April 2017 Relieving pain…….Improving lives Exhibit 99.1

Special Note Regarding Forward-Looking Statements This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements, among other things, relate to our business strategy, goals and expectations concerning our product candidates, future operations, prospects, plans and objectives of management. The words "anticipate", "believe", "could", "estimate", "expect", "intend", "may", "plan", "predict", "project", "will" and similar terms and phrases are used to identify forward-looking statements in this presentation. Our operations involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward-looking statements ultimately prove to be correct. This presentation is intended to be nonpromotional and for investor discussion purposes only. The information provided herein contains references to investigational products and use of these products has not been approved by the FDA. The safety and efficacy of the investigational use of these development products has not been determined. There is no guarantee that the investigational use listed will be filed with and/or approved for marketing by any regulatory agency. These forward-looking statements should be considered together with the risks and uncertainties that may affect our business and future results included in our filings with the Securities and Exchange Commission at www.sec.gov. These forward-looking statements are based on information currently available to us, and we assume no obligation to update any forward-looking statements except as required by applicable law.

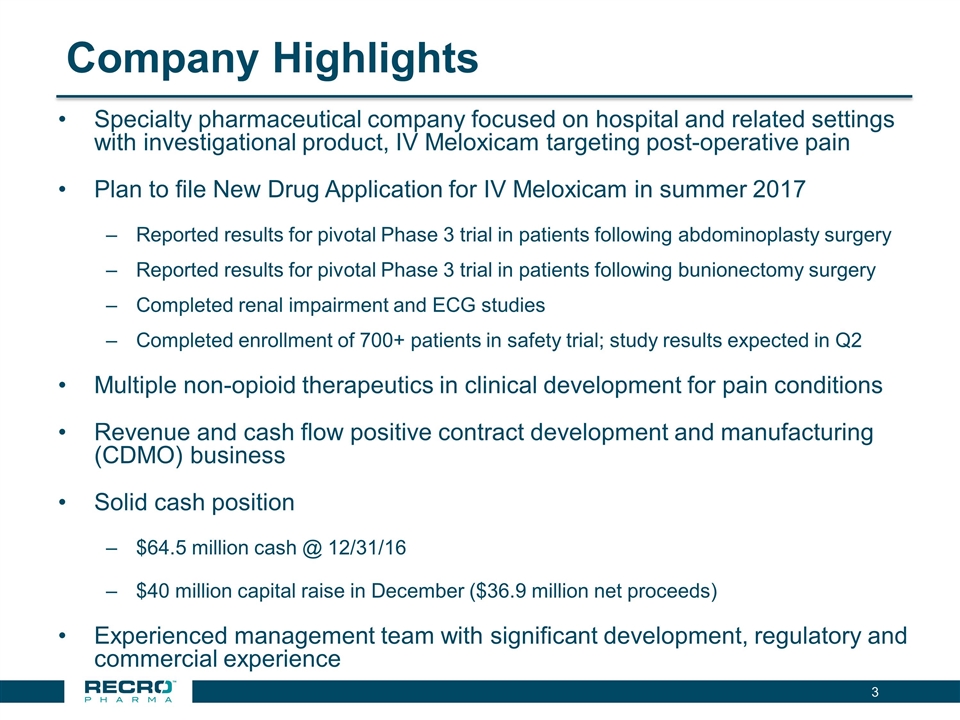

Company Highlights Specialty pharmaceutical company focused on hospital and related settings with investigational product, IV Meloxicam targeting post-operative pain Plan to file New Drug Application for IV Meloxicam in summer 2017 Reported results for pivotal Phase 3 trial in patients following abdominoplasty surgery Reported results for pivotal Phase 3 trial in patients following bunionectomy surgery Completed renal impairment and ECG studies Completed enrollment of 700+ patients in safety trial; study results expected in Q2 Multiple non-opioid therapeutics in clinical development for pain conditions Revenue and cash flow positive contract development and manufacturing (CDMO) business Solid cash position $64.5 million cash @ 12/31/16 $40 million capital raise in December ($36.9 million net proceeds) Experienced management team with significant development, regulatory and commercial experience

Experienced Management and Board Gerri Henwood – President and CEO Founded Auxilium Pharmaceuticals (AUXL, NASDAQ) and IBAH (former NASDAQ Co. – acquired 1998); GSK Michael Celano – CFO Over 35 years of financial leadership experience – Kensey Nash, BioRexis, Orasure, Arthur Andersen/KPMG Randy Mack – SVP, Development Over 25 years of clinical development experience – Adolor, Auxilium, Abbott Labs and Harris Labs Stewart McCallum, MD – CMO Over 9 years of GSK Clinical experience – Development experience; past clinical Investigator, KOL and Stanford U. Fred Graff – CCO Over 30 years of successful commercial experience, including sales and marketing leadership roles at Sepracor, RPR, and MAP Pharmaceuticals Board of Directors Wayne B. Weisman – Chairman SCP VitaLife Partners Alfred Altomari CEO, Agile Therapeutics William L. Ashton Harrison Consulting Group; frmly Amgen Michael Berelowitz, M.D. Former SVP, Specialty Care Business Unit, Pfizer Winston J. Churchill SCP VitaLife Partners Karen Flynn President-Pharmaceutical Packaging Systems, West Pharmaceutical Services, Inc. Gerri Henwood – CEO Bryan Reasons SVP and CFO, Impax Laboratories

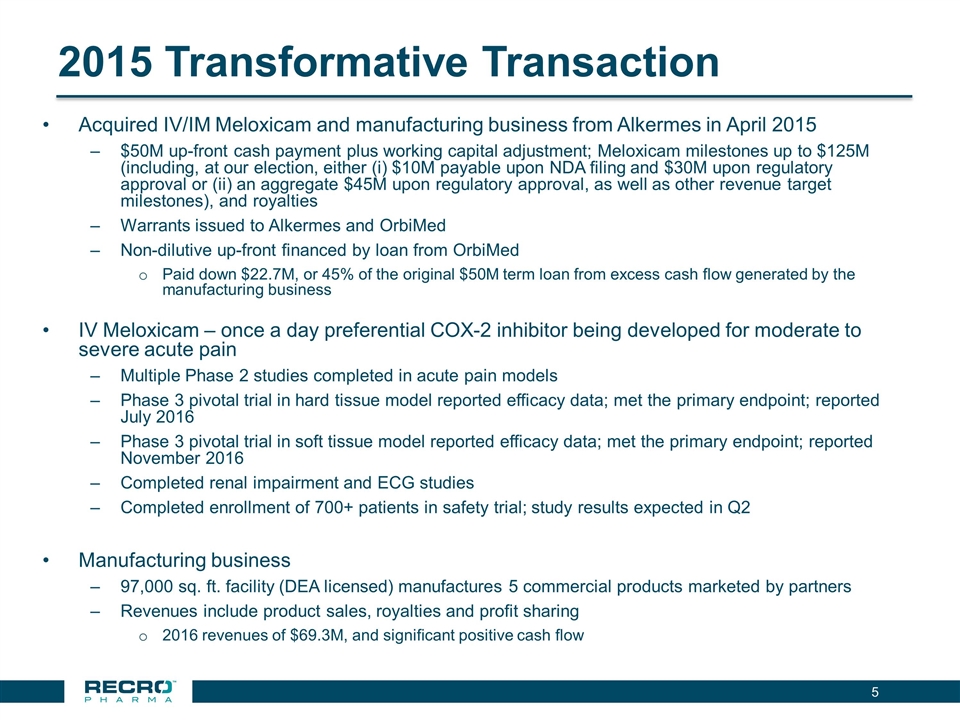

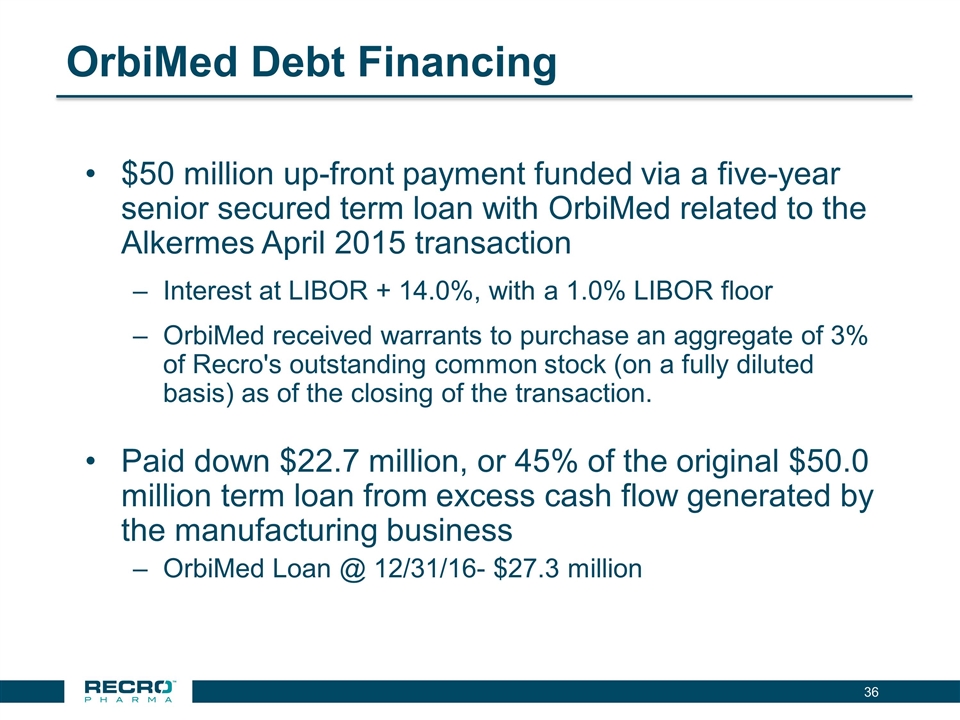

2015 Transformative Transaction Acquired IV/IM Meloxicam and manufacturing business from Alkermes in April 2015 $50M up-front cash payment plus working capital adjustment; Meloxicam milestones up to $125M (including, at our election, either (i) $10M payable upon NDA filing and $30M upon regulatory approval or (ii) an aggregate $45M upon regulatory approval, as well as other revenue target milestones), and royalties Warrants issued to Alkermes and OrbiMed Non-dilutive up-front financed by loan from OrbiMed Paid down $22.7M, or 45% of the original $50M term loan from excess cash flow generated by the manufacturing business IV Meloxicam – once a day preferential COX-2 inhibitor being developed for moderate to severe acute pain Multiple Phase 2 studies completed in acute pain models Phase 3 pivotal trial in hard tissue model reported efficacy data; met the primary endpoint; reported July 2016 Phase 3 pivotal trial in soft tissue model reported efficacy data; met the primary endpoint; reported November 2016 Completed renal impairment and ECG studies Completed enrollment of 700+ patients in safety trial; study results expected in Q2 Manufacturing business 97,000 sq. ft. facility (DEA licensed) manufactures 5 commercial products marketed by partners Revenues include product sales, royalties and profit sharing 2016 revenues of $69.3M, and significant positive cash flow

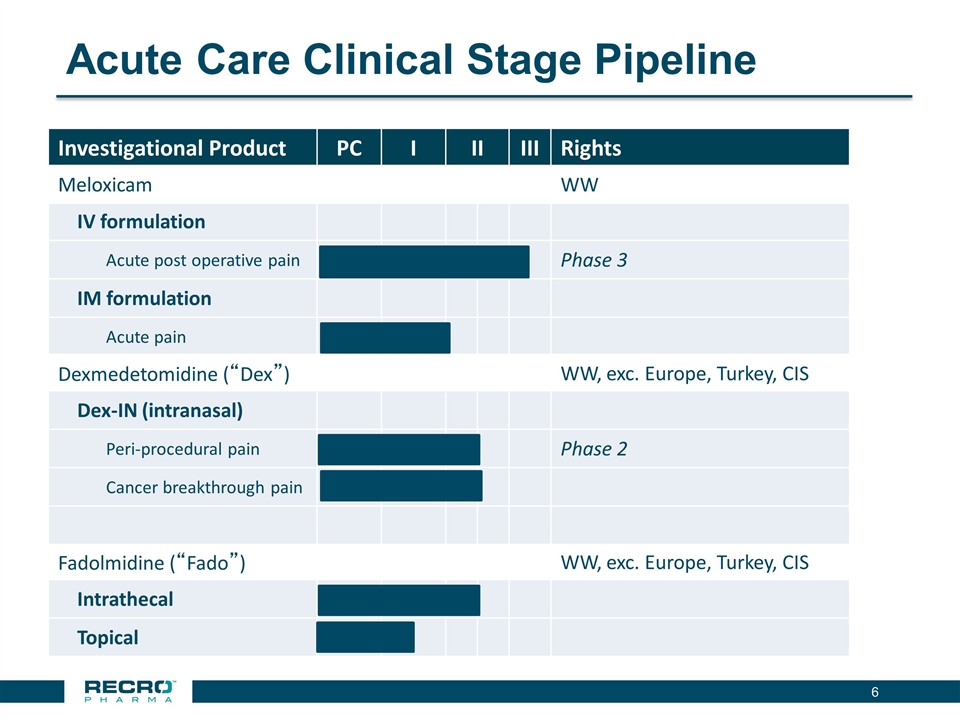

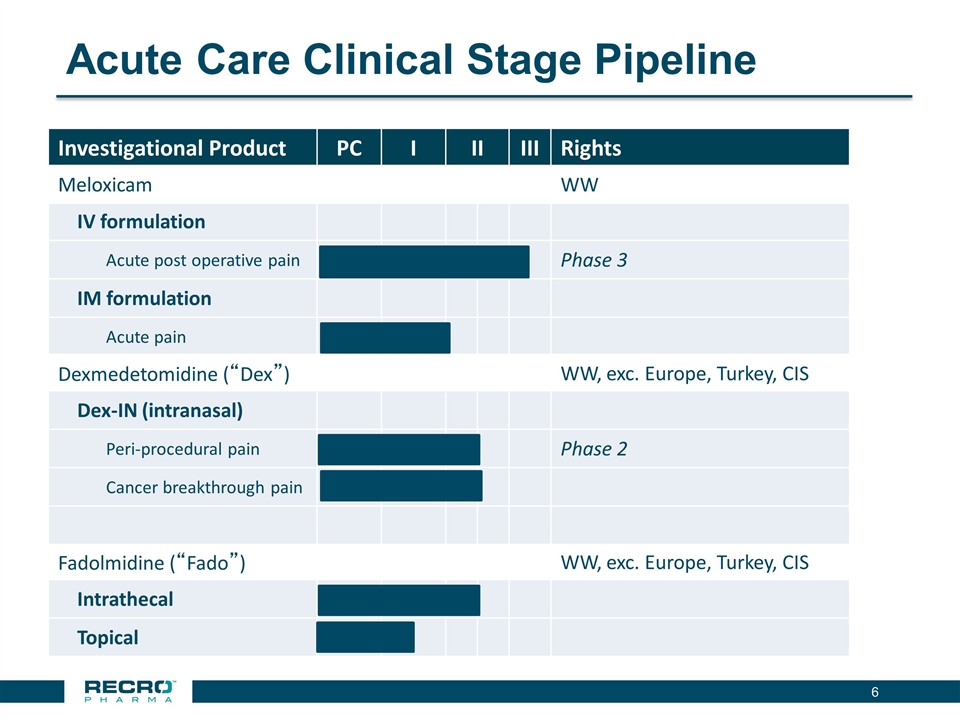

Acute Care Clinical Stage Pipeline Investigational Product PC I II III Rights Meloxicam WW IV formulation Acute post operative pain Phase 3 IM formulation Acute pain Dexmedetomidine (“Dex”) WW, exc. Europe, Turkey, CIS Dex-IN (intranasal) Peri-procedural pain Phase 2 Cancer breakthrough pain Fadolmidine (“Fado”) WW, exc. Europe, Turkey, CIS Intrathecal Topical

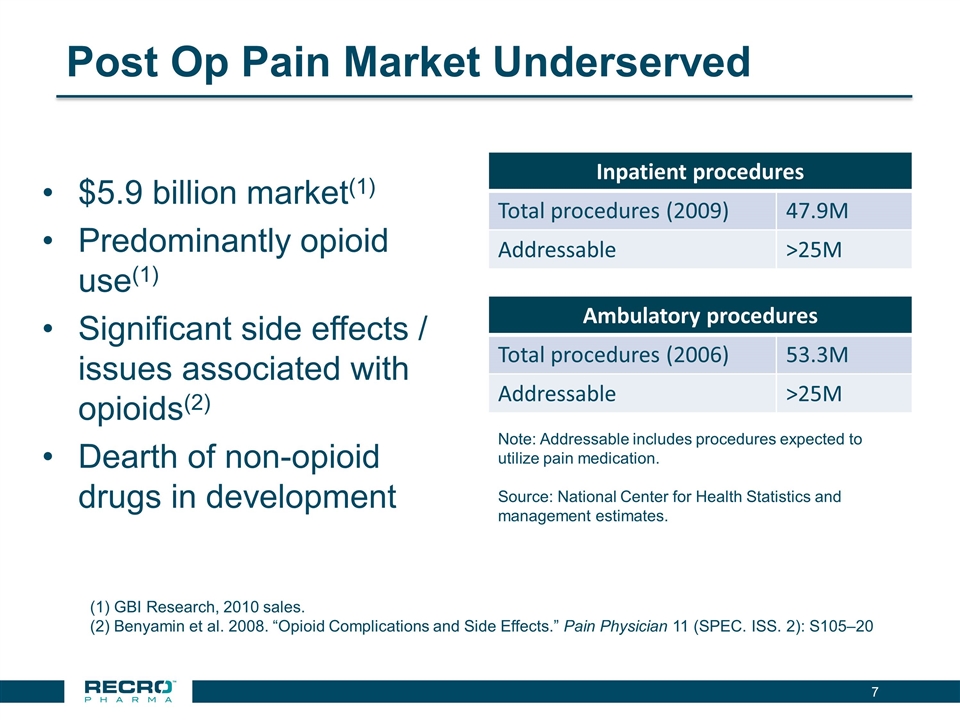

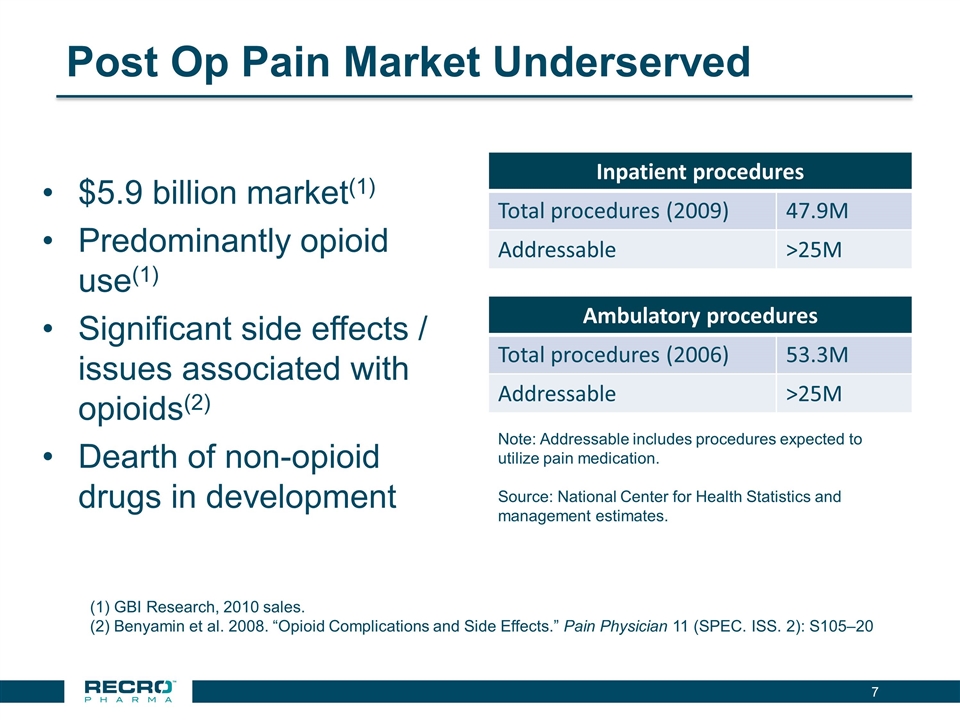

Post Op Pain Market Underserved $5.9 billion market(1) Predominantly opioid use(1) Significant side effects / issues associated with opioids(2) Dearth of non-opioid drugs in development Inpatient procedures Total procedures (2009) 47.9M Addressable >25M Ambulatory procedures Total procedures (2006) 53.3M Addressable >25M Note: Addressable includes procedures expected to utilize pain medication. Source: National Center for Health Statistics and management estimates. GBI Research, 2010 sales. Benyamin et al. 2008. “Opioid Complications and Side Effects.” Pain Physician 11 (SPEC. ISS. 2): S105–20

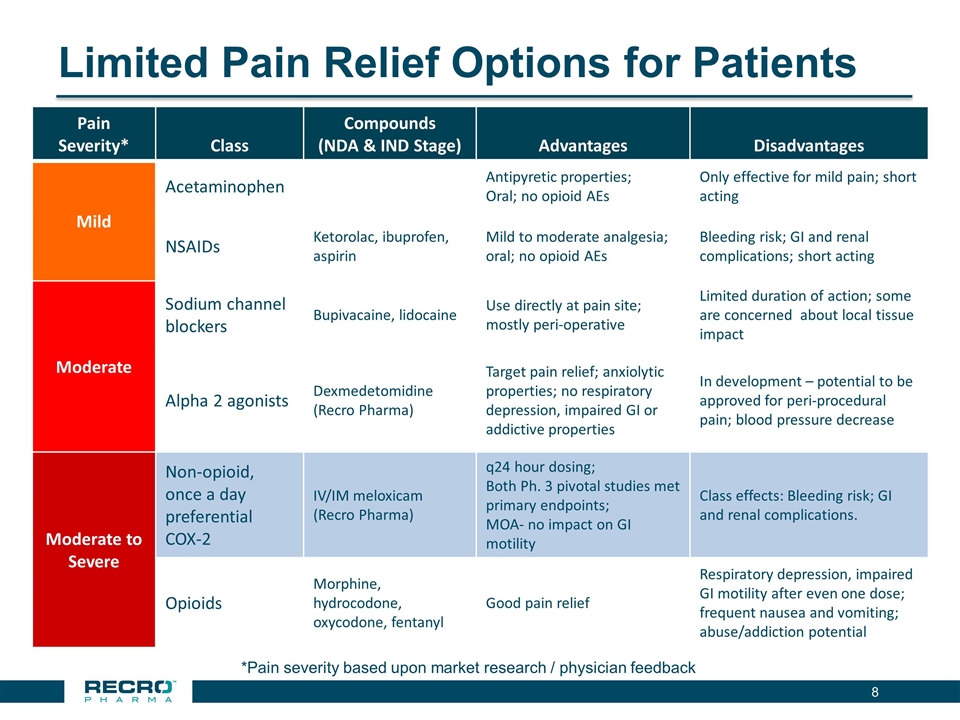

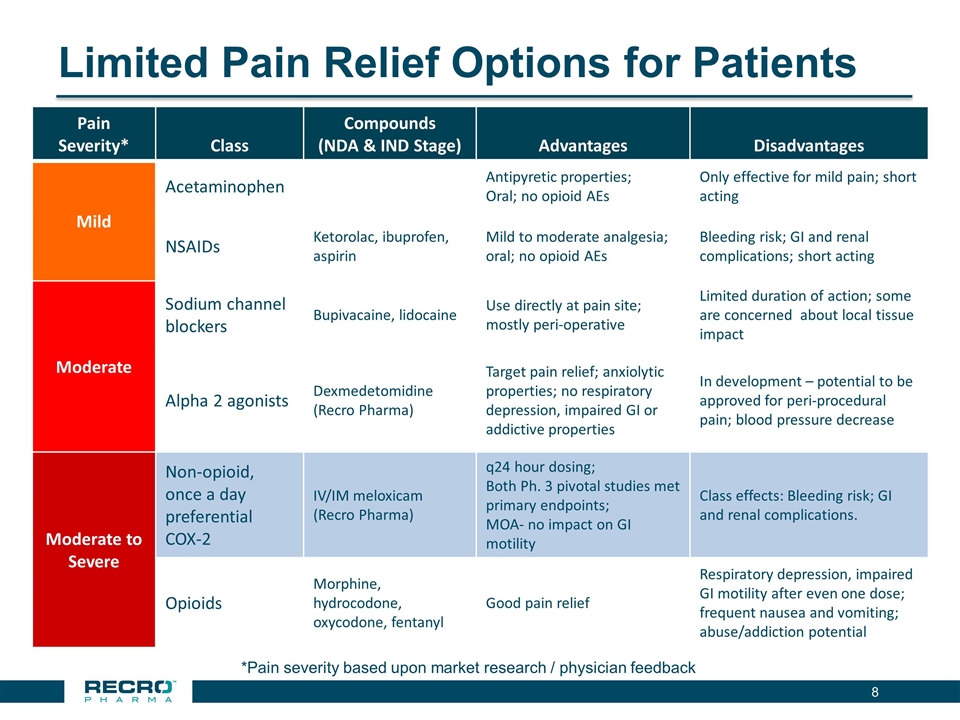

Limited Pain Relief Options for Patients *Pain severity based upon market research / physician feedback Pain Severity* Class Compounds (NDA & IND Stage) Advantages Disadvantages Mild Acetaminophen Antipyretic properties; Oral; no opioid AEs Only effective for mild pain; short acting NSAIDs Ketorolac, ibuprofen, aspirin Mild to moderate analgesia; oral; no opioid AEs Bleeding risk; GI and renal complications; short acting Moderate Sodium channel blockers Bupivacaine, lidocaine Use directly at pain site; mostly peri-operative Limited duration of action; some are concerned about local tissue impact Alpha 2 agonists Dexmedetomidine (Recro Pharma) Target pain relief; anxiolytic properties; no respiratory depression, impaired GI or addictive properties In development – potential to be approved for peri-procedural pain; blood pressure decrease Moderate to Severe Non-opioid, once a day preferential COX-2 IV/IM meloxicam (Recro Pharma) q24 hour dosing; Both Ph. 3 pivotal studies met primary endpoints; MOA- no impact on GI motility Class effects: Bleeding risk; GI and renal complications. Opioids Morphine, hydrocodone, oxycodone, fentanyl Good pain relief Respiratory depression, impaired GI motility after even one dose; frequent nausea and vomiting; abuse/addiction potential

IV Meloxicam

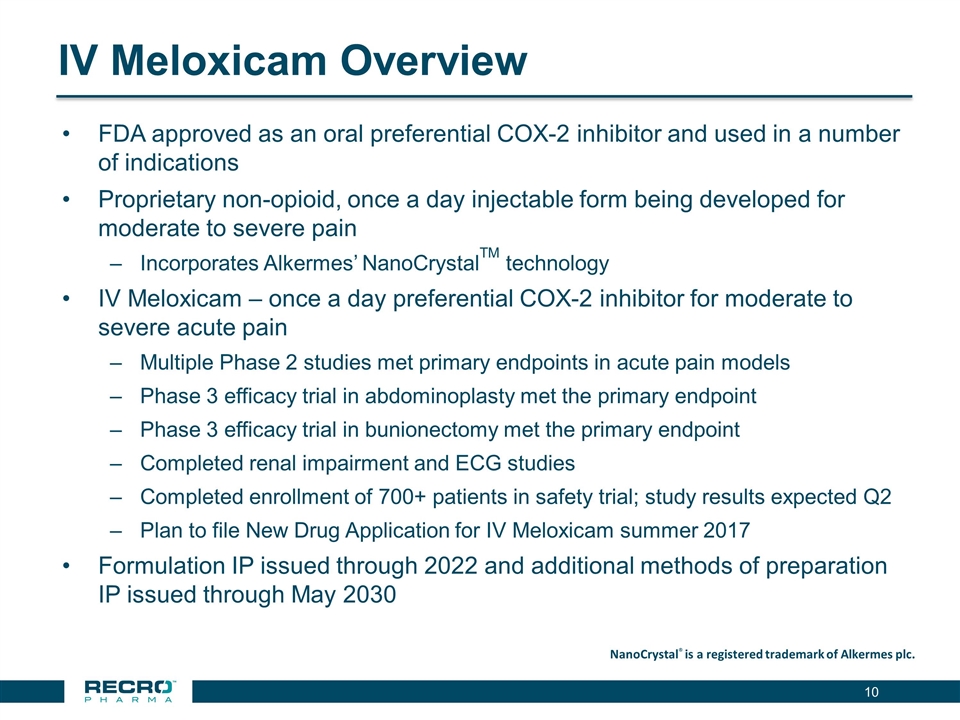

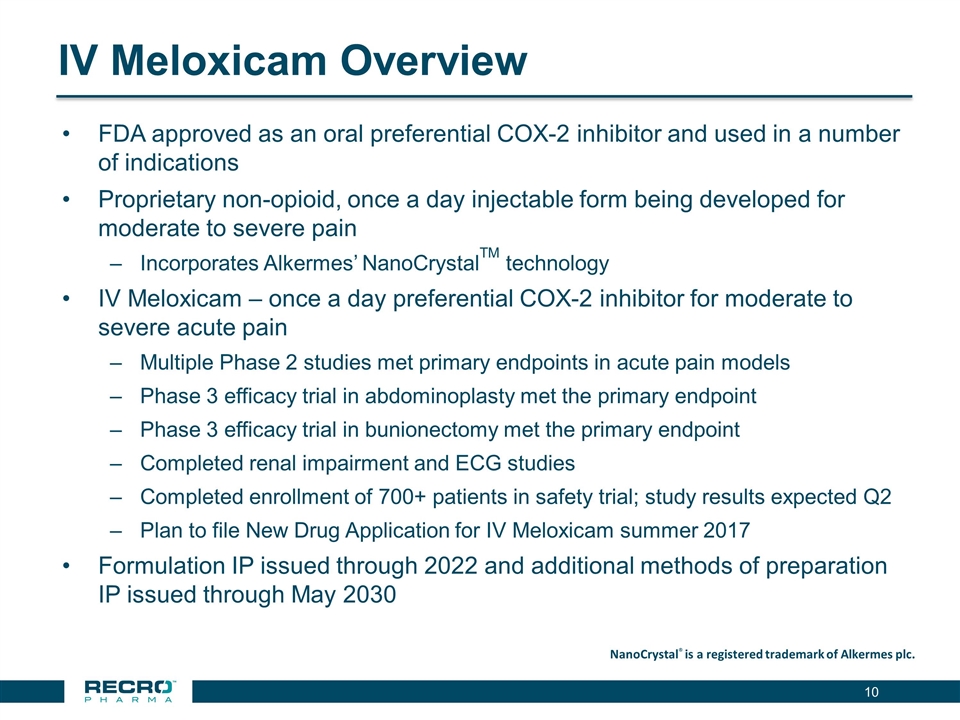

IV Meloxicam Overview FDA approved as an oral preferential COX-2 inhibitor and used in a number of indications Proprietary non-opioid, once a day injectable form being developed for moderate to severe pain Incorporates Alkermes’ NanoCrystalTM technology IV Meloxicam – once a day preferential COX-2 inhibitor for moderate to severe acute pain Multiple Phase 2 studies met primary endpoints in acute pain models Phase 3 efficacy trial in abdominoplasty met the primary endpoint Phase 3 efficacy trial in bunionectomy met the primary endpoint Completed renal impairment and ECG studies Completed enrollment of 700+ patients in safety trial; study results expected Q2 Plan to file New Drug Application for IV Meloxicam summer 2017 Formulation IP issued through 2022 and additional methods of preparation IP issued through May 2030 NanoCrystal® is a registered trademark of Alkermes plc.

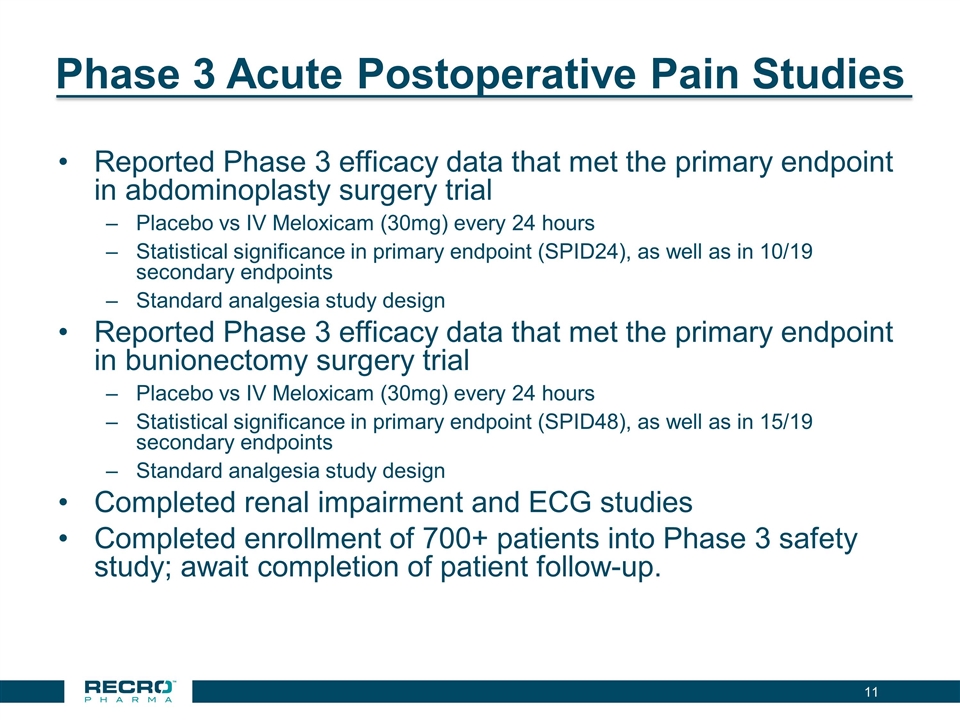

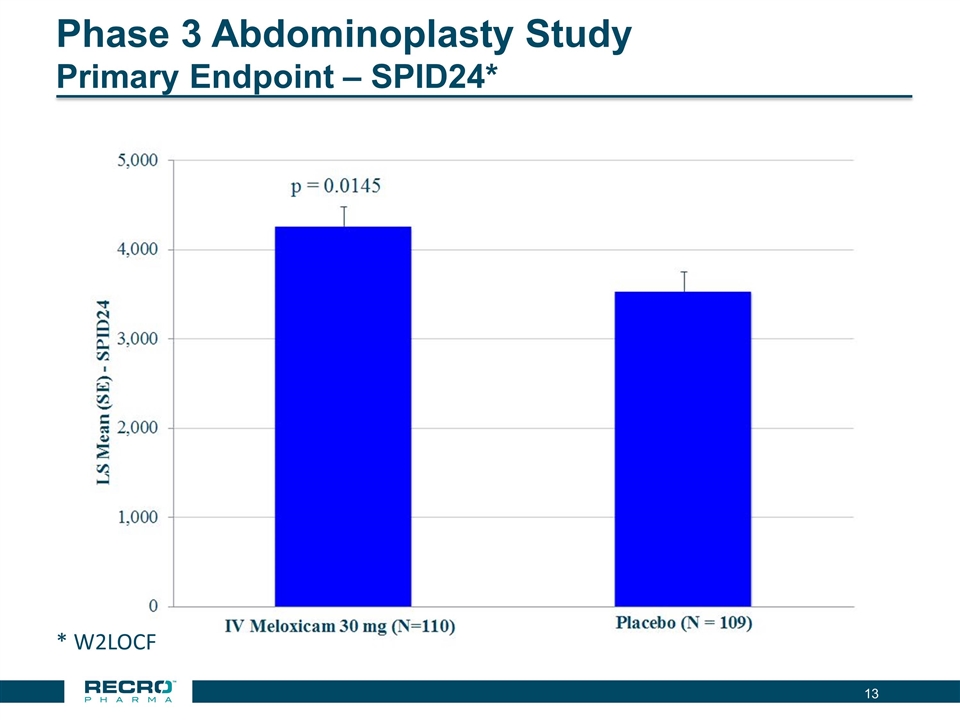

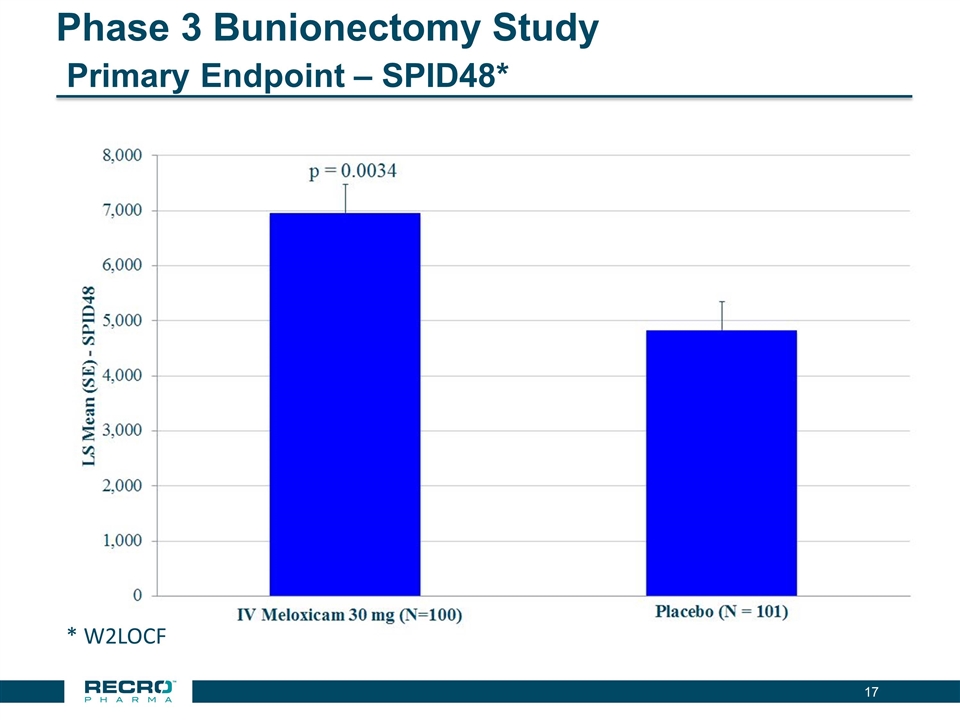

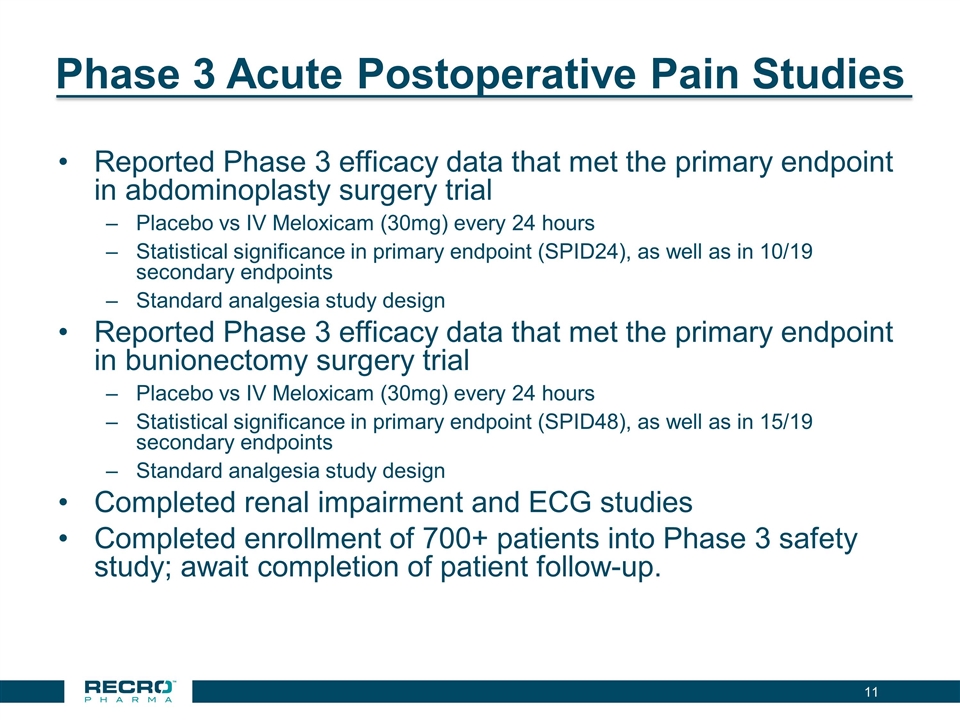

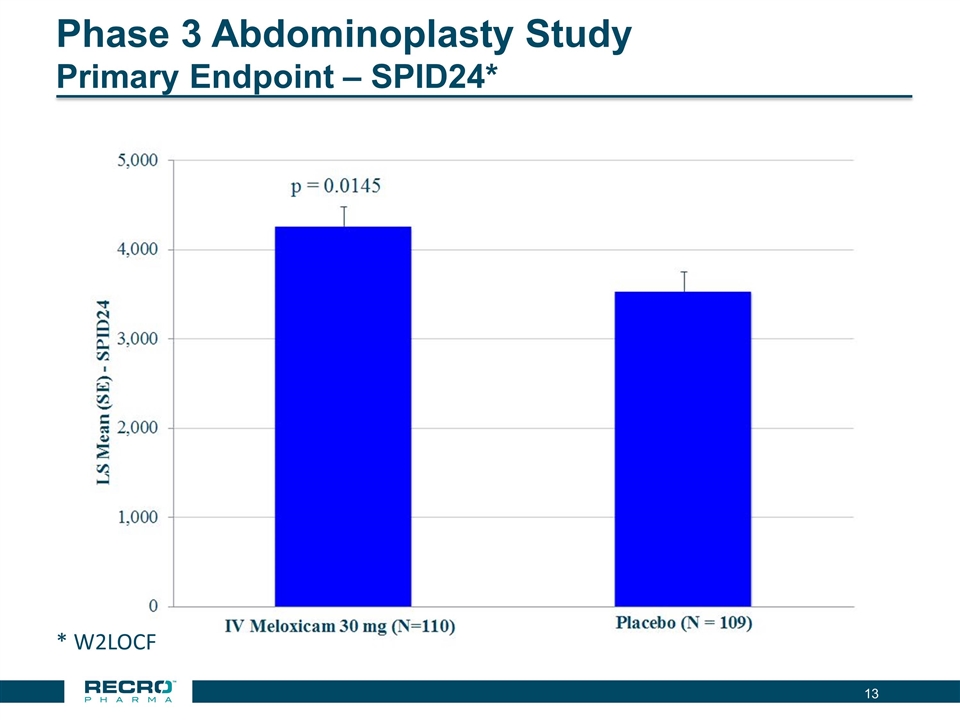

Phase 3 Acute Postoperative Pain Studies Reported Phase 3 efficacy data that met the primary endpoint in abdominoplasty surgery trial Placebo vs IV Meloxicam (30mg) every 24 hours Statistical significance in primary endpoint (SPID24), as well as in 10/19 secondary endpoints Standard analgesia study design Reported Phase 3 efficacy data that met the primary endpoint in bunionectomy surgery trial Placebo vs IV Meloxicam (30mg) every 24 hours Statistical significance in primary endpoint (SPID48), as well as in 15/19 secondary endpoints Standard analgesia study design Completed renal impairment and ECG studies Completed enrollment of 700+ patients into Phase 3 safety study; await completion of patient follow-up.

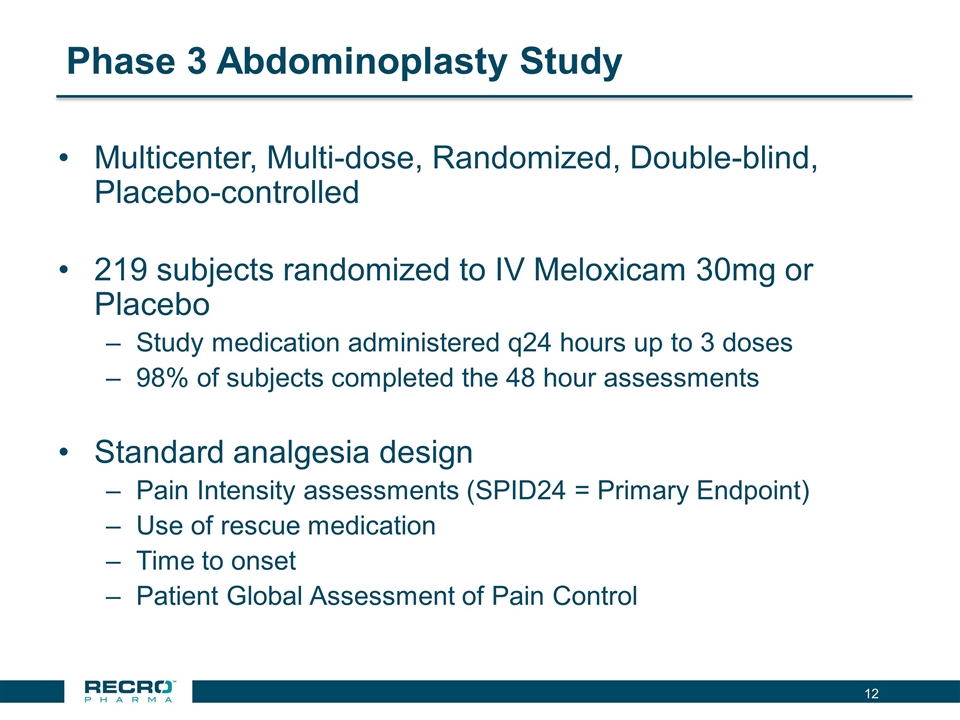

Phase 3 Abdominoplasty Study Multicenter, Multi-dose, Randomized, Double-blind, Placebo-controlled 219 subjects randomized to IV Meloxicam 30mg or Placebo Study medication administered q24 hours up to 3 doses 98% of subjects completed the 48 hour assessments Standard analgesia design Pain Intensity assessments (SPID24 = Primary Endpoint) Use of rescue medication Time to onset Patient Global Assessment of Pain Control

Phase 3 Abdominoplasty Study Primary Endpoint – SPID24* * W2LOCF

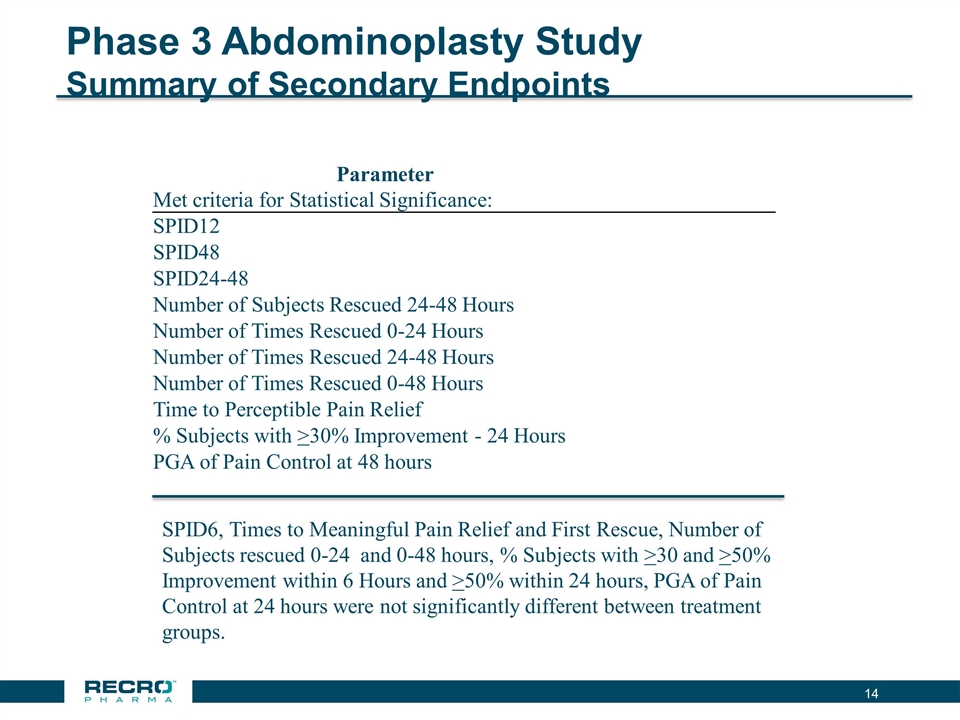

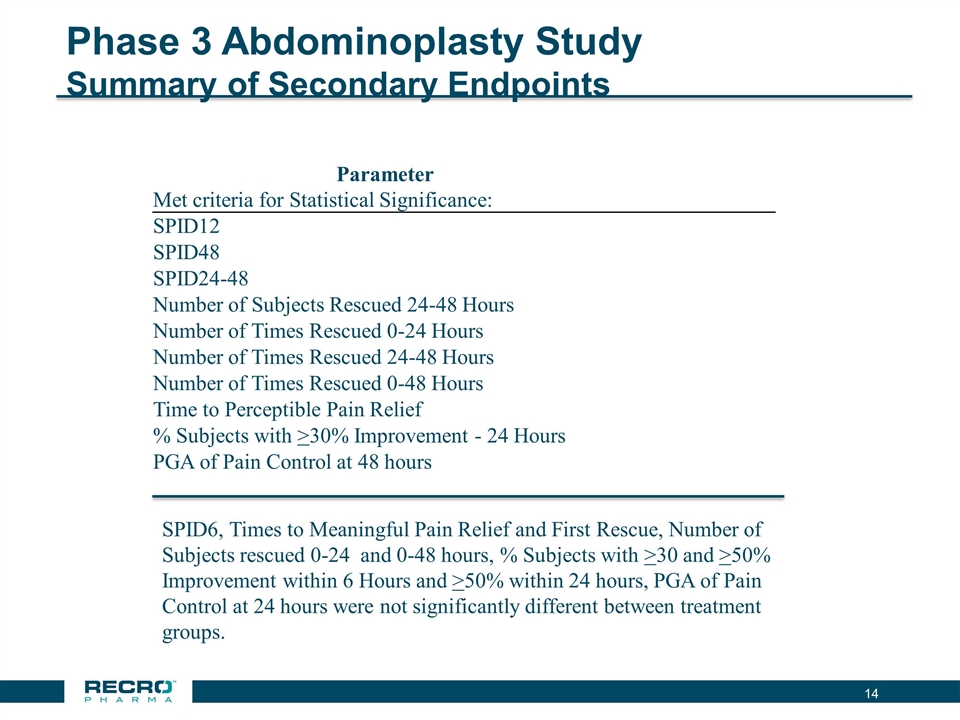

Phase 3 Abdominoplasty Study Summary of Secondary Endpoints SPID6, Times to Meaningful Pain Relief and First Rescue, Number of Subjects rescued 0-24 and 0-48 hours, % Subjects with >30 and >50% Improvement within 6 Hours and >50% within 24 hours, PGA of Pain Control at 24 hours were not significantly different between treatment groups. Parameter Met criteria for Statistical Significance: SPID12 SPID48 SPID24-48 Number of Subjects Rescued 24-48 Hours Number of Times Rescued 0-24 Hours Number of Times Rescued 24-48 Hours Number of Times Rescued 0-48 Hours Time to Perceptible Pain Relief % Subjects with >30% Improvement - 24 Hours PGA of Pain Control at 48 hours

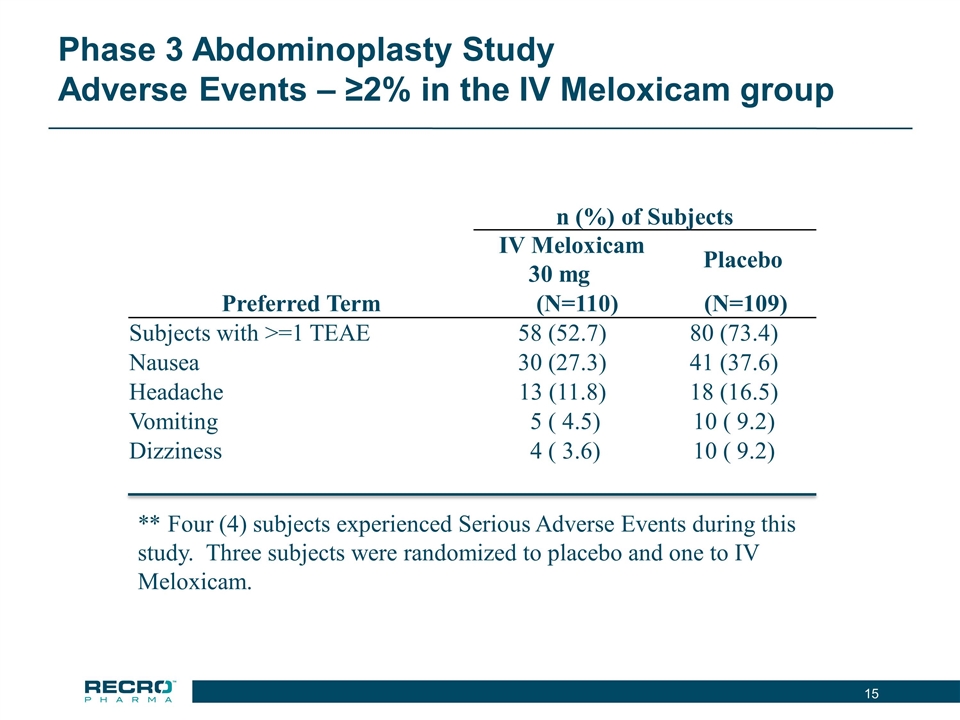

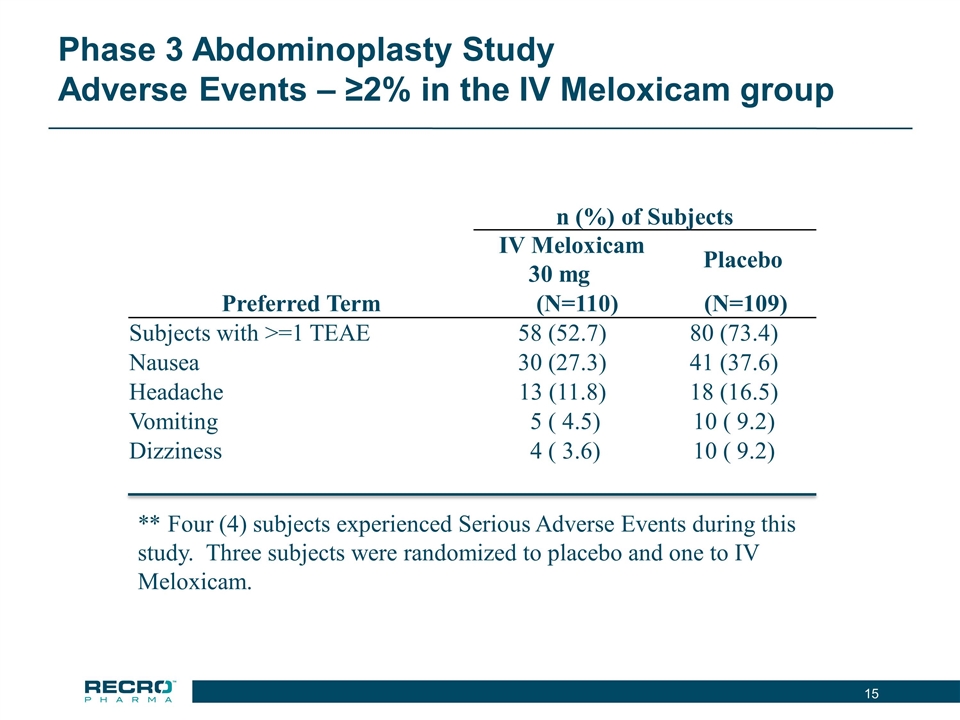

Phase 3 Abdominoplasty Study Adverse Events – ≥2% in the IV Meloxicam group n (%) of Subjects IV Meloxicam 30 mg Placebo Preferred Term (N=110) (N=109) Subjects with >=1 TEAE 58 (52.7) 80 (73.4) Nausea 30 (27.3) 41 (37.6) Headache 13 (11.8) 18 (16.5) Vomiting 5 ( 4.5) 10 ( 9.2) Dizziness 4 ( 3.6) 10 ( 9.2) ** Four (4) subjects experienced Serious Adverse Events during this study. Three subjects were randomized to placebo and one to IV Meloxicam.

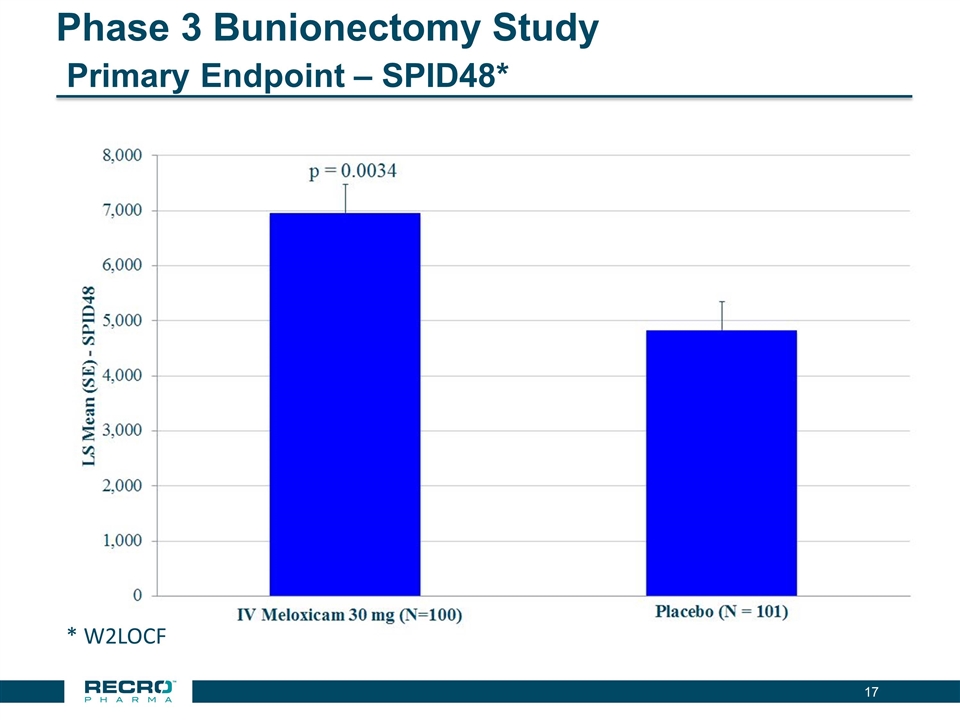

Phase 3 Bunionectomy Study Multicenter, Multi-dose, Randomized, Double-blind, Placebo-controlled 201 subjects randomized to either IV Meloxicam 30 mg or Placebo Study medication administered q24 hours up to 3 doses 95% of subjects completed the 48 hour assessments Standard analgesia design Pain Intensity assessments (SPID48 = Primary Endpoint) Use of rescue medication Time to onset Patient Global Assessment of Pain Control

Phase 3 Bunionectomy Study Primary Endpoint – SPID48* * W2LOCF

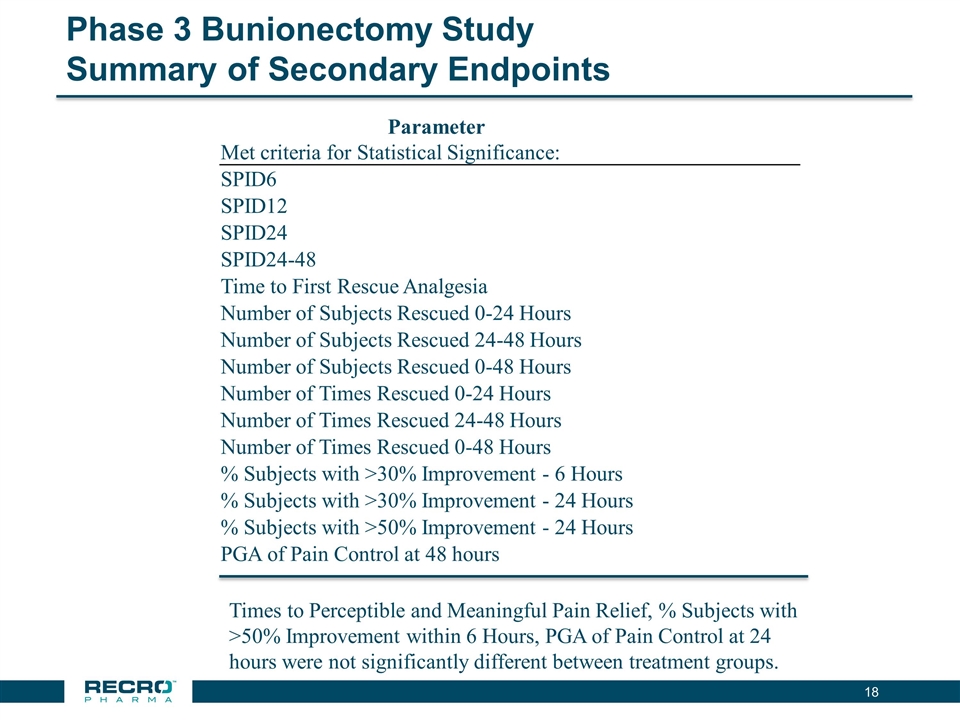

Phase 3 Bunionectomy Study Summary of Secondary Endpoints Parameter Met criteria for Statistical Significance: SPID6 SPID12 SPID24 SPID24-48 Time to First Rescue Analgesia Number of Subjects Rescued 0-24 Hours Number of Subjects Rescued 24-48 Hours Number of Subjects Rescued 0-48 Hours Number of Times Rescued 0-24 Hours Number of Times Rescued 24-48 Hours Number of Times Rescued 0-48 Hours % Subjects with >30% Improvement - 6 Hours % Subjects with >30% Improvement - 24 Hours % Subjects with >50% Improvement - 24 Hours PGA of Pain Control at 48 hours Times to Perceptible and Meaningful Pain Relief, % Subjects with >50% Improvement within 6 Hours, PGA of Pain Control at 24 hours were not significantly different between treatment groups.

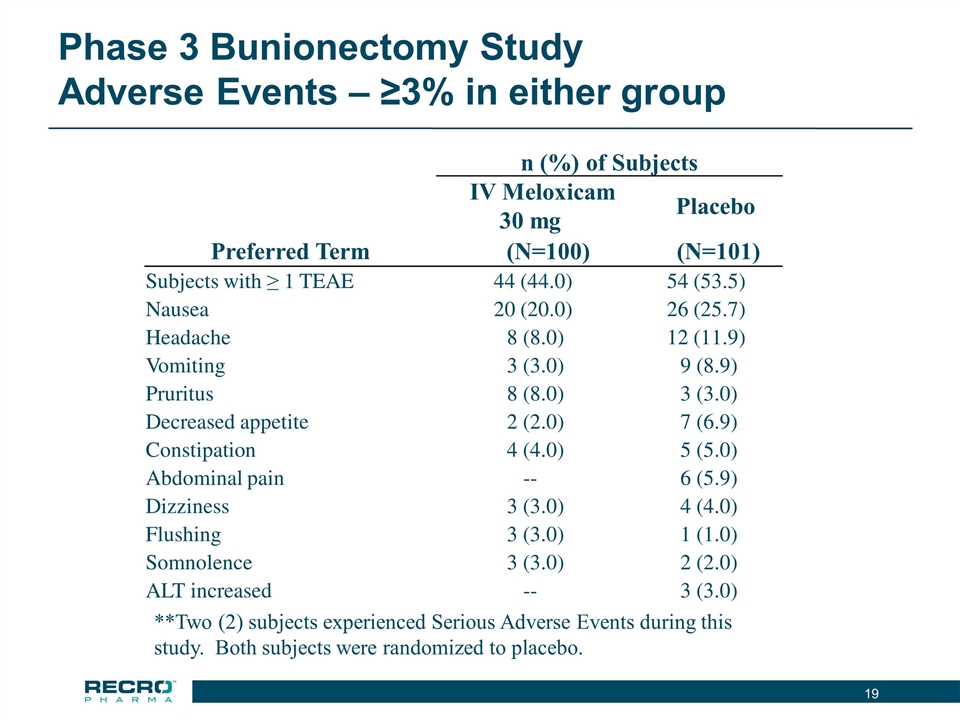

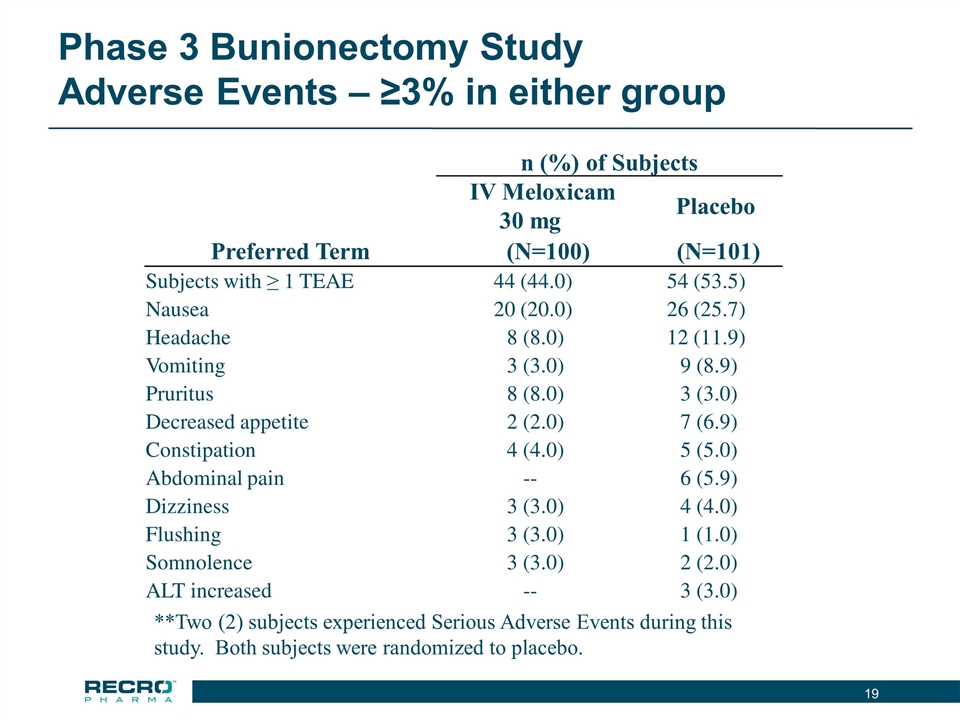

Phase 3 Bunionectomy Study Adverse Events – ≥3% in either group n (%) of Subjects IV Meloxicam 30 mg Placebo Preferred Term (N=100) (N=101) Subjects with ≥ 1 TEAE 44 (44.0) 54 (53.5) Nausea 20 (20.0) 26 (25.7) Headache 8 (8.0) 12 (11.9) Vomiting 3 (3.0) 9 (8.9) Pruritus 8 (8.0) 3 (3.0) Decreased appetite 2 (2.0) 7 (6.9) Constipation 4 (4.0) 5 (5.0) Abdominal pain -- 6 (5.9) Dizziness 3 (3.0) 4 (4.0) Flushing 3 (3.0) 1 (1.0) Somnolence 3 (3.0) 2 (2.0) ALT increased -- 3 (3.0) **Two (2) subjects experienced Serious Adverse Events during this study. Both subjects were randomized to placebo.

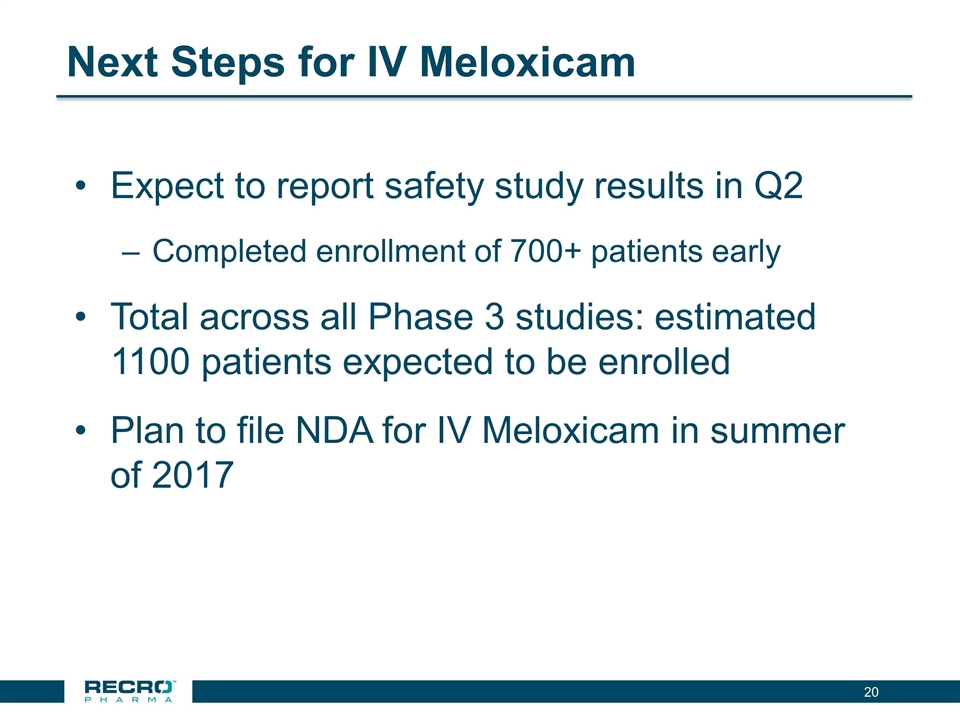

Next Steps for IV Meloxicam Expect to report safety study results in Q2 Completed enrollment of 700+ patients early Total across all Phase 3 studies: estimated 1100 patients expected to be enrolled Plan to file NDA for IV Meloxicam in summer of 2017

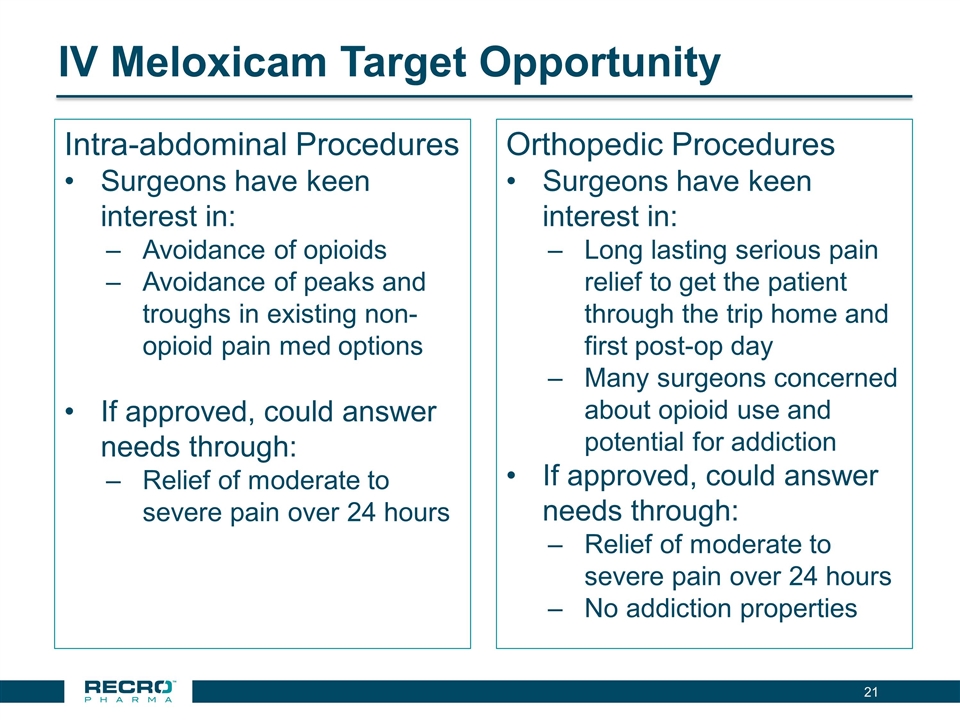

IV Meloxicam Target Opportunity Intra-abdominal Procedures Surgeons have keen interest in: Avoidance of opioids Avoidance of peaks and troughs in existing non-opioid pain med options If approved, could answer needs through: Relief of moderate to severe pain over 24 hours Orthopedic Procedures Surgeons have keen interest in: Long lasting serious pain relief to get the patient through the trip home and first post-op day Many surgeons concerned about opioid use and potential for addiction If approved, could answer needs through: Relief of moderate to severe pain over 24 hours No addiction properties

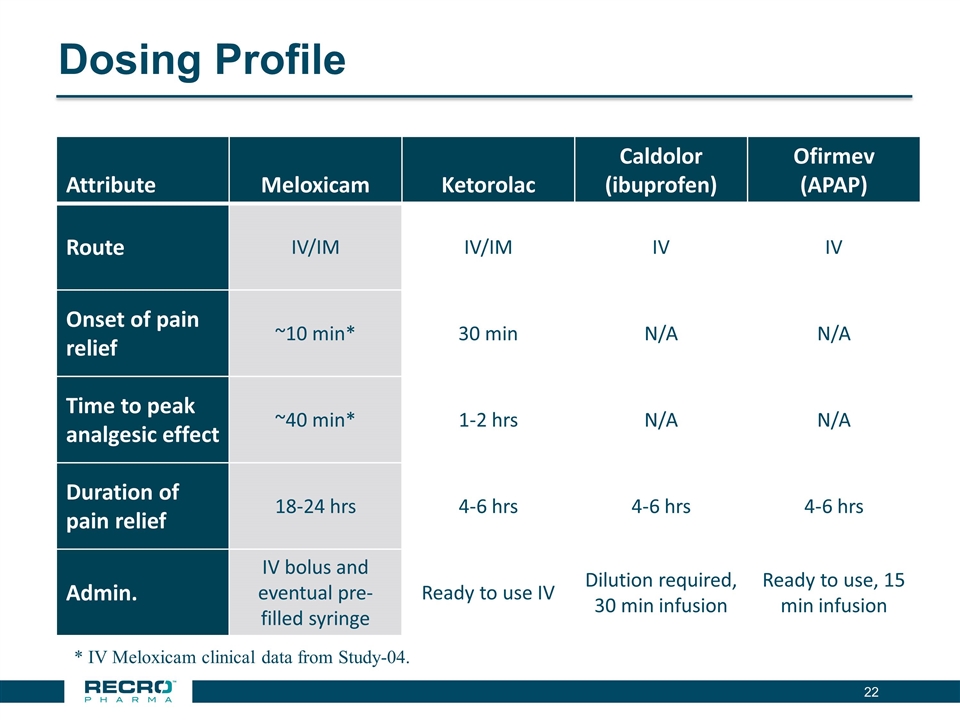

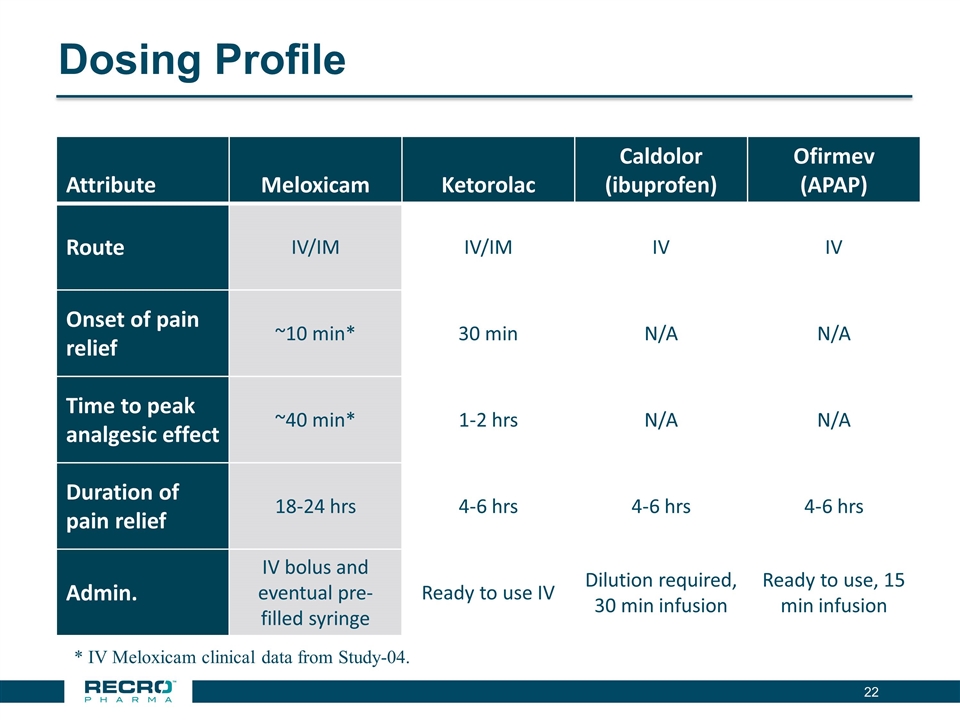

Dosing Profile Attribute Meloxicam Ketorolac Caldolor (ibuprofen) Ofirmev (APAP) Route IV/IM IV/IM IV IV Onset of pain relief ~10 min* 30 min N/A N/A Time to peak analgesic effect ~40 min* 1-2 hrs N/A N/A Duration of pain relief 18-24 hrs 4-6 hrs 4-6 hrs 4-6 hrs Admin. IV bolus and eventual pre-filled syringe Ready to use IV Dilution required, 30 min infusion Ready to use, 15 min infusion * IV Meloxicam clinical data from Study-04.

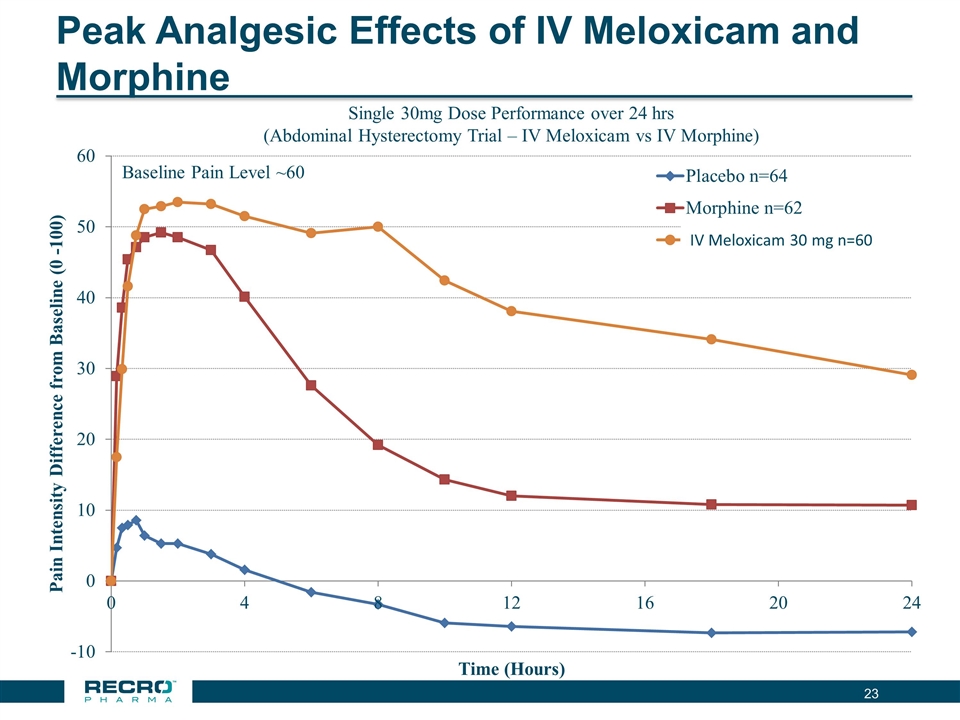

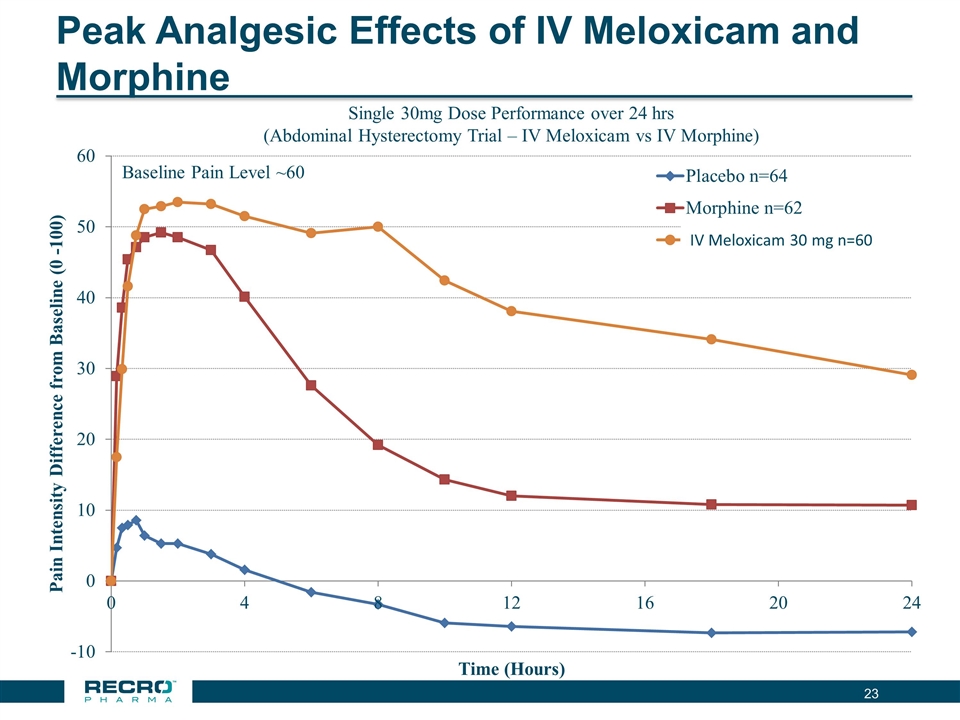

Peak Analgesic Effects of IV Meloxicam and Morphine Single 30mg Dose Performance over 24 hrs (Abdominal Hysterectomy Trial – IV Meloxicam vs IV Morphine) Baseline Pain Level ~60

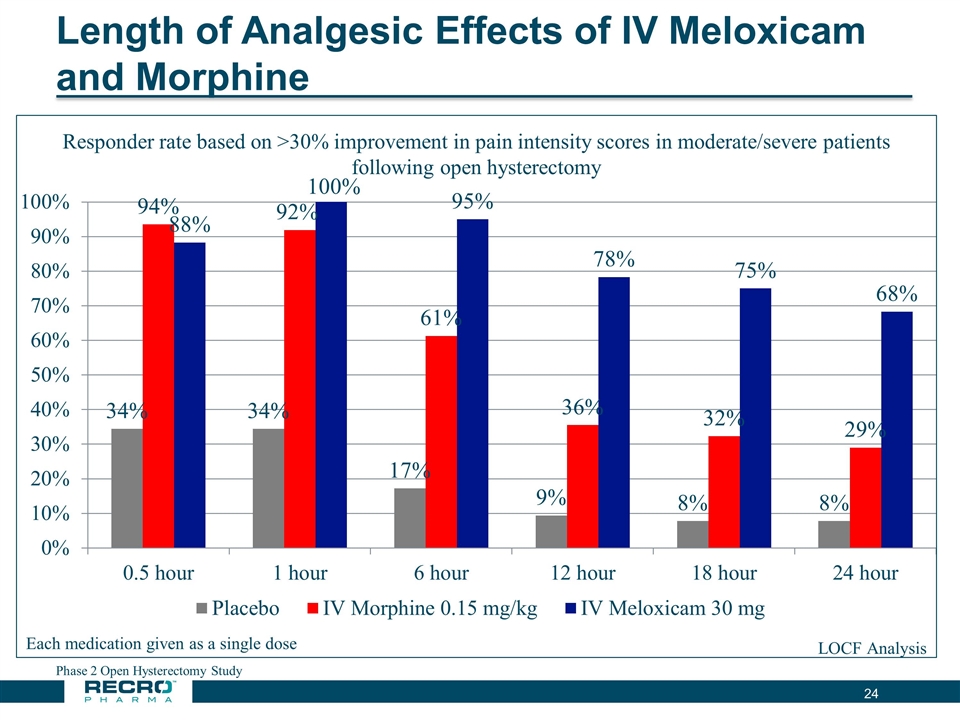

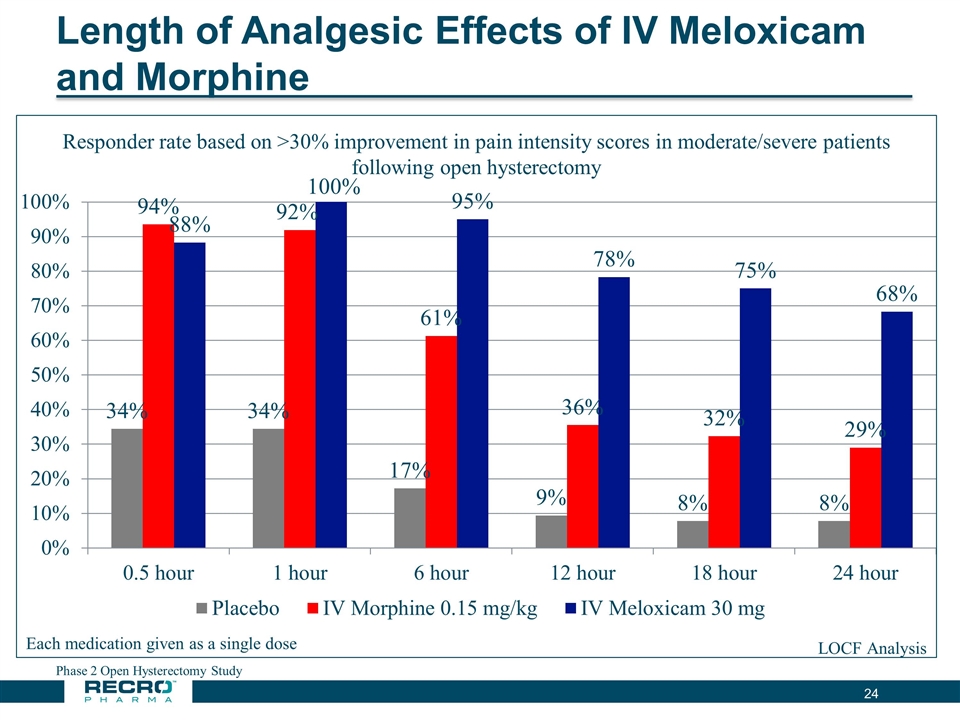

Length of Analgesic Effects of IV Meloxicam and Morphine Phase 2 Open Hysterectomy Study

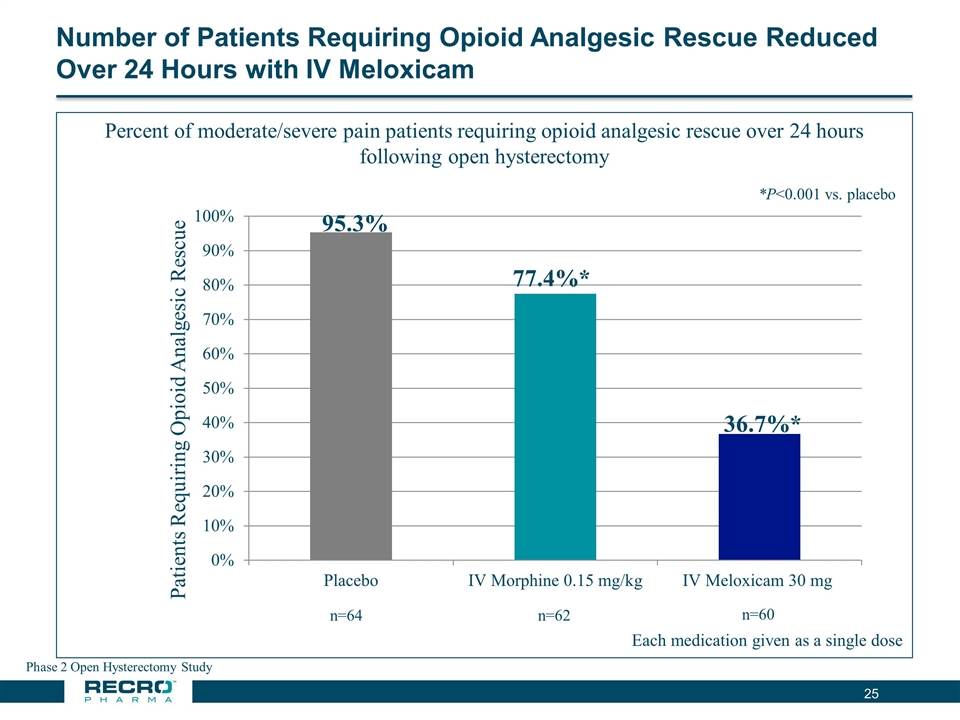

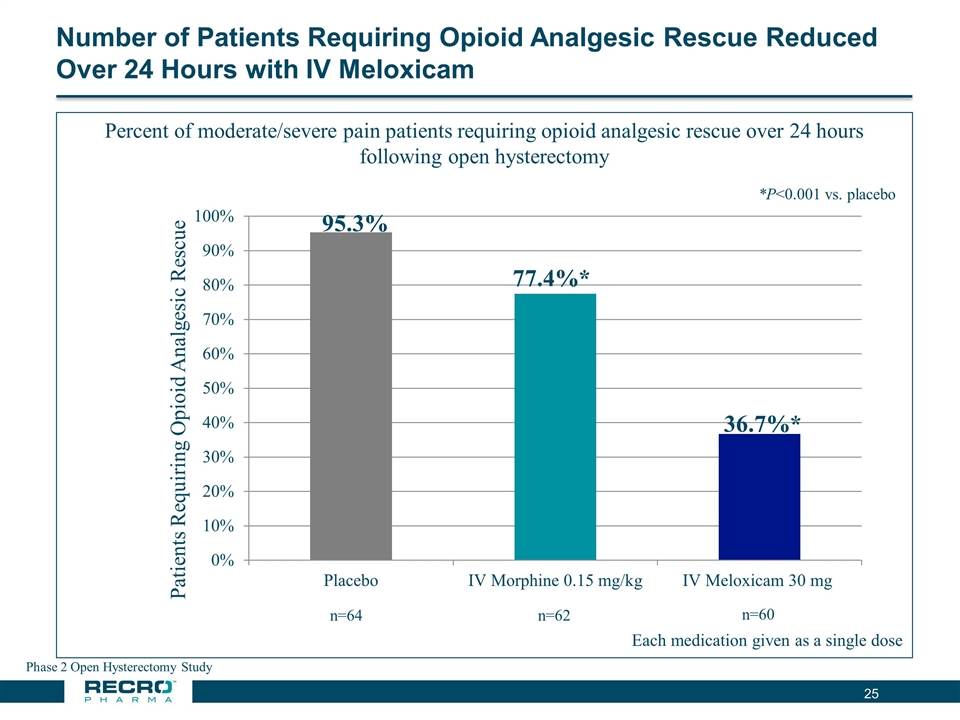

Number of Patients Requiring Opioid Analgesic Rescue Reduced Over 24 Hours with IV Meloxicam Phase 2 Open Hysterectomy Study *P<0.001 vs. placebo 77.4%* 36.7%*

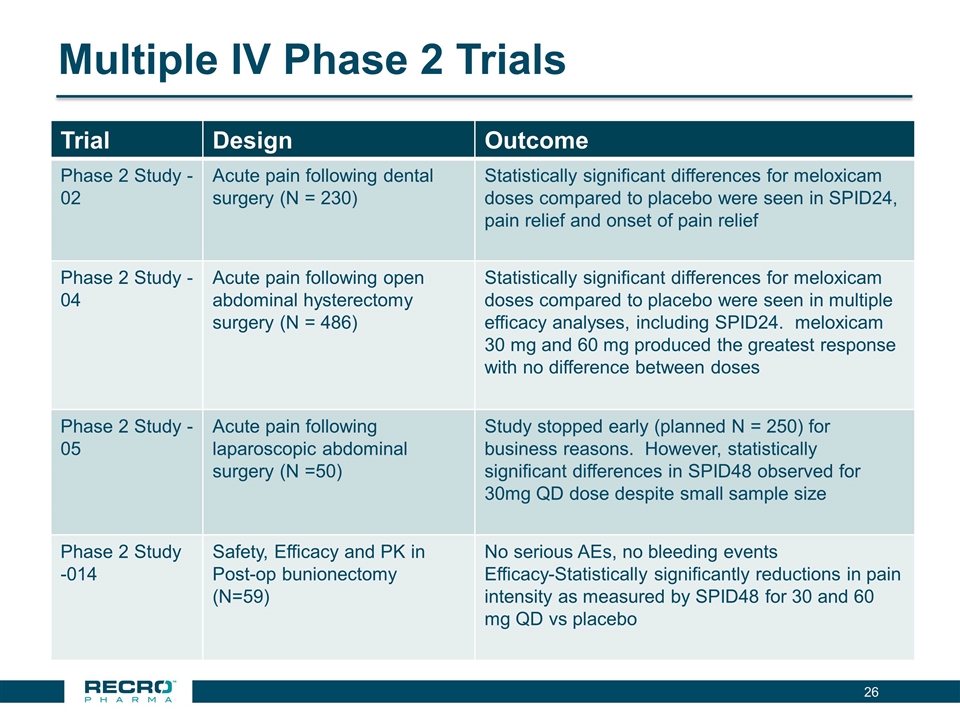

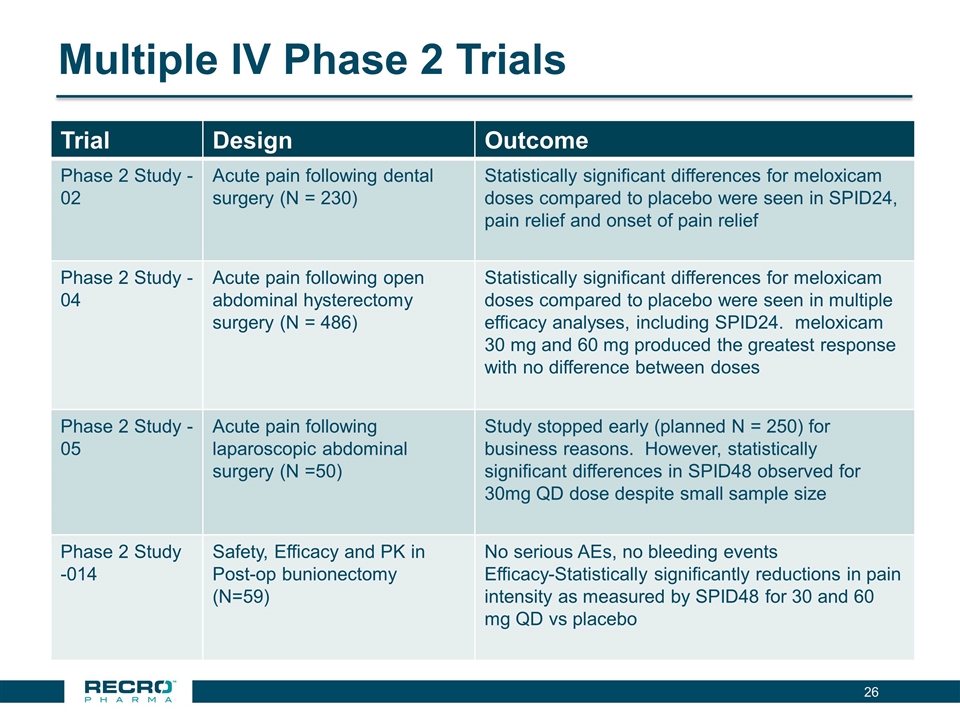

Multiple IV Phase 2 Trials Trial Design Outcome Phase 2 Study -02 Acute pain following dental surgery (N = 230) Statistically significant differences for meloxicam doses compared to placebo were seen in SPID24, pain relief and onset of pain relief Phase 2 Study -04 Acute pain following open abdominal hysterectomy surgery (N = 486) Statistically significant differences for meloxicam doses compared to placebo were seen in multiple efficacy analyses, including SPID24. meloxicam 30 mg and 60 mg produced the greatest response with no difference between doses Phase 2 Study -05 Acute pain following laparoscopic abdominal surgery (N =50) Study stopped early (planned N = 250) for business reasons. However, statistically significant differences in SPID48 observed for 30mg QD dose despite small sample size Phase 2 Study -014 Safety, Efficacy and PK in Post-op bunionectomy (N=59) No serious AEs, no bleeding events Efficacy-Statistically significantly reductions in pain intensity as measured by SPID48 for 30 and 60 mg QD vs placebo

Dexmedetomidine (“Dex”)

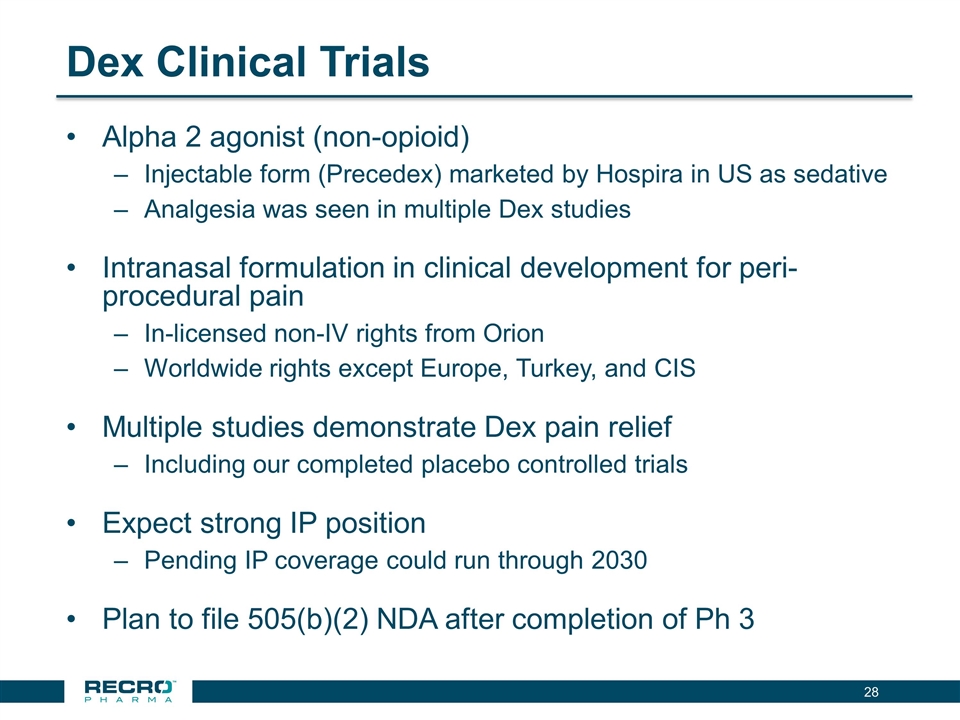

Dex Clinical Trials Alpha 2 agonist (non-opioid) Injectable form (Precedex) marketed by Hospira in US as sedative Analgesia was seen in multiple Dex studies Intranasal formulation in clinical development for peri-procedural pain In-licensed non-IV rights from Orion Worldwide rights except Europe, Turkey, and CIS Multiple studies demonstrate Dex pain relief Including our completed placebo controlled trials Expect strong IP position Pending IP coverage could run through 2030 Plan to file 505(b)(2) NDA after completion of Ph 3

Dex-IN Ph 2 Results (REC-14-013 – Post Op Day 1 Dosing) Randomized, placebo controlled Phase 2 bunionectomy study (168 patients) Randomized, placebo controlled study 50 mcg of Dex-IN or placebo every 6 hours Primary endpoint – SPID48 (p=0.0214) Oral opioid rescue therapy allowed 6 patients discontinued for lack of efficacy (3 in each treatment group) and 1 patient due to serious adverse event of hypotension Most common adverse events observed in the study were: blood pressure decrease / hypotension nausea (similar incidences to placebo) nasal discomfort and headache Adverse event of bradycardia was reported in 3 subjects in the Dex-IN treatment group

Fadolmidine (“Fado”)

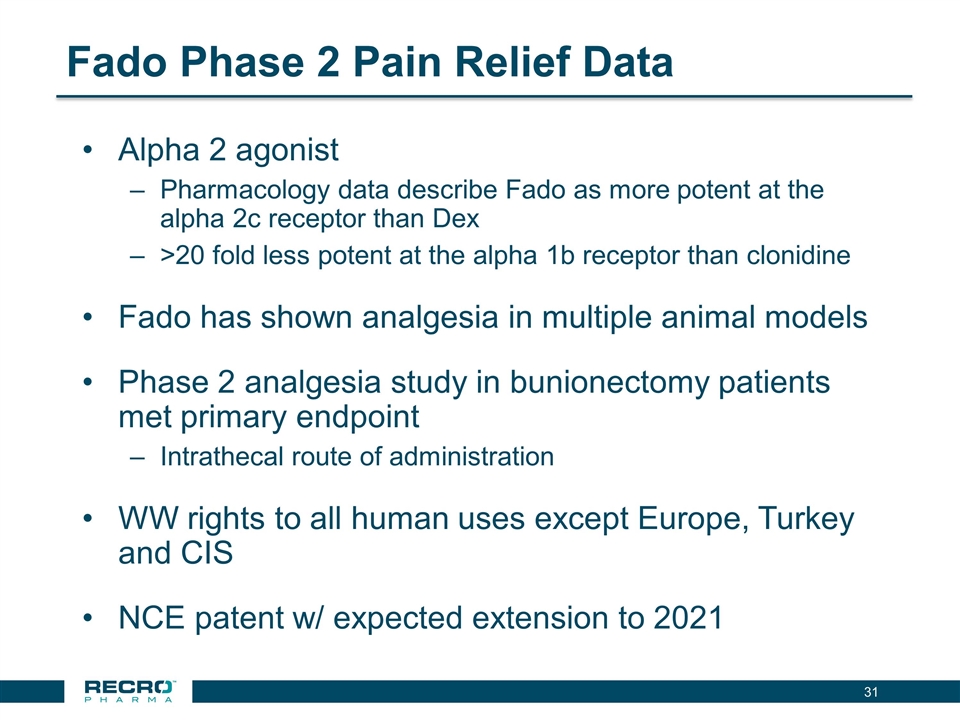

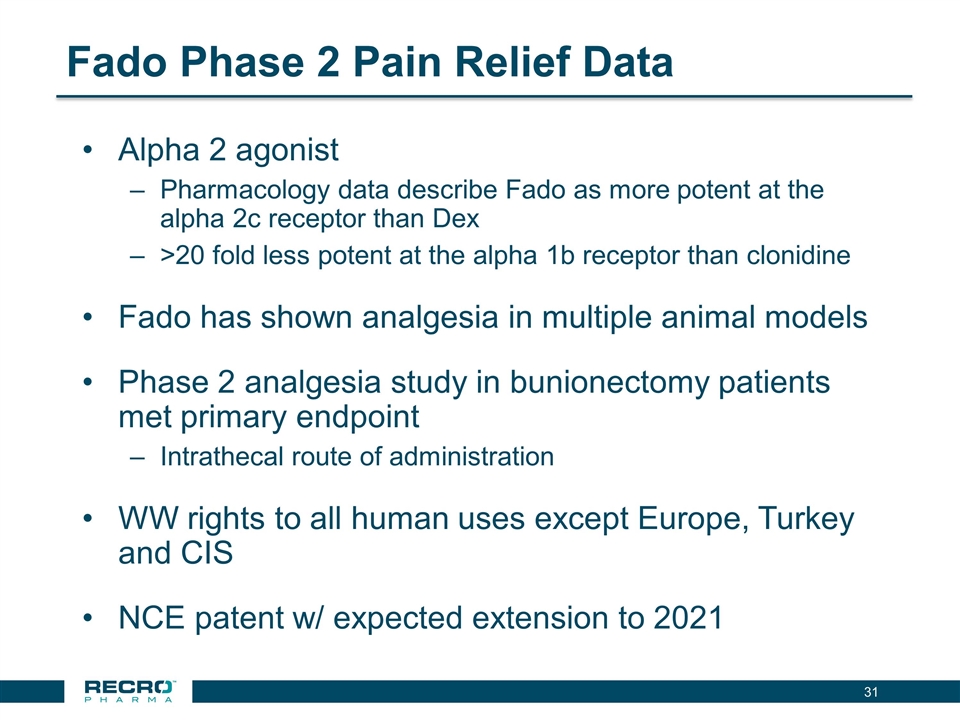

Fado Phase 2 Pain Relief Data Alpha 2 agonist Pharmacology data describe Fado as more potent at the alpha 2c receptor than Dex >20 fold less potent at the alpha 1b receptor than clonidine Fado has shown analgesia in multiple animal models Phase 2 analgesia study in bunionectomy patients met primary endpoint Intrathecal route of administration WW rights to all human uses except Europe, Turkey and CIS NCE patent w/ expected extension to 2021

Contract Development and Manufacturing (CDMO) Business Overview Gainesville

Gainesville CDMO Facility

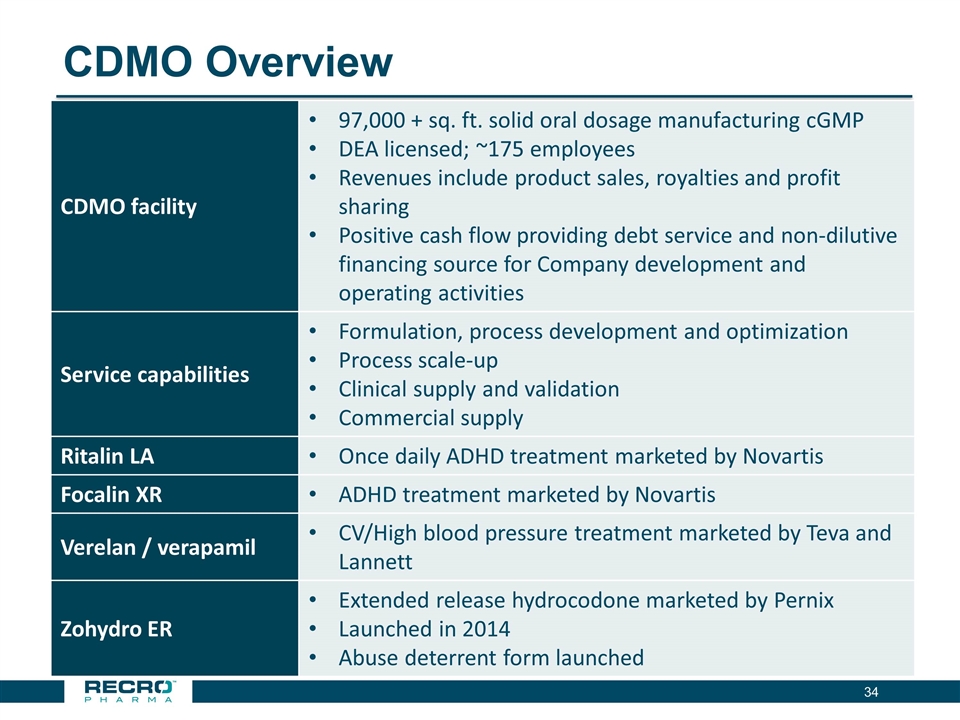

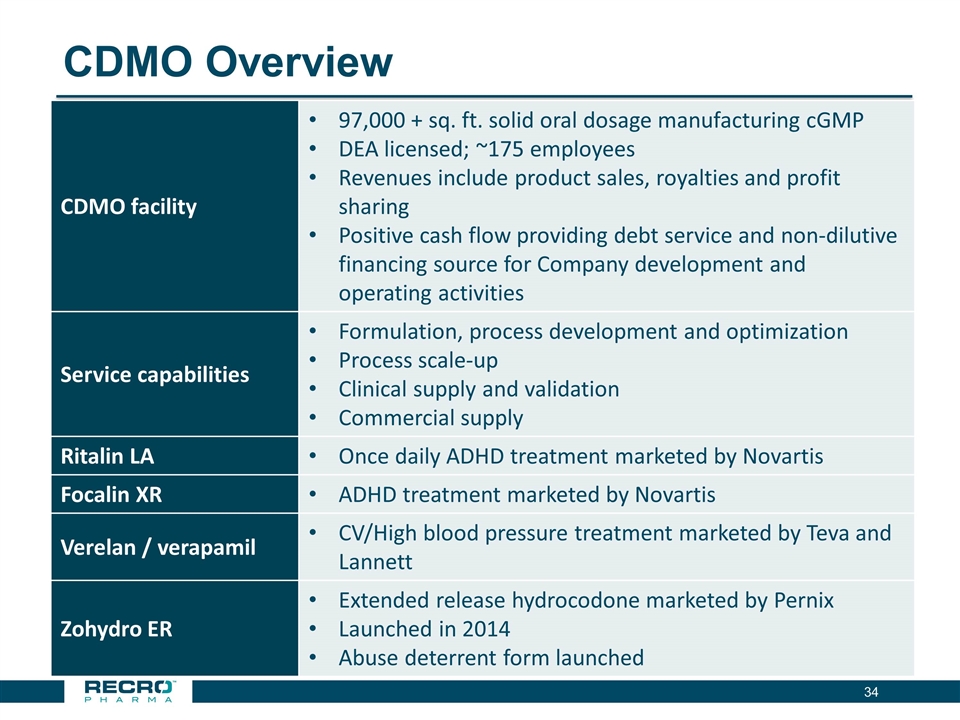

CDMO Overview CDMO facility 97,000 + sq. ft. solid oral dosage manufacturing cGMP DEA licensed; ~175 employees Revenues include product sales, royalties and profit sharing Positive cash flow providing debt service and non-dilutive financing source for Company development and operating activities Service capabilities Formulation, process development and optimization Process scale-up Clinical supply and validation Commercial supply Ritalin LA Once daily ADHD treatment marketed by Novartis Focalin XR ADHD treatment marketed by Novartis Verelan / verapamil CV/High blood pressure treatment marketed by Teva and Lannett Zohydro ER Extended release hydrocodone marketed by Pernix Launched in 2014 Abuse deterrent form launched

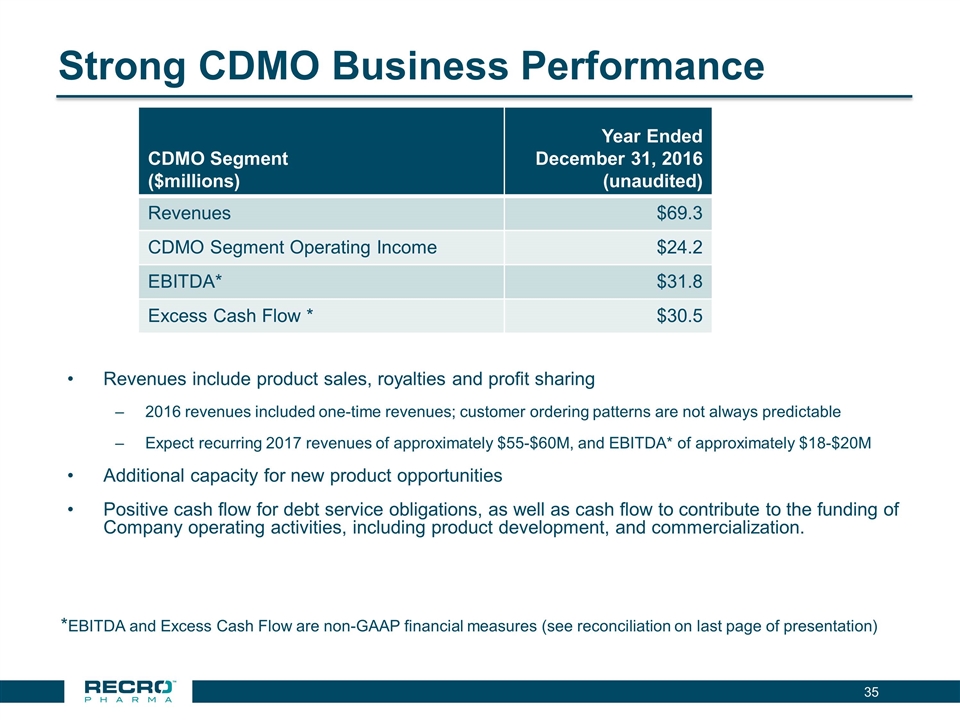

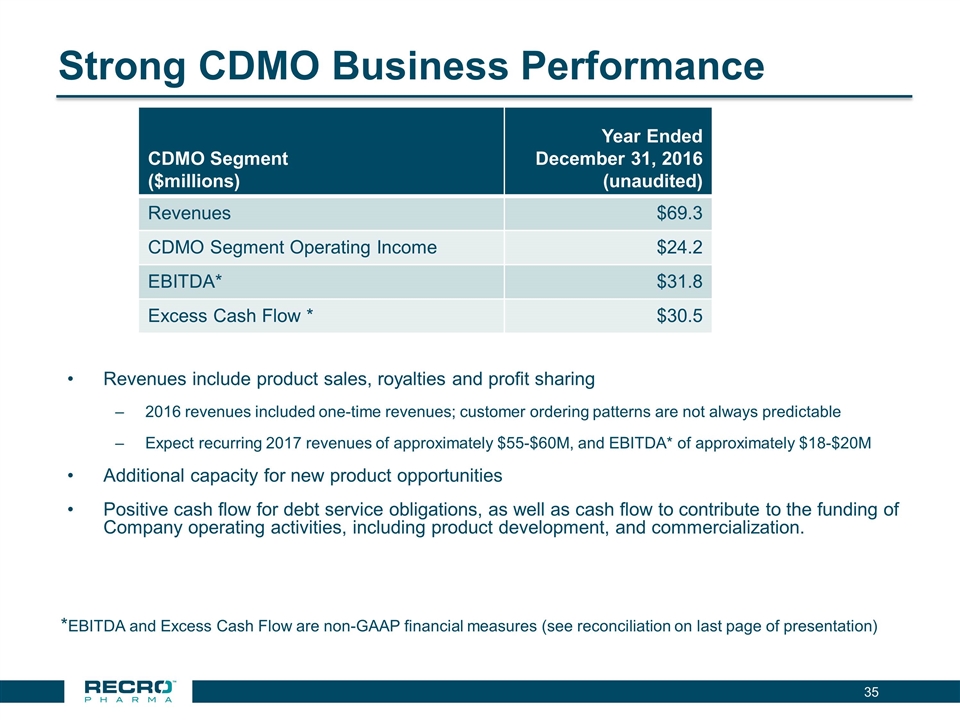

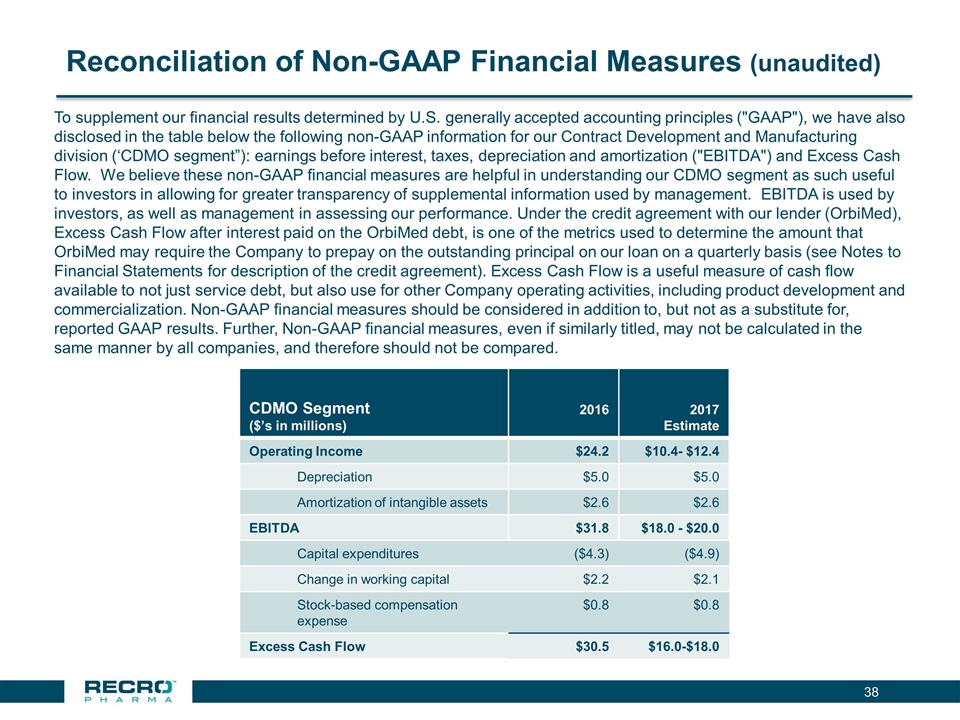

Strong CDMO Business Performance Revenues include product sales, royalties and profit sharing 2016 revenues included one-time revenues; customer ordering patterns are not always predictable Expect recurring 2017 revenues of approximately $55-$60M, and EBITDA* of approximately $18-$20M Additional capacity for new product opportunities Positive cash flow for debt service obligations, as well as cash flow to contribute to the funding of Company operating activities, including product development, and commercialization. *EBITDA and Excess Cash Flow are non-GAAP financial measures (see reconciliation on last page of presentation) CDMO Segment ($millions) Year Ended December 31, 2016 (unaudited) Revenues $69.3 CDMO Segment Operating Income $24.2 EBITDA* $31.8 Excess Cash Flow * $30.5

OrbiMed Debt Financing $50 million up-front payment funded via a five-year senior secured term loan with OrbiMed related to the Alkermes April 2015 transaction Interest at LIBOR + 14.0%, with a 1.0% LIBOR floor OrbiMed received warrants to purchase an aggregate of 3% of Recro's outstanding common stock (on a fully diluted basis) as of the closing of the transaction. Paid down $22.7 million, or 45% of the original $50.0 million term loan from excess cash flow generated by the manufacturing business OrbiMed Loan @ 12/31/16- $27.3 million

Company Highlights Specialty pharmaceutical company focused on hospital and related settings with investigational product, IV Meloxicam targeting post-operative pain Plan to file New Drug Application for IV Meloxicam in summer 2017 Reported results for pivotal Phase 3 trial in patients following abdominoplasty surgery Reported results for pivotal Phase 3 trial in patients following bunionectomy surgery Completed renal impairment and ECG studies Completed enrollment of 700+ patients in safety trial; study results expected in Q2 Multiple non-opioid therapeutics in clinical development for pain conditions Revenue and cash flow positive contract development and manufacturing (CDMO) business Solid cash position $64.5 million cash @ 12/31/16 $40 million capital raise in December ($36.9 million net proceeds) Experienced management team with significant development, regulatory and commercial experience

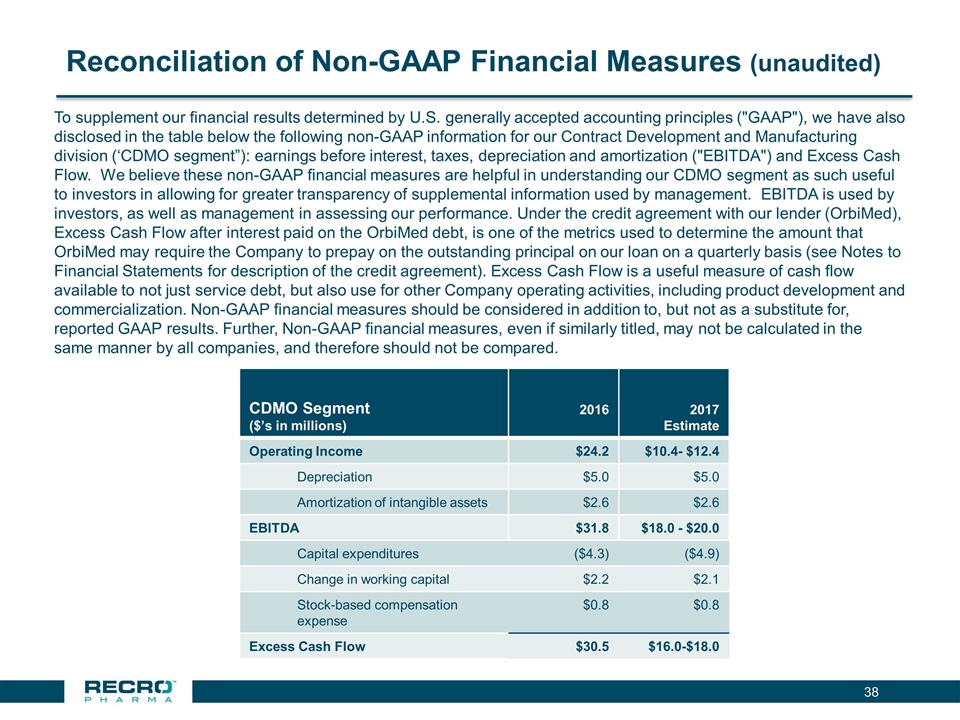

Reconciliation of Non-GAAP Financial Measures (unaudited) CDMO Segment ($’s in millions) 2016 2017 Estimate Operating Income $24.2 $10.4- $12.4 Depreciation $5.0 $5.0 Amortization of intangible assets $2.6 $2.6 EBITDA $31.8 $18.0 - $20.0 Capital expenditures ($4.3) ($4.9) Change in working capital $2.2 $2.1 Stock-based compensation expense $0.8 $0.8 Excess Cash Flow $30.5 $16.0-$18.0 To supplement our financial results determined by U.S. generally accepted accounting principles ("GAAP"), we have also disclosed in the table below the following non-GAAP information for our Contract Development and Manufacturing division (‘CDMO segment”): earnings before interest, taxes, depreciation and amortization ("EBITDA") and Excess Cash Flow. We believe these non-GAAP financial measures are helpful in understanding our CDMO segment as such useful to investors in allowing for greater transparency of supplemental information used by management. EBITDA is used by investors, as well as management in assessing our performance. Under the credit agreement with our lender (OrbiMed), Excess Cash Flow after interest paid on the OrbiMed debt, is one of the metrics used to determine the amount that OrbiMed may require the Company to prepay on the outstanding principal on our loan on a quarterly basis (see Notes to Financial Statements for description of the credit agreement). Excess Cash Flow is a useful measure of cash flow available to not just service debt, but also use for other Company operating activities, including product development and commercialization. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, reported GAAP results. Further, Non-GAAP financial measures, even if similarly titled, may not be calculated in the same manner by all companies, and therefore should not be compared.