UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant☒ |

Filed by a Party other than the Registrant☐ |

Check the appropriate box: |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

| |

TWINLAB CONSOLIDATED HOLDINGS, INC. |

(Name of Registrant as Specified In Its Charter) |

| |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

Payment of Filing Fee (Check the appropriate box): |

☒ | No fee required.

|

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies:

|

| | (2) | Aggregate number of securities to which transaction applies:

|

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | (4) | Proposed maximum aggregate value of transaction:

|

| | (5) | Total fee paid:

|

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid:

|

| | (2) | Form, Schedule or Registration Statement No.:

|

| | (3) | Filing Party:

|

| | (4) | Date Filed:

|

TWINLAB CONSOLIDATED HOLDINGS, INC.

PROXY

STATEMENT

Annual Meeting of Stockholders

May 25, 2017

10:00 a.m. (Eastern Time)

TWINLAB CONSOLIDATED HOLDINGS, INC.

4800 T-REX AVENUE, SUITE 305, BOCA RATON, FLORIDA 33431

May 1, 2017

To Our Stockholders:

You are cordially invited to attend the 2017 Annual Meeting of Stockholders of Twinlab Consolidated Holdings, Inc. at 10:00a.m. Eastern time, on Thursday, May 25, 2017, at 4920 Conference Way South, Main Conference Room, Boca Raton, Florida 33431.

The Notice of Meeting and Proxy Statement on the following pages describe the matters to be presented at the Annual Meeting.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to promptly vote and submit your proxy by signing, dating, and returning the enclosed proxy card in the enclosed envelope, which requires no postage if mailed in the United States. The enclosed proxy statement contains information pertaining to the matters to be voted on at the annual meeting. A copy of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016 is being mailed with this proxy statement. If you decide to attend the Annual Meeting, you will be able to vote in person, even if you have previously submitted your proxy.

Thank you for your support.

Sincerely,

Naomi L. Whittel

Chief Executive Officer and Director

Table of Contents

Page

Proxy Statement | 2 |

Proposals | 2 |

Recommendations of the Board | 3 |

Information About This Proxy Statement | 3 |

Questions and Answers about the 2017 Annual Meeting of Stockholders | 3 |

Proposals to be Voted On | 7 |

Proposal 1 - Election of Directors | 7 |

Proposal 2 - Ratification of Appointment of Independent Registered Public Accounting Firm | 11 |

Report of the Audit Committee of the Board of Directors | 11 |

Independent Registered Public Accounting Firm Fees and Other Matters | 12 |

Executive Officers | 12 |

Corporate Governance | 13 |

General | 13 |

Board Composition | 13 |

Director Independence | 13 |

Director Candidates | 14 |

Communications from Interested Parties | 14 |

Board Leadership Structure and Role in Risk Oversight | 14 |

Risk Considerations in Our Compensation Program | 14 |

Code of Ethics | 14 |

Attendance by Members of the Board of Directors At Meetings | 15 |

Executive Sessions | 15 |

Committees of the Board | 15 |

Audit Committee | 15 |

Compensation Committee | 16 |

Executive and Director Compensation | 16 |

Security Ownership of Certain Beneficial Owners and Management | 21 |

Certain Relationships and Related Person Transactions | 23 |

Section 16(a) Beneficial Ownership Reporting Compliance | 28 |

Stockholders' Proposals | 29 |

Other Matters | 29 |

Solicitation of Proxies | 29 |

Twinlab Consolidated Holdings Inc.'s Annual Report on Form 10-K | 29 |

Notice of Annual Meeting of Stockholders

To Be Held Thursday, May 25, 2017

TWINLAB CONSOLIDATED HOLDINGS, INC.

4800 T-REX AVENUE, SUITE 305, BOCA RATON, FLORIDA 33431

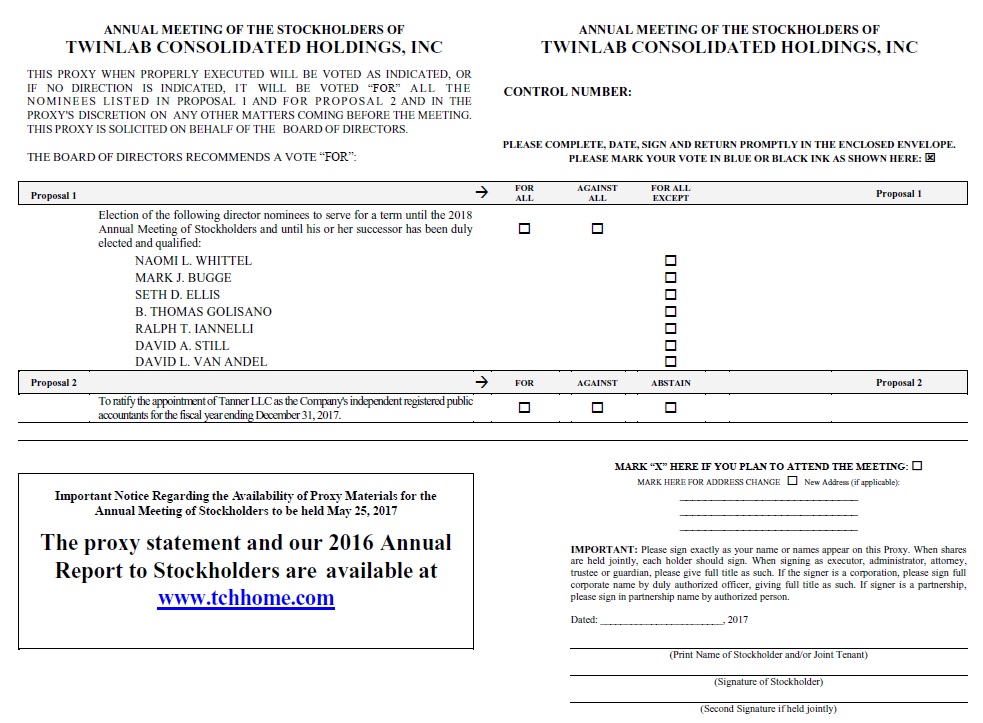

The Annual Meeting of Stockholders (the "Annual Meeting") of Twinlab Consolidated Holdings, Inc., a Nevada corporation (the "Company"), will be held at 4920 Conference Way South, Main Conference Room, Boca Raton, Florida 33431, on Thursday, May 25, 2017, at 10:00 a.m. Eastern time, for the following purposes:

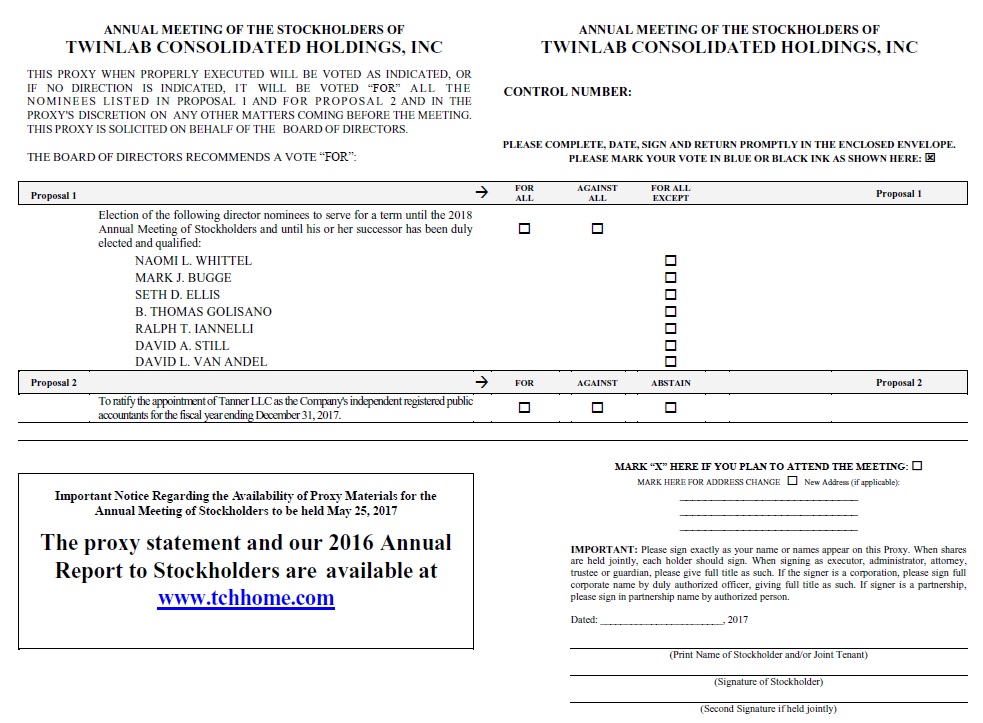

1. | To elect Naomi L Whittel, Mark J. Bugge, Seth D. Ellis, B. Thomas Golisano, Ralph T. Iannelli, David A. Still and David L. Van Andel as Directors to serve until the 2018 Annual Meeting of Stockholders, or until their successors shall have been duly elected and qualified; |

2. | To ratify the appointment of Tanner LLC as our independent registered public accounting firm for the fiscal year ending December 31, 2017; and |

3. | To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting. |

Holders of record of our Common Stock at the close of business on March 24, 2017 are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement or adjournment of the Annual Meeting. The Annual Meeting may be continued or adjourned from time to time without notice other than by announcement at the Annual Meeting.

It is important that your shares be represented regardless of the number of shares you may hold. Whether or not you plan to attend the Annual Meeting in person, we urge you to vote your shares as described in the enclosed materials by signing, dating and mailing the proxy card in the enclosed return envelope. Promptly voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy is revocable at your option.

By Order of the Board of Directors

Mary L. Marbach

Chief Legal Officer and Corporate Secretary

Boca Raton, Florida

May 1, 2017

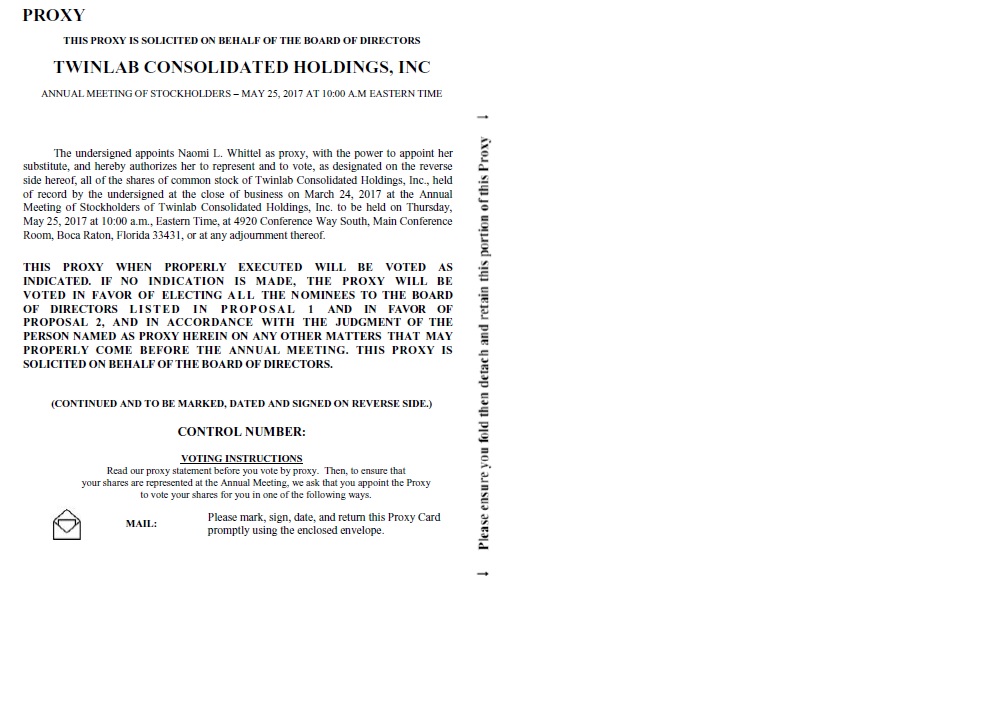

Proxy Statement

TWINLAB CONSOLIDATED HOLDINGS, INC.

4800 T-Rex Avenue, Suite 305, Boca Raton, Florida 33431

This proxy statement is furnished in connection with the solicitation by the Board of Directors of Twinlab Consolidated Holdings, Inc. of proxies to be voted at our Annual Meeting of Stockholders to be held on Thursday, May 25, 2017 (the "Annual Meeting"), at 4920 Conference Way South, Main Conference Room, Boca Raton, Florida 33431, at 10:00a.m. Eastern time, and at any continuation, postponement, or adjournment of the Annual Meeting. Holders of record of shares of Common Stock, $0.001 par value ("Common Stock"), at the close of business on March 24, 2017 (the "Record Date"), will be entitled to notice of and to vote at the Annual Meeting and any continuation, postponement, or adjournment of the Annual Meeting. As of the Record Date, there were approximately 252,924,027 shares of Common Stock issued and outstanding and entitled to vote at the Annual Meeting. Each share of Common Stock is entitled to one vote on any matter presented to stockholders at Annual Meeting. The holders of Common Stock will vote together as a single class on each matter to come before the Annual Meeting.

This proxy statement and the Company's Annual Report to Stockholders for the fiscal year ended December 31, 2016 (the "2016 Annual Report") will be released on or about May 1, 2017 to our stockholders on the Record Date.

In this proxy statement, "we," "us," "our" and the "Company" refer to Twinlab Consolidated Holdings, Inc. and, unless the context requires otherwise, its consolidated subsidiaries.

| |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON THURSDAY, MAY 25, 2017. |

This Proxy Statement and our 2016 Annual Report to Stockholders are available atwww.tchhome.com. |

DIRECTIONS TO THE ANNUAL MEETING

The Annual Meeting of Stockholders will be held at 4920 Conference Way South, Main Conference Room, Boca Raton, Florida 33431, on Thursday, May 25, 2017 at 10:00 a.m. We have set forth below directions to the Annual Meeting of Stockholders. The directions for the meeting are as follows:

From I-95

| | ● | Take exit 48 (West) – Yamato Rd |

| | ● | Turn left onto Broken Sound Blvd NW |

| | ● | Turn left onto Technology Way |

| | ● | Turn right onto Conference Way S. |

PROPOSALS

At the Annual Meeting, our stockholders will be asked:

1. | To elect Naomi L Whittel, Mark J. Bugge, Seth D. Ellis, B. Thomas Golisano, Ralph T. Iannelli, David A. Still and David L. Van Andel as Directors to serve until the 2018 Annual Meeting of Stockholders, or until their successors shall have been duly elected and qualified; |

2. | To ratify the appointment of Tanner LLC as our independent registered public accounting firm for the fiscal year ending December 31, 2017; and |

3. | To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting. |

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, the proxy holders named on the Company's proxy card will vote your shares in accordance with their best judgment.

RECOMMENDATIONS OF THE BOARD

The Board of Directors, or Board, recommends that you vote your shares as indicated below. If you return a properly completed proxy card, your shares of Common Stock will be voted on your behalf as you direct. If not otherwise specified, the shares of Common Stock represented by the proxies will be voted, and the Board of Directors recommends that you vote:

1. | FOR the election of each of Naomi L Whittel, Mark J. Bugge, Seth D. Ellis, B. Thomas Golisano, Ralph T. Iannelli, David A. Still and David L. Van Andel as Directors; and |

2. | FOR the ratification of the appointment of Tanner LLC as our independent registered public accounting firm for the fiscal year ending December 31, 2017. |

INFORMATION ABOUT THIS PROXY STATEMENT

Why you received this proxy statement. You have received these proxy materials because Twinlab Consolidated Holdings, Inc.'s Board of Directors is soliciting your proxy to vote your shares at the Annual Meeting. This proxy statement includes information that we are required to provide to you pursuant to the rules of the Securities and Exchange Commission ("SEC") and that is designed to assist you in voting your shares.

Our Proxy Materials. The enclosed proxy card contains instructions regarding how you can vote on matters at the annual meeting.

Householding. The SEC's rules permit us to deliver a single set of proxy materials to one address shared by two or more of our stockholders. This delivery method is referred to as "householding" and can result in significant cost savings. To take advantage of this opportunity, we have delivered only one set of proxy materials to multiple stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate copy of the proxy materials, as requested, to any stockholder at the shared address to which a single copy of those documents was delivered.

If you are currently a stockholder sharing an address with another stockholder and wish to receive only one copy of proxy materials for your household, please contact Broadridge Financial Solutions, Inc. at (800) 542-1061 or in writing at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717

Questions and Answers about the 2017 Annual Meeting of Stockholders

WHO IS ENTITLED TO VOTE AT THE ANNUAL MEETING?

The Record Date for the Annual Meeting is March 24, 2017. You are entitled to vote at the Annual Meeting only if you were a holder of record of Common Stock at the close of business on that date, or if you hold a valid proxy for the Annual Meeting. Each outstanding share of Common Stock is entitled to one vote for all matters to come before the Annual Meeting. At the close of business on the Record Date, there were 252,924,027 shares of Common Stock issued and outstanding and entitled to vote at the Annual Meeting. The holders of Common Stock will vote together as a single class on each matter to come before the Annual Meeting.

WHAT IS THE DIFFERENCE BETWEEN BEING A "RECORD HOLDER" AND HOLDING SHARES IN "STREET NAME"?

A record holder holds shares in his or her name. Shares held in "street name" means shares that are held in the name of a bank or broker on a person's behalf.

AM I ENTITLED TO VOTE IF MY SHARES ARE HELD IN "STREET NAME"?

Yes. If your shares are held by a bank or a brokerage firm, you are considered the "beneficial owner" of those shares held in "street name." If your shares are held in street name, these proxy materials are being provided to you by your bank or brokerage firm, along with a voting instruction card if you received printed copies of our proxy materials. As the beneficial owner, you have the right to direct your bank or brokerage firm on how to vote your shares, and the bank or brokerage firm is required to vote your shares in accordance with your instructions. If your shares are held in street name, you may not vote your shares in person at the Annual Meeting unless you obtain a legal proxy from your bank or brokerage firm.

HOW MANY SHARES MUST BE PRESENT TO HOLD THE ANNUAL MEETING?

A quorum, consisting of not less than 33% of the shares entitled to vote at the Annual Meeting, must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, in person or by proxy, of the holders of a majority in voting power of the Common Stock outstanding and entitled to vote on the Record Date will constitute a quorum.

WHO CAN ATTEND THE 2017 ANNUAL MEETING OF STOCKHOLDERS?

You may attend the Annual Meeting only if you are a Twinlab Consolidated Holdings, Inc. stockholder who is entitled to vote at the Annual Meeting, or if you hold a valid proxy for the Annual Meeting. In order to be admitted into the Annual Meeting, you must present government-issued photo identification (such as a valid driver's license). If your bank or broker holds your shares in street name, you will also be required to present proof of beneficial ownership of our Common Stock on the Record Date, such as a bank or brokerage statement or a letter from your bank or broker showing that you owned shares of our Common Stock at the close of business on the Record Date.

WHAT IF A QUORUM IS NOT PRESENT AT THE ANNUAL MEETING?

If a quorum is not present at the scheduled time of the Annual Meeting, a majority in voting power of the stockholders entitled to vote at the Annual Meeting, present in person or represented by proxy, may adjourn the Annual Meeting.

WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE SET OF PROXY MATERIALS?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each set of proxy materials, please submit your proxy by signing, dating and returning the enclosed proxy card in the enclosed envelope.

HOW DO I VOTE?

We recommend that stockholders vote by proxy even if they plan to attend the Annual Meeting and vote in person. If you are a stockholder of record, you can vote by mail by signing, dating and mailing the proxy card, which you received by mail.

If your shares are held in street name through a bank or broker, you will receive instructions on how to vote from the bank or broker. You must follow their instructions in order for your shares to be voted. Telephone and Internet voting also may be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you would like to vote your shares in person at the Annual Meeting, you should contact your bank or broker to obtain a legal proxy and bring it to the Annual Meeting in order to vote.

CAN I CHANGE MY VOTE AFTER I SUBMIT MY PROXY?

Yes.

If you are a registered stockholder, you may revoke your proxy and change your vote:

● | by submitting a duly executed proxy bearing a later date; |

● | by giving written notice of revocation to the Secretary of Twinlab Consolidated Holdings, Inc. prior to or at the Annual Meeting; or |

● | by voting in person at the Annual Meeting. |

Your most recent proxy card is the one that is counted. Your attendance at the Annual Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Secretary before your proxy is voted or you vote in person at the Annual Meeting.

If your shares are held in street name, you may change or revoke your voting instructions by following the specific directions provided to you by your bank or broker, or you may vote in person at the Annual Meeting by obtaining a legal proxy from your bank or broker and submitting the legal proxy along with your ballot.

WHO WILL COUNT THE VOTES?

A representative of the Company will act as our inspector of election and will tabulate and certify the votes.

WHAT IF I DO NOT SPECIFY HOW MY SHARES ARE TO BE VOTED?

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board of Directors. The Board of Directors' recommendations are indicated on page 3 of this proxy statement, as well as with the description of each proposal in this proxy statement.

WILL ANY OTHER BUSINESS BE CONDUCTED AT THE ANNUAL MEETING?

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, the proxy holders named on the Company's proxy card will vote your shares in accordance with their best judgment.

HOW MANY VOTES ARE REQUIRED FOR THE APPROVAL OF THE PROPOSALS TO BE VOTED UPON AND HOW WILL ABSTENTIONS AND BROKER NON-VOTES BE TREATED?

Proposal | | Votes required | | Effect of Votes Withheld / Abstentions

and Broker Non-Votes |

| | | | |

Proposal 1: Election of Directors | | The plurality of the votes cast. This means that the nominees receiving the highest number of affirmative "FOR" votes by holders of Common Stock will be elected as Directors. | | Votes withheld and broker non-votes will have no effect. |

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm | | The affirmative vote of the holders of a majority in voting power of the shares of Common Stock which are present in person or by proxy and entitled to vote on the proposal. | | Abstentions will have the same effect as votes against the proposal. We do not expect any broker non-votes on this proposal. |

WHAT IS AN ABSTENTION AND HOW WILL VOTES WITHHELD AND ABSTENTIONS BE TREATED?

A "vote withheld," in the case of the proposal regarding the election of directors, or an "abstention," in the case of the proposal regarding the ratification of the appointment of Tanner LLC as our independent registered public accounting firm, represents a stockholder's affirmative choice to decline to vote on a proposal. Votes withheld and abstentions are counted as present and entitled to vote for purposes of determining a quorum. Votes withheld have no effect on the election of directors. Abstentions have the same effect as votes against on the ratification of the appointment of Tanner LLC.

WHAT ARE BROKER NON-VOTES AND DO THEY COUNT FOR DETERMINING A QUORUM?

Generally, broker non-votes occur when shares held by a broker in "street name" for a beneficial owner are not voted with respect to a particular proposal because the broker (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares. A broker is entitled to vote shares held for a beneficial owner on routine matters, such as the ratification of the appointment of Tanner LLC as our independent registered public accounting firm, without instructions from the beneficial owner of those shares. On the other hand, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on non-routine matters, such as the election of directors. Broker non-votes count for purposes of determining whether a quorum is present.

WHERE CAN I FIND THE VOTING RESULTS OF THE 2017 ANNUAL MEETING OF STOCKHOLDERS?

We plan to announce preliminary voting results at the Annual Meeting and we will report the final results in a Current Report on Form 8-K, which we intend to file with the SEC after the Annual Meeting.

PROPOSALS TO BE VOTED ON

PROPOSAL 1 - Election of Directors

At the Annual Meeting, all Directors are to be elected to hold office until the Annual Meeting of Stockholders to be held in 2018 and until such directors' successors are elected and qualified or until such directors' earlier death, resignation or removal.

We currently have seven (7) directors on our Board. The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the nominees receiving the highest number of affirmative "FOR" votes will be elected as Directors. Votes withheld and broker non-votes will have no effect on the outcome of the vote on this proposal.

At each annual meeting of stockholders, the successor to each director whose term then expires will be elected to serve from the time of election and qualification until the next annual meeting of stockholders following election or such director's death, resignation or removal, whichever is earliest to occur. Directors shall be elected at each annual meeting of the stockholders to hold office until the next annual meeting. The term of each of the current directors expires at the 2017 Annual meeting of Stockholders. The current Directors are Naomi L Whittel, Mark J. Bugge, Seth D. Ellis, B. Thomas Golisano, Ralph T. Iannelli, David A. Still and David L. Van Andel.

Messrs. Van Andel and Bugge were originally appointed to the Board of Directors in February 2016 as the designees of Great Harbor Capital, LLC (the "Great Harbor Designees") pursuant to the Voting Agreement, dated as of October 5, 2015, and entered into among Great Harbor Capital, LLC, an affiliate of Mr. Van Andel, Golisano Holdings LLC, Thomas A. Tolworthy, the former President and Chief Executive Officer of the Company, Little Harbor, LLC, the David L. Van Andel Trust U/A dated November 30, 1993 and the Company (the “Great Harbor Voting Agreement”). Pursuant to the Great Harbor Voting Agreement, each of the parties agreed to vote the shares over which such holder has voting control in favor of the Great Harbor Designees for so long as Great Harbor Capital, LLC continues to beneficially own at least 10% of the outstanding shares of the Company's common stock.

Messrs. Golisano and Still were originally appointed to the Board of Directors in April 2016 as the designees of Golisano Holdings LLC (the "Golisano Designees") pursuant to the Voting Agreement, dated as of October 5, 2015, and entered into among Golisano Holdings LLC, an affiliate of Mr. Golisano, Thomas A. Tolworthy, Little Harbor, LLC, Great Harbor Capital, LLC, the David L. Van Andel Trust U/A dated November 30, 1993 and the Company (the “Golisano Voting Agreement”). Pursuant to the Golisano Voting Agreement, each of the parties agreed to vote the shares over which such holder has voting control in favor of the Golisano Designees for so long as Golisano Holdings LLC continues to beneficially own at least 10% of the outstanding shares of the Company's common stock.

As indicated in our Bylaws, our Board of Directors consists of no fewer than one (1) and no more than seven (7) directors, the exact number to be determined from time to time by resolution of the Board. Vacancies in the Board may be filled by the affirmative vote of a majority of the remaining directors then in office, even though less than a quorum of the Board of Directors.

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote the shares of Common Stock represented by the proxy for the election of Naomi L Whittel, Mark J. Bugge, Seth D. Ellis, B. Thomas Golisano, Ralph T. Iannelli, David A. Still and David L. Van Andel as Directors. Messrs. Bugge, Ellis, Golisano, Iannelli, Still, Van Andel and Ms. Whittel are currently serving as our Directors. In the event that any of the Director Nominees should become unable to serve or for good cause will not serve as a director, it is intended that votes will be cast for a substitute nominee designated by the Board of Directors or the Board may elect to reduce its size. The Board of Directors has no reason to believe that any of the director nominees will be unable to serve if elected. Each of the Director Nominees has consented to being named in this proxy statement and to serve if elected.

VOTE REQUIRED

The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the nominees receiving the highest number of affirmative "FOR" votes will be elected as Directors. Votes withheld and broker non-votes will have no effect on the outcome of the vote on this proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

| The Board of Directors unanimously recommends a vote FOR the election of the Director Nominees below. |

DIRECTOR NOMINEES

The current members of the Board of Directors who are also nominees for election to the Board of Directors as Directors are as follows:

Name | | Age | | Served as a

Director Since | | Positions with Twinlab Consolidated Holdings, Inc. |

| | | | | | |

Naomi L. Whittel | | 43 | | 2016 | | Chief Executive Officer/Director |

Mark J. Bugge | | 48 | | 2016 | | Director |

Seth D. Ellis | | 61 | | 2015 | | Director |

B. Thomas Golisano | | 75 | | 2016 | | Director |

Ralph T. Iannelli | | 69 | | 2016 | | Director |

David A. Still | | 65 | | 2016 | | Director |

David L. Van Andel | | 57 | | 2015 | | Chairman of the Board/Director |

The principal occupations and business experience, for at least the past five years, of each Director Nominee for election at the 2017 Annual Meeting are as follows:

| | NAOMI L. WHITTEL | | Age 43 |

| | | | | |

Effective March 16, 2016, Ms. Whittel became the Company’s Chief Executive Officer, filling the vacancy created by the termination of the Company’s former CEO, Thomas A. Tolworthy. Ms. Whittel was appointed to the Board on March 21, 2016. Ms. Whittel is the founder of Organic Holdings and was CEO of Organic Holdings when it was acquired by Twinlab in October 2015. Ms. Whittel founded Organic Holdings in 2009 with a goal of becoming an innovator in the health and wellness field by providing best-in-class, first-to-market nutritional supplements made with science-based ingredients. Ms. Whittel was the EY Entrepreneur of the Year 2013 Florida Award recipient in the Emerging category, as well as a national finalist. Ms. Whittel has extensive experience in the dietary supplement industry generally and in particular as the founder of an enterprise that was recently acquired by the Company and now constitutes a significant part of the Company’s business. The Board believes this experience qualifies her to serve as a director.

| | MARK J. BUGGE | | Age 48 |

| | | | | |

Mr. Bugge was appointed to the Board on February 26, 2016. Mr. Bugge is Chief Financial Officer of and leads VA Enterprises, LLC (“VAE”) the family office representing the Van Andel family. The core holding is Amway Corporation, a $10B in global revenue direct selling organization co-founded by the late Jay Van Andel. A graduate of Central Michigan University with an M.B.A. from Davenport University, Mr. Bugge began his career in 1992 at Amway Corporation working in a variety of finance positions until the family office formed in 2000. Mr. Bugge’s primary responsibilities and experience includes oversight of internal/external staff, finance, risk management, human resources, portfolio investments and as a liaison with Amway. In addition to the responsibilities at VAE, Mr. Bugge serves as board member and audit committee chairman for $1.7B of assets - Macatawa Bank (NASDAQ: MCBC), board member and chairman of the investment committee for Knighthead Annuity & Life Assurance Company. As a volunteer, Mr. Bugge is chairman of the investment committee for the Grand Rapids Public Museum and also serves on the board and finance committee of the Southeast/Mary Free Bed YMCA. Mr. Bugge has extensive finance and audit committee experience as well as significant knowledge regarding the Company’s history and business based on his work as an officer of Little Harbor LLC and Great Harbor Capital, LLC, each of which is or has been a shareholder of and lender to the Company or certain of its predecessors. The Board believes this experience qualifies him to serve as a director.

| | SETH D. ELLIS | | Age 61 |

| | | | | |

Mr. Ellis was appointed to the Board on February 23, 2015. Mr. Ellis founded Penta Mezzanine Fund in 2012 and has been Managing Principal since inception. Prior to founding Penta Mezzanine Fund, he was a Principal and Co-Founder of the Florida Mezzanine Fund, a mezzanine fund based in Orlando, Florida. He is the former CEO of Digital Infrared Imaging, Inc. Mr. Ellis co-founded Florida Regional Emergency Services, a hospital-based ambulance management company. Mr. Ellis began his career as an auditor with Ernst & Young and KPMG. He is a CPA and received a B.S. in Accounting from the University of Florida. Mr. Ellis has extensive experience as a CPA and as the head of an investment fund. The Board believes this experience qualifies him to serve as a director.

| | B. THOMAS GOLISANO | | Age 75 |

| | | | | |

Mr. Golisano was appointed to the Board on April 15, 2016. Mr. Golisano founded the B. Thomas Golisano Foundation in 1985. He also founded Paychex Inc., in 1971 and served as its President and Chief Executive Officer from 1971 to October 2004. He has been the Chairman of Paychex, Inc. since October 1, 2004 and also a Director since 1979. Mr. Golisano serves as the Chairman of Bluetie, Inc. He served as Chairman of Store To Door LLC. He served as the Chairman of Mykonos Software, Inc. Mr. Golisano served as the Chairman of Greater Rochester Fights Back, a coalition to combat illegal drugs and alcohol abuse. Mr. Golisano served as the Chairman of Safesite Records Management Corporation until its acquisition by Iron Mountain Incorporated in June 1997. He served as a Director of Ultra-Scan Corporation. He served as an Independent Director of Iron Mountain Incorporated from June 1997 to May 24, 2006. He served as a Director of SmartCare Clinics Inc. He serves a Trustee of the Rochester Institute of Technology and the Rochester Chamber of Commerce. The Board believes this experience qualifies him to serve as a director.

| | RALPH T. IANNELLI | | Age 69 |

| | | | | |

Mr. Iannelli was appointed to the Board on February 26, 2016. Mr. Iannelli is the Founder, Chief Executive Officer, and President of Essex, which is located in Montecito, California. Since its inception in 1993, Essex has provided over $1 billion in funding to a variety of credit-worthy companies focusing on funding companies that acquire assets through leasing rather than purchasing and presently includes over fifteen public and private companies in its portfolio. Mr. Iannelli is an investor and active board member for a broad range of companies including Neos Technologies LLC, Emida Technologies Inc. and a number of other start-up and later stage companies. Mr. Iannelli is also a member of the Investment Committee and Board of Trustees for the Santa Barbara Foundation and a member of the Board of Directors for ICivic.org. Mr. Iannelli began his career in 1970 in securities trading and sales at Loeb, Rhoades and Company. He later held management positions at IBM, and as an Executive Vice President at Nixdorf Computer and Pitney Bowes. Mr. Iannelli was a Partner at American Computer Leasing Corporation and a Principal at RAM Capital Corporation. Mr. Iannelli holds a Bachelor of Arts in History from St. Josephs College in Rensselaer, Indiana and attended the University of Chicago. Mr. Iannelli has extensive experience as a lender, investor and board member as well as significant knowledge regarding the Company’s history and business based on Essex entering into several machinery and equipment leases with the Company and certain of its predecessors. The Board believes this experience qualifies him to serve as a director.

| | DAVID A. STILL | | Age 65 |

| | | | | |

Mr. Still has been a Director of Twinlab Consolidated Holdings, Inc. since April 15, 2016. Mr. Still has served as a Director of Bak USA LLC since 2015, as a Trustee for WXXI Public Broadcasting Corporation since 2013 and as a Trustee and the Current Chairman of the Rochester Area Community Foundation since 2011. Mr. Still began his career in banking with Barclays Bank and has also served as Senior Managing Director of Fishers Asset Management from 1998 to 2017, as Chief Executive Officer of Networx Corporation Inc. from 2014 to 2016 and held various positions with Chase Manhattan Bank and Dunfries Corporation, a subsidiary of Chase Manhattan Bank, from 1991 to 1998, including most recently as Vice President and Portfolio Manager of Real Estate Lending. Mr. Still holds a Bachelor of Arts in Philosophy and a Master of Business Administration, both from the University of Pittsburgh. The Board believes this experience qualifies him to serve as a director.

| | DAVID T. VAN ANDEL | | Age 57 |

| | | | | |

Mr. Van Andel was appointed to the Board on February 23, 2015 and elected Chairman on February 26, 2016. He is Chairman and CEO of the Van Andel Institute for Education and Medical Research. He currently serves on the Board of Directors of Amway Corporation and serves on its Executive, Governance and Audit Committees and prior to leading the Van Andel Institute held various positions at Amway since 1977. He was a shareholder and member of the Board of Directors of Twinlab Holdings, Inc. ("THI") from January 1, 2013 through August 7, 2014 when THI was acquired by and became a subsidiary of Twinlab Consolidated Corporation ("TCC"). He co-founded IdeaSphere Inc., a predecessor of THI. He holds a B.A. in Business Administration from Hope College. Mr. Van Andel has an extensive history as a director and stockholder of certain of the Company’s predecessors. In addition, he has extensive experience as a corporate executive and investor in numerous industries. The Board believes this experience qualifies him to serve as a director.

We believe that all of our current Board members possess the professional and personal qualifications necessary for Board service, and have highlighted particularly noteworthy attributes for each Board member in the individual biographies above.

PROPOSAL 2 - Ratification of Appointment of Independent Registered Public Accounting Firm

Our Audit Committee has appointed Tanner LLC as our independent registered public accounting firm for the fiscal year ending December 31, 2017. Our Board has directed that this appointment be submitted to our stockholders for ratification. Although ratification of our appointment of Tanner LLC is not required, we value the opinions of our stockholders and believe that stockholder ratification of our appointment is a good corporate governance practice.

Tanner LLC also served as our independent registered public accounting firm for the fiscal year ended December 31, 2016. Neither the accounting firm nor any of its members has any direct or indirect financial interest in or any connection with us in any capacity other than as our auditors, providing audit and non-audit related services. A representative of Tanner LLC is expected to attend the Annual Meeting, make a statement if so desired and be available to respond to appropriate questions from stockholders.

In the event that the appointment of Tanner LLC is not ratified by the stockholders, the Audit Committee will consider this fact when it appoints the independent auditors for the fiscal year ending December 31, 2018. Even if the appointment of Tanner LLC is ratified, the Audit Committee retains the discretion to appoint a different independent auditor at any time if it determines that such a change is in the best interests of Twinlab Consolidated Holdings, Inc.

VOTE REQUIRED

This proposal requires the approval of the affirmative vote of the holders of a majority in voting power of the shares of Common Stock of the Company which are present in person or by proxy and entitled to vote thereon. Abstentions will have the same effect as a vote against this proposal. Because brokers have discretionary authority to vote on the ratification of the appointment of Tanner LLC, we do not expect any broker non-votes in connection with this proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

| | The Board of Directors unanimously recommends a vote FOR the Ratification of the Appointment of Tanner LLC as our Independent Registered Public Accounting Firm. |

| | | |

Report of the Audit Committee of the Board of Directors

The Audit Committee has reviewed our audited financial statements for the fiscal year ended December 31, 2016 and has discussed these financial statements with management and our independent registered public accounting firm. The Audit Committee has also received from, and discussed with, our independent registered public accounting firm various communications that such independent registered public accounting firm is required to provide to the Audit Committee, including the matters required to be discussed by statement on Auditing Standard No. 1301,Communications with Audit Committees, as adopted by the Public Company Accounting Oversight Board ("PCAOB").

Our independent registered public accounting firm also provided the Audit Committee with a formal written statement required by PCAOB Rule 3526 (Communications with Audit Committees Concerning Independence) describing all relationships between the independent registered public accounting firm and Twinlab Consolidated Holding's Inc., including the disclosures required by the applicable requirements of the PCAOB regarding the independent registered public accounting firm's communications with the Audit Committee concerning independence. In addition, the Audit Committee discussed with the independent registered public accounting firm its independence from Twinlab Consolidated Holding's Inc.

Based on its discussions with management and the independent registered public accounting firm, and its review of the representations and information provided by management and the independent registered public accounting firm, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in Twinlab Consolidated Holding's Inc.'s Annual Report on Form 10-K for the fiscal year ended December 31, 2016.

Mark J. Bugge, Chairman

David A. Still

Ralph T. Iannelli

Independent Registered Public Accounting Firm Fees and Other Matters

The following table summarizes the fees of Tanner LLC, our independent registered public accounting firm, billed to us for each of the last two fiscal years for audit services and billed to us in each of the last two fiscal years for other services:

Fee Category | | December 31, 2016 | | | December 31, 2015 | |

Audit Fees | | $ | 297,307 | | | $ | 260,400 | |

Audit-Related Fees | | | 2,095 | | | | — | |

Tax Fees | | | 35,925 | | | | 65,150 | |

All Other Fees | | | 20,000 | | | | — | |

Total Fees | | $ | 355,327 | | | $ | 325,550 | |

AUDIT FEES

Tanner LLC (“Tanner”) billed the Company $297,307 and $260,400 in the aggregate for services rendered for the audits of the Company's 2016 and 2015 fiscal years and the review of the Company's interim financial statements included in the Company's Quarterly Reports on Form 10-Q for the Company's 2016 and 2015 fiscal years.

AUDIT-RELATED FEES

Tanner billed the Company $2,095 in the aggregate for audit-related services as defined by the SEC for the 401(k) audit for the Company’s 2016 fiscal year and did not render any bills to the Company for audit-related services for the 2015 fiscal year.

TAX FEES

Tanner billed the Company $35,925 and $65,150 in the aggregate for tax fees for the preparation of federal and state income tax returns for the Company’s 2016 and 2015 fiscal years.

ALL OTHER FEES

Tanner billed the Company $20,000 in the aggregate for other fees relating to the 2015 preparation of federal and state income tax returns for the Company’s 2016 fiscal year and did not render any bills to the Company for other services for the 2015 fiscal year.

AUDIT COMMITTEE PRE-APPROVAL POLICY AND PROCEDURES

The Board of Directors of the Company has appointed an Audit Committee, which operates pursuant to a written charter. The charter provides for the pre-approval of all audit services and all permitted non-audit services to be performed for the Company by the independent registered public accounting firm, subject to the requirements of applicable law. The procedures for pre-approving all audit and non-audit services provided by the independent registered public accounting firm will include the Audit Committee reviewing audit-related services, tax services and other services. The Audit Committee will periodically monitor the services rendered by and actual fees paid to the independent registered public accounting firm to ensure that such services are within the parameters approved by the Audit Committee.

All of the audit, audit-related and tax services provided by Tanner LLC to us in 2016 and 2015 were approved by the Audit Committee pursuant to these procedures. All non-audit services provided in 2016 and 2015 were reviewed with the Audit Committee, which concluded that the provision of such services by Tanner LLC was compatible with the maintenance of that firm's independence in the conduct of its auditing function.

Executive Officers

The following table identifies our current executive officers:

Name | | Age | | Position |

| | | | |

Naomi L Whittel | | 43 | | Chief Executive Officer and Director |

Alan S. Gever | | 62 | | Chief Financial Officer and Chief Operating Officer |

Mary L. Marbach | | 50 | | Chief Legal Officer and Corporate Secretary |

Gregory Thomas Grochoski | | 70 | | Executive Vice President and Chief Science Officer |

Naomi L. Whittel—Please refer to the biographical information for Ms. Whittel listed above under "Election of Directors."

Alan S. Gever — Mr. Gever has served as our Chief Financial Officer and Chief Operating Officer since March 2017. Prior to joining the Company, Mr. Gever served as Chief Financial Officer of Spice Chain Corporation. Previously, he served as Chief Financial Officer and Chief Operating Officer of Vitalicious, Inc., Chief Financial Officer of Mavis Tire Supply Corp., Executive Vice President, Chief Financial Officer and Treasurer of Smart Balance, Inc., Chief Executive Officer of CCW Holdings, Inc., Chief Financial Officer of Ultimate Juice Company, and Co-CEO of Sharemax, Inc. He was also a Principal with Northpointe Consulting Group. Earlier in his career, he held senior management positions with Nabisco, Inc., most recently as Vice President and General Manager. Mr. Gever has his B.S. from Seton Hall University. Mr. Gever received a Bachelor of Science degree in Business Management from Seton Hall University, is a member of the Council of Supply Chain Management Professionals and a founding member of the Conference Board's Council of Purchasing and Supply Management.

Mary L. Marbach — Ms. Marbach has served as our Chief Legal Officer since December 2016. Prior to joining the Company, Ms. Marbach was Vice President and General Counsel at Wetherill Associates, Inc, Chief Legal Officer and Corporate Secretary at Vitacost.com, Inc, and Senior Transactional Counsel at Imperial Finance and Trading, LLC in Boca Raton, Florida. Ms. Marbach was an associate at Greenberg Traurig, LLP in its Corporate and Securities Group in Boca Raton, Florida. Prior to that, she was an associate at Morrison & Foerster, LLP in its Corporate & Securities Group in Palo Alto, California. Ms. Marbach has her B.S. from Syracuse University, her M.B.A. from University of Miami, and her J.D. from Boston University School of Law. Ms. Marbach is a member of the State Bar of California and the State Bar of Florida.

Gregory Thomas Grochoski — Mr. Grochoski has served as our Executive Vice President and Chief Science Officer since September 2014. Prior thereto, he served as Chief Science Officer for THI and its predecessor company commencing in 2004. Mr. Grochoski holds a BS in Economics and a BS in Chemistry from Grand Valley State University.

Corporate Governance

GENERAL

The Company has adopted a Code of Ethics and Business Conduct that applies to all of its directors, officers (including its Chief Executive Officer, Chief Financial Officer, Controller and any person performing similar functions) and employees. The Company has made the Code of Ethics and Business Conduct available on its website at www.tchhome.com/code-of-ethics. Effective February 26, 2016, the Board of Directors created an audit committee. The Audit Committee is composed of Mark J. Bugge (Chairman), David A. Still and Ralph T. Iannelli. The Board of Directors has also formed a Compensation Committee, composed of B. Thomas Golisano (Chairman), Mark Bugge and Seth Ellis. We currently do not have a standing nominating committee of our Board of Directors, or a committee performing similar functions. Until such formal committee is established, our entire Board of Directors performs the same functions as a nominating committee.

BOARD COMPOSITION

Our Board of Directors currently consists of seven (7) directors: Naomi L Whittel, Mark J. Bugge, Seth D. Ellis, B. Thomas Golisano, Ralph T. Iannelli, David A. Still and David L. Van Andel. As indicated in our Bylaws, our Board of Directors consists of no fewer than one (1) and no more than seven (7) directors, the exact number to be determined from time to time by resolution of the Board. Vacancies in the Board may be filled by the affirmative vote of a majority of the remaining directors then in office, even though less than a quorum of the Board of Directors. At each annual meeting of stockholders, the successor to each director whose term then expires will be elected to serve from the time of election and qualification until the next annual meeting following election or such director's death, resignation or removal, whichever is earliest to occur

DIRECTOR INDEPENDENCE

Messrs. Bugge, Ellis, Golisano, Iannelli, Still and Van Andel are currently the Board’s independent directors, as the term “independent” is defined under the Nasdaq Stock Market ("NASDAQ") rules. Since the OTCPK does not have rules regarding director independence, the Board makes its determination as to director independence based on the definition of “independence” as defined under the rules of the Nasdaq Stock Market. In evaluating and determining the independence of the directors, the Board considered the relationships disclosed below under "Certain Relationships and Related Person Transactions" and determined that those relationships do not impair the directors' independence from us and our management under the NASDAQ rules.

DIRECTOR CANDIDATES

The Company does not have a separate nominating committee. The Board of Directors believes that the task of nominating prospective directors requires the participation of all current independent directors, rather than a separate committee consisting of only certain independent directors. The independent directors will consider all qualified director candidates identified by various sources, including members of the Board, management and stockholders. Candidates for directors recommended by stockholders will be given the same consideration as those identified from other sources. The independent directors are responsible for reviewing each candidate’s biographical information, meeting with each candidate and assessing each candidate’s independence, skills and expertise based on a number of factors. While we do not have a formal policy on diversity, when considering the selection of director nominees, the independent directors consider individuals with diverse backgrounds, viewpoints, accomplishments, cultural backgrounds, and professional expertise, among other factors.

COMMUNICATIONS FROM INTERESTED PARTIES

The Board of Directors provides a process for interested parties, including stockholders, to send communications to the Board. Anyone who would like to communicate with, or otherwise make his or her concerns known directly to the Chairman of the Board, the chairperson of the Audit Committee, or to the non-management or independent directors as a group, may do so by addressing such communications or concerns to the Secretary of the Company, 4800 T-Rex Avenue, Suite 305, Boca Raton, Florida 33431, who will forward all communications that, in his or her judgment, are appropriate for consideration to the appropriate party. Examples of communications that would not be appropriate for consideration by the directors include commercial solicitations and matters not relevant to the shareholders, to the functioning of the board, or to the affairs of the Company. Such communications may be done confidentially or anonymously.

BOARD LEADERSHIP STRUCTURE AND ROLE IN RISK OVERSIGHT

Our Board of Directors is currently chaired by Mr. Van Andel, while Ms. Whittel serves as our Chief Executive Officer. Based on the Company's present circumstances, our Board of Directors believes that the Company and its stockholders are best served by having Mr. Van Andel serve as its Chairman of the Board and Ms. Whittel serve as its Chief Executive Officer. Our current leadership structure permits Ms. Whittel to focus her attention on managing our Company and permits Mr. Van Andel to manage the Board. Accordingly, we believe our current leadership structure is the optimal structure for us at this time.

Our Board of Directors is responsible for overseeing our risk management process. Our Board of Directors focuses on our general risk management strategy, the most significant risks facing us, and oversees the implementation of risk mitigation strategies by management. Our Board of Directors is also apprised of particular risk management matters in connection with its general oversight and approval of corporate matters and significant transactions. Our Board of Directors does not believe that its role in the oversight of our risks affects the Board's leadership structure.

RISK CONSIDERATIONS IN OUR COMPENSATION PROGRAM

We believe our compensation policies present no risks that are reasonably likely to have a material adverse effect on our Company.

CODE OF ETHICS

The Company has adopted a Code of Ethics and Business Conduct that applies to all of its directors, officers (including its Chief Executive Officer, Chief Financial Officer, Controller and any person performing similar functions) and employees. The Company has made this Code of Ethics and Business Conduct available on its website at www.tchhome.com/code-of-ethics. We expect that any amendments to the Code of Ethics and Business Conduct, or any waivers of its requirements, that are required to be disclosed by SEC rules will be disclosed on our website.

ATTENDANCE BY MEMBERS OF THE BOARD OF DIRECTORS AT MEETINGS

There were six meetings of the Board of Directors during the fiscal year ended December 31, 2016. During the fiscal year ended December 31, 2016, each director attended at least 75% of the aggregate of (i) all meetings of the Board of Directors and (ii) all meetings of the committees on which the director served during the period in which he or she served as a director.

Currently, we do not maintain a formal policy regarding director attendance at annual meetings of stockholders; however, it is expected that absent compelling circumstances, directors will attend each year's annual meeting of stockholders.

EXECUTIVE SESSIONS

The non-management members of the Board meet in regularly scheduled executive sessions. The Chairman presides over the regularly scheduled executive sessions.

Committees of the Board

Our Board has established a standing Audit committee, which operates under a written charter that was approved by our Board on April 12, 2016, and a Compensation Committee, which has not adopted a written charter. The members of the Audit Committee are Mark J. Bugge, who serves as committee chair, Ralph T. Iannelli and David A. Still. The members of our Compensation Committee are B. Thomas Golisano, who serves as committee chair, Mark J. Bugge and Seth Ellis.

AUDIT COMMITTEE

Our Audit Committee's responsibilities include, but are not limited to:

● | appointing, compensating, retaining and overseeing our independent registered public accounting firm; |

● | at least annually obtaining and reviewing our independent registered public accounting firms' report on independence and quality control; |

● | reviewing with our independent registered public accounting firm the scope and results of their audit, any audit problems or difficulties and management's response to any problems or difficulties; |

● | pre-approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm; |

● | overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC; |

● | reviewing the facts and circumstances of each related party transaction under the Company's Related Party Transaction Policy and Procedures and either approve or disapprove of each related party transaction; |

● | reviewing and monitoring compliance with laws, rules, regulations and the Company's Code of Ethics and Business Conduct; and |

● | establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal controls or auditing matters, and for the confidential and anonymous submission by Company employees of concerns regarding questionable accounting or auditing matters. |

We have determined that each of Messrs. Bugge, Iannelli and Still meets the definition of "independent director" for purposes of serving on an audit committee under Rule 10A-3 and the NASDAQ rules. In addition, our Board of Directors has determined that Mr. Bugge qualifies as an "audit committee financial expert," as such term is defined in Item 407(d)(5) of Regulation S-K.

The Audit Committee held four meetings during the fiscal year ended December 31, 2016.

COMPENSATION COMMITTEE

The Compensation Committee is responsible for, among other matters:

● | reviewing and approving the compensation of our Chief Executive Officer (either alone or, if directed by the Board of Directors, in conjunction with a majority of independent directors) and reviewing and setting or making recommendations to the Board of Directors on the compensation of our other executive officers; |

● | reviewing and making recommendations to the Board of Directors on the compensation of our directors; |

● | appointing and overseeing any compensation consultants, legal counsel or other advisers; |

● | reviewing and approving or making recommendations to the Board of Directors regarding incentive compensation and equity-based plans and arrangements; and |

● | reviewing and discussing with management the Company's "Compensation Discussion & Analysis" to the extent required to be included in filings with the SEC. |

We have determined that each of Messrs. Golisano, Bugge, and Ellis meets the definition of "independent director" for purposes of serving on a compensation committee under the NASDAQ rules.

The Compensation Committee did not hold any meetings during the fiscal year ended December 31, 2016.

During 2016, KornFerry Future Step ("KornFerry") served as a compensation consultant to the Company and advised the Company and management with respect to grants of stock options and restricted stock units to the executive officers, other employees and directors. Other than as described above, KornFerry was not asked to perform any other services for the Company or management during 2016.

Executive and Director Compensation

This section discusses the material components of the executive compensation program for our executive officers who are named in the "2016 Summary Compensation Table" below. In 2016, our "named executive officers" consisted of the following:

| | ● | Naomi Whittel, Chief Executive Officer; |

| | ● | Thomas A. Tolworthy,Former Chief Executive Officer and Former President, |

| | ● | William E. Stevens,Former Chief Financial Officer, |

| | ● | Gregory Thomas Grochoski,Executive Vice President and Chief Science Officer, and |

| | ● | Glenn S. Wolfson,Former Executive Vice President and Former Chief Administrative Officer. |

We are an "emerging growth company" under applicable federal securities laws and therefore permitted to take advantage of certain reduced public company reporting requirements. As an emerging growth company, we provide in this proxy statement the scaled disclosure permitted under the Jumpstart Our Business Startups Act of 2012, including the executive compensation disclosures required of a "smaller reporting company." In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which votes must be conducted.

2016 Summary Compensation Table

The following table sets forth information concerning the compensation of our named executive officers for the years ended December 31, 2016 and December 31, 2015.

Name and principal position | Year | Salary ($) | Bonus ($) | Stock Awards ($)(2) | Option Awards

($) | Non-Equity Incentive Plan Compensation ($) | All Other Compensation ($) | Total ($) |

| | | | | | | | |

Naomi Whittel(1) | | | | | | | | |

Chief Executive Officer | 2016 | $254,231 | — | $660,000 | — | — | — | $914,231 |

| | 2015 | — | — | — | — | — | — | — |

Thomas A. Tolworthy(3) | | | | | | | | |

Former Chief Executive Officerand Former President | 2016 | $115,560 | — | — | — | — | $544,073(4) | $659,633 |

| | 2015 | $442,325 | — | — | — | — | — | $442,325 |

William E. Stevens(5) | | | | | | | | |

Former Chief Financial Officer | 2016 | $246,154 | — | — | — | $50,000 | — | $296,154 |

| | 2015 | — | — | — | — | — | — | --- |

Gregory Thomas Grochoski | | | | | | | | |

Executive Vice President and Chief Science Officer | 2016 | $262,500 | — | — | — | — | — | $262,500 |

| | 2015 | $232,218 | — | — | — | — | — | $232,218 |

Glenn S. Wolfson(6) | | | | | | | | |

Former Executive Vice President and Chief Administrative Officer | 2016 | $82,576 | — | $55,000 | — | — | $201,823(7) | $339,399 |

| 2015 | $313,930 | — | — | — | — | — | $313,930 |

1 | Ms. Whittel was appointed as Chief Executive Officer of the Company effective March 16, 2016. |

2 | Reflects the aggregate grant date fair value of the stock awards granted to the named executive officers in 2016. See Note 11-Stockholders' Equity (Deficit) in our Annual Report on Form 10-K for such year for the assumptions used in valuing such stock awards. |

3 | Mr. Tolworthy was appointed as Chief Executive Officer and President and as a director of the Company on the closing date of the Merger on September 16, 2014 and served in those positions through March 16, 2016. |

4 | The amount in the all other compensation column includes the $500,000 paid to Mr. Tolworthy to repurchase his shares of the Company's common stock and $44,073 in accrued vacation pay under the terms of his Separation Agreement discussed under the "Narrative Disclosure to Summary Compensation Table" section below. |

5 | Mr. Stevens served as Chief Financial Officer from February 2016 to December 2016. |

6 | Mr. Wolfson served as Executive Vice President and Chief Administrative Officer from December 2014 to March 2016. |

7 | The amount in the all other compensation column includes the $175,000 paid to Mr. Wolfson as severance pay and consisting of twenty-six weeks of salary and $26,823 in accrued vacation pay. |

Narrative Disclosure to Summary Compensation Table

Employment Agreement with Naomi L. Whittel

Employment Term and Position

On September 21, 2016, the Company and Ms. Whittel entered into an employment agreement (the " Whittel Agreement") that has a three-year term from its commencement date of March 16, 2016 with automatic one-year renewal terms if the Board does not notify Ms. Whittel that the Company will not be renewing the employment term at least 180 days in advance of the end of the applicable term. The Whittel Agreement supersedes all previous employment agreements by and between the Company and Ms. Whittel. Pursuant to the Whittel Agreement, Ms. Whittel serves as Chief Executive Officer of the Company.

Base Salary, Annual Bonus, Benefits

Pursuant to the terms of the Whittel Agreement, Ms. Whittel is entitled to an annual base salary of $300,000 and an annual bonus of up to 150% of her annual salary pursuant to the satisfaction of performance targets and goals. In addition, Ms. Whittel is eligible to participate in the Company’s standard employee benefits programs available to senior executives. Ms. Whittel is also entitled to receive equity awards pursuant to satisfaction of performance goals. For a description of the equity award granted to Ms. Whittel, please see below under "—Equity-Based Compensation Awards."

Severance

The Whittel Agreement provides for severance upon a termination by us without cause or by Ms. Whittel for good reason. Upon a termination of Ms. Whittel's employment by us without cause or by reason of her resignation for "good reason" (as defined in the Whittel Agreement), Ms. Whittel is entitled to (1) a lump sum severance payment in the amount of $450,000, payable sixty days after termination, (2) all unpaid benefits, bonuses business expense reimbursements and (3) vesting of all granted stock options that are not vested at such time, subject to Ms. Whittel signing a general release. Ms. Whittel is also entitled to continued health benefits in accordance with Company policies. If Ms. Whittel’s employment is terminated by the Company exercising its termination rights or by Ms. Whittel for good reason, or after the fourth anniversary of the Whittel Agreement, Ms. Whittel shall have the right to sell to the Company, any and all of the shares of the Company’s common stock and restricted stock units then held by her and the Company shall be required to purchase them, at the terms set forth in the Whittel Agreement.

Restrictive Covenants

Pursuant to the Whittel Agreement, Ms. Whittel is subject to non-competition and non-solicitation restrictions for a 12 month period after termination of employment. Ms. Whittel is also subject to confidentiality restrictions.

Employment Agreement and Separation Agreement with Thomas A. Tolworthy

Employment Term and Position

On August 7, 2014, the Company and Mr. Tolworthy entered into an employment agreement (the "Tolworthy Agreement"). Pursuant to the Tolworthy Agreement, Mr. Tolworthy served as Chief Executive Officer and President of the Company.

Base Salary, Annual Bonus, Benefits

Pursuant to the terms of the Tolworthy Agreement, Mr. Tolworthy was entitled to a base salary based on an annualized rate of $500,000 from the start date through December 31, 2014 and beginning January 1, 2015, an initial base salary based on an annualized rate of $600,000, plus a discretionary cash bonus for the remainder of 2014 and a performance-based target annual bonus payable upon achievement of applicable performance metrics thereafter. Mr. Tolworthy did not accept payment of the additional $100,000 of base salary for 2015, agreeing instead to accept $500,000 of base salary for 2015. In addition, Mr. Tolworthy was eligible to participate in the Company’s equity incentive program and standard employee benefits programs available to senior executives.

Separation and Release Agreement Terms

On March 23, 2016, the Company and Mr. Tolworthy entered into a Separation and Release Agreement (the “Separation Agreement”). Pursuant to the Separation Agreement, the Company agreed to (i) purchase from Mr. Tolworthy 35,551,724 shares of the Company’s common stock for an aggregate price of $500,000; (ii) pay the cost of Mr. Tolworthy’s health insurance continuation coverage available under the federal COBRA law for the twelve (12) months following the termination date if Mr. Tolworthy timely elected and remained eligible for coverage under COBRA during that period; and (iii) pay Mr. Tolworthy $44,073 as settlement for accrued vacation pay.

Pursuant to the Separation Agreement, the Company provided notice of its request that Mr. Tolworthy surrender 9,306,898 shares of common stock pursuant to that certain Subscription and Surrender Agreement, dated as of September 3, 2014, entered into between Twinlab Consolidation Corporation, a wholly-owned subsidiary of the Company, and Mr. Tolworthy and assumed by the Company on September 16, 2014 (the “Surrender Agreement”).

The Separation Agreement included mutual release, standstill, and similar provisions typical for this type of separation agreement.

Restrictive Covenants

Pursuant to the Tolworthy Agreement, Mr. Tolworthy was subject to non-competition and non-solicitation restrictions for a 12 month period after termination of employment. Mr. Tolworthy was also subject to confidentiality restrictions.

Terms of Agreement with William E. Stevens

Employment Term and Position

Mr. Stevens was appointed Chief Financial Officer of the Company pursuant to the Terms of Agreement effective as of January 1, 2016 (the “Stevens Agreement”). On December 6, 2016, Mr. Stevens informed the Company that he did not intend to renew the term of his employment agreement, and as a result his employment term ended on December 31, 2016.

Base Salary, Annual Bonus, Benefits

Under the Stevens Agreement, Mr. Stevens was entitled to a base salary at an original annualized rate of $250,000. Mr. Stevens' was also entitled to an annual bonus opportunity of $50,000 based on metrics to be set by his supervisor.

Severance

Mr. Stevens was not entitled to any severance payments under the Stevens Agreement.

Restrictive Covenants

There were no restrictive covenants in the Stevens Agreement.

Employment Agreement with Glenn S. Wolfson

Employment Term and Position

On December 1, 2014, the Company and Mr. Wolfson entered into an employment agreement (the "Wolfson Agreement"). Mr. Wolfson's employment relationship with the Company under the Employment Agreement was at-will. Pursuant to the Employment Agreement, Mr. Wolfson served as the Company's Chief Administrative Officer.

Base Salary, Annual Bonus, Benefits

Pursuant to the terms of the Wolfson Agreement, Mr. Wolfson was entitled to an annual base salary at an annualized rate of $350,000, plus a discretionary cash bonus for the remainder of 2014, and a performance-based target annual bonus of 50% of his annual salary pursuant to the satisfaction of performance targets and goals to be approved by the Board. In addition, Mr. Wolfson was eligible to participate in the Company’s equity incentive program and standard employee benefits programs available to senior executives.

Severance

Mr. Wolfson's employment relationship with the Company was at-will, subject to his right to receive under the Wolfson Employment Agreement, and subject to certain conditions, severance pay in the event of termination without cause or resignation for good reason consisting of twenty-six weeks of salary and other minor benefits.

Restrictive Covenants

Pursuant to the Wolfson Agreement, Mr. Wolfson was subject to non-competition and non-solicitation restrictions for a 12 month period after termination of employment. Mr. Wolfson was also subject to confidentiality restrictions.

Equity-Based Compensation Awards

The only equity compensation plan currently in effect is the Twinlab Consolidation Corporation 2013 Stock Incentive Plan (the “TCC Plan”), which was assumed by the Company on September 16, 2014. The TCC Plan originally established a pool of 20,000,000 shares of common stock for issuance as incentive awards to employees for the purposes of attracting and retaining qualified employees who will aid in our success. During 2016 and 2015, we granted Restricted Stock Units ("RSUs"), to certain employees pursuant to the TCC Plan. Each Restricted Stock Unit relates to one share of the Company’s common stock. The Restricted Stock Unit awards vest 25% each annually on various dates through 2019. We estimated the grant date fair market value per share of the Restricted Stock Units and are amortizing the total estimated grant date value over the vesting periods. During the year ended December 31, 2016, a total of 822,890 shares of common stock were issued to employees pursuant to the vesting of Restricted Stock Units. As of December 31, 2016, 4,819,394 shares remain available for use in the TCC Plan

In 2016, the Company also granted 3,000,000 full vested shares of Company common stock, subject to the terms and conditions of the TCC Plan, as amended from time to time, to Ms. Whittel.

Other Elements of Compensation

Retirement Plans

Until June 2016, the Company maintained a defined contribution retirement plan (the “Plan”) which qualified under Section 401(k) of the Internal Revenue Code of 1986, as amended. All employees over the age of 18 were eligible for participation in the Plan, on the 1st day of the 1st month following 30 days of employment with the Company. The Plan was a safe harbor plan, requiring the Company to match 100% of the first 1% of eligible salary contributed per pay period by participating employees, and to match 50% on the next 5% of eligible salary contributed per pay period by participating employees (with matching capped at 6% per pay period). Currently, we no longer offer matching but do allow our employees to contribute to a 401(k) portfolio. The Company recognized expenses of $203 and $353 related to the Plan in 2016 and 2015, respectively.

Outstanding Equity Awards at Fiscal Year-End

The outstanding equity awards at fiscal year-end table has been omitted as there is no required information to be disclosed for the fiscal year ended December 31, 2016.

DIRECTOR COMPENSATION

We do not currently have an established compensation package for Board members.

Security Ownership of Certain Beneficial Owners and Management

The following table presents information about the beneficial ownership of the Company’s common stock as of March 24, 2017 by those persons known to beneficially own more than 5% of our capital stock and by our directors, named executive officers, and current executive officers and directors as a group. The percentage of beneficial ownership for the following table is based on 252,924,027 shares of common stock outstanding.

Beneficial ownership is determined in accordance with the rules of the SEC and does not necessarily indicate beneficial ownership for any other purpose. Under these rules, beneficial ownership includes those shares of common stock over which the stockholder has sole or shared voting or investment power. It also includes shares of common stock that the stockholder has a right to acquire within 60 days after March 24, 2017, pursuant to options, warrants, restricted stock units or other rights. The percentage of ownership of the outstanding common stock, however, is based on the assumption, expressly required by the rules of the SEC, that only the person or entity whose ownership is being reported has vested restricted stock units or converted options or warrants into shares of our common stock.

| | Beneficial Ownership |

Name and Address of beneficial owner1 | Shares of Common Stock | Percentage

of Class |

5% Stockholders | | |

Little Harbor LLC2 | 33,168,948 | 13.11% |

Great Harbor Capital, LLC3 | 48,332,266 | 19.11% |

David L. Van Andel Trust u/a dated November 19934 | 34,791,814 | 13.76% |

Golisano Holdings LLC.5 | 91,766,636 | 36.04% |

Named Executive Officers and Directors | | |

Naomi L. Whittel6 | 6,493,450 | 2.57% |

Thomas A. Tolworthy7 | - | -- |

William E. Stevens7 | 250,000 | * |

Gregory Thomas Grochoski | 1,200,000 | * |

Glenn C. Wolfson7 | 250,000 | * |

Mark J. Bugge | - | * |

Seth D. Ellis8 | - | * |

Ralph T. Iannelli9 | 1,109,204 | * |

David L. Van Andel10 | 116,293,028 | 45.98% |

B. Thomas Golisano 5 | 91,766,636 | 36.04% |

David A. Still | - | * |

All executive officers and directors as a group (10 persons) | 216,862,318 | 85.18% |

* | Less than 1% of the applicable class or combined voting power. |

1 | Except as otherwise provided, each party's address is care of the Company at 4800 T-Rex Avenue, Suite 305, Boca Raton, Florida 33431. |

2 | These shares are owned by Little Harbor LLC, a Nevada limited liability company, of which David L. Van Andel is the sole manager and a holder of as sole trustee of the David L. Van Andel Trust u/a dated November 30, 1993 of 80.5% of the membership interests. This number does not include a warrant issued into escrow in favor of Little Harbor LLC on July 21, 2016 and exercisable for up to 2, 168,178 shares of the Company’s common stock but which only become exercisable if removed from escrow upon the failure of the Company to make payment in full of the promissory note at maturity, as the same may be accelerated in accordance with the terms of the note. The business address of Little Harbor LLC is 3133 Orchard Vista Drive SE, Grand Rapids, Michigan 49546. |

3 | These shares are owned by Great Harbor Capital, LLC, a Delaware limited liability company, of which David L. Van Andel is the sole manager and a holder as sole trustee of the David L. Van Andel Trust of 100% of the membership interests. This number does not include warrants issued into escrow in favor of Great Harbor Capital, LLC on January 28, 2016, March 21, 2016 and December 31, 2016 and exercisable for up to 1,136,363, 3,181,816 and 1,136,363 shares of the Company’s common stock, respectively, but which only become exercisable if removed from escrow upon the failure of the Company to make payment in full of the promissory note in connection with which each warrant was issued at maturity, as the same may be accelerated in accordance with the terms of each respective note. The business address of Great Harbor Capital, LLC is 3133 Orchard Vista Drive SE, Grand Rapids, Michigan 49546. |

4 | These shares are owned by the David L. Van Andel Trust u/a dated November 30, 1993, of which David L. Van Andel is the sole trustee and the principal beneficiary. The business address of the David L. Van Andel Trust u/a dated November 30, 1993 is 3133 Orchard Vista Drive SE, Grand Rapids, Michigan 49546. |