The amount in any individual’s 401(k) Restoration Plan account will be paid to such individual at termination of employment or following the elected specified payment date. Actual 401(k) Restoration Plan participation will begin when an executive’s total cash compensation exceeds the Code earnings limit for the qualified 401(k) ($285,000 for 2020). Individuals who elect to defer their eligible pay under the 401(k) Restoration Plan will defer federal and state (to the extent allowed by state law) taxes until the account is paid to the individual.

Executive Deferred Compensation Plan.The Executive Deferred Compensation Plan permits executives to elect to defer up to 100% of the following year’s LTI compensation that is granted in RSUs that settle in shares of our stock.

Deferral of the RSUs delays the imposition of federal and state (as allowed under state laws) taxes, which normally applies when the RSUs vest. The taxable event is delayed until the deferred RSUs are settled in shares. The RSUs may be deferred to a specified payment date on which the elected disbursement(s) under the participant’s account will commence. The value of the compensation an executive receives upon the share delivery is based on the value of the Company’s shares on the date the deferral is delivered to the executive, and the executive will be responsible for the federal and state taxes at that time.

The Executive Deferred Compensation Plan also allows an executive to defer up to 50% of his or her annual incentive compensation award. When an executive makes his or her irrevocable election to defer cash incentive compensation, he or she also elects a specified payment date in which the elected disbursement(s) under the participant’s account will commence.

Employment and Change in Control Agreements; Severance Agreements

The Company generally enters into a written employment agreement with each of the NEOs. The purpose of these agreements and the compensation and benefits provided for therein is to aid recruitment and retention and to reinforce an ongoing commitment to shareholder value creation and preservation.

On April 24, 2019, the Company entered into an executive employment agreement with Mr. Campanelli, which was effective April 24, 2019 and has a term through September 23, 2022, to replace his prior agreement dated September 23, 2016, which had a three-year term.

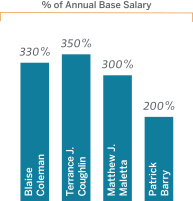

On July 30, 2019, the Committee approved Continuity Compensation arrangements for critical leadership positions in the Company, excluding Mr. Campanelli, but including the following named executive officers: Messrs. Coleman, Coughlin, Maletta and Barry. The Continuity Compensation arrangements were extended to these NEOs in response to shareholder feedback based on the critical nature of the leadership and contributions of these NEOs to the planning and execution of Endo’s transformational strategy and multi-year turnaround plan.

On December 9, 2019, the Company entered into a new executive employment agreement with Mr. Coughlin, which was effective December 9, 2019 and has a term of three years, to replace his prior agreement, dated December 9, 2016, that expired pursuant to its terms.

On December 12, 2019, the Committee approved a Letter Agreement in connection with Mr. Campanelli’s announced retirement as President and Chief Executive Officer. The Letter Agreement governs the terms and conditions of Mr. Campanelli’s compensation during the succession planning period until a successor Chief Executive Officer was appointed, and subsequently as Chairman of the Board and strategic advisor to the Company supporting the transition period until Mr. Campanelli’s retirement as an employee on December 31, 2020.

On December 19, 2019, the Company entered into an executive employment agreement with Mr. Coleman, which was effective December 19, 2019 and has a term of three years, to replace his prior agreement, dated December 19, 2016, that expired pursuant to its terms.

On February 19, 2020, the Company entered into a new executive employment agreement with Mr. Coleman in connection with his appointment to President and Chief Executive Officer, which was effective March 6, 2020 and has a term of three years, to replace his prior agreement, dated December 19, 2019.

On February 19, 2020, the Company entered into a new executive employment agreement with Mark Bradley in connection with his appointment to Executive Vice President and Chief Financial Officer, which was effective March 6, 2020 and has a term of three years, to replace his prior agreement, dated November 6, 2018.

On April 28, 2020, the Company entered into an executive employment agreement with Mr. Barry, which was effective April 26, 2020 and has a term of three years, to replace his prior agreement, dated April 26, 2017, that expired pursuant to its terms.

The payments and benefits to be received by each NEO upon certain terminations of employment by each NEO are governed by their various employment agreements and Continuity Compensation arrangements. These payments and benefits and the triggering events are further described in the “Compensation of Executive Officers” section below under the heading “Potential Payments Upon Termination or Change in Control.” Each NEO’s employment agreement contains post-termination restrictive covenants.

38