- PAYC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Paycom Software (PAYC) DEF 14ADefinitive proxy

Filed: 28 Mar 24, 4:06pm

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

| ☒ | No fee required. | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. | |

Letter from our Co-Chief Executive Officers

Dear Fellow Stockholders,

In 2023, Paycom celebrated its 25-year anniversary of excellence and our continued commitment to simplifying the lives of employees and creating efficiencies for employers. From the very start, innovation has been at the core of our success and remains a key driver of our vision for the future as we continue to redefine human capital management systems and their capabilities. Driven by the relentless efforts of our team members across our operations, we have built a world-class HR and payroll software company and changed the way businesses and their employees operate, but we are still just at the beginning of our journey with many stockholder value creation opportunities ahead.

2023 Highlights

Paycom delivered strong financial results in 2023 thanks to the considerable coordinated efforts across the organization. We ended the year with 23.2% growth in revenue, a net income margin of 20.1%, and an adjusted EBITDA margin of 42.5%. Our latest tools further enhance our offerings. Our revolutionary enhancement to Time-Off Requests, GONE™, emphasizes our continued efforts to highlight the value clients achieve through the automation we provide. While automations like GONE are exciting, it is Beti® that continues to turn heads in the marketplace. Our clients want a strong return on their HCM investment, and Beti is where they are finding it. As part of our international expansion strategy, we announced our development and launch of native payroll in Canada and Mexico, and in early 2024, announced that we are expanding automated payroll with Beti into the United Kingdom. As a testament to our industry-leading solutions, we were awarded a Gold Globee® at the 2023 Globee Business Awards, which honors organizations with exemplary performance across diverse business domains based on achievements in innovation, leadership and customer service.

New Leadership Structure to Advance Paycom’s Growth

As we continue to revolutionize the HR and payroll software industry and as a natural progression for our expanding operations, in February 2024, we were appointed Co-Chief Executive Officers. We have great trust in this new leadership structure, which we believe will substantially increase our time investments in areas where Paycom can have the biggest impact on clients, including product innovation and strategy, while maintaining excellence in our operations. We also recently named Jason Clark, who previously served as an independent member of the Board, as Chief Administrative Officer to tap into his operational and executive leadership experience as we work to strengthen efficiency across our operations.

Our People Strategy Supports Our Growth and Continued Innovation

As a company serving both employers and employees, we recognize that our talented team members are the foundation of our success. Our commitment to attracting and retaining the best talent remains steadfast, with continued investments in employee engagement, DEI and learning and development programs. In 2023, we continued to provide top-tier benefits to our team members, including Paycom’s $1 per-pay period health insurance, on-site well-being advisors and paid family leave, among many industry-leading investments in our employees’ well-being. We were pleased that as a result of our continued commitment to our employees, Paycom was recognized as one of America’s Greatest Workplaces for Diversity and for Parents & Families by Newsweek. We also received Gallup’s Exceptional Workplace Award.

Looking Ahead

As we enter 2024, we remain focused on three strategic priority areas: providing world-class service, enhancing solution automation, and achieving client ROI. Our guiding goal is to continue bringing the power of Paycom to employers and employees through our innovative cloud-based HR solutions. We believe our expanded world-class leadership team has the necessary industry expertise and appreciation of Paycom’s innate potential to drive sustainable value creation for our stockholders and we look forward to what we will build together this year and beyond.

Thank you for your continued support of Paycom, our Board and our leadership team.

Sincerely,

|

|

|  | |||||

CHAD RICHISON | CHRIS G. THOMAS | |||||||

| Co-Chief Executive Officer, President and Chairman of the Board of Directors | Co-Chief Executive Officer |

Letter from our Lead Independent Director

Dear Fellow Stockholders,

On behalf of the full Board, I would like to thank you for your continued investment in Paycom and your support of the management team and the Board. We were pleased with the Company’s continued track record of success in 2023 as demonstrated by strong revenue growth, stellar profitability margins and unstoppable drive to innovate through the launch of new product offerings. We are confident that the new Co-Chief Executive Officer leadership structure will promote our growth and create value for our stockholders, clients and employees.

Returning Value to Our Stockholders

Last year, after 25 years of investments that propelled our rapid growth and established a market-leading position in the payroll and HR software services market, we announced our first cash dividend policy. We are happy to report that in the first year of this policy, combined with our stock buyback program, we returned over $365 million to our stockholders in 2023. This new dimension of our capital allocation strategy represents an important milestone that demonstrates our maturity to simultaneously invest both in long-term growth innovations and returning value to our stockholders.

We Listened and Responded to Stockholder Feedback

Stockholder input remains a critical element of the Board’s oversight process and strategic considerations. To better understand our stockholders’ priorities, we maintain a stockholder outreach program that is led by our independent Board members. In 2023 and in direct response to certain stockholders’ preferences, the Board approved an amendment to the bylaws that removed certain requirements of the advance notice provisions that our stockholders viewed to be unnecessary. In response to the majority-supported stockholder proposal from the 2023 annual meeting, we further amended our bylaws and adopted a majority vote standard for uncontested director elections.

Furthermore, the change in Mr. Richison’s position from Chief Executive Officer to Co-Chief Executive Officer triggered the forfeiture of his 2020 CEO performance award in accordance with its terms, which directly addressed remaining stockholder concerns related to the magnitude of the award as reflected in our recent say-on-pay vote outcomes.

Committed to Sustainable Operations

Paycom is firmly committed to creating a safe and inclusive workplace, giving back to the community and minimizing our environmental impact. We are also committed to maintaining the highest standards for data privacy and cybersecurity. Our information security program is designed to ensure that management and the Board of Directors are adequately informed about, and provided with the tools necessary to monitor, (i) material risks from cybersecurity threats and (ii) our efforts related to the prevention, detection, mitigation, and remediation of cybersecurity incidents. In recognition of our continued efforts to elevate cybersecurity standards, Paycom was recognized as American Hospital Association’s Preferred Cybersecurity Provider for secure payroll and HCM services in 2023.

As we look into the future, the Board believes in Paycom’s strategy and the ability of our expanded leadership team to grow and deliver stockholder value. We look forward to continuing the dialogue with our stockholders and would like to thank everyone who engaged with us over the last few years.

On behalf of the Board, thank you for your commitment to Paycom.

Sincerely,

|

FREDERICK C. PETERS II Lead Independent Director |

| Notice of 2024 Annual Meeting of Stockholders |

7501 W. Memorial Road Oklahoma City, Oklahoma 73142 (405) 722-6900 |

Date and Time April 29, 2024 11:00 a.m. local time | Location Gaillardia 5300 Gaillardia Boulevard Oklahoma City, Oklahoma 73142 | Record Date March 11, 2024 | ||||||

| ITEMS OF BUSINESS | ||||||||||

| Proposal | Board of Directors Recommendation | See Page | ||||||||

| 1 | To elect three Class II directors, each to serve until the date of the 2027 annual meeting of stockholders and until his or her successor has been duly elected and qualified, or his or her earlier death, resignation or removal; | FOR

each director nominee | 28 | |||||||

| 2 | To ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the year ending December 31, 2024; and | FOR | 31 | |||||||

| 3 | To approve, on an advisory basis, the compensation of our named executive officers. | FOR | 73 | |||||||

| Stockholders will also transact such other business that may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. | ||||||||||

| Voting | Adjournments and Postponements | |||||

In person

Online

By telephone

By mail | To vote in person, you must attend the Annual Meeting and obtain and submit a ballot. The ballot will be provided at the Annual Meeting.

You may vote by proxy online by following the instructions found on the proxy card.

You may vote by proxy by calling the toll-free number found on the proxy card.

You may vote by proxy by completing, signing, dating and promptly returning the enclosed proxy card in the postage-paid envelope. |

| Any action on the items of business described above may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed.

Stockholder List

A complete list of stockholders entitled to vote at the Annual Meeting will be available for inspection at the principal executive offices of the Company during regular business hours for a period of 10 calendar days ending on the day before the Annual Meeting. | |||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON APRIL 29, 2024 | ||||||

In addition to delivering paper copies of these proxy materials to you by mail, this notice and the accompanying proxy statement, form of proxy and 2023 Annual Report are available at www.proxydocs.com/PAYC.

| ||||||

YOUR VOTE IS IMPORTANT. Regardless of whether you plan to attend the Annual Meeting, we urge you to vote your shares as soon as possible. For more information about voting, please refer to “Appendix B – Questions and Answers”.

By Order of the Board of Directors, | ||

|

| |

| Chad Richison | Chris G. Thomas | |

Co-Chief Executive Officer, President and | Co-Chief Executive Officer | |

Chairman of the Board of Directors | Oklahoma City, Oklahoma | |

Oklahoma City, Oklahoma | March 28, 2024 | |

March 28, 2024 |

Table of Contents

| 1 | ||||

| 2 | ||||

| 6 | ||||

| 7 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 25 | ||||

Commitment to Social Responsibility and Environmental Sustainability | 26 | |||

| 28 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

Proposal 2: Ratification of the Appointment of Our Independent Registered Public Accounting Firm | 31 | |||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 38 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 45 | ||||

| 49 | ||||

| 53 | ||||

| 56 | ||||

| 57 | ||||

| 57 | ||||

| 59 | ||||

| 61 | ||||

| 63 | ||||

| 63 | ||||

| 66 | ||||

| 68 | ||||

| 69 | ||||

| 72 | ||||

| 72 | ||||

| 73 | ||||

| 73 | ||||

| 73 | ||||

| 74 | ||||

Review and Approval or Ratification of Transactions with Related Parties | 74 | |||

| 74 | ||||

Security Ownership of Certain Beneficial Owners and Management | 75 | |||

| 77 | ||||

| 77 | ||||

| 77 | ||||

| 77 | ||||

| 78 | ||||

| A-1 | ||||

| B-1 | ||||

PROXY STATEMENT

for

the Annual Meeting of Stockholders

to be held on April 29, 2024

Unless the context otherwise requires, (i) references to “Paycom,” “we,” “us,” “our” and the “Company” are to Paycom Software, Inc., a Delaware corporation, and its consolidated subsidiaries, and (ii) references to “stockholders” are to the holders of shares of our common stock, par value $0.01 per share (“Common Stock”), including unvested shares of restricted stock.

|

The accompanying proxy is solicited by the Board of Directors (the “Board”) on behalf of Paycom Software, Inc., a Delaware corporation, to be voted at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held on April 29, 2024, at the time and place and for the purposes set forth in the accompanying Notice of 2024 Annual Meeting of Stockholders (the “Notice”) and at any adjournment(s) or postponement(s) of the Annual Meeting. This proxy statement and accompanying form of proxy are dated March 28, 2024 and are expected to be first sent or given to stockholders on or about March 29, 2024.

Our principal executive offices are located at, and our mailing address is, 7501 W. Memorial Road, Oklahoma City, Oklahoma 73142.

Voting Roadmap

Proposal

| Election of Directors

|

| ||||||

1 | The Board of Directors recommends that you vote “FOR” each director nominee.

|

| ||||||

Upon the recommendation of the Nominating and Corporate Governance Committee, the Board of Directors has nominated Robert J. Levenson, Frederick C. Peters II and Felicia Williams for election as Class II directors. The Board of Directors believes that each director nominee possesses the necessary skills, experiences, qualifications and perspectives to, collectively with the other incumbent directors, provide quality advice and counsel to the Company’s management, effectively oversee the business and serve the long-term interests of the Company’s stockholders. See pages 7-9 for more information about each director nominee.

|

| |||||||

Proposal

| Ratification of Appointment of Independent Registered Public Accounting Firm

|

| ||||||

2 | The Board of Directors recommends that you vote “FOR” the ratification of the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024.

|

| ||||||

The Audit Committee has appointed Grant Thornton LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024. As a matter of good corporate governance, stockholders are being asked to ratify the Audit Committee’s appointment of Grant Thornton LLP. See page 31 for more information.

|

| |||||||

Proposal

| Advisory Vote to Approve Executive Compensation

|

| ||||||

3 | The Board of Directors recommends that you vote “FOR” the advisory approval of the compensation of the Company’s named executive officers.

|

| ||||||

The Company seeks a non-binding advisory vote to approve the compensation of its named executive officers as described in the Compensation Discussion and Analysis beginning on page 35 and the compensation tables and related narrative discussion beginning on page 57.

|

| |||||||

1

2023 Highlights

Company Overview

We are a leading provider of a comprehensive, cloud-based human capital management (“HCM”) solution delivered as Software-as-a-Service (“SaaS”). We provide functionality and data analytics that businesses need to manage the complete employment lifecycle, from recruitment to retirement. Our solution requires virtually no customization and is based on a core system of record maintained in a single database for all HCM functions, including payroll, talent acquisition, talent management, human resources (“HR”) management and time and labor management applications. Our user-friendly software allows for easy adoption of our solution by employees, enabling self-management of their HCM activities in the cloud, which reduces the administrative burden on employers and increases employee productivity.

Looking ahead, we remain confident that we have the right leadership team and plan in place to create stockholder value through our expanding customer base, topline growth and strong profitability margins.

The Paycom Offering – All in a Single Software

Payroll

|

Talent Acquisition

|

Talent Management

|

HR Management

|

Time and Labor Management

|

2023 Company Highlights

Continued to redefine what HR tech can be with the launch of GONETM, Client Action Center and EverydayTM

| 7,300+ Paycom employees | 25+ years of innovation | Global HCM available in 180 countries and 15 languages / announced native payroll launch in Canada and Mexico

| |||

| Newsweek’s Greatest Workplaces for Parents and Families | Newsweek’s Greatest Workplaces for Diversity | America’s Greatest Workplaces (Technology, Media and Telecom)

| Gallup Exceptional Workplace Award |

2023 Performance Highlights

23.2% Revenue Growth

$1.694 Billion Full Year Revenue | 20.1% Net Income Margin

$341 Million Full Year Net Income | 42.5% Adjusted EBITDA Margin*

$719 Million Adjusted EBITDA* | 36,820 Clients as of Dec. 31, 2023

19,481 Clients (based on parent company grouping) as of Dec. 31, 2023

|

*Adjusted EBITDA margin and adjusted EBITDA are non-GAAP financial measures. See Appendix A for more information.

2024 Growth Strategy

World-Class Service

|

Solution Automation

|

Client ROI Achievement

|

2

Board Highlights

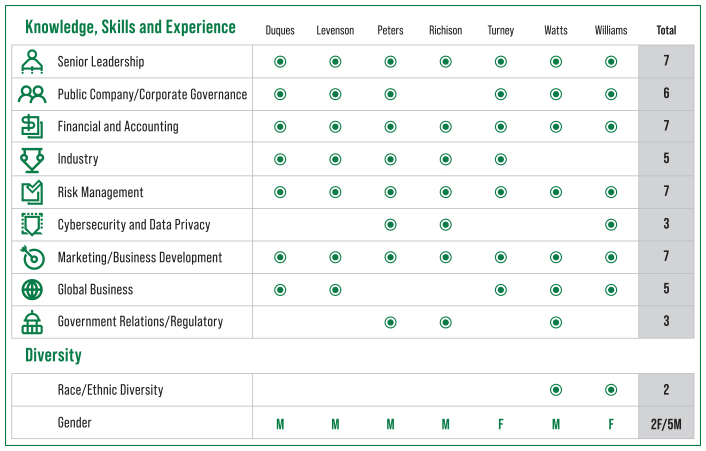

The following table provides information about each director currently serving on our Board of Directors, including the director nominees.

3

Committed to Robust Governance Practices

Paycom is committed to good corporate governance, which we believe is important to the success of our business and to advancing stockholder interests. Highlights include the following:

INDEPENDENT BOARD |

All directors except Mr. Richison (our Co-Chief Executive Officer, President and Chairman of the Board) are independent, and all committees are composed entirely of independent directors. Mr. Peters serves as Lead Independent Director.

| |||

ENGAGED DIRECTORS |

All directors attended more than 90% of Board and applicable committee meetings in 2023.

| |||

REGULAR BOARD SELF- ASSESSMENT |

All directors assess the performance of the Board and each committee every year.

| |||

ROBUST BOARD OVERSIGHT | |

Risk: Our Board and Audit Committee receive regular updates from management on our enterprise risk management program. | ||

| Sustainability: Our Nominating and Corporate Governance Committee maintains oversight of social responsibility and environmental sustainability. | |||

| Cybersecurity: Our Chief Information Officer and Executive Vice President of Information Technology and Information Security present quarterly reports to the Audit Committee on our cybersecurity risks and program. | |||

| Succession Planning: Our full Board is engaged in managing long-term executive succession planning.

| |||

STRONG CODE OF ETHICS |

We are committed to operating with the highest level of integrity, and maintain a Code of Ethics and Business Conduct that applies to all directors, officers and other employees.

| |||

ACCOUNTABLE TO STOCKHOLDERS |

In 2023, we adopted a majority vote standard for uncontested director elections, with a plurality carve-out for contested elections.

We hold an annual say-on-pay vote.

| |||

ROBUST STOCKHOLDER ENGAGEMENT |

We engage with our top stockholders throughout the year and solicit their feedback on our compensation, governance and sustainability programs.

| |||

ROBUST STOCK OWNERSHIP GUIDELINES |

We maintain robust stock ownership guidelines equivalent to 6x salary for our Co-Chief Executive Officers, 3x salary for other executive officers and 5x cash compensation for non-employee directors.

| |||

INDEPENDENT COMPENSATION CONSULTANT

|

The Compensation Committee directly retains an independent compensation consultant that performs no services for the Company other than those for the Compensation Committee.

| |||

4

Stockholder Engagement Highlights

We are committed to ongoing, active dialogue with our stockholders throughout the year to maintain a strong alignment of our strategic priorities with investor expectations. In 2023, members of the Board of Directors, including our Lead Independent Director and the then-serving chairpersons of each committee, together with members of our legal and investor relations management teams, engaged with stockholders prior to and following the 2023 annual meeting to discuss updates to our business, executive compensation, corporate governance and environmental and social practices. We believe our stockholders’ perspectives are an important consideration for the Board’s ongoing deliberations about the evolution of the Company’s governance, compensation and sustainability practices.

CONTACTED 25 STOCKHOLDERS representing 49% of outstanding shares held by non-affiliates as of 6/30/2023

| ENGAGED WITH 15 STOCKHOLDERS representing 39% of outstanding shares held by non-affiliates as of 6/30/2023

|

100% of engagement meetings attended by at least two independent Board members

|

Key Topics Discussed

› Executive compensation program

› Board oversight of strategic priorities

› Corporate governance

› Voting standard for director elections

› Cybersecurity

› Human capital management

› Environmental reporting developments | Our Response to Stockholder Feedback

› Amended bylaws to remove certain advance notice provisions that were viewed unfavorably by certain stockholders, as conveyed during the engagement meetings prior to the 2023 annual meeting

› Adopted a majority vote standard for uncontested director elections in response to a majority-supported stockholder proposal presented at the 2023 annual meeting

› Introduced Company financial performance metrics into the equity incentive program

|

Executive Compensation Highlights

Our executive compensation program is designed to incentivize the achievement of our strategic objectives and stockholder value creation, attract and retain highly qualified executives and further align their interests with those of our stockholders. For additional detail on our compensation program, please see “Compensation Discussion and Analysis.”

The compensation opportunities for our executives in 2023 were informed by the following considerations:

| 1. Need to promote leadership continuity to support our strategic growth priorities designed to drive stockholder value creation | 2. Limited retentive value of equity incentives outstanding at the end of 2022 in light of tracking performance levels, posing retention concerns in the highly competitive SaaS talent market | 3. Focus on fostering alignment with the interests of our stockholders to drive absolute long-term stockholder value creation and successful execution of strategic growth initiatives |

Realizable compensation for our legacy named executive officers (“NEOs”) (excluding Mr. Richison) was 40% and 53% below the intended target value on a one- and three-year average basis, respectively. Over the past three years, our compensation program for our executives has emphasized incentives with value tied to the achievement of rigorous Company financial performance targets, stock price performance or both. The absolute and relative performance of our stock price had a material impact on the amount of compensation realized by our legacy NEOs on a three-year basis, underscoring the robust pay-for-performance foundation of our executive compensation program.

5

(1) | For purposes of this graphic, the legacy NEOs are Mrs. Faurot and Messrs. Boelte and Smith, who were NEOs in each of the last three years. Target compensation reflects base salary in effect at the end of the applicable fiscal year, target Annual Incentive Plan compensation, and the reported target value of annual equity awards, in each case presented as an average of such amounts for these three legacy NEOs. Realizable compensation reflects base salary paid, Annual Incentive Plan payout paid, and equity awards granted in the applicable year, in each case presented as an average of such amounts for these three legacy NEOs. Realizable value of equity awards is based on actual or tracking performance levels, as applicable (for performance-based restricted stock units (“PSUs”)), or based on the closing price of our Common Stock on the last trading day of 2023 (for restricted stock awards (“RSAs”) and time-based restricted stock units (“RSUs”)). PSUs granted in 2021 were earned at 15% of target; PSUs granted in 2022 paid out at 0% for the first tranche and are tracking at 0% for the second and final tranche; PSUs granted in 2023 paid out at 0% for Mrs. Faurot and Mr. Smith and 30% for Mr. Boelte (based on target achievement of one of three performance metrics applicable to Mr. Boelte’s award). |

Directors and Corporate Governance

Paycom’s business and affairs are managed under the direction of our Board of Directors, which currently consists of seven directors. Pursuant to our Amended and Restated Certificate of Incorporation and our Amended and Restated Bylaws, our Board of Directors is divided into three classes, with the members of the classes serving three-year terms that expire in successive years. The terms of office of the current members of our Board of Directors are divided as follows:

| • | the term of office for our Class II directors will expire at the Annual Meeting; |

| • | the term of office for our Class III directors will expire at the annual meeting of stockholders to be held in 2025; and |

| • | the term of office for our Class I directors will expire at the annual meeting of stockholders to be held in 2026. |

The Board of Directors has nominated Robert J. Levenson, Frederick C. Peters II and Felicia Williams for election as Class II directors (each, a “Director Nominee” and collectively, the “Director Nominees”), each to serve for a term expiring on the date of the annual meeting of stockholders to be held in 2027 and until his or her successor has been duly elected and qualified or his or her earlier death, resignation or removal. Each Director Nominee currently serves on our Board of Directors.

6

Director Skills, Experience and Background

The biographies of the Director Nominees are as follows:

| RATIONALE FOR NOMINATION | ||||||

Frederick C. Peters II

LEAD INDEPENDENT DIRECTOR

INDEPENDENT DIRECTOR SINCE: 2014

AGE: 74

COMMITTEES:

› Audit

EDUCATION:

› BA, Political Science, Amherst College | Mr. Peters contributes to the Board his extensive financial and accounting expertise, senior executive and public company board experience, risk management, industry and deep institutional knowledge, as well as first-hand knowledge of government relations and the regulatory landscape.

| |||||

KEY SKILLS AND QUALIFICATIONS | ||||||

› |

Financial and Accounting – acquired experience over his 40+ years in the banking and financial sector, including serving in his current role as CEO of Community Financial Institutions Fund (formerly Bluestone Financial Institutions Fund) and previous senior leadership and board roles at Bryn Mawr Bank Corporation (NASDAQ: BMTC) and the Federal Reserve Bank of Philadelphia, where he supervised complex financial service offerings, banks and bank holding companies. | |||||

› |

Risk Management – obtained expertise through his first-hand experience in founding two community banks, which required extensive, broad ranging oversight responsibilities, including evaluation of corporate risk; also has served in numerous executive and board leadership roles at various public and private companies. | |||||

› |

Industry – developed extensive knowledge of the payments ecosystem, payment processing technologies, regulatory frameworks, banking sector and evolving market preferences over his more than four decades in banking and payments adjacent industries. | |||||

› |

Government Relations/Regulatory – gained experience during his time chairing the Audit Committee for the Federal Reserve Bank of Philadelphia and while serving as a member of the Federal Reserve Bank’s Committee of Audit Chairs in Washington, D.C.

| |||||

EXPERIENCE

| ||||||

| COMMUNITY FINANCIAL INSTITUTIONS FUND (formerly Bluestone Financial Institutions Fund), an asset management company | ||||||

› | Chairman and CEO (since 2015)

| |||||

| BRYN MAWR BANK CORPORATION, a community bank and wealth management organization | ||||||

› | Chairman, President and CEO (2001-2014)

| |||||

› | Director (2001-2017)

| |||||

| FIRST MAIN LINE BANK | ||||||

› | Founder, Chairman and CEO (1995-2001)

| |||||

| NATIONAL BANK OF THE MAIN LINE | ||||||

› | Founder, Chairman and CEO (1985-1995)

| |||||

Other experience: Held lending and executive positions at Philadelphia National Bank, Hamilton Bank and Industrial Valley Bank

| ||||||

OTHER BOARD SERVICE

| ||||||

THE FEDERAL RESERVE BANK OF PHILADELPHIA (2009–2014), AUDIT COMMITTEE CHAIR (2013-2014)

| ||||||

| FEDERAL RESERVE BANK’S COMMITTEE OF AUDIT CHAIRS (2013–2014) | ||||||

VARIOUS NON-PROFIT BOARDS OF DIRECTORS, including Foundation for Delaware County, Bryn Mawr Film Institute and Main Line Health | ||||||

7

| RATIONALE FOR NOMINATION | ||||||

Felicia Williams

INDEPENDENT DIRECTOR SINCE: 2022

AGE: 58

COMMITTEES:

› Audit (Chairperson)

› Nominating and Corporate Governance

EDUCATION:

› BS, Accounting, Florida A&M University

› Certified Public Accountant | Ms. Williams contributes to the Board her broad-based financial and accounting expertise, senior executive and public company board experience, risk management, and cybersecurity knowledge. The Board benefits from her experience as the Macy’s, Inc. Fellow for CEO Action for Racial Equity, where she advised on the development of sustainability policies and corporate best practices that address social injustice.

| |||||

KEY SKILLS AND QUALIFICATIONS

| ||||||

› |

Financial and Accounting – oversaw finance organization and operational execution in various leadership positions at Macy’s (NYSE: M), including as interim CFO; brings broad-based finance knowledge through her over 30 years of corporate financial leadership experience at multiple large-cap public companies with complex operations, including The Coca-Cola Company (NYSE: KO) and Bristol-Myers Squibb (NYSE: BMY), where she gained deep financial industry knowledge. | |||||

› |

Risk Management – acquired expertise through her extensive first-hand experience serving in audit and enterprise risk management leadership roles, beginning at Arthur Andersen and continued through her roles at Macy’s, where she served as Senior Vice President, Finance, subsequent to her role as Enterprise Risk Officer, and was responsible for overseeing the company’s financial stability during the height of the pandemic. | |||||

› |

Cybersecurity and Data Privacy – developed her knowledge of information security, privacy and data risk management of technologies and processes during her executive career, leading roles directly responsible for cybersecurity, IT security operations, enterprise business resiliency, and data protection practices. | |||||

› |

Global Business – obtained through domestic and international assignments with The Coca-Cola Company, Coca-Cola Hellenic Bottling Company, and Bristol-Myers Squibb, where she gained first-hand experience in global business finance, treasury, tax, and internal control and audit operations.

| |||||

EXPERIENCE | ||||||

MACY’S, INC., one of the largest American department store holding companies | ||||||

| › | Senior Vice President, Finance (2020-2023) | |||||

| › | Interim Chief Financial Officer (June 2020-November 2020) | |||||

| › | Senior Vice President, Controller and Enterprise Risk Officer (2016-2020) | |||||

| › | Senior Vice President, Finance and Risk Management (2011-2016) | |||||

| › |

Held leadership roles across key corporate finance functions, including treasury, investor relations, risk management, financial planning and analysis, and as the chief audit executive (2004-2011) | |||||

| COCA-COLA HELLENIC BOTTLING COMPANY, a consumer packaged goods business and strategic bottling partner of The Coca-Cola Company | ||||||

| › | Vice President, Internal Audit (2002-2004) | |||||

| THE COCA-COLA COMPANY, a beverage company | ||||||

| › | Group Controller and Treasury (1994-2002) | |||||

| Other experience: Held various audit and financial roles at Bristol-Myers Squibb and Arthur Andersen & Company | ||||||

| OTHER BOARD SERVICE | ||||||

| ANYWHERE REAL ESTATE INC. (NYSE: HOUS) (since 2021), Chair of Audit Committee | ||||||

MERIDIAN BIOSCIENCE, INC. (formerly NASDAQ: VIVO) (2018-2023) | ||||||

8

| RATIONALE FOR NOMINATION | ||||||

Robert J. Levenson

INDEPENDENT DIRECTOR SINCE: 2007

AGE: 82

COMMITTEES:

› Audit

› Compensation

EDUCATION:

› BA, Business Administration, Kent State University | Mr. Levenson contributes to the Board his extensive knowledge of the payroll and human capital management industry and scaling software technology and service companies, senior executive and public company board experience, financial and accounting expertise, strategic planning and risk management knowledge.

| |||||

KEY SKILLS AND QUALIFICATIONS

| ||||||

› |

Industry – acquired comprehensive knowledge of the software, services and technology industry, including payment processing technologies, through his career at companies such as Automatic Data Processing, Inc. (NASDAQ: ADP) and Medco Containment Services, which was further enhanced after he founded Lenox Capital, a private venture capital investment company focused primarily on investing in early-stage software and technology-based service companies. | |||||

› |

Financial and Accounting – gained experience throughout his lengthy tenure at First Data Corporation, a financial services company, and in his current role in private venture capital investing; contributed to increased revenue, profitability and growth of various companies. | |||||

› |

Risk Management – developed expertise through his experience in various senior leadership roles at ADP, Medco and First Data Corporation, where he oversaw operations and strategic planning considerations, which involved extensive risk management and mitigation. | |||||

› |

Senior Leadership – obtained skills through serving in various senior leadership positions including as an executive officer, founder, and director at numerous companies across different industries, all of which were technology-based enterprises.

| |||||

EXPERIENCE | ||||||

LENOX CAPITAL GROUP, LLC, a private venture capital investment company | ||||||

| › | Founder and Managing Member (since 2000) | |||||

FIRST DATA CORPORATION, an electronic commerce and payment services company (fintech) | ||||||

› |

Consultant (2000-2006) | |||||

| › |

Sr. Executive Vice President and Director (1992-2000) | |||||

| MEDCO CONTAINMENT SERVICES, INC., a mail order pharmacy company later acquired by Merck & Co., Inc. | ||||||

| › |

Office of the President, Chief Operating Officer and Director (1990-1993) | |||||

AUTOMATIC DATA PROCESSING, INC. (“ADP”), a global provider of human resources management software and solutions | ||||||

› |

Held several executive management positions including Group President—Employer Services, member of the Corporate Executive Committee and member of the Board of Directors (1981-1990)

| |||||

| OTHER BOARD SERVICE | ||||||

| Served on several boards of directors of public and private companies as well as civic and philanthropic organizations, which included: ADP, First Data Corporation, Medco, Central Data Systems, Ceridian Corp, Comnet, Polyvision, Broadway & Seymour, Superior Telecom Inc., Vestcom International, Emisphere Technologies, and Elite Pharmaceuticals | ||||||

9

The biographies of the directors currently serving as Class I directors are as follows:

| Ms. Turney contributes to the Board her significant senior executive and public company board experience, industry expertise related to high growth and ecommerce companies and growing world-class brands, sales and marketing, risk management and financial reporting.

KEY SKILLS AND QUALIFICATIONS

› Senior Leadership – seasoned executive with extensive payment processing technology knowledge developed over her extensive career in the retail sector; multiple CEO positions at large retailers, including Gloria Jeans, Victoria’s Secret and Neiman Marcus Direct, have given her tremendous experience overseeing all aspects of corporate operations, including sales operations and marketing.

› Marketing and Business Development – gained over three decades of experience launching and growing global brands; served in executive and board leadership roles at high growth retail companies, where she was responsible for strategic planning and brand development.

› Public Company/Corporate Governance – acquired during her career serving on multiple publicly traded boards, including as chair of the compensation committee at Bread Financial Holdings (NYSE: BFH), and various executive leadership roles at large retailers.

› Global Experience – acquired during her career serving in various executive leadership roles, where her expertise extended to the global retail scale; in addition to global experience gained during her time at Gloria Jeans, she has advised several international brands such as Mark and Spencer (London), Cosmo Lady (China) and Clovia (India).

EXPERIENCE

GLORIA JEANS, an international retailer of fashion apparel, footwear, and accessories

› Chief Executive Officer (2018-2019)

VICTORIA’S SECRET, a division of L Brands, Inc.

› President and Chief Executive Officer (2006-2016)

› President and Chief Executive Officer, Victoria’s Secret Direct (2000-2006)

NEIMAN MARCUS GROUP, a luxury retailer (1989-2000)

› President and Chief Executive Officer, Neiman Marcus Direct

› Held various executive roles in merchandising, creative production, advertising and public relations

OTHER BOARD SERVICE

BREAD FINANCIAL HOLDINGS, INC. (NYSE: BFH) (since 2019), chair of compensation committee and member of nominating and governance committee

ACADEMY SPORTS AND OUTDOORS, INC. (NASDAQ: ASO) (2021-2024), former member of compensation and nominating and governance committees

HAPPY SOCKS AB (2018-2019)

M/I HOMES, INC. (2011-2018)

FULLBEAUTY BRANDS (2016-2018)

NATIONWIDE CHILDREN’S HOSPITAL, INC. (2012-2018)

JAY H. BAKER RETAILING INITIATIVE ADVISORY BOARD AT THE WHARTON SCHOOL, UNIVERSITY OF PENNSYLVANIA (since 2004)

UNIVERSITY OF OKLAHOMA FOUNDATION INVESTMENT COMMITTEE (since 2000) | |||

| ||||

Sharen J. Turney

INDEPENDENT DIRECTOR SINCE: 2021

AGE: 67

COMMITTEES:

› Compensation

› Nominating and Corporate Governance (Chairperson)

EDUCATION:

› BA, Business Education, University of Oklahoma |

| |||

10

| Mr. Watts contributes to the Board his extensive first-hand knowledge of government relations and the evolving regulatory landscape, public company board experience and senior leadership experience.

KEY SKILLS AND QUALIFICATIONS

› Public Company/Corporate Governance – developed skills through his extensive experience serving on public company boards, including Dillard’s, CSX Corporation, ITC Holdings, Clear Channel Communications, Inc. and Terex Corporation.

› Senior Leadership – experienced professional who served in various leadership roles in the United States House of Representatives; advised several public company boards and has over two decades of experience as Co-Founder and CEO of Watts Partners, a boutique corporate and government affairs consulting firm.

› Marketing/Business Development – established a prominent consulting firm with a diverse client-base to which he provides strategic focus and program leadership; vast experience advising on business development and public affairs strategies.

› Government Relations/Regulatory – acquired during his time as an elected official, first on the Oklahoma Corporation Commission and then during his eight years in Congress, where he served on the United States House Committees on Armed Services, Financial Services, and Transportation and Infrastructure.

EXPERIENCE

WATTS PARTNERS, a boutique corporate and government affairs consulting firm

› Co-Founder, President and Chief Executive Officer (since 2003)

THE UNITED STATES HOUSE OF REPRESENTATIVES

› Representative for the State of Oklahoma (1995-2003)

› Chairman of the Republican Conference (1999-2003)

› Served on the United States House Committees on Armed Services, Financial Services, and Transportation and Infrastructure (1995-2003)

› Sponsored and led the establishment of the Committee on Homeland Security (2002)

OTHER BOARD SERVICE

DILLARD’S, INC. (NYSE: DDS) (since 2009; 2003-2008), member of audit committee

CSX CORPORATION (2011-2014)

ITC HOLDINGS CORP. (2011-2014)

CLEAR CHANNEL COMMUNICATIONS, INC. (2003-2007)

TEREX CORPORATION (2003-2006)

| |||

| ||||

J.C.

INDEPENDENT DIRECTOR SINCE: 2016

AGE: 66

COMMITTEES:

› Compensation (Chairperson)

› Nominating and Corporate Governance

EDUCATION:

› BA, Journalism and Public Relations, University of Oklahoma |

| |||

11

The biographies of the directors currently serving as Class III directors are as follows:

| Mr. Duques contributes to the Board his extensive industry, senior executive and public company board experience, risk management and financial and accounting expertise.

KEY SKILLS AND QUALIFICATIONS

› Industry – obtained comprehensive knowledge of payment processing software and technology through his 30-year career in the financial services industry; while at First Data Corporation, helped develop and grow the company into one of the largest processors of point of sale credit card transactions at the time.

› Risk Management – acquired significant expertise through his decades of leadership experience through overseeing complex organizations with global presence, including business operations, enterprise risk management and strategic planning.

› Financial and Accounting – developed proficiency through his career in executive and board leadership roles at financial services companies; as CEO of First Data Corporation, oversaw its acquisition by KKR which, at $29 billion, was one of the largest contemporary leveraged buyouts of a technology company at the time.

› Public Company/Corporate Governance – gained vital governance experience by serving on the board of directors of Unisys Corporation for over a decade, where he acted as Chairman for two years.

EXPERIENCE

FIRST DATA CORPORATION, an electronic commerce and payment services company

› Chairman and Chief Executive Officer (1992-2002; 2005-2007)

AMERICAN EXPRESS TRAVEL RELATED SERVICES COMPANY, INC., the predecessor of First Data Corporation

› President and Chief Executive Officer, Database Services Group (1987-1992)

AUTOMATIC DATA PROCESSING, INC., a global provider of human resources management software and solutions

› Group President Financial Services and Director (1984-1987)

› Advanced through roles of increasing responsibility (1973-1984)

OTHER BOARD SERVICE

UNISYS CORPORATION (1998-2014), Chairman (2006-2008)

SUNGARD CORP. (2003-2005)

CHECKFREE CORPORATION (2000-2004)

MASTERCARD (1997-1999)

THE GEORGE WASHINGTON UNIVERSITY BOARD OF TRUSTEES (1998-2008)

| |||

| ||||

Henry C.

INDEPENDENT DIRECTOR SINCE: 2016

AGE: 80

COMMITTEES:

› Audit

› Compensation

EDUCATION:

› BA, Business Administration, The George Washington University

› MBA, The George Washington University |

| |||

12

| Mr. Richison contributes to the Board his extensive industry and cybersecurity knowledge, expertise in data automation and in the SaaS sector, and senior executive and business development experience.

KEY SKILLS AND QUALIFICATIONS

› Senior Leadership – as the Co-Chief Executive Officer, President and Chairman of the Board of Paycom, he has garnered vast experience guiding Paycom from startup to a large publicly traded company; has overseen Paycom’s strategic vision and direction, contributing to its reputation as an innovator; leadership is marked by a focus on service excellence, technology development, and employee culture.

› Industry – as the founder of Paycom, he brings a comprehensive knowledge of the software, payments and technology industry; having started his career at a national payroll and HR company and a regional payroll company, Mr. Richison recognized opportunities to enhance efficiency of payroll and talent management operations and founded Paycom, which rapidly became one the first companies to offer cloud-based payroll service with a range of complementary HCM applications.

› Cybersecurity – obtained extensive knowledge of the technologies and processes resulting in the establishment of in-depth industry-leading data privacy and cybersecurity standards and technologies at Paycom needed to protect the Company and client data.

› Marketing/Business Development – under his leadership, Paycom has added tens of thousands of clients through elevating the Paycom brand, quality client engagement and providing world-class service.

EXPERIENCE

PAYCOM

› Co-Chief Executive Officer, President and Chairman (since February 2024)

› Chief Executive Officer, President and Chairman (2016-2024)

› Chief Executive Officer and President (1998-2016)

| |||

| ||||

Chad

CO-CHIEF EXECUTIVE OFFICER, PRESIDENT AND CHAIRMAN

CHAIRMAN SINCE: 2016

DIRECTOR SINCE: 1998

AGE: 53

EDUCATION:

› BA, Mass Communications—Journalism, University of Central Oklahoma |

| |||

13

14

Board of Directors Independence

Our Board of Directors relies on the criteria set forth in the New York Stock Exchange (“NYSE”) Listed Company Manual for purposes of evaluating the independence of directors and, based on such criteria, has affirmatively determined that each of Mses. Turney and Williams and each of Messrs. Duques, Levenson, Peters and Watts qualifies as “independent.” In making such determinations, the Board of Directors considered transactions and relationships between each non-employee director and the Company, if any, that would require disclosure pursuant to Item 404 of Regulation S-K under the Securities Act of 1933, as amended (the “Securities Act”). The Board of Directors also considered other transactions or relationships that do not rise to the level of requiring disclosure, including transactions and relationships (i) between the Company and entities affiliated with certain directors as a result of such entities’ purchase (at standard rates) and ongoing use of the Company’s HCM and payroll software and (ii) between the Company and a director’s immediate family member who was previously employed by the Company as an administrative assistant. There are no family relationships between any of our directors or executive officers.

Board Leadership Structure

Our Corporate Governance Guidelines provide that both independent and management directors are eligible for appointment as Chairman of the Board of Directors. We believe it is important that the Board of Directors retain flexibility to determine whether these roles should be separate or combined based upon all relevant facts and circumstances at a given point in time. Our Corporate Governance Guidelines provide that if the Chairman is not an independent director, the non-management directors are required to appoint a Lead Independent Director to represent and coordinate the activities of the non-management and independent directors and to help ensure the independence of the Board. A copy of the Corporate Governance Guidelines is available on our website at investors.paycom.com/corporate-governance.

| ||

Chairman of the Board of Directors |

Lead Independent Director | |

Our Co-Chief Executive Officer and President, Chad Richison, also serves as Chairman of the Board. The Board of Directors believes that, as founder of Paycom, Mr. Richison’s experience and in-depth knowledge make him best suited to effectively assess the opportunities and challenges facing the Company and our business. At this time, the Board believes that this leadership structure promotes decisive leadership, fosters clear accountability and enhances our ability to communicate our strategy clearly and consistently to our stockholders, employees and clients.

| Mr. Peters currently serves as Lead Independent Director. In this role, his responsibilities are to (i) preside over regularly scheduled executive sessions of non-management and independent directors, (ii) facilitate communication among the non-management and independent directors, (iii) act as a liaison between the non-management and independent directors and the Co-Chief Executive Officers and (iv) perform such other roles and responsibilities as may be assigned to him by the Board of Directors.

| |

Board of Directors Meetings

During the fiscal year ended December 31, 2023, the Board of Directors held five meetings. Each director attended more than 90% of the aggregate number of meetings held by the Board and the committees of the Board during the period such director served on the Board of Directors or committee(s), if applicable, in 2023. Except for Ms. Turney, each member of the Board of Directors attended the annual meeting of stockholders in 2023. The Board of Directors does not have a policy requiring director attendance at annual meetings of stockholders.

15

Executive Sessions of Independent Directors

The independent directors hold executive sessions at every regularly scheduled Board meeting and every regularly scheduled Audit Committee meeting. The other committees hold executive sessions from time to time, as deemed appropriate by the applicable committee. Each executive session is chaired by the Lead Independent Director (at Board meetings) or by the committee chairperson (at committee meetings), each of whom is an independent director.

Committees

Our Board of Directors has established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The composition and primary responsibilities of each committee are described below. Members serve on these committees until their resignation or death or until otherwise determined by our Board of Directors.

| Audit Committee | ||||

Current Membership

| ||||

Henry C. Duques • Robert J. Levenson • Frederick C. Peters II • Felicia Williams (Chairperson)

| ||||

Independence

| Qualifications

| 6 meetings in 2023

| ||

Each member is independent for purposes of serving on the Audit Committee, per applicable Securities and Exchange Commission (“SEC”) rules and regulations and the NYSE Listed Company Manual. | Each member is financially literate. Each of Ms. Williams and Mr. Peters is an “audit committee financial expert” and has accounting or related financial management expertise as required under the NYSE Listed Company Manual. | |||

Role and Responsibilities

| ||||

Our Audit Committee oversees our accounting and financial reporting processes and the audit of our financial statements. In that regard, our Audit Committee assists board oversight of the integrity of our financial statements, our compliance with legal and regulatory requirements, the independent auditor’s qualifications and independence and the performance of our internal audit function and independent auditors. Among other matters, the Audit Committee is responsible for the appointment, compensation, retention, oversight and pre-approval of our independent auditors, including oversight of firm and partner rotation; evaluating the qualifications, performance and independence of our independent auditors; reviewing our annual and interim financial statements; discussing press releases, financial information and earnings guidance provided to analysts and rating agencies; discussing policies with respect to risk assessment and risk management; reviewing and ensuring the adequacy of our internal control systems; reviewing the compliance and effectiveness of our Code of Ethics and Business Conduct; reviewing and approving related party transactions; and annually reviewing the Audit Committee charter and the Audit Committee’s performance.

| ||||

| Committee Charter | ||||

The Audit Committee operates under a written charter that satisfies the applicable SEC rules and regulations and the requirements of the NYSE Listed Company Manual. A copy of the Audit Committee charter is available on our website at investors.paycom.com/corporate-governance.

| ||||

16

| Compensation Committee | ||||

Current Membership

| ||||

Henry C. Duques • Robert J. Levenson • Sharen J. Turney • J.C. Watts, Jr. (Chairperson)

| ||||

Independence

| 10 meetings in 2023 | |||

Each member (i) is independent for purposes of serving on the Compensation Committee, per applicable SEC rules and regulations and the NYSE Listed Company Manual, and (ii) qualifies as a “non-employee director” for purposes of Rule 16b-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

| ||||

Role and Responsibilities

| ||||

Our Compensation Committee reviews and approves, or recommends that our Board of Directors approve, the compensation of our executive officers. Among other matters, the Compensation Committee reviews and approves corporate goals and objectives relevant to the compensation of our Co-Chief Executive Officers and other executive officers; evaluates the performance of these officers in light of those goals and objectives; approves all equity-related awards to our executive officers; approves and administers incentive-based compensation plans and equity-based compensation plans; and reviews and makes recommendations with respect to the annual Compensation Discussion and Analysis. The Compensation Committee also annually reviews the Compensation Committee charter and the Compensation Committee’s performance.

| ||||

Committee Charter

| ||||

The Compensation Committee operates under a written charter that satisfies the applicable SEC rules and regulations and the requirements of the NYSE Listed Company Manual. A copy of the Compensation Committee charter is available on our website at investors.paycom.com/corporate-governance.

| ||||

Compensation Committee Interlocks and Insider Participation

| ||||

Ms. Turney and each of Messrs. Levenson and Watts served on the Compensation Committee for the entirety of 2023. Mr. Peters served on the Compensation Committee at the beginning of 2023 but transitioned off the Compensation Committee in April 2023. Mr. Duques joined the Compensation Committee in May 2023. None of the persons who served on the Compensation Committee during 2023 is or has been an officer or employee of Paycom and none had any relationship with Paycom or any of its subsidiaries during 2023 that would be required to be disclosed as a transaction with a related person. None of our executive officers currently serves, or has in the last completed fiscal year served, on the board of directors or compensation or similar committee of another company at any time during which an executive officer of such other company served on our Board of Directors or Compensation Committee.

| ||||

17

| Nominating and Corporate Governance Committee | ||||

Current Membership

| ||||

Sharen J. Turney (Chairperson) • J.C. Watts, Jr. • Felicia Williams

| ||||

Independence

| 6 meetings in 2023 | |||

Each member is independent for purposes of serving on the Nominating and Corporate Governance Committee, per applicable SEC rules and regulations and the NYSE Listed Company Manual. | ||||

Role and Responsibilities

| ||||

Our Nominating and Corporate Governance Committee is responsible for, among other matters, identifying, evaluating and recommending candidates for membership on our Board of Directors, including nominees recommended by stockholders; reviewing and recommending the composition of our committees; overseeing our Code of Ethics and Business Conduct and Corporate Governance Guidelines; reporting and making recommendations to our Board of Directors concerning governance matters; overseeing our policies and programs on issues of social responsibility and environmental sustainability; and overseeing the preparation and publication of the Company’s Corporate Social Responsibility Report. The Nominating and Corporate Governance Committee also annually reviews the Nominating and Corporate Governance Committee charter, the performance of the Board of Directors and management, and its own performance.

| ||||

Committee Charter

| ||||

The Nominating and Corporate Governance Committee operates under a written charter that satisfies the applicable SEC rules and regulations and the requirements of the NYSE Listed Company Manual. A copy of the Nominating and Corporate Governance Committee charter is available on our website at investors.paycom.com/corporate-governance.

| ||||

18

Risk Oversight

Board of Directors

Our Board of Directors, as a whole and through its committees, is responsible for the oversight of our enterprise risk management strategy, and oversees our long-term strategic, organizational, and financial goals, executive performance reviews and succession planning, among other matters.

| ||||||||

Audit Committee

Retains primary responsibility for overseeing enterprise risk management, including strategic, operating, compliance, and cybersecurity risk management.

Regularly discusses areas of significant financial risk with management, including the Chief Financial Officer, as well as the programs and actions to limit, monitor or control such exposures.

|

Compensation Committee

Oversees risks related to our compensation program and practices.

In conjunction with management, reviews the potential risks arising from compensation design, including incentivizing excessive or unnecessary risk-taking behavior, and is responsible for ensuring resulting programs appropriately balance risk and reward.

|

Nominating and Corporate Governance Committee

Oversees risks related to corporate governance, the composition of our Board of Directors and its committees, and risks related to our social responsibility and environmental sustainability.

Annually reviews the composition of our Board of Directors and its committees to ensure appropriate skills and independence.

| ||||||

| ||||||||

Senior Management Team

Our senior management team is responsible for assessing, implementing and managing our risk management processes on a day-to-day basis, and for reporting to the Board on significant risks and risk management programs. Our senior management team, along with risk management leaders and our internal audit function, meet regularly to assess risk and ensure proper risk governance.

| ||||||||

Functional Risk Management

Our senior management team delegates to specific business function leaders responsibility for assessment, identification and mitigation of certain risks, such as those related to talent, finance, and cybersecurity. These business function leaders regularly report to the senior management team on the scope of such risks and the steps taken to detect, monitor, and mitigate risk exposure.

|

| Internal Audit

Our internal audit function reports to the Audit Committee and is responsible for maintaining and improving our risk management, corporate governance, and internal control environment. |

Board Oversight of Cybersecurity Risks

The Board of Directors has delegated to the Audit Committee primary responsibility for overseeing enterprise risk management, including oversight of risks from cybersecurity threats. Our Chief Information Officer oversees the activities of our information technology and information security teams. Our Chief Information Officer, together with our Executive Vice President of Information Technology and Information Security (who reports to our Chief Information Officer), is responsible for designing, implementing, and managing our information security risk management program, which includes our cybersecurity policies, practices and infrastructure. To assess whether our risks related to cybersecurity are being appropriately managed, the Audit Committee receives quarterly reports and updates from our Chief Information Officer and our Executive Vice President of Information Technology and Information Security with respect to cybersecurity risk management. Such reports cover our information security program, including its current status, capabilities, objectives and plans; the outcomes of regular business continuity, crisis communications, and disaster recovery exercises; updates on our ongoing compliance with applicable regulations and international cybersecurity standards; participation rates in our twice annual information security and monthly phishing trainings for employees; and the evolving cybersecurity threat landscape.

19

Director Nomination Procedures

|

| |||

1. Assess Need

The Nominating and Corporate Governance Committee annually evaluates the composition of our Board of Directors, including the directors’ array of experiences, skills, and backgrounds, to ensure the Board can effectively manage its responsibilities. When a position is open on the Board of Directors, or the Nominating and Corporate Governance Committee determines that a director with certain skills or background would enhance our Board’s effectiveness, the Nominating and Corporate Governance Committee undertakes a process to identify and recommend qualified candidates to the Board.

| ||||

|  | |||

2. Identify Candidates

The Nominating and Corporate Governance Committee oversees the search process, which may include recommendations from, and discussions with, our other independent directors and senior members of management, suggestions from our stockholders, and recommendations from an independent search firm. As part of the search process, the Nominating and Corporate Governance Committee seeks to include candidates representing diversity in race, ethnicity, gender, age, skills and professional experiences that enhance the quality of deliberations and decisions of the Board within the context of the needs of the Board at any given point in time.

| ||||

|  | |||

3. Evaluate Fit

The Nominating and Corporate Governance Committee screens all potential candidates for their independence, skills, qualifications, and potential conflicts. Candidates are evaluated in the same manner regardless of the source of recommendation. Qualifying candidates are then interviewed by the Chairman of the Board of Directors, our Lead Independent Director, our Nominating and Corporate Governance Committee chairperson and members of the senior management team.

| ||||

|  | |||

4. Recommend to the Board of Directors

The Nominating and Corporate Governance Committee narrows candidates to a final list and interviews are scheduled with other directors as appropriate. The Nominating and Corporate Governance Committee meets to select a candidate to recommend to the full Board for nomination or appointment.

| ||||

| ||||

| ||||

|

Results

Our Board of Directors has appointed two new directors over the past three years, Ms. Turney and Ms. Williams, both of whom have brought valuable skills, experiences, and perspectives to our Board of Directors. Ms. Turney, who joined the Board of Directors in 2021, has extensive board, executive leadership and management experience, particularly in digital/e-commerce as well as global operations. Our most recent addition, Ms. Williams, joined the Board of Directors in 2022 and brings over three decades of corporate financial leadership, audit, and enterprise risk management experience. |

| ||

|

The Nominating and Corporate Governance Committee has adopted a formal policy regarding stockholder nominees. The Nominating and Corporate Governance Committee will consider nomination recommendations submitted by stockholders entitled to vote generally in the election of directors. The Nominating and Corporate Governance Committee has not established a minimum number of shares of Common Stock a stockholder must own or required length of ownership to recommend a director candidate, but the committee will take into account the size and duration of a recommending stockholder’s ownership interest, as well as whether the stockholder intends to maintain its ownership interest in Paycom. The Nominating and Corporate Governance Committee will consider only recommendations of nominees who satisfy its minimum candidate qualifications, including that a director must represent the interests of all stockholders and not just one particular stockholder group or other constituency. The Nominating and Corporate Governance Committee will consider only recommendations submitted in compliance with our Amended and Restated Bylaws and any other procedural requirements disclosed in this proxy statement.

20

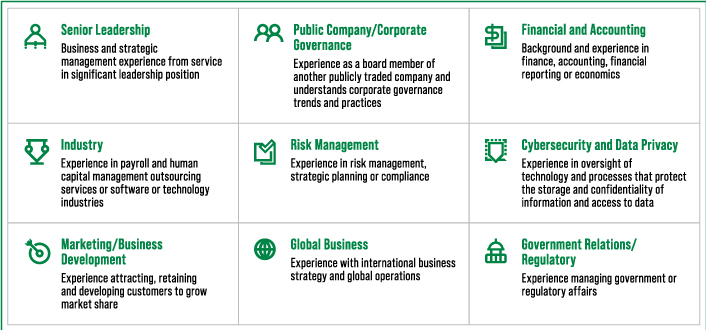

Director Qualifications

Our Nominating and Corporate Governance Committee is responsible for, among other things, assisting our Board of Directors in identifying qualified director nominees and recommending nominees to stand for election at each annual meeting of stockholders. The Nominating and Corporate Governance Committee’s goal is to assemble a board with a wide range of relevant experience, skills and perspectives. The Nominating and Corporate Governance Committee has adopted a set of criteria and standards for assessing the necessary skills and characteristics of director candidates (the “Director Qualification Standards”). In accordance with the Director Qualification Standards, the Nominating and Corporate Governance Committee will select director candidates on the basis of recognized achievements, knowledge, experience and other factors as deemed appropriate, including but not limited to a candidate’s (i) ability to bring sound and informed business judgment to the deliberations of the Board of Directors, (ii) character, integrity and loyalty to the Company, (iii) independence, (iv) ability to bring diverse points of view to bear on discussions, (v) representation of a mix of backgrounds, diversity of race/ethnicity, gender, age, skills and professional experiences that enhance the quality of the deliberations and decisions of our Board of Directors, in the context of the perceived needs of the structure of our Board of Directors at that point in time, (vi) financial knowledge and experience and (vii) understanding of marketing, technology, law, the impact of government regulations or other specific areas or disciplines. In connection with the adoption of the Director Qualification Standards, the Nominating and Corporate Governance Committee expressly reserved the right to deviate from and/or modify the Director Qualification Standards from time to time in its reasonable discretion.

The Nominating and Corporate Governance Committee believes that it is important that directors represent diverse viewpoints and individual perspectives. Diversity, equity and inclusion are values ingrained in our culture and essential to our business. The Board of Directors and the Nominating and Corporate Governance Committee aim to identify a diverse group of candidates and believe that no single criterion such as gender or minority status is determinative in obtaining diversity on the Board of Directors.

Annual Board and Director Self-Assessment Process

Each director completes an annual self-assessment of the Board of Directors and each committee, in each case to evaluate its effectiveness in fulfilling its responsibilities and to provide an opportunity for directors to provide feedback on potential improvements to processes and practices. The Nominating and Corporate Governance Committee leads the assessment process and analyzes the results. Topics directors are asked to provide feedback on include:

| • | the size, composition and structure of the Board of Directors and its committees; |

| • | the content, timing, and materials of Board and committee meetings; |

| • | the contributions and performance of the Board and each committee; |

| • | the performance of the executive team; and |

| • | succession planning. |

21

Communications with the Board of Directors

Any stockholder or other interested party who desires to communicate with the Board of Directors, a committee of the Board of Directors, the non-management/independent directors, the Lead Independent Director or any other individual director may do so by writing to such director or group of directors at: Paycom Software, Inc., 7501 W. Memorial Road, Oklahoma City, OK 73142, Attn: Legal Department.

The communication must prominently display the legend “BOARD COMMUNICATION” in order to indicate to the Legal Department that it is a communication for the Board of Directors. Upon receiving such a communication, the Legal Department will promptly forward the communication to the relevant individual or group to which it is addressed. The Board of Directors has requested that certain items that are unrelated to its duties and responsibilities should be excluded, such as spam, junk mail and mass mailings, resumes and other forms of job inquiries, surveys and business solicitations or advertisements.

The Legal Department will not forward any communication determined in its good faith belief to be frivolous, unduly hostile, threatening, illegal or similarly unsuitable. The Legal Department will maintain a list of each communication that was not forwarded because it was determined to be frivolous. Such list is delivered to the Board of the Directors at its quarterly meetings. In addition, each communication subject to this policy that was not forwarded because it was determined by the Legal Department to be frivolous is retained in our files and made available at the request of any member of the Board of Directors to whom such communication was addressed.

Code of Ethics and Business Conduct

We have adopted a Code of Ethics and Business Conduct that applies to all employees, officers and directors, including our Co-Chief Executive Officers, Chief Financial Officer and other principal executive and senior officers responsible for financial reporting. The Code of Ethics and Business Conduct is available on our website at investors.paycom.com/corporate-governance. Our Code of Ethics and Business Conduct is a “code of ethics,” as defined in Item 406(b) of Regulation S-K. The information contained on, or accessible from, our website is not part of this proxy statement by reference or otherwise. We will make any legally required disclosures regarding amendments to, or waivers of, provisions of our code of ethics on our website.

Hedging Policy

Our insider trading policy requires that any employee, executive officer or director wishing to enter into any hedging or similar transaction with respect to our securities must pre-clear such transaction with our Chief Financial Officer at least two weeks prior to, and must provide justification for, the proposed transaction.

22

Director Compensation

Overview and Philosophy

The Board of Directors believes that each director who is not employed by us (each, a “non-employee director”) should be compensated through a mix of cash and equity-based compensation, which is awarded in the form of restricted stock. The Compensation Committee, consisting entirely of independent directors, has primary responsibility for reviewing and considering any revisions to director compensation. Periodically, the Compensation Committee has reviewed director compensation with assistance from its independent compensation consultant, including conducting benchmarking against the Company’s peer group to help assess the appropriateness and competitiveness of our non-employee director compensation program. The Board of Directors reviews the Compensation Committee’s recommendations, discussing those recommendations among themselves, and determines the amount of director compensation. Historically, our philosophy is to align target total non-employee director compensation, including cash and equity, to be in a competitive range of our peer group.

Director Compensation in 2023

In 2023, the compensation package for non-employee directors consisted of (i) annual compensation for service as a director and as a member or chairperson of any committee(s), payable in cash in four quarterly installments (the “Director Cash Compensation”), and (ii) an award under the Paycom Software, Inc. 2023 Long-Term Incentive Plan (the “2023 LTIP”) of restricted stock with an aggregate fair market value of $235,000 (based on the closing price of the Common Stock on the date of grant, but rounded down to the nearest whole share to avoid the issuance of fractional shares) (the “Director Equity Compensation”). All directors are also entitled to reimbursement for their reasonable out-of-pocket expenditures incurred in connection with their service. The Director Cash Compensation is summarized below.

| Recipient(s) |

2023 Annual | ||||

Non-employee directors | 75,000 | ||||

Lead Independent Director | 25,000 | ||||

Audit Committee chairperson | 30,000 | ||||

Audit Committee members (excluding chairperson) | 15,000 | ||||

Compensation Committee chairperson | 23,000 | ||||

Compensation Committee members (excluding chairperson) | 13,000 | ||||

Nominating and Corporate Governance Committee chairperson | 15,000 | ||||

Nominating and Corporate Governance Committee members (excluding chairperson) | 10,000 | ||||

With respect to Director Equity Compensation, the shares of restricted stock were granted on the date of the 2023 annual meeting of stockholders and are scheduled to cliff-vest on the seventh (7th) day following the first (1st) anniversary of the 2023 annual meeting, provided that the non-employee director is providing services to the Company through the applicable vesting date. Any unvested Director Equity Compensation will be forfeited in the event that the non-employee director’s service to the Company terminates prior to the vesting date, unless (i) such director resigns concurrently with the annual meeting of stockholders immediately prior to the scheduled vesting date, (ii) such annual meeting is held not more than thirty (30) days prior to the scheduled vesting date and (iii) the resigning director continues to serve on the Board of Directors through the date of such annual meeting.

In the event that a new non-employee director is appointed to the Board of Directors other than at an annual meeting of stockholders (a “Mid-Term Director”), such Mid-Term Director is entitled to receive (i) the Director Cash Compensation beginning on the first quarterly payment date following his or her appointment and (ii) a partial award of the Director Equity Compensation on the date of his or her appointment, with the aggregate fair market value of such award to be determined based on the timing of such Mid-Term Director’s appointment in relation to the quarterly payment dates for the Director Cash Compensation.

23