- CZR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Caesars Entertainment (CZR) 425Business combination disclosure

Filed: 24 Jun 19, 6:15am

Transformational Strategic Combination June 24, 2019 Exhibit 99.2

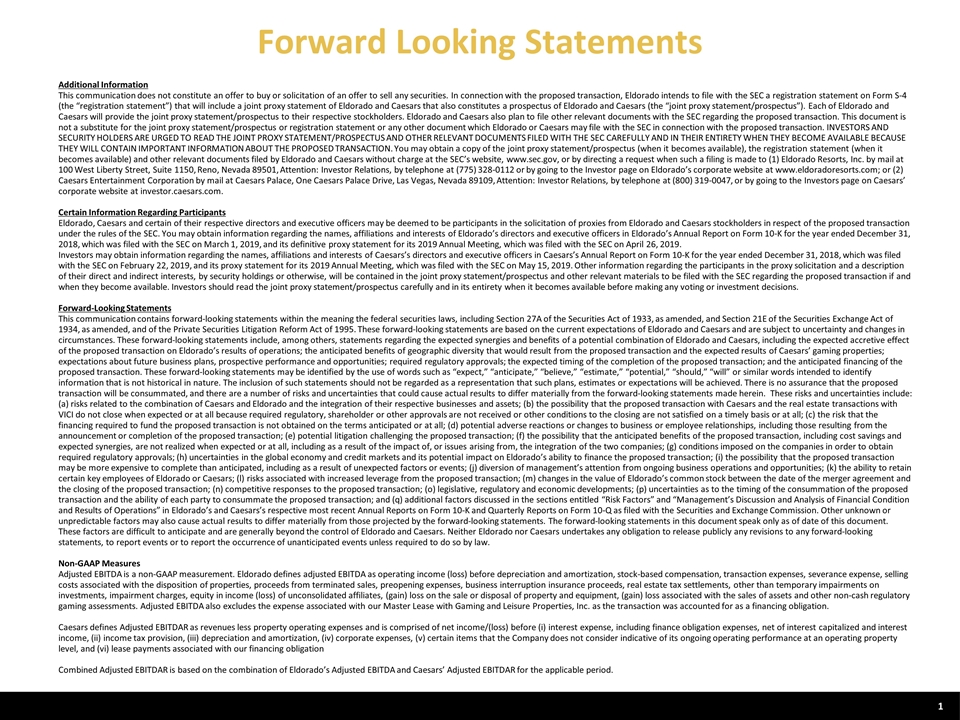

Additional Information This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. In connection with the proposed transaction, Eldorado intends to file with the SEC a registration statement on Form S-4 (the “registration statement”) that will include a joint proxy statement of Eldorado and Caesars that also constitutes a prospectus of Eldorado and Caesars (the “joint proxy statement/prospectus”). Each of Eldorado and Caesars will provide the joint proxy statement/prospectus to their respective stockholders. Eldorado and Caesars also plan to file other relevant documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or registration statement or any other document which Eldorado or Caesars may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. You may obtain a copy of the joint proxy statement/prospectus (when it becomes available), the registration statement (when it becomes available) and other relevant documents filed by Eldorado and Caesars without charge at the SEC’s website, www.sec.gov, or by directing a request when such a filing is made to (1) Eldorado Resorts, Inc. by mail at 100 West Liberty Street, Suite 1150, Reno, Nevada 89501, Attention: Investor Relations, by telephone at (775) 328-0112 or by going to the Investor page on Eldorado’s corporate website at www.eldoradoresorts.com; or (2) Caesars Entertainment Corporation by mail at Caesars Palace, One Caesars Palace Drive, Las Vegas, Nevada 89109, Attention: Investor Relations, by telephone at (800) 319-0047, or by going to the Investors page on Caesars’ corporate website at investor.caesars.com. Certain Information Regarding Participants Eldorado, Caesars and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Eldorado and Caesars stockholders in respect of the proposed transaction under the rules of the SEC. You may obtain information regarding the names, affiliations and interests of Eldorado’s directors and executive officers in Eldorado’s Annual Report on Form 10-K for the year ended December 31, 2018, which was filed with the SEC on March 1, 2019, and its definitive proxy statement for its 2019 Annual Meeting, which was filed with the SEC on April 26, 2019. Investors may obtain information regarding the names, affiliations and interests of Caesars’s directors and executive officers in Caesars’s Annual Report on Form 10-K for the year ended December 31, 2018, which was filed with the SEC on February 22, 2019, and its proxy statement for its 2019 Annual Meeting, which was filed with the SEC on May 15, 2019. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction if and when they become available. Investors should read the joint proxy statement/prospectus carefully and in its entirety when it becomes available before making any voting or investment decisions. Forward-Looking Statements This communication contains forward-looking statements within the meaning the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on the current expectations of Eldorado and Caesars and are subject to uncertainty and changes in circumstances. These forward-looking statements include, among others, statements regarding the expected synergies and benefits of a potential combination of Eldorado and Caesars, including the expected accretive effect of the proposed transaction on Eldorado’s results of operations; the anticipated benefits of geographic diversity that would result from the proposed transaction and the expected results of Caesars’ gaming properties; expectations about future business plans, prospective performance and opportunities; required regulatory approvals; the expected timing of the completion of the proposed transaction; and the anticipated financing of the proposed transaction. These forward-looking statements may be identified by the use of words such as “expect,” “anticipate,” “believe,” “estimate,” “potential,” “should,” “will” or similar words intended to identify information that is not historical in nature. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. There is no assurance that the proposed transaction will be consummated, and there are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made herein. These risks and uncertainties include: (a) risks related to the combination of Caesars and Eldorado and the integration of their respective businesses and assets; (b) the possibility that the proposed transaction with Caesars and the real estate transactions with VICI do not close when expected or at all because required regulatory, shareholder or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all; (c) the risk that the financing required to fund the proposed transaction is not obtained on the terms anticipated or at all; (d) potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction; (e) potential litigation challenging the proposed transaction; (f) the possibility that the anticipated benefits of the proposed transaction, including cost savings and expected synergies, are not realized when expected or at all, including as a result of the impact of, or issues arising from, the integration of the two companies; (g) conditions imposed on the companies in order to obtain required regulatory approvals; (h) uncertainties in the global economy and credit markets and its potential impact on Eldorado’s ability to finance the proposed transaction; (i) the possibility that the proposed transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; (j) diversion of management’s attention from ongoing business operations and opportunities; (k) the ability to retain certain key employees of Eldorado or Caesars; (l) risks associated with increased leverage from the proposed transaction; (m) changes in the value of Eldorado’s common stock between the date of the merger agreement and the closing of the proposed transaction; (n) competitive responses to the proposed transaction; (o) legislative, regulatory and economic developments; (p) uncertainties as to the timing of the consummation of the proposed transaction and the ability of each party to consummate the proposed transaction; and (q) additional factors discussed in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Eldorado’s and Caesars’s respective most recent Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q as filed with the Securities and Exchange Commission. Other unknown or unpredictable factors may also cause actual results to differ materially from those projected by the forward-looking statements. The forward-looking statements in this document speak only as of date of this document. These factors are difficult to anticipate and are generally beyond the control of Eldorado and Caesars. Neither Eldorado nor Caesars undertakes any obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events unless required to do so by law. Non-GAAP Measures Adjusted EBITDA is a non-GAAP measurement. Eldorado defines adjusted EBITDA as operating income (loss) before depreciation and amortization, stock-based compensation, transaction expenses, severance expense, selling costs associated with the disposition of properties, proceeds from terminated sales, preopening expenses, business interruption insurance proceeds, real estate tax settlements, other than temporary impairments on investments, impairment charges, equity in income (loss) of unconsolidated affiliates, (gain) loss on the sale or disposal of property and equipment, (gain) loss associated with the sales of assets and other non-cash regulatory gaming assessments. Adjusted EBITDA also excludes the expense associated with our Master Lease with Gaming and Leisure Properties, Inc. as the transaction was accounted for as a financing obligation. Caesars defines Adjusted EBITDAR as revenues less property operating expenses and is comprised of net income/(loss) before (i) interest expense, including finance obligation expenses, net of interest capitalized and interest income, (ii) income tax provision, (iii) depreciation and amortization, (iv) corporate expenses, (v) certain items that the Company does not consider indicative of its ongoing operating performance at an operating property level, and (vi) lease payments associated with our financing obligation Combined Adjusted EBITDAR is based on the combination of Eldorado’s Adjusted EBITDA and Caesars’ Adjusted EBITDAR for the applicable period. Forward Looking Statements

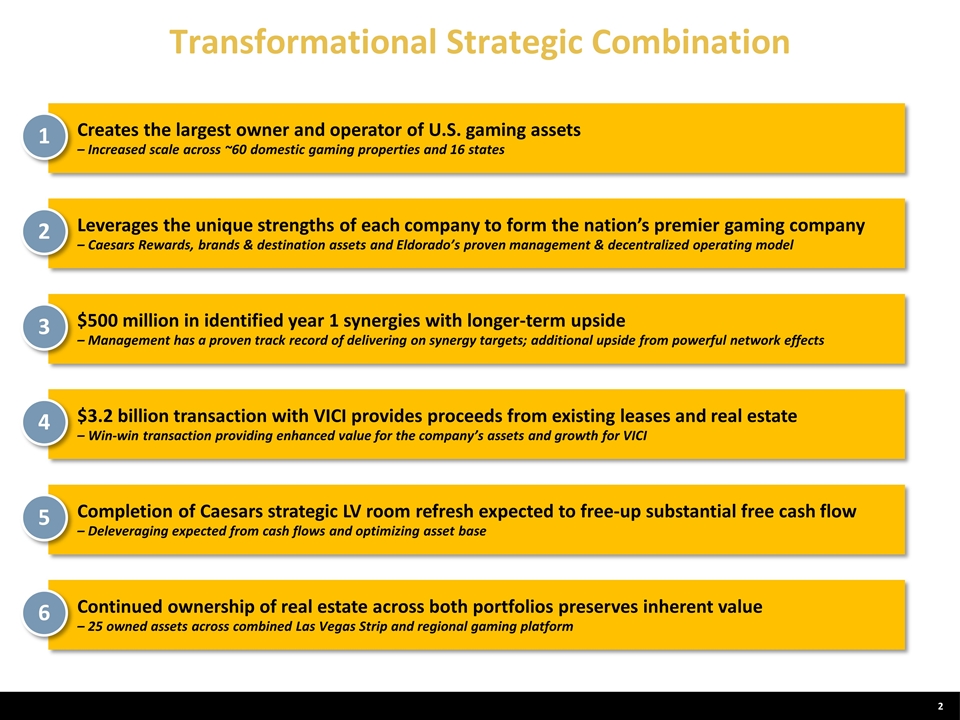

Transformational Strategic Combination Creates the largest owner and operator of U.S. gaming assets – Increased scale across ~60 domestic gaming properties and 16 states 1 Leverages the unique strengths of each company to form the nation’s premier gaming company – Caesars Rewards, brands & destination assets and Eldorado’s proven management & decentralized operating model 2 $500 million in identified year 1 synergies with longer-term upside – Management has a proven track record of delivering on synergy targets; additional upside from powerful network effects 3 $3.2 billion transaction with VICI provides proceeds from existing leases and real estate – Win-win transaction providing enhanced value for the company’s assets and growth for VICI 4 Completion of Caesars strategic LV room refresh expected to free-up substantial free cash flow – Deleveraging expected from cash flows and optimizing asset base 5 Continued ownership of real estate across both portfolios preserves inherent value – 25 owned assets across combined Las Vegas Strip and regional gaming platform 6

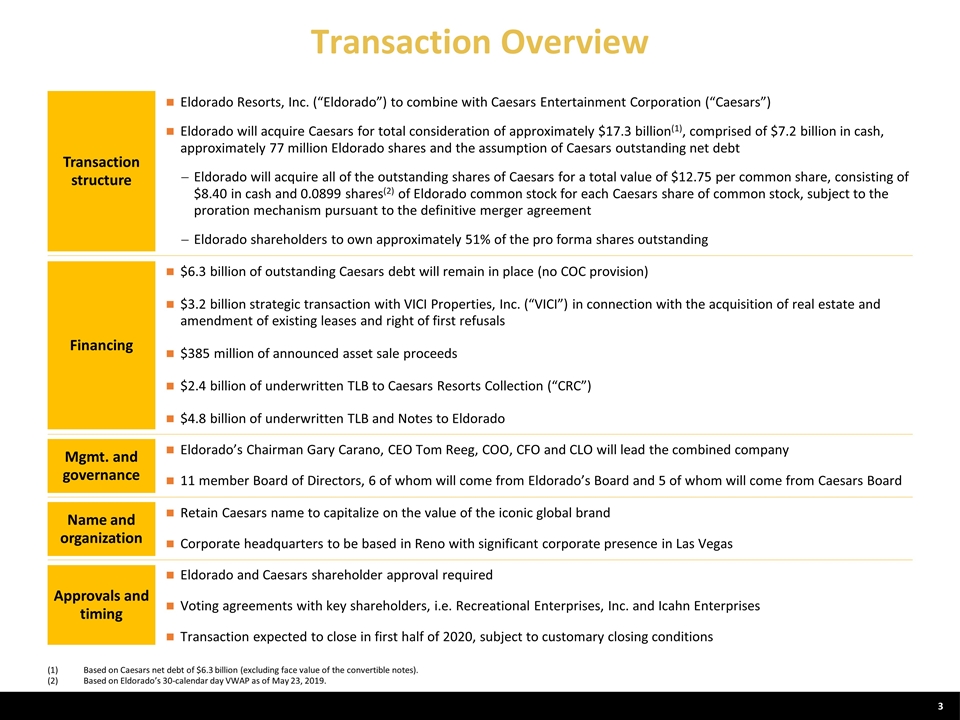

Transaction Overview Transaction structure Eldorado Resorts, Inc. (“Eldorado”) to combine with Caesars Entertainment Corporation (“Caesars”) Eldorado will acquire Caesars for total consideration of approximately $17.3 billion(1), comprised of $7.2 billion in cash, approximately 77 million Eldorado shares and the assumption of Caesars outstanding net debt Eldorado will acquire all of the outstanding shares of Caesars for a total value of $12.75 per common share, consisting of $8.40 in cash and 0.0899 shares(2) of Eldorado common stock for each Caesars share of common stock, subject to the proration mechanism pursuant to the definitive merger agreement Eldorado shareholders to own approximately 51% of the pro forma shares outstanding Approvals and timing Financing $6.3 billion of outstanding Caesars debt will remain in place (no COC provision) $3.2 billion strategic transaction with VICI Properties, Inc. (“VICI”) in connection with the acquisition of real estate and amendment of existing leases and right of first refusals $385 million of announced asset sale proceeds $2.4 billion of underwritten TLB to Caesars Resorts Collection (“CRC”) $4.8 billion of underwritten TLB and Notes to Eldorado Eldorado and Caesars shareholder approval required Voting agreements with key shareholders, i.e. Recreational Enterprises, Inc. and Icahn Enterprises Transaction expected to close in first half of 2020, subject to customary closing conditions (1)Based on Caesars net debt of $6.3 billion (excluding face value of the convertible notes). (2) Based on Eldorado’s 30-calendar day VWAP as of May 23, 2019. Mgmt. and governance Eldorado’s Chairman Gary Carano, CEO Tom Reeg, COO, CFO and CLO will lead the combined company 11 member Board of Directors, 6 of whom will come from Eldorado’s Board and 5 of whom will come from Caesars Board Name and organization Retain Caesars name to capitalize on the value of the iconic global brand Corporate headquarters to be based in Reno with significant corporate presence in Las Vegas

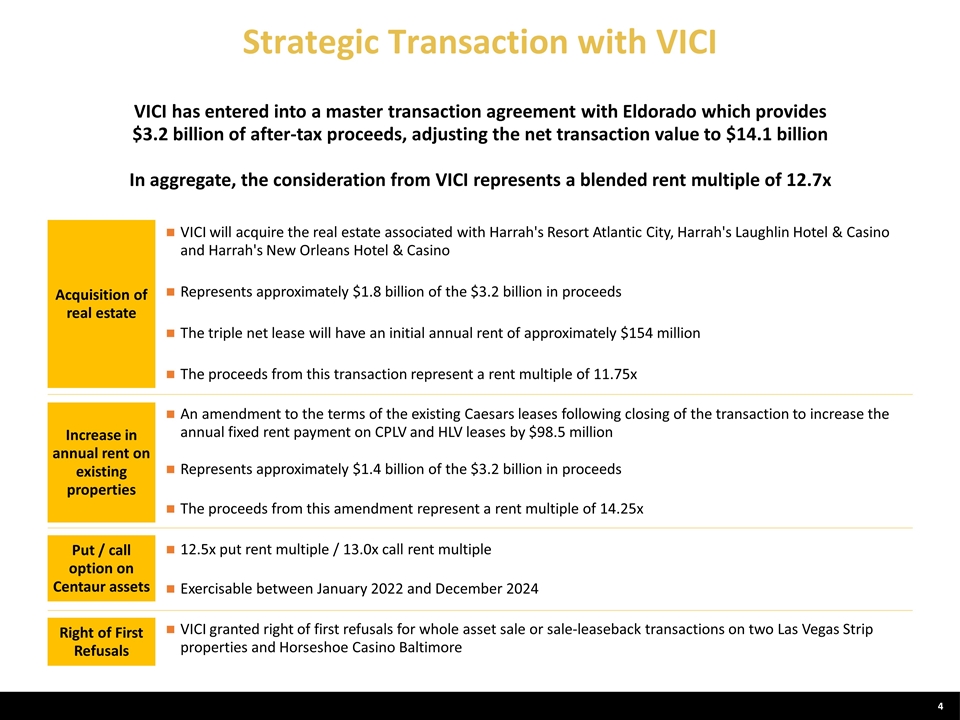

Right of First Refusals Acquisition of real estate VICI will acquire the real estate associated with Harrah's Resort Atlantic City, Harrah's Laughlin Hotel & Casino and Harrah's New Orleans Hotel & Casino Represents approximately $1.8 billion of the $3.2 billion in proceeds The triple net lease will have an initial annual rent of approximately $154 million The proceeds from this transaction represent a rent multiple of 11.75x VICI granted right of first refusals for whole asset sale or sale-leaseback transactions on two Las Vegas Strip properties and Horseshoe Casino Baltimore Increase in annual rent on existing properties An amendment to the terms of the existing Caesars leases following closing of the transaction to increase the annual fixed rent payment on CPLV and HLV leases by $98.5 million Represents approximately $1.4 billion of the $3.2 billion in proceeds The proceeds from this amendment represent a rent multiple of 14.25x Put / call option on Centaur assets 12.5x put rent multiple / 13.0x call rent multiple Exercisable between January 2022 and December 2024 VICI has entered into a master transaction agreement with Eldorado which provides $3.2 billion of after-tax proceeds, adjusting the net transaction value to $14.1 billion In aggregate, the consideration from VICI represents a blended rent multiple of 12.7x Strategic Transaction with VICI

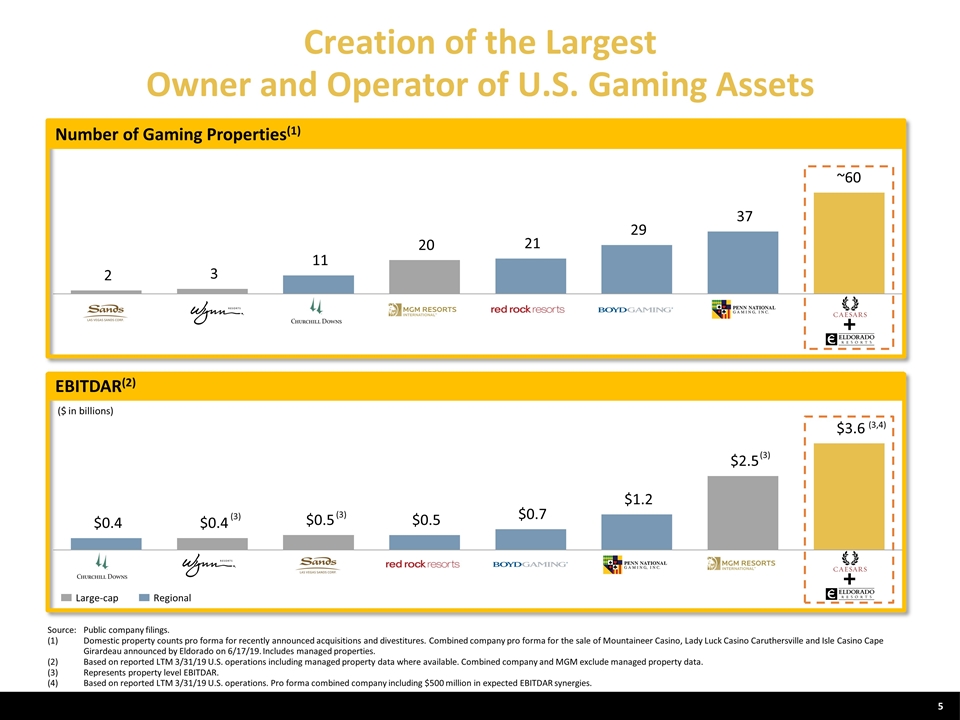

Creation of the Largest Owner and Operator of U.S. Gaming Assets ($ in billions) (3,4) Source: Public company filings. (1)Domestic property counts pro forma for recently announced acquisitions and divestitures. Combined company pro forma for the sale of Mountaineer Casino, Lady Luck Casino Caruthersville and Isle Casino Cape Girardeau announced by Eldorado on 6/17/19. Includes managed properties. (2)Based on reported LTM 3/31/19 U.S. operations including managed property data where available. Combined company and MGM exclude managed property data. (3)Represents property level EBITDAR. (4)Based on reported LTM 3/31/19 U.S. operations. Pro forma combined company including $500 million in expected EBITDAR synergies. Number of Gaming Properties(1) EBITDAR(2) Large-cap Regional (3) (3) (3)

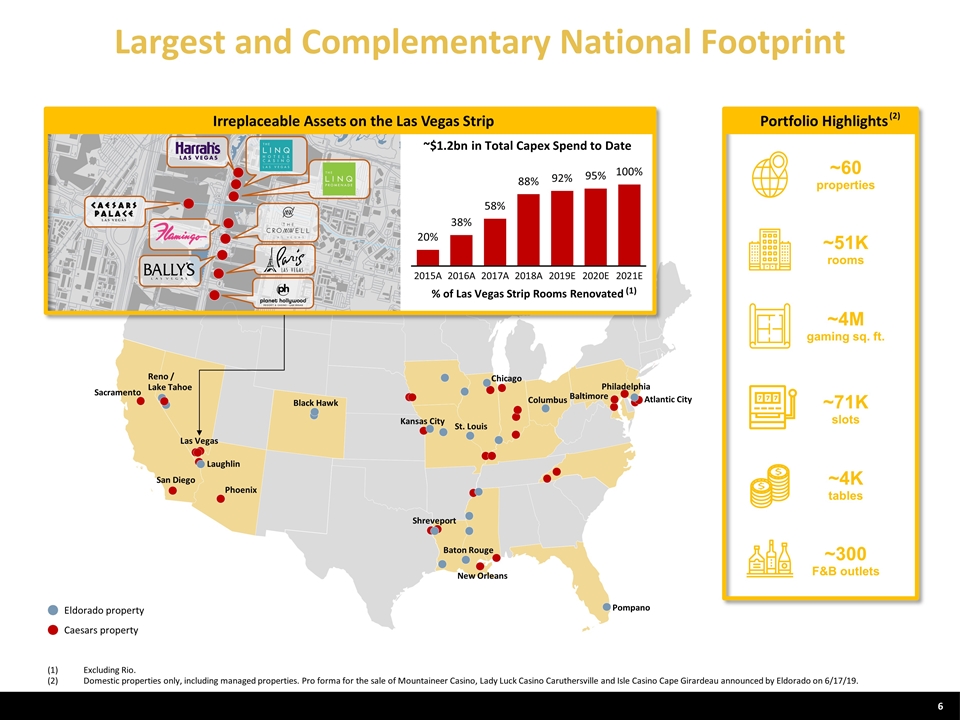

Las Vegas Laughlin Largest and Complementary National Footprint (1) Excluding Rio. (2) Domestic properties only, including managed properties. Pro forma for the sale of Mountaineer Casino, Lady Luck Casino Caruthersville and Isle Casino Cape Girardeau announced by Eldorado on 6/17/19. Caesars property Eldorado property Reno / Lake Tahoe Black Hawk Atlantic City Chicago Kansas City St. Louis New Orleans Philadelphia Pompano Baton Rouge Columbus Shreveport ~$1.2bn in Total Capex Spend to Date Irreplaceable Assets on the Las Vegas Strip Phoenix San Diego Baltimore Sacramento Portfolio Highlights (2) ~71K slots ~4K tables ~51K rooms ~300 F&B outlets ~4M gaming sq. ft. ~60 properties Link to check locations: https://investor.caesars.com/caesars-properties?map=ia (1)

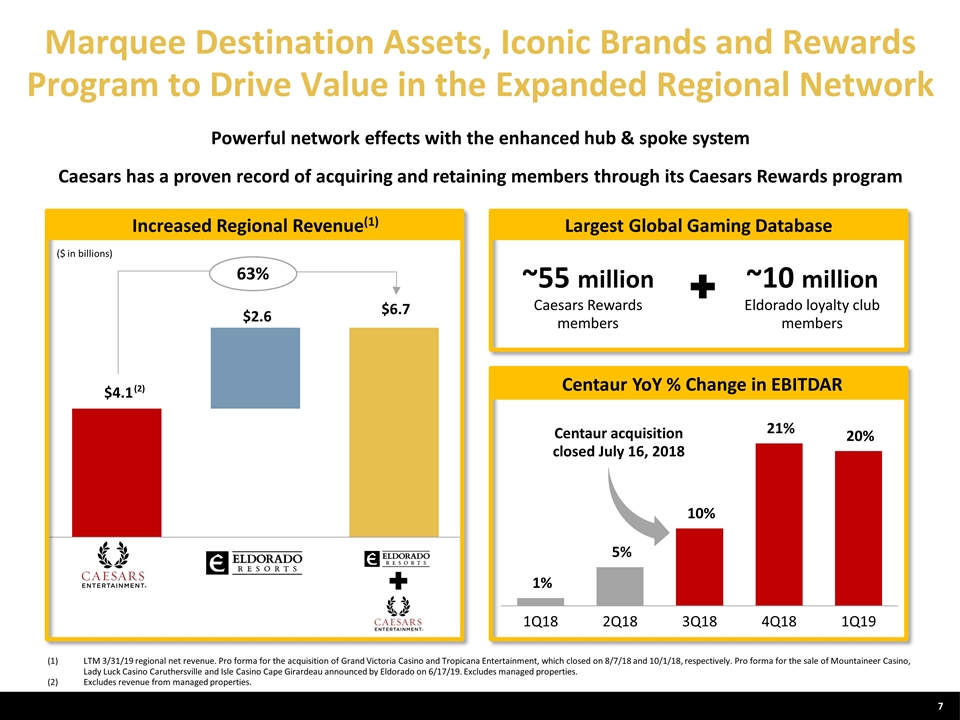

Marquee Destination Assets, Iconic Brands and Rewards Program to Drive Value in the Expanded Regional Network (1)LTM 3/31/19 regional net revenue. Pro forma for the acquisition of Grand Victoria Casino and Tropicana Entertainment, which closed on 8/7/18 and 10/1/18, respectively. Pro forma for the sale of Mountaineer Casino, Lady Luck Casino Caruthersville and Isle Casino Cape Girardeau announced by Eldorado on 6/17/19. Excludes managed properties. (2)Excludes revenue from managed properties. ($ in billions) 63% (2) Powerful network effects with the enhanced hub & spoke system ~55 million Caesars Rewards members ~10 million Eldorado loyalty club members Caesars has a proven record of acquiring and retaining members through its Caesars Rewards program Increased Regional Revenue(1) Largest Global Gaming Database Centaur acquisition closed July 16, 2018 Centaur YoY % Change in EBITDAR

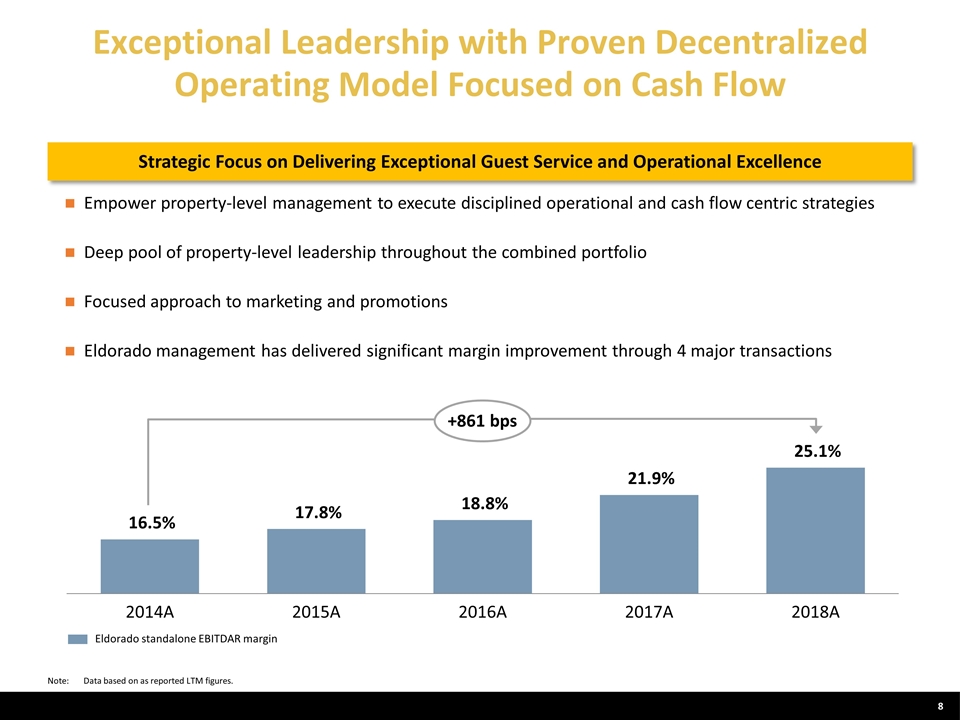

Exceptional Leadership with Proven Decentralized Operating Model Focused on Cash Flow Empower property-level management to execute disciplined operational and cash flow centric strategies Deep pool of property-level leadership throughout the combined portfolio Focused approach to marketing and promotions Eldorado management has delivered significant margin improvement through 4 major transactions Strategic Focus on Delivering Exceptional Guest Service and Operational Excellence Note:Data based on as reported LTM figures. Eldorado standalone EBITDAR margin +861 bps

$500 Million in Identified Year 1 Synergies with Longer-term Upside Implementation of Eldorado’s lean, decentralized management structure Reduction in duplicative public company costs More effective traditional marketing spend across platforms Revenue uplift from network effect of the hub and spoke system Elimination of software and IT infrastructure redundancies Insurance and procurement savings driven from increased scale / purchasing volume More efficient property-level cost structure to align with Eldorado’s operating standards

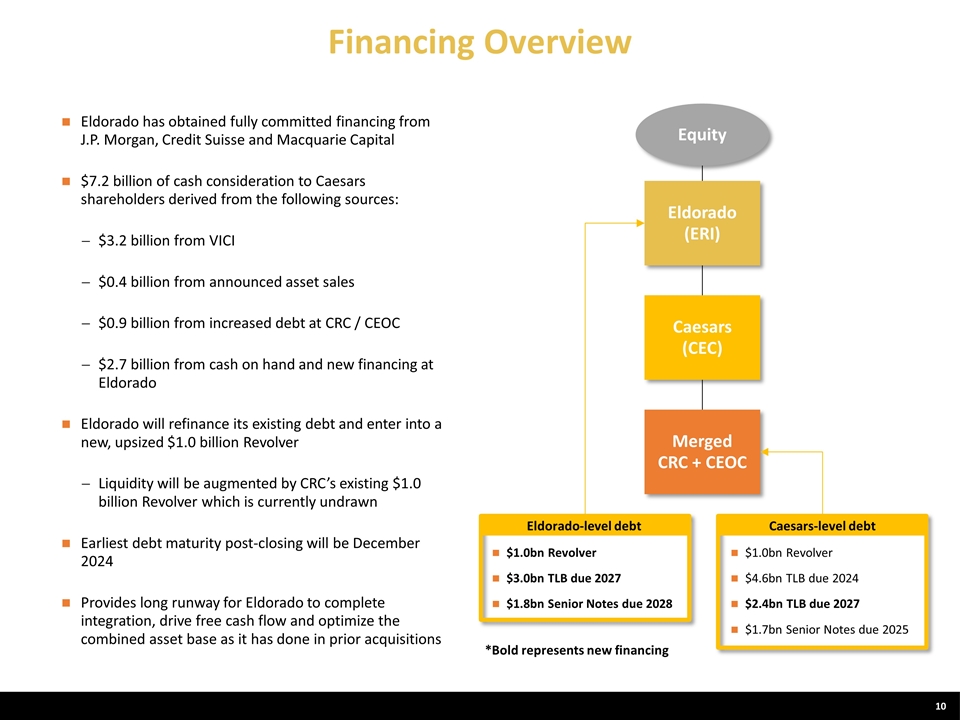

Financing Overview Eldorado has obtained fully committed financing from J.P. Morgan, Credit Suisse and Macquarie Capital $7.2 billion of cash consideration to Caesars shareholders derived from the following sources: $3.2 billion from VICI $0.4 billion from announced asset sales $0.9 billion from increased debt at CRC / CEOC $2.7 billion from cash on hand and new financing at Eldorado Eldorado will refinance its existing debt and enter into a new, upsized $1.0 billion Revolver Liquidity will be augmented by CRC’s existing $1.0 billion Revolver which is currently undrawn Earliest debt maturity post-closing will be December 2024 Provides long runway for Eldorado to complete integration, drive free cash flow and optimize the combined asset base as it has done in prior acquisitions $1.0bn Revolver $3.0bn TLB due 2027 $1.8bn Senior Notes due 2028 $1.0bn Revolver $4.6bn TLB due 2024 $2.4bn TLB due 2027 $1.7bn Senior Notes due 2025 Equity Merged CRC + CEOC Eldorado (ERI) Caesars (CEC) Eldorado-level debt Caesars-level debt *Bold represents new financing

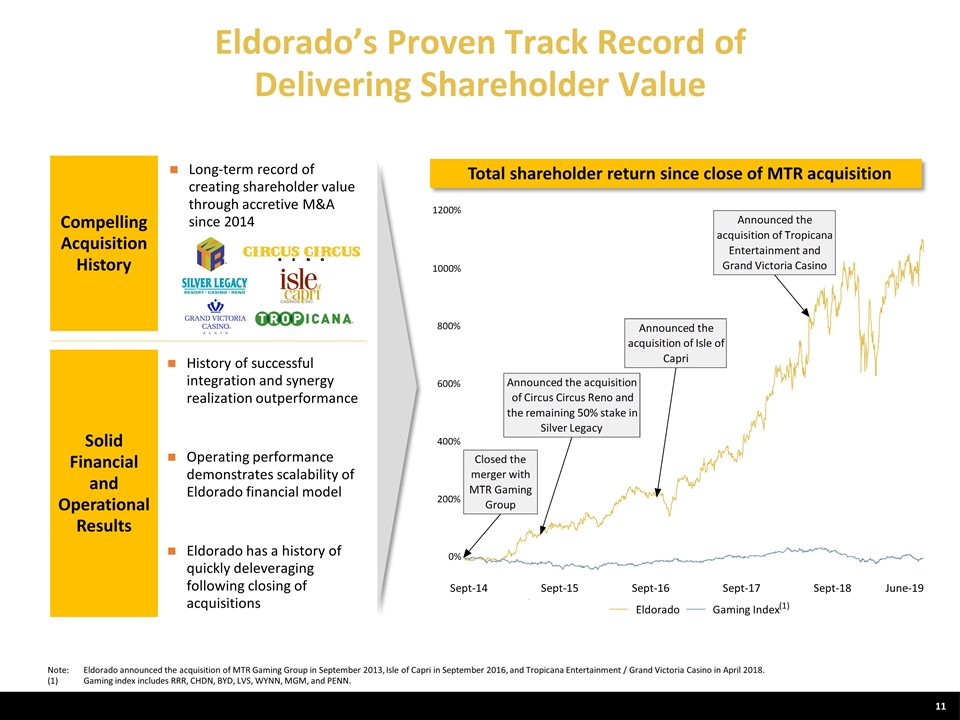

Eldorado’s Proven Track Record of Delivering Shareholder Value Note: Eldorado announced the acquisition of MTR Gaming Group in September 2013, Isle of Capri in September 2016, and Tropicana Entertainment / Grand Victoria Casino in April 2018. (1)Gaming index includes RRR, CHDN, BYD, LVS, WYNN, MGM, and PENN. Total shareholder return since close of MTR acquisition Compelling Acquisition History Solid Financial and Operational Results Long-term record of creating shareholder value through accretive M&A since 2014 History of successful integration and synergy realization outperformance Operating performance demonstrates scalability of Eldorado financial model Eldorado has a history of quickly deleveraging following closing of acquisitions (1) Sept-14 Sept-15 Sept-16 Sept-17 Sept-18 June-19