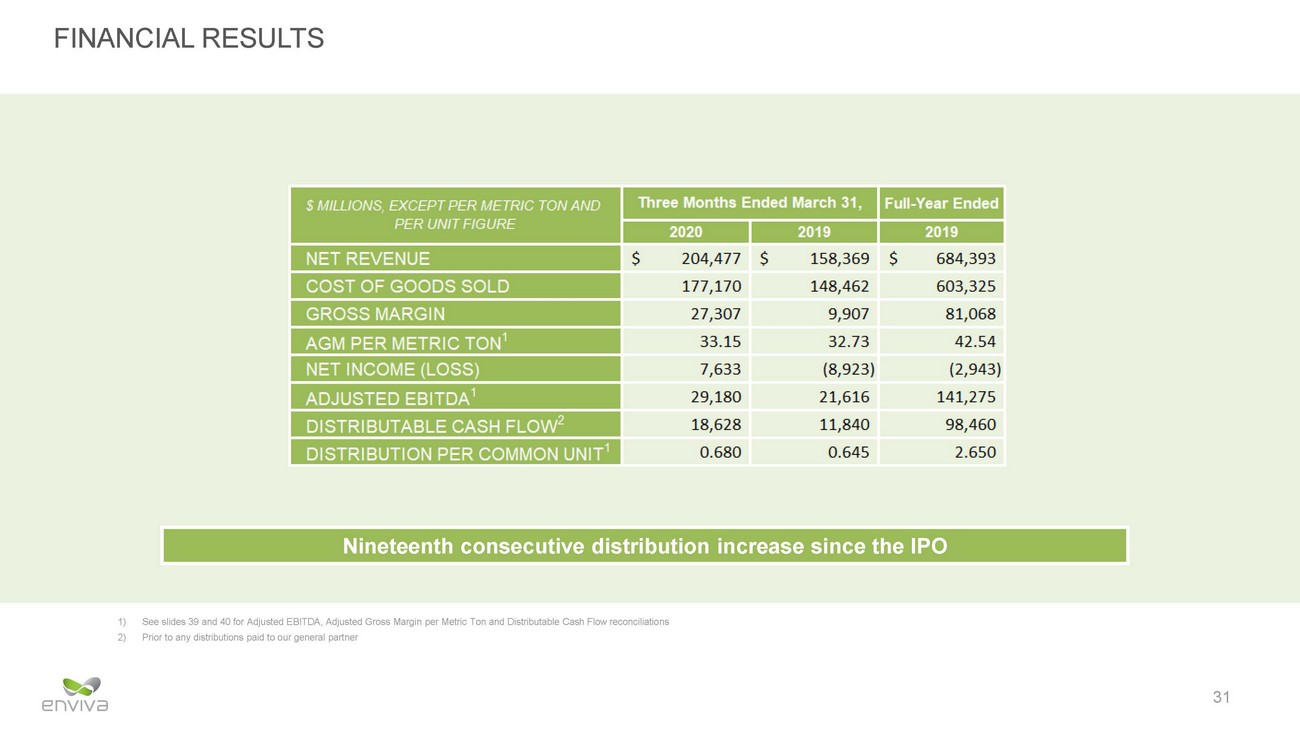

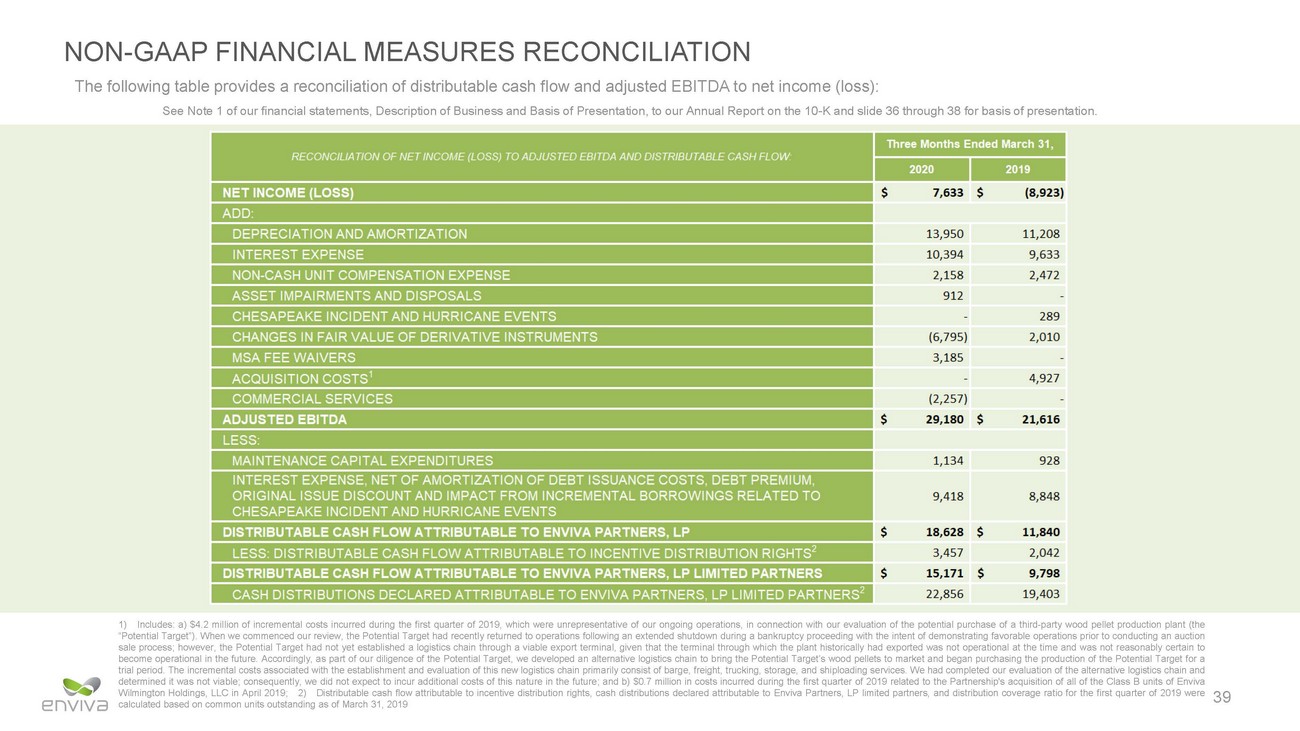

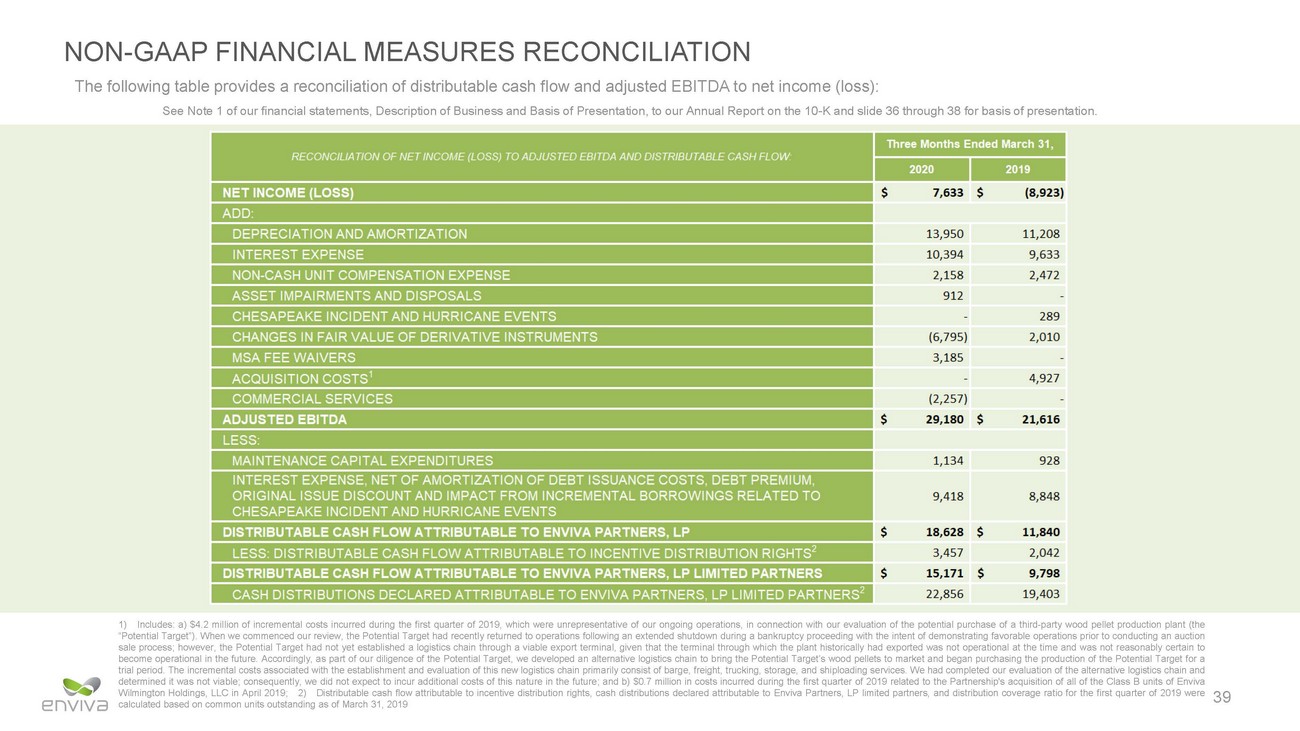

| NON-GAAP FINANCIAL MEASURES RECONCILIATION The following table provides a reconciliation of distributable cash flow and adjusted EBITDA to net income (loss): See Note 1 of our financial statements, Description of Business and Basis of Presentation, to our Annual Report on the 10-K and slide 36 through 38 for basis of presentation. s s 7,633 (8,923) 13,950 10,394 2,158 912 11,208 9,633 2,472 I SPOSALS 289 2,010 (6,795) 3,185 4,927 ( 2,257) 29,180 s s 21,616 1,134 928 9,418 8,848 EVENTS s s s s 18,628 3,457 15,171 22,856 11,840 2,042 9,798 19,403 2 2 1) Includes a) $4.2 million of incremental costs incurred during the first quarter of 2019, which were unrepresentative of our ongoing operations, in connection with our evaluation of the potential purchase of a third-party wood pellet production plant (the "Potential Target") When we commenced our review, the Potential Target had recently returned to operations following an extended shutdown during a bankruptcy proceeding with the intent of demonstrating favorable operations prior to conducting an auction sale process; however, the Potential Target had not yet established a logistics chain through a viable export terminal, given that the terminal through which the plant historically had exported was not operational at the time and was not reasonably certain to become operational in the future Accordingly, as part of our diligence of the Potential Target, we developed an alternative logistics chain to bring the Potential Target's wood pellets to market and began purchasing the production of the Potential Target for a trial period. The incremental costs associated with the establishment and evaluation of this new logistics chain primarily consist of barge, freight, trucking, storage, and shiploading services. We had completed our evaluation of the alternative logistics chain and determined it was not viable; consequently, we did not expect to incur additional costs of this nature in the future; and b) $0.7 million in costs incurred during the first quarter of 2019 related to the Partnership's acquisition of all of the Class B units of Enviva Wilmington Holdings, LLC in April 2019; 2) Distributable cash fiow attributable to incentive distribution rights, cash distributions declared attributable to Enviva Partners, LP limited partners, and distribution coverage ratio for the first quarter of 2019 were calculated based on common units outstanding as of March 31, 2019 39 MAINTENANCE CAPITAL EXPENDITURES INTEREST EXPENSE, NET OF AMORTIZATION OF DEBT ISSUANCE COSTS, DEBT PREMIUM , ORIGINAL ISSUE DISCOUNT AND IMPACT FROM I N CREMENTAL BORROWINGS RELATED TO CHESAPEAKE INCIDENT AND HURRICANE DISTRIBUTABLE CASH FLOW ATTRIBUTABLE TO ENVIVA PARTNERS,LP LESS: DISTRIBUTABLE CASH FLOW ATTRIBUTABLE TO INCENTIVE DISTRIBUTION RIGHTS DISTRIBUTABLE CASH FLOW ATTRIBUTABLE TO ENVIVA PARTNERS,LP LIMITED PARTNERS CASH DISTRI BUTIONS DECLARED ATTRIBUTABLE TO ENVIVA PARTNERS, LP LIMITED PARTNERS DEPRECIATION AND AMORTIZATION INTEREST EXPENSE NON-CASH UNIT COMPENSAT I ON EXPENSE ASSET MPAIRMENTS AND DI CHESAPEAKE INCIDENT AND HURRICANE EVENTS CHANGES IN FAIR VALUE OF DERIVATIVE INSTRUMENTS MSA FEE WAIVERS ACQUISITION COSTS 1 COMMERC IAL SERVI CES ADJUSTED EBITDA LESS: NET INCOME (LOSS) ADD : 2019 2020 RECONCILIATION OF NET INCOME (LOSS) TO ADJUSTED EBITDA AND DISTRIBUTABLE CASH FLOW Three Months Ended March 31, |