Filed pursuant to Rule 253(g)(2)

File No. 024-10496

Groundfloor Finance Inc.

Supplement No. 1

to the Offering Circular

qualified on December 15, 2015

Dated: December 30, 2015

This Supplement No. 1 to the Offering Circular qualified on December 15, 2015 (the “Offering Circular Supplement”) supplements the offering circular of Groundfloor Finance Inc. (the “Company,” “we,” “us,” or “our”), dated December 8, 2015 (as amended or supplemented from time to time, the “Offering Circular”). Unless otherwise defined in this supplement, capitalized terms used in this supplement shall have the same meanings as set forth in the Offering Circular.

The purpose of this supplement is to

| · | Amend the terms of four of the series of LROs covered by the Offering Circular (the “Amended LROs”). |

| · | Update a risk factor to remove certain ameliorative language as requested by NASAA. |

Amended LROs

We are changing certain terms of the Amended LROs. We have not commenced offering of any of the Amended LROs through our Platform or otherwise.

These amendments change the letter grade from C to B and reduce the interest rates from 13.4% to 9.2%. No other terms of the LROs have been altered. These changes were negotiated with the Developer as a result of it supplying us with a current BPO on each property, increasing the score applied for this factor in the Grading Algorithm and reducing the interest rate on the corresponding Loans.

As a result of these changes, the tabular information disclosed under “The LROs Covered by this Offering Circular” (on page 7 and page 96 of the Offering Circular) with respect to the Amended LROs is replaced, in its entirety, as follows:

| Series of LRO/Project Name: 53 Harrison Lane, Dallas, GA 30132 |

| Developer (borrowing entity): Georgia House Buyers Inc. |

| Aggregate Purchase Amount of the LRO:$105,000 | Expected Return Rate of the LRO: 9.2% per annum |

| Final Payment Date:12 months following issuance | Extended Payment Date: maximum of two years following Final Payment Date |

| General Information on Project: | Details of Loan: |

· Purpose for Loan: New Construction · Address/Location of Project: 53 Harrison Lane, Dallas, GA 30132 | · Loan Principal: $105,000 · Interest Rate: 9.2% and Grade: B · Term and Repayment Terms: 12 months – Balloon payment · Loan Position: First Lien |

| Financing Conditions: Receipt of clean title search. Title insurance obtained in connection with closing the Loan. |

| Series of LRO/Project Name: 70 Harrison Lane, Dallas, GA 30132 |

| Developer (borrowing entity): Georgia House Buyers Inc. |

| Aggregate Purchase Amount of the LRO:$105,000 | Expected Return Rate of the LRO: 9.2% per annum |

| Final Payment Date:12 months following issuance | Extended Payment Date: maximum of two years following Final Payment Date |

| General Information on Project: | Details of Loan: |

· Purpose for Loan: New Construction · Address/Location of Project: 70 Harrison Lane, Dallas, GA 30132 | · Loan Principal: $105,000 · Interest Rate: 9.2% and Grade: B · Term and Repayment Terms: 12 months – Balloon payment · Loan Position: First Lien |

| Financing Conditions: Receipt of clean title search. Title insurance obtained in connection with closing the Loan. |

| Series of LRO/Project Name: 175 Timothy Drive, Dallas, GA 30132 |

| Developer (borrowing entity): Georgia House Buyers, Inc. |

| Aggregate Purchase Amount of the LRO:$105,000 | Expected Return Rate of the LRO: 9.2% per annum |

| Final Payment Date:12 months following issuance | Extended Payment Date: maximum of two years following Final Payment Date |

| General Information on Project: | Details of Loan: |

· Purpose for Loan: New Construction · Address/Location of Project: 175 Timothy Drive, Dallas, GA 30132 | · Loan Principal: $105,000 · Interest Rate: 9.2% and Grade: B · Term and Repayment Terms: 12 months – Balloon payment · Loan Position: First Lien |

| Financing Conditions: Receipt of clean title search. Title insurance obtained in connection with closing the Loan. |

| Series of LRO/Project Name: 244 Timothy Drive, Dallas, GA 30132 |

| Developer (borrowing entity): Georgia House Buyers Inc. |

| Aggregate Purchase Amount of the LRO:$105,000 | Expected Return Rate of the LRO: 9.2% per annum |

| Final Payment Date:12 months following issuance | Extended Payment Date: maximum of two years following Final Payment Date |

| General Information on Project: | Details of Loan: |

· Purpose for Loan: New Construction · Address/Location of Project: 244 Timothy Drive, Dallas, GA 30132 | · Loan Principal: $105,000 · Interest Rate: 9.2% and Grade: B · Term and Repayment Terms: 12 months – Balloon payment · Loan Position: First Lien |

| Financing Conditions: Receipt of clean title search. Title insurance obtained in connection with closing the Loan. |

In addition, each Project Summary for the Amended LROs (included on pages PS-3, PS-4, PS-6 and PS-7, of the Offering Circular, respectively), is replaced, in its entirety, with those attached below.

Revised Risk Factor

The following risk factor (included on page 24 of the Offering Circular) is replaced, in its entirety, as follows:

We have entered into material transactions with our promoters.

Since inception, we have entered into certain material transactions involving our officers, directors and principal shareholders (collectively, the “Promoters”). For instance, certain affiliates and family members of our directors have participated in the Series Seed Financing, the Bridge Financing, and the Series A Financing (each as defined below). We have adopted a policy that a majority of our disinterested Independent Directors (as defined below) must approve any loan to or on behalf of, or other material affiliated transaction involving, our Promoters. However, we have lacked sufficient disinterested Independent Directors to approve the prior material affiliated transactions listed above at the time each was consummated and may choose to enter into transactions in the future for which we lack sufficient disinterested Independent Directors. See “Interest of Management and Others in Certain Transactions” and “Transactions with Promoters” below.

* * * *

This Offering Circular Supplement is not complete without, and may not be delivered or used except in connection with, the Offering Circular, including all amendments or supplements thereto. The information included in this Offering Circular Supplement modifies and supersedes, in part, the information contained in the Offering Circular only with respect to the Amended LROs and the Revised Risk Factor as set forth above. Any information that is modified or superseded in the Offering Circular shall not be deemed to constitute a part of the Offering Circular, except as so modified or superseded by this Offering Circular Supplement.

We may further amend or supplement the Offering Circular from time to time by filing additional amendments or supplements as required. You should read the entire Offering Circular and any amendments or supplements carefully before you make an investment decision.

The LROs covered by the Offering Circular may only be purchased by investors residing in California, Georgia, Illinois, Maryland, Massachusetts, Texas, Virginia, Washington, and the District of Columbia. This Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sales of these securities in any state in which such offer, solicitation or sale would be, unlawful, prior to registration or qualification under the laws of any such state. In addition, the LROs are offered only to investors who meet certain financial suitability requirements outlined in the Offering Circular.

NO FEDERAL OR STATE SECURITIES COMMISSION HAS APPROVED, DISAPPROVED, ENDORSED, OR RECOMMENDED THIS OFFERING. YOU SHOULD MAKE AN INDEPENDENT DECISION WHETHER THIS OFFERING MEETS YOUR INVESTMENT OBJECTIVES AND FINANCIAL RISK TOLERANCE LEVEL. NO INDEPENDENT PERSON HAS CONFIRMED THE ACCURACY OR TRUTHFULNESS OF THIS DISCLOSURE, NOR WHETHER IT IS COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS ILLEGAL.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

PROJECT SUMMARIES FOR AMENDED LROs

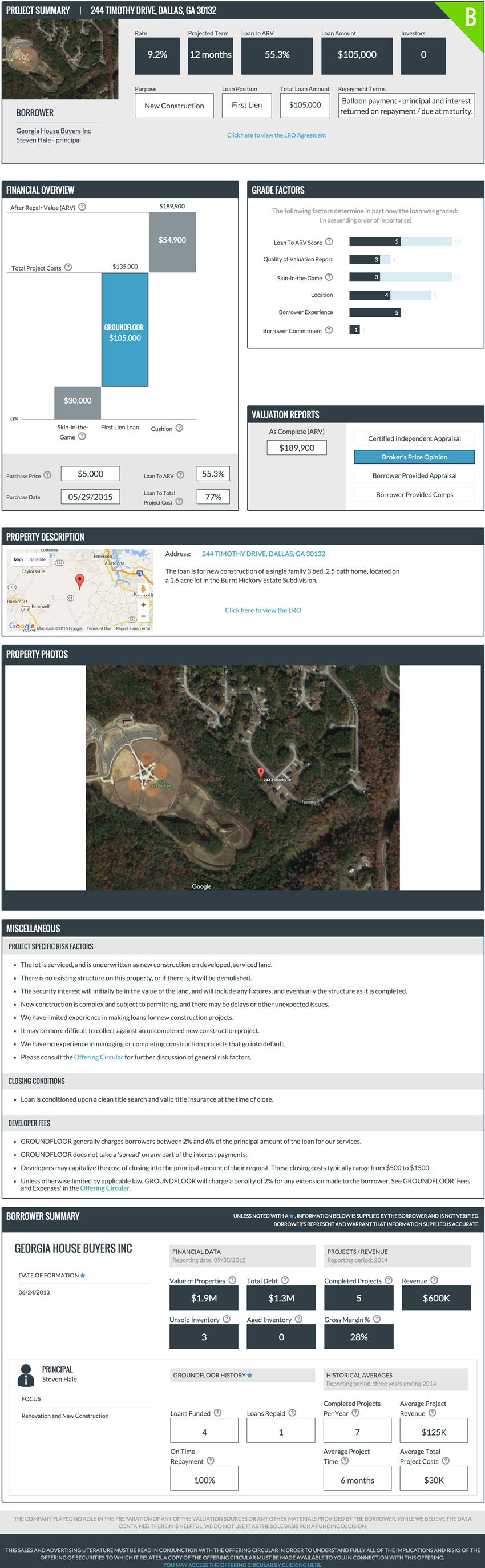

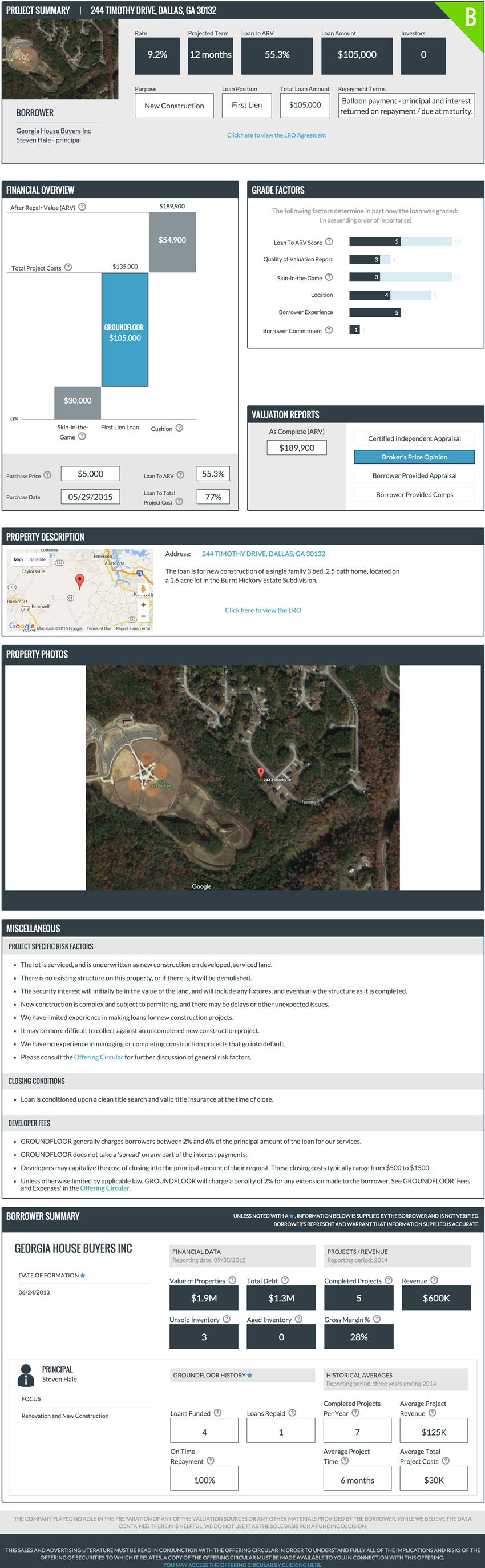

PROJECT SUMMARY │ 53 HARRISON LANE, DALLAS, GA 30132 B Rate Projected Term Loan to ARV Loan Amount Investors 9.2% 12 months 55.3% $105,000 0 Purpose Loan Position Total Loan Amount Repayment Terms New Construction First Lien $105,000 Balloon payment - principal and interest returned on repayment / due at maturity. Click here to view the LRO Agreement BORROWER Georgia House Buyers Inc Steven Hale – principal FINANCIAL OVERVIEW After Repair Value (ARV) $189,900 $54,900 Total Project Costs $135,000 GROUNDFLOOR $105,000 $30,000 0% Skin-in-the Game First Lien Loan Cushion Purchase Price $5,000 Loan To ARV 55.3% Purchase Date 05/29/2015 Loan To Total Project Cost 77% GRADE FACTORS The following factors determine in part how the loan was graded: (in descending order of importance) Loan To ARV Score 5 10 Quality of Valuation Report 3 4 Skin-in-the-Game 5 10 Location 4 8 Borrower Experience 4 5 Borrower Commitment 1 1 VALUATION REPORTS As Complete (ARV) $189,900 Certified Independent Appraisal Broker's Price Opinion Borrower Provided Appraisal Borrower Provided Comps PROPERTY DESCRIPTION Address: 53 HARRISON LANE, DALLAS, GA 30132 The loan is for new construction of a single family 3 bed, 2.5 bath home, located on a 2.08 acre lot in the Burnt Hickory Estate Subdivision. Click here to view the LRO PROPERTY PHOTOS MISCELLANEOUS PROJECT SPECIFIC RISK FACTORS The lot is serviced, and is underwritten as new construction on developed, serviced land. There is no existing structure on this property, or if there is, it will be demolished. The security interest will initially be in the value of the land, and will include any fixtures, and eventually the structure as it is completed. New construction is complex and subject to permitting, and there may be delays or other unexpected issues. We have limited experience in making loans for new construction projects. It may be more difficult to collect against an uncompleted new construction project. We have no experience in managing or completing construction projects that go into default. Please consult the Offering Circular for further discussion of general risk factors. CLOSING CONDITIONS Loan is conditioned upon a clean title search and valid title insurance at the time of close. DEVELOPER FEES GROUNDFLOOR generally charges borrowers between 2% and 6% of the principal amount of the loan for our services. GROUNDFLOOR does not take a 'spread' on any part of the interest payments. Developers may capitalize the cost of closing into the principal amount of their request. These closing costs typically range from $500 to $1500. Unless otherwise limited by applicable law, GROUNDFLOOR will charge a penalty of 2% for any extension made to the borrower. See GROUNDFLOOR 'Fees and Expenses' in the Offering Circular. BORROWER SUMMARY UNLESS NOTED WITH A *, INFORMATION BELOW IS SUPPLIED BY THE BORROWER AND IS NOT VERIFIED. BORROWER’S REPRESENT AND WARRANT THAT INFORMATION SUPPLIED IS ACCURATE. GEORGIA HOUSE BUYERS INC FINANCIAL DATA PROJECTS/REVENUE Reporting date: 09/30/2015 Reporting period: 2014 DATE OF FORMATION * Value of Properties Total Debt Completed Projects Revenue 06/24/2013 $1.9M $1.3M 5 $600K Unsold Inventory Aged Inventory Gross Margin % 3 0 28% PRINCIPAL GROUNDFLOOR HISTORY * HISTORICAL AVERAGES Steven Hale Reporting period: three years ending 2014 FOCUS Completed Projects Average Project Renovation and New Construction Loans Funded Loans Repaid Per Year Revenue 4 1 7 $125K On Time Average Project Average Total Repayment Time Project Costs 100% 6 months $30K THE COMPANY PLAYED NO ROLE IN THE PREPARATION OF ANY OF THE VALUATION SOURCES OR ANY OTHER MATERIALS PROVIDED BY THE BORROWER. WHILE WE BELIEVE THE DATA CONTAINED THEREIN IS HELPFUL, WE DO NOT USE IT AS THE SOLE BASIS FOR A FUNDING DECISION. THIS SALES AND ADVERTISING LITERATURE MUST BE READ IN CONJUNCTION WITH THE OFFERING CIRCULAR IN ORDER TO UNDERSTAND FULLY ALL OF THE IMPLICATIONS AND RISKS OF THE OFFERING OF SECURITIES TO WHICH IT RELATES. A COPY OF THE OFFERING CIRCULAR MUST BE MADE AVAILABLE TO YOU IN CONNECTION WITH THIS OFFERING. YOU MAY ACCESS THE OFFERING CIRCULAR BY CLICKING HERE.

PROJECT SUMMARY │ 70 HARRISON LANE, DALLAS, GA 30132 B Rate Projected Term Loan to ARV Loan Amount Investors 9.2% 12 months 55.3% $105,000 0 Purpose Loan Position Total Loan Amount Repayment Terms New Construction First lien $105,000 Balloon payment - principal and interest returned on repayment / due at maturity. Click here to view the LRO Agreement BORROWER Georgia House Buyers Inc Steven Hale – principal FINANCIAL OVERVIEW After Repair Value (ARV) $189,900 $54,900 Total Project Costs $135,000 GROUNDFLOOR $105,000 $30,000 0% Skin-in-the-Game First Lien Loan Cushion Purchase Price $5,000 Loan To ARV 55.3% Purchase Date 05/29/2015 Loan To Total Project Cost 77% GRADE FACTORS The following factors determine in part how the loan was graded: (in descending order of importance) Loan To ARV Score 5 10 Quality of Valuation Report 3 4 Skin-in-the-Game 5 10 Location 4 8 Borrower Experience 4 5 Borrower Commitment 1 1 VALUATION REPORTS As Complete (ARV) $189,900 Certified Independent Appraisal Broker's Price Opinion Borrower Provided Appraisal Borrower Provided Comps PROPERTY DESCRIPTION Address: 70 HARRISON LANE, DALLAS, GA 30132 The loan is for new construction of a single family 3 bed, 2.5 bath home, located on a 1.576 acre lot in the Burnt Hickory Estate Subdivision. Click here to view the LRO PROPERTY PHOTOS MISCELLANEOUS PROJECT SPECIFIC RISK FACTORS The lot is serviced, and is underwritten as new construction on developed, serviced land. There is no existing structure on this property, or if there is, it will be demolished. The security interest will initially be in the value of the land, and will include any fixtures, and eventually the structure as it is completed. New construction is complex and subject to permitting, and there may be delays or other unexpected issues. We have limited experience in making loans for new construction projects. It may be more difficult to collect against an uncompleted new construction project. We have no experience in managing or completing construction projects that go into default. Please consult the Offering Circular for further discussion of general risk factors. CLOSING CONDITIONS Loan is conditioned upon a clean title search and valid title insurance at the time of close. DEVELOPER FEES GROUNDFLOOR generally charges borrowers between 2% and 6% of the principal amount of the loan for our services. GROUNDFLOOR does not take a 'spread' on any part of the interest payments. Developers may capitalize the cost of closing into the principal amount of their request. These closing costs typically range from $500 to $1500. Unless otherwise limited by applicable law, GROUNDFLOOR will charge a penalty of 2% for any extension made to the borrower. See GROUNDFLOOR 'Fees and Expenses' in the Offering Circular. BORROWER SUMMARY UNLESS NOTED WITH A *, INFORMATION BELOW IS SUPPLIED BY THE BORROWER AND IS NOT VERIFIED. BORROWER’S REPRESENT AND WARRANT THAT INFORMATION SUPPLIED IS ACCURATE. GEORGIA HOUSE BUYERS INC DATE OF FORMATION * 06/24/2013 FINANCIAL DATA PROJECTS/REVENUE Reporting date: 09/30/2015 Reporting period: 2014 Value of Properties Total Debt Completed Projects Revenue $1.9M $1.3M 5 $600K Unsold Inventory Aged Inventory Gross Margin% 3 0 28% PRINCIPAL GROUNDFLOOR HISTORY* HISTORICAL AVERAGES Steven Hale Reporting period: three years ending 2014 FOCUS Completed Projects Average Project Renovation and New Construction Loans Funded Loans Repaid Per Year Revenue 4 1 7 $125K On Time Average Project Average Total Repayment Time Project Costs 100% 6 months $30K THE COMPANY PLAYED NO ROLE IN THE PREPARATION OF ANY OF THE VALUATION SOURCES OR ANY OTHER MATERIALS PROVIDED BY THE BORROWER. WHILE WE BELIEVE THE DATA CONTAINED THEREIN IS HELPFUL, WE DO NOT USE IT AS THE SOLE BASIS FOR A FUNDING DECISION. THIS SALES AND ADVERTISING LITERATURE MUST BE READ IN CONJUNCTION WITH THE OFFERING CIRCULAR IN ORDER TO UNDERSTAND FULLY ALL OF THE IMPLICATIONS AND RISKS OF THE OFFERING OF SECURITIES TO WHICH IT RELATES. A COPY OF THE OFFERING CIRCULAR MUST BE MADE AVAILABLE TO YOU IN CONNECTION WITH THIS OFFERING. YOU MAY ACCESS THE OFFERING CIRCULAR BY CLICKING HERE.

PROJECT SUMMARY I 175 TIMOTHY DRIVE, DALLAS, GA 30132 B Rate Projected Term Loan to ARV Loan Amount Investors 9.2% 12 months 55.3% $105,000 0 Purpose Loan Position Total Loan Amount Repayment Terms New Construction First Lien $105,000 Balloon payment - principal and interest BORROWER returned on repayment / due at maturity. Georgia House Buyers Inc Steven Hale - principal Click here to view the LRO Agreement FINANCIAL OVERVIEW After Repair Value (ARV) $189,900 $54,900 Total Project Costs $135,000 GROUNDFLOOR $105,000 $30,000 0% Skin-in- First Lien Loan Cushion the-Game Purchase Price $5,000 Loan To ARV 55.3% Loan To Total Purchase Date 05/29/2015 77% Project Cost GRADE FACTORS The following factors determine in part how the loan was graded: (in descending order of importance) Loan To ARV Score 5 10 Quality of Valuation Report 3 4 Skin-in-the-Game 5 10 Location 4 8 Borrower Experience 4 5 Borrower Commitment 1 1 VALUATION REPORTS As Complete (ARV) $189,900 Certified Independent Appraisal Broker's Price Opinion Borrower Provided Appraisal Borrower Provided Comps PROPERTY DESCRIPTION Address: 175 TIMOTHY DRIVE, DALLAS, GA 30132 The loan is for new construction of a single family 3 bed, 2.5 bath home, located on a 1.43 acre lot in the Burnt Hickory Estate Subdivision. Click here to view the LRO PROPERTY PHOTOS MISCELLANEOUS PROJECT SPECIFIC RISK FACTORS The lot is serviced, and is underwritten as new construction on developed, serviced land. There is no existing structure on this property, or if there is, it will be demolished. The security interest will initially be in the value of the land, and will include any fixtures, and eventually the structure as it is completed. New construction is complex and subject to permitting, and there may be delays or other unexpected issues. We have limited experience in making loans for new construction projects. It may be more difficult to collect against an uncompleted new construction project. We have no experience in managing or completing construction projects that go into default. Please consult the Offering Circular for further discussion of general risk factors. CLOSING CONDITIONS Loan is conditioned upon a clean title search and valid title insurance at the time of close. DEVELOPER FEES GROUNDFLOOR generally charges borrowers between 2% and 6% of the principal amount of the loan for our services. GROUNDFLOOR does not take a 'spread' on any part of the interest payments. Developers may capitalize the cost of closing into the principal amount of their request. These closing costs typically range from $500 to $1500. Unless otherwise limited by applicable law, GROUNDFLOOR will charge a penalty of 2% for any extension made to the borrower. See GROUNDFLOOR 'Fees and Expenses' in the Offering Circular. BORROWER SUMMARY UNLESS NOTED WITH A *, INFORMATION BELOW IS SUPPLIED BY THE BORROWER AND IS NOT VERIFIED. BORROWER'S REPRESENT AND WARRANT THAT INFORMATION SUPPLIED IS ACCURATE. GEORGIA HOUSE BUYERS INC FINANCIAL DATA PROJECTS / REVENUE Reporting date: 09/30/2015 Reporting period: 2014 DATE OF FORMATION * Value of Properties Total Debt Completed Projects Revenue 06/24/2013 $1.9M $1.3M 5 $600K Unsold Inventory Aged Inventory Gross Margin% 3 0 28% PRINCIPAL GROUNDFLOOR HISTORY* HISTORICAL AVERAGES Steven Hale Reporting period: three years ending 2014 FOCUS Completed Projects Average Project Renovation and New Construction Loans Funded Loans Repaid Per Year Revenue 4 1 7 $125K On Time Average Project Average Total Repayment Time Project Costs 100% 6 months $30K THE COMPANY PLAYED NO ROLE IN THE PREPARATION OF ANY OF THE VALUATION SOURCES OR ANY OTHER MATERIALS PROVIDED BY THE BORROWER. WHILE WE BELIEVE THE DATA CONTAINED THEREIN IS HELPFUL, WE DO NOT USE IT AS THE SOLE BASIS FORA FUNDING DECISION. THIS SALES AND ADVERTISING LITERATURE MUST BE READ IN CONJUNCTION WITH THE OFFERING CIRCULAR IN ORDER TO UNDERSTAND FULLY ALL OF THE IMPLICATIONS AND RISKS OF THE OFFERING OF SECURITIES TO WHICH IT RELATES. A COPY OF THE OFFERING CIRCULAR MUST BE MADE AVAILABLE TO YOU IN CONNECTION WITH THIS OFFERING. YOU MAY ACCESS THE OFFERING CIRCULAR BY CLICKING HERE.

PROJECT SUMMARY I 244 TIMOTHY DRIVE, DALLAS, GA 30132 B Rate Projected Term Loan Amount Investors 9.2% 12 months Loan to ARV 55.3% $105,000 0 Purpose Loan Position Total Loan Amount Repayment Terms Balloon payment - principal and interest New Construction First Lien $105,000 BORROWER returned on repayment / due at maturity. Georgia House Buyers Inc Click here to view the LRO Agreement Steven Hale - principal FINANCIAL OVERVIEW After Repair Value (ARV) $189,900 $54,900 Total Project Costs $135,000 GROUNDFLOOR $105,000 $30,000 0% Skin-in- First Lien Loan Cushion the-Game GRADE FACTORS The following factors determine in part how the loan was graded: (in descending order of importance) Loan To ARV Score 5 10 Quality of Valuation Report 3 4 Skin-in-the-Game 3 10 Location 4 Borrower 8 Experience 5 5 Borrower Commitment 1 1 VALUATION REPORTS As Complete (ARV) Certified Independent Appraisal $189,900 Broker's Price Opinion Borrower Provided Appraisal Borrower Provided Comps Purchase Price $5,000 Loan To ARV 55.3% Loan To Total Purchase Date 05/29/2015 77% Project Cost PROPERTY DESCRIPTION Address: 244 TIMOTHY DRIVE, DALLAS, GA 30132 The loan is for new construction of a single family 3 bed, 2.5 bath home, located on a 1.6 acre lot in the Burnt Hickory Estate Subdivision. Click here to view the LRO PROPETY PHOTOS MISCELLANEOUS PROJECT SPECIFIC RISK FACTORS The lot is serviced, and is underwritten as new construction on developed, serviced land. There is no existing structure on this property, or if there is, it will be demolished. The security interest will initially be in the value of the land, and will include any fixtures, and eventually the structure as it is completed. New construction is complex and subject to permitting, and there may be delays or other unexpected issues. We have limited experience in making loans for new construction projects. It may be more difficult to collect against an uncompleted new construction project. We have no experience in managing or completing construction projects that go into default. Please consult the Offering Circular for further discussion of general risk factors. CLOSING CONDITIONS Loan is conditioned upon a clean title search and valid title insurance at the time of close. DEVELOPER FEES GROUNDFLOOR generally charges borrowers between 2% and 6% of the principal amount of the loan for our services. GROUNDFLOOR does not take a 'spread' on any part of the interest payments. Developers may capitalize the cost of closing into the principal amount of their request. These closing costs typically range from $500 to $1500. Unless otherwise limited by applicable law, GROUNDFLOOR will charge a penalty of 2% for any extension made to the borrower. See GROUNDFLOOR 'Fees and Expenses' in the Offering Circular. BORROWER SUMMARY UNLESS NOTED WITH A *, INFORMATION BELOW IS SUPPLIED BY THE BORROWER AND IS NOT VERIFIED.BORROWER'S REPRESENT AND WARRANT THAT INFORMATION SUPPLIED IS ACCURATE. GEORGIA HOUSE BUYERS INC FINANCIAL DATA PROJECTS/REVENUE Reporting date: 09/30/2015 Reporting period: 2014 DATE OF FORMATION * Value of Properties Total Debt Completed Projects Revenue 06/24/2013 $1.9M $1.3M 5 $600K Unsold Inventory Aged Inventory Gross Margin % 3 0 28% GROUNDFLOOR HISTORY * HISTORICAL AVERAGES Steven Hale PRINCIPAL Reporting period: three years ending 2014 FOCUS Completed Projects Average Project Renovation and New Construction Loans Funded Loans Repaid Per Year Revenue 4 1 7 $125K On Time Average Project Average Total Repayment Time Project Costs 100% 6 months $30K THE COMPANY PLAYED NO ROLE IN THE PREPARATION OF ANY OF THE VALUATION SOURCES OR ANY OTHER MATERIALS PROVIDED BY THE BORROWER. WHILE WE BELIEVE THE DATA CONTAINED THEREIN IS HELPFUL, WE DO NOT USE IT AS THE SOLE BASIS FOR A FUNDING DECISION. THIS SALES AND ADVERTISING LITERATURE MUST BE READ IN CONJUNCTION WITH THE OFFERING CIRCULAR IN ORDER TO UNDERSTAND FULLYALL OF THE IMPLICATIONS AND RISKS OF THE OFFERING OF SECURITIES TO WHICH IT RELATES. A COPY OF THE OFFERING CIRCULAR MUST BE MADE AVAILABLE TO YOU IN CONNECTION WITH THIS OFFERING. YOU MAY ACCESS THE OFFERING CIRCULAR BY CLICKING HERE.