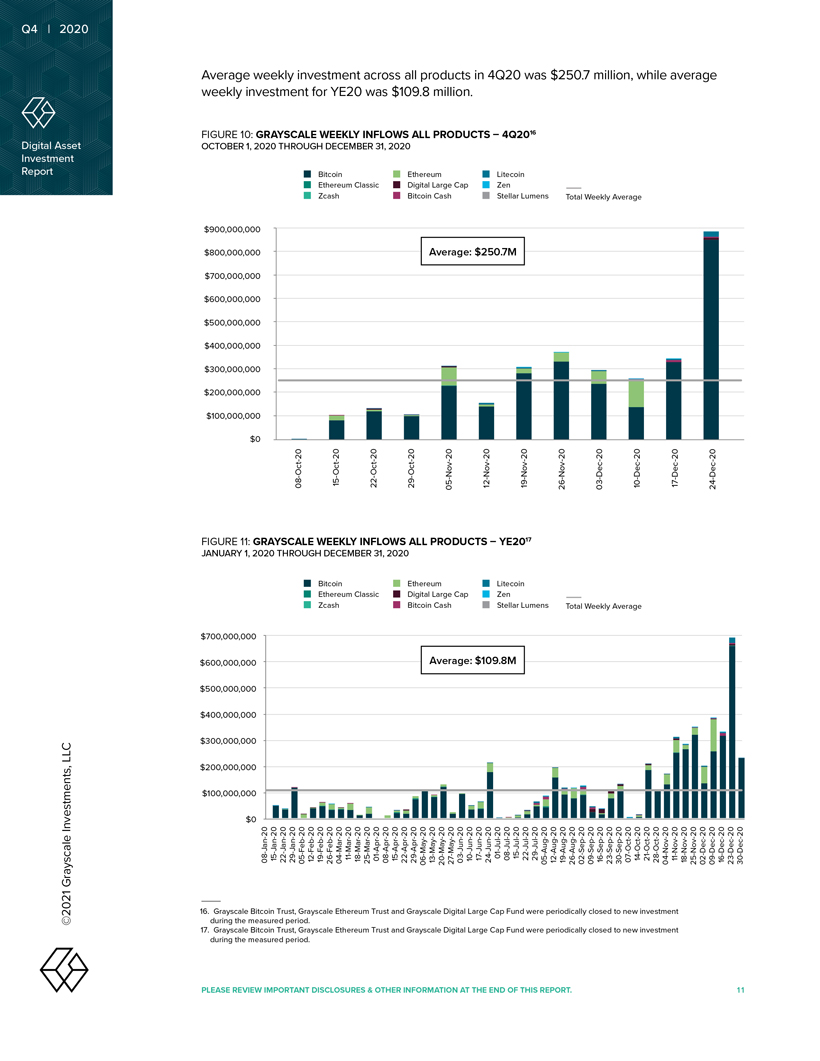

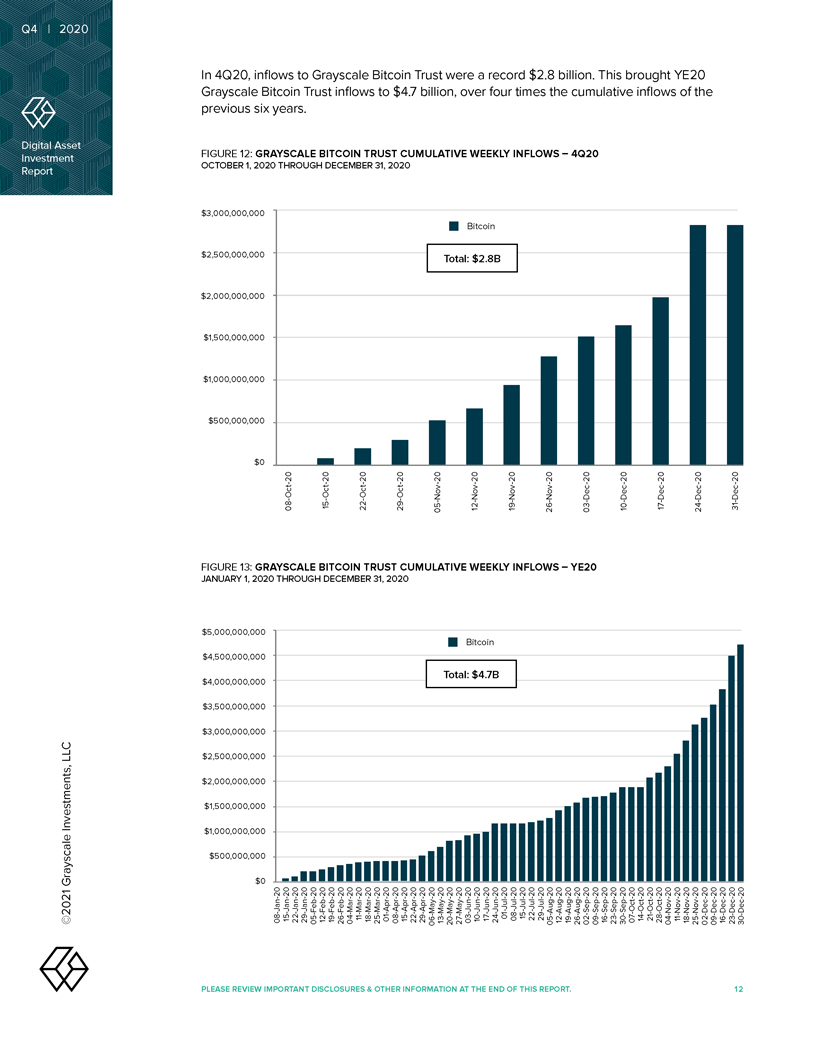

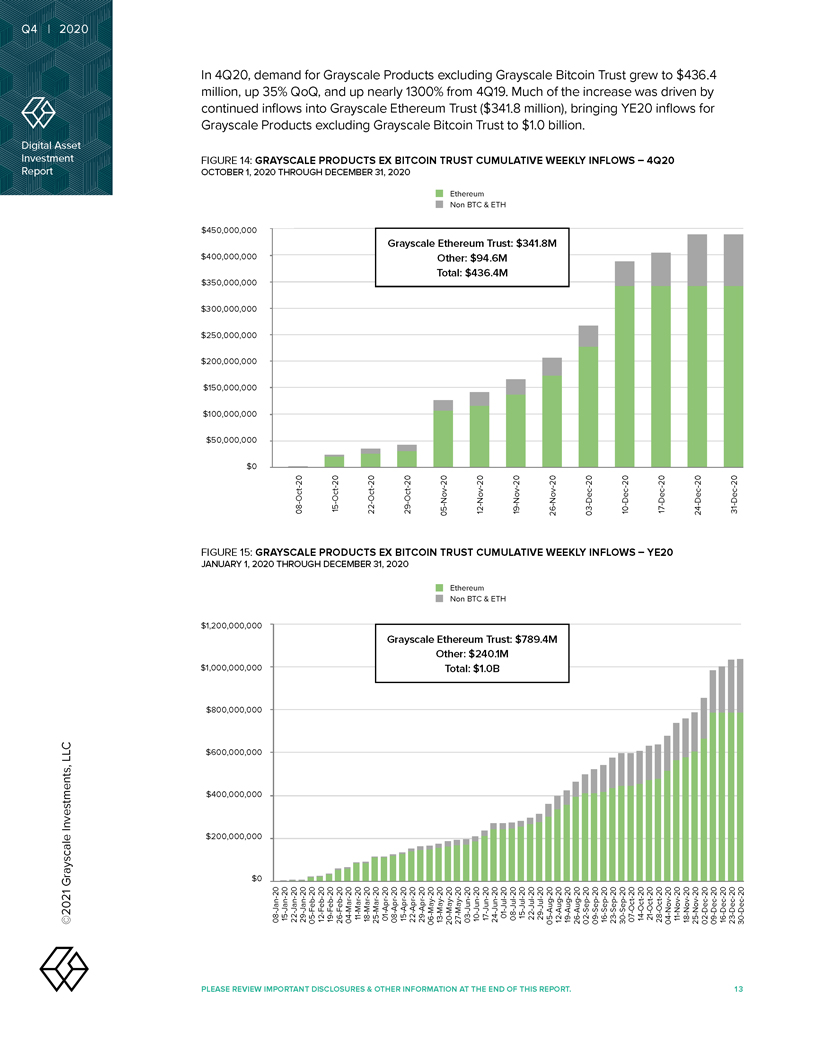

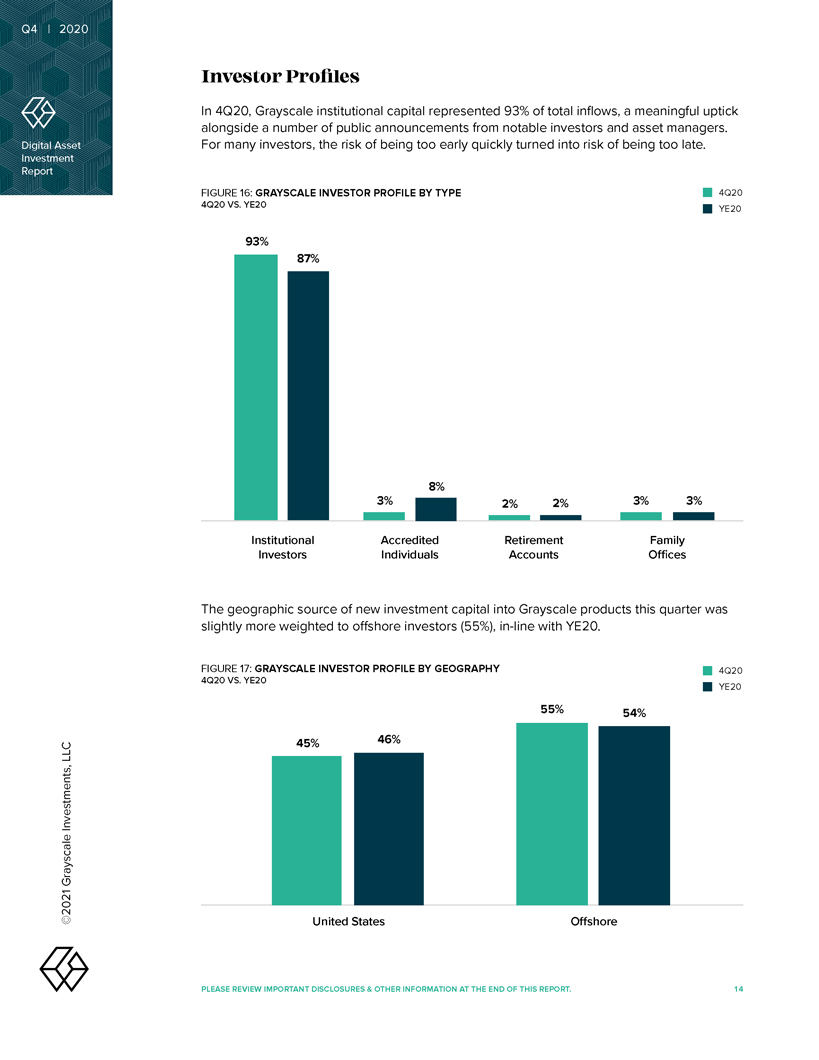

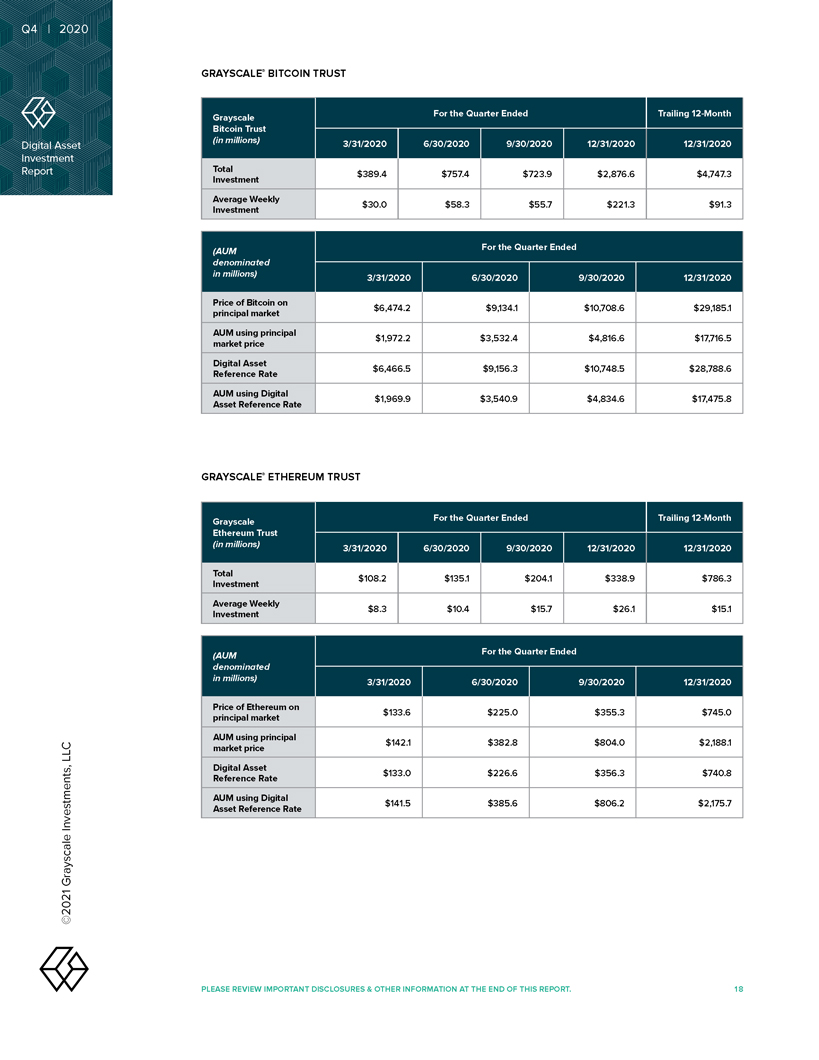

Q4 | 2020 Digital Asset Investment Report LLC Investments, Grayscale ©2021 Digital Asset Investment TOTAL AUM4 $20.2B Report 4Q20 Highlights5 • Total Investment into Grayscale Products6: $3.3 billion • Average Weekly Investment – All Products: $250.7 million • Average Weekly Investment – Grayscale® Bitcoin Trust: $217.1 million • Average Weekly Investment – Grayscale® Ethereum Trust: $26.3 million • Average Weekly Investment – Grayscale® Digital Large Cap Fund: $1.6 million • Average Weekly Investment – Grayscale Products ex Bitcoin Trust7: $33.6 million • Majority of investment (93%) came from institutional investors, dominated by asset managers. Year Ended 2020 (“YE20”) Highlights8 • Total Investment into Grayscale Products: $5.7 billion • Average Weekly Investment – All Products: $109.8 million • Average Weekly Investment – Grayscale® Bitcoin Trust: $90.0 million • Average Weekly Investment – Grayscale® Ethereum Trust: $15.2 million • Average Weekly Investment – Grayscale® Digital Large Cap Fund: $1.4 million • Average Weekly Investment – Grayscale Products ex Bitcoin Trust9: $19.8 million • Majority of investment (86%) came from institutional investors, dominated by asset managers. The Takeaway 2020 was a hallmark year for Grayscale and digital assets more broadly. Thank you to the community and our investors for making it possible. We are proud to share data that reflects the astonishing adoption throughout 2020, and specifically, 4Q20. 4. As of December 31, 2020. 5. For the period from October 1, 2020 through December 31, 2020. 6. On December 23, 2020, the Sponsor announced that it had ceased accepting new subscriptions for the Grayscale XRP Trust (XRP) (“XRP Trust”) private placement following the Securities and Exchange Commission’s December 22, 2020 decision to file a federal court action against certain third parties as-serting that XRP is a “security” under federal securities law. On January 13, 2021, the Sponsor announced that it had commenced dissolution of XRP Trust. As a result of the foregoing, XRP Trust is not reflected in this report. 7. “Grayscale Products ex Bitcoin Trust’’ include Grayscale Bitcoin Cash Trust, Grayscale Ethereum Trust, Grayscale Ethereum Classic Trust, Grayscale Horizen Trust, Grayscale Litecoin Trust, Grayscale Stellar Lumens Trust, Grayscale Zcash Trust, and Grayscale Digital Large Cap Fund. 8. For the period from January 1, 2020 through December 31, 2020. 9. See footnote 7. PLEASE REVIEW IMPORTANT DISCLOSURES & OTHER INFORMATION AT THE END OF THIS REPORT. ASSETS UNDER MANAGEMENT (AUM), INFLOWS, TOTAL INVESTMENT AND AVERAGE WEEKLY INVESTMENT ARE CALCULATED USING THE DIGITAL ASSET REFERENCE RATE FOR EACH PRODUCT, WHICH ARE NOT MEASURES CALCULATED IN ACCORDANCE WITH GAAP. SEE NON-GAAP MEASURES FOR MORE INFORMATION. UNLESS OTHERWISE NOTED, ALL FIGURES INCLUDED HEREIN ARE CALCULATED USING NON-GAAP METHODOLOGIES. 4