UNITED STATES SECURITIES AND EXCHANGE COMMISSION

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended September 30, 2019

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

to

| | | | | | | | | | | | | |

| | | | | Name of Registrant, State of Incorporation, Address of Principal Offices, and Telephone No. | | | | | IRS Employer Identification No. |

| | | | | | Spectrum Brands Holdings, Inc. 3001 Deming Way, Middleton, WI 53562 | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | (a Delaware limited liability company) 3001 Deming Way, Middleton, WI 53562 | | | | | | |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | |

| | | | | | | | | | Name of each exchange on which registered |

Spectrum Brands Holdings, Inc. | | | | | | Common Stock, Par Value $0.01 | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrants are well-known seasoned issuers, as defined in Rule 405 of the Securities Act.

| | | | | | | |

Spectrum Brands Holdings, Inc. | | | | | | |

| | | | | | |

Indicate by check mark if the registrants are not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| | | | | | | |

Spectrum Brands Holdings, Inc. | | | | | | |

| | | | | | |

Indicate by check mark whether the registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| | | | | | | |

Spectrum Brands Holdings, Inc. | | | | | | |

| | | | | | |

Indicate by check mark whether the registrants have submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation

S-T

(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

| | | | | | | |

Spectrum Brands Holdings, Inc. | | | | | | |

| | | | | | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated

filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company in Rule 12b-2 of the Exchange Act.:

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Spectrum Brands Holdings, Inc. | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| | | | | |

Spectrum Brands Holdings, Inc. | | | | |

| | | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| | | | | | | |

Spectrum Brands Holdings, Inc. | | | | No ☒ | | |

| | | | | | |

The aggregate market value of the voting stock held by

non-affiliates

of Spectrum Brands Holdings, Inc. was approximately $2,439 million based upon the closing price on the last business day of the registrant’s most recently completed second fiscal quarter (March 31, 2019). For the sole purposes of making this calculation, term

“non-affiliate”

has been interpreted to exclude directors and executive officers and other affiliates of the registrant. Exclusion of shares held by any person should not be construed as a conclusion by the registrant, or an admission by any such person, or that such person is an “affiliate” of the Company, as defined by applicable securities law.

As of January 6, 2020, there were outstanding 46,045,746 shares of Spectrum Brands Holdings, Inc.’s common stock, par value $0.01 per share.

SB/RH Holdings, LLC meets the conditions set forth in General Instruction I(1)(a) and (b) of Form

10-K

and has therefore omitted the information otherwise called for by Items 10 to 13 of Form

10-K

as allowed under General Instruction I(2)(c).

DOCUMENTS INCORPORATED BY REFERENCE

Lead Independent Director

Mr. Polistina was appointed to our Board, and as our Lead Independent Director in July 2018. In his capacity as our Lead Independent Director, Mr. Polistina:

| | • | presides at all meetings of the Board at which the Chairman of the Board is not present; |

| | • | presides at all executive sessions of the independent members of the Board, and has the authority to call meetings of the independent members of the Board; |

| | • | serves as liaison between the management and the independent members of the Board, and provides our Chief Executive Officer (“CEO”) and other members of management with feedback from executive sessions of the independent members of the Board; |

| | • | reviews and approves the information to be provided to the Board; |

| | • | reviews and approves meeting agendas and coordinates with management to develop such agendas; |

| | • | approves meeting schedules to assure there is sufficient time for discussion of all agenda items; |

| | • | if requested by major shareholders, ensures that he is available for consultation and direct communication; |

| | • | interviews, along with the Chair of our NGC Committee, Board and senior management candidates and makes recommendations with respect to Board candidates and hiring of senior management; |

| | • | consults with the Chair and other members of our Compensation Committee with respect to the performance review of our CEO and other member of our senior management team; and |

| | • | performs such other functions and responsibilities as requested by the Board from time to time. |

Mr. Maura serves as our Executive Chairman and our CEO. Given Mr. Maura’s broad experience in mergers and acquisitions, the consumer products and retail sectors, and finance and investments, as well as his role in SPB Legacy’s strategy and growth since 2010, our Board believes that it is in the best interest of the Company for Mr. Maura to concurrently serve as our Executive Chairman and CEO.

In accordance with the New York Stock Exchange Listed Company Manual (the “NYSE Rules”) and our Corporate Governance Guidelines, a majority of our Board is required to be comprised of independent directors. All of our directors, except for David Maura (our Chairman and CEO), qualify as independent directors. More specifically, our Board has affirmatively determined that none of the following directors has a material relationship with the Company (either directly or as a partner, stockholder, or officer of an organization that has a relationship with the Company): Kenneth C. Ambrecht, Sherianne James, Norman S. Matthews, Terry L. Polistina and Hugh R. Rovit. Our Board has adopted the definition of “independent director” set forth under Section 303A.02 of the NYSE Rules to assist it in making determinations of independence. Our Board has determined that the directors referred to above currently meet these standards and qualify as independent.

Meetings of Independent Directors

The Company generally holds executive sessions at each Board and committee meeting. In his capacity as our Lead Independent Director, Mr. Polistina presides over executive sessions of the entire Board and the Chair of each committee presides over the executive sessions of that committee.

Committees Established by Our Board of Directors

Our Board has designated three principal standing committees: our Audit Committee, our Compensation Committee, and our NCG Committee, each of which has a written charter addressing each such committee’s purpose and responsibilities. Each such committee is comprised entirely of independent directors.

Our Audit Committee has been established in accordance with Section 303A.06 of the NYSE Rules and Rule

10A-3

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), for the purpose of overseeing the Company’s

accounting and financial reporting processes and audits of our financial statements. Our Audit Committee is responsible for monitoring (i) the integrity of our financial statements, (ii) our independent registered public accounting firm’s qualifications and independence, (iii) the performance of our internal audit function and independent auditors, and (iv) our compliance with legal and regulatory requirements. The responsibilities and authority of our Audit Committee are described in further detail in the Charter of the Audit Committee, as adopted by our Board in July 2018, a copy of which is available at our website www.spectrumbrands.com under “

Investor Relations—Corporate Governance Documents

”.

The current members of our Audit Committee are Terry L. Polistina (Chair), Kenneth C. Ambrecht, and Hugh R. Rovit. Our Board has determined that each member of our Audit Committee qualifies as an “audit committee financial expert” as defined in the rules promulgated by the SEC in furtherance of Section 407 of the Sarbanes-Oxley Act of 2002. Our Board has determined that all of the members of our Audit Committee qualify as independent, as such term is defined in Section 303A.02 of the NYSE Rules, Section 10A(m)(3)(B) of the Exchange Act, and Exchange Act Rule

10A-3(b).

Our Compensation Committee is responsible for (i) overseeing our compensation and employee benefits plans and practices, including our executive compensation plans and our incentive-compensation and equity-based plans, (ii) evaluating and approving the performance of our Executive Chairman and CEO and other executive officers in light of those goals and objectives, and (iii) reviewing and discussing with management our compensation discussion and analysis disclosure and compensation committee reports in order to comply with our public reporting requirements. The responsibilities and authority of our Compensation Committee are described in further detail in the Charter of the Compensation Committee, as adopted by our Board in July 2018, a copy of which is available at our website www.spectrumbrands.com under “

Investor Relations—Corporate Governance Documents

”.

The current members of our Compensation Committee are Kenneth C. Ambrecht (Chair), Norman S. Matthews and Terry L. Polistina. Our Board has determined that all of the members of our Compensation Committee qualify as independent, as such term is defined in Section 303A.02 of the NYSE Rules.

Our NCG Committee is responsible for (i) identifying and recommending to our Board individuals qualified to serve as our directors and on our committees of our Board, (ii) advising our Board with respect to board composition, procedures and committees, (iii) developing and recommending to our Board a set of corporate governance principles applicable to the Company, and (iv) overseeing the evaluation process of our Board and our Executive Chairman and CEO. The responsibilities and authority of our NCG Committee are described in further detail in the Charter of the NCG Committee, as adopted by our Board in July 2018, a copy of which is available at our website www.spectrumbrands.com under “

Investor Relations—Corporate Governance Documents

”.

The current members of our NCG Committee are Norman S. Matthews (Chair), Kenneth C. Ambrecht, and Sherianne James. Ms. James was appointed as a member of the NCG Committee on January 28, 2020. Our Board has determined that all of the members of our NCG Committee qualify as independent, as such term is defined in Section 303A.02 of the NYSE Rules.

Board and Committee Activities

During Fiscal 2019, our Board held a total of 11 meetings, and acted by unanimous written consent on a total of 6 occasions. Our Audit Committee held a total of 7 meetings during Fiscal 2019. Our Compensation Committee held 8 meetings and acted by unanimous written consent on 2 occasions during Fiscal 2019. Our NCG Committee held 3 meetings during Fiscal 2019.

During Fiscal 2019, all of our directors attended at least 75% of the meetings of the Board and committees on which they served.

Our Practices and Policies

Corporate Governance Guidelines and Code of Ethics and Business Conduct

Our Board has adopted our Corporate Governance Guidelines to assist it in the exercise of its responsibilities. These guidelines reflect our Board’s commitment to monitor the effectiveness of policy and decision-making both at our Board and management level, with a view to enhancing stockholder value over the long-term. Our Corporate Governance Guidelines address, among other things, our Board and Board committee composition and responsibilities, director qualifications standards and selection and evaluation of our CEO.

Our Board has adopted a Code of Business Conduct and Ethics Policy for directors, officers and employees and a Code of Ethics for the Principal Executive and Senior Financial Officers to provide guidance to our CEO, chief financial officer (“CFO”), principal accounting officer or controller, and our business segment chief financial officers or persons performing similar functions.

Majority Voting and Director Resignation Policy

During Fiscal 2019, our Board adopted a majority voting policy for the election of directors. Pursuant to this policy, which applies in the case of uncontested director elections, a director must be elected by a majority of the votes cast with respect to the election of such director. For purposes of this policy, a “majority of the votes cast” means that the number of shares voted “for” a director must exceed the number of shares voted “against” that director and abstentions and broker

non-votes

are not counted as “votes cast.”

The policy also provides that in the event that an incumbent director nominee receives a greater number of votes “against” than votes “for” his or her election, he or she must (within five business days following the final certification of the related election results) offer to tender his or her written resignation from the Board to the NCG Committee. The NCG Committee will review such offer of resignation and will consider such factors and circumstances as it may deem relevant, and, within 90 days following the final certification of the election results, will make a recommendation to the Board concerning the acceptance or rejection of such tendered offer of resignation. The policy requires the decision of the Board to be promptly publicly disclosed.

The Company believes it is improper and inappropriate for our directors, officers and employees and certain of their family members (each, a “Subject Person”) to engage in hedging, short-term or speculative transactions involving the Company’s securities. Our anti-hedging policy, which we further strengthened during Fiscal 2019, applies to all Subject Persons. The Company prohibits Subject Persons from engaging in (i) derivative, speculative, hedging, or monetization transactions in Company securities (including, but not limited to, any trading on derivatives (such as swaps, forwards, and/or futures) of Company securities that allow a stockholder to lock in the value of Company securities in exchange for all or part of the potential upside appreciation in the value of such stock), (ii) short sales (i.e., selling stock the Subject Person does not own and borrowing shares to make delivery), and (iii) buying or selling puts, calls, options or other derivatives in respect of Company securities.

In addition, the Company believes it is improper and inappropriate for any Subject Person to engage in pledging transactions involving the Company’s securities. During Fiscal 2019, we adopted a robust anti-pledging policy, which prohibits Subject Persons from pledging or encumbering Company securities as collateral for a loan or other indebtedness. This prohibition includes, but is not limited to, holding such shares in a margin account as collateral for a margin loan or borrowing against Company securities on margin. Any pledges (and any modifications or replacements of such pledges) that existed prior to the adoption of our policy are grandfathered unless otherwise prohibited by applicable law or Company policy and so long as any modification or replacement of any

pre-existing

pledge does not result in additional shares being pledged.

Securities Trading Policy

Our Company believes that it is appropriate to monitor and prohibit certain trading in the securities of our Company. Accordingly, trading of the Company’s securities by directors, executive officers and certain other employees who are so designated by the office of the Company’s General Counsel is subject to trading period limitations or must be conducted in accordance with a previously established trading plan that meets SEC requirements. At all times, including during approved

trading periods, directors, executive officers and certain other employees notified by the office of the Company’s General Counsel are required to obtain preclearance from the Company’s General Counsel or his designee prior to entering into any transactions in Company securities, unless those transactions occur in accordance with a previously established trading plan that meets SEC requirements.

Transactions subject to our securities trading policy include, among others, purchases and sales of Company stock, bonds, options, puts and calls, derivative securities based on securities of the Company, gifts of Company securities, contributions of Company securities to a trust, sales of Company stock acquired upon the exercise of stock options, broker-assisted cashless exercises of stock options, market sales to raise cash to fund the exercise of stock options, and trades in Company’s stock made under an employee benefit plan.

Stock Ownership Guidelines

Our Board believes that our directors, NEOs and certain of the Company’s other officers and employees should own and hold Company common stock to further align their interests with the interests of stockholders and to further promote the Company’s commitment to sound corporate governance.

To memorialize this commitment, effective January 29, 2013, our Board, upon the recommendation of our Compensation Committee, established stock ownership and retention guidelines (the “SOG”) applicable to the Company’s directors, NEOs and all other officers of the Company and its subsidiaries with a level of Vice President or above (such officers and our NEOs, our “Covered Officers”). Effective January 1, 2020, the Company improved and enhanced the SOG to further align it with best practices by: (i) increasing our directors’ and Covered Officers’ retention requirement from 25% to 50% of their net

after-tax

shares received under awards granted (other than equity awards granted pursuant to the annual cash bonus plan) until they reach their required stock ownership under the SOG; and (ii) extending the applicable time period for our directors and Covered Officers to achieve the minimum ownership requirements to five (5) years from the date of eligibility or promotion. Even when the required stock ownership is obtained, all employee incentive plan participants, including NEOs, are subject to an additional stock retention requirement requiring them to retain at least 25% of their net

after-tax

shares of Company stock received under awards for one year after date of vesting.

Under the updated SOG, our directors are expected to achieve stock ownership with a value of at least five times their annual cash retainer. In addition, our Covered Officers are expected to achieve the levels of stock ownership indicated below (which equal a dollar value of stock based on a multiple of the Covered Officer’s base salary).

| | | | | |

| | Retained (Multiple of Base | | |

| | | | | |

| | | | |

| | | | | |

Executive Chairman and CEO | | | | |

| | | | | |

COO, CFO, General Counsel, and Presidents of business units | | | | |

| | | | | |

| | | | |

| | | | | |

| | | | |

The stock ownership levels attained by a director or a Covered Officer are based on shares directly owned by the director or Covered Officer, whether through earned and vested restricted stock units (“RSU”) or performance stock units (“PSU”) or restricted stock grants or open market purchases. Unvested restricted shares, unvested RSUs and PSUs, and stock options do not count toward the ownership goals; provided, that, effective January 1, 2020, unvested time-based restricted stock and unvested time-based RSUs will count. On an annual basis, our Compensation Committee reviews the progress of our directors and Covered Officers in meeting these guidelines. In some circumstances, failure to meet the guidelines by a director or a Covered Officer could result in additional retention requirements or other actions by our Compensation Committee.

Compensation Clawback Policy

We have adopted a Compensation Clawback Policy setting forth the conditions under which applicable incentive compensation provided to our executive officers may be subject to forfeiture, disgorgement, recoupment, or diminution (“clawback”). This policy provides that our Board or our Compensation Committee shall require the clawback or adjustment of incentive-based compensation to the Company in the following circumstances:

| | ● | As required by Section 304 of the Sarbanes Oxley Act of 2002, which generally provides that if the Company is required to prepare an accounting restatement due to material noncompliance as a result of misconduct with financial reporting requirements under the securities laws, then the CEO and CFO must reimburse the Company for any incentive-based compensation or equity compensation and profits from the sale of the Company’s securities during the 12-month period following initial publication of the financial statements that had been restated; |

| | ● | As required by Section 954 of the Dodd-Frank Act and Rule 10D-1 of the Exchange Act, which generally require that, in the event the Company is required to prepare an accounting restatement due to its material noncompliance with financial reporting requirements under the securities laws, the Company may recover from any of its current or former executive officers who received incentive compensation, including stock options, during the three-year period preceding the date on which the Company is required to prepare a restatement based on the erroneous financial reporting, any amount that exceeds what would have been paid to the executive officer after giving effect to the restatement; and |

| | ● | As required by any other applicable law, regulation, or regulatory requirement. |

Additionally, our Board or Compensation Committee in their discretion may require that any executive officer who has been awarded incentive-based compensation shall forfeit, disgorge, return, or adjust such compensation in the following circumstances:

| | ● | If the Company suffers significant financial loss, reputational damage, or similar adverse impact as a result of actions taken or decisions made by the executive officer in circumstances constituting illegal or intentionally wrongful conduct or gross negligence; or |

| | ● | If the executive officer is awarded or is paid out under any incentive compensation plan of the Company on the basis of a material misstatement of financial calculations or information, or if events coming to light after the award disclose a material misstatement which would have significantly reduced the amount of the award or payout if known at the time of the award or payout. |

The awards and incentive compensation subject to clawback under this policy include vested and unvested equity awards, shares acquired upon vesting or lapse of restrictions, short- and long-term incentive bonuses and similar compensation, discretionary bonuses, and any other awards or compensation under the Company’s equity plans, and any other incentive compensation plan of the Company. Any clawback under this policy may, in the discretion of our Board or Compensation Committee, be effectuated through the reduction, forfeiture, or cancellation of awards, the return of

paid-out

cash or exercised or released shares, adjustments to future incentive compensation opportunities, or in such other manner as our Board and Compensation Committee determine to be appropriate, except as otherwise required by law.

In addition, under the Company’s equity plans, any equity award granted may be cancelled by our Compensation Committee in its sole discretion, except as prohibited by applicable law, if the participant, without the consent of the Company, while employed by or providing services to the Company or any affiliate or after termination of such employment or service, violates a

non-competition,

non-solicitation,

or

non-disclosure

covenant or agreement or otherwise engages in activity that is in conflict with or is adverse to the interests of the Company or any affiliate, including fraud or conduct contributing to any financial restatements or irregularities engaged in, as determined by our Compensation Committee in its sole discretion. Our Compensation Committee may also provide in any award agreement that the participant will forfeit any gain realized on the vesting or exercise of such award, and must repay the gain to the Company, in each case except as prohibited by applicable law, if (i) the participant engages in any activity referred to in the preceding sentence, or (ii) the amount of any such gain is in excess of what the participant should have received under the terms of the award for any reason (including without limitation by reason of a financial restatement, mistake in calculations, or other administrative error). Additionally, awards are subject to claw-back, forfeiture, or similar requirements to the extent required by applicable law (including without limitation Section 304 of the Sarbanes-Oxley Act and Section 954 of the Dodd Frank Act). Equity awards issued have included these provisions.

The Company’s risk assessment and management function is led by the Company’s senior management, which is responsible for

day-to-day

management of the Company’s risk profile, with oversight from our Board and its committees. Central to our Board’s oversight function is our Audit Committee. In accordance with our Audit Committee Charter, our Audit Committee is responsible for the oversight of the financial reporting process and internal controls. In this capacity, our Audit Committee is responsible for reviewing and evaluating guidelines and policies governing the process by which senior management of the Company and the relevant departments of the Company, including the internal audit department, assess and manage the Company’s exposure to risk, as well as the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures.

The Company has implemented an annual formalized risk assessment process. In accordance with this process, a governance risk and compliance committee of certain members of senior management has the responsibility to identify, assess and oversee the management of risk for the Company. This committee obtains input from other members of management and subject matter experts as needed. Management uses the collective input received to measure the potential likelihood and impact of key risks and to determine the adequacy of the Company’s risk management strategy. Periodically, representatives of this committee report to our Audit Committee on its activities and the Company’s risk exposure.

In Fiscal 2019, our management and our Audit Committee reviewed our reporting processes and took a number of actions to further enhance such processes. In connection with such efforts, we made changes to our internal control over financial reporting and successfully remediated the material weakness that we disclosed in our Annual Report on Form

10-K

for Fiscal 2018. See Item 9A of the Original Form

10-K

for a detailed discussion of this remediation process.

Environmental, Social and Governance Matters

We are committed to sustainability and recognize the impact our business has on the world. We believe in making a positive difference in the communities in which we live and work and strive to discharge our corporate social responsibilities from a global perspective and throughout every aspect of our operations. Our Board recognizes the negative effect poor environmental practices and human capital management may have on us and our returns. Our Board carefully considers and balances the impact on the environment, people and the communities of which we are a part in deciding how to operate our business. Our Board receives periodic reports regarding our risk exposure and risk mitigation efforts in these areas.

Related Person Transactions Policy

Our Board has adopted a written policy for the review, approval and ratification of transactions that involve related persons and potential conflicts of interest. See

“Certain Relationships and Related Transactions”

for discussion of this policy and disclosure of our related person transactions.

Transfer of Our Shares of Common Stock

Our Company has substantial deferred tax assets related to net operating losses and tax credits (together, “Tax Attributes”) for U.S. federal and state income tax purposes. These Tax Attributes are an important asset of the Company because we expect to use these Tax Attributes to offset future taxable income. The Company’s ability to utilize or realize the carrying value of such Tax Attributes may be impacted if the Company experiences an “ownership change” or certain other events under applicable tax rules. If an “ownership change” were to occur, we could lose the ability to use a significant portion of its Tax Attributes, which could have a material adverse effect on the Company’s results of operations and financial condition.

Accordingly, we have adopted certain transfer restrictions designed to limit an “ownership change.” These transfer restrictions are subject to certain exceptions, including, among others, prior approval of a Prohibited Transfer by our Board. As previously disclosed, our Board has granted

pre-approvals

to certain large institutional investors and their affiliates. The foregoing description of the transfer restrictions contained within our Charter is not complete and is qualified in its entirety by reference to the full text of the Charter, which is incorporated by reference into this report.

Governance Documents Availability

We have posted our Corporate Governance Guidelines, Code of Business Conduct and Ethics for directors, officers and employees, Code of Ethics for the Principal Executive and Senior Financial Officers, Audit Committee Charter, Compensation Committee Charter, and NCG Committee Charter on our website www.spectrumbrands.com under “

Investor Relations—Corporate Governance Documents

”. We intend to disclose any amendments to, and, if applicable, any waivers of, these governance documents on that section of our website. These governance documents are also available in print without charge to any stockholder of record that makes a written request to the Company. Inquiries must be directed to the Investor Relations Department at Spectrum Brands Holdings, Inc., 3001 Deming Way, Middleton, WI 53562.

Our Compensation Committee is responsible for approving, subject to review by our Board as a whole, compensation programs for our

non-employee

directors. In that function, our Compensation Committee considers market and peer company data regarding director compensation and annually evaluates the Company’s director compensation practices in light of that data and the characteristics of the Company as a whole, with the assistance of its independent compensation advisors. Under our director compensation program, at the beginning of each fiscal year, each

non-employee

director receives an annual grant of RSUs equal to that number of shares of the Company’s common stock with a value on the date of grant of $125,000. Additionally, each director is eligible to receive an annual cash retainer of $105,000 which is paid quarterly. In addition, the Lead Independent Director receives an additional annual cash retainer of $40,000 and an additional annual equity retainer amount of $20,000.

For Fiscal 2019, compensation for service on the standing committees of our Board, was paid in an annual amount as follows below. Mr. Maura, our only director who is an employee of the Company, does not receive compensation for his service as a director.

Director Compensation Table for Fiscal 2019

The table set forth below, together with its footnotes, provides information regarding compensation paid to our directors in Fiscal 2019. In Fiscal 2019, Mr. Polistina (who was appointed Lead Independent Director in July 2018) received the $60,000 paid in cash for his service as Lead Independent Director in Fiscal 2019. Mr. Polistina also received an additional $11,500 representing the

portion of these fees for his service in Fiscal 2018, which was not paid in Fiscal 2018. Directors are permitted to make an annual election to receive all of their director compensation (including for service on committees of our Board) in the form of Company stock in lieu of cash. For Fiscal 2019, the grants of RSUs were made on October 1, 2018 (except for Ms. James who became a director on October 23, 2018 and received a grant of RSUs on November 1, 2018). All such RSUs (including those awarded to Ms. James) vested on October 1, 2019.

| | | | | | | | | | | | | | | | | |

| | Fees Earned or Paid in Cash (2) | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Joseph S. Steinberg (2)(5)(6) | | | | | | | | | | | | | | | | |

| (1) | This table includes only directors who received compensation during Fiscal 2019. |

| (2) | Amounts reflected in this column include the annual retainer fees and committee Chair fees paid in cash to the applicable director during Fiscal 2019. |

| (3) | Amounts in this column represent the aggregate grant date fair value of each award computed in accordance with FASB ASC Topic 718. The value was computed by multiplying the number of shares underlying the stock award by the closing price per share of the Company’s common stock on each grant date (or, as applicable, the last trading date immediately prior to the grant date if the grant date fell on a date when the New York Stock Exchange was closed), which was $74.45 on October 1, 2018, and was $66.17 on November 1, 2018. The directors received RSUs on October 1, 2018, which vested on October 1, 2019 as follows: Mr. Ambrecht, 3,279; Mr. Harris, 3,078; Mr. Matthews, 3,279; Mr. Polistina, 3,346; Mr. Rovit, 3,079; and Mr. Steinberg, 3,078. In connection with her appointment to our Board on October 23, 2018, Ms. James received 1,834 RSUs on November 1, 2018, which vested on October 1, 2019. |

| (4) | As of September 30, 2019, Messrs. Ambrecht, Harris, Matthews, Polistina, Rovit and Steinberg held 3,279, 3,078, 4,103, 3,346, 3,078 and 3,078 outstanding unvested RSUs respectively, and Ms. James held 1,834 outstanding unvested RSUs. |

| (5) | Includes dividends paid on RSUs which were not factored into the grant date fair value of the RSUs. The amount of the dividends for Messrs. Ambrecht, Harris, Matthews, Polistina, Rovit and Steinberg was $5,509, $5,171, $5,509, $5,621, $5,171, $5,171, respectively and $3,081 for Ms. James. |

| (6) | In connection with the termination of the Company’s shareholder agreement with Jefferies Financial Group, Inc. (“Jefferies Financial”), Messrs. Joseph S. Steinberg and David S. Harris (each of whom had been appointed as Board designees of Jefferies Financial pursuant to such agreement) resigned from our Board. |

We began Fiscal 2019 by building on the completion of our Merger with our previous majority stockholder, HRG Legacy. The Merger was a significant achievement for the Company and its stockholders and was negotiated and completed over a significant period of time and consumed a substantial amount of our management’s and directors’ time and efforts. Among other things, the Merger enabled us to acquire certain Tax Attributes of HRG Legacy at a meaningful discount, advance the transformation of the Company into an independent company without a controlling stockholder and increase the float and reduce the volatility in the trading of our common stock.

During and following the time that we were completing the Merger with HRG Legacy, we also sought and ran a process to dispose of three of our business segments: our GBL business, our GAC business and our appliances business. On January 15, 2018, we announced the sale of the GBL business (the “GBL Sale”), which took over 12 months to consummate, to Energizer Holdings, Inc. (“Energizer”) and on November 5, 2018, we announced the sale of the GAC business (the “GAC Sale”), also to Energizer. Both sales were completed in January 2019, resulting in aggregate net proceeds of $2.9 billion to the Company, prior to purchase price adjustments. We ultimately retained our appliances business as part of our continuing operations. The sales process and related negotiation and completion (as applicable) of these three businesses was the source of a significant amount of time and effort for the Company, its management and employees, both domestically and abroad. In particular, the sale of our GBL business was completed only after a protracted and extended regulatory approval process, particularly in Europe.

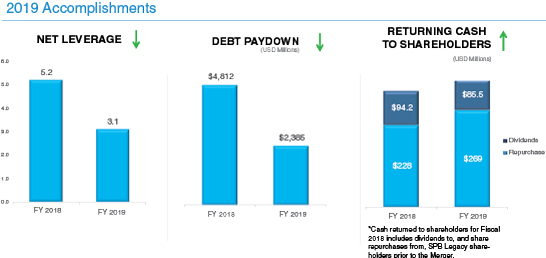

Through the completion of the sales of our GBL and GAC businesses we streamlined our Company and our operational focus. We were able to effectively realize the benefits of having acquired HRG Legacy’s Tax Attributes in the Merger, sheltering the gains we realized on the completion of the GBL Sale and substantially reducing the taxes that would otherwise have been payable. The $2.9 billion in proceeds, prior to purchase price adjustments, that we received from the GBL Sale and GAC Sale has enabled us to aggressively pay down debt, materially reduce our leverage and strengthen our balance sheet. Our net leverage ratio was 5.2x at the end of Fiscal 2018 and was reduced to 3.1x at the end of Fiscal 2019. Our improved balance sheet will allow us to be more nimble and act strategically as opportunities arise, and also to better withstand any future downturns in the economy. In addition, as part of the respective asset sales, we acquired shares in Energizer so that we have indirectly retained potential upside in the value of our sold businesses.

Following the completion of the asset sales, we commenced a thorough review of the Company’s operations with a view towards resetting our operating model and business strategies to lower costs, improve efficiencies and enable greater organic growth for each of our divisions. This assessment yielded key findings that we are using to overhaul our operating and strategy model, our commercial

go-to-market

plans, our sourcing and procurement processes, and our use of technology and automation to operate our business more efficiently. We are referring to this project as our Global Productivity Improvement Program and anticipate it will reduce our overall annualized operating costs by at least $100 million within the next 16 to 22 months. These savings will place the Company on a positive trajectory in the future because we expect that a substantial portion of the savings will be reinvested in growth-enabling activities, including improved consumer insights and additional research and development and marketing.

We also made significant changes to our executive management team, including the hiring of a new CFO, the hiring of a new General Counsel, the promotion of an executive to be our COO and the promotion of an executive to be the global head of HR. We also made changes to the senior management team at our business units in order to align our business unit senior management team with our new operating model and business strategy. These changes are designed to provide fresh new ideas, build on the success for the future, and show our commitment to diversity and inclusion.

We also undertook a complex and comprehensive project of consolidating certain of our distribution centers, which required a significant amount of time and resources. While we experienced some operational challenges with respect to this initiative, we took positive steps to address those challenges and, ultimately, were successful in reaching this milestone, which positions the Company well to achieve its goals for Fiscal 2020 and beyond.

The amount of time and effort required to operate our business (including achieving positive economic and financial results) alongside with pursuing these strategic and transformational initiatives (including the asset sales and the distribution center consolidation) created disruption and distraction for our employees and presented us with additional challenges in Fiscal 2019. Our management and employees devoted substantial additional time and effort to pursue or complete these initiatives, which were quite difficult to achieve particularly during the period of operational challenges and uncertainty facing the Company.

In Fiscal 2019, we transitioned away from annual Equity Incentive Program (“EIP”) grants with

one-year

performance periods and our

two-year

stretch Spectrum 3B Plan (“S3B Plan”) to a new program with cliff vesting following a three-year cumulative performance period. This transition to a three-year cliff vesting performance and service period under the new long term incentive program (“LTIP”) created a “gap” in our employees’ compensation opportunity, in that, under this new plan, there would be no long-term incentive vesting opportunity until September 30, 2021. The lack of any potential vesting or payout of

long-term

compensation opportunities during this gap period, which represents a significant portion of overall compensation, raised retention concerns. To address this gap, our Compensation Committee granted our NEOs and other selected employees special “Bridge Grants” (which will not be part of ongoing compensation) comprised of RSUs and PSUs that were primarily designed to: (i) provide annual vesting opportunities until the first of the new, annually granted long-term incentive awards would potentially vest after September 30, 2021, and (ii) address the related potential retention concerns.

These Bridge Grants were granted at the beginning of Fiscal 2019 and were designed as two grants to cover two performance cycles, namely the Fiscal 2019 compensation cycle and the Fiscal 2020 compensation cycle. The vesting criteria applicable for the Bridge Grants are:

| | ● | Fiscal 2019 Bridge Grant: |

| | ● | Fiscal 2020 Bridge Grant: |

In addition, in recognition of the additional work and completion of the sales, we rewarded our NEOs with special transaction success bonuses (which represented in the aggregate 0.22% of the $2.9 billion net proceeds, prior to purchase price adjustments, received from the sales). No amounts would have been paid if the sales were not consummated. Because of the special circumstances surrounding the sale of our GBL and GAC businesses and our transition to a new long-term equity plan noted above, we do not believe that the Bridge Grants and the transaction success bonuses are indicative of our regular, ongoing annual compensation.

In conjunction with these changes to our equity compensation plans, we made further enhancements to our executive compensation programs by introducing for Fiscal 2020 a third performance metric (Adjusted Return on Equity) that will be weighted equally with Adjusted EBITDA and Adjusted Free Cash Flow for purposes of our equity performance programs; eliminating tax equalization on our financial and tax planning benefit, automobile allowance, and life insurance for all executives in Fiscal 2020; our CEO voluntarily agreeing to eliminate, commencing in Fiscal 2020, his tax planning and financial assistance benefit (including tax equalization) and his executive automobile allowance.

We also made improvements to our corporate governance and executive policies, including adopting a robust anti-pledging policy and strengthening our anti-hedging policy. We also added a majority voting and director resignation policy. In addition, as of January 1, 2020, we increased the required retention of net

after-tax

shares by our directors, NEOs and other executives to 50% until they satisfy our stock ownership guidelines. See

“Item 10: Directors, Executive Officers and Corporate Governance—Corporate Governance—Our Practices and Policies”

for more information on these policies. Furthermore, we eliminated certain perquisites including any related tax equalization.

As Fiscal 2019 came to a close, Jefferies Financial announced, and shortly thereafter completed, the distribution of its 14% stake in the Company to its stockholders. Following the distribution, the representative of Jefferies Financial left our Board, completing our Company’s transition from being a controlled company to a widely-held public stockholder constituency.

Alongside all of the transformational activities, operational and management changes, and additional demands placed on our team, we attained positive financial results in Fiscal 2019, including those discussed below.

| | ● | We increased or maintained our market positions, which includes our #1 position in the U.S. with residential and luxury locksets, outdoor insect control, grills, toaster ovens, indoor grills and our #1 global position with aquatics and rawhide chews. |

| | ● | Our efforts with respect to our transformational and strategic initiatives are being recognized by the market, as our stock has increased 52.2% in price in calendar 2019, and has returned 56.2% in calendar 2019, including dividends. |

| | ● | Revenue of $3,802.1 million and net loss from continuing operations of $186.7 million, including $151.4 million of non-cash impairment charges. |

| | ● | Adjusted EBITDA of $567 million. |

| | ● | Adjusted EBITDA stabilized and in line with guidance with increased investments across the divisions. |

| | ● | Reduced total debt by $2.4 billion with proceeds from divestitures of the GBL and GAC businesses. |

We value stockholder engagement and feedback as we strive to deliver strong financial performance and sustained value creation for our investors. Our ongoing investor engagement program includes outreach focused on the Company’s business strategy, corporate governance and executive compensation programs. In addition to stockholder engagement by our management, many of these engagements include participation by members of our Board, including our Executive Chairman and Lead Independent Director. Robust stockholder engagement continues to be a priority for us in Fiscal 2020.

What we learn through our ongoing engagements is regularly shared with our Board and incorporated into our disclosures, plans and practices, as deemed appropriate. In addition to our ongoing discussions with our stockholders, during Fiscal 2019, we invited stockholders representing nearly 46% of our outstanding shares to discuss their views with our Board regarding our business strategy, corporate governance and executive compensation programs. Partially in response to such feedback, we made the following changes:

| | | |

| | We modified our long-term incentive program: ● We combined our one-year EIP and our two-year stretch performance plan (mostly recently, the S3B Plan) into a new single long-term incentive program that will payout in a cliff only at the end of a three-year performance period ending September 30, 2021, with 70% based on performance and 30% based on continued service. ● We eliminated our EIP and our S3B Plan, which provided for one-year and two-year performance periods, respectively. ● We introduced in Fiscal 2020 a third performance metric (Adjusted Return on Equity), which will be weighted equally with Adjusted EBITDA and Adjusted Free Cash Flow for purposes of our equity performance programs. |

| | Our NEO salaries and annual bonus targets did not change in Fiscal 2019, except for Mr. Lewis and Ms. Long, whose increases were in connection with their promotions and increased responsibilities. In Fiscal 2020, our NEOs’ base salaries and annual bonus targets will remain the same as in Fiscal 2019. |

| | We adopted a robust anti-pledging policy and further strengthened our anti-hedging policy. |

| | We strengthened our stock ownership guidelines by increasing, as of January 1, 2020, to 50% the net after-tax portion of our directors’, NEOs’, and other Covered Officers’ shares that they must retain to satisfy our stock ownership requirements. |

| | Commencing in Fiscal 2020, our CEO voluntarily eliminated his tax planning and financial assistance benefit (and any related tax equalization) and his executive automobile allowance. |

| | We eliminated the tax equalization on our financial and tax planning benefit, life insurance, and automobile allowance for all executives in Fiscal 2020. |

Compensation Overview and Philosophy

Our compensation programs are administered by our Compensation Committee. In Fiscal 2019, these programs were based on our

“pay-for-performance”

philosophy in which variable compensation represents a majority of an executive’s potential compensation. The variable incentive compensation programs continued our focus on the Company-wide goals of increasing growth and earnings, maximizing free cash flow generation, and building for superior long-term stockholder returns. Each year, the Compensation Committee and the Company, along with the assistance of independent compensation consultants, go through a thoughtful process to review risks and opportunities applicable to the Company. As noted above, Fiscal 2019 was a year of transition and uncertainty.

In establishing our compensation programs, our Compensation Committee obtained the advice of two independent compensation consultants, (i) Lyons, Benenson & Company Inc. (“LB & Co.”), and (ii) Pearl Meyer & Partners (“Pearl Meyer”), and evaluated the compensation programs with reference to a peer group of 14 companies, as outlined in the section below entitled “

Role of Committee-Retained Consultants

”.

Background on Compensation Considerations

Our Compensation Committee pursued several objectives in determining our executive compensation programs for Fiscal 2019:

| | ● | To attract and retain highly qualified executives for the Company, each of our business segments and our overall corporate objectives. |

| | ● | To align the compensation paid to our executives with our overall corporate business strategies while leaving the flexibility necessary to respond to changing business priorities and circumstances. |

| | ● | To address the compensation opportunity gap and retention concerns created by adopting our new compensation plan and to recognize and reward the significant amount of additional time and effort expended by our management team and employees to pursue a number of strategic initiatives and activities, which are further described in “Compensation Discussion and Analysis—Fiscal 2019 Business Highlights |

| | ● | To align the interests of our executives with those of our stockholders and to reward our executives when they perform in a manner that creates value for our stockholders. |

In order to pursue these objectives, our Compensation Committee:

| | ● | Considered the advice of our independent compensation consultants on executive compensation issues and program design, including advice on the corporate compensation program as it compared to our peer group companies. |

| | ● | Conducted an annual review of total compensation for each NEO, including the compensation and benefit values offered to each executive and other compensation factors. |

| | ● | Consulted with our CEO and other members of senior management with regard to compensation matters and met in executive session without management to evaluate management’s input. |

| | ● | Solicited comments and concurrence from other Board members regarding its recommendations and actions. |

Philosophy on Performance-Based Compensation

Our Compensation Committee designed the Fiscal 2019 executive compensation programs so that, at target levels of performance, a significant portion of the value of each NEO’s annual compensation (which varies by individual) would be based on the achievement of Company-wide Fiscal 2019 performance objectives. Our Compensation Committee concluded that a combination of annual fixed base pay and incentive-based pay provided our NEOs with an appropriate mix of cash compensation and equity-based compensation.

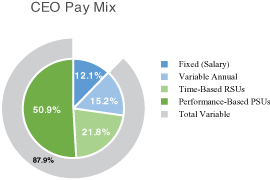

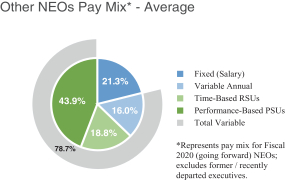

For Fiscal 2019, the percentage of ongoing annual compensation at target based on the achievement of Company-wide performance for the CEO was 87.9% and for the other current NEOs was 78.7% as a group. The chart below sets forth the percentage of compensation that was fixed compared to variable (or at risk) for the CEO and the other current NEOs as a group. The chart below excludes the Bridge Grants and transaction success bonuses as these are not a regular part of our ongoing compensation programs.

In addition, to highlight the alignment of the incentive plans with stockholder interests, our ongoing annual and long-term incentive programs (whether equity or cash-based) in Fiscal 2019 were predominantly performance-based with (i) the Management Incentive Plan (“MIP”) being 100% performance-based and (ii) the three-year long-term equity incentive program being 70% performance-based.

The remainder of each executive’s compensation was made up of amounts that did not vary based on performance. For each of our NEOs, these

non-performance-based

amounts are set forth in agreements with the executives as described in “

—Executive Compensation Tables—Termination and Change in Control Provisions—Executive-Specific Provisions regarding Employment, Termination and Change in Control—Agreements with NEOs

,” and are subject to annual review and potential increase by our Compensation Committee. These amounts are determined by our Compensation Committee taking into account the executive’s performance, current market conditions, the Company’s financial condition at the time such compensation levels are determined, compensation levels for similarly situated executives with other companies, experience level and the duties and responsibilities of such executive’s position.

Role of Committee-Retained Consultants

In Fiscal 2019, our Compensation Committee continued to retain outside consultants, LB & Co. and hired a new firm, Pearl Meyer, to assist in formulating and evaluating executive and director compensation programs. Our consultants provided advice on the implications of changes to our business (including the lengthy asset sale processes, our Global Productivity Improvement Plan, the consolidation of our distribution centers and the streamlining of our business and operational focus), our corporate governance and compensation structure and the philosophy of our executive compensation plans. During the past year, our Compensation Committee periodically requested LB & Co and/or Pearl Meyer to:

| | ● | Provide comparative market data for our peer group, and other groups on request, with respect to compensation matters. |

| | ● | Analyze our compensation and benefit programs relative to our peer group, including our mix of performance-based compensation, non-variable compensation and the retentive features of our compensation plans in light of the Company’s strategies and prospects. |

| | ● | Review the plan designs, including the performance metrics selected, for our various incentive plans and make recommendations to our Compensation Committee on appropriate plan designs to support the overall corporate strategic objectives, including the extensive work performed and benefits obtained from the efforts of our NEOs and other employees in carrying out the Company’s transformative M&A transactions and transformative strategic transactions. |

| | ● | Advise our Compensation Committee on compensation matters and management proposals with respect to compensation matters. |

| | ● | Assist in the preparation of our Compensation Discussion and Analysis disclosure and related matters. |

| | ● | On request, participate in meetings of our Compensation Committee. |

In order to encourage an independent viewpoint, our Compensation Committee and its members (i) had access to LB & Co. and Pearl Meyer at any time without management present; and (ii) have consulted from time to time with each other, other

non-management

members of our Board and LB & Co. and Pearl Meyer without management present.

LB & Co., with input from management and our Compensation Committee, developed a peer group of companies based on a variety of criteria, including type of business, revenue, assets and market capitalization. The composition of this peer group is reviewed annually and, if appropriate, revised, based on changes in business orientation of peer group companies, changes in financial size or performance of the Company and the peer group companies, and any mergers, acquisitions, spin-offs or bankruptcies of the companies in the peer group or changes at our Company. At the end of Fiscal 2019, the peer group utilized consisted of the following 14 companies:

| | | | | |

✓ Central Garden and Pet Company | | ✓ Fortune Brands Home & Security, Inc. | | ✓ Nu Skin Enterprises, Inc., |

✓ Church & Dwight Co., Inc. | | | | ✓ The Scotts Miracle-Gro Company |

| | | | |

✓ Edgewell Personal Care Company | | | | ✓ Tupperware Brands Corporation |

✓ Energizer Holdings, Inc. | | | | |

For Fiscal 2019, our Compensation Committee determined to remove Stanley Black & Decker, Inc. from the compensation peer group given its revenue, assets and market capitalization size. No further changes were made to the compensation peer group in Fiscal 2019.

Our Compensation Committee reviews market data as part of assessing the appropriateness and reasonableness of our compensation levels and mix of pay. Although our Compensation Committee does not target a particular range for total compensation as compared to our peer group, it does take this information into account when establishing our compensation programs.

No fees were paid to LB & Co. or Pearl Meyer for services other than executive and director compensation consulting during Fiscal 2019. In accordance with SEC rules, our Compensation Committee considered the independence of LB & Co., and Pearl Meyer including an assessment of the following factors: (i) other services provided to the Company by each consultant, (ii) fees paid by the Company as a percentage of the consulting firm’s total revenue, (iii) policies or procedures maintained by LB & Co. or Pearl Meyer that are designed to prevent conflicts of interest, (iv) any business or personal relationships between the individual consultants involved in the engagement and any member of our Compensation Committee, (v) any Company stock owned by individual consultants involved in the engagement, and (vi) any business or personal relationships between our executive officers and the consultants or the individual consultants involved in the engagement. Our Compensation Committee has concluded that no conflicts of interest prevented LB & Co. or Pearl Meyer from independently advising our Compensation Committee during Fiscal 2019.

In Fiscal 2019, our ongoing annual compensation for our NEOs included the following elements:

| | | | | | | |

| | | | | | |

| | ● Forms basis for competitive compensation package | | ● Base salary reflects competitive market conditions, individual performance, and internal parity. | | ● Performance of the individual is taken into account by the Compensation Committee, which is advised by its independent compensation consultant, when setting and reviewing base salary levels and continued employment |

| | | | | | | |

| | ● Motivate achievement of strategic priorities relating to key annual financial metrics | | ● Target bonus opportunities are determined by competitive market practices and internal parity. ● Actual bonus payouts, which can range from 0-250% of target for the CEO and 0-200% of target for our other NEOs are determined based on achievement of financial metrics established at the beginning of the performance period | | ● Equally weighted between Adjusted EBITDA and Adjusted Free Cash Flow |

Restricted Stock Units (majority is performance-based and remainder is time-based) | | ● Align compensation with key drivers of the business ● Encourage focus on long-term shareholder value creation | | ● Size of award determined by competitive market practices, corporate and individual performance and internal parity and retention considerations | | ● Long-term incentive awards focusing on cumulative performance over three-year period ending Fiscal 2021, based on Adjusted EBITDA and Adjusted Free Cash Flow. For Fiscal 2020 grants, a third performance metric, Adjusted Return on Equity, is included (and equally weighted with the other two metrics). ● The majority of each of the new long-term incentive awards (70%) are performance-based. |

In addition to the foregoing, our NEOs received special Bridge Grants and transaction success bonuses that are described further below.

The annual base salaries for our NEOs were initially set forth in each executive’s employment agreement or separate letter agreement and such salaries may be increased from time to time by our Compensation Committee. In determining the initial annual base salary for each NEO or in making any subsequent increases, our Compensation Committee considered the market conditions at the time such compensation levels were determined, the Company’s financial condition at the time such compensation levels were determined, compensation levels for similarly situated executives at other companies, experience level, and the duties and responsibilities of such executive’s position.

Base salary levels are subject to evaluation from time to time by our Compensation Committee to determine whether increases are appropriate. Our Compensation Committee reviewed the current salaries of our NEOs during Fiscal 2019 and increased the salaries for Mr. Lewis and Ms. Long in connection with their promotions and increased responsibilities. In Fiscal 2019, our other NEO salaries did not increase. In Fiscal 2020, our NEO’s base salaries will remain the same as in Fiscal 2019.

Our management personnel, including our NEOs, participate in our annual MIP cash bonus program, which is designed to compensate executives and other managers based on achievement of annual corporate, business segment, and/or divisional financial goals. Under the MIP bonus plan, 100% of the annual bonus is performance-based and no bonus is paid if the relevant performance metrics are not achieved. Although the MIP is a cash bonus program, our Compensation Committee may elect to pay such bonuses in the form of equity. In Fiscal 2019, MIP bonus targets increased for Mr. Lewis and Ms. Long in connection with their promotions and increased responsibilities. Our other NEO MIP bonus targets did not increase. For Fiscal 2019, based on our Adjusted EBITDA and Adjusted Free Cash Flow performance, the MIP payout was achieved at 113.70% of target. In Fiscal 2020, our NEO’s MIP bonus targets will remain the same as their MIP bonus targets in Fiscal 2019.

Under the MIP, each participant has the opportunity to earn a threshold, target, or maximum bonus amount that is 100% contingent upon achieving the annual performance goals set by our Compensation Committee and reviewed by our Board. Particular performance goals are established during the first quarter of the relevant fiscal year and reflect our Compensation Committee’s views of the critical indicators of corporate success in light of primary business priorities. The specific financial targets with respect to performance goals are then set by our Compensation Committee based on our annual operating plan, as approved by our Board, during the first quarter of the relevant fiscal year. The annual operating plan includes performance targets for the Company as a whole as well as for each business segment.

The Fiscal 2019 MIP design included a minimum financial threshold level for each of Adjusted EBITDA and Adjusted Free Cash Flow, below which no payout would be earned with respect to that objective. The achievement of the goals of Adjusted EBITDA and Adjusted Free Cash Flow is determined and earned independently of one another.

In establishing the Fiscal 2019 MIP performance targets, the Compensation Committee considered the GBL Sale and the GAC Sale, and the resulting decrease in Adjusted EBITDA and Free Cash Flow attributable to each sold business unit. Because the Company’s size reduced by approximately 35%, the resulting threshold levels, target levels and maximum level for each of Adjusted EBITDA and Adjusted Free Cash Flow for Fiscal 2019 was lower as compared to Fiscal 2018.

For the purposes of our MIP and LTIP, Adjusted EBITDA and Adjusted Free Cash Flow have the following meanings:

“

” means net earnings before interest, taxes, depreciation and amortization, but excluding restructuring, acquisition and integration charges, and other

one-time

charges. The result of the formula in the preceding sentence is then adjusted by the Compensation Committee in good faith, after consultation with the CEO, so as to negate the effects of any dispositions; provided, however, that Adjusted EBITDA resulting from businesses or products lines acquired (in Board approved transactions) during the applicable fiscal year will, to the extent reasonably and in good faith determined by the Compensation Committee to be appropriate (after consultation with the CEO), be included in the calculation from the date of acquisition.

“

” means Adjusted EBITDA, plus or minus changes in current and long-term assets and liabilities, less cash payments for taxes, restructuring and interest. Any reductions in Adjusted Free Cash Flow resulting from transaction costs or financing fees incurred in connection with any Board approved acquisition or refinancing (in each case during the applicable fiscal year) are added back to Adjusted Free Cash Flow, subject to the approval of the Compensation Committee, reasonably and in good faith, after consultation with the CEO. The result of the formula in the preceding sentences is then adjusted by the Compensation Committee reasonably and in good faith, after consultation with the CEO, so as to negate the effects of any dispositions

; provided, however,

that Adjusted Free Cash Flow resulting from businesses or products lines acquired (in Board approved transactions) during the fiscal year will, to the extent reasonably and in good faith determined by the Compensation Committee to be appropriate (after consultation with the CEO), be included in the calculation from the date of acquisition.

In Fiscal 2019, we eliminated our EIP that had provided annual equity grants with only a

one-year

performance period and our longer-term S3B Plan with a

two-year

stretch performance period. By simplifying and streamlining our compensation program to a single LTIP with performance measured over three years, we are able to effectively focus on the achievement of significant and sustained improvements in performance and strategic initiatives over the long-term. For Fiscal 2019, we provided our LTIP grants in the form of time-based RSUs and performance-based PSUs that will be eligible to vest after the three-year period commencing October 1, 2018 and ending September 30, 2021. These awards have the features described below.

| | ● | 70% of the award vests in a cliff based on three-year cumulative performance against Adjusted EBITDA and Adjusted Free Cash Flow measures. The relatively large performance component of these awards is believed to serve as a valuable incentive to drive outcomes over the long-term for our Company and stockholders. |

| | ● | 30% will vest in a cliff at the end of the three-year service period. The relatively small time-based component of these awards as part of our overall compensation mix is believed to serve as an important long-term retention and risk mitigation feature. See “—Fiscal 2019 Compensation Component Pay-Outs—LTIP |

| | ● | In addition, there is an opportunity to earn additional PSUs under the LTIP (subject to a cap of 125% of target PSUs) if superior performance is achieved. |

| | ● | As noted above, for Fiscal 2020, we have added Adjusted Return on Equity as a third performance metric (equally weighted). |

As noted above, Fiscal 2019 was a transformative year as we, among other things, launched a sale process for three of our business units and completed the sale of GBL and GAC businesses, resulting in net proceeds of $2.9 billion (prior to purchase price adjustments), substantially reduced our debt and strengthened our balance sheet, transitioned to an independent company with greater liquidity and less volatility in trading of our stock, significantly enhanced our executive management team and implemented a Global Productivity Improvement Plan and a new long-term equity plan. In recognition of the special circumstances created by these initiatives, our Compensation Committee determined, with the advice of its independent compensation consultant, to make special Bridge Grants and transaction success bonuses, each of which is described herein. For more information regarding the Bridge Grants and the transaction success bonuses, see

“—Fiscal 2019 Business Highlights.”

Because of the special circumstances surrounding the sale of our GBL and GAC businesses and our transition to a new long-term equity plan noted above, we do not believe that the Bridge Grants and the transaction success bonuses are indicative of our regular, ongoing annual compensation.

Analysis of our CEO’s Fiscal 2019 Compensation

Mr. Maura’s total Fiscal 2019 compensation is reported in the Summary Compensation Table. Because of the special circumstances surrounding the sale of our GBL and GAC businesses and our transition to a new long-term equity plan, we do not believe the Bridge Grants and transaction success awards included in Mr. Maura’s Fiscal 2019 compensation are indicative of his regular, ongoing annual compensation levels.

| | ● | Mr. Maura’s annual compensation opportunity breaks down as follows: 12% fixed (base salary) and 88% variable (annual and long-term incentives). |

| | ● | Mr. Maura’s ongoing target direct compensation (base salary, MIP bonus, and target annual LTIP award grant date value) is $7,425,000. |

| | ● | Mr. Maura’s variable compensation is made up of 25% time-based RSUs that will cliff vest at the conclusion of a three-year service period and are subject to market risk, and 75% performance-based annual incentives (under the MIP) and PSUs (under the LTIP), which are only eligible to be earned on the basis of Company performance relative to pre-established goals. These performance-based incentives will not pay out ifpre-established goals are not satisfied. |

As discussed earlier in this report, there are two special compensation items that impacted Mr. Maura’s Fiscal 2019 compensation as reported in the Summary Compensation Table below: (i) his Bridge Grant of RSUs and PSUs valued at $5,972,190, a portion of which vested based on time and performance through November 21, 2019 and the remainder of which may vest based on service through November 2020 and (ii) his transaction success bonus of $5,000,000. Neither of these are part of his regular compensation package. Further, SEC disclosure rules require that the Fiscal 2020 RSU portion of the Bridge Grant (which relates to service through November 21, 2020) is required to be included in the Fiscal 2019 compensation tables. Each of these compensation items were approved by our Compensation Committee, with the advice of its independent compensation consultant.

| | ● | As noted above, the Bridge Grant to Mr. Maura (and to the other NEOs and employees) was awarded in recognition of the fact that following the adoption of our new, three-year, cliff vesting long-term incentive plan there would be a “gap” in the compensation opportunity for our CEO and all long-term incentive participants (Fiscal 2019 and Fiscal 2020) during which time there would be no awards that could potentially vest; or in other words, under this new plan, there would be no long-term incentive vesting opportunity until the conclusion of Fiscal 2021. These Bridge Grants were designed as two grants to cover two performance cycles, namely the Fiscal 2019 compensation cycle and the Fiscal 2020 compensation cycle. |

The table below shows the two performance metrics for our NEOs and the applicable levels of performance required to achieve threshold, target and maximum payouts. The maximum MIP Bonus payable is 250% of target for our CEO, and 200% for our other NEOs. As described in the table below, we achieved performance of 127.39% of Adjusted EBITDA and 100% of Adjusted Free Cash Flow.

| | | | | | | | | | | | | |

Performance Required to Achieve Bonus % as Indicated ($ in millions) |

| | | | | | | | | | | | Calculated

2019 Payout

Factor (% of

Target |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

During any fiscal year, we engage in a number of strategies to maintain our liquidity and manage our cash position. These strategies have costs associated with them, which are included in our annual operating plans and targets. In Fiscal 2019 we did not need to engage in these cash management strategies because we had reduced debt borrowings and received the proceeds from the GBL Sale and the GAC Sale. As a result, our NEOs voluntarily recommended to our Board that the Company reduce such cash management strategies even though such reduction would have had a negative impact on our NEOs’ achievement of maximum bonuses. For Fiscal 2019, if the Company had engaged in its typical cash management strategies, it would have achieved the maximum payout under the Adjusted Free Cash Flow metric (250% for the CEO and 200% for the other NEOs) under the MIP bonus program and the Bridge Grants, and without them, absent a corresponding adjustment, it would achieve performance less than the amount required to receive a payment under such programs. The Compensation Committee, based on our NEOs’ recommendations, determined that it would be in the best interests of the Company to reduce such cash management strategies and to pay at 100% (as opposed to 250% for the CEO and 200% for the other NEOs, which otherwise would have been earned for Fiscal 2019) with respect to the Adjusted Free Cash Flow measure under the MIP bonus plan and the achievement of the Adjusted Free Cash Flow under the Bridge Grant for Fiscal 2019. This change, which came at the request of our NEOs, resulted in a reduction of compensation paid to our employees of approximately $1.43 million; a lower actual payout of approximately $2.62 million as opposed to the higher payout of approximately $4.06 million that could have been otherwise earned.

Our Fiscal 2019 LTIP grants cover service and cumulative performance over the three-year period commencing October 1, 2018 and ending September 30, 2021. Of the total grant, 70% is in the form of PSUs and will vest based on the achievement of cumulative Adjusted EBITDA and cumulative Adjusted Free Cash Flow over the three-year period. The remaining 30% is in the form of RSUs, which will vest based on continued service, with cliff vesting at the end of such three-year period. In addition, with respect to the PSU component of the LTIP, there is an opportunity to earn additional PSUs if superior performance is achieved (subject to a cap of 125% of the target PSUs).

For Fiscal 2019, there were two performance measures (Adjusted Free Cash Flow and Adjusted EBITDA). The chart below sets forth the number of PSUs and RSUs each NEO was granted in Fiscal 2019 pursuant to the LTIP.

| | | | | | | | | | | | | |

| | | | | | | | Potential Upside

Performance- | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

One-half

of the PSUs are subject to achievement of cumulative Adjusted EBITDA performance goals and

one-half

are subject to achievement of cumulative Adjusted Free Cash Flow performance goals.

| | | | | | | | | | | | | |

Performance Measure (in $ millions) | | | | | | | | Maximum

(125%) of

PSUs vest) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Under the LTIP, the two performance goals may be earned independently of one another. The achievement of the performance goals for each of our NEOs will be measured on a consolidated Company-wide basis. Acquisitions by the Company are included in the Adjusted EBITDA and Adjusted Free Cash Flow calculations, subject to the negative discretion of our Compensation Committee. Awards for performance between threshold and target levels, and between target and maximum levels, will be determined based on linear interpolation. If neither threshold performance level is achieved, then no PSUs will be earned.