UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Schedule 14A Information

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to §240.14a-12

Blue Bird Corporation

(Name of registrant as specified in its charter)

____________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

þ No fee required.

o Fee paid previously with preliminary materials.

o Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a(6)(i)(1) and 0-11.

January 27, 2025

Dear Fellow Stockholder:

You are hereby invited to attend the 2025 Annual Meeting of Stockholders, which will be held at 9:00 a.m. local time on Friday, March 14, 2025, at the Company’s corporate headquarters, 3920 Arkwright Road, Suite 200, Macon, Georgia 31210.

.

The accompanying Notice of the Annual Meeting, Notice of Internet Availability of Proxy Materials and Proxy Statement provide important information about the meeting and will serve as your guide to the business to be conducted at the meeting.

The Internet will be the primary means by which we furnish proxy materials to our stockholders. We will send stockholders a notice with instructions for how to access these materials. The notice will also include information for obtaining paper copies of our proxy materials if stockholders choose to do so. This process lowers costs and saves paper, adding convenience for stockholders and contributing to our sustainability efforts.

Your vote is very important to us. We urge you to read the accompanying materials regarding the matters to be voted on at the meeting.

You may vote either by submitting your proxy via smartphone/tablet, online or, if you receive a paper proxy card in the mail, by mailing the completed proxy card. If you vote before the meeting but later decide to attend the meeting in person, you may still vote in person at the meeting.

Thank you for your continued support.

Sincerely,

/s/ Philip Horlock

Philip Horlock

President and Chief Executive Officer and Director

Blue Bird Corporation

NOTICE OF 2025 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MARCH 14, 2025

NOTICE IS HEREBY GIVEN that the 2025 Annual Meeting of Stockholders (the “Annual Meeting”) of Blue Bird Corporation (the “Company”) will be held on Friday, March 14, 2025, at the hour of 9:00 a.m. (local time) at the Company’s corporate headquarters, 3920 Arkwright Road, Suite 200, Macon, Georgia 31210, for the following purposes:

1.TO ELECT three (3) Class II members of the Board of Directors named in the Proxy Statement for a term of three (3) years, and until their successors are elected and qualified; and

2.TO RATIFY the appointment of BDO USA, P.C. as our independent registered public accounting firm for the current fiscal year ending September 27, 2025; and

To transact such other business that may properly come before the meeting.

Holders of record of the Company’s common stock, $0.0001 par value (the “Common Stock”) at the close of business on January 15, 2025 (the “Record Date”) will be entitled to notice of and to vote at the meeting and any postponements or adjournments thereof. To attend the annual meeting, you must have valid proof of identification and other proof of beneficial ownership of the Company’s Common Stock (such as a brokerage statement reflecting your stock ownership) as of the Record Date.

You may vote by mail, smartphone/tablet, or the internet to the extent described in the Company’s Notice of Internet Availability of Proxy Materials and Proxy Statement.

Audited financial statements as of and for the year ended September 28, 2024, and the related Management’s Discussion and Analysis of Financial Condition and Results of Operations, are included in our Annual Report on Form 10-K, such portions of which are also contained in the Annual Report to Stockholders included with our proxy materials.

Whether or not you expect to be present, please vote via smartphone/tablet, online or, if you receive a paper proxy card, by mail. Submitting the proxy will not affect your right to vote in person if you attend the meeting.

DATED at Macon, Georgia the 27th day of January, 2025.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ Philip Horlock

Philip Horlock

President and Chief Executive Officer and Director

Blue Bird Corporation

Important Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to be held on March 14, 2025: In accordance with U.S. Securities and Exchange Commission (“SEC”) rules, we are using the internet as our primary means of furnishing proxy materials to our stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send stockholders a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials, including our Proxy Statement and 2024 Annual Report, and voting via the Internet. The Notice of Internet Availability of Proxy Materials also provides information on how stockholders may obtain paper copies of our proxy materials if they so choose. The Proxy Statement, form of proxy card and 2024 Annual Report also are available free of charge at www.proxyvote.com.

BLUE BIRD CORPORATION PROXY STATEMENT

TABLE OF CONTENTS

| | | | | | | | | | | |

| DATE, TIME AND PLACE OF ANNUAL MEETING; MAILING AND RECORD DATE | | |

|

| |

| RECORD DATE; PROXIES; VOTING | | |

| Record Date; Who Can Vote; Votes Per Share | | |

| How to Vote; Submitting Your Proxy; Revoking Your Proxy | | |

| How Your Proxy Will Be Voted; Discretionary Authority of Proxies | | |

| Quorum; Votes Necessary to Approve Proposals | | |

| Electronic Availability | | |

| Cost of Solicitation of Proxies; Tabulation of Votes | | |

|

| |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | |

|

| |

| PROPOSAL ONE - ELECTION OF DIRECTORS | | |

| Terms of Our Classified Board | | |

| Recommendation of the Board | | |

|

| |

| PROPOSAL TWO - RATIFICATION OF APPOINTMENT OF BDO USA, P.C. | | |

| Recommendation of the Board | | |

|

| |

| INFORMATION CONCERNING MANAGEMENT | | |

| Directors and Executive Officers | | |

|

| |

| CORPORATE GOVERNANCE AND BOARD MATTERS | | |

| Classified Board of Directors | | |

| Director Independence | | |

| Board Membership Diversity | | |

| Stockholder Communications with the Board of Directors | | |

| Leadership Structure and Risk Oversight | | |

| Annual Meeting Attendance | | |

| Board Meetings | | |

| Committees of the Board of Directors | | |

| Audit Committee | | |

| Compensation Committee | | |

| Corporate Governance and Nominating Committee | | |

| Stockholder Nominations | | |

| Insider Trading Policy and Hedging Restrictions | | |

| Code of Ethics | | |

| Indemnification Agreements | | |

|

| |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 19 | |

| Policies and Procedures for Related Person Transactions | | |

| Related Person Transactions | | |

|

| |

| DELINQUENT SECTION 16(a) REPORTS | | |

|

| |

| DIRECTOR AND EXECUTIVE COMPENSATION | 21 | |

|

| |

| COMPENSATION DISCUSSION AND ANALYSIS (“CD&A”) | | |

| | | | | | | | | | | |

| Introduction; Financial Highlights | | |

| Fiscal 2024 Financial Results and Business Highlights……………………………………………..Second Quarter Fiscal 2024 Approval of Change in Control Plan & Executive Employment Agreements | 21 | |

|

|

| Second Quarter Fiscal 2024 Approval of Change in Control Plan and Executive Employment Agreements | | |

| Compensation Program Objectives, Policies and Structure | | |

| Key Compensation Policies | | |

| Components of Short-Term Performance Compensation | | |

| Components of Long-Term Performance Compensation | | |

| Participants and Decision Makers in Determining Named Executive Officer Compensation | | |

| Industry Compensation Comparisons | | |

| Role of Compensation Consultants | | |

| Elements of Total Compensation | | |

| Compensation of the Chief Executive Officer | | |

| Stock Ownership Guidelines | | |

| Effect of Post-Termination Events | | |

| Federal Income Tax Considerations | | |

| Compensation Forfeiture and Clawback Policy | | |

| Fiscal 2025 Compensation Program | | |

| Stockholder Approval for the Company’s Executive Compensation Programs | | |

| Conclusion and Compensation Committee Report | | |

|

| |

| FISCAL 2024 DIRECTOR COMPENSATION | 33 | |

|

| |

| NAMED EXECUTIVE OFFICER COMPENSATION | 35 | |

| Summary Compensation Table | | |

| Omnibus Equity Incentive Plan | | |

| Tax-Qualified Retirement Plan | | |

| Executive Employment Agreements and Other Arrangements with Named Executive Officers | | |

Change in Control Plan and Amendment to Awards Under The 2015 Omnibus Equity

Incentive Plan | | |

| Potential Payments Upon Termination or Change in Control | | |

| Grants of Plan-Based Awards Table | | |

| Outstanding Equity Awards at 2024 Fiscal Year-End Table | | |

| Option Exercises and Stock Vested Table | | |

| CEO Pay Ratio | | |

| Pay Versus Performance Disclosure | | |

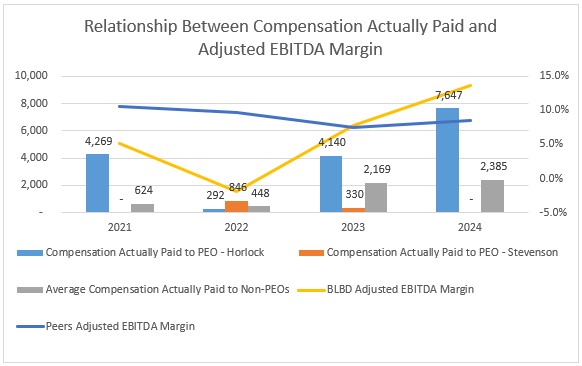

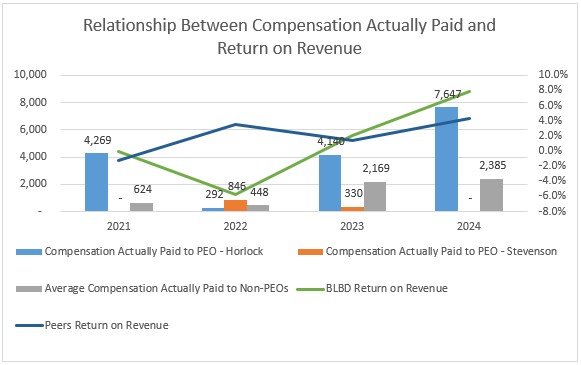

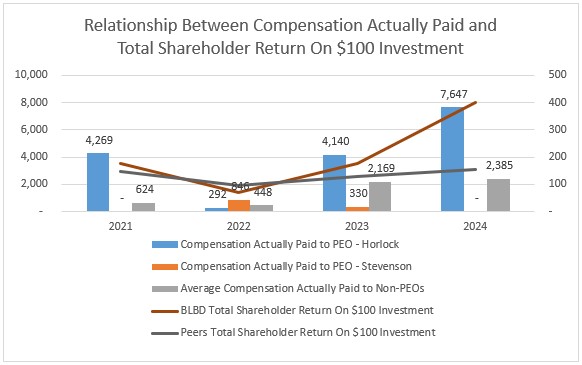

| Relationship Between Pay and Performance | 48 | |

| List of Important Financial Measures | 50 | |

| Compensation Committee Interlocks and Insider Participation | 50 | |

| Compensation Committee Report | 50 | |

|

| |

| CERTAIN ACCOUNTING AND AUDIT MATTERS | | |

| Report of the Audit Committee | | |

| Policy on Pre-Approval of Services Provided by Independent Registered Public Accounting Firm | | |

| Independent Registered Public Accounting Firm Fees | | |

|

| |

| TRANSFER AGENT AND REGISTRAR | | |

|

| |

| DELIVERY OF DOCUMENTS TO STOCKHOLDERS | | |

|

| |

| FUTURE STOCKHOLDER PROPOSALS | | |

|

| |

| | | | | | | | | | | |

| WHERE YOU CAN FIND ADDITIONAL INFORMATION | | |

|

| |

| OTHER MATTERS | | |

| Admission to Meeting | | |

| Action on Other Matters at the Annual Meeting | | |

|

| |

| | | | | | |

BLUE BIRD CORPORATION PROXY STATEMENT | | | | |

DATE, TIME AND PLACE OF ANNUAL MEETING; MAILING AND RECORD DATE

Unless otherwise indicated, or the context otherwise requires, “Company”, “Blue Bird”, “we”, “our” or “us” refers to Blue Bird Corporation and its direct and indirect subsidiaries. The Company’s principal executive offices are located at 3920 Arkwright Road, Suite 200, Macon, Georgia 31210.

This proxy statement (this “Proxy Statement”) is furnished in connection with the solicitation of proxies by Blue Bird’s Board of Directors (the “Board”) on behalf of the Company, for use at the 2025 Annual Meeting of Stockholders (the “Annual Meeting”) of the Company’s common stock, $0.0001 par value (the “Common Stock”) to be held on Friday, March 14, 2025 at the hour of 9:00 a.m. (local time) at the Company’s corporate headquarters, 3920 Arkwright Road, Suite 200, Macon, Georgia 31210, and at all postponements or adjournments thereof, for the purposes set forth in the accompanying notice of the Annual Meeting (the “Notice of Meeting”).

In accordance with the rules of the Securities and Exchange Commission (the “SEC”), we mailed the Notice of Internet Availability of Proxy Materials on January 27, 2025 to our stockholders of record (the “Stockholders”) as of the close of business on January 15, 2025 (the “Record Date”). We also provided access to our proxy materials over the Internet beginning on that date. If you would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability of Proxy Materials.

RECORD DATE; PROXIES; VOTING

Record Date; Who Can Vote; Votes Per Share

The Board has set Wednesday, January 15, 2025, as the Record Date for determining voter eligibility. At the Meeting, each Stockholder of record of Common Stock at the close of business on the Record Date will be entitled to vote on all matters proposed to come before the Annual Meeting. Each such Stockholder of record will be entitled to one (1) vote per share of Common Stock on each matter submitted to a vote of the Stockholders, if those shares are represented at the Meeting, either in person or by proxy. As of the Record Date, there were 32,111,078 shares of Common Stock outstanding.

How to Vote; Submitting Your Proxy; Revoking Your Proxy

You may vote your shares either by voting in person at the Annual Meeting, by mailing a completed form of proxy if you receive a paper proxy card, or by smartphone/tablet or online. By submitting your form of proxy, you are legally authorizing another person to vote your shares. The persons specified on the enclosed form of proxy are officers of the Company.

If you plan to attend the meeting and vote in person, we will provide a ballot to you when you arrive; however, if your shares are not registered in your name but in the “street name” of a bank, broker or other holder of record (a “nominee”), then your name will not appear in Blue Bird’s record of stockholders, and you are considered a “Beneficial Holder.” Those shares are held in your nominee’s name, on your behalf, and your nominee will be entitled to vote your shares. If you are a Beneficial Holder, please refer to the information from your bank, broker or other nominee on how to submit voting instructions, which includes the deadlines for submission of voting instructions. Beneficial Holders may vote shares held in street name at the Annual Meeting only if they obtain a signed proxy from the record holder (bank, broker or other nominee) giving the Beneficial Holder the right to vote the shares.

Your proxy is revocable. A Beneficial Holder who has given instructions to its nominee with respect to the voting of its Common Stock may instruct the nominee to thereafter revoke the relevant proxy in accordance with the instructions provided to the Beneficial Holder by its bank, broker or other nominee. A registered Stockholder who has submitted a form of proxy may revoke the proxy: (i) by completing, signing and submitting a form of proxy bearing a later date; (ii) by notifying Mr. Ted Scartz, the Company’s Secretary, by email at ted.scartz@blue-bird.com, or in writing to Mr. Ted Scartz, Secretary, c/o Blue Bird Corporation, 3920 Arkwright Road, Suite 200, Macon, Georgia 31210, before the Annual Meeting that you have revoked your proxy, or (iii) you may attend the Annual Meeting, revoke your proxy and vote in person. Attendance at the Annual Meeting will not itself be deemed to revoke your proxy unless you give notice at the meeting that you intend to revoke your proxy and vote in person as described above.

Even if you plan to attend the Annual Meeting, we encourage you to vote in advance so that your vote will be counted if you later decide not to attend the Annual Meeting. Voting your proxy by the Internet, smartphone/tablet or mail will not limit your right to vote at the Annual Meeting if you later decide to attend in person, subject to compliance with the foregoing requirements.

How Your Proxy Will Be Voted; Discretionary Authority of Proxies

The persons named in the form of proxy will vote the shares of Common Stock in respect of which they are appointed in accordance with the instructions of the Stockholder as indicated in the form of proxy. In the absence of such specification, such Common Stock will be voted at the Annual Meeting as follows:

•FOR the election of each of the director nominees as directors of the Company for a term of three (3) years, and until their successors are elected and qualified; and

•FOR the ratification of BDO USA, P.C. as our independent registered public accounting firm for the fiscal year ending September 27, 2025 (“fiscal 2025”).

The persons named in the accompanying form of proxy are conferred with discretionary authority to vote the shares of Common Stock in respect of which they are appointed on any amendments to or variations of matters identified in the Notice of 2025 Annual Meeting of Stockholders and Proxy Statement and on any other matters that are properly brought up at the Annual Meeting. In addition, a Stockholder will confer discretionary authority to the proxy holder in respect of one or more of the items of business identified on the proxy form if the Stockholder properly completes and delivers the proxy but leaves blank the voting selection for that item on the form. In the event that amendments or variations to matters identified in the Notice of 2025 Annual Meeting of Stockholders and Proxy Statement, or other matters are properly brought up at the Annual Meeting, it is the intention of the persons designated in the enclosed proxy card to vote in accordance with their discretion and judgment on such matter or business. At the time of printing the Proxy Statement, the members of the Board knew of no such amendments, variations or other matters.

Quorum; Votes Necessary to Approve Proposals

Pursuant to the Company’s Certificate of Incorporation and bylaws, a quorum for the transaction of business at the Annual Meeting is established if holders of a majority in voting power of the Company’s Common Stock issued and outstanding and entitled to vote at the Annual Meeting, are present in person or represented by proxy. For purposes of determining a quorum in accordance with Delaware law, abstentions will be counted as present in determining whether a quorum is established; broker “non-votes” will not be counted towards the establishment of a quorum. Abstentions and broker “non-votes” will not be counted as votes cast and will not affect the voting results for any of the proposals identified in the Notice of 2025 Annual Meeting of Stockholders. A broker “non-vote” occurs when a nominee (such as a broker) holding shares for a Beneficial Holder refrains from voting on a particular proposal because the nominee does not have discretionary voting power for that proposal and has not received instructions from the Beneficial Holder on how to vote those shares. Under current NASDAQ Global Market (“Nasdaq”) rules, your broker will not have discretion to vote your uninstructed shares with respect to any of the proposals except the proposal to ratify the appointment of our independent registered public accounting firm.

The proposals being considered and voted on at the Annual Meeting are subject to the following standards for approval:

Proposal 1 - To elect directors, a plurality of the votes cast is required. This means that the three nominees will be elected if they receive more affirmative votes than any other nominee for the same position. Stockholders may not cumulate their votes with respect to the election of directors. In an uncontested election, where the number of nominees and available board seats are equal, each nominee is elected upon receiving just one “for” vote. Stockholders are allowed to withhold authority to vote “for” one or more nominees. Withholding a vote allows stockholders to communicate their dissatisfaction with a given nominee, but it has no legal effect on the outcome of the election.

Proposal 2 – The proposal for ratification of the appointment of our auditors requires the affirmative vote of a majority of the votes cast by stockholders present in person or represented by proxy at the Annual Meeting and entitled to vote.

Electronic Availability

In compliance with the proxy rules promulgated by the SEC, our Proxy Statement and 2024 Annual Report to Stockholders are available over the Internet at www.proxyvote.com, a website established specifically for access to such materials. Such materials are also available on the Company’s website at www.blue-bird.com.

Cost of Solicitation of Proxies; Tabulation of Votes

The Company will bear the cost of soliciting proxies on behalf of the Company. Our directors, officers and employees may also solicit proxies in person or by telephone, electronic transmission and facsimile transmission. We will not specially compensate our directors, officers and employees for those services, but they may be reimbursed for their out-of-pocket expenses incurred in connection with the solicitation. We will also reimburse brokers, fiduciaries and custodians for their costs in forwarding proxy materials to Beneficial Holders of our Common Stock.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information known to us (by required filings with the SEC) regarding beneficial ownership of shares of our Company’s Common Stock on January 15, 2025 by:

•each person who is the beneficial owner of more than five percent (5%) of the outstanding shares of the Common Stock;

•each of our named executive officers, directors and director nominees; and

•all executive officers and directors of our Company as a group.

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power over that security or has the right to acquire beneficial ownership of the security within sixty (60) days, including options, rights, warrants or convertible securities that are currently exercisable or exercisable within sixty (60) days. As of the record date, January 15, 2025, there were 32,111,078 shares of Common Stock outstanding.

Unless otherwise indicated, we believe that all persons named in the table below have sole voting and investment power with respect to all shares of Common Stock beneficially owned by them.

| | | | | | | | |

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class (%) |

| Greater than 5% Stockholders |

|

|

BlackRock, Inc.1 50 Hudson Yards New York, New York 10001 | 2,856,489 | 8.9 |

FMR LLC2 245 Summer Street Boston, Massachusetts 02210 | 4,341,804 | 13.5 |

The Vanguard Group3 100 Vanguard Boulevard Malvern, Pennsylvania 19355 | 2,401,167 | 7.5 |

Westwood Management Corp.4 200 Crescent Court, Suite 1200 Dallas, Texas 75201 | 1,684,762 | 5.2 |

| Directors, Nominees and Named Executive Officers |

|

|

| Mark Blaufuss | 3,938 | * |

| Julie A. Fream | 3,309 | * |

| Douglas Grimm | 20,850 | * |

| Edward T. Hightower | — | — |

Philip Horlock5 | 276,943 | * |

| Simon J. Newman | 3,938 | * |

| Kevin S. Penn | — | — |

Razvan Radulescu6 | 2,848 | * |

Ted Scartz7 | 21,032 | * |

| Britton Smith | 4,814 | * |

| Dan Thau | 700 | * |

All directors and executive officers as a group (11 persons)8 | 338,372 | 1.1 |

* Less than one percent.

1. Based upon a Schedule 13G/A filed by the reporting person in November 2024.

2. Based upon a Schedule 13G/A filed by the reporting persons in December 2024.

3. Based upon a Schedule 13G/A filed by the reporting person in November 2024.

4. Based upon a Schedule 13G filed by the reporting person in November 2024.

5. Includes 121,708 shares subject to presently exercisable stock options.

6. Includes 2,165 shares subject to presently exercisable stock options.

7. Includes 8,877 shares subject to presently exercisable stock options.

8. Includes 132,750 shares subject to presently exercisable stock options and 32,035 director restricted stock units, including units that will vest on April 1, 2025.

PROPOSAL ONE -

ELECTION OF DIRECTORS

The Company’s Board is presently comprised of eight (8) members and is classified into three separate classes of directors. One class of directors is normally elected at each annual meeting of stockholders for a term of three (3) years. At the 2025 Annual Meeting, Stockholders will elect three (3) members to the Board, each of whom will serve as a Class II director, to hold office until the 2028 Annual Meeting of Stockholders. The Board has nominated Mark Blaufuss, Julie A. Fream and Simon J. Newman for election as Class II directors for terms of office of three (3) years, and until their successors are elected and qualified.

Terms of Our Classified Board

As stated above, the terms of the Class II directors will expire at the 2025 Annual Meeting of Stockholders. The terms of the Class I directors, including Edward T. Hightower and Kevin Penn, will expire at the Annual Meeting of Stockholders in 2027. The terms of the Class III directors, including Douglas Grimm, Philip Horlock and Dan Thau, will expire at the Annual Meeting of Stockholders in 2026. See “INFORMATION CONCERNING MANAGEMENT” for more information on our Board members.

It is the intention of the proxy agents named in the proxy, unless otherwise directed, to vote such proxies for the election of the Class II nominees. Should any of such nominees be unable to accept the office of director, an eventuality which is not anticipated, proxies may be voted with discretionary authority for a substitute nominee or nominees designated by the Board.

Recommendation of the Board

The Board unanimously recommends that Stockholders vote “FOR” the election of Mark Blaufuss, Julie A. Fream and Simon J. Newman as Class II directors of the Company.

PROPOSAL TWO -

RATIFICATION OF APPOINTMENT OF BDO USA, P.C.

BDO USA, P.C. served as our independent registered public accounting firm for the fiscal year ended September 28, 2024, and has been selected to serve as our independent registered public accounting firm for the 2025 fiscal year ending September 27, 2025. The Board proposes that Stockholders ratify this selection at the Annual Meeting. Management is not aware that such firm nor any of its members or associates has or has had during the past year any financial interest in us, direct or indirect, or any relationship with us other than in connection with their professional engagement.

Stockholder ratification of this appointment is not required. The Board has submitted this proposal to the Stockholders because it believes the Stockholders' views on the matter should be considered, and if the proposal is not approved, the Board may reconsider the appointment. Representatives of BDO USA, P.C. are expected to be present at the Annual Meeting.

Recommendation of the Board

The Board unanimously recommends that Stockholders vote “FOR” the ratification of the appointment of BDO USA, P.C. as our independent registered public accounting firm for the 2025 fiscal year.

INFORMATION CONCERNING MANAGEMENT

Directors and Executive Officers

Our current directors, nominees for director and executive officers are set forth below.

| | | | | | | | |

| Name | Age* | Position |

| Philip Horlock | 68 | President and Chief Executive Officer (“CEO”); Director |

| Razvan Radulescu | 50 | Chief Financial Officer (“CFO”) |

| Ted Scartz | 54 | Senior Vice President and General Counsel; Secretary |

| Mark Blaufuss | 57 | Director |

| Julie A. Fream | 61 | Director |

| Douglas Grimm | 62 | Director, Chairman |

| Edward T. Hightower | 59 | Director |

| Simon J. Newman | 62 | Director |

| Kevin Penn | 63 | Director |

| Dan Thau | 34 | Director |

*As of January 15, 2025.

Class I Directors

Edward T. Hightower has been a Class I director of the Company since October 23, 2024. Mr. Hightower is the founder and managing director of Motoring Ventures LLC, an investment, growth, strategy, and operations consulting firm focused on driving value in the global automotive industry, since 2011. Mr. Hightower previously served as CEO and President of Lordstown Motors Corp., an original equipment manufacturer (“OEM”) of electric vehicles (“EV”) for the commercial fleet market, from 2021 to 2024. In June 2023, Lordstown filed a petition under the federal bankruptcy laws; a reorganization plan was approved in March 2024. He led the operational turnaround of the company and the launch of its first vehicle, the Endurance all-electric full-size pickup truck. Lordstown was one of the few new light-duty EV OEMs to successfully develop, launch and deliver vehicles to customers. Mr. Hightower also served as CEO of the EV design and engineering joint venture between Lordstown and Foxconn, a Taiwanese electronics manufacturer. In addition, Mr. Hightower held senior engineering, marketing and business development roles at Ford Motor Company, BMW of North America and General Motors Company. Mr. Hightower also worked as a hands-on growth, strategy, operations and M&A consultant at AlixPartners, LLP. Mr. Hightower holds a B.S. degree in General Engineering from the University of Illinois Urbana-Champaign and an M.B.A. degree from the University of Michigan Ross School of Business. Mr. Hightower has been selected to serve on our board of directors based upon his extensive executive experience in the automotive industry.

Kevin Penn has been a Class I director of the Company since June 3, 2016, and has served as a Managing Director of American Securities LLC since 2009. Mr. Penn served as Chairman of the Board of Blue Bird Corporation from 2016 to August 2024 and is currently Chairman of the Board of Learning Care Group, Foundation Building Materials, NWN Carousel, Conair, Trace3 and SOLV Energy. Prior to joining American Securities, Mr. Penn founded and headed ACI Capital Co., LLC (in 1995). Previously, Mr. Penn was Executive Vice President and Chief Investment Officer for a family investment company, First Spring Corporation, where he managed private equity, direct investment, and public investment portfolios. Earlier in his career, Mr. Penn was a Principal with the private equity firm Adler & Shaykin, and was a founding member of the Leveraged Buyout Group at Morgan Stanley & Co. Mr. Penn holds a B.S. degree in Economics from the University of Pennsylvania’s Wharton School of Business and an M.B.A. degree from Harvard Business School with high distinction. Mr. Penn has been selected to serve on our board of directors based on his knowledge of Blue Bird Corporation and his experience as a board member of, and executive with, private equity firms that invest in other manufacturing companies.

Class II Directors

Mark Blaufuss has been a Class II director of the Company since May 31, 2023. Mr. Blaufuss has been a Managing Director and founder of Green & White Advisory, a consulting firm specializing in mergers and acquisitions, strategic and financial advisory services, since 2017. Mr. Blaufuss has also served as an Operating Executive with The Carlyle Group (“Carlyle,” a private equity firm), since February 2019. From September 2020 to December 2022, Mr. Blaufuss served as CFO of Victory Innovations, an early growth stage portfolio company of Carlyle. In 2022, the market collapsed for the company’s primary product, a sterilization device targeted for the Covid-19 pandemic, and the company voluntarily pursued an out of court proceeding under the insolvency statutes of the State of Delaware. This proceeding resulted in the complete liquidation of the company and satisfaction of all outstanding debt to the company’s only secured lender. From 2014 to 2017, Mr. Blaufuss served as CFO of Metaldyne Performance Group, Inc. Mr. Blaufuss also currently serves as a member of the Board of Directors and Audit Committee Chairman of both The Jason Group (automotive and industrial aerosols) and Old World Industries (automotive additives). Mr. Blaufuss holds a B.S. degree in Accounting from Michigan State University. Mr. Blaufuss has been selected to serve on our board of directors based on his background in finance and experience as a CFO and senior executive with operating companies and consulting and private equity firms.

Julie A. Fream has been a Class II director of the Company since October 19, 2023. From 2013 to 2024, Ms. Fream was the President and CEO of the MEMA Original Equipment Suppliers, a North American trade association representing over 500 automotive suppliers based in Southfield, Michigan that advocates and advances vehicle suppliers’ business needs in North America. Prior to that position, Ms. Fream served in multiple roles with Visteon Corporation, an $8 billion international automotive component supplier, ultimately as Vice President of the North American Customer Group, Global Communications, and Corporate Strategy. Ms. Fream’s experience includes extensive experience with major corporations in the automotive industry, including General Motors Company, Ford Motor Company, and TRW, Inc. Ms. Fream currently serves on the Board of Directors of Corewell Health and Shape Corporation, a privately held automotive supplier, and has previously served on the Board of Directors of Beaumont Health and the Board of Trustees of Michigan Technological University. Ms. Fream holds a B.S. degree in Chemical Engineering from Michigan Technological University and an M.B.A. degree from Harvard Business School. Ms. Fream has been selected to serve on our board of directors based upon her extensive experience in the automotive industry as an executive and a Board member.

Simon J. Newman has been a Class II director of the Company since March 31, 2023. Mr. Newman has over 40 years’ manufacturing industry experience with extensive expertise in the field of precision engineered component manufacturing and executive strategy. In February 2022, Mr. Newman was appointed to the position of Chairman of MW Components and Paragon Medical. MW Components is a leading provider of highly engineered springs, specialty fasteners, bellows, and other precision components with manufacturing facilities across the United States, and Paragon Medical is a global contract manufacturing organization (“CMO”), supplying implants and surgical devices to the medical industry. Prior to February 2022, Mr. Newman also served as CEO of Form Technologies for 18 years. He began his career with the Dynacast organization, now a Form Technologies division, in 1979, progressively working through the company in all facets of operations leading to a long and prolific tenure as the Group Chief Executive. Mr. Newman became the CEO of MW Components in 2020, but moved into the role of Chairman in 2023. He is also a member of the Board of Directors of Elgen Manufacturing Company Inc. and Chromalloy, a Veritas company. Mr. Newman holds a Bachelor of Science degree in Operations Management from California Coast University. Mr. Newman has been selected to serve on our board of directors based on his extensive executive experience in the manufacturing industry.

Class III Directors

Douglas Grimm has been a Class III director of the Company since April 1, 2017, and was elected Chairman of the Board in August 2024. Mr. Grimm is the owner and CEO of V-to-X, LLC, which is focused on advising and investing in the mobility sector, since April 2017. From December 2015 to April 2017, Mr. Grimm served as President and Chief Operating Officer of Metaldyne Performance Group, Inc. Mr. Grimm was previously (starting in August 2014) Co-President in connection with the merger of Grede Holdings LLC, HHI Group Holdings and Metaldyne LLC, three established automotive suppliers. Mr. Grimm has also served as Chairman, President and CEO of Grede Holdings LLC and its legacy business, Citation Corporation, since January 2008. Prior to co-founding Grede Holdings LLC, Mr. Grimm served as Vice President - Global Ford, Materials Management, Powertrain Electronics & Fuel Operations of Visteon Corporation, from 2006 to 2008. Prior to that time, Mr. Grimm spent five years at Metaldyne as a Vice President in various executive positions, including Commercial Operations, General Manager of Forging and Casting Operations, as well as having responsibility for global purchasing and quality. Before joining Metaldyne in 2001, Mr. Grimm was with Dana Corporation, and served in various executive positions including Vice President - Global Strategic Sourcing. Prior to that, Mr. Grimm spent 10 years at Chrysler Corporation in progressive management positions.

Mr. Grimm serves as Chairman of the Board of Electrical Components International, Inc. and serves as a director of Pangea Corporation. Mr. Grimm holds a B.A. degree in Economics and Management from Hiram College (OH), and an M.B.A. degree from the University of Detroit. Mr. Grimm has been selected to serve on our board of directors based on his extensive executive experience in the automotive industry.

Philip Horlock has been a Class III director of the Company since February 24, 2015, and is currently our President and CEO. Mr. Horlock was reappointed President and CEO effective September 28, 2024, following the resignation of Mr. Britton Smith from the office of President. Prior to that date, Mr. Horlock served as CEO, beginning May 31, 2023, following the resignation of Matthew Stevenson. On May 31, 2023, Mr. Horlock relinquished the office of President, when the board of directors appointed Mr. Smith as President, and retained the office of CEO. Mr. Horlock served as President and CEO of the Company from February 24, 2015 to October 31, 2021. Subsequently, Mr. Horlock served as a Senior Advisor to the Company until December 31, 2021, at which time Mr. Horlock became a consultant to the Company, serving until he was appointed President and CEO in May 2023. Mr. Horlock served as School Bus Holdings’ President and CEO from April 2011 to October 31, 2021. Mr. Horlock served as School Bus Holdings’ CFO and Chief Administrative Officer from January 2010 until April 2011. Before joining School Bus Holdings, Mr. Horlock spent over 30 years with Ford Motor Company, where he held senior executive positions in Finance and Operations worldwide. His last three positions with Ford were Chairman & CEO of Ford Motor Land Development, Controller of Corporate Finance, and CFO Ford Asia Pacific & Africa. While at Ford, Mr. Horlock served on the Advisory Board of Mazda Motor Corporation and also previously served as a director of LoJack Corporation. Mr. Horlock holds a B.S. degree in Psychology and Mathematics from Sheffield University in England. He also completed the Ford Executive Development Program (Capstone) through the University of Michigan. Mr. Horlock has been selected to serve on our board of directors based on his extensive automotive and school bus industry experience and the results that he achieved with the Company and School Bus Holdings during his tenure.

Dan Thau has been a Class III director of the Company since May 19, 2023. Mr. Thau currently serves as CFO of ACES, a leading provider of ABA therapy to individuals with autism spectrum disorder. He has been in that position since June 2024. Previously, Dan served as a Vice President of American Securities LLC, a private equity firm he joined in 2015. Prior to joining American Securities, Mr. Thau was employed by Goldman Sachs as an analyst in the Financial Institutions Group in New York and in the Israel Group in Tel Aviv. Mr. Thau holds a B.S. degree in Economics from the University of Pennsylvania’s Wharton School and an M.B.A. degree from Harvard

Business School. Mr. Thau has been selected to serve on our board of directors based on his experience as a board member of, and executive with, private equity firms that invest in other manufacturing companies.

Executive Officers

Information on our current executive officers (other than Mr. Horlock) is provided below.

Razvan Radulescu was appointed CFO of the Company effective October 1, 2021. Prior to this appointment, Mr. Radulescu was employed in various management positions by Daimler AG, since 2000. He has over 20 years of experience at Daimler AG in various roles of increasing responsibility in Finance and Controlling, as well as Procurement, including IT and Compliance. From 2020 until he joined the Company, Mr. Radulescu served as General Manager – Procurement and Global Lead Cab Interior/Exterior and Aftersales, for Daimler Trucks North America (“DTNA”), responsible for all production and aftersales purchases, as well as the Global Daimler Trucks Cab Interior/Exterior parts and aftersales. From 2017 to 2020, Mr. Radulescu served as CFO of the Global Powertrain Trucks Business Unit in Stuttgart, Germany. From 2013 to 2017, Mr. Radulescu served as Controller – Freightliner Trucks for DTNA. Mr. Radulescu holds a B.S. degree in Computer Science from the Academy of Economics Studies in Bucharest, Romania and an M.B.A. degree from Case Western Reserve University.

Ted Scartz was appointed Senior Vice President and General Counsel of the Company in May 2022. Mr. Scartz also serves as Corporate Secretary for the Company. Mr. Scartz has worked in the corporate legal community for over 25 years and has worked as in-house corporate counsel at multiple publicly-traded companies for the past 15 years. He leads all aspects of Blue Bird's legal function, including corporate governance, SEC reporting, and governmental relations, as well as commercial contracts and litigation.

Prior to joining Blue Bird, Mr. Scartz was Vice President and Deputy General Counsel at The Aaron's Company, Inc. He was employed by The Aaron's Company, Inc. or its predecessor entity in various positions from 2013 to 2022, including as General Counsel to the Aaron's Sales & Lease Division. From 2007 to 2013, Mr. Scartz was Division Lead Counsel for the Low & Medium Voltage Divisions of Siemens Industry, Inc. and other capacities as counsel for Siemens's manufacturing operations in North America. Prior to moving to an in-house career, Mr. Scartz worked in the commercial litigation practice of prominent law firms in Atlanta, Georgia. Mr. Scartz holds a B.A. degree in Political Science from Wake Forest University and a J.D. degree from the University of Georgia.

Newly-Appointed Executive and Director

John Wyskiel, age 60, was appointed by the Board of Directors as President and CEO on January 22, 2025, effective February 17, 2025, and was also elected a Class I Director, effective February 17, 2025. Mr. Wyskiel is an automotive industry veteran who brings more than 35 years of experience in manufacturing leadership, operational excellence and global supply chain management to Blue Bird. Wyskiel returns to Blue Bird after a 20-year career at Magna International, where he most recently served as President of Magna Seating, from January 2020 to January 2025. In this role, he was responsible for leading a $6 billion business with 33,000 employees across 60 manufacturing facilities in 15 countries. Before then, Wyskiel served as General Manager of Blue Bird Coach in Canada, one of the largest manufacturers of Type A and Type C school buses, from 2002 to 2004. Prior to that, he held various senior manufacturing, operations, engineering, product management and sales roles at Dana Corporation and Borg Warner, both global automotive component suppliers.

Mr. Wyskiel holds a CET Accreditation from Mohawk College of Applied Arts & Technology in Hamilton, Ontario. He is a graduate of the University of Michigan Business School Executive Development Program and of the Global Leadership Executive Fundamentals Program at ISEAD Business School in Paris, France.

CORPORATE GOVERNANCE AND BOARD MATTERS

Classified Board of Directors

Our board of directors is classified into three classes, each comprising as nearly as possible one-third of the total number of directors, to serve three-year terms. Messrs. Hightower and Penn have been elected to serve in Class I, which term will expire at our 2027 Annual Meeting of Stockholders. Messrs. Blaufuss and Newman and Ms. Fream have been elected to serve in Class II, which term will expire at our 2025 Annual Meeting of Stockholders. Messrs. Grimm, Horlock and Thau have been elected to serve in Class III, which term will expire at our 2026 Annual Meeting of Stockholders.

Director Independence

Nasdaq listing standards require that a majority of our board of directors be independent unless we are a “controlled company.” An “independent director” is defined under the Nasdaq rules generally as a person other than an officer or employee of the company or its subsidiaries or any other individual having a relationship which in the opinion of the company’s board of directors, would interfere with the director’s exercise of independent judgment in carrying out the responsibilities of a director.

Our Board has determined that each of our directors, other than Mr. Horlock, is an “independent director” as defined in the Nasdaq listing standards and applicable SEC rules. Our independent directors have regularly scheduled meetings at which only independent directors are present.

Board Membership Diversity

Nasdaq’s Board Diversity Rules (Rule 5605(f) and Rule 5606) were approved by the SEC in 2021. On December 11, 2024, the United States Court of Appeals for the Fifth Circuit (the “Fifth Circuit”) vacated the SEC’s order approving Nasdaq’s board diversity rules. The ruling means that Nasdaq-listed companies will no longer be required to meet specified board diversity criteria or make prescribed disclosures regarding their board’s diversity characteristics. Nasdaq has indicated it does not intend to appeal the Fifth Circuit’s decision. The SEC has not yet announced whether it intends to appeal. However, we have elected to continue to present our Board diversity statistics pending any further developments regarding this matter.

The following Board Diversity Matrix presents our Board diversity statistics. The rule’s minimum diversity objective is two diverse directors, including one who self-identifies as female, and one who self-identifies as either an underrepresented minority or LGBTQ+. “Underrepresented Minority” means an individual who self-identifies as one or more of the following: Black or African American, Hispanic or Latinx, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander, or Two or More Races or Ethnicities. “Two or More Races or Ethnicities” means a person who identifies with more than one of the following categories: White (not of Hispanic or Latinx origin), Black or African American, Hispanic or Latinx, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander. Our Board currently includes two diverse directors.

| | | | | | | | | | | | | | |

| Board Diversity Matrix (As of January 15, 2024) |

| Total Number of Directors | 8 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity |

| Directors | 1 | 7 | 0 | 0 |

| Part II: Demographic Background |

| African American or Black | 0 | 1 | 0 | 0 |

| Alaskan Native or Native American | 0 | 0 | 0 | 0 |

| Asian | 0 | 0 | 0 | 0 |

| Hispanic of Latinx | 0 | 0 | 0 | 0 |

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

| White | 1 | 6 | 0 | 0 |

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 |

| LGBTQ+ | 0 |

| Did Not Disclose Demographic Background | 0 |

Stockholder Communications with the Board of Directors

Our corporate governance guidelines provide that our Chairman and our CEO are responsible for establishing effective communications with our Stockholders. Our Board has implemented a process for Stockholders to send communications to our Board and to specific individual directors.

Stockholders who wish to communicate directly with our Board, or any individual director, should direct communications in writing to our Corporate Secretary, Blue Bird Corporation, 3920 Arkwright Road, Suite 200, Macon, Georgia 31210, or by email to ted.scartz@blue-bird.com. The communication must contain a clear notation indicating that it is a “Board Communication” or “Director Communication.” All such communications must identify the author and clearly state whether the intended recipients are all members of the Board or just certain specified individual directors. The Corporate Secretary will make copies of all such communications and circulate them to the appropriate director or directors.

The Company’s “whistleblower” policy prohibits the Company or any of its employees from retaliating or taking any adverse action against anyone for raising a concern. If a Stockholder or employee nonetheless prefers to raise his or her concern in a confidential or anonymous manner, the concern may be directed to the Audit Committee Chairman at the Company’s headquarters or by telephone at 1-866-766-1953.

Leadership Structure and Risk Oversight

The Board does not have a lead independent director. Douglas Grimm is our Chairman of the Board. Although we do not have a formal policy regarding the separation of the CEO and Chairman of the Board positions, at this time those positions are held by two separate individuals, Mr. Horlock and Mr. Grimm, respectively.

The Board does not have a formal risk management committee but administers this oversight function through various standing committees of the Board. The Audit Committee maintains responsibility for oversight of financial reporting-related risks, including those related to our accounting, enterprise risk management assessment, auditing, and financial reporting practices, which include internal controls over financial reporting. The Audit Committee also reviews reports of, and considers any material allegations regarding, potential violations of our Company’s Code of Ethics, as well as oversight of our Environmental, Social and Governance (“ESG”) Program. The Compensation Committee oversees risks arising from our compensation policies and programs. The

Compensation Committee also has responsibility for evaluating and approving our executive compensation and benefit plans, policies, and programs.

Annual Meeting Attendance

The Board encourages all its members to attend the Annual Meeting of Stockholders. All director nominees and all continuing directors are encouraged to be personally present or to attend the Annual Meeting of Stockholders by teleconference. All directors attended the 2024 Annual Meeting either in person or by teleconference.

Board Meetings

The Board held eight (8) meetings during fiscal 2024. The Board has three (3) standing committees: an Audit Committee, a Compensation Committee and a Corporate Governance and Nominating Committee, each as further described below. Each standing committee has the right to retain its own legal and other advisors.

All directors attended 75% or more of the aggregate of (i) the total number of meetings of the Board (held during the period for which each has been a director); and (ii) the total number of meetings held by all committees of the Board on which each served (during the periods that they served) during our fiscal year ended September 28, 2024.

Committees of the Board of Directors

The standing committees of our Board currently consist of an Audit Committee, a Compensation Committee and a Corporate Governance and Nominating Committee.

Audit Committee

Our Audit Committee consists of Messrs. Blaufuss, Hightower and Thau, with Mr. Blaufuss serving as the Chairman of the Audit Committee. We believe that each of these individuals qualifies as an independent director according to the rules and regulations of the SEC and Nasdaq with respect to audit committee membership. The Board has determined that Mr. Blaufuss qualifies as our “audit committee financial expert,” as such term is defined in Item 407 of Regulation S-K, and that each member of the Audit Committee is financially literate.

Our Board has adopted a written charter for the Audit Committee, which is available on our corporate website at www.blue-bird.com. The Audit Committee reviews and assesses the adequacy of its charter annually. The Audit Committee met five (5) times in fiscal 2024.

Responsibilities of the Audit Committee include, among others contained in its charter:

•the appointment, compensation, retention, replacement, and oversight of the work of the independent registered public accounting firm and any other independent registered public accounting firm engaged by us;

•pre-approval of all audit and non-audit services to be provided by the independent registered public accounting firm or any other independent registered public accounting firm engaged by us for the purpose of preparing or issuing an audit report or performing any audit, review or attestation services, and establishing pre-approval policies and procedures;

•oversight, review and discussion with management and the independent registered public accounting firm of audit results, our financial statements, financial disclosures and related financial reporting and internal control matters, including oversight of the internal audit function;

•review and discussion with the independent registered public accounting firm of all relationships the independent registered public accounting firm has with us in order to evaluate its continued independence;

•setting clear hiring policies for employees or former employees of the independent registered public accounting firm;

•setting clear policies for audit partner rotation in compliance with applicable laws and regulations;

•obtaining and reviewing a report, at least annually, from the independent registered public accounting firm describing the firm’s internal quality-control procedures; any material issues raised by the most recent internal quality-control review, or peer review, of the firm, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the firm, and any steps taken to deal with any such issues; and assessment of the independent registered public accounting firm’s independence and all relationships between the independent registered public accounting firm and the Company;

•review and approval of any related party transaction required to be disclosed pursuant to Item 404 of Regulation S-K promulgated by the SEC prior to our entering into such transaction;

•review with management, the independent registered public accounting firm, and our legal advisors, as appropriate, any legal, regulatory or compliance matters, including any correspondence with regulators or government agencies and any employee complaints or published reports that raise material issues regarding our financial statements or accounting policies and any significant changes in accounting standards or rules promulgated by the Financial Accounting Standards Board, the SEC or other regulatory authorities;

•oversight and monitoring of the Company’s compliance policies and practices with respect to legal and regulatory requirements and codes of conduct;

•annual review of the Company’s enterprise risk management program, including cybersecurity; and

•oversight, review and discussion with management of the Company’s ESG program.

Compensation Committee

Our Compensation Committee consists of Messrs. Penn, Grimm and Newman, with Mr. Penn serving as the Chairman of the Compensation Committee. We believe that each of these individuals qualifies as an independent director according to Nasdaq requirements.

Our Board has adopted a written charter for the Compensation Committee, which is available on our corporate website at www.blue-bird.com. The Compensation Committee reviews and assesses the adequacy of its charter annually. The Compensation Committee met five (5) times in fiscal 2024.

Responsibilities of the Compensation Committee include, among others contained in its charter:

•review and approval on an annual basis of the corporate goals and objectives relevant to our CEO’s compensation, evaluating our CEO’s performance in light of such goals and objectives and determining and approving the compensation of our CEO based on such evaluation;

•review and approval of the compensation of all of our other executive officers;

•review and approval of our executive compensation policies, plans, and programs;

•implementation and administration of our equity-based compensation plans;

•assisting management in complying with our SEC filings and annual report disclosure requirements;

•approval of all special perquisites, special cash payments and other special compensation and benefits arrangements for our executive officers and employees;

•approving our Compensation Discussion and Analysis (“CD&A”) disclosures and producing a report on executive compensation to be included in our annual proxy statement (if required by law); and

•review, evaluation, and recommendation of changes, if appropriate, to the compensation of our directors.

The Compensation Committee charter also provides that the Compensation Committee may, in its sole discretion, retain or obtain the advice of a compensation consultant, legal counsel or other adviser and is directly responsible for the appointment, compensation and oversight of the work of any such adviser. Before engaging or receiving advice from a compensation consultant, external legal counsel or any other adviser, the Compensation Committee will consider the independence of each such adviser, including the factors required by the SEC and Nasdaq.

In March 2015, when we first became a public company, the Compensation Committee retained Meridian Compensation Partners, LLC (“Meridian”) to provide advice to the Compensation Committee, as requested from time to time, in connection with matters pertaining to executive and director compensation. The scope of the engagement pursuant to the engagement letter includes general guidance on executive and director compensation matters, advice on the Company’s executive pay philosophy and compensation peer group, advice on the design of incentive plan and other compensation programs, the provision of comprehensive competitive market studies and market data, and updates on best practices and changes in the regulatory or corporate governance environment. The Compensation Committee had no material interactions with Meridian in the past three fiscal years.

Corporate Governance and Nominating Committee

Our Corporate Governance and Nominating Committee consists of Ms. Fream and Messrs. Grimm and Penn, with Ms. Fream serving as the Chairperson of the Corporate Governance and Nominating Committee. We believe that each of these individuals qualifies as an independent director according to Nasdaq requirements.

Our Board has adopted a written charter for the Corporate Governance and Nominating Committee, which is available on our corporate website at www.blue-bird.com. The Corporate Governance and Nominating Committee reviews and assesses the adequacy of its charter annually. The Corporate Governance and Nominating Committee met five (5) times in fiscal 2024.

Responsibilities of the Corporate Governance and Nominating Committee include, among others contained in its charter:

•identifying individuals qualified to become members of our board of directors, consistent with criteria approved by our Board;

•overseeing the organization of our Board and making recommendations to the Board regarding the Board’s size, composition, membership in the staggered classes, composition of Board committees, the process for filling vacancies and the tenure of members;

•developing and recommending to our Board a set of corporate governance guidelines and principles applicable to us; and

•leading the Board in the annual review of the Board and management.

In considering a candidate for election to our Board, the Corporate Governance and Nominating Committee will carefully evaluate all relevant qualifications and experience of such candidate to assess such person’s ability to be a valuable and contributing member of our Board. Such evaluation shall be made without regard to race, religion, gender, ancestry, national origin or disability. Although the Board does not have a formal policy with regard to the consideration of diversity in identifying director nominees, our Board currently includes two diverse directors, and the Corporate Governance and Nominating Committee will consider diversity in evaluating and identifying potential future director nominees.

For fiscal 2024, in lieu of an annual Board Self-Survey, the Corporate Governance and Nominating Committee commissioned a third party, Nasdaq Board Advisory Services (“NBAS”), to conduct an independent Board Evaluation and Report. In this process each Director completed a self-evaluation, followed by a one-on-one interview with NBAS, the results of which were compiled into a final report provided to the Committee. The Committee then provided a report-out to the Board as a whole. The goal of the process and the report was to provide the Board with an understanding of how Board members view the Board’s effectiveness, highlight areas of strength and areas for improvement, and promote positive board dynamics.

Stockholder Nominations

Our Corporate Governance and Nominating Committee will consider candidates for the Board recommended by Stockholders. Our bylaws include provisions related to the nomination of directors. To recommend or to nominate director candidates, Stockholders must follow all applicable laws, rules of the SEC and the Company’s governing instruments, including our bylaws. Below is a summary of the requirements contained in our bylaws, effective as of February 2, 2023:

(a) Only persons who are nominated in accordance with the following procedures shall be eligible for election as directors of the Company. Nominations of persons for election to the Board at any annual meeting of stockholders, or at any special meeting of stockholders called for the purpose of electing directors as set forth in the Company’s notice of such special meeting, may be made (i) by or at the direction of the Board, or (ii) by any stockholder of the Company (x) who is a stockholder of record on the date of the giving of the notice for such meeting and on the Record Date for the determination of stockholders entitled to vote at such meeting and (y) who complies with (1) the notice procedures and other requirements set forth in our bylaws and (2) the requirements of Rule 14a-19 under the Exchange Act (or any amended or successor rule).

In addition to any other applicable requirements, for a nomination to be made by a stockholder, such stockholder must have given timely notice thereof in proper written form to the Secretary of the Company. To be timely, a stockholder’s notice to the Secretary must be received by the Secretary at the principal executive offices of the Company (i) in the case of an annual meeting, not later than the close of business on the 90th day nor earlier than

the opening of business on the 120th day before the anniversary date of the immediately preceding annual meeting of stockholders; provided, however, that in the event that the annual meeting is called for a date that is not within 45 days before or after such anniversary date, notice by the stockholder to be timely must be so received not earlier than the opening of business on the 120th day before the meeting and not later than the later of (x) the close of business on the 90th day before the meeting or (y) the close of business on the 10th day following the day on which public announcement of the date of the annual meeting was first made by the Company; and (ii) in the case of a special meeting of stockholders called for the purpose of electing directors, not later than the close of business on the 10th day following the day on which public announcement of the date of the special meeting is first made by the Company.

A stockholder’s notice to the Secretary must set forth (i) as to each person whom the stockholder proposes to nominate for election as a director (A) the name, age, business address and residence address of the person, (B) the principal occupation or employment of the person, (C) the class or series and number of shares of capital stock of the Company that are owned beneficially or of record by the person and (D) any other information relating to the person that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder; and (ii) as to the stockholder giving the notice (A) the name and record address of such stockholder and the name and address of the beneficial owner, if any, on whose behalf the nomination is made, (B) the class or series and number of shares of capital stock of the Company that are owned beneficially and of record by such stockholder and the beneficial owner, if any, on whose behalf the nomination is made, (C) a description of all arrangements or understandings relating to the nomination to be made by such stockholder among such stockholder, the beneficial owner, if any, on whose behalf the nomination is made, each proposed nominee and any other person or persons (including their names), (D) a representation that such stockholder intends to appear in person or by proxy at the meeting to nominate the persons named in its notice and (E) any other information relating to such stockholder and the beneficial owner, if any, on whose behalf the nomination is made that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder. Such notice must also (i) include all other information required by Rule 14a-19 under the Exchange Act (or any amended or successor rule), and (ii) be accompanied by a written consent of each proposed nominee to being named as a nominee in any proxy statement relating to the annual meeting or special meeting, as applicable, and to serve as a director if elected.

If the Board or the chairman of the meeting of stockholders determines that any nomination was not made in accordance with the bylaws and/or applicable federal and state laws, or that the solicitation in support of such nominee was not made in compliance with Rule 14a-19 (or any amended or successor rule), then such nomination shall not be considered at the meeting in question. Notwithstanding the foregoing, if the stockholder (or a qualified representative of the stockholder) does not appear at the meeting of stockholders of the Company to present the nomination, such nomination shall be disregarded, notwithstanding that proxies in respect of such nomination may have been received by the Company.

In addition to the foregoing, a Stockholder shall also comply with (i) all applicable requirements of federal and state laws, including the requirements of the Exchange Act and the rules and regulations thereunder, and (ii) all governing documents of the Company, including the articles of incorporation and bylaws, with respect to the matters set forth herein.

Insider Trading Policy and Hedging Restrictions

The Board has adopted an insider trading policy. The provisions of this policy expressly prohibit directors, officers and other employees of the Company and its subsidiaries from trading, either directly or indirectly, in securities of the Company after becoming aware of material nonpublic information related to the Company. To

further ensure adherence with this policy, procedures have been established for setting blackout periods and permissible open trading windows, as well as advance notice of market transactions. The insider trading policy provides guidance as to what constitutes material information and when information becomes public. The insider trading policy addresses transactions by family members and under Company plans, as well as other transactions which may be prohibited, such as short-term trading, short sales, publicly trading in options, hedging transactions and post-termination transactions. The policy discusses the consequences of an insider trading violation, additional trading restrictions and certain reporting requirements applicable to directors, officers, and designated key employees. The policy also contains guidelines and requirements related to the establishment of Rule 10b5-1 trading plans, in accordance with the safe harbor requirements of Securities Exchange Act Rule 10b5-1.

The insider trading policy also expressly prohibits all officers, directors and employees of the Company and its subsidiaries from engaging in short sales of Company securities or engaging in any other type of transaction where they will earn a profit based on a decline in the Company’s stock price, or otherwise entering into any hedging or similar arrangement with respect to Company securities.

Our insider trading policy and related Rule 10b5-1 trading plan requirements have been filed with the SEC as an exhibit (Exhibit 19.1) to our Annual Report on Form 10-K for the fiscal year ended September 30, 2023, filed on December 11, 2023.

Code of Ethics

We have adopted a Code of Ethics that applies to all our employees, including our CEO, CFO and principal accounting officer. Our Code of Ethics is available on our website at www.blue-bird.com. If we amend or grant a waiver of one or more of the provisions of our Code of Ethics, we intend to satisfy the requirements under Item 5.05 of Form 8-K regarding the disclosure of amendments to or waivers from provisions of our Code of Ethics that apply to our principal executive officer, principal financial officer and principal accounting officer by posting the required information on our website at the above address.

Indemnification Agreements

Our certificate of incorporation and bylaws provide for indemnification of our directors and officers to the maximum extent permitted by Delaware law. In addition, we have entered into indemnification agreements with each of our current directors and executive officers. Each indemnification agreement provides that we will indemnify the director or executive officer to the fullest extent permitted by law if the director or officer was, is made, or is threatened to be made a party to any proceeding, other than a proceeding by or in the right of the Company, for all expenses, judgments, liabilities, fines, penalties and amounts paid in settlement actually and reasonably incurred by the director or officer, or, for all expenses actually and reasonably incurred by the director or officer in connection with any proceeding by or in the right of the Company, in both cases, so long as the director or officer acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the Company, and, in the case of a criminal proceeding, in addition, had no reason to believe his or her conduct was unlawful. The indemnification agreement also provides for, among other things, (i) partial indemnification of expenses incurred by the director or officer in the event that he or she was successful as to less than all of the claims in any proceeding; (ii) in a case where the Company is jointly liable with the director or officer, to the fullest extent permitted by law, the waiver by the Company of any right of contribution it may have against the director or officer; (iii) proportionate contribution by the Company of expenses incurred in the event the director or officer elects or is required to pay all or any portion of a judgment or settlement in any proceeding in which the Company is jointly liable; and (iv) to the fullest extent permitted by law, advancement of expenses incurred by or on behalf of the director or officer in connection with any proceeding, provided that the director or officer undertakes to repay the amounts advanced to the extent it is ultimately determined that the director or officer is not entitled to indemnification. We intend to enter into indemnification agreements with our future directors and executive officers.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Policies and Procedures for Related Person Transactions

Our Board has adopted a written related person transaction policy that sets forth the policies and procedures for the review and approval or ratification of related person transactions. Our policy requires that a “related person” (as defined in paragraph (a) of Item 404 of Regulation S-K) must promptly disclose to our General Counsel any “related person transaction” (defined as any transaction that is reportable by us under Item 404(a) of Regulation S-K in which we are or will be a participant and the amount involved exceeds $120,000 and in which any related person has or will have a direct or indirect material interest) and all material facts with respect thereto. Our General Counsel will promptly communicate such information to our Audit Committee, or another independent committee of our Board appointed to consider such transactions. No related person transaction will be entered into without the approval or ratification of our Audit Committee, another independent body of our Board, or the independent disinterested members of our Board. It is our policy that directors interested in a related person transaction will recuse themselves from any such vote. Our policy does not specify the standards to be applied by our Audit Committee or another independent body of our Board in determining whether or not to approve or ratify a related person transaction, although such determinations will be made in accordance with Delaware law.

Related Person Transactions

There were no related person transactions in fiscal 2024, or any currently proposed transaction, except as disclosed below.

Secondary Public Offering Expenses Paid on behalf of Greater Than 5% Stockholders. We previously entered into certain registration rights agreements with an affiliate of American Securities, LLC (ASP BB Holdings LLC), and registered shares held by this stockholder for resale on a Registration Statement on Form S-3 filed with the SEC. ASP BB Holdings was a greater than 5% stockholder during fiscal 2024. Pursuant to these registration rights, we paid the offering expenses, including discounts and commissions, on behalf of the selling stockholder related to two secondary offerings in fiscal 2024 (December 2023 and February 2024) with respect to ASP BB Holdings. With respect to our obligations to the selling stockholder, we paid an aggregate of $3.2 million in expenses related to the offerings. Kevin Penn and Dan Thau are directors of Blue Bird and are, or were, employed by American Securities; however, Messrs. Penn and Thau disclaim any direct or indirect material interest in this transaction.

Retention of LightSource Labs, Inc. (“LightSource”). In March 2024, the Company entered a three-year subscription license agreement with LightSource, a company that provides a software platform for assessing, publishing and sharing information relating to buyers and suppliers in the supply chain ecosystem. The CEO and principal owner of LightSource is Spencer Penn, son of our Board member Kevin Penn. The fee for the three-year subscription license is $167,230. Prior to signing the agreement with LightSource, management presented the opportunity to the Audit Committee, along with an analysis supporting the conclusion that the evaluation to retain LightSource was made as an arms-length transaction and demonstrating that the amount of the license was comparable and competitive to similar solutions provided by non-related parties. The Audit Committee approved the retention of LightSource for the engagement.

DELINQUENT SECTION 16(a) REPORTS

Section 16(a) of the Exchange Act requires directors, certain officers of the Company and owners of more than 10% of our outstanding common stock to file ownership reports with the SEC reflecting such person’s ownership of our common stock.

During the fiscal year ended September 28, 2024, the Company believes, based solely on a review of copies of the reports furnished to the Company and written representations to it that no other reports were required, that all Section 16 filing requirements have been met by the reporting persons, except as follows: Mr. Dan Thau filed one Form 3 report late (Initial Statement of Beneficial Ownership); and Ms. Julie Fream filed one Form 3 report and one Form 4 report (reporting one transaction) late.

DIRECTOR AND EXECUTIVE COMPENSATION

This section discusses the material components of the executive compensation programs for Blue Bird’s Named Executive Officers who are identified in the Summary Compensation Table below, as well as our director compensation programs.

Our named executive officers (the “Named Executive Officers” or “NEOs”) for our fiscal year ended September 28, 2024, include: Philip Horlock, our President and Chief Executive Officer (President re-appointment effective September 28, 2024); Britton Smith, our former President (resigned effective September 28, 2024); Razvan Radulescu, our Chief Financial Officer; and Ted Scartz, our Senior Vice President and General Counsel.

COMPENSATION DISCUSSION AND ANALYSIS (“CD&A”)

Introduction; Financial Highlights

For fiscal 2024, the Company exceeded its fiscal 2024 revenue and Adjusted EBITDA guidance and reported a 19% increase in net sales and an increase of almost $82 million in net income.

Fiscal 2024 Financial Results and Business Highlights:

• Unit sales of 9,000

• Net sales of $1.35 billion

• Net income of $105.5 million

• Diluted earnings per share of $3.16

• Adjusted EBITDA of $183 million

• Adjusted Net Income of $115 million

• Adjusted Diluted Earnings per Share of $3.46