UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. ___)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | | Preliminary Proxy Statement |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| S | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material Pursuant to Section 240.14a-12 |

MEDOVEX CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | | No fee required. |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | 1) | Title of each class of securities to which transaction applies: |

__________________________________________________________

| | 2) | Aggregate number of securities to which transaction applies: |

__________________________________________________________

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

__________________________________________________________

| | 4) | Proposed maximum aggregate value of transaction: |

__________________________________________________________

__________________________________________________________

| ☐ | | Fee paid previously with preliminary materials |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously Paid:

__________________________________________________________

(2) Form, Schedule or Registration Statement No.:

__________________________________________________________

(3) Filing Party:

__________________________________________________________

(4) Date Filed:

__________________________________________________________

MEDOVEX CORP.

3279 Hardee Avenue

Atlanta, Georgia 30341

(844) 633-6839

Dear Shareholder:

On behalf of the Board of Directors and management, I invite you to attend the Annual Meeting of Shareholders of Medovex Corp. (the “Company” or “Medovex”) to be held at the offices of Womble, Carlyle, Sandridge & Rice, LLP at 271 17th Street NW Suite 2400 Atlanta, GA 30363-1017 on November 10, 2015 at 1:00 p.m. EDT.

The notice of annual meeting and proxy statement accompanying this letter describe the specific business to be acted upon at the meeting.

In addition to the specific matters to be acted upon, there will be a report on the progress of the Company and an opportunity for questions of general interest to the shareholders.

Your vote is important. Whether or not you plan to attend the meeting in person, you are requested to complete, sign, date, and promptly return the enclosed proxy card in the envelope provided. Your proxy will be voted at the annual meeting in accordance with your instructions. If you do not specify a choice on one of the proposals described in this proxy statement, your proxy will be voted as recommended by the Board of Directors. If you hold your shares through an account with a brokerage firm or other nominee or fiduciary such as a bank, please follow the instructions you receive from such brokerage firm or other nominee or fiduciary to vote your shares.

If you plan to attend the meeting in person, please respond affirmatively to the request for that information by marking the box on the proxy card. You will be asked to present valid picture identification. Cameras, recording devices, and other electronic devices will not be permitted at the meeting.

| | Sincerely, /s/ Jarrett Gorlin

Jarrett Gorlin Chief Executive Officer |

MEDOVEX CORP.

3279 Hardee Avenue

Atlanta, Georgia 30341

(844) 633-6839

NOTICE OF 2015 ANNUAL MEETING OF SHAREHOLDERS

Dear Shareholder:

On behalf of the Board of Directors and management, I invite you to attend the Annual Meeting of Shareholders of Medovex Corp. (the “Company” or “Medovex”) to be held at the offices of Womble, Carlyle, Sandridge & Rice, LLP at 271 17th Street NW Suite 2400 Atlanta, GA 30363-1017- on November 10, 2015 at 1:00 p.m. EDT.

At the annual meeting, we will ask you to:

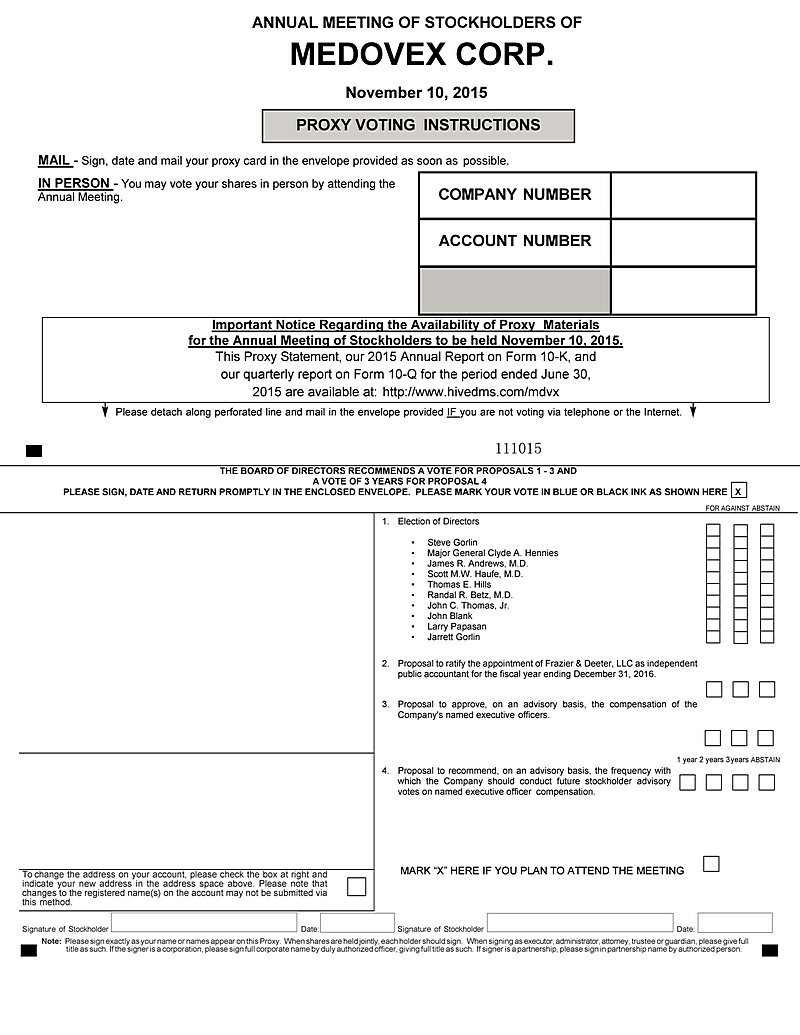

| 1. | Elect as directors the nominees named in the proxy statement; |

| 2. | Ratify the retention of Frazier & Deeter, LLC as the independent registered public accounting firm for the fiscal year ending December 31, 2016; |

| 3. | Hold an advisory vote to approve the compensation of our Named Executive Officers; |

| 4. | Recommend, on an advisory basis, a three-year frequency with which the Company should conduct future stockholder advisory votes on named executive officer compensation; and |

| 5. | Transact such other business as may properly come before the meeting or any adjournments. |

The Board of Directors unanimously recommends a vote FOR the election of each of the nominees for director named in the proxy statement; FOR the ratification of the retention of Frazier & Deeter, LLC as the independent registered public accounting firm for the fiscal year ending December 31, 2016; and FOR approval of the compensation of our Named Executive Officers. The Board of Directors recommends voting for a three-year frequency with which the Company should conduct future stockholder advisory votes on named executive officer compensation.

Shareholders of record at the close of business on September 28, 2015, will be entitled to notice of and to vote at the 2015 Annual Meeting and any adjournments or postponements thereof.

By Order of the Board of Directors,

| | Sincerely, /s/ Jarrett Gorlin

Jarrett Gorlin Chief Executive Officer |

YOUR VOTE AT THE ANNUAL MEETING IS IMPORTANT

Your vote is important. Please vote as promptly as possible even if you plan to attend the meeting.

For information on how to vote your shares, please see the instruction form from your broker or other fiduciary, as applicable, as well as “Information About the 2015 Annual Meeting and Voting” in the proxy statement accompanying this notice.

We encourage you to vote by completing, signing, and dating the proxy card, and returning it in the enclosed envelope.

If you have questions about voting your shares, please contact our Corporate Secretary at Medovex Corp., at 1735 Buford Hwy Ste 215-113, Cumming GA 30041, telephone number (844) 633-6839.

If you decide to change your vote, you may revoke your proxy in the manner described in the attached proxy statement at any time before it is voted.

We urge you to review the accompanying materials carefully and to vote as promptly as possible. Note that we have enclosed with this notice (i) our Annual Report to Shareholders, which includes our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, (ii) our quarterly report on Form 10-Q for the quarter ended June 30, 2015 (the “quarterly report”), and (iii) a Proxy Statement.

THE PROXY STATEMENT, ANNUAL REPORT TO STOCKHOLDERS AND QUARTERLY REPORT ARE AVAILABLE AT: http:/www.hivedms.com/mdvx

By Order of the Board of Directors,

| | Sincerely,

Charles Farrahar Corporate Secretary |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON NOVEMBER 10, 2015 AT 1:00 P.M. EDT. The Notice of Annual Meeting of Shareholders, our Proxy Statement Annual Report to Shareholders for the fiscal year ended December 31, 2014, and our quarterly report on Form 10-Q for the quarter ended June 30, 2015 are available at: http:/www.hivedms.com/mdvx |

TABLE OF CONTENTS

MEDOVEX CORP.

3279 Hardee Avenue

Atlanta, Georgia 30341

(844) 633-6839

PROXY STATEMENT FOR ANNUAL MEETING

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON NOVEMBER 10, 2015:

THE PROXY STATEMENT, ANNUAL REPORT TO SHAREHOLDERS, AND QUARTERLY REPORT ARE AVAILABLE AT: http:/www.hivedms.com/mdvx

SHAREHOLDERS CAN REQUEST A COPY OF THE PROXY STATEMENT, ANNUAL REPORT, QUARTERLY REPORT, AND FORM OF PROXY FOR THIS MEETING AND FUTURE MEETINGS BY CALLING (844) 633-6839 OR SENDING AN EMAIL TO cfarrahar@medovex.com.

This proxy statement provides information that you should read before you vote on the proposals that will be presented to you at the 2015 Annual Meeting of Shareholders of Medovex Corp.

The 2015 Annual Meeting will be held on November 10, 2015, at 1:00 p.m. local time, at the offices of Womble, Carlyle, Sandridge & Rice, LLP at 271 17th Street NW Suite 2400 Atlanta, GA 30363-1017.

On or about September 30, 2015, we mailed this proxy statement, our 2015 Annual Report and our quarterly report, in paper copy. For information on how to vote your shares of our common stock, see the instructions included on the proxy card, or the instruction form you receive from your broker or other fiduciary, as well as the information under “Information About the 2015 Annual Meeting and Voting” in this proxy statement. Shareholders who, according to our records, owned shares of the Company’s common stock at the close of business on September 28, 2015, will be entitled to vote at the 2015 Annual Meeting.

If you would like to attend the meeting and vote in person, please send an email to cfarrahar@medovex.com and directions will be provided to you.

Why am I receiving these proxy materials?

The Board of Directors (“Board”) of Medovex Corp. (the “Company”) is asking for your proxy for use at the 2015 Annual Meeting of Shareholders of the Company, to be held at the offices of Womble, Carlyle, Sandridge & Rice, LLP at 271 17th Street NW Suite 2400 Atlanta, GA 30363 on November 10, 2015 at 1:00 p.m. local time, and at any adjournment or postponement of the meeting. As a shareholder, you are invited to attend the meeting and are entitled to and requested to vote on the items of business described in this proxy statement.

This proxy statement is furnished to shareholders of Medovex Corp., a Nevada corporation, in connection with the solicitation of proxies by the Board for use at the 2015 Annual Meeting of Shareholders (the “Annual Meeting”).

Sharing the Same Last Name and Address

We are sending only one copy of our Annual Report to Shareholders, our quarterly report, and our proxy statement to shareholders who share the same last name and address, unless they have notified us that they want to continue receiving multiple copies. This practice, known as “householding,” is designed to reduce duplicate mailings and save significant printing and postage costs.

If you received a householded mailing this year and you would like to have additional copies of our Annual Report to Shareholders, our quarterly report, and our proxy statement mailed to you or you would like to opt out of this practice for future mailings, we will promptly deliver such additional copies to you if you submit your request to Charles Farrahar, our Corporate Secretary at 1735 Buford Hwy Ste 215-113, Cumming GA 30041, or call us at (844) 633-6839. You may also contact us in the same manner if you received multiple copies of the Annual Meeting materials and would prefer to receive a single copy in the future.

Who is soliciting my vote?

The Board is soliciting your vote.

When were the enclosed solicitation materials first given to shareholders?

We expect to mail to shareholders of the Company this proxy statement, a proxy card, our 2015 Annual Report, and our quarterly report on or about September 30, 2015.

What is the purpose of the meeting?

You will be voting on:

| 1. | Election of the nominees named in the proxy statement as directors; |

| 2. | Ratification of the appointment of Frazier & Deeter, LLC as the independent certified public accountants of the Company for the fiscal year ending December 31, 2016; |

| 3. | Approval, in an advisory vote, of the compensation of our Named Executive Officers as disclosed in the proxy statement; |

| 4. | Recommendation, on an advisory basis, of a three-year frequency with which the Company should conduct future stockholder advisory votes on named executive officer compensation; and |

| 5. | Other business that is properly presented at the meeting. |

What are the Board’s recommendations?

The Board recommends a vote:

| 1. | “FOR” election of the nominees named in the proxy statement as directors; |

| 2. | “FOR” ratification of the appointment of Frazier & Deeter, LLC as the independent certified public accountants of the Company for the fiscal year ending December 31, 2016; |

| 3. | “FOR” approval, in an advisory vote, of the compensation of our Named Executive Officers as disclosed in the proxy statement; and |

| 4. | “FOR” recommendation on an advisory basis of a three-year frequency with which the Company should conduct future stockholder advisory votes on named executive officer compensation. |

Who is entitled to vote at the meeting, what is the “record date”, and how many votes do they have?

Holders of record of our common stock at the close of business on September 28, 2015 (the “record date”) will be entitled to vote at the meeting. Each share of common stock has one vote. There were 10,824,742 shares of common stock outstanding on the record date. There were 1,391,305 Series A Warrants as of the record date, that could be exercised to yield 1,391,305 shares of common stock.

What is a quorum of shareholders?

In order to carry on the business of the Annual Meeting, a quorum must be present. If a majority of the shares outstanding and entitled to vote on the record date are present, either in person or by proxy, we will have a quorum at the meeting. Any shares represented by proxies that are marked for, against, withhold, or abstain from voting on a proposal will be counted as present in determining whether we have a quorum. If a broker, bank, custodian, nominee, or other record holder of our common stock indicates on a proxy card that it does not have discretionary authority to vote certain shares on a particular matter, and if it has not received instructions from the beneficial owners of such shares as to how to vote on such matters, the shares held by that record holder will not be voted on such matter (referred to as “broker non-votes”) but will be counted as present for purposes of determining whether we have a quorum. Since there were 10,824,742 shares of common stock outstanding on September 28, 2015, the presence of holders of 5,412,372 shares will represent a quorum. We must have a quorum to conduct the meeting.

How many votes does it take to pass each matter?

| Proposal 1: Election of Directors | | The nominees for director who receive the most votes (also known as a plurality) will be elected. You may vote either FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one of the nominees. Votes that are withheld will not be included in the vote tally for the election of directors. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the election of directors. As a result, any shares not voted by a beneficial owner will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

| Proposal 2: Ratification of the Appointment of Frazier & Deeter, LLC as Our Independent Public Accountant for the Fiscal Year Ending December 31, 2016 | | The appointment of Frazier & Deeter, LLC as our independent public accountant for the fiscal year ending December 31, 2016 will be ratified if the votes cast in favor of the proposal exceed the votes cast against the proposal. Abstentions will be counted towards the tabulation of votes cast on this proposal and will have the same effect as a negative vote. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. We are not required to obtain the approval of our stockholders to appoint our independent accountant. However, if our stockholders do not ratify the appointment of Frazier & Deeter, LLC as our independent public accountant for the fiscal year ending December 31, 2016, the Audit Committee of the Board may reconsider its appointment. |

Proposal 3: Advisory Vote to Approve the Compensation of Our Named Executive Officers Proposal #4: Recommendation, on an advisory basis, of a three-year frequency for future stockholder advisory votes on named executive officer compensation | | The advisory vote to approve the compensation of our named executive officers will be approved if the votes cast in favor of the proposal exceed the votes cast against the proposal. Abstentions and broker non-votes will not be counted as either votes cast for or against this proposal. While the results of this advisory vote are non-binding, the Compensation Committee of the Board and the Board values the opinions of our stockholders and will consider the outcome of the vote, along with other relevant factors, in deciding whether any actions are necessary to address the concerns raised by the vote and when making future compensation decisions for named executive officers. The advisory vote to recommend that the Company conduct future stockholder advisory votes on named executive officer compensation on a three-year frequency will be approved if the votes cast in favor of the proposal exceed the votes cast against the proposal. Abstentions and broker non-votes will not be counted as either votes cast for or against this proposal. While the results of this advisory vote are non-binding, the Compensation Committee of the Board and the Board values the opinions of our stockholders and will consider the outcome of the vote, along with other relevant factors, in deciding whether any actions are necessary to address the concerns raised by the vote and when making future compensation decisions for named executive officers. |

Who can attend the meeting?

All shareholders as of September 28, 2015, or their duly appointed proxies, may attend the meeting.

What do I need to attend the meeting?

In order to be admitted to the meeting, a shareholder must present proof of ownership of common stock. If your shares are held in the name of a broker, bank, custodian, nominee, or other record holder (“street name”), you must obtain a proxy, executed in your favor, from the holder of record (that is, your broker, bank, custodian, or nominee) to be able to vote at the meeting. You will also be required to present a form of photo identification, such as a driver’s license.

What is a proxy?

A proxy is another person you authorize to vote on your behalf. We ask shareholders to instruct the proxy how to vote so that all common shares may be voted at the meeting even if the holders do not attend the meeting.

How are abstentions and broker non-votes treated?

Abstentions and broker non-votes count for purposes of determining the presence of a quorum. Abstentions and broker non-votes will not be counted as votes cast either for or against any of the proposals being presented to shareholders and will have no impact on the result of the vote on these proposals.

How do I vote?

If you are a shareholder of record, you may vote by mailing a completed proxy card or in person at the Annual Meeting.

If you are a street name holder (meaning that your shares are held in a brokerage account by a bank, broker or other nominee), you may direct your broker or nominee how to vote your shares; however, you may not vote in person at the Annual Meeting unless you have obtained a signed proxy from the record holder giving you the right to vote your beneficially owned shares.

You must be present, or represented by proxy, at the meeting in order to vote your shares. You can submit your proxy by completing, signing, and dating your proxy card and mailing it in the accompanying pre-addressed envelope. YOUR PROXY CARD WILL BE VALID ONLY IF YOU COMPLETE, SIGN, DATE, AND RETURN IT BEFORE THE MEETING DATE.

How will my proxy vote my shares?

If your proxy card is properly completed and received, and if it is not revoked, before the meeting, your shares will be voted at the meeting according to the instructions indicated on your proxy card. If you sign and return your proxy card, but do not give any voting instructions, your shares will be voted as follows:

| 1. | “FOR” election of the nominees named in the proxy statement as directors; |

| 2. | “FOR” ratification of the appointment of Frazier & Deeter, LLC as the independent certified public accountants of the Company for the fiscal year ending December 31, 2016; |

| 3. | “FOR” approval, in an advisory vote, of the compensation of our Named Executive Officers as disclosed in the proxy statement; and |

| 4. | “FOR” recommendation, on an advisory basis, of a three-year frequency with which the Company should conduct future stockholder advisory votes on named executive officer compensation |

To our knowledge, no other matters will be presented at the meeting. However, if any other matters of business are properly presented, the proxy holders named on the proxy card are authorized to vote the shares represented by proxies according to their judgment.

If my shares are held in “street name” by my broker, will my broker vote my shares for me?

If your shares are held in a brokerage account, you will receive from your broker a full meeting package including a voting instruction form to vote your shares. Your brokerage firm may permit you to provide voting instructions by telephone or by the internet. Brokerage firms have the authority under NASDAQ rules to vote their clients’ unvoted shares on certain routine matters.

The following matters are considered a routine matter under the rules of the NASDAQ. Therefore, if you do not vote on these proposals, your brokerage firm may choose to vote for you or leave your shares unvoted on this proposal:

| • | Proposal 2: Ratification of the appointment of our independent registered public accounting firm. |

NASDAQ rules, however, do not permit brokerage firms to vote their clients’ unvoted shares in:

| • | Proposal 1: Election of directors; |

| • | Proposal 3: Advisory vote to approve the compensation of our Named Executive Officers; |

| • | Proposal 4: Advisory recommendation of a three-year frequency with which the Company should conduct future stockholder advisory votes on named executive officer compensation. |

Therefore, if you do not vote on these proposals, your shares will remain unvoted on those proposals. We urge you to provide voting instructions to your brokerage firm so that your vote will be cast on those proposals.

What does it mean if I receive more than one proxy card or instruction form?

If you receive more than one proxy card or instruction form, it means that you have multiple accounts with our transfer agent and/or a broker or other nominee or fiduciary or you may hold your shares in different ways or in multiple names (e.g., joint tenancy, trusts, and custodial accounts). Please vote all of your shares.

How do I revoke my proxy and change my vote prior to the meeting?

If you are a registered shareholder (meaning your shares are registered directly in your name with our transfer agent) you may change your vote at any time before voting takes place at the meeting. You may change your vote by:

| 1. | Delivering another proxy card or voter instruction form to Medovex Corp., ATTN: Corporate Secretary, 1735 Buford Hwy Ste 215-113 Cumming GA 30041, with a written notice dated later than the proxy you want to revoke stating that the proxy is revoked. |

| 2. | You may complete and send in another proxy card or voting instruction form with a later date. |

| 3. | You may attend the meeting and vote in person. |

For shares you hold beneficially or in “street name,” you may change your vote by submitting new voting instructions to your bank, broker or other nominee or fiduciary in accordance with that entity’s procedures, or if you obtained a legal proxy form giving you the right to vote your shares, by attending the meeting and voting in person.

Who pays for the proxy solicitation and how will the Company solicit votes?

We will pay the costs of preparing, printing, and mailing the notice of Annual Meeting of Shareholders, this proxy statement, the enclosed proxy card, and our 2015 Annual Report. We will also reimburse brokerage firms and others for reasonable expenses incurred by them in connection with their forwarding of proxy solicitation materials to beneficial owners. The solicitation of proxies will be conducted primarily by mail, but may also include telephone, facsimile, or oral communications by directors, officers, or regular employees of the Company acting without special compensation.

We have retained Interwest Transfer Co., Inc to aid in the distribution of proxy materials and to provide voting and tabulation services for the Annual Meeting. For these services, we will pay total fees of approximately $9,000.

Proposals to be Presented at the Annual Meeting

We will present four proposals at the meeting. We have described in this proxy statement all of the proposals that we expect will be made at the meeting. If any other proposal is properly presented at the meeting, we will, to the extent permitted by applicable law, use your proxy to vote your shares of common stock on such proposal in our best judgment.

PROPOSALS OF SECURITY HOLDERS AT 2016 ANNUAL MEETING

Any shareholder wishing to present a proposal which is intended to be presented at the 2016 Annual Meeting of Shareholders should submit such proposal to the Company at its principal executive offices no later than August 15, 2016. It is suggested that any proposals be sent by certified mail, return receipt requested.

OTHER MATTERS

Should any other matter or business be brought before the meeting, a vote may be cast pursuant to the accompanying proxy in accordance with the judgment of the proxy holder. The Company does not know of any such other matter or business.

INCORPORATION BY REFERERENCE

The Commission allows us to "incorporate by reference" into this proxy statement documents that we file with the SEC. This means that we can disclose important information to you by referring to those documents. The information incorporated by reference is considered to be a part of this proxy statement, and later information that we file with the Commission will update and supersede that information. This proxy statement incorporates by reference our (i) annual report on Form 10-K for the fiscal year ended December 31, 2014 and (ii) quarterly report on Form 10-Q for the quarter ended June 30, 2015 that we have previously filed with the Commission. The Form 10-K and Form 10-Q contain important information about us and our financial condition and a copy of each is being delivered with this proxy statement.

ADDITIONAL INFORMATION

Additional information about our Company is contained in our current and periodic reports filed with the Commission. These reports, their accompanying exhibits and other documents filed with the Commission may be inspected without charge at the Public Reference Room maintained by the Commission at 100 F. Street, N.E., Washington, D.C. 20549. You can obtain information about operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. The Commission also maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Commission at www.sec.gov. Copies of such materials can be obtained from the Public References of the Commission at prescribed parties.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Proxy Statement contains “forward-looking statements” and information relating to our business that are based on our beliefs as well as assumptions made by us or based upon information currently available to us. When used in this Proxy Statement, the words anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “should” and similar expressions are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements relating to our performance in “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014. These statements reflect our current views and assumptions with respect to future events and are subject to risks and uncertainties. Actual and future results and trends could differ materially from those set forth in such statements due to various factors. Such factors include, among others: general economic and business conditions; industry capacity; industry trends; competition; changes in business strategy or development plans; project performance; availability, terms, and deployment of capital; and availability of qualified personnel. These forward-looking statements speak only as of the date of this Proxy Statement. Subject at all times to relevant securities law disclosure requirements, we expressly disclaim any obligation or undertaking to disseminate any update or revisions to any forward-looking statement contained herein to reflect any change in our expectations with regard thereto or any changes in events, conditions or circumstances on which any such statement is based. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Our Board currently consists of ten members. The Nominating and Corporate Governance Committee and Board have unanimously approved the recommended slate of ten directors.

The following table shows the Company’s nominees for election to the Board. Each nominee, if elected, will serve until the next Annual Meeting of Shareholders and until a successor is named and qualified, or until his or her earlier resignation or removal. All nominees are members of the present Board of Directors. We have no reason to believe that any of the nominees is unable or will decline to serve as a director if elected. Unless otherwise indicated by the shareholder, the accompanying proxy will be voted for the election of the ten (10) persons named under the heading “Nominees for Directors.” Although the Company knows of no reason why any nominee could not serve as a director, if any nominee shall be unable to serve, the accompanying proxy will be voted for a substitute nominee.

NOMINEES FOR DIRECTOR

| Name of Nominee | | Age | | Position(s) |

| Steve Gorlin | | 77 | | Director |

| Major General Clyde.A Hennies | | 78 | | Director |

| James R. Andrews, M.D. | | 72 | | Director |

| Scott M. W. Haufe, M.D. | | 48 | | Director |

| Thomas E. Hills | | 38 | | Director |

| Randal R. Betz, M.D. | | 62 | | Director |

| John C. Thomas, Jr | | 60 | | Director |

| John Blank M.D. | | 64 | | Director |

| Larry Papasan | | 73 | | Chairman of the Board |

| Jarrett Gorlin | | 39 | | Chief Executive Officer and Director |

The Nominating and Corporate Governance Committee and the Board seek, and the Board is comprised of, individuals whose characteristics, skills, expertise, and experience complement those of other Board members. We have set out below biographical and professional information about each of the nominees, along with a brief discussion of the experience, qualifications, and skills that the Board considered important in concluding that the individual should serve as a current director and as a nominee for re-election as a member of our Board.

Steve Gorlin. Steve Gorlin is the Co-founder of Debride Inc., the first company acquired by MedoveX. Over the past 40 years, Mr. Gorlin has founded several biotechnology and pharmaceutical companies, including HycorBiomedical, Inc. (acquired by Agilent), Theragenics Corporation (NYSE: TGX) , CytRx Corporation (NASDAQ: CYTR), Medicis Pharmaceutical Corporation (sold to Valeant for approximately $2.6 billion), EntreMed, Inc. (NASDAQ: ENMD), MRI Interventions (MRIC), DARA BioSciences, Inc. (NASDAQ: DARA), MiMedx (NASDAQ: MDXG), and Medivation, Inc. (NASDAQ: MDVN). Mr. Gorlin served for many years on the Business Advisory Council to the Johns Hopkins School of Medicine and on The Johns Hopkins BioMedical Engineering Advisory Board. He presently serves on the board of directors of the Andrews Institute. Mr. Gorlin founded a number of non-medical related companies, including Perma-Fix, Inc., Pretty Good Privacy, Inc. (sold to Network Associates), and NTC China. He started The Touch Foundation, a nonprofit organization for the blind and was a principal financial contributor to the founding of Camp Kudzu for diabetic children. Presently, he serves as a member of the board of directors and of the executive committee of DemeRx, Inc., Conkwest, Inc., and is on the Board of NTC China, Inc.

Major General C.A. “Lou” Hennies. Mr. Hennies became a director of the Company in September 2013. Lou Hennies is a career soldier having served his country in uniform for 41 years where he rose through the ranks from enlisted status to that of a commissioned officer retiring in 2001 as a Major General.

He served a total of 37 months in combat in Republic of Vietnam as a Company/Troop commander of four units and as a battalion/squadron staff officer in the 4th Battalion, 23rd Infantry Regiment, 25th Infantry Division, Cu Chi, and the 7th Squadron, 17th Air Cavalry in II Corps. Stateside he commanded another Air Cavalry Troop followed by command of the 1st Squadron, 17th Air Cavalry in the 82nd Airborne Division.

Selected for Brigadier General in 1986, he subsequently served as the Army’s Deputy Chief of Public Affairs and Director of Army Safety and Commanding General of the U.S Army Safety Center. Initially retiring in 1991, he returned to service in 1995 as The Adjutant General (TAG) of the Alabama Army and Air National Guard and as a Cabinet Officer in the Administration of Governor Fob James Jr.

He is a graduate of the Army’s Command and General Staff College, The Army War College, and The Center for Creative Leadership. A graduate of the University of Nebraska-Omaha with a Bachelor Degree in Political Science, he also holds a Master of Arts Degree in Journalism from the University of Nebraska-Lincoln and a Master of Science in Public Administration from Shippensburg University, Pennsylvania.

His awards and decorations include the Army Distinguished Medal with Oak Leaf Cluster, the Silver Star, the Legion of Merit with Oak Leaf Cluster, the Distinguished Flying Cross, the Soldiers Medal, the Bronze Star with “V” device and 5 Oak Leaf Clusters, the Purple Heart, the Air Medal with “V” (2) and numeral 29, and the Alabama Distinguished Medal with Oak Leaf Cluster. He is also a recipient of numerous foreign decorations from the Republic of Vietnam and the Republic of Korea.

He has been awarded the Army Aviation Order of Saint Michael (Gold), the Infantry’s Order of Saint Maurice (Primercius) and the Army Aviation Hall of Fame Medallion and has been inducted into the Infantry Officer Candidate Hall of Fame, the Army Aviation Hall of Fame, and the Air Force Gathering of Eagles Class of 2000.

James R. Andrews, M.D. James R. Andrews, M.D., has served as a Director of the Company since September 2013. Dr. Andrews is recognized throughout the world for his scientific and clinical research contributions in knee, shoulder and elbow injuries, and his skill as an orthopedic surgeon. Dr. Andrews is a founder and current Medical Director for the American Sports Medicine Institute, a non-profit organization dedicated to the prevention, education and research in orthopaedic and sports medicine, as well as the Andrews Research and Education Institute.

He is Clinical Professor of Orthopaedic Surgery at the University of Alabama Birmingham Medical School, the University of Virginia School of Medicine and the University of South Carolina Medical School. He is Adjunct Professor in the Department of Orthopaedic Surgery at the University of South Alabama and Clinical Professor of Orthopaedics at Tulane University School of Medicine.

He serves as Medical Director for Auburn University Intercollegiate Athletics and Team Orthopaedic Surgeon; Senior Orthopaedic Consultant at the University of Alabama; Orthopaedic Consultant for the college athletic teams at Troy University, University of West Alabama, Tuskegee University and Samford University. He serves on the Tulane School of Medicine Board of Governors.

Dr. Andrews serves on the Medical and Safety Advisory Committee of USA Baseball and on the Board of Little League Baseball, Inc. He has been a member of the Sports Medicine Committee of the United States Olympic Committee and served on the NCAA Competitive Safeguards in Medical Aspects of Sports Committee.

In the professional sports arena, Dr. Andrews is Senior Consultant for the Washington Redskins Football team; Medical Director for the Tampa Bay Rays Baseball team and Medical Director of the Ladies Professional Golf Association.

Dr. Andrews serves as the National Medical Director for Physiotherapy Associates, a national outpatient rehabilitation provider. He serves on the board of directors of Fast Health Corporation and Robins Morton Construction Company. He has a Doctor of Laws Degree from Livingston University and Doctor of Science Degrees from Troy and Louisiana State Universities. He has recently written a book, Any Given Monday, about sports injuries and how to prevent them for athletes, parents and coaches.

Scott M. W. Haufe, M.D. Scott M. W. Haufe, M.D., is a co-founder of Debride and has been a Director of the Company since September 2013. Dr. Haufe is a board certified physician in the fields of Anesthesiology, Pain Medicine and Hospice /Palliative Medicine. He began his career in the field of Anesthesiology where he served as Chief of Anesthesiology and Pain Management with St. Lucie Anesthesia Associates until 1998 while continuing his passion for research. Beginning in 1993, Dr. Haufe was first published and has since authored numerous peer reviewed journal articles. Specifically, in 2005, he was recognized for his publication on the endoscopic treatment for sacroilitis. During 2006, he again authored the first paper on intradiscal stem cell therapy in an attempt to rejuvenate the human disc and in 2010 he developed a minimally invasive procedure for resolving spinal arthritis and subsequently published his findings in the Internal Journal of Med Sci. Additionally, he is named on multiple patents for treating pain related issues. Dr. Haufe earned his MD from the University of South Florida College of Medicine in 1992 with honors and completed his residency in Anesthesiology in 1996. He currently practices in Destin, FL with Anesthesia, Inc., and is affiliated with Sacred Heart Hospital, Destin Surgery Center, and Healthmark Medical Center. He is a member of the American Society of Anesthesiologists and the Florida Society of Anesthesiologists.

Larry Papasan. Larry Papasan has served as Chairman of the board of directors of the Company since September 2013. From July 1991 until his retirement in May 2002, Mr. Papasan served as President of Smith & Nephew Orthopedics. He has been a Director and Chairman of the board of directors of BioMimetic Therapeutics, Inc. [NasdaqGM:BMTI] since August 2005. BioMimetic Therapeutics is developing and commercializing bio-active recombinant protein-device combination products for the healing of musculoskeletal injuries and disease, including orthopedic, periodontal, spine and sports injury applications. Mr. Papasan has also served as a member of the board of directors of Reaves Utility Income Fund [NasdaqCM:UTG], a closed-end management investment company, since February 2003 and of Triumph Bancshares, Inc. (a bank holding company) since April 2005. Mr. Papasan also serves as a Director of SSR Engineering, Inc., AxioMed Spine Corporation, and MiMedx Group, Inc.

John C. Thomas, Jr. John Thomas has been a director of the Company since September 2013 and currently serves as a director and the CFO/corporate secretary for CorMatrix Cardiovascular, Inc., a privately held medical device company which he joined in 2001. Over the past 24 years, Mr. Thomas has served as the CFO of numerous startup companies and managed their financing activities from the initial financing up to their initial public offering. Some of these companies are still private and some have become public entities. The companies in the health care industry that have gone public while Mr. Thomas was the CFO include CytRx Corporation (1986 – 1990), CytRx Biopool (1988 – 1991), Medicis Pharmaceutical Corporation (1988 –1991), EntreMed, Inc. (1991 – 1997), DARA BioSciences, Inc. (1998 – 2009) and, MiMedx, Inc. (2006 – 2009). He has also been the CFO of Surgi-Vision, Inc., a private research company involved in MRI technology (1998 – 2010). Mr. Thomas has also been the CFO of Motion Reality, Inc., a privately-held company with proprietary software that captures and analyzes motion data since 1991. Presently, he serves as a member of the board of directors of QLT, Inc., (QLT) a publicly traded medical company and Conkwest, Inc. a privately held company. Mr. Thomas is a certified public accountant.

Thomas E. Hills. Thomas Hills has been a Director of the Company since September 2013. Mr. Hills is currently President and Chief Investment Officer of healthcare focused Hills Capital Management; the family office for the Paul F. Hills family in Barrington, IL which he joined in 2007. In addition to his experience in the asset management business and prior to founding Hills Capital Management, Tom was in sales and marketing at Sage Products, Inc. At Hills Capital, Tom leads the family’s public and private equity healthcare investment efforts. He is a board member of MedShape in Atlanta, Georgia and Chairman of Barrington Children’s Charities which he and his wife founded. Tom holds a BBA from St. Norbert College and an MBA from Loyola University of Chicago.

Randal R. Betz, M.D. Dr. Randal Betz has been a director of the Company since September 2013. Dr. Betz is an orthopedic spine surgeon with a private practice in Princeton, New Jersey. Dr. Betz has held hospital positions as Chief of Staff at Shriners Hospitals for Children and Medical Director of Shriners’ Spinal Cord Injury Unit. Dr. Betz is also a Professor of Orthopedic Surgery at Temple University School of Medicine.

Dr. Betz earned a Medical Degree from Temple University School of Medicine and was awarded the Alpha Omega Alpha honor. His Internship in general surgery and Residency in Orthopedic Surgery were at Temple University Hospital. Dr. Betz’s Fellowship in Pediatric Orthopedics was at the Alfred I DuPont Institute. Since his graduate work, Dr. Betz has had postdoctoral fellowship experiences with ABC Traveling Fellowship, North American Traveling Fellowship, SRS Traveling fellowship and the Berg-Sloat Traveling Fellowship. Many national and international professional societies count Dr. Betz as a member including: the Academic Orthopedic Society, American Academy for Cerebral Palsy and Developmental Medicine, American Academy of Orthopedic Surgeons, American Orthopedic Association, American Paraplegia Society, American Spinal Injury Association, British Scoliosis Society, International Functional Electrical Stimulation Society, North American Spine Society, Pediatric Orthopedic Society of North America, Scoliosis Research Society, and Spinal Deformity Education Group. For many of these organizations, Dr. Betz has fulfilled the roles of board of director member, committee member and President of the Scoliosis Research Society in 2005.

In addition to an active hospital practice in pediatric spinal surgery, research is an important area of Dr. Betz’s career. He is a recipient of many research grants and he has ten patents, including several involving research in spinal deformities: fusionless treatment of spinal deformities. Dr. Betz is author of several medical texts. He has contributed 45 chapters to medical books and written 280 peer-reviewed or invited articles. Worldwide, Dr. Betz has delivered hundreds of paper presentations and invited lectures. Dr. Betz is on the Editorial Board of the Journal of Pediatric Orthopedics and a Reviewer for the Journal of Bone and Joint Surgery, Journal of Pediatric Orthopedics, and Spine.

Jarrett Gorlin. Jarrett Gorlin has served as the Chief Executive Officer, President, and a Director of the Company since November, 2013. Prior to joining the Company, Mr. Gorlin served as the President of Judicial Correction Services, Inc. (“JCS”), the largest provider of private probation services in the country, which he co-founded in 2001. In 2011, he successfully negotiated the sale of JCS to Correctional Healthcare Companies (“CHC”), after which he has continued to serve as the President of JCS. Under Mr. Gorlin’s leadership, JCS made INC. Magazine’s list of the Fastest Growing Companies in America in 2010, 2011, and 2012. Mr. Gorlin began his career by becoming the youngest rated commercial helicopter pilot at the age of 16, and becoming the chief pilot for the Fulton County Sheriff’s Office in Atlanta, Georgia. Mr. Gorlin has served a Captain and Commander at the Fulton County Sheriff’s Office where he has worked from 1996 to present. He continues to serve his community through law enforcement as the commander of a reserve unit overseeing 90 deputy sheriffs, who work in the courts, jail and warrant divisions. Mr. Gorlin also serves as a political advisor and consultant to many elected officials in the Atlanta area, including the current sitting Sheriff of Fulton and Clayton County, Georgia. He has also served on the campaign finance committee for the former Governor of Georgia Roy Barnes.

John Paul Blank, M.D. John Paul Blank, M.D., became a member of the board of directors on March 25, 2015 as a result of the Company’s acquisition of Streamline. Dr. Blank is a board certified physician in pediatrics and pediatric haematology/oncology. He currently serves as Chairman of the Board of Directors of Treehouse Health, an innovation center formed to assist emerging companies gain customers and grow their business. He has an extensive career in the managed care and services sectors of the healthcare industry. Prior to joining Treehouse Health in 2013, Dr. Blank was Senior Vice President of the Emerging Business Group at United Healthcare Group, a position held from 2011 to 2012. From 2008 to 2011, he was the Chief Operating Officer of AmeriChoice, a subsidiary of United Healthcare Group. He became employed by AmeriChoice after it acquired Unison Health Plans in 2008. Dr. Blank was Chief Executive Officer of Unison Health Plans for 4 years at the time of acquisition, when it was generating $950 million in revenues. From 2001 until 2004, Dr. Blank was Chief Executive Officer of Harmony Health Plan, when it was acquired by WellCare Health Plans, Inc. in 2004. Dr. Blank has a medical degree from McGill University and did his fellowship at Childrens Hospital of Philadelphia.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THE ELECTION OF ALL OF THE NOMINEES FOR DIRECTOR.

Corporate Governance

The Company has determined that Major General Clyde Hennies, Scott M. W. Haufe, M.D., Thomas E. Hills, John C. Thomas, Jr. and Larry Papasan are "independent" as defined by, and determined under, the applicable director independence standards of The NASDAQ Stock Market LLC.

Our Articles of Incorporation provide that to the fullest extent permitted under Nevada law, our directors will not be personally liable to the Company or its stockholders for monetary damages for breach of the duty of care, breach of fiduciary duty or breach of any other duties as directors. Our Articles of Incorporation also provide for indemnification of our directors and officers by the Company to the fullest extent permitted by law.

Our board of directors has responsibility for the oversight of the Company’s risk management processes and, either as a whole or through its committees, regularly discusses with management our major risk exposures, their potential impact on our business and the steps we take to manage them. The risk oversight process includes receiving regular reports from board committees and members of senior management to enable our board to understand the company’s risk identification, risk management and risk mitigation strategies with respect to areas of potential material risk, including operations, finance, legal, regulatory, strategic and reputational risk.

The audit committee reviews information regarding liquidity and operations, and oversees our management of financial risks. Periodically, the audit committee reviews our policies with respect to risk assessment, risk management, loss prevention and regulatory compliance. Oversight by the audit committee includes direct communication with our external auditors, and discussions with management regarding significant risk exposures and the actions management has taken to limit, monitor or control such exposures. The compensation committee is responsible for assessing whether any of our compensation policies or programs has the potential to encourage excessive risk-taking. The nominating/corporate governance committee manages risks associated with the independence of the board, corporate disclosure practices, and potential conflicts of interest. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire board is regularly informed through committee reports about such risks. Matters of significant strategic risk are considered by our board as a whole.

Our board of directors has established an audit committee, a nominating and corporate governance committee and a compensation committee, each of which operates under a charter that has been approved by our board.

Each of the Company's current independent directors, Major General Clyde Hennies, Scott M. W. Haufe, M.D., Thomas E. Hills, John C. Thornas Jr., and Larry Papasan, are independent under the rules of the NASDAQ Capital Market. Accordingly, our board has determined that all of the members of each of the board’s three standing committees are independent as defined under the rules of the NASDAQ Capital Market. In addition, all members of the audit committee meet the independence requirements contemplated by Rule 10A-3 under the Securities Exchange Act of 1934, or the Exchange Act.

Audit Committee

The members of our audit committee are John C. Thomas, Jr., Thomas Hills and Larry Papasan. Mr. Thomas chairs the audit committee. The audit committee’s main function is to oversee our accounting and financial reporting processes, internal systems of control, independent registered public accounting firm relationships and the audits of our financial statements. This committee’s responsibilities include, among other things:

| ● | appointing, approving the compensation of and assessing the independence of our registered public accounting firm; |

| ● | overseeing the work of our independent registered public accounting firm, including through the receipt and consideration of reports from such firm; |

| ● | reviewing and discussing with management and the independent registered public accounting firm our annual and quarterly financial statements and related disclosures; |

| ● | monitoring our internal control over financial reporting, disclosure controls and procedures and code of business conduct and ethics; |

| ● | overseeing our internal audit function; |

| ● | overseeing our risk assessment and risk management policies; |

| ● | establishing policies regarding hiring employees from the independent registered public accounting firm and procedures for the receipt and retention of accounting related complaints and concerns; |

| ● | meeting independently with our internal auditing staff, independent registered public accounting firm and management; |

| ● | reviewing and approving or ratifying any related person transactions; and |

| ● | preparing the audit committee report required by the Securities and Exchange Commission, or SEC, rules. |

All audit and non-audit services, other than de minimis non-audit services, to be provided to us by our independent registered public accounting firm must be approved in advance by our audit committee.

Our board of directors has determined that John C. Thomas, Jr. is an “audit committee financial expert” as defined in applicable SEC rules.

Nominating and Corporate Governance Committee

The members of our nominating and corporate governance committee are Major General C.A. “Lou” Hennies, Thomas Hills and Larry Papasan. Mr. Hennies chairs the nominating and corporate governance committee. This committee’s responsibilities include, among other things:

| ● | identifying individuals qualified to become members of our board of directors; |

| ● | recommending to our board of directors the persons to be nominated for election as directors and to each of our board’s committees; |

| ● | developing, recommending to the board, and assessing corporate governance principles, codes of conduct and compliance mechanisms; and |

| ● | overseeing the evaluation of our board of directors. |

Compensation Committee

The members of our compensation committee are Larry Papasan, Major General Clyde Hennies and Scott M. W. Haufe, M.D. Mr. Papasan chairs the compensation committee. This committee’s responsibilities include, among other things:

| ● | reviewing and recommending corporate goals and objectives relevant to the compensation of our chief executive officer and other executive officers; |

| ● | making recommendations to our board of directors with respect to, the compensation level of our executive officers; |

| ● | reviewing and recommending to our board of directors employment agreements and significant arrangements or transactions with executive officers; |

| ● | reviewing and recommending to our board of directors with respect to director compensation; and |

| ● | overseeing and administering our equity-based incentive plans; |

Compensation Committee Interlocks and Insider Participation

None of our executive officers serves as a member of the compensation committee, or other committee serving an equivalent function, of any other entity that has one or more of its executive officers serving as a member of our board of directors or our compensation committee. Mr. Gorlin, CEO and Director, will abstain on any board vote involving executive compensation by the board as a whole.

Our nominating and corporate governance committee will be responsible for reviewing with the board of directors, on an annual basis, the appropriate characteristics, skills and experience required for the board of directors as a whole and its individual members. In evaluating the suitability of individual candidates (both new candidates and current members), the nominating and corporate governance committee, in recommending candidates for election, and the board of directors, in approving (and, in the case of vacancies, appointing) such candidates, will take into account many factors, including the following:

| · | personal and professional integrity, ethics and values; |

| · | experience in corporate management, such as serving as an officer or former officer of a publicly-held company; |

| · | development or commercialization experience in large medical products companies; |

| · | experience as a board member or executive officer of another publicly-held company; |

| · | strong finance experience; |

| · | diversity of expertise and experience in substantive matters pertaining to our business relative to other board members; |

| · | diversity of background and perspective, including with respect to age, gender, race, place of residence and specialized experience; |

| · | conflicts of interest; and |

| · | practical and mature business judgment. |

Currently, our board of directors evaluates each individual in the context of the board of directors as a whole, with the objective of assembling a group that can best maximize the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of experience in these various areas.

We have adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A current copy of the code will be posted on the Corporate Governance section of our website, www.MedoveX.com. In addition, we intend to post on our website all disclosures that are required by law or the listing standards of The NASDAQ Capital Market concerning any amendments to, or waivers from, any provision of the code. The reference to our website address does not constitute incorporation by reference of the information contained at or available through our website, and you should not consider it to be a part of this Annual Report.

There have been no material changes to the procedures by which security holders may recommend nominees to the board of directors since the Company last described such procedures or any material changes thereto.

The Company's policy encourages board members to attend annual meetings of stockholders.

Section 16(a) of the Exchange Act requires each person who is a director or officer or beneficial owner of more than 10% of the common stock of the Company to file reports in connection with certain transactions. To the knowledge of the Company, based solely upon a review of forms or representations furnished to the Company during or with respect to the most recent completed fiscal year, no person who was subject to Section 16 at any time during such fiscal year failed to file on a timely basis, as disclosed in such forms, reports required by Section 16(a) during such fiscal year or prior fiscal years.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS |

On January 31, 2013, Debride entered into a Contribution and Royalty Agreement with Scott W. Haufe, M.D., a Director of the Company, pursuant to which agreement, Debride acquired all of Dr. Haufe’s right, title and ownership of U.S. Patent 8,167,879 B2, together with all of Dr. Haufe’s right, title and interest in and to the Debride intellectual property in exchange for shares of common stock of Debride. The agreement provides that Dr. Haufe shall receive a royalty of one (1%) percent of Debride’s net sales during the life of the patent.

In September 2013, we entered into a Co-Development Agreement with James Andrews, M.D., a director of the Company, whereby Dr. Andrews committed to further evaluate the Debride and to seek to make modifications and improvements to such technology. In exchange for such services, the Company agreed to pay Dr. Andrews a royalty equal to two (2%) percent of Debride’s net sales during the five (5) year term of the Co-Development Agreement. Upon the termination of the term of the Co-Development Agreement, which has a minimum term of five (5) years, then the royalty payable to Dr. Andrews shall be reduced to one (1%) percent of Debride’s net sales after such termination of products covered by any U.S. patent on which Dr. Andrews is listed as a co-inventor; if any such patents are obtained. Such one (1%) percent royalty shall continue during the effectiveness of such patent. Pursuant to the Co-Development Agreement, Dr. Andrews agreed to assign any modifications or improvements to the Debride to the Company subject to the royalty rights described above.

Several directors of the Company or their family members participated in the 2013 private placement of shares of common stock of the Company at $2.50 per share on the same terms as non-affiliated stockholders. In the aggregate, directors of the Company purchased 137,500 shares in the 2013 private placement. The resale of these shares are subject to a lock up.

The Company pays TAG Aviation (“TAG”), a company owned by CEO Jarrett Gorlin, for approximately 1,200 square feet of office space in Atlanta Georgia for executive office space at a rate of $1,800 per month plus related utilities. The rental rate is 90% of the amount billed to TAG Aviation by the owner of the property. The Company has also chartered aircraft from TAG Aviation. The total amount spent for chartered service with TAG Aviation was approximately $34,000 in 2013 and $33,000 in 2014. The Company believes that such aircraft charter is on terms no less favorable then it would receive from a third party.

AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

FOR THE FISCAL YEAR ENDING DECEMBER 31, 2016

The Audit Committee has retained Frazier & Deeter LLC as the Company’s independent registered public accounting firm to perform the audit of the Company’s consolidated financial statements for the fiscal year ending December 31, 2015, and the audit of the Company’s internal control over financial reporting as of December 31, 2015.

Frazier & Deeter LLC has confirmed to the Audit Committee and the Company that it complies with all rules, standards, and policies of the Public Company Accounting Oversight Board (“PCAOB”), and the SEC rules governing auditor independence.

Representatives of Frazier & Deeter LLC will be present at the meeting and will have the opportunity to make a statement at the meeting if they wish to do so, and will respond to appropriate questions asked by shareholders. See “Independent Registered Public Accounting Firm Fees and Services” below for a description of the fees paid to firms for the years ended December 31, 2015 and 2014, and other matters relating to the procurement of services.

We are seeking shareholder ratification of the retention of Frazier & Deeter LLC. Although shareholder ratification of the retention of our independent registered public accounting firm is not required, we are submitting the selection of Frazier & Deeter LLC for ratification as a matter of good corporate governance. Even if the selection is ratified, the Audit Committee in its discretion may appoint an alternative independent registered public accounting firm if it deems such action appropriate. If the Audit Committee selection is not ratified, the Audit Committee will take that fact into consideration, together with such other factors as it deems relevant, in deeming its selection of an independent registered public accounting firm.

Marcum LLP (“Marcum”) served as our independent auditors for the fiscal year ended December 31, 2013. On January 27, 2015, we dismissed Marcum, and Frazier & Deeter, LLP became our independent auditor. The decision to change accountants was recommended and approved by our Audit Committee following the Committee’s further process to determine our independent registered public accounting firm.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS SHAREHOLDERS VOTE “FOR” RATIFYING THE RETENTION OF FRAZIER & DEETER LLC AS INDEPENDENT REGISTERED PUBLIC ACOUNTING FIRM FOR THE FISCAL YEAR ENDED DECEMBER 31, 2016.

Item 14 of Part III of our Annual Report on Form 10-K, as filed (our “Annual Report”) is incorporated herein by reference.

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) and Section 14A of the Exchange Act entitle the Company’s stockholders to cast a non-binding advisory vote regarding the approval of the compensation disclosed in this Proxy Statement of the Company’s executive officers who are named in the Summary Compensation Table herein (the “Named Executive Officers”). The Company has disclosed the compensation of the Named Executive Officers pursuant to rules adopted by the SEC.

The Company believes that its executive compensation programs are designed to (1) motivate and retain executive officers, (2) reward the achievement of the Company’s short-term and long-term performance goals, (3) establish an appropriate relationship between executive pay and short-term and long-term performance and (4) align executive officers’ interests with those of the Company’s stockholders.

The Company is asking stockholders to indicate their support for the compensation of the Company’s Named Executive Officers as disclosed herein. This proposal, commonly known as a “say-on-pay” proposal, gives the Company’s stockholders the opportunity to express their views on the Company’s executive compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of the Company’s Named Executive Officers and the philosophy, policies and practices described in this proxy statement. Accordingly, the Company asks its stockholders to vote “FOR” the following resolution at the Annual Meeting:

“RESOLVED, that the compensation paid to the Company’s Named Executive Officers, as disclosed in the Company’s Proxy Statement for the Annual Meeting of Stockholders pursuant to Item 402 of Regulation S-K, including the compensation table, other executive compensation tables and related narrative disclosures, is hereby APPROVED.”

The say-on-pay vote is advisory and, therefore, not binding on the Company or the Company’s Board of Directors. The Company’s Board of Directors value the opinions of stockholders and to the extent there is any significant vote against the Named Executive Officer compensation as disclosed in this proxy statement, the Company will consider stockholders’ concerns and the Board of Directors will evaluate whether any actions are necessary to address those concerns.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” ADVISORY APPROVAL OF THE COMPENSATION OF THE EXECUTIVE OFFICERS AS DISCLOSED IN THE PROXY STATEMENT.

The table below sets forth, for the last two fiscal years, the compensation earned by each person acting as our Chief Executive Officer, Chief Financial Officer and three most highly compensated executive officers whose total annual compensation exceeded $100,000 (together, the “Named Executive Officers”).

| Name & Position | | Fiscal Year | | Salary ($) | | | Bonus ($) | | | Stock Awards ($) | | | All Other Compensation ($) | | | Total ($) | |

| Jarrett Gorlin, CEO | | 2013 | | | 37,500 | | | | 0 | | | | 0 | | | | 0 | | | | 37,500 | |

| | | 2014 | | | 180,000 | | | | 36,000 | | | | | | | | | | | | 216,000 | |

| Patrick Kullmann, COO | | 2013 | | | 25,000 | | | | 0 | | | | 0 | | | | 0 | | | | 25,000 | |

| | | 2014 | | | 170,000 | | | | 34,000 | | | | | | | | | | | | 204,000 | |

| Charles Farrahar, Former CFO | | 2013 | | | 22,917 | | | | 0 | | | | 0 | | | | 0 | | | | 22,917 | |

| | | 2014 | | | 110,000 | | | | 22,000 | | | | | | | | | | | | 132,000 | |

| Jeffery Wright, CFO | | 2013 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| | | 2014 | | | 110,000 | | | | 0 | | | | | | | | | | | | 110,000 | |

| Dennis Moon, SVP | | 2013 | | | 25,000 | | | | 0 | | | | 0 | | | | 0 | | | | 25,000 | |

| | | 2014 | | | 120,000 | | | | 24,000 | | | | | | | | | | | | 144,000 | |

On January 27, 2015, Charles Farrahar resigned from his position as Chief Financial Officer and Treasurer of the Company, and was replaced by Jeffery Wright. Mr. Farrahar remains with the Company on a part-time basis as its Secretary.

From their first date of employment, the Company entered into Employment and Confidential Information and Inventions Assignment (“Confidentiality”) Agreements with each of its four officers. These agreements are identical with the exception of the salary amount in the Employment Agreement.

The Confidentiality Agreement, among other things, obligates each officer not to disclose Confidential Information (as defined in the Agreement) for a period of 5 years after their last date of employment. It commits the employee to assign any work product developed at MedoveX to the Company and assist with obtaining patents for that work as necessary. It contains a provision prohibiting employees from soliciting clients or hiring Company personnel for a period of 2 years after their separation.

The Employment Agreements are for a term of three years and define the compensation and benefits each employee will receive when they start employment. They also define the circumstances for and the effect on compensation and benefits under the following scenarios:

| a. | Termination without cause |

| b. | Termination upon death or disability |

| c. | Termination by the Company for cause |

| d. | Termination by the employee for good reason, including material diminishment of position, demands to move or change in control of the Company |

| e. | Termination by the Company without cause, upon disability or by employee with good reason |

| f. | Termination for other reasons |

If the Company terminates without cause or the employee terminates with good reason, the employee continues to collect his salary and benefits for 6 months after termination. The Employment Agreement also contains a non-compete clause prohibiting the employee from competing with the Company for 1 year after their separation.

The current annualized salaries of our executive officers are as follows:

| Name & Position | | Annual Salary | |

| Jarrett Gorlin, CEO | | $ | 272,000 | |

| Patrick Kullmann, President & COO | | $ | 231,000 | |

| Jeffery Wright, CFO | | $ | 130,000 | |

| Dennis Moon, EVP | | $ | 201,000 | |

| Manfred Sablowski, SVP | | $ | 120,000 | |

There were no equity awards granted to the named executive officers in 2013 or 2014.

The information is presented for each person we know to be a beneficial owner of 5% or more of our securities, each of our directors and executive officers, and our officers and directors as a group.

The percentage of common equity beneficially owned is based upon 11,056,125 shares of Common Stock issued and outstanding as of September 28, 2015, under the assumption that all Streamline shareholders submit their transmittal letters to receive their proportional interest in shares of Medovex common stock.

The number of shares beneficially owned by each stockholder is determined under the rules issued by the Securities and Exchange Commission and includes voting or investment power with respect to such securities. Under these rules, beneficial ownership includes any shares as to which the individual or entity has sale or shared voting power or investment power. Unless otherwise indicated, the address of all listed stockholders is c/o MEDOVEX, 3279 Hardee Avenue, Atlanta, Georgia 30341. Unless otherwise indicated each of the stockholders listed has sole voting and investment power with respect to the shares beneficially owned, subject to community property laws where applicable.

| | | Number of Shares Beneficially Owned(1) | | | Percentage of common equity beneficially owned | |

| Scott M.W. Haufe, M.D., Director | | | 774,110 | (2)(4) | | | 7.0 | % |

| Manfred Sablowski, Officer | | | 29,600 | (9) | | | 0.3 | % |

| Jarrett Gorlin, Director and Officer | | | 506,837 | (3) | | | 4.6 | % |

| Larry W. Papasan, Chairman | | | 201,076 | (4) | | | 1.8 | % |

| John C. Thomas, Jr., Director | | | 75,400 | | | | 0.7 | % |

| Patrick Kullmann, Officer | | | 213,269 | (5) | | | 1.9 | % |

| Jeffery Wright, Officer | | | 12,500 | (7) | | | -- | % |

| Major General Clyde Hennies, Director | | | 104,288 | (4) | | | 0.9 | % |

| James R. Andrews, M.D., Director | | | 104,288 | (4) | | | 0.9 | % |

| Thomas E. Hills, Director | | | 104,288 | (4) | | | 0.9 | % |

| Steve Gorlin, Director | | | 329,462 | (6) | | | 3.0 | % |

| Randal R. Betz, M.D., Director | | | 104,288 | (4) | | | 0.9 | % |

| John Paul Blank, M.D., Director | | | 109,435 | | | | 1.0 | % |

| Dennis Moon, Officer | | | 197,326 | | | | 1.7 | % |

| Officers and Directors as a Group (12 persons) | | | 2,866,167 | | | | 25.7 | % |

| (1) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and includes voting or investment power with respect to shares beneficially owned and options exercisable within 60 days. Beneficial ownership is based on information furnished by the individuals or entities. |

| (2) | Includes 532,335 shares held by Morgan Stanley Smith Barney custodian for Nicole Haufe Roth IRA, 209,275 shares held by Nicole Haufe and 25,000 shares held by the Haufe Family Limited Partnership. Mr. Haufe disclaims beneficial ownership of the shares. |

| (3) | Represents shares held by The Jarrett S. & Rebecca L. Gorlin Family Limited Partnership. Mr. Gorlin disclaims beneficial ownership of the shares. |

| (4) | Includes 7,500 shares pursuant to options exercisable within 60 days. |

| (5) | Includes 96,788 shares held by Pamela M.C. Kullmann. Mr. Kullmann disclaims beneficial ownership of Pamela M.C. Kullmann’s shares. Includes 8,750 shares pursuant to stock options exercisable within 60 days. |

| (6) | Includes 125,000 shares held by Mr. Gorlin's spouse, Deborah Gorlin. Mr. Gorlin disclaims beneficial ownership of Deborah Gorlin’s shares. |

| (7) | Includes 12,500 shares pursuant to options exercisable within 60 days. |

| (8) | Includes 3,750 shares pursuant to options exercisable within 60 days. |

| (9) | Includes 25,000 shares pursuant to options exercisable within 60 days. |

ADVISORY VOTE ON THE FREQUENCY OF HOLDING

AN ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Act and Section 14A of the Exchange Act also entitle the Company’s stockholders to cast a non-binding advisory vote regarding how frequently the Company should seek from its stockholders a non-binding advisory vote on the compensation disclosed in the Company’s proxy statement of its Named Executive Officers. By voting on this frequency proposal, stockholders may indicate whether they would prefer that the advisory vote on the compensation of the Company’s Named Executive Officers occur every one, two or three years. Stockholders may also abstain from voting on the proposal. Accordingly, the following resolution is submitted for an advisory stockholder vote at the Annual Meeting:

RESOLVED, that the highest number of votes cast by the stockholders of the Company for the option set forth below shall be the preferred frequency of the Company’s stockholders for holding an advisory vote on the compensation of the Company’s executive officers who are named in the Summary Compensation Table of the Company’s Proxy Statement:

• every year;

• every two years; or

• every three years.

The Board of Directors has determined that an advisory vote by the Company’s stockholders on executive compensation that occurs every three years is the most appropriate alternative for the Company. In formulating its conclusion, the Board of Directors considered that, because the Company’s compensation program for executive officers is not complex, a stockholder advisory vote every three years should be sufficient to permit our stockholders to express their views about our compensation program. Also, the Board of Directors believes that the success of the Company’s executive compensation program should be judged over a period of time that is longer than one year.

You may cast your vote on your preferred voting frequency by choosing the option of one year, two years or three years when you vote in response to this proposal, and you may also abstain from voting on the proposal. Your vote on this proposal is not a vote to approve or disapprove of the Board of Director’s recommendation but rather is a vote to select one of the options described in the preceding sentence. The option of one year, two years or three years that receives the highest number of votes cast by stockholders will be the frequency of the advisory vote on executive compensation that has been recommended by the stockholders. However, because this vote is advisory and not binding on either the Board of Directors or the Company, the Board of Directors may subsequently decide that it is in the best interests of the Company and its stockholders to hold an advisory vote on executive compensation that differs in frequency from the option that received the highest number of votes from the Company’s stockholders at the Annual Meeting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” A THREE-YEAR FREQUENCY FOR HOLDING AN ADVISORY VOTE ON EXECUTIVE COMPENSATION.

Cost and Method

We will pay all of the costs of soliciting these proxies. In addition to solicitation by mail, our employees, officers and directors may, without additional compensation, solicit proxies by mail, e-mail, facsimile, in person or by telephone or other forms of telecommunication. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses.

Participants in the Proxy Solicitation