Corporate�Presentation November 2021 Exhibit 99.1

Any historical or projected financial information contained in this presentation for IRISYS and Recro are not intended to be indicative of future financial results of the combined business. The events and circumstances reflected in the Company's forward-looking statements, including potential results related to IRISYS, may not be achieved or occur, and actual results could differ materially from those projected in the forward-looking statements. Undue reliance should not be placed on the forward-looking statements. Moreover, the Company operates in a dynamic industry and economy. New risk factors could emerge from time to time, and it is not possible for the Company's management to predict all uncertainties that the Company may face. Non-GAAP To supplement our financial results determined by U.S. generally accepted accounting principles (“GAAP”), we have included certain non-GAAP information for our business, including EBITDA, as adjusted. We believe this non-GAAP financial measure is helpful in understanding our business as it is useful to investors in allowing for greater transparency of supplemental information used by management. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, reported GAAP results. Please see the “Reconciliation of GAAP to Non-GAAP Financial Measures” at the end of this presentation for a reconciliation of non-GAAP adjusted EBITDA to its most directly comparable GAAP measure. To supplement IRISYS financial results determined by GAAP, we have included certain non-GAAP information for IRISYS’s business, including EBITDA. We believe this non-GAAP financial measure is helpful in understanding IRISYS’ past and potential future business performance as it is useful to investors in allowing for greater transparency of supplemental information used by management. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, reported GAAP results. Please see the "Reconciliation of GAAP to Non-GAAP Financial Measures" at the end of this presentation for a reconciliation of non-GAAP EBITDA, to its most directly comparable GAAP measure. This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements, among other things, relate to the Company’s growth drivers and expected levels of our organic growth; synergies and value creation potential created by our acquisition of IRISYS, LLC (“IRISYS”) (the “Acquisition”); the impact of our investment in development and commercial initiatives; financial guidance, including timing of revenues and EBITDA from the Acquisition; our ability to manage costs and to achieve our financial goals; our ability to operate under increased leverage and associated lending covenants; our ability to pay our debt under our credit agreement and to maintain relationships with CDMO commercial partners and develop additional commercial and development partnerships. The words "anticipate", "believe", "could", "estimate", “upcoming”, "expect", "intend", "may", "plan", "predict", "project", "will" and similar terms and phrases may be used to identify forward-looking statements in this presentation. The forward-looking statements in this presentation are only predictions. Our operations involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially affect our results of operations, and the forward-looking statements contained herein could ultimately prove to be incorrect. Factors that could cause our actual outcomes to differ materially from those expressed in or underlying these forward-looking statements include the ability to successfully integrate IRISYS with the Company (including achievement of synergies and cost reductions), our ability to fund our combined operations, our expectations and beliefs regarding future growth of the combined business and the markets in which we operate, the final accounting treatment of the Acquisition, the ongoing economic and social consequences of the COVID-19 pandemic, including any adverse impact on customer ordering patterns or inventory rebalancing or disruption in raw materials or supply chain; demand for our services, which depends in part on customers’ research and development and the clinical plans and market success of their products; customers' changing inventory requirements and manufacturing plans; customers’ and prospective customers’ decisions to move forward with our manufacturing services; the average profitability, or mix, of the products the Company or IRISYS manufactures; our ability to enhance existing or introduce new services in a timely manner; fluctuations in the costs, availability, and suitability of the components of the products the Company manufactures, including active pharmaceutical ingredients, excipients, purchased components and raw materials, or the Company's or IRISYS's customers facing increasing or new competition. These forward-looking statements should be considered together with the risks and uncertainties that may affect our business or the business of IRISYS and future results presented herein along with those risks and uncertainties discussed in our filings with the Securities and Exchange Commission (the “SEC”) at www.sec.gov. These forward-looking statements are based on information currently available to us, and we assume no obligation to update any forward-looking statements except as required by applicable law. Forward Looking Statements

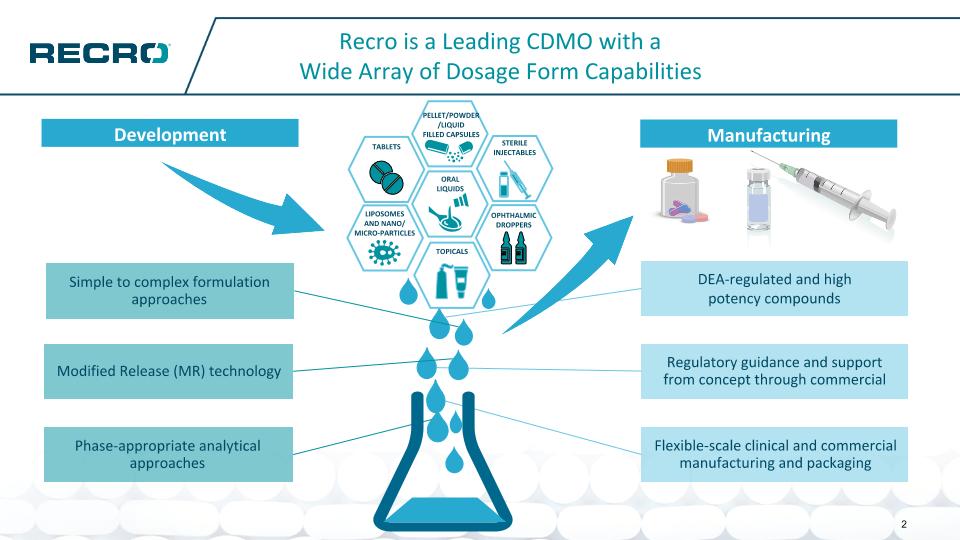

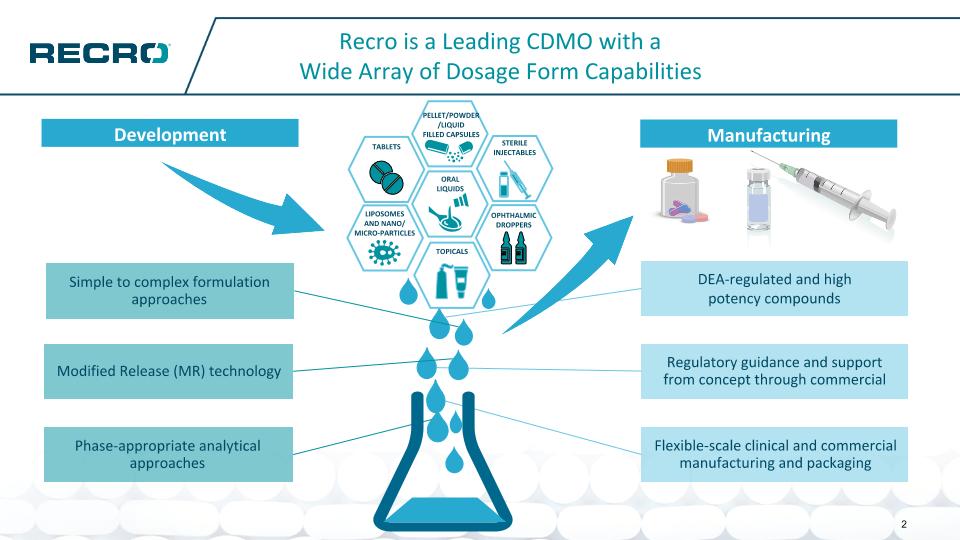

Recro is a Leading CDMO with a �Wide Array of Dosage Form Capabilities 2 DEA-regulated and high �potency compounds Regulatory guidance and support �from concept through commercial Flexible-scale clinical and commercial manufacturing and packaging Simple to complex formulation approaches Modified Release (MR) technology Phase-appropriate analytical approaches LIPOSOMES �AND NANO/�MICRO-PARTICLES PELLET/POWDER/LIQUID �FILLED CAPSULES ORAL �LIQUIDS TABLETS OPHTHALMIC DROPPERS STERILE INJECTABLES TOPICALS Manufacturing Development

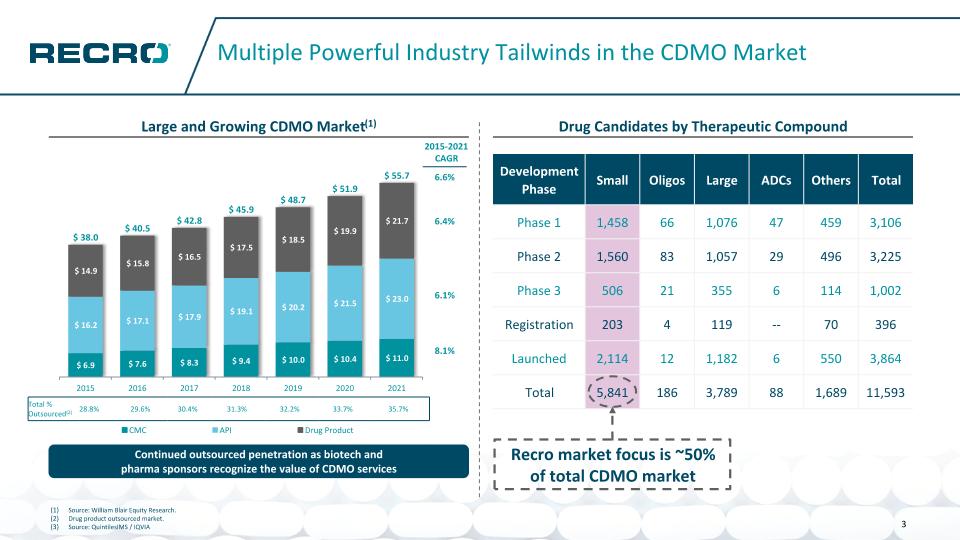

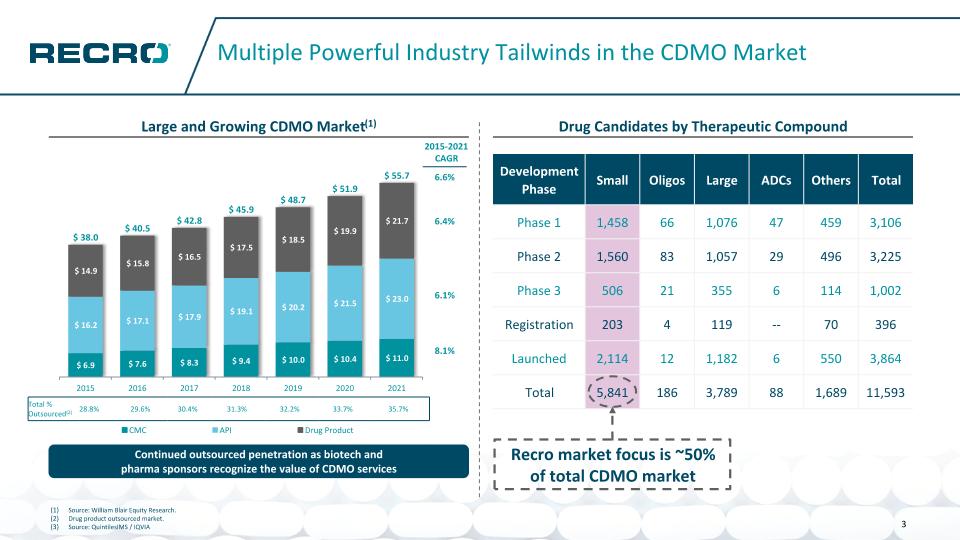

14 3 Multiple Powerful Industry Tailwinds in the CDMO Market Drug Candidates by Therapeutic Compound Total % Outsourced(2) 28.8% 29.6% 30.4% 31.3% 32.2% 33.7% 35.7% Continued outsourced penetration as biotech and �pharma sponsors recognize the value of CDMO services 6.6% 6.4% 6.1% 8.1% 2015-2021 CAGR Large and Growing CDMO Market(1) Source: William Blair Equity Research. Drug product outsourced market. Source: QuintilesIMS / IQVIA Recro market focus is ~50% of total CDMO market Development Phase Small Oligos Large ADCs Others Total Phase 1 1,458 66 1,076 47 459 3,106 Phase 2 1,560 83 1,057 29 496 3,225 Phase 3 506 21 355 6 114 1,002 Registration 203 4 119 -- 70 396 Launched 2,114 12 1,182 6 550 3,864 Total 5,841 186 3,789 88 1,689 11,593

Investment Highlights Re-Organized Company Poised for Growth and Diversification Success in Robust Market State-of-the-Art, Newly Upgraded Facilities, Available Capacity 30+ Years of Successful Commercial Manufacturing for Multiple Global Customers Solid Base of Development and Commercial Customers Highly Experienced Management Team and Talented Workforce to Drive Future Growth Strong Regulatory Track Record Spanning Multiple Countries and Agencies NDA Ownership and Profit-Sharing Structure for Certain Drug Assets End-to-End Capabilities with Unique Expertise Solving a Wide Array of Complex Dosage Formulation & Development Challenges 4

Executing on Near-Term Reorganization Plan to Strengthen Business In 2020 and 2021, key CDMO executives appointed to leadership and board in addition to strengthening the business development team with six new hires Deploying best practices across entire organization Strengthening Leadership and Organization Strengthening �Balance Sheet Recently restructured, extended maturity and reduced debt to improve balance sheet $25M reduction in debt principal balance and a 1.5% interest rate reduction Stronger balance sheet best positions company for organic and inorganic growth Expanding and Diversifying Customer Base Continuing to add new manufacturing customers as well as expanding existing customer projects Commercial manufacturing business continues to grow Acquired IriSys, creating bi-coastal, full service CDMO with expansion and complementary capabilities In 2020, launched clinical trials materials business to support early-stage customers Upgrading and expanding capabilities to best support clinical stage projects, expanding commercial programs, and high value tech transfers Constructed two new manufacturing suites, as well as adding capabilities for smaller scale production, high potency, and clinical trial support services Enhancing Capabilities �and Competencies 5

A Leading CDMO with Fully-Integrated Solutions for Wide Array of Drug Products Capabilities Overview Formulation Development Analytical Methods �Development Pharmaceutical Manufacturing Regulatory Support Formulation Development Optimization CTM Manufacture Scale-Up Regulatory Filing PPQ Product�Launch Commercial Supply Development Expertise Quality Assurance Manufacturing Expertise Ability to Take Advanced Dosage Forms from Early Development to Commercialization Pharma Packaging �and Logistics Contract packaging and logistics to maintain safety and integrity of products Single line operation with annual maximum capacity of 2.5M bottles per shift Able to package round or square bottles 40cc – 500cc and up to 500 units/bottle Primary and secondary packaging, DSCSA-compliant serialization services, and timely shipping Formulation services support the development of a range of pharma products for a wide array of advanced dosage forms (at a development scale) Expertise in complex formulations including extended release, high potency, and other complex formulation, often resulting in IP generation Reformulation capabilities Physical characterization and excipient compatibility Conduct feasibility studies, identify critical variables and inefficiencies, and optimize process Diverse analytical services designed to assess quality Best-in-class facilities house full range of analytical equipment and testing Analytical testing: Raw material, WIP, and finished product testing ICH stability Method development / validation Microbiology lab Analytical equipment: Chromatography Spectroscopy Stability chambers Capable of serving clients from small, early-phase batches to clinical and commercial production Structured tech transfer services Key technologies: Milling Blending Compression Spray granulation Rotary granulation Particle / bead coating Encapsulation Liquids, ophthalmics Sterile fill & finish Lyophilization Extensive experience across all steps of drug approval (e.g., IND, DMF, NDA) Strong regulatory support services, including handling communications with the FDA on behalf of sponsor companies and consultation and guidance for client FDA meetings and responses Utilizes industry best practices including standardized reports for eCTD submission and pharmacovigilance reporting support “Start with Recro, Stay with Recro” 6

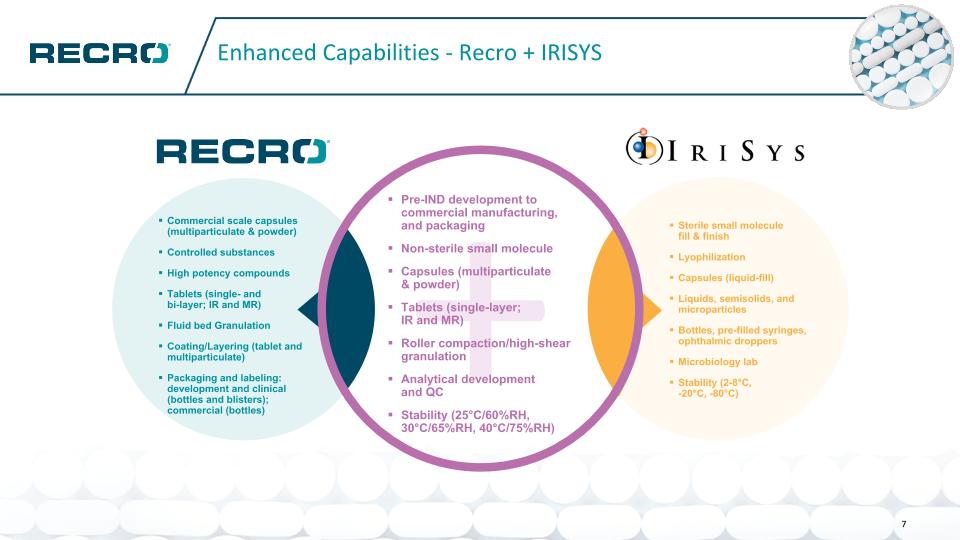

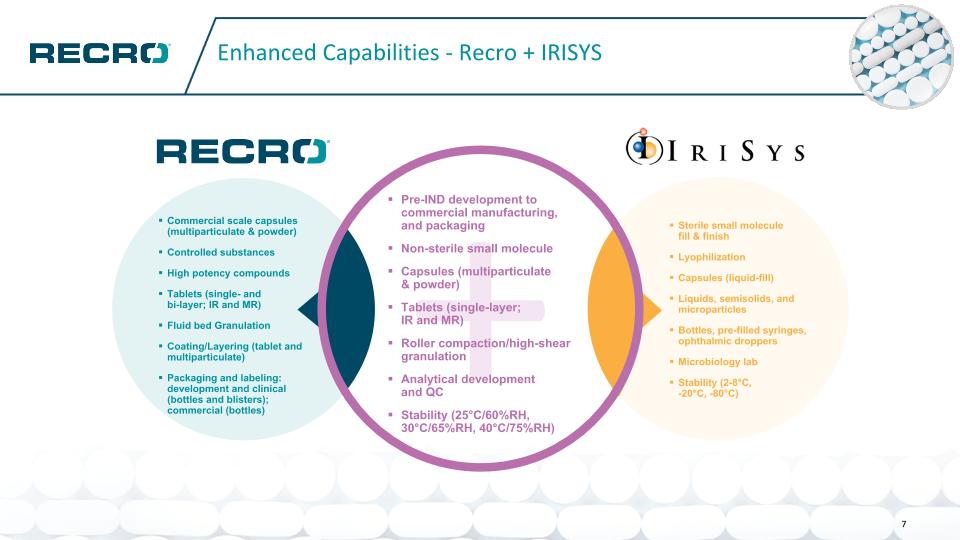

Enhanced Capabilities - Recro + IRISYS + Pre-IND development to commercial manufacturing, �and packaging Non-sterile small molecule Capsules (multiparticulate �& powder) Tablets (single-layer; �IR and MR) Roller compaction/high-shear granulation Analytical development �and QC Stability (25°C/60%RH, 30°C/65%RH, 40°C/75%RH) Commercial scale capsules (multiparticulate & powder) Controlled substances High potency compounds Tablets (single- and �bi-layer; IR and MR) Fluid bed Granulation Coating/Layering (tablet and multiparticulate) Packaging and labeling: development and clinical (bottles and blisters); commercial (bottles) Sterile small molecule �fill & finish Lyophilization Capsules (liquid-fill) Liquids, semisolids, and microparticles Bottles, pre-filled syringes, ophthalmic droppers Microbiology lab Stability (2-8°C, �-20°C, -80°C) 7

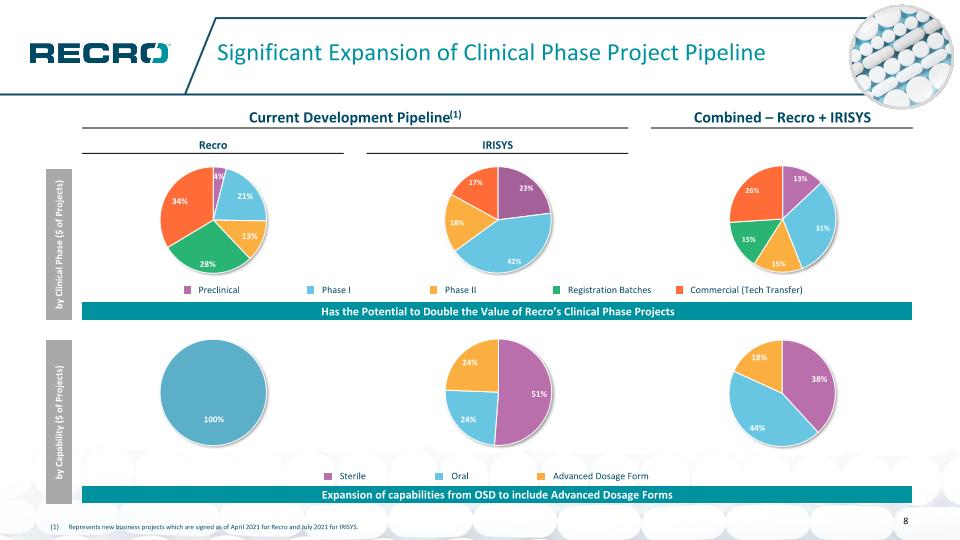

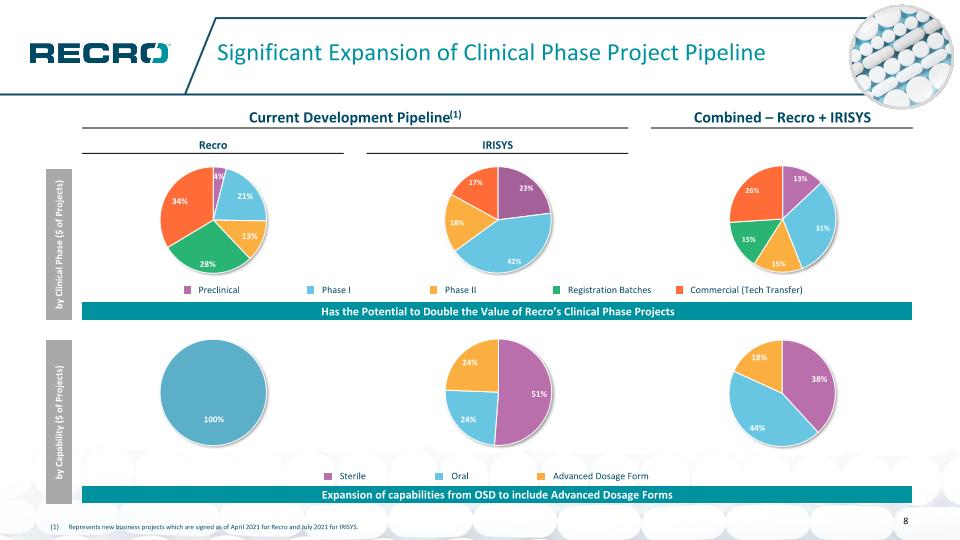

Significant Expansion of Clinical Phase Project Pipeline Represents new business projects which are signed as of April 2021 for Recro and July 2021 for IRISYS. Recro Expansion of capabilities from OSD to include Advanced Dosage Forms Current Development Pipeline(1) Combined – Recro + IRISYS Recro IRISYS by Clinical Phase ($ of Projects) Has the Potential to Double the Value of Recro’s Clinical Phase Projects by Capability ($ of Projects) Preclinical Phase I Phase II Registration Batches Commercial (Tech Transfer) Sterile Oral Advanced Dosage Form 8

Expanded Base of Commercial Customers Recro Commercial Customers End-to-end solutions for customers from early-stage development to scaled commercial production Strong commercial customer base stabilizes business and minimizes fluctuations in revenues Long-term relationships (20+ years) with key commercial partners and fully contracted through 2023 at the earliest, 2025 at the far end Commercial customer forecasts (generally 12-to-24-month projections) with binding PO’s typically for first three months, provides demand visibility and helps optimize supply chain execution Verapamil PM/Verelan™ SR/PM Recro owns NDA and DMF Branded & authorized generic sustained release capsules Complex formulation and manufacturing – proprietary know-how Exclusive sole supplier Mature relatively stable/flat(1) single player market Verapamil SR Recro owns NDA and DMF Authorized generic sustained release capsules, including an exclusive dosage form Complex formulation and manufacturing–proprietary ‘know-how’ Exclusive sole supplier Mature relatively stable/flat(1) two player market – Teva maintains ~50% market share Ritalin LA ™/Focalin XR Recro owns DMF Branded & authorized generic sustained release capsules – sold US/OUS Complex formulation and manufacturing Exclusive sole supplier Mature market dominated by Novartis/Sandoz(1) Regulatory & tech transfer risk and cost given Recro quality track record and lifecycle of product Excludes impact of COVID-19 on market dynamics. 9 Donnatal® Elixir and Tablets Exclusive sole supplier, 5yr agreement through beginning of 2025 4 API’s and multi-step manufacturing process Annual minimum purchase requirements Scot-Tussin® Cough/Cold Liquids Recro owns trademark and formulations Sold in over 7,000 CVS stores nationwide

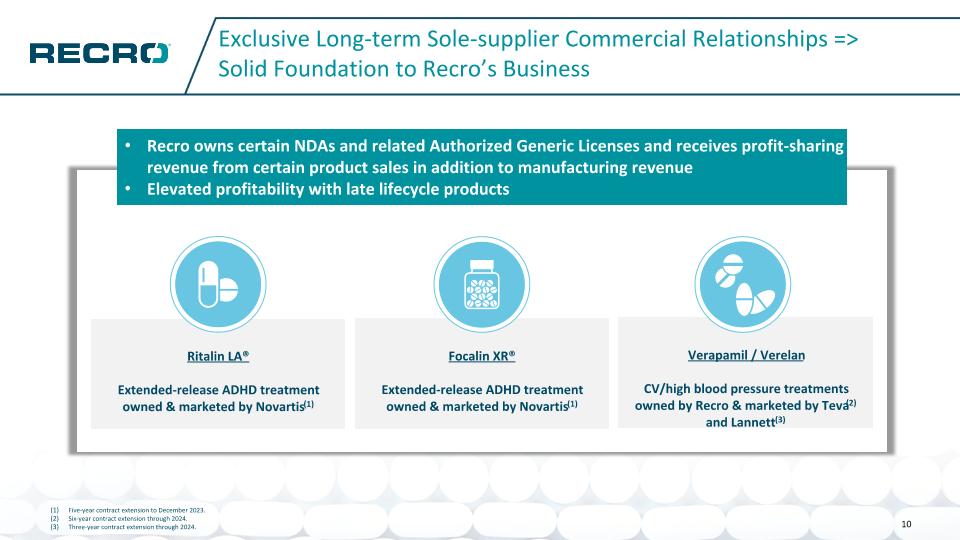

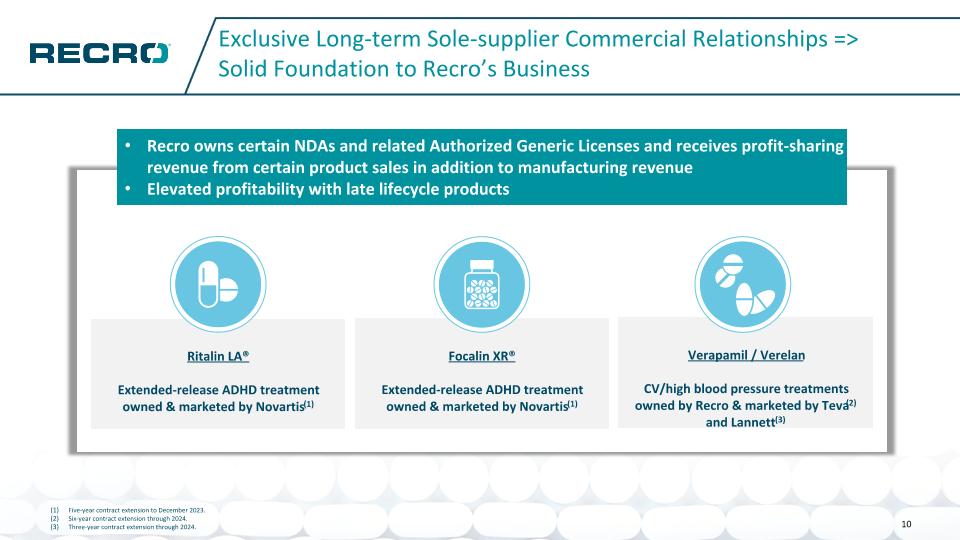

Exclusive Long-term Sole-supplier Commercial Relationships => Solid Foundation to Recro’s Business Five-year contract extension to December 2023. Six-year contract extension through 2024. Three-year contract extension through 2024. Ritalin LA® Extended-release ADHD treatment owned & marketed by Novartis(1) Focalin XR® Extended-release ADHD treatment owned & marketed by Novartis(1) Verapamil / Verelan CV/high blood pressure treatments owned by Recro & marketed by Teva(2) and Lannett(3) Recro owns certain NDAs and related Authorized Generic Licenses and receives profit-sharing revenue from certain product sales in addition to manufacturing revenue Elevated profitability with late lifecycle products 10

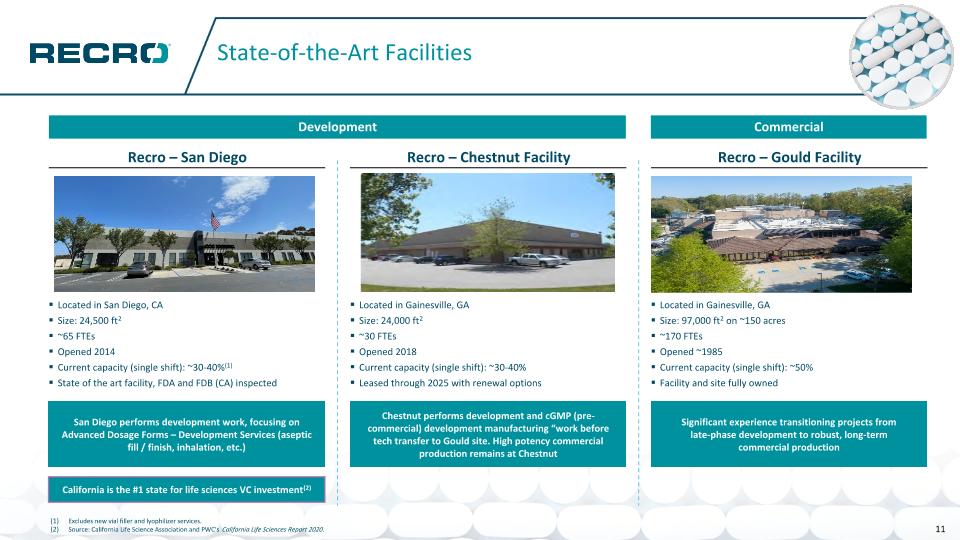

State-of-the-Art Facilities Recro – Gould Facility Located in Gainesville, GA Size: 24,000 ft2 ~30 FTEs Opened 2018 Current capacity (single shift): ~30-40% Leased through 2025 with renewal options Located in Gainesville, GA Size: 97,000 ft2 on ~150 acres ~170 FTEs Opened ~1985 Current capacity (single shift): ~50% Facility and site fully owned Chestnut performs development and cGMP (pre-commercial) development manufacturing “work before tech transfer to Gould site. High potency commercial production remains at Chestnut Significant experience transitioning projects from �late-phase development to robust, long-term �commercial production Recro – Chestnut Facility Recro – San Diego Located in San Diego, CA Size: 24,500 ft2 ~65 FTEs Opened 2014 Current capacity (single shift): ~30-40%(1) State of the art facility, FDA and FDB (CA) inspected San Diego performs development work, focusing on Advanced Dosage Forms – Development Services (aseptic fill / finish, inhalation, etc.) Commercial Development California is the #1 state for life sciences VC investment(2) Excludes new vial filler and lyophilizer services. Source: California Life Science Association and PWC’s California Life Sciences Report 2020. 11

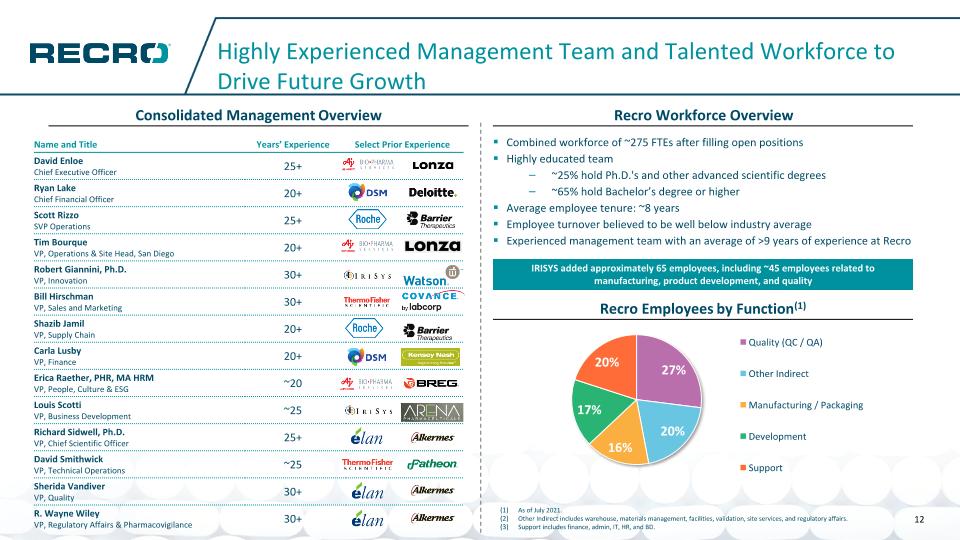

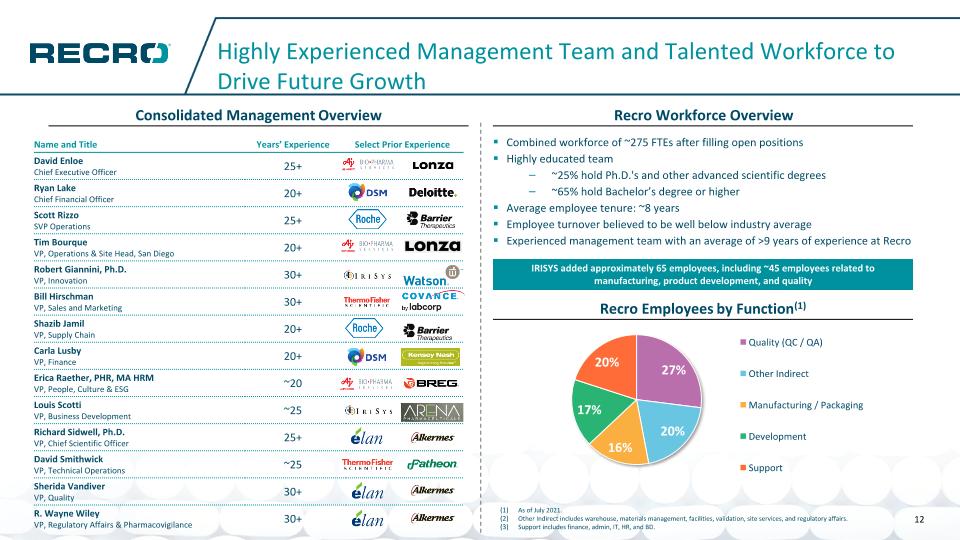

Highly Experienced Management Team and Talented Workforce to Drive Future Growth Recro Workforce Overview Consolidated Management Overview Combined workforce of ~275 FTEs after filling open positions Highly educated team ~25% hold Ph.D.'s and other advanced scientific degrees ~65% hold Bachelor’s degree or higher Average employee tenure: ~8 years Employee turnover believed to be well below industry average Experienced management team with an average of >9 years of experience at Recro Recro Employees by Function(1) As of July 2021. Other Indirect includes warehouse, materials management, facilities, validation, site services, and regulatory affairs. Support includes finance, admin, IT, HR, and BD. Name and Title Years’ Experience Select Prior Experience David Enloe�Chief Executive Officer 25+ Ryan Lake�Chief Financial Officer 20+ Scott Rizzo�SVP Operations 25+ Tim Bourque�VP, Operations & Site Head, San Diego 20+ Robert Giannini, Ph.D.�VP, Innovation 30+ Bill Hirschman VP, Sales and Marketing 30+ Shazib Jamil VP, Supply Chain 20+ Carla Lusby VP, Finance 20+ Erica Raether, PHR, MA HRM VP, People, Culture & ESG ~20 Louis Scotti�VP, Business Development ~25 Richard Sidwell, Ph.D. VP, Chief Scientific Officer 25+ David Smithwick VP, Technical Operations ~25 Sherida Vandiver VP, Quality 30+ R. Wayne Wiley VP, Regulatory Affairs & Pharmacovigilance 30+ IRISYS added approximately 65 employees, including ~45 employees related to manufacturing, product development, and quality 12

Successful inspection history with FDA, FDB, DEA, and Foreign Health Ministries. Regular Quality audits by clients and consultants. Strong Compliance and Inspection History 8 DEA inspections over 10 years 11 FDA audits since 2006 7 Foreign Health Ministries audits over 15 years 2 Quality Audits per Month 10 PAI’s with 3 Waived FDA Agencies include: ANVISA Danish Inspectorate Turkish MOH 13

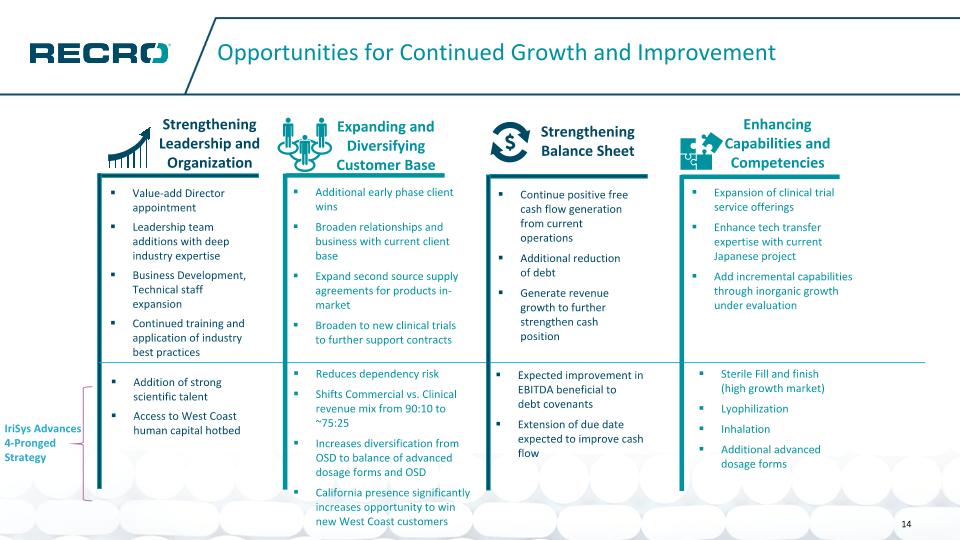

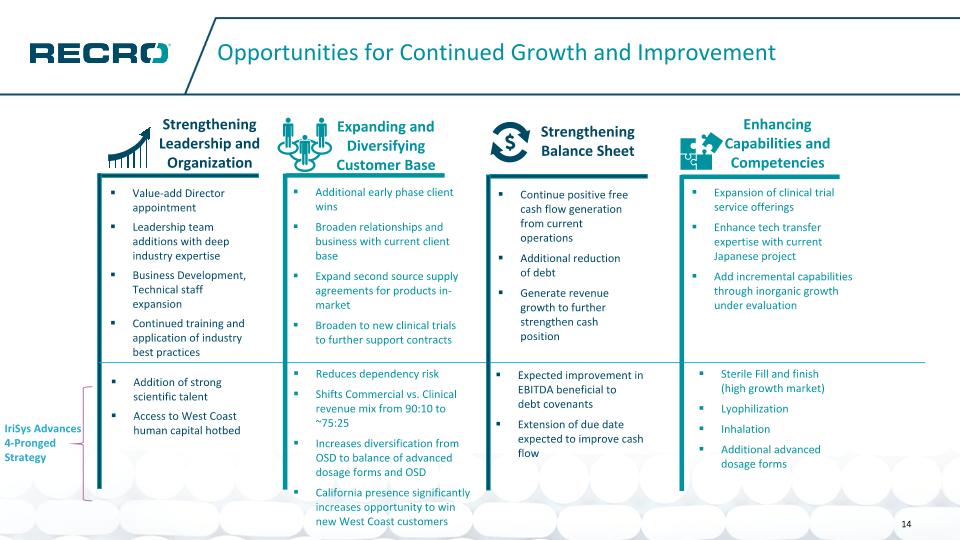

Opportunities for Continued Growth and Improvement 14 Value-add Director appointment Leadership team additions with deep industry expertise Business Development, Technical staff expansion Continued training and application of industry best practices Additional early phase client wins Broaden relationships and business with current client base Expand second source supply agreements for products in-market Broaden to new clinical trials to further support contracts Continue positive free cash flow generation from current operations Additional reduction �of debt Generate revenue growth to further strengthen cash position Expansion of clinical trial service offerings Enhance tech transfer expertise with current Japanese project Add incremental capabilities through inorganic growth under evaluation Strengthening Leadership and Organization Expanding and Diversifying Customer Base Strengthening �Balance Sheet Enhancing Capabilities and Competencies Addition of strong scientific talent Access to West Coast human capital hotbed IriSys Advances 4-Pronged Strategy Reduces dependency risk Shifts Commercial vs. Clinical revenue mix from 90:10 to ~75:25 Increases diversification from OSD to balance of advanced dosage forms and OSD California presence significantly increases opportunity to win new West Coast customers Expected improvement in �EBITDA beneficial to �debt covenants Extension of due date expected to improve cash flow Sterile Fill and finish (high growth market) Lyophilization Inhalation Additional advanced dosage forms

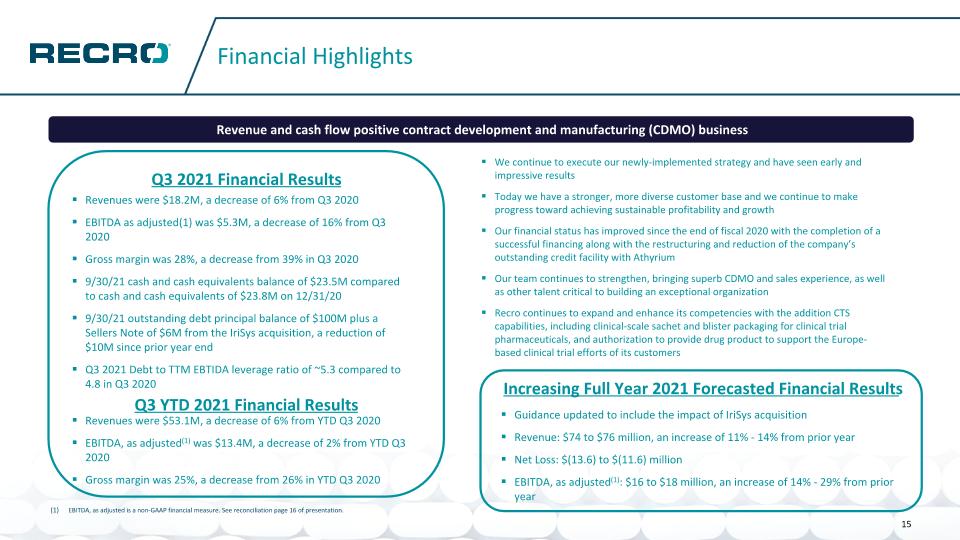

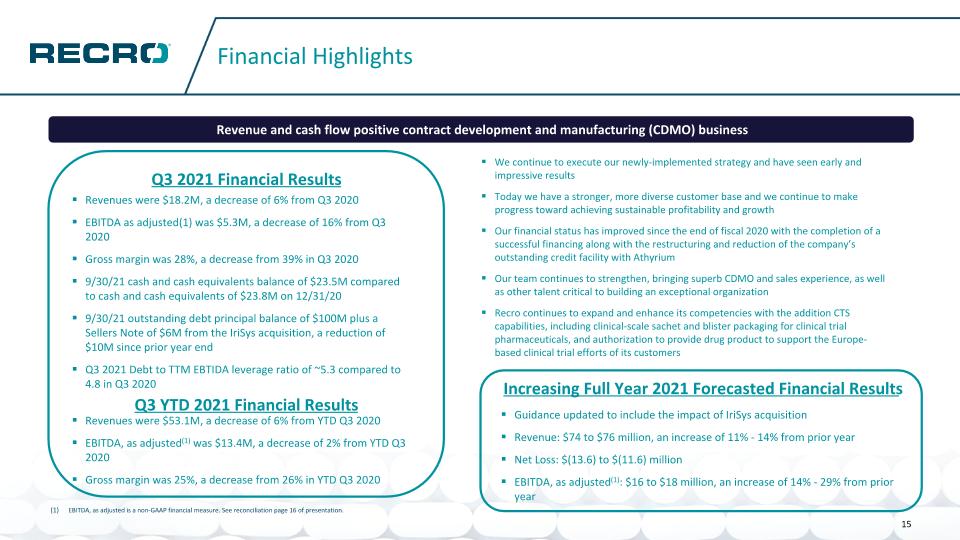

Financial Highlights 15 Q3 2021 Financial Results Q3 YTD 2021 Financial Results Revenues were $18.2M, a decrease of 6% from Q3 2020 EBITDA as adjusted(1) was $5.3M, a decrease of 16% from Q3 2020 Gross margin was 28%, a decrease from 39% in Q3 2020 9/30/21 cash and cash equivalents balance of $23.5M compared to cash and cash equivalents of $23.8M on 12/31/20 9/30/21 outstanding debt principal balance of $100M plus a Sellers Note of $6M from the IriSys acquisition, a reduction of $10M since prior year end Q3 2021 Debt to TTM EBTIDA leverage ratio of ~5.3 compared to 4.8 in Q3 2020 Revenue and cash flow positive contract development and manufacturing (CDMO) business Increasing Full Year 2021 Forecasted Financial Results Guidance updated to include the impact of IriSys acquisition Revenue: $74 to $76 million, an increase of 11% - 14% from prior year Net Loss: $(13.6) to $(11.6) million EBITDA, as adjusted(1): $16 to $18 million, an increase of 14% - 29% from prior year We continue to execute our newly-implemented strategy and have seen early and impressive results Today we have a stronger, more diverse customer base and we continue to make progress toward achieving sustainable profitability and growth Our financial status has improved since the end of fiscal 2020 with the completion of a successful financing along with the restructuring and reduction of the company’s outstanding credit facility with Athyrium Our team continues to strengthen, bringing superb CDMO and sales experience, as well as other talent critical to building an exceptional organization Recro continues to expand and enhance its competencies with the addition CTS capabilities, including clinical-scale sachet and blister packaging for clinical trial pharmaceuticals, and authorization to provide drug product to support the Europe-based clinical trial efforts of its customers EBITDA, as adjusted is a non-GAAP financial measure. See reconciliation page 16 of presentation. Revenues were $53.1M, a decrease of 6% from YTD Q3 2020 EBITDA, as adjusted(1) was $13.4M, a decrease of 2% from YTD Q3 2020 Gross margin was 25%, a decrease from 26% in YTD Q3 2020

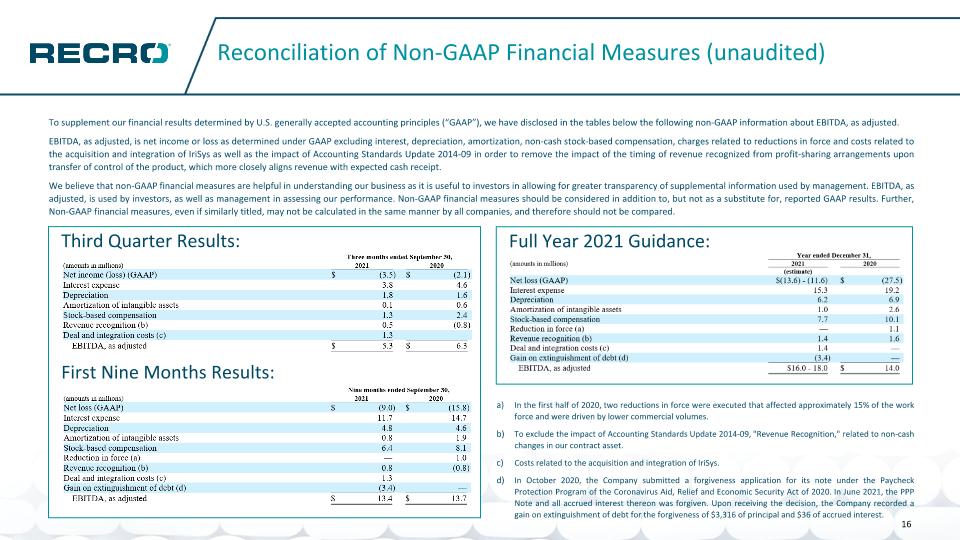

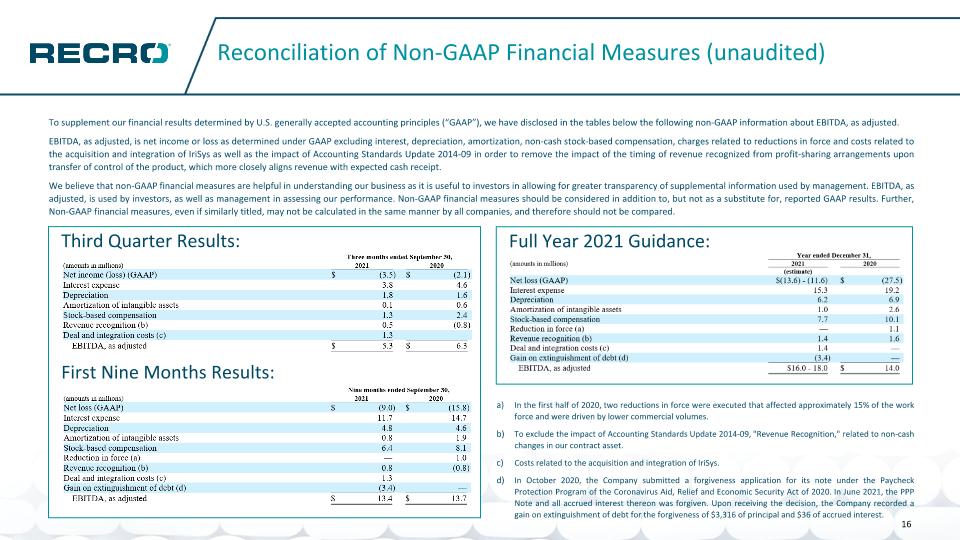

Reconciliation of Non-GAAP Financial Measures (unaudited) To supplement our financial results determined by U.S. generally accepted accounting principles (“GAAP”), we have disclosed in the tables below the following non-GAAP information about EBITDA, as adjusted. EBITDA, as adjusted, is net income or loss as determined under GAAP excluding interest, depreciation, amortization, non-cash stock-based compensation, charges related to reductions in force and costs related to the acquisition and integration of IriSys as well as the impact of Accounting Standards Update 2014-09 in order to remove the impact of the timing of revenue recognized from profit-sharing arrangements upon transfer of control of the product, which more closely aligns revenue with expected cash receipt. We believe that non-GAAP financial measures are helpful in understanding our business as it is useful to investors in allowing for greater transparency of supplemental information used by management. EBITDA, as adjusted, is used by investors, as well as management in assessing our performance. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, reported GAAP results. Further, Non-GAAP financial measures, even if similarly titled, may not be calculated in the same manner by all companies, and therefore should not be compared. In the first half of 2020, two reductions in force were executed that affected approximately 15% of the work force and were driven by lower commercial volumes. To exclude the impact of Accounting Standards Update 2014-09, "Revenue Recognition," related to non-cash changes in our contract asset. Costs related to the acquisition and integration of IriSys. In October 2020, the Company submitted a forgiveness application for its note under the Paycheck Protection Program of the Coronavirus Aid, Relief and Economic Security Act of 2020. In June 2021, the PPP Note and all accrued interest thereon was forgiven. Upon receiving the decision, the Company recorded a gain on extinguishment of debt for the forgiveness of $3,316 of principal and $36 of accrued interest. 16 Third Quarter Results: First Nine Months Results: Full Year 2021 Guidance: