2016 Investor and Analyst Day September 12, 2016

SAFE HARBOR 1 Please note that in this presentation, we may discuss events or results that have not yet occurred or been realized, commonly referred to as forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements made by or on behalf of the Company. Such discussion and statements will often contain words such as “expect,” “anticipate,” “believe,” “intend,” “plan” and “estimate,” and include, without limitations, statements regarding the Company's adjusted EBITDA and adjusted diluted earnings per share, expected or estimated revenue, meeting financial and/or strategic, organic goals and objectives, segment earnings, net interest expense, income tax provision, cash flow from operations, full year cash taxes, capital expenditures, restructuring costs and other non-cash charges, the outlook for the Company's markets and the demand for its products, consistent profitable growth, free cash flows, future revenues, gross, operating and EBITDA margin requirements and expansion, organic net sales growth, performance trends, bank leverage ratios, the success of new product introductions, growth in costs and expenses, the impact of commodities and currencies costs, the Company's ability to manage its risk in these areas, the Company’s ability to identify, hire and retain executives and other qualified employees, the Company’s assessment over its internal control over financial reporting, and the impact of acquisitions, divestitures, restructurings, and other unusual items, including the Company's ability to raise new debt and equity and to integrate and obtain the anticipated results and synergies from its consummated acquisitions. These projections and statements are based on management's estimates and assumptions with respect to future events and financial performance and are believed to be reasonable, though are inherently uncertain and difficult to predict. Actual results could differ materially from those projected as a result of certain factors. A discussion of factors that could cause results to vary is included in the Company's periodic and other reports filed with the Securities and Exchange Commission. The Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise. This presentation also contains unaudited “comparable” financial information which assumes full period contribution of all the Company’s acquired businesses to date: the Chemtura AgroSolutions business of Chemtura Corporation and Percival S.A., or Agriphar, acquired in 2014; Alent plc, Arysta LifeScience Ltd, and the Electronic Chemicals and Photomasks businesses of OM Group, Inc. acquired in 2015; and OMG Electronic Chemicals (M) Sdn Bhd acquired in 2016. This combined information is provided for informational purposes only and is not necessarily, and should not be assumed to be, an indication of the results that would have been achieved had the Company’s acquisitions been completed as of the dates indicated, or that may be achieved in the future. Historical financial results and information included herein relating to these acquired businesses were derived from public filings, when applicable, and/or information provided by management of these businesses prior to their acquisitions by the Company. Although we believe it is reliable, this information has not been verified, internally or independently. In addition, financial information for some of these acquired businesses was historically prepared in accordance with non-GAAP accounting methods, and may or may not be comparable to the Company’s financial statements. Consequently, there is no assurance that the financial results and information for these legacy businesses included herein are accurate or complete, or representative in any way of the Company’s actual or future results as a consolidated company. Industry, market and competitive position data described in this presentation were obtained from our own internal estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. While Platform believes its internal estimates and research are reliable and the market definitions are appropriate, such estimates, research and definitions have not been verified by any independent source. You are cautioned not to place undue reliance on this data.

NON-GAAP INFORMATION 2 For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of a company's historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statements of operations, balance sheets, or statements of cash flows of the company; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. To supplement the financial measures prepared in accordance with GAAP, Platform has provided in this presentation non-GAAP financial measures, including comparable sales, adjusted EBITDA, comparable adjusted EBITDA, comparable capital expenditures and comparable cash flow. We also present our results of operations on a comparable constant currency basis. Management believes that these measures provide useful information to investors by excluding certain items that it believes are not representative of the Company's business and including other items that it believes are useful in evaluating the Company's business; thereby providing a more complete understanding of the Company's operational results and a meaningful comparison of the Company's performance between periods and to its peers. When reconciled to the corresponding GAAP measures, these non-GAAP measures also help the Company's investors to understand the long-term profitability trends of its businesses. Finally, these non-GAAP measures address questions the Company routinely receives from securities analysts, investors and other interested parties in the evaluation of companies in our industry and, in order to assure that all investors have access to the same data, the Company has determined that it is appropriate to make this data available to all. Non-GAAP financial measures are however not prepared in accordance with GAAP, as they exclude certain items as described herein, and may not be indicative of the results that the Company expects to recognize for future periods. In addition, these non-GAAP financial measures may differ from measures that other companies may use. As a result, these non-GAAP financial measures should be considered in addition to, and not a substitute for, financial information prepared in accordance with GAAP. Investors are encouraged to review the reconciliation of these non-GAAP measures to their most directly comparable GAAP financial measures included in the appendices of this presentation. The Company only provides guidance, organic sales growth and synergy potential on a non-GAAP basis and does not provide reconciliations of such forward-looking non-GAAP measures to GAAP, due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations, including adjustments that could be made for restructuring, integration and acquisition-related expenses, share-based compensation amounts, adjustments to inventory and other charges reflected in our reconciliation of historic numbers, the amount of which, based on historical experience, could be significant.

AGENDA Introduction – Martin E. Franklin State of the Company – Rakesh Sachdev Performance Solutions – Scot Benson Agricultural Solutions – Diego Lopez Casanello Integration Overview – Benjamin Gliklich Financial Overview – Sanjiv Khattri Conclusion – Rakesh Sachdev Appendices 3

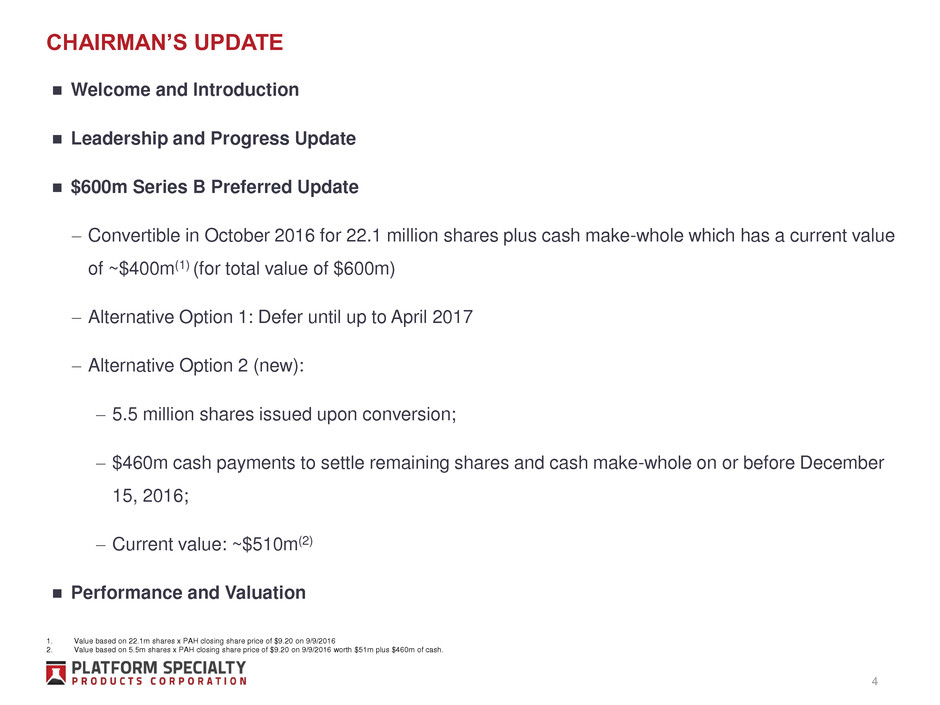

CHAIRMAN’S UPDATE 4 Welcome and Introduction Leadership and Progress Update $600m Series B Preferred Update − Convertible in October 2016 for 22.1 million shares plus cash make-whole which has a current value of ~$400m(1) (for total value of $600m) − Alternative Option 1: Defer until up to April 2017 − Alternative Option 2 (new): − 5.5 million shares issued upon conversion; − $460m cash payments to settle remaining shares and cash make-whole on or before December 15, 2016; − Current value: ~$510m(2) Performance and Valuation 1. Value based on 22.1m shares x PAH closing share price of $9.20 on 9/9/2016 2. Value based on 5.5m shares x PAH closing share price of $9.20 on 9/9/2016 worth $51m plus $460m of cash.

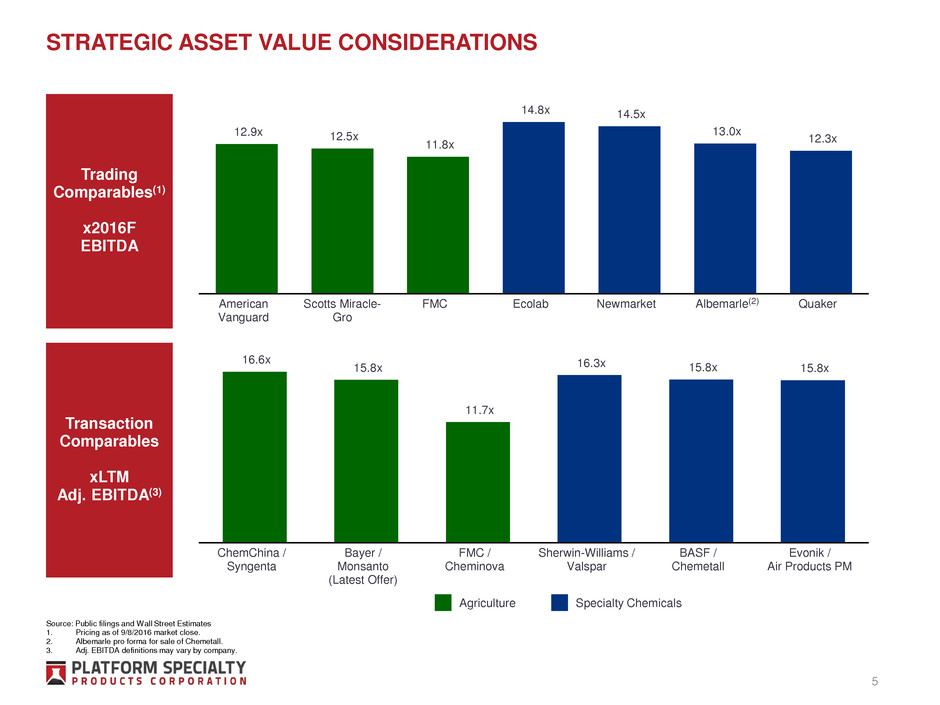

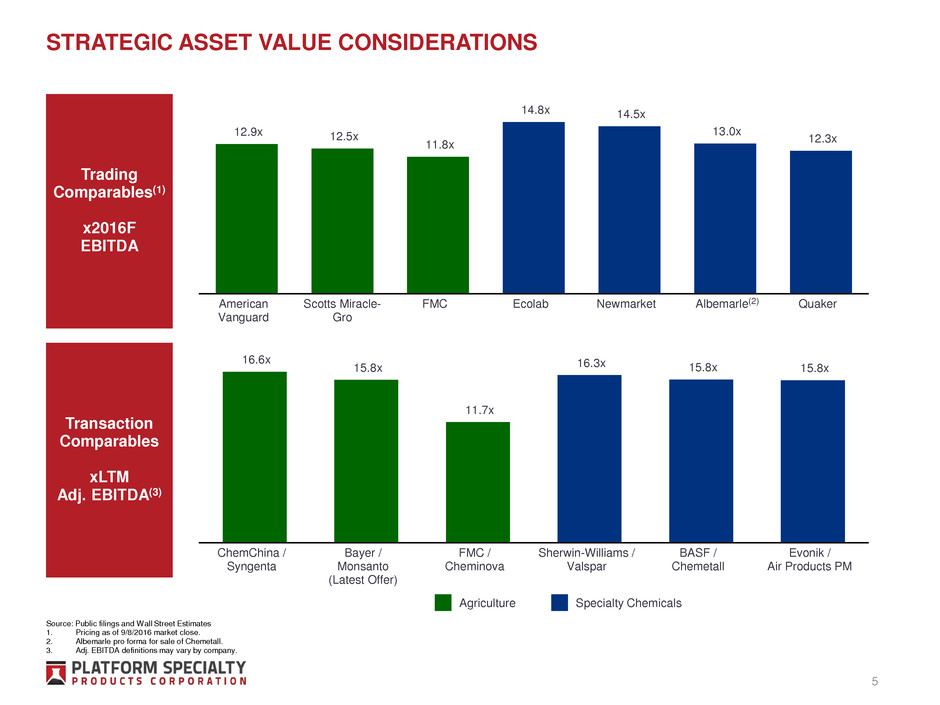

STRATEGIC ASSET VALUE CONSIDERATIONS 5 Trading Comparables(1) x2016F EBITDA Transaction Comparables xLTM Adj. EBITDA(3) 12.9x 12.5x 11.8x 14.8x 14.5x 13.0x 12.3x American Vanguard Scotts Miracle- Gro FMC Ecolab Newmarket Albemarle Quaker 16.6x 15.8x 11.7x 16.3x 15.8x 15.8x ChemChina / Syngenta Bayer / Monsanto (Latest Offer) FMC / Cheminova Sherwin-Williams / Valspar BASF / Chemetall Evonik / Air Products PM Agriculture Specialty Chemicals Source: Public filings and Wall Street Estimates 1. Pricing as of 9/8/2016 market close. 2. Albemarle pro forma for sale of Chemetall. 3. Adj. EBITDA definitions may vary by company. (2)

AGENDA Introduction – Martin E. Franklin State of the Company – Rakesh Sachdev Performance Solutions – Scot Benson Agricultural Solutions – Diego Lopez Casanello Integration Overview – Benjamin Gliklich Financial Overview – Sanjiv Khattri Conclusion – Rakesh Sachdev Appendices 6

AGENDA State of the Company Platform Overview How Did We Get Here Revisiting the Platform Thesis Strategic Objectives 7

PLATFORM COMPARABLE FINANCIAL OVERVIEW (NON-GAAP) Significant end-market and geographic diversity $741mm $955 mm $948 mm $289 mm $687 mm NOTE: THE COMPARABLE FINANCIAL MEASURES ON THIS SLIDE AND THROUGHOUT THIS PRESENTATION ARE NOT IN ACCORDANCE WITH GAAP. FOR DEFINITIONS OF THESE NON-GAAP MEASURES, DISCUSSIONS OF ADJUSTMENTS AND RECONCILIATIONS, PLEASE REFER TO THE APPENDICES OF THIS PRESENTATION. Comparable, on this slide and throughout this presentation, assumes full period contribution of all businesses acquired in 2015 and 2016. 1. Segment Adjusted EBITDA excludes corporate cost allocations. Performance Solutions Sales: $1.8 bn Adj. EBITDA: $407m(1) Employees: ~4,500 Automotive Industrial Electronics Consumer Packaging Offshore Energy Agricultural Solutions Sales: $1.8bn Adj. EBITDA: $382m (1) Employees: ~4,000 Crop Protection Seed Treatment Plant Nutrition BioSolutions 2015 Sales: $3.6bn Adj. EBITDA: $742m Employees: ~8,500 8

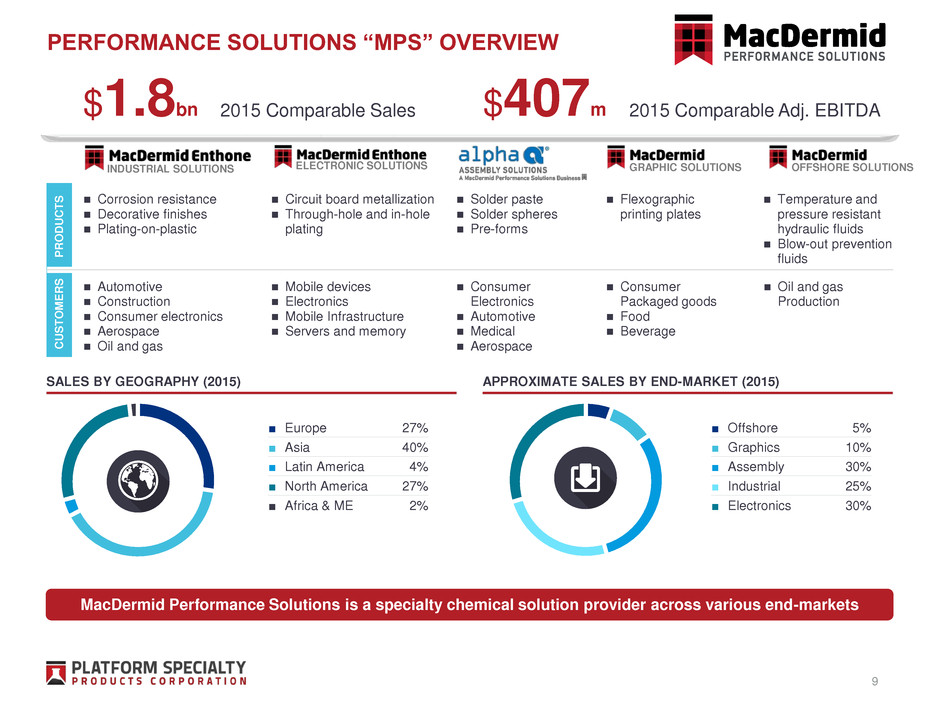

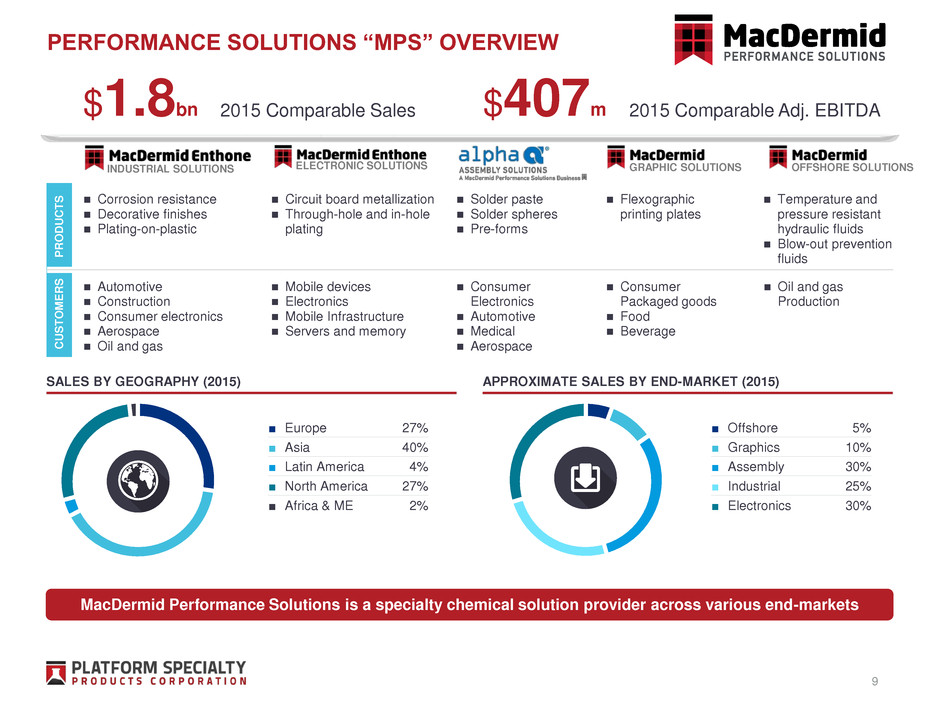

PERFORMANCE SOLUTIONS “MPS” OVERVIEW GRAPHIC SOLUTIONS OFFSHORE SOLUTIONS P R O D U C T S C U S T O M E R S Oil and gas Production Consumer Electronics Automotive Medical Aerospace Automotive Construction Consumer electronics Aerospace Oil and gas Consumer Packaged goods Food Beverage Mobile devices Electronics Mobile Infrastructure Servers and memory Corrosion resistance Decorative finishes Plating-on-plastic Solder paste Solder spheres Pre-forms Circuit board metallization Through-hole and in-hole plating Temperature and pressure resistant hydraulic fluids Blow-out prevention fluids Flexographic printing plates INDUSTRIAL SOLUTIONS ELECTRONIC SOLUTIONS $1.8bn $407m2015 Comparable Sales 2015 Comparable Adj. EBITDA APPROXIMATE SALES BY END-MARKET (2015)SALES BY GEOGRAPHY (2015) MacDermid Performance Solutions is a specialty chemical solution provider across various end-markets ■ Europe 27% ■ Asia 40% ■ Latin America 4% ■ North America 27% ■ Africa & ME 2% ■ Offshore 5% ■ Graphics 10% ■ Assembly 30% ■ Industrial 25% ■ Electronics 30% 9

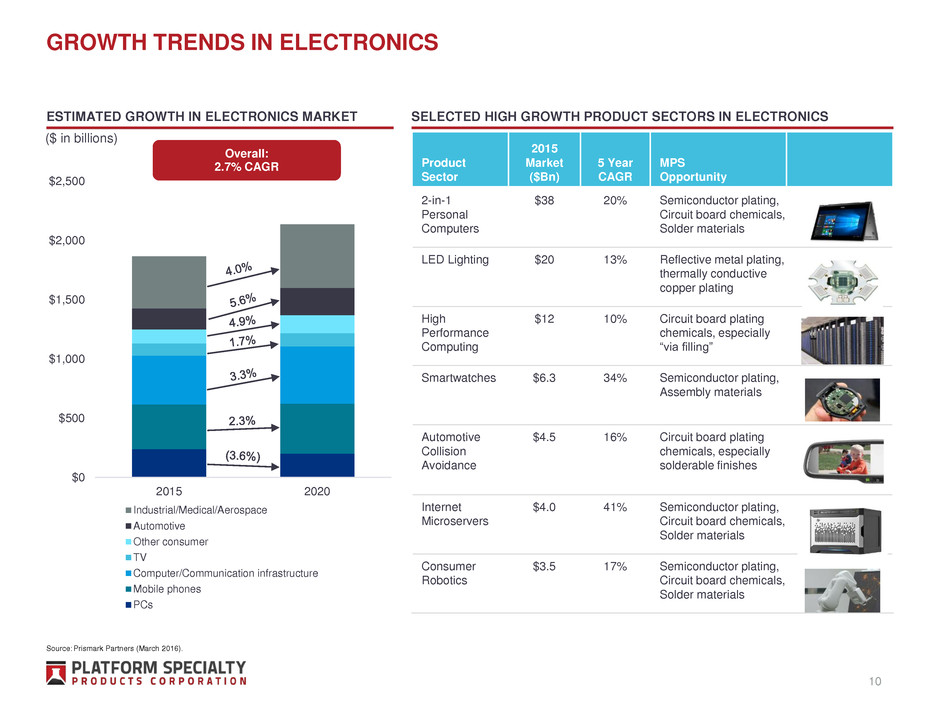

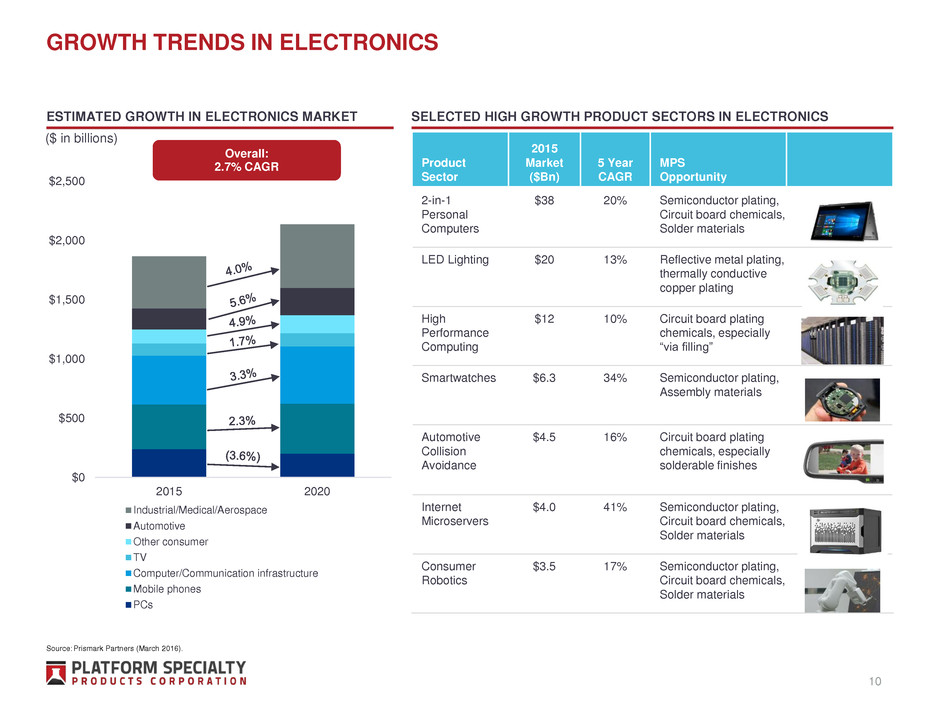

Overall: 2.7% CAGR $0 $500 $1,000 $1,500 $2,000 $2,500 2015 2020 Industrial/Medical/Aerospace Automotive Other consumer TV Computer/Communication infrastructure Mobile phones PCs ESTIMATED GROWTH IN ELECTRONICS MARKET ($ in billions) 10 Product Sector 2015 Market ($Bn) 5 Year CAGR MPS Opportunity 2-in-1 Personal Computers $38 20% Semiconductor plating, Circuit board chemicals, Solder materials LED Lighting $20 13% Reflective metal plating, thermally conductive copper plating High Performance Computing $12 10% Circuit board plating chemicals, especially “via filling” Smartwatches $6.3 34% Semiconductor plating, Assembly materials Automotive Collision Avoidance $4.5 16% Circuit board plating chemicals, especially solderable finishes Internet Microservers $4.0 41% Semiconductor plating, Circuit board chemicals, Solder materials Consumer Robotics $3.5 17% Semiconductor plating, Circuit board chemicals, Solder materials SELECTED HIGH GROWTH PRODUCT SECTORS IN ELECTRONICS GROWTH TRENDS IN ELECTRONICS Source: Prismark Partners (March 2016).

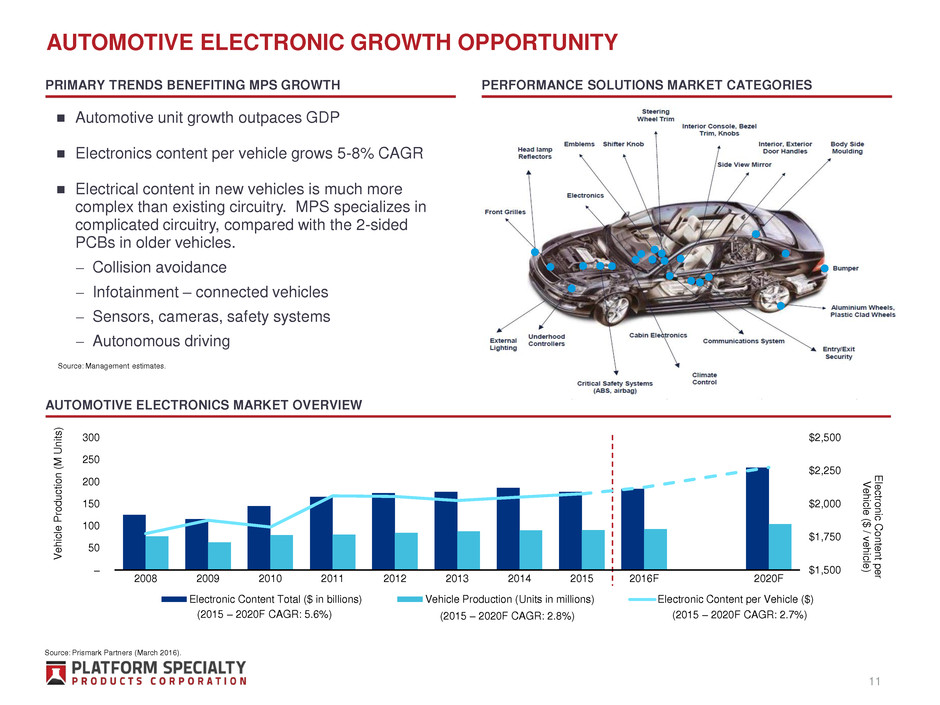

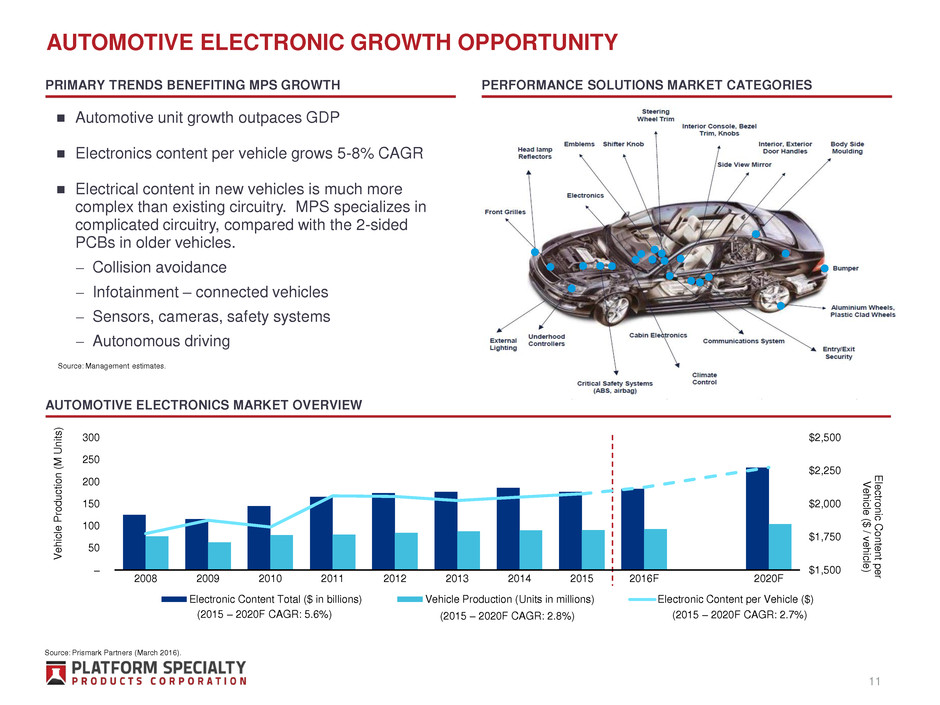

AUTOMOTIVE ELECTRONIC GROWTH OPPORTUNITY V e h ic le P ro d u c tio n ( M U n it s ) E le c tro n ic C o n te n t p e r V e h ic le ($ / v e h ic le ) (2015 – 2020F CAGR: 5.6%) (2015 – 2020F CAGR: 2.8%) (2015 – 2020F CAGR: 2.7%) Automotive unit growth outpaces GDP Electronics content per vehicle grows 5-8% CAGR Electrical content in new vehicles is much more complex than existing circuitry. MPS specializes in complicated circuitry, compared with the 2-sided PCBs in older vehicles. − Collision avoidance − Infotainment – connected vehicles − Sensors, cameras, safety systems − Autonomous driving PERFORMANCE SOLUTIONS MARKET CATEGORIES AUTOMOTIVE ELECTRONICS MARKET OVERVIEW $1,500 $1,750 $2,000 $2,250 $2,500 – 50 100 150 200 250 300 2008 2009 2010 2011 2012 2013 2014 2015 2016F 2020F Electronic Content Total ($ in billions) Vehicle Production (Units in millions) Electronic Content per Vehicle ($) 11 Source: Prismark Partners (March 2016). PRIMARY TRENDS BENEFITING MPS GROWTH Source: Management estimates.

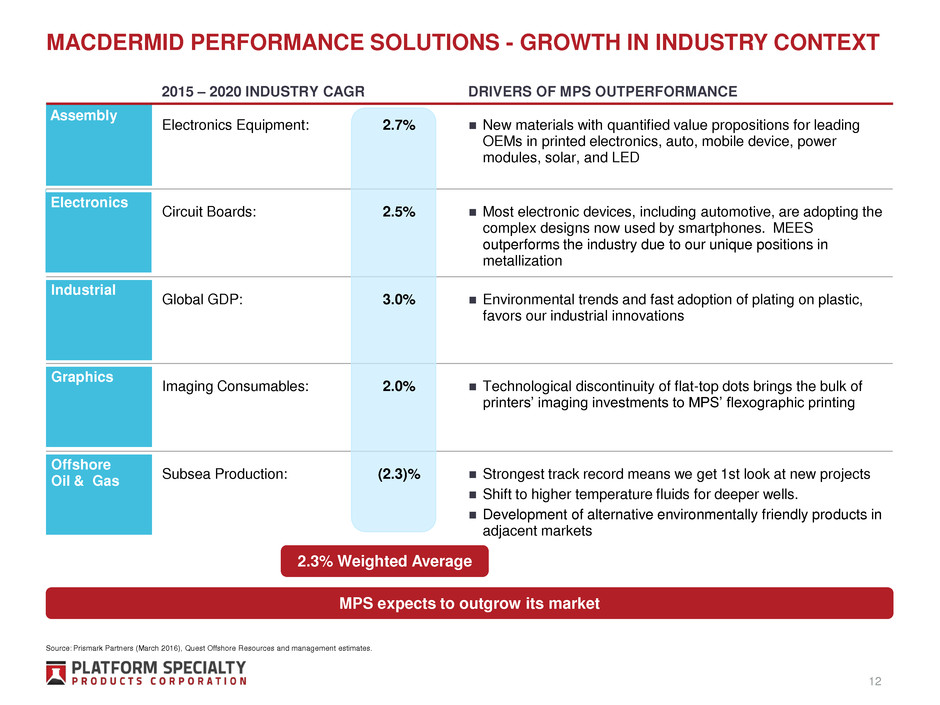

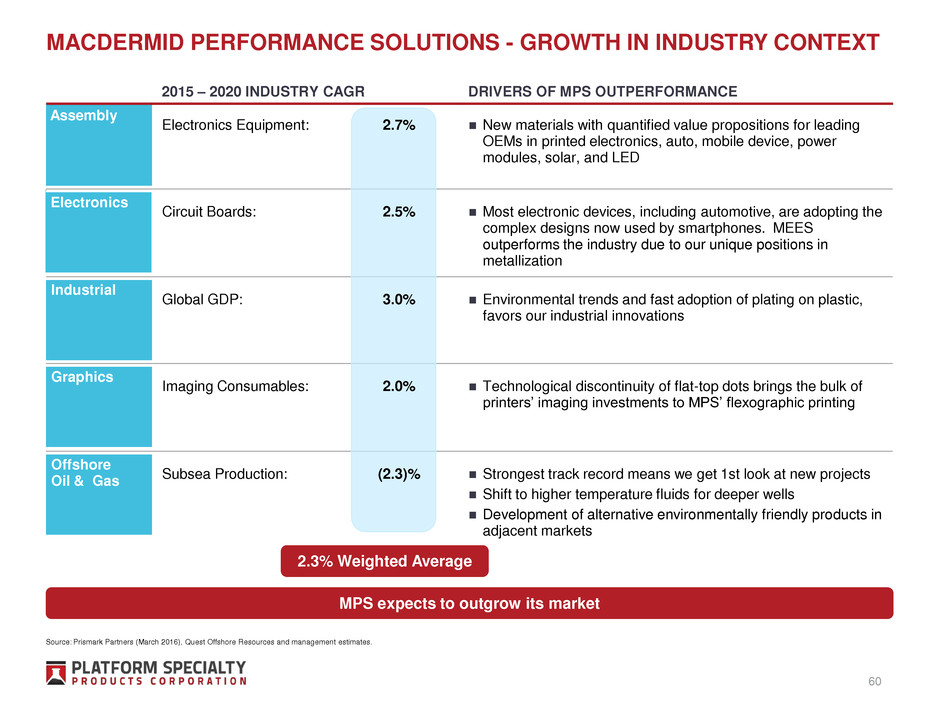

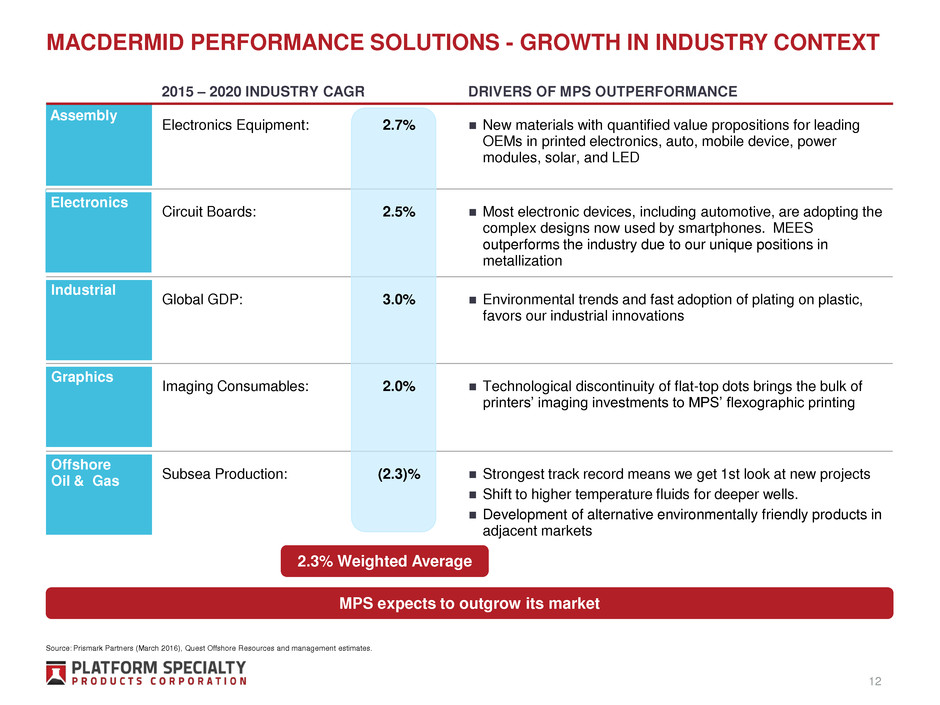

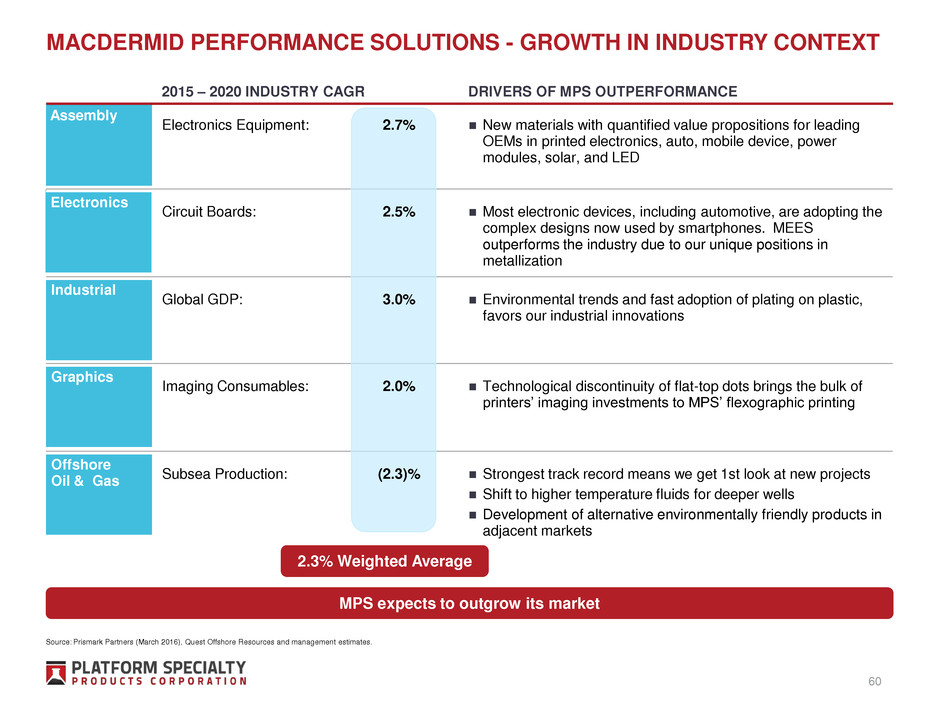

MACDERMID PERFORMANCE SOLUTIONS - GROWTH IN INDUSTRY CONTEXT Assembly Electronics Equipment: New materials with quantified value propositions for leading OEMs in printed electronics, auto, mobile device, power modules, solar, and LED Electronics Circuit Boards: Most electronic devices, including automotive, are adopting the complex designs now used by smartphones. MEES outperforms the industry due to our unique positions in metallization Industrial Global GDP: Environmental trends and fast adoption of plating on plastic, favors our industrial innovations Graphics Imaging Consumables: Technological discontinuity of flat-top dots brings the bulk of printers’ imaging investments to MPS’ flexographic printing 2015 – 2020 INDUSTRY CAGR DRIVERS OF MPS OUTPERFORMANCE Offshore Oil & Gas Subsea Production: Strongest track record means we get 1st look at new projects Shift to higher temperature fluids for deeper wells. Development of alternative environmentally friendly products in adjacent markets 2.7% 2.5% 3.0% 2.0% (2.3)% MPS expects to outgrow its market 2.3% Weighted Average 12 Source: Prismark Partners (March 2016), Quest Offshore Resources and management estimates.

AGRICULTURAL SOLUTIONS “ARYSTA” OVERVIEW $1.8bn $382m2015 Comparable Sales 2015 Comparable Adj. EBITDA F&V 30% Main Row Crops 32% Other 38% Africa & ME 14% Asia 13% Europe 26% Latin America 34% North America 14% SALES BY CROP FOCUS Arysta LifeScience is a global provider of crop protection and yield enhancement products focused on niche specialty segments SALES BY PRODUCT SALES BY GEOGRAPHY 13 Fungicides 20% Herbicides 32% Insecticides 31% Bio-stimulants 4% Other 13% S LES Y CR P S LES Y PRODUCT S LES Y GE P Y K E Y P R O DUC T S FUNGICIDES HERBICIDES INSECTICIDES BIOSOLUTIONS SEED-TREATMENT

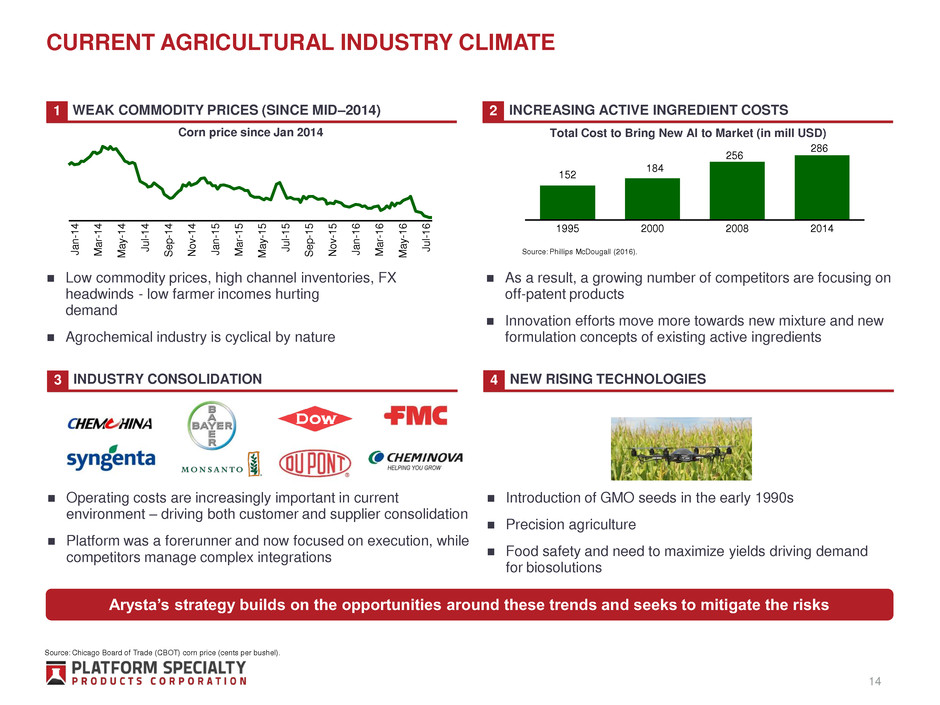

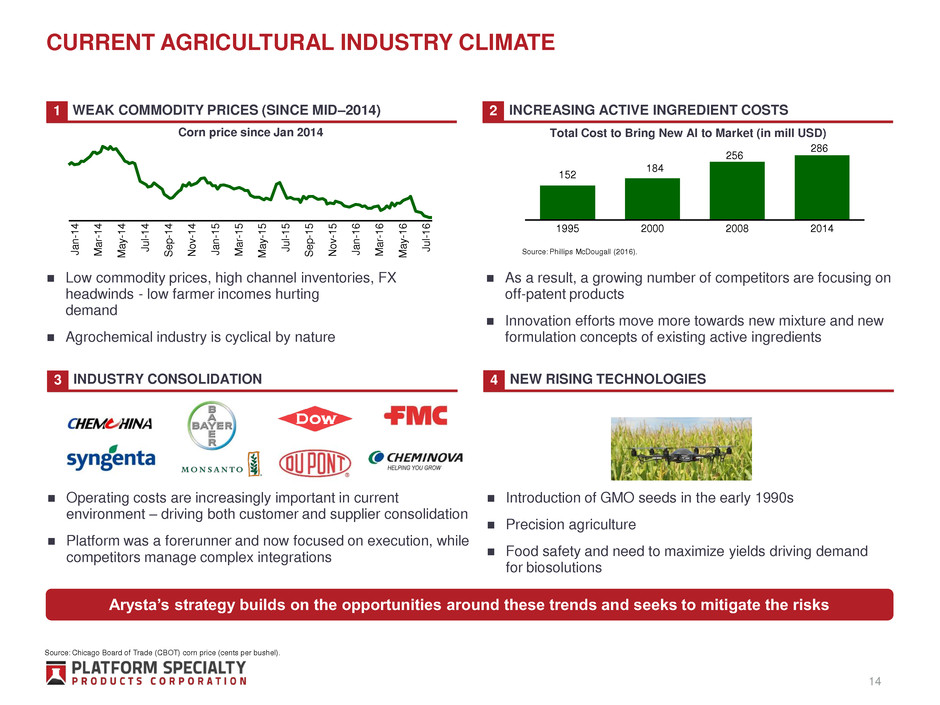

J a n -1 4 Ma r- 1 4 M a y -1 4 J u l- 1 4 S e p -1 4 N o v -1 4 J a n -1 5 Ma r- 1 5 M a y -1 5 J u l- 1 5 S e p -1 5 N o v -1 5 J a n -1 6 Ma r- 1 6 M a y -1 6 J u l- 1 6 Low commodity prices, high channel inventories, FX headwinds - low farmer incomes hurting demand Agrochemical industry is cyclical by nature CURRENT AGRICULTURAL INDUSTRY CLIMATE As a result, a growing number of competitors are focusing on off-patent products Innovation efforts move more towards new mixture and new formulation concepts of existing active ingredients INCREASING ACTIVE INGREDIENT COSTSWEAK COMMODITY PRICES (SINCE MID–2014) Operating costs are increasingly important in current environment – driving both customer and supplier consolidation Platform was a forerunner and now focused on execution, while competitors manage complex integrations Introduction of GMO seeds in the early 1990s Precision agriculture Food safety and need to maximize yields driving demand for biosolutions NEW RISING TECHNOLOGIESINDUSTRY CONSOLIDATION Arysta’s strategy builds on the opportunities around these trends and seeks to mitigate the risks Corn price since Jan 2014 152 184 256 286 1995 2000 2008 2014 Total Cost to Bring New AI to Market (in mill USD) 1 2 3 4 14 Source: Phillips McDougall (2016). Source: Chicago Board of Trade (CBOT) corn price (cents per bushel).

13 14 14 14 15 15 17 19 21 22 23 24 24 24 26 29 30 30 30 29 29 27 26 28 32 33 33 36 43 40 41 47 50 54 57 51 1 9 8 0 1 9 8 1 1 9 8 2 1 9 8 3 1 9 8 4 1 9 8 5 1 9 8 6 1 9 8 7 1 9 8 8 1 9 8 9 1 9 9 0 1 9 9 1 1 9 9 2 1 9 9 3 1 9 9 4 1 9 9 5 1 9 9 6 1 9 9 7 1 9 9 8 1 9 9 9 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 30+ YEARS OF INDUSTRY GROWTH The crop protection market has grown at a 4% average annual rate for 30+ years $ billions of revenue 15 Source: Phillips McDougall (2016).

ATTRACTIVE LONG-TERM AGRICULTURAL FUNDAMENTALS 0.0 0.1 0.2 0.3 0.4 0.5 1 9 6 0 1 9 7 0 1 9 8 0 1 9 9 0 2 0 0 0 2 0 1 0 2 0 2 0 2 0 3 0 2 0 4 0 2 0 5 0 Hectares 80% 10% 10% DECLINING ARABLE LAND / CAPITA Global Population Growth World Population (bn) 0 2 4 6 8 10 1 9 6 0 1 9 6 5 1 9 7 0 1 9 7 5 1 9 8 0 1 9 8 5 1 9 9 0 1 9 9 5 2 0 0 0 2 0 0 5 2 0 1 0 2 0 1 5 2 0 2 0 2 0 2 5 2 0 3 0 2 0 3 5 2 0 4 0 2 0 4 5 2 0 5 0 Developed Countries Developing countries Arable Land per Capita (ha) More Income – More Calories % of every new dollar spent on food 0 20 40 60 80 100 India China US Calorific Multiplier WEALTH EFFECT DRIVES PROTEIN CONSUMPTION Projected Sources of Growth in Crop Production Arable LandCrop Intensity Yield Increase Increases in production will largely rely on increasing yield 16 Source: UNFAO, OECD. 0 2 4 6 8 Beef Pork Poultry

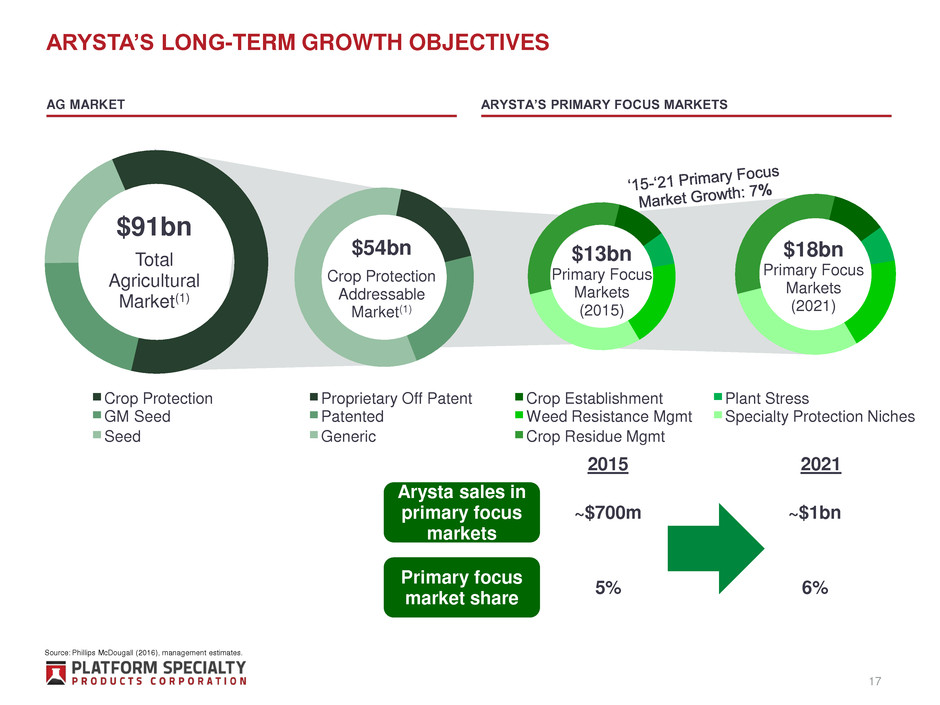

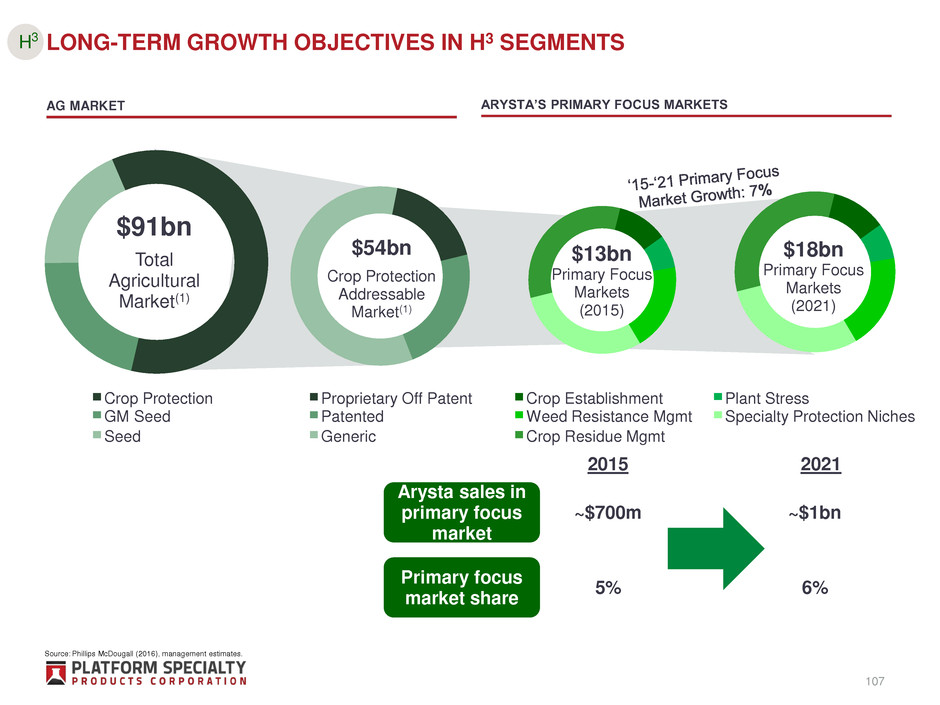

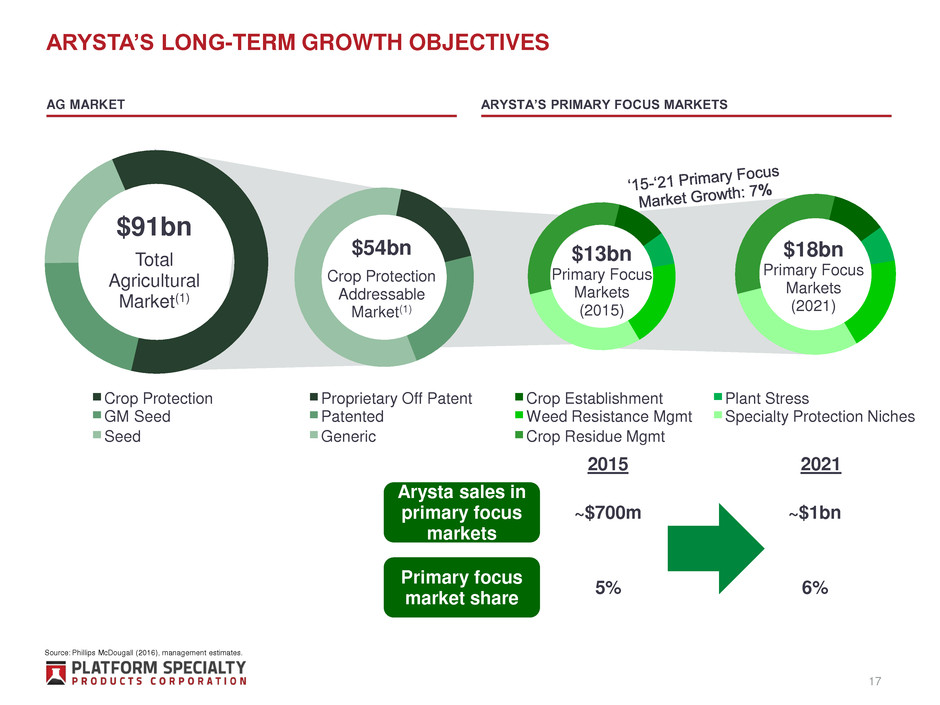

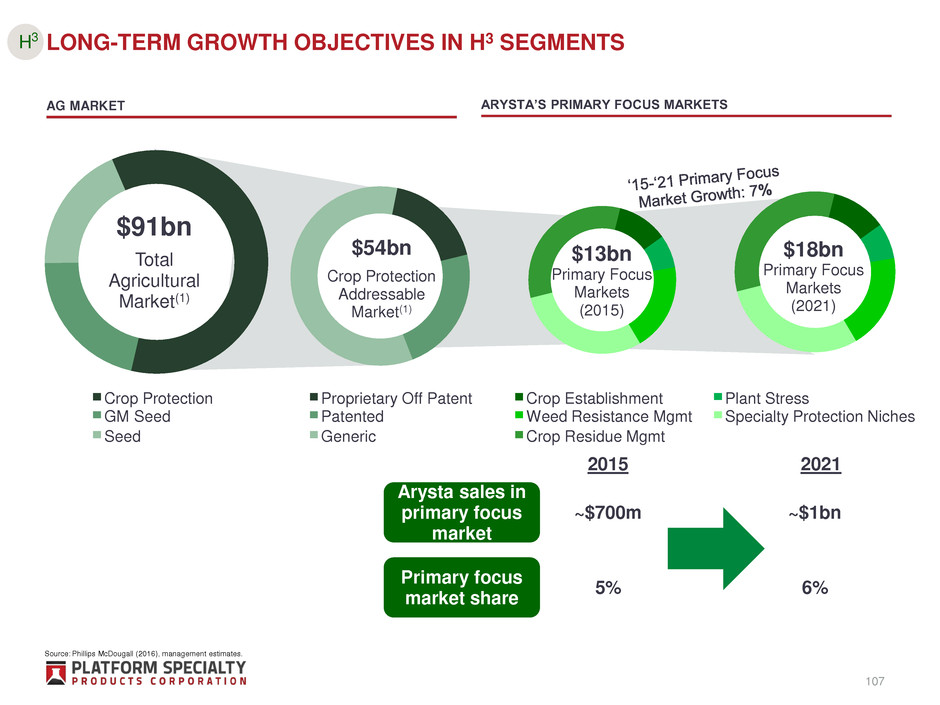

ARYSTA’S LONG-TERM GROWTH OBJECTIVES $91bn Total Agricultural Market(1) $54bn Crop Protection Addressable Market(1) $13bn Primary Focus Markets (2015) $18bn Primary Focus Markets (2021) AG MARKET ARYSTA’S PRIMARY FOCUS MARKETS Crop Protection GM Seed Seed Proprietary Off Patent Patented Generic 17 Crop Establishment Plant Stress Weed Resistance Mgmt Specialty Protection Niches Crop Residue Mgmt Arysta sales in primary focus markets Primary focus market share 2015 ~$700m ~$1bn 2021 5% 6% Source: Phillips McDougall (2016), management estimates.

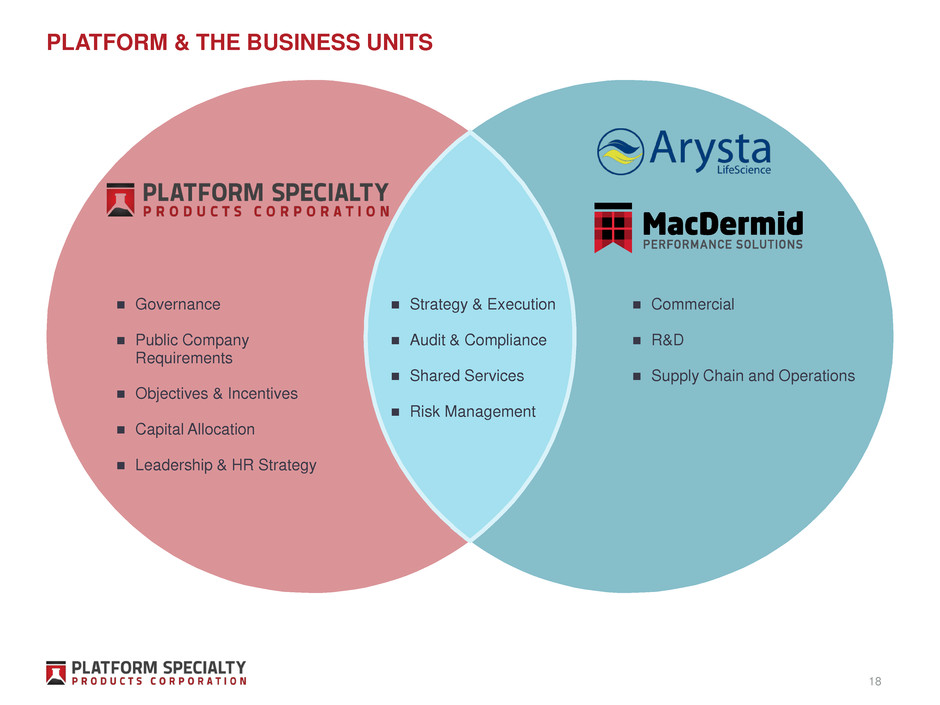

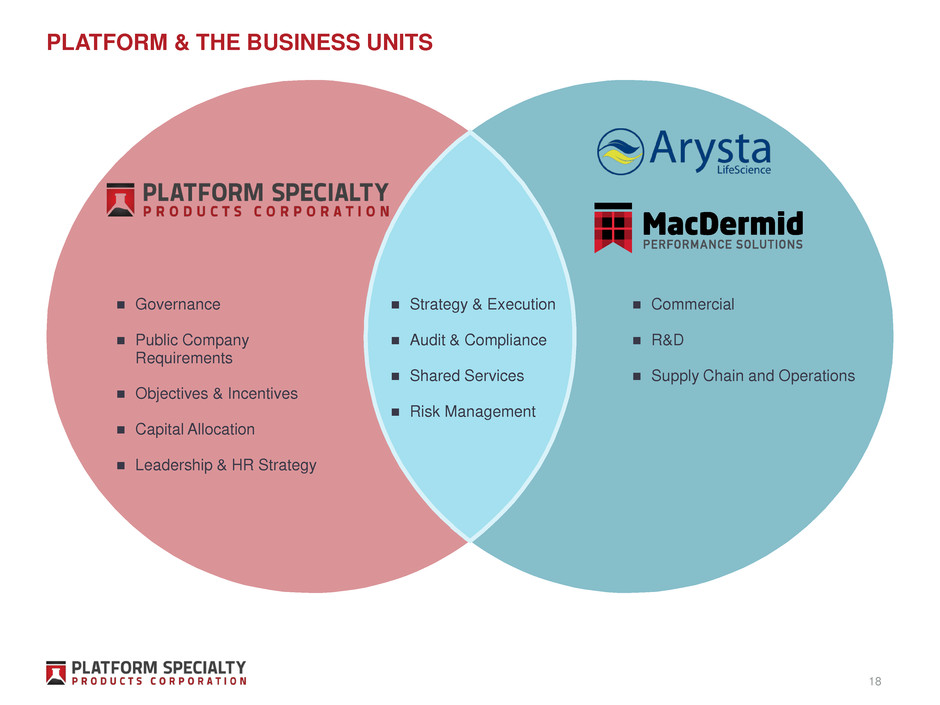

PLATFORM & THE BUSINESS UNITS Governance Public Company Requirements Objectives & Incentives Capital Allocation Leadership & HR Strategy Strategy & Execution Audit & Compliance Shared Services Risk Management Commercial R&D Supply Chain and Operations 18

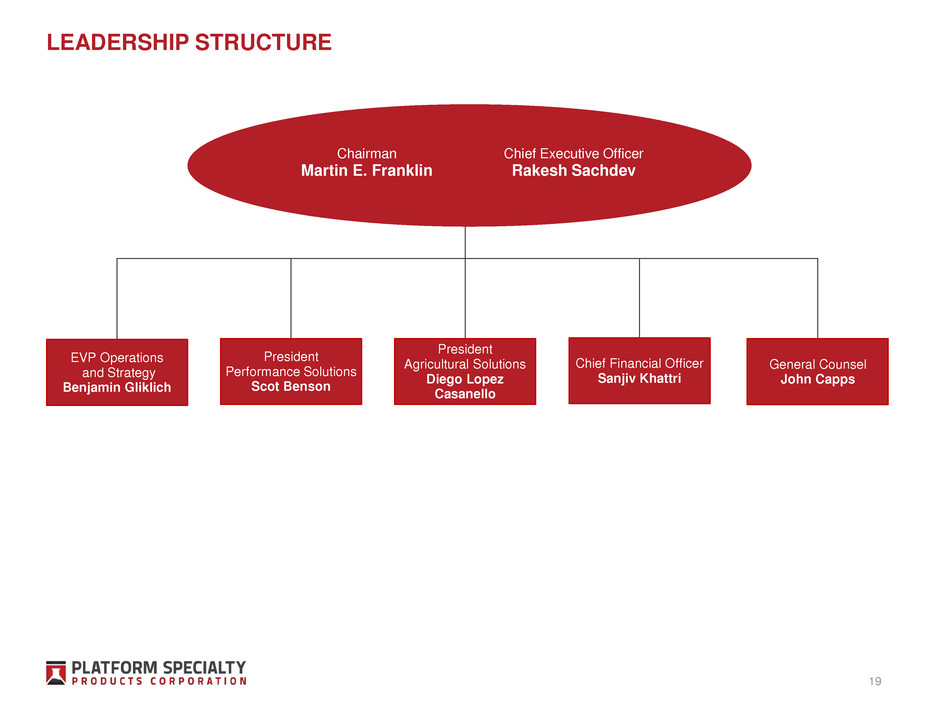

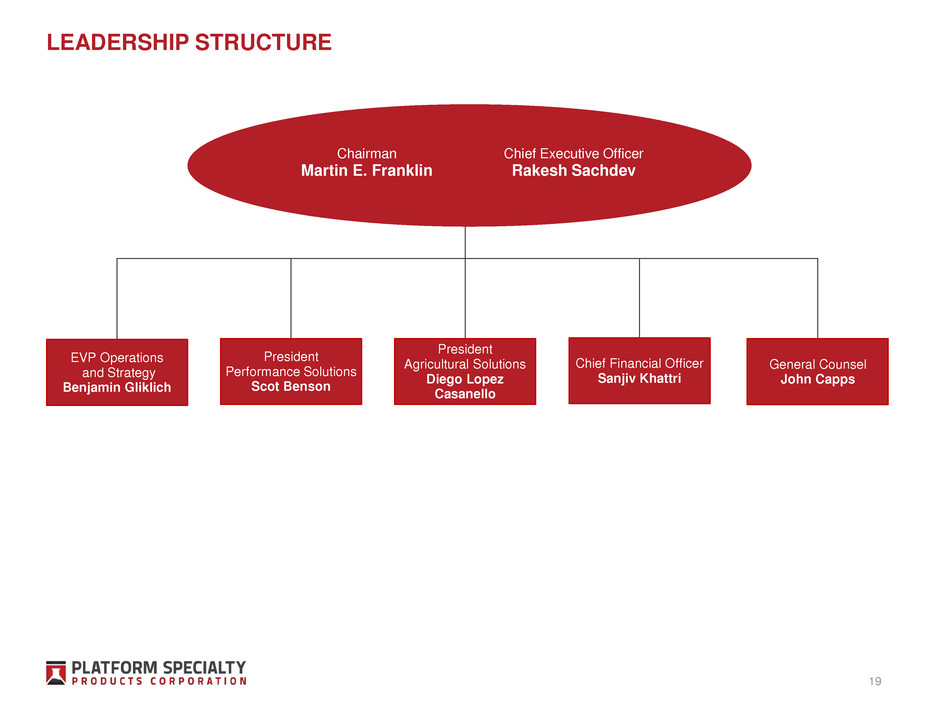

LEADERSHIP STRUCTURE EVP Operations and Strategy Benjamin Gliklich Chief Financial Officer Sanjiv Khattri General Counsel John Capps Chief Executive Officer Rakesh Sachdev 19 Chairman Martin E. Franklin President Agricultural Solutions Diego Lopez Casanello President Performance Solutions Scot Benson

AGENDA State of the Company Platform Overview How Did We Get Here Revisiting the Platform Thesis Strategic Objectives 20

Swift growth through complementary acquisition strategy PLATFORM STRATEGIC TIMELINE 20152014 2016 Performance Solutions Agricultural Solutions 2013 MacDermid Acquisition − ~$1.8 billion − Closed: Oct 2013 CAS Acquisition − ~$1.0 billion − Closed: Nov 2014 Agriphar Acquisition − ~€300 million − Closed: Oct 2014 Arysta Acquisition − ~$3.5 billion − Closed: Feb 2015 OMG Acquisitions − $239 million − Closed: Oct 2015 Alent Acquisition − ~$2.3 billion − Closed: Dec 2015 OMG Malaysia Acquisition − ~$124 million − Closed: Jan 2016 21

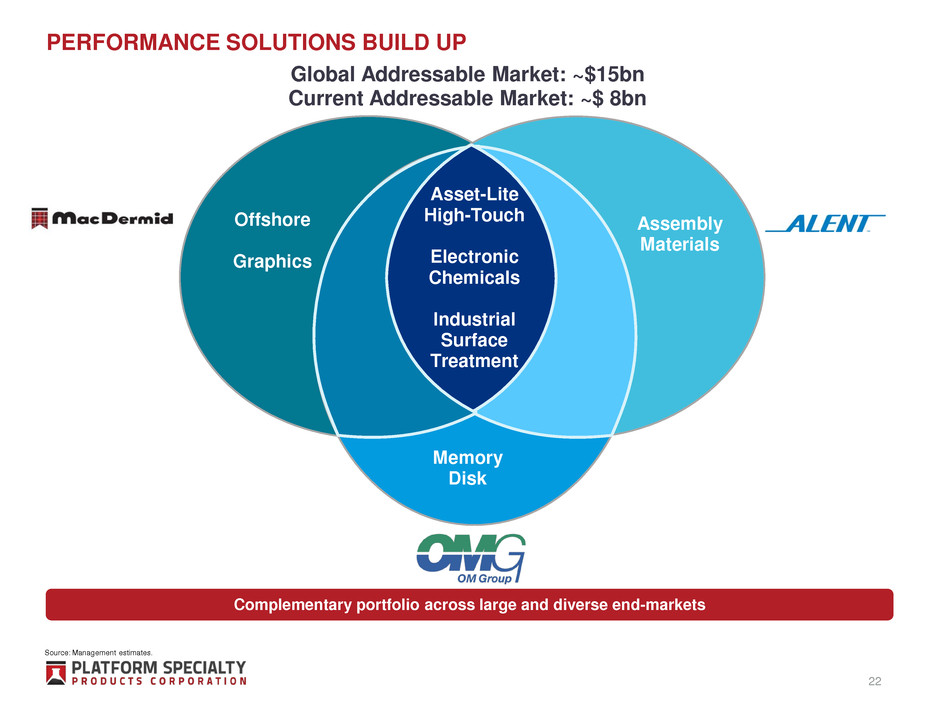

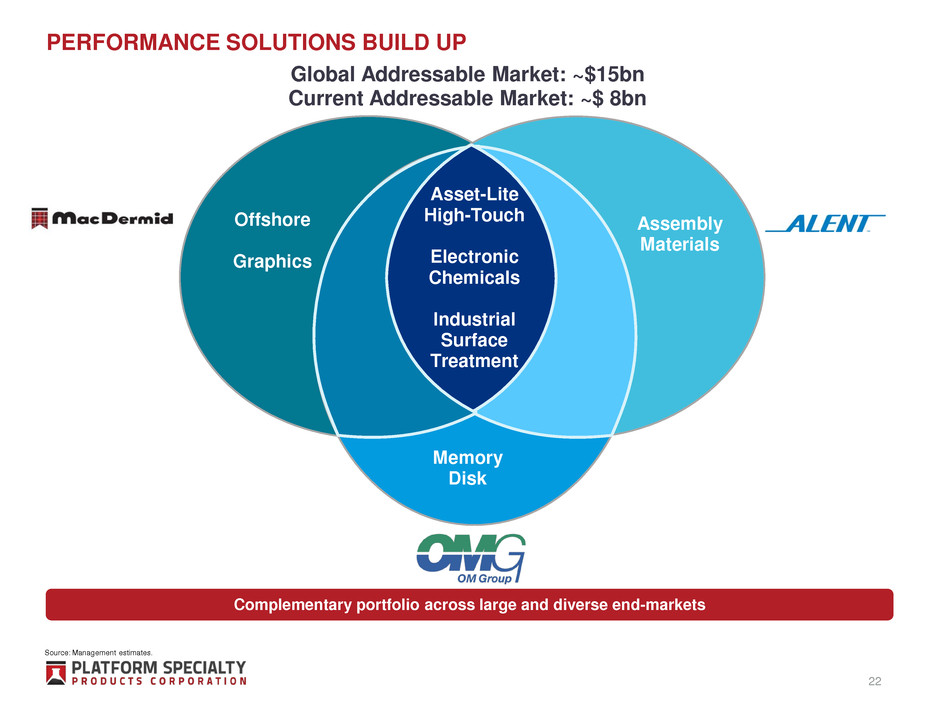

Complementary portfolio across large and diverse end-markets PERFORMANCE SOLUTIONS BUILD UP Global Addressable Market: ~$15bn Current Addressable Market: ~$ 8bn Memory Disk Asset-Lite High-Touch Electronic Chemicals Industrial Surface Treatment Assembly Materials Offshore Graphics 22 Source: Management estimates.

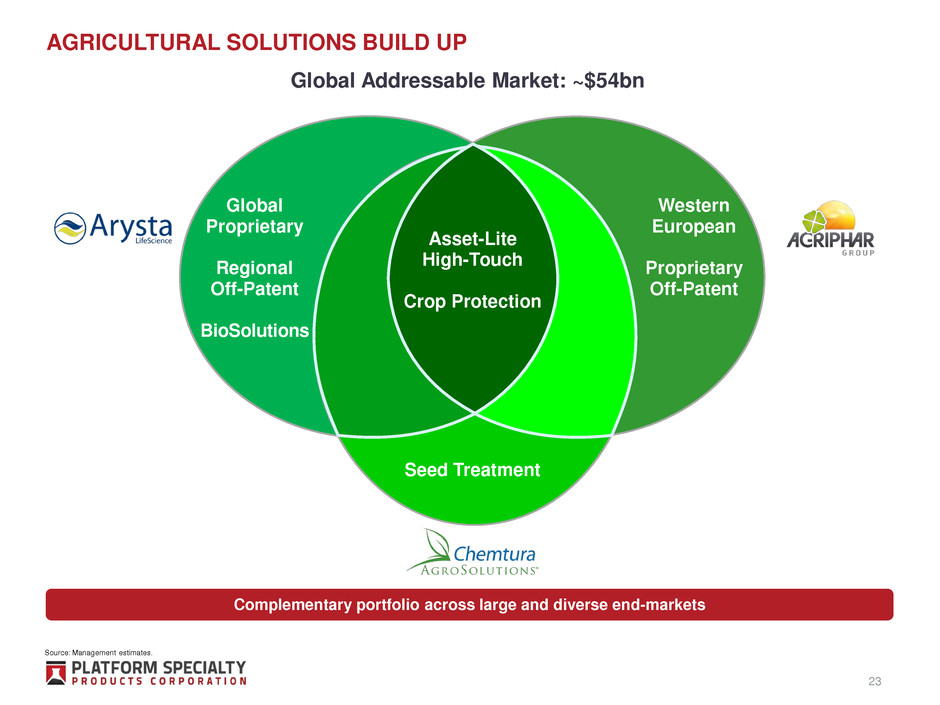

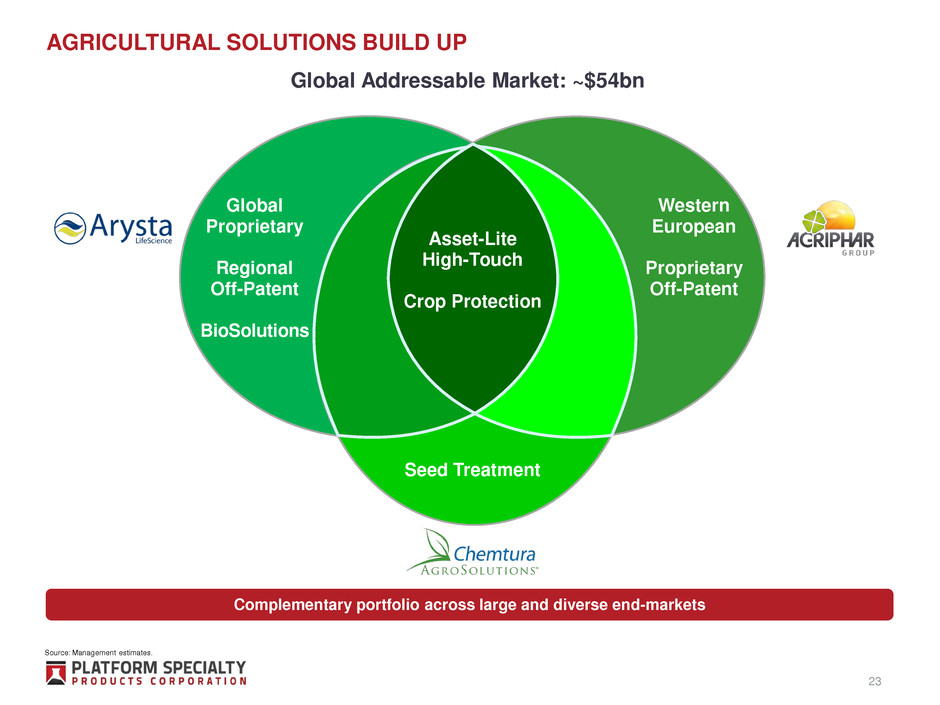

Complementary portfolio across large and diverse end-markets AGRICULTURAL SOLUTIONS BUILD UP Global Addressable Market: ~$54bn Asset-Lite High-Touch Crop Protection Global Proprietary Regional Off-Patent BioSolutions Western European Proprietary Off-Patent Seed Treatment 23 Source: Management estimates.

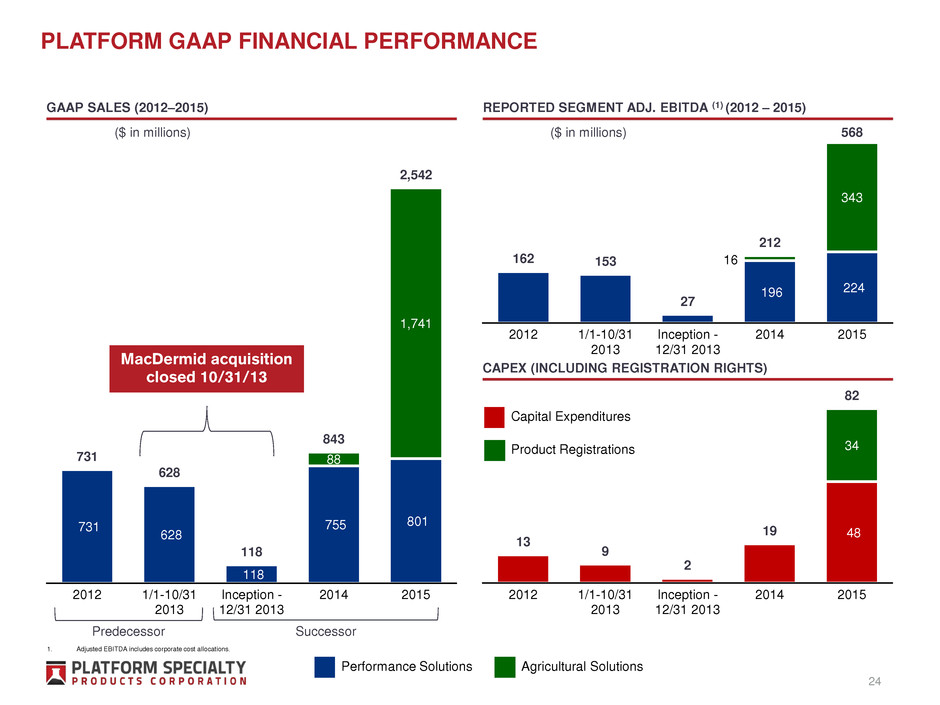

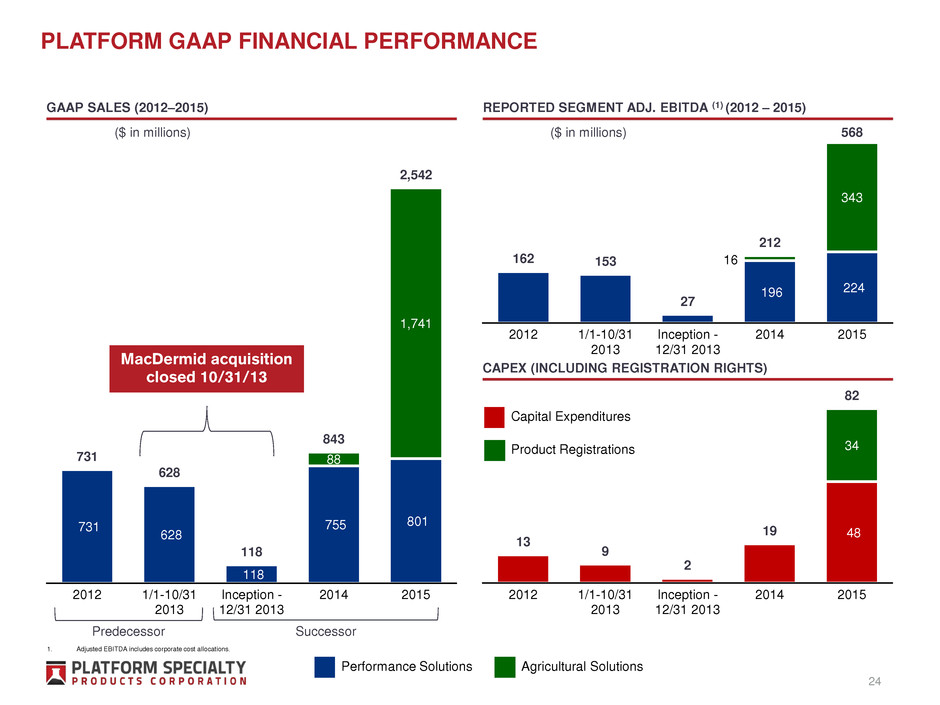

48 34 13 9 2 19 82 2012 1/1-10/31 2013 Inception - 12/31 2013 2014 2015 1. Adjusted EBITDA includes corporate cost allocations. PLATFORM GAAP FINANCIAL PERFORMANCE 731 628 118 755 801 88 1,741 731 628 118 843 2,542 2012 1/1-10/31 2013 Inception - 12/31 2013 2014 2015 REPORTED SEGMENT ADJ. EBITDA (1) (2012 – 2015)GAAP SALES (2012–2015) Capital Expenditures Product Registrations ($ in millions) ($ in millions) 196 224 16 343 162 153 27 212 568 2012 1/1-10/31 2013 Inception - 12/31 2013 2014 2015 24 CAPEX (INCLUDING REGISTRATION RIGHTS) Predecessor Successor MacDermid acquisition closed 10/31/13 Performance Solutions Agricultural Solutions

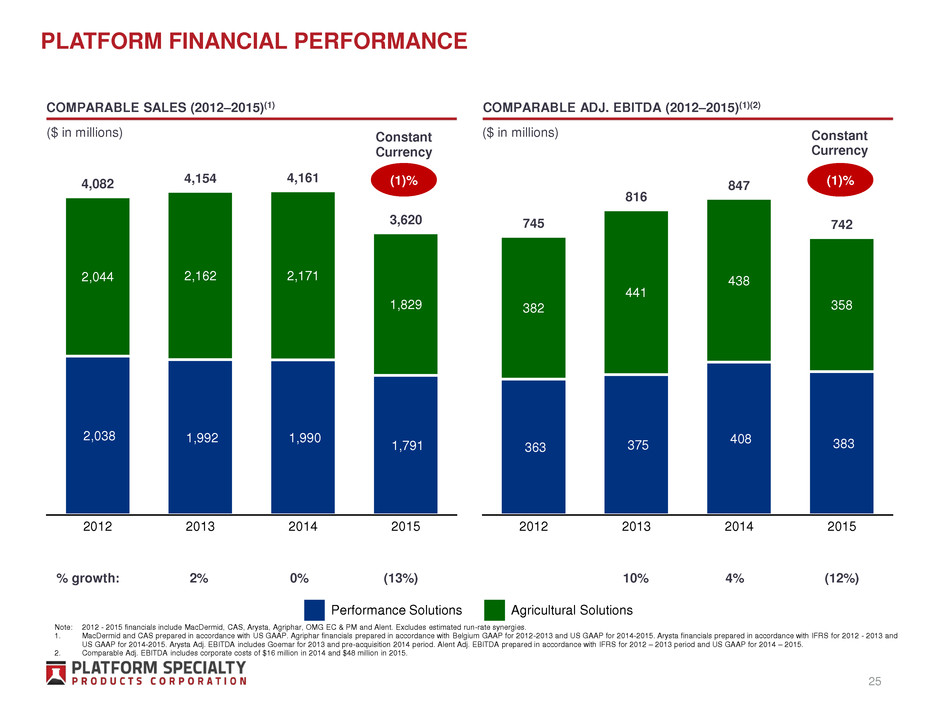

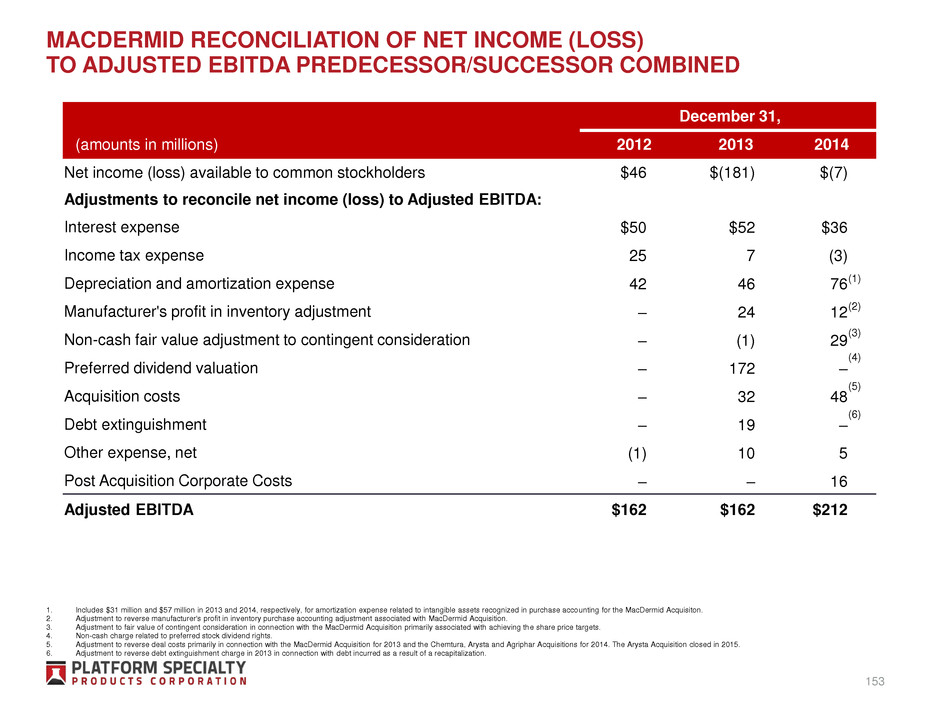

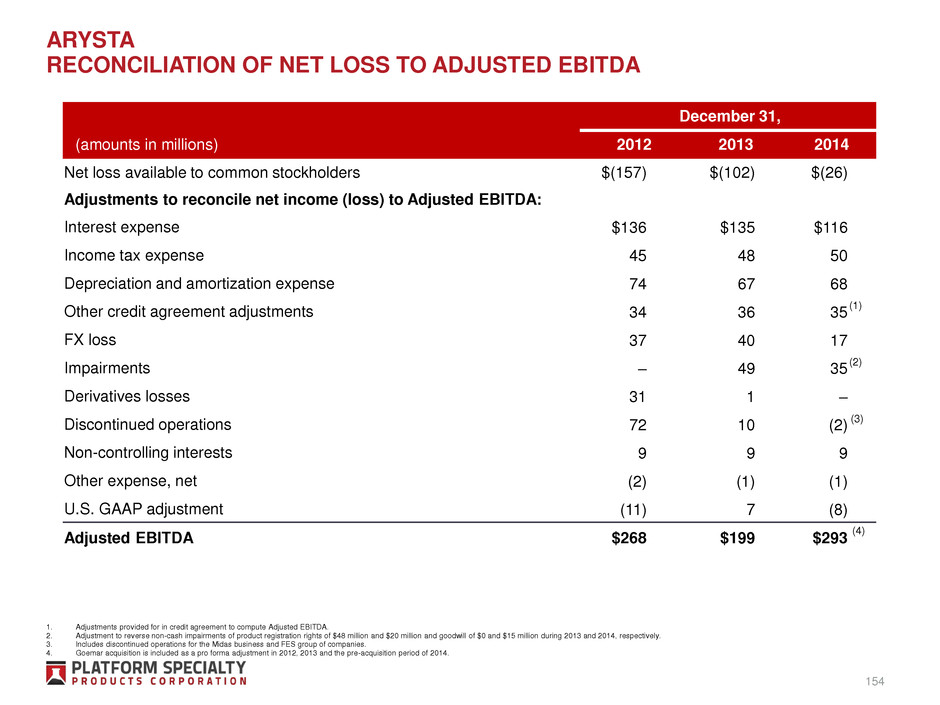

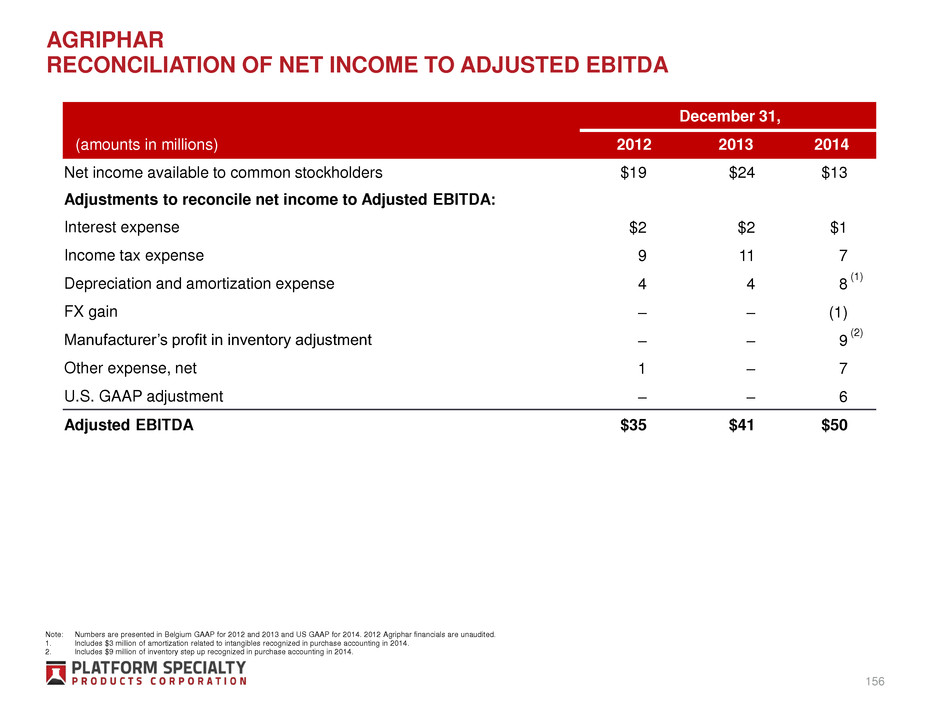

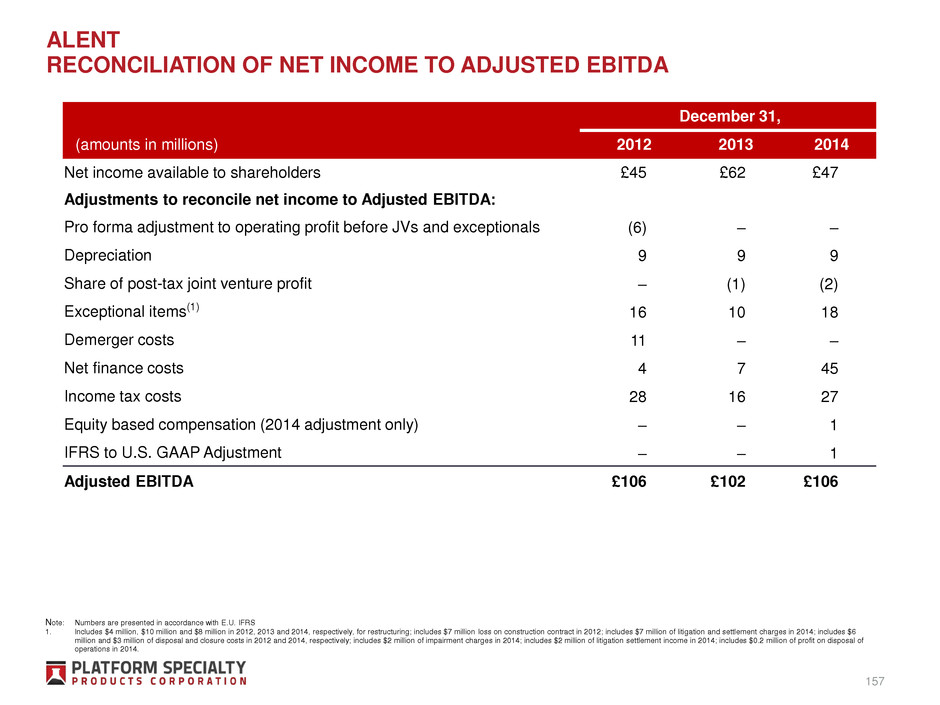

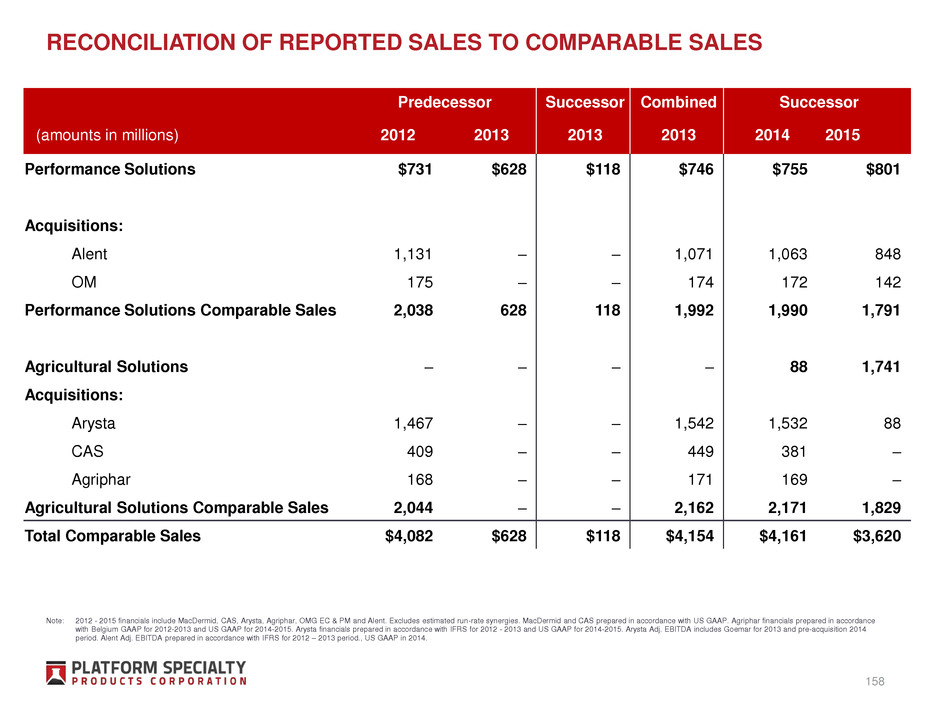

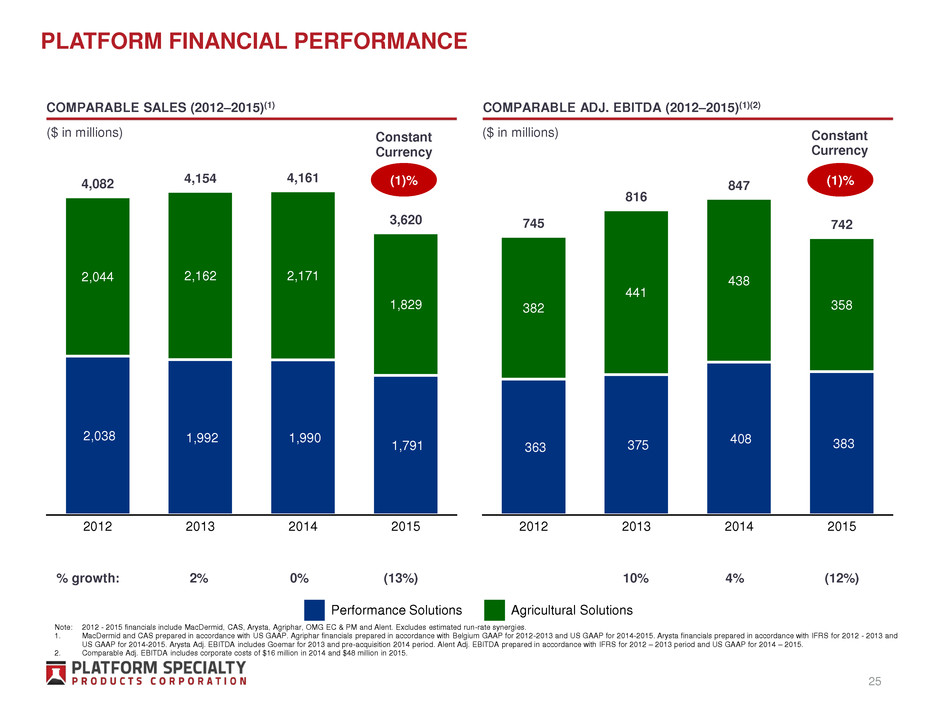

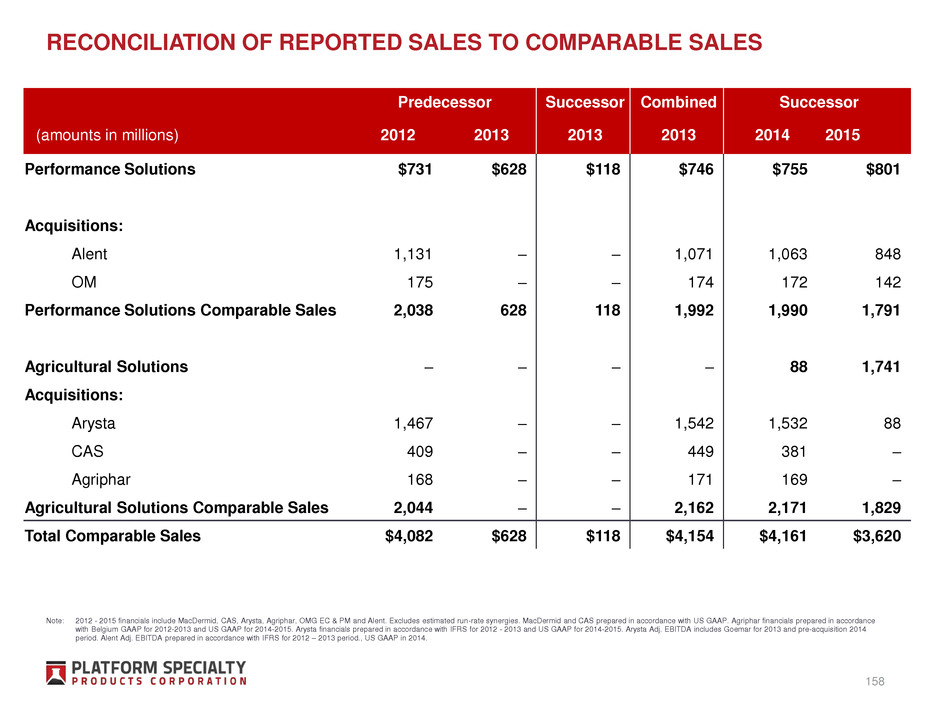

PLATFORM FINANCIAL PERFORMANCE 2,038 1,992 1,990 1,791 2,044 2,162 2,171 1,829 4,082 4,154 4,161 3,620 2012 2013 2014 2015 COMPARABLE ADJ. EBITDA (2012–2015)(1)(2)COMPARABLE SALES (2012–2015)(1) Performance Solutions Agricultural Solutions ($ in millions) ($ in millions) % growth: 2% 0% (13%) 363 375 408 383 382 441 438 358 745 816 847 742 2012 2013 2014 2015 10% 4% (12%) 25 Note: 2012 - 2015 financials include MacDermid, CAS, Arysta, Agriphar, OMG EC & PM and Alent. Excludes estimated run-rate synergies. 1. MacDermid and CAS prepared in accordance with US GAAP. Agriphar financials prepared in accordance with Belgium GAAP for 2012-2013 and US GAAP for 2014-2015. Arysta financials prepared in accordance with IFRS for 2012 - 2013 and US GAAP for 2014-2015. Arysta Adj. EBITDA includes Goemar for 2013 and pre-acquisition 2014 period. Alent Adj. EBITDA prepared in accordance with IFRS for 2012 – 2013 period and US GAAP for 2014 – 2015. 2. Comparable Adj. EBITDA includes corporate costs of $16 million in 2014 and $48 million in 2015. Constant Currency (1)% (1)% Constant Currency

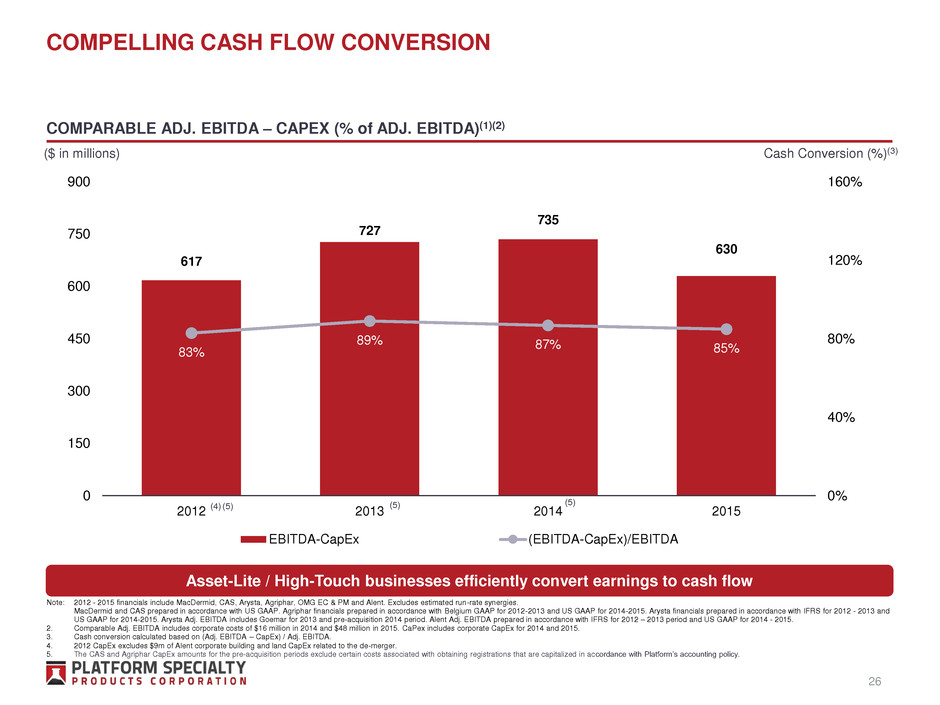

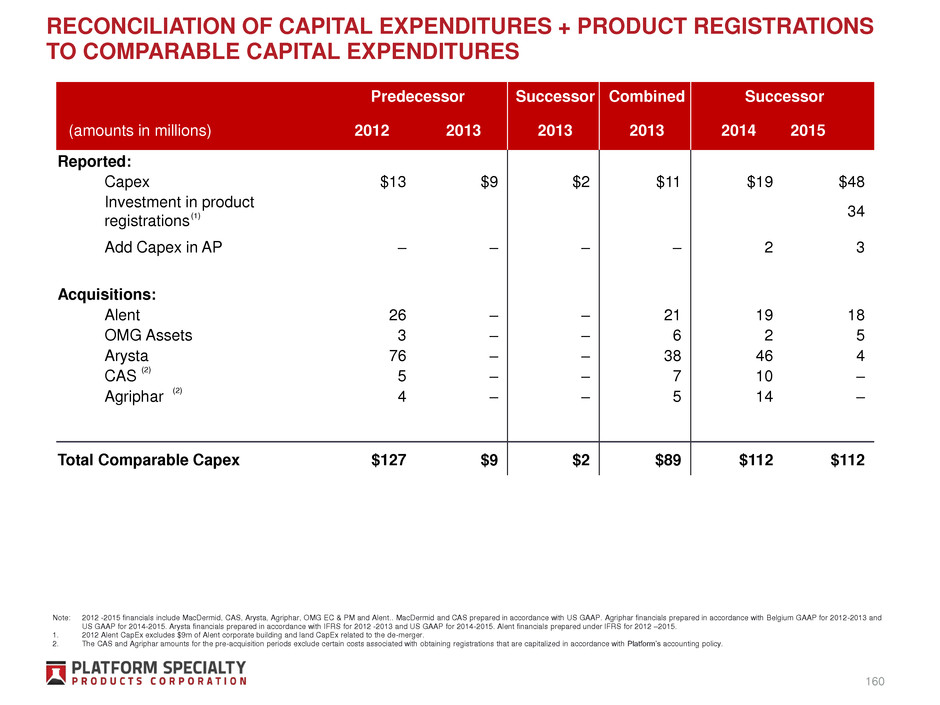

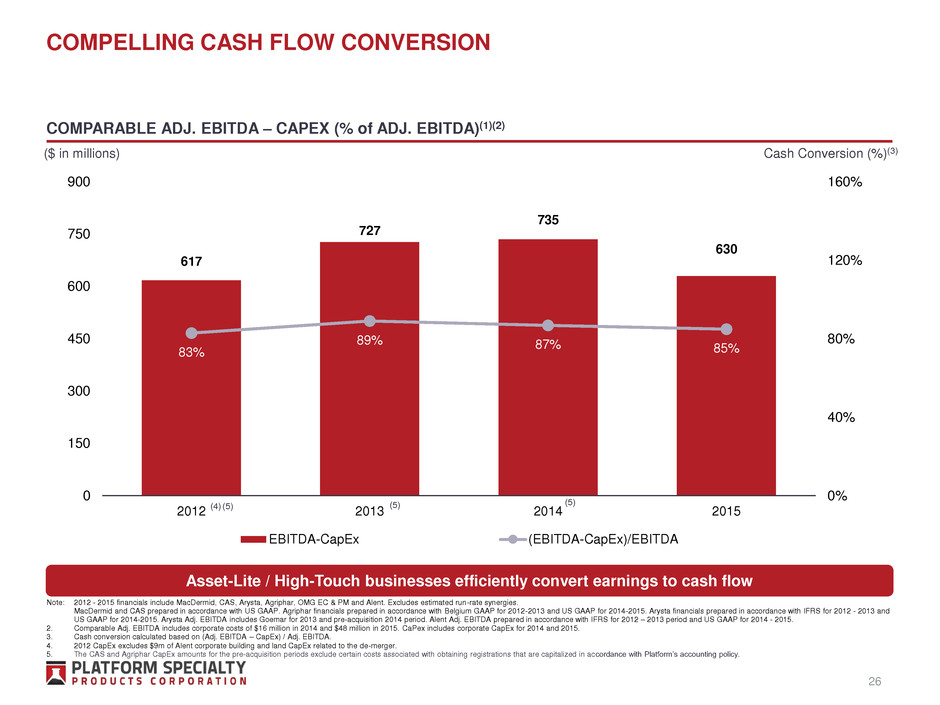

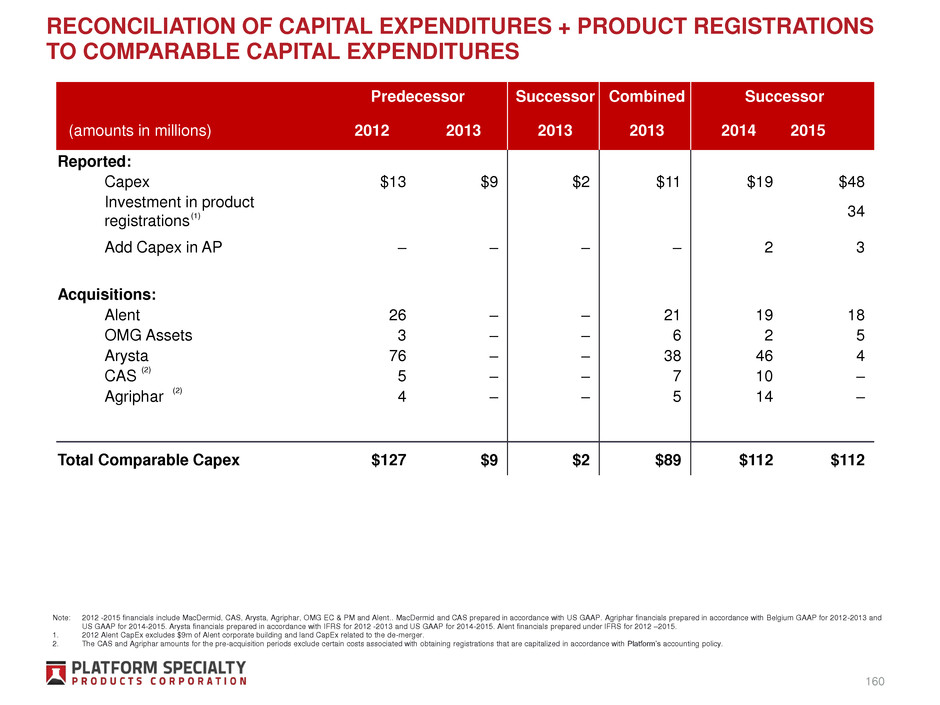

COMPARABLE ADJ. EBITDA – CAPEX (% of ADJ. EBITDA)(1)(2) Asset-Lite / High-Touch businesses efficiently convert earnings to cash flow COMPELLING CASH FLOW CONVERSION ($ in millions) Cash Conversion (%)(3) 26 Note: 2012 - 2015 financials include MacDermid, CAS, Arysta, Agriphar, OMG EC & PM and Alent. Excludes estimated run-rate synergies. 1. MacDermid and CAS prepared in accordance with US GAAP. Agriphar financials prepared in accordance with Belgium GAAP for 2012-2013 and US GAAP for 2014-2015. Arysta financials prepared in accordance with IFRS for 2012 - 2013 and US GAAP for 2014-2015. Arysta Adj. EBITDA includes Goemar for 2013 and pre-acquisition 2014 period. Alent Adj. EBITDA prepared in accordance with IFRS for 2012 – 2013 period and US GAAP for 2014 - 2015. 2. Comparable Adj. EBITDA includes corporate costs of $16 million in 2014 and $48 million in 2015. CaPex includes corporate CapEx for 2014 and 2015. 3. Cash conversion calculated based on (Adj. EBITDA – CapEx) / Adj. EBITDA. 4. 2012 CapEx excludes $9m of Alent corporate building and land CapEx related to the de-merger. 5. The CAS and Agriphar CapEx amounts for the pre-acquisition periods exclude certain costs associated with obtaining registrations that are capitalized in accordance with Platform’s accounting policy. 617 727 735 630 83% 89% 87% 85% 0% 40% 80% 120% 160% 0 150 300 450 600 750 900 2012 2013 2014 2015 EBITDA-CapEx (EBITDA-CapEx)/EBITDA (5)(4) (5) (5)

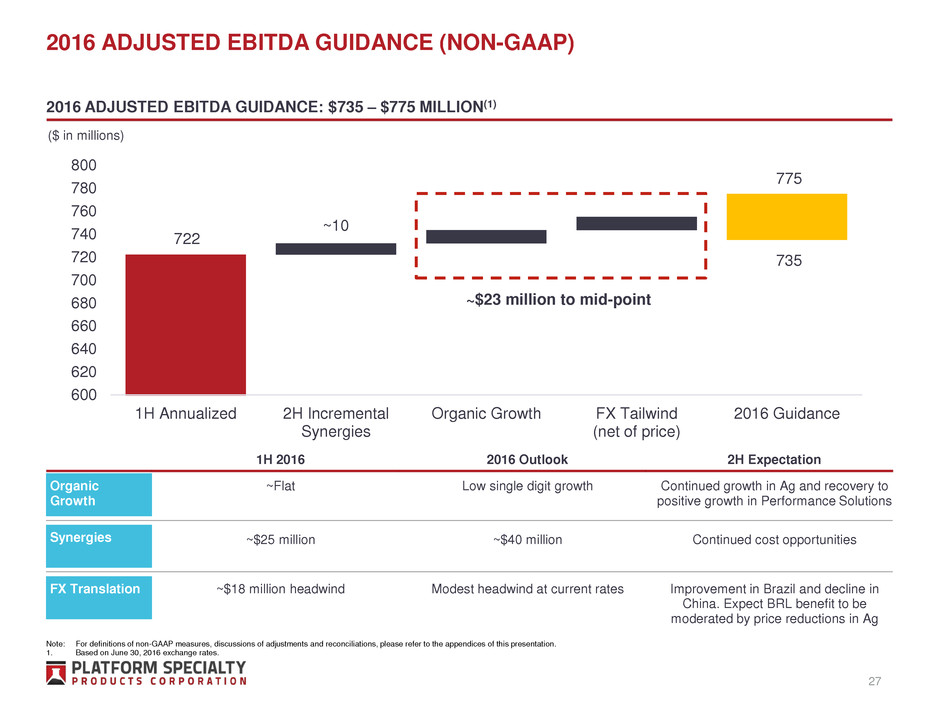

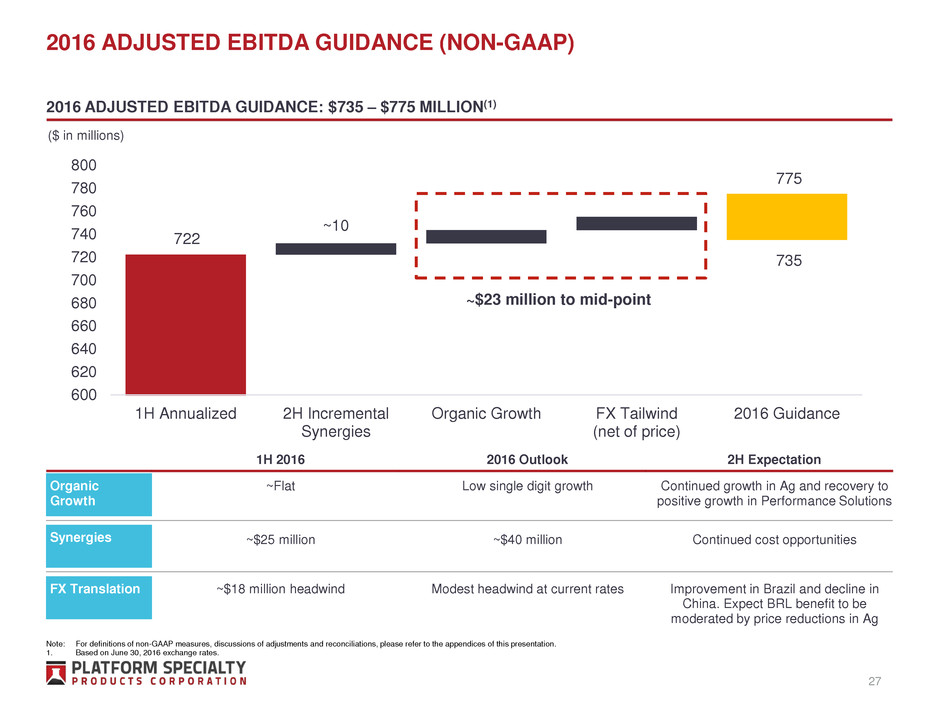

2016 ADJUSTED EBITDA GUIDANCE (NON-GAAP) 27 2016 ADJUSTED EBITDA GUIDANCE: $735 – $775 MILLION(1) Organic Growth ~Flat Low single digit growth Continued growth in Ag and recovery to positive growth in Performance Solutions 1H 2016 2016 Outlook 2H Expectation Synergies ~$25 million ~$40 million Continued cost opportunities FX Translation ~$18 million headwind Modest headwind at current rates Improvement in Brazil and decline in China. Expect BRL benefit to be moderated by price reductions in Ag Note: For definitions of non-GAAP measures, discussions of adjustments and reconciliations, please refer to the appendices of this presentation. 1. Based on June 30, 2016 exchange rates. ~10 722 600 620 640 660 680 700 720 740 760 780 800 1H Annualized 2H Incremental Synergies Organic Growth FX Tailwind (net of price) 2016 Guidance 775 735 ~$23 million to mid-point ($ in millions)

Ag markets impacted by lower commodity prices and a challenging FX environment − Platform’s Ag business experiencing organic growth in most regions − Softness in North America persists Opportunity to focus on organic sales growth Opportunity to improve businesses and performance through improved corporate infrastructure, best practice sharing and cultural bridge building High leverage requires us to focus attention on improving our capital structure CHALLENGES & OPPORTUNITIES Diversified global portfolio of high-quality specialty chemical businesses Healthy blend of stable (electronics, automotive, industrial) and higher growth (Ag) end-markets Relatively high and stable margins: − Products critical to functionality of customer’s products − Low relative cost − Niche focus – no single product or customer significantly material − Asset-lite Strong and nimble commercial management with increasing focus on customer solutions Strong track record of integration Experienced, global leadership team STRENGTHS OBSERVATIONS AND ASSESSMENT 28

AGENDA State of the Company Platform Overview How Did We Get Here Revisiting the Platform Thesis Strategic Objectives 29

We aspire to build a leading, global diversified specialty chemicals company focused on “Asset-Lite, High-Touch” businesses Our ability to drive shareholder value relies on: 1. Existence of large and fragmented end-markets with growing product categories 2. Availability of “Asset-Lite, High-Touch” businesses in these end-markets at values that are accretive to intrinsic value per share 3. Our ability to manage and grow these businesses across diverse end-markets through effective strategy development and execution 4. Our ability to improve the businesses we buy through effective integration REVIEW OF THE PLATFORM THESIS 30 Our long-term strategy remains unchanged

Large and fragmented end-markets with growing product categories LARGE AND ATTRACTIVE SPECIALTY CHEMICAL END-MARKETS Performance Solutions Platform Specialty Products Water Treatment & Cleaning Solutions Oilfield Chemicals $15bn Ag Solutions Market Segment: Coatings (Niche Applications) Flavors & Fragrances Specialty Agricultural Packaging Offshore Specialty Electronic Materials Surface Treatment Assembly Materials $10bn $10bn $10bn$54bn$0.2bn $1bn$4bn $7bn$3bn Market Size: 31 Source: Management estimates.

AGENDA State of the Company Platform Overview How Did We Get Here Revisiting the Platform Thesis Strategic Objectives 32

Platform’s long-term objectives should translate to shareholder value creation PLATFORM’S LONG-TERM OBJECTIVES Portfolio of high-quality and differentiated businesses Leading positions in our priority markets Organic sales growth faster than end-markets we serve Healthy and flexible balance sheet Best-in-class margins and returns on invested capital 1 2 3 4 5 33

Continued Capex discipline Strong R&D prioritization process with strict hurdles and stage gates Facility rationalization opportunities ROIC AND CASH FLOW FOCUS Focus on high-value and high-margin new product initiatives Continued synergy realization Supply chain and procurement optimization MARGIN ENHANCING INITIATIVES Become integral: products and people without which the supply chain breaks down Two-pronged selling strategy − Strategic OEM relationships which leverage market leading position across several complementary portions of the supply chain to win specifications − Tactical technical service and sales at applicator level to become trusted partner on the factory floor Focus on high growth niches where combined MacDermid / Alent portfolio is expected to provide an advantaged position ORGANIC REVENUE GROWTH PATH WINNING STRATEGIES – MACDERMID PERFORMANCE SOLUTIONS 34

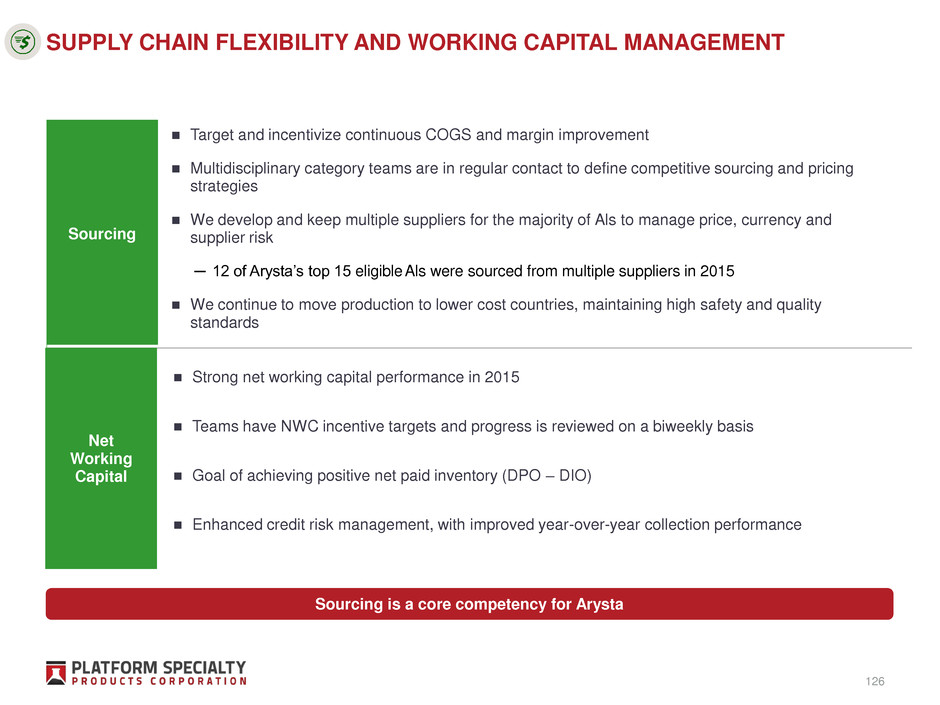

Focus on Asset-Lite model Disciplined working capital management with close attention to collections and customer credit Efforts to further align receivable and payable terms to reduce cash conversion cycle Pricing discipline in the face of volatile currencies and crop prices Supply chain excellence to provide competitive cost/quality proposition Continued synergy realization Focus on higher margin products (biosolutions and seed treatment) Focus on fast-growing niche segments where Arysta can lead with differentiated solutions Continue to be a favored post-patent partner given formulation and regulatory expertise Leverage our access to active ingredients via technology partnerships to develop sustainable pipeline Emphasize high-touch customer initiatives to drive demand WINNING STRATEGIES – ARYSTA LIFESCIENCE ROIC AND CASH FLOW FOCUS MARGIN ENHANCING INITIATIVES ORGANIC REVENUE GROWTH PATH 35

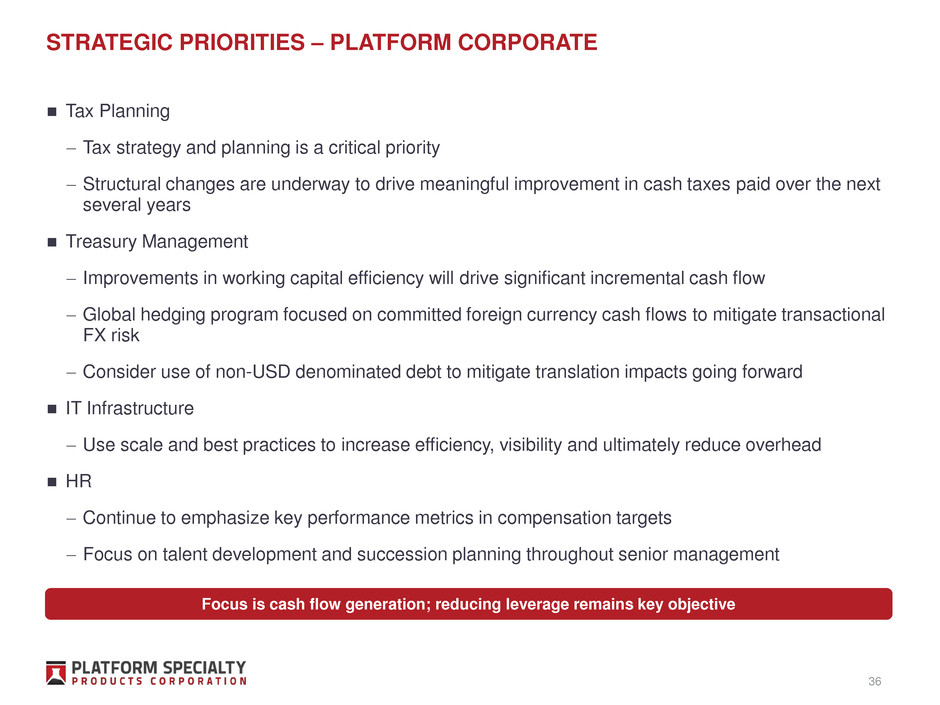

Tax Planning − Tax strategy and planning is a critical priority − Structural changes are underway to drive meaningful improvement in cash taxes paid over the next several years Treasury Management − Improvements in working capital efficiency will drive significant incremental cash flow − Global hedging program focused on committed foreign currency cash flows to mitigate transactional FX risk − Consider use of non-USD denominated debt to mitigate translation impacts going forward IT Infrastructure − Use scale and best practices to increase efficiency, visibility and ultimately reduce overhead HR − Continue to emphasize key performance metrics in compensation targets − Focus on talent development and succession planning throughout senior management STRATEGIC PRIORITIES – PLATFORM CORPORATE 36 Focus is cash flow generation; reducing leverage remains key objective

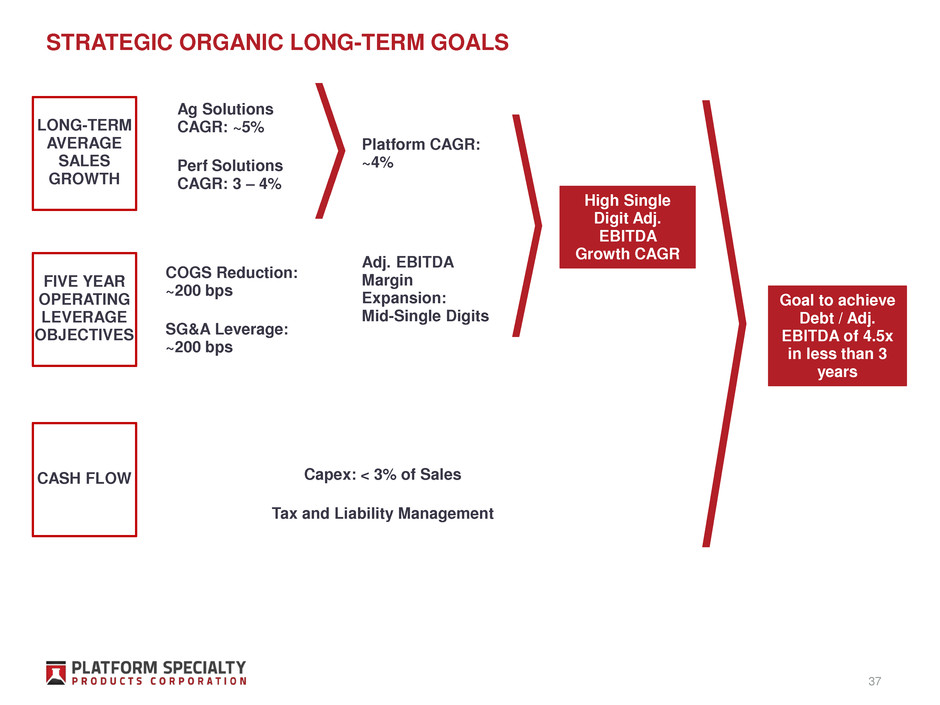

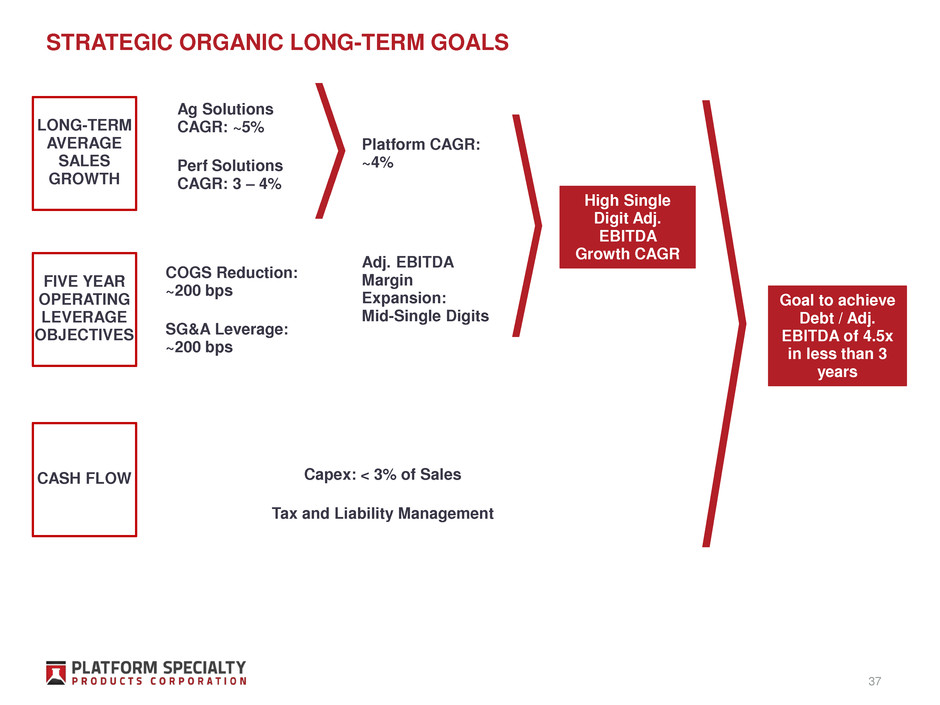

Goal to achieve Debt / Adj. EBITDA of 4.5x in less than 3 years Adj. EBITDA Margin Expansion: Mid-Single Digits Platform CAGR: ~4% FIVE YEAR OPERATING LEVERAGE OBJECTIVES Ag Solutions CAGR: ~5% Perf Solutions CAGR: 3 – 4% STRATEGIC ORGANIC LONG-TERM GOALS Capex: < 3% of Sales Tax and Liability Management COGS Reduction: ~200 bps SG&A Leverage: ~200 bps High Single Digit Adj. EBITDA Growth CAGR 37 LONG-TERM AVERAGE SALES GROWTH CASH FLOW

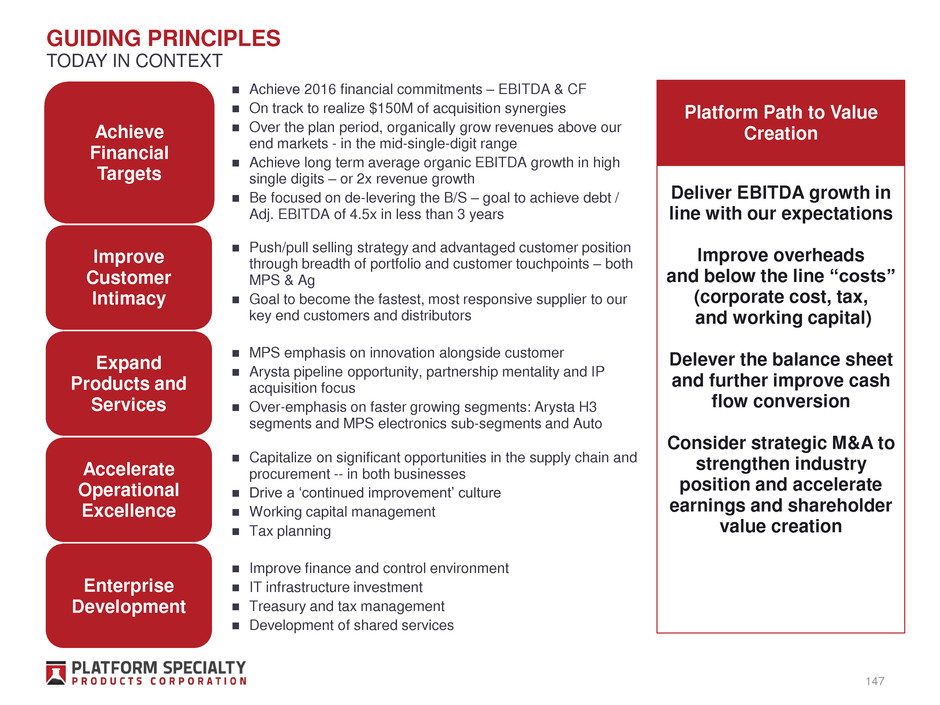

GUIDING PRINCIPLES 38 Improve Customer Intimacy Expand Products and Services Accelerate Operational Excellence Enterprise Development Achieve 2016 financial commitments – EBITDA & CF On track to realize $150M of acquisition synergies Over the plan period, organically grow revenues above our end markets - in the mid-single-digit range Achieve long term average organic EBITDA growth in high single digits – or 2x revenue growth Be focused on de-levering the B/S – goal to achieve debt / Adj. EBITDA of 4.5x in less than 3 years Push/pull selling strategy and advantaged customer position through breadth of portfolio and customer touchpoints – both MPS & Ag Goal to become the fastest, most responsive supplier to our key end customers and distributors MPS emphasis on innovation alongside customer Arysta pipeline opportunity, partnership mentality and IP acquisition focus Over-emphasis on faster growing segments: Arysta H3 segments and MPS electronics sub-segments and Auto Capitalize on significant opportunities in the supply chain and procurement -- in both businesses Drive a ‘continued improvement’ culture Working capital management Tax planning Improve finance and control environment IT infrastructure investment Treasury and tax management Development of shared services Deliver EBITDA growth in line with our expectations Improve overheads and below the line “costs” (corporate cost, tax, and working capital) Delever the balance sheet and further improve cash flow conversion Consider strategic M&A to strengthen industry position and accelerate earnings and shareholder value creation Platform Path to Value CreationAchieve Financial Targets TODAY IN CONTEXT

AGENDA Introduction – Martin E. Franklin State of the Company – Rakesh Sachdev Performance Solutions – Scot Benson Agricultural Solutions – Diego Lopez Casanello Integration Overview – Benjamin Gliklich Financial Overview – Sanjiv Khattri Conclusion – Rakesh Sachdev Appendices 39

Performance Solutions Overview Market Growth Strategy in Action Our Competitive Advantage Financial Performance 40

Acquired Oct. 2013 Acquired Oct. 2015 / Jan. 2016 Acquired Dec. 2015 OM Group Assets MACDERMID PERFORMANCE SOLUTIONS A COMBINATION OF HIGH QUALITY BUSINESSES 41

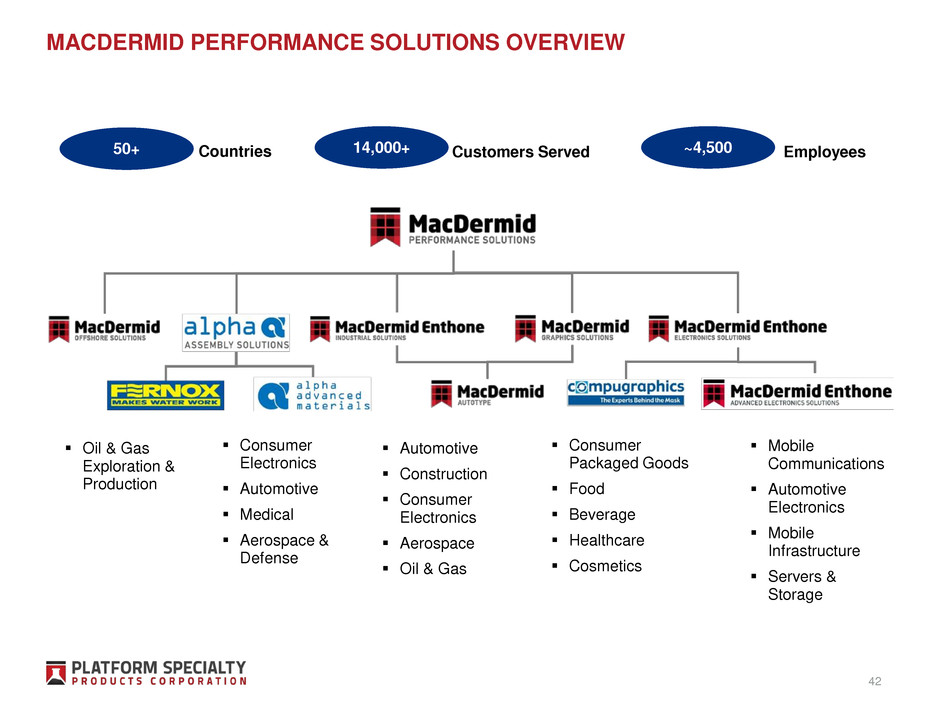

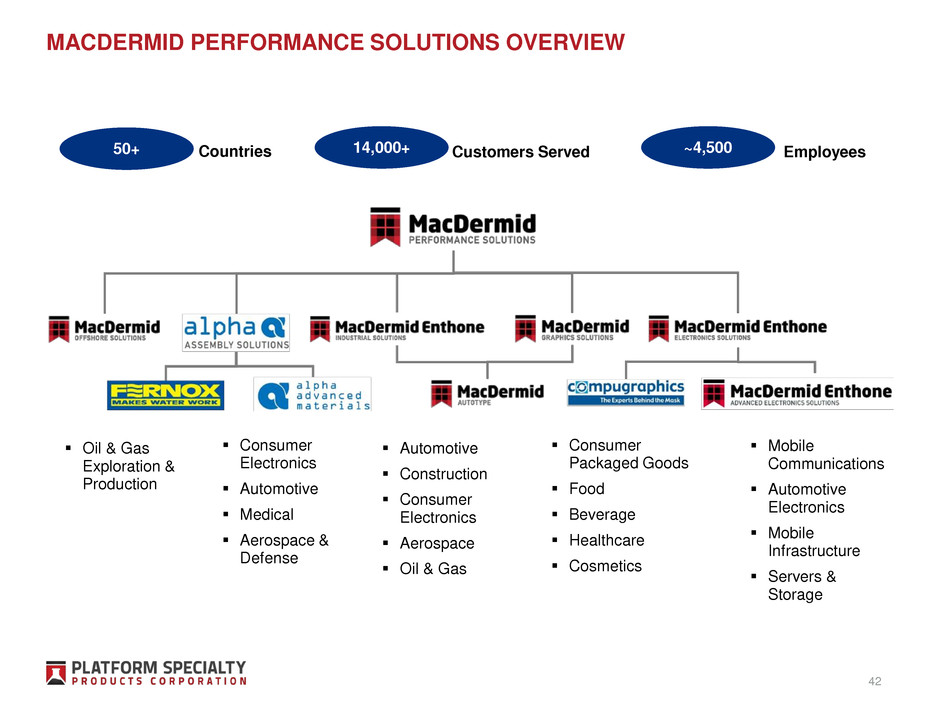

MACDERMID PERFORMANCE SOLUTIONS OVERVIEW EmployeesCountries Customers Served Oil & Gas Exploration & Production Consumer Electronics Automotive Medical Aerospace & Defense Automotive Construction Consumer Electronics Aerospace Oil & Gas Consumer Packaged Goods Food Beverage Healthcare Cosmetics Mobile Communications Automotive Electronics Mobile Infrastructure Servers & Storage ~4,50014,000+50+ 42

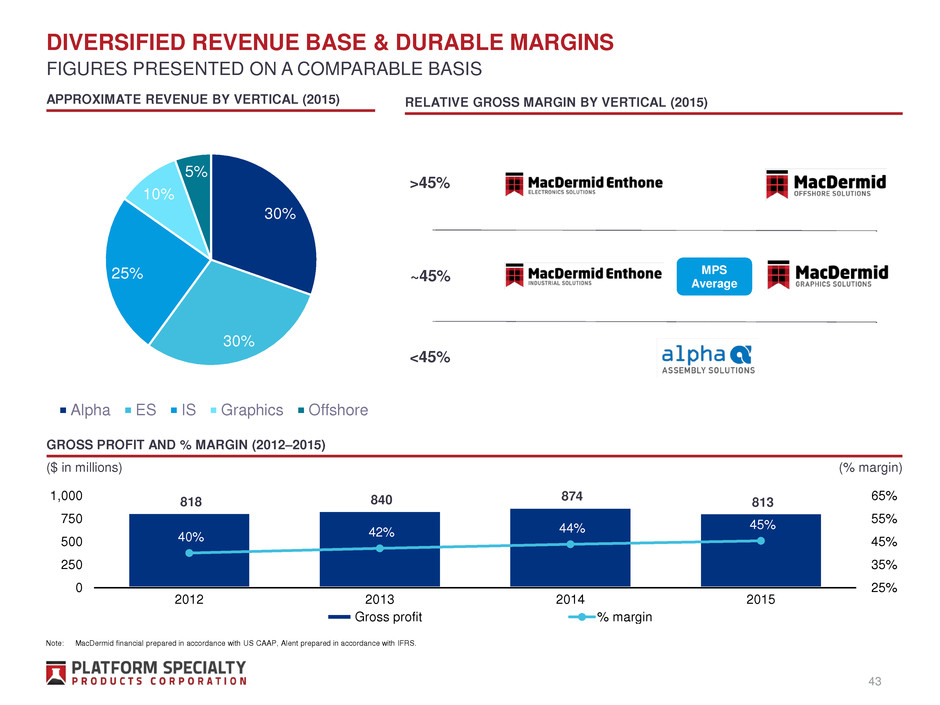

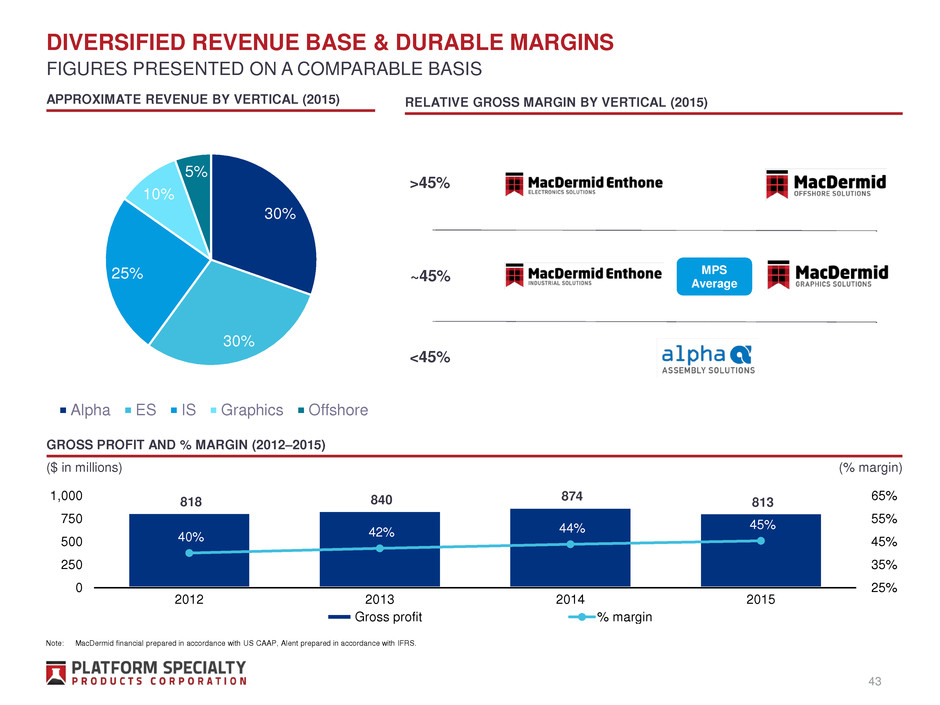

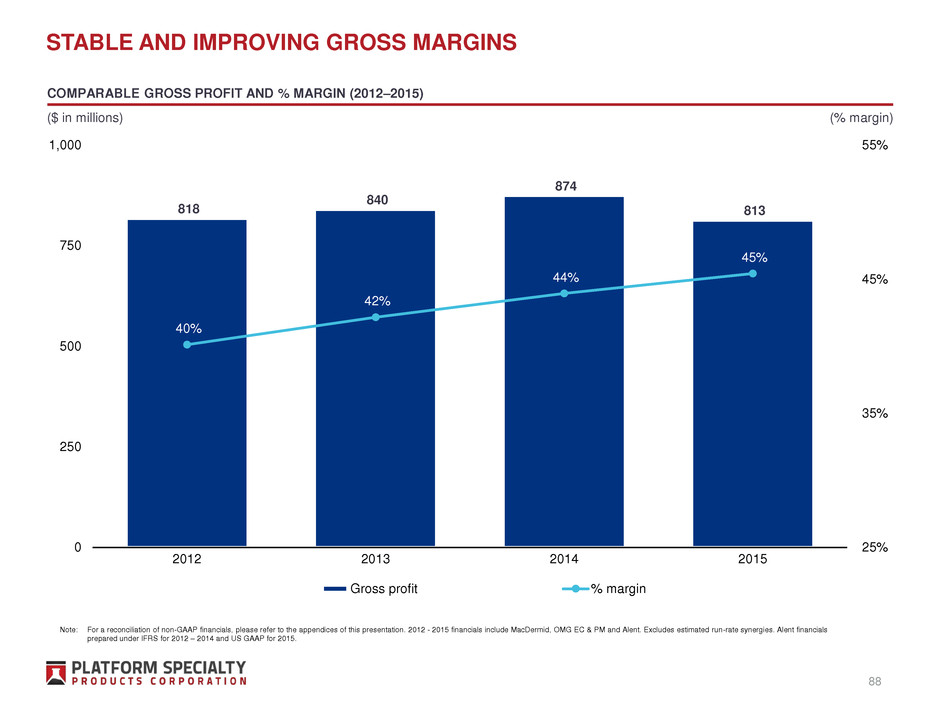

DIVERSIFIED REVENUE BASE & DURABLE MARGINS FIGURES PRESENTED ON A COMPARABLE BASIS 43 30% 30% 25% 10% 5% Alpha ES IS Graphics Offshore APPROXIMATE REVENUE BY VERTICAL (2015) RELATIVE GROSS MARGIN BY VERTICAL (2015) GROSS PROFIT AND % MARGIN (2012–2015) 818 840 874 813 40% 42% 44% 45% 25% 35% 45% 55% 65% 0 250 500 750 1,000 2012 2013 2014 2015 Gross profit % margin ($ in millions) (% margin) ~45% >45% <45% MPS Average Note: MacDermid financial prepared in accordance with US CAAP, Alent prepared in accordance with IFRS.

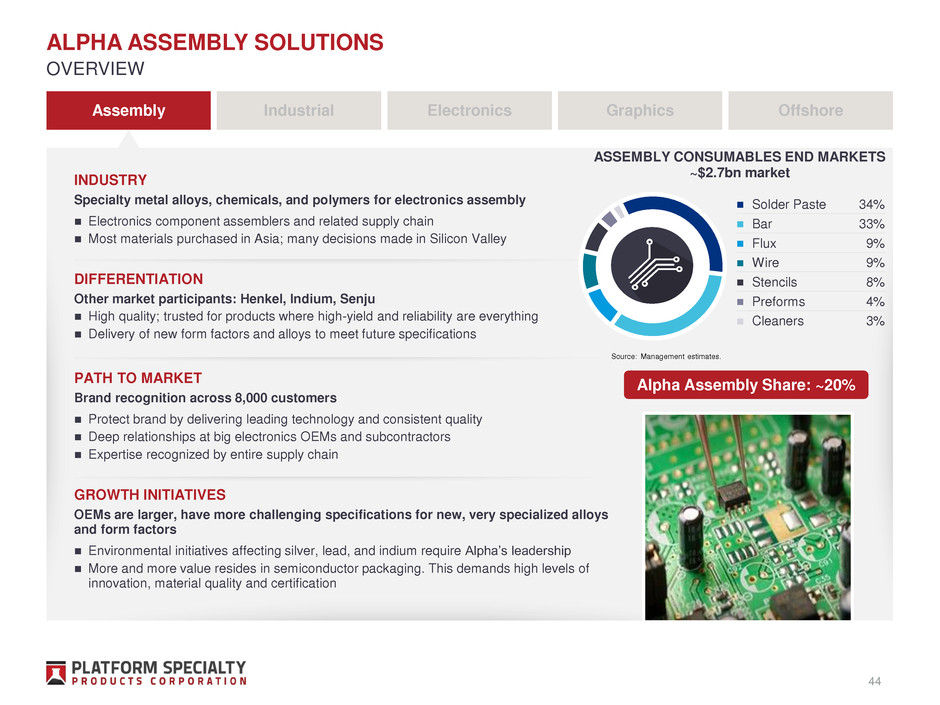

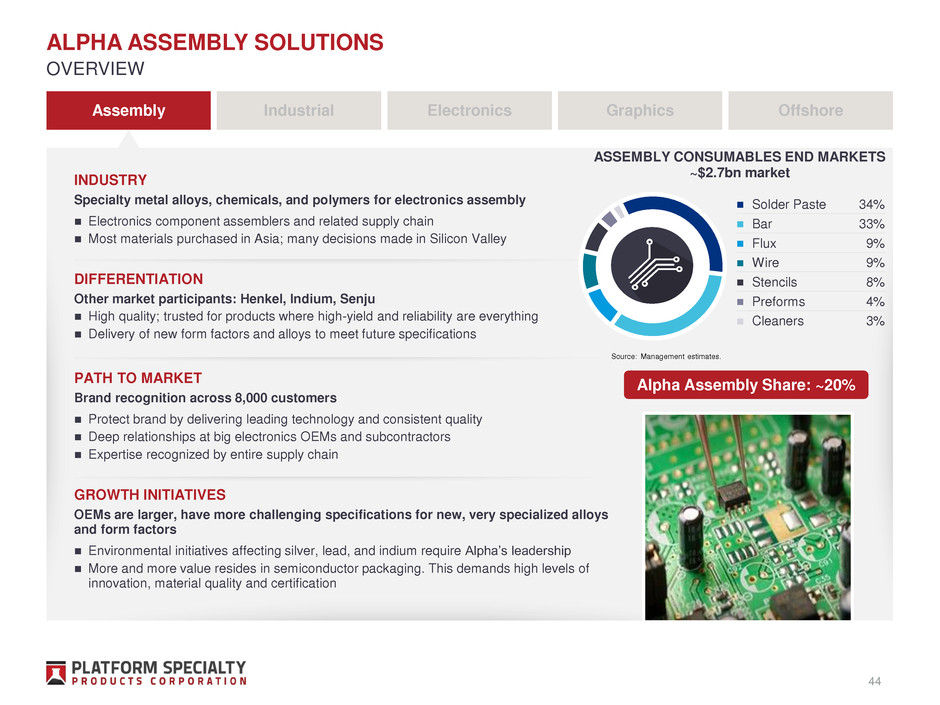

ALPHA ASSEMBLY SOLUTIONS OVERVIEW INDUSTRY Specialty metal alloys, chemicals, and polymers for electronics assembly Electronics component assemblers and related supply chain Most materials purchased in Asia; many decisions made in Silicon Valley DIFFERENTIATION Other market participants: Henkel, Indium, Senju High quality; trusted for products where high-yield and reliability are everything Delivery of new form factors and alloys to meet future specifications PATH TO MARKET Brand recognition across 8,000 customers Protect brand by delivering leading technology and consistent quality Deep relationships at big electronics OEMs and subcontractors Expertise recognized by entire supply chain GROWTH INITIATIVES OEMs are larger, have more challenging specifications for new, very specialized alloys and form factors Environmental initiatives affecting silver, lead, and indium require Alpha’s leadership More and more value resides in semiconductor packaging. This demands high levels of innovation, material quality and certification Assembly Industrial Electronics Graphics Offshore 44 Alpha Assembly Share: ~20% ASSEMBLY CONSUMABLES END MARKETS ~$2.7bn market ■ Solder Paste 34% ■ Bar 33% ■ Flux 9% ■ Wire 9% ■ Stencils 8% ■ Preforms 4% ■ Cleaners 3% Source: Management estimates.

ALPHA ASSEMBLY FOOTPRINT Altoona, PA Manufacturing Monterrey, Mexico Manufacturing South Plainfield, NJ R&D Laboratory Langenfeld, Germany Service Laboratory Naarden, Netherlands Manufacturing S-Hertogenbosch, Netherlands, Mfg Dunaharaszti, Hungary Manufacturing Bangalore, India R&D Laboratory Manaus, Brazil Manufacturing Singapore Manufacturing, Service Laboratory Siheung-city, S. Korea Manufacturing, Service Laboratory Hiratsuka, Japan R&D Laboratory Shenzhen, China Manufacturing Taoyuan, Taiwan Manufacturing, Service Laboratory Shanghai, China Manufacturing, Service Laboratory R&D Laboratory Service Laboratory Manufacturing Facility 5 3 12 Chennai, India Manufacturing 45

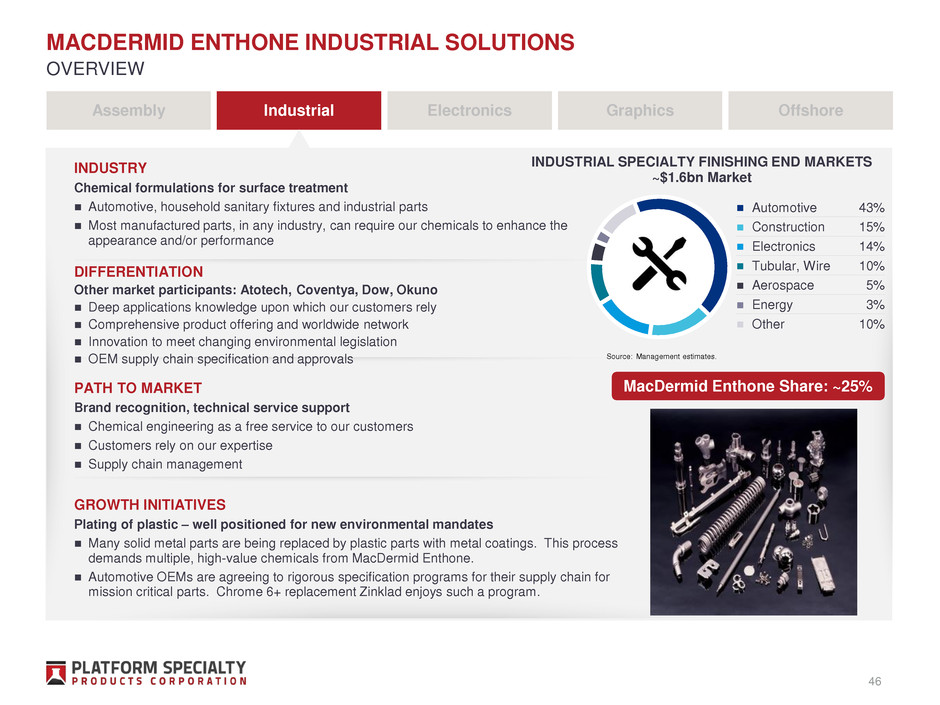

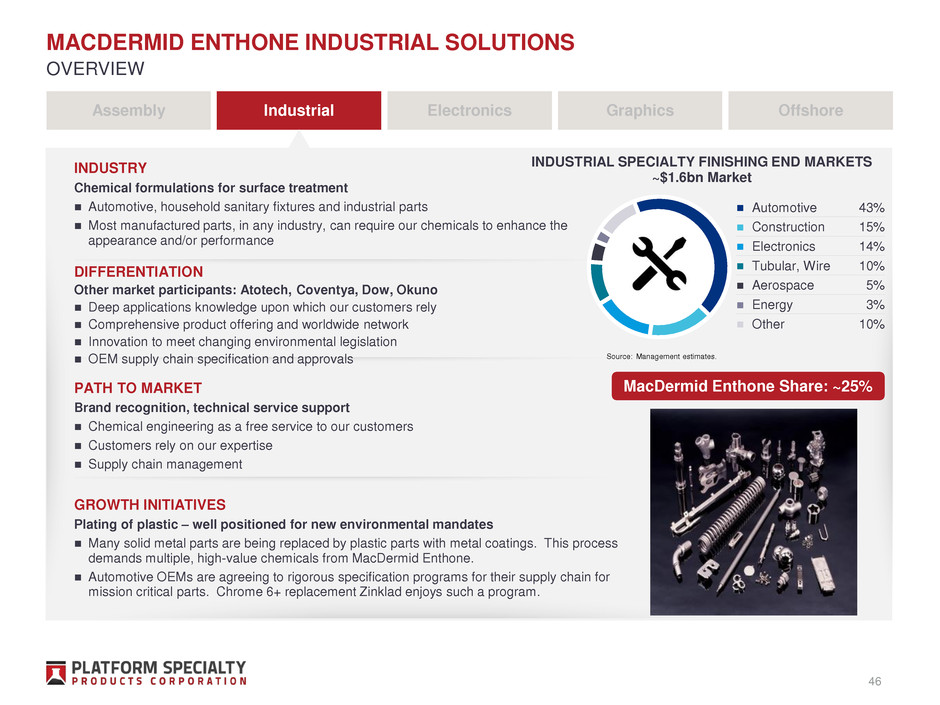

MACDERMID ENTHONE INDUSTRIAL SOLUTIONS INDUSTRY Chemical formulations for surface treatment Automotive, household sanitary fixtures and industrial parts Most manufactured parts, in any industry, can require our chemicals to enhance the appearance and/or performance DIFFERENTIATION Other market participants: Atotech, Coventya, Dow, Okuno Deep applications knowledge upon which our customers rely Comprehensive product offering and worldwide network Innovation to meet changing environmental legislation OEM supply chain specification and approvals PATH TO MARKET Brand recognition, technical service support Chemical engineering as a free service to our customers Customers rely on our expertise Supply chain management GROWTH INITIATIVES Plating of plastic – well positioned for new environmental mandates Many solid metal parts are being replaced by plastic parts with metal coatings. This process demands multiple, high-value chemicals from MacDermid Enthone. Automotive OEMs are agreeing to rigorous specification programs for their supply chain for mission critical parts. Chrome 6+ replacement Zinklad enjoys such a program. Assembly Industrial Electronics Graphics Offshore 46 OVERVIEW ■ Automotive 43% ■ Construction 15% ■ Electronics 14% ■ Tubular, Wire 10% ■ Aerospace 5% ■ Energy 3% ■ Other 10% MacDermid Enthone Share: ~25% INDUSTRIAL SPECIALTY FINISHING END MARKETS ~$1.6bn Market Source: Management estimates.

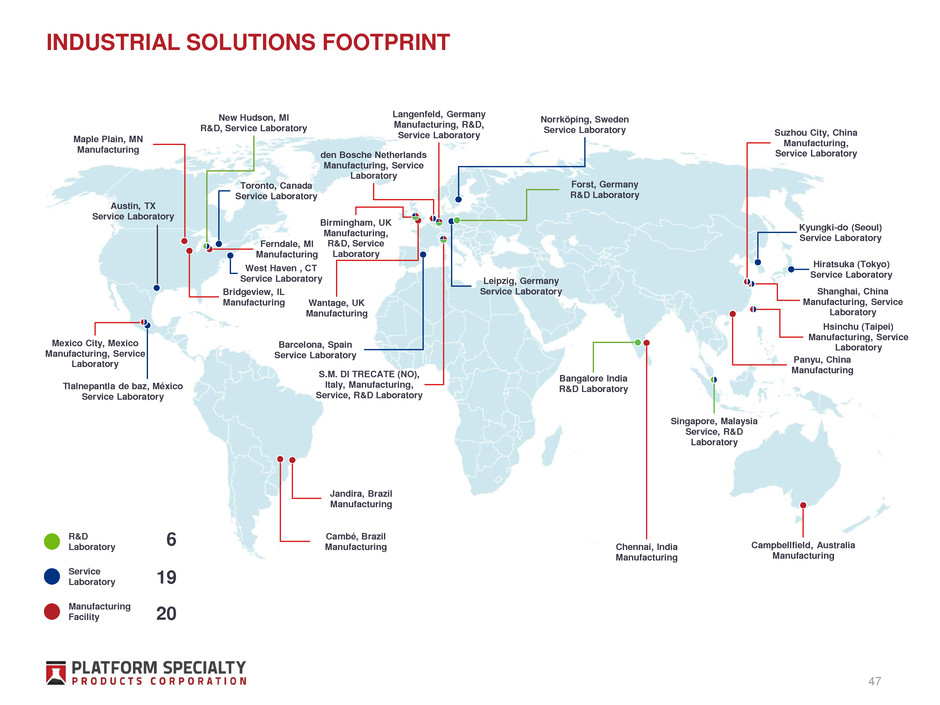

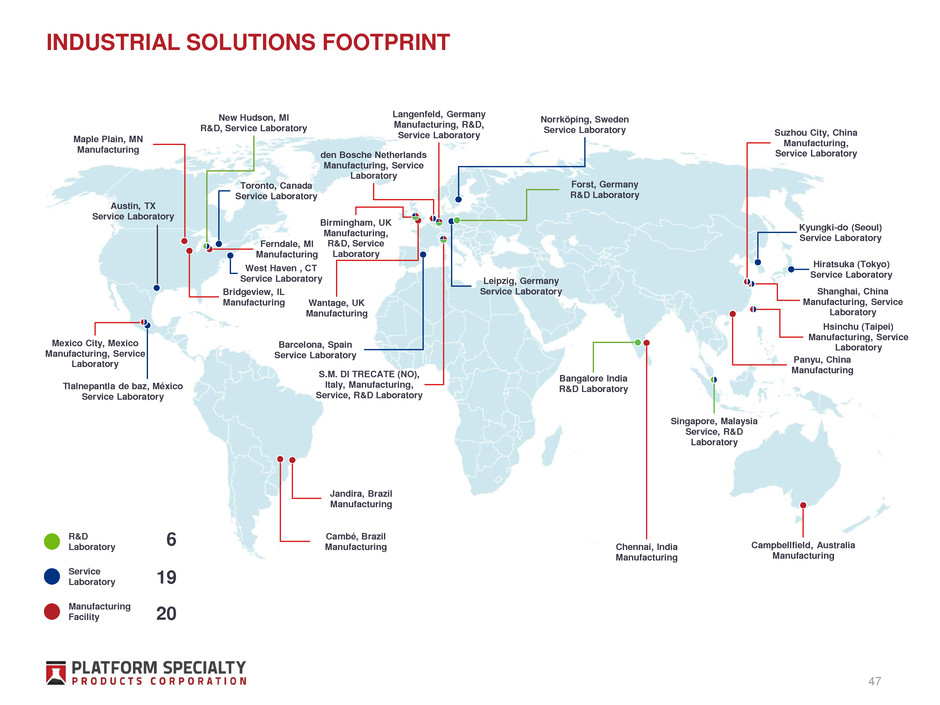

INDUSTRIAL SOLUTIONS FOOTPRINT Maple Plain, MN Manufacturing Birmingham, UK Manufacturing, R&D, Service Laboratory S.M. DI TRECATE (NO), Italy, Manufacturing, Service, R&D Laboratory Chennai, India Manufacturing Suzhou City, China Manufacturing, Service Laboratory Shanghai, China Manufacturing, Service Laboratory Austin, TX Service Laboratory Mexico City, Mexico Manufacturing, Service Laboratory Cambé, Brazil Manufacturing New Hudson, MI R&D, Service Laboratory Ferndale, MI Manufacturing Jandira, Brazil Manufacturing Wantage, UK Manufacturing Langenfeld, Germany Manufacturing, R&D, Service Laboratory Leipzig, Germany Service Laboratory Norrköping, Sweden Service Laboratory Forst, Germany R&D Laboratory Campbellfield, Australia Manufacturing R&D Laboratory Service Laboratory Manufacturing Facility 19 6 20 Bridgeview, IL Manufacturing Toronto, Canada Service Laboratory Tlalnepantla de baz, México Service Laboratory West Haven , CT Service Laboratory den Bosche Netherlands Manufacturing, Service Laboratory Barcelona, Spain Service Laboratory Bangalore India R&D Laboratory Singapore, Malaysia Service, R&D Laboratory Panyu, China Manufacturing Hiratsuka (Tokyo) Service Laboratory Kyungki-do (Seoul) Service Laboratory Hsinchu (Taipei) Manufacturing, Service Laboratory 47

MACDERMID ENTHONE ELECTRONICS SOLUTIONS INDUSTRY Chemistry formulations for circuitry and Si wafers Printed Circuit Boards and semiconductor packaging Semiconductor wafer plating and interconnect Memory disk, connectors, molded interconnect, solar cells, LED DIFFERENTIATION Other market participants: Atotech, Dow, Uyemura Chemicals performing in high-volume manufacturing at high yield Ability to anticipate technological disruptions PATH TO MARKET Direct support of all facilities making circuitry Deep supply chain coordination Customer dependency on our expertise GROWTH INITIATIVES Key markets adopting more complicated circuitry designs – shifting to high-profit chemistry Electronics content in automobiles is growing quickly . Further, the types of electronics demand higher complexity. This will drive volume to our higher profit chemicals Large product categories, such as smartphones, may not be manufactured without our industry leading chemistry product – providing a moat Assembly Industrial Electronics Graphics Offshore 48 OVERVIEW ELECTRONICS SPECIALTY CHEMICALS END MARKETS ~$2.3bn Market MacDermid Enthone Share: ~18% ■ PCB - Metallization 46% ■ PCB - Finishing 18% ■ Connectors 6% ■ Lead Frames 5% ■ Passives 2% ■ Memory Disk 3% ■ MID 1% ■ Wafer Plating 9% ■ PCB - Innerlayers 10% Source: Management estimates.

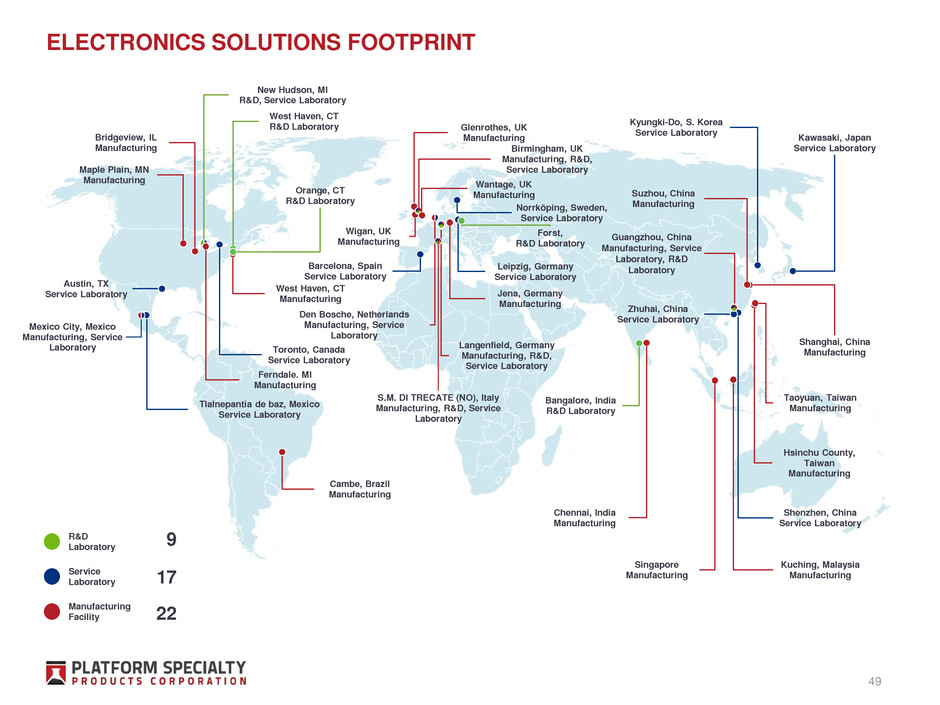

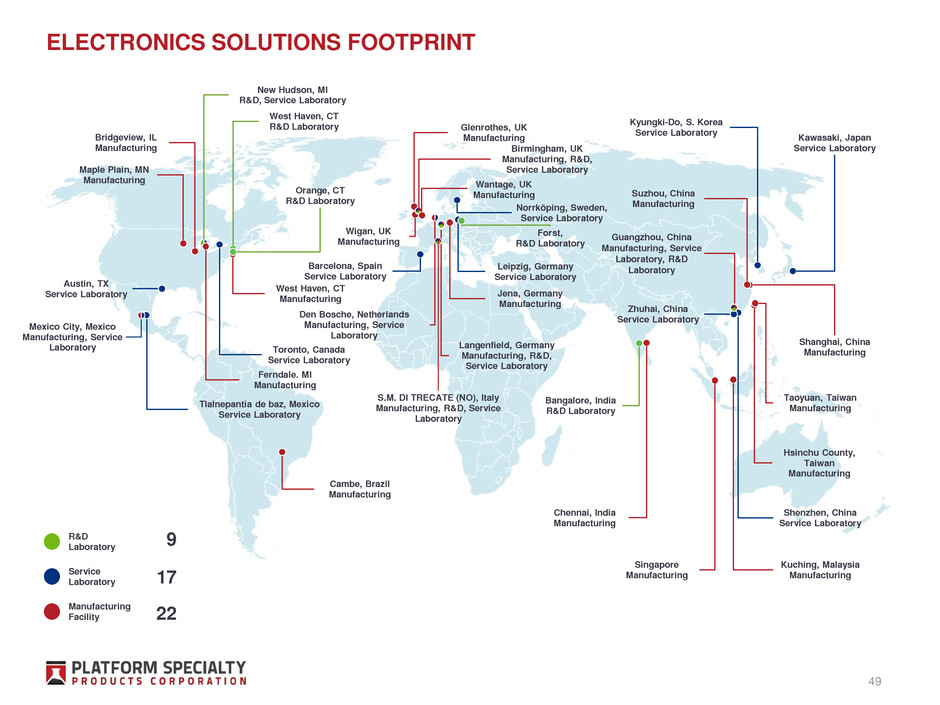

ELECTRONICS SOLUTIONS FOOTPRINT Bridgeview, IL Manufacturing West Haven, CT R&D Laboratory West Haven, CT Manufacturing Orange, CT R&D Laboratory Glenrothes, UK Manufacturing Bangalore, India R&D Laboratory Shenzhen, China Service Laboratory Singapore Manufacturing Kuching, Malaysia Manufacturing Hsinchu County, Taiwan Manufacturing Taoyuan, Taiwan Manufacturing Shanghai, China Manufacturing Kyungki-Do, S. Korea Service Laboratory Kawasaki, Japan Service Laboratory Wigan, UK Manufacturing Jena, Germany Manufacturing Chennai, India Manufacturing Suzhou, China Manufacturing Zhuhai, China Service Laboratory Guangzhou, China Manufacturing, Service Laboratory, R&D Laboratory R&D Laboratory Service Laboratory Manufacturing Facility 17 9 22 Tlalnepantia de baz, Mexico Service Laboratory Maple Plain, MN Manufacturing Austin, TX Service Laboratory Mexico City, Mexico Manufacturing, Service Laboratory New Hudson, MI R&D, Service Laboratory Ferndale. MI Manufacturing Toronto, Canada Service Laboratory Birmingham, UK Manufacturing, R&D, Service Laboratory Wantage, UK Manufacturing Barcelona, Spain Service Laboratory Den Bosche, Netherlands Manufacturing, Service Laboratory Langenfield, Germany Manufacturing, R&D, Service Laboratory S.M. DI TRECATE (NO), Italy Manufacturing, R&D, Service Laboratory Norrköping, Sweden, Service Laboratory Leipzig, Germany Service Laboratory Forst, R&D Laboratory Cambe, Brazil Manufacturing 49

MACDERMID GRAPHICS SOLUTIONS – OVERVIEW INDUSTRY Consumables to transfer ink in printing operations Consumer-level food packaging Newspaper printing Industrial packaging and labeling DIFFERENTIATION Other market participants: Asahi, DuPont, Flint Linking chemistry with print performance through a complex process Innovative solutions for image transfer quality and brand consistency, e.g. LUX Service reputation, e.g. “Meet The Experts” who help customers print better PATH TO MARKET Strong relationships with distribution networks Process and technical service allows deep relationships with global producers Reputation for innovation, e.g. “The Flat Top Dot Experts” Global span, strong local relationships GROWTH INITIATIVES Enabling the transition to flexographic printing Simplicity, CapEx, and environmental footprint favor flexography over gravure We believe our new capacity expansions allow us to take market share readily Our innovative products give customers a reason to switch to flexography and to MGS Assembly Industrial Electronics Graphics Offshore 50 OVERVIEW ■ Corrugated 43% ■ Flexible Packaging 28% ■ Tag & Label 19% ■ Non-Packaging 10% MacDermid Share: ~15% GRAPHIC CONSUMABLES END MARKETS ~$1.0bn Market Source: Management estimates.

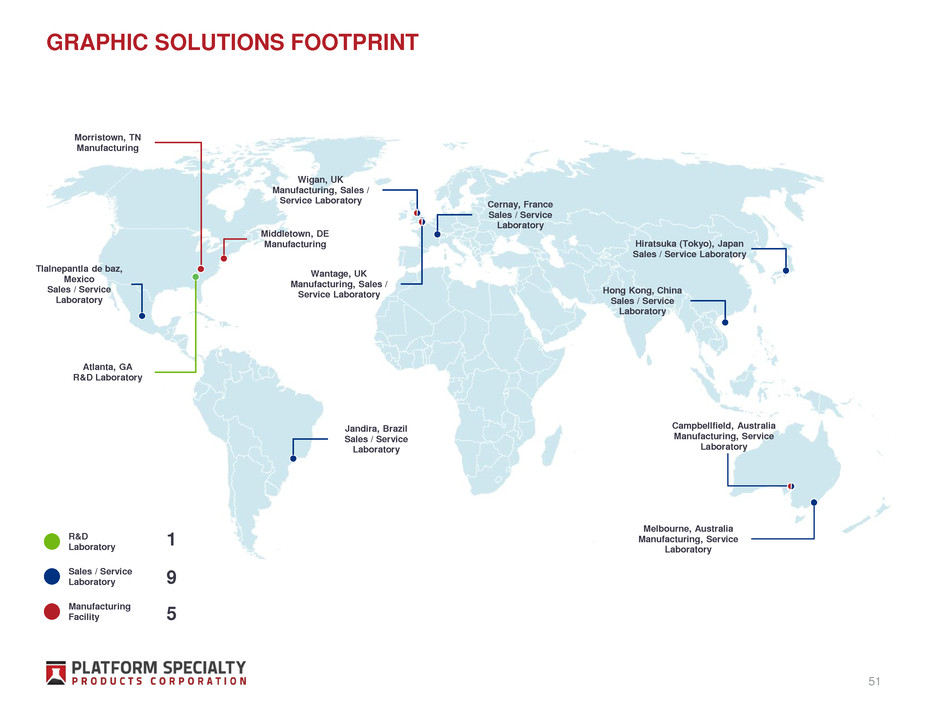

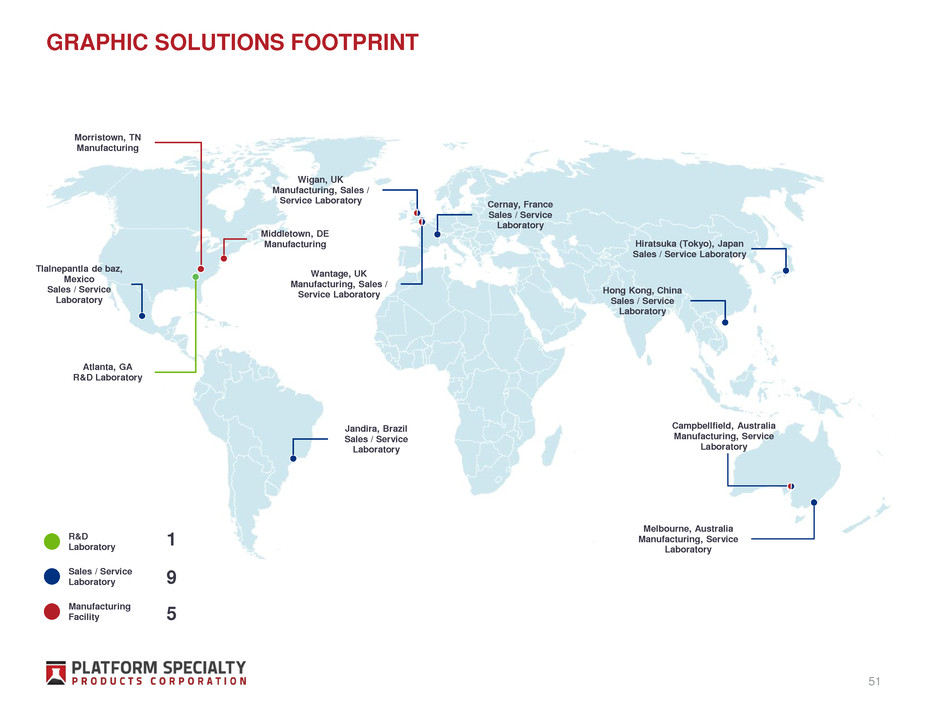

Morristown, TN Manufacturing Atlanta, GA R&D Laboratory Middletown, DE Manufacturing GRAPHIC SOLUTIONS FOOTPRINT R&D Laboratory Sales / Service Laboratory Manufacturing Facility 9 1 5 Cernay, France Sales / Service Laboratory Tlalnepantla de baz, Mexico Sales / Service Laboratory Hong Kong, China Sales / Service Laboratory Jandira, Brazil Sales / Service Laboratory Hiratsuka (Tokyo), Japan Sales / Service Laboratory Wigan, UK Manufacturing, Sales / Service Laboratory Melbourne, Australia Manufacturing, Service Laboratory Wantage, UK Manufacturing, Sales / Service Laboratory Campbellfield, Australia Manufacturing, Service Laboratory 51

MACDERMID OFFSHORE SOLUTIONS – OVERVIEW INDUSTRY Environmentally friendly water-based fluids for subsea valve control Offshore oil and natural gas exploration and production Americas, North Sea, Asia and Africa DIFFERENTIATION Other market participants: Castrol, Houghton Innovative, reliable, well-recognized products and superior technical support Intimate knowledge of customers’ needs and expected future demands Long-term positive industry reputation PATH TO MARKET Fully B2B with all levels of the small customer base Qualified with all equipment manufacturers Strong relationships with customer technical authorities Specification on long-term projects within a close-knit, integrated supply chain GROWTH INITIATIVES Technological discontinuities and environmental mandates New reserves are increasingly found in much deeper water. Our fluids have proven tolerance to the higher temperatures of deep wells. Following BP’s highly-visible mishap, pressure has increased to deploy environmentally compatible and reliable fluids – a MacDermid strength Assembly Industrial Electronics Graphics Offshore 52 OVERVIEW ■ Production Fluids 59% ■ Drilling Fluids 41% MacDermid Share: ~54% OFFSHORE SPECIATLY FLUIDS END MARKETS ~$0.2bn Market Source: Management estimates.

OFFSHORE SOLUTIONS FOOTPRINT Pasadena, TX Manufacturing, R&D, Service Laboratory Stavanger, Norway Service Laboratory Wigan, UK Manufacturing, R&D + Service Laboratory Takoradi, Ghana Service Laboratory R&D Laboratory Service Laboratory Manufacturing Facility 8 2 5 Cambé, Paraná, Brazil Manufacturing Jandira, São Paulo, Brazil Manufacturing, Service Laboratory Melbourne, Australia Manufacturing, Service Laboratory Ghangzhou, China Service Laboratory Singapore Service Laboratory 53

DIVERSE END MARKETS MOBILE OIL & GAS HOME CONSUMER 54 AUTOMOTIVE

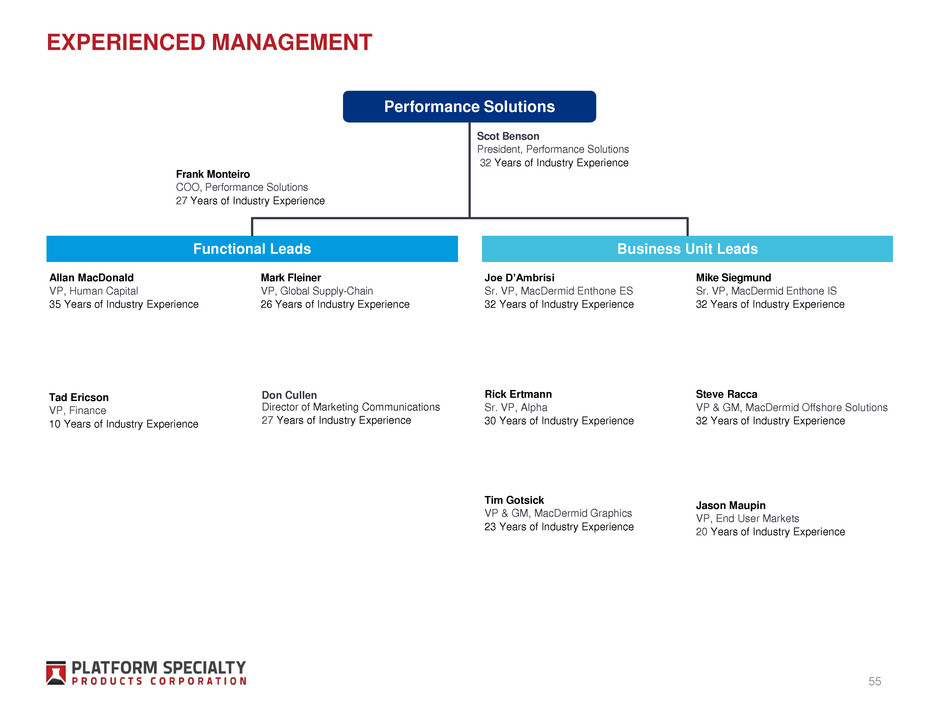

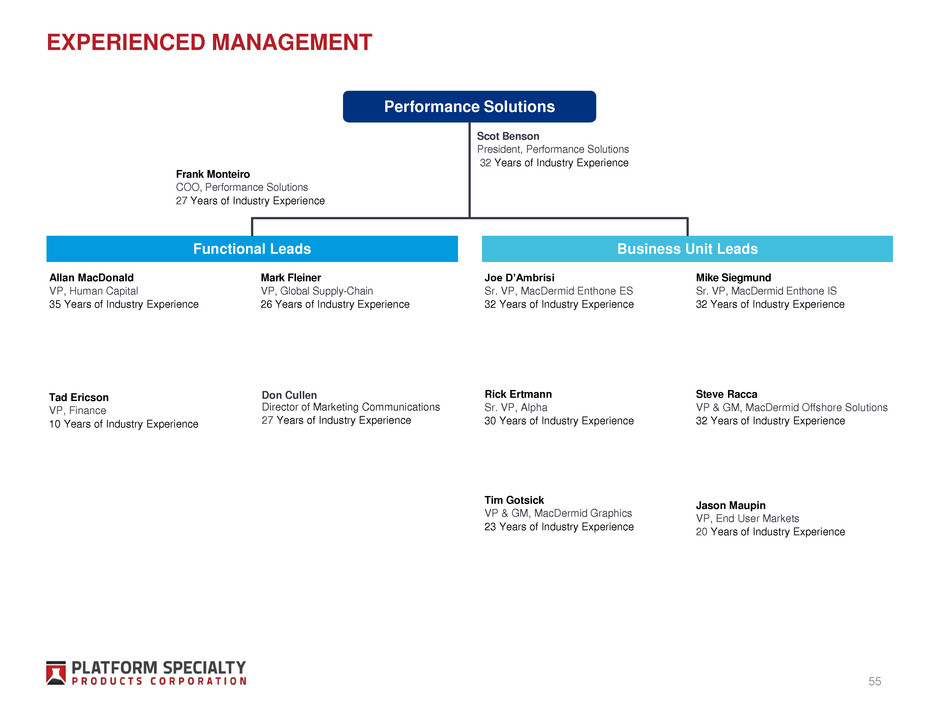

EXPERIENCED MANAGEMENT Performance Solutions Tad Ericson VP, Finance 10 Years of Industry Experience Allan MacDonald VP, Human Capital 35 Years of Industry Experience Functional Leads Business Unit Leads Don Cullen Director of Marketing Communications 27 Years of Industry Experience Jason Maupin VP, End User Markets 20 Years of Industry Experience Mark Fleiner VP, Global Supply-Chain 26 Years of Industry Experience Tim Gotsick VP & GM, MacDermid Graphics 23 Years of Industry Experience Rick Ertmann Sr. VP, Alpha 30 Years of Industry Experience Joe D’Ambrisi Sr. VP, MacDermid Enthone ES 32 Years of Industry Experience Steve Racca VP & GM, MacDermid Offshore Solutions 32 Years of Industry Experience Mike Siegmund Sr. VP, MacDermid Enthone IS 32 Years of Industry Experience Frank Monteiro COO, Performance Solutions 27 Years of Industry Experience Scot Benson President, Performance Solutions 32 Years of Industry Experience 55

Performance Solutions Overview Market Growth Strategy in Action Our Competitive Advantage Financial Performance 56

Overall: 2.7% CAGR $0 $500 $1,000 $1,500 $2,000 $2,500 2015 2020 Industrial/Medical/Aerospace Automotive Other consumer TV Computer/Communication infrastructure Mobile phones PCs ESTIMATED GROWTH IN ELECTRONICS MARKET ($ in billions) 57 Product Sector 2015 Market ($Bn) 5 Year CAGR MPS Opportunity 2-in-1 Personal Computers $38 20% Semiconductor plating, Circuit board chemicals, Solder materials LED Lighting $20 13% Reflective metal plating, thermally conductive copper plating High Performance Computing $12 10% Circuit board plating chemicals, especially “via filling” Smartwatches $6.3 34% Semiconductor plating, Assembly materials Automotive Collision Avoidance $4.5 16% Circuit board plating chemicals, especially solderable finishes Internet Microservers $4.0 41% Semiconductor plating, Circuit board chemicals, Solder materials Consumer Robotics $3.5 17% Semiconductor plating, Circuit board chemicals, Solder materials SELECTED HIGH GROWTH PRODUCT SECTORS IN ELECTRONICS GROWTH TRENDS IN ELECTRONICS Source: Prismark Partners (March 2016).

AUTOMOTIVE ELECTRONIC GROWTH OPPORTUNITY V e h ic le P ro d u c tio n ( M U n it s ) E le c tro n ic C o n te n t p e r V e h ic le ($ / v e h ic le ) (2015 – 2020F CAGR: 5.6%) (2015 – 2020F CAGR: 2.8%) (2015 – 2020F CAGR: 2.7%) Automotive unit growth outpaces GDP Electronics content per vehicle grows 5-8% CAGR Electrical content in new vehicles is much more complex than existing circuitry. MPS specializes in complicated circuitry, compared with the 2-sided PCBs in older vehicles. − Collision avoidance − Infotainment – connected vehicles − Sensors, cameras, safety systems − Autonomous driving PERFORMANCE SOLUTIONS MARKET CATEGORIES AUTOMOTIVE ELECTRONICS MARKET OVERVIEW $1,500 $1,750 $2,000 $2,250 $2,500 – 50 100 150 200 250 300 2008 2009 2010 2011 2012 2013 2014 2015 2016F 2020F Electronic Content Total ($ in billions) Vehicle Production (Units in millions) Electronic Content per Vehicle ($) 58 Source: Management estimates and Prismark Partners (March 2016). PRIMARY TRENDS BENEFITING MPS GROWTH

Assembly KEY MPS GROWTH INITIATIVES Increasingly influential OEMs Novel chemistries and alloys Sintered materials adopted in new products for increased reliability Share gain in the automotive, mobile communication, LED, and power module markets Industrial Plating of plastic Hex chrome replacement Rigorous OEM specifications Metal parts are replaced by low weight plastics with metal coatings Chrome 6+ replacement: extend Zinklad’s high industry penetration Electronics Key markets adopting more complicated circuitry High density circuitry ‘Driver Assist’ in automobiles: multilayers, ViaFill, packaging Advanced semiconductor packaging: copper pillars, tin bumps Extend our unique capability in copper plating from mobile devices to automotive, infrastructure, military, and aerospace Graphics Expanded adoption of flexographic printing Macroeconomic shift to more graphic packaging Quality, Capex and cost-of-ownership metrics favor Lux Enable penetration of flexographic printing through manufacturing capacity expansion; efficiency improvements bring profitability GROWTH INITIATIVE Offshore Technological discontinuities Environmental mandates Trend to deep water wells demands high-temperature fluids Innovative drilling and production fluids to comply with next generation environmental standards MARKET TREND 59

MACDERMID PERFORMANCE SOLUTIONS - GROWTH IN INDUSTRY CONTEXT Assembly Electronics Equipment: New materials with quantified value propositions for leading OEMs in printed electronics, auto, mobile device, power modules, solar, and LED Electronics Circuit Boards: Most electronic devices, including automotive, are adopting the complex designs now used by smartphones. MEES outperforms the industry due to our unique positions in metallization Industrial Global GDP: Environmental trends and fast adoption of plating on plastic, favors our industrial innovations Graphics Imaging Consumables: Technological discontinuity of flat-top dots brings the bulk of printers’ imaging investments to MPS’ flexographic printing 2015 – 2020 INDUSTRY CAGR DRIVERS OF MPS OUTPERFORMANCE Offshore Oil & Gas Subsea Production: Strongest track record means we get 1st look at new projects Shift to higher temperature fluids for deeper wells Development of alternative environmentally friendly products in adjacent markets 2.7% 2.5% 3.0% 2.0% (2.3)% MPS expects to outgrow its market 2.3% Weighted Average 60 Source: Prismark Partners (March 2016), Quest Offshore Resources and management estimates.

Performance Solutions Overview Market Growth Strategy in Action Our Competitive Advantage Financial Performance 61

MPS STRATEGIC OBJECTIVES Create the most responsive, innovative company in all the markets we serve − Develop and maintain broad-based extensive interaction within the entire supply chain of each end market − Focus on developing more touch points and relationships than any of our competitors − Our innovation, support and people should be integral to the success of our customers Create an environment where our people have an opportunity to win and to influence the success of our company at all levels Aim to consistently grow faster than the markets we serve Building a leading specialty chemical company 62

INTEGRAL TO CUSTOMER SUCCESS Specialized experts in the chemical interactions of our customers’ processes Dependency on our comprehensive technical service Frequent on-site visits by our sales/service staff Our PEOPLE are integral to our customers’ success: Our SOLUTIONS are integral to our customers’ success: Our chemicals represent a very small portion of our customers’ products bill of materials Though small, the chemistry has an outsized importance on the success of manufacturing and quality Without specialized chemistry, customers’ production lines shut down 63

CONSISTENT, MULTI-PRONGED AND CROSS-BUSINESS SELLING Multiple “Touch Points” in each Industry’s Supply Chain Proactive and responsive relationships with specifier and applicator Customer needs accessed daily with access to information at all steps of design-to-build Multi-Business Integration Pan-MPS Solutions Every day contact at the customer’s site Direct customer relationships High customer dependency Alpha relationships win MacDermid Enthone business We believe that no competitor owns such broad and diverse position High-level, global perspective Supply chain relationships 64

THE PATH OF VALUE TO OUR CUSTOMERS 65 CUSTOMER AWARENESS OF OUR BRANDS Tradeshows & advertising Direct sales Legacy relationships Supply chain referrals 1. Customer Intimacy 2. Strategic analysis and resource allocation 3. From innovation to service 4. A typical sale 5. Supply chain – a holistic approach 6. Sticky sales

THE PATH OF VALUE TO OUR CUSTOMERS 66 Capabilities assessment Total available market Qualifies as a “sticky sale” Risk/reward analysis R&D in USA, Germany, UK, Japan and India 1. Customer Intimacy 2. Strategic analysis and resource allocation 3. From innovation to service 4. A typical sale 5. Supply chain – a holistic approach 6. Sticky sales

THE PATH OF VALUE TO OUR CUSTOMERS 67 Stage-Gate development discipline Knowledge transfer R&D to applications Schools: internal, external, regional Global development applications centers 1. Customer Intimacy 2. Strategic analysis and resource allocation 3. From innovation to service 4. A typical sale 5. Supply chain – a holistic approach 6. Sticky sales

THE PATH OF VALUE TO OUR CUSTOMERS 68 Sales staff: “Value Proposition” 20L, 220L, 1500L containers at $5–$200 per liter Chemistry is consumed; repeat orders Typical customer is $100k - $2,000k/year Service staff: customer troubleshooting 1. Customer Intimacy 2. Strategic analysis and resource allocation 3. From innovation to service 4. A typical sale 5. Supply chain – a holistic approach 6. Sticky sales

THE PATH OF VALUE TO OUR CUSTOMERS 69 Maintain focus on end-product quality Specification and qualification support Partnerships with equipment vendors First to know about future designs Effective problem solving solidifies customer loyalty 1. Customer Intimacy 2. Strategic analysis and resource allocation 3. From innovation to service 4. A typical sale 5. Supply chain – a holistic approach 6. Sticky sales

THE PATH OF VALUE TO OUR CUSTOMERS 70 WE DEVELOP A “MOAT” THROUGH: Long-term, in-depth knowledge of the industry and supply chain needs Patents and OEM specifications Highly efficient, low asset manufacturing Customer dependency on our technical service 1. Customer Intimacy 2. Strategic analysis and resource allocation 3. From innovation to service 4. A typical sale 5. Supply chain – a holistic approach 6. Sticky sales

METALLIZATION IN ACTION 71

Performance Solutions Overview Growth in our Markets Strategy in Action Our Competitive Advantage Financial Performance 72

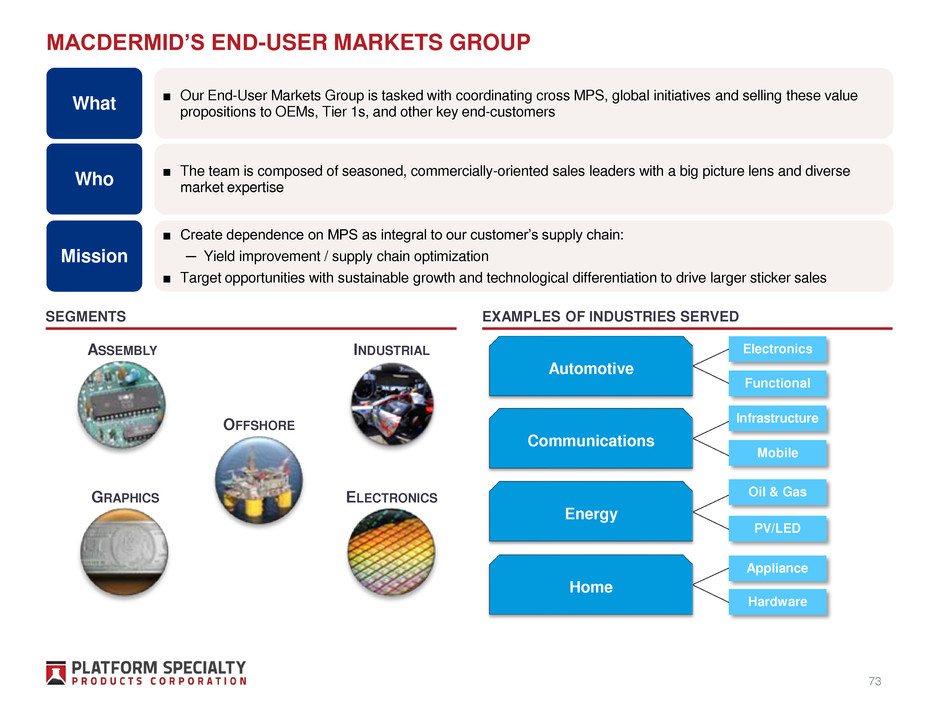

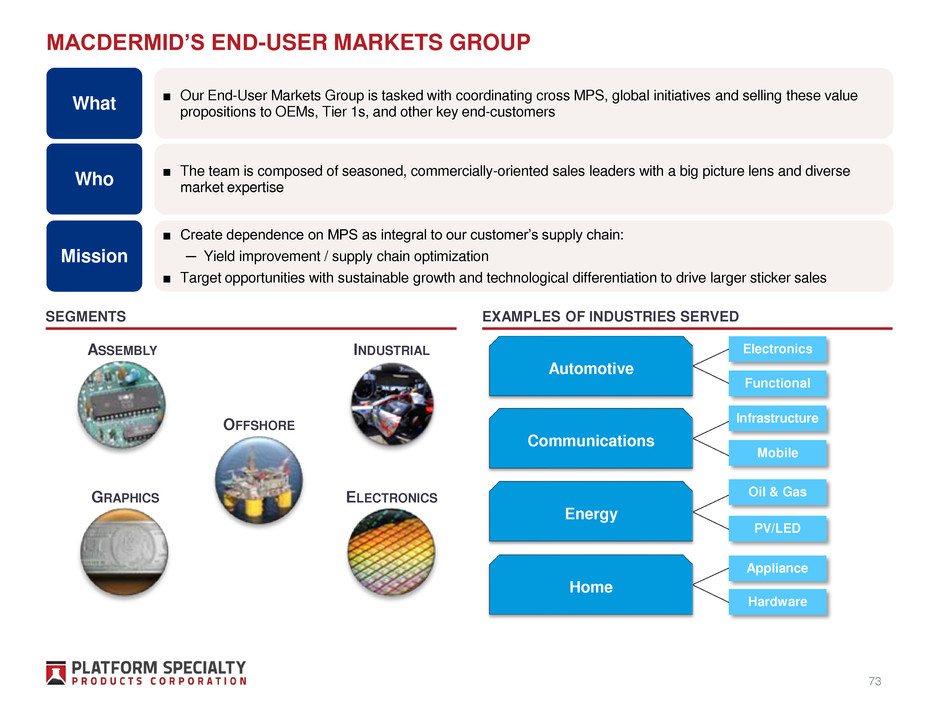

MACDERMID’S END-USER MARKETS GROUP EXAMPLES OF INDUSTRIES SERVED OFFSHORE ELECTRONICSGRAPHICS ASSEMBLY INDUSTRIAL ■ Our End-User Markets Group is tasked with coordinating cross MPS, global initiatives and selling these value propositions to OEMs, Tier 1s, and other key end-customers ■ The team is composed of seasoned, commercially-oriented sales leaders with a big picture lens and diverse market expertise ■ Create dependence on MPS as integral to our customer’s supply chain: ─ Yield improvement / supply chain optimization ■ Target opportunities with sustainable growth and technological differentiation to drive larger sticker sales What Who Mission Functional Electronics Automotive Mobile Infrastructure Communications Oil & Gas PV/LED Energy Hardware Appliance Home SEGMENTS 73

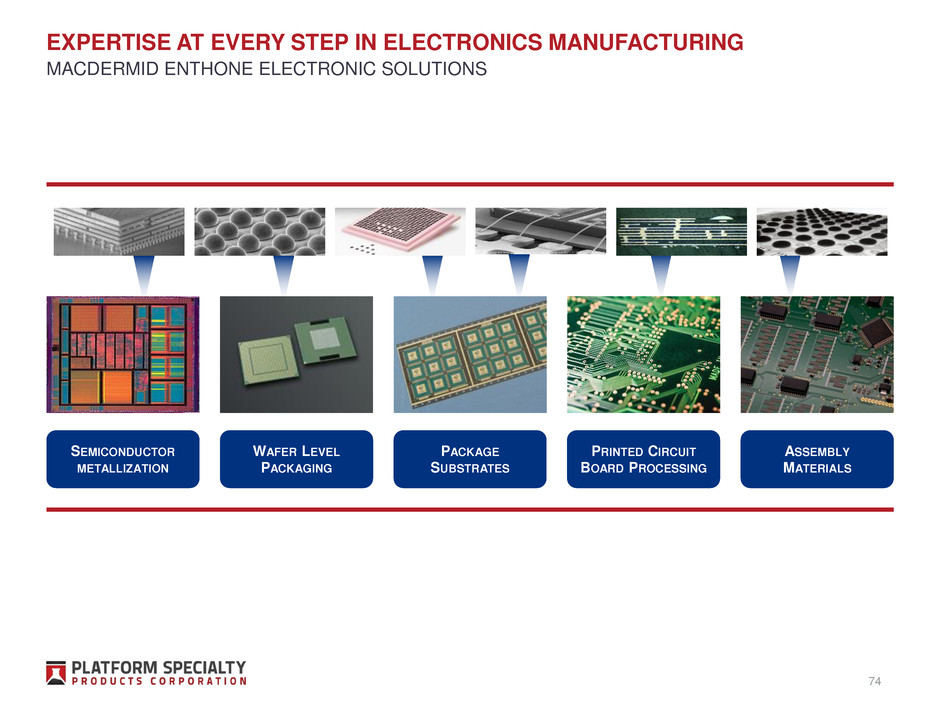

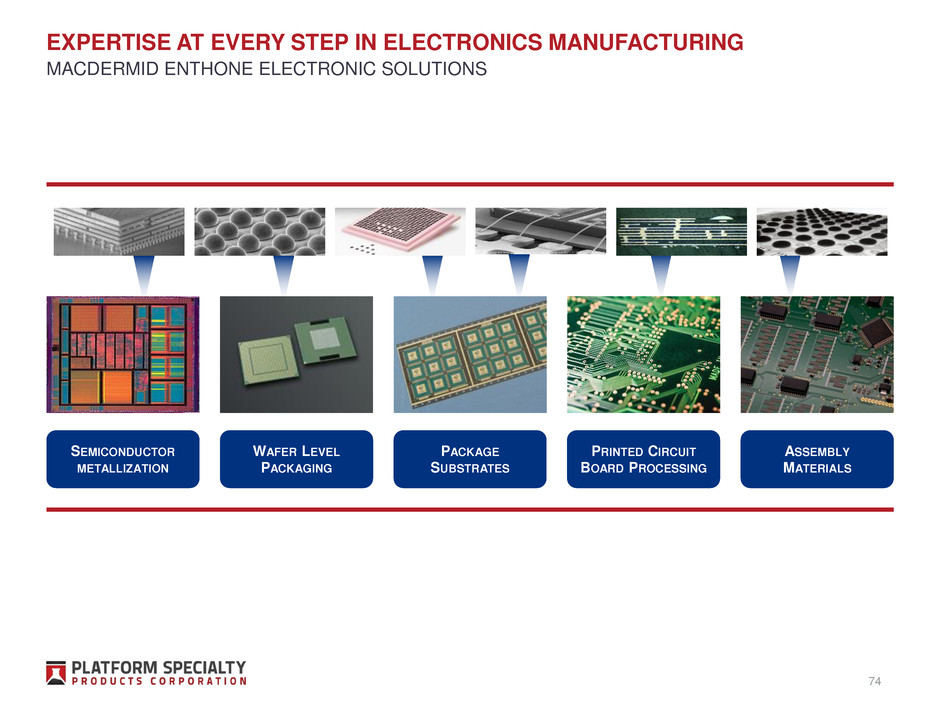

EXPERTISE AT EVERY STEP IN ELECTRONICS MANUFACTURING SEMICONDUCTOR METALLIZATION WAFER LEVEL PACKAGING PACKAGE SUBSTRATES PRINTED CIRCUIT BOARD PROCESSING ASSEMBLY MATERIALS 74 MACDERMID ENTHONE ELECTRONIC SOLUTIONS

ENHANCED PRODUCT PORTFOLIO Fabrication Step Process MacDermid Post- Integration Oxide Oxide Alternative Desmear Desmear Electroless Copper Electroless Copper Carbon Graphite Conductive Polymer High Productivity High Throw DC Pulse Plating ViaFill Immersion Silver Immersion Tin Nickel Gold Organic Innerlayer Processing Direct Metallization Electrolytic Copper Final Finish Package Component Process MacDermid Post- Integration Solderable Precious Metal Passives Tin Plating Memory Disk Electroless Nickel Electroless Copper Electroless Nickel Damascene Copper Wafer level Semiconductor Wafer Molded Interconnect Device Connectors PRINTED CIRCUIT FABRICATIONELECTRONICS PACKAGING 75 Source: Management estimates. MACDERMID ENTHONE ELECTRONIC SOLUTIONS Acquisition activity complemented existing product portfolio

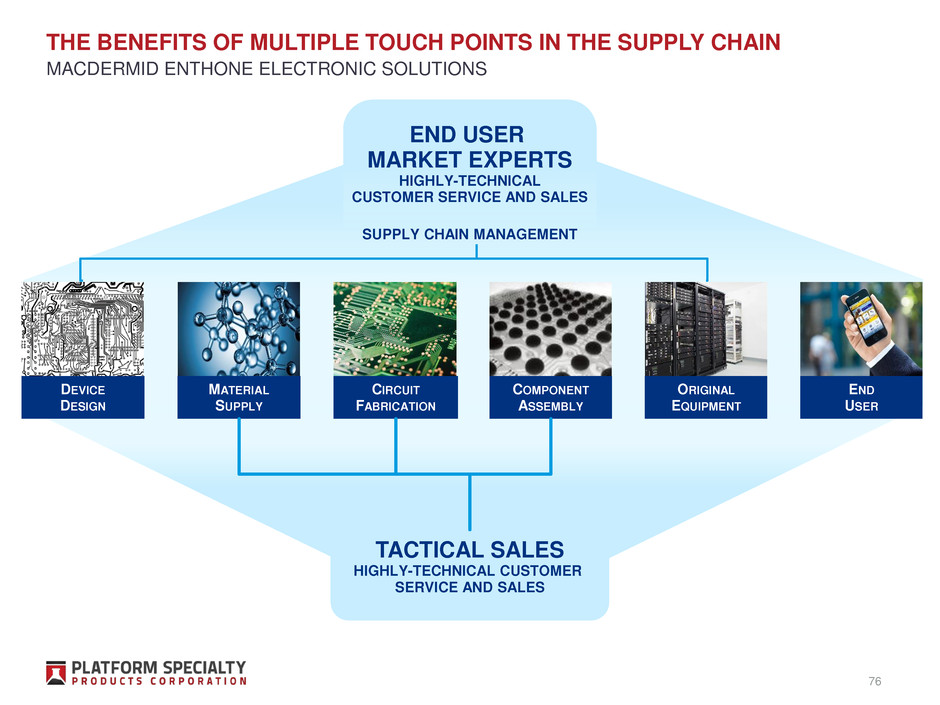

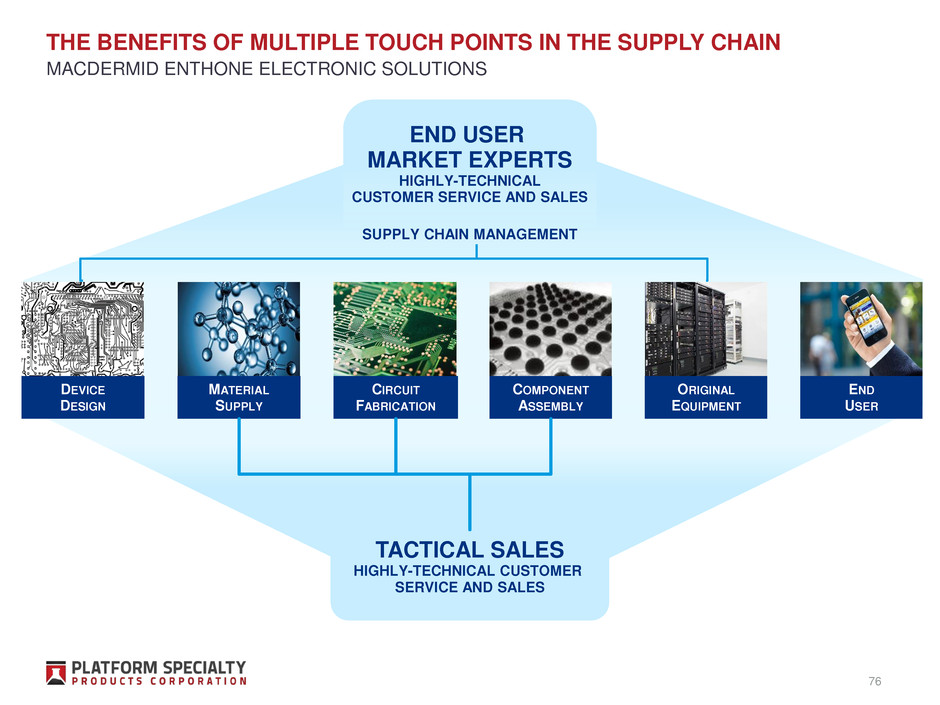

THE BENEFITS OF MULTIPLE TOUCH POINTS IN THE SUPPLY CHAIN TACTICAL SALES HIGHLY-TECHNICAL CUSTOMER SERVICE AND SALES MATERIAL SUPPLY CIRCUIT FABRICATION DEVICE DESIGN COMPONENT ASSEMBLY END USER ORIGINAL EQUIPMENT 76 END USER MARKET EXPERTS HIGHLY-TECHNICAL CUSTOMER SERVICE AND SALES SUPPLY CHAIN MANAGEMENT MACDERMID ENTHONE ELECTRONIC SOLUTIONS

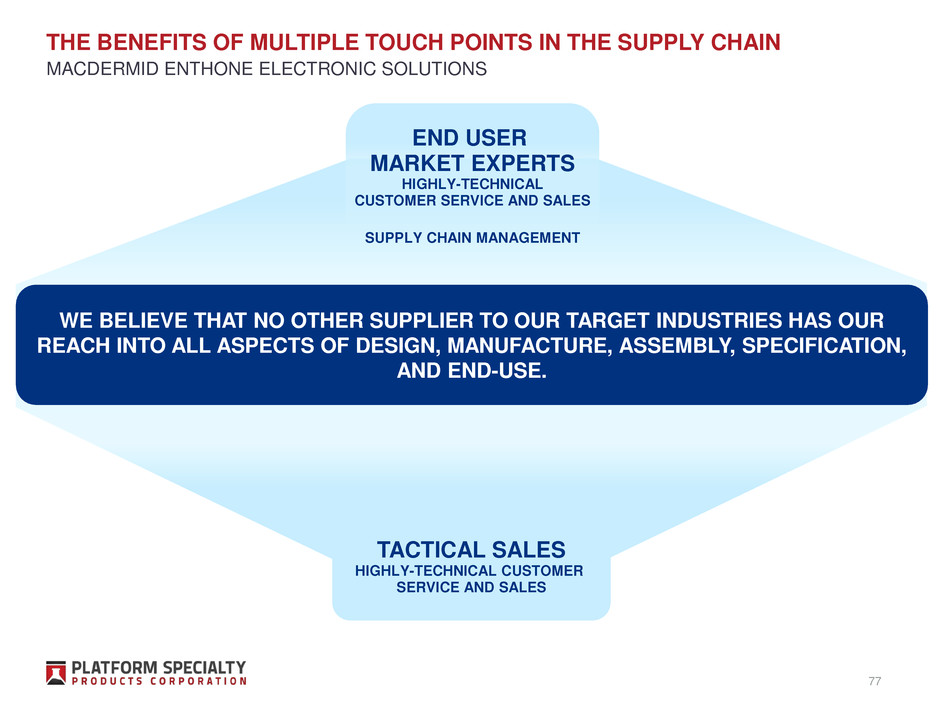

THE BENEFITS OF MULTIPLE TOUCH POINTS IN THE SUPPLY CHAIN TACTICAL SALES HIGHLY-TECHNICAL CUSTOMER SERVICE AND SALES 77 END USER MARKET EXPERTS HIGHLY-TECHNICAL CUSTOMER SERVICE AND SALES SUPPLY CHAIN MANAGEMENT WE BELIEVE THAT NO OTHER SUPPLIER TO OUR TARGET INDUSTRIES HAS OUR REACH INTO ALL ASPECTS OF DESIGN, MANUFACTURE, ASSEMBLY, SPECIFICATION, AND END-USE. MACDERMID ENTHONE ELECTRONIC SOLUTIONS

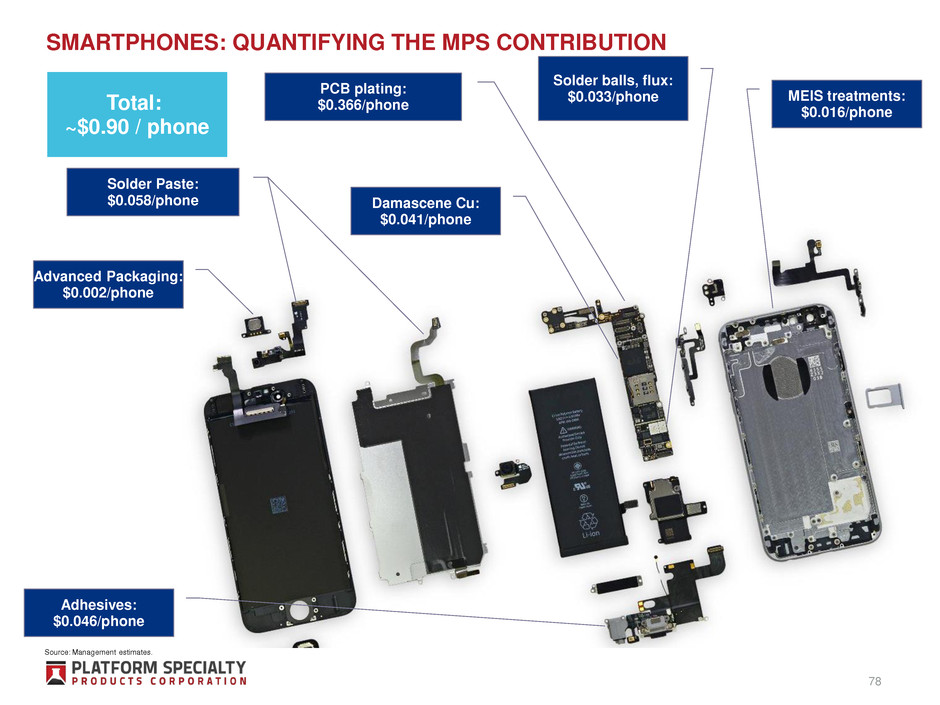

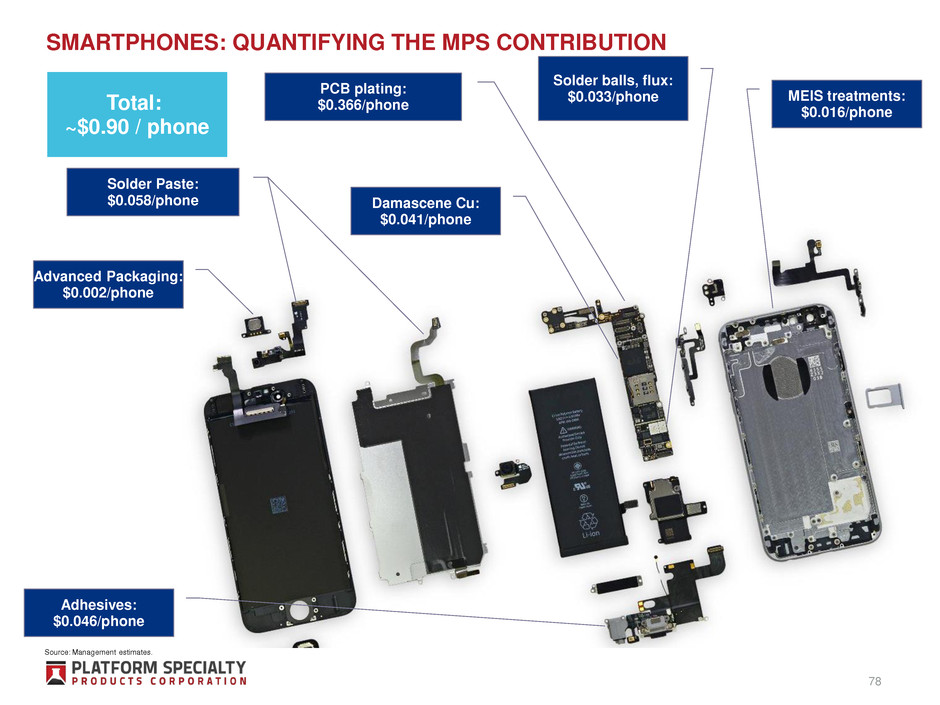

SMARTPHONES: OUR PRODUCTS Silicon package: WLP Flexible circuit: Direct Metallization Printed circuits ViaFill Phone Housing MEIS treatments Interposers Solder balls, preforms Silicon processors Damascene Cu Antenna MID Q ANTIFYING THE MPS CONTRIBUTION Advanced Packaging: $0.002/phone Solder Paste: $0.058/phone PCB plating: $0.366/phone MEIS treatments: $0.016/phone Solder balls, flux: $0.033/phone Damascen Cu: $0.041/phone Adhesives: $0.046/phone Total: ~$0.90 / phone 78 Source: Management estimates.

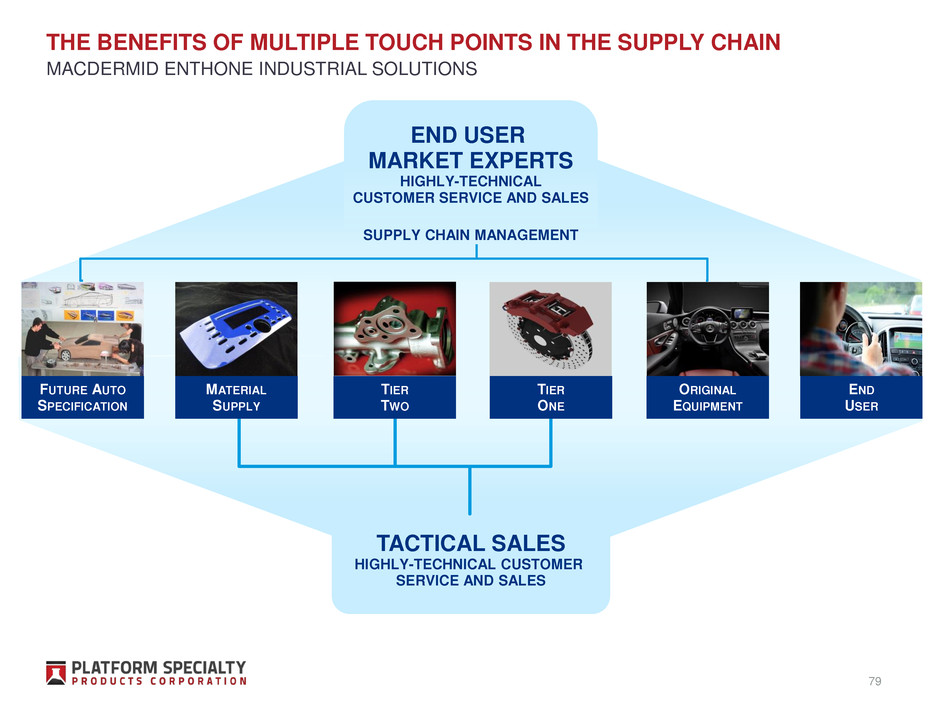

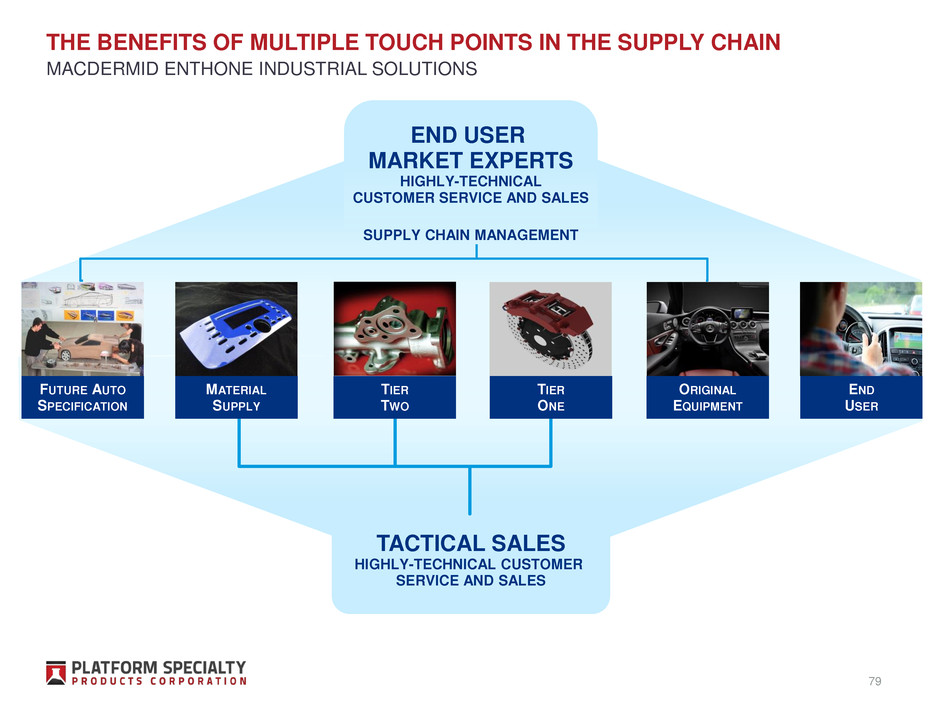

THE BENEFITS OF MULTIPLE TOUCH POINTS IN THE SUPPLY CHAIN FUTURE AUTO SPECIFICATION ORIGINAL EQUIPMENT END USER 79 TACTICAL SALES HIGHLY-TECHNICAL CUSTOMER SERVICE AND SALES MATERIAL SUPPLY TIER TWO TIER ONE END USER MARKET EXPERTS HIGHLY-TECHNICAL CUSTOMER SERVICE AND SALES SUPPLY CHAIN MANAGEMENT MACDERMID ENTHONE INDUSTRIAL SOLUTIONS

THE BENEFITS OF MULTIPLE TOUCH POINTS IN THE SUPPLY CHAIN TACTICAL SALES HIGHLY-TECHNICAL CUSTOMER SERVICE AND SALES 80 END USER MARKET EXPERTS HIGHLY-TECHNICAL CUSTOMER SERVICE AND SALES SUPPLY CHAIN MANAGEMENT WE BELIEVE THAT NO OTHER SUPPLIER TO OUR TARGET INDUSTRIES HAS OUR REACH INTO ALL ASPECTS OF DESIGN, MANUFACTURE, ASSEMBLY, SPECIFICATION, AND END-USE. MACDERMID ENTHONE INDUSTRIAL SOLUTIONS

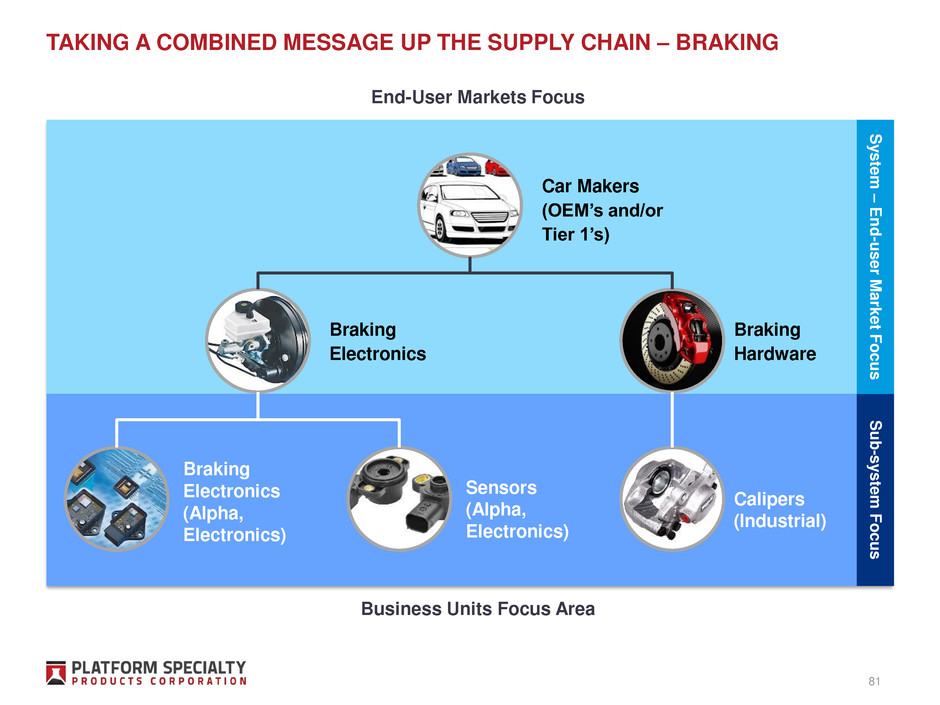

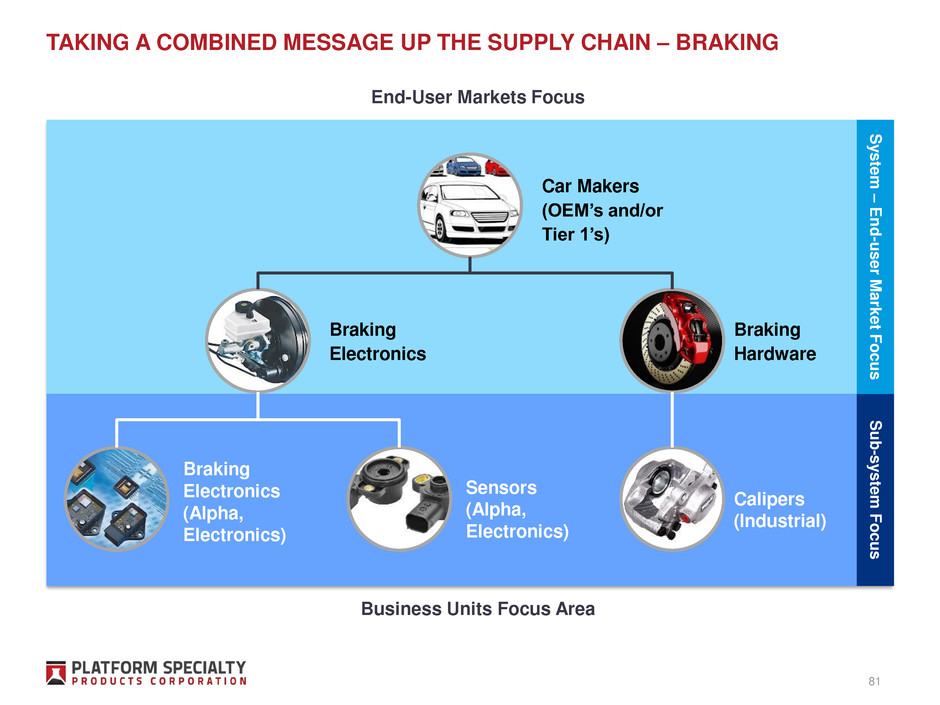

TAKING A COMBINED MESSAGE UP THE SUPPLY CHAIN – BRAKING S u b -s y s tem Focu s S y stem – En d -us e r M a rk e t F o cu s End-User Markets Focus Business Units Focus Area Car Makers (OEM’s and/or Tier 1’s) Braking Electronics Braking Hardware Calipers (Industrial) Sensors (Alpha, Electronics) Braking Electronics (Alpha, Electronics) 81

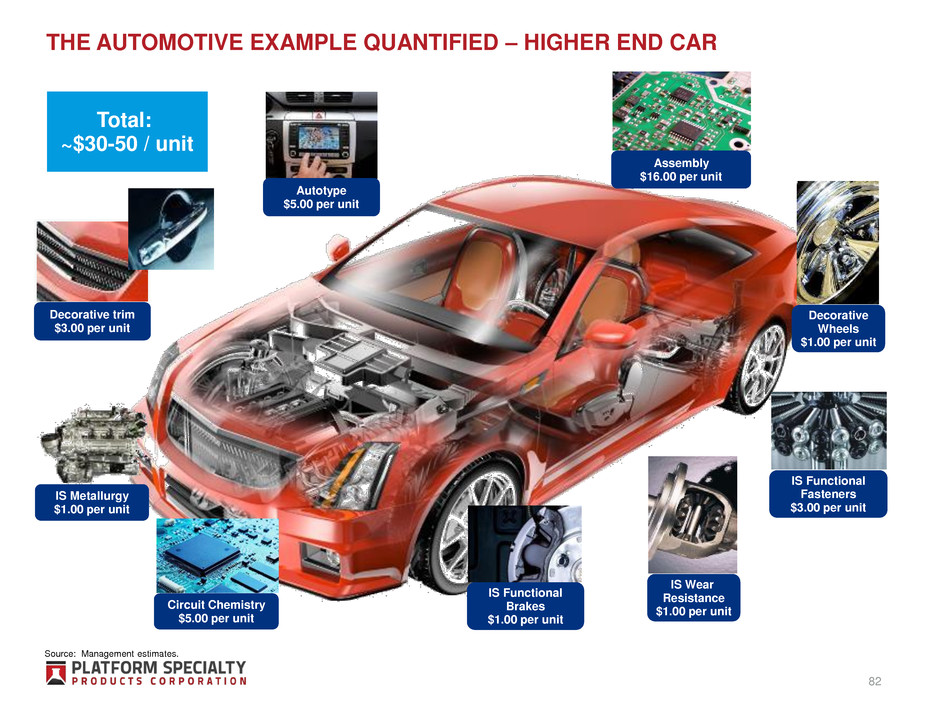

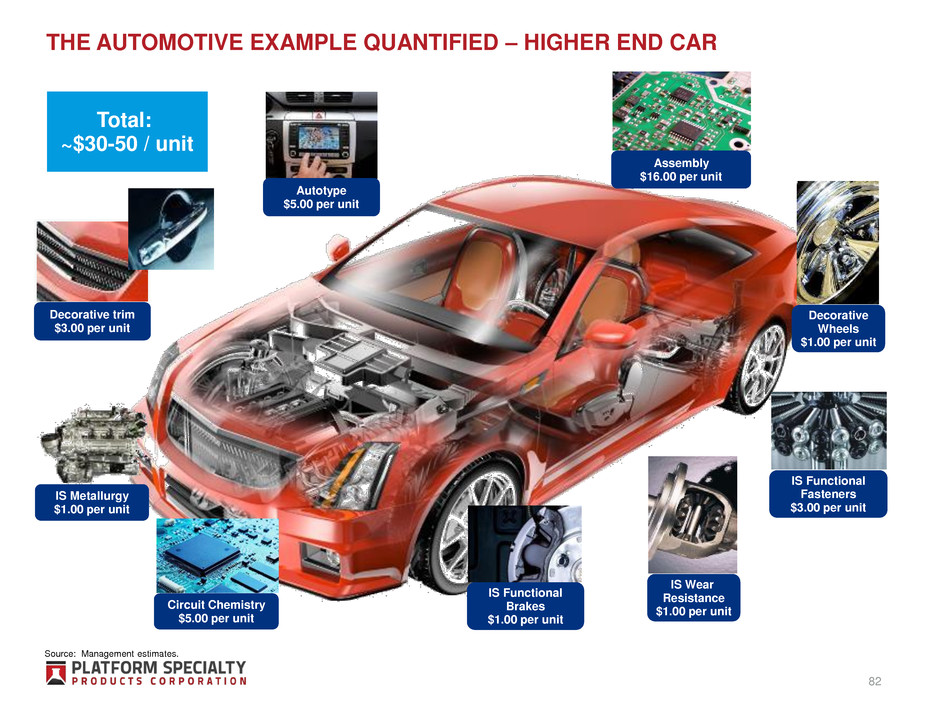

THE AUTOMOTIVE EXAMPLE QUANTIFIED – HIGHER END CAR Autotype $5.00 per unit Decorative trim $3.00 per unit IS Wear Resistance $1.00 per unit Decorative Wheels $1.00 per unit IS Functional Fasteners $3.00 per unit IS Functional Brakes $1.00 per unit IS Metallurgy $1.00 per unit Circuit Chemistry $5.00 per unit Assembly $16.00 per unit Total: ~$30-50 / unit 82 Source: Management estimates.

AUTOMOTIVE OPPORTUNITY – HIGHER END CAR Addressable Market Specialty Consumable Materials: $30-50 per unit $3-5 billion per year Electronics Chemicals ~$5 per car Indu s tri a l C h e mi c a ls ~ $ 1 5 p e r c a r A s s e m b ly M a te ria ls ~ $ 1 6 p e r c a r Industrial - Decorative Industrial - Surface Prep Industrial - Anticorrosion Industrial - Autotype Films Industrial - Engineering Electronics - PCB Plating Electronics - PCB Finishing Electronics - Semi Plating Assembly - Pastes Assembly - Bar Assembly - Flux Assembly - Other 83 Source: Management estimates.

Performance Solutions Overview Growth in our Markets Strategy in Action Our Competitive Advantage Financial Performance 84

PERFORMANCE SOLUTIONS COMPARABLE FINANCIAL OVERVIEW MacDermid Alent OMG 731 746 755 709 1,131 1,071 1,063 919 175 174 172 163 2,038 1,992 1,990 1,791 2012 2013 2014 2015 ADJ. EBITDA (2012–2015)(1)SALES (2012–2015) ($ in millions) ($ in millions) % growth: 162 180 212 221 168 161 175 155 32 33 30 31 363 375 416 407 2012 2013 2014 2015 85 Note: For a reconciliation of non-GAAP financials, please refer to the appendices of this presentation. 2012 - 2015 financials include MacDermid, OMG EC & PM and Alent. Excludes estimated run-rate synergies. Alent financials prepared under IFRS for 2012 – 2013 and under US GAAP for 2014 -2015. 1. Comparable Adj. EBITDA excludes corporate costs for the 2014 and 2015 periods. Constant Currency: (4)% 4% (2)%11%3%(10)% . 0%(2)%

CAPEX AND CAPEX % OF SALES (2012–2015) 25 27 18 20 18 12 12 15 43 40 30 35 2.1% 2.0% 1.5% 2.0% 0 10 20 30 40 50 60 70 2012 2013 2014 2015 Maintenance CapEx Growth CapEx CapEx % of Sales ($ in millions) PERFORMANCE SOLUTIONS COMPARABLE CAPITAL EXPENDITURES 86 Note: For a reconciliation of non-GAAP financials, please refer to the appendices of this presentation. 2012 - 2015 financials include MacDermid, OMG EC & PM and Alent. Excludes estimated run-rate synergies. Alent financials prepared under IFRS for 2012 – 2014. 1. 2012 CapEx excludes $9m of Alent corporate building and land CapEx related to the de-merger. (1)

PERFORMANCE SOLUTIONS COST OF GOODS COMPARABLE COST OF GOODS SOLD BREAKDOWN (2015) Material Cost 82% Fixed Labor / Overhead 14% Freight / Warehouse 4% 2015 material costs of $800 million - 1% decrease in material cost would improve Adj. EBITDA margin by 50 bps Procurement initiatives in 2016 have already secured run-rate savings in excess of $4 million Focused on driving incremental savings in 2017 and beyond 87 Highly variable cost structure

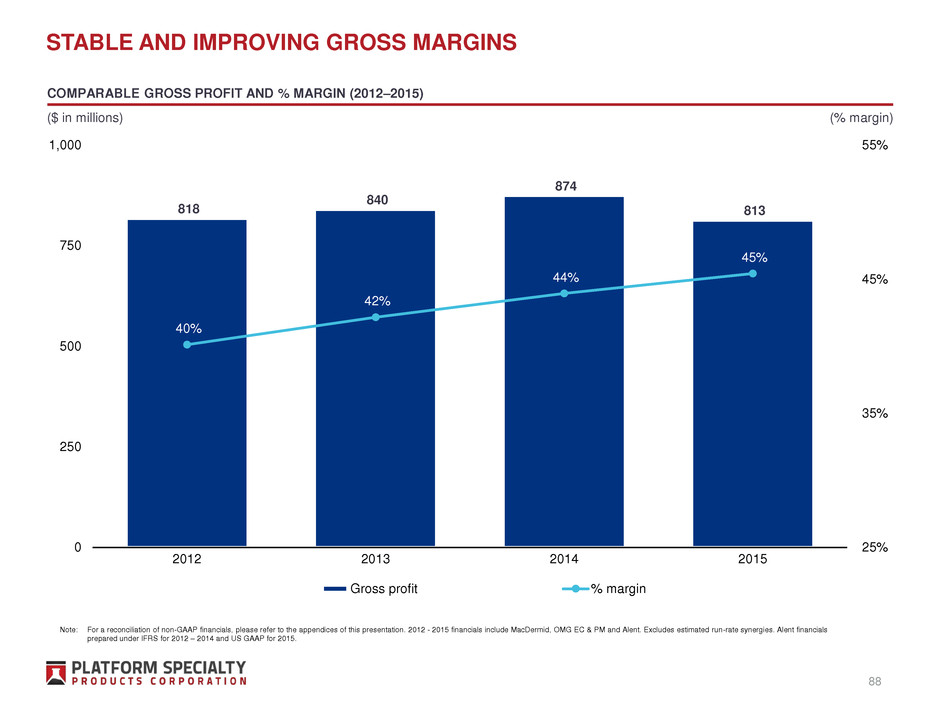

STABLE AND IMPROVING GROSS MARGINS 818 840 874 813 40% 42% 44% 45% 25% 35% 45% 55% 0 250 500 750 1,000 2012 2013 2014 2015 Gross profit % margin COMPARABLE GROSS PROFIT AND % MARGIN (2012–2015) ($ in millions) (% margin) 88 Note: For a reconciliation of non-GAAP financials, please refer to the appendices of this presentation. 2012 - 2015 financials include MacDermid, OMG EC & PM and Alent. Excludes estimated run-rate synergies. Alent financials prepared under IFRS for 2012 – 2014 and US GAAP for 2015.

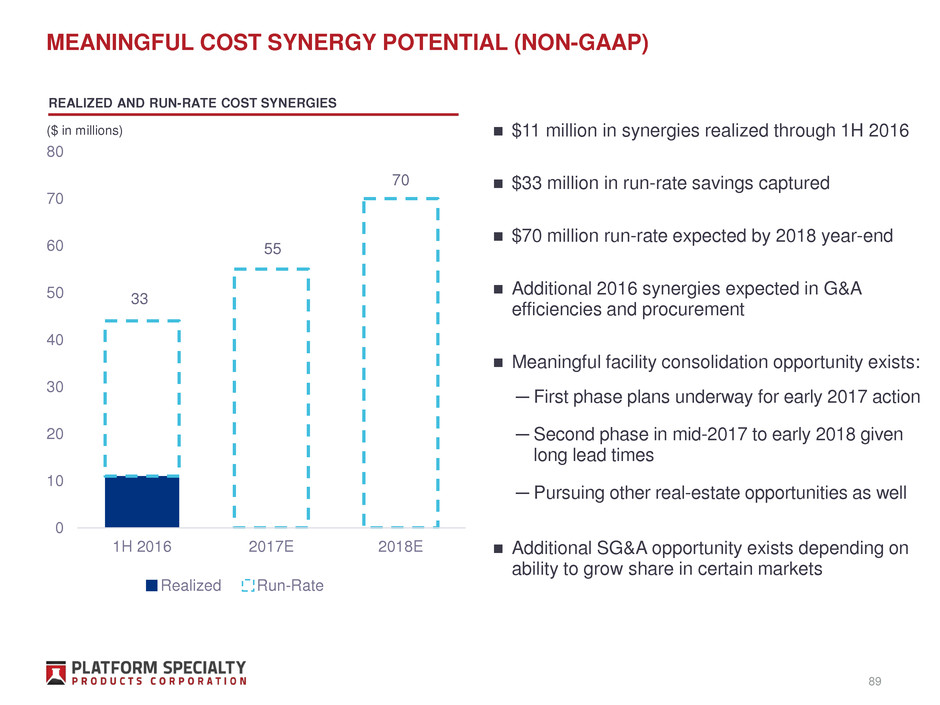

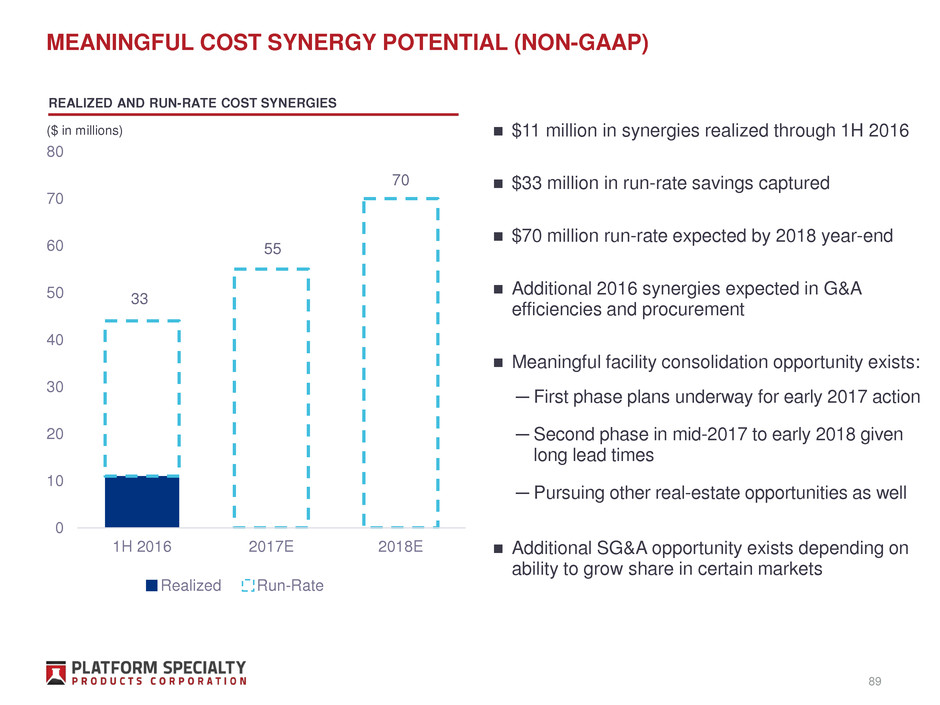

MEANINGFUL COST SYNERGY POTENTIAL (NON-GAAP) 33 55 70 0 10 20 30 40 50 60 70 80 1H 2016 2017E 2018E $11 million in synergies realized through 1H 2016 $33 million in run-rate savings captured $70 million run-rate expected by 2018 year-end Additional 2016 synergies expected in G&A efficiencies and procurement Meaningful facility consolidation opportunity exists: ─ First phase plans underway for early 2017 action ─ Second phase in mid-2017 to early 2018 given long lead times ─ Pursuing other real-estate opportunities as well Additional SG&A opportunity exists depending on ability to grow share in certain markets REALIZED AND RUN-RATE COST SYNERGIES 89 ($ in millions) Realized Run-Rate

AGENDA Introduction – Martin E. Franklin State of the Company – Rakesh Sachdev Performance Solutions – Scot Benson Agricultural Solutions – Diego Lopez Casanello Integration Overview – Benjamin Gliklich Financial Overview – Sanjiv Khattri Conclusion – Rakesh Sachdev Appendices 90

Agricultural Solutions Overview Industry Considerations Strategy for Growth 91

THE NEW ARYSTA: MORE THAN THE SUM OF ITS PARTS Strength in Latin America, Africa, Japan & Eastern Europe Portfolio of proprietary niche herbicides and insecticides Leader in BioSolutions Regulatory and product development expertise Leading supply chain & sourcing expertise Strength in North and Latin America Leader in seed treatment Leader in acaricides for specialty crops Regulatory and product development expertise Leading formulation development capabilities Strength in Western Europe Regulatory expertise Formulation capability Specialty player with global scale Balanced portfolio and geographic presence Leader in BioSolutions and seed treatments Enhanced R&D, regulatory and formulation capabilities Leading supply chain and sourcing organization Unique asset light model 92

UNIQUE BUSINESS MODEL IN THE INDUSTRY 93 Active ingredient Discovery Active ingredient manufacturing New Product Development & Registration Formulation & packaging Marketing & distribution Value chain focus Primary Market Focus Discovery focused Companies Asset Heavy Mainstream Proprietary Post Patent Management “Generics”: Off-Patent AI Manufacturers Mainstream Off Patent Arysta has access to a library of hundreds of active ingredients (AIs) This library continues to grow through access or acquisition of IP of new/existing AIs from technology partners Focus our innovation activities on creating new proprietary mixtures & formulations of these AIs Source/toll all AI production from 3rd parties, mostly in low cost countries Formulate mixtures locally or regionally to keep high degree of flexibility and customer service Target specialty niche segments Specialty Segments Arysta: Asset-Light, High-Touch Asset Light Asset Light Asset- Lite Asset Heavy ASSET-LITE / HIGH-TOUCH

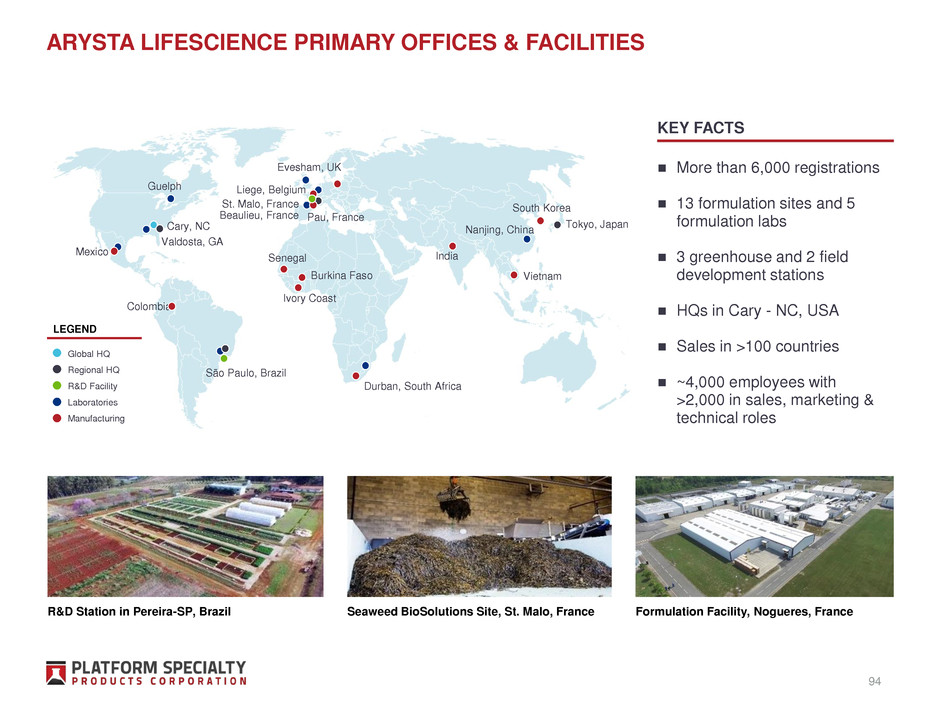

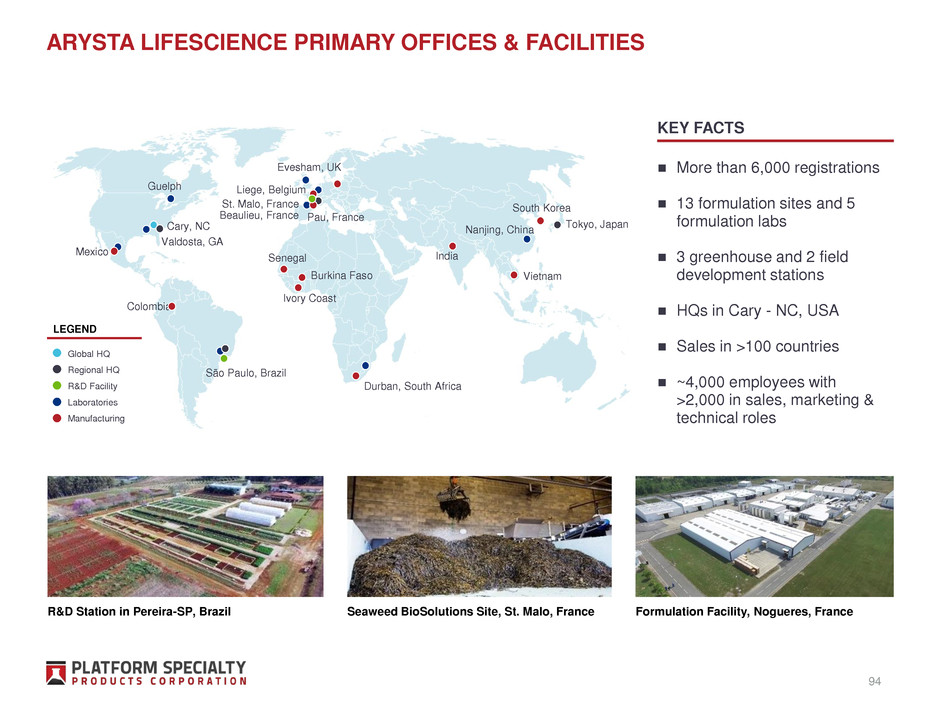

ARYSTA LIFESCIENCE PRIMARY OFFICES & FACILITIES More than 6,000 registrations 13 formulation sites and 5 formulation labs 3 greenhouse and 2 field development stations HQs in Cary - NC, USA Sales in >100 countries ~4,000 employees with >2,000 in sales, marketing & technical roles KEY FACTS 94 R&D Station in Pereira-SP, Brazil Seaweed BioSolutions Site, St. Malo, France Formulation Facility, Nogueres, France Mexico Colombia St. Malo, France Beaulieu, France Guelph Cary, NC Valdosta, GA Senegal São Paulo, Brazil Durban, South Africa Burkina Faso Evesham, UK Liege, Belgium Pau, France India Nanjing, China South Korea Tokyo, Japan Vietnam Ivory Coast Global HQ Regional HQ R&D Facility Laboratories Manufacturing LEGEND

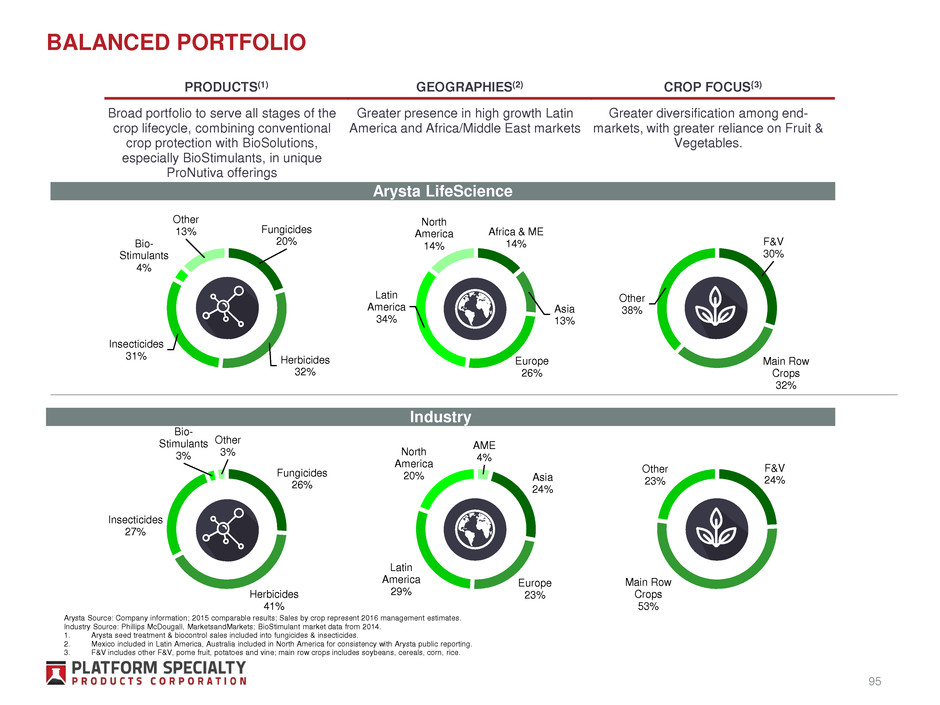

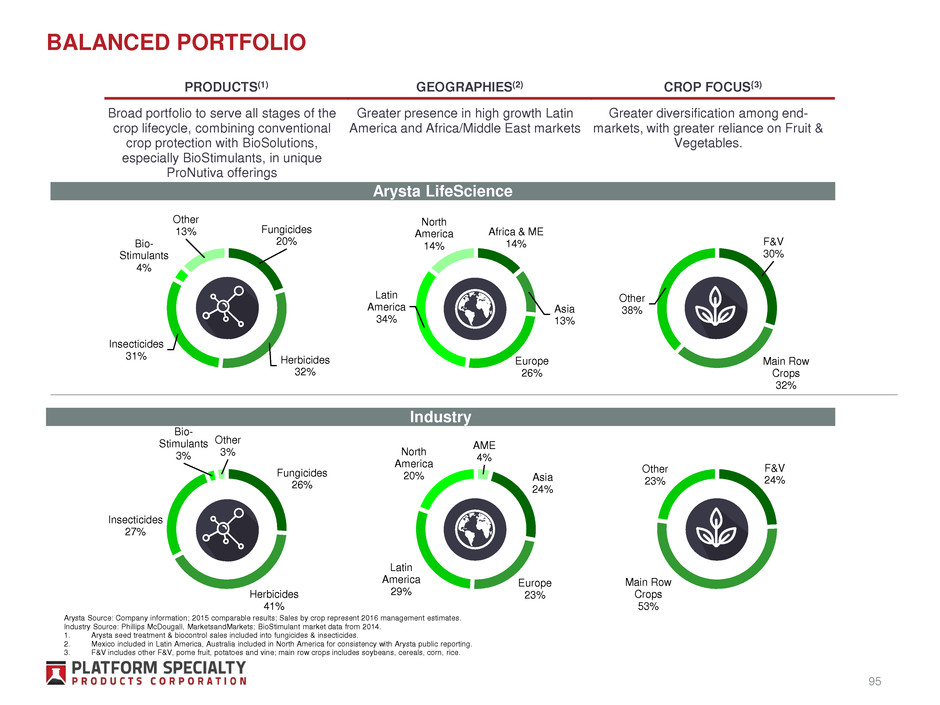

AME 4% Asia 24% Europe 23% Latin America 29% North America 20% F&V 24% Main Row Crops 53% Other 23% BALANCED PORTFOLIO Fungicides 20% Herbicides 32% Insecticides 31% Bio- Stimulants 4% Other 13% Broad portfolio to serve all stages of the crop lifecycle, combining conventional crop protection with BioSolutions, especially BioStimulants, in unique ProNutiva offerings PRODUCTS(1) Greater presence in high growth Latin America and Africa/Middle East markets GEOGRAPHIES(2) Greater diversification among end- markets, with greater reliance on Fruit & Vegetables. CROP FOCUS{3) Africa & ME 14% Asia 13% Europe 26% Latin America 34% North America 14% F&V 30% Main Row Crops 32% Other 38% Fungicides 26% Herbicides 41% Insecticides 27% Bio- Stimulants 3% Other 3% 95 Arysta Source: Company information; 2015 comparable results; Sales by crop represent 2016 management estimates. Industry Source: Phillips McDougall, MarketsandMarkets; BioStimulant market data from 2014. 1. Arysta seed treatment & biocontrol sales included into fungicides & insecticides. 2. Mexico included in Latin America, Australia included in North America for consistency with Arysta public reporting. 3. F&V includes other F&V, pome fruit, potatoes and vine; main row crops includes soybeans, cereals, corn, rice. Arysta LifeScience Industry

KEY PRODUCTS BY CROP CEREALS & CORN FRUITS & VEGETABLES PERENNIAL CROPS Herbicides Fungicides Insecticides Bio Solutions Seed Treatment SOYBEAN Arysta’s broad offering across crops makes it a valued partner to distributors 96

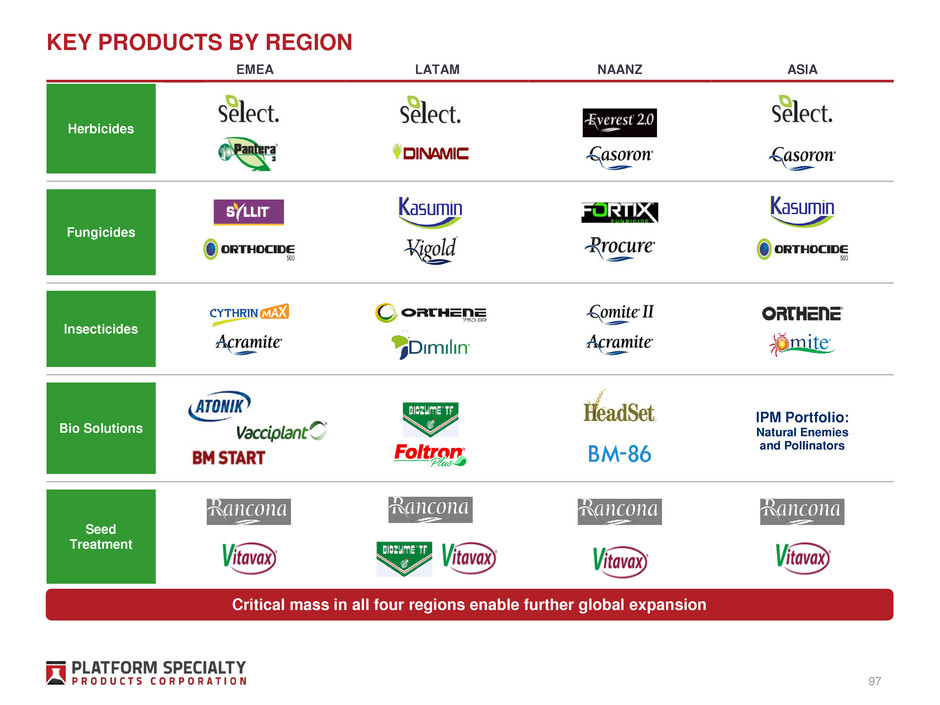

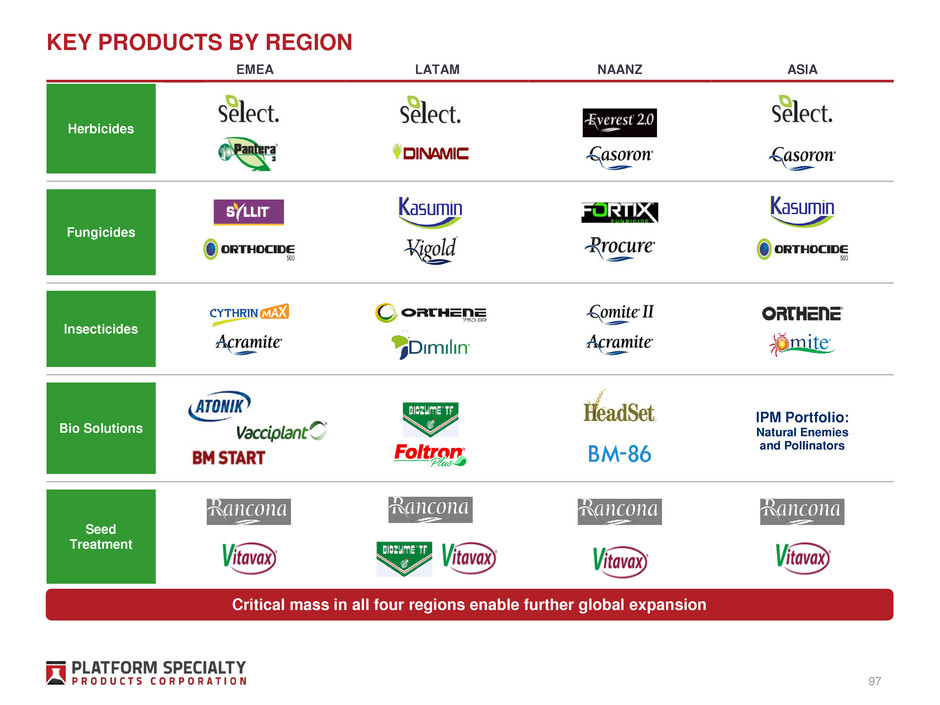

KEY PRODUCTS BY REGION Herbicides Fungicides Insecticides Bio Solutions Seed Treatment IPM Portfolio: Natural Enemies and Pollinators EMEA LATAM NAANZ ASIA 97 Critical mass in all four regions enable further global expansion

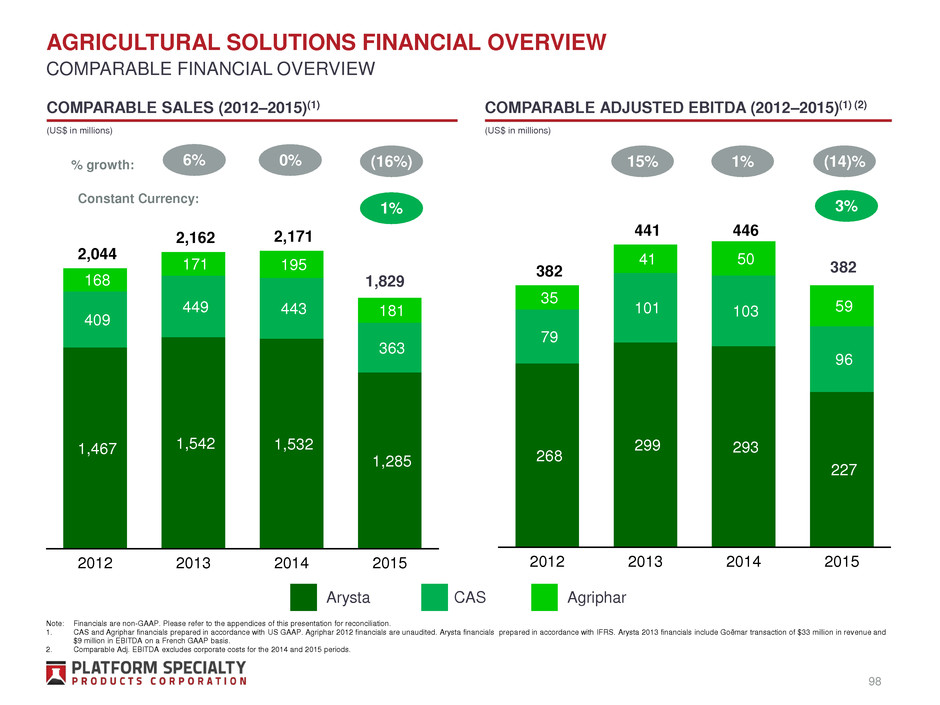

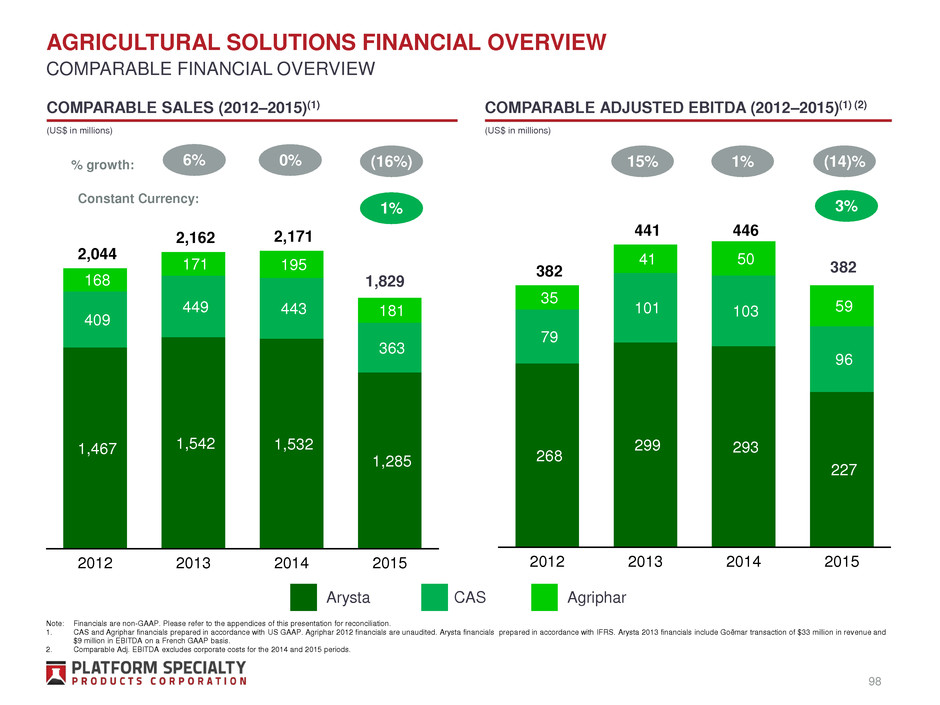

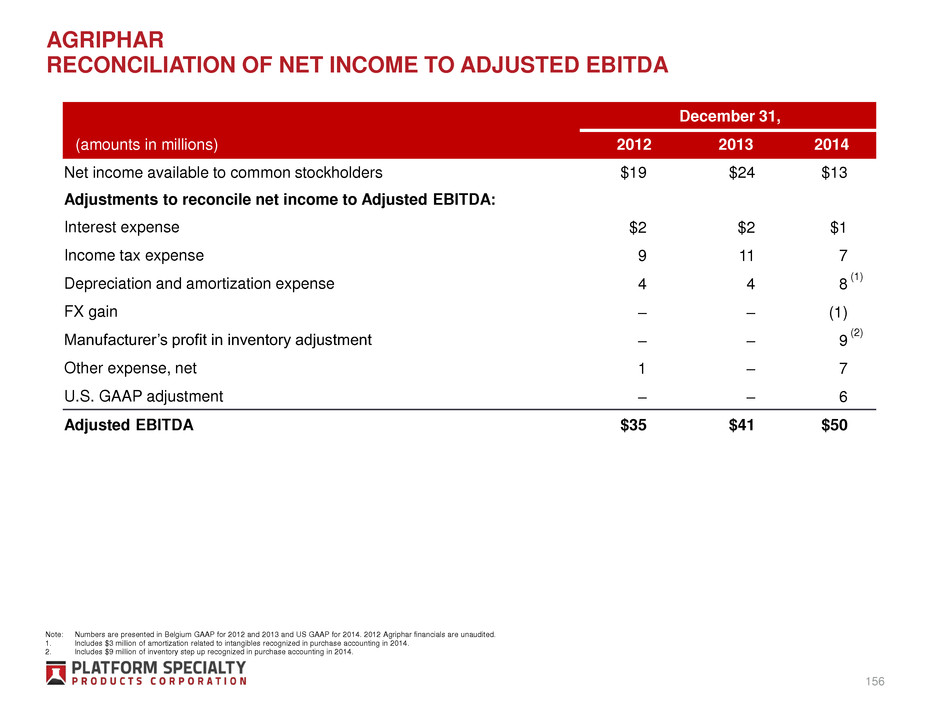

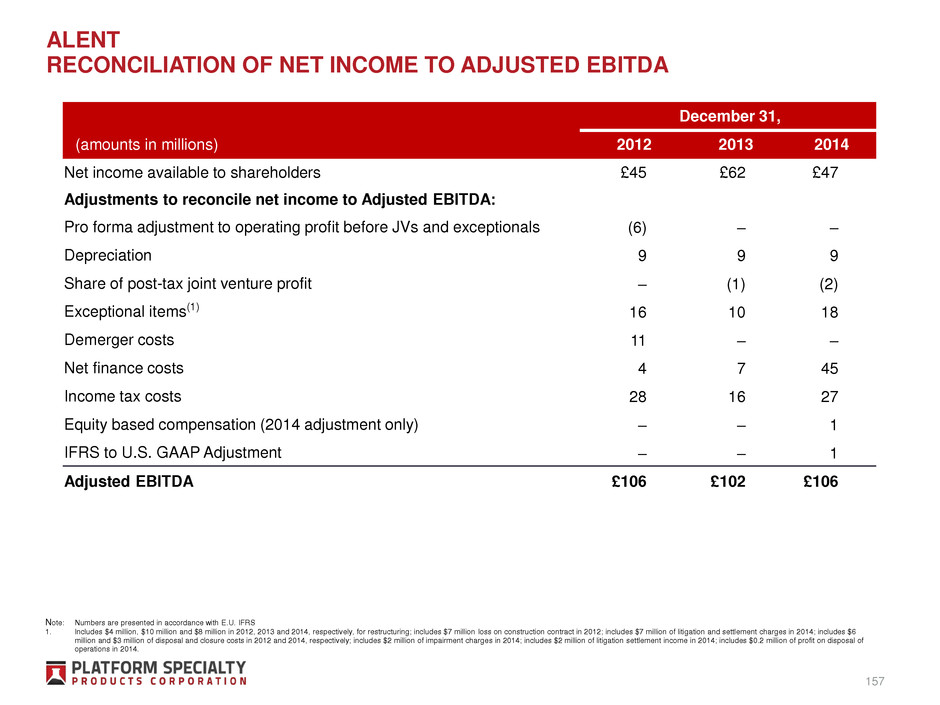

AGRICULTURAL SOLUTIONS FINANCIAL OVERVIEW COMPARABLE FINANCIAL OVERVIEW 98 Note: Financials are non-GAAP. Please refer to the appendices of this presentation for reconciliation. 1. CAS and Agriphar financials prepared in accordance with US GAAP. Agriphar 2012 financials are unaudited. Arysta financials prepared in accordance with IFRS. Arysta 2013 financials include Goëmar transaction of $33 million in revenue and $9 million in EBITDA on a French GAAP basis. 2. Comparable Adj. EBITDA excludes corporate costs for the 2014 and 2015 periods. % growth: 6% 0% 15% 1% COMPARABLE SALES (2012–2015)(1) COMPARABLE ADJUSTED EBITDA (2012–2015)(1) (2) Arysta CAS Agriphar 1,467 1,542 1,532 1,285 409 449 443 363 168 171 195 181 2,044 2,162 2,171 2012 2013 2014 2015 268 299 293 227 79 101 103 96 35 41 50 59 382 441 446 2012 2013 2014 2015 (US$ in millions) (US$ in millions) (16%) (14)% 1% Constant Currency: 1,829 382 3%

AGENDA Agricultural Solutions Overview Industry Considerations Strategy for Growth 99

13 14 14 14 15 15 17 19 21 22 23 24 24 24 26 29 30 30 30 29 29 27 26 28 32 33 33 36 43 40 41 47 50 54 57 51 1 9 8 0 1 9 8 1 1 9 8 2 1 9 8 3 1 9 8 4 1 9 8 5 1 9 8 6 1 9 8 7 1 9 8 8 1 9 8 9 1 9 9 0 1 9 9 1 1 9 9 2 1 9 9 3 1 9 9 4 1 9 9 5 1 9 9 6 1 9 9 7 1 9 9 8 1 9 9 9 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 30+ YEARS OF INDUSTRY GROWTH The crop protection market has grown at a 4% average annual rate for 30+ years $ billions of revenue 100 Source: Phillips McDougall (2016).

MEGATRENDS AND THEIR IMPACT ON THE AG INDUSTRY AgChem market expected to grow in volume driven by demographics and other secular trends Higher regulatory hurdles driving increase in R&D costs Globalization of crop commodities driving grain price cycles Introduction of GMO technology increasing seed market share Crop price volatility and increasing operating costs are driving consolidation at farmer, distributor and supplier level With fewer new active ingredients, generic players have grown to > 30% of the market(1) New technologies like BioSolutions and Precision Farming have emerged as reaction to current trends 101 1. Share of generic companies between 30 and 35% in the period 2007-2014, as defined by Phillips McDougall. GROWING FOOD DEMAND FOOD SAFETY CONCERNS CLIMATE CHANGE LIMITED ARABLE LAND

IMPACT OF INDUSTRY CONSOLIDATION Consolidation Trends Expected rise of two to three new mega-players with larger portfolios and market leverage Arysta Opportunities Further ability to target differentiated, niche markets that are less meaningful to larger competitors Partnerships with discovery based companies that seek to accelerate and expand the penetration of their AI into niche segments Speed and flexibility are even greater differentiators against larger companies With integration largely complete, Arysta is now focused on the customer, while competitors are distracted Forced portfolio divestments could create chances for Arysta 102

Agricultural Solutions Overview Industry Considerations Strategy for Growth Financial Performance 103

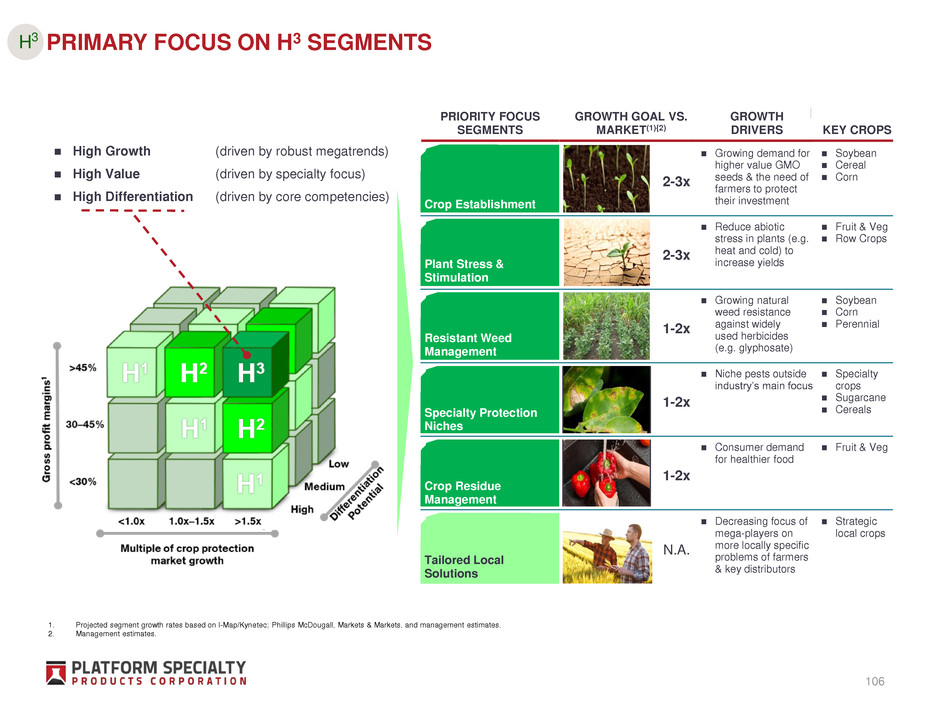

ARYSTA ASPIRES TO PROFITABLE GROWTH THROUGH LEADING POSITIONS IN CHOSEN SPECIALTY SEGMENTS Organically grow 2% p.a. above the market, while continuing to have Adj. EBITDA margins of > 20% Leadership in our primary focus segments and #1 in BioStimulants Achieve +15% of the total gross profit from products registered in last 3 years 104 OUR GOALS

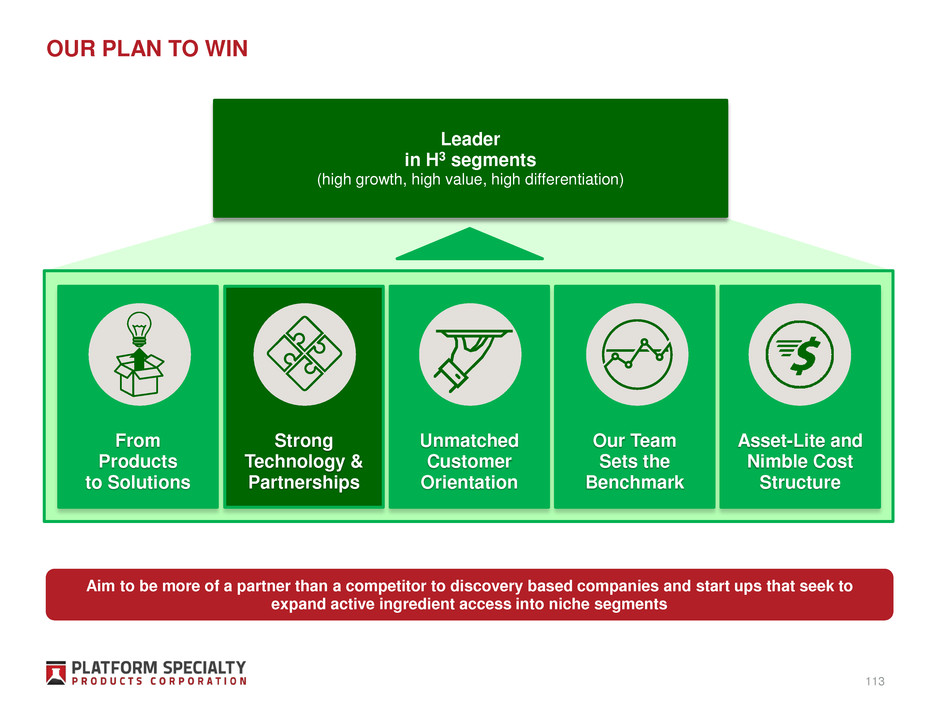

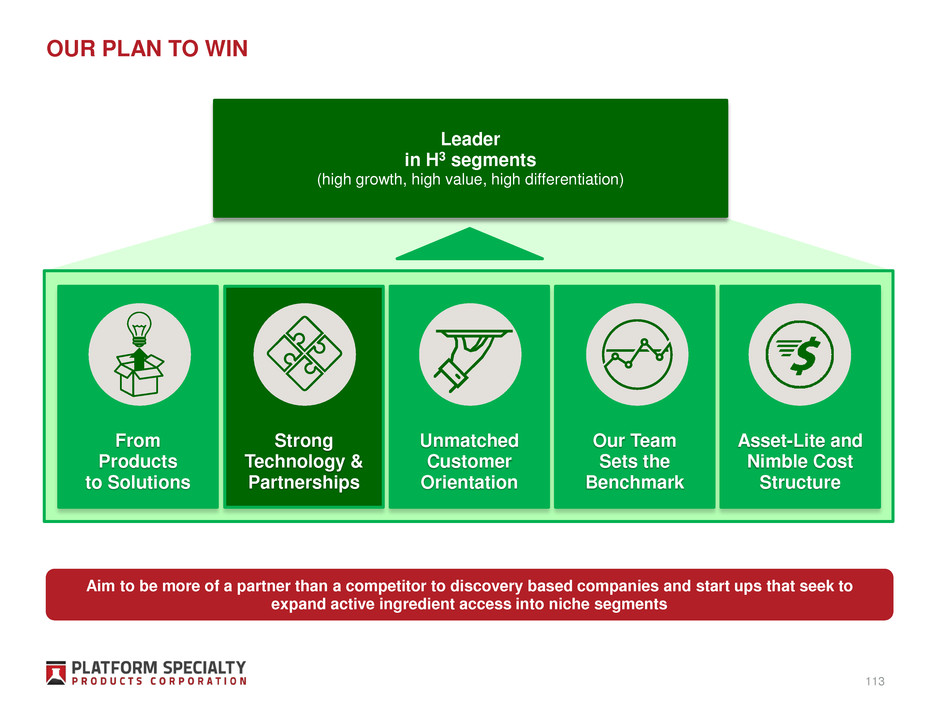

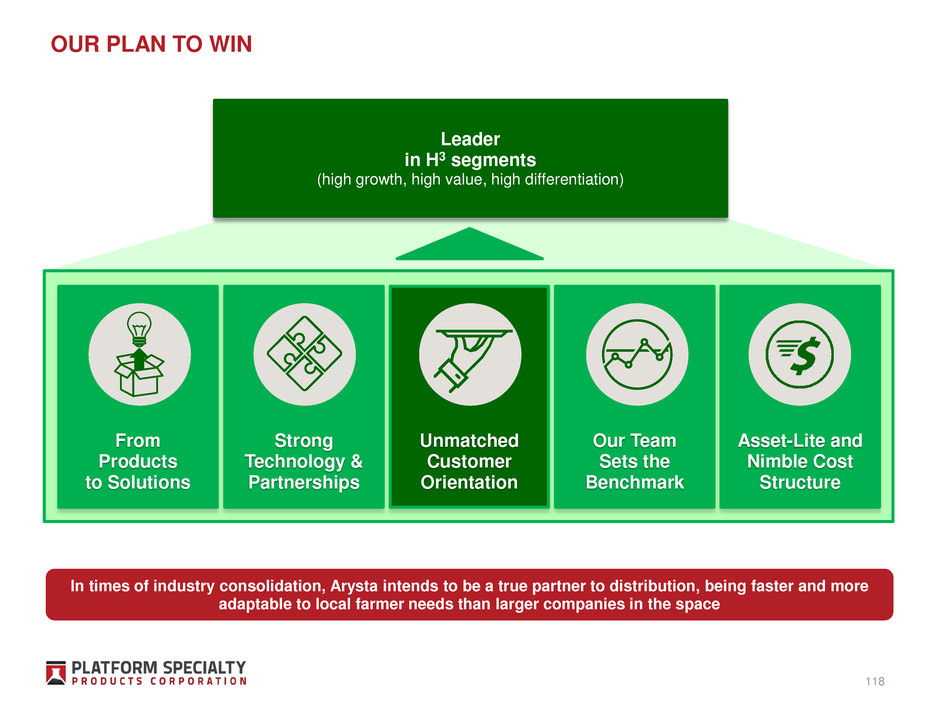

By setting our primary focus on high growth, high value, high differentiation (H3) segments, we plan to drive profitable organic growth faster than the market OUR PLAN TO WIN Leader in H3 segments (high growth, high value, high differentiation) Asset-Lite and Nimble Cost Structure Our Team Sets the Benchmark Unmatched Customer Orientation Strong Technology & Partnerships From Products to Solutions H3 105

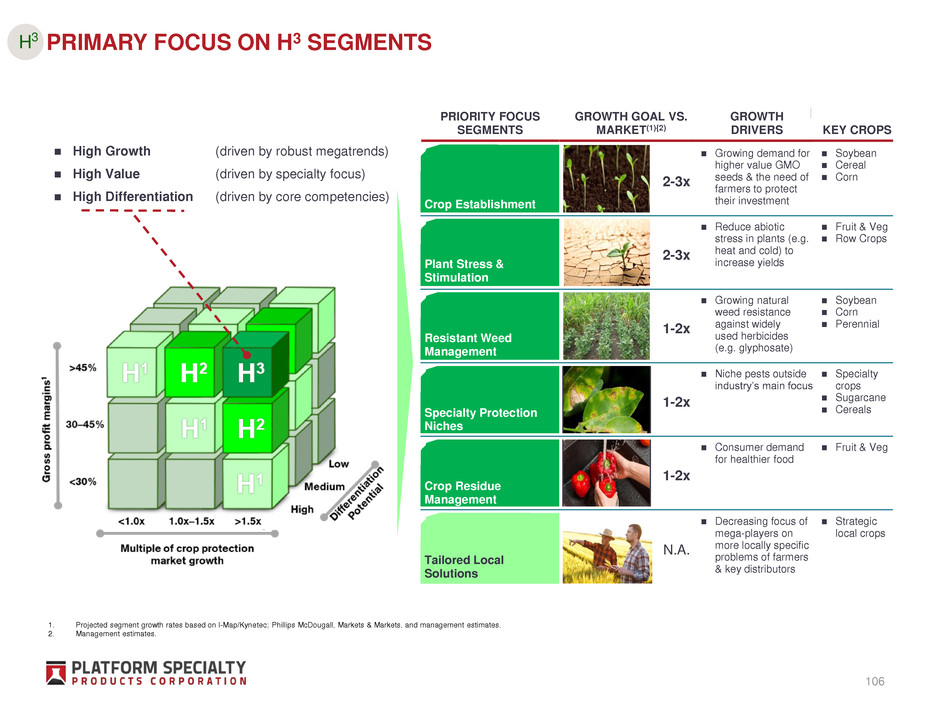

Crop Residue Management Plant Stress & Stimulation Specialty Protection Niches Resistant Weed Management Crop Establishment Soybean Cereal Corn Fruit & Veg Row Crops Soybean Corn Perennial Specialty crops Sugarcane Cereals 2-3x Growing demand for higher value GMO seeds & the need of farmers to protect their investment 2-3x Reduce abiotic stress in plants (e.g. heat and cold) to increase yields 1-2x Growing natural weed resistance against widely used herbicides (e.g. glyphosate) 1-2x Niche pests outside industry’s main focus Fruit & Veg Strategic local crops 1-2x Consumer demand for healthier food N.A. Decreasing focus of mega-players on more locally specific problems of farmers & key distributors PRIMARY FOCUS ON H3 SEGMENTS High Growth (driven by robust megatrends) High Value (driven by specialty focus) High Differentiation (driven by core competencies) GROWTH GOAL VS. MARKET(1){2) GROWTH DRIVERS KEY CROPS Tailored Local Solutions PRIORITY FOCUS SEGMENTS H3 106 1. Projected segment growth rates based on I-Map/Kynetec; Phillips McDougall, Markets & Markets, and management estimates. 2. Management estimates.

LONG-TERM GROWTH OBJECTIVES IN H3 SEGMENTS $91bn Total Agricultural Market(1) $54bn Crop Protection Addressable Market(1) $13bn Primary Focus Markets (2015) $18bn Primary Focus Markets (2021) AG MARKET ARYSTA’S PRIMARY FOCUS MARKETS Crop Protection GM Seed Seed Proprietary Off Patent Patented Generic 107 Crop Establishment Plant Stress Weed Resistance Mgmt Specialty Protection Niches Crop Residue Mgmt Arysta sales in primary focus market Primary focus market share 2015 ~$700m ~$1bn 2021 5% 6% H3 Source: Phillips McDougall (2016), management estimates.

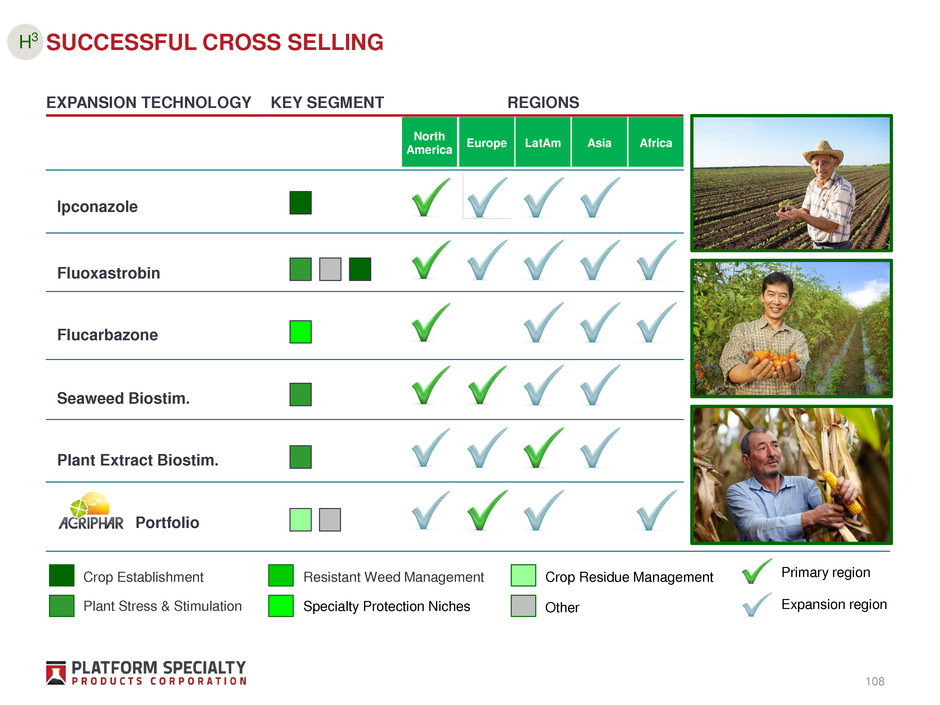

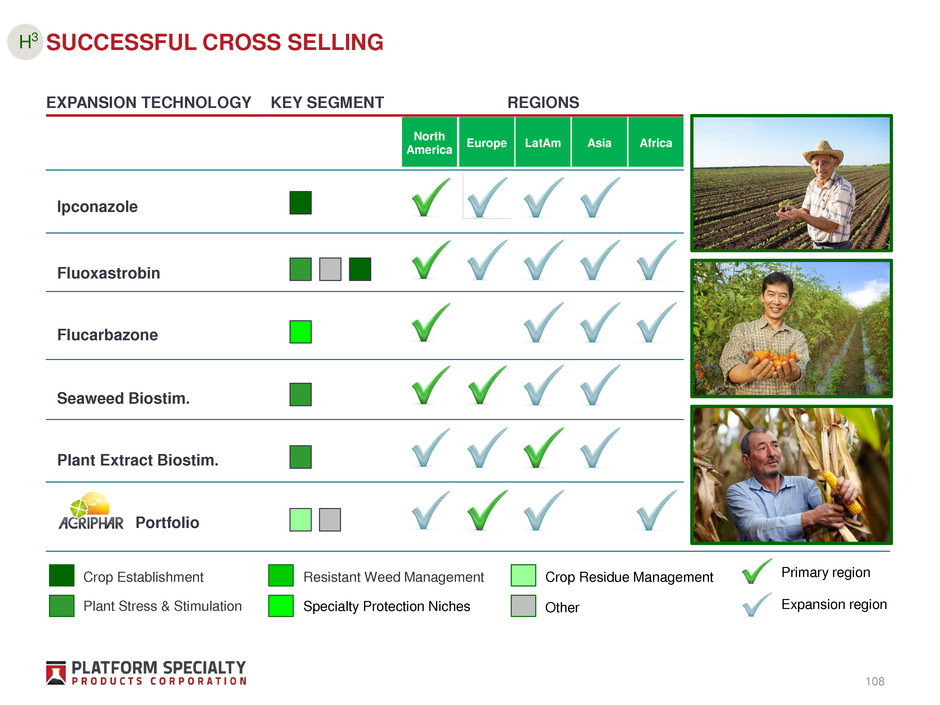

SUCCESSFUL CROSS SELLING Crop Establishment Plant Stress & Stimulation Resistant Weed Management Specialty Protection Niches Crop Residue Management Other Primary region Expansion region Ipconazole Flucarbazone Plant Extract Biostim. Portfolio Fluoxastrobin Seaweed Biostim. EXPANSION TECHNOLOGY KEY SEGMENT REGIONS North America Europe LatAm Asia Africa H3 108

By migrating from product to solution focus, Arysta intends to leverage the strengths of the combined business, while creating strong differentiation Leader in H3 segments (high growth, high value, high differentiation) Asset-Lite and Nimble Cost Structure Our Team sets the Benchmark Unmatched Customer Orientation Strong Technology & Partnerships From Products to Solutions 109 OUR PLAN TO WIN

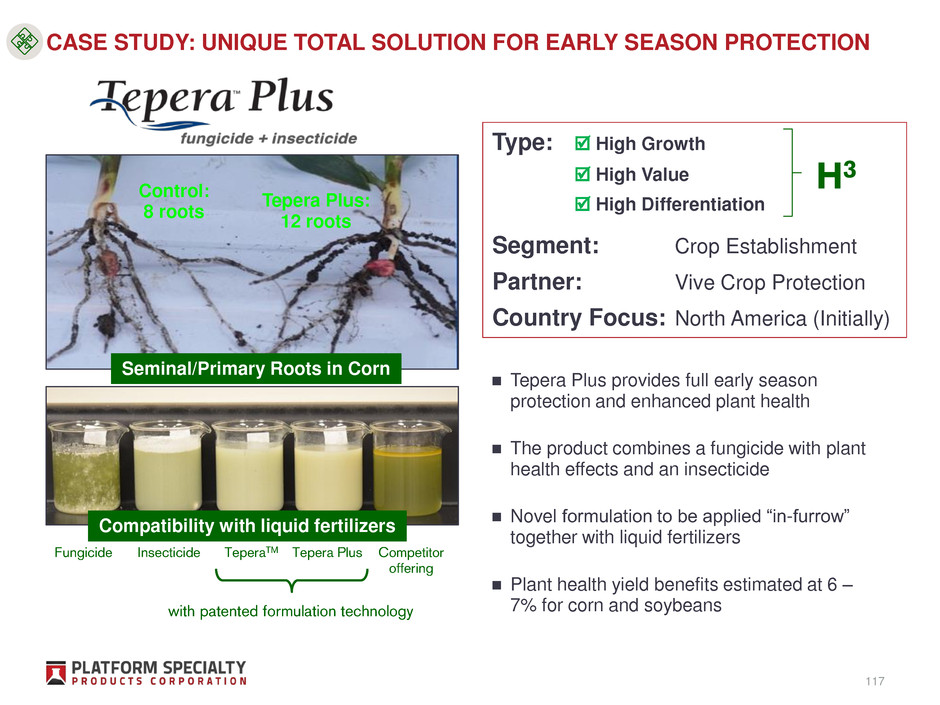

Comprehensive portfolios and expertise in crop establishment, as well as best-in-class formulation technology CROP ESTABLISHMENT ST Application Technology ST Biological Control Colours & Coatings Biological Stimulation Customer Technical Service & Support Early Post Em. Insecticide action from ST Early Post Em. Fungicide action from ST In-Furrow Products 110 EXAMPLE OF ARYSTA’S SOLUTION OFFERING IN AN H3 SEGMENT

BioStimulants 1920 1930 1940 1950 1960 1970 1980 1990 2000 2010 2020 2030 8 7 6 5 4 3 9 2 1 0 W o rld p o p u lati o n B ill io n s New technologyAll dates are approximate only Wide scale mechanization of farm equipment NPK Fertilizers Increasing farmer professionalization(1) Chemical crop protection 111 Source: GGDC; Dunham Trimmer. Note: Timing of new technologies is approximate only. 1. Increasing proliferation of Agricultural schools, research and precision farming. GMO Seeds BIOSTMULATION IS THE EXPECTED NEXT WAVE

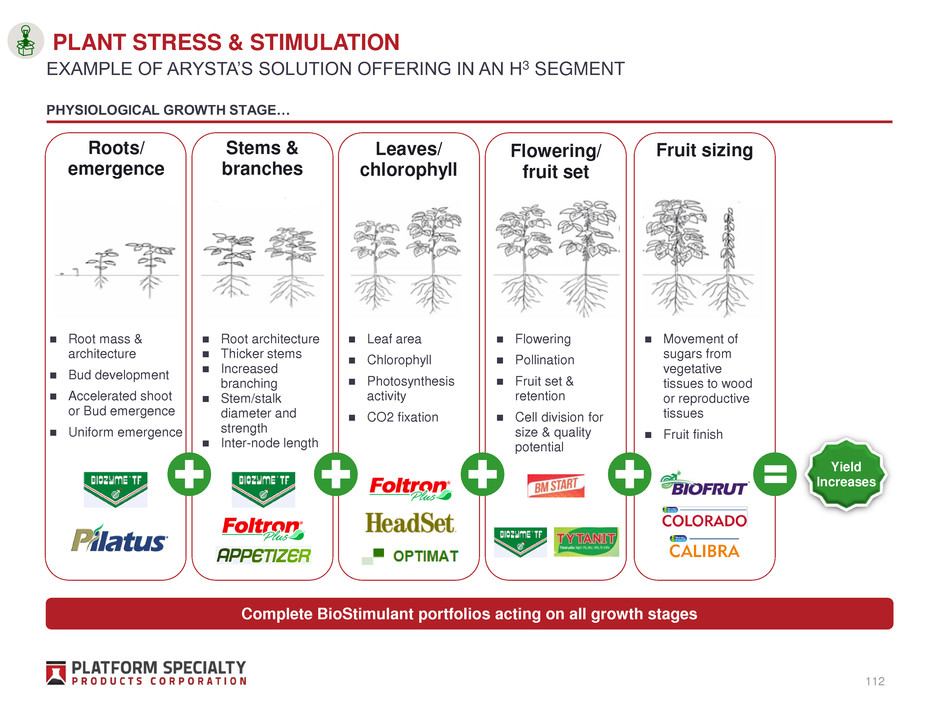

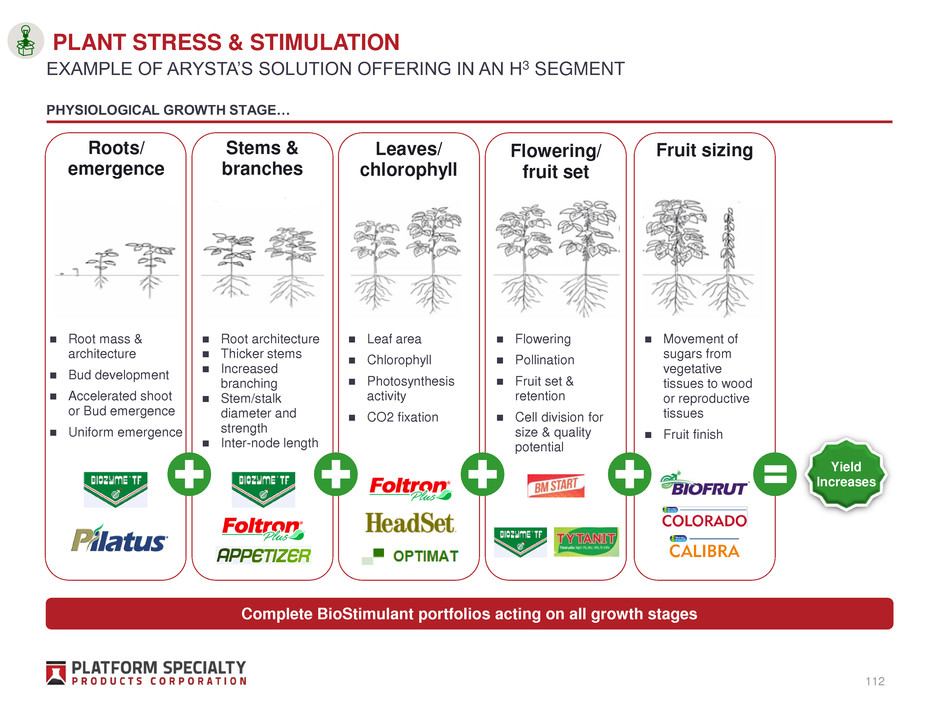

PLANT STRESS & STIMULATION Complete BioStimulant portfolios acting on all growth stages PHYSIOLOGICAL GROWTH STAGE… Stems & branches Root mass & architecture Bud development Accelerated shoot or Bud emergence Uniform emergence Root architecture Thicker stems Increased branching Stem/stalk diameter and strength Inter-node length Leaves/ chlorophyll Leaf area Chlorophyll Photosynthesis activity CO2 fixation Flowering/ fruit set Flowering Pollination Fruit set & retention Cell division for size & quality potential Fruit sizing Movement of sugars from vegetative tissues to wood or reproductive tissues Fruit finish Yield Increases Roots/ emergence 112 EXAMPLE OF ARYSTA’S SOLUTION OFFERING IN AN H3 SEGMENT

Aim to be more of a partner than a competitor to discovery based companies and start ups that seek to expand active ingredient access into niche segments Leader in H3 segments (high growth, high value, high differentiation) Asset-Lite and Nimble Cost Structure Our Team Sets the Benchmark Unmatched Customer Orientation Strong Technology & Partnerships From Products to Solutions 113 OUR PLAN TO WIN

KEY PRODUCT ACQUISITIONS & LICENSING DEALS Selected Portfolio Acquisitions Selected Licensing Deals = BioSolutions SOURCE YEAR KEY AI Biozyme2007 Amicarbazone2001 Flucarbazone2002 Tebuthiuron2008Volcano Agroscience Physio Activator & Natural Protect portfolios 2014 Cypermethrin2004 Propisochlor2006 SOURCE YEAR KEY AI 2006 Ipconazole Fluoxastrobin Cloquintocet2012 2013 Tetraconazole 2015 Co-occlusion technology 2012 2016 Certain Protein Technologies 2016 Quizalofop-e1 2 x BioStimulants 2 x Insecticides 2 x Fungicides 3 x Herbicides 2016 Various (in progress) 2015 Patented formulation technology 114 1. Nissan has granted access to Quizalofop mixtures in Brazil. Technology partners are showing significant interest in collaboration with the new Arysta

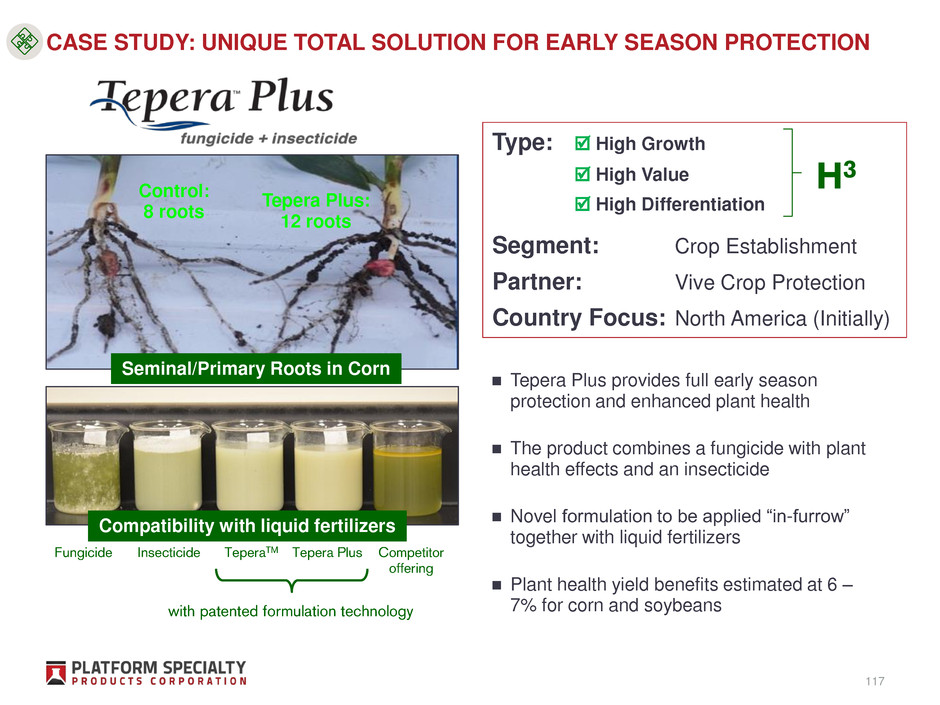

STRONG PIPELINE WITH ~$700M PEAK SALES POTENTIAL(1) WE ARE ALIGNING OUR PIPELINE OF NEW FORMULATIONS AND MIXTURES TO OUR PRIMARY FOCUS SEGMENTS Products in launch 2014–2016 Cereal Seed Treatment for Europe Seaweed Portfolio Expansion Row Crop Fungicide Mixture Attractant for lepidoptera Broad Spectrum Fungicide for Fruits and Vegetables SAR bio-fungicide Broad-spectrum Herbicide for Corn Planned launches 2017+ In-furrow Dual-purpose Fungicide/Insecticide Bio-insecticide for Fruits & Veggies Technology for Cold stress management Broader-spectrum Bio- insecticide Combination Seed Treatment Fungicide and BioStimulant Broad-spectrum ST Fungicide Broad-spectrum Herbicide Mixtures for Difficult-to- Control Weeds Herbicide Mixture for Herbicide Resistant Weeds Broad Spectrum Fungicide for Row Crops and Cereals in NA Crop established Plant stress & stimulation Resistant Weed Management Specialty Protection Niches Crop Residue Management Other 115 1. Peak sales potential of products in launch since 2016 and to be launched in the future (excluding re-registration projects). New products are based on mixtures of proven new and existing active ingredients with full regulatory dossier, reducing pipeline risk

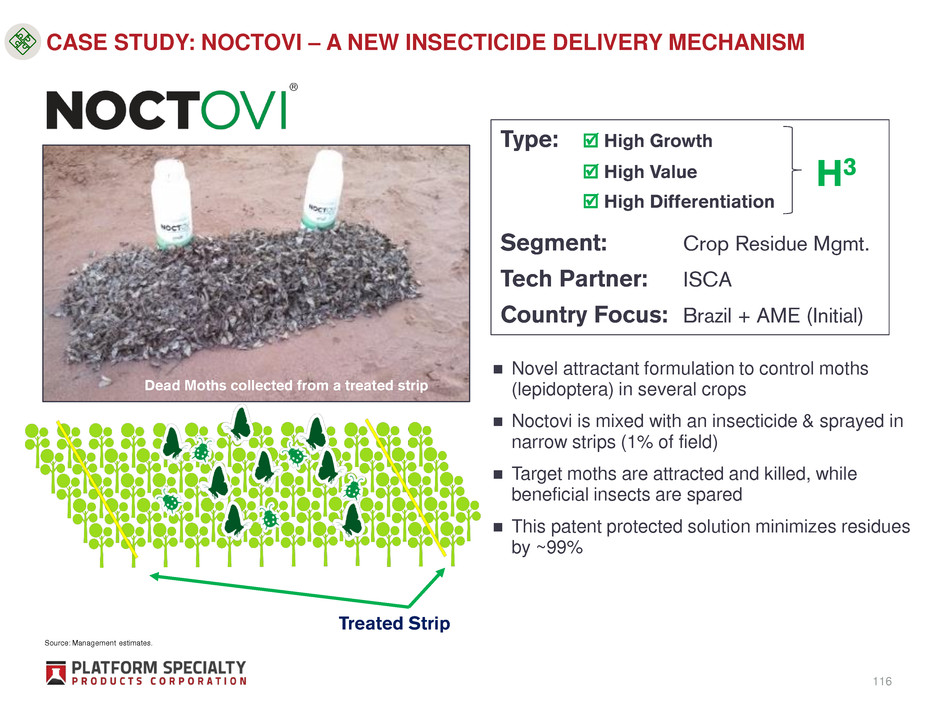

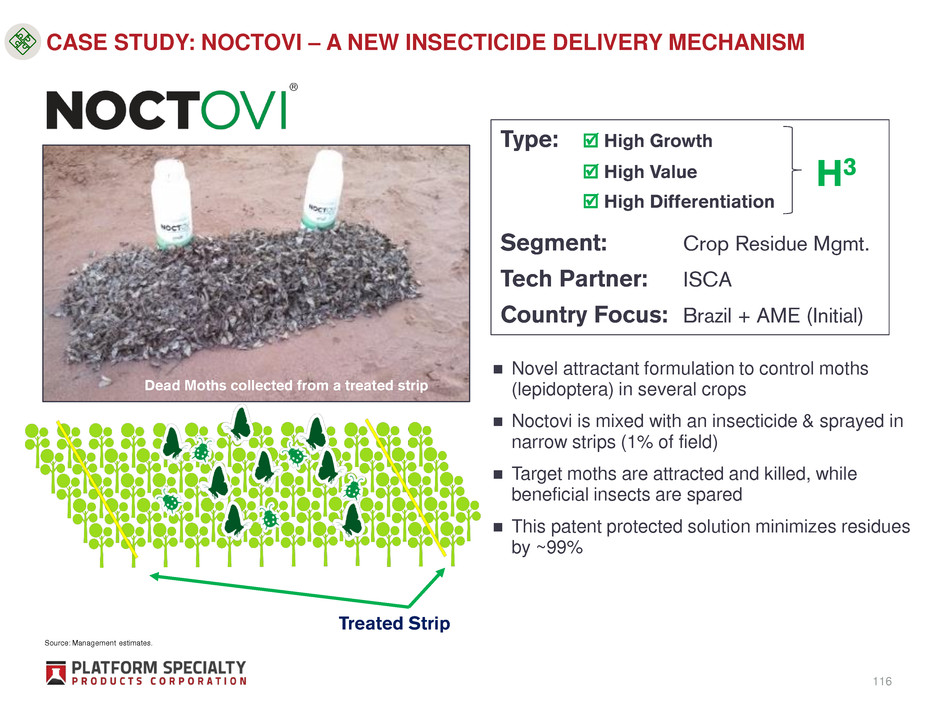

Novel attractant formulation to control moths (lepidoptera) in several crops Noctovi is mixed with an insecticide & sprayed in narrow strips (1% of field) Target moths are attracted and killed, while beneficial insects are spared This patent protected solution minimizes residues by ~99% Dead Moths collected from a treated strip Treated Strip Type: High Growth High Value High Differentiation Segment: Crop Residue Mgmt. Tech Partner: ISCA Country Focus: Brazil + AME (Initial) H3 Source: Management estimates. CASE STUDY: NOCTOVI – A NEW INSECTICIDE DELIVERY MECHANISM 116