Filed Pursuant to Rule 424(b)(3)

Registration No. 333-194162

UNITED DEVELOPMENT FUNDING INCOME FUND V

SUPPLEMENT NO. 6 DATED DECEMBER 11, 2014

TO THE PROSPECTUS DATED JULY 25, 2014

This document supplements, and should be read in conjunction with, the prospectus of United Development Funding Income Fund V dated July 25, 2014, as supplemented by Supplement No. 1 dated September 10, 2014, Supplement No. 2 dated October 15, 2014, Supplement No. 3 dated October 22, 2014, Supplement No. 4 dated November 7, 2014 and Supplement No. 5 dated November 10, 2014. Unless otherwise defined in this supplement, capitalized terms used in this supplement shall have the same meanings as set forth in the prospectus. The purpose of this Supplement No. 6 is to disclose:

| · | the status of our public offering; |

| · | our real property loans and investments; |

| · | our revolving line of credit; |

| · | our declaration of distributions; |

| · | updates to the “Investment Objectives and Criteria – Our Business” section of our prospectus; and |

| · | the delivery of a revised form of our Subscription Agreement, attached hereto as Exhibit B. |

Status of Our Public Offering

We commenced our initial public offering of our common shares of beneficial intereston July 25, 2014. As of December 10, 2014, we had accepted subscriptions and issued an aggregate of 382,132 common shares of beneficial interest in exchange for gross proceeds of approximately $7.3 million. As of December 10, 2014, approximately 37,117,868 common shares of beneficial interest remained available for sale in the offering for approximately $742.4 million, excluding shares offered pursuant to our distribution reinvestment plan (DRIP).

We will offer our common shares of beneficial interest pursuant to the offering until July 25, 2016, unless our board of trustees terminates the offering at an earlier date or all shares being offered have been sold, in which case the offering will be terminated. If all of the shares we are offering have not been sold by July 25, 2016, we may extend the offering for an additional year or as otherwise permitted by applicable law. In addition, at the discretion of our board of trustees, we may elect to extend the termination date of our offering of shares reserved for issuance pursuant to our DRIP, in which case participants in the plan will be notified. The offering must be registered in every state in which we offer or sell shares. Generally, such registrations are for a period of one year. Thus, we may have to stop selling shares in any state in which our registration is not renewed or otherwise extended annually.

Investments

The following information should be read in conjunction with the discussion contained in the “Prospectus Summary – Description of Investments” section on page 10 of the prospectus and the “Investment Objectives and Criteria — Real Estate Property Loans and Investments” section on page 89 of the prospectus:

CTMGT Frisco 113, LLC

Effective December 1, 2014, we entered into a loan agreement to provide a $10,660,000 land development loan (CTMGT Frisco Loan) to CTMGT Frisco 113, LLC, an unaffiliated Texas limited liability company (CTMGT Frisco). The CTMGT Frisco Loan is evidenced and secured by a first lien deed of trust to be recorded against 81 acres of entitled residential land in Collin County, Texas, a promissory note, assignments of builder lot sale contracts, and other loan documents. The CTMGT Frisco Loan is guaranteed by the principals of CTMGT Frisco. The proceeds of the loan will be used to refinance CTMGT Frisco’s land acquisition and to develop the 81 acres into single family residential lots for sale to homebuilders. The annual interest rate under the CTMGT Frisco Loan is the lower of 13% or the highest rate allowed by law. The CTMGT Frisco Loan matures and becomes due and payable in full on December 1, 2017. During the CTMGT Frisco Loan term, CTMGT Frisco is required to pay down the CTMGT Frisco Loan by paying over to us all net proceeds of land and lot sales. Payments on the CTMGT Frisco Loan will be generally applied first to accrued interest, and then to principal. The loan documents contain representations, warranties, covenants, and provisions for events of default that are typical for loans of this nature. As of December 1, 2014, UDF V had funded $1,072,435 to CTMGT Frisco under the CTMGT Frisco Loan.

Rosehill Reserve, Ltd.

Effective December 5, 2014, we entered into a loan agreement to provide a $42,372,200 land acquisition and development loan (Rosehill Loan) to Rosehill Reserve, Ltd., an unaffiliated single-purpose entity (Rosehill). The Rosehill Loan is evidenced and secured by a first lien deed of trust to be recorded against 304 acres of land in Tomball, Harris County, Texas, a promissory note, assignments of builder lot sale contracts, and other loan documents. The Rosehill Loan is guaranteed by a principal of Rosehill. The proceeds of the loan will be used to finance Rosehill’s land acquisition and to develop Phase 1 into single family residential lots for sale to homebuilders. The annual interest rate under the Rosehill Loan is the lower of 13% or the highest rate allowed by law. The Rosehill Loan matures and becomes due and payable in full on December 5, 2016. During the Rosehill Loan term, Rosehill is required to pay down the Rosehill Loan by paying over to us all net proceeds of land and lot sales. Payments on the Rosehill Loan will be generally applied first to accrued interest, and then to principal. The loan documents contain representations, warranties, covenants, and provisions for events of default that are typical for loans of this nature. We received an origination fee equal to $529,627 at the closing of the loan and are entitled to receive a net profits interest in the project. As of December 5, 2014, $10,244,887 had been funded to Rosehill under the Rosehill Loan by us and through the Veritex Credit Facility (as defined below).

Revolving Line of Credit

The following information should be read in conjunction with the discussion contained in the “Prospectus Summary – Possible Leverage” section on page 10 of the prospectus and the “Investment Objectives and Criteria — Borrowing Policies” section beginning on page 83 of the prospectus:

On November 14, 2014, we entered into a loan agreement (Veritex Loan Agreement) for up to $10 million of borrowings pursuant to a revolving line of credit (Veritex Credit Facility) from Veritex Community Bank (Veritex). The interest rate on the Veritex Credit Facility is equal to the prime rate of interest as published in the Wall Street Journal plus 1.25% per annum. Accrued interest on the outstanding principal amount of the Veritex Credit Facility is payable monthly. The Veritex Credit Facility matures and becomes due and payable in full on May 14, 2016. On November 14, 2014, the interest rate under the Veritex Credit Facility was 4.5%. As of December 11, 2014, we had borrowed $7,536,218 under the Veritex Credit Facility.

The amount available to us to draw under the Veritex Credit Facility is subject to a borrowing base determined by Veritex, which is generally based on the unpaid principal balance of an eligible loan to be originated by us or the appraised value of the real property securing an eligible loan to be originated by us, subject to reduction by Veritex for a borrower concentration or other discretionary reasons.

The Veritex Credit Facility is secured by a first priority security interest in all of our current and future assets. The Veritex Credit Facility will also be secured by the collateral assignment to Veritex of loans originated by us, if required by Veritex. In connection with the Veritex Credit Facility, we paid Veritex a commitment fee of $100,000, which is 1% of the maximum borrowings under the Veritex Credit Facility.

The Veritex Loan Agreement requires Veritex to maintain a leverage ratio of not greater than 1:1. The Veritex Loan Agreement includes usual and customary events of default for facilities of this nature. If a default occurs under the Veritex Credit Facility, Veritex may declare the Veritex Credit Facility to be due and payable immediately, after giving effect to any notice and cure periods provided for in the Veritex Loan Agreement and associated documents. In such event, Veritex may exercise any rights or remedies it may have, including, without limitation, a foreclosure of the collateral or an increase of the interest rate to 18% per annum.

Declaration of Distributions

The following information should be read in conjunction with the discussion contained in the “Prospectus Summary – Distribution Policy” section beginning on page 12 of the prospectus and the “Description of Shares – Distribution Policy and Distributions” section beginning on page 166 of the prospectus:

Our board of trustees authorized distributions to our shareholders of record beginning as of the close of business on each day of the period commencing on November 21, 2014 and ending December 31, 2014. The distributions will be calculated based on 365 days in the calendar year and will be equal to $0.0040274 per common share of beneficial interest, assuming a purchase price of $20.00 per share. These distributions will be aggregated and paid monthly in arrears either in cash or in our common shares of beneficial interest for shareholders participating in our DRIP. Therefore, the distributions declared for each record date in the November 2014 and December 2014 periods will be paid in December 2014 and January 2015, respectively, only from legally available funds.

| 2 |

In addition, on November 21, 2014, our board of trustees authorized special distributions to our shareholders of record beginning as of the close of business on each day of the period commencing on November 21, 2014 and ending November 30, 2014. The distributions are calculated based on 365 days in the calendar year and are equal to $0.0040274 per common share of beneficial interest, assuming a purchase price of $20.00 per share. These distributions will be aggregated and paid in cash in December 2014 only from legally available funds.

Investment Objectives and Criteria

The following information should be read in conjunction with the discussion contained in the “Investment Objectives and Criteria – Our Business” section beginning on page 76 of the prospectus:

UDF V was formed to generate current interest income by investing in secured loans and producing profits from investments in residential real estate. We will derive a significant portion of our income by originating, purchasing and holding for investment secured loans for the acquisition and/or development of parcels of real property into single-family residential lots. We also will make direct investments in land for development into single-family lots.

| 3 |

The following chart illustrates the gradual recovery in housing since the market reached a bottom in 2009. Although current levels remain considerably below the 2005 peak, the upward sloping “L” shaped trend in new home sales indicates a slow, steady increase in demand since 2009. According to the Census Bureau, new single-family home sales do not include sales of existing homes or multi-family homes but refer directly to the type of properties in which we make loans. Increasing sales indicate a rising demand for new homes, which may lead to homebuilders’ growing need for capital to keep pace with the expanding market.

Source: Census Bureau

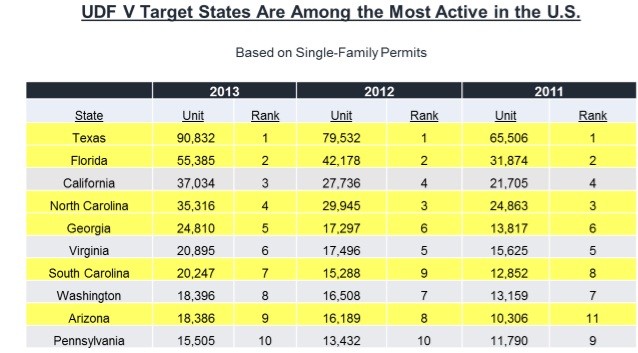

As illustrated in the tables below, based on the Census Bureau Annual Permits Release, the states and cities which we intend to focus our investments (which are highlighted in the following two tables) are consistently among the most active in the U.S., exhibiting the highest numbers of new privately owned housing units. The U.S. Census Bureau Annual Permits Release represents homebuilding markets ranked by single-family permits. The granting of single-family permits is a key indicator of growth in a housing market. An increase in the number of permits granted in Core Based Statistical Areas (CBSA) indicates an increase in future new homes, which we believe also leads to an increase in demand for future land acquisition and development financing.

| 4 |

Source: Census Bureau, Annual Permits Release

The National Association of Realtors (NAR) affordability index measures whether or not a typical family can qualify for a mortgage loan on a typical home. The affordability index compares median income levels to the income level required to purchase an existing median-priced home. An affordability index less than 1.0 indicates that the median-income family in the respective region has insufficient income to qualify for the loan to purchase the existing median-priced house. An affordability index greater than 1.0 indicates that the median-income family earns more than enough to buy the existing median-priced house. We believe that affordability has been restored across the country, with the Midwest and South showing the highest levels of affordability, as illustrated in the table below.

Source: As of 5/12/14 - National Association of Realtors®

We believe that job growth is a fundamental demand driver for new home sales. According to data compiled from the U.S. Census Bureau and Bureau of Labor Statistics, since December 2007 the U.S. has lost approximately one million jobs, while Texas has gained approximately 800,000 jobs during that same time period.

| 5 |

Sources: UDF V compiled from Bureau of Labor Statistics, U.S. Census Bureau

Texas metropolitan statistical areas (MSAs) continue to demonstrate strong employment growth. As shown in the following table, according to data compiled from the Bureau of Labor Statistics, for the trailing twelve months through October 2014, the major markets in Texas are ranked among the top MSAs in job creation nationally. The Houston area reported the second highest total job growth in the nation for the trailing twelve months ending October 2014, Dallas - Fort Worth reported the third highest growth, Austin the 19th highest growth and San Antonio the 21st highest.

Source: UDF V complied from Bureau of Labor Statistics

| 6 |

The housing recovery continues to emerge in the Southeast, where there is also strengthening job creation, most notably in South Carolina, North Carolina and Florida. As evidenced by the following data from the Bureau of Labor Statistics and the U.S. Census Bureau, since bottoming out in 2009 the markets of Tampa, Orlando, Charlotte, and Raleigh-Durham have shown strong increases in employment, significantly outpacing the growth in single family residential housing permits. As new jobs are created, we believe that households will be formed, excess housing inventory will be absorbed, and eventually demand will increase for new single family housing.

Source: UDF V complied from Bureau of Labor Statistics and U.S. Census Bureau

In the major Texas markets, new home starts have increased over the past three years. At the same time, vacant developed lot inventories are down in those same markets. The discrepancy between the change in new home starts and the change in developed lot inventories indicates an increasing demand for new homes in specific Texas housing markets. As a result, we believe that land development will become an even more important area of investment as the number of vacant developed lots available to builders continues to decrease.

| 7 |

Source: MetroStudy Q2 2O14 Report

We believe that population growth can be a strong driver of new home and finished lot demand. The following table illustrates the population growth in the top eight U.S. metropolitan markets in 2013, as well as markets in which we intend to concentrate our investments (markets in which we intend to invest are highlighted).

Source: U.S. Census Bureau

| 8 |

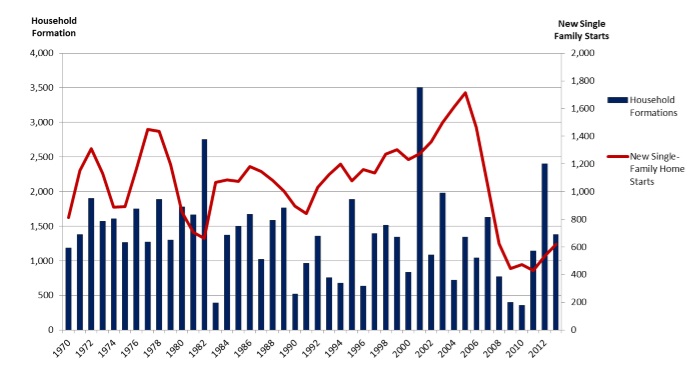

Household formation is a fundamental driver for new home demand, but has lagged significantly from a national perspective since the end of the Great Recession. According to the following data from the U.S. Census Bureau, growth in household formation and new single-family home starts has been slow. As household formations increase, we believe that the number of new home starts are also likely to rise.

Source: Census Bureau; 1/15/2014

As shown in the following table, according to the Joint Center for Housing Studies at Harvard University, population and household formations are projected to increase, which we believe will drive the demand for new homes.

Source: U.S. Census Bureau and Joint Center for Housing Studies of Harvard University

| 9 |

As illustrated in the following table, according to the U.S. Census Bureau, over 75% of the new homes sold in 2013 were under $399,000, which is the market where we focus our lending and investing activities. This segment supports conforming loans and serves the new home buyer.

Source: U.S. Census Bureau

As shown below, private builders account for over 70% of new home sales. The private builders are in need of capital to fund and expand their operations, and are therefore the primary borrowers to whom we intend to lend.

Source: Bloomberg

| 10 |

According to data from the Federal Deposit Insurance Corporation, outstanding construction loans for both residential and commercial projects increased to $223.2 billion in the second quarter of 2014, but still are far below the peak reached in 2007 when overall construction lending exceeded $600 billion. Local and regional banks are a primary source of capital for private homebuilders. The inability of homebuilders to access capital as a result of banks not being willing to issue construction loans has been a significant impediment to the growth of private homebuilders, resulting in increased merger and acquisitions by public homebuilders.

Source: FDIC

The University of Michigan Consumer Sentiment Index Thomson Reuters/University of Michigan Surveys of Consumers is a consumer confidence index published monthly by the University of Michigan and Thomson Reuters. Increasing consumer sentiment indicates consumers are upbeat about their personal finances and the national economy. We believe increases in consumer sentiment and a stronger job market can lead to an increase in household formations and a demand for more housing.

| 11 |

Consumer Sentiment

Source: Reuters/University of Michigan

Our underwriting will identify multiple exit strategies and repayment sources for the projects we fund or invest in. We believe the financing of residential development provides multiple exit strategies including the sale or securitization of finished lots, sale of land and paper lots to national and regional production homebuilders and secure third party financing as a source to repay our loans.

Revised Form of Subscription Agreement

The prospectus is hereby supplemented to include a revised form of our Subscription Agreement, which is attached hereto as Exhibit B. Such revised form of Subscription Agreement replaces in its entirety Exhibit B to the prospectus.

| 12 |

EXHIBIT B

FORM OF SUBSCRIPTION AGREEMENT