- SCTL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Societal CDMO (SCTL) DEF 14ADefinitive proxy

Filed: 6 Apr 23, 8:25am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-l2

Societal CDMO, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

1 E. Uwchlan Ave., Suite 112

Exton, Pennsylvania 19341

2023 ANNUAL MEETING OF SHAREHOLDERS

To be Held on May 17, 2023

April 6, 2023

Dear Shareholder:

We are pleased to invite you to attend the 2023 Annual Meeting of Shareholders, or the Annual Meeting, of Societal CDMO, Inc., or Societal or the Company, which will be held at 10:00 a.m., Eastern time, on May 17, 2023. The Annual Meeting will be a completely virtual meeting and can be accessed via the Internet at: www.virtualshareholdermeeting.com/SCTL2023.

Details regarding admission to the Annual Meeting and the business to be conducted are more fully described in the accompanying Notice of 2023 Annual Meeting of Shareholders, or Notice, and 2023 Annual Meeting Proxy Statement, or Proxy Statement. Other than the proposals described in the Proxy Statement, our board of directors, or Board, is not aware of any other matters to be presented for a vote at the Annual Meeting.

Your vote is important. Whether or not you plan to virtually attend the Annual Meeting, we hope you will vote as soon as possible. Information about voting methods is set forth in the accompanying Notice and Proxy Statement.

If you have any questions with respect to voting, please call our Chief Financial Officer, Ryan D. Lake, at (770) 531-8365.

Sincerely,

|

|

Wayne B. Weisman | J. David Enloe, Jr. |

Chairman of the Board | Director, President and Chief Executive Officer |

NOTICE OF 2023 ANNUAL MEETING OF SHAREHOLDERS

Dear Shareholder:

You are invited to attend the Annual Meeting. At the Annual Meeting, shareholders will vote on the following:

Shareholders also will transact any other business that may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting.

MEETING INFORMATION:

Date: May 17, 2023

Time: 10:00 a.m.

Location: Via the Internet

www.virtualshareholdermeeting.com/SCTL2023

Record Date: You can vote if you were a shareholder of record on March 20, 2023

Your vote matters. Whether or not you plan to virtually attend the Annual Meeting, please ensure that your shares are represented by voting, signing, dating and returning your proxy in the enclosed envelope, which requires no postage if mailed in the United States.

On or about April 6, 2023, the Company will first send to its shareholders of record as of March 20, 2023, the record date for the Annual Meeting, a copy of this Proxy Statement, including this Notice of 2023 Annual Meeting of Shareholders and the proxy card, and the Company’s 2022 Annual Report to Shareholders (the “2022 Annual Report”). Please carefully review this Proxy Statement for information on the matters to be presented at the Annual Meeting and for instructions on how to vote your shares. Our 2022 Annual Report, including financial statements for such period, does not constitute any part of the material for the solicitation of proxies, but copies are available to shareholders upon request.

By Order of the Board of Directors,

Carla Lusby

Corporate Secretary

April 6, 2023

PROXY SUMMARY |

To assist you in reviewing this year’s proposals, we call your attention to the following proxy summary and urge you to review this Proxy Statement and our 2022 Annual Report in full. This proxy statement and enclosed proxy card are first being sent to shareholders on or about April 6, 2023.

SUMMARY OF SHAREHOLDER VOTING MATTERS

Proposal | For More | Board of Directors | ||

Item 1: Election of two Class III directors for a three-year term expiring in 2026 | Page 42 | ✓ FOR Each Nominee | ||

William L. Ashton Laura L. Parks, Ph.D.

| ||||

| ||||

Item 2: Adopt and approve an amendment to our Second Amended and Restated Articles of Incorporation, as amended, to increase the number of authorized shares of common stock from 95 million to 185 million | Page 43 | ✓ FOR | ||

Item 3: Approval, on a non-binding advisory basis, of the compensation of our named executive officers | Page 45 | ✓ FOR | ||

| ||||

Item 4: Ratification of appointment of KPMG LLP as our independent registered public accounting firm for the 2023 fiscal year | Page 46 | ✓ FOR | ||

| ||||

OUR DIRECTOR NOMINEES

The term of office of our Class III directors expires at the Annual Meeting. You are being asked to vote on the election of William L. Ashton and Laura L. Parks, Ph.D. as Class III directors. We are nominating Mr. Ashton and Dr. Parks for election at the Annual Meeting to serve until the 2026 Annual Meeting of Shareholders and until their successors, if any, are elected or appointed, or their earlier death, resignation, retirement, disqualification or removal.

The number of members of our Board is currently set at nine members and is divided into three classes, each of which has a three-year term. Currently, each class consists of three directors. Dr. Michael Berelowitz, a current Class III member of our Board, has advised us that due to other professional commitments, he will not stand for re-election at the Annual Meeting, and his service as a member of our Board will end effective as of the Annual Meeting. As a result, we intend to reduce the size of our Board from nine to eight, effective as of the Annual Meeting. We extend our deepest gratitude to Dr. Berelowitz for his distinguished service to our Board.

Directors are elected by a plurality of the votes cast by our shareholders at the Annual Meeting. The two nominees receiving the most FOR votes (among votes properly cast in person or by proxy) will be elected. If no contrary indication is made, shares represented by executed proxies will be voted FOR the election of Mr. Ashton and Dr. Parks. Each nominee has agreed to serve as a director if elected, and we have no reason to believe that any nominee will be unable to serve.

i

The following table reflects director nominee biographical information and committee memberships:

Name | Age | Director | Occupation | Independent | Committee Memberships | Other Current Public Company Boards | ||||||||||

|

|

|

| AC | CC | GC |

| |||||||||

William L. Ashton | 72 | 2009 | Principal at Harrison Consulting Group, Inc. | Yes | - | C | M | Spectrum Pharmaceuticals, Inc.; Baudax Bio, Inc. | ||||||||

Laura L. Parks, Ph.D. | 64 | 2021 | Retired | Yes | - | M | M | None | ||||||||

AC = Audit Committee | CC = Compensation Committee | C = Chair | ||||||||||||||

GC = Nominating and Corporate Governance Committee | M = Member | |||||||||||||||

CORPORATE GOVERNANCE SUMMARY FACTS

The following table summarizes our current Board structure and key elements of our corporate governance framework:

Governance Items | ||

Size of Board (set by the Board) | 9 (to be reduced to 8 as of the Annual Meeting) | |

Number of Independent Directors | 8 (to be reduced to 7 as of the Annual Meeting) | |

Independent Chairman of the Board | Yes | |

Board Self-Evaluation | Annual | |

Review of Independence of Board | Annual | |

Independent Directors Meet Without Management Present | Yes | |

Voting Standard for Election of Directors in Uncontested Elections | Plurality | |

Diversity of Board background, experience and skills | Yes | |

2022 CORPORATE HIGHLIGHTS

ii

iii

TABLE OF CONTENTS | ||

|

|

|

i | ||

2 | ||

5 | ||

| 5 | |

| 7 | |

| 7 | |

| 8 | |

| 9 | |

| 10 | |

14 | ||

| 14 | |

| 14 | |

| 14 | |

| 14 | |

| 15 | |

| 16 | |

| 16 | |

| 16 | |

| 16 | |

| BOARD ATTENDANCE, COMMITTEE MEETINGS AND COMMITTEE MEMBERSHIP | 17 |

| 21 | |

| 21 | |

| 21 | |

| 21 | |

24 | ||

26 | ||

27 | ||

28 | ||

29 | ||

| 29 | |

| 32 | |

| 33 | |

38 | ||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 38 | |

41 | ||

42 | ||

| ITEM 1: ELECTION OF CLASS III DIRECTORS FOR A THREE-YEAR TERM EXPIRING IN 2026 | 42 |

| 43 | |

| 45 | |

| 46 | |

47 | ||

A-1 | ||

-i-

PROXY STATEMENT

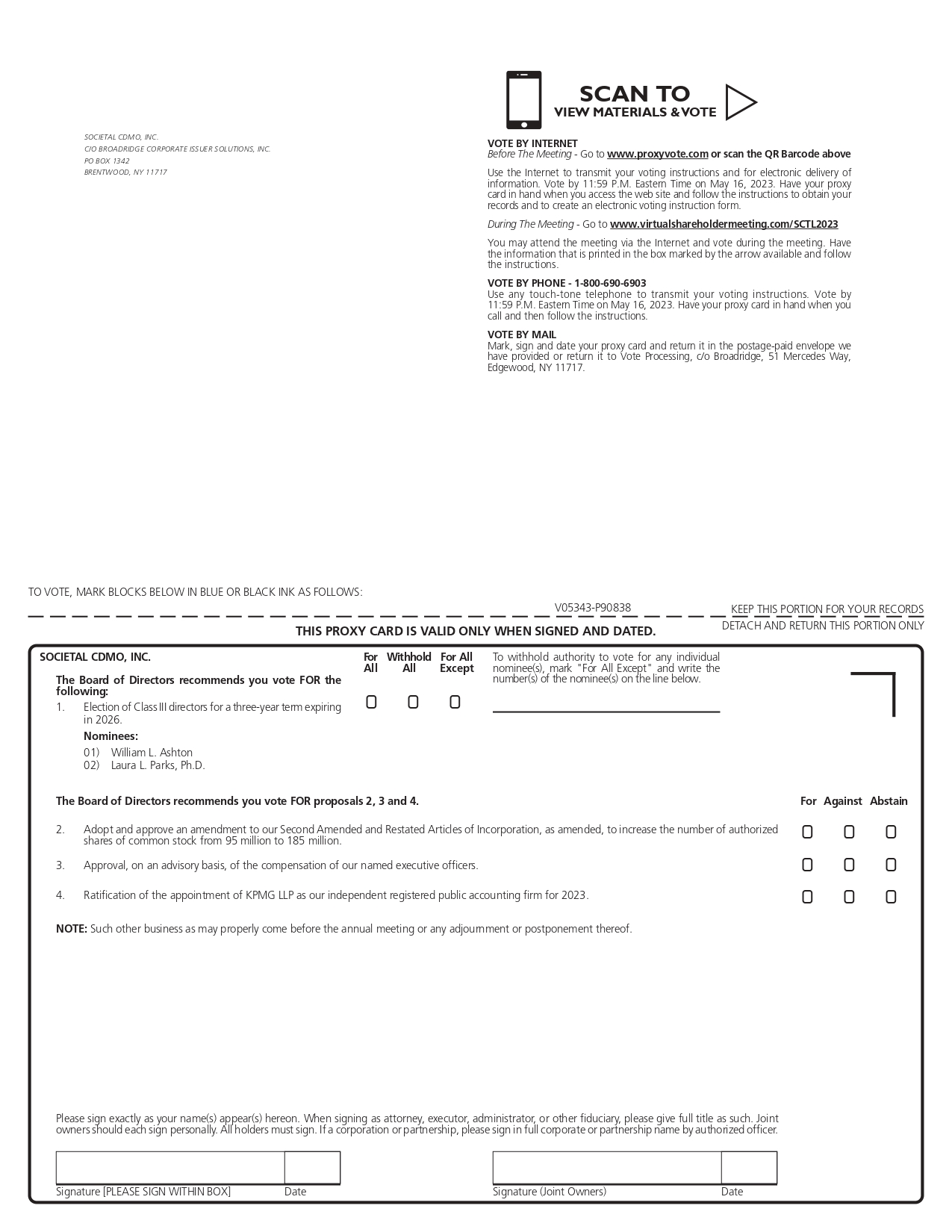

This Proxy Statement, with the enclosed proxy card, is being furnished to shareholders of Societal in connection with the solicitation by our Board of proxies to be voted at our Annual Meeting and at any postponements or adjournments thereof. The Annual Meeting will be held on May 17, 2023, at 10:00 a.m., Eastern time via the Internet at www.virtualshareholdermeeting.com/SCTL2023.

This Proxy Statement and the enclosed proxy card, along with the 2022 Annual Report to Shareholders, are first being made available to our shareholders on or about April 6, 2023.

1

GENERAL INFORMATION ABOUT THE MEETING |

PROXY SOLICITATION

Our Board is soliciting your vote on matters that will be presented at the Annual Meeting and at any adjournment or postponement thereof. This Proxy Statement contains information on these matters to assist you in voting your shares.

This Proxy Statement and the proxy card, along with the 2022 Annual Report to Shareholders, are first being made available to our shareholders on or about April 6, 2023. This Proxy Statement and our 2022 Annual Report are available to holders of our common stock at www.proxyvote.com.

SHAREHOLDERS ENTITLED TO VOTE

All shareholders of record of our common stock at the close of business on March 20, 2023, or the Record Date, are entitled to receive the Notice and to vote their shares at the Annual Meeting. As of that date, 84,902,318 shares of our common stock were outstanding. Each share is entitled to one vote on each matter properly brought to the meeting.

VOTING METHODS

You may vote at the Annual Meeting in person (virtually) or you may cast your vote in any of the following ways:

HOW YOUR SHARES WILL BE VOTED

In each case, your shares will be voted as you instruct. If you return a signed proxy card but do not provide voting instructions, your shares will be voted FOR each of the proposals in Items 1, 2, 3 and 4. If you are the record holder of your shares, you may revoke or change your vote any time before the proxy is exercised. To do so, you must do one of the following:

If your shares are held by your broker, bank or other holder of record as a nominee or agent (i.e., the shares are held in “street name”), you should follow the instructions provided by your broker, bank or other holder of record.

2

Deadline for Voting. The deadline for voting by telephone or internet, other than virtually attending the Annual Meeting, is 11:59 p.m., Eastern time on May 16, 2023. If you are a registered shareholder and virtually attend the Annual Meeting, you may vote online during the Annual Meeting.

BROKER VOTING AND VOTES REQUIRED FOR EACH PROPOSAL

If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of shares held in street name. The Notice has been forwarded to you by your broker, bank or other holder of record who is considered the shareholder of record of those shares. As the beneficial owner, you may direct your broker, bank or other holder of record on how to vote your shares by using the proxy card included in the materials made available or by following their instructions for voting on the internet.

A broker non-vote occurs when a broker or other nominee that holds shares for another does not vote on a particular item because the nominee does not have discretionary voting authority for that item and has not received instructions from the beneficial owner of the shares. The following table summarizes the proposals to be considered at the Annual Meeting, the vote required with respect to each proposal, how broker non-votes and abstentions are treated with respect to each proposal, and broker discretionary voting authority:

Proposal | Votes Required | Treatment of Withhold, Abstentions and Broker | Broker | |||

|

| |||||

Item 1: Election of Class III directors for a three-year term expiring in 2026 | Plurality of the | Withhold and broker non-votes will not be taken into account in determining the outcome of the proposal | No | |||

|

| |||||

Item 2: Adopt and approve an amendment to our Second Amended and Restated Articles of Incorporation, as amended, to increase the number of authorized shares of common stock from 95 million to 185 million | Majority of the | Abstentions and broker non-votes will not be taken into account in determining the outcome of the proposal | No | |||

|

|

|

|

|

|

|

Item 3: Approval, on a non-binding advisory basis, of the compensation of our named executive officers |

| Majority of the | Abstentions and broker non-votes will not be taken into account in determining the outcome of the proposal | No | ||

|

| |||||

Item 4: Ratification of appointment of KPMG LLP as our independent registered public accounting firm for the 2023 fiscal year

| Majority of the | Abstentions and broker non-votes, if any, will not be taken into account in determining the outcome of the proposal | Yes | |||

|

| |||||

QUORUM

We must have a quorum for the transaction of business at the Annual Meeting. The presence of shareholders entitled to cast at least a majority of the votes that all shareholders are entitled to cast on a particular matter to be acted upon at the meeting shall constitute a quorum for the purpose of consideration and action on the matter. To the extent that a quorum is present with respect to consideration of and action on a particular matter or matters but a quorum is not present as to another matter or matters, consideration of and action on the matter or matters for which a quorum is present may occur and, after such consideration and action, the meeting may be adjourned for purposes of the consideration of and action on the matter or matters for which a quorum is not present. For the purpose of establishing a quorum, abstentions, shares withheld, and broker non-votes are considered shareholders who are present and entitled to vote, and count toward the quorum. If there is no quorum, the holders of a majority of the shareholders present and entitled to vote or the presiding officer of the Annual Meeting may adjourn the meeting to another date.

3

PROXY SOLICITATION COSTS

We pay the cost of soliciting proxies. Proxies will be solicited on behalf of the Board by mail, telephone and other electronic means or in person. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

4

BOARD OF DIRECTORS |

Our Board is the Company’s ultimate decision-making body, except with respect to those matters reserved to the shareholders. Our Board selects the members of our senior management team, who in turn are responsible for the day-to-day operations of the Company. Our Board acts as an advisor and counselor to senior management and oversees its performance.

Our Board consists of directors divided into three staggered classes, with each class holding office for a three-year term. William L. Ashton and Laura L. Parks, Ph.D., current Class III directors, have been nominated by our Board for re-election at the Annual Meeting for three-year terms that will expire at the 2026 Annual Meeting of Shareholders and until their successors, if any, are elected or appointed, or their earlier death, resignation, retirement, disqualification or removal. Each of the nominees has agreed to be named and to serve, and we expect each nominee to be able to serve if elected. If any nominee is unable to serve, the Nominating and Corporate Governance Committee, or the Governance Committee, of our Board will recommend to our Board a replacement nominee. The Board may then designate the other nominee to stand for election. If you voted for the unavailable nominee, your vote will be cast for his or her replacement.

BOARD STRUCTURE AND COMPOSITION

The Governance Committee of our Board is responsible for recommending the composition and structure of our Board and for developing criteria for Board membership. The Governance Committee regularly reviews director competencies, qualities and experiences, with the goal of ensuring that our Board is comprised of an effective team of directors who function collegially and who are able to apply their experience toward meaningful contributions to our business strategy and oversight of our performance, risk management, organizational development and succession planning.

Our Fourth Amended and Restated Bylaws, or Bylaws, provide that the number of members of our Board shall be fixed by the Board from time to time. Our Board is currently fixed at nine members. Dr. Berelowitz’s service as a member of our Board will end effective as of the Annual Meeting and he is not standing for re-election. As a result, we intend to reduce the size of our Board from nine to eight, effective as of the Annual Meeting. The Governance Committee is responsible for identifying individuals that it believes are qualified to become Board members.

5

BOARD DIVERSITY

Board diversity and inclusion is critical to our success. While we do not have a formal policy on Board diversity, the Board is committed to building a Board that consists of the optimal mix of skills, expertise, and diversity capable of effectively overseeing the execution of our business and meeting our evolving needs, with diversity reflecting gender, age, race, ethnicity, background, professional experience and perspectives. The Governance Committee considers the value of diversity on the Board in evaluating director nominees. Accordingly, the Governance Committee’s evaluation of director nominees includes consideration of their ability to contribute to the diversity of personal and professional experiences, opinions, perspectives and backgrounds on the Board.

As presently constituted, the Board represents a deliberate mix of members who have a deep understanding of our business as well as members who have different skill sets and points of view. The listing requirements of the Nasdaq Stock Market LLC, or Nasdaq, require each listed company to have, or explain why it does not have, two diverse directors on the board, including at least one diverse director who self-identifies as female and at least one diverse director who self-identifies as an underrepresented minority or LGBTQ+, or for smaller reporting companies, two female directors. Our current board composition is in compliance with this requirement. We are particularly proud of the diversity on our Board, which includes two Board members who self-identify as diverse and lead our newly formed Environmental, Social and Governance Subcommittee. The matrix below provides certain highlights of the composition of our Board members based on self-identification. |

|

|

Board Diversity Matrix (As of April 3, 2023) |

|

|

|

|

| |||||

|

|

|

|

|

| |||||

Total Number of Directors | 9 | |||||||||

|

|

|

|

|

| |||||

Female | Male | Non-Binary | Did Not Disclose | |||||||

|

|

|

|

|

| |||||

Part I: Gender Identity |

|

|

|

|

| |||||

Directors | 2 | 7 |

| — | — | |||||

Part II: Demographic Background | ||||||||||

|

|

|

|

|

| |||||

African American or Black | — | — | — | — | ||||||

|

|

|

|

|

| |||||

Alaskan Native or Native American | — | — | — | — | ||||||

|

|

|

|

|

| |||||

Asian | — | — | — | — | ||||||

|

|

|

|

|

| |||||

Hispanic or Latinx | — | — | — | — | ||||||

|

|

|

|

|

| |||||

Native Hawaiian or Pacific Islander | — | — | — | — | ||||||

|

|

|

|

|

| |||||

White | 2 | 7 | — | — | ||||||

|

|

|

|

|

| |||||

Two or More Races or Ethnicities | — | — | — | — | ||||||

|

|

|

|

|

| |||||

LGBTQ+ | 1 | — |

|

| ||||||

|

|

|

|

|

| |||||

Did Not Disclose Demographic Background | — |

| ||||||||

6

CRITERIA FOR BOARD MEMBERSHIP

The Governance Committee has identified certain criteria that it will consider in identifying director nominees. Important general criteria and considerations for Board membership include:

GENERAL CRITERIA |

Ability to contribute to the Board’s range of talent, skill and experience to provide sound and prudent guidance with respect to the Company’s strategy and operations, including, but not limited to: • Experience at senior levels in public companies; • Technology and financial expertise; • Experience in leadership roles in the life sciences, healthcare or public health fields, including experience in the areas of development and commercialization of drug products and pharmaceutical manufacturing and quality control, including oversight and expansion of contract manufacturing and development operations; • Personal integrity and ethical character, commitment and independence of thought and judgment; • Capability to fairly and equally represent our shareholders; • Confidence and willingness to express ideas and engage in constructive discussion with other Board members and management, to actively participate in the Board’s decision-making process and make difficult decisions in the best interest of the Company; • Willingness and ability to devote sufficient time, energy and attention to the affairs of the Company and the Board; and • Lack of actual and potential conflicts of interest.

|

The Governance Committee also considers, on an ongoing basis, the background, experience and skills of the incumbent directors that are important to our current and future business needs, and evaluates the experience and skills that would be valuable in new Board members.

SELECTION OF CANDIDATES

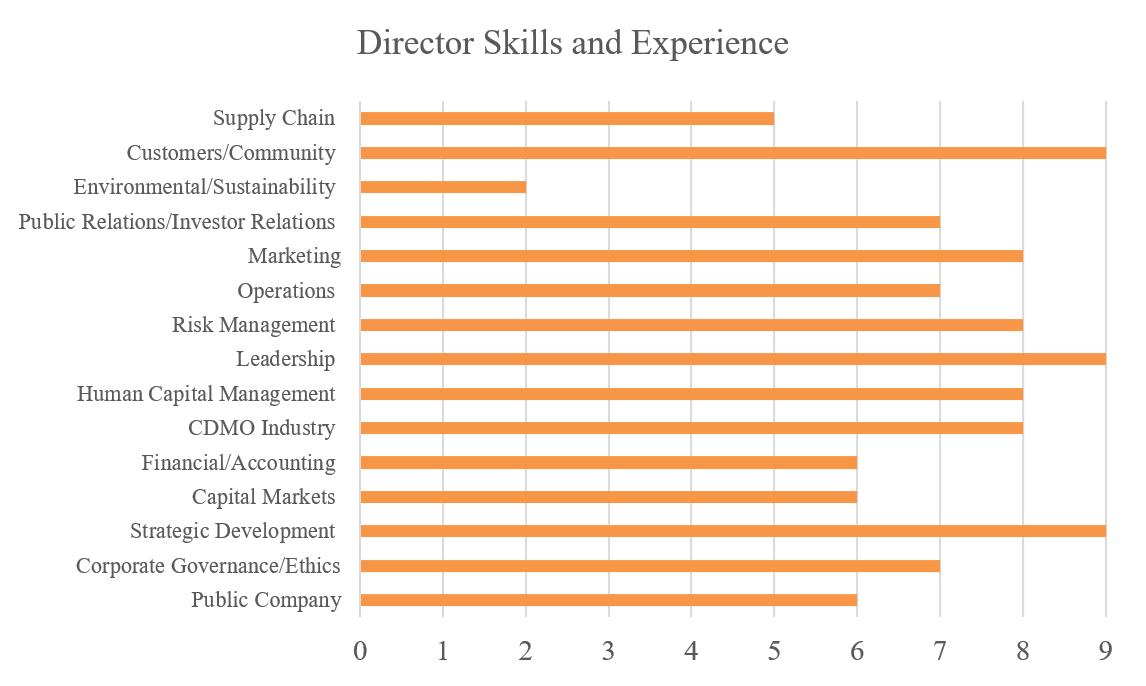

Director Skill Set Considerations; Use of Matrix

In recruiting and selecting Board candidates, the Governance Committee takes into account the size of the Board and utilizes a skills matrix. The expertise and experience included in the skills matrix are tied to our strategic goals, and the intent of the skills matrix is to ensure that the Board members collectively possess qualities that facilitate effective oversight of our strategic plans and help determine whether those skills and/or other attributes qualify him or her for service on a particular committee. While the matrix is useful for determining the collective skills of the Board as a whole, it is not a comparative or complete measure of the value of directors; a director with more focused experience could nonetheless contribute broadly and effectively. The Governance Committee also considers a wide range of additional factors, including: each director’s or candidate’s projected retirement date, to assist in Board succession planning; other positions the director or candidate holds, including other boards of directors on which he or she serves; and the independence of each director or candidate, to ensure that a substantial majority of the Board is independent. While the Company does not have a formal policy on Board diversity, the Governance Committee considers the value of diversity on the Board in evaluating director nominees. Accordingly, the Governance Committee’s evaluation of director nominees includes consideration of their ability to contribute to the diversity of personal and professional experiences, opinions, perspectives and backgrounds on the Board.

7

The matrix below displays the current Board’s skills and experience, including Dr. Berelowitz, who will not stand for re-election at the Annual Meeting, and whose service as a member of our Board will end effective as of the Annual Meeting:

POTENTIAL DIRECTOR CANDIDATES

On an ongoing basis, the Governance Committee considers potential director candidates identified on its own initiative as well as candidates referred or recommended to it by other directors, members of management, search firms, shareholders and others (including individuals seeking to join the Board). Shareholders who wish to recommend candidates may contact the Governance Committee in the manner described under the heading “Shareholder Communications to the Board” in this Proxy Statement. Shareholder nominations must be made according to the procedures required under our Bylaws and described in this Proxy Statement under the heading “Requirements for Submission of Shareholder Proposals for Next Year’s Annual Meeting.” Shareholder-recommended candidates and shareholder nominees whose nominations comply with these procedures and who meet the criteria referred to above will be evaluated by the Governance Committee in the same manner as the Governance Committee’s nominees.

In each of the director nominee and continuing director biographies that follow, we highlight the specific experience, qualifications, attributes and skills that led the Board to conclude that the director nominee or continuing director should serve on our Board at this time.

8

DIRECTOR NOMINEES

CLASS III DIRECTORS — TERMS EXPIRING AT THE ANNUAL MEETING

WILLIAM L. ASHTON | ||||

Age: 72 Director Since: 2009 | Committee Memberships: | Other Public Directorships: | ||

William L. Ashton has been a member of our Board since 2009. Since the beginning of 2013, Mr. Ashton has been a principal at Harrison Consulting Group, Inc., a privately-held biopharmaceutical consulting firm. From August 2009 to June 2013, Mr. Ashton was the senior vice president of external affairs reporting to the president and an assistant professor at the University of the Sciences in Philadelphia, Pennsylvania. From August 2005 to August 2009, Mr. Ashton was the founding Dean of the Mayes College of Healthcare Business and Policy. Mr. Ashton has 29 years’ experience in the biopharmaceutical industry. From 1989 to 2005, Mr. Ashton held a number of positions at Amgen Inc., a biotechnology company, including vice president of U.S. sales and vice president of commercial and government affairs. Mr. Ashton currently serves on the boards of directors of Spectrum Pharmaceuticals, Inc. and Baudax Bio. He previously served on the board of directors of Galena Biopharma, Inc. from April 2013 until January 2018. He is also a member of the board of directors of the National Osteoporosis Foundation and Friends of the National Library of Medicine at the National Institutes of Health. Mr. Ashton holds a B.S. in Education, from the California University of Pennsylvania and an M.A. in Education, from the University of Pittsburgh. | ||||

Skills & Qualifications: Mr. Ashton’s extensive experience with pharmaceutical and biological product commercialization and reimbursement issues, including developing and leading a commercial sales force, his past advisory role during the early years of Auxilium Pharmaceuticals, Inc., as well as his governance experience as a board member of public and privately-held companies and his reimbursement and scientific expertise contributed to our Board’s conclusion that he should serve as a director of our Company. | ||||

LAURA L. PARKS, PH.D. | ||||

Age: 64 Director Since: 2021 | Committee Memberships: | Other Public Directorships: None | ||

Laura L. Parks, Ph.D. has been a member of our Board since 2021. Dr. Parks has most recently served on the executive leadership team at Patheon, a global biopharma CDMO, until its acquisition by Thermo Fischer Scientific in 2017. In this role, she led strategic commercial and operational initiatives including development and execution of an end-to-end pharmaceutical services offering, as well as global strategic enterprise accounts organization. Prior to her role with Patheon, she served as president of DSM Pharmaceuticals, the CDMO subsidiary of DSM focused on finished dose pharmaceuticals, including sterile injectables, orals and topicals, from June 2012 until its merger in March 2014 with Patheon. Dr. Parks also has extensive experience in the food ingredient industry, having served as vice president of sales for Solae, a division of DuPont. While at Solae, Dr. Parks also held the position of regional vice president, North America, leading the company’s $120 million food ingredients business. She currently serves on the advisory board of Lindy BioSciences, a Durham, NC-based development-stage protein therapeutic formulations company. Dr. Parks earned a Ph.D. in food science from the University of Georgia and bachelor’s degree from The Ohio State University. | ||||

Skills & Qualifications: Dr. Parks’ extensive executive leadership experience as well as her many years of experience in the biopharma CDMO industry contributed to our Board’s conclusion that she should serve as a director of our Company. | ||||

9

CONTINUING DIRECTORS

CLASS I DIRECTORS – TERMS EXPIRING AT THE 2024 ANNUAL MEETING OF SHAREHOLDERS

WINSTON CHURCHILL | ||||

Age: 82 Director Since: 2008 | Committee Memberships: | Other Public Directorships: Innovative Solutions and Support, Inc., Amkor Technology, Inc., Baudax Bio, Inc. | ||

Winston J. Churchill has been a member of our Board since 2008. Since 2007, Mr. Churchill has been a director of the corporate general partner of the common general partner of SCP Vitalife Partners II, L.P. and SCP Vitalife Partners (Israel) II, L.P., collectively referred to herein as SCP Vitalife. He has also served as a managing member of SCP Vitalife Management Company, LLC, which by contract provides certain management services to the common general partner of SCP Vitalife. Mr. Churchill has also served since 1993 as the President of CIP Capital Management, Inc., the general partner of CIP Capital, L.P., a Small Business Administration-licensed private equity fund. Prior to that, Mr. Churchill was a managing partner of Bradford Associates, which managed private equity funds on behalf of Bessemer Securities Corporation and Bessemer Trust Company. From 1967 to 1983, Mr. Churchill practiced law at the Philadelphia firm of Saul Ewing, LLP, where he served as Chairman of the Banking and Financial Institutions Department, Chairman of the Finance Committee and was a member of the Executive Committee. Mr. Churchill is a director of Innovative Solutions and Support, Inc., Amkor Technology, Inc., Baudax Bio and various SCP Vitalife portfolio companies and he previously served as a director of Griffin Industrial Realty from April 1997 until 2017. In addition, he serves as a director on the boards of a number of charities and as a trustee of educational institutions including the Gesu School and Young Scholars Charter School and is a Trustee Fellow of Fordham University. From 1989 to 1993, Mr. Churchill served as Chairman of the Finance Committee of the Pennsylvania Public School Employees’ Retirement System. He was awarded a B.S. in Physics, summa cum laude, from Fordham University followed by an M.A. in Economics from Oxford University, where he studied as a Rhodes Scholar, and a J.D. from Yale Law School. | ||||

Skills & Qualifications: Mr. Churchill’s insight into financial and investment matters from his experience in private equity investing in life sciences companies, his financial and corporate governance experience from serving on numerous public and private boards of directors, as well as his long service as a director on our Board, where he gained extensive knowledge of our business and history, contributed to our Board’s conclusion that he should serve as a director of our Company. | ||||

JAMES C. MILLER | ||||

Age: 72 Director Since: 2021 | Committee Memberships: | Other Public Directorships: None | ||

James Miller has been a member of our Board since February 2021. Mr. Miller previously served as the founder and president of PharmSource Information Services, Inc., a market intelligence service, from 1996 to February 2018. Since February 2018, Mr. Miller has provided pharmaceutical manufacturing strategy consulting services to various pharmaceutical manufacturing companies. Mr. Miller previously served as a consultant in corporate strategy at the Boston Consulting Group and as an economist at The World Bank. Mr. Miller received a Bachelor in International Study degree and Economics from American University, a Master of Regional Planning degree at the University of North Carolina, Chapel Hill and an MBA from Stanford University Graduate School of Business. | ||||

Skills & Qualifications: Mr. Millers’ extensive experience with pharmaceutical and biological contract manufacturing and development, his deep industry knowledge and his experience as a pharmaceutical and biological manufacturing consultant contributed to our Board’s conclusion that he should serve as a director of our Company. | ||||

10

WAYNE B. WEISMAN | ||||

Age: 67 Director Since: 2008 | Committee Memberships: Governance | Other Public Directorships: ReWalk Robotics Ltd., Baudax Bio, Inc. | ||

Wayne B. Weisman has been a member and the chairman of our Board since 2008. Since 2007, Mr. Weisman has been a director of the corporate general partner of the common general partner of SCP Vitalife. He has also served as a managing member of SCP Vitalife Management Company, LLC, which by contract provides certain management services to the common general partner of SCP Vitalife. He has also led the activities of SCP Private Equity Partners II, L.P., a venture capital fund of which he and Mr. Churchill are principals, in the life sciences area; these activities include investments in the United States and Israel. He has also led several other technology investments for SCP Private Equity Partners II, L.P. He has been a member of the investment committee of the Vitalife Life Sciences funds since their inception in 2002 and has worked closely with these funds since then. Mr. Weisman was a member of the board of directors of CIP Capital, L.P., a small business investment company licensed by the U.S. Small Business Administration since its inception in 1991 until 2017. From 1992 to 1994, Mr. Weisman was executive vice president and member of the board of a public drug delivery technology company. In addition, he also operated a management and financial advisory firm focusing on the reorganization and turnaround of troubled companies and began his career practicing reorganization law at a large Philadelphia law firm. Mr. Weisman possesses extensive experience in venture capital investing, particularly in the life sciences area. In addition to being our Chairman, Mr. Weisman serves on the board of directors of ReWalk Robotics Ltd. and Baudax Bio and on the board of directors for a number of private companies. He is the Vice Chairman of the board of trustees of Young Scholars Charter School, and was chairman of that board from 2010 to 2017. He is also an advisory board member of Mid-Atlantic Diamond Ventures, the venture forum of Temple University. Mr. Weisman holds a B.A. from the University of Pennsylvania, and a J.D. from the University of Michigan Law School. | ||||

Skills & Qualifications: As a long time director of our company, Mr. Weisman’s extensive knowledge of our business and history, experience as a board member of multiple publicly-traded and privately-held companies and expertise in developing, financing and providing strong executive leadership to numerous growing life science companies contributed to our Board’s conclusion that he should serve as a director of our Company. | ||||

11

CLASS II DIRECTORS – TERMS EXPIRING AT THE 2025 ANNUAL MEETING OF SHAREHOLDERS

J. DAVID ENLOE, JR. | ||||

Age: 59 Director Since: 2020 | Committee Memberships: None | Other Public Directorships: None | ||

J. David Enloe, Jr. has been a member of our Board since December 2020. Mr. Enloe has served as our President and Chief Executive Officer since December 2020 and formerly served as President and Chief Executive Officer of Ajinomoto Bio-Pharma Services, a global, fully integrated CDMO from December 2013 to December 2020. Before joining Ajinomoto, Mr. Enloe served as the Head of the Viral Therapeutics Business Unit at Lonza Group AG, a Swiss multinational chemicals and biotechnology company, which unit was the result of Lonza’s acquisition of Vivante GMP Solutions, a gene therapy CDMO, that Mr. Enloe founded in June 2009 and where he served as President and CEO until its sale to Lonza AG. Before founding Vivante, Mr. Enloe spent 14 years with Introgen Therapeutics, joining as its first employee in 1995 and spending several years as Senior Vice President and COO before ultimately being named President and CEO. He is a Certified Public Accountant and started his career in public accounting with Arthur Andersen & Co. Mr. Enloe received a B.B.A. in Accounting from the University of Texas at Austin. | ||||

Skills & Qualifications: Mr. Enloe’s extensive leadership experience in the CDMO industry, including holding senior leadership positions at a number of CDMOs, along with his deep knowledge of the pharmaceutical industry and insights into the CDMO market contributed to our Board’s conclusion that he should serve as a director of our Company. | ||||

BRYAN M. REASONS | ||||

Age: 55 Director Since: 2017 | Committee Memberships: | Other Public Directorships: | ||

Bryan M. Reasons has been a member of our Board since 2017. Mr. Reasons has served as the Chief Financial Officer of Mallinckrodt plc, a global specialty pharmaceutical company since March 2019. Prior to that, Mr. Reasons served as the Senior Vice President, Finance and Chief Financial Officer of Impax Laboratories, Inc., or Impax, a specialty pharmaceutical company, from December 2012 until February 2019. He previously served as the Acting Chief Financial Officer of Impax from June 2012 to December 2012 and as the Vice President, Finance of Impax from January 2012 to June 2012. Prior to joining Impax, Mr. Reasons served as Vice President, Finance, from January 2010 to November 2011 and as Vice President, Risk Management and General Auditor, from October 2005 to January 2010 at Cephalon, Inc., or Cephalon, a biopharmaceutical company. Following the acquisition of Cephalon by Teva Pharmaceutical Industries Ltd., or Teva, a generic pharmaceuticals company, he served as Vice President, Finance of Teva from November 2011 to January 2012. Prior to joining Cephalon, Mr. Reasons held various finance management positions at E.I. Du Pont De Nemours and Company from 2003 to 2005 and served as senior manager at PricewaterhouseCoopers LLP from 1992 to 2003. Mr. Reasons currently serves as a director and chair of the audit committee of Aclaris Therapeutics, Inc., a position he has held since April 2018. Mr. Reasons has a B.S. in accounting from Pennsylvania State University and an M.B.A. from Widener University and is a certified public accountant. | ||||

Skills & Qualifications: Mr. Reasons’ extensive experience in the pharmaceutical industry, including his experience in senior leadership positions at a number of large pharmaceutical companies, as well as his expertise in financial and accounting matters, contributed to our Board’s conclusion that he should serve as a director of our Company. | ||||

12

Elena Cant | ||||

Age: 46 Director Since: 2022 | Committee Memberships: Governance | Other Public Directorships: None | ||

Elena Cant has been a member of our Board since September 2022. Since October 2022, she has been the Chief Operating Officer at Culture Biosciences, where her responsibilities span across different functions, including supply chain strategy, bioreactor manufacturing, bioprocessing services, quality, regulatory, and business development. Prior to that, Ms. Cant served as the Chief Operating Officer of TwinStrand BioSciences Inc., a private genomics company, where she managed all operational matters related to the company’s products, including manufacturing, supply chain, quality and regulatory, from January 2020 until September 2022. From 2012 to 2019, Ms. Cant served in several roles for Takeda Pharmaceutical Company Limited, a global biopharmaceutical company, including Commercial Head, Vaccine Business Unit (2016-2019) and Global Head of Vaccine Business Operations (2012-2016). Ms. Cant started her career in life sciences as a strategy consultant at McKinsey & Co, where she consulted large pharmaceutical and medical device companies, major health insurers, and hospital chains. Ms. Cant received her Bachelor of Science degree in economics and management from the Technical University of Moldova and her M.B.A. from the Booth School of Business at the University of Chicago. | ||||

Skills & Qualifications: Ms. Cant’s extensive experience in the healthcare and life sciences industries with experience across a wide variety of functional areas contributed to our Board’s conclusion that she should serve as a director of our Company. | ||||

13

CORPORATE GOVERNANCE AND RISK MANAGEMENT |

We are committed to good corporate governance and integrity in our business dealings. Our governance practices are documented in our Second Amended and Restated Articles of Incorporation, as amended, or Articles of Incorporation, our Bylaws, our Code of Business Conduct and Ethics, or the Code of Conduct, our Corporate Governance Guidelines and the charters of the committees of our Board, or collectively, the Committees. Aspects of our governance documents are summarized below. You can find the current charter for each Committee and our Code of Conduct on our website www.societalcdmo.com under “Investors — Governance — Governance Documents.”

BOARD INDEPENDENCE

Our Board has determined that each individual that served as a director of the Company during the year ended December 31, 2022, except for Mr. Enloe and Ms. Gerri Henwood, is an “independent” director, as defined under the rules of the Nasdaq Capital Market, or Nasdaq. Ms. Henwood resigned as a director in January 2022. In making such determination, the Board considered the relationships that each such non-employee director has with the Company and all other facts and circumstances that the Board deemed relevant in determining their independence, including the beneficial ownership of our common stock by each non-employee director. Our independent directors generally meet in executive session at each regularly scheduled Board meeting.

BOARD LEADERSHIP STRUCTURE

The Board does not have a formal policy with respect to the separation of the offices of Chief Executive Officer, or CEO, and Chairman of the Board. It is the Board’s view that rather than having a rigid policy, the Board, with the advice and assistance of the Governance Committee, and upon consideration of all relevant factors and circumstances, will determine, as and when appropriate, whether the two offices should be separate. Currently, our leadership structure separates the offices of CEO and Chairman of the Board with Mr. Enloe serving as our CEO and Mr. Weisman serving as Chairman of the Board. Our Board believes that the separation of the positions of CEO and Chairman of the Board reinforces the independence of the Board from management, creates an environment that encourages objective oversight of management’s performance and enhances the effectiveness of our Board as a whole.

BOARD COMMITTEES

Our Board has established various Committees to assist in discharging its duties: the Audit Committee, the Compensation Committee and the Governance Committee. Each member of our Committees is an independent director as that term is defined by the SEC and Nasdaq. The primary responsibilities of each of the Committees and the Committee memberships are provided below under the section entitled “Board Attendance, Committee Meetings and Committee Membership.”

Each of the Committees has the authority, as its members deem appropriate, to engage legal counsel or other experts or consultants to assist the Committee in carrying out its responsibilities.

RISK MANAGEMENT

The Board’s role in risk oversight is consistent with our leadership structure, with management having day-to-day responsibility for assessing and managing our risk exposure and the Board actively overseeing management of our risks – both at the Board and Committee level. The risk oversight process includes receiving regular reports from Committees and our executive officers to enable our Board to understand our risk identification, risk management and risk mitigation strategies with respect to areas of potential material risk, operations (including cybersecurity), finance, legal, regulatory, strategic and reputational risk.

14

The Board focuses on the overall risks which may affect us. Each Committee has been delegated the responsibility for the oversight of specific risks that fall within its areas of responsibility. For example:

While each Committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through Committee reports about such risks. Matters of significant strategic risk are considered by our entire Board.

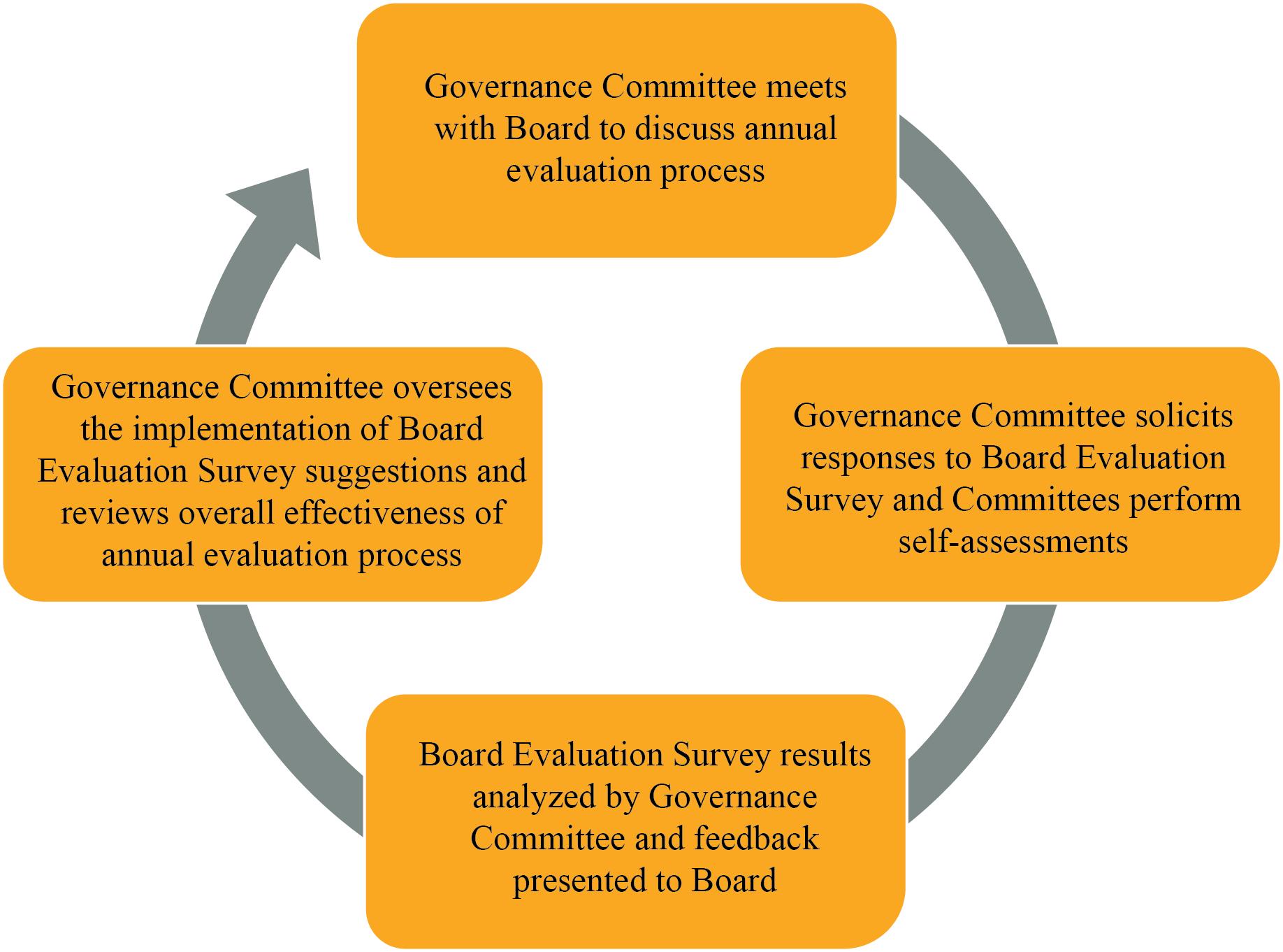

EVALUATING BOARD EFFECTIVENESS

The Board, led by the Governance Committee, is committed to continuous improvement and believes annual self-evaluations are an important tool for evaluating effectiveness. It has established and conducted an annual self-evaluation of the Board, which is presented by the chairman of the Governance Committee to the Board for discussion. In addition, each committee conducts an annual self-assessment in a review process similar to that used by the Board. Below is a graphic depicting the Board and Governance Committee annual cycle in evaluating Board effectiveness.

15

CODE OF CONDUCT

We have a written Code of Conduct that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The Code of Conduct covers fundamental ethical and compliance-related principles and practices such as accurate accounting records and financial reporting, avoiding conflicts of interest, the protection and use of our property and information and compliance with legal and regulatory requirements. Any amendments to the Code of Conduct, or any waivers of its requirements, will be disclosed on our website at www.societalcdmo.com.

DIRECTOR ORIENTATION AND CONTINUING EDUCATION

Our director orientation programs familiarize new directors with the Company’s businesses, strategies, and policies, and assist new directors in developing the skills and knowledge required for their service on the Board. All other directors are also invited to attend the orientation programs. From time to time, management advises, or invites outside experts to attend Board meetings to advise, the Board on its responsibilities, management’s responsibilities, developments relevant to corporate governance and best corporate practices. Additionally, Board members may attend, and are encouraged to attend, accredited director education programs at the Company’s expense.

RESTRICTIONS ON THE HEDGING AND PLEDGING OF SOCIETAL SHARES

Pursuant to the Company’s Insider Trading Policy, which applies to all officers, all directors and all employees of the Company and any of the Company’s subsidiaries, or the Covered Individuals, the Covered Individuals are prohibited from purchasing financial instruments or otherwise engaging in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of any equity security of Societal or any such subsidiary. Covered Individuals are also prohibited from selling “short” any securities of those companies.

Covered Individuals are further prohibited from holding any equity securities of Societal or any such subsidiary in a margin account or otherwise pledging such securities as collateral for a loan. Additionally, standing and limit orders create heightened risks for insider trading, with the possibility that such a transaction will be entered at a time when a director, officer, or other employee holds material, nonpublic information. Societal discourages these types of transactions. If placed, their timeframe should be short in duration and comply with the additional procedures of the Company’s Insider Trading Policy.

These prohibitions also apply to family members living in the same household as Covered Individuals, as well as entities influenced or controlled by the Covered Individuals.

CORPORATE GOVERNANCE GUIDELINES

We have a written set of corporate governance guidelines that are designed to help ensure effective corporate governance of our Company. Our Corporate Governance Guidelines cover topics including, but not limited to, director qualification criteria, director responsibilities, director compensation, director orientation and continuing education, the annual evaluations of our Board and its Committees and succession planning. Succession planning for the Board is critical to our success. Our goal is to achieve a Board that provides effective oversight of the Company through the appropriate balance of diversity of perspectives, experience, expertise and skills. Our Corporate Governance Guidelines are reviewed at least annually by the Governance Committee and amended by our Board when appropriate.

16

BOARD ATTENDANCE, COMMITTEE MEETINGS AND COMMITTEE MEMBERSHIP

Director |

| Independent |

| Board |

| AC |

| CC |

| GC |

|

|

|

| |||||||

William Ashton | Yes | M | C | M | ||||||

|

|

|

| |||||||

Michael Berelowitz* | Yes | M | C | |||||||

|

|

|

| |||||||

Winston Churchill | Yes | M | M | M | ||||||

|

|

|

| |||||||

J. David Enloe, Jr. | No | M | ||||||||

|

|

|

| |||||||

Elena Cant | Yes | M | M | |||||||

|

|

|

| |||||||

James Miller | Yes | M | M | M | ||||||

|

|

|

| |||||||

Laura L. Parks, Ph.D. | Yes | M |

| M | M | |||||

|

|

|

| |||||||

Bryan M. Reasons | Yes | M | C | |||||||

|

|

|

| |||||||

Wayne B. Weisman | Yes | C | M | |||||||

|

|

|

| |||||||

2022 Meetings |

| 13 | 4 | 7 | 5 | |||||

|

|

|

|

|

AC = Audit Committee | CC = Compensation Committee | C = Chair | ||

GC = Governance Committee | M = Member | |||

* Dr. Berelowitz provided notice to us that he will not stand for reelection at the Annual Meeting.

During 2022, each director attended at least 75% of the meetings of the Board and meetings of each Committee on which he or she served. Although we do not have a formal policy regarding attendance by members of our Board at our Annual Meeting, we encourage all of our directors to attend. All of our then-serving directors attended our 2022 Annual Meeting of Shareholders.

Following Dr. Berelowitz’s resignation from the Board, Mr. Ashton will succeed him as the chair of the Governance Committee, and Dr. Parks will succeed Mr. Ashton as the chair of the Compensation Committee.

17

Audit Committee | |

Chair: Bryan M. Reasons Additional Members: • Winston Churchill • James Miller | The Audit Committee assists the Board by providing oversight of our financial management, independent auditor and financial reporting procedures, as well as such other matters as directed by the Board or the Audit Committee Charter. Among other things, the Audit Committee’s responsibilities include: • appointing, retaining, compensating, overseeing, evaluating, and, when appropriate, terminating our independent registered public accounting firm; • discussing with management and the independent registered public accounting firm our annual and quarterly financial statements and related disclosures; • periodically reviewing policies and procedures with respect to data privacy and security we employ in conducting our business; • reviewing with management its assessment of our internal control over financial reporting, disclosure controls and procedures; • reviewing our Code of Conduct and recommending any changes to the Board; • overseeing our risk assessment and risk management processes; • reviewing and ratifying all related party transactions, based on the standards set forth in our Related Party Transactions Policy; and • preparing and approving the Audit Committee report required to be included in our annual proxy statement. |

✓ All members of our Audit Committee are deemed “independent” and financially literate under the applicable rules and regulations of the SEC and Nasdaq. ✓ Mr. Reasons also qualifies as an “audit committee financial expert” within the meaning of SEC regulations. | |

18

Governance Committee | |

Chair: Michael Berelowitz Additional Members: • William Ashton • Elena Cant • Laura L. Parks, Ph.D. • Wayne Weisman Dr. Berelowitz has advised us that, due to other professional commitments, he will not stand for re-election at the Annual Meeting, and his service as a member of our Board will end effective as of the Annual Meeting. Following Dr. Berelowitz’s resignation from the Board, Mr. Ashton will succeed him as the chair of the Governance Committee. | The Governance Committee identifies qualified individuals for membership on the Board, recommends to the Board the director nominees to fill vacancies on the Board and to stand for election at the next annual meeting of shareholders, develops and recommends to the Board a set of corporate governance guidelines for the Board and provides oversight of the corporate governance affairs of the Board, as well as such other matters as directed by the Board or the Governance Committee Charter. Among other things, our Governance Committee’s responsibilities include: • developing and submitting to the Board for its adoption a list of selection criteria for new directors to serve on the Board; • identifying, reviewing and evaluating candidates, including candidates submitted by shareholders, for election to the Board and recommending to the Board (i) nominees to fill vacancies or new positions on the Board and (ii) the slate of nominees to stand for election by the Company’s shareholders at each annual meeting of shareholders; • developing, recommending, and overseeing the implementation of and monitor compliance with, our corporate governance guidelines, and periodically reviewing and recommending any necessary or appropriate changes to our corporate governance guidelines; • annually recommending to the Board (i) the assignment of directors to serve on each Committee; (ii) the chairperson of each Committee and (iii) the chairperson of the Board or lead independent director, as appropriate; • periodically assessing the appropriate size and composition of the Board as a whole, the needs of the Board and the respective committees of the Board, and the qualification of director candidates in light of these needs; • reviewing the adequacy of the Articles of Incorporation and Bylaws and recommending to the Board, as conditions dictate, amendments for consideration by the shareholders; • reviewing any proposals submitted by shareholders for action at the annual meeting of shareholders and make recommendations to the Board regarding action to be taken in response to each proposal; • implementing policies with respect to governance risk oversight, assessment and management of risk associated with the independence of our Board and director nominees, potential conflicts of interest of members of our Board and our executive officers and the effectiveness of the Board and the committees thereof; and • overseeing our approach to environmental, social and governance matters, or ESG, through a dedicated ESG Subcommittee. The Governance Committee is responsible for identifying individuals that the Committee believes are qualified to become Board members, as described above in the section entitled “Board Structure and Composition.” |

✓ All members are deemed independent under the listing standards of Nasdaq | |

19

Compensation Committee | |

Chair: William Ashton Additional Members: • Winston Churchill • James Miller • Laura L. Parks, Ph.D. Following Mr. Ashton's appointment as chair of the Governance Committee, Dr. Parks will succeed him as the chair of the Compensation Committee. | The Compensation Committee reviews the performance and development of our management in achieving corporate goals and objectives and assures that our executive officers (including our CEO) are compensated effectively in a manner consistent with our strategy, competitive practice and shareholder interests, as well as such other matters as directed by the Board or the Compensation Committee Charter. Among other things, the Compensation Committee’s responsibilities include: • annually reviewing and recommending to the Board for approval the corporate goals and objectives applicable to the compensation of our CEO and other executive officers and evaluating at least annually our CEO’s and other executive officers’ performance in light of those goals and objectives; • determining and approving our CEO’s and other executive officers’ compensation level (including salary, cash and equity-based incentive awards and any personal benefits); • administering, or where appropriate, overseeing the administration of, executive and equity compensation plans and such other compensation and benefit plans that are adopted by us from time to time; • determining stock ownership guidelines for our CEO and other executive officers and monitoring compliance with such guidelines, if deemed advisable by our Board or the Compensation Committee; and • overseeing risks and exposures associated with executive compensation plans and arrangements. |

✓ All members are deemed independent under the listing standards of Nasdaq ✓ All members are “non-employee directors” for purposes of Rule 16b-3 under the applicable rules and regulations of Nasdaq and the Securities Exchange Act of 1934, as amended, or the Exchange Act. | |

COMPENSATION CONSULTANT

Our Compensation Committee has delegated authority to our CEO to grant options or other stock awards, in accordance with guidelines established by our compensation consultant, to our non-executive officers. Our Compensation Committee also has the authority to form and delegate authority to one or more subcommittees as it deems appropriate from time to time under the circumstances.

Our CEO annually reviews the performance of each of the other executive officers, including the other named executive officers. He then recommends annual merit salary adjustments and any changes in annual or long-term incentive opportunities for other executives. The Compensation Committee considers our CEO’s recommendations in addition to data and recommendations presented by our executive compensation consultant.

Pay Governance, LLC, or Pay Governance, is our executive compensation consultant. Pay Governance was engaged by and reports directly to the Compensation Committee, and provides various executive compensation services to the Compensation Committee, including advising the Compensation Committee on the principal aspects of our executive compensation program and evolving industry practices and providing market information and analysis regarding the competitiveness of our program design and our award values in relation to performance. Upon request by the Compensation Committee, a representative of Pay Governance attended Compensation Committee meetings. Pay Governance does not provide services to us other than its advice to the Compensation Committee on executive and director compensation matters. The Compensation Committee determined Pay Governance to be independent under the Nasdaq and SEC regulations.

20

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During 2022, none of the members of the Compensation Committee was one of our officers or employees, none was formerly an officer of the company, and none had a relationship requiring disclosure with respect to related party transactions. During 2022, none of our executive officers served on the compensation committee or board of directors of any company that employed or employs any member of our Compensation Committee or Board.

FAMILY RELATIONSHIPS

There are no family relationships among any of our directors or executive officers.

Connect

Engaging with investors is fundamental to our commitment to good governance and essential to maintaining strong corporate governance practices. Throughout the year, we seek opportunities to connect with our investors to gain and share valuable insights into current and emerging global governance trends.

Collaborate

We strive for a collaborative approach to shareholder engagement and value the variety of investors’ perspectives received, which helps deepen our understanding of their interests and motivations.

Communicate

Our goal is to communicate with our shareholders through various platforms, including via our website, in print and in person at investor presentations or shareholder meetings. We view communication between our shareholders and the Board as a dialogue.

How to Communicate with our Directors By mail: Corporate Secretary, Societal CDMO, Inc 1 E. Uwchlan Ave., Suite 112 Exton, Pennsylvania 19341

OUR VALUES — ENVIRONMENTAL, SOCIAL AND CORPORATE GOVERNANCE

Societal’s approach to ESG is driven by the commitment to further our mission of “improving patients’ lives through client partnerships, while contributing to the communities in which we operate. Our pursuit is three-fold: (i) fostering sound corporate governance to ensure the long-term health of our company; (ii) creating a great place to work and do business that gives back to the communities we serve; and (iii) operating more efficiently while supporting our new and existing customers’ own sustainability aspirations. Our thoughtful approach enhances Societal’s ability to compete in the marketplace while bringing tailored solutions to our clients.

21

Designing and implementing organization-wide initiatives that align with our mission and values in a meaningful way is not a process that can be executed overnight. Since becoming a standalone, public company at the end of 2019, Societal has remained dedicated to ensuring that this process is timely and proactive, but also maintains a deliberate approach toward optimal effectiveness.

Accomplishments/Engagement

2022

2021

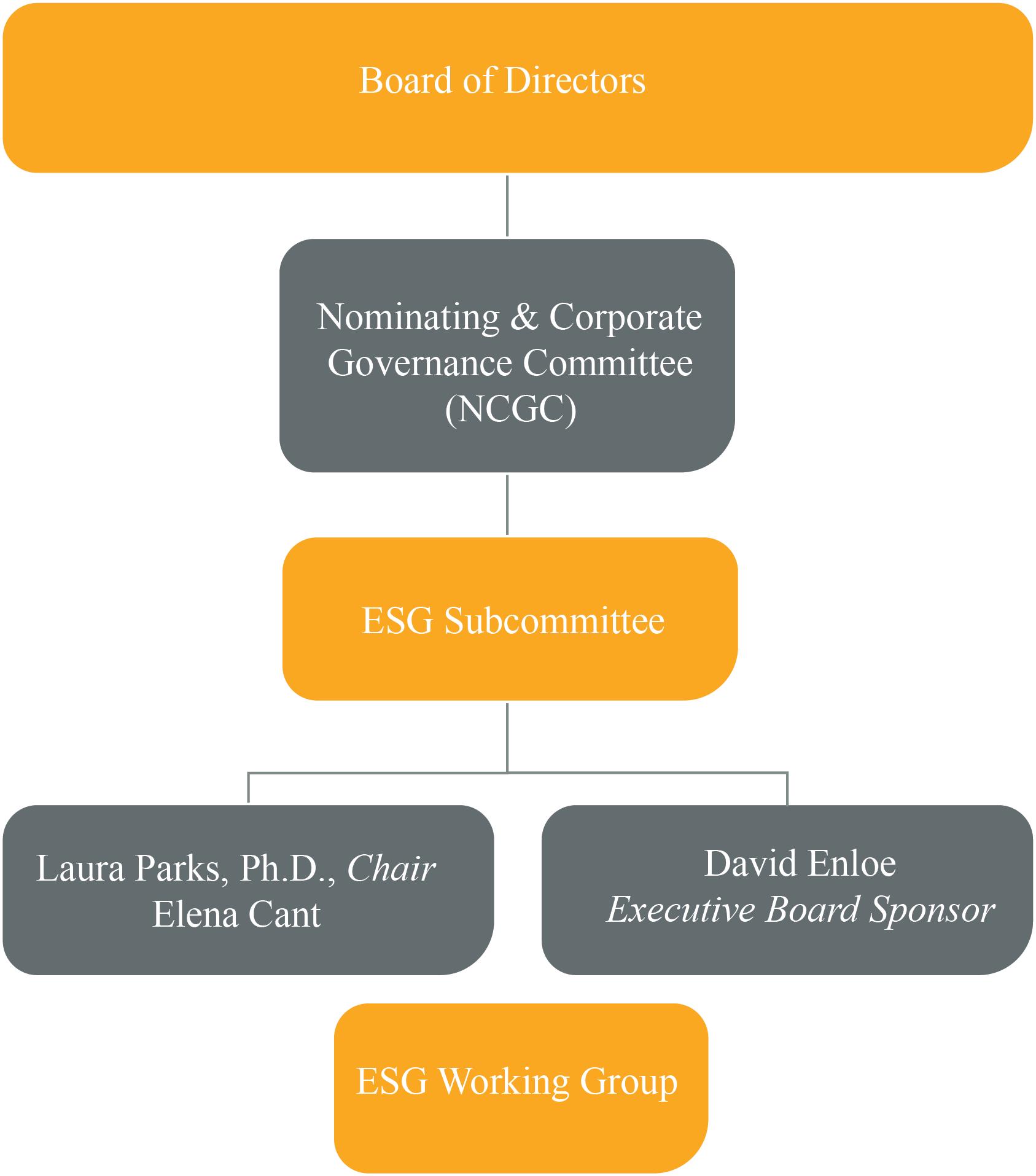

ESG Governance

In 2022 a dedicated ESG Subcommittee was created to ensure our ESG initiatives were well understood and guided at the Board level. We have a written set of corporate governance guidelines that are designed to help ensure effective corporate governance of our Company. See "Corporate Governance and Risk Management - Corporate Governance Guidelines" above.

22

Disclosures

We also believe in the importance of maintaining transparency. We publish several disclosures designed to keep our stakeholders apprised of our progress around ESG. Stakeholders interested in more detailed information on our ESG efforts are encouraged to consult our annual ESG Highlights Report, which adheres to SASB standards and includes workforce demographics (EEO-1). These disclosures, along with our Code of Conduct, Supplier Code of Conduct, and Environmental Health and Safety Policy, will be available on our upcoming ESG webpage at ir.societalcdmo.com.

Forward-Looking Statements

The goals discussed in this proxy statement and our ESG disclosures are aspirational, and no guarantees or promises are made that all goals will be met. Neither our ESG disclosures nor this section of the proxy statement are comprehensive. As such, they should be read in conjunction with the reports that Societal has filed with the SEC pursuant to the Exchange Act, including the “Forward-Looking Statements” and “Risk Factors” sections of our Annual Report on Form 10-K for the period ended December 31, 2022. This and other SEC filings are available through our website at ir.societalcdmo.com and on the SEC’s website at sec.gov. Unless otherwise stated, all information in this section is as of December 31, 2022.

23

DIRECTOR COMPENSATION |

We have designed and implemented our compensation program for our non-employee directors to attract, motivate and retain individuals who are committed to our values and goals and who have the expertise and experience that we need to achieve those goals.

DIRECTOR COMPENSATION PROGRAM

The table below depicts our compensation program for our non-employee directors in effect during 2022:

Non-Employee Director Compensation Program | ||

Cash | ||

Annual Cash Retainer | $40,000 | |

Annual Committee Chair Retainer: | ||

Audit | $20,000 | |

Compensation | $15,000 | |

Governance | $10,000 | |

Committee Member Retainer: | ||

Audit | $10,000 | |

Compensation | $ 7,500 | |

Governance | $ 5,000 | |

Annual Non-Executive Chairman of the Board Cash Retainer | $40,000 | |

Equity | ||

Initial Equity Grant | A stock option to purchase 20,000 shares of our common stock vesting in three equal annual installments | |

Annual Equity Retainer | $70,000 in restricted stock units and $65,000 in stock options, granted annually following our annual meeting of shareholders, and in each case vesting on the first anniversary of the date of grant | |

Cash fees are paid quarterly and are typically pro-rated for non-employee directors who cease to provide services mid-year. Our non-employee directors are also reimbursed for their business-related expenses incurred in connection with attendance at Board and Committee meetings and related activities. Our only employee director, Mr. Enloe, receives no separate compensation for his service in such capacity.

24

DIRECTOR COMPENSATION 2022

The following table provides summary information regarding 2022 compensation to our non-employee directors.

Name |

| Fees Earned or Paid in Cash ($) |

| Option Awards ($)(1) |

| Stock Awards ($)(1) |

| Total ($) |

William L. Ashton (2) |

| 60,000 |

| 64,894 |

| 70,000 |

| 194,894 |

Michael Berelowitz (2) |

| 50,000 |

| 64,894 |

| 70,000 |

| 184,894 |

Elena Cant (2) (3) |

| 13,334 |

| 17,462 |

| — |

| 30,796 |

Winston Churchill (2) |

| 57,500 |

| 64,894 |

| 70,000 |

| 192,394 |

James C. Miller (2) |

| 57,500 |

| 64,894 |

| 70,000 |

| 192,394 |

Laura L. Parks, Ph.D. (2) |

| 55,000 |

| 64,894 |

| 70,000 |

| 189,894 |

Bryan M. Reasons (2) |

| 60,000 |

| 64,894 |

| 70,000 |

| 194,894 |

Wayne B. Weisman (2) |

| 85,000 |

| 64,894 |

| 70,000 |

| 219,894 |

Gerri Henwood (4) |

| 2,000 |

| — |

| — |

| 2,000 |

(1) | Reflects the aggregate grant date fair value of restricted stock units and options determined in accordance with the Financial Accounting Standards Board Accounting Standards, Codification Topic 718, Compensation – Stock Compensation, or ASC 718. The assumptions made in these valuations are included in Note 13 to the Annual Financial Statements included in our 2022 Annual Report. |

(2) | As of December 31, 2022, (i) Messrs. Ashton, Churchill and Weisman each had stock options to purchase 240,452 shares of common stock, (ii) Dr. Berelowitz had stock options to purchase 232,952 shares of common stock, (iii) Ms. Cant had stock options to purchase 20,000 shares of common stock, (iv) Mr. Miller had stock options to purchase 176,194 shares of common stock, (v) Dr. Parks had stock options to purchase 138,182 shares of common stock, and (vi) Mr. Reasons had stock options to purchase 208,452 shares of common stock. In addition, as of December 31, 2022, each of our non-employee directors, except Ms. Cant, had 87,500 outstanding and unvested restricted stock units. |

(3) | Ms. Cant was appointed as a director on September 1, 2022. |

(4) | Ms. Henwood resigned as a director in January, 2022. |

25

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FEES

The Audit Committee works with our management in order to negotiate appropriate fees with KPMG and is ultimately responsible for approving those fees. The following is a summary and description of audit fees paid or payable to KPMG for each of the years ended December 31, 2022 and 2021 and the fees billed by KPMG for other services in each of those years:

Service |

| 2022 |

| 2021 |

Audit fees |

| $773,925 |

| $930,830 |

Audit-related fees |

| — |

| 116,888 |

Tax fees |

| 89,241 |

| 99,580 |

All other fees |

| — |

| — |

Total |

| $863,166 |

| $1,147,298 |

“Audit fees” represented the aggregate fees for professional services rendered for the audit of our annual consolidated financial statements, consents for the use of audit reports and reference to the auditor as an expert in our registration statements, and professional services rendered for the review of our quarterly consolidated financial statements that are customary under the standards of the Public Company Accounting Oversight Board (United States) and in connection with regulatory filings.

“Audit-related fees” consisted of due diligence fees related to the acquisition of IriSys, LLC.

“Tax fees” consisted of fees related to tax compliance, tax planning and tax advice.

AUDIT COMMITTEE PRE-APPROVAL POLICIES AND PROCEDURES

The Audit Committee is responsible for appointing, setting compensation for, and overseeing the work of the independent registered public accounting firm. The Audit Committee’s charter establishes a policy that all audit and permissible non-audit services provided by the independent registered public accounting firm will be pre-approved by the Audit Committee.

All such audit and permissible non-audit services were pre-approved in accordance with this policy during the fiscal year ended December 31, 2022. These services may include audit services, audit-related services, tax services and other services. The Audit Committee considers whether the provision of each non-audit service is compatible with maintaining the independence of our independent registered public accounting firm. The responsibility to pre-approve audit and non-audit services may be delegated by the Audit Committee to one or more members of the Audit Committee; provided that any decisions made by such member or members must be presented to the full Audit Committee at its next scheduled meeting.

26

AUDIT COMMITTEE REPORT |

The primary purpose of the Audit Committee is to assist the Board in its general oversight of the Company’s financial reporting process.

Management is primarily responsible for the preparation, presentation, and integrity of the Company’s consolidated financial statements, accounting and financial reporting principles, internal controls and procedures designed to ensure compliance with accounting standards, applicable laws and regulations. The Company’s independent registered public accounting firm for the fiscal years 2022, 2021 and 2020, KPMG, is responsible for performing an independent audit of the consolidated financial statements and expressing an opinion on the conformity of those consolidated financial statements with generally accepted accounting principles.

The Audit Committee has reviewed and discussed the audited financial statements with management. The Audit Committee and the chairman of the Audit Committee met with management during fiscal year 2022 to consider the adequacy of the Company’s internal controls, and discussed these matters and the overall scope and plans for the audit of the Company with KPMG. The Audit Committee also discussed with management and KPMG the Company’s disclosure controls and procedures.

The Audit Committee has reviewed and discussed management’s assessment of the effectiveness of the Company’s internal controls and the audited consolidated financial statements contained in the Company’s 2022 Annual Report with management. The Audit Committee has discussed with KPMG the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board Auditing Standard and the Securities and Exchange Commission. In addition, KPMG has provided the Audit Committee with the written disclosures and the letter required by the applicable requirements of the Public Company Accounting Oversight Board regarding KPMG’s communications with the Audit Committee concerning independence, and the Audit Committee has discussed with KPMG its independence.

The Audit Committee also considered whether the independent registered public accounting firm’s provision of non-audit services to the Company is compatible with the auditor’s independence. The Audit Committee has concluded that the independent registered public accounting firm is independent from the Company and its management. Based on the review and discussions referred to above, the Audit Committee recommended to the Board that the audited consolidated financial statements be included in the Company’s 2022 Annual Report.

Audit Committee

Bryan Reasons (Chairman)

Winston J. Churchill

James C. Miller

27

EXECUTIVE OFFICERS |

The following table sets forth the name, age and position of each of our executive officers as of the date of this Proxy Statement:

Name | Position | Age | ||

J. David Enloe, Jr. | President, Chief Executive Officer | 59 | ||

Ryan D. Lake | Chief Financial Officer | 45 |

J. David Enloe, Jr. — See biography information above.

Ryan D. Lake has served as our Chief Financial Officer since January 2018. He had previously served as our Senior Vice President of Finance and Chief Accounting Officer since June 2017. Mr. Lake also served as the Chief Financial Officer of Baudax Bio following the separation of Baudax Bio from the Company, or the Separation, from November 2019 to December 2020. Mr. Lake has over 20 years of senior financial and life sciences leadership experience. Prior to joining us, Mr. Lake served as Chief Financial Officer and Vice President of Finance of Aspire Bariatrics, Inc., a privately-held, commercial-stage, medical device company from July 2015 to May 2017. From 2012 to 2015, Mr. Lake held executive management and senior finance positions, including Director of the Natural Materials Division, Controller and Senior Director of Finance, at DSM Biomedical (successor to Kensey Nash Corporation after its acquisition in 2012), a division of Royal DSM (listed on Euronext Amsterdam), a global science-based company active in health, nutrition and materials. From 2002 to 2012, Mr. Lake held various senior financial positions of increasing responsibility, most notably Senior Director of Finance and Interim Chief Financial Officer, with Kensey Nash Corporation, a medical device company. Earlier in his career, Mr. Lake worked at Deloitte & Touche, LLP. Mr. Lake has a B.S. degree in Accounting from West Chester University of Pennsylvania and is a certified public accountant and Chartered Global Management Accountant.

28

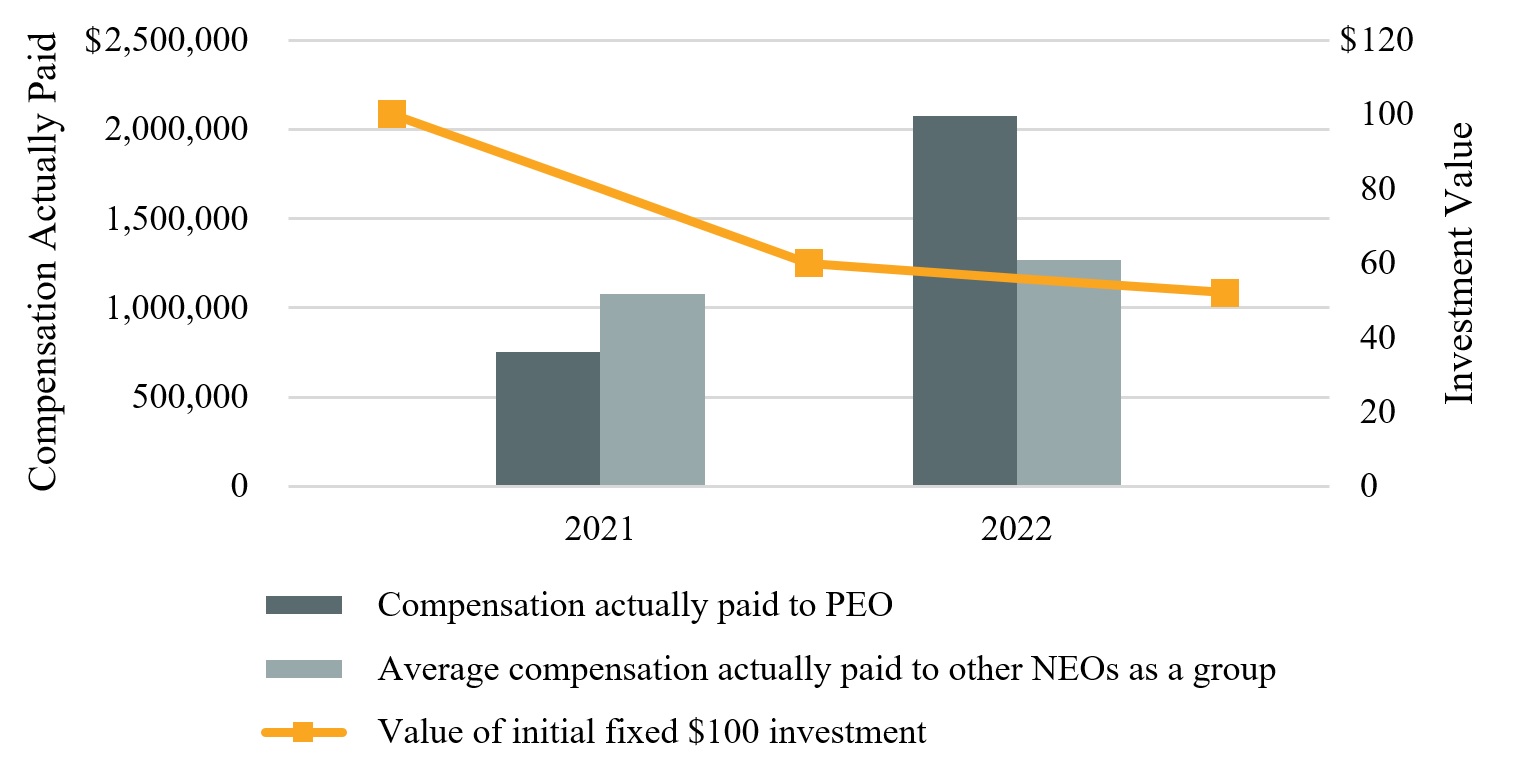

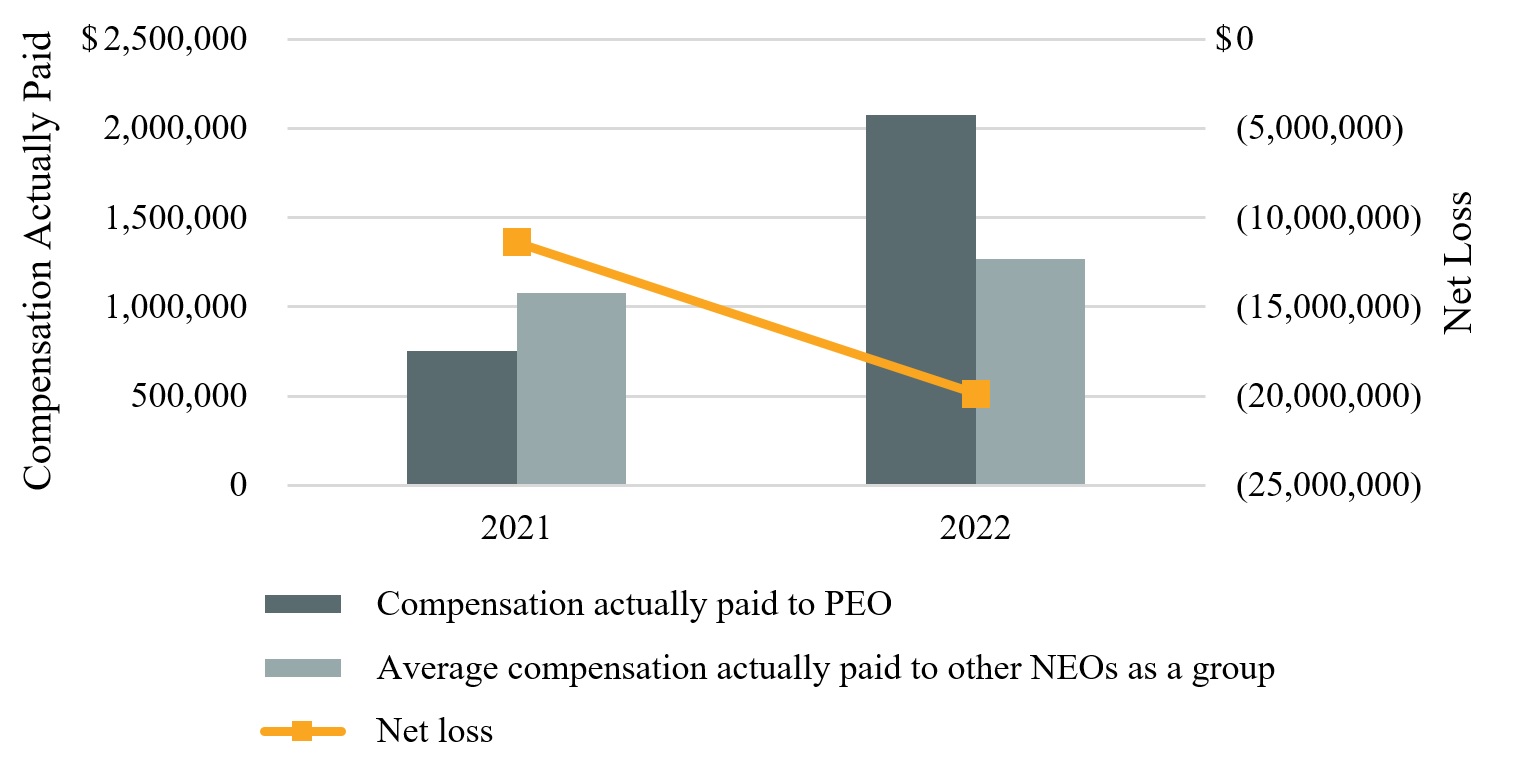

EXECUTIVE COMPENSATION |

Our named executive officers are J. David Enloe, Jr., our President and CEO, and Ryan D. Lake, our Chief Financial Officer. This section discusses the material components of the executive compensation program for our named executive officers.

2022 SUMMARY COMPENSATION TABLE

The following table sets forth information concerning the compensation awarded to, earned by or paid to our named executive officers during the fiscal years ended December 31, 2022 and 2021:

Name and Principal Position | Year | Salary | Bonus |

| Stock Awards | Option Awards | Non-Equity Incentive Plan | All Other | Total |

J. David Enloe, Jr. | 2022 | 572,115 | 400,000 | (3) | 749,999 | 498,982 | — | 50,444 | 2,271,540 |

President and Chief Executive Officer | 2021 | 550,000 | — |

| 120,793 | — | 377,190 | 49,062 | 1,097,045 |

Ryan D. Lake | 2022 | 438,269 | 225,000 | (3) | 419,999 | 279,431 | — | 52,993 | 1,415,692 |

Chief Financial Officer | 2021 | 425,385 | — |

| 867,815 | — | 242,887 | 49,062 | 1,585,149 |

(1) | Reflects the aggregate grant date fair value of restricted stock units and options determined in accordance with the Financial Accounting Standards Board Accounting Standards, Codification Topic 718, Compensation — Stock Compensation, or ASC 718. The assumptions made in these valuations are included in Note 13 to the Annual Financial Statements included in our 2022 Annual Report. |