|

Exhibit 99.1

|

Exhibit 99.1

Endo International plc

Annual General Meeting of Shareholders

June 10, 2014

©2014 Endo Pharmaceuticals Inc. All rights reserved.

Forward Looking Statements; Non GAAP Financial Measures

This presentation contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and Canadian securities legislation.

Statements including words such as “believes,” “expects,” “anticipates,” “intends,” “estimates,” “plan,” “will,” “may,” “look forward,” “intend,” “guidance,” “future” or similar expressions are forward looking statements. Because these statements reflect our current views, expectations and beliefs concerning future events, these

forward looking statements involve risks and uncertainties. Although Endo believes that these forward looking statements and information are based upon reasonable assumptions and expectations, readers should not place undue

reliance on them, or any other forward looking statements or information in this news release. Investors should note that many

factors, as more fully described in the documents filed by Endo with securities regulators in the United States and Canada including

under the caption “Risk Factors” in Endo’s and EHSI’s Form 10 K, Form 10 Q and Form 8 K filings, as applicable, with the Securities and Exchange Commission and with securities regulators in Canada on System for

Electronic Document Analysis and Retrieval (“SEDAR”) and as otherwise enumerated herein or therein, could affect Endo’s future

financial results and could cause Endo’s actual results to differ materially from those expressed in forward looking statements contained in EHSI’s Annual Report on Form 10 K. The forward looking statements in this presentation are qualified by these risk factors. These are factors that, individually or in the aggregate,

could cause our actual results to differ materially from expected and historical results. Endo assumes no obligation to publicly update

any forward looking statements, whether as a result of new information, future developments or otherwise, except as may be required under

applicable securities law.

This presentation may refer to non GAAP financial measures, including adjusted diluted EPS, that are not prepared in accordance with accounting principles generally

accepted in the United States and that may be different from non GAAP financial measures used by other companies. Investors are encouraged to review Endo’s current report on Form 8 K filed with the SEC for Endo’s reasons for including those non GAAP financial measures in this presentation. Reconciliation of non GAAP financial measures to the nearest comparable GAAP amounts have been provided within the appendix at the end of this

presentation.

1

©2014 Endo Pharmaceuticals Inc. All rights reserved.

Today’s Agenda

Company Strategy

First Year Progress

Near Term Objectives and Progress 2014 Financial Guidance Summary and Q&A

2

©2014 Endo Pharmaceuticals Inc. All rights reserved.

Endo’s strategic direction

Build a leading global specialty healthcare company

Focus on maximizing the value of each of our core businesses

Participate in specialty areas offering above average growth and favorable margins

Transform operating model to maximize growth potential and cash flow generation

Continue our commitment to serving our patients and customers

Maximize shareholder value by adapting to market realities and customer changes

3

@2014 Endo Pharmaceuticals Inc. All rights reserved.

Endo Operating Model

Lean, efficient operating model

Performance metrics aligned with shareholder interests

M&A an important component of building & growing the business long term Agnostic on therapeutic areas, but with focus in specialty areas Focused, de risked R&D

Streamlined and diversified organization with quick decision making

4

©2014 Endo Pharmaceuticals Inc. All rights reserved.

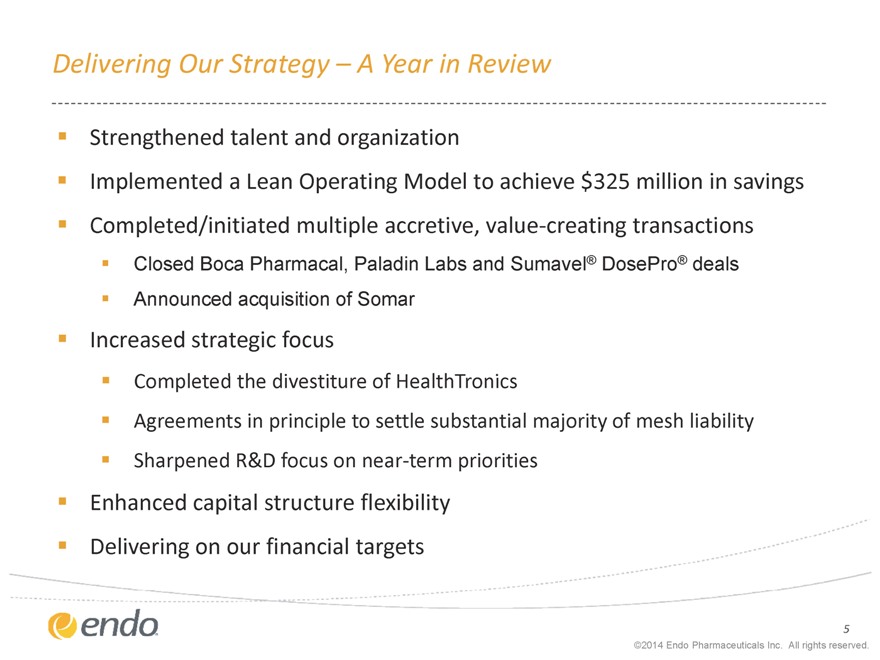

Delivering Our Strategy – A Year in Review

Strengthened talent and organization

Implemented a Lean Operating Model to achieve $325 million in savings Completed/initiated multiple accretive, value creating transactions

Closed Boca Pharmacal, Paladin Labs and Sumavel® DosePro® deals Announced acquisition of Somar

Increased strategic focus

Completed the divestiture of HealthTronics

Agreements in principle to settle substantial majority of mesh liability Sharpened R&D focus on near term priorities

Enhanced capital structure flexibility Delivering on our financial targets

5

©2014 Endo Pharmaceuticals Inc. All rights reserved.

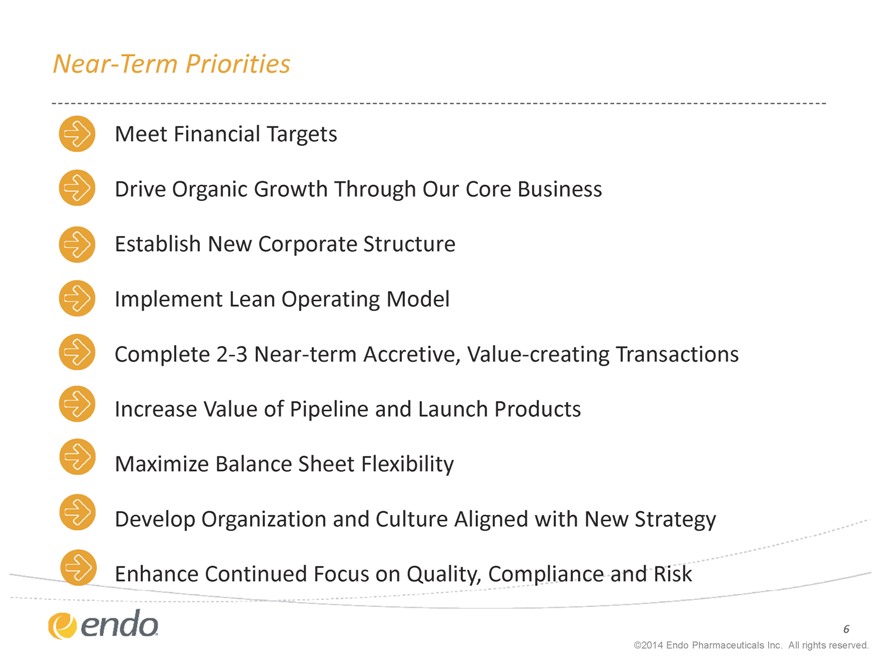

Near Term Priorities

Meet Financial Targets

Drive Organic Growth Through Our Core Business Establish New Corporate Structure Implement Lean Operating Model

Complete 2 3 Near term Accretive, Value creating Transactions Increase Value of Pipeline and Launch Products Maximize Balance Sheet Flexibility Develop Organization and Culture Aligned with New Strategy Enhance Continued Focus on Quality, Compliance and Risk

6

©2014 Endo Pharmaceuticals Inc. All rights reserved.

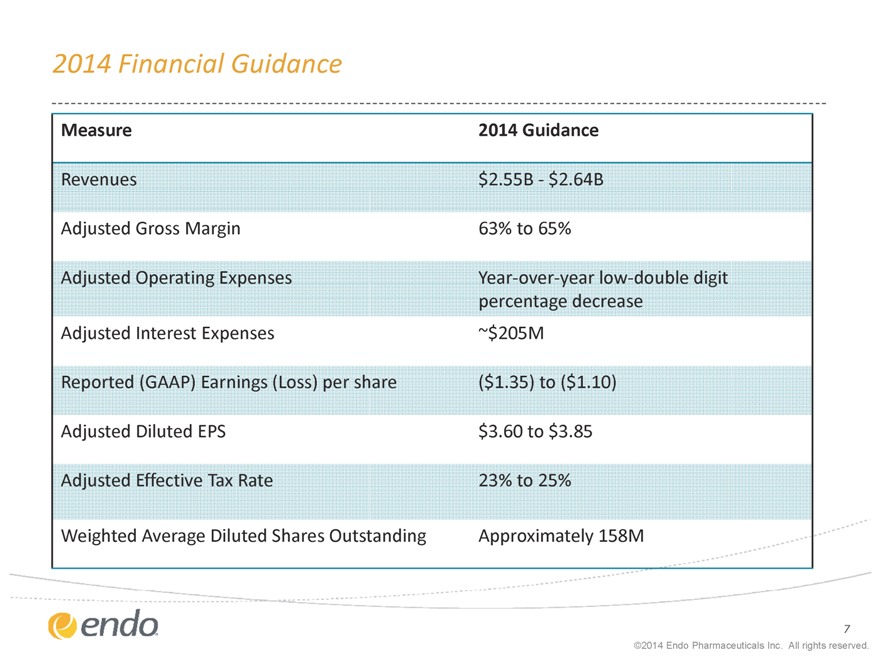

2014 Financial Guidance

Measure 2014 Guidance

Revenues $2.55B $2.64B

Adjusted Gross Margin 63% to 65%

Adjusted Operating Expenses Year over year low double digit percentage decrease Adjusted Interest Expenses ~$205M

Reported (GAAP) Earnings (Loss) per share ($1.35) to ($1.10) Adjusted Diluted EPS $3.60 to $3.85 Adjusted Effective Tax Rate 23% to 25% Weighted Average Diluted Shares Outstanding Approximately 158M

7

©2014 Endo Pharmaceuticals Inc. All rights reserved.

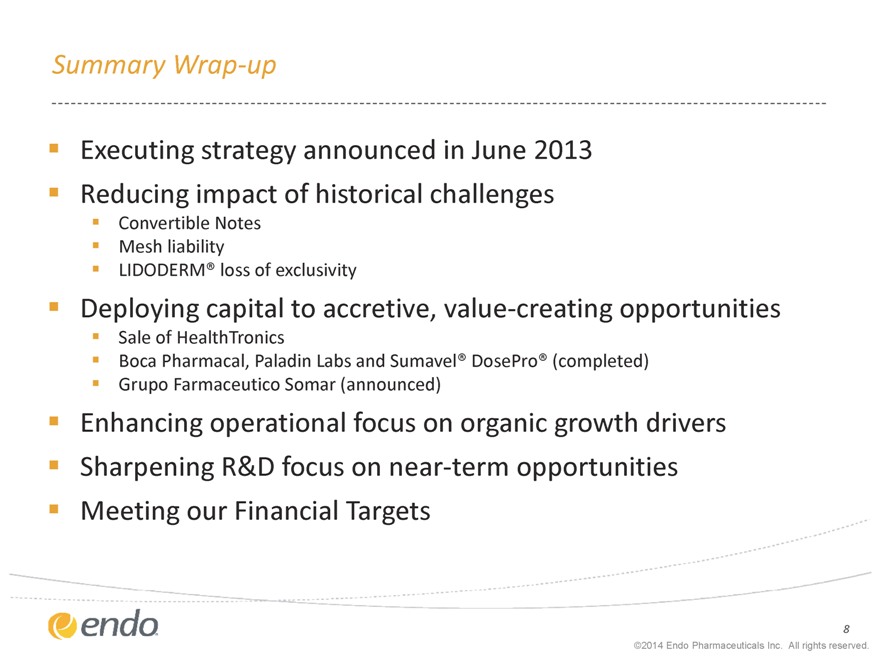

Summary Wrap up

Executing strategy announced in June 2013 Reducing impact of historical challenges

Convertible Notes Mesh liability

LIDODERM® loss of exclusivity

Deploying capital to accretive, value creating opportunities

Sale of HealthTronics

Boca Pharmacal, Paladin Labs and Sumavel® DosePro® (completed) Grupo Farmaceutico Somar (announced)

Enhancing operational focus on organic growth drivers Sharpening R&D focus on near term opportunities Meeting our Financial Targets

8

©2014 Endo Pharmaceuticals Inc. All rights reserved.

Appendix

©2014 Endo Pharmaceuticals Inc. All rights reserved.

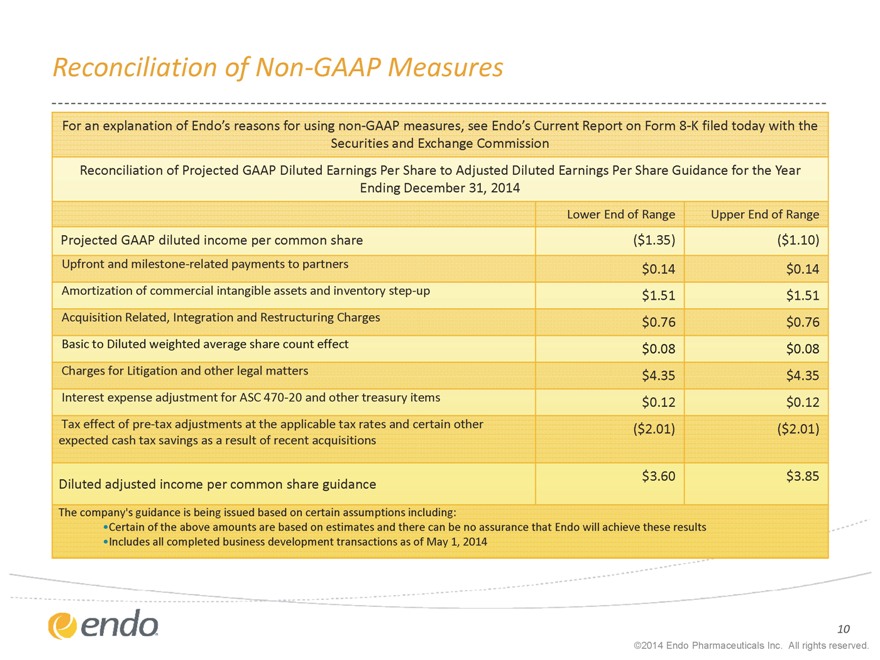

Reconciliation of Non GAAP Measures

For an explanation of Endo’s reasons for using non GAAP measures, see Endo’s Current Report on Form 8 K filed today with the Securities and Exchange Commission

Reconciliation of Projected GAAP Diluted Earnings Per Share to Adjusted Diluted Earnings Per Share Guidance for the Year

Ending December 31, 2014

Lower End of Range Upper End of Range

Projected GAAP diluted income per common share ($1.35) ($1.10)

Upfront and milestone related payments to partners $0.14 $0.14 Amortization of commercial intangible assets and inventory step up $1.51 $1.51 Acquisition Related, Integration and Restructuring Charges $0.76 $0.76 Basic to Diluted weighted average share count effect $0.08 $0.08 Charges for Litigation and other legal matters $4.35 $4.35 Interest expense adjustment for ASC 470 20 and other treasury items $0.12 $0.12 Tax effect of pre tax adjustments at the applicable tax rates and certain other ($2.01) ($2.01) expected cash tax savings as a result of recent acquisitions

$3.60 $3.85 Diluted adjusted income per common share guidance

The company’s guidance is being issued based on certain assumptions including:

Certain of the above amounts are based on estimates and there can be no assurance that Endo will achieve these results

Includes all completed business development transactions as of May 1, 2014

10

©2014 Endo Pharmaceuticals Inc. All rights reserved.

Endo International plc

Annual General Meeting of Shareholders

June 10, 2014

©2014 Endo Pharmaceuticals Inc. All rights reserved.