UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22961

EA Series Trust

(Exact name of registrant as specified in charter)

19 E. Eagle Road

Havertown, PA 19083

(Address of principal executive offices) (Zip code)

19 E. Eagle Road

Havertown, PA 19083

(Name and address of agent for service)

215-882-9983

Registrant’s telephone number, including area code

Date of fiscal year end: September 30, 2023

Date of reporting period: September 30, 2023

Item 1. Reports to Stockholders.

Alpha Architect U.S. Quantitative Value ETF

Alpha Architect International Quantitative Value ETF

Alpha Architect U.S. Quantitative Momentum ETF

Alpha Architect International Quantitative Momentum ETF

Alpha Architect Value Momentum Trend ETF

Alpha Architect High Inflation and Deflation ETF

Alpha Architect Tail Risk ETF

Annual Report

September 30, 2023

ALPHA ARCHITECT ETFs

TABLE OF CONTENTS

| | | | | | | | |

| | | Page |

| | |

| Performance Summary and Portfolio Allocation | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

ALPHA ARCHITECT ETFs

LETTER TO SHAREHOLDERS

Dear Alpha Architect Family of Funds Shareholders,

Thank you for your investment in the Alpha Architect U.S. Quantitative Value ETF (“QVAL”), Alpha Architect International Quantitative Value ETF (“IVAL”), Alpha Architect U.S. Quantitative Momentum ETF (“QMOM”), Alpha Architect International Quantitative Momentum ETF (“IMOM”), Alpha Architect Value Momentum Trend ETF (“VMOT”), Alpha Architect High Inflation and Deflation ETF ("HIDE”) and Alpha Architect Tail Risk ETF ("CAOS”), collectively referred to as the “Funds”. The information presented in this letter relates to the operations of the Funds for the fiscal year ended September 30, 2023 (“FY 2023”).

VMOT is structured as a “fund of funds” ETF that seeks to invest in value and momentum securities (using QVAL and IVAL ETFs for value investments, and QMOM and IMOM for momentum investments) as well as applying hedging rules to the U.S. (QVAL and QMOM) and International (IVAL and IMOM) allocations based on a monthly assessment. VMOT seeks to provide long term capital appreciation while attempting to minimize market drawdowns. .

The investment strategies and approaches used in managing the Funds generally remain the same, regardless of market conditions. QVAL seeks to identify cheap, high-quality stocks in the domestic (U.S.) market. IVAL seeks to identify cheap, high-quality stocks in international markets. QMOM seeks to identify stocks with the highest quality momentum in the domestic (U.S.) market. IMOM seeks to identify stocks with the highest quality momentum in international markets. HIDE seeks to deliver portfolio protection during high inflation or deflationary regimes. CAOS seeks to earn positive returns during significant market drawdowns. VMOT seeks to identify Value (QVAL and IVAL) and Momentum (QMOM and IMOM) securities in both the domestic (U.S.) market and international markets (through the fund-of-funds structure) while also applying hedging rules based on a monthly assessment. All Funds target mid and large cap equities, either directly (QVAL, IVAL, QMOM, IMOM) or indirectly (VMOT, which holds shares of QVAL, QMOM, IVAL, and IMOM). The standalone Funds (QVAL, QMOM, IVAL, and IMOM) generally hold 50 or fewer positions. QVAL, IVAL, QMOM, and IMOM are diversified funds. HIDE and VMOT hold shares of other ETFs and are considered diversified on a look-through basis. In addition, CAOS generally holds options on the S&P 500 Index and is considered diversified on a look-through basis.

The primary headline for FY 2023 was a shift in the market from being a growth-driven market to a value-driven market, much of which was tied to a dramatic change in inflation expectations and interest rates. Due to strong value tilts, two of the four Alpha Architect factor funds (QVAL and IVAL) experienced strong relative performance in the year versus their respective benchmarks.

Despite the volatility of financial markets in FY 2023, we continue to follow the quantitative methodologies behind each of the Funds. At times like these, we like to highlight that concentrated factor strategies focused on a specific style (e.g., value, growth, momentum, and so forth) can deviate greatly from traditional capitalization-weighted portfolios. This deviation from standard passive benchmarks is often more pronounced when factor style portfolios are more concentrated, which is the case for our factor funds, QVAL, IVAL, QMOM, IMOM, and VMOT.

The individual fund performance drivers during the most recent fiscal year/period are outlined below.

QVAL

For FY 2023, QVAL was up 30.11% at its market price and up 30.39% at net asset value (NAV). The best and worst securities listed below are based on their contribution to the fund’s return, taking into consideration the weighting of each security.

The best performing security in the Fund’s portfolio during the period was Alpha Metallurgical Resource, which was up 72.53%. The second best performing security was Consol Energy Inc, which was up 55.29% for the period. The third best performing security for the period was Pbf Energy Inc-Class A, which was up 55.13% for the period.

The worst performing security in the Fund’s portfolio during the period was Comstock Resources Inc., which was down 39.13%. The second worst performing security was Mosaic Co/The, which was down 26.74% for the period. The third worst performing security was Cf Industries Holdings Inc., which was down 24.38% for the period.

ALPHA ARCHITECT ETFs

LETTER TO SHAREHOLDERS

For FY 2023, QVAL outperformed the Solactive GBS United States 1000 NTR Index, which was up 20.60%.

QVAL distributed income to shareholders on a quarterly basis.

IVAL

For FY 2023, IVAL was up 30.73% at its market price and up 30.86% at NAV. The best and worst securities listed below are based on their contribution to the Fund’s return, taking into consideration the weighting of each security.

The best performing security in the Fund’s portfolio during the period was Aurubis Ag, which was up 92.99%. The second best performing security was Screen Holdings Co Ltd., which was up 91.37% for the period. The third best performing security for the period was Shinko Electric Industries, which was up 86.43% for the period.

The worst performing security in the Fund’s portfolio during the period was Harbour Energy Plc, which was down 39.57%. The second worst performing security was Icl Group Ltd., which was down 28.75% for the period. The third worst performing security was Boliden Ab, which was down 22.1% for the period.

For FY 2023, IVAL outperformed the Solactive GBS Developed Markets ex N.A. Large & Mid Cap NTR Index (USD), which was up 25.22%.

IVAL distributed income to shareholders on an quarterly basis.

QMOM

For FY 2023, QMOM was down 0.82% at its market price and down 0.71% at NAV. The best and worst securities listed below are based on their contribution to the Fund’s return, taking into consideration the weighting of each security.

The best performing security in the Fund’s portfolio during the period was Super Micro Computer Inc., which was up 202.97%. The second best performing security was Elf Beauty Inc., which was up 48.04% for the period. The third best performing security for the period was Sylvamo Corp., which was up 61.68% for the period.

The worst performing security in the Fund during the period was Sage Therapeutics Inc., which was down 59.06%. The second worst performing security was Impinj Inc., which was down 48.36% for the period. The third worst performing security was Texas Pacific Land Corp., which was down 47.88% for the period.

For FY 2023, QMOM underperformed the Solactive GBS United States 1000 NTR Index, which was up 20.60%.

QMOM distributed income to shareholders on an annual basis.

IMOM

For FY 2023, IMOM was up 13.88% at its market price and up 13.50% at NAV. The best and worst securities listed below are based on their contribution to the fund’s return, taking into consideration the weighting of each security.

The best performing security in the Fund’s portfolio during the period was Centrica Plc, which was up 91.89%. The second best performing security was Rheinmetall Ag, which was up 68.19% for the period. The third best performing security for the period was Commerzbank Ag, which was up 55.38% for the period.

The worst performing security in the Fund’s portfolio during the period was Sosei Group Corp., which was down 49.35%. The second worst performing security was Delek Group Ltd., which was down 37.9% for the period. The third worst performing security was Whitehaven Coal Ltd., which was down 31.42% for the period.

For FY 2023, IMOM underperformed the Solactive GBS Developed Markets ex N.A. Large & Mid Cap NTR Index (USD), which was up 25.22%.

ALPHA ARCHITECT ETFs

LETTER TO SHAREHOLDERS

IMOM distributed income to shareholders on an annual basis.

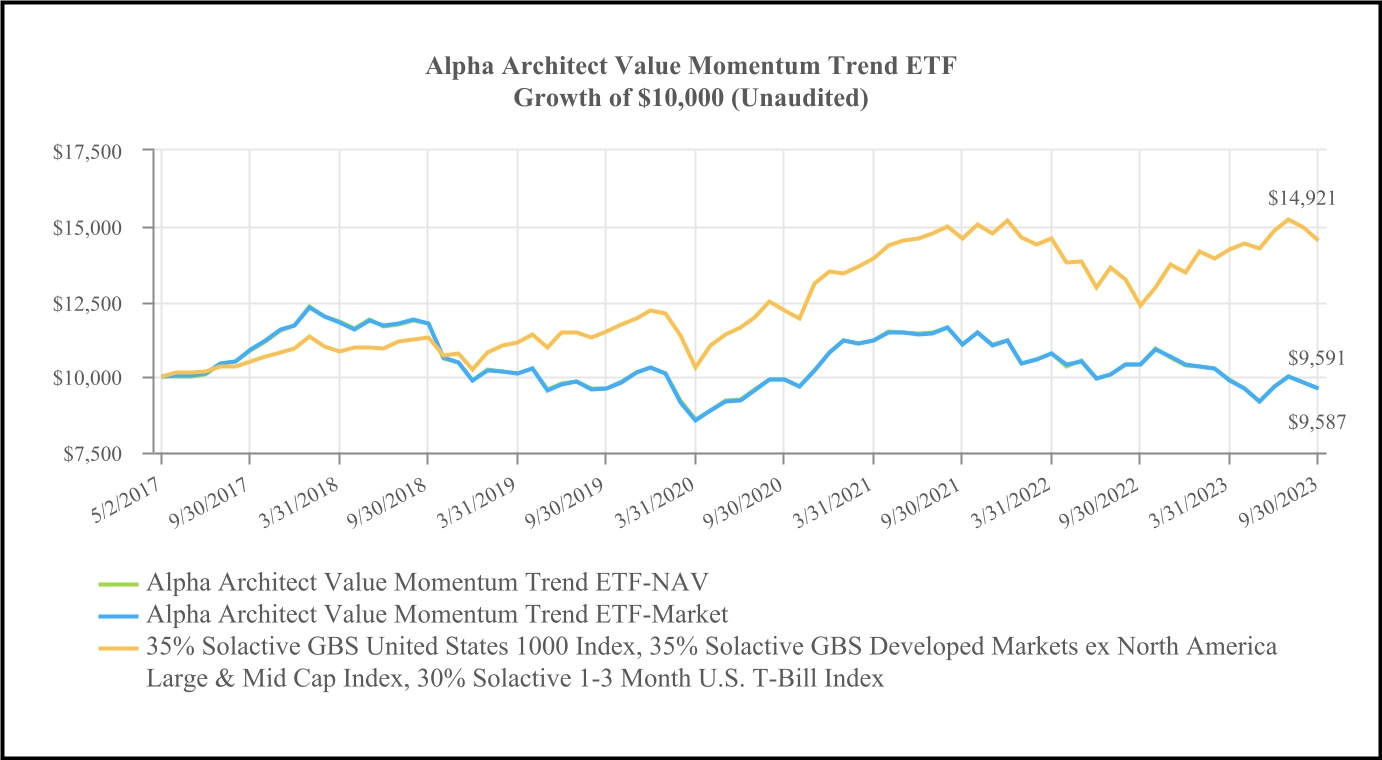

VMOT

For FY 2023, VMOT was down 7.68% at its market price and down 7.75% at NAV.

At times, VMOT will employ hedging when the trend-following signals are “triggered”. During FY 2023, these rules were triggered for much of the year in both domestic and international markets. These hedging signals prevented the portfolio from suffering the full extent of the broad market sell-off and lead to strong outperformance during FY 2023.

For FY 2023, VMOT outperformed a portfolio of 70% World Developed Stocks and 30% U.S. Treasury Bills[1], which was up 17.50%.

VMOT distributed income to shareholders on an annual basis.

[1] 35% Solactive GBS United States 1000 NTR Index, 35% Solactive GBS Developed Markets ex North America Large & Mid Cap NTR Index, 30% Solactive 1-3 month US T-Bill Index

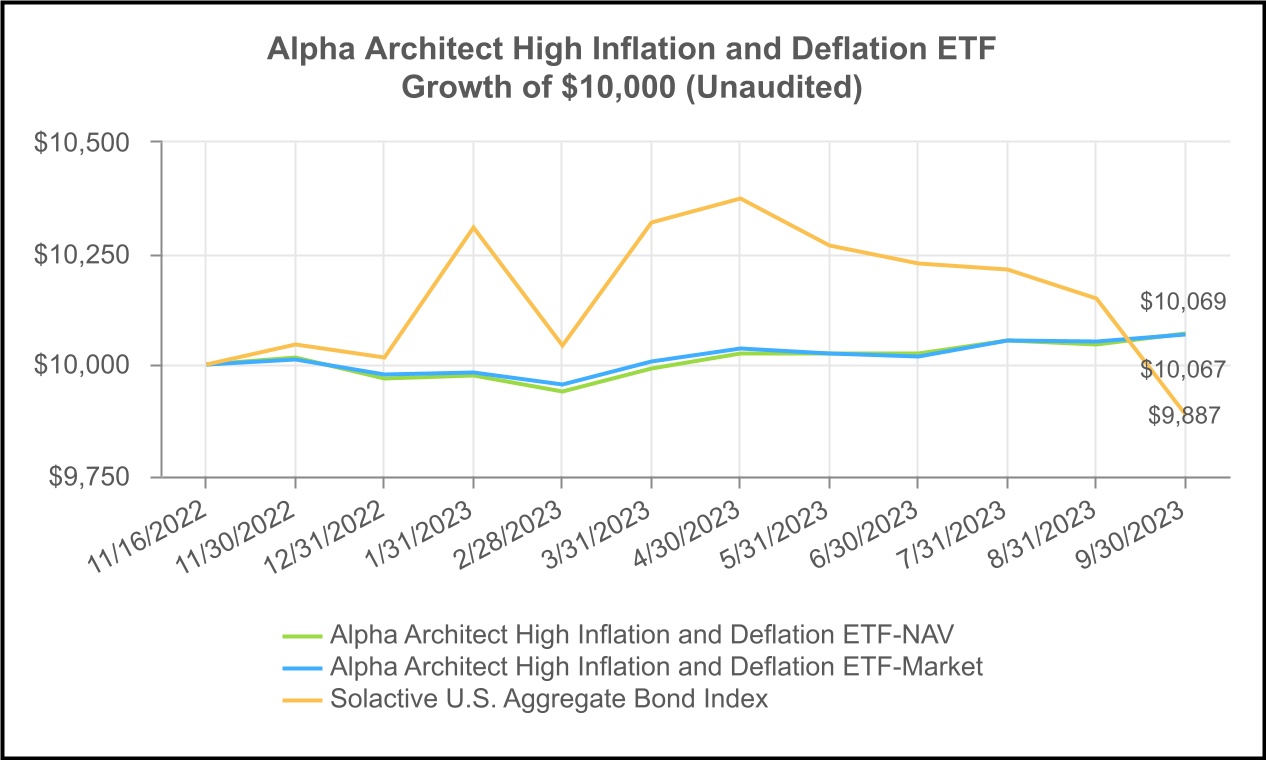

HIDE

For FY 2023, HIDE was up 0.67% at its market price and up 0.69% at NAV. We are using the Since Inception (11/16/2023) performance because the fund is launched less than one year.

The best performing security in the Fund’s portfolio during the period was Schwab Intermediate-Term US, which was down 3.22%. The second best performing security was Vanguard Real Estate ETF, which was down 3.63% for the period. The third best performing security for the period was Graniteshares Bcom Broad Str, which was down 5.81% for the period.

The worst performing security in the Fund’s portfolio during the period was Graniteshares Bcom Broad Str, which was down 5.81% for the period. The second worst performing security was Vanguard Real Estate ETF, which was down 3.63% for the period. The third worst performing security was Schwab Intermediate-Term US, which was down 3.22% for the period.

For FY 2023, HIDE outperformed the Solactive US Aggregate Bond Index, which was down 1.13%.

HIDE distributed income to shareholders on an annual basis.

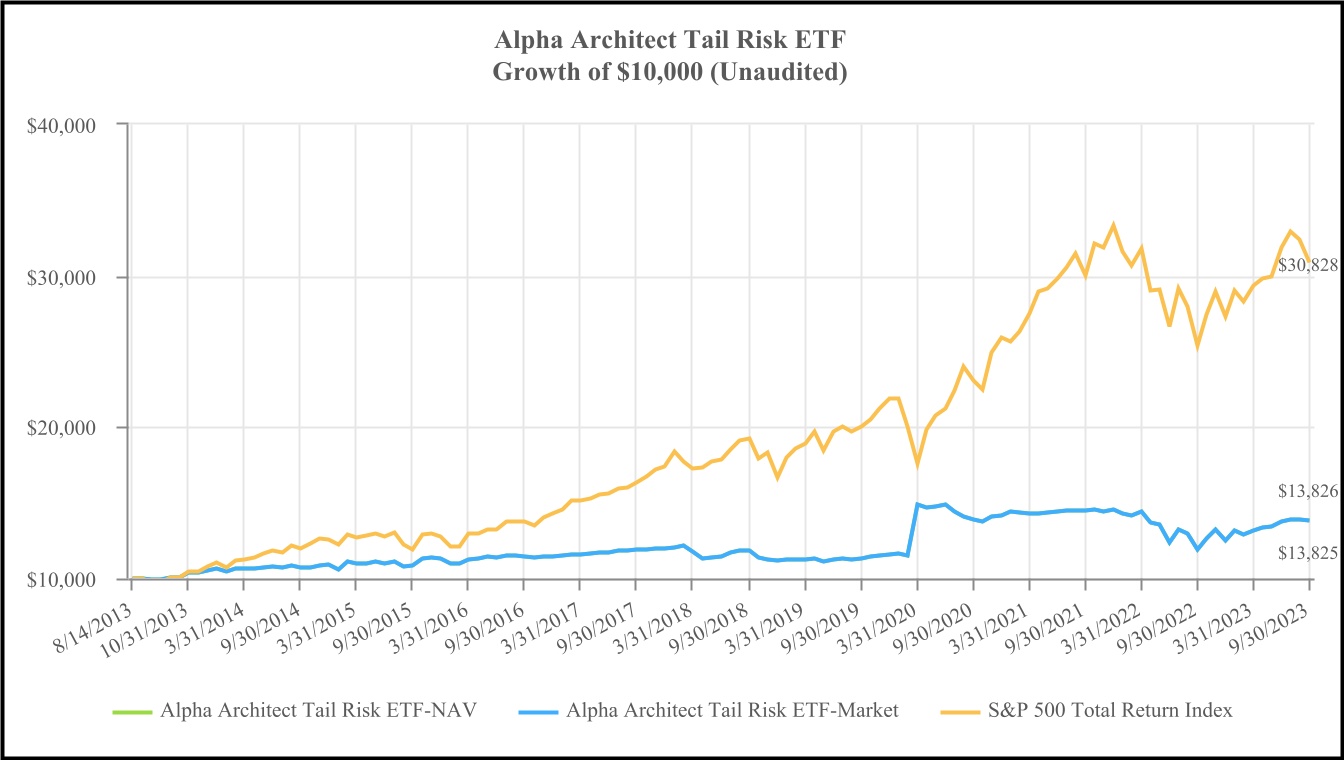

CAOS

For FY 2023, CAOS was up 7.31% at its market price and up 7.32% at NAV.

For FY 2023, CAOS underperformed the S&P 500 TR, which was up 9.04%.

CAOS distributed income to shareholders on an annual basis.

[1] 35% Solactive GBS United States 1000 NTR Index, 35% Solactive GBS Developed Markets ex North America Large & Mid Cap NTR Index, 30% Solactive 1-3 month US T-Bill Index

ALPHA ARCHITECT ETFs

LETTER TO SHAREHOLDERS

Please note, returns of the best/worst performers cited above reflect the returns of the stocks during the time period held by the Funds, not necessary for the entire fiscal year.

We appreciate your continued investment in the Funds.

Sincerely,

/s/ Patrick R. Cleary

Patrick R. Cleary

Chief Executive Officer

Empowered Funds, LLC dba EA Advisers

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For the most recent month-end performance, please call (215) 882-9983 or visit the Funds’ website at etfsite.alphaarchitect.com.

Shares are bought and sold at market price (not at net asset value, (“NAV”)), and are not individually redeemed from the Funds. Market price returns are based upon the midpoint of the bid/ask spread at the close of the exchange and does not represent the returns an investor would receive if shares were traded at other times. Brokerage commissions will reduce returns. NAVs are calculated using prices as of the close of regular trading on the exchange, normally 4:00 p.m. Eastern Time.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Any offering must be preceded or accompanied by a prospectus.

Fund holdings and allocations are subject to change at any time and should not be considered a recommendation to buy, hold or sell any security. Please see the Schedule of Investments in this report for complete Fund holdings.

RISKS

Investments involve risk. Principal loss is possible.

Non-diversification Risk. Because VMOT is non-diversified, it may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Funds’ Shares and greater risk of loss.

Value Style Risk. Value investing is subject to the risk that intrinsic values of investments may not be recognized by the broad market or that their prices may decline.

Momentum Style Risk. Investing in or having exposure to securities with positive momentum entails investing in securities that have had above-average recent returns. These securities may be more volatile than a broad cross section of securities. Returns on securities that have previously exhibited momentum may be less than returns on other styles of investing or the overall stock market. Momentum can turn quickly and cause significant variation from other types of investments, and stocks that previously exhibited high momentum may not experience continued positive momentum. In addition, there may be periods when the momentum style is out of favor, and during which the investment performance of the Funds using a momentum strategy may suffer.

Quantitative Management Risk. Investments utilizing quantitative methods may perform differently than the market as a result of characteristics and data used and changes in trends.

ALPHA ARCHITECT ETFs

LETTER TO SHAREHOLDERS

Foreign Security Risk. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods.

Small Company Risk. Investments in smaller companies involve limited liquidity and greater volatility than larger companies.

High Portfolio Turnover Rate Risk. High portfolio turnover could increase a Fund’s transactions costs, resulting in taxable distributions to shareholders and negatively impact performance.

Derivatives Risk. Derivatives can be volatile and involve various types of degrees of risks including hedging risks. The use of derivatives in connection with the VMOT index's hedging strategies may expose the index (and therefore the Fund) to losses (some of which may be sudden) that it would not have otherwise been exposed to if it had only invested directly in equity securities.

Fund of Funds Risk. VMOT primarily invests in the other Alpha Architect Funds and its performance largely depends on the investment performance of those underlying Alpha Architect Funds. An investor will indirectly bear the principal risks and its share of fees and expenses of the underlying funds.

INDICES

The Solactive GBS United States 1000 Index intends to track the performance of the largest 1000 companies from the US stock market and is based on the Solactive Global Benchmark Series. Constituents are selected based on company market capitalization and weighted by free float market capitalization. The index is calculated as a net total return index in USD and is reconstituted quarterly.

The Solactive GBS Developed Markets ex North America Large & Mid Cap USD Index (CA NTR) is part of the Solactive Global Benchmark Series which includes benchmark indices for developed and emerging market countries. The index tracks the performance of the large and mid cap segment covering approximately the largest 85% of the free-float market capitalization in the Developed Markets excluding North America. It is calculated as a Net Total Return index in CAD and weighted by free-float market capitalization.

The Solactive 1-3 month US T-Bill Index is a rules-based, market value weighted index engineered for the short-term T-Bill market denominated in USD. The index is comprised of USD denominated T-Bills with a time to maturity of 1 to 3 months.

The Alpha Architect Value Momentum Trend Index will be composed primarily of the other Funds included in this report which invest in either domestic or international equity securities and employ either a “momentum” or “value” investment strategy. In addition, the Index may, from time to time, use hedging strategies.

The Solactive US Aggregate Bond Index aims to track the performance of the USD denominated bond market. The INDEX COMPONENTS are weighted with the aim to replicate the distribution of the weights of the entire market.

S&P500: It is an unmanaged index of 500 common stocks primarily traded on the New York Stock Exchange, weighted by market capitalization. Index performance includes the reinvestment of dividends and capital gains.

Indices do not incur any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

*Alpha is defined as the excess return of the fund relative to the return of the benchmark index.

The Funds are distributed by Quasar Distributors, LLC. The Funds’ investment advisor is Empowered Funds, LLC, which is doing business as EA Advisers.

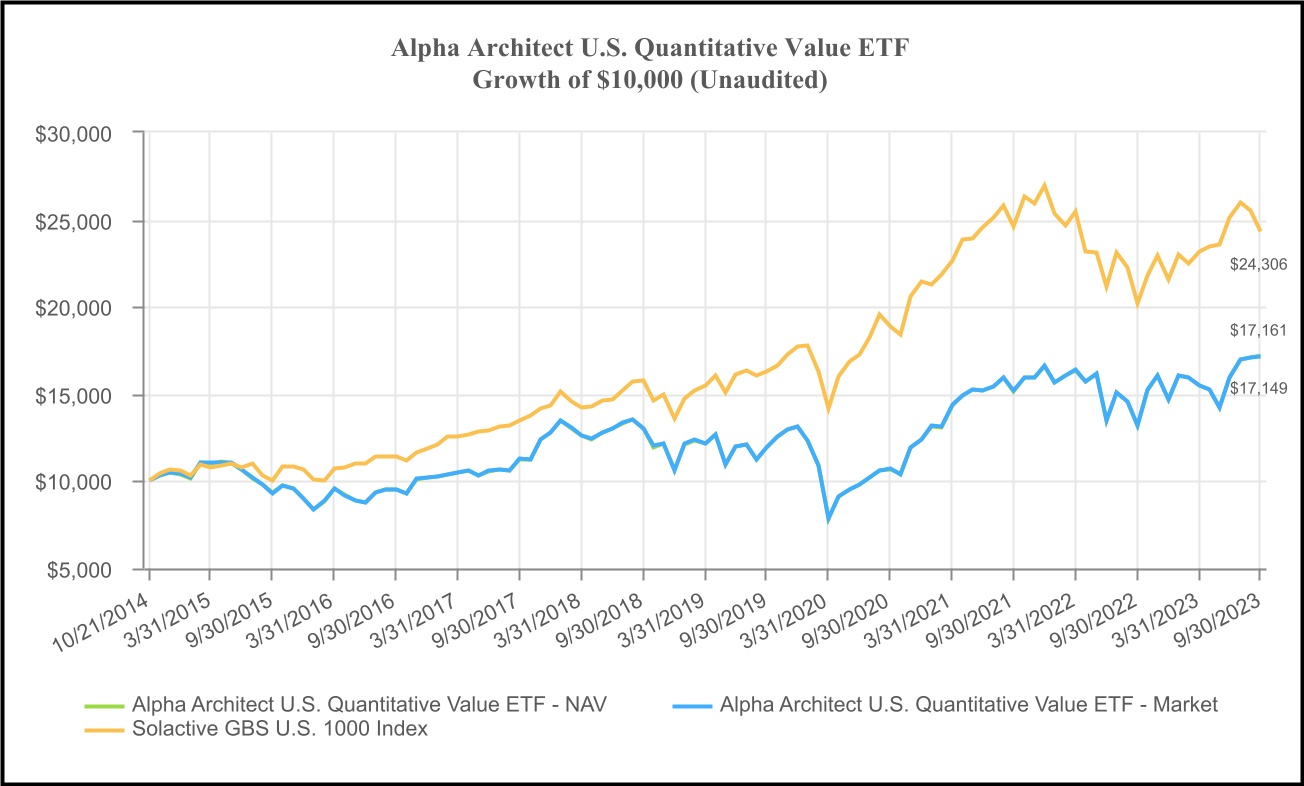

| | | | | | | | | | | | | | | | | | | | |

| | | | Average Annual Return* |

| | | | | | Since Inception |

| | | | 1 Year | 5 Year | (October 21, 2014) |

| Alpha Architect U.S. Quantitative Value ETF - NAV | | 30.39% | 5.69% | 6.23% |

| Alpha Architect U.S. Quantitative Value ETF - Market | 30.11% | 5.69% | 6.22% |

| Solactive GBS U.S. 1000 Index | 20.60% | 9.07% | 10.44% |

| | | | | | |

| See “Index Overview” section for a description of the Index. | | | |

| | | | | | |

*This chart assumes an initial gross investment of $10,000 made on October 21, 2014. Returns shown include the dividends. Past performance does not guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. |

|

|

|

Tabular Presentation of Schedule of Investments

As of September 30, 2023

Alpha Architect U.S. Quantitative Value ETF

| | | | | | | | |

Sector1 | | % Net Assets |

| Energy | | 38.7%² |

| Consumer Discretionary | | 27.2%² |

| Industrials | | 17.8% |

| Materials | | 4.1% |

| Information Technology | | 4.0% |

| Communication Services | | 3.8% |

| Health Care | | 2.1% |

| Consumer Staples | | 2.1% |

Other3 | | 0.2% |

| Total | | 100.0% |

1 Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment adviser's internal sector classifications.

2 For purposes of the Fund's compliance with its concentration limits, the Fund uses various sub-classifications and none of the Fund's holdings in the sub-classifications exceed 25% of the Fund's total assets.

3 Cash, cash equivalents, short-term investments and other assets less liabilities.

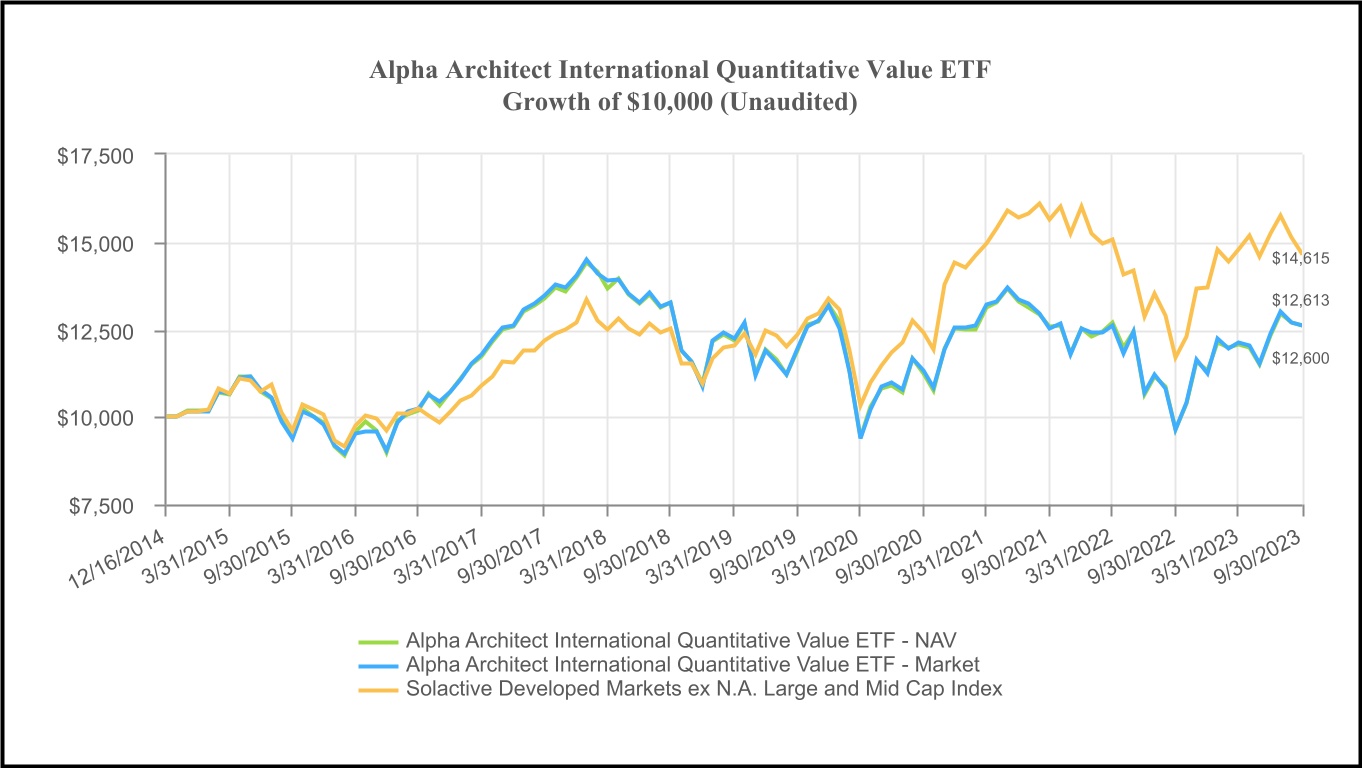

| | | | | | | | | | | | | | | | | | | | |

| | | | Average Annual Return* |

| | | | | | Since Inception |

| | | | 1 Year | 5 Year | (December 16, 2014) |

| Alpha Architect International Quantitative Value ETF - NAV | 30.86% | -1.00% | 2.68% |

| Alpha Architect International Quantitative Value ETF - Market | 30.73% | -1.00% | 2.66% |

| Solactive Developed Markets ex N.A. Large and Mid Cap Index | 25.22% | 3.16% | 4.41% |

| | | | | | |

| See “Index Overview” section for a description of the Index. | | | |

| | | | | | |

*This chart assumes an initial gross investment of $10,000 made on December 16, 2014. Returns shown include the dividends. Past performance does not guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. |

|

|

|

Tabular Presentation of Schedule of Investments

As of September 30, 2023

Alpha Architect International Quantitative Value ETF

| | | | | | | | |

Sector1 | | % Net Assets |

| Consumer Discretionary | | 32.4%² |

| Energy | | 22.7% |

| Industrials | | 18.4% |

| Materials | | 13.4% |

| Utilities | | 5.9% |

| Information Technology | | 4.1% |

| Consumer Staples | | 1.9% |

Other3 | | 1.2% |

| Total | | 100.0% |

1 Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment adviser's internal sector classifications.

2 For purposes of the Fund's compliance with its concentration limits, the Fund uses various sub-classifications and none of the Fund's holdings in the sub-classifications exceed 25% of the Fund's total assets.

3 Cash, cash equivalents, short-term investments and other assets less liabilities.

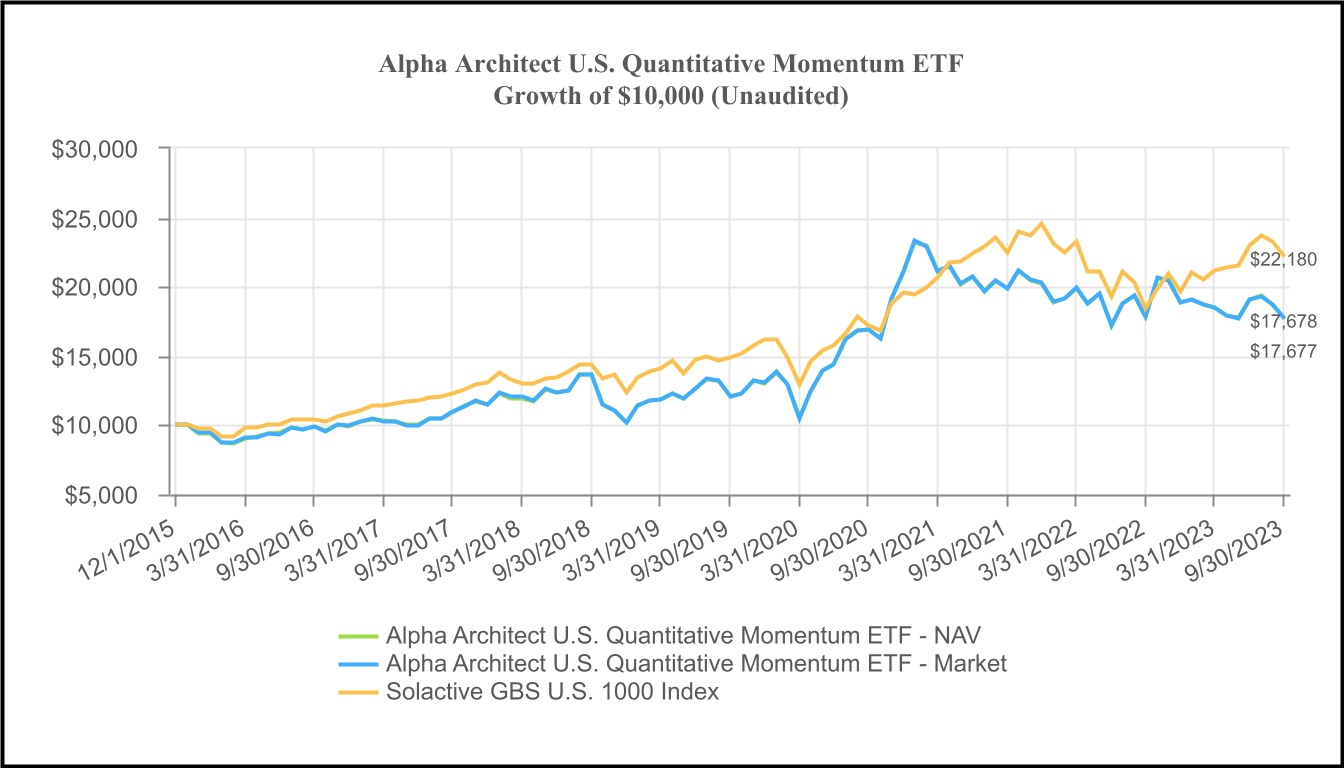

| | | | | | | | | | | | | | | | | | | | |

| | | | Average Annual Return* |

| | | | | | Since Inception |

| | | | 1 Year | 5 Year | (December 1, 2015) |

| Alpha Architect U.S. Quantitative Momentum ETF - NAV | -0.71% | 5.28% | 7.54% |

| Alpha Architect U.S. Quantitative Momentum ETF - Market | -0.82% | 5.28% | 7.54% |

| Solactive GBS U.S. 1000 Index | 20.60% | 9.07% | 10.71% |

| | | | | | |

| See “Index Overview” section for a description of the Index. | | | |

| | | | | | |

*This chart assumes an initial gross investment of $10,000 made on December 1, 2015. Returns shown include the dividends. Past performance does not guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. |

|

|

|

Tabular Presentation of Schedule of Investments

As of September 30, 2023

Alpha Architect U.S. Quantitative Momentum ETF

| | | | | | | | |

Sector1 | | % Net Assets |

| Consumer Discretionary | | 29.6%² |

| Industrials | | 27.7%² |

| Information Technology | | 16.0% |

| Energy | | 8.6% |

| Financials | | 6.5% |

| Health Care | | 6.0% |

| Materials | | 2.0% |

| Communication Services | | 1.8% |

| Consumer Staples | | 1.7% |

Other3 | | 0.1% |

| Total | | 100.0% |

1 Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment adviser's internal sector classifications.

2 For purposes of the Fund's compliance with its concentration limits, the Fund uses various sub-classifications and none of the Fund's holdings in the sub-classifications exceed 25% of the Fund's total assets.

3 Cash, cash equivalents, short-term investments and other assets less liabilities.

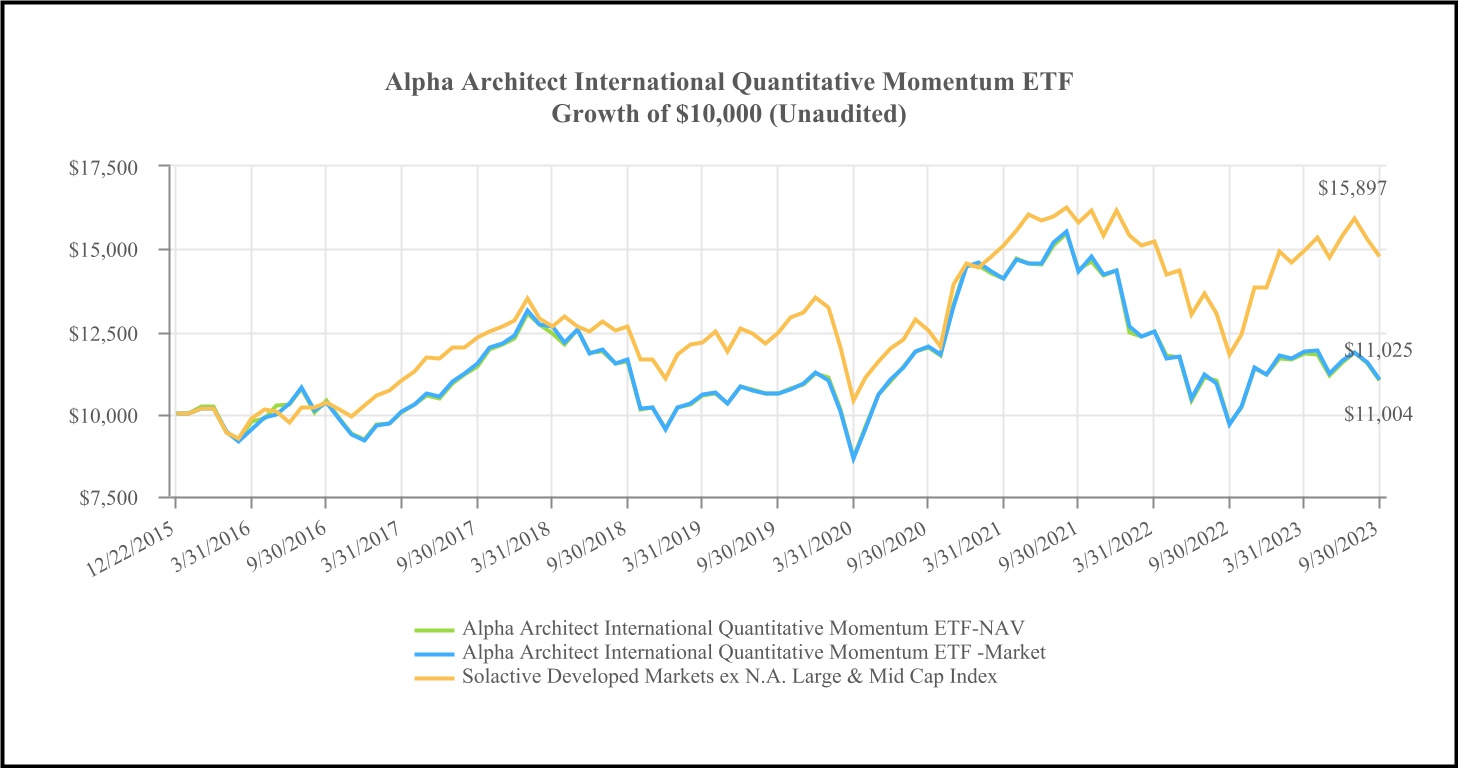

| | | | | | | | | | | | | | | | | | | | |

| | | | Average Annual Return* |

| | | | | | Since Inception |

| | | | 1 Year | 5 Year | (December 22, 2015) |

| Alpha Architect International Quantitative Momentum ETF - NAV | 13.50% | -1.03% | 1.24% |

| Alpha Architect International Quantitative Momentum ETF - Market | 13.88% | -1.09% | 1.26% |

| Solactive Developed Markets ex N.A. Large & Mid Cap Index | 25.22% | 3.16% | 5.14% |

| | | | | | |

| See “Index Overview” section for a description of the Index. | | | |

| | | | | | |

*This chart assumes an initial gross investment of $10,000 made on December 22, 2015. Returns shown include the dividends. Past performance does not guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. |

|

|

|

Tabular Presentation of Schedule of Investments

As of September 30, 2023

Alpha Architect International Quantitative Momentum ETF

| | | | | | | | |

Sector1 | | % Net Assets |

| Financials | | 33.1%² |

| Consumer Discretionary | | 21.5% |

| Information Technology | | 13.7% |

| Materials | | 11.7% |

| Industrials | | 5.9% |

| Utilities | | 5.9% |

| Communication Services | | 4.0% |

| Health Care | | 3.6% |

| Other³ | | 0.6% |

| Total | | 100.0% |

1 Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment adviser's internal sector classifications.

2 For purposes of the Fund's compliance with its concentration limits, the Fund uses various sub-classifications and none of the Fund's holdings in the sub-classifications exceed 25% of the Fund's total assets.

3 Cash, cash equivalents, short-term investments and other assets less liabilities.

| | | | | | | | | | | | | | | | | | | | |

| | | | Average Annual Return* |

| | | | | | Since Inception |

| | | | 1 Year | 5 Year | (May 2, 2017) |

| Alpha Architect Value Momentum Trend ETF - NAV | -7.75% | -4.00% | -0.65% |

| Alpha Architect Value Momentum Trend ETF - Market | -7.68% | -4.00% | -0.66% |

| 35% Solactive GBS United States 1000 Index, 35% Solactive GBS Developed Markets ex North America Large & Mid Cap Index, 30% Solactive 1-3 Month U.S. T-Bill Index | 17.50% | 5.18% | 5.99% |

| | | | | | |

| See “Index Overview” section for a description of the Index. | | | |

| | | | | | |

*This chart assumes an initial gross investment of $10,000 made on May 2, 2017. Returns shown include the dividends. Past performance does not guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. |

|

|

|

Tabular Presentation of Schedule of Investments

As of September 30, 2023

Alpha Architect Value Momentum Trend ETF

| | | | | | | | |

Sector1 | | % Net Assets |

| Investment Companies | | 98.7% |

Other2 | | 1.3% |

| Total | | 100.0% |

1 Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment adviser's internal sector classifications.

2 Cash, cash equivalents, short-term investments and other assets less liabilities.

| | | | | | | | | | | | | | | | | |

| | | | Cumulative Return |

| | | | Since Inception |

| | | | (November 16, 2022) |

| Alpha Architect High Inflation and Deflation ETF - NAV | 0.69% |

| Alpha Architect High Inflation and Deflation ETF - Market | 0.67% |

| Solactive U.S. Aggregate Bond Index | -1.13% |

| | | | | |

| See “Index Overview” section for a description of the Index. | |

| | | | | |

*This chart assumes an initial gross investment of $10,000 made on November 16, 2022. Returns shown include the dividends. Past performance does not guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. |

|

|

|

Tabular Presentation of Schedule of Investments

As of September 30, 2023

Alpha Architect High Inflation and Deflation ETF

| | | | | | | | |

Sector1 | | % Net Assets |

| U.S. Treasury Bills | | 87.1% |

| Investment Companies | | 12.4% |

| Other² | | 0.5% |

| Total | | 100.0% |

1 Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment adviser's internal sector classifications.

2 Cash, cash equivalents, short-term investments and other assets less liabilities.

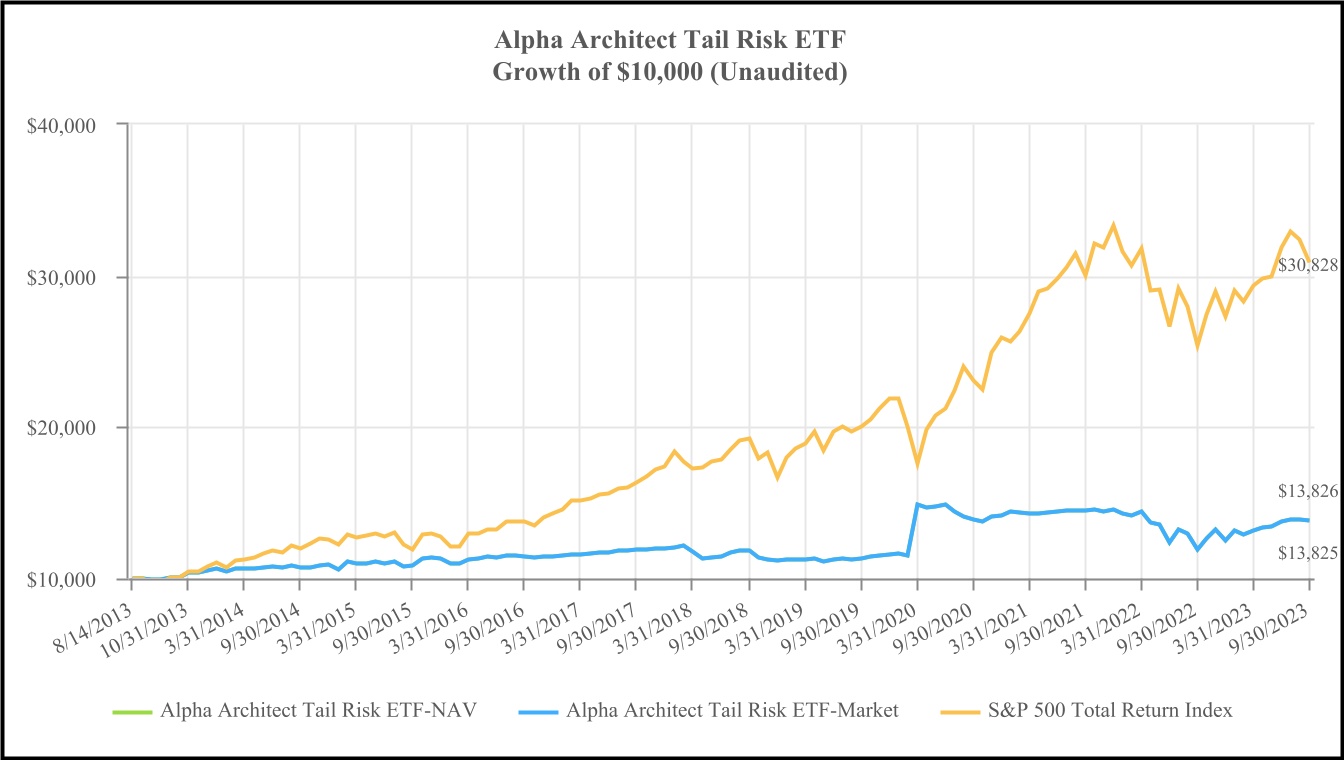

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | Average Annual Return* |

| | | Since Conversion | | | | Since Inception |

| | 7 Months | (March 6, 2023) | 1 Year | 5 Year | 10 Year | (August 14, 2013) |

| Alpha Architect Tail Risk ETF - NAV | 7.32% | 5.61% | 16.18% | 3.19% | 3.24% | 3.25% |

| Alpha Architect Tail Risk ETF - Market | 7.31% | 5.62% | 16.17% | 3.19% | 3.24% | 3.25% |

| S&P 500 Total Return Index | 9.04% | 6.90% | 21.62% | 9.92% | 11.91% | 11.76% |

| | | | | | | |

| See “Index Overview” section for a description of the Index. | |

| | | | | | | |

*This chart assumes an initial gross investment of $10,000 made on August 14, 2013. Returns shown include the dividends. Past performance does not guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost. The Fund converted from a mutual fund to an ETF on March 6, 2023. The Fund has adopted the mutual fund’s prior performance for the periods before the conversion. |

|

|

|

Tabular Presentation of Schedule of Investments

As of September 30, 2023

Alpha Architect Tail Risk ETF

| | | | | | | | |

Sector1 | | % Net Assets |

| Purchased Options | | 82.5% |

| Affiliated Investment Companies | | 65.2% |

| Other² | | (47.7%) |

| Total | | 100.0% |

1 Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment adviser's internal sector classifications.

2 Cash, cash equivalents, short-term investments and other assets less liabilities.

ALPHA ARCHITECT ETFs

INDEX OVERVIEW

SEPTEMBER 30, 2023 (UNAUDITED)

Solactive GBS U.S. 1000 Index

The Solactive GBS U.S. 1000 Index intends to track the performance of the largest 1000 companies from the US stock market and is based on the Solactive Global Benchmark Series. Constituents are selected based on company market capitalization and weighted by free float market capitalization. The index is calculated as a net total return index in USD and is reconstituted quarterly.

Solactive Developed Markets ex N.A. Large and Mid Cap Index

The Solactive Developed Markets ex N.A. Large and Mid Cap Index is part of the Solactive Global Benchmark Series which includes benchmark indices for developed and emerging market countries. The index tracks the performance of the large and mid-cap segment covering approximately the largest 85% of the free-float market capitalization in the Developed Markets excluding North America. It is calculated as a Net Total Return index in CAD and weighted by free-float market capitalization.

Solactive 1-3 Month U.S. T-Bill Index

The Solactive 1-3 Month U.S. T-Bill Index is a rules-based, market value weighted index engineered for the short-term T-Bill market denominated in USD. The index is comprised of USD denominated T-Bills with a time to maturity of 1 to 3 months.

Solactive Aggregate U.S. Bond Index

The Solactive Aggregate U.S. Bond Index aims to track the performance of the USD denominated bond market.

S&P 500 Total Return Index

The S&P 500 Total Return Index is a stock market index tracking the performance of 500 large companies listed on stock exchanges in the United States.

| | |

| Alpha Architect U.S. Quantitative Value ETF |

| Schedule of Investments |

| September 30, 2023 |

| | | | | | | | | | | |

| Shares | | | Value |

| COMMON STOCKS - 99.8% | | |

| Agricultural & Farm Machinery - 1.9% | | |

| 45,624 | AGCO Corp. | | $ | 5,396,406 | |

| Air Freight & Logistics - 2.0% | | |

| 69,490 | Hub Group, Inc. - Class A (a) | | 5,457,745 | |

| Automotive Retail - 2.1% | | |

| 21,405 | Group 1 Automotive, Inc. | | 5,751,738 | |

| Biotechnology - 2.1% | | |

| 25,483 | United Therapeutics Corp. (a) | | 5,755,845 | |

| Broadcasting - 3.8% | | |

| 175,210 | Fox Corp. - Class A | | 5,466,552 | |

| 348,722 | TEGNA, Inc. | | 5,080,880 | |

| | | 10,547,432 | |

| Broadline Retail - 2.1% | | |

| 500,347 | Macy's, Inc. | | 5,809,029 | |

| Building Products - 4.0% | | |

| 41,160 | Owens Corning | | 5,614,636 | |

| 54,666 | UFP Industries, Inc. | | 5,597,798 | |

| | | 11,212,434 | |

| Coal & Consumable Fuels - 4.3% | | |

| 57,012 | CONSOL Energy, Inc. | | 5,981,129 | |

| 230,887 | Peabody Energy Corp. | | 6,000,753 | |

| | | 11,981,882 | |

| Construction Machinery & Heavy Transportation Equipment - 2.0% | | |

| 93,946 | Terex Corp. | | 5,413,169 | |

| Electrical Components & Equipment - 2.0% | | |

| 37,918 | Atkore, Inc. (a) | | 5,656,986 | |

| Electronic Components - 2.0% | | |

| 224,441 | Vishay Intertechnology, Inc. | | 5,548,182 | |

| Homebuilding - 19.2% | | |

| 20,240 | Cavco Industries, Inc. (a) | | 5,376,958 | |

| 49,993 | D.R. Horton, Inc. | | 5,372,748 | |

| 117,380 | KB Home | | 5,432,346 | |

| 47,796 | Lennar Corp. - Class A | | 5,364,145 | |

| 43,935 | Meritage Homes Corp. | | 5,377,205 | |

| 73,608 | PulteGroup, Inc. | | 5,450,672 | |

| 80,607 | Skyline Champion Corp. (a) | | 5,136,278 | |

| 124,793 | Taylor Morrison Home Corp. (a) | | 5,317,430 | |

| 71,497 | Toll Brothers, Inc. | | 5,287,918 | |

| 194,883 | Tri Pointe Homes, Inc. (a) | | 5,330,050 | |

| | | 53,445,750 | |

| Industrial Machinery & Supplies & Components - 2.1% | | |

| 76,047 | Mueller Industries, Inc. | | 5,715,693 | |

The accompanying notes are an integral part of these financial statements.

21

| | |

| Alpha Architect U.S. Quantitative Value ETF |

| Schedule of Investments (Continued) |

| September 30, 2023 |

| | | | | | | | | | | |

| Shares | | | Value |

| Integrated Oil & Gas - 2.0% | | |

| 47,865 | Exxon Mobil Corp. | | $ | 5,627,967 | |

| Oil & Gas Equipment & Services - 2.0% | | |

| 305,124 | Liberty Energy, Inc. | | 5,650,896 | |

| Oil & Gas Exploration & Production - 14.1% | | |

| 147,076 | Callon Petroleum Co. (a) | | 5,753,613 | |

| 35,257 | Chord Energy Corp. | | 5,714,102 | |

| 42,516 | EOG Resources, Inc. | | 5,389,328 | |

| 134,271 | EQT Corp. | | 5,448,717 | |

| 123,073 | Murphy Oil Corp. | | 5,581,361 | |

| 174,529 | Range Resources Corp. | | 5,656,485 | |

| 142,488 | SM Energy Co. | | 5,649,649 | |

| | | 39,193,255 | |

| Oil & Gas Refining & Marketing - 10.1% | | |

| 162,862 | CVR Energy, Inc. | | 5,542,194 | |

| 36,410 | Marathon Petroleum Corp. | | 5,510,289 | |

| 164,969 | Par Pacific Holdings, Inc. (a) | | 5,928,986 | |

| 103,633 | PBF Energy, Inc. - Class A | | 5,547,474 | |

| 39,034 | Valero Energy Corp. | | 5,531,508 | |

| | | 28,060,451 | |

| Oil & Gas Storage & Transportation - 6.2% | | |

| 33,867 | Cheniere Energy, Inc. | | 5,620,567 | |

| 131,116 | International Seaways, Inc. ADR (b) | | 5,900,220 | |

| 103,859 | Scorpio Tankers, Inc. ADR (b) | | 5,620,849 | |

| | | 17,141,636 | |

| Other Specialty Retail - 3.8% | | |

| 111,690 | Academy Sports & Outdoors, Inc. | | 5,279,586 | |

| 73,204 | Signet Jewelers Ltd. ADR (b) | | 5,256,779 | |

| | | 10,536,365 | |

| Packaged Foods & Meats - 2.1% | | |

| 121,264 | Cal-Maine Foods, Inc. | | 5,871,603 | |

| Passenger Airlines - 3.8% | | |

| 420,481 | American Airlines Group, Inc. (a) | | 5,386,362 | |

| 122,471 | United Airlines Holdings, Inc. (a) | | 5,180,523 | |

| | | 10,566,885 | |

| Steel - 4.1% | | | |

| 108,029 | Commercial Metals Co. | | 5,337,713 | |

| 56,489 | Steel Dynamics, Inc. | | 6,056,751 | |

| | | 11,394,464 | |

| Technology Distributors - 2.0% | | |

| 44,278 | Arrow Electronics, Inc. (a) | | 5,545,377 | |

| TOTAL COMMON STOCKS (Cost $259,648,789) | | 277,281,190 | |

| | | |

The accompanying notes are an integral part of these financial statements.

22

| | |

| Alpha Architect U.S. Quantitative Value ETF |

| Schedule of Investments (Continued) |

| September 30, 2023 |

| | | | | | | | | | | |

| Shares | | | Value |

| MONEY MARKET FUNDS - 0.2% | | |

| 506,480 | First American Government Obligations Fund - Class X, 5.26% (c) | | $ | 506,480 | |

| TOTAL MONEY MARKET FUNDS (Cost $506,480) | | 506,480 | |

| | | |

| TOTAL INVESTMENTS (Cost $260,155,269) - 100.0% | | 277,787,670 | |

| Other Assets in Excess of Liabilities - 0.0% (d) | | 65,184 | |

| TOTAL NET ASSETS - 100.0% | | $ | 277,852,854 | |

Percentages are stated as a percent of net assets.

| | | | | | | | |

| ADR - American Depositary Receipt | |

| | |

| (a) Non-income producing security. |

| (b) Foreign issued security. |

| (c) Rate shown is the 7-day effective yield. |

| (d) Represents less than 0.05% of net assets. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

23

| | |

| Alpha Architect International Quantitative Value ETF |

| Schedule of Investments |

| September 30, 2023 |

| | | | | | | | | | | |

| Shares | | | Value |

| COMMON STOCKS - 98.8% | | |

| Australia - 14.0% | | |

| 245,939 | Fortescue Metals Group Ltd. | | $ | 3,308,009 | |

| 101,551 | JB Hi-Fi Ltd. | | 2,965,575 | |

| 803,961 | New Hope Corp. Ltd. | | 3,282,361 | |

| 1,029,572 | Pilbara Minerals Ltd. | | 2,846,444 | |

| 792,236 | Qantas Airways Ltd. (a) | | 2,638,528 | |

| 710,895 | Whitehaven Coal Ltd. | | 3,249,769 | |

| 124,303 | Woodside Energy Group Ltd. | | 2,916,305 | |

| | | 21,206,991 | |

| Austria - 5.7% | | |

| 63,800 | OMV AG | | 3,056,950 | |

| 101,853 | voestalpine AG | | 2,782,557 | |

| 110,996 | Wienerberger AG | | 2,821,107 | |

| | | 8,660,614 | |

| Bermuda - 2.1% | | |

| 509,028 | Hafnia Ltd. | | 3,166,955 | |

| | | |

| France - 7.4% | | |

| 200,854 | Air France-KLM (a) | | 2,526,575 | |

| 97,206 | Cie Generale des Etablissements Michelin SCA | | 2,987,555 | |

| 130,673 | Rexel S.A. | | 2,942,681 | |

| 224,549 | Vallourec SACA (a) | | 2,744,395 | |

| | | 11,201,206 | |

| Italy - 1.8% | | |

| 102,377 | Buzzi S.p.A. | | 2,805,531 | |

| | | |

| Japan - 44.1% | | |

| 285,911 | Amada Co., Ltd. | | 2,878,433 | |

| 60,864 | Ebara Corp. | | 2,854,629 | |

| 366,615 | Fujikura Ltd. | | 2,947,590 | |

| 58,364 | Horiba Ltd. | | 3,161,123 | |

| 211,521 | Inpex Corp. | | 3,193,197 | |

| 236,746 | Isuzu Motors Ltd. | | 2,979,128 | |

| 90,249 | Japan Petroleum Exploration Co., Ltd. | | 3,400,039 | |

| 66,027 | Macnica Holdings, Inc. | | 3,106,061 | |

| 290,039 | Mazda Motor Corp. | | 3,292,634 | |

| 786,702 | Mitsubishi Motors Corp. | | 3,429,187 | |

| 130,535 | Niterra Co., Ltd. | | 2,955,905 | |

| 88,410 | Open House Group Co., Ltd. | | 3,001,822 | |

| 68,550 | Sankyo Co., Ltd. | | 3,144,016 | |

| 197,026 | Sanwa Holdings Corp. | | 2,621,036 | |

| 95,648 | Shin-Etsu Chemical Co., Ltd. | | 2,779,706 | |

| 158,397 | Subaru Corp. | | 3,080,177 | |

| 120,066 | Sumitomo Heavy Industries Ltd. | | 3,046,643 | |

The accompanying notes are an integral part of these financial statements.

24

| | |

| Alpha Architect International Quantitative Value ETF |

| Schedule of Investments (Continued) |

| September 30, 2023 |

| | | | | | | | | | | |

| Shares | | | Value |

| 77,012 | Suzuki Motor Corp. | | $ | 3,100,269 | |

| 130,185 | Tokyo Gas Co., Ltd. | | 2,954,077 | |

| 266,263 | Tokyo Steel Manufacturing Co., Ltd. | | 3,002,229 | |

| 161,822 | Toyota Boshoku Corp. | | 2,951,865 | |

| 116,569 | Yamaha Motor Co., Ltd. | | 3,066,333 | |

| | | 66,946,099 | |

| Luxembourg - 1.9% | | |

| 185,899 | Tenaris S.A. | | 2,945,178 | |

| Netherlands - 5.7% | | |

| 215,578 | CNH Industrial N.V. ADR | | 2,608,494 | |

| 308,592 | Iveco Group N.V. (a) | | 2,891,307 | |

| 163,556 | Stellantis N.V. ADR (b) | | 3,128,826 | |

| | | 8,628,627 | |

| Spain - 4.1% | | |

| 147,582 | Endesa S.A. | | 3,007,499 | |

| 191,728 | Repsol S.A. | | 3,156,108 | |

| | | 6,163,607 | |

| United Kingdom - 11.9% | | |

| 538,432 | Barratt Developments PLC | | 2,897,784 | |

| 59,984 | Berkeley Group Holdings PLC | | 3,005,787 | |

| 489,791 | BP PLC | | 3,175,634 | |

| 92,855 | British American Tobacco PLC | | 2,919,562 | |

| 1,597,544 | Centrica PLC | | 3,010,501 | |

| 2,133,983 | Taylor Wimpey PLC | | 3,054,126 | |

| | | 18,063,394 | |

| TOTAL COMMON STOCKS (Cost $145,604,439) | | 149,788,202 | |

| | | |

| INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING - 0.5% | | |

| 790,000 | First American Government Obligations Fund - Class X, 5.26% (c) | | 790,000 | |

| TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING (Cost $790,000) | | 790,000 | |

| | | |

| SHORT-TERM INVESTMENTS - 0.3% | | |

| MONEY MARKET FUNDS - 0.3% | | |

| 440,434 | First American Government Obligations Fund - Class X, 5.26% (c) | | 440,434 | |

| TOTAL MONEY MARKET FUNDS (Cost $440,434) | | 440,434 | |

| | | |

| TOTAL INVESTMENTS (Cost $146,834,873) - 99.6% | | 151,018,636 | |

| Other Assets in Excess of Liabilities - 0.4% | | 659,070 | |

| TOTAL NET ASSETS - 100.0% | | $ | 151,677,706 | |

The accompanying notes are an integral part of these financial statements.

25

| | |

| Alpha Architect International Quantitative Value ETF |

| Schedule of Investments (Continued) |

| September 30, 2023 |

Percentages are stated as a percent of net assets.

| | |

| ADR - American Depositary Receipt |

| PLC - Public Limited Company |

|

| (a) Non-income producing security. |

| (b) This security or a portion of this security was out on loan as of September 30, 2023. Total loaned securities had a market value of $765,200 as of September 30, 2023. |

| (c) Rate shown is the 7-day effective yield. |

The accompanying notes are an integral part of these financial statements.

26

| | |

| Alpha Architect U.S. Quantitative Momentum ETF |

| Schedule of Investments |

| September 30, 2023 |

| | | | | | | | | | | | | | |

| Shares | | | | Value |

| COMMON STOCKS - 99.9% | | |

| Apparel Retail - 4.4% | | |

| 57,886 | | Abercrombie & Fitch Co. - Class A (a) | | $ | 3,263,035 | |

| 94,309 | | Urban Outfitters, Inc. (a) | | 3,082,962 | |

| | | | 6,345,997 | |

| Application Software - 3.8% | | |

| 15,942 | | Appfolio, Inc. - Class A (a) | | 2,911,487 | |

| 91,392 | | DoubleVerify Holdings, Inc. (a) | | 2,554,406 | |

| | | | 5,465,893 | |

| Automotive Parts & Equipment - 2.0% | | |

| 63,416 | | Modine Manufacturing Co. (a) | | 2,901,282 | |

| Biotechnology - 4.1% | | |

| 24,227 | | Krystal Biotech, Inc. (a) | | 2,810,332 | |

| 264,187 | | Roivant Sciences Ltd. ADR (a)(b) | | 3,085,704 | |

| | | | 5,896,036 | |

| Building Products - 3.8% | | |

| 21,407 | | Builders FirstSource, Inc. (a) | | 2,664,957 | |

| 21,355 | | Owens Corning | | 2,913,036 | |

| | | | 5,577,993 | |

| Cargo Ground Transportation - 2.0% | | |

| 7,242 | | Saia, Inc. (a) | | 2,887,023 | |

| Casinos & Gaming - 3.9% | | |

| 96,307 | | International Game Technology PLC (b) | | 2,920,028 | |

| 30,455 | | Wynn Resorts Ltd. | | 2,814,347 | |

| | | | 5,734,375 | |

| Communications Equipment - 1.9% | | |

| 112,639 | | Extreme Networks, Inc. (a) | | 2,726,990 | |

| Construction & Engineering - 5.8% | | |

| 16,586 | | Comfort Systems USA, Inc. | | 2,826,420 | |

| 13,688 | | EMCOR Group, Inc. | | 2,879,818 | |

| 37,314 | | Sterling Infrastructure, Inc. (a) | | 2,741,833 | |

| | | | 8,448,071 | |

| Construction Machinery & Heavy Transportation Equipment - 4.1% | | |

| 50,915 | | Allison Transmission Holdings, Inc. | | 3,007,040 | |

| 50,141 | | Terex Corp. | | 2,889,124 | |

| | | | 5,896,164 | |

| Copper - 2.0% | | | | |

| 38,032 | | Southern Copper Corp. | | 2,863,429 | |

| Diversified Banks - 2.2% | | |

| 448,157 | | NU Holdings Ltd. - Class A ADR (a)(b) | | 3,249,138 | |

| Electrical Components & Equipment - 6.0% | | |

| 20,103 | | Atkore, Inc. (a) | | 2,999,167 | |

| 29,393 | | EnerSys | | 2,782,635 | |

| 54,277 | | nVent Electric PLC ADR (b) | | 2,876,138 | |

| | | | 8,657,940 | |

The accompanying notes are an integral part of these financial statements.

27

| | |

| Alpha Architect U.S. Quantitative Momentum ETF |

| Schedule of Investments (Continued) |

| September 30, 2023 |

| | | | | | | | | | | | | | |

| Shares | | | | Value |

| Electronic Equipment & Instruments - 2.0% | | |

| 51,470 | | Crane NXT Co. | | $ | 2,860,188 | |

| Electronic Manufacturing Services - 2.3% | | |

| 26,694 | | Jabil, Inc. | | 3,387,202 | |

| Footwear - 2.0% | | |

| 5,837 | | Deckers Outdoor Corp. (a) | | 3,000,743 | |

| Health Care Equipment - 1.9% | | |

| 11,467 | | Penumbra, Inc. (a) | | 2,773,982 | |

| Homebuilding - 15.3% | | |

| 25,891 | | D.R. Horton, Inc. | | 2,782,506 | |

| 60,723 | | KB Home | | 2,810,260 | |

| 25,756 | | Lennar Corp. - Class A | | 2,890,596 | |

| 31,545 | | M/I Homes, Inc. (a) | | 2,651,042 | |

| 22,199 | | Meritage Homes Corp. | | 2,716,936 | |

| 37,568 | | PulteGroup, Inc. | | 2,781,910 | |

| 65,245 | | Taylor Morrison Home Corp. (a) | | 2,780,089 | |

| 37,650 | | Toll Brothers, Inc. | | 2,784,594 | |

| | | | 22,197,933 | |

| Hotels, Resorts & Cruise Lines - 2.0% | | |

| 31,029 | | Royal Caribbean Cruises Ltd. ADR (a)(b) | | 2,859,012 | |

| Industrial Conglomerates - 2.0% | | |

| 26,852 | | General Electric Co. | | 2,968,489 | |

| Movies & Entertainment - 1.8% | | |

| 7,081 | | Netflix, Inc. (a) | | 2,673,786 | |

| Oil & Gas Drilling - 2.0% | | |

| 57,390 | | Noble Corp. PLC ADR (b) | | 2,906,804 | |

| Oil & Gas Equipment & Services - 6.6% | | |

| 162,986 | | TechnipFMC PLC ADR (b) | | 3,315,135 | |

| 45,862 | | Tidewater, Inc. (a) | | 3,259,412 | |

| 34,159 | | Weatherford International PLC ADR (a)(b) | | 3,085,582 | |

| | | | 9,660,129 | |

| Personal Care Products - 1.7% | | |

| 22,078 | | elf Beauty, Inc. (a) | | 2,424,827 | |

| Property & Casualty Insurance - 2.2% | | |

| 39,796 | | Arch Capital Group Ltd. ADR (a)(b) | | 3,172,139 | |

| Semiconductor Materials & Equipment - 1.8% | | |

| 16,037 | | Axcelis Technologies, Inc. (a) | | 2,614,833 | |

| Semiconductors - 2.1% | | |

| 53,938 | | Rambus, Inc. (a) | | 3,009,201 | |

| Technology Hardware, Storage & Peripherals - 2.1% | | |

| 11,189 | | Super Micro Computer, Inc. (a) | | 3,068,248 | |

| Trading Companies & Distributors - 4.0% | | |

| 28,207 | | Boise Cascade Co. | | 2,906,449 | |

| 82,832 | | FTAI Aviation Ltd. ADR (b) | | 2,944,678 | |

| | | | 5,851,127 | |

The accompanying notes are an integral part of these financial statements.

28

| | |

| Alpha Architect U.S. Quantitative Momentum ETF |

| Schedule of Investments (Continued) |

| September 30, 2023 |

| | | | | | | | | | | | | | |

| Shares | | | | Value |

| Transaction & Payment Processing Services - 2.1% | | |

| 122,915 | | Remitly Global, Inc. (a) | | $ | 3,099,916 | |

| | TOTAL COMMON STOCKS (Cost $145,609,014) | | 145,178,890 | |

| | | | |

| MONEY MARKET FUNDS - 0.1% | | |

| 182,039 | | First American Government Obligations Fund - Class X, 5.26% (c) | | 182,039 | |

| | TOTAL MONEY MARKET FUNDS (Cost $182,039) | | 182,039 | |

| | | | |

| | TOTAL INVESTMENTS (Cost $145,791,053) - 100.0% | | 145,360,929 | |

| | Liabilities in Excess of Other Assets - (0.0%) (d) | | (39,930) | |

| | TOTAL NET ASSETS - 100.0% | | $ | 145,320,999 | |

Percentages are stated as a percent of net assets.

ADR - American Depositary Receipt

PLC - Public Limited Company

| | | | | |

| (a) | Non-income producing security. |

| (b) | Foreign issued security. |

| (c) | Rate shown is the 7-day effective yield. |

| (d) | Represents less than 0.05% of net assets. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

29

| | |

| Alpha Architect International Quantitative Momentum ETF |

| Schedule of Investments |

| September 30, 2023 |

| | | | | | | | | | | | | | |

| Shares | | | | Value |

| COMMON STOCKS - 99.4% | | |

| Cayman Islands - 1.9% | | |

| 140,037 | | Melco Resorts & Entertainment Ltd. ADR (a) | | $ | 1,384,966 | |

| Denmark - 2.1% | | |

| 14,687 | | Pandora A/S | | 1,523,153 | |

| France - 11.5% | | |

| 42,507 | | Accor S.A. | | 1,435,401 | |

| 743 | | Hermes International SCA | | 1,358,822 | |

| 19,356 | | Publicis Groupe S.A. | | 1,468,506 | |

| 65,420 | | Rexel S.A. | | 1,473,221 | |

| 48,964 | | SCOR SE | | 1,525,579 | |

| 32,083 | | Verallia S.A. (b) | | 1,264,529 | |

| | | | 8,526,058 | |

| Germany - 19.4% | | |

| 40,342 | | AIXTRON SE | | 1,485,128 | |

| 138,845 | | Commerzbank AG | | 1,583,906 | |

| 172,110 | | Deutsche Lufthansa AG (a) | | 1,365,817 | |

| 12,102 | | Gerresheimer AG | | 1,272,447 | |

| 18,883 | | Heidelberg Materials AG | | 1,467,757 | |

| 42,745 | | Infineon Technologies AG | | 1,417,000 | |

| 3,941 | | Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen | | 1,537,900 | |

| 10,948 | | SAP SE | | 1,421,614 | |

| 22,894 | | Talanx AG | | 1,452,281 | |

| 82,649 | | TeamViewer SE (a)(b) | | 1,394,595 | |

| | | | 14,398,445 | |

| Ireland - 6.0% | | |

| 334,536 | | AIB Group PLC | | 1,506,712 | |

| 154,270 | | Bank of Ireland Group PLC | | 1,515,217 | |

| 26,758 | | CRH PLC | | 1,424,114 | |

| | | | 4,446,043 | |

| Italy - 14.0% | | | | |

| 802,422 | | A2A S.p.A. | | 1,430,336 | |

| 167,507 | | Banca Mediolanum S.p.A. | | 1,434,838 | |

| 324,270 | | Banco BPM S.p.A. | | 1,554,754 | |

| 511,671 | | BPER Banca | | 1,567,173 | |

| 50,691 | | Buzzi S.p.A. | | 1,389,132 | |

| 576,691 | | Intesa Sanpaolo S.p.A. | | 1,487,684 | |

| 63,475 | | UniCredit S.p.A. | | 1,525,387 | |

| | | | 10,389,304 | |

| Japan - 16.3% | | |

| 7,852 | | Disco Corp. | | 1,449,131 | |

| 124,125 | | Kobe Steel Ltd. | | 1,618,841 | |

| 111,553 | | NOK Corp. | | 1,482,123 | |

| 33,654 | | Sumitomo Mitsui Financial Group, Inc. | | 1,654,550 | |

| 95,956 | | T&D Holdings, Inc. | | 1,584,712 | |

The accompanying notes are an integral part of these financial statements.

30

| | |

| Alpha Architect International Quantitative Momentum ETF |

| Schedule of Investments |

| September 30, 2023 |

| | | | | | | | | | | | | | |

| Shares | | | | Value |

| 88,204 | | TBS Holdings, Inc. | | $ | 1,484,134 | |

| 27,704 | | Tokyo Seimitsu Co., Ltd. | | 1,388,537 | |

| 32,145 | | Zensho Holdings Co., Ltd. | | 1,397,740 | |

| | | | 12,059,768 | |

| Luxembourg - 2.1% | | |

| 212,239 | | B&M European Value Retail S.A. | | 1,518,508 | |

| Netherlands - 3.8% | | |

| 4,785 | | Ferrari N.V. ADR | | 1,414,159 | |

| 107,391 | | ING Groep N.V. | | 1,424,916 | |

| | | | 2,839,075 | |

| Singapore - 1.9% | | |

| 380,678 | | Sembcorp Industries Ltd. | | 1,417,448 | |

| Spain - 8.4% | | | | |

| 43,449 | | ACS Actividades de Construccion y Servicios S.A. | | 1,565,055 | |

| 195,259 | | Banco Bilbao Vizcaya Argentaria S.A. | | 1,591,634 | |

| 107,647 | | Indra Sistemas S.A. | | 1,559,194 | |

| 39,703 | | Industria de Diseno Textil S.A. | | 1,481,333 | |

| | | | 6,197,216 | |

| Sweden - 2.0% | | |

| 102,686 | | H & M Hennes & Mauritz AB | | 1,461,122 | |

| Switzerland - 2.0% | | |

| 23,196 | | Holcim AG | | 1,489,551 | |

| United Kingdom - 8.0% | | |

| 61,154 | | 3i Group PLC | | 1,546,758 | |

| 808,409 | | Centrica PLC | | 1,523,411 | |

| 11,291 | | Games Workshop Group PLC | | 1,456,148 | |

| 55,593 | | Hikma Pharmaceuticals PLC | | 1,416,279 | |

| | | | 5,942,596 | |

| | TOTAL COMMON STOCKS (Cost $75,407,678) | | 73,593,253 | |

| | | | |

| MONEY MARKET FUNDS - 0.2% | | |

| 145,636 | | First American Government Obligations Fund - Class X, 5.26% (c) | | 145,636 | |

| | TOTAL MONEY MARKET FUNDS (Cost $145,636) | | 145,636 | |

| | | | |

| | TOTAL INVESTMENTS (Cost $75,553,314) - 99.6% | | 73,738,889 | |

| | Other Assets in Excess of Liabilities - 0.4% | | 285,071 | |

| | TOTAL NET ASSETS - 100.0% | | $ | 74,023,960 | |

Percentages are stated as a percent of net assets.

ADR - American Depositary Receipt

PLC - Public Limited Company

| | | | | |

| (a) | Non-income producing security. |

| (b) | 144A restricted security. |

| (c) | Rate shown is the 7-day effective yield. |

The accompanying notes are an integral part of these financial statements.

31

| | |

| Alpha Architect Value Momentum Trend ETF |

| Schedule of Investments |

| September 30, 2023 |

| | | | | | | | | | | | | | |

| Shares | | | | Value |

| INVESTMENT COMPANIES - 98.7% | | |

| International Developed Equity - 54.2% | | |

| 281,078 | | Alpha Architect International Quantitative Momentum ETF (a) | | $ | 6,892,369 | |

| 513,468 | | Alpha Architect International Quantitative Value ETF (a)(b) | | 12,112,351 | |

| | | | 19,004,720 | |

| U.S. Equity - 44.5% | | |

| 116,054 | | Alpha Architect U.S. Quantitative Momentum ETF (a) | | 5,004,121 | |

| 285,252 | | Alpha Architect U.S. Quantitative Value ETF (a) | | 10,585,702 | |

| | | | 15,589,823 | |

| | TOTAL INVESTMENT COMPANIES (Cost $34,307,918) | | 34,594,543 | |

| | | | |

| INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING - 0.0% | | |

| 2,450 | | First American Government Obligations Fund - Class X, 5.26% (c)(d) | | 2,450 | |

| | TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING (Cost $2,450) | | 2,450 | |

| | | | |

| MONEY MARKET FUNDS - 0.9% | | |

| 328,886 | | First American Government Obligations Fund - Class X, 5.26% (c) | | 328,886 | |

| | TOTAL MONEY MARKET FUNDS (Cost $328,886) | | 328,886 | |

| | | | |

| | TOTAL INVESTMENTS (Cost $34,639,254) - 99.6% | | 34,925,879 | |

| | Other Assets in Excess of Liabilities - 0.4% | | 147,282 | |

| | TOTAL NET ASSETS - 100.0% | | $ | 35,073,161 | |

Percentages are stated as a percent of net assets.

| | | | | |

| (a) | Affiliated fund. |

| (b) | This security or a portion of this security was out on loan as of September 30, 2023. Total loaned securities had a market value of $2,359 as of September 30, 2023. |

| (c) | Rate shown is the 7-day effective yield. |

| (d) | Represents less than 0.05% of Net Assets |

The accompanying notes are an integral part of these financial statements.

32

| | |

| Alpha Architect High Inflation and Deflation ETF |

| Schedule of Investments |

| September 30, 2023 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares | | | | | | | | Value |

| INVESTMENT COMPANIES - 12.4% | | | | | | |

| 94,947 | | GraniteShares Bloomberg Commodity Broad Str No K-1 | | | | | | $ | 2,049,906 | |

| | TOTAL INVESTMENT COMPANIES (Cost $2,076,623) | | | | | | 2,049,906 | |

| | | | | | | | |

| Principal Amount | | | | Effective Yield | | Maturity Date | | |

| SHORT TERM INVESTMENTS - 87.6% | | | | | | |

| U.S. Treasury Bills - 87.1% | | | | | | |

| 3,892,000 | | United States Treasury Bill (a) | | 4.21% | | 10/05/2023 | | 3,889,772 | |

| 480,000 | | United States Treasury Bill (a) | | 5.16% | | 11/02/2023 | | 477,790 | |

| 179,000 | | United States Treasury Bill (a) | | 5.23% | | 11/09/2023 | | 177,990 | |

| 1,869,000 | | United States Treasury Bill (a) | | 5.33% | | 12/07/2023 | | 1,850,814 | |

| 3,385,000 | | United States Treasury Bill (a) | | 5.34% | | 12/14/2023 | | 3,348,591 | |

| 393,000 | | United States Treasury Bill (a) | | 5.34% | | 12/19/2023 | | 388,489 | |

| 416,000 | | United States Treasury Bill (a) | | 5.37% | | 12/21/2023 | | 411,097 | |

| 3,929,000 | | United States Treasury Bill (a) | | 5.37% | | 12/28/2023 | | 3,878,629 | |

| | | | | | | | 14,423,172 | |

| | | | | | | | |

| Money Market Deposit Account - 0.5% | | | | | | |

| 78,261 | | U.S. Bank Money Market Deposit Account, 5.20% (b) | | | | | | 78,261 | |

| | TOTAL SHORT TERM INVESTMENTS (Cost $14,501,165) | | | | | | 14,501,433 | |

| | | | | | | | |

| | TOTAL INVESTMENTS (Cost $16,577,788) - 100.0% | | | | | | 16,551,339 | |

| | Liabilities in Excess of Other Assets - (0.0%) (c) | | | | | | (1,040) | |

| | TOTAL NET ASSETS - 100.0% | | | | | | $ | 16,550,299 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Percentages are stated as a percent of net assets. | | | | | | | | |

| | | | | | | | | |

| (a) | Zero coupon bond. | | | | | | | | |

| (b) | The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term investment vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on conditions and may change daily and by any amount. The rate shown is as of September 30, 2023. | | | | | | | | |

| (c) | Represents less than 0.05% of net assets. | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

33

| | |

| Alpha Architect Tail Risk ETF |

| Schedule of Investments |

| September 30, 2023 |

| | | | | | | | | | | | | | | | | | | | |

| Shares | | | | | Value |

| AFFILIATED INVESTMENT COMPANIES - 65.2% | | | |

| 1,035,000 | | | Alpha Architect 1-3 Month Box ETF (a) | | $ | 107,308,800 | |

| | | | TOTAL INVESTMENT COMPANIES (Cost $104,646,575) | | | 107,308,800 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Contracts | | | | | Notional

Amount | | | |

| PURCHASED OPTIONS - 82.5% (b)(c)(d) | | | | | | | |

| CALL OPTIONS - 12.5% | | | | | | | |

| | | | S&P 500® Index | | | | | | | |

| 4 | | | Expiration: 12/15/2023, Strike Price $4,000 | | $ | 1,715,220 | | | | | 145,300 | |

| 321 | | | Expiration: 01/19/2024, Strike Price $4,000 | | | 137,646,405 | | | | | 12,766,812 | |

| | | | | | | | | | | 12,912,112 | |

| | | MercadoLibre, Inc. | | | | | | | |

| 3,000 | | | Expiration: 10/27/2023, Strike Price $1,331 (e) | | | 380,364,000 | | | | | 7,666,650 | |

| | | | | | | | | | 7,666,650 | |

| PUT OPTIONS - 70.0% | | | | | | | |

| | | | S&P 500® Index | | | | | | | |

| 402 | | | Expiration: 10/13/2023, Strike Price $4,250 | | | 172,379,610 | | | | | 1,368,810 | |

| 1,596 | | | Expiration: 10/20/2023, Strike Price $1,900 | | | 684,372,780 | | | | | 7,980 | |

| 672 | | | Expiration: 11/17/2023, Strike Price $1,900 | | | 288,156,960 | | | | | 10,080 | |

| 960 | | | Expiration: 11/17/2023, Strike Price $1,900 | | | 411,652,800 | | | | | 12,000 | |

| 2,188 | | | Expiration: 12/15/2023, Strike Price $2,200 | | | 938,225,340 | | | | | 158,630 | |

| 4 | | | Expiration: 12/15/2023, Strike Price $5,000 | | | 1,715,220 | | | | | 266,543 | |

| 220 | | | Expiration: 12/15/2023, Strike Price $7,300 | | | 94,337,100 | | | | | 64,575,500 | |

| 200 | | | Expiration: 01/19/2024, Strike Price $2,200 | | | 85,761,000 | | | | | 33,500 | |

| 321 | | | Expiration: 01/19/2024, Strike Price $5,000 | | | 137,646,405 | | | | | 20,648,729 | |

| | | | | | | | | | 87,081,772 | |

| | | MercadoLibre, Inc. | | | | | | | |

| 3,000 | | | Expiration: 10/27/2023, Strike Price $1,346 (e) | | | 380,364,000 | | | | | 28,089,120 | |

| | | | | | | | | | | 28,089,120 | |

| | | | TOTAL PURCHASED OPTIONS (Cost $145,963,158) | | | | | | | 135,749,654 | |

| Shares | | | | | | | | | |

| MONEY MARKET FUNDS - 0.1% | | | | | | | |

| 216,904 | | | First American Government Obligations Fund - Class X, 5.26% (f) | | | | | | | 216,904 | |

| | | | TOTAL MONEY MARKET FUNDS (Cost $216,904) | | | | | | | 216,904 | |

| | | | | | | | | | | |

| | | | TOTAL INVESTMENTS (Cost $250,826,637) - 147.8% | | | | | | | 243,275,358 | |

| | | | Liabilities in Excess of Other Assets - (47.8%) | | | | | | | (78,685,310) | |

| | | | TOTAL NET ASSETS - 100.0% | | | | | | $ | 164,590,048 | |

The accompanying notes are an integral part of these financial statements.

34

| | | | | | | | |

| Percentages are stated as a percent of net assets. |

| | |

| (a) | Affiliated fund. |

| (b) | Exchange-Traded. |

| (c) | Purchased option contracts are held in connection with corresponding written option contracts. See the Schedule of Written Options for further information. |

| (d) | Each contract equals 100 shares. |

| (e) | Flexible Exchange® Options. |

| (f) | Rate shown is the 7-day effective yield. |

The accompanying notes are an integral part of these financial statements.

35

| | |

| Alpha Architect Tail Risk ETF |

| Schedule of Written Options |

| September 30, 2023 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Contracts | | | | | Notional

Amount | | | Value |

| WRITTEN OPTIONS - (47.8%) (a)(b) | | | | | | | |

| CALL OPTIONS - (3.9%) | | | | | | | |

| | | | S&P 500® Index | | | | | | | |

| 4 | | | Expiration: 12/15/2023, Strike Price $5,000.00 | | $ | (1,715,220) | | | | $ | (310) | |

| 321 | | | Expiration: 01/19/2024, Strike Price $5,000.00 | | | (137,646,405) | | | | | (66,386) |

| | | | | | | | | | | (66,696) |

| | | MercadoLibre, Inc. | | | | | | | |

| 3,000 | | | Expiration: 10/27/2023, Strike Price $1,346.00 (c) | | | (380,364,000) | | | | | (6,365,310) |

| | | | | | | | | | (6,365,310) |

| PUT OPTIONS - (43.9%) | | | | | | | |

| | | | S&P 500® Index | | | | | | | |

| 402 | | | Expiration: 10/13/2023, Strike Price $4,150.00 | | | (172,379,610) | | | | | (538,680) |

| 402 | | | Expiration: 10/13/2023, Strike Price $4,300.00 | | | (172,379,610) | | | | | (2,100,450) |

| 4 | | | Expiration: 12/15/2023, Strike Price $4,000.00 | | | (1,715,220) | | | | | (16,307) |

| 220 | | | Expiration: 12/15/2023, Strike Price $6,300.00 | | | (94,337,100) | | | | | (42,834,000) |

| 321 | | | Expiration: 01/19/2024, Strike Price $4,000.00 | | | (137,646,405) | | | | | (1,806,671) |

| | | | | | | | | | (47,296,108) |

| | | MercadoLibre, Inc. | | | | | | | |

| 3,000 | | | Expiration: 10/27/2023, Strike Price $1,331.00 (c) | | | (380,364,000) | | | | | (24,909,930) |

| | | | TOTAL WRITTEN OPTIONS (Premiums Received $71,323,659) | | | | | | $ | (78,638,044) | |

| | | | | | | | |

| Percentages are stated as a percent of net assets. |

| | |

| (a) | Exchange-Traded. |

| (b) | Each contract equals 100 shares. |

| (c) | Flexible Exchange® Options. |

The accompanying notes are an integral part of these financial statements.

36

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2023

| | | | | | | | | | | |

| Alpha Architect U.S. Quantitative Value ETF | | Alpha Architect International Quantitative Value ETF |

| Assets: | | | |

Investments in securities, at value (1) | $ | 277,787,670 | | | $ | 151,018,636 | |

| Foreign currency, at value | — | | | 13,290 | |

| Receivable for investments sold | 8,107,690 | | | — | |

| Receivable for fund shares sold | — | | | 3,541,140 | |

| Dividends and interest receivable | 221,865 | | | 1,450,465 | |

| Securities lending income receivable (Note 5) | 2 | | | 57 | |

| Total assets | 286,117,227 | | | 156,023,588 | |

| | | |

| Liabilities: | | | |

| Payable for fund shares redeemed | 8,172,142 | | | — | |

| Payable for investment securities purchased | — | | | 3,494,263 | |

| Due to securities lending agent (Note 5) | — | | | 790,000 | |

| Accrued investment advisory fees | 92,231 | | | 61,619 | |

| Total liabilities | 8,264,373 | | | 4,345,882 | |

| Net Assets | $ | 277,852,854 | | | $ | 151,677,706 | |

| | | |

| Net Assets Consist of: | | | |

| Paid-in capital | 390,800,657 | | | 247,619,284 | |

| Total distributable earnings (accumulated deficit) | (112,947,803) | | | (95,941,578) | |

| Net Assets: | $ | 277,852,854 | | | $ | 151,677,706 | |

| | | |

| Calculation of Net Asset Value Per Share: | | | |

| Net Assets | $ | 277,852,854 | | | $ | 151,677,706 | |

| Shares Outstanding (unlimited shares of beneficial interest authorized, no par value) | 7,480,000 | | | 6,425,000 | |

| Net Asset Value per Share | $ | 37.15 | | | $ | 23.61 | |

| | | |

| Cost of Investments in Securities | $ | 260,155,269 | | | $ | 146,834,873 | |

| Cost of Foreign Currency | $ | — | | | $ | 13,235 | |

(1) Includes loaned securities with a value of | $ | — | | | $ | 765,200 | |

The accompanying notes are an integral part of these financial statements.

37

STATEMENT OF ASSETS AND LIABILITIES

| | | | | | | | | | | |

| Alpha Architect U.S. Quantitative Momentum ETF | | Alpha Architect International Quantitative Momentum ETF |

| Assets: | | | |

| Investments in securities, at value | $ | 145,360,929 | | | $ | 73,738,889 | |

| Dividends and interest receivable | 9,370 | | | 335,374 | |

| Total assets | 145,370,299 | | | 74,074,263 | |

| | | |

| Liabilities: | | | |

| Due to custodian | — | | | 19,101 | |

| Accrued investment advisory fees | 49,300 | | | 31,202 | |

| Total liabilities | 49,300 | | | 50,303 | |

| Net Assets | $ | 145,320,999 | | | $ | 74,023,960 | |

| | | |

| Net Assets Consist of: | | | |

| Paid-in capital | $ | 247,629,147 | | | $ | 157,875,620 | |

| Total distributable earnings (accumulated deficit) | (102,308,148) | | | (83,851,660) | |

| Net Assets: | $ | 145,320,999 | | | $ | 74,023,960 | |

| | | |

| Calculation of Net Asset Value Per Share: | | | |

| Net Assets | $ | 145,320,999 | | | $ | 74,023,960 | |

| Shares Outstanding (unlimited shares of beneficial interest authorized, no par value) | 3,370,000 | | | 3,025,000 | |

| Net Asset Value per Share | $ | 43.12 | | | $ | 24.47 | |

| | | |

| Cost of Investments in Securities | $ | 145,791,053 | | | $ | 75,553,314 | |

The accompanying notes are an integral part of these financial statements.

38

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2023

| | | | | | | | | | | |

| Alpha Architect Value Momentum Trend ETF | | Alpha Architect High Inflation and Deflation ETF |

| Assets: | | | |

Investments in affiliates, at value (1) | $ | 34,594,543 | | | $ | — | |

| Non-affiliated investments, at value | 331,336 | | | 16,551,339 | |

| Total Investments, at value | 34,925,879 | | | 16,551,339 | |

| Cash | 161,720 | | | — | |

| Securities lending income receivable (Note 5) | 756 | | | — | |

| Dividends and interest receivable | 527 | | | 2,700 | |

| Total assets | 35,088,882 | | | 16,554,039 | |

| | | |

| Liabilities: | | | |

| Due to broker for securities sold short | 7,709 | | | — | |

| Accrued investment advisory fees | 5,562 | | | 3,740 | |

| Due to securities lending agent (Note 5) | 2,450 | | | — | |

| Total liabilities | 15,721 | | | 3,740 | |

| Net Assets | $ | 35,073,161 | | | $ | 16,550,299 | |

| | | |

| Net Assets Consist of: | | | |

| Paid-in capital | $ | 58,956,581 | | | $ | 16,688,082 | |

| Total distributable earnings (accumulated deficit) | (23,883,420) | | | (137,783) | |

| Net Assets: | $ | 35,073,161 | | | $ | 16,550,299 | |

| | | |

| Calculation of Net Asset Value Per Share: | | | |

| Net Assets | $ | 35,073,161 | | | $ | 16,550,299 | |

| Shares Outstanding (unlimited shares of beneficial interest authorized, no par value) | 1,560,000 | | | 700,000 | |

| Net Asset Value per Share | $ | 22.48 | | | $ | 23.64 | |

| | | |

| Cost of Investments in Affiliates | $ | 34,307,918 | | | $ | — | |

| Cost of Non-Affiliated Investments | $ | 331,336 | | | $ | 16,577,788 | |

(1) Includes loaned securities with a value of | $ | 2,359 | | | $ | — | |

The accompanying notes are an integral part of these financial statements.

39

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2023

| | | | | | | | | | | |

| | | | Alpha Architect Tail Risk ETF |

| Assets: | | | |

| Non-affiliated investments, at value | | | $ | 135,966,558 | |

| Investments in affiliates, at value | | | 107,308,800 | |

| Total Investments, at value | | | 243,275,358 | |

| Receivable for investments sold | | | 3,313,959 | |

| Deposit at broker for options | | | 124,419 | |

| Dividends and interest receivable | | | 523 | |

| Broker interest and fees receivable | | | 112 | |

| Total assets | | | 246,714,371 | |

| Liabilities: | | | |

| Options written, at value | | | 78,638,044 | |

| Payable to custodian | | | 2,010,368 | |

| Payable for investment securities purchased | | | 1,413,932 | |

| Accrued investment advisory fees | | | 61,979 | |

| Total liabilities | | | 82,124,323 | |

| Net Assets | | | $ | 164,590,048 | |

| | | | |

| Net Assets Consist of: | | | |

| Paid-in capital | | | $ | 232,347,335 | |

| Total distributable earnings (accumulated deficit) | | | (67,757,287) | |

| Net Assets: | | | $ | 164,590,048 | |

| | | | |

| Calculation of Net Asset Value Per Share: | | | |

| Net Assets | | | $ | 164,590,048 | |

| Shares Outstanding (unlimited shares of beneficial interest authorized, no par value) | | | 2,023,847 | |

| Net Asset Value per Share | | | $ | 81.33 | |

| | | | |

| Cost of Non-Affiliated Investments | | | $ | 146,180,062 | |

| Cost of Investments in Affiliates | | | $ | 104,646,575 | |

| Premiums Received from Options Written | | | $ | 71,323,659 | |

The accompanying notes are an integral part of these financial statements.

40

STATEMENT OF OPERATIONS

September 30, 2023

| | | | | | | | | | | |

| Alpha Architect U.S. Quantitative Value ETF | | Alpha Architect International Quantitative Value ETF |

| Investment Income: | | | |

| Dividend income (net of foreign withholding tax of $0 and $810,043, respectively) | $ | 6,456,536 | | | $ | 7,866,222 | |

| Interest income | 36,612 | | | 23,429 | |

| Securities lending income, net (See Note 5) | 1,751 | | | 59 | |

| Total investment income | 6,494,899 | | | 7,889,710 | |

| | | |

| Expenses: | | | |

| Investment advisory fees | 1,018,002 | | | 698,963 | |

| Net expenses | 1,018,002 | | | 698,963 | |

| | | |

| Net Investment Income/(Loss) | 5,476,897 | | | 7,190,747 | |

| | | |

| Realized and Unrealized Gain (Loss) on Investments: | | | |

| Net realized gain (loss) on: | | | |

| Investments | 18,716,123 | | | (3,533,266) | |

| Foreign currency | — | | | (370,422) | |

| 18,716,123 | | | (3,903,688) | |

| Net change in unrealized appreciation/(depreciation) on: | | | |

| Investments | 33,513,536 | | | 22,569,617 | |

| Foreign currency | — | | | 7,120,420 | |

| 33,513,536 | | | 29,690,037 | |

| Net realized and unrealized gain (loss) on investments: | 52,229,659 | | | 25,786,349 | |

| Net Increase/ (Decrease) in Net Assets Resulting from Operations | $ | 57,706,556 | | | $ | 32,977,096 | |

The accompanying notes are an integral part of these financial statements.

41

STATEMENT OF OPERATIONS (CONTINUED)

For the Year Ended September 30, 2023

| | | | | | | | | | | |

| Alpha Architect U.S. Quantitative Momentum ETF | | Alpha Architect International Quantitative Momentum ETF |

| Investment Income: | | | |

| Dividend income (net of foreign withholding tax of $0 and $281,583, respectively) | $ | 2,472,907 | | | $ | 2,943,416 | |

| Interest income | 19,009 | | | 12,216 | |

| Securities lending income, net (See Note 5) | 85 | | | 4,095 | |

| Total investment income | 2,492,001 | | | 2,959,727 | |

| | | |

| Expenses: | | | |

| Investment advisory fees | 579,497 | | | 362,815 | |

| Overdraft fees expense | — | | | 1,356 | |

| Net expenses | 579,497 | | | 364,171 | |

| | | |

| Net Investment Income/(Loss) | 1,912,504 | | | 2,595,556 | |

| | | |

| Realized and Unrealized Gain (Loss) on Investments: | | | |

| Net realized gain (loss) on: | | | |

| Investments | (13,661,716) | | | (859,499) | |

| Foreign currency | — | | | (232,798) | |

| (13,661,716) | | | (1,092,297) | |

| Net change in unrealized appreciation/(depreciation) on: | | | |

| Investments | 4,866,116 | | | 2,616,359 | |

| Foreign currency | — | | | 2,886,171 | |

| 4,866,116 | | | 5,502,530 | |

| Net realized and unrealized gain (loss) on investments: | (8,795,600) | | | 4,410,233 | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ | (6,883,096) | | | $ | 7,005,789 | |

The accompanying notes are an integral part of these financial statements.

42

STATEMENT OF OPERATIONS (CONTINUED)

For the Period Ended September 30, 2023

| | | | | | | | | | | |

| Alpha Architect Value Momentum Trend ETF | | Alpha Architect High Inflation and Deflation ETF⁽¹⁾ |

| Investment Income: | | | |

| Dividend income from affiliates | $ | 1,808,032 | | | $ | — | |

| Dividend income from non-affiliates | — | | | 312,681 | |

| Interest income | 612,409 | | | 448,474 | |

| Securities lending income, net (See Note 5) | 27,323 | | | — | |

| Total investment income | 2,447,764 | | | 761,155 | |

| | | |

| Expenses: | | | |

| Dividend expense | 264,762 | | | — | |

| Investment advisory fees | 172,558 | | | 32,667 | |

| Other expenses | 186 | | | — | |

| Total expenses | 437,506 | | | 32,667 | |

| Less: Reimbursement of expenses from Advisor (Note 4) | (74,113) | | | (2,129) | |

| Net expenses | 363,393 | | | 30,538 | |

| | | |