Investor Presentation December 2021 Exhibit 99.1

Forward looking statements and non-GAAP financial measures Forward-Looking Statements Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “will,” “could,” “expect,” “believes,” “estimates,” “predicts,” “potential,” “plans,” or “continue,” the negative of these terms and other comparable terminology that conveys uncertainty of future events or outcomes. These forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause actual results to differ materially from statements made in this presentation, including in relation to our ability to attract and retain advisors, shifting investor preferences, our financial performance, investments in new products, services and capabilities, our ability to execute strategic transactions and successfully integrate Voyant, general market, political, economic and business conditions, demand from our customers and end investors and our operating results. Other potential risks and uncertainties that could cause actual results to differ from the results predicted include, among others, those risks and uncertainties included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2020. Additional information is set forth in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2021. All information provided in this presentation is based on information available to us as of the date of this presentation and any forward-looking statements contained herein are based on assumptions that we believe are reasonable as of this date. Undue reliance should not be placed on the forward-looking statements in this presentation, which are inherently uncertain. We undertake no duty to update this information unless required by law. Use of Non-GAAP Financial Information To supplement our financial information, which is prepared and presented in accordance with generally accepted accounting principles in the United States of America, or GAAP, we use non-GAAP financial measures: adjusted EBITDA, adjusted EBITDA margin and adjusted net income. The presentation of these non-GAAP financial metrics is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. We believe that the presentation of non-GAAP financial information provides important supplemental information to management and investors regarding financial and business trends relating to our financial condition and results of operations. For further information regarding these non-GAAP measures, including the limitations thereof and reconciliations of each non-GAAP financial measure to its most directly comparable GAAP financial measure, please refer to our earnings release and Form 10-Q.

Contents Opportunity Highlights Market Overview Company Overview Financial Overview Appendix

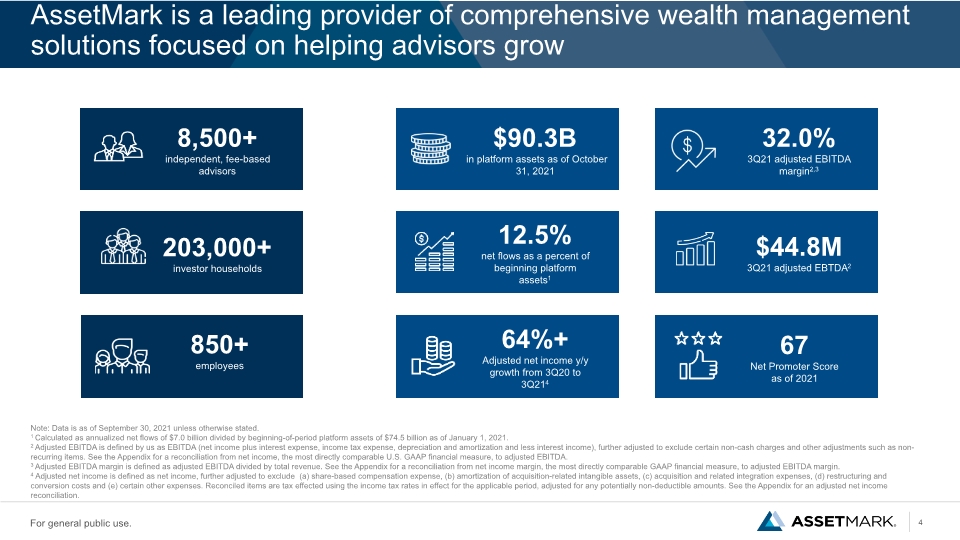

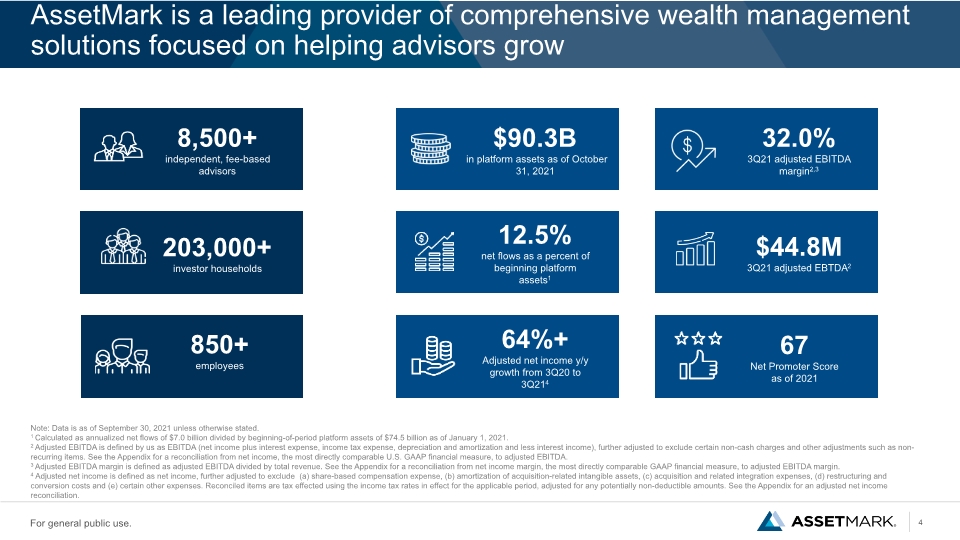

AssetMark is a leading provider of comprehensive wealth management solutions focused on helping advisors grow Note: Data is as of September 30, 2021 unless otherwise stated. 1 Calculated as annualized net flows of $7.0 billion divided by beginning-of-period platform assets of $74.5 billion as of January 1, 2021. 2 Adjusted EBITDA is defined by us as EBITDA (net income plus interest expense, income tax expense, depreciation and amortization and less interest income), further adjusted to exclude certain non-cash charges and other adjustments such as non-recurring items. See the Appendix for a reconciliation from net income, the most directly comparable U.S. GAAP financial measure, to adjusted EBITDA. 3 Adjusted EBITDA margin is defined as adjusted EBITDA divided by total revenue. See the Appendix for a reconciliation from net income margin, the most directly comparable GAAP financial measure, to adjusted EBITDA margin. 4 Adjusted net income is defined as net income, further adjusted to exclude (a) share-based compensation expense, (b) amortization of acquisition-related intangible assets, (c) acquisition and related integration expenses, (d) restructuring and conversion costs and (e) certain other expenses. Reconciled items are tax effected using the income tax rates in effect for the applicable period, adjusted for any potentially non-deductible amounts. See the Appendix for an adjusted net income reconciliation. 12.5% net flows as a percent of beginning platform assets1 67 Net Promoter Score as of 2021 64%+ Adjusted net income y/y growth from 3Q20 to 3Q214

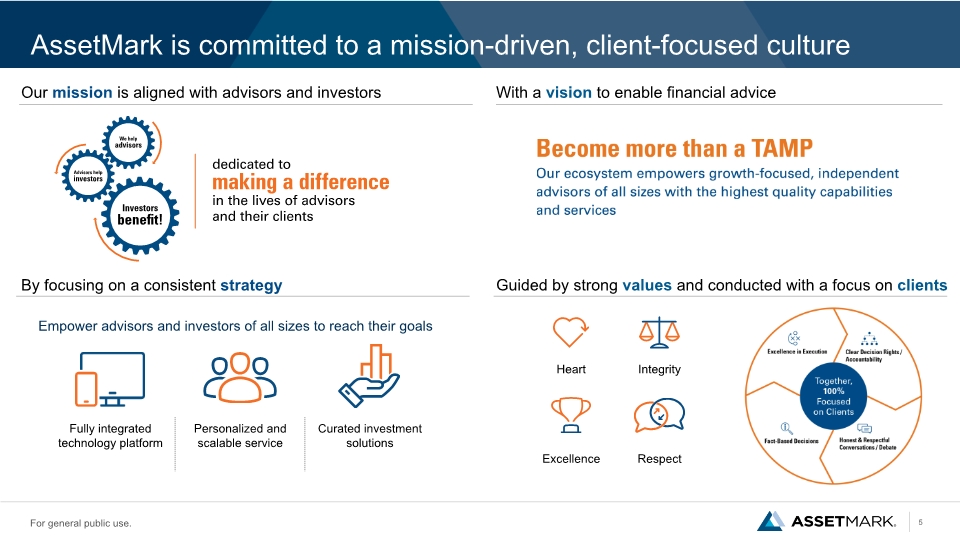

AssetMark is committed to a mission-driven, client-focused culture Our mission is aligned with advisors and investors With a vision to enable financial advice By focusing on a consistent strategy Guided by strong values and conducted with a focus on clients Empower advisors and investors of all sizes to reach their goals Respect Heart Excellence Integrity

Contents Opportunity Highlights Market Overview Company Overview Financial Overview Appendix

The depth of our platform and our focus on advisor growth and scale across multiple affiliations differentiates us from other providers Broker Dealers Asset Managers Custodians FinTech Firms Ecosystem that empowers growth-focused, independent fee-based advisors with the highest quality capabilities and services Fully integrated technology platform with solutions that enable dynamic conversations between advisors and their clients and enhance advisor effectiveness Personalized support to create a trusted relationship that empowers advisor growth and investor success Curated investments solutions and insights that help investors of all sizes achieve their unique goals Compliance and supervisory services Safekeeping of assets, recordkeeping and securities transactions Asset management Specialty service or technology solution

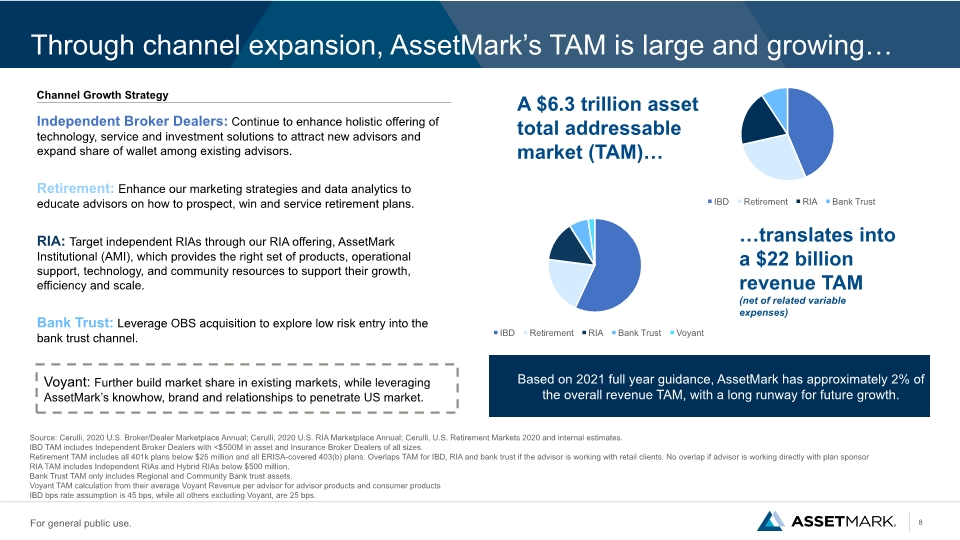

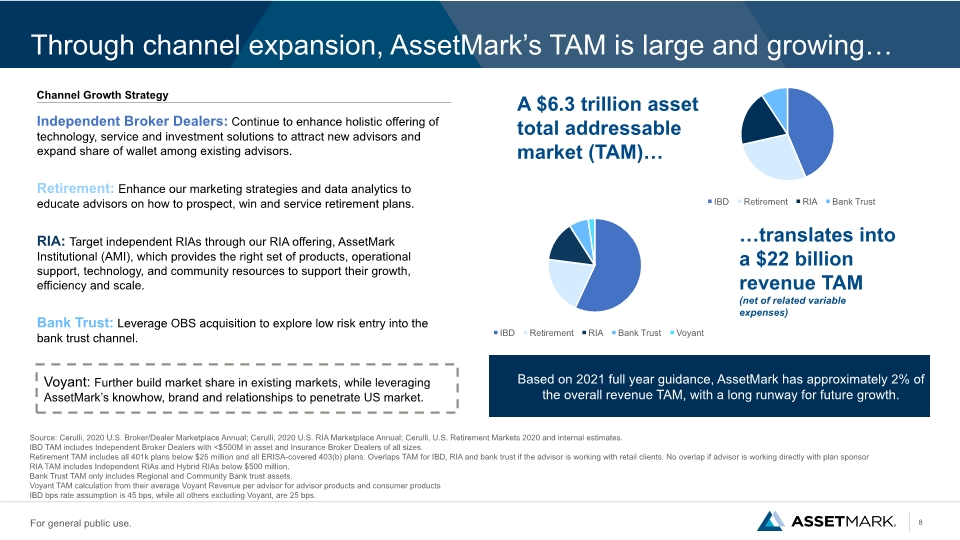

Through channel expansion, AssetMark’s TAM is large and growing… Source: Cerulli, 2020 U.S. Broker/Dealer Marketplace Annual; Cerulli, 2020 U.S. RIA Marketplace Annual; Cerulli, U.S. Retirement Markets 2020 and internal estimates. IBD TAM includes Independent Broker Dealers with <$500M in asset and Insurance Broker Dealers of all sizes. Retirement TAM includes all 401k plans below $25 million and all ERISA-covered 403(b) plans. Overlaps TAM for IBD, RIA and bank trust if the advisor is working with retail clients. No overlap if advisor is working directly with plan sponsor RIA TAM includes Independent RIAs and Hybrid RIAs below $500 million. Bank Trust TAM only includes Regional and Community Bank trust assets. Voyant TAM calculation from their average Voyant Revenue per advisor for advisor products and consumer products IBD bps rate assumption is 45 bps, while all others excluding Voyant, are 25 bps. …translates into a $22 billion revenue TAM (net of related variable expenses) Based on 2021 full year guidance, AssetMark has approximately 2% of the overall revenue TAM, with a long runway for future growth. A $6.3 trillion asset total addressable market (TAM)… Channel Growth Strategy Independent Broker Dealers: Continue to enhance holistic offering of technology, service and investment solutions to attract new advisors and expand share of wallet among existing advisors. Retirement: Enhance our marketing strategies and data analytics to educate advisors on how to prospect, win and service retirement plans. RIA: Target independent RIAs through our RIA offering, AssetMark Institutional (AMI), which provides the right set of products, operational support, technology, and community resources to support their growth, efficiency and scale. Bank Trust: Leverage OBS acquisition to explore low risk entry into the bank trust channel. Voyant: Further build market share in existing markets, while leveraging AssetMark’s knowhow, brand and relationships to penetrate US market.

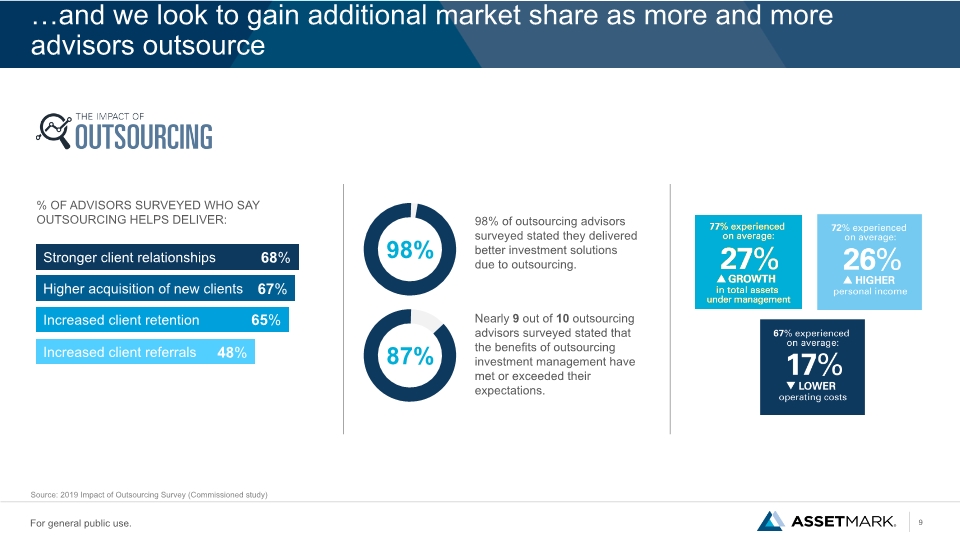

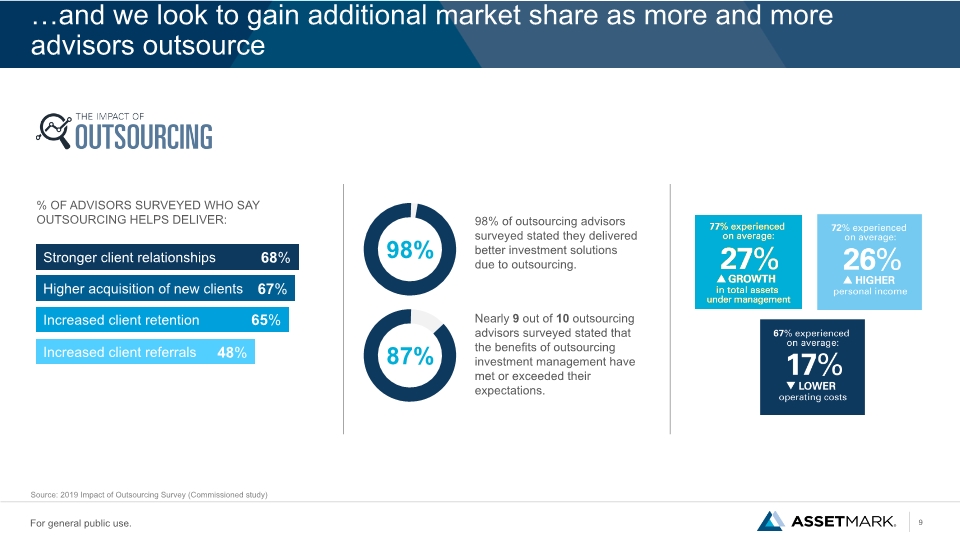

…and we look to gain additional market share as more and more advisors outsource Stronger client relationships Higher acquisition of new clients Increased client retention Increased client referrals 48% 65% 67% 68% 98% of outsourcing advisors surveyed stated they delivered better investment solutions due to outsourcing. Nearly 9 out of 10 outsourcing advisors surveyed stated that the benefits of outsourcing investment management have met or exceeded their expectations. % OF ADVISORS SURVEYED WHO SAY OUTSOURCING HELPS DELIVER: Source: 2019 Impact of Outsourcing Survey (Commissioned study)

Contents Opportunity Highlights Market Overview Company Overview Financial Overview Appendix

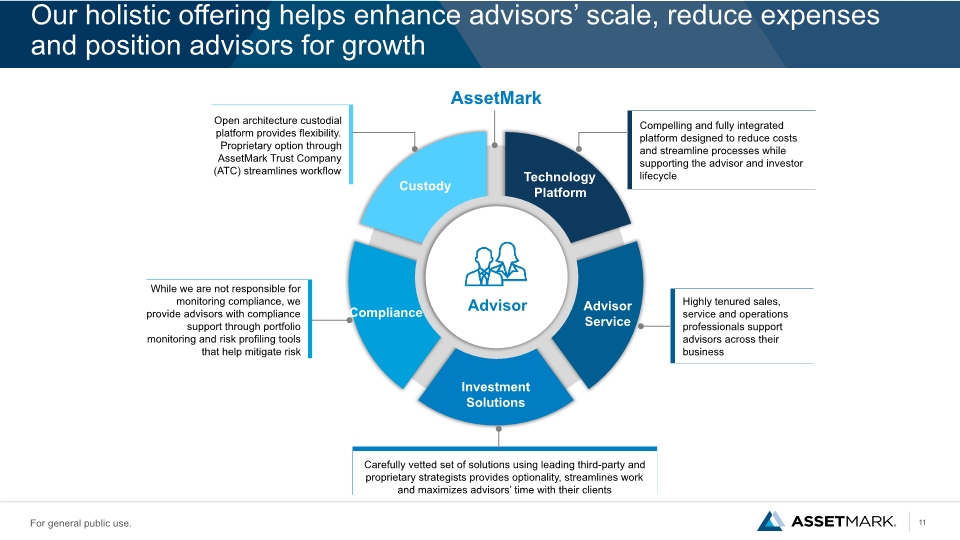

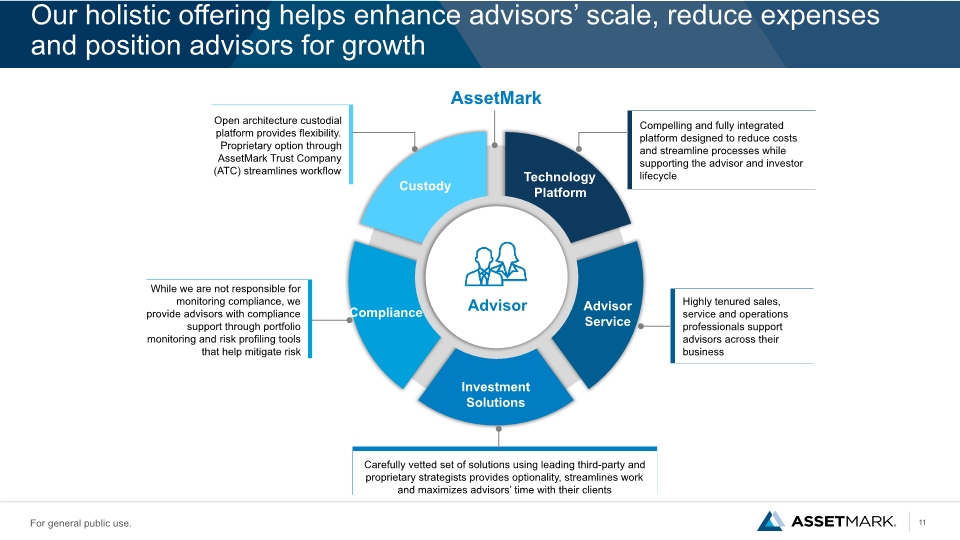

Our holistic offering helps enhance advisors’ scale, reduce expenses and position advisors for growth AssetMark Compelling and fully integrated platform designed to reduce costs and streamline processes while supporting the advisor and investor lifecycle Technology Platform Advisor Service Investment Solutions Compliance Custody Highly tenured sales, service and operations professionals support advisors across their business Carefully vetted set of solutions using leading third-party and proprietary strategists provides optionality, streamlines work and maximizes advisors’ time with their clients Open architecture custodial platform provides flexibility. Proprietary option through AssetMark Trust Company (ATC) streamlines workflow While we are not responsible for monitoring compliance, we provide advisors with compliance support through portfolio monitoring and risk profiling tools that help mitigate risk Advisor

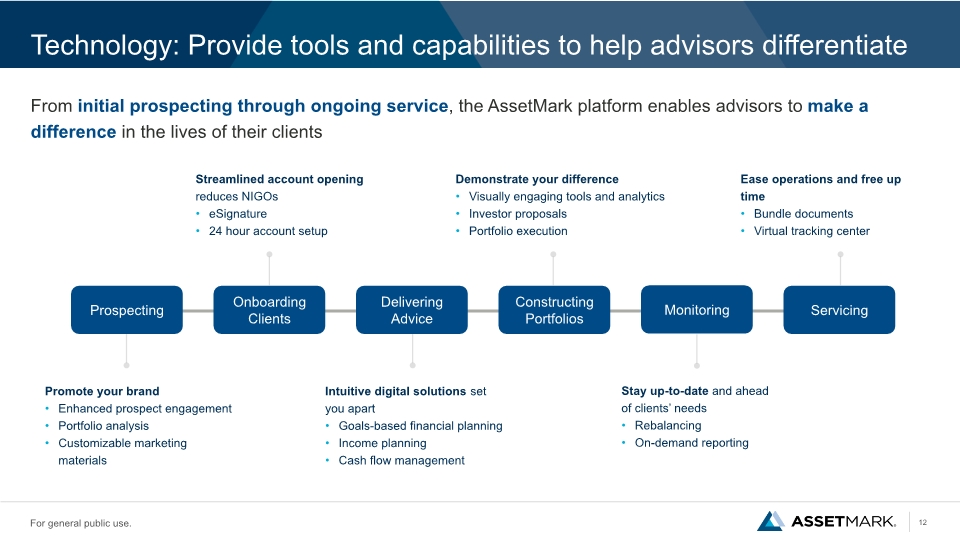

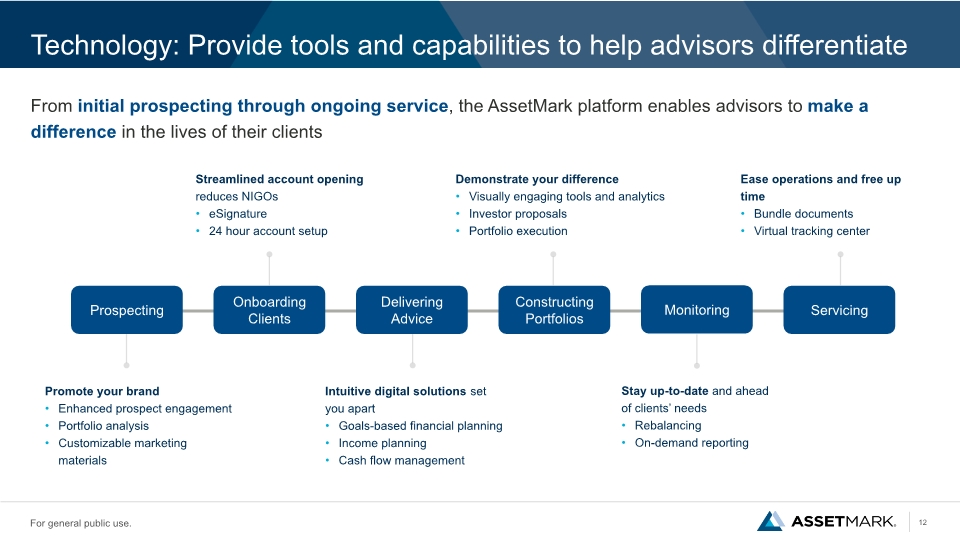

Technology: Provide tools and capabilities to help advisors differentiate Promote your brand Enhanced prospect engagement Portfolio analysis Customizable marketing materials From initial prospecting through ongoing service, the AssetMark platform enables advisors to make a difference in the lives of their clients Streamlined account opening reduces NIGOs eSignature 24 hour account setup Intuitive digital solutions set you apart Goals-based financial planning Income planning Cash flow management Demonstrate your difference Visually engaging tools and analytics Investor proposals Portfolio execution Ease operations and free up time Bundle documents Virtual tracking center Stay up-to-date and ahead of clients’ needs Rebalancing On-demand reporting

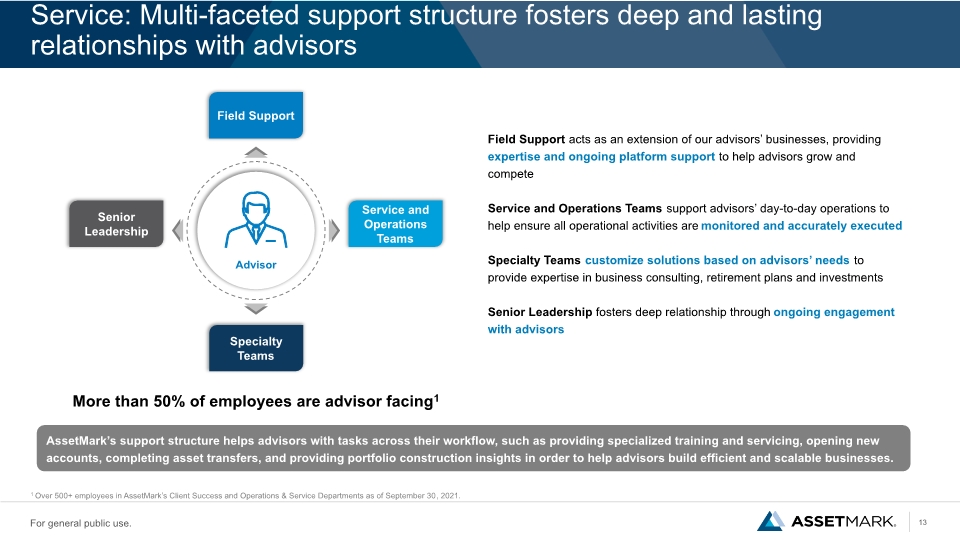

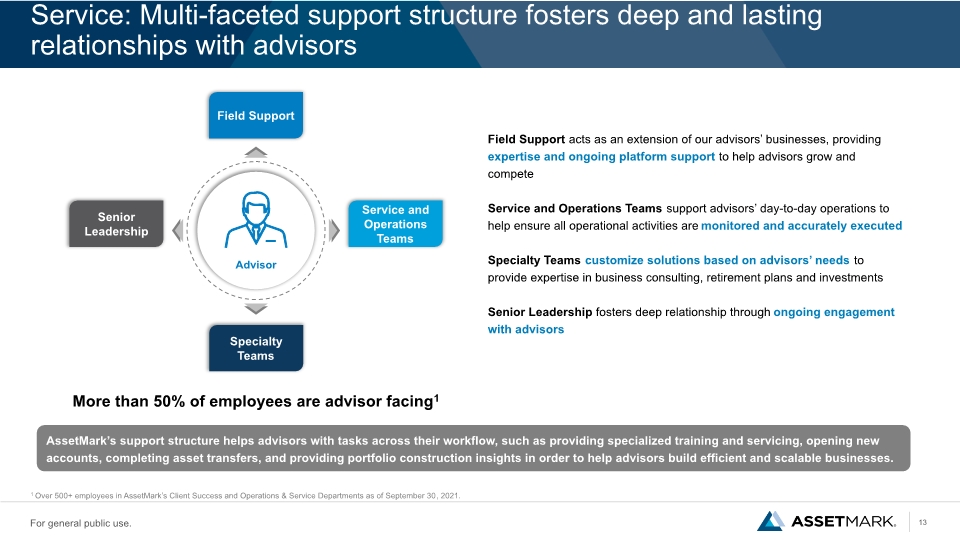

Service: Multi-faceted support structure fosters deep and lasting relationships with advisors Field Support acts as an extension of our advisors’ businesses, providing expertise and ongoing platform support to help advisors grow and compete Service and Operations Teams support advisors’ day-to-day operations to help ensure all operational activities are monitored and accurately executed Specialty Teams customize solutions based on advisors’ needs to provide expertise in business consulting, retirement plans and investments Senior Leadership fosters deep relationship through ongoing engagement with advisors AssetMark’s support structure helps advisors with tasks across their workflow, such as providing specialized training and servicing, opening new accounts, completing asset transfers, and providing portfolio construction insights in order to help advisors build efficient and scalable businesses. More than 50% of employees are advisor facing1 1 Over 500+ employees in AssetMark’s Client Success and Operations & Service Departments as of September 30, 2021.

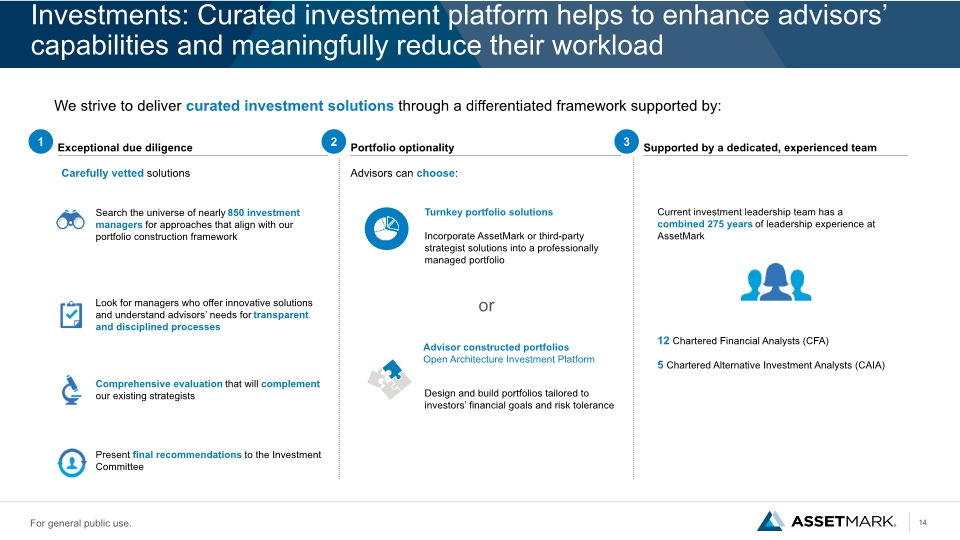

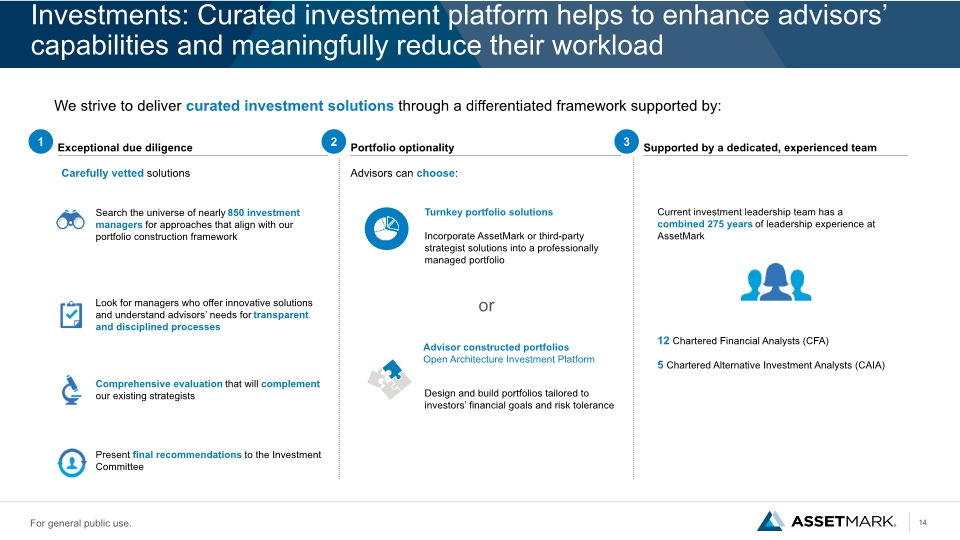

Investments: Curated investment platform helps to enhance advisors’ capabilities and meaningfully reduce their workload Exceptional due diligence Portfolio optionality Supported by a dedicated, experienced team Carefully vetted solutions Current investment leadership team has a combined 275 years of leadership experience at AssetMark 12 Chartered Financial Analysts (CFA) 5 Chartered Alternative Investment Analysts (CAIA) Search the universe of nearly 850 investment managers for approaches that align with our portfolio construction framework Look for managers who offer innovative solutions and understand advisors’ needs for transparent and disciplined processes Comprehensive evaluation that will complement our existing strategists Present final recommendations to the Investment Committee Advisors can choose: 1 or Incorporate AssetMark or third-party strategist solutions into a professionally managed portfolio Design and build portfolios tailored to investors’ financial goals and risk tolerance Turnkey portfolio solutions Advisor constructed portfolios Open Architecture Investment Platform We strive to deliver curated investment solutions through a differentiated framework supported by: 1 2 3

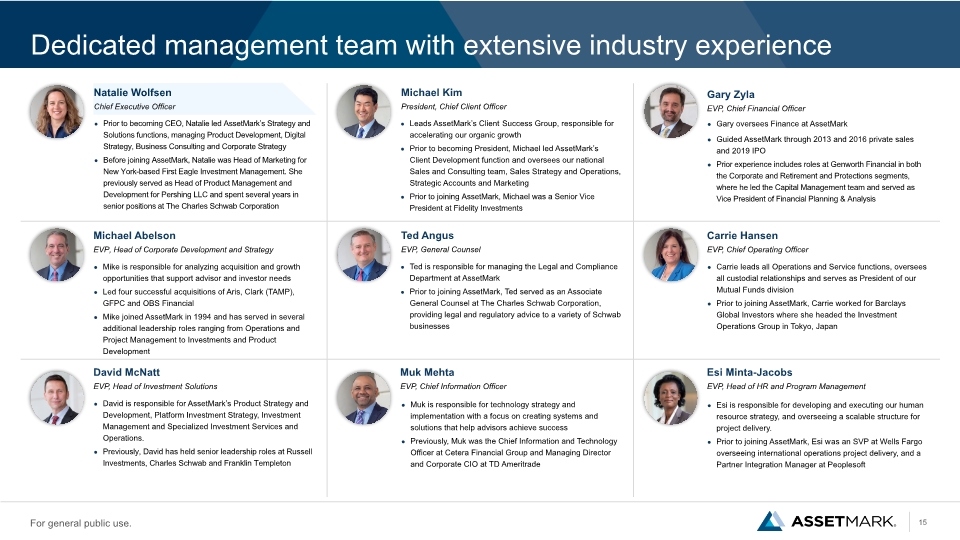

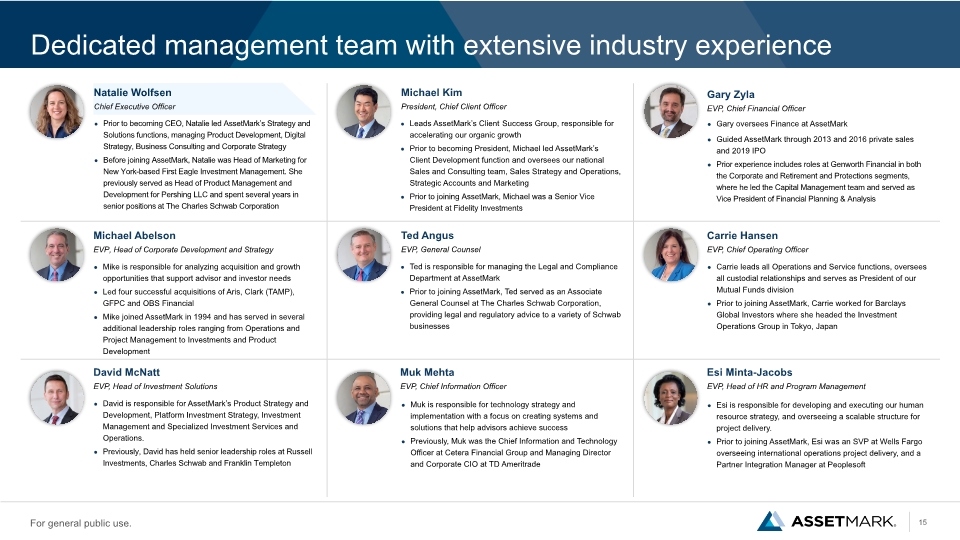

Dedicated management team with extensive industry experience Prior to becoming CEO, Natalie led AssetMark’s Strategy and Solutions functions, managing Product Development, Digital Strategy, Business Consulting and Corporate Strategy Before joining AssetMark, Natalie was Head of Marketing for New York-based First Eagle Investment Management. She previously served as Head of Product Management and Development for Pershing LLC and spent several years in senior positions at The Charles Schwab Corporation Natalie Wolfsen Chief Executive Officer Michael Kim President, Chief Client Officer Leads AssetMark’s Client Success Group, responsible for accelerating our organic growth Prior to becoming President, Michael led AssetMark’s Client Development function and oversees our national Sales and Consulting team, Sales Strategy and Operations, Strategic Accounts and Marketing Prior to joining AssetMark, Michael was a Senior Vice President at Fidelity Investments Gary Zyla EVP, Chief Financial Officer Gary oversees Finance at AssetMark Guided AssetMark through 2013 and 2016 private sales and 2019 IPO Prior experience includes roles at Genworth Financial in both the Corporate and Retirement and Protections segments, where he led the Capital Management team and served as Vice President of Financial Planning & Analysis Michael Abelson EVP, Head of Corporate Development and Strategy Mike is responsible for analyzing acquisition and growth opportunities that support advisor and investor needs Led four successful acquisitions of Aris, Clark (TAMP), GFPC and OBS Financial Mike joined AssetMark in 1994 and has served in several additional leadership roles ranging from Operations and Project Management to Investments and Product Development Ted Angus EVP, General Counsel Ted is responsible for managing the Legal and Compliance Department at AssetMark Prior to joining AssetMark, Ted served as an Associate General Counsel at The Charles Schwab Corporation, providing legal and regulatory advice to a variety of Schwab businesses Carrie Hansen EVP, Chief Operating Officer Carrie leads all Operations and Service functions, oversees all custodial relationships and serves as President of our Mutual Funds division Prior to joining AssetMark, Carrie worked for Barclays Global Investors where she headed the Investment Operations Group in Tokyo, Japan David McNatt EVP, Head of Investment Solutions Muk Mehta EVP, Chief Information Officer Esi Minta-Jacobs EVP, Head of HR and Program Management David is responsible for AssetMark’s Product Strategy and Development, Platform Investment Strategy, Investment Management and Specialized Investment Services and Operations. Previously, David has held senior leadership roles at Russell Investments, Charles Schwab and Franklin Templeton Muk is responsible for technology strategy and implementation with a focus on creating systems and solutions that help advisors achieve success Previously, Muk was the Chief Information and Technology Officer at Cetera Financial Group and Managing Director and Corporate CIO at TD Ameritrade Esi is responsible for developing and executing our human resource strategy, and overseeing a scalable structure for project delivery. Prior to joining AssetMark, Esi was an SVP at Wells Fargo overseeing international operations project delivery, and a Partner Integration Manager at Peoplesoft

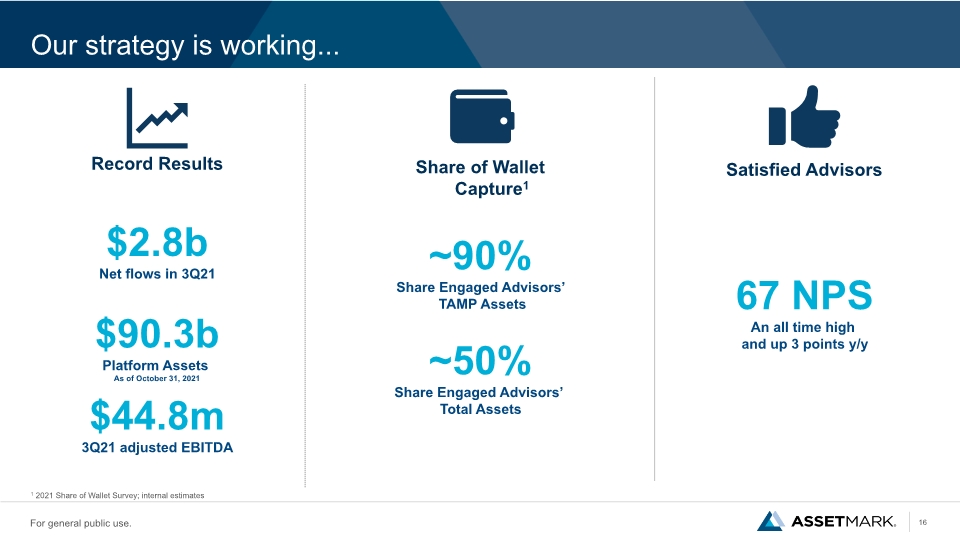

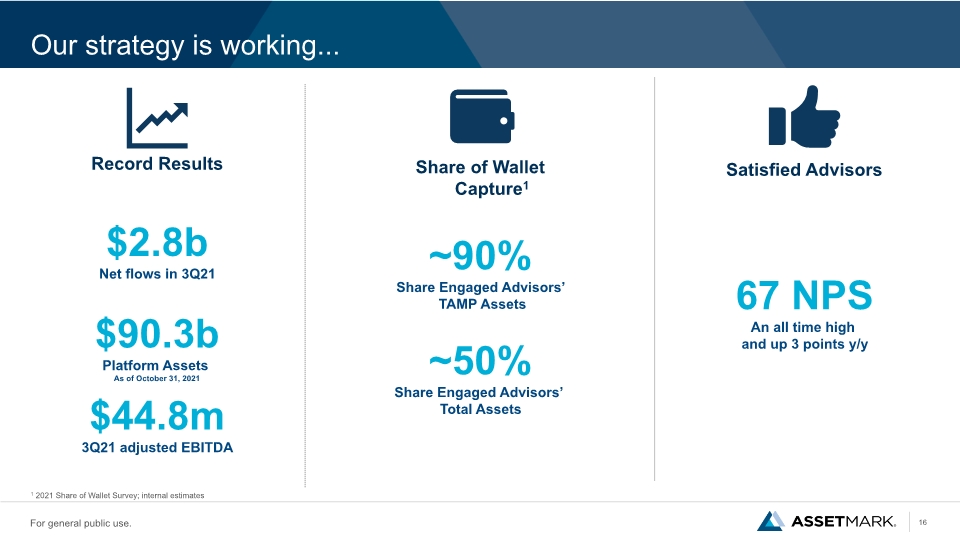

Record Results Satisfied Advisors Our strategy is working... 67 NPS An all time high and up 3 points y/y $2.8b Net flows in 3Q21 $90.3b Platform Assets As of October 31, 2021 $44.8m 3Q21 adjusted EBITDA 1 2021 Share of Wallet Survey; internal estimates

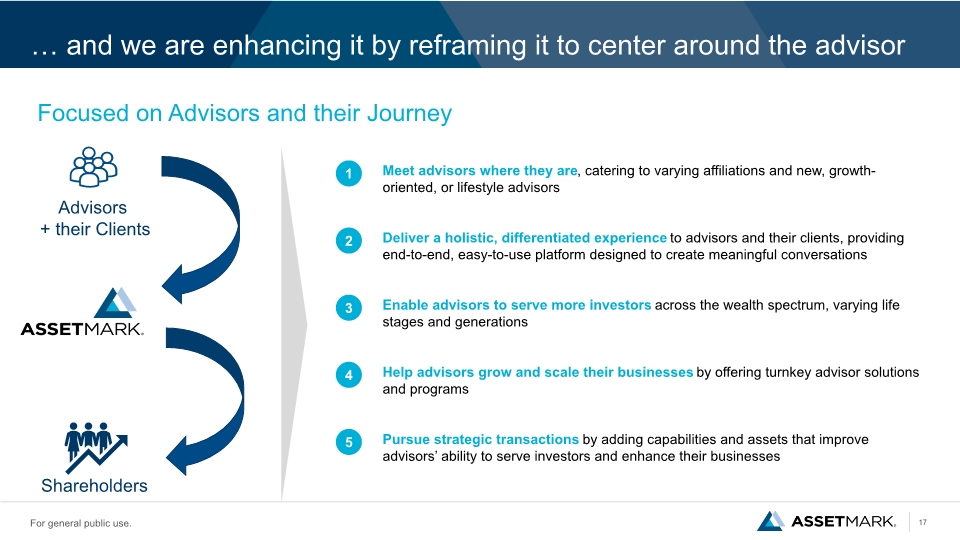

… and we are enhancing it by reframing it to center around the advisor Meet advisors where they are, catering to varying affiliations and new, growth-oriented, or lifestyle advisors Deliver a holistic, differentiated experience to advisors and their clients, providing end-to-end, easy-to-use platform designed to create meaningful conversations Enable advisors to serve more investors across the wealth spectrum, varying life stages and generations Help advisors grow and scale their businesses by offering turnkey advisor solutions and programs Pursue strategic transactions by adding capabilities and assets that improve advisors’ ability to serve investors and enhance their businesses 1 2 3 4 5 Focused on Advisors and their Journey Advisors + their Clients Shareholders

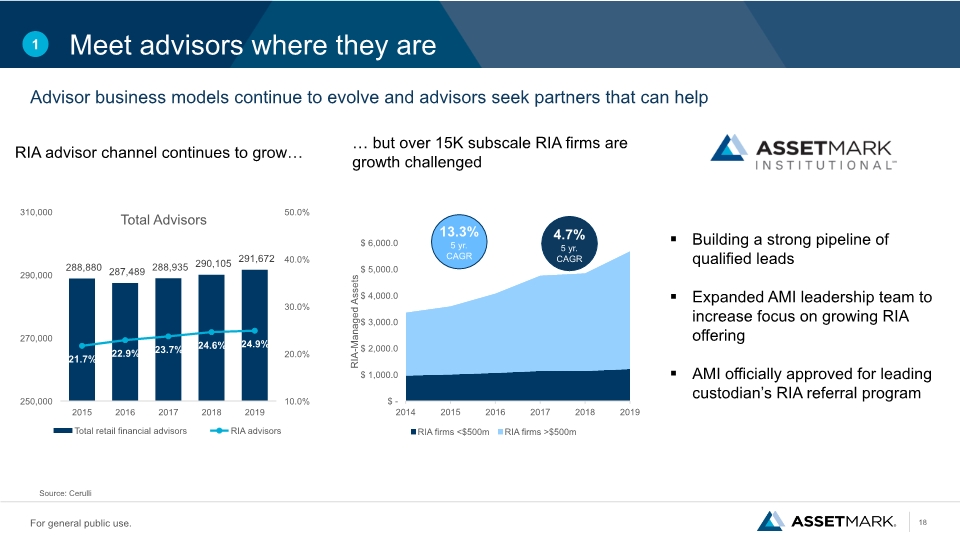

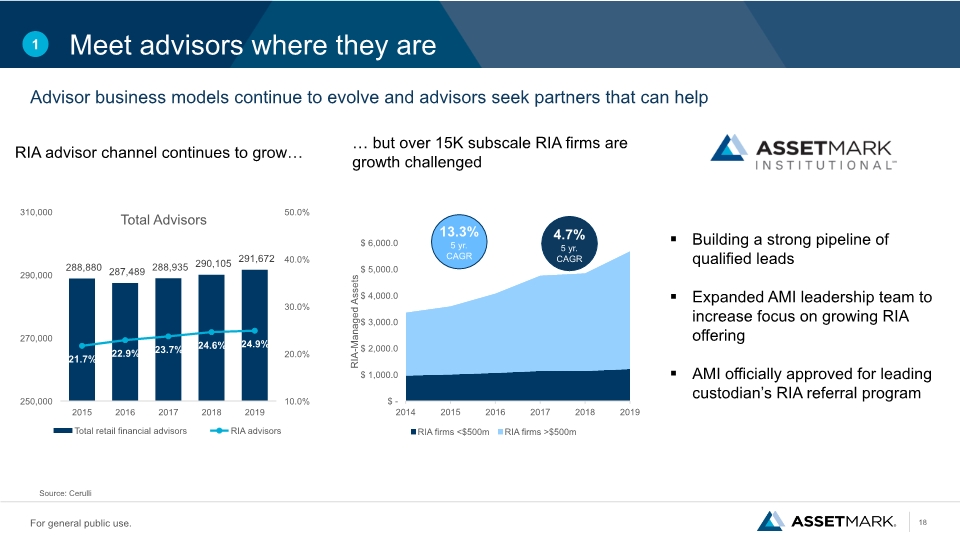

Meet advisors where they are 1 Advisor business models continue to evolve and advisors seek partners that can help RIA advisor channel continues to grow… Source: Cerulli Building a strong pipeline of qualified leads Expanded AMI leadership team to increase focus on growing RIA offering AMI officially approved for leading custodian’s RIA referral program … but over 15K subscale RIA firms are growth challenged

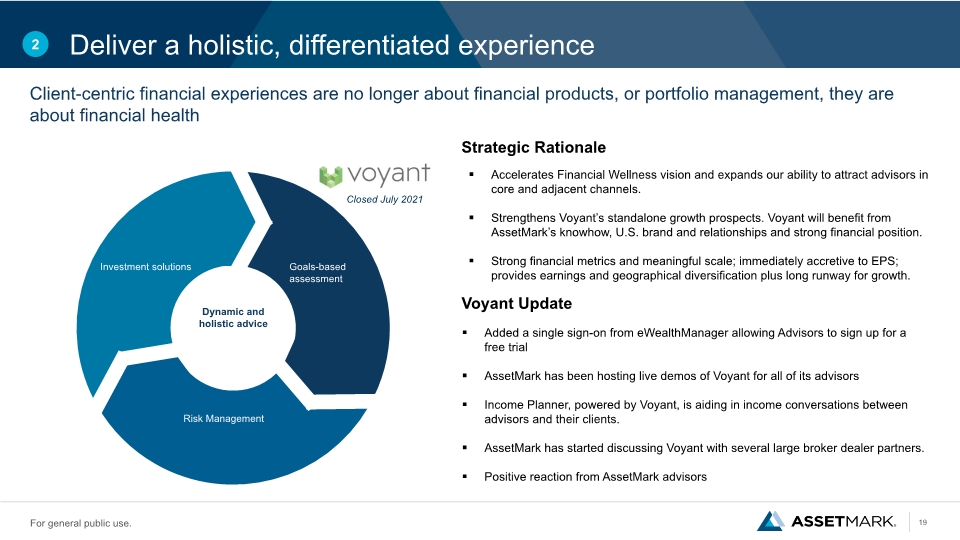

Deliver a holistic, differentiated experience 2 Strategic Rationale Voyant Update Accelerates Financial Wellness vision and expands our ability to attract advisors in core and adjacent channels. Strengthens Voyant’s standalone growth prospects. Voyant will benefit from AssetMark’s knowhow, U.S. brand and relationships and strong financial position. Strong financial metrics and meaningful scale; immediately accretive to EPS; provides earnings and geographical diversification plus long runway for growth. Added a single sign-on from eWealthManager allowing Advisors to sign up for a free trial AssetMark has been hosting live demos of Voyant for all of its advisors Income Planner, powered by Voyant, is aiding in income conversations between advisors and their clients. AssetMark has started discussing Voyant with several large broker dealer partners. Positive reaction from AssetMark advisors Client-centric financial experiences are no longer about financial products, or portfolio management, they are about financial health Closed July 2021

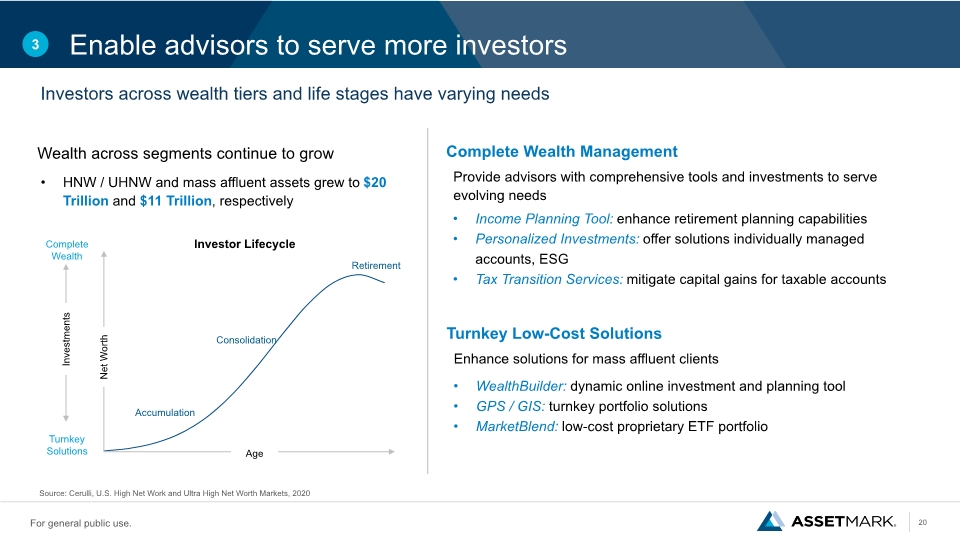

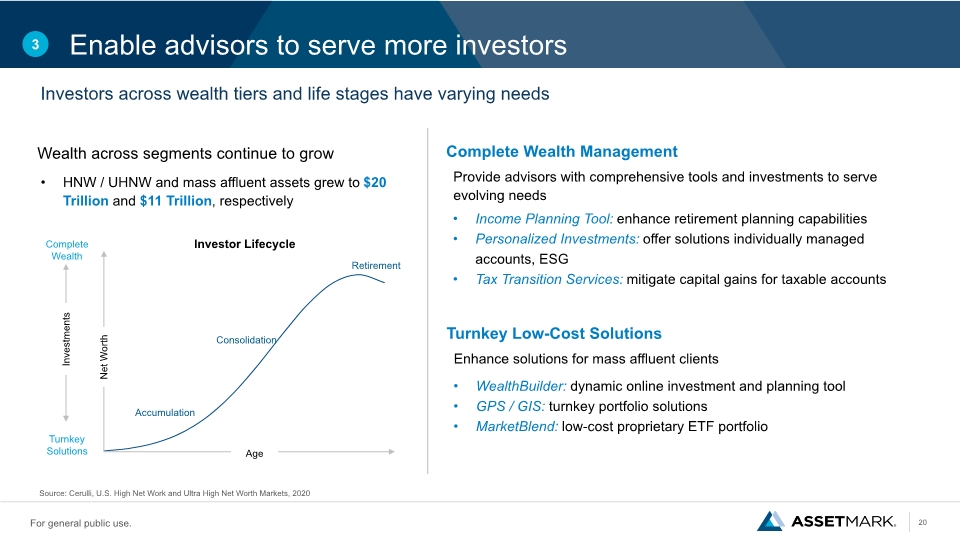

Enable advisors to serve more investors 3 Investors across wealth tiers and life stages have varying needs Income Planning Tool: enhance retirement planning capabilities Personalized Investments: offer solutions individually managed accounts, ESG Tax Transition Services: mitigate capital gains for taxable accounts Complete Wealth Management Wealth across segments continue to grow Provide advisors with comprehensive tools and investments to serve evolving needs WealthBuilder: dynamic online investment and planning tool GPS / GIS: turnkey portfolio solutions MarketBlend: low-cost proprietary ETF portfolio Turnkey Low-Cost Solutions Enhance solutions for mass affluent clients HNW / UHNW and mass affluent assets grew to $20 Trillion and $11 Trillion, respectively Source: Cerulli, U.S. High Net Work and Ultra High Net Worth Markets, 2020

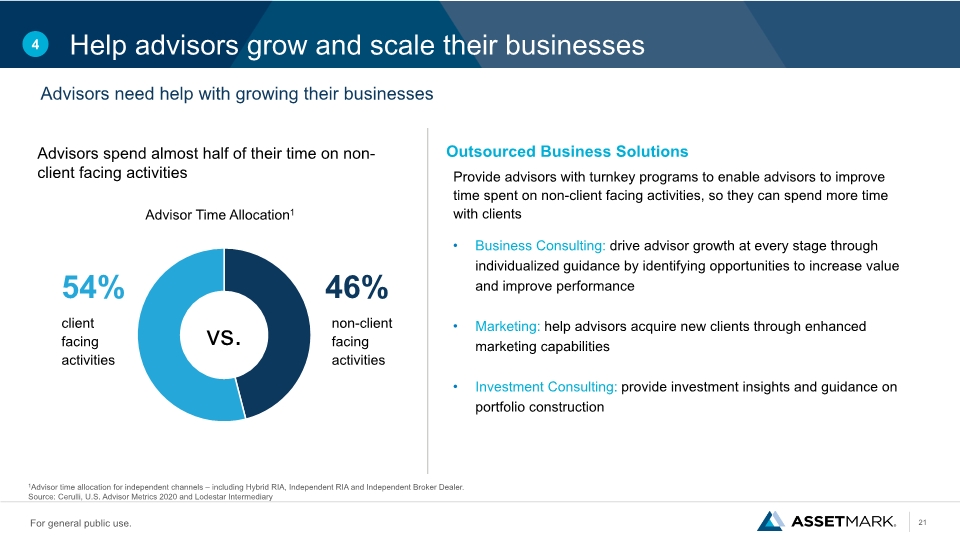

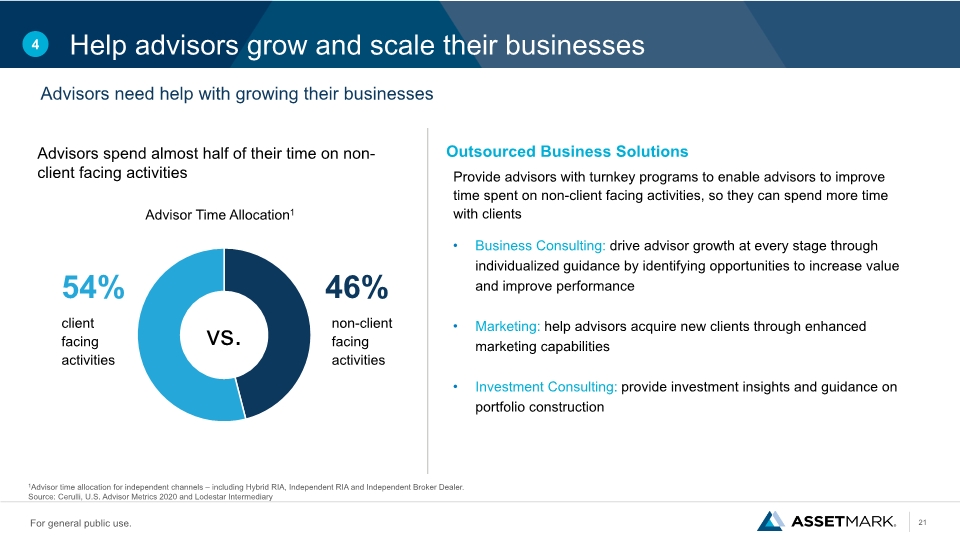

Help advisors grow and scale their businesses 4 54% 46% client facing activities non-client facing activities 1Advisor time allocation for independent channels – including Hybrid RIA, Independent RIA and Independent Broker Dealer. Source: Cerulli, U.S. Advisor Metrics 2020 and Lodestar Intermediary Advisors need help with growing their businesses Outsourced Business Solutions Advisors spend almost half of their time on non-client facing activities Business Consulting: drive advisor growth at every stage through individualized guidance by identifying opportunities to increase value and improve performance Marketing: help advisors acquire new clients through enhanced marketing capabilities Investment Consulting: provide investment insights and guidance on portfolio construction Provide advisors with turnkey programs to enable advisors to improve time spent on non-client facing activities, so they can spend more time with clients

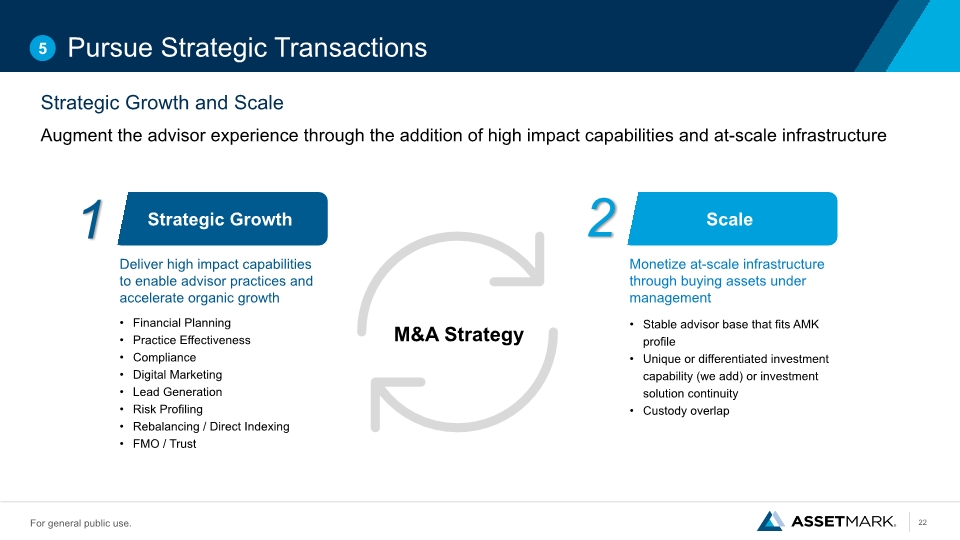

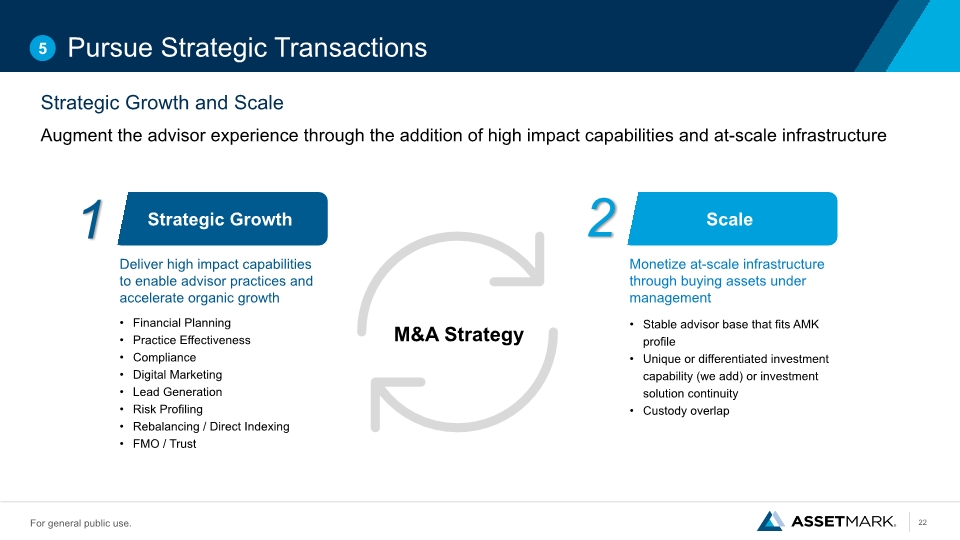

Pursue Strategic Transactions Scale M&A Strategy Strategic Growth 1 2 Financial Planning Practice Effectiveness Compliance Digital Marketing Lead Generation Risk Profiling Rebalancing / Direct Indexing FMO / Trust Deliver high impact capabilities to enable advisor practices and accelerate organic growth Monetize at-scale infrastructure through buying assets under management Stable advisor base that fits AMK profile Unique or differentiated investment capability (we add) or investment solution continuity Custody overlap 5 Strategic Growth and Scale Augment the advisor experience through the addition of high impact capabilities and at-scale infrastructure

Contents Opportunity Highlights Market Overview Company Overview Financial Overview Appendix

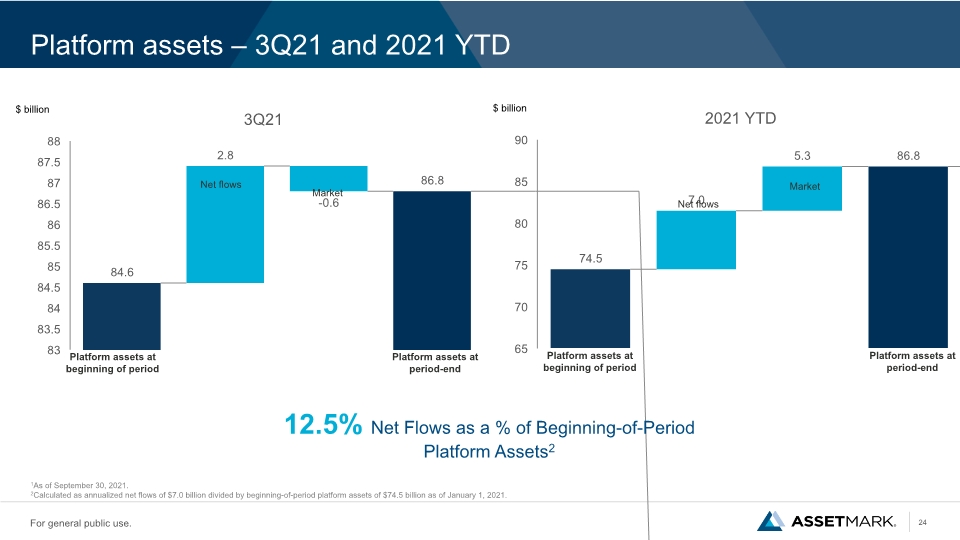

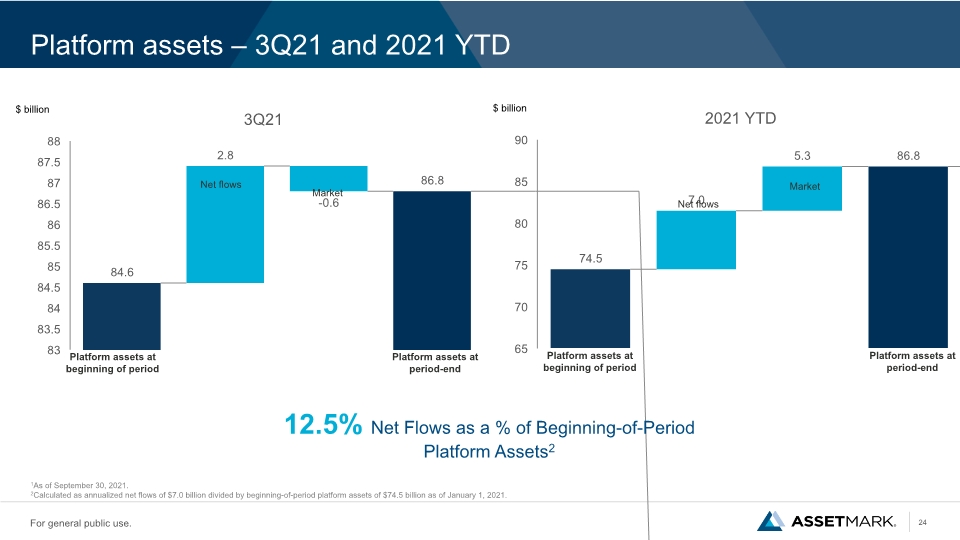

Platform assets – 3Q21 and 2021 YTD $ billion 12.5% Net Flows as a % of Beginning-of-Period Platform Assets2 Platform assets at beginning of period Net flows Market Platform assets at period-end 1As of September 30, 2021. 2Calculated as annualized net flows of $7.0 billion divided by beginning-of-period platform assets of $74.5 billion as of January 1, 2021. $ billion Platform assets at beginning of period Net flows Market Platform assets at period-end

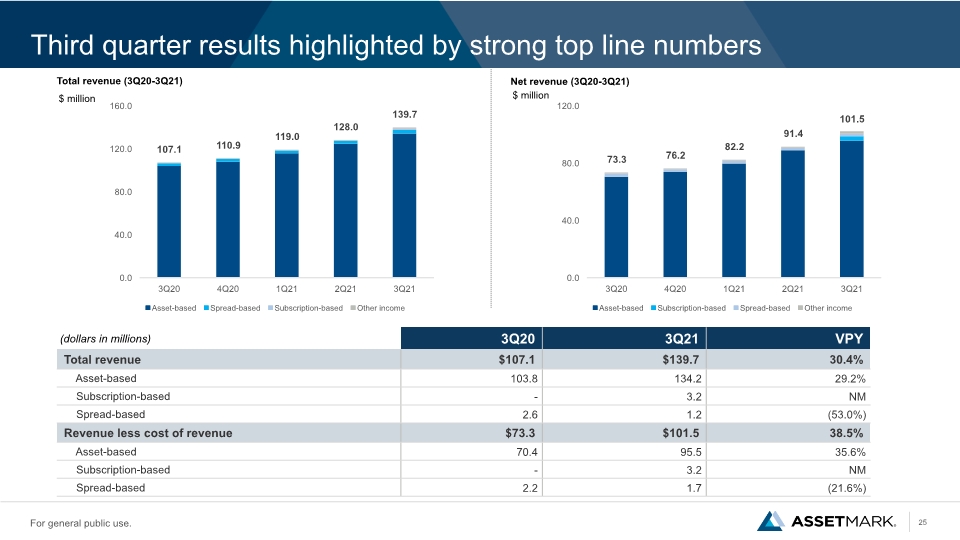

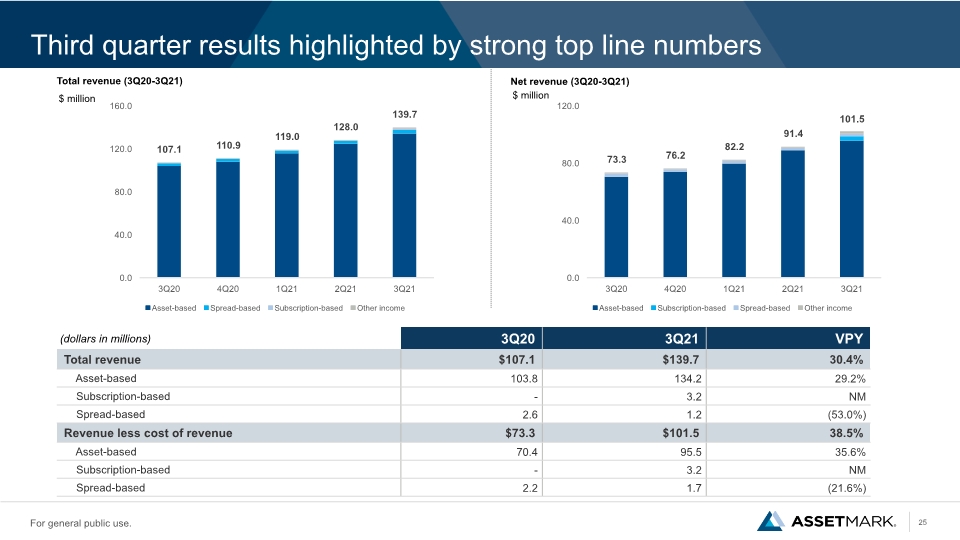

Third quarter results highlighted by strong top line numbers Total revenue (3Q20-3Q21) $ million Net revenue (3Q20-3Q21) $ million

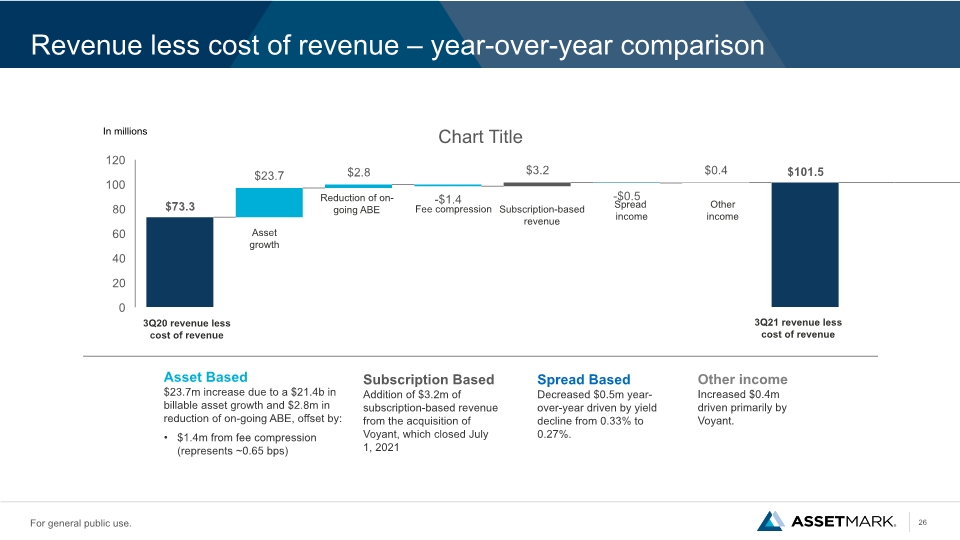

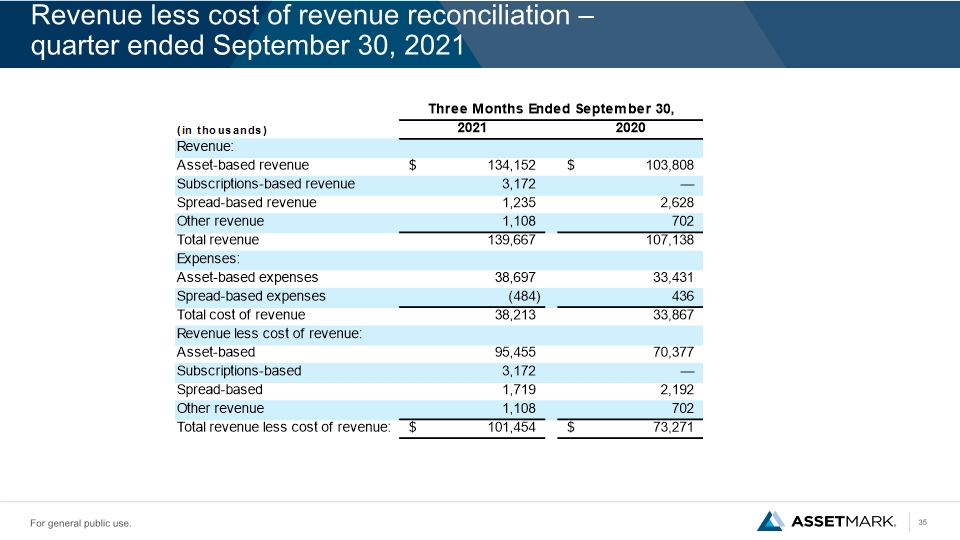

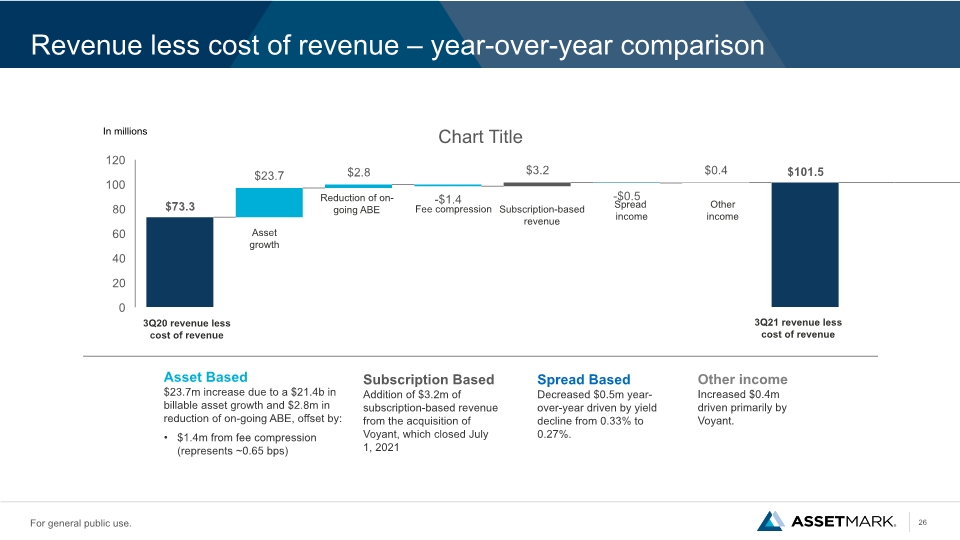

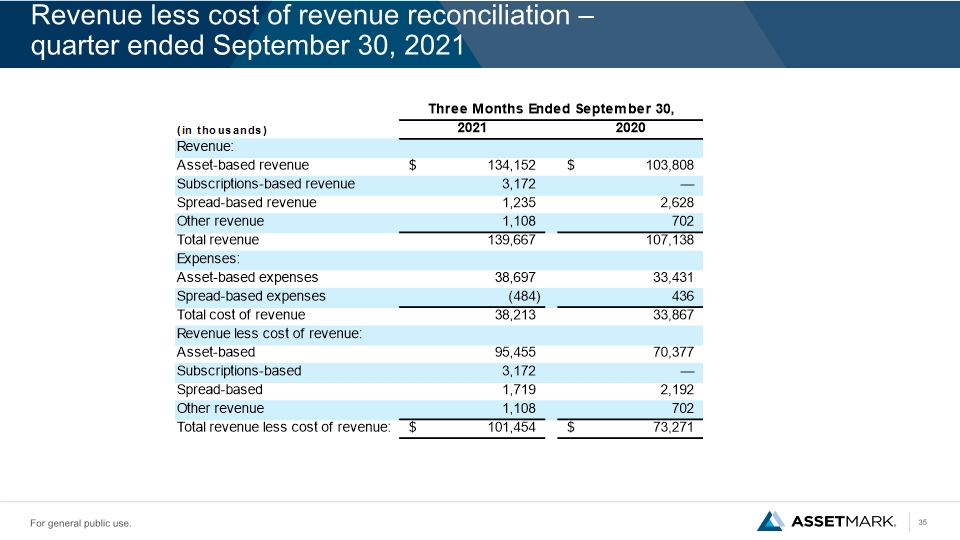

Revenue less cost of revenue – year-over-year comparison Asset Based $23.7m increase due to a $21.4b in billable asset growth and $2.8m in reduction of on-going ABE, offset by: $1.4m from fee compression (represents ~0.65 bps) Spread Based Decreased $0.5m year-over-year driven by yield decline from 0.33% to 0.27%. Other income Increased $0.4m driven primarily by Voyant. Reduction of on-going ABE Subscription-based revenue Subscription Based Addition of $3.2m of subscription-based revenue from the acquisition of Voyant, which closed July 1, 2021

Asset-based yield trend analysis (3Q20-3Q21) Asset-based Yield Commentary Moving forward, we will only be reporting and discussing asset-based yield 3Q21 yield up 0.6 bps year over year driven by proactive measures to reduce on-going asset-based expenses (1.3 bps) offset by fee compression (0.7 bps) As we have historically communicated, we still expect a bp per year decline in asset-based fee yield as a result of mix shift.

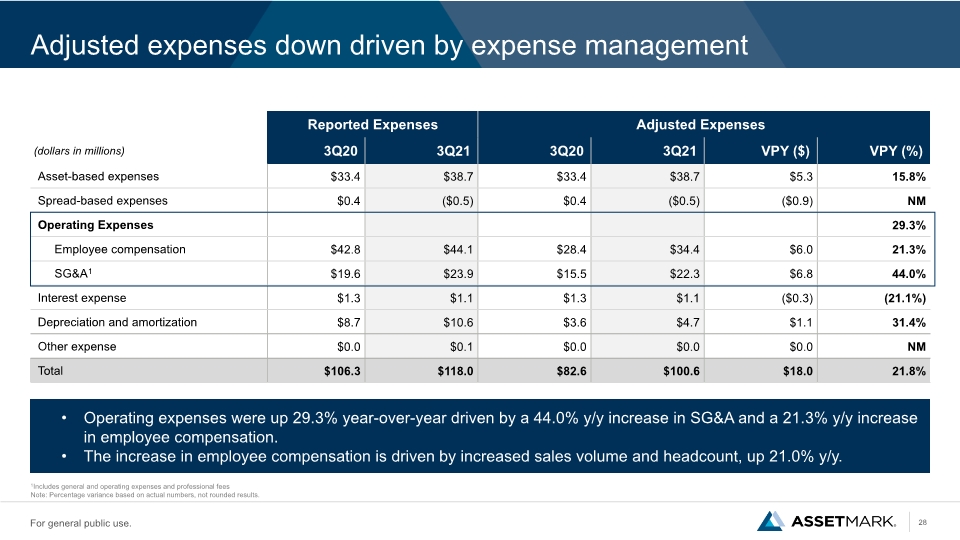

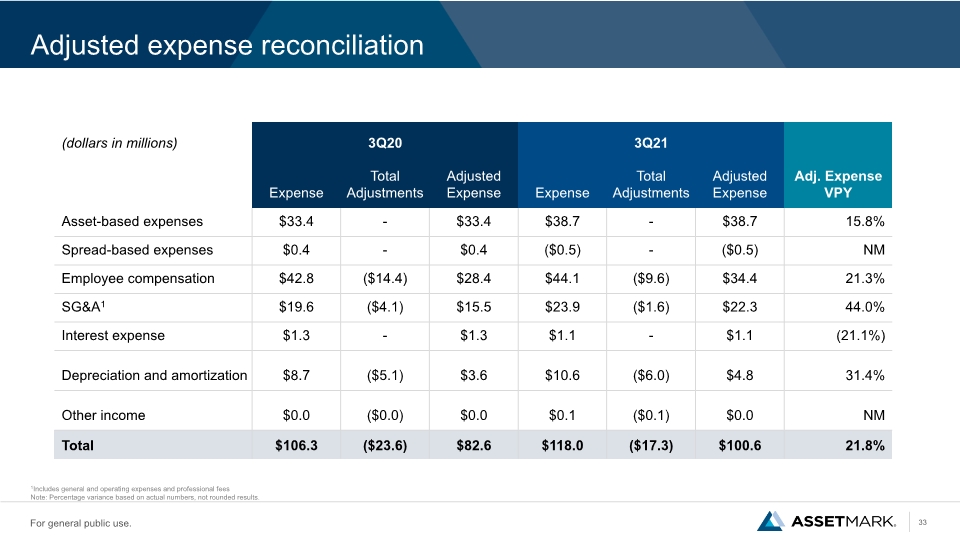

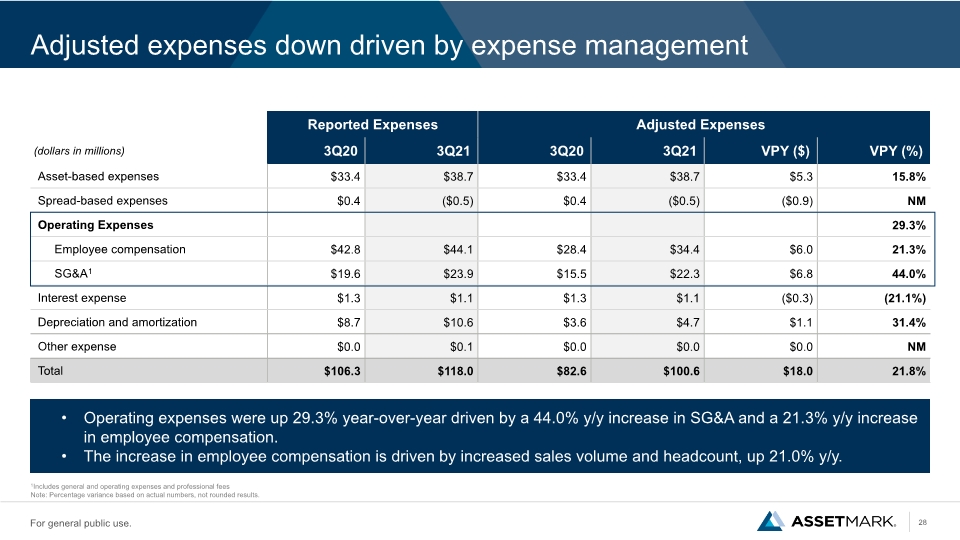

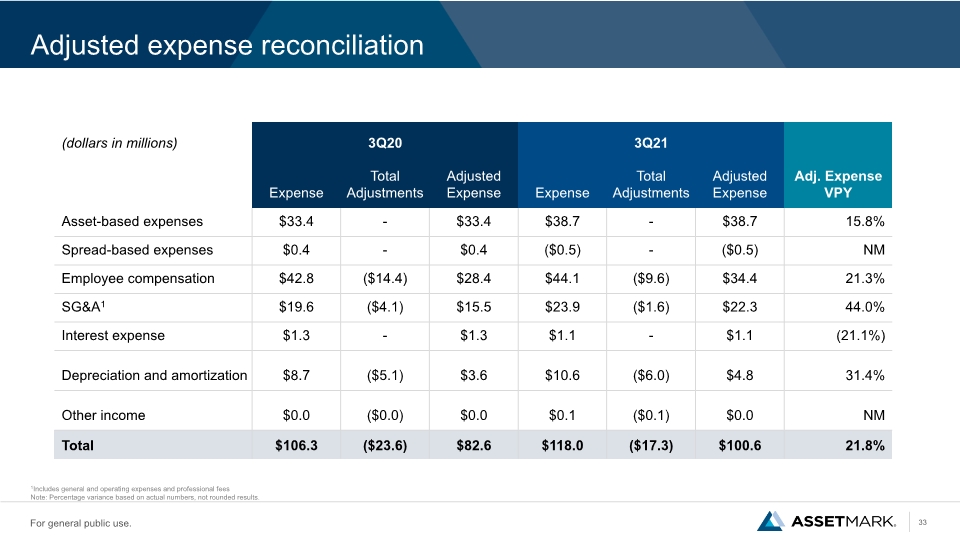

Adjusted expenses down driven by expense management 1Includes general and operating expenses and professional fees Note: Percentage variance based on actual numbers, not rounded results. Operating expenses were up 29.3% year-over-year driven by a 44.0% y/y increase in SG&A and a 21.3% y/y increase in employee compensation. The increase in employee compensation is driven by increased sales volume and headcount, up 21.0% y/y.

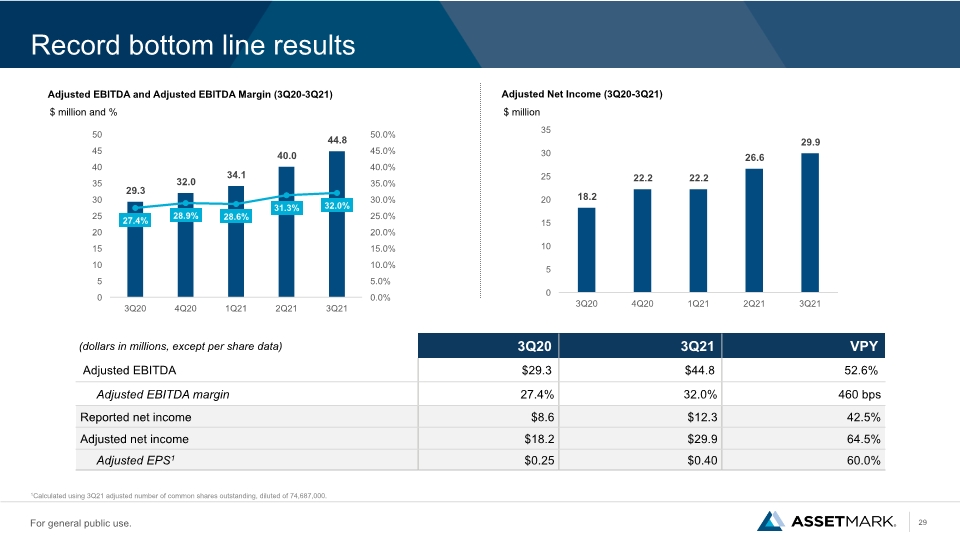

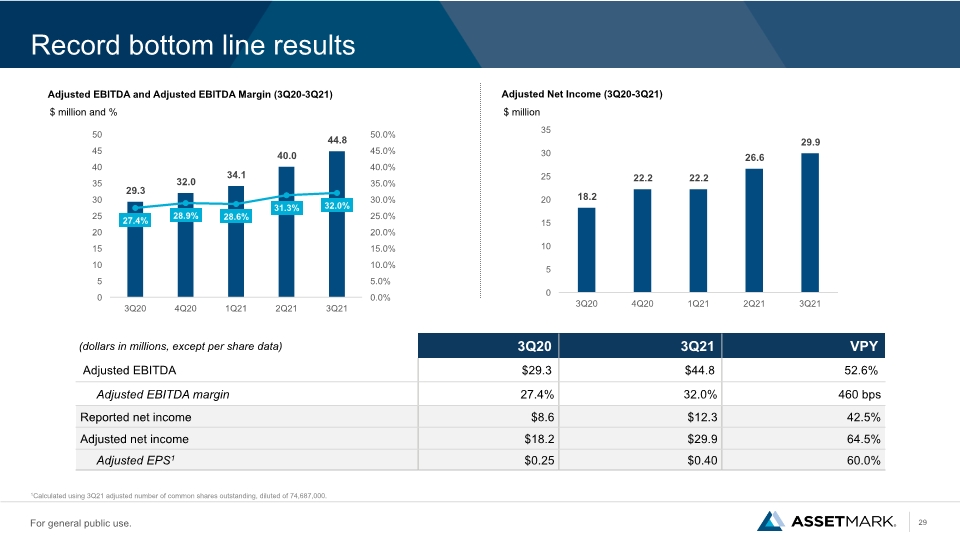

Record bottom line results 1Calculated using 3Q21 adjusted number of common shares outstanding, diluted of 74,687,000. Adjusted EBITDA and Adjusted EBITDA Margin (3Q20-3Q21) Adjusted Net Income (3Q20-3Q21) $ million and % $ million

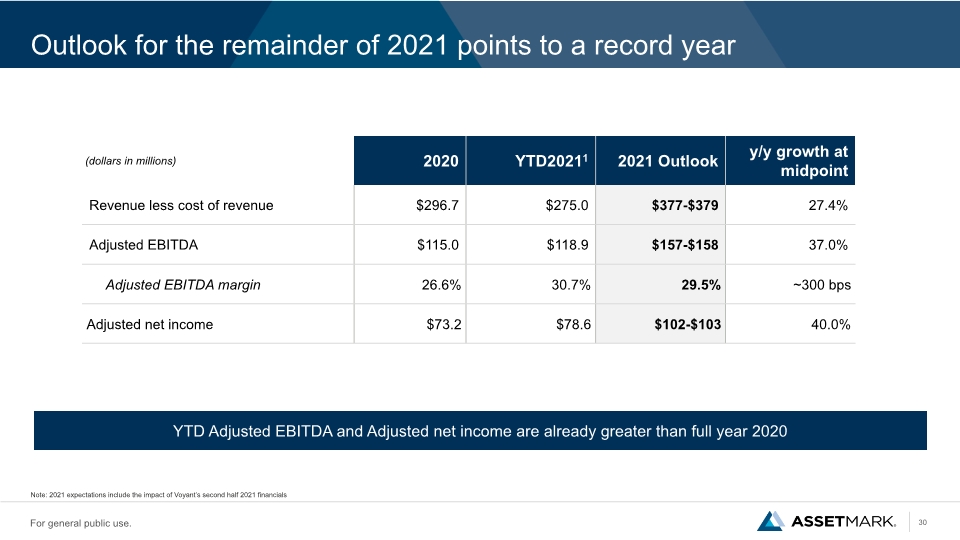

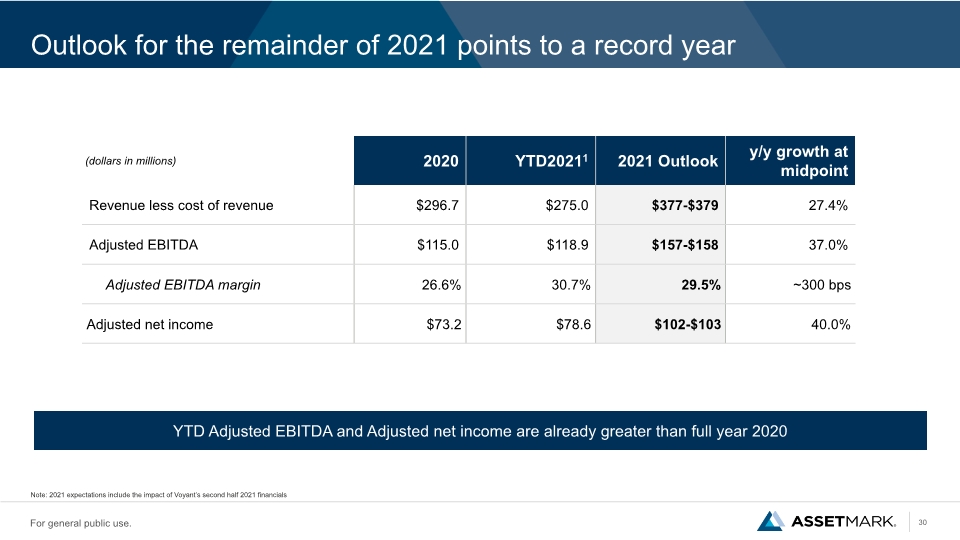

Outlook for the remainder of 2021 points to a record year Note: 2021 expectations include the impact of Voyant’s second half 2021 financials YTD Adjusted EBITDA and Adjusted net income are already greater than full year 2020

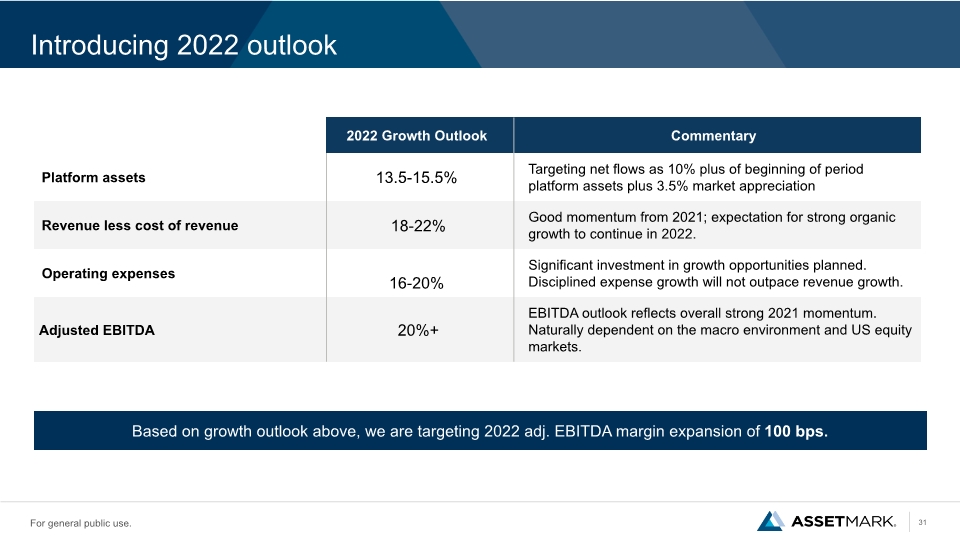

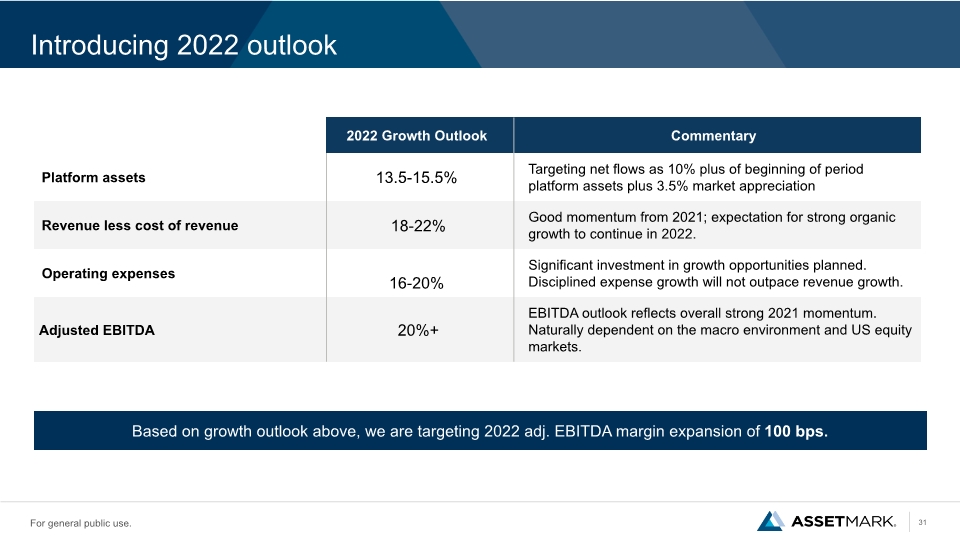

Introducing 2022 outlook Based on growth outlook above, we are targeting 2022 adj. EBITDA margin expansion of 100 bps.

Contents Opportunity Highlights Market Overview Company Overview Financial Overview Appendix

Adjusted expense reconciliation 1Includes general and operating expenses and professional fees Note: Percentage variance based on actual numbers, not rounded results.

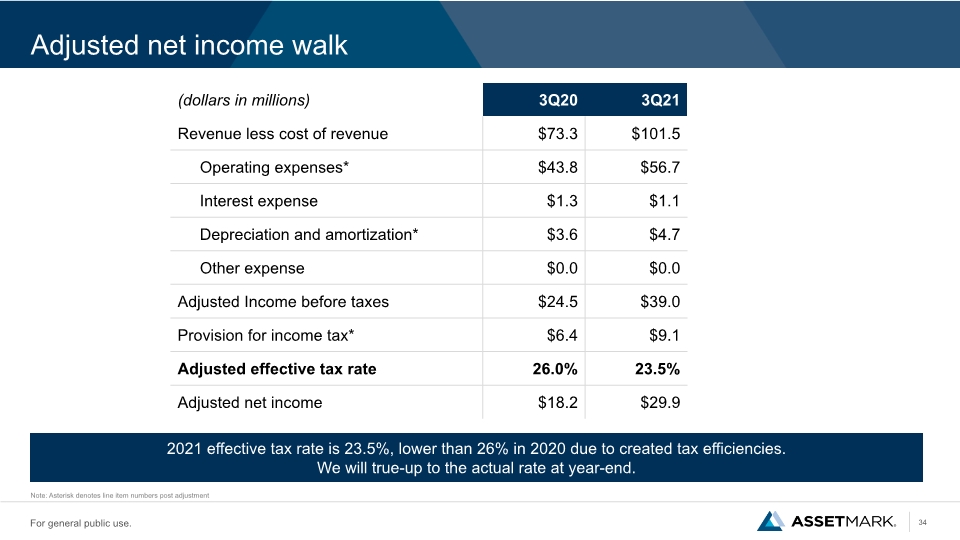

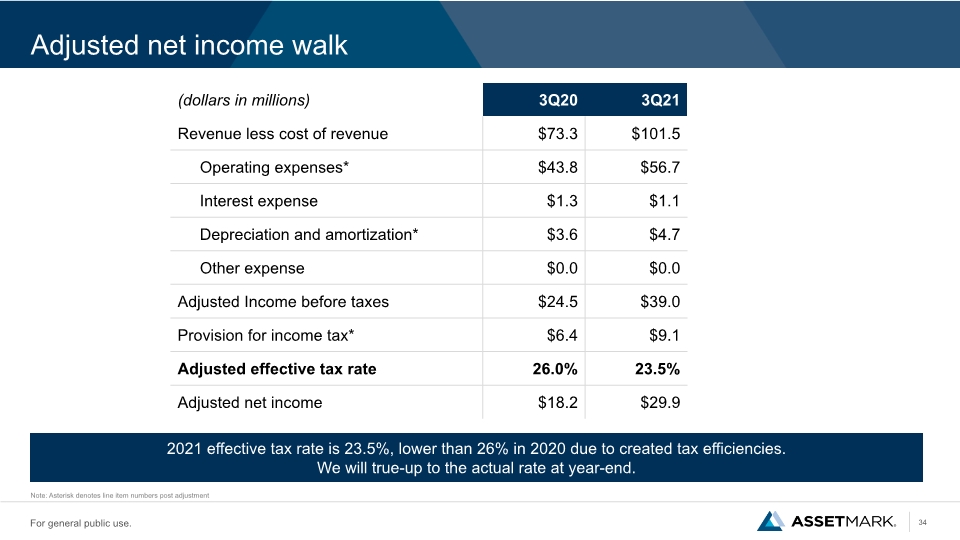

Adjusted net income walk 2021 effective tax rate is 23.5%, lower than 26% in 2020 due to created tax efficiencies. We will true-up to the actual rate at year-end. Note: Asterisk denotes line item numbers post adjustment

Revenue less cost of revenue reconciliation – quarter ended September 30, 2021

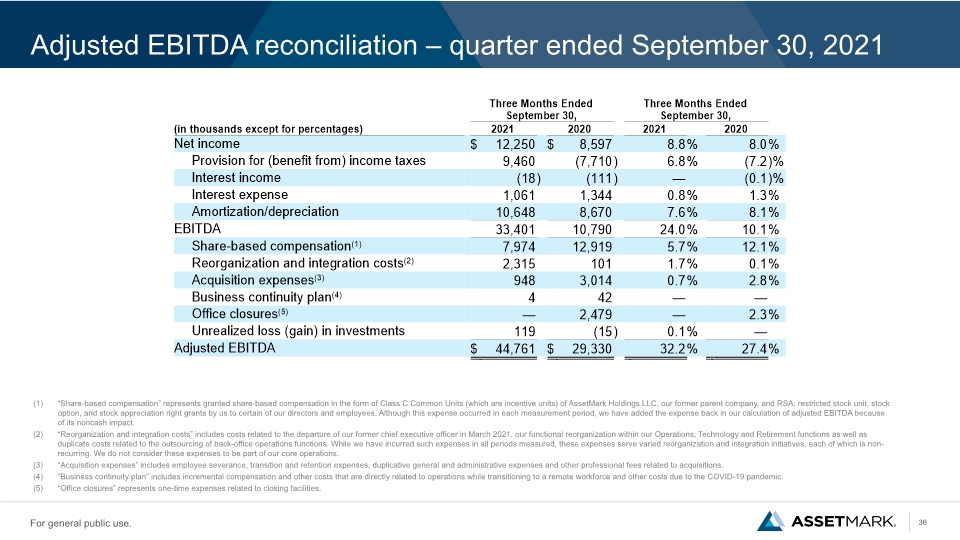

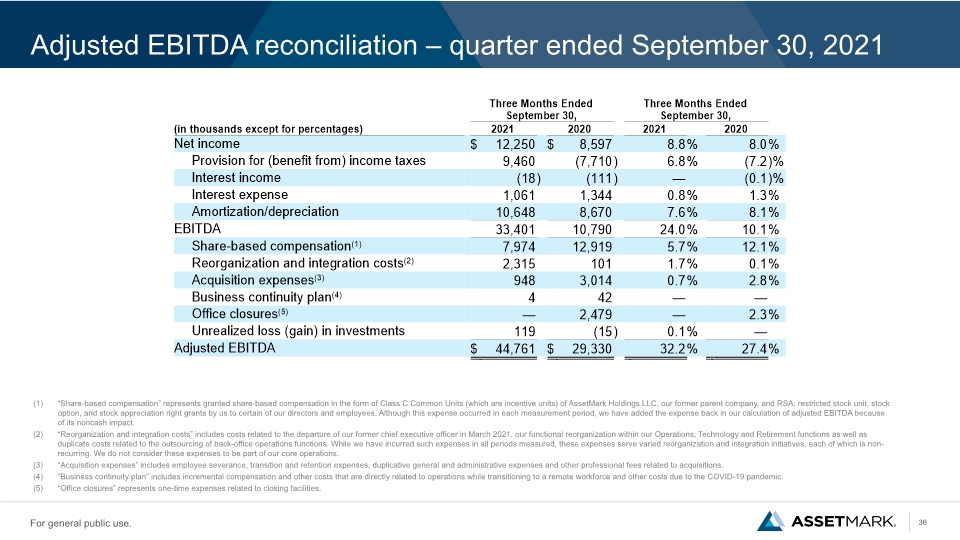

Adjusted EBITDA reconciliation – quarter ended September 30, 2021 (1) “Share-based compensation” represents granted share-based compensation in the form of Class C Common Units (which are incentive units) of AssetMark Holdings LLC, our former parent company, and RSA, restricted stock unit, stock option, and stock appreciation right grants by us to certain of our directors and employees. Although this expense occurred in each measurement period, we have added the expense back in our calculation of adjusted EBITDA because of its noncash impact. (2) “Reorganization and integration costs” includes costs related to the departure of our former chief executive officer in March 2021, our functional reorganization within our Operations, Technology and Retirement functions as well as duplicate costs related to the outsourcing of back-office operations functions. While we have incurred such expenses in all periods measured, these expenses serve varied reorganization and integration initiatives, each of which is non-recurring. We do not consider these expenses to be part of our core operations. (3) “Acquisition expenses” includes employee severance, transition and retention expenses, duplicative general and administrative expenses and other professional fees related to acquisitions. (4) “Business continuity plan” includes incremental compensation and other costs that are directly related to operations while transitioning to a remote workforce and other costs due to the COVID-19 pandemic. (5) “Office closures” represents one-time expenses related to closing facilities.

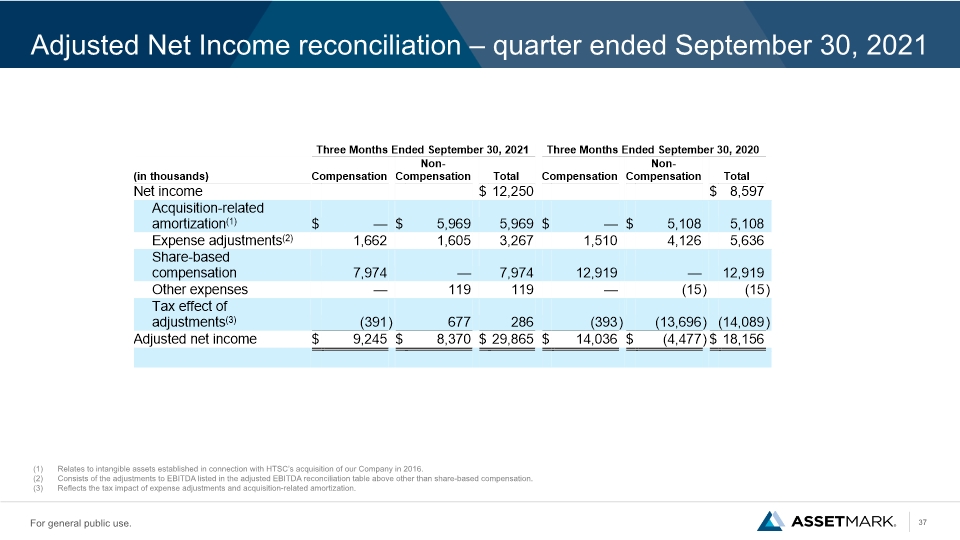

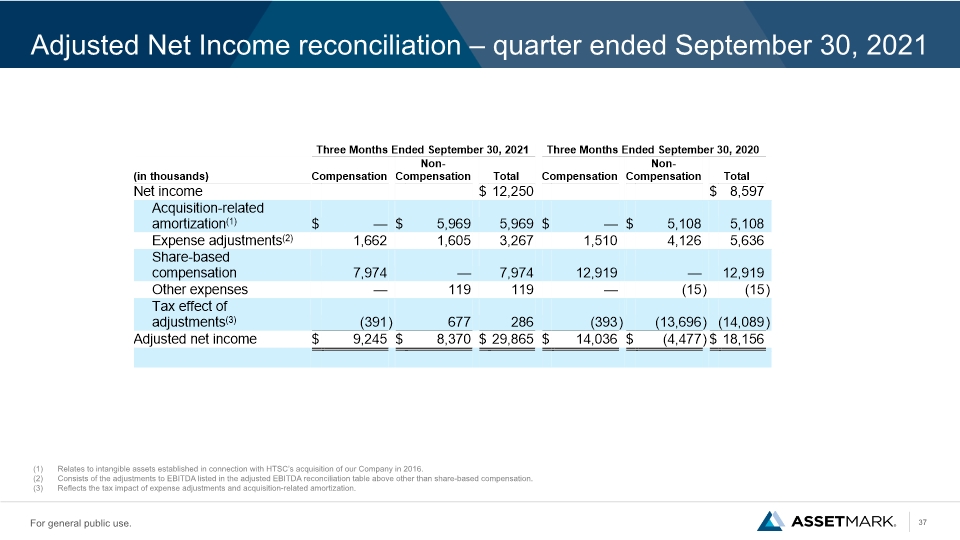

Adjusted Net Income reconciliation – quarter ended September 30, 2021 (1) Relates to intangible assets established in connection with HTSC’s acquisition of our Company in 2016. (2) Consists of the adjustments to EBITDA listed in the adjusted EBITDA reconciliation table above other than share-based compensation. (3) Reflects the tax impact of expense adjustments and acquisition-related amortization.