Exhibit 99.2 Viridian Therapeutics May 2022

Cautionary note regarding forward-looking statements This presentation contains forward-looking statements relating to Viridian Therapeutics, Inc., including statements about our plans to obtain funding, develop and commercialize our therapeutic candidates, our planned clinical trials, the timing of and our ability to obtain and maintain regulatory approvals for our therapeutic candidates, the clinical utility of our therapeutic candidates and our intellectual property position. You can identify forward-looking statements by the use of forward-looking terminology including “believes,” “expects,” “may,” “will,” “should,” “seeks,” “intends,” “plans,” “pro forma,” “estimates,” or “anticipates” or the negative of these words and phrases or other variations of these words and phrases or comparable terminology. All statements other than statements of historical fact are statements that could be deemed forward-looking statements. These statements involve substantial known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. These forward-looking statements should not be relied upon as predictions of future events as we cannot assure you that the events or circumstances reflected in these statements will be achieved or will occur. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make due to a number of important factors, including uncertainty regarding our ability to raise additional capital and fund our development programs, risks inherent in conducting clinical trials and seeking to demonstrate safety and efficacy to the satisfaction of the applicable regulatory authorities, and those risks discussed in “Risk Factors” and elsewhere in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (SEC) on March 11, 2022, subsequently filed periodic reports and in other filings we make with the SEC from time to time. The forward-looking statements in this presentation represent our views as of the date of this presentation. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this presentation. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. 2

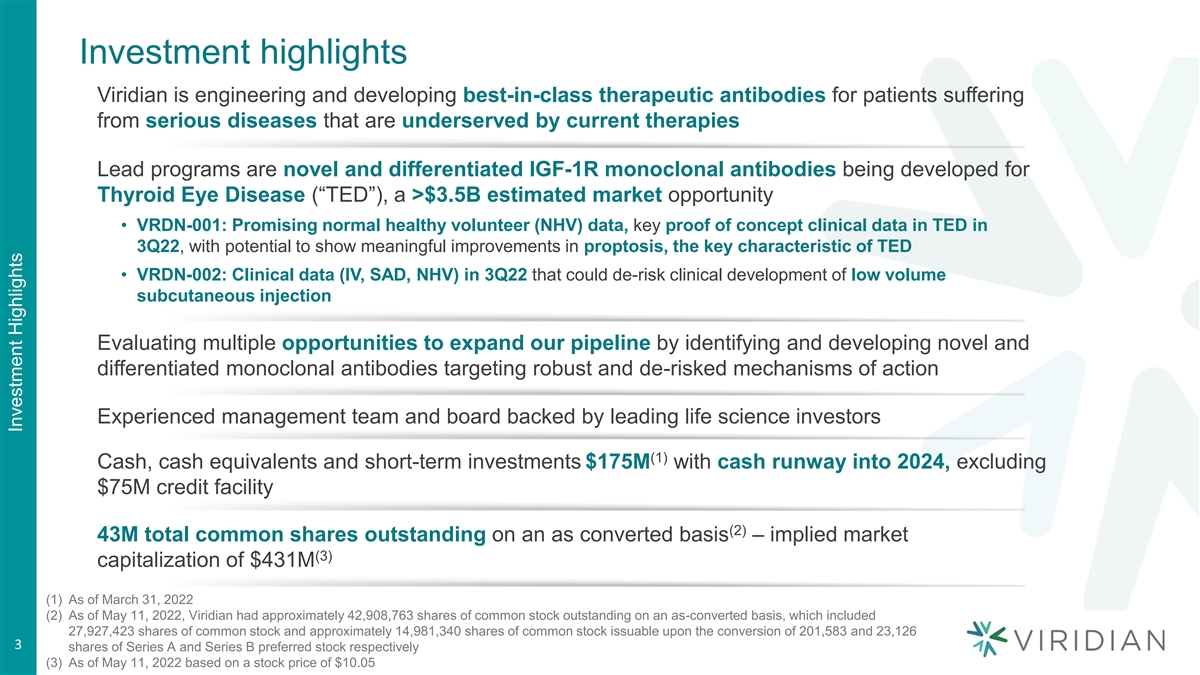

Investment highlights Viridian is engineering and developing best-in-class therapeutic antibodies for patients suffering from serious diseases that are underserved by current therapies Lead programs are novel and differentiated IGF-1R monoclonal antibodies being developed for Thyroid Eye Disease (“TED”), a >$3.5B estimated market opportunity • VRDN-001: Promising normal healthy volunteer (NHV) data, key proof of concept clinical data in TED in 3Q22, with potential to show meaningful improvements in proptosis, the key characteristic of TED • VRDN-002: Clinical data (IV, SAD, NHV) in 3Q22 that could de-risk clinical development of low volume subcutaneous injection Evaluating multiple opportunities to expand our pipeline by identifying and developing novel and differentiated monoclonal antibodies targeting robust and de-risked mechanisms of action Experienced management team and board backed by leading life science investors (1) Cash, cash equivalents and short-term investments $175M with cash runway into 2024, excluding $75M credit facility (2) 43M total common shares outstanding on an as converted basis – implied market (3) capitalization of $431M (1) As of March 31, 2022 (2) As of May 11, 2022, Viridian had approximately 42,908,763 shares of common stock outstanding on an as-converted basis, which included 27,927,423 shares of common stock and approximately 14,981,340 shares of common stock issuable upon the conversion of 201,583 and 23,126 3 shares of Series A and Series B preferred stock respectively (3) As of May 11, 2022 based on a stock price of $10.05 Investment Highlights

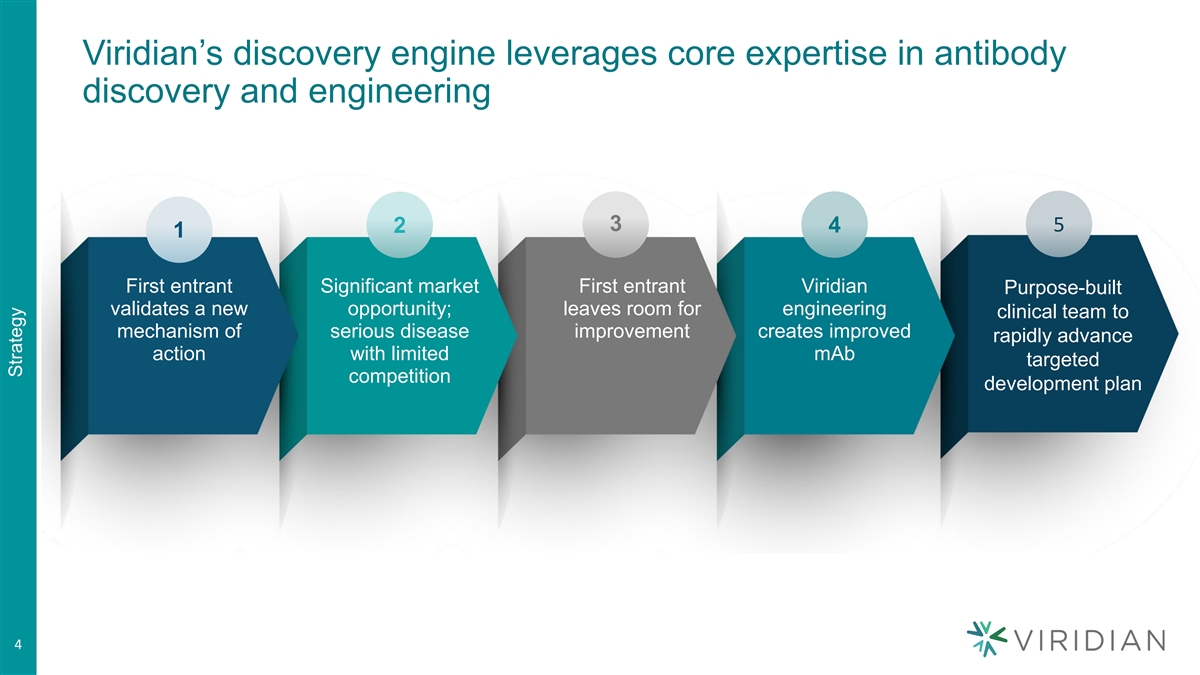

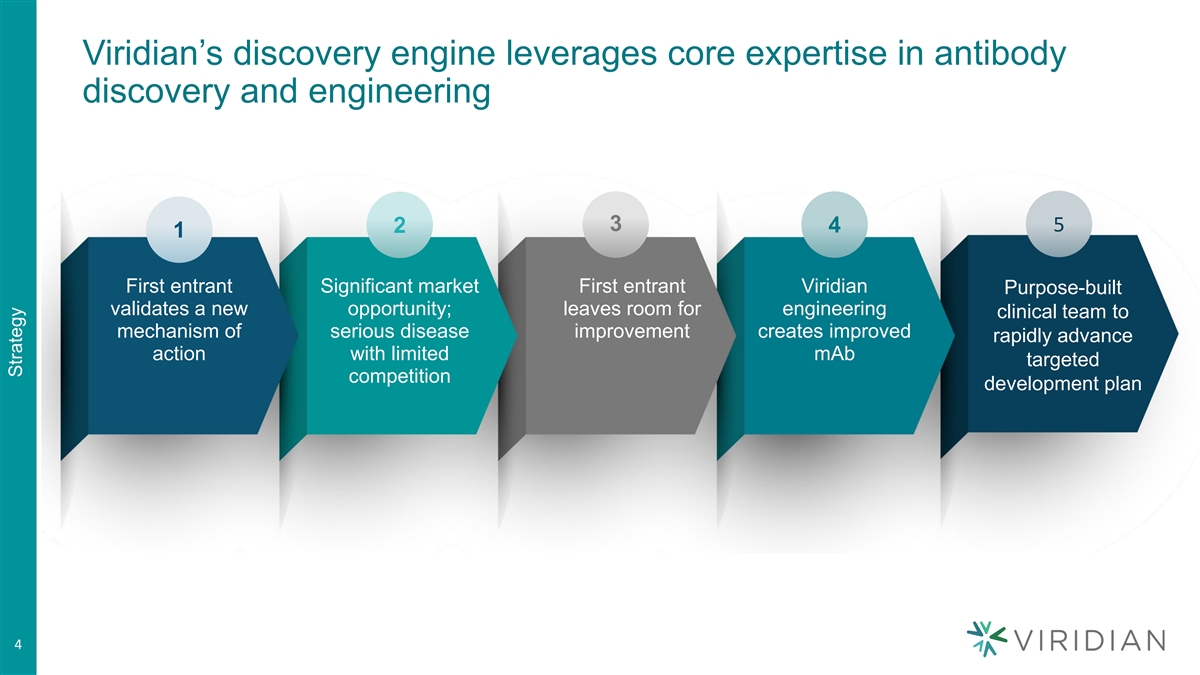

Viridian’s discovery engine leverages core expertise in antibody discovery and engineering 3 5 2 4 1 First entrant Significant market First entrant Viridian Purpose-built validates a new opportunity; leaves room for engineering clinical team to mechanism of serious disease improvement creates improved rapidly advance action with limited mAb targeted competition development plan 4 Strategy

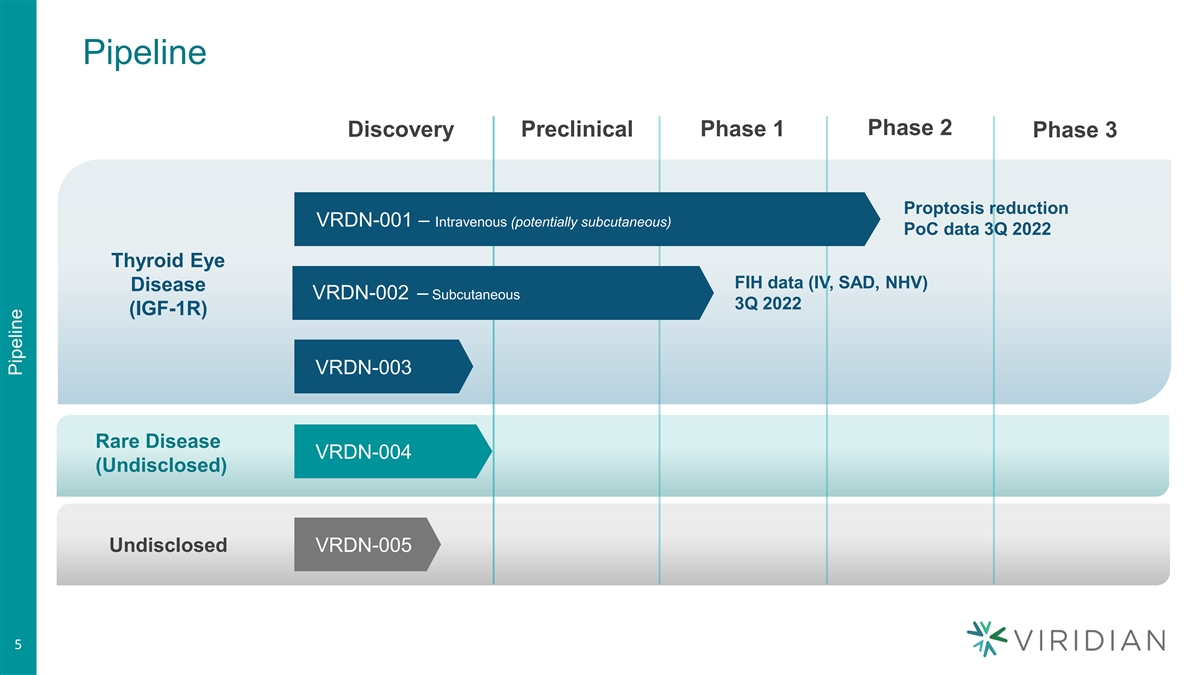

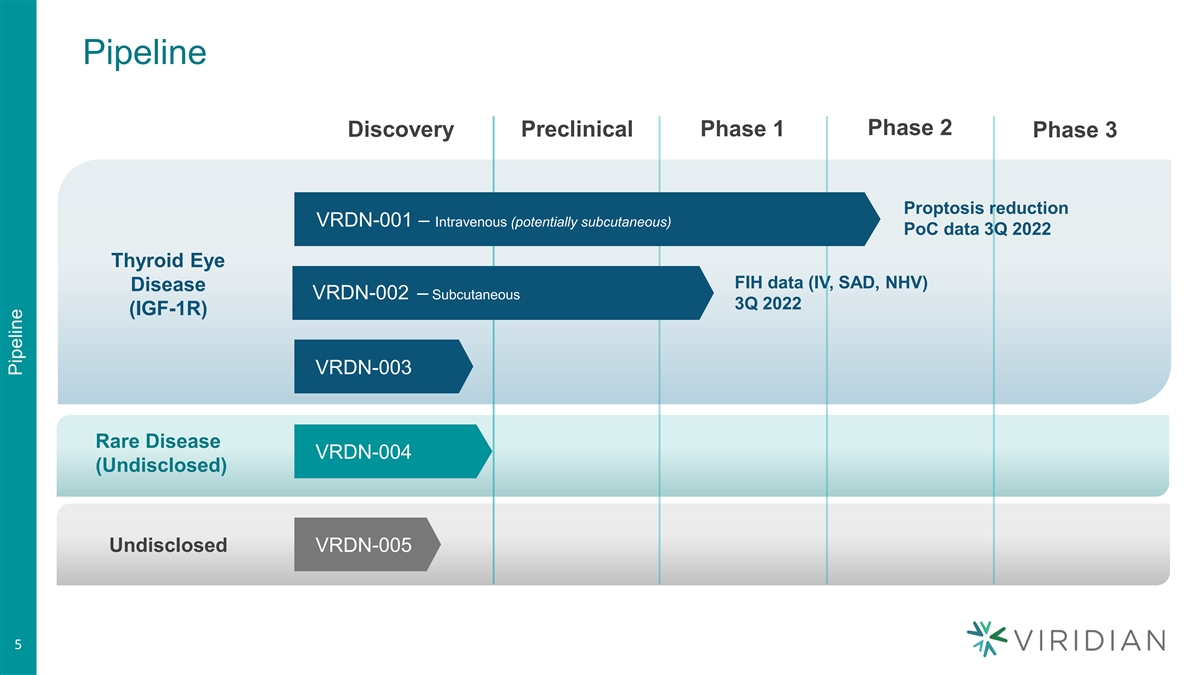

Pipeline Phase 2 Preclinical Phase 1 Discovery Phase 3 Proptosis reduction VRDN-001 – Intravenous (potentially subcutaneous) PoC data 3Q 2022 Thyroid Eye FIH data (IV, SAD, NHV) Disease VRDN-002 – Subcutaneous 3Q 2022 (IGF-1R) VRDN-003 Rare Disease VRDN-004 (Undisclosed) Undisclosed VRDN-005 5 5 Pipeline

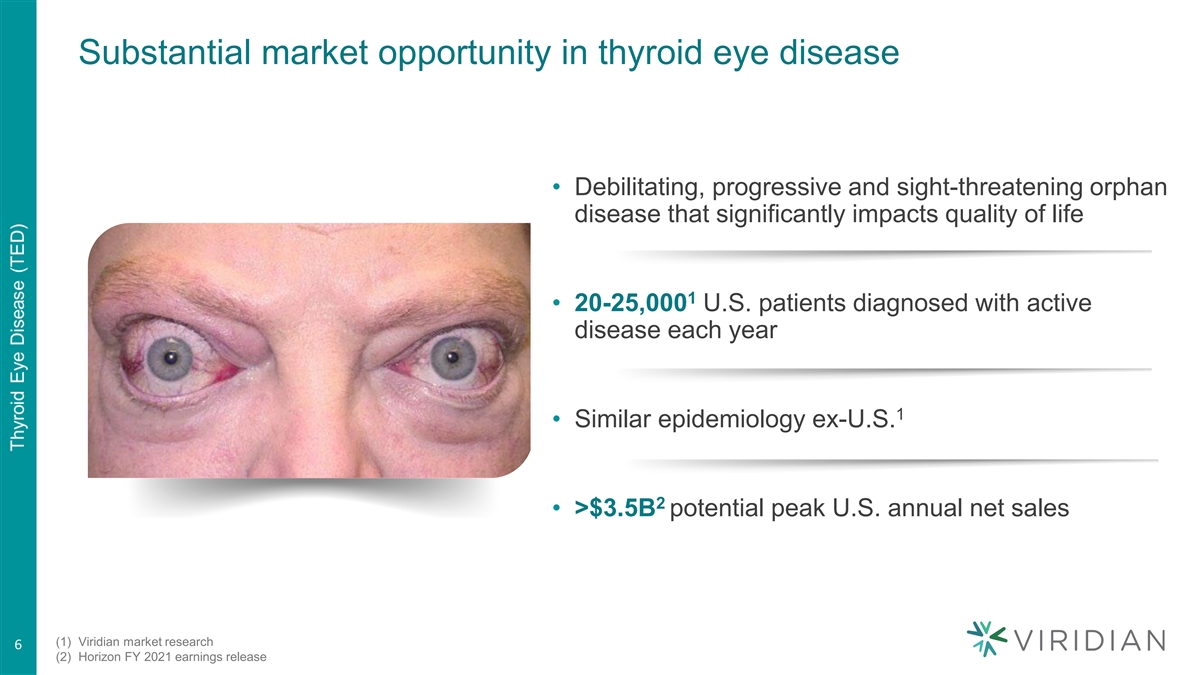

Substantial market opportunity in thyroid eye disease • Debilitating, progressive and sight-threatening orphan disease that significantly impacts quality of life 1 • 20-25,000 U.S. patients diagnosed with active disease each year 1 • Similar epidemiology ex-U.S. 2 • >$3.5B potential peak U.S. annual net sales (1) Viridian market research 6 (2) Horizon FY 2021 earnings release

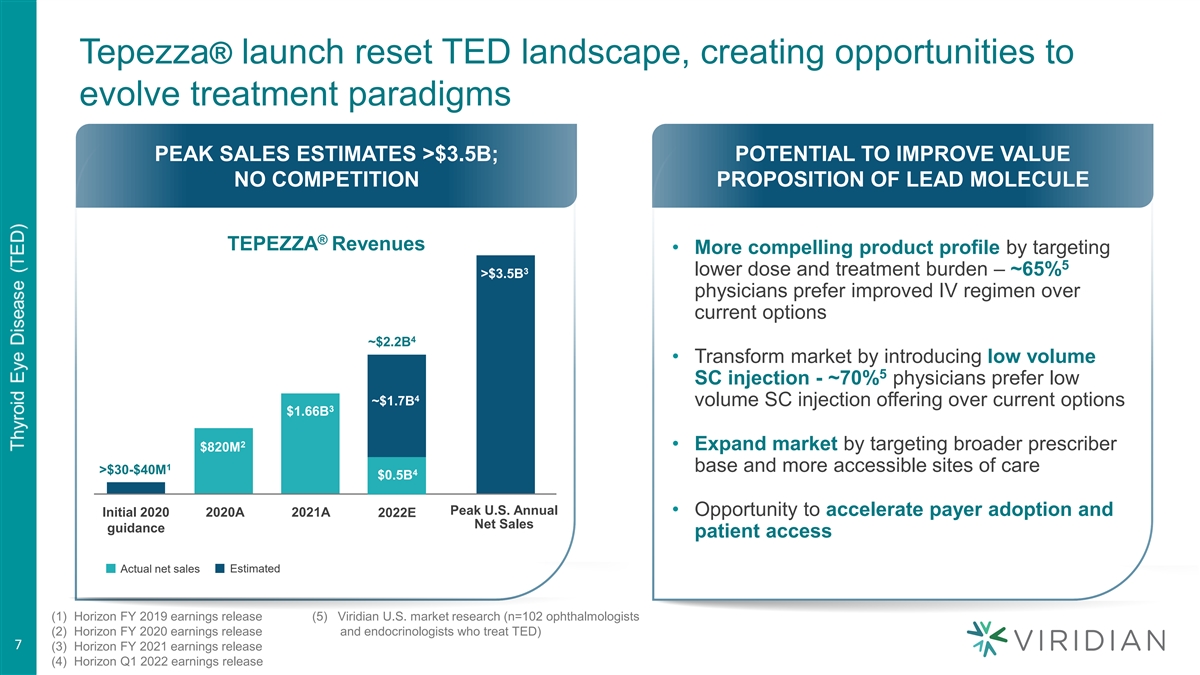

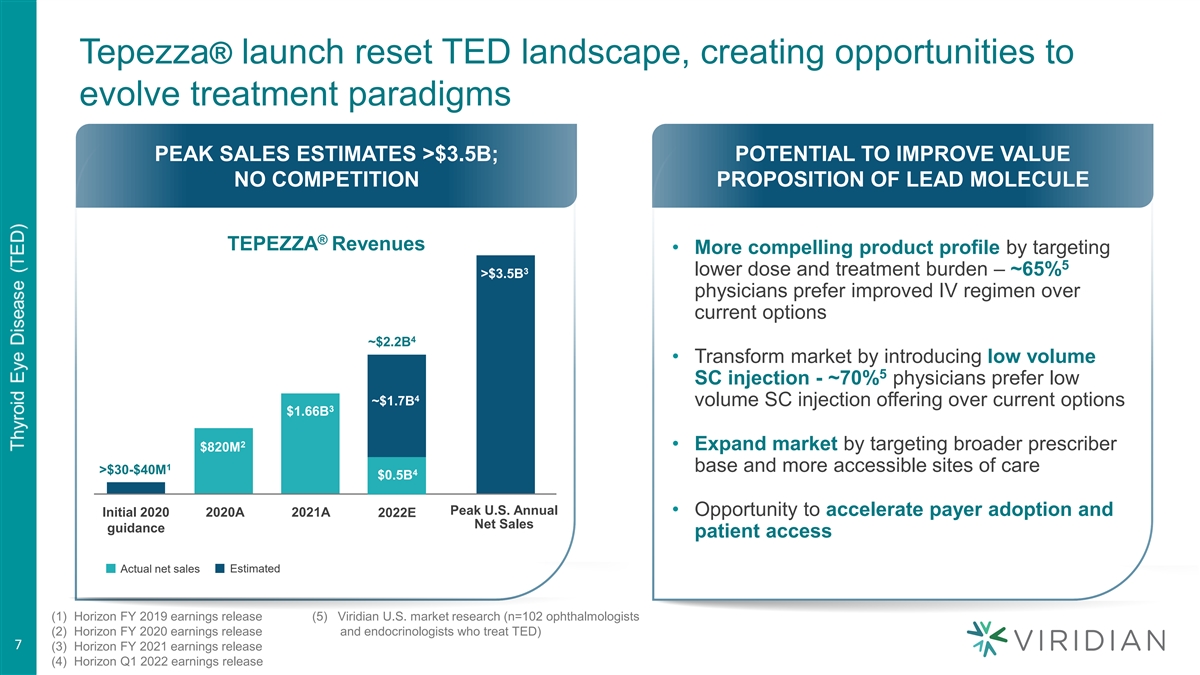

Tepezza® launch reset TED landscape, creating opportunities to evolve treatment paradigms PEAK SALES ESTIMATES >$3.5B; POTENTIAL TO IMPROVE VALUE NO COMPETITION PROPOSITION OF LEAD MOLECULE ® TEPEZZA Revenues • More compelling product profile by targeting 5 3 lower dose and treatment burden – ~65% >$3.5B physicians prefer improved IV regimen over current options 4 ~$2.2B • Transform market by introducing low volume 5 SC injection - ~70% physicians prefer low 4 ~$1.7B volume SC injection offering over current options 3 $1.66B 2 • Expand market by targeting broader prescriber $820M 1 base and more accessible sites of care >$30-$40M 4 $0.5B Peak U.S. Annual • Opportunity to accelerate payer adoption and Initial 2020 2020A 2021A 2022E Net Sales guidance patient access Actual net sales Estimated (1) Horizon FY 2019 earnings release (5) Viridian U.S. market research (n=102 ophthalmologists (2) Horizon FY 2020 earnings release and endocrinologists who treat TED) 7 (3) Horizon FY 2021 earnings release (4) Horizon Q1 2022 earnings release

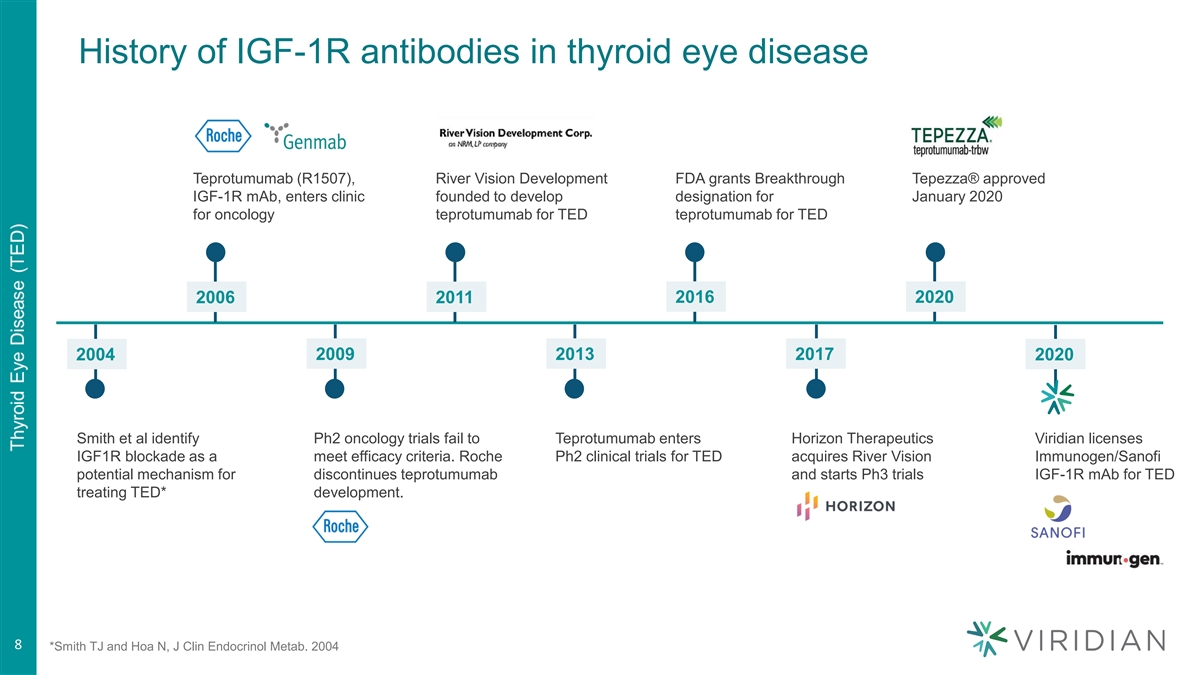

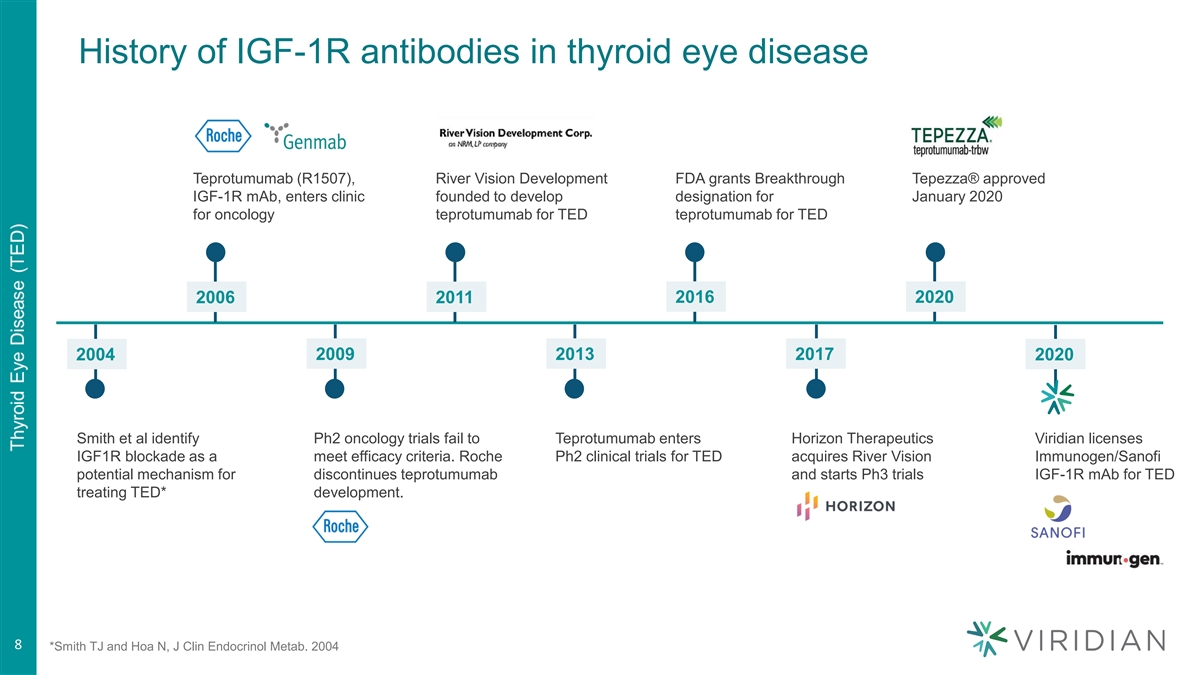

History of IGF-1R antibodies in thyroid eye disease Teprotumumab (R1507), River Vision Development FDA grants Breakthrough Tepezza® approved IGF-1R mAb, enters clinic founded to develop designation for January 2020 for oncology teprotumumab for TED teprotumumab for TED 2016 2020 2006 2011 2004 2009 2013 2017 2020 Smith et al identify Ph2 oncology trials fail to Teprotumumab enters Horizon Therapeutics Viridian licenses IGF1R blockade as a meet efficacy criteria. Roche Ph2 clinical trials for TED acquires River Vision Immunogen/Sanofi potential mechanism for discontinues teprotumumab and starts Ph3 trials IGF-1R mAb for TED treating TED* development. 8 8 *Smith TJ and Hoa N, J Clin Endocrinol Metab. 2004

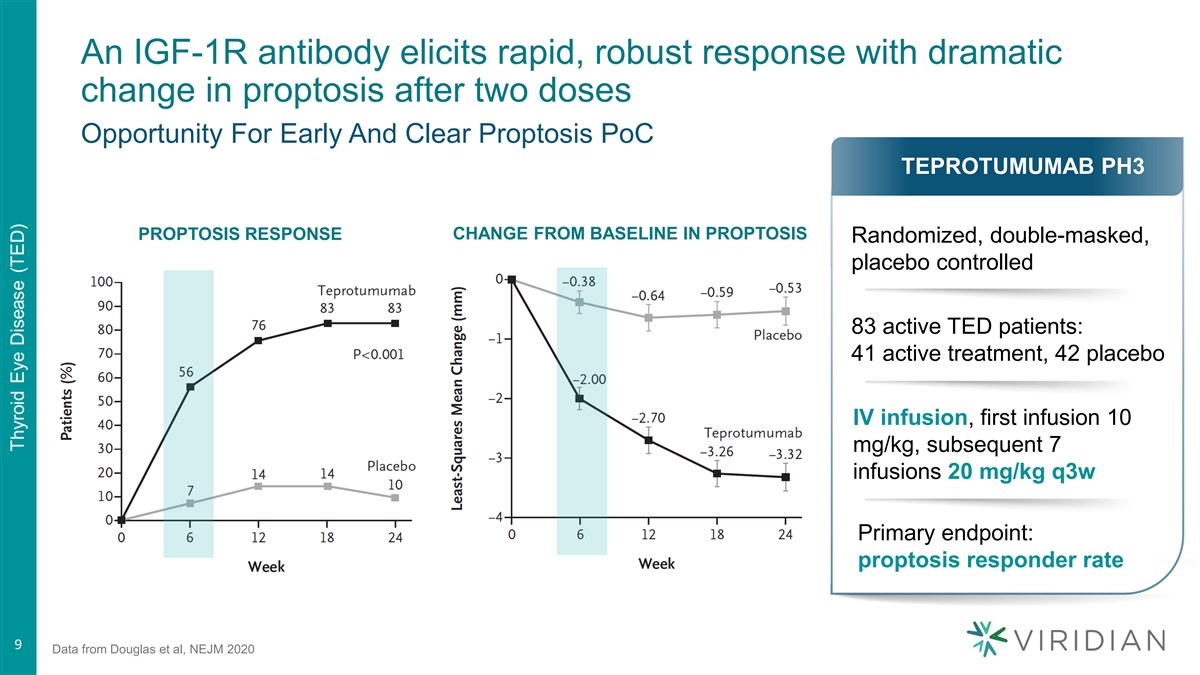

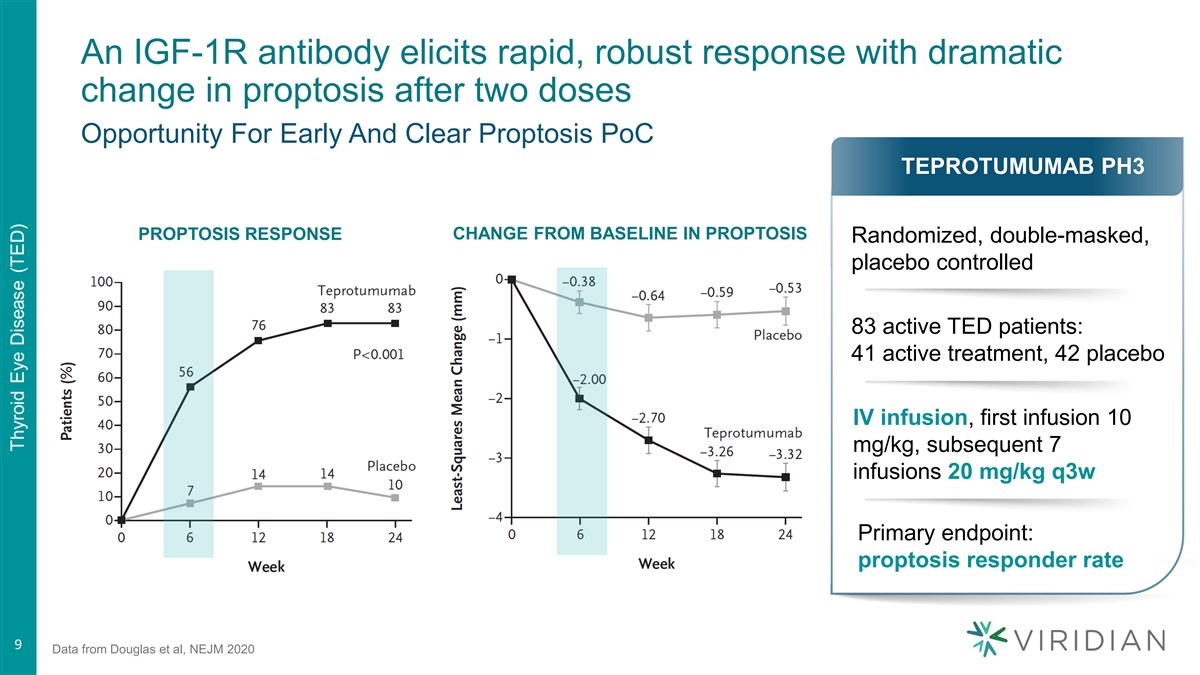

An IGF-1R antibody elicits rapid, robust response with dramatic change in proptosis after two doses Opportunity For Early And Clear Proptosis PoC TEPROTUMUMAB PH3 PROPTOSIS RESPONSE CHANGE FROM BASELINE IN PROPTOSIS Randomized, double-masked, placebo controlled 83 active TED patients: 41 active treatment, 42 placebo IV infusion, first infusion 10 mg/kg, subsequent 7 infusions 20 mg/kg q3w Primary endpoint: proptosis responder rate 9 9 Data from Douglas et al, NEJM 2020

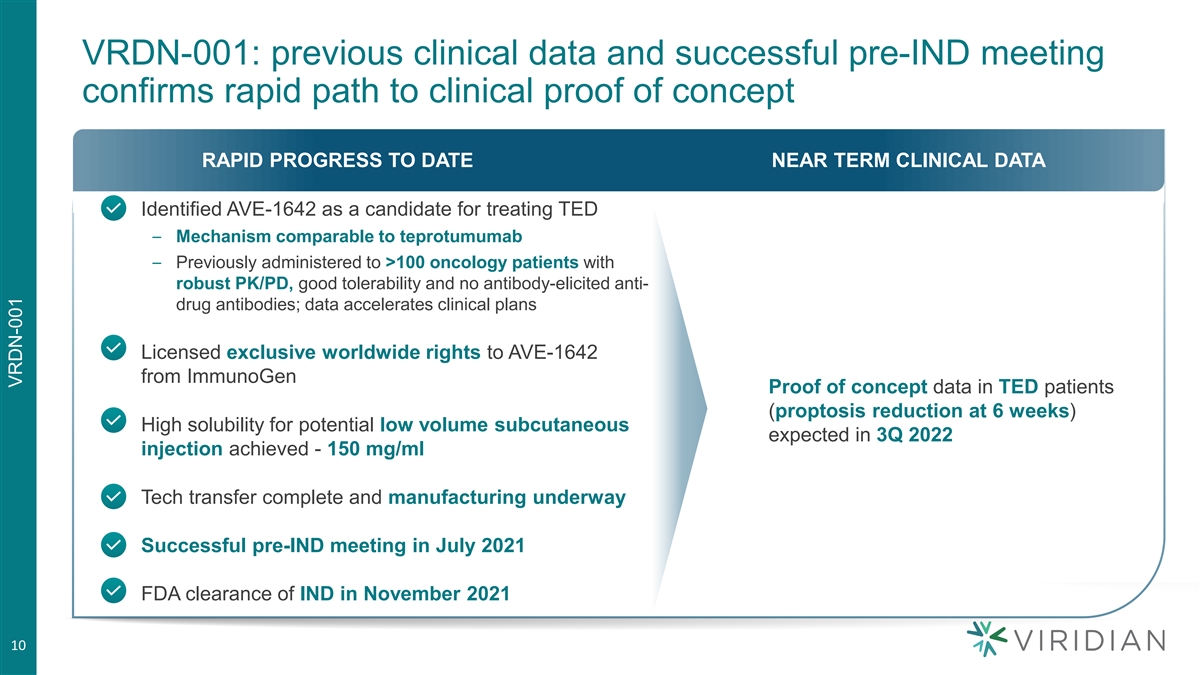

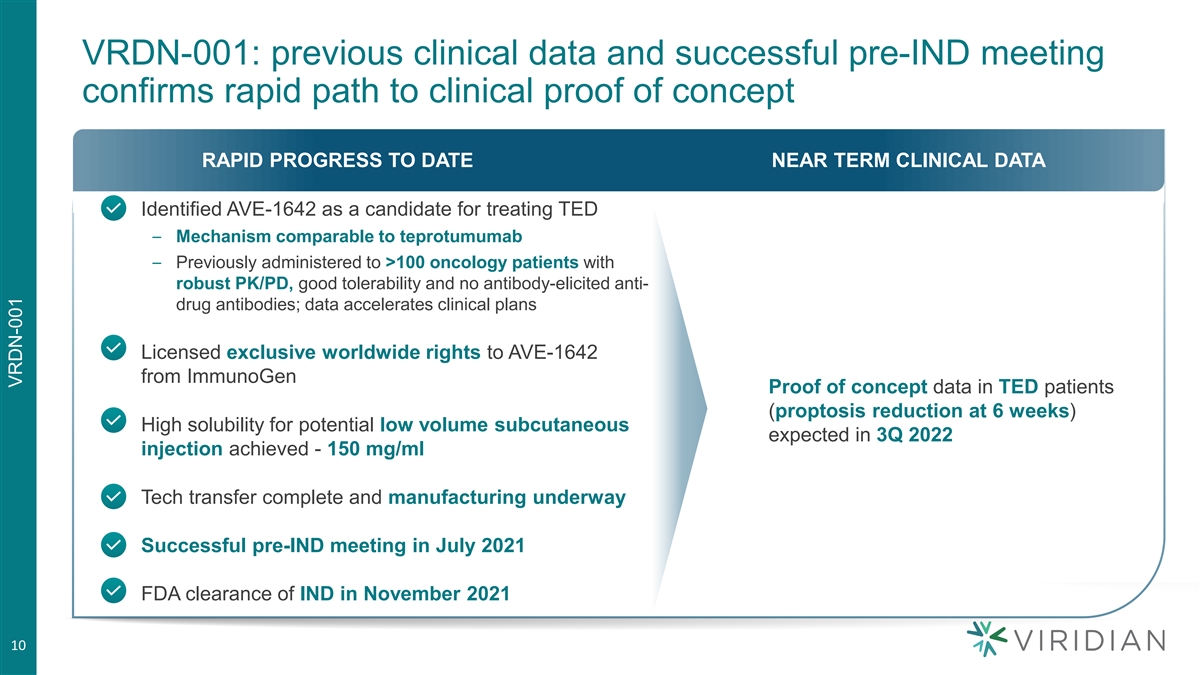

VRDN-001: previous clinical data and successful pre-IND meeting confirms rapid path to clinical proof of concept RAPID PROGRESS TO DATE NEAR TERM CLINICAL DATA • Identified AVE-1642 as a candidate for treating TED – Mechanism comparable to teprotumumab – Previously administered to >100 oncology patients with robust PK/PD, good tolerability and no antibody-elicited anti- drug antibodies; data accelerates clinical plans • Licensed exclusive worldwide rights to AVE-1642 from ImmunoGen Proof of concept data in TED patients (proptosis reduction at 6 weeks) • High solubility for potential low volume subcutaneous expected in 3Q 2022 injection achieved - 150 mg/ml • Tech transfer complete and manufacturing underway • Successful pre-IND meeting in July 2021 • FDA clearance of IND in November 2021 10 VRDN-001

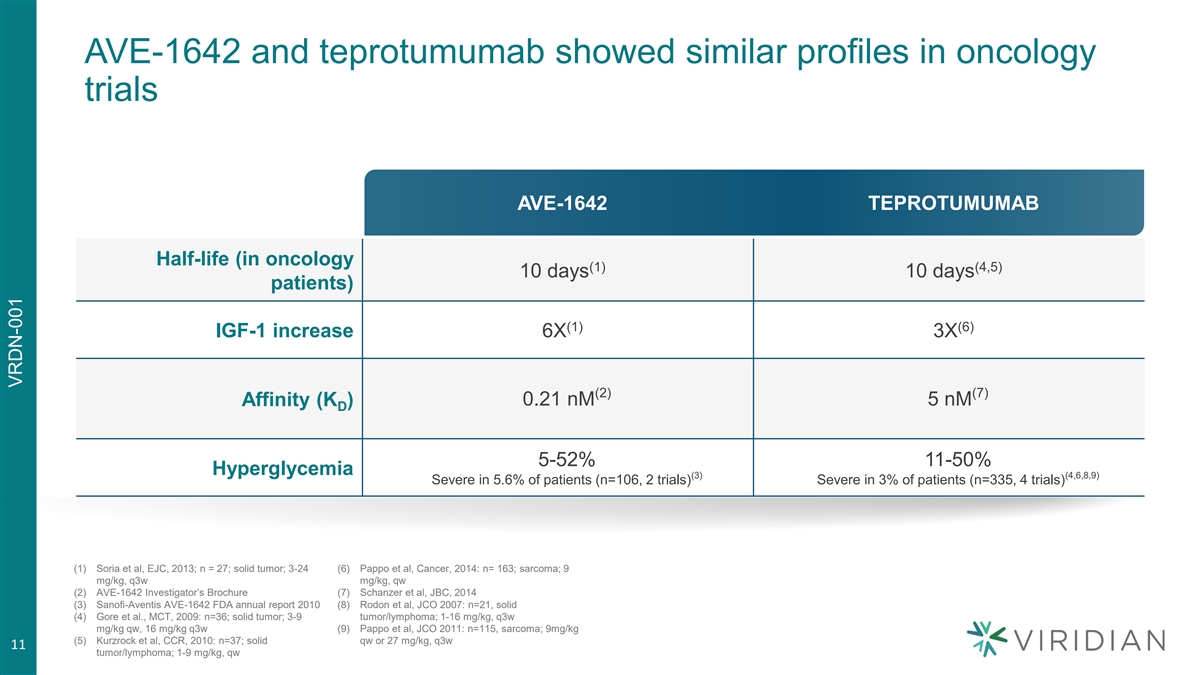

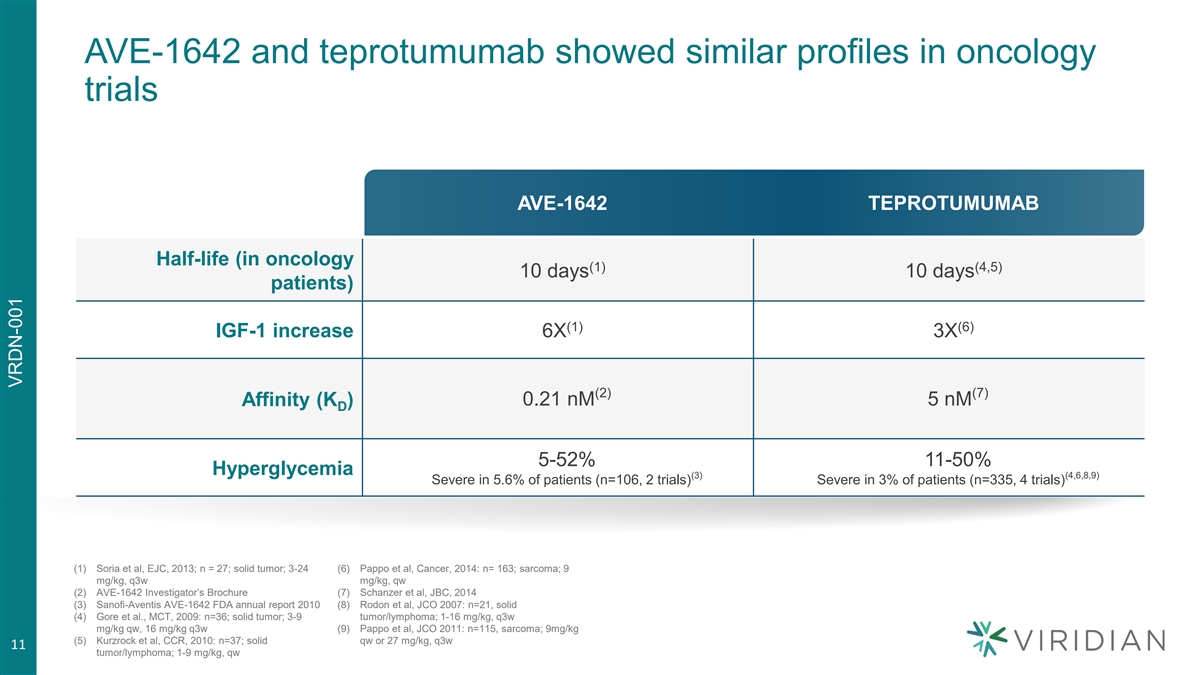

AVE-1642 and teprotumumab showed similar profiles in oncology trials AVE-1642 TEPROTUMUMAB Half-life (in oncology (1) (4,5) 10 days 10 days patients) (1) (6) IGF-1 increase 6X 3X (2) (7) Affinity (K ) 0.21 nM 5 nM D 5-52% 11-50% Hyperglycemia (3) (4,6,8,9) Severe in 5.6% of patients (n=106, 2 trials) Severe in 3% of patients (n=335, 4 trials) (1) Soria et al, EJC, 2013; n = 27; solid tumor; 3-24 (6) Pappo et al, Cancer, 2014: n= 163; sarcoma; 9 mg/kg, q3w mg/kg, qw (2) AVE-1642 Investigator’s Brochure (7) Schanzer et al, JBC, 2014 (3) Sanofi-Aventis AVE-1642 FDA annual report 2010 (8) Rodon et al, JCO 2007: n=21, solid (4) Gore et al., MCT, 2009: n=36; solid tumor; 3-9 tumor/lymphoma; 1-16 mg/kg, q3w mg/kg qw, 16 mg/kg q3w (9) Pappo et al, JCO 2011: n=115, sarcoma; 9mg/kg (5) Kurzrock et al, CCR, 2010: n=37; solid qw or 27 mg/kg, q3w 11 tumor/lymphoma; 1-9 mg/kg, qw VRDN-001

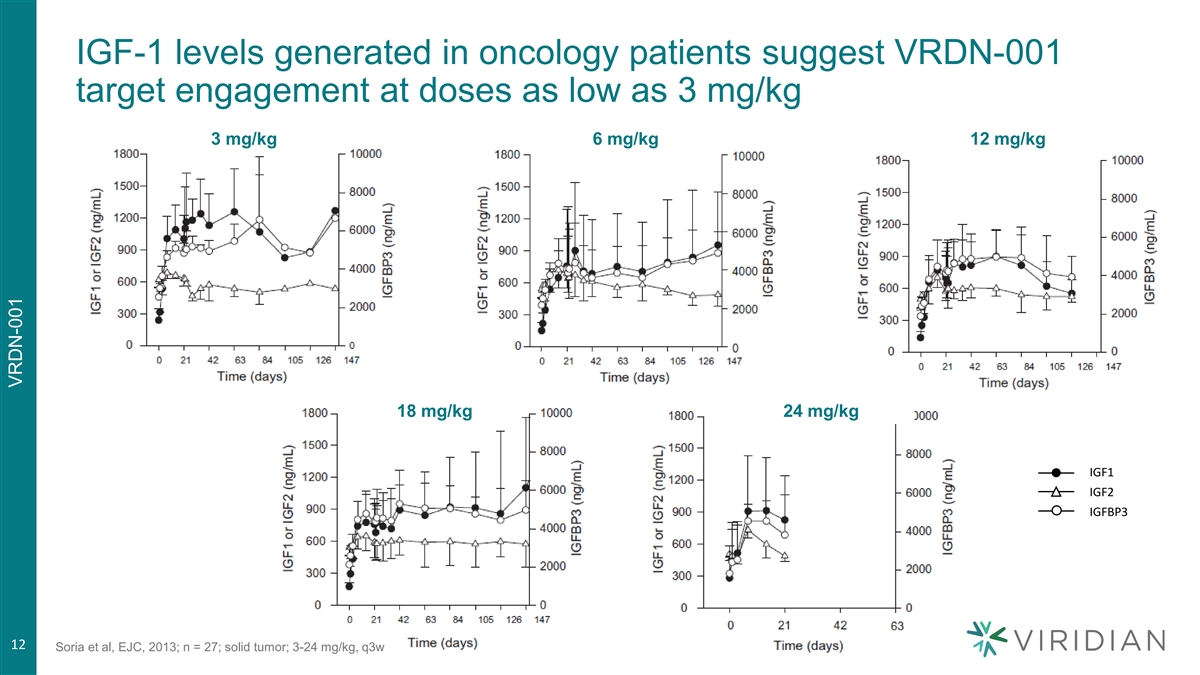

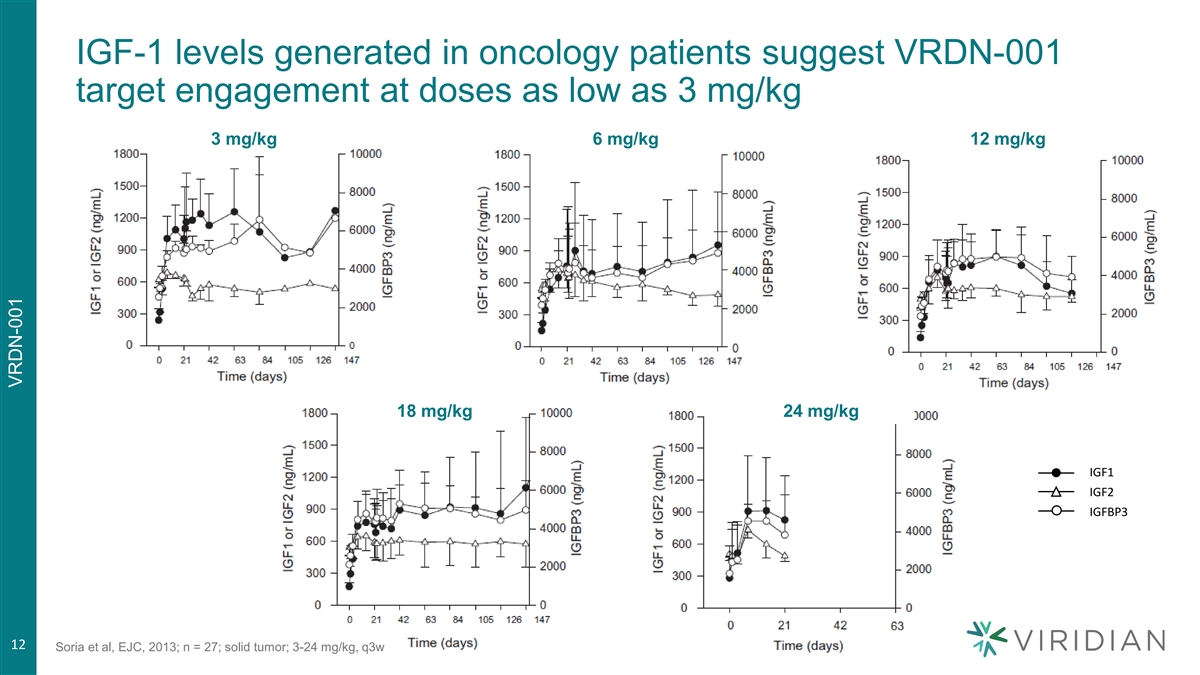

IGF-1 levels generated in oncology patients suggest VRDN-001 target engagement at doses as low as 3 mg/kg 3 mg/kg 6 mg/kg 12 mg/kg 18 mg/kg 24 mg/kg IGF1 IGF2 IGFBP3 12 Soria et al, EJC, 2013; n = 27; solid tumor; 3-24 mg/kg, q3w VRDN-001

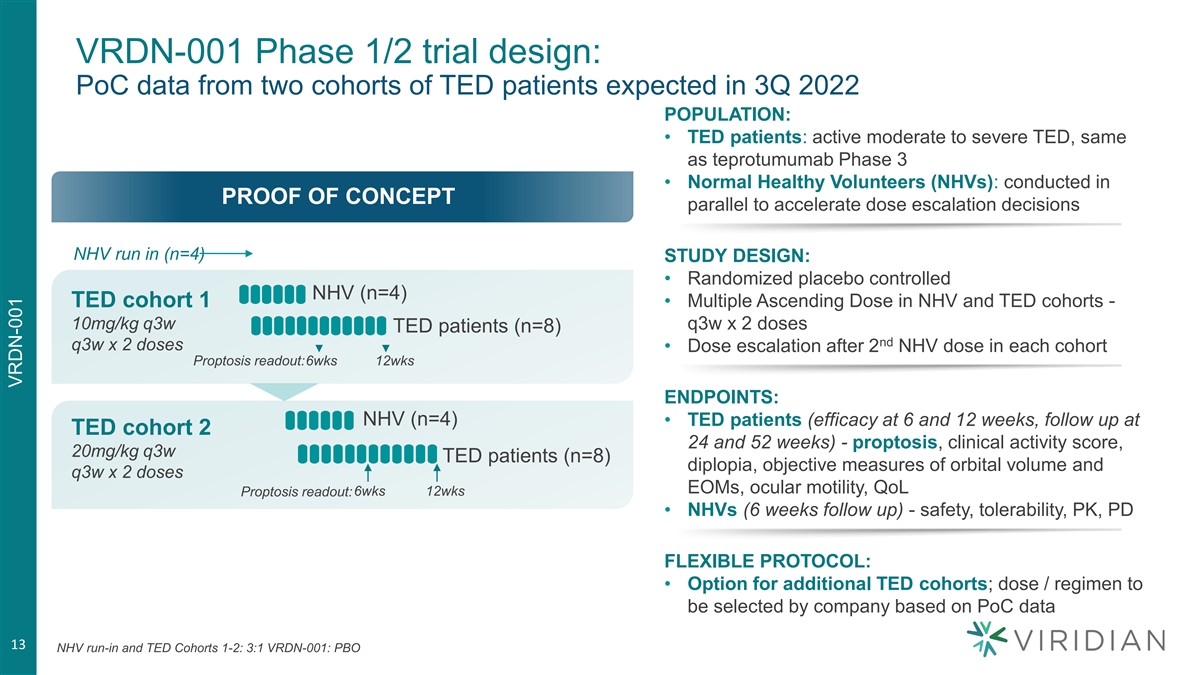

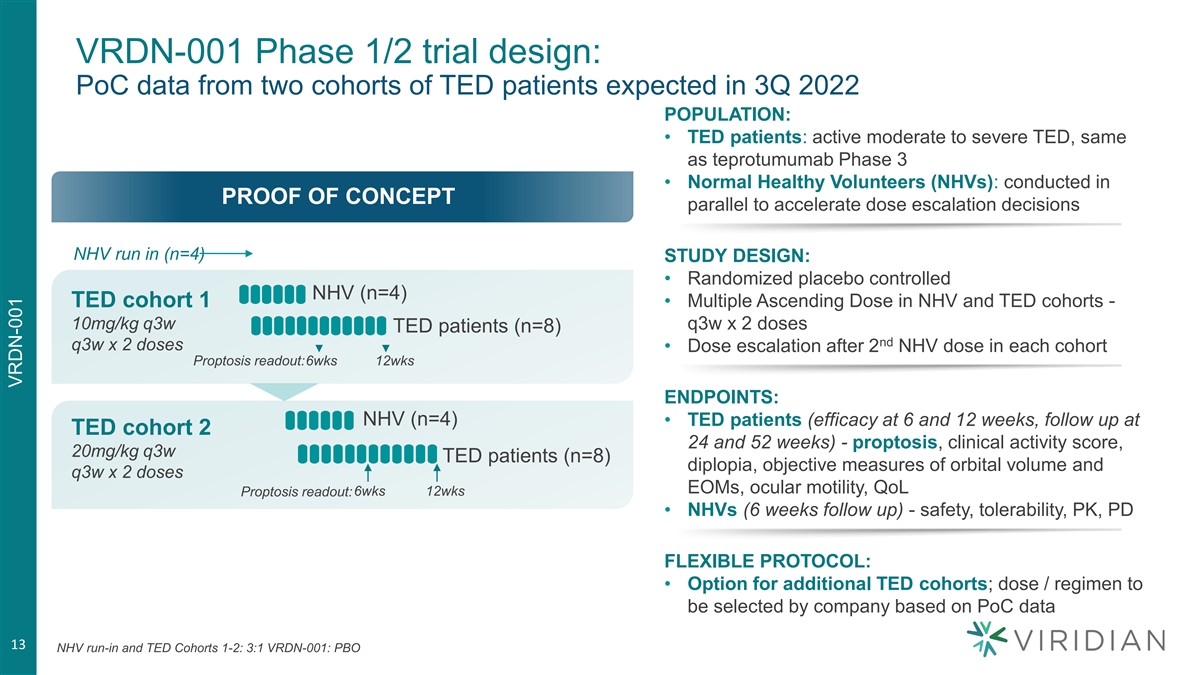

VRDN-001 Phase 1/2 trial design: PoC data from two cohorts of TED patients expected in 3Q 2022 POPULATION: • TED patients: active moderate to severe TED, same as teprotumumab Phase 3 • Normal Healthy Volunteers (NHVs): conducted in PROOF OF CONCEPT parallel to accelerate dose escalation decisions NHV run in (n=4) STUDY DESIGN: • Randomized placebo controlled NHV (n=4) TED cohort 1 • Multiple Ascending Dose in NHV and TED cohorts - 10mg/kg q3w q3w x 2 doses TED patients (n=8) nd q3w x 2 doses • Dose escalation after 2 NHV dose in each cohort Proptosis readout:6wks 12wks ENDPOINTS: NHV (n=4) • TED patients (efficacy at 6 and 12 weeks, follow up at TED cohort 2 24 and 52 weeks) - proptosis, clinical activity score, 20mg/kg q3w TED patients (n=8) diplopia, objective measures of orbital volume and q3w x 2 doses EOMs, ocular motility, QoL Proptosis readout:6wks 12wks • NHVs (6 weeks follow up) - safety, tolerability, PK, PD FLEXIBLE PROTOCOL: • Option for additional TED cohorts; dose / regimen to be selected by company based on PoC data 13 NHV run-in and TED Cohorts 1-2: 3:1 VRDN-001: PBO VRDN-001

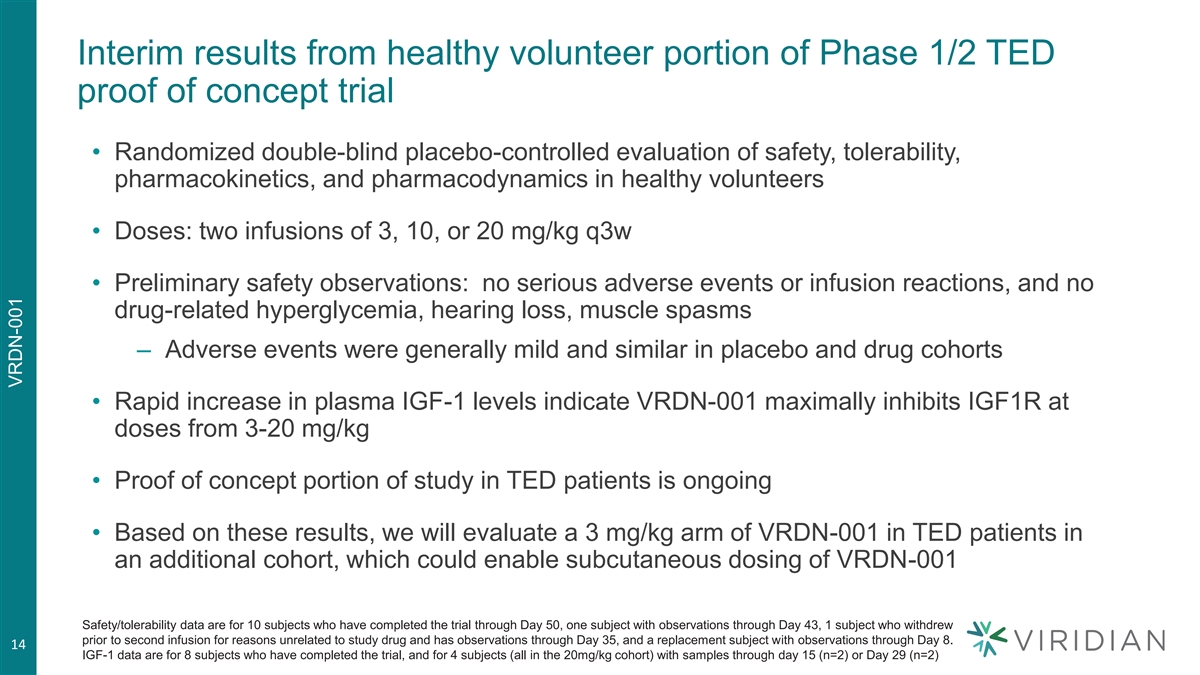

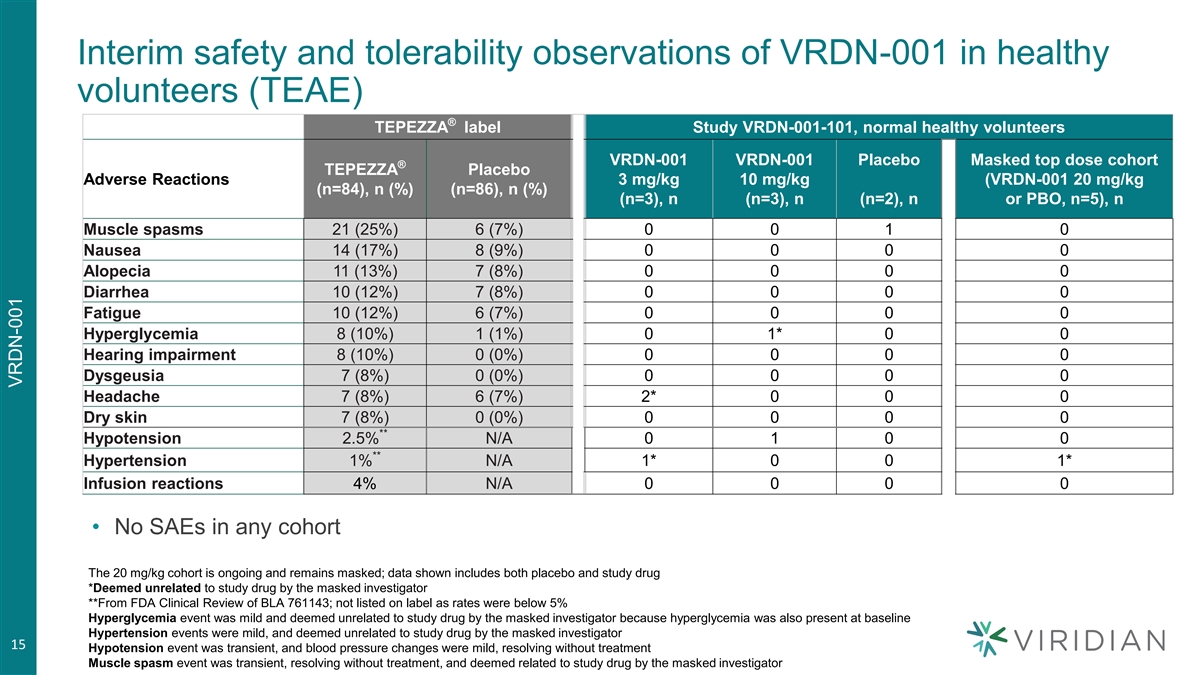

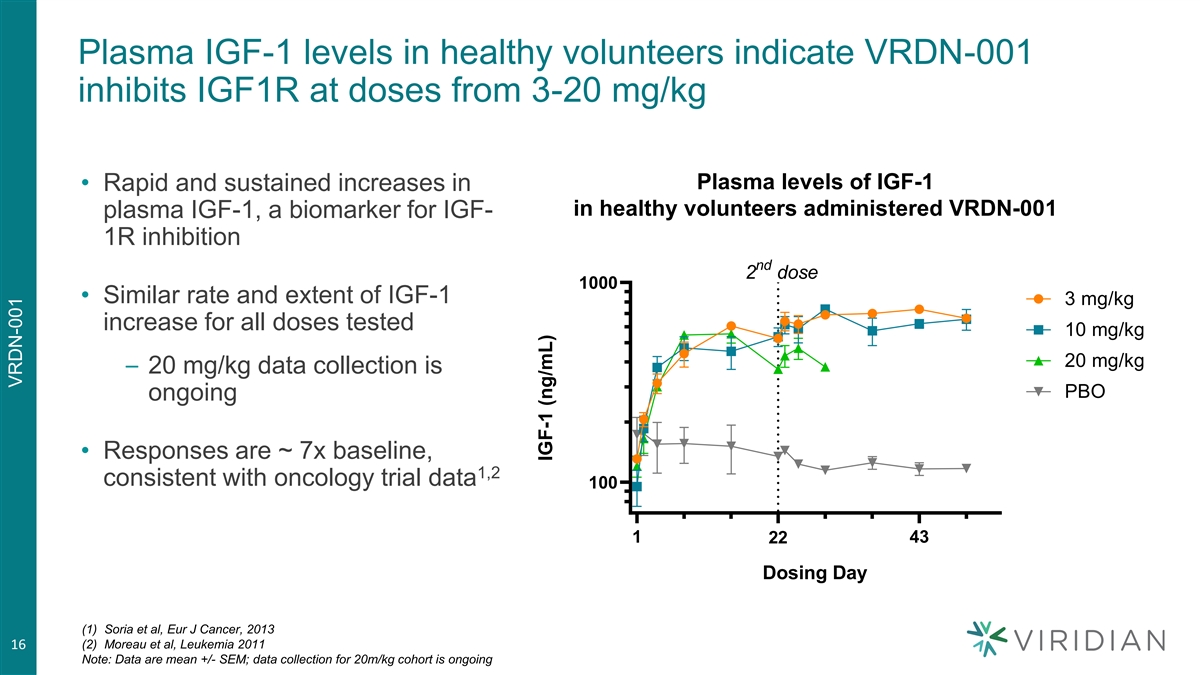

Interim results from healthy volunteer portion of Phase 1/2 TED proof of concept trial • Randomized double-blind placebo-controlled evaluation of safety, tolerability, pharmacokinetics, and pharmacodynamics in healthy volunteers • Doses: two infusions of 3, 10, or 20 mg/kg q3w • Preliminary safety observations: no serious adverse events or infusion reactions, and no drug-related hyperglycemia, hearing loss, muscle spasms ‒ Adverse events were generally mild and similar in placebo and drug cohorts • Rapid increase in plasma IGF-1 levels indicate VRDN-001 maximally inhibits IGF1R at doses from 3-20 mg/kg • Proof of concept portion of study in TED patients is ongoing • Based on these results, we will evaluate a 3 mg/kg arm of VRDN-001 in TED patients in an additional cohort, which could enable subcutaneous dosing of VRDN-001 Safety/tolerability data are for 10 subjects who have completed the trial through Day 50, one subject with observations through Day 43, 1 subject who withdrew prior to second infusion for reasons unrelated to study drug and has observations through Day 35, and a replacement subject with observations through Day 8. 14 IGF-1 data are for 8 subjects who have completed the trial, and for 4 subjects (all in the 20mg/kg cohort) with samples through day 15 (n=2) or Day 29 (n=2) VRDN-001

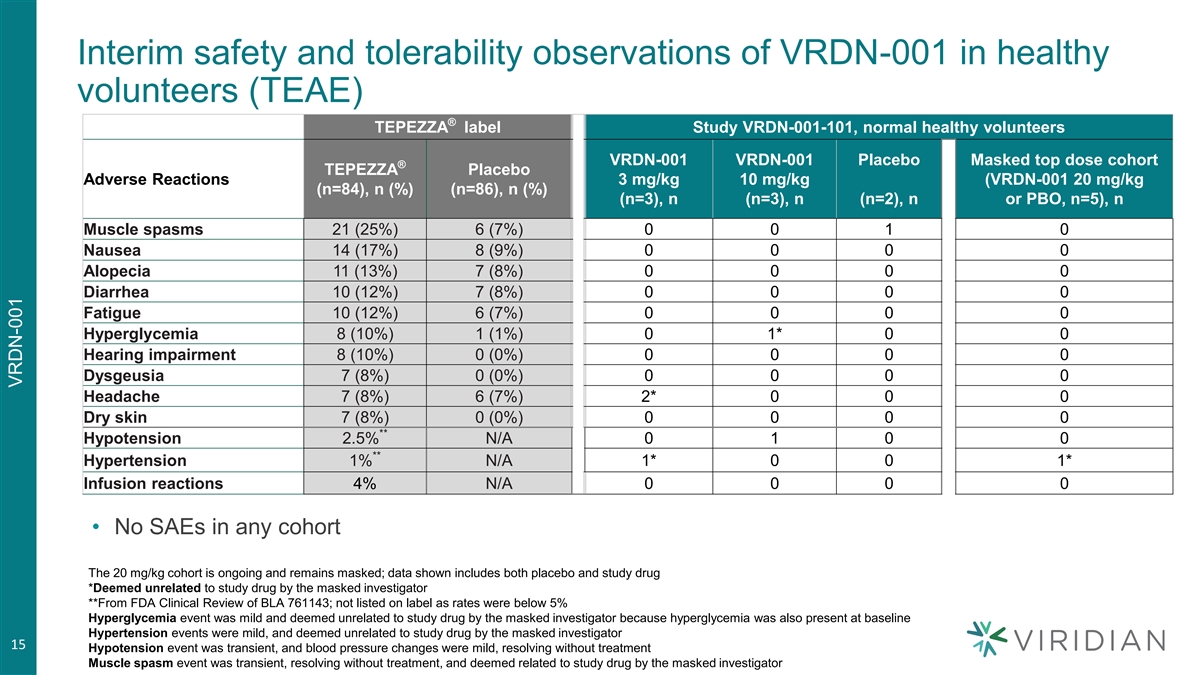

Interim safety and tolerability observations of VRDN-001 in healthy volunteers (TEAE) ® TEPEZZA label Study VRDN-001-101, normal healthy volunteers VRDN-001 VRDN-001 Placebo Masked top dose cohort ® TEPEZZA Placebo Adverse Reactions 3 mg/kg 10 mg/kg (VRDN-001 20 mg/kg (n=84), n (%) (n=86), n (%) (n=3), n (n=3), n (n=2), n or PBO, n=5), n Muscle spasms 21 (25%) 6 (7%) 0 0 1 0 Nausea 14 (17%) 8 (9%) 0 0 0 0 Alopecia 11 (13%) 7 (8%) 0 0 0 0 Diarrhea 10 (12%) 7 (8%) 0 0 0 0 Fatigue 10 (12%) 6 (7%) 0 0 0 0 Hyperglycemia 8 (10%) 1 (1%) 0 1* 0 0 Hearing impairment 8 (10%) 0 (0%) 0 0 0 0 Dysgeusia 7 (8%) 0 (0%) 0 0 0 0 Headache 7 (8%) 6 (7%) 2* 0 0 0 Dry skin 7 (8%) 0 (0%) 0 0 0 0 ** Hypotension 2.5% N/A 0 1 0 0 ** Hypertension 1% N/A 1* 0 0 1* Infusion reactions 4% N/A 0 0 0 0 • No SAEs in any cohort The 20 mg/kg cohort is ongoing and remains masked; data shown includes both placebo and study drug *Deemed unrelated to study drug by the masked investigator **From FDA Clinical Review of BLA 761143; not listed on label as rates were below 5% Hyperglycemia event was mild and deemed unrelated to study drug by the masked investigator because hyperglycemia was also present at baseline Hypertension events were mild, and deemed unrelated to study drug by the masked investigator 15 Hypotension event was transient, and blood pressure changes were mild, resolving without treatment Muscle spasm event was transient, resolving without treatment, and deemed related to study drug by the masked investigator VRDN-001

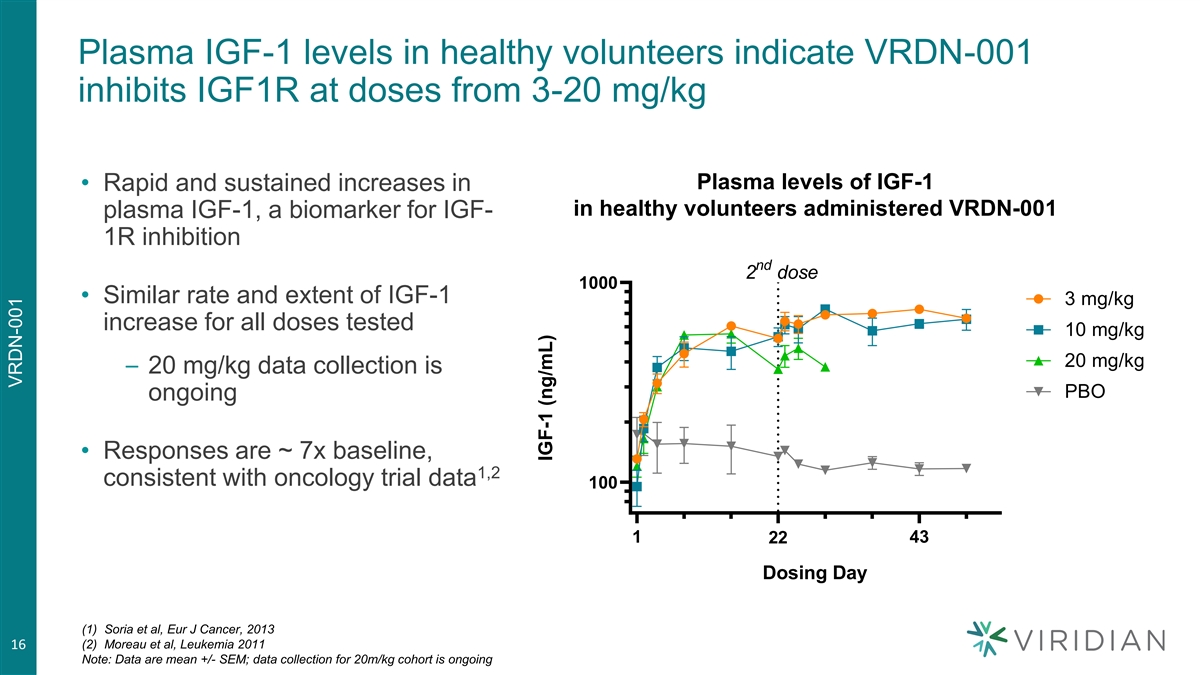

Plasma IGF-1 levels in healthy volunteers indicate VRDN-001 inhibits IGF1R at doses from 3-20 mg/kg Plasma levels of IGF-1 • Rapid and sustained increases in in healthy volunteers administered VRDN-001 plasma IGF-1, a biomarker for IGF- 1R inhibition nd 2 dose 1000 • Similar rate and extent of IGF-1 3 mg/kg increase for all doses tested 10 mg/kg 20 mg/kg – 20 mg/kg data collection is PBO ongoing • Responses are ~ 7x baseline, 1,2 consistent with oncology trial data 100 1 43 22 Dosing Day (1) Soria et al, Eur J Cancer, 2013 16 (2) Moreau et al, Leukemia 2011 Note: Data are mean +/- SEM; data collection for 20m/kg cohort is ongoing VRDN-001 IGF-1 (ng/mL)

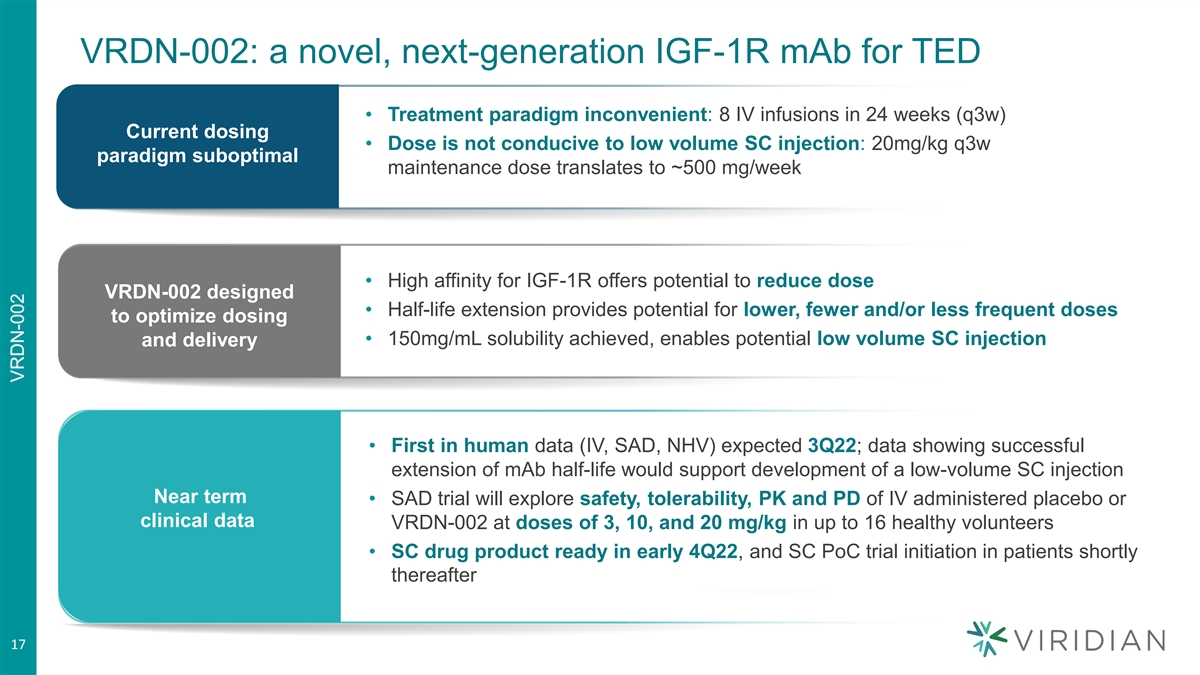

VRDN-002: a novel, next-generation IGF-1R mAb for TED • Treatment paradigm inconvenient: 8 IV infusions in 24 weeks (q3w) Current dosing • Dose is not conducive to low volume SC injection: 20mg/kg q3w paradigm suboptimal maintenance dose translates to ~500 mg/week • High affinity for IGF-1R offers potential to reduce dose VRDN-002 designed • Half-life extension provides potential for lower, fewer and/or less frequent doses to optimize dosing • 150mg/mL solubility achieved, enables potential low volume SC injection and delivery • First in human data (IV, SAD, NHV) expected 3Q22; data showing successful extension of mAb half-life would support development of a low-volume SC injection Near term • SAD trial will explore safety, tolerability, PK and PD of IV administered placebo or clinical data VRDN-002 at doses of 3, 10, and 20 mg/kg in up to 16 healthy volunteers • SC drug product ready in early 4Q22, and SC PoC trial initiation in patients shortly thereafter 17

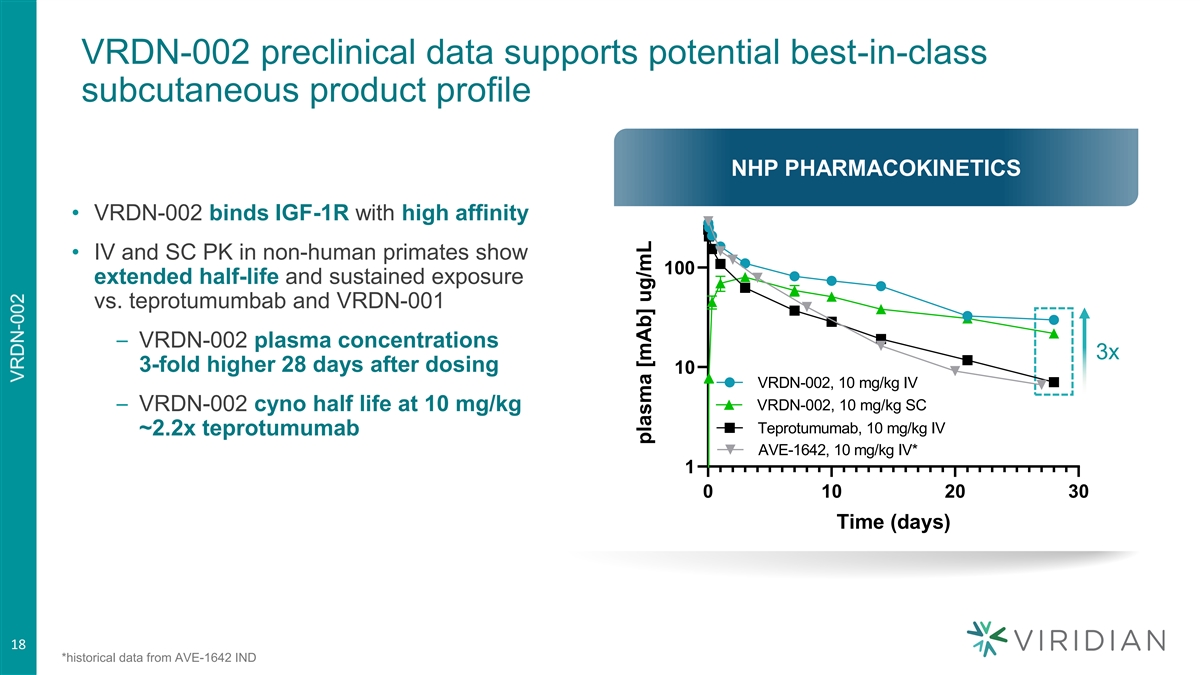

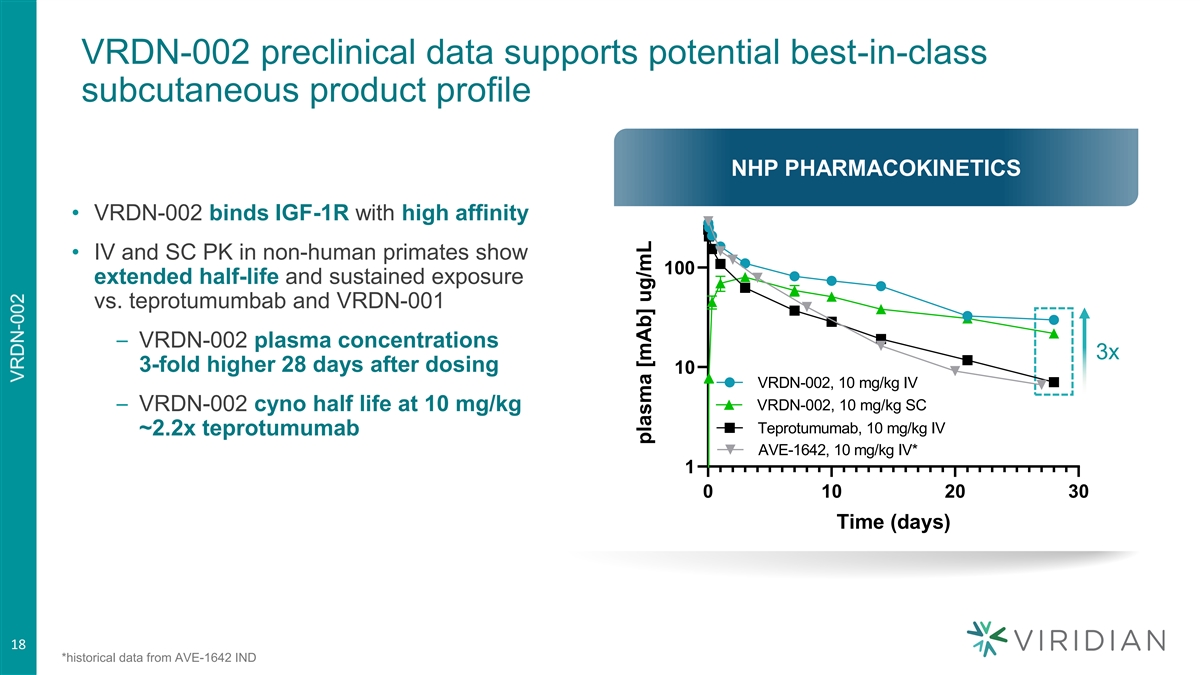

VRDN-002 preclinical data supports potential best-in-class subcutaneous product profile NHP PHARMACOKINETICS NHP PK • VRDN-002 binds IGF-1R with high affinity • IV and SC PK in non-human primates show 100 extended half-life and sustained exposure vs. teprotumumbab and VRDN-001 – VRDN-002 plasma concentrations 3x 3-fold higher 28 days after dosing 10 VRDN-002, 10 mg/kg IV VRDN-002, 10 mg/kg SC – VRDN-002 cyno half life at 10 mg/kg Teprotumumab, 10 mg/kg IV ~2.2x teprotumumab AVE-1642, 10 mg/kg IV* 1 0 10 20 30 Time (days) 18 *historical data from AVE-1642 IND plasma [mAb] ug/mL

Leadership Management team Jonathan Violin, Ph.D. President & CEO Vahe Bedian, Ph.D. Chief Scientist Kristian Humer Chief Financial & Business Officer Barrett Katz, M.D. Chief Medical Officer Deepa Rajagopalan, M.D. SVP, New Product and Portfolio Development Janielle Newland SVP, Human Resources Lara Meisner, J.D. SVP, General Counsel Angela She, Ph.D. VP, R&D Operations and Chief of Staff 19 Viridian Leadership

Leadership Board of Directors Tomas Kiselak Chairman of the Board Managing Member, Fairmount Funds Management, LLC Peter Harwin Director Managing Member, Fairmount Funds Management, LLC Arlene Morris Director Chief Executive Officer, Willow Advisors, LLC Jennifer Moses, CPA Director, Audit Committee Chair Chief Financial Officer, G1 Therapeutics Jonathan Violin, Ph.D. Director Chief Executive Officer, Viridian Therapeutics, Inc. 20 Viridian Leadership

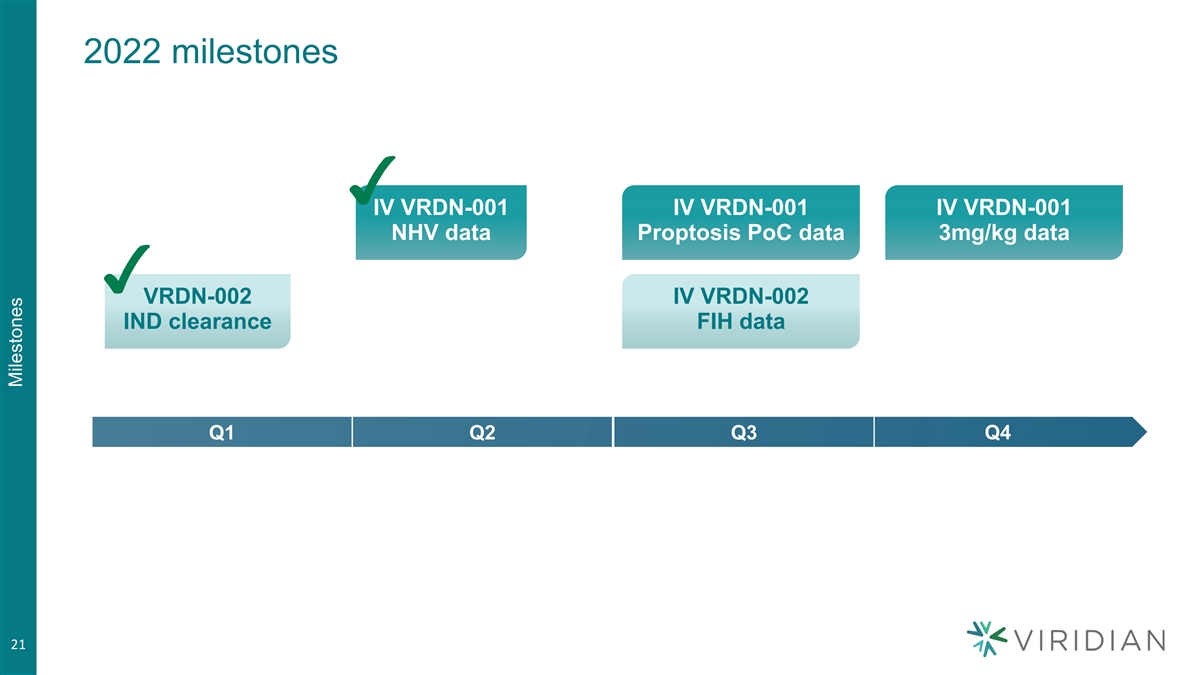

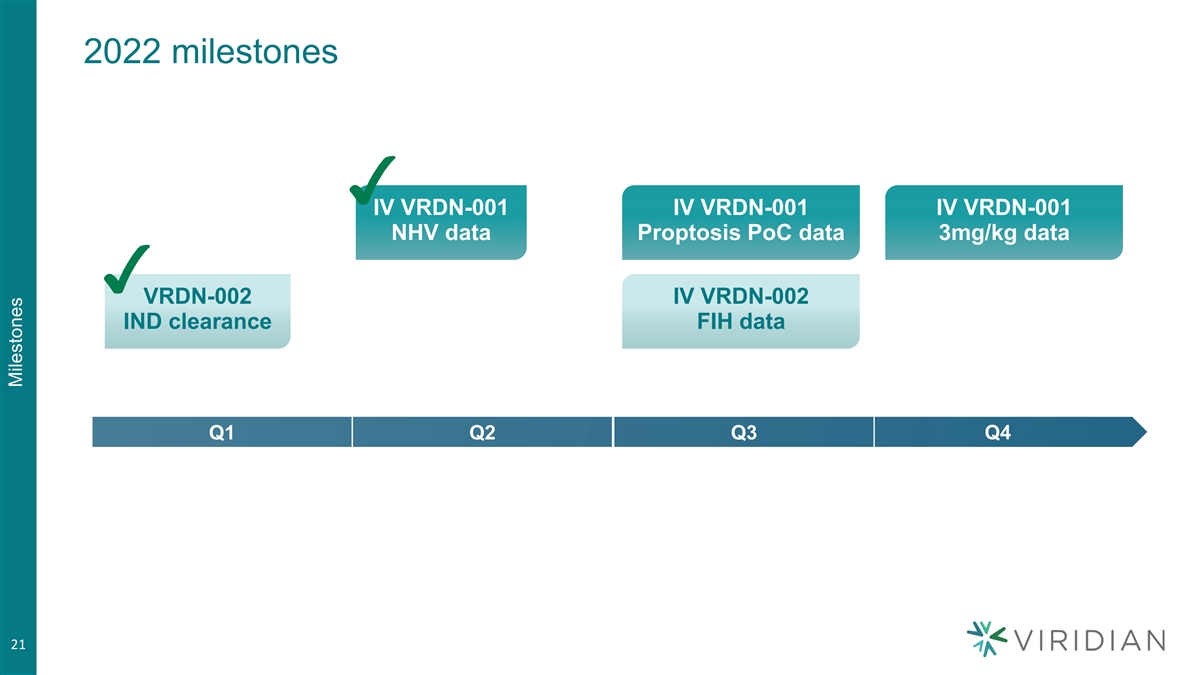

2022 milestones IV VRDN-001 IV VRDN-001 IV VRDN-001 NHV data Proptosis PoC data 3mg/kg data VRDN-002 IV VRDN-002 IND clearance FIH data Q1 Q2 Q3 Q4 21 Milestones

Investment highlights Viridian is engineering and developing best-in-class therapeutic antibodies for patients suffering from serious diseases that are underserved by current therapies Lead programs are novel and differentiated IGF-1R monoclonal antibodies being developed for Thyroid Eye Disease (“TED”), a >$3.5B estimated market opportunity • VRDN-001: Promising normal healthy volunteer (NHV) data, key proof of concept clinical data in TED in 3Q22, with potential to show meaningful improvements in proptosis, the key characteristic of TED • VRDN-002: Clinical data (IV, SAD, NHV) in 3Q22 that could de-risk clinical development of low volume subcutaneous injection Evaluating multiple opportunities to expand our pipeline by identifying and developing novel and differentiated monoclonal antibodies targeting robust and de-risked mechanisms of action Experienced management team and board backed by leading life science investors (1) Cash, cash equivalents and short-term investments $175M with cash runway into 2024, excluding $75M credit facility (2) 43M total common shares outstanding on an as converted basis – implied market (3) capitalization of $431M (1) As of March 31, 2022 (2) As of May 11, 2022, Viridian had approximately 42,908,763 shares of common stock outstanding on an as-converted basis, which included 27,927,423 shares of common stock and approximately 14,981,340 shares of common stock issuable upon the conversion of 201,583 and 23,126 22 shares of Series A and Series B preferred stock respectively (3) As of May 11, 2022 based on a stock price of $10.05 Investment Highlights

Viridian Therapeutics Contact us: viridiantherapeutics.com IR@viridiantherapeutics.com