- ANY Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

F-4/A Filing

Sphere 3D (ANY) F-4/ARegistration of securities (foreign) (amended)

Filed: 12 Sep 14, 12:00am

Exhibit 8.3

| ||||

|  | |||

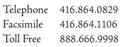

Reply To: | Brent Pidborochynski | |||

Direct Line: | (416) 864-0784 | |||

E-Mail: | bpidborochynski@thor.ca |

September 11, 2014

Sphere 3D Corporation

240 Matheson Blvd. East

Mississauga, Ontario, Canada

L4Z 1X1

Dear Sirs/Mesdames:

Re: Sphere 3D Corporation

We have acted as Canadian tax counsel to Sphere 3D Corporation (“Sphere 3D”) in connection with the proposed merger between S3D Acquisition Company (the “Merger Sub”), a wholly-owned subsidiary of Sphere 3D, and Overland Storage, Inc. (“Overland”) pursuant to an Agreement and Plan of Merger (the “Agreement”) between Sphere 3D, Merger Sub, and Overland dated May 15, 2014, with Overland surviving as a wholly-owned subsidiary of Sphere 3D. Pursuant to the Agreement, the shareholders of Overland will receive common shares of Sphere 3D (the “Common Shares”).

We provided this opinion in connection with the registration of the Common Shares under the Form F-4 (the “Registration Statement”) filed by Sphere 3D on the date hereof with the United States Securities and Exchange Commission pursuant to the United States Securities Act of 1933, as amended (the “Act”).

We have participated in the preparation of the discussion set forth in the section entitled “Certain Canadian Federal Income Tax Considerations” in the Registration Statement. In our opinion, such discussions, constitutes, in all material respects an accurate summary of the Canadian federal income tax matters described therein subject to the qualifications, assumptions and limitations stated therein.

We express our opinion herein only as to those matters of Canadian federal income tax specifically set forth under the caption “Certain Canadian Federal Income Tax Considerations” in the Registration Statement and no opinion should be inferred as to the tax consequences of the Agreement under any provincial, state, local or foreign law, or with respect to any other areas of Canadian federal taxation.

The opinions expressed herein are as of the date hereof. This opinion is strictly limited to the matters stated herein and no other or more extensive opinion is intended, implied or to be inferred beyond the matters expressed stated herein. We hereby consent to the filing of this opinion as an exhibit to the Registration Statement and for no other purpose. Except for such use, this opinion may not be quoted, circulated or published, in whole or in part, or otherwise referred to, filed with or furnished to any other person or entity, without our express prior written authorization. In giving this consent, we do not

| Page 2 |

thereby admit that we are included in the category of person whose consent is required by the Act or the rules and regulations promulgated thereunder.

Yours very truly,

/s/ Brent Pidborochynski

THORSTEINSSONS LLP