SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| | | |

Filed by the Registrant [X] | | Filed by a party other than the Registrant [ ] |

Check the appropriate box:

| | | |

[ ] | | Preliminary Proxy Statement |

[ ] | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

[X] | | Definitive Proxy Statement |

[ ] | | Definitive Additional Materials |

[ ] | | Soliciting Material under §240.14a-12 |

EVANSTON ALTERNATIVE OPPORTUNITIES FUND

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | |

[X] | | | No fee required |

| | |

[ ] | | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | |

| | | | (1 | ) | | Title of each class of securities to which transaction applies: |

| | | | (2 | ) | | Aggregate number of securities to which transaction applies: |

| | | | (3 | ) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | (4 | ) | | Proposed maximum aggregate value of transaction: |

| | | | (5 | ) | | Total fee paid: |

| | |

[ ] | | | Fee paid previously with preliminary materials. |

| | |

[ ] | |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for

which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the

Form or Schedule and the date of its filing. |

| | | |

| | | | (1 | ) | | Amount Previously Paid: |

| | | | (2 | ) | | Form, Schedule or Registration Statement No.: |

| | | | (3 | ) | | Filing Party: |

| | | | (4 | ) | | Date Filed: |

EVANSTON ALTERNATIVE OPPORTUNITIES FUND

1560 Sherman Avenue, Suite 960

Evanston, Illinois 60201

The enclosed Proxy Statement contains information about the following proposals (each, a “Proposal”, and collectively, the “Proposals”) for approval by the shareholders of Evanston Alternative Opportunities Fund (the “Fund”) at a special meeting of shareholders to be held on Thursday, March 14, 2024: (1) a new investment advisory agreement (the “New Advisory Agreement”) between the Fund and North Square Investments, LLC (“NSI”); (2) a new investment sub-advisory agreement (the “New Sub-Advisory Agreement”) between NSI and Evanston Capital Management, LLC (“ECM”), the current investment adviser to the Fund, with respect to the Fund; (3) the election of each of David B. Boon, Donald J. Herrema, Catherine A. Zaharis and Ian Martin as a Trustee of the Fund, who are the current members of the Board of Trustees of the North Square Investments Trust (each a “Proposed Trustee” and, together, the “Proposed Trustees”; also referred to as the “NSI Board”).

The Proposals are contemplated by an agreement (“Transition Agreement”) by and among ECM, NSI and the Fund which, in turn, contemplates NSI becoming the investment adviser to the Fund, ECM becoming the investment sub-adviser to the Fund and the Proposed Trustees replacing the current Trustees to the Fund, in each instance, subject to shareholder approval (the “Proposed Transition”). The Transition Agreement provides that, among other matters, ECM and NSI will use commercially reasonable efforts to cause the Proposals to be approved.

ECM currently serves as the investment adviser to the Fund under an investment advisory agreement between the Fund and ECM (the “Current Advisory Agreement”). The Board of Trustees of the Fund (the “Board”) has determined that it would be in the best interests of the Fund and its shareholders if NSI were to become the investment adviser to the Fund, with ECM continuing to provide portfolio management services to the Fund as the Fund’s sub-adviser. The Board has also determined that it would be in the best interests of the Fund and its shareholders if the Proposed Trustees replaced the current Trustees. If the Proposed Transition is consummated, it is anticipated that Ultimus Fund Solutions, LLC and its affiliates (collectively, “Ultimus”) will be engaged by the Fund to provide certain administrator, transfer agent, fund accountant and compliance services, including providing an experienced Chief Compliance Officer for the Fund. In addition, if the Proposed Transition is consummated, it is anticipated that the Fund will share, to some extent, fixed and variable overhead expenses as part of a “shared” operational and governance structure with twelve other mutual funds currently advised by NSI. It is anticipated that the nature and quality of the services the Fund receives will not be diminished as a result of any service provider changes. The Board believes these changes in the current operational and governance structure of the Fund would enable the Fund to achieve potential initial and future cost savings and other benefits. It would also enable the Fund to be marketed together with other registered investment funds advised by NSI, with the potential for enhanced growth for the Fund.

As described in greater detail in the enclosed Proxy Statement, consummation of the Proposed Transition is contingent upon the New Advisory Agreement, New Sub-Advisory Agreement and election of all of the Proposed Trustees each being approved by shareholders of the Fund. Under the Investment Company Act of 1940, as amended (the “1940 Act”), to be approved, the New Advisory Agreement, New Sub-Advisory Agreement and election of the Proposed Trustees must be approved at a meeting of the shareholders as required under the 1940 Act. The New Advisory Agreement has terms which are substantially the same as the Current Advisory Agreement, including the advisory fee rate. NSI has also agreed to continue the expense limitation agreement agreed to by ECM which is currently in effect, and extend it until January 1, 2026. ECM historically has voluntarily absorbed certain limited expenses on behalf of the Fund, including particular compliance costs, which voluntary practice will not be continued by NSI following the closing of the Proposed Transition. Following the Proposed Transition, it is anticipated that the Fund will share, to some extent, fixed and variable overhead expenses as part of a “shared” operational and governance structure with twelve other mutual funds currently advised by NSI. NSI expects that this operational and governance structure change will result in an overall decrease in the total operating expenses of the Fund even after accounting for certain compliance costs being paid directly by the Fund and no longer absorbed by ECM. The New Sub-Advisory Agreement contemplates that ECM, as the Fund’s sub-adviser under the oversight of NSI, will continue to

provide the same portfolio management services it provides to the Fund under the Current Advisory Agreement.

The enclosed Proxy Statement contains additional information regarding each Proposal.

The Board voted unanimously to approve each of the Proposals. The Board believes that the Proposals are in the best interests of the Fund and its shareholders. The Board recommends that you vote in favor of the Proposals to approve the New Advisory Agreement, the New Sub-Advisory Agreement and the election of each of David B. Boon, Donald J. Herrema, Catherine A. Zaharis and Ian Martin as Trustees.

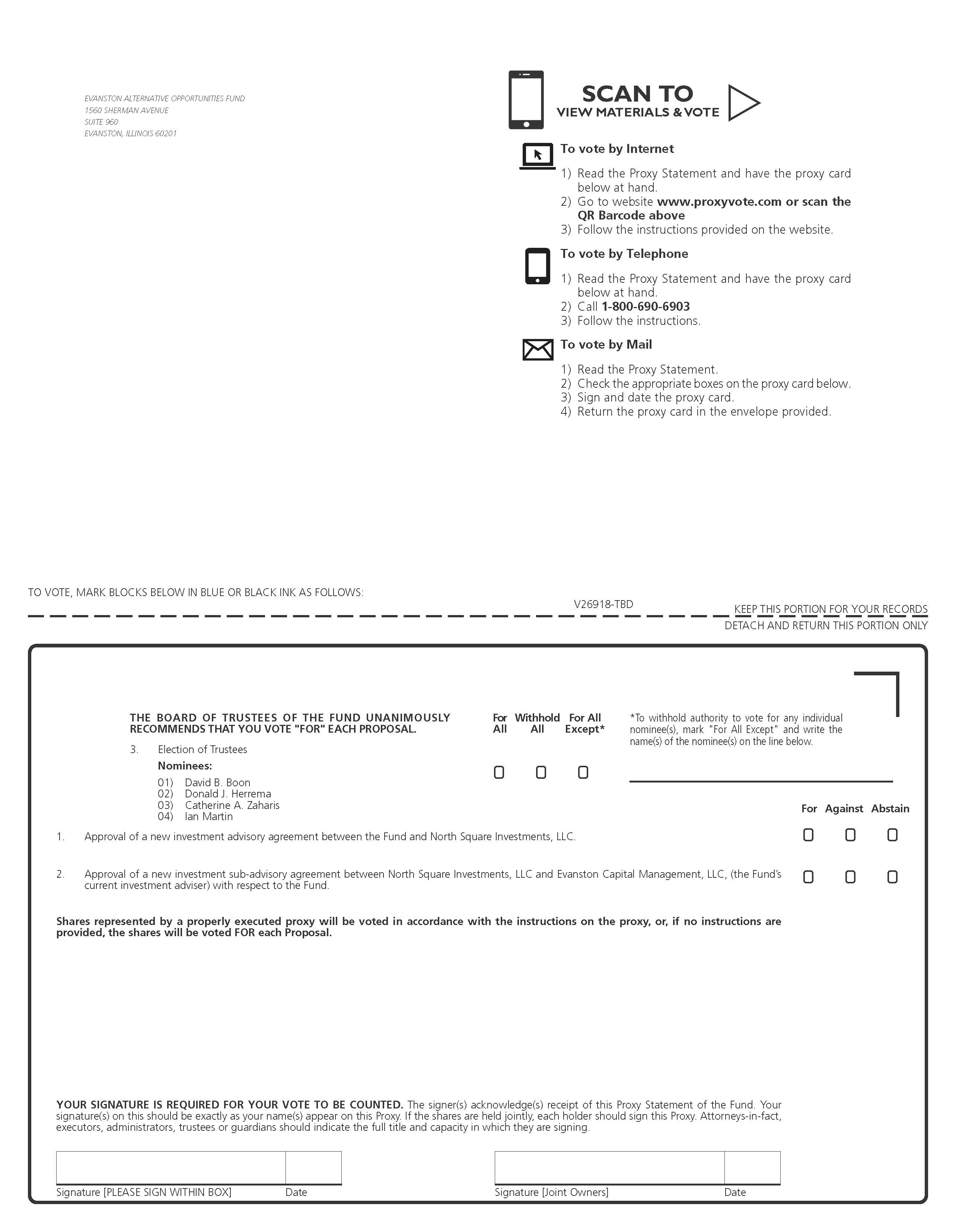

The enclosed Proxy Statement describes the voting process for shareholders. The proxy votes will be reported at the special meeting of shareholders scheduled for March 14, 2024. Please submit your proxy via the internet, phone or mail as soon as possible. Specific instructions for these voting options can be found on the enclosed Proxy Card. To ensure that your vote is counted, your executed proxy card must be received by 11:59 p.m. (Eastern Time) on Wednesday, March 13, 2024.

Thank you for your continued support.

| | |

| | Sincerely, |

| | |

| | /s/ Kenneth A. Meister |

| | Kenneth A. Meister, President and Principal Executive Officer |

EVANSTON ALTERNATIVE OPPORTUNITIES FUND

1560 Sherman Avenue, Suite 960

Evanston, Illinois 60201

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held on March 14, 2024

Notice is hereby given that a special meeting of shareholders (the “Meeting”) of the Evanston Alternative Opportunities Fund (the “Fund”) will be held at the Fund’s principal office located at 1560 Sherman Avenue, Suite 960, Evanston, Illinois 60201 on Thursday, March 14, 2024 at 10:00 AM, Central Time, or at any adjournment(s) or postponement(s) thereof, to approve the following proposals:

| (1) | A new investment advisory agreement between the Fund and North Square Investments, LLC; |

| (2) | A new investment sub-advisory agreement between North Square Investments, LLC and Evanston Capital Management, LLC, (the Fund’s current investment adviser) with respect to the Fund; and |

| (3) | the election of each of David B. Boon, Donald J. Herrema, Catherine A. Zaharis and Ian Martin as a Trustee of the Fund. |

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting To Be Held on March 14, 2024:

The Notice of Special Meeting of Shareholders and Proxy Statement to Shareholders are available at www.proxyvote.com.

If you would like additional information concerning the proposals described above, please call Ken Meister (President and Chief Operating Officer) or Tracey Balderson (Senior Vice President – Investor Administration) of Evanston Capital Management, LLC Monday through Friday between 8:30 a.m. and 5:00 p.m. (Central Time) at 833-877-0116.

| | | |

| | | By Order of the Board of Trustees |

| | |

Dated: January 2, 2024 | | /s/ Kenneth A. Meister |

| | | Kenneth A. Meister |

| | | President and Principal Executive Officer |

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE IN FAVOR OF EACH OF THE PROPOSALS TO APPROVE THE NEW INVESTMENT ADVISORY AGREEMENT, THE NEW INVESTMENT SUB-ADVISORY AGREEMENT AND THE ELECTION OF EACH OF DAVID B. BOON, DONALD J. HERREMA, CATHERINE A. ZAHARIS AND IAN MARTIN AS TRUSTEES OF THE FUND.

YOU ARE INVITED TO ATTEND THE MEETING AND VOTE IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE RETURN YOUR PROXY CARD PROMPTLY IN ACCORDANCE WITH THE INSTRUCTIONS NOTED ON THE ENCLOSED PROXY CARD. EVEN IF YOU HAVE VOTED BY PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE MEETING. YOUR VOTE IS IMPORTANT REGARDLESS OF HOW

MANY SHARES YOU OWN. BY VOTING PROMPTLY, YOU CAN HELP AVOID THE EXPENSE OF ADDITIONAL MAILINGS.

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON MARCH 14, 2024

YOUR VOTE IS VERY IMPORTANT!

While we encourage you to read the full text of the enclosed Proxy Statement, the following provides a summary of the Proposals submitted for your approval.

| Q. | What are shareholders being asked to vote “FOR” at the upcoming Special Meeting of Shareholders on March 14, 2024 (the “Meeting”)? |

| A. | At the Meeting, shareholders of the Evanston Alternative Opportunities Fund (the “Fund”) will be voting on proposals (each, a “Proposal,” and collectively, the “Proposals”) to approve: (1) A new investment advisory agreement (the “New Advisory Agreement”) between the Fund and North Square Investments, LLC (“NSI”); (2) A new investment sub-advisory agreement (the “New Sub-Advisory Agreement”) between NSI and Evanston Capital Management, LLC (“ECM”) (the Fund’s current investment adviser), with respect to the Fund; and (3) The election of each of David B. Boon, Donald J. Herrema, Catherine A. Zaharis and Ian Martin as a trustee of the Fund, who are the current members of the Board of Trustees of the North Square Investments Trust (each a “Proposed Trustee” and collectively the “Proposed Trustees”; also referred to as the “NSI Board”). |

| Q. | Has the Board of Trustees of the Fund approved the Proposals? |

| A. | An in-person meeting was held on December 14, 2023, which was called for the purpose of approving the New Advisory Agreement, the New Sub-Advisory Agreement and approving the nomination of each of Mr. Boon, Mr. Herrema, Ms. Zaharis, and Mr. Martin for election as a Trustee. The Board, including the Trustees who are not “interested persons” of the Fund (the “Independent Trustees”), as such term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”), unanimously approved (1) the New Advisory Agreement for the Fund, (2) the New Sub-Advisory Agreement with respect to the Fund, and (3) the nomination of the Proposed Trustees for election as Trustees of the Fund. |

| Will my fees increase if the Proposals are approved? |

| NO. THERE ARE NO PROPOSED FEE INCREASES. NSI has also agreed to continue the expense limitation agreement agreed to by ECM which is currently in effect, and extend it until January 1, 2026. ECM historically has voluntarily absorbed certain limited expenses on behalf of the Fund, including particular compliance costs, which voluntary practice will not be continued by NSI following the closing of the Proposed Transition. As discussed below, following the Proposed Transition, it is anticipated that the Fund will share, to some extent, fixed and variable overhead expenses as part of a “shared” operational and governance structure with twelve other mutual funds currently advised by NSI. NSI expects that this operational and governance structure change will result in an overall decrease in the total operating expenses of the Fund even after accounting for certain compliance costs being paid directly by the Fund and no longer absorbed by ECM. |

| Q. | Why, and for what reasons, are shareholders being asked to vote on the Proposals? |

Proposal 1 and Proposal 2

| A. | ECM currently serves as the investment adviser to the Fund under an investment advisory agreement between the Fund and ECM (the “Current Advisory Agreement”). The Board has determined that it would be in the best interests of the Fund and its shareholders if NSI were to become the investment adviser to the Fund, with ECM continuing to provide portfolio management services to the Fund as the Fund’s sub-adviser. The Board has also determined that it would be in the best interests of the Fund and its shareholders if the Proposed Trustees replaced the Current Trustees. If the Proposed Transition is consummated, it is anticipated that Ultimus Fund Solutions, LLC and its affiliates (collectively, “Ultimus”) will be engaged by the Fund to provide certain administrator, transfer agent, fund accountant and compliance services, including providing an experienced Chief Compliance Officer for the Fund. In addition, if the Proposed Transition is consummated, it is anticipated that the Fund will share, to some extent, fixed and variable overhead expenses as part of a “shared” operational and governance structure with twelve other mutual funds currently advised by NSI. It is anticipated that the nature and quality of the services the Fund receives will not be diminished as a result of any service provider changes. The Board believes these changes in the current operational and governance structure of the Fund would enable the Fund to achieve potential initial and future cost savings and other benefits. It would also enable the Fund to be marketed together with other registered investment funds advised by NSI, with the potential for enhanced growth for the Fund. The Proposals are contemplated by an agreement (“Transition Agreement”) by and among ECM, NSI and the Fund which, in turn, contemplates NSI becoming the investment adviser to the Fund, ECM becoming the investment sub-adviser to the Fund and the Proposed Trustees replacing the current Trustees to the Fund, in each instance, subject to shareholder approval (the “Proposed Transition”). The Transition Agreement provides that, among other matters, ECM and NSI will use commercially reasonable efforts to cause the Proposals to be approved. If all Proposals are approved, the Current Advisory Agreement will be terminated and replaced by the New Advisory Agreement and the New Sub-Advisory Agreement, both of which will become effective upon consummation of the Proposed Transition. The 1940 Act prohibits any person from serving as an investment adviser, or investment sub-adviser, of a registered investment company, such as the Fund, except pursuant to a written contract that has been approved by the vote of a majority of the outstanding voting securities of the investment company. Accordingly, shareholders of the Fund are being asked to approve the New Advisory Agreement and New Sub-Advisory Agreement. |

| A. | The Board believes that Mr. Boon, Mr. Herrema, Ms. Zaharis, and Mr. Martin are each well qualified for service on the Board due to their extensive knowledge of financial matters and investments, and substantial experience in serving as directors, officers and advisers to other registered investment companies, including the funds of the North Square Investment Trust. If all Proposals are approved, the resignations of the Current Trustees would then become effective, and the Current Trustees will be replaced by the Proposed Trustees. Mr. Boon, Mr. Herrema, and Ms. Zaharis would serve as Independent Trustees, and Mr. Martin would serve as a Trustee who is an “interested person” (as that term is defined under the 1940 Act) (“Interested Trustee”). Mr. Martin would be an Interested Trustee by virtue of his position with Ultimus Financial Services, the administrator, transfer agent and fund accountant that is expected to be engaged by the Fund if the Proposed Transition is consummated. The Board has approved the nomination of each of the Proposed Trustees. Accordingly, shareholders of the Fund are being asked to approve the election of the Proposed Trustees as Trustees of the Fund. |

| Q. | What happens if all Proposals are not approved? |

| A. | The consummation of the Proposed Transition is contingent on all Proposals being approved by shareholders of the Fund. If the Proposed Transition is not consummated: (1) the Current Advisory Agreement would not be terminated and would remain in effect; (2) the New Advisory Agreement and New Sub-Advisory Agreement would not become effective; and (3) the Current Trustees would not resign, and the Proposed Trustees would not become Trustees of the Fund. Approval of each Proposal is contingent upon the approval of all the Proposals presented at the Meeting. Shareholders are NOT being asked to approve the Proposed Transition. |

| Q. | How does the Board recommend that I vote? |

| A. | The Board recommends that you vote FOR all three Proposals. |

| Q. | How will the approval of the Proposals affect shareholders of the Fund? |

| A. | The Fund’s investment objective and investment strategies will not change as a result of the approval of the New Advisory Agreement, the New Sub-Advisory Agreement or the election of the Proposed Trustees. You will still own the same shares in the same Fund. Approval of the Proposals will not result in personnel changes to the Fund’s portfolio management team. ECM and its portfolio management team, as sub-adviser, will continue to be responsible for implementing the Fund’s investment strategies through its provision of portfolio management services. NSI will serve as the Fund’s investment adviser and provide advisory and administrative services to the Fund, including oversight of the sub-adviser. |

| | The approval of the Proposals will not increase the advisory fee rate paid by the Fund and are not anticipated to increase the Fund’s operating expense ratios. In addition, the approval of the Proposals will not result in any change in the level of expense reimbursement that is currently provided by the investment adviser with respect to the Fund. The cost of preparing, printing and mailing the enclosed Proxy Statement and related proxy materials and all other costs incurred in connection with this solicitation of proxies, including any additional solicitation made by mail, telephone, e-mail or in person, will be paid by NSI and ECM. The election of the Proposed Trustees will result in a new set of members of the Board who will be responsible for overseeing the operations of the Fund. |

| Q. | Are there any material differences between the Current Advisory Agreement and the New Advisory Agreement? |

| A. | No. The New Advisory Agreement has terms which are substantially the same as the Current Advisory Agreement, including the advisory fee rate. NSI has also agreed to continue the expense limitation agreement agreed to by ECM which is currently in effect, and extend it until January 1, 2026. ECM historically has voluntarily absorbed certain limited expenses on behalf of the Fund, including particular compliance costs, which voluntary practice will not be continued by NSI following the closing of the Proposed Transition. As discussed above, following the Proposed Transition, it is anticipated that the Fund will share, to some extent, fixed and variable overhead expenses as part of a “shared” operational and governance structure with twelve other mutual funds currently advised by NSI. NSI expects that this operational and governance structure change will result in an overall decrease in the total operating expenses of the Fund even after accounting for certain compliance costs being paid directly by the Fund and no longer absorbed by ECM. In addition, the New Advisory Agreement also provides for certain additional non-advisory administrative-related services to be provided by NSI, which are not expressly provided for under the Current Advisory Agreement. The administrative-related services to be provided include, among others, coordinating and supervising all aspects of the Fund's operations, including required filings, shareholder communications, the pricing process, Board meetings, compliance with Fund policies and procedures and the Fund's code of ethics, budgeting and payment of Fund expenses, implementing and maintaining a business continuation and disaster recovery program for the Fund, and performing due diligence on the Fund's third-party service providers and negotiating service agreements with those third-parties. More information comparing the Current Advisory Agreement and the New Advisory Agreement, including additional detail relating to the additional non-advisory administrative-related services to be provided by NSI, can be found under Proposal 1 – Comparison of the Current Advisory Agreement and the New Advisory Agreement. |

| A. | You can vote in person at the Meeting. If you cannot attend and vote at the Meeting in person, we urge you to vote your shares by submitting your proxy via the internet, phone or mail as soon as possible. Specific instructions for these voting options can be found on the enclosed Proxy Card. To ensure that your vote is counted, your executed proxy card must be received by 11:59 p.m. (Eastern Time) on Wednesday, March 13, 2024. |

Introduction

This joint Proxy Statement is furnished in connection with the solicitation of proxies by the Board for voting at the Meeting to be held at the Fund’s principal office located at 1560 Sherman Avenue, Suite 960, Evanston, Illinois 60201 on Thursday, March 14, 2024 at 10:00 AM, Central Time, or at any adjournment(s) or postponement(s) thereof. This Proxy Statement, the Notice of Special Meeting of Shareholders (the “Notice”) and the Proxy Card will be first sent to shareholders of the Fund on or about January 8, 2024. Shareholders of all classes of shares of the Fund will vote jointly on each Proposal of the Fund.

At the Meeting, shareholders of the Fund will be asked to vote on each of the Proposals to approve (1) the New Advisory Agreement between the Fund and NSI; (2) the New Sub-Advisory Agreement between NSI and ECM, with respect to the Fund; and (3) the election of each of David B. Boon, Donald J. Herrema, Catherine A. Zaharis and Ian Martin as a Trustee of the Fund. The Board knows of no business, other than that specifically mentioned in the Notice, that will be presented for consideration at the Meeting. If other business should properly come before the Meeting, the proxy holders will vote thereon in accordance with their best judgment.

Voting Information

Record Date; Shareholders Entitled to Vote

The Board has fixed the close of business on January 2, 2024 as the record date (the “Record Date”) for the determination of shareholders of the Fund entitled to notice of and to vote at the Meeting. Shareholders of the Fund are entitled to one vote for each full share held and a proportionate fractional vote for each fractional share held on the Record Date. The Fund offers two classes of shares: Class A Shares and Class I Shares. The number of shares outstanding as of December 1, 2023 (the “Outstanding Shares”) was 150,899.066 and 11,481,212.169 for Class A and Class I, respectively, which in each case equals the number of votes to which each such class is entitled.

This solicitation of proxies is being made by and on behalf of the Fund. The cost of preparing, printing and mailing this Proxy Statement, the Notice and the accompanying Proxy Card and all other costs incurred in connection with the solicitation of proxies, including any additional solicitation made by mail, telephone, e-mail or in person, will be paid by ECM and NSI. ECM and NSI have retained Broadridge Financial Solutions (“Broadridge”), a third-party proxy vendor, to assist in the proxy solicitation and tabulation. ECM and NSI collectively, and not the Fund, will bear all costs related to the Proposed Transition and this Proxy Statement. This includes Broadridge’s fees, which are estimated to be approximately $10,000, and include the costs of typesetting, filing, printing, and mailing the proxy materials. ECM and NSI will also bear any legal expenses to prepare the proxy materials and other miscellaneous related expenses.

While solicitation will be primarily by mail, certain officers and representatives of the Fund, officers, employees or agents of ECM, and certain financial service firms and their representatives, who will receive no extra compensation for their services, may solicit proxies by telephone, e-mail or in person.

Revocation of Proxies

Shareholders may revoke their proxies at any time before such proxies are voted by written notification to the Fund or by a duly executed Proxy Card bearing a later date. Shareholders may also revoke their proxies previously given by attending the Meeting and voting in person.

Quorum; Adjournment; Required Vote

The presence at the Meeting, in person or by proxy, of at least one-third (33-1/3%) of the Outstanding Shares of the Fund constitutes a quorum for the Meeting. Thus, the Meeting can only take place if one-third or more of the Outstanding Shares of the Fund is present in person or represented by proxies.

If a quorum is not present at the Meeting, or if a quorum is present at the Meeting but sufficient votes in favor of the Proposals are not received, the Meeting may be adjourned to permit further solicitation of proxies. Any lesser number of Outstanding Shares of the Fund than the quorum will be sufficient for an adjournment. No notice of any adjournment of the Meeting will be given other than announcement at the Meeting or an adjournment or postponement thereof.

Shares represented by a properly executed proxy will be voted in accordance with the instructions on the proxy, or, if no instructions are provided, the shares will be voted FOR each Proposal. Abstentions will be treated as votes present at the Meeting and therefore will be included for purposes of determining whether a quorum is present. However, abstentions will not be treated as votes cast at such Meeting. Abstentions, therefore, will have no effect on proposals that require an affirmative vote of a majority of votes cast for approval. In contrast, broker “non-votes” (that is, proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owner or other persons entitled to vote shares on a particular matter with respect to which the brokers or nominees do not have discretionary power) will not be treated as votes present at the Meeting and will not be treated as votes cast at such Meeting. Broker “non-votes”, therefore: (i) will not be included for purposes of determining whether a quorum is present; and (ii) will have no effect on proposals that require an affirmative vote of a majority of votes cast for approval.

With respect to Proposal 1 and Proposal 2, the affirmative vote of a “majority of the outstanding voting securities” of the Fund present, in person or by proxy, and voting at the Meeting is required to approve the New Advisory Agreement and the New Sub-Advisory Agreement. A “majority of the outstanding voting securities” of the Fund means the affirmative vote of the lesser of (i) 67% or more of the voting securities of the Fund present at the Meeting, if the holders of more than 50% of the outstanding voting securities of the Fund are present or represented by proxy at the Meeting; or (ii) more than 50% of the outstanding voting securities of the Fund.

With respect to Proposal 3, the affirmative vote of a plurality of votes cast at the Meeting is required for the approval of the election of each of David B. Boon, Donald J. Herrema, Catherine A. Zaharis and Ian Martin as a Trustee, as long as a quorum is present at the Meeting. A nominee achieves a plurality by receiving the highest number of favorable votes cast for an open directorship position, even if they do not receive a majority of the votes cast. When a nominee runs unopposed and receives any votes, other votes to withhold and votes against have no effect on the outcome of the election.

Consummation of the Proposed Transition is contingent upon approval of all the Proposals being received. If the Proposed Transition is not consummated, the Current Advisory Agreement would not be terminated and would remain in effect, the New Advisory Agreement and the New Sub-Advisory Agreement would not become effective, the Current Trustees would not resign and the Proposed Trustees would not become Trustees of the Fund. Approval of each Proposal is contingent upon the approval of all the Proposals presented at the Meeting. Shareholders are NOT being asked to approve the Proposed Transition.

Shareholders are not entitled to any rights of appraisal or similar rights of dissenters with respect to the Proposals.

PROPOSAL 1: APPROVAL OF THE NEW ADVISORY AGREEMENT, AND

PROPOSAL 2: APPROVAL OF THE NEW SUB-ADVISORY AGREEMENT

ECM currently serves as the investment adviser to the Fund under the Current Advisory Agreement dated May 11, 2020, as amended from time to time. The Board of Trustees of the Fund has determined that it would be in the best interests of the Fund and its shareholders if NSI were to become the investment adviser to the Fund, with ECM continuing to provide portfolio management services to the Fund as the Fund’s sub-adviser. The Board has also determined that it would be in the best interests of the Fund and its shareholders if the Proposed Trustees replaced the Current Trustees. If the Proposed Transition is consummated, it is anticipated that Ultimus Fund Solutions, LLC and its affiliates (collectively, “Ultimus”) will be engaged by the Fund to provide certain administrator, transfer agent, fund accountant and compliance services, including providing an experienced Chief Compliance Officer for the Fund. In addition, if the Proposed Transition is consummated, it is anticipated that the Fund will share, to some extent, fixed and variable overhead expenses as part of a “shared” operational and governance structure with twelve other mutual funds currently advised by NSI. It is anticipated that the nature and quality of the services the Fund receives will not be diminished as a result of any service provider changes. The Board believes these changes in the current operational and governance structure of the Fund would enable the Fund to achieve potential initial and future cost savings and other benefits. It would also enable the Fund to be marketed together with the other registered investment funds advised by NSI, with the potential for enhanced growth for the Fund.

The Proposals are contemplated by an agreement (“Transition Agreement”) by and among ECM, NSI and the Fund which, in turn, contemplates NSI becoming the investment adviser to the Fund, ECM becoming the investment sub-adviser to the Fund and the Proposed Trustees replacing the current Trustees to the Fund, in each instance, subject to shareholder approval (the “Proposed Transition”). The Transition Agreement provides that, among other matters, ECM and NSI will use commercially reasonable efforts to cause the Proposals to be approved.

Under Section 15(a) of the 1940 Act, NSI can serve as the investment adviser to the Fund under the New Advisory Agreement, and ECM can serve as the investment sub-adviser to the Fund under the New Sub-Adviser Agreement only if each agreement is approved by the vote of a majority of the outstanding voting securities of the Fund. Accordingly, shareholders of the Fund are being asked to approve the New Advisory Agreement and New Sub-Advisory Agreement.

The New Advisory Agreement has terms which are substantially the same as the Current Advisory Agreement, including the advisory fee rate. The Fund’s investment objectives will not change as a result of the Proposed Transition, and shareholders will still own the same shares in the same Fund. NSI has also agreed to continue the expense limitation agreement agreed to by ECM which is currently in effect, and extend it until January 1, 2026. ECM historically has voluntarily absorbed certain limited expenses on behalf of the Fund, including particular compliance costs, which voluntary practice will not be continued by NSI following the closing of the Proposed Transition. As described above, following the Proposed Transition, it is anticipated that the Fund will share, to some extent, fixed and variable overhead expenses as part of a “shared” operational and governance structure with twelve other mutual funds currently advised by NSI. NSI expects that this operational and governance structure change will result in an overall decrease in the total operating expenses of the Fund even after accounting for certain compliance costs being paid directly by the Fund and no longer absorbed by ECM. In addition, the New Advisory Agreement also provides for certain additional non-advisory administrative-related services to be provided by NSI, which are not expressly provided for under the Current Advisory Agreement. The New Sub-Advisory Agreement contemplates that ECM, as the Fund’s sub-adviser under the oversight of NSI, will continue to provide the same portfolio management services it provides to the Fund under the Current Advisory Agreement. No changes are expected in the personnel at ECM providing portfolio management services to the Fund. If all Proposals are approved, the New Advisory Agreement and New Sub-Advisory Agreement will each become effective upon consummation of the Proposed Transition.

If the New Advisory Agreement and New Sub-Advisory Agreement are not approved, the Board will take such action as it deems to be in the best interests of the Fund and its shareholders. Alternatives the Board may consider include (1) again seeking approval by shareholders of the Fund of the New Advisory Agreement and Sub-Advisory Agreement or seeking approval of different advisory and sub-advisory agreements; (2) continuing to retain ECM as the sole investment adviser for the Fund; and/or (3) the possible liquidation of the Fund.

NSI, a Delaware limited liability company, together with its affiliates, provides investment advisory services to private funds, separate accounts and investment companies registered under the 1940 Act. NSI is registered as an investment adviser under the Investment Advisers Act of 1940, as amended (“Advisers Act”). NSI’s offices are located at 200 West Madison Street, Suite 2610, Chicago, Illinois 60606.

Estancia Managing Directors, LLC is the indirect parent company of NSI and is located at 20865 North 90th Place, Suite 200, Scottsdale, AZ 85255.

NSI is wholly owned by NSI Holdco, LLC. NSI Holdco, LLC, in turn, is wholly owned by CSM NSI Aggregator, LLC which, in turn, is wholly owned by Estancia Capital Partners Fund II, L.P. All voting interests of Estancia Capital Partners Fund II, L.P. are owned by Estancia GP II, L.P. Estancia GP II, L.P. is controlled by Estancia Managing Directors, LLC. All of these entities are located at 20865 North 90th Place, Suite 200, Scottsdale, AZ 85255.

The following chart sets forth the name, address and principal occupation of the principal executive officers and managers of NSI:

| Name | Address | Principal Occupation |

| Mark D. Goodwin | 200 West Madison Street, Suite 2610, Chicago, IL 60606 | Chief Executive Officer |

| Alan Molotsky | 200 West Madison Street, Suite 2610, Chicago, IL 60606 | General Counsel |

| Bradley Cox | 200 West Madison Street, Suite 2610, Chicago, IL 60606 | Chief Financial Officer |

| Phillip Callahan | 200 West Madison Street, Suite 2610, Chicago, IL 60606 | Head of Distribution and Marketing |

| David Gaspar | 200 West Madison Street, Suite 2610, Chicago, IL 60606 | Chief Operations and Information Officer |

| Ulf Skreppen | 200 West Madison Street, Suite 2610, Chicago, IL 60606 | Chief Operating Officer and Chief Compliance Officer |

ECM

ECM, a Delaware limited liability company, currently serves as the Fund’s investment adviser and is responsible for the day-to-day management of the Fund and for investing the Fund’s assets in various underlying funds in which the Fund invests, subject to policies adopted by the Board. The Board provides broad oversight over the operations and affairs of the Fund. ECM is registered as an investment adviser under the Advisers Act. ECM’s offices are located at 1560 Sherman Avenue, Suite 960, Evanston, Illinois 60201.

The following chart sets forth the name, address and principal occupation of the principal executive officers and managers of ECM:

| Name | Address | Principal Occupation |

| Kenneth A. Meister | 1560 Sherman Avenue, Suite 960, Evanston, Illinois 60201 | President and Chief Operating Officer |

| Adam Blitz | 1560 Sherman Avenue, Suite 960, Evanston, Illinois 60201 | Chief Executive Officer and Chief Investment Officer |

As described below under Additional Information, Kenneth A. Meister, Brian Lease, Scott Zimmerman and Melanie Lorenzo are all Trustees and/or officers of the Fund and also serve as employees of ECM.

Comparison of the Current Advisory Agreement and the New Advisory Agreement

The Current Advisory Agreement was entered into on May 11, 2020 by and between ECM and the Fund and was approved by the Fund’s shareholders on May 11, 2020. The Current Advisory Agreement was last renewed at an in-person Board meeting held on December 14, 2023 by the Board, including a majority of the Trustees who are not “interested persons” of the Fund, as defined under the 1940 Act (the “Independent Trustees”), for an additional one-year term.

The Current Advisory Agreement and the New Advisory Agreement are each attached hereto as Exhibit A and Exhibit B, respectively. The following is a comparison of the terms of the Current Advisory Agreement and the New Advisory Agreement:

Under the Current Advisory Agreement, ECM acts as investment adviser to the Fund and supervises investments of the Fund on behalf of the Fund in accordance with the investment objectives, programs and restrictions of the Fund as provided in the Fund’s governing documents. The Current Advisory Agreement requires that ECM continuously furnish an investment program for the Fund, including managing the investment and reinvestment of the Fund’s assets, determining what investments will be purchased, held, sold or exchanged by the Fund and what portion, if any, of the assets of the Fund will be held uninvested, and continuously reviewing, supervising and administering the investment program of the Fund.

The provisions of the New Advisory Agreement relating to services to be provided by NSI contain requirements that are substantially the same to corresponding provisions in the Current Advisory Agreement. In addition, the New Advisory Agreement contemplates that NSI will also provide the following non-advisory administrative-related services, either separately or in coordination with other service providers to the Fund: (i) coordinate and supervise all aspects of the Fund’s operations; (ii) provide office space, equipment, office supplies and other facilities; (iii) coordinate and oversee the preparation and filing with the SEC of registration statements, notices, shareholder reports, proxy statements and other material for the Fund required to be filed under applicable law; (iv) oversee and assist in the preparation of all general or routine shareholder communications; (v) supervise and monitor the pricing process; (vi) arrange, as may be reasonably requested by the Board, for officers and employees of the NSI to serve as Board members, officers, or agents of the Fund; (vii) coordinate, prepare and distribute, as applicable, materials for Board and Board Committee meetings; (viii) oversee and monitor the Fund’s compliance with its policies and procedures and with applicable laws; (ix) administer the Fund’s code of ethics and report to the Board on compliance therewith; (x) assist, as relevant, the Fund in connection with regulatory examinations, inspections or investigations; (xi) monitor, budget, approve and arrange for payment of expenses of the Fund; (xii) monitor Board compliance with personal trading guidelines; (xiii) overseeing the Fund’s fidelity bond coverage and insurance coverage and administering claims thereunder, and filing any fidelity bonds and related notices with the SEC as required by the 1940 Act; (xiv) assist the Fund with its obligations under Section 302 and 906 of the Sarbanes-Oxley Act of 2002 and Rule 30a-2 under the 1940 Act; (xv) oversee the maintenance of the Fund’s books and records; (xvi) oversee the administration and implementation of the Fund’s privacy policy; (xvii) implement and maintain a business continuation and disaster recovery program for the Fund; (xviii) arrange for all meetings of shareholders; (xix) maintain and retain all charter documents and filing all documents required to maintain the Fund’s organizational status; (xx) perform due diligence on the Fund’s third-party service providers and negotiate service agreements with those third-parties; and (xxi) provide such other services as the parties hereto may agree upon from time to time for the efficient operation of the Fund.

Advisory Fees and Expense Limitations

Under the Current Advisory Agreement, the Fund pays ECM quarterly in arrears a fee (the “Management Fee”), calculated at the annual rate of 1.00% of the aggregate value of its outstanding shares determined as

of the last calendar day of each month (before any repurchases of shares and prior to the Management Fee being calculated). For the fiscal year ended March 31, 2023, ECM was paid $1,094,194 as compensation under the Current Advisory Agreement.

ECM has contractually agreed to limit the total annualized operating expenses of the Fund (excluding any borrowing and investment-related costs and fees, taxes, extraordinary expenses and the fees and expenses of underlying portfolio funds in which the Fund invests) to 1.50% with respect to the Class I Shares and 2.25% with respect to the Class A Shares. In addition, ECM is permitted to recover fees and expenses it has waived or borne pursuant to the expense limitation agreement from the applicable class or classes of Shares (whether through reduction of its Management Fee or otherwise) in later periods to the extent that the Fund’s expenses with respect to the applicable class of shares fall below the annual rate of 1.50% with respect to Class I Shares or 2.25% with respect to Class A Shares (the “Expense Limitation Agreement”). The Fund, however, is not obligated to pay any such amount more than three years after the end of the fiscal year in which ECM deferred a fee or reimbursed an expense. Any such recovery by ECM will not cause the Fund to exceed the annual limitation rate set forth above or otherwise in effect at the time of recovery. If the Proposed Transition is consummated, ECM will continue to be entitled to recover fees and expenses it has waived or borne pursuant to the expense limitation agreement prior to the closing of the Proposed Transition under the same terms as described above. Any such recovered fees and expenses shall be payable solely to ECM, and to the extent NSI receives any such recovered fees and expenses it shall cause such amounts to be transferred to ECM pursuant to the Expense Limitation Agreement. As part of the determinations to approve the New Advisory Agreement and New Sub-Advisory Agreement, the Board considered that it would be ECM that would remain solely responsible for implementing the Fund's investment program and that ECM's existing rights to recover fees and expenses it has waived or borne pursuant to the expense limitation agreement prior to the closing of the Proposed Transition would continue without change following the Proposed Transition being consummated, consistent with the terms of the current Expense Limitation Agreement under which the Fund has benefited from waivers and reimbursements made by ECM during the relevant three-year period for recovery.

The provisions of the New Advisory Agreement relating to the advisory fees of NSI are substantially the same as the corresponding provisions of the Current Advisory Agreement. NSI has also agreed to continue the Expense Limitation Agreement agreed to by ECM which is currently in effect, and extend it until January 1, 2026.

Under the Current Advisory Agreement ECM is not responsible, except to the extent of the reasonable compensation of the Fund’s employees who are partners, managers, officers, or employees of ECM whose services may be involved, for the following expenses of the Fund: all fees and expenses directly related to portfolio transactions and positions for the Fund’s account such as direct and indirect expenses associated with the Fund’s investments and enforcing the Fund’s rights in respect of such investments; brokerage commissions; interest and fees on any borrowings by the Fund; professional fees (including, without limitation, expenses of consultants, experts and specialists); research expenses; fees and expenses of outside legal counsel (including fees and expenses associated with the review of documentation for prospective investments by the Fund), including foreign legal counsel; accounting, auditing and tax preparation expenses; fees and expenses in connection with repurchase offers and any repurchases or redemptions of Fund shares; taxes and governmental fees (including tax preparation fees); fees and expenses of any custodian, sub-custodian, administrator, transfer agent, registrar, and any other agent of the Fund; all costs and charges for equipment or services used in communicating information regarding the Fund’s transactions among ECM and any custodian or other agent engaged by the Fund; bank services fees; expenses of preparing, printing, and distributing copies of the registration statement (including the prospectus) and any other sales material (and any supplements or amendments thereto), reports, notices, other communications to holders of shares of the Fund, and proxy materials; expenses of preparing, printing, and filing reports and other documents with government agencies; expenses of shareholders’ meetings; expenses of corporate data processing and related services; shareholder recordkeeping and shareholder account services, fees, and disbursements; expenses relating to investor and public relations; extraordinary expenses such as litigation expenses; and any other expenses reasonably considered an expense of the Fund or otherwise approved by the Fund’s Board as an expense of the Fund.

The provisions of the New Advisory Agreement relating to the expenses to be paid by the Fund are substantially similar to the corresponding provisions of the Current Advisory Agreement. ECM historically has voluntarily absorbed certain limited expenses on behalf of the Fund, including particular compliance costs, which voluntary practice will not be continued by NSI following the closing of the Proposed Transition. As described above, following the Proposed Transition, it is anticipated that the Fund will share, to some extent, fixed and variable overhead expenses as part of a “shared” operational and governance structure with twelve other mutual funds currently advised by NSI. NSI expects that this operational and governance structure change will result in an overall decrease in the total operating expenses of the Fund even after accounting for certain compliance costs being paid directly by the Fund and no longer absorbed by ECM.

Liability and Indemnification

The Current Advisory Agreement provides that neither ECM, nor its partners, officers, managers, employees, affiliates, successors, or other legal representatives shall be subject to any liability for any act or omission, error of judgment, mistake of law, or for any loss suffered by the Fund, in connection with the provision of services to be rendered under the Current Advisory Agreement, except by reason of willful misfeasance, bad faith, or gross negligence by ECM in the performance of its duties or by reason of reckless disregard by ECM of its obligations and duties.

With respect to indemnification, the Current Advisory Agreement provides that the Fund will indemnify ECM and any ECM affiliate, and each of their partners, members, managers, officers, and employees and any of their affiliated persons, executors, heirs, assigns, successors, or other legal representatives (each an “Indemnified Person”) against any and all costs, losses, claims, damages, or liabilities, joint or several, including, without limitation, reasonable attorneys’ fees and disbursements, resulting in any way from the performance or non-performance of any Indemnified Person's duties in respect of the Fund, except those resulting from the willful misfeasance, bad faith or gross negligence of an Indemnified Person or the Indemnified Person's reckless disregard of such duties and, in the case of criminal proceedings, unless such Indemnified Person had reasonable cause to believe its actions were unlawful.

The provisions of the New Advisory Agreement relating to the liability and indemnification of NSI are substantially the same as the corresponding provisions of the Current Advisory Agreement.

The Current Advisory Agreement may be continued in effect from year to year if such continuance is approved annually by the Board or by vote of a majority of the outstanding voting securities of the Fund; provided that in either event the continuance is also separately approved by a majority of the Fund’s Independent Trustees by vote cast in person at a meeting called for the purpose of voting on such approval. The Current Advisory Agreement is terminable without penalty, on sixty (60) days’ prior written notice: by the Fund’s Board; by vote of a majority of the outstanding voting securities of the Fund; or by ECM. The Current Advisory Agreement also provides that it will terminate automatically in the event of its “assignment,” as defined by the 1940 Act and the rules thereunder.

The provisions of the New Advisory Agreement relating to the term and termination of the New Advisory Agreement are substantially the same as the corresponding provisions of the Current Advisory Agreement, other than the initial term of the New Advisory Agreement and New Sub-Advisory Agreement which will be two years given that each such agreement will be approved as new agreements by the Board and the shareholders of the Fund.

The New Sub-Advisory Agreement

The New Sub-Advisory Agreement is attached hereto as Exhibit C. The following is a summary of the terms of the New Sub-Advisory Agreement:

Sub-Advisory Services

Under the New Sub-Advisory Agreement, ECM, subject to the oversight of NSI as investment adviser, is being retained to provide investment sub-advisory services with respect to the Fund’s investment portfolio. Such services include: (i) managing the investment and reinvestment of the Fund’s assets in accordance with the Fund’s investment policies; (ii) arranging for the purchase and sale of securities and other assets; (iii) providing investment research and analysis concerning the Fund’s assets; (iv) placing orders for purchases and sales of the Fund’s assets; (v) maintaining books and records required to support the Fund’s investment operations; (vi) making reports and providing information to the Board and NSI concerning the investment portfolio of the Fund as well as changes or developments affecting the Fund; and (vii) voting

proxies relating to the Fund’s portfolio securities in accordance with ECM’s proxy voting policies and procedures. The portfolio management services to be provided by ECM pursuant to the New Sub-Advisory Agreement are substantially the same as the portfolio management services that ECM currently provides as investment adviser to the Fund pursuant to the Current Advisory Agreement.

Expenses

The New Sub-Advisory Agreement provides that ECM will pay for all expenses it incurs in performing its duties under the agreement, other than the cost of securities and other investments made by the Fund (including brokerage commissions and other transaction charges).

Sub-Advisory Fees

The New Sub-Advisory Agreement will not result in any change in the advisory fee rate paid by the Fund. Pursuant to the New Sub-Advisory Agreement, ECM receives, as compensation for all services rendered by ECM, a sub-advisory fee, quarterly in arrears, equal to fifty percent (50%) of the advisory fee payable by the Fund to NSI under the New Advisory Agreement. The sub-advisory fee is payable to ECM by NSI, which receives an advisory fee from the Fund payable quarterly in arrears calculated at the annual rate of 1.00% of the aggregate value of the Fund’s outstanding shares determined as of the last calendar day of each month (before any repurchases and prior to the fee being calculated).

Liability and Indemnification

The Current Advisory Agreement provides that neither ECM, nor its partners, officers, managers, employees, affiliates, successors, or other legal representatives shall be subject to any liability for any act or omission, error of judgment, mistake of law, or for any loss suffered by the Fund, in connection with the provision of services to be rendered under the Current Advisory Agreement, except by reason of willful misfeasance, bad faith, or gross negligence by ECM in the performance of its duties or by reason of reckless disregard by ECM of its obligations and duties.

With respect to indemnification, the Current Advisory Agreement provides that the Fund will indemnify ECM and any ECM affiliate, and each of their partners, members, managers, officers, and employees and any of their affiliated persons, executors, heirs, assigns, successors, or other legal representatives (each an “Indemnified Person”) against any and all costs, losses, claims, damages, or liabilities, joint or several, including, without limitation, reasonable attorneys’ fees and disbursements, resulting in any way from the performance or non-performance of any Indemnified Person's duties in respect of the Fund, except those resulting from the willful misfeasance, bad faith or gross negligence of an Indemnified Person or the Indemnified Person's reckless disregard of such duties and, in the case of criminal proceedings, unless such Indemnified Person had reasonable cause to believe its actions were unlawful.

The provisions of the New Sub-Advisory Agreement relating to the liability of ECM are substantially the same as the corresponding provisions of the Current Advisory Agreement. The provisions of the New Sub-Advisory Agreement relating to the indemnification of ECM are substantially the same as the corresponding provisions of the Current Advisory Agreement, except that, as the Fund is not a party under the new Sub-Advisory Agreement, the New Sub-Advisory Agreement provides that NSI will indemnify ECM or any of its Indemnified Persons

Assuming approval by shareholders, the New Sub-Advisory Agreement will become effective upon consummation of the Proposed Transition and have an initial term of two years. Thereafter, the New Sub-Advisory Agreement shall continue in effect from year to year after the initial term if approved annually (i) by the Board or the holders of a majority of the outstanding voting securities of the Fund and (ii) by a majority of the trustees who are not “interested persons” of any party to the New Sub-Advisory Agreement. The New Sub-Advisory Agreement may be terminated (i) by the Board, the holders of a majority of the

outstanding voting securities of the Fund, or NSI at any time, without the payment of any penalty, upon giving ECM 60 days’ written notice, or (ii) by ECM on 60 days’ written notice to the Fund. The New Sub-Advisory Agreement will also immediately terminate in the event of its assignment, as defined in the 1940 Act. The New Sub-Advisory Agreement also terminates upon the termination of the New Advisory Agreement.

Trustee Actions, Considerations, and Recommendations

At an in-person meeting of the Board held on December 14, 2023, the Trustees, including the Independent Trustees, considered the approval of the New Advisory Agreement and the New Sub-Advisory Agreement, each for an initial two-year period. The Board was assisted in its review by K&L Gates LLP, the Fund’s outside counsel. Prior to the December Board meeting, the Independent Trustees met telephonically with K&L Gates, LLP to discuss the process and the appropriate factors to consider when determining whether to approve the New Advisory Agreement and the New Sub-Advisory Agreement. The Independent Trustees also met with K&L Gates LLP at the December Board meeting in executive session separate from the representatives of NSI and ECM. During such executive session, the Independent Trustees spent additional time reviewing and discussing the information and materials that had been furnished by NSI and its counsel at the request of the Fund’s Board (the “NSI Materials”), relating to the New Advisory Agreement and the information and materials that had been furnished by ECM at the request of the Fund’s Board (the “ECM Materials”), relating to the New Sub-Advisory Agreement. At previous Board meetings, the Board also received and considered information related to the Proposed Transition and the qualifications of NSI and ECM.

In voting to approve the New Advisory Agreement, the Board specifically noted that the New Advisory Agreement has terms which are substantially the same as the Current Advisory Agreement, including the advisory fee rate. ECM historically has voluntarily absorbed certain limited expenses on behalf of the Fund, including particular compliance costs, which voluntary practice will not be continued by NSI following the closing of the Proposed Transition. Following the Proposed Transition, it is anticipated that the Fund will share, to some extent, fixed and variable overhead expenses as part of a “shared” operational and governance structure with twelve other mutual funds currently advised by NSI. NSI expects that this operational and governance structure change will result in an overall decrease in the total operating expenses of the Fund even after accounting for certain compliance costs being paid directly by the Fund and no longer absorbed by ECM. In addition, the New Advisory Agreement also provides for certain additional non-advisory administrative-related services to be provided by NSI, which are not expressly provided for under the Current Advisory Agreement. In voting to approve the New Sub-Advisory Agreement, the Board also specifically noted that the terms of the New Sub-Advisory Agreement relating to the provision of portfolio management services by ECM are substantially the same as the corresponding provisions of the Current Advisory Agreement.

In connection with the Board’s consideration of approving the New Advisory Agreement and the New Sub-Advisory Agreement, the Board noted that all facts and circumstances surrounding the relationships and proposed relationships between the Fund and each of NSI and ECM are appropriate for consideration, but that the most relevant factors generally are the following: (1) the nature, extent, and quality of the services to be provided by NSI; (2) the Fund’s investment performance; (3) a comparative analysis of advisory fees paid by, and the expense ratios of other similar funds; (4) the costs of the services provided and the resulting profits which could be realized by NSI from its relationship with the Fund, including the extent to which NSI could realize economies of scale through growth of Fund assets; (5) whether economies of scale actually achieved or that may potentially be achieved suggest that a contract should contain breakpoints so that shareholders obtain the benefits of such economies of scale; and (6) other sources of revenue and intangible benefits to NSI from its relationship with the Fund.

The information, material facts, and conclusions that formed the basis for the Board’s, including the Independent Trustees, approval of the New Sub-Advisory Agreement included: (1) the nature, extent, and quality of the services to be provided by ECM; (2) the Fund’s investment performance; (3) a comparative analysis of advisory fees paid by, and the expense ratios of other similar funds; (4) the costs of the services

provided and the resulting profits which could be realized by ECM from its relationship with the Fund, including the extent to which ECM could realize economies of scale through growth of Fund assets; and (5) other sources of revenue and intangible benefits to ECM from its relationship with the Fund.

A presentation was made by NSI at the December Board meeting regarding the services to be provided by NSI pursuant to the New Advisory Agreement, including, but not limited to, investment advisory services and certain additional non-advisory administrative-related services. ECM also conducted a similar presentation at the December Board meeting regarding the portfolio management services to be provided by ECM pursuant to the New Sub-Advisory Agreement, including, but not limited to, ECM’s selection and review process of the portfolio funds in which the Fund invests. Through these presentations, the NSI Materials, and the ECM Materials, the Board received and considered information regarding the nature, extent and quality of the services to be provided to the Fund by NSI as investment adviser, and ECM as investment sub-adviser.

The Board reviewed the investment objective and policies of the Fund with NSI and ECM. The Board also reviewed the experience, qualifications, backgrounds, and responsibilities of NSI’s and ECM’s senior investment professionals who would be primarily responsible for the Fund’s management. The Board also considered NSI’s role and experience in supervising sub-advisers and third-party fund service providers and providing related services and assistance in meeting legal and regulatory requirements. The Board discussed the ability of ECM to manage the Fund’s investments in accordance with the Fund’s stated investment objectives and policies, as well as the services to be provided by NSI and ECM that are necessary for the operation of the Fund. The Board considered the benefits that the Fund is anticipated to derive from the resources available to NSI and ECM.

The Board also reviewed with NSI and ECM a presentation of the Fund’s performance as compared to a group of other registered funds of hedge funds that have objectives and strategies that are similar to those of the Fund. Among other things, the Board was provided with performance data versus a peer group of similar registered closed-end funds-of-hedge funds for the fiscal years ended 2019 through 2023, as well as the 5-year return for each peer fund. The Board noted that the Fund, as compared to the peer group, generally outperformed in the long term. The peer group performance was obtained from publicly available sources and measured as of each such peer group fund’s most recent fiscal year end.

In addition, the Board reviewed and considered a chart setting forth the fee structure of other similar registered funds of hedge funds (the “Fee Comparison Chart”). The Board reviewed and discussed the fees and the expense ratio of the Fund, as well as the fees and expense ratios of these other similar funds, as set forth in the Fee Comparison Chart. The Board determined that the proposed management fee for the Fund was within the range of the management fees associated with these similar funds. The Board compared the Fund’s expense ratio to these comparable funds and considered NSI’s willingness to contractually cap certain operating expenses of the Fund. The Board determined that the expense ratio was within range of the expense ratios of similar funds, after taking into account the effects of the current expense waiver. After review, the Board concluded that the expense ratio for the Fund was appropriate.

The Board reviewed information prepared by NSI concerning any profits which may be realized by it with respect to the Fund. The Board noted that NSI is responsible for all salaries and employee benefit expenses of its employees and any of its affiliates involved in the management and conduct of the Fund’s business and affairs and related overhead (including rent and other similar items, but not the Fund’s Chief Compliance Officer). As such, the Fund will not be responsible for these expenses. In evaluating the potential profitability of NSI with respect to the Fund, the Board took into account the expenses to be borne by NSI, NSI’s continuation and extension of the Fund’s expense limitation agreement, NSI’s payment of sub-advisory fees to ECM, and NSI’s resources to be utilized in managing the Fund.

The Board considered whether there have been economies of scale in respect of the management of the Fund, whether the Fund has appropriately benefited from any economies of scale, and whether there is potential for realization of any further economies of scale. NSI stated that as the assets of the Fund potentially increase over time, the Fund and its shareholders may realize economies of scale as certain expenses become a smaller percentage of overall assets. However, the Board noted that NSI had not incorporated any breakpoints to reflect the potential for reducing the management fee as assets grow. The Board determined that, because of the Fund’s asset size and the revenues expected to be generated, the Board did not believe breakpoints were appropriate at this time.

The Board also considered the potential for so-called “fall-out” or ancillary benefits to NSI as a result of its relationship with the Fund. Although the Board acknowledged that the Fund will enhance the line of investment products managed by NSI and therefore NSI’s management of the Fund may increase the amount of assets managed and revenue generated by NSI, based on the profits realized by NSI, NSI does not expect to receive any significant indirect benefits from managing the Fund at this time.

The Board also reviewed information prepared by ECM concerning any profits which may be realized by it serving as sub-adviser to the Fund. The Board noted that ECM is responsible for all salaries and employee benefit expenses of its employees and any of its affiliates involved in the management and conduct of the Fund’s business and affairs and related overhead (including rent and other similar items). As such, the Fund will not be responsible for these expenses. In evaluating the potential profitability of ECM with respect to the Fund, the Board took into account the expenses to be borne by ECM, the expense limitation agreement as it applies to ECM, and ECM’s resources to be utilized in managing the Fund, and that ECM does not expect to receive any significant indirect benefits from acting as sub-adviser for the Fund.

Based on its discussions and considerations as described above, the Board made the following conclusions and determinations:

| • | The Board concluded that the nature, extent and quality of the services to be provided by NSI would be adequate and appropriate, noting the benefits of NSI’s investment advisory and non-advisory administrative-related services to be provided. |

| • | The Board concluded that the Fund’s management fee to be paid to NSI and the potential profitability to NSI from its relationship with Fund were reasonable in light of the considerations discussed above. |

| • | The Board recognized that, given the Fund’s assets, significant economies would not be realized until the size of the Fund increases. |

| • | The Board concluded that the nature, extent and quality of the services to be provided by ECM would be adequate and appropriate, noting the benefits of ECM’s portfolio management services to be provided. |

| • | The Board concluded that the management fee to be paid to ECM by NSI and the potential profitability to ECM from its relationship with Fund were reasonable in light of the considerations discussed above.

|

The Board considered these conclusions and determinations in their totality and, without any one factor being dispositive, determined that approving the New Advisory Agreement and the New Sub-Advisory Agreement, in light of the weighing and balancing of all factors considered and in the exercise of the Trustees’ business judgment, was in the best interests of the Fund and its shareholders, and the Board approved the New Advisory Agreement and the New Sub-Advisory Agreement.

The consummation of the Proposed Transition is contingent upon approval of all the Proposals being received. If the Proposed Transition is not consummated, the Current Advisory Agreement would not be terminated and would remain in effect, and the New Advisory Agreement and New Sub-Advisory Agreement would not become effective. Approval of each Proposal is contingent upon the approval of all the Proposals presented at the Meeting. Shareholders are NOT being asked to approve the Proposed Transition.

Board Recommendation for Proposal 1 and Proposal 2

The Board, including the Independent Trustees, believes that Proposal 1, to approve the New Advisory Agreement and Proposal 2, to approve the New Sub-Advisory Agreement are in the best interests of the Fund and its shareholders.

The Board unanimously recommends that you vote FOR Proposal 1, to approve the New Advisory Agreement and Proposal 2, to approve the New Sub-Advisory Agreement.

PROPOSAL 3: APPROVAL OF THE ELECTION OF DAVID B. BOON, DONALD J.

HERREMA, CATHERINE A. ZAHARIS AND IAN MARTIN AS TRUSTEES OF THE FUND

General Information

Proposal 3 is one of the Proposals contemplated by the Transition Agreement. Shareholders of the Fund are being asked to approve the election of each of David B. Boon, Donald J. Herrema, Catherine A. Zaharis and Ian Martin as a Trustee. Pertinent information about each is set forth below. None of the Proposed Trustees serve as a Current Trustee. The Current Trustees would resign effective upon the consummation of the Proposed Transition. The Proposed Trustees comprise all of the current members of the Board of Trustees of the North Square Investment Trust.

The Audit Committee, which is comprised solely of the current Independent Trustees of the Fund, conducted a review of the qualifications, experience and background of the Proposed Trustees. While there is no formal list of qualifications, the Audit Committee considered, among other things, whether prospective nominees have distinguished records in their primary careers, integrity, and substantive knowledge in areas important to the Board’s operations, such as background or education in finance, auditing, securities law, the workings of the securities markets, or investment advice. For candidates to serve as Independent Trustees, independence from the Fund’s investment adviser, its affiliates and other principal service providers is critical, as is an independent and questioning mindset. The Audit Committee also considered whether the prospective nominees’ workloads would allow them to attend the vast majority of Board meetings, be available for service on Board committees, and devote the additional time and effort necessary to keep up with Board matters and the rapidly changing regulatory environment in which the Fund operates. The Board further believes that Mr. Boon’s, Mr. Herrema’s, Ms. Zaharis’s, and Mr. Martin’s current positions as trustees of the North Square Investment Trust, an open-end investment company made up of 12 series, which is advised by NSI makes them particularly well suited for service on the Board.

Prospective nominees are evaluated on the basis of their resumes, considered in light of the criteria discussed above. Those prospective nominees that appear likely to be able to fill a significant need of the Board then would be contacted to discuss the position, and if there appeared to be sufficient interest, an in-person meeting with the Fund’s investment adviser would be arranged. A meeting with the Board would be scheduled to provide the Board with an overview of the nominee evaluation process, and for its consideration of the prospective nominee candidate identified by the Fund’s investment adviser and his or her qualifications. The Fund has not paid a fee to third parties to assist in finding nominees.

After conducting a review of the Proposed Trustees based on the process above, the Audit Committee determined that nominating each of Mr. Boon, Mr. Herrema and Ms. Zaharis for election as an Independent Trustee, and Mr. Martin for election as an Interested Trustee of the Fund would be in the best interests of the Fund and its shareholders.

At a meeting held on December 14, 2023, the Board received the recommendation of the Fund’s Audit Committee regarding the nomination of the Proposed Trustees. After discussion and consideration of, among other things, the background of the Proposed Trustees, the Board voted to nominate the Proposed Trustees for election as Trustees, to hold office until resignation or removal.

Mr. Boon, Mr. Herrema, Ms. Zaharis, and Mr. Martin have consented to be named in this Proxy Statement and to serve as Trustee if elected. The Board has no reason to believe that any Proposed Trustee will become unavailable for election as a Trustee, but if that should occur before the Meeting, the proxies will be voted for such other nominees as the Board may recommend.

Following consummation of the Proposed Transition, it is expected that Mr. Herrema will become the chairman of the Board and Mr. Martin will become the President of the Fund. Given Mr. Herrema’s expected assumption of the role of Board Chairman as an Independent Trustee, there is no need for a separate lead independent trustee.

None of the Proposed Trustees are related to any other Trustee or officer of the Fund, nor is any Current Trustee or Officer related to another Trustee or officer of the Fund. The following tables set forth certain information regarding the Proposed Trustees. The business address of the Proposed Trustees is North Square Investments Trust, c/o Ultimus Fund Solutions, LLC, 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246.

Information Regarding Nominees for Election

| Name and Year of Birth | Position(s) with the Fund | Principal Occupation(s) During the Past 5 Years | Number of Portfolios in the ECM Fund Complex Overseen by Trustee | Other Directorships During the Past 5 Years |

| Independent Trustees |

| David B. Boon (1960) | Nominee | Chief Financial Officer and Managing Director, Eagle Capital Management, LLC (since 2018); Chief Financial Officer and Partner, Cedar Capital, LLC (2013 – 2018). | N/A** | Trustee, North Square Investment Trust (open-end mutual fund) (since 2018). |

| Donald J. Herrema (1952) | Nominee | Vice Chair and Chief Investment Officer, Independent Life Insurance Company (since 2018); Financial Services Executive, Advisor and Founder of BlackSterling Partners, LLC (private investments and advisory firm) (since 2004). | N/A** | Chairman, North Square Investment Trust (open-end mutual fund) (since 2018); Chairman and Director Emeritus, TD Funds USA (2009 – 2019); Director, Abel Noser Holdings, LLC (since 2016); Member, USC Marshall Business School Board (since 2010); Director, FEG Investment Advisors (since 2017); Director, Independent Life Insurance Company (since 2018). |

| Catherine A. Zaharis (1960) | Nominee | Professor of Practice (since 2019), Director, Professional/ Employer Development, Finance Department (2015 – 2019), Adjunct Lecturer (2010 – 2019), and Business Director, MBA Finance Career Academy (2008 – 2015), University of Iowa, Tippie College of Business; Chair (2013 – 2016), Director (1999 – 2016), and Investment Committee Member (1999 –

| N/A** | Trustee, North Square Investment Trust (open-end mutual fund) (since 2018); Director, The Vantage Point Funds (2015-2016). |

| | | 2013) and Chair (2003 – 2013), University of Iowa Foundation. | | |

| Interested Trustee |

| Ian Martin (1968)* | Nominee | Executive Vice President, Chief Administrative Officer of Ultimus Fund Solutions, LLC (2019 – present); Executive Vice President (1992 – 2019), U.S. Bank Global Fund Services. | N/A** | Trustee, North Square Investment Trust (open-end mutual fund) (since May 2023) |

* Mr. Martin would be considered to be an “interested person” of the Trust as that term is defined in the 1940 Act by virtue of his position with the administrator, transfer agent and fund accountant that is expected to be engaged by the Fund if the Proposed Transition is consummated.

**The Proposed Trustees listed in the table above currently oversee 12 series in the NSI Fund Complex.