UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-22904

Evanston Alternative Opportunities Fund

(Exact name of registrant as specified in charter)

1560 Sherman Avenue, Suite 960

Evanston, Illinois 60201

(Address of principal executive offices) (Zip code)

Scott Zimmerman

1560 Sherman Avenue, Suite 960

Evanston, Illinois 60201

(Name and address of agent for service)

Copies of Communications to:

Pablo Man

Clair E. Pagnano

K&L Gates LLP

1 Lincoln Street

Boston, Massachusetts 02111

(617) 261-3100

Registrant’s telephone number, including area code: (847) 328-4961

Date of fiscal year end: March 31

Date of reporting period: March 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a) The Report to Shareholders is attached herewith.

Evanston Alternative Opportunities Fund

Financial Statements

As of and for the year ended March 31, 2023

with Report of Independent Registered Public Accounting Firm

Evanston Alternative Opportunities Fund

Financial Statements

For the year ended March 31, 2023

Contents

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

This report provides certain performance data for Evanston Alternative Opportunities Fund (the “Fund”) for the fiscal year ended March 31, 2023.

The Fund’s Investment Approach

The Fund’s investment objective is to seek attractive long-term risk adjusted returns. The Fund is a “fund of funds” formed to invest substantially all of its assets in investment vehicles often referred to as hedge funds (“Portfolio Funds”) that are managed by independent investment managers (“Portfolio Fund Managers”). The Fund generally allocates its assets to Portfolio Funds whose Portfolio Fund Managers invest in one or more of the following strategy areas: Long/Short Equity, Event Driven, Relative Value and Global Asset Allocation.

Performance Review

General Fund and Market Commentary

Risk assets sold off during the reporting period (S&P 500 Index -7.7%, MSCI World Index -7.0%, and U.S. Aggregate Bond ETF -4.7%). Persistently high inflation and rapidly rising interest rates contributed to concerns about slowing economic growth and pressured corporate margins. Markets were volatile, with investors continually recalibrating the probability of recession. Near the end of the reporting period, in March 2023, heighted macroeconomic uncertainty was punctuated by the failures of three small- to mid-sized U.S. banks and UBS’s sudden acquisition of Credit Suisse in a government-brokered deal.

The Fund’s Class I Shares returned -5.0% and the Fund’s Class A Shares returned -5.7% for the reporting period, protecting capital relative to broader market indices but underperforming the HFRI Fund of Funds Composite Index (the “HFRI Index”), which returned -1.9% for the reporting period. The Fund’s allocation to long/short equity was responsible for most of the Fund’s loss. The Fund’s other three strategy allocations either performed positively, in the case of global asset allocation (“GAA” or “global macro), or preserved capital relatively well given the market environment, in the case of relative value and event-driven strategies.

Long/Short Equity

The Fund’s allocation to long/short equity was the biggest detractor from the Fund’s performance during the reporting period. Performance among the Fund’s individual long/short equity Portfolio Funds was mixed, but a handful of outsized losers weighed on the group’s overall results. Generally speaking, Portfolio Funds that ran with higher net exposure to the falling market and/or had a bias toward growth stocks, such as within the technology sector, fared poorly, especially at the beginning of the reporting period. Meanwhile, Portfolio Funds that take more of a top-down approach to stock selection, have more of a value bias, and/or more actively adjust net exposure contributed positively to performance.

1

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

Event Driven

The Fund’s event driven allocation was the second largest detractor from the Fund’s performance for the reporting period. The biggest contributors were credit-oriented Portfolio Funds that added value through security selection, active risk management, and opportunistic buying, particularly when high-yield credit spreads widened to nearly 6% in July 2022. The largest detractor was a Portfolio Fund focused on stressed and distressed debt, which incurred losses on several long positions that are undergoing longer-term turnarounds and/or restructurings without benefit from short positions and hedges. An equity-oriented Portfolio Fund also held back overall results within the event-driven allocation, mostly suffering from net long exposure to the market’s decline.

Relative Value

The Fund’s relative value allocation was approximately flat for the reporting period. Most of the individual Portfolio Funds in this sleeve produced small, positive returns that were uncorrelated to broader risk assets. The largest contributor was a Portfolio Fund that specializes in convertible bonds, which gained from both volatility arbitrage and credit positioning. Another contributor was a Portfolio Fund that pursues a systematic equity market-neutral strategy designed to benefit from price insensitive capital flows, such as index rebalancing activity. Losses in long/short credit strategies about offset these gains.

Global Asset Allocation

The Fund’s global macro allocation was the largest contributor to the Fund’s performance for the reporting period despite varying results among individual Portfolio Funds. A steady view that interest rates would rise more than the markets expected took the lead in terms of profits, with support from bullish positioning in commodities and commodity-linked equities, long positions in the dollar, as well as tactical trading and bets that benefited from higher realized volatility.

2

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

Fund Performance

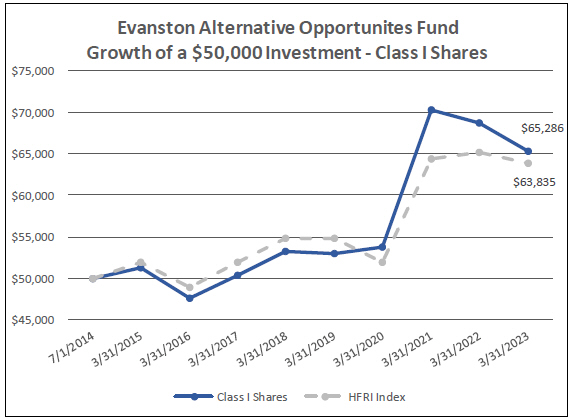

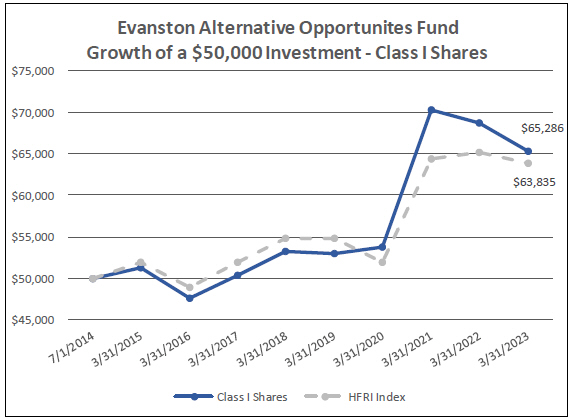

For the 12-month fiscal period ended March 31, 2023, the Fund’s Class I Shares returned -5.0%. The HFRI Index

returned -1.9%.

| | | | | | | | | | | | |

| | | 1-Year | | | 5-Year* | | | Inception* | |

| | | | |

| Fund NAV - Class I Shares | | | -5.00 | % | | | 4.15 | % | | | 3.10 | % |

| | | | |

| Fund NAV - Class A Shares | | | -5.71 | % | | | 3.37 | % | | | 3.90 | % |

| | | | |

| HFRI Index | | | -1.95 | % | | | 3.10 | % | | | 2.83 | % |

*Annualized: Inception of Class I Shares is July 1, 2014, Class A Shares is March 1, 2016

HFRI Index inception for this chart is July 1, 2014

The graph compares a hypothetical $50,000 investment in the Fund’s Class I Shares with a similar investment in the HFRI Index. The table compares an investment in the Fund’s Class I Shares and Class A Shares against the HFRI Index. The HFRI Index is an index composed of funds of hedge funds that voluntarily report their performance to Hedge Fund Research. All figures for the Fund are based on its net asset value on the last business day of the first and each subsequent fiscal year, include the reinvestment of all distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the repurchase or sale of Fund shares. The Fund’s past performance does not predict future performance.

3

| | |

| | Deloitte & Touche LLP 111 South Wacker Drive Chicago, IL 60606-4301 USA Tel: +1 312 486 1000 Fax: +1 312 486 1486 www.deloitte.com |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the shareholders and Board of Trustees of Evanston Alternative Opportunities Fund:

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities of Evanston Alternative Opportunities Fund (the “Fund”), including the schedule of investments, as of March 31, 2023, the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of March 31, 2023, and the results of its operations and its cash flows for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our procedures included confirmation of investments owned as of March 31, 2023, by correspondence with the custodian or the investment manager or administrator of the portfolio funds. We believe that our audits provide a reasonable basis for our opinion.

Chicago, Illinois

May 23, 2023

We have served as the auditor of Evanston Alternative Opportunities Fund since 2017.

4

Evanston Alternative Opportunities Fund

Statement of Assets and Liabilities

March 31, 2023

| | | | |

Assets | | | | |

| |

Cash | | $ | 2,097,671 | |

Investments in Portfolio Funds, at fair value (cost $101,406,528) | | | 108,373,485 | |

Short-term investments (cost $4,714,755) | | | 4,714,755 | |

Receivable from investments in Portfolio Funds | | | 26,215 | |

Due from the Adviser | | | 4,747 | |

Other assets | | | 3,765 | |

| | | | |

| |

Total assets | | | 115,220,638 | |

| |

Liabilities | | | | |

| |

Payable to redeeming shareholders | | | 2,664,317 | |

Capital subscriptions received in advance | | | 1,750,000 | |

Management fees payable | | | 281,357 | |

Accounts payable and accrued liabilities | | | 139,831 | |

Trustees fees payable | | | 22,500 | |

| | | | |

| |

Total liabilities | | | 4,858,005 | |

| | | | |

| |

Net assets | | $ | 110,362,633 | |

| | | | |

| |

Net assets comprised of: | | | | |

Paid in capital | | $ | 124,797,615 | |

Distributable earnings | | | (14,434,982 | ) |

| | | | |

| |

Net assets | | $ | 110,362,633 | |

| | | | |

| |

Net assets for Class I Shares | | $ | 108,573,770 | |

| | | | |

| |

Net assets for Class A Shares | | $ | 1,788,863 | |

| | | | |

| |

Class I net asset value per share (unlimited shares authorized; 12,515,061 shares issued and outstanding) | | $ | 8.68 | |

| | | | |

| |

Class A net asset value per share (unlimited shares authorized; 220,566 shares issued and outstanding) | | $ | 8.11 | |

| | | | |

See accompanying notes to financial statements.

5

Evanston Alternative Opportunities Fund

Schedule of Investments

March 31, 2023

| | | | | | | | | | | | | | | | | | | | |

| Investments in Portfolio Funds* | | First

Acquisition

Date | | | Cost | | Fair Value | | Percentage

of Net Assets | | Liquidity** | |

Event Driven(a) | | | | | | | | | | | | | | | | | | | | |

Hein Park Offshore Investors Ltd | | | 1/1/2022 | | | $ | 4,250,000 | | | $ | 3,347,849 | | | | 3.03 | % | | | Quarterly | |

Redwood Opportunity Offshore Fund, Ltd. | | | 7/1/2020 | | | | 4,000,000 | | | | 4,433,423 | | | | 4.02 | | | | Quarterly | |

Silver Point Capital Offshore Fund, Ltd. | | | 1/1/2016 | | | | 7,180,612 | | | | 9,486,068 | | | | 8.60 | | | | Annually | |

| | | | | | | | | | | | | | | | | | | | |

Total Event Driven | | | | | | | 15,430,612 | | | | 17,267,340 | | | | 15.65 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Global Asset Allocation(b) | | | | | | | | | | | | | | | | | | | | |

Rokos Global Macro Fund Limited | | | 11/1/2015 | | | | 7,312,448 | | | | 9,014,823 | | | | 8.17 | | | | Monthly | |

| | | | | | | | | | | | | | | | | | | | |

Total Global Asset Allocation | | | | | | | 7,312,448 | | | | 9,014,823 | | | | 8.17 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Long-Short(c) | | | | | | | | | | | | | | | | | | | | |

12 West Capital Fund Ltd | | | 3/1/2022 | | | | 3,600,000 | | | | 2,875,300 | | | | 2.61 | | | | Annually | |

Eversept Global Healthcare Offshore Fund, Ltd. | | | 12/1/2020 | | | | 4,150,000 | | | | 4,476,570 | | | | 4.06 | | | | Quarterly | |

Glenernie Long/Short Fund Ltd | | | 1/1/2022 | | | | 4,500,000 | | | | 3,330,552 | | | | 3.02 | | | | Quarterly | |

Matrix Capital Management Fund (Offshore) Ltd. | | | 7/1/2014 | | | | 5,638,842 | | | | 5,565,022 | | | | 5.04 | | | | Quarterly | |

Oxbow Fund (Offshore) Limited | | | 9/1/2015 | | | | 4,550,753 | | | | 4,942,498 | | | | 4.48 | | | | Quarterly | |

Pleiad Asia Offshore Feeder Fund | | | 12/1/2014 | | | | 4,095,314 | | | | 3,898,863 | | | | 3.53 | | | | Quarterly | |

Soroban Decarbonization Beneficiaries Cayman Fund Ltd. | | | 4/1/2022 | | | | 4,200,000 | | | | 3,642,196 | | | | 3.30 | | | | ****** | |

Whale Rock Flagship Fund Ltd. | | | 7/1/2014 | | | | 2,688,672 | | | | 2,277,612 | | | | 2.06 | | | | Quarterly | |

| | | | | | | | | | | | | | | | | | | | |

Total Long-Short | | | | | | | 33,423,581 | | | | 31,008,613 | | | | 28.10 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Relative Value(d) | | | | | | | | | | | | | | | | | | | | |

Boundary Creek Fund Offshore Ltd | | | 7/1/2021 | | | | 3,500,000 | | | | 3,511,596 | | | | 3.18 | | | | Quarterly | |

Dark Forest Global Equity Offshore Fund Ltd | | | 4/1/2021 | | | | 6,750,000 | | | | 7,135,418 | | | | 6.46 | | | | Quarterly | |

Iguazu Investors (Cayman), SPC | | | 7/1/2014 | | | | 1,278,071 | | | | 2,240,044 | | | | 2.03 | | | | Quarterly | |

Steelhead Pathfinder Fund Ltd. | | | 1/1/2020 | | | | 3,757,699 | | | | 4,279,347 | | | | 3.88 | | | | Monthly | |

Triton Fund, Ltd.*** | | | 7/1/2014 | | | | 69,559 | | | | 28,648 | | | | 0.03 | | | | N/A***** | |

| | | | | | | | | | | | | | | | | | | | |

Total Relative Value | | | | | | | 15,355,329 | | | | 17,195,053 | | | | 15.58 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Multi-Discipline(e) | | | | | | | | | | | | | | | | | | | | |

140 Summer Partners Offshore Ltd. | | | 2/1/2022 | | | | 5,250,000 | | | | 5,149,690 | | | | 4.67 | | | | Quarterly | |

Anchorage Capital Partners Offshore, Ltd. | | | 7/1/2014 | | | | 224,440 | | | | 324,500 | | | | 0.29 | | | | Annually | |

Castle Hook Offshore Fund Ltd. | | | 1/1/2017 | | | | 3,376,043 | | | | 4,443,986 | | | | 4.03 | | | | Quarterly | |

Crake Global Feeder Fund ICAV**** | | | 10/1/2019 | | | | 3,000,000 | | | | 4,469,582 | | | | 4.05 | | | | Monthly | |

FourSixThree Overseas Fund, Ltd. | | | 1/1/2022 | | | | 5,700,000 | | | | 5,622,095 | | | | 5.09 | | | | Quarterly | |

Sachem Head Offshore Ltd. | | | 7/1/2014 | | | | 4,788,894 | | | | 5,552,047 | | | | 5.03 | | | | Quarterly | |

TIG Zebedee Focus Fund Limited | | | 7/1/2014 | | | | 7,545,181 | | | | 8,325,756 | | | | 7.54 | | | | Monthly | |

| | | | | | | | | | | | | | | | | | | | |

Total Multi-Discipline | | | | | | | 29,884,558 | | | | 33,887,656 | | | | 30.70 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total investments in Portfolio Funds | | | | | | $ | 101,406,528 | | | | 108,373,485 | | | | 98.20 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

See accompanying notes to financial statements.

6

Evanston Alternative Opportunities Fund

Schedule of Investments (continued)

March 31, 2023

| | | | | | | | | | | | | | | | | | | | |

| Investments in short-term investments | | First

Acquisition

Date | | | Cost | | | Fair Value | | | Percentage

of Net Assets | | | Liquidity** | |

| | | | | |

Short-term investments | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Money Market Fund | | | | | | | | | | | | | | | | | | | | |

| | | | | |

BlackRock Liquidity Fund, Treasury Trust Fund

(Institutional Shares) (4,714,755 shares) | | | | | | $ | 4,714,755 | | | $ | 4,714,755 | | | | 4.27 % | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total investments in Portfolio Funds and short-term investments | | | | | | $ | 106,121,283 | | | | 113,088,240 | | | | 102.47 | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Remaining assets less liabilities | | | | | | | | | | | (2,725,607) | | | | (2.47) | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets | | | | | | | | | | $ | 110,362,633 | | | | 100.00 % | | | | | |

| | | | | | | | | | | | | | | | | | | | |

See accompanying notes to financial statements.

7

Evanston Alternative Opportunities Fund

Schedule of Investments (continued)

March 31, 2023

| | | | |

Investments by Strategy (as a percentage of total investments) |

| | | | |

Event Driven | | | 15.27 % | |

Global Asset Allocation | | | 7.97 | |

Long-Short | | | 27.42 | |

Relative Value | | | 15.20 | |

Multi-Discipline | | | 29.97 | |

Short-term investments | | | 4.17 | |

| | | | |

Total | | | 100.00 % | |

| | | | |

| * | Investments in Portfolio Funds are non-income producing. All Portfolio Funds are domiciled in the Cayman Islands, unless otherwise noted. |

| ** | Available frequency of redemptions after initial lock-up period, if any. Different tranches may have different liquidity terms and may be subject to investor level gates. Redemption notice periods range from 30 to 180 days. If applicable, the lock up period is 12-24 months. |

| *** | This Portfolio Fund is domiciled in Bermuda. |

| **** | This Portfolio Fund is domiciled in Ireland. |

| ***** | This Portfolio Fund is not redeemable; rather the Fund receives distributions through the liquidation of the underlying assets of this Portfolio Fund. |

| ****** | The term of the Portfolio Fund is December 31, 2024 and will not allow a liquidity event prior to its termination other than a Key Man or Bad Actor Event. |

| (a) | Event driven strategies involve investing in opportunities created by significant transaction events, such as spin-offs, mergers and acquisitions, and reorganizations. These strategies include but are not limited to risk arbitrage, distressed situations investing, special situations, and opportunistic investing. |

| (b) | Global asset allocation strategies seek to exploit opportunities in various global markets. Portfolio Funds employing these strategies have a broad mandate to invest in those markets and instruments which they believe provide the best opportunity. Portfolio Funds employing a global asset allocation strategy may take positions in currencies, sovereign bonds, global equities and equity indices, or commodities. |

| (c) | Long-short strategies seek to profit by taking positions in equities and generally involve fundamental analysis in the investment decision process. Portfolio Fund Managers in these strategies tend to be “stock pickers” and typically manage market exposure by shifting allocations between long and short investments depending on market conditions and outlook. Long-short strategies may comprise investments in one or multiple countries, including emerging markets and one or multiple sectors. |

| (d) | Relative value strategies seek to profit by exploiting pricing inefficiencies between related instruments while remaining long-term neutral to directional price movements in any one market. Relative value strategies consist of an exposure to some second order aspect of the market. |

| (e) | Multi-discipline managers employ a combination of any of the above mentioned strategies. |

See accompanying notes to financial statements.

8

Evanston Alternative Opportunities Fund

Statement of Operations

For the year ended March 31, 2023

| | | | |

Investment income | | | | |

Interest income | | $ | 14,755 | |

Other income | | | 9,318 | |

| | | | |

| |

Total investment income | | | 24,073 | |

| |

Expenses | | | | |

Management fees | | | 1,094,194 | |

Professional fees | | | 363,235 | |

Administration and custody fees | | | 214,474 | |

Trustees fees | | | 90,000 | |

Distribution and service fee - Class A shares | | | 15,028 | |

Other expenses | | | 185,646 | |

| | | | |

| |

Total expenses | | | 1,962,577 | |

| |

Less: expenses reimbursed by the Adviser (Note 6) | | | (294,925) | |

| | | | |

| |

Net expenses | | | 1,667,652 | |

| |

Net investment loss | | | (1,643,579) | |

| |

Realized and unrealized loss on investments in Portfolio Funds | | | | |

Net realized loss on investments in Portfolio Funds | | | (120,608) | |

Net change in unrealized appreciation/depreciation on investments in Portfolio Funds | | | (3,938,926) | |

| | | | |

| |

Net realized and unrealized loss on investments in Portfolio Funds | | | (4,059,534) | |

| | | | |

| |

Net decrease in net assets resulting from operations | | $ | (5,703,113) | |

| | | | |

See accompanying notes to financial statements.

9

Evanston Alternative Opportunities Fund

Statements of Changes in Net Assets

| | | | | | | | |

| | | For the year ended

March 31, 2023 | | | For the year ended

March 31, 2022 | |

Net decrease in net assets resulting from operations | | | | | | | | |

Net investment loss | | $ | (1,643,579) | | | $ | (1,276,590) | |

Net realized gain (loss) on investments in Portfolio Funds | | | (120,608) | | | | 1,935,240 | |

Net change in unrealized appreciation/depreciation on investments in Portfolio Funds | | | (3,938,926) | | | | (3,945,192) | |

| | | | | | | | |

| | |

Net decrease in net assets resulting from operations | | | (5,703,113) | | | | (3,286,542) | |

| | |

Shareholders’ transactions | | | | | | | | |

Class I capital subscriptions (2,547,145 and 5,356,342 shares, respectively) | | | 22,522,200 | | | | 54,005,830 | |

Class A capital subscriptions (0 and 159,621 shares, respectively) | | | – | | | | 1,530,000 | |

Class I reinvestment of distributions (0 and 765,157 shares, respectively) | | | – | | | | 7,227,371 | |

Class A reinvestment of distributions (0 and 17,436 shares, respectively) | | | – | | | | 155,415 | |

Distributions to Class I shareholders | | | – | | | | (7,327,334) | |

Distributions to Class A shareholders | | | – | | | | (155,415) | |

Class I tender offers (1,138,034 and 455,646 shares, respectively) | | | (9,785,485) | | | | (4,377,722) | |

Class A tender offers (23,921 and 0 shares, respectively) | | | (194,008) | | | | – | |

| | | | | | | | |

| | |

Net increase in net assets resulting from shareholders’ transactions (1,409,111 and 5,665,853 Class I shares, respectively and 23,921 and 177,057 Class A shares, respectively) | | | 12,542,707 | | | | 51,058,145 | |

| | | | | | | | |

| | |

Change in net assets | | | 6,839,594 | | | | 47,771,603 | |

| | |

Net assets, beginning of year (11,105,950 and 5,440,097 Class I shares, respectively and 244,487 and 67,430 Class A shares, respectively) | | | 103,523,039 | | | | 55,751,436 | |

| | | | | | | | |

Net assets, end of year (12,515,061 and 11,105,950 Class I shares, respectively and 220,566 and 244,487 Class A shares, respectively) | | $ | 110,362,633 | | | $ | 103,523,039 | |

| | | | | | | | |

See accompanying notes to financial statements.

10

Evanston Alternative Opportunities Fund

Statement of Cash Flows

For the year ended March 31, 2023

| | | | |

Operating activities | | | | |

Net decrease in net assets resulting from operations | | $ | (5,703,113) | |

Adjustments to reconcile net decrease in net assets resulting from operations to net cash used in operating activities: | | | | |

Investments in Portfolio Funds | | | (19,350,000) | |

Withdrawals from Portfolio Funds | | | 13,847,918 | |

Investments in short-term investments | | | (6,314,755) | |

Withdrawals from short-term investments | | | 1,600,000 | |

Net realized loss on investments in Portfolio Funds | | | 120,608 | |

Net change in unrealized appreciation/depreciation on investments in Portfolio Funds | | | 3,938,926 | |

Decrease in due from the Adviser | | | 27,003 | |

Increase in other assets | | | (14) | |

Increase in management fees payable | | | 28,354 | |

Decrease in accounts payable and accrued liabilities | | | (12,685) | |

| | | | |

Net cash used in operating activities | | | (11,817,758) | |

| | | | |

| |

Financing activities | | | | |

Capital subscriptions | | | 22,602,200 | |

Capital redemptions | | | (9,194,885) | |

| | | | |

Net cash provided by financing activities | | | 13,407,315 | |

| | | | |

| |

Net change in cash | | | 1,589,557 | |

Cash, beginning of year | | | 508,114 | |

| | | | |

Cash, end of year | | $ | 2,097,671 | |

| | | | |

See accompanying notes to financial statements.

11

Evanston Alternative Opportunities Fund

Financial Highlights

Class I

| | | | | | | | | | | | | | | | | | | | |

| | | For the year

ended

March 31,

2023 | | | For the year

ended

March 31,

2022 | | | For the year

ended

March 31,

2021 | | | For the year

ended

March 31,

2020 | | | For the year

ended

March 31,

2019 | |

| Net asset value per share, beginning of year | | $ | 9.13 | | | $ | 10.13 | | | $ | 9.07 | | | $ | 9.19 | | | $ | 9.67 | |

| | | | | |

| Net income (loss) from investment operations*: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.13) | | | | (0.15) | | | | (0.15) | | | | (0.13) | | | | (0.15) | |

Net realized and unrealized gain (loss) on investments | | | (0.32) | | | | (0.06) | | | | 2.91 | | | | 0.28 | | | | 0.07 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (0.45) | | | | (0.21) | | | | 2.76 | | | | 0.15 | | | | (0.08) | |

Distributions paid from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.00 | | | | (0.79) | | | | (1.70) | | | | (0.27) | | | | (0.40) | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Net asset value per share, end of year | | $ | 8.68 | | | $ | 9.13 | | | $ | 10.13 | | | $ | 9.07 | | | $ | 9.19 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total return | | | (5.00%) | | | | (2.31%) | | | | 30.86% | | | | 1.52% | | | | (0.61%) | |

| | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000s) | | $ | 108,574 | | | $ | 101,420 | | | $ | 55,100 | | | $ | 41,303 | | | $ | 43,547 | |

| | | | | |

| Portfolio turnover | | | 6.60% | | | | 17.16% | | | | 33.12% | | | | 16.16% | | | | 17.60% | |

| Ratio of expenses to average net assets before expense waiver and reimbursement** | | | 1.77% | | | | 1.83% | | | | 2.45% | | | | 2.20% | | | | 2.37% | |

| Ratio of expenses to average net assets after expense waiver and reimbursement** | | | 1.51% | | | | 1.50% | | | | 1.53% | | | | 1.50% | | | | 1.66% | |

| Ratio of net investment loss to average net assets** | | | (1.48)% | | | | (1.50%) | | | | (1.53%) | | | | (1.44%) | | | | (1.61%) | |

| * | Per share data of net income (loss) from investment operations is computed using the total of monthly income and expense divided by average beginning of month shares. |

| ** | The ratios of expenses and net investment loss to average net assets do not include the impact of expenses and incentive fees or allocations related to the Portfolio Funds. |

See accompanying notes to financial statements.

12

Evanston Alternative Opportunities Fund

Financial Highlights

Class A

| | | | | | | | | | | | | | | | | | | | |

| | | For the year

ended

March 31,

2023 | | | For the year

ended

March 31,

2022 | | | For the year

ended

March 31,

2021 | | | For the year

ended

March 31,

2020 | | | For the year

ended

March 31,

2019 | |

| Net asset value per share, beginning of year | | $ | 8.60 | | | $ | 9.66 | | | $ | 8.77 | | | $ | 8.96 | | | $ | 9.51 | |

| | | | | |

| Net income (loss) from investment operations*: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.18) | | | | (0.21) | | | | (0.22) | | | | (0.20) | | | | (0.22) | |

Net realized and unrealized gain (loss) on investments | | | (0.31) | | | | (0.06) | | | | 2.81 | | | | 0.28 | | | | 0.07 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (0.49) | | | | (0.27) | | | | 2.59 | | | | 0.08 | | | | (0.15) | |

Distributions paid from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.00 | | | | (0.79) | | | | (1.70) | | | | (0.27) | | | | (0.40) | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Net asset value per share, end of year | | $ | 8.11 | | | $ | 8.60 | | | $ | 9.66 | | | $ | 8.77 | | | $ | 8.96 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total return** | | | (5.71%) | | | | (3.04%) | | | | 29.88% | | | | 0.77% | | | | (1.35%) | |

| | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000s) | | $ | 1,789 | | | $ | 2,103 | | | $ | 651 | | | $ | 163 | | | $ | 216 | |

| | | | | |

| Portfolio turnover | | | 6.60% | | | | 17.16% | | | | 33.12% | | | | 16.16% | | | | 17.60% | |

| Ratio of expenses to average net assets before expense waiver and reimbursement*** | | | 2.89% | | | | 3.07% | | | | 5.85% | | | | 6.49% | | | | 6.73% | |

| Ratio of expenses to average net assets after expense waiver and reimbursement*** | | | 2.25% | | | | 2.24% | | | | 2.29% | | | | 2.25% | | | | 2.40% | |

| Ratio of net investment loss to average net assets*** | | | (2.23%) | | | | (2.24%) | | | | (2.29%) | | | | (2.19%) | | | | (2.35%) | |

| * | Per share data of net income (loss) from investment operations is computed using the total of monthly income and expense divided by average beginning of month shares. |

| ** | Sales loads applicable to Class A shares are not reflected in the total return. |

| *** | The ratios of expenses and net investment loss to average net assets do not include the impact of expenses and incentive fees or allocations related to the Portfolio Funds. |

See accompanying notes to financial statements.

13

Evanston Alternative Opportunities Fund

Notes to Financial Statements

For the year ended March 31, 2023

Evanston Alternative Opportunities Fund (the “Fund”) was formed on October 16, 2013 as a Delaware statutory trust that is registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund is a closed-end, non-diversified, management investment company and commenced operations on July 1, 2014. The Fund’s investment objective is to seek attractive long-term risk adjusted returns. The Fund is a “fund of funds” formed to invest substantially all of its assets in investment vehicles often referred to as hedge funds (“Portfolio Funds”) that are managed by independent investment managers (“Portfolio Fund Managers”).

Evanston Capital Management, LLC (the “Adviser”), a Delaware limited liability company, serves as the Fund’s investment adviser and is responsible for the day-to-day management of the Fund and for investing the Fund’s assets in various Portfolio Funds, subject to policies adopted by the Board of Trustees of the Fund (the “Board”). The Board provides broad oversight over the operations and affairs of the Fund. The Adviser is registered as an investment adviser under the Investment Advisers Act of 1940, as amended.

| 2. | Significant Accounting Policies |

Basis of Accounting — The financial statements are prepared in accordance with U.S. generally accepted accounting principles (“US GAAP”). The Fund is an investment company and follows the accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946 – Financial Services – Investment Companies.

Income Recognition and Expenses — All investment transactions are recorded on the trade date. Realized gains and losses on investments in Portfolio Funds are determined using the average cost method. Interest income and expenses are recognized on an accrual basis. Income, expenses, gains and losses are allocated pro rata to each of the share classes in the Fund based on each class’s beginning net asset value, except those expenses that are specifically attributable to a share class are allocated solely to such class.

Use of Estimates — The preparation of the financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

Taxes — The Fund is classified as a corporation for federal income tax purposes and qualifies to be taxed as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”).

The Fund generally invests its assets in foreign corporations that are classified as passive foreign investment companies (“PFICs”). The Fund has elected to have a tax year end of October 31. The Fund intends to distribute to its shareholders all of its distributable net investment income and net realized gains on investments in Portfolio Funds. In addition, the Fund intends to make distributions as required to avoid excise taxes. Accordingly, no provision for U.S. federal income or excise tax has been recorded in these financial statements.

FASB ASC Topic 740 - Income Taxes, provides guidance on how uncertain tax positions should be recognized, measured, presented, and disclosed in the financial statements. This standard defines the threshold for recognizing the benefits of tax-return positions in the financial statements as “more-likely-than-not” to be sustained by the taxing authority and requires measurement of a tax position meeting the more-likely-than-not criterion based on the largest benefit that is more than 50 percent likely to be realized. The Fund has not

14

Evanston Alternative Opportunities Fund

Notes to Financial Statements

For the year ended March 31, 2023

| 2. | Significant Accounting Policies (continued) |

taken any tax positions that do not meet the more-likely-than-not threshold. Therefore, no additional tax expense, including any interest or penalties, was recorded for the year ended March 31, 2023. To the extent the Fund is required to record interest and penalties, they would be included in interest expense and other expenses, respectively, in the Statement of Operations.

Certain tax years remain subject to examination by the Internal Revenue Service and taxes associated with State and foreign jurisdictions remain subject to examination based on varying statutes of limitations.

Dividend Reinvestment Plan — Pursuant to the Fund’s Dividend Reinvestment Plan (“DRP”), each Shareholder will automatically be a participant under the DRP and all income distributions, whether dividend distributions and/or capital gains distributions, will automatically be reinvested in the Fund. Shareholders who affirmatively choose not to participate in the DRP will receive any income distributions, whether dividend distributions and/or capital gains distributions, in cash.

Net Asset Value Determination — The net asset value (“NAV”) of the Fund is determined as of the close of business on the last day of each month pursuant to the Adviser’s valuation policies and procedures with respect to the Fund, which have been approved by the Board.

Investments in Portfolio Funds — The Fund values investments in Portfolio Funds at fair value in good faith, generally at the Fund’s pro rata interest in the net assets of these entities. Investments held by these Portfolio Funds are valued at prices that approximate fair value. The fair value of certain of the investments held by these Portfolio Funds, which may include private placements and other securities for which values are not readily available, are determined in good faith by the Portfolio Fund Managers of the respective Portfolio Funds. The estimated fair values may differ significantly from the values that would have been used had a ready market existed for these investments, and these differences could be material. Net asset valuations are provided monthly by these Portfolio Funds. Gain (loss) on investments in Portfolio Funds is net of all fees and allocations payable to the Portfolio Fund Managers of the Portfolio Funds.

Capital Subscriptions Received in Advance — Capital subscriptions received in advance represent cash receipts from shareholders received on or prior to March 31, 2023 for which shares were issued on April 1, 2023.

As of March 31, 2023, gross unrealized appreciation and depreciation of the Fund’s investments, based on cost for federal income tax purposes were as follows:

| | | | |

Cost of investments | | $ | 115,890,514 | |

| | | | |

| |

Gross unrealized appreciation | | $ | 11,221,517 | |

Gross unrealized depreciation | | | (18,738,546) | |

| | | | |

| |

Net unrealized appreciation/(depreciation) on investments | | $ | (7,517,029) | |

| | | | |

The difference between cost amounts for financial statement and federal income tax purposes is due primarily to timing differences in recognizing certain gains and losses in security transactions.

15

Evanston Alternative Opportunities Fund

Notes to Financial Statements

For the year ended March 31, 2023

| 3. | Income Taxes (continued) |

The tax basis of distributable earnings as of October 31, 2022, the Fund’s last tax year, shown below represent distribution requirements met by the Fund subsequent to the fiscal tax year end in order to satisfy income tax regulations and losses the Fund may be able to offset against income and gains realized in future years. The capital loss carryforward is not subject to expiration and will be utilized to offset future realized gains. The capital loss carryforward will reduce the Fund’s taxable income arising from future net realized gains on investments, if any, to the extent permitted by the Code, and thus will reduce the amount of the distributions to shareholders which would otherwise be necessary to relieve the Fund of any liability for federal tax:

| | | | | | | | |

Undistributed

Ordinary

Income | | Capital Loss

Carryforward | | | Net Unrealized

Appreciation/

(Depreciation) | |

| | |

| $ 0 | | $ | (4,271,094) | | | $ | (8,170,794) | |

Permanent book-to-tax basis differences resulted in the reclassification of amounts stated below as of October 31, 2022, the Fund’s tax year end, between accumulated net investment loss, accumulated net realized loss from investments in Portfolio Funds and paid in capital reported on the Fund’s Statement of Assets and Liabilities as of March 31, 2023. Such permanent reclassifications are attributable to the Fund’s net operating loss and characterization of distributions. Net assets and NAV per Share were not affected by these reclassifications.

| | | | | | | | |

Accumulated Net

Investment Loss | | | Accumulated Net

Realized Loss | | Paid in Capital | |

| | |

| $ | 2,130,694 | | | $ 0 | | $ | (2,130,694) | |

Dividends and Distributions to Shareholders — Net investment income dividends and capital gains distributions are determined in accordance with income tax regulations, which may differ from US GAAP. If the total dividends and distributions made in any tax year exceed net investment income and accumulated realized capital gains, a portion of the total distribution may be treated as a return of capital for tax purposes.

Distribution of Income and Gains — The Fund declares and distributes dividends from net investment income and net realized gains, if any, on an annual basis. The tax character of distributions paid for the fiscal year ended March 31, 2023 and March 31, 2022 was as follows:

Ordinary income: $0 and $7,482,749, respectively

| 4. | Investments by the Fund |

Portfolio Fund Managers, who operate Portfolio Funds in which the Fund invests, receive fees for their services. The fees include management and incentive fees or allocations based upon the net asset value of the Fund’s investment. These fees are deducted directly from the Portfolio Fund’s assets in accordance with the governing documents of the Portfolio Fund. During the year ended March 31, 2023, the fees for these services range from 0.45% to 2.0% per annum for management fees and 5% to 35% for incentive fees or allocations. In certain cases, the incentive fees or allocations may be subject to a hurdle rate.

16

Evanston Alternative Opportunities Fund

Notes to Financial Statements

For the year ended March 31, 2023

| 4. | Investments by the Fund (continued) |

Based on the information the Adviser typically receives from the Fund’s Portfolio Funds, the Fund is unable to determine on a look-through basis if any investments, on an aggregate basis, held by the Portfolio Funds represent greater than 5% of the Fund’s net assets.

The Fund has no unfunded capital commitments to Portfolio Funds as of March 31, 2023.

The Fund offered Class I shares of beneficial interests to investors at an initial price of $10.00 per Share. As of June 1, 2015, the Fund offers two separate classes of Shares designated as Class A (“Class A Shares”) and Class I (“Class I Shares” and together with the Class A Shares, the “Shares”). Class A Shares and Class I Shares are subject to different fees and expenses. All Shares issued prior to June 1, 2015 have been designated as Class I Shares in terms of rights accorded and expenses borne. Foreside Fund Services, LLC (the “Distributor”) acts as the distributor of the Shares, on a best efforts basis, subject to various conditions. Shares of the Fund may be purchased from the Fund or through advisers, brokers, and dealers that have entered into selling agreements with the Distributor. Shares are offered and may be purchased on a monthly basis.

The Shares are sold at the current NAV per Share as of the date on which the purchase is accepted. Each investor will be required to represent that they are acquiring Shares directly or indirectly for the account of an eligible investor, which is limited to accredited investors as defined in Regulation D under the Securities Act of 1933, as amended. The minimum initial investment in the Fund is $50,000, and the minimum additional investment in the Fund is $10,000. The Fund may accept investments for a lesser amount under certain circumstances, as determined by the Adviser. Certain selling brokers or dealers and financial advisers may impose higher minimum investment levels, or other requirements. Class A Shares may be subject to a sales load of up to 3%. Such sales load will be subtracted from the investment amount and will not form part of an investor’s investment in the Fund. The sales load may be waived for institutional investors, employees of the Adviser, the Distributor or a financial intermediary and their affiliates and members of their immediate families, and such other persons at the discretion of the Adviser.

Because the Fund is a closed-end fund, shareholders do not have the right to require the Fund to repurchase any or all of their Shares. At the discretion of the Board, the Fund intends to provide a limited degree of liquidity to shareholders by conducting repurchase offers generally quarterly. In determining whether the Fund should repurchase Shares from shareholders pursuant to written tenders, the Board will consider a variety of factors. In each repurchase offer, the Fund may offer to repurchase its Shares at their NAV per Share as determined as of approximately March 31, June 30, September 30, and December 31, of each year, as applicable (each, a “Valuation Date”). The expiration date of the repurchase offer (the “Expiration Date”) will be a date set by the Board occurring no sooner than twenty (20) business days after the commencement date of the repurchase offer and at least ten (10) business days from the date that notice of an increase or decrease in the percentage of the securities being sought or consideration offered is first published, sent, or given to shareholders. The Expiration Date may be extended by the Board in its sole discretion. The Fund generally will not accept any repurchase request received by it or its designated agent after the Expiration Date. Each repurchase offer ordinarily will be limited to the repurchase of approximately 5-25% of the Shares outstanding, but if the value of Shares tendered for repurchase exceeds the value the Fund intended to repurchase, the Fund may determine to repurchase less than the full number of Shares tendered. In such event, shareholders will have their Shares repurchased on a pro rata basis, and tendering shareholders will not

17

Evanston Alternative Opportunities Fund

Notes to Financial Statements

For the year ended March 31, 2023

| 5. | Share Capital (continued) |

have all of their tendered Shares repurchased by the Fund. Shareholders tendering Shares for repurchase will be asked to give written notice of their intent to do so by the date specified in the notice describing the terms of the applicable repurchase offer.

If the interval between the date of purchase of Shares and the date in which Shares are repurchased is less than one year then such repurchase will be subject to a 3.00% early withdrawal fee payable to the Fund. There were $9,318 in withdrawal fees charged to shareholders during the fiscal year. In determining whether the repurchase of Shares is subject to an early withdrawal fee, the Fund will repurchase those Shares held longest first.

In connection with the Class A Shares of the Fund, the Fund pays the Distributor or a designee a distribution and service fee equal to 0.75% per annum of the aggregate value of the Fund’s Class A Shares outstanding, determined as of the last calendar day of each month (prior to any repurchases of Class A Shares and prior to the Management Fee being calculated) (“Distribution and Service Fee”). The Distribution and Service Fee is payable quarterly.

| 6. | Management Fee and Related Party Transactions |

In consideration of the management services the Adviser provides to the Fund, the Fund pays the Adviser a quarterly fee (the “Management Fee”). From July 1, 2015 through December 31, 2018 the Management Fee was computed at an annual rate of 1.20% of the aggregate value of the Fund’s outstanding Shares determined as of the last calendar day of each month and payable quarterly (before any repurchases of Shares and prior to the Management Fee being calculated). Effective as of January 1, 2019 the Management Fee was reduced to 1.00% per annum.

Through December 31, 2018, the Adviser contractually agreed to limit the total annualized operating expenses of the Fund (exclusive of any borrowing and investment-related costs and fees, taxes, extraordinary expenses, and the fees and expenses associated with the underlying Portfolio Funds) to 1.70% with respect to the Class I Shares and 2.45% with respect to the Class A Shares (due to Distribution and Service Fee). From January 1, 2019 up to and including July 31, 2023, the annualized operating expense limits have been reduced commensurate with the Management Fee reduction for Class I Shares and Class A Shares to 1.50% and 2.25%, respectively (the “Expense Limitation Agreement”). Thereafter, the Expense Limitation Agreement shall automatically renew for one-year terms and may be terminated by the Adviser or the Fund upon thirty (30) days’ prior written notice to the other party. In addition, the Adviser is permitted to recover from the Fund expenses it has borne (whether through reduction of its Management Fee or otherwise) in later periods to the extent that the Fund’s expenses fall below the annual rate of 1.50% with respect to the Class I Shares or 2.25% with respect to the Class A Shares. Moreover, pursuant to certain prior expense limitation agreements (each, a “Prior Expense Limitation Agreement”), the Adviser is permitted to recover fees and expenses it has waived or borne pursuant to such Prior Expense Limitation Agreement from the applicable class or classes of Shares (whether through reduction of its fees or otherwise) to the extent that the Fund’s expenses with respect to the applicable class of Shares fall below the annual rate set forth in such Prior Expense Limitation Agreement pursuant to which such fees and expenses were waived or borne; provided, however, that the Fund is not obligated to pay any such reimbursed fees or expenses more than three years after the date on which the fee or expense was borne by the Adviser. Any such recovery by the Adviser will not cause the Fund to exceed the annual limitation rate (1.50% and 2.25%, respectively) set forth above. For the year ended March 31, 2023, operating expenses reimbursed by the Adviser were $294,925, but are subject to recapture.

18

Evanston Alternative Opportunities Fund

Notes to Financial Statements

For the year ended March 31, 2023

| 6. | Management Fee and Related Party Transactions (continued) |

As of March 31, 2023, no amounts were recaptured. The amount subject to potential future recapture by the Adviser is $996,365. Such potential future recaptures will expire as follows:

| | | | |

| Subject to expiration in the year ended: | | Amount | |

| |

March 31, 2024 | | $ | 410,266 | |

March 31, 2025 | | | 291,174 | |

March 31, 2026 | | | 294,925 | |

| | | | |

| | $ | 996,365 | |

| | | | |

Of the $294,925 reimbursed by the Adviser for the year ended March 31, 2023, $4,747 is due from the Adviser as of March 31, 2023.

Compensation to the Trustees of the Fund during the year ended March 31, 2023 was $90,000. No fees were paid by the Fund to the Interested Trustee or Officers. As of March 31, 2023, related parties of the Adviser held Shares in the Fund that comprise 1% of total net assets.

| 7. | Administrative Services, Line of Credit and Custody Agreements |

BNY Mellon Investment Servicing (US) Inc. provides certain administrative services to the Fund.

The Fund was a party to a note purchase agreement (the “Prior Facility”) with an unaffiliated lender. The Prior Facility provided for a total commitment of $5 million. As of October 18, 2022, the Prior Facility was terminated and the Fund entered into a credit agreement (the “Current Facility”) with a different unaffiliated lender (the “Lender”). The Current Facility provides for a total commitment of $5 million and is set to expire on October 17, 2023. Subject to certain events of default and other financial conditions set forth in the Current Facility, the Fund is permitted to draw on the Current Facility in an amount equal to the lesser of (i) the maximum commitment amount and (ii) the borrowing base. Funds drawn under the Current Facility are generally used to finance short-term timing differences between (a) the repurchases requested from the Fund’s shareholders and redemptions requested by the Fund from its Portfolio Funds and (b) investments in the Fund’s Portfolio Funds while waiting for subscription proceeds from the Fund’s shareholders or redemption proceeds from Portfolio Funds.

Under the Current Facility, the fee on unused amounts is equal to 0.40% per annum and the interest rate for funds drawn is equal to either the Secured Overnight Financing Rate (“SOFR”) or one month term SOFR, as selected by the Fund, plus 1.45% per annum, in each case. There was no outstanding balance under the Current Facility as of March 31, 2023.

The Fund has entered into a Global Custody Agreement with The Bank of New York Mellon (the “Custodian”) as custodian for the Fund’s securities and other assets registered in the name of the Custodian (or its nominees). In order to secure the Fund’s obligations under the Current Facility, the Fund has pledged and granted a security interest to the Lender (i) in the custodial account maintained with the Custodian in which investments in Portfolio Funds are to be credited, (ii) in the Fund’s securities entitlements with respect to all investments credited to such custodial account and (iii) in other assets of the Fund.

19

Evanston Alternative Opportunities Fund

Notes to Financial Statements

For the year ended March 31, 2023

| 8. | Securities Transactions |

Aggregate purchases and proceeds from sales of Portfolio Funds for the year ended March 31, 2023 amounted to $24,350,000 and $6,999,160, respectively.

In accordance with Accounting Standards Update (“ASU”) 2015-07, Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent), investments in Portfolio Funds valued at NAV are not required to be included in the fair value hierarchy. As such, investments in Portfolio Funds with a fair value of $108,373,485 are excluded from the fair value hierarchy as of March 31, 2023.

As of March 31, 2023, the Fund held $4,714,755 in short-term investments in a money market fund which is categorized as Level 1. In accordance with FASB ASC Topic 820, Fair Value Measurement, Level 1 refers to identical securities traded in an active market. Such securities are traded on national exchanges and are valued at the closing sales price or, if there are no sales, at the latest bid quotations.

For the year ended March 31, 2023, the Fund had no direct commitments to purchase or sell securities, financial instruments, or commodities relating to derivative financial instruments. The Fund may have indirect commitments that arise through positions held by Portfolio Funds in which the Fund invests. However, as a shareholder in these Portfolio Funds, the Fund’s risk is limited to the current value of its investment, which is reflected in the Statement of Assets and Liabilities and the Schedule of Investments.

The Adviser has no knowledge of any financial institution, brokerage firm, or other trading counterparty with which the Fund had a concentration of direct credit risk relating to any direct trading activity for the year ended March 31, 2023.

The Fund and the Portfolio Funds may be involved in certain legal actions in the ordinary course of their businesses. The Adviser is not currently aware of any such actions that will have a material adverse effect on the net assets or results of the operation of the Fund. In addition, the Fund enters into contracts that contain a variety of indemnifications. The Fund’s maximum exposure under these agreements, if any, is unknown. However, the Fund has not had any prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

Management has evaluated the impact of all subsequent events of the Fund through May 23, 2023, the date the financial statements were issued and determined that there were no material events that would require adjustment to or disclosure in the financial statements through this date, other than discussed below.

On May 3, 2023, the amount due from the Adviser was settled.

20

Evanston Alternative Opportunities Fund

Supplemental Information (Unaudited)

Board of Trustees’ Consideration of Investment Management Agreement with the Adviser

The 1940 Act requires that the Board of the Fund, including a majority of the members of the Board who are not affiliated with the Adviser (“Independent Trustees”), voting separately, approve the continuance of the Investment Management Agreement between the Fund and the Adviser, as investment adviser.

At the in-person meeting of the Board on December 14, 2022 (the “Board Meeting”), the Board considered the continuance of the Investment Management Agreement between the Fund and the Adviser for an additional one year period. The Board was assisted in its review by K&L Gates LLP, the Fund’s outside counsel. Prior to the Board Meeting, the Independent Trustees met telephonically with K&L Gates LLP to discuss the process and the appropriate factors to consider when determining whether to approve the continuance of the Investment Management Agreement. The Independent Trustees also met with K&L Gates LLP at the Board Meeting in the executive session separate from the representatives of the Adviser. In connection with the Board’s consideration of the approval of the continuance of the Investment Management Agreement, the Adviser provided certain materials and information reasonably necessary for the Board to evaluate the terms of the Investment Management Agreement (the “Adviser Materials”).

In connection with the Board’s consideration of approving the continuance of the Investment Management Agreement, the Board noted that all facts and circumstances surrounding the Adviser’s relationship with the Fund are appropriate for consideration but that the most relevant factors generally are the following: (1) the nature, extent, and quality of the services provided by the Adviser; (2) the Fund’s investment performance; (3) a comparative analysis of advisory fees paid by, and the expense ratios of other similar funds; (4) the costs of the services provided and the resulting profits realized by the Adviser from its relationship with the Fund, including the extent to which the Adviser has realized economies of scale through growth of Fund assets; (5) whether economies of scale actually achieved or that may potentially be achieved suggest that a contract should contain breakpoints so that shareholders obtain the benefits of such economies of scale; and (6) other sources of revenue and intangible benefits to the Adviser from its relationship with the Fund. A presentation was made by the Adviser at the Board Meeting regarding the services provided by the Adviser pursuant to the Investment Management Agreement, including, but not limited to, the Adviser’s selection and review process of Portfolio Funds. Through this presentation, the pre-Board Meeting conference call with K&L Gates LLP, and the Adviser Materials, the Board received and considered information regarding the nature, extent and quality of the services provided to the Fund by the Adviser.

The Board reviewed the investment objective and policies of the Fund with the Adviser and the experience, qualifications, backgrounds and responsibilities of the Adviser’s senior investment professionals who are primarily responsible for the Fund’s portfolio management. The Board also considered the Adviser’s role in supervising third-party fund service providers and providing related services and assistance in meeting legal and regulatory requirements. The Board discussed the ability of the Adviser to manage the Fund’s investments in accordance with the Fund’s stated investment objectives and policies, as well as the services provided by the Adviser to the Fund that are necessary for the operation of the Fund. The Board considered the benefits that the Fund derives from the resources available to the Adviser.

The Board also reviewed with the Adviser a presentation of the Fund’s performance as compared to a group of other registered funds of hedge funds that have objectives and strategies that are similar to those of the Fund. Among other things, the Board was provided with performance data versus a peer group of similar registered closed-end funds-of-hedge funds for the fiscal years ended 2018 through 2022, as well as the 5-year return of each fund. The Board noted that the Fund, as compared to the peer group, generally outperformed in the long term. The peer group performance was obtained from publicly available sources and measured as of each such peer group fund’s most recent fiscal year end.

21

Evanston Alternative Opportunities Fund

Supplemental Information (Unaudited)

Board of Trustees’ Consideration of Investment Management Agreement with the Adviser

In addition, the Board reviewed and considered a chart setting forth the fee structure of other similar registered funds of hedge funds (the “Fee Comparison Chart”). The Board reviewed and discussed the fees and the expense ratio of the Fund, as well as the fees and expense ratios of these other similar funds, as set forth in the Fee Comparison Chart. The Board determined that the Management Fee for the Fund was within the range of the management fees associated with these similar funds. The Board compared the Fund’s expense ratio to these comparable funds and considered the Adviser’s willingness to contractually cap certain operating expenses of the Fund. The Board determined that the expense ratio was within range of the expense ratios of similar funds, after taking into account the effects of the current expense waiver. After review, the Board concluded that the expense ratio for the Fund was appropriate.

The Board reviewed information prepared by the Adviser concerning any profits realized by it with respect to the Fund. The Board noted that the Adviser is responsible for all salaries and employee benefit expenses of its employees and any of its affiliates involved in the management and conduct of the Fund’s business and affairs and related overhead (including rent and other similar items). As such, the Fund will not be responsible for these expenses. In evaluating the profitability of the Adviser with respect to the Fund, the Board took into account the expenses borne by the Adviser, the Expense Limitation Agreement and the Adviser’s resources utilized in managing the Fund. The Board also observed that the Adviser believes the Fund will be reasonably profitable to the Adviser over the long term, notwithstanding that, given the size of the Fund, the Adviser does not expect to generate significant profits from advising the Fund until its size increases substantially.

The Board considered whether there have been economies of scale in respect of the management of the Fund, whether the Fund has appropriately benefited from any economies of scale, and whether there is potential for realization of any further economies of scale. The Adviser stated that as the assets of the Fund increase over time, the Fund and its Shareholders may realize economies of scale as certain expenses become a smaller percentage of overall assets. However, the Board noted that the Adviser had not incorporated any breakpoints to reflect the potential for reducing the Management Fee as assets grow. The Board determined that, because of the Fund’s asset size and the revenues expected to be generated, the Board did not believe breakpoints were appropriate at this time.

The Board also considered so-called “fall-out” or ancillary benefits to the Adviser as a result of its relationship with the Fund. Although the Board acknowledged that the Fund enhances the line of investment products managed by the Adviser and therefore the Adviser’s management of the Fund may increase the amount of assets managed and revenue generated by the Adviser, based on the profits realized by the Adviser, the Adviser does not expect to receive any significant indirect benefits from managing the Fund.

Based on its discussions and considerations as described above, the Board made the following conclusions and determinations:

● The Board concluded that the nature, extent and quality of the services to be provided by the Adviser would be adequate and appropriate, noting the benefits of the Adviser’s investment process and portfolio management and other services to be provided by the Adviser.

● The Board concluded that the performance of the Fund and the Adviser was reasonable, in light of other considerations, to support the continuation of the Investment Management Agreement.

● The Board concluded that the Fund’s Management Fee to be paid to the Adviser was reasonable in light of the considerations discussed above.

22

Evanston Alternative Opportunities Fund

Supplemental Information (Unaudited)

Board of Trustees’ Consideration of Investment Management Agreement with the Adviser

● The Board concluded that the Fund’s profitability to the Adviser from its relationship with the Fund was reasonable, in light of other considerations, to support the continuation of the Investment Management Agreement.

● The Board recognized that, given the Fund’s assets, significant economies would not be realized until the size of the Fund increases.

At the Board Meeting, the Board considered these conclusions and determinations in their totality and, without any one factor being dispositive, determined that approving the continuance of the Investment Management Agreement, in light of a weighing and balancing of all factors considered and in the exercise of the Trustees’ business judgment, was in the best interests of the Fund and its Shareholders, and the Board approved the continuance of the Investment Management Agreement, at the Board Meeting for an additional twelve month period.

23

Evanston Alternative Opportunities Fund

Supplemental Information (Unaudited)

Trustees’ and Officers’ Biographical Data

The identity of, and brief biographical information regarding, each Independent Trustee is set forth below. The business address of each Trustee is care of Evanston Capital Management, LLC, 1560 Sherman Avenue, Suite 960, Evanston, Illinois 60201.

| | | | | | | | | | |

| INDEPENDENT TRUSTEES*** |

Name

and Age | | Position(s) with the Fund and Length of Time Served | | Term of

Office | | Principal Occupation(s) During Past 5 Years | | Number of Portfolios in Fund Complex* Overseen By Trustee | | Other Directorships

Held by Trustee

During the Last Five

Years |

| Robert Moyer Age: 76 | | Trustee since February 2014 | | Perpetual until resignation or removal | | Retired. Formerly President and Chief Executive Officer of Driehaus Capital Management, Inc. (an investment adviser) and Driehaus Securities Corporation (a mutual fund distributor). | | 1 | | N/A |

| Ingrid Stafford Age: 69 | | Trustee since February 2014 | | Perpetual until resignation or removal | | Retired. Northwestern University, 1977-2019; Senior Advisor, 2018- 2019; Vice President for Financial Operations & Treasurer, 2014- 2018; Associate Vice President for Financial Operations & Treasurer, 2006-2014. | | 1 | | Wintrust, Inc. (1998- 2021); Wintrust Bank (1994-present); Wintrust Wealth (2021- present); Evangelical Lutheran Church in America (2013-2019); Evangelical Lutheran Church in America Foundation (2021- present) |

William Adams IV Age: 67 | | Trustee since May 2020 | | Perpetual until resignation or removal | | Retired. Formerly Senior Adviser (2017), Co-Chief Executive Officer and Co-President (2016- 2017), Senior Executive Vice President, Global Structured Products (2010-2016) of Nuveen Investments, Inc.; Executive Vice President (2017) of Nuveen, LLC; Co-President, Global Products and Solutions (2017), Co-Chief Executive Officer (2016-2017) of Nuveen Securities, LLC; Co- President (2011-2017) of Nuveen Fund Advisors, LLC; President (2011-2017) of Nuveen Commodities Asset Management, LLC | | 1 | | Nuveen Investments, Inc. (179 open-end and closed-end mutual funds) (2013-2017); Chicago Symphony Orchestra; Gilda’s Club Chicago |

24

Evanston Alternative Opportunities Fund

Supplemental Information (Unaudited)

Trustees’ and Officers’ Biographical Data (continued)

| | | | | | | | | | |

| INTERESTED TRUSTEE** AND OFFICERS*** |

Name and Age | | Position(s) with the Fund and Length of Time Served | | Term of Office | | Principal Occupation(s)

During Past 5 Years | | Number of Portfolios in Fund Complex* Overseen By Trustee | | Other Directorships Held by Trustee During the Last Five Years |

| Kenneth A. Meister ** Age: 54 | | Trustee since 2014, President and Principal Executive Officer since 2013 | | Perpetual until resignation or removal | | President (since January 2013) and Chief Operating Officer of Evanston Capital Management, LLC | | 1 | | Ravinia Festival Association (Dec 2017 - Present) |

Brian Lease Age: 38 | | Treasurer and Principal Financial Officer since 2021 | | Perpetual until resignation or removal | | Chief Financial Officer of Evanston Capital Management, LLC (January 2021-present); Managing Director, Accounting and Finance of Evanston Capital Management, LLC (February 2019-December 2020); Vice President, Fund Controller of Evanston Capital Management, LLC (May 2015-January 2019) | | N/A | | N/A |

| Scott Zimmerman Age: 46 | | Secretary and Chief Legal Officer since 2013 | | Perpetual until resignation or removal | | General Counsel of Evanston Capital Management, LLC | | N/A | | N/A |

Melanie Lorenzo Age: 43 | | Chief Compliance Officer since 2013 | | Perpetual until resignation or removal | | Associate General Counsel and Chief Compliance Officer of Evanston Capital Management, LLC | | N/A | | N/A |

* “Fund Complex” means two or more registered investment companies that hold themselves out to investors as related companies for purposes of investment and investor services, or that have a common investment adviser or have an investment adviser that is an affiliated person of the investment adviser of any of the other registered investment companies. There are no other funds in the Fund Complex.

** An Interested Trustee is a Trustee of the Fund who is an “interested person” as defined by the 1940 Act.

25

Evanston Alternative Opportunities Fund

Supplemental Information (Unaudited)

Trustees’ and Officers’ Biographical Data (continued)

*** Additional information about the Trustees and Officers is available in the Fund’s Statement of Additional Information, which can be obtained upon request and without charge by writing to the Fund at Evanston Alternative Opportunities Fund, c/o BNY Mellon Investment Servicing (US) Inc., 400 Bellevue Parkway, Wilmington, Delaware 19809, by calling the Fund at 1-877-356-6316, or on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

Additional Information

Proxy Voting

A description of the Fund’s proxy voting policies and procedures and the Fund’s portfolio securities voting record during the prior twelve month period ending June 30 of each year is available without charge, upon request, by calling the Fund at 1-877-356-6316 and on the SEC web site at http://www.sec.gov.

Filing of Quarterly Schedule of Portfolio Holdings (“FORM N-PORT”)

In addition to the Schedule of Investments provided in each semi-annual and annual report, the Fund files a complete schedule of its portfolio holdings with the SEC on Form N-PORT as of the end of each fiscal quarter. The Fund’s Forms N-PORT are available on the SEC’s website at http://www.sec.gov and also may be reviewed and copied at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information on the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330.

26

(b) Not applicable

Item 2. Code of Ethics.

| | (a) | The Registrant, as of the end of the period covered by this report, has adopted a code of ethics that applies to the Registrant’s principal executive officer and principal financial officer. |

| | (b) | No item to be disclosed pursuant to this paragraph. |

| | (c) | During the period covered by this report, the Registrant did not amend provisions of its Code of Ethics that applies to the Registrant’s principal executive officer and principal financial officer. A copy of the Registrant’s Code of Ethics is filed herewith. |

| | (d) | The Registrant has not granted any waivers, including an implicit waiver, from a provision of the code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the Registrant or a third party, that relates to one or more of the items set forth in paragraph (b) of this item’s instructions. |

| | (f) | The Registrant’s Code of Ethics that applies to the Registrant’s principal executive officer and principal financial officer is attached hereto as Exhibit (a)(1) pursuant to Item 13(a)(1). |

Item 3. Audit Committee Financial Expert.

As of the end of the period covered by the report, the Registrant’s board of trustees has determined that Ingrid Stafford is qualified to serve as an audit committee financial expert serving on its audit committee and that she is “independent,” as defined by Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Audit Fees

| | (a) | The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the Registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are $43,000 for 2023 and $40,000 for 2022. |

Audit-Related Fees

| | (b) | The aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the Registrant’s financial statements and are not reported under paragraph (a) of this Item are $2,500 for 2023 and $2,500 for 2022. This represents the cost of the consent of the independent registered public accounting firm for the N-2. |

Tax Fees

| | (c) | The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning are $0 for 2023 and $0 for 2022. |

All Other Fees

| | (d) | The aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item are $0 for 2023 and $0 for 2022. |

| | (e)(1) | Disclose the audit committee’s pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X. |