UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under §240.14a-12

MALIBU BOATS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: |

Fee paid previously with preliminary materials.

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| 1. | Amount Previously Paid: |

| 2. | Form, Schedule or Registration Statement No.: |

| 3. | Filing Party: |

| 4. | Date Filed: |

MALIBU BOATS, INC.

5075 Kimberly Way

Loudon, Tennessee 37774

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On November 6, 2019

To the Stockholders of Malibu Boats, Inc.:

Notice is hereby given that the 2019 annual meeting of stockholders (the “Annual Meeting”) of Malibu Boats, Inc. (the “Company”) will be held at the offices of Pursuit Boats, 3901 St. Lucie Blvd, Fort Pierce, Florida 34946, Wednesday, November 6, 2019, at 11:00 a.m., Eastern time, for the following purposes:

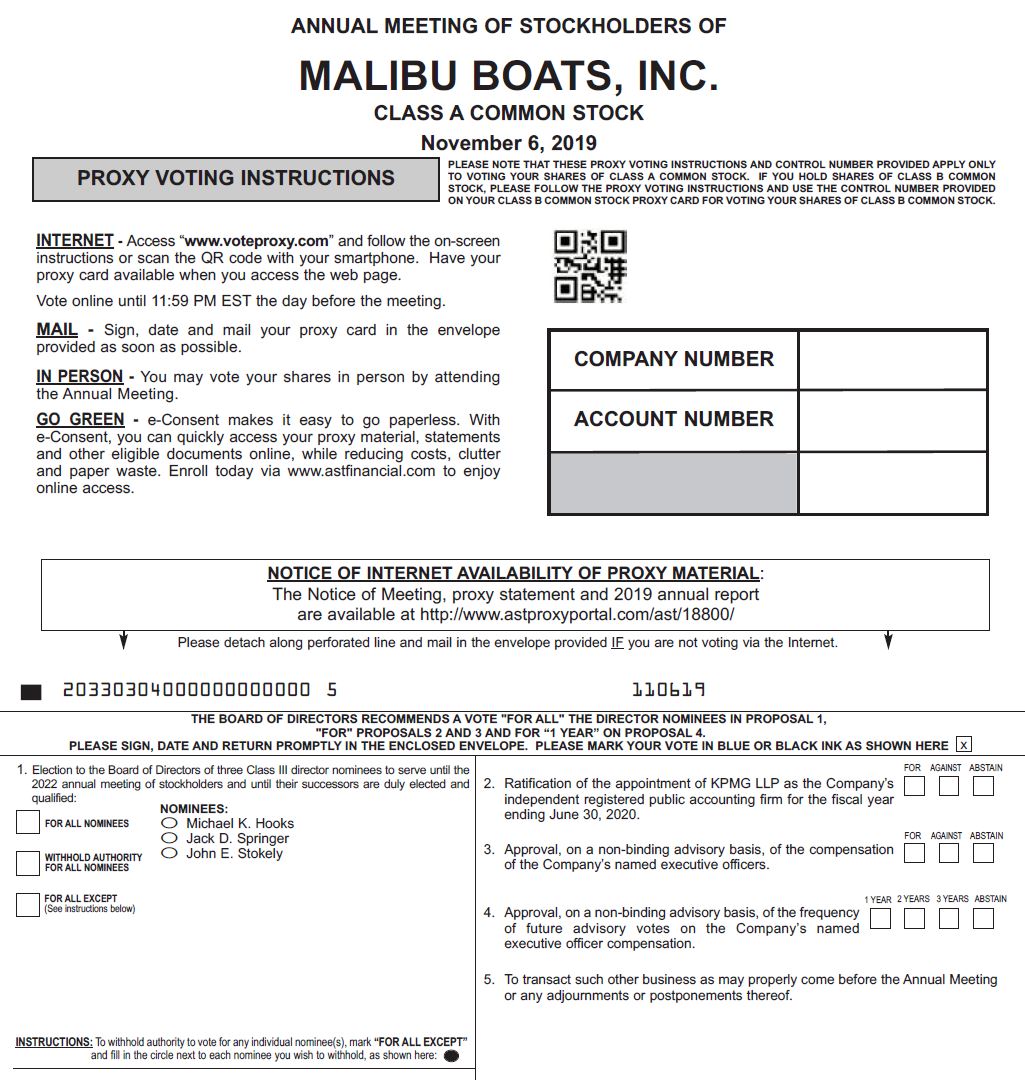

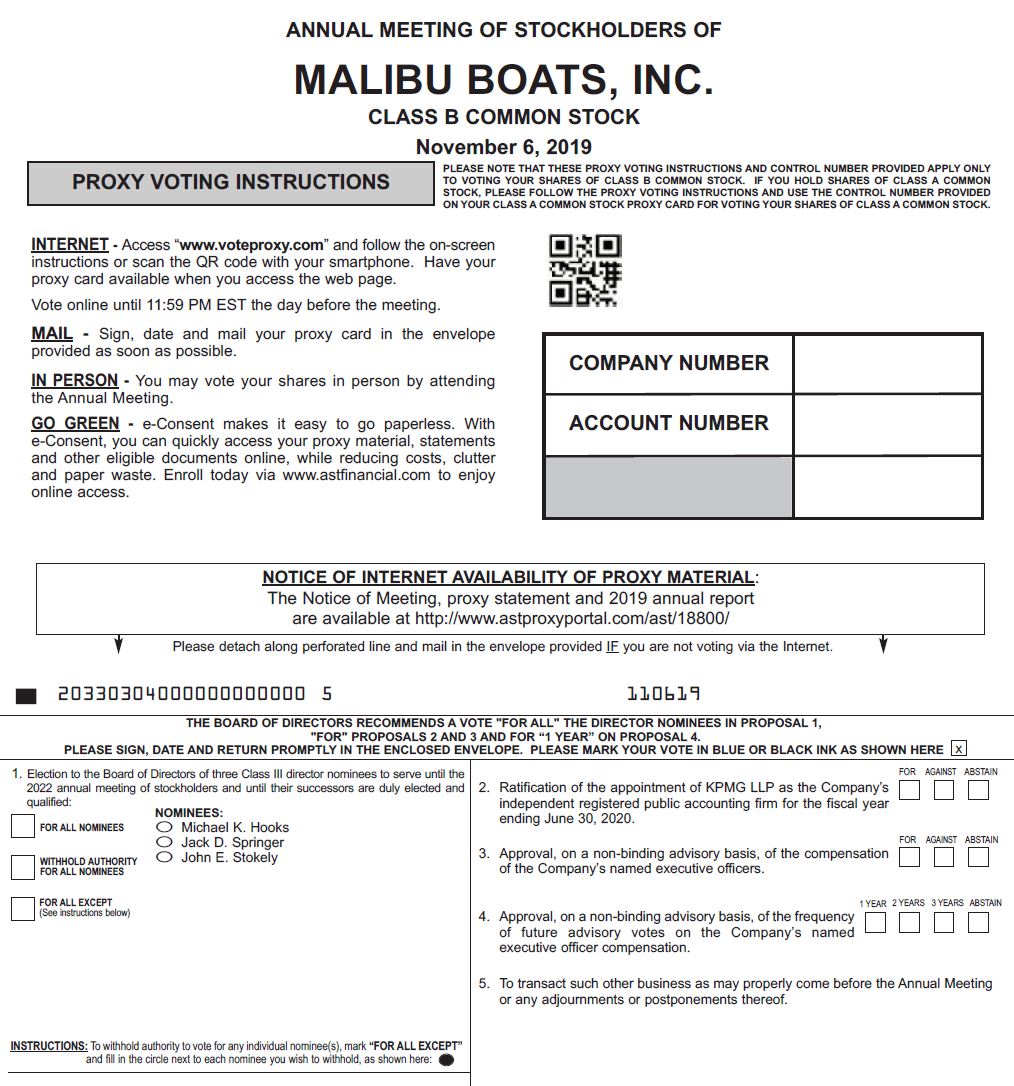

| (1) | To elect to the Board of Directors the three (3) nominees named in the attached Proxy Statement to serve until the Company’s 2022 annual meeting of stockholders and until their successors are duly elected and qualified; |

| (2) | To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2020; |

| (3) | To approve, on a non-binding advisory basis, the compensation of the Company's named executive officers; |

| (4) | To approve, on a non-binding advisory basis, the frequency of future advisory votes on the Company’s named executive officer compensation; and |

| (5) | To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

Only stockholders of record of the Company’s Class A common stock and Class B common stock as of the close of business on September 12, 2019 are entitled to notice of, and to vote at, the Annual Meeting and any postponements or adjournments thereof.

You are cordially invited to attend the Annual Meeting in person. Your vote is important to us. Whether or not you expect to attend the Annual Meeting, please submit your proxy as soon as possible. If you attend the Annual Meeting and vote in person, your proxy will not be used.

| By Order of the Board of Directors, | |

| |

| Wayne R. Wilson | |

| Chief Financial Officer and Secretary | |

Loudon, Tennessee

September 18, 2019

PLEASE DATE, SIGN AND MAIL THE ENCLOSED PROXY CARD OR

SUBMIT YOUR PROXY USING THE INTERNET.

SUBMIT YOUR PROXY USING THE INTERNET.

Use of the enclosed envelope requires no postage for mailing in the United States.

MALIBU BOATS, INC.

5075 Kimberly Way

Loudon, Tennessee 37774

PROXY STATEMENT

The Board of Directors of Malibu Boats, Inc. solicits your proxy for the 2019 annual meeting of stockholders (the “Annual Meeting”) to be held at 11:00 a.m., Eastern time, on Wednesday, November 6, 2019 at the offices of Pursuit Boats, 3901 St. Lucie Blvd, Fort Pierce, Florida 34946, and at any and all postponements or adjournments of the Annual Meeting. The approximate date on which these proxy materials are first being sent or made available to our stockholders is September 18, 2019.

Unless otherwise expressly indicated or the context otherwise requires, in this Proxy Statement:

| • | we use the terms “Malibu Boats,” the “Company,” “we,” “us,” “our” or similar references to refer (1) prior to the consummation of our initial public offering of Class A common stock (the “IPO”) to Malibu Boats Holdings, LLC (the “LLC”), and its consolidated subsidiaries and (2) after the IPO, to Malibu Boats, Inc. and its consolidated subsidiaries; |

| • | we refer to owners of membership interests in the LLC immediately prior to the consummation of the IPO, collectively, as our “pre-IPO owners”; and |

| • | we refer to owners of membership interests in the LLC, collectively, as our “LLC members”. |

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS

This Proxy Statement and our 2019 Annual Report on Form 10-K are available on the Internet at http:// www.astproxyportal.com/ast/18800/.

TABLE OF CONTENTS

Page

| Page | |

2

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

| Q: | What items will be voted on at the Annual Meeting? |

| A: | The items of business scheduled to be voted on at the Annual Meeting are: |

| • | the election to the Board of Directors of the three (3) nominees named in this Proxy Statement to serve until the 2022 annual meeting of stockholders and until their successors are duly elected and qualified (Proposal No. 1); |

| • | the ratification of the appointment of KPMG LLP (“KPMG”) as our independent registered public accounting firm for the fiscal year ending June 30, 2020 (Proposal No. 2); |

| • | the approval, on a non-binding advisory basis, of our named executive officer compensation (Proposal No. 3); and |

| • | the approval, on a non-binding advisory basis, of the frequency of future advisory votes on our named executive officer compensation (Proposal No. 4). |

We will also consider any other business that properly comes before the Annual Meeting or any adjournments or postponements thereof. See “—How will voting on any other business be conducted?” below.

| Q: | How does the Board recommend I vote on these items? |

| A: | The Board of Directors recommends that you vote your shares: |

| • | FOR the election to the Board of Directors of each of the following three nominees: Michael K. Hooks, Jack D. Springer and John E. Stokely (Proposal No. 1); |

| • | FOR the ratification of the appointment of KPMG as our independent registered public accounting firm for the fiscal year ending June 30, 2020 (Proposal No. 2); |

| • | FOR the approval, on a non-binding advisory basis, of our named executive officer compensation (Proposal No. 3); and |

| • | ONE YEAR with respect to the frequency of future advisory votes on our named executive officer compensation (Proposal No. 4). |

| Q: | Who is entitled to vote at the Annual Meeting? |

| A: | The record date for the Annual Meeting is September 12, 2019. Stockholders of record of Malibu Boats’ Class A common stock and Class B common stock as of the close of business on the record date are entitled to vote at the Annual Meeting. |

| Q: | What options are available to me to vote my shares? |

| A: | Whether you hold shares directly as the stockholder of record or through a bank, broker or other nominee (that is, in “street name”), your shares may be voted at the Annual Meeting by following any of the voting options available to you below: |

You may vote via the Internet.

| (1) | If you received proxy materials by email, you may submit your proxy or voting instructions over the Internet by following the instructions included in the email; or |

| (2) | If you received a printed set of the proxy materials by mail, including a paper copy of the proxy card (if you are a stockholder of record) or voting instruction form (if you hold your shares in street name), you |

3

may submit your proxy or voting instructions over the Internet by following the instructions on the proxy card or voting instruction form.

If you hold shares of Class A common stock and Class B common stock, you will receive two separate proxy cards or voting instruction forms with two separate control numbers, one each for Class A common stock and Class B common stock. You must follow the instructions on each separate proxy card or voting instruction form, one each for Class A common stock and Class B common stock, for all of your votes to be counted.

You may vote by mail. If you received a printed set of the proxy materials, you can submit your proxy or voting instructions by completing and signing the separate proxy card or voting instruction form you received and mailing it in the accompanying prepaid and addressed envelope. If you hold shares of Class A common stock and Class B common stock, you will receive two separate proxy cards, one each for Class A common stock and Class B common stock. You must submit both cards, one each for Class A common stock and Class B common stock, for all of your votes to be counted. For instance, if you only submit the proxy card for your shares of Class A common stock, but not the proxy card for your shares of Class B common stock, we will not include your votes for your Class B common stock.

You may vote in person at the meeting. All stockholders of record may vote in person at the Annual Meeting. Written ballots will be passed out to anyone who wants to vote at the Annual Meeting. However, if you are the beneficial owner of shares held in street name through a bank, broker or other nominee, you may not vote your shares at the Annual Meeting unless you obtain a “legal proxy” from the bank, broker or nominee that holds your shares giving you the right to vote the shares at the Annual Meeting.

Even if you plan to attend the Annual Meeting, we recommend that you submit your proxy or voting instructions in advance to authorize the voting of your shares at the Annual Meeting so that your vote will be counted if you later are unable to attend the Annual Meeting.

| Q: | What is the deadline for voting my shares? |

| A: | If you are a stockholder of record, your proxy must be received by the Internet by 11:59 p.m. Eastern time on November 5, 2019 in order for your shares to be voted at the Annual Meeting. However, if you are a stockholder of record and you received a copy of the proxy materials by mail, you may instead mark, sign, date and return the proxy card you received and return it in the accompanying prepaid and addressed envelope so that it is received by Malibu Boats before the Annual Meeting in order for your shares to be voted at the Annual Meeting. If you hold your shares in street name, please provide your voting instructions by the deadline specified by the bank, broker or other nominee who holds your shares. |

| Q: | Once I have submitted my proxy, is it possible for me to change or revoke my proxy? |

| A: | Yes. Any stockholder of record has the power to change or revoke a previously submitted proxy at any time before it is voted at the Annual Meeting by: |

| • | submitting to our Secretary, before the voting at the Annual Meeting, a written notice of revocation bearing a later date than the proxy; |

| • | properly submitting a proxy on a later date prior to the deadlines specified in “—What is the deadline for voting my shares?” above (only the latest proxy submitted by a stockholder by Internet or mail will be counted); or |

| • | attending the Annual Meeting and voting in person. |

For shares held in street name, you may revoke any previous voting instructions by submitting new voting instructions to the bank, broker or nominee holding your shares by the deadline for voting specified in the voting instructions provided by your bank, broker or nominee. Alternatively, if your shares are held in street name and you have obtained a legal proxy from the bank, broker or nominee giving you the right to vote the shares at the Annual Meeting, you may revoke any previous voting instructions by attending the Annual Meeting and voting in person.

4

Attendance at the Annual Meeting will not by itself constitute a revocation of a proxy.

| Q: | How many shares are eligible to vote at the Annual Meeting? |

| A: | If you are a holder of our Class A common stock, then you are entitled to one vote at our Annual Meeting for each share of our Class A common stock that you held as of the record date. If you are a holder of our Class B common stock, then you are entitled to the number of votes at our Annual Meeting that is equal to the number of membership units in Malibu Boats Holdings, LLC (the “LLC Units”) held by you, regardless of the number of shares of Class B common stock held by you. All matters presented to our stockholders at the Annual Meeting will be voted on by the holders of our Class A common stock and Class B common stock voting together as a single class. |

As of September 12, 2019, we had 20,508,698 shares of Class A common stock outstanding that will carry 20,508,698 votes and 15 shares of Class B common stock outstanding that will carry an aggregate of 830,152 votes (i.e., a number of votes that is equal to the aggregate number of outstanding LLC Units, other than LLC Units held by Malibu Boats, Inc.).

| Q: | How is a quorum determined? |

| A: | A quorum refers to the number of shares that must be in attendance at an annual meeting of stockholders to lawfully conduct business. The representation, in person or by proxy, of holders entitled to cast a majority of all of the votes entitled to be cast at the Annual Meeting constitutes a quorum at the meeting. Your shares will be counted for purposes of determining whether a quorum exists for the Annual Meeting if you returned a signed and dated proxy card or voting instruction form, if you submitted a proxy or voting instructions by the Internet, or if you vote in person at the Annual Meeting, even if you abstain from voting on any of the proposals. In addition, if you are a street name holder, your shares may also be counted for purposes of determining whether a quorum exists for the Annual Meeting even if you do not submit voting instructions to your broker. See “—What is required to approve each proposal at the Annual Meeting and what effect do votes withheld, abstentions and broker non-votes have?” below. |

| Q: | How will my shares be voted if I do not give specific voting instructions in the proxy or voting instruction form I submit? |

| A: | If you are a stockholder of record and you properly submit a proxy but do not indicate your specific voting instructions on one or more of the items listed above in the notice of meeting, your shares will be voted as recommended by the Board of Directors on those items. See “—How does the Board recommend I vote on these items?” above. |

If you hold your shares in street name through a brokerage account and you do not submit voting instructions to your broker, your broker may generally vote your shares in its discretion on routine matters but not on non-routine matters. See “—What is required to approve each proposal at the Annual Meeting and what effect do votes withheld, abstentions and broker non-votes have?” below.

| Q: | What is required to approve each proposal at the Annual Meeting and what effect do votes withheld, abstentions and broker non-votes have? |

| A: | Election of Directors (Proposal No. 1). Once a quorum has been established, the affirmative vote of a plurality of all the votes cast on the matter at the Annual Meeting in person or by proxy will be required for the election of each director nominee, meaning that the persons receiving the highest number of FOR votes, up to the total number of directors to be elected at the meeting, will be elected. Stockholders are not permitted to cumulate their shares for the purpose of electing directors. For purposes of Proposal No. 1 (election of directors), you may vote “FOR” any or all of the nominees or “WITHHOLD” your vote from any or all of the nominees. Shares voted WITHHOLD and broker non-votes will not be counted in determining the outcome of the director nominees’ election. |

Other Items (Proposals No. 2, 3 and 4). Once a quorum has been established, pursuant to our Bylaws, approval of each of the other items to be submitted for a vote of stockholders at the Annual Meeting requires the

5

affirmative vote of a majority of all of the votes cast on the item at the Annual Meeting. Notwithstanding this vote standard required by our Bylaws, Proposal No. 2 (ratification of the appointment of KPMG as our independent registered public accounting firm for the fiscal year ending June 30, 2020), Proposal No. 3 (approval, on a non-binding advisory basis, of our named executive officer compensation) and Proposal No. 4 (approval, on a non-binding advisory basis, of the frequency of future advisory votes on our named executive officer compensation) are advisory only and are not binding on us. Our Board of Directors will consider the outcome of the vote on each of these items in considering what action, if any, should be taken in response to the vote by stockholders.

For purposes of Proposal No. 2 (ratification of the appointment of KPMG as our independent registered public accounting firm for the fiscal year ending June 30, 2020) and Proposal No. 3 (approval, on a non-binding advisory basis, of our named executive officer compensation), you may vote “FOR,” “AGAINST” or “ABSTAIN.” For purposes of Proposal No. 4 (approval, on a non-binding advisory basis, of the frequency of future advisory votes on our named executive officer compensation) you may vote “ONE YEAR,” “TWO YEARS,” or “THREE YEARS” or “ABSTAIN.” If no frequency option receives the affirmative vote of a majority of all the votes cast on Proposal No. 4 at the Annual Meeting, our Board of Directors will consider the option receiving the highest number of votes as the preferred frequency option of our stockholders.

Abstentions with respect to any proposal at the Annual Meeting will be counted as present and entitled to vote for purposes of determining the presence of a quorum, but will not be counted as a vote cast on the proposal and therefore will not be counted in determining the vote for the election of directors, the ratification of the appointment of KPMG, the approval of named executive officer compensation or the approval of the frequency of future advisory votes on named executive officer compensation.

If you hold your shares in street name through a brokerage account and you do not submit voting instructions to your broker, your broker may generally vote your shares in its discretion on routine matters. However, a broker cannot vote shares held in street name on non-routine matters unless the broker receives voting instructions from the street name holder. The proposal to ratify the appointment of KPMG as our independent registered public accounting firm for the fiscal year ending June 30, 2020 (Proposal No. 2) is considered routine under applicable rules, while each of the other items to be submitted for a vote of stockholders at the Annual Meeting is considered non-routine. Accordingly, if you hold your shares in street name through a brokerage account and you do not submit voting instructions to your broker, your broker may exercise its discretion to vote your shares on Proposal No. 2, but will not be permitted to vote your shares on any of the other proposals at the Annual Meeting. If your broker exercises this discretion, your shares will be counted as present for the purpose of determining the presence of a quorum at the Annual Meeting and will be voted on Proposal No. 2 in the manner directed by your broker, but your shares will constitute “broker non-votes” on Proposals No. 1, 3 and 4 at the Annual Meeting. Broker non-votes will not be counted as a vote cast with respect to Proposals No. 1, 3 and 4 and therefore will not be counted in determining the outcome of those items.

| Q: | How will voting on any other business be conducted? |

| A: | Although the Board of Directors does not know of any business to be considered at the Annual Meeting other than the items described in this Proxy Statement, if any other business properly comes before the Annual Meeting, a stockholder’s properly submitted proxy gives authority to the proxy holders to vote on those matters in their discretion. |

| Q: | Who will bear the costs of the solicitation of proxies? |

| A: | The cost of preparing the Notice of Annual Meeting of Stockholders, this Proxy Statement, and the form of proxy, the cost of making such materials available on the Internet and the cost of soliciting proxies will be paid by Malibu Boats. We have retained D.F. King & Co., Inc., a third-party solicitation firm, to assist in the distribution of proxy materials and solicitation of proxies on our behalf for an estimated fee of $5,500 plus reimbursement of certain out-of-pocket expenses. In addition to solicitation by mail, certain officers, regular employees and directors of Malibu Boats, without receiving any additional compensation, may solicit proxies personally or by telephone. Malibu Boats will request brokerage houses, banks and other custodians or nominees holding stock in their names for others to forward proxy materials to their customers or principals |

6

who are the beneficial owners of shares of our Class A common stock and Class B common stock and will reimburse them for their expenses in doing so.

| Q: | Where can I find the voting results of the Annual Meeting? |

| A: | We intend to announce preliminary voting results at the Annual Meeting and disclose final voting results in a Current Report on Form 8-K to be filed with the Securities and Exchange Commission (“SEC”) within four business days following the Annual Meeting. |

7

SECURITY OWNERSHIP OF PRINCIPAL STOCKHOLDERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of shares of our Class A common stock and Class B common stock and of LLC Units of our subsidiary, Malibu Boats Holdings, LLC, as of September 12, 2019 by (1) each person known to us to beneficially own more than 5% of any class of the outstanding voting securities of Malibu Boats, Inc., (2) each of our directors and named executive officers and (3) all of our current directors and executive officers as a group.

The number of shares of our Class A common stock and of LLC Units outstanding and the percentage of beneficial ownership is based on 20,508,698 shares of our Class A common stock and 21,338,850 LLC Units outstanding as of September 12, 2019. Each holder of LLC Units holds one share of our Class B common stock. Each share of Class B common stock entitles the holder to one vote for each LLC Unit held by such holder. Accordingly, the holders of LLC Units collectively have a number of votes in Malibu Boats, Inc. that is equal to the aggregate number of LLC Units that they hold. Beneficial ownership reflected in the table below includes the total shares or units held by the individual and his or her affiliates. Beneficial ownership is determined in accordance with the rules of the SEC.

Unless otherwise indicated and subject to applicable community property laws, to our knowledge, each stockholder named in the following table possesses sole voting and investment power over the shares listed. Unless otherwise noted below, the address of each person listed on the table is c/o Malibu Boats, Inc., 5075 Kimberly Way, Loudon, Tennessee 37774.

Class A Common Stock Beneficially Owned (1) | LLC Units Beneficially Owned (1) | Class B Common Stock Beneficially Owned | Combined Voting Power (2) | |||||||||

| Name of Beneficial Owner | Number | % | Number | % | Number | % | ||||||

| 5% Stockholders | ||||||||||||

BlackRock, Inc. (3) | 1,637,655 | 8.0 | — | — | — | 7.7 | ||||||

Macquarie Group Limited (4) | 1,266,606 | 6.2 | — | — | 5.9 | |||||||

Lord, Abbett & Co. LLC (5) | 1,242,146 | 6.1 | — | — | — | 5.8 | ||||||

Lazard Asset Management LLC (6) | 1,143,933 | 5.6 | — | — | — | 5.4 | ||||||

Renaissance Technologies LLC (7) | 1,079,101 | 5.3 | — | — | — | 5.1 | ||||||

The Vanguard Group (8) | 1,031,198 | 5.0 | — | — | — | 4.8 | ||||||

Malibu Boats, Inc. (9) | — | — | 20,508,698 | 96.1 | — | — | ||||||

| Directors and Named Executive Officers | ||||||||||||

Jack D. Springer (10) | 144,599 | * | 52,735 | * | 1 | * | ||||||

Wayne R. Wilson (11) | 55,120 | * | 29,352 | * | 1 | * | ||||||

Ritchie L. Anderson (12) | 49,058 | * | 9,912 | * | 1 | * | ||||||

Deborah S. Kent (13) | 3,429 | * | — | — | — | * | ||||||

Michael K. Hooks (14) | 37,256 | * | 25,000 | * | 1 | * | ||||||

James R. Buch (15) | 20,999 | * | — | — | — | * | ||||||

Ivar S. Chhina (16) | 20,999 | * | — | — | — | * | ||||||

Michael J. Connolly (17) | 36,562 | * | — | — | — | * | ||||||

Mark W. Lanigan (18) | 36,329 | * | 50,136 | * | 1 | * | ||||||

| Joan M. Lewis | 646 | * | — | — | — | * | ||||||

Peter E. Murphy (19) | 23,999 | * | — | — | — | * | ||||||

William Paxson St. Clair, Jr. (20) | 24,575 | * | — | — | — | * | ||||||

John E. Stokely (21) | 20,999 | * | — | — | — | * | ||||||

| Current Directors and Executive Officers as a group | ||||||||||||

(12 persons) (22) | 449,995 | 2.2 | 167,135 | * | 5 | 2.9 | ||||||

___________

8

| * | Less than 1.0% |

| (1) | Subject to the terms of the exchange agreement, the LLC Units are exchangeable for shares of our Class A common stock on a one-for-one basis. See “Certain Relationships and Related Party Transactions—Exchange Agreement.” Beneficial ownership of LLC Units reflected in these tables has not been reflected as beneficial ownership of shares of our Class A common stock for which such units may be exchanged. |

| (2) | Includes the voting power of each owner based on the voting power held through both the owners’ Class A common stock and Class B common stock (which Class B common stock reflects each owner’s holdings of LLC Units). Represents percentage of voting power of the Class A common stock and Class B common stock of Malibu Boats, Inc. voting together as a single class. |

| (3) | Based on a Schedule 13G/A filed on February 6, 2019 by BlackRock, Inc. (“BlackRock”). According to the Schedule 13G/A, as of December 31, 2018, BlackRock has sole voting power over 1,565,994 shares and sole dispositive power over 1,637,655 shares. The address of BlackRock is 55 East 52nd Street, New York, New York 10055. |

| (4) | Based on a Schedule 13G/A filed on February 14, 2019 by Macquarie Group Limited on behalf of itself and Macquarie Bank Limited, Macquarie Investment Management Holdings Inc., Macquarie Investment Management Business Trust and Macquarie Funds Management Hong Kong Limited. According to the Schedule 13G/A, as of December 31, 2018, Macquarie Investment Management Holdings Inc. has sole voting and dispositive power over 1,262,662 shares, Macquarie Investment Management Business Trust has sole voting and dispositive power over 1,262,662 shares and Macquarie Funds Management Hong Kong Limited has sole voting and dispositive power over 500 shares. Macquarie Group Limited and Macquarie Bank Limited are each deemed to beneficially own 1,266,606 shares due to their ownership of the entities above. The address of Macquarie Group Limited and Macquarie Bank Limited is 50 Martin Place, Sydney, New South Wales, Australia. The address of Macquarie Investment Management Holdings Inc. and Macquarie Investment Management Business Trust is 2005 Market Street, Philadelphia, Pennsylvania 19103. The address of Macquarie Funds Management Hong Kong Limited is Level 18, Once International Finance Centre, 1 Harbour View Street, Hong Kong. |

| (5) | Based on a Schedule 13G filed on February 14, 2019 by Lord, Abbett & Co. LLC (“Lord Abbett”). According to the Schedule 13G, as of December 31, 2018, Lord Abbett has sole voting power over 1,207,837 shares and sole dispositive power over 1,097,699 shares. The address of Lord Abbett is 90 Hudson Street, Jersey City, New Jersey 07302. |

| (6) | Based on a Schedule 13G/A filed on February 12, 2019 by Lazard Asset Management LLC (“Lazard”). According to the Schedule 13G/A, as of December 31, 2018, Lazard has sole voting power over 601,260 shares and sole dispositive power over 1,143,933 shares. The address of Lazard is 30 Rockefeller Plaza, New York, New York 10112. |

| (7) | Based on a Schedule 13G filed on February 12, 2019 by Renaissance Technologies LLC on behalf of itself and Renaissance Technologies Holdings Corporation. According to the Schedule 13G, as of December 31, 2018, Renaissance Technologies LLC has sole voting power over 1,000,701 shares, sole dispositive power over 1,003,115 shares and shared dispositive power over 75,986 shares. Renaissance Technologies Holdings Corporation has sole voting power over 1,000,701 shares, sole dispositive power over 1,003,115 shares and shared dispositive power over 75,986 shares. The address of Renaissance Technologies LLC and Renaissance Technologies Holdings Corporation is 800 Third Avenue, New York, New York 10022. |

| (8) | Based on a Schedule 13G/A filed on February 11, 2019 by The Vanguard Group (“Vanguard”). According to the Schedule 13G/A, as of December 31, 2018, Vanguard has sole voting power over 40,241 shares, sole dispositive power over 990,957 shares and shared dispositive power over 40,241 shares. The address of Vanguard is 100 Vanguard Blvd., Malvern, Pennsylvania 19355. |

9

| (9) | Represents the number of LLC Units held by Malibu Boats, Inc. Malibu Boats, Inc. does not hold any Class B common stock. |

| (10) | Includes (i) 22,671 shares of Class A common stock held directly by Mr. Springer, (ii) 10,124 shares of restricted stock vesting in two equal annual installments beginning on November 4, 2019, (iii) 5,650 shares of restricted stock vesting on November 6, 2019, (iv) 8,250 shares of restricted stock vesting in three equal annual installments beginning on November 6, 2019, (v) 12,000 shares of restricted stock vesting in four equal annual installments beginning on November 6, 2019, (vi) options to purchase 26,750 shares of Class A common stock that are fully vested, (vii) options to purchase 2,500 shares of Class A common stock vesting on November 6, 2019 and (viii) 19,562 shares of restricted stock that vest subject to the achievement of certain performance targets. Does not include (i) options to purchase 26,000 shares of Class A common stock vesting in two equal annual installments beginning on June 29, 2020, (ii) options to purchase 18,750 shares of Class A common stock vesting in three equal annual installments beginning on August 22, 2020, (iii) options to purchase 5,000 shares of Class A common stock vesting in two equal annual installments beginning on November 6, 2020 and (iv) options to purchase 5,000 shares of Class A common stock that vest subject to the achievement of certain performance targets. Includes 37,092 shares of Class A common stock and 52,735 LLC Units held directly by a limited liability company. Mr. Springer and his wife each own a 50% membership interest in, and Mr. Springer is the managing member of, the limited liability company. |

| (11) | Includes (i) 14,631 shares of Class A common stock held directly by Mr. Wilson, (ii) 3,500 shares of restricted stock vesting in two equal annual installments beginning on November 4, 2019, (iii) 4,125 shares of restricted stock vesting in three equal annual installments beginning on November 6, 2019, (iv) 6,000 shares of restricted stock vesting in four equal annual installments beginning on November 6, 2019, (v) options to purchase 13,375 shares of Class A common stock that are fully vested, (vi) options to purchase 1,250 shares of Class A common stock vesting on November 6, 2019, (vii) 10,500 shares of restricted stock that vest subject to the achievement of certain performance targets and (viii) 1,739 restricted stock units vesting on November 6, 2019. Does not include (i) options to purchase 13,000 shares of Class A common stock vesting in two equal annual installments beginning on June 29, 2020, (ii) options to purchase 9,375 shares of Class A common stock vesting in three equal annual installments beginning on August 22, 2020, (iii) options to purchase 2,500 shares of Class A common stock vesting in two equal annual installments beginning on November 6, 2020 and (iv) options to purchase 2,500 shares of Class A common stock that vest subject to the achievement of certain performance targets. The restricted stock units represent the contingent right to receive an equivalent number of shares of our Class A common stock. Includes 29,352 LLC Units held directly by Mr. Wilson. |

| (12) | Includes (i) 12,005 shares of Class A common stock held directly by Mr. Anderson, (ii) 2,500 shares of restricted stock vesting in two equal annual installments beginning on November 4, 2019, (iii) 4,125 shares of restricted stock vesting in three equal annual installments beginning on November 6, 2019, (iv) 6,000 shares of restricted stock vesting in four equal annual installments beginning on November 6, 2019, (v) options to purchase 10,875 shares of Class A common stock that are fully vested, (vi) options to purchase 1,250 shares of Class A common stock vesting on November 6, 2019, (vii) 11,000 shares of restricted stock that vest subject to the achievement of certain performance targets and (viii) 1,303 restricted stock units vesting on November 6, 2019. Does not include (i) options to purchase 13,000 shares of Class A common stock vesting in two equal annual installments beginning on June 29, 2020, (ii) options to purchase 9,375 shares of Class A common stock vesting in three equal annual installments beginning on August 22, 2020, (iii) options to purchase 2,500 shares of Class A common stock vesting in two equal annual installments beginning on November 6, 2020 and (iv) options to purchase 2,500 shares of Class A common stock that vest subject to the achievement of certain performance targets. The restricted stock units represent the contingent right to receive an equivalent number of shares of our Class A common stock. Includes 9,912 LLC Units held directly by Mr. Anderson. |

| (13) | Includes (i) 2,003 shares of Class A common stock held directly by Ms. Kent, (ii) 725 restricted stock units vesting on November 4, 2019, (iii) 369 restricted stock units vesting on November 6, 2019 and (iv) 332 |

10

restricted stock units vesting on November 6, 2019. Does not include (i) 725 restricted stock units vesting on November 4, 2020, (ii) 737 restricted stock units vesting in two substantially equal annual installments beginning on November 6, 2020 and (iii) 993 restricted stock units vesting in three substantially equal annual installments beginning on November 6, 2020. The restricted stock units represent the contingent right to receive an equivalent number of shares of our Class A common stock.

| (14) | Includes 37,256 stock units and 25,000 LLC Units held directly by Mr. Hooks. The stock units are fully vested and payable in an equivalent number of shares of our Class A common stock upon or as soon as practicable, and in all events within 30 days, following the first to occur of (A) the date of Mr. Hooks’ separation from service (as defined in our director compensation policy) or (B) the occurrence of a change in control under our Long-Term Incentive Plan. |

| (15) | Includes 20,999 stock units. The stock units are fully vested and payable in an equivalent number of shares of our Class A common stock upon or as soon as practicable, and in all events within 30 days, following the first to occur of (A) the date of Mr. Buch’s separation from service (as defined in our director compensation policy) or (B) the occurrence of a change in control under our Long-Term Incentive Plan. |

| (16) | Includes 20,999 stock units. The stock units are fully vested and payable in an equivalent number of shares of our Class A common stock upon or as soon as practicable, and in all events within 30 days, following the first to occur of (A) the date of Mr. Chhina’s separation from service (as defined in our director compensation policy) or (B) the occurrence of a change in control under our Long-Term Incentive Plan. |

| (17) | Includes 36,562 stock units. The stock units are fully vested and payable in an equivalent number of shares of our Class A common stock upon or as soon as practicable, and in all events within 30 days, following the first to occur of (A) the date of Mr. Connolly’s separation from service (as defined in our director compensation policy) or (B) the occurrence of a change in control under our Long-Term Incentive Plan. |

| (18) | Includes 36,329 stock units and 50,136 LLC Units held directly by Mr. Lanigan. The stock units are fully vested and payable in an equivalent number of shares of our Class A common stock upon or as soon as practicable, and in all events within 30 days, following the first to occur of (A) the date of Mr. Lanigan’s separation from service (as defined in our director compensation policy) or (B) the occurrence of a change in control under our Long-Term Incentive Plan. |

| (19) | Includes 3,000 shares of Class A common stock and 20,999 stock units held directly by Mr. Murphy. The stock units are fully vested and payable in an equivalent number of shares of our Class A common stock upon or as soon as practicable, and in all events within 30 days, following the first to occur of (A) the date of Mr. Murphy’s separation from service (as defined in our director compensation policy) or (B) the occurrence of a change in control under our Long-Term Incentive Plan. |

| (20) | Includes (i) 24,262 shares of Class A common stock held directly by Mr. St. Clair and (ii) 313 restricted stock units vesting on November 6, 2019. Does not include 937 restricted stock units vesting in three substantially equal annual installments beginning on November 6, 2020. The restricted stock units represent the contingent right to receive an equivalent number of shares of our Class A common stock. Mr. St. Clair resigned as President of Cobalt Boats, LLC and as a director effective as of July 6, 2019 and transitioned to the role of Corporation Liaison - Sales and External Relationships for Cobalt Boats. |

| (21) | Includes 20,999 stock units. The stock units are fully vested and payable in an equivalent number of shares of our Class A common stock upon or as soon as practicable, and in all events within 30 days, following the first to occur of (A) the date of Mr. Stokely’s separation from service (as defined in our director compensation policy) or (B) the occurrence of a change in control under our Long-Term Incentive Plan. |

| (22) | Includes 62,274 shares of restricted stock with time-based vesting requirements and 41,062 shares of restricted stock that vest subject to the achievement of certain performance targets. Also includes (i) 92,048 shares of Class A common stock, (ii) 194,143 vested stock units, (iii) 725 restricted stock units vesting on |

11

November 4, 2019, (iv) 3,743 restricted stock units vesting on November 6, 2019, (v) vested options to purchase 51,000 shares of Class A Common Stock and (vi) options to purchase 5,000 shares of Class A common stock vesting on November 6, 2019. Does not include (i) 725 restricted stock units vesting on November 4, 2020, (ii) 737 restricted stock units vesting in two substantially equal annual installments beginning on November 6, 2020, (iii) 993 restricted stock units vesting in three substantially equal annual installments beginning on November 6, 2020, (iv) options to purchase 52,000 shares of Class A common stock vesting in two equal annual installments beginning on June 29, 2020, (v) options to purchase 37,500 shares of Class A common stock vesting in three equal annual installments beginning on August 22, 2020, (vi) options to purchase 10,000 shares of Class A common stock vesting in two equal annual installments beginning on November 6, 2020 and (vii) options to purchase 10,000 shares of Class A common stock that vest subject to the achievement of certain performance targets. The restricted stock units represent the contingent right to receive an equivalent number of shares of our Class A common stock.

12

BOARD OF DIRECTORS AND EXECUTIVE OFFICERS

Directors of the Company

Our Board of Directors is divided into three classes with staggered three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. Our directors are currently divided among the three classes as follows:

| • | The Class I directors are Messrs. Chhina, Connolly and Lanigan, and their terms will expire at the annual meeting of stockholders to be held in 2020; |

| • | The Class II directors are Mr. Buch, Mr. Murphy and Ms. Lewis, and their terms will expire at the annual meeting of stockholders to be held in 2021; and; |

| • | The Class III directors are Messrs. Hooks, Springer, and Stokely, and their terms will expire at the Annual Meeting. |

The following sets forth certain information about our directors as of September 12, 2019:

| Name | Age | Principal Position | ||

| Jack D. Springer | 58 | Chief Executive Officer and Director | ||

| Michael K. Hooks | 57 | Chairman of the Board and Director | ||

| James R. Buch | 65 | Director | ||

| Ivar S. Chhina | 56 | Director | ||

| Michael J. Connolly | 53 | Director | ||

| Mark W. Lanigan | 59 | Director | ||

| Joan M. Lewis | 53 | Director | ||

| Peter E. Murphy | 56 | Director | ||

| John E. Stokely | 66 | Director | ||

Jack D. Springer, Chief Executive Officer and Director. Mr. Springer was our interim Chief Executive Officer beginning in May 2009 and became our Chief Executive Officer in February 2010. Mr. Springer has been a director of the LLC since May 2009 and he became a member of our Board of Directors in 2014 in connection with the IPO. From June 2003 to February 2010, Mr. Springer was a partner and managing director with Qorval, LLC, a private consultancy that provides strategic leadership and executive management across various industries. As a result of his role with Qorval, Mr. Springer has served as Chief Executive Officer at Diamondback Tactical LLP, a manufacturer of tactical armor systems for federal, state and local law enforcement agencies and defense contractors, as Chief Restructuring Officer of American Plastics, Inc., a thermoform plastics manufacturer for the restaurant and hospitality industry and as interim Chief Executive Officer of Allen White Inc., a furniture manufacturer and wholesaler. While at Qorval, Mr. Springer was also Chief Integration Officer at Nautic Global Group from 2004 to 2007, during which time he was responsible for the integration of two boat manufacturers. Mr. Springer received a B.A. in Accountancy from the University of Texas of the Permian Basin. Based on his perspective and experience as our Chief Executive Officer, as well as his depth of experience in the boat manufacturing industry and as a chief executive, we believe that Mr. Springer is qualified to serve on our Board of Directors.

Michael K. Hooks, Chairman of the Board and Director. Mr. Hooks has been a director of the LLC since 2006 and he became a member of our Board of Directors in 2014 in connection with the IPO. He is a co-founder and has been managing partner of Westhook Capital LLC since 2017, and he is a co-founder and has been a managing director of Black Canyon Capital LLC since 2004. Previously, Mr. Hooks was a co-head of the Los Angeles office of Credit Suisse First Boston and a managing director in the Los Angeles office of Donaldson, Lufkin & Jenrette. He also serves on the board of directors of Metco Landscape Holdings, LLC, a private company. He previously served on the boards of directors of JDC Healthcare Management, Saunders & Associates, TASI Holdings, Virgin America, Logan’s Roadhouse and Switchcraft, as well as the Supervisory Board of Pfeiffer Vacuum Technology, at the time a

13

public company listed on the New York Stock Exchange. Mr. Hooks received a degree in Economics from Princeton University and an M.B.A. with distinction from the Wharton School of Business. Based on his extensive experience as an investment banker advising companies on their financing and strategic alternatives, his experience as a private equity manager working with companies and their management teams to grow and improve their businesses, and his deep knowledge of Malibu Boats given his thirteen-year tenure as a board member of the LLC, we believe Mr. Hooks is qualified to serve on our Board of Directors.

James R. Buch, Director. Mr. Buch became a member of our Board of Directors in 2014 in connection with the IPO. Since May 2017, Mr. Buch has held the position of chief executive officer of UMA Enterprises, Inc., which is a private company and one of the largest distributors of home decor products in North America. From 2012 to 2016, he served as president and chief executive officer of Lynx Grills, a manufacturer of grills and outdoor kitchen products for residential consumers. In 2011 and 2012, Mr. Buch was interim president and chief executive officer of Sunbrite TV, a manufacturer of high-definition televisions, and he was a consultant and operating advisor to various private equity and investment firms from 2008 to 2010, assisting businesses on multiple fronts, including growth strategies, restructuring and business model assessment. Mr. Buch has also served and continues to serve on board and advisory councils for a number of private and nonprofit organizations. He received a bachelor’s degree and an M.B.A. from California State University-Fullerton. Based on his extensive leadership and advisory experience with manufacturers of consumer products, we believe Mr. Buch is qualified to serve on our Board.

Ivar S. Chhina, Director. Mr. Chhina became a member of our Board of Directors in 2014 in connection with the IPO. Now retired, from 2009 to 2011, he served as the chief financial officer and executive vice president for Recreational Equipment, Inc. (REI), a national retailer of recreational equipment and apparel, and previously served on its board from 2006 to 2009, where he was chair of its audit and finance committee as well as board vice chair. From 2001 to 2007, Mr. Chhina was chairman and chief executive officer, and previously chief operating officer and chief restructuring officer of Interdent, Inc., a health care services company. From 1991 to 2001, Mr. Chhina held senior executive, finance and operational roles with several portfolio companies of Mehta & Company, a private equity firm for which he was an operating partner and is currently a venture partner. Mr. Chhina also serves on the board of Northwestern Management Services LLC, PPV Holding Company LLC, Troy Lee Designs Inc., Lone Peak Holdings, LLC, and Dimensional Dental Management, LLC, all of which are private companies. Previously, he held executive positions and/or directorships with several companies, including as interim chief executive officer, and later as a director/advisor to the managing member of JDC Management LLC, on the board of directors of Stat Health Holding, LLC, and DDP DMO Superholdings LLC, and has served on and chaired boards and committees of charitable and educational entities, including most recently as a board director and member of the audit and finance committee of the Pacific Science Center, as a director and past chair of the finance committee of the Washington chapter of The Nature Conservancy, and as a director, past board chair and finance chair of Fort Mason Center. Mr. Chhina received an M.A. in international policy studies from the Middlebury College Monterey Institute and a dual B.A. in economics and political science from the University of Nevada-Reno. We believe Mr. Chhina is qualified to serve on our Board of Directors based on his financial expertise, knowledge of the recreational products industry and extensive experience advising, operating and directing businesses across multiple industries.

Michael J. Connolly, Director. Mr. Connolly became a member of our Board of Directors in 2014 in connection with the IPO. He is a founding partner of Breakaway Capital Management, LLC, a private investment fund manager which provides debt and structured equity capital to lower middle market companies. In addition, Mr. Connolly is chief executive officer and sole director of Motorini, Inc., which operates a motorcycle dealership and service provider. From 2007 to 2013, he was a partner with Leonard Green & Partners, LP., a private equity firm. Previously, Mr. Connolly was an investment banker at UBS Securities, LLC, where he served as managing director and co-head of UBS’s Los Angeles investment banking office, and a senior vice president at Donaldson, Lufkin & Jenrette. From 2010 through May 2017, he was on the board of Cascade Bancorp (Nasdaq: CACB), where he was the chairman of the board loan committee and member of the compensation and audit committees. From 2011 through 2016, he was on the board of FP Holdings, LP, a private company and the parent company of the Palms Casino Resort. He is a member of the emeritus board of the Los Angeles Regional Food Bank. He received a bachelor’s degree from the University of California-Berkeley. Based on his extensive experience as an investment banker advising companies on their strategic alternatives and his experience as a private equity manager working

14

with companies and their management teams to grow and improve their businesses, we believe Mr. Connolly is qualified to serve on our Board of Directors.

Mark W. Lanigan, Director. Mr. Lanigan has been a director of the LLC since 2006 and he became a member of our Board of Directors in 2014 in connection with the IPO. He was a co-founder and has been a managing director of Black Canyon Capital LLC since 2004. Mr. Lanigan has also been a consultant with Tailwind Capital, a private equity firm, since 2015. Mr. Lanigan was formerly a co-head of the Los Angeles office and a member of the Investment Banking Executive Board of Credit Suisse First Boston and head of the Los Angeles office of Donaldson, Lufkin & Jenrette. He also serves on the boards of directors of LRW Holdings, LLC, Lone Peak Holdings, LLC and Benevis Holdings, LLC, which are all private companies, and he previously served on the boards of directors of Abode Healthcare, Inc., JDC Healthcare Management, Virgin America, Archway Marketing Services, TASI Holdings, Inc. and Saunders & Associates. Mr. Lanigan graduated summa cum laude, Phi Beta Kappa with a degree in Economics from Colgate University and received a J.D. degree from Harvard Law School and an M.B.A. from Harvard Business School. We believe Mr. Lanigan is qualified to serve on our Board of Directors based on his extensive experience as an investment banker advising companies on their financing and strategic alternatives, his experience as a private equity manager working with companies and their management teams to grow and improve their businesses, and his deep knowledge of Malibu Boats given his thirteen-year tenure as a board member of the LLC.

Joan M. Lewis, Director. Ms. Lewis became a member of our Board of Directors in July 2019. Ms. Lewis serves on the boards of several private companies and is an independent consultant to product/service companies and fast-growing technology start-ups. Previously, she was Senior Vice President and Officer, Consumer & Market Knowledge of The Procter & Gamble Company, a consumer packaged goods company, from 2008 through December, 2014. Prior to that, she held a number of other leadership positions with Procter & Gamble Consumer & Market Knowledge, including Vice President, Global Operations and Director, North America. Ms. Lewis previously served as Board Chair of comScore, Inc. in 2016 and as a member of the Audit Committee and Chair of the Technology and Innovation Committee of comScore, Inc. from 2015 to 2016. Ms. Lewis has also previously served on the Singapore Industry Advisory Board for Consumer Insights, the Advertising Research Foundation Board of Directors, and the Business Advisory Council for the Farmer School of Business at Miami University. She holds a B.S. from Miami University. We believe Ms. Lewis is qualified to serve on our Board of Directors based on her experience working as a consultant to product/service companies, her background in consumer and market knowledge, her history as an executive at a global company and her prior service as a director of a public company.

Peter E. Murphy, Director. Mr. Murphy became a member of our Board of Directors in 2014 in connection with the IPO. He is the founder and chief executive officer of Wentworth Capital Management, a private investment and venture capital firm focused on media, technology and branded consumer businesses. From 2009 to 2011, he served as president of strategy & development of Caesars Entertainment, where he was responsible for corporate strategy and growth, mergers and acquisitions, corporate development and real estate development around the world. From 2007 to 2008, Mr. Murphy served as an operating partner at Apollo Global Management and, prior to that, he spent 18 years in senior executive roles with The Walt Disney Company, including chief strategic officer of Disney and chief financial officer of ABC, Inc. Mr. Murphy is currently a board member and chairman of the audit committee of Tribune Media (NYSE: TRCO), and a board advisor to DECA TV. He has previously served as chairman of the board of Revel Entertainment and on the boards of The Stars Group, Inc., Dial Global and Fisher Communications. Mr. Murphy received an M.B.A. from the Wharton School of Business and a bachelor’s degree, magna cum laude and Phi Beta Kappa, from Dartmouth College. We believe Mr. Murphy is qualified to serve on our Board because of his long history as an executive and director of national and international companies and experience facilitating international growth and strategy.

John E. Stokely, Director. Mr. Stokely became a member of our Board of Directors in 2014 in connection with the IPO. He has been the lead independent director of Pool Corporation (Nasdaq: POOL) since 2000 and has been its chairman of the board since May 2017. Mr. Stokely is also a member of the audit committee and chair of the governance committee of Pool Corporation. In addition, Mr. Stokely was president, chief executive officer and chair of the board of Richfood Holdings, Inc., a food retailer and wholesale grocery distributor, and he served as president of JES, Inc., an investment and consulting firm. Previously, he also served on the boards and committees of a

15

number of other publicly traded companies, including ACI Worldwide, Inc., AMF Bowling, Imperial Sugar Company (which was previously a publicly traded company), O’Charley’s Inc., Performance Food Group and Nash-Finch Company. Mr. Stokely received a bachelor’s degree from the University of Tennessee. We believe Mr. Stokely is qualified to serve on our Board because of his extensive experience as a director of publicly-traded companies engaged in a variety of industries, strategic insights, distribution experience and senior leadership experience.

Executive Officers of the Company

The following sets forth certain information about our executive officers as of September 12, 2019:

| Name | Age | Principal Position | ||

| Jack D. Springer | 58 | Chief Executive Officer and Director | ||

| Wayne R. Wilson | 39 | Chief Financial Officer | ||

| Ritchie L. Anderson | 54 | Chief Operating Officer | ||

| Deborah S. Kent | 55 | Vice President of Human Resources | ||

Please see “—Directors of the Company” above for the biographical information for Jack D. Springer. The biographical information for our other executive officers is set forth below.

Wayne R. Wilson, Chief Financial Officer. Mr. Wilson has served as our Chief Financial Officer since November 2009. From September 2008 to November 2009, Mr. Wilson served on the LLC’s executive board. Prior to joining Malibu Boats, Mr. Wilson was a vice president of Black Canyon Capital LLC where he was employed since its founding in 2004. While at Black Canyon Capital, he was responsible for due diligence and execution of numerous acquisitions and financings. Prior to joining Black Canyon Capital, Mr. Wilson was an investment banker at Credit Suisse First Boston, where he gained experience advising and financing companies across a range of industries. Mr. Wilson received a B.A. in Business Economics from the University of California, Los Angeles.

Ritchie L. Anderson, Chief Operating Officer. Mr. Anderson has served as our Chief Operating Officer since September 2013 and joined Malibu Boats in July 2011 as our Vice President of Operations. Prior to joining Malibu Boats, Mr. Anderson was Vice President of Operations at MasterCraft Boat Company, where he spent 28 years in production management. While at MasterCraft, he held various roles in operations that included management responsibility for manufacturing, supply chain, quality, customer service, environmental and safety. Mr. Anderson has over 30 years of experience in the boat manufacturing industry.

Deborah S. Kent, Vice President of Human Resources. Ms. Kent has served as our Vice President of Human Resources since September 2013 after joining Malibu Boats in January 2011 as our Director of Human Resources. Prior to that, Ms. Kent was Vice President of Human Resources at IdleAire, Inc., a company that provides in-cab services to truckers through centralized systems at truck stops around the United States, where she began serving as the Director of Employment and Employee Relations in 2004. Ms. Kent received a B.S. in Education from East Central University and a M.S. in Adult Education from the University of Central Oklahoma.

There are no family relationships between or among any of our executive officers or directors.

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) requires our directors and executive officers, and persons who own more than 10% of a registered class of our equity securities, to file with the SEC reports of ownership and reports of changes in ownership of our equity securities. To our knowledge, based solely on our review of reports filed electronically with the SEC during the fiscal year ended June 30, 2019, including any amendments thereto, and written responses to annual directors’ and officers’ questionnaires that no other reports were required, all Section 16(a) reports required to be filed during the fiscal year ended June 30, 2019 were timely filed.

16

CORPORATE GOVERNANCE

Corporate Governance Principles

The Board of Directors has adopted Corporate Governance Principles, which provide the framework for the governance of our company and represent the Board’s current views with respect to selected corporate governance issues considered to be of significance to our stockholders. The Corporate Governance Principles direct our Board’s actions with respect to, among other things, our Board composition and director qualifications, composition of the Board’s standing committees, stockholder communications with the Board, succession planning and the Board’s annual performance evaluation. A current copy of the Corporate Governance Principles is posted in the Investors — Corporate Governance section of our website at www.malibuboats.com.

Director Independence

Under the listing requirements and rules of the Nasdaq Stock Market, LLC (“Nasdaq”), independent directors must compose a majority of our Board of Directors. Audit Committee members must satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act. Applicable Nasdaq rules also require that each member of our Compensation Committee must be independent within the meaning of applicable Nasdaq rules. Applicable Nasdaq rules also require that director nominees must be selected, or recommended for selection by our Board of Directors, either by (1) a nominating committee comprised solely of independent directors or (2) independent directors constituting a majority of our independent directors in a vote in which only independent directors participate.

The Board of Directors has reviewed the independence of our directors, based on the corporate governance standards of Nasdaq. Based on this review, the Board of Directors determined that each of Messrs. Buch, Chhina, Connolly, Hooks, Lanigan, Murphy and Stokely and Ms. Lewis is an “independent director” under the applicable Nasdaq rules (the “Independent Directors”). The Board of Directors had also determined that Mr. Estes who resigned from our Board of Directors effective November 2, 2018 was an “independent director” under the applicable Nasdaq rules. In making this determination, our Board of Directors considered the relationships that each of these non-employee directors has with Malibu Boats and all other facts and circumstances our Board of Directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock held by each non-employee director. As required under applicable Nasdaq rules, our Independent Directors will meet in regularly scheduled executive sessions at which only Independent Directors are present.

Board Committees

Our Board of Directors has established an Audit Committee, a Compensation Committee and a Nominating and Governance Committee that have the composition and responsibilities described below. Current copies of the charters for each of these committees are posted in the Investors — Corporate Governance section of our website at www.malibuboats.com. Our Board of Directors may establish additional committees from time to time, in accordance with our Bylaws.

Audit Committee

Our Audit Committee is currently comprised of Messrs. Chhina (chair), Buch and Stokely. Our Audit Committee oversees our corporate accounting and financial reporting process. The Board of Directors has determined that each member of the Audit Committee is an “independent director” under the Nasdaq rules. In addition, each member of the Audit Committee is also “independent” under Rule 10A-3 of the Exchange Act, and satisfies the additional financial literacy requirements of the Nasdaq rules. The Board of Directors has designated one member of the Audit Committee, Mr. Chhina as an “audit committee financial expert” as defined by SEC rules. Among other matters, the Audit Committee:

| • | evaluates the independent registered public accounting firm’s qualifications, independence and performance; |

| • | determines the engagement of the independent registered public accounting firm; |

| • | reviews and approves the scope of the annual audit and the audit fee; |

17

| • | discusses with management and the independent registered public accounting firm the results of the annual audit and the review of our quarterly financial statements; |

| • | approves the retention of the independent registered public accounting firm to perform any proposed permissible non-audit services; |

| • | reviews our critical accounting policies and estimates; and |

| • | annually reviews the Audit Committee charter and the committee’s performance. |

The Audit Committee operates under a written charter adopted by the Board that satisfies the applicable standards of Nasdaq.

Compensation Committee

Our Compensation Committee is currently comprised of Messrs. Murphy (chair), Connolly and Lanigan, and Ms. Lewis. The Board of Directors has determined that each member of the Compensation Committee is an “independent director” under the Nasdaq rules. In making the determination regarding the independence of each member of the Compensation Committee, the Board of Directors considered whether the director has a relationship with Malibu Boats that is material to the director’s ability to be independent from management in connection with the duties of a member of the Compensation Committee. Our Compensation Committee reviews and approves the compensation of our Chief Executive Officer and other executive officers, including salaries, bonuses, perquisites and awards of equity-based compensation, approves all employment, severance and similar agreements for executive officers, makes recommendations to the Board of Directors with respect to our stock-based benefit plans, administers our stock-based benefit plans and makes recommendations to the Board of Directors concerning the compensation of directors. The Compensation Committee also reviews and approves corporate goals and objectives relevant to the compensation of our Chief Executive Officer and other executive officers, evaluates the performance of these officers in light of those goals and objectives, and either approves or makes recommendations to the independent members of the Board of Directors regarding compensation of these officers based on such evaluations. The Compensation Committee reviews and evaluates, at least annually, the performance of the Compensation Committee. The Compensation Committee operates under a written charter adopted by the Board of Directors that satisfies the applicable standards of Nasdaq.

Our Compensation Committee (or the independent members of the Board of Directors based on the recommendation of the Compensation Committee) is responsible for making the final decisions on compensation for our Chief Executive Officer and other executive officers. However, the Compensation Committee takes into account recommendations of our Chief Executive Officer in determining the compensation (including stock awards) of executive officers other than the Chief Executive Officer. Otherwise, our executive officers do not have any role in determining the form or amount of compensation paid to our executive officers. In addition, the Compensation Committee retains the power to appoint and delegate matters to a subcommittee comprised of at least one member of the Compensation Committee, and may also delegate the authority to make compensation decisions (including the ability to grant stock awards) with respect to non-executive employees of the Company to the Chief Executive Officer. The Compensation Committee does not currently intend to delegate any of its responsibilities to a subcommittee or the Chief Executive Officer.

Pursuant to its charter, the Compensation Committee is authorized to retain compensation consultants to assist in the evaluation of compensation for our executive officers and other employees. As further described under “Executive Compensation - Compensation Discussion and Analysis” below, during fiscal year 2019, the Compensation Committee retained Exequity LLP (“Exequity”) as its independent compensation consultant to assist the Compensation Committee with the design and structure of our executive compensation programs and the amounts payable thereunder. During fiscal year 2019, the Compensation Committee engaged Exequity to help the Compensation Committee construct a representative group of peer companies, and also to perform an independent review of our executive compensation programs to provide a competitive reference on pay levels for our executives relative to our newly constructed peer group of companies. This independent review by Exequity was considered by the Compensation Committee when establishing the amounts of compensation paid to our executive officers during fiscal year 2019. The Compensation Committee is directly responsible for the appointment, compensation and oversight of Exequity’s work, and pursuant to Securities and Exchange Commission rules, does not believe Exequity’s work has raised any conflict of interest. Exequity reports only to the Compensation Committee and does

18

not perform services for us, except for executive and director compensation-related services on behalf of, and as instructed by, the Compensation Committee. All compensation decisions were made solely by the Compensation Committee.

Nominating and Governance Committee

Our Nominating and Governance Committee is currently comprised of Messrs. Connolly (chair), Buch, Chhina, Hooks, Lanigan, Murphy and Stokely, and Ms. Lewis. The Board of Directors has determined that each member of the Nominating and Governance Committee is an “independent director” under the Nasdaq rules. Among other matters, the Nominating and Governance Committee:

| • | assists our Board of Directors in identifying prospective director nominees and recommends nominees for each annual meeting of stockholders to our Board of Directors; |

| • | recommends members for each committee of our Board of Directors; |

| • | oversees the evaluation of our Board of Directors and its committees; and |

| • | reviews developments in corporate governance matters and develops appropriate recommendations for the Board of Directors. |

The Nominating and Governance Committee operates under a written charter adopted by the Board that satisfies the applicable standards of Nasdaq.

Meetings and Attendance

During the fiscal year ended June 30, 2019, there were five meetings of the Board of Directors, six meetings of the Audit Committee, two meetings of the Compensation Committee and two meetings of the Nominating and Governance Committee. Each of our directors who served on our Board of Directors during the fiscal year ended June 30, 2019 attended at least 75% of the aggregate meetings of the Board and the committees of the Board on which the director served during fiscal year 2019. In addition, the Independent Directors meet regularly in executive session without the presence of management.

Our Board of Directors expects each director to attend the annual meeting of stockholders. All directors who were then serving on our Board of Directors attended our annual meeting of stockholders during the fiscal year ended June 30, 2019.

Annual Board Evaluation

Pursuant to our Corporate Governance Principles, the Nominating and Governance Committee shall lead an annual evaluation of the Board, and each committee shall lead an annual self-evaluation. The evaluations are designed to assess whether the Board of Directors and its committees function effectively and make valuable contributions and to identify opportunities for improving its operations and procedures. The effectiveness of individual directors is considered each year when the relevant directors stand for re-nomination.

In fiscal year 2019, the Board completed an evaluation process focusing on the experience, qualifications, attributes and skills of each individual director, the effectiveness of the performance of the Board as a whole and each of the Board’s committees.

Board Leadership Structure

The Board does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board as the Board believes it is in the best interests of the Company to make that determination based on the position and direction of the Company and the membership of the Board. The Board has determined that having a non-employee director serve as Chairman is in the best interests of the Company’s stockholders at this time. This structure permits the Chief Executive Officer to focus on the management of the Company’s day-to-day operations. The Company also believes that having a non-employee director serve as Chairman of the Board ensures a greater

19

role for the non-employee directors in the oversight of the Company and active participation of the non-employee directors in setting agendas and establishing Board priorities and procedures.

Risk Oversight

One of the principal functions of our Board of Directors is to provide oversight concerning the assessment and management of risk related to our business. The Board of Directors is involved in risk oversight through direct decision-making authority with respect to fundamental financial and business strategies and major corporate activities, including material acquisitions and financings, as well as through its oversight of management and the committees of the Board of Directors. Management is responsible for identifying the material risks facing Malibu Boats, implementing appropriate risk management strategies and ensuring that information with respect to material risks is shared with the Board of Directors or the appropriate Board committee. In connection with this responsibility, members of management provide regular reports to the Board of Directors regarding business operations and strategic planning, financial planning and budgeting and regulatory matters, including any material risk to Malibu Boats relating to such matters. Also, at least annually the Board of Directors receives an update relating to cybersecurity risks that Malibu Boats faces and the steps that management has taken in order to address these risks.

The Board of Directors has delegated oversight for specific areas of risk exposure to committees of the Board of Directors as follows:

| • | The Audit Committee is responsible for discussing Malibu Boats’ overall risk assessment and risk management policies with management, our internal auditors and our independent registered public accounting firm as well as Malibu Boats’ plans to monitor and control any financial risk exposure. The Audit Committee is also responsible for primary risk oversight related to our financial reporting, accounting and internal controls. |

| • | The Compensation Committee oversees Malibu Boats’ incentive compensation arrangements to confirm that incentive pay arrangements do not encourage unnecessary risk-taking. |

| • | The Nominating and Governance Committee reviews the leadership structure of the Board of Directors and evaluates the effect of such leadership structure in risk oversight of the Company. |

At each regular meeting of our Board of Directors, the chairperson of each committee reports to the full Board regarding the matters reported and discussed at any committee meetings, including any matters relating to risk assessment or risk management. Our Chief Executive Officer, Chief Financial Officer and outside legal counsel regularly attend meetings of these committees when they are not in executive session, and often report on matters that may not be otherwise addressed at these meetings. In addition, our directors are encouraged to communicate directly with members of management regarding matters of interest, including matters related to risk, at times when meetings are not being held. Our Board of Directors believes that the processes it has established for overseeing risk would be effective under a variety of leadership frameworks and therefore do not materially affect its choice of leadership structure as described under “Board Leadership Structure” above.

Policy on Hedging and Pledging

We recognize that hedging against losses in Company stock is not appropriate or acceptable trading activity for individuals employed by or serving the Company. We have incorporated prohibitions on various hedging activities within our stock trading guidelines, which guidelines apply to directors, officers and employees. The guidelines prohibit:

| • | all short sales of the Company’s securities and any transactions in puts, calls or other derivative securities, on an exchange or in any other organized markets; |

| • | purchasing financial instruments (including prepaid variable forward contracts, equity swaps, collars and exchange funds), or otherwise engaging in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of the Company’s securities; and |

20

| • | holding the Company’s securities in a margin account or pledging securities of the Company as collateral for a loan, subject to a limited exception where a person wishes to pledge Company securities as collateral for a loan (not including margin debt) and clearly demonstrates in the sole discretion of our Chief Financial Officer that such person has the financial capacity to repay the loan without resort to the pledged securities. |

Director Nomination Process

Identifying and Evaluating Director Nominee Candidates