- SCTL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Societal CDMO (SCTL) 8-KOther Events

Filed: 18 Jul 17, 12:00am

July 2017 Relieving pain…….Improving lives Exhibit 99.1

Special Note Regarding Forward-Looking Statements This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements, among other things, relate to our business strategy, goals and expectations concerning our product candidates, future operations, prospects, plans and objectives of management. The words "anticipate", "believe", "could", "estimate", "expect", "intend", "may", "plan", "predict", "project", "will" and similar terms and phrases are used to identify forward-looking statements in this presentation. Our operations involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward-looking statements ultimately prove to be correct. This presentation is intended to be nonpromotional and for investor discussion purposes only. The information provided herein contains references to investigational products and use of these products has not been approved by the FDA. The safety and efficacy of the investigational use of these development products has not been determined. There is no guarantee that the investigational use listed will be filed with and/or approved for marketing by any regulatory agency. These forward-looking statements should be considered together with the risks and uncertainties that may affect our business and future results included in our filings with the Securities and Exchange Commission at www.sec.gov. These forward-looking statements are based on information currently available to us, and we assume no obligation to update any forward-looking statements except as required by applicable law.

Company Highlights Specialty pharmaceutical company focused on hospital and related settings with late stage investigational product, IV Meloxicam targeting post-operative pain Plan to file New Drug Application for IV Meloxicam in early Q3 2017 Reported results for pivotal Phase 3 trial in patients following abdominoplasty surgery Reported results for pivotal Phase 3 trial in patients following bunionectomy surgery Reported results for Phase 3 safety study demonstrating solid safety and tolerability profile Largest Phase 3 double blind placebo controlled non-opioid study evaluating post operative IV pain product in a post-operative setting Completed renal impairment and ECG studies Multiple non-opioid therapeutics in clinical development for pain conditions Revenue and cash flow positive contract development and manufacturing (CDMO) business Solid cash position- $55.5 million cash @ 3/31/17 Experienced management team with significant development, regulatory and commercial experience

Experienced Management and Board Gerri Henwood – President and CEO Founded Auxilium Pharmaceuticals (AUXL, NASDAQ) and IBAH (former NASDAQ Co. – acquired 1998); GSK Michael Celano – CFO Over 35 years of financial leadership experience – Kensey Nash, BioRexis, Orasure, Arthur Andersen/KPMG Randy Mack – SVP, Development Over 25 years of clinical development experience – Adolor, Auxilium, Abbott Labs and Harris Labs Stewart McCallum, MD – CMO Over 9 years of GSK Clinical experience – Development experience; past clinical Investigator, KOL and Stanford U. Fred Graff – CCO Over 30 years of successful commercial experience, including sales and marketing leadership roles at Sepracor, RPR, and MAP Pharmaceuticals Ryan Lake- SVP of Finance & Chief Accounting Officer Over 15 years of senior financial experience- Aspire Bariatrics, DSM Biomedical, Kensey Nash, Deloitte Board of Directors Wayne B. Weisman – Chairman SCP VitaLife Partners Alfred Altomari CEO, Agile Therapeutics William L. Ashton Harrison Consulting Group; frmly Amgen Michael Berelowitz, M.D. Former SVP, Specialty Care Business Unit, Pfizer Winston J. Churchill SCP VitaLife Partners Karen Flynn Senior Vice President and Chief Commercial Officer of West Pharmaceutical Services, Inc. Gerri Henwood – CEO Bryan Reasons SVP and CFO, Impax Laboratories

2015 Transformative Transaction Acquired IV/IM Meloxicam and manufacturing business from Alkermes in April 2015 $50M up-front cash payment plus working capital adjustment; Meloxicam milestones up to $125M (including, at our election, either (i) $10M payable upon NDA filing and $30M upon regulatory approval or (ii) an aggregate $45M upon regulatory approval, as well as other revenue target milestones), and royalties Warrants issued to Alkermes and OrbiMed Non-dilutive up-front financed by loan from OrbiMed Paid down $22.7M, or 45% of the original $50M term loan from excess cash flow generated by the manufacturing business IV Meloxicam – once a day preferential COX-2 inhibitor being developed for moderate to severe acute pain Multiple Phase 2 studies completed in acute pain models Phase 3 pivotal trial in hard tissue model reported efficacy data; met the primary endpoint; reported July 2016 Phase 3 pivotal trial in soft tissue model reported efficacy data; met the primary endpoint; reported November 2016 Phase 3 safety study completed-721 patient study; reported May 2017; demonstrating solid safety and tolerability profile Completed renal impairment and ECG studies Manufacturing business 97,000 sq. ft. facility (DEA licensed) manufactures 5 commercial products marketed by partners Revenues include product sales, royalties and profit sharing 2016 revenues of $69.3M, and significant positive cash flow

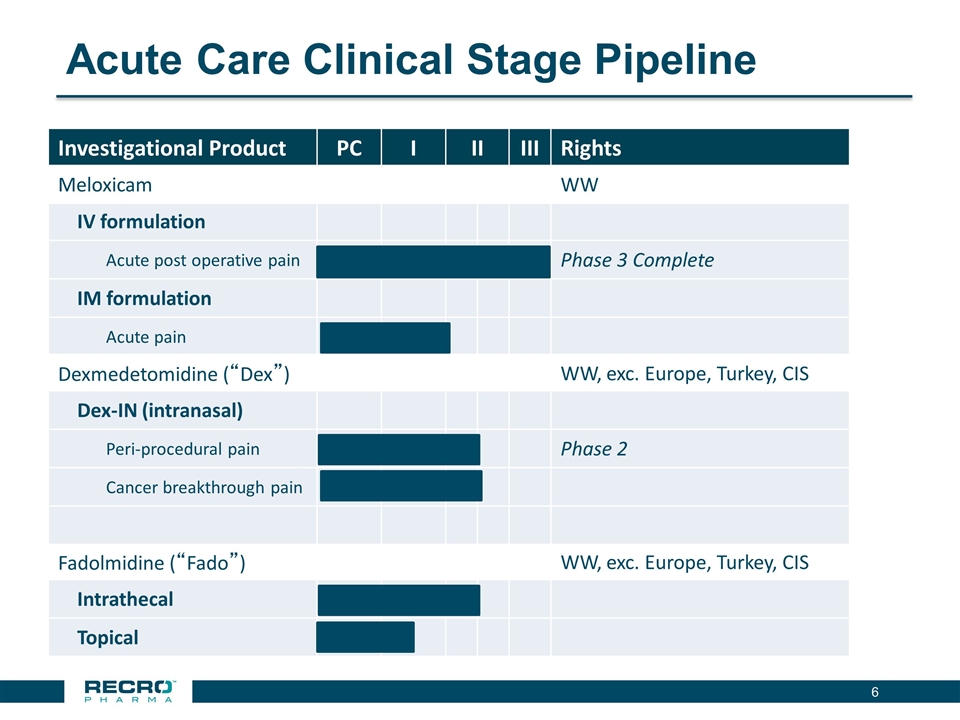

Acute Care Clinical Stage Pipeline Investigational Product PC I II III Rights Meloxicam WW IV formulation Acute post operative pain Phase 3 Complete IM formulation Acute pain Dexmedetomidine (“Dex”) WW, exc. Europe, Turkey, CIS Dex-IN (intranasal) Peri-procedural pain Phase 2 Cancer breakthrough pain Fadolmidine (“Fado”) WW, exc. Europe, Turkey, CIS Intrathecal Topical

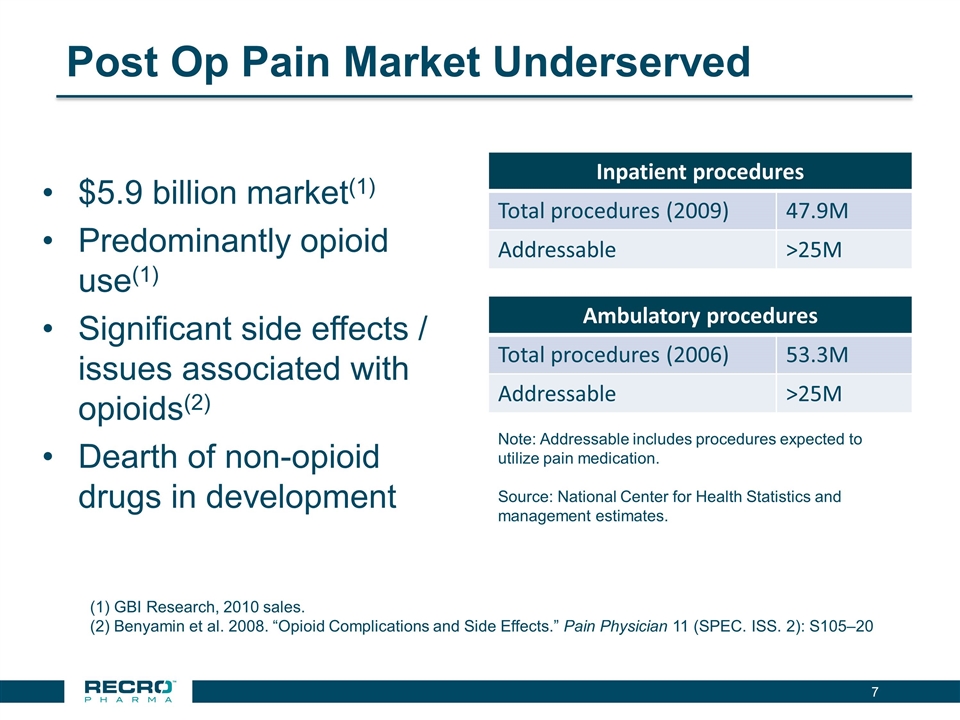

Post Op Pain Market Underserved $5.9 billion market(1) Predominantly opioid use(1) Significant side effects / issues associated with opioids(2) Dearth of non-opioid drugs in development Inpatient procedures Total procedures (2009) 47.9M Addressable >25M Ambulatory procedures Total procedures (2006) 53.3M Addressable >25M Note: Addressable includes procedures expected to utilize pain medication. Source: National Center for Health Statistics and management estimates. GBI Research, 2010 sales. Benyamin et al. 2008. “Opioid Complications and Side Effects.” Pain Physician 11 (SPEC. ISS. 2): S105–20

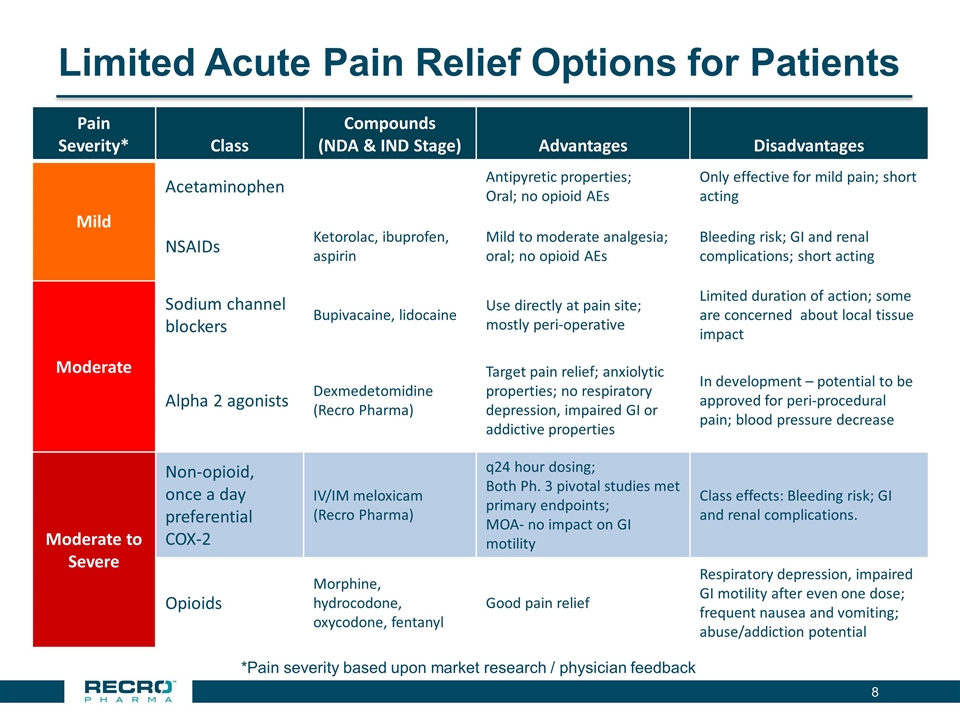

Limited Acute Pain Relief Options for Patients *Pain severity based upon market research / physician feedback Pain Severity* Class Compounds (NDA & IND Stage) Advantages Disadvantages Mild Acetaminophen Antipyretic properties; Oral; no opioid AEs Only effective for mild pain; short acting NSAIDs Ketorolac, ibuprofen, aspirin Mild to moderate analgesia; oral; no opioid AEs Bleeding risk; GI and renal complications; short acting Moderate Sodium channel blockers Bupivacaine, lidocaine Use directly at pain site; mostly peri-operative Limited duration of action; some are concerned about local tissue impact Alpha 2 agonists Dexmedetomidine (Recro Pharma) Target pain relief; anxiolytic properties; no respiratory depression, impaired GI or addictive properties In development – potential to be approved for peri-procedural pain; blood pressure decrease Moderate to Severe Non-opioid, once a day preferential COX-2 IV/IM meloxicam (Recro Pharma) q24 hour dosing; Both Ph. 3 pivotal studies met primary endpoints; MOA- no impact on GI motility Class effects: Bleeding risk; GI and renal complications. Opioids Morphine, hydrocodone, oxycodone, fentanyl Good pain relief Respiratory depression, impaired GI motility after even one dose; frequent nausea and vomiting; abuse/addiction potential

IV Meloxicam

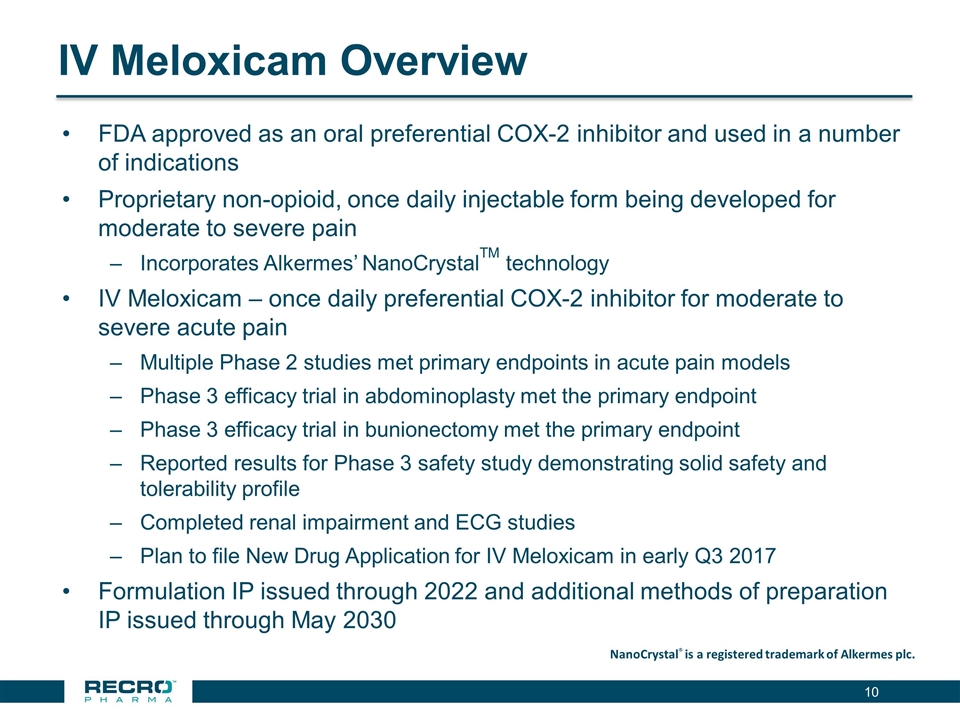

IV Meloxicam Overview FDA approved as an oral preferential COX-2 inhibitor and used in a number of indications Proprietary non-opioid, once daily injectable form being developed for moderate to severe pain Incorporates Alkermes’ NanoCrystalTM technology IV Meloxicam – once daily preferential COX-2 inhibitor for moderate to severe acute pain Multiple Phase 2 studies met primary endpoints in acute pain models Phase 3 efficacy trial in abdominoplasty met the primary endpoint Phase 3 efficacy trial in bunionectomy met the primary endpoint Reported results for Phase 3 safety study demonstrating solid safety and tolerability profile Completed renal impairment and ECG studies Plan to file New Drug Application for IV Meloxicam in early Q3 2017 Formulation IP issued through 2022 and additional methods of preparation IP issued through May 2030 NanoCrystal® is a registered trademark of Alkermes plc.

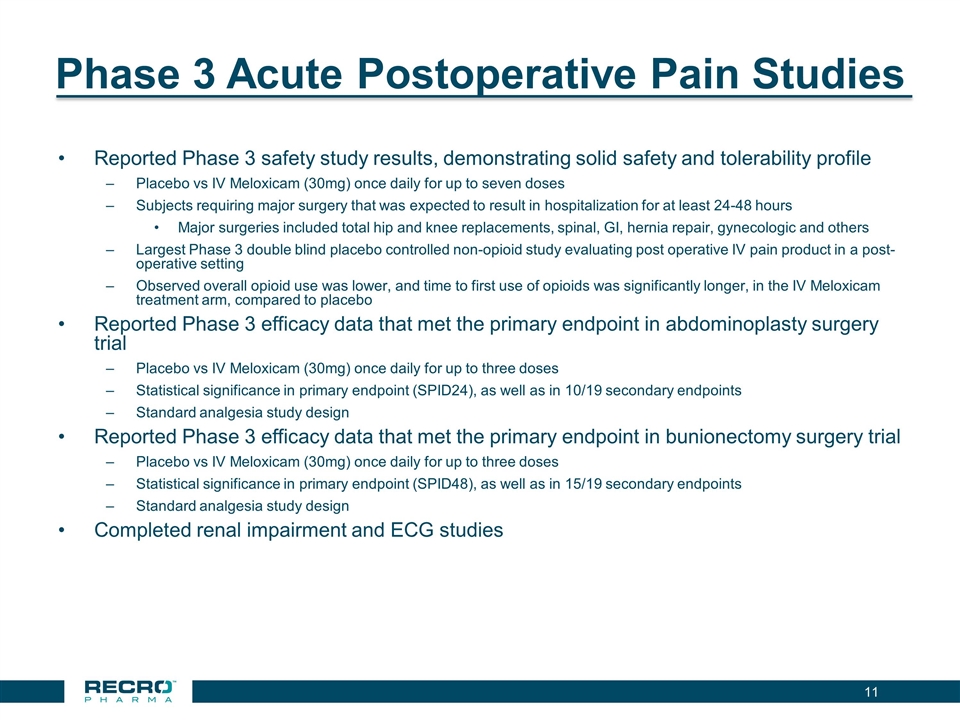

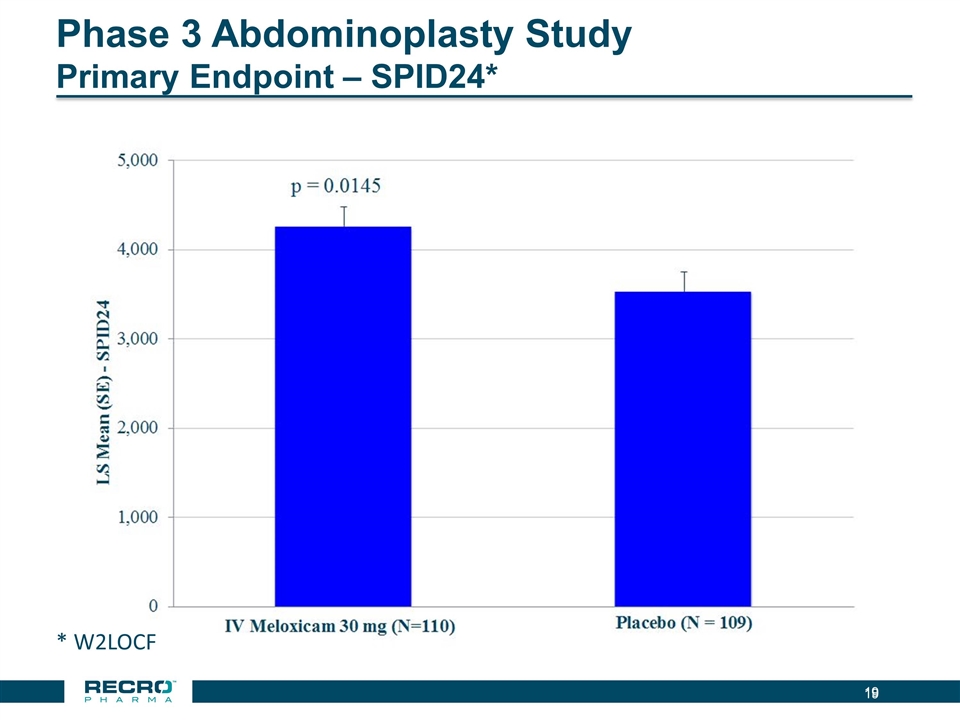

Phase 3 Acute Postoperative Pain Studies Reported Phase 3 safety study results, demonstrating solid safety and tolerability profile Placebo vs IV Meloxicam (30mg) once daily for up to seven doses Subjects requiring major surgery that was expected to result in hospitalization for at least 24-48 hours Major surgeries included total hip and knee replacements, spinal, GI, hernia repair, gynecologic and others Largest Phase 3 double blind placebo controlled non-opioid study evaluating post operative IV pain product in a post-operative setting Observed overall opioid use was lower, and time to first use of opioids was significantly longer, in the IV Meloxicam treatment arm, compared to placebo Reported Phase 3 efficacy data that met the primary endpoint in abdominoplasty surgery trial Placebo vs IV Meloxicam (30mg) once daily for up to three doses Statistical significance in primary endpoint (SPID24), as well as in 10/19 secondary endpoints Standard analgesia study design Reported Phase 3 efficacy data that met the primary endpoint in bunionectomy surgery trial Placebo vs IV Meloxicam (30mg) once daily for up to three doses Statistical significance in primary endpoint (SPID48), as well as in 15/19 secondary endpoints Standard analgesia study design Completed renal impairment and ECG studies

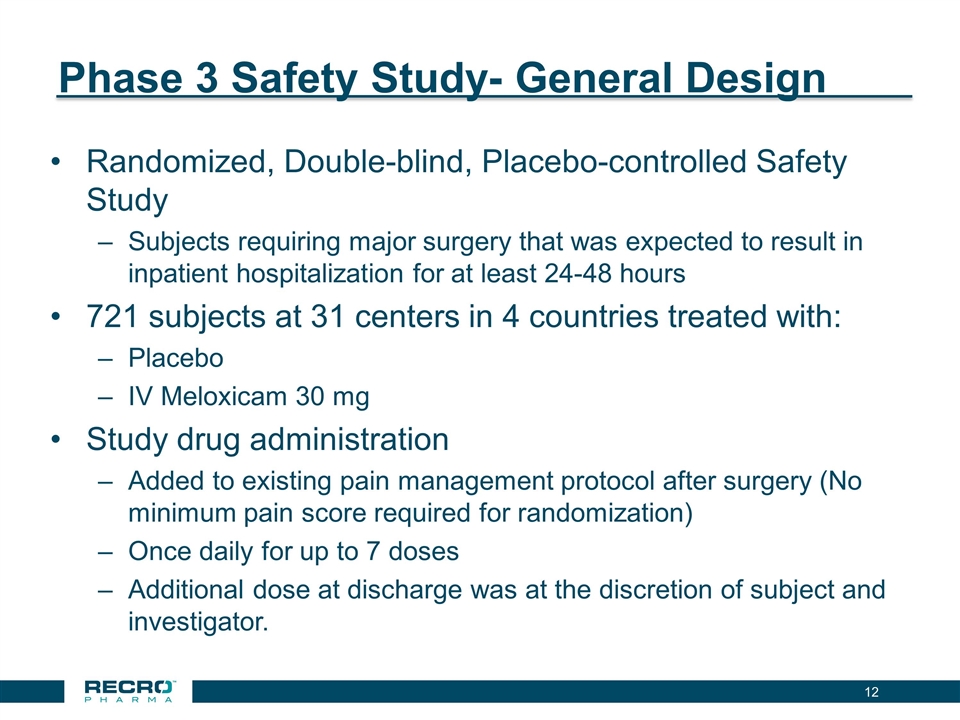

Phase 3 Safety Study- General Design Randomized, Double-blind, Placebo-controlled Safety Study Subjects requiring major surgery that was expected to result in inpatient hospitalization for at least 24-48 hours 721 subjects at 31 centers in 4 countries treated with: Placebo IV Meloxicam 30 mg Study drug administration Added to existing pain management protocol after surgery (No minimum pain score required for randomization) Once daily for up to 7 doses Additional dose at discharge was at the discretion of subject and investigator.

Phase 3 Safety Study- Endpoints Incidence of AEs and SAEs Change from baseline in laboratory tests; incidence of abnormal clinical laboratory tests Change from baseline in vital signs; incidence of clinically significant changes in vital signs Incidence of clinically significant abnormal ECG findings Incidence of abnormal wound healing Opioid consumption over 48 hours

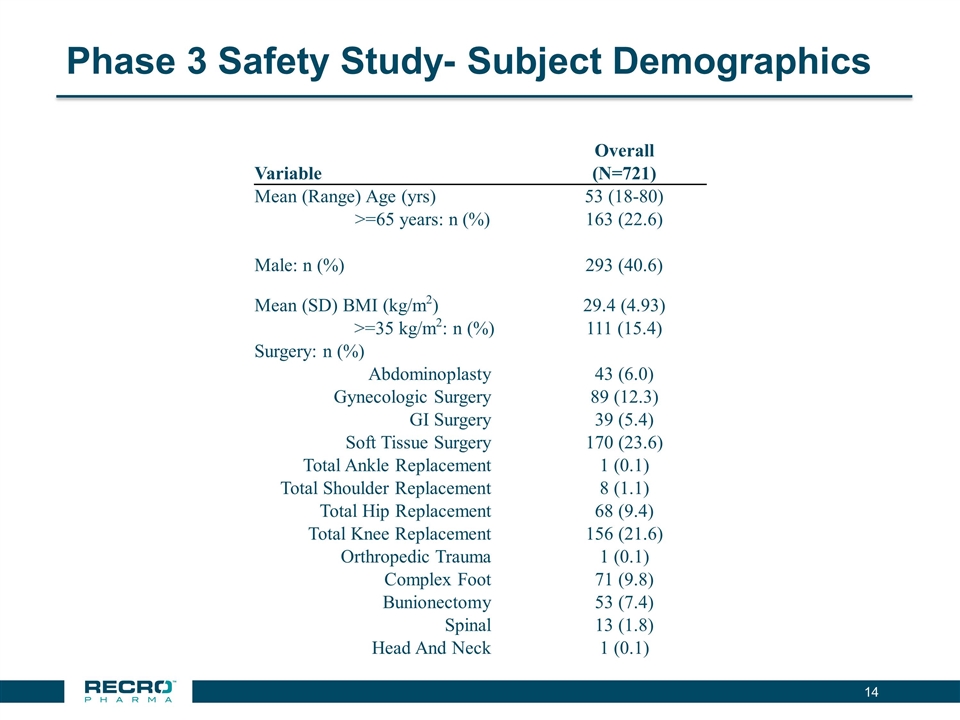

Phase 3 Safety Study- Subject Demographics Overall Variable (N=721) Mean (Range) Age (yrs) 53 (18-80) >=65 years: n (%) 163 (22.6) Male: n (%) 293 (40.6) Mean (SD) BMI (kg/m2) 29.4 (4.93) >=35 kg/m2: n (%) 111 (15.4) Surgery: n (%) Abdominoplasty 43 (6.0) Gynecologic Surgery 89 (12.3) GI Surgery 39 (5.4) Soft Tissue Surgery 170 (23.6) Total Ankle Replacement 1 (0.1) Total Shoulder Replacement 8 (1.1) Total Hip Replacement 68 (9.4) Total Knee Replacement 156 (21.6) Orthropedic Trauma 1 (0.1) Complex Foot 71 (9.8) Bunionectomy 53 (7.4) Spinal 13 (1.8) Head And Neck 1 (0.1)

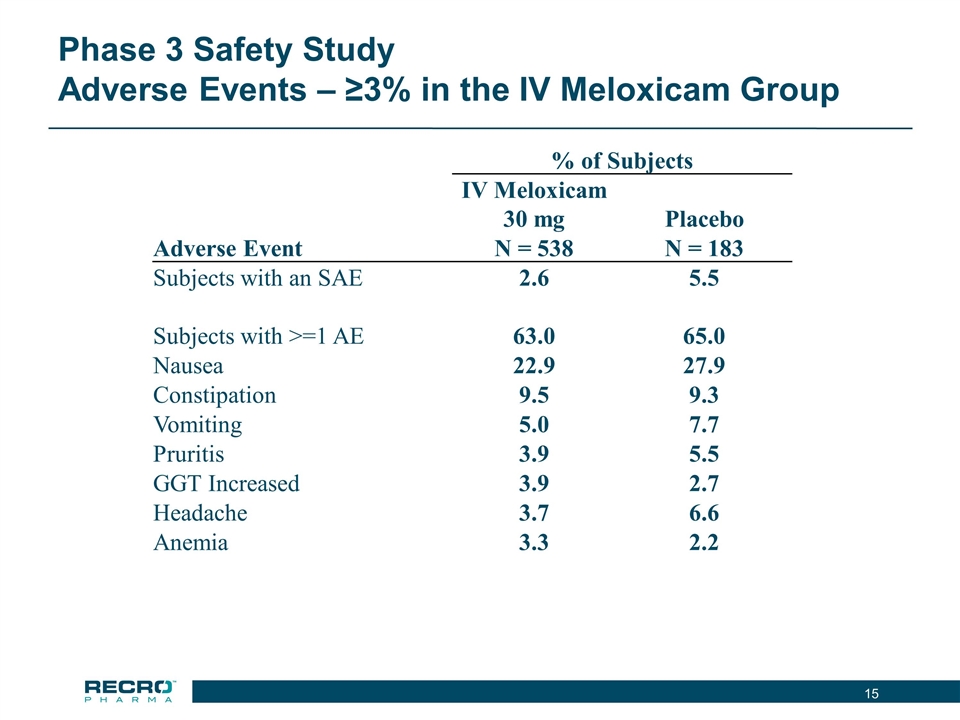

Phase 3 Safety Study Adverse Events – ≥3% in the IV Meloxicam Group % of Subjects IV Meloxicam 30 mg Placebo Adverse Event N = 538 N = 183 Subjects with an SAE 2.6 5.5 Subjects with >=1 AE 63.0 65.0 Nausea 22.9 27.9 Constipation 9.5 9.3 Vomiting 5.0 7.7 Pruritis 3.9 5.5 GGT Increased 3.9 2.7 Headache 3.7 6.6 Anemia 3.3 2.2

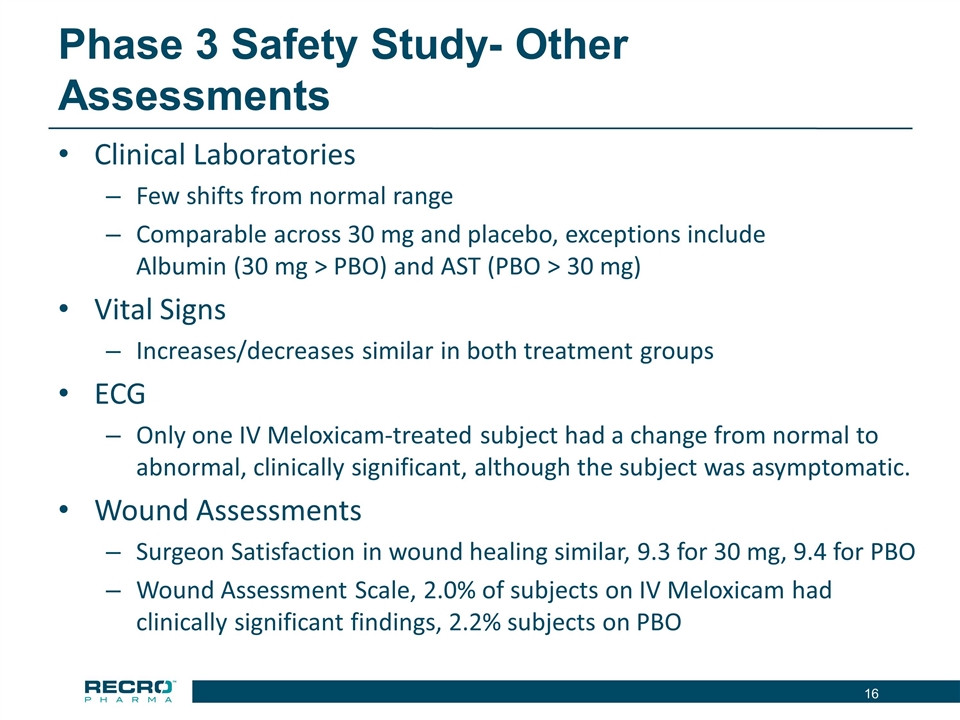

Phase 3 Safety Study- Other Assessments Clinical Laboratories Few shifts from normal range Comparable across 30 mg and placebo, exceptions include Albumin (30 mg > PBO) and AST (PBO > 30 mg) Vital Signs Increases/decreases similar in both treatment groups ECG Only one IV Meloxicam-treated subject had a change from normal to abnormal, clinically significant, although the subject was asymptomatic. Wound Assessments Surgeon Satisfaction in wound healing similar, 9.3 for 30 mg, 9.4 for PBO Wound Assessment Scale, 2.0% of subjects on IV Meloxicam had clinically significant findings, 2.2% subjects on PBO

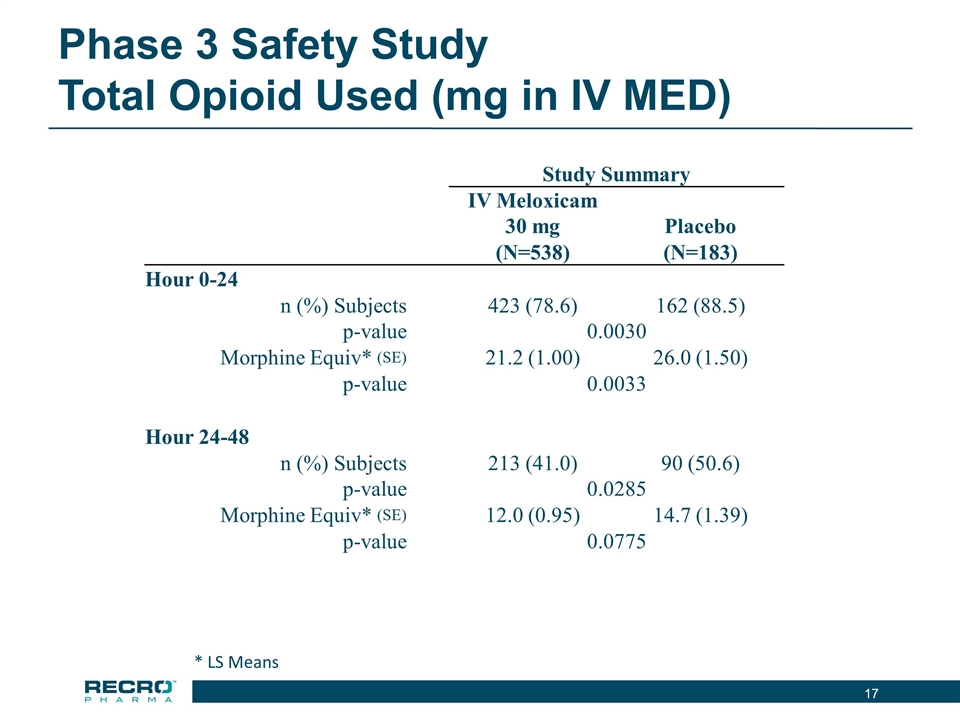

Phase 3 Safety Study Total Opioid Used (mg in IV MED) Study Summary IV Meloxicam 30 mg Placebo (N=538) (N=183) Hour 0-24 n (%) Subjects 423 (78.6) 162 (88.5) p-value 0.0030 Morphine Equiv* (SE) 21.2 (1.00) 26.0 (1.50) p-value 0.0033 Hour 24-48 n (%) Subjects 213 (41.0) 90 (50.6) p-value 0.0285 Morphine Equiv* (SE) 12.0 (0.95) 14.7 (1.39) p-value 0.0775 * LS Means

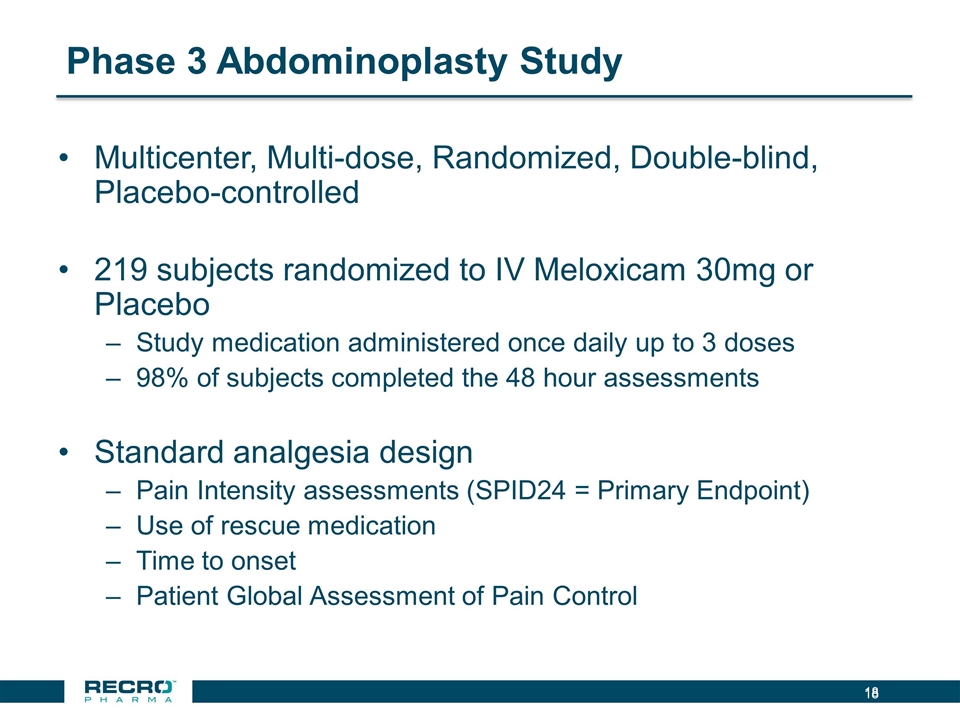

Phase 3 Abdominoplasty Study Multicenter, Multi-dose, Randomized, Double-blind, Placebo-controlled 219 subjects randomized to IV Meloxicam 30mg or Placebo Study medication administered once daily up to 3 doses 98% of subjects completed the 48 hour assessments Standard analgesia design Pain Intensity assessments (SPID24 = Primary Endpoint) Use of rescue medication Time to onset Patient Global Assessment of Pain Control

Phase 3 Abdominoplasty Study Primary Endpoint – SPID24* * W2LOCF

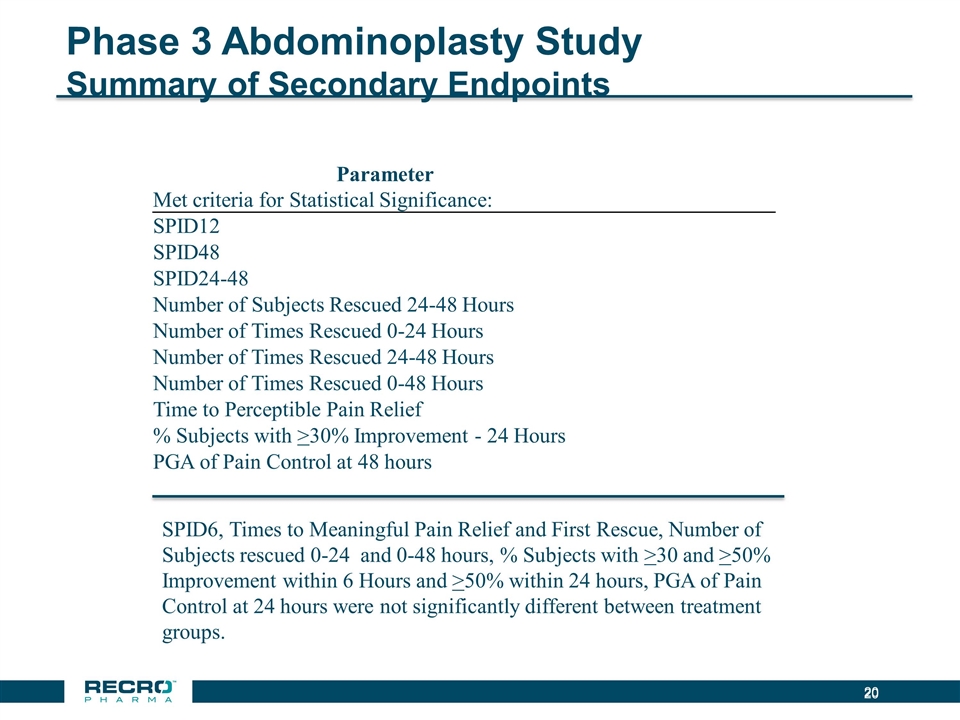

Phase 3 Abdominoplasty Study Summary of Secondary Endpoints SPID6, Times to Meaningful Pain Relief and First Rescue, Number of Subjects rescued 0-24 and 0-48 hours, % Subjects with >30 and >50% Improvement within 6 Hours and >50% within 24 hours, PGA of Pain Control at 24 hours were not significantly different between treatment groups. Parameter Met criteria for Statistical Significance: SPID12 SPID48 SPID24-48 Number of Subjects Rescued 24-48 Hours Number of Times Rescued 0-24 Hours Number of Times Rescued 24-48 Hours Number of Times Rescued 0-48 Hours Time to Perceptible Pain Relief % Subjects with >30% Improvement - 24 Hours PGA of Pain Control at 48 hours

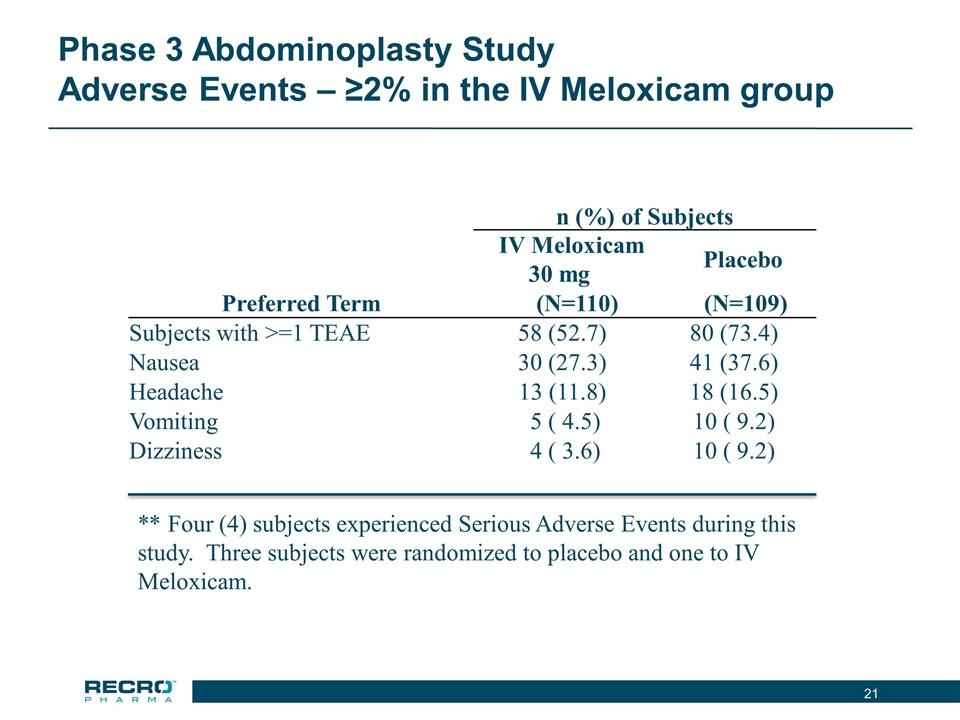

Phase 3 Abdominoplasty Study Adverse Events – ≥2% in the IV Meloxicam group n (%) of Subjects IV Meloxicam 30 mg Placebo Preferred Term (N=110) (N=109) Subjects with >=1 TEAE 58 (52.7) 80 (73.4) Nausea 30 (27.3) 41 (37.6) Headache 13 (11.8) 18 (16.5) Vomiting 5 ( 4.5) 10 ( 9.2) Dizziness 4 ( 3.6) 10 ( 9.2) ** Four (4) subjects experienced Serious Adverse Events during this study. Three subjects were randomized to placebo and one to IV Meloxicam.

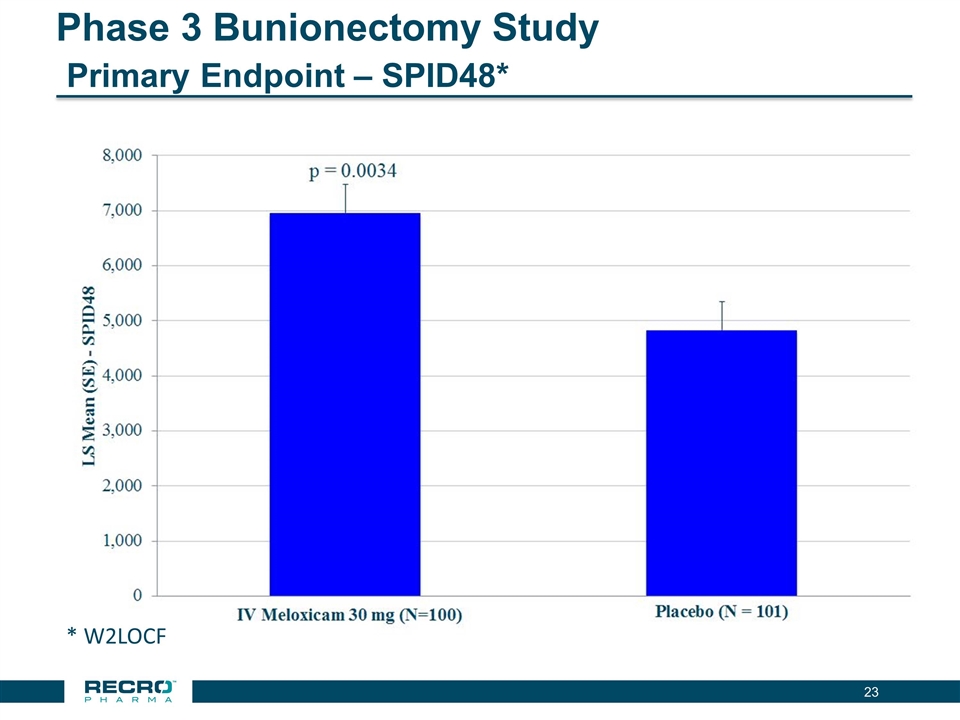

Phase 3 Bunionectomy Study Multicenter, Multi-dose, Randomized, Double-blind, Placebo-controlled 201 subjects randomized to either IV Meloxicam 30 mg or Placebo Study medication administered once daily hours up to 3 doses 95% of subjects completed the 48 hour assessments Standard analgesia design Pain Intensity assessments (SPID48 = Primary Endpoint) Use of rescue medication Time to onset Patient Global Assessment of Pain Control

Phase 3 Bunionectomy Study Primary Endpoint – SPID48* * W2LOCF

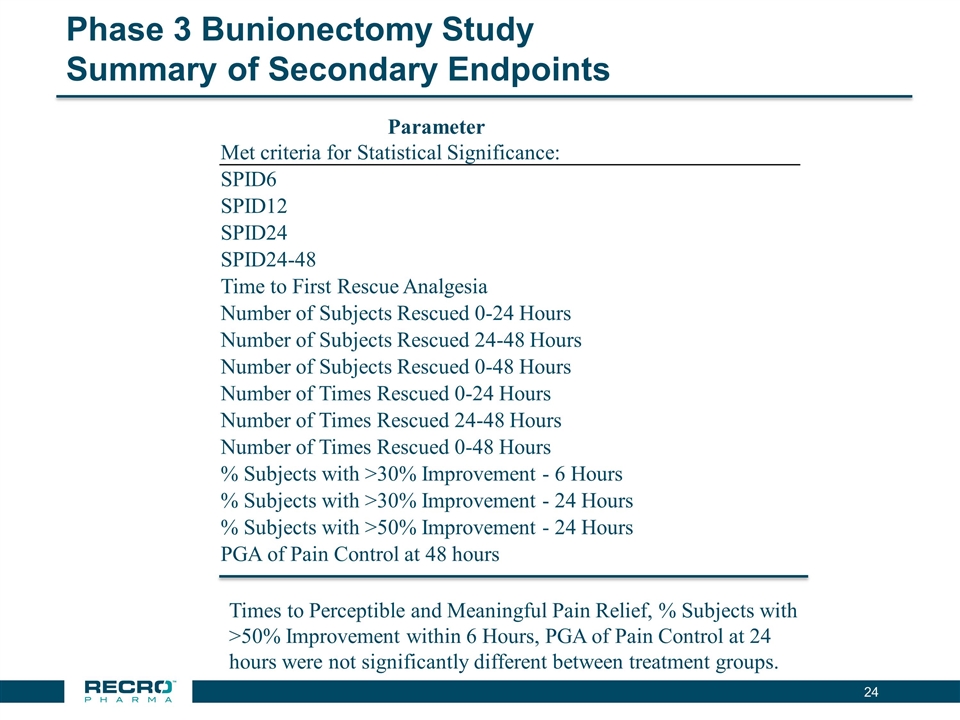

Phase 3 Bunionectomy Study Summary of Secondary Endpoints Parameter Met criteria for Statistical Significance: SPID6 SPID12 SPID24 SPID24-48 Time to First Rescue Analgesia Number of Subjects Rescued 0-24 Hours Number of Subjects Rescued 24-48 Hours Number of Subjects Rescued 0-48 Hours Number of Times Rescued 0-24 Hours Number of Times Rescued 24-48 Hours Number of Times Rescued 0-48 Hours % Subjects with >30% Improvement - 6 Hours % Subjects with >30% Improvement - 24 Hours % Subjects with >50% Improvement - 24 Hours PGA of Pain Control at 48 hours Times to Perceptible and Meaningful Pain Relief, % Subjects with >50% Improvement within 6 Hours, PGA of Pain Control at 24 hours were not significantly different between treatment groups.

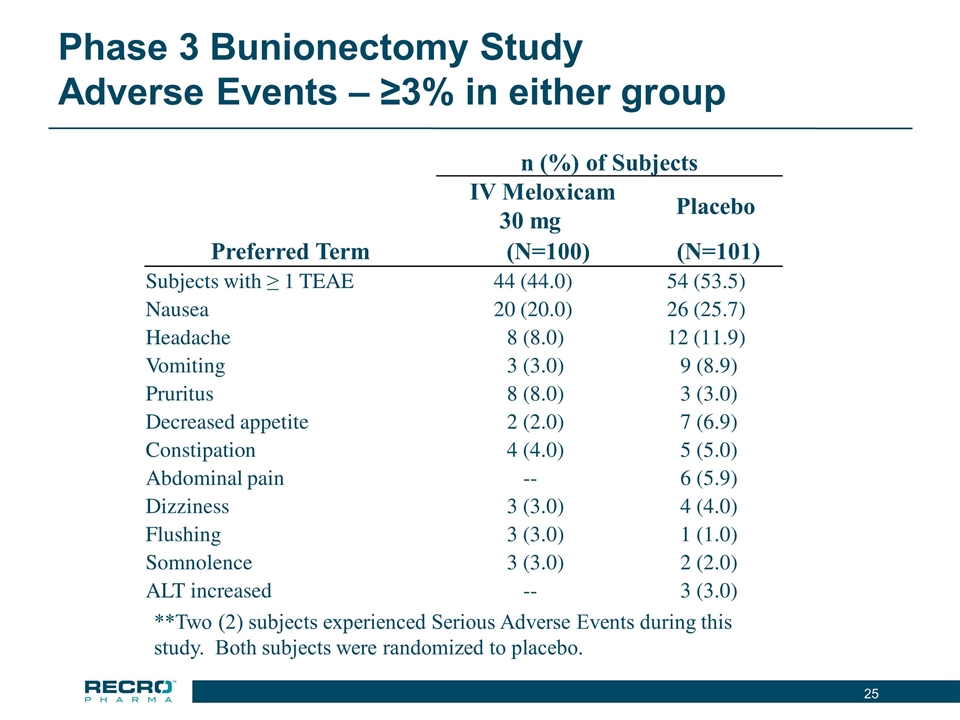

Phase 3 Bunionectomy Study Adverse Events – ≥3% in either group n (%) of Subjects IV Meloxicam 30 mg Placebo Preferred Term (N=100) (N=101) Subjects with ≥ 1 TEAE 44 (44.0) 54 (53.5) Nausea 20 (20.0) 26 (25.7) Headache 8 (8.0) 12 (11.9) Vomiting 3 (3.0) 9 (8.9) Pruritus 8 (8.0) 3 (3.0) Decreased appetite 2 (2.0) 7 (6.9) Constipation 4 (4.0) 5 (5.0) Abdominal pain -- 6 (5.9) Dizziness 3 (3.0) 4 (4.0) Flushing 3 (3.0) 1 (1.0) Somnolence 3 (3.0) 2 (2.0) ALT increased -- 3 (3.0) **Two (2) subjects experienced Serious Adverse Events during this study. Both subjects were randomized to placebo.

Next Steps for IV Meloxicam Reported safety study results in May 2017 Total across all Phase 3 studies: approximately 1100 patients enrolled Plan to file NDA for IV Meloxicam in early Q3 2017 Finalize design and initiate Phase 3B study Orthopedic surgery (total knee)- opioid consumption/pain intensity Colorectal surgery-opioid consumption; length of stay

Commercialization Trends in IV Pain Management Alternative payment models – bundled payments “Setting of care” and general movement to lower acuity settings as site of service Opioid avoidance –anti-addiction efforts across HHS Reimbursement strategy- IV, oral and generic factors High cost of drugs Multimodal drug approach Value proposition supported with real world evidence and HE data beyond evidence for FDA approval

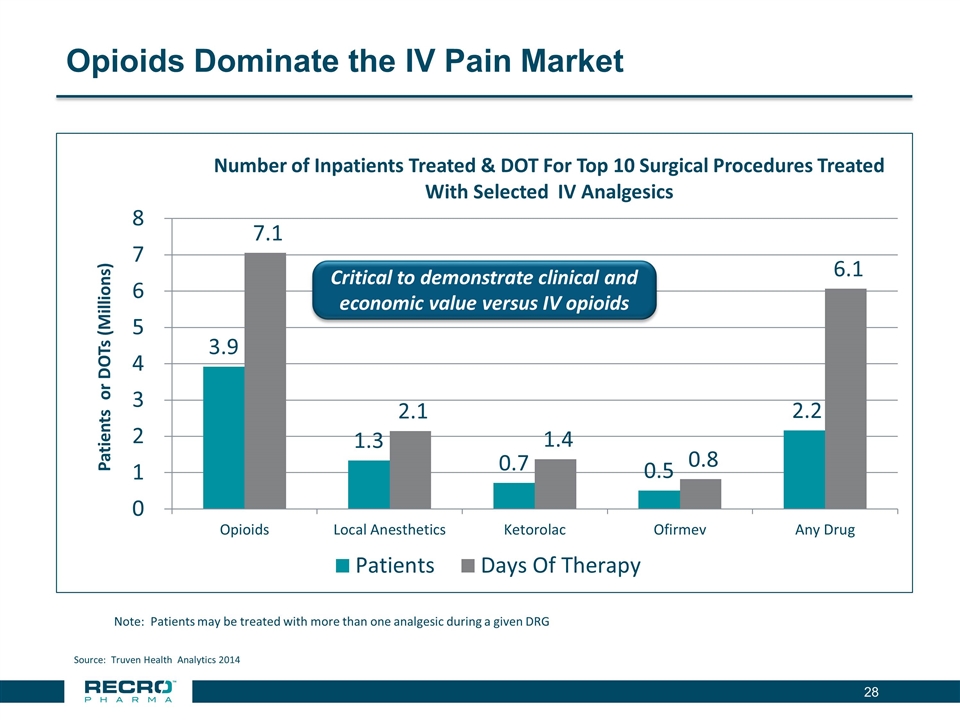

Opioids Dominate the IV Pain Market Note: Patients may be treated with more than one analgesic during a given DRG Source: Truven Health Analytics 2014 Critical to demonstrate clinical and economic value versus IV opioids

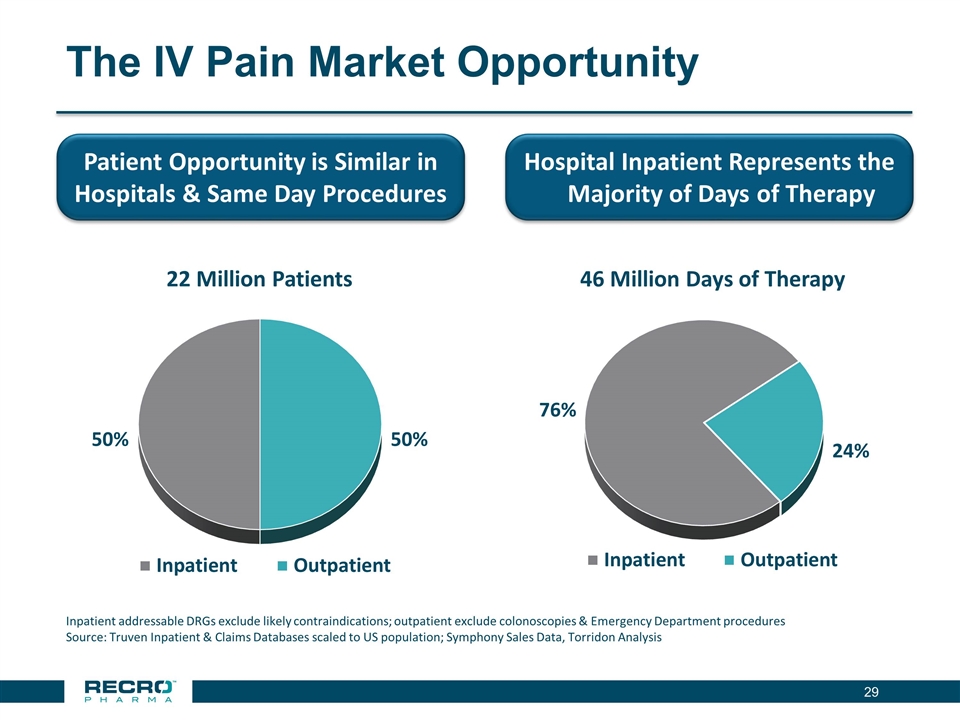

The IV Pain Market Opportunity Patient Opportunity is Similar in Hospitals & Same Day Procedures Hospital Inpatient Represents the Majority of Days of Therapy Inpatient addressable DRGs exclude likely contraindications; outpatient exclude colonoscopies & Emergency Department procedures Source: Truven Inpatient & Claims Databases scaled to US population; Symphony Sales Data, Torridon Analysis

IV Meloxicam Target Opportunity Intra-abdominal Procedures Surgeons have keen interest in: Avoidance of opioids Avoidance of troughs in existing non-opioid pain med options If approved, could answer needs through: Relief of moderate to severe pain over 24 hours Orthopedic Procedures Surgeons have keen interest in: Long lasting serious pain relief to get the patient through the trip home and first post-op day/night Many surgeons concerned about opioid use and potential for addiction If approved, could answer needs through: Relief of moderate to severe pain over 24 hours No addiction properties

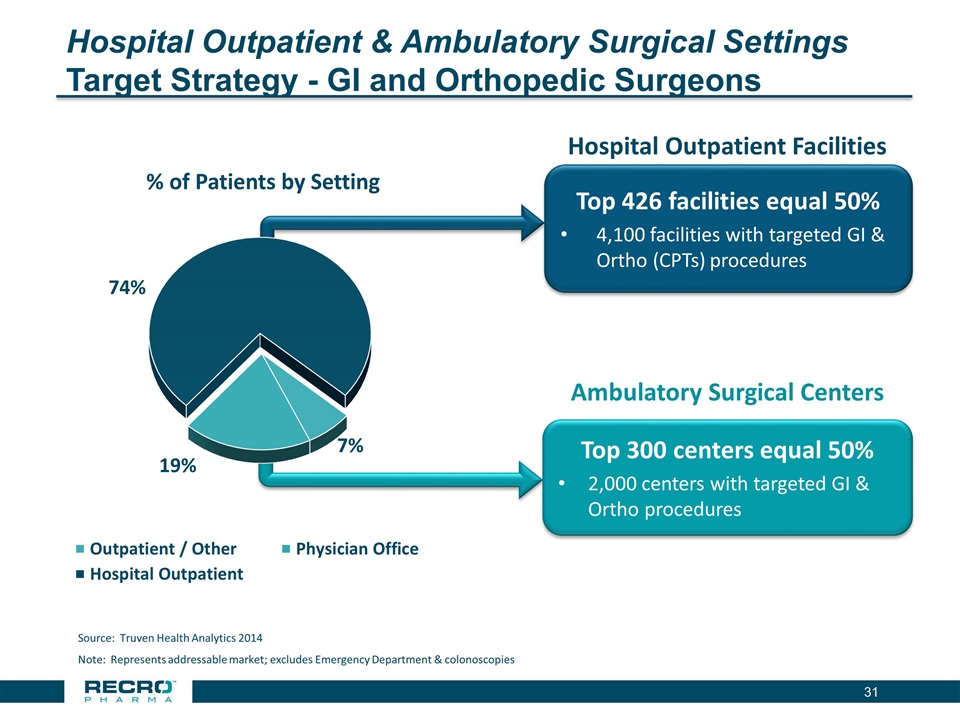

Hospital Outpatient & Ambulatory Surgical Settings Target Strategy - GI and Orthopedic Surgeons Note: Represents addressable market; excludes Emergency Department & colonoscopies Source: Truven Health Analytics 2014 Top 300 centers equal 50% 2,000 centers with targeted GI & Ortho procedures Top 426 facilities equal 50% 4,100 facilities with targeted GI & Ortho (CPTs) procedures Hospital Outpatient Facilities Ambulatory Surgical Centers

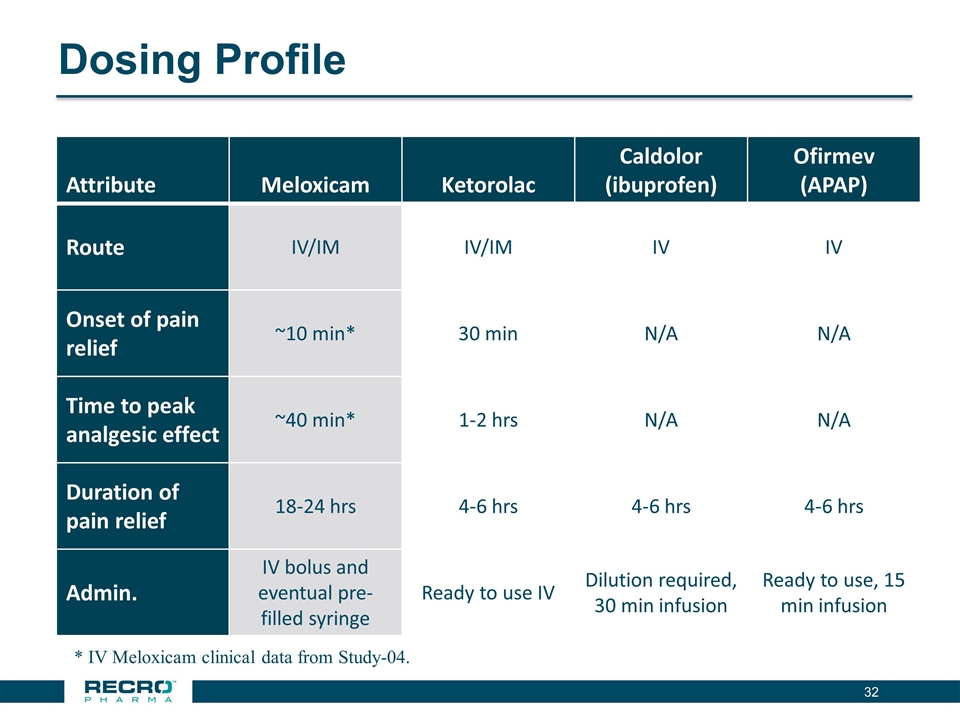

Dosing Profile Attribute Meloxicam Ketorolac Caldolor (ibuprofen) Ofirmev (APAP) Route IV/IM IV/IM IV IV Onset of pain relief ~10 min* 30 min N/A N/A Time to peak analgesic effect ~40 min* 1-2 hrs N/A N/A Duration of pain relief 18-24 hrs 4-6 hrs 4-6 hrs 4-6 hrs Admin. IV bolus and eventual pre-filled syringe Ready to use IV Dilution required, 30 min infusion Ready to use, 15 min infusion * IV Meloxicam clinical data from Study-04.

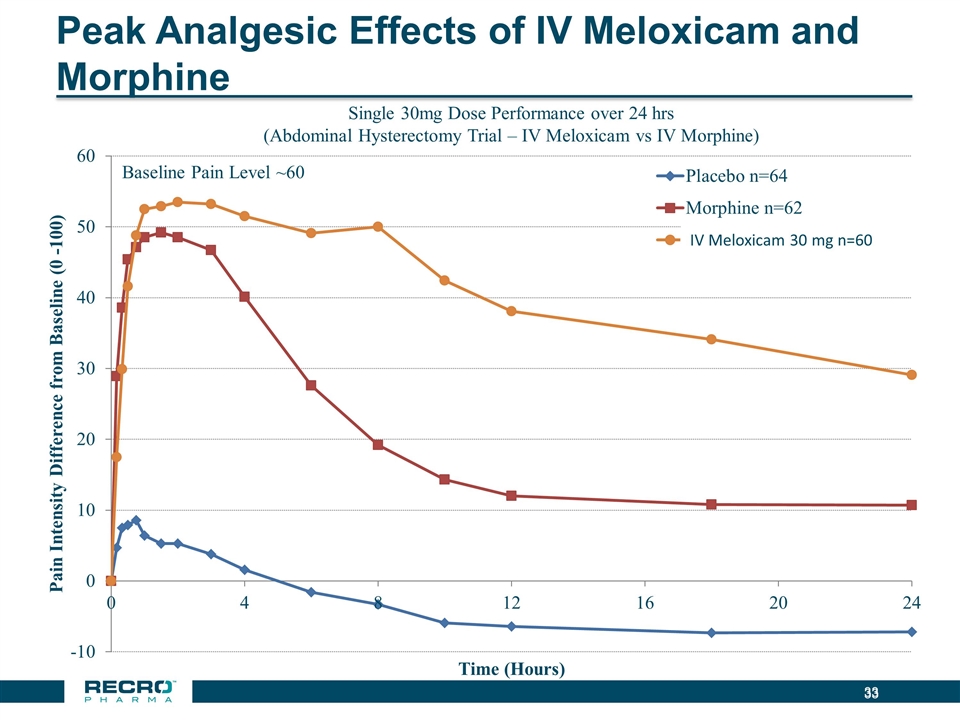

Peak Analgesic Effects of IV Meloxicam and Morphine Single 30mg Dose Performance over 24 hrs (Abdominal Hysterectomy Trial – IV Meloxicam vs IV Morphine) Baseline Pain Level ~60

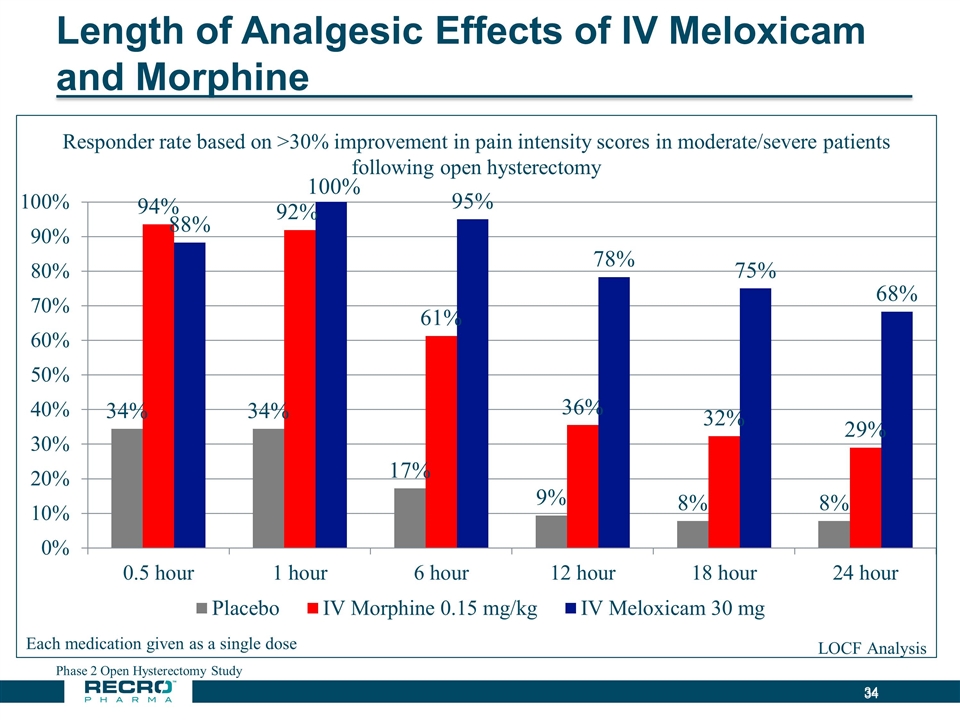

Length of Analgesic Effects of IV Meloxicam and Morphine Phase 2 Open Hysterectomy Study

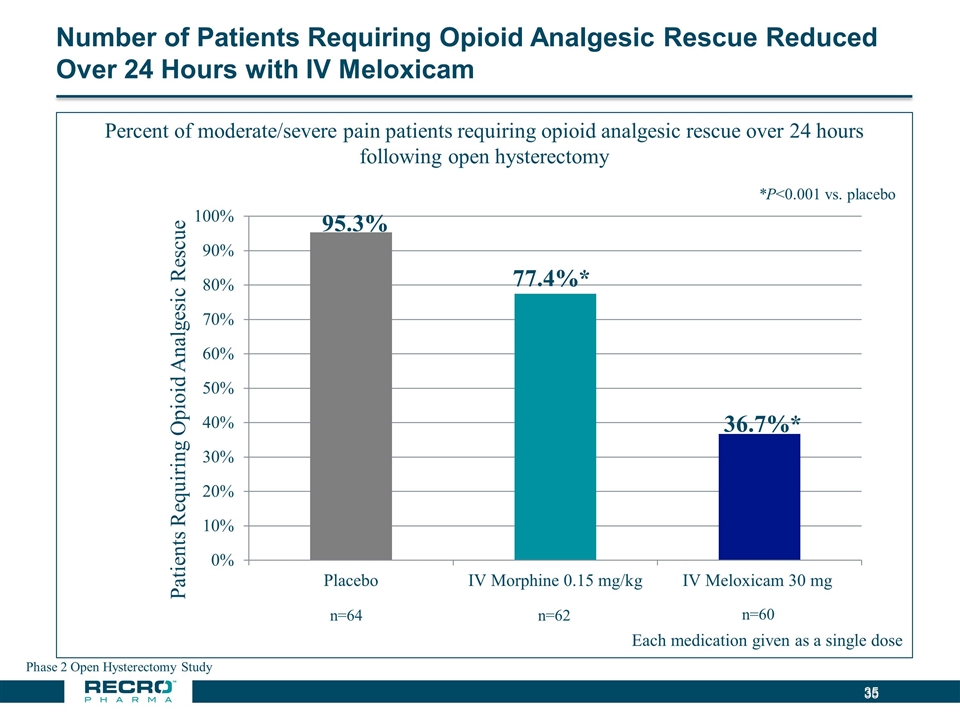

Number of Patients Requiring Opioid Analgesic Rescue Reduced Over 24 Hours with IV Meloxicam Phase 2 Open Hysterectomy Study *P<0.001 vs. placebo 77.4%* 36.7%*

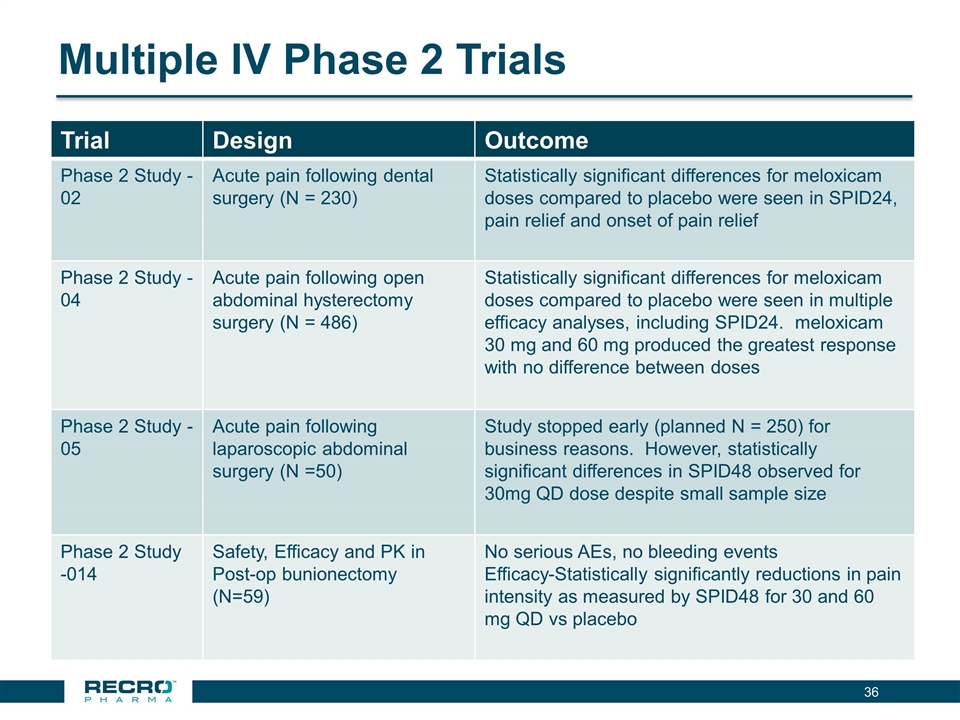

Multiple IV Phase 2 Trials Trial Design Outcome Phase 2 Study -02 Acute pain following dental surgery (N = 230) Statistically significant differences for meloxicam doses compared to placebo were seen in SPID24, pain relief and onset of pain relief Phase 2 Study -04 Acute pain following open abdominal hysterectomy surgery (N = 486) Statistically significant differences for meloxicam doses compared to placebo were seen in multiple efficacy analyses, including SPID24. meloxicam 30 mg and 60 mg produced the greatest response with no difference between doses Phase 2 Study -05 Acute pain following laparoscopic abdominal surgery (N =50) Study stopped early (planned N = 250) for business reasons. However, statistically significant differences in SPID48 observed for 30mg QD dose despite small sample size Phase 2 Study -014 Safety, Efficacy and PK in Post-op bunionectomy (N=59) No serious AEs, no bleeding events Efficacy-Statistically significantly reductions in pain intensity as measured by SPID48 for 30 and 60 mg QD vs placebo

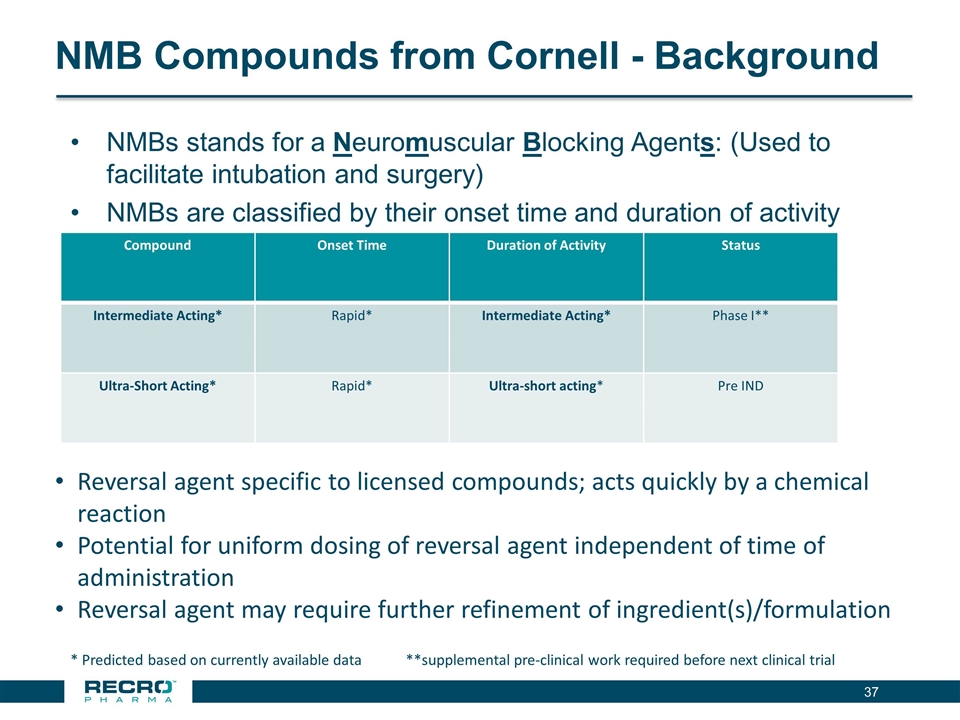

NMB Compounds from Cornell - Background NMBs stands for a Neuromuscular Blocking Agents: (Used to facilitate intubation and surgery) NMBs are classified by their onset time and duration of activity * Predicted based on currently available data **supplemental pre-clinical work required before next clinical trial Compound Onset Time Duration of Activity Status Intermediate Acting* Rapid* Intermediate Acting* Phase I** Ultra-Short Acting* Rapid* Ultra-short acting* Pre IND Reversal agent specific to licensed compounds; acts quickly by a chemical reaction Potential for uniform dosing of reversal agent independent of time of administration Reversal agent may require further refinement of ingredient(s)/formulation

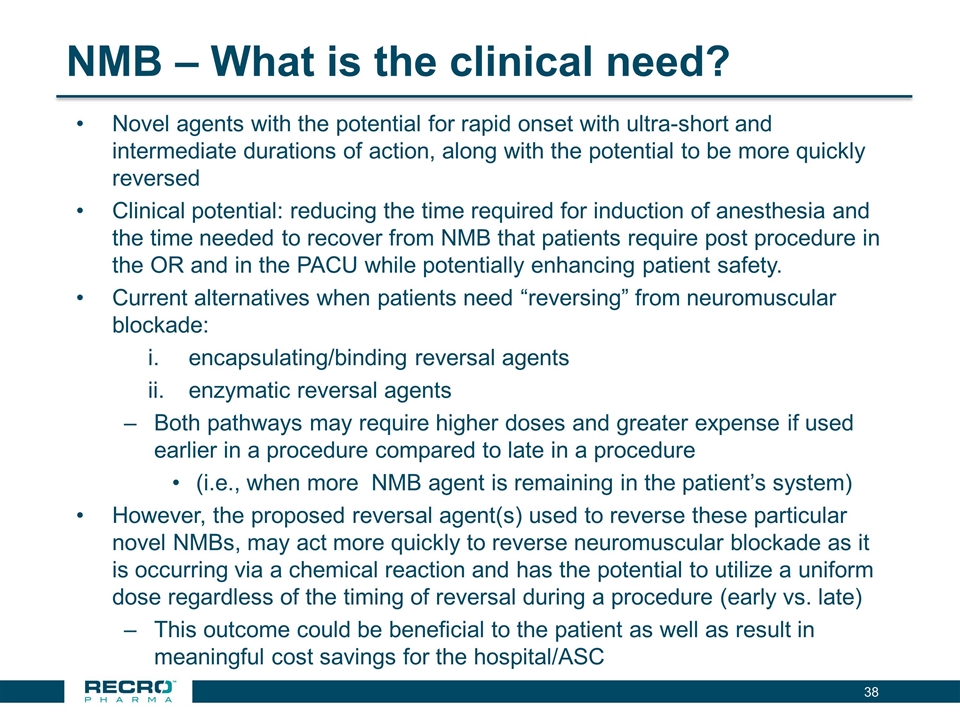

NMB – What is the clinical need? Novel agents with the potential for rapid onset with ultra-short and intermediate durations of action, along with the potential to be more quickly reversed Clinical potential: reducing the time required for induction of anesthesia and the time needed to recover from NMB that patients require post procedure in the OR and in the PACU while potentially enhancing patient safety. Current alternatives when patients need “reversing” from neuromuscular blockade: encapsulating/binding reversal agents enzymatic reversal agents Both pathways may require higher doses and greater expense if used earlier in a procedure compared to late in a procedure (i.e., when more NMB agent is remaining in the patient’s system) However, the proposed reversal agent(s) used to reverse these particular novel NMBs, may act more quickly to reverse neuromuscular blockade as it is occurring via a chemical reaction and has the potential to utilize a uniform dose regardless of the timing of reversal during a procedure (early vs. late) This outcome could be beneficial to the patient as well as result in meaningful cost savings for the hospital/ASC

Contract Development and Manufacturing (CDMO) Business Overview Gainesville

Gainesville CDMO Facility

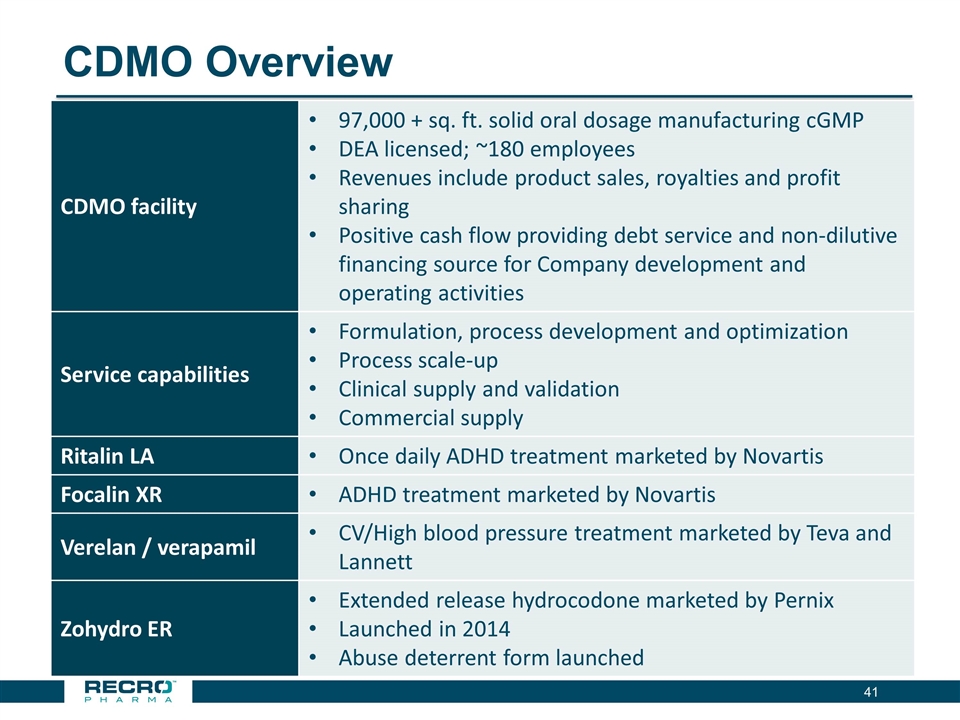

CDMO Overview CDMO facility 97,000 + sq. ft. solid oral dosage manufacturing cGMP DEA licensed; ~180 employees Revenues include product sales, royalties and profit sharing Positive cash flow providing debt service and non-dilutive financing source for Company development and operating activities Service capabilities Formulation, process development and optimization Process scale-up Clinical supply and validation Commercial supply Ritalin LA Once daily ADHD treatment marketed by Novartis Focalin XR ADHD treatment marketed by Novartis Verelan / verapamil CV/High blood pressure treatment marketed by Teva and Lannett Zohydro ER Extended release hydrocodone marketed by Pernix Launched in 2014 Abuse deterrent form launched

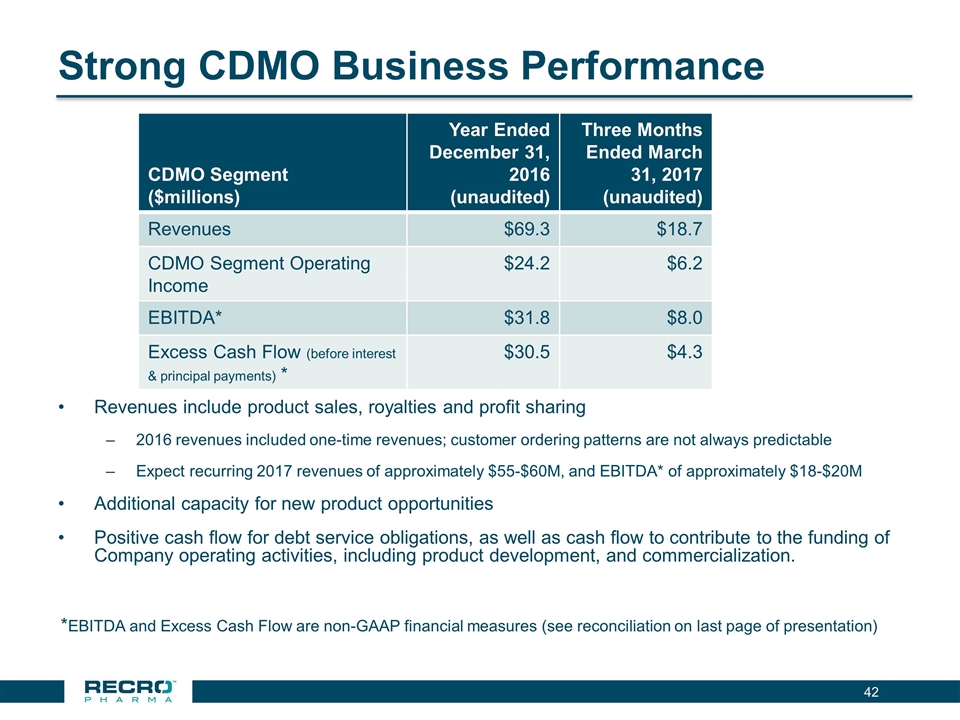

Strong CDMO Business Performance Revenues include product sales, royalties and profit sharing 2016 revenues included one-time revenues; customer ordering patterns are not always predictable Expect recurring 2017 revenues of approximately $55-$60M, and EBITDA* of approximately $18-$20M Additional capacity for new product opportunities Positive cash flow for debt service obligations, as well as cash flow to contribute to the funding of Company operating activities, including product development, and commercialization. *EBITDA and Excess Cash Flow are non-GAAP financial measures (see reconciliation on last page of presentation) CDMO Segment ($millions) Year Ended December 31, 2016 (unaudited) Three Months Ended March 31, 2017 (unaudited) Revenues $69.3 $18.7 CDMO Segment Operating Income $24.2 $6.2 EBITDA* $31.8 $8.0 Excess Cash Flow (before interest & principal payments) * $30.5 $4.3

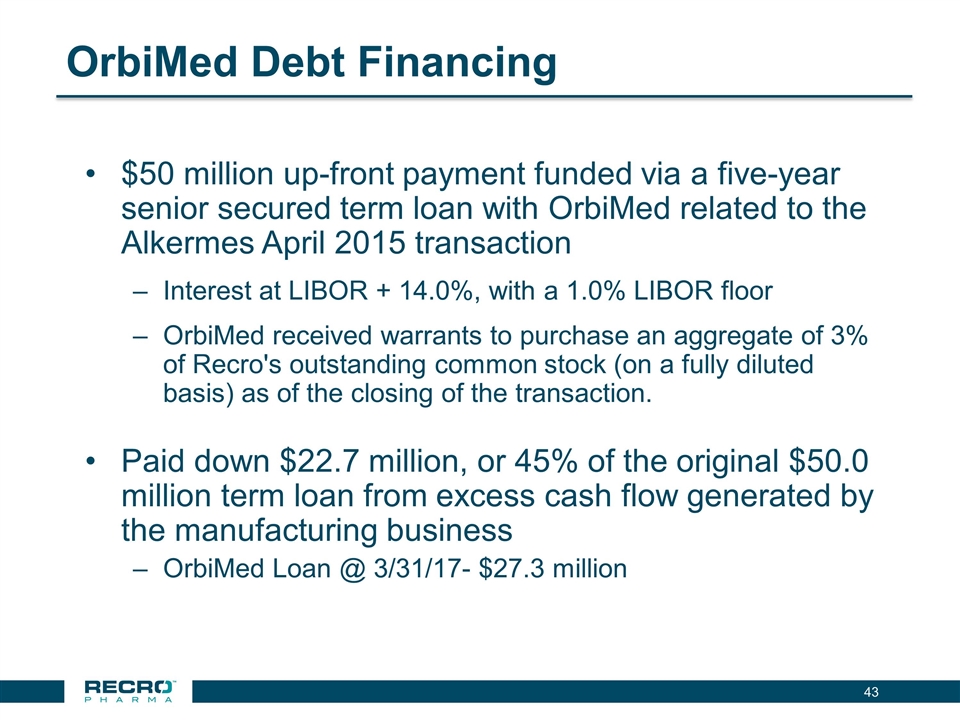

OrbiMed Debt Financing $50 million up-front payment funded via a five-year senior secured term loan with OrbiMed related to the Alkermes April 2015 transaction Interest at LIBOR + 14.0%, with a 1.0% LIBOR floor OrbiMed received warrants to purchase an aggregate of 3% of Recro's outstanding common stock (on a fully diluted basis) as of the closing of the transaction. Paid down $22.7 million, or 45% of the original $50.0 million term loan from excess cash flow generated by the manufacturing business OrbiMed Loan @ 3/31/17- $27.3 million

Company Highlights Specialty pharmaceutical company focused on hospital and related settings with late stage investigational product, IV Meloxicam targeting post-operative pain Plan to file New Drug Application for IV Meloxicam during early Q3 2017 Reported results for pivotal Phase 3 trial in patients following abdominoplasty surgery Reported results for pivotal Phase 3 trial in patients following bunionectomy surgery Reported results for Phase 3 safety study demonstrating solid safety and tolerability profile Completed renal impairment and ECG studies Multiple non-opioid therapeutics in clinical development for pain conditions Revenue and cash flow positive contract development and manufacturing (CDMO) business Solid cash position $55.5 million cash @ 3/31/17 Experienced management team with significant development, regulatory and commercial experience

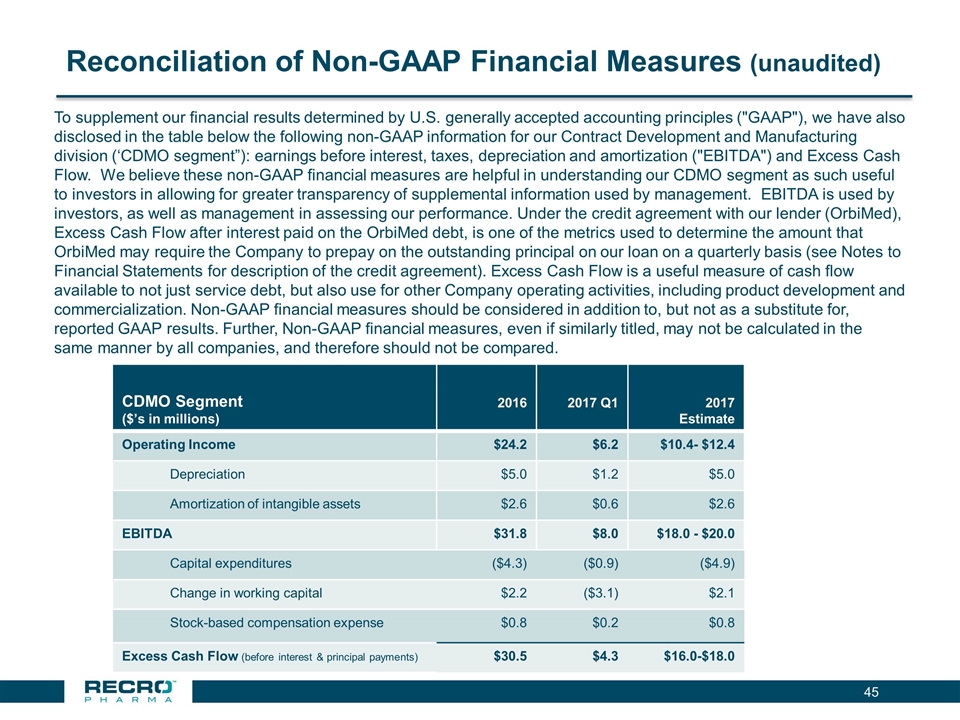

Reconciliation of Non-GAAP Financial Measures (unaudited) CDMO Segment ($’s in millions) 2016 2017 Q1 2017 Estimate Operating Income $24.2 $6.2 $10.4- $12.4 Depreciation $5.0 $1.2 $5.0 Amortization of intangible assets $2.6 $0.6 $2.6 EBITDA $31.8 $8.0 $18.0 - $20.0 Capital expenditures ($4.3) ($0.9) ($4.9) Change in working capital $2.2 ($3.1) $2.1 Stock-based compensation expense $0.8 $0.2 $0.8 Excess Cash Flow (before interest & principal payments) $30.5 $4.3 $16.0-$18.0 To supplement our financial results determined by U.S. generally accepted accounting principles ("GAAP"), we have also disclosed in the table below the following non-GAAP information for our Contract Development and Manufacturing division (‘CDMO segment”): earnings before interest, taxes, depreciation and amortization ("EBITDA") and Excess Cash Flow. We believe these non-GAAP financial measures are helpful in understanding our CDMO segment as such useful to investors in allowing for greater transparency of supplemental information used by management. EBITDA is used by investors, as well as management in assessing our performance. Under the credit agreement with our lender (OrbiMed), Excess Cash Flow after interest paid on the OrbiMed debt, is one of the metrics used to determine the amount that OrbiMed may require the Company to prepay on the outstanding principal on our loan on a quarterly basis (see Notes to Financial Statements for description of the credit agreement). Excess Cash Flow is a useful measure of cash flow available to not just service debt, but also use for other Company operating activities, including product development and commercialization. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, reported GAAP results. Further, Non-GAAP financial measures, even if similarly titled, may not be calculated in the same manner by all companies, and therefore should not be compared.