Nasdaq: AGFS AgroFresh Solutions, Inc. Investment Overview October 2018

Safe Harbor In addition to historical information, this presentation contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this presentation that address activities, events or developments that the Company expects or anticipates will or may occur in the future are forward-looking statements and are identified with, but not limited to, words such as “anticipate”, “believe”, “expect”, “estimate”, “plan”, “outlook”, and “project” and other similar expressions (or the negative versions of such words or expressions). Forward-looking statements include, without limitation, information concerning the Company’s possible or assumed future results of operations, including all statements regarding financial guidance, anticipated future growth, business strategies, competitive position, industry environment, potential growth opportunities and the effects of regulation. These statements are based on management’s current expectations and beliefs, as well as a number of assumptions concerning future events. Such forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the Company’s management’s control that could cause actual results to differ materially from the results discussed in the forward-looking statements. These risks include, without limitation, the risk of increased competition and the ability of the business to grow and manage growth profitably; risks associated with acquisitions and investments, including that our acquisition of Tecnidex may not yield the results expected; changes in applicable laws or regulations, and the possibility that the Company may be adversely affected by other economic, business, and/or competitive factors. Some of these risks and uncertainties are identified and discussed in the Company’s filings with the SEC, including the Annual Report on Form 10-K filed on March 22, 2018, available at the SEC’s website at www.sec.gov. Any forward-looking statement made in this presentation is based only on information currently available to the Company and speaks only as of the date on which it is made. The Company undertakes no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. This presentation contains the financial measures EBITDA and Adjusted EBITDA, which are not presented in accordance with GAAP. These non-GAAP financial measures are being presented because they are used by the Company’s management to evaluate the Company’s performance. Management believes that these measures enhance a reader’s understanding of the financial performance of the Company, are more indicative of operating performance of the Company, and facilitate a better comparison among fiscal periods, as they exclude items that are not considered core to the Company’s operations. In particular, EBITDA and Adjusted EBITDA are key measures used by the Company to evaluate its performance. The Company does not intend for these non-GAAP financial measure to be a substitute for any GAAP financial information. Readers of this presentation should use these non-GAAP financial measures only in conjunction with the comparable GAAP financial measure. Reconciliations of the non-GAAP financial measures to the most comparable GAAP measure are provided in this presentation. TM Trademark of AgroFresh 2

Solutions for Preventing Food Waste One-third of all food produced is wasted1, equating to $1 trillion in food waste globally2 ONE-HALF1 SOLUTIONS 50% of fruits and vegetables perish before being consumed AgroFresh provides technologies and solutions that extend the life of crops in: STORAGE TRANSIT STORE HOME (1) UN FAO 2012, UN DESA 2015 (2) IFPRI 2016 3

Nasdaq: AGFS AgroFresh Snapshot Last 12 Months (ended June 30, 2018) AgroFresh is focused on providing the breakthrough, end-to-end solutions that enable more people everywhere to enjoy the freshest, best-tasting produce, prevent food waste and conserve our planet’s resources. Revenue ⬡ $172 million Global innovator with leading market share poised for an acceleration in growth Gross Margins ⬡ 77% Longstanding and diverse global customer base Adjusted EBITDA ⬡ $67 million ‘Asset-lite, high-touch’ model allows for attractive margin profile and sustainable cash flow Cash Position1 ⬡ $42 million Strong technological heritage with global network of innovation centers around the world Enterprise Value ⬡ ~$725 million (1) As of June 30, 2018 4

Our History Pushing the potential of produce for nearly 25 years AgroFresh is formed; AgroFresh Solutions, Inc. becomes AgroFresh gains exclusive Rohm and Haas acquires standalone public company; introduces Acquisition of Tecnidex rights to 1-MCP technology Introduction of ActiMist 1-MCP technology RipeLock™, LandSpring™ 1994 1999 2002 2007 2009 2015 2016 2017 2018 1-MCP use patent is filed backed SmartFresh™ commercial Dow completes acquisition of Rohm New CEO appointed FreshCloud launched; by USDA, researchers at North launch – first registration granted and Haas Company; AgroFresh New partnerships established with: It’s Fresh!, Pagoda Carolina State University in Chile; followed by U.S. operates as a fully owned subsidiary of Dow AgroSciences LLC 5

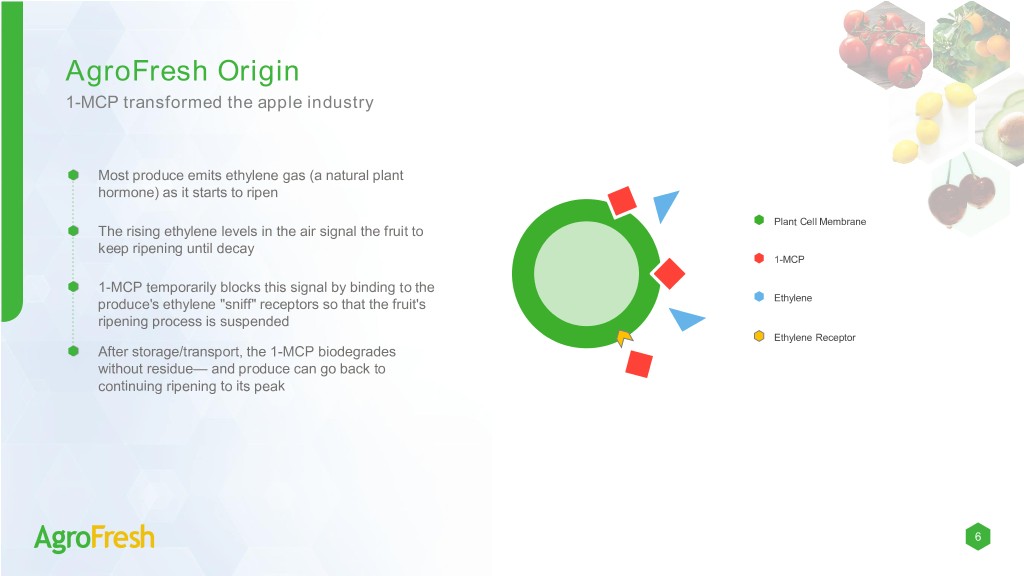

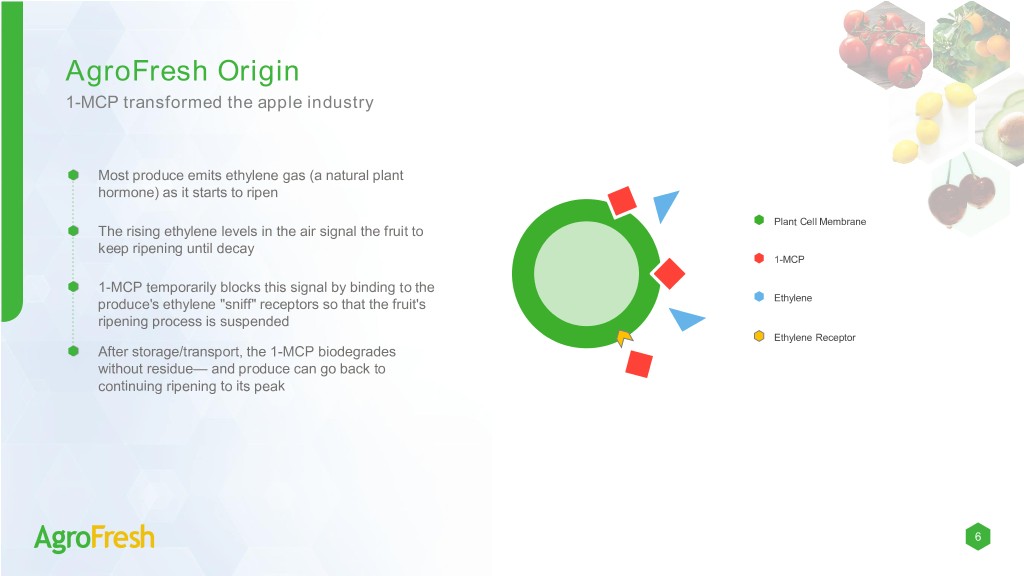

AgroFresh Origin 1-MCP transformed the apple industry Most produce emits ethylene gas (a natural plant hormone) as it starts to ripen Plant Cell Membrane The rising ethylene levels in the air signal the fruit to keep ripening until decay 1-MCP 1-MCP temporarily blocks this signal by binding to the produce's ethylene "sniff" receptors so that the fruit's Ethylene ripening process is suspended Ethylene Receptor After storage/transport, the 1-MCP biodegrades without residue— and produce can go back to continuing ripening to its peak 6

A Global Franchise 2017 Revenue by region (including Tecnidex) 284 full time employees1 Global HQ 33% Europe Business in 45 countries R&D Centers 33% North America Approximately 3,700 direct customers Commercial 8% Teams 10% Asia Pacific Africa and Middle East 25,000+ storage rooms serviced worldwide 16% Latin America 60 patent families active or granted globally (1) As of December 31, 2017 7

Leadership with a Vision A new, experienced and energized team Our leadership team brings together deep industry experience and a diversity of perspectives to help us create exceptional results for customers, stakeholders and employees. Jordi Ferre Graham Miao Paul Nselel Mark Zettler Bill Lucas Tom Ermi CEO CFO VP & Global GM, VP, R&D & VP, Global Marketing & VP, Secretary & Post Harvest Regulatory Affairs Business Development General Counsel 25+ years of 25+ years global international experience experience in life Global industry Joined AgroFresh in 20+ years in marketing and 25+ years of litigation, retail sales at leading in food operations, sciences, specialty experience at Monsanto 2013 with 30+ years of corporate counsel and M&A consumer brands manufacturing, finance, chemicals and financial with strategic planning industry experience legal experience sales and marketing services roles at Nike Kraft Foods, Lexmark, Previously Dow Global Newell Brands 17+ years with AgroFresh COO at PureCircle and CFO in several public Background in applied R&D Leader and New and its predecessors executive roles at Tate & companies and mathematics and Business Development Lyle and Chupa Chups executive roles at finance Audit experience with Price Symrise and Pharmacia Waterhouse 8

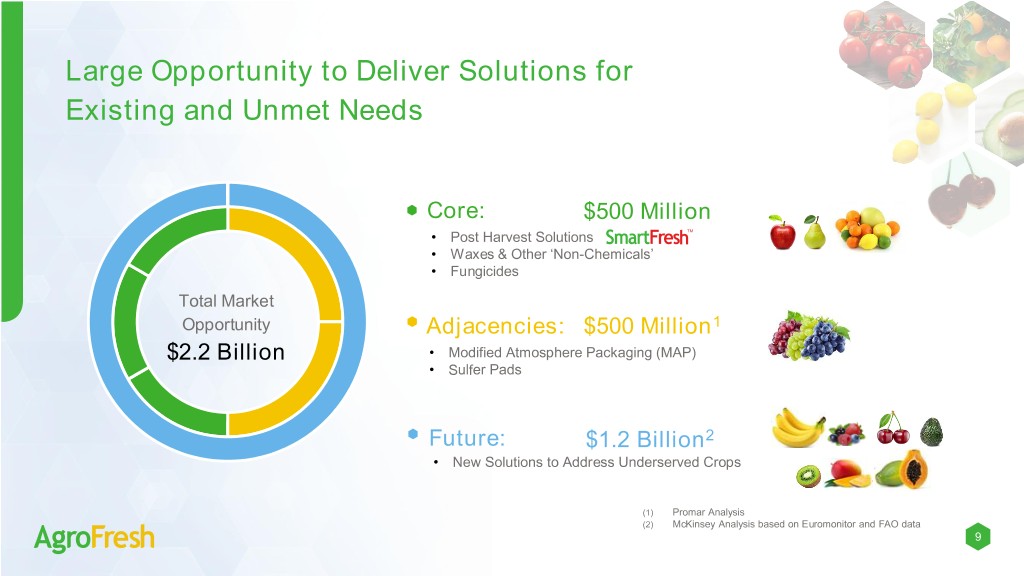

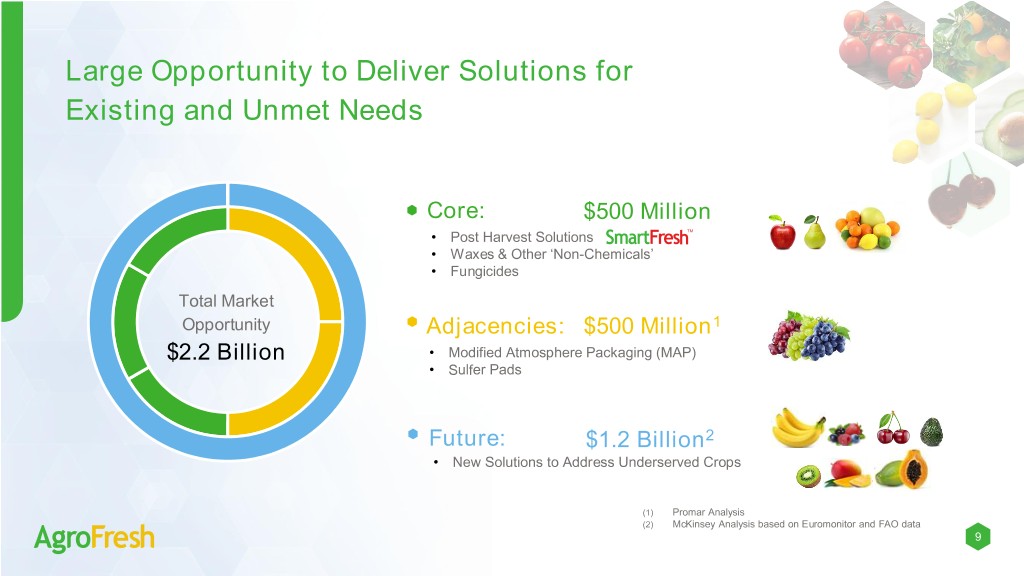

Large Opportunity to Deliver Solutions for Existing and Unmet Needs Core: $500 Million • Post Harvest Solutions • Waxes & Other ‘Non-Chemicals’ • Fungicides Total Market Opportunity Adjacencies: $500 Million1 $2.2 Billion • Modified Atmosphere Packaging (MAP) • Sulfer Pads Future: $1.2 Billion2 • New Solutions to Address Underserved Crops (1) Promar Analysis (2) McKinsey Analysis based on Euromonitor and FAO data 9

Advancing the Future of Freshness Targeting $500 million of revenue in five years Growth Strategy Organic Grow share and expand addressable market through innovation Acquisitions Accelerate growth strategy through acquisitions that diversify product offerings and end markets served Partnerships To bring novel technologies to market 10

Solutions Across the Supply Chain Solutions that deliver value from the fields and orchards to the shopping cart Equips Customers with Timely Information to Optimize Decision Making and Profits NEAR HARVEST STORAGE PACKING & DISTRIBUTION RETAIL CONSUMER Reduces Pre-harvest Maintains Firmness Improves Pack-Out Better Appearance Extends Produce Shelf Life Losses and Extends the Adds Marketing Flexibility Opens Longer-Distance Markets Increases Consumer Appeal Harvest Window Improves Appearance Improved Buyer Experience Reduces Shrinkage 11

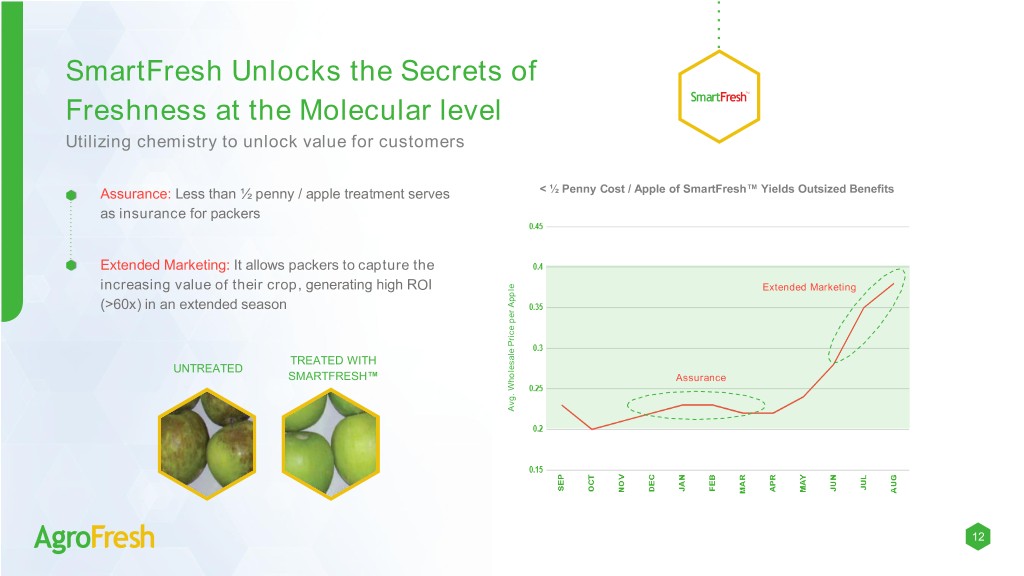

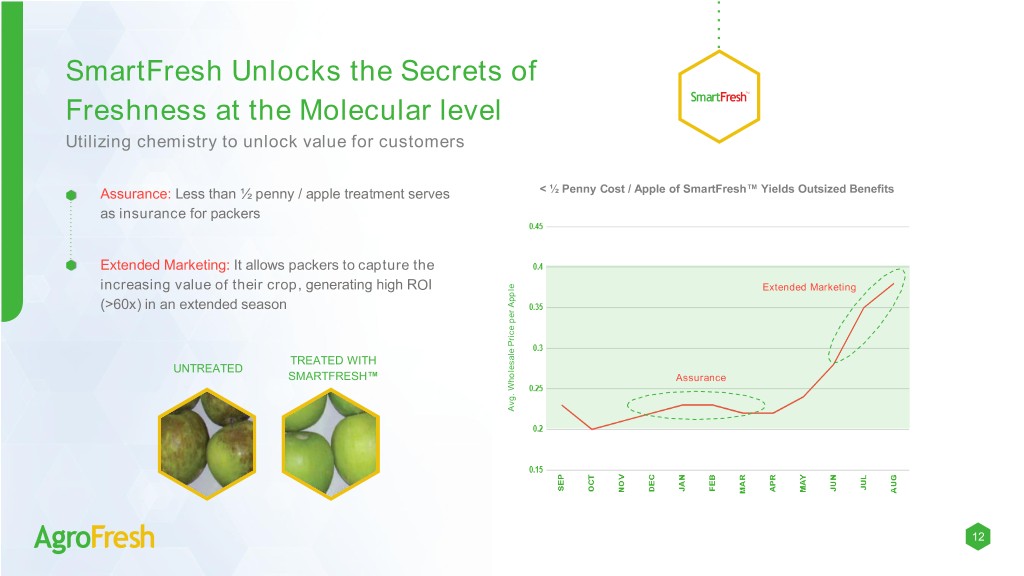

SmartFresh Unlocks the Secrets of Freshness at the Molecular level Utilizing chemistry to unlock value for customers Assurance: Less than ½ penny / apple treatment serves < ½ Penny Cost / Apple of SmartFresh™ Yields Outsized Benefits as insurance for packers Extended Marketing: It allows packers to capture the increasing value of their crop, generating high ROI Extended Marketing (>60x) in an extended season TREATED WITH UNTREATED SMARTFRESH™ Assurance Avg. Wholesale Price Apple Price per WholesaleAvg. 12

Harvista A near-harvest, synergistic solution with SmartFresh Applied just before harvest, reducing losses UNTREATED TREATED WITH HARVISTA™ Extends the ideal harvest window for greater fruit quality, color, and size Allows for improved labor management Expansion from apples & pears into cherries Patent protection through 2025 Use with SmartFresh to create an amplified effect Help slow respiration and the ripening process to retain firmness and quality for an even longer period Source: Business management Note: Orchard located in Ontario, Canada. 2013. 13

RipeLock Ideal solution for the banana industry Opportunities ⬡ Extends 1-MCP benefits to take advantage of global opportunities ⬡ Patent protection through 2030 Del Monte Partnership ⬡ Signed collaboration agreement in North America to UNTREATED TREATED WITH RIPELOCK™ jointly market to retailers Retail Rollout ⬡ Initial rollout with a large U.S. grocer (1)Four days after simulated delivery to retailer (2)Four days after simulated delivery to retailer and removal from RipeLock modified atmosphere packaging (“MAP”) bags 14

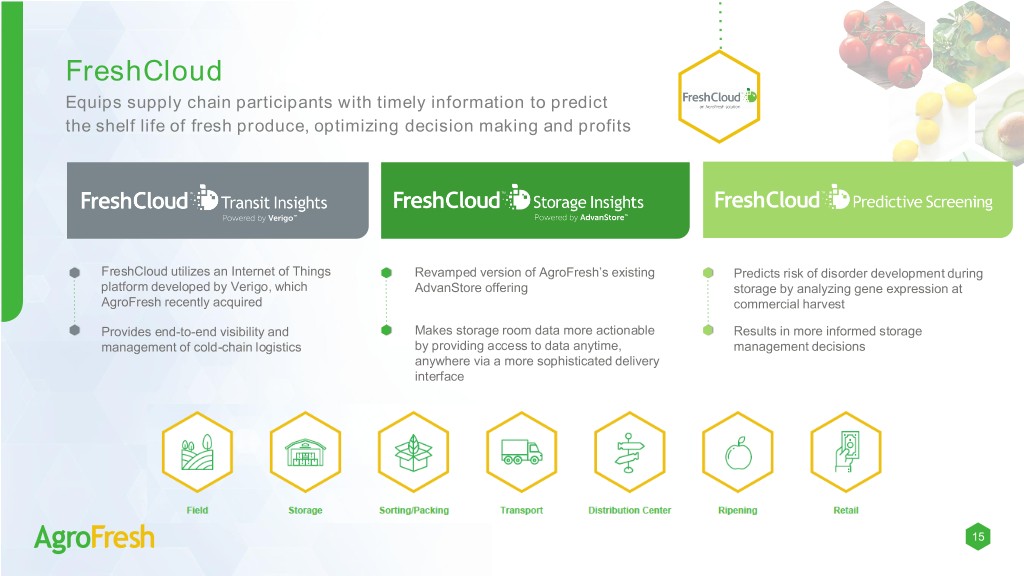

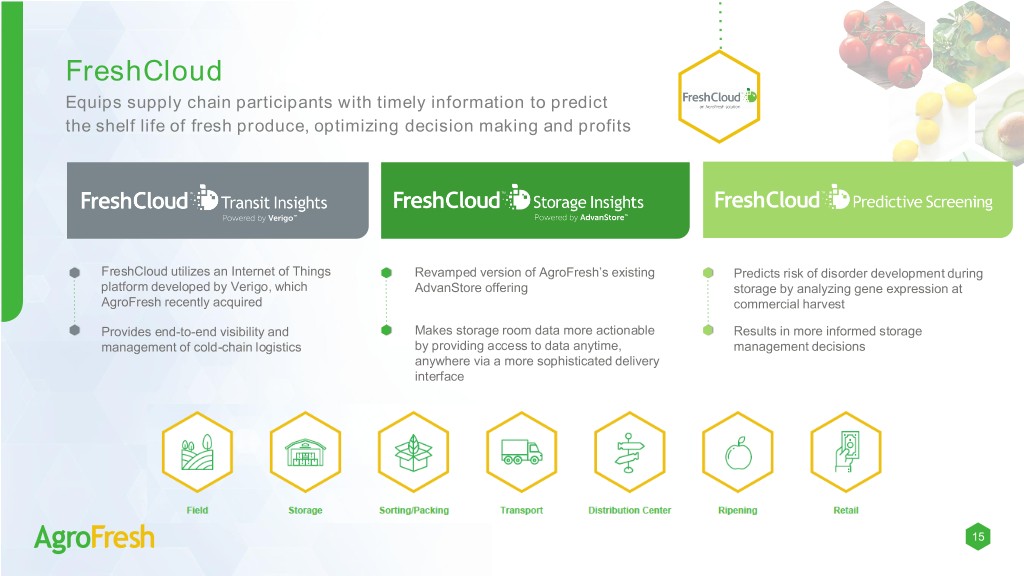

FreshCloud Equips supply chain participants with timely information to predict the shelf life of fresh produce, optimizing decision making and profits FreshCloud utilizes an Internet of Things Revamped version of AgroFresh’s existing Predicts risk of disorder development during platform developed by Verigo, which AdvanStore offering storage by analyzing gene expression at AgroFresh recently acquired commercial harvest Provides end-to-end visibility and Makes storage room data more actionable Results in more informed storage management of cold-chain logistics by providing access to data anytime, management decisions anywhere via a more sophisticated delivery interface 15

Tecnidex A leader in the citrus market Provides post harvest crop diversification; Citrus 80+% of revenue Strengthens geographic diversification (Spain, Morocco are major markets) Technical expertise in fungicides, coatings and waxes with leading global suppliers Strong Product Portfolio Fungicides, Biocides, Disinfectants, Waxes, Service/solution-oriented approach with 700 direct customers Coatings, Sanitizers, Equipment, Services 2017 Revenue ~$20 million Attractive margins and EBITDA 16

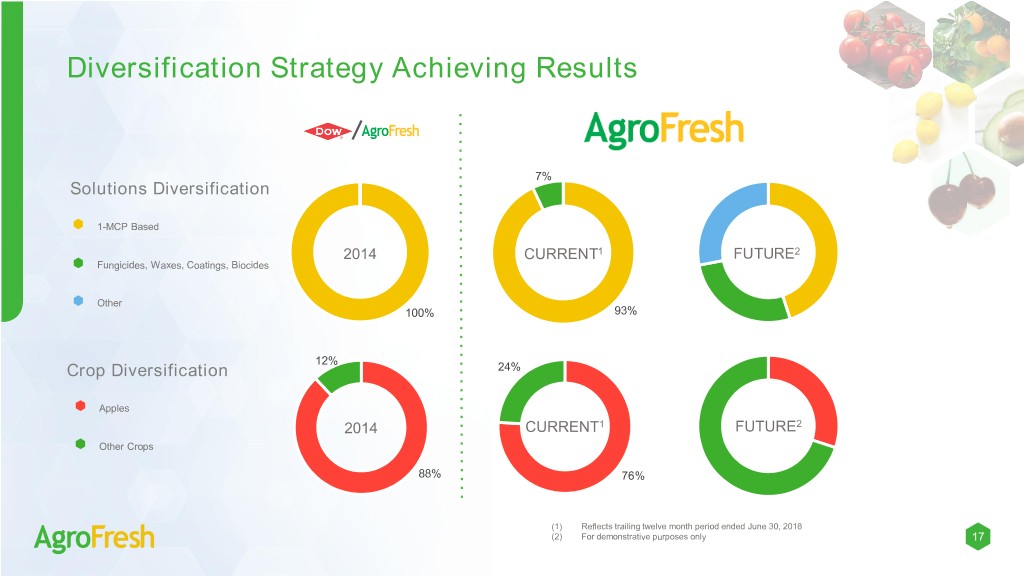

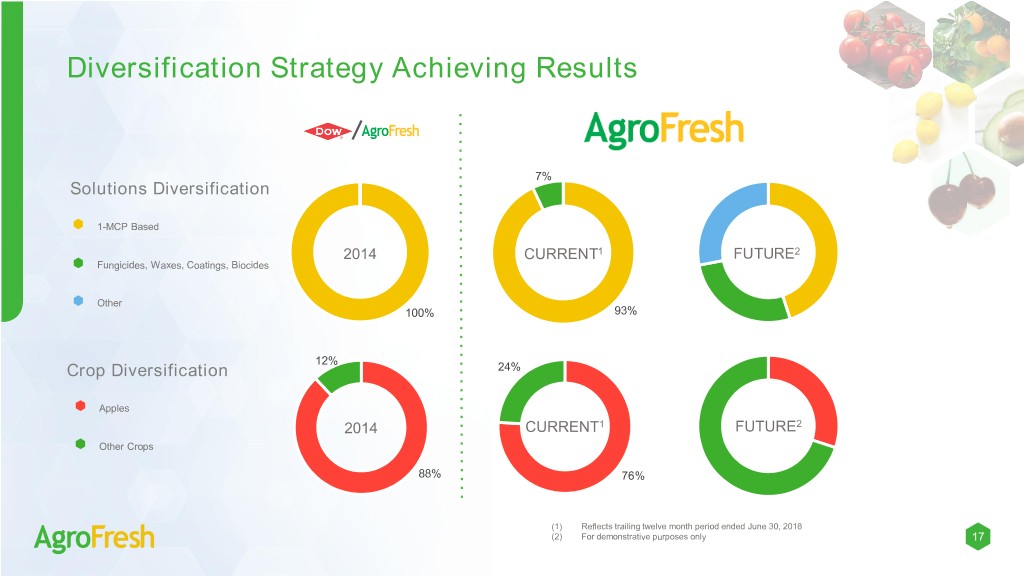

Diversification Strategy Achieving Results 7% Solutions Diversification 1-MCP Based 2014 CURRENT1 FUTURE2 Fungicides, Waxes, Coatings, Biocides Other 100% 93% 12% Crop Diversification 24% Apples 2014 CURRENT1 FUTURE2 Other Crops 88% 76% (1) Reflects trailing twelve month period ended June 30, 2018 (2) For demonstrative purposes only 17

Strategic Initiatives to Address Underserved Markets Investment ⬡ Continued investment in internal R&D for future commercialization Technology ⬡ Strong external pipeline of future technologies Innovation Centers ⬡ Opening two new innovations centers in 2018 (California and China) ⬡ Complements four existing locations (Washington, Pennsylvania, Italy, Chile) Mapping Program ⬡ First Genomics mapping program launched 18

Recent Partnerships Extending Our Innovation Terra • This ag-tech incubator is designed to open innovation between Through Partnerships corporations and startups • We're joining other leading companies from the global food/agricultural sector in the inaugural cohort of corporate partners Seeking next-generation solutions to advance freshness Ripelocker • RipeLocker is developing a unique system to manage atmospheric pressure, humidity and gas composition in containers Pursuing growth of our addressable market through • The system is designed to cost-effectively maintain produce quality as innovation it travels through adverse conditions during the post-harvest journey Developing new technologies to address underserved It’s Fresh! segments that lack a current preservation solution • Strategic investment in Food Freshness Technology, which has a proprietary ethylene technology “It’s Fresh!” • Commercial agreement allows for joint marketing of RipeLock and It’s Fresh! to growers and retailers • Currently have commercial trials with 18 customers in Europe and Asia Pagoda • Pagoda is the largest fruit retail chain in China with 3,000 outlets and plans to expand to 10,000 locations by 2020 • The partnership allows AgroFresh entry into a large and growing market • Collaborating to research quality problems and deliver actionable insights and solutions 19

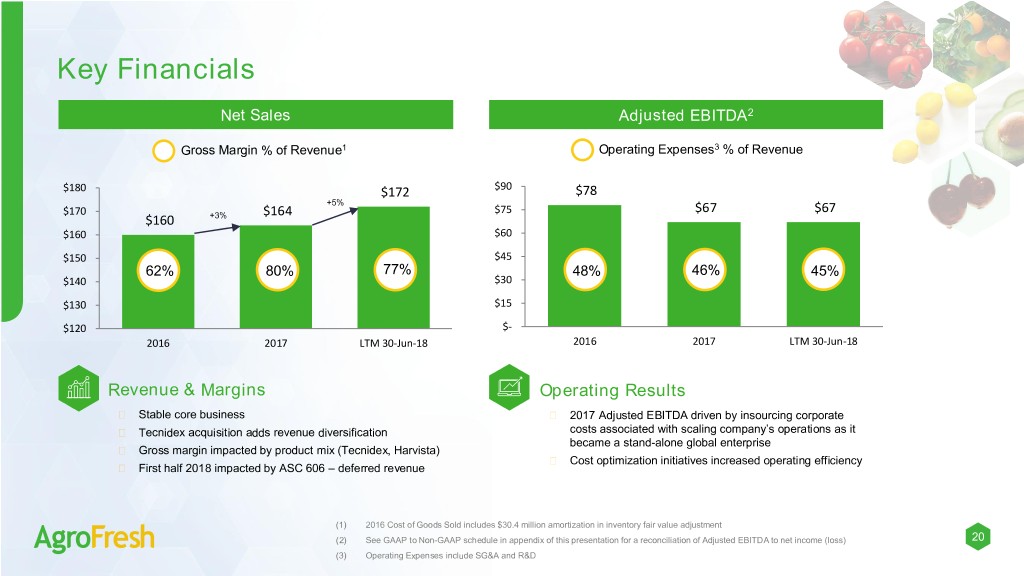

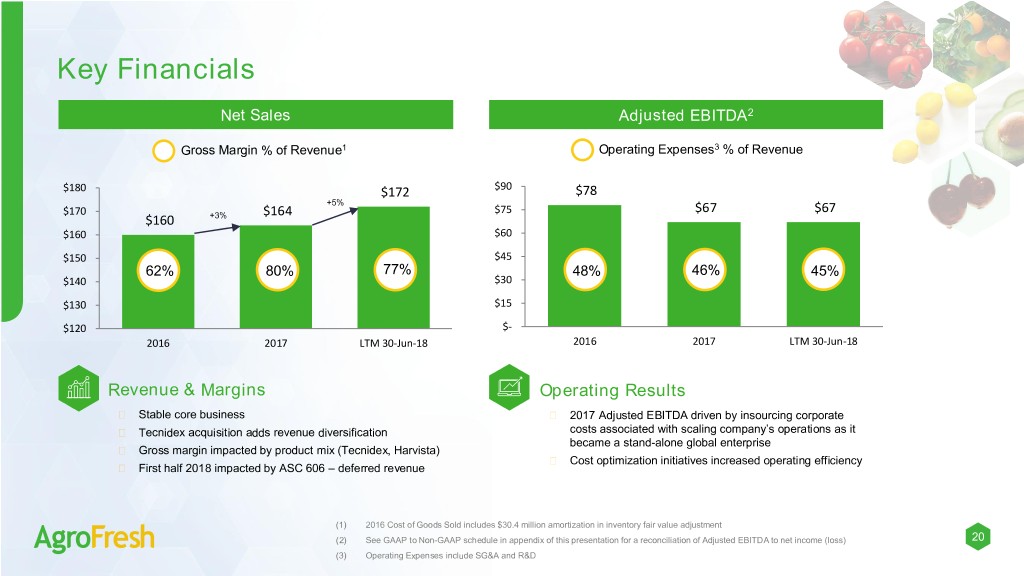

Key Financials Net Sales Adjusted EBITDA2 Gross Margin % of Revenue1 Operating Expenses3 % of Revenue $180 $172 $90 $78 +5% $170 $164 $75 $67 $67 $160 +3% $160 $60 $150 $45 62% 80% 77% 48% 46% 45% $140 $30 $130 $15 $120 $- 2016 2017 LTM 30-Jun-18 2016 2017 LTM 30-Jun-18 Revenue & Margins Operating Results ⬡ Stable core business ⬡ 2017 Adjusted EBITDA driven by insourcing corporate ⬡ Tecnidex acquisition adds revenue diversification costs associated with scaling company’s operations as it became a stand-alone global enterprise ⬡ Gross margin impacted by product mix (Tecnidex, Harvista) ⬡ Cost optimization initiatives increased operating efficiency ⬡ First half 2018 impacted by ASC 606 – deferred revenue (1) 2016 Cost of Goods Sold includes $30.4 million amortization in inventory fair value adjustment (2) See GAAP to Non-GAAP schedule in appendix of this presentation for a reconciliation of Adjusted EBITDA to net income (loss) 20 (3) Operating Expenses include SG&A and R&D

AgroFresh Capital Structure Highlights 6/30/18 Directors Title Shares Outstanding 50M Nance Dicciani Chairman Overview and key shareholders Share Price $7.01 Jordi Ferre CEO & Director $25 million revolver undrawn (except $0.5 million LCs, no meaningful maturities Equity Value $351M Robert Campbell Director until 2021) Total Debt $416M Torsten Kraef Director Annual 1% principal payment on term loan Cash $42M Macauley Whiting Director Net Debt $374M Gregory Freiwald Director No financial maintenance covenants on term loan Enterprise Value $725M George Lobisser Director Denise Devine Director Key Shareholders1 The Dow Chemical Company 39% T. Rowe Price Associates 15% Templeton Investment Counsel 7% (1) As of 6/30/18, except Dow as of 9/28/18 First Manhattan Co. 6% Remaining Ownership 33% 21

Why Invest in AgroFresh? Global Leadership Position with Scalable Model ⬡ Leader in global post-harvest market ⬡ Expanding our addressable market ⬡ Experienced management team Poised for Growth ⬡ Drive organic growth through innovation ⬡ Accelerate growth through M&A that diversifies product mix and adds scale ⬡ Leverage partnerships to bring novel technologies to market Improved Operating Structure ⬡ Revenue objective to grow to $500M in next 5 years ⬡ High gross margin enables strong cash flow generation ⬡ Cost optimization initiatives in place 22

Appendix AgroFresh Solutions, Inc.

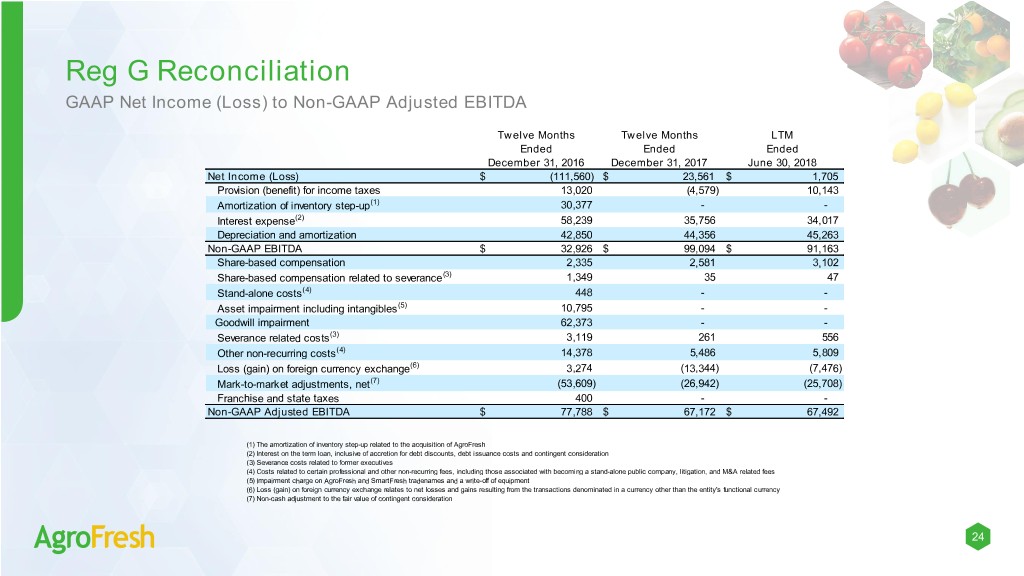

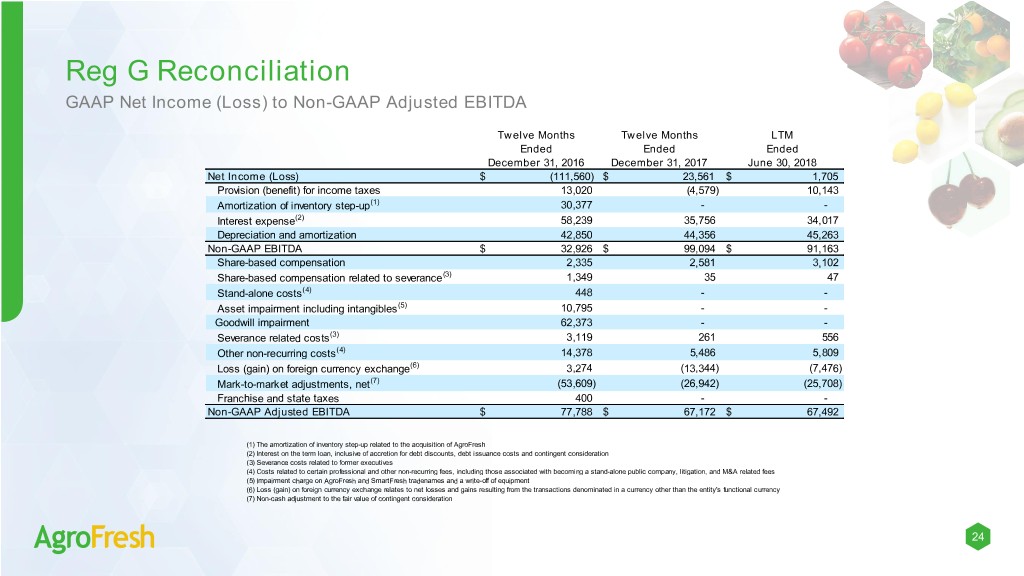

Reg G Reconciliation GAAP Net Income (Loss) to Non-GAAP Adjusted EBITDA Twelve Months Twelve Months LTM Ended Ended Ended December 31, 2016 December 31, 2017 June 30, 2018 Net Income (Loss) $ (111,560) $ 23,561 $ 1,705 Provision (benefit) for income taxes 13,020 (4,579) 10,143 Amortization of inventory step-up(1) 30,377 - - Interest expense(2) 58,239 35,756 34,017 Depreciation and amortization 42,850 44,356 45,263 Non-GAAP EBITDA $ 32,926 $ 99,094 $ 91,163 Share-based compensation 2,335 2,581 3,102 Share-based compensation related to severance(3) 1,349 35 47 Stand-alone costs(4) 448 - - Asset impairment including intangibles(5) 10,795 - - Goodwill impairment 62,373 - - Severance related costs(3) 3,119 261 556 Other non-recurring costs(4) 14,378 5,486 5,809 Loss (gain) on foreign currency exchange(6) 3,274 (13,344) (7,476) Mark-to-market adjustments, net(7) (53,609) (26,942) (25,708) Franchise and state taxes 400 - - Non-GAAP Adjusted EBITDA $ 77,788 $ 67,172 $ 67,492 (1) The amortization of inventory step-up related to the acquisition of AgroFresh (2) Interest on the term loan, inclusive of accretion for debt discounts, debt issuance costs and contingent consideration (3) Severance costs related to former executives (4) Costs related to certain professional and other non-recurring fees, including those associated with becoming a stand-alone public company, litigation, and M&A related fees (5) Impairment charge on AgroFresh and SmartFresh tradenames and a write-off of equipment (6) Loss (gain) on foreign currency exchange relates to net losses and gains resulting from the transactions denominated in a currency other than the entity's functional currency (7) Non-cash adjustment to the fair value of contingent consideration 24