1450 Centrepark Boulevard, Suite 210

West Palm Beach, FL 33401

(561) 207-9600

June 16, 2017

VIA EDGAR SUBMISSION

Mr. John Cash

Branch Chief

Office of Manufacturing and Construction

United States Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

|

| | |

| | RE: | Platform Specialty Products Corporation |

| | | Form 10-K for the Year Ended December 31, 2016 |

| | | Filed March 13, 2017 |

| | | Definitive Proxy Statement on Schedule 14A |

| | | File April 14, 2017 |

| | | File No. 1-36272 |

Dear Mr. Cash:

We are writing in response to the comments we received from the staff of the Securities and Exchange Commission (the "Staff") by letter dated June 2, 2017 (the "Comment Letter") regarding the above-referenced filings of Platform Specialty Products Corporation ("Platform," the "Company" or "we"). For ease of reference in this letter, the headings and numbered paragraphs correspond to the headings and paragraph numbers contained in the Comment Letter. To facilitate your review, we have also reproduced below the text of the Staff's comments in italics directly above the Company's responses.

Form 10-K for the year ended December 31, 2016

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 36

Year Ended December 31, 2016 Compared to the Year Ended December 31, 2015, page 43

| |

| 1. | Throughout your results of operations discussion you cite multiple reasons for changes in results period over period. In future filings, please separately quantify the individual factors which impact your results of operations. |

In response to the Staff's comment, in future filings, the Company will separately quantify any individual factors which had material impact on its results of operations period over period.

Significant Accounting Policies and Critical Estimates, page 63

Goodwill, page 64

| |

| 2. | Your disclosure indicates that you have six reporting units and you recorded an impairment charge in your Performance Solutions segment. In future filings please disclose whether or not your reporting units’ fair value is substantially in excess of its reporting unit. To the extent that any of your reporting units have estimated fair values that are not substantially in excess of the carrying value and to the extent that goodwill for these reporting units, in the aggregate or individually, if impaired, could materially impact your operating results, please provide the following disclosure for each of these reporting units: |

| |

| • | Identify the reporting unit; |

| |

| • | Quantify the percentage by which fair value exceeds the carrying value as of the most recent step-one test; |

| |

| • | The amount of goodwill associated with that reporting unit; |

| |

| • | A discussion of any potential events and/or circumstances that could have a negative effect on the estimated fair value. |

In response to the Staff's comment, in future filings, the Company will disclose whether or not its reporting units' fair value is substantially in excess of their respective carrying value. To the extent that any of the Company's reporting units have estimated fair values that are not substantially in excess of their carrying value and to the extent that goodwill for these reporting units, in the aggregate or individually, if impaired, could materially impact the Company's operating results, the additional disclosure requested by the Staff in this comment No. 2 will also be provided, similar to the information that was provided in our 2016 Form 10-K for the Agro Business, a reporting unit within our Agricultural Solutions segment, whose estimated fair value was not considered significantly in excess of its carrying value.

Consolidated Statements of Cash Flows, page F-6

| |

| 3. | The change in other assets and liabilities appears to be substantial. In future filings, to the extent that there are material changes in an individual line item, please provide supplemental disclosure that explains the most significant components of the change. |

In response to the Staff's comment, in future filings, the Company, to the extent that there are material changes in an additional line item of its Consolidated Financial Statements, will provide supplemental disclosure that explains the most significant components of the change.

12. Stockholders’ Equity, page F-49

Series B Convertible Preferred Stock, page F-50

| |

| 4. | We note that as a result of the settlement agreement, for accounting purposes, the Series B Convertible Preferred Stock had been deemed an extinguishment in exchange of issuance of another financial instrument and that you recognized a gain. Please tell us how you determined that recording a gain in the Statement of Operations was appropriate and cite the relative authoritative guidance you relied on. |

As a result of the settlement agreement and release entered into with the seller of Arysta LifeScience Limited (the “Arysta Seller”) on September 9, 2016 (the “Settlement Agreement”), the Company recognized a total gain of $135.9 million, calculated as the difference between the carrying value of the Series B Convertible Preferred Stock and its fair value after the Settlement Agreement. This total gain was bifurcated into two components: a gain of $32.9 million in retained earnings, which increased "Net income (loss) attributable to common stockholders," and a gain of $103 million in "Other income, net" in its Consolidated Statement of Operations.

Subsequent to the conclusion that the Settlement Agreement represented an extinguishment in exchange of the issuance of another financial instrument, a $32.9 million gain was attributed to the extinguishment of the Series B Convertible Preferred Stock, representing the difference between the carrying value of the Series B Convertible Preferred Stock and its fair value on the date of the Settlement Agreement. Considering that the extinguishment related to a mezzanine-classified instrument, this gain was recognized as a reduction to the net loss to arrive at "Net income (loss) attributable to common stockholders," in accordance with Accounting Standard Codification (“ASC”) 260-10-S99-2.

The remaining $103 million gain was attributed to the Settlement Agreement, which was entered into by and between the Company and the Arysta Seller to, among other things, settle any disputes, claims or disagreements that any of them had, may have had, or could have had against the other arising out of, or relating to, the original Arysta Share Purchase Agreement. Accordingly, the Company allocated the portion of the Settlement Agreement associated with the settlement of such disputes, claims or disagreements and recorded it as a gain in "Other income, net" in the Statement of Operations.

The Company determined that the recognition of the $103 million gain in its Consolidated Statement of Operations was appropriate based primarily on an analogy to ASC 505-30-30-2 and 30-3 which notes that “an allocation of repurchase price to other elements of the repurchase transaction may be required if an entity purchases treasury shares at a stated price significantly in excess of the current market price of the shares.” While this guidance is in reference to the payment of an amount in excess of the underlying capital transaction, the Company believes it is appropriate to apply this guidance by analogy to this situation where the amount paid to redeem the Series B Convertible Preferred Stock was less than the amount that would have been required pursuant to the original capital transaction.

14. Earnings Loss Per Share, page F-52

| |

| 5. | We note that you have made several adjustments to the numerator and denominator of your diluted earnings per share calculation. These adjustments appear to primarily relate to the settlement of the Series B Convertible Preferred Stock. Please provide a comprehensive explanation for these adjustments and cite the authoritative literature you relied on in determining they were appropriate. |

As noted in the Company’s Summary of Significant Accounting Policies in Footnote 1 of the 2016 Form 10-K, the diluted earnings (loss) per common share assumes the issuance of all potentially dilutive share equivalents using the if-converted or treasury stock method, provided that the effects are not anti-dilutive. Each potentially dilutive instrument was considered in sequence from the most dilutive to the least dilutive, and two instruments were determined as dilutive to our earnings per share: the Series B Convertible Preferred Stock and the non-controlling minority interest held by stockholders of Platform Delaware Holdings, Inc. ("PDH"), a subsidiary of Platform.

As such, considering the guidance in ASC 260-10-45, the Company determined that the net gain associated with the Series B Convertible Preferred Stock (i.e. the settlement, amendment and remeasurement adjustments associated with the Series B Convertible Preferred Stock) should be adjusted out of the numerator used in calculating the Company's diluted earnings per share. In accordance with the if-converted method, the Company assumed that the conversion of the Series B Convertible Preferred Stock took place at the beginning of the fiscal year and excluded the Series B Convertible Preferred Stock related transactions recorded during the 2016 period from the numerator in calculating diluted earnings per share.

The Company also adjusted the numerator used in calculating its diluted earnings per share to reflect the non-controlling minority interest held by the PDH stockholders, pursuant to the if-converted method and in accordance with the guidance referenced above, as such PDH stockholders are entitled to exchange their PDH common stock for common stock of Platform on a one-for-one basis. The Company assumed that the conversion of the PDH common stock took place at the beginning of the fiscal year and excluded the PDH related transactions recorded during the 2016 period from the numerator in calculating diluted earnings per share.

Considering the guidance in ASC 260-10-45-42, the Company adjusted the denominator used in calculating diluted earnings per share to reflect the weighted average number of outstanding shares of Series B Convertible Preferred Stock, calculated based on the bifurcation of the original instrument, which was settled on September 9, 2016 pursuant to the Settlement Agreement, and the amended instrument, which was entered into on September 9, 2016 and subsequently redeemed on December 13, 2016. A similar adjustment was recorded related to Platform's common stock issuable to PDH stockholders as noted above.

Definitive Proxy Statement on Schedule 14A filed April 14, 2017

Compensation Discussion and Analysis, page 27

IV. Executive Compensation, page 27

Annual Bonus Plan, page 36

| |

| 6. | We note that you have not disclosed the company targets for adjusted EBITDA, organic growth and working capital for your Annual Bonus plan. We also note that you have not disclosed the adjusted EBITDA targets for your Special Long-Term Incentive Grants in 2016. Please explain how disclosure of these targets would cause you competitive harm, applying the standards that would be used in making a request for confidential treatment under Rule 406 or Rule 24b-2. We also note your disclosure that achieving these goals “represents a significant, yet appropriate, challenge for [y]our executives.” However, you have not disclosed how difficult it would be for the executive or how likely it would be for the company to have achieved these targets, as required by Instruction 4 to Item 402(b) of Regulation S-K. Please tell us how you will address this requirement in future filings. Please see Regulation S-K Compliance & Disclosure Interpretation 118.04 and Instruction 4 to Item 402(b) of Regulation S-K. |

In response to the Staff's comment, we have reconsidered Regulation S-K Compliance & Disclosure Interpretation 118.04 and Instruction 4 to Item 402(b) of Regulation S-K and will disclose, in applicable future filings, the applicable targets for the Company's Annual Bonus Plan and the Special Long-term Incentive Grants.

Equity-Based Long-Term Incentives, page 38

| |

| 7. | In future filings, please revise your Executive Compensation disclosure to more clearly disclose to investors the elements of your compensation and how you determined the payout for each component of your compensation. By way of example and not limitation, please revise your “How Equity-Based Compensation is Determined” section on page 38 to clearly disclose how you determined your equity-based compensation, including the payouts for each component (i.e. PRSU, RSU, and SOP) of your equity-based compensation. For example, you disclose that PRSU payouts are based on two metrics, return on invested capital and TSR. However, the table on page 40 that discusses the PRSU payout schedule only references TSR. Please disclose the weight and performance goals for each metric. In addition, please clarify the payouts under the PRSU. For example, we note your disclosure on page 39 that a payout of common stock could range from 0% to 250% of the number of PRSUs awarded. However, on page 39 you also disclose payouts of 50%, 100%, or 200% following achievement of either threshold, target, and, maximum of performance goals. It appears that your Grants of Plan-Based Awards Table reflects a PRSU |

payout of 75%, 100% and 250% for the threshold, target and maximum. Please provide the staff with proposed revised disclosure.

In response to the Staff's comment, in future filings, the Company will revise its Executive Compensation disclosure to more clearly describe the elements of its executive compensation program and how payout of each component is determined, including a description of performance goals and weighting. We have included below examples of such expanded disclosure in the leading paragraph under "Equity-Based Long-Term Incentives," on page 38, the "How Equity-Based Compensation is Determined" section, starting on page 38, and footnote 4 to the Grants of Plan-Based Awards Table, on page 53.

With respect to the PRSU payouts, in response to the Staff's comment, we have improved the descriptions of the ROIC and TSR performance goals and clarified that the two performance metrics are equally weighted. We have also clarified that the payout under the PRSUs could range from 0% if neither ROIC nor TSR achieves the minimum levels at which payout occurs, to 250% if both ROIC and TSR achieve the maximum levels, which represents the average of a maximum payout of 200% for ROIC and 300% for TSR. The revised disclosure includes illustrations of achievement levels for each of the performance metrics that would result in ROIC payouts at 50%, 100% or 200% and TSR payouts at 100%, 200% and 300%.

To facilitate the Staff's review process, the portions of the revised disclosure mentioned above are shown in underline and strikethrough under "Revised Executive Compensation Disclosure" below. Conforming changes will be made throughout the Executive Compensation section to be consistent with this revised disclosure.

Revised Executive Compensation Disclosure:

Equity-Based Long-Term Incentives

The Company’s LTI Program is designed to align the financial interests of executives with those of stockholders by rewarding the achievement of pre-established financial metrics over multi-year performance periods, and therefore long-term stockholder value. The Compensation Committee believes that providing executives with the opportunities to acquire significant stakes in our growth and prosperity (through grants of equity-based compensation), while maintaining other components of our compensation program at competitive levels, will incentivize and reward executives for sound business management, develop a high-performance team environment, foster the accomplishment of short-term and long-term strategic and operational objectives and compensate executives for improvement in shareholder value, all of which are essential to our ongoing success.

The annual equity-based long term incentive element of our executive compensation program is typically delivered in the form of:

| |

| • | PRSUs, for which vesting is based on the performance of two equally-weighted financial metrics (average return on invested capital ("ROIC") and relative total shareholder return ("TSR")), each calculated over a three-year performance period; |

•RSUs, for which vesting is based solely on the passage of time over a three-year period; and

•SOPs, which vest annually on a pro rata basis over a three-year period.

How Equity-Based Compensation is Determined

Annually, the Compensation Committee reviews our LTI Program to determine (i) determine the equity compensation mix, (ii) the vesting periods, and (iii), with respect to PRSUs, the metrics that should be used to encourage long-term success, the weightings that should be applied to such metrics and the annual and cumulative targets for such metrics. The mix of equity-based incentive awards typically consists of 50%

PRSUs, 25% RSUs and 25% SOPs. The Compensation Committee believes that commencing a new three-year cycle each year provides a regular opportunity to re-evaluate long-term metrics, aligns goals with the ongoing strategic planning process, and reflects our evolving business priorities and market factors and, when applicable, re-evaluate long-term metrics. The Compensation Committee also annually sets a LTI Program target award for each Named Executive Officer, which reflects the total LTI Program target award a Named Executive Officer has the opportunity to receive at the end of the applicable three-year performance period cycle if the Company meets all its targets. With respect to PRSUs, to the extent that we meet the minimum financial goals or the maximum financial goals, the actual payout to the Named Executive Officer could be significantly less or more than the initial total LTI Program PRSU target award, with the recipient eligible to earn up to 250% of the number of PRSUs initially granted or as few as zero shares, as described below under "Performance-Based Restricted Stock Unit (PRSU) Awards."

LTI Awards are typically made in the first quarter of the fiscal year in connection with other annual compensation decisions. LTI Awards may also be given from time to time during the year in connection with hiring decisions and recognition of exemplary achievement, promotions or other compensation adjustments.

All LTI Awards consist of PRSU, RSU and SOP awards, as further described below. All LTI Awards are granted under the 2013 Plan, which was approved by the stockholders of the Company in June 2014. A maximum of 15,500,000 shares of common stock were authorized to be issued under the 2013 Plan. As of December 31, 2016, a total of 373,434 shares of common stock had been issued and 2,828,003 PRSUs, RSUs and SOPs were outstanding under the 2013 Plan.

A description of each component of our LTI Program is included below:

Time-Based Restricted Stock Unit (RSU) Awards. The number of RSUs granted to an executive is typically determined by dividing 25% of the total LTI Award for such executive by the value of a share of our common stock on the grant date. RSU vesting is based solely on the passage of time over a three-year period. RSUs awards represent shares of our common stock, on a one-for-one basis, that are not issued to the award recipient until after the end of such three-year a certain restriction period in addition to the satisfaction of any other applicable conditions. Accordingly, holders of RSUs have no voting rights with respect to the RSUs they received. The RSUs may, in certain circumstances, become immediately vested as of the date of a change in control of Platform.

The value of the grants is dependent upon continued service with the Company as well as stock price appreciation and thus enhances both retention and stockholder value creation. The number and grant date fair value of the RSU grants made in 2016 to each Named Executive Officer are listed in the Grants of Plan-Based Awards for 2016 in this Proxy Statement in the columns titled “All Other Stock Awards: Number of Shares of Stock or Units” and “Grant Date Fair Value of Stock and Option Awards.”

For information about the RSU awards granted by the Compensation Committee to the Named Executive Officers on February 21, 2017, see "Recent Compensation Highlights" below.

Performance-Based Restricted Stock Unit (PRSU) Awards. The number of PRSUs granted to an executive is typically determined by dividing 50% of the total LTI Award for such executive by the value of a share of our common stock on the grant date. The number of PRSUs granted represents a target number of PRSUs that the executive has the opportunity to receive. The actual number of PRSUs awarded to the executive at the end of the applicable three-year performance period is determined based on the performance of two equally-weighted financial metrics: average ROIC and relative TSR.

Average ROIC and relative TSR performance achievements are calculated at the end of the three-year ROIC performance period or TSR performance period, as applicable. The payout of shares of Platform common stock will range from 0% of the target number of PRSUs initially awarded (if ROIC does not achieve its threshold goal (an average of 25 bps improvement per annum) and TSR delivers under the 50th

percentile relative to the S&P MidCap 400 Index), to 250% of the target number of PRSUs initially awarded (if ROIC achieves its stretch goal (an average improvement of 100 bps per annum) and TSR delivers at the 100th percentile). For each of the ROIC and TSR metrics, threshold, target and maximum performance goals are established by the Compensation Committee at the beginning of the year. The achievement of ROIC and TSR performance goals which results in the payouts described below, of 50%, 100% or 200% of target with proportional adjustment between the minimum and maximum targets these points: No payout occurs for performance below the threshold level:

PRSU metrics are defined below:

ROIC = Return on Invested Capital (50% weighting of PRSUs)

Return on invested capital ("ROIC") is defined as cash from operations less net capital expenditures, adjusted for after-tax interest expense and acquisition transaction costs, divided by a five-point average of the sum of book debt and book equity less cash. ROIC may be adjusted for significant foreign exchange impacts at the discretion of the Compensation Committee. ROIC performance levels and the corresponding ROIC performance goals and payouts for that portion of the PRSU award attributable to ROIC are as follows:

|

| | |

| ROIC Payout Schedule |

| Performance Level | Performance Goal* | Payout % |

| Threshold | 25 bps/year | 50 |

| Target | 50 bps/year | 100 |

| Stretch | 100 bps/year | 200 |

| | | |

* ROIC's performance goals are expressed as an average business point improvement per year.

|

TSR = Total Shareholder Return (50% weighting of PRSUs)

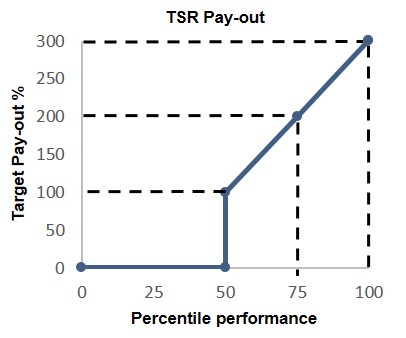

TSR compares the results of investing in the Company's common stock versus the stock of other companies in the S&P MidCap 400 over the TSR performance period. Share price is calculated at the beginning and end of the TSR performance period based on a 30 calendar-day average up to each such date. TSR performance rankings and the corresponding payouts representing the threshold, target and stretch payout for that portion of the PRSU award attributable to TSR are is as follows:

|

| | |

| PRSU Payout Schedule |

| (based on S&P MidCap 400 TSR) |

| Performance Level | Percentile Rank | Payout % |

| Threshold | 50th | 100 |

| Target | 75th | 100 |

| Stretch | 100th | 200 |

The ROIC measure is expected to provide a balance between growth and asset efficiency measures consistent with our strategic goals while the relative TSR measure aligns executive compensation with stockholders in a manner that adjusts for equity market dynamics. The Compensation Committee believes this combination of metrics provides a balanced approach to executive compensation.

PRSU vesting is calculated without management or Compensation Committee discretion, except in the event of large movements in foreign currency exposure in either direction. Any award earned will be delivered 100% in shares of our common stock, on a one-for-one basis, subject to applicable tax withholding.

Holders of PRSUs have no voting rights with respect to the PRSUs they receive. The PRSUs may, in certain circumstances, become immediately vested as of the date of a change in control of Platform. The number and grant date fair value of the PRSU grants made in 2016 to each Named Executive Officer are listed in the "Target" column under "Estimated Future Payouts Under Equity Incentive Plan Awards" and "Grant Date Fair Value of Stock and Option Awards" of the Grants of Plan-Based Awards table below.

For information about the PRSU awards granted by the Compensation Committee to the Named Executive Officers on February 21, 2017, see "Recent Compensation Highlights" below.

Stock Options (SOP) Awards. The SOPs are typically granted at an exercise price equal to the fair market value of Platform's shares of common stock on the grant date. The number of SOPs granted to an executive is determined by dividing 25% of the total LTI Award for such executive by an estimated Black-Scholes value of the SOP. SOPs vest annually on a pro rata basis over a three-year period.

SOP awards entitle the holder to purchase shares of our common stock during a specified period at a purchase price set by the Compensation Committee. The holder has no rights and privileges of a stockholder of the Company with respect to any shares purchasable or issuable upon the exercise of the SOP, in whole or in part, prior to the date on which the shares subject to the SOP are issued. In no event SOP holders are entitled to dividends or dividend equivalents. The SOP may, in certain circumstances, become immediately vested as of the date of a change in control of Platform.

The grant date fair value of SOPs which equals the expense related to the 2016 SOPs grants to the Named Executive Officers is listed in the “Option Awards” column of the 2016 Summary Compensation Table and the “Grant Date Fair Value of Stock and Option Awards” column of the Grants of Plan-Based Awards for 2016 table below.

For information about the SOP awards granted by the Compensation Committee to the Named Executive Officers on February 21, 2017, see "Recent Compensation Highlights" below."

[...]

Grant of Plan-Based Awards in 2016

[...]

(4) Amounts shown in the "Target" column are the number of PRSU awards granted in 2016 under the 2013 Plan to be paid in December 2018 or shortly thereafter for the 2016-2018 ROIC performance period. The

"threshold" column corresponds to the number of PRSUs earned if ROIC achieves its threshold goal (an average of 25 bps improvement per annum) and TSR delivers at the 50th percentile relative to the S&P MidCap 400 Index. The "Maximum" column corresponds to the number of PRSUs earned if ROIC achieves its stretch goal (an average improvement of 100 bps per annum) and TSR delivers at the 100th percentile The threshold payout is 50% and the maximum payout is 250% of the target amount. For additional information about the 2016 PRSU awards, see "Compensation Discussion and Analysis - Equity-Based Long-Term Incentives" above.

* * *

If you or any other members of the Staff have any questions with respect to the foregoing, please contact me at (475) 208-6420 or John E. Capps, Platform's General Counsel, at (561) 207-9604.

|

| |

| | Very truly yours, |

| | |

| | /s/ John P. Connolly |

| | John P. Connolly |

| | Chief Financial Officer |

cc: John E. Capps, General Counsel, Platform Specialty Products Corporation

Carrie Quinn, Engagement Partner, PricewaterhouseCoopers LLP

Mindy Hooker, Securities and Exchange Commission

Frank Pigott, Securities and Exchange Commission