Exhibit 99.1 …focused on improving patients lives… November 2019Exhibit 99.1 …focused on improving patients lives… November 2019

Forward Looking Statements This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements, among other things, relate to the Company’s ability to complete the spin of its Acute Care business segment, uncertainty of whether the anticipated benefits of the spin-off can be achieved, risks of unexpected costs or delays in the Company’s ability to complete the spin-off, the Company’s ability continue the development and commercialization of IV meloxicam, the Company’s ability to execute its strategic initiatives, the Company’s ability to adequately resolve the outstanding labeling issues with the FDA for IV meloxicam, and the time frame associated with any such resolution; the Company’s ability to raise future financing for continued product development and IV meloxicam commercialization; with regard to the Company’s clinical trial results, whether there may be changes in the interpretation by the FDA of the data of the Company’s clinical trials and the length, cost and uncertain results and timing of our ongoing clinical trials; with regard to the potential commercial opportunity of IV meloxicam, whether any FDA approval of IV meloxicam will include labeling restrictions and the potential that IV meloxicam does not receive regulatory approval or does not receive reimbursement by third party payors, that IV meloxicam is not accepted by the medical community, including physicians, patients, health care providers and hospital formularies or that a commercial market for IV meloxicam does not develop; the Company’s ability to manage costs and execute on its operational and budget plans, the Company’s ability to achieve its financial goals, including financial guidance, the Company’s ability to pay its debt under its credit agreement; the Company’s ability to maintain relationships with CDMO commercial partners; and the Company’s ability to obtain, maintain and successfully enforce adequate patent and other intellectual property protection. The words anticipate , believe , could , estimate , expect , intend , may , plan , predict , project , will and similar terms and phrases may be used to identify forward-looking statements in this presentation. Our operations involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward-looking statements ultimately prove to be correct. These forward-looking statements should be considered together with the risks and uncertainties that may affect our business and future results included in our filings with the Securities and Exchange Commission at www.sec.gov. These forward-looking statements are based on information currently available to us, and we assume no obligation to update any forward-looking statements except as required by applicable law. Non-Promotion: This presentation is intended to be non-promotional and for investor discussion purposes only. The information provided herein contains references to IV meloxicam, an investigational product. Use of IV meloxicam has not been approved by the FDA. The safety and efficacy of the investigational use of IV meloxicam has not been determined. There is no guarantee that IV meloxicam will be approved for marketing by any regulatory agency. 2Forward Looking Statements This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements, among other things, relate to the Company’s ability to complete the spin of its Acute Care business segment, uncertainty of whether the anticipated benefits of the spin-off can be achieved, risks of unexpected costs or delays in the Company’s ability to complete the spin-off, the Company’s ability continue the development and commercialization of IV meloxicam, the Company’s ability to execute its strategic initiatives, the Company’s ability to adequately resolve the outstanding labeling issues with the FDA for IV meloxicam, and the time frame associated with any such resolution; the Company’s ability to raise future financing for continued product development and IV meloxicam commercialization; with regard to the Company’s clinical trial results, whether there may be changes in the interpretation by the FDA of the data of the Company’s clinical trials and the length, cost and uncertain results and timing of our ongoing clinical trials; with regard to the potential commercial opportunity of IV meloxicam, whether any FDA approval of IV meloxicam will include labeling restrictions and the potential that IV meloxicam does not receive regulatory approval or does not receive reimbursement by third party payors, that IV meloxicam is not accepted by the medical community, including physicians, patients, health care providers and hospital formularies or that a commercial market for IV meloxicam does not develop; the Company’s ability to manage costs and execute on its operational and budget plans, the Company’s ability to achieve its financial goals, including financial guidance, the Company’s ability to pay its debt under its credit agreement; the Company’s ability to maintain relationships with CDMO commercial partners; and the Company’s ability to obtain, maintain and successfully enforce adequate patent and other intellectual property protection. The words anticipate , believe , could , estimate , expect , intend , may , plan , predict , project , will and similar terms and phrases may be used to identify forward-looking statements in this presentation. Our operations involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward-looking statements ultimately prove to be correct. These forward-looking statements should be considered together with the risks and uncertainties that may affect our business and future results included in our filings with the Securities and Exchange Commission at www.sec.gov. These forward-looking statements are based on information currently available to us, and we assume no obligation to update any forward-looking statements except as required by applicable law. Non-Promotion: This presentation is intended to be non-promotional and for investor discussion purposes only. The information provided herein contains references to IV meloxicam, an investigational product. Use of IV meloxicam has not been approved by the FDA. The safety and efficacy of the investigational use of IV meloxicam has not been determined. There is no guarantee that IV meloxicam will be approved for marketing by any regulatory agency. 2

Company Highlights • RECRO CDMO: Revenue and cash flow positive contract development and manufacturing (CDMO) business – Q3 2019 – Revenue $25.3 million; YTD 2019 – Revenue $81.6 million – 2019 Full Year Financial Guidance Revenue of approximately $98-100 million – Operating Income expected to be in the range of $40-44 million – EBITDA (as Adjusted*) Full Year Financial Guidance of $48-50 million • Cash position – $37.9 million as of September 30, 2019 • Company achieved consolidated operating profitability in Q3 2019 and generated $4.8 million in cash from operations and expects to remain cash flow positive for the second half of 2019 (excluding the impact from any strategic transactions) • Signed Multi-year Manufacturing and Supply Agreement with Novartis to supply Ritalin LA® and Focalin XR® Capsules for five years and six year amendment to License and Supply Agreement with TEVA to supply Verapamil SR® for six years • IV Meloxicam / Baudax Bio Form 10 Effective as of November 13, 2019; Distribution Date November 21, 2019 Ø October 2019 – Appeal granted for the IV Meloxicam New Drug Application (NDA). The company is preparing a comprehensive response to the U.S. Food and Drug Administration (FDA) for re-filing • Spin out of Acute Care Segment into a new entity named Baudax Bio (NASDAQ) in Q4 *EBITDA, as Adjusted is a non-GAAP financial measures (See reconciliation on last page of presentation). 3Company Highlights • RECRO CDMO: Revenue and cash flow positive contract development and manufacturing (CDMO) business – Q3 2019 – Revenue $25.3 million; YTD 2019 – Revenue $81.6 million – 2019 Full Year Financial Guidance Revenue of approximately $98-100 million – Operating Income expected to be in the range of $40-44 million – EBITDA (as Adjusted*) Full Year Financial Guidance of $48-50 million • Cash position – $37.9 million as of September 30, 2019 • Company achieved consolidated operating profitability in Q3 2019 and generated $4.8 million in cash from operations and expects to remain cash flow positive for the second half of 2019 (excluding the impact from any strategic transactions) • Signed Multi-year Manufacturing and Supply Agreement with Novartis to supply Ritalin LA® and Focalin XR® Capsules for five years and six year amendment to License and Supply Agreement with TEVA to supply Verapamil SR® for six years • IV Meloxicam / Baudax Bio Form 10 Effective as of November 13, 2019; Distribution Date November 21, 2019 Ø October 2019 – Appeal granted for the IV Meloxicam New Drug Application (NDA). The company is preparing a comprehensive response to the U.S. Food and Drug Administration (FDA) for re-filing • Spin out of Acute Care Segment into a new entity named Baudax Bio (NASDAQ) in Q4 *EBITDA, as Adjusted is a non-GAAP financial measures (See reconciliation on last page of presentation). 3

Contract Development and Manufacturing (CDMO) Business Overview 4Contract Development and Manufacturing (CDMO) Business Overview 4

Gainesville CDMO Facility 5Gainesville CDMO Facility 5

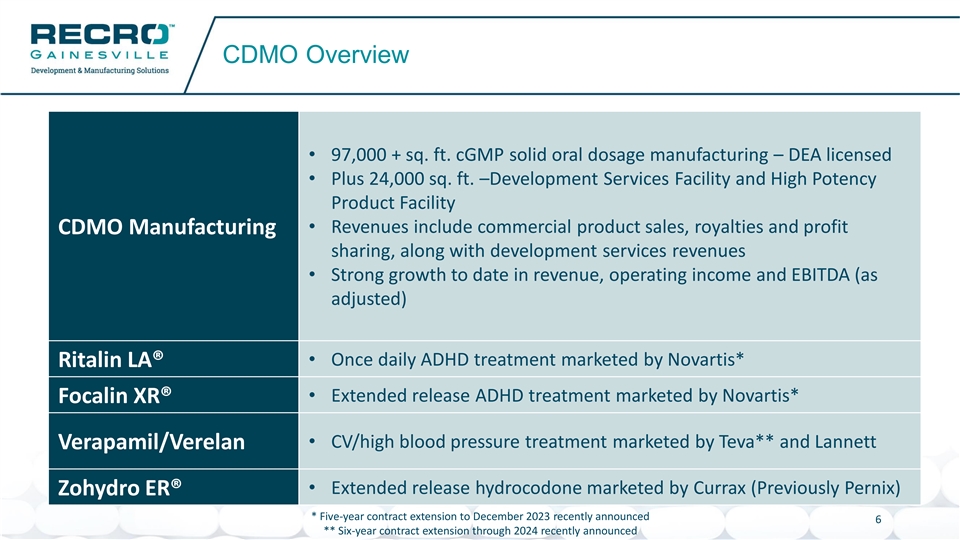

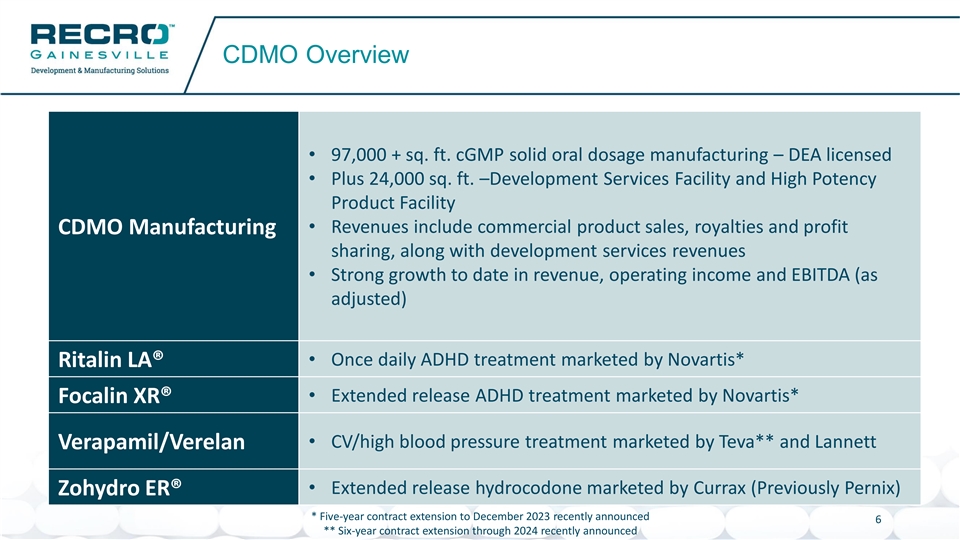

CDMO Overview • 97,000 + sq. ft. cGMP solid oral dosage manufacturing – DEA licensed • Plus 24,000 sq. ft. –Development Services Facility and High Potency Product Facility • Revenues include commercial product sales, royalties and profit CDMO Manufacturing sharing, along with development services revenues • Strong growth to date in revenue, operating income and EBITDA (as adjusted) • Once daily ADHD treatment marketed by Novartis* Ritalin LA® • Extended release ADHD treatment marketed by Novartis* Focalin XR® • CV/high blood pressure treatment marketed by Teva** and Lannett Verapamil/Verelan • Extended release hydrocodone marketed by Currax (Previously Pernix) Zohydro ER® * Five-year contract extension to December 2023 recently announced 6 ** Six-year contract extension through 2024 recently announcedCDMO Overview • 97,000 + sq. ft. cGMP solid oral dosage manufacturing – DEA licensed • Plus 24,000 sq. ft. –Development Services Facility and High Potency Product Facility • Revenues include commercial product sales, royalties and profit CDMO Manufacturing sharing, along with development services revenues • Strong growth to date in revenue, operating income and EBITDA (as adjusted) • Once daily ADHD treatment marketed by Novartis* Ritalin LA® • Extended release ADHD treatment marketed by Novartis* Focalin XR® • CV/high blood pressure treatment marketed by Teva** and Lannett Verapamil/Verelan • Extended release hydrocodone marketed by Currax (Previously Pernix) Zohydro ER® * Five-year contract extension to December 2023 recently announced 6 ** Six-year contract extension through 2024 recently announced

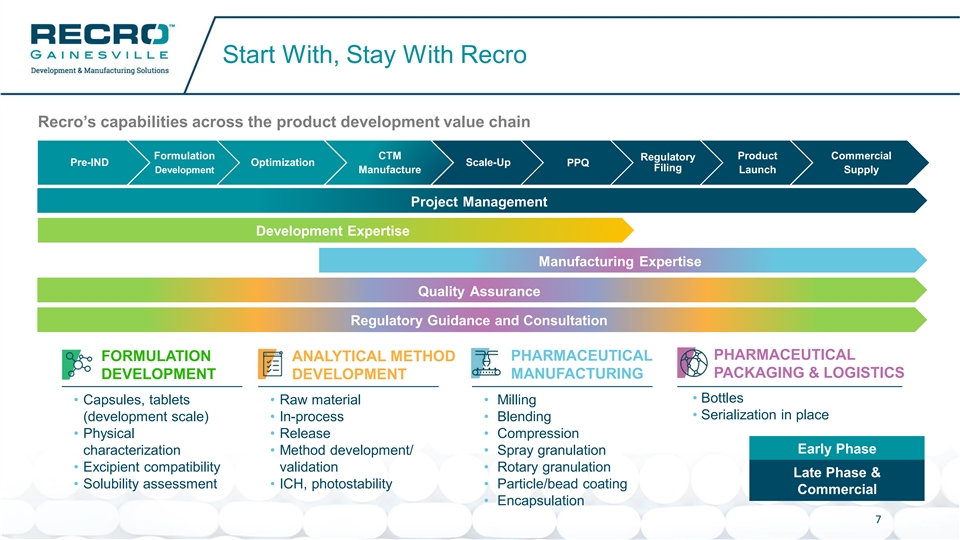

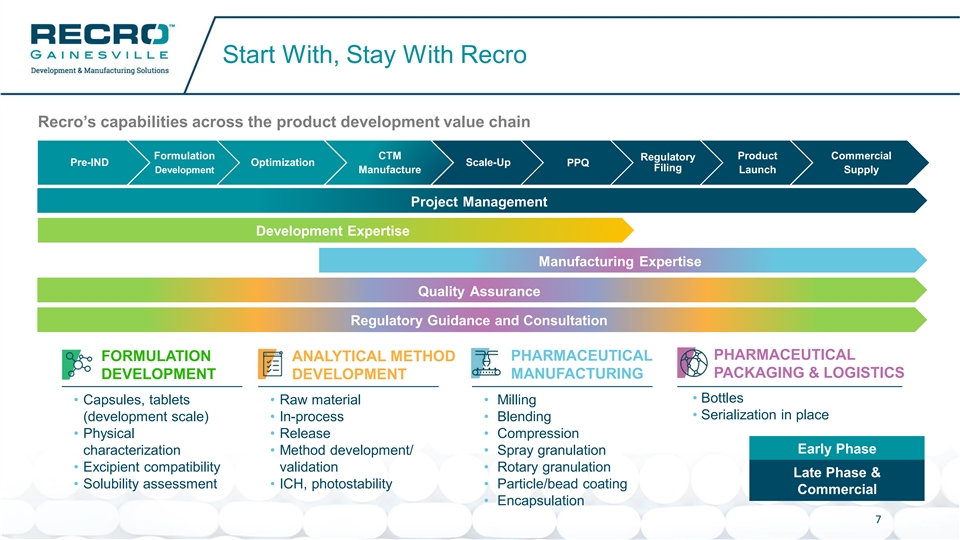

Start With, Stay With Recro Recro’s capabilities across the product development value chain Formulation CTM Product Commercial Regulatory Pre-IND Optimization Scale-Up PPQ Filing Development Manufacture Launch Supply Project Management Development Expertise Manufacturing Expertise Quality Assurance Regulatory Guidance and Consultation PHARMACEUTICAL FORMULATION ANALYTICAL METHOD PHARMACEUTICAL PACKAGING & LOGISTICS DEVELOPMENT DEVELOPMENT MANUFACTURING • Bottles • Capsules, tablets • Raw material • Milling • Serialization in place (development scale) • In-process • Blending • Physical • Release • Compression Early Phase characterization • Method development/ • Spray granulation • Excipient compatibility validation • Rotary granulation Late Phase & • Solubility assessment • ICH, photostability • Particle/bead coating Commercial • Encapsulation 7Start With, Stay With Recro Recro’s capabilities across the product development value chain Formulation CTM Product Commercial Regulatory Pre-IND Optimization Scale-Up PPQ Filing Development Manufacture Launch Supply Project Management Development Expertise Manufacturing Expertise Quality Assurance Regulatory Guidance and Consultation PHARMACEUTICAL FORMULATION ANALYTICAL METHOD PHARMACEUTICAL PACKAGING & LOGISTICS DEVELOPMENT DEVELOPMENT MANUFACTURING • Bottles • Capsules, tablets • Raw material • Milling • Serialization in place (development scale) • In-process • Blending • Physical • Release • Compression Early Phase characterization • Method development/ • Spray granulation • Excipient compatibility validation • Rotary granulation Late Phase & • Solubility assessment • ICH, photostability • Particle/bead coating Commercial • Encapsulation 7

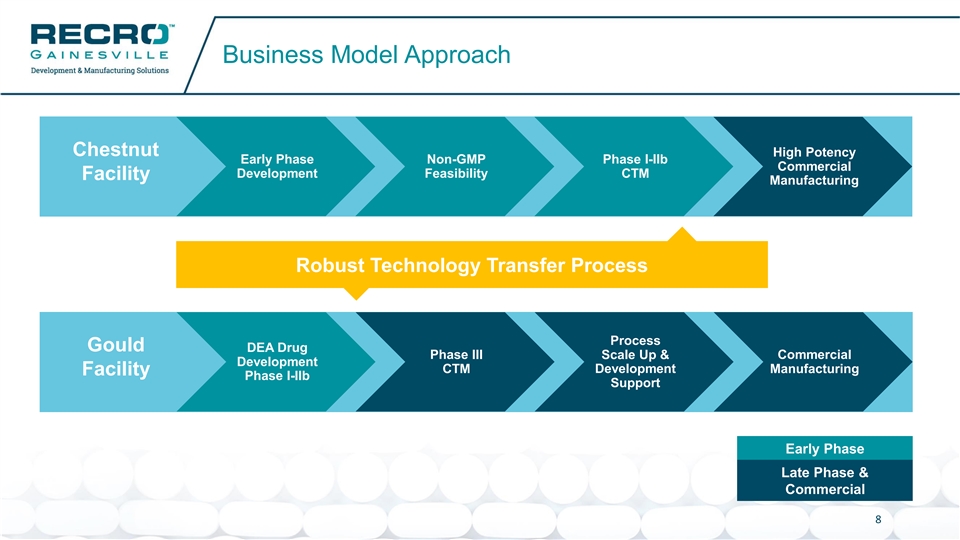

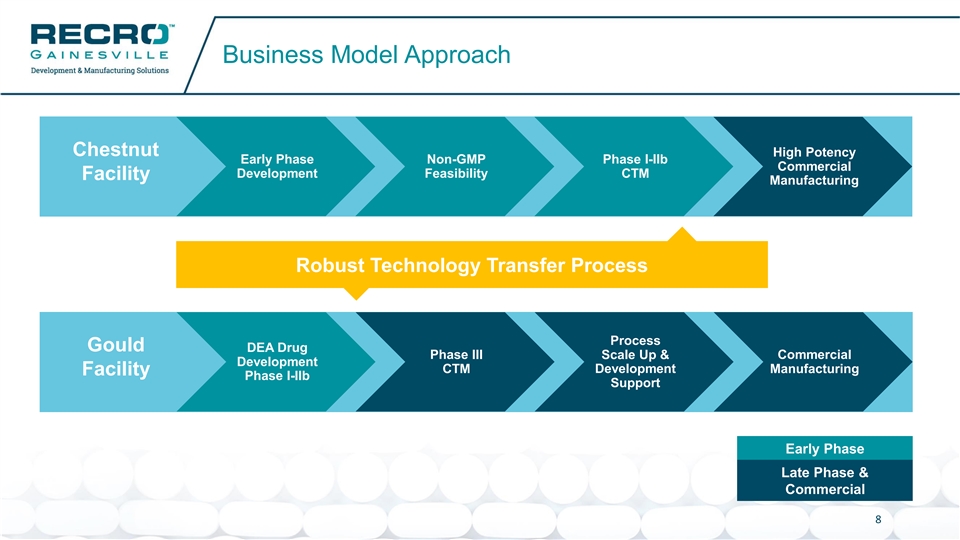

Business Model Approach Chestnut High Potency Early Phase Non-GMP Phase I-IIb Commercial Development Feasibility CTM Facility Manufacturing Robust Technology Transfer Process Process Gould DEA Drug Phase III Scale Up & Commercial Development CTM Development Manufacturing Facility Phase I-IIb Support Early Phase Late Phase & Commercial 8Business Model Approach Chestnut High Potency Early Phase Non-GMP Phase I-IIb Commercial Development Feasibility CTM Facility Manufacturing Robust Technology Transfer Process Process Gould DEA Drug Phase III Scale Up & Commercial Development CTM Development Manufacturing Facility Phase I-IIb Support Early Phase Late Phase & Commercial 8

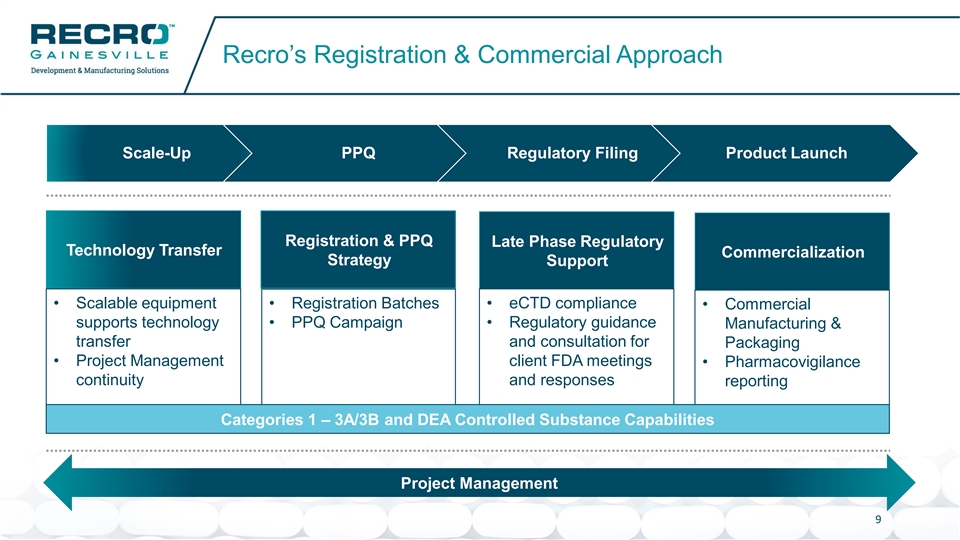

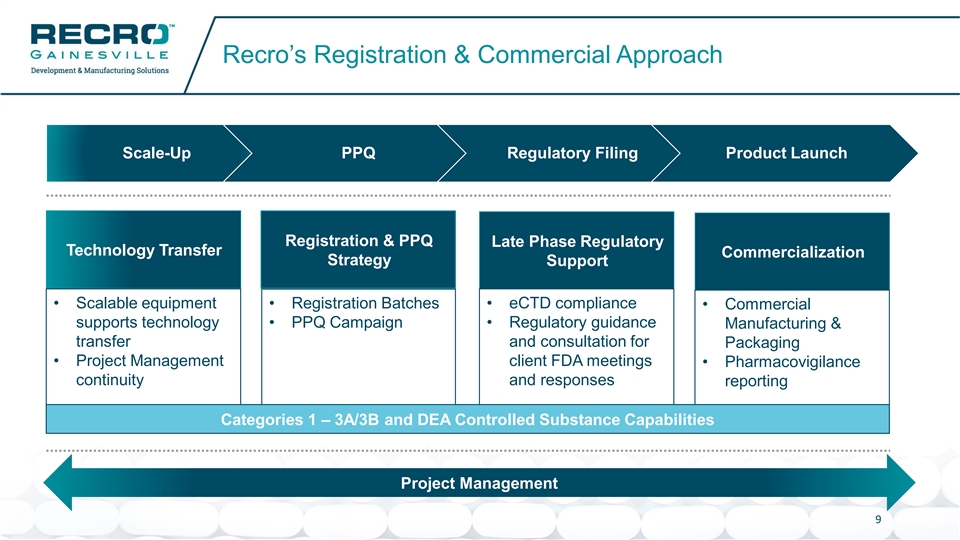

Recro’s Registration & Commercial Approach Scale-Up PPQ Regulatory Filing Product Launch Registration & PPQ Late Phase Regulatory Technology Transfer Commercialization Strategy Support • Scalable equipment • eCTD compliance • Registration Batches • Commercial supports technology • PPQ Campaign • Regulatory guidance Manufacturing & transfer and consultation for Packaging • Project Management client FDA meetings • Pharmacovigilance continuity and responses reporting Categories 1 – 3A/3B and DEA Controlled Substance Capabilities Project Management 9Recro’s Registration & Commercial Approach Scale-Up PPQ Regulatory Filing Product Launch Registration & PPQ Late Phase Regulatory Technology Transfer Commercialization Strategy Support • Scalable equipment • eCTD compliance • Registration Batches • Commercial supports technology • PPQ Campaign • Regulatory guidance Manufacturing & transfer and consultation for Packaging • Project Management client FDA meetings • Pharmacovigilance continuity and responses reporting Categories 1 – 3A/3B and DEA Controlled Substance Capabilities Project Management 9

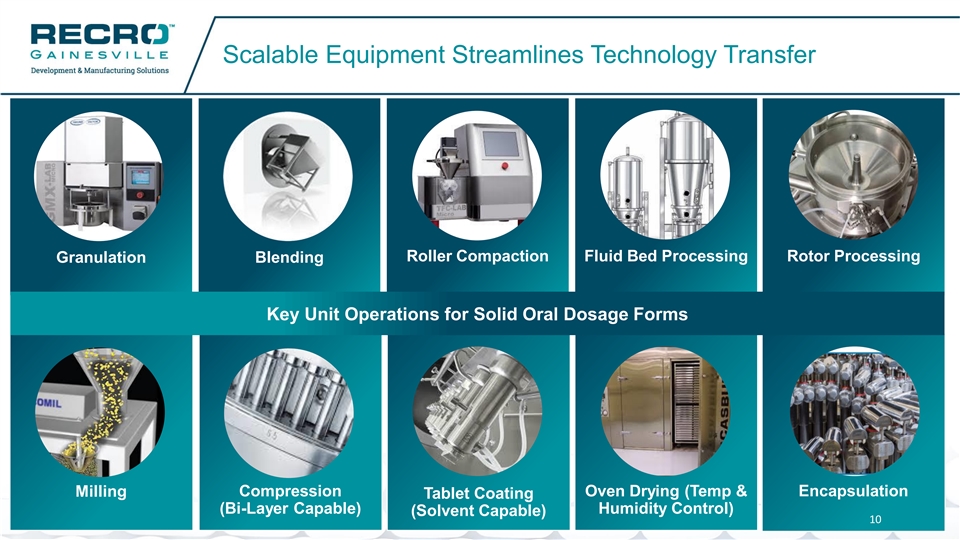

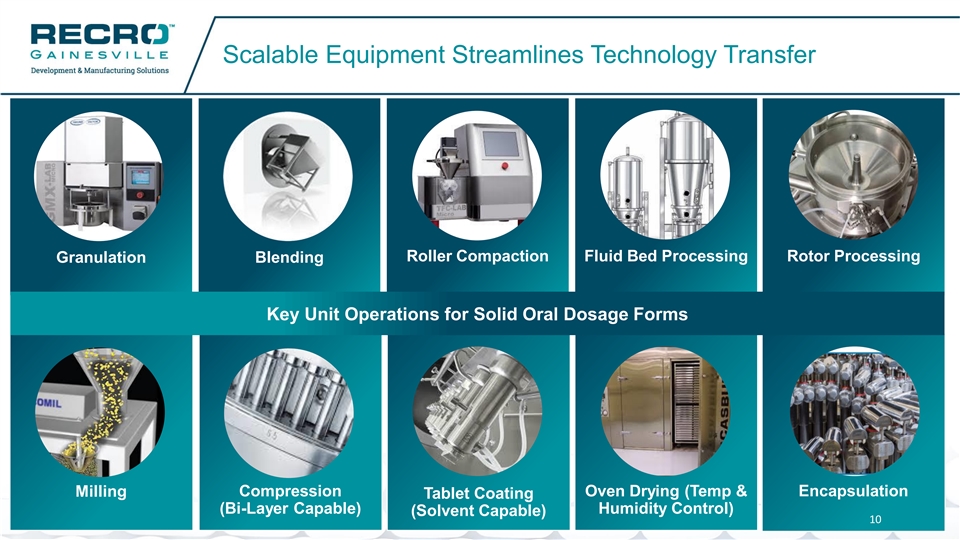

Scalable Equipment Streamlines Technology Transfer Roller Compaction Fluid Bed Processing Rotor Processing Granulation Blending Key Unit Operations for Solid Oral Dosage Forms Oral Solid Dosage Unit Operations Compression Oven Drying (Temp & Encapsulation Milling Tablet Coating (Bi-Layer Capable) Humidity Control) (Solvent Capable) 10Scalable Equipment Streamlines Technology Transfer Roller Compaction Fluid Bed Processing Rotor Processing Granulation Blending Key Unit Operations for Solid Oral Dosage Forms Oral Solid Dosage Unit Operations Compression Oven Drying (Temp & Encapsulation Milling Tablet Coating (Bi-Layer Capable) Humidity Control) (Solvent Capable) 10

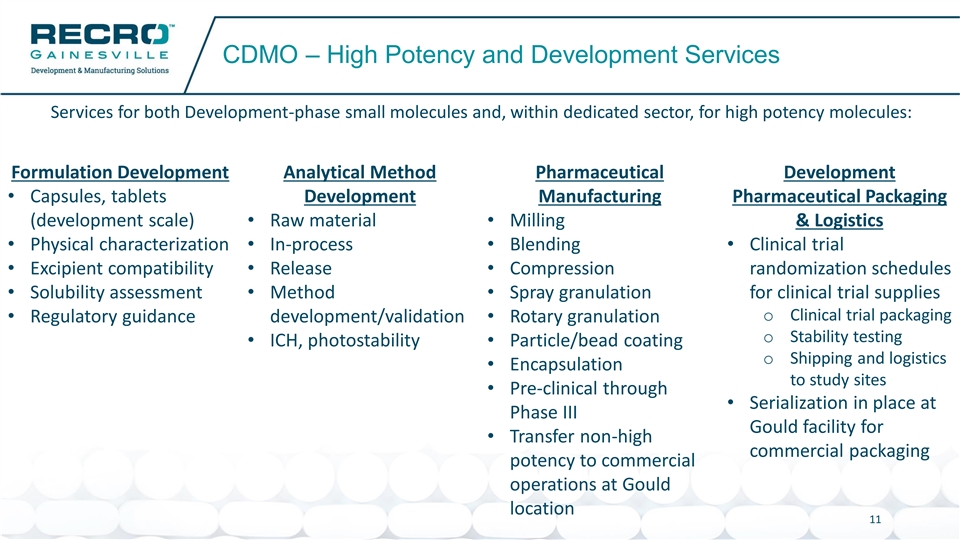

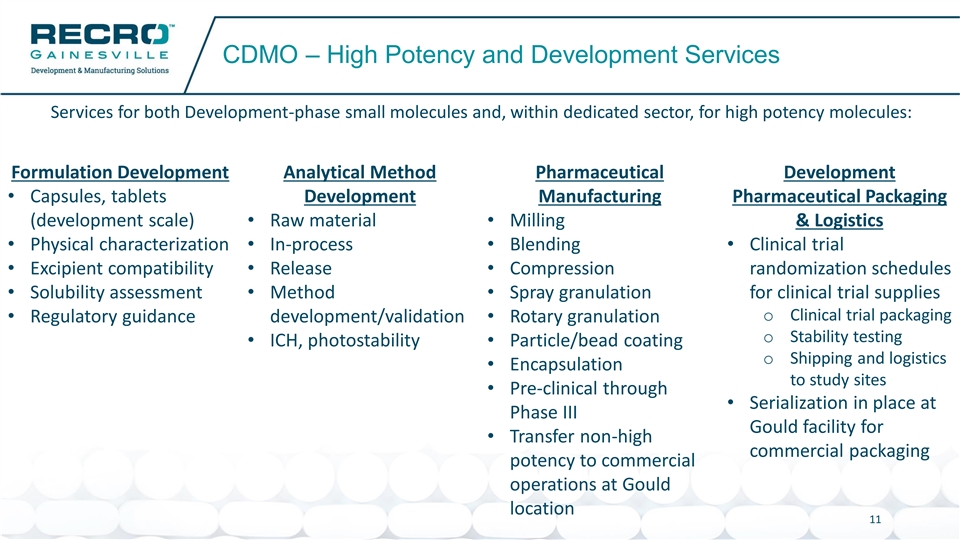

CDMO – High Potency and Development Services Services for both Development-phase small molecules and, within dedicated sector, for high potency molecules: Formulation Development Analytical Method Pharmaceutical Development • Capsules, tablets Development Manufacturing Pharmaceutical Packaging (development scale) • Raw material • Milling & Logistics • Physical characterization • In-process • Blending • Clinical trial • Excipient compatibility • Release • Compression randomization schedules • Solubility assessment • Method • Spray granulation for clinical trial supplies o Clinical trial packaging • Regulatory guidance development/validation • Rotary granulation o Stability testing • ICH, photostability • Particle/bead coating o Shipping and logistics • Encapsulation to study sites • Pre-clinical through • Serialization in place at Phase III Gould facility for • Transfer non-high commercial packaging potency to commercial operations at Gould location 11CDMO – High Potency and Development Services Services for both Development-phase small molecules and, within dedicated sector, for high potency molecules: Formulation Development Analytical Method Pharmaceutical Development • Capsules, tablets Development Manufacturing Pharmaceutical Packaging (development scale) • Raw material • Milling & Logistics • Physical characterization • In-process • Blending • Clinical trial • Excipient compatibility • Release • Compression randomization schedules • Solubility assessment • Method • Spray granulation for clinical trial supplies o Clinical trial packaging • Regulatory guidance development/validation • Rotary granulation o Stability testing • ICH, photostability • Particle/bead coating o Shipping and logistics • Encapsulation to study sites • Pre-clinical through • Serialization in place at Phase III Gould facility for • Transfer non-high commercial packaging potency to commercial operations at Gould location 11

Strong CDMO Business Performance CDMO Segment 2017 2018 Q3 YTD 2019 2019 ($millions) (unaudited) (unaudited) (unaudited) Estimate Revenues $71.8 $77.3 $81.6 $98 - $100 Operating Income $25.4 $24.9 $37.3 $40 - $44 Operating Income, as Adjusted* $25.4 $23.5 $31.9 $38 - $40 EBITDA, as Adjusted* $33.8 $32.2 $39.4 $48 - $50 • Revenues include product sales, royalties, profit sharing and R&D services • 2019 Guidance - Revenues of approximately $98-100M, Operating Income of $40-44M and EBITDA, as Adjusted* of approximately $48-50M • Signed Exclusive Five-Year Manufacturing and Supply Agreement through 2023 with Novartis to supply Ritalin LA® and Focalin XR® Capsules with “Total Revenue Per Capsule Economics” Expected to be Similar to Prior Contracts • Signed Six-Year agreement with Teva to supply Verapamil SR® though 2024 • Additional capacity for new product opportunities and recent facility expansion significantly enhancing development and high potency product service offerings • Positive cash flow for debt service obligations, as well as cash flow to contribute toward working capital and operating activities *Operating Income, as Adjusted and EBITDA, as Adjusted is a non-GAAP financial measure (see reconciliation on last page of presentation) 12Strong CDMO Business Performance CDMO Segment 2017 2018 Q3 YTD 2019 2019 ($millions) (unaudited) (unaudited) (unaudited) Estimate Revenues $71.8 $77.3 $81.6 $98 - $100 Operating Income $25.4 $24.9 $37.3 $40 - $44 Operating Income, as Adjusted* $25.4 $23.5 $31.9 $38 - $40 EBITDA, as Adjusted* $33.8 $32.2 $39.4 $48 - $50 • Revenues include product sales, royalties, profit sharing and R&D services • 2019 Guidance - Revenues of approximately $98-100M, Operating Income of $40-44M and EBITDA, as Adjusted* of approximately $48-50M • Signed Exclusive Five-Year Manufacturing and Supply Agreement through 2023 with Novartis to supply Ritalin LA® and Focalin XR® Capsules with “Total Revenue Per Capsule Economics” Expected to be Similar to Prior Contracts • Signed Six-Year agreement with Teva to supply Verapamil SR® though 2024 • Additional capacity for new product opportunities and recent facility expansion significantly enhancing development and high potency product service offerings • Positive cash flow for debt service obligations, as well as cash flow to contribute toward working capital and operating activities *Operating Income, as Adjusted and EBITDA, as Adjusted is a non-GAAP financial measure (see reconciliation on last page of presentation) 12

Company Highlights • RECRO CDMO: Revenue and cash flow positive contract development and manufacturing (CDMO) business – Q3 2019 – Revenue $25.3 million; YTD 2019 – Revenue $81.6 million – 2019 Full Year Financial Guidance Revenue of approximately $98-100 million – Operating Income expected to be in the range of $40-44 million – EBITDA (as Adjusted*) Full Year Financial Guidance of $48-50 million • Cash position – $37.9 million as of September 30, 2019 • Company achieved consolidated operating profitability in Q3 2019 and generated $4.8 million in cash from operations and expects to remain cash flow positive for the second half of 2019 (excluding the impact from any strategic transactions) • Signed Multi-year Manufacturing and Supply Agreement with Novartis to supply Ritalin LA® and Focalin XR® Capsules for five years and six year amendment to License and Supply Agreement with TEVA to supply Verapamil SR® for six years • IV Meloxicam / Baudax Bio Form 10 Effective as of November 13, 2019; Distribution Date November 21, 2019 Ø October 2019 – Appeal granted for the IV Meloxicam New Drug Application (NDA). The company is preparing a comprehensive response to the U.S. Food and Drug Administration (FDA) for re-filing • Spin out of Acute Care Segment into a new entity named Baudax Bio (NASDAQ) in Q4 *EBITDA, as Adjusted is a non-GAAP financial measures (See reconciliation on last page of presentation). 13Company Highlights • RECRO CDMO: Revenue and cash flow positive contract development and manufacturing (CDMO) business – Q3 2019 – Revenue $25.3 million; YTD 2019 – Revenue $81.6 million – 2019 Full Year Financial Guidance Revenue of approximately $98-100 million – Operating Income expected to be in the range of $40-44 million – EBITDA (as Adjusted*) Full Year Financial Guidance of $48-50 million • Cash position – $37.9 million as of September 30, 2019 • Company achieved consolidated operating profitability in Q3 2019 and generated $4.8 million in cash from operations and expects to remain cash flow positive for the second half of 2019 (excluding the impact from any strategic transactions) • Signed Multi-year Manufacturing and Supply Agreement with Novartis to supply Ritalin LA® and Focalin XR® Capsules for five years and six year amendment to License and Supply Agreement with TEVA to supply Verapamil SR® for six years • IV Meloxicam / Baudax Bio Form 10 Effective as of November 13, 2019; Distribution Date November 21, 2019 Ø October 2019 – Appeal granted for the IV Meloxicam New Drug Application (NDA). The company is preparing a comprehensive response to the U.S. Food and Drug Administration (FDA) for re-filing • Spin out of Acute Care Segment into a new entity named Baudax Bio (NASDAQ) in Q4 *EBITDA, as Adjusted is a non-GAAP financial measures (See reconciliation on last page of presentation). 13

Reconciliation of Non-GAAP Financial Measures (unaudited) To supplement our financial results determined by U.S. generally accepted accounting principles ( GAAP ), we have also disclosed in the table below the following non-GAAP information for our Contract Development and Manufacturing Organization (CDMO): “Operating Income, as Adjusted” which is Operating Income without the impact of ASU, No.2014-09 as to remove the variability of timing of revenue recognized and expected cash receipt, and “EBITDA, as Adjusted” which is “Operating Income, as Adjusted” before interest, taxes, depreciation, amortization and non-cash stock-based compensation. We believe these non-GAAP financial measures are helpful in understanding our CDMO Business as it is useful to investors in allowing for greater transparency of supplemental information used by management. “EBITDA, as Adjusted” is used by investors, as well as management in assessing our performance. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, reported GAAP results. Further, Non-GAAP financial measures, even if similarly titled, may not be calculated in the same manner by all companies, and therefore should not be compared. CDMO Business Full Year Full Year Q3 YTD Full Year 2019 ($millions) 2017 2018 2019 Estimate Operating Income $25.4 $24.9 $37.3 $40 - $44 less: Revenue recognition * na $1.4 $5.4 $2.0 - $4.0 Operating Income, as Adjusted $25.4 $23.5 $31.9 $38 - $40 Depreciation $4.8 $4.8 $4.3 $5.6 Amortization of intangible assets $2.6 $2.6 $1.9 $2.6 Non-Cash stock-based compensation $1.0 $1.3 $1.3 $1.8 EBITDA, as Adjusted * $33.8 $32.2 $39.4 $48 - $50 * Impact of adoption of ASU, No. 2014-09 starting January 2018 14Reconciliation of Non-GAAP Financial Measures (unaudited) To supplement our financial results determined by U.S. generally accepted accounting principles ( GAAP ), we have also disclosed in the table below the following non-GAAP information for our Contract Development and Manufacturing Organization (CDMO): “Operating Income, as Adjusted” which is Operating Income without the impact of ASU, No.2014-09 as to remove the variability of timing of revenue recognized and expected cash receipt, and “EBITDA, as Adjusted” which is “Operating Income, as Adjusted” before interest, taxes, depreciation, amortization and non-cash stock-based compensation. We believe these non-GAAP financial measures are helpful in understanding our CDMO Business as it is useful to investors in allowing for greater transparency of supplemental information used by management. “EBITDA, as Adjusted” is used by investors, as well as management in assessing our performance. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, reported GAAP results. Further, Non-GAAP financial measures, even if similarly titled, may not be calculated in the same manner by all companies, and therefore should not be compared. CDMO Business Full Year Full Year Q3 YTD Full Year 2019 ($millions) 2017 2018 2019 Estimate Operating Income $25.4 $24.9 $37.3 $40 - $44 less: Revenue recognition * na $1.4 $5.4 $2.0 - $4.0 Operating Income, as Adjusted $25.4 $23.5 $31.9 $38 - $40 Depreciation $4.8 $4.8 $4.3 $5.6 Amortization of intangible assets $2.6 $2.6 $1.9 $2.6 Non-Cash stock-based compensation $1.0 $1.3 $1.3 $1.8 EBITDA, as Adjusted * $33.8 $32.2 $39.4 $48 - $50 * Impact of adoption of ASU, No. 2014-09 starting January 2018 14

…focused on improving patients lives… November 2019…focused on improving patients lives… November 2019