DISCLAIMER The presentations today contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, particularly statements regarding future business plans, prospects and financial performance of Time Inc. (the “Company”) and its business. These statements are based on management’s current expectations or beliefs, and are subject to uncertainty and changes in circumstances. Actual results may vary materially from those expressed or implied in the presentations due to changes in economic, business, competitive, technological, strategic, regulatory and/or other factors. More detailed information about these factors may be found in the Company’s filings with the Securities and Exchange Commission, including its most recent Annual Report on Form 10-K and subsequent Quarterly Re- ports on Form 10-Q. The Company is under no obligation, and expressly disclaims any such obligation, to update or alter its forward-looking statements, whether as a result of new information, future events or otherwise. Non-GAAP financial measures such as operating income before depreciation and amortization (“OIBDA”), Adjusted OIBDA and Free Cash Flow, as included in today’s presentations, are supplemental measures that are not calculated in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). Definitions of these measures and reconciliations to the most directly-comparable U.S. GAAP measures are included at the end of the presentation decks. Our non-GAAP financial measures have limitations as analytical and comparative tools and you should consider OIBDA, Adjusted OIBDA and Free Cash Flow in addition to, and not as a substitute for, the Company’s Operating In- come (Loss), Net Income (Loss) from Continuing Operations and various cash flow measures (e.g. Cash Provided by (Used in) Operations), as well as other measures of financial performance and liquidity reported in accordance with U.S. GAAP.

JOE RIPP CEO & Chairman, Time Inc. Transforming Time Inc.

TODAY AGENDA TIME INC. DIGITAL STRATEGY – Jen Wong INNOVATIVE AD SOLUTIONS – Mark Ford & Lauren Newman CELEBRITY & ENTERTAINMENT: ENGAGING CONSUMER PASSIONS – Rich Battista, Jess Cagle & Will Lee TIME INC. UK: DRIVING REVENUE CROSSOVER – Marcus Rich & Andrea Davies VIDEO: GO BEYOND – Rich Battista & Ian Orefice UNLOCKING THE TIME BRAND – Evelyn Webster, Nancy Gibbs & Meredith Long VIANT: PEOPLE-BASED AD TECH – Tim & Chris Vanderhook SPORTS ILLUSTRATED PLAY: NEW EXPERIENCES – Jeff Karp TIME INC. LIVE MEDIA – Scott Cullather & Kristina McCoobery FINANCIAL REVIEW – Jeff Bairstow Q&A

S P E C I A L D O U B L E I S S U E INSIDE WALMART’S RADICAL REINVENTION P . 1 3 4 T H E R E D E M P T I O N O F O R AC L E ’S M A R K H U R D P . 1 6 6 FACE BOO K ST R I K E S V I D E O G O L D P . 1 4 8 T H E R A I L ROAD W I T H B ET T E R PROF I T MAR G I N S T H A N G OO G L E P . 2 1 0 CA E SA R S : A N E P I C G AM B L E G ON E W R ON G P . 1 8 6 H A S I N D R A N O O Y I F I X E D P E P S I ? P . 2 4 6 I S S U E 6 . 15 . 15 F O R T U N E . C O M DISPLAY UNTIL AUGUST 24, 2015 plus N O M O R E T R I L L I O N - D O L L A R W E A K L I N G S : B LACKROCK & VANGUARD F L EX THE I R MUSCLES P . 9 5 THE 20 BEST- PERFORMING STOCKS P. F-25 PASSIONATE AUDIENCES STRATEGY PORTFOLIO & CONTENT FOUNDATION FOR Transformation DEEP RELATIONSHIPS WITH ADVERTISERS S P E C I A L D O U B L E I S S U E INSIDE WALMART’S RADICAL REINVENTION P . 1 3 4 T H E R E D E M P T I O N O F O R AC L E ’S M A R K H U R D P . 1 6 6 FACE BOO K ST R I K E S V I D E O G O L D P . 1 4 8 T H E R A I L ROAD W I T H B ET T E R PROF I T MAR G I N S T H A N G OO G L E P . 2 1 0 CA E SA R S : A N E P I C G AM B L E G ON E W R ON G P . 1 8 6 H A S I N D R A N O O Y I F I X E D P E P S I ? P . 2 4 6 I S S U E 6 . 15 . 15 F O R T U N E . C O M DISPLAY UNTIL AUGUST 24, 2015 plus N O M O R E T R I L L I O N - D O L L A R W E A K L I N G S : B LACKROCK & VANGUARD F L EX THE I R MUSCLES P . 9 5 THE 20 BEST- PERFORMING STOCKS P. F-25 SPECIALDOUBLEISSUE INSIDE WALMART’S RADICAL REINVENTION P. 134 THE REDEMPTION OF ORACLE’S MARK HURD P. 166 FACEBOOK STRIKES VIDEO GOLD P. 148 THE RAILROAD WITH BETTER PROFIT MARGINS THAN GOOGLE P. 210 CAESARS: AN EPIC GAMBLE GONE WRONG P. 186 HAS INDRA NOOYI FIXED PEPSI? P. 246 ISSUE 6.15.15 FORTUNE.COM DISPLAYUNTIL AUGUST 24,2015 plus NO MORE TRILLION-DOLLAR WEAKLINGS: BLACKROCK & VANGUARD FLEX THEIR MUSCLESP. 95 THE 20 BEST- PERFORMING STOCKS P. F-25

Six Pillars OF REVENUE CROSSOVER

Six Pillars OF REVENUE CROSSOVER 2016 1 POWERFUL STORIES 1 TEAM 2 DIGITAL SCALE 3 TARGETING & DATA 5 VIDEO 6 NEW EXPERIENCES 4 BRANDED CONTENT & NATIVE

Let’s get started

Accelerating Digital Growth JEN WONG EVP & President of Digital, Time Inc.

LANDSCAPE TRENDS IN THE MARKETPLACE DATA, TARGETING, AND AD TECH VIDEO eCOMMERCE NATIVE ADVERTISING

NATIVE ADVERTISING MARKET WILL GROW 2x FROM 2015- 18 TO $9B source: Socintel360 as cited in company blog, 2014 LANDSCAPE

DATA, TARGETING AND AD TECH TOP INVESTMENT AREA FOR CMOS LANDSCAPE

VIDEO ADVERTISING LANDSCAPE $70B IN TV AD MARKET UP FOR GRABS 30% OF VIDEO AD REVENUE IS NATIVE source: emarketer, March 2016, 2016 IAB Video Ad Spend Study

eCOMMERCE WILL BE $650B IN SALES IN 2018 AND STILL JUST 17% OF COMMERCE LANDSCAPE source: US Department of Commerce, Kantar retail analysis

STRATEGY GROWTH ENGAGEMENT SCALE MARKETING EQUATION

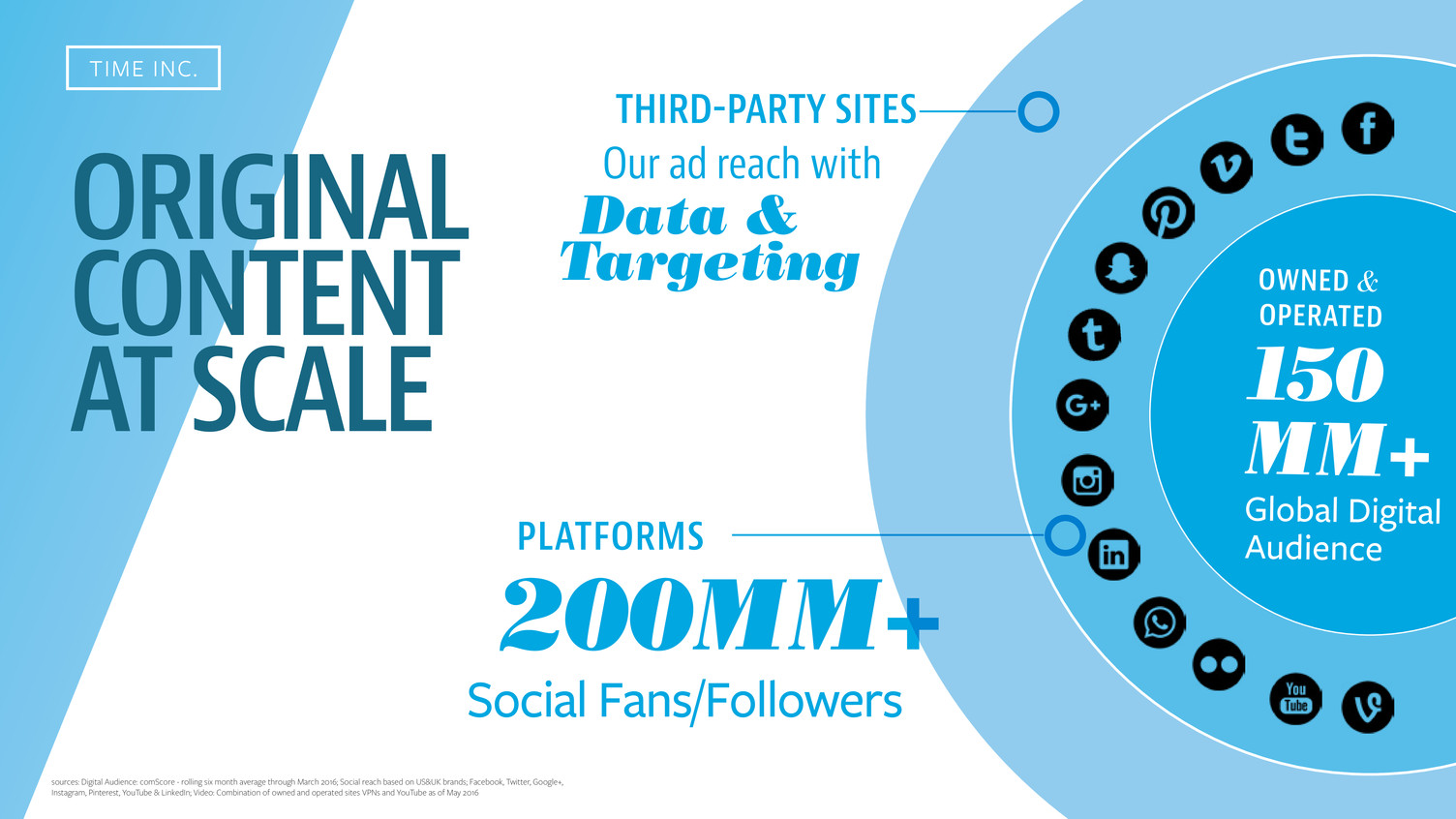

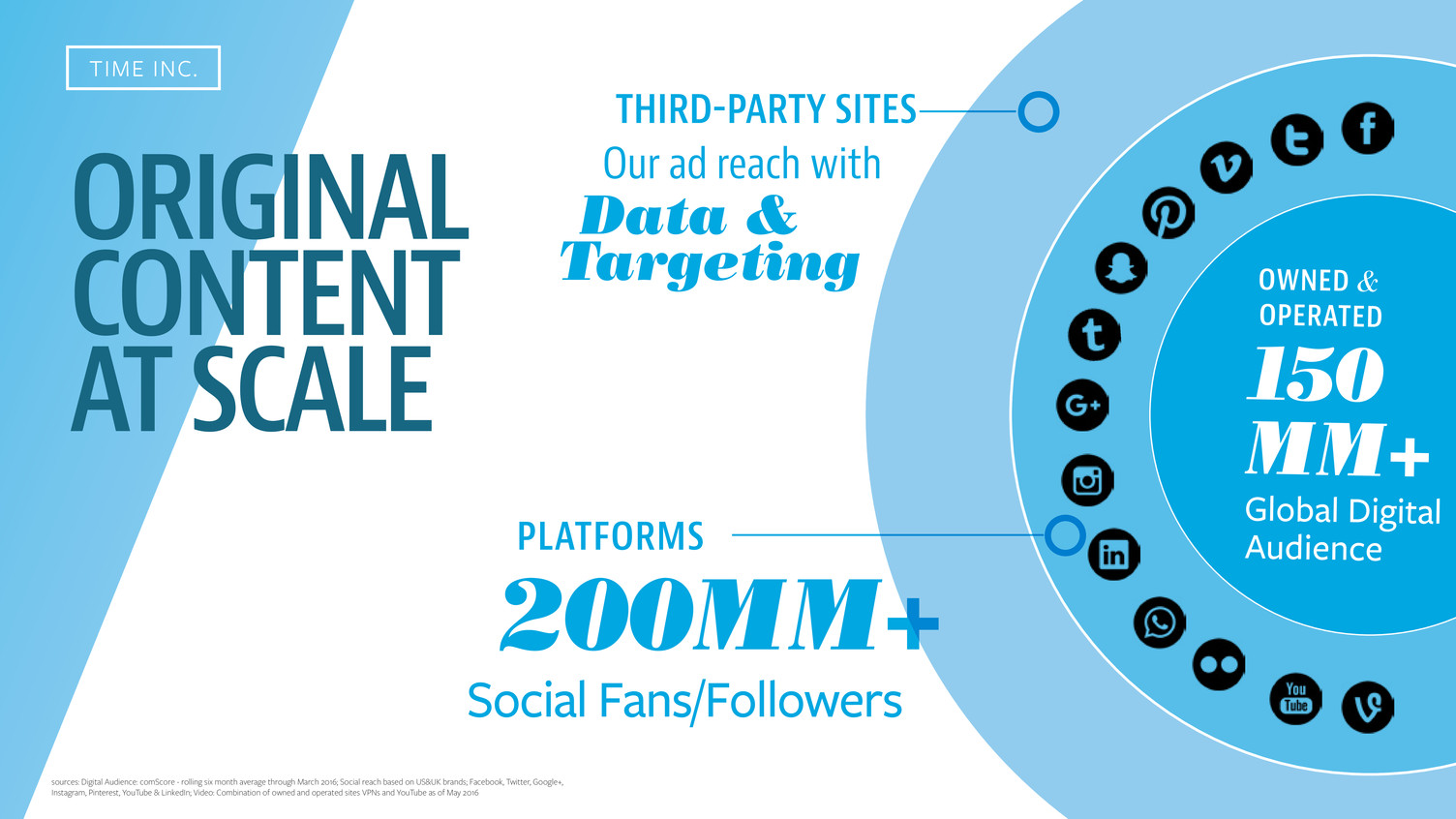

TIME INC. ORIGINAL CONTENT AT SCALE OWNED & OPERATED 150 MM+ Global Digital Audience THIRD-PARTY SITES Our ad reach with Data & Targeting PLATFORMS 200MM+ Social Fans/Followers source: Digital Audience: comScore - rolling six month average; Social reach: based on US&UK brands; Facebook, Twitter, Google+, Instagram, Pinterest, YouTube & LinkedIn sources: Digital Audience: comScore - rolling six month average through March 2016; Social reach based on US&UK brands; Facebook, Twitter, Google+, Instagram, Pinterest, YouTube & LinkedIn; Video: Combination of owned and operated sites VPNs and YouTube as of May 2016

ENGAGEMENT CONTENT

THE MARKETING EQUATION STRATEGY

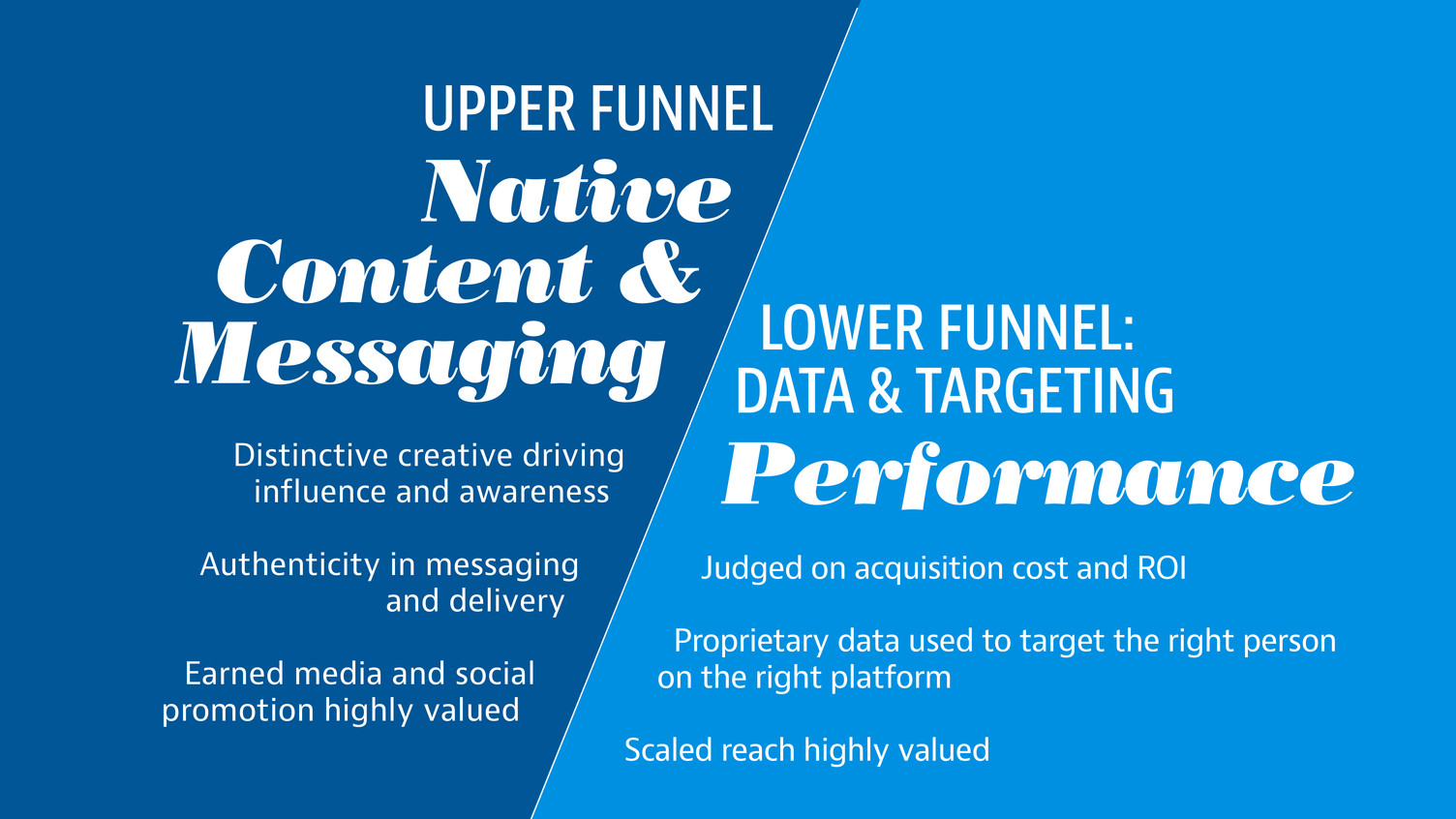

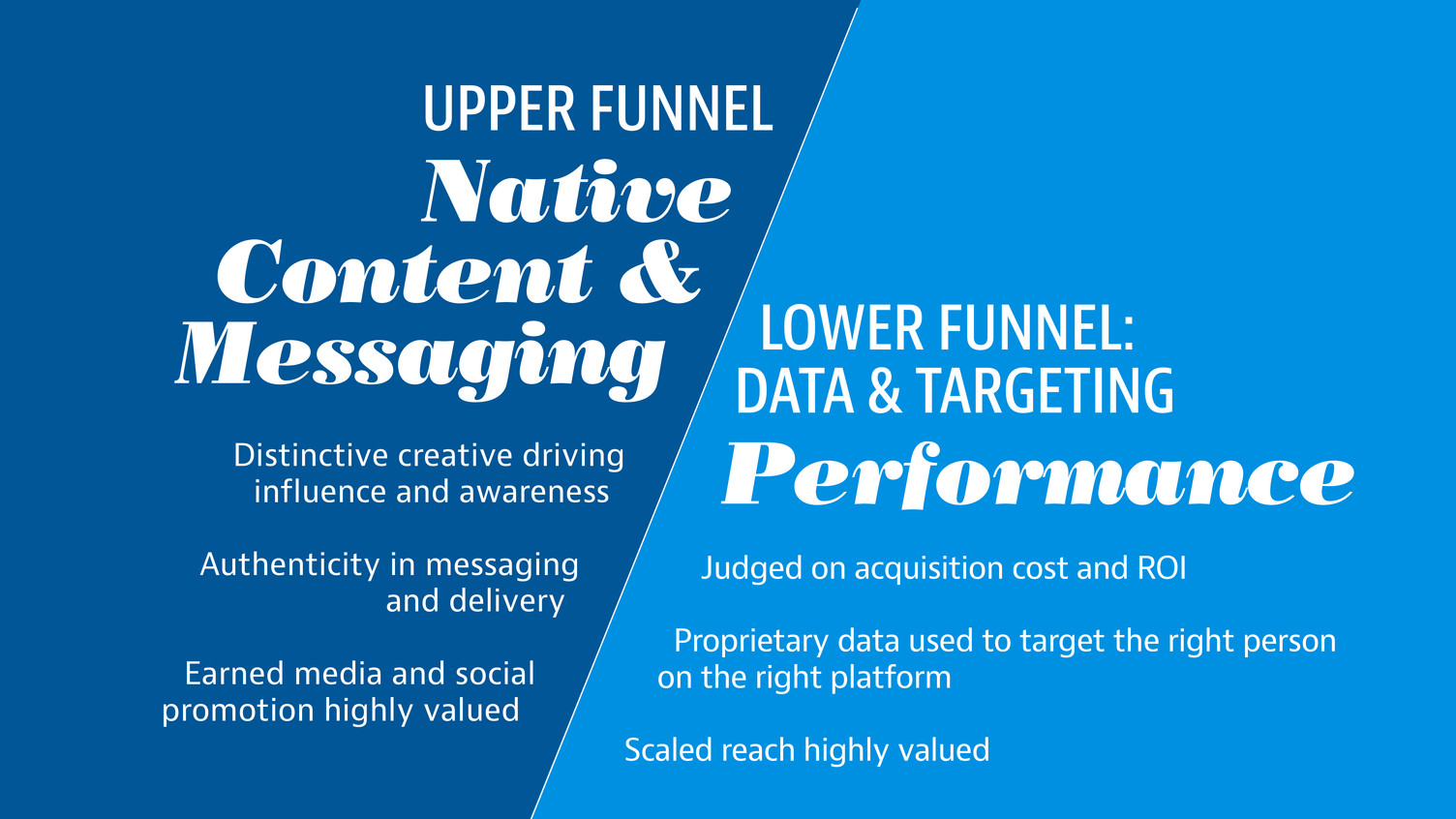

UPPER FUNNEL Native Content & Messaging LOWER FUNNEL: DATA & TARGETING Performance Distinctive creative driving influence and awareness Authenticity in messaging and delivery Earned media and social promotion highly valued Judged on acquisition cost and ROI Proprietary data used to target the right person on the right platform Scaled reach highly valued

1 Content Engine 1 Distribution Platform 1 Scaled Ad Buy STRATEGY SCALE

STRATEGY GROWTH ENGAGEMENT SCALE MARKETING EQUATION

Innovative Ad Solutions MARK FORD EVP, Chief Revenue Officer Global Advertising, Time Inc.

BIGGER DEALS PERFORMANCE- DRIVEN EXPERIENTIAL SCALE NATIVE What Advertisers Want

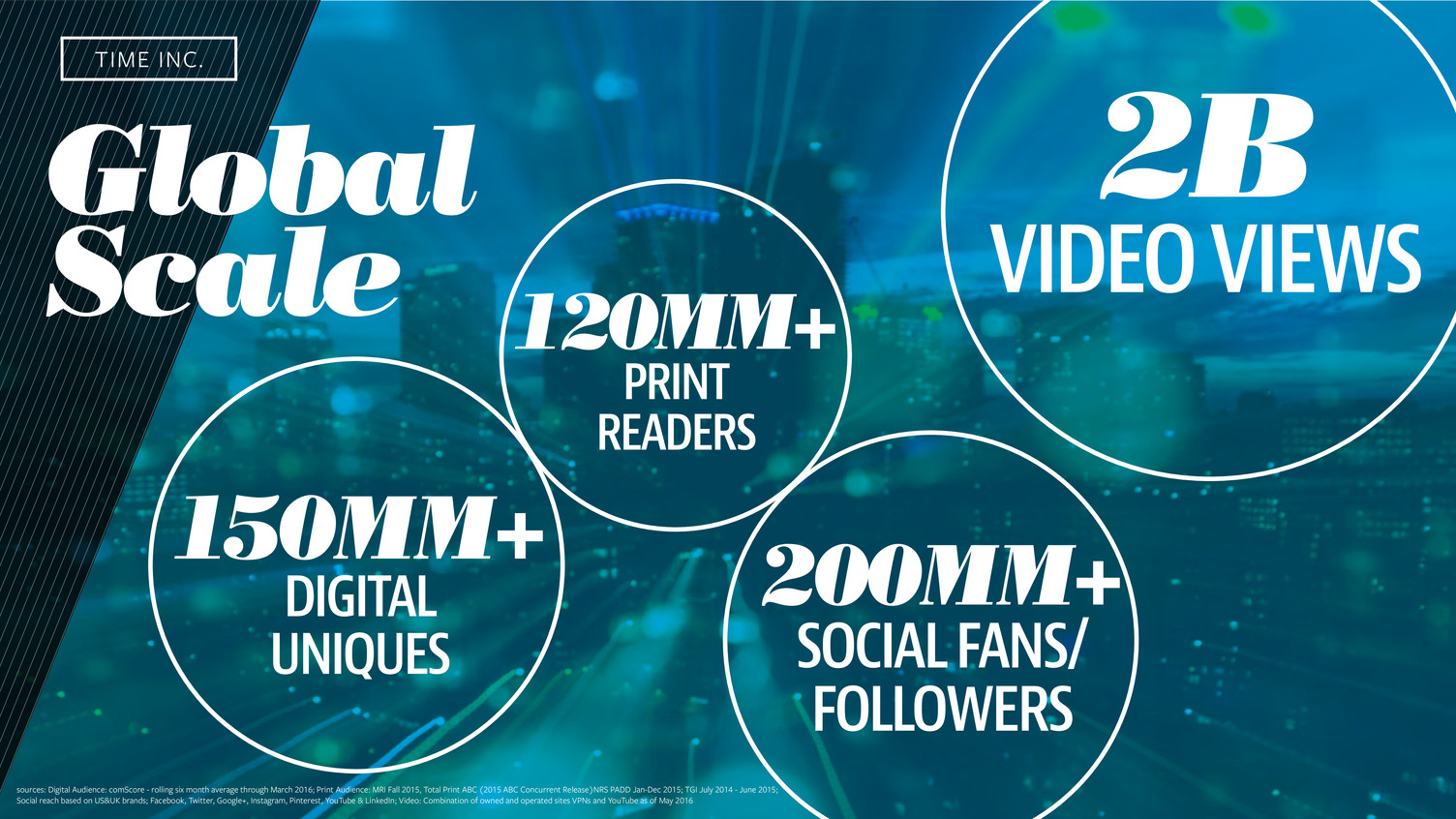

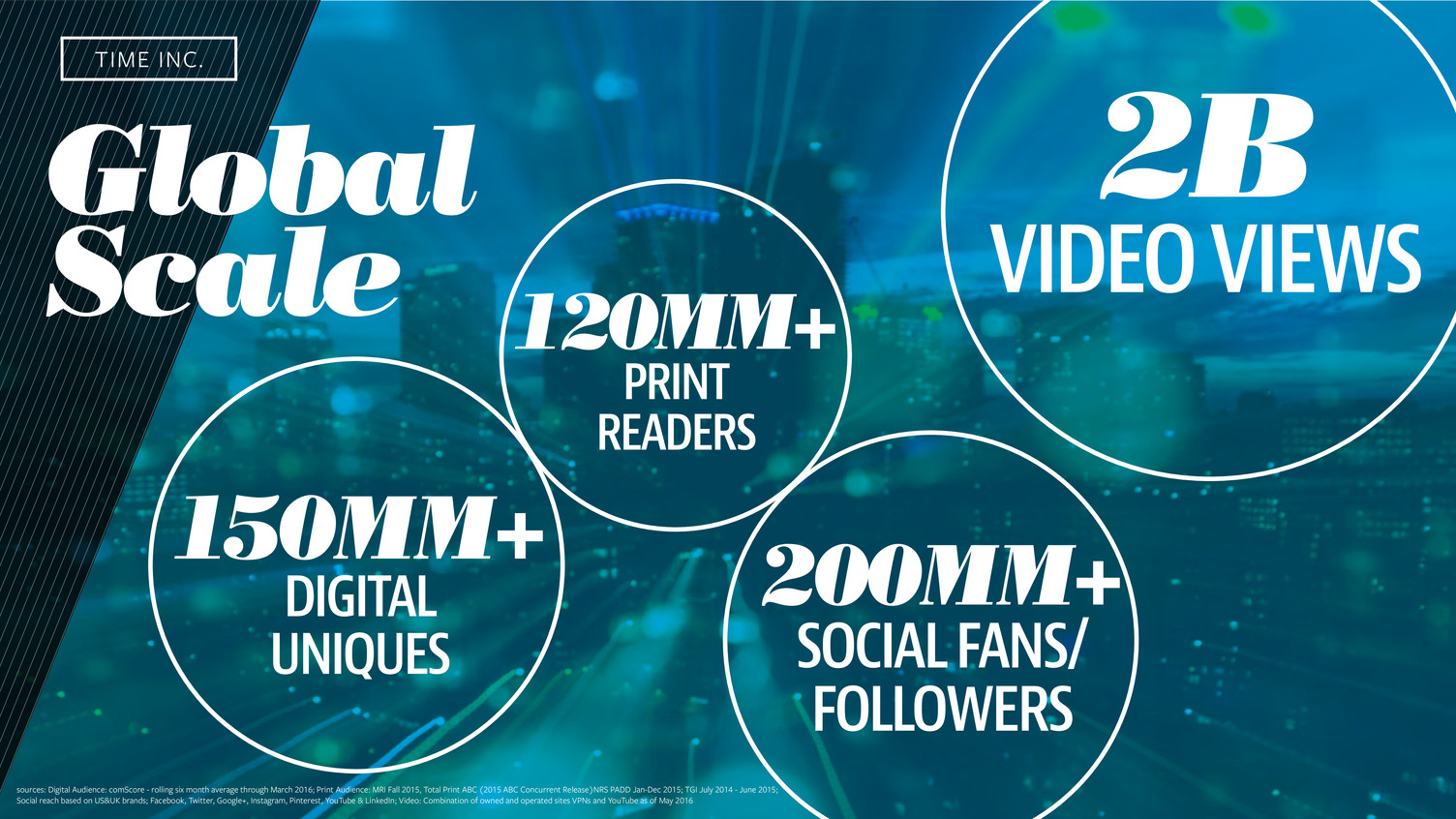

Global Scale 2B VIDEO VIEWS 150MM+ DIGITAL UNIQUES 120MM+ PRINT READERS 200MM+ SOCIAL FANS/ FOLLOWERS sources: Digital Audience: comScore - rolling six month average through March 2016; Print Audience: MRI Fall 2015, Total Print ABC (2015 ABC Concurrent Release)NRS PADD Jan-Dec 2015; TGI July 2014 - June 2015; Social reach based on US&UK brands; Facebook, Twitter, Google+, Instagram, Pinterest, YouTube & LinkedIn; Video: Combination of owned and operated sites VPNs and YouTube as of May 2016 TIME INC.

$9B MARKETPLACE BY 2018 Native http://www.adweek.com/news/technology/infographic-native-advertising-grows-despite-budget-and-transparency-concerns-162963 TIME INC.

Experiential 2014 Convention Industry Council & Research from PWC INDUSTRY $280B MARKETPLACE

Performance- Driven BRANDING $24.6B 42% Product Launch Awareness Reputation 58% eCommerce Lead Gen Site Visitation PERFORMANCE- DRIVEN $33.9B eMarketer, “US Digital Ad Spending Share, by Industry and Objective, 2015 (billions and % of total digital ad spending)”, May 2015 INDUSTRY

Bigger Deals BIG AGENCY DEALS PARTNERSHIPS WITH TOP MARKETERS

Integrated Solutions for Our Clients Integrated Solutions Bigger deals EXPERIENTIAL Native PerFOrMaNCe- driveN sCale

LAUREN NEWMAN SVP, Corporate Sales Time Inc. Walgreens Case Study

WALGREENS Case Study OBJECTIVE: Start a new conversation around beauty that inspires women to reconsider how they think of Walgreens’ role in their holistic beauty routine.

STARTING THE CONVERSATION EDITORIALLY WITH EXPERTS This is a movement to say we’re more than just our dresses… It’s hard being a woman in Hollywood or any industry. – Reese Witherspoon

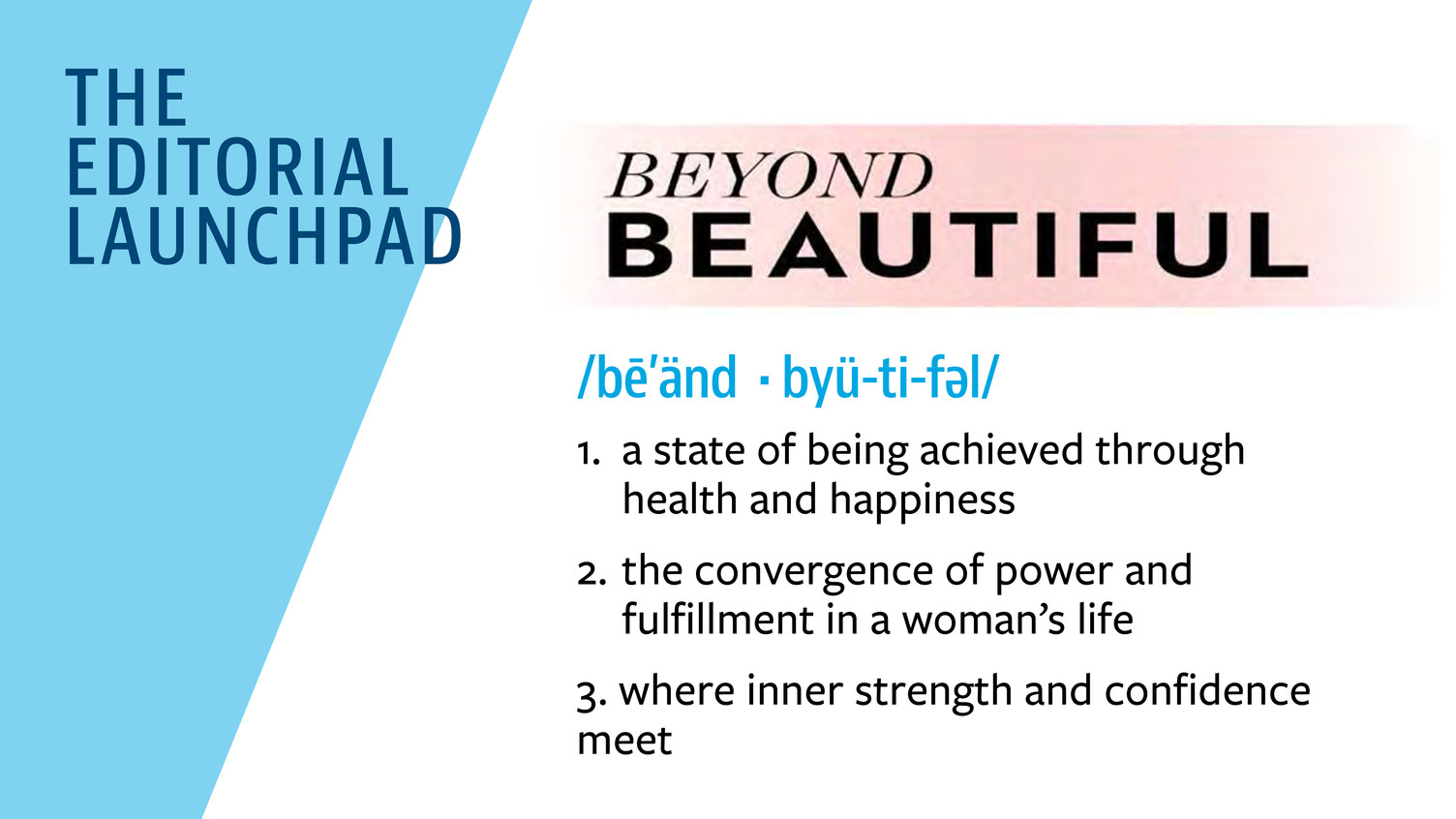

/bē’änd • byü-ti-fəl/ THE EDITORIAL LAUNCHPAD 1. a state of being achieved through health and happiness 2. the convergence of power and fulfillment in a woman’s life 3. where inner strength and confidence meet

BEAUTIFUL PARTNERS

INTRODUCING BEYOND BEAUTIFUL CULTURAL INSPIRATION LED TIME INC. TO DEVELOP A NEW EDITORIAL FRANCHISE E V A L O N G O R I A 7. 4 T W I T T E R F O L L O W E R S million 2.1 I N S T A G R A M R E A C H million B R A N D S 4 0 A G E A C T I V I S M Causes include the Eva Longoria Foundation (evalongoria foundation.org) and Eva’s Heroes (evasheroes.org) Executive producer and star of NBC’s Telenovela; will appear opposite Demian Bichir in the film Low Riders U P C O M I N G P R O J E C T S Her production company, UnbeliEVAble Entertainment; brand ambassador for L’Oréal Paris 30 EW.COM FEBRUARY 12, 2016 feeling, we will have not done our jobs. That’s the point: to not feel the pressure to be extraordinary. LONGORIA Every time I direct, I’m so well prepared. But I’m like that in life. And every DP I’ve ever worked with has said, “You are so good.” And I say, “Yeah. Why are you surprised?” When are they not going to be surprised that a woman can do this job? BANKS I was lucky. I worked with my husband and a great producing partner who had recognized that I should direct and had already been trying to groom me to do it. So the two people that stood next to me on set every day allowed me to be the boss, without question. Kerry, your latest project, the HBO movie Confirmation, was your first producer credit. Howwas that experience? WASHINGTON I loved it. When I hear you all talk about feeling like you were being underused, I felt like I was being overbearing in the work that I was doing because I wanted to contribute so much. And [people would react] like, “Stay in your lane, actor.” So it felt like I finally got to do what I always do, but to do it with permission, with a title. Eva, with DeviousMaids and Telenovela, was there amoment where you thought, “I’m really good at this”? LONGORIA Oh, I’ve always said that. [Laughs ] I was an extra for two years when I first moved to Hollywood. And I was like a sponge. “Why is the camera there? What does ‘checking the gate’ mean?” I quickly realized, too, that actors have no power. I was like, “Who are those people behind the monitor? That’s the director.” And I thought, “Oh, I want his job.” And then I became a director. And I thought, “Wait, who are those people telling me what to do? They’re producers. Oh, okay, now I want that job.” [Laughs ] I’m just climbing my way up the ladder. BANKS Oh, please, it took me years. I work in a company with my husband [so] it was always “Who’s the blond actress and her dips--t husband who are trying to do stuff?” No one said it to my face, but it was definitely a feeling I had of “Oh, that’s nice, that’s cute.” WITHERSPOON “Now get your ass back in front of the camera.” SHIRT: PO LO BY RALPH LAUREN/SAKS FIFTH AVENUE BEVERLY HILLS; JEANS: M OTHER; SHO ES: CHRISTIAN LO UBO UTIN; EARRINGS: ANITA KO 32 EW.COM FEBRUARY 12, 2016 Reese, is there one film that stands out in terms of what it’s taught you or what you accomplishedwith it? WITHERSPOON Well, Wild is more reflective of who I really am than any other film I’ve done. It was very raw and personal. I knew that if I took it on a traditional studio route, they’d be like, “[This character’s] not very likable, and she does drugs. And we don’t want to see Reese do drugs.” I hear that all the time. [But Wild ] was so important to me. It was really well received, and it did really well, yet it wasn’t in Oscar consideration for Best Picture. At the time I was like, “Oh, okay, well, it’s one of the best-reviewed films of the year, but it’s not one of the top 10?” Then I looked: None of the [Best Picture nomi- nees] starred a woman [in a prominent role]. And now there’s the #OscarsSoWhite controversy. What do you all think of the fact that the Academy is finally institut- ing some changes? WITHERSPOON None of it was fast. We’ve been talking about these things for years and nothing’s changed. I [do] think social media changed. BANKS It’s that whole embarrassment thing I was talking about earlier. WASHINGTON But it’s cyclical. The Academy dictates what the industry does because everybody in the industry wants those awards. So it’s this codependent rela- tionship. But there will be lots of changes in the coming years because of these decisions. WITHERSPOON Studios have entire sub-companies to create and promote Oscar films. WASHINGTON They have had to cater to that audience, and that audience does not look like [us at] this table. Most of them are over a certain age, male, and white. And if the audience you have to cater to, and address and seduce, is more representative of who we all are, then we all win. Let’s talk about social media. It feels like such an empowering tool for all of you to use. Reese, you’re like the new Oprah when it comes to books. WITHERSPOON It’s been really great, just to see the impact that it’s made on the actual writers. They’re selling hundreds of thousands, if not millions, more books. Because we’re not just optioning them, but we’re making them pretty quickly. Wild E L I Z A B E T H B A N K S 2.1 T W I T T E R F O L L O W E R S million 1 I N S T A G R A M R E A C H million B R A N D S 4 1 A G E A C T I V I S M Participated in the Center for Reproductive Rights’ Draw the Line campaign (reproductiverights.org) Set to play one of the first female war photographers in Sloane U’Ren’s WWII film Rita Hayworth With a Hand Grenade , in addition to produc- ing Netflix’s film The Most Hated Woman in America , starring Melissa Leo U P C O M I N G P R O J E C T S Brownstone Productions, which develops film and TV projects SHIRT: AQ UILANO RIM O NDI; JEANS: GO LDSIGN; SHO ES: CHRISTIAN LO UBO UTIN; EARRINGS: ARIEL GO RDO N; STUD EARRINGS AND RINGS: ANITA KO 34 EW.COM FEBRUARY 12, 2016 went from galleys to screen in 18 months. Gone Girl , 14 months. And Big Little Lies [adapted into a series that’s currently filming]—I mean, [only] 15 months ago we read the book in galleys. You’re all interacting on social media in very personal ways. Eva, you shared your engagement. LONGORIA Almost . Not quite. I didn’t realize I was getting engaged. I was just Snapchatting in the desert, and I was like, “Seems like I should stop this right now, something important is about to happen.” [ Laughs ] I love social media. WITHERSPOON It’s scary [to some, but] you’ve just got to charge ahead with blinders on. Do not scroll down. LONGORIA I remember starting on Twitter. I loved the immediate way I could correct things. At the time, there were just so many lies. It was stupid stuff, like “Eva’s pregnant, Eva’s pregnant, Eva’s pregnant.” I’m like, “Guys, I ate a burger. I’m not pregnant”…because my mom would call! WITHERSPOON Oh, my mom. [ A ff ecting a Southern twang ] “Did you go on a date with George Clooney?” No, Mom, I didn’t. [Laughs ] But it’s great when you know who you are in this world. It took me a while to figure out who I am and what I wanted to say. It’s empowering. And it connects me to all these amazing women. How do youmake decisions about which endorsements you take on? LONGORIA I’m definitely calculated. I’ve been with L’Oréal 10 years. But I actually grew up with L’Oréal. And the story behind “Because You’re Worth It” [meant something to me]. And I grew up with Lay’s, too. My first kiss was with a guy with Cheetos. And I used to crush potato chips into my sandwich. WASHINGTON It has to feel authentic. In this latest round when Neutrogena came to me, I said, “You know what, if we’re going to do this, I have to have a voice in the com- pany. I can’t just be a face. I can’t just kind of get up there and sell product.” And we carved out a creative-consultant relationship that had never happened at the company before. WASHINGTON [To Witherspoon ] What you’re doing with [the Southern-focused lifestyle shopping site] Draper James is amazing because it’s so you. K E R R Y W A S H I N G T O N 3.5 T W I T T E R F O L L O W E R S million 2.2 I N S T A G R A M R E A C H million B R A N D S 39 A G E A C T I V I S M The Purple Purse foundation (purplepurse.com); President’s Committee on the Arts and the Humanities Playing Olivia Pope on ABC’s Sc andal ; starring as Anita Hill in HBO’s Conf irmation (April 16), which she also executive-produced U P C O M I N G P R O J E C T S A line of Sc andal -inspired clothing for the Limited; creative consultant for Neutrogena SHIRT: PO LO BY RALPH LAUREN/SAKS FIFTH AVENUE BEVERLY HILLS; JEANS: M OTHER; SHO ES: CASADEI; EARRINGS: JEN M EYER; RING: SHYLEE RO SE 36 EW.COM FEBRUARY 12, 2016 WITHERSPOON Oh, thanks. I started it because I think I know my audience. It has been so much fun to learn a new business and new language at my age. WASHINGTON When we did the Scandal clothing line, that was something that the Limited was going to do with ABC. And Lyn Paolo, our costume designer, and I were going to have no part of it. My face was going to be on every clothing tag. BANKS Heck, no! WASHINGTON Because my face was the poster for the show. And that image is owned. And I was like, whoa. Lyn Paolo and I have worked so hard on creating this iconic fashion identity for this character. You feel a responsibility to your fans and to the people that are embracing this content to say, “I want to make this as good as you want it to be. I want to live up to the aspiration that you’re holding on to.” What about acting? Is it more difficult because you have all these other things swirling around? BANKS I love acting. It’s the break from everything. WITHERSPOON Isn’t that sad that you think, “Oh, I get to start a movie, it’s going to be a break”? BANKS No one can ask me to do anything else. Twelve hours a day [I can say], “Sorry, I’m unavailable.” What role are you dying to play? BANKS I would like to be James Bond. WASHINGTON So badass. WITHERSPOON That’s a good idea. WASHINGTON Would she be Jamie Bond? BANKS No, she’d be James Bond! WASHINGTON The people whose careers I really admire are people like Cicely Tyson. She’s 91 and was just on Broadway. I want to be able to do what I love to do for as long as I want to do it. BANKS You want longevity. WITHERSPOON I was at [an event] and Eva Marie Saint got up and said, “I’ve been at the front of the bus, and I’ve been at the back of the bus. All I want to tell you ladies is: Just stay on the bus.” WASHINGTON Amen! ◆ MORE ON EW.COM Watch the full, uncut conversation at ew.com/ beyondbeautiful R E E S E W I T H E R S P O O N 1.2 T W I T T E R F O L L O W E R S million 5.1 I N S T A G R A M R E A C H million B R A N D S 39 A G E A C T I V I S M Girls Inc. (girlsinc.org), a charity to help at-risk teenagers in her hometown of Nashville Producing and starring in HBO’s adaptation of Liane Moriarty’s Big Little Lies; a starring role opposite Matt Damon in the Alexander Payne film Downsizing U P C O M I N G P R O J E C T S Pacific Standard, her production company; Draper James (draperjames.com), a Southern- focused retail site SHIRT: DRAPER JAM ES; JEANS: M O THER; SHO ES: CHRISTIAN LO UBO UTIN; EARRINGS: TIFFANY & CO .; RINGS: TIFFANY & CO . AND ANITA KO E V A L O N G O R I A 7. 4 T W I T T E R F O L L O W E R S million 2.1 I N S T A G R A M R E A C H million B R A N D S 4 0 A G E A C T I V I S M Causes include the Eva Longoria Foundation (evalongoria foundation.org) and Eva’s Heroes (evasheroes.org) Executive producer and star of NBC’s Telenovela; will appear opposite Demian Bichir in the film Low Riders U P C O M I N G P R O J E C T S Her production company, UnbeliEVAble Entertainment; brand ambassador for L’Oréal Paris 30 EW.COM FEBRUARY 12, 2016 feeling, we will have not done our jobs. That’s the point: to not feel the pressure to be extraordinary. LONGORIA Every time I direct, I’m so well prepared. But I’m like that in life. And every DP I’ve ever worked with has said, “You are so good.” And I say, “Yeah. Why are you surprised?” When are they not going to be surprised that a woman can do this job? BANKS I was lucky. I worked with my husband and a great producing partner who had recognized that I should direct and had already been trying to groom me to do it. So the two people that stood next to me on set every day allowed me to be the boss, without question. Kerry, your latest project, the HBO movie Confirmation, was your first producer credit. Howwas that experience? WASHINGTON I loved it. When I hear you all talk about feeling like you were being underused, I felt like I was being overbearing in the work that I was doing because I wanted to contribute so much. And [people would react] like, “Stay in your lane, actor.” So it felt like I finally got to do what I always do, but to do it with permission, with a title. Eva, with DeviousMaids and Telenovela, was there amoment where you thought, “I’m really good at this”? LONGORIA Oh, I’ve always said that. [Laughs ] I was an extra for two years when I first moved to Hollywood. And I was like a sponge. “Why is the camera there? What does ‘checking the gate’ mean?” I quickly realized, too, that actors have no power. I was like, “Who are those people behind the monitor? That’s the director.” And I thought, “Oh, I want his job.” And then I became a director. And I thought, “Wait, who are those people telling me what to do? They’re producers. Oh, okay, now I want that job.” [Laughs ] I’m just climbing my way up the ladder. BANKS Oh, please, it took me years. I work in a company with my husband [so] it was always “Who’s the blond actress and her dips--t husband who are trying to do stuff?” No one said it to my face, but it was definitely a feeling I had of “Oh, that’s nice, that’s cute.” WITHERSPOON “Now get your ass back in front of the camera.” SHIRT: PO LO BY RALPH LAUREN/SAKS FIFTH AVENUE BEVERLY HILLS; JEANS: M OTHER; SHO ES: CHRISTIAN LO UBO UTIN; EARRINGS: ANITA KO 32 EW.COM FEBRUARY 12, 2016 Reese, is there one film that stands out in terms of what it’s taught you or what you accomplishedwith it? WITHERSPOON Well, Wild is more reflective of who I really am than any other film I’ve done. It was very raw and personal. I knew that if I took it on a traditional studio route, they’d be like, “[This character’s] not very likable, and she does drugs. And we don’t want to see Reese do drugs.” I hear that all the time. [But Wild ] was so important to me. It was really well received, and it did really well, yet it wasn’t in Oscar consideration for B st Picture. At the time I was like, “Oh, okay, well, it’s one of the best-reviewed films of the year, but it’s not one of the top 10?” Then I looked: None of the [Best Picture nomi- nees] starred a woman [in a prominent role]. And now there’s the #OscarsSoWhite controversy. What do you all think of the fact that the Academy is finally institut- ing some changes? WITHERSPOON None of it was fast. We’ve been talking about these things for years and nothing’s changed. I [do] think social media changed. BANKS It’s that whole embarrassment thing I was talking about earlier. WASHINGTON But it’s cyclical. The Academy dictates what the industry does because everybody in the industry wants those awards. So it’s this codependent rela- tionship. But there will be lots of changes in the coming years because of these decisions. WITHERSPOON Studios have entire sub-companies to create and promote Oscar films. WASHINGTON They have had to cater to that audience, and that audience does not look like [us at] this table. Most of them are over a certain age, male, and white. And if the audience you have to cater to, and address and seduce, is more representative of who we all are, then we all win. Let’s talk about social media. It feels like such an empowering tool for all of you to use. Reese, you’re like the new Oprah when it comes to books. WITHERSPOON It’s been really great, just to see the impact that it’s made on the actual writers. They’re selling hundreds of thousands, if not millions, more books. Because we’re not just optioning them, but we’re making them pretty quickly. Wild E L I Z A B E T H B A N K S 2.1 T W I T T E R F O L L O W E R S million 1 I N S T A G R A M R E A C H million B R A N D S 4 1 A G E A C T I V I S M Participated in the Center for Reproductive Rights’ Draw the Line campaign (reproductiverights.org) Set to play one of the first female war photographers in Sloane U’Ren’s WWII film Rita Hayworth With a Hand Grenade , in addition to produc- ing Netflix’s film The Most Hated Woman in America , starring Melissa Leo U P C O M I N G P R O J E C T S Brownstone Productions, which develops film and TV projects SHIRT: AQ UILANO RIM O NDI; JEANS: GO LDSIGN; SHO ES: CHRISTIAN LO UBO UTIN; EARRINGS: ARIEL GO RDO N; STUD EARRINGS AND RINGS: ANITA KO 34 EW.COM FEBRUARY 12, 2016 went from galleys to screen in 18 months. Gone Girl , 14 months. And Big Little Lies [adapted into a series that’s currently filming]—I mean, [only] 15 months ago we read the book in galleys. You’re all interacting on social media in very personal ways. Eva, you shared your engagement. LONGORIA Almost . Not quite. I didn’t realize I was getting engaged. I was just Snapchatting in the desert, and I was like, “Seems like I should stop this right now, something important is about to happen.” [ Laughs ] I love social media. WITHERSPOON It’s scary [to some, but] you’ve just got to charge ahead with blinders o . Do not scroll down. LONGORIA I remember starting on Twitter. I loved the immediate way I could correct things. At the time, there were just so many lies. It was stupid stuff, like “Eva’s pregnant, Eva’s pregnant, Eva’s pregnant.” I’m like, “Guys, I ate a burger. I’m not pregnant”…because my mom would call! WITHERSPOON Oh, my mom. [ A ff ecting a Southern twang ] “Did you go on a date with George Clooney?” No, Mom, I didn’t. [Laughs ] But it’s great when you know who you are in this world. It took me a while to figure out who I am and what I wanted to say. It’s empowering. And it connects me to all these amazing women. How do youmake decisions about which endorsements you take on? LONGORIA I’m definitely calculated. I’ve been with L’Oréal 10 years. But I actually grew up with L’Oréal. And the story behind “Because You’re Worth It” [meant something to me]. And I grew up with Lay’s, too. My first kiss was with a guy with Cheetos. And I used to crush potato chips into my sandwich. WASHINGTON It has to feel authentic. In this latest round when Neutrogena came to me, I said, “You know what, if we’re going to do this, I have to have a voice in the com- pany. I can’t just be a face. I can’t just kind of get up there and sell product.” And we carved out a creative-consultant relationship that had never happened at the company before. WASHINGTON [To Witherspoon ] What you’re doing with [the Southern-focused lifestyle shopping site] Draper James is amazing because it’s so you. K E R R Y W A S H I N G T O N 3.5 T W I T T E R F O L L O W E R S million 2.2 I N S T A G R A M R E A C H million B R A N D S 39 A G E A C T I V I S M The Purple Purse foundation (purplepurse.com); President’s Committee on the Arts and the Humanities Playing Olivia Pope on ABC’s Sc andal ; starring as Anita Hill in HBO’s Conf irmation (April 16), which she also executive-produced U P C O M I N G P R O J E C T S A line of Sc andal -inspired clothing for the Limited; creative consultant for Neutrogena SHIRT: PO LO BY RALPH LAUREN/SAKS FIFTH AVENUE BEVERLY HILLS; JEANS: M OTHER; SHO ES: CASADEI; EARRINGS: JEN M EYER; RING: SHYLEE RO SE 36 EW.COM FEBRUARY 12, 2016 WITHERSPOON Oh, thanks. I started it because I think I know my audience. It has been so much fun to learn a new business and new language at my age. WASHINGTON When we did the Scandal clothing line, that was something that the Limited was going to do with ABC. And Lyn Paolo, our costume designer, and I were going to have no part of it. My face was going to be on every clothing tag. BANKS Heck, no! WASHINGTON Because my face was the poster for the show. And that image is owned. And I was like, whoa. Lyn Paolo and I have worked so hard on creating this iconic fashion identity for this character. You feel a responsibility to your fans and to the people that are embracing this content to say, “I want to make this as good as you want it to be. I want to live up to the aspiration that you’re holding on to.” What about acting? Is it more difficult because you have all these other things swirling around? BANKS I love acting. It’s the break from everything. WITHERSPOON Isn’t that sad that you think, “Oh, I get to start a movie, it’s going to be a break”? BANKS No one can ask me to do anything else. Twelve hours a day [I can say], “Sorry, I’m unavailable.” What role are you dying to play? BANKS I would like to be James Bond. WASHINGTON So badass. WITHERSPOON That’s a good idea. WASHINGTON Would she be Jamie Bond? BANKS No, she’d be James Bond! WASHINGTON The people whose careers I really admire are people like Cicely Tyson. She’s 91 and was just on Broadway. I want to be able to do what I love to do for as long as I want to do it. BANKS You want longevity. WITHERSPOON I was at [an event] and Eva Marie Saint got up and said, “I’ve been at the front of the bus, and I’ve been at the back of the bus. All I want to tell you ladies is: Just stay on the bus.” WASHINGTON Amen! ◆ MORE ON EW.COM Watch the full, uncut conversation at ew.com/ beyondbeautiful R E E S E W I T H E R S P O O N 1.2 T W I T T E R F O L L O W E R S million 5.1 I N S T A G R A M R E A C H million B R A N D S 39 A G E A C T I V I S M Girls Inc. (girlsinc.org), a charity to help at-risk teenagers in her hometown of Nashville Producing and starring in HBO’s adaptation of Liane Moriarty’s Big Little Lies; a starring role opposite Matt Damon in the Alexander Payne film Downsizing U P C O M I N G P R O J E C T S Pacific Standard, her production company; Draper James (draperjames.com), a Southern- focused retail site SHIRT: DRAPER JAM ES; JEANS: M O THER; SHO ES: CHRISTIAN LO UBO UTIN; EARRINGS: TIFFANY & CO .; RINGS: TIFFANY & CO . AND ANITA KO

BEYOND BEAUTIFUL EDIT BUZZ #BeyondBeautiful FACEBOOK POSTS INSTAGRAM POSTS TWITTER POSTS TV COVERAGE

BRINGING EDIT AND CUSTOM CONTENT TOGETHER TIME INC.’s Beyond Beautiful A New Editorial Franchise Sponsored by Walgreens WALGREENS’ Feeling Beautiful A Companion Custom Content Program

CUSTOM CONTENT PLATFORM: FEELING BEAUTIFUL

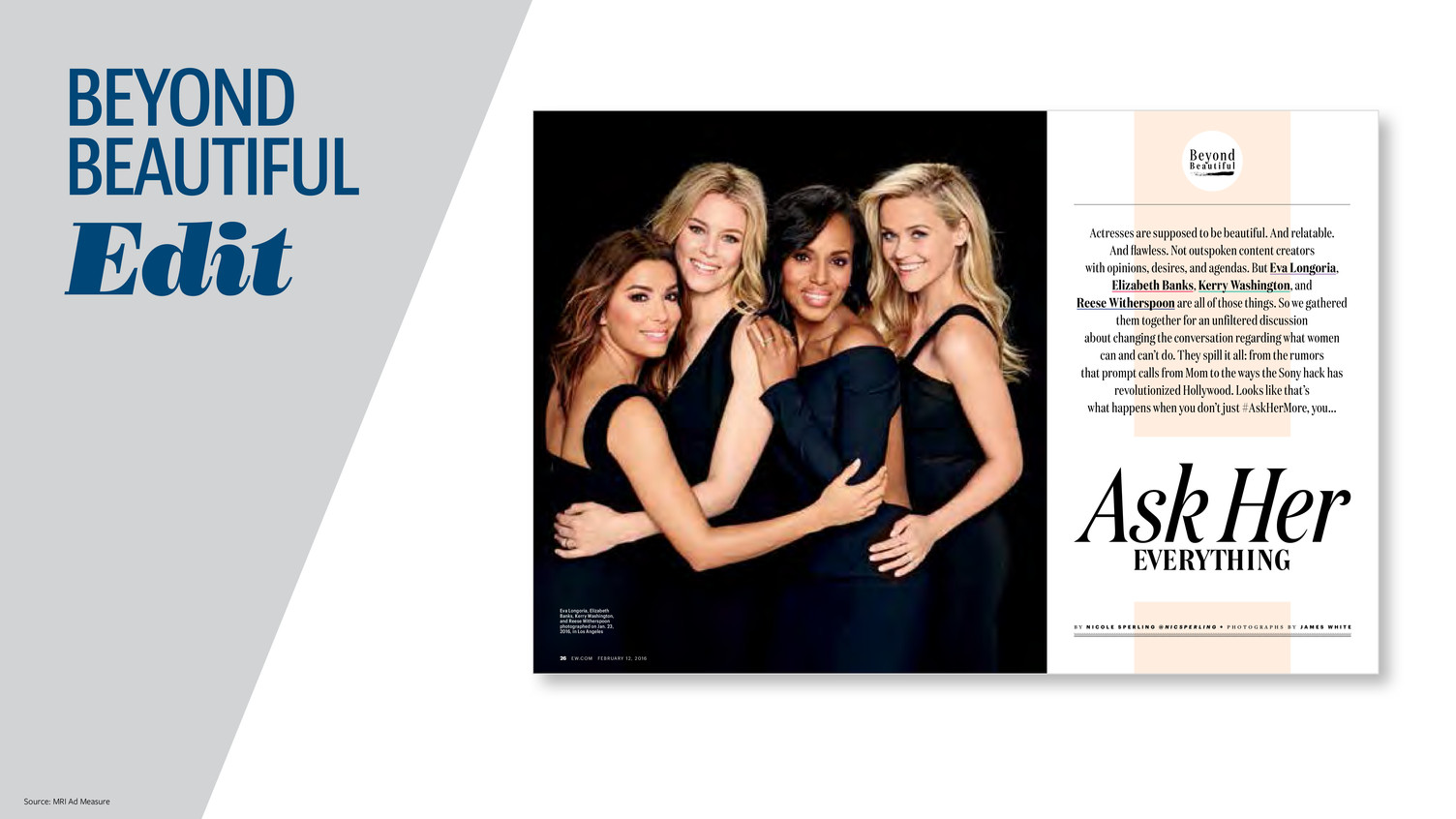

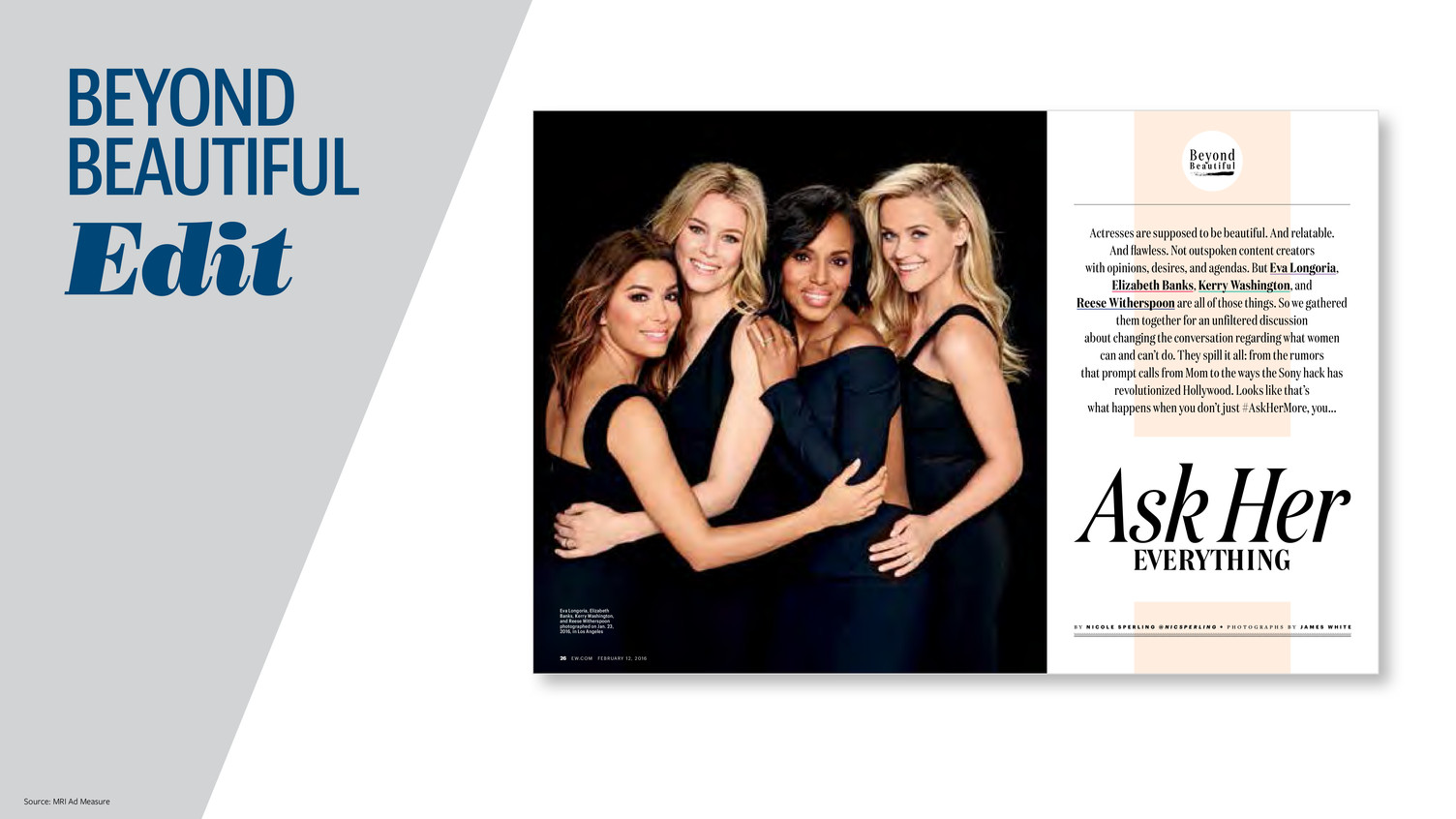

BEYOND BEAUTIFUL Edit 26 EW.COM MONTH XX, 2016 Eva Longoria, Elizabeth Banks, Kerry Washington, and Reese Witherspoon photographed on Jan. 23, 2016, in Los Angeles FEBRUARY 12, 2016 EVERYTH I NG Ask Her Actresses are supposed to be beautiful. And relatable. And flawless. Not outspoken content creators with opinions, desires, and agendas. But Eva Longoria, Elizabeth Banks, Kerry Washington, and Reese Witherspoon are all of those things. So we gathered them together for an unfiltered discussion about changing the conversation regarding what women can and can’t do. They spill it all: from the rumors that prompt calls from Mom to the ways the Sony hack has revolutionized Hollywood. Looks like that’s what happens when you don’t just #AskHerMore, you... B Y N I C O L E S P E R L I N G @ N I C S P E R L I N G P H O T O G R A P H S B Y J A M E S W H I T E Source: MRI Ad Measure

FEELING BEAUTIFUL CUSTOM CONTENT EXPERIENCES: Print 87% read this content Source: MRI Ad Measure

BEYOND BEAUTIFUL Edit Source: MRI Ad Measure

FEELING BEAUTIFUL CUSTOM CONTENT EXPERIENCES: Print 65% of readers took action Source: MRI Ad Measure

BEYOND BEAUTIFUL Edit ESSENCE: Who contributes to thebeautiful parts of your life?KEKE PALMER: Definitely my mom.My best friends Cashawn, Christoland Caryn; they’re three sisters.They have been with me for a longtime. I think my little brother andsister, Lawrence and Lawrencia, arethe coolest kids. And my older sister and my nieces and my nephews. I adore them so much. ESSENCE: What’s the best beauty advice you’ve ever received? PALMER: To clean my brushes. You’ll be like, “Why is my face breaking out?” Then you realize you haven’t washed your brushes in two months. ESSENCE: What is the smartest beauty move you’ve made? PALMER: Cutting my hair freed me. Not only as a woman but also as a Black woman. I had wanted to cut it since I was 17, but people kept telling me I needed my hair. They made me so nervous about it. When I cut it, I was like, I don’t care. I feel too good. You make the hair, the hair doesn’t make you. I just felt so empowered from that day forward. ESSENCE: Have you had a Black Girl Magic moment? PALMER: When I played Cinderella on Broadway. That was definitely a Black Girl Magic moment for me. Also, when I did Grease: Live. My role in the show was important to me. This was something that all Black girls could see and say, “Guess what? We can do that too.” w Shining Stars Keke Palmer YEAH, THEY’RE YOUNG, FUN AND TALENTED BUT THEY STILL KNOW WHAT MATTERS MOST IN LIFE: FAMILY, FRIENDS AND, OF COURSE, THEIR FANS BY PAMELA EDWARDS CHRISTIANI AND CORI MURRAY Bobbi Brown Basic Brush Collection, $195, bobbi brown.com. In 2014, Keke Palmer became the first African- American to play Cinderella on Broadway. BEAUTY : STRAIGHT TALK Keke Palmer at the 2016 People’s Choice Awards in Los Angeles 42 ESSENCE .COM APRIL 2016 FR O M LEFT: W A LTER M CB R ID E /W IR EIM A G E; C O U R TESY O F B R A N D ; A LLEN B ER E ZO V SK Y/G E TT Y IM A G ES.

FEELING BEAUTIFUL CUSTOM CONTENT EXPERIENCES: Print

FEELING BEAUTIFUL CUSTOM CONTENT EXPERIENCES: Print

BEYOND BEAUTIFUL Edit 4.5MM Impressions BEYOND BEAUTIFUL EDITORIAL VIDEO & ARTICLE PAGES source: Total Impressions for Custom Hub: DFA - OMD's 3rd Party ad server, campaign flight 2/5/16-4/30/16; Native Articles: Simple Reach, campaign flight 2/5/16-4/30/16; Lightbox Expansion Rate: Sizmek, campaign flight 3/9/16-YTD; Benchmarks: Averages pulled from Time Inc Lightbox units and Native ad campaigns over the course of 1 year

FEELING BEAUTIFUL CUSTOM CONTENT EXPERIENCES: Digital 60.5 Seconds Spent/Double TI Benchmarks NATIVE PAGES 1.41% Expansion Rates/Triple TI Benchmarks LIGHTBOX UNIT source: Total Impressions for Custom Hub: DFA - OMD's 3rd Party ad server, campaign flight 2/5/16-4/30/16; Native Articles: Simple Reach, campaign flight 2/5/16-4/30/16; Lightbox Expansion Rate: Sizmek, campaign flight 3/9/16-YTD; Benchmarks: Averages pulled from Time Inc Lightbox units and Native ad campaigns over the course of 1 year

STYLEHAUL�� StyleHaul, “the largest global style community of content creators,” and Time Inc. have partnered on an unprecedented offering to bring together influencers and tastemakers driving social conversation with the largest publisher of premium beauty and celebrity editorial.

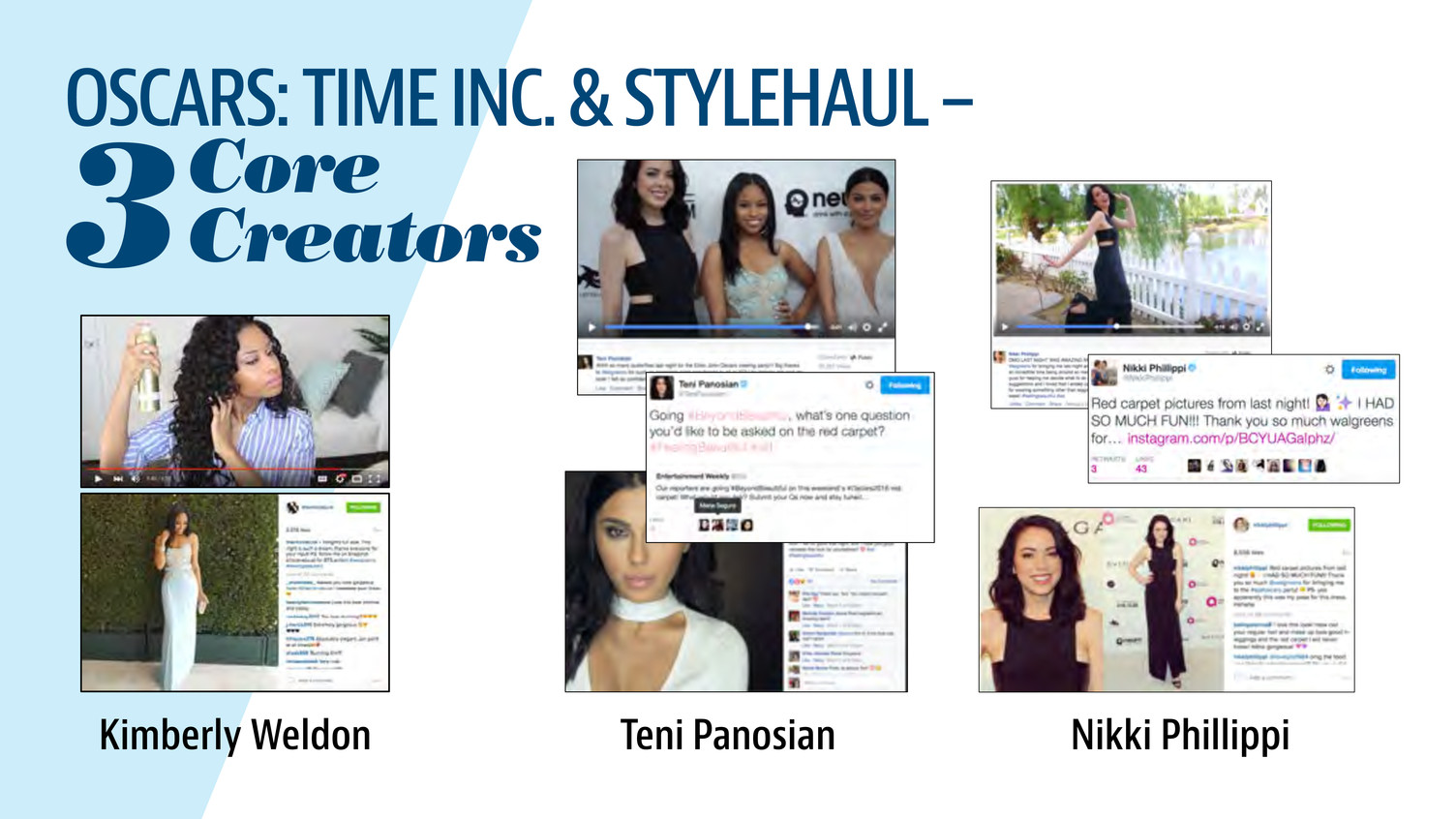

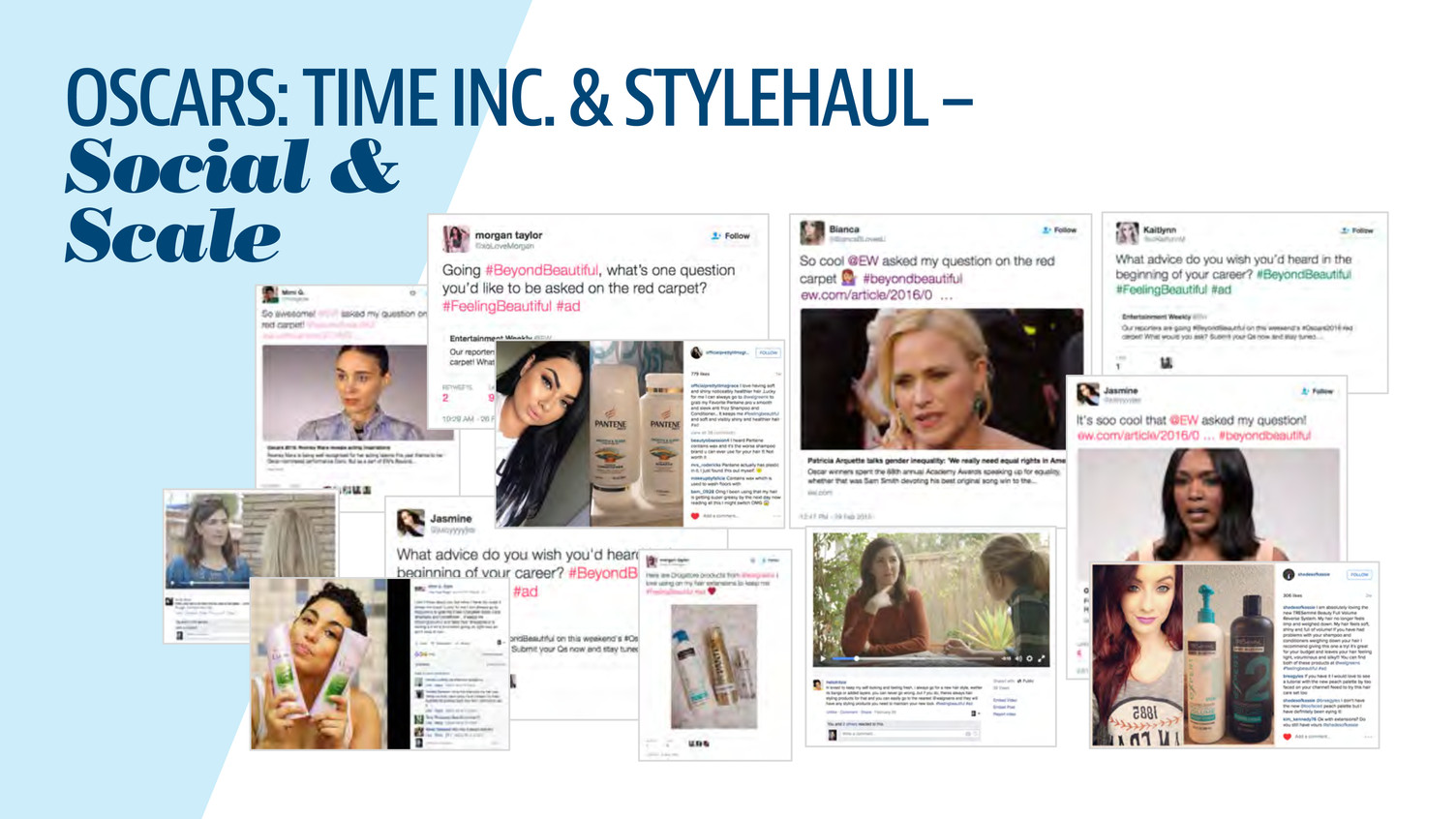

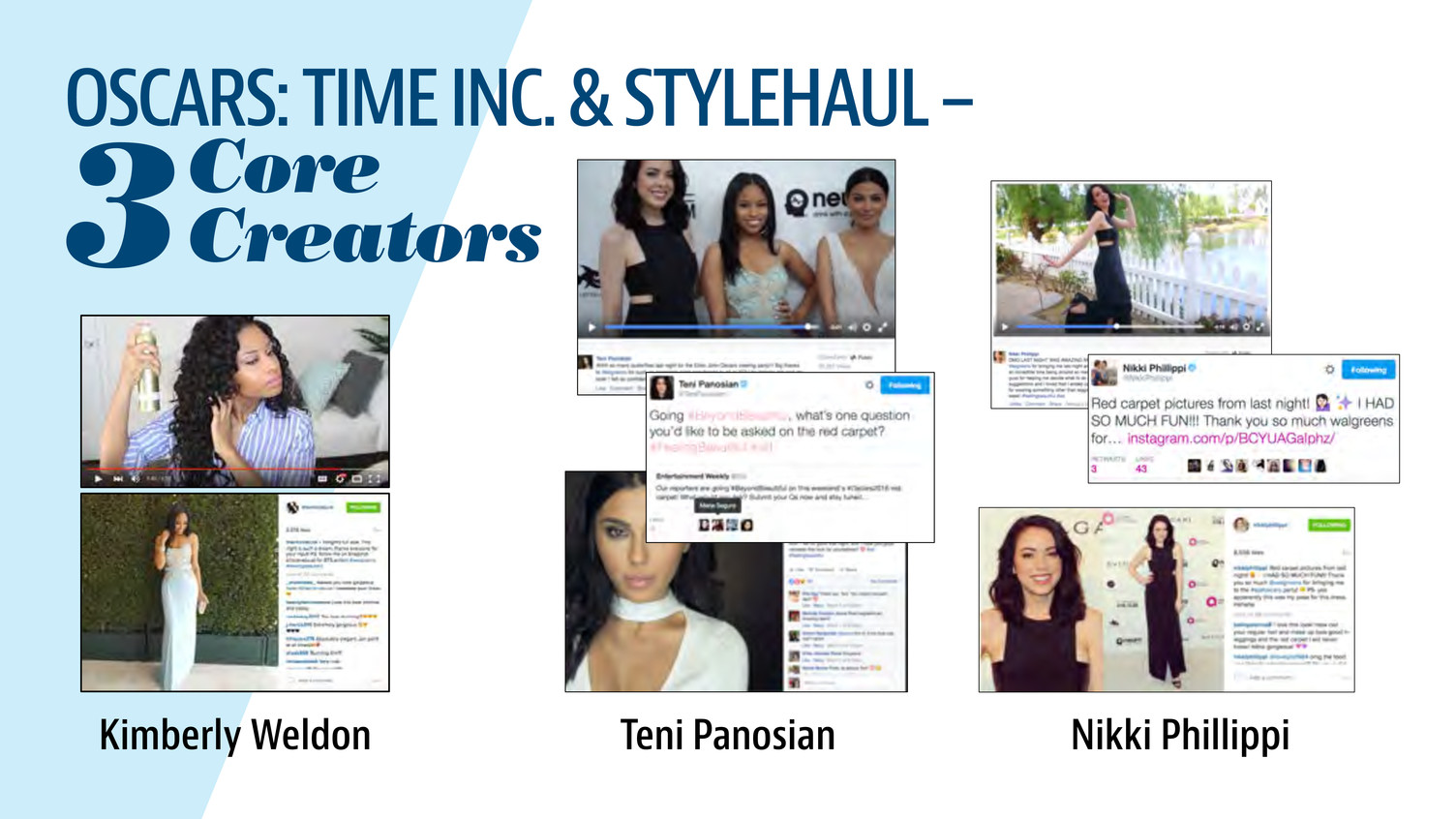

OSCARS: TIME INC. & STYLEHAUL – 3Core Creators Kimberly Weldon Teni Panosian Nikki Phillippi

OSCARS: TIME INC. & STYLEHAUL – Social & Scale

FEELING BEAUTIFUL Amplifications 17 Creators 25 Videos ViewsViews Social Impressions Social Engagements 100 Social Content Posts 300 Social @ Scale Posts 2.9MM 400K 4.6MM Identified to match Walgreens’ sensibility and push out content Videos available to repurpose on Walgreens-owned channels Expanding theme from video to social Reinserted Walgreens into the Social conversation source: social data: Tubular, May 2016; views data: YouTube CMS, May 2016

A BEAUTIFUL New Conversation Launched the stage to spark a fresh conversation through editorial and custom content Inspiration Shaped and encouraged an ongoing 1:1 conversation on Walgreens Beauty across social Conversation Turned conversation into action by providing all of her holistic beauty needs Action

CHANGING PERCEPTION: EW INITIAL RESULTS WALGREENS: A New Beauty Destination 29% increase in sentiment in agreeing that Walgreens is a destination that they will go to for all their beauty needs 67% agreed that the content informed them of beauty products that can improve their overall health & happiness 71% agreed that the content improved their view of Walgreens as a beauty destination 64% agreed that the content inspired them to try something that makes them feel beautiful Source: MRI Ad Measure Custom Questions; Based on Noters of the Walgreens Ad and Advertorial

RICH BATTISTA JESS CAGLE EVP; President, Entertainment & Sports Group and Video, Time Inc. Editorial Director, People & Entertainment Weekly Celebrity & Entertainment: Engaging Consumer Passions WILL LEE Digital Editorial Director, People & Entertainment Weekly

Powerful Brands. Massive Footprint. 100MM+ Consumers MPA Magazine Media 360° Brand Audience Report, March 2016

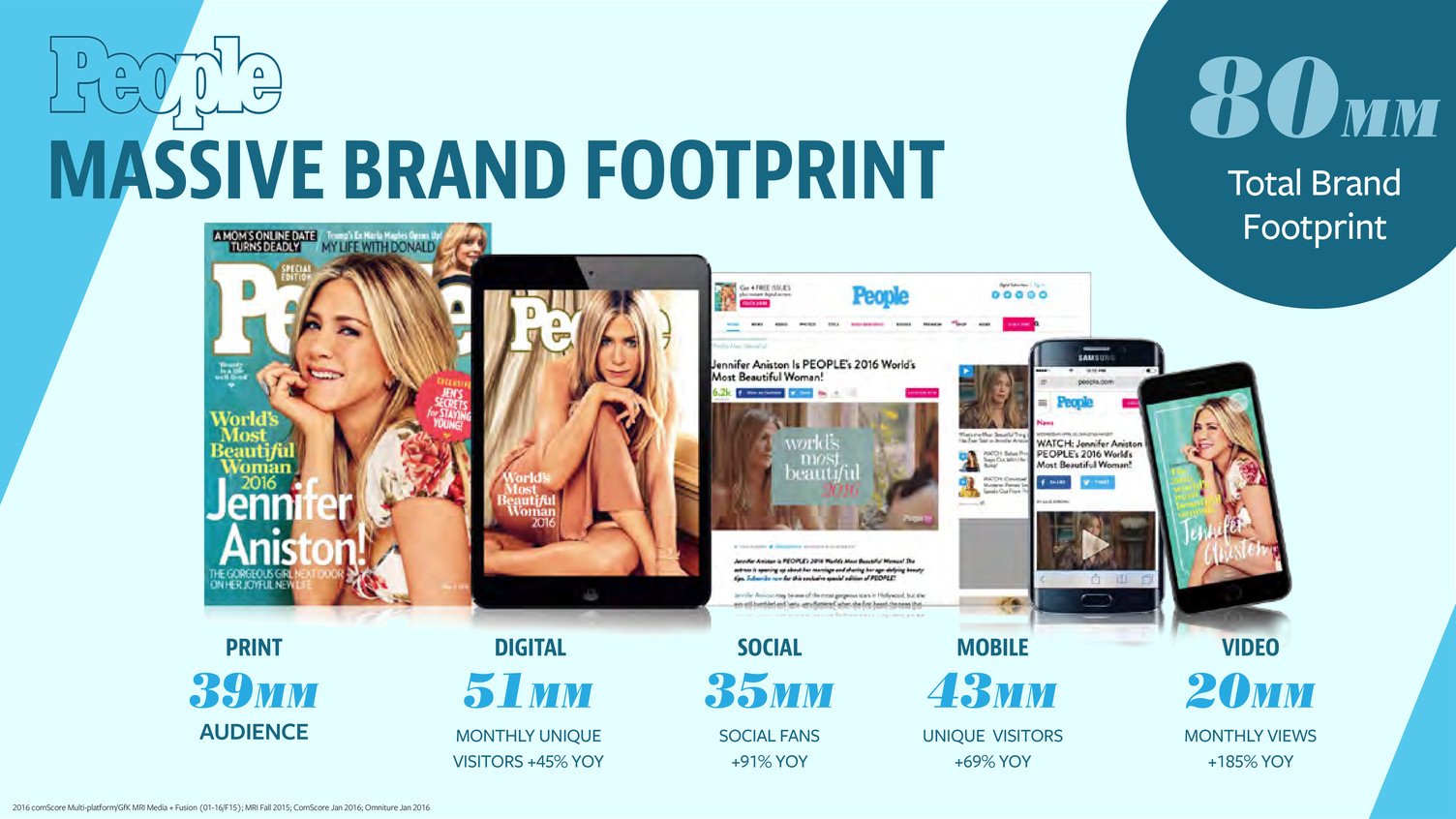

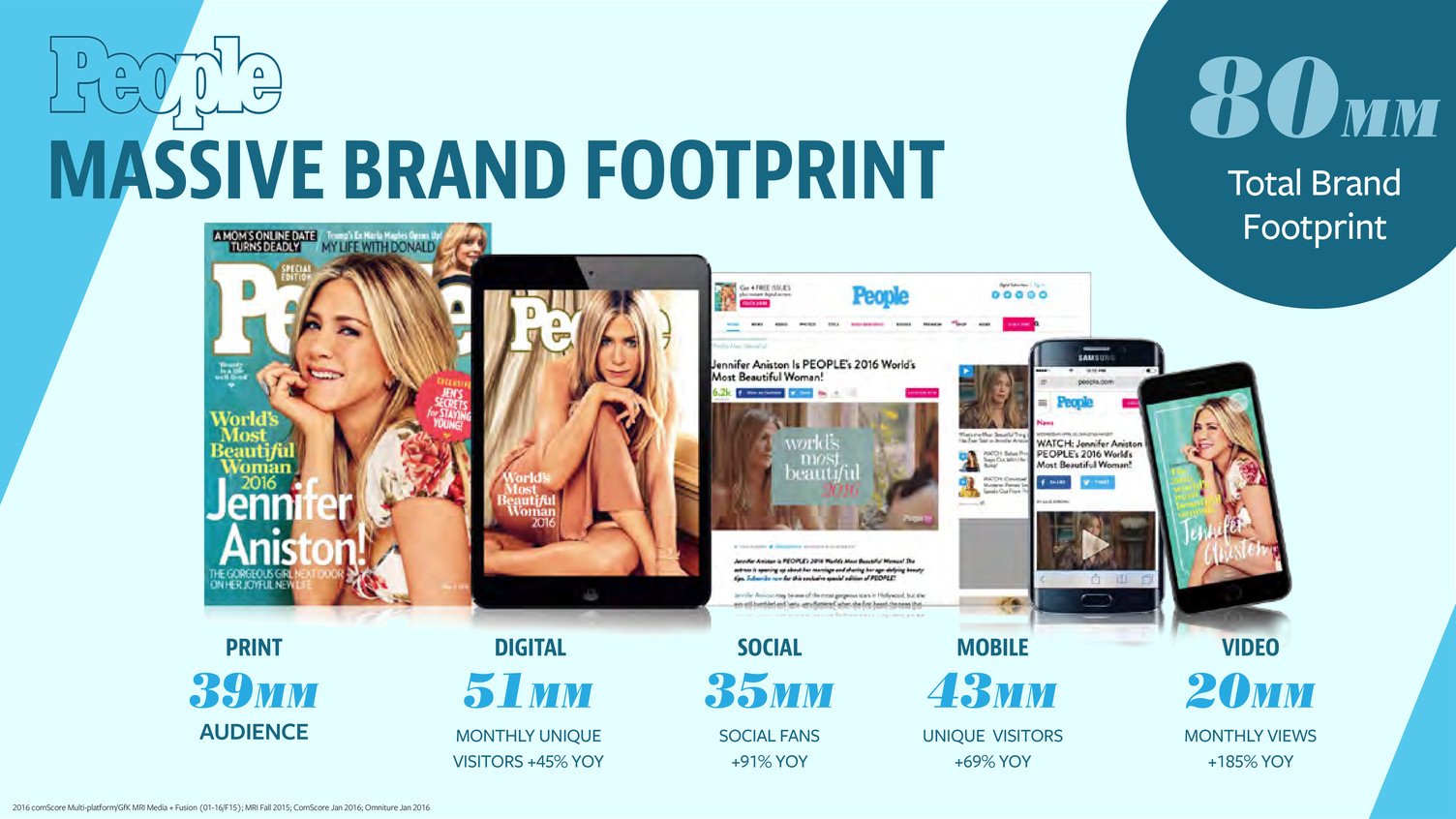

39mm 51mm 35mm 43mm 20mm PRINT AUDIENCE DIGITAL SOCIAL MOBILE VIDEO MONTHLY UNIQUE VISITORS +45% YOY SOCIAL FANS +91% YOY UNIQUE VISITORS +69% YOY MONTHLY VIEWS +185% YOY 80MM Total Brand Footprint MASSIVE BRAND FOOTPRINT 2016 comScore Multi-platform/GfK MRI Media + Fusion (01-16/F15); MRI Fall 2015; ComScore Jan 2016; Omniture Jan 2016

Entertaining. Empowering. Inspiring.

THE AUTHORITY IN ENTERTAINMENT 8mm 21mm 12mm 16mm 4mm PRINT DIGITAL PLATFORMS SOCIAL MOBILE VIDEO MONTHLY UNIQUE VISITORS +38% YOY SOCIAL FOLLOWERS +38% YOY UNIQUE VISITORS +63% YOY MONTHLY VIEWS +89% YOY 28MM Total Brand Footprint AUDIENCE 2016 comScore Multi-platform/GfK MRI Media + Fusion (01-16/F15); MRI Fall 2015; ComScore Jan 2016; Omniture Jan 2016

We Own Pop Culture

7.6MM Total Brand Footprint THE POWER OF AN ICONIC BRAND MRI DOUBLEBASE 2015; COMSCORE MULTI-PLATFORM FEB 2016; SOCIAL MEDIA FOLLOWERS AS OF 04.21.16 6.6mm 1.3mm 6.5mm 4.5b PRINT DIGITAL PLATFORMS SOCIAL EXPERIENTIAL UNIQUE VISITORS SOCIAL FOLLOWERS IMPRESSIONS GARNERED IN 2015AUDIENCE

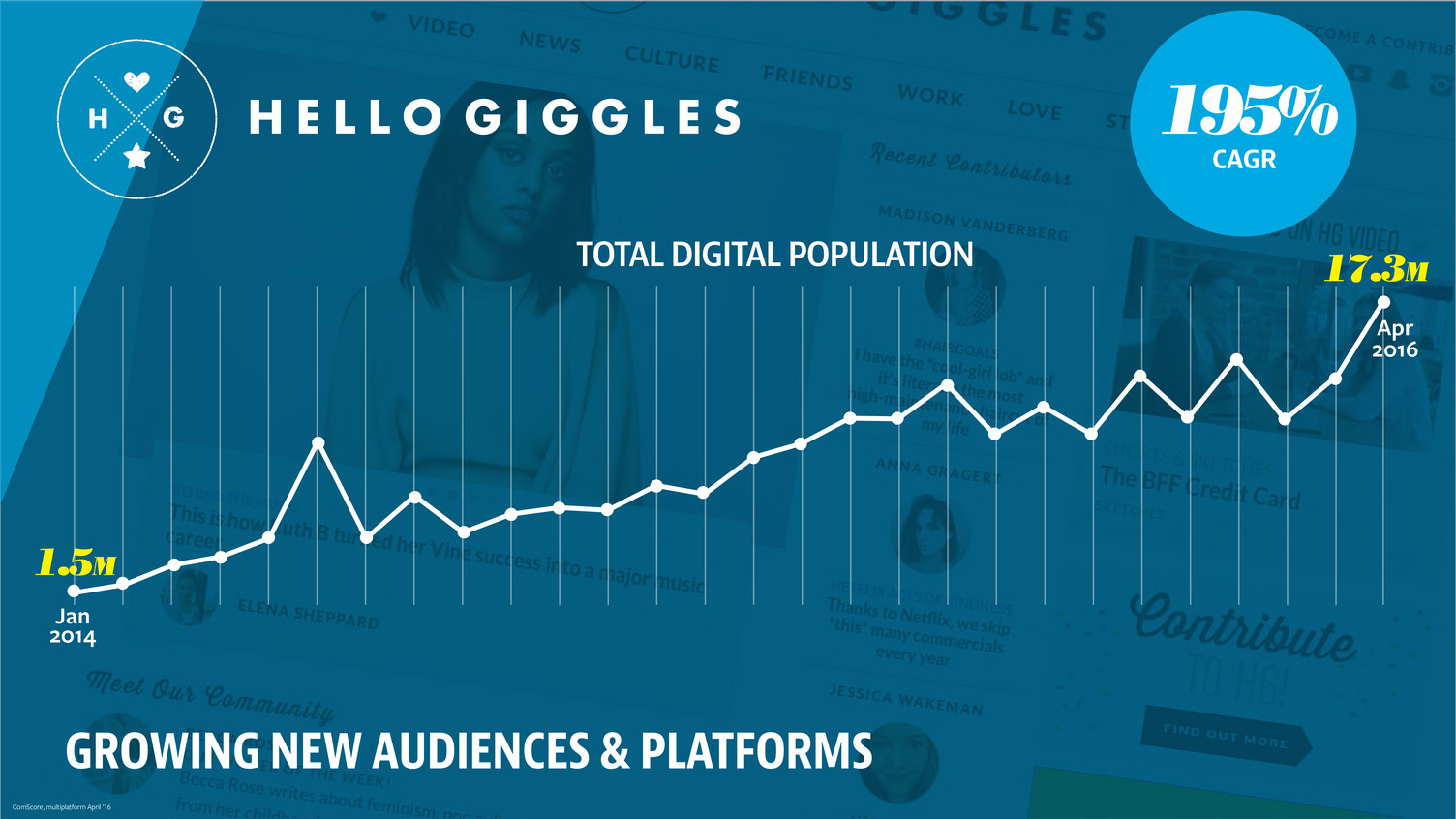

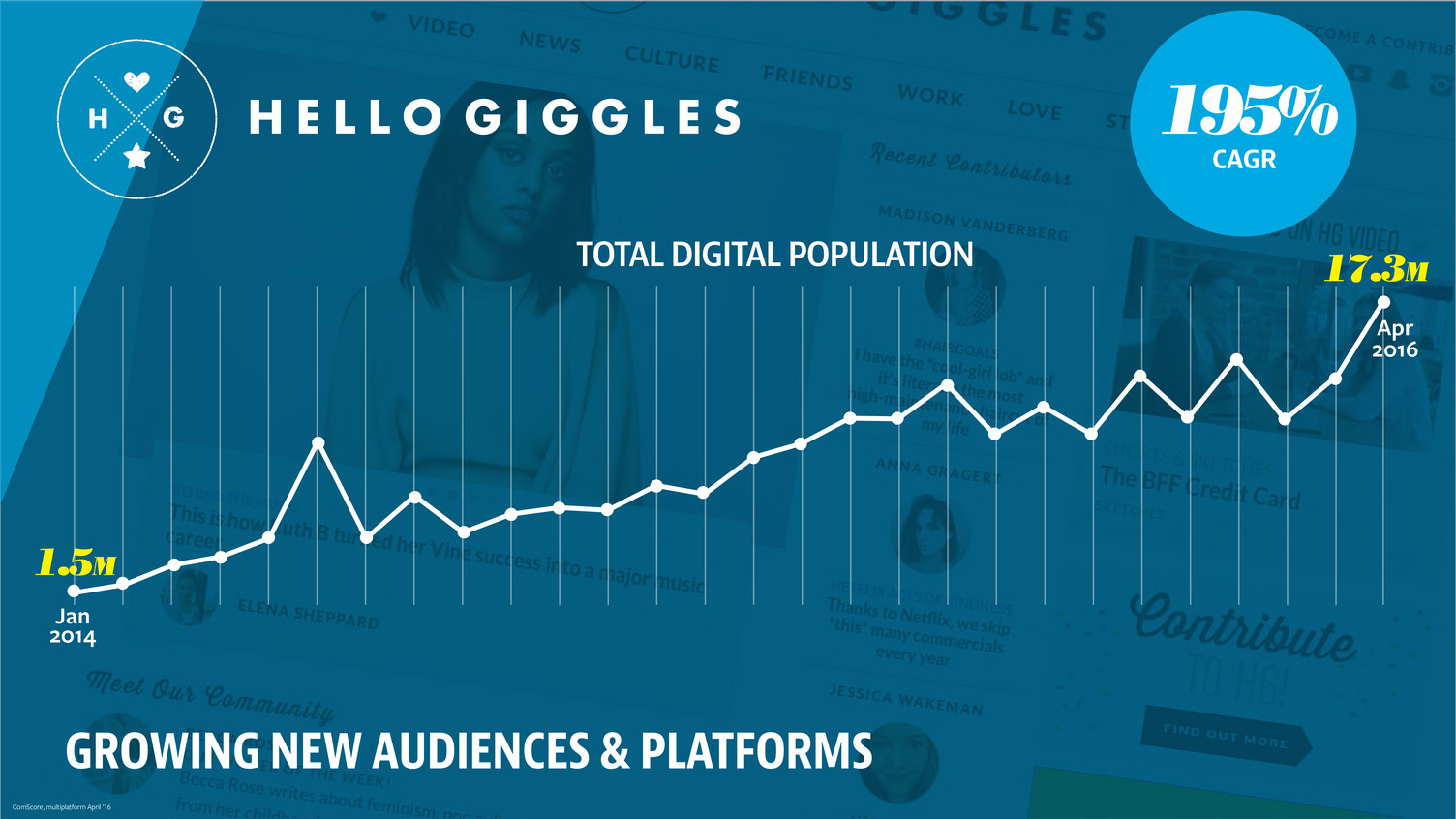

GROWING NEW AUDIENCES & PLATFORMS TOTAL DIGITAL POPULATION 195% 1.5m 17.3m CAGR ComScore, multiplatform April ’16 Jan 2014 Apr 2016

Our Brands Across the Multimedia Landscape digital growth innovation new extensions & revenue streams Expanding

Digital Growth

DYNAMIC BRANDS. DRAMATIC GROWTH. #1 IN ENTERTAINMENT NEWS CATEGORY comScore March 2016.

#1 DYNAMIC BRANDS. DRAMATIC GROWTH. #1 IN ENTERTAINMENT NEWS CATEGORY Entertainment news destination with mobile users comScore March 2016.

#1 #1 DYNAMIC BRANDS. DRAMATIC GROWTH. #1 IN ENTERTAINMENT NEWS CATEGORY Entertainment news destination with mobile users In engagement (total minutes) among entertainment news comScore March 2016.

#1 #1 #1 DYNAMIC BRANDS. DRAMATIC GROWTH. #1 IN ENTERTAINMENT NEWS CATEGORY Entertainment news destination with mobile users In entertainment news among females In engagement (total minutes) among entertainment news comScore March 2016.

#1 #1 #1 #1 DYNAMIC BRANDS. DRAMATIC GROWTH. #1 IN ENTERTAINMENT NEWS CATEGORY Entertainment news destination with mobile users In entertainment news among females In engagement (total minutes) among entertainment news In entertainment news among female millennials comScore March 2016.

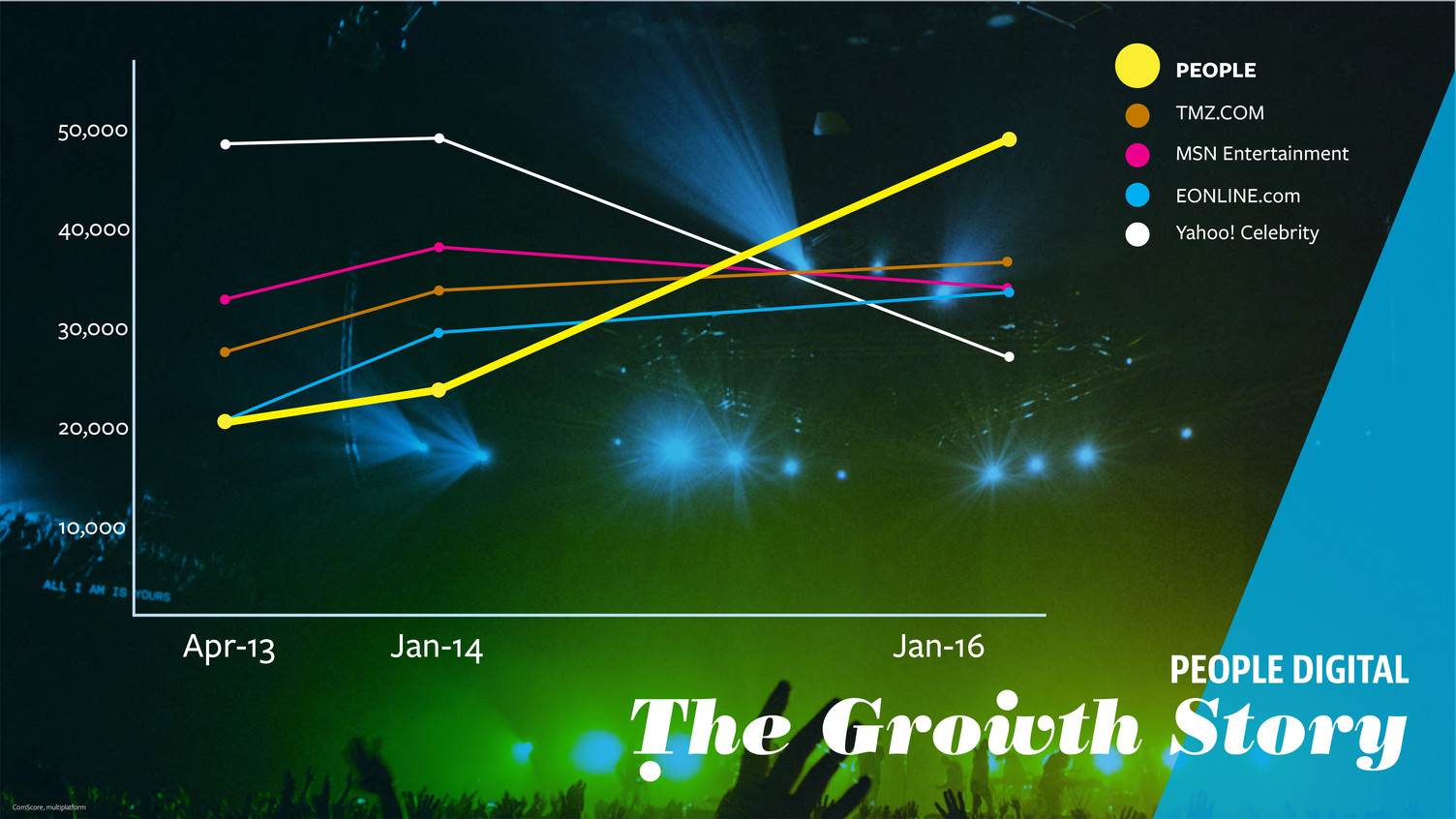

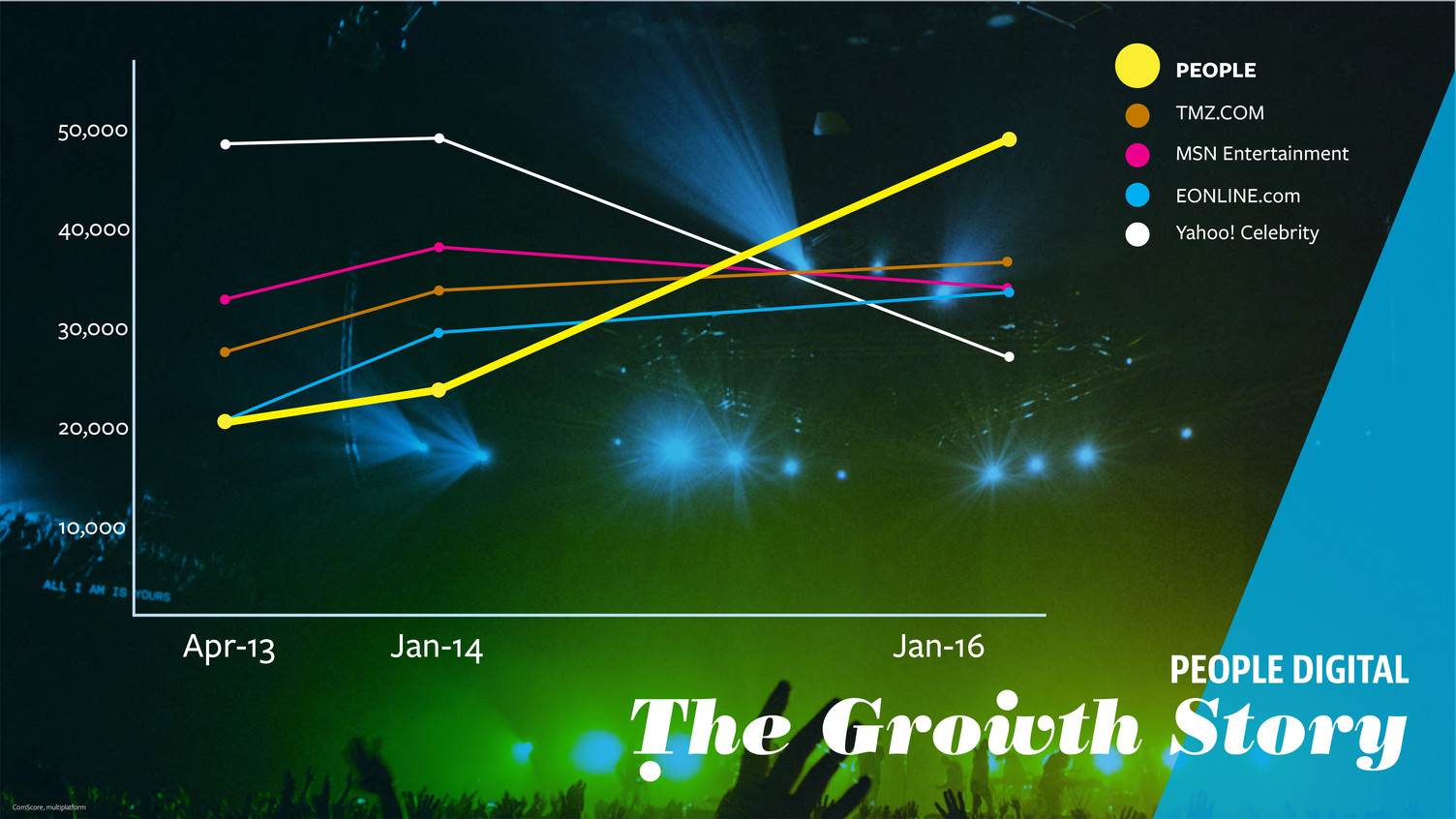

PEOPLE TMZ.COM MSN Entertainment EONLINE.com Yahoo! Celebrity The Growth Story 10,000 Apr-13 Jan-14 Jan-16 20,000 30,000 40,000 50,000 PEOPLE DIGITAL

PEOPLE TMZ.COM MSN Entertainment EONLINE.com Yahoo! Celebrity The Growth Story 10,000 Apr-13 Jan-16 20,000 30,000 40,000 50,000 PEOPLE DIGITALJan-14

PEOPLE TMZ.COM MSN Entertainment EONLINE.com Yahoo! Celebrity The Growth Story 10,000 Apr-13 Jan-16 20,000 30,000 40,000 50,000 PEOPLE DIGITALJan-14 ComScore, multiplatform

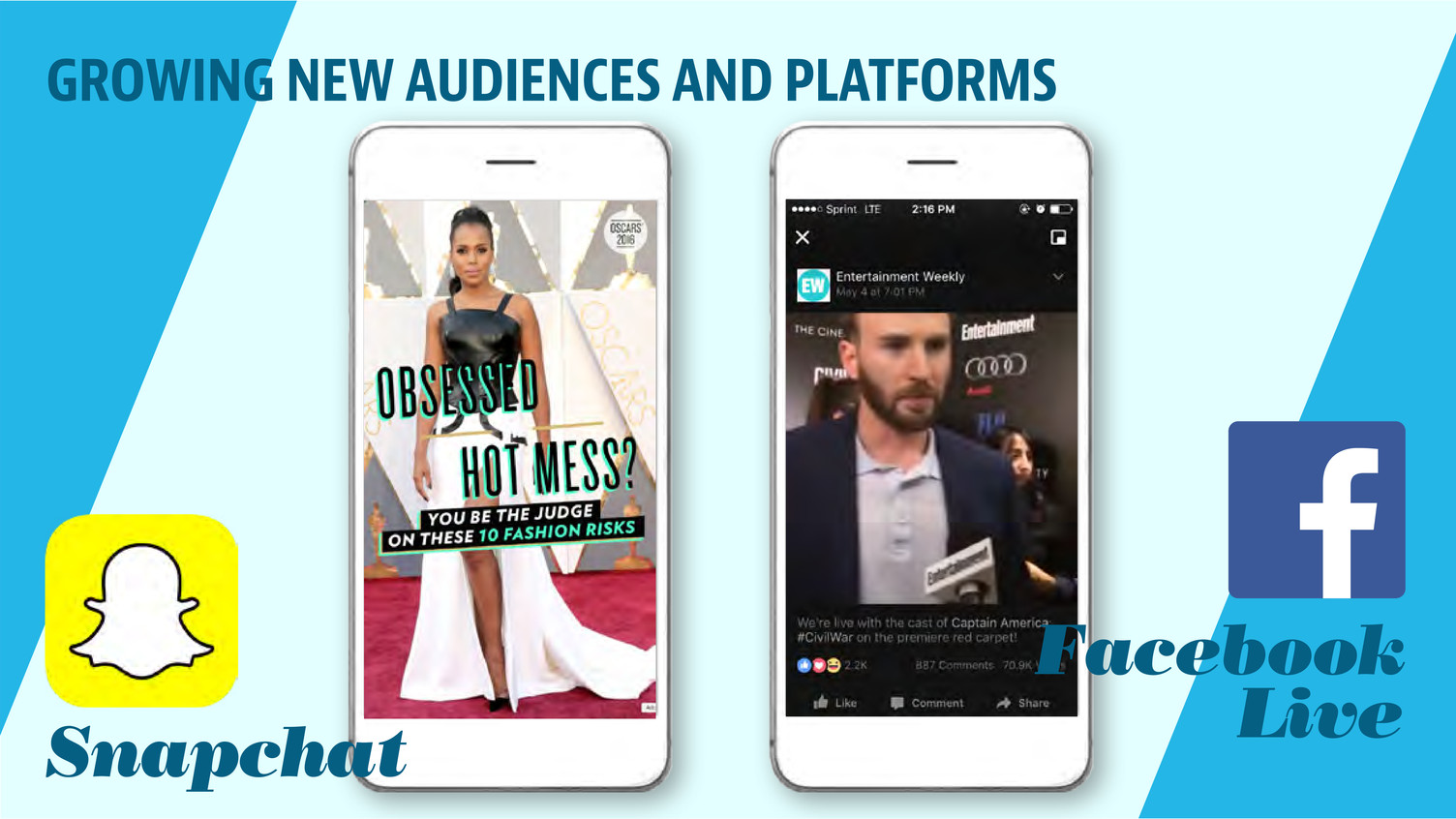

GROWING NEW AUDIENCES AND PLATFORMS Facebook LiveSnapchat

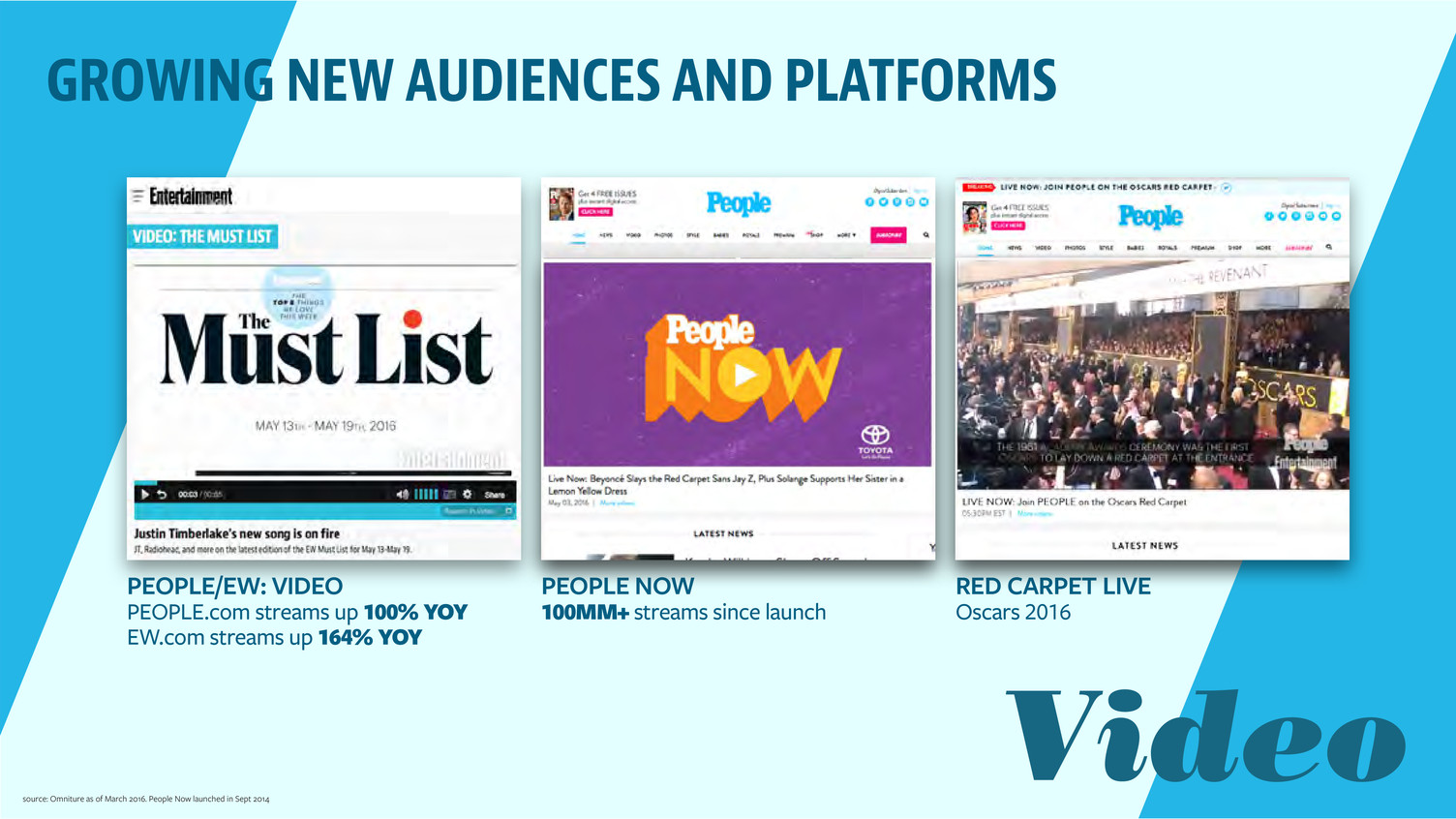

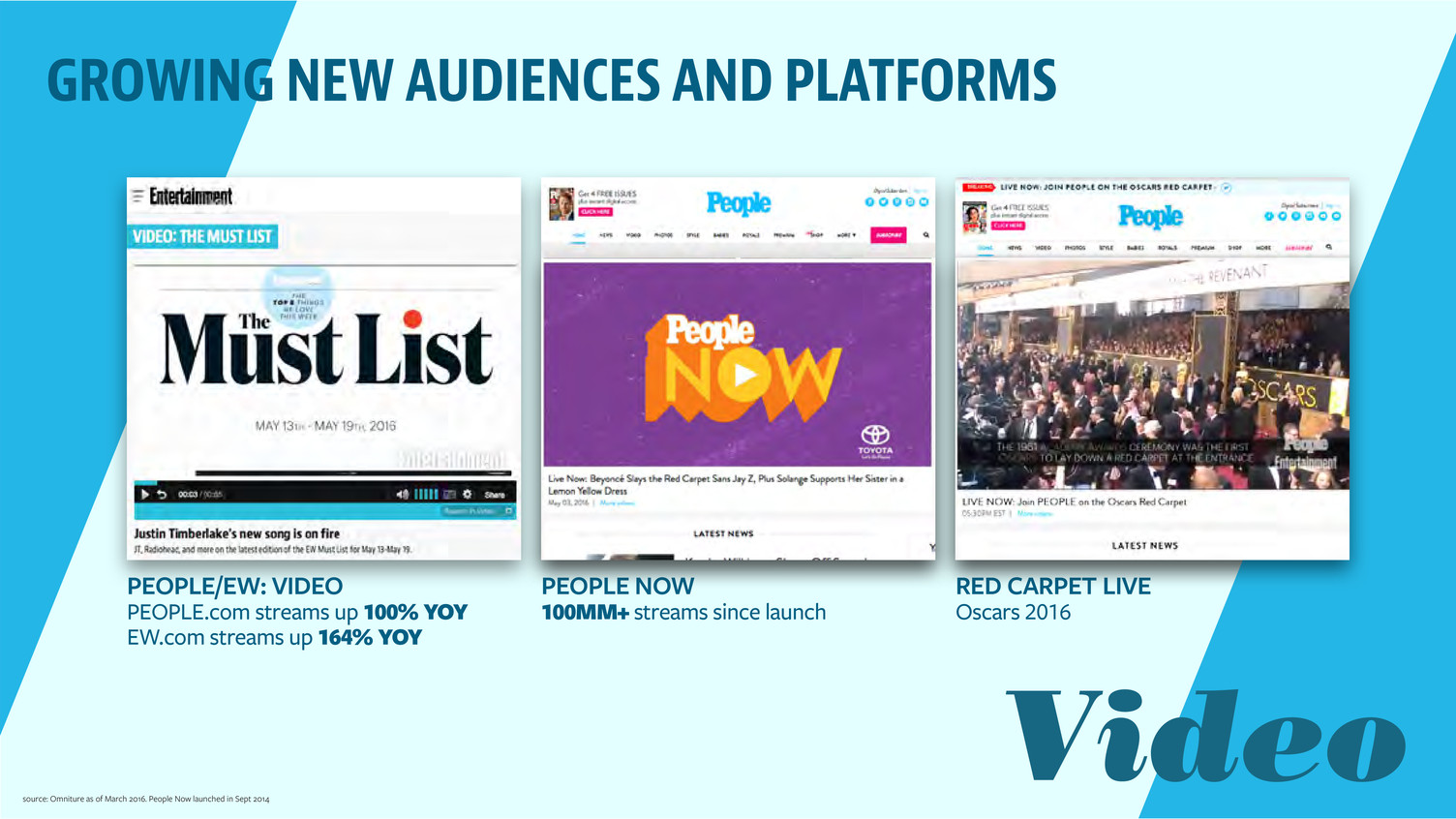

GROWING NEW AUDIENCES AND PLATFORMS Video PEOPLE/EW: VIDEO PEOPLE.com streams up 100% YOY EW.com streams up 164% YOY PEOPLE NOW 100MM+ streams since launch RED CARPET LIVE Oscars 2016 source: Omniture as of March 2016. People Now launched in Sept 2014

Innovation

OTT VIEWERSHIP POISED FOR RAPID GROWTH 200MM connected TVs in 2020 OTT ADVERTISING GROWTH WILL FOLLOW $40B ad spending in 2020 Over the Top source: eMarketer Nov 16, 2015; The Diffusion Group Apr 9, 2015

PEOPLE/EW will seize the opportunity by launching a free, ad-supported service tailored to OTT’s lean-back, long-form experience “Land grab” happening and we are planting our flag Original and library programming from iconic pop culture brands Substantial built-in assets creates efficient cost structure OTT

LAUNCHING A NEW BRAND FOR A NEW GENERATION OF CELEBRITY Smosh PewDiePie Lele Pons FAns And FolloweRs FAns And FolloweRs FAns And FolloweRs 32MM+ 50MM+ 17MM+

All Mobile. All Video. Native Ads.

New Extensions & REVENUE STREAMS

$3.4B Market Size for Celebrity Licensed Products in Global Retail Sales eCommerce Experiential A Five-City Beauty Tour Bringing the Pros to the People The Ultimate Pop Culture Festival LIMA Global Licensing Industry Survey 2015 report

estAblishinG new FoRmAts And FRAnChises LONG-FORM Programming (Working Title)

A NEXT-GENERATION MEDIA COMPANY WITH DYNAMIC BRANDS BUILDING GROWTH THROUGH NEW PRODUCTS AND REVENUE STREAMS

MARCUS RICH ANDREA DAVIES CEO, Time Inc. UK Group Managing Director, Time Inc. UK Time Inc. UK: Driving Revenue Crossover

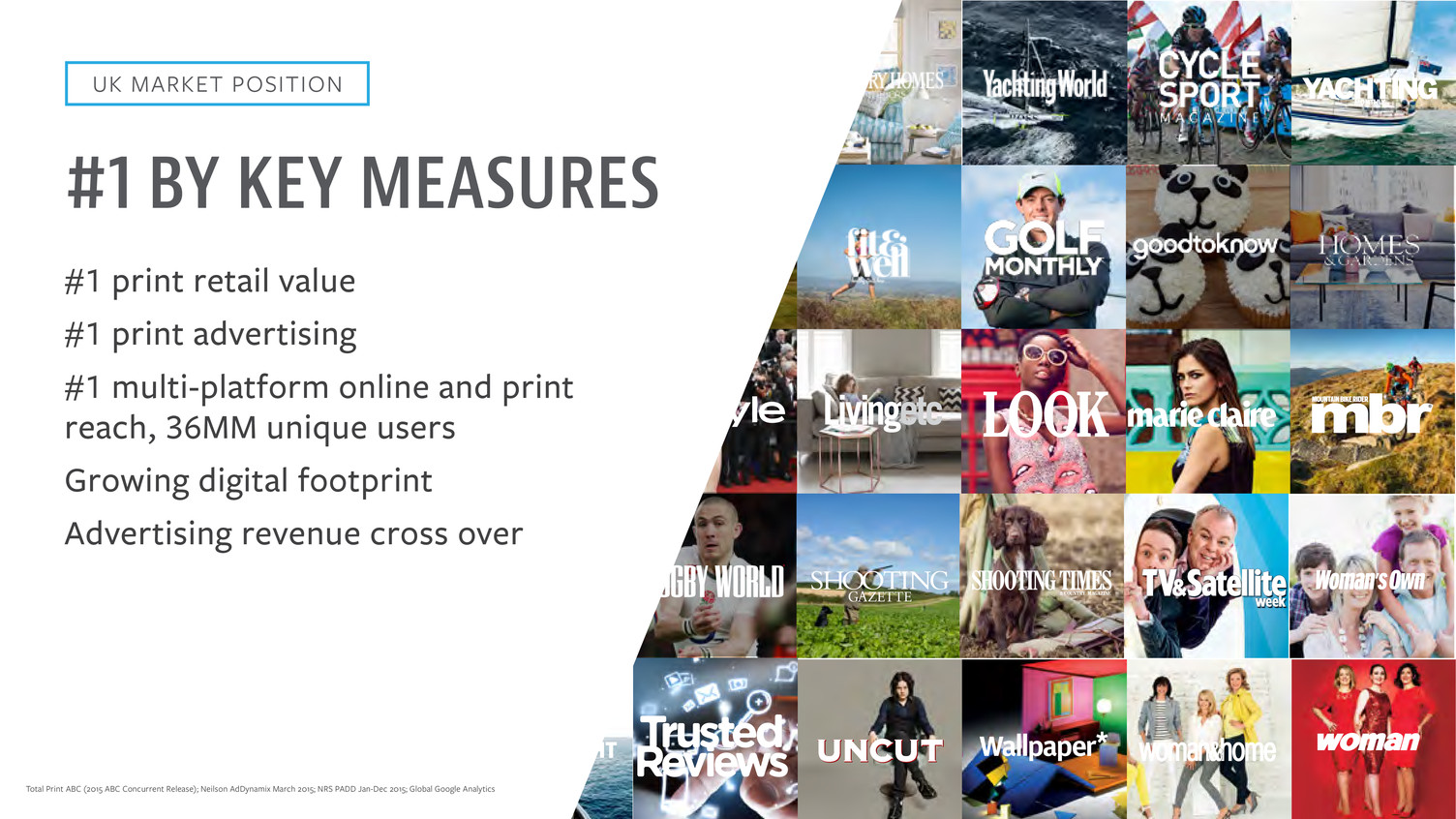

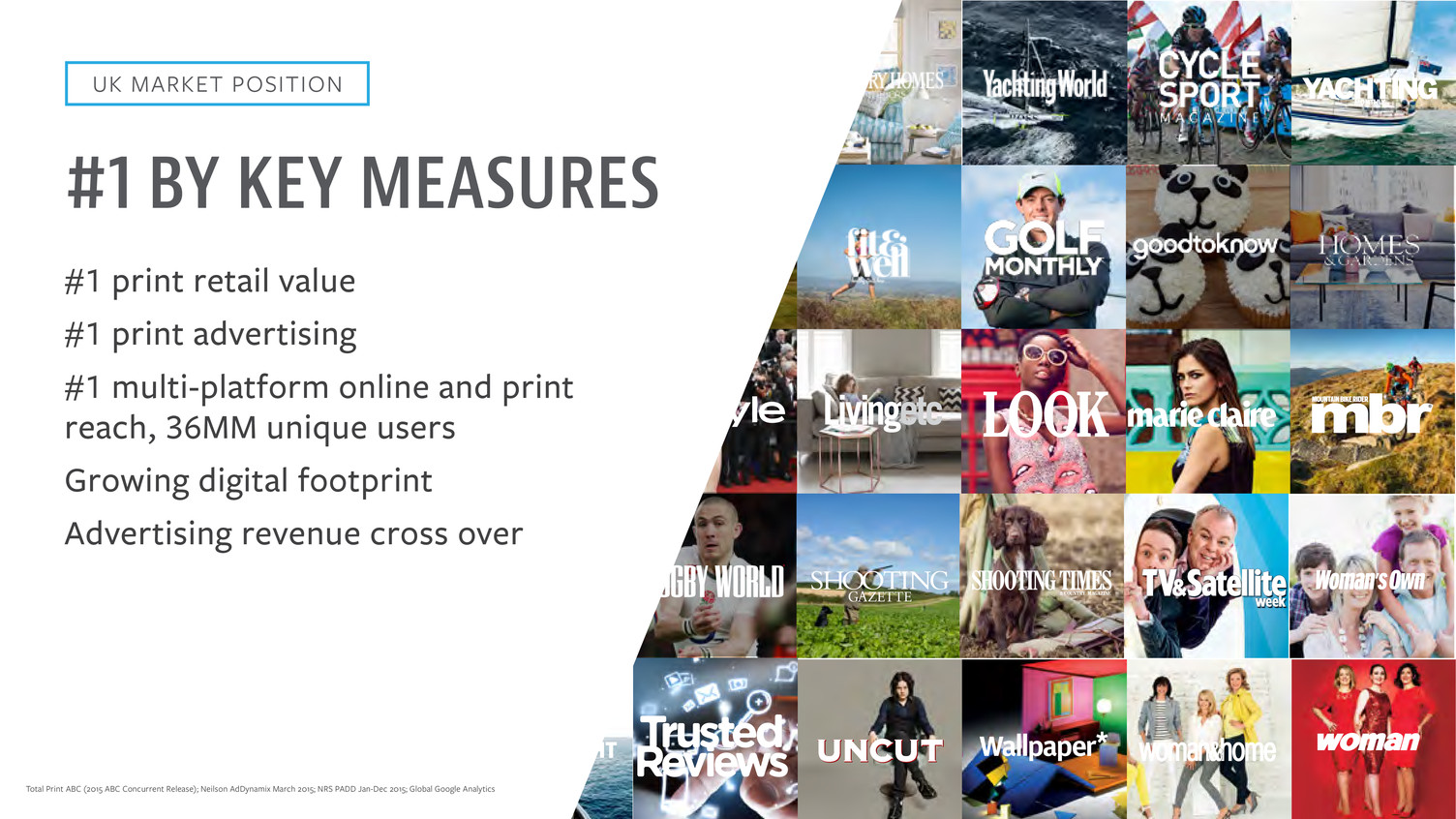

#1 BY KEY MEASURES #1 print retail value #1 print advertising #1 multi-platform online and print reach, 36MM unique users Growing digital footprint Advertising revenue cross over Total Print ABC (2015 ABC Concurrent Release); Neilson AdDynamix March 2015; NRS PADD Jan-Dec 2015; Global Google Analytics UK MARKET POSITION

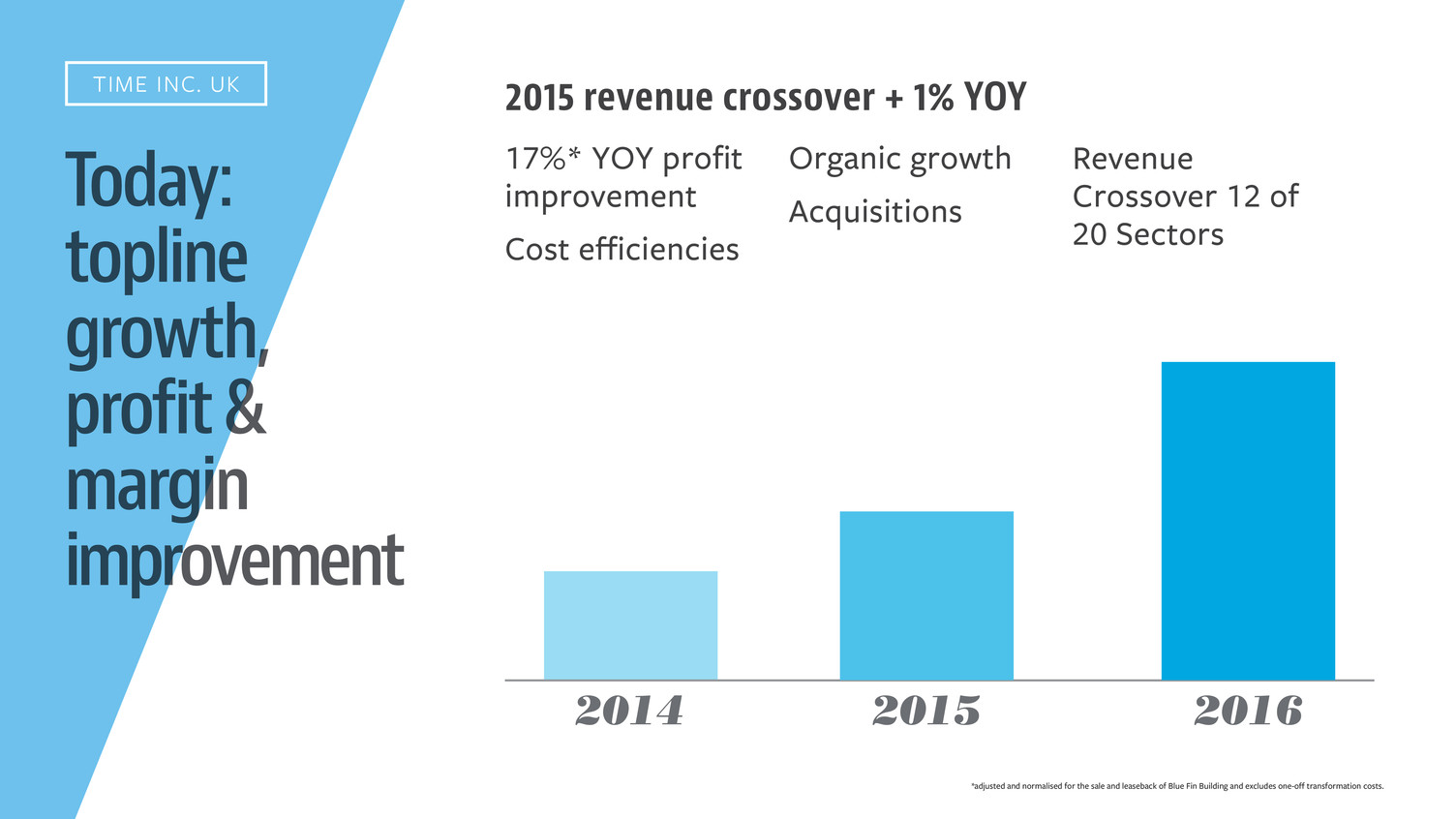

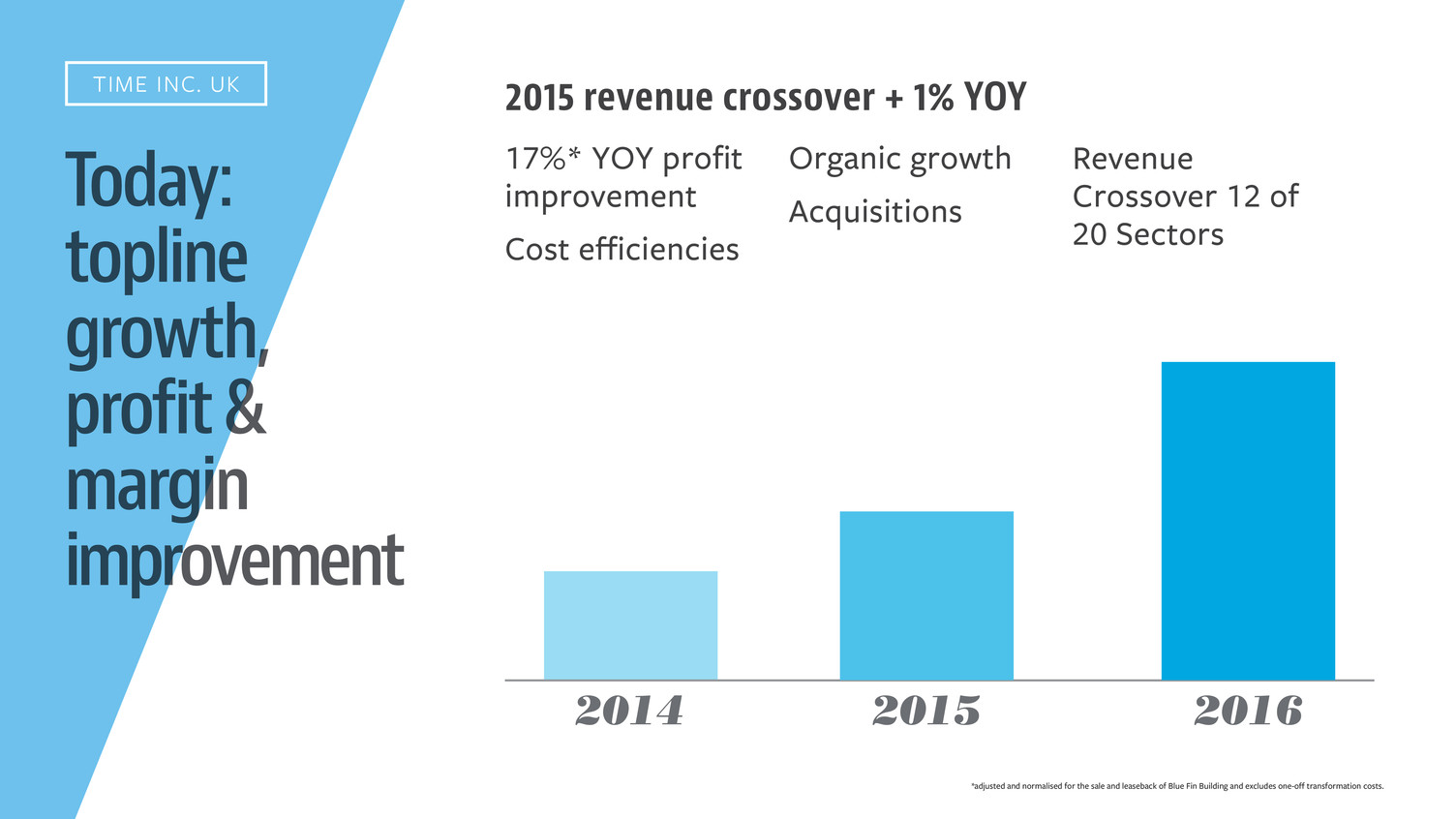

Today: topline growth, profit & margin improvement TIME INC. UK 2015 revenue crossover + 1% YOY 17%* YOY profit improvement Cost efficiencies Organic growth Acquisitions Revenue Crossover 12 of 20 Sectors 20152014 2016 *adjusted and normalised for the sale and leaseback of Blue Fin Building and excludes one-off transformation costs.

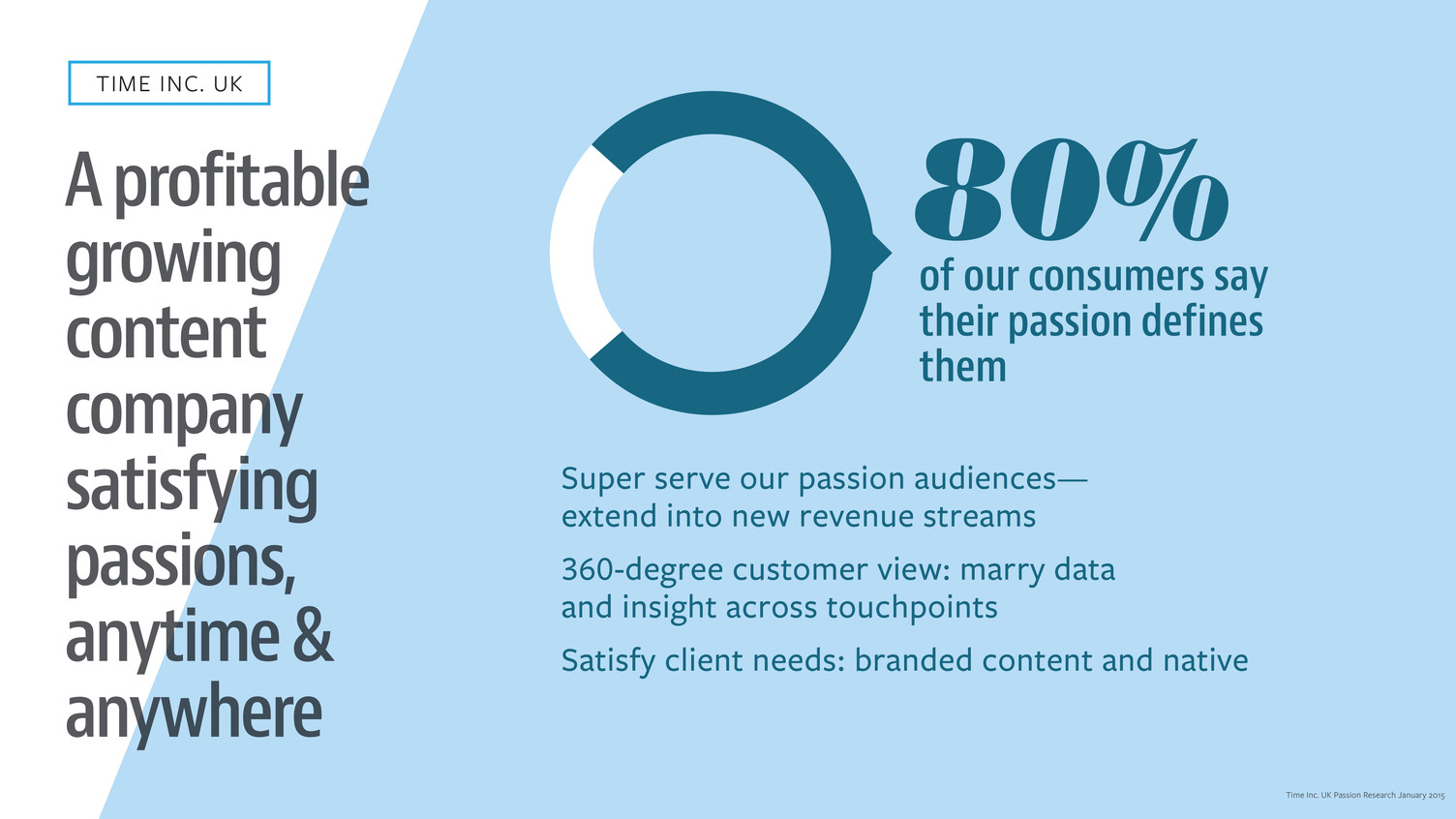

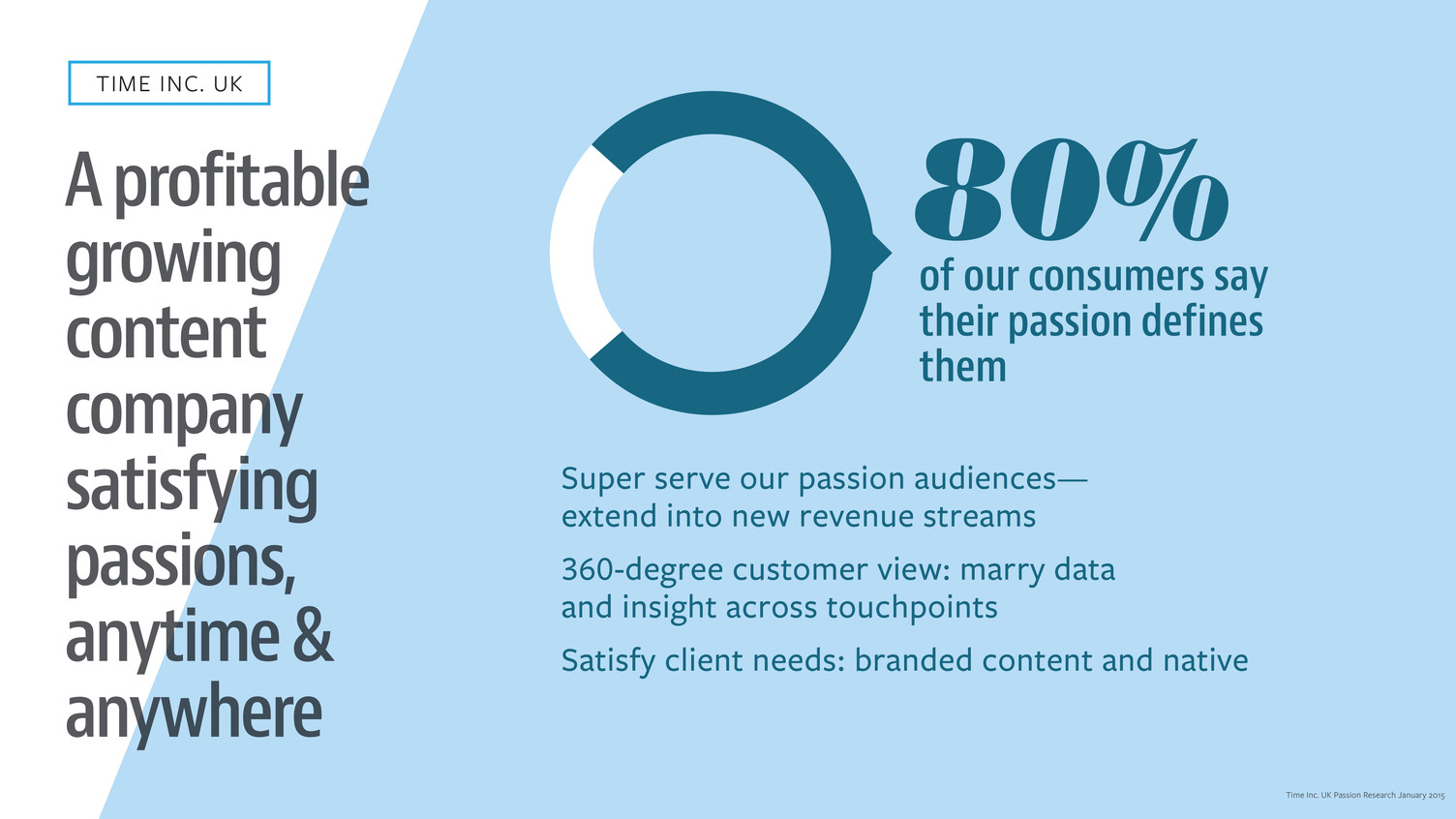

A profitable growing content company satisfying passions, anytime & anywhere TIME INC. UK Time Inc. UK Passion Research January 2015 Super serve our passion audiences— extend into new revenue streams 360-degree customer view: marry data and insight across touchpoints Satisfy client needs: branded content and native 80% of our consumers say their passion defines them

STARTED THE JOURNEY Drive for Growth Search for Efficiency

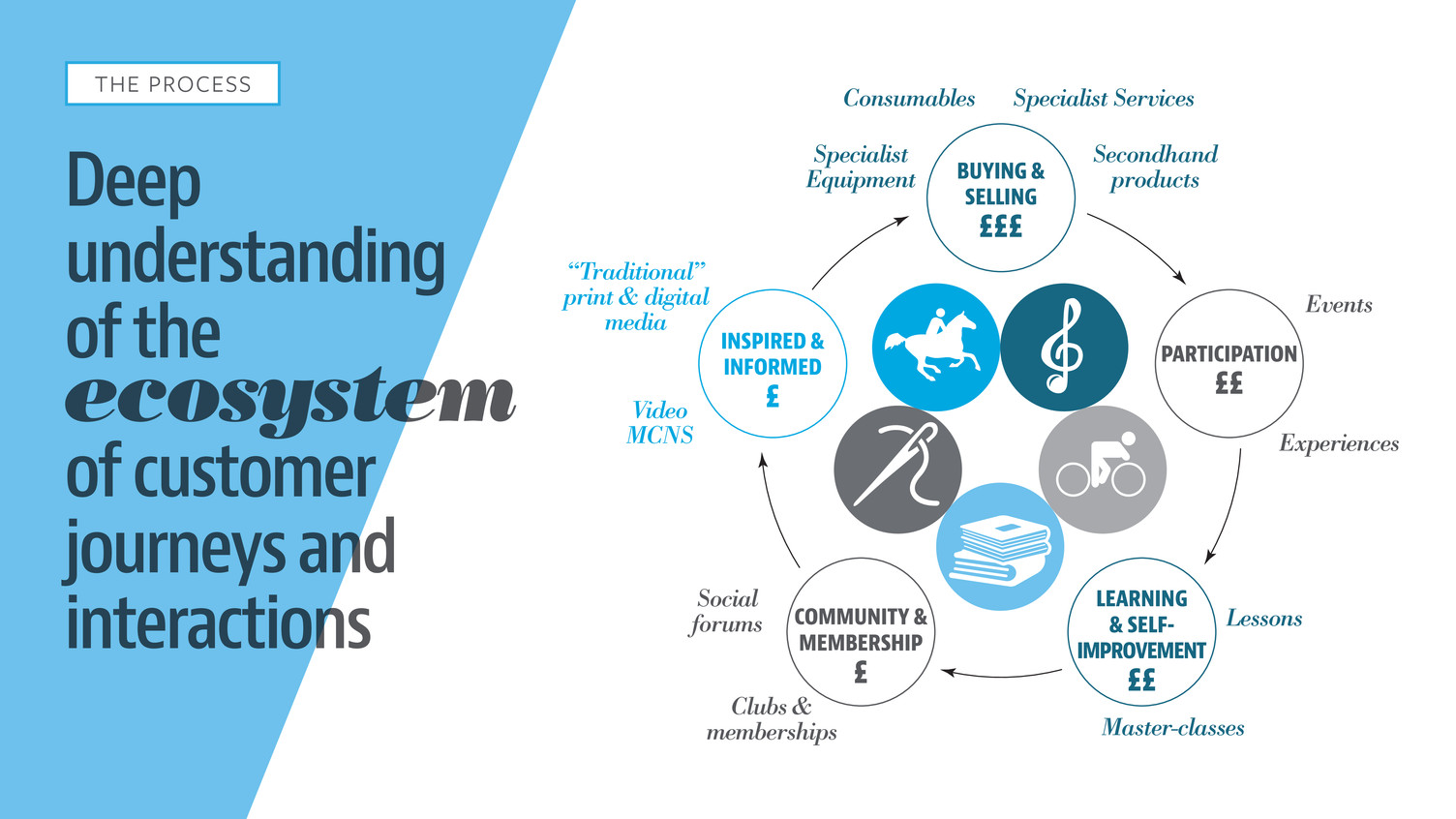

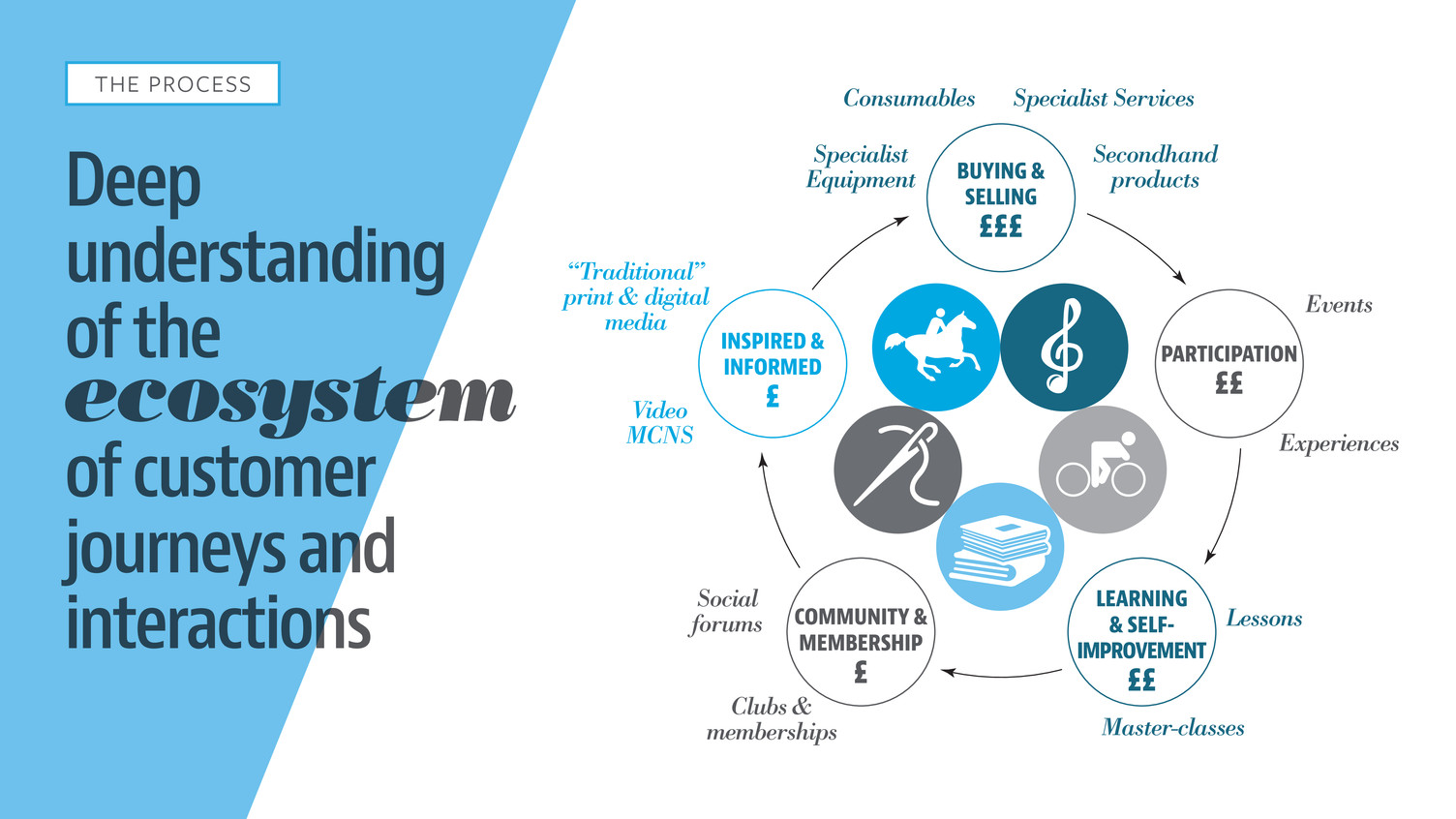

Deep understanding of the ecosystem of customer journeys and interactions THE PROCESS INSPIRED & INFORMED £ COMMUNITY & MEMBERSHIP £ LEARNING & SELF- IMPROVEMENT ££ PARTICIPATION ££ BUYING & SELLING £££ Consumables Specialist Services Specialist Equipment Secondhand products Events Social forums Clubs & memberships Master-classes Lessons Experiences “Traditional” print & digital media Video MCNS

ARPU Total Audience Specialist eCommerce Learning Memberships Newsstand Copy Sales Subscriptions Events & Experiences Print & Digital Advertising Use data and consumer insight to help us fill in and migrate up the demand curve

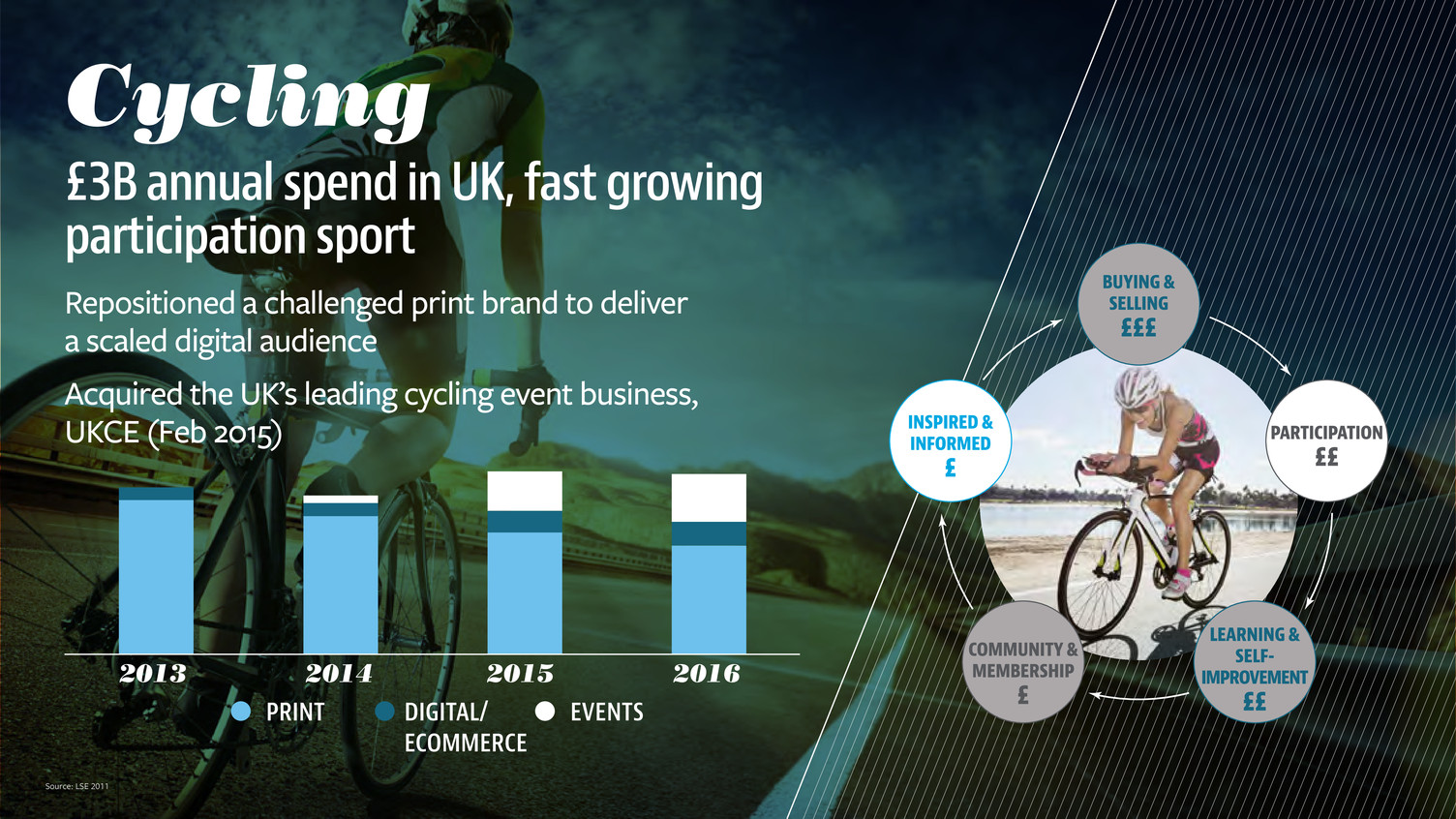

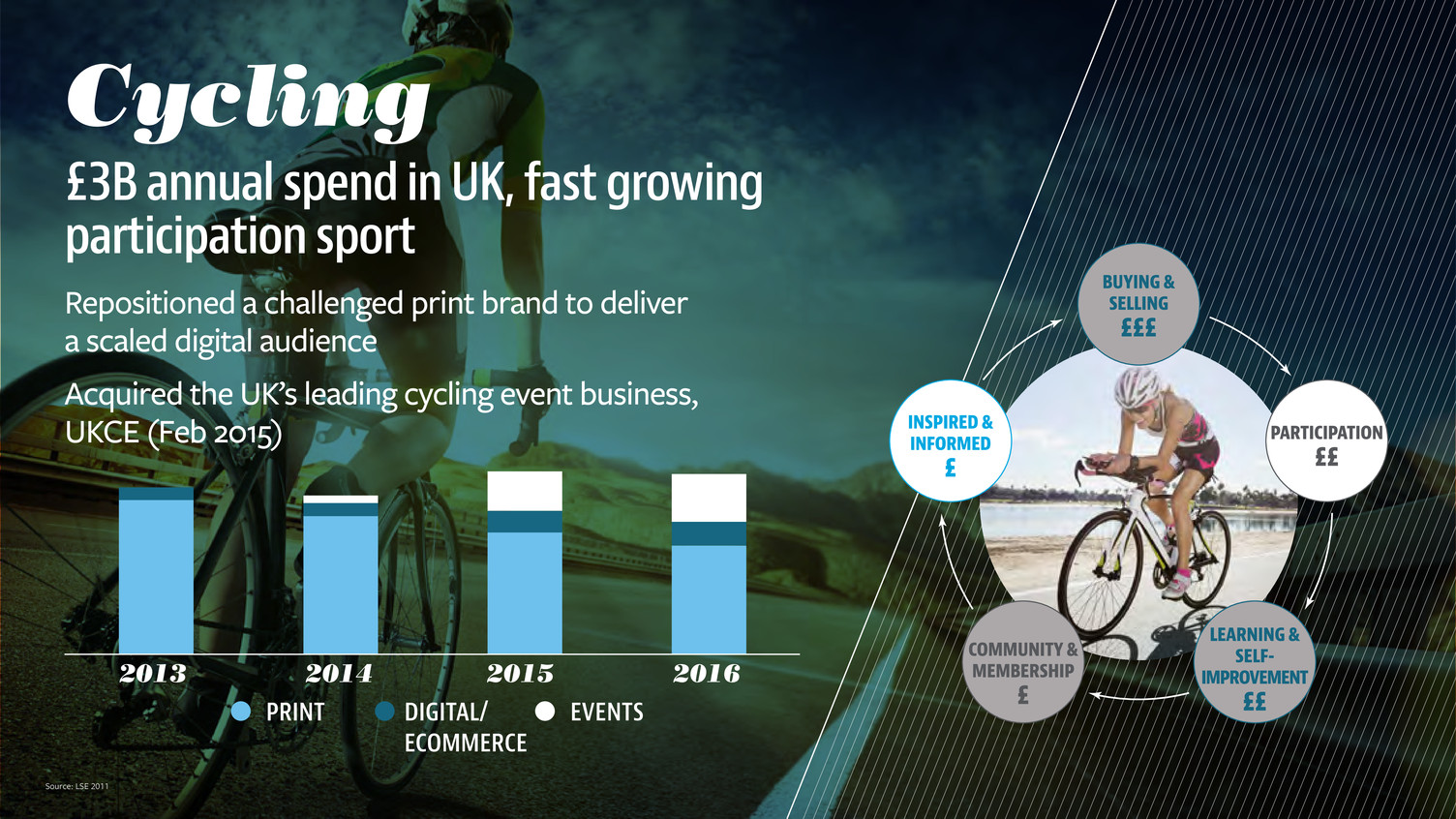

Cycling Repositioned a challenged print brand to deliver a scaled digital audience Acquired the UK’s leading cycling event business, UKCE (Feb 2015) £3B annual spend in UK, fast growing participation sport PRINT DIGITAL/ ECOMMERCE EVENTS 2013 20152014 2016 Source: LSE 2011

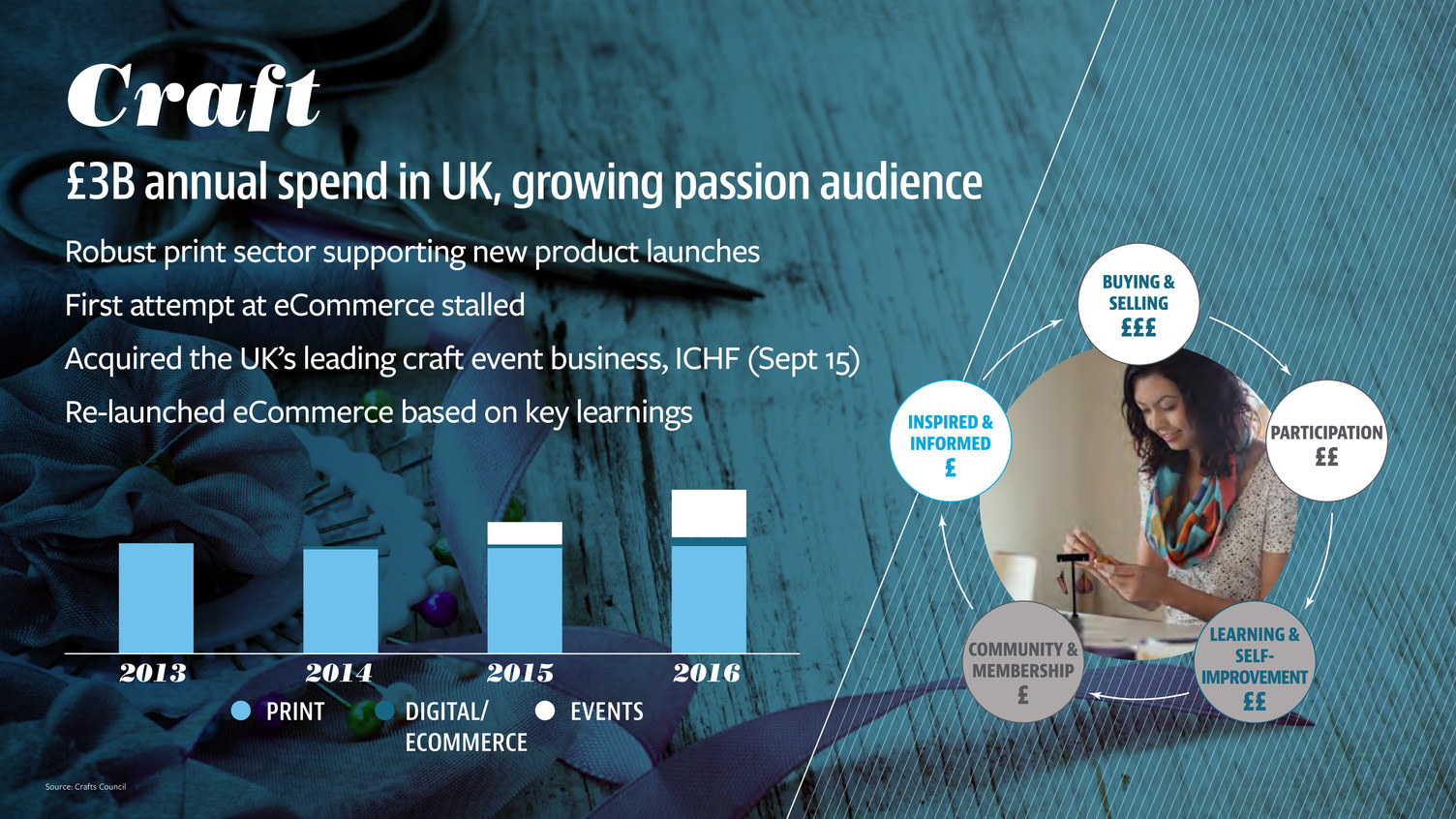

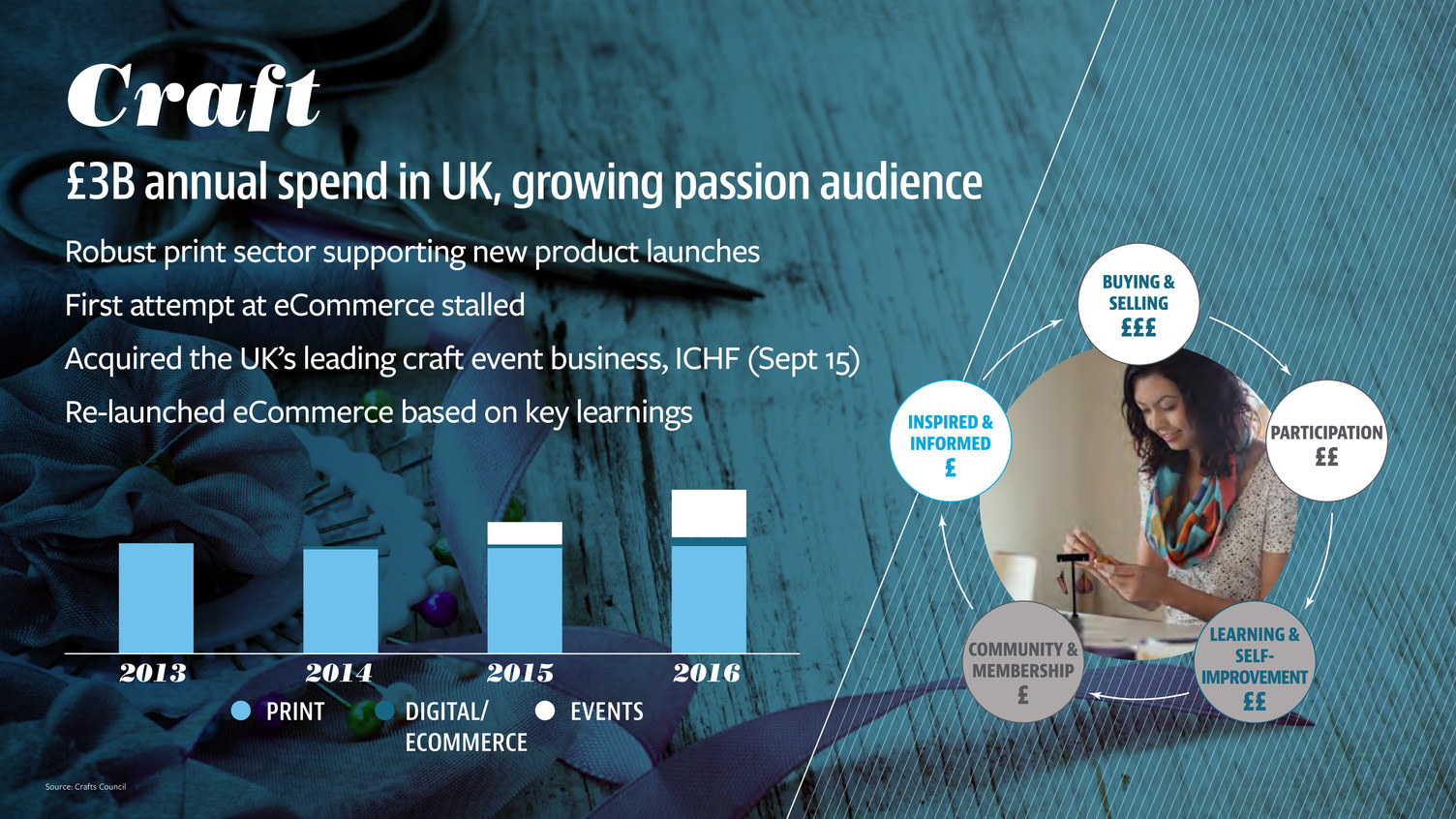

Craft Robust print sector supporting new product launches First attempt at eCommerce stalled Acquired the UK’s leading craft event business, ICHF (Sept 15) Re-launched eCommerce based on key learnings £3B annual spend in UK, growing passion audience PRINT DIGITAL/ ECOMMERCE EVENTS 2013 20152014 2016 Source: Crafts Council

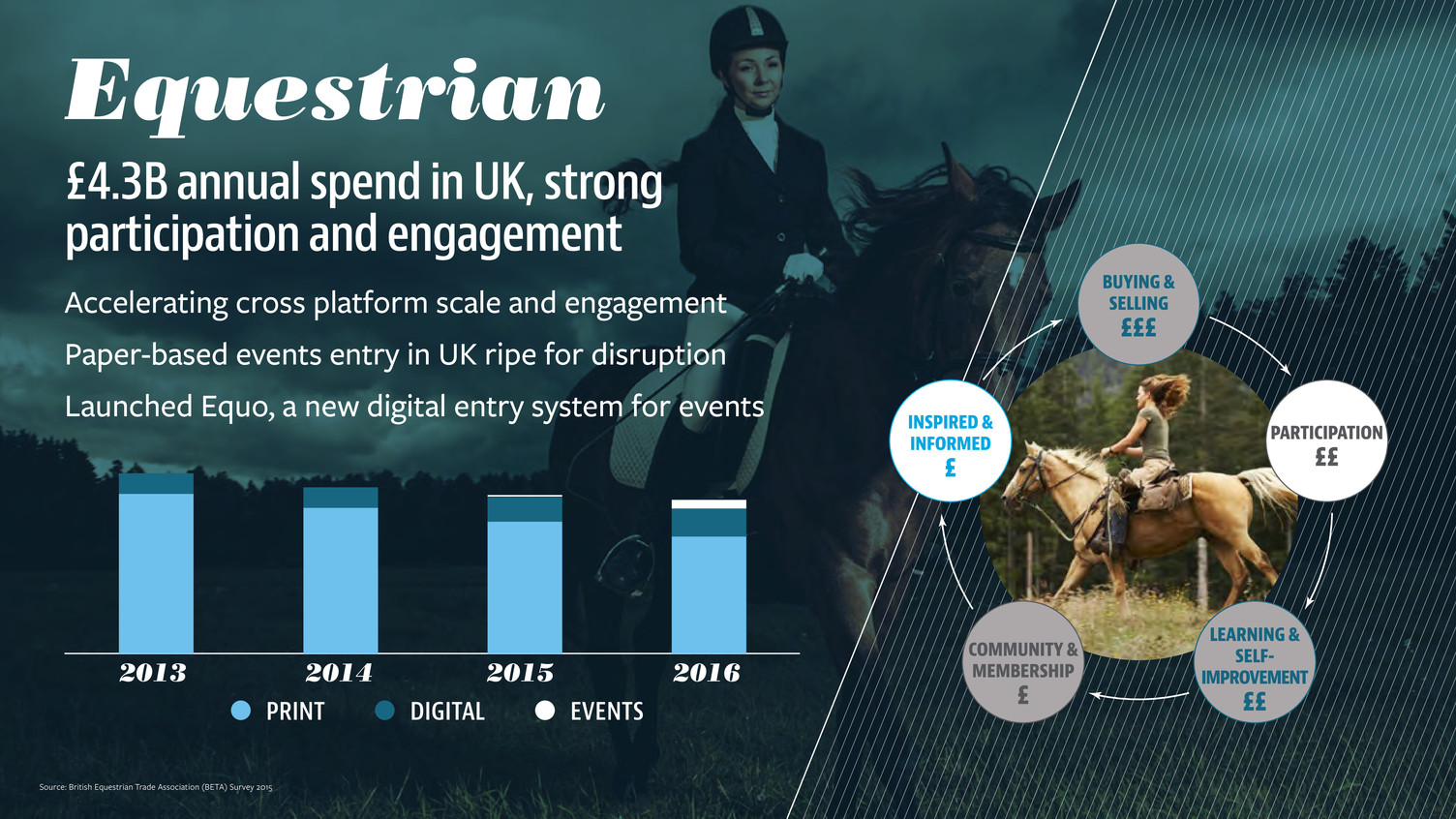

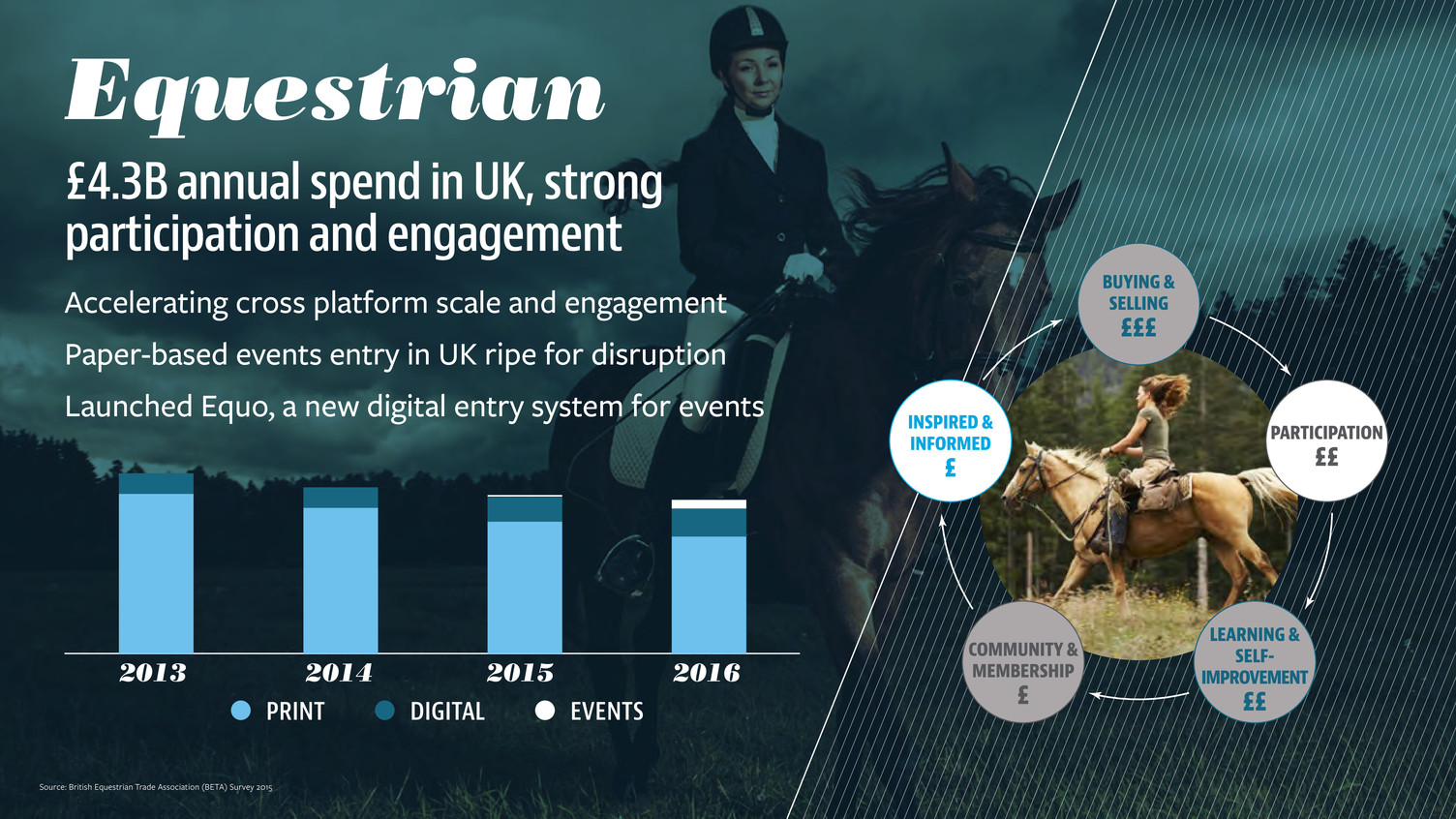

Equestrian Accelerating cross platform scale and engagement Paper-based events entry in UK ripe for disruption Launched Equo, a new digital entry system for events £4.3B annual spend in UK, strong participation and engagement 2013 20152014 2016 PRINT DIGITAL EVENTS Source: British Equestrian Trade Association (BETA) Survey 2015

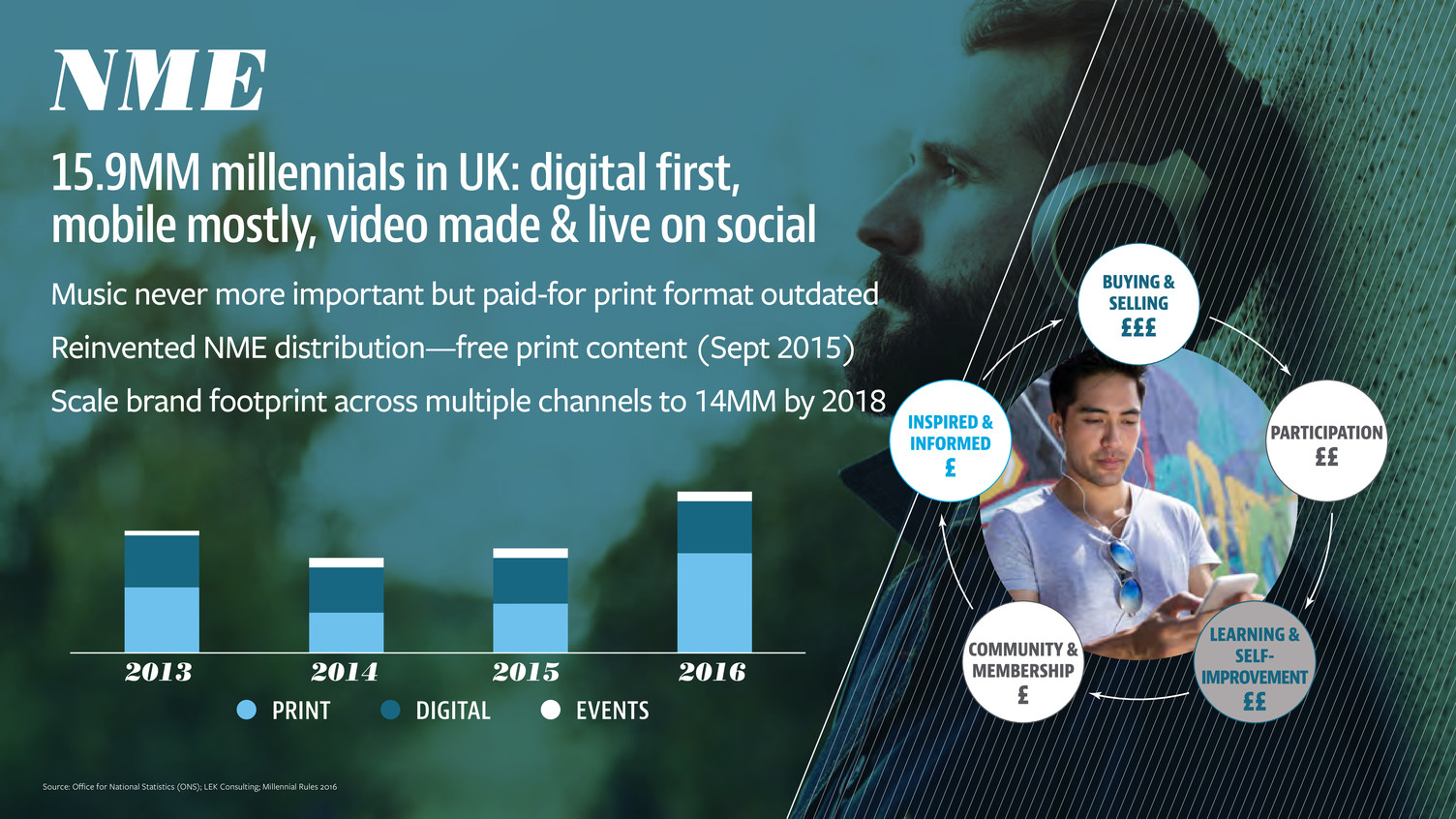

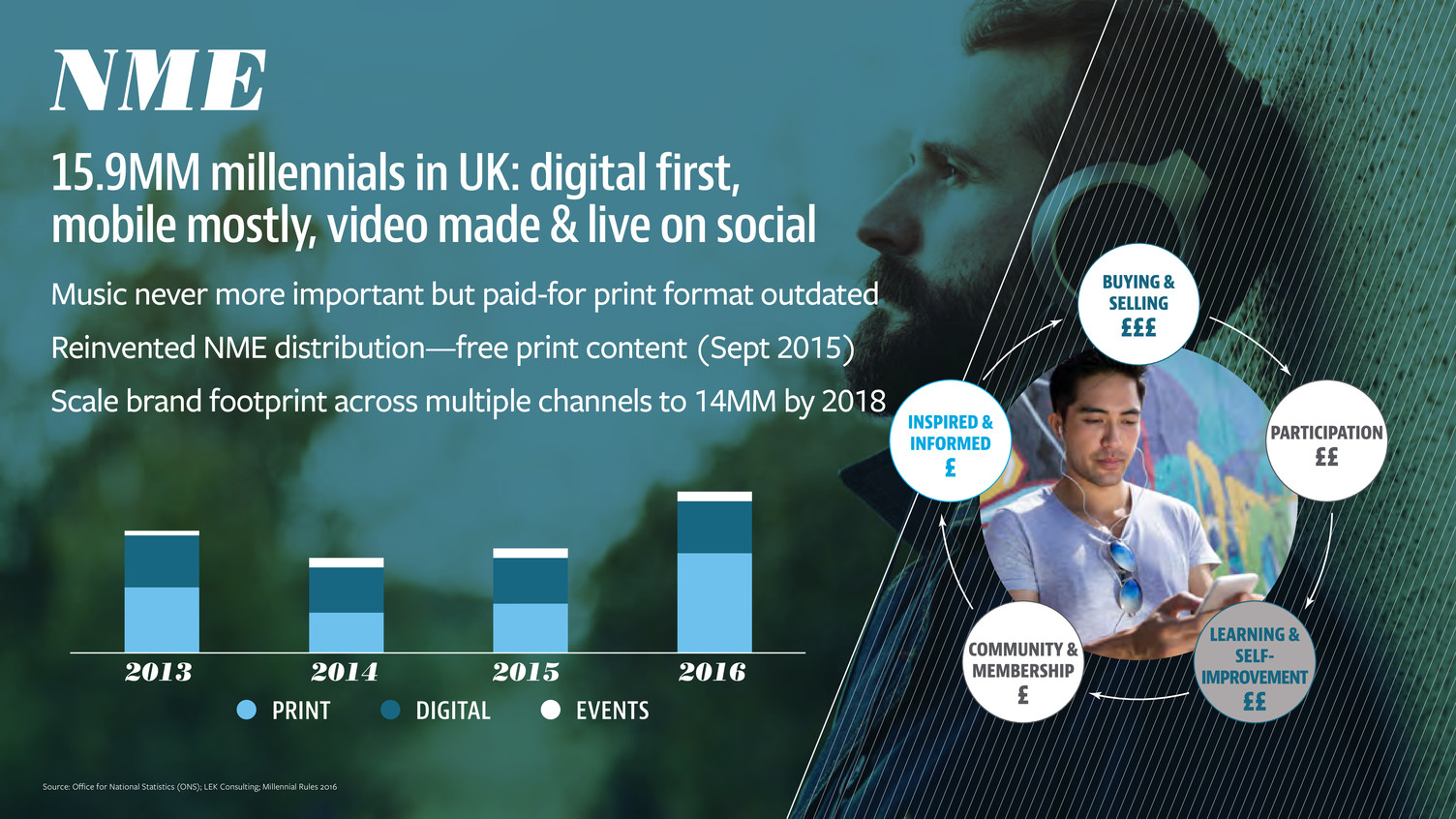

NME Music never more important but paid-for print format outdated Reinvented NME distribution—free print content (Sept 2015) Scale brand footprint across multiple channels to 14MM by 2018 15.9MM millennials in UK: digital first, mobile mostly, video made & live on social PRINT DIGITAL EVENTS 2013 20152014 2016 Source: Office for National Statistics (ONS); LEK Consulting; Millennial Rules 2016

OUR FUTURE Super serve our consumers and clients across more of our passion verticals INSPIRED & INFORMED £ COMMUNITY & MEMBERSHIP £ LEARNING & SELF- IMPROVEMENT ££ PARTICIPATION ££ BUYING & SELLING £££ Consumables Specialist Services Specialist Equipment Secondhand products Events Social forums Clubs & memberships Master-classes Lessons Experiences “Traditional” print & digital media Video MCNS Icon sources: Created by anbileru adaleru, Created by Søren Michelsen, Created by Gabriele Malaspina

2014 2018 OUR BELIEF Evolve Time Inc. UK from timeless magazine publisher to contemporary cross-media network *adjusted and normalised for the sale and leaseback of Blue Fin Building and excludes one-off transformation costs.

IAN OREFICE Sr. Executive Producer, Current & Original Programming RICH BATTISTA Video: Going Beyond EVP, President, Entertainment & Sports Group and Video, Time Inc.

The Time Inc. Difference Unparalleled Access Powerful Brands Storytelling DNA KEY PILLARS

Global Digital Audience EXTRAORDINARY REACH & MARKETING MUSCLE Social Audience 200MM+ 150MM+ source: Digital: comScore - rolling six month average through March 2016; Social reach based on US&UK brands; Facebook, Twitter, Google+, Instagram, Pinterest, YouTube & LinkedIn THE TIME INC DIFFERENCE

48B source: Video Mobile Traffic: Cisco Visual Networking Index released 2.1.16; Video Views: comScore Video Metrix Video Consumption: eMarketer 2.3.16 A NEW ERA IN VIDEO In 2016 monthly video views average 48BN (through March) In 2015 video accounted for 55% of all mobile traffic By 2020 it is estimated that 232 million people will be consuming digital video, nearly 80% of them watching digital TV programming

$28B INCREASING AD SPEND By 2020 digital video ad spending is expected to increase to $28B A NEW ERA IN VIDEO eMarketer published 1.11.16

OVER-THE-TOP By 2020 advertiser spending on OTT is projected to reach $40B $40B A NEW ERA IN VIDEO source: The Diffusion Group published 4.9.2015

Our Approach Content Everywhere Premium Experiences Monetization Everywhere

STATE-OF-THE-ART PRODUCTION FACILITIES On pace to produce over 40,000 videos this calendar year 40,000 Based on internal estimates

200% VIDEO GROWTH 200% YOY growth in views in Q1, equaling BILLIONS of video streams across digital and social in 2016 MOMENTUM Based on internal reporting

Grey outline; white fill White outline; 50% white fill Based on internal reporting MOMENTUM BRAND GROWTH 20 brands have experienced at least double-digit YOY growth in total video starts 10 of these have triple-digit growth, and 5 have quadruple-digit growth

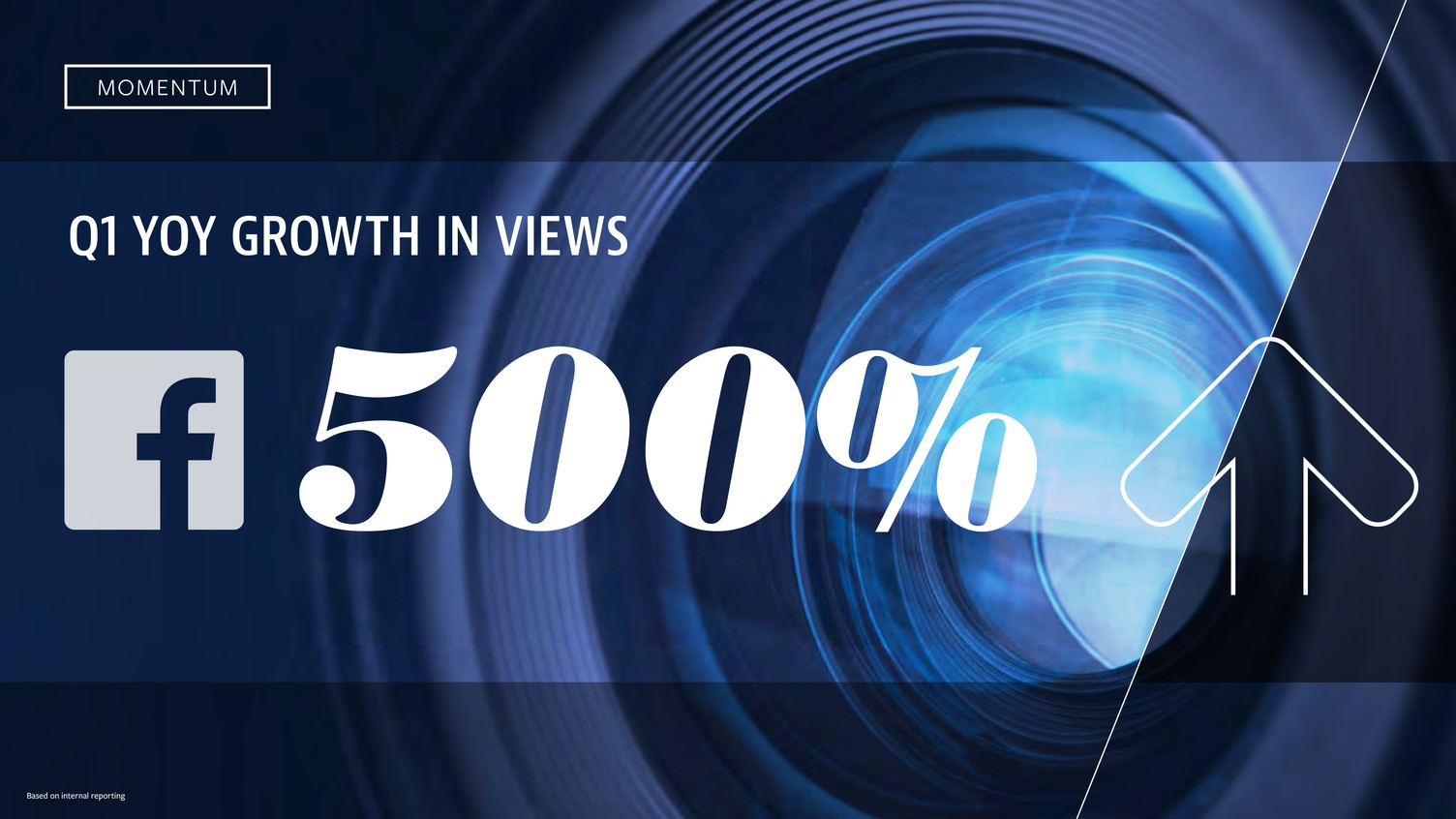

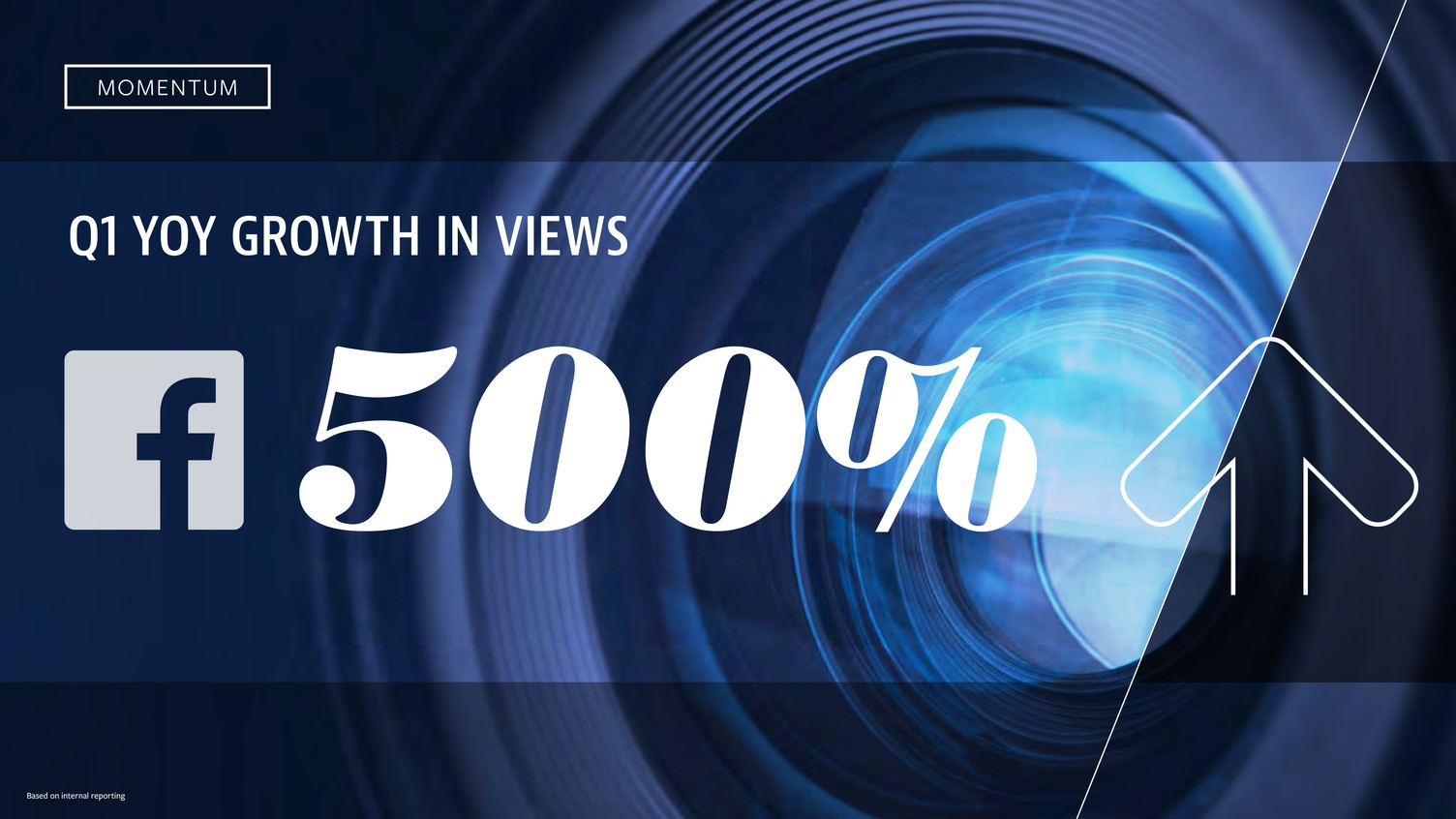

Based on internal reporting MOMENTUM Q1 YOY GROWTH IN VIEWS 500%

3 Types of Programming Formats Daily, Social & Live Short-Form Series Long-Form Programming CONTENT EVERYWHERE

CONTENT EVERYWHERE Cover Reveal Special (TNT) Live Stream Red Carpet Special VR Digital Video Instagram DVD Mobile App Snapchat Twitter

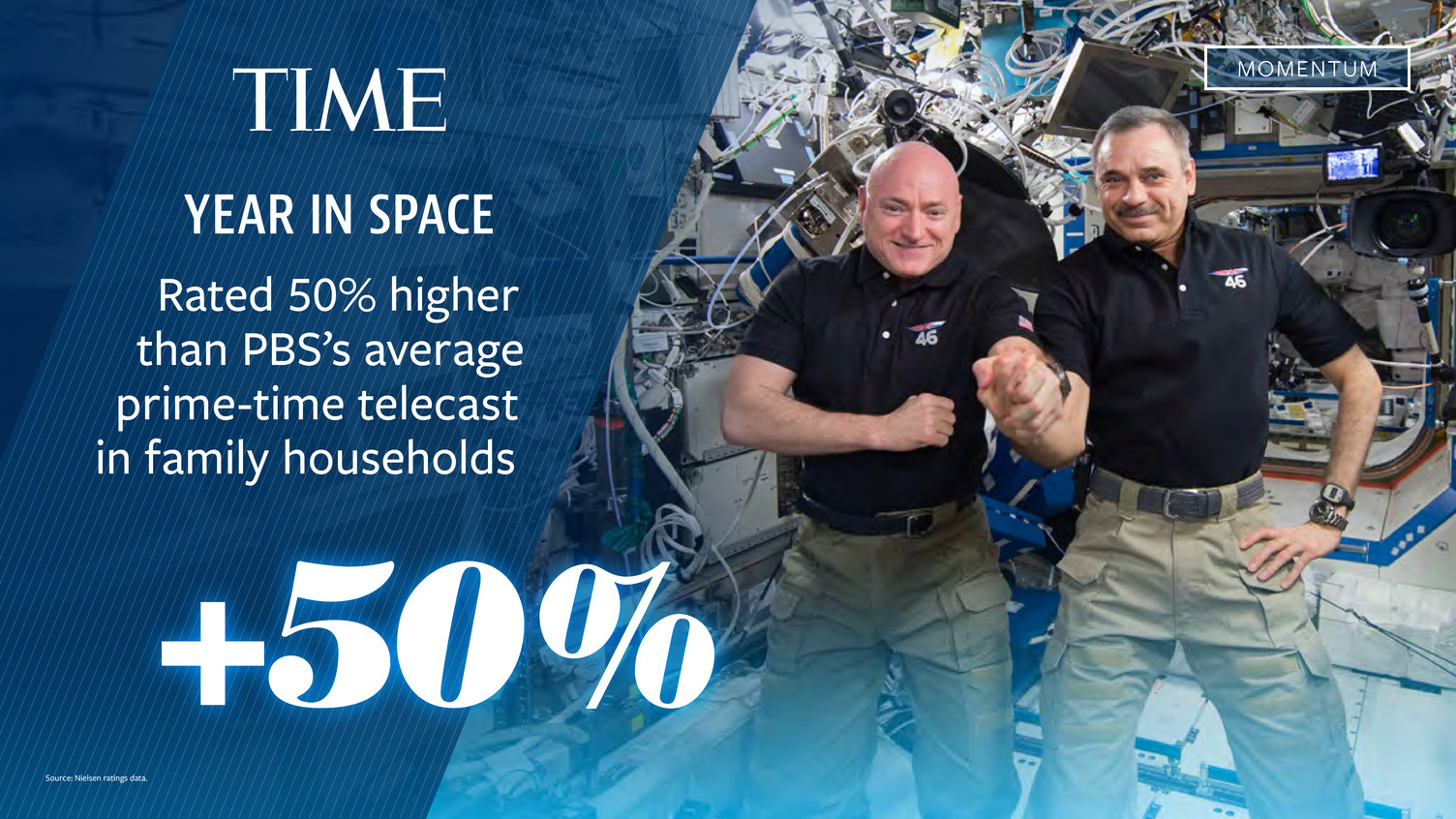

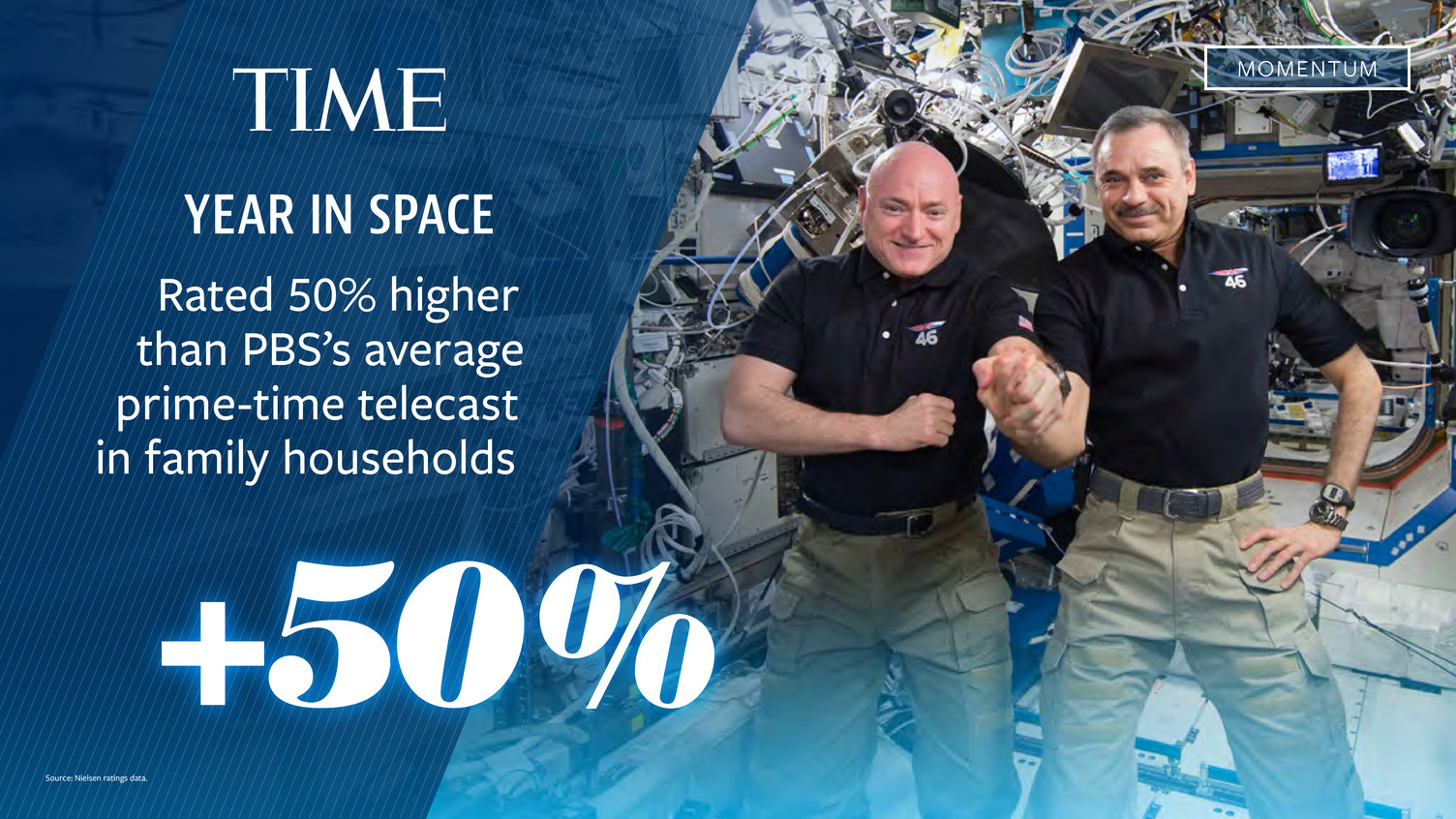

+50% Source: Nielsen ratings data. YEAR IN SPACE Rated 50% higher than PBS’s average prime-time telecast in family households MOMENTUM

MOMENTUM LONG-FORM PROGRAMMING EXPANSION

MOMENTUM 150 PREMIUM PROJECTS IN DEVELOPMENT

“Time Inc. to Launch People/Entertainment Weekly Streaming Network” “Time Inc. Partners With Kobe Bryant, Morgan Spurlock and Jenna Bush Hager on Video Projects” “Today is a good day for Time Inc.” “Kobe Bryant Kicks Off Post-NBA Life With Time Inc. Partnership” “Kobe Bryant Inks Sports Illustrated Deal for ‘Dear Basketball’ Animated Film” “Time Inc. unveils streaming network, Kobe Bryant short film” “Time’s ‘Life VR’ will ‘showcase the world through virtual reality’” “At its star-studded NewFront presentations, Time Inc. revealed it is launching a new video network — People/ Entertainment Weekly Network (PEWN) — with a short animated show with retiring NBA star Kobe Bryant and a virtual reality app built around its Life brand.” NEWFRONT

Unlocking the TIME Brand MEREDITH LONG Group Publisher, Time, Fortune & Money NANCY GIBBS Editor, Time EVELYN WEBSTER EVP, Time Inc.

Unlocking the TIME Brand MEREDITH LONG Group Publisher, Time, Fortune & Money NANCY GIBBS Editor, Time EVELYN WEBSTER EVP, Time Inc.

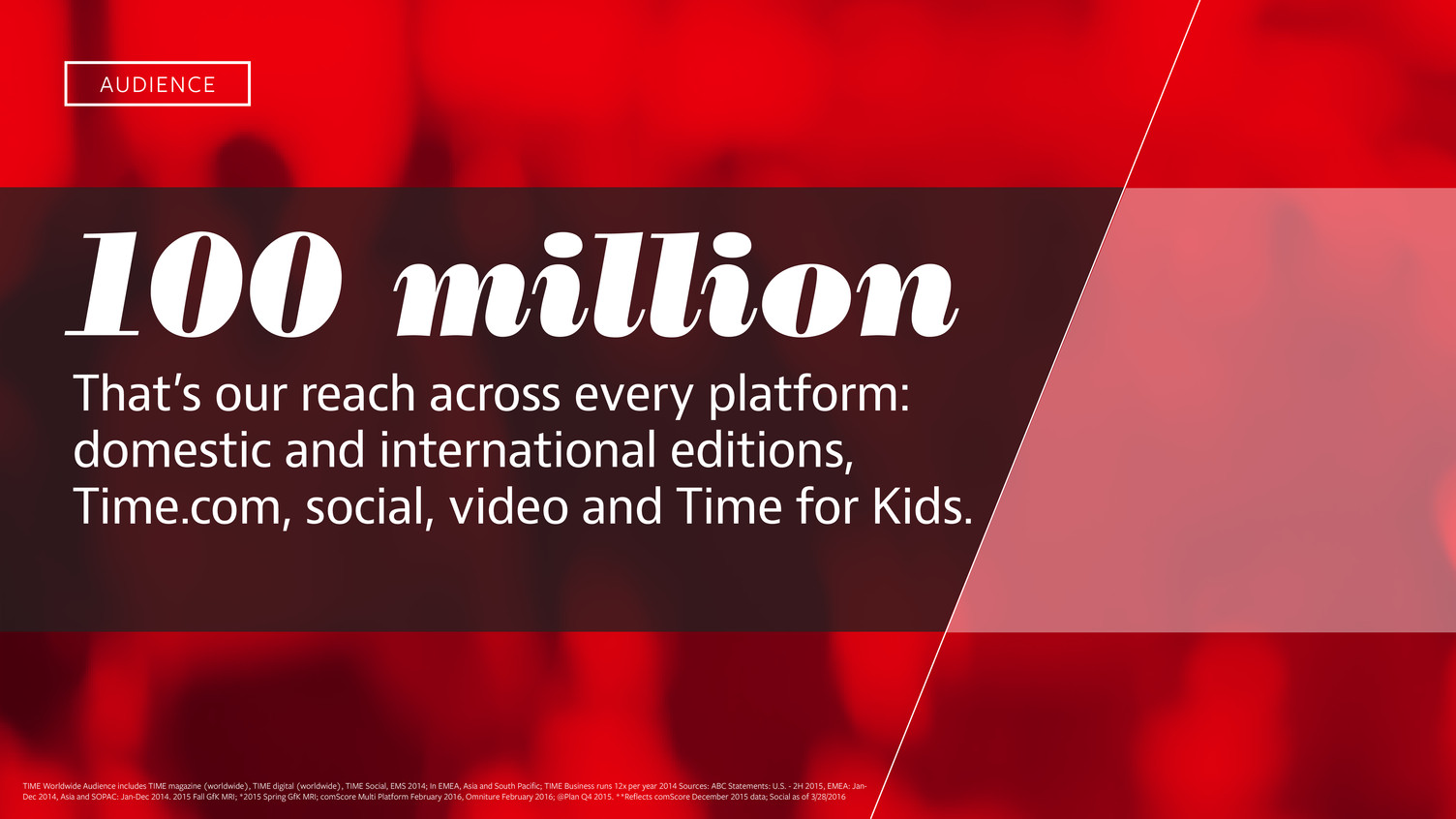

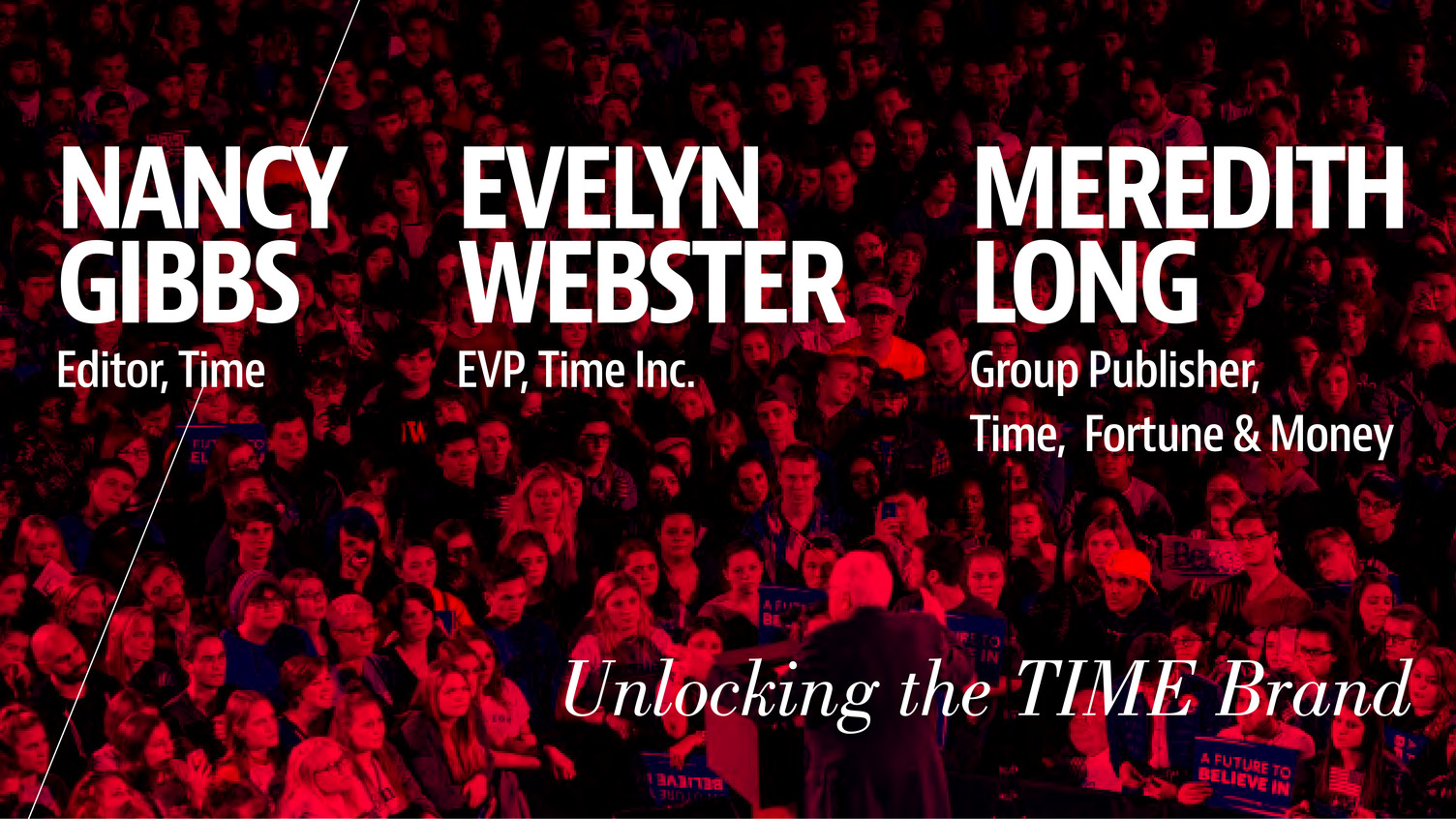

100 million AUDIENCE That’s our reach across every platform: domestic and international editions, Time.com, social, video and Time for Kids. TIME Worldwide Audience includes TIME magazine (worldwide), TIME digital (worldwide), TIME Social, EMS 2014; In EMEA, Asia and South Pacific; TIME Business runs 12x per year 2014 Sources: ABC Statements: U.S. - 2H 2015, EMEA: Jan- Dec 2014, Asia and SOPAC: Jan-Dec 2014. 2015 Fall GfK MRI; *2015 Spring GfK MRI; comScore Multi Platform February 2016, Omniture February 2016; @Plan Q4 2015. **Reflects comScore December 2015 data; Social as of 3/28/2016

42 million DIGITAL unique visitors to Time.com in the United States comScore March 2016

DIGITAL 15 million unique visitors to Time.com internationally Omniture March 2016

122 million VIDEO video streams in 2015, a 58% increase over the previous year Brightcove January 2015-Dec. 2015 and January 2014- December 2014

30MM SOCIAL social media followers, one of the largest in the news industry FACEBOOK Vox TWITTER Buzzfeed INSTAGRAM NYT Facebook, Twitter, Instagram

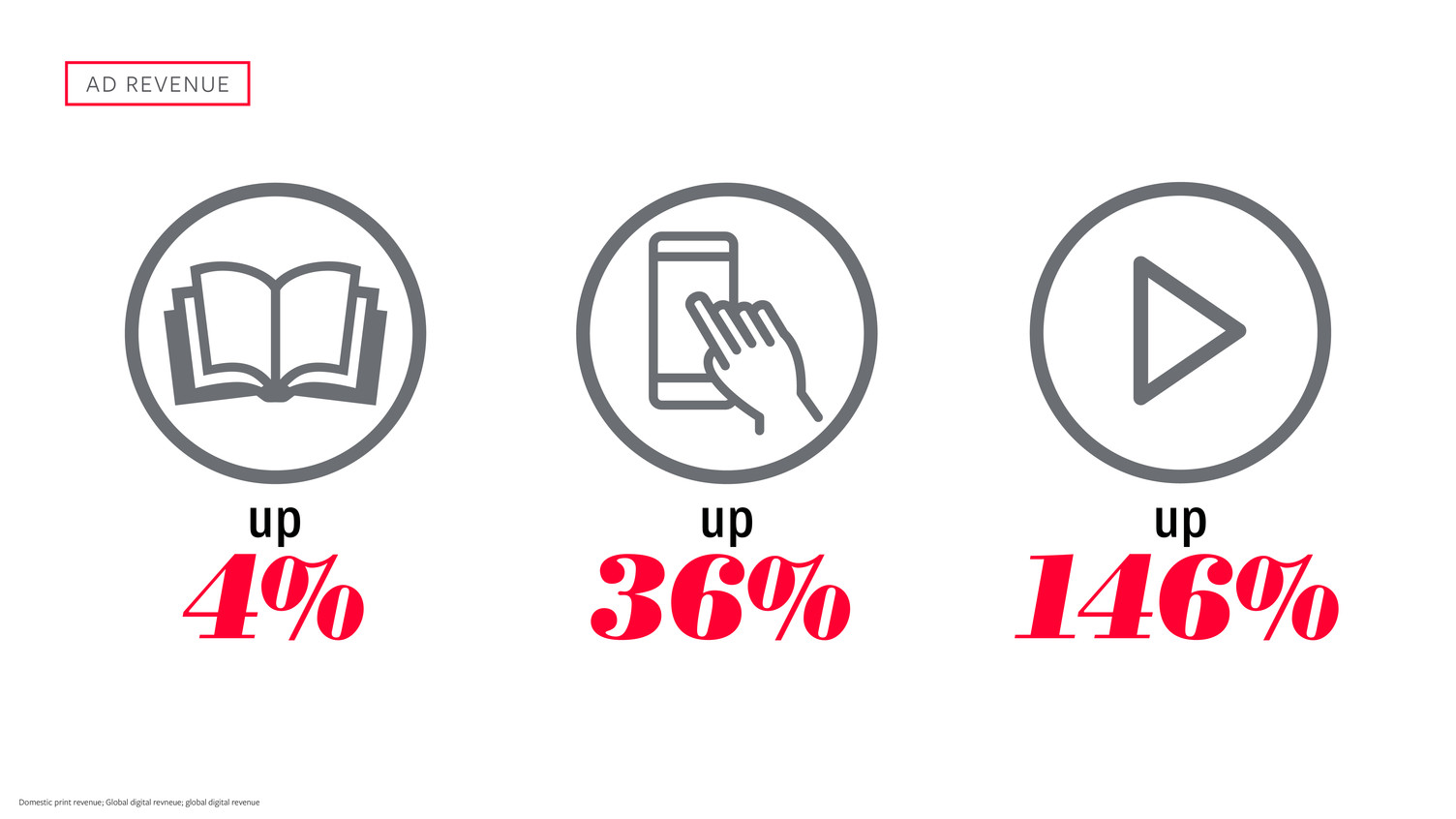

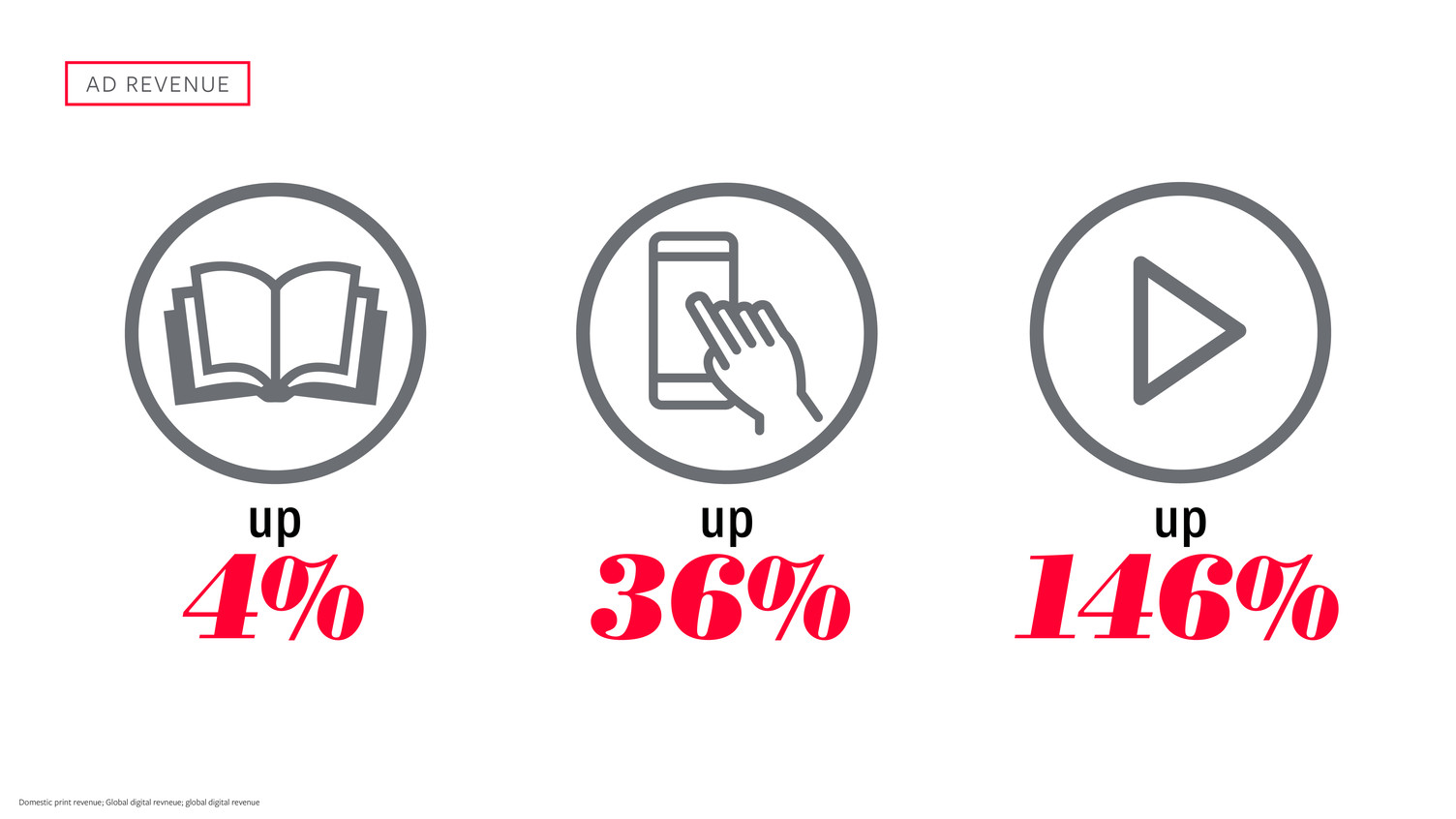

AD REVENUE 4% up up up 36% 146% Domestic print revenue; Global digital revneue; global digital revenue

SHOP

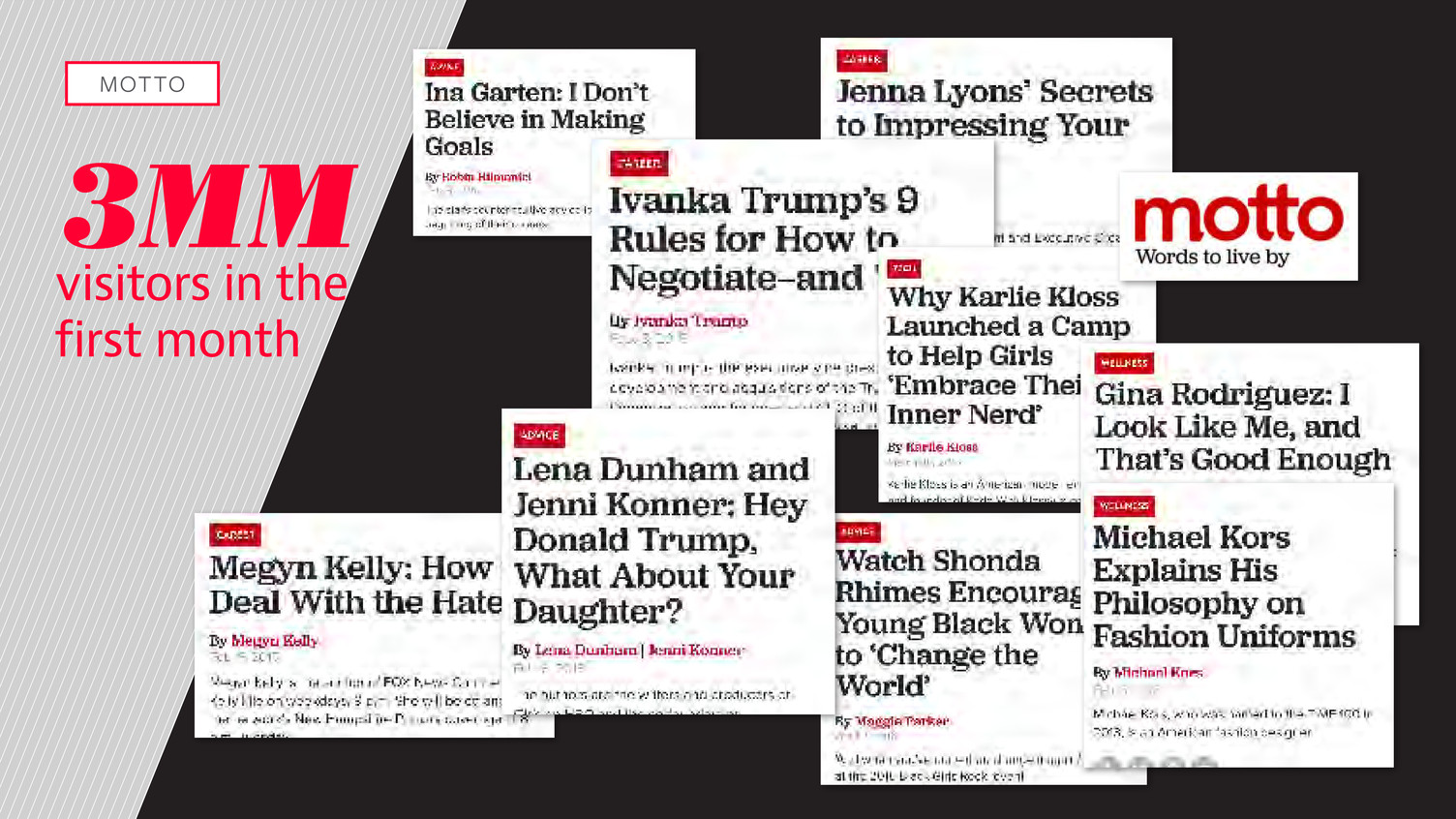

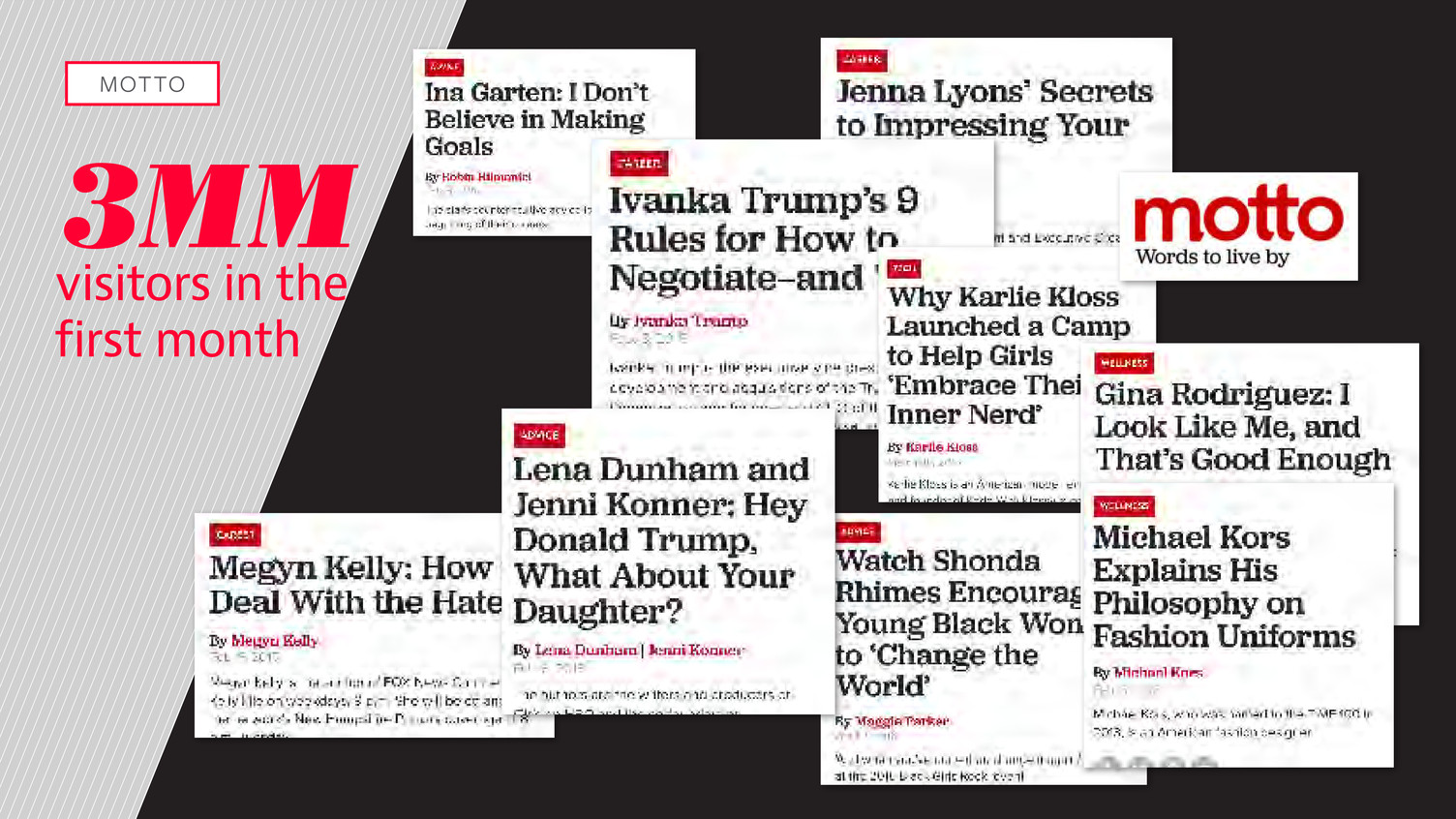

3MM MOTTO visitors in the first month Omniture February/March 2016

TRUMP EAGLE 1 MINUTE

YEAR IN SPACE PLAYS W/ NO SOUND IN BACKGROUND

SHOP

1960s TIME NEWSROOM

2016 TIME NEWSROOM

TIME 100 2 MINUTES

Viant: People-Based Ad Tech TIM VANDERHOOK CEO, Viant CHRIS VANDERHOOK COO, Viant

BUSINESS OVERVIEW enables marketers’ ad campaigns to reach the specific consumers they want through advanced data, targeting and measurement capabilities available in the Viant Advertising CloudTM

BUSINESS OVERVIEW directly links ad exposure to consumer action and purchases— both ecommerce and in-store purchases—to allow marketers to determine the true return on investment they are receiving from their advertising dollars.

Advertising Is Split into Two Large Buckets LANDSCAPE Branding Performance

U.S. Digital Advertising Is Split into 2 Large Buckets 58% $33.9B 42% $24.6B LANDSCAPE BRANDING PERFORMANCE Source, eMarketer 2015.

OPPORTUNITY MARKETPLACE Leaders “Will Fast-Follower Google Dominate People-Based Advertising?” “Facebook’s New People- Based Ad Technology Is ‘Marketing Nirvana’” “People-Based Marketing’s Your Only Option in This Programmatic Age. Here’s Why.”

Leading REGISTRATION PLATFORMS OPPORTUNITY

Leading REGISTRATION PLATFORMS OPPORTUNITY

Consumer Relationships: POINT OF DIFFERENTIATION POSITIONING

The Power of Direct Consumer Relationships

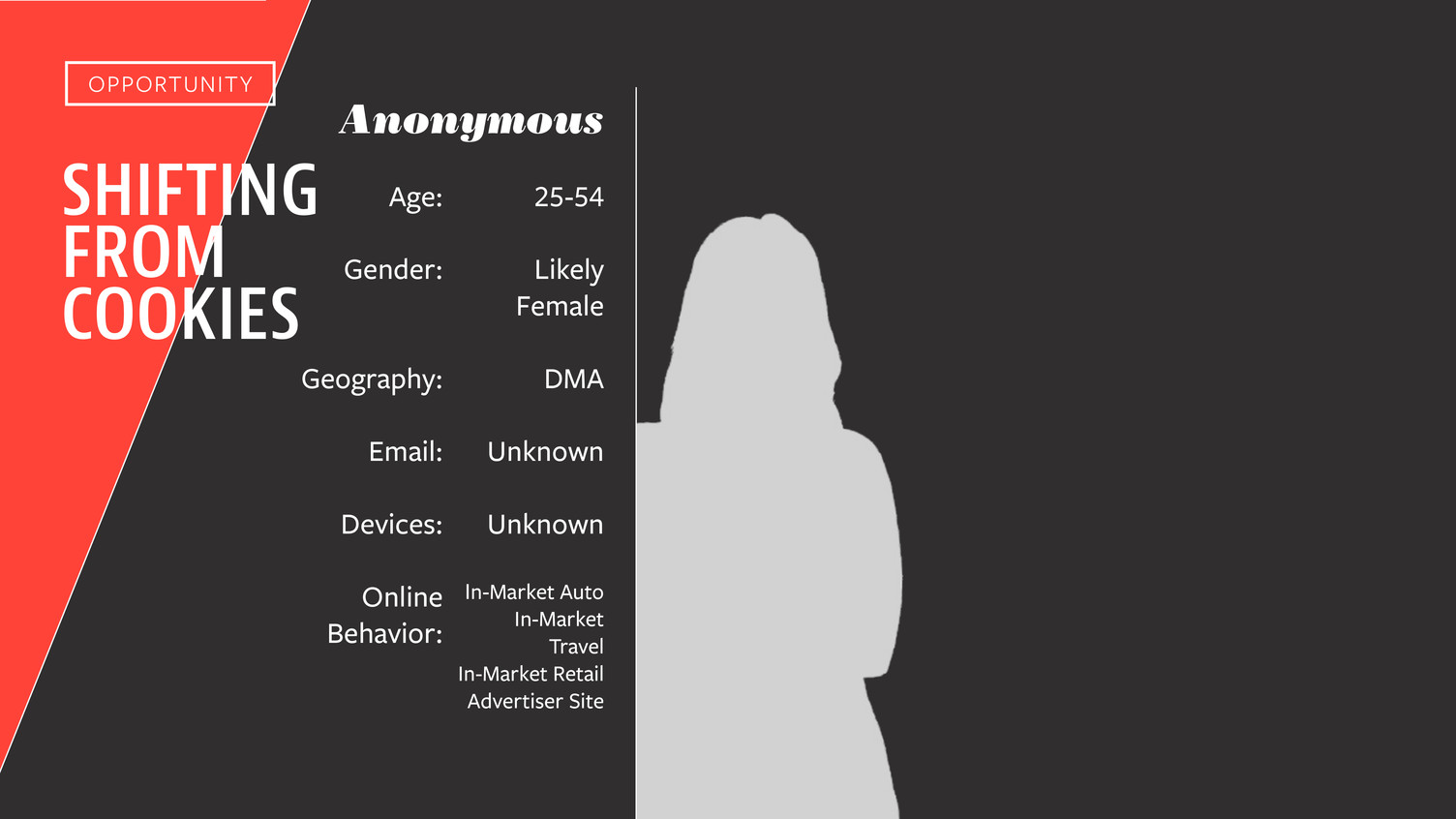

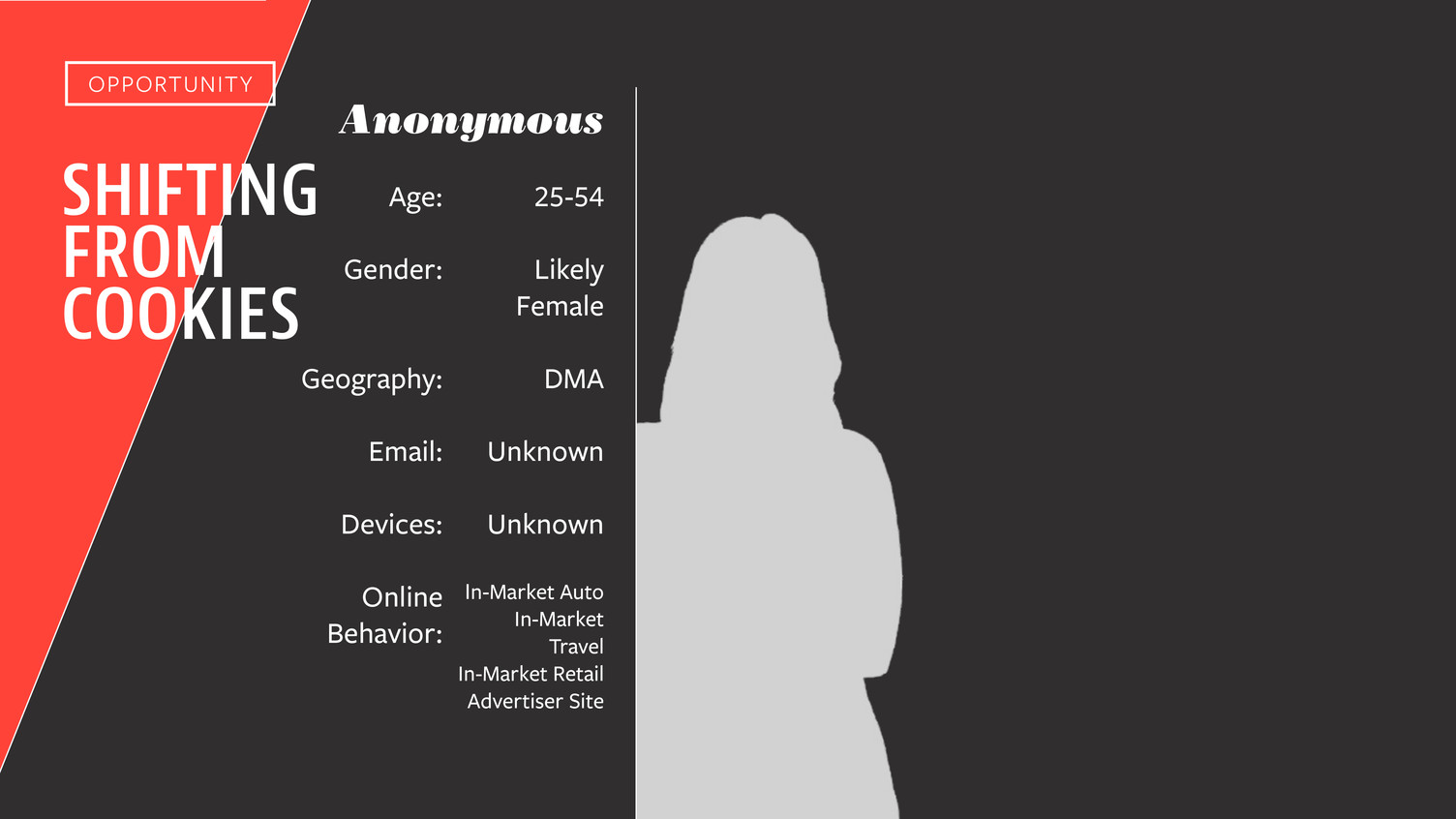

SHIFTING FROM COOKIES OPPORTUNITY Anonymous Age: Gender: Geography: Email: Devices: Online Behavior: 25-54 Likely Female DMA Unknown Unknown In-Market Auto In-Market Travel In-Market Retail Advertiser Site

Shifting from Cookies TO A PEOPLE- BASED SOLUTION OPPORTUNITY Anonymous Age: Gender: Geography: Email: Devices: Online Behavior: 25-54 Likely Female DMA Unknown Unknown In-Market Auto In-Market Travel In-Market Retail Advertiser Site Kate Anderson Age: Gender: Geography: Email: Devices: Online Behavior: 32 Female Chicago, IL 60614 kate@ email.com iPhone 5, iPad, MacBook Pro In-Market Auto In-Market Travel In- Market Retail

PEOPLE-BASED PLAN EXECUTE MEASURE Our Mission Enabling marketers to plan, execute and measure their advertising investments

PEOPLE-BASED Our Mission Enabling marketers to plan, execute and measure their advertising investments PLAN EXECUTE MEASURE

IDENTITY MANAGEMENT PLATFORMVISION 1 Internal Viant statistics 113MM US Households matched with Experian 550MM US Devices tied to registered users1 250MM US Registered users across 90+ titles1

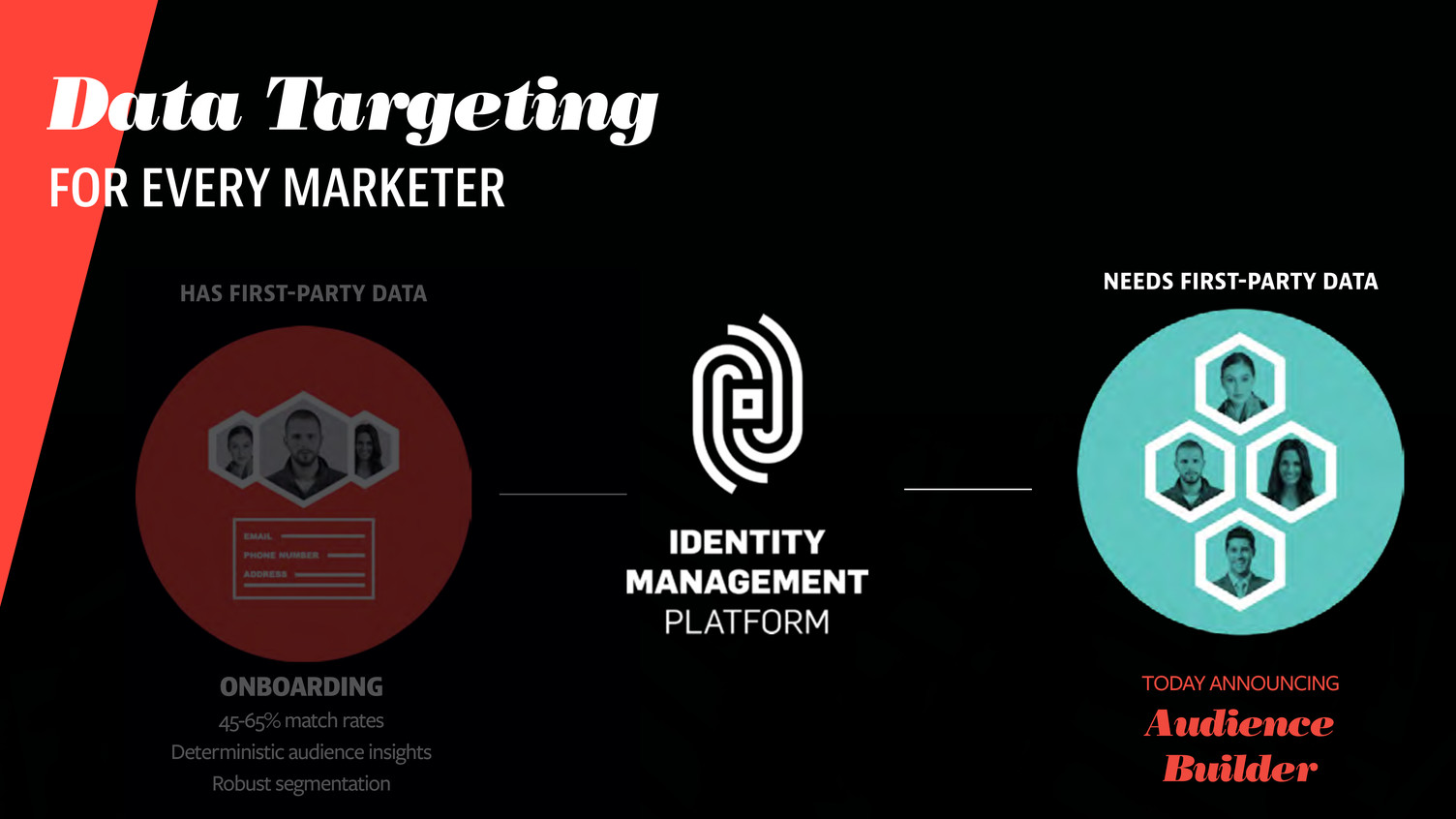

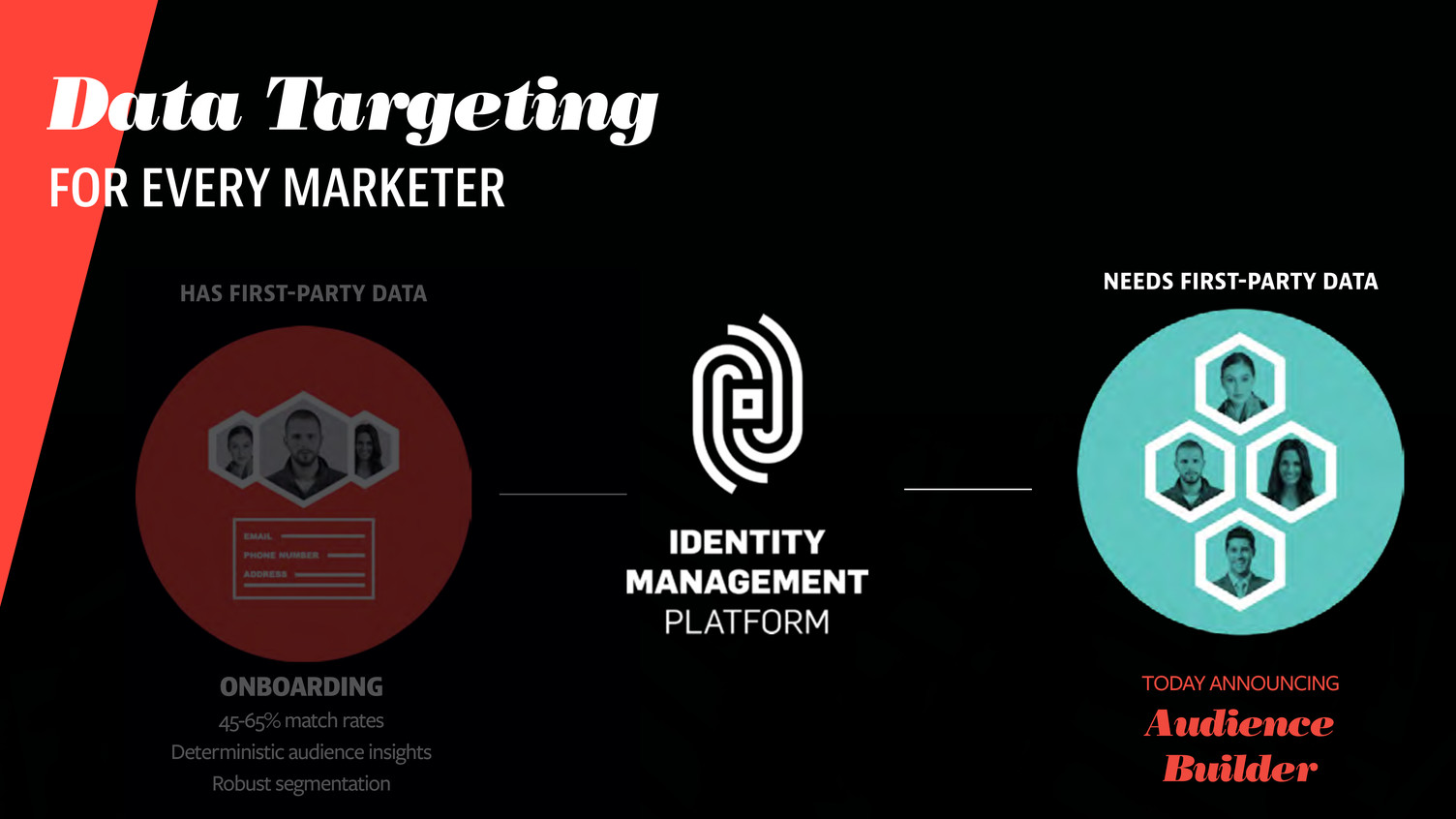

Data Targeting FOR EVERY MARKETER HAS FIRST-PARTY DATA ONBOARDING 45-65% match rates Deterministic audience insights Robust segmentation

HAS FIRST-PARTY DATA NEEDS FIRST-PARTY DATA ONBOARDING 45-65% match rates Deterministic audience insights Robust segmentation TODAY ANNOUNCING Audience Builder Data Targeting FOR EVERY MARKETER

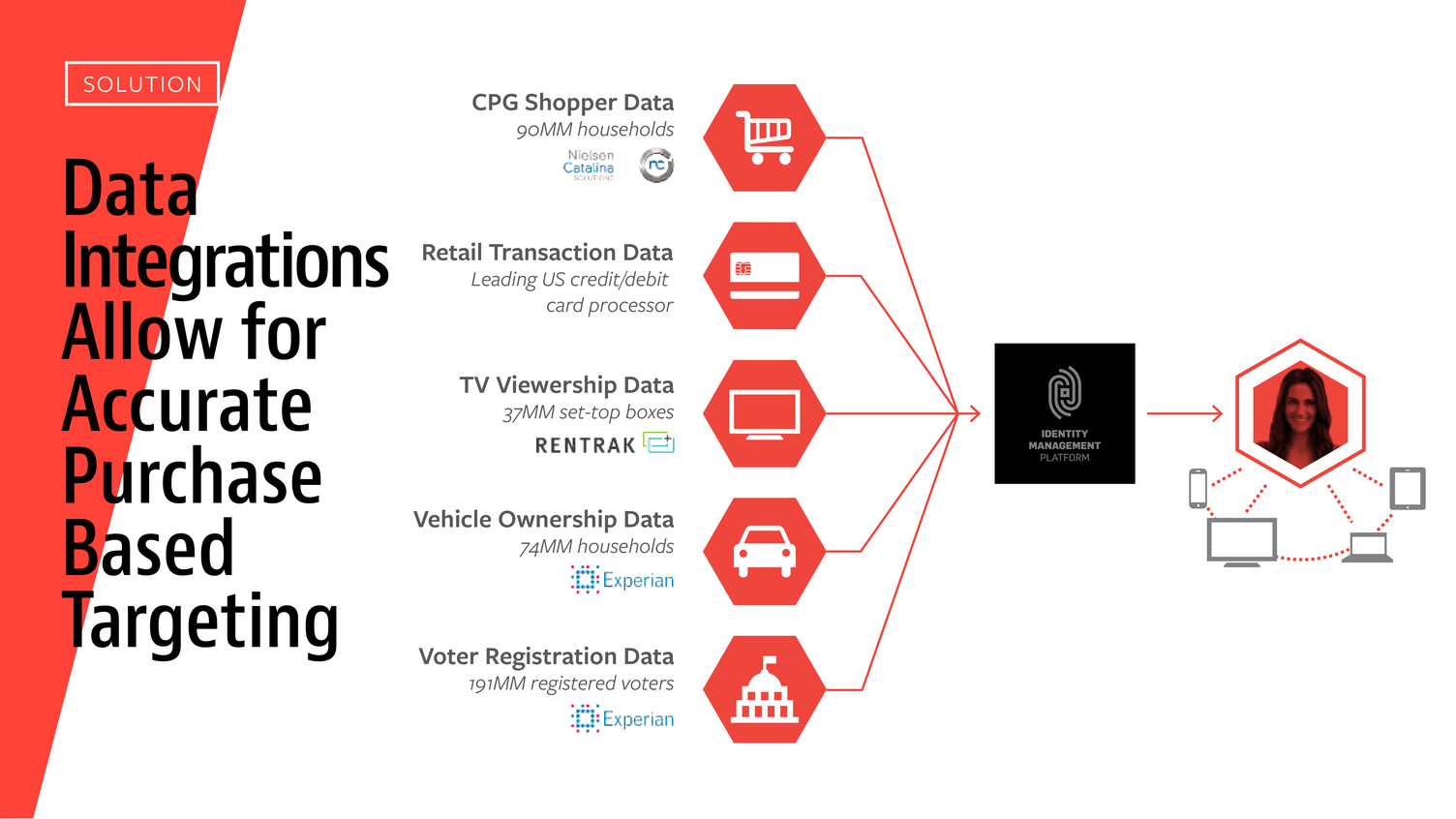

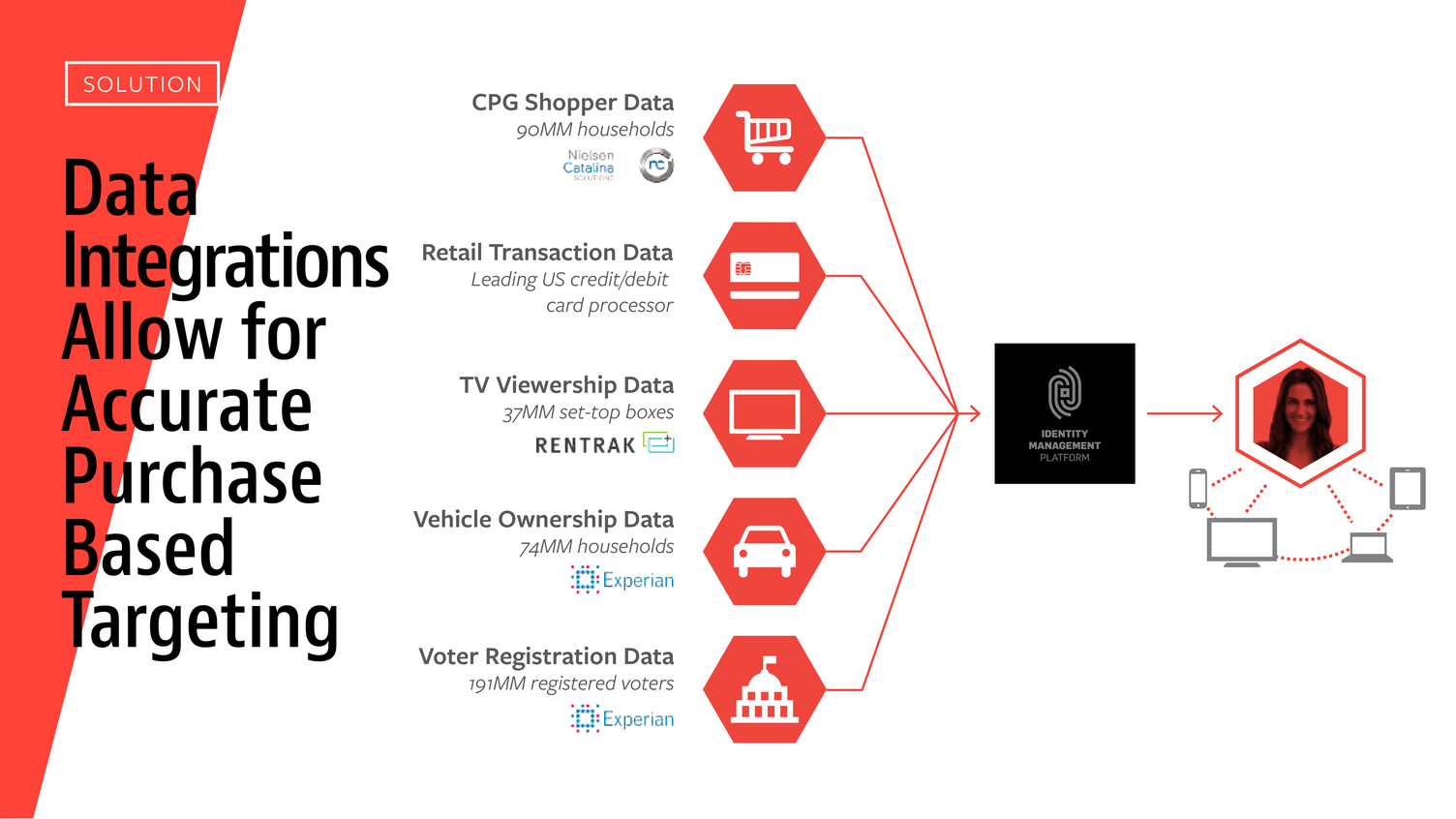

Data Integrations Allow for Accurate Purchase Based Targeting SOLUTION Retail Transaction Data Leading US credit/debit card processor Voter Registration Data 191MM registered voters Vehicle Ownership Data 74MM households TV Viewership Data 37MM set-top boxes CPG Shopper Data 90MM households

Media EXECUTION PLATFORM PEOPLE-BASED PLATFORM TIME INC. INVENTORY 3RD-PARTY PUBLISHERS

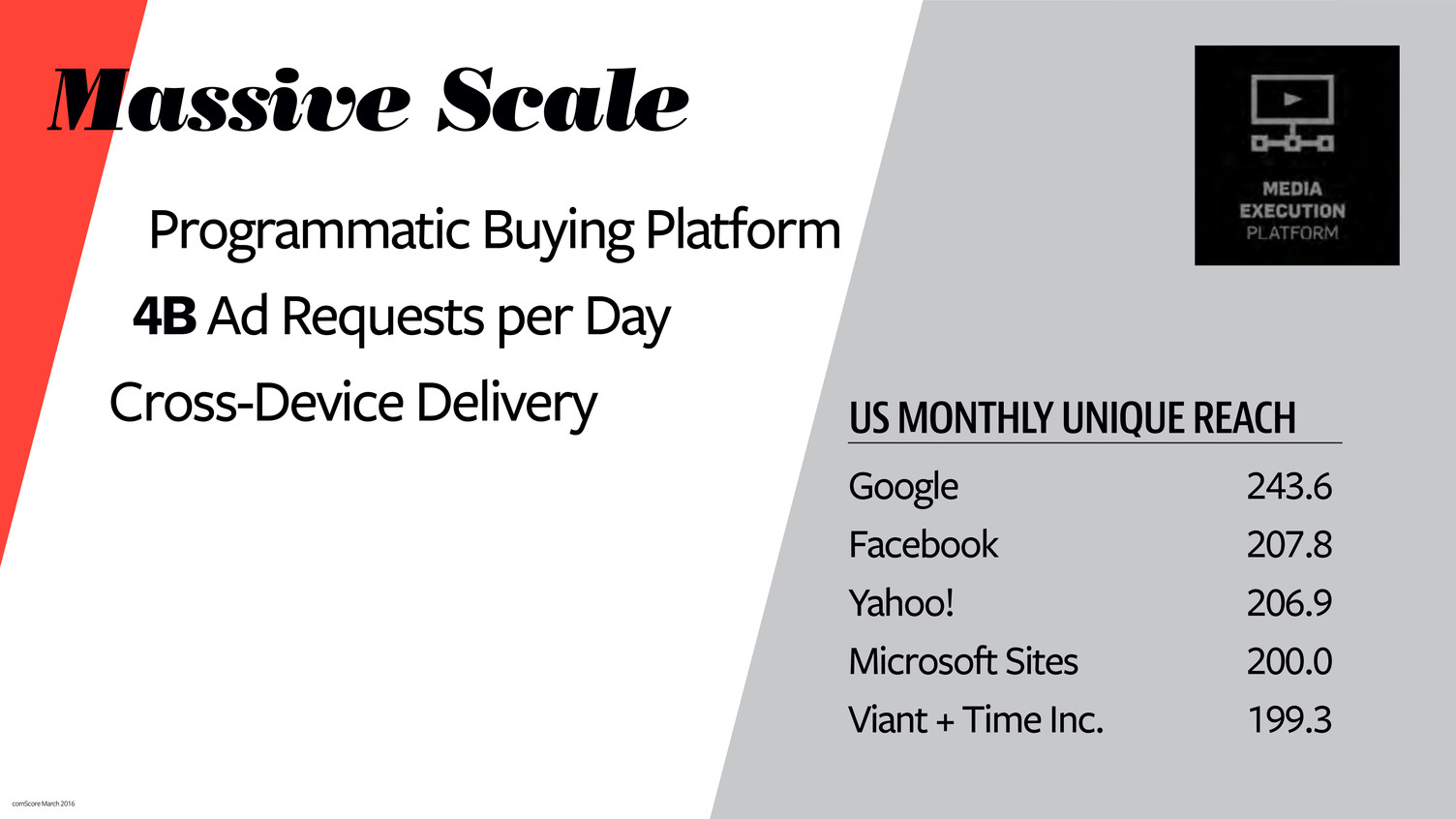

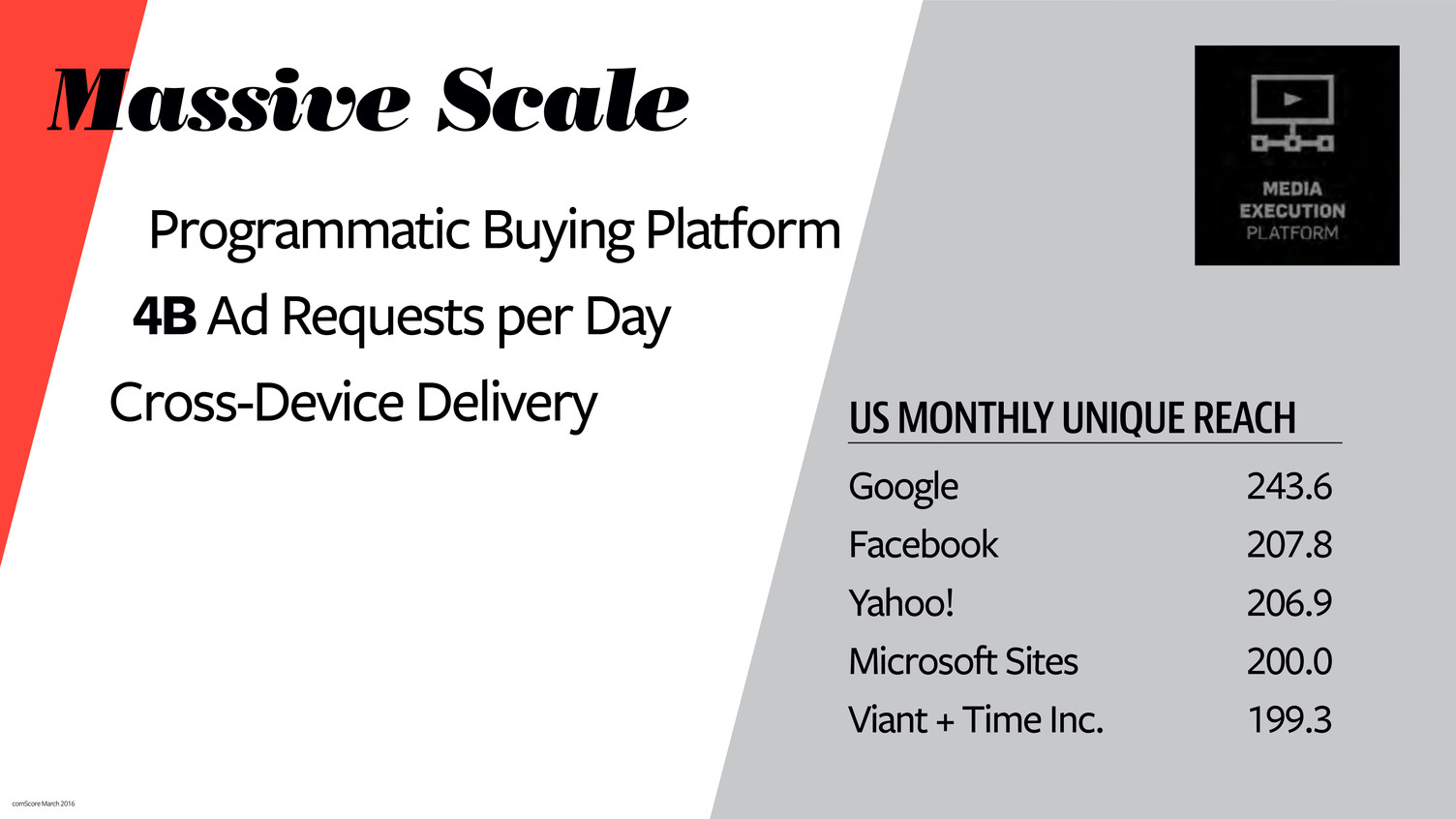

Massive Scale Programmatic Buying Platform 4B Ad Requests per Day Cross-Device Delivery Google 243.6 Facebook 207.8 Yahoo! 206.9 Microsoft Sites 200.0 Viant + Time Inc. 199.3 US MONTHLY UNIQUE REACH comScore March 2016

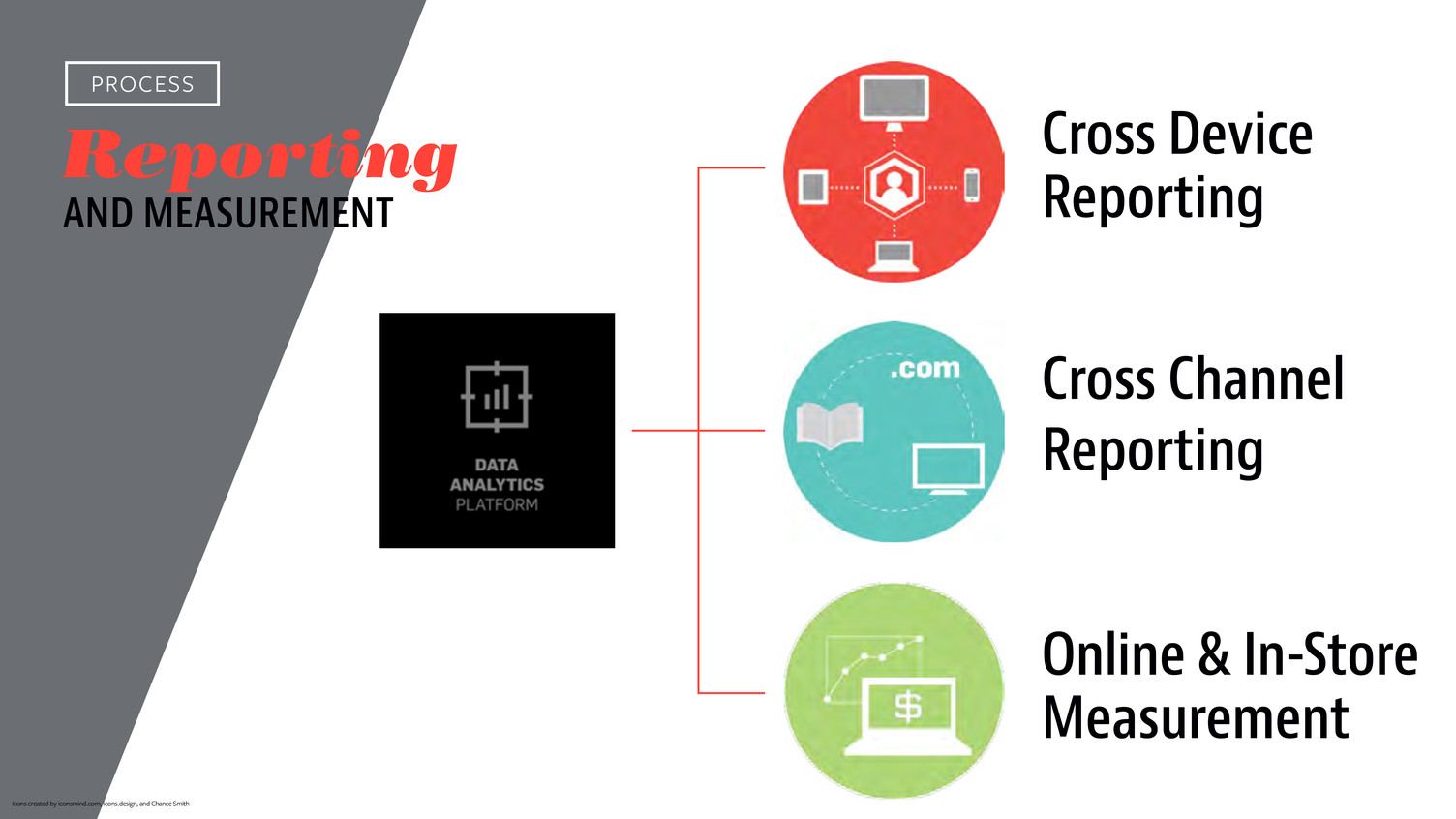

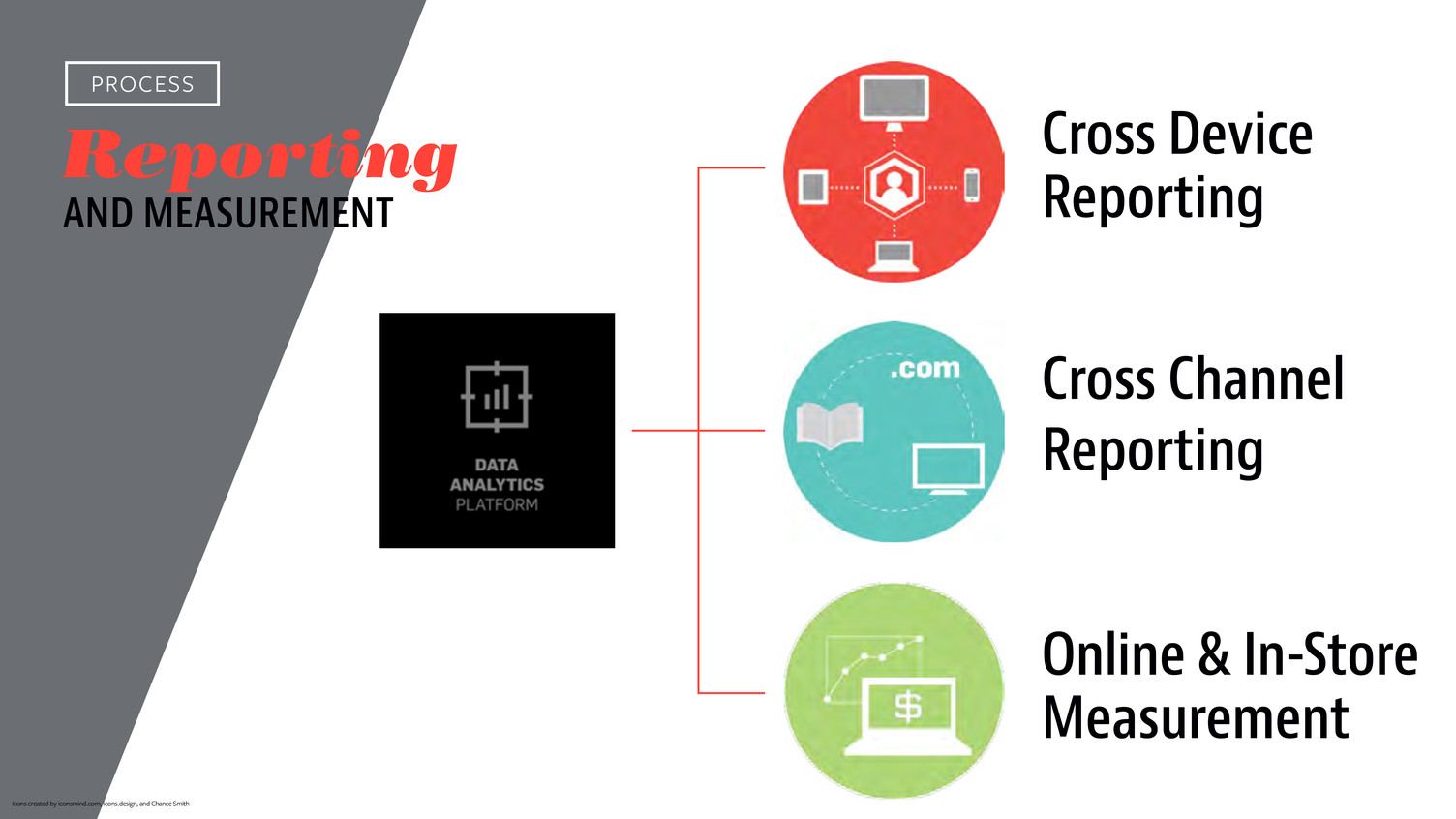

Cross Device Reporting Cross Channel Reporting Online & In-Store Measurement Reporting AND MEASUREMENT PROCESS Icons created by iconsmind.com, icons.design, and Chance Smith

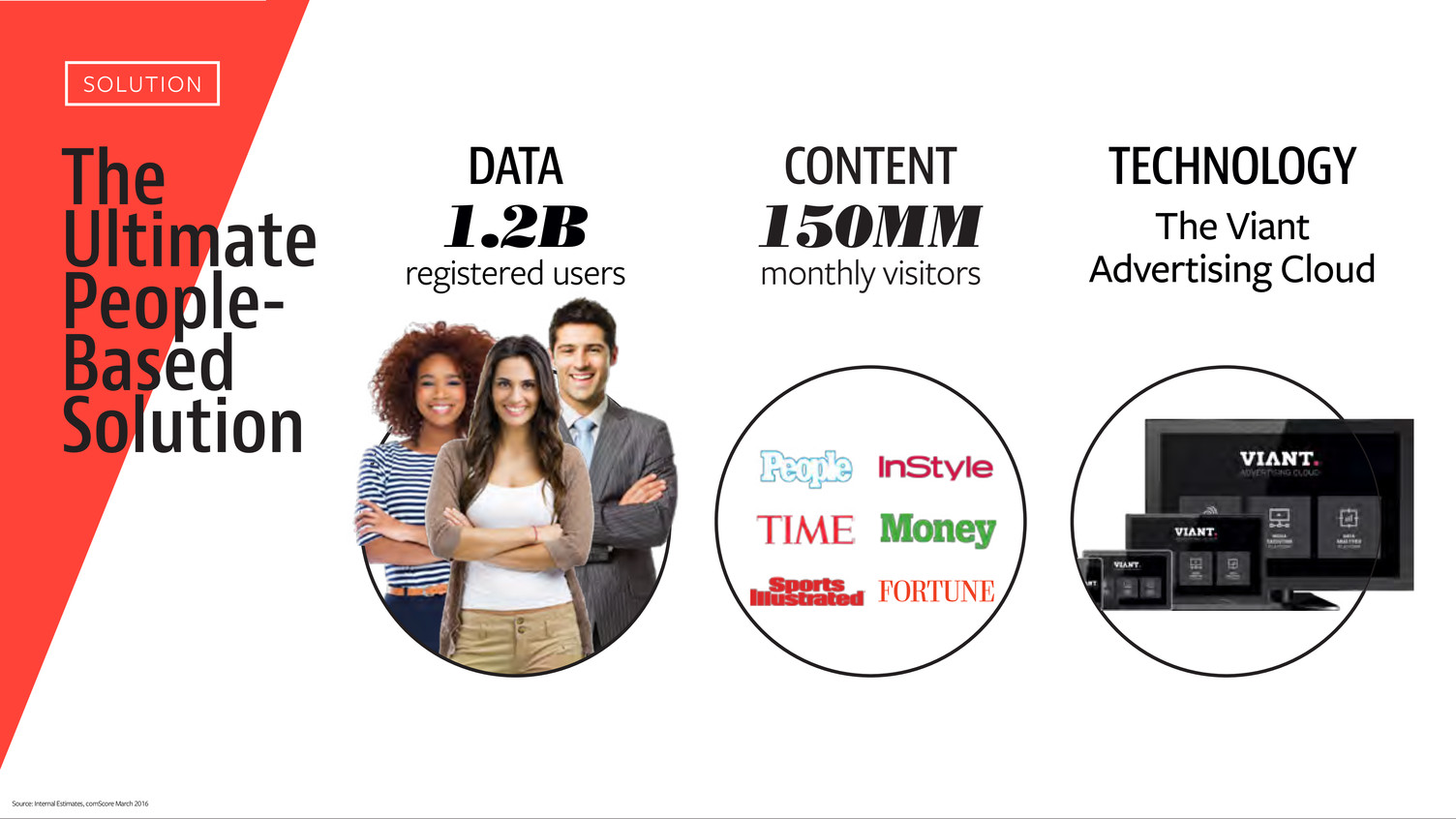

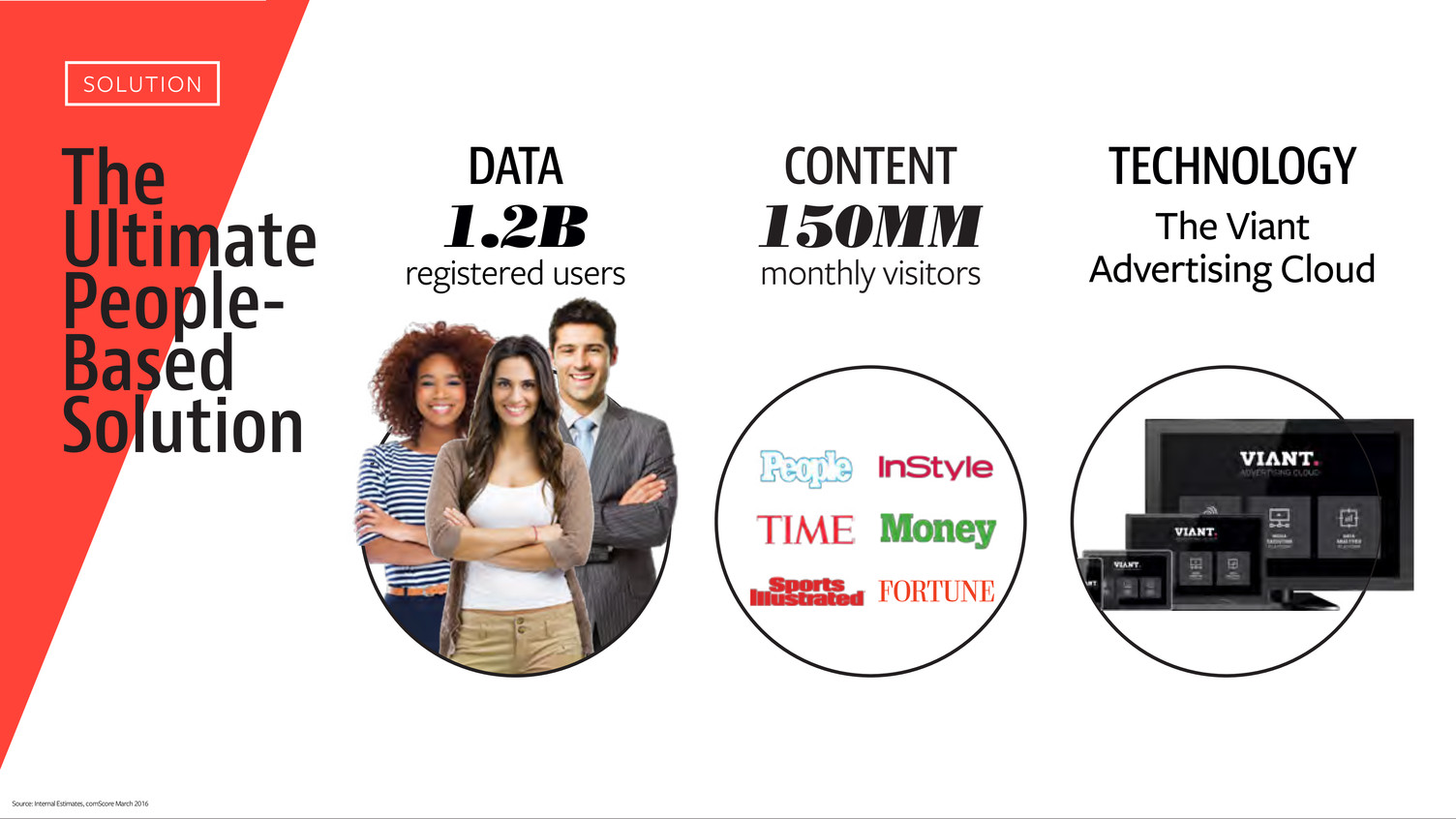

The Ultimate People- Based Solution DATA 1.2B registered users CONTENT 150MM monthly visitors TECHNOLOGY The Viant Advertising Cloud SOLUTION SUPERIOR TECHNOLOGY Programmatic Ad Platform Measures Online and In-Store Source: Internal Estimates, comScore March 2016

Sports Illustrated Play: New Experiences CEO, Sports Illustrated Play JEFF KARP

A LARGE AND ENGAGED YOUTH SPORTS AUDIENCE Youth Sports Market Passionate Audience of 150MM US Admins & Coaches 5.5MM Fans 41MM Parents 65MM Players 38MM Players - sources include http://www.statisticbrain.com/youth-sports-statistics/, http://www.ncbi.nlm.nih.gov/pmc/articles/PMC3871410/. Fans - estimated by SI Play: youth sports players (38MM) x 1.1 fans per player (internal estimate). Admins & Coaches - estimated by SI Play: Youth sports coaches (3.5MM) + youth sports coaches x 3/5 (ratio of coaches to admins/volunteers of largest youth sports organization in US); sources include http://www.prweb.com/releases/sports/coaching/prweb907124.htm, http://www.usyouthsoccer.org/media_kit/ataglance/ Parents - estimated by SI Play: Youth sports players (38MM) x 1.7 parents per player;1.7=(2*70%)+(1*30%); source: Source:http://www.pewresearch.org/fact-tank/2014/12/22/less-than-half-of-u-s-kids-today-live-in-a-traditional- family/. LANDSCAPE

A PASSION UNDERSERVED BY TECHNOLOGY Hail a cab Watch a movie Shop Join teams? LANDSCAPE

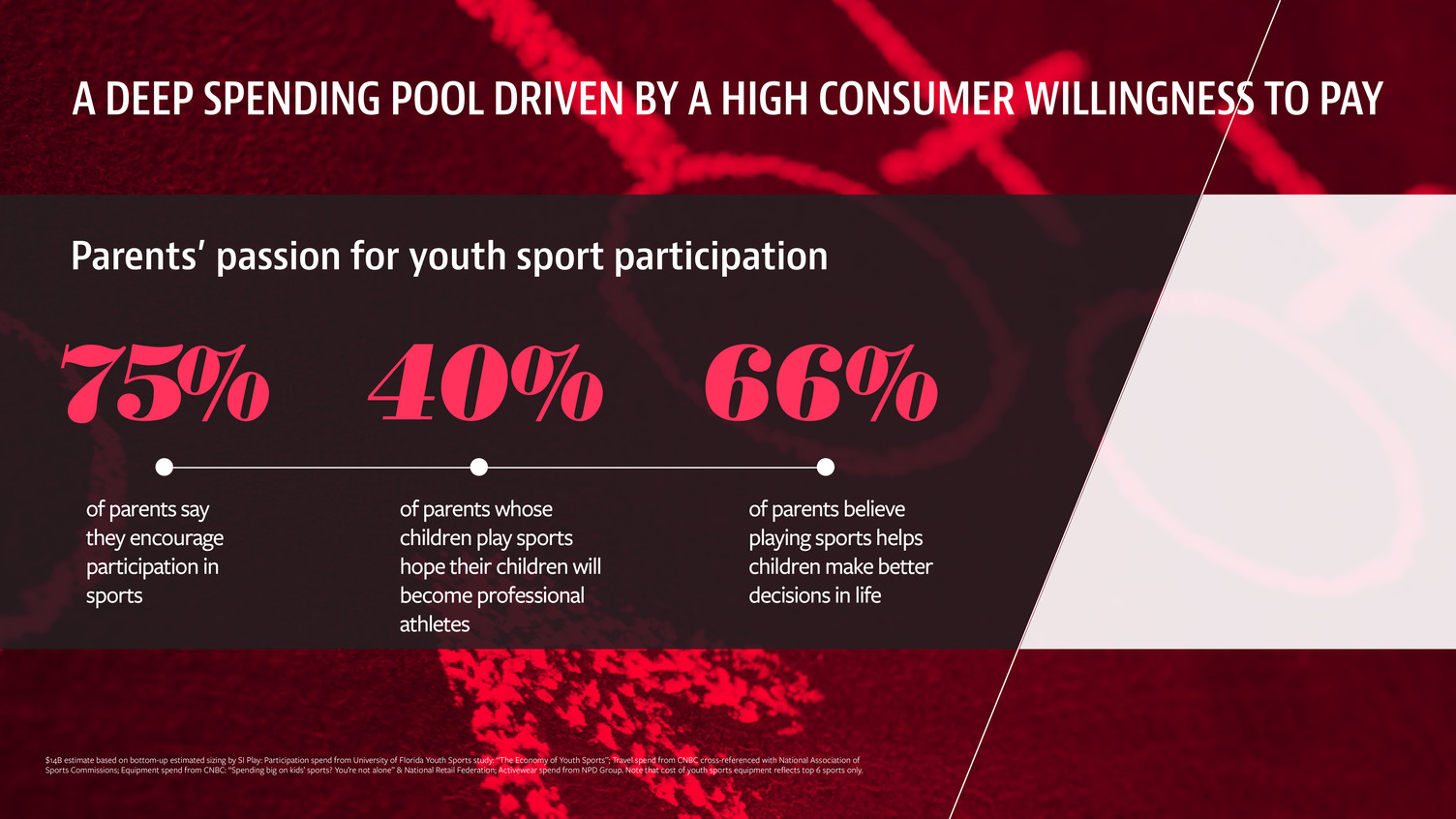

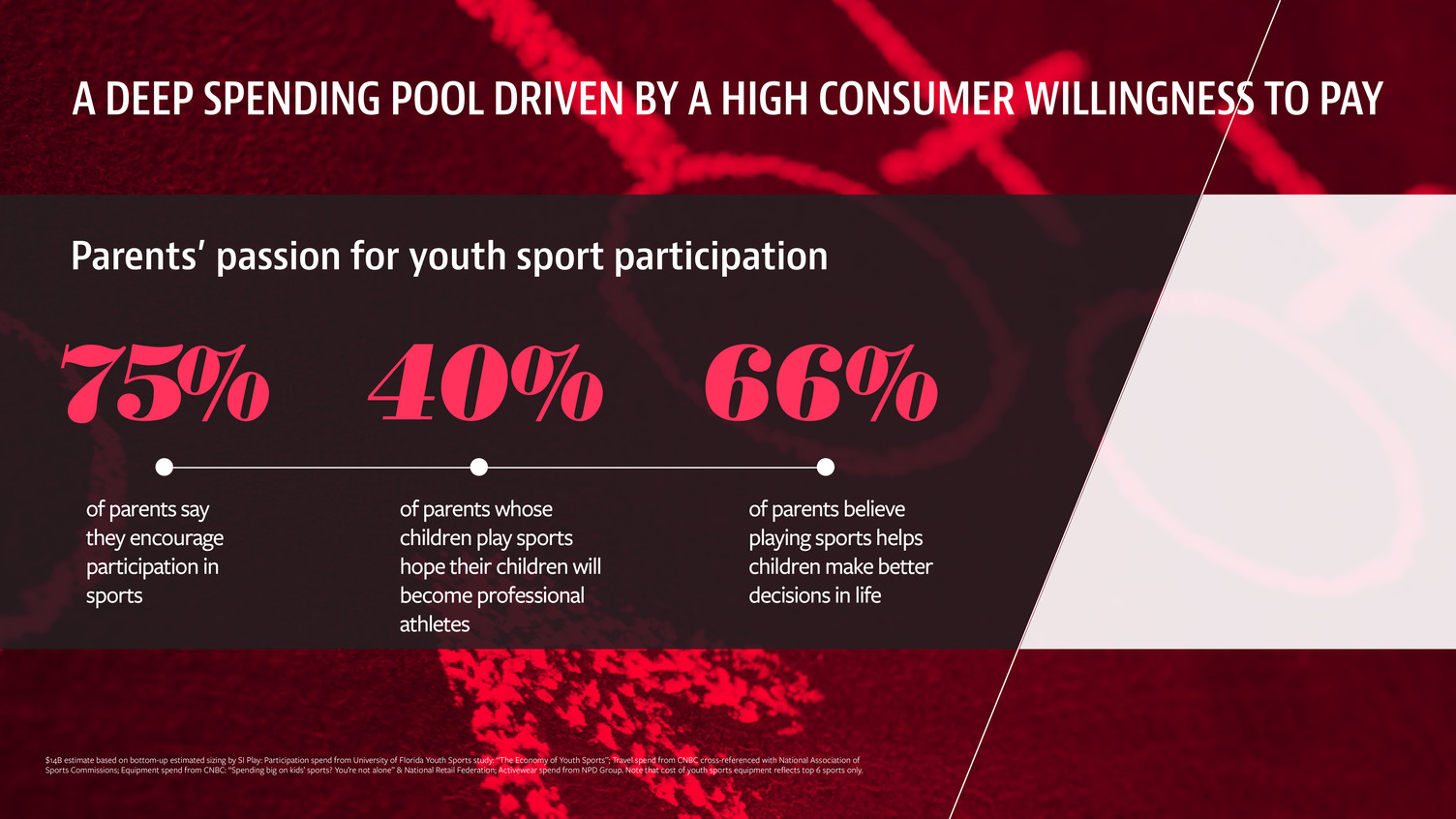

A DEEP SPENDING POOL DRIVEN BY A HIGH CONSUMER WILLINGNESS TO PAY Parents’ passion for youth sport participation 75% 40% 66% of parents say they encourage participation in sports of parents whose children play sports hope their children will become professional athletes of parents believe playing sports helps children make better decisions in life $14B estimate based on bottom-up estimated sizing by SI Play: Participation spend from University of Florida Youth Sports study: “The Economy of Youth Sports”; Travel spend from CNBC cross-referenced with National Association of Sports Commissions; Equipment spend from CNBC: “Spending big on kids’ sports? You’re not alone” & National Retail Federation; Activewear spend from NPD Group. Note that cost of youth sports equipment reflects top 6 sports only.

A DEEP SPENDING POOL DRIVEN BY A HIGH CONSUMER WILLINGNESS TO PAY $14B estimate based on bottom-up estimated sizing by SI Play: Participation spend from University of Florida Youth Sports study: “The Economy of Youth Sports”; Travel spend from CNBC cross-referenced with National Association of Sports Commissions; Equipment spend from CNBC: “Spending big on kids’ sports? You’re not alone” & National Retail Federation; Activewear spend from NPD Group. Note that cost of youth sports equipment reflects top 6 sports only. ...fuels a $14B U.S. youth sports market $3.5B $7.0B $1.5B $2.3B Annual U.S. spend on participation (registration and fees) Annual cost of U.S. youth sports related travel (including accommodations, food) Annual cost of U.S. youth sports-related equipment Activewear / footwear

One simple vision Youth Sports ConneCting the world of $14B estimate based on bottom-up estimated sizing by SI Play: Participation spend from University of Florida Youth Sports study: “The Economy of Youth Sports”; Travel spend from CNBC cross-referenced with National Association of Sports Commissions; Equipment spend from CNBC: “Spending big on kids’ sports? You’re not alone” & National Retail Federation; Activewear spend from NPD Group. Note that cost of youth sports equipment reflects top 6 sports only.

Monthly ACtive Users 10,000,000 Internal Estimates

si PlAy PArtnerssi PlAy CoMPAnies

Powered by players

ADMINISTRATORS Make their own lives more efficient and their organizations more successful.

CoAChes & volUnteers Manage their teams to ensure a positive parent and player experience.

PArents Keep up with it all and enable their kids to succeed.

fAMily & friends Share in the passion of the ones they care about.

SIMPLIFYING AND CELEBRATING MY SPORTS LIFE

SIMPLIFYING AND CELEBRATING MY SPORTS LIFE Fuel My League 24/7 Online Registration Website/CMS Scheduling Communication Payments Background Checks Data & Analytics Fundraising ADMINISTRATORS

SIMPLIFYING AND CELEBRATING MY SPORTS LIFE Grow My Team 24/7 Online Registration Create Team Rosters Full League Scheduling Manage/Check Volunteers Tournaments/Tourney Machine Communication Collect Payments Fundraising COACHES & VOLUNTEERS

SIMPLIFYING AND CELEBRATING MY SPORTS LIFE Scheduling Chat & Text Rosters & Notifications Tournaments & Brackets Gear Store/ SquadLocker Scoring & Statistics Live Gamecasts/ iScore PARENTS Simplify My World

SIMPLIFYING AND CELEBRATING MY SPORTS LIFE Celebrate My Sports Life COMING SOON... PLAYERS / FAMILY & FRIENDS

SPORTS ILLUSTRATED PLAY HAS THE RIGHT TO WIN BUILT-IN REACH 150MM+ Monthly visitors to Time Inc. digital network properties YOUTH SPORTS EXPERTISE 4 Leaders In the sports management industry TRUSTED BRANDS 6 Brands In the iconic SI portfolio SEASONED LEADERSHIP 200+ Years Leadership experience at some of the world’s top mobile, gaming or online companies 150+MM is the six month average of our global multiplatform comScore #s (September 2015-February 2016)

Time Inc.Live Media SCOTT CULLATHER KRISTINA MCCOOBERY Global Managing Partner, INVNT Managing Partner, INVNT

Live ON THE RISE

78% Experience over material source: eventbrite-s3.s3.amazonaws.com/marketing/Millennials_Research/Gen_PR_Final.pdf

80% Participated in the past twelve months source: eventbrite-s3.s3.amazonaws.com/marketing/Millennials_Research/Gen_PR_Final.pdf

70% Experience fomo source: eventbrite-s3.s3.amazonaws.com/marketing/Millennials_Research/Gen_PR_Final.pdf

70%+ SINCE 1987 source: eventbrite-s3.s3.amazonaws.com/marketing/Millennials_Research/Gen_PR_Final.pdf Increased consumer spending on live experiences and events

Enormous MARKET OPPORTUNITY

Enormous 2MM events MARKET OPPORTUNITY source: conventionindustry.org/researchinfo/EconomicSignificanceStudy/ESSKeyFindings.aspx

Enormous 1.78MM jobs MARKET OPPORTUNITY source: conventionindustry.org/researchinfo/EconomicSignificanceStudy/ESSKeyFindings.aspx

Enormous $280B spent MARKET OPPORTUNITY source: conventionindustry.org/researchinfo/EconomicSignificanceStudy/ESSKeyFindings.aspx

Why LIVE MEDIA?

500,000 attendees Internal Reporting

100 hours of programming Internal Reporting

24 hours of daily streaming video Internal Reporting

1.5B social impressions Internal Reporting

Digital,social and mobile content for TIME properties

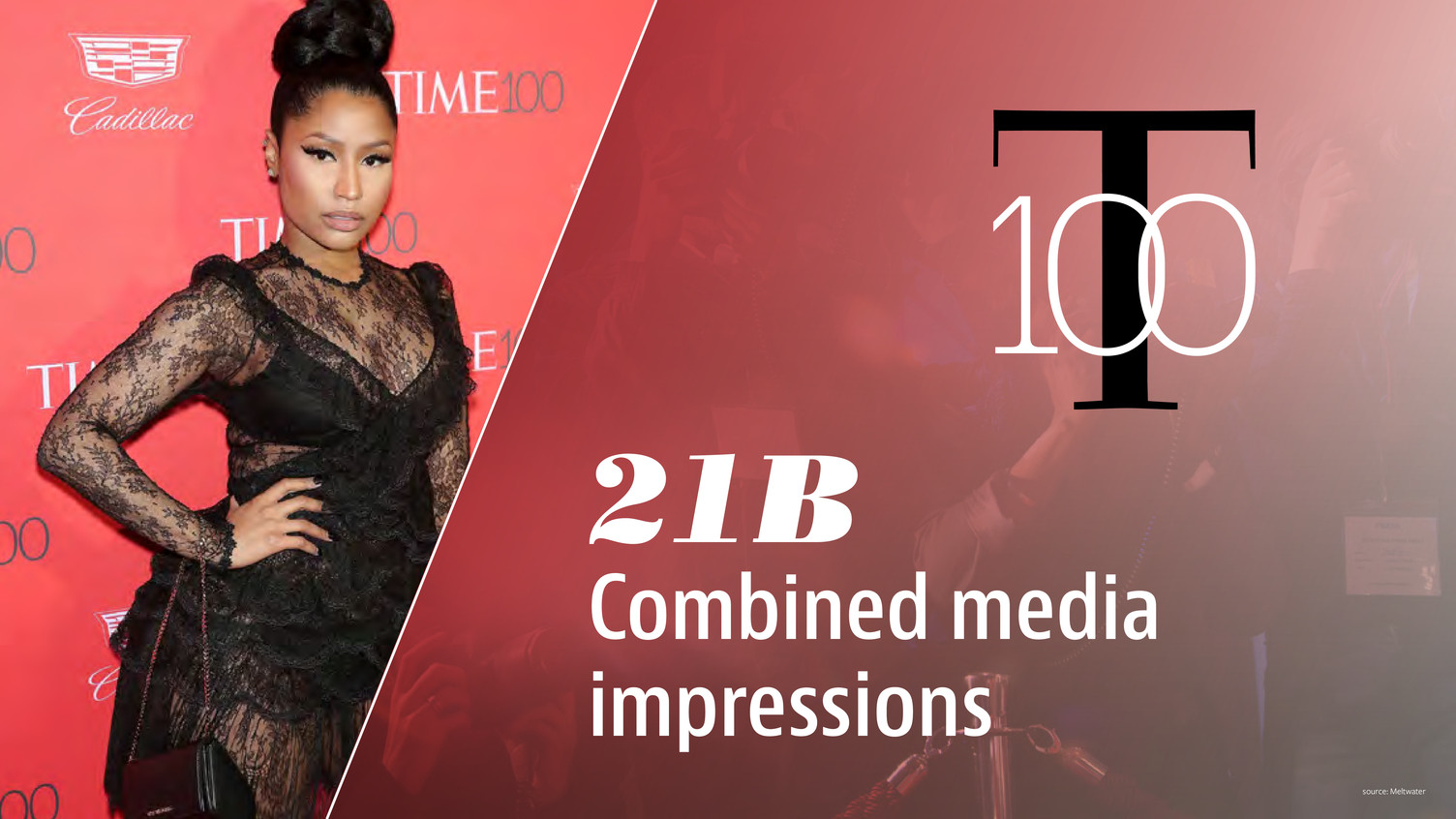

21B Combined media impressions source: Meltwater

Live MATTERS

Our Opportunity LIVE MEDIA:

Live Media opportunity for Brand Partners

New PROPERTIES

TALKS

Revenue TICKETS MERCHANDISE MOBILE PRINT F&B DIGITAL SPONSORSHIP SOCIAL

Live Media WHERE WE’RE HEADING

Financial Review JEFF BAIRSTOW EVP & CFO, Time Inc.

KEY FINANCIAL TAKEAWAYS Projecting revenue growth in 2016 Positive results from growth initiatives & acquisitions Aggressively pursuing cost and efficiency initiatives Focusing asset portfolio; raised over $800MM through asset sales Balanced approach to capital allocation Expect ~$300MM of free cash flow in 2017

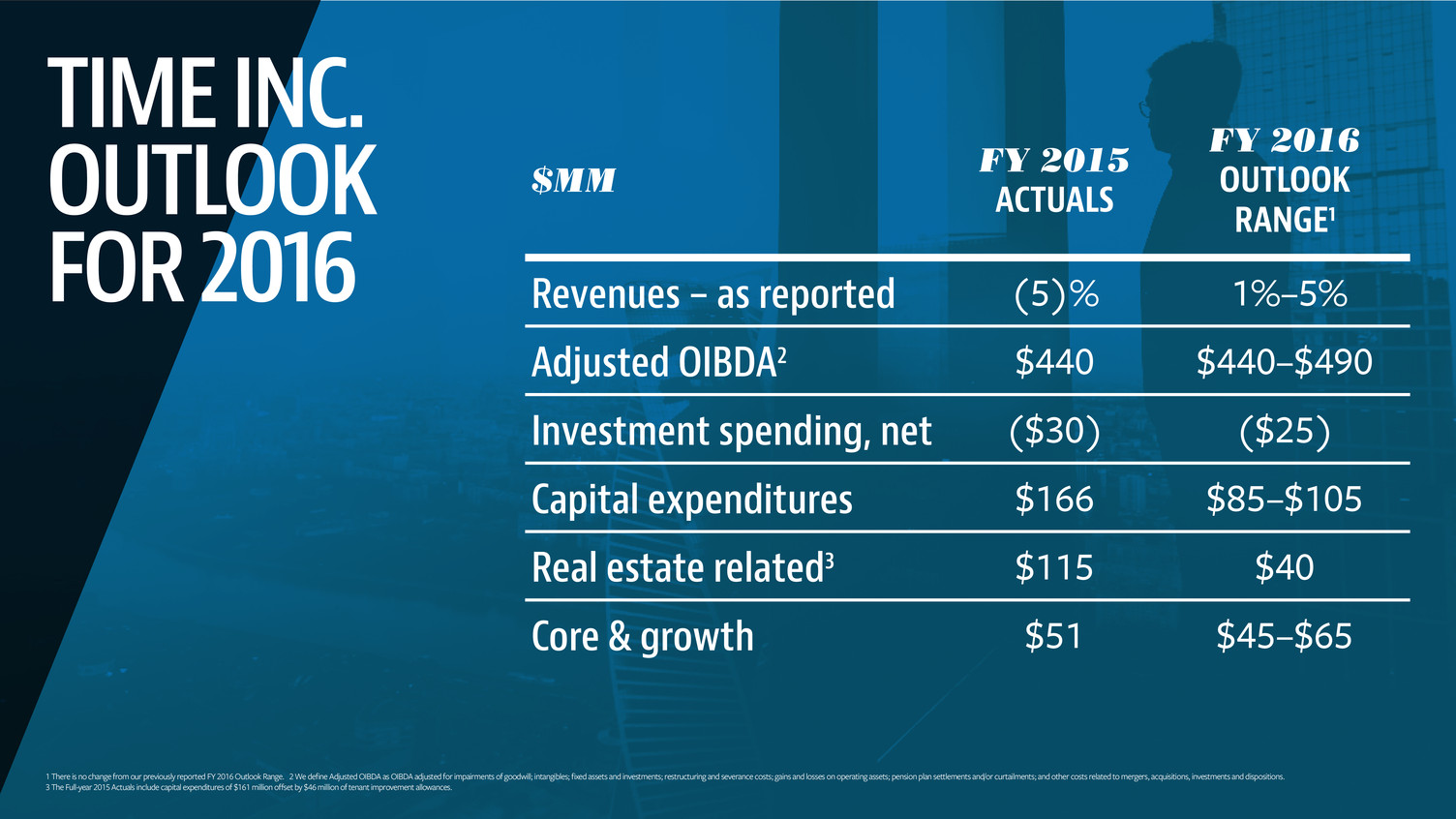

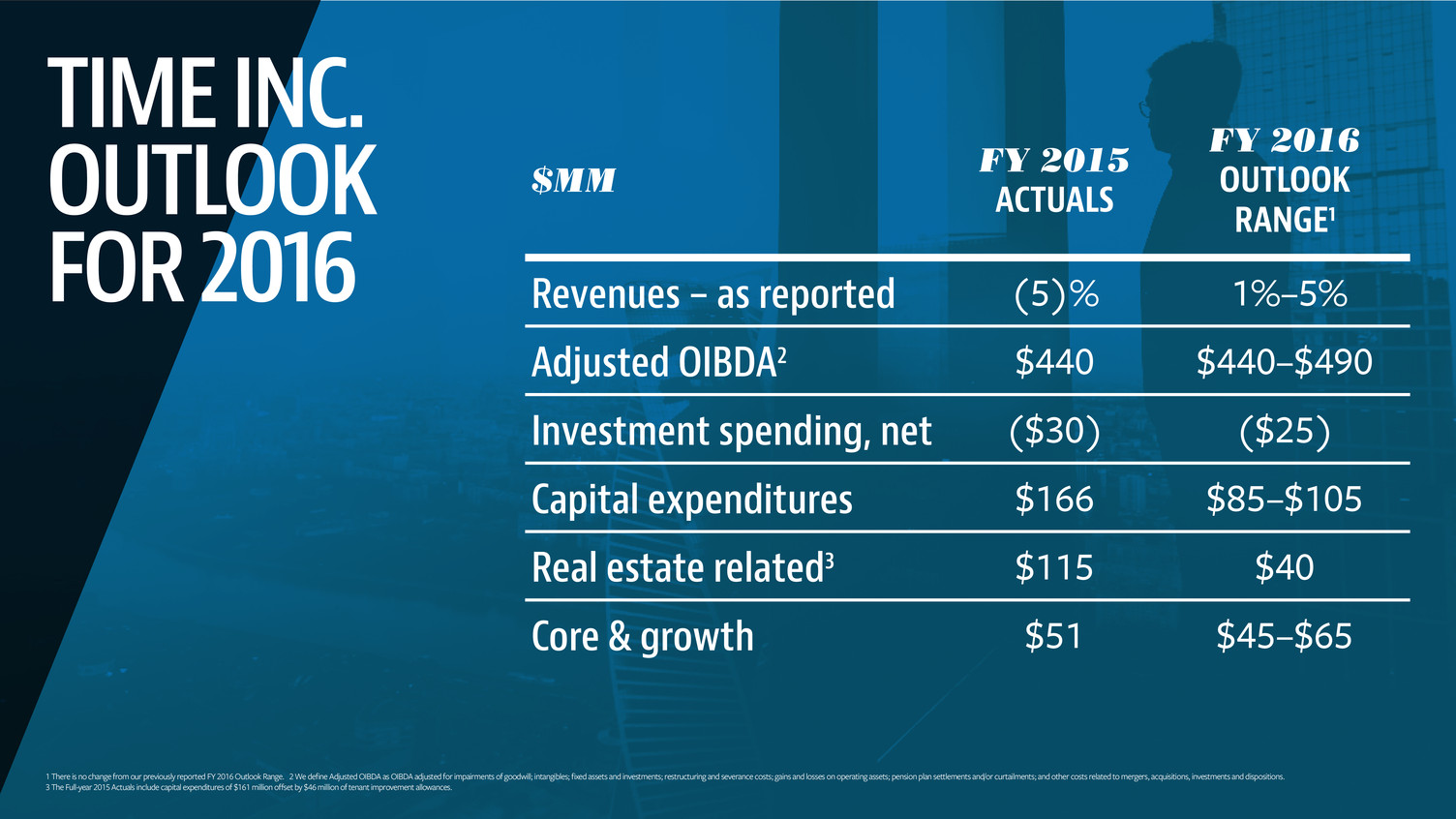

TIME INC. OUTLOOK FOR 2016 1 There is no change from our previously reported FY 2016 Outlook Range. 2 We define Adjusted OIBDA as OIBDA adjusted for impairments of goodwill; intangibles; fixed assets and investments; restructuring and severance costs; gains and losses on operating assets; pension plan settlements and/or curtailments; and other costs related to mergers, acquisitions, investments and dispositions. 3 The Full-year 2015 Actuals include capital expenditures of $161 million offset by $46 million of tenant improvement allowances. $MM FY 2015 ACTUALS FY 2016 OUTLOOK RANGE1 Revenues – as reported (5)% 1%–5% Adjusted OIBDA2 $440 $440–$490 Investment spending, net ($30) ($25) Capital expenditures $166 $85–$105 Real estate related3 $115 $40 Core & growth $51 $45–$65

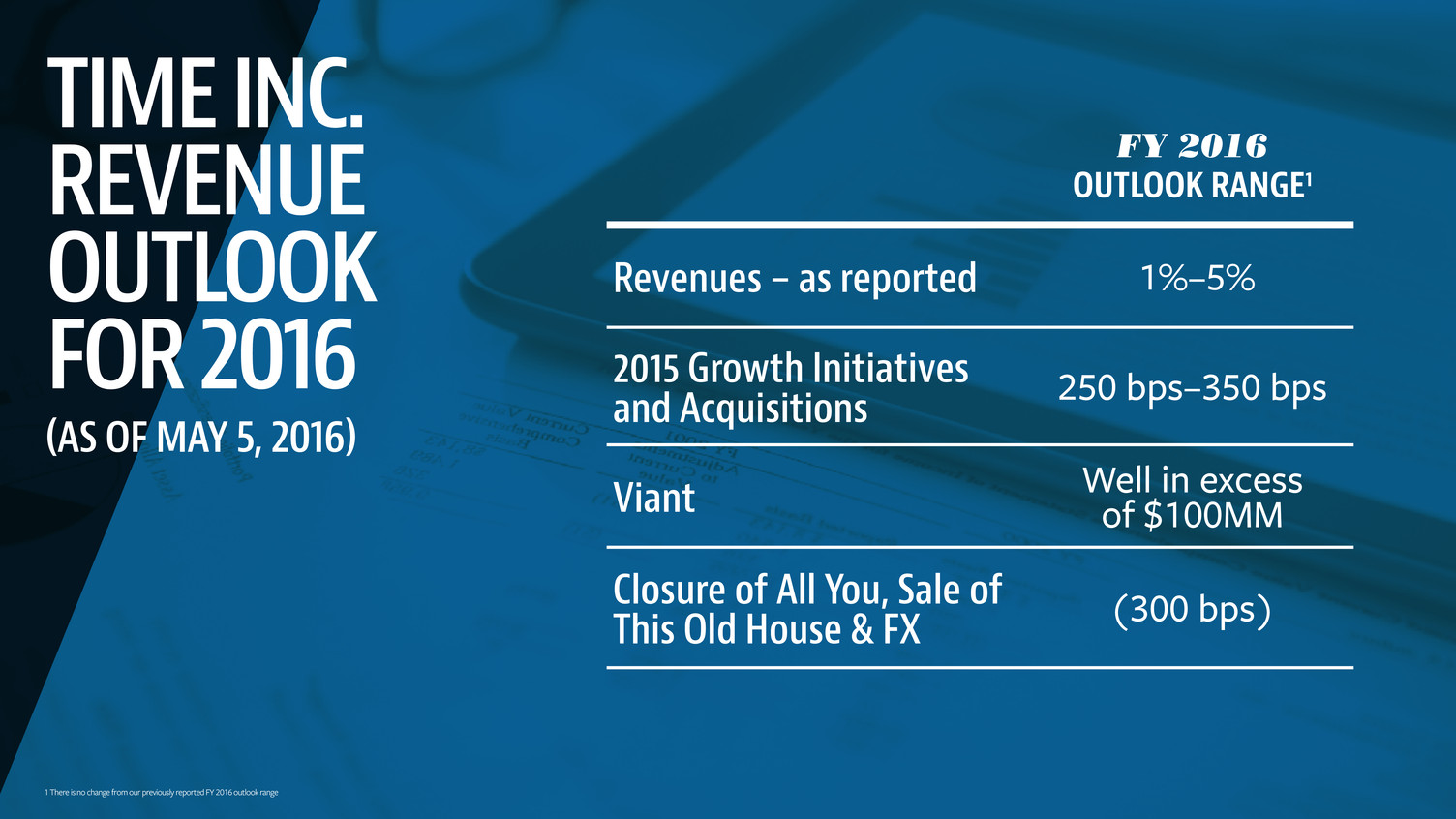

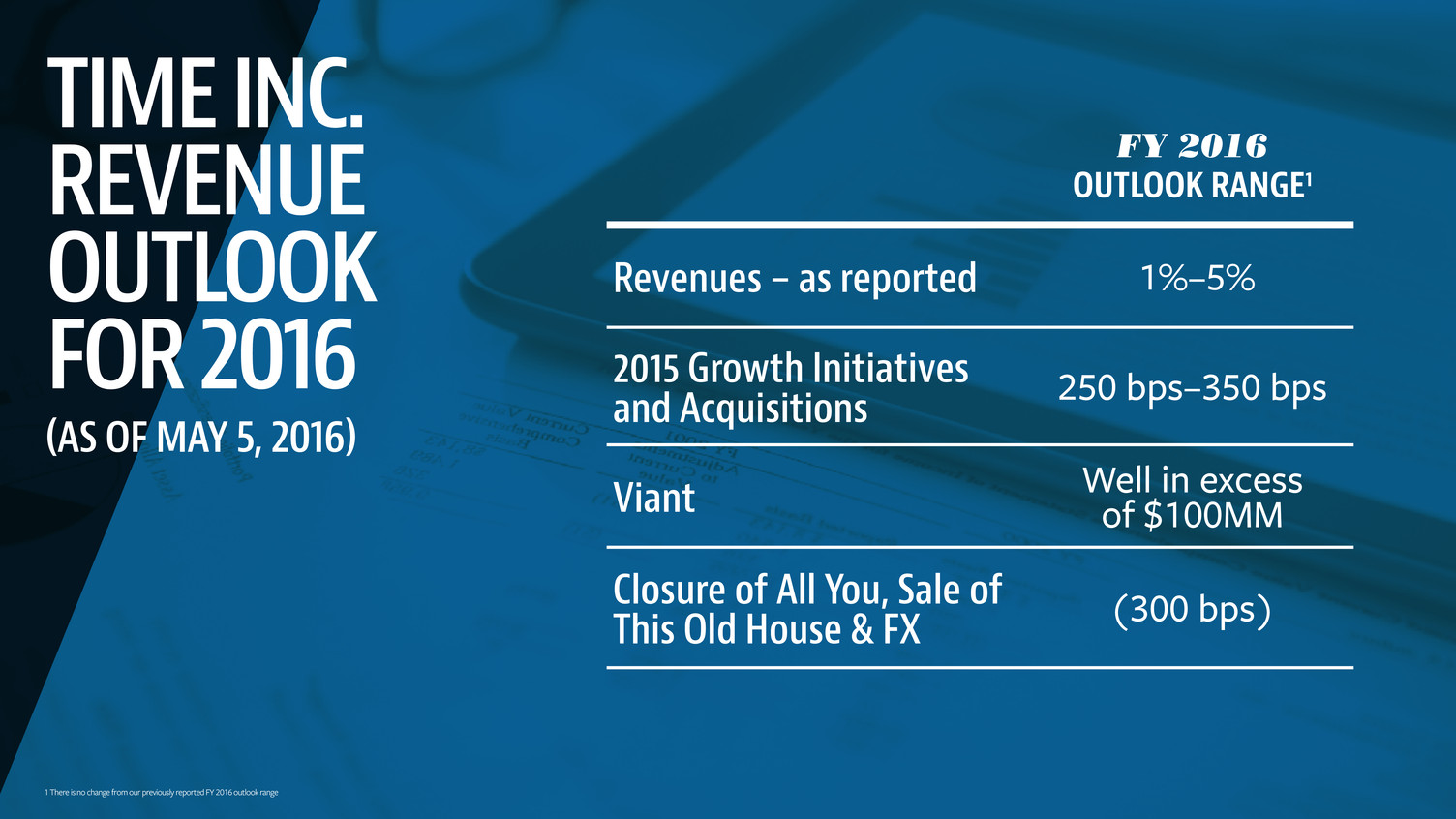

TIME INC. REVENUE OUTLOOK FOR 2016 (AS OF MAY 5, 2016) FY 2016 OUTLOOK RANGE1 Revenues – as reported 1%–5% 2015 Growth Initiatives and Acquisitions 250 bps–350 bps Viant Well in excess of $100MM Closure of All You, Sale of This Old House & FX (300 bps) 1 There is no change from our previously reported FY 2016 outlook range

TIME INC. REVENUE MIX % OF REPORTED REVENUE Print & Other Ad/Circulation Digital Ad & Other Revenue Total Revenue Performance 2014 78% 22% 2015 76% 24% 2016E ~2/3 ~1/3

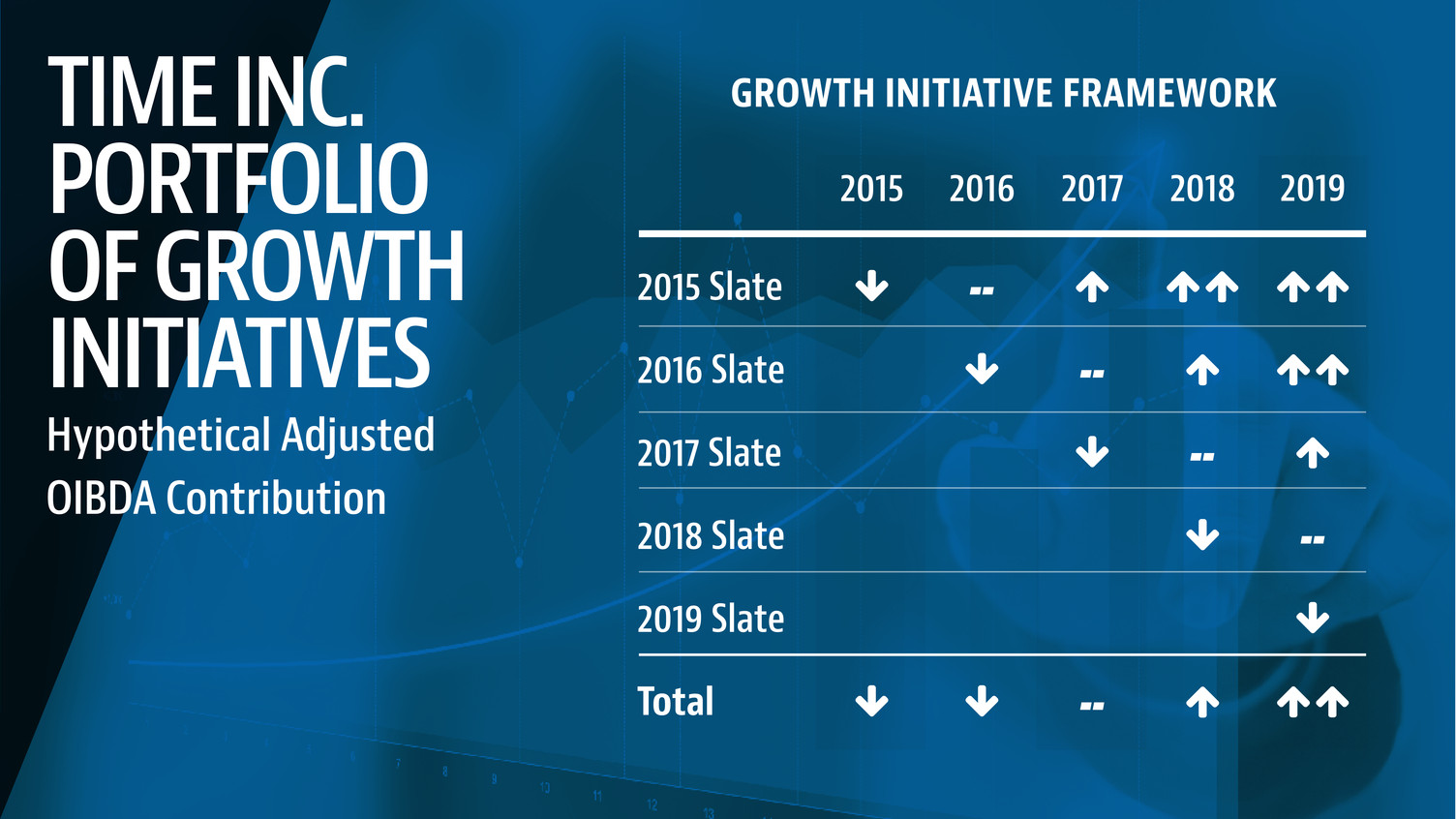

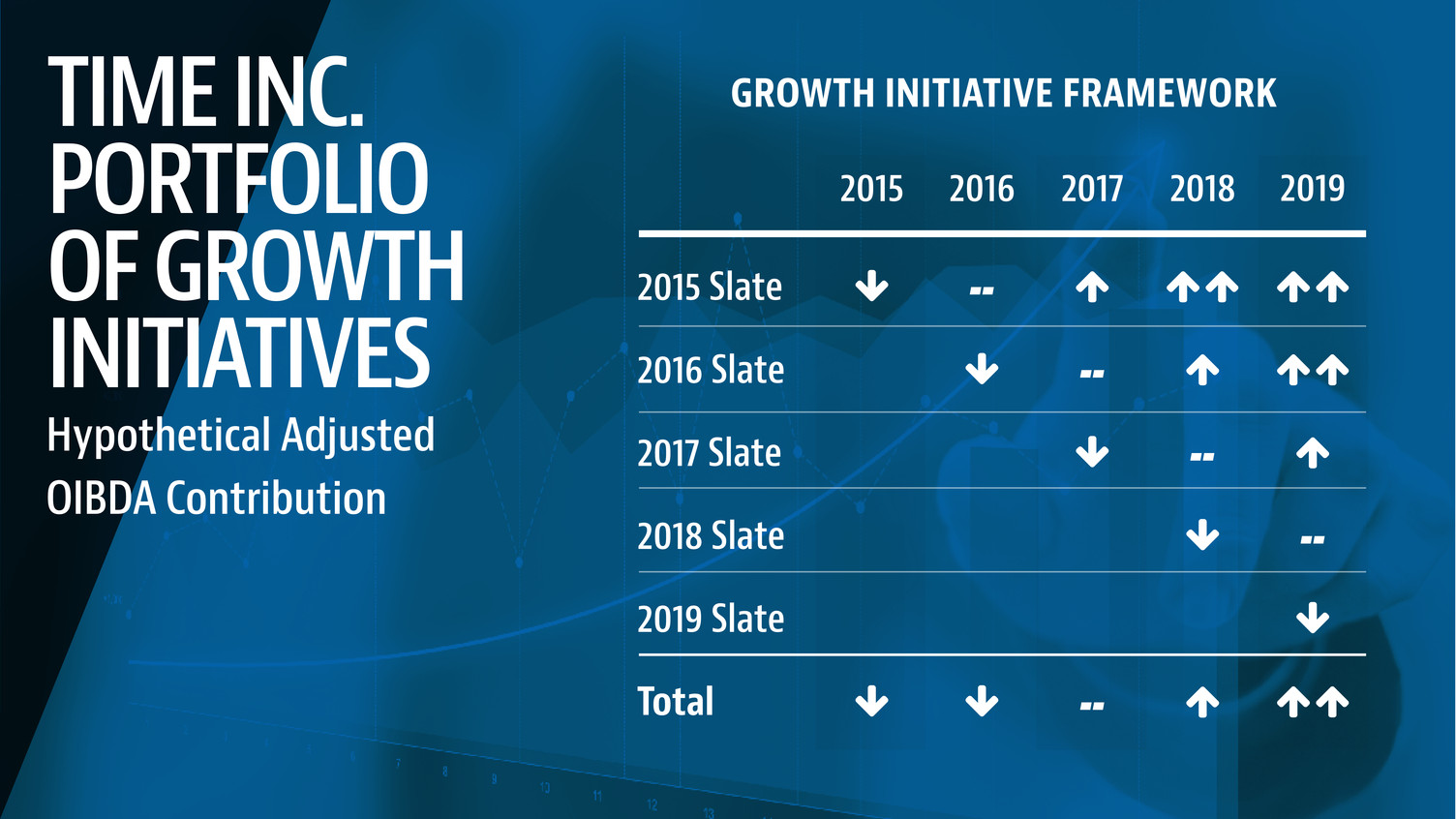

TIME INC. PORTFOLIO OF GROWTH INITIATIVES Hypothetical Adjusted OIBDA Contribution 2015 Slate 2016 Slate 2017 Slate 2018 Slate 2019 Slate Total 2015 2016 -- 2017 -- -- 2018 -- 2019 -- GROWTH INITIATIVE FRAMEWORK

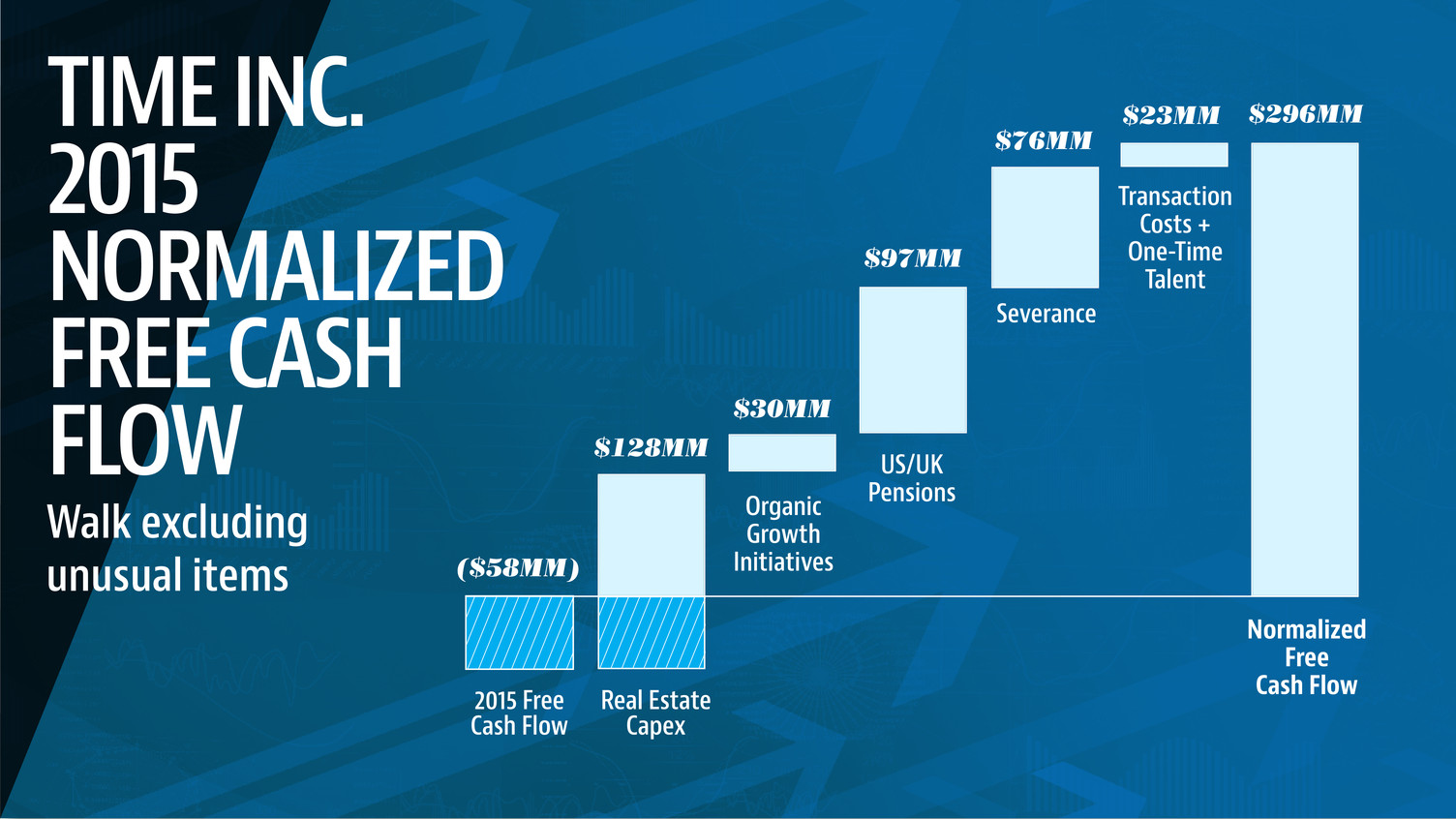

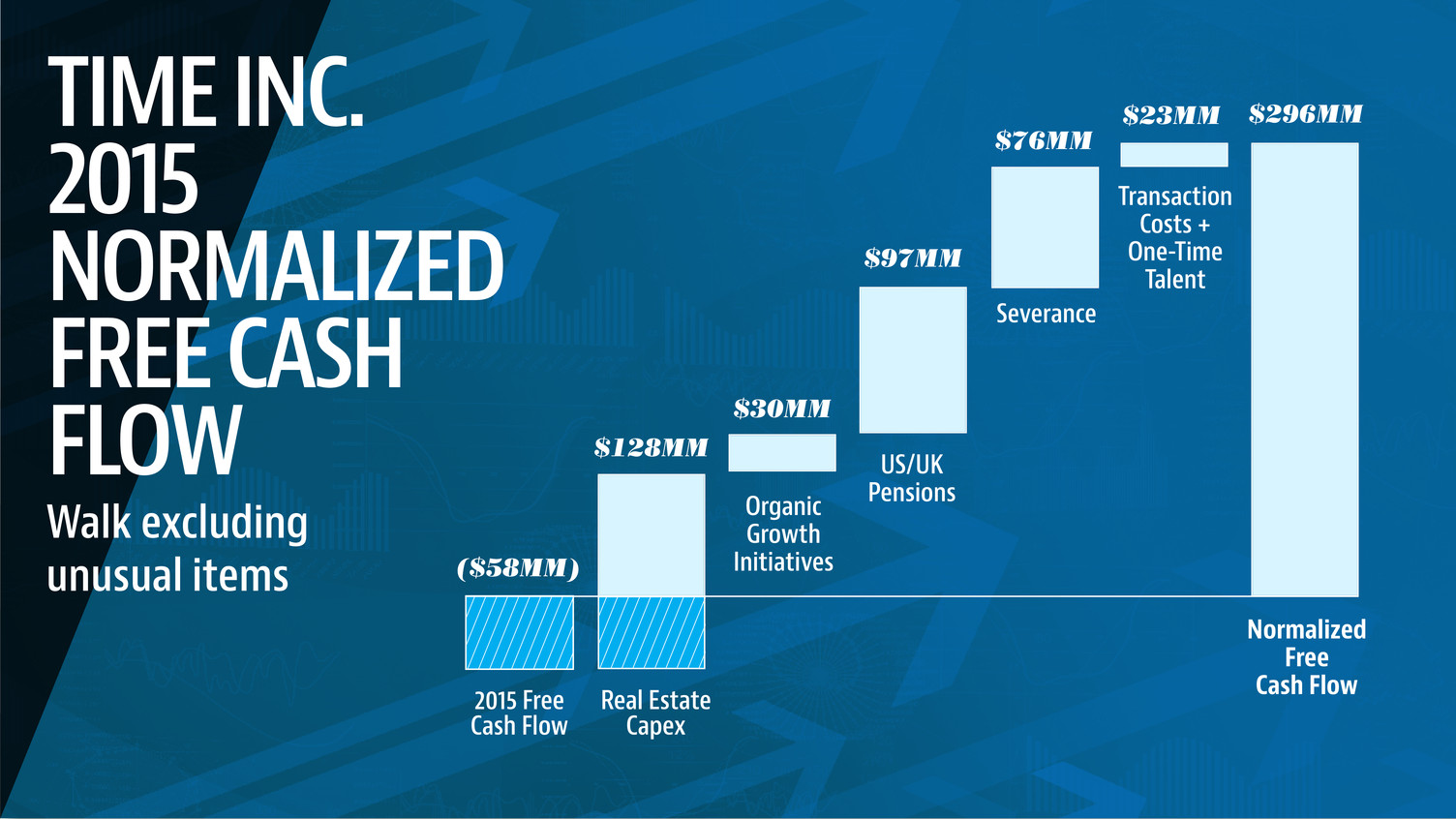

TIME INC. 2015 NORMALIZED FREE CASH FLOW Walk excluding unusual items $128MM ($58MM) $30MM $97MM $76MM $23MM $296MM Real Estate Capex 2015 Free Cash Flow Organic Growth Initiatives US/UK Pensions Severance Transaction Costs + One-Time Talent Normalized Free Cash Flow

FINANCIAL SUMMARY We continue to see opportunity to reposition the company for growth including: Reengineering & optimizing our advertising sales process Moving us toward being a more data-centric organization Building out social, mobile, video and native advertising capabilities Expanding New Experiences, including live events and SI Play Time Inc. has a great opportunity to leverage our brands, audiences and premium content for new revenue streams and profitable growth.