MASTER LEASE AGREEMENT

THIS MASTER LEASE AGREEMENT (this “Lease”) is made as of December 14, 2022 (the “Effective Date”), by and between Tenet Equity Funding SPE Gainesville, LLC, a Delaware limited liability company (“Lessor”), whose address is 7332 E. Butherus Drive, Suite 100, Scottsdale, Arizona 85260, and SOCIETAL CDMO GAINESVILLE, LLC, a Massachusetts limited liability company (“Lessee”), whose address is 1300 Gould Drive, Gainesville, Georgia 30504.

The terms contained in this Lease shall apply to and be effective as of the Effective Date, without novation, replacement or substitution of this Lease, and the leasehold estate of Lessee shall mean the leasehold estate commencing under this Lease.

In consideration of the mutual covenants and agreements herein contained, Lessor and Lessee hereby covenant and agree to the terms and provisions set forth in this Lease.

Basic Lease Terms

| |

Adjustment Date. | December 1, 2023 and annually thereafter during the Lease Term (including any Extension Term). |

Base Annual Rental. | Initially $3,510,000.00, as described in Article III. |

Extension Options. | Four (4) extension(s) of ten (10) year(s) each, as described in Section 2.02. |

Guarantor. | Societal CDMO, Inc., a Pennsylvania corporation. |

Initial Term Expiration Date. | December 31, 2042. |

Lessee Tax Identification No. | 04-3903487. |

Lessor Tax Identification No. | 87-333144. |

Properties. | The street addresses and legal descriptions of the Properties are set forth on Exhibit A attached hereto and incorporated herein. |

Rental Adjustment. | Upon the first anniversary of the Effective Date, at the greater of: (a) 3.00% or (b) the change in the Price Index, not to exceed 5.00% Thereafter, on each successive anniversary of the Effective Date, a 3.00% annual increase. |

Term Expiration Date (if fully extended). | December 31, 2082 |

DEFINED TERMS

The following terms shall have the following meanings for all purposes of this Lease:

“Additional Rental” has the meaning set forth in Section 3.03.

“Adjustment Date” has the meaning set forth in the Basic Lease Terms.

“Affiliate” means any Person which directly or indirectly controls, is under common control with or is controlled by any other Person. For purposes of this definition, “controls,” “under common control with,” and “controlled by” means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such Person, whether through the ownership of voting securities or otherwise.

“Anti-Money Laundering Laws” means all applicable Laws, regulations and government guidance on the prevention and detection of money laundering, including, without limitation, (a) 18 U.S.C. §§ 1956 and 1957; and (b) the Bank Secrecy Act, 31 U.S.C. §§ 5311 et seq., and its implementing regulations, 31 CFR Part 103.

“Base Annual Rental” has the meaning set forth in the Basic Lease Terms.

“Base Monthly Rental” means an amount equal to 1/12 of the applicable Base Annual Rental.

“Business Day” means any weekday other than a day on which banks located in New York, New York are required or authorized to remain closed.

“Casualty” means any loss of or damage to any property included within or related to the Properties or arising from an adjoining property caused by an Act of God, fire, flood or other catastrophe.

“Capital Lease” shall mean all leases of any Properties, whether real, personal or mixed, by a Person, which leases would, in conformity with GAAP, be required to be accounted for as a capital lease on the balance sheet of such Person. The term Capital Lease shall not include any operating lease.

“CFCCR” means with respect to the twelve-month period of time immediately preceding the date of determination, the ratio calculated for such period of time of (i) EBITDAR to (ii) the sum of Operating Lease Expense and Interest Expense (excluding non-cash interest expense and amortization of non-cash financing expenses).

“Code” means the Internal Revenue Code of 1986, as the same may be amended from time to time.

“Condemnation” means a Taking.

“Costs” means all reasonable costs and expenses incurred by a Person, including, without limitation, reasonable attorneys’ fees and expenses, court costs, expert witness fees, costs of tests and analyses, travel and accommodation expenses, deposition and trial transcripts, copies and other similar costs and fees, brokerage fees, escrow fees, title insurance premiums, appraisal fees, stamp taxes, recording fees and transfer taxes or fees, as the circumstances require.

“Debt” shall mean with respect to a Person, and for the period of determination (i) indebtedness for borrowed money, (ii) subject to the limitation set forth in sub item (iv) below, obligations evidenced by bonds, indentures, notes or similar instruments, (iii) obligations under leases which should be, in accordance with GAAP, recorded as Capital Leases, and (iv) obligations under direct or indirect guarantees in respect of, and obligations (contingent or otherwise) to purchase or otherwise acquire, or otherwise to assure a creditor against loss in respect of, indebtedness or obligations of others of the kinds referred to in clauses (i) through (iv) above, except for guaranty obligations of such Person, which, in conformity with GAAP, are not included on the balance sheet of such Person.

“Default Rate” means ten percent (10%) per annum or the highest rate permitted by Law, whichever is less.

“EBITDA” means for the twelve (12) month period ending on the date of determination, the sum of a Person’s net income (loss) for such period plus, in each case to the extent previously deducted in calculating net income (loss): (i) income taxes, (ii) principal and interest payments on all of its debt obligations (including any borrowings under short term credit facilities), (iii) all non-cash charges and expenses including depreciation and amortization, and (iv) Non-Recurring Items.

“EBITDAR” means the sum of a Person’s EBITDA and its total land and building rent for the preceding twelve (12) month period ending on the date of determination.

“Effective Date” has the meaning set forth in the introductory paragraph of this Lease.

“Environmental Laws” means federal, state and local Laws, ordinances, common law requirements and regulations and standards, rules, policies and other governmental requirements, administrative rulings and court judgments and decrees having the effect of Law in effect now or in the future and including all amendments, that relate to Hazardous Materials, Regulated Substances, USTs, and/or the protection of human health or the environment, or relating to liability for or Costs of Remediation or prevention of Releases, and apply to Lessee and/or the Properties expense.

“Environmental Liens” means any liens and other encumbrances imposed pursuant to any Environmental Law.

“Environmental Policy” means a pollution legal liability insurance policy issued by Environmental Insurer to Lessor and Lessor’s lender, which Environmental Policy shall be in form and substance reasonably satisfactory to Lessor.

“Event of Default” has the meaning set forth in Section 11.01.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Extension Option” has the meaning set forth in Section 2.02.

“Extension Term” has the meaning set forth in Section 2.02.

“Force Majeure” has the meaning set forth in Section 15.01.

“GAAP” means generally accepted accounting principles in the United States set forth in the opinions and pronouncements of the Accounting Principles Board and the American Institute of Certified Public Accountants and statement and pronouncement of the Financial Accounting Standards Board, consistently applied and as in effect from time to time.

“Governmental Authority” means any governmental authority, agency, department, commission, bureau, board, instrumentality, court or quasigovernmental authority of the United States, any state or any political subdivision thereof with authority to adopt, modify, amend, interpret, give effect to or enforce any federal, state and local Laws, statutes, ordinances, rules or regulations, including common law, or to issue court orders.

“Guaranty” means the Unconditional Guaranty Agreement made by Societal CDMO, Inc., a Pennsylvania corporation, for the benefit of Lessor dated as of the date hereof.

“Hazardous Materials” includes: (a) oil, petroleum products, flammable substances, explosives, radioactive materials, hazardous wastes or substances, toxic wastes or substances or any other materials, contaminants or pollutants, the presence of which causes any of the Properties to be in violation of any local, state or federal Law or regulation, or Environmental Law, or are defined as or included in the definition of “hazardous substances,” “hazardous wastes,” “hazardous materials,” “toxic substances,” “contaminants,” “pollutants,” or words of similar import under any applicable local, state or federal Law or under the regulations adopted, orders issued, or publications promulgated pursuant thereto, including, but not limited to: (i) the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended, 42 U.S.C. § 9601, et seq.; (ii) the Hazardous Materials Transportation Act, as amended, 49 U.S.C. § 5101, et seq.; (iii) the Resource Conservation and Recovery Act, as amended, 42 U.S.C. § 6901, et seq.; and (iv) regulations adopted and publications promulgated pursuant to the aforesaid Laws; (b) asbestos in any form which is friable, urea formaldehyde foam insulation, transformers or other equipment which contain dielectric fluid containing levels of polychlorinated biphenyls in excess of fifty (50) parts per million; (c) underground storage tanks; and (d) any other chemical, material or substance, exposure to which is prohibited, limited or regulated by any Governmental Authority.

“Indemnified Parties” means Lessor and its members, managers, officers, directors, shareholders, partners, employees, agents, servants, representatives, contractors, subcontractors, affiliates, subsidiaries, participants, successors and assigns, including, but not limited to, any successors by merger, consolidation or acquisition of all or a substantial portion of the assets and business of Lessor.

“Initial Term” has the meaning set forth in Section 2.01.

“Insolvency Event” means (a) a Person’s (i) failure to generally pay its debts as such debts become due; (ii) admitting in writing its inability to pay its debts generally; or (iii) making a general assignment for the benefit of creditors; (b) any proceeding being instituted by or against any Person (i) seeking to adjudicate it bankrupt or insolvent; (ii) seeking liquidation, dissolution, winding up, reorganization, arrangement, adjustment, protection, relief, or composition of it or its debts under any Law relating to bankruptcy, insolvency, or reorganization or relief of debtors; or (iii) seeking the entry of an order for relief or the appointment of a receiver, trustee, or other similar official for it or for any substantial part of its property, and in the case of any such proceeding instituted against any Person, either such proceeding shall remain undismissed for a period of one hundred eighty (180) days or any of the actions sought in such proceeding shall occur; or (c) any Person taking any corporate action to authorize any of the actions set forth above in this definition.

“Interest Expense” shall mean for any period of determination, the sum of all interest accrued or which should be accrued in respect of all Debt of a Person, as determined in accordance with GAAP.

“Law(s)” means any constitution, statute, rule of law, code, ordinance, order, judgment, decree, injunction, rule, regulation, policy, requirement or administrative or judicial determination, even if unforeseen or extraordinary, of every duly constituted Governmental Authority, court or agency, now or hereafter enacted or in effect.

“Lease” has the meaning set forth in the introductory paragraph of this document.

“Lease Adjusted Leverage” means with respect to a Person, as of any applicable date, the sum of (i) ten (10) times such Person’s total land and building rent for the preceding twelve (12) month period ending on the date of determination, and (ii) the total current balance of such Person’s total debt obligations (including any borrowings under short term credit facilities and excluding any obligations associated with this Lease) on such date, divided by EBITDAR.

“Lease Rate” means a percentage equal to (a) the then-current Base Monthly Rental multiplied by twelve (12), divided by (b) the aggregate purchase price of all of the Properties paid by Lessor (or Lessor’s predecessor-in-interest).

“Lease Term” has the meaning described in Section 2.01.

“Legal Requirements” means the requirements of all present and future Laws (including, without limitation, Environmental Laws and Laws relating to accessibility to, usability by, and discrimination against, disabled individuals), all judicial and administrative interpretations thereof, including any judicial order, consent, decree or judgment, and all covenants, restrictions and conditions now or hereafter of record which may be applicable to Lessee or to any of the Properties, or to the use, manner of use, occupancy, possession, operation, maintenance, alteration, repair or restoration of any of the Properties, even if compliance therewith necessitates structural changes or improvements or results in interference with the use or enjoyment of any of the Properties.

“Lender” means any lender in connection with any loan secured by Lessor’s interest in any or all of the Properties, and any servicer of any loan secured by Lessor’s interest in any or all of the Properties.

“Lessee Entity” or “Lessee Entities” means individually or collectively, as the context may require, Lessee and all Affiliates thereof.

“Lessee’s Information” has the meaning set forth in Section 15.05(b).

“Lessor Entity” or “Lessor Entities” means individually or collectively, as the context may require, Lessor and all Affiliates of Lessor.

“Losses” means any and all claims, suits, liabilities (including, without limitation, strict liabilities), actions, proceedings, obligations, debts, damages, losses, Costs, diminutions in value, fines, penalties, interest, charges, fees, judgments, awards, amounts paid in settlement and damages of whatever kind or nature, inclusive of bodily injury and property damage to third parties (including, without limitation, attorneys’ fees and other Costs of defense), but in no event shall Losses include punitive, special or consequential damages; provided, however, if and to the extent that Lessor or Indemnified Parties shall be required to pay any amount in connection with the Property to any third party on account of punitive, special or consequential damages, then such amount shall be deemed to constitute actual damages incurred by such Person and the same shall be payable hereunder).

“Material Adverse Effect” means a material adverse effect on (a) any Property, including without limitation, the operation of any Property as a Permitted Facility and/or the value of any Property; (b) Lessee’s ability to perform its obligations under this Lease; (c) Lessor’s interests in any of the Properties, this Lease or the other Transaction Documents or (d) Guarantor’s ability to perform any and all obligations under the Guaranty.

“Monetary Obligations” means all Rental and all other sums payable, including without limitation, replenishment of the Security Deposit, or reimbursable by Lessee under this Lease to Lessor, to any third party on behalf of Lessor, or to any Indemnified Party.

“Mortgages” means, collectively, the mortgages, deeds of trust or deeds to secure debt, assignments of rents and leases, security agreements and fixture filings executed by Lessor for the benefit of Lender with respect to any or all of the Properties, as such instruments may be amended, modified, restated or supplemented from time to time and any and all replacements or substitutions.

“Net Award” means (a) the entire award payable with respect to a Property by reason of a Condemnation whether pursuant to a judgment or by agreement or otherwise; or (b) the entire proceeds of any insurance required under Section 5.03(a)(i) payable with respect to a Property, as the case may be, and in either case, less any Costs incurred by Lessor or Lessee in collecting such award or proceeds.

“Non-Recurring Items” shall mean with respect to a Person, items of the sum (whether positive or negative) of revenue minus expenses that are unusual in nature, occur infrequently and are not representative of the ongoing or future earnings or expenses of such Person, including any losses in such period resulting from any disposition outside of the ordinary course of business, including any net loss from discontinued operations.

“OFAC Laws” means Executive Order 13224 issued by the President of the United States, and all regulations promulgated thereunder, including, without limitation, the Terrorism Sanctions Regulations (31 CFR Part 595), the Terrorism List Governments Sanctions Regulations (31 CFR Part 596), the Foreign Terrorist Organizations Sanctions Regulations (31 CFR Part 597), and the Cuban Assets Control Regulations (31 CFR Part 515), and all other present and future federal, state and local Laws, ordinances, regulations, policies, lists (including, without limitation, the Specially Designated Nationals and Blocked Persons List) and any other requirements of any Governmental Authority (including without limitation, the U.S. Department of the Treasury Office of Foreign Assets Control) addressing, relating to, or attempting to eliminate, terrorist acts and acts of war, each as supplemented, amended or modified from time to time after the Effective Date, and the present and future rules, regulations and guidance documents promulgated under any of the foregoing, or under similar Laws, ordinances, regulations, policies or requirements of other states or localities.

“Operating Lease Expense” shall mean the sum of all payments and expenses incurred by a Person, under any operating leases during the period of determination, as determined in accordance with GAAP.

“Partial Condemnation” has the meaning set forth in Section 10.03.

“Permitted Amounts” shall mean, with respect to any given level of Hazardous Materials or Regulated Substances, that level or quantity of Hazardous Materials or Regulated Substances in any form or combination of forms which does not constitute a violation of any Environmental Laws.

“Permitted Facility” or “Permitted Facilities” or “Permitted Use” means a pharmaceutical services, development, and manufacturing facility, all related purposes such as ingress, egress and parking, and uses incidental thereto.

“Permitted Use” has the meaning set forth in Section 7.01.

“Person” means any individual, partnership, corporation, limited liability company, trust, unincorporated organization, Governmental Authority or any other form of entity.

“Personalty” means any and all “goods” (excluding “inventory,” and including, without limitation, all “equipment,” “fixtures,” appliances and furniture (as “goods,” “inventory,” “equipment” and “fixtures” are defined in the applicable Uniform Commercial Code then in effect in the applicable jurisdiction)) from time to time situated on or used in connection with any of the Properties, whether now owned or held or hereafter arising or acquired, together with all replacements and substitutions therefore.

“Price Index” means the Consumer Price Index which is designated for the applicable month of determination as the United States City Average for All Urban Consumers, All Items, Not Seasonally Adjusted, with a base period equaling 100 in 1982, as published by the United States Department of Labor’s Bureau of Labor Statistics or any successor agency. In the event that the Price Index ceases to be published, its successor index measuring cost of living as published by the same Governmental Authority which published the Price Index shall be substituted and any necessary reasonable adjustments shall be made by Lessor and Lessee in order to carry out the intent of Section 3.02. In the event there is no successor index measuring cost of living, Lessor shall reasonably select a comparable price index measuring cost of living that will constitute a reasonable substitute for the Price Index.

“Property” or “Properties” means those parcels of real estate legally described on Exhibit A attached hereto, all rights, privileges, and appurtenances associated therewith, and all buildings, fixtures and other improvements owned by Lessee now or hereafter located on such real estate (whether or not affixed to such real estate).

“Real Estate Taxes” has the meaning set forth in Section 5.04.

“Regulated Substances” means “petroleum” and “petroleum based substances” or any similar terms described or defined in any of the Environmental Laws and any applicable federal, state, county or local Laws applicable to or regulating USTs.

“REIT” means a real estate investment trust as defined under Section 856 of the Code.

“Release” means any presence, release, deposit, discharge, emission, leaking, spilling, seeping, migrating, injecting, pumping, pouring, emptying, escaping, dumping, disposing or other movement of Hazardous Materials, Regulated Substances or USTs in violation of Environmental Laws.

“Remediation” means any response, remedial, removal, or corrective action, any activity to cleanup, detoxify, decontaminate, contain or otherwise remediate any Hazardous Materials, Regulated Substances or USTs, any actions to prevent, cure or mitigate any Release and any action to correct existing non-compliance with any Environmental Laws or with any permits issued pursuant thereto.

“Rental” means, collectively, the Base Annual Rental and the Additional Rental.

“Rental Adjustment” means: (a) for the first Adjustment Date, the amount set forth in the Basic Lease Terms table in this Lease multiplied by the then current Base Annual Rental. The change in Price Index shall be calculated as the percentage change between the Price Index for the month which is two months prior to the first Adjustment Date and the Price Index used for the two months preceding the Effective Date in the case of the first Adjustment Date. By way of example, if the Adjustment Date is January 1, 2023, the change in Price Index shall be the percentage change between the Price Index for November 2022 and the Price Index for November 2021; provided, however, in no event shall the Rental Adjustment for the first Adjustment Date exceed five percent (5.00%), and (b) for each Adjustment Date thereafter, an amount equal to three percent (3.00%).

“Reserve” has the meaning in Section 5.04.

“Securities” has the meaning set forth in Section 16.09.

“Securities Act” means of the Securities Act of 1933, as amended.

“Security Deposit” such sums as shall be deposited by Lessee with Lessor for the full and faithful performance of Lessee’s obligations to be performed under this Lease.

“Securitization” has the meaning set forth in Section 16.09.

“Sublease” has the meaning set forth in Section 13.04.

“Successor Lessor” has the meaning set forth in Section 12.03.

“Taking” means (a) any taking or damaging of all or a portion of the Properties (i) in or by condemnation or other eminent domain proceedings pursuant to any Law, general or special; or (ii) by reason of any agreement with any Governmental Authority condemnor in settlement of or under threat of any such condemnation or other eminent domain proceeding; or (b) any de facto condemnation. The Taking shall be considered to have taken place as of the later of the date actual physical possession is taken by the condemnor, or the date on which the right to compensation and damages accrues under the Law applicable to the Properties.

“Temporary Taking” has the meaning set forth in Section 10.04.

“Threatened Release” means a substantial likelihood of a Release which requires action to prevent or mitigate damage to the soil, surface waters, groundwaters, land, stream sediments, surface or subsurface strata, ambient air or any other environmental medium comprising or surrounding any Property which may result from a Release.

“Total Condemnation” has the meaning set forth in Section 10.02.

“Transaction” has the meaning set forth in Section 13.01.

“Transaction Documents” means this Lease, the Guaranty, and all documents related thereto.

“U.S. Publicly Traded Entity” means an entity whose securities are listed on a national securities exchange or quoted on an automated quotation system in the United States or a wholly owned subsidiary of such an entity.

“USTs” means any one or combination of tanks and associated product piping systems used in connection with storage, dispensing and general use of Regulated Substances.

Article I

Lease of Properties

Section 1.01.Lease. In consideration of Lessee’s payment of the Rental and other Monetary Obligations and Lessee’s performance of all other obligations hereunder, Lessor hereby leases to Lessee, and Lessee hereby takes and hires, the Properties, “AS IS” and “WHERE IS” without representation or warranty by Lessor, and subject to the existing state of title, the parties in possession, any statement of facts which an accurate survey or physical inspection might reveal, and all Legal Requirements now or hereafter in effect.

Section 1.02.Quiet Enjoyment. So long as Lessee shall pay the Rental and other Monetary Obligations provided in this Lease and shall keep and perform all of the terms, covenants and conditions on its part contained herein, Lessee shall have, subject to the terms and conditions set forth herein, the right to the peaceful and quiet enjoyment and occupancy of the Properties.

Article II

Lease Term; Extension

Section 2.01.Initial Term. The initial term of this Lease (“Initial Term”) shall commence on the Effective Date and shall expire at midnight on November 30, 2042 unless terminated sooner as provided in this Lease and as may be extended as provided herein. The time period during which this Lease shall actually be in effect, including any Extension Term, is referred to as the “Lease Term.”

Section 2.02.Extensions. Unless this Lease has expired or has been sooner terminated, or an Event of Default has occurred and is continuing at the time any extension option is exercised, Lessee shall have the right and option (each, an “Extension Option”) to extend the Initial Term for all and not less than all of the Properties for four (4) additional successive periods of ten (10) years each (each, an “Extension Term”), pursuant to the terms and conditions of this Lease then in effect.

Section 2.03.Notice of Exercise. Lessee may only exercise the Extension Options by giving written notice thereof to Lessor of its election to do so no later than one hundred twenty (120) days prior to the expiration of the then-current Lease Term. If written notice of the exercise of any Extension Option is not received by Lessor by the applicable dates described above, then this Lease shall terminate on the last day of the Initial Term or, if applicable, the last day of the Extension Term then in effect. Upon the request of Lessor or Lessee, the parties hereto will, at the expense of the requesting party, execute and exchange an instrument in recordable form setting forth the extension of the Lease Term in accordance with this Section 2.03.

Section 2.04.Removal of Personalty. Upon the expiration of the Lease Term, and if Lessee is not then in breach hereof, Lessee may remove from the Properties all personal property belonging to Lessee. Lessee shall repair any damage caused by such removal and shall leave all of the Properties clean and in good and working condition and repair inside and out, subject to normal wear and tear, casualty and condemnation. Any property of Lessee left on the Properties on the tenth day following the expiration of the Lease Term shall, at Lessor’s option, be deemed abandoned by Lessee and automatically and immediately become the property of Lessor. Lessee shall be responsible for the cost of removal of any personal property of Lessee not removed by Lessee at the expiration of the Lease Term.

Article III

Rental and Other Monetary Obligations

Section 3.01.Base Monthly Rental. During the Lease Term, on or before the first day of each calendar month, Lessee shall pay in advance the Base Monthly Rental then in effect. Lessee understands, acknowledges and agrees that if the first day of a given calendar month is not a Business Day, then Base Monthly Rental for that month shall be due and payable on last Business Day before such day. If the Effective Date is a date other than the first day of the month, Lessee shall pay to Lessor on the Effective Date the Base Monthly Rental prorated by multiplying the Base Monthly Rental by a fraction, the numerator of which is the number of days remaining in the month (including the Effective Date) for which Rental is being paid, and the denominator of which is the total number of days in such month.

Section 3.02.Adjustments. During the Lease Term (including any Extension Term), on the first Adjustment Date and on each Adjustment Date thereafter, the Base Annual Rental shall increase by an amount equal to the Rental Adjustment.

Section 3.03.Additional Rental. Lessee shall pay and discharge, as additional rental (“Additional Rental”), all sums of money required to be paid by Lessee under this Lease which are not specifically referred to as Base Annual Rental. Lessee shall pay and discharge any Additional Rental when the same shall become due, provided that amounts which are billed to Lessor or any third party, but not to Lessee, shall be paid within thirty (30) days, after Lessor’s delivery or presentation of an invoice to Lessee and demand for payment thereof or, if earlier, when the same are due, provided, if the invoice for such amount has been delivered to Lessor, Lessor has forwarded the same to Lessee within three (3) Business Days following receipt. In no event shall Lessee be required to pay to Lessor any item of Additional Rental that Lessee is obligated to pay and has paid to any third party pursuant to any provision of this Lease.

Section 3.04.Rentals to be Net to Lessor. The Base Annual Rental payable hereunder shall be net to Lessor, so that this Lease shall yield to Lessor the Rentals specified during the Lease Term, and all Costs incurred by Lessee and obligations of every kind and nature whatsoever relating to the Properties to be performed by Lessee pursuant to this Lease shall be performed and paid by Lessee. Lessee shall perform all of its obligations under this Lease at its sole cost and expense. All Rental and other Monetary Obligations, which Lessee is required to pay hereunder shall be the unconditional obligation of Lessee and shall be payable in full when due and payable, without notice or demand, and without any setoff, abatement, deferment, deduction or counterclaim whatsoever.

Section 3.05.Security Deposit. After an uncured Event of Default, Lessor may apply, in its sole discretion at any time during the Lease Term, all or any part of any Security Deposit to the payment of any Rental or other expenses for which Lessee is required to pay to Lessor under this Lease. During the continuance of an Event of Default, the Security Deposit (if not already applied as hereinabove provided) shall be deemed to be automatically applied, without waiver of any rights Lessor may have under this Lease or at law or in equity as a result of an Event of Default, to the payment of any Rental not paid when due, the repair of damage to the Premises or the payment of any other amount which Lessor may spend or become obligated to spend by reason of an Event of Default, or to compensate Lessor for any other loss or damage which Lessor may suffer by reason of an Event of Default, to the full extent permitted by law. If any portion of the Security Deposit is so applied, Lessee shall, within two (2) Business Days after written demand therefor, deposit cash with Lessor in an amount sufficient to restore the Security Deposit to its original amount. Lessor shall not be required to keep the Security Deposit separate from its general funds.

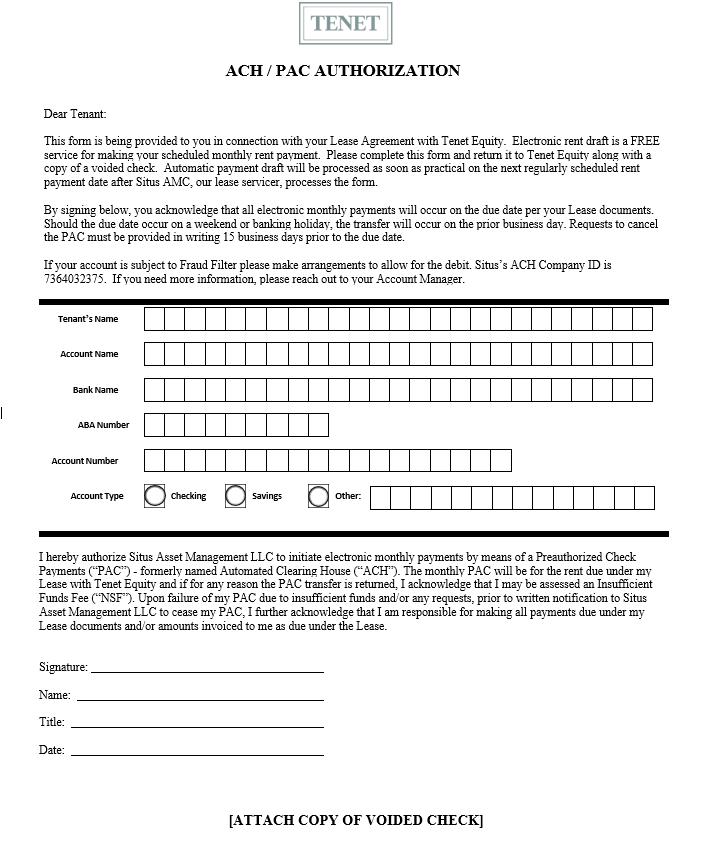

Section 3.06.ACH Authorization. Upon execution of this Lease, Lessee shall deliver to Lessor a complete Authorization Agreement - Pre-Arranged Payments in the form of Exhibit B attached hereto and incorporated herein by this reference, together with a voided check for account verification, establishing arrangements whereby payments of the Base Monthly Rental are transferred by Automated Clearing House Debit initiated by Lessor from an account established by Lessee at a United States bank or other financial institution to such account as Lessor may designate. Lessee shall continue to pay all Rental by Automated Clearing House Debit unless otherwise directed by Lessor.

Section 3.07.Late Charges; Default Interest. Any payment not made within three (3) days of the date due shall, in addition to any other remedy of Lessor, incur a late charge of five percent (5%) (which late charge is intended to compensate Lessor for the cost of handling and processing such delinquent payment and should not be considered interest). Any payment not made within five (5) days of the due date shall also bear interest at the Default Rate, such interest to be computed from and including the date such payment was due through and including the date of the payment; provided, however, in no event shall Lessee be obligated to pay a sum of late charge and interest higher than the maximum legal rate then in effect.

Section 3.08.Holdover. IF LESSEE REMAINS IN POSSESSION OF THE PROPERTIES AFTER THE EXPIRATION OF THE TERM HEREOF, LESSEE, AT LESSOR’S OPTION AND WITHIN LESSOR’S SOLE DISCRETION, MAY BE DEEMED A LESSEE ON A MONTH TO MONTH BASIS AND SHALL CONTINUE TO PAY RENTALS AND OTHER MONETARY OBLIGATIONS IN THE AMOUNTS HEREIN PROVIDED, EXCEPT THAT THE BASE MONTHLY RENTAL SHALL BE AUTOMATICALLY INCREASED TO ONE HUNDRED FIFTY PERCENT (150%) OF THE LAST BASE MONTHLY RENTAL PAYABLE UNDER THIS LEASE, AND LESSEE SHALL COMPLY WITH ALL THE TERMS OF THIS LEASE; PROVIDED THAT NOTHING HEREIN NOR THE ACCEPTANCE OF RENTAL BY LESSOR SHALL BE DEEMED A CONSENT TO SUCH HOLDING OVER. LESSEE SHALL DEFEND, INDEMNIFY, PROTECT AND HOLD THE INDEMNIFIED PARTIES HARMLESS FROM AND AGAINST ANY AND ALL LOSSES RESULTING FROM LESSEE’S FAILURE TO SURRENDER POSSESSION UPON THE EXPIRATION OF THE LEASE TERM.

Article IV

Representations and Warranties of Lessee

The representations and warranties of Lessee contained in this Article IV are being made to induce Lessor to enter into this Lease, and Lessor has relied and, except with respect to the representation set forth in Section 4.03 below, will continue to rely, upon such representations and warranties. Lessee represents and warrants to Lessor as of the Effective Date as follows:

Section 4.01.Organization, Authority and Status of Lessee. Lessee has been duly organized or formed, is validly existing and in good standing under the laws of its state of formation and is qualified as a foreign corporation to do business in any jurisdiction where such qualification is required. All necessary corporate action has been taken to authorize the execution, delivery and performance by Lessee of this Lease and of the other documents, instruments and agreements provided for herein. Lessee is not, and if Lessee is a “disregarded entity,” the owner of such disregarded entity is not, a “nonresident alien,” “foreign corporation,” “foreign partnership,” “foreign trust,” “foreign estate,” or any other “person” that is not a “United States Person” as those terms are defined in the Code and the regulations promulgated thereunder. The Person who has executed this Lease on behalf of Lessee is duly authorized to do so.

Section 4.02.Enforceability. This Lease constitutes the legal, valid and binding obligation of Lessee, enforceable against Lessee in accordance with its terms.

Section 4.03.Litigation. There are no suits, actions, proceedings or investigations pending, or to the best of its knowledge, threatened against or involving any Lessee Entity or the Properties before any arbitrator or Governmental Authority which might reasonably result in any Material Adverse Effect.

Section 4.04.Absence of Breaches or Defaults. Lessee is not in default under any document, instrument or agreement to which Lessee is a party or by which Lessee, the Properties or any of Lessee’s property is subject or bound, which has had, or could reasonably be expected to result in, a Material Adverse Effect. The authorization, execution, delivery and performance of this Lease and the documents, instruments and agreements provided for herein will not result in any breach of or default under any document, instrument or agreement to which Lessee is a party or by which Lessee, the Properties or any of Lessee’s property is subject or bound.

Section 4.05.Franchise and License Agreements. Lessee is not in default under any franchise or license agreement applicable to the operation of the Properties and each such franchise or license agreement is valid, binding, and in full force and effect permitting Lessee to operate a Permitted Facility on each of the Properties.

Section 4.06.Compliance with OFAC Laws. None of the Lessee Entities, and no individual or entity owning directly or indirectly any interest in any of the Lessee Entities, is an individual or entity whose property or interests are subject to being blocked under any of the OFAC Laws or is otherwise in violation of any of the OFAC Laws; provided, however, that the representation contained in this sentence shall not apply to any Person to the extent such Person’s interest is in or through a U.S. Publicly Traded Entity.

Section 4.07.Solvency. There is no contemplated, pending or, to Lessee’s knowledge, threatened Insolvency Event or similar proceedings, whether voluntary or involuntary, affecting Lessee or any Lessee Entity. Lessee does not have unreasonably small capital to conduct its business.

Section 4.08.Ownership. None of (i) Lessee, (ii) any Affiliate of Lessee, or (iii) any Person owning ten percent (10%) or more of Lessee, owns, directly or indirectly, ten percent (10%) or more of the total voting power or total value of capital stock in Tenet Equity Holdings, LP, Tenet Equity Partners, Inc.

Article V

Taxes and Assessments; Utilities; Insurance

(a)Payment. Subject to the provisions of Section 5.01(b) below, Lessee shall pay, prior to the earlier of delinquency or the accrual of interest on the unpaid balance, all taxes and assessments of every type or nature assessed by applicable Governmental Authorities having jurisdiction over the Properties against or imposed upon the Properties, Lessee or Lessor during the Lease Term related to or arising out of this Lease and the activities of the parties hereunder, including without limitation, (i) all taxes or assessments upon the Properties or any part thereof and upon any personal property, trade fixtures and improvements located on the Properties, whether belonging to Lessor or Lessee, or any tax or charge levied in lieu of such taxes and assessments; (ii) all taxes, charges, license fees and or similar fees imposed by reason of the use of the Properties by Lessee; (iii) all excise, franchise, transaction, privilege, sales, use and other taxes upon the Rental or other Monetary Obligations hereunder, the leasehold estate of either party or the activities of either party pursuant to this Lease; and (iv) all franchise, privilege or similar taxes of Lessor calculated on the value of the Properties or on the amount of capital apportioned to the Properties provided, however, taxes shall not include net income (measured by the income of Lessor from all sources or from sources other than solely rent), capital stock or franchise taxes of Lessor, unless levied or assessed against Lessor in whole or in part in lieu of, as a substitute for, or as an addition to any other taxes. Additionally, in no event shall Lessee be liable for any taxes or assessment arising out of or otherwise due in connection with any transaction described in Section 13.01 or 16.09 of this Lease.

(b)Right to Contest. Within five (5) Business Days of the date by which each tax and assessment payment is required by this Section 5.01 to be paid, Lessee shall provide Lessor with receipts or other evidence reasonably satisfactory to Lessor that each tax and assessment has been timely paid by Lessee. In the event Lessor receives a tax bill, Lessor shall use commercially reasonable efforts to forward said bill to Lessee within five (5) Business Days of Lessor’s receipt thereof. Lessee may, at its own expense, contest or cause to be contested (in the case of any item involving more than $10,000, after prior written notice to Lessor, which shall be given prior to contesting any matter as permitted herein), by appropriate legal proceedings conducted in good faith and with due diligence, any above described item or lien with respect thereto, including, without limitation, the amount or validity or application, in whole or in part, of such item, provided that (i) neither the Properties nor any interest therein would be in any danger of being sold, forfeited or lost by reason of such proceedings; (ii) no Event of Default has occurred and is continuing; (iii) if and to the extent required by the applicable taxing authority and/or Lessor or Lessor’s lender, Lessee posts a bond or takes other steps acceptable to such taxing authority and/or Lessor or Lessor’s lender that removes such lien or stays enforcement thereof; (iv) Lessee shall promptly provide Lessor with copies of all material notices received or delivered by Lessee and filings made by Lessee in connection with such proceeding; and (v) upon termination of such proceedings, it shall be the obligation of Lessee to pay the amount of any such tax and assessment or part thereof as finally determined in such proceedings, the payment of which may have been deferred during the prosecution of such proceedings, together with any costs, fees (including attorneys’ fees and disbursements), interest, penalties or other liabilities in connection therewith. Lessor shall at the request of Lessee, execute or join in the execution of any instruments or documents necessary in connection with such contest or proceedings, but Lessor shall incur no cost or obligation thereby.

Section 5.02.Utilities. Lessee shall contract, in its own name, for and pay when due all charges for the connection and use of water, gas, electricity, telephone, garbage collection, sewer use and other utility services supplied to the Properties during the Lease Term. Under no circumstances shall Lessor be responsible for any cost or interruption of any utility service.

Section 5.03.Insurance and Indemnification.

(a)Coverage. Throughout the Lease Term, Lessee shall maintain, with respect to each of the Properties, at its sole expense, the following types and amounts of insurance, in addition to such other insurance as Lessor may reasonably require from time to time:

(i)Insurance against loss or damage to real property and personal property under an “all risk” or “special form” insurance policy, which shall include coverage against all risks of direct physical loss, including but not limited to loss by fire, lightning, wind, terrorism, and other risks normally included in the standard ISO special form (and shall also include earthquake insurance if any Property is located within a moderate to high earthquake hazard zone as determined by an approved insurance company set forth in Section 5.03(b)(x) below). Such policy shall also include soft costs, a joint loss agreement, coverage for ordinance or law covering the loss of value of the undamaged portion of the Properties, costs to demolish and the increased costs of construction if any of the improvements located on, or the use of, the Properties shall at any time constitute legal non-conforming structures or uses. Ordinance or law limits shall be in an amount equal to the full replacement cost for the loss of value of the undamaged portion of the Properties and no less than 25% of the replacement cost for costs to demolish and the increased cost of construction, or in an amount otherwise reasonably specified by Lessor and approved by Lessee’s insurance broker. Such insurance shall be in amounts not less than 100% of the full insurable replacement cost values (without deduction for depreciation), with an agreed amount endorsement or without any coinsurance provision, and with sublimits satisfactory to Lessor, as determined from time to time at Lessor’s request but not more frequently than once in any 12-month period.

(ii)Commercial general liability insurance covering Lessor and Lessee against bodily injury liability, property damage liability and personal and advertising injury, liquor liability coverage if liquor is sold at any of the Properties, including without limitation any liability arising out of the ownership, maintenance, repair, condition or operation of every Property or adjoining ways, streets, parking lots or sidewalks. Such insurance policy or policies shall contain a broad form contractual liability endorsement under which the insurer agrees to insure Lessee’s obligations under Article IX hereof to the extent insurable, and a “severability of interest” clause or endorsement which precludes the insurer from denying the claim of Lessee or Lessor because of the negligence or other acts of the other, and terrorism coverage, shall be in amounts of $10,000,000 per occurrence for bodily injury and property damage, and $10,000,000 general aggregate, or such higher limits as Lessor may reasonably require from time to time, and shall be of form and substance satisfactory to Lessor. Such limits of insurance can be acquired through Commercial General liability and Umbrella liability policies.

(iii)Workers’ compensation in the amount required by state statute and Employers Liability insurance in the amount of $1,000,000, covering all persons employed by Lessee on the Properties in connection with any work done on or about any of the Properties for which claims for death or bodily injury could be asserted against Lessor, Lessee or the Properties.

(iv)Business interruption insurance including Rental Value Insurance payable to Lessor at all locations for a period of not less than twelve (12) months. Such insurance is to follow the form of the real property “all risk” or “special form” coverage and is not to contain a co-insurance clause. Such insurance is to have a minimum of 180 days of extended period of indemnity.

(v)Automobile liability insurance, including owned, non-owned and hired car liability insurance for combined limits of liability of $5,000,000 per occurrence. The limits of liability can be provided in a combination of an automobile liability policy and an umbrella liability policy.

(vi)Comprehensive Boiler and Machinery or Equipment Breakdown Insurance against loss or damage from explosion of any steam or pressure boilers or similar apparatus, if any, and other building equipment including HVAC units located in or about each Property.

(vii)Products and clinical trial liability insurance in an amount of $5,000,000.

(viii)Cyber liability insurance in an amount of $5,000,000.

(b)Insurance Provisions. All insurance policies shall:

(i)provide for a waiver of subrogation by the insurer as to claims against Lessor, its employees and agents;

(ii)be primary and provide that any “other insurance” clause in the insurance policy shall exclude any policies of insurance maintained by Lessor and the insurance policy shall not be brought into contribution with insurance maintained by Lessor;

(iii)contain deductibles not to exceed $100,000, except for property insurance and workers’ compensation insurance which may have a deductible up to $250,000;

(iv)contain a standard noncontributory mortgagee clause or endorsement in favor of any Lender designated by Lessor;

(v)provide that the policy of insurance shall not be terminated, cancelled or amended without at least thirty (30) days’ prior written notice to Lessor and to any Lender covered by any standard mortgagee clause or endorsement;

(vi)provide that the insurer shall not have the option to restore the Properties if Lessor elects to terminate this Lease in accordance with the terms hereof;

(vii)be in amounts sufficient at all times to satisfy any coinsurance requirements thereof;

(viii)except for workers’ compensation insurance referred to in Section 5.03(a)(iii) above, include Lessor and any Lessor Affiliate or Lender requested by Lessor, as an “additional insured” with respect to liability insurance, and as a “loss payee” with respect to real property and rental value insurance, as appropriate and as their interests may appear;

(ix)be evidenced by delivery to Lessor and any Lender designated by Lessor of an Acord Form 28 for property, business interruption and boiler & machinery coverage and an Acord Form 25 for commercial general liability, workers’ compensation and umbrella coverage; provided that in the event that either such form is no longer available, such evidence of insurance shall be in a form reasonably satisfactory to Lessor and any Lender designated by Lessor; and

(x)be issued by insurance companies licensed to do business in the states where the Properties are located and which are rated no less than A- by S&P, A-X by Best’s Insurance Guide or are otherwise approved by Lessor.

(c)Additional Obligations. It is expressly understood and agreed that (i) if any insurance required hereunder, or any part thereof, shall expire, be withdrawn, become void by breach of any condition thereof by Lessee, or become void or in jeopardy by reason of the failure or impairment of the capital of any insurer, Lessee shall immediately obtain new or additional insurance reasonably satisfactory to Lessor and any Lender designated by Lessor; (ii) the minimum limits of insurance coverage set forth in this Section 5.03, as well as the coverages actually obtained by Lessee and the deductibles owed by Lessee thereunder, shall not limit the liability of Lessee as provided in this Lease for its acts, omissions, or otherwise; (iii) Lessee shall provide to Lessor and any servicer or Lender of Lessor certificates of insurance evidencing that insurance satisfying the requirements of this Lease is in effect at all times; (iv) Lessee shall pay as they become due all premiums for the insurance required by this Section 5.03; (v) in the event that Lessee fails to comply with any of the requirements set forth in this Section 5.03, within ten (10) days of the giving of written notice by Lessor to Lessee, (A) Lessor shall be entitled to procure such insurance; and (B) any sums expended by Lessor in procuring such insurance shall be Additional Rental and shall be repaid by Lessee, together with interest thereon at the Default Rate, from the time of payment by Lessor until fully paid by Lessee immediately upon written demand therefor by Lessor; and (vi) Lessee shall maintain all insurance policies required in this Section 5.03 not to be cancelled, invalidated or suspended on account of the conduct of Lessee, its officers, directors, managers, members, employees or agents, or anyone acting for Lessee or any sublessee or other occupant of the Properties, and shall comply with all policy conditions and warranties at all times to avoid a forfeiture of all or a part of any insurance payment.

(d)Blanket Policies. Notwithstanding anything to the contrary in this Section 5.03, any insurance which Lessee is required to obtain pursuant to this Section 5.03 may be carried under a “blanket” policy or policies covering other properties or liabilities of Lessee provided that such “blanket” policy or policies otherwise comply with the provisions of this Section 5.03 and provides for limits that are sufficient, in the reasonable determination of Lessor, to ensure that the Properties are insured in a manner consistent with the insurance provisions set forth herein and that such insurance will not be materially compromised or exhausted by claims against other properties covered by such blanket policy.

(e)Indemnification and Release. Lessee hereby assumes all risk of damage to property or injury to persons in, upon or about the Properties from any cause whatsoever and agrees that Lessor Entities shall not be liable for, and are hereby released from any responsibility for, any damage either to person or property or resulting from the loss of use thereof, which damage is sustained by Lessee or by other persons claiming through Lessee. Lessee shall indemnify, defend, protect, and hold harmless the Lessor Entities from any and all loss, cost, damage, expense and liability (including without limitation court costs and reasonable attorneys' fees) incurred in connection with or arising from any cause in, on or about the Properties, any violation of any applicable laws, including, without limitation, any environmental laws, any acts, omissions or negligence Lessee Entities, in, on or about the Properties, or any injury or damage to the person, property, or business of Lessee Entities or any other person entering upon the Properties under the express or implied invitation of Lessee (whether such injury or damage occurs in the Properties or in, on, or about the Properties), or any breach of the terms of this Lease, either prior to, during, or after the expiration of the Term, provided that the terms of the foregoing indemnity shall not apply to the willful misconduct of Lessor. Should Lessor be named as a defendant in any suit brought against Lessee in connection with or arising out of Lessee’s occupancy of the Properties, Lessee shall pay to Lessor its costs and expenses incurred in such suit, including without limitation, its actual professional fees such as appraisers', accountants' and attorneys' fees. Further, Lessee's agreement to indemnify Lessor pursuant to this Section 5.03(e) is not intended and shall not relieve any insurance carrier of its obligations under policies required to be carried by Lessee pursuant to the provisions of this Lease, to the extent such policies cover the matters subject to Lessee's indemnification obligations; nor shall they supersede any inconsistent agreement of the parties set forth in any other provision of this Lease. The provisions of this Section 5.03(e) shall survive the expiration or sooner termination of this Lease with respect to any claims or liability arising in connection with any event occurring prior to such expiration or termination.

Section 5.04.Tax Impound.

(a)Upon the occurrence of an Event of Default which remains uncured, in addition to any other remedies, Lessor may require Lessee to pay to Lessor on the first day of each month the amount that Lessor reasonably estimates will be necessary in order to accumulate with Lessor sufficient funds in an impound account (which shall not be deemed a trust fund) (the “Reserve”) for Lessor to pay any and all real estate taxes (“Real Estate Taxes”) for the Properties for the ensuing twelve (12) months, or, if due sooner, Lessee shall pay the required amount in equal monthly installments over such short period of time. Lessor shall, upon prior written request of Lessee, provide Lessee with evidence reasonably satisfactory to Lessee that payment of the Real Estate Taxes was made in a timely fashion. In the event that the Reserve does not contain sufficient funds to timely pay any Real Estate Taxes, upon Lessor’s written notification thereof, Lessee shall, within five (5) Business Days of such notice, provide funds to Lessor in the amount of such deficiency. Lessor shall pay or cause to be paid directly to the applicable taxing authorities any Real Estate Taxes then due and payable for which there are funds in the Reserve; provided, however, that in no event shall Lessor be obligated to pay any Real Estate Taxes in excess of the funds held in the Reserve, and Lessee shall remain liable for any and all Real Estate Taxes, including fines, penalties, interest or additional costs imposed by any taxing authority (unless incurred as a result of Lessor’s failure to timely pay Real Estate Taxes for which it had funds in the Reserve). Lessee shall cooperate fully with Lessor in assuring that the Real Estate Taxes are timely paid. Lessor may deposit all Reserve funds in accounts insured by any federal or state agency and may commingle such funds with other funds and accounts of Lessor. Interest or other gains from such funds, if any, shall be the sole property of Lessor. Upon an Event of Default, in addition to any other remedies, Lessor may apply all impounded funds in the Reserve against any sums due from Lessee to Lessor. Lessor shall give to Lessee an annual accounting showing all credits and debits to and from such impounded funds received from Lessee.

(b)Notwithstanding Section 5.04(a), Lessor and Lessee shall reasonably cooperate with each other and diligently use commercially reasonable efforts to cause the appropriate Governmental Authority has issued a separate tax parcel identification number for the Property and such tax parcel identification number shall include no other property that is not a part of the Property (the “New Tax ID”). Accordingly, from and after the Effective Date until such time as the appropriate Governmental Authority has issued the New Tax ID for the Property and such tax parcel identification number shall include no other property that is not a part of the Property, Lessee shall deposit together with each payment of Base Monthly Rental, an amount equal to 1/12th of the Real Estate Taxes that Lessor or Lessor’s lender estimates will be payable during the next ensuing twelve (12) months. During such period as Lessor’s lender requires a Reserve for Real Estate Taxes, the terms and provisions of Section 5.04(a) shall govern.

Article VI

Maintenance; Alterations

Section 6.01.Condition of Property; Maintenance. Lessee hereby accepts the Properties “AS IS” and “WHERE IS” with no representation or warranty of Lessor as to the condition thereof. Lessee shall, at its sole cost and expense, be responsible for (a) keeping all of the building, structures and improvements erected on each of the Properties in good order and repair, free from actual or constructive waste; (b) the repair or reconstruction of any building, structures or improvements erected on the Properties damaged or destroyed by a Casualty; (c) subject to Section 6.02, making all necessary structural, non-structural, exterior and interior repairs and replacements to any building, structures or improvements (site improvements or otherwise) erected on the Properties; (d) (i) ensuring that no party encroaches upon any Property, and (ii) prosecuting any claims that Lessee seeks to bring against any Person relating to Lessee’s use and possession of any Property; and (e) paying all operating costs of the Properties in the ordinary course of business. Lessee waives any right to require Lessor to maintain, repair or rebuild all or any part of the Properties or make repairs at the expense of Lessor pursuant to any Legal Requirements at any time in effect.

Section 6.02.Alterations and Improvements. During the Lease Term, Lessee shall not materially alter the exterior, structural, plumbing or electrical elements of the Properties in any manner without the consent of Lessor, which consent shall not be unreasonably withheld, delayed or conditioned; provided, however, Lessee may undertake alterations to the Properties, individually, costing $750,000.00 or less without Lessor’s prior written consent. Notwithstanding the foregoing, any structural or exterior alterations to the Properties shall require the consent of Lessor. Any work at any time commenced by Lessee on the Properties shall be performed by a licensed contractor, prosecuted diligently to completion, shall be of good workmanship and materials and shall comply fully with all the terms of this Lease and all Legal Requirements. Upon completion of any alterations individually costing more than $750,000.00, Lessee shall promptly provide Lessor with evidence of full payment to all laborers and materialmen contributing to the alterations. Additionally, upon written request and completion of any alterations individually costing more than $750,000.00, Lessee shall promptly provide Lessor with (a) an architect’s certificate certifying the alterations to have been completed in conformity with the plans and specifications (if the alterations are of such a nature as would require the issuance of such a certificate from the architect); (b) a certificate of occupancy (if the alterations are of such a nature as would require the issuance of a certificate of occupancy); and (c) any related documents or information reasonably requested by Lessor. Lessee shall keep the Properties free from any liens arising out of any work performed on, or materials furnished to, the Properties to the extent not being disputed by Lessee. Lessee shall execute and file or record, as appropriate, a “Notice of Non Responsibility,” or any equivalent notice permitted under applicable Law in the states where the Properties are located which provides that Lessor is not responsible for the payment of any costs or expenses relating to the additions or alterations. Any addition to or alteration of the Properties, shall be deemed a part of the Properties and belong to Lessor, and Lessee shall execute and deliver to Lessor such instruments as Lessor may require to evidence the ownership by Lessor of such addition or alteration. Lessor and Lessee acknowledge and agree that their relationship is and shall be solely that of “Lessor-Lessee” (thereby excluding a relationship of “owner-contractor,” “owner-agent” or other similar relationships). Accordingly, all materialmen, contractors, artisans, mechanics, laborers and any other persons now or hereafter contracting with Lessee, any contractor or subcontractor of Lessee or any other Lessee party for the furnishing of any labor, services, materials, supplies or equipment with respect to any portion of the Properties at any time from the date hereof until the end of the Lease Term, are hereby charged with notice that they look exclusively to Lessee to obtain payment for same.

Section 6.03.Encumbrances. During the Lease Term, following reasonable prior notice to Lessee, Lessor shall have the right to grant easements on, over, under and above the Properties, provided that such easements will not interfere with Lessee’s use of the Properties as Permitted Facilities for the normal conduct of Lessee’s business therefrom. Lessee shall comply with and perform all obligations of Lessor under all easements, declarations, covenants, restrictions and other items of record now or hereafter encumbering the Properties; provided, however, that Lessor shall provide prior written notice to Lessee of any easements, declarations, covenants, and restrictions to which Lessor subjects the Property. Without Lessor’s prior written consent, Lessee shall not grant any easements on, over, under or above the Properties.

Article VII

Use of the Properties; Compliance

Section 7.01.Use. During the Lease Term, each of the Properties shall be used solely for the operation of a Permitted Facility (a “Permitted Use”).

Section 7.02.Compliance. LESSEE’S USE AND OCCUPATION OF EACH OF THE PROPERTIES, AND THE CONDITION THEREOF, SHALL, AT LESSEE’S SOLE COST AND EXPENSE, COMPLY FULLY WITH ALL LEGAL REQUIREMENTS AND ALL RESTRICTIONS, COVENANTS AND ENCUMBRANCES OF RECORD, AND ANY OWNER OBLIGATIONS UNDER SUCH LEGAL REQUIREMENTS, OR RESTRICTIONS, COVENANTS AND ENCUMBRANCES OF RECORD, WITH RESPECT TO THE PROPERTIES, IN EITHER EVENT, THE FAILURE WITH WHICH TO COMPLY COULD HAVE A MATERIAL ADVERSE EFFECT. WITHOUT IN ANY WAY LIMITING THE FOREGOING PROVISIONS, LESSEE SHALL COMPLY WITH ALL LEGAL REQUIREMENTS RELATING TO ANTI TERRORISM, TRADE EMBARGOS, ECONOMIC SANCTIONS, ANTI-MONEY LAUNDERING LAWS, AND THE AMERICANS WITH DISABILITIES ACT OF 1990, AS SUCH ACT MAY BE AMENDED FROM TIME TO TIME, AND ALL REGULATIONS PROMULGATED THEREUNDER, AS IT AFFECTS THE PROPERTIES NOW OR HEREAFTER IN EFFECT. LESSEE SHALL OBTAIN, MAINTAIN AND COMPLY WITH ALL REQUIRED LICENSES AND PERMITS, BOTH GOVERNMENTAL AND PRIVATE, TO USE AND OPERATE THE PROPERTIES AS PERMITTED FACILITIES. UPON LESSOR’S WRITTEN REQUEST FROM TIME TO TIME DURING THE LEASE TERM, LESSEE SHALL CERTIFY IN WRITING TO LESSOR THAT LESSEE’S REPRESENTATIONS, WARRANTIES AND OBLIGATIONS UNDER SECTION 4.05 THIS SECTION 7.02 OR SECTION 7.03 REMAIN TRUE AND CORRECT AND HAVE NOT BEEN BREACHED WHICH BREACH REMAINS UNCURED. AT LESSOR’S REQUEST, LESSEE SHALL PROVIDE TO LESSOR COPIES OF ALL NOTICES, REPORTS AND OTHER COMMUNICATIONS EXCHANGED WITH, OR RECEIVED FROM, GOVERNMENTAL AUTHORITIES RELATING TO A BREACH OF THE REPRESENTATIONS AND WARRANTIES AND OBLIGATIONS UNDER SECTION 4.05 THIS SECTION 7.02 OR SECTION 7.03. LESSEE SHALL ALSO REIMBURSE LESSOR FOR ALL COSTS INCURRED BY LESSOR IN: (A) ENFORCING LESSOR’S RIGHTS UNDER THE TRANSACTION DOCUMENTS; OR (B) COMPLYING WITH ALL LEGAL REQUIREMENTS APPLICABLE TO LESSOR AS THE RESULT OF LESSEE’S FAILURE TO COMPLY WITH ANY LEGAL REQUIREMENTS AND ALL RESTRICTIONS, COVENANTS AND ENCUMBRANCES OF RECORD AND FOR ANY PENALTIES OR FINES IMPOSED UPON LESSOR AS A RESULT THEREOF. LESSEE WILL USE GOOD FAITH EFFORTS TO PREVENT ANY ACT OR CONDITION TO EXIST ON OR ABOUT THE PROPERTIES THAT WILL MATERIALLY INCREASE ANY INSURANCE RATE THEREON, EXCEPT WHEN SUCH ACTS ARE REQUIRED IN THE NORMAL COURSE OF ITS BUSINESS AND LESSEE SHALL PAY FOR SUCH INCREASE. LESSEE AGREES THAT IT WILL DEFEND, INDEMNIFY AND HOLD HARMLESS THE INDEMNIFIED PARTIES FROM AND AGAINST ANY AND ALL LOSSES CAUSED BY, INCURRED OR RESULTING FROM LESSEE’S FAILURE TO COMPLY WITH ITS OBLIGATIONS UNDER THIS SECTION 7.02, EXCLUDING LOSSES SUFFERED BY AN INDEMNIFIED PARTY ARISING OUT OF THE GROSS NEGLIGENCE OR WILLFUL MISCONDUCT OF SUCH INDEMNIFIED PARTY.

Section 7.03.Environmental.

(i)Lessee covenants to Lessor, subject to the limitations of subsection (ii) below, as follows:

(A)Lessee shall permit no uses or operations on or of the Properties, whether by Lessee or any other Person, that are not in compliance with all Environmental Laws and permits issued pursuant thereto.

(B)Lessee shall permit no Releases in, on, under or from the Properties, except in Permitted Amounts.

(C)Lessee shall permit no Hazardous Materials or Regulated Substances in, on or under the Properties, except in Permitted Amounts. Above and below ground storage tanks shall be properly permitted and only used as permitted. Lessee shall not install any new below ground storage tanks without the written consent of Lessor.

(D)Lessee shall keep the Properties or cause the Properties to be kept free and clear of all Environmental Liens, whether due to any act (other than acts of Lessor, its agents or employees) or omission of Lessee or any other Person.

(E)Lessee shall not act or fail to act or allow any other Lessee, occupant, guest, customer or other user of the Properties to act or fail to act in any way that (1) materially increases a risk to human health or the environment, (2) poses an unreasonable or unacceptable risk of harm to any Person or the environment (whether on or off any of the Properties), (3) has a Material Adverse Effect, (4) is contrary to any material requirement set forth in the insurance policies maintained by Lessee, (5) constitutes a public or private nuisance or constitutes waste, (6) violates any covenant, condition, agreement or easement applicable to the Properties as of the Effective Date, or (7) would result in any reopening or reconsideration of any prior investigation, which prior investigation Lessee or Lessor was aware of as of the Effective Date, or causes a new investigation by a Governmental Authority having jurisdiction over any Property, which could reasonably be anticipated to result in a Release, Threatened Release or Remediation.

(F)Lessee shall, at its sole cost and expense, fully and expeditiously cooperate in all activities pursuant to this Section 7.03.

(ii)Notwithstanding any provision of this Lease to the contrary, an Event of Default shall not be deemed to have occurred as a result of the failure of Lessee to satisfy any one or more of the covenants set forth in subsections (A) through (E) above provided that Lessee shall be in compliance with the requirements of any Governmental Authority with respect to the Remediation of any Release by Lessee, its agents or employees at the Properties.

(b)Notification Requirements. During the Lease Term, Lessee shall promptly notify Lessor in writing upon Lessee obtaining actual knowledge of (i) any Releases or Threatened Releases in, on, under or from any of the Properties other than in Permitted Amounts, or migrating towards any of the Properties; (ii) any noncompliance with or violation of any Environmental Laws related in any way to any of the Properties; (iii) any actual or potential Environmental Lien or activity use limitation being imposed by a Governmental Authority; (iv) any required or proposed Remediation of environmental conditions relating to any of the Properties required by applicable Governmental Authorities; and (v) any written or oral notice or other communication of which Lessee becomes aware from any source whatsoever (including but not limited to a Governmental Authority) relating in any way to Remediation of Hazardous Materials, Regulated Substances or above or below ground storage tanks, , possible liability of any Person relating to any of the Properties pursuant to any Environmental Law, other environmental conditions in connection with any of the Properties, or any actual or potential administrative or judicial proceedings in connection with anything referred to in this Section 7.03.

(c)Remediation. Lessee shall, at its sole cost and expense, and without limiting any other provision of this Lease, effectuate any Remediation required by any Governmental Authority of any condition (including, but not limited to, a Release or Threatened Release) in, on, under or from the Properties and take any other reasonable action deemed necessary by any Governmental Authority for protection of human health or the environment. Should Lessee fail to undertake any required Remediation in accordance with the preceding sentence, Lessor, after reasonable prior written notice to Lessee and Lessee’s failure to promptly commence to undertake such Remediation and diligently pursue same to completion, shall be permitted to complete such Remediation, and all Costs incurred in connection therewith shall be paid by Lessee. Any Cost so paid by Lessor, together with interest at the Default Rate, shall be deemed to be Additional Rental hereunder and shall be due from Lessee to Lessor within thirty (30) days following Lessee’s receipt of Lessor’s written invoice therefor together with reasonable supporting documentation of such Cost.

(d)Indemnification. LESSEE SHALL, AT ITS SOLE COST AND EXPENSE, PROTECT, DEFEND, INDEMNIFY, RELEASE AND HOLD HARMLESS EACH OF THE INDEMNIFIED PARTIES FROM AND AGAINST ANY AND ALL LOSSES, INCLUDING, BUT NOT LIMITED TO, ALL COSTS OF REMEDIATION (WHETHER OR NOT PERFORMED VOLUNTARILY), ARISING OUT OF OR IN ANY WAY RELATING TO ANY ENVIRONMENTAL LAWS, HAZARDOUS MATERIALS, REGULATED SUBSTANCES, ABOVE OR BELOW GROUND STORAGE TANKS, OR OTHER ENVIRONMENTAL MATTERS CONCERNING THE PROPERTIES, WHETHER CAUSED DURING OR PRIOR TO THE LEASE TERM, EXCLUDING LOSSES SUFFERED BY AN INDEMNIFIED PARTY ARISING OUT OF THE GROSS NEGLIGENCE OR WILLFUL MISCONDUCT OF ANY INDEMNIFIED PARTY. IT IS EXPRESSLY UNDERSTOOD AND AGREED THAT LESSEE’S OBLIGATIONS UNDER THIS SECTION 7.03 SHALL SURVIVE THE EXPIRATION OR EARLIER TERMINATION OF THIS LEASE FOR ANY REASON PURSUANT TO SUBSECTION 7.03(G) BELOW.

(e)Right of Entry. In the event that Lessor has a reasonable basis to believe that a Release or a violation of any Environmental Law has occurred, Lessor and any other Person designated by Lessor, including but not limited to any receiver, any representative of a Governmental Authority, and any environmental consultant, shall have the right, but not the obligation, to enter upon the Properties during business hours with reasonable prior notice to assess any and all aspects of the environmental condition of any Property and its use, including but not limited to conducting any environmental assessment or audit (the scope of which shall be determined in Lessor’s sole and absolute discretion) and taking samples of soil, groundwater or other water, air, or building materials, and conducting other invasive testing; provided, however, that such entry does not unreasonably interfere with Lessee’s operations or impose any risk on persons or property on the Properties and shall be in accordance with Lessee’s then current security protocol. Lessee shall cooperate with and provide access to Lessor and any other Person designated by Lessor. Any such assessment or investigation shall be at Lessor’s sole cost and expense unless it is determined as a result of such assessment or investigation that there then exists a Release or a violation of Environmental Law.

(f)Environmental Inspection. Throughout the Lease Term, upon prior written notice to Lessee, Lessor shall have the right, at its sole cost and expense, to maintain an Environmental Policy with respect to the Properties. Upon expiration of an Environmental Policy, Lessee shall reasonably cooperate with Lessor in connection with Lessor’s renewal or replacement of such Environmental Policy. Lessee shall reasonably cooperate with Lessor in connection with r any necessary environmental investigations of the Properties by Lessor.

(g)Survival. The obligations of Lessee and the rights and remedies of Lessor under this Section 7.03 shall survive the termination, expiration and/or release of this Lease.

Article VIII

Additional Covenants

Section 8.01.Performance at Lessee’s Expense. Lessee acknowledges and confirms that Lessor may impose and collect its reasonable and actual third party costs and expenses, including without limitation, reasonable attorneys’ fees, costs and expenses in connection with (a) any extension, renewal, modification, amendment and termination of this Lease requested by Lessee, excluding any extension right granted Lessee pursuant to the terms of this Lease ; (b) any release or substitution of Properties requested by Lessee; (c) the procurement of consents, waivers and approvals with respect to the Properties or any matter related to this Lease requested by Lessee; (d) the review of any assignment or sublease or proposed assignment or sublease or the preparation or review of any subordination or non-disturbance agreement requested by Lessee; (e) the collection, maintenance and/or disbursement of reserves created under this Lease or the other Transaction Documents (following and during the continuance of an Event of Default); (f) inspections required to make certain determinations under this Lease or the other Transaction Documents following Lessor’s reasonable belief of a breach under this Lease or any other Transaction Documents and (g) reimbursement or payment of any reasonable, administrative, processing, and/or servicing fees imposed or charged by Lessor’s lender in connection with any of the foregoing items in clauses (a) through (f).

Section 8.02.Inspection. Lessor and its authorized representatives shall have the right, at all reasonable times and upon giving reasonable (at least 24 hours) prior notice (except in the event of an emergency, in which case no prior notice shall be required), to enter the Properties or any part thereof and inspect the same; provided, however, that such inspections shall not unreasonably interfere with the business of Lessee or impose any risk on any people or property at the Properties and shall be in accordance with Lessee’s then current security protocol.

Section 8.03.Financial Information.

(a)Financial Statements. To the extent not publicly available, within forty five (45) days after the end of each fiscal quarter and within ninety (90) days after the end of each fiscal year of Guarantor, Lessee shall cause Guarantor to deliver to Lessor complete consolidated financial statements that consolidate Lessee and Guarantor, including a balance sheet, profit and loss statement, statement of stockholders’ equity and statement of cash flows and all other related schedules for the fiscal period then ended, such statements to detail separately interest expense, income taxes, non-cash expenses, non-recurring expenses, operating lease expense and current portion of long-term debt - capital leases. All such financial statements shall be prepared in accordance with GAAP, and shall be certified to be accurate and complete by an officer or director of Guarantor. Lessee shall deliver to Lessor: (i) income statements for the business at the Properties, and (ii) the supplemental financial information set forth on Schedule 8.03. In the event that Lessee’s business at the Properties is ordinarily consolidated with other business for financial statements purposes, a separate profit and loss statement shall be provided showing separately the sales, profits and losses pertaining to each Property with interest expense, income taxes, non-cash expenses, non-recurring expenses and operating lease expense (rent), with the basis for allocation of overhead or other charges being clearly set forth in accordance with Schedule 8.03. The financial statements delivered to Lessor need not be audited, but Lessee shall deliver to Lessor copies of any audited financial statements of Guarantor which may be prepared, as soon as they are available. Lessee shall or shall cause Guarantor to transmit all financial statements and other information required to be provided pursuant to this Section 8.03 to Lessor at financials@tenetequity.com. or to such other address or such other person as Lessor may from time to time hereafter specify to Lessee.