Exhibit 99.1

MASSROOTS (OTC: MSRT) 1 OTC: MSRT October 8, 2021 MassRoots, Inc. Empire Acquisition Overview

MASSROOTS (OTC: MSRT) 2 SAFE HARBOR STATEMENT This presentation is being provided for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any of MassRoots, Inc.’s (the “Company” or “MassRoots”) securities. This presentation is not intended, nor should it be distributed, for advertising purposes, nor is it intended for broadcast or publication to the general public. Any such offer of the Company’s securities will only be made in compliance with applicable state and federal securities laws pursuant to a prospectus or an offering memorandum and related offering documents which will be provided to qualified prospective investors upon request. This presentation contains certain forward - looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are identified by the use of the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “continue,” “predict,” “potential,” “project” and similar expressions that are intended to identify forward - looking statements. All forward - looking statements speak only as of the date of this presentation. You should not place undue reliance on these forward - looking statements. Although we believe that our plans, objectives, expectations and intentions reflected in or suggested by the forward - looking statements are reasonable, we can give no assurance that these plans, objectives, expectations or intentions will be achieved. Forward - looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from historical experience and present expectations or projections. Actual results may differ materially from those in the forward - looking statements and the trading price for our common stock may fluctuate significantly. Forward - looking statements also are affected by the risk factors described in our filings with the U.S. Securities and Exchange Commission. Except as required by law, we undertake no obligation to update or revise publicly any forward - looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

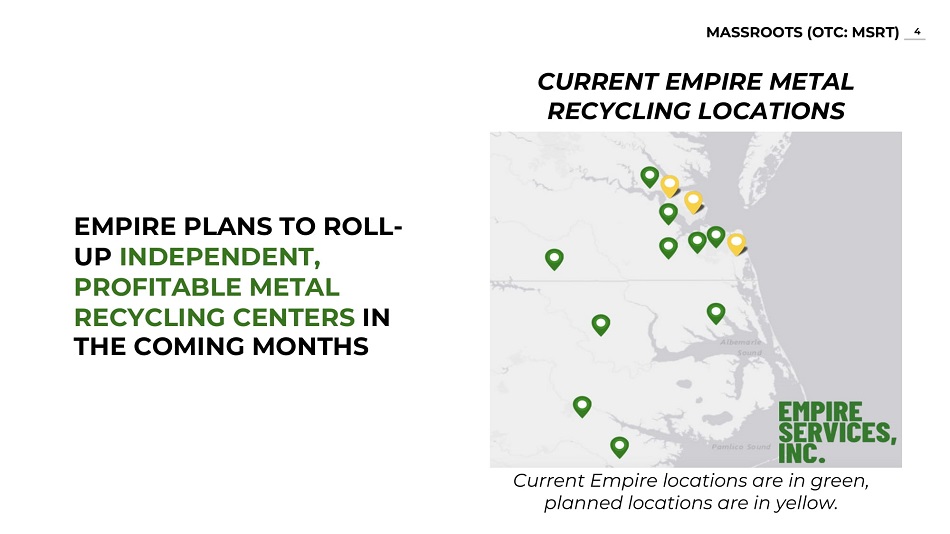

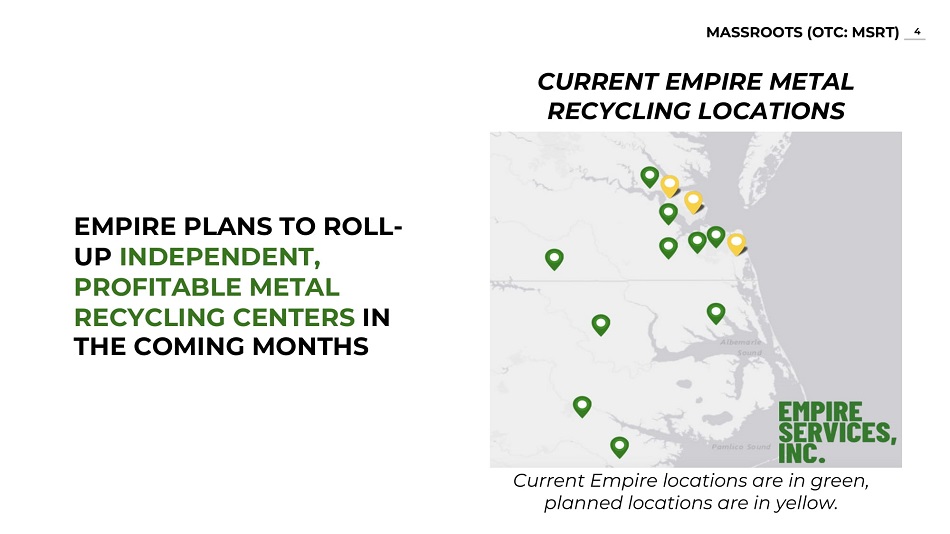

MASSROOTS (OTC: MSRT) 3 On September 30, 2021, we closed our acquisition of Empire Services, Inc. (“Empire”). We now operate 10 metal recycling facilities in Virginia and North Carolina, and are on track to generate $24+ million in revenue during fiscal year 2021. In the coming weeks, we will publically disclose Empire’s audited financial statements and we intend to apply to uplist to the Nasdaq Capital Market or the NYSE American Market . We believe this will result in a significant increase in visibility, liquidity, and institutional interest for our stock. In the coming months, we plan to rapidly expand Empire’s footprint through the roll - up of independent, profitable metal recycling facilities. THE EMPIRE ACQUISITION IS TRANSFORMATIVE FOR MSRT SHAREHOLDERS

MASSROOTS (OTC: MSRT) 4 EMPIRE PLANS TO ROLL - UP INDEPENDENT, PROFITABLE METAL RECYCLING CENTERS IN THE COMING MONTHS CURRENT EMPIRE METAL RECYCLING LOCATIONS Current Empire locations are in green, planned locations are in yellow.

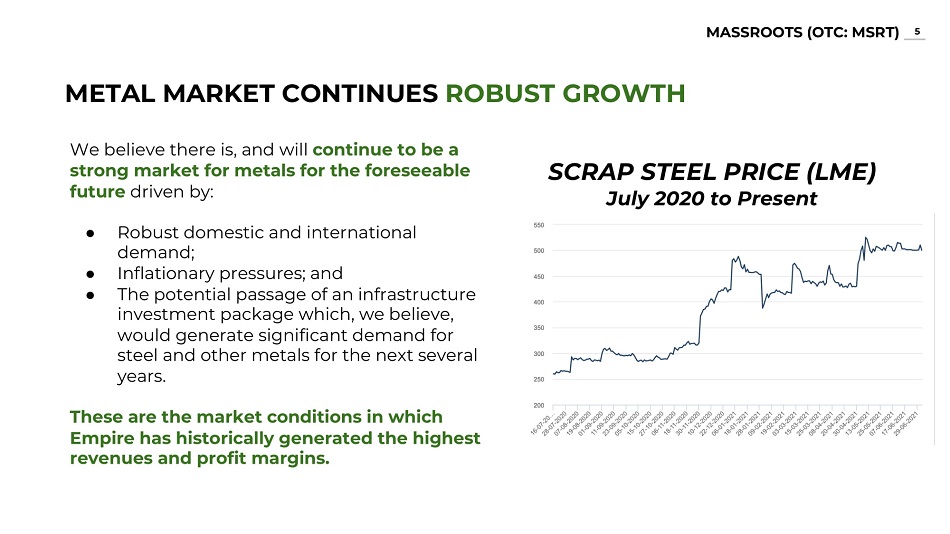

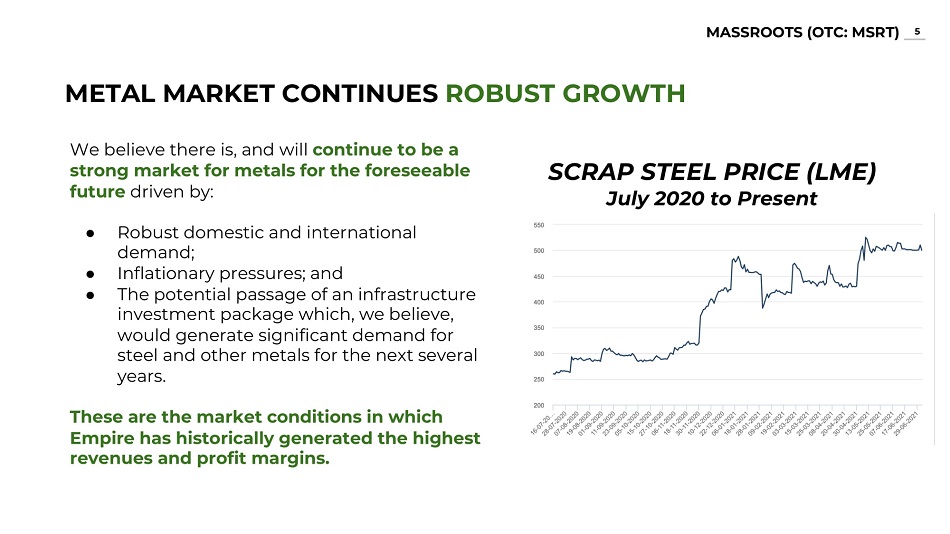

MASSROOTS (OTC: MSRT) 5 METAL MARKET CONTINUES ROBUST GROWTH We believe there is, and will continue to be a strong market for metals for the foreseeable future driven by: ● Robust domestic and international demand; ● Inflationary pressures; and ● The potential passage of an infrastructure investment package which, we believe, would generate significant demand for steel and other metals for the next several years. These are the market conditions in which Empire has historically generated the highest revenues and profit margins. SCRAP STEEL PRICE (LME) July 2020 to Present

MASSROOTS (OTC: MSRT) 6 As a technology company, MassRoots has significant experience in developing complex, cloud - based platforms. With the Empire acquisition, we are applying our expertise and knowledge to an overlooked but highly profitable industry. We have implemented several technology solutions that have already increased metal volumes and operating efficiencies at Empire’s existing facilities. These include: ● A cloud - based ERP system for each system to manage their inventories and operations; ● A corporate website with live metal prices for each location ; and ● In the very near future, an instant online quoting system for people looking to sell their junk cars. By applying our technology experience to Empire’s existing facilities, we are already creating organic growth and streamlining operations to increase profit margins. USING TECHNOLOGY TO CREATE ORGANIC GROWTH AND OPERATING EFFICIENCIES

MASSROOTS (OTC: MSRT) 7 OUR LEADERSHIP TEAM Danny Meeks - Chairman and Chief Executive Officer Mr. Meeks is the Chief Executive Officer of MassRoots. He has significant experience in the waste manage and disposal industry. Additionally, Mr. Meeks has served as President of DWM Properties, LLC, his real estate holding company, since 2002. Isaac Dietrich – Director and Chief Information Officer Mr. Dietrich is the Chief Information Officer and a Director of MassRoots, Inc., which he founded in 2013. Additionally, he was the founder and CEO of RoboCent, Inc., one of the nation’s leading providers of political communications.

MASSROOTS (OTC: MSRT) 8 There have been significant recent developments that we believe will be transformative for MassRoots shareholders: ● Closed the acquisition of Empire in a primarily stock - based transaction, resulting in the Company generating significant revenues and strengthening its balance sheet; ● Retired all warrants with ratchet provisions and settled more than $500,000 in convertible and non - convertible notes; and ● Deferred conversion of the Company’s preferred stock into common shares until November 2022 . RECENT D E V E L O P M E N T S For more information, please see MassRoots’ Current Report on Form 8 - K filed on [fix date] 25, 2021. Additionally, look our for our upcoming 8 - K/A which we hope to file on or before October 31, 2021, which will provide our audited financials, consolidated proformas and supporting financial disclosures

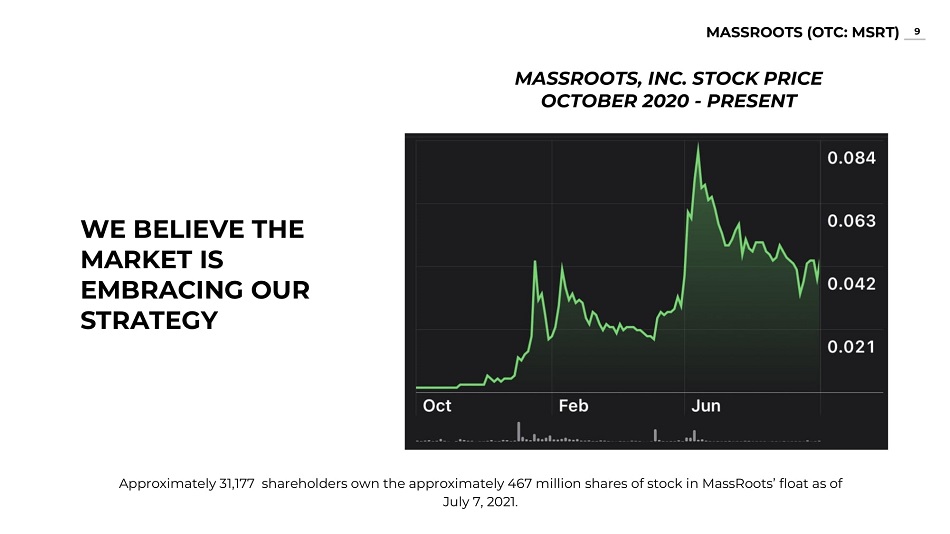

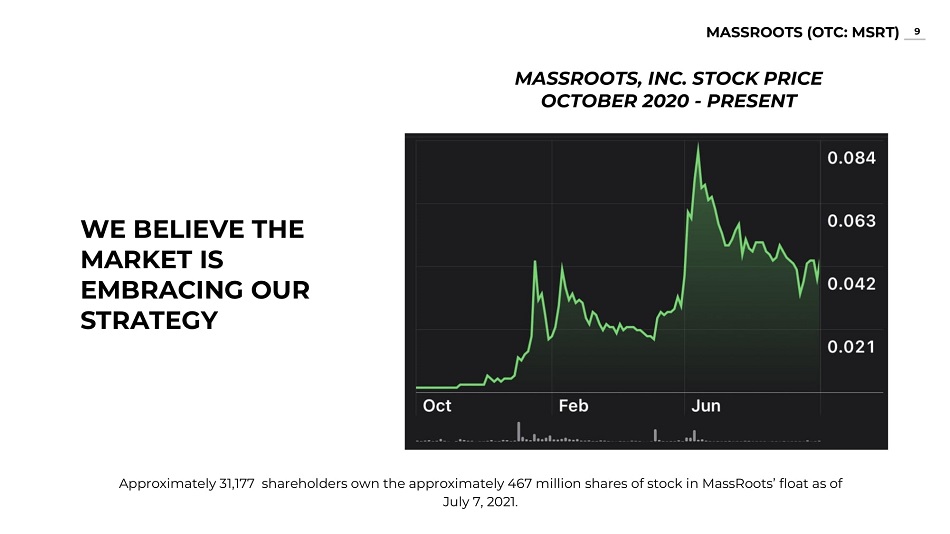

MASSROOTS (OTC: MSRT) 9 WE BELIEVE THE MARKET IS EMBRACING OUR STRATEGY MASSROOTS, INC. STOCK PRICE OCTOBER 2020 - PRESENT Approximately 31,177 shareholders own the approximately 467 million shares of stock in MassRoots’ float as of July 7, 2021.

MASSROOTS (OTC: MSRT) 10 As a result of the Empire acquisition, MassRoots is on track to generate $24+ million in revenue during fiscal year 2021. With this stable financial footing and a greatly improved capitalization structure, we plan to aggressively grow Empire’s footprint through the roll - up of independent, profitable recycling centers. We plan to apply to uplist to the Nasdaq Capital Market or NYSE American Market in the coming weeks as well as renaming our Company Greenwave Technology Solutions, Inc. 2021 OUTLOOK